UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-22452

-----------

First Trust Series Fund

-------------------------------------------------------

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

-------------------------------------------------------

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

-------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 765-8000

----------------

Date of fiscal year end: October 31

------------

Date of reporting period: October 31, 2017

------------------

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 100 F Street, NE,

Washington, DC 20549. The OMB has reviewed this collection of information under

the clearance requirements of 44 U.S.C. ss. 3507.

<PAGE>

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

FIRST TRUST

First Trust Preferred

Securities and Income Fund

-----------------------------------------

Annual Report

For the Year Ended

October 31, 2017

STONEBRIDGE

Advisors LLC

<PAGE>

--------------------------------------------------------------------------------

TABLE OF CONTENTS

--------------------------------------------------------------------------------

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

ANNUAL REPORT

OCTOBER 31, 2017

Shareholder Letter........................................................... 1

At a Glance.................................................................. 2

Portfolio Commentary......................................................... 4

Understanding Your Fund Expenses............................................. 6

Portfolio of Investments..................................................... 7

Statement of Assets and Liabilities.......................................... 13

Statement of Operations...................................................... 14

Statements of Changes in Net Assets.......................................... 15

Financial Highlights......................................................... 16

Notes to Financial Statements................................................ 21

Report of Independent Registered Public Accounting Firm...................... 28

Additional Information....................................................... 29

Board of Trustees and Officers............................................... 33

Privacy Policy............................................................... 35

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements within the meaning of

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934,

as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. ("First

Trust" or the "Advisor") and/or Stonebridge Advisors LLC ("Stonebridge" or the

"Sub-Advisor") and their respective representatives, taking into account the

information currently available to them. Forward-looking statements include all

statements that do not relate solely to current or historical fact. For example,

forward-looking statements include the use of words such as "anticipate,"

"estimate," "intend," "expect," "believe," "plan," "may," "should," "would" or

other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and

other factors that may cause the actual results, performance or achievements of

First Trust Preferred Securities and Income Fund (the "Fund") to be materially

different from any future results, performance or achievements expressed or

implied by the forward-looking statements. When evaluating the information

included in this report, you are cautioned not to place undue reliance on these

forward-looking statements, which reflect the judgment of the Advisor and/or

Sub-Advisor and their respective representatives only as of the date hereof. We

undertake no obligation to publicly revise or update these forward-looking

statements to reflect events and circumstances that arise after the date hereof.

PERFORMANCE AND RISK DISCLOSURE

There is no assurance that the Fund will achieve its investment objective. The

Fund is subject to market risk, which is the possibility that the market values

of securities owned by the Fund will decline and that the value of Fund shares

may therefore be less than what you paid for them. Accordingly, you can lose

money by investing in the Fund. See "Risk Considerations" in the Additional

Information section of this report for a discussion of certain other risks of

investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of

future results, and current performance may be lower or higher than the figures

shown. For the most recent month-end performance figures, please visit

http://www.ftportfolios.com or speak with your financial advisor. Investment

returns and net asset value will fluctuate and Fund shares, when sold, may be

worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund

performance on the Fund's webpage at http://www.ftportfolios.com.

HOW TO READ THIS REPORT

This report contains information that may help you evaluate your investment in

the Fund. It includes details about the Fund and presents data and analysis that

provide insight into the Fund's performance and investment approach.

By reading the portfolio commentary from the Sub-Advisor of the Fund, you may

obtain an understanding of how the market environment affected the Fund's

performance. The statistical information that follows may help you understand

the Fund's performance compared to that of relevant market benchmarks.

It is important to keep in mind that the opinions expressed by the Sub-Advisor

are just that, informed opinions. They should not be considered to be promises

or advice. The opinions, like the statistics, cover the period through the date

on the cover of this report. The material risks of investing in the Fund are

spelled out in the prospectus, the statement of additional information, this

report and other Fund regulatory filings.

<PAGE>

--------------------------------------------------------------------------------

SHAREHOLDER LETTER

--------------------------------------------------------------------------------

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

ANNUAL LETTER FROM THE CHAIRMAN AND CEO

OCTOBER 31, 2017

Dear Shareholders:

Thank you for your investment in First Trust Preferred Securities and Income

Fund.

First Trust is pleased to provide you with the annual report which contains

detailed information about your investment for the 12 months ended October 31,

2017, including a market overview and a performance analysis for the period. We

encourage you to read this report carefully and discuss it with your financial

advisor.

The U.S. bull market continued through the November 2016 election and the first

nine months of the Trump presidency. During that period, November 8, 2016

(Election Day 2016) through October 31, 2017, the S&P 500(R) Index (the "Index")

posted a total return of 22.73%, according to Bloomberg. Ten of the eleven Index

sectors were up on a total return basis as well. Since the beginning of 2017

through October 31, 2017, the Index has closed its trading sessions at all-time

highs on 50 occasions. Finally, as of October 31, 2017, the Index has spent the

entire year in positive territory. This has only happened in 10 different years

over the past seven decades.

The current bull market, as measured from March 9, 2009 through October 31,

2017, is the second longest in history. While we are optimistic about the U.S.

economy, we are also aware that no one can predict the future or know how

markets will perform in different economic environments. We believe that one

should invest for the long term and be prepared for market volatility by keeping

current on your portfolio and investing goals by speaking regularly with your

investment professional. It is also important to keep in mind that past

performance can never guarantee future results.

Thank you for giving First Trust the opportunity to be a part of your investment

plan. We value our relationship with you and will continue to focus on bringing

the types of investments that we believe can help you reach your financial

goals.

Sincerely,

/s/ James A. Bowen

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

Page 1

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

"AT A GLANCE"

AS OF OCTOBER 31, 2017 (UNAUDITED)

-----------------------------------------------------------

FUND STATISTICS

-----------------------------------------------------------

FIRST TRUST PREFERRED SECURITIES NET ASSET

AND INCOME FUND VALUE (NAV)

-----------------------------------------------------------

Class A (FPEAX) $22.39

Class C (FPECX) $22.44

Class F (FPEFX) $22.62

Class I (FPEIX) $22.49

Class R3 (FPERX) $22.35

-----------------------------------------------------------

-----------------------------------------------------------

% OF TOTAL

TOP TEN HOLDINGS INVESTMENTS

-----------------------------------------------------------

Liberty Mutual Group, Inc. 2.2%

Bank of America Corp., Series DD 2.0

Enel S.p.A. 1.9

Farm Credit Bank of Texas, Series 1 1.9

Wells Fargo & Co., Series K 1.8

Zions Bancorporation, Series J 1.8

Barclays PLC 1.8

Aquarius & Investments PLC for Swiss

Reinsurance Co., Ltd. 1.7

Enbridge Energy Partners 1.7

Credit Agricole S.A. 1.7

------

Total 18.5%

======

-----------------------------------------------------------

% OF TOTAL

SECTOR ALLOCATION INVESTMENTS

-----------------------------------------------------------

Financials 77.3%

Utilities 6.1

Energy 5.3

Consumer Staples 4.0

Real Estate 3.9

Industrials 2.5

Materials 0.5

Telecommunication Services 0.4

------

Total 100.0%

======

-----------------------------------------------------------

% OF TOTAL

CREDIT QUALITY(1) INVESTMENTS

-----------------------------------------------------------

A+ 0.4%

A 2.3

A- 2.3

BBB+ 12.0

BBB 16.5

BBB- 20.9

BB+ 23.3

BB 9.6

BB- 6.3

B+ 2.5

B 0.1

Not Rated 3.8

------

Total 100.0%

======

<TABLE>

<CAPTION>

------------------------------------------------------------------------------------------------------------------------

CLASS CLASS CLASS CLASS CLASS

DIVIDEND DISTRIBUTIONS A SHARES C SHARES F SHARES I SHARES R3 SHARES

------------------------------------------------------------------------------------------------------------------------

<S> <C> <C> <C> <C> <C>

Current Monthly Distribution per Share(2) $0.0954 $0.0814 $0.0972 $0.1000 $0.0908

Current Distribution Rate on NAV(3) 5.11% 4.35% 5.16% 5.34% 4.88%

</TABLE>

(1) The credit quality and ratings information presented above reflects the

ratings assigned by one or more nationally recognized statistical rating

organizations (NRSROs), including Standard & Poor's Ratings Group, a

division of The McGraw-Hill Companies, Inc., Moody's Investors Service,

Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a

security is rated by more than one NRSRO and the ratings are not

equivalent, the highest rating is used. Sub-investment grade ratings are

those rated BB+/Ba1 or lower. Investment grade ratings are those rated

BBB-/Baa3 or higher. The credit ratings shown relate to the

creditworthiness of the issuer of the underlying securities in the Fund

and not the Fund or its shares. Credit ratings are subject to change.

