Washington, D.C. 20549

Kevin M. Robinson

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: [Provide full text of annual report.]

WWW.GUGGENHEIMINVESTMENTS.COM/GBAB

... YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT THE GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST

The shareholder report you are reading right now is just the beginning of the story. Online at

www.guggenheiminvestments.com/gbab, you will find:

| • | Daily, weekly and monthly data on share prices, net asset values, distributions and more |

| | |

| • | Monthly portfolio overviews and performance analyses |

| | |

| • | Announcements, press releases and special notices |

| | |

| • | Fund and adviser contact information |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are continually updating and expanding shareholder information services on the Trust’s website, in an ongoing effort to provide you with the most current information about how your Trust’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Trust.

| (Unaudited) | November 30, 2012 |

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Build America Bonds Managed Duration Trust (the “Trust”). This report covers the Trust’s performance for the semiannual period ended November 30, 2012.

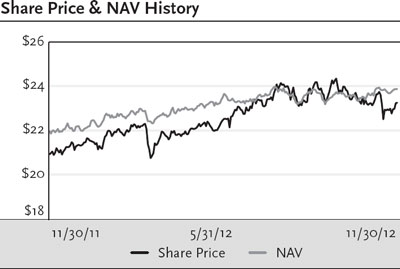

All Trust returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2012, the Trust provided a total return based on market price of 7.01% and a total return based on NAV of 4.98%. As of November 30, 2012, the Trust’s market price of $23.25 per share represented a discount of 2.56% to its NAV of $23.86 per share. The market value of the Trust’s shares fluctuates from time to time, and it may be higher or lower than the Trust’s NAV.

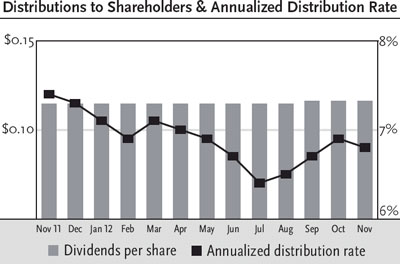

In each month from June 2012 through August 2012, the Trust paid a monthly dividend of $0.1290 per share. The Trust announced a 2.5% increase in its monthly dividend to $0.1322 per share, effective with its September 2012 dividend, and that amount was paid in September, October and November 2012. In November 2012, the Trust announced another increase to the monthly dividend, which took effect with the December 2012 dividend. The dividend as of November 30, 2012, represents an annualized distribution rate of 6.8% based on the Trust’s closing market price of $23.25 on November 30, 2012.

Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”) serves as the investment adviser to the Trust. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Trust’s investment sub-adviser and is responsible for the management of the Trust’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Trust through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 36 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Trust purchased in the market at a price less than NAV. Conversely, when the market price of the Trust’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an Internal Revenue Service (“IRS”) limitation that the purchase price cannot be more than 5% below the market price per share. The DRIP provides a cost effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Trust endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Trust shares when the share price is lower than when the price is higher.

To learn more about the Trust’s performance and investment strategy for the semiannual period ended November 30, 2012, we encourage you to read the Questions & Answers section of this report, which begins on page 4.

We are honored that you have chosen the Guggenheim Build America Bonds Managed Duration Trust as part of your investment portfolio. For the most up-to-date information regarding your investment, please visit the Trust’s website at www.guggenheiminvestments.com/gbab.

Sincerely,

Donald C. Cacciapaglia

Chief Executive Officer

Guggenheim Build America Bonds Duration Trust

December 31, 2012

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 3 |

| QUESTIONS & ANSWERS (Unaudited) | November 30, 2012 |

The Guggenheim Build America Bonds Managed Duration Trust (the “Trust”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”). This team includes B. Scott Minerd, Chief Executive Officer and Chief Investment Officer; Anne Bookwalter Walsh, CFA, JD, Senior Managing Director; and James E. Pass, Managing Director. In the following interview, the investment team discusses the market environment and the Trust’s strategy and performance for the six-month period ended November 30, 2012.

What were the most important developments in the Trust over the past six months?

Two related actions stand out. The Sub-Adviser has been actively managing the Trust to add value in the 20% allocation of the portfolio not dedicated to Build America Bonds, primarily by increasing exposure to bank loans and other floating-rate securities. The improved yield from these investments has also enabled the Trust to increase the distribution rate, as we raised the dividend twice, once by 2.5% in September and then by 2.0%, which took effect in December 2012 after the period ended.

GPIM believes the macroeconomic environment is constructive for the leveraged credit market, which includes bank loans and high-yield bonds, as markets awash with liquidity are supportive of refinancing and result in low default rates. Bank loans have attractive yields, secured status, seniority in the capital structure and covenant protection. All floating rate securities, including bank loans and asset-backed securities, are less sensitive to changes in interest rates, which is especially valuable in this era of historically low yields.

What is the Trust’s investment objective and how is it pursued?

The Trust’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in a diversified portfolio of taxable municipal securities known as “Build America Bonds” (“BABs”). Under normal market conditions, the Trust will invest at least 80% of its Managed Assets (net assets plus leverage) (“Managed Assets”) in BABs. The Trust may invest up to 20% of its Managed Assets in securities other than BABs, including taxable municipal securities that do not qualify for federal subsidy payments under the American Recovery and Reinvestment Act of 2009 (the “Act”), municipal securities, the interest income from which is exempt from regular federal income tax (sometimes referred to as “tax-exempt municipal securities”), asset-backed securities (“ABS”), senior loans and other income-producing securities.

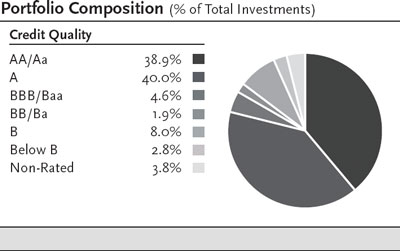

At least 80% of the Trust’s Managed Assets will be invested in securities that, at the time of investment, are investment grade quality. The Trust may invest up to 20% of its Managed Assets in securities that, at the time of investment, are below investment grade quality. Securities of below investment grade quality are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal.

The Trust will not invest more than 25% of its Managed Assets in municipal securities in any one state of origin or more than 15% of its Managed Assets in municipal securities that, at the time of investment, are illiquid.

BABs are taxable municipal securities that include bonds issued by state and local governments to finance capital projects such as public schools, roads, transportation infrastructure, bridges, ports and public buildings, pursuant to the Act. In contrast to traditional municipal bonds, interest received on BABs is subject to federal income tax and may be subject to state income tax. However, issuers of Direct Payment BABs are eligible to receive a subsidy from the U.S. Treasury of up to 35% of the interest paid on the bonds, allowing such issuers to issue BABs that pay interest rates that are competitive with the rates typically paid by private bond issuers in the taxable fixed-income market.

The Sub-Adviser employs investment and trading strategies to seek to maintain the leverage-adjusted duration of the Trust’s portfolio at approximately 10 years. (Duration is a measure of a bond’s price sensitivity to changes in interest rates, expressed in years. Duration is a weighted average of the times that interest payments and the final return of principal are received. The weights are the amounts of the payments discounted by the yield to maturity of the bond.)

In addition, the Sub-Adviser may seek to manage the duration of the Trust’s portfolio through the use of derivative instruments, including U.S. Treasury swaps, credit default swaps, total return swaps and futures contracts, in an attempt to reduce the overall volatility of the Trust’s portfolio to changes in market interest rates. The Sub-Adviser does not currently use such derivative instruments to manage the duration of the Trust’s portfolio but may do so in the future. The Sub-Adviser may seek to manage the Trust’s duration in a flexible and opportunistic manner based primarily on then-current market conditions and interest rate levels. The Trust may incur costs in implementing the duration management strategy, but such strategy will seek to reduce the volatility of the Trust’s portfolio.

What were the significant events affecting the economy and market environment over the past six months?

The U.S. economic expansion has slowed as a result of declining margins and consumer demand and a knock-on effect from Europe. Unprecedented policy actions by the Federal Reserve (“the Fed”) continue to provide ample liquidity and accommodation to stimulate growth of the U.S.

| |

4 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

economy. Recent action, such as the third round of quantitative easing announced in September 2012, shows an increased tolerance for potentially higher levels of inflation. The Fed was aggressive in its policy action by announcing an open-ended bond purchasing program that focused on agency mortgages. Operation Twist, the Fed’s program of buying longer duration Treasury securities while simultaneously selling shorter duration securities, was also extended.

