December 11, 2013

|

| |

| Annual Information Form | |

| Year Ended September 30, 2013 |

Explanatory Notes

The information in this Annual Information Form (“AIF”) is given as of September 30, 2013, unless otherwise indicated. All figures are presented in thousands of Canadian dollars, unless otherwise disclosed. In this AIF, unless the context otherwise requires, all references to “the Company” or “Cash Store Financial” are to The Cash Store Financial Services Inc.

Cash Store Financial is a Canadian corporation and is not affiliated with Cottonwood Financial Ltd. or the outlets Cottonwood Financial Ltd. operates in the United States under the name “Cash Store”. Cash Store Financial does not conduct business under the name “Cash Store” in the United States and does not own or provide any consumer lending services in the United States.

Forward-Looking Information

In order to help our investors understand our current results and future prospects, this AIF includes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States federal securities legislation. These types of statements are referred to collectively, as “forward-looking information”. Forward-looking information includes, but is not limited to, information with respect to our objectives, strategies, operations and financial results, competition as well as initiatives to grow revenue or reduce retention payments.

Forward-looking information can generally be identified by the use of words such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases. They may also be identified by statements that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied. These risks and uncertainties may include (but are not limited to) changes in economic and political conditions, legislative or regulatory developments, technological developments, third party arrangements, competition, litigation, market conditions, the availability of alternative transactions, shareholder, legal, regulatory and court approvals and third party consents and other factors described under the heading “Risks and Uncertainties”.

Management has attempted to identify the important factors that could cause actual results to differ materially from those contained in forward-looking information, but other factors unknown to us at the time of writing could cause results to vary. There can be no assurance that forward-looking information will prove to be accurate. Actual results could differ materially. Management cautions readers not to place undue reliance on forward-looking information. Unless required by law, the Company does not undertake to update any forward-looking information.

CORPORATE STRUCTURE

The Company was incorporated on February 23, 2001, under the Business Corporations Act (Ontario) (the “OBCA”), as B&B Capital Corporation. On August 1, 2001, B&B Capital Corporation changed its name to “Rentcash Inc.” and subsequently amalgamated with Larkfield Capital Corp. (“Larkfield”), under the OBCA, effective January 17, 2002 (the “Amalgamation”), with the amalgamated company continuing as Rentcash Inc. Larkfield was incorporated under the Company Act (British Columbia) on May 15, 2000, under the name Willow Creek Capital Corp. (“Willow Creek”). The name of Willow Creek was changed to “Larkfield Capital Corp.” on August 24, 2000, and Larkfield was subsequently continued into Ontario under the OBCA, effective January 15, 2002.

Pursuant to the Amalgamation, each common share of Rentcash was exchanged for one common share of the Company, and each three common shares of Larkfield were exchanged for one common share of the Company.

The Company changed its name on March 31, 2008, from Rentcash Inc. to “The Cash Store Financial Services Inc.” in connection with the spin-off of its rental division. Cash Store Financial’s common shares (the “Common Shares”) are traded on the Toronto Stock Exchange (“TSX”) under the symbol “CSF”. On June 8, 2010, the Company began trading its shares on the New York Stock Exchange (“NYSE”) under the symbol “CSFS”.

On March 31, 2008, pursuant to a plan of arrangement, the Company separated its rental business and certain of its assets and liabilities into an independent, publicly-traded company. Each existing shareholder of Cash Store Financial received one common share of Insta-Rent for each Common Share held on March 31, 2008.

On April 28, 2010, the Company’s board of directors (the "Board") approved a change in its fiscal year end from June 30 to September 30.

The registered office of the Company is located at Scotia Plaza, Suite 2100, 40 King Street West, Toronto, Ontario M5H 3C2. The head office of the Company is located at 15511 - 123 Avenue, Edmonton, Alberta T5V 0C3.

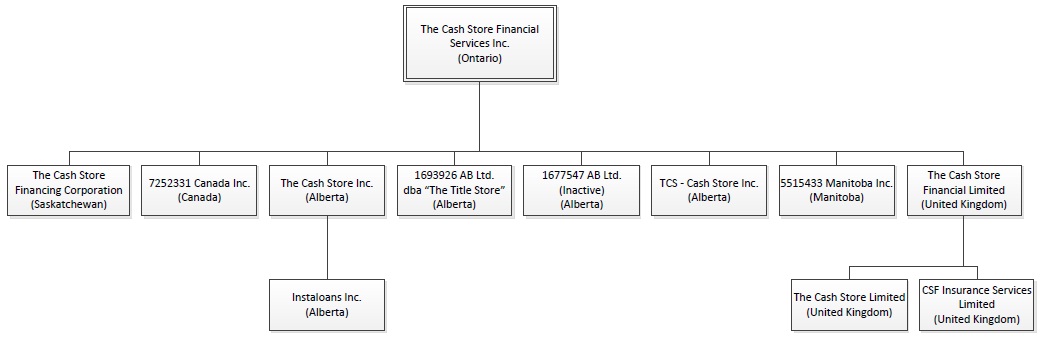

The Company’s principal direct and indirect subsidiaries are as set forth in the following chart. The Company owns 100% of the issued and outstanding shares of each principal subsidiary. The Cash Store Inc., in turn, owns 100% of the issued and outstanding shares of Instaloans Inc.; and The Cash Store Financial Limited owns 100% of the issued and outstanding shares of The Cash Store Limited and CSF Insurance Services Limited. Included in parenthesis within the corporate organization chart is the respective jurisdiction of incorporation of each entity:

GENERAL DEVELOPMENT OF THE BUSINESS

The Company, under its “Cash Store Financial”, “Instaloans” and "The Title Store" banners, provides consumers with alternative financial products and services, serving everyday people for whom traditional banking may be inconvenient or unavailable. The Company acts as both a broker and lender of short term advances and offers a range of other products and services to help customers meet their day to day financial service needs. The Company employs a combination of payday loans and lines of credit as its primary consumer lending product offerings and earns fees and interest income on these consumer lending products. The Company also offers a wide range of financial products and services including bank accounts, prepaid MasterCard and private label credit and debit cards, cheque cashing, money transfers, payment insurance and prepaid phone cards. The Company has agency arrangements with a variety of companies to provide these products.

