UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR | |

| | | |

£ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from ____________ to ____________

Commission file number: 333-167650

GXS Worldwide, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 35-2181508 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

| 9711 Washingtonian Boulevard, Gaithersburg, MD | 20878 |

| (Address of principal executive offices) | (Zip Code) |

301-340-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or shorter period that the registrant was required to submit and post such files). Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer £ Accelerated filer £ Non-accelerated filer R Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ NoR

As of March 16, 2012, the registrant had 1,000 outstanding shares of common stock, all of which was held by an affiliate of the registrant.

Documents incorporated by reference: None.

GXS WORLDWIDE, INC.

ANNUAL REPORT FOR THE YEAR ENDED DECEMBER 31, 2011

In this Annual Report, all references to “our,” “us,” “we,” “the company” and “GXS” refer to GXS Worldwide, Inc. and its subsidiaries as a consolidated entity, unless the context otherwise requires or where otherwise indicated. All references to “Inovis” refer to Inovis International, Inc., which we acquired on June 2, 2010. All references to “fiscal year 2011” or “2011” refer to the year ended December 31, 2011, all references to “fiscal year 2010” or “2010” refer to the year ended December 31, 2010, and all references to “fiscal year 2009” or “2009” refer to the year ended December 31, 2009, unless otherwise indicated.

We own or have rights to use various trademarks, trade names and service marks in conjunction with the operation of our business, including, but not limited to: GXS Trading Grid®, GXS RollStreamTM, Inovis, Inovis Catalogue, ActiveSM Applications, BetweenMarkets, BizLink, BizManager, BizConnect, TrustedLink and, in certain foreign jurisdictions, GXS and Tradanet.

Market and industry data and forecasts used in this Annual Report on Form 10-K have been obtained from independent industry sources. Some data is also based on our good faith estimates. Although we believe these third party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and other forward-looking information obtained from these sources and our estimates are subject to the same qualifications and uncertainties as the other forward-looking statements in this Annual Report on Form 10-K. The Gartner Report described herein (the “Gartner Report”) represents data, research opinions or viewpoints published as part of a syndicated subscription service by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this Annual Report on Form 10-K) and the opinions expressed in the Gartner Report are subject to change without notice.

The common stock of GXS, Inc., GXS Worldwide, Inc.’s only subsidiary, is collateral for the Company’s 9.75% Senior Secured Notes due 2015. Securities and Exchange Commission (“SEC”) Rule 3-16 of Regulation S-X (“Rule 3-16”) requires financial statements for each of the registrant’s affiliates whose securities constitute a substantial portion of the collateral for registered securities. The common stock of GXS, Inc. is considered to constitute a substantial portion of the collateral for the registered notes. Accordingly, the financial statements of GXS, Inc. would be required by Rule 3-16. Management does not believe the GXS, Inc. financial statements would add meaningful disclosure and has not included those financial statements herein, because they are substantially identical to the GXS Worldwide, Inc. financial statements and the total assets, revenues, operating income, net income (loss) and cash flows of GXS, Inc. are expected to continue to constitute substantially all of the corresponding amounts for GXS Worldwide, Inc. and its subsidiaries.

Certain statements contained in this Annual Report on Form 10-K and other materials we file with the SEC, or in other written or oral statements made or to be made by us, other than statements of historical fact, are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements give our current expectations or forecasts of future events. Words such as “may”, “assume”, “forecast”, “position”, “predict”, “strategy”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “believe”, “project”, “budget”, “potential”, or “continue”, and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such risk factors and you should not consider the following list to be a complete statement of all potential risks and uncertainties. Risk factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

| | · | our ability to maintain our prices at an acceptable level; |

| | · | increasing price and product and services competition by United States (“U.S.”) and foreign competitors, including new entrants and in-house information technology departments; |

| | · | rapid technological developments and changes and our ability to introduce competitive new products and services on a timely, cost effective basis; |

| | · | our mix of products and services; |

| | · | customer demand for our products and services; |

| | · | general domestic and international economic conditions and growth rates, including sluggish and recessionary economic conditions and exposure to customers in high economic risk sectors; |

| | · | declines in the creditworthiness of our customers or their ability to pay us on a timely basis; |

| | · | currency exchange rate fluctuations; |

| | · | our ability to market our products and services effectively; |

| | · | the length of life cycles for the products and services we offer; |

| | · | our ability to protect our intellectual property rights; |

| | · | our ability to protect against data security breaches and to protect our data centers from damage; |

| | · | technical or other problems that adversely impact the availability and quality of our products and services or otherwise adversely affect the customer experience; |

| | · | our ability to attract and retain talent in key technological areas; |

| | · | changes in U.S. and foreign governmental laws and regulations; |

| | · | the continued availability of financing in the amounts, at the times and on the terms required to support our future operations and our levels of indebtedness; |

| | · | our ability to comply with existing and future loan agreements; |

| | · | our ability to effectively implement our growth strategy; |

| | · | the outcome of existing or future litigation; |

| | · | our ability to negotiate acquisitions, dispositions, and other transactions and to integrate assets and/or acquired companies and realize synergies successfully; and |

| | · | higher than expected costs or expenses arising from our acquisitions. |

This list of risk factors is not exhaustive, and new risk factors may emerge or changes to these risk factors may occur that would impact our business. Additional information regarding these and other risk factors may be contained in our filings with the SEC, especially on Forms 10-K, 10-Q and 8-K. All such risk factors are difficult to predict, and are subject to material uncertainties that may affect actual results and may be beyond our control. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date of this Annual Report on Form 10-K, and we undertake no obligation to update any of these forward-looking statements to reflect subsequent events or circumstances except to the extent required by applicable law.

All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements.

PART I

Our Company

We are a leading global provider of business-to-business (“B2B”) cloud integration services that simplify and enhance business process integration, data quality and compliance, and collaboration amongst businesses. Our services and solutions enable our customers to manage and improve mission critical supply chain functions, securely process financial transactions related to the exchange of goods and services, and automate and control other critical cross-enterprise business processes. By utilizing these services, our customers realize a number of key benefits such as lower total cost of ownership, accelerated time to market and enhanced reliability and security. Our approximately 40,000 customers and their approximately 360,000 trading partners – a combined trading community of over 400,000 businesses - conduct business together via GXS Trading Grid®, our integration cloud that includes specialized capabilities for automating, assembling, monitoring, and improving multi-enterprise business processes.

Our services and solutions help our customers manage information flow throughout their supply chain with their customers and business partners. We manage a wide variety of information flows including sales activity and inventory, purchase orders and invoicing, global shipping, service automation and electronic payment instructions. The globalization of supply and localization of demand has increased the challenges businesses face managing and complying with a growing diversity of communication protocols, industry and regional standards, regulatory and customer requirements, and technical capabilities, especially with small-and-medium trading partners. GXS Trading Grid® shields our customers from the complexities of these challenges and reduces the associated implementation and ongoing maintenance costs inherent in operating and managing global supply chains that serve customers around the world.

