|

| |

| Management's Discussion and Analysis | |

| For the three months and year ended September 30, 2013 |

December 11, 2013

The following discussion of the financial condition and results of operations of The Cash Store Financial Services Inc. (“Cash Store Financial” or “Company”) should be read in conjunction with the Company’s audited consolidated financial statements for the year ended September 30, 2013.

The Company’s board of directors (the “Board of Directors”), on the recommendation of the Company’s audit committee (the “Audit Committee”), approved the content of this MD&A on December 11, 2013.

All figures are presented in thousands of Canadian dollars, unless otherwise specified, and are reported in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

|

| |

| Table of Contents | |

| The Business | |

| Strategy | |

| Performance | |

| Selected Annual Information | |

| Results of Operations | |

| Summary of Quarterly Results | |

| Fourth Quarter | |

| Liquidity and Capital Resources | |

| Off-Balance Sheet Arrangements | |

| Other Financial Information | |

| Controls and Procedures | |

| Risks and Uncertainties | |

Other Information

Additional information about Cash Store Financial, including our annual information form, information circular, and annual and quarterly reports, is available on SEDAR at www.sedar.com and EDGAR at http://www.sec.gov/edgar.shtml.

Non-GAAP Performance Measures

Throughout this MD&A, terms that are not specifically defined under U.S. GAAP are referenced and used. These non-U.S. GAAP measures may not be comparable to similar measures presented by other companies. These non-U.S. GAAP measures are presented because the Company believes that they provide investors with additional insight into the Company’s financial results. For a definition of these measures, refer to the subsection entitled "Non-GAAP Performance Measures".

Note

Cash Store Financial is a Canadian corporation and is not affiliated with Cottonwood Financial Ltd. or the outlets Cottonwood Financial Ltd. operates in the United States under the name “Cash Store”. Cash Store Financial does not conduct business under the name “Cash Store” in the United States and does not own or provide any consumer lending services in the United States.

Forward-Looking Information

In order to help investors understand the Company’s current results

and future prospects, this MD&A includes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States federal securities legislation. Management refers to these types of statements collectively, as “forward-looking information”. Forward-looking information includes, but is not limited to: information with respect to our objectives, strategies, operations and financial results, competition; initiatives to grow revenue or reduce retention payments and other costs; the Company's strategy to enable customers to access mainstream credit products in the section entitled "Strategy"; and the Company's financial results in the sections entitled "Performance" and "Liquidity and Capital Resources."

Forward-looking information can generally be identified by the use of words such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases. They may also be identified by statements that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied. These risks and uncertainties may include (but are not limited to) changes in economic and political conditions, legislative or regulatory developments, technological developments, third party arrangements, competition, litigation, market conditions, the availability of alternative transactions, shareholder, legal, regulatory and court approvals and third party consents and other factors described under the heading “Risks and Uncertainties”.

Management has attempted to identify the important factors that could cause actual results to differ materially from those contained in forward-looking information, but other factors unknown to us at the time of writing could cause results to vary. There can be no assurance that forward-looking information will prove to be accurate. Actual results could differ materially. Management cautions readers not to place undue reliance on forward-looking information. Unless required by law, the Company does not undertake to update any forward-looking information.

| 2 |

FY2013 Management’s Discussion & Analysis

The Business

NOTE: This section contains forward-looking information. By its nature, forward-looking information requires that certain assumptions be made and is subject to inherent risks and uncertainties. Please see "Forward-Looking Information" and "Risks and Uncertainties" for additional information on the factors that could cause results to vary.

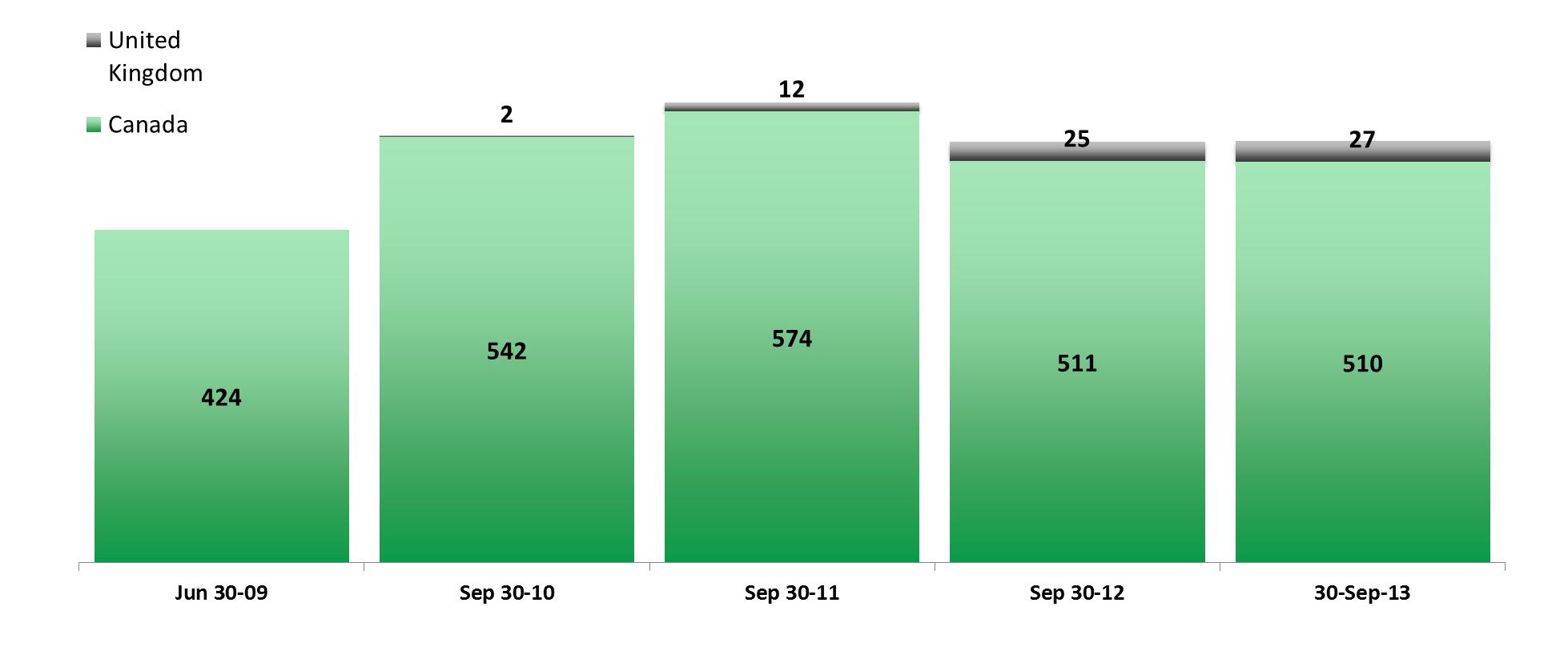

Cash Store Financial is a leading provider of alternative financial products and services, serving everyday people for whom traditional banking may be inconvenient or unavailable. The Company owns and operates Canada’s largest network of retail branches in the alternative financial products and services industry, with 510 branches across Canada under the banners “Cash Store Financial”, “Instaloans” and “The Title Store.” Cash Store Financial also owns and operates 27 branches in the United Kingdom (the "UK") under the banner “Cash Store Financial”.

The Company is listed on both the Toronto Stock Exchange (TSX:CSF) and New York Stock Exchange (NYSE:CSFS).

Cash Store Financial acts as both a broker and lender of short-term advances and offers a range of other products and services to help customers meet their day to day financial service needs. The Company employs a combination of payday loans and lines of credit as its primary consumer lending product offerings and earns fees and interest income on these consumer lending products. Cash Store Financial also offers a wide range of financial products and services including bank accounts, prepaid MasterCard, private label credit and debit cards, cheque cashing, money transfers, payment insurance and prepaid phone cards. The Company has agency arrangements with a variety of companies to provide these products.

The table below illustrates the Company’s primary consumer lending offerings summarized by jurisdiction since October 1, 2011:

|

| | | | | | | | | | |

| Jurisdiction | | Branches | | Oct 1, 2011 to Jan 31, 2012 | | Feb 1, 2012 to Sep 30, 2012 | | Oct 1, 2012 to Jan 31, 2013 | | Feb 1, 2013 to Present |

| | | | | | | | | | | |

| British Columbia, Alberta Saskatchewan Nova Scotia | | 278 | | Payday Loans (Brokered) | | Payday Loans (Direct Lending) |

| | | | | | | | | |

| Manitoba | | 25 | | Payday Loans (Brokered) | | Payday Loans (Direct Lending) | | Lines of Credit (Brokered) |

| | | | | | | | | | | |

| Ontario | | 174 | | Payday Loans (Brokered) | | Payday Loans (Direct Lending) | | Lines of Credit (Brokered) |

| | | | | | | | | | | |

| New Brunswick Newfoundland Prince Edward Isl. Yukon / NWT | | 33 | | Payday Loans (Brokered) |

| | | | | |

| United Kingdom | | 27 | | Payday Loans (Direct Lending) |

Regulatory Environment

Management views regulations affecting its primary product offerings of payday loans and lines of credit as the most critical factor affecting the Company's ability to successfully operate and execute its business strategy.