The table below illustrates the Company’s primary consumer lending offerings summarized by jurisdiction since October 1, 2011:

|

| | | | | | | | | | |

| Jurisdiction | | Branches | | Oct 1, 2011 to

Jan 31, 2012 | | Feb 1, 2012 to

Sep 30, 2012 | | Oct 1, 2012 to

Jan 31, 2013 | | Feb 1,

2013 to Present |

| | | | | | | | | | | |

| British Columbia, Alberta Saskatchewan Nova Scotia | | 278 | | Payday Loans

(Brokered) | | Payday Loans

(Direct Lending) |

| | | | | | | | | |

| Manitoba | | 25 | | Payday Loans

(Brokered) | | Payday Loans

(Direct Lending) | | Lines of Credit

(Brokered) |

| | | | | | | | | | | |

| Ontario | | 174 | | Payday Loans

(Brokered) | | Payday Loans

(Direct Lending) | | Lines of Credit

(Brokered) |

| | | | | | | | | | | |

| New Brunswick Newfoundland Prince Edward Isl. Yukon / NWT | | 33 | | Payday Loans

(Brokered) |

| | | | | |

| United Kingdom | | 27 | | Payday Loans

(Direct Lending) |

Three Year History and Acquisitions

Since late 2009, the Canadian payday loan market has been in transition from an unregulated market to varying states of regulation. The key components of payday loans regulation are caps on the loan size, length and fees that can be charged. Typically regulations limit payday loans to a maximum of $1,500 and 62 days in duration as well as providing a rate cap. The following table shows the date that regulations came into effect in the provinces where the Company currently offers payday loans and their rate cap:

|

| | |

| Province | Rate Cap

(per $100) | Effective Date |

| British Columbia | $23 | November 18, 2009 |

| Alberta | $23 | March 1, 2010 |

| Nova Scotia | $25 | April 1, 2011 |

| Saskatchewan | $23 | January 1, 2012 |

On April 14, 2010, the Company opened its first branch in the UK and has since expanded its operations to include 27 branches in the UK at September 30, 2013.

In January 2012, the Company completed a private placement of $132.5 million of 11.5% senior secured notes (the “Notes”) and used most of the net proceeds of this offering to acquire a portfolio of consumer loans from third-party lenders. With the acquisition of the loan portfolio, the Company began funding payday loans directly in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario and Nova Scotia.

On October 1, 2012 and February 1, 2013 the Company launched a new suite of line of credit products in Manitoba and Ontario, respectively, and payday loans are no longer being offered in those provinces. The lines of credit are traditional, unsecured, medium term revolving credit lines, with regular minimum payments tailored to customers’ needs and profiles. This suite of line of credit products enables consumers to move up the credit ladder toward credit-scored products that will eventually enable access to mainstream lending

products. The Company is subject to regulatory risk and actions related to the lines of credit products and a discussion of these risk factors can be found in the section entitled “Risks and Uncertainties” in the Company’s Management Discussion and Analysis (“MD&A”) dated December 11, 2013 for the year ended September 30, 2013 and available on the Company's profile on SEDAR at www.sedar.com

DESCRIPTION OF THE BUSINESS

Products and Services

|

| |

| Consumer Loans & Line of Credit |

| Payday | - Bridge loans to help our clients span temporary cash shortfalls or meet emergency or unexpected expenses - Short-term non-collateralized loans - Range from $100 to $1500. |

| Signature | - Short-term loan against a government source of income (Child Tax, Disability, Pension, Employment Insurance) |

| Lines of Credit | - Up to $5000 unsecured - Helps customers to rebuild their credit - Customers borrow as needed and repay at any time - Minimum payments are due at regular intervals - Introduced early in FY2012 |

Injury Claims

| - Immediate cash for personal injury claims awaiting payout - Provided by Rhino Legal Finance Inc. |

| Diversified Financial Products |

| Bank Accounts: Standard & Premium | - Provided by DC Bank - Gives customers access to a variety of services - CDIC insured |

| Cheque Cashing | - Fast turn around - Funds transferred electronically; branches do not hold cash |

| Prepaid Credit Card | - Supplied by DC Bank and MasterCard - Provides the convenience of a credit card without interest - Can be used online |

| Prepaid Debit Card | - Supplied by DC Bank - Preloaded with funds for daily transactional needs and access to cash at ATMs |

| Money Transfer | - Provided by RIA Financial Services - Provides an easy and reliable way to pay bills or send and receive funds worldwide |

| Payment Insurance | - Covers outstanding loan balances in the event of unexpected events such as: involuntary unemployment, accidental injury, critical illness, death, dismemberment |

Payday loans – direct lending

The Company typically arranges for advances to customers that range from $100 to $1,500. In order to receive an advance, a customer is required to provide proof of income, copies of recent bank statements, current proof of residence and current telephone and utility bills. The customer must then either write a cheque or execute a pre-authorized debit agreement for the amount of the advance plus loan fees. Deposit of the cheque is deferred until the due date of the loan, which is the customer’s next payday (normally 7 to 14 days but no later than 31 days).

Payday loans – brokering

For loans that the Company brokers on behalf of customers, the application process and documentation requirements are similar to those for direct lending. After an application is completed and other relevant information is obtained from a customer, the Company brokers the customer’s loan request to third-party lenders. Based on approval criteria established by the third-party lenders, the customers’ eligibility for an advance is assessed. If the customer is approved, the Company provides the lender’s loan documentation to the customer. Upon fulfillment of the loan documentation requirements, the Company is authorized by the lender to forward the cash advance to the customer on behalf of the lender. When an advance becomes due and payable, the customer must make repayment of the principal and interest owing to the lender through the Company, which, in turn, remits the funds to the third-party lender. If there is difficulty with the collection process, the customer’s account may be turned over to an independent collection agency.

Principal Markets and Foreign Operations

The Company conducts business in Canada and the United Kingdom. As at September 30, 2013, the Company operated 537 (September 30, 2012 - 536) short-term advance branches across Canada (510 branches) and the United Kingdom (27 branches). The Company operates branches in all Canadian provinces and territories except Quebec and Nunavut. The following chart presents the geographic distribution of the Company’s branches:

|

| |

| September 30, 2013 | Branches |

| British Columbia | 97 |

| Alberta | 122 |

| Saskatchewan | 34 |

| Manitoba | 25 |

| Ontario | 174 |

| New Brunswick | 14 |

| Nova Scotia | 25 |

| Prince Edward Island | 3 |

| Newfoundland and Labrador | 13 |

| Northwest Territories | 2 |

| Yukon | 1 |

| United Kingdom | 27 |

| Total | 537 |

The Company also has investments in the following foreign operations:

| |

| • | 18.3% of the outstanding common shares of The Cash Store Australia Holdings Inc., which operated payday loan branches in Australia under the name “The Cash Store Pty.” ("Pty"). The Cash Store Australia Holdings Inc. is publicly listed on the TSX Venture exchange under the symbol “AUC”. In December of 2012 the Alberta, Ontario and British Columbia Securities Commissions issued cease trade orders in respect of the shares of AUC for failure to file financial statements. On September 13, 2013 Pty appointed a voluntary administrator pursuant to Section 436A of the Australian Corporations Act 2001. In the opinion of the directors of Pty, Pty is insolvent. The Administrator has taken control of the operations and assets of Pty and the application to have the cease trade orders revoked have been withdrawn by AUC. |

| |

| • | 15.7% of the outstanding common shares of RTF Financial Holdings Inc., a private company in the business of short-term lending by utilizing highly automated mobile technology (SMS text message lending). RTF Financial Holdings Inc. currently operates in the UK. |

Competition

The Company has a market share of approximately one third of all payday loan branches in Canada. The Company estimates there are approximately 1,500 short-term advance branches across Canada. The Company’s biggest competitor is DFC Global Corp. (“Dollar Financial”), a U.S.-based public company. Dollar Financial operates approximately 489 branches in Canada under the banner “Money Mart”. “Cash Money” is the next largest operator in Canada with approximately 120 branches. The remainder of the payday loans market consists of small, single store operations and regional operations that may have a number of payday loan advance centres in a given region. Competition also comes from companies, such as cheque cashers, pawnshops, rental stores and others, that offer the payday loan service as an ancillary service. Several companies also provide payday loans via the Internet.

