UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22436

EntrepreneurShares Series Trust

(Exact name of registrant as specified in charter)

175 Federal Street, Suite #875

Boston, MA 02110

(Address of principal executive offices) (Zip code)

Dr. Joel M. Shulman

175 Federal Street, Suite #875

Boston, MA 02110

(Name and address of agent for service)

(617) 917-2605

Registrant's telephone number, including area code

Date of fiscal year end: June 30, 2016

Date of reporting period: June 30, 2016

Item 1. Reports to Stockholders.

Annual Report

June 30, 2016

EntrepreneurShares Global Fund

Entrepreneur U.S. All Cap Fund

Entrepreneur U.S. Large Cap Fund

Each a series of EntrepreneurShares Series Trust

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

EntrepreneurShares Series Trust

August 15, 2016

Dear Shareholders:

We are enclosing the report for results covering the fiscal period July 1, 2015 through June 30, 2016.

The global equity landscape proved to be turbulent over the past twelve months. A number of macroeconomic and political factors contributed to above-average volatility resulting in risk-averse investors moving toward historically “safe-haven” asset classes. U.S. Large Capitalized stocks, represented by the S&P 500 Total Return Index, appreciated 3.99%, compared to -2.19% for Global Equity markets as measured by the MSCI The World Index. U.S. Domestic Small-Cap stocks, as measured by the Russell 2000 Total Return Index, were among the worst performers, generating returns of -6.73%.

Not surprisingly, our Entrepreneur Mutual Funds, that traditionally have above average Up-Capture and Down-Capture, under performed their benchmarks during this time period. Several key factors need to be addressed. First, our models work best during periods of market appreciation and low volatility. Our historical above average Up-Capture suggests that when markets rise, our Entrepreneurial stocks tend to rise faster. The corollary also tends to hold true: our above average Down-Capture suggests that during periods of market decline our Entrepreneurial stocks tend to fall faster than peer benchmarks. Except for the U.S. Large Cap Fund, as explained below, this was the case for the most recent fiscal period. Another important distinguishing characteristic is that the majority of our alpha-generating Entrepreneurial stocks tend to fall in the Growth and High Beta classification and reside within the Information Technology, Consumer Discretionary and Health Care sectors. When equity markets favor Value and Low Beta stocks, or reward industries such as Industrials, Materials, Energy or Utilities, our Entrepreneur portfolios will under-perform the markets. Such was the case for much of the recent fiscal period.

During the last fiscal period, our U.S. Large Cap Fund (IMPLX) generated -0.49%, our U.S. All Cap Fund (IMPAX) generated -9.63% and our Global Fund (ENTIX) generated -2.75%. The top performing sectors for the S&P 500 Total Return Index were Utilities (31.5% vs 42.4% for Entrepreneurs), Telecommunications (25.1% vs -6.1% for Entrepreneurs), Staples (18.5% vs 18.6% for Entrepreneurs) and Industrials (6.6% vs 4.2% for Entrepreneurs). Most of the discrepancy between the U.S. Large Cap (IMPLX) and the S&P 500 Total Return Index benchmark can be attributed to weak performance among Energy stocks (-35.2% vs -4.0% for the benchmark) and Biotechnology stocks (-11.7% vs -4.5% for the benchmark). Highlights included Information Technology (9.2% vs 4.7% for the benchmark) and Materials (24.5% vs -2.2% for the benchmark). In the latter case, much of the alpha generated from Materials can be attributed to the acquisition of Airgas (+30.2%).

Among U.S. All Cap stocks, the best performing sectors for the Russell 2000 Total Return Index benchmark included Utilities (30.6% vs 48.4% for Entrepreneurs), Telecommunication (16.9% vs 24.1% for Entrepreneurs), Staples (10.6% vs 3.7% for Entrepreneurs), and Financials (1.8% vs -3.6% for Entrepreneurs). Most of the discrepancy between the U.S. All Cap Fund and the Russell 2000 Total Return Index can be attributed to weak performance among Energy (-65.3% for Entrepreneurs vs -39.2%), Financials, Utilities (due to 3.1% sector under-weight for Entrepreneurs), Materials (-16.5% for Entrepreneurs vs -4.8%) and Industrials (-13.9% for Entrepreneurs vs -7.3%). Bright spots included Health Care (-13.9% for Entrepreneurs vs -21.7%), Consumer Discretionary (-7.6% for Entrepreneurs vs -14.8%) and Information Technology (1.7% for Entrepreneurs vs -3.3%). Each of these traditionally strong areas helped narrow the gap between the U.S. All Cap Fund and its benchmark.

When reviewing Global equity performance, applying MSCI The World Index, we note that the best performing sectors were Utilities (15.6% vs 48.4% for Entrepreneurs), Consumer Staples (13.6% vs 1.0% for Entrepreneurs) and Telecommunication (8.5% vs 14.4% for Entrepreneurs). Interestingly, though the Global Fund outperformed the peer benchmark in the Utilities and Telecommunication sectors, given the paucity of entrepreneurial companies in these sectors, the weights for the Global Fund were -1.7% (1.6% vs 3.3% weight for the benchmark) in Utilities and -3.1% weight (0.4% Entrepreneur weight vs 3.5%) in Telecommunications. Consequently, the strong performance in these two sectors had limited impact on the overall comparative performance. The strongest relative performance, other than the ones mentioned, occurred in the Information Technology space (3.5% vs 2.3% for the benchmark) and Health Care (-0.4% vs -4.3% for the benchmark). In the case of Energy, not unlike the U.S. Large Cap Fund and the U.S. All Cap Fund, the

EntrepreneurShares Series Trust

Global Fund experienced under performance among Energy stocks (-11.6% vs -4.6% for the benchmark). However, the effect on overall returns was relatively modest given the under-weight position of this sector.

We observe consistent behavior across all three portfolios: Utilities, Telecommunications and Consumer Staples were among the top performers and Energy was among the worst. Moreover, we note that the patterns of returns were very uneven during the fiscal period July 1, 2015 to June 30, 2016. Prior to February 11, 2016, U.S. Large Cap stocks appreciably outperformed U.S. Small Cap stocks (by as much as 1,000 basis points), however this pattern has reversed significantly since February 11, 2016 through the time of this writing (900+ basis points).

As a closing summary to this report, we acknowledge the underperformance of our Funds, though we remain encouraged for future success. The behavior of our three mutual funds is not surprising given market conditions favoring value and low beta stocks during this past fiscal year. Though we obviously cannot predict the future or market direction, we remain optimistic that the basic premise of the Entrepreneur model is intact, productive and operating accordingly. The key Entrepreneur sectors of Health Care, Information Technology and Consumer Discretionary, we believe, will continue to offer strong returns to investors over an extended period of time and be rewarded for patience.

We extend our gratitude for your continued support and look forward to sharing more updates to you in the future.

Sincerely,

Joel Shulman Ph.D., CFA

Managing Director

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-271-8811 or visiting www.ershares.com.

Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a full prospectus which contains this and other information about the Funds offered by EntrepreneurShares, call 1-877-271-8811.

Please read the full prospectus carefully before investing. The full prospectus is distributed by Rafferty Capital Markets, LLC.

The EntrepreneurShares Global Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Entrepreneur U.S. All Cap Fund invests in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Entrepreneur U.S. Large Cap Fund is exposed to common stock risk. Common stock prices fluctuate based on changes in a company’s financial condition and on overall market and economic conditions. Additional risks are detailed in the prospectus.

The MSCI The World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Russell 2000 Total Return Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The S&P 500 Total Return Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Returns assume the reinvestments of all dividends.

One cannot invest directly in an index.

Diversification does not guarantee a profit or assure against a loss.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

EntrepreneurShares Global Fund

PERFORMANCE HIGHLIGHTS

EntrepreneurShares Global Fund vs. MSCI The World Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on November 11, 2010 (commencement of operations of the Fund). Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had the Advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total net operational expenses, including underlying Funds, were 1.77% per the November 1, 2015 prospectus.

MSCI The World Index – A free float-adjusted market capitalization weighted index that is designed to measure the equity performance of developed markets. Returns assume the reinvestments of all dividends.

Total Annualized Returns for the period ended June 30, 2016

| | | | Since |

| | | | Inception |

| | 1-Year | 5-Year | (11/11/10) |

| EntrepreneurShares Global Fund – Institutional Class | -2.75% | 4.66% | 6.34% |

| MSCI The World Index | -2.19% | 7.23% | 7.97% |

EntrepreneurShares U.S. All Cap Fund

PERFORMANCE HIGHLIGHTS

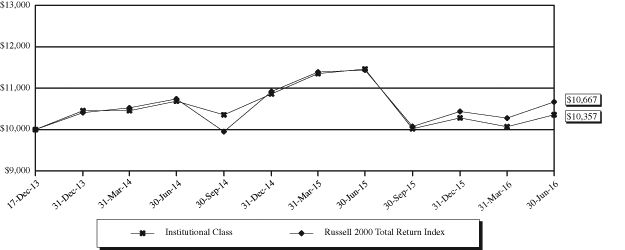

Entrepreneur U.S. All Cap Fund vs. Russell 2000 Total Return Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on December 17, 2013 (commencement of operations of the Fund). Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had the Advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total net operational expenses, including underlying Funds, were 0.92% per the November 1, 2015 prospectus.

