UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22452

First Trust Series Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

Securities and Income Fund

| 1 | |

| 2 | |

| 5 | |

| 6 | |

| 7 | |

| 15 | |

| 16 | |

| 17 | |

| 18 | |

| 23 | |

| 30 |

| Fund Statistics | |

| First Trust Preferred Securities and Income Fund | Net Asset Value (NAV) |

| Class A (FPEAX) | $20.36 |

| Class C (FPECX) | $20.49 |

| Class F (FPEFX) | $20.62 |

| Class I (FPEIX) | $20.50 |

| Class R3 (FPERX) | $20.29 |

| Sector Allocation | % of Total Investments |

| Financials | 71.9% |

| Energy | 9.8 |

| Utilities | 8.3 |

| Industrials | 4.0 |

| Consumer Staples | 3.5 |

| Real Estate | 1.7 |

| Communication Services | 0.8 |

| Total | 100.0% |

| Country Allocation | % of Total Investments |

| United States | 51.9% |

| United Kingdom | 8.8 |

| Canada | 8.1 |

| Switzerland | 5.7 |

| France | 5.7 |

| Bermuda | 3.7 |

| Netherlands | 3.3 |

| Australia | 2.2 |

| Italy | 2.1 |

| Spain | 1.8 |

| Multinational | 1.5 |

| Germany | 1.3 |

| Mexico | 1.3 |

| Denmark | 1.2 |

| Finland | 1.0 |

| Sweden | 0.4 |

| Total | 100.0% |

| Credit Quality(1) | % of Total Fixed-Income Investments |

| A | 0.2% |

| BBB+ | 9.3 |

| BBB | 22.0 |

| BBB- | 28.3 |

| BB+ | 22.5 |

| BB | 9.7 |

| BB- | 3.8 |

| B+ | 0.2 |

| B | 1.0 |

| Not Rated | 3.0 |

| Total | 100.0% |

| Top Ten Holdings | % of Total Investments |

| Barclays PLC | 2.8% |

| AerCap Holdings N.V. | 2.2 |

| Emera, Inc., Series 16-A | 1.8 |

| Enbridge, Inc., Series 16-A | 1.7 |

| Credit Suisse Group AG | 1.5 |

| Wells Fargo & Co., Series L | 1.5 |

| Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. | 1.5 |

| Credit Agricole S.A. | 1.3 |

| Lloyds Banking Group PLC | 1.3 |

| Land O’Lakes Capital Trust I | 1.2 |

| Total | 16.8% |

| Dividend Distributions | Class A Shares | Class C Shares | Class F Shares | Class I Shares | Class R3 Shares |

| Current Monthly Distribution per Share(2) | $0.0756 | $0.0624 | $0.0773 | $0.0800 | $0.0713 |

| Current Distribution Rate on NAV(3) | 4.46% | 3.65% | 4.50% | 4.68% | 4.22% |

| (1) | The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

| (2) | Most recent distribution paid through April 30, 2022. Subject to change in the future. |

| (3) | Distribution rates are calculated by annualizing the most recent distribution paid through the report date and then dividing by NAV as of April 30, 2022. Subject to change in the future. |

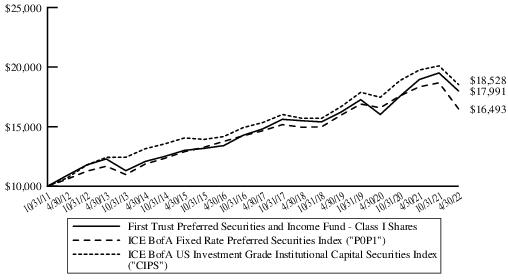

| Performance as of April 30, 2022 | |||||||||||||||||||||||||||||||

| A Shares Inception 2/25/2011 | C Shares Inception 2/25/2011 | F Shares Inception 3/2/2011 | I Shares Inception 1/11/2011 | R3 Shares Inception 3/2/2011 | Blended Index* (4)(5)(6) | P0P1* ICE BofA Fixed Rate Preferred Securities Index | CIPS* ICE BofA US Investment Grade Institutional Capital Securities Index | Prior Blended Index* (7) | |||||||||||||||||||||||

| Cumulative Total Returns | w/o sales charge | w/max 4.50% sales charge | w/o sales charge | w/max 1.00% contingent deferred sales charge | w/o sales charge | w/o sales charges | w/o sales charges | w/o sales charges | w/o sales charges | w/o sales charges | w/o sales charges | ||||||||||||||||||||

| 6 Months | (7.94)% | (12.08)% | (8.28)% | (9.18)% | (7.92)% | (7.77)% | (8.08)% | (10.15)% | (11.70)% | (7.82)% | (9.89(% | ||||||||||||||||||||

| 1 Year | (5.37)% | (9.63)% | (6.06)% | (6.96)% | (5.39)% | (5.10)% | (5.67)% | (8.15)% | (10.10)% | (6.20)% | (8.16)% | ||||||||||||||||||||

| Average Annual Total Returns | |||||||||||||||||||||||||||||||

| 5 Years | 3.66% | 2.71% | 2.96% | 2.96% | 3.79% | 3.97% | 3.37% | 3.56% | 2.39% | 3.84% | 3.19% | ||||||||||||||||||||

| 10 Years | 4.86% | 4.38% | 4.10% | 4.10% | 4.96% | 5.13% | 4.55% | N/A | 4.53% | 5.65% | 5.09% | ||||||||||||||||||||

| Since Inception | 5.45% | 5.02% | 4.71% | 4.71% | 5.59% | 5.81% | 5.11% | N/A | 5.00% | 5.78% | 5.38% | ||||||||||||||||||||

| 30-Day SEC Yield(8) | 5.79% | 5.31% | 6.05% | 6.36% | 5.69% | N/A | N/A | N/A | N/A | ||||||||||||||||||||||

| (4) | On July 6, 2021, the Fund’s benchmark changed from the Prior Blended Index to the Blended Index, because the Advisor believes that the Blended Index better reflects the investment strategies of the Fund. |

| (5) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. The Blended Index is intended to reflect the proportional market cap of each segment of the preferred and hybrid securities market. The indices do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Indices are unmanaged and an investor cannot invest directly in an index. The Blended Index returns are calculated by using the monthly returns of the four indices during each period shown above. At the beginning of each month the four indices are rebalanced to a 30/30/30/10 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Index for each period shown above. |

| (6) | Since the ICE USD Contingent Capital Index had an inception date of December 31, 2013, the performance of the Blended Index is not available for all of the periods disclosed. |

| (7) | The Prior Blended Index consists of a 50/50 blend of the ICE BofA Fixed Rate Preferred Securities Index and the ICE BofA U.S. Capital Securities Index. The indices do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Indices are unmanaged and an investor cannot invest directly in an index. The Prior Blended Index returns are calculated by using the monthly returns of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50/50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Prior Blended Index for each period shown above. |

| (8) | 30-day SEC yield is calculated by dividing the net investment income per share earned during the most recent 30-day period by the maximum offering price per share on the last day of the period. The reported SEC yields are subsidized. The subsidized yields reflect the waiver and/or a reimbursement of Fund expenses, which has the effect of lowering the Fund’s expense ratio and generating a higher yield. |

| Actual Expenses | Hypothetical (5% Return Before Expenses) | |||||||

| Beginning Account Value 11/1/2021 | Ending Account Value 4/30/2022 | Expenses Paid During Period 11/1/2021 - 4/30/2022 (a) | Beginning Account Value 11/1/2021 | Ending Account Value 4/30/2022 | Expenses Paid During Period 11/1/2021 - 4/30/2022 (a) | Annualized Expense Ratios (b) | ||

Class A | $ 1,000.00 | $ 920.60 | $ 6.19 | $ 1,000.00 | $ 1,018.35 | $ 6.51 | 1.30% | |

Class C | $ 1,000.00 | $ 917.20 | $ 9.65 | $ 1,000.00 | $ 1,014.73 | $ 10.14 | 2.03% | |

Class F | $ 1,000.00 | $ 920.80 | $ 6.19 | $ 1,000.00 | $ 1,018.35 | $ 6.51 | 1.30% | |

Class I | $ 1,000.00 | $ 922.30 | $ 4.81 | $ 1,000.00 | $ 1,019.79 | $ 5.06 | 1.01% | |

Class R3 | $ 1,000.00 | $ 919.20 | $ 7.85 | $ 1,000.00 | $ 1,016.61 | $ 8.25 | 1.65% | |

| (a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (November 1, 2021 through April 30, 2022), multiplied by 181/365 (to reflect the six-month period). |

| (b) | These expense ratios reflect expense caps. |

| Shares | Description | Stated Rate | Stated Maturity | Value | ||||

| $25 PAR PREFERRED SECURITIES – 13.9% | ||||||||

| Banks – 2.0% | ||||||||

| 444 | Atlantic Union Bankshares Corp., Series A | 6.88% | (a) | $11,420 | ||||

| 6,746 | Citizens Financial Group, Inc., Series D (b) | 6.35% | (a) | 174,519 | ||||

| 1,727 | Fifth Third Bancorp, Series I (b) | 6.63% | (a) | 44,712 | ||||

| 39,734 | First Republic Bank, Series M | 4.00% | (a) | 695,345 | ||||

| 21,018 | JPMorgan Chase & Co., Series LL | 4.63% | (a) | 407,329 | ||||

| 8,764 | Old National Bancorp, Series A | 7.00% | (a) | 229,354 | ||||

| 40,177 | Pinnacle Financial Partners, Inc., Series B | 6.75% | (a) | 1,028,129 | ||||

| 62,765 | Signature Bank, Series A | 5.00% | (a) | 1,200,695 | ||||

| 4,971 | Texas Capital Bancshares, Inc., Series B | 5.75% | (a) | 110,207 | ||||

| 27,348 | Valley National Bancorp, Series B (b) | 5.50% | (a) | 654,711 | ||||

| 4,496 | Wells Fargo & Co., Series Q (b) | 5.85% | (a) | 109,657 | ||||

| 30,000 | WesBanco, Inc., Series A (b) | 6.75% | (a) | 810,300 | ||||

| 7,275 | Western Alliance Bancorp, Series A (b) | 4.25% | (a) | 159,832 | ||||

| 5,636,210 | ||||||||

| Capital Markets – 0.8% | ||||||||

| 25,553 | Affiliated Managers Group, Inc. | 4.20% | 09/30/61 | 456,888 | ||||

| 53,733 | Carlyle Finance LLC | 4.63% | 05/15/61 | 1,008,031 | ||||

| 39,115 | KKR Group Finance Co., IX LLC | 4.63% | 04/01/61 | 753,746 | ||||

| 2,218,665 | ||||||||

| Diversified Financial Services – 0.4% | ||||||||

| 11,530 | Apollo Asset Management, Inc., Series B | 6.38% | (a) | 293,784 | ||||