In addition to other unsecured consumer lending and cheque cashing stores and online lenders, the Company competes with banks and other financial services entities and retail businesses that offer consumer loans and lines of credit, cash cheques, sell money orders, provide money transfer services or offer other products and services offered by the Company.

The Company estimates that the UK market for small, unsecured short-term consumer loans is served by approximately 1,200 store locations as well as numerous online lenders.

Some of the Company's competitors have larger and more established customer bases in other provinces and substantially greater financial and other resources than the Company.

Competitive Strengths

Management believes that the Company has a number of competitive strengths that provide a solid base for continued growth.

The Company’s branch environment is unique in the market. Because Cash Store Financial branches do not disburse cash, the Company is able to offer a comfortable, upscale, open concept floor plan where customers can sit down with a customer service advisor to discuss their needs, much like they would in a traditional bank.

This differentiated environment complements the Company’s expanded product offering, which is designed for long term customer retention.

Customers choose to do business with the Company for a number of reasons, including:

| |

| • | the range of products offered; |

| |

| • | the provision of access to flexible credit products through a graduated line of credit suite that rewards good payment behavior; |

| |

| • | the provision of opportunities for consumers to rebuild credit; |

| |

| • | the comfortable, friendly, open concept branch environment that is more bank-like than other consumer lending stores; |

| |

| • | the specialized support and committed customer service that they receive from well-trained associates; and |

| |

| • | the convenience of branch locations and hours. |

Intangible Assets

Through past business combinations, the Company has acquired customer lists, contracts, and relationships as well as brand names. These intangible assets have been and will continue to be important to the Company’s overall success.

In January 2012, the Company acquired significant non-compete agreements, favourable supplier relationships, and proprietary knowledge from third-party lenders through the acquisition of consumer loans. Given that the majority of the Company’s operations are in the the provinces where the loans were originated and the Company continues to depend on third-party lenders, the Company views these intangibles as critical to its future success and future growth.

Cycles

The Company has observed that the payday loans market, in terms of sales, has been relatively stable over the last several years and not strongly tied to general economic conditions.

The Company’s business is not significantly affected by seasonality. Typically the Company’s strongest

revenues are in its third and fourth fiscal quarters (which correspond with tax season and the summer months) followed by the Company’s first fiscal quarter (Christmas/holiday season). The Company’s second fiscal quarter is typically the weakest. In addition to seasonal demand, quarterly results are impacted by the number and timing of new branch openings.

Economic Dependence

The Company’s business depends on the willingness of third-party lenders to make significant funds available for lending to the Company’s customers and to purchase loans that the Company has made. There are no assurances that existing or new third-party lenders will continue to make funds available. Any reduction or withdrawal of funds could have a material adverse impact on the Company’s results of operations and financial condition.

For a description of arrangements with third-party lenders, refer to the section entitled "Off-Balance Sheet Arrangements" in the Company’s MD&A available on the Company's profile on SEDAR at www.sedar.com

Employees

As at September 30, 2013, the Company had 1,856 active employees across Canada and the United Kingdom.

Risks and Uncertainties

The Company’s business is subject to risks and uncertainties that could result in material adverse effects on its business and financial results. Additional risks and uncertainties not presently known to Cash Store Financial, or that it currently deems immaterial, may also impair its business operations.

A discussion of the risk factors relating to business and operations can be found in the section entitled "Risks and Uncertainties" in the Company’s MD&A available on the Company's profile on SEDAR at www.sedar.com.

RATINGS

The following information relating to the Company’s credit ratings is provided as it relates to financing costs and liquidity. Specifically, credit ratings affect the Company’s ability to obtain short-term and long-term financing and the cost of such financing. A reduction in the current ratings on the Company's debt by its rating agencies, particularly a downgrade or a negative change in the ratings outlook, could adversely affect the Company’s cost of financing and its access to sources of liquidity and capital. In addition, changes in credit ratings may affect the Company’s ability to, and the associated costs of, entering into normal course derivative or hedging transactions or its ability to maintain ordinary course contracts with customers and suppliers on acceptable terms.

Moody’s Investor Service, Inc. (“Moody’s”)

Caa1: The Caa1 rating assigned to the Company’s corporate family and the Notes is within the C rating category which is the seventh highest rating of Moody’s nine rating categories, which range from Aaa to C. Moody’s appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aaa through Caa. The modifier 1 indicates a ranking in the higher end of that generic rating category. The outlook trend for this rating is negative.

Moody’s rating description: Obligations rated Caa are judged to be of poor standing and are subject to very high credit risk.

Standard and Poor’s Ratings Services, a division of The McGraw-Hill Companies, Inc. (“S&P”)

CCC+ (Recovery Rating 4): The CCC+ rating assigned to the Company and the Notes is within the CCC rating category which is the ninth highest rating of S&P’s twelve rating categories, which range from AAA to D. The ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. A recovery rating of 4 indicates an average recovery, or 30-50% of accrued principal plus interest at the time of default. S&P’s ratings outlook is negative.

S&P Rating Description: An obligation rated 'CCC' is currently vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments.

Credit ratings are intended to provide investors with an independent assessment of the credit quality of an issue or an issuer of securities and such ratings do not address the suitability of a particular security for a particular investor. The ratings assigned to a security may not reflect the potential impact of all risks on the value of the security. The Company pays the applicable rating agency fees to have its debt rated by the rating agency. A rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the rating organization.

CAPITAL STRUCTURE

Cash Store Financial is authorized to issue an unlimited number of Common Shares having the following rights, privileges, restrictions and conditions:

| |

| 1. | The holders of Common Shares are entitled to receive notice of, and vote at, every meeting of the shareholders of Cash Store Financial and shall have one vote for each such Common Share held. |

| |

| 2. | Subject to the rights, privileges, restrictions and conditions attached to any preferred shares of Cash Store Financial, the holders of Common Shares are entitled to receive such dividends as the directors of the Company may from time to time, by resolution, declare. |

| |

| 3. | Subject to the rights, privileges, restrictions and conditions attached to any Common Shares of Cash Store Financial, in the event of liquidation, dissolution or winding up of Cash Store Financial or upon any distribution of the assets of Cash Store Financial among shareholders being made (other than by way of dividends out of monies properly applicable to the payment of dividends), the holders of Common Shares shall be entitled to share pro rata. |

DIVIDENDS

The Company paid dividends to shareholders from 2008 to 2012. Starting in the fourth fiscal quarter of 2012 the Board suspended quarterly dividends. The dividend distribution policy is reviewed on a quarterly basis. This review includes evaluating the Company’s financial position, profitability, cash flow and other factors that the Board considers relevant. The ability to declare and pay dividends is subject to compliance with a restricted payment covenant stipulated in the indenture governing the Notes.