In Canada, certain provinces have developed regulations specific to payday loans. The key components of payday loan regulations are caps on the loan size, length and fees that can be charged. Typically regulations limit payday loans to a maximum of $1,500 and 62 days in duration, as well as providing a rate cap. The following table shows the rate caps in the provinces where the Company currently offers payday loans:

| 3 |

FY2013 Management’s Discussion & Analysis

|

| |

| Province | Rate Cap

(per $100) |

| British Columbia | $23 |

| Alberta | $23 |

| Nova Scotia | $25 |

| Saskatchewan | $23 |

The Company is subject to class action proceedings initiated in the Canadian provinces of British Columbia, Alberta, Saskatchewan, Manitoba and Ontario, alleging non-compliance with rate caps in those provinces. The Company believes that it has complied with all applicable provincial regulations and is defending these actions vigorously.

The Company's newly introduced primary product offering of lines of credit in Ontario, where approximately one third of the Company's branch network is located, has been subject to examination by the Ontario Minister of Consumer Services and the Registrar of payday loans (the "Ontario Regulator"), who is responsible for regulating the payday loans sector in that province. The Ontario Regulator has proposed amended regulations which may capture the lines of credit under the existing Payday Loans Act and may require the Company to re-apply for licenses to continue to offer its products and comply with payday loans regulations. The new regulations do not propose a rate cap for the lines of credit. The Ontario Regulator is currently considering industry feedback on the proposed amendments and the content and timing of such amended regulations is not yet known.

The UK does not currently have specific regulations for payday loans, however in April 2014 the Financial Conduct Authority ("FCA") will assume responsibility for regulating the sector. The FCA has proposed new payday lender measures that will include limiting to two the number of loan rollovers and the number of times that lenders can access a borrower’s bank account for payment, both of which have an implementation date of July 1, 2014. The FCA will also require a borrower affordability assessment before payday lenders can extend a loan and will require that lenders include clear risk warnings on advertisements. In addition, the FCA plans to put in place dedicated supervision and enforcement teams. The FCA opened its proposed rules for comment and is expected to publish final guidance in February 2014. The Company has obtained interim licenses to operate as a payday lender in the UK in advance of the regulations. On November 25, 2013, legislators in the UK announced that a rate cap setting power for payday loans will be included through amendments to the Banking Reform Bill which is currently before the House of Lords. It has been reported that the rate cap will be set by the FCA and address the total cost of borrowing. The Banking Reform Bill is expected to receive final reading on December 9, 2013 and rate caps are expected to come into force during 2015.

Loan rollovers (extensions of existing loans for a fee and/or provision of new loans to pay out previous loans) are prohibited in certain Canadian provinces. Cash Store Financial does not engage the practice of rollovers in any Canadian province and limits the number of rollovers to four for consumers in the UK. Although the proposed regulations in the UK would represent a change from current practice, the Company does not expect a material negative impact given that only approximately 5% of its branch network is located in the UK.

Please see "Risks and Uncertainties" for additional information on regulations and litigation.

Giving Back

Cash Store Financial is proud to be partnered with the Canadian Diabetes Foundation. Part of the Company’s fundraising activities is to host Freedom Runs across Canada. In FY2013, Cash Store Financial hosted 15 Freedom Runs and sponsored 5 runs for diabetes. To date, these efforts have helped contribute over $1 million to this cause.

| 4 |

FY2013 Management’s Discussion & Analysis

Strategy

NOTE: This section contains forward-looking information. By its nature, forward-looking information requires that certain assumptions be made and is subject to inherent risks and uncertainties. Please see "Forward-Looking Information" and "Risks and Uncertainties" for additional information on the factors that could cause results to vary.

The Company’s long-term goal remains unchanged: to become the premier financial service provider to consumers in its target market by complementing the products and services of traditional banks and providing a step up for those consumers who do not have access to traditional bank products.

A Look Back

The Company's objective for FY2013 was to continue to move upstream by building on its differentiated branch environment, introducing new products and services that will maintain customer relationships for longer time periods and shifting the focus from short-term payday loans to longer term line of credit products.

In keeping with this objective, on October 1, 2012 and February 1, 2013, the Company launched a new suite of line of credit products in Manitoba and Ontario, respectively, and payday loans are no longer being offered in those provinces at this time. The lines of credit are traditional, unsecured, medium-term revolving credit lines, with regular minimum payments tailored to customers’ needs and profiles. This suite of line of credit products enables consumers to move up the credit ladder toward credit-scored products that will eventually enable access to other mainstream lending products.

The lines of credit were designed to offer the following benefits:

|

| | |

| Benefits to Consumers | Public Policy Objectives | Benefits for the Company |

- Access to flexible credit products that did not previously exist in the marketplace - Lower credit costs through a graduated line of credit suite that rewards good payment behavior - Ability to reduce borrowing costs that will improve overall indebtedness

- Opportunities to rebuild credit

| - Bring consumers with no, limited, or poor credit into mainstream economic products - A mechanism for consumers to save money and rebuild their creditworthiness - Innovative products for the underserved lower-end of the credit market - Reduce indebtedness and encourage savings

| - Diversification beyond payday lending and a growing recognition as a full-service financial services provider - Access to a broader segment of the consumer market - Delivery of a broader spectrum of financial services products

- Extended customer relationships reduces high acquisition costs and adds incremental revenue

- Uniform platform and delivery of consistent consumer experience

|

In Manitoba and Ontario, the Company has graduated customers from its Basic line of credit to its Progressive line of credit that offers better rates and more flexible minimum repayment terms. These lines of credit supplement the Company’s lowest cost Elite line of credit that has been offered to qualifying customers across Canada starting in Q1 of FY2012.

| 5 |

FY2013 Management’s Discussion & Analysis

The following is a summary of the Company's progress in relation to the four strategic priorities in FY2013:

|

| |

| Element | Progress |

| Platform & Distribution Growth | |

- Continue to optimize branch operations.

- Continue methodical expansion into underserved markets.

- Grow branch network through training and incentive programs.

- Develop online lending platform and internet presence. | - Increased revenue per branch compared to the same period last year.

- Launched consumer testing for online payday lending in Alberta and in the UK. Hired Dean Ozanne, an experienced banking executive, as Senior VP of Virtual Operations and Innovation.

- Hired Michael Baker, and experienced executive in the financial services and banking sector as Senior VP of Canadian Operations. - Launched "the Title Store" banner in Alberta brokering short term loans secured against motor vehicles in 10 locations. |

| Product Growth | |

- Continue to focus on other financial products and services.

- Continue to move upstream and bridge the gap between payday loans and the products of traditional banks.

- Help customers achieve greater financial freedom through graduated products at reduced costs that will help them rebuild their credit. | - Introduced new lines of credit in Manitoba and Ontario that will help customers rebuild their credit rating.

- Graduated customers in Manitoba and Ontario from the Basic line of credit to the lower cost Progressive line of credit. |

| Improved Margin Management | |

- Continue to focus on cost savings and branch operating metrics.

- Improve collections. | - Reduction in sales expenses of 8% compared to last year. |

| Financial Risk Management and Funding Model |

| - Continue to proactively manage risk to protect Cash Store Financial from changes in funding markets, interest rate, currency fluctuations and regulatory environment. | - Exited from direct lending of payday loans in Manitoba and Ontario and introduction of brokered lines of credit. |

| 6 |

FY2013 Management’s Discussion & Analysis

The Road Ahead

In FY2013, the Company made significant progress in key areas that lay the foundation for transforming the business for the future, including the transition to lines of credit and new product introductions.

The Company will continue to move upstream by building on its differentiated branch environment and expanding new products and services that will maintain customer relationships for longer time periods and shifting the focus from short-term payday loans to longer term line of credit products.