| 38,721 | Equitable Holdings, Inc., Series A | 5.25% | (a) | 842,569 | ||||

| 1,136,353 | ||||||||

| Diversified Telecommunication Services – 0.4% | ||||||||

| 38,862 | Qwest Corp. | 6.50% | 09/01/56 | 868,566 | ||||

| 5,477 | Qwest Corp. | 6.75% | 06/15/57 | 122,904 | ||||

| 991,470 | ||||||||

| Electric Utilities – 0.9% | ||||||||

| 35,878 | Brookfield BRP Holdings Canada, Inc. | 4.63% | (a) | 626,968 | ||||

| 28,651 | Brookfield Infrastructure Finance ULC | 5.00% | 05/24/81 | 557,262 | ||||

| 2,694 | SCE Trust III, Series H (b) | 5.75% | (a) | 63,148 | ||||

| 18,460 | SCE Trust IV, Series J (b) | 5.38% | (a) | 402,428 | ||||

| 12,068 | SCE Trust V, Series K (b) | 5.45% | (a) | 288,063 | ||||

| 27,160 | Southern (The) Co., Series 2020A | 4.95% | 01/30/80 | 573,619 | ||||

| 2,511,488 | ||||||||

| Equity Real Estate Investment Trusts – 0.4% | ||||||||

| 20,431 | Agree Realty Corp., Series A | 4.25% | (a) | 383,898 | ||||

| 1,510 | DigitalBridge Group, Inc., Series I | 7.15% | (a) | 34,624 | ||||

| 115 | DigitalBridge Group, Inc., Series J | 7.13% | (a) | 2,593 | ||||

| 27,478 | Global Net Lease, Inc., Series A | 7.25% | (a) | 696,293 | ||||

| 2,712 | National Storage Affiliates Trust, Series A | 6.00% | (a) | 68,207 | ||||

| 1,185,615 | ||||||||

| Food Products – 0.1% | ||||||||

| 6,575 | CHS, Inc., Series 4 | 7.50% | (a) | 181,601 | ||||

| Gas Utilities – 0.1% | ||||||||

| 24,497 | South Jersey Industries, Inc. | 5.63% | 09/16/79 | 428,697 | ||||

| Independent Power & Renewable Electricity Producers – 0.2% | ||||||||

| 21,958 | Brookfield Renewable Partners L.P., Series 17 | 5.25% | (a) | 458,044 | ||||

| Shares | Description | Stated Rate | Stated Maturity | Value | ||||

| $25 PAR PREFERRED SECURITIES (Continued) | ||||||||

| Insurance – 3.3% | ||||||||

| 61,062 | Aegon Funding Co., LLC | 5.10% | 12/15/49 | $1,291,461 | ||||

| 91 | Allstate (The) Corp. (b) | 5.10% | 01/15/53 | 2,293 | ||||

| 74,883 | American Equity Investment Life Holding Co., Series A (b) | 5.95% | (a) | 1,848,861 | ||||

| 36,659 | American Equity Investment Life Holding Co., Series B (b) | 6.63% | (a) | 949,102 | ||||

| 4,822 | AmTrust Financial Services, Inc. | 7.25% | 06/15/55 | 91,618 | ||||

| 5,383 | AmTrust Financial Services, Inc. | 7.50% | 09/15/55 | 100,931 | ||||

| 28,000 | Arch Capital Group Ltd., Series G | 4.55% | (a) | 540,120 | ||||

| 5,235 | Aspen Insurance Holdings Ltd. | 5.63% | (a) | 121,923 | ||||

| 48,607 | Aspen Insurance Holdings Ltd. | 5.63% | (a) | 1,125,252 | ||||

| 1,136 | Aspen Insurance Holdings Ltd. (b) | 5.95% | (a) | 27,821 | ||||

| 28,847 | Athene Holding Ltd., Series A (b) | 6.35% | (a) | 734,156 | ||||

| 23,160 | CNO Financial Group, Inc. | 5.13% | 11/25/60 | 474,780 | ||||

| 73,827 | Delphi Financial Group, Inc., 3 Mo. LIBOR + 3.19% (c) | 3.70% | 05/15/37 | 1,531,910 | ||||

| 10,700 | Phoenix Cos. (The), Inc. | 7.45% | 01/15/32 | 195,623 | ||||

| 3,793 | RenaissanceRe Holdings Ltd., Series G | 4.20% | (a) | 71,233 | ||||

| 9,107,084 | ||||||||

| Mortgage Real Estate Investment Trusts – 0.9% | ||||||||

| 16,372 | AGNC Investment Corp., Series C (b) | 7.00% | (a) | 403,079 | ||||

| 30,561 | AGNC Investment Corp., Series F (b) | 6.13% | (a) | 706,570 | ||||

| 47,332 | Annaly Capital Management, Inc., Series F (b) | 6.95% | (a) | 1,175,253 | ||||

| 7,000 | Annaly Capital Management, Inc., Series I (b) | 6.75% | (a) | 173,180 | ||||

| 2,458,082 | ||||||||

| Multi-Utilities – 0.8% | ||||||||

| 29,834 | Brookfield Infrastructure Partners L.P., Series 13 | 5.13% | (a) | 579,970 | ||||

| 25 | Brookfield Infrastructure Partners L.P., Series 14 | 5.00% | (a) | 473 | ||||

| 22,444 | DTE Energy Co. | 4.38% | 12/01/81 | 445,065 | ||||

| 35,444 | Integrys Holding, Inc. (b) | 6.00% | 08/01/73 | 894,961 | ||||

| 10,872 | Sempra Energy | 5.75% | 07/01/79 | 260,384 | ||||

| 2,180,853 | ||||||||

| Oil, Gas & Consumable Fuels – 1.5% | ||||||||

| 3,965 | Energy Transfer L.P., Series C (b) | 7.38% | (a) | 94,248 | ||||

| 274 | Energy Transfer L.P., Series D (b) | 7.63% | (a) | 6,587 | ||||

| 104,068 | Energy Transfer L.P., Series E (b) | 7.60% | (a) | 2,518,446 | ||||

| 25,320 | NuStar Energy L.P., Series A, 3 Mo. LIBOR + 6.77% (c) | 7.59% | (a) | 607,680 | ||||

| 1,283 | NuStar Energy L.P., Series C (b) | 9.00% | (a) | 31,433 | ||||

| 39,987 | NuStar Logistics L.P., 3 Mo. LIBOR + 6.73% (c) | 7.78% | 01/15/43 | 1,011,271 | ||||

| 4,269,665 | ||||||||

| Real Estate Management & Development – 1.3% | ||||||||

| 53,333 | Brookfield Property Partners L.P., Series A | 5.75% | (a) | 1,053,327 | ||||

| 10,209 | Brookfield Property Partners L.P., Series A-1 | 6.50% | (a) | 223,986 | ||||

| 53,680 | Brookfield Property Partners L.P., Series A2 | 6.38% | (a) | 1,132,111 | ||||

| 57,982 | Brookfield Property Preferred L.P. | 6.25% | 07/26/81 | 1,210,084 | ||||

| 3,619,508 | ||||||||

| Trading Companies & Distributors – 0.4% | ||||||||

| 42,181 | WESCO International, Inc., Series A (b) | 10.63% | (a) | 1,204,268 | ||||

| Wireless Telecommunication Services – 0.4% | ||||||||

| 11,017 | United States Cellular Corp. | 6.25% | 09/01/69 | 238,739 | ||||

| Shares | Description | Stated Rate | Stated Maturity | Value | ||||

| $25 PAR PREFERRED SECURITIES (Continued) | ||||||||

| Wireless Telecommunication Services (Continued) | ||||||||

| 43,583 | United States Cellular Corp. | 5.50% | 06/01/70 | $878,851 | ||||

| 1,117,590 | ||||||||

Total $25 Par Preferred Securities | 38,705,193 | |||||||

| (Cost $43,039,421) | ||||||||

| $100 PAR PREFERRED SECURITIES – 1.9% | ||||||||

| Banks – 1.9% | ||||||||

| 9,400 | AgriBank FCB (b) | 6.88% | (a) | 989,350 | ||||

| 32,500 | CoBank ACB, Series F (b) | 6.25% | (a) | 3,282,500 | ||||

| 10,500 | Farm Credit Bank of Texas (b) (d) | 6.75% | (a) | 1,089,375 | ||||

Total $100 Par Preferred Securities | 5,361,225 | |||||||

| (Cost $5,556,125) | ||||||||

| $1,000 PAR PREFERRED SECURITIES – 2.2% | ||||||||

| Banks – 2.0% | ||||||||

| 1,127 | Bank of America Corp., Series L | 7.25% | (a) | 1,371,356 | ||||

| 3,353 | Wells Fargo & Co., Series L | 7.50% | (a) | 4,062,126 | ||||

| 5,433,482 | ||||||||

| Diversified Financial Services – 0.2% | ||||||||

| 500 | Compeer Financial ACA (b) (d) | 6.75% | (a) | 510,000 | ||||

Total $1,000 Par Preferred Securities | 5,943,482 | |||||||

| (Cost $6,618,059) | ||||||||

| Par Amount | Description | Stated Rate | Stated Maturity | Value | ||||

| CAPITAL PREFERRED SECURITIES – 78.5% | ||||||||

| Banks – 34.7% | ||||||||

| $1,400,000 | Australia & New Zealand Banking Group Ltd. (b) (d) (e) | 6.75% | (a) | 1,467,669 | ||||

| 600,000 | Australia & New Zealand Banking Group Ltd. (b) (e) (f) | 6.75% | (a) | 629,001 | ||||

| 1,300,000 | Banco Bilbao Vizcaya Argentaria S.A., Series 9 (b) (e) | 6.50% | (a) | 1,262,625 | ||||

| 300,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 6.88% | (a) | 297,194 | ||||

| 600,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 7.50% | (a) | 575,265 | ||||

