Annual Report

June 30, 2020

ERShares Global Fund

ERShares US Small Cap Fund

ERShares US Large Cap Fund

Each a series of EntrepreneurSharesTM Series Trust

c/o UMB Fund Services, Inc.

235 W. Galena Street

Milwaukee, Wisconsin 53212

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on https://www.entrepreneurshares.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change; and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by visiting https://www.entrepreneurshares.com or by calling 877-271-8811. If you own shares in a Fund through a financial intermediary, please contact your financial intermediary to make this election.

You may elect to receive paper copies of all future reports free of charge by calling 877-271-8811 or, if you own your shares through a financial intermediary, by contacting your financial intermediary. Your election to receive reports in paper will apply to all of the Funds in the EntrepreneurShares fund family.

EntrepreneurShares Series Trust

(Unaudited)

July 28, 2020

Dear Shareholders:

We are enclosing the report for results covering the fiscal year July 1, 2019 through June 30, 20201. We note that our performance is not symmetrical or consistent through the year with quarters in the past couple of years varying considerably from period to period. We note that the interpretation of results is best measured over an extended period, especially as measured against a consistent benchmark.

The objective of this letter is to provide our shareholders an informative review of our Funds’ performance, present comparison of each Fund’s performance vs. appropriate benchmarks, and discuss each Fund’s top performing sector. Our Funds include three mutual funds; ERShares Global Fund, ERShares US Small Cap Fund and ERShares US Large Cap Fund. The Trust also includes two exchange traded funds; these are covered in their own Annual Report separately. Overall, all funds have positive annual returns, despite the unusual market conditions brought by COVID-19.

Several key factors need to be addressed. First, our models work best during periods of market appreciation and low volatility. Our historical above average Up-Capture suggests that when markets rise, our Entrepreneurial stocks tend to rise faster. The corollary also tends to hold true: our above average Down-Capture suggests that during periods of market decline our Entrepreneurial stocks tend to fall faster than peer benchmarks. The period July 1, 2019 through June 30, 2020 included periods with extreme movements in both directions. Our Funds performed as expected during these periods. If our Funds were evaluated during a calendar year, investors would have an entirely different interpretation of results.

An important distinguishing characteristic of our strategy is that many of our alpha-generating Entrepreneurial stocks tend to fall in the Growth and High Beta classification. This includes a handful of sectors with most stocks residing within the Information Technology, Consumer Discretionary, Communication Services and Health Care sectors. When equity markets favor these sectors or Growth and High Beta stocks, our Entrepreneur portfolios tend to out-perform the markets over that time period.

ERShares Global Fund

ERShares Global Fund (“ENTIX”) is one of the three mutual funds. ENTIX is benchmarked against the MSCI The World Index (Net)2. During the last fiscal year, ENTIX performed 9.80% vs. 2.84%, respectively.

The ERShares Global Fund top performing sectors for the period were Health Care, Technology, and Communication Services. The Fund’s performance vs. the benchmark for the period was 54.26% vs. 15.26%, 33.29% vs. 32.72%, and 21.38% vs. 7.60%, respectively. The ERShares Global Fund’s worst performing sectors were Energy, Consumer Staples, and Financials. The Fund’s performance vs the benchmark for the period was: -61.31% vs -35.60%, -21.21% vs 1.38%, and -10.28% vs -15.37%, respectively.

ERShares US Small Cap Fund

ERShares US Small Cap Fund (“IMPAX”) is one of the three mutual funds. IMPAX is benchmarked against the S&P SmallCap 600 Index. During the last fiscal year, IMPAX performed 0.86% vs. -11.29%, respectively.

The ERShares US Small Cap Fund top performing sectors for the period were Technology, Health Care, and Industrials. The Fund’s performance vs. the benchmark for the period was; 40.18% vs. 1.89%, 13.79% vs. 0.31%, and 2.85% vs. -11.29%, respectively. The ERShares US Small Cap Fund’s worst performing sectors for the period were Energy, Consumer Discretionary, and Financials. The Fund’s performance vs. the benchmark for the period was; -89.88% vs. -59.93%, -12.05% vs. -4.98%, and -12.02% vs. -23.87%, respectively.

________________

1 | Performance based off the end of day price from Friday June 28, 2019 to Monday June 30, 2020. This period reflects the last closing price prior to July 1, 2019 (June 29, 2019 and June 30, 2019 were not trading days) and the closing price on June 30, 2020. Thus, the performance is representative of the last fiscal year. |

| | Performance Source: Bloomberg and Fund Administration records |

2 | Reflects no deduction for fees, expenses or taxes. MSCI publishes two versions of this index reflecting the reinvestment of dividends using two different methodologies: gross dividends and net dividends. The Fund believes that the net dividends version better reflects the returns U.S. investors might expect were they to invest directly in the component securities of the index. |

EntrepreneurShares Series Trust

(Unaudited)

ERShares US Large Cap Fund

ERShares US Large Cap Fund (“IMPLX”) is one of the three mutual funds. IMPLX is benchmarked against the S&P 500 Total Return Index. During the last fiscal year, IMPLX performed 18.50% vs. 7.51%, respectively.

The ERShares US Large Cap Fund top performing sectors for the period were Consumer Discretionary, Health Care, and Technology. The Fund’s performance vs. the benchmark for the period was; 42.64% vs. 12.57%, 38.23% vs. 10.89%, and 34.59% vs. 35.94%, respectively. The ERShares US Large Cap Fund’s worst performing sectors for the period were Energy, Materials, and Industrials. The Fund’s performance vs. the benchmark for the period was; -62.30% vs. -36.09%, -2.25% vs. -1.13%, and 0.93% vs. -9.71%, respectively.

In this past fiscal year, we note that our relative performance is not consistent across strategies. We do not see this divergence as a reflection of our Entrepreneur strategy, but rather, individual stock performance during a specific time period. We had relatively strong performance as measured against our benchmark in Global, US Small Cap, and US Large Cap. We note that when our Fund performance is viewed on a calendar year basis or over an extended time period, different interpretations would follow. We continue to provide evidence that our Entrepreneur Model works over an extended period and extend our gratitude to all of our shareholders for continued support. We look forward to sharing more updates with you in the future.

Sincerely,

Joel Shulman Ph.D., CFA

Founder and Chief Investment Officer

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-271-8811 or visiting www.ershares.com.

Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a full prospectus which contains this and other information about the Funds offered by EntrepreneurShares, call 1-877-271-8811. Please read the full prospectus carefully before investing. The Mutual Funds are distributed by Foreside Fund Services, LLC.

The ERShares Global Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The ERShares US Small Cap Fund invests in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The ERShares US Large Cap Fund is exposed to common stock risk. Common stock prices fluctuate based on changes in a company’s financial condition and on overall market and economic conditions. Additional risks are detailed in the prospectus.

The MSCI The World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The S&P 500 Total Return Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Returns assume the reinvestments of all dividends. The Russell 2000 Total Return Index is a subset of the Russell 3000® Total Return Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The Up-Capture ratio is the statistical measure of an investment manager's performance in up-markets. The Down Capture ratio is the statistical measure of an investment manager's performance in down-markets.

One cannot invest directly in an index.

Diversification does not guarantee a profit or assure against a loss.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

ERShares Global Fund

PERFORMANCE HIGHLIGHTS (Unaudited)

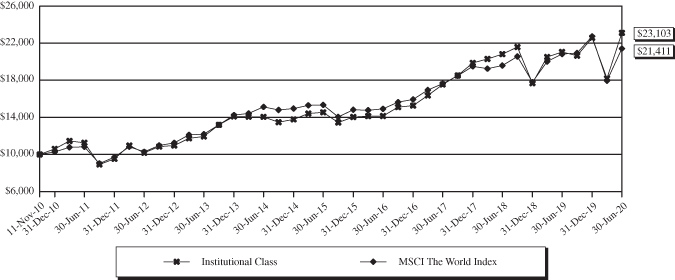

ERShares Global Fund Institutional Class vs. MSCI The World Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on November 11, 2010 (commencement of operations of the Fund). Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower/higher had the expenses not been waived or absorbed/recovered by Seaport Global Advisors, LLC. The fund’s total gross and net operational expenses, including underlying funds, were 1.57% per the November 1, 2019 prospectus.

MSCI The World Index – A free float-adjusted market capitalization weighted index that is designed to measure the equity performance of developed markets. Returns assume the reinvestments of all dividends. Investors cannot invest directly in an index.

Total Annualized Returns for the year or period ended June 30, 2020

| | | | Since |

| | | | Inception |

| | 1-Year | 5-Year | (11/11/10) |

ERShares Global Fund – Institutional Class | 9.80% | 9.70% | 9.08% |

MSCI The World Index | 2.84% | 6.90% | 8.22% |

ERShares US Small Cap Fund

PERFORMANCE HIGHLIGHTS (Unaudited)

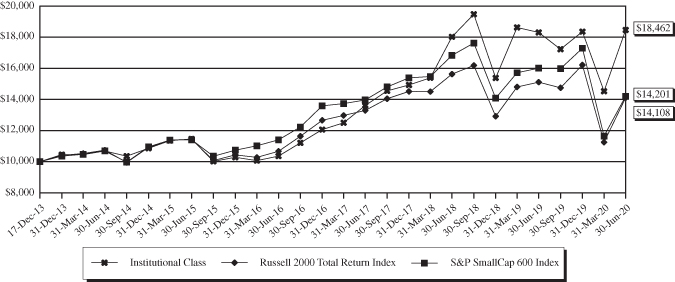

ERShares US Small Cap Fund Institutional Class vs. Russell 2000 Total Return Index vs. S&P SmallCap 600 Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on December 17, 2013 (commencement of operations of the Fund). Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had Capital Impact Advisors, LLC not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross and net operational expenses, including underlying funds, were 0.90% and 0.86%, respectfully, per the November 1, 2019 prospectus.