Russell 2000 Index – A subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 3000® Index was not included as the Russell 2000 Total Return Index best compares the Fund’s performance with the returns of an index reflecting the performance of investments similar to the Fund. The assumed $10,000 investment would have returned, from July 1, 2015 to June 30, 2016, -6.73%, if invested in the Russell 2000 Total Return Index and 2.14%, if invested in the Russell 3000® Index.

Returns assume the reinvestments of all dividends.

Total Annualized Returns for the period ended June 30, 2016

| | | Since |

| | | Inception |

| | 1-Year | (12/17/13) |

| Entrepreneur U.S. All Cap Fund – Institutional Class | -9.63% | 1.39% |

| Russell 2000 Total Return Index | -6.73% | 2.58% |

EntrepreneurShares U.S. Large Cap Fund

PERFORMANCE HIGHLIGHTS

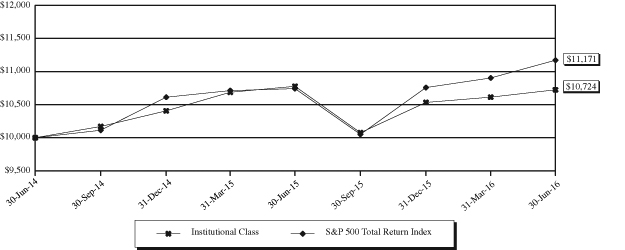

Entrepreneur U.S. Large Cap Fund vs. S&P 500 Total Return Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on June 30, 2014 (commencement of operations of the Fund). Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had the Advisor not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total net operational expenses, including underlying Funds, were 0.86% per the November 1, 2015 prospectus.

S&P 500 Total Return Index – Includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Returns assume the reinvestments of all dividends.

Total Annualized Returns for the period ended June 30, 2016

| | | Since |

| | | Inception |

| | 1-Year | (6/30/14) |

| Entrepreneur U.S. Large Cap Fund – Institutional Class | -0.49% | 3.56% |

| S&P 500 Total Return Index | 3.99% | 5.69% |

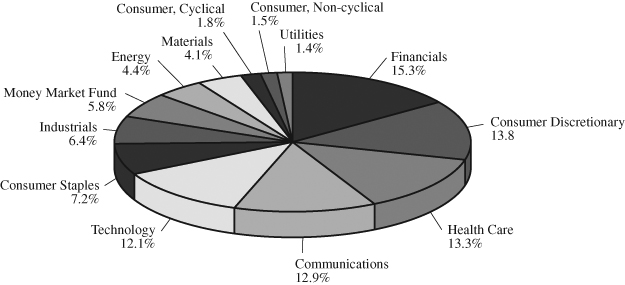

EntrepreneurShares Global Fund

SECTOR ALLOCATION(1)

June 30, 2016 (Unaudited)

As a Percentage of Portfolio

TOP TEN HOLDINGS

as of June 30, 2016 (Unaudited)(1)(2)

Issuer | | % of Net Assets | |

| United Therapeutics Corp. | | | 4.04 | % | |

| Mellanox Technologies Ltd. | | | 2.15 | % | |

| The Hain Celestial Group, Inc. | | | 2.11 | % | |

| Cerner Corp. | | | 2.04 | % | |

| Check Point Software Technologies Ltd | | | 1.90 | % | |

| SoftBank Corp. | | | 1.75 | % | |

| Globus Medical, Inc. – Class A | | | 1.65 | % | |

| USANA Health Sciences, Inc. | | | 1.61 | % | |

| J&J Snack Foods Corp. | | | 1.60 | % | |

| Regus plc | | | 1.58 | % | |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

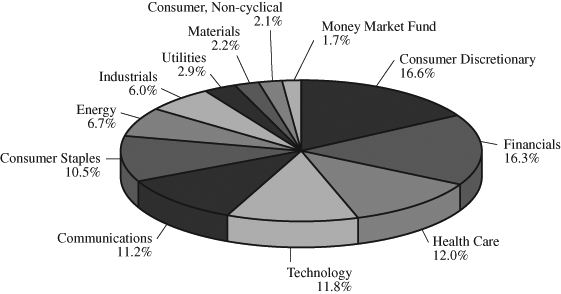

Entrepreneur U.S. All Cap Fund

SECTOR ALLOCATION(1)

June 30, 2016 (Unaudited)

As a Percentage of Portfolio

TOP TEN HOLDINGS

as of June 30, 2016 (Unaudited)(1)(2)

Issuer | | % of Net Assets | |

| United Therapeutics Corp. | | | 1.60 | % | |

| Insperity, Inc. | | | 1.07 | % | |

| National Beverage Corp. | | | 1.05 | % | |

| PRA Group, Inc. | | | 1.01 | % | |

| LGI Homes, Inc. | | | 1.00 | % | |

| MacroGenics, Inc. | | | 0.99 | % | |

| LifeLock, Inc. | | | 0.98 | % | |

| Vascular Solutions, Inc. | | | 0.95 | % | |

| Masimo Corp. | | | 0.94 | % | |

| TASER International, Inc. | | | 0.93 | % | |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

Entrepreneur U.S. Large Cap Fund

SECTOR ALLOCATION(1)

June 30, 2016 (Unaudited)

As a Percentage of Portfolio

TOP TEN HOLDINGS

as of June 30, 2016 (Unaudited)(1)

Issuer | | % of Net Assets | |

| Alphabet, Inc. – Class C | | | 3.62 | % | |

| Amazon.com, Inc. | | | 3.18 | % | |

| Facebook, Inc. – Class A | | | 3.14 | % | |

| Apple, Inc. | | | 2.45 | % | |

| Starbucks Corp. | | | 2.01 | % | |

| Exxon Mobil Corp. | | | 1.96 | % | |

| Oracle Corp. | | | 1.79 | % | |

| BlackRock, Inc. | | | 1.71 | % | |

| Cerner Corp. | | | 1.69 | % | |

| Salesforce.com, Inc. | | | 1.69 | % | |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

EntrepreneurShares Series Trust

EXPENSE EXAMPLE

June 30, 2016 (Unaudited)

As a shareholder of the EntrepreneurShares Global Fund, the Entrepreneur U.S. All Cap Fund, or the Entrepreneur U.S. Large Cap Fund (the “Funds”), you incur two types of costs: (1) transaction costs, including redemption fees on shares held less than 5 business days; and (2) ongoing costs, including investment advisory fees, and other expenses for the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period from January 1, 2016 to June 30, 2016.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged for wire redemptions by the Funds’ transfer agent. To the extent that the Funds invests in other investment companies as part of its investment strategy, you will indirectly bear your proportional share of any fees and expenses charged by the underlying funds in which the Funds invests in addition to expenses of the Funds. These expenses are not included in the following example. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other fund.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemptions fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relevant total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

EntrepreneurShares Series Trust

EXPENSE EXAMPLE (Continued)

June 30, 2016 (Unaudited)

EntrepreneurShares Global Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | January 1, 2016 – |

| | January 1, 2016 | June 30, 2016 | June 30, 2016 |

Institutional Class – Actual(2) | $1,000.00 | $1,007.70 | $8.49 |

| Institutional Class – Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,016.41 | $8.52 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio of 1.70%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| (2) | Based on actual returns for the six-month period ended June 30, 2016 of 0.77%. |

Entrepreneur U.S. All Cap Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | January 1, 2016 – |

| | January 1, 2016 | June 30, 2016 | June 30, 2016 |

Institutional Class – Actual(2) | $1,000.00 | $1,007.40 | $4.24 |

| Institutional Class – Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.64 | $4.27 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| (2) | Based on actual returns for the six-month period ended June 30, 2016 of 0.74%. |

Entrepreneur U.S. Large Cap Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | January 1, 2016 – |

| | January 1, 2016 | June 30, 2016 | June 30, 2016 |

Institutional Class – Actual(2) | $1,000.00 | $1,018.20 | $3.76 |

| Institutional Class – Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.13 | $3.77 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio of 0.75%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| (2) | Based on actual returns for the six-month period ended June 30, 2016 of 1.82%. |

