UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22452

First Trust Series Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

1 | |

2 | |

5 | |

6 | |

7 | |

14 | |

15 | |

16 | |

17 | |

22 | |

29 |

Fund Statistics | |

First Trust Preferred Securities and Income Fund | Net Asset Value (NAV) |

Class A (FPEAX) | $18.94 |

Class C (FPECX) | $19.10 |

Class F (FPEFX) | $19.21 |

Class I (FPEIX) | $19.11 |

Class R3 (FPERX) | $18.86 |

Sector Allocation | % of Total Investments |

Financials | 78.9% |

Energy | 7.9 |

Utilities | 6.7 |

Consumer Staples | 2.9 |

Real Estate | 1.5 |

Communication Services | 1.2 |

Industrials | 0.7 |

Consumer Discretionary | 0.2 |

Total | 100.0% |

Country Allocation | % of Total Investments |

United States | 52.8% |

Canada | 12.2 |

United Kingdom | 8.2 |

France | 6.1 |

Bermuda | 3.3 |

Spain | 3.2 |

Netherlands | 2.9 |

Multinational | 2.3 |

Mexico | 2.3 |

Italy | 2.1 |

Germany | 1.5 |

Australia | 0.9 |

Sweden | 0.9 |

Chile | 0.5 |

Switzerland | 0.5 |

Japan | 0.3 |

Total | 100.0% |

Credit Quality(1) | % of Total Fixed-Income Investments |

A- | 0.3% |

BBB+ | 14.4 |

BBB | 23.4 |

BBB- | 34.6 |

BB+ | 13.8 |

BB | 8.5 |

BB- | 2.1 |

B+ | 0.1 |

B | 0.7 |

Not Rated | 2.1 |

Total | 100.0% |

Top Ten Holdings | % of Total Investments |

Bank of America Corp., Series TT | 2.7% |

Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. | 2.3 |

Barclays PLC | 2.3 |

Wells Fargo & Co., Series L | 2.0 |

JPMorgan Chase & Co., Series NN | 1.8 |

Intesa Sanpaolo S.p.A. | 1.8 |

Global Atlantic Fin Co. | 1.7 |

Toronto-Dominion Bank (The) | 1.7 |

Lloyds Banking Group PLC | 1.6 |

Energy Transfer, L.P., Series G | 1.6 |

Total | 19.5% |

Dividend Distributions | Class A Shares | Class C Shares | Class F Shares | Class I Shares | Class R3 Shares |

Current Monthly Distribution per Share(2) | $0.0885 | $0.0764 | $0.0901 | $0.0925 | $0.0846 |

Current Distribution Rate on NAV(3) | 5.61% | 4.80% | 5.63% | 5.81% | 5.38% |

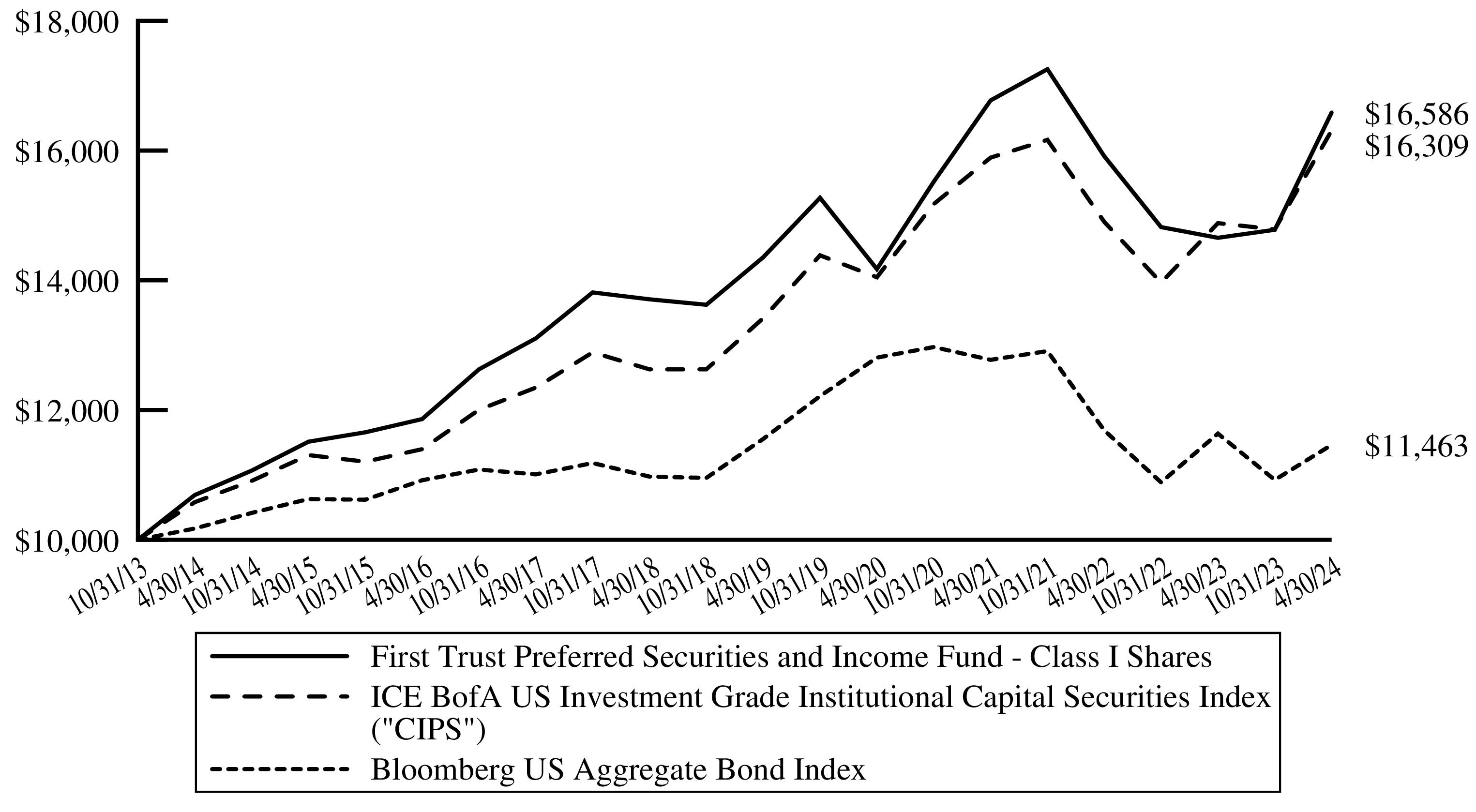

Performance as of April 30, 2024 | |||||||||||||

A Shares Inception 2/25/2011 | C Shares Inception 2/25/2011 | F Shares Inception 3/2/2011 | I Shares Inception 1/11/2011 | R3 Shares Inception 3/2/2011 | Blended Index*(4)(5) | CIPS* ICE BofA US Investment Grade Institutional Capital Securities Index | Bloomberg US Aggregate Bond Index | ||||||

Cumulative Total Returns | w/o sales charge | w/max 4.50% sales charge | w/o sales charge | w/max 1.00% contingent deferred sales charge | w/o sales charge | w/o sales charge | w/o sales charge | w/o sales charge | w/o sales charge | w/o sales charge | |||

6 Months | 12.02% | 6.98% | 11.64% | 10.64% | 12.14% | 12.23% | 11.94% | 11.78% | 10.31% | 4.97% | |||

1 Year | 12.86% | 7.76% | 12.10% | 11.10% | 13.02% | 13.27% | 12.64% | 10.06% | 9.61% | (1.47)% | |||

Average Annual Total Returns | X | X | -->|||||||||||

5 Years | 2.69% | 1.74% | 1.97% | 1.97% | 2.79% | 2.96% | 2.41% | 2.58% | 3.98% | (0.16)% | |||

10 Years | 4.20% | 3.73% | 3.47% | 3.47% | 4.31% | 4.49% | 3.92% | 4.28% | 4.42% | 1.20% | |||

Since Inception | 4.89% | 4.52% | 4.15% | 4.15% | 5.03% | 5.26% | 4.54% | N/A | 5.60% | 1.84% | |||

30-Day SEC Yield(6) | 5.21% | 4.70% | 5.55% | 5.79% | 5.34% | N/A | N/A | N/A | |||||

Actual Expenses | Hypothetical (5% Return Before Expenses) | ||||||

Beginning Account Value 11/1/2023 | Ending Account Value 4/30/2024 | Expenses Paid During Period 11/1/2023 - 4/30/2024 (a) | Beginning Account Value 11/1/2023 | Ending Account Value 4/30/2024 | Expenses Paid During Period 11/1/2023 - 4/30/2024 (a) | Annualized Expense Ratios (b) | |

Class A | $ 1,000.00 | $ 1,120.20 | $ 7.43 | $ 1,000.00 | $ 1,017.85 | $ 7.07 | 1.41 % |

Class C | $ 1,000.00 | $ 1,116.40 | $ 11.37 | $ 1,000.00 | $ 1,014.12 | $ 10.82 | 2.16 % |

Class F | $ 1,000.00 | $ 1,121.40 | $ 6.91 | $ 1,000.00 | $ 1,018.35 | $ 6.57 | 1.31 % |

Class I | $ 1,000.00 | $ 1,122.30 | $ 5.86 | $ 1,000.00 | $ 1,019.34 | $ 5.57 | 1.11 % |

Class R3 | $ 1,000.00 | $ 1,119.40 | $ 8.75 | $ 1,000.00 | $ 1,016.61 | $ 8.32 | 1.66 % |

(a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (November 1, 2023 through April 30, 2024), multiplied by 182/366 (to reflect the six-month period). |

(b) | These expense ratios reflect expense caps. |

Shares | Description | Stated Rate | Stated Maturity | Value |

$25 PAR PREFERRED SECURITIES – 14.9% | ||||

Automobiles – 0.2% | ||||

2,045 | Ford Motor Co. | 6.00 % | 12/01/59 | $49,080 |

13,042 | Ford Motor Co. | 6.50 % | 08/15/62 | 319,529 |

368,609 | ||||

Banks – 0.9% | ||||

31,680 | Bank of America Corp., Series KK | 5.38 % | (a) | 721,037 |

15,899 | KeyCorp (b) | 6.20 % | (a) | 356,137 |

29,236 | Pinnacle Financial Partners, Inc., Series B | 6.75 % | (a) | 674,474 |

10,557 | US Bancorp, Series K | 5.50 % | (a) | 246,084 |

1,997,732 | ||||

Capital Markets – 2.0% | ||||

25,553 | Affiliated Managers Group, Inc. | 4.20 % | 09/30/61 | 423,158 |

41,682 | Affiliated Managers Group, Inc. | 6.75 % | 03/30/64 | 1,067,059 |

8,104 | Brookfield Oaktree Holdings LLC, Series A | 6.63 % | (a) | 176,667 |

53,659 | Carlyle Finance LLC | 4.63 % | 05/15/61 | 971,764 |

28,058 | KKR Group Finance Co., IX LLC | 4.63 % | 04/01/61 | 530,577 |

48,000 | TPG Operating Group II, L.P. | 6.95 % | 03/15/64 | 1,237,920 |

4,407,145 | ||||

Consumer Finance – 0.0% | ||||

2,923 | Capital One Financial Corp., Series J | 4.80 % | (a) | 53,666 |

Diversified REITs – 0.3% | ||||

27,478 | Global Net Lease, Inc., Series A | 7.25 % | (a) | 549,835 |

Diversified Telecommunication Services – 0.4% | ||||

42,284 | AT&T, Inc., Series C | 4.75 % | (a) | 830,458 |

Electric Utilities – 1.3% | ||||

12,419 | SCE Trust IV, Series J (b) | 5.38 % | (a) | 292,964 |

9,729 | SCE Trust V, Series K (b) | 5.45 % | (a) | 238,944 |

85,000 | SCE Trust VII, Series M | 7.50 % | (a) | 2,218,500 |

2,750,408 | ||||

Financial Services – 0.4% | ||||

38,898 | Equitable Holdings, Inc., Series A | 5.25 % | (a) | 847,976 |

Gas Utilities – 0.4% | ||||

67,017 | South Jersey Industries, Inc. | 5.63 % | 09/16/79 | 931,049 |

Independent Power & Renewable Electricity Producers – 0.4% | ||||

35,878 | Brookfield BRP Holdings Canada, Inc. | 4.63 % | (a) | 557,903 |

21,958 | Brookfield Renewable Partners, L.P., Series 17 | 5.25 % | (a) | 373,286 |

