UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-22436

EntrepreneurShares Series Trust

(Exact name of registrant as specified in charter)

175 Federal Street, Suite #875

Boston, MA 02110

(Address of principal executive offices) (Zip code)

Dr. Joel M. Shulman

175 Federal Street, Suite #875

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-617-917-2605

Date of fiscal year end: June 30

Date of reporting period: June 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

EntrepreneurShares Series Trust™

EntrepreneurShares Series Trust (“Trust”) is a registered investment company consisting of separate investment portfolios called “Funds.” This Annual Report relates solely to the following Funds:

| Name | Ticker Symbol |

| ERShares Global Fund | ENTIX |

| ERShares US Small Cap Fund | IMPAX |

| ERShares US Large Cap Fund | IMPLX |

June 30, 2021

175 Federal Street

Suite #875

Boston, MA 02110

Toll Free: 877-271-8811

EntrepreneurShares Series Trust

(Unaudited)

Dear Shareholders:

We are enclosing the report for results covering the fiscal year July 1, 2020 through June 30, 2021. We note that our performance is not symmetrical or consistent through the year with quarters in the past couple of years varying considerably from period to period. We note that the interpretation of results is best measured over an extended period, especially as measured against a consistent benchmark.

The objective of this letter is to provide our shareholders an informative review of our Funds’ performance, present comparison of each fund’s performance vs. appropriate benchmarks, and discuss each fund’s top performing sector. This letter addresses our three mutual funds; ERShares Global Fund, ERShares US Large Cap Fund, and ERShares US Small Cap Fund. The Trust also includes two ETFs; these are separately covered in their own Annual Report. Overall, all funds have positive annual returns, despite the unusual market conditions brought by COVID-19.

Several key factors need to be addressed. First, our models work best during periods of market appreciation and low volatility. Our historical above average Up-Capture suggests that when markets rise, our Entrepreneurial stocks tend to rise faster. The corollary also tends to hold true: our above average Down-Capture suggests that during periods of market decline our Entrepreneurial stocks tend to fall faster than peer benchmarks. The period July 1, 2020 through June 30, 2021 included periods with extreme movements in both directions. Our funds performed as expected during these periods, though with more volatility due to the pandemic and more volatile interest rates. We believe if our funds were evaluated during a Calendar year, investors would have an entirely different interpretation of results.

An important distinguishing characteristic of our strategy is that many of our alpha(1)-generating Entrepreneurial stocks tend to fall in the Growth and High Beta(2) classification. This includes a handful of sectors with most stocks residing within the Information Technology, Consumer Discretionary, Communication Services and Health Care sectors. When equity markets favor these sectors or Growth and High Beta stocks, our Entrepreneur portfolios tend to out-perform the markets over that time period. The opposite also holds true.

ERShares Global Fund

ERShares Global Fund (“ENTIX”) is one of the three mutual funds. ENTIX is benchmarked against the MSCI The World Index (Net)(3). During the last fiscal year, ENTIX performed 42.63% vs. 39.04%, respectively.

The ERShares Global Fund’s top performing sectors for the fiscal year were Financials, Consumer Discretionary, and Communication Services. The Fund’s performance vs. the benchmark in these sectors for the period was 371% vs. 52.87%, 71.70% vs. 48.63% and 56.98% vs. 46.56%, respectively. The ERShares Global Fund’s worst performing sectors were Real Estate, Consumer Staples, and Energy. The Fund’s performance vs the benchmark in these sectors for the fiscal year was -16.39% vs. 30.30%, 2.17% vs. 21.56%, and 20.03% vs. 43.04%, respectively.

| (1) | Alpha compares the risk-adjusted performance of a portfolio to a benchmark index. A positive alpha means the portfolio has outperformed the index on a risk-adjusted basis. |

| (2) | Beta is a measure of the volatility of a portfolio in comparison to a benchmark index. Less than one means the portfolio is less volatile than the index, while greater than one indicates more volatility than the index. Standard deviation measures historical volatility. |

| (3) | Reflects no deduction for fees, expenses or taxes. MSCI publishes two versions of this index reflecting the reinvestment of dividends using two different methodologies: gross dividends and net dividends. The Fund believes that the net dividends version better reflects the returns U.S. investors might expect were they to invest directly in the component securities of the index. |

EntrepreneurShares Series Trust

(Unaudited)

ERShares US Small Cap Fund

ERShares US Small Cap Fund (“IMPAX”) is one of the three mutual funds. IMPAX is benchmarked against the S&P SmallCap 600 and the Russell 2000 Total Return Index. During the last fiscal year, IMPAX performed 42.19% vs. 67.40% vs. 62.03%, respectively.

The ERShares US Small Cap Fund top performing sectors for the period were Consumer Discretionary, Financials, and Real Estate. The Fund’s performance vs. the benchmark in these sectors for the fiscal year was 107.38% vs. 99.41%, 96.66% vs. 56.75%, and 85.59% vs. 45.23%, respectively. The ERShares US Small Cap Fund’s worst performing sectors for the fiscal year were Health Care, Communication Services, and Energy. The Fund’s performance vs. the benchmark for the fiscal year was 31.18% vs. 41.53%, 32.38% vs. 101.76%, and 38.20% vs. 133.20%, respectively.

In this past fiscal year, we note that our relative performance is not consistent across strategies. We had underperformance as measured against our benchmark in the US Large Cap and US Small Cap funds. We do not see this performance as a reflection of our Entrepreneur strategy, but rather, individual stock performance during a specific time period. We note that when our Fund performance is viewed on a calendar year basis or over an extended time period, different interpretations would follow. We believe that we continue to provide evidence that our Entrepreneur Model works over an extended period and extend our gratitude to all of our shareholders for continued support. We look forward to sharing more updates with you in the future.

ERShares US Large Cap Fund

ERShares US Large Cap Fund (“IMPLX”) is one of the three mutual funds. IMPLX is benchmarked against the S&P 500 Total Return Index. During the last fiscal year, IMPLX performed 24.30%% vs. 40.79%, respectively.

The ERShares US Large Cap Fund top performing sectors for the period were Industrials, Information Technology, and Communication Services. The Fund’s performance vs. the benchmark in these sectors for the fiscal year was 68.53% vs. 51.21%, 56.19% vs. 42.48%, and 42.42% vs. 48.39%, respectively. The ERShares US Large Cap Fund’s worst performing sectors for the fiscal year were Real Estate, Health Care, and Consumer Discretionary. The Fund’s performance vs. the benchmark in these sectors for the fiscal year was -23.75% vs. 31.80%, 15.45% vs. 27.86%, 16.59% vs 38.26%, respectively.

Sincerely,

Joel Shulman Ph.D., CFA

Founder and Chief Investment Officer

EntrepreneurShares Series Trust

(Unaudited)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-271-8811 or visiting www.ershares.com.

Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a full prospectus which contains this and other information about the Funds offered by EntrepreneurShares, call 1-877-271-8811. Please read the full prospectus carefully before investing. The Mutual Funds and ETFs are distributed by Foreside Fund Services, LLC.

The ERShares Global Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The ERShares US Small Cap Fund invests in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The funds are exposed to common stock risk. Common stock prices fluctuate based on changes in a company’s financial condition and on overall market and economic conditions. Additional risks are detailed in the prospectus.

The MSCI The World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Russell 2000 Total Return Index is a subset of the Russell 3000 Total Return Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The S&P 500 Total Return Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Returns assume the reinvestments of all dividends.

Index performance does not represent actual fund or portfolio performance and such performance does not reflect the actual investment experience of any investor. An investor cannot invest directly in an index.

Diversification does not guarantee a profit or assure against a loss.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

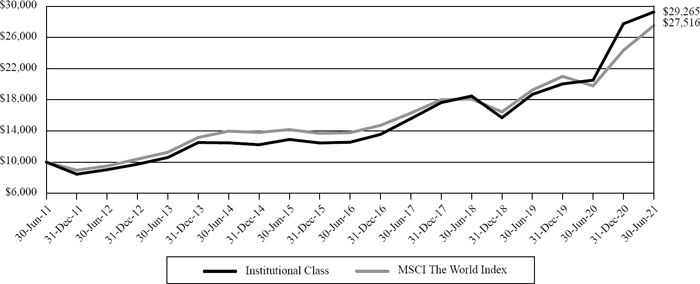

ERShares Global Fund

PERFORMANCE HIGHLIGHTS (Unaudited)

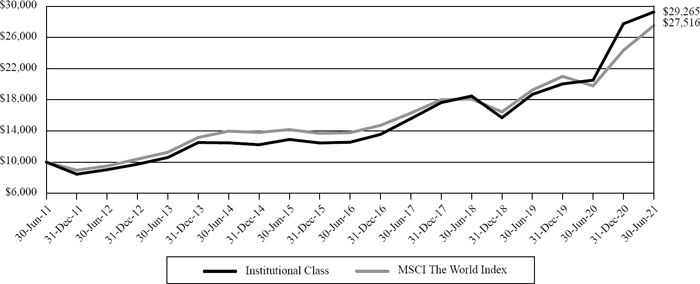

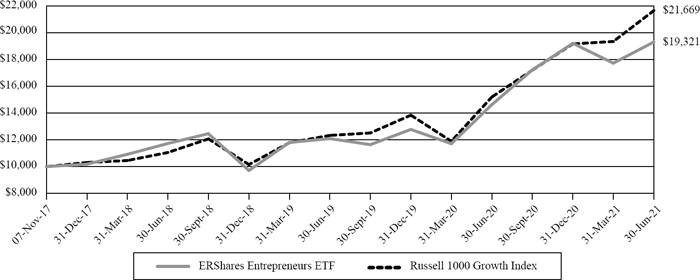

ERShares Global Fund Institutional Class vs. MSCI The World Index (Net)

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on June 30, 2011 and held through June 30, 2021. Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on ERShares Global Fund (“Global Fund”) distributions or the redemption of Global Fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower/higher had the expenses not been waived or absorbed/recovered by Seaport Global Advisors, LLC. The Global Fund’s total gross and net operational expenses, including underlying funds, were 1.50% per the October 28, 2020 (as amended February 9, 2021) prospectus.

