UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22437

Guggenheim Taxable Municipal Managed Duration Trust

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: May 31

Date of reporting period: June 1, 2017 – November 30, 2017

Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/GBAB

... YOUR LINK TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT THE GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/gbab, you will find:

• Daily, weekly and monthly data on share prices, net asset values, distributions and more

• Monthly portfolio overviews and performance analyses

• Announcements, press releases and special notices

• Trust and adviser contact information

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are continually updating and expanding shareholder information services on the Trust’s website in an ongoing effort to provide you with the most current information about how your Trust’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Trust.

| | |

(Unaudited) | November 30, 2017 |

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Taxable Municipal Managed Duration Trust (the “Trust”). This report covers the Trust’s performance for the six-month period ended November 30, 2017.

The Trust’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. Under normal market conditions, the Trust invests at least 80% of its net assets plus the amount of any borrowings for investment purposes (“Managed Assets”) in a diversified portfolio of taxable municipal securities, and may invest up to 20% of Managed Assets in securities other than taxable municipal securities.

All Trust returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2017, the Trust provided a total return based on market price of 0.16% and a total return based on NAV of 3.41%. As of November 30, 2017, the Trust’s market price of $22.51 per share represented a discount of 3.51% to its NAV of $23.33 per share.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Trust expenses. The market price of the Trust’s shares fluctuates from time to time, and may be higher or lower than the Trust’s NAV.

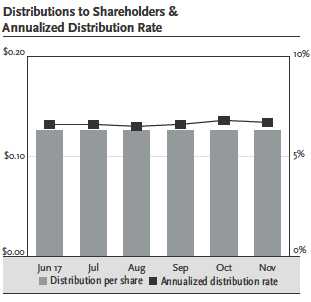

Each month of the period, the Trust paid a monthly distribution of $0.12573 per share. The most recent distribution represents an annualized rate of 6.70% based on the Trust’s closing market price of $22.51 on November 30, 2017. There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. The Trust’s distribution rate is not constant and the amount of distributions, when declared by the Trust’s Board of Trustees, is subject to change based on the performance of the Trust. Please see Note 2(d) on page 42 for more information on distributions for the period.

Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”) serves as the investment adviser to the Trust. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Trust’s investment sub-adviser and is responsible for the management of the Trust’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Trust through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 60 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly distribution in common shares of the Trust purchased in the market at a price less than NAV. Conversely, when the market price of the Trust’s common shares is at a premium above NAV, the DRIP reinvests participants’ distributions in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Trust endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 3| | |

DEAR SHAREHOLDER (Unaudited) continued | November 30, 2017 |

causes shareholders to accumulate a larger number of Trust shares when the share price is lower than when the price is higher.

To learn more about the Trust’s performance and investment strategy for the semiannual period ended November 30, 2017, we encourage you to read the Questions & Answers section of this report, which begins on page 5.

We are honored that you have chosen the Guggenheim Taxable Municipal Managed Duration Trust as part of your investment portfolio. For the most up-to-date information regarding your investment, please visit the Trust’s website at guggenheiminvestments.com/gbab.

Sincerely,

Guggenheim Funds Investment Advisors, LLC

December 31, 2017

4 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) | November 30, 2017 |

Guggenheim Taxable Municipal Managed Duration Trust (the “Trust”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”). This team includes B. Scott Minerd, Chairman of Investments and Global Chief Investment Officer; Anne B. Walsh, CFA, JD, Senior Managing Director and Assistant Chief Investment Officer; Jeffrey S. Carefoot, CFA, Senior Managing Director and Portfolio Manager; and Allen Li, CFA, Managing Director and Portfolio Manager. Effective December 1, 2017, James E. Pass no longer serves as a portfolio manager for the Trust. In the following interview, the investment team discusses the market environment and the Trust’s strategy and performance for the six-month period ended November 30, 2017.

What is the Trust’s investment objective and how is it pursued?

The Trust’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in a diversified portfolio of taxable municipal securities. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in taxable municipal securities, including Build America Bonds (“BABs”), which qualify for federal subsidy payments under the American Recovery and Reinvestment Act of 2009 (the “Act”).

Under normal market conditions, the Trust may invest up to 20% of its Managed Assets in securities other than taxable municipal securities, including municipal securities, the interest income from which is exempt from regular federal income tax (sometimes referred to as “tax-exempt municipal securities”); and asset-backed securities (“ABS”), senior loans, and other income-producing securities.

At least 80% of the Trust’s Managed Assets are invested in securities that, at the time of investment, are investment grade quality. The Trust may invest up to 20% of its Managed Assets in securities that, at the time of investment, are below investment grade quality. Securities of below investment grade quality are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. The Trust does not invest more than 25% of its Managed Assets in municipal securities in any one state of origin or more than 15% of its Managed Assets in municipal securities that, at the time of investment, are illiquid.

Most of the portfolio is invested in Build America Bonds. Has anything changed in that market?

Most of the Trust’s taxable municipal allocation is currently in BABs. BABs are taxable municipal securities that were created to support the public finance market following the 2009 financial crisis, and also to provide funding for projects that would create jobs. They include bonds issued by state and local governments to finance capital projects such as public schools, roads, transportation infrastructure, bridges, ports, and public buildings. In contrast to traditional municipal bonds, interest received on BABs is subject to federal income tax and may be subject to state income tax. However,

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 5| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

issuers of Direct Payment BABs are eligible to receive a subsidy from the U.S. Treasury of up to 35% of the interest paid on the bonds, allowing them to issue BABs that pay interest rates that are competitive with the rates typically paid by private bond issuers in the taxable fixed-income market.

Because the relevant provisions of the Act were not extended, bonds issued after December 31, 2010 cannot qualify as BABs. Therefore, the number of BABs available in the market is limited. Nearly $200 billion in BABs were issued before the program ended in 2010.

BABs have a feature that provides issuers the option to redeem the BABs if the U.S. government reduces the subsidy to the municipality. Most BABs became callable after Congress mandated sequestration in 2013. The subsidy has continued to be cut by about 7% in each of the past several fiscal years, effectively increasing the cost of borrowing for issuers. Nevertheless, the subsidy still in effect remains attractive to issuers, so relatively few BABs have been called.

Since the issuances under the BABs program concluded, gridlock at the federal level has meant state and local issuers have been the only source of municipal bonds. Proposals to reauthorize BABs or enact similar legislation have not been successful. A domestic infrastructure spending could result in some sort of qualified infrastructure bonds, including a program similar to Build America Bonds as a supplement to other programs involving other taxable or tax-exempt municipal bonds.

What were the significant events affecting the economy and market environment over the six-month period ended November 30, 2017?

At period end, the economy was enjoying the lowest unemployment rate since December 2000, the highest small business optimism since 1983, strong corporate earnings growth, and the prospect of a new tax regime that could stimulate growth and business investment. Regulatory relief for banks was also in the offing, alleviating undue burdens on mid-sized lenders. All this positive news prompted the U.S. Federal Reserve (the “Fed”) to gradually raise rates toward neutral in 2017, but an overheating labor market could force the Fed to continue on that path in 2018.

The fourth quarter of 2017 saw the commencement of the Fed’s balance sheet roll-off in October and another rate hike in December, taking the federal funds target to a range of 1.25% to 1.50%. Soft inflation surprised many market participants in 2017, but due to base effects and a tight labor market, core inflation may start to rise. With the unemployment rate approaching 3.5%, Fed hikes may occur at a faster pace in 2018 than policymakers or financial markets currently expect.

While the 2018 economic outlook is positive, the Fed is moving to an increasingly tight policy, and investors need to remain vigilant for late-cycle trends in the business cycle. In the meantime, the reduction in the corporate tax rate to 21% should be good for earnings, and the immediate expensing of capital expenditures could cause a surge in capital spending. However, higher levered segments of the fixed-income market may face negative effects from new rules governing tax deductibility of interest expense above certain limits. Investors must ensure that they are being adequately compensated for taking on credit risk in this environment.

6 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

How did the Trust perform for the six-month period ended November 30, 2017?

All Trust returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2017, the Trust provided a total return based on market price of 0.16% and a total return based on NAV of 3.41% As of November 30, 2017, the Trust’s market price of $22.51 per share represented a discount of 3.51% to its NAV of $23.33 per share. As of May 31, 2017, the Trust’s market price of $23.23 per share represented a discount of 0.30% to its NAV of $23.30 per share.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Trust expenses. The market price of the Trust’s shares fluctuates from time to time, and may be higher or lower than the Trust’s NAV.

The Trust paid a monthly distribution of $0.12573. The most recent distribution represents an annualized rate of 6.70% based on the Trust’s closing market price of $22.51 on November 30, 2017.

There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. The Trust’s distribution rate is not constant and the amount of distributions, when declared by the Trust’s Board of Trustees, is subject to change based on the performance of the Trust. Please see Note 2(d) on page 42 for more information on distributions for the period.