Management has worked closely with the Board of Directors to develop a tactical plan of actions and accountabilities for FY2014. Progress towards the achievement of the tactical plan is monitored monthly. The strategies addressed in this tactical plan for FY2014 include:

Financial Priorities

| |

| • | Growth in loan fees with the roll-out of a suite of line of credit products to attract new customers. |

| |

| • | Grow other income by developing other service offerings such as bank accounts, payment card products, payment insurance that focus on providing long term value for customers and result in increased customer retention. |

| |

| • | Reduce corporate expenses through a reduction in external professional fees. |

| |

| • | Stabilize and reduce credit losses through improvements in underwriting and operational improvements in branch and centralized collections processes. |

| |

| • | Improve UK financial performance through customer growth and more cost effective business partners to provide other financial products and service offerings. |

Growth Opportunities

| |

| • | Carefully pursue UK growth through branch network growth. |

| |

| • | Grow revenue from the Title Store through network expansion and marketing to existing customer base. |

| |

| • | Complete testing phase of online lending in the UK and Canada and expand online lending volumes profitably through a "bricks and clicks" strategy to leverage the Company's existing physical branch network. |

| 7 |

FY2013 Management’s Discussion & Analysis

Performance

NOTE: This section contains forward-looking information. By its nature, forward-looking information requires that certain assumptions be made and is subject to inherent risks and uncertainties. Please see "Forward-Looking Information" and "Risks and Uncertainties" for additional information on the factors that could cause results to vary.

FY2013 consolidated revenue of $190.8 million increased by 1.8% compared to $187.4 million in FY2012 despite a 2.0% decline in loan volume. Loan fee revenue increased by $14.4 million, offsetting a reduction in other income of $11.1 million. FY2013 revenue from Canadian operations increased by $3.2 million while revenue from UK operations was flat compared to FY2012.

Branch sales expenses of $110.4 million for the year ended Sept 30, 2013 decreased by 8% compared to $120.5 million in the same period last year as a result of the 63 branch consolidations that occurred during FY2012 and an increased focus on cost control.

On an adjusted basis, the FY2013 provision for credit losses as a percentage of direct loan volume was stable at 5.2% compared to 5.1% in FY2012. As of September 30, 2013, the Company recorded an additional provision for credit losses of $5.2 million resulting from a change in estimation methodology to charge-off advances at 90 days past due.

Retention payments increased to 4.8% of brokered loan volume in FY2013 compared to 3.6% in FY2012 as a result of the Company's efforts to manage its overall credit loss exposure to third-party lenders.

EBITDA for FY2013 was negative $1.0 million, up from negative $31.7 million in FY2012. Significant items that impacted FY2013 reported EBITDA were as follows:

| |

| • | A reduction in other income; |

| |

| • | Increased provision for credit losses resulting from the estimation methodology change to charge-off advances at 90 days past due; |

| |

| • | Impairments on acquired advances and certain long-lived assets; |

| |

| • | Increased corporate salaries and legal costs; |

| |

| • | Costs associated with restatements of previously issued financial statements and the special investigation; and |

| |

| • | Allowances for significantly aged receivables from a vendor. |

In FY2012, the Company recorded $44.8 million of charges, primarily comprised of a $36.8 million expense for the settlement of pre-existing relationships with third-party lenders and $5.0 million related to asset impairments and branch consolidations.

Diluted EPS for FY2013 was a $2.02 loss compared to a loss of $2.50 in FY2012.

Cash at September 30, 2013 decreased by $7.7 million to $11.5 million from $19.1 million at September 30, 2012. Cash used in operating activities during FY2013 was negative $0.7 million, down from $15.0 million provided by operating activities in FY2012. The Company has secured credit facilities subsequent to September 30, 2013 to assist in meeting ongoing working capital requirements and fund strategic growth initiatives.

| 8 |

FY2013 Management’s Discussion & Analysis

Selected Annual Information |

| | | | | | | | | | | | | |

| ($000s, except for per share amounts, number of loans and branch count) | | | | Year Ended September 30, 2012 |

| | Year Ended September 30, 2013 |

| | 2013 vs. 2012 % change |

|

| Consolidated results | | | | | | | | |

| No. of branches | | Canada | | 511 |

| | 510 |

| | — | % |

| | | United Kingdom | | 25 |

| | 27 |

| | 8 | % |

| | | | | 536 |

| | 537 |

| | — | % |

| | | | | | | | | |

| Loan volume | | Direct | | $ | 517,075 |

| | $ | 540,427 |

| | 5 | % |

| | | Brokered | | 280,637 |

| | 241,371 |

| | (14 | )% |

| | | | | 797,712 |

| | 781,798 |

| | (2 | )% |

| Revenue | | | | | | | | |

| Loan fees | | | | $ | 137,994 |

| | $ | 152,430 |

| | 10 | % |

| Other income | | | | 49,418 |

| | 38,335 |

| | (22 | )% |

| | | | | 187,412 |

| | 190,765 |

| | 2 | % |

| | | | | | | | | |

| Sales expenses | | | | | | | | |

| Salaries and benefits | | | | 65,944 |

| | 58,653 |

| | (11 | )% |

| Rent | | | | 18,940 |

| | 18,581 |

| | (2 | )% |

| Selling, general and administrative | | | | 23,595 |

| | 20,449 |

| | (13 | )% |

| Advertising and promotion | | | | 5,180 |

| | 6,307 |

| | 22 | % |

| Depreciation of property and equipment | | 6,843 |

| | 6,366 |

| | (7 | )% |

| | | | | 120,502 |

| | 110,356 |

| | (8 | )% |

| | | | | | | | | |

| Provision for credit losses | | | | 31,004 |

| | 36,607 |

| | 18 | % |

| Retention payments | | | | 9,968 |

| | 11,659 |

| | 17 | % |

| Corporate expenses | | | | 22,684 |

| | 38,142 |

| | 68 | % |

| Interest expense | | | | 12,339 |

| | 18,583 |

| | 51 | % |

| Branch closures costs | | | | 1,574 |

| | 123 |

| | (92 | )% |

| Impairment of property and equipment | | | | 3,425 |

| | 1,236 |

| | (64 | )% |

| Expense to settle pre-existing relationships with third-party lenders | | | | 36,820 |

| | — |

| | (100 | )% |

| Class action settlements | | | |

|

| | — |

| | — | % |

| Other depreciation and amortization | | | | 835 |

| | 1,794 |

| | 115 | % |

| Loss before income taxes | | | | $ | (56,877 | ) | | $ | (35,252 | ) | | (38 | )% |

| Net loss and comprehensive loss | | (43,522 | ) | | (35,532 | ) | | (18 | )% |

| EBITDA | | | | (31,722 | ) | | (992 | ) | | (97 | )% |

| Adjusted EBITDA | | | | 25,749 |

| | 22,651 |

| | (12 | )% |

| Weighted average number of shares outstanding | | - basic | | 17,432 |

| | 17,564 |

| | 1 | % |

| | | - diluted | | 17,432 |

| | 17,564 |

| | 1 | % |

| Basic earnings (loss) per share | | | | $ | (2.50 | ) | | $ | (2.02 | ) | | (19 | )% |

| Diluted earnings (loss) per share | | | | $ | (2.50 | ) | | $ | (2.02 | ) | | (19 | )% |

| Consolidated Balance Sheet Information | | | | | | |

| Working capital | | | | 58,720 |

| | 35,564 |

| | (39 | )% |

| Total assets | | | | 202,444 |

| | 164,585 |

| | (19 | )% |

| Total long-term financial liabilities | | | | 129,641 |

| | 130,623 |

| | 1 | % |

| Total long-term liabilities | | | | 137,375 |

| | 137,161 |

| | — | % |

| 9 |

FY2013 Management’s Discussion & Analysis

Results of Operations

Branches

Total branch count of 537 reflects the FY2013 addition of 2 new branches in the United Kingdom as well as 10 new Title Store branches and a new Cash Store Financial branch offset by the closure of 12 branches in Canada. During FY2012, the Company consolidated 63 branches in Canada and transferred customers from affected branches to nearby branches.

Revenue

Loan Volume

Total loan volume of $781.8 million for the year ended September 30, 2013 decreased by 2% compared to $797.7 million for the year ended September 30, 2012. The decrease in loan volume reflects tightening certain underwriting criteria on the Basic line of credit product in an effort to manage credit risk and improve operating profitability as well as the impact of the revolving portion of the lines of credit.

The Company measures loan volume based on the total principal advanced to consumers.

Loan Fees

Loan fees include payday loan fees and fees charged for the credit assessment and brokering of advances and lines of credit on behalf of consumers.

|

| | | | | | | | | |

| (000s) | | Year Ended September 30, 2012 |

| | Year Ended September 30, 2013 |

| | % Change |

| Payday loan fees | | 133,134 |

| | 112,171 |

| | (16 | )% |

| Broker and credit assessment fees on lines of credit | | 4,860 |

| | 40,259 |

| | 728 | % |

| Total Loan Fees | | 137,994 |

| | 152,430 |

| | 10 | % |

The year over year changes in the type of loan fees earned are reflective of the Company's cessation of payday loans and introduction of lines of credit in Manitoba and Ontario in FY2013. Despite the decrease in loan volume, the overall increase in loan fees of 10% is due to different revenue recognition policies between brokered and direct lending consumer advances. The Company earns its broker and credit

| 10 |

FY2013 Management’s Discussion & Analysis

assessment fees for lines of credit at the time the line of credit is brokered while fees on directly originated short-term advances are deferred and recognized over the term of the advance.