EntrepreneurShares Global Fund

SCHEDULE OF INVESTMENTS

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | COMMON STOCKS – 94.31% | | | |

| | | | | | |

| | | Asset Management – 2.22% | | | |

| | 37,952 | | Grupo Financiero Interacciones SA de CV (b) | | $ | 185,270 | |

| | 17,972 | | Magellan Financial Group Ltd. (b) | | | 298,229 | |

| | | | | | | 483,499 | |

| | | | | | | | |

| | | | Automotive – 1.15% | | | | |

| | 7,021 | | Linamar Corp. (b) | | | 250,092 | |

| | | | | | | | |

| | | | | | | | |

| | | | Banking – 1.27% | | | | |

| | 13,956 | | Home BancShares, Inc. | | | 276,189 | |

| | | | | | | | |

| | | | | | | | |

| | | | Biotechnology & Pharmaceutical – 7.04% | | | | |

| | 9,250 | | Hikma Pharmaceuticals plc (b) | | | 303,543 | |

| | 8,300 | | United Therapeutics Corp. (a) | | | 879,136 | |

| | 3,143 | | USANA Health Sciences, Inc. (a)(b) | | | 350,225 | |

| | | | | | | 1,532,904 | |

| | | | | | | | |

| | | | Consumer Products – 4.39% | | | | |

| | 9,222 | | The Hain Celestial Group, Inc. (a) | | | 458,794 | |

| | 5,220 | | Inter Parfums, Inc. (b) | | | 149,135 | |

| | 2,915 | | J&J Snack Foods Corp. | | | 347,672 | |

| | 25 | | Wilmar International Ltd. (b) | | | 61 | |

| | | | | | | 955,662 | |

| | | | | | | | |

| | | | Containers & Packaging – 2.85% | | | | |

| | 43,617 | | Cascades, Inc. (b) | | | 308,909 | |

| | 420,000 | | Lee & Man Paper Manufacturing Ltd. (b) | | | 311,288 | |

| | | | | | | 620,197 | |

| | | | | | | | |

| | | | Electrical Equipment – 2.48% | | | | |

| | 12,442 | | Orbotech Ltd. (a)(b) | | | 317,893 | |

| | 7,679 | | Renishaw plc (b) | | | 223,162 | |

| | | | | | | 541,055 | |

| | | | | | | | |

| | | | Gaming, Lodging & Restaurants – 3.57% | | | | |

| | 4,145 | | The Cheesecake Factory, Inc. | | | 199,540 | |

| | 3,726 | | Papa John’s International, Inc. | | | 253,368 | |

| | 5,671 | | Starbucks Corp. | | | 323,928 | |

| | | | | | | 776,836 | |

| | | | | | | | |

| | | | Hardware – 0.87% | | | | |

| | 2,545 | | Nidec Corp. (b) | | | 190,311 | |

| | | | | | | | |

| | | | | | | | |

| | | | Health Care Facilities & Services – 5.40% | | | | |

| | 5,963 | | Molina Healthcare, Inc. (a) | | | 297,554 | |

| | 19,471 | | NMC Health plc (b) | | | 335,675 | |

| | 1,500 | | Universal Health Services, Inc. – Class B | | | 201,150 | |

| | 5,051 | | VCA, Inc. (a) | | | 341,498 | |

| | | | | | | 1,175,877 | |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | Institutional Financial Services – 1.46% | | | |

| | 1,246 | | Intercontinental Exchange, Inc. | | $ | 318,926 | |

| | | | | | | | |

| | | | | | | | |

| | | | Iron & Steel – 1.35% | | | | |

| | 11,976 | | Steel Dynamics, Inc. | | | 293,412 | |

| | | | | | | | |

| | | | | | | | |

| | | | Media – 11.35% | | | | |

| | 423 | | Alphabet, Inc. – Class A (a) | | | 297,593 | |

| | 6,985 | | Criteo SA – ADR (a)(b) | | | 320,751 | |

| | 4,100 | | CyberAgent, Inc. (b) | | | 244,972 | |

| | 2,763 | | Facebook, Inc. – Class A (a) | | | 315,756 | |

| | 15,000 | | GMO Internet, Inc. (b) | | | 153,537 | |

| | 23,507 | | Seek Ltd. (b) | | | 266,655 | |

| | 2,955 | | Teleperformance (b) | | | 252,410 | |

| | 3,447 | | VeriSign, Inc. (a) | | | 298,027 | |

| | 14,773 | | Yandex NV – Class A (a)(b) | | | 322,790 | |

| | | | | | | 2,472,491 | |

| | | | | | | | |

| | | | Medical Equipment & Devices – 2.60% | | | | |

| | 2,803 | | Coloplast A/S – Class B (b) | | | 208,156 | |

| | 15,076 | | Globus Medical, Inc. – Class A (a) | | | 359,261 | |

| | | | | | | 567,417 | |

| | | | | | | | |

| | | | Oil, Gas & Coal – 4.43% | | | | |

| | 13,517 | | AltaGas Ltd. (b) | | | 328,522 | |

| | 17,215 | | Kinder Morgan, Inc. | | | 322,265 | |

| | 32,412 | | Subsea 7 SA (a)(b) | | | 314,873 | |

| | | | | | | 965,660 | |

| | | | | | | | |

| | | | Passenger Transportation – 1.34% | | | | |

| | 17,864 | | WestJet Airlines Ltd. (b) | | | 291,477 | |

| | | | | | | | |

| | | | | | | | |

| | | | Real Estate – 4.26% | | | | |

| | 7,846 | | Colliers International Group, Inc. (b) | | | 267,940 | |

| | 30,852 | | Hemfosa Fastigheter AB (b) | | | 315,423 | |

| | 89,633 | | Regus plc (b) | | | 344,848 | |

| | | | | | | 928,211 | |

| | | | | | | | |

| | | | Recreation Facilities & Services – 1.10% | | | | |

| | 10,158 | | Flight Centre Travel Group Ltd. (b) | | | 239,245 | |

| | | | | | | | |

| | | | | | | | |

| | | | Retail – Consumer Staples – 2.95% | | | | |

| | 4,465 | | Dollarama, Inc. (b) | | | 311,733 | |

| | 10,310 | | Whole Foods Market, Inc. | | | 330,126 | |

| | | | | | | 641,859 | |

| | | | | | | | |

| | | | Retail – Discretionary – 8.73% | | | | |

| | 436 | | Amazon.com, Inc. (a) | | | 312,010 | |

| | 3,806 | | L Brands, Inc. | | | 255,497 | |

| | 2,866 | | Luxottica Group S.p.A – ADR (b) | | | 140,033 | |

| | 1,492 | | MercadoLibre, Inc. (b) | | | 209,879 | |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | | | |

| | 2,333 | | Netflix, Inc. (a) | | $ | 213,423 | |

| | 16,800 | | Rakuten, Inc. (b) | | | 179,364 | |

| | 15,133 | | SM Investments Corp. (b) | | | 311,039 | |

| | 109 | | Ted Baker plc (a)(b) | | | 3,514 | |

| | 10,038 | | Urban Outfitters, Inc. (a) | | | 276,045 | |

| | | | | | | 1,900,804 | |

| | | | | | | | |

| | | | Semiconductors – 4.94% | | | | |

| | 7,269 | | ARM Holdings plc – ADR (b) | | | 330,812 | |

| | 3,473 | | IPG Photonics Corp. (a) | | | 277,840 | |

| | 9,761 | | Mellanox Technologies Ltd. (a)(b) | | | 468,138 | |

| | | | | | | 1,076,790 | |

| | | | | | | | |

| | | | Software – 6.45% | | | | |

| | 12,652 | | Atlassian Corp. plc – Class A (a)(b) | | | 327,687 | |

| | 7,580 | | Cerner Corp. (a) | | | 444,188 | |

| | 5,196 | | Check Point Software Technologies Ltd (a)(b) | | | 414,017 | |

| | 5,373 | | Oracle Corp. | | | 219,917 | |

| | | | | | | 1,405,809 | |

| | | | | | | | |

| | | | Specialty Finance – 4.87% | | | | |

| | 9,831 | | Air Lease Corp. (b) | | | 263,274 | |

| | 4,149 | | Capital One Financial Corp. | | | 263,503 | |

| | 3,473 | | LendingTree, Inc. (a) | | | 306,770 | |

| | 9,389 | | PRA Group, Inc. (a) | | | 226,651 | |

| | | | | | | 1,060,198 | |

| | | | | | | | |

| | | | Telecommunications – 1.75% | | | | |

| | 6,800 | | SoftBank Corp. (b) | | | 381,206 | |

| | | | | | | | |

| | | | | | | | |

| | | | Transportation & Logistics – 4.03% | | | | |

| | 2,272 | | FedEx Corp. | | | 344,844 | |

| | 28,276 | | Hornbeck Offshore Services, Inc. (a) | | | 235,822 | |

| | 19,369 | | Swift Transportation Co. (a) | | | 298,476 | |

| | | | | | | 879,142 | |

| | | | | | | | |

| | | | Utilities – 1.46% | | | | |

| | 6,777 | | ITC Holdings Corp. | | | 317,299 | |

| | | | TOTAL COMMON STOCKS (Cost $19,958,427) | | | 20,542,568 | |

| | | | | | | | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS (REITs) – 1.47% | | | | |

| | | | | | | | |

| | | | Real Estate – 1.47% | | | | |

| | 9,348 | | The GEO Group, Inc. | | | 319,515 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS (REITs) (Cost $289,417) | | | 319,515 | |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | MONEY MARKET FUNDS – 5.89% | | | |

| | 1,282,587 | | First American Treasury Obligations Fund – Class Z, 0.23% (c) | | $ | 1,282,587 | |

| | | | TOTAL MONEY MARKET FUNDS (Cost $1,282,587) | | | 1,282,587 | |

| | | | | | | | |

| | | | Total Investments (Cost $21,530,431) – 101.67% | | | 22,144,670 | |

| | | | Liabilities in Excess of Other Assets – (1.67)% | | | (363,087 | ) |

| | | | TOTAL NET ASSETS – 100.00% | | $ | 21,781,583 | |

Percentages are stated as a percent of net assets.

