UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22421

iShares MSCI Russia Capped Index Fund, Inc.

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

200 Clarendon Street, Boston, MA 02116-5021

(Address of principal executive offices) (Zip code)

The Corporation Trust Incorporated

351 West Camden Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-474-2737

Date of fiscal year end: August 31, 2011

Date of reporting period: August 31, 2011

| Item 1. Reports to Stockholders. | |

| | |

| |

| | August 31, 2011 |

2011 Annual Report

iShares MSCI Russia Capped Index Fund, Inc.

iShares MSCI Russia Capped Index Fund | ERUS | NYSE Arca

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Performance as of August 31, 2011

| | | | |

| Cumulative Total Returns |

|

| Inception to 8/31/11 |

| | |

| NAV | | MARKET | | INDEX |

| 1.76% | | 1.16% | | 1.91% |

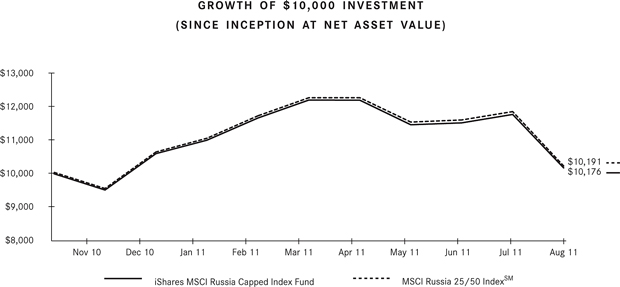

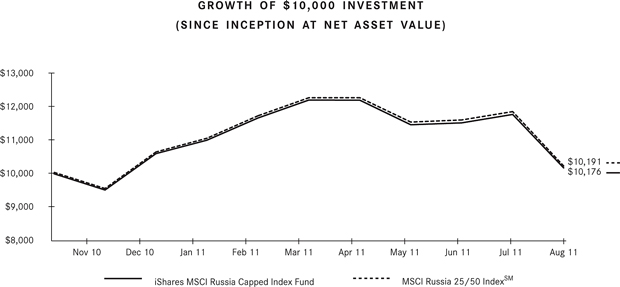

“Cumulative Total Returns” represent the total change in value of an investment over the period indicated and are calculated from an inception date of 11/9/10.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (11/10/10), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| | | | |

| MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE | | | 5 | |

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

| | | | |

PORTFOLIO ALLOCATION As of 8/31/11 | |

| Sector | | Percentage of Net Assets | |

Energy | | | 52.72 | % |

| |

Basic Materials | | | 16.11 | |

| |

Financial | | | 13.86 | |

| |

Communications | | | 7.58 | |

| |

Utilities | | | 5.77 | |

| |

Consumer Non-Cyclical | | | 2.55 | |

| |

Industrial | | | 0.72 | |

| |

Short-Term and Other Net Assets | | | 0.69 | |

| | | | |

| |

TOTAL | | | 100.00 | % |

| | | | |

| | | | |

TEN LARGEST FUND HOLDINGS As of 8/31/11 | |

| Security | | Percentage of Net Assets | |

Gazprom OAO | | | 21.67 | % |

| |

LUKOIL OAO | | | 11.57 | |

| |

Sberbank of Russia | | | 10.05 | |

| |

Rosneft Oil Co. OJSC | | | 4.76 | |

| |

NovaTek OAO SP GDR | | | 4.63 | |

| |

MMC Norilsk Nickel OJSC | | | 4.62 | |

| |

Uralkali OJSC | | | 4.54 | |

| |

Tatneft OAO | | | 3.65 | |

| |

Mobile TeleSystems OJSC SP ADR | | | 3.49 | |

| |

Rostelecom OJSC | | | 3.37 | |

| | | | |

| |

TOTAL | | | 72.35 | % |

| | | | |

The iShares MSCI Russia Capped Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Russia 25/50 IndexSM (the “Index”). The Index is a free-float adjusted market capitalization weighted index designed to measure the performance of equity securities in the top 85% by market capitalization of equity securities listed on stock exchanges in Russia. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the period from November 9, 2010 (inception date of the Fund) through August 31, 2011 (“the reporting period”), the total return for the Fund was 1.76%, net of fees, while the total return for the Index was 1.91%.

The Russian equity market delivered modestly positive results for the reporting period amid signs of a recovering economy. Inflation, as measured by consumer prices, climbed more than expected on a year-over-year basis in May, but slowed later in the reporting period as food costs declined. By July 2011, the inflation rate was reported at 9%. The unemployment rate also continued to decline, registering below 6.1% in June.

Amid signs of stabilizing inflation and lower unemployment levels, consumer confidence rose for the second quarter of 2011. Meanwhile, after falling amid capital flight and shrinking demand, industrial production reversed course late in the reporting period, expanding 6.2% in August as strong local demand drove up manufacturing levels.

The world’s largest oil producer and the largest exporter of natural gas, nickel, and palladium, Russia benefited from high energy and commodity prices, which drove export levels higher during the reporting period. As with the currencies of many countries, the ruble appreciated against the U.S. dollar during the reporting period as investors sought growth opportunities. Compared with its European neighbors, Russia maintained one of the smallest debt burdens in the world during the reporting period.

| | | | |

| 6 | | | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS | |

Shareholder Expenses (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2011 to August 31, 2011.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value (3/1/11) | | | Ending Account Value (8/31/11) | | | Annualized Expense Ratio | | | Expenses Paid During Perioda

(3/1/11 to 8/31/11) | |

Actual | | $ | 1,000.00 | | | $ | 872.70 | | | | 0.58 | % | | $ | 2.74 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.30 | | | | 0.58 | | | | 2.96 | |

| a | Expenses are calculated using each Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). |