MSCI The World Index (Net) – A free float-adjusted market capitalization weighted index that is designed to measure the equity performance of developed markets. Returns assume the reinvestments of all dividends. Investors cannot invest directly in an index.

| Total Annualized Returns as of June 30, 2021 |

| | | 1-Year | | 5-Year | | 10-Year |

| ERShares Global Fund – Institutional Class | | 42.63% | | 18.44% | | 11.34% |

| MSCI The World Index (Net) | | 39.04% | | 14.83% | | 10.65% |

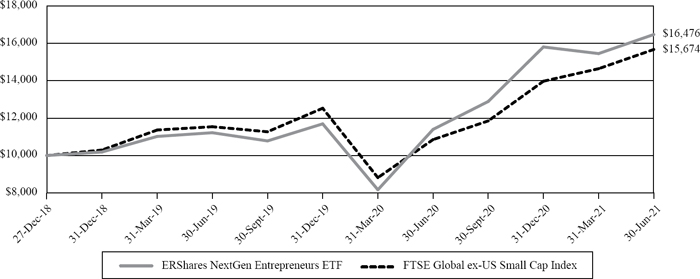

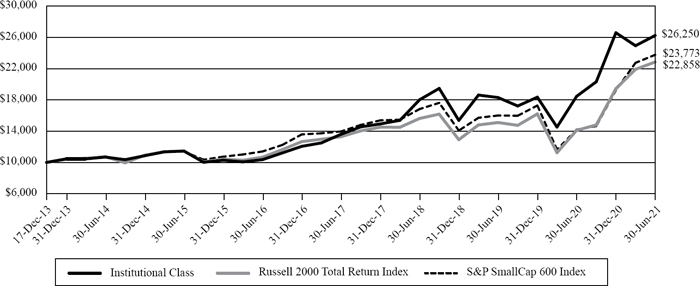

ERShares US Small Cap Fund

PERFORMANCE HIGHLIGHTS (Unaudited)

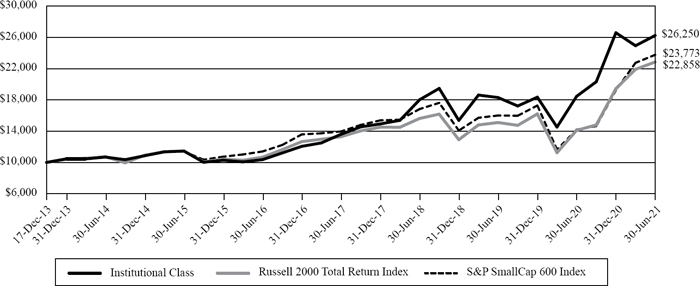

ERShares US Small Cap Fund Institutional Class vs. Russell 2000 Total Return Index vs. S&P SmallCap 600 Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on December 17, 2013 (commencement of operations of the ERShares US Small Cap Fund (“US Small Cap Fund”)) and held through June 30, 2021. Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on US Small Cap Fund distributions or the redemption of US Small Cap Fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had Capital Impact Advisors, LLC not waived its fees and reimbursed a portion of the US Small Cap Fund’s expenses. The US Small Cap Fund’s total gross and net operational expenses, including underlying funds, were 0.92% and 0.87%, respectfully, per the October 28, 2020 (as amended February 9, 2021) prospectus.

S&P SmallCap 600 Index – An index that covers roughly the small-cap range of US stocks, using a capitalization-weighted index. Investors cannot invest directly in an index.

Russell 2000 Total Return Index – A subset of the Russell 3000® Total Return Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Investors cannot invest directly in an index.

Returns assume the reinvestments of all dividends.

Total Annualized Returns as of June 30, 2021

| | | 1-Year | | 5-Year | | Since Inception (12/17/13) |

| ERShares US Small Cap Fund – Institutional Class | | 42.19% | | 20.44% | | 13.67% |

| Russell 2000 Total Return Index | | 62.03% | | 16.47% | | 11.60% |

| S&P SmallCap 600 Index | | 67.40% | | 15.82% | | 12.18% |

ERShares US Large Cap Fund

PERFORMANCE HIGHLIGHTS (Unaudited)

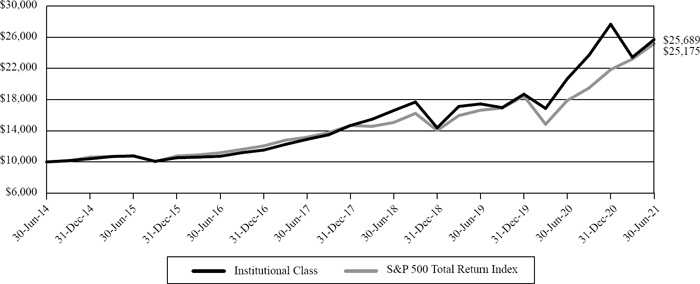

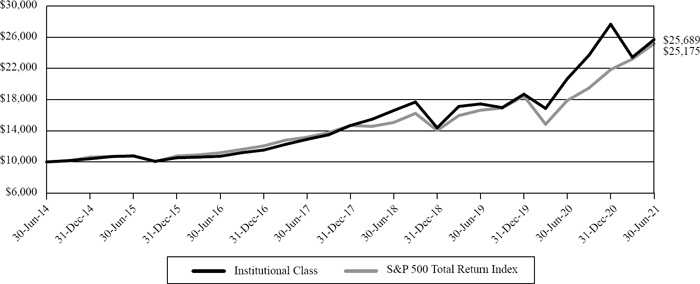

ERShares US Large Cap Fund Institutional Class vs. S&P 500 Total Return Index

Value of $10,000 Investment

This chart assumes an initial gross investment of $10,000 made in the Institutional Class on June 30, 2014 (commencement of operations of the ERShares US Large Cap Fund (“US Large Cap Fund”)) and held through June 30, 2021. Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on US Large Cap Fund distributions or the redemption of US Large Cap Fund shares. In the absence of fee waivers and reimbursements, total returns would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Total returns would have been lower had Capital Impact Advisors, LLC not waived its fees and reimbursed a portion of the US Large Cap Fund’s expenses. The US Large Cap Fund’s total gross and net operational expenses, including underlying funds, were 0.82% and 0.77%, respectfully, per the October 28, 2020 (as amended February 9, 2021) prospectus.

S&P 500 Total Return Index – Includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Returns assume the reinvestments of all dividends. Investors cannot invest directly in an index.

Total Annualized Returns as of June 30, 2021

| | | | | | | Since |

| | | | | | | Inception |

| | | 1-Year | | 5-Year | | (6/30/14) |

| ERShares US Large Cap Fund – Institutional Class | | 24.30% | | 19.09% | | 14.43% |

| S&P 500 Total Return Index | | 40.79% | | 17.65% | | 14.10% |

| ERShares Global Fund |

| |

| SCHEDULE OF INVESTMENTS SUMMARY TABLE(1) |

| June 30, 2021 (Unaudited) |

| | | % of Net Assets | |

| Communications | | | 29.79 | % |

| Consumer Discretionary | | | 8.34 | % |

| Financials | | | 1.44 | % |

| Health Care | | | 24.98 | % |

| Industrials | | | 1.00 | % |

| Real Estate | | | 1.66 | % |

| Technology | | | 31.93 | % |

| Money Market Funds | | | 5.11 | % |

| Liabilities in Excess of Other Assets | | | (4.25 | )% |

| Total | | | 100.00 | % |

| TOP TEN EQUITY HOLDINGS(1)(2) |

| as of June 30, 2021 (Unaudited) |

| Issuer | | % of Net Assets | |

| Roku, Inc. | | | 4.07 | % |

| Square, Inc., Class A | | | 3.60 | % |

| Teladoc Health, Inc. | | | 3.52 | % |

| Twist Bioscience Corp. | | | 3.05 | % |

| Fiverr International Ltd. | | | 2.93 | % |

| Twilio, Inc., Class A | | | 2.79 | % |

| CRISPR Therapeutics AG | | | 2.78 | % |

| Veeva Systems, Inc., Class A | | | 2.58 | % |

| Zillow Group, Inc., Class A | | | 2.49 | % |

| Spotify Technology S.A. | | | 2.12 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