ADR – American Depository Receipt

| (a) | Non-income producing security. |

| (b) | Global security, as classified by the Fund’s Investment Advisor, in accordance to the definition in the Fund’s prospectus. |

| (c) | The rate quoted is the annualized seven-day effective yield as of June 30, 2016. |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| | | Percent of Net | |

| Country | | Assets | |

| United States | | | 57.3 | % | |

| Canada | | | 8.1 | % | |

| Israel | | | 5.5 | % | |

| Japan | | | 5.3 | % | |

| Australia | | | 5.2 | % | |

| United Kingdom | | | 4.1 | % | |

| France | | | 2.6 | % | |

| United Arab Emirates | | | 1.5 | % | |

| Russia | | | 1.5 | % | |

| Sweden | | | 1.5 | % | |

| Luxembourg | | | 1.4 | % | |

| Philippines | | | 1.4 | % | |

| Hong Kong | | | 1.4 | % | |

| Jordan | | | 1.4 | % | |

| Argentina | | | 1.0 | % | |

| Denmark | | | 1.0 | % | |

| Mexico | | | 0.9 | % | |

| Italy | | | 0.6 | % | |

| Singapore | | | 0.0 | % | |

| | | | 101.7 | % | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

SCHEDULE OF INVESTMENTS

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | COMMON STOCKS – 90.74% | | | |

| | | | | | |

| | | Aerospace & Defense – 0.93% | | | |

| | 48,883 | | TASER International, Inc. (a) | | $ | 1,216,209 | |

| | | | | | | | |

| | | | | | | | |

| | | | Apparel & Textile Products – 0.60% | | | | |

| | 17,100 | | G-III Apparel Group Ltd. (a) | | | 781,812 | |

| | | | | | | | |

| | | | | | | | |

| | | | Asset Management – 0.79% | | | | |

| | 25,539 | | Cohen & Steers, Inc. | | | 1,032,797 | |

| | | | | | | | |

| | | | | | | | |

| | | | Automotive – 0.68% | | | | |

| | 57,562 | | Gentex Corp. | | | 889,333 | |

| | | | | | | | |

| | | | | | | | |

| | | | Banking – 5.34% | | | | |

| | 22,022 | | Bank of the Ozarks, Inc. | | | 826,265 | |

| | 58,269 | | Fidelity Southern Corp. | | | 913,075 | |

| | 46,412 | | Home BancShares, Inc. | | | 918,494 | |

| | 56,530 | | Live Oak Bancshares, Inc. | | | 797,638 | |

| | 19,100 | | Pinnacle Financial Partners, Inc. | | | 933,035 | |

| | 31,261 | | Preferred Bank | | | 902,661 | |

| | 54,375 | | TriState Capital Holdings, Inc. (a) | | | 746,569 | |

| | 25,158 | | United Bancshares, Inc. | | | 943,677 | |

| | | | | | | 6,981,414 | |

| | | | | | | | |

| | | | Biotechnology & Pharmaceutical – 6.88% | | | | |

| | 9,000 | | Acorda Therapeutics, Inc. (a) | | | 229,545 | |

| | 49,644 | | Albany Molecular Research, Inc. (a) | | | 667,215 | |

| | 24,637 | | Emergent BioSolutions, Inc. (a) | | | 692,792 | |

| | 42,983 | | FibroGen, Inc. (a) | | | 705,351 | |

| | 18,088 | | Intra-Cellular Therapies, Inc. (a) | | | 702,176 | |

| | 20,646 | | Ironwood Pharmaceuticals, Inc. – Class A (a) | | | 269,947 | |

| | 11,662 | | Karyopharm Therapeutics, Inc. (a) | | | 78,252 | |

| | 47,737 | | MacroGenics, Inc. (a) | | | 1,288,422 | |

| | 50,537 | | OPKO Health, Inc. (a) | | | 472,016 | |

| | 7,768 | | Sage Therapeutics, Inc. (a) | | | 234,050 | |

| | 23,413 | | Sangamo BioSciences, Inc. (a) | | | 135,561 | |

| | 6,820 | | TESARO, Inc. (a) | | | 573,221 | |

| | 19,785 | | United Therapeutics Corp. (a) | | | 2,095,627 | |

| | 7,654 | | USANA Health Sciences, Inc. (a) | | | 852,885 | |

| | | | | | | 8,997,060 | |

| | | | | | | | |

| | | | Chemicals – 0.72% | | | | |

| | 69,935 | | Huntsman Corp. | | | 940,626 | |

| | | | | | | | |

| | | | | | | | |

| | | | Commercial Services – 5.16% | | | | |

| | 9,160 | | Cimpress NV (a) | | | 847,117 | |

| | 22,689 | | CorVel Corp. (a) | | | 979,711 | |

| | 56,500 | | The Hackett Group, Inc. | | | 783,655 | |

| | 18,150 | | Insperity, Inc. | | | 1,401,724 | |

| | 81,161 | | LifeLock, Inc. (a) | | | 1,283,155 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | | | |

| | 35,687 | | National Research Corp. – Class A | | $ | 488,912 | |

| | 65,243 | | Resources Connection, Inc. | | | 964,292 | |

| | | | | | | 6,748,566 | |

| | | | | | | | |

| | | | Consumer Products – 4.70% | | | | |

| | 5,103 | | The Boston Beer Co., Inc. – Class A (a) | | | 872,766 | |

| | 22,759 | | The Hain Celestial Group, Inc. (a) | | | 1,132,260 | |

| | 28,373 | | Inter Parfums, Inc. | | | 810,617 | |

| | 8,426 | | J&J Snack Foods Corp. | | | 1,004,969 | |

| | 21,895 | | National Beverage Corp. (a) | | | 1,375,225 | |

| | 26,308 | | Seneca Foods Corp. – Class A (a) | | | 952,613 | |

| | | | | | | 6,148,450 | |

| | | | | | | | |

| | | | Consumer Services – 0.78% | | | | |

| | 42,887 | | Carriage Services, Inc. | | | 1,015,564 | |

| | | | | | | | |

| | | | | | | | |

| | | | Containers & Packaging – 1.52% | | | | |

| | 13,600 | | AEP Industries, Inc. | | | 1,094,256 | |

| | 17,253 | | Silgan Holdings, Inc. | | | 887,839 | |

| | | | | | | 1,982,095 | |

| | | | | | | | |

| | | | Design, Manufacturing & Distribution – 0.75% | | | | |

| | 36,700 | | Sanmina Corp. (a) | | | 983,927 | |

| | | | | | | | |

| | | | | | | | |

| | | | Electrical Equipment – 0.57% | | | | |

| | 12,696 | | OSI Systems, Inc. (a) | | | 738,018 | |

| | | | | | | | |

| | | | | | | | |

| | | | Engineering & Construction Services – 0.71% | | | | |

| | 38,888 | | Mistras Group, Inc. (a) | | | 928,257 | |

| | | | | | | | |

| | | | | | | | |

| | | | Gaming, Lodging & Restaurants – 2.24% | | | | |

| | 17,500 | | The Cheesecake Factory, Inc. | | | 842,450 | |

| | 16,226 | | Papa John’s International, Inc. | | | 1,103,368 | |

| | 21,528 | | Texas Roadhouse, Inc. | | | 981,677 | |

| | | | | | | 2,927,495 | |

| | | | | | | | |

| | | | Hardware – 2.56% | | | | |

| | 19,800 | | Netgear, Inc. (a) | | | 941,292 | |

| | 24,929 | | Super Micro Computer, Inc. (a) | | | 619,486 | |

| | 23,989 | | Ubiquiti Networks, Inc. (a) | | | 927,415 | |

| | 84,688 | | Vicor Corp. (a) | | | 852,808 | |

| | | | | | | 3,341,001 | |

| | | | | | | | |

| | | | Health Care Facilities & Services – 3.75% | | | | |

| | 32,768 | | Diplomat Pharmacy, Inc. (a) | | | 1,146,880 | |

| | 27,120 | | LHC Group, Inc. (a) | | | 1,173,754 | |

| | 13,496 | | Molina Healthcare, Inc. (a) | | | 673,450 | |

| | 15,681 | | PAREXEL International Corp. (a) | | | 986,021 | |

| | 84,935 | | Select Medical Holdings Corp. (a) | | | 923,244 | |

| | | | | | | 4,903,349 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | Home & Office Products – 3.83% | | | |