Schedule of Investments

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

August 31, 2011

| | | | | | | | |

| Security | | Shares | | | Value | |

COMMON STOCKS – 95.71% | |

| | |

BANKS – 13.28% | | | | | | | | |

Sberbank of Russia | | | 3,816,050 | | | $ | 11,232,992 | |

VTB Bank OJSC | | | 1,390,865,000 | | | | 3,615,485 | |

| | | | | | | | |

| | | | | | | 14,848,477 | |

| | |

CHEMICALS – 4.54% | | | | | | | | |

Uralkali OJSC | | | 516,065 | | | | 5,076,002 | |

| | | | | | | | |

| | | | | | | 5,076,002 | |

| | |

COAL – 0.67% | | | | | | | | |

Raspadskaya OAO | | | 158,030 | | | | 747,750 | |

| | | | | | | | |

| | | | | | | 747,750 | |

| | |

ELECTRIC – 5.77% | | | | | | | | |

Federal Grid Co. of Unified Energy

System OJSC | | | 207,360,000 | | | | 2,098,593 | |

Inter RAO UES OJSC | | | 1,169,182,000 | | | | 1,414,255 | |

RusHydro OJSC | | | 67,996,000 | | | | 2,938,565 | |

| | | | | | | | |

| | | | | | | 6,451,413 | |

| | |

FOOD – 2.55% | | | | | | | | |

Magnit OJSC SP GDRa | | | 119,850 | | | | 2,852,430 | |

| | | | | | | | |

| | | | | | | 2,852,430 | |

|

IRON & STEEL – 4.97% | |

Mechel OAO SP ADR | | | 97,558 | | | | 1,839,944 | |

Novolipetsk Steel OJSC SP GDRa | | | 53,911 | | | | 1,649,137 | |

Severstal OAO | | | 133,625 | | | | 2,074,847 | |

| | | | | | | | |

| | | | | | | 5,563,928 | |

|

METAL FABRICATE & HARDWARE – 0.72% | |

TMK OAO SP GDRa | | | 64,067 | | | | 810,448 | |

| | | | | | | | |

| | | | | | | 810,448 | |

| | |

MINING – 6.60% | | | | | | | | |

MMC Norilsk Nickel OJSC | | | 20,659 | | | | 5,163,989 | |

Polymetal OJSCb | | | 102,150 | | | | 2,220,926 | |

| | | | | | | | |

| | | | | | | 7,384,915 | |

| | |

OIL & GAS – 49.03% | | | | | | | | |

Gazprom OAO | | | 3,926,295 | | | | 24,233,625 | |

LUKOIL OAO | | | 214,605 | | | | 12,936,288 | |

NovaTek OAO SP GDRa | | | 37,983 | | | | 5,177,083 | |

Rosneft Oil Co. OJSC | | | 673,370 | | | | 5,321,192 | |

Surgutneftegas OJSC | | | 3,628,600 | | | | 3,081,240 | |

Tatneft OAO | | | 747,745 | | | | 4,081,825 | |

| | | | | | | | |

| | | | | | | 54,831,253 | |

|

TELECOMMUNICATIONS – 7.58% | |

Mobile TeleSystems OJSC SP ADR | | | 230,154 | | | | 3,896,507 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

Rostelecom OJSC | | | 578,500 | | | $ | 3,769,481 | |

Sistema JSFC SP GDRa | | | 43,478 | | | | 807,386 | |

| | | | | | | | |

| | | | | | | 8,473,374 | |

| | | | | | | | |

|

TOTAL COMMON STOCKS | |

(Cost: $115,854,076) | | | | | | | 107,039,990 | |

|

PREFERRED STOCKS – 3.60% | |

| | |

BANKS – 0.58% | | | | | | | | |

Sberbank of Russia | | | 264,895 | | | | 651,857 | |

| | | | | | | | |

| | | | | | | 651,857 | |

| | |

OIL & GAS – 1.69% | | | | | | | | |

Surgutneftegas OJSC | | | 3,881,400 | | | | 1,882,837 | |

| | | | | | | | |

| | | | | | | 1,882,837 | |

| | |

PIPELINES – 1.33% | | | | | | | | |

Transneft OAO SP ADR | | | 1,083 | | | | 1,483,876 | |

| | | | | | | | |

| | | | | | | 1,483,876 | |

| | | | | | | | |

|

TOTAL PREFERRED STOCKS | |

(Cost: $4,196,503) | | | | | | | 4,018,570 | |

|

SHORT-TERM INVESTMENTS – 0.50% | |

|

MONEY MARKET FUNDS – 0.50% | |

BlackRock Cash Funds: Treasury, | | | | | |

SL Agency Shares | | | | | | | | |

0.00%c,d | | | 560,028 | | | | 560,028 | |

| | | | | | | | |

| | | | | | | 560,028 | |

| | | | | | | | |

|

TOTAL SHORT-TERM INVESTMENTS | |

(Cost: $560,028) | | | | | | | 560,028 | |

| | | | | | | | |

|

TOTAL INVESTMENTS

IN SECURITIES – 99.81% | |

(Cost: $120,610,607) | | | | | | | 111,618,588 | |

| |

Other Assets, Less Liabilities – 0.19% | | | | 216,717 | |

| | | | | | | | |

| | |

NET ASSETS – 100.00% | | | | | | $ | 111,835,305 | |

| | | | | | | | |

SP ADR – Sponsored American Depositary Receipts

SP GDR – Sponsored Global Depositary Receipts

| a | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| b | Non-income earning security. |

| c | Affiliated issuer. See Note 2. |

| d | The rate quoted is the annualized seven-day yield of the fund at period end. |

See notes to financial statements.

| | | | |

| 8 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Statement of Assets and Liabilities

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

August 31, 2011

| | | | |

ASSETS | | | | |

Investments, at cost: | | | | |

Unaffiliated | | $ | 120,050,579 | |

Affiliated (Note 2) | | | 560,028 | |

| | | | |

Total cost of investments | | $ | 120,610,607 | |

| | | | |

Investments in securities, at fair value (Note 1): | | | | |

Unaffiliated | | $ | 111,058,560 | |

Affiliated (Note 2) | | | 560,028 | |

| | | | |

Total fair value of investments | | | 111,618,588 | |

Cash | | | 24,401 | |

Receivables: | | | | |

Investment securities sold | | | 4,217,193 | |

Due from custodian (Note 4) | | | 542,038 | |

Dividends and interest | | | 605,514 | |

| | | | |

Total Assets | | | 117,007,734 | |

| | | | |

| |

LIABILITIES | | | | |

Payables: | | | | |

Investment securities purchased | | | 5,116,115 | |

Investment advisory fees (Note 2) | | | 56,314 | |

| | | | |

Total Liabilities | | | 5,172,429 | |

| | | | |

| |

NET ASSETS | | $ | 111,835,305 | |

| | | | |

| |

Net assets consist of: | | | | |

Paid-in capital | | $ | 122,776,049 | |

Accumulated net realized loss | | | (1,932,175 | ) |

Net unrealized depreciation on investments and translation of assets and liabilities in foreign currencies | | | (9,008,569 | ) |

| | | | |

NET ASSETS | | $ | 111,835,305 | |

| | | | |

| |

Shares outstandinga | | | 4,450,000 | |

| | | | |

| |

Net asset value per share | | $ | 25.13 | |

| | | | |

| a | $0.001 par value, number of shares authorized: 1 billion. |

See notes to financial statements.