| ERShares US Small Cap Fund |

| |

| SCHEDULE OF INVESTMENTS SUMMARY TABLE(1) |

| June 30, 2021 (Unaudited) |

| | | % of Net Assets | |

| Communications | | | 11.50 | % |

| Consumer Discretionary | | | 10.26 | % |

| Consumer Staples | | | 0.61 | % |

| Energy | | | 3.61 | % |

| Financials | | | 16.50 | % |

| Health Care | | | 27.68 | % |

| Industrials | | | 5.39 | % |

| Materials | | | 0.45 | % |

| Real Estate | | | 2.35 | % |

| Technology | | | 21.32 | % |

| Money Market Funds | | | 11.52 | % |

| Liabilities in Excess of Other Assets | | | (11.19 | )% |

| Total | | | 100.00 | % |

| TOP TEN EQUITY HOLDINGS(1)(2) |

| as of June 30, 2021 (Unaudited) |

| Issuer | | % of Net Assets | |

| Trupanion, Inc. | | | 3.66 | % |

| Futu Holdings Ltd. - ADR | | | 3.36 | % |

| GrowGeneration Corp. | | | 2.93 | % |

| Fiverr International Ltd. | | | 2.72 | % |

| Zynex, Inc. | | | 2.62 | % |

| CRISPR Therapeutics AG | | | 2.51 | % |

| Zscaler, Inc. | | | 2.27 | % |

| Natera, Inc. | | | 2.22 | % |

| Ameresco, Inc., Class A | | | 2.19 | % |

| HubSpot, Inc. | | | 2.02 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

| ERShares US Large Cap Fund |

| |

| SCHEDULE OF INVESTMENTS SUMMARY TABLE(1) |

| June 30, 2021 (Unaudited) |

| | | % of Net Assets | |

| Communications | | | 21.09 | % |

| Consumer Discretionary | | | 13.16 | % |

| Energy | | | 1.36 | % |

| Financials | | | 5.68 | % |

| Health Care | | | 20.87 | % |

| Industrials | | | 1.03 | % |

| Materials | | | 0.86 | % |

| Real Estate | | | 2.07 | % |

| Technology | | | 33.23 | % |

| Money Market Funds | | | 2.49 | % |

| Liabilities in Excess of Other Assets | | | (1.84 | )% |

| Total | | | 100.00 | % |

| TOP TEN EQUITY HOLDINGS(1)(2) |

| as of June 30, 2021 (Unaudited) |

| Issuer | | % of Net Assets | |

| Twilio, Inc., Class A | | | 3.62 | % |

| Alphabet, Inc., Class A | | | 3.14 | % |

| Teladoc Health, Inc. | | | 2.93 | % |

| Spotify Technology S.A. | | | 2.88 | % |

| NVIDIA Corp. | | | 2.85 | % |

| Masimo Corp. | | | 2.84 | % |

| Etsy, Inc. | | | 2.46 | % |

| Veeva Systems, Inc., Class A | | | 2.46 | % |

| EPAM Systems, Inc. | | | 2.37 | % |

| Facebook, Inc., Class A | | | 2.34 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

| (2) | Short-term investments are not included. |

| ERShares Global Fund |

| |

| SCHEDULE OF INVESTMENTS |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks — 99.14% | | | | | | | | |

| Argentina — 1.86% | | | | | | | | |

| Consumer Discretionary — 1.86% | | | | | | | | |

| MercadoLibre, Inc.(a) | | | 1,454 | | | $ | 2,265,027 | |

| | | | | | | | | |

| Total Argentina | | | | | | | 2,265,027 | |

| | | | | | | | | |

| Australia — 3.62% | | | | | | | | |

| Communications — 0.97% | | | | | | | | |

| SEEK Ltd. | | | 47,663 | | | | 1,184,586 | |

| | | | | | | | | |

| Technology — 2.65% | | | | | | | | |

| Technology One Ltd.(a) | | | 263,516 | | | | 1,839,878 | |

| WiseTech Global Ltd. | | | 57,748 | | | | 1,382,829 | |

| | | | | | | | 3,222,707 | |

| Total Australia | | | | | | | 4,407,293 | |

| Canada — 2.44% | | | | | | | | |

| Communications — 2.00% | | | | | | | | |

| Shopify, Inc., Class A(a) | | | 1,665 | | | | 2,432,531 | |

| | | | | | | | | |

| Consumer Discretionary — 0.34% | | | | | | | | |

| Spin Master Corp.(a) | | | 10,652 | | | | 414,359 | |

| | | | | | | | | |

| Technology — 0.10% | | | | | | | | |

| Topicus.com, Inc.(a) | | | 1,714 | | | | 124,513 | |

| | | | | | | | | |

| Total Canada | | | | | | | 2,971,403 | |

| | | | | | | | | |

| Cayman Islands — 8.06% | | | | | | | | |

| Communications — 4.35% | | | | | | | | |

| 51job, Inc. - ADR(a) | | | 14,585 | | | | 1,134,275 | |

| HUYA, Inc. - ADR(a),(b) | | | 130,126 | | | | 2,296,724 | |

| KE Holdings, Inc., Institutional Class - ADR(a) | | | 39,091 | | | | 1,863,859 | |

| | | | | | | | 5,294,858 | |

| Consumer Discretionary — 1.72% | | | | | | | | |

| NagaCorp Ltd. | | | 977,282 | | | | 942,756 | |

| Yadea Group Holdings Ltd. | | | 536,125 | | | | 1,153,136 | |

| | | | | | | | 2,095,892 | |

The accompanying notes are an integral part of these financial statements.

| ERShares Global Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Cayman Islands (Continued) | | | | | | | | |

| Technology — 1.99% | | | | | | | | |

| Agora, Inc. - ADR(a) | | | 42,861 | | | $ | 1,798,448 | |

| Kingsoft Corp. Ltd. | | | 102,564 | | | | 614,911 | |

| | | | | | | | 2,413,359 | |

| Total Cayman Islands | | | | | | | 9,804,109 | |

| China — 8.10% | | | | | | | | |

| | | | | | | | | |

| Communications — 2.64% | | | | | | | | |

| Bilibili, Inc. - ADR(a) | | | 16,879 | | | | 2,056,537 | |

| Weimob, Inc.(a) | | | 521,703 | | | | 1,150,336 | |

| | | | | | | | 3,206,873 | |

| Consumer Discretionary — 1.09% | | | | | | | | |

| Niu Technologies - ADR(a) | | | 40,435 | | | | 1,320,203 | |

| | | | | | | | | |

| Financials — 1.44% | | | | | | | | |

| Futu Holdings Ltd. - ADR(a) | | | 9,759 | | | | 1,747,739 | |

| | | | | | | | | |

| Health Care — 2.93% | | | | | | | | |

| BeiGene Ltd. - ADR(a) | | | 6,384 | | | | 2,190,925 | |

| Sino Biopharmaceutical Ltd. | | | 1,405,433 | | | | 1,379,313 | |

| | | | | | | | 3,570,238 | |

| Total China | | | | | | | 9,845,053 | |

| | | | | | | | | |

| Denmark — 1.92% | | | | | | | | |

| Health Care — 1.92% | | | | | | | | |

| Genmab A/S(a) | | | 5,693 | | | | 2,329,398 | |

| | | | | | | | | |

| Total Denmark | | | | | | | 2,329,398 | |

| | | | | | | | | |

| France — 2.08% | | | | | | | | |

| Health Care — 0.77% | | | | | | | | |

| Cellectis S.A. - ADR(a) | | | 60,683 | | | | 938,766 | |

| | | | | | | | | |

| Technology — 1.31% | | | | | | | | |

| Teleperformance | | | 3,929 | | | | 1,594,712 | |

| | | | | | | | | |

| Total France | | | | | | | 2,533,478 | |

The accompanying notes are an integral part of these financial statements.

| ERShares Global Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Israel — 6.14% | | | | | | | | |

| Communications — 4.83% | | | | | | | | |

| Fiverr International Ltd.(a) | | | 14,692 | | | $ | 3,562,664 | |

| Wix.com Ltd.(a) | | | 7,961 | | | | 2,310,919 | |

| | | | | | | | 5,873,583 | |

| Technology — 1.31% | | | | | | | | |

| Check Point Software Technologies Ltd.(a) | | | 13,718 | | | | 1,593,071 | |

| | | | | | | | | |

| Total Israel | | | | | | | 7,466,654 | |

| | | | | | | | | |

| Japan — 1.45% | | | | | | | | |

| Communications — 1.45% | | | | | | | | |

| GMO internet, Inc. | | | 64,534 | | | | 1,760,097 | |

| | | | | | | | | |

| Total Japan | | | | | | | 1,760,097 | |

| | | | | | | | | |

| Luxembourg — 2.12% | | | | | | | | |

| Communications — 2.12% | | | | | | | | |

| Spotify Technology S.A.(a) | | | 9,335 | | | | 2,572,633 | |

| | | | | | | | | |

| Total Luxembourg | | | | | | | 2,572,633 | |

| | | | | | | | | |

| Singapore — 1.38% | | | | | | | | |

| Communications — 1.38% | | | | | | | | |

| Sea Ltd. - ADR(a) | | | 6,128 | | | | 1,682,749 | |

| | | | | | | | | |

| Total Singapore | | | | | | | 1,682,749 | |

| | | | | | | | | |

| Sweden — 3.97% | | | | | | | | |

| Communications — 1.42% | | | | | | | | |

| Embracer Group A.B.(a) | | | 63,968 | | | | 1,730,360 | |

| | | | | | | | | |

| Consumer Discretionary — 1.51% | | | | | | | | |

| Evolution Gaming Group A.B. | | | 11,579 | | | | 1,829,780 | |

| | | | | | | | | |

| Health Care — 1.04% | | | | | | | | |

| CELLINK A.B.(a) | | | 25,538 | | | | 1,265,844 | |

| | | | | | | | | |

| Total Sweden | | | | | | | 4,825,984 | |

The accompanying notes are an integral part of these financial statements.

