UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22442

First Trust High Income Long/Short Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant’s telephone number, including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | | The Report to Shareholders is attached herewith. |

First Trust

High Income Long/Short Fund (FSD)

Semi-Annual Report

For the Six Months Ended

April 30, 2021

First Trust High Income Long/Short Fund (FSD)

Semi-Annual Report

April 30, 2021

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or MacKay Shields LLC (“MacKay” or the “Sub-Advisor”) and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust High Income Long/Short Fund (the “Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Principal Risks” in the Additional Information section of this report for a discussion of certain other risks of investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance compared to that of a relevant market benchmark.

It is important to keep in mind that the opinions expressed by personnel of First Trust and MacKay are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust High Income Long/Short Fund (FSD)

Semi-Annual Letter from the Chairman and CEO

April 30, 2021

Dear Shareholders,

First Trust is pleased to provide you with the semi-annual report for the First Trust High Income Long/Short Fund (the “Fund”), which contains detailed information about the Fund for the six months ended April 30, 2021.

I would like to begin my remarks by saying that this is a time for all of us to be thankful. It is astounding to me that our scientists and extended health care community successfully discovered, developed, and distributed multiple effective vaccines to treat the coronavirus (“COVID-19”) in the span of just 15 months. Suffice it to say that we are witnessing history in the making. We even received some good news recently with respect to wearing masks in public, a polarizing act for many politicians and Americans. The Centers for Disease Control and Prevention released a new set of guidelines in mid-May for those individuals who have been fully vaccinated. It essentially says fully vaccinated Americans can quit wearing their masks outdoors (even in crowds), in most indoor settings, and can drop social distancing altogether. This is a big step towards expediting the reopening of the U.S. economy.

For those who may not know, we subscribe to the buy-and-hold philosophy of investing here at First Trust Advisors L.P., even though it means enduring lots of tough times. While the notion of being able to time the market is seductive on its face, very few investors are skilled enough to make it work over time. I can think of no better example than the COVID-19 pandemic. The degree of uncertainty surrounding the onset of the virus alone was enough to make the average investor want to run for cover. And if that was not enough, the 33.8% plunge in the S&P 500® Index (the “Index”) from February 19, 2020, through March 23, 2020 (23 trading days) was a real gut check for most of us. But a funny thing happened on the way to another potential collapse of the market − it did not happen. In fact, thanks to the U.S. Federal government stepping up with trillions of dollars of timely fiscal and monetary support, the stock market roared. From March 23, 2020 through May 14, 2021, the Index posted a total return of 90.14%, according to Bloomberg. What a shame for those investors who may have moved some, or all, of their capital out of equities. What looked like a great time to de-risk turned out to be just the opposite.

The overall climate for investing looks bright for a few reasons. First, U.S. real gross domestic product (“GDP”) growth is expected to grow by 6.4% year-over-year in 2021, according to the International Monetary Fund. The last time the U.S. economy grew that fast was in 1984, when real GDP growth reached 7.2%. Second, corporate earnings are expected to recover from their 2020 slide. Bloomberg’s consensus year-over-year earnings growth rate estimates for the Index for 2021 and 2022 were 33.17% and 12.87%, respectively, as of May 14, 2021. That is a significant rebound from the 12.44% decline in earnings in 2020. Third, inflation is rising, and that is exactly what the Federal Reserve has been wanting for some time. Central banks around the world have spent years battling deflationary pressures, so a little bit of inflation is welcome at this stage of the recovery. Lastly, the U.S. labor market is robust despite the talk about the millions of people who lost their jobs in the COVID-19 pandemic and are living off unemployment benefits. As of March 31, 2021, there were 8.12 million job openings in the U.S., the highest total since record-keeping began in December 2000, according to the Bureau of Labor Statistics. We need to get people back to work.

While it seems fashionable to sell fear these days, we choose to follow the data. Remember, the Index has never failed to fully recoup the losses sustained in a market correction or bear market. Stay the course!

Thank you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

First Trust High Income Long/Short Fund (FSD)

“AT A GLANCE”

As of April 30, 2021 (Unaudited)

| Fund Statistics | |

| Symbol on New York Stock Exchange | FSD |

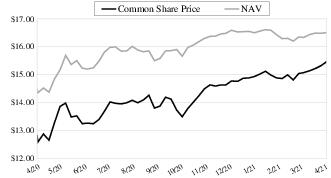

| Common Share Price | $15.46 |

| Common Share Net Asset Value (“NAV”) | $16.51 |

| Premium (Discount) to NAV | (6.36)% |

| Net Assets Applicable to Common Shares | $552,565,622 |

| Current Monthly Distribution per Common Share(1) | $0.1100 |

| Current Annualized Distribution per Common Share | $1.3200 |

| Current Distribution Rate on Common Share Price(2) | 8.54% |

| Current Distribution Rate on NAV(2) | 8.00% |

Common Share Price & NAV (weekly closing price)

| Performance | | | | | |

| | | Average Annual Total Returns |

| | 6 Months Ended

4/30/21 | 1 Year Ended

4/30/21 | 5 Years Ended

4/30/21 | 10 Years Ended

4/30/21 | Inception

(9/27/10)

to 4/30/21 |

| Fund Performance(3) | | | | | |

| NAV | 10.21% | 25.05% | 8.30% | 6.61% | 7.11% |

| Market Value | 19.80% | 32.25% | 9.77% | 6.45% | 5.99% |

| Index Performance | | | | | |

| ICE BofA US High Yield Constrained Index | 8.13% | 20.01% | 7.31% | 6.26% | 6.79% |

| (1) | Most recent distribution paid or declared through 4/30/2021. Subject to change in the future. |

| (2) | Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 4/30/2021. Subject to change in the future. |

| (3) | Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

First Trust High Income Long/Short Fund (FSD)

“AT A GLANCE” (Continued)

As of April 30, 2021 (Unaudited)

| Credit Quality(4) | % of Total

Fixed-Income

Investments(5) |

| BBB- and above | 8.8% |

| BB | 48.8 |

| B | 29.4 |

| CCC+ and below | 13.0 |

| Total | 100.0% |

| Industry Classification | % of

Long-Term

Investments(5) |

| Energy | 11.2% |

| Capital Goods | 10.2 |

| Services | 8.7 |

| Telecommunications | 8.5 |

| Healthcare | 8.0 |

| Consumer Goods | 7.9 |

| Basic Industry | 7.0 |

| Media | 6.1 |

| Retail | 6.0 |

| Automotive | 5.3 |

| Leisure | 4.2 |

| Technology & Electronics | 4.1 |

| Financial Services | 3.8 |

| Real Estate | 2.5 |

| Banking | 2.1 |

| Insurance | 2.0 |

| Transportation | 1.6 |

| Commercial Mortgage-Backed Securities | 0.4 |

| Agency | 0.3 |

| Utility | 0.1 |

| Collateralized Mortgage Obligations | 0.0* |

| Total | 100.0% |

| * | Amount is less than 0.1%. |

| Asset Classification | % of

Long-Term

Investments(5) |

| Corporate Bonds and Notes | 73.3% |

| Foreign Corporate Bonds and Notes | 19.6 |

| Capital Preferred Securities | 4.9 |

| Senior Floating-Rate Loan Interests | 1.7 |

| Mortgage-Backed Securities | 0.4 |

| Equity | 0.1 |

| Total | 100.0% |

| Country Exposure | % of

Long-Term

Investments(5) |

| United States | 79.9% |

| Canada | 6.1 |

| Luxembourg | 3.3 |

| Multinational | 3.3 |

| Netherlands | 2.3 |

| United Kingdom | 1.1 |

| Mexico | 0.9 |

| France | 0.8 |

| Germany | 0.6 |

| Finland | 0.6 |

| Austria | 0.4 |

| Ireland | 0.3 |

| Denmark | 0.3 |

| Cayman Islands | 0.1 |

| Total | 100.0% |

| Fund Allocation | % of Net Assets |

| Corporate Bonds and Notes | 98.4% |

| Foreign Corporate Bonds and Notes | 26.3 |

| Capital Preferred Securities | 6.6 |

| Senior Floating-Rate Loan Interests | 2.2 |

| Mortgage-Backed Securities | 0.6 |

| Common Stocks | 0.1 |

| Rights | 0.0 |

| U.S. Government Bonds Sold Short | (10.3) |

| Corporate Bonds Sold Short | (0.9) |

| Foreign Corporate Bonds Sold Short | (0.6) |

| Outstanding Loan | (24.2) |

| Net Other Assets and Liabilities(6) | 1.8 |

| Total | 100.0% |

| (4) | The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including Standard & Poor’s Ratings Group, a division of the McGraw Hill Companies, Inc., Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

| (5) | Percentages are based on long positions only. Short positions are excluded. |

| (6) | Includes forward foreign currency contracts. |

Portfolio Commentary

First Trust High Income Long/Short Fund (FSD)

Semi-Annual Report

April 30, 2021 (Unaudited)

Advisor

First Trust Advisors L.P. (“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust High Income Long/Short Fund (the “Fund”). First Trust is responsible for the ongoing monitoring of the Fund’s investment portfolio, managing the Fund’s business affairs and providing certain administrative services necessary for the management of the Fund.

Sub-Advisor

MacKay Shields LLC, Sub-Advisor to the Fund, was founded in 1938 and became a registered investment advisor in 1969. The Fund trades under the ticker symbol FSD on the New York Stock Exchange. As of April 30, 2021, MacKay had approximately $157.4 billion in assets under management.