We market our services broadly across two primary service lines, each leveraging the GXS Trading Grid®. “Messaging Services” represents our largest service offering and provides for the automated and reliable exchange of business documents such as purchase orders, invoices, shipment notice images and other files, amongst businesses worldwide. “Managed Services” represents our fastest growing business and combines many value-added integration services within GXS Trading Grid® designed to optimize and improve multi-enterprise business processes including data transformation, data quality management, multi-lingual web-based enablement, real-time dashboards and reporting, and end-to-end monitoring and message track-and-trace. For customers of both our Messaging and Managed Services offerings, GXS Trading Grid® also offers Software-as-a-Service (“SaaS”) applications which enhance visibility and control for B2B operators and business users. These services are branded “ActiveSM Applications” and are built on our cloud integration platform, GXS Trading Grid®. In 2011, our Managed Services business achieved $150.4 million in total revenue, achieving a compound annual growth rate (“CAGR”) of 28.7% in the last 5 years through 2011. We offer B2B Software and Service solutions for customers seeking to deploy private integration clouds on their premises. We also offer Data Synchronization services which enable B2B participants, particularly in the retail and consumer products supply chain, to synchronize and manage vast quantities of product and pricing data both internally within their planning, distribution and sales organizations, as well as externally amongst their global trading partners and industry standards bodies. Finally, we offer Custom B2B Outsourcing solutions for a small set of large enterprise customers requiring a dedicated hosted solution.

The majority of our revenue is generated through transaction processing and subscription service fees for access and use of GXS Trading Grid®, our cloud integration platform. In 2011, we managed approximately twelve billion electronic transactions across an estimated six million integration pairs, or trading partner relationships, creating a combined trading community of over 400,000 businesses. We have substantial vertical expertise in a variety of key industries such as retail, consumer products, financial services, automotive and high technology. Today, our platform links businesses across 50 countries which we support in 15 different languages. We believe customers view our services and solutions as essential to their day-to-day supply chain operations and they typically enter into long-term contracts with us. Our recurring revenues, which are primarily attributable to transaction processing and software maintenance fees, represent approximately 87.1% of our total revenue for the year ended December 31, 2011. Additionally, 96.0% of our top 50 customers, based on annual revenue in fiscal 2011, have been our customers for five or more years.

Our Industry

The multi-enterprise B2B integration industry is defined by the increasingly global and complex nature of supply chains in today’s business environment. As companies have continued to push their supply chains and trading partner relationships across borders, as well as exploit trends in off-shoring, outsourcing and contract manufacturing, the need for trusted intermediaries that can help companies improve their ability to source, build, sell, and distribute their goods and services globally continues to accelerate.

Multi-enterprise B2B integration involves the electronic exchange of and collaboration around supply chain data between organizations. There are a variety of global, industry-specific and regionally defined standards which govern the ability to deliver this information electronically. The most popular are Extensible Markup Language (“XML”)-based and local Electronic Data Interchange (“EDI”) standards (such as ANSI X12, EDIFACT) which are defined and structured around a process or industry. However, as additional processes between businesses are increasingly digitized, an increasing percentage of data processed is unstructured and unique to large businesses and their supply chain or business partner relationships. By enabling the efficient flow of information, structured or unstructured, between businesses, our industry can help address data integration and business process inefficiencies and improve business agility, such as new market expansion, new product introduction, and enhance business results, such as time-to-revenue or customer satisfaction.

Industry analyst firm Gartner, Inc. (“Gartner”) defines multi-enterprise infrastructure (also referred to as B2B infrastructure) as an information technology (“IT”) project that is composed of some combination of B2B software and B2B services that companies use to perform multi-enterprise integration with external business partners. Gartner estimates the multi-enterprise/B2B infrastructure market to be $2.9 billion, or 17.0%, of the Application Infrastructure and Middleware (“AIM”) Software and Outsourcing Market. Between 2010 and 2015, Gartner expects Global 2000 companies to at least double their multi-enterprise traffic (i.e., transactions, documents and process execution events), and this will have a significant impact on the amount of spending that goes toward multi-enterprise/B2B infrastructures. Additionally, Gartner expects the embedded multi-enterprise/B2B infrastructure market will grow at a 9.0% CAGR, which is about 2 percentage points higher than the growth expected for the overall AIM market (Gartner “Market Trends: Multi-enterprise/B2B Infrastructure Market, Worldwide, 2010-2015” by Fabrizio Biscotti, Paolo Malinverno, Benoit J. Lheureux, Thomas Skybakmoen, February 10, 2011).

The process of integrating information between businesses is central to a company’s ability to build and manufacture products with speed and quality, coordinate timely logistics and shipping activity, and better serve customers. With the advent of Internet-based communications, the increasing number of communication protocols and global XML or EDI-based standards, and the challenges working with businesses in remote regions of the world, multi-enterprise integration is increasingly complex and costly. However, the benefits from integration are substantial, including gaining end-to-end supply chain visibility, eliminating excess inventory, tracking global shipments, optimizing the launch of a new product, understanding customer purchasing trends and managing payments and cash flow. For example, in 2007, Stanford University’s Global Supply Chain Management Forum determined that our Managed Services customers improve customer satisfaction by 62.0%, improve technical capabilities to serve partners by 75.0%, and achieve a 63.0% reduction in redundant internal B2B platforms.

Examples of multi-enterprise business processes include collaborative demand planning, procure-to-pay, electronic invoicing, global shipping, trouble ticket management, and global payments, among others. A simplified example includes the traditional procure-to-pay process whereby one business places an order to one or more other businesses. In response, the partner business acknowledges the order, provides shipment details, invoices the customer, and ultimately receives payment. Businesses gain speed advantages and reduce costs when up-to-date, accurate information is exchanged electronically versus delivered via facsimile or by post. Businesses gain additional advantages when they utilize our ActiveSM Applications. ActiveSM Applications provide a higher level of visibility and control around global transaction flows or multi-enterprise business processes, identifying exceptions and errors, uncovering inefficiencies, and highlighting opportunities for performance improvement. To deliver these benefits, the four primary segments we participate in are: global messaging services, B2B managed services, B2B gateway software, and data synchronization.

Global Messaging Services. Global messaging includes the secure, reliable exchange of structured business documents, such as purchase orders, invoices and shipment notices, from one business to another, primarily over the Internet. Businesses are provided one or more unique addresses to send and retrieve documents and files. A database is maintained that stores relationships between businesses, referred to as integration pairs or trading partner relationships.

These relationships enable messages to flow securely between businesses. Gartner refers to the global messaging segment as integration-platform-as-a-service (“iPaaS”), and estimates that segment was approximately $862.1 million in 2011 (Gartner “Market Trends: Multi-enterprise/B2B Infrastructure Market, Worldwide, 2010-2015” by Fabrizio Biscotti, Paolo Malinverno, Benoit J. Lheureux and Thomas Skybakmoen, February 10, 2011).