Why did the Trust accrue excise tax during the six-month period ended November 30, 2017?

As a registered investment company, the Trust is subject to a 4% excise tax that is imposed if the Trust does not distribute by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on October 31 of the calendar year (unless an election is made to use the trust’s fiscal year). The Trust generally intends to distribute income and capital gains in the manner necessary to minimize (but not necessarily eliminate) the imposition of such excise tax. While the Trust’s income and capital gains can vary significantly from year to year, the Trust seeks to maintain more stable monthly distributions over time. The Trust may retain income or capital gains and pay excise tax when it is determined that doing so is in the best interest of shareholders. Management, in consultation with the Board, evaluates the costs of the excise tax relative to the benefits of retaining income and capital gains, including that such undistributed amounts (net of the excise tax paid) remain available for investment by the Trust and are available to supplement future distributions, which may facilitate the payment of more stable monthly distributions year over year.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 7| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

How did other markets perform in this environment for the six-month period ended November 30, 2017?

| | |

| Index | Total Return |

| ICE BofA ML Build America Bond Index | 3.34% |

| Bloomberg Barclays Taxable Municipal Index | 3.31% |

| Bloomberg Barclays Municipal Index | 0.40% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 0.68% |

| Bloomberg Barclays U.S. Corporate High Yield Index | 2.28% |

| Credit Suisse Leveraged Loan Index | 1.78% |

| ICE BofA/ML ABS Master BBB-AA Index | 1.49% |

| S&P 500 Index | 10.89% |

What was notable in the municipal market for the six-month period ended November 30, 2017?

As of November 30, 2017, gross municipal issuance totaled $374 billion, 13% lower over the same period in 2016 and closer to 10-year averages. The lower volume reflected policy uncertainties, new political landscapes, and fewer refinancing opportunities. Following the period end, issuance in December 2017 reached a record high of $62.5 billion compared to a 5-year average of $27.2 billion in December. As of December 31, 2017, gross municipal issuance totaled $436 billion, 3% lower over the prior year. According to Lipper, municipal funds experienced net inflows of $18.1 billion in 2017.

Over the last six months, the municipal market continued to digest the progress of a wide range of federal policies, tax reform in particular. Finalized in December, the new tax bill included a provision to eliminate the federal income tax exemption on advanced refunding bonds, which municipal issuers use to refinance debt more than 90 days prior to bonds’ respective maturity dates.

In the months prior to January 1, 2018, the effective date of the tax legislation, the municipal market saw a sharp increase in new issue supply, driven by the expected expiration of tax exemption on advanced refunding bonds and uncertainty surrounding tax exemption provisions for private activity bonds most frequently issued by hospitals and universities. These types of bonds have accounted for approximately one-quarter of municipal bond supply in recent years.

The municipal market continued to focus on the Commonwealth of Puerto Rico, whose restructuring affects over $70 billion of debt, equivalent to greater than four times the debt included in the City of Detroit’s bankruptcy that began in 2013. Debt recoveries in Puerto Rico will hinge on legal decisions surrounding the priority of numerous stakeholders’ claims to Puerto Rico’s available resources. Implications of restructuring proceedings may impact the broader municipal market.

What is attractive about taxable municipals?

Taxable municipal issuance has accounted for roughly 10% of the annual new-issue municipal supply, and in 2017 is expected to total about $30 billion. As record-low interest rates globally spurred a demand for yield, the percentage of taxable municipal bonds held by non-U.S. investors has doubled

8 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

since 2009. These investors have been drawn by yields that are generally higher than comparable Treasury securities and have default rates and volatility lower than corporate bonds. Taxable municipals also have low correlation to other fixed income sectors, as well as equities. For these reasons, among others, the index of taxable municipals outpaced that of the broader municipal market for the six-month period ended November 30, 2017.

Discuss Trust asset allocation and respective performance for the six-month period ended November 30, 2017.

The Trust’s asset allocation changed little over the six-month period. The percentage of the Trust’s long-term investments (excluding cash) that was invested in taxable municipals (including BABs) Qualified School Construction Bonds (“QSCBs”), and other taxable municipal securities stayed at about 87%.

The balance of the Trust’s Managed Assets, equal to approximately 13% of the Trust’s long-term investments, was invested in ABS, bank loans, and high yield corporate bonds, as well as non-taxable municipal securities, such as tax-exempt municipal bonds. This exposure to leveraged credit, including senior floating rate interests and high yield bonds, and to ABS contributed to Trust performance, as these sectors had good returns over the six-month period with low correlation to the Trust’s core holdings.

Positively influencing the Trust’s return for the period were duration and yield curve positioning, sector allocation, the use of derivatives, and the use of leverage to enhance the Trust’s returns. Performance was driven by favorable security selection and lower interest rate sensitivity than the benchmark. Trust duration and credit quality remained stable over the period, helping manage risk. In addition, the Trust held interest rate swaps over the period to help manage the cost of leverage and to manage duration. The Trust continued to focus on A-rated taxable municipals in credit selection. Given increased market volatility and idiosyncratic weakness, the Trust continues to seek attractive risk-adjusted investment opportunities.

Discuss the Trust’s duration.

The Sub-Adviser employs investment and trading strategies that seek to maintain the leverage-adjusted duration of the Trust’s portfolio to generally less than 10 years. At November 30, 2017, the Trust’s duration was approximately seven years. (Duration is a measure of a bond’s price sensitivity to changes in interest rates, expressed in years. Duration is a weighted average of the times that interest payments and the final return of principal are received. The weights are the amounts of the payments discounted by the yield to maturity of the bond.)

The Sub-Adviser may seek to manage the duration of the Trust’s portfolio through the use of derivative instruments, including U.S. Treasury swaps, credit default swaps, total return swaps, and futures contracts, in an attempt to reduce the overall volatility of the Trust’s portfolio to changes in market interest rates. The Sub-Adviser used derivative instruments to manage the duration of the Trust’s

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 9| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

portfolio during the period. The Sub-Adviser may seek to manage the Trust’s duration in a flexible and opportunistic manner based primarily on then-current market conditions and interest rate levels. The Trust may incur costs in implementing the duration management strategy, but such strategy will seek to reduce the volatility of the Trust’s portfolio.

Discuss the Trust’s use of leverage.

Since leverage adds to performance when the cost of leverage is less than the total return generated by investments, the use of leverage contributed to the Trust’s total return based on NAV during this period. The Trust utilizes leverage as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged. Leverage will not exceed 33.33% of the Trust’s Managed Assets.

As of November 30, 2017, the Trust’s leverage was approximately 21% of Managed Assets (including the proceeds of leverage), compared with approximately 22% as of May 31, 2017. The Trust currently employs leverage through reverse repurchase agreements with two counterparties and a credit facility with a major bank.

There is no guarantee that the Trust’s leverage strategy will be successful. The Trust’s use of leverage may cause the Trust’s NAV and market price of common shares to be more volatile and could magnify the effect of any losses.

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The ICE BofA/ML Build America Bond Index is designed to track the performance of U.S. dollar-denominated Build America Bonds publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. market.

Bloomberg Barclays Taxable Municipal Index tracks performance of investment-grade fixed income securities issued by state and local governments whose income is not exempt from tax, issued generally to finance a project or activity that does not meet certain “public purpose/ use” requirements.

Bloomberg Barclays Municipal Index is a broad market performance benchmark for the tax-exempt bond market. The bonds included in this index must have a minimum credit rating of at least Baa.

10 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

The Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

The Credit Suisse Leveraged Loan Index is an index designed to mirror the investable universe of the U.S.-dollar-denominated leveraged loan market.

The ICE BofA/ML ABS Master BBB-AA Index is a subset of The BofA/ML U.S. Fixed Rate Asset Backed Securities Index including all securities rated AA1 through BBB3, inclusive.

The Standard & Poor’s (“S&P 500”) Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of U.S. stock market.

Risks and Other Considerations

Investing involves risk, including the possible loss of principal and fluctuation of value.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are expressed for informational purposes only and are subject to change at any time, based on market and other conditions, and may not come to pass. These views may differ from views of other investment professionals at Guggenheim and should not be construed as research, investment advice or a recommendation of any kind regarding the fund or any issuer or security, do not constitute a solicitation to buy or sell any security and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific investor.

The views expressed in this report may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. Actual results or events may differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include general economic conditions such as inflation, recession and interest rates.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 11| | |

QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2017 |

There can be no assurance that the Trust will achieve its investment objectives or that any investment strategies or techniques discussed herein will be effective. The value of the Trust will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown.