Effective June 30, 2019 the S&P SmallCap 600 Index was made the primary benchmark and the Russell 2000 Total Return Index was made a supplemental benchmark of the Fund.

S&P SmallCap 600 Index – An index that covers roughly the small-cap range of US stocks, using a capitalization-weighted index. Investors cannot invest directly in an index.

Russell 2000 Total Return Index – A subset of the Russell 3000® Total Return Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Investors cannot invest directly in an index.

Returns assume the reinvestments of all dividends.

Total Annualized Returns for the year or period ended June 30, 2020

| | | | Since |

| | | | Inception |

| | 1-Year | 5-Year | (12/17/13) |

ERShares US Small Cap Fund – Institutional Class | 0.86% | 10.00% | 9.84% |

Russell 2000 Total Return Index | (6.63)% | 4.29% | 5.41% |

S&P SmallCap 600 Index | (11.29)% | 4.48% | 5.51% |

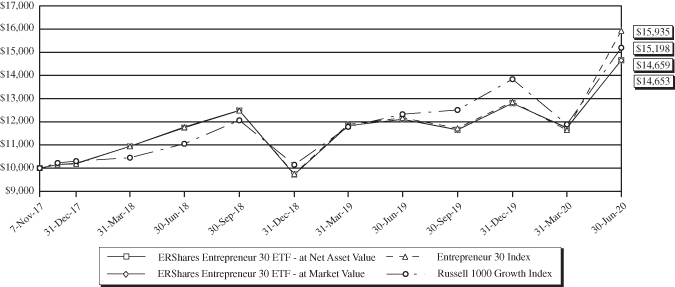

ERShares US Large Cap Fund

PERFORMANCE HIGHLIGHTS (Unaudited)

ERShares US Large Cap Fund Institutional Class vs. S&P 500 Total Return Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on June 30, 2014 (commencement of operations of the Fund). Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had Capital Impact Advisors, LLC not waived its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross and net operational expenses, including underlying funds, were 0.80% and 0.76%, respectfully, per the November 1, 2019 prospectus.

S&P 500 Total Return Index – Includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Returns assume the reinvestments of all dividends. Investors cannot invest directly in an index.

Total Annualized Returns for the year or period ended June 30, 2020

| | | | Since |

| | | | Inception |

| | 1-Year | 5-Year | (6/30/14) |

ERShares US Large Cap Fund – Institutional Class | 18.50% | 13.91% | 12.86% |

S&P 500 Total Return Index | 7.51% | 10.73% | 10.17% |

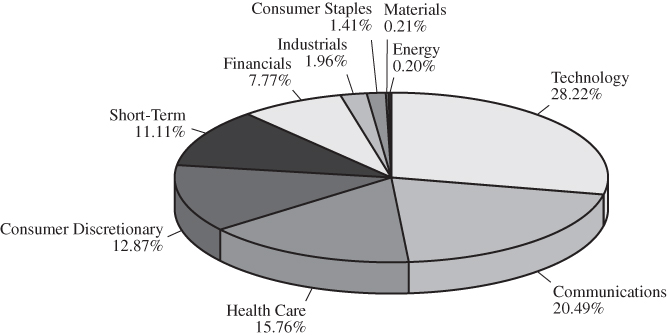

ERShares Global Fund

SECTOR ALLOCATION(1)

June 30, 2020 (Unaudited)

As a Percentage of Total Investments

TOP TEN EQUITY HOLDINGS(1)(2)

as of June 30, 2020 (Unaudited)

Issuer | % of Net Assets | |

| Amazon.com, Inc. | 3.84% | |

| Sino Biopharmaceutical Ltd. | 3.27% | |

| Alphabet, Inc. – Class A | 3.23% | |

| Genmab A/S | 3.14% | |

| Spotify Technology S.A. | 3.03% | |

| NVIDIA Corp. | 2.94% | |

| Facebook, Inc. – Class A | 2.79% | |

| SS&C Technologies Holdings, Inc. | 2.67% | |

| ResMed, Inc. | 2.50% | |

| Veeva Systems, Inc. – Class A | 2.50% | |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Short-term investments are not included. |

ERShares US Small Cap Fund

SECTOR ALLOCATION(1)

June 30, 2020 (Unaudited)

As a Percentage of Total Investments

TOP TEN EQUITY HOLDINGS(1)(2)

as of June 30, 2020 (Unaudited)

Issuer | % of Net Assets | |

| Arrowhead Pharmaceuticals, Inc. | 2.39% | |

| WisdomTree Investments, Inc. | 1.85% | |

| Corcept Therapeutics, Inc. | 1.82% | |

| MongoDB, Inc. | 1.80% | |

| Super Micro Computer, Inc. | 1.75% | |

| Vicor Corp. | 1.73% | |

| Skechers U.S.A., Inc. – Class A | 1.71% | |

| Madrigal Pharmaceuticals, Inc. | 1.68% | |

| LendingTree, Inc. | 1.68% | |

| Insperity, Inc. | 1.67% | |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Short-term investments are not included. |

ERShares US Large Cap Fund

SECTOR ALLOCATION(1)

June 30, 2020 (Unaudited)

As a Percentage of Total Investments

TOP TEN EQUITY HOLDINGS(1)(2)

as of June 30, 2020 (Unaudited)

Issuer | % of Net Assets | |

| Alphabet, Inc. – Class A | 7.45% | |

| Amazon.com, Inc. | 7.07% | |

| Facebook, Inc. – Class A | 5.23% | |

| Netflix, Inc. | 3.72% | |

| Arrowhead Pharmaceuticals, Inc. | 2.50% | |

| Masimo Corp. | 2.39% | |

| VeriSign, Inc. | 2.22% | |

| Microsoft Corp. | 2.16% | |

| SS&C Technologies Holdings, Inc. | 2.12% | |

| ResMed, Inc. | 2.05% | |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Short-term investments are not included. |

EntrepreneurShares Series Trust

EXPENSE EXAMPLE

June 30, 2020 (Unaudited)

As a shareholder of ERShares Global Fund, the ERShares US Small Cap Fund, or the ERShares US Large Cap Fund (the “Funds”), you incur two types of costs: (1) transaction costs, including redemption fees on shares held less than 5 business days and exchange fees; and (2) ongoing costs, including management fees and other specific expenses for the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the most recent six-month period.

The Actual Expense comparison provides information about actual account values and actual expenses. A shareholder may use the information in this line, together with the amount invested, to estimate the expenses paid over the period. A shareholder may divide his/her account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid on his/her account during the period.

The Hypothetical Example for Comparison Purposes provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid for the period. A shareholder may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, a shareholder would compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The expenses shown in the table are meant to highlight ongoing costs only and do not reflect any transactional costs, such as redemptions fees or exchange fees. Therefore, the Hypothetical Example for Comparison Purposes is useful in comparing ongoing costs only, and will not help determine the relevant total cost of owning different funds. In addition, if these transactional costs were included, shareholder costs would be higher.

ERShares Global Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | January 1, 2020 – |

| | January 1, 2020 | June 30, 2020 | June 30, 2020 |

Institutional Class – Actual(2) | $1,000.00 | $1,023.70 | $7.60 |

| Institutional Class – Hypothetical | | | |

| (5% annual return before expenses) | 1,000.00 | 1,017.40 | 7.57 |

(1) | Expenses are equal to the Fund’s annualized expense ratio of 1.51%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

(2) | Based on actual returns for the six-month period ended June 30, 2020 of 2.37%. |

ERShares US Small Cap Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | January 1, 2020 – |

| | January 1, 2020 | June 30, 2020 | June 30, 2020 |

Institutional Class – Actual(2) | $1,000.00 | $1,005.90 | $4.24 |

| Institutional Class – Hypothetical | | | |

| (5% annual return before expenses) | 1,000.00 | 1,020.70 | 4.27 |

(1) | Expenses are equal to the Fund’s annualized expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

(2) | Based on actual returns for the six-month period ended June 30, 2020 of 0.59%. |

EntrepreneurShares Series Trust

EXPENSE EXAMPLE (Continued)

June 30, 2020 (Unaudited)

ERShares US Large Cap Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | January 1, 2020 – |

| | January 1, 2020 | June 30, 2020 | June 30, 2020 |

Institutional Class – Actual(2) | $1,000.00 | $1,106.00 | $3.93 |

| Institutional Class – Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,021.20 | 3.77 |

(1) | Expenses are equal to the Fund’s annualized expense ratio of 0.75%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

(2) | Based on actual returns for the six-month period ended June 30, 2020 of 10.60%. |