The following is the Company’s dividend history for the past three fiscal years:

|

| | | |

| Date declared | Date paid | Dividend per Common Share | Total amount paid ($000’s) |

| December 6, 2010 | December 21, 2010 | $0.10 | $1,710 |

| February 7, 2011 | February 21, 2011 | $0.12 | $2,062 |

| May 9, 2011 | May 24, 2011 | $0.12 | $2,084 |

| August 10, 2011 | August 25, 2011 | $0.12 | $2,073 |

| November 16, 2011 | December 14, 2011 | $0.12 | $2,091 |

| February 8, 2012 | March 7, 2012 | $0.12 | $2,091 |

| May 10, 2012 | June 7, 2012 | $0.06 | $1,039 |

| August 10, 2012 | September 7, 2012 | $0.06 | $1,049 |

MARKET FOR SECURITIES

Trading Price and Volume

The Common Shares are listed on the TSX under the symbol “CSF” and on the NYSE under the symbol “CSFS”. The volume and price range for the Common Shares as traded on the TSX for each month for the twelve month period ended September 30, 2013, were as follows:

|

| | | |

| Month | Volume of shares traded | Price Range ($CDN) |

| Low | High |

| October, 2012 | 280,884 | 4.57 | 5.73 |

| November, 2012 | 778,620 | 4.00 | 4.85 |

| December, 2012 | 504,860 | 2.85 | 4.44 |

| January, 2013 | 304,445 | 3.32 | 4.05 |

| February, 2013 | 490,438 | 2.85 | 4.38 |

| March, 2013 | 402,532 | 2.49 | 3.00 |

| April, 2013 | 806,482 | 1.65 | 3.07 |

| May, 2013 | 208,383 | 2.86 | 3.45 |

| June, 2013 | 220,774 | 2.35 | 3.37 |

| July, 2013 | 109,261 | 2.05 | 2.71 |

| August, 2013 | 79,744 | 2.15 | 2.50 |

| September, 2013 | 284,519 | 1.50 | 2.18 |

Prior Sales

On January 31, 2012, the Company completed a private placement offering in Canada and the US for $132.5 million of 11.5% Notes. The Notes mature on January 31, 2017 and bear interest semi-annually on January 31 and July 31 each year. The Notes were issued at a price of 94.608% resulting in an effective interest rate of 13.4%.

The indenture governing the Notes ("the Indenture") contains certain covenants that limit the Company’s ability to:

| |

• | incur or guarantee additional indebtedness; |

| |

• | make capital expenditures; |

| |

• | make certain investments and acquisitions; |

| |

• | amend the Company’s dividend policy or pay dividends or make distributions on capital stock or make certain other restricted payments; |

| |

• | sell assets, including capital stock of the Company’s restricted subsidiaries; |

| |

• | enter into transactions with affiliates; |

| |

• | agree to payment restrictions affecting restricted subsidiaries; |

| |

• | amend underwriting standards; |

| |

• | form subsidiaries or fund foreign subsidiaries; and |

| |

• | consolidate, merge, sell or otherwise dispose of assets, except those in the ordinary course of operations. |

The ability to declare and pay dividends is subject to compliance with a restricted payment covenant stipulated

in the Indenture.

Compliance with the covenants are not impacted solely through the ordinary course of operations or the results of operations. The Company remains in compliance with all of the covenants under this Indenture.

In the event of specified change of control events, holders of Notes will have the right to require the Company to purchase all or a portion of the Notes at a purchase price in cash equal to 101% of the principal amount purchased, plus accrued interest to the date of purchase. In addition, upon certain asset sales, we may be required to use the net proceeds of such sales to offer to repurchase a portion of the Notes at a price in cash equal to 100% of the principal amount purchased, plus accrued and unpaid interest to the date of purchase.

Under the terms of the Notes, the Company may redeem up to 35% of the Notes with the net proceeds of certain equity offerings at a redemption price equal to 111.5% of the principal amount redeemed, plus accrued and unpaid interest to the redemption date any time before July 31, 2014. The Notes are redeemable in whole or in part, at any time on or after July 31, 2014 at the redemption prices (expressed as percentages of principal amounts) in the table below, plus accrued and unpaid interest:

|

| |

| For the period | Percentage |

| On or after July 31, 2014 | 103.084% |

| On or after January 31, 2015 | 102.091% |

| On or after July 31, 2015 | 101.127% |

| On or after January 31, 2016 | 101.194% |

| On or after July 31, 2016 | 100.000% |

The Indenture contains a first lien carve out that allows us to obtain credit facilities of up to $32.5 million.

Proceeds from the issuance of the Notes were $125.2 million. The Company used $116.3 million of the proceeds to acquire a portfolio of loans from third-party lenders. $8.2 million of the proceeds were used to pay fees and expenses related to the issuance and remainder was used for general corporate purposes.

DIRECTORS AND OFFICERS

As at December 11, 2013, the Company’s directors and senior executive officers together beneficially owned 4,665,700 (26.5%) of the outstanding Common Shares.

The names and province or state, and country of residence of the directors and senior executive officers of the Company, the date when the individual first became a director, their principal occupations, the positions in the Company held by them and the number and percentage of voting securities of the Company as at December 11, 2013, are set out in the following table:

|

| | | |

| Name, Province or State, and Country of Residence | Position with the Company and Date First Became a Director | Principal Occupation, Business or Employment

(5 preceding years unless otherwise indicated) | Number and percentage of Common Shares beneficially owned, directly or indirectly, or over which control or

direction is exercised |

Eugene I. Davis (2)(3) Livingston, New Jersey, USA

| Chairman of the Board June 26, 2013 | Chairman of the Board of Atlas Air Worldwide Holdings Inc. (Nasdaq: AAWW), and U.S. Concrete, Inc (Nasdaq:USCR). Director of Global Power Equipment Group Inc (Nasdaq:GLPW)., Spectrum Brands Holdings Inc.(NYSE:SPB) and WMI Holdings Corp. | Nil |

Gordon Reykdal (2) Edmonton, Alberta, Canada | Director and Chief Executive Officer February 23, 2001 | Founder and Chief Executive Officer of the Company. | 3,640,300(4) 20.7% |

William C. (Mickey) Dunn (3) Calgary, Alberta, Canada | Director May 14, 2002 | Chairman of Bellatrix Exploration (NYSE:BXE), an oil and gas exploration company. A director of Precision Drilling Inc. prior to the 2009 Arrangement of True Energy. | 750,000 4.3% |

Edward C. McClelland (2) Burlington, Ontario, Canada | Director November 8, 2005 | Chairman of TEC (The Executive Committee) Group 223 & 323, an organization of international CEO’s. Director of The Cash Store Australia Holdings Inc. since 2009. | 29,500 0.2% |

Donald C. Campion (1) Commerce Twp, Michigan, USA | Director August 14, 2013 | Director of Haynes International, Inc. (NASDAQ: HAYN) and is an independent director and Chair of the Audit Committee for three privately held companies. | Nil |

Thomas L. Fairfield (1)(3) Landenberg, Pennsylvania, USA | Director August 14, 2013 | Executive Vice President, Chief Operating Officer, Counsel and a Director of Capmark Financial Group Inc, a financial services company focused on the commercial real estate industry. | Nil |