FSD Portfolio Management Team

Joseph Cantwell – Senior Managing Director, Co-Head of Global Fixed Income Division and Head of Credit

Matthew Jacob – Managing Director, Global Fixed Income Division

Shu-Yang Tan, CFA – Managing Director, Global Fixed Income Division

Market Recap

This report covers the Fund for the six-month period ended April 30, 2021.

| • | Reflecting over the last six months, the year 2020 closed on an upward trend in both equity and credit markets, recovering strongly from the volatility experienced earlier in 2020 from the coronavirus (“COVID-19”) world health pandemic. Likewise, 2021 opened with the same positive tone in markets with the continued ultra-accommodative policies of the Federal Reserve (the “Fed”), a new U.S. Administration and a Democratic-controlled House and Congress and expanding fiscal support. At the end of March 2021, Congress passed the $1.9 trillion COVID-19 relief package. |

| • | Yields along the front-end of the U.S. treasury curve over the six-month period remained relatively anchored, while the longer end significantly rose. The 10-Year and 30-Year yield increased 75 and 66 basis points (“bps”), respectively. The Fed Funds Rate and asset purchases remained unchanged, as the Fed continued its ultra-accommodative policies. |

| • | U.S. equity markets, as measured by the S&P 500® Index, soared over the last six months returning 28.9%. In commodity markets, oil prices rose significantly over the period, both in the U.S. and globally. According to Markets Insider, both West Texas Intermediate (WTI) and Brent crude oil increased approximately 80% since the end of October 2020. |

| • | These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the COVID-19 pandemic. |

| • | Global manufacturing activity, as measured by IHS Markit’s JPM Global Manufacturing PMI, remains solid keeping up the rate of expansion. Production rose at the fastest pace in over a decade. At 55.8, as of April 30, 2021, it was the best reading since April 2010. However, pressure on capacity remained elevated, with average supplier lead times and the rate of growth in work backlogs increasing. China’s manufacturing companies, as measured by Caixin China PMI, slowed as 2020 ended but picked up in 2021 with recent strong increases in output and sales, although recent delivery times continued to lengthen. In 2021, U.S. business activity, as measured by the IHS Markit U.S. Services PMI, expanded at the fastest pace on record amid a marked uptick in client demand while pressure on capacity remains evident. Private sectors in the Eurozone, as measured by the IHS Markit Eurozone Composite PMI, experienced a return to growth in 2021 on the back of strong manufacturing performance. |

Performance Analysis

During the six-month period ending April 30, 2021, U.S. high yield spreads tightened by 204 bps to 328 bps over Treasuries according to ICE Data. With the overall U.S. high yield index up 8.1% for the same period, all rating categories were higher with performance in the lower quality segment outpacing their higher quality counterparts. BB-rated bonds were up 6.2%, while B’s returned 7.5% and CCC’s and Distressed credits added 19.3% and 55.1%, respectively.

Portfolio Commentary (Continued)

First Trust High Income Long/Short Fund (FSD)

Semi-Annual Report

April 30, 2021 (Unaudited)

Past performance is no guarantee of future results.

Source: BB, ICE BofA BB U.S. High Yield Index

2B, ICE BofA Single-B U.S. High Yield Index3

CCC and Lower, ICE BofA CCC & Lower U.S. High Yield Index4

Distressed, ICE BofA U.S. Distressed High Yield Index5

With a larger percentage of the population vaccinated, the COVID-19 landscape in the U.S. continued to improve. In addition, the Democratic sweep resulted in the signing of a larger than expected stimulus package and the expectation for a more robust stimulus in the future focused on infrastructure, jobs and family support fostered confidence in the durability of the economic recovery. These factors furthered the rally in high yield, resulting in spread levels edging closer to the October 2018 tight of 316 bps. During this semi-annual period, returns for all sectors within the high yield market were positive. This was despite an increase in the 10-Year Treasury yield of 75 bps to 1.63% on expectations of faster economic growth leading to inflationary pressures. The rise in yields largely affected longer duration and higher quality securities leading to the relative underperformance of BB’s. With stronger expectations for the U.S. economy and the continuation of the “reopening” theme, the distressed segment outperformed as investors searched for additional yield. The Energy sector was the top performing sector for the six-month period ended April 30, 2021, gaining 21% as WTI crude rallied close to 80%. Sectors that are more correlated with further economic reopening and improvement posted strong returns, notably the Transportation, Leisure and Capital Goods sectors. Defensive sectors, including Telecom, lagged during the period.

Portfolio Commentary (Continued)

First Trust High Income Long/Short Fund (FSD)

Semi-Annual Report

April 30, 2021 (Unaudited)

Looking at high yield market activity, the asset class experienced net outflows of $7.9 billion year to date, according to JP Morgan. April 2021 was the first monthly inflow since November 2020 with a total of $10.9 billion of outflows since then. Year to date, new issuance continued the torrid pace we have seen over the last year with $208 billion pricing across 317 deals where April 2021 was the eighth highest monthly total on record. Notably, April’s non-refi (net issuance) volume of $18.4 billion is the largest since the $24.5 billion we saw in June 2020. To illustrate the extent of issuance we are seeing in the marketplace, six of the largest 10 months on record have occurred in the last year. Year to date, the pace of defaults has continued to slow; seven companies defaulted impacting $3.6 billion in bonds and loans with four distressed transactions totaling $1 billion. The combined total of $4.6 billion is the lightest start to a year since 2011 when just $1.9 billion had defaulted by this point (JP Morgan).

Turning to performance, the Fund had a net asset value total return** of 10.21% and a market value total return** of 19.80% for the six-month period ended April 30, 2021, outperforming its benchmark, the ICE BofA High Yield Constrained Index6 (the “Benchmark”), which increased by 8.13% for the same period. Given the rally in high yield, the outperformance during the period was driven by the additional high yield exposure from the leverage within the Fund created with the proceeds from short sales, primarily of U.S. Treasuries. These positions are expressed in the belly of the curve7 and are used to reduce the portfolio’s exposure to interest rate risk, while at the same time purchasing additional high yield securities to lever up the portfolio8. Positioning in several higher beta names in the Aerospace & Defense and Energy sectors were the strongest contributors, with a few technology related names also positively contributing. Alternatively, the underweight to the highest beta part of the market, defined as those credits trading with a spread north of 1000 bps, weighed on results. From an industry perspective, positioning within the Consumer Goods sector also negatively impacted results, largely due to the underperformance of the longer duration, higher quality nature of the sector.

Outlook

Our core views for the global economy remain in place, as we continue to expect a robust recovery in growth as a result of waning influences of the pandemic and still-sizeable policy supports. There remain significant differences across countries when it comes to containing the pandemic, vaccine campaigns and policy accommodation. For example, we believe many emerging market economies will lag the global recovery as they continue to face high virus caseloads and restrictions on household and business activities. But these cross-country variations do not meaningfully change our assessment of a post-pandemic recovery coming into view. On the policy front, several central banks are beginning to signal an eventual reduction in policy accommodation. However, we expect the shift to tighter policy to be quite gradual, as policy makers will look through inflation pressures this year and will err on the side of falling behind the curve to ensure a speedy return to full employment.

As for the United States, we continue to expect sustained improvement in the labor market despite a somewhat disappointing April employment situation report, as the ongoing vaccine campaign and unprecedented fiscal stimulus leave consumers well-positioned to increase consumption in the months ahead. We are closely watching the current debate over additional fiscal measures targeting long-standing Democratic priorities such as funding for infrastructure, a transition to clean energy, redressing inequality and a host of measures aimed at supporting families and children. We anticipate this policy thrust to lead to additional fiscal support for the economy in the years ahead, but the measures will also add to deficits. Whether the programs and associated tax increases on corporations and higher-income households meaningfully change underlying trend growth remains to be seen. Spending on infrastructure, education, job training and childcare hold out the potential of increasing the economy’s productive capacity. However, higher corporate tax rates and potentially higher interest rates associated with larger deficits could restrain business investment in the years ahead.

| ** | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

Portfolio Commentary (Continued)

First Trust High Income Long/Short Fund (FSD)

Semi-Annual Report

April 30, 2021 (Unaudited)

Fund Notes:

1 ICE BofA US High Yield Index.

2 The ICE BofA BB U.S. High Yield Index (H0A1) is a subset of ICE BofA U.S. High Yield Index including all securities rated BB1 through BB3, inclusive.

3 ICE BofA Single-B U.S. High Yield Index (H0A2) is a subset of ICE BofA U.S. High Yield Index including all securities rated B1 through B3, inclusive.

4 ICE BofA CCC & Lower U.S. High Yield Index (H0A3) is a subset of ICE BofA U.S. High Yield Index including all securities rated CCC1 or lower.

5 ICE BofA U.S. Distressed High Yield Index (H0DI) is a subset of ICE BofA U.S. High Yield Index including all securities with an option-adjusted spread greater than or equal to 1,000 basis points.

6 ICE BofA U.S. High Yield Constrained Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market but caps issuer exposure at 2%. ICE BofA utilizes its own composite scale, similar to those of Moody’s, S&P and Fitch, when publishing a composite rating on an index constituent (e.g. BBB3, BBB2, BBB1). Index constituent composite ratings are the simple averages of numerical equivalent values of the ratings from Moody’s, S&P and Fitch. If only two of the designated agencies rate a bond, the composite rating is based on an average of the two. Likewise, if only one of the designated agencies rates a bond, the composite rating is based on that one rating.

7 Belly of yield curve is the middle of the yield curve; generally considered to be bond maturities from two years up to, but not including, the ten-year bond.

8 Lever up is to use leverage. Leverage is a technique where a fund’s manager borrows assets at one rate and invests the proceeds from the borrowed assets at another rate, seeking to increase yield and total return. Use of leverage can result in additional risk and cost and can magnify the effect of any losses.

SOURCE INFORMATION

ICE Data Indices, LLC (“ICE Data”), is used with permission. ICE® is a registered trademark of ICE Data or its affiliates and BOFA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates (“BOFA”) and may not be used without BOFA’s prior written approval. ICE data, its affiliates and their respective third party suppliers disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the indices, index data and any data included in, related to, or derived therefrom. Neither ICE Data, its affiliates nor their respective third party suppliers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the indices or the index data or any component thereof, and the indices and index data and all components thereof are provided on an “as is” basis and your use is at your own risk. ICE data, its affiliates and their respective third party suppliers do not sponsor, endorse, or recommend MacKay Shields LLC, or any of its products or services.