Statement of Operations

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Period from November 9, 2010 (commencement of operations) through August 31, 2011

| | | | |

NET INVESTMENT INCOME | | | | |

Dividends – unaffiliateda | | $ | 1,949,131 | |

Interest – affiliated (Note 2) | | | 49 | |

| | | | |

Total investment income | | | 1,949,180 | |

| | | | |

| |

EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 442,194 | |

| | | | |

Total expenses | | | 442,194 | |

| | | | |

Net investment income | | | 1,506,986 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) from: | | | | |

Investments – unaffiliated | | | (2,000,813 | ) |

In-kind redemptions – unaffiliated | | | 790,066 | |

Foreign currency transactions | | | (33,804 | ) |

| | | | |

Net realized loss | | | (1,244,551 | ) |

| | | | |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (8,992,019 | ) |

Translation of assets and liabilities in foreign currencies | | | (16,550 | ) |

| | | | |

Net change in unrealized appreciation/depreciation | | | (9,008,569 | ) |

| | | | |

Net realized and unrealized loss | | | (10,253,120 | ) |

| | | | |

| |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (8,746,134 | ) |

| | | | |

| a | Net of foreign withholding tax of $343,964. |

See notes to financial statements.

| | |

| 10 | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Statement of Changes in Net Assets

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

| | | | |

| | | Period from November 9, 2010a to August 31, 2011 | |

INCREASE (DECREASE) IN NET ASSETS | | | | |

| |

OPERATIONS: | | | | |

Net investment income | | $ | 1,506,986 | |

Net realized loss | | | (1,244,551 | ) |

Net change in unrealized appreciation/depreciation | | | (9,008,569 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | (8,746,134 | ) |

| | | | |

| |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

From net investment income | | | (1,554,120 | ) |

| | | | |

Total distributions to shareholders | | | (1,554,120 | ) |

| | | | |

| |

CAPITAL SHARE TRANSACTIONS: | | | | |

Proceeds from shares sold | | | 129,749,002 | |

Cost of shares redeemed | | | (7,613,443 | ) |

| | | | |

Net increase in net assets from capital share transactions | | | 122,135,559 | |

| | | | |

INCREASE IN NET ASSETS | | | 111,835,305 | |

| |

NET ASSETS | | | | |

Beginning of period | | | – | |

| | | | |

End of period | | $ | 111,835,305 | |

| | | | |

| |

SHARES ISSUED AND REDEEMED | | | | |

Shares sold | | | 4,754,000 | |

Shares redeemed | | | (304,000 | ) |

| | | | |

Net increase in shares outstanding | | | 4,450,000 | |

| | | | |

| a | Commencement of operations. |

See notes to financial statements.

Financial Highlights

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

(For a share outstanding throughout the period)

| | | | |

| | | Period from

Nov. 9, 2010a to Aug. 31, 2011 | |

Net asset value, beginning of period | | $ | 25.00 | |

| | | | |

| |

Income from investment operations: | | | | |

Net investment incomeb | | | 0.45 | |

Net realized and unrealized gainc | | | 0.03 | |

| | | | |

Total from investment operations | | | 0.48 | |

| | | | |

| |

Less distributions from: | | | | |

Net investment income | | | (0.35 | ) |

| | | | |

Total distributions | | | (0.35 | ) |

| | | | |

Net asset value, end of period | | $ | 25.13 | |

| | | | |

| |

Total return | | | 1.76 | %d |

| | | | |

| |

Ratios/Supplemental data: | | | | |

Net assets, end of period (000s) | | $ | 111,835 | |

Ratio of expenses to average net assetse | | | 0.58 | % |

Ratio of net investment income to average net assetse | | | 1.99 | % |

Portfolio turnover ratef | | | 22 | % |

| a | Commencement of operations. |

| b | Based on average shares outstanding throughout the period. |

| c | The amount reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| e | Annualized for periods of less than one year. |

| f | Portfolio turnover rate excludes portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

See notes to financial statements.

| | |

| 12 | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Notes to Financial Statements

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

iShares MSCI Russia Capped Index Fund, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of the State of Maryland on May 21, 2010 pursuant to Articles of Incorporation.

These financial statements relate only to the following fund (the “Fund”):

| | | | |

| iShares MSCI Index Fund | | Diversification

Classification | |

Russia Cappeda | | | Non-diversified | |

| a | Fund commenced operations on November 9, 2010. |

Non-diversified funds generally hold securities of fewer issuers than diversified funds and may be more susceptible to the risks associated with these particular issuers, or to a single economic, political or regulatory occurrence affecting these issuers.

The investment objective of the Fund is to seek investment results that correspond generally to the price and yield performance, before fees and expenses, of its underlying index. The investment adviser uses a “passive” or index approach to try to achieve the Fund’s investment objective.

The Fund invests in securities of non-U.S. issuers that may trade in non-U.S. markets. This may involve certain considerations and risks not typically associated with securities of U.S. issuers. Such risks include, but are not limited to: generally less liquid and less efficient securities markets; generally greater price volatility; exchange rate fluctuations and exchange controls; imposition of restrictions on the expatriation of funds or other assets of the Fund; less publicly available information about issuers; the imposition of withholding or other taxes; higher transaction and custody costs; settlement delays and risk of loss attendant in settlement procedures; difficulties in enforcing contractual obligations; less regulation of securities markets; different accounting, disclosure and reporting requirements; more substantial governmental involvement in the economy; higher inflation rates; greater social, economic and political uncertainties; the risk of nationalization or expropriation of assets and the risk of war.

Pursuant to the Company’s organizational documents, the Fund’s officers and directors are indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

1. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

SECURITY VALUATION

The securities and other assets of the Fund are valued pursuant to the pricing policy and procedures approved by the Board of Directors of the Company (the “Board”) using a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). The

| | | | |

| NOTESTO FINANCIAL STATEMENTS | | | 13 | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

| | • | | Level 1 – Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date (a “Level 1 Price”); |

| | • | | Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means (a “Level 2 Price”); and |

| | • | | Level 3 – Inputs that are unobservable for the asset or liability (a “Level 3 Price”). |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3 of the fair value hierarchy.

The level of a value determined for a financial instrument within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The categorization of a value determined for a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, and whose values are therefore classified as Level 1 Prices, include active listed equities. The Fund does not adjust the quoted price for such instruments, even in situations where the Fund holds a large position and a sale could reasonably impact the quoted price.

Investments that trade in markets that are not considered to be active, but whose values are based on inputs such as quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified within Level 2. These generally include U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations. As Level 2 investments include positions that are not traded in active markets and/or are subject to transfer restrictions, valuations may be adjusted to reflect illiquidity and/or non-transferability, which are generally based on available market information.

Investments whose values are classified as Level 3 Prices have significant unobservable inputs, as they may trade infrequently or not at all. Investments whose values are classified as Level 3 Prices may include unlisted securities related to corporate actions, securities whose trading have been suspended or which have been de-listed from their primary trading exchange, less liquid corporate debt securities (including distressed debt instruments), collateralized debt obligations, and less liquid mortgage securities (backed by either commercial or residential real estate). When observable prices are not available for these securities, the Fund uses one or more valuation techniques (e.g., the market approach or the income approach) for which sufficient and reliable data is available. Within Level 3 of the fair value hierarchy, the use of the market approach generally consists of using comparable market transactions, while the use of the income approach generally consists of the net present value of estimated future cash flows, adjusted as appropriate for liquidity, credit, market and/or other risk factors.

