UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22421

iShares MSCI Russia Capped Index Fund, Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| c/o: State Street Bank and Trust Company |

| 200 Clarendon Street, Boston, MA 02116-5021 |

| (Address of principal executive offices) (Zip code) |

The Corporation Trust Incorporated

351 West Camden Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-474-2737

Date of fiscal year end: August 31, 2012

Date of reporting period: August 31, 2012

| Item 1. Reports to Stockholders. | | |

| | |

| | August 31, 2012 |

2012 Annual Report

iShares MSCI Russia Capped Index Fund, Inc.

iShares MSCI Russia Capped Index Fund | ERUS | NYSE Arca

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Performance as of August 31, 2012

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns | | Cumulative Total Returns |

| Year Ended 8/31/12 | | Inception to 8/31/12 | | Inception to 8/31/12 |

| NAV | | MARKET | | INDEX | | NAV | | MARKET | | INDEX | | NAV | | MARKET | | INDEX |

| (13.75)% | | (13.30)% | | (13.15)% | | (6.95)% | | (6.99)% | | (6.53)% | | (12.23)% | | (12.30)% | | (11.49)% |

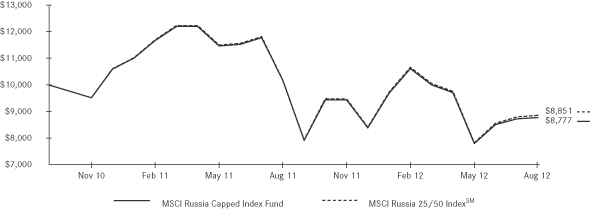

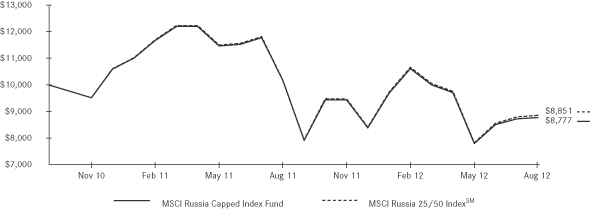

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

Total returns for the period since inception are calculated from the inception date of the Fund (11/9/10). “Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (11/10/10), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| | | | |

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE | | | 5 | |

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

PORTFOLIO ALLOCATION

As of 8/31/12

| | |

| Sector | | Percentage of

Net Assets |

| | | | |

Energy | | | 53.95 | % |

Financial | | | 14.15 | |

Basic Materials | | | 11.91 | |

Communications | | | 7.42 | |

Utilities | | | 5.79 | |

Consumer Non-Cyclical | | | 4.55 | |

Industrial | | | 1.06 | |

Short-Term and Other Net Assets | | | 1.17 | |

| | | | |

TOTAL | | | 100.00 | % |

| | | | |

TEN LARGEST FUND HOLDINGS

As of 8/31/12

| | |

| Security | | Percentage of

Net Assets |

| | | | |

Gazprom OAO | | | 22.36 | % |

LUKOIL OAO | | | 12.16 | |

Sberbank of Russia | | | 10.13 | |

Magnit OJSC SP GDR | | | 4.55 | |

NovaTek OAO SP GDR | | | 4.47 | |

Tatneft OAO | | | 4.37 | |

Uralkali OJSC | | | 4.36 | |

Rosneft Oil Co. OJSC | | | 4.21 | |

Mobile TeleSystems OJSC SP ADR | | | 4.00 | |

MMC Norilsk Nickel OJSC | | | 3.94 | |

| | | | |

TOTAL | | | 74.55 | % |

| | | | |

The iShares MSCI Russia Capped Index Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Russia 25/50 IndexSM (the “Index”). The Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities in the top 85% by market capitalization of equity securities listed on stock exchanges in Russia. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2012 (the “reporting period”), the total return for the Fund was (13.75)%, net of fees, while the total return for the Index was (13.15)%.

As represented by the Index, the Russian stock market posted a double-digit decline for the reporting period. The Russian economy grew by 4% for the reporting period, matching the growth rate from the prior 12–month period. However, this growth masked some economic volatility during the reporting period. The Russian economy gained momentum in the fourth quarter of 2011 and first quarter of 2012, reflecting improving economic conditions elsewhere in the world, most notably in the U.S. and U.K. Russia’s stock market responded positively to these developments, rallying in late 2011 through the first quarter of 2012.

However, the Russian economy slowed markedly over the remainder of the reporting period. Russia’s economy is driven primarily by commodities, as the world’s largest oil producer and natural gas exporter, and a major producer of metals such as nickel and palladium. Over the last five months of the reporting period, many of Russia’s main trading partners experienced weaker economic activity. In particular, the continuing sovereign debt crisis in Europe led to a meaningful slowdown in European economic growth, including recessions in the most fiscally challenged countries in the region. Exports to the eurozone are an important component of Russia’s economy, and the economic weakness in the region weighed on its growth rate. Falling commodity prices also put downward pressure on Russia’s economy and stock market over the last five months of the reporting period.

In addition, Russia’s central bank raised short-term interest rates in 2011 to curb rising inflation, and this had a negative impact on economic growth in 2012 as higher borrowing costs put downward pressure on domestic economic activity. The Russian central bank’s efforts succeeded in curbing the increase in Russia’s inflation rate, which peaked at 9.6% in mid-2011 and fell back to 3.6% by mid-2012. As a result, the Russian central bank moved to lower interest rates in early 2012.

| | |

| 6 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

The most significant factor behind the Index’s overall decline was a stronger U.S. dollar, which lowered international equity returns for U.S. investors (in local currency terms, the Index declined 3.67% for the reporting period). The U.S. dollar appreciated by approximately 12% versus the Russian ruble for the reporting period. The U.S. dollar’s strong rally against the Russian ruble resulted from a broad trend toward risk aversion during the reporting period. Investors concerned about the European sovereign debt crisis and slowing economic conditions globally shifted assets into larger, more stable markets such as the U.S.

| | | | |

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE | | | 7 | |

Shareholder Expenses (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2012 to August 31, 2012.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(3/1/12) | | | Ending

Account Value

(8/31/12) | | | Annualized

Expense Ratio | | | Expenses Paid

During Period a | |

Actual | | $ | 1,000.00 | | | $ | 827.30 | | | | 0.62 | % | | $ | 2.85 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.00 | | | | 0.62 | | | | 3.15 | |

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (366 days). | |

| | |

| 8 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Schedule of Investments

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

August 31, 2012

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

COMMON STOCKS – 94.67% | | | | | | | | |

| | |

BANKS — 12.77% | | | | | | | | |

Sberbank of Russia | | | 5,169,410 | | | $ | 14,898,712 | |

VTB Bank OJSC | | | 2,350,495,000 | | | | 3,883,102 | |

| | | | | | | | |

| | | | | | | 18,781,814 | |

CHEMICALS — 4.36% | | | | | | | | |

Uralkali OJSC | | | 839,565 | | | | 6,415,486 | |

| | | | | | | | |

| | | | | | | 6,415,486 | |

ELECTRIC — 5.78% | | | | | | | | |

Federal Grid Co. of Unified Energy System OJSCa | | | 353,060,000 | | | | 2,183,213 | |