(2) Most recent distribution paid or declared through 10/31/17. Subject to

change in the future.

(3) Distribution rates are calculated by annualizing the most recent

distribution paid or declared through the report date and then dividing by

NAV as of 10/31/2017. Subject to change in the future.

Page 2

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

"AT A GLANCE" (CONTINUED)

AS OF OCTOBER 31, 2017 (UNAUDITED)

-----------------------------------------------------------

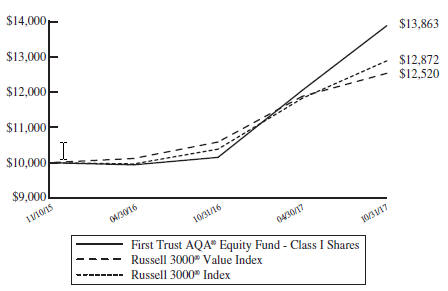

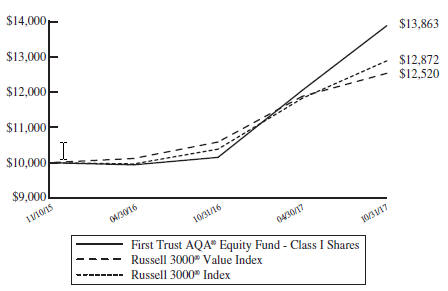

PERFORMANCE OF A $10,000 INVESTMENT

-----------------------------------------------------------

This chart compares your Fund's Class I performance to that

of the ICE BofAML Fixed Rate Preferred Securities Index,

the ICE BofAML U.S. Capital Securities Index and the Blended

Index(a) from 1/11/2011 through 10/31/2017.

<TABLE>

<CAPTION>

First Trust Preferred ICE BofAML Fixed Rate ICE BofAML U.S.

Securities and Income Preferred Securities Capital Securities Blended

Fund - Class I Shares Index ("POP1") Index ("C0CS") Index (a)

<S> <C> <C> <C> <C>

1/11/11 $10,000 $10,000 $10,000 $10,000

4/30/11 10,393 10,454 10,484 10,469

10/31/11 10,521 10,521 10,138 10,330

4/30/12 11,475 11,142 10,861 11,002

10/31/12 12,398 11,847 11,958 11,903

4/30/13 12,931 12,288 12,651 12,470

10/31/13 11,894 11,553 12,711 12,132

4/30/14 12,715 12,485 13,445 12,965

10/31/14 13,163 12,992 13,899 13,446

4/30/15 13,693 13,573 14,391 13,987

10/31/15 13,862 13,965 14,123 14,056

4/30/16 14,101 14,480 14,365 14,436

10/31/16 15,009 14,975 15,157 15,080

4/30/17 15,572 15,421 15,451 15,451

10/31/17 16,409 15,959 16,152 16,072

</TABLE>

(a) The Blended Index return is 50/50 split between the ICE BofAML Fixed Rate

Preferred Securities Index and ICE BofAML U.S. Capital Securities Index.

<TABLE>

<CAPTION>

------------------------------------------------------------------------------------------------------------------------------------

PERFORMANCE AS OF OCTOBER 31, 2017

------------------------------------------------------------------------------------------------------------------------------------

A SHARES C SHARES F SHARES I SHARES R3 SHARES BLENDED P0P1* C0CS*

Inception Inception Inception Inception Inception INDEX* ICE BofAML ICE BofAML

2/25/2011 2/25/2011 3/2/2011 1/11/2011 3/2/2011 Fixed Rate U.S. Capital

Preferred Securities

Securities Index(1) Index(2)

------------------------------------------------------------------------------------------------------------------------------------

W/MAX

1.00%

W/MAX CONTINGENT

W/O 4.50% W/O DEFERRED W/O W/O W/O W/O W/O W/O

CUMULATIVE SALES SALES SALES SALES SALES SALES SALES SALES SALES SALES

TOTAL RETURNS CHARGES CHARGE CHARGES CHARGE CHARGES CHARGES CHARGES CHARGES CHARGES CHARGES

<S> <C> <C> <C> <C> <C> <C> <C> <C>

1 Year 9.05% 4.15% 8.27% 7.27% 9.27% 9.39% 8.70% 6.58% 6.58% 6.57%

AVERAGE ANNUAL

TOTAL RETURNS

5 Year 5.50% 4.53% 4.72% 4.72% 5.61% 5.79% 5.21% 6.18% 6.14% 6.19%

Since Inception 7.19% 6.45% 6.41% 6.41% 7.36% 7.57% 6.81% 7.22% 7.11% 7.30%

30-Day SEC Yield(3) 4.14% 3.36% 4.45% 4.36% 3.14% N/A N/A N/A

------------------------------------------------------------------------------------------------------------------------------------

</TABLE>

* Since inception return is based on the Class I Shares inception date.

Performance figures assume reinvestment of all distributions and do not reflect

the deduction of taxes that the shareholder would pay on Fund distributions or

the redemption of Fund shares. The total returns would have been lower if

certain fees had not been waived and expenses reimbursed by the Advisor and

Sub-Advisor. An index is a statistical composite that tracks a specific

financial market or sector. Unlike the Fund, these indices do not actually hold

a portfolio of securities and therefore do not incur the expenses incurred by

the Fund. These expenses negatively impact the performance of the Fund. The

Fund's past performance does not predict future performance.

Performance of share classes will vary due to differences in sales charges and

expenses. Total return with sales charges includes payment of the maximum sales

charge of 4.50% for Class A Shares, a contingent deferred sales charge ("CDSC")

of 1.00% for Class C Shares in year one and 12b-1 service fees of 0.25% per year

of average daily net assets for Class A Shares and combined Rule 12b-1

distribution and service fees of 1.00% per year of average daily net assets for

Class C Shares. Class F, Class I and Class R3 Shares do not have a front-end

sales charge or a CDSC; therefore, performance is at net asset value. The Rule

12b-1 service fees are 0.15% of average daily net assets for Class F Shares and

combined Rule 12b-1 distribution and service fees are 0.50% of average daily net

assets for Class R3 Shares, while Class I Shares do not have these fees. Prior

to December 15, 2011, the combined Rule 12b-1 distribution and service fees for

Class R3 Shares were 0.75% of average daily net assets.

(1) Effective October 22, 2017, the index name changed from BofA Merrill Lynch

Fixed Rate Preferred Securities Index to ICE BofAML Fixed Rate Preferred

Securities Index.

(2) Effective October 22, 2017, the index name changed from BofA Merrill Lynch

U.S. Capital Securities Index to ICE BofAML U.S. Capital Securities Index.

(3) 30-day SEC yield is calculated by dividing the net investment income per

share earned during the most recent 30-day period by the maximum offering

price per share on the last day of the period. The reported SEC yields are

subsidized. The subsidized yields reflect the fee waiver and/or

reimbursement of Fund expenses, which has the effect of lowering the

Fund's expense ratio and generating a higher yield.

Page 3

<PAGE>

--------------------------------------------------------------------------------

PORTFOLIO COMMENTARY

--------------------------------------------------------------------------------

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

ANNUAL REPORT

OCTOBER 31, 2017 (UNAUDITED)

ADVISOR

First Trust Advisors L.P. ("First Trust") is the investment advisor to the First

Trust Preferred Securities and Income Fund (the "Fund"). First Trust is

responsible for the ongoing monitoring of the Fund's investment portfolio,

managing the Fund's business affairs and providing certain administrative

services necessary for the management of the Fund.

SUB-ADVISOR

Stonebridge Advisors LLC ("Stonebridge" or the "Sub-Advisor") is the sub-advisor

to the Fund and is a registered investment advisor based in Wilton, Connecticut.

Stonebridge specializes in the management of preferred and hybrid securities.