ERShares Global Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS – 96.8% | | | |

| | | Asset Management – 2.6% | | | |

| | 2,114 | | BlackRock, Inc. | | $ | 1,150,206 | |

| | 7,500 | | Noah Holdings Ltd*,1 | | | 191,025 | |

| | | | | | | 1,341,231 | |

| | | | Automotive – 2.1% | | | | |

| | 1,000 | | Tesla, Inc.* | | | 1,079,810 | |

| | | | Biotechnology & Pharmaceutical – 12.0% | | | | |

| | 4,892 | | Ascendis Pharma A/S ADR*,1 | | | 723,527 | |

| | 4,804 | | Genmab A/S*,1 | | | 1,607,973 | |

| | 6,795 | | Jazz Pharmaceuticals PLC* | | | 749,760 | |

| | 5,000 | | Livongo Health, Inc.* | | | 375,950 | |

| | 1,587 | | Regeneron Pharmaceuticals, Inc.* | | | 989,732 | |

| | 889,622 | | Sino Biopharmaceutical Ltd.1 | | | 1,675,825 | |

| | | | | | | 6,122,767 | |

| | | | Commercial Services – 2.2% | | | | |

| | 2,000 | | Cimpress PLC*,1 | | | 152,680 | |

| | 3,666 | | Cintas Corp. | | | 976,476 | |

| | | | | | | 1,129,156 | |

| | | | Consumer Products – 0.1% | | | | |

| | 900 | | Inter Parfums, Inc. | | | 43,335 | |

| | | | Containers & Packaging – 1.8% | | | | |

| | 999,079 | | Nine Dragons Paper Holdings Ltd.1 | | | 903,625 | |

| | | | Distributors – Discretionary – 1.2% | | | | |

| | 7,243 | | Copart, Inc.* | | | 603,125 | |

| | | | Electrical Equipment – 1.8% | | | | |

| | 15,281 | | Cognex Corp. | | | 912,581 | |

| | | | Engineering & Construction Services – 1.6% | | | | |

| | 51,915 | | HomeServe PLC1 | | | 839,518 | |

| | | | Hardware – 3.9% | | | | |

| | 3,000 | | Apple, Inc. | | | 1,094,400 | |

| | 7,609 | | Roku, Inc.* | | | 886,677 | |

| | | | | | | 1,981,077 | |

| | | | Institutional Financial Services – 1.0% | | | | |

| | 5,675 | | Intercontinental Exchange, Inc. | | | 519,830 | |

| | | | Insurance – 0.7% | | | | |

| | 2,500 | | Enstar Group, Ltd.*,1 | | | 381,925 | |

| | | | Iron & Steel – 0.4% | | | | |

| | 8,200 | | Steel Dynamics, Inc. | | | 213,938 | |

| | | | Leisure Products – 0.7% | | | | |

| | 20,000 | | Spin Master Corp.*,1,2 | | | 361,373 | |

The accompanying notes are an integral part of these financial statements.

ERShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Media – 19.2% | | | |

| | 1,165 | | Alphabet, Inc. – Class A* | | $ | 1,652,028 | |

| | 6,295 | | Facebook, Inc. – Class A* | | | 1,429,405 | |

| | 46,334 | | GMO internet, Inc.1 | | | 1,277,484 | |

| | 1,971 | | Netflix, Inc.* | | | 896,884 | |

| | 26,824 | | SEEK Ltd.1 | | | 405,201 | |

| | 6,020 | | Spotify Technology S.A.* | | | 1,554,304 | |

| | 17,752 | | Tencent Holdings Ltd.1 | | | 1,142,010 | |

| | 4,454 | | VeriSign, Inc.* | | | 921,221 | |

| | 10,000 | | Zillow Group, Inc. – Class A* | | | 574,800 | |

| | | | | | | 9,853,337 | |

| | | | Medical Equipment & Devices – 4.6% | | | | |

| | 4,776 | | Masimo Corp.* | | | 1,088,880 | |

| | 6,673 | | ResMed, Inc. | | | 1,281,216 | |

| | | | | | | 2,370,096 | |

| | | | Recreation Facilities & Services – 0.5% | | | | |

| | 35,000 | | Flight Centre Travel Group Ltd1 | | | 268,581 | |

| | | | Retail – Consumer Staples – 1.5% | | | | |

| | 25,373 | | Alimentation Couche-Tard, Inc. – Class B1 | | | 789,770 | |

| | | | Retail – Discretionary – 7.6% | | | | |

| | 2,150 | | Alibaba Group Holding Ltd. – ADR*1 | | | 463,755 | |

| | 713 | | Amazon.com, Inc.* | | | 1,967,039 | |

| | 797 | | MercadoLibre, Inc.*,1,3 | | | 785,659 | |

| | 79,016 | | Rakuten, Inc.1 | | | 693,745 | |

| | | | | | | 3,910,198 | |

| | | | Semiconductors – 5.0% | | | | |

| | 9,859 | | Microchip Technology, Inc.3 | | | 1,038,251 | |

| | 3,958 | | NVIDIA Corp. | | | 1,503,684 | |

| | | | | | | 2,541,935 | |

| | | | Software – 18.5% | | | | |

| | 5,000 | | Bill.com Holdings, Inc.* | | | 451,050 | |

| | 7,931 | | Check Point Software Technologies Ltd.*,1 | | | 852,027 | |

| | 10,000 | | Cloudflare, Inc.* | | | 359,500 | |

| | 922 | | Constellation Software, Inc.1 | | | 1,041,047 | |

| | 5,000 | | Crowdstrike Holdings, Inc. – Class A* | | | 501,450 | |

| | 5,000 | | Datadog, Inc.* | | | 434,750 | |

| | 5,300 | | Microsoft Corp. | | | 1,078,603 | |

| | 1,554 | | NetEase, Inc. – ADR1 | | | 667,257 | |

| | 24,200 | | SS&C Technologies Holdings, Inc. | | | 1,366,816 | |

| | 148,303 | | Technology One Ltd.1 | | | 899,581 | |

| | 5,457 | | Veeva Systems, Inc. – Class A* | | | 1,279,230 | |

| | 5,000 | | Zscaler, Inc.* | | | 547,500 | |

| | | | | | | 9,478,811 | |

The accompanying notes are an integral part of these financial statements.

ERShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Specialty Finance – 4.6% | | | |

| | 55,000 | | Burford Capital Ltd.1 | | $ | 316,914 | |

| | 6,500 | | Capital One Financial Corp. | | | 406,835 | |

| | 5,800 | | Euronet Worldwide, Inc.* | | | 555,756 | |

| | 3,993 | | FleetCor Technologies, Inc.* | | | 1,004,359 | |

| | 10,000 | | Tricon Capital Group, Inc.1 | | | 67,398 | |

| | | | | | | 2,351,262 | |

| | | | Technology Services – 2.2% | | | | |

| | 4,350 | | Teleperformance1 | | | 1,103,994 | |

| | | | Transportation & Logistics – 1.0% | | | | |

| | 3,465 | | FedEx Corp. | | | 485,862 | |

| | | | TOTAL COMMON STOCKS (Cost $37,230,540) | | | 49,587,137 | |

| | | | | | | | |

| | | | SHORT-TERM INVESTMENTS – 5.5% | | | | |

| | 270,548 | | BlackRock Liquidity Funds FedFund Portfolio – Institutional Class, 0.100%4,5 | | | 270,548 | |

| | 3,228 | | Fidelity Investments Money Market Government Portfolio – Class I, 0.060%4,5 | | | 3,228 | |

| | 1,669,030 | | Fidelity Investments Money Market Treasury Only Portfolio – Class I, 0.046%5 | | | 1,669,030 | |

| | 2,461 | | Invesco Short-Term Investments Trust Government & Agency Portfolio – | | | | |

| | | | Institutional Class, 0.090%4,5 | | | 2,461 | |

| | 858,533 | | JPMorgan U.S. Government Money Market Fund – Capital Class, 0.100%4,5 | | | 858,533 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $2,803,800) | | | 2,803,800 | |

| | | | | | | | |

| | | | Total Investments – 102.3% (Cost $40,034,340) | | | 52,390,937 | |

| | | | Liabilities in Excess of Other Assets – (2.3)% | | | (1,157,099 | ) |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 51,233,838 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

PLC – Public Limited Company

| * | Non-income producing security. |

1 | Global Security, as classified by the Fund’s Investment Advisor, in accordance to the definition in the Fund’s prospectus. |

2 | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $361,373 which represents 0.7% of Net Assets. |

3 | All or a portion of shares are on loan. Total loaned securities had a value of $1,136,302. See Note 2. |

4 | All or a portion of this security was purchased with cash proceeds from securities lending. Total collateral had a value of $1,134,770. See Note 2. |

5 | The rate is the annualized seven-day yield at period end. |

The accompanying notes are an integral part of these financial statements.