| | 53,995 | | Century Communities, Inc. (a) | | $ | 936,273 | |

| | 41,100 | | LGI Homes, Inc. (a) | | | 1,312,734 | |

| | 25,900 | | Meritage Homes Corp. (a) | | | 972,286 | |

| | 81,048 | | The New Home Co., Inc. (a) | | | 773,198 | |

| | 98,325 | | PGT, Inc. (a) | | | 1,012,748 | |

| | | | | | | 5,007,239 | |

| | | | | | | | |

| | | | Institutional Financial Services – 0.59% | | | | |

| | 34,333 | | Moelis & Co. – Class A | | | 772,492 | |

| | | | | | | | |

| | | | | | | | |

| | | | Insurance – 3.33% | | | | |

| | 61,239 | | American Equity Investment Life Holding Co. | | | 872,656 | |

| | 39,211 | | Citizens, Inc. (a) | | | 298,004 | |

| | 28,897 | | HCI Group, Inc. | | | 788,310 | |

| | 42,308 | | National General Holdings Corp. | | | 906,237 | |

| | 80,257 | | RPX Corp. (a) | | | 735,957 | |

| | 70,700 | | State National Co., Inc. | | | 744,471 | |

| | | | | | | 4,345,635 | |

| | | | | | | | |

| | | | Iron & Steel – 0.80% | | | | |

| | 42,640 | | Steel Dynamics, Inc. | | | 1,044,680 | |

| | | | | | | | |

| | | | | | | | |

| | | | Media – 3.74% | | | | |

| | 116,449 | | Entravision Communications Corp. – Class A | | | 782,537 | |

| | 43,814 | | HealthStream, Inc. (a) | | | 1,161,947 | |

| | 19,263 | | Nexstar Broadcasting Group, Inc. – Class A | | | 916,534 | |

| | 23,957 | | Shutterstock, Inc. (a) | | | 1,097,231 | |

| | 50,800 | | World Wrestling Entertainment, Inc. – Class A | | | 935,228 | |

| | | | | | | 4,893,477 | |

| | | | | | | | |

| | | | Medical Equipment & Devices – 3.35% | | | | |

| | 39,626 | | Globus Medical, Inc. – Class A (a) | | | 944,287 | |

| | 23,427 | | Masimo Corp. (a) | | | 1,230,269 | |

| | 48,600 | | Merit Medical Systems, Inc. (a) | | | 963,738 | |

| | 29,709 | | Vascular Solutions, Inc. (a) | | | 1,237,677 | |

| | | | | | | 4,375,971 | |

| | | | | | | | |

| | | | Metals & Mining – 0.56% | | | | |

| | 55,800 | | Hi-Crush Partners LP | | | 729,306 | |

| | | | | | | | |

| | | | | | | | |

| | | | Oil, Gas & Coal – 1.92% | | | | |

| | 214,671 | | Northern Oil and Gas, Inc. (a) | | | 991,780 | |

| | 31,200 | | Western Refining, Inc. | | | 643,656 | |

| | 18,500 | | World Fuel Services Corp. | | | 878,565 | |

| | | | | | | 2,514,001 | |

| | | | | | | | |

| | | | Renewable Energy – 0.58% | | | | |

| | 174,722 | | Ameresco, Inc. – Class A (a) | | | 763,535 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | Retail – Consumer Staples – 1.47% | | | |

| | 42,442 | | Ollie’s Bargain Outlet Holdings, Inc. (a) | | $ | 1,056,382 | |

| | 27,160 | | Whole Foods Market, Inc. | | | 869,663 | |

| | | | | | | 1,926,045 | |

| | | | | | | | |

| | | | Retail – Discretionary – 2.07% | | | | |

| | 115,500 | | 1-800-Flowers.com, Inc. – Class A (a) | | | 1,041,810 | |

| | 18,166 | | Dick’s Sporting Goods, Inc. | | | 818,560 | |

| | 49,420 | | Sonic Automotive, Inc. – Class A | | | 845,576 | |

| | | | | | | 2,705,946 | |

| | | | | | | | |

| | | | Semiconductors – 3.14% | | | | |

| | 20,021 | | Ambarella, Inc. (a) | | | 1,017,267 | |

| | 143,785 | | Amkor Technology, Inc. (a) | | | 826,764 | |

| | 8,580 | | IPG Photonics Corp. (a) | | | 686,400 | |

| | 65,632 | | IXYS Corp. | | | 672,728 | |

| | 13,207 | | Monolithic Power Systems, Inc. | | | 902,302 | |

| | | | | | | 4,105,461 | |

| | | | | | | | |

| | | | Software – 6.97% | | | | |

| | 32,275 | | Envestnet, Inc. (a) | | | 1,075,080 | |

| | 162,997 | | Lionbridge Technologies, Inc. (a) | | | 643,838 | |

| | 15,373 | | LogMeIn, Inc. (a) | | | 975,110 | |

| | 32,300 | | Omnicell, Inc. (a) | | | 1,105,629 | |

| | 23,906 | | Paycom Software, Inc. (a) | | | 1,032,978 | |

| | 58,069 | | PDF Solutions, Inc. (a) | | | 812,385 | |

| | 32,056 | | Pegasystems, Inc. | | | 863,909 | |

| | 38,615 | | Rackspace Hosting, Inc. (a) | | | 805,509 | |

| | 25,854 | | Synchronoss Technologies, Inc. (a) | | | 823,709 | |

| | 53,723 | | VASCO Data Security International, Inc. (a) | | | 880,520 | |

| | 19,825 | | Zedge, Inc. – Class B (a) | | | 90,997 | |

| | | | | | | 9,109,664 | |

| | | | | | | | |

| | | | Specialty Finance – 7.28% | | | | |

| | 27,667 | | Air Lease Corp. | | | 740,922 | |

| | 2,609 | | AMERCO | | | 977,201 | |

| | 4,685 | | Credit Acceptance Corp. (a) | | | 867,100 | |

| | 10,471 | | Ellie Mae, Inc. (a) | | | 959,667 | |

| | 11,299 | | Euronet Worldwide, Inc. (a) | | | 781,778 | |

| | 42,092 | | Green Dot Corp. – Class A (a) | | | 967,695 | |

| | 33,126 | | HFF, Inc. – Class A | | | 956,679 | |

| | 9,950 | | LendingTree, Inc. (a) | | | 878,883 | |

| | 41,490 | | Liberty Tax, Inc. | | | 552,647 | |

| | 60,304 | | NewStar Financial, Inc. (a) | | | 507,760 | |

| | 54,717 | | PRA Group, Inc. (a) | | | 1,320,868 | |

| | | | | | | 9,511,200 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | Technology Services – 6.22% | | | |

| | 11,242 | | EPAM Systems, Inc. (a) | | $ | 722,973 | |

| | 16,098 | | ExlService Holdings, Inc. (a) | | | 843,696 | |

| | 24,501 | | Forrester Research, Inc. | | | 903,107 | |

| | 25,422 | | ManTech International Corp. – Class A | | | 961,460 | |

| | 7,300 | | MarketAxess Holdings, Inc. | | | 1,061,420 | |

| | 25,805 | | Medidata Solutions, Inc. (a) | | | 1,209,480 | |

| | 45,029 | | NIC, Inc. | | | 987,936 | |

| | 28,919 | | TeleTech Holdings, Inc. | | | 784,572 | |

| | 22,720 | | Virtusa Corp. (a) | | | 656,154 | |

| | | | | | | 8,130,798 | |

| | | | | | | | |

| | | | Telecommunications – 2.79% | | | | |

| | 24,200 | | Cogent Communications Holdings, Inc. | | | 969,452 | |

| | 51,316 | | General Communication, Inc. – Class A (a) | | | 810,793 | |

| | 59,476 | | IDT Corp. – Class B | | | 843,964 | |

| | 51,588 | | RingCentral, Inc. – Class A (a) | | | 1,017,315 | |

| | | | | | | 3,641,524 | |

| | | | | | | | |

| | | | Transportation & Logistics – 1.87% | | | | |

| | 97,700 | | Hornbeck Offshore Services, Inc. (a) | | | 814,818 | |

| | 55,352 | | Swift Transportation Co. (a) | | | 852,974 | |

| | 33,900 | | Werner Enterprises, Inc. | | | 778,683 | |

| | | | | | | 2,446,475 | |

| | | | | | | | |

| | | | Utilities – 0.79% | | | | |

| | 22,169 | | ITC Holdings Corp. | | | 1,037,953 | |

| | | | | | | | |

| | | | | | | | |

| | | | Waste & Environmental Services & Equipment – 0.76% | | | | |

| | 18,946 | | Clean Harbors, Inc. (a) | | | 987,276 | |

| | | | TOTAL COMMON STOCKS (Cost $115,657,838) | | | 118,604,651 | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS (REITs) – 6.10% | | | | |

| | | | | | | | |

| | | | Real Estate – 6.10% | | | | |

| | 23,873 | | American Assets Trust, Inc. | | | 1,013,170 | |

| | 29,153 | | The GEO Group, Inc. | | | 996,450 | |

| | 30,937 | | Healthcare Realty Trust, Inc. | | | 1,082,486 | |

| | 73,125 | | Medical Properties Trust, Inc. | | | 1,112,231 | |

| | 80,038 | | Monmouth Real Estate Investment Corp. | | | 1,061,304 | |

| | 32,100 | | Pebblebrook Hotel Trust | | | 842,625 | |

| | 40,084 | | RLJ Lodging Trust | | | 859,802 | |

| | 38,998 | | Terreno Realty Corp. | | | 1,008,878 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS (REITs) (Cost $7,739,090) | | | 7,976,946 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | MONEY MARKET FUNDS – 3.17% | | | |

| | 4,138,217 | | First American Treasury Obligations Fund – Class Z, 0.23% (b) | | $ | 4,138,217 | |

| | | | TOTAL MONEY MARKET FUNDS (Cost $4,138,217) | | | 4,138,217 | |

| | | | | | | | |

| | | | Total Investments (Cost $127,535,145) – 100.01% | | | 130,719,814 | |

| | | | Liabilities in Excess of Other Assets – (0.01)% | | | (14,427 | ) |

| | | | TOTAL NET ASSETS – 100.00% | | $ | 130,705,387 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate quoted is the annualized seven-day effective yield as of June 30, 2016. |

