CORPORATE PRESENTATION

APPROVED FOR USE JULY 1, 2014

Table of Contents

| Legal Disclaimer | Page 3 |

| | |

| Executive Summary | Page 4 |

| | |

| A Better Solution – NaPI Technology | Page 5 |

| | |

| NaPI Technology Benefits | Page 6 |

| | |

| Market Drivers | Page 7 |

| | |

| Competition | Page 8 |

| | |

| Product Development | Page 8 |

| | |

| Intellectual Property | Page 9 |

| | |

| Manufacture and Distribution | Page 9 |

| | |

| Company Leadership | Page 10 |

| | |

| Markets and Marketing Strategy | Page 10 |

| | |

| Current Cash Needs | Page 11 |

| | |

| Financing Strategy | Page 11 |

| | |

| Key Business Milestones | Page 11 |

| | |

| Financials | Page 12 |

LEGAL DISCLAIMER

This July 1, 2014 Corporate Presentation contains forward-looking statements, including statements regarding the Company's targeted business model. Forward-looking statements are identified by words such as "believe" "expect," "plan," "will," "should," "could," "anticipate," "intend," "estimate," and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. We based these forward-looking statements on our current expectations and projections about future events, and they speak only as of the date they are made. For such statements, we claim the protection of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Our actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Factors that could cause actual results to differ from those implied by the forward-looking statements include a number of risks and uncertainties, including that the Company may not be able to implement its strategic priorities, or that if implemented they will not prove successful, decreased government spending on emission control projects or decreased regulation of emissions, the failure to secure required regulatory approvals, the failure to achieve or sustain customer acceptance of our products, as well as those described risks set in our reports filed with the SEC, especially in the section entitled "Risk Factors" in the Form S-1 filed with SEC on May 6, 2014 and other cautionary statements described in our reports filed with the Securities and Exchange Commission, all of which could have a material impact on our financial performance and prospects. The Company undertakes no obligation to publicly update any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. The Company cautions readers not to place undue reliance on those statements.

This Corporate Presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities of the Company, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This is presented as a source of information and not an investment recommendation.

Executive Summary

Enerpulse Technologies, Inc. (“Enerpulse” or “the Company”) has developed and commercialized the first real breakthrough in automotive spark plug technology in over 120 years. Its nano-plasma ignition (“NaPI”) technology employs a novel integrated capacitor that stores and compresses electrical energy to intensify the ignition spark. This “pulse discharge”, which occurs during the first few nano-seconds of the spark event, saturates the resident fuel charge with an energy-rich plasma field creating highly charged radicals, ions and fractured HC chains. This ionization process “conditions” the resident fuel charge into a highly reactive state which results in much more precise combustion initiation and a faster more robust burn.

This well accepted and patented process increases fuel economy, reduces tailpipe emissions and improves engine performance – a revolutionary feature unattainable by conventional spark plugs. In fact, tests conducted at certified third-party labs, and internally at Enerpulse, confirm that its NaPI technology increases fuel economy on modern engines as much as 5.5% while, at the same time, significantly improving tailpipe emissions and engine performance when compared to conventional spark plugs - even in “plug-and-play” installations.

Enerpulse has a defined market of $10+ billion, within three distinct verticals:

| • | Automotive/Power Sports Aftermarket |

| • | NatGas Fueled SI Engines (NG, CNG, LNG, LPG, Bio-Gas) –Stationary & Vehicular Applications |

Our marketing strategy in each segment is as follow:

Automotive/Power Sports Aftermarket: We have recently released our latest product-line enhancement under the brand Pulstar® with PlasmaCore. This will be supported by a targeted advertising program in digital, social, video and print media. Enerpulse has also contracted Al User Jr. as its Pulstar spokesman. He will make personal appearances and his image and testimonials will be included in numerous advertisements.

Distribution of Enerpulse’s “plug & play” aftermarket product, branded PULSTAR®, is already established through multiple “big box” and Dot-Com automotive parts retailers. Launch of a major advertising and promotion program in mid-2014 is expected to increase consumer recognition and demand for PULSTAR®plugs and drive sustained revenue growth in this segment.