IDGC Holding JSCa | | | 27,105,200 | | | | 1,449,021 | |

Inter RAO UES OJSCa | | | 2,460,382,000 | | | | 1,972,111 | |

RusHydro OJSC | | | 114,814,000 | | | | 2,901,985 | |

| | | | | | | | |

| | | | | | | 8,506,330 | |

FOOD — 4.55% | | | | | | | | |

Magnit OJSC SP GDRb | | | 209,612 | | | | 6,684,527 | |

| | | | | | | | |

| | | | | | | 6,684,527 | |

IRON & STEEL — 3.61% | | | | | | | | |

Mechel OAO SP ADR | | | 249,783 | | | | 1,431,257 | |

Novolipetsk Steel OJSC SP GDRb | | | 92,852 | | | | 1,678,764 | |

Severstal OAO | | | 191,825 | | | | 2,192,201 | |

| | | | | | | | |

| | | | | | | 5,302,222 | |

METAL FABRICATE & HARDWARE — 1.06% | |

TMK OAO SP GDRb | | | 113,146 | | | | 1,555,758 | |

| | | | | | | | |

| | | | | | | 1,555,758 | |

MINING — 3.94% | |

MMC Norilsk Nickel OJSC | | | 39,198 | | | | 5,789,280 | |

| | | | | | | | |

| | | | | | | 5,789,280 | |

OIL & GAS — 50.20% | | | | | | | | |

Gazprom OAO | | | 6,752,625 | | | | 32,881,803 | |

LUKOIL OAO | | | 314,418 | | | | 17,872,667 | |

NovaTek OAO SP GDRb | | | 55,044 | | | | 6,566,749 | |

Rosneft Oil Co. OJSC | | | 1,036,940 | | | | 6,184,989 | |

Surgutneftegas OJSC | | | 4,489,700 | | | | 3,872,612 | |

Tatneft OAO | | | 1,060,575 | | | | 6,423,412 | |

| | | | | | | | |

| | | | | | | 73,802,232 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

REAL ESTATE — 0.98% | | | | | | | | |

LSR Group OJSC SP GDRb | | | 349,307 | | | $ | 1,440,891 | |

| | | | | | | | |

| | | | | | | 1,440,891 | |

TELECOMMUNICATIONS — 7.42% | | | | | | | | |

Mobile TeleSystems OJSC SP ADR | | | 319,720 | | | | 5,886,045 | |

Rostelecom OJSC | | | 1,088,370 | | | | 4,156,673 | |

Sistema JSFC SP GDRb | | | 44,063 | | | | 868,482 | |

| | | | | | | | |

| | | | | | | 10,911,200 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost: $163,371,313) | | | | | | | 139,189,740 | |

| | |

PREFERRED STOCKS — 4.16% | | | | | | | | |

| | |

BANKS — 0.40% | | | | | | | | |

Sberbank of Russia | | | 278,095 | | | | 589,077 | |

| | | | | | | | |

| | | | | | | 589,077 | |

OIL & GAS — 1.82% | | | | | | | | |

Surgutneftegas OJSC | | | 4,156,100 | | | | 2,676,979 | |

| | | | | | | | |

| | | | | | | 2,676,979 | |

PIPELINES — 1.94% | | | | | | | | |

AK Transneft OAO | | | 1,748 | | | | 2,848,066 | |

| | | | | | | | |

| | | | | | | 2,848,066 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(Cost: $5,463,256) | | | | | | | 6,114,122 | |

|

SHORT-TERM INVESTMENTS — 1.10% | |

| | |

MONEY MARKET FUNDS — 1.10% | | | | | | | | |

BlackRock Cash Funds: Treasury,

SL Agency Shares | | | | | | | | |

0.06%c,d | | | 1,626,628 | | | | 1,626,628 | |

| | | | | | | | |

| | | | | | | 1,626,628 | |

| | | | | | | | |

| | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

(Cost: $1,626,628) | | | | | | | 1,626,628 | |

| | | | | | | | |

Schedule of Investments (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

August 31, 2012

| | | | | | |

| | | | | Value | |

| | |

TOTAL INVESTMENTS

IN SECURITIES — 99.93%

(Cost: $170,461,197) | | | | $ | 146,930,490 | |

Other Assets, Less Liabilities — 0.07% | | | | | 95,607 | |

| | | | | | |

NET ASSETS — 100.00% | | | | $ | 147,026,097 | |

| | | | | | |

| | |

SP ADR | | — Sponsored American Depositary Receipts |

SP GDR | | — Sponsored Global Depositary Receipts |

| a | Non-income earning security. |

| b | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| c | Affiliated issuer. See Note 2. |

| d | The rate quoted is the annualized seven-day yield of the fund at period end. |

See notes to financial statements.

| | |

| 10 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Statement of Assets and Liabilities

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

August 31, 2012

| | | | |

| | |

ASSETS | | | | |

Investments, at cost: | | | | |

Unaffiliated | | $ | 168,834,569 | |

Affiliated (Note 2) | | | 1,626,628 | |

| | | | |

Total cost of investments | | $ | 170,461,197 | |

| | | | |

Investments in securities, at fair value (Note 1): | | | | |

Unaffiliated | | $ | 145,303,862 | |

Affiliated (Note 2) | | | 1,626,628 | |

| | | | |

Total fair value of investments | | | 146,930,490 | |

Cash | | | 22,907 | |

Receivables: | | | | |

Investment securities sold | | | 2,685,543 | |

Due from custodian (Note 4) | | | 1,325,532 | |

Dividends and interest | | | 197,632 | |

| | | | |

Total Assets | | | 151,162,104 | |

| | | | |

| |

LIABILITIES | | | | |

Payables: | | | | |

Investment securities purchased | | | 4,054,947 | |

Investment advisory fees (Note 2) | | | 81,060 | |

| | | | |

Total Liabilities | | | 4,136,007 | |

| | | | |

| |

NET ASSETS | | $ | 147,026,097 | |

| | | | |

| |

Net assets consist of: | | | | |

Paid-in capital | | $ | 176,122,235 | |

Accumulated net realized loss | | | (5,552,059 | ) |

Net unrealized depreciation on investments and translation of assets and liabilities in foreign currencies | | | (23,544,079 | ) |

| | | | |

NET ASSETS | | $ | 147,026,097 | |

| | | | |

| |

Shares outstandinga | | | 6,950,000 | |

| | | | |

| |

Net asset value per share | | $ | 21.15 | |

| | | | |

| a | $0.001 par value, number of shares authorized: 1 billion. |

See notes to financial statements.