PORTFOLIO MANAGEMENT TEAM

SCOTT T. FLEMING - PRESIDENT AND CHIEF INVESTMENT OFFICER OF STONEBRIDGE

ADVISORS LLC

ROBERT WOLF - SENIOR VICE PRESIDENT AND SENIOR PORTFOLIO MANAGER

DANIELLE SALTERS, CFA - VICE PRESIDENT, PORTFOLIO MANAGER AND CREDIT ANALYST

ANNUAL REPORT COMMENTARY

MARKET RECAP

The fiscal year ended October 31, 2017 was a period of solid returns for the

preferred and hybrid securities markets. The period began with substantial

volatility following an increase in interest rates in the fourth quarter of 2016

from the unexpected victory of Donald Trump in the U.S. Presidential election

and continued Republican control of the U.S. Congress. Higher rates were also

supported by improving economic and employment data, which allowed the Federal

Reserve (the "Fed") to increase short-term interest rates by 0.25% twice during

the period. However, risk assets recovered and performed well throughout the

last three quarters of the period due to stabilizing long-term interest rates, a

flattening yield curve, and significant spread tightening. Contingent capital

securities ("CoCos") were the best performing part of the preferred and hybrid

securities markets during the period, returning 16.78%. We believe this was due

to the improvement in credit quality of European banks (largest issuers of

CoCos), attractive yields and structures compared to U.S. bank tier 1 capital

securities, and the increasing investor comfort with the securities and more

stable investor base. After initial weakness during the period, the retail

preferred securities market was pushed higher by inflows into passive preferred

exchange-traded funds ("ETFs"), limited new issuance, and stable rates, which

were positive for the fixed for life structures that make up the majority of the

retail market. For the fiscal year, the retail market earned 6.58% while the

institutional market earned 6.57%, according to the ICE BofAML Fixed Rate

Preferred Securities Index ("P0P1") and the ICE BofAML U.S. Capital Securities

Index ("C0CS"), respectively.

PERFORMANCE ANALYSIS

The Fund continues to strive to provide comparable income to peer funds while

focusing on limiting the downside risks. The Fund experienced strong performance

during the fiscal year despite more defensive positioning, driven by active

management with a focus on security selection. The Fund's Class I Shares

produced a total return of 9.39% for the fiscal year ended October 31, 2017,

compared to the benchmark's (a 50/50 blend of P0P1 and C0CS) total return of

6.58%. Outperformance was primarily driven by security selection within

fixed-to-float securities and an overweight of floating-rate securities and

CoCos, both of which are not held in the benchmark.

The Fund continues to maintain its core strategy of overweighting fixed-to-float

securities and securities with high coupons and relatively short call dates. The

Fund's exposure to floating-rate securities, in particular, was a substantial

contributor to performance with those securities experiencing substantial

capital appreciation driven by increases in the London Interbank Offered Rate

("LIBOR") throughout the period. The Fund also benefitted from its allocation to

CoCos, not held in the benchmark. The Fund has continued to increase exposure to

the space given the reasons stated above. This allocation was a substantial

contributor to the Fund's outperformance. These positive impacts were partially

offset by the Fund's bias toward lower duration securities in the environment in

which longer duration securities outperformed.

Page 4

<PAGE>

--------------------------------------------------------------------------------

PORTFOLIO COMMENTARY (CONTINUED)

--------------------------------------------------------------------------------

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

ANNUAL REPORT

OCTOBER 31, 2017 (UNAUDITED)

We will continue deploying the strategy of mitigating risk to the downside by

remaining overweight in less interest-rate-sensitive securities, limiting

exposure to risky issuers and industries, and limiting overlap with passive

ETFs. We believe this strategy will also allow the Fund to show more resilience

in a market downturn and potentially outperform in a rising rate environment.

MARKET AND FUND OUTLOOK

The strong macro-economic backdrop, strong corporate earnings and solid

creditworthiness, particularly within financials, continue to support a risk-on

environment, in our opinion. Stable to gradually increasing rates, moderate

issuance, and the continued demand for yield continue to be positive for the

preferred and hybrid securities markets. However, we believe strong performance

across equity and credit markets and increased economic optimism has stretched

valuations of new issuance in some cases, which could become problematic if

interest rates or supply increases. Recently, weaker security structures have

come to market, but the deals were many times oversubscribed, supported by

investor demand for yield and some buyers that are indiscriminate about pricing,

in the form of passive ETFs, taking up a larger share of markets and deals. We

believe this could put pressure on distributions if higher yielding legacy

securities continue to be redeemed and replaced by lower yielding securities.

Stonebridge continues to believe that the yield curve is likely to remain flat,

as short-term rates are likely to increase and may push long term rates higher.

We have long anticipated, and positioned for, a rising rate environment, and we

continue to hold the view that this process will be gradual. We believe U.S.

fiscal policy and potential tax and regulatory changes have the potential to

boost economic growth but we also believe this impact is likely to be muted and

slow given political uncertainty and the likelihood that any changes will likely

be phased in over time. Stonebridge continues to focus on protecting the

principal of our investors and, as such, we believe it is prudent to protect

investors against a potential rise in interest rates through actively managing

interest rate risk.

Page 5

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

UNDERSTANDING YOUR FUND EXPENSES

OCTOBER 31, 2017 (UNAUDITED)

As a shareholder of the First Trust Preferred Securities and Income Fund, you

incur two types of costs: (1) transaction costs, including sales charges (loads)

on purchases of Class A Shares and contingent deferred sales charges on the

lesser of purchase price or redemption proceeds of Class C Shares; and (2)

ongoing costs, including management fees, distribution and/or service (12b-1)

fees, if any, and other Fund expenses. This Example is intended to help you

understand your ongoing costs (in U.S. dollars) of investing in the Fund and to

compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the

period and held through the six-month period ended October 31, 2017.

ACTUAL EXPENSES

The first three columns of the table below provide information about actual

account values and actual expenses. You may use the information in these

columns, together with the amount you invested, to estimate the expenses that

you paid over the period. Simply divide your account value by $1,000 (for

example, an $8,600 account value divided by $1,000 = 8.6), then multiply the

result by the number in the third column under the heading entitled "Expenses

Paid During Period" to estimate the expenses you paid on your account during the

period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The next three columns of the table below provide information about hypothetical

account values and hypothetical expenses based on the Fund's actual expense

ratio and an assumed rate of return of 5% per year before expenses, which is not

the Fund's actual return. The hypothetical account values and expenses may not

be used to estimate the actual ending account balance or expenses you paid for

the period. You may use this information to compare the ongoing cost of

investing in the Fund and other funds. To do so, compare this 5% hypothetical

example with the 5% hypothetical examples that appear in the shareholder reports

of the other funds.

Please note that the expenses shown in the table are meant to highlight your

ongoing costs only and do not reflect any transactional costs, such as sales

charges (loads) or contingent deferred sales charges. Therefore, the

hypothetical section of the table is useful in comparing ongoing costs only, and

will not help you determine the relative total costs of owning different funds.

In addition, if these transactional costs were included, your costs would have

been higher.

<TABLE>

<CAPTION>

---------------------------------------------------------------------------------------------------

HYPOTHETICAL

ACTUAL EXPENSES (5% RETURN BEFORE EXPENSES)

------------------------------------------- ---------------------------------------

ENDING EXPENSES PAID BEGINNING ENDING EXPENSES PAID

BEGINNING ACCOUNT DURING PERIOD ACCOUNT ACCOUNT DURING PERIOD ANNUALIZED

ACCOUNT VALUE VALUE 5/1/2017 - VALUE VALUE 5/1/2017 - EXPENSE

5/1/2017 10/31/2017 10/31/2017 (a) 5/1/2017 10/31/2017 10/31/2017 (a) RATIOS (b)

----------------------------------------------------------------------------------------------------------------

<S> <C> <C> <C> <C> <C> <C> <C>

Class A $ 1,000.00 $ 1,051.50 $ 6.83 $1,000.00 $ 1,018.55 $ 6.72 1.32%

Class C 1,000.00 1,048.00 10.27 1,000.00 1,015.17 10.11 1.99

Class F 1,000.00 1,053.40 6.73 1,000.00 1,018.65 6.61 1.30

Class I 1,000.00 1,054.00 4.97 1,000.00 1,020.37 4.89 0.96

Class R3 1,000.00 1,049.80 8.47 1,000.00 1,016.94 8.34 1.64

</TABLE>

(a) Expenses are equal to the annualized expense ratios, multiplied by the

average account value over the period May 1, 2017 through October 31,

2017, multiplied by 184/365 (to reflect the six-month period).