B2B Managed Services. Within the multi-enterprise integration market, the fastest growing segment is B2B managed services, also known as B2B Integration Outsourcing or Integration Brokerage. Businesses use B2B managed services to extend or enhance a multi-enterprise business process or to outsource the management of an entire B2B program. A B2B program includes all of the hardware, software and staff required to support a company’s business partners electronically, including customers, suppliers, shipment carriers and banks. Managed services offer an alternative delivery model designed for companies either struggling to achieve returns from B2B integration software investments or unable to handle the considerable tasks associated with worldwide B2B programs. In the managed services model, there is no B2B integration or translation software to purchase or manage. Instead, corporations leverage an on-demand B2B integration platform by outsourcing the management of the underlying server hardware, storage platforms and B2B translation technology. Through this model, companies are able to achieve their B2B integration goals faster and at a lower cost than through in-house and software-based approaches. Gartner estimates that companies spent more than $1.3 billion on B2B Integration Outsourcing or Integration Brokerage in 2011, and that this segment will register a CAGR of 17.0% through 2015—reaching over $2.3 billion in annual spend. If measured on its own, Integration Brokerage would be one of the largest and fastest growing segments within the AIM market (Gartner “Market Trends: Multi-enterprise/B2B Infrastructure Market, Worldwide, 2010-2015” by Fabrizio Biscotti, Paolo Malinverno, Benoit J. Lheureux and Thomas Skybakmoen, February 10, 2011).

B2B Gateway Software. B2B gateway software is deployed within a business and can be used to complement global messaging services or as a stand-alone messaging platform to connect directly to business partners. B2B gateway software provides communication and integration technology to enable a business to connect its internal systems and processes with its partners. B2B gateway software is typically sophisticated software, including data translation, visibility and monitoring, communication and community management components, which often require significant trained resources to implement and maintain. A company must keep current every integration point both within and outside its enterprise, creating significant ongoing staffing and resource requirements. Files that are very large in size, such as three-dimensional computer-aided design files or check images, are often exchanged through unique addresses with specially-designed efficient infrastructure. The management of large and bulk file exchange is often referred to as Managed File Transfer (“MFT”). Gartner estimates that companies spent $748.1 million on B2B gateway software in 2011 and these expenditures are projected to reach in excess of $997.0 million in 2015, representing a CAGR of over 6.0% (Gartner “Market Trends: Multi-enterprise/B2B Infrastructure Market, Worldwide, 2010-2015” by Fabrizio Biscotti, Paolo Malinverno, Benoit J. Lheureux and Thomas Skybakmoen, February 10, 2011).

Data Synchronization. Data synchronization technologies are used to exchange product and price information between the suppliers of consumer products and the retailers that sell them. Product information typically consists of brand, description, price, promotion, packaging, weight, tax and regulatory data for each stock keeping unit (“SKU”). Historically, there has been a great deal of inaccuracy for product data in the supply chain which results in delays to new product introductions and high volumes of invoice discrepancies. Software applications such as Product Information Management (“PIM”) are used by retailers and suppliers of consumer products to house the information about each SKU being sold. Data pools and electronic catalogue services provide a network to exchange information between the retailer and supplier using a “publish and subscribe” model. These data synchronization technologies have witnessed the greatest adoption within the U.S. apparel and general merchandise segment. High levels of adoption have also been attained in the consumer packaged goods, food and beverage segments in Canada, Mexico, Australia and the U.S.

Our Business Model

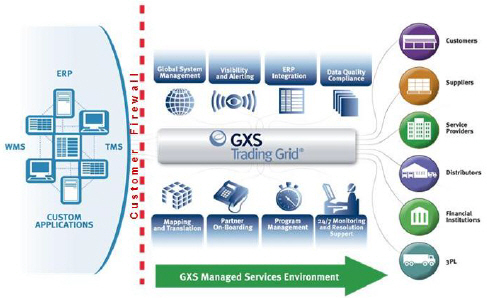

We employ a subscription-based cloud services model for the vast majority of our services. This model entails offering B2B cloud integration services and solutions to large, industry-leading companies and their community of business partners or trading partners, including customers, suppliers, government entities, logistics providers, and banks. These customers process high volumes of transactions with their trading partners and, over time, these customers will typically add additional business partners or automate additional processes, resulting in additional revenue opportunities for us. We deliver integration services through GXS Trading Grid®, our integration cloud platform, as illustrated below:

GXS Trading Grid®

Although our cloud-based services appeal to companies in a wide variety of industries, our typical customer is a retailer or manufacturer of goods such as automobiles, industrial parts, consumer packaged goods, apparel and footwear, and computer or telecommunications equipment. Other major customer segments include logistics providers responsible for the warehousing, transportation, exporting or importing of goods and financial institutions responsible for payment, financing or risk mitigation of the supply chain transactions. We enable these constituents to digitize their business information and process business transactions relating to their integrated supply chain activities. An example of business transactions related to a retail supply chain follows:

| | · | A supplier publishes an electronic product catalog containing critical information including branding, packaging, pricing, promotions and other attribute data important to the buyer. |

| | · | The buyer forecasts short-term demand, assesses which products to buy and issues an electronic purchase order to the supplier specifying the types of products, quantities, ship-to-locations and other terms and conditions. |

| | · | The supplier acknowledges receipt of the electronic order. |

| | · | As the buyer’s forecast changes, it may issue one or many changes to the purchase order, which would in turn be acknowledged by the supplier. |

| | · | Upon fulfillment and shipment of the order, the supplier sends an electronic advance shipment notice, which informs the buyer of the products shipped, quantities, transportation carriers and expected arrival dates and locations. |

| | · | For long distance international supply chains, air, ocean, and ground freight carriers may issue multiple status messages to update both buyer and supplier on the location of the shipments. |

| | · | Upon receipt of the packages by the buyer, the logistics provider will send an electronic proof of delivery to the supplier. |

| | · | The supplier will send an invoice to the buyer requesting payment to be issued consistent with terms of the purchase agreement. |

| | · | Once the invoice has been approved, the buying organization will send instructions to its bank to send payment via an automated clearinghouse (“ACH”) or wire transfer to the supplier. |

| | · | Additionally, the buyer will send a detailed remittance advice to the supplier providing the accounting details necessary to post the receivable to its general ledger. |

Significant variations to the business process outlined above may occur resulting in a different sequence or combination of electronic transactions being exchanged between the buyer, supplier and service providers. Examples include:

| | · | vendor managed inventory models in which the supplier assumes responsibility for the replenishment decisions and may also hold title to the inventory at the buyer’s locations; |

| | · | international trade scenarios in which a letter of credit is issued to mitigate the risk of non-payment by the buyer; and |

| | · | “drop ship” scenarios in which the supplier forwards an order fulfillment request on to one of its suppliers for shipment directly to the customer, thereby avoiding unnecessary logistics and inventory expenses. |

We believe that our ability to automate the exchange of essential business information between trading partners with dissimilar processes and applications adds value at each step of the supply chain. In a typical GXS Trading Grid® implementation, a customer hires us to:

| | · | conduct the necessary processes to connect the company to our infrastructure; |

| | · | roll out our B2B cloud integration services and solutions to the customer and its trading partners (as required) and connect those trading partners to our infrastructure either directly or via an interconnect through a competing provider; and |

| | · | act as a trusted intermediary, providing services such as security, authentication, translation and audit tracking, among others, to the customer and its trading community. |

Furthermore, through our Managed Services offering , our comprehensive B2B outsourcing service, we offer a suite of services around GXS Trading Grid® which perform all day-to-day management of our customer’s technical infrastructures, including systems health monitoring, data backup, network management, systems administration, database management, and application support. In a typical Managed Services implementation, we identify, on-board, and test our customer’s trading partner networks, as well as manage all data mapping and translation tasks, perform change management and issue resolution with any trading community, and proactively troubleshoot and reprocess documents, if necessary, through GXS Trading Grid®. Additionally, our Managed Services customers often elect to utilize one of our ActiveSM Applications which layer additional value-added services onto their supply chain activities, such as data compliance, process control and document visibility.