The U.S. election at the beginning of November may have had a small effect on the market’s perception of the path and pace towards economic recovery. Improving housing data and private payrolls have largely driven U.S. GDP growth, though uncertainty surrounding consumer demand continues to make it difficult for the corporate sector to make investment decisions with respect to hiring and capital investment. U.S. capital markets late in the year were preoccupied with decisions about the U.S. fiscal cliff.

Central banks around the world have tagged along with U.S. policymakers and are engaging in their own forms of accommodative policy actions, which we believe should continue to benefit risk assets and assets linked to inflation bets.

How did the Trust perform for the six months ended November 30, 2012?

All Trust returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2012, the Trust provided a total return based on market price of 7.01% and a total return based on NAV of 4.98%. The Trust’s NAV return surpassed the return of the Bank of America Build America Bond Index (the “Index”), which measures return of BABs as an asset class, even though the Trust has operating expenses that affect performance, while the Index has no expenses.

As of November 30, 2012, the Trust’s market price of $23.25 per share represented a discount of 2.56% to its NAV of $23.86 per share. On May 31, 2012, the Trust’s market price of $22.46 per share represented a discount of 4.38% to its NAV of $23.49 per share. As of November 30, 2011, the Trust’s market price of $20.92 per share represented a discount of 4.78% to its NAV of $21.97 per share. The market value of the Trust’s shares fluctuates from time to time and it may be higher or lower than the Trust’s NAV. Past performance is not a guarantee of future results.

In each month from June 2012 through August 2012, the Trust paid a monthly dividend of $0.1290 per share. The Trust announced a 2.5% increase in its monthly dividend to $0.1322 per share, effective with its September 2012 dividend, and that amount was paid in September, October and November 2012. In November 2012, the Trust announced another increase to the monthly dividend, which took effect with the December 2012 dividend. The dividend as of November 30, 2012, represents an annualized distribution rate of 6.8% based on the Trust’s closing market price of $23.25 on November 30, 2012. Of course, the Trust’s distribution rate is not constant and is subject to change based on the performance of the Trust.

What factors affected Trust performance during the six-month period ended November 30, 2012?

The entire portfolio has appreciated because of the relatively subdued rate environment, as spreads tightened over the period. BABs are strongly correlated with U.S. Treasuries, and both generally rallied over the period, particularly when financial events in Europe or Asia pushed investors into the relative safety of U.S. government debt. Factors aiding BABs performance were lack of primary issuance, which creates scarcity that helps support prices. Existing issues also typically carry high dollar prices, which limits activity in the sector. Another contributor to spread tightening was the outcome of recent elections in some big-issue states like California, which approved a ballot measure to increase taxes.

Describe how the Trust’s assets are invested?

As of November 30, 2012, approximately 83% of the Trust’s long-term investments were in BABs and Qualified School Construction Bonds (“QSCBs”), which are qualifying investments for purposes of the Trust’s policy of investing at least 80% of its managed assets in BABs. Within the Trust’s BABs holdings, we did add positions from time to time, although no single position was a significant contributor or detractor to return. No BABs have been sold since the inception of the portfolio.

The remainder of the Trust (approximately 17% of the Trust’s long-term investments as of November 30, 2012) was invested in non-BABs securities. These include asset-backed securities, bank loans, corporate bonds (including high yield bonds) and other securities, by which we were able to add incremental yield.

The most significant change within this allocation was increasing bank loans by about three percentage points. The Trust also regularly sold floating-rate instruments with yields in the low single digits in order to create more capacity for higher-yielding floaters.

How did other markets perform in this environment?

In the bond market, the lowest quality issues performed best during the six-month period ended November 30, 2012, as investors generally embraced risk. The return of the Barclays U.S. Treasury Composite Index, which includes Treasury securities of all maturities, was 0.57%. The Barclays U.S. Aggregate Bond Index (the “Barclays Aggregate”), which is a proxy for the U.S. investment grade bond market, returned 1.99% for the period, while

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 5 |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

the Barclays U.S. Corporate High Yield Index returned 8.54%. BABs were among the best performing asset classes: return of the Index, which measures return of BABs as an asset class, was 3.98% for the 6 months ended November 30, 2012.

Reflecting the Federal Reserve’s (“the Fed”) continuing accommodative monetary policy, interest rates on short-term securities remained at their lowest levels in many years; the return of the Barclays 1–3 Month U.S. Treasury Bill Index was 0.04% for the same period.

What is the Trust’s leverage strategy?

Since leverage adds to performance when the cost of leverage is less than the total return generated by investments, the use of leverage contributed positively to the Trust’s total return during this period. The Trust utilizes leverage (borrowing) as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged. Leverage will not exceed 33% of the Trust’s Managed Assets.

As of November 30, 2012, the Trust’s leverage was approximately 25% of Managed Assets. GPIM currently employs leverage through reverse repurchase agreements with at least three different counterparties and a credit facility with a major bank. Under the reverse repurchase agreements, securities are transferred to another party, such as a bank or broker-dealer, in return for cash which can be used for additional investments.

There is no guarantee that the Trust’s leverage strategy will be successful. The Trust’s use of leverage may cause the Trust’s NAV and market price of common shares to be more volatile and can magnify the effect of any losses.

What is the state of the municipal market?

The credit situation has improved at the state level and in certain markets at the local level, offset by credits from some municipal issuers still dealing with fiscal stress. Another benefit for the portfolio is its diversification across industry groups and states. The top 10 holdings in the portfolio together represent only about 23% of the Trust’s long-term investments, and the largest position represents less than 3%.

What is the prospect for further issuance of BABs?

Remote, but it could be part of a comprehensive tax reform package. There was much discussion about whether the BAB program would be extended beyond December 31, 2010 when it expired, but in the end it was not. Many BABs issues remain outstanding, and there is a secondary market in these bonds, most of which have maturities of 20 to 30 years.

Index Definitions:

The Bank of America Build America Bond Index is designed to track the performance of U.S. dollar-denominated Build America Bonds publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. market.

The Barclays U.S. Treasury Composite Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. Securities in the index roll up to the U.S. Aggregate, U.S. Universal, and Global Aggregate Indices. The U.S. Treasury Index was launched on January 1, 1973.

The Barclays U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays U.S. Corporate High Yield Index is an unmanaged index of below investment grade bonds issued by U.S. corporations.

The Barclays 1-3 Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury bills with a remaining maturity of one to three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

Risks and Other Considerations

The views expressed in this report reflect those of the Sub-Adviser only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. There can be no assurance that the Trust will achieve its investment objectives. The value of the Trust will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. There can be no assurance that the Trust will achieve its investment objectives.

Build America Bonds Risk. The BABs market is smaller and less diverse than the broader municipal securities market. In addition, because BABs are a new form of municipal financing and because bonds issued after December 31, 2010, currently do not qualify as BABs, it is impossible to predict market conditions for such bonds, meaning that BABs may experience less liquidity than other types of municipal securities. Because the ability to issue BABs was not extended beyond December 31, 2010, the number of BABs available in the market is limited and there can be no assurance that BABs will continue

6 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

to be actively traded. Reduced liquidity may negatively affect the value of the BABs. Because issuers of direct payment BABs held in the Trust’s portfolio receive reimbursement from the U.S. Treasury with respect to interest payments on bonds, there is a risk that those municipal issuers will not receive timely payment from the U.S. Treasury and may remain obligated to pay the full interest due on direct payment BABs held by the Trust. Furthermore, it is possible that a municipal issuer may fail to comply with the requirements to receive the direct pay subsidy or that a future Congress may terminate the subsidy altogether. In addition, the Internal Revenue Code of 1986, as amended (the “Code”) contains a general offset rule (the “IRS Offset Rule”) which allows for the possibility that subsidy payments to be received by issuers of BABs may be subject to offset against amounts owed by them to the federal government. Moreover, the Internal Revenue Service (the “IRS”) may audit the agencies issuing BABs and such audits may, among other things, examine the price at which BABs are initially sold to investors. If the IRS concludes that a BAB was mis-priced based on its audit, it could disallow all or a portion of the interest subsidy received by the issuer of the BAB. The IRS Offset Rule and the disallowance of any interest subsidy as a result of an IRS audit could potentially adversely affect a BABs issuer’s credit rating, and adversely affect the issuer’s ability to repay or refinance BABs. This, in turn, could adversely affect the ratings and value of the BABs held by the Trust and the Trust’s net asset value.