Entrepreneur U.S. Large Cap Fund

SCHEDULE OF INVESTMENTS

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | COMMON STOCKS – 95.91% | | | |

| �� | | | | | |

| | | Aerospace & Defense – 0.69% | | | |

| | 4,697 | | The Boeing Co. | | $ | 609,999 | |

| | | | | | | | |

| | | | Apparel & Textile Products – 2.95% | | | | |

| | 12,863 | | Michael Kors Holdings, Ltd. (a) | | | 636,461 | |

| | 8,501 | | NIKE, Inc. – Class B | | | 469,255 | |

| | 32,530 | | Under Armour, Inc. – Class A (a) | | | 1,305,429 | |

| | 5,608 | | Under Armour, Inc. – Class C (a) | | | 204,114 | |

| | | | | | | 2,615,259 | |

| | | | Asset Management – 1.71% | | | | |

| | 4,429 | | BlackRock, Inc. | | | 1,517,065 | |

| | | | | | | | |

| | | | Banking – 2.95% | | | | |

| | 14,930 | | JPMorgan Chase & Co. | | | 927,750 | |

| | 7,439 | | M&T Bank Corp. | | | 879,513 | |

| | 6,443 | | Signature Bank (a) | | | 804,860 | |

| | | | | | | 2,612,123 | |

| | | | Biotechnology & Pharmaceutical – 7.21% | | | | |

| | 16,498 | | Gilead Sciences, Inc. | | | 1,376,263 | |

| | 5,726 | | Jazz Pharmaceuticals plc (a) | | | 809,141 | |

| | 17,580 | | Medivation, Inc. (a) | | | 1,060,074 | |

| | 20,748 | | Pfizer, Inc. | | | 730,537 | |

| | 3,770 | | Regeneron Pharmaceuticals, Inc. (a) | | | 1,316,597 | |

| | 10,310 | | United Therapeutics Corp. (a) | | | 1,092,035 | |

| | | | | | | 6,384,647 | |

| | | | Chemicals – 2.23% | | | | |

| | 4,298 | | Air Products and Chemicals, Inc. | | | 610,488 | |

| | 8,549 | | The Dow Chemical Co. | | | 424,971 | |

| | 69,462 | | Huntsman Corp. | | | 934,264 | |

| | | | | | | 1,969,723 | |

| | | | Commercial Services – 1.09% | | | | |

| | 9,832 | | Cintas Corp. | | | 964,814 | |

| | | | | | | | |

| | | | Consumer Products – 6.78% | | | | |

| | 10,146 | | Brown-Forman Corp. – Class B | | | 1,012,165 | |

| | 12,583 | | The Coca-Cola Co. | | | 570,387 | |

| | 7,704 | | Constellation Brands, Inc. – Class A | | | 1,274,242 | |

| | 7,533 | | The JM Smucker Co. | | | 1,148,105 | |

| | 6,649 | | Monster Beverage Corp. (a) | | | 1,068,561 | |

| | 10,899 | | The Procter & Gamble Co. | | | 922,818 | |

| | | | | | | 5,996,278 | |

| | | | Electrical Equipment – 2.06% | | | | |

| | 38,640 | | General Electric Co. | | | 1,216,387 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | | | |

| | 5,202 | | Honeywell International, Inc. | | $ | 605,097 | |

| | | | | | | 1,821,484 | |

| | | | | | | | |

| | | | Gaming, Lodging & Restaurants – 3.41% | | | | |

| | 3,058 | | Chipotle Mexican Grill, Inc. (a) | | | 1,231,640 | |

| | 31,202 | | Starbucks Corp. | | | 1,782,258 | |

| | | | | | | 3,013,898 | |

| | | | | | | | |

| | | | Hardware – 2.96% | | | | |

| | 22,647 | | Apple, Inc. | | | 2,165,053 | |

| | 7,036 | | Arista Networks, Inc. (a) | | | 452,978 | |

| | | | | | | 2,618,031 | |

| | | | | | | | |

| | | | Health Care Facilities & Services – 3.25% | | | | |

| | 10,050 | | UnitedHealth Group, Inc. | | | 1,419,060 | |

| | 10,877 | | Universal Health Services, Inc. – Class B | | | 1,458,606 | |

| | | | | | | 2,877,666 | |

| | | | | | | | |

| | | | Home & Office Products – 0.63% | | | | |

| | 2,950 | | Mohawk Industries, Inc. (a) | | | 559,792 | |

| | | | | | | | |

| | | | | | | | |

| | | | Industrial Services – 0.66% | | | | |

| | 2,565 | | W.W. Grainger, Inc. | | | 582,896 | |

| | | | | | | | |

| | | | | | | | |

| | | | Institutional Financial Services – 2.26% | | | | |

| | 3,494 | | The Goldman Sachs Group, Inc. | | | 519,139 | |

| | 5,795 | | Intercontinental Exchange, Inc. | | | 1,483,288 | |

| | | | | | | 2,002,427 | |

| | | | | | | | |

| | | | Insurance – 4.90% | | | | |

| | 12,724 | | Aflac, Inc. | | | 918,164 | |

| | 12,304 | | American Financial Group, Inc. | | | 909,635 | |

| | 4 | | Berkshire Hathaway, Inc. – Class A (a) | | | 867,900 | |

| | 5,086 | | Berkshire Hathaway, Inc. – Class B (a) | | | 736,402 | |

| | 22,069 | | Loews Corp. | | | 906,815 | |

| | | | | | | 4,338,916 | |

| | | | | | | | |

| | | | Media – 9.37% | | | | |

| | 276 | | Alphabet, Inc. – Class A (a) | | | 194,174 | |

| | 4,627 | | Alphabet, Inc. – Class C (a) | | | 3,202,347 | |

| | 10,104 | | Comcast Corp. – Class A | | | 658,680 | |

| | 24,344 | | Facebook, Inc. – Class A (a) | | | 2,782,032 | |

| | 16,874 | | VeriSign, Inc. (a) | | | 1,458,926 | |

| | | | | | | 8,296,159 | |

| | | | | | | | |

| | | | Medical Equipment & Devices – 3.64% | | | | |

| | 11,243 | | Danaher Corp. | | | 1,135,543 | |

| | 1,719 | | Intuitive Surgical, Inc. (a) | | | 1,136,964 | |

| | 6,717 | | Waters Corp. (a) | | | 944,746 | |

| | | | | | | 3,217,253 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | Oil, Gas & Coal – 6.74% | | | |

| | 8,885 | | Chevron Corp. | | $ | 931,414 | |

| | 14,834 | | Continental Resources, Inc. (a) | | | 671,535 | |

| | 18,463 | | Exxon Mobil Corp. | | | 1,730,722 | |

| | 62,200 | | Kinder Morgan, Inc. | | | 1,164,384 | |

| | 20,980 | | Noble Energy, Inc. | | | 752,553 | |

| | 9,517 | | Tesoro Corp. | | | 713,014 | |

| | | | | | | 5,963,622 | |

| | | | | | | | |

| | | | Retail – Consumer Staples – 3.71% | | | | |

| | 7,808 | | Costco Wholesale Corp. | | | 1,226,168 | |

| | 9,373 | | Walgreens Boots Alliance, Inc. | | | 780,490 | |

| | 39,920 | | Whole Foods Market, Inc. | | | 1,278,238 | |

| | | | | | | 3,284,896 | |

| | | | | | | | |

| | | | Retail – Discretionary – 8.56% | | | | |

| | 3,927 | | Amazon.com, Inc. (a) | | | 2,810,240 | |

| | 21,333 | | L Brands, Inc. | | | 1,432,084 | |

| | 15,076 | | Netflix, Inc. (a) | | | 1,379,152 | |

| | 2,488 | | O’Reilly Automotive, Inc. (a) | | | 674,497 | |

| | 46,457 | | Urban Outfitters, Inc. (a) | | | 1,277,568 | |

| | | | | | | 7,573,541 | |

| | | | | | | | |

| | | | Semiconductors – 2.65% | | | | |

| | 11,506 | | IPG Photonics Corp. (a) | | | 920,480 | |

| | 30,284 | | NVIDIA Corp. | | | 1,423,651 | |

| | | | | | | 2,344,131 | |

| | | | | | | | |

| | | | Software – 6.19% | | | | |

| | 15,994 | | Akamai Technologies, Inc. (a) | | | 894,545 | |

| | 25,596 | | Cerner Corp. (a) | | | 1,499,926 | |

| | 38,694 | | Oracle Corp. | | | 1,583,745 | |

| | 18,871 | | Salesforce.com, Inc. (a) | | | 1,498,546 | |

| | | | | | | 5,476,762 | |

| | | | | | | | |

| | | | Specialty Finance – 2.02% | | | | |

| | 1,282 | | AMERCO | | | 480,173 | |

| | 20,539 | | Capital One Financial Corp. | | | 1,304,432 | |

| | | | | | | 1,784,605 | |

| | | | | | | | |

| | | | Telecommunications – 1.82% | | | | |

| | 19,777 | | AT&T, Inc. | | | 854,564 | |

| | 27,151 | | Zayo Group Holdings, Inc. (a) | | | 758,327 | |

| | | | | | | 1,612,891 | |

| | | | | | | | |

| | | | Transportation & Logistics – 1.59% | | | | |

| | 9,287 | | FedEx Corp. | | | 1,409,581 | |

| | | | | | | | |

| | | | | | | | |

| | | | Transportation Equipment – 1.02% | | | | |

| | 17,320 | | PACCAR, Inc. | | | 898,388 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2016

