2015 Investor Day October 28th, 2015 Exhibit 99.1

Safe harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations and are indicated by words or phrases such as “anticipate, “estimate,” “expect,” “project,” “plan,” “we believe,” “will,” “would” and similar words or phrases, and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expressed in or implied by such forward-looking statements. Detailed information concerning those risks and uncertainties are readily available in our Annual Report on Form 10-K for the Fiscal Year Ended July 25, 2015 (“Fiscal 2015 10-K”) which has been filed with the U.S. Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Where indicated, certain financial information herein has been presented on a non-GAAP basis. This basis adjusts for non-recurring items that management believes are not indicative of the Company’s underlying operating performance. In addition, we present the financial performance measure of earnings before interest, taxes, depreciation and amortization (“EBITDA”), which has also been adjusted for these non-recurring items. These measures may not be directly comparable to similar measures used by other companies and should not be considered a substitute for performance measures in accordance with GAAP such as operating income and net income. Reference should be made to the Company’s annual earnings releases for all periods and the Fiscal 2015 10-K for the nature of such adjustments and for a reconciliation of such non-GAAP measures to the Company’s financial results prepared in accordance with GAAP.

Agenda Welcome / IntroductionDavid Jaffe JusticeBrian Lynch Shared Services GroupJohn Sullivan Ann Taylor / LOFTGary Muto Lane BryantLinda Heasley mauricesGeorge Goldfarb dressbarnJeff Gerstel CatherinesBrett Schneider Financials / Wrap-upRobb Giammatteo Q&A*ascena leadership team *Access to individual brand leadership teams to follow

David Jaffe President and CEO

Vision “Serve our shareholders and create value by becoming a family of leading brands with $10 billion in sales and top-tier profitability”

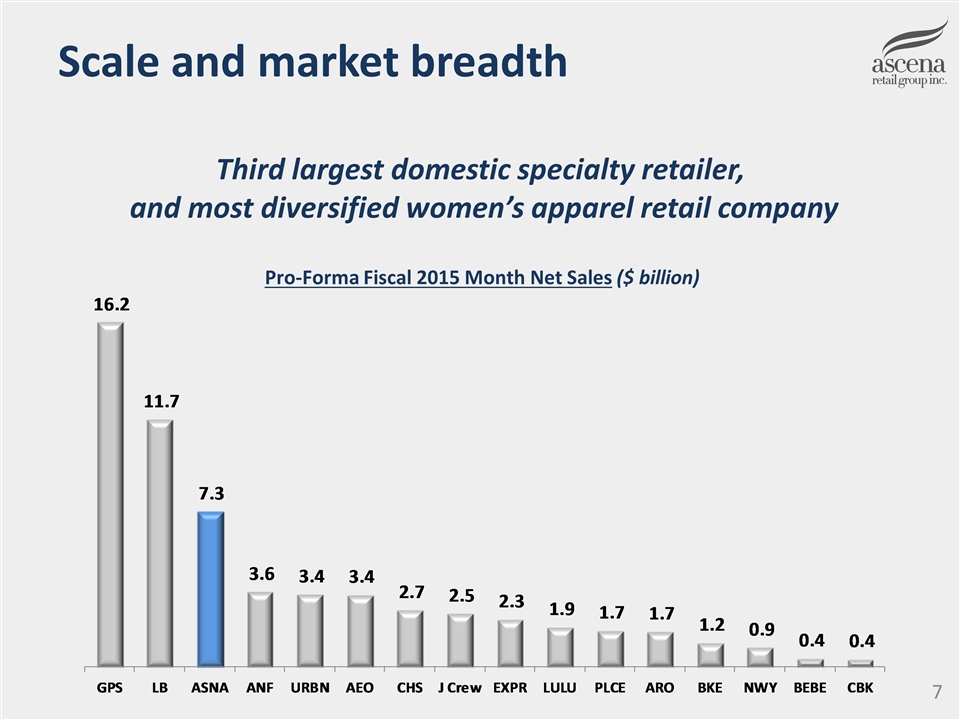

Overview Scale and market breadth Operating model Brand heritage and equity Diversification Operating efficiency

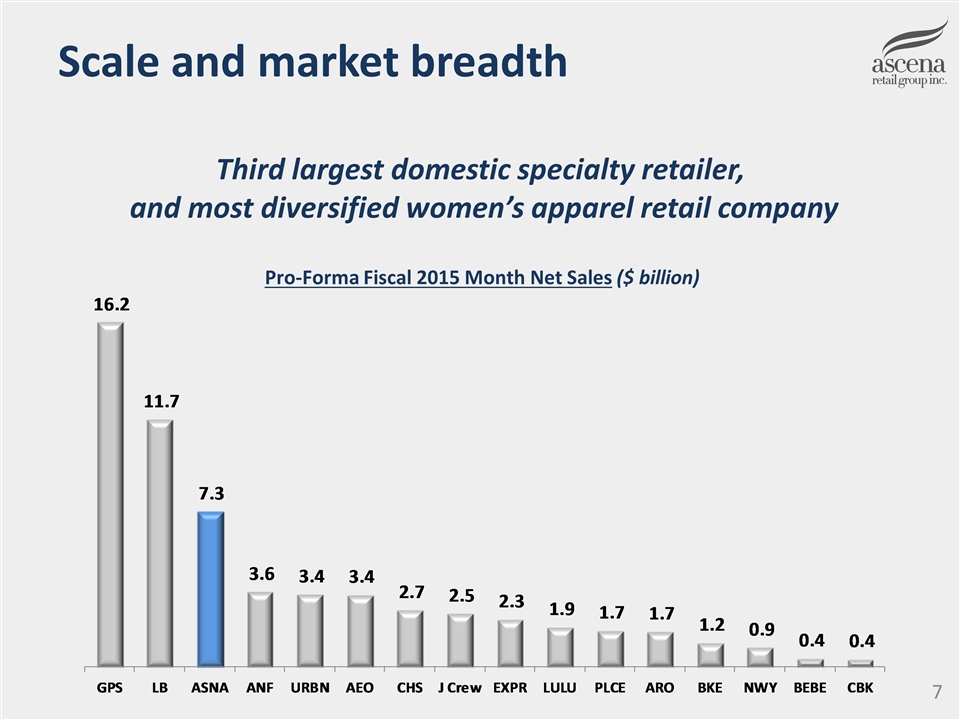

Scale and market breadth Third largest domestic specialty retailer, and most diversified women’s apparel retail company Pro-Forma Fiscal 2015 Month Net Sales ($ billion)

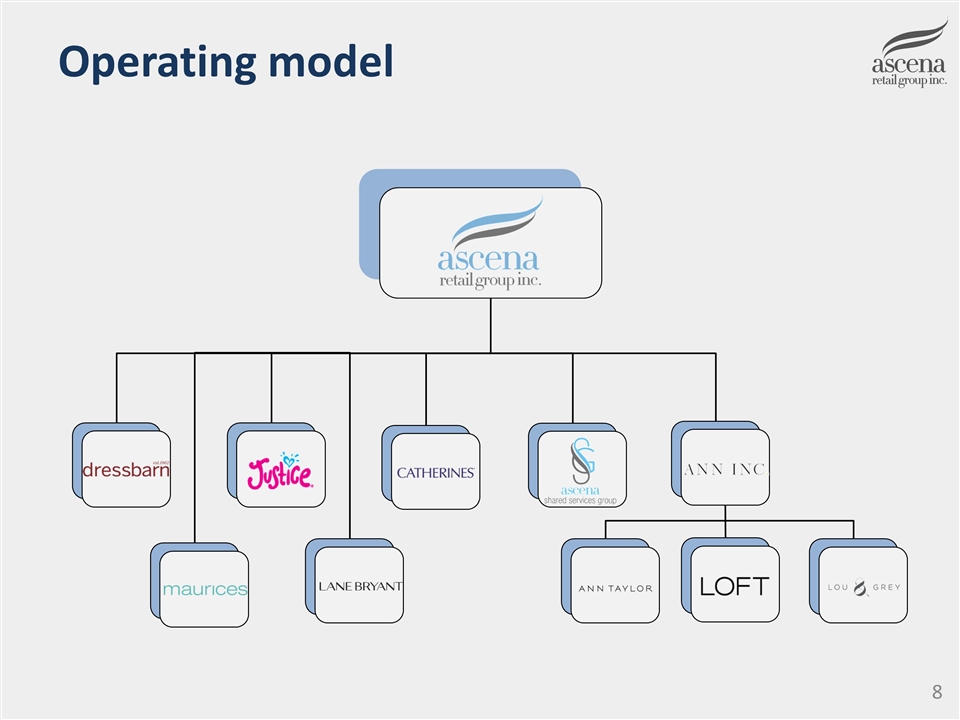

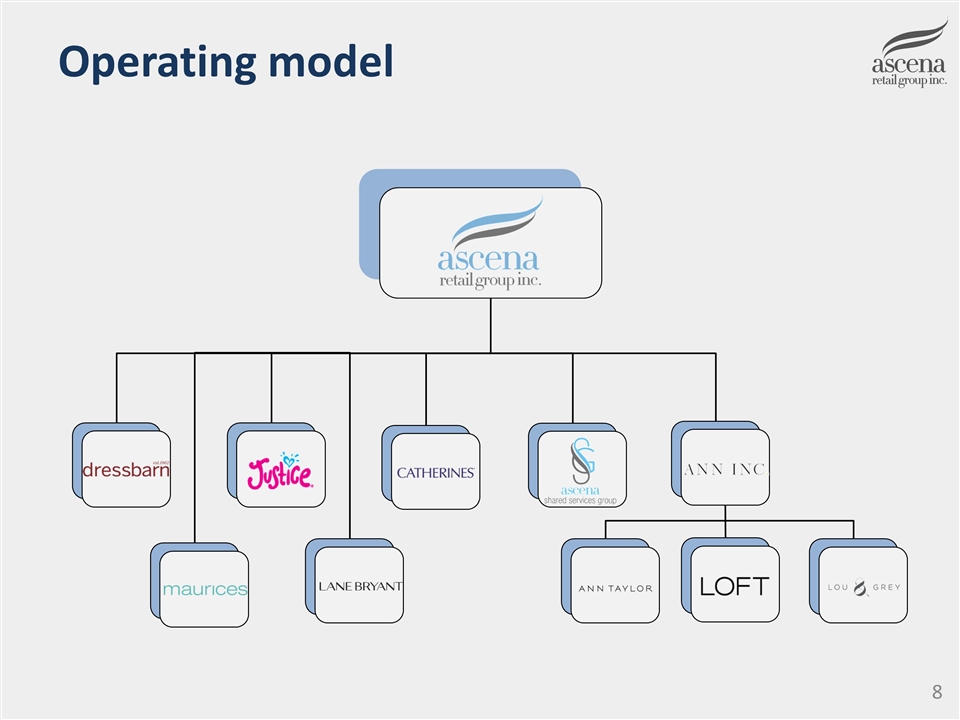

Operating model

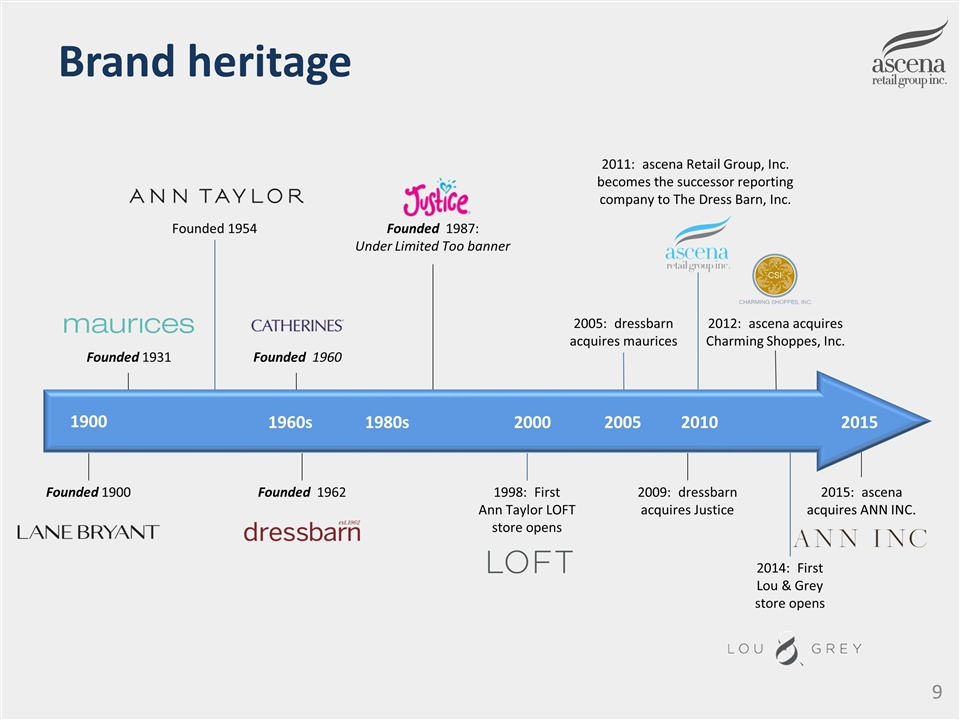

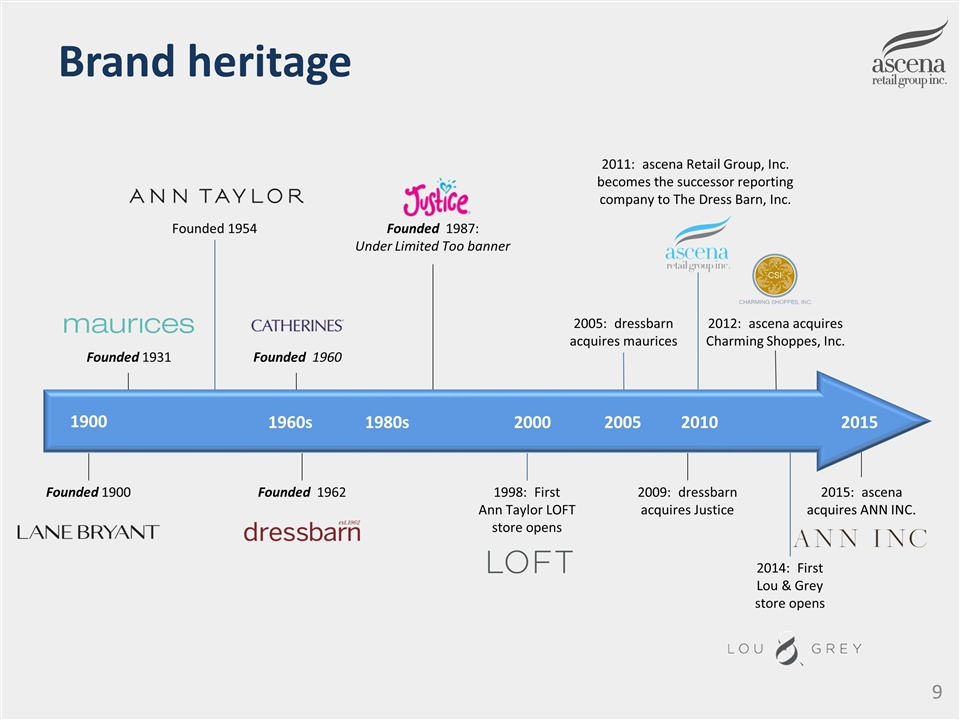

Brand heritage Founded 1931 Founded 1962 Founded 1987: Under Limited Too banner 2009: dressbarn acquires Justice 2005: dressbarn acquires maurices 2011: ascena Retail Group, Inc. becomes the successor reporting company to The Dress Barn, Inc. 2012: ascena acquires Charming Shoppes, Inc. 2015: ascena acquires ANN INC. Founded 1900 Founded 1954 1998: First Ann Taylor LOFT store opens Founded 1960 1960s 1980s 2000 2005 2010 2015 1900 2014: First Lou & Grey store opens