Expiration of BAB Program. Bonds issued after December 31, 2010, do not qualify as BABs. From time to time the Obama administration and Congress may consider a variety of proposals to reinstate the BAB program or establish other similar programs. No assurance can be given as to whether these proposals or other changes in the BABs program will be enacted, nor can it be predicted whether such proposals or changes, if enacted, will have a positive or negative effect on the Trust.

If there are no new issuances of BABs or other taxable municipal securities with interest payments subsidized by the U.S. Government through direct pay subsidies, the Board of Trustees intends to evaluate potential actions with respect to the Trust. In such event the Board of Trustees may consider, among other things, changes to the non-fundamental investment policies of the Trust to permit the Trust to broaden its investment focus, for example to taxable municipal securities generally, merger of the Trust into another fund or termination of the Trust. If the Trust were to be terminated, the Trust would distribute all of its net assets to shareholders of record as of the date of termination after providing for all obligations of the Trust. The Trust’s investment objectives and policies are not designed to seek to return the initial offering price of the common shares in the offering on any future termination date. Investors who purchase common shares may receive more or less than their original investment upon any termination of the Trust.

General Municipal Securities Market Risk. Investing in the municipal securities market involves certain risks. The municipal market is one in which dealer firms make markets in bonds on a principal basis using their proprietary capital, and during the recent market turmoil these firms’ capital was severely constrained. As a result, some firms were unwilling to commit their capital to purchase and to serve as a dealer for municipal bonds. Certain municipal securities may not be registered with the SEC or any state securities commission and will not be listed on any national securities exchange. The amount of public information available about municipal securities is generally less than for corporate equities or bonds, and the Trust’s investment performance may therefore be more dependent on the sub-adviser’s analytical abilities. The secondary market for municipal securities, particularly the below investment-grade bonds in which the Trust may invest, also tends to be less developed or liquid than many other securities markets, which may adversely affect the Trust’s ability to sell its municipal securities at attractive prices or at prices approximating those at which the Trust currently values them. Municipal securities may contain redemption provisions, which may allow the securities to be called or redeemed prior to their stated maturity, potentially resulting in the distribution of principal and a reduction in subsequent interest distributions. Many state and municipal governments are currently under significant economic and financial stress and may not be able to satisfy their obligations. The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns and as governmental cost burdens are reallocated among federal, state and local governments. The taxing powers of any governmental entity may be limited by provisions of state constitutions or laws and an entity’s credit will depend on many factors, including the entity’s tax base, the extent to which the entity relies on federal or state aid, and other factors which are beyond the entity’s control. In addition, laws enacted in the future by Congress or state legislatures or referenda could extend the time for payment of principal and/or interest, or impose other constraints on enforcement of such obligations, or on the ability of municipalities to levy taxes. Issuers of municipal securities might seek protection under Chapter 9 of the U.S. Bankruptcy Code. Although similar to other bankruptcy proceedings in some respects, municipal bankruptcy is significantly different in that there is no provision in the law for liquidation of the assets of the municipality and distribution of the proceeds to creditors. Municipal bankruptcy is available to issuers in certain states. In states in which municipal bankruptcy is not presently available, new legislation would be required to permit a municipal issuer in such state to file for bankruptcy. Municipalities must voluntarily seek protection under the Bankruptcy Code; municipal bankruptcy proceedings cannot be commenced by creditors. Due to the severe limitations placed upon the power of the bankruptcy court in Chapter 9 cases, the bankruptcy court generally is not as active in managing a municipal bankruptcy case as it is in corporate reorganizations. The bankruptcy court cannot appoint a trustee nor interfere with the municipality’s political or governmental powers or with its properties or revenues, for example by ordering reductions in expenditures, increases in taxes, or sales of property, without the municipality’s consent. In addition, the municipality can continue to borrow in the ordinary course without bankruptcy court approval if it is able to do so without affecting the rights of existing creditors. Neither creditors nor courts may control the affairs of the municipality indirectly by proposing a readjustment plan that would effectively determine the municipality’s future tax and spending decisions, so the Trust’s influence over any bankruptcy proceedings would be very limited. In the event of bankruptcy of a municipal

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 7 |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

issuer, the Trust could experience delays in collecting principal and interest, and the Trust may not be able to collect all principal and interest to which it is entitled. There is no provision in municipal bankruptcy proceedings for liquidation of municipal assets in order to distribute proceeds to creditors such as the Trust.

Duration Management Risk. In connection with the Trust’s duration management strategy, the Trust may utilize certain strategies, including interest-rate swaps, in order to manage the duration of the Trust’s portfolio to reduce the interest-rate sensitivity of the Trust’s debt securities and decrease the Trust’s exposure to interest-rate risk. Until the duration management strategy is fully implemented, the Trust may be more subject to interest-rate risk. There can be no assurance that the sub- adviser’s duration management strategy will be successful at any given time in managing the duration of the Trust’s portfolio or helping the Trust to achieve its investment objectives.

Financial Leverage Risk. The Trust employs financial leverage through a bank credit facility and reverse repurchase agreements. The Adviser and the Sub-Adviser believe that the use of financial leverage will result in higher income to common shareholders over time. Use of Financial Leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks. There can be no assurance that a leveraging strategy will be utilized or will be successful. Financial Leverage is a speculative technique that exposes the Trust to greater risk and increased costs than if it were not implemented. Increases and decreases in the value of the Trust’s portfolio will be magnified when the Trust uses Financial Leverage. As a result, Financial Leverage may cause greater changes in the Trust’s net asset value and returns than if Financial Leverage had not been used. The Trust will also have to pay interest on its Indebtedness, if any, which may reduce the Trust’s return. This interest expense may be greater than the Trust’s return on the underlying investment, which would negatively affect the performance of the Trust. Certain types of Indebtedness subject the Trust to covenants in credit agreements relating to asset coverage and portfolio composition requirements. Certain Indebtedness issued by the Trust also may subject the Trust to certain restrictions on investments imposed by guidelines of one or more rating agencies, which may issue ratings for such Indebtedness. Such guidelines may impose asset coverage or portfolio composition requirements that are more stringent than those imposed by the 1940 Act. It is not anticipated that these covenants or guidelines will impede the Sub-Adviser from managing the Trust’s portfolio in accordance with the Trust’s investment objectives and policies. Reverse repurchase agreements involve the risks that the interest income earned on the investment of the proceeds will be less than the interest expense and Trust expenses, that the market value of the securities sold by the Trust may decline below the price at which the Trust is obligated to repurchase such securities and that the securities may not be returned to the Trust. There is no assurance that reverse repurchase agreements can be successfully employed. Dollar roll transactions involve the risk that the market value of the securities the Trust is required to purchase may decline below the agreed upon repurchase price of those securities. If the broker/dealer to whom the Trust sells securities becomes insolvent, the Trust’s right to purchase or repurchase securities may be restricted. Successful use of dollar rolls may depend upon the Sub-Adviser’s ability to correctly predict interest rates and prepayments. There is no assurance that dollar rolls can be successfully employed. Inverse floating rate securities represent beneficial interests in a special purpose trust (sometimes called a “tender option bond trust”) formed by a third party sponsor for the purpose of holding municipal bonds. Investing in such securities may expose the Trust to certain risks. In general, income on inverse floating rate securities will decrease when interest rates increase and increase when interest rates decrease. Investments in inverse floating rate securities may subject the Trust to the risks of reduced or eliminated interest payments and losses of principal. During the time in which the Trust is utilizing Financial Leverage, the amount of the fees paid to the Adviser and the Sub-Adviser for investment advisory services will be higher than if the Trust did not utilize Financial Leverage because the fees paid will be calculated based on the Trust’s Managed Assets, including proceeds of Financial Leverage. This may create a conflict of interest between the Adviser and the Sub-Adviser, on the one hand, and the Common Shareholders, on the other hand. Common Shareholders bear the portion of the investment advisory fee attributable to the assets purchased with the proceeds of Financial Leverage, which means that Common Shareholders effectively bear the entire advisory fee. In order to manage this conflict of interest, the maximum level of and types of Financial Leverage used by the Trust must be approved by the Board of Trustees, and the Board of Trustees will receive regular reports from the Adviser and the Sub-Adviser regarding the Trust’s use of Financial Leverage and the effect of Financial Leverage on the management of the Trust’s portfolio and the performance of the Trust. In addition the Trust may engage in certain derivative transactions, including swaps, that have characteristics similar to leverage. To the extent the terms of any such transaction obligate the Trust to make payments, the Trust intends to earmark or segregate cash or liquid securities in an amount at least equal to the current value of the amount then payable by the Trust under the terms of such transaction in accordance with applicable interpretations of the Staff of the SEC. To the extent the terms of any such transaction obligate the Trust to deliver particular securities to extinguish the Trust’s obligations under such transactions, the Trust may “cover” its obligations under such transaction by either (i) owning the securities or collateral underlying such transactions or (ii) having an absolute and immediate right to acquire such securities or collateral without additional cash consideration (or, if additional cash consideration is required, having earmarked or segregated cash or liquid securities). Securities so segregated or designated as “cover” will be unavailable for sale by the Sub-Adviser (unless replaced by other securities qualifying for segregation or cover requirements), which may adversely affect the ability of the Trust to pursue its investment objectives.