(b) These expense ratios reflect expense caps.

Page 6

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

PORTFOLIO OF INVESTMENTS

OCTOBER 31, 2017

<TABLE>

<CAPTION>

STATED STATED

SHARES DESCRIPTION RATE MATURITY VALUE

------------- --------------------------------------------------- --------- ------------ --------------

<S> <C> <C> <C> <C>

$25 PAR PREFERRED SECURITIES - 17.9%

BANKS - 5.3%

40,000 Bank of America Corp., Series CC................... 6.20% (a) $ 1,072,000

30,000 Citigroup Capital XIII, 3 Mo. LIBOR + 6.37% (b).... 7.75% 10/30/40 816,600

6,799 Citigroup, Inc., Series J (c)...................... 7.13% (a) 195,811

50,000 Citigroup, Inc., Series K (c)...................... 6.88% (a) 1,444,500

13,996 Citigroup, Inc., Series S.......................... 6.30% (a) 378,872

15,456 FNB Corp. (c)...................................... 7.25% (a) 448,070

87,100 GMAC Capital Trust I, Series 2, 3Mo. LIBOR +

5.79% (b)....................................... 7.10% 02/15/40 2,287,246

107,491 People's United Financial, Inc., Series A (c)...... 5.63% (a) 2,897,957

10,700 Regions Financial Corp., Series B (c).............. 6.38% (a) 303,345

16,288 Valley National Bancorp, Series B (c).............. 5.50% (a) 430,003

57,531 Wells Fargo & Co., Series Q (c).................... 5.85% (a) 1,567,145

54,369 Wintrust Financial Corp., Series D (c)............. 6.50% (a) 1,521,788

--------------

13,363,337

--------------

CAPITAL MARKETS - 3.6%

3,157 Charles Schwab Corp., Series D..................... 5.95% (a) 86,502

16,487 Goldman Sachs Group, Inc., Series J (c)............ 5.50% (a) 442,676

71,083 Morgan Stanley, Series E (c)....................... 7.13% (a) 2,057,853

35,100 Morgan Stanley, Series F (c)....................... 6.88% (a) 1,002,105

25,102 Morgan Stanley, Series I (c)....................... 6.38% (a) 702,856

105,359 Morgan Stanley, Series K (c)....................... 5.85% (a) 2,844,693

60,000 State Street Corp., Series D (c)................... 5.90% (a) 1,662,600

12,599 Stifel Financial Corp., Series A................... 6.25% (a) 337,023

--------------

9,136,308

--------------

DIVERSIFIED FINANCIAL SERVICES - 0.8%

78,513 KKR Financial Holdings LLC, Series A............... 7.38% (a) 1,991,875

--------------

EQUITY REAL ESTATE INVESTMENT TRUSTS - 3.8%

8,509 American Homes 4 Rent, Series C (d)................ 5.50% (a) 241,400

23,626 American Homes 4 Rent, Series E.................... 6.35% (a) 623,963

1,061 Colony NorthStar, Inc., Series D................... 8.50% (a) 27,619

49,976 Colony NorthStar, Inc., Series E................... 8.75% (a) 1,349,352

12,305 Colony NorthStar, Inc., Series H................... 7.13% (a) 315,623

74,323 EPR Properties, Series F........................... 6.63% (a) 1,878,142

25,000 Equity Commonwealth................................ 5.75% 08/01/42 627,500

25,000 Farmland Partners, Inc., Series B (d).............. 6.00% (a) 674,563

23,490 Global Net Lease, Inc., Series A................... 7.25% (a) 588,894

15,927 Taubman Centers, Inc., Series J.................... 6.50% (a) 401,361

15,000 Urstadt Biddle Properties, Inc., Series H.......... 6.25% (a) 398,850

102,470 VEREIT, Inc., Series F............................. 6.70% (a) 2,620,158

--------------

9,747,425

--------------

FOOD PRODUCTS - 0.1%

13,791 CHS, Inc., Series 2 (c)............................ 7.10% (a) 381,597

--------------

INSURANCE - 2.0%

7,100 AmTrust Financial Services, Inc.................... 7.50% 09/15/55 191,274

33,556 Aspen Insurance Holdings Ltd....................... 5.63% (a) 849,973

26,151 Aspen Insurance Holdings Ltd. (c).................. 5.95% (a) 704,508

50,000 Delphi Financial Group, Inc., 3Mo. LIBOR +

3.19% (b) (e)................................... 4.51% 05/15/37 1,065,625

</TABLE>

See Notes to Financial Statements Page 7

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

PORTFOLIO OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2017

<TABLE>

<CAPTION>

STATED STATED

SHARES DESCRIPTION RATE MATURITY VALUE

------------- --------------------------------------------------- --------- ------------ --------------

<S> <C> <C> <C> <C>

$25 PAR PREFERRED SECURITIES (CONTINUED)

INSURANCE (CONTINUED)

14,443 National General Holdings Corp..................... 7.63% 09/15/55 $ 371,457

21,000 Phoenix Cos., Inc.................................. 7.45% 01/15/32 393,095

31,725 Reinsurance Group of America, Inc. (c)............. 5.75% 06/15/56 881,955

19,927 Validus Holdings, Ltd., Series B................... 5.80% (a) 503,555

--------------

4,961,442

--------------

MORTGAGE REAL ESTATE INVESTMENT TRUSTS - 1.0%

25,000 AGNC Investment Corp., Series C (c)................ 7.00% (a) 668,750

38,824 Annaly Capital Management, Inc., Series F (c)...... 6.95% (a) 1,024,953

13,200 Invesco Mortgage Capital, Inc., Series B (c)....... 7.75% (a) 348,084

23,000 Two Harbors Investment, Corp., Series B (c)........ 7.63% (a) 610,880

--------------

2,652,667

--------------

MULTI-UTILITIES - 0.8%

40,000 Integrys Holding, Inc. (c)......................... 6.00% 08/01/73 1,132,500

30,000 Just Energy Group, Inc., Series A (c).............. 8.50% (a) 780,000

--------------

1,912,500

--------------

THRIFTS & MORTGAGE FINANCE - 0.5%

46,302 New York Community Bancorp, Inc., Series A (c)..... 6.38% (a) 1,293,215

--------------

TOTAL $25 PAR PREFERRED SECURITIES............................................ 45,440,366

(Cost $44,135,158) --------------

$100 PAR PREFERRED SECURITIES - 2.8%

BANKS - 2.7%

32,500 CoBank ACB, Series F (c) (f)....................... 6.25% (a) 3,510,000

27,000 CoBank ACB, Series G............................... 6.13% (a) 2,761,085

5,500 Farm Credit Bank Of Texas (c) (g).................. 6.75% (a) 606,375

--------------

6,877,460

--------------

CONSUMER FINANCE - 0.1%

5,130 SLM Corp., Series B, 3Mo. LIBOR + 1.7% (b)......... 3.02% (a) 345,351

--------------

TOTAL $100 PAR PREFERRED SECURITIES........................................... 7,222,811

(Cost $6,634,735) --------------

$1,000 PAR PREFERRED SECURITIES - 4.1%

BANKS - 2.6%

4,000 Farm Credit Bank Of Texas, Series 1 (g)............ 10.00% (a) 4,890,000

1,261 Sovereign Real Estate Investment Trust (g)......... 12.00% (a) 1,580,979

--------------

6,470,979

--------------

CONSUMER FINANCE - 0.2%

500 Compeer Financial ACA (c) (g)...................... 6.75% (a) 534,562

--------------

DIVERSIFIED FINANCIAL SERVICES - 0.2%

500 Kinder Morgan GP, Inc., 3Mo. LIBOR +

3.90% (b) (g)................................... 5.21% 08/18/57 469,719

--------------

INSURANCE - 1.1%

3,000 XLIT Ltd., Series D, 3Mo. LIBOR + 3.12% (b)........ 4.48% (a) 2,863,125

--------------

TOTAL $1,000 PAR PREFERRED SECURITIES......................................... 10,338,385

(Cost $10,172,874) --------------

</TABLE>

Page 8 See Notes to Financial Statements

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

PORTFOLIO OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2017

<TABLE>

<CAPTION>

PAR STATED STATED

AMOUNT DESCRIPTION RATE MATURITY VALUE

------------- --------------------------------------------------- --------- ------------ --------------