| ERShares Global Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Switzerland — 2.78% | | | | | | | | |

| Health Care — 2.78% | | | | | | | | |

| CRISPR Therapeutics AG(a) | | | 20,920 | | | $ | 3,386,739 | |

| | | | | | | | | |

| Total Switzerland | | | | | | | 3,386,739 | |

| | | | | | | | | |

| United Kingdom — 1.00% | | | | | | | | |

| Industrials — 1.00% | | | | | | | | |

| HomeServe PLC | | | 92,246 | | | | 1,219,256 | |

| | | | | | | | | |

| Total United Kingdom | | | | | | | 1,219,256 | |

| | | | | | | | | |

| United States — 52.22% | | | | | | | | |

| Communications — 8.63% | | | | | | | | |

| Roku, Inc.(a) | | | 10,785 | | | | 4,953,012 | |

| Skillz, Inc.(a),(b) | | | 71,122 | | | | 1,544,770 | |

| Trade Desk, Inc. (The), Class A(a) | | | 12,523 | | | | 968,779 | |

| Zillow Group, Inc., Class A(a) | | | 24,714 | | | | 3,028,206 | |

| | | | | | | | 10,494,767 | |

| Consumer Discretionary — 1.82% | | | | | | | | |

| DraftKings, Inc., Class A(a) | | | 42,500 | | | | 2,217,225 | |

| | | | | | | | | |

| Health Care — 15.54% | | | | | | | | |

| 10X Genomics, Inc., Class A(a) | | | 8,220 | | | | 1,609,640 | |

| Beam Therapeutics, Inc.(a) | | | 9,093 | | | | 1,170,360 | |

| Exact Sciences Corp.(a) | | | 17,085 | | | | 2,123,837 | |

| Fate Therapeutics, Inc.(a) | | | 11,195 | | | | 971,614 | |

| Intellia Therapeutics, Inc.(a) | | | 7,290 | | | | 1,180,324 | |

| Invitae Corp.(a) | | | 57,488 | | | | 1,939,070 | |

| Masimo Corp.(a) | | | 7,952 | | | | 1,927,962 | |

| Teladoc Health, Inc.(a) | | | 25,722 | | | | 4,277,311 | |

| Twist Bioscience Corp.(a) | | | 27,871 | | | | 3,713,811 | |

| | | | | | | | 18,913,929 | |

| Real Estate — 1.66% | | | | | | | | |

| eXp World Holdings, Inc.(a) | | | 51,931 | | | | 2,013,365 | |

| | | | | | | | | |

| Technology — 24.57% | | | | | | | | |

| Cloudflare, Inc.(a) | | | 12,603 | | | | 1,333,902 | |

| Crowdstrike Holdings, Inc., Class A(a) | | | 6,713 | | | | 1,687,044 | |

| Datadog, Inc.(a) | | | 22,000 | | | | 2,289,759 | |

| Fortinet, Inc.(a) | | | 4,500 | | | | 1,071,855 | |

| Microchip Technology, Inc. | | | 12,518 | | | | 1,874,445 | |

The accompanying notes are an integral part of these financial statements.

| ERShares Global Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| United States (Continued) | | | | | | | | |

| Technology (Continued) | | | | | | | | |

| NVIDIA Corp. | | | 2,762 | | | $ | 2,209,877 | |

| Ontrak, Inc.(a),(b) | | | 4,385 | | | | 142,425 | |

| Palantir Technologies, Inc., Class A(a) | | | 36,574 | | | | 964,091 | |

| Phreesia, Inc.(a) | | | 19,144 | | | | 1,173,527 | |

| Pure Storage, Inc., Class A(a) | | | 77,621 | | | | 1,515,938 | |

| salesforce.com, Inc.(a) | | | 3,462 | | | | 845,663 | |

| Square, Inc., Class A(a) | | | 17,941 | | | | 4,374,016 | |

| Synopsys, Inc.(a) | | | 6,821 | | | | 1,881,164 | |

| Twilio, Inc., Class A(a) | | | 8,599 | | | | 3,389,381 | |

| Veeva Systems, Inc., Class A(a) | | | 10,106 | | | | 3,142,460 | |

| Zoom Video Communications, Inc., Class A(a) | | | 5,094 | | | | 1,971,531 | |

| | | | | | | | 29,867,078 | |

| Total United States | | | | | | | 63,506,364 | |

| | | | | | | | | |

| Total Common Stocks (Cost $108,056,112) | | | | | | | 120,576,237 | |

| | | | | | | | | |

| Money Market Funds — 5.11% | | | | | | | | |

| BlackRock Liquidity Funds FedFund Portfolio, Institutional Class, 0.03%(c)(d) | | | 4,108,150 | | | | 4,108,150 | |

| Fidelity Investments Money Market Treasury Only Portfolio, Class I, 0.01%(c) | | | 2,108,776 | | | | 2,108,776 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $6,216,926) | | | | | | | 6,216,926 | |

| | | | | | | | | |

| Total Investments — 104.25% (Cost $114,273,038) | | | | | | | 126,793,163 | |

| Liabilities in Excess of Other Assets — (4.25)% | | | | | | | (5,166,212 | ) |

| Net Assets — 100.00% | | | | | | $ | 121,626,951 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security was on loan as of June 30, 2021. The total value of securities on loan as of June 30, 2021 was $3,955,547. See Note 2. |

| (c) | Rate disclosed is the seven day effective yield as of June 30, 2021. |

| (d) | All or a portion of this security was purchased with cash proceeds from securities lending. Total collateral had a value of $4,108,150. See Note 2. |

ADR – American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

| ERShares US Small Cap Fund |

| |

| SCHEDULE OF INVESTMENTS |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks — 99.67% | | | | | | | | |

| Communications — 11.50% | | | | | | | | |

| Cardlytics, Inc.(a) | | | 8,204 | | | $ | 1,041,334 | |

| Cargurus, Inc.(a) | | | 33,464 | | | | 877,761 | |

| Fiverr International Ltd.(a) | | | 17,243 | | | | 4,181,255 | |

| fuboTV, Inc.(a),(b) | | | 78,165 | | | | 2,509,878 | |

| HealthStream, Inc.(a) | | | 46,764 | | | | 1,306,586 | |

| HUYA, Inc. - ADR(a),(b) | | | 173,105 | | | | 3,055,303 | |

| Meredith Corp. | | | 50,000 | | | | 2,172,000 | |

| Score Media and Gaming, Inc.(a) | | | 23,419 | | | | 467,209 | |

| World Wrestling Entertainment, Inc., Class A | | | 35,498 | | | | 2,054,979 | |

| | | | | | | | 17,666,305 | |

| Consumer Discretionary — 10.26% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 5,906 | | | | 1,211,557 | |

| Cheesecake Factory, Inc. (The) | | | 20,000 | | | | 1,083,600 | |

| Freshpet, Inc.(a) | | | 15,944 | | | | 2,598,234 | |

| GrowGeneration Corp.(a) | | | 93,434 | | | | 4,494,176 | |

| Niu Technologies - ADR(a),(b) | | | 47,302 | | | | 1,544,410 | |

| RealReal, Inc. (The)(a) | | | 48,709 | | | | 962,490 | |

| Service Corp. International | | | 39,312 | | | | 2,106,730 | |

| Skechers U.S.A., Inc., Class A(a) | | | 7,046 | | | | 351,102 | |

| Sonic Automotive, Inc., Class A | | | 31,381 | | | | 1,403,986 | |

| | | | | | | | 15,756,285 | |

| Consumer Staples — 0.61% | | | | | | | | |

| AquaBounty Technologies, Inc.(a),(b) | | | 82,097 | | | | 440,040 | |

| Inter Parfums, Inc. | | | 6,905 | | | | 497,160 | |

| | | | | | | | 937,200 | |

| Energy — 3.61% | | | | | | | | |

| Ameresco, Inc., Class A(a) | | | 53,608 | | | | 3,362,294 | |

| Matador Resources Co. | | | 60,742 | | | | 2,187,319 | |

| | | | | | | | 5,549,613 | |

| Financials — 16.50% | | | | | | | | |

| B. Riley Financial, Inc. | | | 13,500 | | | | 1,019,250 | |

| Evercore, Inc., Class A | | | 8,667 | | | | 1,220,054 | |

| Futu Holdings Ltd. - ADR(a) | | | 28,826 | | | | 5,162,449 | |

| HCI Group, Inc. | | | 12,814 | | | | 1,274,096 | |

| Houlihan Lokey, Inc. | | | 11,937 | | | | 976,327 | |

| Live Oak Bancshares, Inc. | | | 49,017 | | | | 2,892,003 | |

| Pinnacle Financial Partners, Inc. | | | 22,242 | | | | 1,963,746 | |

| Preferred Bank | | | 18,390 | | | | 1,163,535 | |

| Stifel Financial Corp. | | | 31,554 | | | | 2,046,592 | |

| Trupanion, Inc.(a) | | | 48,842 | | | | 5,621,715 | |

The accompanying notes are an integral part of these financial statements.

