AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON AUGUST 21, 2015 Registration Statement No. 333-200192 UNITED STATES SECURITIES AND EXCHANGE COMMMISSION Washington, D.C. 20549 PRE-EFFECTIVE AMENDMENT NO. 1 TO FORM S-3 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 FIRST NBC BANK HOLDING COMPANY (Exact name of registrant as specified in its charter) Louisiana 14-1985604 (State of incorporation or organization) (I.R.S. Employer Identification Number) 210 Baronne Street New Orleans, Louisiana 70112 (Address of principal executive officers and zip code) Ashton J. Ryan, Jr. President and Chief Executive Officer First NBC Bank Holding Company 210 Baronne Street New Orleans, Louisiana 70112 (504) 566-8000 (Name, address, including zip code, and telephone number, including area code, of agent for service) With a copy to: Geoffrey S. Kay, Esq. Fenimore, Kay, Harrison & Ford, LLP 812 San Antonio Street, Suite 600 Austin, Texas 78701 (512) 583-5909 Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective. If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box If this form is a post-effective amendment to a registration statement pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

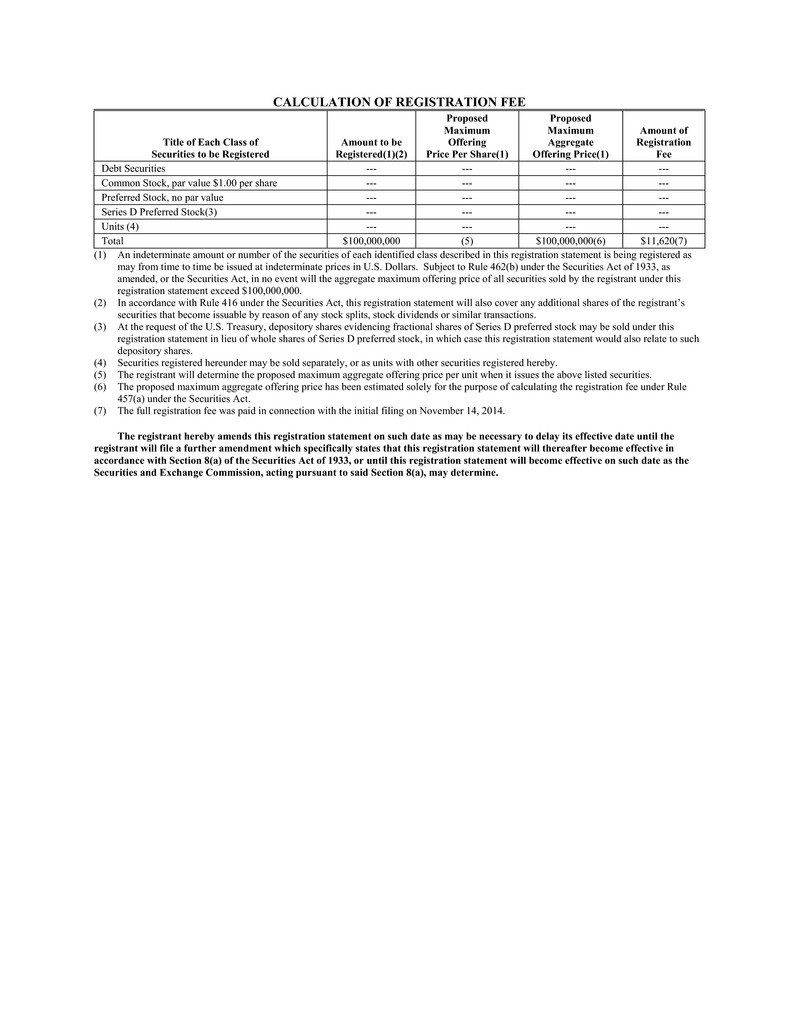

CALCULATION OF REGISTRATION FEE Title of Each Class of Securities to be Registered Amount to be Registered(1)(2) Proposed Maximum Offering Price Per Share(1) Proposed Maximum Aggregate Offering Price(1) Amount of Registration Fee Debt Securities --- --- --- --- Common Stock, par value $1.00 per share --- --- --- --- Preferred Stock, no par value --- --- --- --- Series D Preferred Stock(3) --- --- --- --- Units (4) --- --- --- --- Total $100,000,000 (5) $100,000,000(6) $11,620(7) (1) An indeterminate amount or number of the securities of each identified class described in this registration statement is being registered as may from time to time be issued at indeterminate prices in U.S. Dollars. Subject to Rule 462(b) under the Securities Act of 1933, as amended, or the Securities Act, in no event will the aggregate maximum offering price of all securities sold by the registrant under this registration statement exceed $100,000,000. (2) In accordance with Rule 416 under the Securities Act, this registration statement will also cover any additional shares of the registrant’s securities that become issuable by reason of any stock splits, stock dividends or similar transactions. (3) At the request of the U.S. Treasury, depository shares evidencing fractional shares of Series D preferred stock may be sold under this registration statement in lieu of whole shares of Series D preferred stock, in which case this registration statement would also relate to such depository shares. (4) Securities registered hereunder may be sold separately, or as units with other securities registered hereby. (5) The registrant will determine the proposed maximum aggregate offering price per unit when it issues the above listed securities. (6) The proposed maximum aggregate offering price has been estimated solely for the purpose of calculating the registration fee under Rule 457(a) under the Securities Act. (7) The full registration fee was paid in connection with the initial filing on November 14, 2014. The registrant hereby amends this registration statement on such date as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor any selling shareholder may sell, or accept an offer to buy, these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, nor does it seek an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED AUGUST 21, 2015 PROSPECTUS Debt Securities, Common Stock and Preferred Stock By this prospectus, we may offer from time to time: • Debt securities of one or more series; • Shares of our common stock; • Shares of one or more series of our preferred stock; and • Units of our securities. In addition, this prospectus may be used to offer securities for the account of selling securityholders. When we or selling securityholders offer securities, we or they will provide you with a prospectus supplement describing the terms of the specific issue of securities being offered, including the price at which the securities are being offered to the public. You should read this prospectus and any prospectus supplement carefully before you make an investment decision. We or any selling securityholders may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. Our common stock is listed on the NASDAQ Global Select Market under the ticker symbol “FNBC.” We have not yet determined whether any of the other securities that may be offered by this prospectus will be listed on any exchange. If we apply to list any such securities on a securities exchange upon their issuance, the prospectus supplement relating to those securities will disclose the exchange on which we will apply to have those securities listed. Investing in our securities involves risks. You should refer to the section titled “Risk Factors” in our most recent Annual Report of Form 10-K, which is incorporated by reference, and in any of our subsequently filed quarterly and current reports that are incorporated herein by reference. We may also include specific additional risk factors in an applicable prospectus supplement under the heading “Risk Factors.” You should carefully read this prospectus together with the documents we incorporate by reference and the applicable prospectus supplement before you invest in our securities. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. This prospectus is not an offer to sell any securities other than the securities offered hereby and is not an offer to sell securities in any jurisdiction where the offer or sale is not permitted.