931,189 | ||||

Insurance – 5.9% | ||||

56,757 | AEGON Funding Co., LLC | 5.10 % | 12/15/49 | 1,193,600 |

77,331 | American Equity Investment Life Holding Co., Series A (b) | 5.95 % | (a) | 1,864,450 |

36,659 | American Equity Investment Life Holding Co., Series B (b) | 6.63 % | (a) | 900,712 |

4,822 | AmTrust Financial Services, Inc. | 7.25 % | 06/15/55 | 75,705 |

5,383 | AmTrust Financial Services, Inc. | 7.50 % | 09/15/55 | 87,726 |

28,000 | Arch Capital Group Ltd., Series G | 4.55 % | (a) | 540,400 |

1,909 | Argo Group International Holdings, Inc. (b) | 7.00 % | (a) | 46,389 |

10,322 | Aspen Insurance Holdings, Ltd. | 5.63 % | (a) | 202,827 |

48,607 | Aspen Insurance Holdings, Ltd. | 5.63 % | (a) | 936,171 |

36,000 | Athene Holding Ltd. (b) | 7.25 % | 03/30/64 | 896,760 |

Shares | Description | Stated Rate | Stated Maturity | Value |

$25 PAR PREFERRED SECURITIES (Continued) | ||||

Insurance (Continued) | ||||

29,701 | Athene Holding Ltd., Series A (b) | 6.35 % | (a) | $698,271 |

1,656 | Athene Holding Ltd., Series D (b) | 4.88 % | (a) | 29,311 |

52,818 | Athene Holding Ltd., Series E (b) | 7.75 % | (a) | 1,405,487 |

20,182 | CNO Financial Group, Inc. | 5.13 % | 11/25/60 | 406,465 |

73,827 | Delphi Financial Group, Inc., 3 Mo. CME Term SOFR + CSA + 3.45% (c) | 8.76 % | 05/15/37 | 1,788,459 |

47,092 | F&G Annuities & Life, Inc. | 7.95 % | 12/15/53 | 1,224,392 |

17,455 | Metlife, Inc., Series F | 4.75 % | (a) | 356,431 |

10,700 | Phoenix Cos. (The), Inc. | 7.45 % | 01/15/32 | 192,199 |

3,152 | RenaissanceRe Holdings, Ltd., Series G | 4.20 % | (a) | 55,002 |

12,900,757 | ||||

Mortgage Real Estate Investment Trusts – 0.3% | ||||

23,983 | AGNC Investment Corp., Series F (b) | 6.13 % | (a) | 560,243 |

Multi-Utilities – 0.8% | ||||

27,276 | Algonquin Power & Utilities Corp., Series 19-A (b) | 6.20 % | 07/01/79 | 680,536 |

28,651 | Brookfield Infrastructure Finance ULC | 5.00 % | 05/24/81 | 488,213 |

29,230 | Brookfield Infrastructure Partners, L.P., Series 13 | 5.13 % | (a) | 504,218 |

1,672,967 | ||||

Oil, Gas & Consumable Fuels – 0.1% | ||||

11,798 | NuStar Energy, L.P., Series A, 3 Mo. CME Term SOFR + CSA + 7.03% (c) | 12.36 % | (a) | 301,675 |

Real Estate Management & Development – 0.7% | ||||

52,168 | Brookfield Property Partners, L.P., Series A | 5.75 % | (a) | 652,622 |

4,783 | Brookfield Property Partners, L.P., Series A-1 | 6.50 % | (a) | 69,593 |

48,772 | Brookfield Property Partners, L.P., Series A2 | 6.38 % | (a) | 659,885 |

7,103 | Brookfield Property Preferred, L.P. | 6.25 % | 07/26/81 | 103,065 |

3,087 | DigitalBridge Group, Inc., Series I | 7.15 % | (a) | 69,025 |

115 | DigitalBridge Group, Inc., Series J | 7.13 % | (a) | 2,610 |

1,556,800 | ||||

Specialized REITs – 0.0% | ||||

2,712 | National Storage Affiliates Trust, Series A | 6.00 % | (a) | 58,986 |

Wireless Telecommunication Services – 0.8% | ||||

38,996 | United States Cellular Corp. | 6.25 % | 09/01/69 | 751,063 |

13,223 | United States Cellular Corp. | 5.50 % | 03/01/70 | 234,973 |

49,334 | United States Cellular Corp. | 5.50 % | 06/01/70 | 870,745 |

1,856,781 | ||||

Total $25 Par Preferred Securities | 32,576,276 | |||

(Cost $36,900,752) | ||||

$1,000 PAR PREFERRED SECURITIES – 2.5% | ||||

Banks – 2.5% | ||||

1,013 | Bank of America Corp., Series L | 7.25 % | (a) | 1,164,950 |

3,761 | Wells Fargo & Co., Series L | 7.50 % | (a) | 4,308,000 |

Total $1,000 Par Preferred Securities | 5,472,950 | |||

(Cost $6,420,512) | ||||

Par Amount | Description | Stated Rate | Stated Maturity | Value |

CAPITAL PREFERRED SECURITIES – 78.8% | ||||

Banks – 43.1% | ||||

$1,300,000 | Banco Bilbao Vizcaya Argentaria S.A. (b) (d) | 9.38 % | (a) | $1,368,529 |

1,700,000 | Banco Bilbao Vizcaya Argentaria S.A., Series 9 (b) (d) | 6.50 % | (a) | 1,680,921 |

300,000 | Banco de Credito e Inversiones S.A. (b) (d) (e) | 8.75 % | (a) | 307,658 |

200,000 | Banco de Credito e Inversiones S.A. (b) (d) (f) | 8.75 % | (a) | 205,105 |

600,000 | Banco del Estado de Chile (b) (e) | 7.95 % | (a) | 604,875 |

900,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 7.50 % | (a) | 867,898 |

1,000,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 7.63 % | (a) | 975,771 |

1,100,000 | Banco Mercantil del Norte S.A. (b) (d) (e) | 8.38 % | (a) | 1,095,880 |

1,600,000 | Banco Santander S.A. (b) (d) | 4.75 % | (a) | 1,372,641 |

800,000 | Banco Santander S.A. (b) (d) | 9.63 % | (a) | 840,493 |

1,600,000 | Banco Santander S.A. (b) (d) | 9.63 % | (a) | 1,712,144 |

500,000 | Bank of America Corp., Series RR (b) | 4.38 % | (a) | 459,808 |

5,900,000 | Bank of America Corp., Series TT (b) | 6.13 % | (a) | 5,844,969 |

1,700,000 | Bank of Montreal (b) | 7.70 % | 05/26/84 | 1,701,259 |

2,500,000 | Bank of Nova Scotia (The) (b) | 8.63 % | 10/27/82 | 2,580,100 |

800,000 | Bank of Nova Scotia (The) (b) | 8.00 % | 01/27/84 | 806,247 |

1,300,000 | Barclays PLC (b) (d) | 4.38 % | (a) | 1,061,826 |

4,960,000 | Barclays PLC (b) (d) | 8.00 % | (a) | 4,889,836 |

1,100,000 | Barclays PLC (b) (d) | 9.63 % | (a) | 1,152,392 |

650,000 | BBVA Bancomer S.A. (b) (d) (e) | 5.88 % | 09/13/34 | 600,157 |

1,300,000 | BBVA Bancomer S.A. (b) (d) (e) | 8.45 % | 06/29/38 | 1,343,012 |

3,150,000 | BNP Paribas S.A. (b) (d) (e) | 4.63 % | (a) | 2,535,384 |

1,840,000 | BNP Paribas S.A. (b) (d) (e) | 7.75 % | (a) | 1,860,080 |

600,000 | BNP Paribas S.A. (b) (d) (e) | 8.00 % | (a) | 597,736 |

2,650,000 | BNP Paribas S.A. (b) (d) (e) | 8.50 % | (a) | 2,746,370 |

317,000 | Citigroup, Inc., Series M (b) | 6.30 % | (a) | 318,045 |

2,770,000 | Citigroup, Inc., Series P (b) | 5.95 % | (a) | 2,759,690 |

1,000,000 | Citigroup, Inc., Series X (b) | 3.88 % | (a) | 941,184 |

2,000,000 | Citigroup, Inc., Series Z (b) | 7.38 % | (a) | 2,055,786 |

1,400,000 | Citizens Financial Group, Inc., Series F (b) | 5.65 % | (a) | 1,371,625 |

547,000 | Citizens Financial Group, Inc., Series G (b) | 4.00 % | (a) | 470,148 |

500,000 | CoBank ACB (b) | 7.25 % | (a) | 499,292 |

2,500,000 | CoBank ACB, Series I (b) | 6.25 % | (a) | 2,459,250 |

1,115,000 | CoBank ACB, Series K (b) | 6.45 % | (a) | 1,103,736 |

600,000 | Commerzbank AG (b) (d) (f) | 7.00 % | (a) | 591,166 |

600,000 | Farm Credit Bank of Texas, Series 3 (b) (e) | 6.20 % | (a) | 551,694 |

100,000 | Farm Credit Bank of Texas, Series 4 (b) (e) | 5.70 % | (a) | 98,490 |

630,000 | Fifth Third Bancorp, Series L (b) | 4.50 % | (a) | 602,162 |

200,000 | HSBC Holdings PLC (b) (d) | 4.60 % | (a) | 165,071 |

2,000,000 | HSBC Holdings PLC (b) (d) | 8.00 % | (a) | 2,069,254 |

1,130,000 | ING Groep N.V. (b) (d) | 5.75 % | (a) | 1,067,465 |

1,000,000 | ING Groep N.V. (b) (d) | 6.50 % | (a) | 987,273 |

3,400,000 | ING Groep N.V. (b) (d) (f) | 7.50 % | (a) | 3,340,500 |

600,000 | ING Groep N.V. (b) (d) (f) | 8.00 % | (a) | 599,340 |

3,882,000 | Intesa Sanpaolo S.p.A. (b) (d) (e) | 7.70 % | (a) | 3,857,618 |

3,850,000 | JPMorgan Chase & Co., Series NN (b) | 6.88 % | (a) | 3,954,767 |

600,000 | Lloyds Banking Group PLC (b) (d) | 6.75 % | (a) | 590,508 |

2,331,000 | Lloyds Banking Group PLC (b) (d) | 7.50 % | (a) | 2,313,281 |

3,550,000 | Lloyds Banking Group PLC (b) (d) | 8.00 % | (a) | 3,514,706 |

200,000 | NatWest Group PLC (b) (d) | 6.00 % | (a) | 194,882 |

1,800,000 | NatWest Group PLC (b) (d) | 8.00 % | (a) | 1,804,262 |

1,406,000 | PNC Financial Services Group (The), Inc., Series U (b) | 6.00 % | (a) | 1,355,941 |

494,000 | PNC Financial Services Group (The), Inc., Series V (b) | 6.20 % | (a) | 485,505 |

1,650,000 | PNC Financial Services Group (The), Inc., Series W (b) | 6.25 % | (a) | 1,555,293 |

2,000,000 | Royal Bank of Canada (b) | 7.50 % | 05/02/84 | 2,007,272 |

Par Amount | Description | Stated Rate | Stated Maturity | Value |

CAPITAL PREFERRED SECURITIES (Continued) | ||||

Banks (Continued) | ||||

$870,000 | Societe Generale S.A. (b) (d) (e) | 5.38 % | (a) | $705,875 |

1,500,000 | Societe Generale S.A. (b) (d) (e) | 9.38 % | (a) | 1,530,471 |

1,200,000 | Societe Generale S.A. (b) (d) (e) | 10.00 % | (a) | 1,260,262 |

720,000 | Sumitomo Mitsui Financial Group, Inc. (b) (d) | 6.60 % | (a) | 694,186 |