| ERShares US Small Cap Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Financials (Continued) | | | | | | | | |

| Up Fintech Holding Ltd. - ADR(a),(b) | | | 70,000 | | | $ | 2,028,600 | |

| | | | | | | | 25,368,367 | |

| Health Care — 27.68% | | | | | | | | |

| BeiGene Ltd. - ADR(a) | | | 3,999 | | | | 1,372,417 | |

| Castle Biosciences, Inc.(a) | | | 13,203 | | | | 968,176 | |

| Cellectis S.A. - ADR(a),(b) | | | 113,486 | | | | 1,755,628 | |

| Corcept Therapeutics, Inc.(a) | | | 118,084 | | | | 2,597,848 | |

| CRISPR Therapeutics AG(a) | | | 23,786 | | | | 3,850,715 | |

| Eagle Pharmaceuticals, Inc.(a) | | | 19,276 | | | | 825,013 | |

| Editas Medicine, Inc.(a) | | | 31,480 | | | | 1,783,027 | |

| Ensign Group, Inc. (The) | | | 19,920 | | | | 1,726,466 | |

| Exact Sciences Corp.(a) | | | 12,533 | | | | 1,557,977 | |

| Guardant Health, Inc.(a) | | | 21,202 | | | | 2,633,075 | |

| Invitae Corp.(a),(b) | | | 46,026 | | | | 1,552,457 | |

| Iovance Biotherapeutics, Inc.(a) | | | 40,887 | | | | 1,063,880 | |

| LeMaitre Vascular, Inc. | | | 44,386 | | | | 2,708,434 | |

| Madrigal Pharmaceuticals, Inc.(a) | | | 11,775 | | | | 1,147,003 | |

| Medpace Holdings, Inc.(a) | | | 8,698 | | | | 1,536,328 | |

| Merit Medical Systems, Inc.(a) | | | 47,715 | | | | 3,085,252 | |

| Natera, Inc.(a) | | | 29,978 | | | | 3,403,402 | |

| Neurocrine Biosciences Inc.(a) | | | 24,496 | | | | 2,383,951 | |

| Twist Bioscience Corp.(a) | | | 18,954 | | | | 2,525,621 | |

| Zynex, Inc.(a),(b) | | | 259,139 | | | | 4,024,429 | |

| | | | | | | | 42,501,099 | |

| Industrials — 5.39% | | | | | | | | |

| Clean Harbors, Inc.(a) | | | 25,800 | | | | 2,403,012 | |

| Colfax Corp.(a) | | | 41,718 | | | | 1,911,102 | |

| EHang Holdings Ltd. - ADR(a) | | | 11,459 | | | | 492,737 | |

| Insperity, Inc. | | | 19,844 | | | | 1,793,302 | |

| Titan Machinery, Inc.(a) | | | 54,469 | | | | 1,685,271 | |

| | | | | | | | 8,285,424 | |

| Materials — 0.45% | | | | | | | | |

| Encore Wire Corp. | | | 4,419 | | | | 334,916 | |

| Steel Dynamics, Inc. | | | 6,062 | | | | 361,295 | |

| | | | | | | | 696,211 | |

| Real Estate — 2.35% | | | | | | | | |

| eXp World Holdings, Inc.(a) | | | 58,448 | | | | 2,266,029 | |

| Medical Properties Trust, Inc. | | | 66,638 | | | | 1,339,424 | |

| | | | | | | | 3,605,453 | |

| Technology — 21.32% | | | | | | | | |

| Agora, Inc. - ADR(a),(b) | | | 22,608 | | | | 948,632 | |

The accompanying notes are an integral part of these financial statements.

| ERShares US Small Cap Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Technology (Continued) | | | | | | | | |

| Appfolio, Inc., Class A(a),(b) | | | 18,658 | | | $ | 2,634,510 | |

| Bumble, Inc., Class A(a),(b) | | | 46,209 | | | | 2,661,638 | |

| ExlService Holdings, Inc.(a) | | | 27,287 | | | | 2,899,516 | |

| HubSpot, Inc.(a) | | | 5,333 | | | | 3,107,646 | |

| Impinj, Inc.(a) | | | 18,625 | | | | 960,864 | |

| MongoDB, Inc.(a) | | | 8,034 | | | | 2,904,452 | |

| Monolithic Power Systems, Inc. | | | 7,135 | | | | 2,664,566 | |

| Ontrak, Inc.(a),(b) | | | 47,735 | | | | 1,550,433 | |

| Phreesia, Inc.(a) | | | 42,046 | | | | 2,577,420 | |

| Super Micro Computer, Inc.(a) | | | 84,273 | | | | 2,964,724 | |

| TTEC Holdings, Inc. | | | 17,328 | | | | 1,786,344 | |

| Vicor Corp.(a) | | | 15,142 | | | | 1,601,115 | |

| Zscaler, Inc.(a) | | | 16,173 | | | | 3,494,337 | |

| | | | | | | | 32,756,197 | |

| Total Common Stocks (Cost $129,156,784) | | | | | | | 153,122,154 | |

| | | | | | | | | |

| Money Market Funds — 11.52% | | | | | | | | |

| BlackRock Liquidity Funds FedFund Portfolio, Institutional Class, 0.03%(c)(d) | | | 16,602,846 | | | | 16,602,846 | |

| Fidelity Investments Money Market Treasury Only Portfolio, Class I, 0.01%(c) | | | 1,102,532 | | | | 1,102,532 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $17,705,378) | | | | | | | 17,705,378 | |

| | | | | | | | | |

| Total Investments — 111.19% (Cost $146,862,162) | | | | | | | 170,827,532 | |

| Liabilities in Excess of Other Assets — (11.19)% | | | | | | | (17,199,058 | ) |

| Net Assets — 100.00% | | | | | | $ | 153,628,474 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security was on loan as of June 30, 2021. The total value of securities on loan as of June 30, 2021 was $16,050,431. See Note 2. |

| (c) | Rate disclosed is the seven day effective yield as of June 30, 2021. |

| (d) | All or a portion of this security was purchased with cash proceeds from securities lending. Total collateral had a value of $16,602,846. See Note 2. |

ADR — American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

| ERShares US Large Cap Fund |

| |

| SCHEDULE OF INVESTMENTS |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks — 99.35% | | | | | | | | |

| Communications — 21.09% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 2,056 | | | $ | 5,020,321 | |

| Bilibili, Inc. - ADR(a) | | | 16,879 | | | | 2,056,537 | |

| Facebook, Inc., Class A(a) | | | 10,746 | | | | 3,736,492 | |

| Fiverr International Ltd.(a) | | | 13,223 | | | | 3,206,445 | |

| KE Holdings, Inc., Institutional Class - ADR(a) | | | 19,916 | | | | 949,595 | |

| Roku, Inc.(a) | | | 7,783 | | | | 3,574,343 | |

| Shutterstock, Inc. | | | 14,769 | | | | 1,449,873 | |

| Skillz, Inc.(a),(b) | | | 94,006 | | | | 2,041,810 | |

| Snap, Inc., Class A(a) | | | 40,015 | | | | 2,726,622 | |

| Spotify Technology S.A.(a) | | | 16,717 | | | | 4,607,038 | |

| Trade Desk, Inc. (The), Class A(a) | | | 12,523 | | | | 968,779 | |

| Zillow Group, Inc., Class A(a) | | | 27,399 | | | | 3,357,199 | |

| | | | | | | | 33,695,054 | |

| Consumer Discretionary — 13.16% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 4,626 | | | | 948,978 | |

| Amazon.com, Inc.(a) | | | 383 | | | | 1,317,581 | |

| Copart, Inc.(a) | | | 11,155 | | | | 1,470,564 | |

| DraftKings, Inc., Class A(a) | | | 61,135 | | | | 3,189,413 | |

| Etsy, Inc.(a) | | | 19,069 | | | | 3,925,163 | |

| GrowGeneration Corp.(a) | | | 66,634 | | | | 3,205,094 | |

| L Brands, Inc. | | | 4,277 | | | | 308,201 | |

| MercadoLibre, Inc.(a) | | | 638 | | | | 993,870 | |

| RH(a) | | | 3,887 | | | | 2,639,273 | |

| Service Corp. International | | | 33,503 | | | | 1,795,426 | |

| Wynn Resorts Ltd. | | | 10,070 | | | | 1,231,561 | |

| | | | | | | | 21,025,124 | |

| Energy — 1.36% | | | | | | | | |

| Continental Resources, Inc. | | | 30,829 | | | | 1,172,427 | |

| Enphase Energy, Inc.(a) | | | 5,432 | | | | 997,478 | |

| | | | | | | | 2,169,905 | |

| Financials — 5.68% | | | | | | | | |

| BlackRock, Inc. | | | 2,933 | | | | 2,566,287 | |

| Capital One Financial Corp. | | | 4,093 | | | | 633,146 | |

| Intercontinental Exchange, Inc. | | | 23,931 | | | | 2,840,610 | |

| Stifel Financial Corp. | | | 46,884 | | | | 3,040,896 | |

| | | | | | | | 9,080,939 | |

| Health Care — 20.87% | | | | | | | | |

| 10X Genomics, Inc., Class A(a) | | | 7,717 | | | | 1,511,143 | |

| BeiGene Ltd. - ADR(a) | | | 8,562 | | | | 2,938,393 | |

| Cellectis S.A. - ADR(a) | | | 55,333 | | | | 856,002 | |

| CRISPR Therapeutics AG(a) | | | 21,654 | | | | 3,505,567 | |

The accompanying notes are an integral part of these financial statements.