As illustrated below, our Managed Services solution provides the expertise, infrastructure, and experience necessary to deliver a comprehensive outsourced B2B program, including a world-class global B2B infrastructure, program implementation, operational management, and customer support. This all occurs through a cloud-based delivery model, which precludes the need for our customers having to install on-premise (behind-the-firewall) software.

GXS Managed Services Solution

Our Competitive Strengths

A Leader in the Industry. We are a leading global provider of B2B cloud integration services and solutions. In business for more than 40 years, we have extensive industry experience, comprehensive solutions, a secure and reliable global network, and a large, global customer base. Since 2004, we have made significant investments in GXS Trading Grid®, our integration cloud platform, resulting in an estimated six million integration pairs, or trading partner relationships, that manages approximately twelve billion transactions annually, creating a combined trading community of over 400,000 businesses. Since we were divested from the General Electric Company (“GE”) in 2002, we believe we have consistently led innovation in the industry by introducing and delivering innovative capabilities, such as Intelligent Web Forms, Trading Grid® for Excel, ActiveSM Invoice with Compliance, SWIFT Service Bureau, and GXS RollStreamTM, that enable our customers to automate many of their mission-critical supply chain processes, driving higher business responsiveness, lowering operating costs and broadening the reach of supply chain networks and business partner relationships. Industry analyst firms began identifying our industry shortly after the launch of GXS Trading Grid® in 2004. Since then, we have regularly been positioned as a leader in industry-wide research studies.

Robust Technology Platform. In 2004, we developed a vision for the next generation B2B cloud integration platform, which became known as GXS Trading Grid®. Since 2004, we have made significant investments in building an integration cloud platform, including a multi-tenant, service oriented architecture which supports our ability to quickly build and maintain products that can be shared with multiple customers and a suite of lightweight SaaS applications for supply chain professionals and business users. We believe customers benefit from our integration cloud platform through reduced hardware and software costs, but also benefit from reduced costs to operate, maintain, and improve multi-enterprise process performance. In addition, GXS Trading Grid® has a broad set of automation capabilities that we believe can address the diverse requirements of businesses, small or large, around-the-world, resulting in improved flexibility and return-on-investment.

Scalable Global Business Infrastructure. Businesses are continuously seeking cost advantages through the globalization of their supply chains while, at the same time, entering new markets and attracting new customers. We have a leading capability to directly serve every industrialized country and most emerging markets. Our expertise in various communication protocols, domain expertise in B2B business standards, and localized country-insight into best practices, culture and language enable us to provide a leading global solution for our B2B customers. We have a direct presence in 20 countries located on five continents, with 24x7 operations support and local language support in 15 languages. Through our network of partners and distributors, we provide sales and/or technical support to customers in 30 additional countries and we have active customers in 61 countries around the world.

Diversified Business Mix. Our business and revenues are highly diversified, ensuring that we are not reliant on any individual customer, industry or geography. No single customer exceeded 4.0% of our revenues during the year ended December 31, 2011. We have extensive industry leadership, particularly in retail, consumer products, financial services, automotive and high technology. However, we believe that no single vertical accounted for more than 20.0% of our total revenues during the year ended December 31, 2011. In addition, we believe we have an unmatched international presence in our industry. We generated approximately 41.5% of our revenues for the year ended December 31, 2011, from customers outside the U.S. We have a combined trading community of over 400,000 businesses, including over 72.0% of the companies in the Fortune 500 and over 46.0% of the companies in the Global 2000.

Substantial Recurring Revenue Base and Significant Free Cash Flow Generation. Our revenue has a high degree of visibility and stability due to the recurring nature of transaction processing and software maintenance. In addition, we typically enter into multi-year contracts with our customers. As a result of our contract-based revenue and high renewal rates, we have a predictable business model. Revenue attributable to transaction processing and software maintenance fees, which tend to be recurring in nature, represented approximately 87.1% of our total revenue for the year ended December 31, 2011. The combination of our recurring revenue base, along with our scale, technology, minimal working capital needs and moderate capital expenditures, has allowed us to generate significant free cash flow.

Highly Experienced Management Team. We have an experienced and proven executive management team. On average, the members of our senior management team each have more than twenty years of experience in the software and/or service industries. Our executive management team has led various businesses through periods of rapid growth, organizational restructuring and strategic change, and has a proven record of increasing productivity and reducing costs, making strategic acquisitions and developing and maintaining strong customer relationships.

Our Growth Strategy

Our mission is to extend our segment-leading position by providing innovative, industry-focused B2B cloud integration services and solutions that enable our customers to achieve their business priorities and goals. Our customers trust us with their mission-critical supply chain and multi-enterprise business processes and hence we must operate a service that is highly reliable, scalable, and flexible. Specifically, our growth strategy focuses on four main themes:

Expand the GXS Trading Grid®. The economics of our multi-tenant, elastic technology model enable us to scale incremental volumes and customers at low marginal costs. In addition, we believe the value that we deliver to customers is enhanced as the number of business partners, supported standards, and communications protocols are increased. Our strategy is to rapidly increase the number of endpoints (such as trading partners) that connect to GXS Trading Grid® while simultaneously increasing our ability to assemble, maintain, and optimize the information flowing through GXS Trading Grid®. We intend to continue to introduce new services within GXS Trading Grid® that expand our ability to serve existing customers and improve their business performance. We will go to market primarily through our direct sales force, supplemented by strategic channel partners around the world.

| | · | On average, we believe our customers still have automated less than 50% of their trading partner relationships. We believe there is a significant opportunity to expand by connecting to partners not presently on our network. |

| | · | We believe that there remains a significant opportunity to expand our business in the U.S., which we believe represents almost 60.0% of global B2B spend. We also believe we have underserved opportunities in Europe, Asia and Brazil as demand for B2B integration services and solutions continues to increase. We also believe our direct sales force across these underserved regions has a significant opportunity to distribute software and service products. |

| | · | We believe our services and solutions portfolio can be broadened to enhance the value that we provide to our customers. For example, we have access to a large repository of data related to business transactions and process flows that we believe can be leveraged to provide business analytics tools and dashboards for our customers. |

Capitalize on Growth in Demand for Managed Services. We believe the opportunity to extend an existing B2B process or to outsource an entire B2B program is the fastest growing opportunity in our industry, driven in large part by the need for customers to effectively manage the increasing complexity and cost of their global supply chains or improve their ability to serve customers. Our Managed Services solution enables customers to effectively extend or off-load the management of their B2B operations, allowing them to focus on their core business. Our strategy leverages our leading global footprint and process domain knowledge to provide an integrated, outsourced solution at lower cost, with high quality and increased scalability. We believe this value proposition is most attractive to large or multi-national enterprises and fast-growing regional players with extensive or growing trading partner and customer communities.