| 1,000,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 7.63% | (a) | 991,835 | ||||

| 1,100,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 8.38% | (a) | 1,137,152 | ||||

| 1,600,000 | Banco Santander S.A. (b) (e) | 4.75% | (a) | 1,417,310 | ||||

| 2,200,000 | Banco Santander S.A. (b) (e) (f) | 7.50% | (a) | 2,224,064 | ||||

| 969,000 | Bank of America Corp., Series RR (b) | 4.38% | (a) | 859,987 | ||||

| 1,500,000 | Bank of America Corp., Series TT (b) | 6.13% | (a) | 1,503,000 | ||||

| 696,000 | Bank of America Corp., Series X (b) | 6.25% | (a) | 706,301 | ||||

| 2,200,000 | Bank of Nova Scotia (The) (b) | 4.90% | (a) | 2,164,052 | ||||

| 1,100,000 | Barclays PLC (b) (e) | 4.38% | (a) | 919,875 | ||||

| 1,700,000 | Barclays PLC (b) (e) | 6.13% | (a) | 1,669,179 | ||||

| 7,500,000 | Barclays PLC (b) (e) | 8.00% | (a) | 7,748,437 | ||||

| 650,000 | BBVA Bancomer S.A. (b) (d) (e) | 5.88% | 09/13/34 | 620,445 | ||||

| 3,000,000 | BNP Paribas S.A. (b) (d) (e) | 4.63% | (a) | 2,721,120 | ||||

| 1,500,000 | BNP Paribas S.A. (b) (d) (e) | 6.63% | (a) | 1,516,633 | ||||

| 1,921,000 | Citigroup, Inc. (b) | 3.88% | (a) | 1,740,080 | ||||

| 99,000 | Citigroup, Inc. (b) | 5.90% | (a) | 100,898 | ||||

| 725,000 | Citigroup, Inc. (b) | 5.95% | (a) | 725,000 | ||||

| 1,931,000 | Citigroup, Inc., Series D (b) | 5.35% | (a) | 1,906,862 | ||||

| 1,780,000 | Citigroup, Inc., Series P (b) | 5.95% | (a) | 1,742,531 | ||||

| 262,000 | Citigroup, Inc., Series T (b) | 6.25% | (a) | 265,275 | ||||

| 1,072,000 | Citigroup, Inc., Series W (b) | 4.00% | (a) | 975,520 | ||||

| Par Amount | Description | Stated Rate | Stated Maturity | Value | ||||

| CAPITAL PREFERRED SECURITIES (Continued) | ||||||||

| Banks (Continued) | ||||||||

| $1,140,000 | Citigroup, Inc., Series Y (b) | 4.15% | (a) | $1,011,294 | ||||

| 250,000 | Citizens Financial Group, Inc., Series B (b) | 6.00% | (a) | 239,075 | ||||

| 1,000,000 | Citizens Financial Group, Inc., Series G (b) | 4.00% | (a) | 890,000 | ||||

| 2,500,000 | CoBank ACB, Series I (b) | 6.25% | (a) | 2,518,750 | ||||

| 600,000 | Commerzbank AG (b) (e) (f) | 7.00% | (a) | 593,400 | ||||

| 2,600,000 | Credit Agricole S.A. (b) (d) (e) | 6.88% | (a) | 2,617,550 | ||||

| 3,285,000 | Credit Agricole S.A. (b) (d) (e) | 8.13% | (a) | 3,540,645 | ||||

| 1,000,000 | Danske Bank A.S. (b) (e) (f) | 4.38% | (a) | 906,250 | ||||

| 1,500,000 | Danske Bank A.S. (b) (e) (f) | 6.13% | (a) | 1,486,098 | ||||

| 1,050,000 | Danske Bank A.S. (b) (e) (f) | 7.00% | (a) | 1,046,323 | ||||

| 600,000 | Farm Credit Bank of Texas, Series 3 (b) (d) | 6.20% | (a) | 636,000 | ||||

| 1,100,000 | Farm Credit Bank of Texas, Series 4 (b) (d) | 5.70% | (a) | 1,155,000 | ||||

| 601,000 | Fifth Third Bancorp, Series H (b) | 5.10% | (a) | 585,224 | ||||

| 2,644,000 | HSBC Holdings PLC (b) (e) | 6.38% | (a) | 2,658,952 | ||||

| 470,000 | Huntington Bancshares, Inc., Series G (b) | 4.45% | (a) | 451,239 | ||||

| 1,930,000 | ING Groep N.V. (b) (e) | 5.75% | (a) | 1,854,412 | ||||

| 1,200,000 | ING Groep N.V. (b) (e) | 6.50% | (a) | 1,199,760 | ||||

| 1,954,000 | Intesa Sanpaolo S.p.A. (b) (d) (e) | 7.70% | (a) | 1,973,540 | ||||

| 594,000 | JPMorgan Chase & Co., Series R (b) | 6.00% | (a) | 596,970 | ||||

| 955,000 | JPMorgan Chase & Co., Series V, 3 Mo. LIBOR + 3.32% (c) | 4.29% | (a) | 945,450 | ||||

| 1,600,000 | Lloyds Banking Group PLC (b) (e) | 6.75% | (a) | 1,612,856 | ||||

| 3,400,000 | Lloyds Banking Group PLC (b) (e) | 7.50% | (a) | 3,474,358 | ||||

| 800,000 | M&T Bank Corp. (b) | 3.50% | (a) | 674,010 | ||||

| 500,000 | NatWest Group PLC (b) (e) | 6.00% | (a) | 494,025 | ||||

| 1,600,000 | NatWest Group PLC (b) (e) | 8.00% | (a) | 1,686,944 | ||||

| 2,800,000 | Nordea Bank Abp (b) (d) (e) | 6.63% | (a) | 2,849,000 | ||||

| 950,000 | PNC Financial Services Group (The), Inc., Series T (b) | 3.40% | (a) | 819,375 | ||||

| 750,000 | PNC Financial Services Group (The), Inc., Series U (b) | 6.00% | (a) | 747,150 | ||||

| 850,000 | Regions Financial Corp., Series D (b) | 5.75% | (a) | 869,125 | ||||

| 200,000 | Skandinaviska Enskilda Banken AB (b) (e) (f) | 5.13% | (a) | 192,125 | ||||

| 3,500,000 | Societe Generale S.A. (b) (d) (e) | 5.38% | (a) | 3,081,750 | ||||

| 1,490,000 | Societe Generale S.A. (b) (d) (e) | 7.88% | (a) | 1,528,599 | ||||

| 200,000 | Societe Generale S.A. (b) (d) (e) | 8.00% | (a) | 208,585 | ||||

| 2,800,000 | Standard Chartered PLC (b) (d) (e) | 4.30% | (a) | 2,324,000 | ||||

| 1,500,000 | Standard Chartered PLC (b) (d) (e) | 6.00% | (a) | 1,494,375 | ||||

| 2,128,000 | SVB Financial Group, Series D (b) | 4.25% | (a) | 1,846,040 | ||||

| 1,000,000 | Swedbank AB, Series NC5 (b) (e) (f) | 5.63% | (a) | 991,875 | ||||

| 500,000 | Truist Financial Corp., Series L (b) | 5.05% | (a) | 477,500 | ||||

| 3,100,000 | UniCredit S.p.A. (b) (e) (f) | 8.00% | (a) | 3,132,984 | ||||

| 750,000 | UniCredit S.p.A. (b) (d) | 5.46% | 06/30/35 | 678,215 | ||||

| 2,812,000 | Wells Fargo & Co., Series BB (b) | 3.90% | (a) | 2,567,567 | ||||

| 96,543,700 | ||||||||

| Capital Markets – 9.2% | ||||||||

| 1,568,000 | Apollo Management Holdings L.P. (b) (d) | 4.95% | 01/14/50 | 1,457,920 | ||||

| 1,230,000 | Bank of New York Mellon (The) Corp., Series I (b) | 3.75% | (a) | 1,097,775 | ||||

| 400,000 | Charles Schwab (The) Corp. (b) | 5.00% | (a) | 386,388 | ||||

| 1,815,000 | Charles Schwab (The) Corp., Series I (b) | 4.00% | (a) | 1,648,020 | ||||

| 2,855,000 | Credit Suisse Group AG (b) (d) (e) | 5.25% | (a) | 2,515,969 | ||||

| 800,000 | Credit Suisse Group AG (b) (d) (e) | 6.25% | (a) | 778,399 | ||||

| 1,875,000 | Credit Suisse Group AG (b) (d) (e) | 6.38% | (a) | 1,769,794 | ||||

| 250,000 | Credit Suisse Group AG (b) (d) (e) | 7.50% | (a) | 251,024 | ||||

| 4,100,000 | Credit Suisse Group AG (b) (d) (e) | 7.50% | (a) | 4,070,480 | ||||

| 2,100,000 | Deutsche Bank AG (b) (e) | 6.00% | (a) | 1,963,500 | ||||

| 800,000 | Deutsche Bank AG (b) (e) | 7.50% | (a) | 787,000 | ||||

| Par Amount | Description | Stated Rate | Stated Maturity | Value | ||||

| CAPITAL PREFERRED SECURITIES (Continued) | ||||||||

| Capital Markets (Continued) | ||||||||

| $1,428,000 | EFG International AG (b) (e) (f) | 5.50% | (a) | $1,370,036 | ||||

| 200,000 | Goldman Sachs Group (The), Inc., Series R (b) | 4.95% | (a) | 193,000 | ||||

| 685,000 | Goldman Sachs Group (The), Inc., Series T (b) | 3.80% | (a) | 604,501 | ||||

| 1,718,000 | Goldman Sachs Group (The), Inc., Series U (b) | 3.65% | (a) | 1,494,660 | ||||

| 525,000 | Morgan Stanley, Series M (b) | 5.88% | (a) | 535,382 | ||||

| 1,500,000 | UBS Group AG (b) (d) (e) | 4.88% | (a) | 1,381,875 | ||||

| 2,400,000 | UBS Group AG (b) (e) (f) | 6.88% | (a) | 2,437,824 | ||||

| 960,000 | UBS Group AG (b) (d) (e) | 7.00% | (a) | 978,000 | ||||

| 25,721,547 | ||||||||

| Consumer Finance – 1.3% | ||||||||

| 500,000 | Ally Financial, Inc., Series B (b) | 4.70% | (a) | 433,312 | ||||

| 1,963,000 | American Express Co. (b) | 3.55% | (a) | 1,695,738 | ||||

| 1,652,000 | Capital One Financial Corp., Series M (b) | 3.95% | (a) | 1,437,240 | ||||