Please see guggenheiminvestments.com/gbab for a detailed discussion of the Trust’s risks and considerations.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

12 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

TRUST SUMMARY (Unaudited) | November 30, 2017 |

| |

Trust Statistics | |

| Share Price | $22.51 |

| Net Asset Value | $23.33 |

| Discount to NAV | -3.51% |

| Net Assets ($000) | $406,247 |

| | | | | | |

AVERAGE ANNUAL TOTAL RETURNS FOR | | | | | |

THE PERIOD ENDED NOVEMBER 30, 2017 | | | | | |

| | | | | | Since |

Six Month | One | Three | Five | Inception |

(non-annualized) | Year | Year | Year | (10/27/10) |

| Guggenheim Taxable Municipal Managed Duration Trust | | | | | |

| NAV | 3.41% | 8.27% | 6.42% | 6.74% | 10.03% |

| Market | 0.16% | 14.20% | 8.27% | 6.91% | 9.13% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses and all other Trust expenses. The deduction of taxes that a shareholder would pay on Trust distributions or the sale of Trust shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/gbab. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Trust at the initial share price of $20.00 per share for share price returns or initial NAV of $19.10 per share for NAV returns. Returns for periods of less than one year are not annualized.

| | |

Portfolio Breakdown | % of Net Assets |

| Municipal Bonds | 110.6% |

| Corporate Bonds | 4.5% |

| Asset-Backed Securities | 4.5% |

| Senior Floating Rate Interests | 3.2% |

| Money Market Fund | 1.3% |

| Common Stocks | 0.1% |

| Collateralized Mortgage Obligations | 0.0% |

Total Investments | 124.2% |

Other Assets & Liabilities, net | (24.2)% |

Net Assets | 100.0% |

Portfolio breakdown and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/gbab. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 13| | |

TRUST SUMMARY (Unaudited) continued | November 30, 2017 |

| | | |

Ten Largest Holdings | % of Total Net Assets |

| New Jersey Turnpike Authority Revenue Bonds, Build America Bonds, 7.10% | | 3.6% |

| State of West Virginia, Higher Education Policy Commission, Revenue Bonds, | | |

| Federally Taxable Build America Bonds 2010, 7.65% | | 3.5% |

| Dallas, Texas, Convention Center Hotel Development Corporation, Hotel | | |

| Revenue Bonds, Taxable Build America Bonds, 7.09% | | 3.3% |

| Westchester County Health Care Corporation, Revenue Bonds, Taxable Build | | |

| America Bonds, 8.57% | | 3.2% |

| School District of Philadelphia, Pennsylvania, General Obligation Bonds, | | |

| Series 2011A, Qualified School Construction Bonds – (Federally Taxable – | | |

| Direct Subsidy), 6.00% | | 2.9% |

| Oakland Unified School District, County of Alameda, California, Taxable General | | |

| Obligation Bonds, Election of 2006, Qualified School Construction Bonds, | | |

| Series 2012B, 6.88% | | 2.9% |

| Los Angeles Department of Water & Power Power System Revenue Revenue Bonds, | | |

| Build America Bonds, 7.00% | | 2.8% |

| California, General Obligation Bonds, Various Purpose, Taxable Build America Bonds, 7.70% | 2.8% |

| Noblesville Multi-School Building Corporation, Hamilton County, Indiana, Taxable | | |

| Unlimited Ad Valorem Property Tax First Mortgage Bonds, Build America Bonds, 6.50% | 2.8% |

| Los Angeles Department of Water & Power Power System Revenue Revenue Bonds, | | |

| Build America Bonds, 7.00% | | 2.8% |

| Top Ten Total | | 30.6% |

| “Ten Largest Holdings” excludes any temporary cash or derivative investments. | | |

14 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

TRUST SUMMARY (Unaudited) continued | November 30, 2017 |

| |

Portfolio Composition by Quality Rating* | |

| | % of Total |

Rating | Investments |

Fixed Income Instruments | |

| AAA | 1.1% |

| AA | 57.6% |

| A | 21.9% |

| BBB | 9.9% |

| BB | 4.5% |

| B | 2.9% |

| CCC | 0.2% |

| NR** | 0.7% |

Other Instruments | |

| Money Market Fund | 1.1% |

| Common Stocks | 0.1% |

Total Investments | 100.0% |

* | Source: Factset. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All rated securities have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, which are all a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Unrated securities do not necessarily indicate low credit quality. Security ratings are determined at the time of purchase and may change thereafter. |

| ** | NR securities do not necessarily indicate low credit quality. |

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 15| | |

TRUST SUMMARY (Unaudited) continued | November 30, 2017 |

16 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) | November 30, 2017 |

| | Shares | Value |

COMMON STOCKS† – 0.1% | | |

Energy – 0.1% | | |

| SandRidge Energy, Inc.* | 9,731 | $ 181,094 |

| Approach Resources, Inc.* | 44,160 | 110,400 |

Total Energy | | 291,494 |

Technology – 0.0% | | |

Aspect Software Parent, Inc.*,†††,1,2 | 6,275 | 40,475 |

Aspect Software Parent, Inc.*,†††,1,2 | 2,541 | 16,390 |

Total Technology | | 56,865 |

Consumer, Non-cyclical – 0.0% | | |

Targus Group International Equity, Inc*,†††,1,2 | 18,415 | 34,736 |

Communications – 0.0% | | |

Cengage Learning Acquisitions, Inc.*,†† | 3,457 | 25,927 |

Total Common Stocks | | |

| (Cost $470,772) | | 409,022 |

MONEY MARKET FUND† – 1.3% | | |

Dreyfus Treasury Prime Cash Management Institutional Shares 0.98%3 | 5,380,621 | 5,380,621 |

Total Money Market Fund | | |

| (Cost $5,380,621) | | 5,380,621 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% | | |

California – 22.7% | | |

| Los Angeles Department of Water & Power Power System Revenue Revenue | | |

Bonds, Build America Bonds10 | | |

| 7.00% due 07/01/41 | $ 10,000,000 | 11,562,100 |

| 7.00% due 07/01/41 | 10,000,000 | 11,195,100 |

| Santa Ana Unified School District, California, General Obligation Bonds, | | |

Federal Taxable Build America Bonds10 | | |

| 7.10% due 08/01/40 | 7,755,000 | 10,560,992 |

| 6.80% due 08/01/30 | 2,245,000 | 2,815,746 |

| Oakland Unified School District, County of Alameda, California, Taxable General | | |

| Obligation Bonds, Election of 2006, Qualified School Construction | | |

| Bonds, Series 2012B | | |

| 6.88% due 08/01/33 | 10,000,000 | 11,591,400 |

| California, General Obligation Bonds, Various Purpose, Taxable Build | | |

America Bonds10 | | |

| 7.70% due 11/01/30 | 10,000,000 | 11,515,200 |

| Long Beach Unified School District, California, Qualified School Construction | | |

| Bonds, Federally Taxable, Election of 2008, General Obligation Bonds | | |

| 5.91% due 08/01/25 | 7,500,000 | 8,707,575 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 17| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% (continued) | | |

California – 22.7% (continued) | | |

| Riverside Community College District General Obligation Unlimited | | |

| 7.02% due 08/01/40 | $ 5,000,000 | $ 5,611,600 |

| Metropolitan Water District, Southern California, Water Revenue Bonds, | | |

2010 Authorization, Taxable Build America Bonds10 | | |

| 6.95% due 07/01/40 | 5,000,000 | 5,592,100 |

| Sonoma Valley Unified School District General Obligation Unlimited | | |

| 7.12% due 08/01/28 | 3,330,000 | 3,742,154 |

| California Housing Finance Agency Revenue Bonds | | |

| 3.66% due 02/01/29 | 3,000,000 | 3,038,100 |

| Culver City Redevelopment Agency, California, Taxable Tax Allocation Bonds, | | |

| Culver City Redevelopment Project | | |

| 8.00% due 11/01/20 | 1,570,000 | 1,642,471 |

| Monrovia Unified School District, Los Angeles County, California, Election of 2006 | | |

General Obligation Bonds, Build America Bonds, Federally Taxable10 | | |

| 7.25% due 08/01/28 | 1,025,000 | 1,274,536 |

| Placentia-Yorba Linda Unified School District (Orange County, California), General | | |

| Obligation Bonds, Federally Taxable Direct-Pay Qualified School | | |

| Construction Bonds, Election of 2008 | | |

| 5.40% due 02/01/26 | 1,000,000 | 1,117,810 |

| Cypress Elementary School District (Orange County, California), General Obligation | | |

| Bonds, Direct Pay Qualified School Construction Bonds, 2008 Election | | |

| 6.65% due 08/01/25 | 660,000 | 750,268 |

| 6.05% due 08/01/21 | 340,000 | 363,372 |

| Alhambra Unified School District General Obligation Unlimited | | |

| 6.70% due 02/01/26 | 500,000 | 601,020 |

| California State University Revenue Bonds | | |

| 3.90% due 11/01/47 | 500,000 | 517,690 |

Total California | | 92,199,234 |

Illinois – 10.6% | | |

| Northern Illinois University, Auxiliary Facilities System Revenue Bonds, | | |

Build America Program, Taxable10 | | |

| 8.15% due 04/01/41 | 5,000,000 | 5,494,450 |

| 7.95% due 04/01/35 | 4,500,000 | 4,959,810 |

| Chicago, Illinois, Second Lien Wastewater Transmission Revenue Project | | |

Bonds, Taxable Build America Bonds10 | | |

| 6.90% due 01/01/40 | 5,100,000 | 6,526,266 |

Illinois, General Obligation Bonds, Taxable Build America Bonds10 | | |

| 7.35% due 07/01/35 | 5,000,000 | 5,793,450 |

| Chicago, Illinois, Board of Education, Unlimited Tax General Obligation | | |

Bonds, Dedicated Revenues, Taxable Build America Bonds10 | | |

| 6.52% due 12/01/40 | 5,000,000 | 4,833,200 |

| City of Chicago Illinois General Obligation Unlimited | | |

| 6.26% due 01/01/40 | 2,500,000 | 2,623,550 |

| 5.43% due 01/01/42 | 2,000,000 | 1,948,140 |

See notes to financial statements.