Ron Chicoyne (1)(2) Calgary, Alberta, Canada | Director October 29, 2008 | Founder & Managing Director of Links Capital Partners Ltd., an independent corporate finance firm. | 8,450 0.0% |

|

| | | |

| Name, Province or State, and Country of Residence | Position with the Company and Date First Became a Director | Principal Occupation, Business or Employment

(5 preceding years unless otherwise indicated) | Number and percentage of Common Shares beneficially owned, directly or indirectly, or over which control or

direction is exercised |

Timothy J. Bernlohr (2)(3) Newtown, Pennsylvania, USA | Director August 14, 2013 | Managing Director of TJB Management Consulting, LLC, a firm specializing in project-specific consulting services to businesses in transformation. Chairman of the Board of Directors of Champion Home Builders, Inc. and The Manischewitz Co. and is a director of Atlas Air Worldwide Holdings (Nasdaq:AAWW), Chemtura Corp. (NYSE:CHMT) and Rock-Tenn Company (NYSE:RKT). | Nil |

Kevin Paetz Edmonton, Alberta, Canada | President and Chief Operating Officer, Canadian Operations | Chief Operating Officer, Canadian Operations since March 1, 2012. Prior to this, he spent seven years with DFC Global Corp. (Dollar Financial) in several leadership positions including: Vice President Acquisitions, Vice President of Operations, United Kingdom, and Vice President, Field Operations Canada. | 15,100 0.1% |

Barret Reykdal Bowdon, United Kingdom | President and Chief Operating Officer, UK Operations | Chief Operating Officer of the Company’s UK operations since March 1, 2012. Prior to that he was the Chief Operating Officer of the Company since April 2005. | 170,367 1.0% |

Craig Warnock Edmonton, Alberta, Canada | Chief Financial Officer | Chief Financial Officer of the Company since July 3, 2012. From August 2010 to July 2012 he was Executive Vice President and Chief Financial Officer of a private foreign exchange company. From May 2008 to May 2010 he served as Chief Financial Officer and Treasurer of the City of Edmonton. | 4,000 0.0% |

S. William (Bill) Johnson Edmonton, Alberta, Canada | Senior Executive Vice President | Senior Executive Vice President since November 2008. Chief Financial Officer and Director of affiliated companies The Cash Store Australia Holdings Ltd. and RTF Financial Holdings Inc. | 35,600 0.2% |

Halldor Kristjansson Edmonton, Alberta, Canada | Senior Executive Vice President Banking and Credit | Senior Executive Vice President of the Company since November 2010. Prior to joining the Company, he served as Group Co-Chief Executive Officer and Group Managing Director of a private Icelandic bank. | Nil |

|

| | | |

| Name, Province or State, and Country of Residence | Position with the Company and Date First Became a Director | Principal Occupation, Business or Employment

(5 preceding years unless otherwise indicated) | Number and percentage of Common Shares beneficially owned, directly or indirectly, or over which control or

direction is exercised |

Michael Thompson Edmonton, Alberta, Canada | Senior Vice President Corporate Affairs | Senior Vice President Corporate Affairs since February 2012, prior to which he was the Senior Vice President and Corporate Secretary since February 2008. | 7,383 0.0% |

Michael Baker Edmonton, Alberta, Canada | Senior Vice President, Canadian Operations | Senior Vice President, Canadian Operations since September 2013. From 2010 to 2013 was Senior Vice President Investment Operations with the Alberta Investment Management Corp. Previously spent 11 years with ATB Financial in a variety of executive leadership roles. | 5,000 0.0% |

Dean Ozanne Edmonton, Alberta, Canada | Senior Vice President Virtual Operations and Innovation | Senior Vice President Virtual Operations and Innovation since September, 2013. Previously spent 13 years with ATB Financial in a variety of executive leadership roles. | 27,950 0.2% |

Notes

| |

| (1) | Member of Audit Committee. |

| |

| (2) | Member of Corporate Governance and Nominating Committee. |

| |

| (3) | Member of Compensation Committee. |

| |

| (4) | 3,222,635 of these shares are directly owned by 424187 Alberta Ltd., a company controlled by Mr. Gordon Reykdal; 272,968 are held by Mr. Gordon Reykdal directly and 144,697 are held by Mr. Gordon Reykdal’s spouse. |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Corporate Cease-Trade Orders or Bankruptcies

Other than as set out below, no director, executive officer , or shareholder of the Company holding a sufficient number of securities of the Company to affect materially the control of the Company, or personal holding company of any of such persons, as applicable, is or has been, within the preceding 10 years of the date hereof, a director, chief executive officer or chief financial officer of any company (including the Company) that, while that person was acting in such capacity:

| |

| a) | was the subject o a cease-trade order or similar order or an order that denied the relevant company access to any exemptions under securities legislation for a period of more than 30 consecutive days (an "order"); |

| |

| b) | was subject to an order that was issued after the director, chief executive officer, or chief financial officer ceased to be a director or executive officer and resulted from an event that occurred while that person was acting in such a capacity. |

Disclosure of Ron Chicoyne as a Director of a bankrupt company

Ron Chicoyne served as a director of Paintearth Energy Services Ltd. (“Paintearth”), a private Alberta oilfield services company, from June 2008 to May 18, 2010. Mr. Chicoyne resigned from Paintearth several months before an interim receiver was appointed by the Court of Queen’s Bench of Alberta in respect of the property of Paintearth. On December 20, 2010, the Court of Queen’s Bench of Alberta approved a purchase and sale transaction for the sale of all of the assets of Paintearth to a third party.

Disclosure of Gordon Reykdal and Edward C. McClellend as Directors and S. William (Bill) Johnson as a Director and Chief Financial Officer of The Cash Store Australia Holdings Inc (AUC), a Company subject to a cease trade-order and insolvency

AUC operated payday loan branches in Australia under the name “The Cash Store Pty.” ("Pty"). AUC is publicly listed on the TSX Venture exchange under the symbol “AUC”. In December of 2012 the Alberta, Ontario and British Columbia Securities Commissions issued cease trade orders in respect of the shares of AUC for failure to file financial statements. On September 13, 2013 Pty appointed a voluntary administrator pursuant to Section 436A of the Australian Corporations Act 2001. In the opinion of the directors of Pty, Pty is insolvent. The Administrator has taken control of the operations and assets of Pty and the application to have the cease trade orders revoked have been withdrawn by AUC.

Penalties or Sanctions

No director, executive officer of the Company, or shareholder of the Company holding a sufficient number of securities of the Company to affect materially the control of the Company, or personal holding company of any such persons, is or has been subject to any penalties or sanctions relating to securities legislation imposed by a court or by a securities regulatory authority, or has entered into a settlement agreement with a securities regulatory authority or has been subject to any other penalties or sanction imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision concerning the Company’s securities.