Statement of Operations

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Year ended August 31, 2012

| | | | |

| | |

NET INVESTMENT INCOME | | | | |

Dividends — unaffiliateda | | $ | 3,174,399 | |

Interest — affiliated (Note 2) | | | 126 | |

| | | | |

Total investment income | | | 3,174,525 | |

| | | | |

| |

EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 684,597 | |

| | | | |

Total expenses | | | 684,597 | |

| | | | |

Net investment income | | | 2,489,928 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) from: | | | | |

Investments — unaffiliated | | | (5,487,074 | ) |

In-kind redemptions — unaffiliated | | | 2,615,812 | |

Foreign currency transactions | | | (218,956 | ) |

| | | | |

Net realized loss | | | (3,090,218 | ) |

| | | | |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (14,538,688 | ) |

Translation of assets and liabilities in foreign currencies | | | 3,178 | |

| | | | |

Net change in unrealized appreciation/depreciation | | | (14,535,510 | ) |

| | | | |

Net realized and unrealized loss | | | (17,625,728 | ) |

| | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (15,135,800 | ) |

| | | | |

| a | Net of foreign withholding tax of $563,184. |

See notes to financial statements.

| | |

| 12 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Statements of Changes in Net Assets

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

| | | | | | | | |

| | | Year ended

August 31, 2012 | | | Period from

November 9, 2010a

to

August 31, 2011 | |

| | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 2,489,928 | | | $ | 1,506,986 | |

Net realized loss | | | (3,090,218 | ) | | | (1,244,551 | ) |

Net change in unrealized appreciation/depreciation | | | (14,535,510 | ) | | | (9,008,569 | ) |

| | | | | | | | |

Net decrease in net assets resulting from operations | | | (15,135,800 | ) | | | (8,746,134 | ) |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

From net investment income | | | (2,641,795 | ) | | | (1,554,120 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (2,641,795 | ) | | | (1,554,120 | ) |

| | | | | | | | |

| | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from shares sold | | | 90,887,177 | | | | 129,749,002 | |

Cost of shares redeemed | | | (37,918,790 | ) | | | (7,613,443 | ) |

| | | | | | | | |

Net increase in net assets from capital share transactions | | | 52,968,387 | | | | 122,135,559 | |

| | | | | | | | |

INCREASE IN NET ASSETS | | | 35,190,792 | | | | 111,835,305 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 111,835,305 | | | | — | |

| | | | | | | | |

End of period | | $ | 147,026,097 | | | $ | 111,835,305 | |

| | | | | | | | |

| | |

SHARES ISSUED AND REDEEMED | | | | | | | | |

Shares sold | | | 4,250,000 | | | | 4,754,000 | |

Shares redeemed | | | (1,750,000 | ) | | | (304,000 | ) |

| | | | | | | | |

Net increase in shares outstanding | | | 2,500,000 | | | | 4,450,000 | |

| | | | | | | | |

| a | Commencement of operations. |

See notes to financial statements.

Financial Highlights

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

(For a share outstanding throughout each period)

| | | | | | | | |

| | | Year ended

Aug. 31, 2012 | | | Period from

Nov. 9, 2010a to Aug. 31, 2011 | |

Net asset value, beginning of period | | $ | 25.13 | | | $ | 25.00 | |

| | | | | | | | |

Income from investment operations: | | | | | | | | |

Net investment incomeb | | | 0.50 | | | | 0.45 | |

Net realized and unrealized gain (loss)c | | | (4.00 | ) | | | 0.03 | |

| | | | | | | | |

Total from investment operations | | | (3.50 | ) | | | 0.48 | |

| | | | | | | | |

Less distributions from: | | | | | | | | |

Net investment income | | | (0.48 | ) | | | (0.35 | ) |

| | | | | | | | |

Total distributions | | | (0.48 | ) | | | (0.35 | ) |

| | | | | | | | |

Net asset value, end of period | | $ | 21.15 | | | $ | 25.13 | |

| | | | | | | | |

| | |

Total return | | | (13.75 | )% | | | 1.76 | %d |

| | | | | | | | |

| | |

Ratios/Supplemental data: | | | | | | | | |

Net assets, end of period (000s) | | $ | 147,026 | | | $ | 111,835 | |

Ratio of expenses to average net assetse | | | 0.61 | % | | | 0.58 | % |

Ratio of net investment income to average net assetse | | | 2.22 | % | | | 1.99 | % |

Portfolio turnover ratef | | | 16 | % | | | 22 | % |

| a | Commencement of operations. |

| b | Based on average shares outstanding throughout each period. |

| c | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| e | Annualized for periods of less than one year. |

| f | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

See notes to financial statements.

| | |

| 14 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Notes to Financial Statements

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

iShares MSCI Russia Capped Index Fund, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of the State of Maryland on May 21, 2010 pursuant to Articles of Incorporation.

These financial statements relate only to the following fund (the “Fund”):

| | |

| iShares MSCI Index Fund | | Diversification

Classification |

Russia Capped | | Non-diversified |

Non-diversified funds generally hold securities of fewer issuers than diversified funds and may be more susceptible to the risks associated with these particular issuers, or to a single economic, political or regulatory occurrence affecting these issuers.

The investment objective of the Fund is to seek investment results that correspond generally to the price and yield performance, before fees and expenses, of its underlying index. The investment adviser uses a “passive” or index approach to try to achieve the Fund’s investment objective.

The Fund may invest in securities of non-U.S. issuers that may trade in non-U.S. markets. This may involve certain considerations and risks not typically associated with securities of U.S. issuers. Such risks include, but are not limited to: generally less liquid and less efficient securities markets; generally greater price volatility; exchange rate fluctuations and exchange controls; imposition of restrictions on the expatriation of funds or other assets of the Fund; less publicly available information about issuers; the imposition of withholding or other taxes; higher transaction and custody costs; settlement delays and risk of loss attendant in settlement procedures; difficulties in enforcing contractual obligations; less regulation of securities markets; different accounting, disclosure and reporting requirements; more substantial governmental involvement in the economy; higher inflation rates; greater social, economic and political uncertainties; the risk of nationalization or expropriation of assets and the risk of war.

Pursuant to the Company’s organizational documents, the Fund’s officers and directors are indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

| 1. | SIGNIFICANT ACCOUNTING POLICIES |

The following significant accounting policies are consistently followed by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

SECURITY VALUATION

The Fund’s investments are valued at fair value each day that the Fund’s listing exchange is open. U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) provides oversight of the valuation of investments for the Fund. The investments of the Fund are valued pursuant to policies and procedures developed by the Global Valuation Committee and approved by the Board of Directors of the Company (the “Board”).

| | | | |

NOTESTO FINANCIAL STATEMENTS | | | 15 | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

| | • | | Equity investments traded on a recognized securities exchange are valued at that day’s last reported trade price or the official closing price, as applicable, on the exchange where the stock is primarily traded. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last traded price. |

| | • | | Open-end U.S. mutual funds are valued at that day’s published net asset value (NAV). |

In the event that application of these methods of valuation results in a price for an investment which is deemed not to be representative of the fair value of such investment or if a price is not available, the investment will be valued based upon other available factors deemed relevant by the Global Valuation Committee, in accordance with policies approved by the Board. These factors include but are not limited to (i) attributes specific to the investment; (ii) the principal market for the investment; (iii) the customary participants in the principal market for the investment; (iv) data assumptions by market participants for the investment, if reasonably available; (v) quoted prices for similar investments in active markets; and (vi) other factors, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and/or other default rates. Valuations based on such factors are reported to the Board on a quarterly basis.