The inputs used by the Fund in estimating the value of Level 3 Prices may include the original transaction price, recent transactions in the same or similar instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in

| | | | |

| 14 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

financial ratios or cash flows. Level 3 Prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Fund in the absence of market information. The fair value measurement of Level 3 Prices does not include transaction costs that may have been capitalized as part of the security’s cost basis. Assumptions used by the Fund due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations.

Fair value pricing could result in a difference between the prices used to calculate the Fund’s net asset value and the prices used by the Fund’s underlying index, which in turn could result in a difference between the Fund’s performance and the performance of the Fund’s underlying index.

As of August 31, 2011, the value of each of the Fund’s investments was classified as a Level 1 Price. The breakdown of the Fund’s investments into major categories is disclosed in its Schedule of Investments.

SECURITY TRANSACTIONS AND INCOME RECOGNITION

Security transactions are accounted for on trade date. Dividend income is recognized on the ex-dividend date, net of any foreign taxes withheld at source. Any taxes withheld that are reclaimable from foreign tax authorities as of August 31, 2011 are reflected in dividends receivable. Non-cash dividends received in the form of stock in an elective dividend, if any, are recorded as dividend income at fair value. Distributions received by the Fund may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains. Interest income is accrued daily. Realized gains and losses on investment transactions are determined using the specific identification method.

FOREIGN CURRENCY TRANSLATION

The accounting records of the Fund are maintained in U.S. dollars. Foreign currencies, as well as investment securities and other assets and liabilities denominated in foreign currencies, are translated into U.S. dollars using exchange rates deemed appropriate by the investment adviser. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars on the respective dates of such transactions.

The Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market prices of securities. Such fluctuations are reflected by the Fund as a component of realized and unrealized gains and losses from investments for financial reporting purposes.

FOREIGN TAXES

The Fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, capital gains on investments, certain foreign currency transactions or other corporate events. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Fund invest. These foreign taxes, if any, are paid by the Fund and are reflected in its Statement of Operations as follows: foreign taxes withheld at source are presented as a reduction of income, foreign taxes on capital gains from sales of investments and foreign currency transactions are included in their respective net realized gain (loss) categories, and foreign taxes on other corporate events are reflected in “Other foreign taxes.” Foreign taxes payable as of August 31, 2011, if any, are disclosed in the Fund’s Statement of Assets and Liabilities.

DISTRIBUTIONS TO SHAREHOLDERS

Dividends and distributions paid by the Fund are recorded on the ex-dividend dates. Distributions are determined on a tax basis and may differ from net investment income and net realized capital gains for financial reporting purposes. Dividends and distributions are paid in U.S. dollars and cannot be automatically reinvested in additional shares of the Fund.

| | | | |

| NOTESTO FINANCIAL STATEMENTS | | | 15 | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

As of August 31, 2011, the tax year-end of the Fund, the components of accumulated net earnings (losses) on a tax basis consisted of unrealized depreciation of $10,233,313 and capital and other losses of $707,431 for accumulated net losses of $10,940,744. The difference between book-basis and tax-basis unrealized gains (losses) is attributable primarily to the tax deferral of losses on wash sales.

The tax character of distributions paid during the period ended August 31, 2011 was as follows:

| | | | |

| | | 2011 | |

Distributions paid from: | | | | |

Ordinary income | | $ | 1,554,120 | |

| | | | |

Total Distributions | | $ | 1,554,120 | |

| | | | |

| | | | | |

FEDERAL INCOME TAXES

It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions applicable to regulated investment companies, as defined under Subchapter M of the Internal Revenue Code of 1986, as amended, and to annually distribute substantially all of its ordinary income and any net capital gains (taking into account any capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income and excise taxes. Accordingly, no provision for federal income taxes is required.

As permitted by tax regulations, the Fund has elected to defer net realized capital losses and net foreign currency losses incurred from November 9, 2010 to August 31, 2011 of $707,431 and treat them as arising in the year ending August 31, 2012.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, capital losses incurred by funds for taxable years beginning after December 22, 2010 will not be subject to expiration. The Fund had no non-expiring tax basis net capital loss carryforwards as of August 31, 2011, the tax year-end of the Fund. Net capital loss carryforwards may be applied against any net realized taxable gains in each succeeding year.

The Fund may own shares in certain foreign investment entities, referred to, under U.S. tax law, as “passive foreign investment companies.” The Fund may elect to mark-to-market annually the shares of each passive foreign investment company and would be required to distribute to shareholders any such marked-to-market gains.

As of August 31, 2011, the cost of investments for federal income tax purposes was $121,835,351. Net unrealized depreciation was $10,216,763 of which $2,894,143 represented gross unrealized appreciation on securities and $13,110,906 represented gross unrealized depreciation on securities.

Management has reviewed the tax positions as of August 31, 2011, and has determined that no provision for income tax is required in the Fund’s financial statements.

U.S. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These differences are reclassified by the Fund at the end of its tax year and are primarily attributable to distributions paid in excess of taxable

| | | | |

| 16 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

income and realized gains (losses) from foreign currency transactions and in-kind redemptions. As of August 31, 2011, the Fund made the following reclassifications, which have no effect on net assets or net asset values per share:

| | | | | | | | | | |

Paid-in Capital | | | Undistributed Net Investment Income/Distributions in Excess of Net Investment Income | | | Undistributed Net Realized Gain/ Accumulated Net Realized Loss | |

| $ | 640,490 | | | $ | 47,134 | | | $ | (687,624 | ) |

RECENT ACCOUNTING STANDARD

In May 2011, the Financial Accounting Standards Board issued amended guidance to improve disclosure about fair value measurements which will require the following disclosures for fair value measurements categorized as Level 3: quantitative information about the unobservable inputs and assumptions used in the fair value measurement, a description of the valuation policies and procedures and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, the amounts and reasons for all transfers in and out of Level 1 and Level 2 will be required to be disclosed. The amended guidance is effective for financial statements for fiscal years beginning after December 15, 2011, and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Fund’s financial statements and disclosures.

2. INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an Investment Advisory Agreement with the Company, BlackRock Fund Advisors (“BFA”) manages the investment of the Fund’s assets. BFA is a California corporation indirectly owned by BlackRock, Inc. (“BlackRock”). Under the Investment Advisory Agreement, BFA is responsible for substantially all expenses of the Fund, except interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution fees, litigation expenses and any extraordinary expenses.

For its investment advisory services to the Fund, BFA is entitled to an annual investment advisory fee based on the Fund’s allocable portion of the aggregate of the average daily net assets of the Fund and certain other iShares funds, as follows:

| | |

| Investment Advisory Fee | | Aggregate Average Daily Net Assets |

| 0.74% | | First $2 billion |

| 0.69 | | Over $2 billion, up to and including $4 billion |

| 0.64 | | Over $4 billion, up to and including $8 billion |

| 0.57 | | Over $8 billion, up to and including $16 billion |

| 0.51 | | Over $16 billion, up to and including $32 billiona |

| 0.45 | | Over $32 billiona |

| a | Breakpoint level was modified or added, effective January 1, 2011. |

The Fund may invest its positive cash balances in certain money market funds managed by BFA or an affiliate. The income earned on these temporary cash investments is included in “Interest – affiliated” in the Statement of Operations.