ERShares Global Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020 (Unaudited)

| | | Percent of Net |

| Country of Risk | | Assets |

United States | | | 68.0 | % |

Hong Kong | | | 5.1 | % |

China | | | 4.8 | % |

Denmark | | | 4.6 | % |

Canada | | | 4.3 | % |

Japan | | | 3.9 | % |

Australia | | | 3.0 | % |

United Kingdom | | | 2.2 | % |

France | | | 2.2 | % |

Israel | | | 1.7 | % |

Argentina | | | 1.5 | % |

Bermuda | | | 0.7 | % |

Ireland | | | 0.3 | % |

| | | | 102.3 | % |

The accompanying notes are an integral part of these financial statements.

ERShares US Small Cap Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS – 98.0% | | | |

| | | Apparel & Textile Products – 1.7% | | | |

| | 89,253 | | Skechers U.S.A., Inc. – Class A*,1 | | $ | 2,800,759 | |

| | | | Asset Management – 3.1% | | | | |

| | 30,270 | | Cohen & Steers, Inc. | | | 2,059,874 | |

| | 875,001 | | WisdomTree Investments, Inc.1 | | | 3,036,253 | |

| | | | | | | 5,096,127 | |

| | | | Automotive – 1.3% | | | | |

| | 2,000 | | Tesla, Inc.*,1 | | | 2,159,620 | |

| | | | Banking – 3.1% | | | | |

| | 185,225 | | Live Oak Bancshares, Inc. | | | 2,687,615 | |

| | 27,994 | | Pinnacle Financial Partners, Inc. | | | 1,175,468 | |

| | 27,585 | | Preferred Bank | | | 1,182,017 | |

| | | | | | | 5,045,100 | |

| | | | Biotechnology & Pharmaceutical – 18.7% | | | | |

| | 37,196 | | Allogene Therapeutics, Inc.*,1 | | | 1,592,733 | |

| | 90,685 | | Arrowhead Pharmaceuticals, Inc.*,1 | | | 3,916,685 | |

| | 203,133 | | Catalyst Pharmaceuticals, Inc.*,1 | | | 938,474 | |

| | 177,300 | | Corcept Therapeutics, Inc.*,1 | | | 2,982,186 | |

| | 35,815 | | Eagle Pharmaceuticals, Inc.*,1 | | | 1,718,404 | |

| | 26,362 | | Global Blood Therapeutics, Inc.*,1 | | | 1,664,233 | |

| | 32,943 | | Guardant Health, Inc.*,1 | | | 2,672,666 | |

| | 34,463 | | Ionis Pharmaceuticals, Inc.*,1 | | | 2,031,938 | |

| | 62,331 | | Kura Oncology, Inc.*,1 | | | 1,015,995 | |

| | 13,500 | | Livongo Health, Inc.*,1 | | | 1,015,065 | |

| | 24,351 | | Madrigal Pharmaceuticals, Inc.*,1 | | | 2,757,751 | |

| | 22,106 | | Neurocrine Biosciences, Inc.*,1 | | | 2,696,932 | |

| | 1,500 | | Regeneron Pharmaceuticals, Inc.* | | | 935,475 | |

| | 83,632 | | Supernus Pharmaceuticals, Inc.*,1 | | | 1,986,260 | |

| | 30,582 | | Ultragenyx Pharmaceutical, Inc.*,1 | | | 2,392,124 | |

| | 3,026 | | United Therapeutics Corp.* | | | 366,146 | |

| | | | | | | 30,683,067 | |

| | | | Commercial Services – 4.1% | | | | |

| | 17,026 | | Avalara, Inc.*,1 | | | 2,265,990 | |

| | 3,511 | | Cintas Corp. | | | 935,190 | |

| | 42,216 | | Insperity, Inc.1 | | | 2,732,642 | |

| | 13,917 | | National Research Corp. | | | 810,109 | |

| | | | | | | 6,743,931 | |

| | | | Consumer Products – 2.7% | | | | |

| | 1,700 | | Inter Parfums, Inc1 | | | 81,855 | |

| | 18,222 | | J&J Snack Foods Corp. | | | 2,316,563 | |

| | 34,100 | | National Beverage Corp.*,1 | | | 2,080,782 | |

| | | | | | | 4,479,200 | |

The accompanying notes are an integral part of these financial statements.

ERShares US Small Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Distributors – Discretionary – 1.3% | | | |

| | 24,729 | | Copart, Inc.* | | $ | 2,059,184 | |

| | | | Gaming, Lodging & Restaurants – 1.6% | | | | |

| | 117,100 | | Cheesecake Factory, Inc.1 | | | 2,683,932 | |

| | | | Hardware – 4.5% | | | | |

| | 1,500 | | Apple, Inc. | | | 547,200 | |

| | 100,761 | | Super Micro Computer, Inc.*,1 | | | 2,860,605 | |

| | 6,516 | | Ubiquiti, Inc. | | | 1,137,433 | |

| | 39,282 | | Vicor Corp.* | | | 2,826,340 | |

| | | | | | | 7,371,578 | |

| | | | Health Care Facilities & Services – 1.5% | | | | |

| | 17,698 | | Medpace Holdings, Inc.*,1 | | | 1,646,268 | |

| | 4,500 | | Teladoc Health, Inc.*,1 | | | 858,780 | |

| | | | | | | 2,505,048 | |

| | | | Iron & Steel – 0.2% | | | | |

| | 14,151 | | Steel Dynamics, Inc. | | | 369,200 | |

| | | | Media – 10.4% | | | | |

| | 700 | | Alphabet, Inc. – Class A* | | | 992,635 | |

| | 91,464 | | Cargurus, Inc.* | | | 2,318,612 | |

| | 2,000 | | Facebook, Inc. – Class A*,1 | | | 454,140 | |

| | 46,764 | | HealthStream, Inc.* | | | 1,034,887 | |

| | 1,300 | | Netflix, Inc.*,1 | | | 591,552 | |

| | 2,500 | | Shopify, Inc.* | | | 2,373,000 | |

| | 44,980 | | Shutterstock, Inc. | | | 1,572,951 | |

| | 5,562 | | Trade Desk, Inc. – Class A* | | | 2,260,953 | |

| | 111,532 | | TripAdvisor, Inc. | | | 2,120,223 | |

| | 106,551 | | Yelp, Inc.* | | | 2,464,525 | |

| | 15,000 | | Zillow Group, Inc. – Class A* | | | 862,200 | |

| | | | | | | 17,045,678 | |

| | | | Medical Equipment & Devices – 6.9% | | | | |

| | 12,000 | | Danaher Corp. | | | 2,121,960 | |

| | 3,000 | | Intuitive Surgical, Inc.*,1 | | | 1,709,490 | |

| | 65,173 | | LeMaitre Vascular, Inc. | | | 1,720,567 | |

| | 8,407 | | Masimo Corp.* | | | 1,916,712 | |

| | 31,915 | | Merit Medical Systems, Inc.*,1 | | | 1,456,920 | |

| | 8,873 | | Penumbra, Inc.*,1 | | | 1,586,670 | |

| | 31,734 | | Zynex, Inc.*,1 | | | 789,224 | |

| | | | | | | 11,301,543 | |

| | | | Metals & Mining – 1.4% | | | | |

| | 45,433 | | Encore Wire Corp. | | | 2,218,039 | |

The accompanying notes are an integral part of these financial statements.

ERShares US Small Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Oil, Gas & Coal – 0.2% | | | |

| | 11,903 | | Continental Resources, Inc.1 | | $ | 208,659 | |

| | 5,911 | | Geopark Ltd.1 | | | 57,869 | |

| | | | | | | 266,528 | |

| | | | Real Estate – 2.3% | | | | |

| | 156,274 | | GEO Group, Inc. – REIT1 | | | 1,848,721 | |

| | 99,957 | | Medical Properties Trust, Inc. – REIT | | | 1,879,192 | |

| | | | | | | 3,727,913 | |

| | | | Renewable Energy – 1.0% | | | | |

| | 58,692 | | Ameresco, Inc. – Class A*,1 | | | 1,630,464 | |

| | | | Retail – Discretionary – 2.9% | | | | |

| | 175 | | Amazon.com, Inc.* | | | 482,794 | |

| | 108,515 | | Stitch Fix, Inc. – Class A*,1 | | | 2,706,364 | |

| | 7,581 | | Wayfair, Inc.*,1 | | | 1,498,081 | |

| | | | | | | 4,687,239 | |

| | | | Semiconductors – 3.1% | | | | |

| | 62,016 | | Impinj, Inc.* | | | 1,703,579 | |

| | 5,182 | | Monolithic Power Systems, Inc. | | | 1,228,134 | |

| | 5,500 | | NVIDIA Corp. | | | 2,089,505 | |

| | | | | | | 5,021,218 | |

| | | | Software – 15.4% | | | | |

| | 6,125 | | Alteryx, Inc.*,1 | | | 1,006,215 | |

| | 6,658 | | Appfolio, Inc. – Class A* | | | 1,083,323 | |

| | 14,500 | | Bill.com Holdings, Inc.*,1 | | | 1,308,045 | |

| | 100,888 | | Box, Inc.* | | | 2,094,435 | |

| | 28,500 | | Cloudflare, Inc.*,1 | | | 1,024,575 | |

| | 11,000 | | Crowdstrike Holdings, Inc. – Class A*,1 | | | 1,103,190 | |

| | 13,500 | | Datadog, Inc.* | | | 1,173,825 | |

| | 15,000 | | Fortinet, Inc.* | | | 2,059,050 | |

| | 2,500 | | Microsoft Corp. | | | 508,775 | |

| | 13,042 | | MongoDB, Inc.*,1 | | | 2,951,926 | |

| | 10,000 | | Okta, Inc.*,1 | | | 2,002,300 | |

| | 33,938 | | Omnicell, Inc.*,1 | | | 2,396,702 | |

| | 1,808 | | Paycom Software, Inc.* | | | 559,992 | |

| | 24,224 | | SS&C Technologies Holdings, Inc. | | | 1,368,171 | |

| | 5,200 | | Synopsys, Inc.* | | | 1,014,000 | |

| | 11,500 | | Twilio, Inc. – Class A*,1 | | | 2,523,330 | |

| | 9,750 | | Zscaler, Inc.*,1 | | | 1,067,625 | |

| | | | | | | 25,245,479 | |

| | | | Specialty Finance – 5.5% | | | | |

| | 14,812 | | Euronet Worldwide, Inc.* | | | 1,419,286 | |

| | 46,843 | | Green Dot Corp. – Class A*,1 | | | 2,299,054 | |

The accompanying notes are an integral part of these financial statements.