Copyright ©2021, Markit Economics Limited. All rights reserved and all intellectual property rights retained by Markit Economics Limited.

IMPORTANT DISCLOSURES

Availability of this document and products and services provided by MacKay Shields LLC ( “MacKay Shields”) may be limited by applicable laws and regulations in certain jurisdictions and this document is provided only for persons to whom this document and the products and services of MacKay Shields may otherwise lawfully be issued or made available. None of the products and services provided by MacKay Shields are offered to any person in any jurisdiction where such offering would be contrary to local law or regulation. This document is provided for information purposes only. It does not constitute investment advice and should not be construed as an offer to buy securities. The contents of this document have not been reviewed by any regulatory authority in any jurisdiction.

This material contains the opinions of the Global Fixed Income team but not necessarily those of MacKay Shields. The opinions expressed herein are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and opinions contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Any forward-looking statements speak only as of the date they are made and MacKay Shields assumes no duty and does not undertake to update forward-looking statements. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of MacKay Shields LLC. ©2020, MacKay Shields LLC. All Rights Reserved.

Past performance is not indicative of future results.

*On September 23, 2019, Mr. Roberts announced his retirement effective December 31, 2019, at which time his portfolio management responsibilities ceased and he became a Senior Advisor to MacKay’s Global Fixed Income Division.

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES – 98.4% |

| | | Automotive – 5.1% | | | | | | |

| $1,930,000 | | Allison Transmission, Inc. (a)

| | 3.75% | | 01/30/31 | | $1,864,863 |

| 2,070,000 | | Ford Motor Co.

| | 8.50% | | 04/21/23 | | 2,320,987 |

| 2,170,000 | | Ford Motor Co. (b)

| | 9.00% | | 04/22/25 | | 2,653,172 |

| 1,400,000 | | Ford Motor Co.

| | 4.35% | | 12/08/26 | | 1,491,770 |

| 1,528,000 | | Ford Motor Co.

| | 7.45% | | 07/16/31 | | 1,968,415 |

| 1,610,000 | | Ford Motor Co.

| | 4.75% | | 01/15/43 | | 1,629,119 |

| 2,222,000 | | Ford Motor Credit Co., LLC

| | 2.98% | | 08/03/22 | | 2,260,496 |

| 3,500,000 | | Ford Motor Credit Co., LLC (b)

| | 4.25% | | 09/20/22 | | 3,621,415 |

| 4,605,000 | | Ford Motor Credit Co., LLC (b)

| | 4.13% | | 08/17/27 | | 4,818,488 |

| 5,000,000 | | Ford Motor Credit Co., LLC (b)

| | 5.11% | | 05/03/29 | | 5,470,300 |

| 275,000 | | Real Hero Merger Sub 2, Inc. (a)

| | 6.25% | | 02/01/29 | | 284,906 |

| | | | | 28,383,931 |

| | | Basic Industry – 6.7% | | | | | | |

| 1,370,000 | | BCPE Ulysses Intermediate, Inc. (a) (c)

| | 7.75% | | 04/01/27 | | 1,413,806 |

| 645,000 | | Brundage-Bone Concrete Pumping Holdings, Inc. (a) (b)

| | 6.00% | | 02/01/26 | | 679,598 |

| 3,495,000 | | Builders FirstSource, Inc. (a) (b)

| | 6.75% | | 06/01/27 | | 3,762,892 |

| 850,000 | | Builders FirstSource, Inc. (a)

| | 5.00% | | 03/01/30 | | 904,336 |

| 1,285,000 | | Coeur Mining, Inc. (a)

| | 5.13% | | 02/15/29 | | 1,247,683 |

| 2,852,000 | | Cornerstone Building Brands, Inc. (a)

| | 6.13% | | 01/15/29 | | 3,055,091 |

| 2,540,000 | | Dycom Industries, Inc. (a)

| | 4.50% | | 04/15/29 | | 2,581,275 |

| 1,675,000 | | Foundation Building Materials, Inc. (a)

| | 6.00% | | 03/01/29 | | 1,664,004 |

| 2,445,000 | | JELD-WEN, Inc. (a) (b)

| | 4.88% | | 12/15/27 | | 2,555,025 |

| 2,979,000 | | KB Home (b)

| | 7.50% | | 09/15/22 | | 3,227,791 |

| 3,500,000 | | LGI Homes, Inc. (a) (b)

| | 6.88% | | 07/15/26 | | 3,648,750 |

| 1,855,000 | | Meritage Homes Corp.

| | 6.00% | | 06/01/25 | | 2,097,309 |

| 2,045,000 | | Olin Corp. (b)

| | 5.13% | | 09/15/27 | | 2,137,580 |

| 1,825,000 | | Park River Holdings, Inc. (a)

| | 5.63% | | 02/01/29 | | 1,779,484 |

| 3,765,000 | | TRI Pointe Group, Inc./TRI Pointe Homes, Inc. (b)

| | 5.88% | | 06/15/24 | | 4,197,504 |

| 770,000 | | Weekley Homes LLC/Weekley Finance Corp. (a)

| | 4.88% | | 09/15/28 | | 797,139 |

| 1,055,000 | | White Cap Parent LLC (a) (d)

| | 8.25% | | 03/15/26 | | 1,097,712 |

| | | | | 36,846,979 |

| | | Capital Goods – 8.1% | | | | | | |

| 1,065,000 | | Amsted Industries, Inc. (a)

| | 5.63% | | 07/01/27 | | 1,132,691 |

| 2,675,000 | | Berry Global, Inc. (a) (b)

| | 4.50% | | 02/15/26 | | 2,744,389 |

| 1,470,000 | | EnerSys (a)

| | 4.38% | | 12/15/27 | | 1,544,433 |

| 2,245,000 | | Graham Packaging Co., Inc. (a)

| | 7.13% | | 08/15/28 | | 2,411,972 |

| 2,600,000 | | Howmet Aerospace, Inc.

| | 6.88% | | 05/01/25 | | 3,019,250 |

| 3,100,000 | | Mauser Packaging Solutions Holding Co. (a) (b)

| | 5.50% | | 04/15/24 | | 3,117,375 |

| 1,700,000 | | Mauser Packaging Solutions Holding Co. (a) (b)

| | 7.25% | | 04/15/25 | | 1,655,375 |

| 1,540,000 | | Navistar International Corp. (a)

| | 9.50% | | 05/01/25 | | 1,672,825 |

| 2,870,000 | | Owens-Brockway Glass Container, Inc. (a) (b)

| | 6.63% | | 05/13/27 | | 3,106,043 |

| 530,000 | | Plastipak Holdings, Inc. (a)

| | 6.25% | | 10/15/25 | | 545,569 |

| 2,462,000 | | Spirit AeroSystems, Inc. (a)

| | 7.50% | | 04/15/25 | | 2,638,612 |

| 625,000 | | TransDigm, Inc. (a)

| | 8.00% | | 12/15/25 | | 679,713 |

| 2,685,000 | | TransDigm, Inc. (a)

| | 6.25% | | 03/15/26 | | 2,846,100 |

| 3,055,000 | | TransDigm, Inc. (b)

| | 5.50% | | 11/15/27 | | 3,183,295 |

| 2,375,000 | | Trident TPI Holdings, Inc. (a)

| | 9.25% | | 08/01/24 | | 2,529,850 |

| 2,660,000 | | Trident TPI Holdings, Inc. (a) (b)

| | 6.63% | | 11/01/25 | | 2,717,602 |

| 2,515,000 | | TriMas Corp. (a)

| | 4.13% | | 04/15/29 | | 2,511,844 |

| 200,000 | | Triumph Group, Inc.

| | 5.25% | | 06/01/22 | | 199,000 |

| 1,230,000 | | Triumph Group, Inc. (a)

| | 8.88% | | 06/01/24 | | 1,369,913 |

| 550,000 | | Triumph Group, Inc. (a)

| | 6.25% | | 09/15/24 | | 556,531 |

Page 8

See Notes to Financial Statements

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (Continued) |

| | | Capital Goods (Continued) | | | | | | |

| $4,455,000 | | Triumph Group, Inc. (b)

| | 7.75% | | 08/15/25 | | $4,413,457 |

| | | | | 44,595,839 |

| | | Consumer Goods – 8.9% | | | | | | |

| 1,945,000 | | APX Group, Inc. (a) (b)

| | 6.75% | | 02/15/27 | | 2,093,948 |

| 3,440,000 | | CD&R Smokey Buyer, Inc. (a) (b)

| | 6.75% | | 07/15/25 | | 3,676,500 |

| 750,000 | | Chobani LLC/Chobani Finance Corp., Inc. (a)

| | 7.50% | | 04/15/25 | | 780,469 |

| 600,000 | | Chobani LLC/Chobani Finance Corp., Inc. (a)

| | 4.63% | | 11/15/28 | | 619,500 |

| 3,545,000 | | Darling Ingredients, Inc. (a) (b)

| | 5.25% | | 04/15/27 | | 3,733,328 |

| 2,120,000 | | Edgewell Personal Care Co. (a) (b)

| | 5.50% | | 06/01/28 | | 2,255,150 |

| 1,185,000 | | Energizer Holdings, Inc. (a)

| | 4.38% | | 03/31/29 | | 1,177,665 |

| 3,430,000 | | Kraft Heinz Foods Co.