| 3,566,290 | ||||||||

| Diversified Financial Services – 3.2% | ||||||||

| 2,500,000 | American AgCredit Corp. (b) (d) | 5.25% | (a) | 2,284,375 | ||||

| 1,500,000 | Ares Finance Co. III LLC (b) (d) | 4.13% | 06/30/51 | 1,397,652 | ||||

| 1,500,000 | Capital Farm Credit ACA, Series 1 (b) (d) | 5.00% | (a) | 1,372,500 | ||||

| 600,000 | Compeer Financial ACA (b) (d) | 4.88% | (a) | 533,250 | ||||

| 200,000 | Depository Trust & Clearing (The) Corp., Series D (b) (d) | 3.38% | (a) | 178,000 | ||||

| 2,265,000 | Voya Financial, Inc. (b) | 5.65% | 05/15/53 | 2,256,518 | ||||

| 843,000 | Voya Financial, Inc., Series A (b) | 6.13% | (a) | 840,892 | ||||

| 8,863,187 | ||||||||

| Electric Utilities – 3.3% | ||||||||

| 840,000 | Duke Energy Corp. (b) | 4.88% | (a) | 833,700 | ||||

| 761,000 | Edison International, Series B (b) | 5.00% | (a) | 690,701 | ||||

| 4,756,000 | Emera, Inc., Series 16-A (b) | 6.75% | 06/15/76 | 4,839,230 | ||||

| 1,260,000 | Southern (The) Co., Series 21-A (b) | 3.75% | 09/15/51 | 1,137,150 | ||||

| 1,802,000 | Southern California Edison Co., Series E, 3 Mo. LIBOR + 4.20% (c) | 4.52% | (a) | 1,774,970 | ||||

| 9,275,751 | ||||||||

| Energy Equipment & Services – 0.5% | ||||||||

| 1,500,000 | Transcanada Trust (b) | 5.50% | 09/15/79 | 1,449,375 | ||||

| Food Products – 3.4% | ||||||||

| 300,000 | Dairy Farmers of America, Inc. (g) | 7.13% | (a) | 294,375 | ||||

| 3,000,000 | Land O’Lakes Capital Trust I (g) | 7.45% | 03/15/28 | 3,375,435 | ||||

| 1,400,000 | Land O’Lakes, Inc. (d) | 7.00% | (a) | 1,430,072 | ||||

| 1,200,000 | Land O’Lakes, Inc. (d) | 7.25% | (a) | 1,258,560 | ||||

| 3,000,000 | Land O’Lakes, Inc. (d) | 8.00% | (a) | 3,161,325 | ||||

| 9,519,767 | ||||||||

| Insurance – 9.0% | ||||||||

| 400,000 | Allianz SE (b) (d) | 3.50% | (a) | 363,000 | ||||

| 1,822,000 | Assurant, Inc. (b) | 7.00% | 03/27/48 | 1,884,595 | ||||

| 850,000 | Assured Guaranty Municipal Holdings, Inc. (b) (d) | 6.40% | 12/15/66 | 859,775 | ||||

| 2,100,000 | AXIS Specialty Finance LLC (b) | 4.90% | 01/15/40 | 1,955,877 | ||||

| 1,276,000 | Enstar Finance LLC (b) | 5.75% | 09/01/40 | 1,257,402 | ||||

| 2,585,000 | Enstar Finance LLC (b) | 5.50% | 01/15/42 | 2,408,587 | ||||

| 1,000,000 | Fortegra Financial Corp. (b) (g) | 8.50% | 10/15/57 | 1,196,439 | ||||

| 3,527,000 | Global Atlantic Fin Co. (b) (d) | 4.70% | 10/15/51 | 3,207,313 | ||||

| Par Amount | Description | Stated Rate | Stated Maturity | Value | ||||

| CAPITAL PREFERRED SECURITIES (Continued) | ||||||||

| Insurance (Continued) | ||||||||

| $820,000 | Hartford Financial Services Group (The), Inc., 3 Mo. LIBOR + 2.13% (c) (d) | 2.63% | 02/12/47 | $722,477 | ||||

| 1,174,000 | Kuvare US Holdings, Inc. (b) (d) | 7.00% | 02/17/51 | 1,218,914 | ||||

| 300,000 | La Mondiale SAM (b) (f) | 5.88% | 01/26/47 | 303,823 | ||||

| 1,920,000 | Lancashire Holdings Ltd. (b) (f) | 5.63% | 09/18/41 | 1,717,440 | ||||

| 1,000,000 | Liberty Mutual Group, Inc. (b) (d) | 4.13% | 12/15/51 | 909,045 | ||||

| 1,320,000 | Markel Corp. (b) | 6.00% | (a) | 1,351,350 | ||||

| 1,400,000 | Principal Financial Group, Inc., 3 Mo. LIBOR + 3.04% (c) | 3.55% | 05/15/55 | 1,347,500 | ||||

| 2,000,000 | QBE Insurance Group Ltd. (b) (d) | 5.88% | (a) | 2,015,000 | ||||

| 1,450,000 | QBE Insurance Group Ltd. (b) (f) | 6.75% | 12/02/44 | 1,501,134 | ||||

| 301,000 | QBE Insurance Group Ltd. (b) (f) | 5.88% | 06/17/46 | 306,302 | ||||

| 646,000 | Reinsurance Group of America, Inc., 3 Mo. LIBOR + 2.67% (c) | 3.49% | 12/15/65 | 578,170 | ||||

| 25,104,143 | ||||||||

| Multi-Utilities – 2.9% | ||||||||

| 2,526,000 | Algonquin Power & Utilities Corp. (b) | 4.75% | 01/18/82 | 2,313,740 | ||||

| 2,043,000 | CenterPoint Energy, Inc., Series A (b) | 6.13% | (a) | 1,967,092 | ||||

| 735,000 | NiSource, Inc. (b) | 5.65% | (a) | 712,950 | ||||

| 682,000 | Sempra Energy (b) | 4.88% | (a) | 673,475 | ||||

| 2,620,000 | Sempra Energy (b) | 4.13% | 04/01/52 | 2,314,989 | ||||

| 7,982,246 | ||||||||

| Oil, Gas & Consumable Fuels – 7.6% | ||||||||

| 800,000 | Buckeye Partners L.P. (b) | 6.38% | 01/22/78 | 661,744 | ||||

| 2,693,000 | DCP Midstream L.P., Series A (b) | 7.38% | (a) | 2,565,083 | ||||

| 1,552,000 | DCP Midstream Operating L.P. (b) (d) | 5.85% | 05/21/43 | 1,413,554 | ||||

| 2,132,000 | Enbridge, Inc. (b) | 6.25% | 03/01/78 | 2,154,802 | ||||

| 4,638,000 | Enbridge, Inc., Series 16-A (b) | 6.00% | 01/15/77 | 4,668,839 | ||||

| 2,276,000 | Enbridge, Inc., Series 20-A (b) | 5.75% | 07/15/80 | 2,264,620 | ||||

| 1,786,000 | Energy Transfer L.P., 3 Mo. LIBOR + 3.02% (c) | 3.33% | 11/01/66 | 1,473,450 | ||||

| 657,000 | Energy Transfer L.P., Series A (b) | 6.25% | (a) | 559,271 | ||||

| 903,000 | Energy Transfer L.P., Series F (b) | 6.75% | (a) | 871,395 | ||||

| 271,000 | Energy Transfer L.P., Series H (b) | 6.50% | (a) | 258,157 | ||||

| 2,204,000 | Enterprise Products Operating LLC, 3 Mo. LIBOR + 2.78% (c) | 3.30% | 06/01/67 | 1,926,087 | ||||

| 1,196,000 | Enterprise Products Operating LLC, Series D (b) | 4.88% | 08/16/77 | 1,070,548 | ||||

| 1,200,000 | Transcanada Trust (b) | 5.60% | 03/07/82 | 1,162,500 | ||||

| 21,050,050 | ||||||||

| Trading Companies & Distributors – 2.8% | ||||||||

| 6,410,000 | AerCap Holdings N.V. (b) | 5.88% | 10/10/79 | 6,018,734 | ||||

| 700,000 | Air Lease Corp., Series B (b) | 4.65% | (a) | 631,750 | ||||

| 1,330,000 | Aircastle Ltd. (b) (d) | 5.25% | (a) | 1,185,550 | ||||

| 7,836,034 | ||||||||

| Transportation Infrastructure – 0.6% | ||||||||

| 1,860,000 | AerCap Global Aviation Trust (b) (d) | 6.50% | 06/15/45 | 1,810,859 | ||||

Total Capital Preferred Securities | 218,722,949 | |||||||

| (Cost $229,021,260) | ||||||||

| Principal Value | Description | Stated Coupon | Stated Maturity | Value | ||||

| FOREIGN CORPORATE BONDS AND NOTES – 1.4% | ||||||||

| Insurance – 1.4% | ||||||||

| $3,925,666 | Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. (d) (h) | 7.63% | 10/15/25 | $3,992,128 | ||||

| (Cost $4,127,762) | ||||||||

| CORPORATE BONDS AND NOTES – 0.3% | ||||||||

| Insurance – 0.3% | ||||||||

| 900,000 | AmTrust Financial Services, Inc. | 6.13% | 08/15/23 | 897,737 | ||||

| (Cost $906,460) | ||||||||

| Shares | Description | Value | ||

| EXCHANGE-TRADED FUNDS – 0.2% | ||||

| Capital Markets – 0.2% | ||||

| 50,734 | Invesco Preferred ETF | 632,653 | ||

| (Cost $694,730) | ||||

Total Investments – 98.4% | 274,255,367 | |||

| (Cost $289,963,817) | ||||

Net Other Assets and Liabilities – 1.6% | 4,358,770 | |||

Net Assets – 100.0% | $278,614,137 | |||

| (a) | Perpetual maturity. |

| (b) | Fixed-to-floating or fixed-to-variable rate security. The interest rate shown reflects the fixed rate in effect at April 30, 2022. At a predetermined date, the fixed rate will change to a floating rate or a variable rate. |

| (c) | Floating or variable rate security. |

| (d) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the First Trust Series Fund’s (the “Trust”) Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P., (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At April 30, 2022, securities noted as such amounted to $75,530,757 or 27.1% of net assets. |