800,000 | Svenska Handelsbanken AB (b) (d) (f) | 4.75 % | (a) | 667,718 |

200,000 | Swedbank AB (b) (d) (f) | 7.63 % | (a) | 196,445 |

1,000,000 | Swedbank AB (b) (d) (f) | 7.75 % | (a) | 982,549 |

3,450,000 | Toronto-Dominion Bank (The) (b) | 8.13 % | 10/31/82 | 3,556,270 |

750,000 | UniCredit S.p.A. (b) (e) | 5.46 % | 06/30/35 | 690,301 |

1,000,000 | Wells Fargo & Co. (b) | 7.63 % | (a) | 1,048,132 |

94,228,506 | ||||

Capital Markets – 6.8% | ||||

1,568,000 | Apollo Management Holdings, L.P. (b) (e) | 4.95 % | 01/14/50 | 1,506,699 |

1,500,000 | Ares Finance Co. III LLC (b) (e) | 4.13 % | 06/30/51 | 1,385,936 |

1,516,000 | Charles Schwab (The) Corp., Series G (b) | 5.38 % | (a) | 1,502,927 |

1,000,000 | Charles Schwab (The) Corp., Series H (b) | 4.00 % | (a) | 815,123 |

795,000 | Charles Schwab (The) Corp., Series I (b) | 4.00 % | (a) | 733,482 |

900,000 | Charles Schwab (The) Corp., Series K (b) | 5.00 % | (a) | 843,297 |

4,100,000 | Credit Suisse Group AG, Claim (g) (h) | 471,500 | ||

1,600,000 | Credit Suisse Group AG, Claim (g) (h) | 184,000 | ||

2,425,000 | Credit Suisse Group AG, Claim (g) (h) | 278,875 | ||

1,500,000 | Credit Suisse Group AG, Claim (g) (h) | 172,500 | ||

2,800,000 | Deutsche Bank AG, Series 2020 (b) (d) | 6.00 % | (a) | 2,611,970 |

1,600,000 | Goldman Sachs Group (The), Inc., Series W (b) | 7.50 % | (a) | 1,659,798 |

2,225,000 | Goldman Sachs Group (The), Inc., Series X (b) | 7.50 % | (a) | 2,254,776 |

513,000 | State Street Corp., Series I (b) | 6.70 % | (a) | 514,714 |

14,935,597 | ||||

Electric Utilities – 1.1% | ||||

320,000 | American Electric Power Co., Inc. (b) | 3.88 % | 02/15/62 | 287,346 |

186,000 | Edison International, Series A (b) | 5.38 % | (a) | 178,652 |

500,000 | Emera, Inc., Series 16-A (b) | 6.75 % | 06/15/76 | 496,174 |

1,400,000 | NextEra Energy Capital Holdings, Inc. (b) | 6.70 % | 09/01/54 | 1,387,542 |

2,349,714 | ||||

Financial Services – 3.3% | ||||

2,500,000 | American AgCredit Corp. (b) (e) | 5.25 % | (a) | 2,350,000 |

1,500,000 | Capital Farm Credit ACA, Series 1 (b) (e) | 5.00 % | (a) | 1,440,000 |

600,000 | Compeer Financial ACA (b) (e) | 4.88 % | (a) | 570,000 |

2,920,000 | Corebridge Financial, Inc. (b) | 6.88 % | 12/15/52 | 2,891,629 |

7,251,629 | ||||

Food Products – 2.8% | ||||

300,000 | Dairy Farmers of America, Inc. (i) | 7.13 % | (a) | 280,875 |

1,305,000 | Land O’Lakes Capital Trust I (i) | 7.45 % | 03/15/28 | 1,284,290 |

1,400,000 | Land O’Lakes, Inc. (e) | 7.00 % | (a) | 1,088,500 |

1,200,000 | Land O’Lakes, Inc. (e) | 7.25 % | (a) | 966,000 |

3,000,000 | Land O’Lakes, Inc. (e) | 8.00 % | (a) | 2,625,000 |

6,244,665 | ||||

Insurance – 10.2% | ||||

1,822,000 | Assurant, Inc. (b) | 7.00 % | 03/27/48 | 1,815,098 |

850,000 | Assured Guaranty Municipal Holdings, Inc. (b) (e) | 6.40 % | 12/15/66 | 752,270 |

2,100,000 | AXIS Specialty Finance LLC (b) | 4.90 % | 01/15/40 | 1,884,846 |

Par Amount | Description | Stated Rate | Stated Maturity | Value |

CAPITAL PREFERRED SECURITIES (Continued) | ||||

Insurance (Continued) | ||||

$2,000,000 | CNP Assurances SACA (b) (f) | 4.88 % | (a) | $1,641,760 |

1,276,000 | Enstar Finance LLC (b) | 5.75 % | 09/01/40 | 1,247,155 |

1,085,000 | Enstar Finance LLC (b) | 5.50 % | 01/15/42 | 1,029,584 |

1,000,000 | Fortegra Financial Corp. (b) (i) | 8.50 % | 10/15/57 | 982,405 |

4,027,000 | Global Atlantic Fin Co. (b) (e) | 4.70 % | 10/15/51 | 3,560,086 |

2,870,000 | Hartford Financial Services Group (The), Inc., 3 Mo. CME Term SOFR + CSA + 2.39% (c) (e) | 7.69 % | 02/12/47 | 2,550,967 |

1,174,000 | Kuvare US Holdings, Inc. (b) (e) | 7.00 % | 02/17/51 | 1,188,675 |

300,000 | La Mondiale SAM (b) (f) | 5.88 % | 01/26/47 | 292,143 |

1,920,000 | Lancashire Holdings Ltd. (b) (f) | 5.63 % | 09/18/41 | 1,709,603 |

1,558,000 | Liberty Mutual Group, Inc. (b) (e) | 4.13 % | 12/15/51 | 1,421,839 |

579,000 | Lincoln National Corp., Series C (b) | 9.25 % | (a) | 618,398 |

820,000 | Prudential Financial, Inc. (b) | 6.00 % | 09/01/52 | 794,228 |

500,000 | QBE Insurance Group Ltd. (b) (e) | 5.88 % | (a) | 495,300 |

301,000 | QBE Insurance Group Ltd. (b) (f) | 5.88 % | 06/17/46 | 295,426 |

22,279,783 | ||||

Multi-Utilities – 2.6% | ||||

3,450,000 | Algonquin Power & Utilities Corp. (b) | 4.75 % | 01/18/82 | 2,995,600 |

1,870,000 | Sempra (b) | 4.13 % | 04/01/52 | 1,700,332 |

1,000,000 | Sempra (b) | 6.88 % | 10/01/54 | 989,915 |

5,685,847 | ||||

Oil, Gas & Consumable Fuels – 7.7% | ||||

2,132,000 | Enbridge, Inc. (b) | 6.25 % | 03/01/78 | 1,993,166 |

440,000 | Enbridge, Inc. (b) | 7.63 % | 01/15/83 | 439,166 |

1,200,000 | Enbridge, Inc. (b) | 8.50 % | 01/15/84 | 1,269,058 |

3,040,000 | Enbridge, Inc., Series 16-A (b) | 6.00 % | 01/15/77 | 2,881,078 |

1,360,000 | Enbridge, Inc., Series 20-A (b) | 5.75 % | 07/15/80 | 1,247,624 |

252,000 | Energy Transfer, L.P. (b) | 8.00 % | 05/15/54 | 259,722 |

490,000 | Energy Transfer, L.P., Series B (b) | 6.63 % | (a) | 451,938 |

1,452,000 | Energy Transfer, L.P., Series F (b) | 6.75 % | (a) | 1,422,566 |

3,625,000 | Energy Transfer, L.P., Series G (b) | 7.13 % | (a) | 3,489,478 |

658,000 | Energy Transfer, L.P., Series H (b) | 6.50 % | (a) | 640,134 |

66,000 | Enterprise Products Operating LLC (b) | 5.38 % | 02/15/78 | 61,288 |

1,700,000 | Transcanada Trust (b) | 5.50 % | 09/15/79 | 1,539,626 |

1,200,000 | Transcanada Trust (b) | 5.60 % | 03/07/82 | 1,051,046 |

16,745,890 | ||||

Retail REITs – 0.5% | ||||

400,000 | Scentre Group Trust 2 (b) (e) | 4.75 % | 09/24/80 | 381,920 |

800,000 | Scentre Group Trust 2 (b) (e) | 5.13 % | 09/24/80 | 730,523 |

1,112,443 | ||||

Trading Companies & Distributors – 0.7% | ||||

260,000 | AerCap Holdings N.V. (b) | 5.88 % | 10/10/79 | 257,199 |

1,323,000 | Aircastle Ltd. (b) (e) | 5.25 % | (a) | 1,256,624 |

1,513,823 | ||||

Total Capital Preferred Securities | 172,347,897 | |||

(Cost $183,285,389) | ||||

Principal Value | Description | Stated Coupon | Stated Maturity | Value |

FOREIGN CORPORATE BONDS AND NOTES – 2.3% | ||||

Insurance – 2.3% | ||||

$4,925,666 | Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. (e) (j) | 7.63 % | 10/15/25 | $4,926,457 |

(Cost $4,977,043) | ||||

Total Investments – 98.5% | 215,323,580 | |

(Cost $231,583,696) | ||

Net Other Assets and Liabilities – 1.5% | 3,351,878 | |

Net Assets – 100.0% | $218,675,458 |

(a) | Perpetual maturity. |

(b) | Fixed-to-floating or fixed-to-variable rate security. The interest rate shown reflects the fixed rate in effect at April 30, 2024. At a predetermined date, the fixed rate will change to a floating rate or a variable rate. |

(c) | Floating or variable rate security. |

(d) | This security is a contingent convertible capital security which may be subject to conversion into common stock of the issuer under certain circumstances. At April 30, 2024, securities noted as such amounted to $56,958,635 or 26.0% of net assets. Of these securities, 8.6% originated in emerging markets, and 91.4% originated in foreign markets. |

(e) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the First Trust Series Fund’s (the “Trust”) Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P., (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At April 30, 2024, securities noted as such amounted to $51,426,328 or 23.5% of net assets. |

(f) | This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the 1933 Act. |

(g) | Claim pending with the administrative court of Switzerland. |

(h) | Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be illiquid by the Advisor. |

(i) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the 1933 Act, and may be resold in transactions exempt from registration, normally to qualified institutional buyers (see Note 2C - Restricted Securities in the Notes to Financial Statements). |

(j) | These notes are Senior Payment-in-kind (“PIK”) Toggle Notes whereby the issuer may, at its option, elect to pay interest on the notes (1) entirely in cash or (2) entirely in PIK interest. Interest paid in cash will accrue on the notes at a rate of 7.63% per annum (“Cash Interest Rate”) and PIK interest will accrue on the notes at a rate per annum equal to the Cash Interest Rate plus 75 basis points. For the six months ended April 30, 2024, this security paid all of its interest in cash. |

Abbreviations throughout the Portfolio of Investments: | |

CME | – Chicago Mercantile Exchange |

CSA | – Credit Spread Adjustment |

REITs | – Real Estate Investment Trusts |

SOFR | – Secured Overnight Financing Rate |

Valuation Inputs

Total Value at 4/30/2024 | Level 1 Quoted Prices | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs | |

$25 Par Preferred Securities: | ||||

Gas Utilities | $931,049 | $— | $931,049 | $— |

Insurance | 12,900,757 | 10,756,668 | 2,144,089 | — |

Other Industry Categories* | 18,744,470 | 18,744,470 | — | — |

$1,000 Par Preferred Securities* | 5,472,950 | 5,472,950 | — | — |

Capital Preferred Securities* | 172,347,897 | — | 172,347,897 | — |

Foreign Corporate Bonds and Notes* | 4,926,457 | — | 4,926,457 | — |

Total Investments | $215,323,580 | $34,974,088 | $180,349,492 | $— |

* | See Portfolio of Investments for industry breakout. |

ASSETS: | |

Investments, at value | $ 215,323,580 |

Cash | 1,964,003 |

Foreign currency | 192 |

Receivables: | |

Interest | 2,111,364 |

Fund shares sold | 981,150 |

Investment securities sold | 201,500 |

Dividends | 73,592 |

Reclaims | 44,696 |

Prepaid expenses | 63,920 |

Total Assets | 220,763,997 |

LIABILITIES: | |

Payables: | |

Fund shares redeemed | 907,028 |

Investment securities purchased | 813,216 |

Investment advisory fees | 134,680 |

Distributions | 96,976 |

Transfer agent fees | 30,064 |

12b-1 distribution and service fees | 29,858 |

Audit and tax fees | 25,717 |

Custodian fees | 19,557 |

Shareholder reporting fees | 14,164 |

Administrative fees | 7,260 |

Commitment and administrative agency fees | 2,978 |

Legal fees | 2,164 |

Trustees’ fees and expenses | 1,623 |

Registration fees | 780 |

Financial reporting fees | 747 |

Other liabilities | 1,727 |

Total Liabilities | 2,088,539 |

NET ASSETS | $218,675,458 |

NET ASSETS consist of: | |

Paid-in capital | $ 263,742,687 |

Par value | 114,635 |

Accumulated distributable earnings (loss) | (45,181,864 ) |

NET ASSETS | $218,675,458 |

Investments, at cost | $231,583,696 |

Foreign currency, at cost (proceeds) | $193 |

Class A Shares: | |

Net asset value and redemption price per share (Based on net assets of $44,345,822 and 2,340,860 shares of beneficial interest issued and outstanding) | $18.94 |

