UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22437

Guggenheim Build America Bonds Managed Duration Trust

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: May 31

Date of reporting period: June 1, 2014 – November 30, 2014

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/GBAB

... YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT THE GUGGENHEIM

BUILD AMERICA BONDS MANAGED DURATION TRUST

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com/gbab, you will find:

| · | Daily, weekly and monthly data on share prices, net asset values, distributions and more |

| · | Monthly portfolio overviews and performance analyses |

| · | Announcements, press releases and special notices |

| · | Fund and adviser contact information |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are continually updating and expanding shareholder information services on the Trust’s website in an ongoing effort to provide you with the most current information about how your Trust’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Trust.

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Build America Bonds Managed Duration Trust (the “Trust”). This report covers the Trust’s performance for the six-month period ended November 30, 2014.

The Trust’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. Under normal market conditions, the Trust invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in a diversified portfolio of taxable municipal securities known as Build America Bonds.

All Trust returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions.

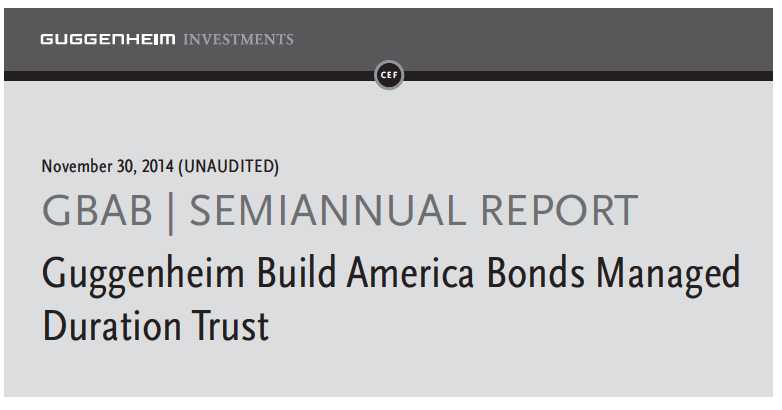

For the six-month period ended November 30, 2014, the Trust provided a total return based on market price of 5.09% and a total return based on NAV of 5.80%. As of November 30, 2014, the Trust’s market price of $21.94 per share represented a discount of 7.66% to its NAV of $23.76 per share. The market value of the Trust’s shares fluctuates from time to time and it may be higher or lower than the Trust’s NAV. NAV performance data reflects fees and expenses of the Trust.

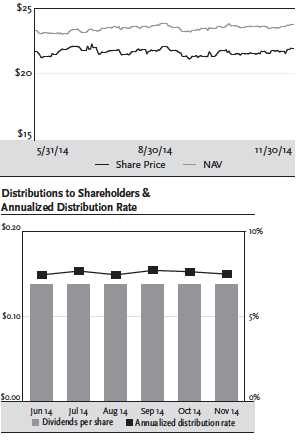

The Trust made a distribution of $0.13817 for each month of the period. This represents an annualized distribution rate of 7.56% based on the Trust’s closing market price of $21.94 on November 30, 2014.

Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”) serves as the investment adviser to the Trust. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Trust’s investment sub-adviser and is responsible for the management of the Trust’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Trust through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 36 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Trust purchased in the market at a price less than NAV. Conversely, when the market price of the Trust’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share of 95% of the market price per share. The DRIP provides a cost effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Trust endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Trust shares when the share price is lower than when the price is higher.

To learn more about the Trust’s performance and investment strategy for the semiannual period ended November 30, 2014, we encourage you to read the Questions & Answers section of this report, which begins on page 4. We are honored that you have chosen the Guggenheim Build America Bonds Managed Duration Trust as part of your investment portfolio. For the most up-to-date information regarding your investment, please visit the Trust’s website at guggenheiminvestments.com/gbab.

Sincerely,

Donald C. Cacciapaglia

President and Chief Executive Officer

Guggenheim Build America Bonds Duration Trust

December 31, 2014

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 3

| QUESTIONS & ANSWERS | November 30, 2014 |

Guggenheim Build America Bonds Managed Duration Trust (the “Trust”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”). This team includes B. Scott Minerd, Chairman of Investments and Global Chief Investment Officer; Anne B. Walsh, CFA, JD, Senior Managing Director; and James E. Pass, Senior Managing Director. In the following interview, the investment team discusses the market environment and the Trust’s strategy and performance for the six-month period ended November 30, 2014.

What were the most important developments in the Trust over the past six months?

The Trust’s performance remained strong for the period, as interest rates remained low and spreads continued to contract. The Trust’s market price return experienced excess performance for the period, outperforming its benchmark, the Bank of America Merrill Lynch Build America Bond Index, by 31 basis points, and many other sectors of the bond market. The Trust during the period entered into interest rate swaps to help manage the cost of leverage and, indirectly, to manage duration. One issue facing the Build American Bonds (“BABs”) market is the reduction in the federal government subsidy to issuers. The 35% subsidy in effect when the bonds were first issued was reduced with the sequestration in 2013. For fiscal 2015, the subsidy is 27.5%. Thus far, the lower subsidy has not negatively affected the BABs market.

What is the Trust’s investment objective and how is it pursued?

The Trust’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in a diversified portfolio of taxable municipal securities known as Build America Bonds or BABs. Under normal market conditions, the Trust invests at least 80% of its managed assets (net assets plus leverage) (“managed assets”) in BABs. The Trust may invest up to 20% of its managed assets in securities other than BABs, including taxable municipal securities that do not qualify for federal subsidy payments under the American Recovery and Reinvestment Act of 2009 (the “Act”), municipal securities, the interest income from which is exempt from regular federal income tax (sometimes referred to as “tax-exempt municipal securities”), asset-backed securities (“ABS”), senior loans and other income-producing securities.

At least 80% of the Trust’s Managed Assets are invested in securities that, at the time of investment, are investment grade quality. The Trust may invest up to 20% of its Managed Assets in securities that, at the time of investment, are below investment grade quality. Securities of below investment grade quality are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. The Trust does not invest more than 25% of its Managed Assets in municipal securities in any one state of origin or more than 15% of its Managed Assets in municipal securities that, at the time of investment, are illiquid.

BABs are taxable municipal securities that include bonds issued by state and local governments to finance capital projects such as public schools, roads, transportation infrastructure, bridges, ports and public buildings, pursuant to the Act. In contrast to traditional municipal bonds, interest received on BABs is subject to federal income tax and may be subject to state income tax. However, issuers of Direct Payment BABs are eligible to receive a subsidy from the U.S. Treasury of up to 35% of the interest paid on the bonds, allowing such issuers to issue BABs that pay interest rates that are competitive with the rates typically paid by private bond issuers in the taxable fixed-income market.

The Sub-Adviser employs investment and trading strategies to seek to maintain the leverage-adjusted duration of the Trust’s portfolio to generally less than 10 years. At November 30, 2014 the Trust’s duration was approximately 9 years. (Duration is a measure of a bond’s price sensitivity to changes in interest rates, expressed in years. Duration is a weighted average of the times that interest payments and the final return of principal are received. The weights are the amounts of the payments discounted by the yield to maturity of the bond.)

In addition, the Sub-Adviser may seek to manage the duration of the Trust’s portfolio through the use of derivative instruments, including U.S. Treasury swaps, credit default swaps, total return swaps and futures contracts, in an attempt to reduce the overall volatility of the Trust’s portfolio to changes in market interest rates. As noted, the Sub-Adviser did use such derivative instruments to manage the duration of the Trust’s portfolio during the period. The Sub-Adviser may seek to manage the Trust’s duration in a flexible and opportunistic manner based primarily on then-current market conditions and interest rate levels. The Trust may incur costs in implementing the duration management strategy, but such strategy will seek to reduce the volatility of the Trust’s portfolio.

What were the significant events affecting the economy and market environment over the past six months?

The U.S. economy continued to grow through the six months ended November 30, 2014, despite some seasonal volatility in September and October that caused spreads in leveraged credit to widen and upward momentum in U.S. stocks to deteriorate. By the end of October, the spread widening had reversed and equities regained their footing, with some key indices shooting to new highs. Markets similarly overcame a weather-related winter soft patch in the first quarter of 2014. The benchmark U.S. 10 year Treasury rate declined from 2.5% to 2.165% over the period, a positive stimulant to continued economic expansion.

4 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| QUESTIONS & ANSWERS continued | November 30, 2014 |

U.S. economic data remain strong, with the third quarter’s 3.5% GDP growth signaling that the economy was doing well across the spectrum. Among the highlights: strong net exports, unemployment that had fallen faster than expected and consumer confidence that was at seven year highs. The fact that government at the state and local level was contributing to GDP growth suggested that a major headwind for the economy—contracting government spending—has gone away. While falling oil prices are helping consumer spending in the near term, they could be signaling that the global economy is not growing fast enough.

The U.S. is adding close to 225,000 jobs per month on average in 2014, considerably more than 2013’s monthly average of 194,000. Employment levels are transitioning from the recovery phase to the expansion phase, which typically coincides with accelerating economic activity. The downward trend in labor force participation has begun to flatten and, as fewer people leave the workforce, the rapid decline in the nation’s unemployment rate could begin to slow. Until unemployment falls below 5.5%, it’s unlikely that the U.S. economy will experience the kind of meaningful wage pressure that would spur action by the Federal Reserve (the “Fed”). An improving labor market, subdued mortgage rates, and tight housing inventory all point to a rebound in the housing market.