Below Investment-Grade Securities Risk. Under normal market conditions, the Trust may invest up to 20% of its Managed Assets in securities that at the time of investment are below investment-grade quality, which are commonly referred to as “junk” bonds and are regarded as predominately speculative with respect to the issuer’s capacity to pay interest and repay principal. Below investment-grade securities may be particularly susceptible to economic downturns. It is likely that an economic recession could severely disrupt the market for such securities and may have an adverse impact on the value of such securities. In addition, it is likely that any such economic down-

8 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

turn could adversely affect the ability of the issuers of such securities to repay principal and pay interest thereon and increase the incidence of default for such securities. Lower grade securities, though high yielding, are characterized by high risk. They may be subject to certain risks with respect to the issuing entity and to greater market fluctuations than certain lower yielding, higher rated securities. The retail secondary market for lower grade securities may be less liquid than that for higher rated securities. Adverse conditions could make it difficult at times for the Trust to sell certain securities or could result in lower prices than those used in calculating the Trust’s net asset value. Because of the substantial risks associated with investments in lower grade securities, you could lose money on your investment in common shares of the Trust, both in the short-term and the long-term.

Special Risks Related to Certain Municipal Securities. The Trust may invest in municipal leases and certificates of participation in such leases. Municipal leases and certificates of participation involve special risks not normally associated with general obligations or revenue bonds. Leases and installment purchase or conditional sale contracts (which normally provide for title to the leased asset to pass eventually to the governmental issuer) have evolved as a means for governmental issuers to acquire property and equipment without meeting the constitutional and statutory requirements for the issuance of debt. The debt issuance limitations are deemed to be inapplicable because of the inclusion in many leases or contracts of “non-appropriation” clauses that relieve the governmental issuer of any obligation to make future payments under the lease or contract unless money is appropriated for such purpose by the appropriate legislative body on a yearly or other periodic basis. In addition, such leases or contracts may be subject to the temporary abatement of payments in the event the governmental issuer is prevented from maintaining occupancy of the leased premises or utilizing the leased equipment. Although the obligations may be secured by the leased equipment or facilities, the disposition of the property in the event of non-appropriation or foreclosure might prove difficult, time consuming and costly, and may result in a delay in recovering or the failure to fully recover the Trust’s original investment. In the event of non-appropriation, the issuer would be in default and taking ownership of the assets may be a remedy available to the Trust, although the Trust does not anticipate that such a remedy would normally be pursued. To the extent that the Trust invests in unrated municipal leases or participates in such leases, the credit quality and risk of cancellation of such unrated leases will be monitored on an ongoing basis. Certificates of participation, which represent interests in unmanaged pools of municipal leases or installment contracts, involve the same risks as the underlying municipal leases. In addition, the Trust may be dependent upon the municipal authority issuing the certificates of participation to exercise remedies with respect to the underlying securities. Certificates of participation entail a risk of default or bankruptcy not only of the issuer of the underlying lease but also of the municipal agency issuing the certificate of participation.

Asset-Backed Securities Risk. Investing in asset-backed securities (“ABS”) entails various risks, including credit risks, liquidity risks, interest-rate risks, market risks and legal risks. ABS are subject to significant credit risks because of the credit risks inherent in the underlying collateral and because issuers are primarily private entities. The structure of ABS and the terms of the investors’ interest in the collateral can vary widely depending on the type of collateral, the desires of investors and the use of credit enhancements. Although the basic elements of all ABS are similar, individual transactions can differ markedly in both structure and execution. Important determinants of the risk associated with issuing or holding the securities include the process by which principal and interest payments are allocated and distributed to investors, how credit losses affect the issuing vehicle and the return to investors in such ABS, whether collateral represents a fixed set of specific assets or accounts, whether the underlying collateral assets are revolving or closed-end, under what terms (including the maturity of the ABS itself) any remaining balance in the accounts may revert to the issuing entity and the extent to which the entity that is the actual source of the collateral assets is obligated to provide support to the issuing vehicle or to the investors in such ABS. The Trust may invest in ABS that are subordinate in right of payment and rank junior to other securities that are secured by or represent an ownership interest in the same pool of assets. In addition, many of the transactions in which such securities are issued have structural features that divert payments of interest and/or principal to more senior classes when the delinquency or loss experience of the pool exceeds certain levels. As a result, such securities have a higher risk of loss as a result of delinquencies or losses on the underlying assets.

Senior and Second Lien Secured Loans Risk: The Trust’s investments in senior loans and second lien secured floating-rate loans are typically below investment grade and are considered speculative because of the credit risk of their issuers. The risks associated with senior loans of below investment grade quality are similar to the risks of other lower-grade income securities. Second lien loans are second in right of payment to senior loans and therefore are subject to the additional risk that the cash flow of the borrower and any property securing the loan may be insufficient to meet scheduled payments after giving effect to the senior-secured obligations of the borrower. Second lien loans are expected to have greater price volatility and exposure to losses upon default than senior loans and may be less liquid.

Liquidity Risk. The Trust may invest up to 15% of its Managed Assets in municipal securities that are, at the time of investment, illiquid and certain other securities in which the Trust may invest may be illiquid. Illiquid securities are securities that cannot be disposed of within seven days in the ordinary course of business at approximately the value that the Trust values the securities. Illiquid securities may trade at a discount from comparable, more liquid securities and may be subject to wide fluctuations in market value. The Trust may be subject to significant delays in disposing of illiquid securities. Accordingly, the Trust may be forced to sell these securities at less than fair market value or may not be able to sell them when the sub-adviser believes it is desirable to do so. Illiquid securities also may entail registration expenses and other transaction costs that are higher than those for liquid securities. Restricted securities (i.e., securities subject to legal or contractual restrictions on resale) may be illiquid. However, some restricted securities (such as securities issued pursuant to Rule 144A under the Securities Act of 1933, as amended (the “1933 Act”) and certain commercial paper) may be treated as liquid for these purposes. Inverse floating-rate securities or the residual interest certificates of tender option bond trusts are not considered illiquid securities.

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 9 |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

Volatility Risk. The use of financial leverage by the Trust will cause the net asset value, and possibly the market price, of the Trust’s common shares to fluctuate significantly in response to changes in interest rates and other economic indicators. In addition, the Trust may invest up to 20% of its Managed Assets in below investment-grade securities (i.e. “junk bonds”), which may be less liquid and therefore more volatile than investment-grade municipal securities. As a result, the net asset value and market price of the common shares of the Trust will be more volatile than those of a closed-end investment company that is not exposed to leverage or that does not invest in below investment-grade securities.

Government Intervention in the Financial Markets. The instability in the financial markets discussed above has led the U.S. Government to take a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that have experienced extreme volatility, and in some cases a lack of liquidity. Federal, state, and other governments, their regulatory agencies, or self regulatory organizations may take actions that affect the regulation of the instruments in which the Trust invests, or the issuers of such instruments. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which was signed into law in July 2010, is expected to result in a significant revision of the U.S. financial regulatory framework. The Dodd-Frank Act covers a broad range of topics, including, among many others: a reorganization of federal financial regulators; the creation of a process designed to ensure financial system stability and the resolution of potentially insolvent financial firms; the enactment of new rules for derivatives trading; the creation of a consumer financial protection watchdog; the registration and regulation of managers of private funds; the regulation of credit rating agencies; and the enactment of new federal requirements for residential mortgage loans. The regulation of various types of derivative instruments pursuant to the Dodd-Frank Act may adversely affect issuers of securities in which the Trust invests that utilize derivatives strategies for hedging or other purposes. The ultimate impact of the Dodd-Frank Act, and any resulting regulation, is not yet certain and issuers of securities in which the Trust invests may also be affected by the new legislation and regulation in ways that are currently unknown and unforeseeable. Governments or their agencies may also acquire distressed assets from financial institutions and acquire ownership interests in those institutions. The implications of government ownership and disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation and performance of the Trust’s portfolio holdings.