18 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% (continued) | | |

Illinois – 10.6% (continued) | | |

Chicago, Illinois, Second Lien Water Revenue Bonds, Taxable Build America Bonds10 | | |

| 6.74% due 11/01/40 | $ 2,990,000 | $ 3,889,900 |

| Southwestern Illinois Development Authority Revenue Bonds | | |

| 7.23% due 10/15/35 | 3,000,000 | 3,280,080 |

| Southwestern Illinois, Development Authority, Taxable Local Government, | | |

| Program Revenue Bonds, Flood Prevention District Project, | | |

Build America Bonds10 | | |

| 7.03% due 04/15/32 | 2,000,000 | 2,179,360 |

| State of Illinois General Obligation Unlimited | | |

| 6.63% due 02/01/35 | 930,000 | 1,030,961 |

| 6.73% due 04/01/35 | 200,000 | 221,156 |

Chicago Board of Education General Obligation Unlimited, Build America Bonds10 | | |

| 6.14% due 12/01/39 | 195,000 | 186,799 |

Total Illinois | | 42,967,122 |

Washington – 10.1% | | |

| Washington State University, Housing and Dining System Revenue Bonds, | | |

Taxable Build America Bonds10 | | |

| 7.40% due 04/01/41 | 6,675,000 | 9,651,382 |

| 7.10% due 04/01/32 | 3,325,000 | 4,400,405 |

| Washington State Convention Center Public Facilities District, Lodging Tax Bonds, | | |

Taxable Build America Bonds10 | | |

| 6.79% due 07/01/40 | 5,000,000 | 6,456,850 |

| Public Hospital District No. 1, King County, Washington, Valley Medical Center, | | |

| Hospital Facilities Revenue Bonds | | |

8.00% due 06/15/404 | 5,800,000 | 6,364,688 |

| Central Washington University, System Revenue Bonds, 2010, Taxable Build | | |

America Bonds10 | | |

6.50% due 05/01/304 | 5,000,000 | 6,109,050 |

| City of Anacortes Washington Utility System Revenue Revenue Bonds | | |

| 6.48% due 12/01/30 | 5,000,000 | 5,437,950 |

| City of Auburn Washington Utility System Revenue Revenue Bonds | | |

6.40% due 12/01/304 | 2,000,000 | 2,190,200 |

| Port of Seattle Washington Revenue Bonds | | |

| 3.76% due 05/01/36 | 300,000 | 305,538 |

Total Washington | | 40,916,063 |

New Jersey – 6.3% | | |

New Jersey Turnpike Authority Revenue Bonds, Build America Bonds10 | | |

| 7.10% due 01/01/41 | 10,000,000 | 14,733,800 |

Camden County Improvement Authority Revenue Bonds, Build America Bonds10 | | |

| 7.75% due 07/01/34 | 8,000,000 | 8,785,200 |

| 7.85% due 07/01/35 | 2,000,000 | 2,196,960 |

Total New Jersey | | 25,715,960 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 19| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% (continued) | | |

Pennsylvania – 6.3% | | |

| School District of Philadelphia, Pennsylvania, General Obligation Bonds, Series 2011A, | | |

| Qualified School Construction Bonds – (Federally Taxable – Direct Subsidy) | | |

| 6.00% due 09/01/30 | $ 10,330,000 | $ 11,796,137 |

| Pittsburgh, Pennsylvania, School District, Taxable Qualified School Construction Bonds | | |

| 6.85% due 09/01/29 | 6,870,000 | 8,536,936 |

Lebanon Authority, Pennsylvania, Sewer Revenue Bonds, Taxable Build America Bonds10 | | |

| 7.14% due 12/15/35 | 4,865,000 | 5,212,799 |

Total Pennsylvania | | 25,545,872 |

New York – 6.2% | | |

| Westchester County Health Care Corporation, Revenue Bonds, Taxable Build | | |

America Bonds10 | | |

| 8.57% due 11/01/40 | 10,000,000 | 13,175,200 |

| Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, | | |

Taxable Build America Bonds10 | | |

| 6.55% due 11/15/31 | 5,000,000 | 6,550,600 |

| 7.13% due 11/15/30 | 5,000,000 | 5,673,350 |

Total New York | | 25,399,150 |

Indiana – 6.2% | | |

| Noblesville Multi-School Building Corporation, Hamilton County, Indiana, | | |

| Taxable Unlimited Ad Valorem Property Tax First Mortgage Bonds, | | |

Build America Bonds10 | | |

| 6.50% due 01/15/21 | 10,000,000 | 11,335,600 |

Evansville-Vanderburgh School Building Corp. Revenue Bonds, Build America Bonds10 | | |

| 6.50% due 01/15/30 | 8,690,000 | 9,523,024 |

County of Knox Indiana Revenue Bonds, Build America Bonds10 | | |

| 5.90% due 04/01/34 | 2,920,000 | 3,080,045 |

| Indiana Finance Authority Revenue Bonds | | |

| 5.50% due 04/01/24 | 1,060,000 | 1,194,673 |

Total Indiana | | 25,133,342 |

Michigan – 6.0% | | |

Detroit City School District General Obligation Unlimited, Build America Bonds10 | | |

| 6.85% due 05/01/40 | 5,000,000 | 5,373,550 |

| 7.75% due 05/01/39 | 2,640,000 | 3,759,307 |

| Whitehall District Schools, Muskegon County, Michigan, 2010 School Building and | | |

| Site Bonds, General Obligation, Unlimited Tax Bonds, Taxable Qualified | | |

| School Construction Bonds | | |

| 6.10% due 05/01/26 | 2,500,000 | 2,720,625 |

| 6.50% due 05/01/29 | 2,000,000 | 2,178,380 |

| Detroit, Michigan, School District, School Building and Site Bonds, Unlimited | | |

| Tax General Obligation Bonds, Taxable Qualified School Construction Bonds | | |

| 6.65% due 05/01/29 | 2,640,000 | 3,246,804 |

See notes to financial statements.

20 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% (continued) | | |

Michigan – 6.0% (continued) | | |

| Fraser Public School District, Macomb County, Michigan, General Obligation | | |

| Federally Taxable School Construction Bonds, 2011 School Building and | | |

| Site Bonds | | |

6.05% due 05/01/264 | $ 3,000,000 | $ 3,216,690 |

| City of Detroit Michigan Water Supply System Revenue Revenue Bonds | | |

| 5.00% due 07/01/41 | 1,555,000 | 1,649,342 |

| Oakridge, Michigan, Public Schools, Unlimited Tax General Obligation Bonds | | |

| 6.75% due 05/01/26 | 1,000,000 | 1,071,040 |

| City of Detroit Michigan Sewage Disposal System Revenue Revenue Bonds | | |

1.50% (3 Month USD LIBOR + 60 bps) due 07/01/325 | 1,000,000 | 923,650 |

| Comstock Park Public Schools General Obligation Unlimited | | |

| 6.30% due 05/01/26 | 415,000 | 463,891 |

Total Michigan | | 24,603,279 |

Texas – 6.0% | | |

| Dallas, Texas, Convention Center Hotel Development Corporation, Hotel Revenue | | |