| Shares | | | | Fair Value | |

| | | | | | |

| | | Utilities – 2.86% | | | |

| | 11,245 | | Dominion Resources, Inc. | | $ | 876,323 | |

| | 16,350 | | ITC Holdings Corp. | | | 765,507 | |

| | 6,818 | | NextEra Energy, Inc. | | | 889,067 | |

| | | | | | | 2,530,897 | |

| | | | TOTAL COMMON STOCKS (Cost $80,272,442) | | | 84,877,744 | |

| | | | | | | | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS (REITs) – 2.46% | | | | |

| | | | | | | | |

| | | | Real Estate – 2.46% | | | | |

| | 7,019 | | Boston Properties, Inc. | | | 925,806 | |

| | 7,746 | | Extra Space Storage, Inc. | | | 716,815 | |

| | 5,368 | | Vornado Realty Trust | | | 537,444 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS (REITs) (Cost $2,154,684) | | | 2,180,065 | |

| | | | | | | | |

| | | | | | | | |

| | | | MONEY MARKET FUNDS – 1.66% | | | | |

| | 1,464,613 | | First American Treasury Obligations Fund – Class Z, 0.23% (b) | | | 1,464,613 | |

| | | | TOTAL MONEY MARKET FUNDS (Cost $1,464,613) | | | 1,464,613 | |

| | | | | | | | |

| | | | Total Investments (Cost $83,891,739) – 100.03% | | | 88,522,422 | |

| | | | Liabilities in Excess of Other Assets – (0.03)% | | | (27,540 | ) |

| | | | TOTAL NET ASSETS – 100.00% | | $ | 88,494,882 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate quoted is the annualized seven-day effective yield as of June 30, 2016. |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Series Trust

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2016

| | | EntrepreneurShares | | | Entrepreneur | | | Entrepreneur | |

| | | Global | | | U.S. All Cap | | | U.S. Large Cap | |

| | | Fund | | | Fund | | | Fund | |

| ASSETS: | | | | | | | | | |

Investments, at fair value(1) | | $ | 22,144,670 | | | $ | 130,719,814 | | | $ | 88,522,422 | |

| Cash | | | 1,633 | | | | — | | | | — | |

| Foreign currency (Cost 126,694) | | | 127,257 | | | | — | | | | — | |

| Dividend and interest receivable | | | 14,800 | | | | 99,926 | | | | 43,604 | |

| Receivable from Fund shares sold | | | — | | | | — | | | | 4,894 | |

| Other assets | | | 7,364 | | | | 9,886 | | | | 8,973 | |

| Total Assets | | | 22,295,724 | | | | 130,829,626 | | | | 88,579,893 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Payable for investments purchased | | | 465,780 | | | | — | | | | — | |

| Payable for Fund shares redeemed | | | — | | | | — | | | | 5,237 | |

| Payable to Investment Advisor | | | 15,845 | | | | 78,876 | | | | 40,941 | |

| Payable to Trustees | | | 339 | | | | 2,165 | | | | 1,496 | |

| Other accrued expenses | | | 32,177 | | | | 43,198 | | | | 37,337 | |

| Total Liabilities | | | 514,141 | | | | 124,239 | | | | 85,011 | |

| | | | | | | | | | | | | |

| NET ASSETS | | $ | 21,781,583 | | | $ | 130,705,387 | | | $ | 88,494,882 | |

| | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Capital stock | | $ | 21,437,000 | | | $ | 133,890,009 | | | $ | 83,294,673 | |

| Accumulated net investment income (loss) | | | (70,663 | ) | | | 219,762 | | | | 268,905 | |

| Accumulated net realized gain (loss) on investments | | | (196,598 | ) | | | (6,589,053 | ) | | | 300,621 | |

| Unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

| Investments | | | 614,239 | | | | 3,184,669 | | | | 4,630,683 | |

| Foreign Currency translations | | | (2,395 | ) | | | — | | | | — | |

| Net Assets | | $ | 21,781,583 | | | $ | 130,705,387 | | | $ | 88,494,882 | |

| | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | |

| Net Assets | | $ | 21,781,583 | | | $ | 130,705,387 | | | $ | 88,494,882 | |

| Shares issued and outstanding | | | 1,844,886 | | | | 13,441,865 | | | | 8,311,301 | |

Net asset value, offering and redemption price per share(2) | | | | | | | | | | | | |

| (Unlimited shares of no par value authorized) | | $ | 11.81 | | | $ | 9.72 | | | $ | 10.65 | |

| | | | | | | | | | | | | |

| (1) Cost of investments | | $ | 21,530,431 | | | $ | 127,535,145 | | | $ | 83,891,739 | |

| (2) | If applicable, redemption price per share may be reduced by a 2.00% redemption fee for shares redeemed within five days of purchase. |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Series Trust

STATEMENTS OF OPERATIONS

For the year ended June 30, 2016

| | | EntrepreneurShares | | | Entrepreneur | | | Entrepreneur | |

| | | Global | | | U.S. All Cap | | | U.S. Large Cap | |

| | | Fund | | | Fund | | | Fund | |

| | | | | | | | | | |

| INVESTMENT INCOME: | | | | | | | | | |

| Dividend income* | | $ | 90,571 | | | $ | 1,307,416 | | | $ | 1,180,920 | |

| Interest income | | | 432 | | | | 7,782 | | | | 3,448 | |

| Total investment income | | | 91,003 | | | | 1,315,198 | | | | 1,184,368 | |

| | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | |

| Investment advisory fees | | | 103,951 | | | | 966,368 | | | | 540,811 | |

| Custody fees | | | 27,244 | | | | 6,413 | | | | 5,755 | |

| Transfer agent fees and expenses | | | 22,606 | | | | 27,312 | | | | 27,915 | |

| Professional fees | | | 18,207 | | | | 30,077 | | | | 22,930 | |

| Federal and state registration fees | | | 15,713 | | | | 6,139 | | | | 9,509 | |

| Fund accounting fees | | | 11,114 | | | | 53,425 | | | | 32,673 | |

| Administration fees | | | 5,736 | | | | 49,359 | | | | 31,995 | |

| Other fees | | | 3,942 | | | | 13,475 | | | | 8,634 | |

| Printing and mailing fees | | | 655 | | | | 5,703 | | | | 4,162 | |

| Trustee fees | | | 650 | | | | 9,350 | | | | 6,005 | |

| Total expenses | | | 209,818 | | | | 1,167,621 | | | | 690,389 | |

| Fees waived | | | (68,444 | ) | | | (72,431 | ) | | | (66,377 | ) |

| Net expenses | | | 141,374 | | | | 1,095,190 | | | | 624,012 | |

| NET INVESTMENT INCOME (LOSS) | | | (50,371 | ) | | | 220,008 | | | | 560,356 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | | | | | | | |

| ON INVESTMENTS AND FOREIGN | | | | | | | | | | | | |

| CURRENCY TRANSACTIONS: | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 643,069 | | | | (6,339,835 | ) | | | 382,688 | |

| Foreign currency transactions | | | 19,755 | | | | — | | | | — | |

| Change in unrealized depreciation on: | | | | | | | | | | | | |

| Investments | | | (587,648 | ) | | | (7,512,069 | ) | | | (1,099,422 | ) |

| Foreign currency translations | | | (1,955 | ) | | | — | | | | — | |

| Net gain (loss) on investments | | | 73,221 | | | | (13,851,904 | ) | | | (716,734 | ) |

| NET INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 22,850 | | | $ | (13,631,896 | ) | | $ | (156,378 | ) |

| * Net of foreign tax withheld of: | | $ | 6,033 | | | $ | — | | | $ | — | |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Global Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (50,371 | ) | | $ | (114,796 | ) |

| Net realized gain on investment transactions | | | | | | | | |

| and foreign currency transactions | | | 662,824 | | | | 2,706,569 | |

| Change in unrealized depreciation on investments | | | | | | | | |

| and foreign currency translations | | | (589,603 | ) | | | (2,162,836 | ) |

| Net increase in net assets resulting from operations | | | 22,850 | | | | 428,937 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 16,774,056 | | | | 133,900 | |

| Proceeds from reinvestment of distributions | | | 6,834 | | | | 1,895,169 | |

| Payment for shares redeemed | | | (519,837 | ) | | | (6,145,859 | ) |

Payment for shares redeemed from redemption-in-kind(1) | | | — | | | | (12,869,830 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | 16,261,053 | | | | (16,986,620 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| From ordinary income | | | (19,570 | ) | | | — | |

| From realized gains | | | — | | | | (2,327,121 | ) |

| Total distributions | | | (19,570 | ) | | | (2,327,121 | ) |

| | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | | | 16,264,333 | | | | (18,884,804 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 5,517,250 | | | | 24,402,054 | |

| End of Year* | | $ | 21,781,583 | | | $ | 5,517,250 | |

| * Including undistributed net investment loss of: | | $ | (70,663 | ) | | $ | (43,924 | ) |

| (1) | See Note 9 of the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | |

| OPERATIONS: | | | | | | |

| Net investment income (loss) | | $ | 220,008 | | | $ | (48,093 | ) |

| Net realized gain (loss) on investments | | | (6,339,835 | ) | | | 8,276,600 | |

| Change in unrealized appreciation (depreciation) on investments | | | (7,512,069 | ) | | | 1,471,680 | |