The Global Valuation Committee employs various methods for calibrating valuation approaches for investments where an active market does not exist, including regular due diligence of the Company’s pricing vendors, a regular review of key inputs and assumptions, transactional back-testing or disposition analysis to compare unrealized gains and losses to realized gains and losses, reviews of missing or stale prices and large movements in market values, and reviews of market related activity.

Fair value pricing could result in a difference between the prices used to calculate the Fund’s net asset value and the prices used by the Fund’s underlying index, which in turn could result in a difference between the Fund’s performance and the performance of the Fund’s underlying index.

Various inputs are used in determining the fair value of financial instruments. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes. The level of a value determined for a financial instrument within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The categorization of a value determined for a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument. The three levels of the fair value hierarchy are as follows:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities; |

| | • | | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| | • | | Level 3 — Unobservable inputs for the asset or liability, including the Fund’s assumptions used in determining the fair value of investments. |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. In accordance with the Company’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the beginning of the reporting period.

| | |

| 16 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

As of August 31, 2012, the value of each of the Fund’s investments was classified as Level 1. The breakdown of the Fund’s investments into major categories is disclosed in its Schedule of Investments.

SECURITY TRANSACTIONS AND INCOME RECOGNITION

Security transactions are accounted for on trade date. Dividend income is recognized on the ex-dividend date, net of any foreign taxes withheld at source. Any taxes withheld that are reclaimable from foreign tax authorities as of August 31, 2012 are reflected in dividends receivable. Non-cash dividends received in the form of stock in an elective dividend, if any, are recorded as dividend income at fair value. Distributions received by the Fund may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains. Interest income is accrued daily. Realized gains and losses on investment transactions are determined using the specific identification method.

FOREIGN CURRENCY TRANSLATION

The accounting records of the Fund are maintained in U.S. dollars. Foreign currencies, as well as investment securities and other assets and liabilities denominated in foreign currencies, are translated into U.S. dollars using exchange rates deemed appropriate by the investment adviser. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars on the respective dates of such transactions.

The Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market prices of securities. Such fluctuations are reflected by the Fund as a component of realized and unrealized gains and losses from investments for financial reporting purposes.

FOREIGN TAXES

The Fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, capital gains on investments, certain foreign currency transactions or other corporate events. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Fund invests. These foreign taxes, if any, are paid by the Fund and are reflected in its Statement of Operations as follows: foreign taxes withheld at source are presented as a reduction of income, foreign taxes on securities lending income are presented as a reduction of securities lending income, foreign taxes on capital gains from sales of investments and foreign currency transactions are included in their respective net realized gain (loss) categories, and foreign taxes on other corporate events are reflected in “Other foreign taxes.” Foreign taxes payable as of August 31, 2012, if any, are disclosed in the Fund’s Statement of Assets and Liabilities.

DISTRIBUTIONS TO SHAREHOLDERS

Dividends and distributions paid by the Fund are recorded on the ex-dividend dates. Distributions are determined on a tax basis and may differ from net investment income and net realized capital gains for financial reporting purposes. Dividends and distributions are paid in U.S. dollars and cannot be automatically reinvested in additional shares of the Fund.

FEDERAL INCOME TAXES

It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions applicable to regulated investment companies, as defined under Subchapter M of the Internal Revenue Code of 1986, as amended, and to annually distribute substantially all of its ordinary income and any net capital gains (taking into account any capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income and excise taxes. Accordingly, no provision for federal income taxes is required.

| | | | |

NOTESTO FINANCIAL STATEMENTS | | | 17 | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

| 2. | INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Pursuant to an Investment Advisory Agreement with the Company, BlackRock Fund Advisors (“BFA”) manages the investment of the Fund’s assets. BFA is a California corporation indirectly owned by BlackRock, Inc. (“BlackRock”). Under the Investment Advisory Agreement, BFA is responsible for substantially all expenses of the Fund, except interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution fees, litigation expenses and any extraordinary expenses.

For its investment advisory services to the Fund, BFA is entitled to an annual investment advisory fee based on the Fund’s allocable portion of the aggregate of the average daily net assets of the Fund and certain other iShares funds, as follows:

| | | | |

| Investment Advisory Fee | | Aggregate Average Daily Net Assets |

| | 0.74% | | First $2 billion |

| | 0.69 | | Over $2 billion, up to and including $4 billion |

| | 0.64 | | Over $4 billion, up to and including $8 billion |

| | 0.57 | | Over $8 billion, up to and including $16 billion |

| | 0.51 | | Over $16 billion, up to and including $32 billion |

| | | 0.45 | | Over $32 billion |

At a special meeting of the Board held on January 5, 2012, the directors approved a new distribution agreement with BlackRock Investments, LLC (“BRIL”). BRIL is an affiliate of BFA. Effective April 1, 2012, BRIL replaced SEI Investments Distribution Co. as the distributor for the Fund. Pursuant to the new distribution agreement, BFA is responsible for any fees or expenses for distribution services provided to the Fund.

The Fund may invest its positive cash balances in certain money market funds managed by BFA or an affiliate. The income earned on these temporary cash investments is included in “Interest — affiliated” in the Statement of Operations.

The PNC Financial Services Group, Inc. is the largest stockholder of BlackRock and is considered to be an affiliate of the Fund for 1940 Act purposes.

Certain directors and officers of the Company are also officers of BlackRock Institutional Trust Company, N.A. and/or BFA.

| 3. | INVESTMENT PORTFOLIO TRANSACTIONS |

Purchases and sales of investments (excluding in-kind transactions and short-term investments) for the year ended August 31, 2012 were $18,673,692 and $18,717,320, respectively.

In-kind purchases and sales (see Note 4) for the year ended August 31, 2012 were $89,202,887 and $37,504,007, respectively.

| 4. | CAPITAL SHARE TRANSACTIONS |

Capital shares are issued and redeemed by the Fund only in aggregations of a specified number of shares or multiples thereof (“Creation Units”) at net asset value. Except when aggregated in Creation Units, shares of the Fund are not redeemable. Transactions in capital shares for the Fund are disclosed in detail in the Statements of Changes in Net Assets.

| | |

| 18 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

The consideration for the purchase of Creation Units of a fund in the Company generally consists of the in-kind deposit of a designated portfolio of securities, which constitutes an optimized representation of the securities of that fund’s underlying index, and a specified amount of cash. Certain funds in the Company may be offered in Creation Units solely or partially for cash in U.S. dollars. Investors purchasing and redeeming Creation Units may pay a purchase transaction fee and a redemption transaction fee directly to State Street Bank and Trust Company, the Company’s administrator, to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units, including Creation Units for cash. Investors transacting in Creation Units for cash pay an additional variable charge to compensate the relevant fund for certain transaction costs (i.e., stamp taxes, taxes on currency or other financial transactions, and brokerage costs) and market impact expenses relating to investing in portfolio securities.