NatGas Fueled SI Engines: Enerpulse has partnered with Freepoint Commodities, a major North American commodities trader, as its exclusive North American distributor to the stationary engine segment. Freepoint has accessed its extensive business network to established nine Beta sites for testing and refinement of our product line. Freepoint already has a core team in place and will expand staffing as needed to support robust sales growth. Commercial sales in this segment are anticipated during Q-4, 2014.

Enerpulse is handling the vehicular segment internally and has established interest from multiple gasoline and/or diesel to NatGas engine converters. Vehicular engine converters desperately need help in improving engine starting, idle quality, fuel consumption, tailpipe emissions and driveability. This segment is readily embracing Enerpulse’s NaPI technology as a promising solution.

Automotive OEM: We are currently in direct discussions with five major automotive OEMs. However, Enerpulse has narrowed its focus to the three most promising in order to manage costs, lower risk and speed adoption. We are in advanced testing at these three targeted automotive OEMs and are moving thru the adoption process. Formal nomination on at least one major engine platform is expected in 2016 with revenues commencing in mid-2017. Establishing a manufacturing agreement with an existing Tier-1 supplier is a key to making this happen.

Enerpulse currently generates a 35% to 50% Standard Gross Margin on sales with its PULSTAR®aftermarket program..These margins will be sustained or improved, even within the NatGas and automotive OEM sectors, with aggressive cost reduction, economies of scale and our strong (and strengthening) patent protection. Enerpulse holds 24 issued patents and 20 patents pending, creating a virtual “minefield” around its core technology.

A Better Solution – NaPI Technology

Pulsed Power is the term used to describe the science and technology of accumulating energy over a relatively long period of time (micro-seconds) and releasing it very quickly (nano-seconds), thus increasing the instantaneous power discharge. It is a proven technology that has been used for many years in such things as Pulsed Beam Weapons (SDI), lasers, radar, electric motor starters, microwave ovens, camera flashes and X-ray. Enerpulse’s founder, Lou Camilli, worked in close cooperation with the Sandia National Laboratories for over 20 years to develop unique applications for Pulsed Power and has made significant advancements in the base and applied science. In fact, Mr. Camilli provided Sandia with highly accurate Pulsed Power devices that fire multiple lasers on their experimental Nuclear Fusion Reactor.

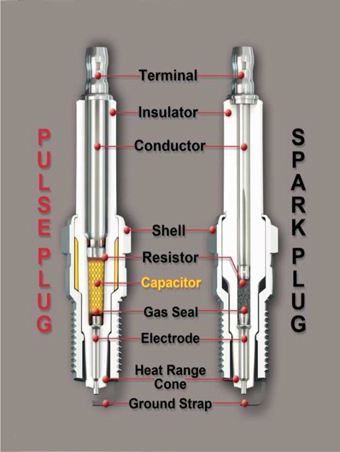

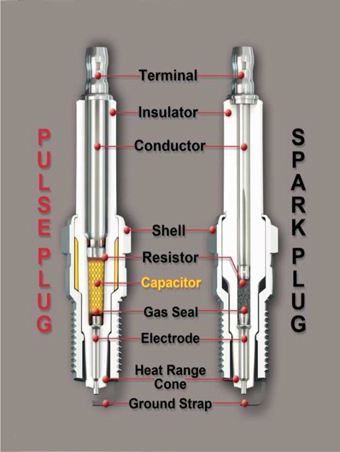

Pulsed Power is at the core of Enerpulse’s NaPI technology, a major breakthrough in automotive ignition systems. For 120 years, ignition technology has been limited by the relatively weak discharge power of conventional spark plugs. However, by incorporating Enerpulse’s NaPI technology into the envelope of a conventional spark plug, discharge power is increased from a maximum of 50 watts (Ultra-Premium conventional spark plug) to over 5-million watts.

Enerpulse’s patented integral capacitor and highly efficient discharge circuitry, generates a visibly larger spark than conventional spark plugs. This larger spark is actually a 3 nano-second/300MHz electrical discharge that saturates the fuel charge with an energy-rich and very reactive plasma field. The plasma field creates highly charged radicals, ions and fractured HC chains that destabilize the fuel charge, essentially “conditioning” it for very precise combustion initiation – and, propagation of a larger and faster burning flame front.