Bonds, Taxable Build America Bonds10 | | |

| 7.09% due 01/01/42 | 10,000,000 | 13,310,700 |

| El Paso, Texas, Combination Tax and Revenue Certification of Obligation, | | |

Taxable Build America Bonds10 | | |

| 6.70% due 08/15/36 | 10,000,000 | 11,055,600 |

Total Texas | | 24,366,300 |

Florida – 4.1% | | |

County of Miami-Dade Florida Transit System Revenue Bonds, Build America Bonds10 | | |

| 6.91% due 07/01/39 | 10,000,000 | 10,729,800 |

| Orlando, Florida, Community Redevelopment Agency, Taxable Tax Increment | | |

Revenue Build America Bonds10 | | |

| 7.78% due 09/01/40 | 5,000,000 | 5,732,200 |

Total Florida | | 16,462,000 |

West Virginia – 3.5% | | |

| State of West Virginia, Higher Education Policy Commission, Revenue Bonds, | | |

Federally Taxable Build America Bonds 201010 | | |

| 7.65% due 04/01/40 | 10,000,000 | 14,070,600 |

Ohio – 3.2% | | |

| American Municipal Power, Inc., Combined Hydroelectric Projects Revenue Bonds, | | |

| New Clean Renewable Energy Bonds | | |

| 7.33% due 02/15/28 | 5,000,000 | 6,353,650 |

| Madison Local School District, Richland County, Ohio, School Improvement, | | |

| Taxable Qualified School Construction Bonds | | |

| 6.65% due 12/01/29 | 2,500,000 | 2,753,650 |

| Cuyahoga County, Ohio, Hospital Revenue Bonds, The Metrohealth System, | | |

Build America Bonds, Taxable10 | | |

8.22% due 02/15/404 | 1,950,000 | 2,514,018 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 21| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% (continued) | | |

Ohio – 3.2% (continued) | | |

| Toronto City School District, Ohio, Qualified School Construction Bonds | | |

| General Obligation Bonds | | |

| 7.00% due 12/01/28 | $ 1,230,000 | $ 1,290,873 |

Total Ohio | | 12,912,191 |

Colorado – 2.9% | | |

| Colorado, Building Excellent Schools Today, Certificates of Participation, | | |

Taxable Build America Bonds10 | | |

| 7.02% due 03/15/31 | 7,500,000 | 8,501,400 |

| Colorado, Building Excellent Schools Today, Certificates of Participation, | | |

| Taxable Qualified School Construction | | |

| 6.82% due 03/15/28 | 2,500,000 | 3,223,975 |

Total Colorado | | 11,725,375 |

Vermont – 2.6% | | |

Vermont State Colleges, Revenue Bonds, Taxable Build America Bonds10 | | |

7.21% due 07/01/404 | 7,500,000 | 8,335,725 |

6.10% due 07/01/254 | 2,155,000 | 2,343,455 |

Total Vermont | | 10,679,180 |

Alabama – 2.6% | | |

| Alabama State University, General Tuition and Fee Revenue Bonds, Taxable | | |

Direct-Pay Build America Bonds10 | | |

7.20% due 09/01/384 | 5,000,000 | 5,280,350 |

7.10% due 09/01/354 | 3,000,000 | 3,174,330 |

7.25% due 09/01/404 | 2,000,000 | 2,109,820 |

Total Alabama | | 10,564,500 |

Nevada – 2.5% | | |

Nevada System of Higher Education University, Revenue Bonds, Build America Bonds10 | | |

| 7.90% due 07/01/40 | 5,050,000 | 5,606,712 |

| 7.60% due 07/01/30 | 1,500,000 | 1,655,700 |

Clark County, Nevada, Airport Revenue Bonds, Build America Bonds10 | | |

| 6.88% due 07/01/42 | 1,425,000 | 1,533,357 |

| Las Vegas Valley Water District, Nevada, Limited Tax General Obligation Water Bonds, | | |

Taxable Build America Bonds10 | | |

| 7.10% due 06/01/39 | 1,200,000 | 1,287,696 |

Total Nevada | | 10,083,465 |

Louisiana – 2.3% | | |

| Orleans Parish, School Board of the Parish of Orleans, Louisiana | | |

| 4.40% due 02/01/21 | 8,000,000 | 8,410,240 |

| Tangipahoa Parish Hospital Service District No. 1, Louisiana, Taxable Hospital | | |

Revenue Bonds, North Oaks Health System Project, Build America Bonds10 | | |

| 7.20% due 02/01/42 | 1,055,000 | 1,114,112 |

Total Louisiana | | 9,524,352 |

See notes to financial statements.

22 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 110.6% (continued) | | |

Mississippi – 1.8% | | |

| Medical Center Educational Building Corporation, Taxable Build America Bonds, | | |

| University of Mississippi Medical Center Facilities Expansion and | | |

Renovation Project10 | | |

| 6.84% due 06/01/35 | $ 5,000,000 | $ 5,473,900 |

| Mississippi, Hospital Equipment and Facilities Authority, Taxable Build America | | |

Revenue Bonds, Forrest County General Hospital Project10 | | |

| 7.27% due 01/01/32 | 1,000,000 | 1,073,450 |

| 7.39% due 01/01/40 | 905,000 | 963,038 |

Total Mississippi | | 7,510,388 |

South Carolina – 1.6% | | |

County of Horry South Carolina Airport Revenue Revenue Bonds, Build America Bonds10 | | |

| 7.33% due 07/01/40 | 5,000,000 | 6,458,100 |

Georgia – 1.4% | | |

| Georgia Municipal Association, Inc., Certificates of Participation, DeKalb | | |

| County Public Schools Project | | |

| 5.21% due 12/01/22 | 5,000,000 | 5,548,500 |

South Dakota – 0.9% | | |

| City of Pierre South Dakota Electric Revenue Revenue Bonds | | |

| 7.50% due 12/15/40 | 3,490,000 | 3,638,534 |

Puerto Rico – 0.8% | | |

| Puerto Rico Electric Power Authority Revenue Bonds | | |

1.41% (3 Month USD LIBOR + 52 bps) due 07/01/295 | 1,205,000 | 1,009,187 |

| 5.25% due 07/01/32 | 1,000,000 | 939,780 |

| Puerto Rico Highway & Transportation Authority Revenue Bonds | | |

| 5.25% due 07/01/36 | 1,300,000 | 1,414,660 |

Total Puerto Rico | | 3,363,627 |

Total Municipal Bonds | | |

| (Cost $384,266,707) | | 449,387,134 |

CORPORATE BONDS†† – 4.5% | | |

Consumer, Non-cyclical – 1.6% | | |

| Kaiser Foundation Hospitals | | |

| 4.15% due 05/01/47 | 1,800,000 | 1,921,080 |

| Tufts Medical Center, Inc. | | |

| 7.00% due 01/01/38 | 1,500,000 | 1,770,996 |

| Valeant Pharmaceuticals International, Inc. | | |

6.50% due 03/15/226 | 1,000,000 | 1,050,000 |

| Avantor, Inc. | | |

6.00% due 10/01/246 | 1,000,000 | 1,000,625 |

| Great Lakes Dredge & Dock Corp. | | |

| 8.00% due 05/15/22 | 250,000 | 263,125 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 23| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

CORPORATE BONDS†† – 4.5% (continued) | | |

Consumer, Non-cyclical – 1.6% (continued) | | |

| WEX, Inc. | | |

4.75% due 02/01/236 | $ 250,000 | $ 255,625 |

| ADT Corp. | | |

| 6.25% due 10/15/21 | 200,000 | 220,000 |

Total Consumer, Non-cyclical | | 6,481,451 |

Energy – 1.3% | | |

| EQT Corp. | | |

| 8.13% due 06/01/19 | 1,200,000 | 1,299,713 |

| 4.88% due 11/15/21 | 250,000 | 267,563 |

| Comstock Resources, Inc. | | |

10.00% due 03/15/2011 | 1,100,000 | 1,134,375 |

| Antero Resources Corp. | | |

| 5.63% due 06/01/23 | 600,000 | 625,500 |

| 5.38% due 11/01/21 | 100,000 | 102,500 |

| Hess Corp. | | |

| 8.13% due 02/15/19 | 650,000 | 691,592 |

| Husky Energy, Inc. | | |

| 3.95% due 04/15/22 | 250,000 | 258,849 |

| 4.00% due 04/15/24 | 195,000 | 202,861 |

| Sabine Pass Liquefaction LLC | | |

| 5.63% due 02/01/21 | 300,000 | 322,565 |

| Buckeye Partners, LP | | |

| 4.35% due 10/15/24 | 250,000 | 255,957 |

| Cheniere Corpus Christi Holdings LLC | | |

| 7.00% due 06/30/24 | 100,000 | 113,500 |

| DCP Midstream Operating, LP | | |

5.35% due 03/15/206 | 100,000 | 103,500 |

| Schahin II Finance Co. SPV Ltd. | | |

5.88% due 09/25/227,12 | 651,500 | 91,210 |

Total Energy | | 5,469,685 |

Communications – 0.8% | | |

| DISH DBS Corp. | | |

| 5.88% due 11/15/24 | 1,050,000 | 1,057,875 |

| Sprint Communications, Inc. | | |

7.00% due 03/01/206 | 900,000 | 964,125 |

9.00% due 11/15/186 | 56,000 | 59,150 |

| T-Mobile USA, Inc. | | |

| 6.00% due 04/15/24 | 500,000 | 532,500 |

| MDC Partners, Inc. | | |

6.50% due 05/01/246 | 500,000 | 502,500 |

| Zayo Group LLC / Zayo Capital, Inc. | | |

| 6.38% due 05/15/25 | 100,000 | 106,125 |

See notes to financial statements.