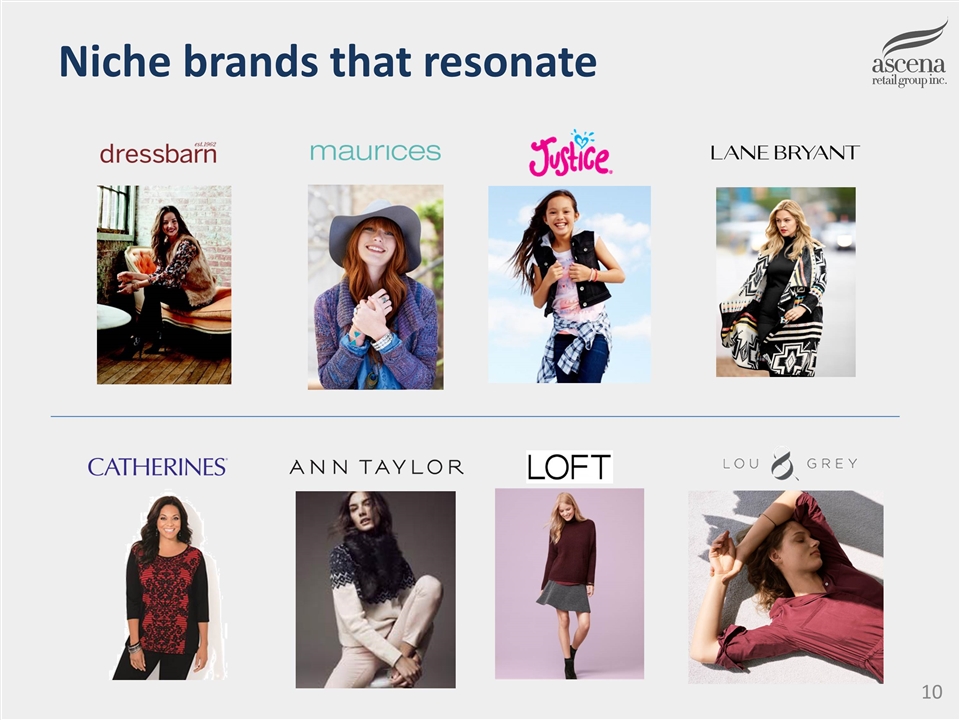

Niche brands that resonate

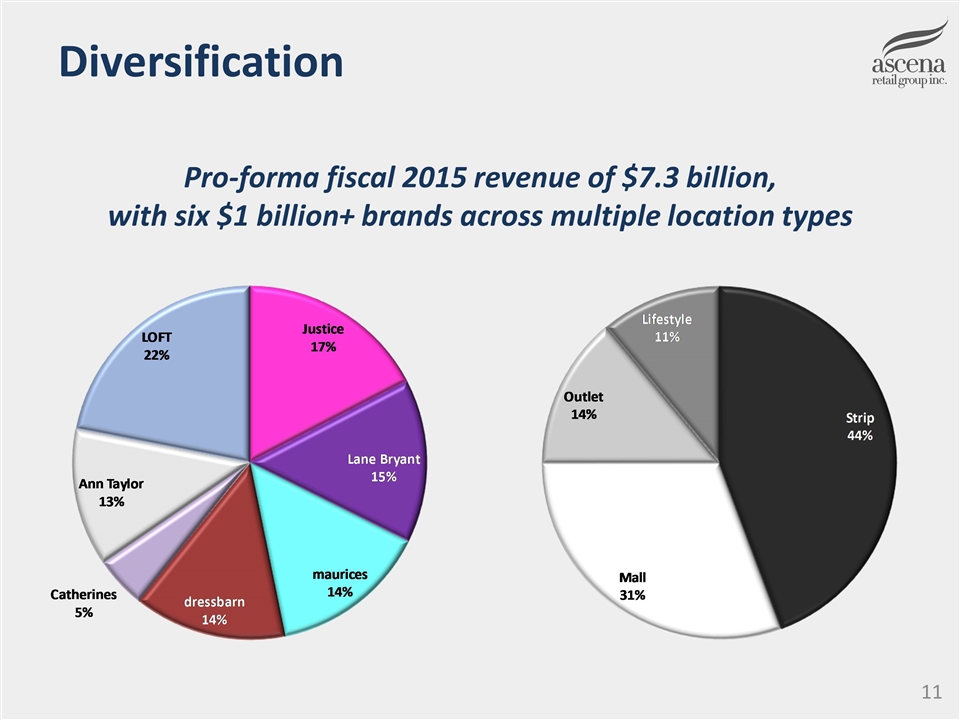

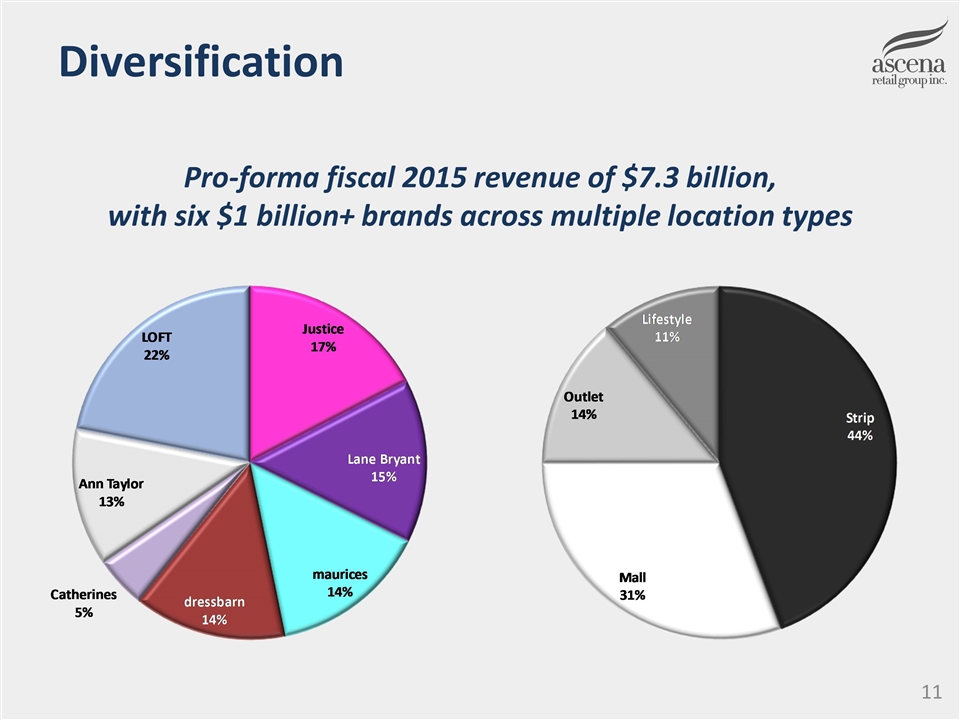

Diversification Pro-forma fiscal 2015 revenue of $7.3 billion, with six $1 billion+ brands across multiple location types

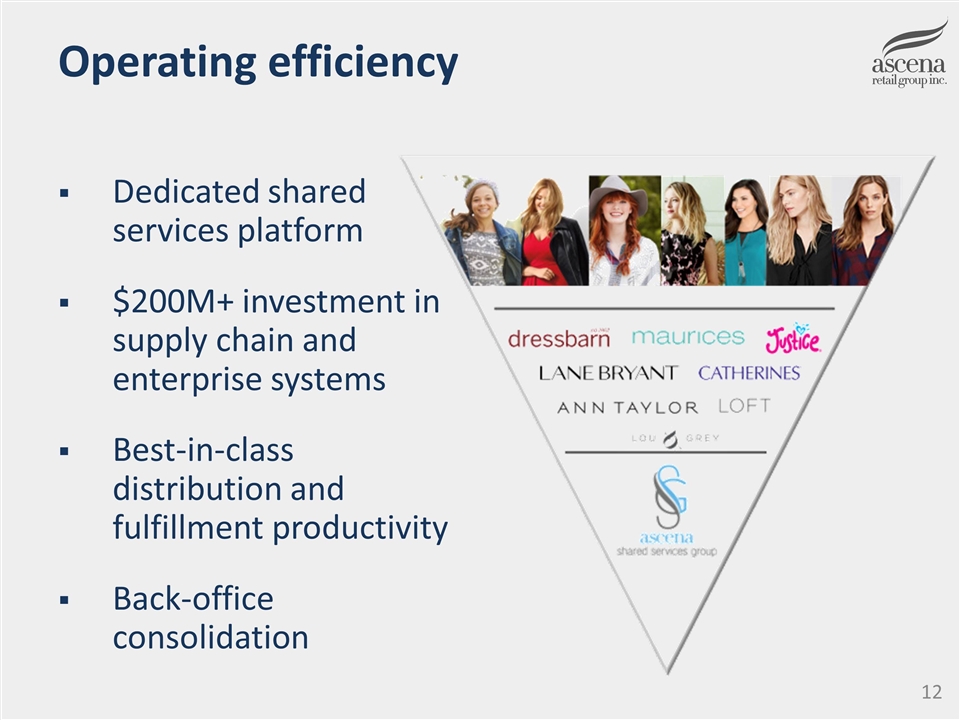

Operating efficiency Dedicated shared services platform $200M+ investment in supply chain and enterprise systems Best-in-class distribution and fulfillment productivity Back-office consolidation

Unique attributes Brand / format diversification Operating efficiency Functional collaboration Talent development Plug and play capability

Brian Lynch President and CEO

Drive turnaround and deliver sustained profitability Focus on what our customer wants…we listened to Mom and Our Girl Create a highly compelling customer-facing environment through in-store and digital efforts Effectively represent Justice to our customer through our Catazine, Social and CRM programs Maintain a disciplined financial architecture

Focus on what our customer wants… assortment / versatility What she said “All you sell is sparkles!”

Focus on what our customer wants… assortment / versatility Action More versatile fashion What she said “All you sell is sparkles!”

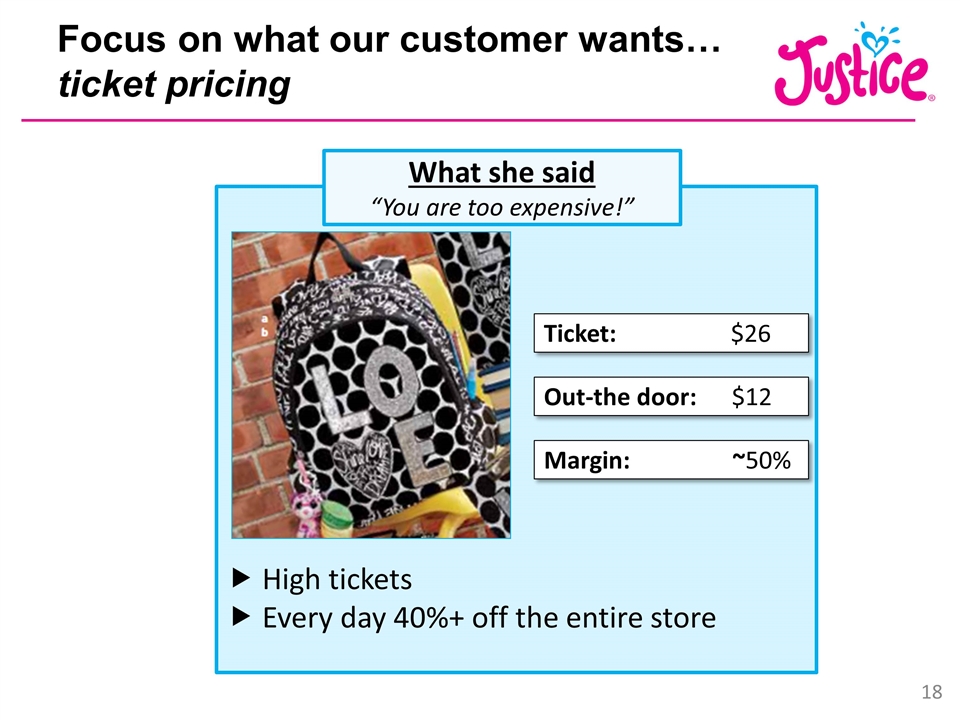

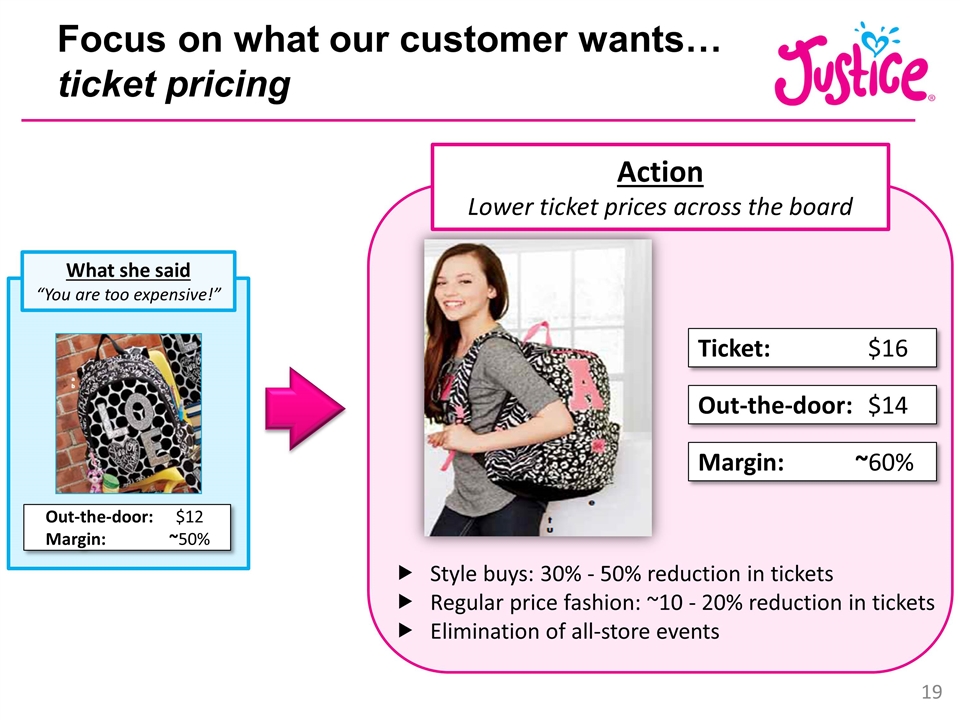

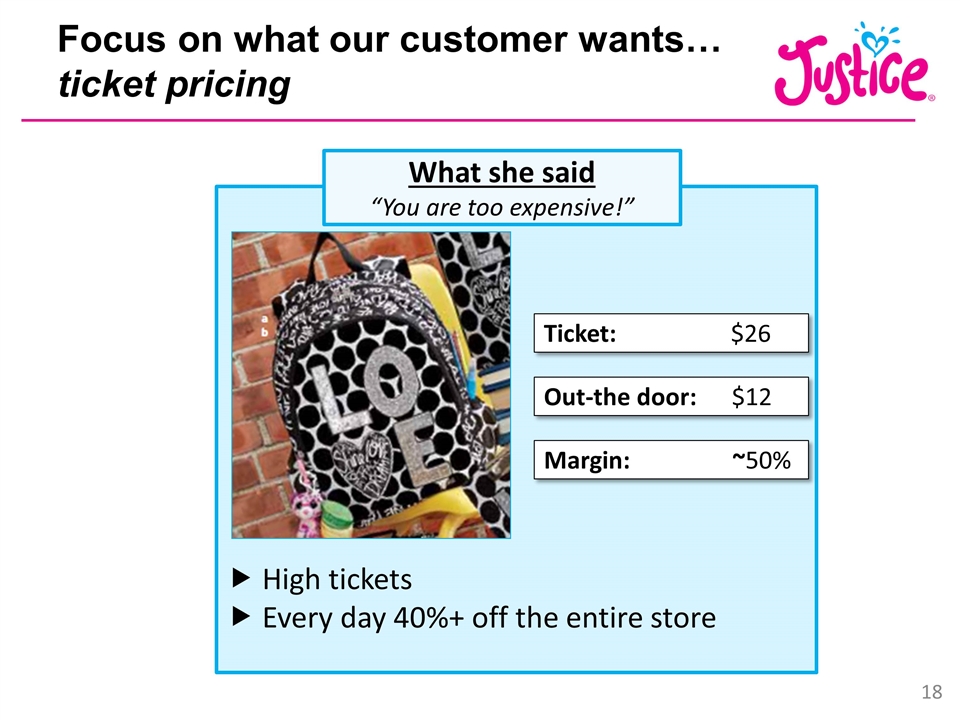

Focus on what our customer wants… ticket pricing High tickets Every day 40%+ off the entire store What she said “You are too expensive!” Ticket: $26 Out-the door: $12 Margin: ~50%