Same Branch Revenue

FY2013 same branch revenue, calculated on the branches in Canada that were open for both the FY2013 and FY2012 was $348. This represents an increase of 4.8% compared to average revenues of $332 for those branches in FY2012 and is comprised of higher loan fees earned offset by a reduction in other income.

Other Income

Other income includes late interest and fees earned on consumer lending products as well as fees earned on other financial products and services such as bank accounts, debit cards and prepaid credit cards, cheque cashing, insurance, money transfers and prepaid phone cards.

|

| | | | | | | | |

| (000s) | Year Ended September 30, 2012 |

| | Year Ended September 30, 2013 |

| | % Change |

| Fees earned on other financial products and services | 43,613 |

| | 28,611 |

| | (34 | )% |

| Interest | 4,072 |

| | 7,963 |

| | 96 | % |

| Default and other fees | 1,733 |

| | 1,761 |

| | 2 | % |

| Total other income | 49,418 |

| | 38,335 |

| | (22 | )% |

The decrease in fees earned on other financial products and services is related to the following:

| |

| • | Price reductions on prepaid debit and credit card products and bank accounts designed to increase customer benefits and promote long term customer retention to ultimately increase profitability in the long-term; |

| |

| • | An increase in consumer take up of cheques and electronic funds transfer as a form of disbursing proceeds as compared to prepaid debit and credit card products; and |

| |

| • | The cessation of a customer payment protection insurance offering on lines of credit in Ontario. |

The increases in interest and other recoveries earned is a result of the accounting treatment of acquired advances. In FY2012, the majority of interest and other recoveries were related to acquired advances and were recorded as a reduction to the acquired portion of consumer advances receivable, net. In the current period the majority of interest and default and other fees are related to direct advances and are recognized as income when received.

Sales Expenses

Sales expenses of $110.4 million for the year ended September 30, 2013 decreased by 8% compared to $120.5 million in the same period last year. The Company attributes these savings to an increased focus on cost control and to the 63 branch consolidations that occurred during FY2012.

| 11 |

FY2013 Management’s Discussion & Analysis

Credit Losses and Recoveries

The Company’s provision for credit losses recorded on the consolidated statement of operations includes all estimated uncollectible contractual principal and loan fees and impairment on acquired portfolios. The provision for credit losses is reduced by any recoveries realized after advances are charged off. Collections of late interest and fees on advances that have not been charged off are recorded in other income on the consolidated statement of operations. When evaluating the Company’s overall credit loss rate, management considers the provision for credit losses net of default and other fees recorded in other income, as follows:

|

| | | | | | | | | | | | |

| (000s) |

| Year Ended September 30, 2012 |

|

| % of

loan

vol. |

|

| Year Ended September 30, 2013 |

|

| % of

loan

vol. |

|

| Provision for credit losses |

| 31,004 |

|

| 6.0 | % |

| 36,607 |

|

| 6.8 | % |

| Default and other fees recorded in other income |

| (1,733 | ) |

| -0.3 | % |

| (1,761 | ) |

| -0.3 | % |

| Net |

| 29,271 |

|

| 5.7 | % |

| 34,846 |

|

| 6.4 | % |

Due primarily to the change in estimation methodology used to calculate the provision, credit losses net of default and other fees for the year ended September 30, 2013 increased by $5.6 million, or 0.7% of direct loan volume in comparison to the prior year.

On an adjusted basis, the provision for credit losses for FY2013 was stable at 5.2% of direct loan volume compared to 5.1% for FY2012.

For the year ended September 30, 2013, the change in estimation methodology to charge-off advances at 90 days past due was approximately $5.2 million. In addition, for FY2013 the provision for credit losses expense includes $1.5 million of impairments related to subsequent changes to the valuation of acquired advances. In FY2012, the provision for credit losses reflected a $3.0 million expense related to the UK which offsets the total increases for year over year comparative purposes.

Retention Payments

This section should be read in conjunction with "Off-Balance Sheet Arrangements".

The nature of the Company’s funding and credit loss expenses under the direct lending model differ from those under the broker model. Under the broker model, the Company makes voluntary retention payments to third-party lenders in order to offset the impact of the credit losses third-party lenders experience.

|

| | | | | |

| (000s) | Year Ended September 30, 2012 |

|

| Year Ended September 30, 2013 |

|

| Losses on acquisition of line of credit advances | — |

|

| 7,110 |

|

| Payments to offset the impact of credit losses | 9,968 |

|

| 4,549 |

|

| Total retention payments expense | 9,968 |

|

| 11,659 |

|

As a percentage of brokered loan volume, retention payments increased to 4.8% for FY2013 from 3.6% in FY2012. The increase was a result of the Company's continuing assessment of credit losses in brokered advances and the strategy to mitigate it exposures to third-party lenders with respect to this risk. IN FY2013 the Company made retention payments to third-party lenders and has repurchased line of credit advances such that its estimated maximum exposure has not increased in proportion to the level of brokering activity on a year over year basis.

| 12 |

FY2013 Management’s Discussion & Analysis

Corporate Expenses

|

| | | | | | | | |

| (000s) | Year Ended September 30, 2012 |

|

| Year Ended September 30, 2013 |

|

| %

Change |

| Salaries and benefits | 11,195 |

|

| 13,553 |

|

| 21 | % |

| Legal expenses | 2,217 |

|

| 4,980 |

|

| 125 | % |

| Audit , accounting and special investigation | 918 |

|

| 4,011 |

|

| 337 | % |

| Other | 8,354 |

|

| 15,598 |

|

| 87 | % |

| Total Corporate Expenses | 22,684 |

|

| 38,142 |

|

| 68 | % |

The increase in corporate salaries and benefits is a result of investments in staffing for new lines of business and other one-time expenses.

Legal expenses increased for FY2013 as a result of additional legal activity related to new regulatory and securities class action claims as well as reserves taken for existing litigation and claims.

Included in audit, accounting and special investigation costs for FY2013 are $1.6 million related to the restatements of previously issued financial statements, as well as $2.0 million related to the special investigation.

Included in other corporate expenses is a $4.4 million provision related to receivables from a vendor. Also included in other expenses are increases in professional fees and other public company expenses such as board fees and additional corporate rent as a result of the move to a new corporate office in Q4 of FY2012.

Refer to the section entitled “Risks and Uncertainties” for additional information on the special investigation, regulatory developments and legal proceedings and "Other Receivables" for additional information on amounts due from vendors.

Depreciation of Property and Equipment and Amortization of Intangible Assets

Total depreciation of property and equipment of $8.2 million for the year ended September 30, 2013 increased compared to $7.7 million in the same periods last year. The increase results primarily from a correction of depreciation of corporate property and equipment.

Amortization of intangible assets of $7.5 million for the year ended September 30, 2013 increased from $5.1 million in the same period last year. The Company acquired proprietary knowledge, non-compete agreements and favorable supplier relationships when advances were acquired from third-party lenders in the second quarter of FY2012.

Net Loss and Comprehensive Loss

The Company reported net loss of $35.5 million for the year ended September 30, 2013 compared to net loss $43.5 million in the same period last year. The prior year included an expense of $36.8 million for the settlement of pre-existing relationships with third-party lenders. Other significant factors contributing to the reported loss in comparison to the same period last year include increased provision for credit losses resulting from a change in estimation methodology to charge-off advances at 90 days past due, impairments on acquired advances, increased corporate salaries and legal costs, costs associated with restatements of previously issued financial statements and the special investigation, allowances for significantly aged receivables from a vendor and an increase to the valuation allowance recorded against deferred tax assets.

| 13 |

FY2013 Management’s Discussion & Analysis

Summary of Quarterly Results

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (thousands of dollars, except for per share amounts and branch figures) | 2012 | 2013 |