From time to time, settlement of securities related to in-kind contributions or in-kind redemptions may be delayed. In such cases, securities related to in-kind contributions are reflected as “Due from custodian” and securities related to in-kind redemptions are reflected as “Securities related to in-kind transactions” in the Statement of Assets and Liabilities.

U.S. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The following permanent differences as of August 31, 2012, attributable to distributions paid in excess of taxable income, foreign currency transactions and realized gains (losses) from in-kind redemptions, were reclassified to the following accounts:

| | | | | | | | |

Paid-in

Capital | | Undistributed

Net Investment

Income/Distributions

in Excess of Net

Investment Income | | | Undistributed

Net Realized

Gain/Accumulated

Net Realized Loss | |

| $377,799 | | $ | 151,867 | | | $ | (529,666) | |

The tax character of distributions paid during the periods ended August 31, 2012 and August 31, 2011 was as follows:

| | | | | | | | |

| | | 2012 | | | 2011 | |

Ordinary income | | $ | 2,641,795 | | | $ | 1,554,120 | |

| | | | | | | | |

| | | | | | | | | |

As of August 31, 2012, the tax components of accumulated net earnings (losses) were as follows:

| | | | | | | | | | | | | | | | |

Undistributed

Ordinary

Income | | Capital

Loss

Carryforwards | | | Net

Unrealized

Gains (Losses) a | | | Qualified

Late-Year

Losses b | | | Total | |

| $ — | | $ | (953,131 | ) | | $ | (27,240,541 | ) | | $ | (902,466 | ) | | $ | (29,096,138 | ) |

| | a | | The difference between book-basis and tax-basis unrealized gains (losses) was attributable primarily to the tax deferral of losses on wash sales. |

| | b | | The Fund has elected to defer certain qualified late-year losses and recognize such losses in the year ending August 31, 2013. |

As of August 31, 2012, the Fund had non-expiring capital loss carryforwards in the amount of $953,131 available to offset future realized capital gains.

| | | | |

NOTESTO FINANCIAL STATEMENTS | | | 19 | |

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

The Fund may own shares in certain foreign investment entities, referred to, under U.S. tax law, as “passive foreign investment companies.” The Fund may elect to mark-to-market annually the shares of each passive foreign investment company and would be required to distribute to shareholders any such marked-to-market gains.

As of August 31, 2012, the cost of investments for federal income tax purposes was $174,157,659. Net unrealized depreciation was $27,227,169, of which $1,880,439 represented gross unrealized appreciation on securities and $29,107,608 represented gross unrealized depreciation on securities.

Management has reviewed the tax positions as of August 31, 2012, inclusive of the open tax return years, and has determined that no provision for income tax is required in the Fund’s financial statements.

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were available to be issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

| | |

| 20 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

iShares MSCI Russia Capped Index Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the iShares MSCI Russia Capped Index Fund (the “Fund”), at August 31, 2012, the results of its operations for the year then ended, and the changes in its net assets and its financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2012 by correspondence with the custodian, transfer agent and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

October 23, 2012

| | | | |

REPORTOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 21 | |

Tax Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

For the fiscal year ended August 31, 2012, the Fund earned foreign source income of $3,737,583 and paid foreign taxes of $543,522 which it intends to pass through to its shareholders pursuant to Section 853 of the Internal Revenue Code (the “Code”).

Under Section 854(b)(2) of the Code, the Fund hereby designates the maximum amount of $3,185,317 as qualified dividend income for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended August 31, 2012.

In February 2013, shareholders will receive form 1099-DIV which will include their share of qualified dividend income distributed during the calendar year 2012. Shareholders are advised to check with their tax advisers for information on the treatment of these amounts on their income tax returns.

| | |

| 22 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Board Review and Approval of Investment Advisory

Contract (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Under Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), the Company’s Board of Directors (the “Board”), including a majority of Directors who are not “interested persons” of the Company (as that term is defined in the 1940 Act) (the “Independent Directors”), is required annually to consider the Investment Advisory Contract between the Company and BFA (the “Advisory Contract”) on behalf of the Fund. The Independent Directors requested, and BFA provided, such information as the Independent Directors, with advice from independent counsel, deemed reasonably necessary to evaluate the Advisory Contract. A committee of Independent Directors (the “15(c) Committee”), with independent counsel, met with management on April 19, 2012, April 27, 2012, and May 16, 2012, to discuss the types of information the Independent Directors required and the manner in which management would organize and present such information. At a meeting held on May 17, 2012, management presented information to the Board relating to the continuance of the Advisory Contract, and the Board, including the Independent Directors, reviewed and discussed such information at length. The Independent Directors requested from management certain additional information, and the 15(c) Committee met with management on June 8, 2012, to discuss the additional requests. At a meeting held on June 20-21, 2012, the Board, including the Independent Directors, reviewed additional information provided by management in response to these requests. The Board, including a majority of the Independent Directors, approved the continuance of the Advisory Contract for the Fund, based on a review of qualitative and quantitative information provided by BFA, including a review of supplemental information management provided at the request of the Independent Directors. The Board noted its satisfaction with the extent and quality of information, and detailed responses, provided by BFA. The Independent Directors were advised by their independent counsel throughout the process. In approving the Advisory Contract for the Fund, the Board, including the Independent Directors, considered the following factors, no one of which was controlling, and made the following conclusions:

Expenses and Performance of the Fund — The Board reviewed statistical information prepared by Lipper Inc. (“Lipper”), an independent provider of investment company data, regarding the expense ratio components, including actual advisory fees, waivers/reimbursements, and gross and net total expenses of the Fund in comparison with the same information for other registered investment companies objectively selected by Lipper as comprising the Fund’s applicable peer group pursuant to Lipper’s proprietary methodology, and any registered funds that would otherwise have been excluded from Lipper’s comparison group because of their size, sponsor, inception date, or other differentiating factors, but that were nonetheless included at the request of BFA (the “Lipper Group”). Because there are few, if any, exchange traded funds or index funds that track indexes similar to those tracked by the Fund, the Lipper Group included in part mutual funds, closed-end funds, exchange traded funds, or funds with differing investment objective classifications, investment focuses and other characteristics (e.g., actively managed funds and funds sponsored by “at cost” service providers), as applicable. In support of its review of the statistical information, the Board was provided with a detailed description of the methodology used by Lipper to determine the applicable Lipper Groups and to prepare this information. The Board also received a detailed explanation from BFA regarding its rationale for including funds that had been excluded from Lipper’s consideration due to Lipper’s methodology parameters, as well as information showing the effect of including these additional funds in the analysis. The Board further noted that due to the limitations in providing comparable funds in the various Lipper Groups, the statistical information may or may not provide meaningful direct comparisons to the Fund.

The Board also noted that the investment advisory fees and overall expenses for the Fund compared favorably to the investment advisory fee rates and overall expenses of the funds in the Lipper Group.