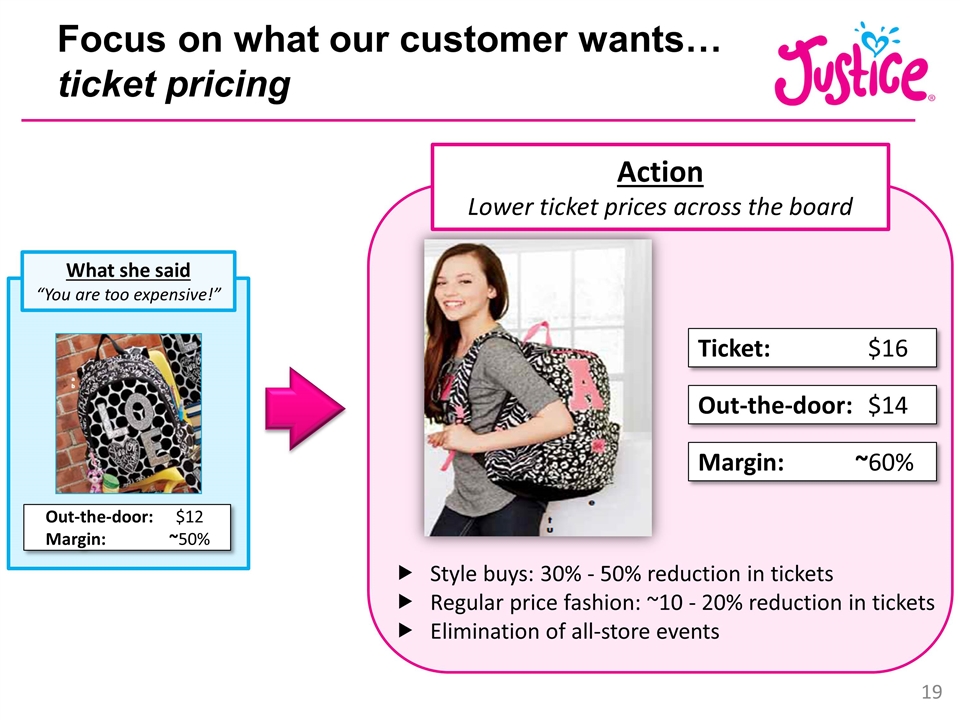

Focus on what our customer wants… ticket pricing Style buys: 30% - 50% reduction in tickets Regular price fashion: ~10 - 20% reduction in tickets Elimination of all-store events What she said “You are too expensive!” Out-the-door: $12 Margin:~50% Ticket: $16 Action Lower ticket prices across the board Out-the-door:$14 Margin:~60%

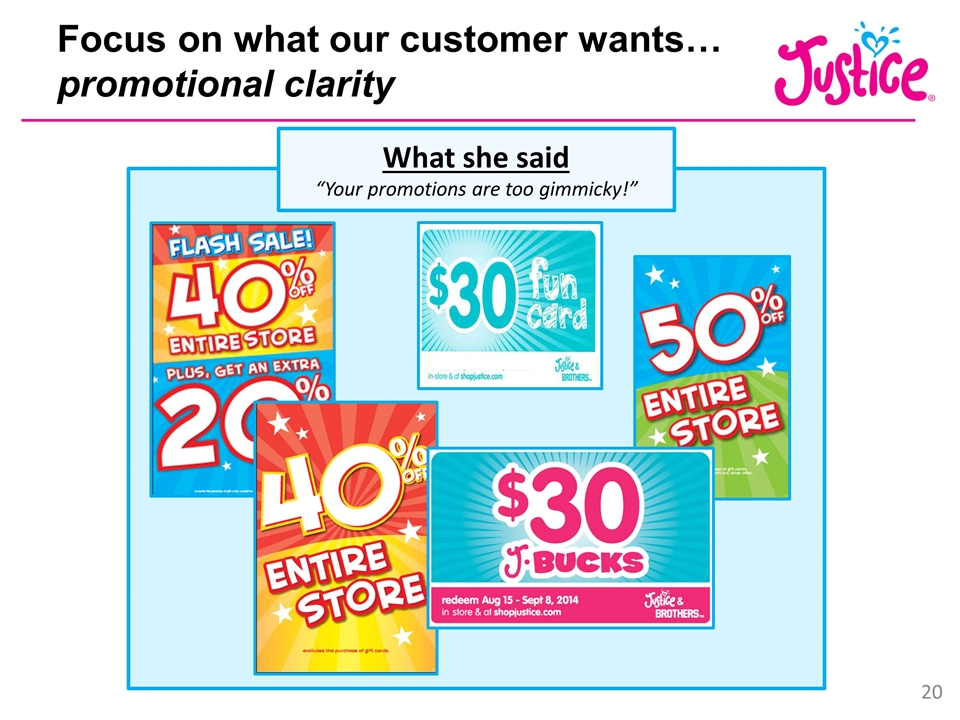

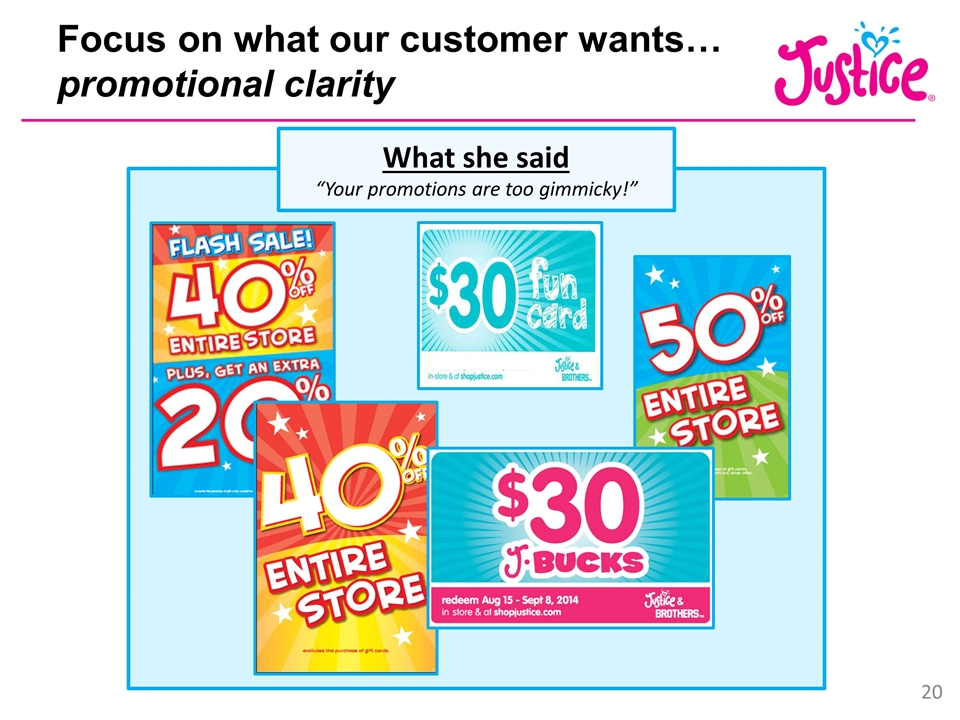

Focus on what our customer wants… promotional clarity What she said “Your promotions are too gimmicky!”

Focus on what our customer wants… promotional clarity Action Style buys, category-focused promotions, and style perks What she said “Your promotions are too gimmicky!” OR

Create a more branded and compelling customer-friendly environment OLD STORE ENVIRONMENT

Create a more branded and compelling customer-friendly environment Old Environment Enhanced Store Environment

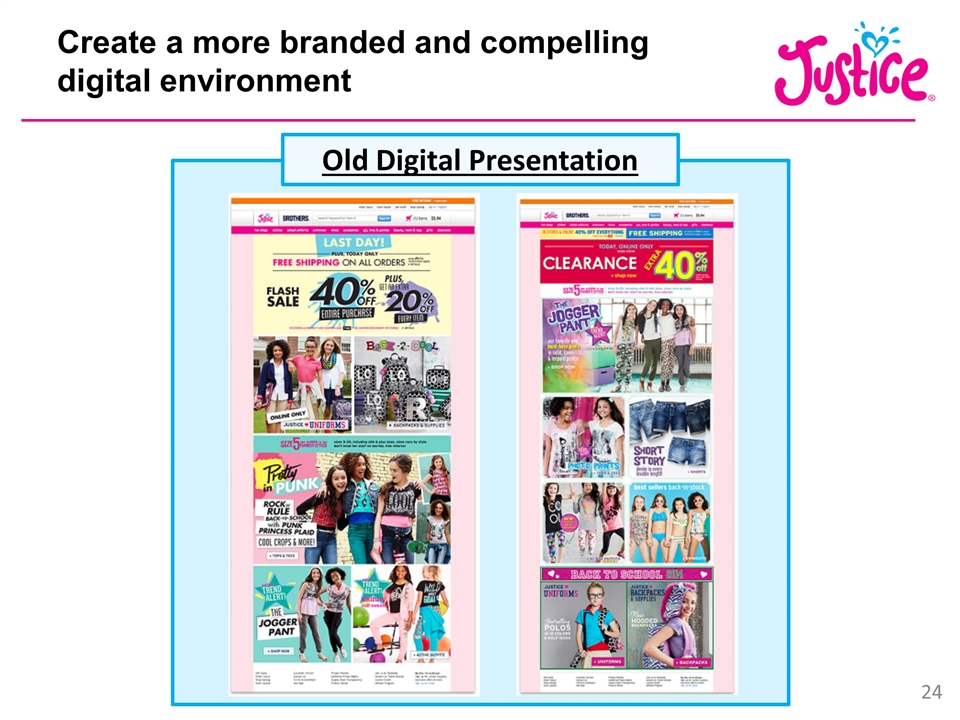

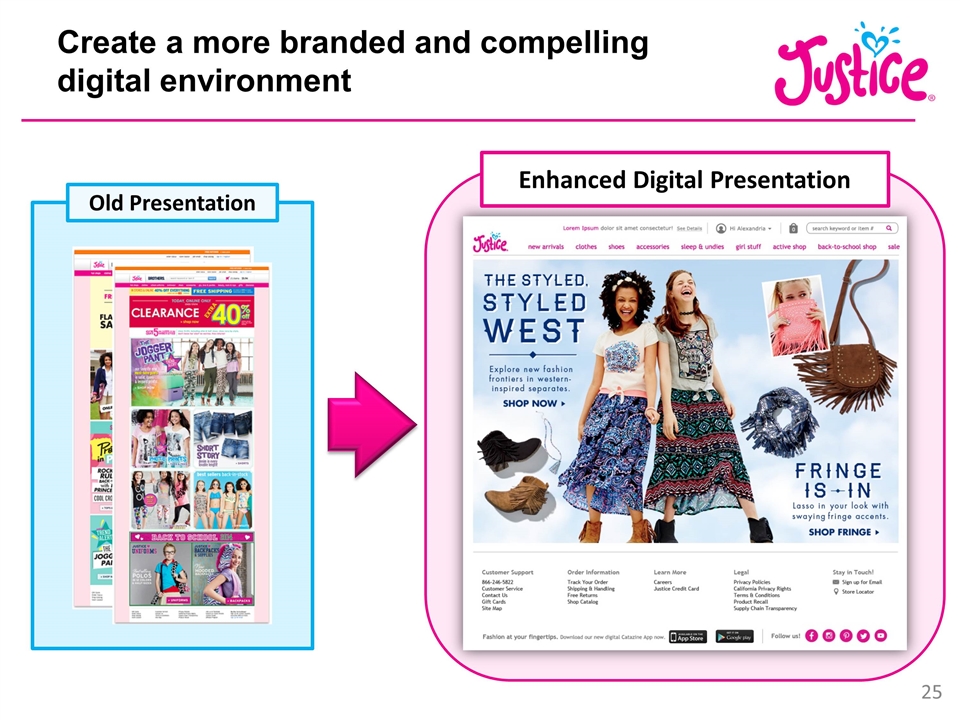

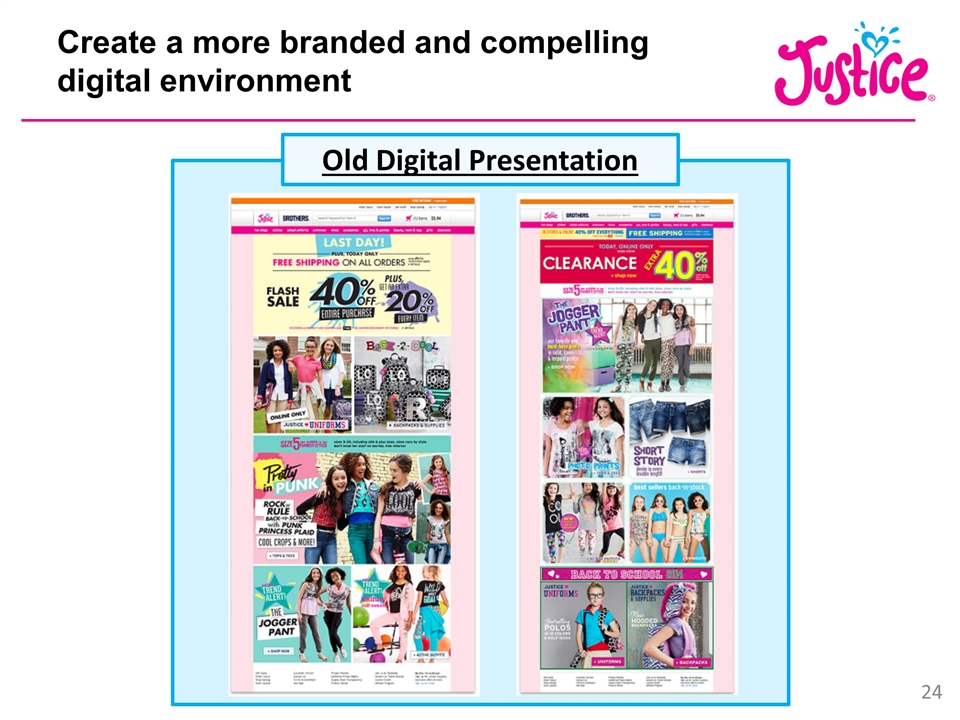

Create a more branded and compelling digital environment Old Digital Presentation