The economies of Europe and Asia continue to deteriorate. The ECB is attempting to inject liquidity into the system, as their current program is not large enough to boost growth. Germany just barely avoided a recession in the third quarter. The Japanese economy is now officially in a recession. The first two arrows of Abenomics, monetary accommodation and fiscal stimulus, were relatively easy, but the third arrow of structural reform has been much more elusive.

Overseas geopolitical concerns and comparatively attractive yields have pushed global investors to U.S. Treasuries. Such “beggar thy neighbor” policies from Europe and Asia were a driving force behind the most recent rally in U.S. fixed income, and indicate that U.S. long-term rate should continue to be well supported. Momentum in the U.S. continued into the fourth quarter, with December’s seasonal effects and the boost from declining fuel prices. Fed tightening expectations continue to decrease on the back of concerns about a global growth slowdown.

How did the Trust perform for the six months ended November 30, 2014?

All Trust returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2014, the Trust provided a total return based on market price of 5.09% and a total return based on NAV of 5.80%. As of November 30, 2014, the Trust’s market price of $21.94 per share represented a discount of 7.66% to its NAV of $23.76 per share. As of May 31, 2014, the Trust’s market price of $21.69 per share represented a discount of 6.75% to its NAV of $23.26 per share. The market value of the Trust’s shares fluctuates from time to time and it may be higher or lower than the Trust’s NAV. NAV performance data reflects fees and expenses of the Trust.

The Trust made a distribution of $0.13817 for each month of the period. This represents an annualized distribution rate of 7.56% based on the Trust’s closing market price of $21.94 on November 30, 2014. The Trust’s distribution rate is not constant and is subject to change based on the performance of the Trust.

Month | Distribution per Share |

June 2014 | $0.13817 |

July | $0.13817 |

August | $0.13817 |

September | $0.13817 |

October | $0.13817 |

November | $0.13817 |

Total | $0.82902 |

How did other markets perform in this environment?

The return of the Bank of America Merrill Lynch Build America Bond Index was 4.78% for the six months ended November 30, 2014. In other fixed income sectors, the Barclays U.S. Aggregate Bond Index returned 1.92% for the period, while the Barclays U.S. Corporate High Yield Index returned -0.60%. The Credit Suisse Leveraged Loan Index return was 1.02%.

What factors affected Trust performance during the six-month period ended November 30, 2014?

Contracting taxable municipal spreads, including BAB spreads, was the main contributor to performance for the period, despite the third-quarter sell-off in high yield bonds. The Trust benefited from good credit selection as part of its bottom-up, downside-protection-led approach. The Trust was helped by attractive risk-adjusted investment opportunities in the A rated category of taxable municipals, as well as in certain story bonds as long as strong legal covenants were present.

The portfolio continues to deal with some price movement of BABs and Qualified School Construction Bonds (“QSCBs”) due to the potential for refinancing in these sectors. Certain issuers have elected to refinance outstanding BABs at par as a result of sequestration and lower expense subsidy. Nonetheless, refunding volume, as the Sub-Adviser expected, was limited and did not materially impact the BABs market during the period. Nonetheless, we expect more issuers to review their BABs and other direct payment indentures for refinancing alternatives as sequestration continues to have an impact on the market.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 5

| QUESTIONS & ANSWERS continued | November 30, 2014 |

In the non-BABs component of the portfolio, the sell-off in high yield in the third quarter was the biggest factor affecting performance. Over the quarter, for example, high-yield bonds fell by 1.9 percent, with CCC bonds underperforming higher rated BB bonds and B bonds by 200 basis points and 150 basis points, respectively. We continue to see opportunity for strong returns in the high yield market, though we are conscious of a larger number of issues coming to market that exhibit lower credit quality and weaker security structures.

The lowest quality credits remain highly vulnerable to volatility in the current environment. The Trust took opportunities during the sell-off to carefully analyze bonds we believed may have been oversold and trading below fair value. We remain positive on credit, but with the potential for more volatility ahead, we continued to gradually move up in quality.

The Trust’s exposure to floating rate assets (primarily bank loans) acted as a buffer to market volatility and their position higher in the capital structure makes them a defensive asset class during periods of market/interest rate volatility. They function as an attractive asset as the credit cycle changes, particularly as interest rates rise. The loan market benefited from strong institutional demand from collateralized loan obligations (“CLOs”) and loan funds over much of the period. For example, CLO issuance is ahead of 2013 full-year volume and has already set a new annual record.

Discuss Trust asset allocation for the six-month period ended November 30, 2014?

As of November 30, 2014, approximately 81% of the Trust’s long-term investments were in the taxable municipal sector, including BABs and QSCBs, which are qualifying investments for purposes of the Trust’s policy of investing at least 80% of its managed assets in BABs. The rest of the Trust’s assets, approximately 19% of the Trust’s long-term investments, were invested in non-BABs securities. These include asset-backed securities, bank loans, corporate bonds (including high yield bonds) and other securities, by which the Trust was able to add incremental yield.

The most significant change within non-BABs over the period was a decrease in below-investment-grade corporate debt, as the Trust sold high yield securities given rich valuations and weak legal covenants. The Trust also sold some bank loans for similar reasons, but continued adding new bank loans for their floating rate feature that helped spread duration decline. The Trust also increased floating rate exposure to better align the non-BABs portion of the Trust with funding costs.

The Trust believes there is sufficient liquidity within non-BABs holdings to manage a decline in the value of BABs holdings, in the event an increase in interest rates causes BABs prices to decline enough to approach the 80% minimum.

What is the Trust’s leverage strategy?

Since leverage adds to performance when the cost of leverage is less than the total return generated by investments, the use of leverage contributed to the Trust’s total return during this period. The Trust utilizes leverage (borrowing) as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged. Leverage will not exceed 33 1/ 3% of the Trust’s Managed Assets.

As of November 30, 2014, the Trust’s leverage was approximately 25% of Managed Assets. The Trust currently employs leverage through reverse repurchase agreements with at least three different counterparties and a credit facility with a major bank. We have been notified that the bank plans to terminate this facility. The Trust is taking steps to substitute the line of credit with another provider.

There is no guarantee that the Trust’s leverage strategy will be successful. The Trust’s use of leverage may cause the Trust’s NAV and market price of common shares to be more volatile and can magnify the effect of any losses.

Why did the Trust accrue excise tax during the period?

While the Trust generally intends to distribute income and capital gains in the manner necessary to minimize imposition of the 4% excise tax imposed on a registered investment company that does not distribute by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on October 31 of the calendar year (unless an election is made to use the fund’s fiscal year), there can be no assurance that sufficient amounts of the Trust’s taxable income and capital gain will be distributed to entirely avoid the imposition of the excise tax. In certain circumstances, the Trust may elect to retain income or capital gain and pay the excise tax on such undistributed amount, to the extent that the Board of Trustees, in consultation with Trust management, determines it to be in the best interest of shareholders at that time.

What is the current outlook for the taxable municipal sector that includes Build America Bonds?

The creation of BABs in 2009 helped issuance of taxable municipal bonds exceed $84 billion in 2009 and $100 billion in 2010, but since the BAB program was allowed to expire, issuance has fallen to historical figures, approximately $30-$35 billion per year, or about 10% of total municipal issuance.

6 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| QUESTIONS & ANSWERS continued | November 30, 2014 |

As investors begin to look towards 2015, low yields and tight credit spreads have created a market environment with little room for error. Taxable issuance should remain muted next year. With limited issuance and the fact that municipal defaults continue to remain low, attractive risk-adjusted investment opportunities do exist, but remain limited as technical issues continue to support this market segment. Potential for increased volatility remains high due to macroeconomic issues and geopolitical concerns. With the end of quantitative easing, municipals generally should move in concert with Treasury price movements, given global economic concerns and accommodative Fed policies.

Index Definitions:

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The Barclays U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays U.S. Corporate High Yield Index is an unmanaged index of below investment grade bonds issued by U.S. corporations.

The Credit Suisse Leveraged Loan Index is an index designed to mirror the investable universe of the $US-denominated leveraged loan market.