| ERShares US Large Cap Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Health Care (Continued) | | | | | | | | |

| Danaher Corp. | | | 3,867 | | | $ | 1,037,748 | |

| Ensign Group, Inc. (The) | | | 17,920 | | | | 1,553,126 | |

| Exact Sciences Corp.(a) | | | 7,568 | | | | 940,778 | |

| Hologic, Inc.(a) | | | 11,760 | | | | 784,627 | |

| Masimo Corp.(a) | | | 18,743 | | | | 4,544,241 | |

| Natera, Inc.(a) | | | 9,165 | | | | 1,040,502 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 3,223 | | | | 1,800,174 | |

| Supernus Pharmaceuticals, Inc.(a) | | | 48,500 | | | | 1,493,315 | |

| Teladoc Health, Inc.(a) | | | 28,155 | | | | 4,681,895 | |

| Twist Bioscience Corp.(a) | | | 26,200 | | | | 3,491,150 | |

| United Therapeutics Corp.(a) | | | 17,638 | | | | 3,164,434 | |

| | | | | | | | 33,343,095 | |

| Industrials — 1.03% | | | | | | | | |

| Cintas Corp. | | | 2,698 | | | | 1,030,636 | |

| Titan Machinery, Inc.(a) | | | 20,000 | | | | 618,800 | |

| | | | | | | | 1,649,436 | |

| Materials — 0.86% | | | | | | | | |

| Steel Dynamics, Inc. | | | 23,024 | | | | 1,372,230 | |

| | | | | | | | | |

| Real Estate — 2.07% | | | | | | | | |

| Colliers International Group, Inc. | | | 9,644 | | | | 1,079,935 | |

| Kimco Realty Corp. | | | 106,724 | | | | 2,225,195 | |

| | | | | | | | 3,305,130 | |

| Technology — 33.23% | | | | | | | | |

| Bill.com Holdings, Inc.(a) | | | 13,896 | | | | 2,545,469 | |

| Bumble, Inc., Class A(a),(b) | | | 36,351 | | | | 2,093,818 | |

| Cloudflare, Inc.(a) | | | 33,667 | | | | 3,563,315 | |

| Crowdstrike Holdings, Inc., Class A(a) | | | 9,709 | | | | 2,439,969 | |

| Datadog, Inc.(a) | | | 30,470 | | | | 3,171,318 | |

| EPAM Systems, Inc.(a) | | | 7,398 | | | | 3,780,081 | |

| FleetCor Technologies, Inc.(a) | | | 4,509 | | | | 1,154,575 | |

| Fortinet, Inc.(a) | | | 6,266 | | | | 1,492,499 | |

| MongoDB, Inc.(a) | | | 2,562 | | | | 926,214 | |

| NVIDIA Corp. | | | 5,695 | | | | 4,556,570 | |

| Okta, Inc.(a) | | | 11,505 | | | | 2,815,043 | |

| Omnicell, Inc.(a) | | | 19,737 | | | | 2,989,169 | |

| Oracle Corp. | | | 11,563 | | | | 900,064 | |

| salesforce.com, Inc.(a) | | | 10,517 | | | | 2,568,988 | |

| Square, Inc., Class A(a) | | | 14,422 | | | | 3,516,084 | |

| SS&C Technologies Holdings, Inc. | | | 18,341 | | | | 1,321,652 | |

| Synopsys, Inc.(a) | | | 12,845 | | | | 3,542,523 | |

The accompanying notes are an integral part of these financial statements.

| ERShares US Large Cap Fund |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks (Continued) | | | | | | | | |

| Technology (Continued) | | | | | | | | |

| Twilio, Inc., Class A(a) | | | 14,683 | | | $ | 5,787,450 | |

| Veeva Systems, Inc., Class A(a) | | | 12,622 | | | | 3,924,811 | |

| | | | | | | | 53,089,612 | |

| Total Common Stocks (Cost $140,737,584) | | | | | | | 158,730,525 | |

| | | | | | | | | |

| Money Market Funds — 2.49% | | | | | | | | |

| BlackRock Liquidity Funds FedFund Portfolio, Institutional Class, 0.03%(c)(d) | | | 3,205,392 | | | | 3,205,392 | |

| Fidelity Investments Money Market Treasury Only Portfolio, Class I, 0.01%(c) | | | 772,946 | | | | 772,946 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $3,978,338) | | | | | | | 3,978,338 | |

| | | | | | | | | |

| Total Investments — 101.84% (Cost $144,715,922) | | | | | | | 162,708,863 | |

| Liabilities in Excess of Other Assets — (1.84)% | | | | | | | (2,936,975 | ) |

| Net Assets — 100.00% | | | | | | $ | 159,771,888 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security was on loan as of June 30, 2021. The total value of securities on loan as of June 30, 2021 was $3,141,172. See Note 2. |

| (c) | Rate disclosed is the seven day effective yield as of June 30, 2021. |

| (d) | All or a portion of this security was purchased with cash proceeds from securities lending. Total collateral had a value of $3,205,392. See Note 2. |

ADR — American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

| EntrepreneurShares Series Trust |

| |

| STATEMENTS OF ASSETS AND LIABILITIES |

| June 30, 2021 |

| | | ERShares | | | ERShares | | | ERShares | |

| | | Global | | | US Small | | | US Large | |

| | | Fund | | | Cap Fund | | | Cap Fund | |

| Assets | | | | | | | | | |

| Investments, at cost | | $ | 114,273,038 | | | $ | 146,862,162 | | | $ | 144,715,922 | |

| Investments, at fair value (a) | | | 126,793,163 | | | | 170,827,532 | | | | 162,708,863 | |

| Foreign currency (cost $5,822, $— and $1,802) | | | 5,822 | | | | — | | | | 1,802 | |

| Receivable for fund shares sold | | | — | | | | 750 | | | | 134,170 | |

| Receivable for investments sold | | | 2,327,156 | | | | 481,351 | | | | 234,696 | |

| Dividends and interest receivable | | | 29,259 | | | | 56,879 | | | | 57,896 | |

| Securities lending income receivable | | | 1,138 | | | | 8,156 | | | | 162 | |

| Tax reclaims receivable | | | 24,823 | | | | 496 | | | | 414 | |

| Prepaid expenses | | | 7,800 | | | | 8,329 | | | | 14,283 | |

| Total Assets | | | 129,189,161 | | | | 171,383,493 | | | | 163,152,286 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Collateral due to broker for securities loaned | | | 4,108,150 | | | | 16,602,846 | | | | 3,205,392 | |

| Due to custodian | | | 3,293,132 | | | | 1,008,921 | | | | — | |

| Payable for fund shares redeemed | | | — | | | | — | | | | 44,207 | |

| Payable to Adviser | | | 119,724 | | | | 109,462 | | | | 95,598 | |

| Payable to Administrator | | | 6,749 | | | | 5,997 | | | | 5,956 | |

| Accrued expenses and other liabilities | | | 34,455 | | | | 27,793 | | | | 29,245 | |

| Total Liabilities | | | 7,562,210 | | | | 17,755,019 | | | | 3,380,398 | |

| Net Assets | | $ | 121,626,951 | | | $ | 153,628,474 | | | $ | 159,771,888 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | | 90,768,545 | | | | 86,657,948 | | | | 103,131,500 | |

| Accumulated earnings | | | 30,858,406 | | | | 66,970,526 | | | | 56,640,388 | |

| Net Assets | | $ | 121,626,951 | | | $ | 153,628,474 | | | $ | 159,771,888 | |

| Institutional Class | | | | | | | | | | | | |

| Net Assets | | $ | 121,626,951 | | | $ | 153,628,474 | | | $ | 159,771,888 | |

| Shares outstanding (unlimited number of shares authorized, $0.01 par value) | | | 5,574,319 | | | | 10,218,557 | | | | 9,136,360 | |

| Net asset value and offering price per share | | $ | 21.82 | | | $ | 15.03 | | | $ | 17.49 | |

| Redemption price per share (NAV * 98%)(b) | | $ | 21.38 | | | $ | 14.73 | | | $ | 17.14 | |

| (a) | Includes securities on loan of $3,955,547, $16,050,431 and $3,141,172, respectively (see Note 2). |

| (b) | The Fund charges a 2% redemption fee on shares redeemed within five business days of purchase. Shares are redeemed at the NAV if held longer than five business days. See Note 8. |

The accompanying notes are an integral part of these financial statements.

| EntrepreneurShares Series Trust |

| |

| STATEMENTS OF OPERATIONS |

| For the year ended June 30, 2021 |

| | | ERShares | | | ERShares | | | ERShares | |

| | | Global | | | US Small | | �� | US Large | |

| | | Fund | | | Cap Fund | | | Cap Fund | |

| Investment Income | | | | | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $13,862, $141 and $1,877) | | $ | 359,157 | | | $ | 471,585 | | | $ | 306,859 | |

| Interest income | | | 227 | | | | 605 | | | | 554 | |

| Securities lending income | | | 237,531 | | | | 402,039 | | | | 86,186 | |

| Total investment income | | | 596,915 | | | | 874,229 | | | | 393,599 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Advisory fees | | | 968,489 | | | | 1,479,566 | | | | 1,163,422 | |

| Fund accounting and administration fees | | | 40,339 | | | | 85,941 | | | | 78,263 | |

| Custodian fees | | | 22,622 | | | | 14,084 | | | | 13,537 | |

| Auditing fees | | | 18,901 | | | | 18,901 | | | | 18,901 | |

| Registration fees | | | 16,835 | | | | 18,531 | | | | 25,207 | |

| Transfer agent | | | 10,753 | | | | 14,222 | | | | 12,838 | |

| Pricing fees | | | 5,079 | | | | 6,035 | | | | 4,167 | |

| Legal fees | | | 4,196 | | | | 9,050 | | | | 8,849 | |

| Shareholder reporting fees | | | 3,779 | | | | 6,007 | | | | 6,145 | |

| Trustees’ fees and expenses | | | 3,433 | | | | 7,303 | | | | 7,001 | |

| Insurance expense | | | 2,150 | | | | 4,033 | | | | 3,277 | |

| Chief Compliance Officer fees | | | 95 | | | | 405 | | | | 386 | |

| Miscellaneous | | | 17,091 | | | | 15,117 | | | | 15,243 | |

| Total expenses | | | 1,113,762 | | | | 1,679,195 | | | | 1,357,236 | |

| Fees contractually waived by Adviser | | | — | | | | (41,450 | ) | | | (43,400 | ) |

| Fees recouped by Adviser | | | — | | | | 39,183 | | | | 25,673 | |

| Net operating expenses | | | 1,113,762 | | | | 1,676,928 | | | | 1,339,509 | |

| Net investment loss | | | (516,847 | ) | | | (802,699 | ) | | | (945,910 | ) |

| | | | | | | | | | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 25,484,857 | | | | 64,226,499 | | | | 46,371,557 | |

| Foreign currency transactions | | | (111,914 | ) | | | — | | | | — | |

| Net realized gain | | | 25,372,943 | | | | 64,226,499 | | | | 46,371,557 | |

| | | | | | | | | | | | | |

| Change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

| Investments | | | 163,528 | | | | 655,048 | | | | (11,660,329 | ) |

| Foreign currency translations | | | 1,118 | | | | — | | | | 12 | |

| Net change in unrealized appreciation (depreciation) | | | 164,646 | | | | 655,048 | | | | (11,660,317 | ) |

| Net realized and change in unrealized gain on investments | | | 25,537,589 | | | | 64,881,547 | | | | 34,711,240 | |

| Net increase in net assets resulting from operations | | $ | 25,020,742 | | | $ | 64,078,848 | | | $ | 33,765,330 | |