24 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

CORPORATE BONDS†† – 4.5% (continued) | | |

Communications – 0.8% (continued) | | |

| McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance | | |

7.88% due 05/15/246 | $ 100,000 | $ 99,750 |

| CSC Holdings LLC | | |

| 5.25% due 06/01/24 | 100,000 | 97,469 |

Total Communications | | 3,419,494 |

Consumer, Cyclical – 0.3% | | |

| Titan International, Inc. | | |

6.50% due 11/30/236 | 850,000 | 845,495 |

| WMG Acquisition Corp. | | |

6.75% due 04/15/226 | 200,000 | 209,374 |

Total Consumer, Cyclical | | 1,054,869 |

Industrial – 0.2% | | |

| Dynagas LNG Partners Limited Partnership / Dynagas Finance, Inc. | | |

| 6.25% due 10/30/19 | 800,000 | 806,000 |

Basic Materials – 0.1% | | |

| GCP Applied Technologies, Inc. | | |

9.50% due 02/01/236 | 500,000 | 556,875 |

| Mirabela Nickel Ltd. | | |

2.38% due 06/24/197,11 | 96,316 | 8,669 |

Total Basic Materials | | 565,544 |

Financial – 0.1% | | |

| FBM Finance, Inc. | | |

8.25% due 08/15/216 | 150,000 | 160,125 |

| Jefferies Finance LLC / JFIN Company-Issuer Corp. | | |

7.25% due 08/15/246 | 125,000 | 128,125 |

Total Financial | | 288,250 |

Technology – 0.1% | | |

| Infor US, Inc. | | |

| 6.50% due 05/15/22 | 200,000 | 206,000 |

Total Corporate Bonds | | |

| (Cost $17,064,344) | | 18,291,293 |

ASSET-BACKED SECURITIES†† – 4.5% | | |

Collateralized Loan Obligations – 4.2% | | |

| Jamestown CLO VI Ltd. | | |

2015-6A, 6.69% (3 Month USD LIBOR + 525 bps) due 02/20/275,6 | 1,250,000 | 1,139,066 |

| FDF I Ltd. | | |

2015-1A, 7.50% due 11/12/306 | 1,000,000 | 1,005,306 |

| Saranac CLO III Ltd. | | |

2014-3A, 4.97% (3 Month USD LIBOR + 365 bps) due 06/22/255,6 | 1,000,000 | 1,002,284 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 25| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

ASSET-BACKED SECURITIES†† – 4.5% (continued) | | |

Collateralized Loan Obligations – 4.2% (continued) | | |

| Betony CLO Ltd. | | |

2015-1A, 6.71% (3 Month USD LIBOR + 535 bps) due 04/15/275,6 | $ 1,000,000 | $ 995,500 |

| Venture XX CLO Ltd. | | |

2015-20A, 7.66% (3 Month USD LIBOR + 630 bps) due 04/15/275,6 | 900,000 | 842,623 |

| KVK CLO Ltd. | | |

2014-2A, 6.11% (3 Month USD LIBOR + 475 bps) due 07/15/265,6 | 300,000 | 279,602 |

2013-2A, 5.01% (3 Month USD LIBOR + 365 bps) due 01/15/265,6 | 250,000 | 250,774 |

2015-1A, 7.19% (3 Month USD LIBOR + 575 bps) due 05/20/275,6 | 250,000 | 244,984 |

| Cent CLO Ltd. | | |

2014-21A, 4.87% (3 Month USD LIBOR + 350 bps) due 07/27/265,6 | 600,000 | 601,793 |

| Eaton Vance CLO Ltd. | | |

2014-1A, 6.39% (3 Month USD LIBOR + 503 bps) due 07/15/265,6 | 600,000 | 588,336 |

| OHA Credit Partners VIII Ltd. | | |

2013-8A, 5.76% (3 Month USD LIBOR + 440 bps) due 04/20/255,6 | 275,000 | 270,697 |

2013-8A, 4.86% (3 Month USD LIBOR + 350 bps) due 04/20/255,6 | 250,000 | 250,976 |

| Ocean Trails CLO V | | |

2014-5A, 6.71% (3 Month USD LIBOR + 535 bps) due 10/13/265,6 | 500,000 | 500,159 |

| Galaxy XVI CLO Ltd. | | |

2013-16A, 4.77% (3 Month USD LIBOR + 335 bps) due 11/16/255,6 | 500,000 | 496,514 |

| WhiteHorse X Ltd. | | |

2015-10A, 6.65% (3 Month USD LIBOR + 530 bps) due 04/17/275,6 | 500,000 | 482,540 |

| Avery Point IV CLO Ltd. | | |

2014-1A, 5.91% (3 Month USD LIBOR + 460 bps) due 04/25/265,6 | 500,000 | 480,428 |

| NewMark Capital Funding CLO Ltd. | | |

2014-2A, 6.14% (3 Month USD LIBOR + 480 bps) due 06/30/265,6 | 500,000 | 472,503 |

| WhiteHorse VIII Ltd. | | |

2014-1A, 5.93% (3 Month USD LIBOR + 455 bps) due 05/01/265,6 | 500,000 | 468,414 |

| Flatiron CLO Ltd. | | |

2013-1A, 6.70% (3 Month USD LIBOR + 535 bps) due 01/17/265,6 | 400,000 | 365,939 |

| TICP CLO I Ltd. | | |

2014-1A, 5.87% (3 Month USD LIBOR + 450 bps) due 04/26/265,6 | 300,000 | 295,885 |

| Regatta IV Funding Ltd. | | |

2014-1A, 6.32% (3 Month USD LIBOR + 495 bps) due 07/25/265,6 | 300,000 | 290,330 |

| Pinnacle Park CLO Ltd. | | |

2014-1A, 6.91% (3 Month USD LIBOR + 555 bps) due 04/15/265,6 | 300,000 | 274,710 |

| Octagon Investment Partners XXI Ltd. | | |

2014-1A, 8.01% (3 Month USD LIBOR + 660 bps) due 11/14/265,6 | 250,000 | 252,478 |

| Staniford Street CLO Ltd. | | |

2014-1A, 4.82% (3 Month USD LIBOR + 350 bps) due 06/15/255,6 | 250,000 | 249,984 |

| Octagon Investment Partners XX Ltd. | | |

2014-1A, 6.66% (3 Month USD LIBOR + 525 bps) due 08/12/265,6 | 250,000 | 248,734 |

| AIMCO CLO | | |

2014-AA, 6.55% (3 Month USD LIBOR + 525 bps) due 07/20/265,6 | 250,000 | 246,392 |

See notes to financial statements.

26 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

ASSET-BACKED SECURITIES†† – 4.5% (continued) | | |

Collateralized Loan Obligations – 4.2% (continued) | | |

| Ballyrock CLO LLC | | |

2014-1A, 6.36% (3 Month USD LIBOR + 500 bps) due 10/20/265,6 | $ 250,000 | $ 246,014 |

| Golub Capital Partners CLO Ltd. | | |

2014-21A, 4.67% (3 Month USD LIBOR + 330 bps) due 10/25/265,6 | 250,000 | 245,521 |

| Newstar Commercial Loan Funding LLC | | |

2014-1A, 6.11% (3 Month USD LIBOR + 475 bps) due 04/20/255,6 | 250,000 | 245,245 |

| BNPP IP CLO Ltd. | | |

2014-2A, 6.63% (3 Month USD LIBOR + 525 bps) due 10/30/255,6 | 250,000 | 244,909 |

| Adams Mill CLO Ltd. | | |

2014-1A, 6.36% (3 Month USD LIBOR + 500 bps) due 07/15/265,6 | 250,000 | 243,914 |

| Mountain Hawk II CLO Ltd. | | |

2013-2A, 4.51% (3 Month USD LIBOR + 315 bps) due 07/22/245,6 | 250,000 | 243,462 |

| Jamestown CLO III Ltd. | | |

2013-3A, 5.96% (3 Month USD LIBOR + 460 bps) due 01/15/265,6 | 250,000 | 243,121 |

| Washington Mill CLO Ltd. | | |

2014-1A, 6.21% (3 Month USD LIBOR + 485 bps) due 04/20/265,6 | 250,000 | 242,993 |