| Net increase (decrease) in net assets resulting from operations | | | (13,631,896 | ) | | | 9,700,187 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 1,373,478 | | | | 15,500 | |

| Proceeds from reinvestment of distributions | | | 7,672,249 | | | | 60,861 | |

| Payment for shares redeemed | | | (157,501 | ) | | | (16,096 | ) |

| Net increase in net assets from capital share transactions | | | 8,888,226 | | | | 60,265 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| From ordinary income | | | (24,155 | ) | | | (60,866 | ) |

| From realized gains | | | (7,648,839 | ) | | | — | |

| Total distributions | | | (7,672,994 | ) | | | (60,866 | ) |

| | | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | | | (12,416,664 | ) | | | 9,699,586 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 143,122,051 | | | | 133,422,465 | |

| End of Year* | | $ | 130,705,387 | | | $ | 143,122,051 | |

| * Including undistributed net investment income of: | | $ | 219,792 | | | $ | 19,256 | |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. Large Cap Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 560,356 | | | $ | 288,519 | |

| Net realized gain (loss) on investments | | | 382,688 | | | | (103,676 | ) |

| Change in unrealized appreciation (depreciation) on investments | | | (1,099,422 | ) | | | 5,742,947 | |

| Net increase (decrease) in net assets resulting from operations | | | (156,378 | ) | | | 5,927,790 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 6,798,752 | | | | 2,301,089 | |

| Proceeds from reinvestment of distributions | | | 505,604 | | | | 50,450 | |

| Payment for shares redeemed | | | (1,125,568 | ) | | | (248,963 | ) |

| Net increase in net assets from capital share transactions | | | 6,178,788 | | | | 2,102,576 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| From ordinary income | | | (508,011 | ) | | | (50,453 | ) |

| Total distributions | | | (508,011 | ) | | | (50,453 | ) |

| | | | | | | | | |

| INCREASE IN NET ASSETS | | | 5,514,399 | | | | 7,979,913 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 82,980,483 | | | | 75,000,570 | |

| End of Year* | | $ | 88,494,882 | | | $ | 82,980,483 | |

| * Including undistributed net investment income of: | | $ | 268,905 | | | $ | 216,457 | |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Global Fund

FINANCIAL HIGHLIGHTS

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.19 | | | $ | 13.19 | | | $ | 11.82 | | | $ | 10.15 | | | $ | 11.23 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.07 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.01 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (0.27 | ) | | | 0.48 | | | | 2.10 | | | | 1.77 | | | | (1.06 | ) |

| Total from investment operations | | | (0.34 | ) | | | 0.40 | | | | 2.07 | | | | 1.75 | | | | (1.07 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.04 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized capital gains | | | — | | | | (1.40 | ) | | | (0.70 | ) | | | (0.08 | ) | | | (0.01 | ) |

| Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.00 | )(2) |

| Total distributions | | | (0.04 | ) | | | (1.40 | ) | | | (0.70 | ) | | | (0.08 | ) | | | (0.01 | ) |

| Net asset value, end of year | | $ | 11.81 | | | $ | 12.19 | | | $ | 13.19 | | | $ | 11.82 | | | $ | 10.15 | |

Total return(3) | | | -2.75 | % | | | 3.49 | % | | | 17.67 | % | | | 17.33 | % | | | -9.55 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 21,782 | | | $ | 5,517 | | | $ | 24,402 | | | $ | 22,552 | | | $ | 15,606 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses(4) | | | 1.70 | % | | | 1.70 | % | | | 1.70 | % | | | 1.71 | %(5) | | | 1.70 | % |

Net investment loss(4) | | | (0.61 | )% | | | (0.63 | )% | | | (0.25 | )% | | | (0.21 | )%(6) | | | (0.13 | )% |

| Portfolio turnover rate | | | 71 | % | | | 69 | %(7) | | | 64 | % | | | 14 | % | | | 19 | % |

| (1) | Net investment loss per share has been calculated based on average shares outstanding during the year. |

| (2) | Amount is less than $0.01 per share. |

| (3) | Total returns assumes reinvestment of dividends and would have been lower in the absence of fees waived. |

| (4) | Net of fees waived of 0.82%, 0.33%, 0.54%, 0.63%, and 1.21% for the years ended June 30, 2016, June 30, 2015, June 30, 2014, June 30, 2013, and June 30, 2012, respectively. |

| (5) | Includes expenses related to the Retail Class that was merged into the Institutional Class on January 10, 2013. In the absence of these expenses, the ratio would have been 1.70%. |

| (6) | Includes income and expenses attributed to the Retail Class that was merged into the Institutional Class on January 10, 2013. In the absence of these expenses, the ratio would have been (0.20)%. |

| (7) | Includes the value of portfolio securities delivered as a result of an in-kind redemption. |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. All Cap Fund

FINANCIAL HIGHLIGHTS

| | | | | | | | | Period From | |

| | | Year Ended | | | Year Ended | | | December 17, | |

| | | June 30, | | | June 30, | | | 2013(1) to June 30, | |

| | | 2016 | | | 2015 | | | 2014 | |

| Per Share Data: | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.45 | | | $ | 10.68 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | |

Net investment income (loss)(2) | | | 0.02 | | | | (0.00 | )(3) | | | 0.01 | |

| Net realized and unrealized gains (losses) on investments | | | (1.14 | ) | | | 0.77 | | | | 0.68 | |

| Total from investment operations | | | (1.12 | ) | | | 0.77 | | | | 0.69 | |

| | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | | (0.00 | )(3) | | | (0.00 | )(3) | | | (0.01 | ) |

| Net realized capital gains | | | (0.61 | ) | | | — | | | | — | |

| Total distributions | | | (0.61 | ) | | | (0.00 | )(3) | | | (0.01 | ) |

| Net asset value, end of period | | $ | 9.72 | | | $ | 11.45 | | | $ | 10.68 | |

Total return(4) | | | -9.63 | % | | | 7.26 | % | | | 6.85 | %(5) |

| | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 130,705 | | | $ | 143,122 | | | $ | 133,422 | |

| Ratios to average net assets: | | | | | | | | | | | | |

Expenses(6) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | %(7) |

Net investment income (loss)(6) | | | 0.17 | % | | | (0.04 | )% | | | 0.09 | %(7) |

| Portfolio turnover rate | | | 67 | % | | | 107 | % | | | 55 | %(5)(8) |

| (1) | The Fund commenced operations on December 17, 2013. |

| (2) | Net investment income (loss) per share has been calculated based on average shares outstanding during the period. |

| (3) | Amount is less than $0.01 per share. |

| (4) | Total returns assumes reinvestment of dividends and would have been lower in the absence of fees waived. |

| (5) | Not annualized. |

| (6) | Net of fees waived of 0.06%, 0.04% and 0.12% for the years ended June 30, 2016, June 30, 2015 and the period ended June 30, 2014, respectively. |

| (7) | Annualized. |

| (8) | Excludes the value of portfolio securities received as a result of in-kind purchases of the Fund’s capital shares. |

The accompanying notes are an integral part of these financial statements.

Entrepreneur U.S. Large Cap Fund

FINANCIAL HIGHLIGHTS

| | | | | | | | | Period From | |

| | | Year Ended | | | Year Ended | | | June 30, | |

| | | June 30, | | | June 30, | | | 2014(1) to June 30, | |

| | | 2016 | | | 2015 | | | 2014 | |

| Per Share Data: | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.77 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | |

Net investment income(2) | | | 0.07 | | | | 0.04 | | | | — | |

| Net realized and unrealized gain (loss) on investments | | | (0.12 | ) | | | 0.74 | | | | (0.00 | )(3) |

| Total from investment operations | | | (0.05 | ) | | | 0.78 | | | | — | |

| | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | | (0.07 | ) | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.07 | ) | | | (0.01 | ) | | | — | |

| Net asset value, end of period | | $ | 10.65 | | | $ | 10.77 | | | $ | 10.00 | |

Total return(4) | | | -0.49 | % | | | 7.77 | % | | | 0.00 | %(5) |

| | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 88,495 | | | $ | 82,980 | | | $ | 75,001 | |

| Ratios to average net assets: | | | | | | | | | | | | |

Expenses(6) | | | 0.75 | % | | | 0.75 | % | | | 0.00 | %(5)(7) |

Net investment income(6) | | | 0.67 | % | | | 0.36 | % | | | 0.00 | %(5)(7) |

| Portfolio turnover rate | | | 77 | % | | | 90 | % | | | 0 | %(5)(8) |

| (1) | The Fund commenced operations on June 30, 2014. |

| (2) | Net investment income per share has been calculated based on average shares outstanding during the period. |

| (3) | Amount is less than $0.01 per share. |

| (4) | Total returns assumes reinvestment of dividends and would have been lower in the absence of fees waived. |

| (5) | Not annualized. |

| (6) | Net of fees waived of 0.08%, 0.08% and 0.01% for the years ended June 30, 2016, June 30, 2015 and the period ended June 30, 2014, respectively. |

| (7) | Amount is based on a one-day fiscal year and is not indicative of future Fund expenses or income. |

| (8) | Excludes the value of portfolio securities received as a result of in-kind purchases of the Fund’s capital shares. |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Series Trust

NOTES TO FINANCIAL STATEMENTS

June 30, 2016