We intend to further enhance our Managed Services offering by adding specialized industry applications to GXS Trading Grid® which provide enhanced visibility and control of a multi-enterprise process. However, it is not our intention to replace customer internal systems, such as Enterprise Resource Planning (“ERP”) or Customer Relationship Management (“CRM”) systems, but to complement and improve their performance. These services are designed to further integrate our solutions into the core business processes of our customers, enhancing the value of our offerings and our ability to lock-in longer term contracts with improved margins.

Specific examples of these types of enhancements to GXS Trading Grid® include:

| | · | GXS RollStreamTM – GXS RollStreamTM, our enterprise community management application, brings the human network to B2B by enabling self-registration and self-maintenance of any trading community’s participants’ information on GXS Trading Grid®, as well as enabling community and private individual collaboration within our customer’s trading community. The GXS RollStreamTM SaaS application provides our customers with more efficient enablement experience and faster issue resolution tools, enhancing our customer’s supply chain performance and visibility; and |

| | · | ActiveSM Invoice with Compliance (“AIC”) – Through our AIC service we have extended our large scale electronic invoice messaging service to include compliance with individual country taxation laws. This SaaS-based service assures our customers compliance with up to 39 different country’s electronic invoicing requirements around the globe, and offers a suite of services around the invoice document, such as content validation and enrichment, digital signature, e‐archive, and reporting. |

Enhance our Global Operating Infrastructure and Platform Capabilities. Since we first launched GXS Trading Grid® in 2004, we have made significant investments in our commercial infrastructure and capabilities. Our platform today is a leading cloud computing infrastructure that supports continuous real-time information flows, while delivering lower unit costs, enhanced scalability and high platform availability. In order to support our growth aspirations for GXS Trading Grid® and ensure we can meet the strong demand in Managed Services in the future, we are continuing to make investments in our operations environments and core platform capabilities. Key investments in these areas, which will improve our service reliability and quality, enhance the value we are able to offer our customers, and lower our operating costs through the elimination of complexity, include:

| | · | Data Center and Technology Upgrades – While historically we have run our own physical data centers, we have made a strategic decision to migrate GXS Trading Grid® technical infrastructure to two state-of-the-art AT&T Internet Data Centers which will allow us to leverage the scale investments of a leading data center operations provider. These Tier-4 data centers in Allen, Texas and Lithia Springs, Georgia provide fault tolerance levels most appropriate for 24x7 mission critical business applications, such as the ones we operate, and provide disaster recovery sites for one another. Concurrently, we are investing in technology standardization across our data center operations to better achieve consistent, scalable performance and service availability. Examples of our technology investments include: fully virtualized processing clusters, high-performance operating systems, state-of-the-art data storage systems, redundant global infrastructure, and clustered database systems. |

These data center and technology investments will allow our customers to benefit from higher service availability, in-region geographic diversity, inherent disaster recovery, and the elimination of maintenance downtime.

| | · | GXS Trading Grid® Architectural Platform Enhancements – Traditionally, when GXS Trading Grid® customers have elected to take advantage of the enhanced suite of value-added services we offer through Managed Services, we deployed these customers on separate platforms within our data centers. These separate platforms were connected to, but were not fully integrated with, GXS Trading Grid®. As Managed Services adoption has grown and the number of these separate Managed Services platforms has grown, we have had to invest significantly more time and effort in routine maintenance associated with these discrete platforms. Additionally, the lack of full integration between GXS Trading Grid® and the Managed Services platforms has made it more challenging for customers to enjoy access to the different suites of services that operate on the different platforms. |

To address this challenge, we are investing in architectural platform enhancements that will combine separate infrastructures into a single, seamlessly integrated platform. These investments will cover a wide variety of activities, principally from product design and engineering, but also will impact our professional and operational service delivery quality, our customer billing services and global support capabilities. The outcome will be lower operating costs and an ability to allow our customers to mix and match sets of services that are not easily combinable today. The enhanced architecture will also enable us to effectively monitor, analyze and report on the massive number of transactions passing through GXS Trading Grid® each day.

These architectural platform investments will deliver key benefits to our customers, including improved service reliability and quality, faster implementations and time-to-value, reduced cost, and improved global business process execution.

Selectively Pursue Strategic Acquisitions. We intend to grow the scope and scale of our business by selectively pursuing acquisitions of companies with complementary products and technologies. Our strategy focuses on acquiring businesses that will extend the number of integrated customers in new geographic or industry segments or which will improve our ability to service the information that is flowing through GXS Trading Grid®. We believe we have developed an internal competency regarding post-acquisition integration that allows us to achieve significant operating leverage when combining with the businesses that we acquire. As such, we will continue to look to acquire businesses that will increase our operational scale in existing markets as well as extend our core Managed Services offering capabilities, such as the acquisitions of Inovis and RollStream.

Our Customers

We provide our products and services to a large customer base across a number of different industries. We serve a combined trading community of over 400,000 businesses, including over 72.0% of the Fortune 500 companies and over 46.0% of the Global 2000 companies, in a broad range of industries including consumer products, financial services, manufacturing, retail, automotive, and technology. Our customers range in size from small businesses to multinational corporations. Our largest customer represented only 4.0% of our revenues in 2011, with the top 10 and top 50 customers accounting for 14.3% and 28.5% of total revenues, respectively. The customer base is also well diversified across geographies with approximately 58.5% of our revenues generated in the U.S.; approximately 21.3% in the Europe, Middle East and Africa (“EMEA”) region; approximately 10.1% in the Asia Pacific region; and approximately 10.1% in the rest of the world for the year ended December 31, 2011.