The securities offered by this prospectus are not savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The date of this prospectus is August 21, 2015

TABLE OF CONTENTS About this Prospectus .................................................................................................................................................... 1 Where You Can Find More Information ....................................................................................................................... 1 Incorporation of Certain Documents by Reference ....................................................................................................... 2 Market Data ................................................................................................................................................................... 2 Cautionary Note Regarding Forward-Looking Statements ........................................................................................... 4 About First NBC Bank Holding Company .................................................................................................................... 6 Risk Factors ................................................................................................................................................................... 6 Use of Proceeds ............................................................................................................................................................. 6 Ratio of Earnings to Fixed Charges and Preferred Stock Dividends ............................................................................. 7 Securities We May Offer ............................................................................................................................................... 8 Description of Debt Securities ....................................................................................................................................... 9 Description of Common Stock .................................................................................................................................... 15 Description of Preferred Stock .................................................................................................................................... 18 Description of Outstanding Series D Preferred Stock ................................................................................................. 22 Description of Units ..................................................................................................................................................... 27 Book Entry Issuance .................................................................................................................................................... 27 Plan of Distribution ..................................................................................................................................................... 30 Legal Matters ............................................................................................................................................................... 32 Experts ....................................................................................................................................................................... 32

1 ABOUT THIS PROSPECTUS This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under the shelf registration statement, we or the selling securityholders may offer and sell, from time to time and in one or more offerings, either separately or together, shares of our common stock, shares of one or more series of our preferred stock, senior debt securities in one or more series, subordinated debt securities in one or more series, and unit purchase agreements as described in this prospectus and an applicable prospectus supplement, up to a maximum aggregate amount of $100.0 million. Each time we sell securities we will provide a prospectus supplement containing specific information about the terms of the securities being offered. The prospectus supplement may include a discussion of any risk factors or other special considerations that apply to those securities. We may also provide a prospectus supplement to add information to, or update or change information contained in, this prospectus. Where appropriate, the applicable prospectus supplement will describe U.S. federal income tax consequences relevant to the securities offered. If there is any inconsistency between the information in this prospectus (including the information incorporated by reference herein) and information in any prospectus supplement, you should rely on the information in the applicable prospectus supplement as it will control. You should carefully read both this prospectus and the applicable prospectus supplement together with additional information described under the heading “Where You Can Find More Information” or incorporated herein by reference as described under the heading “Incorporation of Certain Documents by Reference.” Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “our,” and “us” mean First NBC Bank Holding Company and its consolidated subsidiaries. In this prospectus, we sometimes refer to the debt securities, common stock, preferred stock, unit purchase agreements we may offer and the securities that may be offered by selling securityholders collectively as “offered securities.” You should rely only on the information contained in or incorporated by reference into this prospectus and the applicable prospectus supplement. No one is authorized to provide you with different information, and if anyone provides you with different information, you should not rely on it. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of such documents. WHERE YOU CAN FIND MORE INFORMATION We file annual, quarterly, and special reports, proxy statements, and other information with the SEC. You may read and copy any document that we file with the SEC at the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You also may inspect our filings over the Internet at the SEC’s website, www.sec.gov. The reports and other information we file with the SEC also are available at our website, www.firstnbcbank.com. We have included the SEC’s web address and our web address as inactive textual references only. Except as specifically incorporated by reference into this prospectus, information on those websites is not part of this prospectus. In addition, because our common stock is listed on the NASDAQ Stock Exchange, you may read our reports, proxy statements, and other documents at the offices of the NASDAQ Stock Exchange at One Liberty Plaza, 165 Broadway, New York, New York 10006. We have filed with the SEC a registration statement on Form S-3 under the Securities Act (File No. 333- 200192), relating to the securities covered by this prospectus. The registration statement, including the attached exhibits and schedules, contains additional relevant information about us and the offered securities. This prospectus does not contain all of the information set forth in the registration statement, portions of which we have omitted as permitted by the rules and regulations of the SEC. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete. You should refer to the copy of each contract or document filed as an exhibit to the registration statement or incorporated by reference herein for a complete description. You can get a copy of the registration statement, at prescribed rates, from the sources listed above. You also may request a copy of any document incorporated by reference into this prospectus, at no cost, by writing or calling us at the following address: First NBC Bank Holding Company, 210 Baronne Street, New Orleans, LA 70112, (504) 671- 3870, Attention: William H. Roohi, Email: broohi@firstnbcbank.com.

2 INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE The SEC allows us to “incorporate by reference” information into this prospectus, which means: • incorporated documents are considered part of this prospectus; • we can disclose important information to you by referring you to those documents; and • information that we file later with the SEC automatically will update and supersede this incorporated information and information contained in this prospectus. This prospectus incorporates by reference the documents listed below that we have previously filed with the SEC (File No. 001-35915) under the Exchange Act: • our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 31, 2015, including the information in our proxy statement that is part of our Schedule 14A filed with the SEC on April 22, 2015, that is incorporated by reference in that Annual Report on Form 10-K, as amended by our Form 10-K/A filed with the SEC on June 17, 2015; • our Quarterly Report on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, filed with the SEC on May 8, 2015 and August 17, 2015, respectively; • our Current Reports on Form 8-K filed with the SEC on January 23, 2015; January 30, 2015; February 19, 2015; May 1, 2015; May 26, 2015 and June 24, 2015 (except, with respect to each of the foregoing, any for portions of the reports that were deemed to be furnished and not filed); and • the description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on May 7, 2013, and any other amendment or report filed for the purposes of updating that description. We also incorporate by reference any additional documents that we may file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (except, with respect to each of the foregoing, for any portions of the documents that were deemed to be furnished and not filed), from the date of the registration statement of which this prospectus is a part until the termination of the offering of the securities. These documents may include annual, quarterly and current reports, as well as proxy statements. These documents are available to you without charge. See “Where You Can Find More Information.” Any statement contained in a document incorporated by reference into this registration statement will be deemed to be modified or superseded to the extent that a statement contained in this registration statement, or in any other subsequently filed document that also is incorporated by reference into this registration statement, modifies or supersedes the prior statement. Any statement contained in this registration statement will be deemed to be modified or superseded to the extent that a statement contained in a subsequently filed document that is incorporated by reference in this registration statement modifies or supersedes such prior statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this registration statement. MARKET DATA In this prospectus and the documents incorporated by reference herein, we refer to information and statistics regarding our industry, the size of certain markets and our position within the sectors in which we compete. Some of the market and industry data contained in this prospectus and the documents incorporated by reference herein is based on industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information available to us, which information may be specific to particular markets or geographic locations. Some data is also based on our good faith estimates, which are derived from management's knowledge of the industry and independent sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe these sources are reliable, we have not independently verified the information. Statements as to

3 our market position are based on market data currently available to us. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

4 CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This prospectus, the documents incorporated by reference into this prospectus, and any prospectus supplement may contain forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements reflect our views as of the date of the statement with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or forward-looking nature. Accordingly, these forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that could cause our actual results to differ materially from results anticipated in these forward-looking statements. Because of these uncertainties, you should not rely on these forward-looking statements. Most of these factors are outside of our control and are difficult to predict. Important factors that could cause actual results to differ materially from the forward-looking statements include but are not limited to: • business and economic conditions generally and in the financial services industry, nationally and within our local market area; • changes in management personnel; • changes in government spending on rebuilding projects in New Orleans; • hurricanes, other natural disasters and adverse weather; oil spills and other man-made disasters; acts of terrorism, an outbreak of hostilities or other international or domestic calamities, acts of God and other matters beyond our control; • economic, market, operational, liquidity, credit and interest rate risks associated with our business; • deterioration of our asset quality; • changes in real estate values; • ability to execute our strategy; • increased competition in the financial services industry, nationally, regionally or locally, which may adversely affect pricing and terms; • our ability to identify potential candidates for, and consummate, acquisitions of banking franchises on attractive terms, or at all; • our ability to achieve organic loan and deposit growth and the composition of that growth; • changes in federal tax law or policy; • volatility and direction of market interest rates; • changes in the regulatory environment, including changes in regulations that affect the fees that we charge or expenses that we incur in connection with our operations; • changes in trade, monetary and fiscal policies and laws; • governmental legislation and regulation, including changes in accounting regulation or standards; • changes in interpretation of existing law and regulation; and • further government intervention in the U.S. financial system.