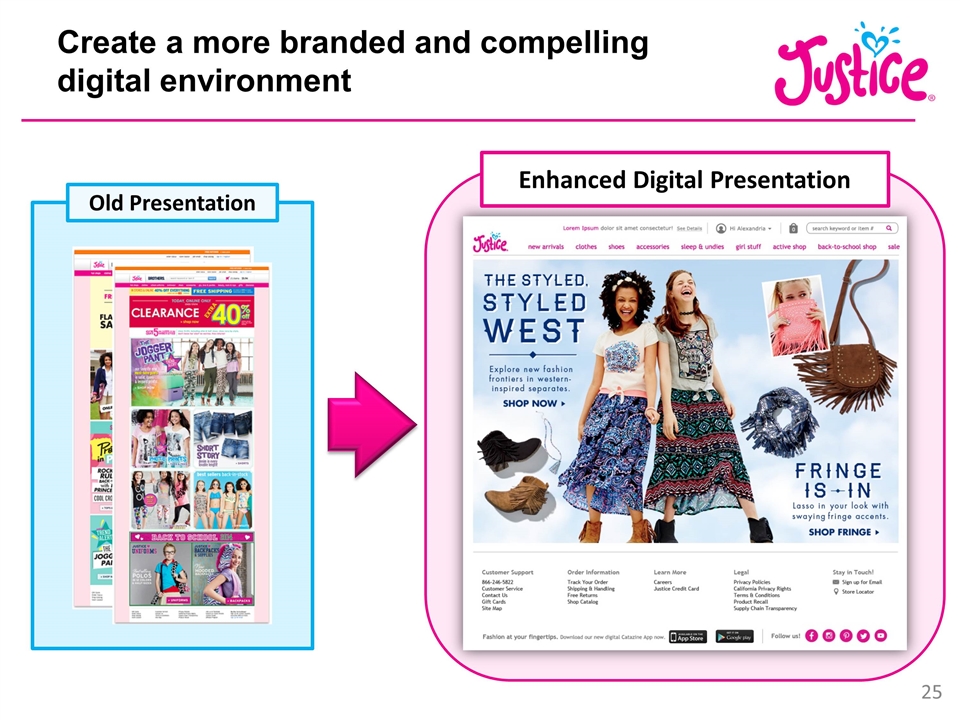

Create a more branded and compelling digital environment Old Presentation Enhanced Digital Presentation

Effectively represent the Justice Brand to our customer Old Catazine

Effectively represent the Justice Brand to our customer Old Catazine Enhanced Catazine

Effectively represent the Justice Brand to our customer Enhance CRM capabilities Improve segmentation Strengthen the customer file Amplify Social programs

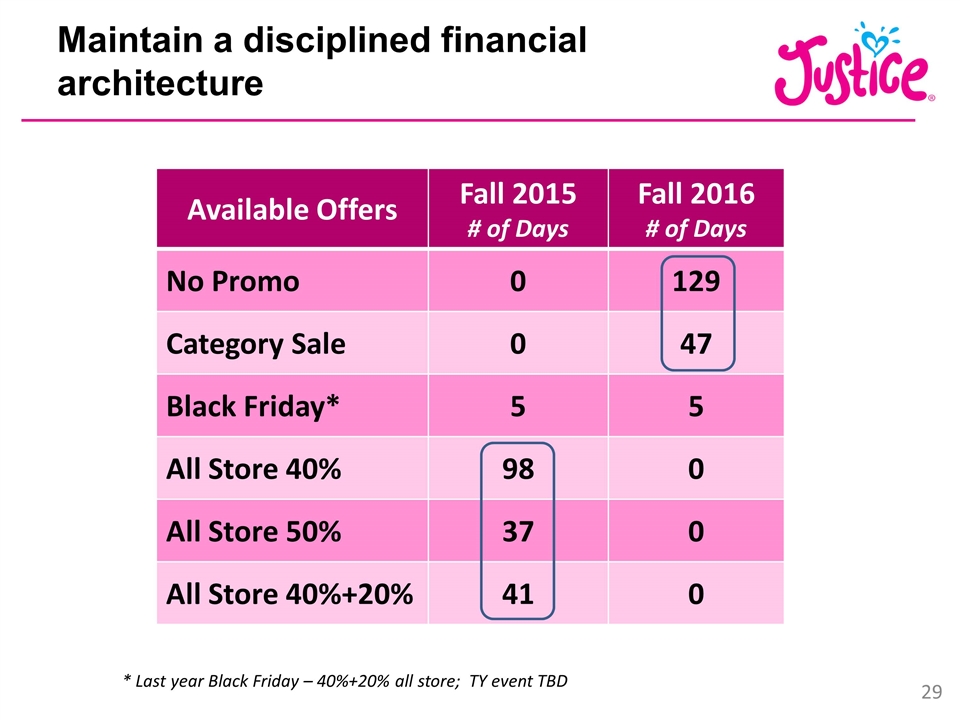

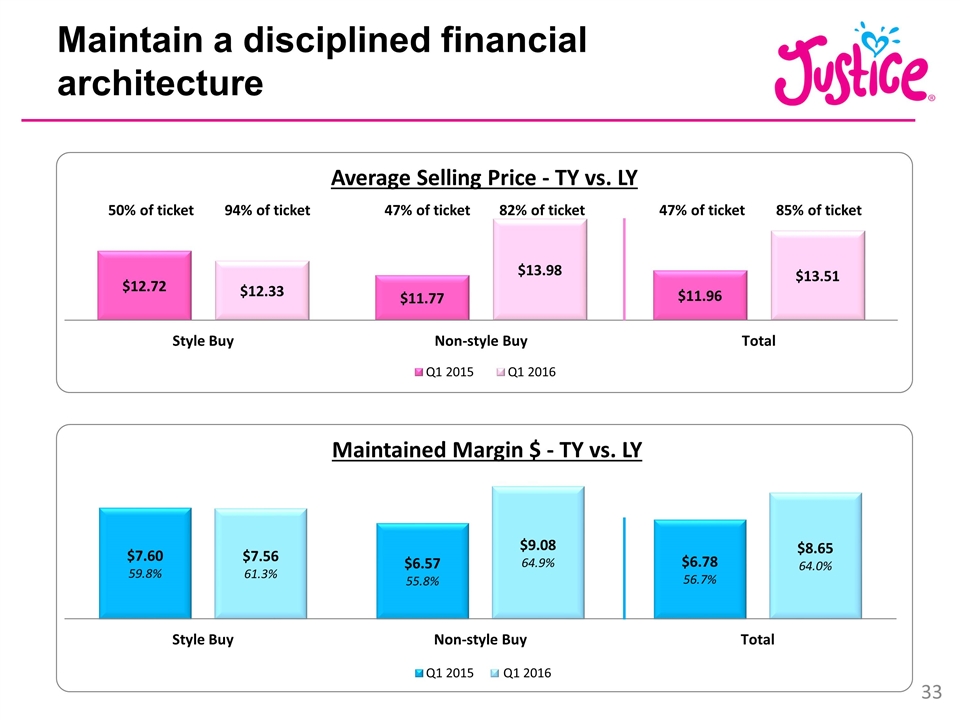

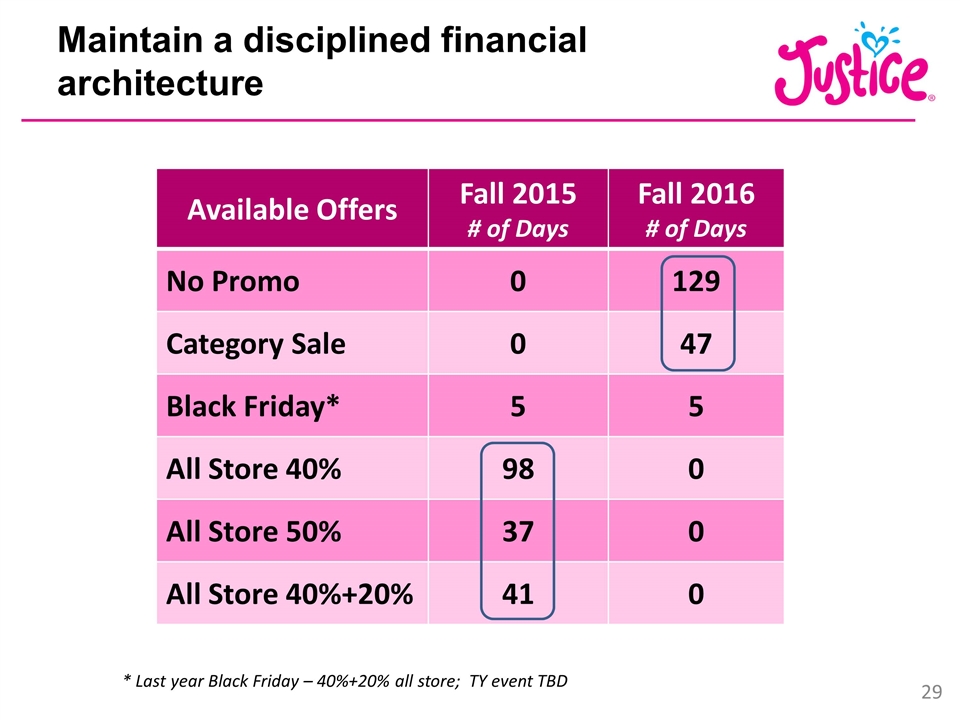

Available Offers Fall 2015 # of Days Fall 2016 # of Days No Promo 0 129 Category Sale 0 47 Black Friday* 5 5 All Store 40% 98 0 All Store 50% 37 0 All Store 40%+20% 41 0 Maintain a disciplined financial architecture * Last year Black Friday – 40%+20% all store; TY event TBD