| (e) | This security is a contingent convertible capital security which may be subject to conversion into common stock of the issuer under certain circumstances. At April 30, 2022, securities noted as such amounted to $84,450,111 or 30.3% of net assets. Of these securities, 4.3% originated in emerging markets, and 95.7% originated in foreign markets. |

| (f) | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the 1933 Act. |

| (g) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the 1933 Act, and may be resold in transactions exempt from registration, normally to qualified institutional buyers (see Note 2C - Restricted Securities in the Notes to Financial Statements). |

| (h) | These notes are Senior Payment-in-kind (“PIK”) Toggle Notes whereby the issuer may, at its option, elect to pay interest on the notes (1) entirely in cash or (2) entirely in PIK interest. Interest paid in cash will accrue on the notes at a rate of 7.63% per annum (“Cash Interest Rate”) and PIK interest will accrue on the notes at a rate per annum equal to the Cash Interest Rate plus 75 basis points. For the six months ended April 30, 2022, this security paid all of its interest in cash. |

| Total Value at 4/30/2022 | Level 1 Quoted Prices | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs | |

| $25 Par Preferred Securities: | ||||

Insurance | $ 9,107,084 | $ 7,187,002 | $ 1,920,082 | $ — |

Multi-Utilities | 2,180,853 | 1,285,892 | 894,961 | — |

Other industry categories* | 27,417,256 | 27,417,256 | — | — |

$100 Par Preferred Securities* | 5,361,225 | — | 5,361,225 | — |

| $1,000 Par Preferred Securities: | ||||

Banks | 5,433,482 | 5,433,482 | — | — |

Diversified Financial Services | 510,000 | — | 510,000 | — |

Capital Preferred Securities* | 218,722,949 | — | 218,722,949 | — |

Foreign Corporate Bonds and Notes* | 3,992,128 | — | 3,992,128 | — |

Corporate Bonds and Notes* | 897,737 | — | 897,737 | — |

Exchange-Traded Funds* | 632,653 | 632,653 | — | — |

Total Investments | $ 274,255,367 | $ 41,956,285 | $ 232,299,082 | $— |

| * | See Portfolio of Investments for industry breakout. |

| ASSETS: | |

Investments, at value (Cost $289,963,817) | $ 274,255,367 |

Cash | 2,471,107 |

| Receivables: | |

Interest | 3,084,872 |

Fund shares sold | 425,299 |

Investment securities sold | 153,852 |

Dividends | 132,314 |

Dividend reclaims | 1,036 |

Total Assets | 280,523,847 |

| LIABILITIES: | |

| Payables: | |

Fund shares redeemed | 1,228,071 |

Investment advisory fees | 185,409 |

Investment securities purchased | 136,056 |

Distributions | 112,030 |

Administrative fees | 71,413 |

12b-1 distribution and service fees | 48,069 |

Transfer agent fees | 41,011 |

Audit and tax fees | 31,811 |

Registration fees | 30,198 |

Shareholder reporting fees | 12,220 |

Custodian fees | 7,487 |

Trustees’ fees and expenses | 1,417 |

Commitment and administrative agency fees | 773 |

Financial reporting fees | 732 |

Other liabilities | 3,013 |

Total Liabilities | 1,909,710 |

NET ASSETS | $278,614,137 |

| NET ASSETS consist of: | |

Paid-in capital | $ 303,188,348 |

Par value | 136,098 |

Accumulated distributable earnings (loss) | (24,710,309) |

NET ASSETS | $278,614,137 |

| Maximum Offering Price Per Share: | |

| Class A Shares: | |

Net asset value and redemption price per share (Based on net assets of $49,108,298 and 2,412,058 shares of beneficial interest issued and outstanding) | $20.36 |

Maximum sales charge (4.50% of offering price) | 0.96 |

Maximum offering price to public | $21.32 |

| Class C Shares: | |

Net asset value and redemption price per share (Based on net assets of $43,607,453 and 2,127,819 shares of beneficial interest issued and outstanding) | $20.49 |

| Class F Shares: | |

Net asset value and redemption price per share (Based on net assets of $843,164 and 40,888 shares of beneficial interest issued and outstanding) | $20.62 |

| Class I Shares: | |

Net asset value and redemption price per share (Based on net assets of $184,338,221 and 8,993,725 shares of beneficial interest issued and outstanding) | $20.50 |

| Class R3 Shares: | |

Net asset value and redemption price per share (Based on net assets of $717,001 and 35,343 shares of beneficial interest issued and outstanding) | $20.29 |

| INVESTMENT INCOME: | ||

Interest | $ 7,035,126 | |

Dividends (net of foreign withholding tax of $2,709) | 1,741,720 | |

Total investment income | 8,776,846 | |

| EXPENSES: | ||

Investment advisory fees | 1,233,195 | |

| 12b-1 distribution and/or service fees: | ||

Class A | 66,474 | |

Class C | 241,993 | |

Class F | 681 | |

Class R3 | 1,801 | |

Transfer agent fees | 130,892 | |

Administrative fees | 65,514 | |

Registration fees | 49,520 | |

Audit and tax fees | 24,902 | |

Shareholder reporting fees | 24,868 | |

Custodian fees | 23,533 | |

Commitment and administrative agency fees | 19,118 | |

Trustees’ fees and expenses | 10,725 | |

Financial reporting fees | 4,586 | |

Legal fees | 3,839 | |

Other | 7,969 | |

Total expenses | 1,909,610 | |

Fees waived and expenses reimbursed by the investment advisor | (20,964) | |

Net expenses | 1,888,646 | |

NET INVESTMENT INCOME (LOSS) | 6,888,200 | |

| NET REALIZED AND UNREALIZED GAIN (LOSS): | ||

Net realized gain (loss) on investments | 838,995 | |

Net change in unrealized appreciation (depreciation) on investments | (32,670,060) | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | (31,831,065) | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $(24,942,865) | |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended 10/31/2021 | ||

| OPERATIONS: | |||

Net investment income (loss) | $ 6,888,200 | $ 13,467,448 | |

Net realized gain (loss) | 838,995 | 5,098,120 | |

Net change in unrealized appreciation (depreciation) | (32,670,060) | 13,312,730 | |

Net increase (decrease) in net assets resulting from operations | (24,942,865) | 31,878,298 | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM INVESTMENT OPERATIONS: | |||

Class A Shares | (1,116,008) | (2,027,973) | |

Class C Shares | (822,833) | (1,899,342) | |

Class F Shares | (19,273) | (41,330) | |

Class I Shares | (4,533,313) | (8,947,567) | |

Class R3 Shares | (14,272) | (27,927) | |

Total distributions to shareholders from investment operations | (6,505,699) | (12,944,139) | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM RETURN OF CAPITAL: | |||

Class A shares | — | (221,139) | |

Class C shares | — | (202,730) | |

Class F shares | — | (4,407) | |

Class I shares | — | (970,230) | |

Class R3 shares | — | (2,998) | |

Total distributions to shareholders from return of capital | — | (1,401,504) | |

| CAPITAL TRANSACTIONS: | |||

Proceeds from shares sold | 34,774,278 | 71,079,673 | |

Proceeds from shares reinvested | 5,779,460 | 12,962,840 | |

Cost of shares redeemed | (56,340,482) | (65,560,931) | |

Net increase (decrease) in net assets resulting from capital transactions | (15,786,744) | 18,481,582 | |

Total increase (decrease) in net assets | (47,235,308) | 36,014,237 | |

| NET ASSETS: | |||

Beginning of period | 325,849,445 | 289,835,208 | |

End of period | $278,614,137 | $325,849,445 |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class A Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 22.58 | $ 21.31 | $ 22.07 | $ 20.85 | $ 22.39 | $ 21.63 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) | 0.47 (a) | 0.95 (a) | 1.01 (a) | 1.12 (a) | 1.11 (a) | 1.11 (a) | |||||

Net realized and unrealized gain (loss) | (2.24) | 1.34 | (0.70) | 1.25 | (1.50) | 0.80 | |||||

Total from investment operations | (1.77) | 2.29 | 0.31 | 2.37 | (0.39) | 1.91 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net investment income | (0.45) | (0.92) | (0.98) | (1.12) | (1.13) | (1.15) | |||||

Return of capital | — | (0.10) | (0.09) | (0.03) | (0.02) | — | |||||

Total distributions | (0.45) | (1.02) | (1.07) | (1.15) | (1.15) | (1.15) | |||||

Net asset value, end of period | $20.36 | $22.58 | $21.31 | $22.07 | $20.85 | $22.39 | |||||

Total return (b) | (7.94)% | 10.89% | 1.53% | 11.75% | (1.77)% | 9.05% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 49,108 | $ 56,365 | $ 43,802 | $ 39,719 | $ 36,262 | $ 39,063 | |||||

Ratio of total expenses to average net assets | 1.30% (c) | 1.33% | 1.36% | 1.41% | 1.37% | 1.36% | |||||

Ratio of net expenses to average net assets | 1.30% (c) | 1.33% | 1.36% | 1.40% | 1.37% | 1.36% | |||||

Ratio of net investment income (loss) to average net assets | 4.40% (c) | 4.22% | 4.78% | 5.27% | 5.15% | 5.11% | |||||

Portfolio turnover rate | 13% | 38% | 46% | 41% | 33% | 44% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum sales charge of 4.50% or contingent deferred sales charge (CDSC). On purchases of $1 million or more, a CDSC of 1% may be imposed on certain redemptions made within twelve months of purchase. If the sales charges were included, total returns would be lower. These returns include Rule 12b-1 service fees of 0.25% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class C Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 22.72 | $ 21.43 | $ 22.18 | $ 20.93 | $ 22.44 | $ 21.67 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) | 0.40 (a) | 0.79 (a) | 0.87 (a) | 0.98 (a) | 0.97 (a) | 0.96 (a) | |||||

Net realized and unrealized gain (loss) | (2.26) | 1.35 | (0.71) | 1.26 | (1.50) | 0.79 | |||||

Total from investment operations | (1.86) | 2.14 | 0.16 | 2.24 | (0.53) | 1.75 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net investment income | (0.37) | (0.77) | (0.83) | (0.96) | (0.96) | (0.98) | |||||