In addition, the Board reviewed statistical information prepared by Lipper regarding the performance of the Fund for the one-, three-, five-, ten-year, and since inception periods, as applicable, and the “last quarter” period ended December 31, 2011, and a comparison of the Fund’s performance to its performance benchmark index for the same periods. To the extent that any of the comparison funds included in the Lipper Group track the same index as the Fund, Lipper also provided, and the Board reviewed, a comparison of the Fund’s performance to that of such relevant comparison funds for the same periods. The Board noted that the Fund generally performed in line with its performance benchmark index over the relevant periods. In considering this information, the Board noted that the Lipper Group includes funds that may have different investment objectives and/or benchmarks from the Fund. In addition, the Board noted that the Fund seeks to

| | | | |

BOARD REVIEWAND APPROVALOF INVESTMENT ADVISORY CONTRACT | | | 23 | |

Board Review and Approval of Investment Advisory

Contract (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

track its benchmark index and that, during the prior year, the Board received periodic reports on the Fund’s performance in comparison with its benchmark index. Such periodic comparative performance information was also considered by the Board.

Based on this review, the other factors considered at the meeting, and their general knowledge of mutual fund pricing, the Board concluded that the investment advisory fees and expense levels and the historical performance of the Fund supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Nature, Extent and Quality of Services Provided by BFA — Based on management’s representations, the Board expected that there would be no diminution in the scope of services required of or provided by BFA under the Advisory Contract for the coming year as compared to the scope of services provided by BFA over prior years. In reviewing the scope of these services, the Board considered BFA’s investment philosophy and experience, noting that BFA and its affiliates have committed significant resources over time, including during the past year, to supporting the Fund and its shareholders. The Board noted that BFA became an indirect wholly-owned subsidiary of BlackRock, Inc. (“BlackRock”) in December 2009. The Board acknowledged that additional resources to support the Fund and its shareholders have been added or enhanced since then, including in such areas as investor education, product management, customized portfolio consulting support, and capital markets support. The Board also considered BFA’s compliance program and its compliance record with respect to the Fund. In that regard, the Board noted that BFA reports to the Board about portfolio management and compliance matters on a periodic basis in connection with regularly scheduled meetings of the Board, and on other occasions as necessary and appropriate, and has provided information and made appropriate officers available as needed to provide further assistance with these matters. The Board also reviewed the background and experience of the persons responsible for the day-to-day management of the Fund. In addition to the above considerations, the Board reviewed and considered BFA’s investment and risk management processes and strategies, and matters related to BFA’s portfolio compliance policies and procedures. The Board noted that the Fund had met its investment objective consistently since its inception date.

Based on review of this information, and the performance information discussed above, the Board concluded that the nature, extent and quality of services provided by BFA to the Fund under the Advisory Contract supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Costs of Services Provided to Fund and Profits Realized by BFA and Affiliates — The Board reviewed information about the profitability to BFA of the Fund based on the fees payable to BFA and its affiliates (including fees under the Advisory Contract), and all other sources of revenue and expense to BFA and its affiliates from the Fund’s operations for the last calendar year. The Board reviewed BlackRock’s profitability methodology for the iShares funds, noting that the 15(c) Committee had focused on the methodology and proposed presentation during its meetings. The Board discussed the sources of direct and ancillary revenue with management, including the revenues to BTC from securities lending by the Fund. The Board also discussed BFA’s profit margin as reflected in the Fund’s profitability analysis and reviewed information regarding economies of scale (as discussed below). Based on this review, the Board concluded that the profits realized by BFA and its affiliates under the Advisory Contract and from other relationships between the Fund and BFA and/or its affiliates, if any, were within a reasonable range in light of the factors considered.

Economies of Scale — The Board reviewed information regarding economies of scale or other efficiencies that may result from increases in the Fund’s assets, noting that the issue of economies of scale had been focused on extensively by the 15(c) Committee during its meetings and addressed by management. The Board and the 15(c) Committee reviewed information provided by BFA regarding scale benefits shared with the iShares funds through breakpoints, waivers, or other fee reductions, as well as through additional investment in the iShares business and the provision of improved or additional infrastructure and services to the iShares funds and their shareholders. The Board and

| | |

| 24 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Board Review and Approval of Investment Advisory

Contract (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

the 15(c) Committee received information regarding BFA’s historical profitability, including BFA’s and its affiliates’ costs in providing services. The cost information distinguished between fixed and variable costs, and explained how the nature of such costs may impact the existence of scale benefits. The Board noted that the Advisory Contract for the Fund already provided for breakpoints in the Fund’s investment advisory fee rates as the assets of the Fund, on an aggregated basis with the assets of certain other iShares funds, increase. The Board noted that it would continue to monitor the sharing of economies of scale to determine the appropriateness of adding new or revised breakpoints in the future. Based on this review, as well as the other factors considered at the meeting, the Board, recognizing its responsibility to consider this issue at least annually, concluded that the structure of the investment advisory fees reflects appropriate sharing of potential economies of scale with the Fund’s shareholders and supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Fees and Services Provided for Other Comparable Funds/Accounts Managed by BFA and its Affiliates — The Board received and considered information regarding the investment advisory/management fee rates for other funds/accounts in the U.S. for which BFA (or its affiliates) provides investment advisory/management services, including open-end and closed-end funds registered under the 1940 Act (including sub-advised funds), collective trust funds and institutional separate accounts (together, the “Other Accounts”). The Board noted that BFA and its affiliates do not manage Other Accounts with a substantially similar investment objective and strategy as the Fund. The Board further noted that BFA provided the Board with detailed information regarding how the Other Accounts (particularly institutional clients) generally differ from the Fund, including in terms of the different generally more extensive services provided, as well as other significant differences in the approach of BFA and its affiliates to the Fund, on one hand, and Other Accounts, on the other. In that regard, the Board considered that the pricing of services to institutional clients is typically based on a number of factors beyond the nature and extent of the specific services to be provided and often depends on the overall relationship between the client and its affiliates and the adviser and its affiliates. In addition, the Board considered the relative complexity and inherent risks of managing and providing other services to the Fund, as a publicly traded exchange traded fund, as compared to the Other Accounts that are institutional clients in light of differing regulatory requirements and client-imposed mandates. The Board also considered the “all-inclusive” nature of the Fund’s advisory fee structure, and the Fund expenses borne by BFA under this arrangement. The Board noted that the investment advisory fee rates under the Advisory Contract for the Fund were generally higher than the investment advisory/management fee rates for the Other Accounts that are institutional clients of BFA (or its affiliates) and concluded that the differences appeared to be consistent with the factors discussed.