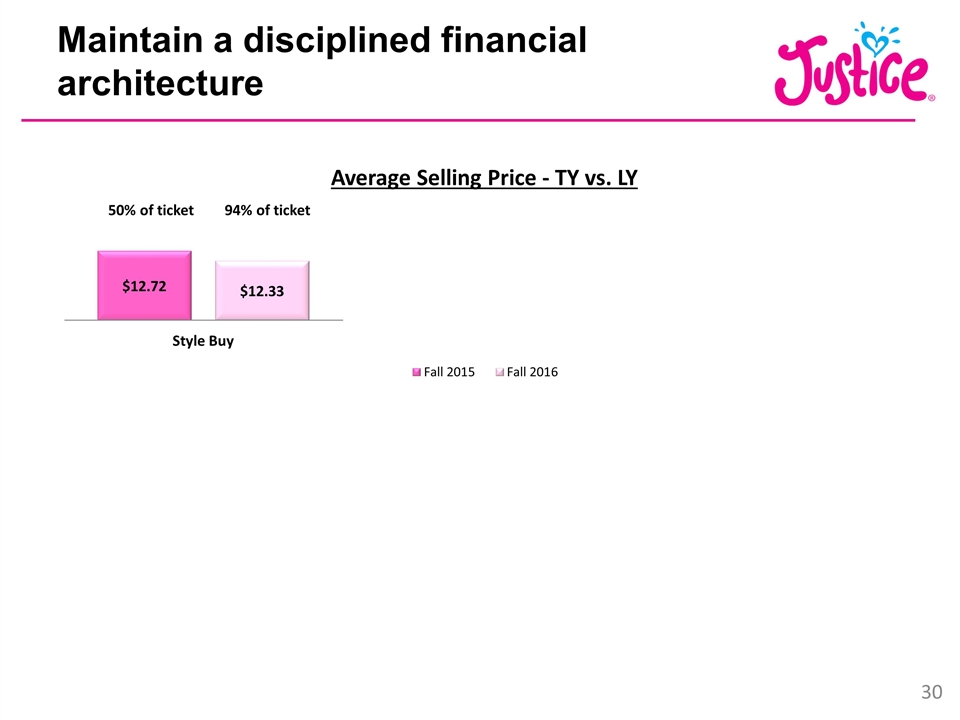

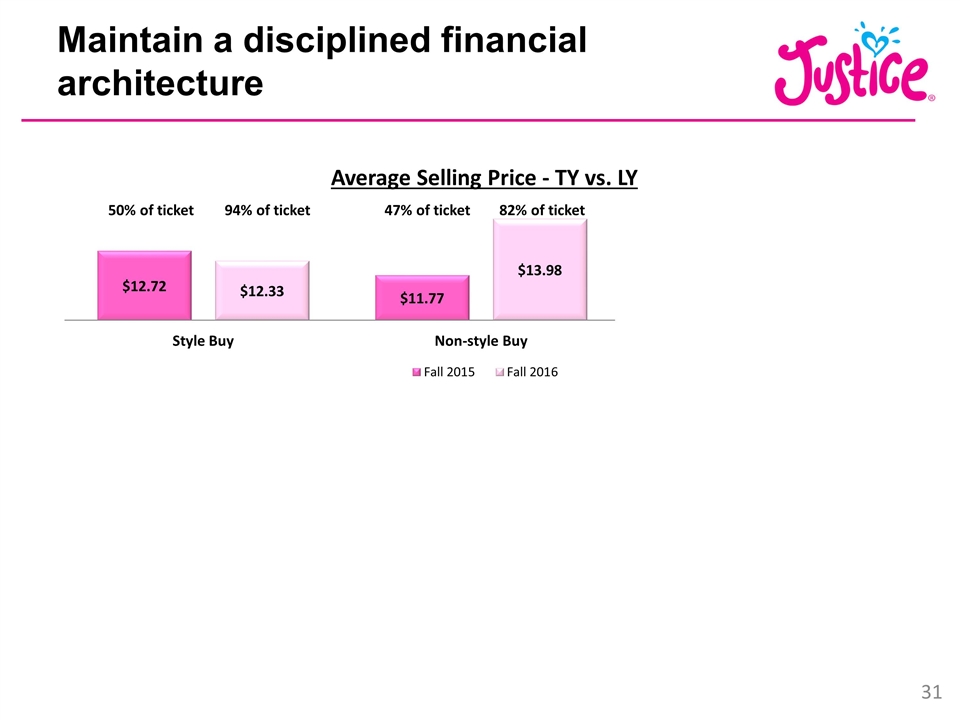

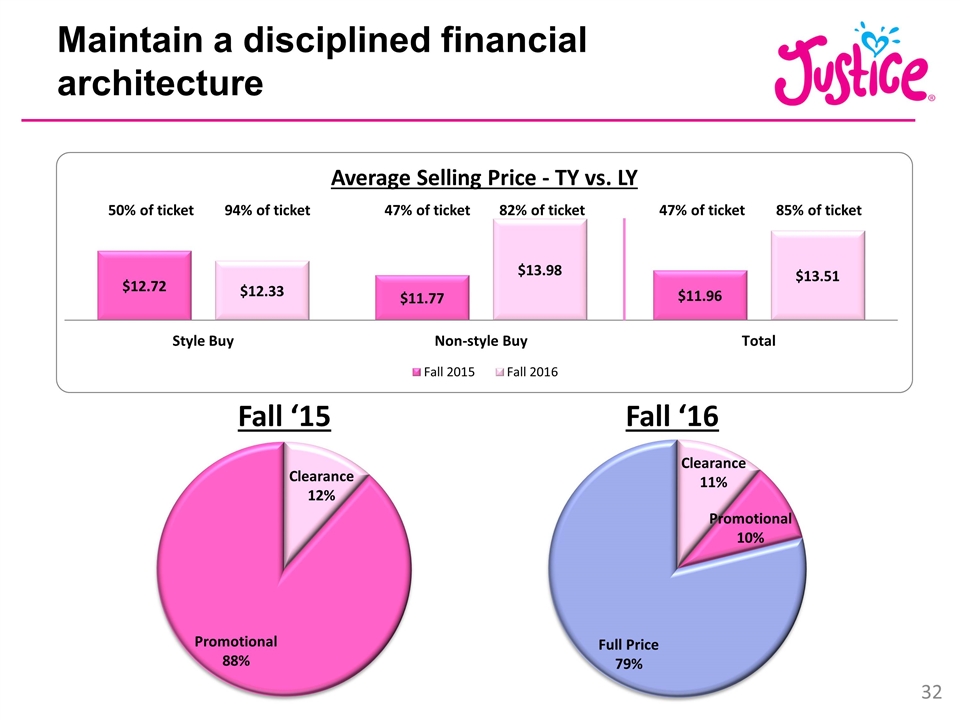

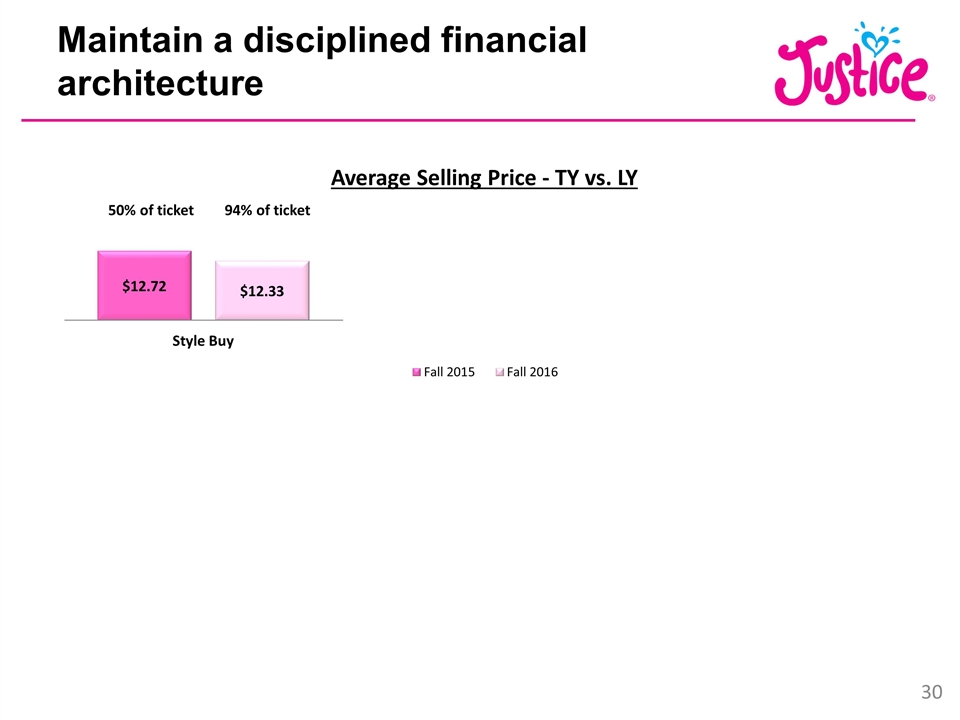

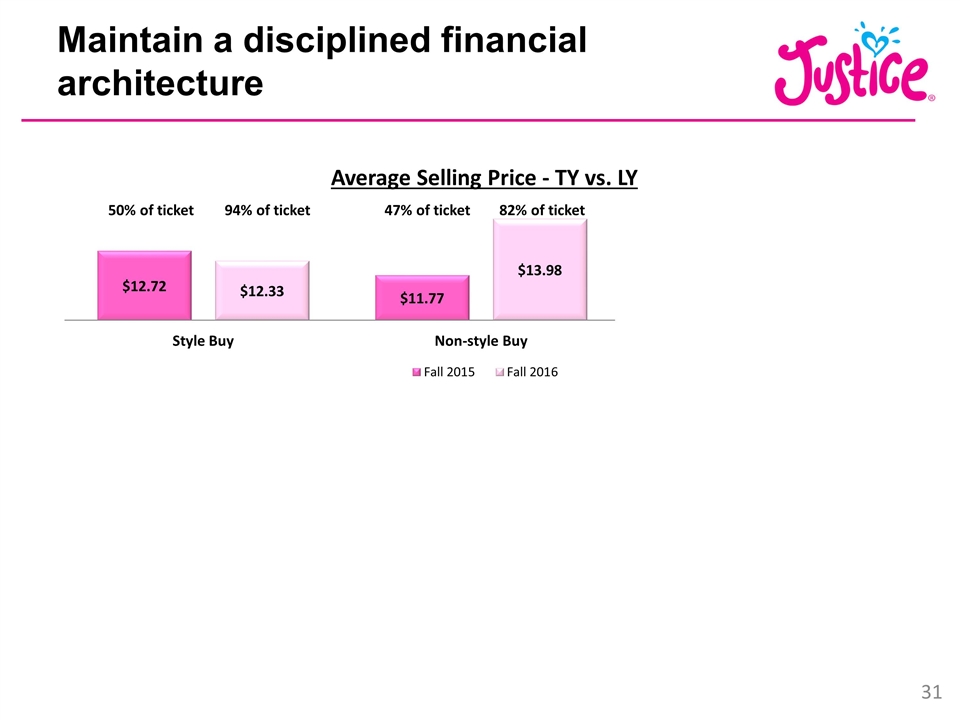

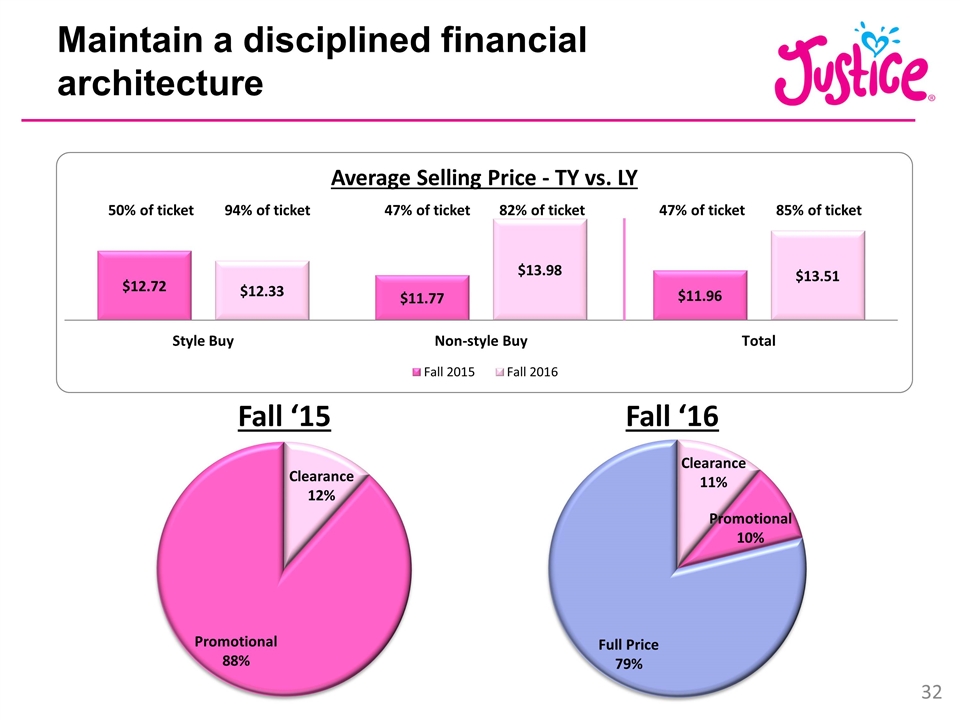

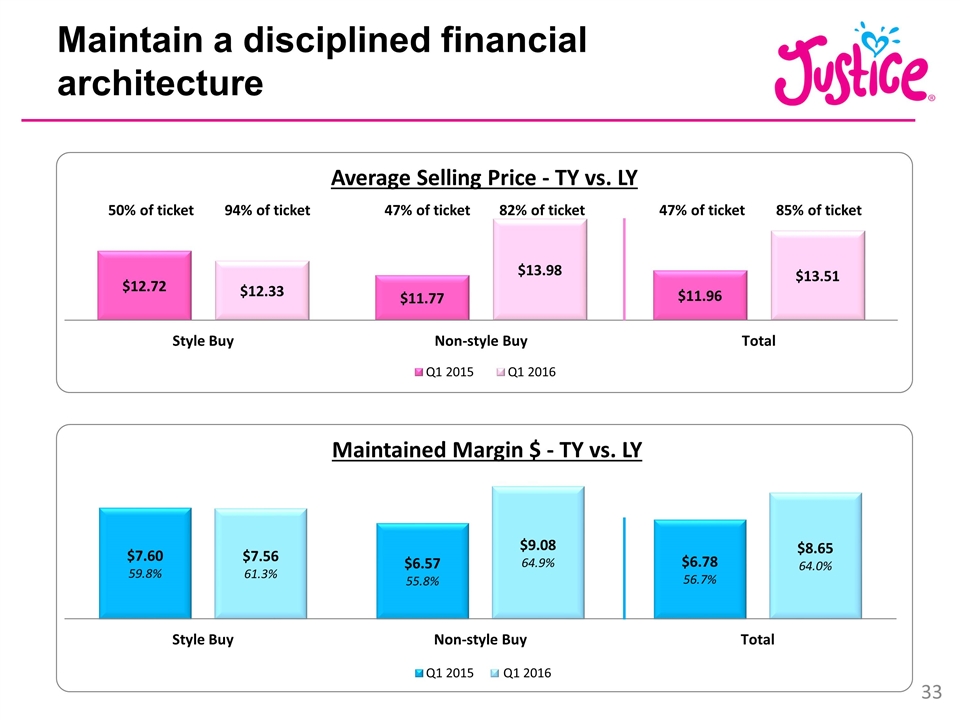

Maintain a disciplined financial architecture 50% of ticket 94% of ticket 47% of ticket 82% of ticket 47% of ticket 85% of ticket

Maintain a disciplined financial architecture 50% of ticket 94% of ticket 47% of ticket 82% of ticket 47% of ticket 85% of ticket

Maintain a disciplined financial architecture Fall ‘15 Fall ‘16 Promotional 88% Clearance 12% Promotional 10% Clearance 11% Full Price 79% 50% of ticket 94% of ticket 47% of ticket 82% of ticket 47% of ticket 85% of ticket

Maintain a disciplined financial architecture 50% of ticket 94% of ticket 47% of ticket 82% of ticket 47% of ticket 85% of ticket Q1 2015 Q1 2016

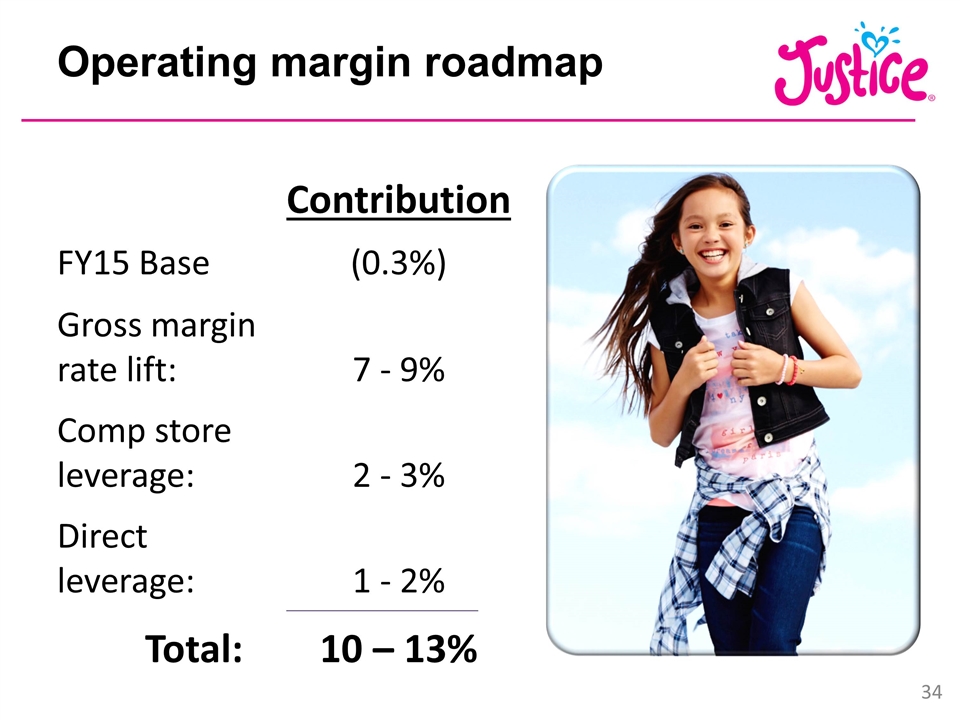

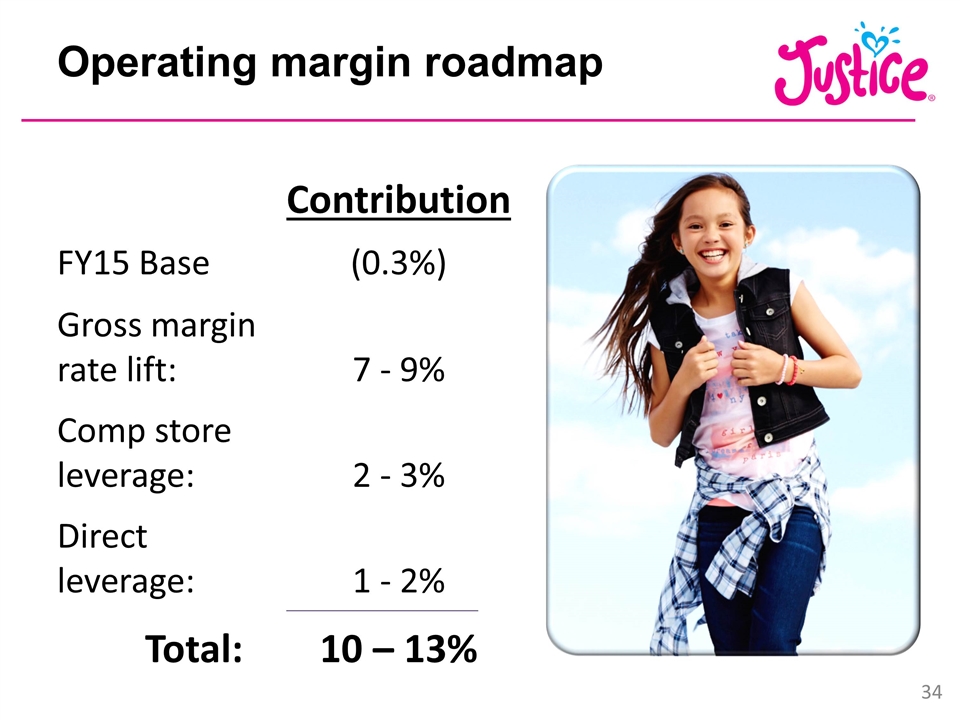

Operating margin roadmap Contribution FY15 Base(0.3%) Gross margin rate lift:7 - 9% Comp store leverage:2 - 3% Direct leverage:1 - 2% Total:10 – 13%