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. There can be no assurance that the Trust will achieve its investment objectives. The value of the Trust will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

Please see guggenheiminvestments.com/ggm for a detailed discussion of the Trust’s risks and considerations.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 7

| TRUST SUMMARY (Unaudited) | November 30, 2014 |

Fund Statistics | |

Share Price | $21.94 |

Net Asset Value | $23.76 |

Discount to NAV | -7.66% |

Net Assets ($000) | $413,765 |

AVERAGE ANNUAL TOTAL RETURNS FOR THE |

PERIOD ENDED NOVEMBER 30, 2014 | | |

| | Six | | | Since |

| | Months | One | Three | Inception |

| | (non-annualized) | Year | Year | (10/28/10) |

Guggenheim Build America Bonds Managed Duration Trust | |

NAV | 5.80% | 17.04% | 10.11% | 12.76% |

Market | 5.09% | 23.60% | 9.41% | 9.77% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. The NAV total returns reflect the Trust’s total annual expenses. For the most recent month-end performance figures, please visit guggenheiminvestments.com/gbab. The investment return and principal value of an investment will fluctuate with changes in the market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

Holdings Diversification | |

(Market Exposure as % of Net Assets) | |

Investments | % of Net Assets |

Investments: | |

Municipal Bond | 108.3% |

Asset Backed Securities | 8.7% |

Senior Floating Rate Interests | 5.3% |

Corporate Bonds | 4.3% |

Preferred Stocks | 1.8% |

Collateralized Mortgage Obligation | 0.3% |

Money Market Fund | 0.1% |

Other | 0.0%* |

Total Investments | 128.8% |

Other Assets & Liabilities, net | -28.8% |

Net Assets | 100.0% |

*Less than 0.1% | |

Ten Largest Holdings | |

(% of Total Net Assets) | |

State of West Virginia, Higher Education Policy Commission, | |

Revenue Bonds, Federally Taxable Build America Bonds 2010 | 3.5% |

New Jersey Turnpike Authority, Turnpike Revenue Bonds, | |

Federally Taxable Issuer Subsidy, Build America Bonds | 3.4% |

Dallas, Texas, Convention Center Hotel Development | |

Corporation, Hotel Revenue Bonds, Taxable Build | |

America Bonds | 3.2% |

California, General Obligation Bonds, Various Purpose, | |

Taxable Build America Bonds | 3.0% |

Los Angeles, California, Department of Water & Power | |

Revenue, Taxable Build America Bonds | 3.0% |

Westchester County Health Care Corporation, Revenue | |

Bonds, Taxable Build America Bonds | 2.9% |

Los Angeles, California, Department of Water & Power | |

Revenue, Taxable Build America Bonds | 2.9% |

Noblesville Multi-School Building Corporation, Hamilton | |

County, Indiana, Taxable Unlimited Ad Valorem Property | |

Tax First Mortgage Bonds, Build America Bonds | 2.9% |

El Paso, Texas, Combination Tax and Revenue Certification | |

of Obligation, Taxable Build America Bonds | 2.9% |

Miami-Dade County, Florida, Transit Sales Surtax Revenue, | |

Taxable Build America Bonds | 2.8% |

Top Ten Total | 30.5% |

Share Price & NAV History

8 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2014 |

| | Shares | Value |

COMMON STOCKS† - 0.0%** | | |

Communications - 0.0%** | | |

Cengage Learning Acquisitions, Inc.* | 3,457 | $ 91,403 |

Basic Materials - 0.0%** | | |

Mirabela Nickel Ltd.* | 335,401 | 9,987 |

Consumer, Cyclical - 0.0% | | |

Global Aviation Holdings, Inc. — Class A*,†††,1,6 | 6,232 | 1 |

Total Common Stocks | | |

(Cost $196,350) | | 101,391 |

PREFERRED STOCKS† - 1.8% | | |

Seaspan Corp. | | |

9.50%2 | 200,000 | 5,318,000 |

Falcons Funding Trust I | | |

8.88%2,3,4,6 | 1,900 | 1,939,900 |

GSC Partners CDO Fund Limited / GSC Partners CDO Fund Corp. | |

0.00% due 11/20/16*,3,4 | 475 | 8,759 |

WhiteHorse II Ltd. | | |

0.00% due 06/15/17*,3,4,6 | 200,000 | 2,000 |

Total Preferred Stocks | | |

(Cost $6,961,640) | | 7,268,659 |

WARRANTS††† - 0.0%** | | |

Alion Science & Technology Corp. | | |

03/15/17 | 1,550 | – |

Total Warrants | | |

(Cost $16) | | – |

MONEY MARKET FUND† - 0.1% | | |

Dreyfus Treasury Prime Cash Management Institutional Shares | 213,382 | 213,382 |

Total Money Market Fund | | |

(Cost $213,382) | | 213,382 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† - 108.3% | | |

California - 22.4% | | |

Los Angeles, California, Department of Water & Power | | |

Revenue, Taxable Build America Bonds | | |

7.00% due 07/01/417 | $ 10,000,000 | $ 12,231,000 |

7.00% due 07/01/417 | 10,000,000 | 12,001,100 |

Santa Ana Unified School District, California, General | | |

Obligation Bonds, Federal Taxable Build America Bonds | | |

7.10% due 08/01/407 | 7,755,000 | 10,197,282 |

6.80% due 08/01/307 | 2,245,000 | 2,816,308 |

California, General Obligation Bonds, Various Purpose, | | |

Taxable Build America Bonds | | |

7.70% due 11/01/307 | 10,000,000 | 12,597,899 |

Oakland Unified School District, County of Alameda, | | |

California, Taxable General Obligation Bonds, Election of | | |

2006, Qualified School Construction Bonds, Series 2012B | | |

6.88% due 08/01/336 | 10,000,000 | 10,499,300 |

Long Beach Unified School District, California, Qualified | | |

School Construction Bonds, Federally Taxable, Election of | | |

2008, General Obligation Bonds | | |

5.91% due 08/01/256 | 7,500,000 | 8,877,375 |

Metropolitan Water District, Southern California, Water | | |

Revenue Bonds, 2010 Authorization, Taxable Build | | |

America Bonds | | |

6.95% due 07/01/407 | 5,000,000 | 6,000,950 |

Riverside Community College District, Riverside County, | | |

California, Election of 2004 General Obligation Bonds, | | |

Taxable Build America Bonds | | |

7.02% due 08/01/407 | 5,000,000 | 5,739,150 |

Sonoma Valley Unified School District, General Obligation, | | |

Federally Taxable Bonds | | |

7.12% due 08/01/286 | 3,330,000 | 3,858,671 |

Culver City Redevelopment Agency, California, Taxable Tax | | |

Allocation Bonds, Culver City Redevelopment Project | | |

8.00% due 11/01/206 | 3,000,000 | 3,336,990 |

Monrovia Unified School District, Los Angeles County, | | |

California, Election of 2006 General Obligation Bonds, | | |

Build America Bonds, Federally Taxable | | |

7.25% due 08/01/286,7 | 1,025,000 | 1,224,803 |

Cypress Elementary School District (Orange County, | | |

California), General Obligation Bonds, Direct Pay | | |

Qualified School Construction Bonds, 2008 Election | | |

6.65% due 08/01/256 | 660,000 | 739,662 |

6.05% due 08/01/216 | 340,000 | 371,572 |

Placentia-Yorba Linda Unified School District (Orange | | |

County, California), General Obligation Bonds, Federally | | |

Taxable Direct-Pay Qualified School Construction Bonds, | | |

Election of 2008 | | |

5.40% due 02/01/266 | 1,000,000 | 1,087,310 |

Alhambra Unified School District, Elementary Schools | | |

Improvement District, Los Angeles County, California, | | |

Election of 2008 General Obligation Bonds, Federally Taxable | | |

6.70% due 02/01/266 | 500,000 | 582,225 |

Total California | | 92,161,597 |

Illinois - 10.6% | | |

Northern Illinois University, Auxiliary Facilities System | | |

Revenue Bonds, Build America Program, Taxable | | |

8.15% due 04/01/417 | 5,000,000 | 5,920,050 |

7.95% due 04/01/356,7 | 4,500,000 | 5,304,330 |

Chicago, Illinois, Second Lien Wastewater Transmission | | |

Revenue Project Bonds, Taxable Build America Bonds | | |

6.90% due 01/01/407 | 5,100,000 | 6,741,078 |

Illinois, General Obligation Bonds, Taxable Build | | |

America Bonds | | |

7.35% due 07/01/357 | 5,000,000 | 5,841,800 |

Chicago, Illinois, Board of Education, Unlimited Tax General | | |

Obligation Bonds, Dedicated Revenues, Taxable Build | | |

America Bonds | | |

6.52% due 12/01/406,7 | 5,000,000 | 5,131,850 |

County of Cook Illinois General Obligation Unlimited | | |

6.22% due 11/15/346 | 4,210,000 | 4,664,932 |

Chicago, Illinois, Second Lien Water Revenue Bonds, | | |

Taxable Build America Bonds | | |

6.74% due 11/01/406,7 | 2,990,000 | 3,894,236 |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 9

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† - 108.3% (continued) | | |