Personal Bankruptcies

No director, executive officer of the Company, or shareholder of the Company holding a sufficient number of securities of the Company to affect materially the control of the Company, or a personal holding company of any such persons, is or has, within the preceding 10 years, become bankrupt, made a proposal under any legislation as at the date hereof relating to bankruptcy or insolvency, or was at the date hereof subject to or instituted any proceedings, arrangement, or compromise with creditors, or had a receiver, receiver-manager or trustee appointed to hold its assets.

The directors, officers and shareholders of the Company holding a sufficient number of securities of the Company to affect materially the control of the Company have furnished the information pertaining to corporate cease-trade orders or bankruptcies, penalties or sanctions and personal bankruptcies.

Conflicts of Interest

To the best of the knowledge of the directors and executive officers of the Company, the following are existing or potential material conflicts of interest between directors or executive officers and the Company, its subsidiaries and entities that the Company holds significant influence:

| |

| • | 424187 Alberta Ltd., a company controlled by the Company’s CEO, Gordon Reykdal, provided a loan to the Company as described in Note 25 to the Company's annual consolidated financial statements; |

| |

| • | Mr. Gordon Reykdal, Mr. S. William Johnson and Mr. Edward C. McClelland are currently on the board of directors of The Cash Store Australia Holdings Inc., a company in which the Company has an investment as described above in "Principal Markets and Foreign Operations"; |

| |

| • | Mr. Gordon Reykdal and Mr. S. William Johnson are currently on the board of directors of RTF Financial Holdings Inc., a company in which the Company has an investment as described above in "Principal Markets and Foreign Operations"; |

| |

| • | Mr. S. William Johnson is the Chief Financial Officer of The Cash Store Australia Holdings Inc. and RTF Financial Holdings Inc.; and |

| |

| • | Mr. Barret J. Reykdal is the son of Mr. Gordon Reykdal. |

LEGAL PROCEEDINGS

The Company is subject to class action proceedings and other material claims in the Canada and the United States. A detailed description of each proceeding and its status can be found in the section entitled “Risks and Uncertainties” in the 2013 annual MD&A available on the Company's profile on SEDAR at www.sedar.com.

REGULATORY ACTIONS

The Company is currently subject to ongoing regulatory actions in the Canadian provinces of British Columbia and Ontario. The result of these regulatory actions may impose significant limitations on the way the Company conducts or expands its business.

A discussion of current regulatory actions and the regulatory environment can be found in the section entitled “Risks and Uncertainties” in the 2013 annual MD&A available on the Company's profile on SEDAR at www.sedar.com.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

Except as disclosed under the heading “conflicts of interest”, to the best of the knowledge of the directors and executive officers of the Company, no director or executive officer of the Company or person or company that is the direct or indirect beneficial owner of, or who exercises control or direction over more than 10% of the outstanding Common Shares of, or any of their associates or affiliates, had any material interest, direct or indirect, in any transaction within the three most recently completed financial years, or during the current financial year, that has materially affected, or is reasonably expected to materially affect the Company.

TRANSFER AGENTS AND REGISTRARS

Computershare Investor Services Inc. acts as the transfer agent and registrar for the Common Shares of Cash Store Financial through its office in Toronto, Ontario.

MATERIAL CONTRACTS

Except for contracts entered into in the ordinary course of business, the Company entered into the following agreements, copies of which can be found on SEDAR at www.sedar.com:

| |

| • | A credit agreement dated November 29, 2013 between the Company and Coliseum Capital Management, LLC, 8028702 Canada Inc. and 424187 Alberta Ltd. pursuant to which $12.0 million of loans were provided to the Company. |

EXPERTS

KPMG LLP, Chartered Accountants (“KPMG”) were the auditors of the Company for the year ended September 30, 2013, and prepared and executed the audit report accompanying the annual financial statements. KPMG LLP have confirmed that they are independent with respect to the Company within the meaning of the relevant rules and related interpretations prescribed by the relevant professional bodies in Canada and any applicable legislation or regulation, and that are independent accountants with respect to the Company under all relevant US professional and regulatory standards.

AUDIT COMMITTEE INFORMATION

Audit Committee’s Charter

The Company’s Audit Committee charter sets out its roles and objectives, responsibilities and duties, and membership standards for reporting to the Board. A copy of the charter is attached hereto as Appendix “A”.

Composition of the Audit Committee

The Company’s board of directors has a separately-designated standing audit committee (the “Audit Committee”) established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). The Audit Committee is composed of Donald Campion, Thomas Fairfield and Ron Chicoyne, all of whom, in the opinion of the Board, are independent and financially literate. Each member of the Audit Committee is “financially literate” within the meaning of applicable Canadian securities laws.

Relevant Education and Experience

1. Donald Campion, BSc., MBA (Chairman of the Audit Committee)

Mr. Campion is a senior executive with broad corporate experience with strategic acquisitions, divestitures, integration activities and international operations. Mr. Campion currently serves as a director of Haynes International, Inc. (NASDAQ: HAYN), where he serves as the Chair of the Audit Committee, and is an independent director and Chair of the Audit Committee for three privately held companies. Mr. Campion had been a senior-level financial executive with a number of public and private companies. He spent 27 years with General Motors Corporation where he held various positions including CFO of several operating divisions, and he was the CFO of four privately held companies.

2. Thomas Fairfield, B.S.F.S.

Mr. Fairfield is Executive Vice President, Chief Operating Officer, Counsel and a director of Capmark Financial Group Inc. Capmark is a financial services company focused on the commercial real estate industry. Prior to joining Capmark in 2006, Mr. Fairfield practiced corporate and securities law for more than 20 years. He is admitted to the bar of the states of Connecticut, Pennsylvania, New York and the District of Columbia, and is a member of the American Bar Association and the National Association of Stock Plan Professionals.

3. Ron Chicoyne, CFA, CF, ICD.D

Mr. Chicoyne holds a Chartered Financial Analyst designation, Corporate Finance Qualification, Institute of Corporate Directors designation and received his Bachelor of Commerce (Honours) degree from the University of Manitoba. He is the founder and Managing Director of Links Capital Partners Ltd., a boutique corporate finance firm. Prior to this, he was a partner and director of the private equity firm, Mercantile

Bancorp Limited.

Audit Committee Financial Expert

The Board has determined that it has at least one Audit Committee financial expert serving on its Audit Committee. The Company’s board of directors has determined that Donald Campion is an audit committee financial expert and is independent (as definded under Rule 10A-3 of the Exchange Act and Section 303A.06 of the New York Stock Exchange’s Listed Company Manual).

The U.S. Securities and Exchange Commission has indicated that the designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose on such person any duties, obligations or liability that are greater than those imposed on such person as a member of the Audit Committee and the Board in the absence of such designation and does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

Pre-approval Policies and Procedures

As part of the Company’s corporate governance structure, the Audit Committee annually reviews and approves the terms and scope of the auditor’s engagement. To further ensure that the independence of the auditors is not compromised, Company policy requires that the Audit Committee also pre-approve all significant engagements of the auditors for non-audit services and monitor all other engagements.

In addition, all non-audit service engagements, regardless of the cost estimate, are required to be coordinated by the Company’s Chief Financial Officer, or a designate, to further ensure that adherence to this policy is monitored. All non-audit service engagements must also be reported to the Audit Committee on a quarterly basis.