John Sullivan President and Chief Operating Officer

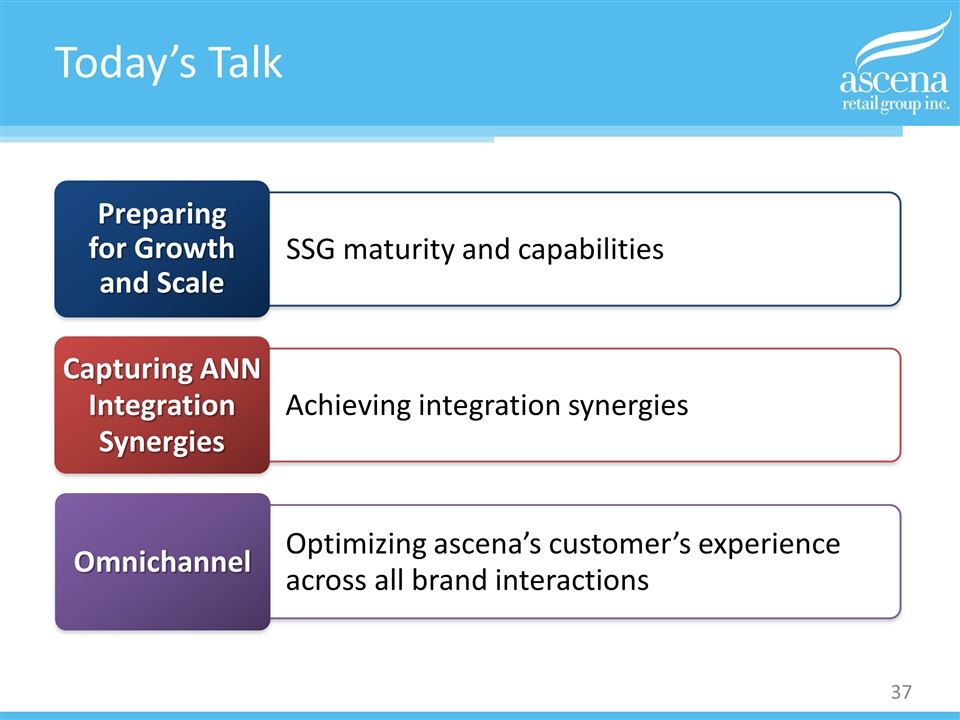

SSG maturity and capabilities Achieving integration synergies Optimizing ascena’s customer’s experience across all brand interactions Today’s Talk Preparing for Growth and Scale Capturing ANN Integration Synergies Omnichannel

Preparing for Growth and Scale Expand on our proven shared services model Best in class distribution operations Effective transportation network Upgraded core business platforms Significant talent investment Leverage valuable insights from previous acquisitions

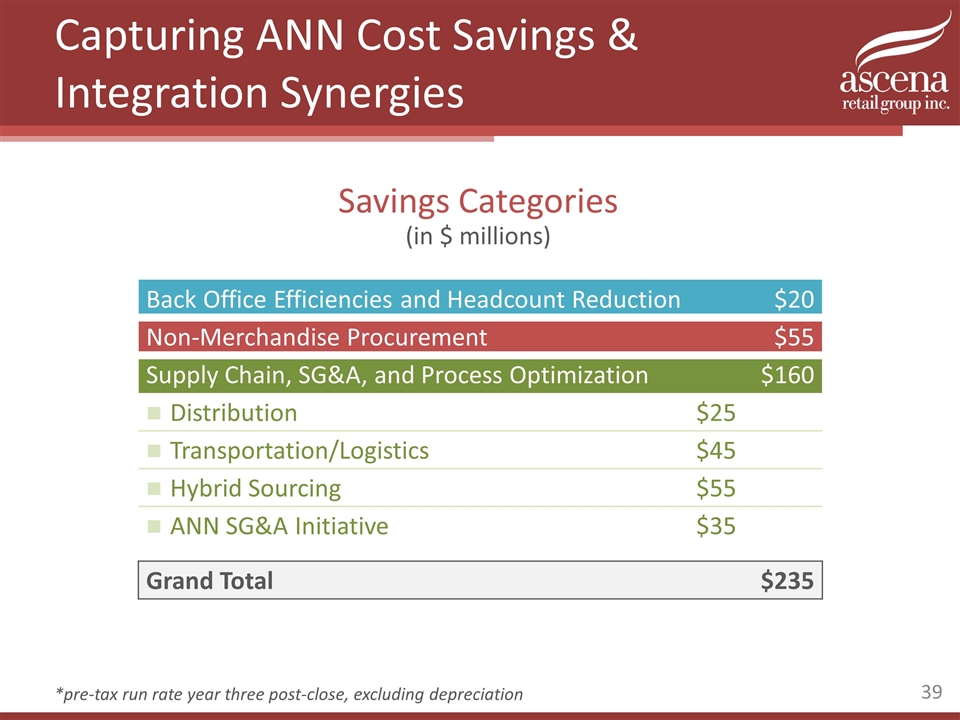

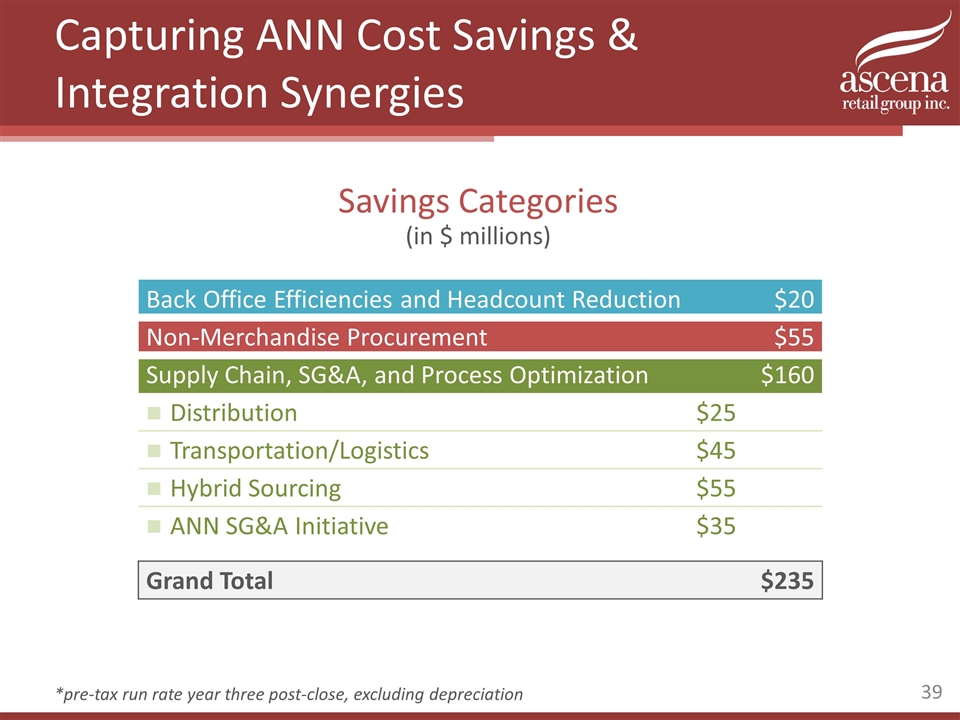

Capturing ANN Cost Savings & Integration Synergies *pre-tax run rate year three post-close, excluding depreciation THE PLAN Back Office Efficiencies and Headcount Reduction $20 Non-Merchandise Procurement $55 Supply Chain, SG&A, and Process Optimization $160 Distribution $25 Transportation/Logistics $45 Hybrid Sourcing $55 ANN SG&A Initiative $35 Grand Total $235 Savings Categories (in $ millions)

Capturing ANN Cost Savings & Integration Synergies Back Office Efficiencies and Headcount Reduction Leveraging New Scale Organizational and back office efficiencies Streamline organizational leadership structure Consolidate operational functions Leverage back office scale

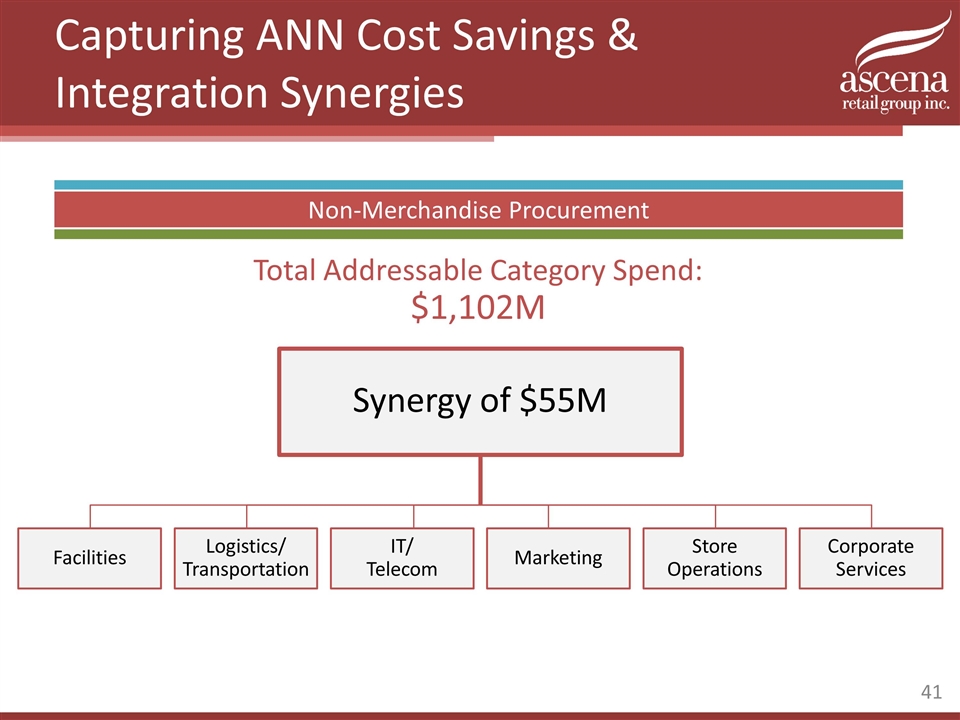

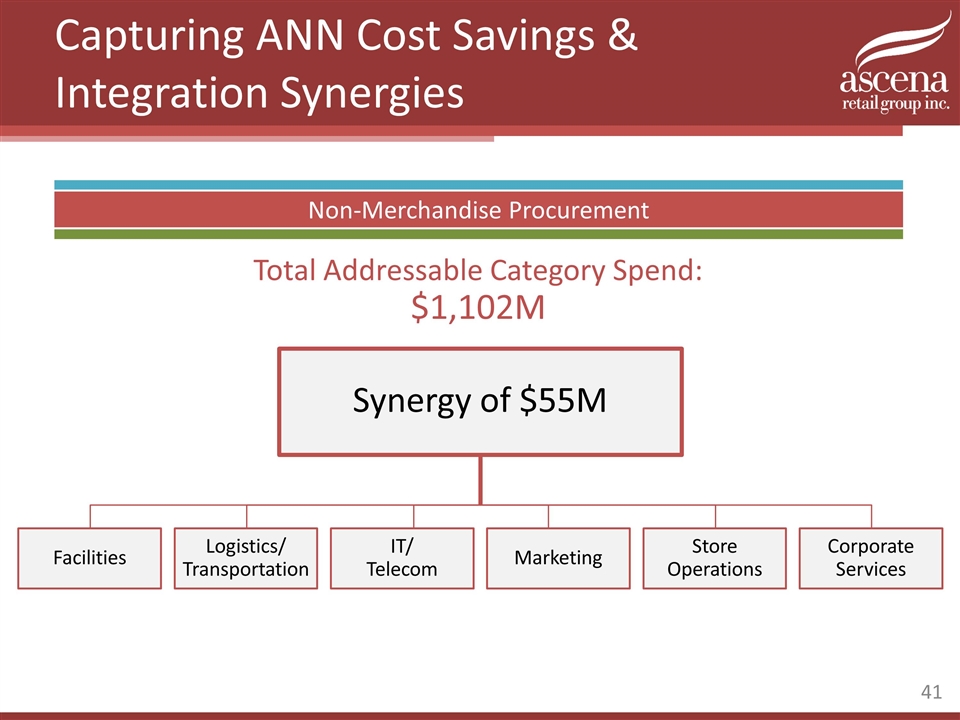

Capturing ANN Cost Savings & Integration Synergies Non-Merchandise Procurement Synergy of $55M Non-Merchandise Procurement Facilities Logistics/ Transportation IT/ Telecom Marketing Store Operations Corporate Services Total Addressable Category Spend: $1,102M

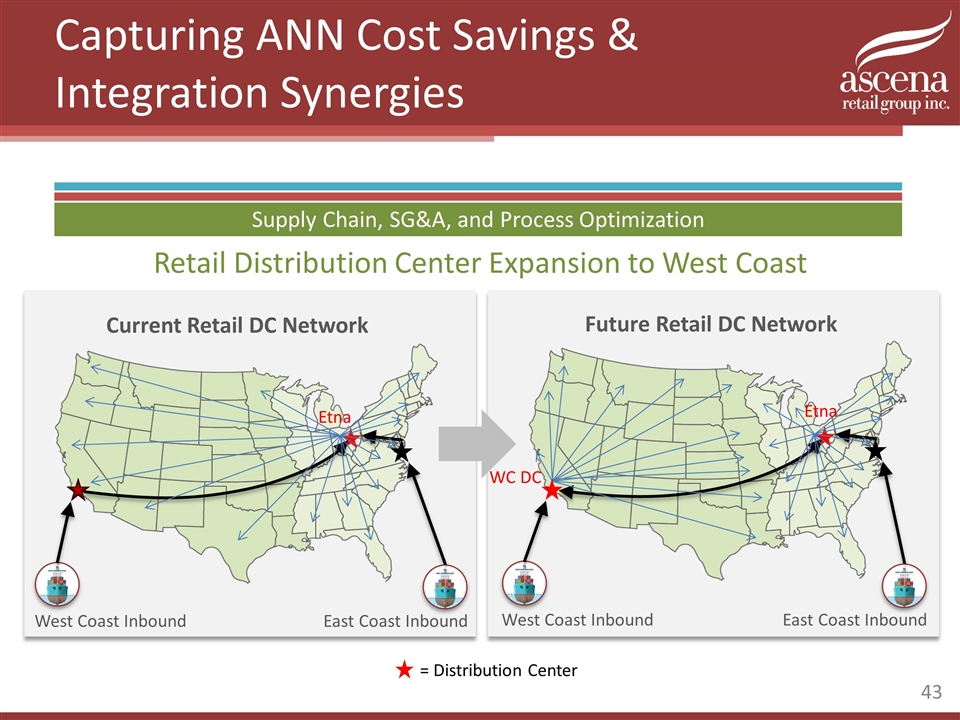

Supply Chain, SG&A, and Process Optimization Capturing ANN Cost Savings & Integration Synergies Distribution Consolidation Consolidate distribution facilities Improve service levels Reduce operational cost per Unit (CPU) Transportation/Logistics Leverage ascena’s lower inbound and outbound costs

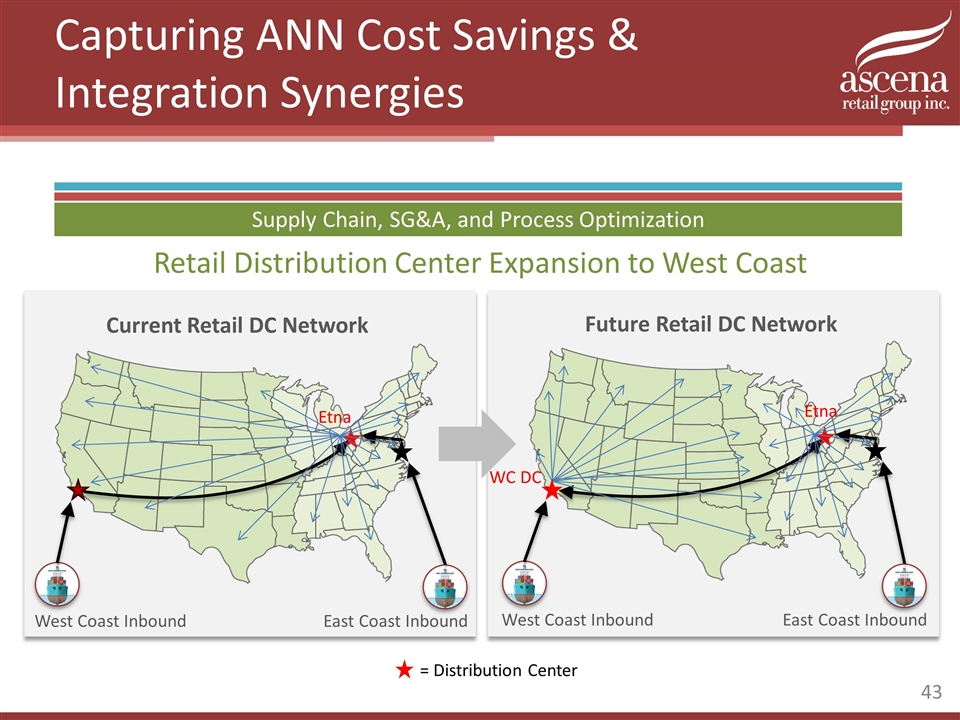

East Coast Inbound West Coast Inbound Etna Current Retail DC Network East Coast Inbound West Coast Inbound Etna Future Retail DC Network WC DC Capturing ANN Cost Savings & Integration Synergies Supply Chain, SG&A, and Process Optimization Retail Distribution Center Expansion to West Coast = Distribution Center