Strategic Transactions Risk. The Trust may engage in various portfolio strategies, including derivatives transactions involving interest rate and foreign currency transactions, swaps, options and futures (“strategic transactions”), for hedging and risk management purposes and to enhance total return. The use of strategic transactions to enhance total return may be particularly speculative. Strategic transactions involve risks, including the imperfect correlation between the value of such instruments and the underlying assets, the possible default of the other party to the transaction and illiquidity of the derivative instruments. Furthermore, the Trust’s ability to successfully use strategic transactions depends on the sub-adviser’s ability to predict pertinent market movements, which cannot be assured. The use of strategic transactions may result in losses greater than if they had not been used, may require the Trust to sell or purchase portfolio securities at inopportune times or for prices other than current market values, may limit the amount of appreciation the Trust can realize on an investment or may cause the Trust to hold a security that it might otherwise sell. Additionally, amounts paid by the Trust as premiums and cash or other assets held in margin accounts with respect to strategic transactions are not otherwise available to the Trust for investment purposes.

Market Discount Risk. Shares of closed-end investment companies frequently trade at a discount from their net asset value, which is a risk separate and distinct from the risk that the Trust’s net asset value could decrease as a result of its investment activities. Although the value of the Trust’s net assets is generally considered by market participants in determining whether to purchase or sell common shares, whether investors will realize gains or losses upon the sale of common shares will depend entirely upon whether the market price of common shares at the time of sale is above or below the investor’s purchase price for common shares. Because the market price of common shares will be determined by factors such as net asset value, dividend and distribution levels (which are dependent, in part, on expenses), supply of and demand for common shares, stability of dividends or distributions, trading volume of common shares, general market and economic conditions and other factors beyond the control of the Trust, the Trust cannot predict whether common shares will trade at, below or above net asset value or at, below or above the initial public offering price. This risk may be greater for investors expecting to sell their common shares soon after the completion of the public offering, as the net asset value of the common shares will be reduced immediately following the offering as a result of the payment of certain offering costs. Common shares of the Trust are designed primarily for long-term investors; investors in common shares should not view the Trust as a vehicle for trading purposes.

Portfolio Turnover Risk. The Trust’s annual portfolio turnover rate may vary greatly from year to year. Portfolio turnover rate is not considered a limiting factor in the execution of investment decisions for the Trust. A higher portfolio turnover rate results in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Trust. High portfolio turnover may result in an increased realization of net short-term capital gains by the Trust which, when distributed to common shareholders, will be taxable as ordinary income. Additionally, in a declining market, portfolio turnover may create realized capital losses. See “Taxation” in the Trust’s prospectus.

Market Disruption and Geopolitical Risk. Instability in the Middle East and terrorist attacks in the United States and around the world have contributed to increased market volatility, may have long-term effects on the U.S. and worldwide financial markets and may cause further economic uncertainties or deterioration in the United States and worldwide. The adviser and subadviser do not know how long the financial markets will continue to be affected by these events and cannot predict the effects of these or similar events in the future on the U.S. and global economies and securities markets. The Trust’s common share price will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Trust’s

10 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2012 |

then-current net asset value. The Trust cannot predict whether its common shares will trade at, above or below net asset value.

In addition to the risks described above, the Trust is also subject to: Income Securities Risk, Foreign Currency Risk, Risks Associated with the Trust’s Covered Call Option Strategy, Risks of Real Property Asset Companies, Private Securities Risk, Investment Funds Risk, Private Investment Funds Risk, Affiliated Investment Funds Risk, Synthetic Investments Risk, Inflation/Deflation Risk, Anti-Takeover Provisions, Market Discount Risk, and Current Developments Risks.

Please see www.guggenheiminvestments.com/gbab for a more detailed discussion about the Trust’s risks and considerations.

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 11 |

| TRUST SUMMARY (Unaudited) | November 30, 2012 |

| | | | | |

| Trust Statistics | | | | |

| Share Price | | $ | 23.25 |

| Common Share Net Asset Value | | $ | 23.86 |

| Premium/Discount to NAV | | | -2.56% |

| Net Assets Applicable to Common Shares ($000) | | $ | 415,483 |

| | | | | | | | |

| Total Returns | | | | | | | |

| (Inception 10/28/10) | | | Market | | NAV |

| Six Month | | | 7.01 | % | | 4.98 | % |

| One Year | | | 18.98 | % | | 16.11 | % |

| Since Inception - Average Annual | | | 14.61 | % | | 18.31 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.guggenheiminvestments.com/gbab. The investment return and principal value of an investment will fluctuate with changes in the market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

| | |

| | % of Municipal |

| State/Territory Allocations | Bonds |

| California | 19.9% |

| Illinois | 11.7% |

| Washington | 8.7% |

| New Jersey | 5.7% |

| Indiana | 5.6% |

| New York | 5.4% |

| Texas | 5.3% |

| Ohio | 4.7% |

| Michigan | 4.0% |

| Pennsylvania | 3.9% |

| Florida | 3.8% |

| West Virginia | 3.1% |

| Colorado | 2.8% |

| Alabama | 2.5% |

| Vermont | 2.4% |

| Nevada | 2.4% |

| Louisiana | 2.2% |

| Mississippi | 1.7% |

| South Carolina | 1.3% |

| Georgia | 1.2% |

| South Dakota | 0.9% |

| Minnesota | 0.8% |

| Portfolio composition and holdings are subject to change daily. For more information, please visit www.guggenheiminvestments.com/gbab. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results. |

| | |

| | % of Total |

| Portfolio Breakdown | Net Assets |

| Municipal Bonds | 109.5% |

| Corporate Bonds | 9.1% |

| Asset Backed Securities | 5.7% |

| Term Loans | 4.8% |

| Preferred Stock | 1.9% |

| Collateralized Mortgage Obligations | 0.5% |

| Total Long-Term Investments | 131.5% |

| Money Market Fund | 0.4% |

| Total Investments | 131.9% |

| Assets in excess of Liabilities | 1.7% |

| Borrowings | -13.9% |

| Reverse Repurchase Agreements | -19.7% |

| Total Net Assets | 100.0% |

Ratings shown are assigned by one or more Nationally Recognized Statistical Credit Rating Organizations (“NRSRO”), such as Standard & Poor’s, Moody’s and Fitch. The ratings are an indication of an issuer’s creditworthiness and typically range from AAA or Aaa (highest) to D (lowest). When two or more ratings are available, the lower rating is used; and when only one is available, that rating is used. The Non-Rated category consists of securities that have not been rated by an NRSRO. U.S. Treasury securities and U.S. Government Agency securities are not rated but deemed to be equivalent to securities rated AA+/Aaa.