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Consolidated Results | | | | | | | | |

| No. of branches | Canada | 573 |

| 569 |

| 529 |

| 511 |

| 511 |

| 513 |

| 510 |

| 510 |

|

| | United Kingdom | 23 |

| 25 |

| 25 |

| 25 |

| 25 |

| 25 |

| 27 |

| 27 |

|

| | | 596 |

| 594 |

| 554 |

| 536 |

| 536 |

| 538 |

| 537 |

| 537 |

|

| | | | | | | | | | |

| Loan volume | Direct | $ | 13,076 |

| $ | 120,487 |

| $ | 188,485 |

| $ | 195,027 |

| $ | 180,599 |

| $ | 127,050 |

| $ | 113,244 |

| $ | 119,534 |

|

| | Brokered | 186,535 |

| 70,543 |

| 11,376 |

| 12,183 |

| 22,864 |

| 59,272 |

| 78,958 |

| 80,277 |

|

| | | 199,611 |

| 191,030 |

| 199,861 |

| 207,210 |

| 203,463 |

| 186,322 |

| 192,202 |

| 199,811 |

|

| | | | | | | | | | |

| Revenue | | | | | | | | |

| Loan fees | $ | 32,892 |

| $ | 30,545 |

| $ | 36,204 |

| $ | 38,353 |

| $ | 38,018 |

| $ | 37,268 |

| $ | 37,657 |

| $ | 39,487 |

|

| Other income | 12,956 |

| 11,544 |

| 12,454 |

| 12,464 |

| 11,485 |

| 9,389 |

| 8,671 |

| 8,790 |

|

| | | 45,848 |

| 42,089 |

| 48,658 |

| 50,817 |

| 49,503 |

| 46,657 |

| 46,328 |

| 48,277 |

|

| Sales Expenses | | | | | | | | |

| Salaries and benefits | 16,856 |

| 17,672 |

| 16,493 |

| 14,921 |

| 14,462 |

| 14,325 |

| 14,902 |

| 14,964 |

|

| Rent | 4,766 |

| 4,911 |

| 4,719 |

| 4,548 |

| 4,434 |

| 4,806 |

| 4,343 |

| 4,998 |

|

| Selling, general and administrative | 6,489 |

| 6,406 |

| 5,725 |

| 4,971 |

| 4,969 |

| 5,076 |

| 5,733 |

| 4,671 |

|

| Advertising and promotion | 1,690 |

| 1,063 |

| 1,212 |

| 1,215 |

| 1,369 |

| 1,437 |

| 1,693 |

| 1,808 |

|

| Depreciation of property and equipment | 1,776 |

| 1,785 |

| 1,675 |

| 1,607 |

| 1,560 |

| 1,568 |

| 1,589 |

| 1,649 |

|

| | | 31,577 |

| 31,837 |

| 29,824 |

| 27,262 |

| 26,794 |

| 27,212 |

| 28,260 |

| 28,090 |

|

| | 14,271 |

| 10,252 |

| 18,834 |

| 23,555 |

| 22,709 |

| 19,445 |

| 18,068 |

| 20,187 |

|

| | | | | | | | | |

| Provision for credit losses | 668 |

| 10,798 |

| 10,104 |

| 9,434 |

| 9,254 |

| 7,289 |

| 7,587 |

| 12,477 |

|

| Retention payments | 6,557 |

| 2,271 |

| 554 |

| 586 |

| 1,769 |

| 1,665 |

| 2,444 |

| 5,781 |

|

| Corporate expenses | 4,960 |

| 6,626 |

| 5,394 |

| 5,706 |

| 6,745 |

| 9,247 |

| 8,602 |

| 13,548 |

|

| Interest expense | 169 |

| 3,068 |

| 4,536 |

| 4,566 |

| 4,603 |

| 4,644 |

| 4,660 |

| 4,676 |

|

| Branch closures costs | — |

| — |

| 908 |

| 666 |

| — |

| — |

| 24 |

| 99 |

|

| Impairment of property and equipment | — |

| 3,017 |

| — |

| 408 |

| — |

| — |

| 522 |

| 714 |

|

| Expense to settle pre-existing relationships with third-party lenders | — |

| 36,820 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Other depreciation and amortization | 583 |

| 1,503 |

| 1,770 |

| 2,117 |

| 2,172 |

| 1,994 |

| 2,796 |

| 2,349 |

|

| Net income (loss) before income taxes and class action settlements | 1,334 |

| (53,851 | ) | (4,432 | ) | 72 |

| (1,834 | ) | (5,394 | ) | (8,567 | ) | (19,457 | ) |

| Class action settlements | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Taxes | $ | 374 |

| $ | (12,691 | ) | $ | (861 | ) | $ | (177 | ) | $ | (132 | ) | $ | (765 | ) | $ | (1,673 | ) | $ | 2,850 |

|

| Net income (loss) and comprehensive income (loss) | $ | 960 |

| $ | (41,160 | ) | $ | (3,571 | ) | $ | 249 |

| $ | (1,702 | ) | $ | (4,629 | ) | $ | (6,894 | ) | $ | (22,307 | ) |

| EBITDA | 3,862 |

| (47,495 | ) | 3,549 |

| 8,362 |

| 6,501 |

| 2,812 |

| 478 |

| (10,783 | ) |

| Adjusted EBITDA | 9,446 |

| 721 |

| 5,516 |

| 10,066 |

| 9,152 |

| 6,332 |

| 4,673 |

| 2,494 |

|

| Basic earnings (loss) per share | $ | 0.06 |

| $ | (2.36 | ) | $ | (0.20 | ) | $ | 0.01 |

| $ | (0.10 | ) | $ | (0.24 | ) | $ | (0.39 | ) | $ | (1.29 | ) |

| Diluted earnings (loss) per share | $ | 0.05 |

| $ | (2.36 | ) | $ | (0.20 | ) | $ | 0.01 |

| $ | (0.10 | ) | $ | (0.24 | ) | $ | (0.39 | ) | $ | (1.29 | ) |

Although the Company’s business is not significantly affected by seasonality, the Company typically experiences its strongest revenues in the third and fourth quarters (which correspond with tax season and the summer months) followed by the first quarter (Christmas/holiday season). The second quarter is typically the weakest.

| 14 |

FY2013 Management’s Discussion & Analysis

Fourth Quarter

Loan Volume

Q4 FY2013 loan volume of $199.8 million decreased by 4% compared to $207.2 million for Q4 of FY2012. The decrease in loan volume reflects tightening certain underwriting criteria on the Basic line of credit product in an effort to manage credit risk and improve operating profitability as well as the impact of the revolving portion of the lines of credit.

Loan Fees

|

| | | | | | | | | |

| (000s) | | Three Months Ended September 30, 2012 |

| | Three Months Ended September 30, 2013 |

| | %

Change |

| Payday loan fees | | 35,275 |

| | 30,023 |

| | (15 | )% |

| Broker and credit assessment fees on lines of credit | | 3,078 |

| | 8,905 |

| | 189 | % |

| Total Loan Fees | | 38,353 |

| | 38,928 |

| | 1 | % |

The year over year changes in the type of loan fees earned are reflective of the Company's cessation of payday loans and introduction of lines of credit in Manitoba and Ontario. Despite the decrease in loan volume compared to Q4 of FY2012, the overall increase in loan fees of 1% reflects pricing differences between payday loans and the new lines of credit.

Same Branch Revenue

Q4 FY2013 same branch revenue, calculated on the branches in Canada that were open for both the Q4 of FY2013 and Q4 of FY2012 was $88. This represents an decrease of 3.3% compared to average revenues of $91 for those branches in Q4 of FY2012 and is a result of the reduction in other income.

Other Income

|

| | | | | | | | | |

| (000s) | | Three Months Ended September 30, 2012 |

| | Three Months Ended September 30, 2013 |

| | %

Change |

| Fees earned on other financial products and services | | 10,102 |

| | 5,577 |

| | (45 | )% |

| Interest | | 1,835 |

| | 1,974 |

| | 8 | % |

| Default and other fees | | 527 |

| | 412 |

| | (22 | )% |

| Total other income | | 12,464 |

| | 8,790 |

| | (29 | )% |

The decrease in fees earned on other financial products and services is related to the following:

| |

• | Price reductions on prepaid debit and credit card products and bank accounts designed to increase customer benefits and promote long term customer retention to ultimately increase profitability in the long term; |

| |

• | An increase in consumer take up of cheques and electronic funds transfer as a form of disbursing proceeds as compared to prepaid debit and credit card products; and |

| |

• | The cessation of a customer payment protection insurance offering on lines of credit in Ontario. |

| 15 |

FY2013 Management’s Discussion & Analysis

Sales Expenses

Sales expenses of $28.1 million for Q4 of FY2013 were relatively flat compared to $27.3 million in Q4 of FY2012. The Company had approximately the same number of branches in Q4 of FY2013 compared to Q4 of FY2012.