Illinois - 10.6% (continued) | | |

Southwestern Illinois, Development Authority, Taxable | | |

Local Government, Program Revenue Bonds, Flood | | |

Prevention District Council Project, Recovery Zone | | |

Economic Development Bonds | | |

7.23% due 10/15/356 | $ 3,000,000 | $ 3,386,520 |

Southwestern Illinois, Development Authority, Taxable | | |

Local Government, Program Revenue Bonds, Flood | | |

Prevention District Project, Build America Bonds | | |

7.03% due 04/15/326,7 | 2,000,000 | 2,238,280 |

State of Illinois General Obligation Unlimited | | |

6.63% due 02/01/35 | 930,000 | 1,032,412 |

6.73% due 04/01/35 | 200,000 | 223,108 |

Total Illinois | | 44,378,596 |

Washington - 10.0% | | |

Washington State University, Housing and Dining System | | |

Revenue Bonds, Taxable Build America Bonds | | |

7.40% due 04/01/416,7 | 6,675,000 | 9,507,669 |

7.10% due 04/01/326,7 | 3,325,000 | 4,397,845 |

Public Hospital District No. 1, King County, Washington, | | |

Valley Medical Center, Hospital Facilities Revenue Bonds | | |

8.00% due 06/15/406 | 5,800,000 | 6,591,178 |

Washington State Convention Center Public Facilities | | |

District, Lodging Tax Bonds, Taxable Build America Bonds | | |

6.79% due 07/01/407 | 5,000,000 | 6,249,700 |

Central Washington University, System Revenue Bonds, 2010, | | |

Taxable Build America Bonds | | |

6.50% due 05/01/306,7 | 5,000,000 | 6,228,200 |

Anacortes, Washington, Utility System Improvement | | |

Revenue Bonds, Build America Bonds | | |

6.48% due 12/01/306,7 | 5,000,000 | 5,860,500 |

Auburn, Washington, Utility System Revenue Bonds, | | |

Taxable Build America Bonds | | |

6.40% due 12/01/306,7 | 2,000,000 | 2,237,040 |

Total Washington | | 41,072,132 |

New Jersey - 6.3% | | |

New Jersey Turnpike Authority, Turnpike Revenue Bonds, | | |

Federally Taxable Issuer Subsidy, Build America Bonds | | |

7.10% due 01/01/417 | 10,000,000 | 14,250,700 |

Camden County Improvement Authority, Camden County, | | |

New Jersey, Lease Revenue Bonds, Cooper Medical School | | |

of Rowan University Project | | |

7.75% due 07/01/346 | 8,000,000 | 9,547,600 |

7.85% due 07/01/356 | 2,000,000 | 2,385,780 |

Total New Jersey | | 26,184,080 |

Michigan - 6.2% | | |

Detroit, Michigan, School District, School Building and Site | | |

Bonds, Unlimited Tax General Obligation Bonds, Taxable | | |

Build America Bonds, | | |

6.85% due 05/01/406,7 | 5,000,000 | 5,329,800 |

Whitehall District Schools, Muskegon County, Michigan, | | |

2010 School Building and Site Bonds, General Obligation, | | |

Unlimited Tax Bonds, Taxable Qualified School | | |

Construction Bonds | | |

6.10% due 05/01/266 | 2,500,000 | 2,716,675 |

6.50% due 05/01/296 | 2,000,000 | 2,179,400 |

Detroit City School District General Obligation Unlimited | | |

7.74% due 05/01/396 | 2,640,000 | 3,460,644 |

Fraser Public School District, Macomb County, Michigan, | | |

General Obligation Federally Taxable School Construction | | |

Bonds, 2011 School Building and Site Bonds | | |

6.05% due 05/01/266 | 3,000,000 | 3,374,940 |

Detroit, Michigan, School District, School Building and Site | | |

Bonds, Unlimited Tax General Obligation Bonds, Taxable | | |

Qualified School Construction Bonds | | |

6.65% due 05/01/296 | 2,640,000 | 3,099,782 |

City of Detroit Michigan Water Supply System Revenue | | |

Revenue Bonds | | |

5.00% due 07/01/41 | 1,555,000 | 1,625,799 |

Michigan Finance Authority Revenue Bonds | | |

5.00% due 07/01/31 | 600,000 | 667,008 |

5.00% due 07/01/32 | 400,000 | 442,964 |

5.00% due 07/01/33 | 200,000 | 220,632 |

Oakridge, Michigan, Public Schools, Unlimited Tax General | | |

Obligation Bonds | | |

6.75% due 05/01/263,6 | 1,000,000 | 1,083,230 |

City of Detroit Michigan General Obligation Unlimited | | |

3.49% due 10/07/166 | 1,000,000 | 1,000,000 |

Comstock Park Public Schools, Kent County, Michigan, 2011 | | |

School Building and Site Bonds, General Obligation - | | |

Unlimited Tax, Federally Taxable - Qualified School | | |

Construction Bonds - Direct Payment | | |

6.30% due 05/01/266 | 415,000 | 453,471 |

Total Michigan | | 25,654,345 |

Indiana - 6.2% | | |

Noblesville Multi-School Building Corporation, Hamilton | | |

County, Indiana, Taxable Unlimited Ad Valorem Property Tax | | |

First Mortgage Bonds, Build America Bonds | | |

6.50% due 07/15/307 | 10,000,000 | 11,858,500 |

Evansville-Vanderburgh Independent School Building | | |

Corporation, Unlimited Taxable Ad Valorem Property Tax | | |

First Mortgage Bonds | | |

6.50% due 01/15/306 | 8,690,000 | 10,489,438 |

Knox County, Indiana, Good Samaritan Hospital Project, | | |

Taxable Economic Development Revenue Bonds, Qualified | | |

Energy Conservation Bonds - Direct Payment, Series 2012B | | |

5.90% due 04/01/346 | 3,000,000 | 3,278,640 |

Total Indiana | | 25,626,578 |

See notes to financial statements.

10 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† - 108.3% (continued) | | |

Texas - 6.0% | | |

Dallas, Texas, Convention Center Hotel Development | | |

Corporation, Hotel Revenue Bonds, Taxable Build | | |

America Bonds | | |

7.09% due 01/01/426,7 | $ 10,000,000 | $ 13,130,800 |

El Paso, Texas, Combination Tax and Revenue Certification | | |

of Obligation, Taxable Build America Bonds | | |

6.70% due 08/15/366,7 | 10,000,000 | 11,851,400 |

Total Texas | | 24,982,200 |

New York - 5.9% | | |

Metropolitan Transportation Authority, New York, | | |

Transportation Revenue Bonds, Taxable Build | | |

America Bonds | | |

6.55% due 11/15/317 | 5,000,000 | 6,489,000 |

7.13% due 11/15/307 | 5,000,000 | 6,066,250 |

Westchester County Health Care Corporation, Revenue | | |

Bonds, Taxable Build America Bonds | | |

8.57% due 11/01/406,7 | 10,000,000 | 12,033,600 |

Total New York | | 24,588,850 |

Florida - 4.2% | | |

Miami-Dade County, Florida, Transit Sales Surtax Revenue, | | |

Taxable Build America Bonds | | |

6.91% due 07/01/396,7 | 10,000,000 | 11,494,300 |

Orlando, Florida, Community Redevelopment Agency, | | |

Taxable Tax Increment Revenue Build America Bonds | | |

7.78% due 09/01/406,7 | 5,000,000 | 5,825,800 |

Total Florida | | 17,320,100 |

Pennsylvania - 4.1% | | |

Pittsburgh, Pennsylvania, School District, Taxable Qualified | | |

School Construction Bonds | | |

6.85% due 09/01/296 | 6,870,000 | 8,933,061 |

Lebanon, Pennsylvania, Sewer Revenue Bonds, Taxable Build | | |

America Bonds | | |

7.14% due 12/15/356,7 | 4,865,000 | 5,642,524 |

School District of Philadelphia, Pennsylvania, General | | |

Obligation Bonds, Series 2011A, Qualified School | | |

Construction Bonds - (Federally Taxable - Direct Subsidy) | | |

6.00% due 09/01/306 | 2,380,000 | 2,549,623 |

Total Pennsylvania | | 17,125,208 |

West Virginia - 3.5% | | |

State of West Virginia, Higher Education Policy Commission, | | |

Revenue Bonds, Federally Taxable Build America Bonds 2010 | | |

7.65% due 04/01/407 | 10,000,000 | 14,532,300 |

Ohio - 3.2% | | |

American Municipal Power, Inc., Combined Hydroelectric | | |

Projects Revenue Bonds, New Clean Renewable | | |

Energy Bonds | | |

7.33% due 02/15/286 | 5,000,000 | 6,566,650 |

Madison Local School District, Richland County, Ohio, | | |

School Improvement, Taxable Qualified School | | |

Construction Bonds | | |

6.65% due 12/01/296 | 2,500,000 | 2,897,550 |

Cuyahoga County, Ohio, Hospital Revenue Bonds, The | | |

Metrohealth System, Build America Bonds, Taxable | | |

8.22% due 02/15/406,7 | 1,950,000 | 2,387,132 |

Toronto City School District, Ohio, Qualified School | | |

Construction Bonds General Obligation Bonds | | |

7.00% due 12/01/286 | 1,230,000 | 1,343,861 |

Total Ohio | | 13,195,193 |

Colorado - 2.9% | | |

Colorado, Building Excellent Schools Today, Certificates of | | |

Participation, Taxable Build America Bonds | | |

7.02% due 03/15/316,7 | 7,500,000 | 8,706,000 |

Colorado, Building Excellent Schools Today, Certificates of | | |

Participation, Taxable Qualified School Construction | | |

6.82% due 03/15/28 | 2,500,000 | 3,155,250 |

Total Colorado | | 11,861,250 |

Vermont - 2.7% | | |

Vermont State Colleges, Revenue Bonds, Taxable Build | | |

America Bonds | | |

7.21% due 07/01/406,7 | 7,500,000 | 8,728,425 |

6.10% due 07/01/256,7 | 2,155,000 | 2,451,528 |

Total Vermont | | 11,179,953 |

Alabama - 2.7% | | |

Alabama State University, General Tuition and Fee Revenue | | |

Bonds, Taxable Direct-Pay Build America Bonds | | |

7.20% due 09/01/386,7 | 5,000,000 | 5,503,800 |

7.10% due 09/01/356,7 | 3,000,000 | 3,293,760 |

7.25% due 09/01/406,7 | 2,000,000 | 2,204,340 |

Total Alabama | | 11,001,900 |

Nevada - 2.6% | | |

Nevada System of Higher Education University, Revenue | | |

Bonds, Build America Bonds | | |

7.90% due 07/01/407 | 5,050,000 | 5,846,941 |

7.60% due 07/01/307 | 1,500,000 | 1,719,585 |

Clark County, Nevada, Airport Revenue Bonds, Build | | |

America Bonds | | |

6.88% due 07/01/426,7 | 1,425,000 | 1,647,257 |

Las Vegas Valley Water District, Nevada, Limited Tax General | | |

Obligation Water Bonds, Taxable Build America Bonds | | |

7.10% due 06/01/396,7 | 1,200,000 | 1,379,976 |

Total Nevada | | 10,593,759 |

Louisiana - 2.3% | | |

Orleans Parish, School Board of the Parish of | | |

Orleans, Louisiana | | |

4.40% due 02/01/216 | 8,000,000 | 8,554,480 |

Tangipahoa Parish Hospital Service District No. 1, Louisiana, | | |

Taxable Hospital Revenue Bonds, North Oaks Health | | |

System Project, Build America Bonds | | |

7.20% due 02/01/427 | 1,055,000 | 1,137,111 |

Total Louisiana | | 9,691,591 |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 11