Maximum sales charge (4.50% of offering price) | 0.89 |

Maximum offering price to public | $19.83 |

Class C Shares: | |

Net asset value and redemption price per share (Based on net assets of $23,885,972 and 1,250,731 shares of beneficial interest issued and outstanding) | $19.10 |

Class F Shares: | |

Net asset value and redemption price per share (Based on net assets of $6,025,740 and 313,695 shares of beneficial interest issued and outstanding) | $19.21 |

Class I Shares: | |

Net asset value and redemption price per share (Based on net assets of $143,752,334 and 7,522,937 shares of beneficial interest issued and outstanding) | $19.11 |

Class R3 Shares: | |

Net asset value and redemption price per share (Based on net assets of $665,590 and 35,299 shares of beneficial interest issued and outstanding) | $18.86 |

INVESTMENT INCOME: | ||

Interest | $ 5,969,486 | |

Dividends | 1,307,991 | |

Foreign withholding tax | (11,039 ) | |

Total investment income | 7,266,438 | |

EXPENSES: | ||

Investment advisory fees | 851,975 | |

12b-1 distribution and/or service fees: | ||

Class A | 56,097 | |

Class C | 124,316 | |

Class F | 2,354 | |

Class R3 | 1,635 | |

Transfer agent fees | 132,995 | |

Registration fees | 48,125 | |

Legal fees | 42,437 | |

Administrative fees | 41,471 | |

Shareholder reporting fees | 32,860 | |

Commitment and administrative agency fees | 27,128 | |

Audit and tax fees | 23,006 | |

Custodian fees | 13,814 | |

Trustees’ fees and expenses | 10,968 | |

Financial reporting fees | 4,601 | |

Listing expense | 1,145 | |

Other | 1,015 | |

Total expenses | 1,415,942 | |

Fees waived and expenses reimbursed by the investment advisor | (32,942 ) | |

Net expenses | 1,383,000 | |

NET INVESTMENT INCOME (LOSS) | 5,883,438 | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | ||

Net realized gain (loss) on: | ||

Investments | (2,082,844 ) | |

Foreign currency transactions | (3 ) | |

Net realized gain (loss) | (2,082,847 ) | |

Net change in unrealized appreciation (depreciation) on: | ||

Investments | 20,076,892 | |

Foreign currency translation | (1 ) | |

Net change in unrealized appreciation (depreciation) | 20,076,891 | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | 17,994,044 | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $ 23,877,482 | |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended 10/31/2023 | |

OPERATIONS: | ||

Net investment income (loss) | $ 5,883,438 | $ 12,488,481 |

Net realized gain (loss) | (2,082,847 ) | (14,723,984 ) |

Net change in unrealized appreciation (depreciation) | 20,076,891 | 1,056,879 |

Net increase (decrease) in net assets resulting from operations | 23,877,482 | (1,178,624 ) |

DISTRIBUTIONS TO SHAREHOLDERS FROM INVESTMENT OPERATIONS: | ||

Class A Shares | (1,284,875 ) | (2,436,132 ) |

Class C Shares | (612,668 ) | (1,509,451 ) |

Class F Shares | (89,231 ) | (97,515 ) |

Class I Shares | (4,123,693 ) | (8,174,525 ) |

Class R3 Shares | (17,981 ) | (34,894 ) |

Total distributions to shareholders from investment operations | (6,128,448 ) | (12,252,517 ) |

CAPITAL TRANSACTIONS: | ||

Proceeds from shares sold | 48,905,917 | 97,745,798 |

Proceeds from shares reinvested | 5,540,044 | 11,043,842 |

Cost of shares redeemed | (51,114,893 ) | (130,199,640 ) |

Net increase (decrease) in net assets resulting from capital transactions | 3,331,068 | (21,410,000 ) |

Total increase (decrease) in net assets | 21,080,102 | (34,841,141 ) |

NET ASSETS: | ||

Beginning of period | 197,595,356 | 232,436,497 |

End of period | $218,675,458 | $197,595,356 |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class A Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 17.39 | $ 18.47 | $ 22.58 | $ 21.31 | $ 22.07 | $ 20.85 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | 0.50 | 1.01 | 0.95 | 0.95 | 1.01 | 1.12 |

Net realized and unrealized gain (loss) | 1.58 | (1.08 ) | (4.12 ) | 1.34 | (0.70 ) | 1.25 |

Total from investment operations | 2.08 | (0.07 ) | (3.17 ) | 2.29 | 0.31 | 2.37 |

Distributions paid to shareholders from: | ||||||

Net investment income | (0.53 ) | (1.01 ) | (0.94 ) | (0.92 ) | (0.98 ) | (1.12 ) |

Return of capital | — | — | (0.00 ) (b) | (0.10 ) | (0.09 ) | (0.03 ) |

Total distributions | (0.53 ) | (1.01 ) | (0.94 ) | (1.02 ) | (1.07 ) | (1.15 ) |

Net asset value, end of period | $18.94 | $17.39 | $18.47 | $22.58 | $21.31 | $22.07 |

Total return (c) | 12.02 % | (0.51 )% | (14.36 )% | 10.89 % | 1.53 % | 11.75 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 44,346 | $ 44,662 | $ 44,713 | $ 56,365 | $ 43,802 | $ 39,719 |

Ratio of total expenses to average net assets | 1.44 % (d) (e) | 1.38 % (e) | 1.30 % | 1.33 % | 1.36 % | 1.41 % |

Ratio of net expenses to average net assets | 1.41 % (d) (e) | 1.38 % (e) | 1.30 % | 1.33 % | 1.36 % | 1.40 % |

Ratio of net investment income (loss) to average net assets | 5.42 % (d) | 5.55 % | 4.61 % | 4.22 % | 4.78 % | 5.27 % |

Portfolio turnover rate | 20 % | 38 % | 30 % | 38 % | 46 % | 41 % |

(a) | Based on average shares outstanding. |

(b) | Amount is less than $0.01. |

(c) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum sales charge of 4.50% or contingent deferred sales charge (CDSC). On purchases of $1 million or more, a CDSC of 1% may be imposed on certain redemptions made within twelve months of purchase. If the sales charges were included, total returns would be lower. These returns include Rule 12b-1 service fees of 0.25% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(d) | Annualized. |

(e) | For the six months ended April 30, 2024 and the year ended October 31, 2023, ratios reflect extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class C Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 17.53 | $ 18.60 | $ 22.72 | $ 21.43 | $ 22.18 | $ 20.93 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | 0.44 | 0.90 | 0.81 | 0.79 | 0.87 | 0.98 |

Net realized and unrealized gain (loss) | 1.59 | (1.10 ) | (4.15 ) | 1.35 | (0.71 ) | 1.26 |

Total from investment operations | 2.03 | (0.20 ) | (3.34 ) | 2.14 | 0.16 | 2.24 |

Distributions paid to shareholders from: | ||||||

Net investment income | (0.46 ) | (0.87 ) | (0.78 ) | (0.77 ) | (0.83 ) | (0.96 ) |

Return of capital | — | — | (0.00 ) (b) | (0.08 ) | (0.08 ) | (0.03 ) |

Total distributions | (0.46 ) | (0.87 ) | (0.78 ) | (0.85 ) | (0.91 ) | (0.99 ) |

Net asset value, end of period | $19.10 | $17.53 | $18.60 | $22.72 | $21.43 | $22.18 |

Total return (c) | 11.64 % | (1.20 )% | (14.97 )% | 10.11 % | 0.84 % | 11.01 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 23,886 | $ 25,016 | $ 36,112 | $ 51,756 | $ 54,264 | $ 57,898 |

Ratio of total expenses to average net assets | 2.20 % (d) (e) | 2.11 % (e) | 2.02 % | 2.04 % | 2.07 % | 2.06 % |

Ratio of net expenses to average net assets | 2.16 % (d) (e) | 2.11 % (e) | 2.02 % | 2.04 % | 2.07 % | 2.06 % |

Ratio of net investment income (loss) to average net assets | 4.66 % (d) | 4.84 % | 3.89 % | 3.51 % | 4.09 % | 4.61 % |

Portfolio turnover rate | 20 % | 38 % | 30 % | 38 % | 46 % | 41 % |

(a) | Based on average shares outstanding. |

(b) | Amount is less than $0.01. |

(c) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum CDSC of 1%, charged on certain redemptions made within one year of purchase. If the sales charge was included, total returns would be lower. These returns include combined Rule 12b-1 distribution and service fees of 1% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(d) | Annualized. |

(e) | For the six months ended April 30, 2024 and the year ended October 31, 2023, ratios reflect extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class F Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 17.62 | $ 18.71 | $ 22.87 | $ 21.59 | $ 22.32 | $ 21.07 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | 0.51 | 0.97 | 0.96 | 0.97 | 1.06 | 1.16 |

Net realized and unrealized gain (loss) | 1.62 | (1.03 ) | (4.16 ) | 1.36 | (0.70 ) | 1.26 |

Total from investment operations: | 2.13 | (0.06 ) | (3.20 ) | 2.33 | 0.36 | 2.42 |

Distributions paid to shareholders from: | ||||||

Net investment income | (0.54 ) | (1.03 ) | (0.96 ) | (0.95 ) | (1.02 ) | (1.14 ) |

Return of capital | — | — | (0.00 ) (b) | (0.10 ) | (0.07 ) | (0.03 ) |

Total distributions | (0.54 ) | (1.03 ) | (0.96 ) | (1.05 ) | (1.09 ) | (1.17 ) |

Net asset value, end of period | $19.21 | $17.62 | $18.71 | $22.87 | $21.59 | $22.32 |

Total return (c) | 12.14 % | (0.41 )% | (14.36 )% | 10.91 % | 1.79 % | 11.87 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 6,026 | $ 783 | $ 688 | $ 969 | $ 993 | $ 4,238 |

Ratio of total expenses to average net assets | 1.96 % (d) (e) | 2.35 % (e) | 3.73 % | 3.17 % | 2.36 % | 1.65 % |

Ratio of net expenses to average net assets | 1.31 % (d) (e) | 1.31 % (e) | 1.30 % | 1.30 % | 1.30 % | 1.30 % |

Ratio of net investment income (loss) to average net assets | 5.42 % (d) | 5.27 % | 4.61 % | 4.25 % | 4.83 % | 5.43 % |

Portfolio turnover rate | 20 % | 38 % | 30 % | 38 % | 46 % | 41 % |

(a) | Based on average shares outstanding. |

(b) | Amount is less than $0.01. |

(c) | Assumes reinvestment of all distributions for the period. These returns include Rule 12b-1 service fees of 0.15% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(d) | Annualized. |

(e) | For the six months ended April 30, 2024 and the year ended October 31, 2023, ratios reflect extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class I Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 17.53 | $ 18.60 | $ 22.72 | $ 21.43 | $ 22.23 | $ 20.98 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | 0.54 | 1.08 | 1.02 | 1.02 | 1.08 | 1.19 |

Net realized and unrealized gain (loss) | 1.60 | (1.09 ) | (4.15 ) | 1.35 | (0.76 ) | 1.26 |

Total from investment operations | 2.14 | (0.01 ) | (3.13 ) | 2.37 | 0.32 | 2.45 |

Distributions paid to shareholders from: | ||||||

Net investment income | (0.56 ) | (1.06 ) | (0.98 ) | (0.97 ) | (1.02 ) | (1.17 ) |