Credit Losses and Recoveries

|

| | | | | | | | | | | | |

| (000s) | | Three Months Ended September 30, 2012 |

| | % of

loan

vol. |

| | Three Months Ended September 30, 2013 |

| | % of

loan

vol. |

|

| Provision for credit losses | | 9,434 |

| | 4.8 | % | | 12,477 |

| | 10.4 | % |

| Default and other fees | | (527 | ) | | -0.3 | % | | (412 | ) | | -0.3 | % |

| Net | | 8,907 |

| | 4.6 | % | | 12,065 |

| | 10.1 | % |

Due primarily to a change in estimation methodology used to calculate the provision, credit losses net of recoveries for Q4 of FY2013 increased by $3.2 million, or 6% of direct loan volume in comparison to Q4 of FY2012. On an adjusted basis, the provision for credit losses for Q4 of FY2013 was 5.4% of direct loan volume compared to 4.6% for Q4 of FY2012. The increase as a percentage of direct loan volume was a result of $0.4 million of impairments recorded on acquired line of credit advances during the quarter.

The impact of the September 30, 2013 change in estimation methodology to charge-off advances at 90 days past due was approximately $5.2 million. In addition, for Q4 of FY2013, the provision for credit losses expense includes $0.4 million of impairments related to subsequent changes to the valuation of acquired advances. These increases were offset by improvements in overall collections compared to the prior year.

Retention Payments

This section should be read in conjunction with "Off-Balance Sheet Arrangements"

|

| | | | | | |

| (000s) | | Three Months Ended September 30, 2012 |

| | Three Months Ended September 30, 2013 |

|

| Losses on acquisition of line of credit advances | | - |

| | 4,183 |

|

| Payments to offset the impact of credit losses | | 586 |

| | 1,598 |

|

| Total retention payments expense | | 586 |

| | 5,781 |

|

As a percentage of brokered loan volume, retention payments increased to 7.2% for Q4 of FY2013 from 4.8% in Q4 of FY2012. The increase was a result of the Company's continuing assessment of credit losses in brokered advances and the strategy to mitigate it exposures to third-party lenders with respect to this risk. The Company has made retention payments and has repurchased line of credit advances such that its estimated maximum exposure has not increased in proportion to the level of brokering activity.

| 16 |

FY2013 Management’s Discussion & Analysis

Corporate Expenses

|

| | | | | | | | | |

| (000s) | | Three Months Ended September 30, 2012 |

| | Three Months Ended September 30, 2013 |

| | %

Change |

| Salaries and benefits | | 2,970 |

| | 4,008 |

| | 35 | % |

| Legal expenses | | 328 |

| | 2,750 |

| | 738 | % |

| Audit , accounting and special investigation | | 336 |

| | 427 |

| | 27 | % |

| Other | | 2,072 |

| | 6,363 |

| | 207 | % |

| Total Corporate Expenses | | 5,706 |

| | 13,548 |

| | 137 | % |

The increase in corporate salaries and benefits is a result of investments in staffing for new lines of business and other one-time expenses.

Legal expenses increased for FY2013 as a result of additional legal activity related to new regulatory and securities class action claims.

Included in other corporate expenses is a $4.4 million provision related to receivables from a vendor. Also contributing to the increase in other corporate expenses is additional corporate rent costs associated with moving to a new corporate office in Q4 of FY2012.

Refer to the section entitled “Risks and Uncertainties” for additional information on regulatory developments and legal proceedings and "Other Receivables" for additional information on amounts due from vendors.

Net Loss and Comprehensive Loss

The Company reported net loss of $22.3 million for Q4 of FY2013 compared to net income of $0.2 million in the same period last year. Significant factors contributing to the reported loss in comparison to the same period last year include the change in estimation methodology to charge-off advances at 90 days past due, allowances for significantly aged receivables from a vendor and an increase to the valuation allowance recorded against deferred tax assets.

| 17 |

FY2013 Management’s Discussion & Analysis

Liquidity and Capital Resources

NOTE: This section contains forward-looking information. By its nature, forward-looking information requires that certain assumptions be made and is subject to inherent risks and uncertainties. Please see "Forward-Looking Information" and "Risks and Uncertainties" for additional information on the factors that could cause results to vary.

Cash balances decreased to $11.5 million as at September 30, 2013, compared to $19.1 million at the end of FY2012.

For FY2013 the Company utilized a combination of third-party lender funds and cash generated from operating activities to manage its working capital requirements. The Company is able to both purchase and sell consumer advances with third-party lenders in order to manage its working capital requirements.

In addition to cash flows from operations, to fund working capital and growth in consumer advances receivable for FY2014, the Company secured additional funding through its available credit facilities. Refer to the section entitled "Credit Facilities."

The Company expects to continue to fund working capital requirements to the end FY2014 through cash generated from operations and credit facilities.

Cash Flows

|

| | | | | | |

| Cash provided by (used in): |

| Year ended September 30, 2012 |

| Year ended September 30, 2013 |

| (000s) | | |

| Operating activities |

| 15,039 |

|

| (698 | ) |

| Investing activities |

| (99,836 | ) | | (4,505 | ) |

| Financing activities |

| 90,926 |

|

| (4,644 | ) |

Cash used in operating activities was negative $0.7 million for FY2013, down from $15.0 million provided by operating activities in FY2012. The decrease was driven primarily by increases in corporate expenses.

Cash used in investing activities for FY2013 reflects the purchase of property and equipment and intangible assets. FY2012 cash used in investing activities reflects a significant acquisition of a portfolio of advances, intangible assets and an expense to settle pre-existing relationships with third-party lenders.

Cash used in financing activities for FY2013 primarily reflects the repayment of capital lease obligations and fluctuations in in funding made available by the third-party lenders for lending to consumers, whereas in FY2012 reflects the issuance of the Notes (defined herein).

Funds advanced from third-party lenders are restricted and can only be used for consumer lending. In FY2013 the Company used funds advanced from third-party lenders to broker advances to customers. The Company also transfers advances to third-party lenders to manage excess float and day-to-day working capital requirements. During FY2013 as part of the normal course of operations the Company transferred $14.3 million (2012 - $17.6 million) of net consumer advances receivable to third-party lenders in exchange for cash.

Consumer Advances Receivable, Net

As at September 30, 2013, the consumer advances receivable, net balance was $25.6 million, down from $32.4 million at September 30, 2012.

| 18 |

FY2013 Management’s Discussion & Analysis

The Company’s consumer advances receivable balance at September 30, 2013 is comprised of $19.3 million (September 30, 2012 - $25.9 million) of net advances that the Company has made directly to consumers and $6.2 million (September 30, 2012 - $6.6 million) in advances that the Company has purchased from third-party lenders.

Direct Advances

The September 30, 2013 direct advances balance of $19.3 million is comprised of gross advances of $29.2 million net of a provision for credit losses of $9.8 million (September 30, 2012 - $52.3 million gross advances and a provision of $26.4 million).

The year over year decrease is due to a change in the estimation methodology used to calculate the provision. As of September 30, 2013 the Company began to charge-off all advances at 90 days past due. This change resulted in an additional expense associated with the charge-off of value previously ascribed to advances greater than 90 days past due. As a result of the change in estimation methodology, all recoveries related to advances greater than 90 days past due will be recognized as a reduction to the provision for credit losses expense when received.

The change in estimation methodology has been made by the Company as a result of the continuing process of obtaining additional information and experience as a direct lender and on the basis that it is preferable. This change has helped management to address the identified material weakness in internal controls (see "Controls and Procedures") by providing better clarity and peer consistency with respect to the Company's accounting policy for credit losses and charge-offs.

Acquired Advances

During FY2013, based on current collection trends, the Company revised its forecast of future cash flows related to the January 31, 2012, fiscal Q2, 2013 and fiscal Q3, 2013 acquired advances. As a result, included in the provision for credit losses expense for FY2013 are impairment charges of $1.5 million related to these acquired portfolios.

Commencing in February, 2013, in order to better facilitate the collections of past due advances on its brokered lines of credit in Ontario and Manitoba, the Company has purchased line of credit advances from third-party lenders. The line of credit advances are not governed by applicable payday loans regulations and the Company needs to be licensed to collect overdue brokered line of credit advances. In the absence of such licenses the Company has chosen to collect the overdue line of credit advances on behalf of the lenders either by purchasing the line of credit advances or by engaging a third party agency for collection. For the purposes of collecting the line of credit advances, the Company elected to purchase the line of credit advances in FY2013 and incurred losses on the difference between the purchase price and fair value of the line of credit advances and recognized the difference as retention payments. The Company expects to continue the practice of repurchasing past due advances on brokered lines of credit for the foreseeable future.

The Company's valuation assumptions reflect the recovery of approximately 82% of the contractual value of the repurchased advances on brokered lines of credit within 12 months.