| | 5.00% | | 07/15/35 | | 4,009,065 |

| 1,855,000 | | Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc. (a)

| | 5.00% | | 12/31/26 | | 1,872,975 |

| 5,560,000 | | Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc. (a) (b)

| | 7.00% | | 12/31/27 | | 5,399,816 |

| 1,275,000 | | Mattel, Inc. (a)

| | 3.38% | | 04/01/26 | | 1,321,219 |

| 1,585,000 | | Mattel, Inc. (a)

| | 5.88% | | 12/15/27 | | 1,744,491 |

| 893,000 | | Newell Brands, Inc.

| | 5.88% | | 04/01/36 | | 1,113,749 |

| 3,965,000 | | Performance Food Group, Inc. (a) (b)

| | 5.50% | | 06/01/24 | | 3,985,142 |

| 1,765,000 | | Post Holdings, Inc. (a) (b)

| | 5.75% | | 03/01/27 | | 1,851,044 |

| 2,760,000 | | Post Holdings, Inc. (a) (b)

| | 4.63% | | 04/15/30 | | 2,792,154 |

| 3,245,000 | | Primo Water Holdings, Inc. (a) (b)

| | 5.50% | | 04/01/25 | | 3,339,008 |

| 3,800,000 | | Primo Water Holdings, Inc. (a)

| | 4.38% | | 04/30/29 | | 3,796,428 |

| 1,100,000 | | Simmons Foods, Inc./Simmons Prepared Foods, Inc./Simmons Pet Food, Inc./Simmons Feed (a)

| | 4.63% | | 03/01/29 | | 1,109,856 |

| 235,000 | | Spectrum Brands, Inc.

| | 5.75% | | 07/15/25 | | 242,203 |

| 2,350,000 | | Triton Water Holdings, Inc. (a)

| | 6.25% | | 04/01/29 | | 2,382,465 |

| | | | | 49,296,175 |

| | | Energy – 13.9% | | | | | | |

| 1,200,000 | | Aethon United BR L.P./Aethon United Finance Corp. (a)

| | 8.25% | | 02/15/26 | | 1,277,250 |

| 1,600,000 | | Antero Midstream Partners L.P./Antero Midstream Finance Corp.

| | 5.38% | | 09/15/24 | | 1,629,000 |

| 1,600,000 | | Apache Corp.

| | 5.10% | | 09/01/40 | | 1,644,000 |

| 2,170,000 | | Archrock Partners L.P./Archrock Partners Finance Corp. (a)

| | 6.25% | | 04/01/28 | | 2,271,547 |

| 1,560,000 | | Ascent Resources Utica Holdings LLC/ARU Finance Corp. (a)

| | 7.00% | | 11/01/26 | | 1,583,751 |

| 970,000 | | Ascent Resources Utica Holdings LLC/ARU Finance Corp. (a) (b)

| | 8.25% | | 12/31/28 | | 1,043,128 |

| 1,919,000 | | Centennial Resource Production LLC (a)

| | 6.88% | | 04/01/27 | | 1,811,037 |

| 1,455,000 | | Cheniere Energy Partners L.P.

| | 4.50% | | 10/01/29 | | 1,521,246 |

| 1,020,000 | | Cheniere Energy, Inc. (a)

| | 4.63% | | 10/15/28 | | 1,064,778 |

| 2,080,000 | | CNX Resources Corp. (a)

| | 7.25% | | 03/14/27 | | 2,249,458 |

| 391,000 | | Continental Resources, Inc./OK

| | 4.38% | | 01/15/28 | | 426,110 |

| 1,960,000 | | Continental Resources, Inc./OK (a)

| | 5.75% | | 01/15/31 | | 2,276,119 |

| 980,000 | | Continental Resources, Inc./OK

| | 4.90% | | 06/01/44 | | 1,022,233 |

| 1,025,000 | | CrownRock L.P./CrownRock Finance, Inc. (a)

| | 5.00% | | 05/01/29 | | 1,050,917 |

| 934,000 | | DCP Midstream Operating L.P.

| | 5.13% | | 05/15/29 | | 999,268 |

| 2,096,000 | | Endeavor Energy Resources L.P./ EER Finance, Inc. (a)

| | 6.63% | | 07/15/25 | | 2,234,860 |

| 610,000 | | EnLink Midstream LLC (a)

| | 5.63% | | 01/15/28 | | 631,350 |

| 5,435,000 | | EnLink Midstream LLC (b)

| | 5.38% | | 06/01/29 | | 5,441,794 |

| 1,825,000 | | EQM Midstream Partners L.P. (a)

| | 6.50% | | 07/01/27 | | 2,017,508 |

| 1,700,000 | | EQM Midstream Partners L.P.

| | 5.50% | | 07/15/28 | | 1,807,865 |

| 1,225,000 | | EQM Midstream Partners L.P. (a)

| | 4.75% | | 01/15/31 | | 1,214,214 |

| 400,000 | | EQT Corp. (b)

| | 3.90% | | 10/01/27 | | 417,536 |

| 390,000 | | EQT Corp.

| | 5.00% | | 01/15/29 | | 426,941 |

| 791,000 | | Hess Midstream Operations L.P. (a)

| | 5.63% | | 02/15/26 | | 821,651 |

| 1,845,000 | | Hilcorp Energy I L.P./Hilcorp Finance Co. (a)

| | 5.75% | | 02/01/29 | | 1,881,632 |

See Notes to Financial Statements

Page 9

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (Continued) |

| | | Energy (Continued) | | | | | | |

| $600,000 | | Hilcorp Energy I L.P./Hilcorp Finance Co. (a)

| | 6.00% | | 02/01/31 | | $619,518 |

| 2,665,000 | | Laredo Petroleum, Inc. (b)

| | 9.50% | | 01/15/25 | | 2,747,868 |

| 1,510,000 | | Laredo Petroleum, Inc.

| | 10.13% | | 01/15/28 | | 1,557,135 |

| 4,280,000 | | Occidental Petroleum Corp. (b)

| | 8.50% | | 07/15/27 | | 5,213,575 |

| 3,070,000 | | Occidental Petroleum Corp. (b)

| | 6.63% | | 09/01/30 | | 3,503,837 |

| 747,000 | | Occidental Petroleum Corp.

| | 4.63% | | 06/15/45 | | 678,489 |

| 2,053,000 | | Occidental Petroleum Corp. (b)

| | 4.40% | | 04/15/46 | | 1,812,686 |

| 3,195,000 | | PBF Holding Co., LLC/PBF Finance Corp. (a) (b)

| | 9.25% | | 05/15/25 | | 3,350,756 |

| 1,445,000 | | PBF Logistics LP / PBF Logistics Finance Corp.

| | 6.88% | | 05/15/23 | | 1,445,000 |

| 2,585,000 | | Southwestern Energy Co.

| | 7.50% | | 04/01/26 | | 2,740,113 |

| 730,000 | | Southwestern Energy Co.

| | 8.38% | | 09/15/28 | | 802,989 |

| 770,000 | | Sunoco L.P./Sunoco Finance Corp.

| | 6.00% | | 04/15/27 | | 810,656 |

| 2,240,000 | | Sunoco L.P./Sunoco Finance Corp. (a) (b)

| | 4.50% | | 05/15/29 | | 2,265,200 |

| 2,000,000 | | Targa Resources Partners L.P./Targa Resources Partners Finance Corp.

| | 5.00% | | 01/15/28 | | 2,108,100 |

| 1,645,000 | | Targa Resources Partners L.P./Targa Resources Partners Finance Corp.

| | 6.88% | | 01/15/29 | | 1,845,601 |

| 730,000 | | Targa Resources Partners L.P./Targa Resources Partners Finance Corp. (a)

| | 4.88% | | 02/01/31 | | 764,036 |

| 1,500,000 | | USA Compression Partners L.P./USA Compression Finance Corp.

| | 6.88% | | 04/01/26 | | 1,574,910 |

| 1,830,000 | | USA Compression Partners L.P./USA Compression Finance Corp.

| | 6.88% | | 09/01/27 | | 1,927,914 |

| 909,000 | | Western Midstream Operating L.P.

| | 4.50% | | 03/01/28 | | 970,358 |

| 1,251,000 | | Western Midstream Operating L.P.

| | 5.30% | | 02/01/30 | | 1,366,718 |

| | | | | 76,870,652 |

| | | Financial Services – 3.1% | | | | | | |

| 2,985,000 | | Freedom Mortgage Corp. (a)

| | 7.63% | | 05/01/26 | | 3,116,325 |

| 785,000 | | Home Point Capital, Inc. (a)

| | 5.00% | | 02/01/26 | | 773,971 |

| 1,645,000 | | LD Holdings Group LLC (a)

| | 6.13% | | 04/01/28 | | 1,651,169 |

| 1,395,000 | | LPL Holdings, Inc. (a) (b)

| | 4.63% | | 11/15/27 | | 1,458,647 |

| 1,010,000 | | Midcap Financial Issuer Trust (a)

| | 6.50% | | 05/01/28 | | 1,047,855 |

| 1,540,000 | | OneMain Finance Corp.

| | 6.13% | | 03/15/24 | | 1,665,125 |

| 765,000 | | OneMain Finance Corp.

| | 8.88% | | 06/01/25 | | 847,907 |

| 1,225,000 | | OneMain Finance Corp. (b)

| | 6.63% | | 01/15/28 | | 1,396,108 |

| 1,011,000 | | OneMain Finance Corp.