| Octagon Investment Partners XXII Ltd. | | |

2014-1A, 7.66% (3 Month USD LIBOR + 630 bps) due 11/25/255,6 | 250,000 | 241,585 |

| Harbourview CLO VII Ltd. | | |

2014-7A, 6.57% (3 Month USD LIBOR + 513 bps) due 11/18/265,6 | 250,000 | 240,312 |

| MP CLO V Ltd. | | |

2014-1A, 7.25% (3 Month USD LIBOR + 590 bps) due 07/18/265,6 | 250,000 | 239,860 |

| Jamestown CLO V Ltd. | | |

2014-5A, 6.45% (3 Month USD LIBOR + 510 bps) due 01/17/275,6 | 250,000 | 239,654 |

| Tuolumne Grove CLO Ltd. | | |

2014-1A, 6.12% (3 Month USD LIBOR + 475 bps) due 04/25/265,6 | 250,000 | 236,758 |

| Avery Point V CLO Ltd. | | |

2014-5A, 6.20% (3 Month USD LIBOR + 490 bps) due 07/17/265,6 | 250,000 | 233,169 |

| WhiteHorse VII Ltd. | | |

2013-1A, 6.25% (3 Month USD LIBOR + 480 bps) due 11/24/255,6 | 200,000 | 199,556 |

| Carlyle Global Market Strategies CLO Ltd. | | |

2012-3A, due 10/04/286,8 | 250,000 | 188,069 |

| Cerberus Onshore II CLO LLC | | |

2014-1A, 5.36% (3 Month USD LIBOR + 400 bps) due 10/15/235,6 | 136,560 | 136,382 |

| Atlas Senior Loan Fund II Ltd. | | |

2012-2A, due 01/30/246,8 | 250,000 | 132,951 |

| West CLO Ltd. | | |

2013-1A, due 11/07/256,8 | 250,000 | 127,258 |

| Great Lakes CLO Ltd. | | |

2014-1A, due 10/15/296,8 | 115,385 | 102,073 |

| DIVCORE CLO Ltd. | | |

2013-1A, 5.15% (1 Month USD LIBOR + 390 bps) due 11/15/325,6 | 53,290 | 53,270 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 27| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

ASSET-BACKED SECURITIES†† – 4.5% (continued) | | |

Collateralized Loan Obligations – 4.2% (continued) | | |

| Gramercy Park CLO Ltd. | | |

2012-1A, due 07/17/236,8 | $ 250,000 | $ 8,301 |

Total Collateralized Loan Obligations | | 16,931,328 |

Collateralized Debt Obligations – 0.3% | | |

| N-Star REL CDO VIII Ltd. | | |

2006-8A, 1.59% (1 Month USD LIBOR + 36 bps) due 02/01/415,6 | 798,688 | 796,594 |

| Highland Park CDO I Ltd. | | |

2006-1A, 1.86% (3 Month USD LIBOR + 40 bps) due 11/25/515,12 | 116,203 | 111,057 |

| Pasadena CDO Ltd. | | |

2002-1A, 2.18% (3 Month USD LIBOR + 85 bps) due 06/19/375,6 | 84,203 | 83,852 |

| Diversified Asset Securitization Holdings II, LP | | |

2000-1X, 1.81% (3 Month USD LIBOR + 49 bps) due 09/15/355 | 4,113 | 4,100 |

Total Collateralized Debt Obligations | | 995,603 |

Whole Business – 0.0% | | |

| Icon Brand Holdings LLC | | |

2012-1A, 4.23% due 01/25/436 | 161,088 | 148,315 |

Transport-Aircraft – 0.0% | | |

| Raspro Trust | | |

2005-1A, 1.73% (3 Month LIBOR + 40 bps) due 03/23/245,6 | 35,033 | 34,232 |

Total Asset-Backed Securities | | |

| (Cost $15,126,935) | | 18,109,478 |

SENIOR FLOATING RATE INTERESTS††,5 – 3.2% | | |

Technology – 1.3% | | |

| EIG Investors Corp. | | |

| 5.46% ((3 Month USD LIBOR + 400 bps) and (1 Month USD LIBOR + 400 bps)) | | |

due 02/09/2313 | 2,460,270 | 2,475,130 |

| TIBCO Software, Inc. | | |

| 4.85% (1 Month USD LIBOR + 350 bps) due 12/04/20 | 680,842 | 682,033 |

| Advanced Computer Software | | |

| 6.94% (3 Month USD LIBOR + 550 bps) due 03/18/22 | 484,705 | 479,252 |

| Lytx, Inc. | | |

8.10% (1 Month USD LIBOR + 675 bps) due 08/31/23†††,1 | 473,684 | 462,460 |

| Aspect Software, Inc. | | |

11.85% (1 Month USD LIBOR + 1050 bps) due 05/25/202 | 432,216 | 428,974 |

| Misys Ltd. | | |

| 4.98% (3 Month USD LIBOR + 350 bps) due 06/13/24 | 350,000 | 349,538 |

| First Data Corp. | | |

| 3.56% (1 Month USD LIBOR + 225 bps) due 04/26/24 | 233,089 | 233,047 |

| Quorum Business Solutions | | |

| 6.13% (3 Month USD LIBOR + 475 bps) due 08/07/21 | 205,088 | 202,525 |

See notes to financial statements.

28 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

SENIOR FLOATING RATE INTERESTS††,5 – 3.2% (continued) | | |

Technology – 1.3% (continued) | | |

| LegalZoom.com, Inc. | | |

| 5.94% (3 Month USD LIBOR + 450 bps) due 11/21/24 | $ 100,000 | $ 99,750 |

Total Technology | | 5,412,709 |

Consumer, Cyclical – 0.6% | | |

| Accuride Corp. | | |

| 8.15% (3 Month USD LIBOR + 700 bps) due 11/17/23 | 317,774 | 321,746 |

| 6.58% (3 Month USD LIBOR + 525 bps) due 11/17/23 | 300,000 | 303,750 |

| LA Fitness International LLC | | |

| 4.85% (1 Month USD LIBOR + 350 bps) due 07/01/20 | 361,657 | 366,630 |

| Toys ‘R’ US, Inc. | | |

| 8.10% (1 Month USD LIBOR + 675 bps) due 01/18/19 | 325,000 | 325,163 |

| Truck Hero, Inc. | | |

| 5.33% (3 Month USD LIBOR + 400 bps) due 04/22/24 | 319,375 | 318,976 |

| Sears Holdings Corp. | | |

| 5.85% (1 Month USD LIBOR + 450 bps) due 06/30/18 | 246,409 | 245,281 |

| Neiman Marcus Group, Inc. | | |

| 4.49% (1 Month USD LIBOR + 325 bps) due 10/25/20 | 241,228 | 196,533 |

| MX Holdings US, Inc. | | |

| 4.10% (1 Month USD LIBOR + 275 bps) due 08/14/23 | 147,022 | 147,941 |

Total Consumer, Cyclical | | 2,226,020 |

Consumer, Non-cyclical – 0.6% | | |

| PT Intermediate Holdings III LLC | | |

9.75% (Commercial Prime Lending Rate + 550 bps) due 06/23/22†††,1 | 1,262,250 | 1,262,250 |

| Springs Industries, Inc. | | |

7.81% (1 Month USD LIBOR + 650 bps) due 06/01/21†††,1 | 493,750 | 493,750 |

| American Tire Distributors, Inc. | | |

| 5.60% (1 Month USD LIBOR + 425 bps) due 09/01/21 | 290,399 | 292,214 |

| Certara, Inc. | | |

| 5.35% (1 Month USD LIBOR + 400 bps) due 08/15/24 | 150,000 | 151,125 |

| Targus Group International, Inc. | | |

14.00% (Commercial Prime Lending Rate + 1,050 bps) due 05/24/16†††,1,2,7,11 | 213,492 | – |