ERShares US Small Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Specialty Finance (Continued) | | | |

| | 9,486 | | LendingTree, Inc.*,1 | | $ | 2,746,482 | |

| | 25,000 | | Square, Inc. – Class A* | | | 2,623,500 | |

| | | | | | | 9,088,322 | |

| | | | Technology Services – 1.0% | | | | |

| | 4,859 | | EPAM Systems, Inc.* | | | 1,224,517 | |

| | 10,700 | | TTEC Holdings, Inc. | | | 498,192 | |

| | | | | | | 1,722,709 | |

| | | | Telecommunications – 1.5% | | | | |

| | 8,500 | | RingCentral, Inc. – Class A* | | | 2,422,585 | |

| | | | Transportation & Logistics – 1.1% | | | | |

| | 12,486 | | FedEx Corp. | | | 1,750,787 | |

| | | | Waste & Environment Services & Equipment – 1.5% | | | | |

| | 41,966 | | Clean Harbors, Inc.* | | | 2,517,121 | |

| | | | TOTAL COMMON STOCKS (Cost $137,332,045) | | | 160,642,371 | |

| | | | | | | | |

| | | | SHORT-TERM INVESTMENTS – 25.2% | | | | |

| | 8,888,881 | | BlackRock Liquidity Funds FedFund Portfolio – Institutional Class, 0.100%2,3 | | | 8,888,881 | |

| | 106,021 | | Fidelity Investments Money Market Government Portfolio – Class I, 0.060%2,3 | | | 106,021 | |

| | 3,986,989 | | Fidelity Investments Money Market Treasury Only Portfolio – Class I, 0.046%3 | | | 3,986,989 | |

| | 80,872 | | Invesco Short-Term Investments Trust Government & Agency Portfolio – | | | | |

| | | | Institutional Class, 0.090%2,3 | | | 80,872 | |

| | 28,207,126 | | JPMorgan U.S. Government Money Market Fund – Capital Class, 0.100%2,3 | | | 28,207,126 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $41,269,889) | | | 41,269,889 | |

| | | | | | | | |

| | | | Total Investments – 123.2% (Cost $178,601,934) | | | 201,912,260 | |

| | | | Liabilities in Excess of Other Assets – (23.2)% | | | (38,084,415 | ) |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 163,827,845 | |

Percentages are stated as a percent of net assets.

REIT – Real Estate Investment Trusts

| * | Non-income producing security. |

1 | All or a portion of shares are on loan. Total loaned securities had a value of $36,970,751 which included loaned securities with a value of $545,787 that have been sold and are pending settlement as of June 30, 2020. The total market value of loaned securities excluding the pending sale is $36,424,964. See Note 2. |

2 | All or a portion of this security was purchased with cash proceeds from securities lending. Total collateral had a value of $37,282,900. See Note 2. |

3 | The rate is the annualized seven-day yield at period end. |

The accompanying notes are an integral part of these financial statements.

ERShares US Large Cap Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS – 92.5% | | | |

| | | Apparel & Textile Products – 0.1% | | | |

| | 6,500 | | Skechers U.S.A., Inc. – Class A* | | $ | 203,970 | |

| | | | Asset Management – 2.2% | | | | |

| | 5,440 | | BlackRock, Inc. | | | 2,959,849 | |

| | 90,780 | | WisdomTree Investments, Inc. | | | 315,007 | |

| | | | | | | 3,274,856 | |

| | | | Automotive – 1.8% | | | | |

| | 2,500 | | Tesla, Inc.* | | | 2,699,525 | |

| | | | Banking – 0.8% | | | | |

| | 5,656 | | First Republic Bank1 | | | 599,480 | |

| | 20,320 | | Live Oak Bancshares, Inc. | | | 294,843 | |

| | 7,300 | | Preferred Bank | | | 312,805 | |

| | | | | | | 1,207,128 | |

| | | | Biotechnology & Pharmaceutical – 10.5% | | | | |

| | 87,498 | | Arrowhead Pharmaceuticals, Inc.* | | | 3,779,039 | |

| | 22,979 | | Exelixis, Inc.* | | | 545,521 | |

| | 5,000 | | Global Blood Therapeutics, Inc.* | | | 315,650 | |

| | 29,244 | | Ionis Pharmaceuticals, Inc.* | | | 1,724,226 | |

| | 13,312 | | Jazz Pharmaceuticals PLC* | | | 1,468,846 | |

| | 13,500 | | Livongo Health, Inc.*,1 | | | 1,015,065 | |

| | 4,115 | | Regeneron Pharmaceuticals, Inc.* | | | 2,566,320 | |

| | 12,679 | | Seattle Genetics, Inc.* | | | 2,154,416 | |

| | 19,032 | | United Therapeutics Corp.* | | | 2,302,872 | |

| | | | | | | 15,871,955 | |

| | | | Commercial Services – 1.8% | | | | |

| | 8,539 | | Cintas Corp. | | | 2,274,448 | |

| | 6,632 | | Insperity, Inc. | | | 429,289 | |

| | | | | | | 2,703,737 | |

| | | | Consumer Products – 1.5% | | | | |

| | 1,661 | | Inter Parfums, Inc. | | | 79,977 | |

| | 1,500 | | J&J Snack Foods Corp. | | | 190,695 | |

| | 28,071 | | Monster Beverage Corp.* | | | 1,945,882 | |

| | | | | | | 2,216,554 | |

| | | | Distributors – Discretionary – 1.0% | | | | |

| | 18,622 | | Copart, Inc.* | | | 1,550,654 | |

| | | | Gaming, Lodging & Restaurants – 1.5% | | | | |

| | 926 | | Cheesecake Factory, Inc.1 | | | 21,224 | |

| | 49,929 | | Las Vegas Sands Corp. | | | 2,273,767 | |

| | | | | | | 2,294,991 | |

| | | | Hardware – 4.0% | | | | |

| | 6,085 | | Apple, Inc. | | | 2,219,809 | |

| | 6,765 | | Arista Networks, Inc.* | | | 1,420,853 | |

The accompanying notes are an integral part of these financial statements.

ERShares US Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Hardware (Continued) | | | |

| | 13,609 | | Roku, Inc.*,1 | | $ | 1,585,857 | |

| | 5,000 | | Ubiquiti, Inc. | | | 872,800 | |

| | | | | | | 6,099,319 | |

| | | | Health Care Facilities & Services – 0.3% | | | | |

| | 2,500 | | Teladoc Health, Inc.*,1 | | | 477,100 | |

| | | | Institutional Financial Services – 1.6% | | | | |

| | 26,074 | | Intercontinental Exchange, Inc. | | | 2,388,378 | |

| | | | Media – 19.7% | | | | |

| | 7,944 | | Alphabet, Inc. – Class A* | | | 11,264,989 | |

| | 7,000 | | Cargurus, Inc.* | | | 177,450 | |

| | 34,860 | | Facebook, Inc. – Class A* | | | 7,915,660 | |

| | 12,386 | | Netflix, Inc.* | | | 5,636,126 | |

| | 8,891 | | Shutterstock, Inc. | | | 310,918 | |

| | 1,300 | | Trade Desk, Inc. – Class A* | | | 528,450 | |

| | 16,212 | | VeriSign, Inc.* | | | 3,353,128 | |

| | 10,000 | | Zillow Group, Inc. – Class A* | | | 574,800 | |

| | | | | | | 29,761,521 | |

| | | | Medical Equipment & Devices – 5.6% | | | | |

| | 10,000 | | Danaher Corp. | | | 1,768,300 | |

| | 15,850 | | Masimo Corp.* | | | 3,613,641 | |

| | 16,125 | | ResMed, Inc. | | | 3,096,000 | |

| | | | | | | 8,477,941 | |

| | | | Metals & Mining – 0.2% | | | | |

| | 6,720 | | Encore Wire Corp. | | | 328,070 | |

| | | | Real Estate – 0.1% | | | | |

| | 10,000 | | GEO Group, Inc. – REIT | | | 118,300 | |

| | | | Renewable Energy – 0.2% | | | | |

| | 11,180 | | Ameresco, Inc. – Class A* | | | 310,580 | |

| | | | Retail – Discretionary – 7.2% | | | | |

| | 3,877 | | Amazon.com, Inc.* | | | 10,695,945 | |

| | 5,000 | | Stitch Fix, Inc. – Class A*,1 | | | 124,700 | |

| | | | | | | 10,820,645 | |

| | | | Semiconductors – 1.8% | | | | |

| | 8,000 | | Impinj, Inc.* | | | 219,760 | |

| | 6,783 | | NVIDIA Corp. | | | 2,576,930 | |

| | | | | | | 2,796,690 | |

| | | | Software – 22.5% | | | | |

| | 6,171 | | Adobe, Inc.* | | | 2,686,298 | |

| | 9,125 | | Alteryx, Inc.*,1 | | | 1,499,055 | |

| | 13,500 | | Bill.com Holdings, Inc.*,1 | | | 1,217,835 | |

| | 28,500 | | Cloudflare, Inc.*,1 | | | 1,024,575 | |

The accompanying notes are an integral part of these financial statements.