| | 5.38% | | 11/15/29 | | 1,091,369 |

| 1,225,000 | | PennyMac Financial Services, Inc. (a)

| | 5.38% | | 10/15/25 | | 1,292,375 |

| 2,640,000 | | Quicken Loans, LLC/Quicken Loans Co-Issuer, Inc. (a)

| | 3.63% | | 03/01/29 | | 2,578,950 |

| | | | | 16,919,801 |

| | | Healthcare – 7.0% | | | | | | |

| 1,425,000 | | Bausch Health Americas, Inc. (a)

| | 8.50% | | 01/31/27 | | 1,588,875 |

| 780,000 | | Carriage Services, Inc. (a)

| | 6.63% | | 06/01/26 | | 823,337 |

| 2,775,000 | | Carriage Services, Inc. (a)

| | 4.25% | | 05/15/29 | | 2,771,531 |

| 1,435,000 | | CHS/Community Health Systems, Inc. (a)

| | 8.13% | | 06/30/24 | | 1,501,369 |

| 875,000 | | CHS/Community Health Systems, Inc. (a)

| | 6.63% | | 02/15/25 | | 924,061 |

| 4,765,000 | | CHS/Community Health Systems, Inc. (a) (b)

| | 8.00% | | 03/15/26 | | 5,140,244 |

| 765,000 | | CHS/Community Health Systems, Inc. (a)

| | 5.63% | | 03/15/27 | | 812,266 |

| 1,485,000 | | CHS/Community Health Systems, Inc. (a)

| | 6.00% | | 01/15/29 | | 1,565,190 |

| 1,930,000 | | CHS/Community Health Systems, Inc. (a)

| | 6.88% | | 04/15/29 | | 2,019,658 |

| 750,000 | | Jaguar Holding Co. II/PPD Development L.P. (a)

| | 5.00% | | 06/15/28 | | 818,812 |

| 732,000 | | Ortho-Clinical Diagnostics, Inc./Ortho-Clinical Diagnostics S.A. (a)

| | 7.38% | | 06/01/25 | | 790,102 |

| 2,065,000 | | Par Pharmaceutical, Inc. (a)

| | 7.50% | | 04/01/27 | | 2,175,994 |

| 1,325,000 | | Prestige Brands, Inc. (a) (b)

| | 5.13% | | 01/15/28 | | 1,390,422 |

| 990,000 | | Prestige Brands, Inc. (a)

| | 3.75% | | 04/01/31 | | 951,603 |

| 4,750,000 | | Service Corp International (b)

| | 7.50% | | 04/01/27 | | 5,752,535 |

Page 10

See Notes to Financial Statements

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (Continued) |

| | | Healthcare (Continued) | | | | | | |

| $615,000 | | Syneos Health, Inc. (a)

| | 3.63% | | 01/15/29 | | $601,931 |

| 1,730,000 | | Teleflex, Inc. (a)

| | 4.25% | | 06/01/28 | | 1,790,100 |

| 7,000,000 | | Tenet Healthcare Corp. (a) (b)

| | 6.13% | | 10/01/28 | | 7,395,500 |

| | | | | 38,813,530 |

| | | Insurance – 1.0% | | | | | | |

| 990,000 | | AmWINS Group, Inc. (a) (b)

| | 7.75% | | 07/01/26 | | 1,054,162 |

| 2,695,000 | | AssuredPartners, Inc. (a)

| | 5.63% | | 01/15/29 | | 2,735,371 |

| 1,275,000 | | MGIC Investment Corp.

| | 5.25% | | 08/15/28 | | 1,346,719 |

| 505,000 | | NMI Holdings, Inc. (a)

| | 7.38% | | 06/01/25 | | 581,479 |

| | | | | 5,717,731 |

| | | Leisure – 4.5% | | | | | | |

| 1,730,000 | | Affinity Gaming (a)

| | 6.88% | | 12/15/27 | | 1,838,644 |

| 500,000 | | Boyd Gaming Corp. (a)

| | 8.63% | | 06/01/25 | | 554,685 |

| 950,000 | | Boyd Gaming Corp.

| | 6.38% | | 04/01/26 | | 982,063 |

| 1,290,000 | | Caesars Entertainment, Inc. (a)

| | 6.25% | | 07/01/25 | | 1,373,140 |

| 3,280,000 | | Caesars Entertainment, Inc. (a)

| | 8.13% | | 07/01/27 | | 3,648,885 |

| 1,055,000 | | Caesars Resort Collection LLC/CRC Finco, Inc. (a)

| | 5.75% | | 07/01/25 | | 1,112,508 |

| 3,520,000 | | Caesars Resort Collection LLC/CRC Finco, Inc. (a) (b)

| | 5.25% | | 10/15/25 | | 3,553,044 |

| 215,000 | | Constellation Merger Sub, Inc. (a)

| | 8.50% | | 09/15/25 | | 208,259 |

| 2,980,000 | | Mohegan Gaming & Entertainment (a) (b)

| | 8.00% | | 02/01/26 | | 3,028,276 |

| 3,900,000 | | Scientific Games International, Inc. (a) (b)

| | 8.25% | | 03/15/26 | | 4,207,125 |

| 3,175,000 | | Scientific Games International, Inc. (a) (b)

| | 7.00% | | 05/15/28 | | 3,421,507 |

| 775,000 | | Station Casinos LLC (a)

| | 4.50% | | 02/15/28 | | 779,451 |

| | | | | 24,707,587 |

| | | Media – 7.5% | | | | | | |

| 1,235,000 | | Arches Buyer, Inc. (a)

| | 4.25% | | 06/01/28 | | 1,233,697 |

| 2,300,000 | | Arches Buyer, Inc. (a) (b)

| | 6.13% | | 12/01/28 | | 2,360,536 |

| 2,200,000 | | CCO Holdings LLC/CCO Holdings Capital Corp. (a) (b)

| | 5.88% | | 05/01/27 | | 2,273,568 |

| 3,330,000 | | CCO Holdings LLC/CCO Holdings Capital Corp. (a) (b)

| | 4.75% | | 03/01/30 | | 3,479,850 |

| 1,285,000 | | Clear Channel Outdoor Holdings, Inc. (a)

| | 7.75% | | 04/15/28 | | 1,324,874 |

| 820,000 | | Clear Channel Worldwide Holdings, Inc.

| | 9.25% | | 02/15/24 | | 857,503 |

| 3,500,000 | | CSC Holdings LLC (b)

| | 5.25% | | 06/01/24 | | 3,795,942 |

| 2,325,000 | | CSC Holdings LLC (a) (b)

| | 5.50% | | 04/15/27 | | 2,441,550 |

| 1,180,000 | | CSC Holdings LLC (a)

| | 5.75% | | 01/15/30 | | 1,255,962 |

| 900,000 | | DISH DBS Corp.

| | 5.88% | | 11/15/24 | | 975,002 |

| 1,200,000 | | DISH DBS Corp.

| | 7.75% | | 07/01/26 | | 1,384,500 |

| 2,820,000 | | DISH DBS Corp.

| | 7.38% | | 07/01/28 | | 3,041,892 |

| 2,100,000 | | iHeartCommunications, Inc.

| | 8.38% | | 05/01/27 | | 2,255,925 |

| 1,255,000 | | iHeartCommunications, Inc. (a)

| | 5.25% | | 08/15/27 | | 1,301,786 |

| 1,250,000 | | iHeartCommunications, Inc. (a)

| | 4.75% | | 01/15/28 | | 1,291,025 |

| 945,000 | | News Corp. (a)

| | 3.88% | | 05/15/29 | | 964,590 |

| 3,520,000 | | Nexstar Broadcasting, Inc. (a)

| | 5.63% | | 07/15/27 | | 3,723,544 |

| 3,150,000 | | Sirius XM Radio, Inc. (a) (b)

| | 5.38% | | 07/15/26 | | 3,256,942 |

| 2,205,000 | | TEGNA, Inc.

| | 4.63% | | 03/15/28 | | 2,254,701 |

| 655,000 | | TripAdvisor, Inc. (a)

| | 7.00% | | 07/15/25 | | 708,219 |

| 1,235,000 | | Urban One, Inc. (a)

| | 7.38% | | 02/01/28 | | 1,279,985 |

| | | | | 41,461,593 |

| | | Real Estate – 3.3% | | | | | | |

| 1,199,000 | | Iron Mountain, Inc. (a) (b)

| | 4.88% | | 09/15/27 | | 1,249,843 |

| 1,845,000 | | Iron Mountain, Inc. (a) (b)

| | 5.25% | | 03/15/28 | | 1,937,730 |

| 1,575,000 | | Iron Mountain, Inc. (a) (b)

| | 5.25% | | 07/15/30 | | 1,635,952 |

See Notes to Financial Statements

Page 11

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (Continued) |

| | | Real Estate (Continued) | | | | | | |

| $1,375,000 | | Iron Mountain, Inc. (a)

| | 4.50% | | 02/15/31 | | $1,373,130 |

| 910,000 | | Iron Mountain, Inc. (a)

| | 5.63% | | 07/15/32 | | 961,884 |

| 1,845,000 | | MGM Growth Properties Operating Partnership L.P./MGP Finance Co-Issuer, Inc.