Return of capital | — | — | (0.01 ) | (0.11 ) | (0.10 ) | (0.03 ) |

Total distributions | (0.56 ) | (1.06 ) | (0.99 ) | (1.08 ) | (1.12 ) | (1.20 ) |

Net asset value, end of period | $19.11 | $17.53 | $18.60 | $22.72 | $21.43 | $22.23 |

Total return (b) | 12.23 % | (0.20 )% | (14.09 )% | 11.21 % | 1.63 % | 12.09 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 143,752 | $ 126,528 | $ 150,234 | $ 216,022 | $ 190,093 | $ 176,503 |

Ratio of total expenses to average net assets | 1.11 % (c) (d) | 1.09 % (d) | 1.00 % | 1.03 % | 1.05 % | 1.04 % |

Ratio of net expenses to average net assets | 1.11 % (c) (d) | 1.09 % (d) | 1.00 % | 1.03 % | 1.05 % | 1.04 % |

Ratio of net investment income (loss) to average net assets | 5.72 % (c) | 5.85 % | 4.90 % | 4.51 % | 5.09 % | 5.60 % |

Portfolio turnover rate | 20 % | 38 % | 30 % | 38 % | 46 % | 41 % |

(a) | Based on average shares outstanding. |

(b) | Assumes reinvestment of all distributions for the period. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(c) | Annualized. |

(d) | For the six months ended April 30, 2024 and the year ended October 31, 2023, ratios reflect extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class R3 Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 17.31 | $ 18.40 | $ 22.51 | $ 21.26 | $ 22.02 | $ 20.81 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | 0.48 | 0.96 | 0.88 | 0.87 | 0.95 | 1.06 |

Net realized and unrealized gain (loss) | 1.58 | (1.09 ) | (4.10 ) | 1.35 | (0.70 ) | 1.24 |

Total from investment operations: | 2.06 | (0.13 ) | (3.22 ) | 2.22 | 0.25 | 2.30 |

Distributions paid to shareholders from: | ||||||

Net investment income | (0.51 ) | (0.96 ) | (0.89 ) | (0.88 ) | (0.92 ) | (1.06 ) |

Return of capital | — | — | (0.00 ) (b) | (0.09 ) | (0.09 ) | (0.03 ) |

Total distributions | (0.51 ) | (0.96 ) | (0.89 ) | (0.97 ) | (1.01 ) | (1.09 ) |

Net asset value, end of period | $18.86 | $17.31 | $18.40 | $22.51 | $21.26 | $22.02 |

Total return (c) | 11.94 % | (0.76 )% | (14.67 )% | 10.56 % | 1.32 % | 11.44 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 666 | $ 605 | $ 690 | $ 738 | $ 683 | $ 792 |

Ratio of total expenses to average net assets | 5.21 % (d) (e) | 4.47 % (e) | 4.53 % | 4.45 % | 4.20 % | 4.46 % |

Ratio of net expenses to average net assets | 1.66 % (d) (e) | 1.66 % (e) | 1.65 % | 1.65 % | 1.65 % | 1.65 % |

Ratio of net investment income (loss) to average net assets | 5.16 % (d) | 5.27 % | 4.29 % | 3.90 % | 4.51 % | 5.02 % |

Portfolio turnover rate | 20 % | 38 % | 30 % | 38 % | 46 % | 41 % |

(a) | Based on average shares outstanding. |

(b) | Amount is less than $0.01. |

(c) | Assumes reinvestment of all distributions for the period. These returns include combined Rule 12b-1 distribution and service fees of 0.50%, and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(d) | Annualized. |

(e) | For the six months ended April 30, 2024 and the year ended October 31, 2023, ratios reflect extraordinary legal expenses of 0.01%, which are not included in the expense cap. |

Security | Acquisition Date | Principal Value/Shares | Current Price | Carrying Cost | Value | % of Net Assets |

Dairy Farmers of America, Inc., 7.13% | 10/04/16 | 300,000 | $93.63 | $310,125 | $280,875 | 0.13 % |

Fortegra Financial Corp., 8.50%, 10/15/57 | 10/12/17 | 1,000,000 | 98.24 | 1,000,000 | 982,405 | 0.45 |

Land O’Lakes Capital Trust I, 7.45%, 03/15/28 | 07/23/14-03/20/15 | 1,305,000 | 98.41 | 1,332,249 | 1,284,290 | 0.59 |

$2,642,374 | $2,547,570 | 1.17 % |

Distributions paid from: | |

Ordinary income | $12,252,517 |

Capital gains | — |

Return of capital | — |

Undistributed ordinary income | $346,309 |

Undistributed capital gains | — |

Total undistributed earnings | 346,309 |

Accumulated capital and other losses | (27,505,644 ) |

Net unrealized appreciation (depreciation) | (35,771,563 ) |

Total accumulated earnings (losses) | (62,930,898 ) |

Other | — |

Paid-in capital | 260,526,254 |

Total net assets | $197,595,356 |

Tax Cost | Gross Unrealized Appreciation | Gross Unrealized (Depreciation) | Net Unrealized Appreciation (Depreciation) |

$231,583,696 | $3,464,537 | $(19,724,653) | $(16,260,116) |

Expenses Subject to Recovery | ||||||

Advisory Fee Waiver | Expense Reimbursement | Six Months Ended October 31, 2021 | Year Ended October 31, 2022 | Year Ended October 31, 2023 | Six Months Ended April 30, 2024 | Total |

$ 32,942 | $ — | $ 18,881 | $ 41,224 | $ 36,989 | $ 32,942 | $ 130,036 |

Six Months Ended April 30, 2024 | Year Ended October 31, 2023 | |||

Shares | Value | Shares | Value | |

Sales: | ||||

Class A | 249,334 | $4,661,212 | 700,969 | $12,677,334 |

Class C | 51,882 | 978,882 | 165,334 | 3,076,384 |

Class F | 286,764 | 5,437,902 | 337,020 | 6,170,657 |

Class I | 2,036,419 | 37,798,996 | 4,036,891 | 75,765,632 |

Class R3 | 1,552 | 28,925 | 3,084 | 55,791 |

Total Sales | 2,625,951 | $48,905,917 | 5,243,298 | $97,745,798 |

Dividend Reinvestment: | ||||

Class A | 54,863 | $1,033,687 | 110,098 | $2,007,862 |

Class C | 28,398 | 539,341 | 71,418 | 1,316,499 |

Class F | 4,275 | 82,222 | 4,480 | 81,585 |

Class I | 203,776 | 3,874,235 | 414,158 | 7,616,976 |

Class R3 | 563 | 10,559 | 1,150 | 20,920 |

Total Dividend Reinvestment | 291,875 | $5,540,044 | 601,304 | $11,043,842 |

Six Months Ended April 30, 2024 | Year Ended October 31, 2023 | |||

Shares | Value | Shares | Value | |

Redemptions: | ||||

Class A | (531,263 ) | $(9,894,096 ) | (663,878 ) | $(12,161,614 ) |

Class C | (256,618 ) | (4,825,820 ) | (750,895 ) | (13,672,700 ) |

Class F | (21,808 ) | (415,857 ) | (333,838 ) | (6,012,421 ) |

Class I | (1,933,322 ) | (35,945,603 ) | (5,310,156 ) | (98,231,767 ) |

Class R3 | (1,785 ) | (33,517 ) | (6,762 ) | (121,138 ) |

Total Redemptions | (2,744,796 ) | $(51,114,893 ) | (7,065,529 ) | $ (130,199,640 ) |

NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE |

FUND ACCOUNTANT &

CUSTODIAN

PUBLIC ACCOUNTING FIRM

1 | |

2 | |

4 | |

5 | |

6 | |

7 | |

8 | |

9 | |

10 | |

13 | |

19 |

Fund Statistics | |

First Trust/Confluence Small Cap Value Fund | Net Asset Value (NAV) |

Class A (FOVAX) | $28.03 |

Class C (FOVCX) | $23.23 |

Class I (FOVIX) | $29.42 |

Sector Allocation | % of Total Long-Term Investments |

Industrials | 25.1% |

Financials | 22.0 |

Consumer Staples | 16.3 |

Consumer Discretionary | 10.5 |

Health Care | 6.8 |

Information Technology | 6.2 |

Communication Services | 4.2 |

Materials | 3.5 |

Utilities | 3.3 |

Energy | 2.1 |

Total | 100.0% |

Top Ten Holdings | % of Total Long-Term Investments |

TripAdvisor, Inc. | 4.2% |

Hagerty, Inc., Class A | 3.9 |

I3 Verticals, Inc., Class A | 3.8 |

Edgewell Personal Care Co. | 3.6 |

AZEK (The) Co., Inc. | 3.6 |

John B. Sanfilippo & Son, Inc. | 3.6 |

Gates Industrial Corp. PLC | 3.6 |

Ecovyst, Inc. | 3.5 |

Sapiens International Corp., N.V. | 3.5 |

UFP Technologies, Inc. | 3.4 |

Total | 36.7% |

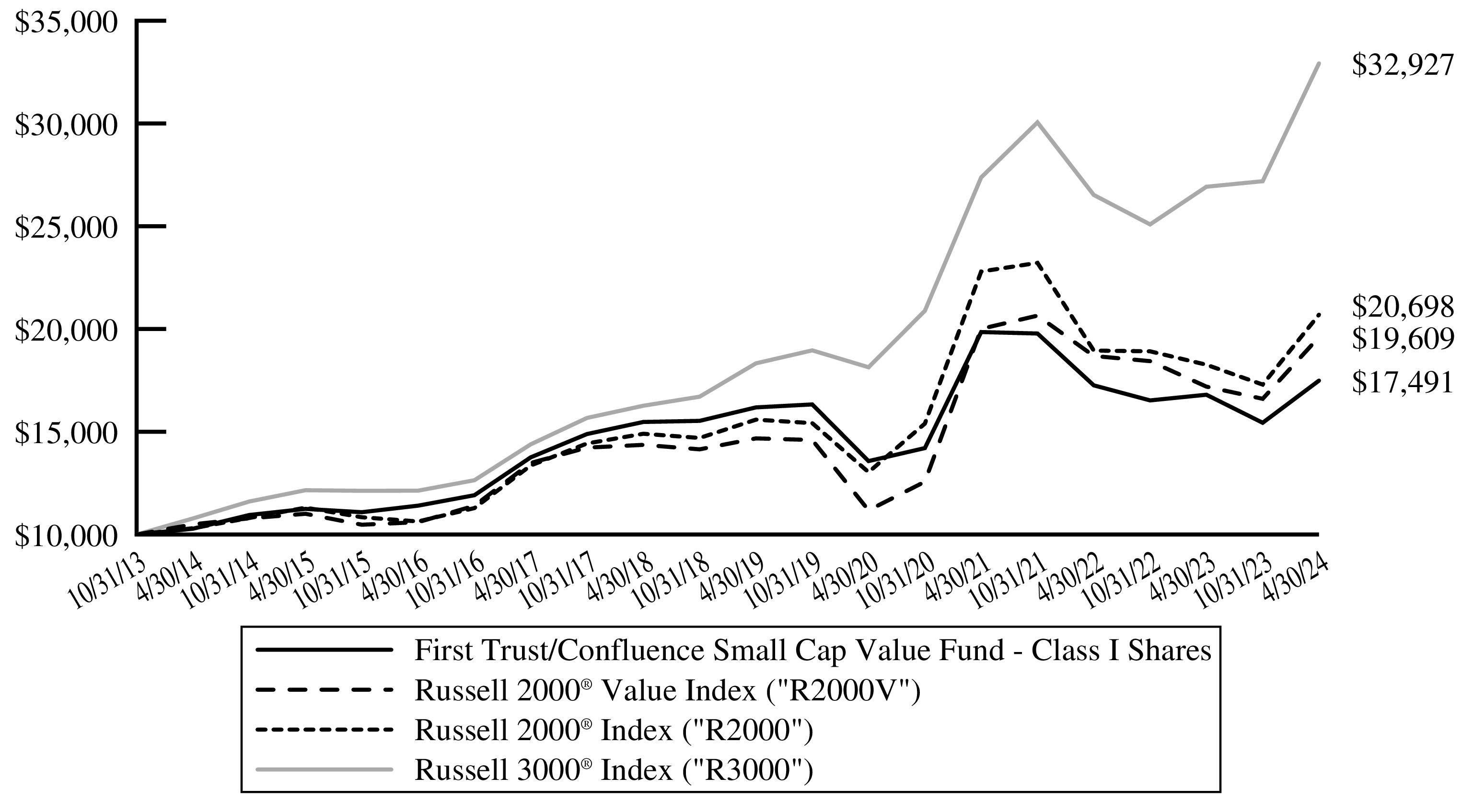

Performance as of April 30, 2024 | |||||||||

Class A Inception 2/24/2011 | Class C Inception 3/2/2011 | Class I Inception 1/11/2011 | R2000V* | R2000* | R3000* | ||||