ERShares US Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Software (Continued) | | | |

| | 10,000 | | Crowdstrike Holdings, Inc. – Class A* | | $ | 1,002,900 | |

| | 12,000 | | Datadog, Inc.* | | | 1,043,400 | |

| | 20,156 | | Fortinet, Inc.* | | | 2,766,814 | |

| | 6,359 | | Intuit, Inc. | | | 1,883,472 | |

| | 16,059 | | Microsoft Corp. | | | 3,268,167 | |

| | 7,500 | | Okta, Inc.* | | | 1,501,725 | |

| | 9,630 | | Paycom Software, Inc.* | | | 2,982,700 | |

| | 14,000 | | salesforce.com, Inc.*,1 | | | 2,622,620 | |

| | 56,822 | | SS&C Technologies Holdings, Inc. | | | 3,209,307 | |

| | 2,700 | | Synopsys, Inc.* | | | 526,500 | |

| | 5,000 | | Twilio, Inc. – Class A* | | | 1,097,100 | |

| | 8,285 | | Veeva Systems, Inc. – Class A*,1 | | | 1,942,170 | |

| | 14,500 | | Workday, Inc. – Class A*,1 | | | 2,716,720 | |

| | 9,750 | | Zscaler, Inc.*,1 | | | 1,067,625 | |

| | | | | | | 34,058,983 | |

| | | | Specialty Finance – 3.5% | | | | |

| | 6,500 | | Capital One Financial Corp. | | | 406,835 | |

| | 3,300 | | Euronet Worldwide, Inc.* | | | 316,206 | |

| | 9,660 | | FleetCor Technologies, Inc.* | | | 2,429,780 | |

| | 8,000 | | Green Dot Corp. – Class A* | | | 392,640 | |

| | 1,000 | | LendingTree, Inc.* | | | 289,530 | |

| | 13,500 | | Square, Inc. – Class A* | | | 1,416,690 | |

| | | | | | | 5,251,681 | |

| | | | Technology Services – 1.7% | | | | |

| | 1,500 | | CoStar Group, Inc.* | | | 1,066,005 | |

| | 6,090 | | EPAM Systems, Inc.* | | | 1,534,741 | |

| | | | | | | 2,600,746 | |

| | | | Telecommunications – 0.9% | | | | |

| | 5,000 | | RingCentral, Inc. – Class A* | | | 1,425,050 | |

| | | | Transportation & Logistics – 2.0% | | | | |

| | 22,069 | | FedEx Corp. | | | 3,094,515 | |

| | | | TOTAL COMMON STOCKS (Cost $110,379,618) | | | 140,032,889 | |

The accompanying notes are an integral part of these financial statements.

ERShares US Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2020

| Shares | | | | Value | |

| | | SHORT-TERM INVESTMENTS – 11.6% | | | |

| | 1,397,385 | | BlackRock Liquidity Funds FedFund Portfolio – Institutional Class, 0.100%2,3 | | $ | 1,397,385 | |

| | 16,671 | | Fidelity Investments Money Market Government Portfolio – Class I, 0.060%2,3 | | | 16,671 | |

| | 11,639,847 | | Fidelity Investments Money Market Treasury Only Portfolio – Class I, 0.046%3 | | | 11,639,847 | |

| | 12,714 | | Invesco Short-Term Investments Trust Government & Agency Portfolio – | | | | |

| | | | Institutional Class, 0.090%2,3 | | | 12,714 | |

| | 4,434,341 | | JPMorgan U.S. Government Money Market Fund – Capital Class, 0.100%2,3 | | | 4,434,341 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $17,500,958) | | | 17,500,958 | |

| | | | | | | | |

| | | | Total Investments – 104.1% (Cost $127,880,576) | | | 157,533,847 | |

| | | | Liabilities in Excess of Other Assets – (4.1)% | | | (6,225,384 | ) |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 151,308,463 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

| * | Non-income producing security. |

1 | All or a portion of shares are on loan. Total loaned securities had a value of $5,846,827 which included loaned securities with a value of $186,925 that have been sold and are pending settlement as of June 30, 2020. The total market value of loaned securities excluding the pending sale is $5,659,902. See Note 2. |

2 | All or a portion of this security was purchased with cash proceeds from securities lending. Total collateral had a value of $5,861,111. See Note 2. |

3 | The rate is the annualized seven-day yield at period end. |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Series Trust

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2020

| | | ERShares | | | ERShares | | | ERShares | |

| | | Global | | | US Small | | | US Large | |

| | | Fund | | | Cap Fund | | | Cap Fund | |

| ASSETS: | | | | | | | | | |

Investments, at cost | | $ | 40,034,340 | | | $ | 178,601,934 | | | $ | 127,880,576 | |

Investments, at value1 | | $ | 52,390,937 | | | $ | 201,912,260 | | | $ | 157,533,847 | |

Receivables: | | | | | | | | | | | | |

| Investment securities sold | | | — | | | | 583,057 | | | | 58,591 | |

| Fund shares sold | | | — | | | | — | | | | 9,000 | |

| Dividends and interest | | | 52,781 | | | | 60,314 | | | | 25,458 | |

| Securities lending income | | | 108 | | | | 17,976 | | | | 873 | |

Prepaid expenses | | | 6,162 | | | | 10,341 | | | | 10,962 | |

| Total assets | | | 52,449,988 | | | | 202,583,948 | | | | 157,638,731 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

Collateral due to broker for securities loaned | | | 1,134,770 | | | | 37,282,900 | | | | 5,861,111 | |

Payables: | | | | | | | | | | | | |

| Due to custodian | | | — | | | | 850,115 | | | | 354,167 | |

| Investment securities purchased | | | — | | | | 486,375 | | | | — | |

| Advisory fees | | | 52,382 | | | | 94,565 | | | | 75,142 | |

| Auditing fees | | | 14,999 | | | | 14,999 | | | | 15,000 | |

| Fund accounting and administration fees | | | 2,712 | | | | 7,260 | | | | 6,755 | |

| Legal fees | | | 2,459 | | | | 6,439 | | | | 5,560 | |

| Transfer agent fees and expenses | | | 2,424 | | | | 4,032 | | | | 4,714 | |

| Shareholder reporting fees | | | 1,344 | | | | 3,201 | | | | 2,772 | |

| Trustees’ fees and expenses | | | 1,097 | | | | 2,515 | | | | 1,928 | |

| Pricing fees | | | 799 | | | | 382 | | | | 286 | |

| Custody fees | | | 262 | | | | 1,938 | | | | 1,116 | |

Accrued other expenses | | | 2,902 | | | | 1,382 | | | | 1,717 | |

| Total liabilities | | | 1,216,150 | | | | 38,756,103 | | | | 6,330,268 | |

| | | | | | | | | | | | | |

| NET ASSETS | | $ | 51,233,838 | | | $ | 163,827,845 | | | $ | 151,308,463 | |

| | | | | | | | | | | | | |

| COMPONENT OF NET ASSETS: | | | | | | | | | | | | |

Paid-in capital (par value of $0.01 per share with an | | | | | | | | | | | | |

unlimited number of shares authorized) | | $ | 38,765,739 | | | $ | 130,132,746 | | | $ | 92,376,103 | |

Total distributable earnings | | | 12,468,099 | | | | 33,695,099 | | | | 58,932,360 | |

| NET ASSETS | | $ | 51,233,838 | | | $ | 163,827,845 | | | $ | 151,308,463 | |

| Institutional Class: | | | | | | | | | | | | |

| Shares of beneficial interest issued and outstanding | | | 3,046,154 | | | | 13,644,605 | | | | 8,954,873 | |

| Net asset value, offering and redemption price per share | | $ | 16.82 | | | $ | 12.01 | | | $ | 16.90 | |

1 | Includes securities on loan of $1,136,302, $36,424,964, and $5,659,902, respectively (see Note 2). |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Series Trust