<S> <C> <C> <C> <C>

CAPITAL PREFERRED SECURITIES - 73.5%

AUTOMOBILES - 1.0%

$ 2,400,000 General Motors Financial Co., Inc., Series A (c)... 5.75% (a) $ 2,514,000

--------------

BANKS - 33.1%

1,500,000 Australia & New Zealand Banking Group

Ltd. (c) (f) (h)................................ 6.75% (a) 1,727,100

2,600,000 Banco Bilbao Vizcaya Argentaria S.A. (c) (h)....... 9.00% (a) 2,691,429

500,000 Banco Mercantil del Norte S.A. (c) (f) (h)......... 6.88% (a) 526,250

1,000,000 Banco Mercantil del Norte S.A. (c) (f) (h)......... 7.63% (a) 1,090,000

4,500,000 Bank of America Corp., Series DD (c)............... 6.30% (a) 5,138,010

200,000 Bank of America Corp., Series K (c)................ 8.00% (a) 202,750

1,000,000 Bank of America Corp., Series M (c)................ 8.13% (a) 1,032,850

1,500,000 Bank of America Corp., Series Z (c)................ 6.50% (a) 1,717,500

4,000,000 Barclays PLC (c) (h)............................... 7.88% (a) 4,468,344

1,100,000 Barclays PLC (c) (h)............................... 8.25% (a) 1,171,043

1,500,000 BNP Paribas S.A. (c) (f) (h)....................... 7.63% (a) 1,685,625

1,000,000 BPCE S.A. (c) (f).................................. 12.50% (a) 1,181,880

1,500,000 Citigroup, Inc., Series O (c)...................... 5.88% (a) 1,572,225

680,000 Citigroup, Inc., Series P (c)...................... 5.95% (a) 744,845

1,250,000 Citigroup, Inc., Series R (c)...................... 6.13% (a) 1,342,187

500,000 Citizens Financial Group, Inc. (c)................. 5.50% (a) 525,000

2,500,000 CoBank ACB, Series I (c)........................... 6.25% (a) 2,753,205

1,000,000 Commerzbank AG..................................... 8.13% 09/19/23 1,217,030

753,000 Cooperatieve Rabobank UA (c)....................... 11.00% (a) 857,479

1,000,000 Cooperatieve Rabobank UA (c) (f)................... 11.00% (a) 1,138,750

2,000,000 Credit Agricole S.A. (c) (f) (h)................... 7.88% (a) 2,281,378

3,485,000 Credit Agricole S.A. (c) (f) (h)................... 8.13% (a) 4,201,471

2,000,000 Credit Agricole S.A. (c)........................... 8.38% (a) 2,220,000

1,000,000 Danske Bank A/S (c) (h)............................ 6.13% (a) 1,087,227

500,000 Fifth Third Bancorp (c)............................ 5.10% (a) 512,500

1,000,000 HSBC Holdings PLC (c) (h).......................... 6.38% (a) 1,096,250

3,000,000 ING Groep N.V. (c) (h)............................. 6.88% (a) 3,349,626

2,954,000 Intesa Sanpaolo S.p.A. (c) (f) (h)................. 7.70% (a) 3,242,015

1,000,000 JPMorgan Chase & Co., Series 1 (c)................. 7.90% (a) 1,026,750

1,500,000 JPMorgan Chase & Co., Series S (c)................. 6.75% (a) 1,721,250

1,000,000 Lloyds Bank PLC (c) (f)............................ 12.00% (a) 1,354,416

1,000,000 Lloyds Banking Group PLC (c) (h)................... 7.50% (a) 1,143,750

1,046,000 Royal Bank Of Scotland Group PLC (c) (h)........... 7.50% (a) 1,123,404

1,000,000 Royal Bank Of Scotland Group PLC (c) (h)........... 8.00% (a) 1,145,700

3,250,000 Royal Bank Of Scotland Group PLC (c) (h)........... 8.63% (a) 3,688,425

1,500,000 Societe Generale S.A. (c) (f) (h).................. 7.38% (a) 1,657,500

2,250,000 Societe Generale S.A. (c) (f) (h).................. 7.88% (a) 2,556,562

2,250,000 Standard Chartered PLC (c) (f) (h)................. 7.75% (a) 2,500,650

2,000,000 UniCredit S.p.A. (c) (f)........................... 5.86% 06/19/32 2,140,440

1,900,000 UniCredit S.p.A. (c) (h)........................... 8.00% (a) 2,107,659

4,500,000 Wells Fargo & Co., Series K (c).................... 7.98% (a) 4,596,975

1,500,000 Wells Fargo & Co., Series U (c).................... 5.88% (a) 1,678,875

4,000,000 Zions Bancorporation, Series J (c)................. 7.20% (a) 4,570,000

--------------

83,786,325

--------------

CAPITAL MARKETS - 3.5%

500,000 Charles Schwab Corp. (c)........................... 5.00% (a) 506,250

2,750,000 Credit Suisse Group AG (c) (f) (h)................. 7.50% (a) 3,203,404

2,000,000 E*Trade Financial Corp., Series A (c).............. 5.88% (a) 2,140,000

</TABLE>

See Notes to Financial Statements Page 9

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

PORTFOLIO OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2017

<TABLE>

<CAPTION>

PAR STATED STATED

AMOUNT DESCRIPTION RATE MATURITY VALUE

------------- --------------------------------------------------- --------- ------------ --------------

<S> <C> <C> <C> <C>

CAPITAL PREFERRED SECURITIES (CONTINUED)

CAPITAL MARKETS (CONTINUED)

$ 500,000 Goldman Sachs Group, Inc., Series L (c)............ 5.70% (a) $ 516,875

1,298,000 Natixis S.A. (c)................................... 10.00% (a) 1,346,675

1,000,000 UBS Group AG (c) (h)............................... 7.13% (a) 1,079,390

--------------

8,792,594

--------------

CONSUMER FINANCE - 0.6%

1,610,000 Discover Financial Services, Series C (c).......... 5.50% (a) 1,644,213

--------------

DIVERSIFIED FINANCIAL SERVICES - 0.4%

1,000,000 Voya Financial, Inc. (c)........................... 5.65% 05/15/53 1,057,500

--------------

DIVERSIFIED TELECOMMUNICATION SERVICES - 0.4%

1,000,000 Koninklijke KPN N.V. (c)........................... 7.00% 03/28/73 1,137,450

--------------

ELECTRIC UTILITIES - 4.6%

3,500,000 Emera, Inc., Series 16-A (c)....................... 6.75% 06/15/76 4,025,350

4,000,000 Enel S.p.A. (c) (f)................................ 8.75% 09/24/73 4,950,000

1,000,000 Nextera Energy Capital Holdings, Inc., Series D,

3Mo. LIBOR + 3.35% (b).......................... 4.66% 09/01/67 1,001,301

1,000,000 Southern (The) Co., Series B (c)................... 5.50% 03/15/57 1,064,862

500,000 Southern California Edison Co., Series E (c)....... 6.25% (a) 564,375

--------------

11,605,888

--------------

FOOD PRODUCTS - 3.8%

1,300,000 Dairy Farmers of America, Inc. (g)................. 7.13% (a) 1,454,375

3,000,000 Land O'Lakes Capital Trust I (g)................... 7.45% 03/15/28 3,525,000

1,200,000 Land O'Lakes, Inc. (f)............................. 7.25% (a) 1,299,000

3,000,000 Land O'Lakes, Inc. (f)............................. 8.00% (a) 3,345,000

--------------

9,623,375

--------------

INDEPENDENT POWER AND RENEWABLE ELECTRICITY PRODUCERS - 0.7%

1,575,000 AES Gener S.A. (c)................................. 8.38% 12/18/73 1,672,918

--------------

INDUSTRIAL CONGLOMERATES - 0.9%

966,000 General Electric Co. (c)........................... 6.38% 11/15/67 969,671

1,250,000 General Electric Co., Series D (c)................. 5.00% (a) 1,306,250