5 The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this prospectus, the documents incorporated by reference into this prospectus, and any prospectus supplement. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

6 ABOUT FIRST NBC BANK HOLDING COMPANY We are a financial holding company and a bank holding company headquartered in New Orleans, Louisiana, which offers a broad range of financial services through our wholly-owned banking subsidiary, First NBC Bank, a Louisiana state non-member bank. Our primary market is southeastern Louisiana, the Mississippi Gulf Coast, and the Florida panhandle. We serve our customers from our main office located in the Central Business District of New Orleans, 35 full service branch offices located throughout our market and a loan production office in Gulfport, Mississippi. We believe that our market exhibits attractive demographic attributes and presents favorable competitive dynamics, thereby offering long-term opportunities for growth. Our strategic focus is on building a franchise with meaningful market share and strong revenues complemented by operational efficiencies that we believe will produce attractive risk-adjusted returns for our shareholders. Our common stock is traded on the NASDAQ Global Select Market under the ticker symbol “FNBC.” Our principal executive office is located at 210 Baronne Street, New Orleans, Louisiana 70112, and our telephone number is (504) 566-8000. Our website address is www.firstnbcbank.com. The information contained on our website is not a part of, or incorporated by reference into, this prospectus. RISK FACTORS An investment in our securities involves certain risks. Before making an investment decision, you should carefully read and consider the risk factors set forth in our most recent Annual Report on Form 10-K filed with the SEC under the heading “Risk Factors,” as well as any updated or additional disclosure about risk factors included in any of our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K or other filings that we have made with the SEC since the date of our most recent Annual Report on Form 10-K that are incorporated by reference into this prospectus. We may also include specific risk factors in an applicable prospectus supplement under the heading “Risk Factors.” Additional risks and uncertainties of which we are not aware or that we believe are not material at the time could also materially and adversely affect our business, financial condition, results of operations or liquidity. In any case, the value of the securities offered by means of this prospectus and any applicable prospectus supplement could decline and you could lose all or part of your investment. USE OF PROCEEDS Unless otherwise indicated in the applicable prospectus supplement, we expect to use the net proceeds from the sale of offered securities by us for general corporate purposes, including: • maintenance of consolidated capital to support our growth, enabling us to continue to satisfy our regulatory capital requirements; • contributions of capital to First NBC Bank to support its growth, enabling it to continue to satisfy its regulatory capital requirements; • funding of acquisitions of financial institutions or other businesses or assets that are related to banking; • redeeming or repurchasing our Series D preferred stock; and • refinancing, reduction or repayment of debt The prospectus supplement with respect to an offering of offered securities may identify different or additional uses for the proceeds of that offering. Except as otherwise stated in an applicable prospectus supplement, pending the application of the net proceeds from the sale of offered securities, we expect to either deposit such net proceeds in deposit accounts or invest them in short-term obligations. We will not receive proceeds from sales of securities by selling securityholders, except as otherwise stated in an applicable prospectus supplement.