STATEMENTS OF OPERATIONS

For the year ended June 30, 2020

| | | ERShares | | | ERShares | | | ERShares | |

| | | Global | | | US Small | | | US Large | |

| | | Fund | | | Cap Fund | | | Cap Fund | |

| INVESTMENT INCOME: | | | | | | | | | |

Dividend income* | | $ | 508,679 | | | $ | 848,814 | | | $ | 682,799 | |

Interest income | | | 35,988 | | | | 100,253 | | | | 79,210 | |

Securities lending income | | | 1,815 | | | | 277,893 | | | | 6,479 | |

| Total investment income | | | 546,482 | | | | 1,226,960 | | | | 768,488 | |

| | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | |

Advisory fees | | | 698,192 | | | | 1,146,865 | | | | 884,991 | |

Fund accounting and administration fees | | | 29,798 | | | | 78,328 | | | | 69,946 | |

Registration fees | | | 22,123 | | | | 28,588 | | | | 30,795 | |

Legal fees | | | 15,100 | | | | 38,789 | | | | 34,372 | |

Auditing fees | | | 14,999 | | | | 14,999 | | | | 14,999 | |

Custody fees | | | 14,659 | | | | 9,340 | | | | 7,929 | |

Transfer agent fees and expenses | | | 14,215 | | | | 20,973 | | | | 21,965 | |

Pricing fees | | | 9,743 | | | | 10,556 | | | | 7,276 | |

Miscellaneous | | | 5,325 | | | | 5,595 | | | | 5,641 | |

Shareholder reporting fees | | | 2,994 | | | | 7,844 | | | | 6,588 | |

Trustees’ fees and expenses | | | 2,833 | | | | 7,104 | | | | 6,270 | |

Insurance fees | | | 1,563 | | | | 5,168 | | | | 4,345 | |

Chief Compliance Officer fees | | | 582 | | | | 1,318 | | | | 1,146 | |

| Total expenses | | | 832,126 | | | | 1,375,467 | | | | 1,096,263 | |

Advisory fees waived | | | — | | | | (75,687 | ) | | | (75,120 | ) |

| Net expenses | | | 832,126 | | | | 1,299,780 | | | | 1,021,143 | |

| NET INVESTMENT LOSS | | | (285,644 | ) | | | (72,820 | ) | | | (252,655 | ) |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON: | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 414,105 | | | | 11,734,063 | | | | 37,691,888 | |

| Foreign currency transactions | | | (233 | ) | | | — | | | | — | |

Net realized gain | | | 413,872 | | | | 11,734,063 | | | | 37,691,888 | |

Net change in unrealized appreciation/depreciation on: | | | | | | | | | | | | |

| Investments | | | 4,968,715 | | | | (8,945,794 | ) | | | (13,899,941 | ) |

| Foreign currency translations | | | 1,378 | | | | (17 | ) | | | (23 | ) |

Net change in unrealized appreciation/depreciation | | | 4,970,093 | | | | (8,945,811 | ) | | | (13,899,964 | ) |

Net realized and unrealized gain | | | 5,383,965 | | | | 2,788,252 | | | | 23,791,924 | |

| NET INCREASE IN NET | | | | | | | | | | | | |

| ASSETS FROM OPERATIONS | | $ | 5,098,321 | | | $ | 2,715,432 | | | $ | 23,539,269 | |

* Net of foreign tax withheld of: | | $ | 25,640 | | | $ | — | | | $ | — | |

The accompanying notes are an integral part of these financial statements.

ERShares Global Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2020 | | | June 30, 2019 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (285,644 | ) | | $ | (220,595 | ) |

| Net realized gain on investments and foreign currency transactions | | | 413,872 | | | | 1,937,109 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency translations | | | 4,970,093 | | | | (970,952 | ) |

Net increase in net assets resulting from operations | | | 5,098,321 | | | | 745,562 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Distributions | | | (1,788,910 | ) | | | (1,496,411 | ) |

Total distributions to shareholders | | | (1,788,910 | ) | | | (1,496,411 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 483,631 | | | | 3,478,107 | |

| Reinvestment of distributions | | | 1,436,494 | | | | 1,069,997 | |

Cost of shares redeemed1 | | | (17,779,900 | ) | | | (3,095,290 | ) |

Net increase (decrease) in net assets from capital transactions | | | (15,859,775 | ) | | | 1,452,814 | |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (12,550,364 | ) | | | 701,965 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

Beginning of year | | | 63,784,202 | | | | 63,082,237 | |

End of year | | $ | 51,233,838 | | | $ | 63,784,202 | |

1 | Net of redemption fee proceeds of $77 and $11, respectively. |

The accompanying notes are an integral part of these financial statements.

ERShares US Small Cap Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2020 | | | June 30, 2019 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (72,820 | ) | | $ | (24,035 | ) |

| Net realized gain on investments | | | 11,734,063 | | | | 12,668,827 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency translations | | | (8,945,811 | ) | | | (10,033,864 | ) |

Net increase in net assets resulting from operations | | | 2,715,432 | | | | 2,610,928 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Distributions | | | (9,831,600 | ) | | | (24,613,660 | ) |

Total distributions to shareholders | | | (9,831,600 | ) | | | (24,613,660 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 13,368,391 | | | | 25,314,608 | |

| Reinvestment of distributions | | | 9,828,304 | | | | 24,552,715 | |

Cost of shares redeemed1 | | | (12,963,145 | ) | | | (26,589,479 | ) |

Net increase in net assets from capital transactions | | | 10,233,550 | | | | 23,277,844 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 3,117,382 | | | | 1,275,112 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

Beginning of year | | | 160,710,463 | | | | 159,435,351 | |

End of year | | $ | 163,827,845 | | | $ | 160,710,463 | |

1 | Net of redemption fee proceeds of $106 and $2,083, respectively. |

The accompanying notes are an integral part of these financial statements.

ERShares US Large Cap Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2020 | | | June 30, 2019 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (252,655 | ) | | $ | (34,655 | ) |

| Net realized gain on investments | | | 37,691,888 | | | | 106,747 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency translations | | | (13,899,964 | ) | | | 6,324,865 | |

Net increase in net assets resulting from operations | | | 23,539,269 | | | | 6,396,957 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Distributions | | | (8,147,630 | ) | | | (2,291,347 | ) |

Total distributions to shareholders | | | (8,147,630 | ) | | | (2,291,347 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 8,188,540 | | | | 8,508,813 | |

| Reinvestment of distributions | | | 8,143,889 | | | | 2,284,603 | |

Cost of shares redeemed1 | | | (13,736,420 | ) | | | (5,970,392 | ) |

Net increase in net assets from capital transactions | | | 2,596,009 | | | | 4,823,024 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 17,987,648 | | | | 8,928,634 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

Beginning of year | | | 133,320,815 | | | | 124,392,181 | |

End of year | | $ | 151,308,463 | | | $ | 133,320,815 | |

1 | Net of redemption fee proceeds of $881 and $94, respectively. |

The accompanying notes are an integral part of these financial statements.

ERShares Global Fund

FINANCIAL HIGHLIGHTS – Institutional Class

Per share operating performance.

For a capital share outstanding throughout each year.

| | | Year Ended June 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Per Share Data: | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 15.78 | | | $ | 16.07 | | | $ | 14.65 | | | $ | 11.81 | | | $ | 12.19 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss1 | | | (0.08 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.07 | ) | | | (0.07 | ) |

| Net realized and unrealized gain (loss) | | | 1.61 | | | | 0.16 | | | | 2.77 | | | | 2.91 | | | | (0.27 | ) |

| Total from investment operations | | | 1.53 | | | | 0.10 | | | | 2.67 | | | | 2.84 | | | | (0.34 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.04 | ) |

| From net realized gain | | | (0.49 | ) | | | (0.39 | ) | | | (1.25 | ) | | | — | | | | — | |

| Total distributions | | | (0.49 | ) | | | (0.39 | ) | | | (1.25 | ) | | | — | | | | (0.04 | ) |

Net asset value, end of year | | $ | 16.82 | | | $ | 15.78 | | | $ | 16.07 | | | $ | 14.65 | | | $ | 11.81 | |

Total return2 | | | 9.80 | % | | | 1.11 | % | | | 18.65 | % | | | 24.05 | % | | | (2.75 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 51,234 | | | $ | 63,784 | | | $ | 63,082 | | | $ | 26,933 | | | $ | 21,782 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recovered | | | 1.49 | % | | | 1.47 | % | | | 1.53 | % | | | 1.74 | % | | | 2.52 | % |

| After fees waived/recovered | | | 1.49 | % | | | 1.56 | % | | | 1.70 | % | | | 1.70 | % | | | 1.70 | % |

Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recovered | | | (0.51 | )% | | | (0.27 | )% | | | (0.47 | )% | | | (0.57 | )% | | | (1.43 | )% |

| After fees waived/recovered | | | (0.51 | )% | | | (0.36 | )% | | | (0.64 | )% | | | (0.53 | )% | | | (0.61 | )% |

Portfolio turnover rate | | | 61 | % | | | 23 | % | | | 38 | % | | | 65 | % | | | 71 | % |

1 | Based on average shares outstanding during the period. |

2 | Total returns would have been lower/higher had certain expenses not been waived/recovered by the advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

The accompanying notes are an integral part of these financial statements.

ERShares US Small Cap Fund

FINANCIAL HIGHLIGHTS – Institutional Class

Per share operating performance.