All advances acquired have been reported on a pooled basis based on the fiscal quarter of acquisition. As the total consideration paid to acquire the line of credit advances exceeded the fair value, for the year ended September 30, 2013 the Company recorded losses of $7.1 million (2012 - $nil) in retention payments expense.

| 19 |

FY2013 Management’s Discussion & Analysis

The Company pools acquired advances for reporting purposes, as follows:

|

| | | | | | | | | | | | |

| (000s) | | Contractual Value at Acquisition Date |

| | Fair Value at Acquisition Date |

| | Remaining Carrying Value September 30, 2013 |

|

| January 31, 2012 loan acquisition | | $ | 319,900 |

| | $ | 50,014 |

| | $ | 1,715 |

|

| Fiscal Q2, 2013 acquired line of credit advances | | $ | 7,138 |

| | $ | 6,382 |

| | $ | 47 |

|

| Fiscal Q3, 2013 acquired line of credit advances | | $ | 11,650 |

| | $ | 9,479 |

| | $ | 1,173 |

|

| Fiscal Q4, 2013 acquired line of credit advances | | $ | 21,031 |

| | $ | 16,848 |

| | $ | 3,313 |

|

Other Receivables

The September 30, 2013 net other receivables balance of $8.9 million (2012 - $19.9 million) is comprised mainly of short term receivables from vendors, with which the Company has agency arrangements to provide bank accounts, debit and prepaid MasterCard and insurance products to consumers.

Included in this amount are gross receivables of $9.8 million (September 30, 2012 - $11.3 million) due from a vendor. The Company has recorded an allowance of $4.4 million (2012 - $nil) against certain of these receivables which are greater than three months past due and collection is considered doubtful. These balances represent a concentration of credit risk to the Company. The Company is actively engaged in the pursuit of the overdue amounts and performs an ongoing review of the credit status of its key vendors.

Credit Facilities

On November 29, 2013 the Company entered into a credit agreement (the “Credit Agreement”) with Coliseum Capital Management, LLC (“Coliseum”), 8028702 Canada Inc. and 424187 Alberta Ltd. (“Alberta Ltd.”) (collectively, the “Lenders”), pursuant to which the Lenders have provided $12.0 million of loans.

Pursuant to the Credit Agreement, 424187 Alberta Ltd. (the “Agent”) acts as agent for the Lenders. The loans made under the credit facility bear interest at 12.5% per annum, payable monthly in arrears, on the 29th day of each month. If an event of default occurs under the Credit Agreement, the interest rate is increased by 2% for so long as the event of default remains. The Credit Agreement provides that an additional $20.5 million may be advanced for a total maximum loan amount of $32.5 million. The Lenders have a right of first refusal in respect of any additional advances. If the Lenders do not exercise their right of first refusal, the Company is free to obtain loan advances from other lenders who agree to become party to the Credit Agreement. The loans outstanding at any time are subject to the requirement that the maximum amount outstanding cannot exceed 75% of the unrestricted cash of the Company plus 75% of the net consumer advances receivable of the Company not more than 90 days in arrears (the “Borrowing Base”). If the total amount outstanding under the loan at any time exceeds the Borrowing Base, the Company must repay to the Initial Lenders, on a pro rata basis, an amount which will result in the loans not being in excess of the Borrowing Base. Such payment must be made within 20 days of the month end in which the Borrowing Base was exceeded.

Loans made under the Credit Facility mature on November 29, 2016 (the “Maturity Date”) or on such earlier date as the principal amount of all loans owing from time to time plus accrued and unpaid interest and all other amounts due under the Credit Agreement may become payable under the Credit Agreement. The Company may repay the loans at any time subject to payment of a prepayment fee as follows:

| |

| (a) | If the prepayment is on or before November 29, 2014, the greater of (A) the interest that would accrue if the amount were to remain outstanding until November 29, 2014 and (B) 4% of the amount; |

| 20 |

FY2013 Management’s Discussion & Analysis

| |

| (b) | If the prepayment is after November 29, 2014 but on or prior to November 29, 2015, 3% of the amount; and |

| |

| (c) | If the prepayment is after November 29, 2015, no fee. |

The Company has agreed to designate the loans made under the Credit Agreement as priority lien debt and obtain the benefit of the security granted by the Company pursuant to the Collateral Trust and Intercreditor Agreement entered into in connection with the Company’s 11.5% senior secured notes.

The Company believes this Credit Agreement to be important in achieving the Company’s long-term strategic plans and will fund operations and growth in key business areas.

In addition to certain covenants relating to the payment of the loans and the authority of the Company to enter into the Credit Agreement, the Company has covenanted in favour of the Lenders:

(a) to comply with the covenants granted to the holders of the 11.5% senior secured notes;

(b) not to designate any additional debt under the Collateral Trust Agreement; and

| |

| (c) | to meet the following Adjusted EBITDA targets on a quarterly basis over the term of the Credit Agreement: |

| |

| i) | $4.0 million for the first 3 months of the 2014 fiscal year |

| |

| ii) | $10.0 million for the first 6 months of the 2014 fiscal year |

| |

| iii) | $17.0 million for the for the first 9 months of the 2014 fiscal year |

| |

| iv) | $25.0 million for the 2014 fiscal year |

| |

| v) | $23.6 million on a rolling four quarter basis at the end of the first quarter of fiscal year 2015 |

| |

| vi) | $26.3 million on a rolling four quarter basis at the end of the second quarter of fiscal year 2015 |

| |

| vii) | $26.9 million on a rolling four quarter basis at the end of the third quarter of fiscal year 2015 |

| |

| viii) | $27.5 million for the 2015 fiscal year |

| |

| ix) | $28.1 million on a rolling four quarter basis at the end of the first quarter of fiscal year 2016 |

| |

| x) | $28.8 million on a rolling four quarter basis at the end of the second quarter of fiscal year 2016 |

| |

| xi) | $29.4 million on a rolling four quarter basis at the end of the third quarter of fiscal year 2016 |

| |

| xii) | $30.0 million for the 2016 fiscal year |

Under the credit agreement, Adjusted EBITDA means the net income (or loss) of the Company, on a consolidated basis, before interest expense, income tax expense, depreciation of property and equipment, and amortization of intangible assets and before the deduction or addition of extraordinary and/or non-recurring expenses as reported in the Borrower’s quarterly and annual Management’s Discussion and Analysis in the section entitled “EBITDA and Adjusted EBITDA reconciliation”.

In addition to the rights of the Lenders to demand payment and instruct the Agent to begin the process to realize on the security under the Collateral Trust and Intercreditor Agreement, upon the occurrence and during the continuance of an event of default, the Lenders have the right, but not the obligation, to appoint a financial advisor to review the affairs of the Company and to appoint a director to the Board.

424187 Alberta Ltd., which has committed to loan $2.0 million of the initial $12.0 million drawn, is controlled by the Company’s CEO and a director, Gordon Reykdal. Coliseum, which has committed to loan $5.0 million of the initial $12.0 million drawn, owns 17.8% of the common shares of the Company.

| 21 |

FY2013 Management’s Discussion & Analysis

Senior Secured Notes

On January 31, 2012, the Company completed a private placement offering in Canada and the US for $132.5 million of 11.5% senior secured notes (the “Notes”). The Notes mature on January 31, 2017 and bear interest semi-annually on January 31 and July 31 each year. The Notes were issued at a price of 94.608% resulting in an effective interest rate of 13.4%.

The indenture governing the Notes (the "Indenture") contains certain covenants that limit the Company’s ability to:

| |

| • | incur or guarantee additional indebtedness; |

| |

| • | make capital expenditures; |

| |

| • | make certain investments and acquisitions; |

| |

| • | amend the Company’s dividend policy, pay dividends, or make distributions on capital stock or make certain other restricted payments; |

| |

| • | sell assets, including capital stock of the Company’s restricted subsidiaries; |

| |

| • | enter into transactions with affiliates; |

| |

| • | agree to payment restrictions affecting restricted subsidiaries; |

| |

| • | amend underwriting standards; |

| |

| • | form subsidiaries or fund foreign subsidiaries; and |

| |

| • | consolidate, merge, sell or otherwise dispose of assets, except those in the ordinary course of operations. |

The ability to declare and pay dividends is subject to compliance with a restricted payment covenant stipulated in the Indenture.

Compliance with the covenants are not impacted solely through the ordinary course of operations or the results of operations. The Company remains in compliance with all of the covenants under the Indenture.

In the event of specified change of control events, holders of Notes will have the right to require the Company to purchase all or a portion of the Notes at a purchase price in cash equal to 101% of the principal amount purchased, plus accrued interest to the date of purchase. In addition, upon certain asset sales, the Company may be required to use the net proceeds of such sales to offer to repurchase a portion of the Notes at a price in cash equal to 100% of the principal amount purchased, plus accrued and unpaid interest to the date of purchase.