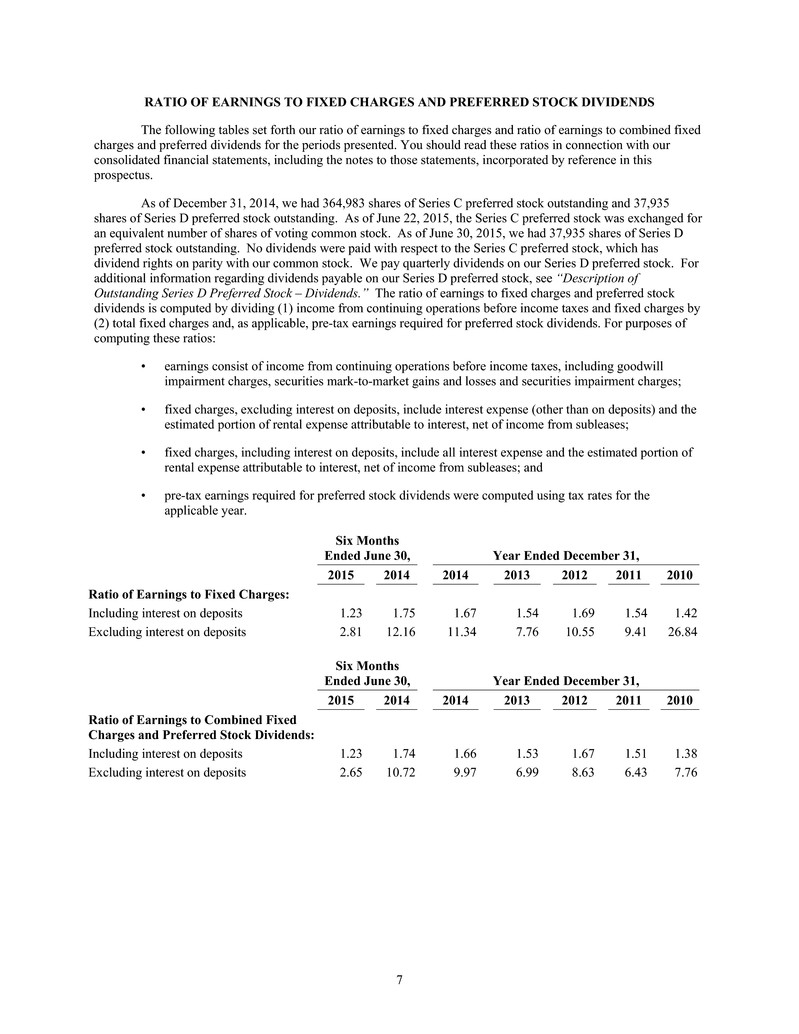

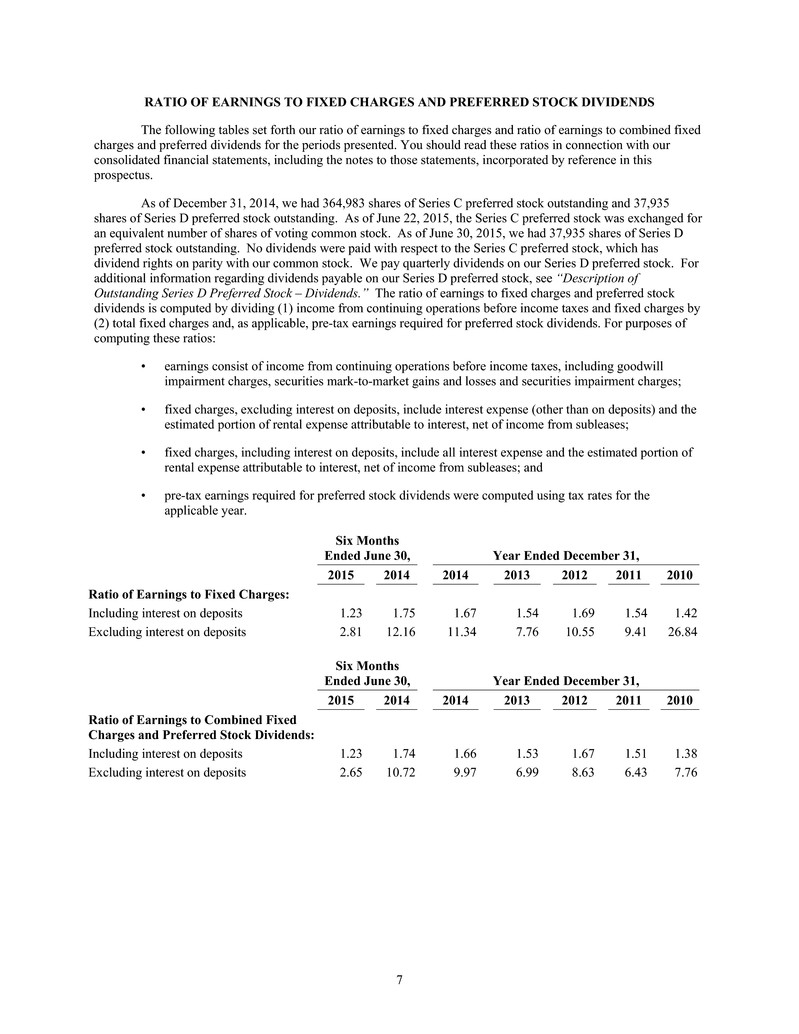

7 RATIO OF EARNINGS TO FIXED CHARGES AND PREFERRED STOCK DIVIDENDS The following tables set forth our ratio of earnings to fixed charges and ratio of earnings to combined fixed charges and preferred dividends for the periods presented. You should read these ratios in connection with our consolidated financial statements, including the notes to those statements, incorporated by reference in this prospectus. As of December 31, 2014, we had 364,983 shares of Series C preferred stock outstanding and 37,935 shares of Series D preferred stock outstanding. As of June 22, 2015, the Series C preferred stock was exchanged for an equivalent number of shares of voting common stock. As of June 30, 2015, we had 37,935 shares of Series D preferred stock outstanding. No dividends were paid with respect to the Series C preferred stock, which has dividend rights on parity with our common stock. We pay quarterly dividends on our Series D preferred stock. For additional information regarding dividends payable on our Series D preferred stock, see “Description of Outstanding Series D Preferred Stock – Dividends.” The ratio of earnings to fixed charges and preferred stock dividends is computed by dividing (1) income from continuing operations before income taxes and fixed charges by (2) total fixed charges and, as applicable, pre-tax earnings required for preferred stock dividends. For purposes of computing these ratios: • earnings consist of income from continuing operations before income taxes, including goodwill impairment charges, securities mark-to-market gains and losses and securities impairment charges; • fixed charges, excluding interest on deposits, include interest expense (other than on deposits) and the estimated portion of rental expense attributable to interest, net of income from subleases; • fixed charges, including interest on deposits, include all interest expense and the estimated portion of rental expense attributable to interest, net of income from subleases; and • pre-tax earnings required for preferred stock dividends were computed using tax rates for the applicable year. Six Months Ended June 30, Year Ended December 31, 2015 2014 2014 2013 2012 2011 2010 Ratio of Earnings to Fixed Charges: Including interest on deposits 1.23 1.75 1.67 1.54 1.69 1.54 1.42 Excluding interest on deposits 2.81 12.16 11.34 7.76 10.55 9.41 26.84 Six Months Ended June 30, Year Ended December 31, 2015 2014 2014 2013 2012 2011 2010 Ratio of Earnings to Combined Fixed Charges and Preferred Stock Dividends: Including interest on deposits 1.23 1.74 1.66 1.53 1.67 1.51 1.38 Excluding interest on deposits 2.65 10.72 9.97 6.99 8.63 6.43 7.76

8 SECURITIES WE MAY OFFER The descriptions of the securities contained in this prospectus, together with the applicable prospectus supplements, summarize certain material terms and provisions of the various types of securities that we or selling securityholders may offer. The particular material terms of the securities offered by a prospectus supplement, to the extent not described in this prospectus, will be described in that prospectus supplement. If indicated in the applicable prospectus supplement, the terms of the offered securities may differ from the terms summarized below. The prospectus supplement will also supplement, where applicable, material U.S. federal income tax considerations relating to the offered securities, and will contain information regarding the securities exchange, if any, on which the offered securities will be listed. The descriptions of our securities being offered appearing herein and in the applicable prospectus supplement do not contain all of the information that you may find useful or that may be important to you. You should refer to the provisions of the actual documents that govern those securities and whose terms are summarized herein and in the applicable prospectus supplement, because those documents, and not the summaries, define your rights as holders of the relevant securities. For more information, please review the forms of these documents, which are or will be filed with the SEC and will be available as described under the heading “Where You Can Find More Information.” We may offer and sell from time to time, in one or more offerings, the following: • our debt securities of one or more series, which debt securities may be our senior, unsecured debt securities or our subordinated, unsecured debt securities; • shares of our common stock; • shares of one or more series of our preferred stock other than shares of our outstanding Series D preferred stock; and/or • unit purchase agreements to which investors would acquire units of two or more of the foregoing securities. Selling securityholders may offer and sell from time to time, in one or more offerings, the following: • shares of our common stock; and/or • shares of our Series D preferred stock.

9 DESCRIPTION OF DEBT SECURITIES The debt securities we are offering will constitute senior debt securities or subordinated debt securities. The senior debt securities and the subordinated debt securities will be issued under separate indentures to be entered into between us and a bank or trust company, or other trustee that is qualified to act under the Trust Indenture Act of 1939, as amended, that we select to act as trustee. A copy of the form of each indenture will be filed as an exhibit to the registration statement of which this prospectus forms a part. We use the term “indentures” to refer to both the senior indenture and the subordinated indenture. The indentures may be modified by one or more supplemental indentures, which we will incorporate by reference as an exhibit to the registration statement of which this prospectus is a part. The following description and any description in a prospectus supplement is a summary only and is subject to, and qualified in its entirety by reference to the terms and provisions of the indentures and any supplemental indentures that we file with the SEC in connection with an issuance of any series of debt securities. You should read all of the provisions of the indentures, including the definitions of certain terms, as well as any supplemental indentures that we file with the SEC in connection with the issuance of any series of debt securities. These summaries set forth certain general terms and provisions of the securities to which any prospectus supplement may relate. The specific terms and provisions of a series of debt securities and the extent to which the general terms and provisions may also apply to a particular series of debt securities will be described in the applicable prospectus supplement. Since we are a holding company, our right, and accordingly, the right of our creditors and shareholders, including the holders of the securities offered by this prospectus and any prospectus supplement, to participate in any distribution of assets of any of our subsidiaries upon its liquidation, reorganization or similar proceeding is subject to the prior claims of creditors of that subsidiary, except to the extent that our claims as a creditor of the subsidiary may be recognized. Terms of the securities Unless otherwise described in a prospectus supplement, the following general terms and provisions will apply to the debt securities. The securities will be not be secured by any of our assets. Neither the indentures nor the securities will limit or otherwise restrict the amounts of other indebtedness which we may incur, or the amount of other securities that we may issue. All of the securities issued under each of the indentures will rank equally and ratably with any additional securities issued under the same indenture. The subordinated debt securities will be subordinated as described below under “Subordination.” Each prospectus supplement will specify the particular terms of the securities offered. These terms may include: • the title of the securities; • any limit on the aggregate principal amount of the securities; • the priority of payments on the securities; • the issue price or prices (which may be expressed as a percentage of the aggregate principal amount) of the securities; • the date or dates, or the method of determining the dates, on which the securities will mature; • the interest rate or rates of the securities, or the method of determining those rates; • the interest payment dates, the dates on which payment of any interest will begin and the regular record dates; • whether the securities will be issuable in temporary or permanent global form and, if so, the identity of the depositary for such global security, or the manner in which any interest payable on a temporary or permanent global security will be paid;