Our Competition

We compete with numerous companies both nationally and internationally. Our competitors generally include:

| | · | Internal Information Technology Departments – we believe our most significant competitor is in-house IT departments within our larger customers that attempt to “build it themselves” rather than engage with a 3rd party provider. We believe that the depth and breadth of our experience in B2B integration allow us to offer a faster, more attractive alternative to internally developed solutions which delivers higher quality at a lower cost to our customers; |

| | · | Large Software Vendors or ERP Providers – companies such as IBM, Oracle, SAP and Tibco offer B2B functionality and/or ERP extensions that provide features similar to our products, but with less functionality. We believe our solutions complement and improve the performance of on-premise software solutions, and our customers often find our cloud-based alternatives more attractive than behind-the-firewall software which involves significant internal resources and lengthy implementation cycles; |

| | · | Large Systems Integrators – companies like Accenture, HP/EDS, CSC and Hitachi offer end-to-end IT project outsourcing and development which occasionally involves B2B or supply chain functionality. Given our singular focus and expertise on B2B integration, we believe we are an attractive, ready-to-serve alternative to systems integrators attempting to build a custom solution from the ground up that may provide limited B2B functionality. In fact, we are often engaged on a sub-contracted basis by large systems integrators to provide our standard suite of B2B services to meet an end-customers’ B2B integration needs; and |

| | · | Multi-enterprise B2B Providers – companies like Sterling Commerce (IBM), Liaison Technologies, E2open and SPS Commerce provide solutions in the B2B integration space. Given our scale and segment leadership position, we believe these integration providers lack the supply chain reach and business process expertise that we are able to provide through GXS Trading Grid®. |

Our ability to compete successfully depends on multiple factors, both within and outside of our control. The principal factors are:

| | · | quality of service, including the reliability and quality of the services and solutions we offer; |

| | · | technical functionality, including delivery of innovative solutions and our speed in developing and bringing to market the next generation of services and solutions; |

| | · | global capabilities, including serving customers with operations in multiple countries; |

| | · | customer service, including our responsiveness, availability and flexibility. |

We believe that our solutions are generally competitive with regard to each of these factors.

Sales and Marketing

We market our services and solutions through our global sales force, which is organized along three lines: industry, geography and major account coverage. Our direct sales teams concentrate on developing new customers within a particular industry and region, as well as increasing the utilization and penetration of existing trading communities. Our sales teams are supported by a team of technical sales and marketing support personnel who assist in the sales process as needed. We also have resellers of our products and services in selected geographies and serving selected industry segments.

Our marketing activities are designed to build market awareness and create demand for our services and solutions through tradeshows, public relations, social media and other web-based marketing initiatives. Our product management teams manage each of our product lines and, together with our marketing communications group, focus on increasing awareness of specific services and solutions that we offer.

Our Data Infrastructure

We currently operate numerous data centers around the world through which we have developed capacity planning, engineering, implementation and disaster recovery policies. These data centers service customers on a regional and global basis and house our data processing infrastructure. We believe our data processing infrastructure is sufficient to effectively meet demand for the foreseeable future and to increase capacity as needed, and we are making significant investments in upgrading our data center locations and technology footprint, such as our planned migration of GXS Trading Grid® infrastructure to two AT&T Tier-4 data centers.

Our data infrastructure is supported by well-trained operations professionals and strict procedures and guidelines for running mission-critical applications. This includes: 1) a 24x7 global operations center to monitor operations, predict

changes, and adjust configurations as required; 2) a 24x7 global customer support organization to provide communication and problem resolution; and 3) our certified operating environments and security policies, (e.g., Statement on Standards for Attestation Engagements (“SSAE”) No. 16 certification).

Our telecommunications infrastructure is a high-speed digital network that connects us to our customers and facilitates the transport of multiple protocols via private lines and the Internet. In 2006, we entered into a network managed services agreement with Verizon Business Services, pursuant to which we outsourced our telecommunications network infrastructure. We have amended this agreement, as well as agreements with other telecommunications services providers, at various times and most recently in 2011, in response to changing business needs and to lower our telecommunications and network infrastructure costs.

Our Intellectual Property

Our success and ability to compete are dependent, in part, upon our ability to adequately protect our proprietary technology and other intellectual property. In this regard, we rely on a combination of intellectual property rights, including patents, trademarks, copyrights, trade secrets and other intellectual property directly related to and important to our business. We also protect our proprietary technology, intellectual property and confidential information through the use of internal and external controls, including nondisclosure and confidentiality agreements with employees, contractors, business partners and advisors. Our policy is to apply for patents with respect to our technology and seek trademark registration of our marks from time to time when management determines that it is competitively advantageous and cost effective to do so.

In the U.S., we own 14 issued patents, one pending patent application, 13 registered trademarks and approximately 100 registered copyrights. We also own a number of registered foreign trademarks and service marks.

While we do not believe that any one single patent, trademark, copyright or license is material to the success of our business as a whole, in the aggregate, these patents, trademarks, copyrights and licenses are material to our business.

Our Employees

As of December 31, 2011, we had 2,424 full-time employees. These employees consisted of:

| | · | 1,934 technical personnel engaged in maintaining or developing our services and solutions or performing related services; |

| | · | 197 administrative, finance and management personnel; and |

| | · | 293 marketing, sales and sales support personnel. |

As of December 31, 2011, 1,056 of these employees were located in the U.S., and the remaining 1,368 of our employees were in various other locations around the world, including: 609 employees in the Philippines; 201 employees in India; 170 employees in the United Kingdom (“U.K.”); and 167 employees in Brazil. We also had 329 full-time contractors, mostly in technical roles. None of our U.S. employees are represented by a labor union. We have not experienced any work stoppages and consider our employee relations to be good.

Our Facilities

We currently lease approximately 83,737 square feet of office space for our corporate headquarters, which is located in Gaithersburg, Maryland. The lease on our corporate headquarters office space expires in 2021. We have subleased our former headquarters consisting of approximately 342,000 square feet of office space, also located in Gaithersburg, Maryland (the “Former Headquarters”). The subtenant also has the option to purchase the Former Headquarters any time prior to April 1, 2014, which, if exercised, would terminate both the sublease and the primary lease of the Former Headquarters.

Our main data center is a 104,000 square foot facility located in Brook Park, Ohio, which we own. We also lease a 54,000 square foot data center in Amstelveen, Netherlands, which expires in 2013 subject to certain renewal options, and portions of data center facilities located in Lithia Springs, Georgia and Allen, Texas, both of which expire in 2014 and are also subject to certain renewal options.

While our corporate headquarters are located in Gaithersburg, Maryland, we lease more than a dozen offices located throughout the U.S. and 28 offices within 19 foreign countries. Many of our offices serve multiple functions including sales, service implementation, customer service, and administrative support. We maintain a customer service center at our corporate headquarters to support primarily our North American customers. We also provide customer support from other U.S. office locations and customer service centers and/or customer service representatives in various locations in Europe, Asia and Brazil to support customers on a regional basis and in Manila, the Philippines, providing global first tier support.