Return of capital | — | (0.08) | (0.08) | (0.03) | (0.02) | — | |||||

Total distributions | (0.37) | (0.85) | (0.91) | (0.99) | (0.98) | (0.98) | |||||

Net asset value, end of period | $20.49 | $22.72 | $21.43 | $22.18 | $20.93 | $22.44 | |||||

Total return (b) | (8.28)% | 10.11% | 0.84% | 11.01% | (2.37)% | 8.27% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 43,607 | $ 51,756 | $ 54,264 | $ 57,898 | $ 59,610 | $ 64,462 | |||||

Ratio of total expenses to average net assets | 2.03% (c) | 2.04% | 2.07% | 2.06% | 2.02% | 2.06% | |||||

Ratio of net expenses to average net assets | 2.03% (c) | 2.04% | 2.07% | 2.06% | 2.02% | 2.06% | |||||

Ratio of net investment income (loss) to average net assets | 3.67% (c) | 3.51% | 4.09% | 4.61% | 4.50% | 4.41% | |||||

Portfolio turnover rate | 13% | 38% | 46% | 41% | 33% | 44% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum CDSC of 1%, charged on certain redemptions made within one year of purchase. If the sales charge was included, total returns would be lower. These returns include combined Rule 12b-1 distribution and service fees of 1% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class F Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 22.87 | $ 21.59 | $ 22.32 | $ 21.07 | $ 22.62 | $ 21.82 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) | 0.48 (a) | 0.97 (a) | 1.06 (a) | 1.16 (a) | 1.14 (a) | 1.13 (a) | |||||

Net realized and unrealized gain (loss) | (2.27) | 1.36 | (0.70) | 1.26 | (1.52) | 0.84 | |||||

Total from investment operations: | (1.79) | 2.33 | 0.36 | 2.42 | (0.38) | 1.97 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net investment income | (0.46) | (0.95) | (1.02) | (1.14) | (1.15) | (1.17) | |||||

Return of capital | — | (0.10) | (0.07) | (0.03) | (0.02) | — | |||||

Total distributions | (0.46) | (1.05) | (1.09) | (1.17) | (1.17) | (1.17) | |||||

Net asset value, end of period | $20.62 | $22.87 | $21.59 | $22.32 | $21.07 | $22.62 | |||||

Total return (b) | (7.92)% | 10.91% | 1.79% | 11.87% | (1.70)% | 9.27% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 843 | $ 969 | $ 993 | $ 4,238 | $ 7,431 | $ 7,339 | |||||

Ratio of total expenses to average net assets | 3.45% (c) | 3.17% | 2.36% | 1.65% | 1.42% | 1.39% | |||||

Ratio of net expenses to average net assets | 1.30% (c) | 1.30% | 1.30% | 1.30% | 1.30% | 1.30% | |||||

Ratio of net investment income (loss) to average net assets | 4.40% (c) | 4.25% | 4.83% | 5.43% | 5.21% | 5.11% | |||||

Portfolio turnover rate | 13% | 38% | 46% | 41% | 33% | 44% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period. These returns include Rule 12b-1 service fees of 0.15% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class I Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 22.72 | $ 21.43 | $ 22.23 | $ 20.98 | $ 22.49 | $ 21.71 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) | 0.51 (a) | 1.02 (a) | 1.08 (a) | 1.19 (a) | 1.20 (a) | 1.20 (a) | |||||

Net realized and unrealized gain (loss) | (2.25) | 1.35 | (0.76) | 1.26 | (1.51) | 0.78 | |||||

Total from investment operations | (1.74) | 2.37 | 0.32 | 2.45 | (0.31) | 1.98 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net investment income | (0.48) | (0.97) | (1.02) | (1.17) | (1.17) | (1.20) | |||||

Return of capital | — | (0.11) | (0.10) | (0.03) | (0.03) | — | |||||

Total distributions | (0.48) | (1.08) | (1.12) | (1.20) | (1.20) | (1.20) | |||||

Net asset value, end of period | $20.50 | $22.72 | $21.43 | $22.23 | $20.98 | $22.49 | |||||

Total return (b) | (7.77)% | 11.21% | 1.63% | 12.09% | (1.38)% | 9.39% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 184,338 | $ 216,022 | $ 190,093 | $ 176,503 | $ 142,161 | $ 141,661 | |||||

Ratio of total expenses to average net assets | 1.01% (c) | 1.03% | 1.05% | 1.04% | 1.02% | 0.99% | |||||

Ratio of net expenses to average net assets | 1.01% (c) | 1.03% | 1.05% | 1.04% | 1.02% | 0.99% | |||||

Ratio of net investment income (loss) to average net assets | 4.68% (c) | 4.51% | 5.09% | 5.60% | 5.51% | 5.49% | |||||

Portfolio turnover rate | 13% | 38% | 46% | 41% | 33% | 44% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class R3 Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 22.51 | $ 21.26 | $ 22.02 | $ 20.81 | $ 22.35 | $ 21.61 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) | 0.44 (a) | 0.87 (a) | 0.95 (a) | 1.06 (a) | 1.05 (a) | 1.05 (a) | |||||

Net realized and unrealized gain (loss) | (2.23) | 1.35 | (0.70) | 1.24 | (1.50) | 0.78 | |||||

Total from investment operations: | (1.79) | 2.22 | 0.25 | 2.30 | (0.45) | 1.83 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net investment income | (0.43) | (0.88) | (0.92) | (1.06) | (1.07) | (1.09) | |||||

Return of capital | — | (0.09) | (0.09) | (0.03) | (0.02) | — | |||||

Total distributions | (0.43) | (0.97) | (1.01) | (1.09) | (1.09) | (1.09) | |||||

Net asset value, end of period | $20.29 | $22.51 | $21.26 | $22.02 | $20.81 | $22.35 | |||||

Total return (b) | (8.08)% | 10.56% | 1.32% | 11.44% | (2.02)% | 8.70% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 717 | $ 738 | $ 683 | $ 792 | $ 724 | $ 756 | |||||

Ratio of total expenses to average net assets | 4.77% (c) | 4.45% | 4.20% | 4.46% | 4.01% | 4.29% | |||||

Ratio of net expenses to average net assets | 1.65% (c) | 1.65% | 1.65% | 1.65% | 1.65% | 1.65% | |||||

Ratio of net investment income (loss) to average net assets | 4.06% (c) | 3.90% | 4.51% | 5.02% | 4.87% | 4.83% | |||||

Portfolio turnover rate | 13% | 38% | 46% | 41% | 33% | 44% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period. These returns include combined Rule 12b-1 distribution and service fees of 0.50%, and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| 1) | benchmark yields; |

| 2) | reported trades; |

| 3) | broker/dealer quotes; |

| 4) | issuer spreads; |

| 5) | benchmark securities; |

| 6) | bids and offers; and |

| 7) | reference data including market research publications. |

| 1) | the credit conditions in the relevant market and changes thereto; |

| 2) | the liquidity conditions in the relevant market and changes thereto; |

| 3) | the interest rate conditions in the relevant market and changes thereto (such as significant changes in interest rates); |

| 4) | issuer-specific conditions (such as significant credit deterioration); and |

| 5) | any other market-based data the Advisor’s Pricing Committee considers relevant. In this regard, the Advisor’s Pricing Committee may use last-obtained market-based data to assist it when valuing portfolio securities using amortized cost. |

| 1) | the type of security; |

| 2) | the size of the holding; |

| 3) | the initial cost of the security; |

| 4) | transactions in comparable securities; |

| 5) | price quotes from dealers and/or third-party pricing services; |

| 6) | relationships among various securities; |

| 7) | information obtained by contacting the issuer, analysts, or the appropriate stock exchange; |

| 8) | an analysis of the issuer’s financial statements; and |

| 9) | the existence of merger proposals or tender offers that might affect the value of the security. |

| 1) | the value of similar foreign securities traded on other foreign markets; |

| 2) | ADR trading of similar securities; |

| 3) | closed-end fund or exchange-traded fund trading of similar securities; |

| 4) | foreign currency exchange activity; |

| 5) | the trading prices of financial products that are tied to baskets of foreign securities; |

| 6) | factors relating to the event that precipitated the pricing problem; |

| 7) | whether the event is likely to recur; and |

| 8) | whether the effects of the event are isolated or whether they affect entire markets, countries or regions. |

| • | Level 1 – Level 1 inputs are quoted prices in active markets for identical investments. An active market is a market in which transactions for the investment occur with sufficient frequency and volume to provide pricing information on an ongoing basis. |

| • | Level 2 – Level 2 inputs are observable inputs, either directly or indirectly, and include the following: |

| o | Quoted prices for similar investments in active markets. |

| o | Quoted prices for identical or similar investments in markets that are non-active. A non-active market is a market where there are few transactions for the investment, the prices are not current, or price quotations vary substantially either over time or among market makers, or in which little information is released publicly. |

| o | Inputs other than quoted prices that are observable for the investment (for example, interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks, and default rates). |

| o | Inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| • | Level 3 – Level 3 inputs are unobservable inputs. Unobservable inputs may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the investment. |

| Security | Acquisition Date | Principal Value | Current Price | Carrying Cost | Value | % of Net Assets | ||

| Dairy Farmers of America, Inc., 7.13% | 10/04/16 | $300,000 | $98.13 | $310,125 | $294,375 | 0.11% | ||

| Fortegra Financial Corp., 8.50%, 10/15/57 | 10/12/17 | 1,000,000 | 119.64 | 1,000,000 | 1,196,439 | 0.43 | ||

| Land O’Lakes Capital Trust I, 7.45%, 03/15/28 | 06/06/14-03/20/15 | 3,000,000 | 112.51 | 3,051,128 | 3,375,435 | 1.21 | ||

| $4,361,253 | $4,866,249 | 1.75% |

| Distributions paid from: | |

Ordinary income | $12,944,139 |

Capital gains | — |

Return of capital | 1,401,504 |

Undistributed ordinary income | $— |

Undistributed capital gains | — |

Total undistributed earnings | — |

Accumulated capital and other losses | (11,465,834) |

Net unrealized appreciation (depreciation) | 18,204,089 |

Total accumulated earnings (losses) | 6,738,255 |

Other | — |

Paid-in capital | 319,111,190 |

Total net assets | $325,849,445 |

| Tax Cost | Gross Unrealized Appreciation | Gross Unrealized (Depreciation) | Net Unrealized Appreciation (Depreciation) | |||