10 • any terms relating to the conversion of the securities into our common stock or preferred stock or other securities offered hereby; • any covenants that may restrict our ability to create, assume or guarantee indebtedness for borrowed money that is secured by a pledge, lien or other encumbrance, that condition or restrict our ability to merge or consolidate with any other person or to sell, lease or convey all or substantially all of our assets to any other person or that otherwise impose restrictions or requirements on us; • any sinking fund or similar provisions applicable to the securities; • any redemption provisions applicable to the securities; • the denomination or denominations in which securities are authorized to be issued; • whether any of the securities will be issued in bearer form and, if so, any limitations on issuance of such bearer securities; • information with respect to book-entry procedures; • each office or agency where securities may be presented for registration of transfer, exchange or conversion; • if other than the trustee, the identity of the registrar and/or paying agent; and • any other specific terms of the securities, which terms may modify or delete any provision of the applicable indenture insofar as it applies to the securities offered. However, no terms of the indentures may be modified or deleted if they are required under the Trust Indenture Act and any modification or deletion of the rights, duties or immunities of an indenture trustee will have been consented to in writing by the trustee. Some of our debt securities may be issued as original issue discount securities. Original issue discount securities bear no interest or bear interest at below-market rates and will be sold at a discount below their stated principal amount. The prospectus supplement will also contain any special tax, accounting or other information relating to original issue discount securities or relating to certain other kinds of securities that may be offered, including securities linked to an index. Acceleration of maturity If an event of default in connection with any outstanding series of securities occurs and is continuing, the trustee or the holders of at least 25% in principal amount of the outstanding securities of that series may declare the principal amount due and payable immediately. If the securities of that series are original issue discount securities, the holders of at least 25% in principal amount of those securities may declare the portion of the principal amount specified in the terms of that series of securities to be due and payable immediately. In either case, a written notice may be given to us, and to the trustee, if notice is given by the holders instead of the trustee. Subject to certain conditions, the declaration of acceleration may be revoked, and past defaults (except uncured payment defaults and certain other specified defaults) may be waived, by the holders of not less than a majority of the principal amount of securities of that series. You should refer to the prospectus supplement relating to each series of securities for the particular provisions relating to acceleration of the maturity upon the occurrence and continuation of an event of default. Registration and transfer Unless otherwise indicated in the applicable prospectus supplement, each series of the offered securities will be issued in registered form only, without coupons. The indentures will also allow us to issue the securities in bearer form only, or in both registered and bearer form. Any securities issued in bearer form will have interest coupons attached, unless they are issued as zero coupon securities. Securities in bearer form will not be offered,

11 sold, resold or delivered in connection with their original issuance in the United States or to any United States person other than to offices of certain United States financial institutions located outside the United States. Unless otherwise indicated in the applicable prospectus supplement, the senior debt securities and subordinated debt securities we are offering will be issued in denominations of $1,000 or an integral multiple of $1,000. No service charge will be made for any transfer or exchange of the securities, but we may require payment of an amount sufficient to cover any tax or other governmental charge payable in connection with a transfer or exchange. Payment and paying agent We will pay principal, interest and any premium on fully registered securities in the designated currency or currency unit at the office of a designated paying agent. At our option, payment of interest on fully registered securities may also be made by check mailed to the persons in whose names the securities are registered on the days specified in the indentures or any prospectus supplement. We will pay principal, interest and any premium on bearer securities in the designated currency or currency unit at the office of a designated paying agent or agents outside of the United States. Payments will be made at the offices of the paying agent in the United States only if the designated currency is U.S. dollars and payment outside of the United States is illegal or effectively precluded. If any amount payable on a security or coupon remains unclaimed at the end of two years after such amount became due and payable, the paying agent will release any unclaimed amounts, and the holder of the security or coupon will look only to us for payment. The designated paying agent in the United States for the securities we are offering is provided in the indentures that are or will be deemed incorporated by reference into this prospectus. Global securities The securities of a series may be issued in whole or in part in the form of one or more global certificates, or global securities, that will be deposited with a depositary that we will identify in a prospectus supplement. Global securities may be issued in either registered or bearer form and in either temporary or permanent form. All global securities in bearer form will be deposited with a depositary outside the United States. Unless and until it is exchanged in whole or in part for individual certificates evidencing securities in definitive form represented thereby, a global security may not be transferred except as a whole by the depositary to a nominee of that depositary or by a nominee of that depositary to a depositary or another nominee of that depositary. The specific terms of the depositary arrangements for each series of securities will be described in the applicable prospectus supplement. Modification and waiver Each indenture will provide that modifications and amendments may be made by us and the trustee with the consent of the holders of a majority in principal amount of the outstanding securities of each series affected by the amendment or modification. However, no modification or amendment may, without the consent of each holder affected: • change the stated maturity date of the security; • reduce the principal amount, any rate of interest, or any additional amounts in respect of any security, or reduce the amount of any premium payable upon the redemption of any security; • change the time or place of payment, currency or currencies in which any security or any premium or interest thereon is payable; • impair the holders' rights to institute suit for the enforcement of any payment on or after the stated maturity date of any security, or in the case of redemption, on or after the redemption date; • reduce the percentage in principal amount of securities required to consent to any modification, amendment or waiver under the indenture;