Other Benefits to BFA and/or its Affiliates — The Board reviewed ancillary revenue received by BFA and/or its affiliates in connection with the services provided to the Fund by BFA, such as payment of revenue to BTC, the Fund’s securities lending agent, for loaning portfolio securities (which was included in the profit margins reviewed by the Board pursuant to BFA’s profitability methodology), and payment of advisory fees and/or administration fees to BFA and BTC (or their affiliates) in connection with any investments by the Fund in other funds for which BFA (or its affiliates) provides investment advisory services and/or administration services. The Board noted that BFA generally does not use soft dollars or consider the value of research or other services that may be provided to BFA (including its affiliates) in selecting brokers for portfolio transactions for the Fund. The Board further noted that any portfolio transactions on behalf of the Fund placed through a BFA affiliate or purchased from an underwriting syndicate in which a BFA affiliate participates, are reported to the Board pursuant to Rule 17e-1 or Rule 10f-3, as applicable, under the 1940 Act. The Board concluded that any such ancillary benefits would not be disadvantageous to the Fund’s shareholders and thus would not alter the Board’s conclusion with respect to the appropriateness of approving the continuance of the Advisory Contract for the coming year.

Based on the considerations described above, the Board determined that the investment advisory fee rates under the Advisory Contract do not constitute fees that are so disproportionately large as to bear no reasonable relationship to the services rendered and that could not have been the product of arm’s-length bargaining, and concluded that it is in the best interest of the Fund and its shareholders to approve the continuance of the Advisory Contract for the coming year.

| | | | |

BOARD REVIEWAND APPROVALOF INVESTMENT ADVISORY CONTRACT | | | 25 | |

Supplemental Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND

Premium/Discount Information

The table that follows presents information about the differences between the daily market price on secondary markets for shares of the Fund and the Fund’s net asset value. Net asset value, or “NAV,” is the price per share at which the Fund issues and redeems shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. The Fund’s Market Price may be at, above or below its NAV. The NAV of the Fund will fluctuate with changes in the market value of its portfolio holdings. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on the given day, generally at the time NAV is calculated. A premium is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

The following information shows the frequency distributions of premiums and discounts for the Fund included in this report. The information shown for the Fund is each full calendar quarter completed after the inception date of the Fund through the date of the most recent calendar quarter-end. The specific period covered for the Fund is disclosed in the table.

Each line in the table shows the number of trading days in which the Fund traded within the premium/discount range indicated. The number of trading days in each premium/discount range is also shown as a percentage of the total number of trading days in the period covered by the table. All data presented here represents past performance, which cannot be used to predict future results.

Period Covered: January 1, 2011 through June 30, 2012

| | | | | | | | |

Premium/Discount Range | | Number

of Days | | | Percentage of

Total Days | |

Greater than 3.0% and Less than 3.5% | | | 3 | | | | 0.80 | % |

Greater than 2.5% and Less than 3.0% | | | 4 | | | | 1.06 | |

Greater than 2.0% and Less than 2.5% | | | 7 | | | | 1.86 | |

Greater than 1.5% and Less than 2.0% | | | 10 | | | | 2.65 | |

Greater than 1.0% and Less than 1.5% | | | 28 | | | | 7.43 | |

Greater than 0.5% and Less than 1.0% | | | 88 | | | | 23.34 | |

Between 0.5% and –0.5% | | | 157 | | | | 41.63 | |

Less than –0.5% and Greater than –1.0% | | | 35 | | | | 9.28 | |

Less than –1.0% and Greater than –1.5% | | | 20 | | | | 5.30 | |

Less than –1.5% and Greater than –2.0% | | | 12 | | | | 3.18 | |

Less than –2.0% and Greater than –2.5% | | | 4 | | | | 1.06 | |

Less than –2.5% and Greater than –3.0% | | | 3 | | | | 0.80 | |

Less than –3.0% and Greater than –3.5% | | | 3 | | | | 0.80 | |

Less than –3.5% and Greater than –4.0% | | | 1 | | | | 0.27 | |

Less than –4.0% and Greater than –4.5% | | | 1 | | | | 0.27 | |

Less than –4.5% and Greater than –5.0% | | | 1 | | | | 0.27 | |

| | | | | | | | |

| | | 377 | | | | 100.00 | % |

| | | | | | | | |

| | |

| 26 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Director and Officer Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

The Board of Directors has responsibility for the overall management and operations of the Company, including general supervision of the duties performed by BFA and other service providers. Each Director serves until he or she resigns, is removed, dies, retires or becomes incapacitated. The President, Treasurer and Secretary shall each hold office until their successors are chosen and qualified, and all other officers shall hold office until he or she resigns or is removed. Directors who are not interested persons (as defined in the 1940 Act) are referred to as Independent Directors.

The registered investment companies advised by BFA or its affiliates are organized into one complex of closed-end funds, two complexes of open-end funds and one complex of exchange-traded funds (“Exchange-Traded Fund Complex”) (each, a “BlackRock Fund Complex”). Each Fund is included in the BlackRock Fund Complex referred to as the Exchange-Traded Fund Complex. Each Director of iShares MSCI Russia Capped Index Fund, Inc. also serves as a Director of iShares, Inc., a Trustee of iShares Trust and a Trustee of iShares U.S. ETF Trust and, as a result, oversees a total of 276 funds within the Exchange-Traded Fund Complex. With the exception of Robert S. Kapito, the address of each Director and Officer is c/o BlackRock, Inc., 400 Howard Street, San Francisco, CA 94105. The address of Mr. Kapito is c/o BlackRock, Inc., Park Avenue Plaza, 55 East 52nd Street, New York, NY 10055. The Board has designated Robert H. Silver as its Independent Chairman. Additional information about the Fund’s Directors and Officers may be found in the Fund’s Statement of Additional Information, which is available without charge, upon request, by calling toll-free 1-800-iShares (1-800-474-2737).

Interested Directors and Officers

| | | | | | |

| | | | |

| Name (Age) | | Position(s)

(Length of Service) | | Principal Occupation(s)

During the Past 5 Years | | Other Directorships Held |

Robert S. Kapitoa (55) | | Director

(since 2010). | | President and Director, BlackRock, Inc. (since 2006 and 2007, respectively); Vice Chairman of BlackRock, Inc. and Head of BlackRock’s Portfolio Management Group (since its formation in 1998) and BlackRock’s predecessor entities (since 1988); Trustee, University of Pennsylvania (since 2009); President of Board of Directors, Hope & Heroes Children’s Cancer Fund (since 2002); President of the Board of Directors, Periwinkle Theatre for Youth (since 1983). | | Director of BlackRock, Inc. (since 2007); Director of iShares, Inc. (since 2009); Trustee of iShares Trust (since 2009); Trustee of iShares U.S. ETF Trust

(since 2011). |

| | | |

Michael Lathamb (47) | | Director

(since 2010);

President

(since 2010). | | Chairman of iShares, BlackRock (since 2011); Global Chief Executive Officer of iShares, BlackRock (2010-2011); Managing Director, BlackRock (since 2009); Head of Americas iShares, Barclays Global Investors (“BGI”) (2007-2009); Director and Chief Financial Officer of Barclays Global Investors International, Inc. (2005-2009); Chief Operating Officer of the Intermediary Investor and Exchange-Traded Products Business, BGI (2003-2007). | | Director of iShares, Inc. (since 2010); Trustee of iShares Trust (since 2010); Trustee of iShares U.S. ETF Trust