The PNC Financial Services Group, Inc. (“PNC”) and Barclays PLC (“Barclays”) are the largest stockholders of BlackRock. Due to the ownership structure, PNC is an affiliate of the Fund for 1940 Act purposes, but Barclays is not.

| | | | |

| NOTESTO FINANCIAL STATEMENTS | | | 17 | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Certain directors and officers of the Company are also officers of BlackRock Institutional Trust Company, N.A. and/or BFA.

3. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments (excluding in-kind transactions and short-term investments) for the period ended August 31, 2011, aggregated $20,807,570 and $20,262,149, respectively.

In-kind purchases and sales (see Note 4) for the period ended August 31, 2011, aggregated $128,075,544 and $7,359,639, respectively.

4. CAPITAL SHARE TRANSACTIONS

Capital shares are issued and redeemed by the Fund only in aggregations of a specified number of shares or multiples thereof (“Creation Units”) at net asset value. Except when aggregated in Creation Units, shares of the Fund are not redeemable. Transactions in capital shares for the Fund are disclosed in detail in the Statements of Changes in Net Assets.

The consideration for the purchase of Creation Units of a fund in the Company generally consists of the in-kind deposit of a designated portfolio of securities, which constitutes an optimized representation of the securities of that fund’s underlying index, and an amount of cash. Certain funds in the Company may be offered in Creation Units solely or partially for cash in U.S. dollars. Investors purchasing and redeeming Creation Units may pay a purchase transaction fee and a redemption transaction fee directly to State Street Bank and Trust Company, the Company’s administrator, to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units, including Creation Units for cash. Investors transacting in Creation Units for cash pay an additional variable charge to compensate the relevant fund for certain transaction costs (i.e., stamp taxes, taxes on currency or other financial transactions, and brokerage costs) and market impact expenses relating to investing in portfolio securities.

From time to time, settlement of securities related to in-kind contributions or in-kind redemptions may be delayed. In such cases, securities related to in-kind contributions are reflected as “Due from custodian” and securities related to in-kind redemptions are reflected as “Securities related to in-kind transactions” in the Statement of Assets and Liabilities.

5. SUBSEQUENT EVENTS

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were available to be issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

| | | | |

| 18 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

iShares MSCI Russia Capped Index Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the iShares MSCI Russia Capped Index Fund, (the “Fund”), at August 31, 2011, the results of its operations, the changes in its net assets and its financial highlights for the period presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at August 31, 2011 by correspondence with the custodian, transfer agent and brokers, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

October 21, 2011

| | | | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 19 | |

Tax Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

For the fiscal period ended August 31, 2011, the Fund earned foreign source income of $2,293,095 and paid foreign taxes of $342,868 which it intends to pass through to its shareholders pursuant to Section 853 of the Internal Revenue Code (the “Code”).

Under Section 854(b)(2) of the Code, the Fund hereby designates the maximum amount of $1,896,988 as qualified dividend income for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal period ended August 31, 2011.

In February 2012, shareholders will receive Form 1099-DIV which will include their share of qualified dividend income distributed during the calendar year 2011. Shareholders are advised to check with their tax advisers for information on the treatment of these amounts on their income tax returns.

| | | | |

| 20 | | | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS | |

Board Review and Approval of Investment Advisory

Contract (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Under Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), the Company’s Board of Directors (the “Board”), including a majority of Directors who are not “interested persons” of the Company (as that term is defined in the 1940 Act) (the “Independent Directors”), is required annually to consider the Investment Advisory Contract between the Company and BFA (the “Advisory Contract”) on behalf of the Fund. As required by Section 15(c), the Board requested and BFA provided such information as the Board, with advice from independent counsel, deemed reasonably necessary to evaluate the Advisory Contract. An ad-hoc sub-committee of the Independent Directors (the “Ad-Hoc Sub-Committee”), with independent counsel, met with management on April 19, 2011, and April 26, 2011, to discuss the types of information the Board required and the manner in which management would organize and present such information. At a meeting held on May 16, 2011, management presented information to the Board relating to the continuance of the Advisory Contract and the Board reviewed and discussed such information at length. The Board also requested from management certain additional information. At a meeting held on June 22-23, 2011, the Board reviewed additional information provided by management in response to the Board’s requests. The Board approved the selection of BFA and the continuance of the Advisory Contract for the Fund, based on its review of qualitative and quantitative information provided by BFA, including its review of supplemental information management provided at the request of the Board. The Board noted its satisfaction with the extent and quality of information, and detailed responses, provided by BFA. The Independent Directors were advised by their independent counsel throughout the process. In selecting BFA and approving the Advisory Contract for the Fund, the Board, including the Independent Directors, considered the following factors, no one of which was controlling, and made the following conclusions:

Nature, Extent and Quality of Services Provided by BFA – Based on management’s representations, the Board expected that there would be no diminution in the scope of services required of or provided by BFA under the Advisory Contract for the coming year as compared to the scope of services provided by BFA over prior years. In reviewing the scope of these services, the Board considered BFA’s investment philosophy and experience, noting that BFA and its affiliates have committed significant resources over time, including during the past year, supporting the Fund and its shareholders. The Board acknowledged that additional resources to support the Fund and its shareholders were added in 2010, for example, in such areas as investor education, product management, and capital markets support. The Board also considered BFA’s compliance program and its compliance record with respect to the Fund. In that regard, the Board noted that BFA reports to the Board about portfolio management and compliance matters on a periodic basis in connection with regularly scheduled meetings of the Board, and on other occasions as necessary and appropriate, and has provided information and made appropriate officers available as needed to provide further assistance with these matters. The Board also reviewed the background and experience of the persons responsible for the day-to-day management of the Fund. In addition to the above considerations, the Board reviewed and considered BFA’s investment processes and strategies, and matters related to BFA’s portfolio compliance policies and procedures. The Board noted that the Fund had met its investment objective consistently since its inception date. Based on review of this information, the Board concluded that the nature, extent and quality of services to be provided by BFA to the Fund under the Advisory Contract supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Expenses and Performance of the Fund – The Board reviewed statistical information prepared by Lipper Inc. (“Lipper”), an independent provider of investment company data, regarding the expense ratio components, including actual advisory fees, waivers/reimbursements, and gross and net total expenses of the Fund in comparison with the same information for other registered investment companies objectively selected by Lipper as comprising the Fund’s applicable peer group pursuant to Lipper’s proprietary methodology and any registered funds that would otherwise have been excluded from Lipper’s comparison group because of their size or other differentiating factors, but were nonetheless included at the request of BFA (the “Lipper Group”). Because there are few, if any, exchange traded funds or index funds that track an index similar to that tracked by the Fund, the Lipper Group included in part mutual funds, closed-end funds, exchange traded funds, or funds with differing investment objective classifications, investment focuses and other characteristics (e.g., actively managed funds and funds sponsored by “at cost” service providers), as applicable. In support of its review of the statistical information, the Board was provided with a detailed description of the methodology used by Lipper to determine the applicable Lipper Groups and to prepare this information. The Board further noted that due to the limitations in providing comparable funds in the Lipper Group, the statistical information may or may not provide meaningful direct comparisons to the Fund.

| | | | |

| BOARD REVIEW AND APPROVAL OF INVESTMENT ADVISORY CONTRACT | | | 21 | |

Board Review and Approval of Investment Advisory Contract (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

The Board also noted that the investment advisory fee and overall expenses for the Fund compared favorably to the investment advisory fee rates and overall expenses of the funds in the Lipper Group.