| $289,963,817 | $2,667,187 | $(18,375,637) | $(15,708,450) |

| Expenses Subject to Recovery | ||||||||||||

| Advisory Fee Waiver | Expense Reimbursement | Six Months Ended October 31, 2019 | Year Ended October 31, 2020 | Year Ended October 31, 2021 | Six Months Ended April 30, 2022 | Total | ||||||

| $ 20,964 | $ — | $ 22,511 | $ 40,267 | $ 38,675 | $ 20,964 | $ 122,417 | ||||||

| Six Months Ended April 30, 2022 | Year Ended October 31, 2021 | ||||||

| Shares | Value | Shares | Value | ||||

| Sales: | |||||||

| Class A | 231,296 | $ 5,007,134 | 732,198 | $ 16,484,863 | |||

| Class C | 74,260 | 1,637,248 | 194,429 | 4,395,572 | |||

| Class F | 53 | 1,153 | 1,475 | 33,532 | |||

| Class I | 1,282,553 | 28,069,567 | 2,218,685 | 50,136,059 | |||

| Class R3 | 2,763 | 59,176 | 1,314 | 29,647 | |||

| Total Sales | 1,590,925 | $ 34,774,278 | 3,148,101 | $ 71,079,673 | |||

| Dividend Reinvestment: | |||||||

| Class A | 42,874 | $ 923,394 | 80,966 | $ 1,820,859 | |||

| Class C | 33,158 | 718,597 | 81,561 | 1,843,949 | |||

| Class F | 531 | 11,585 | 1,472 | 33,510 | |||

| Class I | 189,868 | 4,117,778 | 408,796 | 9,247,640 | |||

| Class R3 | 378 | 8,106 | 753 | 16,882 | |||

| Total Dividend Reinvestment | 266,809 | $ 5,779,460 | 573,548 | $ 12,962,840 | |||

| Redemptions: | |||||||

| Class A | (358,554) | $ (7,741,777) | (372,651) | $ (8,363,254) | |||

| Class C | (257,579) | (5,567,268) | (530,533) | (12,017,995) | |||

| Class F | (2,048) | (44,804) | (6,591) | (149,965) | |||

| Class I | (1,985,364) | (42,973,643) | (1,992,635) | (44,998,460) | |||

| Class R3 | (584) | (12,990) | (1,388) | (31,257) | |||

| Total Redemptions | (2,604,129) | $ (56,340,482) | (2,903,798) | $ (65,560,931) | |||

| NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE |

FUND ACCOUNTANT &

CUSTODIAN

PUBLIC ACCOUNTING FIRM

Small Cap Value Fund

| 1 | |

| 2 | |

| 4 | |

| 5 | |

| 6 | |

| 8 | |

| 9 | |

| 10 | |

| 11 | |

| 14 | |

| 20 |

| Fund Statistics | |

| First Trust/Confluence Small Cap Value Fund | Net Asset Value (NAV) |

| Class A (FOVAX) | $32.03 |

| Class C (FOVCX) | $27.65 |

| Class I (FOVIX) | $33.26 |

| Sector Allocation | % of Total Investments |

| Industrials | 25.5% |

| Financials | 18.0 |

| Consumer Discretionary | 12.9 |

| Real Estate | 11.1 |

| Consumer Staples | 9.4 |

| Utilities | 7.4 |

| Information Technology | 7.2 |

| Energy | 3.9 |

| Materials | 2.5 |

| Health Care | 2.1 |

| Total | 100.0% |

| Top Ten Holdings | % of Total Investments |

| J&J Snack Foods Corp. | 4.0% |

| Rayonier, Inc. | 4.0 |

| Morningstar, Inc. | 4.0 |

| Core Laboratories N.V. | 3.9 |

| Frontdoor, Inc. | 3.9 |

| Northwest Natural Holding Co. | 3.8 |

| RBC Bearings, Inc. | 3.7 |

| Gladstone Commercial Corp. | 3.7 |

| SJW Group | 3.6 |

| Marten Transport Ltd. | 3.6 |

| Total | 38.2% |

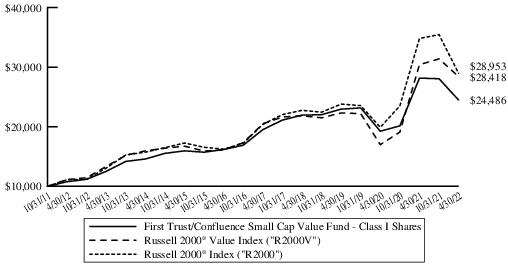

| Performance as of April 30, 2022 | |||||||||||||||||||

| Class A Inception 2/24/2011 | Class C Inception 3/2/2011 | Class I Inception 1/11/2011 | R2000V* | R2000* | |||||||||||||||

| Cumulative Total Returns | w/o sales charge | w/max 5.50% sales charge | w/o sales charge | w/max 1.00% contingent deferred sales charge | w/o sales charge | w/o sales charges | w/o sales charges | ||||||||||||

| 6 Months | -12.84% | -17.64% | -13.16% | -14.02% | -12.75% | (9.50)% | (18.38)% | ||||||||||||

| 1 Year | -13.31% | -18.08% | -13.91% | -14.76% | -13.07% | (6.59)% | (16.87)% | ||||||||||||

| Average Annual Total Returns | |||||||||||||||||||

| 5 Years | 4.36% | 3.19% | 3.64% | 3.64% | 4.64% | 6.75% | 7.24% | ||||||||||||

| 10 Years | 8.28% | 7.67% | 7.47% | 7.47% | 8.55% | 9.81% | 10.06% | ||||||||||||

| Since Inception | 7.75% | 7.20% | 6.58% | 6.58% | 8.05% | 8.90% | 9.29% | ||||||||||||

| Actual Expenses | Hypothetical (5% Return Before Expenses) | |||||||

| Beginning Account Value 11/1/2021 | Ending Account Value 4/30/2022 | Expenses Paid During Period 11/1/2021 - 4/30/2022 (a) | Beginning Account Value 11/1/2021 | Ending Account Value 4/30/2022 | Expenses Paid During Period 11/1/2021 - 4/30/2022 (a) | Annualized Expense Ratios (b) | ||

Class A | $ 1,000.00 | $ 871.60 | $ 7.42 | $ 1,000.00 | $ 1,016.86 | $ 8.00 | 1.60% | |

Class C | $ 1,000.00 | $ 868.40 | $ 10.89 | $ 1,000.00 | $ 1,013.14 | $ 11.73 | 2.35% | |

Class I | $ 1,000.00 | $ 872.50 | $ 6.27 | $ 1,000.00 | $ 1,018.10 | $ 6.76 | 1.35% | |

| (a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (November 1, 2021 through April 30, 2022), multiplied by 181/365 (to reflect the six-month period). |

| (b) | These expense ratios reflect expense caps. |

| Shares | Description | Value | ||

| COMMON STOCKS – 92.5% | ||||

| Air Freight & Logistics – 3.4% | ||||

| 12,422 | Forward Air Corp. | $1,204,561 | ||

| Automobiles – 3.4% | ||||

| 22,109 | Winnebago Industries, Inc. | 1,175,757 | ||

| Banks – 5.7% | ||||

| 29,918 | Bank of Marin Bancorp. | 935,237 | ||

| 32,872 | Veritex Holdings, Inc. | 1,079,845 | ||

| 2,015,082 | ||||

| Beverages – 2.0% | ||||

| 7,750 | MGP Ingredients, Inc. | 707,808 | ||

| Capital Markets – 4.0% | ||||

| 5,506 | Morningstar, Inc. | 1,394,284 | ||

| Commercial Services & Supplies – 2.6% | ||||

| 54,292 | Healthcare Services Group, Inc. | 927,850 | ||

| Diversified Consumer Services – 3.9% | ||||

| 44,379 | Frontdoor, Inc. (a) | 1,371,755 | ||

| Diversified Financial Services – 3.1% | ||||

| 48,376 | Cannae Holdings, Inc. (a) | 1,083,622 | ||

| Electrical Equipment – 6.5% | ||||

| 45,757 | Allied Motion Technologies, Inc. | 1,113,725 | ||

| 77,011 | Thermon Group Holdings, Inc. (a) | 1,155,165 | ||

| 2,268,890 | ||||

| Electronic Equipment, Instruments & Components – 2.0% | ||||

| 20,345 | FARO Technologies, Inc. (a) | 697,630 | ||

| Energy Equipment & Services – 3.9% | ||||

| 52,837 | Core Laboratories N.V. | 1,373,762 | ||

| Food Products – 4.0% | ||||

| 9,458 | J&J Snack Foods Corp. | 1,415,863 | ||

| Gas Utilities – 3.8% | ||||

| 28,090 | Northwest Natural Holding Co. | 1,343,545 | ||

| Health Care Equipment & Supplies – 2.1% | ||||

| 21,819 | Natus Medical, Inc. (a) | 725,918 | ||

| Hotels, Restaurants & Leisure – 1.1% | ||||

| 8,459 | Nathan’s Famous, Inc. | 400,703 | ||

| Insurance – 5.3% | ||||

| 16,043 | Brown & Brown, Inc. | 994,345 | ||

| Shares | Description | Value | ||

| Insurance (Continued) | ||||

| 37,401 | BRP Group, Inc., Class A (a) | $864,711 | ||

| 1,859,056 | ||||

| IT Services – 5.3% | ||||

| 43,680 | I3 Verticals, Inc., Class A (a) | 1,199,016 | ||

| 6,495 | Perficient, Inc. (a) | 645,668 | ||

| 1,844,684 | ||||

| Leisure Products – 1.8% | ||||

| 50,705 | American Outdoor Brands, Inc. (a) | 638,883 | ||

| Machinery – 9.4% | ||||

| 8,181 | John Bean Technologies Corp. | 964,458 | ||

| 5,630 | Kadant, Inc. | 1,041,550 | ||

| 7,701 | RBC Bearings, Inc. (a) | 1,296,464 | ||

| 3,302,472 | ||||

| Paper & Forest Products – 2.5% | ||||

| 24,710 | Neenah, Inc. | 874,734 | ||

| Personal Products – 3.3% | ||||

| 30,800 | Edgewell Personal Care Co. | 1,174,712 | ||

| Real Estate Management & Development – 3.4% | ||||

| 51,572 | RE/MAX Holdings, Inc., Class A | 1,209,879 | ||

| Road & Rail – 3.6% | ||||

| 72,169 | Marten Transport Ltd. | 1,254,297 | ||

| Textiles, Apparel & Luxury Goods – 2.8% | ||||

| 27,002 | Movado Group, Inc. | 971,262 | ||

| Water Utilities – 3.6% | ||||

| 21,513 | SJW Group | 1,269,267 | ||

| Total Common Stocks | 32,506,276 | |||

| (Cost $30,729,733) | ||||

| REAL ESTATE INVESTMENT TRUSTS – 7.6% | ||||

| Equity Real Estate Investment Trusts – 7.6% | ||||

| 61,208 | Gladstone Commercial Corp. | 1,287,816 | ||

| 32,308 | Rayonier, Inc. | 1,395,706 | ||

| Total Real Estate Investment Trusts | 2,683,522 | |||

| (Cost $1,806,459) | ||||

| Total Investments – 100.1% | 35,189,798 | |||

| (Cost $32,536,192) | ||||

| Net Other Assets and Liabilities – (0.1)% | (42,818) | |||

| Net Assets – 100.0% | $35,146,980 | |||

| (a) | Non-income producing security. |

| Total Value at 4/30/2022 | Level 1 Quoted Prices | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs | |

| Common Stocks* | $ 32,506,276 | $ 32,506,276 | $ — | $ — |

| Real Estate Investment Trusts* | 2,683,522 | 2,683,522 | — | — |

| Total Investments | $ 35,189,798 | $ 35,189,798 | $— | $— |

| * | See Portfolio of Investments for industry breakout. |

| ASSETS: | |

Investments, at value (Cost $32,536,192) | $ 35,189,798 |

Cash | 102,085 |

| Receivables: | |

Dividends | 15,017 |

Fund shares sold | 4,011 |

Prepaid expenses | 34,789 |

Total Assets | 35,345,700 |

| LIABILITIES: | |

| Payables: | |

Fund shares redeemed | 103,601 |

Audit and tax fees | 27,926 |

Transfer agent fees | 15,299 |

Investment advisory fees | 14,214 |

Registration fees | 12,077 |

Shareholder reporting fees | 8,890 |

Administrative fees | 8,686 |

Custodian fees | 2,005 |

Trustees’ fees and expenses | 1,852 |

12b-1 distribution and service fees | 1,746 |

Legal fees | 1,251 |

Financial reporting fees | 732 |

Commitment and administrative agency fees | 441 |

Total Liabilities | 198,720 |

NET ASSETS | $35,146,980 |

| NET ASSETS consist of: | |

Paid-in capital | $ 27,650,062 |

Par value | 10,670 |

Accumulated distributable earnings (loss) | 7,486,248 |

NET ASSETS | $35,146,980 |

| Maximum Offering Price Per Share: | |

| Class A Shares: | |

Net asset value and redemption price per share (Based on net assets of $3,643,231 and 113,750 shares of beneficial interest issued and outstanding) | $32.03 |

Maximum sales charge (5.50% of offering price) | 1.86 |

Maximum offering price to public | $33.89 |

| Class C Shares: | |

Net asset value and redemption price per share (Based on net assets of $979,062 and 35,414 shares of beneficial interest issued and outstanding) | $27.65 |

| Class I Shares: | |

Net asset value and redemption price per share (Based on net assets of $30,524,687 and 917,794 shares of beneficial interest issued and outstanding) | $33.26 |

| INVESTMENT INCOME: | ||

Dividends (net of foreign withholding tax of $179) | $ 301,883 | |

Interest | 54 | |

Total investment income | 301,937 | |

| EXPENSES: | ||

Investment advisory fees | 213,393 | |

Transfer agent fees | 45,308 | |

Administrative fees | 26,035 | |

Registration fees | 21,909 | |

Audit and tax fees | 20,948 | |

Commitment and administrative agency fees | 15,261 | |

| 12b-1 distribution and/or service fees: | ||

Class A | 5,138 | |

Class C | 6,880 | |

Shareholder reporting fees | 11,956 | |

Trustees’ fees and expenses | 9,605 | |

Legal fees | 6,165 | |

Financial reporting fees | 4,587 | |

Custodian fees | 4,515 | |

Listing expense | 1,047 | |

Other | 841 | |

Total expenses | 393,588 | |

Fees waived and expenses reimbursed by the investment advisor | (93,480) | |

Net expenses | 300,108 | |

NET INVESTMENT INCOME (LOSS) | 1,829 | |

| NET REALIZED AND UNREALIZED GAIN (LOSS): | ||

Net realized gain (loss) on investments | 4,955,944 | |

Net change in unrealized appreciation (depreciation) on investments | (9,938,031) | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | (4,982,087) | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $(4,980,258) | |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended 10/31/2021 | ||

| OPERATIONS: | |||

Net investment income (loss) | $ 1,829 | $ (132,915) | |

Net realized gain (loss) | 4,955,944 | 1,634,783 | |

Net change in unrealized appreciation (depreciation) | (9,938,031) | 12,511,394 | |

Net increase (decrease) in net assets resulting from operations | (4,980,258) | 14,013,262 | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM INVESTMENT OPERATIONS: | |||

Class A Shares | (38,305) | — | |

Class C Shares | (15,999) | — | |

Class I Shares | (348,176) | — | |

Total distributions to shareholders from investment operations | (402,480) | — | |

| CAPITAL TRANSACTIONS: | |||

Proceeds from shares sold | 3,066,576 | 14,320,289 | |

Proceeds from shares reinvested | 399,634 | — | |

Cost of shares redeemed | (14,524,170) | (11,369,746) | |

Net increase (decrease) in net assets resulting from capital transactions | (11,057,960) | 2,950,543 | |

Total increase (decrease) in net assets | (16,440,698) | 16,963,805 | |

| NET ASSETS: | |||

Beginning of period | 51,587,678 | 34,623,873 | |

End of period | $35,146,980 | $51,587,678 |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class A Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 37.10 | $ 26.75 | $ 30.95 | $ 33.98 | $ 34.48 | $ 27.81 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) (a) | (0.04) | (0.16) | (0.10) | (0.08) | (0.20) | (0.16) | |||||

Net realized and unrealized gain (loss) | (4.68) | 10.51 | (4.10) | 0.83 | 1.63 | 7.20 | |||||

Total from investment operations | (4.72) | 10.35 | (4.20) | 0.75 | 1.43 | 7.04 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net realized gain | (0.35) | — | — | (3.78) | (1.93) | (0.37) | |||||

Net asset value, end of period | $32.03 | $37.10 | $26.75 | $30.95 | $33.98 | $34.48 | |||||

Total return (b) | (12.84)% | 38.69% | (13.57)% | 4.77% | 4.16% | 25.53% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 3,643 | $ 4,381 | $ 3,326 | $ 8,612 | $ 6,692 | $ 5,656 | |||||

Ratio of total expenses to average net assets | 2.47% (c) | 2.41% | 2.69% | 2.66% | 2.71% | 3.56% | |||||

Ratio of net expenses to average net assets | 1.60% (c) | 1.60% | 1.60% | 1.60% | 1.60% | 1.60% | |||||

Ratio of net investment income (loss) to average net assets | (0.20)% (c) | (0.45)% | (0.34)% | (0.28)% | (0.56)% | (0.50)% | |||||

Portfolio turnover rate | 3% | 16% | 18% | 25% | 35% | 28% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum sales charge of 5.50% or contingent deferred sales charge (CDSC). On purchases of $1 million or more, a CDSC of 1% may be imposed on certain redemptions made within twelve months of purchase. If the sales charges were included, total returns would be lower. These returns include Rule 12b-1 service fees of 0.25% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class C Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 32.19 | $ 23.29 | $ 27.30 | $ 30.61 | $ 31.47 | $ 25.61 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) (a) | (0.15) | (0.37) | (0.26) | (0.27) | (0.42) | (0.36) | |||||

Net realized and unrealized gain (loss) | (4.04) | 9.27 | (3.75) | 0.74 | 1.49 | 6.59 | |||||

Total from investment operations | (4.19) | 8.90 | (4.01) | 0.47 | 1.07 | 6.23 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net realized gain | (0.35) | — | — | (3.78) | (1.93) | (0.37) | |||||

Net asset value, end of period | $27.65 | $32.19 | $23.29 | $27.30 | $30.61 | $31.47 | |||||

Total return (b) | (13.16)% | 38.21% | (14.65)% | 4.33% | 3.34% | 24.58% | |||||

| Ratios to average net assets/supplemental data: | |||||||||||

Net assets, end of period (in 000’s) | $ 979 | $ 1,488 | $ 1,811 | $ 2,671 | $ 3,621 | $ 3,962 | |||||

Ratio of total expenses to average net assets | 4.08% (c) | 3.76% | 4.06% | 3.87% | 3.69% | 4.45% | |||||

Ratio of net expenses to average net assets | 2.35% (c) | 2.35% | 2.35% | 2.35% | 2.35% | 2.35% | |||||

Ratio of net investment income (loss) to average net assets | (0.94)% (c) | (1.19)% | (1.05)% | (1.03)% | (1.31)% | (1.25)% | |||||

Portfolio turnover rate | 3% | 16% | 18% | 25% | 35% | 28% | |||||

| (a) | Based on average shares outstanding. |

| (b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum CDSC of 1%, charged on certain redemptions made within one year of purchase. If the sales charge was included, total returns would be lower. These returns include combined Rule 12b-1 distribution and service fees of 1% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

| (c) | Annualized. |

| Six Months Ended 4/30/2022 (Unaudited) | Year Ended October 31, | ||||||||||

| Class I Shares | 2021 | 2020 | 2019 | 2018 | 2017 | ||||||

Net asset value, beginning of period | $ 38.47 | $ 27.63 | $ 31.76 | $ 34.65 | $ 35.07 | $ 28.40 | |||||

| Income from investment operations: | |||||||||||

Net investment income (loss) (a) | 0.01 | (0.08) | (0.03) | (0.01) | (0.11) | (0.09) | |||||

Net realized and unrealized gain (loss) | (4.87) | 10.92 | (4.10) | 0.90 | 1.62 | 7.13 | |||||

Total from investment operations | (4.86) | 10.84 | (4.13) | 0.89 | 1.51 | 7.04 | |||||

| Distributions paid to shareholders from: | |||||||||||

Net realized gain | (0.35) | — | — | (3.78) | (1.93) | (0.37) | |||||