12 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2012 |

| | Principal | | | | | | | Optional Call | | | |

| | Amount | | Description | | Rating * | Coupon | Maturity | Provisions** | | Value | |

| | | | | | | | | | | | |

| | | | Long-Term Investments – 131.5% | | | | | | | | |

| | | | Municipal Bonds – 109.5% | | | | | | | | |

| | | | Alabama – 2.8% | | | | | | | | |

| $ | 3,000,000 | | Alabama State University, General Tuition and Fee Revenue Bonds, Taxable Direct-Pay Build America Bonds, (Assured GTY)(a) (k) | | AA– | 7.100% | 09/01/2035 | 09/01/20 @ 100 | $ | 3,461,430 | |

| | 5,000,000 | | Alabama State University, General Tuition and Fee Revenue Bonds, Taxable Direct-Pay Build America Bonds, (Assured GTY)(a) (k) | | AA– | 7.200% | 09/01/2038 | 09/01/20 @ 100 | | 5,780,100 | |

| | 2,000,000 | | Alabama State University, General Tuition and Fee Revenue Bonds, Taxable Direct-Pay Build America Bonds, (Assured GTY)(a) (k) | | AA– | 7.250% | 09/01/2040 | 09/01/20 @ 100 | | 2,315,640 | |

| | | | | | | | | | | 11,557,170 | |

| | | | | | | | | | | | |

| | | | California – 21.8% | | | | | | | | |

| | 500,000 | | Alhambra Unified School District, Elementary Schools Improvement District, Los Angeles County, California, Election of 2008 General Obligation Bonds, Federally Taxable, Series B-1 | | A+ | 6.700% | 02/01/2026 | N/A | | 605,555 | |

| | 10,000,000 | | California, General Obligation Bonds, Various Purpose, Taxable Build America Bonds(a) | | A– | 7.700% | 11/01/2030 | 11/01/20 @ 100 | | 12,277,900 | |

| | 3,000,000 | | Culver City Redevelopment Agency, California, Taxable Tax Allocation Bonds, Culver City Redevelopment Project, Series 2011B(k) | | A | 8.000% | 11/01/2020 | N/A | | 3,338,640 | |

| | 340,000 | | Cypress Elementary School District (Orange County, California), General Obligation Bonds, Direct Pay Qualified School Construction Bonds, 2008 Election, Series B-2(k) | | A+ | 6.050% | 08/01/2021 | N/A | | 386,730 | |

| | 660,000 | | Cypress Elementary School District (Orange County, California), General Obligation Bonds, Direct Pay Qualified School Construction Bonds, 2008 Election, Series B-2(k) | | A+ | 6.650% | 08/01/2025 | N/A | | 766,300 | |

| | 7,500,000 | | Long Beach Unified School District, California, Qualified School Construction Bonds, Federally Taxable, Election of 2008, General Obligation Bonds, Series B-1(k) | | AA– | 5.914% | 08/01/2025 | N/A | | 9,478,800 | |

| | 10,000,000 | | Los Angeles, California, Department of Water & Power Revenue, Taxable Build America Bonds(a) | | AA– | 7.000% | 07/01/2041 | 07/01/21 @ 100 | | 12,100,100 | |

| | 10,000,000 | | Los Angeles, California, Department of Water & Power Revenue, Taxable Build America Bonds(a) | | AA | 7.003% | 07/01/2041 | 07/01/20 @ 100 | | 11,777,400 | |

| | 5,000,000 | | Metropolitan Water District, Southern California, Water Revenue Bonds, 2010 Authorization, Taxable Build America Bonds, Series A(a) | | AAA | 6.947% | 07/01/2040 | 07/01/20 @ 100 | | 6,272,650 | |

| | 1,025,000 | | Monrovia Unified School District, Los Angeles County, California, Election of 2006 General Obligation Bonds, Build America Bonds, Federally Taxable, Series C-1(a) (k) | | A+ | 7.250% | 08/01/2028 | N/A | | 1,214,112 | |

| | 8,000,000 | | Oakland Unified School District, County of Alameda, California, Taxable General Obligation Bonds, Election of 2006, Qualified School Construction Bonds, Series 2012B(k) | | NR | 6.877% | 08/01/2033 | 08/01/22 @ 100 | | 8,517,840 | |

| | 1,000,000 | | Placentia-Yorba Linda Unified School District (Orange County, California), General Obligation Bonds, Federally Taxable Direct-Pay Qualified School Construction Bonds, Election of 2008, Series E(a) (k) | | AA– | 5.400% | 02/01/2026 | N/A | | 1,123,600 | |

| | 5,000,000 | | Riverside Community College District, Riverside County, California, Election of 2004 General Obligation Bonds, Taxable Build America Bonds, Series 2010 D-1(a) | | AA | 7.021% | 08/01/2040 | 08/01/20 @ 100 | | 5,813,850 | |

| | 2,245,000 | | Santa Ana Unified School District, California, General Obligation Bonds, Federal Taxable Build America Bonds(a) | | Aa3 | 6.800% | 08/01/2030 | N/A | | 2,878,472 | |

| | 7,755,000 | | Santa Ana Unified School District, California, General Obligation Bonds, Federal Taxable Build America Bonds(a) | | Aa3 | 7.100% | 08/01/2040 | N/A | | 10,475,609 | |

| | 3,330,000 | | Sonoma Valley Unified School District, General Obligation, Federally Taxable Bonds(a) (k) | | AA– | 7.123% | 08/01/2028 | 08/01/20 @ 100 | | 3,699,863 | |

| | | | | | | | | | | 90,727,421 | |

| | | | | | | | | | | | |

| | | | Colorado – 3.0% | | | | | | | | |

| | 7,500,000 | | Colorado, Building Excellent Schools Today, Certificates of Participation, Taxable Build America Bonds, Series 2010E(a) | | AA– | 7.017% | 03/15/2031 | 03/15/21 @ 100 | | 9,294,150 | |

| | 2,500,000 | | Colorado, Building Excellent Schools Today, Certificates of Participation, Taxable Qualified School Construction, Series 2010-D | | AA– | 6.817% | 03/15/2028 | N/A | | 3,327,300 | |

| | | | | | | | | | | 12,621,450 | |

| See notes to financial statements. |

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 13 |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2012 |

| | Principal | | | | | | | Optional Call | | | |

| | Amount | | Description | | Rating * | Coupon | Maturity | Provisions** | | Value | |

| | | | | | | | | | | | |

| | | | Florida – 4.2% | | | | | | | | |

| $ | 10,000,000 | | Miami-Dade County, Florida, Transit Sales Surtax Revenue, Taxable Build America Bonds, Series B(a) (k) | | AA | 6.910% | 07/01/2039 | 07/01/19 @ 100 | $ | 11,507,100 | |

| | 5,000,000 | | Orlando, Florida, Community Redevelopment Agency, Taxable Tax Increment Revenue Build America Bonds, Series 2010B(a) (k) | | A | 7.784% | 09/01/2040 | 09/01/20 @ 100 | | 5,743,700 | |

| | | | | | | | | | | 17,250,800 | |

| | | | | | | | | | | | |

| | | | Georgia – 1.3% | | | | | | | | |

| | 5,000,000 | | Georgia Municipal Association, Inc., Certificates of Participation, DeKalb County Public Schools Project, (AGM)(k) | | AA– | 5.210% | 12/01/2022 | N/A | | 5,489,150 | |

| | | | | | | | | | | | |

| | | | Illinois – 12.8% | | | | | | | | |

| | 5,000,000 | | Chicago, Illinois, Board of Education, Unlimited Tax General Obligation Bonds, Dedicated Revenues, Taxable Build America Bonds, Series 2010D(a) | | A+ | 6.519% | 12/01/2040 | N/A | | 5,762,150 | |

| | 5,100,000 | | Chicago, Illinois, Second Lien Wastewater Transmission Revenue Project Bonds, Taxable Build America Bonds, Series 2010B(a) | | A+ | 6.900% | 01/01/2040 | N/A | | 6,563,394 | |

| | 2,990,000 | | Chicago, Illinois, Second Lien Water Revenue Bonds, Taxable Build America Bonds, Series 2010B(a) | | AA– | 6.742% | 11/01/2040 | N/A | | 4,132,808 | |

| | 5,000,000 | | Illinois, General Obligation Bonds, Taxable Build America Bonds, Series 2010-5(a) | | A | 7.350% | 07/01/2035 | N/A | | 6,162,350 | |

| | 7,140,000 | | Northern Illinois Municipal Power Agency, Power Project Taxable Revenue Bonds, Prairie State Project Build America Bonds(a) (k) | | A2 | 7.620% | 01/01/2030 | N/A | | 9,182,040 | |

| | 2,860,000 | | Northern Illinois Municipal Power Agency, Power Project Taxable Revenue Bonds, Prairie State Project Build America Bonds(a) (k) | | A2 | 7.820% | 01/01/2040 | N/A | | 4,087,912 | |

| | 4,500,000 | | Northern Illinois University, Auxiliary Facilities System Revenue Bonds, Build America Program, Taxable, Series 2010, (AGM)(a) | | Aa3 | 7.947% | 04/01/2035 | 04/01/20 @ 100 | | 5,437,980 | |

| | 5,000,000 | | Northern Illinois University, Auxiliary Facilities System Revenue Bonds, Build America Program, Taxable, Series 2010, (AGM)(a) | | Aa3 | 8.147% | 04/01/2041 | 04/01/20 @ 100 | | 6,093,400 | |