In addition, the Board reviewed statistical information prepared by Lipper regarding the performance of the Fund for the one-, three-, five-, ten-year, and since inception periods, as applicable, and the “last quarter” period ended December 31, 2010, and a comparison of the Fund’s performance to its performance benchmark index for the same periods. To the extent that any of the comparison funds included in the Lipper Group track the same index as the Fund, Lipper also provided, and the Board reviewed, a comparison of the Fund’s performance to that of such relevant comparison funds for the same periods. The Board noted that the Fund generally performed in line with its performance benchmark index over the relevant periods. In considering this information, the Board noted that the Lipper Group includes funds that may have different investment objectives and/or benchmarks from the Fund. In addition, the Board noted that the Fund seeks to track its benchmark index and that, during the prior year, the Board received periodic reports on the Fund’s performance in comparison with its relevant benchmark index. Such comparative performance information was also considered by the Board.

Based on this review, the Board concluded that the investment advisory fee and expense level and the historical performance of the Fund, as compared to the investment advisory fees and expense levels and performance of the funds in the relevant Lipper Group, supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Costs of Services Provided to Fund and Profits Realized by BFA and Affiliates – The Board reviewed information about the profitability to BFA of the Fund based on the fees payable to BFA and its affiliates (including fees under the Advisory Contract), and all other sources of revenue and expense to BFA and its affiliates from the Fund’s operations for the last calendar year. The Board reviewed BlackRock’s profitability methodology for the iShares Funds and how such profitability methodology differed from the methodology used to calculate profitability prior to the acquisition of BFA by BlackRock, noting that such matters were focused on by the Ad-Hoc Sub-Committee during its meetings and addressed by management. The Board discussed the sources of direct and ancillary revenue with management, including the revenues to BTC from securities lending by the Fund. The Board also discussed BFA’s profit margin as reflected in the Fund’s profitability analysis and reviewed information regarding economies of scale (as discussed below). Based on this review, the Board concluded that the profits realized by BFA and its affiliates under the Advisory Contract and from other relationships between the Fund and BFA and/or its affiliates, if any, supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Economies of Scale – In connection with its review of the Fund’s profitability analysis, the Board reviewed information regarding economies of scale or other efficiencies that may result from increases in the Fund’s assets. The Board noted that the Advisory Contract for the Fund already provided for breakpoints in the Fund’s investment advisory fee rate as the assets of the Fund, on an aggregated basis with the assets of certain other iShares funds, increase, and that the Board had approved additional breakpoints in a previous year. The Board also reviewed BFA’s historic profitability as investment adviser to the iShares fund complex and noted that BFA and BlackRock had continued to make significant investments in the iShares fund complex and the infrastructure supporting the iShares funds. Based on this review, as well as the discussions described above in connection with the Lipper Group and performance benchmark comparisons, the Board, recognizing its responsibility to consider this issue at least annually, concluded that the structure of the investment advisory fees reflects appropriate sharing of potential economies of scale with the Fund’s shareholders and supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Fees and Services Provided for Other Comparable Funds/Accounts Managed by BFA and its Affiliates – The Board received and considered information regarding the investment advisory/management fee rates for other funds/accounts in the U.S. for which BFA (or its affiliates) provides investment advisory/management services, including open-end and closed-end funds registered under the 1940 Act (including sub-advised funds), collective trust funds and institutional separate accounts (together, the “Other Accounts”). The Board noted that BFA and its affiliates do not manage Other Accounts with a substantially similar investment objective and strategy as the Fund. The Board

| | | | |

| 22 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Board Review and Approval of Investment Advisory Contract (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

further noted that BFA provided the Board with detailed information regarding how the Other Accounts (particularly institutional clients) generally differ from the Fund, including in terms of the different services provided as well as other significant differences in the approach of BFA and its affiliates to the Fund, on one hand, and Other Accounts, on the other. In that regard, the Board considered that the pricing of services to institutional clients is typically based on a number of factors beyond the nature and extent of the specific services to be provided and often depends on the overall relationship between the client and its affiliates and the adviser and its affiliates. In addition, the Board considered the relative complexity and inherent risks of managing and providing other services to the Fund, as a publicly traded exchanged traded fund, as compared to the Other Accounts that are institutional clients in light of differing regulatory requirements and client-imposed mandates. The Board noted that the investment advisory fee rates under the Advisory Contract for the Fund were generally higher than the investment advisory/management fee rates for the Other Accounts that are institutional clients of BFA (or its affiliates) and concluded that the differences appeared to be consistent with the factors discussed.

Other Benefits to BFA and/or its Affiliates – The Board reviewed any ancillary revenue received by BFA and/or its affiliates in connection with the services provided to the Fund by BFA, such as any payment of revenue to BTC, the Fund’s securities lending agent, for loaning any portfolio securities, and payment of advisory fees and/or administration fees to BFA and BTC (or their affiliates) in connection with any investments by the Fund in other funds for which BFA (or its affiliates) provides investment advisory services and/or administration services. The Board noted that BFA does not use soft dollars or consider the value of research or other services that may be provided to BFA (including its affiliates) in selecting brokers for portfolio transactions for the Fund. The Board further noted that any portfolio transactions on behalf of the Fund placed through a BFA affiliate or purchased from an underwriting syndicate in which a BFA affiliate participates, are reported to the Board pursuant to Rule 17e-1 or Rule 10f-3, as applicable, under the 1940 Act. The Board concluded that any such ancillary benefits would not be disadvantageous to the Fund’s shareholders.

Based on the considerations described above, the Board determined that the investment advisory fee rates under the Advisory Contract do not constitute fees that are so disproportionately large as to bear no reasonable relationship to the services rendered and that could not have been the product of arm’s-length bargaining and concluded that it is in the best interest of the Fund and its shareholders to approve the continuance of the Advisory Contract for the coming year.

| | | | |

| BOARD REVIEW AND APPROVAL OF INVESTMENT ADVISORY CONTRACT | | | 23 | |

Supplemental Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Premium/Discount Information

The table that follows presents information about the differences between the daily market price on secondary markets for shares of the Fund and the Fund’s net asset value. Net asset value, or “NAV,” is the price per share at which the Fund issues and redeems shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time the Fund’s NAV is calculated. The Fund’s Market Price may be at, above or below its NAV. The NAV of the Fund will fluctuate with changes in the fair value of its portfolio holdings. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on a given day, generally at the time NAV is calculated. A premium is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

The following information shows the frequency distributions of premiums and discounts for the Fund included in this report. The information shown for the Fund is each full calendar quarter completed after the inception date of the Fund through the date of the most recent calendar quarter-end.