External Audit Fees by Category

KPMG has served continually as the Company’s external auditor since January 2002. The following table lists the fees billed by KPMG, by category, during the last two fiscal years:

|

| | | | | | |

| Year Ended September 30, 2013 | Year Ended September 30, 2012 |

| Audit fees |

| $1,457,885 |

|

| $638,250 |

|

| Audit-related fees |

| $198,780 |

|

| $510,450 |

|

| Tax fees |

| $10,000 |

|

| $3,600 |

|

| All other fees | Nil |

| Nil |

|

| Total fees |

| $1,666,665 |

|

| $1,152,300 |

|

Audit Fees - Audit fees were paid for professional services rendered by the auditors for the audit of the Company’s annual financial statements or services provided in connection with statutory and regulatory filings or engagements and the review of the Company’s interim financial statements.

Audit-related Fees - Audit-related fees were paid for assurance and related services that are related to the performance of the audit or review of the annual and interim financial statements and are not reported under the audit fees item above. These services consisted of special attest services as required by various government entities, services provided in relation to foreign investments and services in respect of special transactions.

Tax Fees - Tax fees were paid for professional services relating to tax compliance, tax advice and tax planning. These services consisted of the review of a goods and services tax re-assessment.

ADDITIONAL INFORMATION

Additional information relating to the Company is available on the Company's profile on SEDAR at www.sedar.com.

Additional information, including directors’ and officers’ remuneration and indebtedness, principal holders of the Company’s securities, and securities authorized for issuance under equity compensation plans is contained in the Company’s management information circular dated December 11, 2013.

Additional financial information is provided in the Company’s audited consolidated financial statements and MD&A for the year ended September 30, 2013, both of which are available on the Company's profile on SEDAR at www.sedar.com.

Security holders may also obtain a copy of the Company’s financial statements and MD&A by writing to the Company at 15511 – 123 Avenue, Edmonton, Alberta T5V 0C3 attention: Chief Financial Officer, or through the Company’s website at www.csfinancial.ca.

APPENDIX “A”

THE CASH STORE FINANCIAL SERVICES INC.

AUDIT COMMITTEE CHARTER

| |

| 1.1 | The primary duties and responsibilities of the Audit Committee of the board of directors (“Board of Directors”) of The Cash Store Financial Services Inc. (the “Corporation”) are to: |

| |

| (a) | assist the Board of Directors with its oversight of the integrity of the Corporation’s financial statements and the Corporation’s compliance with legal and regulatory requirements; |

| |

| (b) | review and recommend to the Board for approval, prior to their public release, all material financial information required to be gathered and disclosed by the Corporation; |

| |

| (c) | oversee management designed and implemented accounting systems and internal controls; and |

| |

| (d) | be directly responsible for recommending, engaging, supervising, arranging for the compensation of and ensuring the independence and qualifications of any external auditor to the Corporation engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Corporation. |

| |

| 2. | COMPOSITION AND MEETINGS |

| |

| 2.1 | The Audit Committee will be comprised of at least three members of the Board each of whom will at all times be independent and financially literate as those terms are defined in National Instrument 52- 110 Audit Committees and the NYSE Listed Company Manual, and possess: |

| |

| (a) | an understanding of the accounting principles used by the Corporation to prepare its financial statements; |

| |

| (b) | the ability to assess the general application of such accounting principles in connection with the accounting for estimates, accruals and reserves; |

| |

| (c) | experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Corporation’s financial statements, or experience actively supervising one or more individuals engaged in such activities; and |

| |

| (d) | an understanding of internal controls and procedures for financial reporting. |

| |

| 2.2 | The Audit Committee shall have at least one audit committee financial expert who has acquired the attributes listed above through education and experience as a principal financial officer, principal accounting officer, controller, public accountant, auditor, experience in positions performing similar functions, experience supervising persons performing similar functions, experience overseeing or assessing the performance of companies or public accountants with respect to preparation, auditing or evaluation of financial statements, or other relevant experience. |

| |

| 2.3 | The Audit Committee is required to meet in person, or by telephone conference call at least once each quarter and as often thereafter as required to discharge the duties of the Audit Committee. |

| |

| 2.4 | Each member of the Audit Committee shall serve at the pleasure of the Board of Directors and, in any event, only so long as that person shall be an independent director. The Board of Directors may remove a member of the Audit Committee at any time in its sole discretion by resolution of the Board of Directors. The Directors may fill vacancies in the Audit Committee by election from among their number. |

| |

| 2.5 | In connection with the appointment of the members of the Audit Committee, the Board of Directors will determine whether any proposed nominee for the Committee serves on the audit committees of more than three public companies. To the extent that any proposed nominee for membership on the Audit Committee serves on the audit committees of more than three public companies, the Board of Directors will make a determination as to whether such simultaneous services would impair the ability of such member to effectively serve on the Audit Committee and may disclose such determination in the Corporation’s annual report on Form 40-F or Form 20-F, as applicable, filed with the United States Securities and Exchange Commission (the “SEC”). |

| |

| 2.6 | The Chairman of the Audit Committee appointed by the Board will, in consultation with the members, determine the schedule, time and place of meetings, and in consultation with management and the external auditor, establish the agenda for meetings. |

| |

| 2.7 | Notice of the time and place of every meeting shall be given in writing, by email or facsimile to each member of the Audit Committee at least 24 hours prior to the time fixed for such meeting, provided that a member may in any manner waive a notice of meeting. |

| |

| 2.8 | The Committee should hold an in-camera session without management present, including management directors, as a regular feature of each regularly scheduled Committee meeting. |

| |

| 3.1 | A quorum for a meeting of the Audit Committee shall be a majority of members present in person or by telephone conference call. |

The Audit Committee is responsible for:

| |

| 4.1 | Financial Reporting - Prior to public disclosure, the Audit Committee will meet to review and discuss with senior management and the independent external auditors and to recommend to the Board of Directors for approval, the Corporation’s: |

| |

| (a) | annual consolidated financial statements and interim unaudited consolidated financial statements; |

| |

| (b) | annual and interim management discussion and analysis of financial condition and results of operations (MD&A); |

| |

| (c) | earnings press release and earnings guidance, if any; and |

| |

| (d) | financial public disclosure documents, including but not limited to, prospectuses, press releases with financial results and relevant sections of the Corporation’s Annual Information Form, Management Information Circular, Annual Report and SEC Form 40-F or Form 20-F, as applicable. |