Under the terms of the Notes, the Company may redeem up to 35% of the Notes with the net proceeds of certain equity offerings at a redemption price equal to 111.5% of the principal amount redeemed, plus accrued and unpaid interest to the redemption date any time before July 31, 2014. The Notes are redeemable in

| 22 |

FY2013 Management’s Discussion & Analysis

whole or in part, at any time on or after July 31, 2014 at the redemption prices (expressed as percentages of principal amounts) in the table below, plus accrued and unpaid interest:

|

| |

| For the period | Percentage |

| On or after July 31, 2014 | 103.084% |

| On or after January 31, 2015 | 102.091% |

| On or after July 31, 2015 | 101.127% |

| On or after January 31, 2016 | 101.194% |

| On or after July 31, 2016 | 100.000% |

The indenture contains a first lien carve out that allows us to obtain credit facilities of up to $32.5 million.

Proceeds from the issuance of the Notes were $125.2 million. The Company used $116.3 million of the proceeds to acquire a portfolio of loans from third-party lenders. $8.2 million of the proceeds were used to pay fees and expenses related to the issuance and remainder was used for general corporate purposes.

Contractual Obligations

|

| | | | | | | | | | | | | | | |

| | | | | Payments due by Period |

| (000s) | | Total | | Less than 1 year | | 1-3 years | | 4-5 years | | After 5 years |

| Senior Secured Notes | | 185,832 |

| | 15,238 |

| | 30,475 |

| | 140,119 |

| | — |

|

| Capital Lease Obligations | | 6,946 |

| | 1,612 |

| | 1,828 |

| | 807 |

| | 2,699 |

|

| Operating Leases | | 83,089 |

| | 20,419 |

| | 24,167 |

| | 13,222 |

| | 25,281 |

|

| Total contractual obligations | | 275,867 |

| | 37,269 |

| | 56,470 |

| | 154,148 |

| | 27,980 |

|

Dividends

The Company paid dividends to shareholders from 2008 to 2012. Starting in the fourth fiscal quarter of 2012 the Board of Directors suspended quarterly dividends. The dividend distribution policy is reviewed on a quarterly basis. This review includes evaluating the Company’s financial position, profitability, cash flow and other factors that the Board of Directors considers relevant.

The ability to declare and pay dividends is subject to compliance with a restricted payment covenant stipulated in the Indenture. This restricted payment covenant is based on achieving a ratio of consolidated cash flows to interest expense of at least 2.5 on a trailing four quarter basis. In order to re-establish quarterly dividends, the Company would need to earn EBITDA of approximately $10.8 million per quarter for four consecutive quarters.

Outstanding Share Data

As at December 11, 2013, the Company had 17,571,813 common shares outstanding. There were also 1,131,402 options to purchase common shares outstanding, which if exercised, would provide the Company with proceeds of approximately $10.5 million. Each option is exchangeable for one common share of the Company.

| 23 |

FY2013 Management’s Discussion & Analysis

Off-Balance Sheet Arrangements

NOTE: This section contains forward-looking information. By its nature, forward-looking information requires that certain assumptions be made and is subject to inherent risks and uncertainties. Please see "Forward-Looking Information" and "Risks and Uncertainties" for additional information on the factors that could cause results to vary.

In FY2013 short term advances of $241.4 million, representing 30.9% (2012 - $280.6 million, 35.2%) of the Company’s total loan volume of $781.8 million (2012 - $797.7 million), was provided directly to consumers by independent third-party lenders.

Description of Arrangements

The Company has entered into written business agreements with a number of third-party lenders who are prepared to consider lending to the Company’s customers or to purchase advances originated by the Company. Pursuant to these agreements, services related to the collection of documents and information, as well as collection services are provided to the third-party lenders.

The agreements also provide that the third-party lenders are responsible for losses suffered due to uncollectible advances provided the Company has fulfilled the duties required under the terms of the agreements. If the Company does not properly perform its duties and the lenders make a claim under the agreements, the Company may be liable to the lenders for losses they have incurred. A liability is recorded when it is determined that the Company has a liability under the agreements.

The contracts between the Company and the third-party lenders do not contemplate continued retention payments. The contracts also do not guarantee repayment or a specified rate of return on the pool of funds committed by the third-party lenders' advanced to the Company's consumers. However, if the third-party lenders were to no longer participate in the brokering of advances to the Company's customers, the Company would lose the anticipated future revenue related to the brokering of advances. Under the broker model, the Company makes voluntary retention payments to the third-party lenders to encourage them to continue making funds available to the Company. The retention payments compensate the third-party lenders for some of the credit losses suffered. The Board of Directors regularly approves a resolution authorizing the Company to pay up to a certain amount of retention payments per quarter to third-party lenders. Retention payments are recorded in the period in which a commitment is made to a lender pursuant to the resolution approved by the Board of Directors.

It is the Company's practice to credit third-party lenders with retention payments such that when combined with portfolio returns, the return on the total funds made available by the third-party lenders for lending to consumers approaches a target of 17.5% (2012: 17.5%) per annum. This total return is determined by the Company based on the nature of product offerings, credit and regulatory risk profile, and the willingness of third-party lenders to make funds available to customers as well as the stability and flexibility of the third-party lenders. In consideration of these factors, the Company continually seeks to further improve and optimize the return to third-party lenders.

Summary of Exposure

At September 30, 2013, the total funds made available by third-party lenders for consumer lending was $44.1 million (September 30, 2012: $33.1 million). If the Company were to reimburse the third-party lenders for all historical loans lossess suffered (provide a "make whole payment"), as of September 30, 2013 the estimated loss would be in the amount of $14.1 million (September 30, 2012 - $13.1 million). This estimated loss represents the Company’s maximum exposure to third-party lenders and is comprised of the following components:

| 24 |

FY2013 Management’s Discussion & Analysis

|

| | | | | | | |

| (000s) | September 30, 2012 | | September 30, 2013 |

| 1. Estimated credit losses on the portfolio of loans and advances of third-party lenders | $ | 11,235 |

| | $ | 2,684 |

|

| 2. Cumulative charge-offs in excess of portfolio returns and retention payments | 1,822 |

| | 11,388 |

|

| Total Exposure | $ | 13,057 |

| | $ | 14,072 |

|

Based on the same methodology that the Company uses to determine the point where advances are charged off, the following summarizes the aging of the advances of the third-party lenders as well as the estimated allowance for credit losses inherent in their portfolios:

|

| | | | | | | |

| (000s) | September 30, 2012 | | September 30, 2013 |

| Current | $ | 13,319 |

| | $ | 25,346 |

|

| 1 to 30 days past due | 4,914 |

| | 2,067 |

|

| 31 to 60 days past due | 2,041 |

| | 303 |

|

| 61 to 90 days past due | 1,918 |

| | 253 |

|

| Greater than 90 days past due | 3,235 |

| | 160 |

|

| Gross Portfolio Value | $ | 25,428 |

| | $ | 28,129 |

|

| Estimated credit losses | (11,235 | ) | | (2,684 | ) |

| Net Value | $ | 14,193 |

| | $ | 25,445 |

|

The following summarizes the status of the funds of third-party lenders made available for consumer lending:

|

| | | | | | | |

| (000s) | September 30, 2012 | | September 30, 2013 |

| Funds made available by third-party lenders for consumer lending | $ | 33,078 |

| | $ | 44,092 |

|

| Less: funds deployed in consumer loans and advances | (25,428 | ) | | (28,129 | ) |

| Less: Cumulative charge-offs in excess of portfolio returns and retention payments | (1,822 | ) | | (11,388 | ) |

| Net funds available for consumer lending | $ | 5,827 |

| | $ | 4,575 |

|

Risk Management and Mitigation Strategy

The Company manages its potential exposure to third-party lenders through retention payments as well as the repurchase of past due line of credit advances.

During FY 2013, the Company voluntarily purchased past due line of credit advances in Ontario and Manitoba from the third-party lenders at the advances contractual value. This resulted in the Company immediately compensating the third-party lenders for any current or future losses inherent in the portfolios acquired. The difference between the purchase price and the fair value of the acquired advances is recorded as a retention payment.

As part of the Company’s strategic plan to mitigate its risks and exposures, the Company expects to continue to make retention payments to third-party lenders such that its maximum exposure does not increase in proportion to the volume of brokering activity during the period.

| 25 |

FY2013 Management’s Discussion & Analysis

Other Financial Information

NOTE: This section contains forward-looking information. By its nature, forward-looking information requires that certain assumptions be made and is subject to inherent risks and uncertainties. Please see "Forward-Looking Information" and "Risks and Uncertainties" for additional information on the factors that could cause results to vary.

Litigation and Claims

The Company is subject to class proceedings and other material claims in Canada and the United States. A detailed description of each proceeding and its status is set out in "Risks and Uncertainties".