| | 3,000,000 | | Southwestern Illinois, Development Authority, Taxable Local Government, Program Revenue Bonds, Flood Prevention District Council Project, Recovery Zone Economic Development Bonds, Series 2010C(k) | | AA | 7.230% | 10/15/2035 | 04/15/20 @ 100 | | 3,412,440 | |

| | 2,000,000 | | Southwestern Illinois, Development Authority, Taxable Local Government, Program Revenue Bonds, Flood Prevention District Project, Build America Bonds, Series 2010-B(a) (k) | | AA | 7.030% | 04/15/2032 | 04/15/20 @ 100 | | 2,181,000 | |

| | | | | | | | | | | 53,015,474 | |

| | | | | | | | | | | | |

| | | | Indiana – 6.2% | | | | | | | | |

| | 8,690,000 | | Evansville-Vanderburgh Independent School Building Corporation, Unlimited Taxable Ad Valorem Property Tax First Mortgage Bonds, Series 2010E | | AA+ | 6.500% | 01/15/2030 | 07/15/20 @ 100 | | 10,500,040 | |

| | 3,000,000 | | Knox County, Indiana, Good Samaritan Hospital Project, Taxable Economic Development Revenue Bonds, Qualified Energy Conservation Bonds – Direct Payment, Series 2012B(k) | | A3 | 5.900% | 04/01/2034 | N/A | | 3,296,610 | |

| | 10,000,000 | | Noblesville Multi-School Building Corporation, Hamilton County, Indiana, Taxable Unlimited Ad Valorem Property Tax First Mortgage Bonds, Build America Bonds, Series 2010(a) | | AA+ | 6.500% | 07/15/2030 | 01/15/21 @ 100 | | 11,759,700 | |

| | | | | | | | | | | 25,556,350 | |

| | | | | | | | | | | | |

| | | | Louisiana – 2.4% | | | | | | | | |

| | 8,000,000 | | Orleans Parish. School Board of the Parish of Orleans, Louisiana, (AGM)(k) | | AA– | 4.400% | 02/01/2021 | N/A | | 8,925,440 | |

| | 1,055,000 | | Tangipahoa Parish Hospital Service District No. 1, Louisiana, Taxable Hospital Revenue Bonds, North Oaks Health System Project, Build America Bonds, Series 2009A, (Assured GTY)(a) | | AA– | 7.200% | 02/01/2042 | 02/01/20 @ 100 | | 1,180,587 | |

| | | | | | | | | | | 10,106,027 | |

| | | | | | | | | | | | |

| | | | Michigan – 4.3% | | | | | | | | |

| | 415,000 | | Comstock Park Public Schools, Kent County, Michigan, 2011 School Building and Site Bonds, General Obligation – Unlimited Tax, Federally Taxable – Qualified School Construction Bonds – Direct Payment, Series A(k) | | AA– | 6.300% | 05/01/2026 | 05/01/21 @ 100 | | 465,439 | |

| | 690,000 | | Detroit, Michigan, School District, Build America Bonds(a) (k) | | AA– | 7.747% | 05/01/2039 | N/A | | 872,119 | |

| See notes to financial statements. |

14 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2012 |

| | Principal | | | | | | | Optional Call | | | |

| | Amount | | Description | | Rating * | Coupon | Maturity | Provisions** | | Value | |

| | | | | | | | | | | | |

| | | | Michigan (continued) | | | | | | | | |

| $ | 5,000,000 | | Detroit, Michigan, School District, School Building and Site Bonds, Unlimited Tax General Obligation Bonds, Taxable Build America Bonds, Series, Series 2010B(a) (k) | | AA– | 6.845% | 05/01/2040 | 05/01/20 @ 100 | $ | 5,358,400 | |

| | 1,640,000 | | Detroit, Michigan, School District, School Building and Site Bonds, Unlimited Tax General Obligation Bonds, Taxable Qualified School Construction Bonds, Series 2010A(k) | | AA– | 6.645% | 05/01/2029 | N/A | | 1,935,807 | |

| | 3,000,000 | | Fraser Public School District, Macomb County, Michigan, General Obligation Federally Taxable School Construction Bonds, 2011 School Building and Site Bonds, Series B(k) | | AA– | 6.050% | 05/01/2026 | 05/01/21 @ 100 | | 3,361,680 | |

| | 1,000,000 | | Oakridge, Michigan, Public Schools, Unlimited Tax General Obligation Bonds(k) | | AA– | 6.750% | 05/01/2026 | 05/01/20 @ 100 | | 1,113,340 | |

| | 2,500,000 | | Whitehall District Schools, Muskegon County, Michigan, 2010 School Building and Site Bonds, General Obligation, Unlimited Tax Bonds, Taxable Qualified School Construction Bonds, Series A(k) | | AA– | 6.100% | 05/01/2026 | 05/01/20 @ 100 | | 2,756,875 | |

| | 2,000,000 | | Whitehall District Schools, Muskegon County, Michigan, 2010 School Building and Site Bonds, General Obligation, Unlimited Tax Bonds, Taxable Qualified School Construction Bonds, Series A(k) | | AA– | 6.500% | 05/01/2029 | 05/01/20 @ 100 | | 2,202,460 | |

| | | | | | | | | | | 18,066,120 | |

| | | | | | | | | | | | |

| | | | Minnesota – 0.9% | | | | | | | | |

| | 1,660,000 | | St. Paul Housing & Redevelopment Authority, Federally Taxable Revenue Bonds(j) (k) | | AA | 7.250% | 02/01/2035 | 02/01/21 @ 100 | | 1,860,927 | |

| | 1,540,000 | | St. Paul Housing & Redevelopment Authority, Federally Taxable Revenue Bonds(j) (k) | | AA | 7.500% | 02/01/2040 | 02/01/21 @ 100 | | 1,719,225 | |

| | | | | | | | | | | 3,580,152 | |

| | | | | | | | | | | | |

| | | | Mississippi – 1.8% | | | | | | | | |

| | 5,000,000 | | Medical Center Educational Building Corporation, Taxable Build America Bonds, University of Mississippi Medical Center Facilities Expansion and Renovation Project, Series 2010A(a) (k) | | AA– | 6.842% | 06/01/2035 | 06/01/20 @ 100 | | 5,584,250 | |

| | 1,000,000 | | Mississippi, Hospital Equipment and Facilities Authority, Taxable Build America Revenue Bonds, Forrest County General Hospital Project, Series 2010(a) (k) | | A2 | 7.265% | 01/01/2032 | 01/01/20 @ 100 | | 1,087,780 | |

| | 905,000 | | Mississippi, Hospital Equipment and Facilities Authority, Taxable Build America Revenue Bonds, Forrest County General Hospital Project, Series 2010(a) (k) | | A2 | 7.390% | 01/01/2040 | 01/01/20 @ 100 | | 974,051 | |

| | | | | | | | | | | 7,646,081 | |

| | | | | | | | | | | | |

| | | | Nevada – 2.6% | | | | | | | | |

| | 1,425,000 | | Clark County, Nevada, Airport Revenue Bonds, Build America Bonds, Series B(a) (k) | | AA– | 6.881% | 07/01/2042 | 07/01/19 @ 100 | | 1,631,269 | |

| | 1,200,000 | | Las Vegas Valley Water District, Nevada, Limited Tax General Obligation Water Bonds, Taxable Build America Bonds, Series 2009A(a) (k) | | AA+ | 7.100% | 06/01/2039 | 06/01/19 @ 100 | | 1,388,028 | |

| | 1,500,000 | | Nevada System of Higher Education University, Revenue Bonds, Build America Bonds(a) (k) | | AA– | 7.600% | 07/01/2030 | 07/01/20 @ 100 | | 1,794,030 | |

| | 5,050,000 | | Nevada System of Higher Education University, Revenue Bonds, Build America Bonds(a) | | AA– | 7.900% | 07/01/2040 | 07/01/20 @ 100 | | 6,060,757 | |

| | | | | | | | | | | 10,874,084 | |

| | | | | | | | | | | | |

| | | | New Jersey – 6.3% | | | | | | | | |

| | 8,000,000 | | Camden County Improvement Authority, Camden County, New Jersey, Lease Revenue Bonds, Cooper Medical School of Rowan University Project, Series 2010A (k) | | A+ | 7.747% | 07/01/2034 | 07/01/20 @ 100 | | 9,286,160 | |