12 • modify, except under limited circumstances, any provision of the applicable indenture relating to modification and amendment of the indenture, waiver of compliance with conditions and defaults thereunder or the right of a majority of holders to take action under the applicable indenture; • adversely affect any rights of conversion; • in the case of the subordinated indenture, alter the provisions regarding subordination of the subordinated debt securities in any way that would be adverse to the holders of those securities; • reduce the principal amount of original issue discount securities which could be declared due and payable upon an acceleration of their maturity; or • change our obligation to pay any additional amounts. The holders of a majority in principal amount of the outstanding securities of any series may waive compliance by us and the trustee with certain provisions of the applicable indenture. The holders of a majority in principal amount of the outstanding securities of any series may waive any past default under the applicable indenture with respect to that series, except a default in the payment of the principal, or any premium, interest, or additional amounts payable on a security of that series or in respect of a covenant or provision which under the terms of the applicable indenture cannot be modified or amended, without the consent of each affected holder. With the trustee, we may modify and amend any indenture without the consent of any holder for any of the following purposes: • to name a successor entity to us; • to add to our covenants for the benefit of the holders of all or any series of securities; • to add to the events of default; • to add to, delete from or revise the conditions, limitations and restrictions on the authorized amount, terms or purposes of issue, authentication and delivery of securities, as set forth in the applicable indenture; • to establish the form or terms of securities of any series and any related coupons; • to provide for the acceptance of appointment by a successor trustee; • to make provision for the conversion rights of the holders of the securities in certain events; • to cure any ambiguity, defect or inconsistency in the applicable indenture, provided that such action is not inconsistent with the provisions of that indenture and does not adversely affect the interests of the applicable holders; • to modify, eliminate or add to the provisions of any indenture to conform our or the trustee's obligations under the applicable indenture to the Trust Indenture Act; or • to make any other changes that apply only to debt securities to be issued thereafter. Calculation of outstanding debt securities To calculate whether the holders of a sufficient principal amount of the outstanding securities have given any request, demand, authorization, direction, notice, consent or waiver under any indenture: • In the case of original issue discount securities, the principal amount that may be included in the calculation is the amount of principal that would be declared to be due and payable upon a declaration of acceleration according to the terms of that original issue discount security as of the date of the calculation.

13 • Any securities owned by us, or owned by any other obligor of the securities or any affiliate of ours or any other obligor, should be disregarded and deemed not to be outstanding for purposes of the calculation. Additional provisions Other than the duty to act with the required standard of care during an event of default, the trustee is not obligated to exercise any of its rights or powers under the applicable indenture at the request or direction of any of the holders of the securities, unless the holders have offered the trustee reasonable indemnification. Each indenture provides that the holders of a majority in principal amount of outstanding securities of any series may, in certain circumstances, direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or other power conferred on the trustee. No holder of a security of any series will have the right to institute any proceeding for any remedy under the applicable indenture, unless: • the holder has provided the trustee with written notice of a continuing event of default regarding the holder's series of securities; • the holders of at least 25% in principal amount of the outstanding securities of a series have made a written request, and offered indemnity satisfactory to the trustee, to the trustee to institute a proceeding for remedy; • the trustee has failed to institute the proceeding within 60 days after its receipt of such notice, request and offer of indemnity; and • the trustee has not received a direction during such 60 day period inconsistent with such request from the holders of a majority in principal amount of the outstanding securities of that series. However, the holder of any security will have an absolute and unconditional right to receive payment of the principal, any premium, any interest or any additional amounts in respect of such security on or after the date expressed in such security and to institute suit for the enforcement of any such payment. We are required to file annually with the trustee a certificate of no default, or specifying any default that exists. Transactions with the trustee We and our subsidiaries may maintain deposit accounts and conduct various banking and other transactions with an indenture trustee. The trustee and its subsidiaries may maintain deposit accounts and conduct various banking transactions with us and our subsidiaries. Conversion rights The applicable prospectus supplement relating to any convertible debt securities will describe the terms on which those securities are convertible. Events of default The following will be events of default under the indenture with respect to the senior debt securities of a series: • failure to pay any interest or any additional amounts on any senior debt security of that series when due, and continuance of such default for 30 days; • failure to pay principal of, or any premium on, any senior debt security of that series when due; • failure to deposit any sinking fund payment for a senior debt security of that series when due;

14 • failure to perform any of our other covenants or warranties in the senior indenture or senior debt securities (other than a covenant or warranty included in that indenture solely for the benefit of a different series of senior debt securities), which has continued for 90 days after written notice as provided in the senior indenture; • acceleration of indebtedness in a principal amount specified in a supplemental indenture for money borrowed by us under the senior indenture, and the acceleration is not annulled, or the indebtedness is not discharged, within a specified period after written notice is given according to the senior indenture; • certain events in bankruptcy, insolvency or reorganization of us or First NBC Bank; and • any other event of default regarding that series of senior debt securities. Unless otherwise described in the prospectus supplement applicable to a particular series of subordinated debt securities, events of default under the subordinated indenture are limited to certain events of bankruptcy, insolvency or reorganization of us or First NBC Bank. There will be no right of acceleration of the payment of principal of a series of subordinated debt securities upon a default in the payment of principal or interest, nor upon a default in the performance of any covenant or agreement in the subordinated debt securities of a particular series or in the applicable indenture. In the event of a default in the payment of interest or principal, the holders of senior debt will be entitled to be paid in full before any payment can be made to holders of subordinated debt securities. However, a holder of a subordinated debt security (or the trustee under the applicable indenture on behalf of all of the holders of the affected series) may, subject to certain limitations and conditions, seek to enforce overdue payments of interest or principal on the subordinated debt securities. Subordination The senior debt securities will be unsecured and will rank equally among themselves and with all of our other unsecured and non-subordinated debt, if any. The subordinated debt securities will be unsecured and will be subordinate and junior in right of payment, to the extent and in the manner set forth below, to the prior payment in full of all of our senior debt, as more fully described in the applicable prospectus supplement. If any of the following circumstances has occurred, payment in full of all principal, premium, if any, and interest must be made or provided for with respect to all outstanding senior debt before we can make any payment or distribution of principal, premium, if any, any additional amounts or interest on the subordinated debt securities • any insolvency, bankruptcy, receivership, liquidation, reorganization or other similar proceeding relating to us or to our property has been commenced; • any voluntary or involuntary liquidation, dissolution or other winding up relating to us has been commenced, whether or not such event involves our insolvency or bankruptcy; • any of our subordinated debt security of any series is declared or otherwise becomes due and payable before its maturity date because of any event of default under the subordinated indenture, provided that such declaration has not been rescinded or annulled as provided in the subordinated indenture; or • any default with respect to senior debt which permits its holders to accelerate the maturity of the senior debt has occurred and is continuing, and either (1) notice of such default has been given to us and to the trustee and judicial proceedings are commenced in respect of such default within 180 days after notice in the case of a default in the payment of principal or interest, or within 90 days after notice in the case of any other default, or (2) any judicial proceeding is pending with respect to any such default.