Each line in the table shows the number of trading days in which the Fund traded within the premium/discount range indicated. The number of trading days in each premium/discount range is also shown as a percentage of the total number of trading days in the period covered by the table. All data presented here represents past performance, which cannot be used to predict future results.

Period Covered: January 1, 2011 through June 30, 2011

| | | | | | | | |

Premium/Discount Range | | Number

of Days | | | Percentage of

Total Days | |

Greater than 2.5% | | | 3 | | | | 2.40 | % |

Greater than 2.0% and Less than 2.5% | | | 1 | | | | 0.80 | |

Greater than 1.5% and Less than 2.0% | | | 4 | | | | 3.20 | |

Greater than 1.0% and Less than 1.5% | | | 8 | | | | 6.40 | |

Greater than 0.5% and Less than 1.0% | | | 48 | | | | 38.40 | |

Between 0.5% and –0.5% | | | 47 | | | | 37.60 | |

Less than –0.5% and Greater than –1.0% | | | 6 | | | | 4.80 | |

Less than –1.0% and Greater than –1.5% | | | 4 | | | | 3.20 | |

Less than –1.5% and Greater than –2.0% | | | 3 | | | | 2.40 | |

Less than –2.0% and Greater than –2.5% | | | 1 | | | | 0.80 | |

| | | | | | | | |

| | | 125 | | | | 100.00 | % |

| | | | | | | | |

| | | | |

| 24 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Director and Officer Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

The Board of Directors has responsibility for the overall management and operations of the Company, including general supervision of the duties performed by BFA and other service providers. Each Officer serves until he or she resigns, is removed, dies, retires or becomes incapacitated. The President, Treasurer and Secretary shall each hold office until their successors are chosen and qualified and all other officers shall hold office until he or she resigns or is removed. Directors who are not interested persons (as defined in the 1940 Act) are referred to as Independent Directors.

The registered investment companies advised by BFA or its affiliates are organized into one complex of closed-end funds, two complexes of open-end funds and one complex of exchange-traded funds (“Exchange-Traded Fund Complex”) (each, a “BlackRock Fund Complex”). The Fund is included in the BlackRock Fund Complex referred to as the Exchange-Traded Fund Complex. Each Director of iShares MSCI Russia Capped Index Fund, Inc. also serves as a Trustee of iShares Trust and a Director of iShares, Inc. and, as a result, oversees a total of 224 funds within the Exchange-Traded Fund Complex. With the exception of Robert S. Kapito, the address of each Director and Officer is c/o BlackRock, Inc., 400 Howard Street, San Francisco, CA 94105. The address of Mr. Kapito is c/o BlackRock, Inc., Park Avenue Plaza, 55 East 52nd Street, New York, NY 10055. The Board has designated George G.C. Parker as its Independent Chairman. Additional information about the Fund’s Directors and Officers may be found in the Fund’s Statement of Additional Information, which is available without charge, upon request, by calling toll-free 1-800-474-2737.

Interested Directors and Officers

| | | | | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s) During the Past 5 Years | | Other Directorships Held |

Robert S. Kapitoa (54) | | Director (since 2010). | | President and Director, BlackRock, Inc. (since 2006 and 2007, respectively); Vice Chairman of BlackRock, Inc. and Head of BlackRock’s Portfolio Management Group (since its formation in 1998) and BlackRock’s predecessor entities (since 1988); Trustee, University of Pennsylvania (since 2009); President of Board of Directors, Hope & Heroes Children’s Cancer Fund (since 2002); President of the Board of Directors, Periwinkle Theatre for Youth (since 1983). | | Trustee of iShares Trust (since 2009); Director of iShares, Inc. (since 2009); Director of BlackRock, Inc. (since 2007). |

| | | |

Michael Lathamb (46) | | Director (since 2010); President (since 2010). | | Chairman of iShares, BTC (since 2011); Global Chief Executive Officer of iShares, BTC (2010-2011); Managing Director, BTC (since 2009); Head of Americas iShares, Barclays Global Investors (“BGI”) (2007-2009); Director and Chief Financial Officer of Barclays Global Investors International, Inc. (2005-2009); Chief Operating Officer of the Intermediary Investor and Exchange Traded Products Business of BGI (2003-2007). | | Trustee of iShares Trust (since 2010); Director of iShares, Inc. (since 2007). |

| a | | Robert S. Kapito is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. |

| b | | Michael Latham is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. and its affiliates. |

| | | | |

| DIRECTORAND OFFICER INFORMATION | | | 25 | |

Director and Officer Information (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

Independent Directors

| | | | | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s) During the Past 5 Years | | Other Directorships Held |

George G.C. Parker (72) | | Director (since 2010); Independent Chairman (since 2010). | | Dean Witter Distinguished Professor of Finance, Emeritus, Stanford University: Graduate School of Business (since 1994). | | Trustee of iShares Trust (since 2002); Director of iShares, Inc. (since 2000); Independent Chairman of iShares Trust (since 2010); Independent Chairman of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Director of Tejon Ranch Company (since 1999); Director of Threshold Pharmaceuticals (since 2004); Director of Colony Financial, Inc. (since 2009); Director of First Republic Bank (since 2010). |

| | | |

Cecilia H. Herbert (62) | | Director (since 2010). | | Director (since 1998) and President (2007-2010) of the Board of Directors, Catholic Charities CYO; Trustee of Pacific Select Funds (2004-2005); Trustee (since 2002) and Chair of the Finance Committee (2006-2009) and Investment Committee (since 2006) of the Thacher School; Member (since 1994) and Chair (1994-2005) of Investment Committee, Archdiocese of San Francisco. | | Trustee of iShares Trust (since 2005); Director of iShares, Inc. (since 2005); Director, Forward Funds (35 portfolios) (since 2009). |

| | | |

Charles A. Hurty (68) | | Director (since 2010). | | Retired; Partner, KPMG LLP (1968-2001). | | Trustee of iShares Trust (since 2005); Director of iShares, Inc. (since 2005); Director of GMAM Absolute Return Strategy Fund (1 portfolio) (since 2002); Director of Skybridge Multi-Adviser Hedge Fund Portfolios LLC (1 portfolio) (since 2002). |

| | | |

John E. Kerrigan (56) | | Director (since 2010). | | Chief Investment Officer, Santa Clara University (since 2002). | | Trustee of iShares Trust (since 2005); Director of iShares, Inc. (since 2005). |

| | | |

John E. Martinez (50) | | Director (since 2010). | | Director of EquityRock, Inc. (since 2005). | | Trustee of iShares Trust (since 2003); Director of iShares, Inc. (since 2003). |

| | | |

Madhav V. Rajan (47) | | Director (since 2011). | | Gregor G. Peterson Professor of Accounting and Senior Associate Dean for Academic Affairs, Stanford University: Graduate School of Business (since 2001); Professor of Law (by courtesy), Stanford Law School (since 2005); Visiting Professor, University of Chicago (Winter 2007-2008). | | Trustee of iShares Trust (since 2011); Director of iShares, Inc. (since 2011). |

| | | | |

| 26 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Director and Officer Information (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