Cumulative Total Returns | w/o sales charge | w/max 5.50% sales charge | w/o sales charge | w/max 1.00% contingent deferred sales charge | w/o sales charge | w/o sales charge | w/o sales charge | w/o sales charge | |

6 Months | 13.12% | 6.92% | 12.67% | 11.67% | 13.29% | 18.09% | 19.66% | 21.09% | |

1 Year | 3.83% | -1.86% | 3.00% | 2.00% | 4.12% | 14.03% | 13.32% | 22.30% | |

Average Annual Total Returns | |||||||||

5 Years | 1.22% | 0.08% | 0.45% | 0.45% | 1.57% | 5.96% | 5.83% | 12.43% | |

10 Years | 5.23% | 4.64% | 4.43% | 4.43% | 5.45% | 6.45% | 7.22% | 11.81% | |

Since Inception | 6.60% | 6.14% | 5.49% | 5.49% | 6.90% | 7.90% | 8.55% | 12.57% | |

Actual Expenses | Hypothetical (5% Return Before Expenses) | ||||||

Beginning Account Value 11/1/2023 | Ending Account Value 4/30/2024 | Expenses Paid During Period 11/1/2023 - 4/30/2024 (a) | Beginning Account Value 11/1/2023 | Ending Account Value 4/30/2024 | Expenses Paid During Period 11/1/2023 - 4/30/2024 (a) | Annualized Expense Ratios (b) | |

Class A | $ 1,000.00 | $ 1,131.20 | $ 8.48 | $ 1,000.00 | $ 1,016.91 | $ 8.02 | 1.60 % |

Class C | $ 1,000.00 | $ 1,126.70 | $ 12.43 | $ 1,000.00 | $ 1,013.18 | $ 11.76 | 2.35 % |

Class I | $ 1,000.00 | $ 1,132.90 | $ 7.16 | $ 1,000.00 | $ 1,018.15 | $ 6.77 | 1.35 % |

(a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (November 1, 2023 through April 30, 2024), multiplied by 182/366 (to reflect the six-month period). |

(b) | These expense ratios reflect expense caps. |

Shares | Description | Value |

COMMON STOCKS – 100.0% | ||

Automobiles – 3.1% | ||

10,953 | Winnebago Industries, Inc. | $674,486 |

Beverages – 2.9% | ||

8,028 | MGP Ingredients, Inc. | 629,716 |

Building Products – 6.8% | ||

17,122 | AZEK (The) Co., Inc. (a) | 781,448 |

51,484 | Hayward Holdings, Inc. (a) | 699,153 |

1,480,601 | ||

Capital Markets – 3.0% | ||

2,305 | Morningstar, Inc. | 651,508 |

Chemicals – 3.5% | ||

81,585 | Ecovyst, Inc. (a) | 769,347 |

Electrical Equipment – 1.9% | ||

14,140 | Allient, Inc. | 415,575 |

Energy Equipment & Services – 2.1% | ||

29,392 | Core Laboratories, Inc. | 464,394 |

Financial Services – 5.6% | ||

19,577 | Cannae Holdings, Inc. (a) | 380,773 |

36,651 | I3 Verticals, Inc., Class A (a) | 832,344 |

1,213,117 | ||

Food Products – 6.8% | ||

5,149 | J&J Snack Foods Corp. | 706,906 |

7,779 | John B. Sanfilippo & Son, Inc. | 775,566 |

1,482,472 | ||

Ground Transportation – 3.1% | ||

39,941 | Marten Transport Ltd. | 675,802 |

Health Care Equipment & Supplies – 6.8% | ||

10,675 | CONMED Corp. | 725,686 |

3,639 | UFP Technologies, Inc. (a) | 749,416 |

1,475,102 | ||

Household Durables – 3.0% | ||

1,785 | Cavco Industries, Inc. (a) | 650,115 |

Household Products – 3.0% | ||

8,032 | Spectrum Brands Holdings, Inc. | 657,580 |

Insurance – 13.4% | ||

7,825 | Brown & Brown, Inc. | 638,051 |

28,083 | BRP Group, Inc., Class A (a) | 748,131 |

94,918 | Hagerty, Inc., Class A (a) | 849,516 |

11,048 | Stewart Information Services Corp. | 685,086 |

2,920,784 | ||

Interactive Media & Services – 4.2% | ||

34,677 | TripAdvisor, Inc. (a) | 913,045 |

Shares | Description | Value |

IT Services – 2.7% | ||

12,441 | Perficient, Inc. (a) | $587,962 |

Leisure Products – 1.4% | ||

38,053 | American Outdoor Brands, Inc. (a) | 297,574 |

Machinery – 13.3% | ||

43,966 | Gates Industrial Corp. PLC (a) | 774,681 |

7,230 | John Bean Technologies Corp. | 644,121 |

2,708 | Kadant, Inc. | 741,423 |

3,037 | RBC Bearings, Inc. (a) | 742,698 |

2,902,923 | ||

Personal Care Products – 3.6% | ||

20,802 | Edgewell Personal Care Co. | 782,571 |

Software – 3.5% | ||

24,415 | Sapiens International Corp., N.V. | 751,982 |

Textiles, Apparel & Luxury Goods – 3.0% | ||

26,056 | Movado Group, Inc. | 663,646 |

Water Utilities – 3.3% | ||

13,047 | SJW Group | 710,409 |

Total Common Stocks | 21,770,711 | |

(Cost $18,241,886) | ||

MONEY MARKET FUNDS – 0.1% | ||

18,132 | Dreyfus Cash Management Fund, Institutional Shares - 5.26% (b) | 18,148 |

(Cost $18,148) | ||

Total Investments – 100.1% | 21,788,859 | |

(Cost $18,260,034) | ||

Net Other Assets and Liabilities – (0.1)% | (11,917 ) | |

Net Assets – 100.0% | $21,776,942 | |

(a) | Non-income producing security. |

(b) | Rate shown reflects yield as of April 30, 2024. |

Valuation Inputs

Total Value at 4/30/2024 | Level 1 Quoted Prices | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs | |

Common Stocks* | $21,770,711 | $21,770,711 | $— | $— |

Money Market Funds | 18,148 | 18,148 | — | — |

Total Investments | $21,788,859 | $21,788,859 | $— | $— |

* | See Portfolio of Investments for industry breakout. |

ASSETS: | |

Investments, at value | $ 21,788,859 |

Cash | 85 |

Receivables: | |

Fund shares sold | 20,369 |

Dividends | 908 |

Interest | 441 |

Prepaid expenses | 34,353 |

Total Assets | 21,845,015 |

LIABILITIES: | |

Payables: | |

Audit and tax fees | 25,492 |

Fund shares redeemed | 17,974 |

Transfer agent fees | 7,494 |

Shareholder reporting fees | 5,494 |

Custodian fees | 2,430 |

Commitment and administrative agency fees | 2,354 |

Registration fees | 2,045 |

Trustees’ fees and expenses | 1,649 |

Investment advisory fees | 1,304 |

Financial reporting fees | 746 |

12b-1 distribution and service fees | 619 |

Administrative fees | 50 |

Other liabilities | 422 |

Total Liabilities | 68,073 |

NET ASSETS | $21,776,942 |

NET ASSETS consist of: | |

Paid-in capital | $ 17,993,972 |

Par value | 7,454 |

Accumulated distributable earnings (loss) | 3,775,516 |

NET ASSETS | $21,776,942 |

Investments, at cost | $18,260,034 |

Class A Shares: | |

Net asset value and redemption price per share (Based on net assets of $1,991,784 and 71,065 shares of beneficial interest issued and outstanding) | $28.03 |

Maximum sales charge (5.50% of offering price) | 1.63 |

Maximum offering price to public | $29.66 |

Class C Shares: | |

Net asset value and redemption price per share (Based on net assets of $210,513 and 9,062 shares of beneficial interest issued and outstanding) | $23.23 |

Class I Shares: | |

Net asset value and redemption price per share (Based on net assets of $19,574,645 and 665,312 shares of beneficial interest issued and outstanding) | $29.42 |

INVESTMENT INCOME: | ||

Dividends | $ 90,382 | |

Interest | 2,545 | |

Total investment income | 92,927 | |

EXPENSES: | ||

Investment advisory fees | 113,847 | |

Transfer agent fees | 48,552 | |

Registration fees | 23,516 | |

Audit and tax fees | 22,979 | |

Commitment and administrative agency fees | 19,160 | |

Shareholder reporting fees | 15,176 | |

Trustees’ fees and expenses | 10,897 | |

Financial reporting fees | 4,601 | |

Legal fees | 4,308 | |

12b-1 distribution and/or service fees: | ||

Class A | 2,727 | |

Class C | 1,497 | |

Custodian fees | 1,545 | |

Listing expense | 688 | |

Administrative fees | (1,734 ) | |

Other | (3,015 ) | |

Total expenses | 264,744 | |

Fees waived and expenses reimbursed by the investment advisor | (106,827 ) | |

Net expenses | 157,917 | |

NET INVESTMENT INCOME (LOSS) | (64,990 ) | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | ||

Net realized gain (loss) on investments | 320,437 | |

Net change in unrealized appreciation (depreciation) on investments | 2,445,465 | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | 2,765,902 | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | $ 2,700,912 | |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended 10/31/2023 | |

OPERATIONS: | ||

Net investment income (loss) | $ (64,990 ) | $ (27,765 ) |

Net realized gain (loss) | 320,437 | 351,667 |

Net change in unrealized appreciation (depreciation) | 2,445,465 | (1,820,720 ) |

Net increase (decrease) in net assets resulting from operations | 2,700,912 | (1,496,818 ) |

DISTRIBUTIONS TO SHAREHOLDERS FROM INVESTMENT OPERATIONS: | ||

Class A Shares | (33,267 ) | (356,896 ) |

Class C Shares | (6,665 ) | (89,342 ) |

Class I Shares | (285,077 ) | (2,674,023 ) |

Total distributions to shareholders from investment operations | (325,009 ) | (3,120,261 ) |

CAPITAL TRANSACTIONS: | ||

Proceeds from shares sold | 2,515,389 | 4,264,267 |

Proceeds from shares reinvested | 324,297 | 3,103,810 |

Cost of shares redeemed | (4,256,012 ) | (9,599,221 ) |

Net increase (decrease) in net assets resulting from capital transactions | (1,416,326 ) | (2,231,144 ) |

Total increase (decrease) in net assets | 959,577 | (6,848,223 ) |

NET ASSETS: | ||

Beginning of period | 20,817,365 | 27,665,588 |

End of period | $21,776,942 | $20,817,365 |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class A Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 25.15 | $ 30.64 | $ 37.10 | $ 26.75 | $ 30.95 | $ 33.98 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | (0.11 ) | (0.08 ) | (0.14 ) | (0.16 ) | (0.10 ) | (0.08 ) |

Net realized and unrealized gain (loss) | 3.41 | (1.76 ) | (5.97 ) | 10.51 | (4.10 ) | 0.83 |

Total from investment operations | 3.30 | (1.84 ) | (6.11 ) | 10.35 | (4.20 ) | 0.75 |

Distributions paid to shareholders from: | ||||||

Net realized gain | (0.42 ) | (3.65 ) | (0.35 ) | — | — | (3.78 ) |

Net asset value, end of period | $28.03 | $25.15 | $30.64 | $37.10 | $26.75 | $30.95 |

Total return (b) | 13.12 % | (6.78 )% | (16.65 )% | 38.69 % | (13.57 )% | 4.77 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 1,992 | $ 2,234 | $ 3,164 | $ 4,381 | $ 3,326 | $ 8,612 |