The location, relative size and year the current lease expires for our larger U.S. office facilities as of December 31, 2011, along with summarized information for the smaller U.S. offices (defined as less than 10,000 square feet), is provided below:

| U.S. Office Facilities |

City | State | Size in Square Feet | Year the Lease Expires |

| Gaithersburg | Maryland | 83,737 | 2021 |

| Alpharetta | Georgia | 53,501 | 2022 |

| Emeryville | California | 17,392 | 2014 |

| Tampa | Florida | 16,511 | 2013 |

| Raleigh | North Carolina | 12,132 | 2014 |

| Concord | California | 11,708 | 2017 |

| Dallas | Texas | 10,924 | 2012 |

| Seven additional offices in six states, each under 10,000 square feet | Approx. 38,000 | 2012 - 2016 |

The location, relative size and year the current lease expires for our larger international office facilities as of December 31, 2011, along with summarized information for the smaller international offices (defined as less than 10,000 square feet), is provided below:

| International Office Facilities |

City | Country | Size in Square Feet | Year the Lease Expires |

| Manila | Philippines | 59,489 | 2015 |

| Bangalore | India | 29,850 | 2016 |

| Sunbury | United Kingdom | 19,605 | 2014 |

| Sao Paulo | Brazil | 16,146 | 2016 |

| Sunbury | United Kingdom | 14,937 | 2012 |

| Cologne | Germany | 11,836 | 2012 |

| Twenty additional offices in fifteen countries, each under 10,000 square feet | Approx. 53,000 | 2012 - 2016 |

Our Corporate Structure

Our corporate structure can be summarized as follows:

_____________________

| 1. | Direct foreign subsidiaries of GXS, Inc. include foreign entities that were subsidiaries of Inovis International, Inc. prior to the Merger, which became wholly owned subsidiaries of GXS, Inc. following the Merger. GXS, Inc. is a 100% shareholder of the majority of its direct and indirect foreign subsidiaries with the primary exceptions of GXS, Inc. (Korea) (85.0%) and EC1 Pte Ltd. (Singapore) (81.0%). |

Percentages are based on outstanding common stock as of December 31, 2011. Francisco Partners and its co-investors indirectly own approximately 68.1% of our outstanding common stock and Golden Gate Capital (and its affiliates) and Cerberus Partners (and its affiliates), private equity firms and the principal investors in Inovis prior to the Merger, each indirectly own approximately 11.8% of our outstanding common stock.

One member of our board of directors is appointed by, and is a partner of, Golden Gate Capital and one member is appointed by, and is a partner of, Cerberus Partners. The remaining seven members are appointed by Francisco Partners, including our current President and Chief Executive Officer.

Corporate Information

The Company, GXS Worldwide, Inc. (formerly GXS Corporation), was incorporated in Delaware on September 9, 2002. Our principal executive offices are located at 9711 Washingtonian Boulevard, Gaithersburg, Maryland, and our telephone number is (301) 340-4000. We maintain a website at www.gxs.com. Information contained on our website is not incorporated by reference into this Annual Report on Form 10-K, or any other report filed with the SEC.

If any of the following risks occur, our business, results of operations or financial condition could be materially adversely affected. You should read the section captioned “Forward-Looking Statements” for a discussion of what types of statements are forward-looking as well as the significance of such statements in the context of this Annual Report on Form 10-K. The risks described below are not the only ones we face. Additional risks of which we are not presently aware or that we currently believe are immaterial may also harm our business, results of operations or financial condition.

Risk Factors Related to our Business

We have incurred substantial losses since inception and we cannot guarantee that we will become profitable in the future.

We have incurred substantial losses since our acquisition by Francisco Partners and its co-investors in September 2002 primarily as a result of interest expense related to our indebtedness. As a result, we had a total accumulated deficit of approximately $264.3 million as of December 31, 2011. We may continue to incur losses and we cannot guarantee that we will report net income in the future.

Companies’ decisions to make significant expenditures on information technology may reduce demand for our products and services and caused our revenue to decline.

There can be no assurance that the level of spending on information technology in general will increase or remain at current levels in future periods. Lower spending on information technology or companies ceasing to outsource these services could result in reduced sales, reduced overall revenue and diminished margin levels and could impair our operating results in future periods. Decisions by our customers to defer investments in new technology solutions and software systems may cause a decrease in sales and may result in additional pricing pressure, which could have a material adverse effect on our business, results of operations and financial condition.

The markets in which we compete are highly competitive.

The markets for our products and services are increasingly global and competitive. As a result, we encounter intense competition in all parts of our business. We expect competition to increase in the future both from existing competitors and new companies that may enter our markets. In addition, we experience competition from in-house information technology departments when companies are determining whether to continue to outsource these services or perform them in-house. To remain competitive, we will need to invest continuously in product development, marketing, customer service and support and our service delivery infrastructure. However, we cannot be certain that new or established competitors or in-house information technology departments will not offer products and services that are superior to or lower in price than ours. We may not have sufficient resources to continue to invest in all areas of product development and marketing needed to maintain our competitive position. Although we have historically had a high customer retention and renewal rate, there can be no guarantee that we will continue to maintain this rate of retention and renewal in the future. In addition, in order to retain certain customers we have had to make certain pricing concessions and we expect this trend to continue.

We may need to change our pricing models to compete successfully.

The intense competition we face in the sales of our products and services and general economic and business conditions can put pressure on us to lower our prices. For example, as our Messaging Services business has become more commoditized, we have experienced pressure to reduce prices. In addition, although many of our customers in our Managed Services business are subject to long-term contracts, they expect to share in the benefits of the decreasing cost of providing some of the services on the Managed Services platform. This often results in additional price pressure when these contracts come up for renewal.

If our competitors offer deep discounts on certain products or services or develop products and services that the marketplace considers more valuable, we may need to lower prices further or offer other favorable terms in order to compete successfully. Furthermore, a shift by our customers towards products and services that are less expensive may also adversely affect pricing for our products. Any such changes could have a material adverse effect on our business, results of operations and financial condition.

Our inability to adapt to rapid technological change could impair our ability to remain competitive.

The industry in which we compete is characterized by rapid technological change, frequent new product and service introductions and evolving industry standards. Our future success will depend in significant part on our ability to anticipate industry standards and to continue to enhance existing products and services and introduce and acquire new products and services on a timely basis to keep pace with technological developments. We expect that we will continue to incur significant expenses in the design, development and marketing of new products and services. Our competitors may implement new technologies before we are able to implement them, allowing our competitors to provide more effective products and services at lower prices.

We cannot provide assurance that we will be successful in developing, acquiring or marketing new or enhanced products or services that respond to technological change or evolving industry standards, that we will not experience difficulties that could delay or prevent the successful development, acquisition or marketing of such products or services or that our new or enhanced products and services will adequately meet the requirements of the marketplace and achieve market acceptance. Any delay or failure in the introduction of new or enhanced products or services, or the failure of such products or services to achieve market acceptance, could have a material adverse effect on our business, results of operations and financial condition.

Risks associated with the Internet, changing standards, alternate technologies, competition, taxation, regulation and associated compliance efforts may adversely impact our business.

The use of the Internet as a vehicle for electronic data interchange, or EDI, and related services currently raises numerous issues, including reliability, data security, data integrity and rapidly evolving standards. New competitors, which may include media, software vendors and telecommunications companies, offer products and services that utilize the Internet in competition with our products and services and may be less expensive or process transactions and data faster and more efficiently. Internet-based commerce is subject to increasing regulation by federal, state and foreign governments, including in the areas of data privacy and breaches. Laws and regulations relating to the solicitation, collection, processing or use of personal or consumer information could affect our customers’ ability to use and share data, potentially reducing demand for Internet-based solutions and restricting our ability to store, process and share data through the Internet. Taxation of services provided over the Internet and governmental restrictions on Internet usage may be imposed in jurisdictions where we operate. Although we believe that the Internet will continue to provide opportunities to expand the use of our products and services, we cannot ensure that our efforts to exploit these opportunities will be successful or that increased usage of the Internet for business integration products and services or increased competition, taxation and regulation will not adversely affect our business, results of operations and financial condition.