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† - 108.3% (continued) | | |

Mississippi - 1.9% | | |

Medical Center Educational Building Corporation, Taxable | | |

Build America Bonds, University of Mississippi Medical | | |

Center Facilities Expansion and Renovation Project | | |

6.84% due 06/01/356,7 | $ 5,000,000 | $ 5,928,000 |

Mississippi, Hospital Equipment and Facilities Authority, | | |

Taxable Build America Revenue Bonds, Forrest County | | |

General Hospital Project | | |

7.27% due 01/01/326,7 | 1,000,000 | 1,105,550 |

7.39% due 01/01/406,7 | 905,000 | 995,310 |

Total Mississippi | | 8,028,860 |

South Carolina - 1.6% | | |

Horry County, South Carolina, Taxable Airport Revenue Bonds, | | |

Recovery Zone Economic Development Bonds | | |

7.33% due 07/01/406 | 5,000,000 | 6,531,150 |

Georgia - 1.3% | | |

Georgia Municipal Association, Inc., Certificates of | | |

Participation, DeKalb County Public Schools Project | | |

5.21% due 12/01/226 | 5,000,000 | 5,581,550 |

South Dakota - 0.9% | | |

Pierre, South Dakota, Taxable Electric Revenue Bonds, | | |

Recovery Zone Economic Development Bonds | | |

7.50% due 12/15/406 | 3,490,000 | 3,811,289 |

Minnesota - 0.8% | | |

St. Paul Housing & Redevelopment Authority, Federally | | |

Taxable Revenue Bonds | | |

7.25% due 02/01/356 | 1,660,000 | 1,814,579 |

7.50% due 02/01/406 | 1,540,000 | 1,688,564 |

Total Minnesota | | 3,503,143 |

Total Municipal Bonds | | |

(Cost $375,104,688) | | 448,605,624 |

ASSET BACKED SECURITIES†† - 8.7% | | |

Churchill Financial Cayman Ltd. | | |

2007-1A, 1.48% due 07/10/193,4,6 | 2,000,000 | 1,913,800 |

2007-1A, 8.37% due 07/10/194,6 | 1,000,000 | 1,007,100 |

2007-1A, 2.83% due 07/10/193,4,6 | 1,000,000 | 937,300 |

Adams Outdoor Advertising, LP | | |

2010-1, 10.76% due 12/20/404,6 | 1,825,000 | 1,919,126 |

2010-1, 8.84% due 12/20/404,6 | 1,300,000 | 1,394,835 |

KVK CLO Ltd. | | |

2014-3A, 2.33% due 10/15/263,4 | 2,000,000 | 1,928,600 |

2014-3A, 3.23% due 10/15/263,4 | 1,000,000 | 958,000 |

Putnam Structured Product Funding 2003-1 Ltd. | | |

2008-1A, 0.60% due 10/15/383,4,6 | 2,592,281 | 2,487,034 |

THL Credit Wind River 2014-2 CLO Ltd. | | |

2014-2A, 2.39% due 07/15/263,4 | 1,000,000 | 964,700 |

2014-2A, 3.39% due 07/15/263,4 | 750,000 | 726,375 |

Gramercy Real Estate CDO 2007-1 Ltd. | | |

2007-1A, 0.51% due 08/15/563,4 | 1,868,833 | 1,652,049 |

N-Star REL CDO VIII Ltd. | | |

2006-8A, 0.51% due 02/01/413,4,6 | 1,500,000 | 1,335,450 |

SRERS Funding Ltd. | | |

2011-RS, 0.40% due 05/09/463,4 | 1,045,282 | 995,631 |

LSTAR Securities Investment Trust 2014-1 | | |

2014-1, 3.25% due 09/01/21†††,3,4 | 981,509 | 982,196 |

Anchorage Capital CLO 2012-1 Ltd. | | |

2012-1A, 3.03% due 01/13/253,4,6 | 1,000,000 | 971,100 |

Vega Containervessel plc | | |

2006-1A, 5.56% due 02/10/214,6 | 977,891 | 965,570 |

Atlas Senior Loan Fund IV Ltd. | | |

2014-2A, 2.93% due 02/17/263,4,6 | 1,000,000 | 943,800 |

Eastland CLO Ltd. | | |

2007-1A, 0.56% due 05/01/223,4,6 | 550,000 | 523,875 |

Marathon CLO Ltd., | | |

3.73% due 10/28/253,4 | 500,000 | 502,250 |

KKR Financial CLO 2007-1 Ltd. | | |

2007-1A, 2.48% due 05/15/213,4,6 | 500,000 | 496,650 |

T2 Income Fund CLO Ltd. | | |

2007-1A, 2.98% due 07/15/193,4,6 | 500,000 | 493,850 |

Neuberger Berman CLO XV | | |

2013-15A, 3.08% due 10/15/253,4 | 500,000 | 479,950 |

Silver Spring CLO Ltd. | | |

2014-1A, 2.32% due 10/15/263,4 | 500,000 | 479,500 |

MCF CLO I LLC | | |

2013-1A, 5.98% due 04/20/233,4 | 500,000 | 468,700 |

Gramercy Park CLO Ltd. | | |

2014-1AR, 4.28% due 07/17/233,4,6 | 250,000 | 246,125 |

0.00% due 07/17/234,5 | 250,000 | 210,075 |

CIFC Funding 2012-I Ltd. | | |

2014-1AR, 3.30% due 08/14/243,4 | 400,000 | 394,960 |

Putnam Structured Product CDO 2002-1 Ltd. | | |

2002-1A, 0.84% due 01/10/383,4,6 | 424,747 | 391,404 |

CIFC Funding 2012-II Ltd. | | |

2012-2A, 3.23% due 12/05/244 | 400,000 | 391,040 |

TICP CLO II Ltd. | | |

2014-2A, 3.23% due 07/20/263,4 | 400,000 | 382,080 |

Cratos CLO Ltd. | | |

2007-1A, 1.33% due 05/19/213,4,6 | 300,000 | 288,690 |

Cerberus Offshore Levered I, LP | | |

2012-1A, 6.23% due 11/30/183,4,6 | 250,000 | 250,150 |

DIVCORE CLO Ltd. | | |

2013-1A B, 4.05% due 11/15/326 | 250,000 | 250,150 |

Regatta V Funding Ltd., | | |

3.38% due 10/25/263,4 | 250,000 | 249,775 |

Race Point V CLO Ltd. | | |

2014-5AR, 3.98% due 12/15/223,4 | 250,000 | 249,425 |

Newstar Commercial Loan Funding 2013-1 LLC | | |

2013-1A, 4.78% due 09/20/233,4 | 250,000 | 245,550 |

Battalion Clo 2007-I Ltd. | | |

2007-1A, 2.38% due 07/14/223,4 | 250,000 | 243,750 |

NewStar Arlington Senior Loan Program LLC | | |

2014-1A, 3.53% due 07/25/253,4 | 250,000 | 243,650 |

See notes to financial statements.