--------------

2,275,921

--------------

INSURANCE - 17.2%

1,000,000 AG Insurance S.A. (c).............................. 6.75% (a) 1,060,000

4,200,000 Aquarius & Investments PLC for Swiss Reinsurance

Co., Ltd. (c)................................... 8.25% (a) 4,402,822

1,215,000 Assured Guaranty Municipal Holdings, Inc. (c) (f).. 6.40% 12/15/66 1,190,700

4,100,000 Catlin Insurance Co., Ltd., 3 Mo. LIBOR +

2.98% (b) (f)................................... 4.33% (a) 3,895,000

1,000,000 CNP Assurances (c)................................. 6.88% (a) 1,072,500

2,500,000 CNP Assurances (c)................................. 7.50% (a) 2,630,625

1,000,000 Fortegra Financial Corp. (c) (g)................... 8.50% 10/15/57 1,005,000

3,300,000 Friends Life Holdings PLC (c)...................... 7.88% (a) 3,494,050

1,000,000 Fukoku Mutual Life Insurance Co. (c)............... 6.50% (a) 1,132,130

2,500,000 La Mondiale SAM (c)................................ 7.63% (a) 2,670,283

2,663,000 Liberty Mutual Group, Inc. (f)..................... 7.80% 03/15/37 3,382,010

3,285,000 Liberty Mutual Group, Inc. (c)..................... 10.75% 06/15/58 5,461,312

1,830,000 MetLife, Inc. (f).................................. 9.25% 04/08/38 2,724,413

1,250,000 Metlife, Inc....................................... 10.75% 08/01/39 2,090,625

977,000 Mitsui Sumitomo Insurance Co., Ltd. (c) (f)........ 7.00% 03/15/72 1,123,452

</TABLE>

Page 10 See Notes to Financial Statements

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

PORTFOLIO OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2017

<TABLE>

<CAPTION>

PAR STATED STATED

AMOUNT DESCRIPTION RATE MATURITY VALUE

------------- --------------------------------------------------- --------- ------------ --------------

<S> <C> <C> <C> <C>

CAPITAL PREFERRED SECURITIES (CONTINUED)

INSURANCE (CONTINUED)

$ 1,000,000 Prudential Financial, Inc. (c)..................... 5.63% 06/15/43 $ 1,087,750

2,000,000 QBE Insurance Group, Ltd. (c) (f).................. 7.50% 11/24/43 2,319,000

2,500,000 QBE Insurance Group, Ltd. (c)...................... 6.75% 12/02/44 2,840,625

--------------

43,852,297

--------------

METALS & MINING - 0.5%

500,000 BHP Billiton Finance USA Ltd. (c) (f).............. 6.25% 10/19/75 549,000

500,000 BHP Billiton Finance USA Ltd. (c) (f).............. 6.75% 10/19/75 590,000

--------------

1,139,000

--------------

OIL, GAS & CONSUMABLE FUELS - 5.2%

4,231,400 Enbridge Energy Partners L.P., 3Mo. LIBOR +

3.80% (b)....................................... 5.13% 10/01/37 4,231,400

600,000 Enbridge, Inc. (c)................................. 5.50% 07/15/77 619,500

500,000 Enbridge, Inc., Series 16-A (c).................... 6.00% 01/15/77 536,320

2,661,000 Energy Transfer LP, 3Mo. LIBOR + 3.02% (b)......... 4.39% 11/01/66 2,414,857

1,500,000 Enterprise Products Operating LLC, Series A,

3Mo. LIBOR + 3.71% (b).......................... 5.08% 08/01/66 1,500,000

1,155,000 Enterprise Products Operating LLC, Series B (c).... 7.03% 01/15/68 1,160,775

2,500,000 Transcanada Trust, Series 16-A (c)................. 5.88% 08/15/76 2,737,500

--------------

13,200,352

--------------

TRANSPORTATION INFRASTRUCTURE - 1.6%

3,720,000 AerCap Global Aviation Trust (c) (f)............... 6.50% 06/15/45 4,073,400

--------------

TOTAL CAPITAL PREFERRED SECURITIES............................................ 186,105,233

(Cost $178,262,832) --------------

PRINCIPAL STATED STATED

VALUE DESCRIPTION RATE MATURITY VALUE

------------- --------------------------------------------------- --------- ------------ --------------

CORPORATE BONDS AND NOTES - 0.4%

INSURANCE - 0.4%

1,000,000 AmTrust Financial Services, Inc.................... 6.13% 08/15/23 995,000

(Cost $995,207) --------------

TOTAL INVESTMENTS - 98.7%..................................................... 250,101,795

(Cost $240,200,806) (i)

NET OTHER ASSETS AND LIABILITIES - 1.3%....................................... 3,179,135

--------------

NET ASSETS - 100.0%........................................................... $ 253,280,930

==============

</TABLE>

(a) Perpetual maturity.

(b) Floating rate security.

(c) Fixed-to-floating or fixed-to-variable rate security. The interest rate

shown reflects the fixed rate in effect at October 31, 2017. At a

predetermined date, the fixed rate will change to a floating rate or a

variable rate.

(d) Step-up security. A security where the coupon increases or steps up at a

predetermined date.

(e) Pursuant to procedures adopted by the First Trust Series Fund's (the

"Trust") Board of Trustees, this security has been determined to be

illiquid by Stonebridge Advisors LLC, the Fund's sub-advisor

(the "Sub-Advisor").

(f) This security, sold within the terms of a private placement memorandum, is

exempt from registration upon resale under Rule 144A under the Securities

Act of 1933, as amended (the "1933 Act"), and may be resold in

transactions exempt from registration, normally to qualified institutional

buyers. Pursuant to procedures adopted by the Trust's Board of Trustees,

this security has been determined to be liquid by the Sub-Advisor.

Although market instability can result in periods of increased overall

market illiquidity, liquidity for each security is determined based on

security specific factors and assumptions, which require subjective

judgment. At October 31, 2017, securities noted as such amounted to

$63,438,416 or 25.0% of net assets.

See Notes to Financial Statements Page 11

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

PORTFOLIO OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2017

(g) This security, sold within the terms of a private placement memorandum, is

exempt from registration upon resale under Rule 144A under the 1933 Act,

as amended, and may be resold in transactions exempt from registration,

normally to qualified institutional buyers (see Note 2C - Restricted

Securities in the Notes to Financial Statements).

(h) This security is a contingent convertible capital security, which may be

subject to conversion into common stock of the issuer under certain

circumstances. At October 31, 2017, securities noted as such amounted to

$48,824,202 or 19.3% of net assets. Of these securities, 3.3% originated

in emerging markets and 96.7% originated in foreign markets.

(i) Aggregate cost for federal income tax purposes is $240,187,134. As of

October 31, 2017, the aggregate gross unrealized appreciation for all

investments in which there was an excess value over tax cost was

$12,023,917 and the aggregate gross unrealized depreciation for all

investments in which there was an excess of tax cost over value was

$2,109,256. The net unrealized appreciation was $9,914,661.

LIBOR - London Interbank Offered Rate

-----------------------------

VALUATION INPUTS

A summary of the inputs used to value the Fund's investments as of October 31,

2017 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial

Statements):

<TABLE>

<CAPTION>

LEVEL 2 LEVEL 3

TOTAL LEVEL 1 SIGNIFICANT SIGNIFICANT

VALUE AT QUOTED OBSERVABLE UNOBSERVABLE

10/31/2017 PRICES INPUTS INPUTS

------------- ------------- ------------- -------------

<S> <C> <C> <C> <C>

$25 Par Preferred Securities:

Insurance......................................... $ 4,961,442 $ 3,502,722 $ 1,458,720 $ --

Multi-Utilities................................... 1,912,500 780,000 1,132,500 --

Other industry categories*........................ 38,566,424 38,566,424 -- --

------------- ------------- ------------- -------------

Total $25 Par Preferred Securities................... 45,440,366 42,849,146 2,591,220 --

$100 Par Preferred Securities:

Banks............................................. 6,877,460 -- 6,877,460 --

Consumer Finance.................................. 345,351 345,351 -- --

------------- ------------- ------------- -------------

Total $100 Par Preferred Securities.................. 7,222,811 345,351 6,877,460 --

$1,000 Par Preferred Securities*..................... 10,338,385 -- 10,338,385 --

Capital Preferred Securities*........................ 186,105,233 -- 186,105,233 --

Corporate Bonds and Notes*........................... 995,000 -- 995,000 --

------------- ------------- ------------- -------------

Total Investments.................................... $ 250,101,795 $ 43,194,497 $ 206,907,298 $ --

============= ============= ============= =============

</TABLE>

* See the Portfolio of Investments for industry breakout.