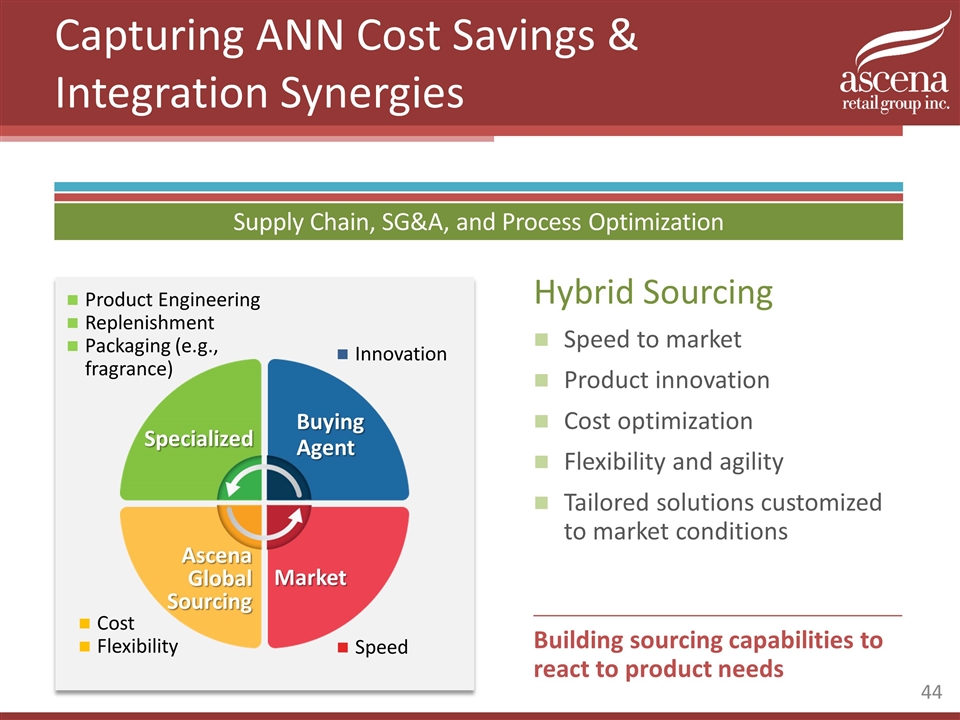

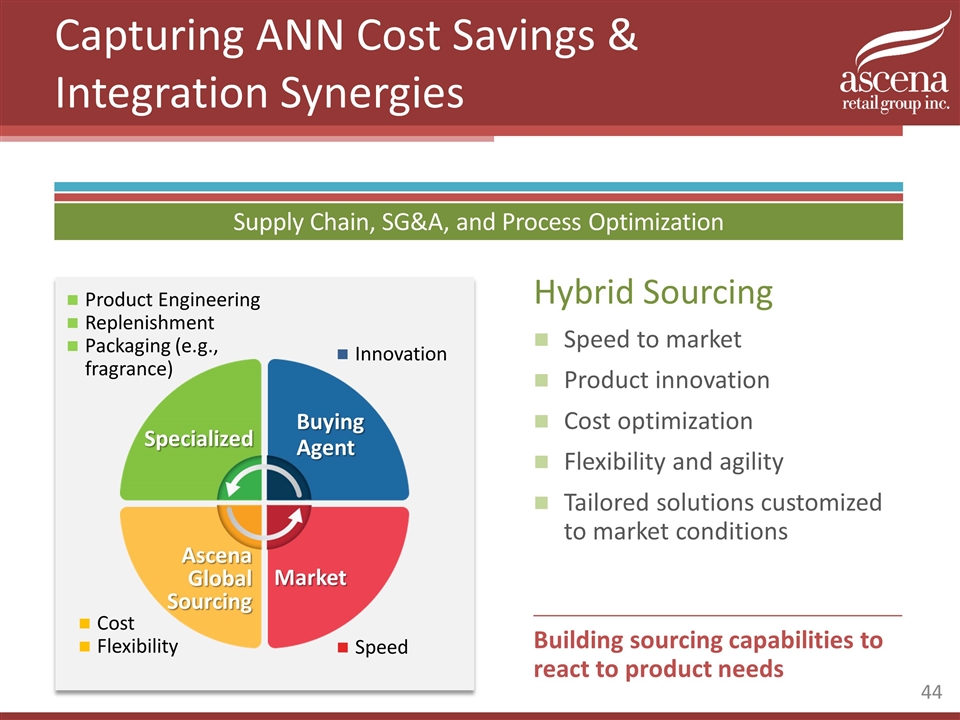

Specialized Buying Agent Ascena Global Sourcing Market Capturing ANN Cost Savings & Integration Synergies Hybrid Sourcing Speed to market Product innovation Cost optimization Flexibility and agility Tailored solutions customized to market conditions Cost Flexibility Supply Chain, SG&A, and Process Optimization Building sourcing capabilities to react to product needs Speed Product Engineering Replenishment Packaging (e.g., fragrance) Innovation

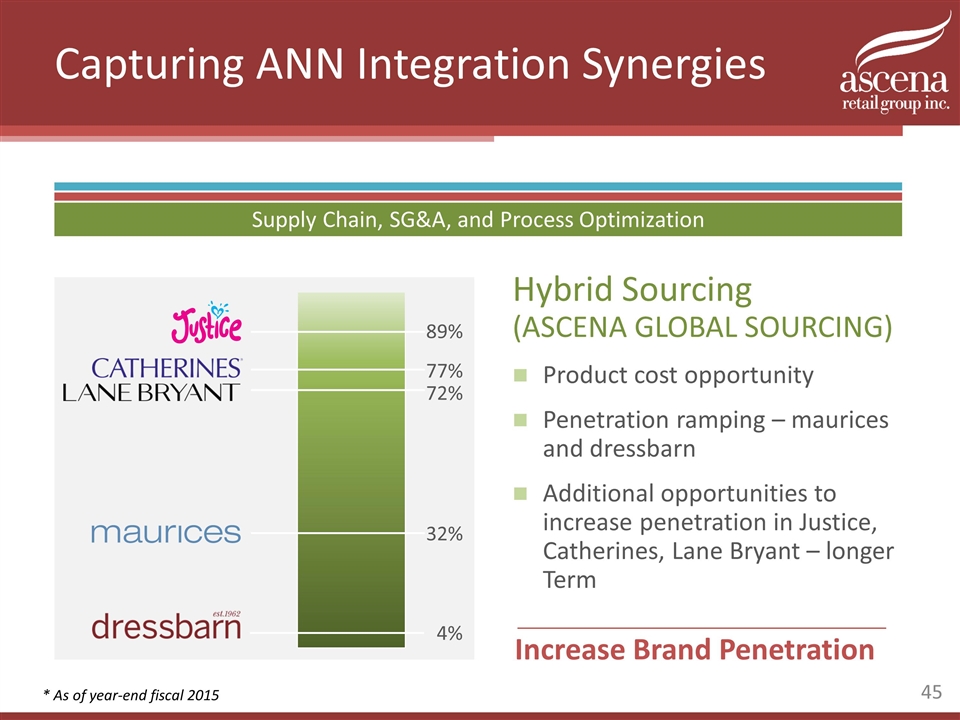

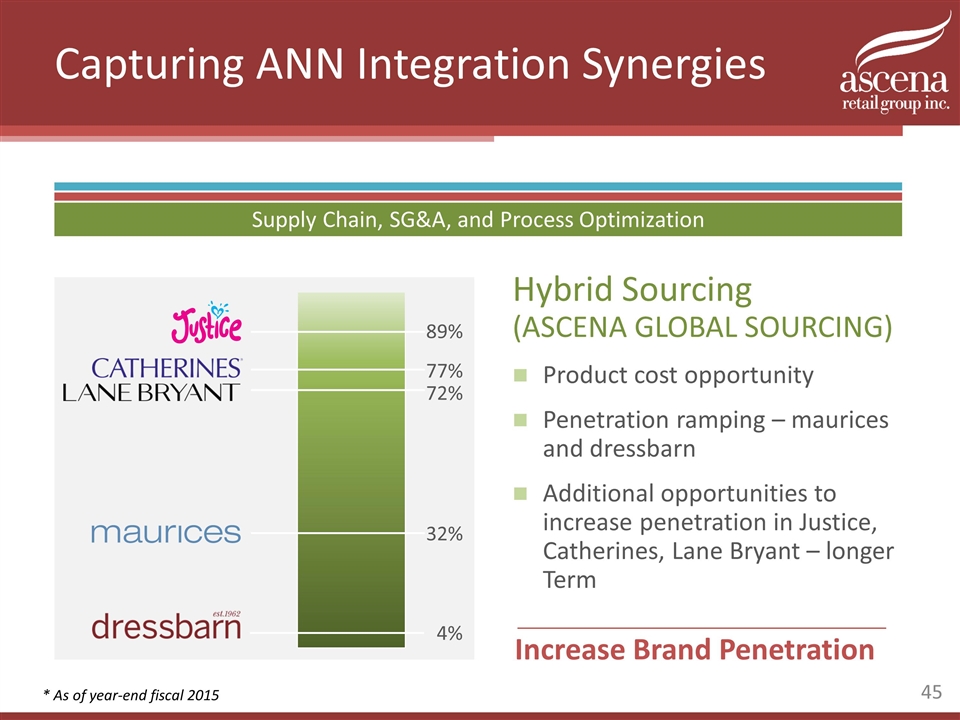

Capturing ANN Integration Synergies * As of year-end fiscal 2015 Supply Chain, SG&A, and Process Optimization Hybrid Sourcing (ASCENA GLOBAL SOURCING) Product cost opportunity Penetration ramping – maurices and dressbarn Additional opportunities to increase penetration in Justice, Catherines, Lane Bryant – longer Term Increase Brand Penetration 77% 72% 32% 4%

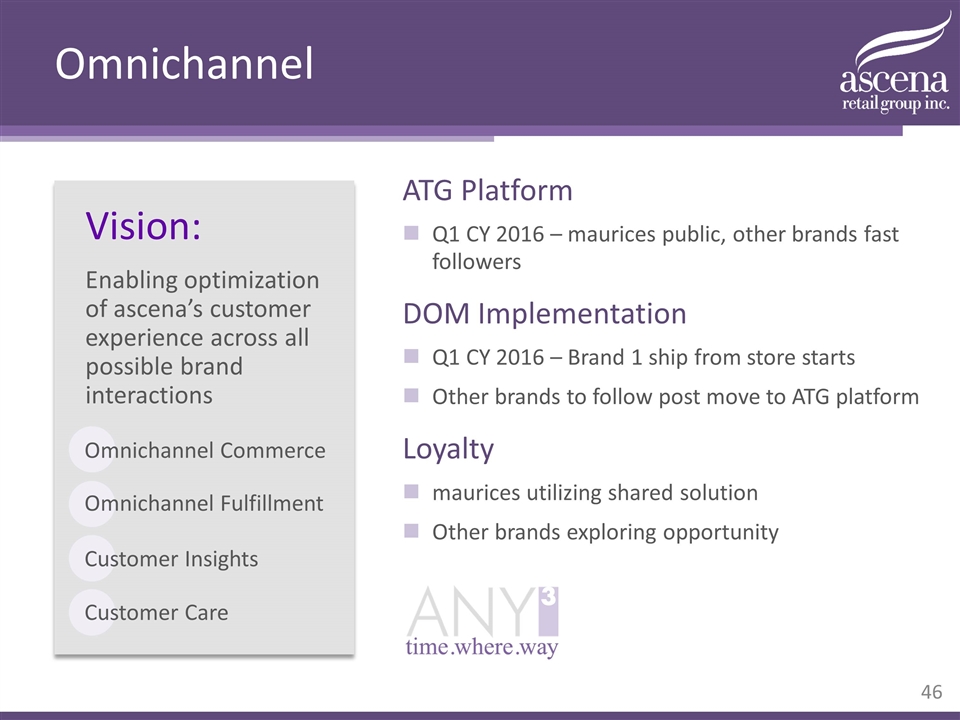

Omnichannel ATG Platform Q1 CY 2016 – maurices public, other brands fast followers DOM Implementation Q1 CY 2016 – Brand 1 ship from store starts Other brands to follow post move to ATG platform Loyalty maurices utilizing shared solution Other brands exploring opportunity Vision: Enabling optimization of ascena’s customer experience across all possible brand interactions Omnichannel Commerce Omnichannel Fulfillment Customer Insights Customer Care

In Summary, We Will… SSG maturity and capabilities Achieving integration synergies Optimizing ascena’s customer’s experience across all brand interactions Preparing for Growth and Scale Capturing ANN Integration Synergies Omnichannel SSG maturity and capabilities Achieving integration synergies Optimizing ascena’s customer’s experience across all brand interactions Preparing for Growth and Scale Capturing ANN Integration Synergies Omnichannel Support all current and future brand partners to better execute their business plans by providing high quality expertise and cost effective service with passion, integrity and respect

Gary Muto - President and CEO

The Ann Taylor brand is the top of mind style destination for every generation of working women. It appeals to women who appreciate Ann’s timeless modern classic point of view. The brand is known as polished, professional, sophisticated and always appropriate. The product is anchored in versatile pieces to fit her various lifestyle needs, especially her work wardrobe.

Evolve product offering to be relevant and build on existing strength in work wear Offer an appropriate balance of fashion newness and versatility Grow customer file Optimize market presence / rationalize store footprint and continue to grow ecommerce Brand initiatives

Ann Taylor is the destination for work wear in the women’s apparel market, always offering fashion newness, versatility, and great quality that is relevant to today’s working woman Our client base is highly loyal, appreciates the brand heritage, and seeks appropriate and timeless clothing The brand has opportunity to capitalize on the established work wear consideration and capture new clients, who are interested in fashion but do not need to be first The addressable market for Ann Taylor is $50B and presents attractive opportunities for new clients that are younger and spend more annually on clothing Wear-to-work focus

Protect established market position Focus assortment around fashion newness Balance product and pricing tiers to maximize assortment profitability Expand the Direct channel Product strategy

Marketing strategies and initiatives Grow traffic across all channels Acquire, retain and reactivate high value clients Scale personalization and segmentation capabilities Create distinctive marketing and messaging that expands brand perception Deliver consistent brand experience across channels

The LOFT brand appeals to a woman who wants to be stylish and fashionable in a relaxed yet classic way. She craves versatility and loves our surprising prices and engaging shopping environment. LOFT has broad appeal across consumer segments, ages and end use. In short, LOFT is a brand that appeals to everybody. It’s ageless.