A global economic downturn, like the one experienced in 2008, could adversely affect our business, results of operations and financial condition.

A broad sustained deterioration of economic conditions and/or disruptions in the credit, financial and currency markets worldwide will likely have a negative impact on our business, results of operations and financial condition. In particular, we would be materially adversely affected by any deterioration of economic conditions in the U.S., Europe and Asia because we derive a substantial portion of our revenue in these geographic regions.

Business disruptions could adversely affect our business, results of operations and financial condition.

Unexpected events, including natural disasters and severe weather events, could increase the cost of doing business or otherwise harm our business or our customers’ businesses. It is not possible for us to predict the occurrence or consequence of any such events. However, such events could reduce demand for our products and services or make it difficult or impossible for us to deliver our products and services to our customers.

We operate internationally, which exposes us to risks that are difficult to quantify.

Sales of our products and services outside the U.S. are significant. For the year ended December 31, 2011, we derived approximately 41.5% of our total revenues from customers outside of the U.S. Our ability to operate our business internationally in the future will depend upon, among other things, our ability to attract and retain talented and qualified

managerial, technical and sales personnel, our ability to sell to customers outside of the U.S. and our ability to continue to manage our international operations. International operations are subject to the risks inherent in doing business abroad, including:

| | · | currency exchange rate fluctuations and changes in the proportion of our revenue and expenses denominated in foreign currencies; |

| | · | unexpected changes in laws, regulatory requirements and enforcement, including with respect to data protection and privacy, and the associated costs of compliance; |

| | · | longer payment cycles for collecting accounts receivable; |

| | · | potentially adverse tax consequences from operating in multiple jurisdictions; |

| | · | difficulties in repatriating earnings; |

| | · | political, social and economic instability; |

| | · | global and regional economic slowdowns; |

| | · | power supply stoppages and shutdowns; |

| | · | localization of our products and services, including foreign language translation and support; |

| | · | difficulties in staffing and managing foreign operations and other labor problems; |

| | · | the increased travel, infrastructure and legal compliance costs associated with managing multiple international locations; |

| | · | seasonal reductions in business activity in the summer months in Europe and other regions; |

| | · | the credit risk of local customers and distributors; and |

| | · | potential difficulties in protecting intellectual property rights. |

Furthermore, the sale and shipment of products and the sale and provision of services across international borders subject us to extensive U.S. and foreign governmental trade regulations. Compliance with such regulations is costly and exposes us to penalties for non-compliance. Other laws and regulations that can significantly impact us include various anti-bribery laws, such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act, laws restricting business with suspected terrorists and anti-boycott laws. Any failure to comply with applicable legal and regulatory obligations could impact us in a variety of ways that include, but are not limited to, significant criminal, civil and administrative penalties, including imprisonment of individuals, fines and penalties, denial of export privileges, seizure of shipments and restrictions on certain business activities. Also, the failure to comply with applicable legal and regulatory obligations could result in the disruption of our shipping and sales activities.

Because we operate internationally, our results of operations may be affected by currency fluctuations.

Although the U.S. dollar is our reporting currency, a significant portion of our business is conducted in currencies other than the U.S. dollar, including but not limited to the Euro, British pound, Brazilian real, Japanese yen, Australian dollar and Canadian dollar. Approximately 41.5% of our consolidated revenue in 2011 was attributable to operations in non-U.S. dollar countries and translated into the U.S. dollar for reporting purposes. As a consequence, period-to-period changes in the average exchange rate in a particular currency versus the U.S. dollar can significantly affect reported revenue and, to a lesser degree, operating results. In general, appreciation of the U.S. dollar relative to another currency has a negative effect on reported results of operations, while depreciation of the U.S. dollar has a positive effect, although such effects may be short term in nature. We continually monitor our exposure to currency risk; however we have no foreign currency hedging instruments in place. See the section captioned “Foreign Currency Risk” within “Item 7A—Quantitative and Qualitative Disclosures about Market Risk”.

Because much of our operations are conducted, and most of our assets are held, by our subsidiaries, we depend on our subsidiaries for cash and to service our debt.

Substantially all of our operations are conducted through our domestic and foreign subsidiaries. Consequently, our cash flow and ability to service our debt obligations, including the notes, are dependent upon the earnings of our operating subsidiaries and the distribution of those earnings to us, or upon loans, advances or other payments made by our subsidiaries to us. The ability of our subsidiaries to pay dividends or make other payments or advances to us will depend upon their operating results and will be subject to applicable laws and contractual restrictions contained in the instruments governing their debt. Although our revolving credit facility (the “Revolver”) and the indenture that governs the notes limit the ability of these subsidiaries to enter into consensual restrictions on their ability to pay dividends and make other payments to us, these limitations are subject to a number of significant qualifications. We cannot provide assurance that the earnings of our operating subsidiaries will be made available to us in an amount sufficient for us to service our debt obligations or meet our other obligations as they become due.

Our products and services may not achieve market acceptance, which could cause our revenue to decline.

Deployment of our products and services requires interoperability with a variety of software applications and systems and, in some cases, the ability to process a high number of transactions. If our products and services fail to satisfy these demanding technological objectives, our customers may be dissatisfied and we may be unable to generate future sales. Failure to establish a significant base of customer references will significantly reduce our ability to sell our products and services to additional customers.

We are frequently required to enhance and update our products and services as a result of changing standards and technological developments, which makes it difficult to recover the cost of development and forces us to continually qualify new products with our customers.

For our products to be competitive, we must be among the first to market with next-generation products. Over the last several years, the rate at which new technological developments have been introduced into the market has grown at a much more rapid pace than it had previously. Continually updated standards for the electronic exchange of information, such as those issued by the American National Standards Institute, have required us to produce frequent enhancements to our products and services and provide some of our value-added solutions and related software with additional functionality. The frequency with which we must enhance our products makes it more difficult for us to recover the costs associated with product development because those costs must be recovered over increasingly shorter periods of time. We expect this trend to continue, and it may even accelerate. As a result, we may not be able to recover all of our product development costs, which could affect our profitability. Any failure or delay in our product development or quality assurance process could result in our losing sales until we are able to introduce the new product.

We may experience product failures or other problems with new products, all of which could adversely impact our business.

Software products and application-based services as complex as those we offer may contain undetected errors or failures when first introduced or when new versions are released. If software errors are discovered after introduction, our software licensees may seek to assert claims of liability. We also could experience delays or lost revenues during the period required to correct the errors or loss of, or delay in, market acceptance, which could have a material adverse effect on our business, results of operations and financial condition.