Ratio of total expenses to average net assets | 3.45 % (c) | 3.04 % | 2.61 % | 2.41 % | 2.69 % | 2.66 % |

Ratio of net expenses to average net assets | 1.60 % (c) | 1.60 % | 1.60 % | 1.60 % | 1.60 % | 1.60 % |

Ratio of net investment income (loss) to average net assets | (0.78 )% (c) | (0.30 )% | (0.42 )% | (0.45 )% | (0.34 )% | (0.28 )% |

Portfolio turnover rate | 12 % | 21 % | 17 % | 16 % | 18 % | 25 % |

(a) | Based on average shares outstanding. |

(b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum sales charge of 5.50% or contingent deferred sales charge (CDSC). On purchases of $1 million or more, a CDSC of 1% may be imposed on certain redemptions made within twelve months of purchase. If the sales charges were included, total returns would be lower. These returns include Rule 12b-1 service fees of 0.25% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(c) | Annualized. |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class C Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 20.99 | $ 26.34 | $ 32.19 | $ 23.29 | $ 27.30 | $ 30.61 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | (0.18 ) | (0.25 ) | (0.35 ) | (0.37 ) | (0.26 ) | (0.27 ) |

Net realized and unrealized gain (loss) | 2.84 | (1.45 ) | (5.15 ) | 9.27 | (3.75 ) | 0.74 |

Total from investment operations | 2.66 | (1.70 ) | (5.50 ) | 8.90 | (4.01 ) | 0.47 |

Distributions paid to shareholders from: | ||||||

Net realized gain | (0.42 ) | (3.65 ) | (0.35 ) | — | — | (3.78 ) |

Net asset value, end of period | $23.23 | $20.99 | $26.34 | $32.19 | $23.29 | $27.30 |

Total return (b) | 12.67 % | (7.48 )% | (17.27 )% | 38.21 % | (14.65 )% | 4.33 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 210 | $ 379 | $ 664 | $ 1,488 | $ 1,811 | $ 2,671 |

Ratio of total expenses to average net assets | 11.00 % (c) | 6.39 % | 4.76 % | 3.76 % | 4.06 % | 3.87 % |

Ratio of net expenses to average net assets | 2.35 % (c) | 2.35 % | 2.35 % | 2.35 % | 2.35 % | 2.35 % |

Ratio of net investment income (loss) to average net assets | (1.53 )% (c) | (1.05 )% | (1.18 )% | (1.19 )% | (1.05 )% | (1.03 )% |

Portfolio turnover rate | 12 % | 21 % | 17 % | 16 % | 18 % | 25 % |

(a) | Based on average shares outstanding. |

(b) | Assumes reinvestment of all distributions for the period and does not include payment of the maximum CDSC of 1%, charged on certain redemptions made within one year of purchase. If the sales charge was included, total returns would be lower. These returns include combined Rule 12b-1 distribution and service fees of 1% and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(c) | Annualized. |

Six Months Ended 4/30/2024 (Unaudited) | Year Ended October 31, | |||||

Class I Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $ 26.35 | $ 31.85 | $ 38.47 | $ 27.63 | $ 31.76 | $ 34.65 |

Income from investment operations: | ||||||

Net investment income (loss) (a) | (0.08 ) | (0.02 ) | (0.06 ) | (0.08 ) | (0.03 ) | (0.01 ) |

Net realized and unrealized gain (loss) | 3.57 | (1.83 ) | (6.21 ) | 10.92 | (4.10 ) | 0.90 |

Total from investment operations | 3.49 | (1.85 ) | (6.27 ) | 10.84 | (4.13 ) | 0.89 |

Distributions paid to shareholders from: | ||||||

Net realized gain | (0.42 ) | (3.65 ) | (0.35 ) | — | — | (3.78 ) |

Net asset value, end of period | $29.42 | $26.35 | $31.85 | $38.47 | $27.63 | $31.76 |

Total return (b) | 13.29 % | (6.56 )% | (16.45 )% | 39.23 % | (13.00 )% | 5.14 % |

Ratios to average net assets/supplemental data: | ||||||

Net assets, end of period (in 000’s) | $ 19,575 | $ 18,204 | $ 23,838 | $ 45,719 | $ 29,487 | $ 15,747 |

Ratio of total expenses to average net assets | 2.08 % (c) | 2.18 % | 1.79 % | 1.65 % | 1.96 % | 2.22 % |

Ratio of net expenses to average net assets | 1.35 % (c) | 1.35 % | 1.35 % | 1.35 % | 1.35 % | 1.35 % |

Ratio of net investment income (loss) to average net assets | (0.53 )% (c) | (0.06 )% | (0.16 )% | (0.21 )% | (0.11 )% | (0.02 )% |

Portfolio turnover rate | 12 % | 21 % | 17 % | 16 % | 18 % | 25 % |

(a) | Based on average shares outstanding. |

(b) | Assumes reinvestment of all distributions for the period. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if certain fees had not been waived and expenses reimbursed by the investment advisor. Total return is calculated for the time period presented and is not annualized for periods of less than one year. |

(c) | Annualized. |

Distributions paid from: | |

Ordinary income | $— |

Capital gains | 3,120,261 |

Return of capital | — |

Undistributed ordinary income | $— |

Undistributed capital gains | 318,312 |

Total undistributed earnings | 318,312 |

Accumulated capital and other losses | — |

Net unrealized appreciation (depreciation) | 1,081,301 |

Total accumulated earnings (losses) | 1,399,613 |

Other | — |

Paid-in capital | 19,417,752 |

Total net assets | $20,817,365 |

Tax Cost | Gross Unrealized Appreciation | Gross Unrealized (Depreciation) | Net Unrealized Appreciation (Depreciation) |

$18,260,034 | $4,681,104 | $(1,152,279) | $3,528,825 |

Expenses Subject to Recovery | ||||||

Advisory Fee Waiver | Expense Reimbursement | Six Months Ended October 31, 2021 | Year Ended October 31, 2022 | Year Ended October 31, 2023 | Six Months Ended April 30, 2024 | Total |