This vastly different ignition process significantly improves combustion efficiency and increases peak cylinder pressure i.e., higher engine torque. Increased torque improves engine performance (better responsiveness, faster acceleration, and/or more towing capacity) or, inversely, performs the same work with less fuel consumption.

The use of plasma saturation to improve combustion of HC fuels is a well-known science and the subject of multiple scholarly technical papers. In fact, many attempts have been made to utilize high-energy ignition strategies to capture its significant benefits. Unfortunately, all were flawed until Enerpulse invented and developed its NaPI technology.

NaPI Technology Benefits

* Combustion Timeframe = 0.015 sec; A: F = Phi 0.75

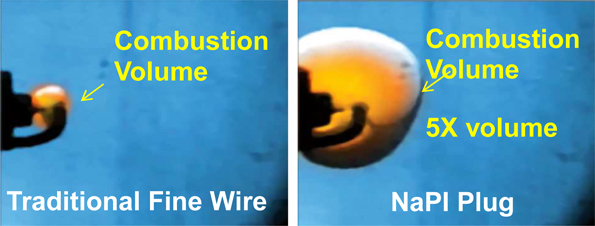

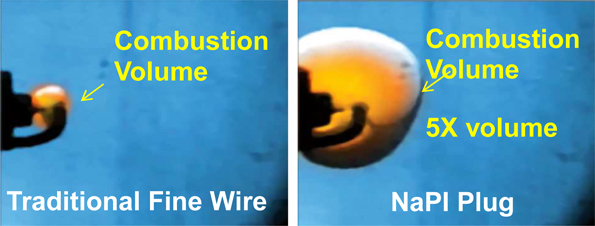

Tests conducted at a leading U.S. engine laboratory demonstrate how spark plugs incorporating Enerpulse’s NaPI technology burn fuel more efficiently than conventional spark plugs. In this high-speed video-capture (shot at 68,000 frames per second - each frame representing 14µs) one can actually see the NaPI enhanced combustion plume growing at more than twice the speed of the conventional spark plug. Enerpulse’s NaPI technology generates a much larger and energy-dense spark envelope than conventional spark plugs, which reduces overall burn time and combusts the fuel (hydrocarbons) more efficiently and effectively.

Given the lower than expected net proceeds from its recent public offering, existing infrastructure and assets will be leveraged to achieve these objectives. A small amount of CAPEX will be budgeted for R&D and manufacturing projects aimed at technology advancements and cost reduction.

Market Drivers

Strong market drivers are expected to create increasing demand for Enerpulse’ NaPI technology for many years into the future:

Automotive Aftermarket

There is robust consumer demand for cost-effective “plug-and-play” upgrades in both the fuel economy and performance demographics. Targeted and effective advertising & consumer education will underpin sustained sales growth of Enerpulse’s Pulstar banded plugs in this vertical. Furthermore, global turmoil in oil producing countries will continue to raise the cost of gasoline and increase interest in fuel savings.

Stationary NatGas Fueled Engines

Oil & Gas companies are aggressively pursuing ways to reduce operating costs and meet increasing emissions regulations. NatGas fueled SI engines, from small V-8’s to massive 6,000 HP 16-cylinder models, are pumping oil and compressing natural gas from well-heads to consumers. These engines use massive amounts of fuel, require near-constant maintenance and utilize large and expensive emission abatement systems – just to meet current government regulations. Enerpulse’s NaPI technology has demonstrated reduced fuel consumption and lower engine-out emissions (especially NOx). Equally important, engines operating with our technology show dramatic improvements in peak pressure crank angle variation. This operating parameter is measured as “Coefficient of Variation” (COV) and is constantly monitored on larger compression engines since it directly correlates to maintenance cost.