15 DESCRIPTION OF COMMON STOCK General The following summarizes some of the important rights of the holders of shares of our common stock. This discussion does not purport to be a complete description of these rights. These rights can be determined in full only by reference to federal and state banking laws and regulations, the Louisiana Business Corporation Act, or the LBCA, and our articles of incorporation and bylaws. Our authorized capital stock consists of 100,000,000 shares of common stock, par value $1.00 per share, and 10,000,000 shares of preferred stock, no par value $0.01 per share. As of August 7, 2015, 19,021,969 shares of our common stock were issued and outstanding, all of which were fully paid and nonassessable. As of August 7, 2015, we had approximately 255 holders of record of our common stock. The authorized but unissued shares of our capital stock will be available for future issuance without shareholder approval, unless otherwise required by applicable law or the rules of the NASDAQ Global Select Market. You should refer to the prospectus supplement relating to the shares of our common stock being offered for sale for the number of shares of our common stock being offered and the price per share to the public at which such shares of common stock are being offered. Voting rights Each holder of our common stock is entitled to one vote for each share on all matters submitted to the shareholders, except as otherwise required by law and subject to the rights and preferences of the holders of any outstanding shares of our preferred stock. Holders of our common stock are not entitled to cumulative voting in the election of directors. Accordingly, holders of 50% or more of the shares voting will be able to elect all of the directors. Except as otherwise required by law or our articles of incorporation, a majority of votes actually cast will decide any matter properly brought before the shareholders at a meeting at which a quorum is present, except that directors are elected by plurality of the votes actually cast. Dividends and other distributions Holders of our common stock are entitled to share equally in dividends from legally available funds, when, as, and if declared by our Board of Directors. We have not paid any dividends on our common stock since inception. Instead, we have retained all of our earnings to support growth and build capital. Any future declaration and payment of dividends on our common stock would depend upon our earnings and financial condition, liquidity and capital requirements, the general economic and regulatory climate in which we operate, our ability to service any equity or debt obligations senior to our common stock and other factors deemed relevant by our Board of Directors. Upon any voluntary or involuntarily liquidation, dissolution or winding up of our affairs, all shares of our common stock would be entitled to share equally in all of our remaining assets available for distribution to our shareholders after payment of creditors and subject to any prior distribution rights related to our preferred stock. Our ability to pay dividends on our common stock is also subject to certain limitations based on the terms of our Series D preferred stock. Under its terms, we may not pay any dividends or make any other cash distributions on our common stock or repurchase or redeem any of our shares of our capital stock, including any equity securities or trust preferred securities issued by us or any of our affiliates, unless after giving effect to such repurchase or redemption, our tier 1 capital would be at least equal to the tier 1 dividend threshold, which is defined below in the section titled “Description of Outstanding Series D Preferred Stock – Restrictions on dividends and repurchases,” and all dividends have been paid on the Series D preferred stock for the most recently completed quarterly dividend period (or sufficient funds have been reserved). Other Our common stock has no preemptive or conversion rights and is not entitled to the benefits of any redemption or sinking fund provision.

16 NASDAQ listing Our common stock is listed on the NASDAQ Global Select Market under the symbol “FNBC.” Selected provisions of our articles of incorporation and bylaws Protective provisions. Certain provisions of our articles of incorporation and bylaws highlighted below may have anti-takeover effects and may delay, prevent or make more difficult unsolicited tender offers or takeover attempts that a shareholder may consider to be in his or her best interest, including those attempts that might result in a premium over the market price for the shares held by shareholders. These provisions may also have the effect of making it more difficult for third parties to cause the replacement of our current management. Among other things, our articles of incorporation and bylaws: • enable our Board of Directors to issue “blank check” preferred stock up to the authorized amount, with such preferences, limitations and relative rights, including voting rights, as may be determined from time to time by the Board; • require an 80% vote of our shareholders to repeal the sections of our articles of incorporation addressing limitation of liability and indemnification of our officers and directors; • enable our Board of Directors to increase, between annual meetings, the number of persons serving as directors and to fill the vacancies created as a result of the increase by a majority vote of the directors present at the meeting; • enable our Board of Directors to amend our bylaws without shareholder approval; • do not provide for cumulative voting rights (therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose); • require the written request of the holders of not less than two-thirds of the holders of all issued and outstanding stock entitled to vote at a meeting (as validated by the Board of Directors) to call a special shareholders’ meeting; and • establish an advance notice procedure with regard to business to be brought before an annual or special meeting of shareholders and with regard to the nomination of candidates for election as directors, other than by or at the direction of the Board of Directors. In addition, the corporate laws and regulations applicable to us enable our Board of Directors to issue, from time to time and at its discretion, but subject to any rules of the NASDAQ Global Select Market, any authorized but unissued shares of our common or preferred stock. The ability of our Board of Directors to issue authorized but unissued shares of our common or preferred stock at its sole discretion may enable our Board to sell shares to individuals or groups who the Board perceives as friendly with management, which may make more difficult unsolicited attempts to obtain control of our organization. In addition, the ability of our Board of Directors to issue authorized but unissued shares of our capital stock at its sole discretion could deprive the shareholders of opportunities to sell their shares of common stock or preferred stock for prices higher than prevailing market prices. Although our bylaws do not give our Board of Directors any power to approve or disapprove shareholder nominations for the election of directors or proposals for action, they may have the effect of precluding a contest for the election of directors or the consideration of shareholder proposals if the established procedures are not followed, and of discouraging or deterring a third party from conducting a solicitation of proxies to elect its own slate of directors or to approve its proposal without regard to whether consideration of the nominees or proposals might be harmful or beneficial to our shareholders and us. Indemnification. Our articles of incorporation provide generally that we will indemnify and hold harmless, to the fullest extent permitted by Louisiana law, our respective directors and officers, as well as other persons who have served as directors, officers, fiduciaries or in other representative capacities, serving at our request in connection with any actual or threatened action, proceeding or investigation, subject to limited exceptions. To the

17 extent that indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons, we have been advised that, in the opinion of the SEC, this indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. Finally, our ability to provide indemnification to our directors and officers is limited by federal banking laws and regulations. Limitation of liability. Our articles of incorporation limit the personal liability of our directors in actions brought on our behalf or on behalf of our shareholders for monetary damages as a result of a director’s acts or omissions while acting in a capacity as a director, with certain exceptions. Our articles of incorporation do not eliminate or limit our right or the right of our shareholders to seek injunctive or other equitable relief not involving monetary damages. Shareholder action upon written consent. Our articles of incorporation provide that any action required or permitted by law to be taken at a meeting of our shareholders may be taken without a meeting, without prior notice, and without a vote, if a written consent setting forth the action taken is signed by the holders of shares representing not less than the minimum number of votes that would be necessary to take such action at a meeting at which all shares entitled to vote were present and voted. Transfer agent and registrar The transfer agent and registrar for our common stock is Computershare Shareholder Services, 250 Royall St., Canton, Massachusetts 02021.

18 DESCRIPTION OF PREFERRED STOCK The following description is a general summary of the terms of the preferred stock that we may issue. The description below and in any prospectus supplement relating to the offer for sale of shares of a series of our preferred stock does not purport to be complete and is subject to and qualified in its entirety by reference to our articles of incorporation, the applicable amendment to our articles of incorporation establishing the terms of the series of preferred stock being offered for sale by means of a prospectus supplement, and our bylaws, each of which we will make available upon request. See “Where You Can Find More Information” for additional information. General We are authorized to issue 10,000,000 shares of preferred stock, no par value per share. As of August 7, 2015, 37,935 shares of our Series D preferred stock were issued and outstanding. Our articles of incorporation permit us to issue one or more series of preferred stock and authorize our Board of Directors to designate the preferences, limitations and relative rights of any such series of preferred stock. Each share of a series of preferred stock will have the same relative rights as, and be identical in all respects with, all the other shares of the same series. Preferred stock may have voting rights, subject to applicable law and determination at issuance of our Board of Directors. While the terms of preferred stock may vary from series to series, common shareholders should assume that all shares of preferred stock will be senior to our common stock in respect of distributions and on liquidation. Although the creation and authorization of preferred stock does not, in and of itself, have any effect on the rights of the holders of our common stock, the issuance of one or more series of preferred stock may affect the holders of common stock in a number of respects, including the following: by subordinating our common stock to the preferred stock with respect to dividend rights, liquidation preferences, and other rights, preferences, and privileges; by diluting the voting power of our common stock; by diluting the earnings per share of our common stock; and by issuing common stock, upon the conversion of the preferred stock, at a price below the fair market value or original issue price of the common stock that is outstanding prior to such issuance. Terms of the preferred stock that we may offer You should refer to the prospectus supplement relating to the shares of one or more series of preferred stock being offered for sale for the specific terms of that series, including: • the title of the series being offered and the price per share at which the shares are being offered to the public; • the number of shares of the series; • the liquidation preference per share of the series; • the dividend rate(s), period(s) and/or payment date(s) or method(s) of calculating the payment date(s) applicable to the shares of the series; • whether dividends will be cumulative or noncumulative and, if cumulative, the date from which dividends will accumulate; • the procedures for any auction and remarketing, if any, for the shares; • the provisions for redemption, if applicable, of the shares of preferred stock being offered; • any listing of the shares of preferred stock being offered on any securities exchange or market; • the terms and conditions, if applicable, upon which the shares of preferred stock being offered will be convertible into or exchangeable for other securities or rights, or a combination of the foregoing, including the name of the issuer of the securities or rights, conversion or exchange ratio or price, or the