All transfers in and out of the Levels during the period are assumed to occur on

the last day of the period at their current value. There were no transfers

between Levels at October 31, 2017.

Page 12 See Notes to Financial Statements

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2017

<TABLE>

<CAPTION>

ASSETS:

<S> <C>

Investments, at value

(Cost $240,200,806)................................................................................. $ 250,101,795

Cash................................................................................................ 3,214,257

Prepaid expenses.................................................................................... 48,416

Receivables:

Investment securities sold....................................................................... 5,482,981

Interest......................................................................................... 2,399,410

Fund shares sold................................................................................. 638,203

Dividends........................................................................................ 50,960

-------------

Total Assets..................................................................................... 261,936,022

-------------

LIABILITIES:

Payables:

Investment securities purchased.................................................................. 7,212,470

Fund shares repurchased.......................................................................... 931,889

Investment advisory fees......................................................................... 169,221

Distributions payable............................................................................ 77,346

12b-1 distribution and service fees.............................................................. 64,002

Transfer agent fees.............................................................................. 59,790

Administrative fees.............................................................................. 42,834

Audit and tax fees............................................................................... 33,202

Registration fees................................................................................ 22,720

Printing fees.................................................................................... 18,312

Custodian fees................................................................................... 12,756

Commitment and administrative agency fees........................................................ 4,645

Trustees' fees and expenses...................................................................... 2,949

Legal fees....................................................................................... 1,842

Financial reporting fees......................................................................... 770

Other liabilities................................................................................... 344

-------------

Total Liabilities................................................................................ 8,655,092

-------------

NET ASSETS.......................................................................................... $ 253,280,930

=============

NET ASSETS CONSIST OF:

Paid-in capital..................................................................................... $ 252,425,442

Par value........................................................................................... 112,736

Accumulated net investment income (loss)............................................................ 557,195

Accumulated net realized gain (loss) on investments................................................. (9,715,432)

Net unrealized appreciation (depreciation) on investments........................................... 9,900,989

-------------

NET ASSETS.......................................................................................... $ 253,280,930

=============

MAXIMUM OFFERING PRICE PER SHARE:

CLASS A SHARES:

Net asset value and redemption price per share (Based on net assets of $39,063,437 and 1,744,911

shares of beneficial interest issued and outstanding).......................................... $ 22.39

Maximum sales charge (4.50% of offering price)................................................... 1.05

-------------

Maximum offering price to public................................................................... $ 23.44

=============

CLASS C SHARES:

Net asset value and redemption price per share (Based on net assets of $64,462,350 and 2,872,480

shares of beneficial interest issued and outstanding)......................................... $ 22.44

=============

CLASS F SHARES:

Net asset value and redemption price per share (Based on net assets of $7,338,706 and 324,427

shares of beneficial interest issued and outstanding)......................................... $ 22.62

=============

CLASS I SHARES:

Net asset value and redemption price per share (Based on net assets of $141,660,626 and 6,297,920

shares of beneficial interest issued and outstanding)......................................... $ 22.49

=============

CLASS R3 SHARES:

Net asset value and redemption price per share (Based on net assets of $755,811 and 33,820

shares of beneficial interest issued and outstanding)......................................... $ 22.35

=============

</TABLE>

See Notes to Financial Statements Page 13

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED OCTOBER 31, 2017

<TABLE>

<CAPTION>

INVESTMENT INCOME:

<S> <C>

Interest ........................................................................................... $ 9,964,416

Dividends .......................................................................................... 4,261,117

Other............................................................................................... 30,801

-------------

Total investment income.......................................................................... 14,256,334

-------------

EXPENSES:

12b-1 distribution and/or service fees:

Class A.......................................................................................... 96,278

Class C.......................................................................................... 550,278

Class F.......................................................................................... 11,544

Class R3......................................................................................... 3,409

Investment advisory fees............................................................................ 1,765,175

Transfer agent fees................................................................................. 151,570

Administrative fees................................................................................. 93,775

Registration fees................................................................................... 77,871

Commitment and administrative agency fees........................................................... 59,594

Audit and tax fees.................................................................................. 34,126

Custodian fees...................................................................................... 33,760

Printing fees....................................................................................... 32,945

Trustees' fees and expenses......................................................................... 18,424

Financial reporting fees............................................................................ 9,250

Excise tax expense.................................................................................. 6,995

Legal fees.......................................................................................... 4,390

Listing expense..................................................................................... 2,993

Expenses previously waived or reimbursed............................................................ 2,494

Other............................................................................................... 11,460

-------------

Total expenses................................................................................... 2,966,331

Fees waived or expenses reimbursed by the investment advisor..................................... (25,178)

-------------

Net expenses..................................................................................... 2,941,153

-------------

NET INVESTMENT INCOME (LOSS)........................................................................ 11,315,181

-------------

NET REALIZED AND UNREALIZED GAIN (LOSS):

Net realized gain (loss) on:

Net realized gain (loss) on investments.......................................................... 2,374,196

Net change in unrealized appreciation (depreciation) on investments.............................. 5,842,618

-------------

NET REALIZED AND UNREALIZED GAIN (LOSS)............................................................. 8,216,814

-------------

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS..................................... $ 19,531,995

=============

</TABLE>

Page 14 See Notes to Financial Statements

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

<TABLE>

<CAPTION>

YEAR ENDED YEAR ENDED

10/31/2017 10/31/2016

------------- -------------

<S> <C> <C>

OPERATIONS:

Net investment income (loss)........................................................ $ 11,315,181 $ 9,267,054

Net realized gain (loss)............................................................ 2,374,196 (1,017,162)

Net change in unrealized appreciation (depreciation)................................ 5,842,618 4,709,234

------------- -------------

Net increase (decrease) in net assets resulting from operations..................... 19,531,995 12,959,126

------------- -------------

DISTRIBUTIONS TO SHAREHOLDERS FROM NET INVESTMENT INCOME:

Class A Shares...................................................................... (2,021,236) (1,636,847)

Class C Shares...................................................................... (2,466,076) (2,206,079)

Class F Shares...................................................................... (405,856) (242,014)

Class I Shares...................................................................... (6,495,243) (5,104,605)

Class R3 Shares..................................................................... (34,204) (17,199)

------------- -------------

(11,422,615) (9,206,744)

------------- -------------

CAPITAL TRANSACTIONS:

Proceeds from shares sold........................................................... 120,198,101 91,244,153

Proceeds from shares reinvested..................................................... 10,184,046 8,118,073

Cost of shares redeemed............................................................. (83,818,787) (67,454,788)

------------- -------------

Net increase (decrease) in net assets resulting from capital transactions........... 46,563,360 31,907,438

------------- -------------

Total increase (decrease) in net assets............................................. 54,672,740 35,659,820

NET ASSETS:

Beginning of period................................................................. 198,608,190 162,948,370

------------- -------------

End of period....................................................................... $ 253,280,930 $ 198,608,190

============= =============

Accumulated net investment income (loss) at end of period........................... $ 557,195 $ 763,275

============= =============

</TABLE>

See Notes to Financial Statements Page 15

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

<TABLE>

<CAPTION>

YEAR ENDED OCTOBER 31,

---------------------------------------------------------------

CLASS A SHARES 2017 2016 2015 2014 2013

----------- ----------- ----------- ----------- -----------

<S> <C> <C> <C> <C> <C>

Net asset value, beginning of period.......... $ 21.63 $ 21.13 $ 21.20 $ 20.27 $ 22.42

------- ------- ------- ------- -------

INCOME FROM INVESTMENT OPERATIONS:

Net investment income (loss).................. 1.11 (a) 1.16 (a) 1.18 (a) 1.14 (a) 0.98 (a)

Net realized and unrealized gain (loss)....... 0.80 0.49 (0.13) 0.91 (1.91)

------- ------- ------- ------- -------

Total from investment operations.............. 1.91 1.65 1.05 2.05 (0.93)