Independent Directors (Continued)

| | | | | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s) During the Past 5 Years | | Other Directorships Held |

Robert H. Silver (56) | | Director (since 2010). | | President and Co-Founder of The Bravitas Group, Inc. (since 2006); Member, Non- Investor Advisory Board of Russia Partners II, LP (since 2006); Director and Vice Chairman of the YMCA of Greater NYC (since 2001); Broadway Producer (since 2006); Co-Founder and Vice President of Parentgiving Inc. (since 2008); Director and Member of the Audit and Compensation Committee of EPAM Systems, Inc. (2006-2009). | | Trustee of iShares Trust (since 2007); Director of iShares, Inc. (since 2007). |

| | | | |

| DIRECTORAND OFFICER INFORMATION | | | 27 | |

Director and Officer Information (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

Officers

| | | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s) During the Past 5 Years |

Geoffrey D. Flynn (54) | | Executive Vice President and Chief Operating Officer (since 2010). | | Managing Director, BTC (since 2009); Chief Operating Officer, U.S. iShares, BGI (2007-2009); President, Van Kampen Investors Services (2003-2007); Managing Director, Morgan Stanley (2002-2007); President, Morgan Stanley Trust, FSB (2002-2007). |

| | |

Eilleen M. Clavere (59) | | Secretary (since 2010). | | Director, BTC (since 2009); Director of Legal Administration of Intermediary Investor Business of BGI (2006-2009); Legal Counsel and Vice President of Atlas Funds, Atlas Advisers, Inc. and Atlas Securities, Inc. (2005-2006). |

| | |

Jack Gee (52) | | Treasurer and Chief Financial Officer (since 2010). | | Managing Director, BTC (since 2009); Senior Director of Fund Administration of Intermediary Investor Business of BGI (2009); Director of Fund Administration of Intermediary Investor Business of BGI (2004-2009). |

| | |

Amy Schioldager (49) | | Executive Vice President (since 2010). | | Managing Director, BTC (since 2009); Global Head of Index Equity, BGI (2008-2009); Global Head of U.S. Indexing, BGI (2006-2008); Head of Domestic Equity Portfolio Management, BGI (2001-2006). |

| | |

Ira P. Shapiro (48) | | Vice President and Chief Legal Officer (since 2010). | | Managing Director, BTC (since 2009); Associate General Counsel, BGI (2004-2009). |

| | |

Matt Tucker (39) | | Vice President (since 2010). | | Managing Director, BTC (since 2009); Director of Fixed Income Investment Strategy, BGI (2009); Head of U.S. Fixed Income Investment Solutions, BGI (2005-2008). |

| | | | |

| 28 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

Notes:

Notes:

| | | | |

| 30 | | | 2011 iSHARES ANNUAL REPORTTO SHAREHOLDERS | |

For more information visit www.iShares.com

or call 1-800-474-2737

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current prospectus.

Investing involves risk, including possible loss of principal.

The iShares Funds are distributed by SEI Investments Distribution Co. (“SEI”). BlackRock Fund Advisors (“BFA”) serves as the investment advisor to the Funds. BFA is a subsidiary of BlackRock Institutional Trust Company, N.A., neither of which is affiliated with SEI.

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the iShares Funds. Neither SEI, nor BlackRock Institutional Trust Company, N.A., nor any of their affiliates, are affiliated with the company listed above.

A description of the policies that the Fund uses to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies

relating to portfolio securities during the most recent twelve-month period ending June 30 is available without charge, upon request, by calling toll-free 1-800-474-2737; on the Fund’s website at www.iShares.com; and on the U.S. Securities and Exchange Commission (SEC) website at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website or may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund also discloses its complete schedule of portfolio holdings on a monthly basis on the Fund’s website.

©2011 BlackRock Institutional Trust Company, N.A. All rights reserved. iShares® is a registered trademark of BlackRock Institutional Trust Company, N.A. All other trademarks, servicemarks, or registered trademarks are the property of their respective owners.

| | |

| Go paperless. . . | |

|

It’s Fast, Convenient, and Timely! | |

| To sign up today, go to www.icsdelivery.com |

iS-AR-89-0811

iShares MSCI Russia Capped Index Fund, Inc. (the “Registrant”) adopted a new code of ethics on July 1, 2011 that applies to persons appointed by the Registrant’s Board of Directors as the President and/or Chief Financial Officer, and any persons performing similar functions. For the fiscal year ended August 31, 2011, there were no amendments to any provision of the former and new codes of ethics, nor were there any waivers granted from any provision of the former and new codes of ethics. A copy of the new code of ethics is filed with this Form N-CSR under Item 12(a)(1).

| Item 3. | Audit Committee Financial Expert. |

The Registrant’s Board of Directors has determined that the Registrant has more than one audit committee financial expert, as that term is defined under Item 3(b) and 3(c), serving on its audit committee. The audit committee financial experts serving on the Registrant’s audit committee are Charles A. Hurty, John E. Kerrigan, George G.C. Parker and Robert H. Silver, all of whom are independent, as that term is defined under Item 3(a)(2).

| Item 4. | Principal Accountant Fees and Services. |

The principal accountant fees disclosed in items 4(a), 4(b), 4(c), 4(d) and 4(g) are for the sole series of the Registrant for which the fiscal year-end is August 31, 2011 (the “Fund”), and whose annual financial statements are reported in Item 1.

(a) Audit Fees – The aggregate fees billed for the fiscal period from the commencement of operations on November 9, 2010 through August 31, 2011 for professional services rendered by the principal accountant for the audit of the Fund’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements was $15,400.

(b) Audit-Related Fees – There were no fees billed for the fiscal period from the commencement of operations on November 9, 2010 through August 31, 2011 for assurance and related services by the principal accountant that were reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (a) of this Item.

(c) Tax Fees – The aggregate fees the fiscal period from the commencement of operations on November 9, 2010 through August 31, 2011 for professional services rendered by the principal accountant for the review of the Fund’s tax returns and excise tax calculations, was $5,050.

(d) All Other Fees – There were no other fees billed for the fiscal period from the commencement of operations on November 9, 2010 through August 31, 2011 for products and services provided by the principal accountant, other than the services reported in (a) through (c) of this Item.