Total Consumer, Non-cyclical | | 2,199,339 |

Communications – 0.3% | | |

| TVC Albany, Inc. | | |

| 5.30% (3 Month USD LIBOR + 400 bps) due 09/18/24 | 500,000 | 501,250 |

| Market Track LLC | | |

| 5.58% (3 Month USD LIBOR + 425 bps) due 06/05/24 | 249,375 | 248,128 |

| Houghton Mifflin Co. | | |

| 4.35% (1 Month USD LIBOR + 300 bps) due 05/28/21 | 248,475 | 230,461 |

| Mcgraw-Hill Global Education Holdings LLC | | |

| 5.35% (1 Month USD LIBOR + 400 bps) due 05/04/22 | 199,244 | 199,351 |

Total Communications | | 1,179,190 |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 29| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

| | Face | |

| | Amount | Value |

SENIOR FLOATING RATE INTERESTS††,5 – 3.2% (continued) | | |

Industrial – 0.2% | | |

| Transdigm, Inc. | | |

4.33% (3 Month USD LIBOR + 300 bps) due 06/04/219 | $ 483,750 | $ 484,084 |

| Imagine Print Solutions LLC | | |

| 6.09% (3 Month USD LIBOR + 475 bps) due 06/21/22 | 199,000 | 193,030 |

| SI Organization | | |

| 6.08% (3 Month USD LIBOR + 475 bps) due 11/23/19 | 170,128 | 171,086 |

| NaNa Development Corp. | | |

| 8.08% (3 Month USD LIBOR + 675 bps) due 03/15/18 | 30,247 | 29,642 |

Total Industrial | | 877,842 |

Utilities – 0.1% | | |

| MRP Generation Holding | | |

| 8.33% (3 Month USD LIBOR + 700 bps) due 10/18/22 | 297,000 | 274,354 |

| Bhi Investments LLC | | |

| 5.83% (3 Month USD LIBOR + 450 bps) due 08/28/24 | 200,000 | 198,000 |

Total Utilities | | 472,354 |

Financial – 0.1% | | |

| Jane Street Group LLC | | |

| 5.88% ((2 Month USD LIBOR + 450 bps) and (3 Month USD LIBOR + 450 bps)) | | |

due 08/25/2213 | 400,000 | 403,000 |

Energy – 0.0% | | |

| PSS Companies | | |

| 5.83% (3 Month USD LIBOR + 450 bps) due 01/28/20 | 192,863 | 178,398 |

Total Senior Floating Rate Interests | | |

| (Cost $13,004,212) | | 12,948,852 |

COLLATERALIZED MORTGAGE OBLIGATION†† – 0.0% | | |

Residential Mortgage Backed Securities – 0.0% | | |

| Nomura Resecuritization Trust | | |

2012-1R, 1.38% (1 Month USD LIBOR + 44 bps) due 08/27/475,6 | 31,531 | 31,526 |

Total Collateralized Mortgage Obligation | | |

| (Cost $30,728) | | 31,526 |

Total Investments – 124.2% | | |

| (Cost $435,344,319) | | $ 504,557,926 |

Other Assets & Liabilities, net – (24.2)% | | (98,311,285) |

Total Net Assets – 100.0% | | $ 406,246,641 |

See notes to financial statements.

30 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

CENTRALLY CLEARED INTEREST RATE SWAP AGREEMENTS†† |

Counterparty Exchange | Floating Rate Type | Floating Rate Index | Fixed Rate | Payment Frequency | Maturity Date | Notional Amount | Market Value | Unrealized Gain (Loss) |

| Bank of America CME | Receive | 3 Month LIBOR | 1.64% | Semi-annual | 10/16/19 | $(57,000,000) | $313,057 | $313,057 |

| Merrill Lynch | | | | | | | | |

| Bank of America CME | Receive | 3 Month LIBOR | 1.46% | Semi-annual | 10/17/19 | (25,000,000) | 222,507 | 222,507 |

| Merrill Lynch | | | | | | | | |

| | | | | | | | | $535,564 |

| | |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs, unless otherwise noted — See Note 4. |

| †† | Value determined based on Level 2 inputs, unless otherwise noted — See Note 4. |

| ††† | Value determined based on Level 3 inputs — See Note 4. |

| 1 | Security was fair valued by the Valuation Committee at November 30, 2017. The total market value of fair valued securities amounts to $2,310,061, (cost $2,686,546) or 0.6% of total net assets. |

| 2 | Investment in an affiliated issuer. |

| 3 | Rate indicated is the 7 day yield as of November 30, 2017. |

| 4 | All or a portion of these securities have been physically segregated in connection with borrowings and reverse repurchase agreements. As of November 30, 2017, the total value of securities segregated was $260,713,561. |

| 5 | Variable rate security. The rate indicated is the rate effective at November 30, 2017. In some instances, the underlying reference rate shown was below the minimum rate earned by the security or has been adjusted by a predetermined factor. The settlement status of a position may also impact the effective rate indicated. In instances where multiple underlying reference rates and spread amounts are shown, the effective rate is based on a weighted average. |

| 6 | Security is a 144A or Section 4(a)(2) security. These securities have been determined to be liquid under guidelines established by the Board of Trustees. The total market value of 144A or Section 4(a)(2) securities is $23,961,116 (cost $20,800,356), or 5.9% of total net assets. |

| 7 | Security is in default of interest and/or principal obligations. |

| 8 | Security has no stated coupon. However, it is expected to receive residual cash flow payments on defined deal dates. |

| 9 | Term loan interests in the Trust’s portfolio generally have variable rates. All or a portion of this security represents unsettled loan positions and may not have a stated coupon rate. |

| 10 | Taxable municipal bond issued as part of the Build America Bond program. |

| 11 | Payment-in-kind security. |

| 12 | Security is a 144A or Section 4(a)(2) security. These securities have been determined to be illiquid and restricted under guidelines established by the Board of Trustees. The total market value of 144A or Section 4(a)(2) illiquid and restricted securities is $202,267 (cost $601,534), or less than 0.1% of total net assets — See Note 12. |

| 13 | The effective rate shown is based on a weighted average of the underlying reference rates and spread amounts listed. |

| | |

| bps | Basis Points |

| CME | Chicago Mercantile Exchange |

| LIBOR | London Interbank Offered Rate |

See notes to financial statements.

GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT l 31| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |

See Sector Classification in Other Information section.

The following table summarizes the inputs used to value the Trust’s investments at November 30, 2017 (See Note 4 in the Notes to Financial Statements):

| | | | | | | | | | | | | |

| | | | | | Level 2 | | | Level 3 | | | | |

| | | | | | Significant | | | Significant | | | | |

| | | Level 1 | | | Observable | | | Unobservable | | | | |

Investments in Securities (Assets) | | Quoted Prices | | | Inputs | | | Inputs | | | Total | |

| Common Stocks | | $ | 291,494 | | | $ | $25,927 | | | $ | 91,601 | | | $ | 409,022 | |

| Money Market Fund | | | 5,380,621 | | | | – | | | | – | | | | 5,380,621 | |

| Municipal Bonds | | | – | | | | 449,387,134 | | | | – | | | | 449,387,134 | |

| Corporate Bonds | | | – | | | | 18,291,293 | | | | – | | | | 18,291,293 | |

| Asset-Backed Securities | | | – | | | | 18,109,478 | | | | – | | | | 18,109,478 | |

| Senior Floating Rate Interests | | | – | | | | 10,730,392 | | | | 2,218,460 | | | | 12,948,852 | |

| Collateralized Mortgage Obligations | | | – | | | | 31,526 | | | | – | | | | 31,526 | |

| Interest Rate Swap Agreements* | | | – | | | | 535,564 | | | | – | | | | 535,564 | |

Total Assets | | $ | 5,672,115 | | | $ | 497,111,314 | | | $ | 2,310,061 | | | $ | 505,093,490 | |

| | |

Investments in Securities (Liabilities) | | | | | | | | | | | | | | | | |

| Reverse Repurchase Agreements | | $ | – | | | $ | 59,660,979 | | | $ | – | | | $ | 59,660,979 | |

| Unfunded Loan Commitments | | | – | | | | – | | | | 209,202 | | | | 209,202 | |

Total Liabilities | | $ | – | | | $ | 59,660,979 | | | $ | 209,202 | | | $ | 59,870,181 | |

| * Interest rate swap agreements are reported as unrealized gain/loss at period end. | |

Please refer to the Schedule of Investments for a breakdown of investment type by industry category.

The following is a summary of the significant unobservable input used in the fair valuation of assets and liabilities categorized within the Level 3 of the fair value hierarchy:

| | | | | |

| | Ending Balance at | | | |

Category | 11/30/2017 | Valuation Technique | Unobservable Inputs | Input Range |

Assets: | | | | |

| Common Stocks | $ 56,865 | Enterprise Value | Valuation Multiple | 8.9x-8.9x |

| Common Stocks | 34,736 | Enterprise Value | Valuation Multiple | 7.8x-7.8x |

| Senior Floating Rate Interests | 1,724,710 | Model Price | Purchase Price | – |

| Senior Floating Rate Interests | 493,750 | Enterprise Value | Valuation Multiple | 9.8x-9.8x |

Total Assets | $2,310,061 | | | |

Liabilities: | | | | |

| Unfunded Loan Commitments | $ 209,202 | Model Price | Purchase Price | – |

Significant changes in valuation multiples or liquidation values would generally result in significant changes in the fair value of the security.

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. Transfers between valuation levels, if any, are in comparison to the valuation levels at the end of the previous fiscal year, and are effective using the fair value as of the end of the current fiscal period.

For the period ended November 30, 2017, there were no transfers between levels.

See notes to financial statements.

32 l GBAB l GUGGENHEIM TAXABLE MUNICIPAL MANAGED DURATION TRUST SEMIANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2017 |