The accompanying notes are an integral part of these financial statements.

| ERShares Global Fund |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | June 30, 2021 | | | June 30, 2020 | |

| Increase (Decrease) in Net Assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment loss | | $ | (516,847 | ) | | $ | (285,644 | ) |

| Net realized gain on investments and foreign currency transactions | | | 25,372,943 | | | | 413,872 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency translations | | | 164,646 | | | | 4,970,093 | |

| Net increase in net assets resulting from operations | | | 25,020,742 | | | | 5,098,321 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings Institutional Class | | | | | | | | |

| Distributions | | | (6,630,435 | ) | | | (1,788,910 | ) |

| Total distributions to shareholders | | | (6,630,435 | ) | | | (1,788,910 | ) |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 50,836,900 | | | | 483,631 | |

| Proceeds from redemption fees(a) | | | 23 | | | | 77 | |

| Reinvestment of distributions | | | 5,884,564 | | | | 1,436,494 | |

| Cost of shares redeemed | | | (4,718,681 | ) | | | (17,779,977 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 52,002,806 | | | | (15,859,775 | ) |

| Total Increase (Decrease) in Net Assets | | | 70,393,113 | | | | (12,550,364 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 51,233,838 | | | | 63,784,202 | |

| End of year | | $ | 121,626,951 | | | $ | 51,233,838 | |

| | | | | | | | | |

| Share Transactions Institutional Class | | | | | | | | |

| Shares sold | | | 2,470,158 | | | | 30,378 | |

| Shares issued in reinvestment of distributions | | | 268,212 | | | | 87,859 | |

| Shares redeemed | | | (210,205 | ) | | | (1,114,539 | ) |

| Net increase (decrease) in shares outstanding | | | 2,528,165 | | | | (996,302 | ) |

| (a) | The Fund charges a 2% redemption fee on shares redeemed within five business days of purchase. Shares are redeemed at the NAV if held longer than five business days. |

The accompanying notes are an integral part of these financial statements.

| ERShares US Small Cap Fund |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | June 30, 2021 | | | June 30, 2020 | |

| Increase (Decrease) in Net Assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment loss | | $ | (802,699 | ) | | $ | (72,820 | ) |

| Net realized gain on investments and foreign currency transactions | | | 64,226,499 | | | | 11,734,063 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency translations | | | 655,048 | | | | (8,945,811 | ) |

| Net increase in net assets resulting from operations | | | 64,078,848 | | | | 2,715,432 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings Institutional Class | | | | | | | | |

| Distributions | | | (30,803,421 | ) | | | (9,831,600 | ) |

| Total distributions to shareholders | | | (30,803,421 | ) | | | (9,831,600 | ) |

| | | | | | | | | |

| Capital Transactions Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 5,237,380 | | | | 13,368,391 | |

| Proceeds from redemption fees(a) | | | 228 | | | | 106 | |

| Reinvestment of distributions | | | 30,801,244 | | | | 9,828,304 | |

| Cost of shares redeemed | | | (79,513,650 | ) | | | (12,963,251 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | (43,474,798 | ) | | | 10,233,550 | |

| Total Increase (Decrease) in Net Assets | | | (10,199,371 | ) | | | 3,117,382 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 163,827,845 | | | | 160,710,463 | |

| End of year | | $ | 153,628,474 | | | $ | 163,827,845 | |

| | | | | | | | | |

| Share Transactions Institutional Class | | | | | | | | |

| Shares sold | | | 318,094 | | | | 1,289,169 | |

| Shares issued in reinvestment of distributions | | | 1,845,491 | | | | 823,831 | |

| Shares redeemed | | | (5,589,633 | ) | | | (1,115,447 | ) |

| Net increase (decrease) in shares outstanding | | | (3,426,048 | ) | | | 997,553 | |

| (a) | The Fund charges a 2% redemption fee on shares redeemed within five business days of purchase. Shares are redeemed at the NAV if held longer than five business days. |

The accompanying notes are an integral part of these financial statements.

| ERShares US Large Cap Fund |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | June 30, 2021 | | | June 30, 2020 | |

| Increase (Decrease) in Net Assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment loss | | $ | (945,910 | ) | | $ | (252,655 | ) |

| Net realized gain on investments and foreign currency transactions | | | 46,371,557 | | | | 37,691,888 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency translations | | | (11,660,317 | ) | | | (13,899,964 | ) |

| Net increase in net assets resulting from operations | | | 33,765,330 | | | | 23,539,269 | |

| | | | | | | | | |

| Distributions to Shareholders from Earnings Institutional Class | | | | | | | | |

| Distributions | | | (36,057,302 | ) | | | (8,147,630 | ) |

| Total distributions to shareholders | | | (36,057,302 | ) | | | (8,147,630 | ) |

| | | | | | | | | |

| Capital Transactions Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 4,235,322 | | | | 8,188,540 | |

| Proceeds from redemption fees(a) | | | 392 | | | | 881 | |

| Reinvestment of distributions | | | 36,005,767 | | | | 8,143,889 | |

| Cost of shares redeemed | | | (29,486,084 | ) | | | (13,737,301 | ) |

| Net increase in net assets resulting from capital transactions | | | 10,755,397 | | | | 2,596,009 | |

| Total Increase in Net Assets | | | 8,463,425 | | | | 17,987,648 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 151,308,463 | | | | 133,320,815 | |

| End of year | | $ | 159,771,888 | | | $ | 151,308,463 | |

| | | | | | | | | |

| Share Transactions Institutional Class | | | | | | | | |

| Shares sold | | | 218,367 | | | | 531,797 | |

| Shares issued in reinvestment of distributions | | | 1,794,904 | | | | 534,727 | |

| Shares redeemed | | | (1,831,784 | ) | | | (898,773 | ) |

| Net increase in shares outstanding | | | 181,487 | | | | 167,751 | |

| (a) | The Fund charges a 2% redemption fee on shares redeemed within five business days of purchase. Shares are redeemed at the NAV if held longer than five business days. |

The accompanying notes are an integral part of these financial statements.

| ERShares Global Fund |

| |

| FINANCIAL HIGHLIGHTS – Institutional Class |

| |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 16.82 | | | $ | 15.78 | | | $ | 16.07 | | | $ | 14.65 | | | $ | 11.81 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.14 | ) | | | (0.08 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.07 | ) |

| Net realized and unrealized gain | | | 7.32 | | | | 1.61 | | | | 0.16 | | | | 2.77 | | | | 2.91 | |

| Total from investment operations | | | 7.18 | | | | 1.53 | | | | 0.10 | | | | 2.67 | | | | 2.84 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | (2.18 | ) | | | (0.49 | ) | | | (0.39 | ) | | | (1.25 | ) | | | — | |

| Total distributions | | | (2.18 | ) | | | (0.49 | ) | | | (0.39 | ) | | | (1.25 | ) | | | — | |

| Paid-in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | |

| Net asset value, end of year | | $ | 21.82 | | | $ | 16.82 | | | $ | 15.78 | | | $ | 16.07 | | | $ | 14.65 | |

| Total Return(c) | | | 42.63 | % | | | 9.80 | % | | | 1.11 | % | | | 18.65 | % | | | 24.05 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 121,627 | | | $ | 51,234 | | | $ | 63,784 | | | $ | 63,082 | | | $ | 26,933 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | 1.44 | % | | | 1.49 | % | | | 1.47 | % | | | 1.53 | % | | | 1.74 | % |

| After fees waived/recouped | | | 1.44 | % | | | 1.49 | % | | | 1.56 | % | | | 1.70 | % | | | 1.70 | % |

| Ratio of net investment loss to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | (0.67 | )% | | | (0.51 | )% | | | (0.27 | )% | | | (0.47 | )% | | | (0.57 | )% |

| After fees waived/recouped | | | (0.67 | )% | | | (0.51 | )% | | | (0.36 | )% | | | (0.64 | )% | | | (0.53 | )% |

| Portfolio turnover rate | | | 477 | % (d) | | | 61 | % | | | 23 | % | | | 38 | % | | | 65 | % |

| (a) | Based on average shares outstanding during the year. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total returns would have been lower/higher had certain expenses not been waived/recovered by the advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

| (d) | The Fund has experienced an unusual interest rate environment combined with volatile markets resulting from inflationary concerns during the past fiscal year. These two factors posed potential adverse effects to the Fund. Thus, the portfolio manager engaged in temporary defensive positions as well as positioned the Fund to take the best advantage of the environment it was facing. These two actions, combined with a reversion of the defensive positions, resulted in an increased turnover for the Fund. |

The accompanying notes are an integral part of these financial statements.