12 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| | Face | |

| | Amount | Value |

ASSET BACKED SECURITIES†† - 8.7% (continued) | | |

Golub Capital Partners CLO 18 Ltd. | | |

2014-18A, 4.23% due 04/25/263,4,6 | $ 250,000 | $ 242,750 |

ING IM CLO 2011-1 Ltd. | | |

2011-1A, 3.53% due 06/22/213,4 | 250,000 | 242,650 |

Fortress Credit Opportunities V CLO Ltd. | | |

2014-5A, 3.78% due 10/15/263,4 | 250,000 | 242,500 |

Black Diamond CLO 2005-2 Delaware Corp. | | |

2005-2A, 2.03% due 01/07/183,4 | 250,000 | 242,07 |

Golub Capital Partners CLO 21M Ltd., | | |

3.53% due 10/25/263,4 | 250,000 | 241,025 |

Ocean Trails CLO IV | | |

2013-4A, 3.23% due 08/13/253,4 | 250,000 | 240,525 |

Monroe Capital CLO 2014-1 Ltd. | | |

2014-1A, 3.82% due 10/22/263,4 | 250,000 | 240,325 |

CIFC Funding 2014-II Ltd. | | |

2014-2A, 3.08% due 05/24/263,4 | 250,000 | 237,600 |

WhiteHorse VIII Ltd. | | |

2014-1A, 2.98% due 05/01/263,4 | 250,000 | 236,250 |

Cerberus Onshore II CLO LLC | | |

2014-1A, 4.23% due 10/15/233,4 | 250,000 | 235,950 |

West Coast Funding Ltd. | | |

2006-1A, 0.37% due 11/02/413,4 | 239,910 | 235,928 |

ALM VII R Ltd. | | |

2013-7RA, 3.68% due 04/24/243,4 | 250,000 | 235,225 |

Wrightwood Capital Real Estate CDO 2005-1 Ltd. | | |

2005-1A, 0.66% due 11/21/403,4 | 250,000 | 230,275 |

Atlas Senior Loan Fund II Ltd. | | |

2012-2A, 0.00% due 01/30/244,5,6 | 250,000 | 227,000 |

Rockwall CDO II Ltd. | | |

2007-1A, 0.78% due 08/01/243,4 | 250,000 | 226,950 |

Mountain Hawk II CLO Ltd., | | |

3.38% due 07/22/243,4 | 250,000 | 224,450 |

Carlyle Global Market Strategies CLO 2012-3 Ltd. | | |

2012-3A, 0.00% due 10/14/244,5,6 | 250,000 | 220,225 |

Finn Square CLO Ltd. | | |

2012-1A, 0.00% due 12/24/234,5 | 250,000 | 213,700 |

Great Lakes CLO 2012-1 Ltd. | | |

2012-1A, 0.00% due 01/15/234,5,6 | 250,000 | 204,150 |

Gallatin CLO VII 2014-1 Ltd. | | |

2014-1A, 3.99% due 07/15/233,4,6 | 200,000 | 193,640 |

Katonah IX CLO Ltd. | | |

2006-9A, 0.95% due 01/25/193,4,6 | 200,000 | 191,500 |

CIFC Funding 2013-II Ltd., | | |

3.83% due 04/21/253,4 | 200,000 | 190,760 |

CIFC Funding 2007-I Ltd. | | |

2007-1A, 1.73% due 05/10/213,4 | 200,000 | 190,420 |

West CLO 2013-1 Ltd., | | |

0.00% due 11/07/254,5 | 250,000 | 184,100 |

Ares XXV CLO Ltd. | | |

2013-3A, 0.00% due 01/17/244,5,6 | 250,000 | 183,225 |

ARES XXVI CLO Ltd. | | |

2013-1A, 0.00% due 04/15/254,5,6 | 250,000 | 181,125 |

Cedar Woods CRE CDO Ltd. | | |

2006-1A, 0.42% due 07/25/51 | 154,114 | 137,624 |

Credit Card Pass-Through Trust 2012-BIZ | | |

2012-BIZ, 0.00% due 12/15/49†††,4,5,6 | 140,391 | 124,330 |

Highland Park CDO I Ltd. | | |

2006-1A, 0.56% due 11/25/513,4,6 | 107,353 | 102,898 |

Raspro Trust | | |

2005-1A, 0.63% due 03/23/243,4,6 | 88,850 | 86,851 |

Insurance Note Capital VII | | |

2005-1R1A, 0.48% due 06/09/333,4,6 | 67,600 | 63,882 |

Diversified Asset Securitization Holdings II, LP | | |

2000-1X, 0.72% due 09/15/353 | 37,240 | 36,570 |

Bush Truck Leasing LLC | | |

2011-AA, 5.00% due 09/25/184,6 | 21,607 | 18,814 |

BlackRock Senior Income Series Corp. | | |

2004-1A, 0.00% due 09/15/164,5,6 | 100,000 | 10 |

Total Asset Backed Securities | | |

(Cost $34,714,147) | | 35,869,567 |

SENIOR FLOATING RATE INTERESTS††,3 - 5.3% | | |

Industrial - 1.6% | | |

HD Supply, Inc. | | |

4.00% due 06/28/18 | 977,500 | 973,834 |

Ceridian Corp. | | |

4.50% due 09/15/20 | 738,760 | 732,296 |

NaNa Development Corp. | | |

8.00% due 03/15/18 | 700,000 | 668,500 |

NVA Holdings, Inc. | | |

4.75% due 08/14/21 | 600,000 | 599,628 |

Transdigm, Inc. | | |

3.75% due 06/04/21 | 498,750 | 493,842 |

Multiplan, Inc. | | |

3.75% due 03/31/21 | 476,636 | 468,804 |

CPM Acquisition Corp. | | |

6.25% due 08/29/17 | 396,051 | 394,071 |

Hunter Defense Technologies | | |

6.50% due 08/05/19 | 400,000 | 394,000 |

Goodpack Ltd. | | |

4.75% due 09/09/21 | 300,000 | 300,000 |

Sabre, Inc. | | |

4.00% due 02/19/19 | 295,755 | 293,377 |

Amber Bidco Foster + Partners | | |

4.73% due 06/30/21†††,1 | 250,000 | 245,207 |

SIRVA Worldwide, Inc. | | |

7.50% due 03/27/19 | 246,250 | 244,403 |

Element Materials Technology | | |

5.25% due 08/06/21 | 200,000 | 198,500 |

SI Organization | | |

5.75% due 11/23/19 | 187,876 | 187,760 |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 13

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| | Face | |

| | Amount | Value |

SENIOR FLOATING RATE INTERESTS†† - 5.3% (continued) | | |

Industrial - 1.6% (continued) | | |

Minimax Viking | | |

4.25% due 08/14/20 | $ 150,000 | $ 150,000 |

Univision Communications, Inc. | | |

4.00% due 03/01/20 | 99,747 | 98,656 |

Hunter Fan Co. | | |

6.55% due 12/20/17 | 88,505 | 88,173 |

Global Aviation Holdings, Inc. | | |

3.00% due 02/13/18†††,1 | 38,996 | – |

10.00% due 07/13/17†††,1 | 119,273 | – |

Total Industrial | | 6,531,051 |

Technology - 1.0% | | |

Paradigm Ltd | | |

4.75% due 07/30/19 | 715,556 | 697,667 |

Greenway Medical Technologies | | |

6.00% due 11/04/20 | 645,125 | 643,512 |

Aspect Software, Inc. | | |

7.25% due 05/07/16 | 568,464 | 562,779 |

TIBCO Software, Inc. | | |

6.50% due 11/25/20 | 500,000 | 489,585 |

EIG Investors Corp. | | |

5.00% due 11/09/19 | 442,653 | 442,653 |

GlobalLogic Holdings, Inc. | | |

6.25% due 05/31/19 | 347,375 | 342,164 |

Data Device Corp. | | |

5.75% due 07/15/20 | 298,125 | 297,380 |

Quorum Business Solutions | | |

5.75% due 08/07/21 | 300,000 | 296,250 |

Wall Street Systems | | |

4.50% due 04/30/21 | 238,533 | 235,849 |

Total Technology | | 4,007,839 |

Communications - 0.8% | | |

Charter Communications Operating LLC | | |

4.25% due 09/10/21 | 1,000,000 | 1,006,480 |

Cengage Learning Acquisitions, Inc. | | |

7.00% due 03/31/20 | 995,000 | 994,841 |

Avaya, Inc. | | |

4.65% due 10/26/17 | 534,589 | 518,888 |

6.50% due 03/31/18 | 442,058 | 439,724 |

Zayo Group LLC | | |

4.00% due 07/02/19 | 488,755 | 487,411 |

Total Communications | | 3,447,344 |

Consumer, Non-cyclical - 0.7% | | |

Post Holdings | | |

3.75% due 06/02/21 | 1,496,250 | 1,493,751 |

Albertson's (Safeway) Holdings LLC | | |

4.50% due 08/25/21 | 800,000 | 802,000 |

Targus Group International, Inc. | | |

12.00% due 05/24/16†††,1 | 316,177 | 264,008 |

Mitel Networks Corp. | | |

5.25% due 01/31/20 | 137,065 | 137,065 |

ABG Intermediate Holdings 2 LLC | | |

5.50% due 05/27/21 | 99,500 | 98,754 |

Hostess Brands | | |

6.75% due 04/09/20 | 34,825 | 35,543 |

Total Consumer, Non-cyclical | | 2,831,121 |

Financial - 0.6% | | |

Magic Newco, LLC | | |

5.00% due 12/12/18 | 977,515 | 978,913 |

12.00% due 06/12/19 | 100,000 | 108,500 |

Safe-Guard | | |

6.25% due 08/19/21 | 600,000 | 597,000 |

First Data Corp. | | |

3.66% due 03/23/18 | 350,000 | 345,408 |

Cunningham Lindsey U.S., Inc. | | |

9.25% due 06/10/20 | 155,909 | 152,011 |

Expert Global Solutions | | |

8.50% due 04/03/18 | 102,371 | 101,860 |

Total Financial | | 2,283,692 |

Consumer, Cyclical - 0.5% | | |

Fitness International LLC | | |

5.50% due 07/01/20 | 498,750 | 492,516 |

American Tire Distributors, Inc. | | |

5.75% due 06/01/18 | 298,595 | 298,968 |

Neiman Marcus Group, Inc. | | |

4.25% due 10/25/20 | 248,747 | 247,050 |

Navistar, Inc. | | |

5.75% due 08/17/17 | 236,111 | 237,882 |

BJ's Wholesale Club, Inc. | | |

4.50% due 09/26/19 | 199,497 | 198,251 |

STG-Fairway Acquisitions, Inc. | | |

6.25% due 02/28/19 | 197,001 | 196,509 |

Dave & Busters, Inc. | | |

4.50% due 07/25/20 | 121,698 | 121,576 |

J. Crew Group, Inc. | | |

4.00% due 03/05/21 | 99,749 | 94,720 |

Container Store, Inc. | | |

4.25% due 04/06/19 | 80,340 | 78,833 |

CKX Entertainment, Inc. | | |

9.00% due 06/21/17 | 73,800 | 62,730 |

Total Consumer, Cyclical | | 2,029,035 |

Utilities - 0.1% | | |

Expro Holdings UK 3 Ltd. | | |

5.75% due 09/02/21 | 400,000 | 385,332 |

Terraform Power, Inc | | |

4.75% due 07/23/19 | 199,500 | 199,500 |

Total Utilities | | 584,832 |

See notes to financial statements.