| | 5.63% | | 05/01/24 | | 1,991,622 |

| 2,820,000 | | QualityTech L.P./QTS Finance Corp. (a) (b)

| | 3.88% | | 10/01/28 | | 2,851,711 |

| 905,000 | | Realogy Group LLC / Realogy Co-Issuer Corp. (a)

| | 5.75% | | 01/15/29 | | 940,404 |

| 1,840,000 | | SBA Communications Corp. (a) (b)

| | 3.13% | | 02/01/29 | | 1,764,969 |

| 3,134,000 | | Service Properties Trust (b)

| | 7.50% | | 09/15/25 | | 3,553,411 |

| | | | | 18,260,656 |

| | | Retail – 7.6% | | | | | | |

| 4,290,000 | | Albertsons Cos, Inc./Safeway Inc/New Albertsons L.P./Albertsons LLC (a) (b)

| | 3.50% | | 03/15/29 | | 4,123,934 |

| 662,000 | | Burlington Coat Factory Warehouse Corp. (a)

| | 6.25% | | 04/15/25 | | 704,203 |

| 1,780,000 | | Carvana Co. (a)

| | 5.50% | | 04/15/27 | | 1,803,674 |

| 770,000 | | CP Atlas Buyer, Inc. (a)

| | 7.00% | | 12/01/28 | | 799,687 |

| 950,000 | | GYP Holdings III Corp. (a)

| | 4.63% | | 05/01/29 | | 952,575 |

| 2,000,000 | | Hanesbrands, Inc. (a)

| | 4.63% | | 05/15/24 | | 2,109,580 |

| 3,300,000 | | KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC (a) (b)

| | 5.25% | | 06/01/26 | | 3,398,851 |

| 1,420,000 | | L Brands, Inc. (a)

| | 9.38% | | 07/01/25 | | 1,803,400 |

| 4,100,000 | | L Brands, Inc. (b)

| | 7.50% | | 06/15/29 | | 4,761,904 |

| 1,200,000 | | L Brands, Inc. (a)

| | 6.63% | | 10/01/30 | | 1,384,476 |

| 275,000 | | Macy’s Retail Holdings LLC

| | 2.88% | | 02/15/23 | | 275,718 |

| 2,425,000 | | Macy’s Retail Holdings LLC

| | 3.63% | | 06/01/24 | | 2,455,313 |

| 2,500,000 | | Macy’s Retail Holdings LLC (a)

| | 5.88% | | 04/01/29 | | 2,568,687 |

| 3,770,000 | | Macy’s, Inc. (a) (b)

| | 8.38% | | 06/15/25 | | 4,166,491 |

| 1,900,000 | | Magic Mergeco, Inc. (a)

| | 5.25% | | 05/01/28 | | 1,926,125 |

| 4,655,000 | | Magic Mergeco, Inc. (a) (b)

| | 7.88% | | 05/01/29 | | 4,789,343 |

| 990,000 | | PVH CORP

| | 4.63% | | 07/10/25 | | 1,101,223 |

| 2,680,000 | | QVC, Inc.

| | 4.38% | | 09/01/28 | | 2,746,705 |

| | | | | 41,871,889 |

| | | Services – 8.2% | | | | | | |

| 1,870,000 | | Allied Universal Holdco LLC/Allied Universal Finance Corp. (a) (b)

| | 6.63% | | 07/15/26 | | 1,979,919 |

| 3,505,000 | | Allied Universal Holdco LLC/Allied Universal Finance Corp. (a) (b)

| | 9.75% | | 07/15/27 | | 3,854,501 |

| 390,000 | | Avis Budget Car Rental LLC/Avis Budget Finance, Inc. (a)

| | 5.38% | | 03/01/29 | | 406,575 |

| 1,250,000 | | Brink’s (The) Co. (a) (b)

| | 5.50% | | 07/15/25 | | 1,321,094 |

| 1,900,000 | | Celestial-Saturn Merger Sub, Inc. (a)

| | 4.50% | | 05/01/28 | | 1,899,582 |

| 2,420,000 | | Clean Harbors, Inc. (a) (b)

| | 4.88% | | 07/15/27 | | 2,522,850 |

| 1,100,000 | | Diebold Nixdorf, Inc. (a)

| | 9.38% | | 07/15/25 | | 1,227,187 |

| 3,045,000 | | H&E Equipment Services, Inc. (a)

| | 3.88% | | 12/15/28 | | 2,976,487 |

| 3,605,000 | | Herc Holdings, Inc. (a) (b)

| | 5.50% | | 07/15/27 | | 3,818,524 |

| 2,400,000 | | Imola Merger Corp. (a)

| | 4.75% | | 05/15/29 | | 2,495,304 |

| 650,000 | | LBM Acquisition LLC (a)

| | 6.25% | | 01/15/29 | | 668,155 |

| 1,445,000 | | NESCO Holdings II, Inc. (a)

| | 5.50% | | 04/15/29 | | 1,490,156 |

| 895,000 | | Picasso Finance Sub, Inc. (a)

| | 6.13% | | 06/15/25 | | 953,354 |

| 1,915,000 | | Prime Security Services Borrower, LLC/Prime Finance, Inc. (a)

| | 3.38% | | 08/31/27 | | 1,852,762 |

| 4,835,000 | | Staples, Inc. (a) (b)

| | 7.50% | | 04/15/26 | | 5,010,269 |

| 430,000 | | Stericycle, Inc. (a)

| | 3.88% | | 01/15/29 | | 429,959 |

| 790,000 | | Uber Technologies, Inc. (a)

| | 6.25% | | 01/15/28 | | 859,323 |

| 3,015,000 | | WASH Multifamily Acquisition, Inc. (a)

| | 5.75% | | 04/15/26 | | 3,135,600 |

| 3,650,000 | | Waste Pro USA, Inc. (a) (b)

| | 5.50% | | 02/15/26 | | 3,733,603 |

Page 12

See Notes to Financial Statements

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (Continued) |

| | | Services (Continued) | | | | | | |

| $880,000 | | WESCO Distribution, Inc. (a)

| | 7.13% | | 06/15/25 | | $951,500 |

| 1,045,000 | | WESCO Distribution, Inc. (a)

| | 7.25% | | 06/15/28 | | 1,161,256 |

| 1,050,000 | | White Cap Buyer LLC (a)

| | 6.88% | | 10/15/28 | | 1,115,636 |

| 855,000 | | Williams Scotsman International, Inc. (a)

| | 4.63% | | 08/15/28 | | 874,310 |

| 640,000 | | ZoomInfo Technologies LLC/ZoomInfo Finance Corp. (a)

| | 3.88% | | 02/01/29 | | 632,832 |

| | | | | 45,370,738 |

| | | Technology & Electronics – 5.4% | | | | | | |

| 900,000 | | Boxer Parent Co., Inc. (a)

| | 7.13% | | 10/02/25 | | 968,589 |

| 2,380,000 | | CommScope, Inc. (a)

| | 6.00% | | 03/01/26 | | 2,511,995 |

| 3,150,000 | | CommScope, Inc. (a) (b)

| | 8.25% | | 03/01/27 | | 3,378,375 |

| 1,375,000 | | CommScope, Inc. (a) (b)

| | 7.13% | | 07/01/28 | | 1,489,771 |

| 4,996,000 | | Dell International LLC/EMC Corp. (a) (b)

| | 8.35% | | 07/15/46 | | 7,835,258 |

| 1,300,000 | | Endure Digital, Inc. (a)

| | 6.00% | | 02/15/29 | | 1,247,825 |

| 1,900,000 | | Entegris, Inc. (a)

| | 4.38% | | 04/15/28 | | 1,997,422 |

| 2,330,000 | | Go Daddy Operating Co., LLC/GD Finance Co, Inc. (a) (b)

| | 5.25% | | 12/01/27 | | 2,440,675 |

| 2,220,000 | | NCR Corp. (a)

| | 5.13% | | 04/15/29 | | 2,286,600 |

| 900,000 | | NCR Corp. (a)

| | 5.25% | | 10/01/30 | | 932,625 |

| 585,000 | | Presidio Holdings, Inc. (a)

| | 8.25% | | 02/01/28 | | 639,478 |

| 2,435,000 | | Rackspace Technology Global, Inc. (a)

| | 3.50% | | 02/15/28 | | 2,364,994 |

| 1,535,000 | | Veritas US, Inc./Veritas Bermuda Ltd. (a)

| | 7.50% | | 09/01/25 | | 1,590,644 |

| | | | | 29,684,251 |

| | | Telecommunications – 6.4% | | | | | | |

| 1,200,000 | | Cable One, Inc. (a)

| | 4.00% | | 11/15/30 | | 1,187,314 |

| 720,000 | | Embarq Corp.

| | 8.00% | | 06/01/36 | | 839,480 |

| 5,925,000 | | Level 3 Financing, Inc. (b)

| | 5.38% | | 05/01/25 | | 6,047,944 |

| 3,685,000 | | Level 3 Financing, Inc. (a)

| | 3.63% | | 01/15/29 | | 3,574,450 |

| 1,500,000 | | Level 3 Financing, Inc. (a)

| | 3.75% | | 07/15/29 | | 1,464,375 |

| 3,220,000 | | Lumen Technologies, Inc., Series P

| | 7.60% | | 09/15/39 | | 3,700,843 |

| 3,875,000 | | Sprint Capital Corp. (b)

| | 6.88% | | 11/15/28 | | 4,887,449 |

| 2,045,000 | | Sprint Capital Corp.

| | 8.75% | | 03/15/32 | | 3,034,729 |

| 3,685,000 | | Sprint Corp. (b)

| | 7.63% | | 03/01/26 | | 4,523,338 |

| 3,295,000 | | T-Mobile USA, Inc. (b)

| | 6.00% | | 03/01/23 | | 3,326,962 |

| 2,925,000 | | T-Mobile USA, Inc. (b)

| | 6.00% | | 04/15/24 | | 2,944,173 |

| | | | | 35,531,057 |

| | | Transportation – 1.6% | | | | | | |

| 1,496,824 | | American Airlines 2013-2 Class A Pass Through Trust

| | 4.95% | | 01/15/23 | | 1,512,930 |

| 1,540,000 | | American Airlines, Inc. (a)

| | 11.75% | | 07/15/25 | | 1,930,775 |

| 800,000 | | JetBlue 2020-1 Class B Pass Through Trust

| | 7.75% | | 11/15/28 | | 920,498 |

| 1,300,000 | | Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets Ltd. (a)

| | 6.50% | | 06/20/27 | | 1,425,515 |

| 685,000 | | United Airlines, Inc. (a)

| | 4.38% | | 04/15/26 | | 711,694 |

| 895,000 | | United Airlines, Inc. (a)

| | 4.63% | | 04/15/29 | | 931,203 |

| 1,289,533 | | US Airways 2000-3C Pass Through Trust

| | 8.39% | | 03/01/22 | | 1,281,135 |

| | | | | 8,713,750 |

| | | Utility – 0.1% | | | | | | |

| 655,000 | | Calpine Corp. (a)