(since 2011). |

| a | Robert S. Kapito is deemed to be an “interested person” (as defined in the 1940 Act) of the Trust due to his affiliations with BlackRock, Inc. |

| b | Michael Latham is deemed to be an “interested person” (as defined in the 1940 Act) of the Trust due to his affiliations with BlackRock, Inc. and its affiliates. |

| | | | |

DIRECTORAND OFFICER INFORMATION | | | 27 | |

Director and Officer Information (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

Independent Directors

| | | | | | |

| | | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s)

During the Past 5 Years | | Other Directorships Held |

Robert H. Silver (57) | | Director

(since 2010);

Independent Chairman

(since 2012). | | President and Co-Founder of The Bravitas Group, Inc. (since 2006); Director and Vice Chairman of the YMCA of Greater NYC (2001-2011); Broadway Producer (2006-2011); Co-Founder and Vice President of Parentgiving Inc. (since 2008); Director and Member of the Audit and Compensation Committee of EPAM Systems, Inc. (2006-2009); President and Chief Operating Officer of UBS Financial Services Inc. (formerly Pain Webber Inc.) (2004-2005) and various executive positions with UBS and its affiliates (1988-2005); CPA and Audit Manager of KPMG, LLP (formerly Peat Marwick Mitchell) (1977-1983). | | Director of iShares, Inc. (since 2007); Trustee of iShares Trust (since 2007); Trustee of iShares U.S. ETF Trust

(since 2011); Independent Chairman of iShares, Inc., iShares Trust and iShares U.S. ETF Trust (since 2012). |

| | | |

Cecilia H. Herbert (63) | | Director

(since 2010);

Nominating and Governance Committee Chair and Equity Plus Committee Chair (since 2012). | | Director (since 1998) and President (2007-2011) of the Board of Directors, Catholic Charities CYO; Trustee (since 2002) and Chair of the Finance Committee (2006-2009) and Investment Committee (since 2006), The Thacher School; Trustee of Pacific Select Funds (2004-2005); Member (since 1994) and Chair (1994-2005) of the Investment Committee, Archdiocese of San Francisco. | | Director of iShares, Inc. (since 2005); Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust

(since 2011); Director of Forward Funds (35 portfolios) (since 2009). |

| | | |

Charles A. Hurty (69) | | Director

(since 2010);

Audit Committee Chair (since 2006). | | Retired; Partner, KPMG LLP (1968-2001). | | Director of iShares, Inc. (since 2005); Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust

(since 2011); Director of GMAM Absolute Return Strategy Fund (1 portfolio)

(since 2002); Director of SkyBridge Alternative Investment Multi-Adviser Hedge Fund Portfolios LLC (1 portfolio) (since 2002). |

| | | |

John E. Kerrigan (57) | | Director

(since 2010);

Fixed Income Plus Committee Chair (since 2012). | | Chief Investment Officer, Santa Clara University (since 2002). | | Director of iShares, Inc. (since 2005); Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust

(since 2011). |

| | |

| 28 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

Director and Officer Information (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

Independent Directors (Continued)

| | | | | | |

| | | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s)

During the Past 5 Years | | Other Directorships Held |

John E. Martinez (51) | | Director

(since 2010);

Securities Lending Committee Chair (since 2012). | | Director of FirstREX Agreement Corp. (formerly EquityRock, Inc.) (since 2005). | | Director of iShares, Inc. (since 2003); Trustee of iShares Trust (since 2003); Trustee of iShares U.S. ETF Trust

(since 2011). |

| | | |

George G.C. Parker (73) | | Director

(since 2010). | | Dean Witter Distinguished Professor of Finance, Emeritus, Stanford University Graduate School of Business (Professor since 1973; Emeritus since 2006). | | Director of iShares, Inc. (since 2002); Trustee of iShares Trust (since 2000); Trustee of iShares U.S. ETF Trust

(since 2011); Director of Tejon Ranch Company (since 1999); Director of Threshold Pharmaceuticals (since 2004); Director of Colony Financial, Inc.

(since 2009); Director of First Republic Bank (since 2010). |

| | | |

Madhav V. Rajan (48) | | Director

(since 2011);

15(c) Committee Chair (since 2012). | | Robert K. Jaedicke Professor of Accounting and Senior Associate Dean for Academic Affairs and Head of MBA Program, Stanford University Graduate School of Business (since 2001); Professor of Law (by courtesy), Stanford Law School

(since 2005); Visiting Professor, University of Chicago (Winter 2007-2008). | | Director of iShares, Inc. (since 2011); Trustee of iShares Trust (since 2011); Trustee of iShares U.S. ETF Trust

(since 2011). |

| | | | |

DIRECTORAND OFFICER INFORMATION | | | 29 | |

Director and Officer Information (Unaudited) (Continued)

iSHARES® MSCI RUSSIA CAPPED INDEX FUND, INC.

Officers

| | | | |

| | | |

| Name (Age) | | Position(s) (Length of Service) | | Principal Occupation(s)

During the Past 5 Years |

Edward B. Baer (44) | | Vice President and Chief Legal Officer (since 2012). | | Managing Director, BlackRock (since 2006). |

| | |

Eilleen M. Clavere (60) | | Secretary (since 2010). | | Director, BlackRock (since 2009); Director of Legal Administration of Intermediary Investor Business, BGI (2006-2009). |

| | |

Jack Gee (53) | | Treasurer and Chief Financial Officer (since 2010). | | Managing Director, BlackRock (since 2009); Senior Director of Fund Administration of Intermediary Investor Business, BGI (2009); Director of Fund Administration of Intermediary Investor Business, BGI (2004-2009). |

| | |

Amy Schioldager (50) | | Executive Vice President (since 2010). | | Managing Director, BlackRock (since 2009); Global Head of Index Equity, BGI (2008-2009); Global Head of U.S. Indexing, BGI (2006-2008). |

| | |

Ira P. Shapiro (49) | | Vice President (since 2010). | | Managing Director, BlackRock (since 2009); Chief Legal Officer, Exchange-Traded Funds Complex (2007-2012); Associate General Counsel, BGI (2004-2009). |

| | |

Scott Radell (43) | | Executive Vice President (since 2012). | | Managing Director, BlackRock (since 2009); Head of Portfolio Solutions, BGI (2007-2009); Credit Portfolio Manager, BGI (2005-2007). |

| | |

| 30 | | 2012 iSHARES ANNUAL REPORTTO SHAREHOLDERS |

For more information visit www.iShares.com

or call 1-800-474-2737

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current prospectus.

Investing involves risk, including possible loss of principal.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the iShares Funds. BlackRock is not affiliated with the company listed above.

A description of the policies that the Fund uses to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ending June 30 is available without charge, upon request, by calling toll-free 1-800-474-2737; on the Fund’s website at www.iShares.com; and on the U.S. Securities and Exchange Commission (SEC) website at www.sec.gov.