NatGas Fueled Vehicles

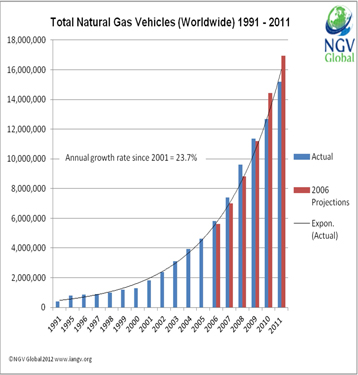

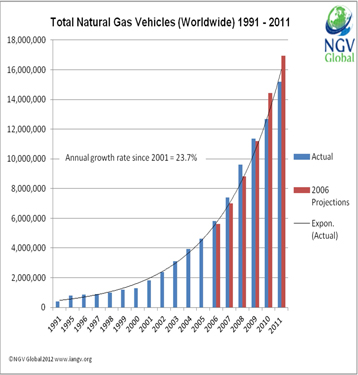

The global NatGas fueled vehicle market is growing at a compounded rate of 24%/year. To date, most of the growth has been outside North America; but, this is changing rapidly. Fleet conversion of gasoline engines to NatGas is on the rise and many operators of mid-size delivery vehicles (such and UPS and FedEx) are converting from diesel to NatGas fuels. Furthermore, several car companies are already producing NatGas fueled passenger vehicles and others have announced plans to produce them in the near-future. Enerpulse’s NaPI technology enables these engines to start easier, run smoother, consume less fuel, produce lower emissions and deliver more power to the wheels.

Automotive OEM

OEMs are faced with daunting new government regulations mandating significant improvements in vehicle fuel consumption and reductions in tailpipe emissions. Known solutions, such as turbo-chargers, gas direct injection (GDI), variable valve timing (VVT) and start-stop have been used to meet current regulation. Going forward, however, the industry is out of known cost-effective solutions; and, we are confident they will include Enerpulse’s NaPI technology in their engine strategy roadmap.

The latest and most notable effort by the automakers is the introduction of hybrid drive using a small SI gasoline engine in concert with an electric motor for propulsion. NaPI technology has shown to be especially effective in improving the performance of these small engines in hybrid drive systems.

Competition

There are no direct competitors to Enerpulse’s NaPI technology. While there is sporadic publicity around Laser Ignition (Bosch & Borg Warner) and Corona Discharge (Federal Mogul), these technologies are no more than laboratory experiments; and, not taken seriously by the major automotive OEMs.

Product Development

Following is a summary of Enerpulse’s product development with respect to its targeted markets.

| · | Automotive and Powersports Aftermarkets – Pulstar with PlasmaCore (a.k.a. Gen4) is currently fulfilling orders thru multiple “Box” and Dot-Com retailers (e.g., AutoZone, O’Reilly’s and Amazon). Further technology developments (e.g. advanced materials, electrode geometry and increased capacitance) are in development. Commercialization will take 12-18 months at an estimated development and validation cost of $500K. |

| · | Stationary NatGas Fueled SI Engines – This segment requires plugs with two different outer geometries, both containing special components and electrode configurations specially designed to operate in NatGas fueled engines: |

| o | Automotive style plugs are used in smaller NatGas SI engines, from single cylinder pump jacks to 5.7L V-8’s. They are also used in larger engines that are fitted with pre-combustion chambers. Enerpulse has demonstrated the required service life of these plugs and is now gathering performance data (fuel consumption, emissions and COV) to initiate commercial sales in Q-4, 2014. |

| o | A much bigger and robust plug is required for large gas-compression and co-generation engines, with or without pre-combustion chambers. We are gathering very promising performance data (fuel consumption, emissions and COV) utilizing this design, and are currently verifying service life at several beta sites. The Company expects to initiate commercial sales on the larger NatGas segment in Q-1, 2015. |

| · | Vehicular NatGas Fueled Engines – The vehicular market for NatGas fueled SI engines runs the gamut from small commuter 2-cylinder/1-liter engines to over-the-road semi-tractors of 22-liter displacement. The majority of current interest is in the medium duty vehicles represented by school buses, delivery vehicles, municipal service vehicles and others that return to base for re-fuelling. |

| o | Enerpulse’s automotive style NaPI plugs are designed for either gasoline to NatGas conversions or OEM NatGas fueled engines (e.g. Fiat and Ford). Special consideration is required in material selection for the plugs due to the aggressive chemistry produced by NatGas combustion. Initial testing has shown the NaPI plugs to deliver improvements in starting, improved power and fuel economy with reductions in overall emissions. These plugs are currently in Beta test at several engine converters/OEMs, with revenue commencing in Q4, 2014. |