| | 3.75% | | 03/01/31 | | 626,953 |

| | | Total Corporate Bonds and Notes

| | 543,673,112 |

| | | (Cost $513,803,399) | | | | | | |

See Notes to Financial Statements

Page 13

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value

(Local

Currency) | | Description | | Stated

Coupon | | Stated

Maturity | | Value

(US Dollars) |

| FOREIGN CORPORATE BONDS AND NOTES – 26.3% |

| | | Agency – 0.4% | | | | | | |

| 2,250,000 | | Petroleos Mexicanos (USD)

| | 6.50% | | 03/13/27 | | $2,382,188 |

| | | Automotive – 0.9% | | | | | | |

| 1,020,000 | | Clarios Global L.P. (USD) (a)

| | 6.75% | | 05/15/25 | | 1,096,826 |

| 675,000 | | Clarios Global L.P./Clarios US Finance Co. (USD) (a)

| | 6.25% | | 05/15/26 | | 716,808 |

| 2,750,000 | | Clarios Global L.P./Clarios US Finance Co. (USD) (a) (b)

| | 8.50% | | 05/15/27 | | 2,973,438 |

| | | | | 4,787,072 |

| | | Basic Industry – 2.7% | | | | | | |

| 2,700,000 | | Alcoa Nederland Holding B.V. (USD) (a) (b)

| | 7.00% | | 09/30/26 | | 2,846,812 |

| 2,500,000 | | Cemex S.A.B. de C.V. (USD) (a)

| | 7.38% | | 06/05/27 | | 2,838,950 |

| 1,900,000 | | James Hardie International Finance DAC (USD) (a) (b)

| | 5.00% | | 01/15/28 | | 2,019,985 |

| 1,325,000 | | NOVA Chemicals, Corp. (USD) (a)

| | 4.25% | | 05/15/29 | | 1,321,317 |

| 1,350,000 | | SpA Holdings 3 Oy (USD) (a)

| | 4.88% | | 02/04/28 | | 1,363,433 |

| 1,625,000 | | SPCM S.A. (USD) (a)

| | 4.88% | | 09/15/25 | | 1,668,192 |

| 2,200,000 | | Stora Enso OYJ (USD) (a)

| | 7.25% | | 04/15/36 | | 2,921,436 |

| | | | | 14,980,125 |

| | | Capital Goods – 5.0% | | | | | | |

| 1,815,000 | | Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC (USD) (a)

| | 3.25% | | 09/01/28 | | 1,792,313 |

| 3,900,000 | | Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc. (USD) (a)

| | 5.25% | | 08/15/27 | | 3,991,010 |

| 1,100,000 | | Bombardier, Inc. (USD) (a)

| | 6.00% | | 10/15/22 | | 1,101,650 |

| 1,063,000 | | Bombardier, Inc. (USD) (a)

| | 6.13% | | 01/15/23 | | 1,115,650 |

| 3,100,000 | | Bombardier, Inc. (USD) (a)

| | 7.88% | | 04/15/27 | | 3,107,750 |

| 2,240,000 | | CANPACK S.A./Eastern PA Land Investment Holding LLC (USD) (a)

| | 3.13% | | 11/01/25 | | 2,277,800 |

| 1,880,000 | | Cascades, Inc./Cascades USA, Inc. (USD) (a)

| | 5.38% | | 01/15/28 | | 1,961,836 |

| 2,725,000 | | Intertape Polymer Group, Inc. (USD) (a) (b)

| | 7.00% | | 10/15/26 | | 2,867,545 |

| 4,330,000 | | Titan Acquisition Ltd./Titan Co-Borrower LLC (USD) (a) (b)

| | 7.75% | | 04/15/26 | | 4,511,643 |

| 4,425,000 | | Vertical Holdco GmbH (USD) (a) (b)

| | 7.63% | | 07/15/28 | | 4,831,547 |

| | | | | 27,558,744 |

| | | Consumer Goods – 1.7% | | | | | | |

| 2,600,000 | | JBS Investments II GmbH (USD) (a)

| | 7.00% | | 01/15/26 | | 2,766,010 |

| 2,725,000 | | JBS USA LUX S.A./JBS USA Food Co./JBS USA Finance, Inc. (USD) (a) (b)

| | 6.50% | | 04/15/29 | | 3,062,246 |

| 1,000,000 | | JBS USA LUX S.A./JBS USA Food Co./JBS USA Finance, Inc. (USD) (a)

| | 5.50% | | 01/15/30 | | 1,101,260 |

| 2,500,000 | | Minerva Luxembourg S.A. (USD) (a)

| | 4.38% | | 03/18/31 | | 2,438,475 |

| | | | | 9,367,991 |

| | | Energy – 1.1% | | | | | | |

| 2,065,000 | | MEG Energy Corp. (USD) (a) (b)

| | 7.13% | | 02/01/27 | | 2,207,547 |

| 1,100,000 | | Petrobras Global Finance BV (USD)

| | 5.60% | | 01/03/31 | | 1,189,100 |

| 1,000,000 | | Petrobras Global Finance BV (USD)

| | 6.75% | | 06/03/50 | | 1,095,710 |

| 1,555,000 | | TechnipFMC PLC (USD) (a)

| | 6.50% | | 02/01/26 | | 1,660,258 |

| | | | | 6,152,615 |

| | | Financial Services – 0.9% | | | | | | |

| 3,256,000 | | Fairstone Financial, Inc. (USD) (a) (b)

| | 7.88% | | 07/15/24 | | 3,420,493 |

Page 14

See Notes to Financial Statements

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value

(Local

Currency) | | Description | | Stated

Coupon | | Stated

Maturity | | Value

(US Dollars) |

| FOREIGN CORPORATE BONDS AND NOTES (Continued) |

| | | Financial Services (Continued) | | | | | | |

| 1,350,000 | | Unifin Financiera SAB de CV (USD) (a)

| | 9.88% | | 01/28/29 | | $1,335,231 |

| | | | | 4,755,724 |

| | | Healthcare – 3.7% | | | | | | |

| 4,130,000 | | Bausch Health Cos., Inc. (USD) (a) (b)

| | 9.00% | | 12/15/25 | | 4,481,050 |

| 4,600,000 | | Bausch Health Cos., Inc. (USD) (a) (b)

| | 5.00% | | 01/30/28 | | 4,674,543 |

| 5,180,000 | | Bausch Health Cos., Inc. (USD) (a)

| | 7.25% | | 05/30/29 | | 5,746,562 |

| 1,250,000 | | Endo Luxembourg Finance Co I Sarl/Endo US, Inc. (USD) (a)

| | 6.13% | | 04/01/29 | | 1,239,063 |

| 3,850,000 | | Teva Pharmaceutical Finance Netherlands III B.V. (USD) (b)

| | 7.13% | | 01/31/25 | | 4,203,988 |

| | | | | 20,345,206 |

| | | Leisure – 1.2% | | | | | | |

| 1,253,000 | | International Game Technology PLC (USD) (a)

| | 5.25% | | 01/15/29 | | 1,330,218 |

| 700,000 | | Melco Resorts Finance Ltd. (USD) (a)

| | 5.75% | | 07/21/28 | | 753,841 |

| 4,385,000 | | Stars Group Holdings B.V./Stars Group U.S. Co-Borrower LLC (USD) (a) (b)

| | 7.00% | | 07/15/26 | | 4,595,918 |

| | | | | 6,679,977 |

| | | Media – 0.6% | | | | | | |

| 1,521,000 | | Clear Channel International B.V. (USD) (a)

| | 6.63% | | 08/01/25 | | 1,595,149 |

| 1,820,000 | | UPC Holding, B.V. (USD) (a)

| | 5.50% | | 01/15/28 | | 1,893,937 |

| | | | | 3,489,086 |

| | | Retail – 0.5% | | | | | | |

| 1,855,000 | | 1011778 BC ULC/New Red Finance, Inc. (USD) (a)

| | 5.75% | | 04/15/25 | | 1,970,168 |

| 1,000,000 | | 1011778 BC ULC/New Red Finance, Inc. (USD) (a) (b)

| | 3.50% | | 02/15/29 | | 976,325 |

| | | | | 2,946,493 |

| | | Services – 2.1% | | | | | | |

| 1,600,000 | | Garda World Security Corp. (USD) (a)

| | 4.63% | | 02/15/27 | | 1,602,000 |

| 1,525,000 | | Garda World Security Corp. (USD) (a)

| | 9.50% | | 11/01/27 | | 1,685,453 |

| 1,407,000 | | GFL Environmental, Inc. (USD) (a)

| | 8.50% | | 05/01/27 | | 1,543,303 |

| 1,050,000 | | GFL Environmental, Inc. (USD) (a)

| | 4.00% | | 08/01/28 | | 1,006,163 |

| 1,500,000 | | Modulaire Global Finance PLC (USD) (a) (b)

| | 8.00% | | 02/15/23 | | 1,534,672 |

| 4,125,000 | | Ritchie Bros. Auctioneers, Inc. (USD) (a) (b)

| | 5.38% | | 01/15/25 | | 4,252,359 |

| | | | | 11,623,950 |

| | | Telecommunications – 5.0% | | | | | | |

| 1,980,000 | | Altice Financing S.A. (USD) (a)

| | 5.00% | | 01/15/28 | | 1,956,903 |

| 6,797,000 | | Altice France Holding S.A. (USD) (a) (b)

| | 10.50% | | 05/15/27 | | 7,665,419 |

| 6,845,000 | | Altice France Holding S.A. (USD) (a) (b)

| | 6.00% | | 02/15/28 | | 6,808,682 |

| 1,840,000 | | Altice France S.A./France (USD) (a)

| | 7.38% | | 05/01/26 | | 1,910,012 |

| 2,535,000 | | Altice France S.A./France (USD) (a)

| | 5.13% | | 07/15/29 | | 2,541,616 |

| 600,000 | | DKT Finance ApS (EUR) (e)