------- ------- ------- ------- -------

DISTRIBUTIONS PAID TO SHAREHOLDERS FROM:

Net investment income......................... (1.15) (1.15) (1.12) (1.09) (0.98)

Net realized gain............................. -- -- -- -- (0.09)

Return of capital............................. -- -- -- (0.03) (0.15)

------- ------- ------- ------- -------

Total distributions........................... (1.15) (1.15) (1.12) (1.12) (1.22)

------- ------- ------- ------- -------

Net asset value, end of period................ $ 22.39 $ 21.63 $ 21.13 $ 21.20 $ 20.27

======= ======= ======= ======= =======

TOTAL RETURN (b).............................. 9.05% 8.09% 5.05% 10.35% (4.36)%

======= ======= ======= ======= =======

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA:

Net assets, end of period (in 000's).......... $39,063 $35,468 $28,585 $32,874 $90,286

Ratio of total expenses to average net assets. 1.36% 1.51% (c) 1.50% (c) 1.40% 1.44%

Ratio of net expenses to average net assets... 1.36% 1.41% (c) 1.41% (c) 1.40% 1.40%

Ratio of net investment income (loss) to

average net assets......................... 5.11% 5.50% 5.55% 5.47% 4.52%

Portfolio turnover rate....................... 44% 71% 123% 170% 60%

</TABLE>

(a) Based on average shares outstanding.

(b) Assumes reinvestment of all distributions for the period and does not

include payment of the maximum sales charge of 4.50% or contingent

deferred sales charge (CDSC). On purchases of $1 million or more, a CDSC

of 1% may be imposed on certain redemptions made within twelve months of

purchase. If the sales charges were included, total returns would be

lower. These returns include Rule 12b-1 service fees of 0.25% and do not

reflect the deduction of taxes that a shareholder would pay on Fund

distributions or the redemption of Fund shares. The total returns would

have been lower if certain fees had not been waived and expenses

reimbursed by the investment advisor. Total return is calculated for the

time period presented and is not annualized for periods of less than one

year.

(c) For the years ended October 31, 2016 and 2015, ratios reflect excise tax

of 0.01% and 0.01%, respectively, which are not included in the expense

cap.

Page 16 See Notes to Financial Statements

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

<TABLE>

<CAPTION>

YEAR ENDED OCTOBER 31,

---------------------------------------------------------------

CLASS C SHARES 2017 2016 2015 2014 2013

----------- ----------- ----------- ----------- -----------

<S> <C> <C> <C> <C> <C>

Net asset value, beginning of period............ $ 21.67 $ 21.17 $ 21.24 $ 20.30 $ 22.45

------- ------- ------- ------- -------

INCOME FROM INVESTMENT OPERATIONS:

Net investment income (loss).................... 0.96 (a) 1.01 (a) 1.02 (a) 0.99 (a) 0.83 (a)

Net realized and unrealized gain (loss)......... 0.79 0.48 (0.13) 0.91 (1.93)

------- ------- ------- ------- -------

Total from investment operations................ 1.75 1.49 0.89 1.90 (1.10)

------- ------- ------- ------- -------

DISTRIBUTIONS PAID TO SHAREHOLDERS FROM:

Net investment income........................... (0.98) (0.99) (0.96) (0.94) (0.84)

Net realized gain............................... -- -- -- -- (0.08)

Return of capital............................... -- -- -- (0.02) (0.13)

------- ------- ------- ------- -------

Total distributions............................. (0.98) (0.99) (0.96) (0.96) (1.05)

------- ------- ------- ------- -------

Net asset value, end of period.................. $ 22.44 $ 21.67 $ 21.17 $ 21.24 $ 20.30

======= ======= ======= ======= =======

TOTAL RETURN (b)................................ 8.27% 7.27% 4.26% 9.56% (5.03)%

======= ======= ======= ======= =======

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA:

Net assets, end of period (in 000's)............ $64,462 $51,004 $45,093 $45,248 $55,376

Ratio of total expenses to average net assets... 2.06% 2.17% (c) 2.16% (c) 2.18% 2.17%

Ratio of net expenses to average net assets..... 2.06% 2.16% (c) 2.16% (c) 2.15% 2.15%

Ratio of net investment income (loss) to

average net assets........................... 4.41% 4.76% 4.79% 4.75% 3.81%

Portfolio turnover rate......................... 44% 71% 123% 170% 60%

</TABLE>

(a) Based on average shares outstanding.

(b) Assumes reinvestment of all distributions for the period and does not

include payment of the maximum CDSC of 1%, charged on certain redemptions

made within one year of purchase. If the sales charge was included, total

returns would be lower. These returns include combined Rule 12b-1

distribution and service fees of 1% and do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares. The total returns would have been lower if certain fees

had not been waived and expenses reimbursed by the investment advisor.

Total return is calculated for the time period presented and is not

annualized for periods of less than one year.

(c) For the years ended October 31, 2016 and 2015, ratios reflect excise tax

of 0.01% and 0.01%, respectively, which are not included in the expense

cap.

See Notes to Financial Statements Page 17

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

<TABLE>

<CAPTION>

YEAR ENDED OCTOBER 31,

---------------------------------------------------------------

CLASS F SHARES 2017 2016 2015 2014 2013

----------- ----------- ----------- ----------- -----------

<S> <C> <C> <C> <C> <C>

Net asset value, beginning of period............ $ 21.82 $ 21.31 $ 21.37 $ 20.42 $ 22.59

------- ------- ------- ------- -------

INCOME FROM INVESTMENT OPERATIONS:

Net investment income (loss).................... 1.13 (a) 1.18 (a) 1.23 (a) 1.18 (a) 1.02 (a)

Net realized and unrealized gain (loss)......... 0.84 0.50 (0.15) 0.91 (1.95)

------- ------- ------- ------- -------

Total from investment operations................ 1.97 1.68 1.08 2.09 (0.93)

------- ------- ------- ------- -------

DISTRIBUTIONS PAID TO SHAREHOLDERS FROM:

Net investment income........................... (1.17) (1.17) (1.14) (1.11) (1.01)

Net realized gain............................... -- -- -- -- (0.08)

Return of capital............................... -- -- -- (0.03) (0.15)

------- ------- ------- ------- -------

Total distributions............................. (1.17) (1.17) (1.14) (1.14) (1.24)

------- ------- ------- ------- -------

Net asset value, end of period.................. $ 22.62 $ 21.82 $ 21.31 $ 21.37 $ 20.42

======= ======= ======= ======= =======

TOTAL RETURN (b)................................ 9.27% 8.18% 5.16% 10.48% (4.32)%

======= ======= ======= ======= =======

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA:

Net assets, end of period (in 000's)............ $ 7,339 $ 5,025 $ 2,501 $ 2,617 $ 3,735

Ratio of total expenses to average net assets... 1.39% 1.70% (c) 1.92% 1.81% 1.58%

Ratio of net expenses to average net assets..... 1.30% 1.31% (c) 1.30% 1.30% 1.30%

Ratio of net investment income (loss) to

average net assets........................... 5.11% 5.55% 5.70% 5.64% 4.63%

Portfolio turnover rate......................... 44% 71% 123% 170% 60%

</TABLE>

(a) Based on average shares outstanding.

(b) Assumes reinvestment of all distributions for the period. These returns

include Rule 12b-1 service fees of 0.15% and do not reflect the deduction

of taxes that a shareholder would pay on Fund distributions or the

redemption of Fund shares. The total returns would have been lower if

certain fees had not been waived and expenses reimbursed by the investment

advisor. Total return is calculated for the time period presented and is

not annualized for periods of less than one year.

(c) For the year ended October 31, 2016, ratios reflect excise tax of 0.01%,

which is not included in the expense cap.

Page 18 See Notes to Financial Statements

<PAGE>

FIRST TRUST PREFERRED SECURITIES AND INCOME FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

<TABLE>

<CAPTION>

YEAR ENDED OCTOBER 31,

---------------------------------------------------------------

CLASS I SHARES 2017 2016 2015 2014 2013

----------- ----------- ----------- ----------- -----------

<S> <C> <C> <C> <C> <C>

Net asset value, beginning of period............ $ 21.71 $ 21.21 $ 21.27 $ 20.33 $ 22.47