| ERShares US Small Cap Fund |

| |

| FINANCIAL HIGHLIGHTS – Institutional Class |

| |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.01 | | | $ | 12.71 | | | $ | 15.27 | | | $ | 12.75 | | | $ | 9.72 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)(a) | | | (0.06 | ) | | | (0.01 | ) | | | — | (b) | | | (0.02 | ) | | | 0.01 | |

| Net realized and unrealized gain (loss) | | | 5.35 | | | | 0.11 | | | | (0.28 | ) | | | 3.89 | | | | 3.04 | |

| Total from investment operations | | | 5.29 | | | | 0.10 | | | | (0.28 | ) | | | 3.87 | | | | 3.05 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.01 | ) | | | — | | | | — | | | | (0.02 | ) |

| Net realized gains | | | (2.27 | ) | | | (0.79 | ) | | | (2.28 | ) | | | (1.35 | ) | | | — | |

| Total distributions | | | (2.27 | ) | | | (0.80 | ) | | | (2.28 | ) | | | (1.35 | ) | | | (0.02 | ) |

| Paid-in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | |

| Net asset value, end of year | | $ | 15.03 | | | $ | 12.01 | | | $ | 12.71 | | | $ | 15.27 | | | $ | 12.75 | |

| Total Return(c) | | | 42.19 | % | | | 0.86 | % | | | 1.58 | % | | | 32.42 | % | | | 31.39 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 153,628 | | | $ | 163,828 | | | $ | 160,710 | | | $ | 159,435 | | | $ | 120,847 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | 0.87 | % | | | 0.90 | % | | | 0.89 | % | | | 0.90 | % | | | 0.90 | % |

| After fees waived/recouped | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| Ratio of net investment loss to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | (0.43 | )% | | | (0.10 | )% | | | (0.05 | )% | | | (0.16 | )% | | | (0.18 | )% |

| After fees waived/recouped | | | (0.41 | )% | | | (0.05 | )% | | | (0.01 | )% | | | (0.11 | )% | | | (0.13 | )% |

| Portfolio turnover rate | | | 439 | % (d) | | | 139 | % (e) | | | 43 | % | | | 72 | % | | | 53 | % |

| (a) | Based on average shares outstanding during the year. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total returns would have been lower/higher had certain expenses not been waived/recovered by the advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

| (d) | The Fund has experienced an unusual interest rate environment combined with volatile markets resulting from inflationary concerns during the past fiscal year. These two factors posed potential adverse effects to the Fund. Thus, the portfolio manager engaged in temporary defensive positions as well as positioned the Fund to take the best advantage of the environment it was facing. These two actions, combined with a reversion of the defensive positions, resulted in an increased turnover for the Fund. |

| (e) | Given the abnormal market circumstances resulting from the COVID-19 situation, the Fund had taken a temporary defensive position. As the market started to recover, the Fund has been reversing its temporary defensive position. This temporary implementation and reversion of the defensive position increased the Fund’s turnover. |

The accompanying notes are an integral part of these financial statements.

| ERShares US Large Cap Fund |

| |

| FINANCIAL HIGHLIGHTS – Institutional Class |

| |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 16.90 | | | $ | 15.17 | | | $ | 14.75 | | | $ | 12.61 | | | $ | 10.65 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)(a) | | | (0.10 | ) | | | (0.03 | ) | | | — | (b) | | | (0.02 | ) | | | 0.04 | |

| Net realized and unrealized gain | | | 4.72 | | | | 2.73 | | | | 0.69 | | | | 3.48 | | | | 2.10 | |

| Total from investment operations | | | 4.62 | | | | 2.70 | | | | 0.69 | | | | 3.46 | | | | 2.14 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.06 | ) |

| Net realized gains | | | (4.03 | ) | | | (0.97 | ) | | | (0.27 | ) | | | (1.31 | ) | | | (0.12 | ) |

| Total distributions | | | (4.03 | ) | | | (0.97 | ) | | | (0.27 | ) | | | (1.32 | ) | | | (0.18 | ) |

| Paid-in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | |

| Net asset value, end of year | | $ | 17.49 | | | $ | 16.90 | | | $ | 15.17 | | | $ | 14.75 | | | $ | 12.61 | |

| Total Return(c) | | | 24.30 | % | | | 18.50 | % | | | 5.09 | % | | | 28.67 | % | | | 20.26 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 159,772 | | | $ | 151,308 | | | $ | 133,321 | | | $ | 124,392 | | | $ | 107,823 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | 0.76 | % | | | 0.80 | % | | | 0.79 | % | | | 0.81 | % | | | 0.82 | % |

| After fees waived/recouped | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived/recouped | | | (0.54 | )% | | | (0.24 | )% | | | (0.07 | )% | | | (0.18 | )% | | | 0.26 | % |

| After fees waived/recouped | | | (0.53 | )% | | | (0.19 | )% | | | (0.03 | )% | | | (0.12 | )% | | | 0.33 | % |

| Portfolio turnover rate | | | 584 | % (d) | | | 149 | % (e) | | | 0 | % | | | 43 | % | | | 43 | % |

| (a) | Based on average shares outstanding during the year. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total returns would have been lower/higher had certain expenses not been waived/recovered by the advisor (see Note 3). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

| (d) | The Fund has experienced an unusual interest rate environment combined with volatile markets resulting from inflationary concerns during the past fiscal year. These two factors posed potential adverse effects to the Fund. Thus, the portfolio manager engaged in temporary defensive positions as well as positioned the Fund to take the best advantage of the environment it was facing. These two actions, combined with a reversion of the defensive positions, resulted in an increased turnover for the Fund. |

| (e) | Given the abnormal market circumstances resulting from the COVID-19 situation, the Fund had taken a temporary defensive position. As the market started to recover, the Fund has been reversing its temporary defensive position. This temporary implementation and reversion of the defensive position increased the Fund’s turnover. |

The accompanying notes are an integral part of these financial statements.

| EntrepreneurShares Series Trust |

| |

| NOTES TO FINANCIAL STATEMENTS |

| June 30, 2021 |

EntrepreneurShares™ Series Trust, a Delaware statutory trust (the “Trust”), was formed on July 1, 2010, and has authorized capital of unlimited shares of beneficial interest. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and is authorized to issue multiple series and classes of shares. The ERShares Global Fund formerly known as the EntrepreneurShares Global Fund (the “Global Fund”), the ERShares US Small Cap Fund formerly known as the Entrepreneur U.S. Small Cap Fund (the “US Small Cap Fund”), and the ERShares US Large Cap Fund formerly known as the Entrepreneur U.S. Large Cap Fund (the “US Large Cap Fund”) (each separately a “Fund”, or collectively, “the Funds”) are each classified as a “diversified” series, as defined in the 1940 Act. The Funds are investment companies and, accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 – Investment Companies including Accounting Standards Update (“ASU”) 2013-08. The Global Fund commenced operations on November 11, 2010. The US Small Cap Fund commenced operations on December 17, 2013. The US Large Cap Fund commenced operations on June 30, 2014.

The investment objective of the Global Fund is long-term capital appreciation. The Global Fund seeks to achieve its objective by investing in equity securities of global companies with market capitalizations that are above $300 million at the time of initial purchase and possess entrepreneurial characteristics, as determined by EntrepreneurShares, LLC, the Global Fund’s sub-advisor (the “Sub-Advisor”), and Seaport Global Advisors, LLC formerly known as Weston Capital Advisors, LLC, the Global Fund’s investment advisor (the “Global Advisor”). Dr. Joel M. Shulman has been the Global Fund’s portfolio manager since November 11, 2010 and Managing Director of the Advisor and President of the Sub-Advisor.

The investment objective of the US Small Cap Fund is long-term capital appreciation. The US Small Cap Fund seeks to achieve its objective by investing at least 80% of its net assets (plus any borrowing for investment purposes) in equity securities of U.S. companies with market capitalization that are above $300 million at the time of initial purchase and possess entrepreneurial characteristics, as determined by Capital Impact Advisors, LLC (the “Advisor”, collectively with the Global Advisor, the “Advisors”), the US Small Cap Fund’s investment advisor. Dr. Joel M. Shulman has been the US Small Cap Fund’s portfolio manager since December 17, 2013 and Chief Executive Officer of the Advisor.

The investment objective of the US Large Cap Fund is long-term capital appreciation. The US Large Cap Fund seeks to achieve its objective by investing in equity securities of U.S. companies with market capitalizations that are above $5 billion at the time of initial purchase and possess entrepreneurial characteristics, as determined by Capital Impact Advisors, LLC, the US Large Cap Fund’s investment advisor. Dr. Joel M. Shulman has been the US Large Cap Fund’s portfolio manager since June 30, 2014 and is Managing Director of the Advisor.

The Global Fund has registered three classes of shares: Class A shares, Retail Class shares and Institutional Class shares. The US Small Cap Fund and US Large Cap Fund each have registered two classes of shares: Institutional Class shares and Retail Class shares. Each share represents an equal proportionate interest in the assets and liabilities belonging to the applicable class and is entitled to such dividends and distributions out of income belonging to the applicable class as are declared by the EntrepreneurShares Series Trust Board of Trustees (the “Board”). On matters that affect the Fund as a whole, each class has the same voting and other rights and preferences as any other class. On matters that affect only one class, only shareholders of that class may vote. Each class votes separately on matters affecting only that class, or on matters expressly required to be voted on separately by state or federal law. Shares of each class of a series have the same voting and other rights and preferences as the other classes and series of the Trust for matters that affect the Trust as a whole. Currently, only Institutional Class shares of each of the Global Fund, US Small Cap Fund and US Large Cap are being offered.

| EntrepreneurShares Series Trust |

| |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| June 30, 2021 |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Investment Valuation

The following is a summary of the Funds’ pricing procedures. It is intended to be a general discussion and may not necessarily reflect all pricing procedures followed by the Funds.