| | 7.00% | | 06/17/23 | | 737,715 |

| 1,116,000 | | DKT Finance ApS (USD) (a)

| | 9.38% | | 06/17/23 | | 1,151,852 |

| 3,540,000 | | Telecom Italia Capital S.A. (USD) (b)

| | 7.72% | | 06/04/38 | | 4,646,250 |

| | | | | 27,418,449 |

| | | Transportation – 0.5% | | | | | | |

| 995,000 | | Air Canada 2020-1 Class C Pass Through Trust (USD) (a)

| | 10.50% | | 07/15/26 | | 1,245,005 |

See Notes to Financial Statements

Page 15

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value

(Local

Currency) | | Description | | Stated

Coupon | | Stated

Maturity | | Value

(US Dollars) |

| FOREIGN CORPORATE BONDS AND NOTES (Continued) |

| | | Transportation (Continued) | | | | | | |

| 1,645,000 | | American Airlines, Inc./AAdvantage Loyalty IP Ltd. (USD) (a)

| | 5.50% | | 04/20/26 | | $1,729,306 |

| | | | | 2,974,311 |

| | | Total Foreign Corporate Bonds and Notes

| | 145,461,931 |

| | | (Cost $139,569,033) | | | | | | |

Par

Amount

(Local Currency) | | Description | | Stated

Rate | | Stated

Maturity | | Value

(US Dollars) |

| CAPITAL PREFERRED SECURITIES – 6.6% |

| | | Automotive – 1.2% | | | | | | |

| 5,935,000 | | General Motors Financial Co., Inc., Series A (USD) (b) (f)

| | 5.75% | | (g) | | 6,455,499 |

| | | Banking – 2.8% | | | | | | |

| 2,940,000 | | Bank of America Corp., Series DD (USD) (f)

| | 6.30% | | (g) | | 3,440,717 |

| 3,000,000 | | Barclays Bank PLC, 3 Mo. EUR LIBOR + 0.71% (EUR) (e) (h)

| | 0.17% | | (g) | | 3,467,421 |

| 4,475,000 | | Citigroup, Inc., Series M (USD) (f)

| | 6.30% | | (g) | | 4,825,829 |

| 3,935,000 | | Citigroup, Inc., Series V (USD) (f)

| | 4.70% | | (g) | | 4,015,373 |

| | | | | 15,749,340 |

| | | Financial Services – 1.1% | | | | | | |

| 3,500,000 | | Goldman Sachs Group (The), Inc., Series P (USD) (f)

| | 5.00% | | (g) | | 3,531,500 |

| 3,210,000 | | Textron Financial Corp., 3 Mo. LIBOR + 1.74% (USD) (a) (b) (h)

| | 1.93% | | 02/15/42 | | 2,608,125 |

| | | | | 6,139,625 |

| | | Insurance – 1.5% | | | | | | |

| 5,400,000 | | Hartford Financial Services Group (The), Inc., 3 Mo. LIBOR + 2.13% (USD) (a) (b) (h)

| | 2.32% | | 02/12/47 | | 5,197,654 |

| 3,500,000 | | Lincoln National Corp., 3 Mo. LIBOR + 2.36% (USD) (b) (h)

| | 2.55% | | 05/17/66 | | 3,018,750 |

| | | | | 8,216,404 |

| | | Total Capital Preferred Securities

| | 36,560,868 |

| | | (Cost $35,183,954) | | | | | | |

Principal

Value | | Description | | Rate (i) | | Stated

Maturity (j) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS – 2.2% |

| | | Capital Goods – 0.6% | | | | | | |

| $3,000,000 | | ADS Tactical, Inc., Term Loan B, 1 Mo. LIBOR + 5.75%, 1.00% Floor

| | 6.75% | | 03/04/28 | | 2,975,640 |

| 438,750 | | Pretium PKG Holdings, Inc., Initial Term Loan, 5 Mo. LIBOR + 8.25%, 0.75% Floor

| | 9.00% | | 11/06/28 | | 445,331 |

| | | | | 3,420,971 |

| | | Insurance – 0.2% | | | | | | |

| 987,525 | | HUB International Ltd., Term Loan B3, 1 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 04/25/25 | | 985,984 |

| | | Services – 1.3% | | | | | | |

| 7,000,000 | | TruGreen L.P., Initial Term Loan, 1 Mo. LIBOR + 8.50%, 0.75% Floor

| | 9.25% | | 11/02/28 | | 7,210,000 |

Page 16

See Notes to Financial Statements

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (i) | | Stated

Maturity (j) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (Continued) |

| | | Technology & Electronics – 0.1% | | | | | | |

| $600,000 | | Dcert Buyer, Inc., Term Loan, 1 Mo. LIBOR + 7.00%, 0.00% Floor

| | 7.11% | | 02/16/29 | | $602,250 |

| | | Total Senior Floating-Rate Loan Interests

| | 12,219,205 |

| | | (Cost $11,810,471) | | | | | | |

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| MORTGAGE-BACKED SECURITIES – 0.6% |

| | | Collateralized Mortgage Obligations – 0.0% | | | | | | |

| | | Washington Mutual Alternative Mortgage Pass-Through Certificates | | | | | | |

| 15,913 | | Series 2007-5, Class A11, 1 Mo. LIBOR x -6 + 39.48% (k)

| | 38.83% | | 06/25/37 | | 30,838 |

| | | Commercial Mortgage-Backed Securities – 0.6% | | | | | | |

| | | Securitized Asset Backed Receivables LLC Trust | | | | | | |

| 7,017,444 | | Series 2006-FR4, Class A2A, 1 Mo. LIBOR + 0.08% (h)

| | 0.19% | | 08/25/36 | | 3,063,850 |

| | | Total Mortgage-Backed Securities

| | 3,094,688 |

| | | (Cost $5,181,454) | | | | | | |

| Shares | | Description | | Value |

| COMMON STOCKS – 0.1% |

| | | Energy – 0.0% | | |

| 7 | | Thunderbird Resources Equity, Inc. (l) (m) (n) (o)

| | 73,622 |

| | | Utility – 0.1% | | |

| 13,918 | | Vistra Corp.

| | 234,797 |

| | | Total Common Stocks

| | 308,419 |

| | | (Cost $997,888) | | |

| RIGHTS – 0.0% |

| | | Utility – 0.0% | | |

| 13,918 | | Vistra Corp., no expiration date (m) (o)

| | 15,421 |

| | | (Cost $22,917) | | |

| | | Total Investments – 134.2%

| | 741,333,644 |

| | | (Cost $706,569,116) (p) | | | | | | |

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| U.S. GOVERNMENT BONDS SOLD SHORT - (10.3)% |

| $(30,000,000) | | United States Treasury Note

| | 1.38% | | 09/30/23 | | (30,827,930) |

| (24,000,000) | | United States Treasury Note

| | 2.88% | | 05/31/25 | | (26,187,656) |

| | | Total U.S. Government Bonds Sold Short

| | (57,015,586) |

| | | (Proceeds $52,553,860) | | | | | | |

| CORPORATE BONDS SOLD SHORT – (0.9)% |

| | | Energy – (0.3)% | | | | | | |

| (1,600,000) | | Halliburton Co.

| | 2.92% | | 03/01/30 | | (1,605,601) |

| | | Technology & Electronics – (0.6)% | | | | | | |

| (2,930,000) | | Amkor Technology, Inc. (a)

| | 6.63% | | 09/15/27 | | (3,157,427) |

| | | Total Corporate Bonds Sold Short

| | (4,763,028) |

| | | (Proceeds $4,479,457) | | | | | | |

See Notes to Financial Statements

Page 17

First Trust High Income Long/Short Fund (FSD)

Portfolio of Investments (Continued)

April 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| FOREIGN CORPORATE BONDS SOLD SHORT – (0.6)% |

| | | Basic Industry – (0.6)% | | | | | | |

| $(2,900,000) | | FMG Resources (August 2006) Pty Ltd. (USD) (a)

| | 5.13% | | 05/15/24 | | $(3,170,222) |

| | | (Proceeds $3,026,975) | | | | | | |

| | | Total Investments Sold Short – (11.8)%

| | (64,948,836) |

| | | (Proceeds $60,060,292) | | | | | | |

| Outstanding Loan – (24.2)%

| | (133,760,967) |

| | Net Other Assets and Liabilities – 1.8%

| | 9,941,781 |

| | Net Assets – 100.0%

| | $552,565,622 |

| Forward Foreign Currency Contracts |

Settlement

Date | | Counterparty | | Amount

Purchased | | Amount

Sold | | Purchase

Value as of

4/30/2021 | | Sale

Value as of

4/30/2021 | | Unrealized

Appreciation/

(Depreciation) |

| 08/02/21 | | JPM | | USD | 4,272,651 | | EUR | 3,531,000 | | $ 4,272,651 | | $ 4,253,374 | | $ 19,277 |

| Counterparty Abbreviations |

| JPM | JPMorgan Chase |

See Note 2D – Forward Foreign Currency Contracts in the Notes to Financial Statements.

|

| (a) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund Board of Trustees, this security has been determined to be liquid by MacKay Shields LLC, the Fund’s sub-advisor (the “Sub-Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At April 30, 2021, securities noted as such amounted to $504,616,896 of total investments and $(6,327,649) of total investments sold short, or 91.3% and (1.1)% of net assets, respectively. |

| (b) | This security or a portion of this security is segregated as collateral for investments sold short. |

| (c) | These notes are Senior Payment-in-kind (“PIK”) Toggle Notes whereby the issuer may, at its option, elect to pay interest on the notes (1) entirely in cash or (2) entirely in PIK interest. Interest paid in cash will accrue on the notes at a rate of 7.75% per annum (“Cash Interest Rate”) and PIK interest will accrue on the notes at a rate per annum equal to the Cash Interest Rate plus 75 basis points. The first interest payment is scheduled for October 1, 2021. |