| o | NaPI Plugs for medium duty engines (e.g. Cummins and Perkins) have the same footprint as automotive style plugs but materials and electrode geometries differ. Due to high engine loads that inherently reduce electrode life, special consideration is given to electrode design. Pre-production prototypes are currently being tested at two Beta sites. Data from the first site has already demonstrated NOx reduction of 15%, with up to 30% reduction expected after calibration optimization. This Beta site has purchased NaPI plugs for further testing on 4 engines. Revenues are expected Q-4, 2014. |

| o | Over-the-road semi-tractor engines utilize NaPI plug designs similar to the large stationary engines. This segment will be approached as fueling stations become available on the interstate system. |

| · | Automotive OEM – Enerpulse has narrowed its focus to 3 high-probability automotive OEMs and one high-probability Powersports OEM (all in Europe). The company is also in advanced discussions with a major European Tier-1 systems integrator to form a JDA to optimize the benefits of Enerpulse’s NaPI technology in a complete ignition system. |

Intellectual Property

The company has 24 issued patents and 20 patents pending. Additional patents are under development to strengthen protection of our core technology, improve its manufacturability and reduce costs. Enerpulse exerted its patent rights against Federal Mogul (FM) in 2013. This challenge was settled in Enerpulse’s favor, without litigation.

No patent challenges exist at this time.

Manufacture and Distribution

Enerpulse is fully capable of manufacturing forecasted product requirement for its automotive aftermarket and NatGas fuel engine segments, at least thru 2015.

The Company continues to discuss potential manufacturing agreements with established Tier-1 spark plug manufacturers. While this process is moving slowly, we are confident agreement will be reached with one or more Tier-1’s by EOY-2014. This is a necessary step in landing an automotive OEM engine platform nomination.

Company Leadership

Experienced and motivated management leadership is already in place to execute its Business Plan and take Enerpulse forward into the OEM market place. In addition, Enerpulse has sales engineering resources “on the ground” to support key automakers located in the US, Italy, Germany and France and Brazil. Enerpulse’s leadership team has extensive managerial, marketing and manufacturing experience in both public and private businesses ranging in size from start-ups to billion-dollar multi-national corporations. It also has strong expertise in related technologies. CEO, Joseph Gonnella, for example, spent more than a decade at General Motors. In the 1990’s Mr. Gonnella took Engelhard’s catalytic converter business from 19% to 45% world market share by establishing technology leadership with the major automotive OEMs. Later he served president & CEO of Wabash Technologies (electronic engine controls).

Markets and Marketing Strategy

|  |

| | |

| NatGas (Stationary) | NatGas (Mobile) |

| | |

|  |

| Automotive/Power Sports | Automotive OEM |

| Aftermarkets | |

TAM = $9.7 Billion

The Automotive and Powersports Aftermarket segment offers the quickest path to the revenue growth needed to extend the Company’s runway and demonstrate key milestone achievement. The Marx Group, Enerpulse’s outside marketing consultants, devised a strategy last year; but, implementation was delayed until June, 2014 due to lack of funding. While timing of the roll-out is less than optimal (summer being the peak time for aftermarket sales), it will serve to build momentum toward the all-important SEMA aftermarket convention held in November 2014.

There are two NaPI plug geometries required to cover all engines in the currently installed NatGas fuel stationary engine base: 1) a standard automotive geometry for smaller displacement engines and large engines fitted with certain pre-combustion chambers and 2) a much bigger geometry for large displacement engines, with and without pre-combustion chambers. Development of our NatGas fueled engine product line was also slowed due to lack of funding. This effort is now back in full-swing with the automotive geometry plug ready for serial production. Further data collection is needed to conclusively demonstrate fuel consumption, emissions and engine stability benefits on both geometry plugs. Adequate service life has been demonstrated on the automotive geometry plug, but further service life testing is needed on the large geometry plug.

Current Cash Needs

Enerpulse plans to raise $3.0 - $5.0M by EOY 2014. This will provide the Company with sufficient funding to get to the next stage in the Company’s strategic development.