14 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| | Face | |

| | Amount | Value |

SENIOR FLOATING RATE INTERESTS†† - 5.3% (continued) | | |

Energy - 0.0%** | | |

PSS Companies | | |

5.50% due 01/28/20 | $ 198,980 | $ 195,996 |

Total Senior Floating Rate Interests | | |

(Cost $22,019,793) | | 21,910,910 |

CORPORATE BONDS†† - 4.3% | | |

Financial - 1.4% | | |

SunTrust Banks, Inc. | | |

5.63% due 12/29/49 | 5,000,000 | 5,012,499 |

Columbia Property Trust Operating Partnership LP | | |

5.88% due 04/01/186 | 750,000 | 792,128 |

Credit Suisse Group AG | | |

6.24% due 12/29/494 | 250,000 | 243,125 |

Jefferies Finance LLC / JFIN Company-Issuer Corp. | | |

7.38% due 04/01/204,6 | 125,000 | 120,625 |

LCP Dakota Fund | | |

10.00% due 08/17/156 | 23,400 | 23,400 |

Total Financial | | 6,191,777 |

Basic Materials - 0.8% | | |

Yamana Gold, Inc. | | |

4.95% due 07/15/24 | 3,000,000 | 2,916,446 |

TPC Group, Inc. | | |

8.75% due 12/15/204,6 | 255,000 | 264,563 |

Mirabela Nickel Ltd. | | |

9.50% due 06/24/19†††,1 | 80,000 | 80,000 |

1.00% due 07/31/44†††,1 | 1,899 | – |

Total Basic Materials | | 3,261,009 |

Consumer, Non-cyclical - 0.6% | | |

Tufts Medical Center, Inc. | | |

7.00% due 01/01/38 | 1,500,000 | 1,708,565 |

JBS USA LLC / JBS USA Finance, Inc. | | |

5.88% due 07/15/244 | 500,000 | 506,250 |

ADT Corp. | | |

6.25% due 10/15/216 | 200,000 | 209,500 |

KeHE Distributors LLC / KeHE Finance Corp. | | |

7.63% due 08/15/214 | 100,000 | 106,000 |

American Seafoods Group LLC / American Seafoods Finance, Inc. | | |

10.75% due 05/15/164,6 | 100,000 | 89,000 |

Total Consumer, Non-cyclical | | 2,619,315 |

Industrial - 0.6% | | |

Atlas Air 2000-1 Class A Pass Through Trust | | |

8.71% due 01/02/196 | 1,131,233 | 1,167,998 |

8.71% due 07/02/214,6 | 27,112 | 27,993 |

Dynagas LNG Partners Limited Partnership / Dynagas | | |

Finance, Inc. | | |

6.25% due 10/30/19 | 800,000 | 768,000 |

CEVA Group plc | | |

7.00% due 03/01/214 | 300,000 | 291,000 |

Tempel Steel Co. | | |

12.00% due 08/15/164,6 | 250,000 | 250,625 |

Total Industrial | | 2,505,616 |

Consumer, Cyclical - 0.4% | | |

GRD Holdings III Corp. | | |

10.75% due 06/01/194,6 | 980,000 | 1,078,000 |

Checkers Drive-In Restaurants, Inc. | | |

11.00% due 12/01/174,6 | 150,000 | 162,750 |

PF Chang's China Bistro, Inc. | | |

10.25% due 06/30/204,6 | 125,000 | 125,938 |

Atlas Air 1999-1 Class A-1 Pass Through Trust | | |

7.20% due 01/02/196 | 81,187 | 83,216 |

Total Consumer, Cyclical | | 1,449,904 |

Energy - 0.2% | | |

Schahin II Finance Company SPV Ltd. | | |

5.88% due 09/25/224 | 449,667 | 395,707 |

Summit Midstream Holdings LLC / Summit Midstream | | |

Finance Corp. | | |

7.50% due 07/01/21 | 200,000 | 216,000 |

Penn Virginia Resource Partners Limited Partnership / Penn | | |

Virginia Resource Finance Corp. | | |

8.38% due 06/01/204 | 138,000 | 149,730 |

Total Energy | | 761,437 |

Communications - 0.2% | | |

SITEL LLC / Sitel Finance Corp. | | |

11.00% due 08/01/174,6 | 500,000 | 516,250 |

Avaya, Inc. | | |

7.00% due 04/01/194 | 150,000 | 146,625 |

Total Communications | | 662,875 |

Technology - 0.1% | | |

Aspect Software, Inc. | | |

10.63% due 05/15/176 | 290,000 | 274,775 |

Eagle Midco, Inc. | | |

9.00% due 06/15/184,6 | 200,000 | 204,000 |

Total Technology | | 478,775 |

Total Corporate Bonds | | |

(Cost $17,600,452) | | 17,930,708 |

COLLATERALIZED MORTGAGE OBLIGATION†† - 0.3% | | |

Nomura Resecuritization Trust 2012-1R | | |

2012-1R,0.59% due 08/27/473,4,6 | 631,811 | 584,426 |

ACRE Commercial Mortgage Trust 2014-FL2 | | |

2014-FL2,2.65% due 08/15/314,6 | 500,000 | 500,519 |

Structured Asset Mortgage Investments II Trust 2006-AR1 | | |

2006-AR1,0.38% due 02/25/36 | 34,373 | 29,357 |

Total Collateralized Mortgage Obligation | | |

(Cost $1,108,008) | | 1,114,302 |

Total Investments - 128.8% | | |

(Cost $457,918,476) | | $ 533,014,543 |

Other Assets & Liabilities, net - (28.8)% | | (119,249,655) |

Total Net Assets - 100.0% | | $ 413,764,888 |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 15

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2014 |

| * | | Non-income producing security. |

| ** | | Less than 0.1%. |

| † | | Value determined based on Level 1 inputs —See Note 4. |

| †† | | Value determined based on Level 2 inputs —See Note 4. |

| ††† | | Value determined based on Level 3 inputs —See Note 4. |

| 1 | | Security was fair valued by the Valuation Committee at November 30, 2014. The total market value of fair valued securities amounts to $589,215, or 0.1% of total net assets. |

| 2 | | Perpetual maturity. |

| 3 | | Variable rate security. Rate indicated is rate effective at November 30, 2014. |

| 4 | | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $43,009,276 (cost $42,221,372), or 10.4% of total net assets. |

| 5 | | Security has no stated coupon. However, it is expected to receive residual cashflow payments on deal defined payment dates. |

| 6 | | All or a portion of these securities have been physically segregated in connection with borrowings, reverse repurchase agreements, and unfunded loan commitments. As of November 30, 2014, the total amount segregated was $314,831,549. |

7 | | Taxable municipal bond issued as part of the Build America Bond program. |

| plc | | Public Limited Company |

See notes to financial statements.

16 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | November 30, 2014 |

| | |

ASSETS: | |

Investments, at value | $ | 533,014,543 |

Restricted cash | | 917,062 |

Cash | | 504 |

Receivables: | | |

Investments sold | | 10,248,908 |

Interest | | 8,430,818 |

Other assets | | 11,387 |

Total assets | | 552,623,222 |

LIABILITIES: | | |

Reverse repurchase agreements | | 101,159,117 |

Borrowings | | 35,963,936 |

Interest due on borrowings | | 223,462 |

Unrealized depreciation on swaps | | 86,599 |

Payable for: | | |

Investments purchased | | 675,000 |

Excise tax | | 294,000 |

Investment advisory fees | | 264,098 |

Administration fees | | 9,880 |

Other fees | | 182,242 |

Total liabilities | | 138,858,334 |

NET ASSETS | $ | 413,764,888 |

NET ASSETS CONSIST OF: | | |

Common Stock, $0.01 par value per share, unlimited number of shares authorized, | | |

17,413,674 shares issued and outstanding | | 174,137 |

Paid-in capital | | 331,227,326 |

Undistributed net investment income | | 3,998,488 |

Undistributed net realized gain on investments | | 3,355,469 |

Net unrealized appreciation on investments | | 75,009,468 |

NET ASSETS | | 413,764,888 |

Shares outstanding ($0.01 par value with unlimited amount authorized) | | 17,413,674 |

Net asset value, offering price and repurchase price per share | $ | 23.76 |

Investments in securities, at cost | | 457,918,476 |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 17

STATEMENT OF OPERATIONS For the six months ended November 30, 2014 (Unaudited) | November 30, 2014 |

| | | |

INVESTMENT INCOME: | | |

Interest | $ | 15,176,192 | |

Dividends | | 508,178 | |

Total investment income | | 15,684,370 | |

EXPENSES: | | | |

Management fees | | 1,607,341 | |

Interest expense | | 708,593 | |

Excise tax | | 294,000 | |

Professional fees | | 77,575 | |

Trustee fees | | 67,045 | |

Fund accounting fees | | 66,753 | |

Administration fees | | 60,239 | |

Printing fees | | 34,961 | |

Registration and filings | | 12,500 | |

Custodian fees | | 11,580 | |

Insurance | | 9,663 | |

Transfer agent fees | | 9,454 | |

Other fees | | 651 | |

Total expenses | | 2,960,355 | |

Net investment income | | 12,724,015 | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | | | |

Net realized gain (loss) on: | | | |

Investments | | 2,516,121 | |

Foreign currency transactions | | (57 | ) |

Net realized gain | | 2,516,064 | |

Net change in unrealized appreciation (depreciation) on: | | | |

Investments | | 8,008,827 | |

Unfunded commitments | | (30 | ) |

Swaps | | (86,599 | ) |

Net change in unrealized appreciation | | 7,922,198 | |

Net realized and unrealized gain | | 10,438,262 | |

Net increase in net assets resulting from operations | $ | 23,162,277 | |

See notes to financial statements.