| | 2,000,000 | | Camden County Improvement Authority, Camden County, New Jersey, Lease Revenue Bonds, Cooper Medical School of Rowan University Project, Series 2010A (k) | | A+ | 7.847% | 07/01/2035 | 07/01/20 @ 100 | | 2,320,340 | |

| | 10,000,000 | | New Jersey Turnpike Authority, Turnpike Revenue Bonds, Federally Taxable Issuer Subsidy, Build America Bonds, Series 2010A(a) | | A+ | 7.102% | 01/01/2041 | N/A | | 14,360,300 | |

| | | | | | | | | | | 25,966,800 | |

| | | | | | | | | | | | |

| | | | New York – 5.9% | | | | | | | | |

| | 5,000,000 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Taxable Build America Bonds, Series 2010E(a) | | A | 7.134% | 11/15/2030 | 11/15/20 @ 100 | | 5,958,450 | |

| | 5,000,000 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Taxable Build America Bonds, Series 2010B-1(a) | | A | 6.548% | 11/15/2031 | N/A | | 6,258,300 | |

| See notes to financial statements. |

GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT | 15 |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2012 |

| | Principal | | | | | | | Optional Call | | | |

| | Amount | | Description | | Rating * | Coupon | Maturity | Provisions** | | Value | |

| | | | | | | | | | | | |

| | | | New York (continued ) | | | | | | | | |

| $ | 10,000,000 | | Westchester County Health Care Corporation, Revenue Bonds, Taxable Build America Bonds, Series 2010(a) (k) | | BBB | 8.572% | 11/01/2040 | N/A | $ | 12,258,600 | |

| | | | | | | | | | | 24,475,350 | |

| | | | | | | | | | | | |

| | | | Ohio – 5.2% | | | | | | | | |

| | 5,000,000 | | American Municipal Power, Inc., Combined Hydroelectric Projects Revenue Bonds, New Clean Renewable Energy Bonds, Series 2010C(k) | | A | 7.334% | 02/15/2028 | N/A | | 6,514,850 | |

| | 1,950,000 | | Cuyahoga County, Ohio, Hospital Revenue Bonds, The Metrohealth System, Build America Bonds, Taxable, Series 2009B(a) (k) | | A– | 8.223% | 02/15/2040 | N/A | | 2,437,831 | |

| | 2,500,000 | | Madison Local School District, Richland County, Ohio, School Improvement, Taxable Build America Bonds, Series 2010A(a) (k) | | AA | 6.900% | 12/01/2034 | 12/01/20 @ 100 | | 2,756,975 | |

| | 2,500,000 | | Madison Local School District, Richland County, Ohio, School Improvement, Taxable Build America Bonds, Series 2010A(a) (k) | | AA | 7.150% | 12/01/2039 | 12/01/20 @ 100 | | 2,742,650 | |

| | 2,500,000 | | Madison Local School District, Richland County, Ohio, School Improvement, Taxable Build America Bonds, Series 2010A(a) (k) | | AA | 7.300% | 12/01/2043 | 12/01/20 @ 100 | | 2,741,250 | |

| | 2,500,000 | | Madison Local School District, Richland County, Ohio, School Improvement, Taxable Qualified School Construction Bonds, Series 2010B(k) | | AA | 6.650% | 12/01/2029 | 12/01/20 @ 100 | | 2,969,150 | |

| | 1,230,000 | | Toronto City School District, Ohio, Qualified School Construction Bonds General Obligation Bonds(k) | | AA | 7.000% | 12/01/2028 | 12/01/20 @ 100 | | 1,381,401 | |

| | | | | | | | | | | 21,544,107 | |

| | | | | | | | | | | | |

| | | | Pennsylvania – 4.3% | | | | | | | | |

| | 4,865,000 | | Lebanon, Pennsylvania, Sewer Revenue Bonds, Taxable Build America Bonds, Series B of 2010(a) (k) | | A+ | 7.140% | 12/15/2035 | 06/15/20 @ 100 | | 5,467,579 | |

| | 7,500,000 | | Pittsburgh, Pennsylvania, School District, Taxable Qualified School Construction Bonds, Series D | | A | 6.850% | 09/01/2029 | N/A | | 9,487,425 | |

| | 2,500,000 | | School District of Philadelphia, Pennsylvania, General Obligation Bonds, Series 2011A, Qualified School Construction Bonds - (Federally Taxable - Direct Subsidy)(k) | | A+ | 5.995% | 09/01/2030 | N/A | | 2,797,675 | |

| | | | | | | | | | | 17,752,679 | |

| | | | | | | | | | | | |

| | | | South Carolina – 1.4% | | | | | | | | |

| | 5,000,000 | | Horry County, South Carolina, Taxable Airport Revenue Bonds, Recovery Zone Economic Development Bonds, Series 2010B(a) (j) (k) | | A– | 7.328% | 07/01/2040 | N/A | | 5,972,600 | |

| | | | | | | | | | | | |

| | | | South Dakota – 0.9% | | | | | | | | |

| | 3,490,000 | | Pierre, South Dakota, Taxable Electric Revenue Bonds, Recovery Zone Economic Development Bonds, Series 2010C(a) (k) | | A2 | 7.500% | 12/15/2040 | 12/15/19 @ 100 | | 3,908,172 | |

| | | | | | | | | | | | |

| | | | Texas – 5.8% | | | | | | | | |

| | 10,000,000 | | Dallas, Texas, Convention Center Hotel Development Corporation, Hotel Revenue Bonds, Taxable Build America Bonds, Series 2009B(a) (k) | | A+ | 7.088% | 01/01/2042 | N/A | | 12,208,200 | |

| | 10,000,000 | | El Paso, Texas, Combination Tax and Revenue Certification of Obligation, Taxable Build America Bonds, Series 2010B(a) | | AA | 6.700% | 08/15/2036 | 08/15/20 @ 100 | | 11,820,500 | |

| | | | | | | | | | | 24,028,700 | |

| | | | | | | | | | | | |

| | | | Vermont – 2.6% | | | | | | | | |

| | 2,155,000 | | Vermont State Colleges, Revenue Bonds, Taxable Build America Bonds, Series 2010B(a) (k) | | A+ | 6.101% | 07/01/2025 | 07/01/20 @ 100 | | 2,373,539 | |

| | 7,500,000 | | Vermont State Colleges, Revenue Bonds, Taxable Build America Bonds, Series 2010B(a) (k) | | A+ | 7.211% | 07/01/2040 | 07/01/20 @ 100 | | 8,521,725 | |

| | | | | | | | | | | 10,895,264 | |

| | | | | | | | | | | | |

| | | | Washington – 9.6% | | | | | | | | |

| | 5,000,000 | | Anacortes, Washington, Utility System Improvement Revenue Bonds, Build America Bonds, Series 2010B(a) (k) | | AA– | 6.479% | 12/01/2030 | 12/01/20 @ 100 | | 5,688,800 | |

| | 2,000,000 | | Auburn, Washington, Utility System Revenue Bonds, Taxable Build America Bonds, Series 2010B(a) (k) | | AA | 6.396% | 12/01/2030 | 12/01/20 @ 100 | | 2,315,520 | |

| See notes to financial statements. |

16 | GBAB | GUGGENHEIM BUILD AMERICA BONDS MANAGED DURATION TRUST SEMIANNUAL REPORT |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | November 30, 2012 |

| | Principal | | | | | | | Optional Call | | | |

| | Amount | | Description | | Rating * | Coupon | Maturity | Provisions** | | Value | |

| | | | | | | | | | | | |

| | | | Washington (continued) | | | | | | | | |

| $ | 5,000,000 | | Central Washington University, System Revenue Bonds, 2010, Taxable Build America Bonds, Series B(a) (k) | | A1 | 6.500% | 05/01/2030 | N/A | $ | 5,815,000 | |

| | 5,800,000 | | Public Hospital District No. 1, King County, Washington, Valley Medical Center, Hospital Facilities Revenue Bonds, Series 2010B(a) (k) | | BBB+ | 8.000% | 06/15/2040 | 06/15/20 @ 100 | | 6,574,822 | |

| | 5,000,000 | | Washington State Convention Center Public Facilities District, Lodging Tax Bonds, Taxable Build America Bonds, Series 2010B(a) | | A+ | 6.790% | 07/01/2040 | N/A | | 6,195,800 | |