Key Business Milestones

The Company must achieve certain key business milestones coupled with a steady flow of market communications:

Achieved Milestones

2014 H1

| · | Completed Public Offering (Q-2) |

| · | Launch of aftermarket marketing program / Hiring of Al Unser Jr. as spokesman (Q-2) |

| · | Launch of Pulstar with PlasmaCore product line (Q-2) |

Target Milestones

2014/2015

| · | Add Independent Board members |

| · | Commercial business in NatGas fueled stationary engine segment |

| · | LOI with Tier-1 spark plug manufacturer |

| · | Joint Enerpulse/AVL technical paper on faster catalytic converter light |

| · | Commercial business in NatGas fueled vehicle segment |

| · | Manufacturing Agreement with Tier-1 spark plug manufacturer |

| · | Cash flow positive in automotive aftermarket and NatGas fueled engine segments |

| · | Two peer-reviewed technical papers |

| · | New product developments |

| · | Uplist to major stock exchange |

2016/2017

| • | Automotive OEM engine platform nomination |

| • | Tier-1 begins supplying production-intent product under Manufacturing Agreement |

| • | Two peer-reviewed technical papers |

| • | Introduction of system optimized NaPI (result of JDA) |

| • | Automotive OEM platform nomination for NaPI “system” (result of JDA) |

| • | Tier-1 begins supplying serial production product under Manufacturing Agreement |

ENERPULSE TECHNOLOGIES, INC.

CONSOLIDATED BALANCE SHEETS

| | | March 31, | | | December 31, | |

| | | 2014 | | | 2013 | |

| | | (Unaudited) | | | | |

| | | | | | | |

| ASSETS | | | | | | | | |

| Current Assets | | | | | | | | |

| Cash and cash equivalents | | $ | 134,167 | | | $ | 281,607 | |

| Accounts receivable | | | 82,823 | | | | 92,960 | |

| Inventory, net | | | 320,908 | | | | 299,383 | |

| Other current assets | | | - | | | | 3,085 | |

| Total current assets | | | 537,898 | | | | 677,035 | |

| Intangible assets, net of accumulated amortization of $103,483 and $96,287, respectively | | | 392,878 | | | | 387,947 | |

| Property and equipment, net | | | 145,701 | | | | 150,586 | |

| Other assets | | | 352,402 | | | | 162,896 | |

| Total assets | | $ | 1,428,879 | | | $ | 1,378,464 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable | | $ | 814,049 | | | $ | 450,646 | |

| Accrued expenses | | | 369,572 | | | | 253,013 | |

| Current portion of capital lease obligation | | | 7,377 | | | | 7,377 | |

| Current portion of notes payable, net | | | 200,781 | | | | - | |

| Warrants liability | | | 37,127 | | | | - | |

| Total current liabilities | | | 1,428,906 | | | | 711,036 | |

| Long-Term Liabilities | | | | | | | | |

| Capital lease obligation, net of current portion | | | 6,938 | | | | 8,672 | |

| Notes payable, net of current portion | | | 166,271 | | | | 166,271 | |

| | | | 173,209 | | | | 174,943 | |

| Total liabilities | | | 1,602,115 | | | | 885,979 | |

| | | | | | | | | |

| Commitments and Contingencies | | | | | | | | |

| | | | | | | | | |

| Puttable Common Stock, 131,287 shares outstanding, $0.001 par value | | | 393,780 | | | | 393,780 | |

| | | | | | | | | |

| Stockholders' (Deficit) Equity | | | | | | | | |

| Preferred stock, 10,000,000 shares authorized; no shares issued and outstanding; $0.001 par value | | | - | | | | - | |

| Common stock, 100,000,000 shares authorized; 8,732,381 and shares issued and outstanding at March 31, 2014 and December 31, 2013, respectively; $0.001 par value | | | 8,733 | | | | 8,733 | |

| Additional paid-in capital | | | 23,696,638 | | | | 23,659,588 | |

| Note receivable, related party | | | (202,577 | ) | | | (202,072 | ) |

| Accumulated deficit | | | (24,069,810 | ) | | | (23,367,544 | ) |

| Total stockholders' (deficit) equity | | | (567,016 | ) | | | 98,705 | |

| Total liabilities and stockholders' (deficit) equity | | $ | 1,428,879 | | | $ | 1,378,464 | |

See notes to accompanying unaudited consolidated financial statements.