$ 106,827 | $ — | $ 88,321 | $ 206.310 | $ 252,730 | $ 106,827 | $ 654,188 |

Six Months Ended April 30, 2024 | Year Ended October 31, 2023 | |||

Shares | Value | Shares | Value | |

Sales: | ||||

Class A | 5,134 | $145,215 | 34,525 | $864,904 |

Class C | 260 | 6,040 | 2,477 | 60,053 |

Class I | 79,575 | 2,364,134 | 112,709 | 3,339,310 |

Total Sales | 84,969 | $2,515,389 | 149,711 | $4,264,267 |

Dividend Reinvestment: | ||||

Class A | 1,172 | $33,129 | 12,950 | $349,645 |

Class C | 279 | 6,561 | 3,939 | 89,342 |

Class I | 9,602 | 284,607 | 94,430 | 2,664,823 |

Total Dividend Reinvestment | 11,053 | $324,297 | 111,319 | $3,103,810 |

Redemptions: | ||||

Class A | (24,064 ) | $(679,461 ) | (61,933 ) | $(1,588,327 ) |

Class C | (9,556 ) | (217,467 ) | (13,545 ) | (320,603 ) |

Class I | (114,770 ) | (3,359,084 ) | (264,629 ) | (7,690,291 ) |

Total Redemptions | (148,390 ) | $(4,256,012 ) | (340,107 ) | $(9,599,221 ) |

NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE |

FUND ACCOUNTANT &

CUSTODIAN

PUBLIC ACCOUNTING FIRM

1 | |

2 | |

5 | |

6 | |

7 | |

16 | |

17 | |

18 | |

19 | |

22 | |

29 |

Fund Statistics | |

First Trust Short Duration High Income Fund | Net Asset Value (NAV) |

Class A (FDHAX) | $17.95 |

Class C (FDHCX) | $17.94 |

Class I (FDHIX) | $17.95 |

Credit Quality(1) | % of Senior Loans and other Debt Securities(2) |

BBB | 0.6% |

BBB- | 6.2 |

BB+ | 4.3 |

BB | 9.3 |

BB- | 7.3 |

B+ | 14.8 |

B | 27.6 |

B- | 15.4 |

CCC+ | 10.2 |

CCC | 1.6 |

CCC- | 0.6 |

Not Rated | 2.1 |

Total | 100.0% |

Top 10 Issuers | % of Senior Loans and other Securities(2) |

Open Text Corporation (GXS) | 3.6% |

SS&C Technologies Holdings, Inc. | 3.1 |

Nexstar Broadcasting, Inc. | 2.8 |

Go Daddy Operating Co., LLC/GD Finance Co, Inc. | 2.6 |

Alliant Holdings I, LLC | 2.6 |

1011778 B.C. Unlimited Liability Company (Restaurant Brands) (aka Burger King/Tim Horton’s) | 2.5 |

Verscend Technologies, Inc. (Cotiviti) | 2.4 |

HUB International Ltd. | 2.1 |

Gainwell Acquisition Corp. (fka Milano) | 2.0 |

United Rentals North America, Inc. | 2.0 |

Total | 25.7% |

Industry Classification | % of Senior Loans and Other Securities(2) |

Software | 21.2% |

Insurance | 13.9 |

Media | 8.6 |

Health Care Technology | 7.5 |

Hotels, Restaurants & Leisure | 7.2 |

Containers & Packaging | 6.6 |

IT Services | 3.9 |

Commercial Services & Supplies | 3.7 |

Diversified Telecommunication Services | 3.0 |

Trading Companies & Distributors | 3.0 |

Automobile Components | 2.5 |

Food Products | 2.4 |

Health Care Providers & Services | 2.1 |

Capital Markets | 1.7 |

Specialty Retail | 1.4 |

Machinery | 1.3 |

Professional Services | 1.3 |

Pharmaceuticals | 1.1 |

Consumer Finance | 1.1 |

Household Products | 1.0 |

Electronic Equipment, Instruments & Components | 1.0 |

Diversified Financial Services | 0.8 |

Aerospace & Defense | 0.8 |

Building Products | 0.7 |

Construction & Engineering | 0.5 |

Food Staples & Retailing | 0.4 |

Industrial Conglomerates | 0.4 |

Health Care Equipment & Supplies | 0.4 |

Diversified Consumer Services | 0.2 |

Railroad | 0.2 |

Leisure Products | 0.1 |

Life Sciences Tools & Services | 0.0* |

Total | 100.0% |

* | Amount is less than 0.1%. |

Dividend Distributions | A Shares | C Shares | I Shares |

Current Monthly Distribution per Share(3) | $0.1212 | $0.1098 | $0.125 |

Current Distribution Rate on NAV(4) | 8.10% | 7.34% | 8.36% |

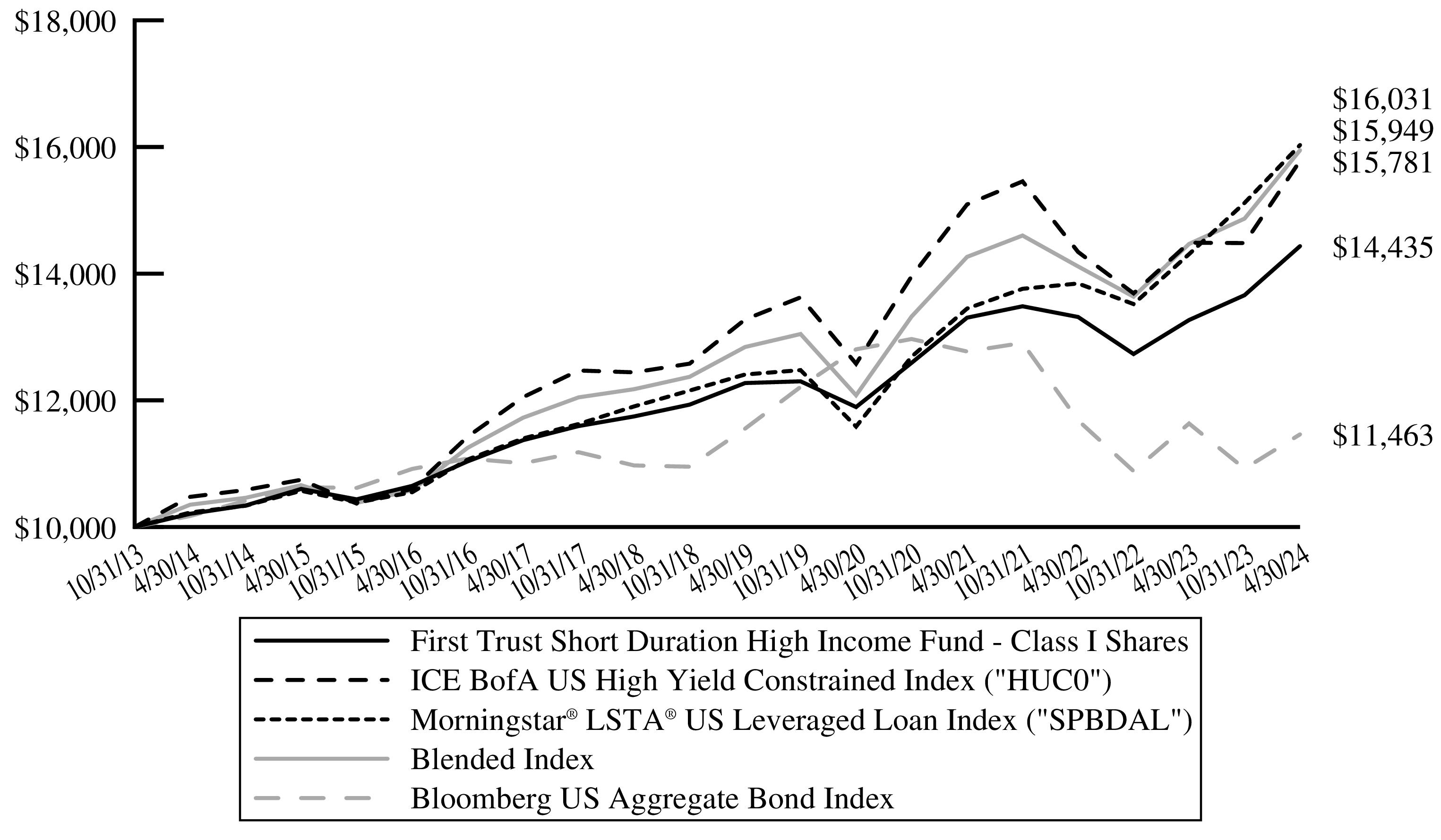

Performance as of April 30, 2024 | ||||||||||

A Shares Inception 11/1/2012 | C Shares Inception 11/1/2012 | I Shares Inception 11/1/2012 | Blended Index* | HUC0* | SPBDAL* | Bloomberg US Aggregate Bond Index | ||||

Cumulative Total Returns | w/o sales charge | w/max 3.50% sales charge | w/o sales charge | w/max 1.00% contingent deferred sales charge | w/o sales charge | w/o sales charge | w/o sales charge | w/o sales charge | w/o sales charge | |

6 Months | 5.61% | 1.93% | 5.17% | 4.17% | 5.75% | 7.52% | 8.96% | 6.05% | 4.97% | |

1 Year | 8.62% | 4.81% | 7.76% | 6.76% | 8.89% | 10.50% | 8.93% | 12.03% | (1.47)% | |

Average Annual Total Returns | ||||||||||

5 Years | 3.06% | 2.33% | 2.28% | 2.28% | 3.32% | 4.43% | 3.52% | 5.26% | (0.16)% | |

10 Years | 3.27% | 2.90% | 2.50% | 2.50% | 3.53% | 4.42% | 4.18% | 4.60% | 1.20% | |

Since Inception | 3.70% | 3.38% | 2.92% | 2.92% | 3.95% | 4.76% | 4.81% | 4.67% | 1.11% | |

30-Day SEC Yield(6) | 7.39% | 6.91% | 7.92% | N/A | N/A | N/A | N/A | |||

Actual Expenses | Hypothetical (5% Return Before Expenses) | ||||||

Beginning Account Value 11/1/2023 | Ending Account Value 4/30/2024 | Expenses Paid During Period 11/1/2023 - 4/30/2024 (a) | Beginning Account Value 11/1/2023 | Ending Account Value 4/30/2024 | Expenses Paid During Period 11/1/2023 - 4/30/2024 (a) | Annualized Expense Ratios (b) | |

Class A | $ 1,000.00 | $ 1,056.10 | $ 6.39 | $ 1,000.00 | $ 1,018.65 | $ 6.27 | 1.25 % |

Class C | $ 1,000.00 | $ 1,051.70 | $ 10.20 | $ 1,000.00 | $ 1,014.92 | $ 10.02 | 2.00 % |

Class I | $ 1,000.00 | $ 1,057.50 | $ 5.12 | $ 1,000.00 | $ 1,019.89 | $ 5.02 | 1.00 % |

(a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (November 1, 2023 through April 30, 2024), multiplied by 182/366 (to reflect the six-month period). |

(b) | These expense ratios reflect expense caps. |

Principal Value | Description | Stated Coupon | Stated Maturity | Value |

CORPORATE BONDS AND NOTES – 44.1% | ||||

Aerospace & Defense – 0.8% | ||||

$111,000 | Transdigm, Inc. (a) | 6.75 % | 08/15/28 | $111,611 |

196,000 | Transdigm, Inc. (a) | 6.38 % | 03/01/29 | 194,748 |

288,000 | Transdigm, Inc. (a) | 6.63 % | 03/01/32 | 287,870 |

594,229 | ||||

Agricultural Products & Services – 0.3% | ||||

316,000 | Lamb Weston Holdings (a) | 4.38 % | 01/31/32 | 274,069 |

Alternative Carriers – 0.7% | ||||

547,000 | Level 3 Financing, Inc. (a) | 11.00 % | 11/15/29 | 558,897 |

Application Software – 2.2% | ||||

530,000 | Alteryx, Inc. (a) | 8.75 % | 03/15/28 | 538,923 |

193,800 | LogMeIn, Inc. (GoTo Group, Inc.) (a) | 5.50 % | 05/01/28 | 165,835 |

193,800 | LogMeIn, Inc. (GoTo Group, Inc.) (a) | 5.50 % | 05/01/28 | 130,100 |

228,000 | RingCentral, Inc. (a) | 8.50 % | 08/15/30 | 232,236 |

665,000 | Ultimate Kronos Group (UKG, Inc.) (a) | 6.88 % | 02/01/31 | 666,686 |

1,733,780 | ||||

Automotive Parts & Equipment – 0.9% | ||||

676,000 | Caliber Collision (Wand NewCo 3, Inc.) (a) | 7.63 % | 01/30/32 | 687,793 |

Automotive Retail – 0.3% | ||||

250,000 | Mavis Tire Express Services Topco Corp. (a) | 6.50 % | 05/15/29 | 231,850 |

Broadcasting – 5.7% | ||||

785,000 | iHeartCommunications, Inc. | 8.38 % | 05/01/27 | 421,951 |

625,000 | iHeartCommunications, Inc. (a) | 4.75 % | 01/15/28 | 446,850 |

2,258,000 | Nexstar Broadcasting, Inc. (a) | 5.63 % | 07/15/27 | 2,125,177 |

57,000 | Sinclair Television Group, Inc. (a) | 5.13 % | 02/15/27 | 51,361 |

1,157,000 | Sirius XM Radio, Inc. (a) | 3.13 % | 09/01/26 | 1,077,897 |

500,000 | Tegna, Inc. | 4.63 % | 03/15/28 | 452,471 |

4,575,707 | ||||

Building Products – 0.5% | ||||

91,000 | American Builders & Contractors Supply Co, Inc. (a) | 4.00 % | 01/15/28 | 83,846 |

320,000 | Builders FirstSource, Inc. (a) | 6.38 % | 03/01/34 | 314,462 |

398,308 | ||||

Cable & Satellite – 1.5% | ||||

200,000 | Cablevision (aka CSC Holdings, LLC) (a) | 11.25 % | 05/15/28 | 177,102 |

1,451,000 | Cablevision (aka CSC Holdings, LLC) (a) | 5.75 % | 01/15/30 | 637,548 |

— | CCO Holdings, LLC/CCO Holdings Capital Corp. (a) | 5.13 % | 05/01/27 | 0 |

433,000 | Charter Communications Operating, LLC (a) | 6.38 % | 09/01/29 | 397,224 |

1,211,874 | ||||

Casinos & Gaming – 2.2% | ||||

50,000 | Fertitta Entertainment, LLC/Fertitta Entertainment Finance Co., Inc. (a) | 4.63 % | 01/15/29 | 45,272 |

369,000 | Golden Nugget, Inc. (Fertitta Entertainment, LLC) (a) | 6.75 % | 01/15/30 | 321,293 |

1,000,000 | VICI Properties 1, LLC (a) | 5.75 % | 02/01/27 | 992,405 |

445,000 | VICI Properties, LP | 5.75 % | 04/01/34 | 428,529 |

1,787,499 | ||||

Commercial Printing – 0.3% | ||||

250,000 | Multi-Color Corp. (LABL, Inc.) (a) | 10.50 % | 07/15/27 | 245,813 |

Principal Value | Description | Stated Coupon | Stated Maturity | Value |

CORPORATE BONDS AND NOTES (Continued) | ||||

Construction & Engineering – 0.4% | ||||

$356,000 | Advanced Drainage Systems, Inc. (a) | 6.38 % | 06/15/30 | $354,247 |

Consumer Finance – 1.0% | ||||

839,000 | FirstCash, Inc. (a) | 6.88 % | 03/01/32 | 829,444 |

Environmental & Facilities Services – 0.6% | ||||

500,000 | Waste Pro USA, Inc. (a) | 5.50 % | 02/15/26 | 489,632 |

Food Distributors – 0.4% | ||||

316,000 | US Foods, Inc. (a) | 7.25 % | 01/15/32 | 323,068 |

Health Care Supplies – 0.4% | ||||

62,000 | Medline Borrower LP/Medline Co-Issuer, Inc. (a) | 6.25 % | 04/01/29 | 61,681 |

250,000 | Medline Borrower, LP (a) | 5.25 % | 10/01/29 | 232,958 |

294,639 | ||||

Health Care Technology – 1.2% | ||||

965,000 | Verscend Technologies, Inc. (Cotiviti) (a) | 9.75 % | 08/15/26 | 965,000 |

Hotels, Resorts & Cruise Lines – 0.1% | ||||

106,000 | Vail Resorts, Inc. (a) | 6.50 % | 05/15/32 | 106,289 |

Household Products – 0.9% | ||||

739,000 | Energizer Spinco, Inc (a) | 6.50 % | 12/31/27 | 730,717 |

Human Resource & Employment Services – 0.5% | ||||

222,000 | TriNet Group, Inc. (a) | 7.13 % | 08/15/31 | 223,306 |

169,000 | ZipRecruiter (a) | 5.00 % | 01/15/30 | 148,844 |

372,150 | ||||

Industrial Conglomerates – 0.4% | ||||

315,000 | Hillenbrand, Inc. | 6.25 % | 02/15/29 | 312,924 |

Industrial Machinery & Supplies & Components – 0.2% | ||||

137,000 | Copeland (Emerald Debt Merger Sub, LLC) (a) | 6.63 % | 12/15/30 | 135,944 |

Insurance Brokers – 5.2% | ||||

1,109,000 | Alliant Holdings I, LLC (a) | 6.75 % | 10/15/27 | 1,088,421 |

968,000 | AmWINS Group, Inc. (a) | 6.38 % | 02/15/29 | 956,885 |

215,000 | AmWINS Group, Inc. (a) | 4.88 % | 06/30/29 | 195,644 |

179,000 | Arthur J. Gallagher & Co. | 5.45 % | 07/15/34 | 173,978 |

135,000 | AssuredPartners, Inc. (a) | 8.00 % | 05/15/27 | 135,165 |

280,000 | AssuredPartners, Inc. (a) | 7.50 % | 02/15/32 | 272,093 |

125,000 | HUB International Limited (a) | 7.25 % | 06/15/30 | 126,921 |

625,000 | HUB International Limited (a) | 7.38 % | 01/31/32 | 619,633 |

556,000 | Panther Escrow Issuer, LLC (a) | 7.13 % | 06/01/31 | 559,239 |

4,127,979 | ||||

Integrated Telecommunication Services – 0.4% | ||||

526,000 | Zayo Group Holdings, Inc. (a) | 6.13 % | 03/01/28 | 351,075 |

Internet Services & Infrastructure – 2.4% | ||||