18 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| STATEMENT OF CHANGES IN NET ASSETS | November 30, 2014 |

| | | | | |

| | Period Ended | | | |

| | November 30, 2014 | | Year ended | |

| | (Unaudited) | | May 31, 2014 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | |

Net investment income | $ | 12,724,015 | | $ | 28,371,160 | |

Net realized gain on investments and foreign currency | | 2,516,064 | | | 379,273 | |

Net change in unrealized (depreciation) appreciation on investments, | | | | | | |

unfunded commitments and swaps | | 7,922,198 | | | (5,974,017 | ) |

Net increase in net assets resulting from operations | | 23,162,277 | | | 22,776,416 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | |

Net investment income | | (14,436,284 | ) | | (27,896,617 | ) |

Capital gains | | – | | | (975,951 | ) |

Total distributions | | (14,436,284 | ) | | (28,872,568 | ) |

Net increase (decrease) in net assets | | 8,725,993 | | | (6,096,152 | ) |

NET ASSETS: | | | | | | |

Beginning of period | | 405,038,895 | | | 411,135,047 | |

End of period | $ | 413,764,888 | | $ | 405,038,895 | |

Undistributed net investment income at end of period | | 3,998,488 | | | 5,710,757 | |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 19

STATEMENT OF CASH FLOWS For the six months ended November 30, 2014 (Unaudited) | November 30, 2014 |

| | | |

Cash Flows from Operating Activities: | | |

Net Increase in net assets resulting from operations | $ | 23,162,277 | |

Adjustments to Reconcile Net Increase in Net Assets Resulting from Operations to | | | |

Net Cash Used by Operating and Investing Activities: | | | |

Net change in unrealized appreciation on investments | | (8,008,827 | ) |

Net change in unrealized depreciation on unfunded commitments | | 30 | |

Net change in unrealized depreciation on swaps | | 86,599 | |

Net realized gain on investments | | (2,516,121 | ) |

Net realized gains on paydowns received | | (46,656 | ) |

Net accretion of bond discount and amortization of bond premium | | (274,983 | ) |

Purchase of long-term investments | | (58,085,604 | ) |

Proceeds from sale of long-term investments | | 43,184,671 | |

Paydowns received on mortgage and asset backed securities | | 6,877,422 | |

Net proceeds of short-term investments | | 4,890,777 | |

Corporate actions and other payments | | 55,761 | |

Decrease in interest receivable | | 345,262 | |

Increase in securities sold receivable | | (9,801,055 | ) |

Increase in other assets | | (3,930 | ) |

Decrease in payable for securities purchased | | (2,137,057 | ) |

Increase in excise tax payable | | 294,000 | |

Increase in interest due on borrowings | | 157,046 | |

Decrease in advisory fee payable | | (548 | ) |

Decrease in administration fee payable | | (123 | ) |

Increase in accrued expenses and other liabilities | | 10,553 | |

Net Cash Used by Operating and Investing Activities | | (1,810,506 | ) |

Cash Flows From Financing Activities: | | | |

Distributions to common shareholders | | (14,436,284 | ) |

Decrease in overdraft due to custodian | | (71,406 | ) |

Increase in reverse repurchase agreements | | 12,235,762 | |

Proceeds from borrowings | | 18,000,000 | |

Payments made on borrowings | | (13,000,000 | ) |

Net Cash Provided by Financing Activities | | 2,728,072 | |

Net increase in cash | | 917,566 | |

Cash at Beginning of Period | | – | |

Cash at End of Period (including restricted cash) | | 917,566 | |

Supplemental Disclosure of Cash Flow Information: Cash paid during the period for interest | | 551,547 | |

See notes to financial statements.

20 l GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT

| FINANCIAL HIGHLIGHTS | November 30, 2014 |

| | | | | | | | | | | |

| | For the | | | | | | | | | |

| | Six Months | | | | | | | | For the period | |

| | Ended | | | | | | | | October 28, 2010 | |

| | November 30, 2014 | | Period Ended | | Period Ended | | Period Ended | | through | |

| | (Unaudited) | | May 31, 2014 | | May 31, 2013 | | May 31, 2012 | | May 31, 2011 | (a) |

Per Share Data: | | | | | | | | | | |

Net asset value, beginning of period | $ | 23.26 | | $ | 23.61 | | $ | 23.49 | | $ | 20.65 | | $ | 19.10 | (b) |

Income from investment operations: | | | | | | | | | | | | | | | |

Net investment income(c) | | 0.73 | | | 1.63 | | | 1.65 | | | 1.59 | | | 0.68 | |

Net (loss) gain on investments (realized and unrealized) | | 0.60 | | | (0.32 | ) | | 0.07 | | | 2.74 | | | 1.50 | |

Total from investment operations | | 1.33 | | | 1.31 | | | 1.72 | | | 4.33 | | | 2.18 | |

Common shares’ offering expenses charged to paid-in capital | | – | | | – | | | – | | | – | | | (0.04 | ) |

Less distributions from: | | | | | | | | | | | | | | | |

Net investment income | | (0.83 | ) | | (1.60 | ) | | (1.60 | ) | | (1.49 | ) | | (0.59 | ) |

Capital Gains | | – | | | (0.06 | ) | | – | | | – | | | – | |

Total distributions to shareholders | | (0.83 | ) | | (1.66 | ) | | (1.60 | ) | | (1.49 | ) | | (0.59 | ) |

Net asset value, end of period | $ | 23.76 | | $ | 23.26 | | $ | 23.61 | | $ | 23.49 | | $ | 20.65 | |

Market Value, end of period | $ | 21.94 | | $ | 21.69 | | $ | 22.70 | | $ | 22.46 | | $ | 19.54 | |

Total Return(d) | | | | | | | | | | | | | | | |

Net asset value | | 5.80 | % | | 6.15 | % | | 7.48 | % | | 21.64 | % | | 11.34 | % |

Market value | | 5.09 | % | | 3.54 | % | | 8.27 | % | | 23.35 | % | | 0.80 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | $ | 413,765 | | $ | 405,039 | | $ | 411,135 | | $ | 408,960 | | $ | 359,444 | |

Ratio to average net assets of: | | | | | | | | | | | | | | | |

Total expenses, including interest expense(g)(h) | | 1.38 | % | | 1.35 | % | | 1.38 | % | | 1.36 | % | | 1.05 | % |

Net investment income, including interest expense(h) | | 6.22 | % | | 7.37 | % | | 6.99 | % | | 7.33 | % | | 6.00 | % |

Portfolio turnover rate(e) | | 8 | % | | 10 | % | | 12 | % | | 7 | % | | 3 | % |

Senior Indebtedness | | | | | | | | | | | | | | | |

Total Borrowings outstanding (in thousands) | $ | 137,123 | | $ | 119,887 | | $ | 129,992 | | $ | 125,542 | | $ | 104,906 | |

Asset Coverage per $1,000 of indebtedness(f) | $ | 4,018 | | $ | 4,379 | | $ | 4,163 | | $ | 4,258 | | $ | 4,426 | |

| (a) | Since commencement of operations: October 28, 2010. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| (b) | Before deduction of offering expenses charged to capital. |

| (c) | Based on average shares outstanding. |

| (d) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Trust’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (e) | Portfolio turnover is not annualized for periods of less than one year. |

| (f) | Calculated by subtracting the Trust’s total liabilities (not including borrowings) from the Trust’s total assets and dividing by the total borrowings. |

| (g) | Excluding interest expense, the operating expense ratio for the periods would be: |

November 30, | May 31, | May 31, | May 31, | May 31, |

2014 | 2014 | 2013 | 2012 | 2011 |

1.03% | 1.02% | 1.02% | 1.04% | 0.91%(e) |

See notes to financial statements.

GBAB l GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT l 21

| NOTES TO FINANCIAL STATEMENTS (Unaudited) | November 30, 2014 |

Note 1 – Organization:

Guggenheim Build America Bonds Managed Duration Trust (the “Trust”) was organized as a Delaware statutory trust on June 30, 2010. The Trust is registered as a diversified closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Trust’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. There can be no assurance that the Trust will achieve its investment objectives. The Trust’s investment objectives are considered fundamental and may not be changed without shareholder approval.

Note 2 – Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of the significant accounting policies followed by the Trust.

(a) Valuation of Investments

The Board of Trustees of the Trust (the “Board”) has adopted policies and procedures for the valuation of the Trust’s investments (the “Valuation Procedures”). Pursuant to the Valuation Procedures, the Board has delegated to a valuation committee, consisting of representatives from Guggenheim’s investment management, fund administration, legal and compliance departments (the “Valuation Committee”), the day-to-day responsibility for implementing the Valuation Procedures, including, under most circumstances, the responsibility for determining the fair value of the Trust’s securities or other assets.