ENERPULSE TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | Three Months Ended | |

| | | March 31, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| Sales | | $ | 97,164 | | | $ | 162,904 | |

| Cost of sales | | | 90,844 | | | | 104,061 | |

| Gross profit | | | 6,320 | | | | 58,843 | |

| Selling, general and administrative expenses | | | 698,476 | | | | 745,844 | |

| Loss from operations | | | (692,156 | ) | | | (687,001 | ) |

| Other expense | | | (10,110 | ) | | | (5,293 | ) |

| | | | | | | | | |

| Net loss | | $ | (702,266 | ) | | $ | (692,294 | ) |

| | | | | | | | | |

| Net loss per common share (basic and diluted) | | $ | (0.08 | ) | | $ | (0.10 | ) |

| Net loss per puttable common share (basic and diluted) | | $ | (0.08 | ) | | $ | - | |

| | | | | | | | | |

| Weighted average number of shares outstanding (basic and diluted) - common | | | 8,732,281 | | | | 7,194,910 | |

| Weighted average number of shares outstanding (basic and diluted) - puttable common | | | 131,287 | | | | - | |

See notes to accompanying unaudited consolidated financial statements.

ENERPULSE TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | Three Months Ended | |

| | | March 31, | |

| | | 2014 | | | 2013 | |

| | | | | | | |

| Cash Flows From Operating Activities | | | | | | | | |

| Net loss | | $ | (702,266 | ) | | $ | (692,294 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | |

| Stock-based compensation | | | 37,050 | | | | 5,000 | |

| Amortization | | | 7,196 | | | | 5,747 | |

| Depreciation | | | 12,446 | | | | 20,280 | |

| Amortization of warrants on notes payable | | | 7,908 | | | | - | |

| Interest on note receivable, related party | | | (505 | ) | | | - | |

| Allowance for doubtful accounts | | | 1,305 | | | | - | |

| Changes in operating assets and liabilities: | | | | | | | - | |

| Accounts receivable | | | 8,832 | | | | (8,681 | ) |

| Inventory | | | (21,525 | ) | | | (18,073 | ) |

| Accounts payable | | | 363,403 | | | | (68,480 | ) |

| Accrued expenses | | | (65,009 | ) | | | (242,777 | ) |

| Other | | | 3,085 | | | | 102,366 | |

| Net cash used in operating activities | | | (348,080 | ) | | | (896,912 | ) |

| | | | | | | | | |

| Cash Flows From Investing Activities | | | | | | | | |

| Purchase of property and equipment | | | (7,561 | ) | | | (10,601 | ) |

| Purchase of intangible assets | | | (12,127 | ) | | | (24,134 | ) |

| Net cash used in investing activities | | | (19,688 | ) | | | (34,735 | ) |

| | | | | | | | | |

| Cash Flows From Financing Activities | | | | | | | | |

| Proceeds from issuance of common stock | | | - | | | | 664,286 | |

| Payments on deferred offering costs | | | (7,938 | ) | | | - | |

| Proceeds from notes payable | | | 230,000 | | | | - | |

| Payments on capital lease and notes payable | | | (1,734 | ) | | | (45,928 | ) |

| Net cash provided by financing activities | | | 220,328 | | | | 618,358 | |

| Net decrease in cash and cash equivalents | | | (147,440 | ) | | | (313,289 | ) |

| Cash and cash equivalents at beginning of year | | | 281,607 | | | | 1,116,870 | |

| Cash and cash equivalents at end of year | | $ | 134,167 | | | $ | 803,581 | |

| | | | | | | | | |

| Supplement cash flow information: | | | | | | | | |

| Cash paid for interest | | $ | 2,680 | | | $ | 5,293 | |

| | | | | | | | | |

| Noncash investing and financing activities: | | | | | | | | |

| Accrued expenses included in deferred offering costs | | $ | 181,568 | | | $ | - | |

See notes to accompanying unaudited consolidated financial statements.