19 manner of calculating the conversion or exchange ratio or price, and the conversion or exchange date(s) or period(s) and whether we will have the option to convert such preferred stock into cash; • voting rights, if any, of the shares of preferred stock being offered; • a discussion of any material and/or special United States federal income tax considerations applicable to the shares of preferred stock being offered; • the relative ranking and preferences of the shares of preferred stock being offered as to dividend rights to participate in our assets and rights upon winding up or termination of our affairs; • any limitations on the issuance of any series of preferred stock ranking senior to or equally with the series of preferred stock being offered as to dividend rights and rights to participate in our assets upon winding up or termination of our affairs; and • any other specific terms, preferences, rights, limitations or restrictions pertaining to the series. Ranking Unless otherwise specified in the prospectus supplement relating to the shares of a series of preferred stock, the shares will rank on an equal basis with each other series of preferred stock and prior to the common stock as to dividends and distributions of assets. Distributions Holders of the preferred stock of each series will be entitled to receive, when, as and if declared by our Board of Directors, out of our assets legally available for payment to shareholders, cash distributions, or distributions in kind or in other property if expressly permitted and described in the applicable prospectus supplement, at the rates and on the dates as we will set forth in such prospectus supplement. We will pay each distribution to holders of record as they appear on our stock transfer books on the record dates determined by our Board of Directors or as set forth in the statement of designation for such series of preferred stock. Distributions on any series of preferred stock may be cumulative or non-cumulative. If any shares of preferred stock of any series are outstanding, no full dividends will be declared or paid or set apart for payment on our preferred stock of any other class or series ranking, as to dividends, equally with or junior to the preferred stock of such series of preferred stock for any period unless all required dividends are paid. The phrase “all required dividends are paid” when used in this prospectus with respect to a series of preferred stock means that: • if the series of preferred stock has a cumulative dividend, full cumulative dividends on the preferred stock of the series have been or contemporaneously are declared and paid or declared and a sum sufficient for the payment is set apart for payment for all past dividend periods and the then current dividend period, or • if the series of preferred stock does not have a cumulative dividend, full dividends on the preferred stock of the series have been or contemporaneously are declared and paid or declared and a sum sufficient for the payment is set apart for the payment for the then current dividend period. When dividends are not paid in full, or a sum sufficient for the full payment is not so set apart, upon the shares of preferred stock of any series and the shares of any other series of preferred stock ranking equally as to dividends with the preferred stock of the series, all dividends declared upon shares of preferred stock of the series and any other series of preferred stock ranking equally as to dividends with the preferred stock will be declared equally so that the amount of dividends declared per share on the preferred stock of the series and the other series of preferred stock will in all cases bear to each other the same ratio that accrued and unpaid dividends per share on the shares of preferred stock of the series, which will not include any accumulation in respect of unpaid dividends for prior dividend periods if the preferred stock does not have cumulative dividend, and the other series of preferred

20 stock bear to each other. No interest, or sum of money in lieu of interest, will be payable in respect of any dividend payment or payments on preferred stock of the series which may be in arrears. Except as provided in the immediately preceding paragraph, unless all required dividends are paid, no dividends, other than in common stock or other stock ranking junior to the preferred stock of the series as to dividends and participation in our assets upon our winding up or termination, will be declared or paid or set aside for payment or other distribution will be declared or made upon our common stock or any of our other capital stock ranking junior or equally with the preferred stock of the series as to dividends or participation in our assets upon our winding up or termination, nor will any common stock or any of our other capital stock ranking junior to or equally with preferred stock of the series as to dividends or participation in our assets upon our winding up or termination be redeemed, purchased or otherwise acquired for any consideration, or any moneys be paid to or made available for a sinking fund for the redemption of any shares of any stock, by us except by conversion into or exchange for our other stock ranking junior to the preferred stock of the series as to dividends and participation in our assets upon our winding up or termination. Any dividend payment made on shares of a series of preferred stock will first be credited against the earliest accrued but unpaid dividend due with respect to shares of the series that remains payable. Redemption If so provided in the applicable prospectus supplement, the preferred stock will be subject to mandatory redemption or redemption at our option, in whole or in part, in each case upon the terms and notice, at the times and at the redemption prices set forth in the prospectus supplement. The prospectus supplement relating to the offer for sale of shares of a series of preferred stock that is subject to mandatory redemption will specify the required notice and the number of shares of the preferred stock that will be redeemed by us in each year commencing after a date to be specified, at a redemption price per share to be specified, together with an amount equal to all accumulated and unpaid dividends thereon, which will not, if the shares of that series of preferred stock does not have a cumulative dividend, include an accumulation in respect of unpaid dividends for prior dividends periods, to the date of redemption. The redemption price may be payable in cash or other property, as specified in the applicable prospectus supplement. If the redemption price for preferred stock of any series is payable only from the net proceeds of the issuance of our stock, the terms of the shares of that series of preferred stock may provide that, if no stock will have been issued or to the extent the net proceeds from any issuance are insufficient to pay in full the aggregate redemption price then due, the preferred stock will automatically and mandatorily be converted into shares of our applicable stock in accordance with any conversion provisions specified in the applicable prospectus supplement. Notwithstanding the foregoing, unless provided otherwise for any series of preferred stock, unless all required dividends are paid: • no shares of the applicable series of preferred stock will be redeemed unless all outstanding shares of preferred stock of the series are simultaneously redeemed, and • we will not purchase or otherwise acquire directly or indirectly any shares of the applicable series of preferred stock except by conversion into or exchange for stock ranking junior to the preferred stock of the series as to dividends and upon our winding up or termination. Liquidation preference Upon any voluntary or involuntary winding up or termination of our affairs as a company, then, before any distribution or payment will be made to the holders of any common stock or any other class or series of shares of our capital stock ranking junior to the shares of a series of the preferred stock in the right to participate in the distribution of assets upon our winding up or termination, the holders of shares of each series of preferred stock will be entitled to receive out of our assets legally available for distribution to shareholders liquidating distributions in the amount of the liquidation preference set forth in the applicable prospectus supplement, plus an amount equal to all accumulated and unpaid distributions. After payment of the full amount of the liquidating distributions to which they are entitled, the holders of shares of such series of preferred stock will have no right or claim to any of our