4.2 Accounting and Financial Management

| |

| (a) | The Audit Committee will review, together with management, the internal auditor and the external auditors: |

| |

| (i) | the Corporation’s major accounting policies (including the impact of alternative accounting policies), key management estimates, risks and judgments that could materially affect the financial results and whether they should be disclosed in the MD&A; |

| |

| (ii) | any proposed changes to the Corporation’s accounting policies including alternative treatment available to the Corporation; |

| |

| (iii) | emerging accounting issues and their potential impact on the Corporation’s financial reporting; |

| |

| (iv) | the evaluation by either the internal or external auditors of the Corporation’s internal control systems, and management’s responses to any identified weaknesses; and |

| |

| (v) | the evaluation by management of the adequacy and effectiveness in the design and operation of the Corporation’s disclosure controls and internal controls over financial reporting. |

| |

| (b) | The Audit Committee will: |

| |

| (i) | be satisfied and obtain reasonable assurances from management and the external auditors that accounting systems are reliable; prescribed internal controls are effective; and adequate procedures are in place for the review of the disclosure of financial information extracted or derived from the Corporation’s financial statements; |

| |

| (ii) | periodically assess the adequacy of accounting systems, internal controls and procedures for the review of disclosure of financial information; |

| |

| (iii) | review control weaknesses identified by the external auditor and management's response; |

| |

| (iv) | review with the external auditor its view of the qualifications and performance of the key financial and accounting executives; |

| |

| (v) | discuss issues of its choosing with the external auditor, management and corporate counsel; and |

| |

| (vi) | make inquiries of the external auditor and legal counsel to the Corporation regarding potential claims, assessments, contingent liabilities, and legal and regulatory matters that may have a material impact on the financial statements of the Corporation. |

4.3 Whistleblower Complaint Procedures

The Committee will:

| |

| (a) | establish procedures for the confidential anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters. Following the receipt of any complaints received submitted through the confidential process established by the Corporation, if a complaint is deemed to require further investigation, the Audit Committee shall take appropriate steps to carry out such investigation, including appointing the appropriate investigators with respect to such complaint; and |

| |

| (b) | establish procedures for the receipt and treatment of complaints received by the Corporation regarding accounting, internal accounting controls and auditing matters and the retention (for at least 7 years) of copies of concerns and evidence of investigations. |

4.4 Independent Audit Function

To preserve the independence of the external auditor responsible for preparing or issuing an auditor’s report or performing other audit, review or attest services for the Corporation, the external auditors will report directly to the Audit Committee and the Committee will be directly responsible for:

| |

| (a) | maintaining direct communications with the external auditors ensuring that the external auditor is answerable to the Audit Committee, as representatives of the shareholders, rather than to the executive officers and management of the Corporation; |

| |

| (b) | overseeing the work of the external auditor; |

| |

| (c) | recommending to the Board of Directors the external auditor to be nominated; |

| |

| (d) | recommending to the Board of Directors the external auditor’s compensation; |

| |

| (e) | evaluating the external auditor’s qualifications, performance and independence including by annually reviewing: |

| |

| (i) | a report of the auditor describing its internal quality-control procedures; |

| |

| (ii) | material issues raised by its most recent internal quality-control review; and |

| |

| (iii) | the results of any inquiry or investigation by government or professional authorities of the auditor within the last five years; |

| |

| (f) | reviewing the experience and qualifications of the senior members of the external auditors, ensure that the lead audit partner is replaced periodically in accordance with applicable law, and that the audit firm continues to be independent; |

| |

| (g) | annually, prior to public disclosure of its annual financial statements, confirming that the external auditor has current participant status with the Canadian Public Accountability Board; |

| |

| (h) | reviewing and pre-approving any engagements for non-audit services to be provided by the external auditor and its affiliates in light of the estimated fees and impact on the external auditor’s independence; |

| |

| (i) | reviewing and approving the Corporation’s hiring policies regarding partners, employees and former partners and employees of the present and most recent former external auditor of the Corporation in compliance with the requirements set out in section 2.4 of National Instrument 52-110; |

| |

| (j) | pre-approving all audit services; |

| |

| (k) | meet with the external auditor prior to the audit to review the scope and general extent of the external auditor’s annual audit including planning and staffing the audit and the factors considered in determining the audit scope, including risk factors; |

| |

| (l) | meeting with the external auditor to: |

| |

| (i) | review significant changes to the audit plan, if any, |

| |

| (ii) | review any disputes or difficulties with management encountered during the audit, including any disagreements which, if not resolved, would have caused the external |

auditor to issue a non-standard report on the Corporation’s financial statements; and

| |

| (iii) | review the co-operation received by the external auditor during its audit and interim reviews including their ability to access all requested records, data and information; |

| |

| (m) | meeting with the external auditor at least annually in the absence of management; |

| |

| (n) | resolving any disagreements between management and the external auditor; |

| |

| (o) | discussing or reviewing specific issues that arise from time-to-time with the external auditor; and |

| |

| (p) | directing the external auditor’s examinations to particular issues. |

4.5 Internal Audit Function

The Audit Committee will:

| |

| (a) | approve the appointment, replacement, or dismissal of the Vice President of the internal audit group; |

| |

| (b) | review and approve the compensation of the Vice President of the internal audit group; |

| |

| (c) | review and approve the reporting relationship of the internal auditor to ensure that an appropriate segregation of duties is maintained and that the internal auditor has an obligation to report directly to the Audit Committee on matters affecting the Audit Committee’s duties, irrespective of his or her other reporting relationships; |

| |

| (d) | direct the Vice President of the internal audit group to review any specific areas the Committee deems necessary; |

| |

| (e) | consider and review the following issues with management and the Vice President of internal audit: |

| |

| i. | significant findings of the internal audit group as well as management’s response to them; |

| |

| ii. | any difficulties encountered in the course of their internal audits, including any restrictions on the scope of their work or access to required information; |

| |

| iii. | the internal auditing budget and staffing; |

| |

| iv. | the Audit Services Charter; and |

| |

| v. | compliance with The Institute of Internal Auditors’ Standards for the Professional Practice of Internal Auditing. |

The Audit Committee will:

| |

| (a) | discuss the Corporation’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which risk assessment and risk management are undertaken; |

| |

| (b) | review transactions involving the Corporation and “related parties” as that term is defined in Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (collectively, “Related Party Transactions”); |

| |

| (c) | monitor any Related Party Transactions and report to the Board of Directors on a regular basis regarding the nature of any Related Party Transactions; |

| |

| (d) | oversee and monitor any litigation, claim or regulatory investigation or proceeding involving the Corporation; |

| |

| (e) | review and approve annually, directors’ and officers’ third party liability insurance coverage; and |

| |

| (f) | review and monitor the Corporation’s insurance claims. |

| |

| 6.1 | The Audit Committee is responsible, following each meeting, to report to the Board of Directors regarding its activities, findings, recommendations, any issues that arise with respect to the quality or integrity of the Corporation’s financial statements, compliance with applicable law, the performance and independence of the external auditor and the effectiveness of the internal audit function. |

| |

| 6.2 | The Audit Committee will prepare any reports required to be prepared by the Committee under applicable law including quarterly reports regarding ongoing investigations made pursuant to the Corporation’s Whistleblower Policy. |

| |

| 7.1 | The Audit Committee has the power to, at the expense of the Corporation and as it determines necessary, retain, instruct, compensate and terminate independent advisors (including independent counsel) to assist the Audit Committee in the discharge of its duties. |

| |

| 8.1 | The Audit Committee is responsible to annually review its own performance, and in its discretion, make recommendations to the Board of Directors regarding changes to its Charter and the position description of its Chairman. |

Approved by the Board of Directors - December 11, 2013