For a capital share outstanding throughout each year.

| | | Year Ended June 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Per Share Data: | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 12.71 | | | $ | 15.27 | | | $ | 12.75 | | | $ | 9.72 | | | $ | 11.45 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)1 | | | (0.01 | ) | | | (— | )2 | | | (0.02 | ) | | | 0.01 | | | | 0.02 | |

| Net realized and unrealized gain (loss) | | | 0.11 | | | | (0.28 | ) | | | 3.89 | | | | 3.04 | | | | (1.14 | ) |

| Total from investment operations | | | 0.10 | | | | (0.28 | ) | | | 3.87 | | | | 3.05 | | | | (1.12 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.01 | ) | | | — | | | | — | | | | (0.02 | ) | | | (— | )2 |

| From net realized gain | | | (0.79 | ) | | | (2.28 | ) | | | (1.35 | ) | | | — | | | | (0.61 | ) |

| Total distributions | | | (0.80 | ) | | | (2.28 | ) | | | (1.35 | ) | | | (0.02 | ) | | | (0.61 | ) |

Net asset value, end of year | | $ | 12.01 | | | $ | 12.71 | | | $ | 15.27 | | | $ | 12.75 | | | $ | 9.72 | |

Total return3 | | | 0.86 | % | | | 1.58 | % | | | 32.42 | % | | | 31.39 | % | | | (9.63 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 163,828 | | | $ | 160,710 | | | $ | 159,435 | | | $ | 120,847 | | | $ | 130,705 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived | | | 0.90 | % | | | 0.89 | % | | | 0.90 | % | | | 0.90 | % | | | 0.91 | % |

| After fees waived | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived | | | (0.10 | )% | | | (0.05 | )% | | | (0.16 | )% | | | (0.18 | )% | | | 0.11 | % |

| After fees waived | | | (0.05 | )% | | | (0.01 | )% | | | (0.11 | )% | | | (0.13 | )% | | | 0.17 | % |

Portfolio turnover rate | | | 139 | %4 | | | 43 | % | | | 72 | % | | | 53 | % | | | 67 | % |

1 | Based on average shares outstanding during the period. |

2 | Amount reported represents less than $.01 per shares. |

3 | Total returns would have been lower had certain expenses not been waived or absorbed by the advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

4 | Given the abnormal market circumstances resulting from the COVID-19 situation, the Fund had taken a temporary defensive position. As the market started to recover, the fund has been reversing its temporary defensive position. This temporary implementation and reversion of the defensive position increased the fund's turnover. |

The accompanying notes are an integral part of these financial statements.

ERShares US Large Cap Fund

FINANCIAL HIGHLIGHTS – Institutional Class

Per share operating performance.

For a capital share outstanding throughout each year.

| | | Year Ended June 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Per Share Data: | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 15.17 | | | $ | 14.75 | | | $ | 12.61 | | | $ | 10.65 | | | $ | 10.77 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)1 | | | (0.03 | ) | | | (— | )2 | | | (0.02 | ) | | | 0.04 | | | | 0.07 | |

| Net realized and unrealized gain (loss) | | | 2.73 | | | | 0.69 | | | | 3.48 | | | | 2.10 | | | | (0.12 | ) |

| Total from investment operations | | | 2.70 | | | | 0.69 | | | | 3.46 | | | | 2.14 | | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | (0.01 | ) | | | (0.06 | ) | | | (0.07 | ) |

| From net realized gain | | | (0.97 | ) | | | (0.27 | ) | | | (1.31 | ) | | | (0.12 | ) | | | — | |

| Total distributions | | | (0.97 | ) | | | (0.27 | ) | | | (1.32 | ) | | | (0.18 | ) | | | (0.07 | ) |

Net asset value, end of year | | $ | 16.90 | | | $ | 15.17 | | | $ | 14.75 | | | $ | 12.61 | | | $ | 10.65 | |

Total return3 | | | 18.50 | % | | | 5.09 | % | | | 28.67 | % | | | 20.26 | % | | | (0.49 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 151,308 | | | $ | 133,321 | | | $ | 124,392 | | | $ | 107,823 | | | $ | 88,495 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived | | | 0.80 | % | | | 0.79 | % | | | 0.81 | % | | | 0.82 | % | | | 0.83 | % |

| After fees waived | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % |

Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived | | | (0.24 | )% | | | (0.07 | )% | | | (0.18 | )% | | | 0.26 | % | | | 0.59 | % |

| After fees waived | | | (0.19 | )% | | | (0.03 | )% | | | (0.12 | )% | | | 0.33 | % | | | 0.67 | % |

Portfolio turnover rate | | | 149 | %4 | | | 0 | % | | | 43 | % | | | 43 | % | | | 77 | % |

1 | Based on average shares outstanding during the period. |

2 | Amount reported represents less than $.01 per shares. |

3 | Total returns would have been lower had certain expenses not been waived or absorbed by the advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

4 | Given the abnormal market circumstances resulting from the COVID-19 situation, the Fund had taken a temporary defensive position. As the market started to recover, the fund has been reversing its temporary defensive position. This temporary implementation and reversion of the defensive position increased the fund's turnover. |

The accompanying notes are an integral part of these financial statements.

EntrepreneurShares Series Trust

NOTES TO FINANCIAL STATEMENTS

June 30, 2020

EntrepreneurShares™ Series Trust, a Delaware statutory trust (the “Trust”), was formed on July 1, 2010, and has authorized capital of unlimited shares of beneficial interest. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and is authorized to issue multiple series and classes of shares. The ERShares Global Fund formerly known as the EntrepreneurShares Global Fund (the “Global Fund”), the ERShares US Small Cap Fund formerly known as the Entrepreneur U.S. Small Cap Fund (the “US Small Cap Fund”), and the ERShares US Large Cap Fund formerly known as the Entrepreneur U.S. Large Cap Fund (the “US Large Cap Fund”) (each separately a “Fund”, or collectively, “the Funds”) are each classified as a “diversified” series, as defined in the 1940 Act. The Funds are investment companies and, accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 – Investment Companies including Accounting Standards Update (“ASU”) 2013-08. The Global Fund commenced operations on November 11, 2010. The US Small Cap Fund commenced operations on December 17, 2013. The US Large Cap Fund commenced operations on June 30, 2014.

The investment objective of the Global Fund is long-term capital appreciation. The Global Fund seeks to achieve its objective by investing in equity securities of global companies with market capitalizations that are above $300 million at the time of initial purchase and possess entrepreneurial characteristics, as determined by EntrepreneurShares, LLC, the “Sub Advisor”, the Global Fund’s Sub-Advisor, and Seaport Global Advisors, LLC formerly known as Weston Capital Advisors, LLC, the Global Fund’s investment advisor (the “Global Advisor”). Dr. Joel M. Shulman has been the Global Fund’s portfolio manager since November 11, 2010 and Managing Director of the Advisor and President of the Sub-Advisor.

The investment objective of the US Small Cap Fund is long-term capital appreciation. The US Small Cap Fund seeks to achieve its objective by investing at least 80% of its net assets (plus any borrowing for investment purposes) in equity securities of U.S. companies with market capitalization that are above $300 million at the time of initial purchase and possess entrepreneurial characteristics, as determined by Capital Impact Advisors, LLC (the “Advisor”, collectively with the Global Advisor, the “Advisors”), the US Small Cap Fund’s investment advisor. Dr. Joel M. Shulman has been the US Small Cap Fund’s portfolio manager since December 17, 2013 and Chief Executive Officer of the Advisor.

The investment objective of the US Large Cap Fund is long-term capital appreciation. The US Large Cap Fund seeks to achieve its objective by investing in equity securities of U.S. companies with market capitalizations that are above $5 billion at the time of initial purchase and possess entrepreneurial characteristics, as determined by Capital Impact Advisors, LLC, the US Large Cap Fund’s investment advisor. Dr. Joel M. Shulman has been the US Large Cap Fund’s portfolio manager since June 30, 2014 and is Managing Director of the Advisor.

The Global Fund, US Small Cap Fund and the US Large Cap Fund offer one share class, the Institutional Class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Investment Valuation

The following is a summary of the Funds’ pricing procedures. It is intended to be a general discussion and may not necessarily reflect all pricing procedures followed by the Funds.

In determining the net asset value (“NAV”) of the Funds’ shares, securities that are listed on a national securities exchange (other than the National Association of Securities Dealers’ Automatic Quotation System (“NASDAQ”)) are valued at the last sale price on the day the valuation is made. Securities that are traded on NASDAQ under one of its three listing tiers, NASDAQ Global Select Market, NASDAQ Global Market and NASDAQ Capital Market, are valued at the NASDAQ Official Closing Price. Price information on listed securities is taken from the exchange where the security is primarily traded. Securities which are listed on an exchange but which are not traded on the valuation date are valued at the most recent bid price.

EntrepreneurShares Series Trust

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2020

Unlisted securities held by the Funds are valued at the average of the quoted bid and ask prices in the over-the-counter market. Securities and other assets for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures established by and under the general supervision and responsibility of the EntrepreneurShares Series Trust Board of Trustees (the “Board”). Investments in registered open-end investment companies other than exchange-traded funds are valued at the reported NAV.