Expand offerings in feminine fashion styles and maintain position in wardrobe essentials Drive growth in the tops category through style / price point diversity Continue to create client loyalty through pants offering Increase brand awareness through breakthrough marketing programs Focus on driving productivity gains and expanding online presence Brand initiatives

Create product that offers multiple end uses from work to weekend Focus on offering easy wardrobing and modern styling Deliver the right product mix, offering her the most compelling fashion must-haves of the season Expand our test and chase strategy to enhance productivity and profitability Build on the strength of our online business by offering product extensions and curated product shops Product strategy

Marketing strategies and initiatives Grow brand awareness and client engagement Acquire and retain high value clients Drive omni-channel traffic Offer a seamless brand experience across all channels

Lou & Grey is a lifewear brand that is a fusion of activewear and streetwear, which creates a casual, easy, effortless, comfortable style. It is positioned to appeal to a younger, more fashion-conscious set of clients with more of a social end use. It is designed to capitalize on the growth of lounge wear in the women’s apparel sector. Lou & Grey is founded on a distinct point of view and is curated to convey a defined lifestyle.

Test and refine differentiated concept Designed to address growth in the Missy Casual and Loungewear markets (~$30bn) Ten standalone stores by year-end, with dedicated ecommerce site Standalone stores are successfully attracting new clients Primarily targeted to millennials, with opportunity to be truly ageless

ANN INC. strategic initiatives Further expansion of omni-channel capabilities Improve gross margin rate through sourcing initiatives and disciplined inventory management Continued focus on expense management

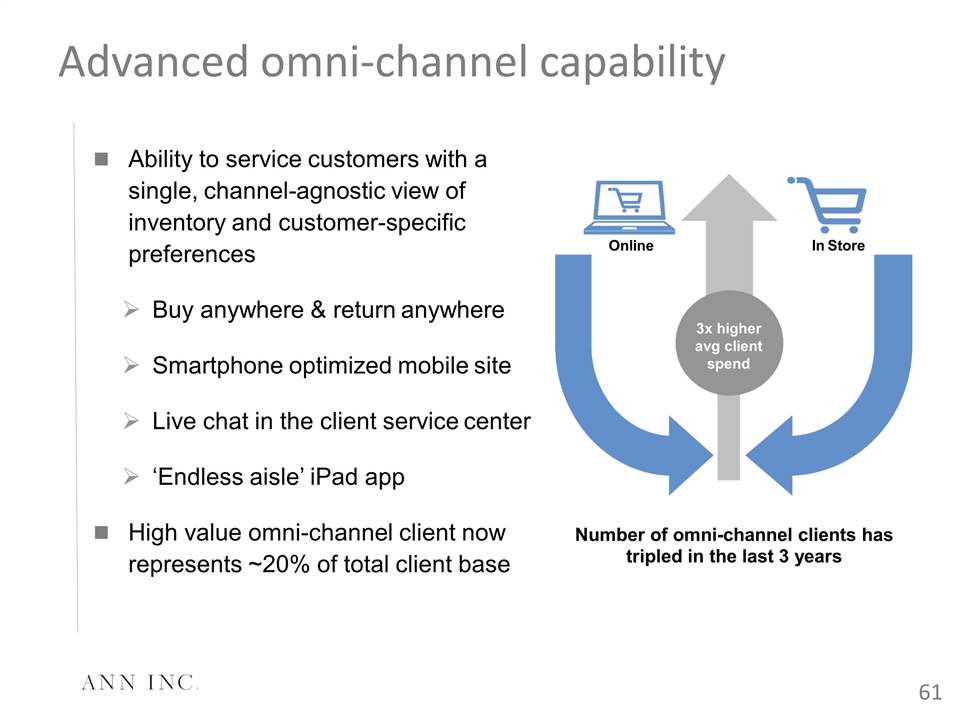

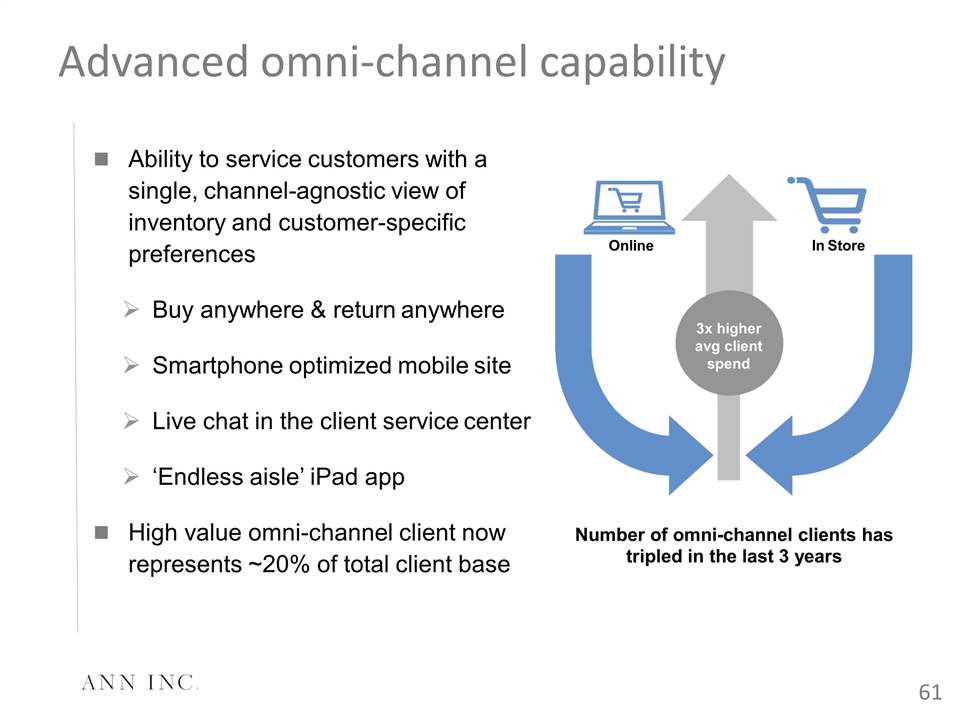

Ability to service customers with a single, channel-agnostic view of inventory and customer-specific preferences Buy anywhere & return anywhere Smartphone optimized mobile site Live chat in the client service center ‘Endless aisle’ iPad app High value omni-channel client now represents ~20% of total client base Advanced omni-channel capability In Store Online 3x higher avg client spend Number of omni-channel clients has tripled in the last 3 years

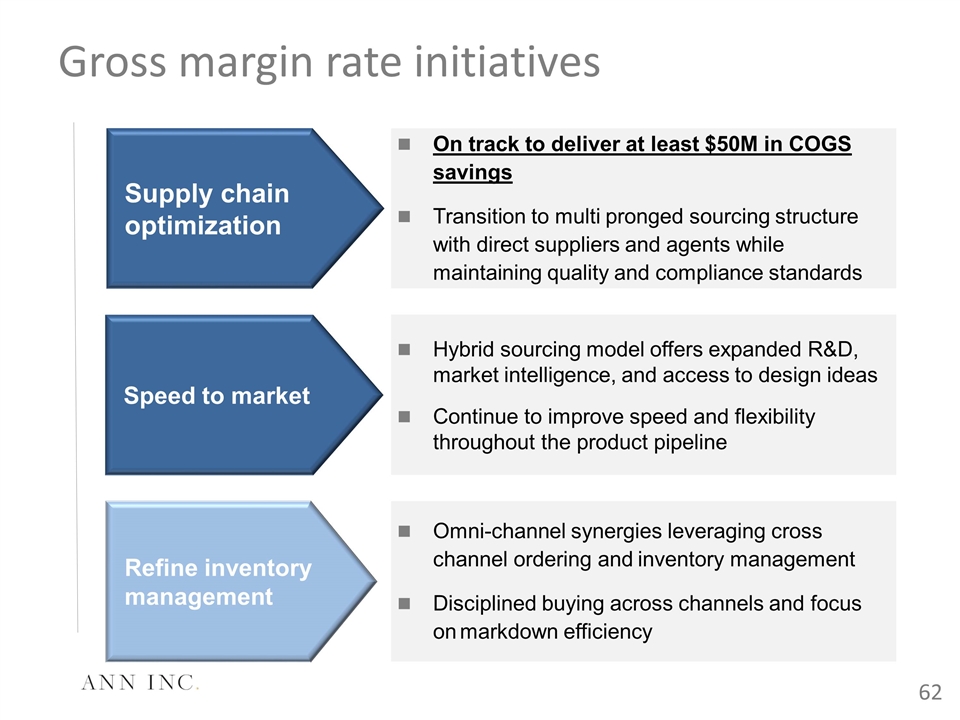

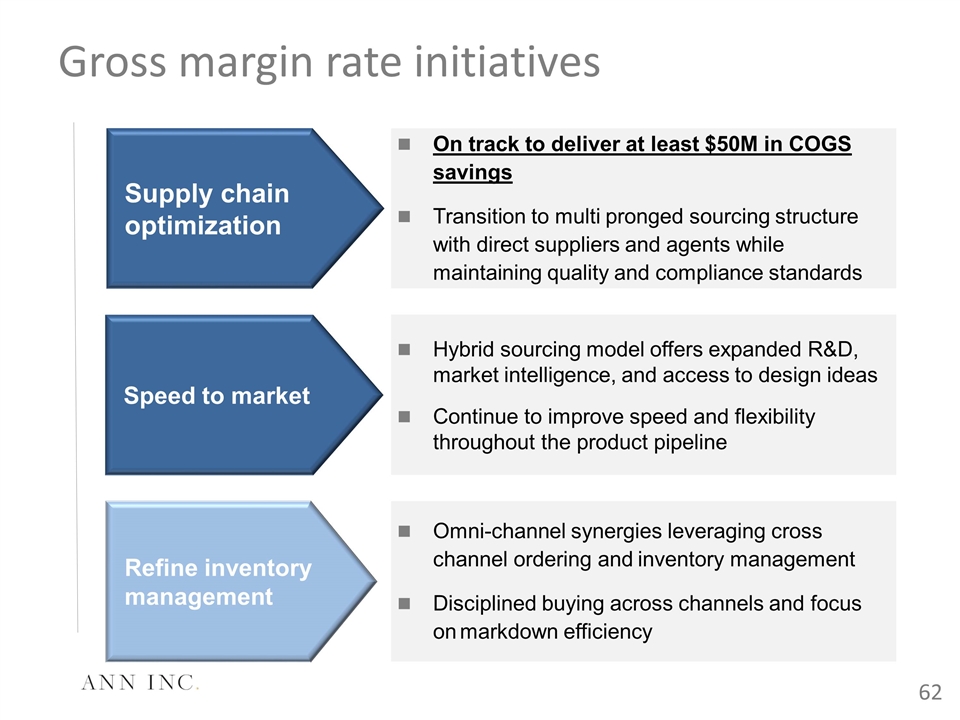

Refine inventory management Omni-channel synergies leveraging cross channel ordering and inventory management Disciplined buying across channels and focus on markdown efficiency Supply chain optimization On track to deliver at least $50M in COGS savings Transition to multi pronged sourcing structure with direct suppliers and agents while maintaining quality and compliance standards Speed to market Hybrid sourcing model offers expanded R&D, market intelligence, and access to design ideas Continue to improve speed and flexibility throughout the product pipeline Gross margin rate initiatives

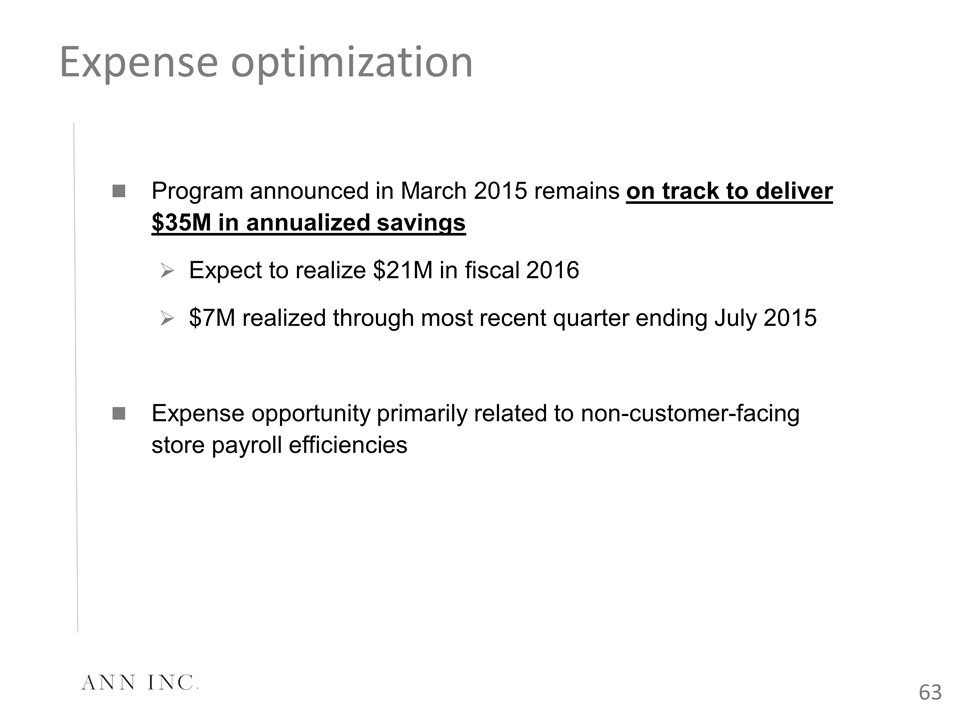

Program announced in March 2015 remains on track to deliver $35M in annualized savings Expect to realize $21M in fiscal 2016 $7M realized through most recent quarter ending July 2015 Expense opportunity primarily related to non-customer-facing store payroll efficiencies Expense optimization

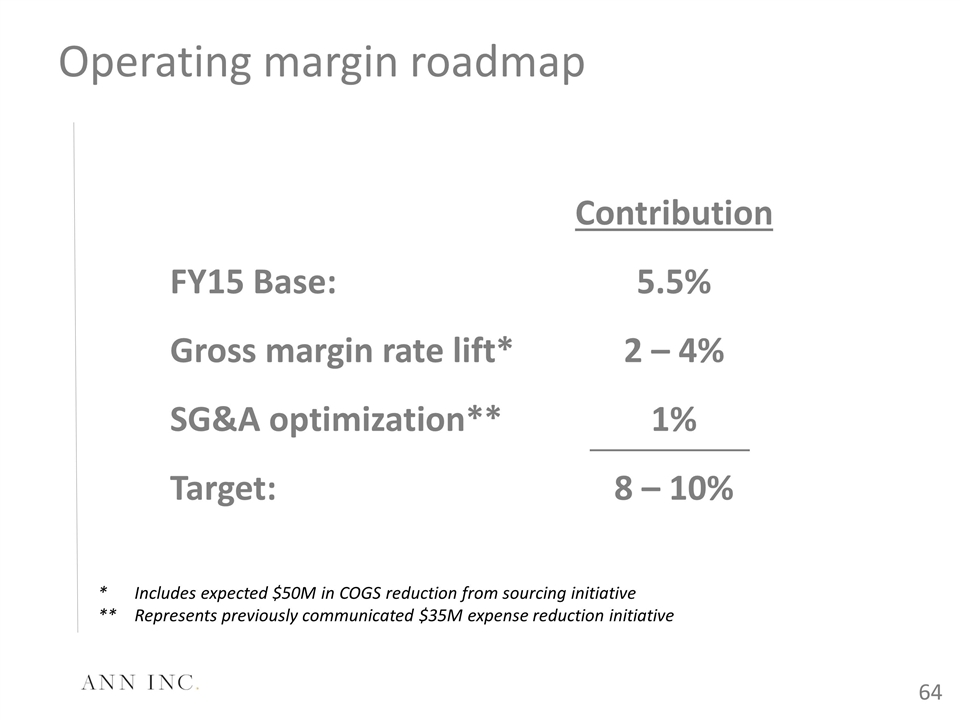

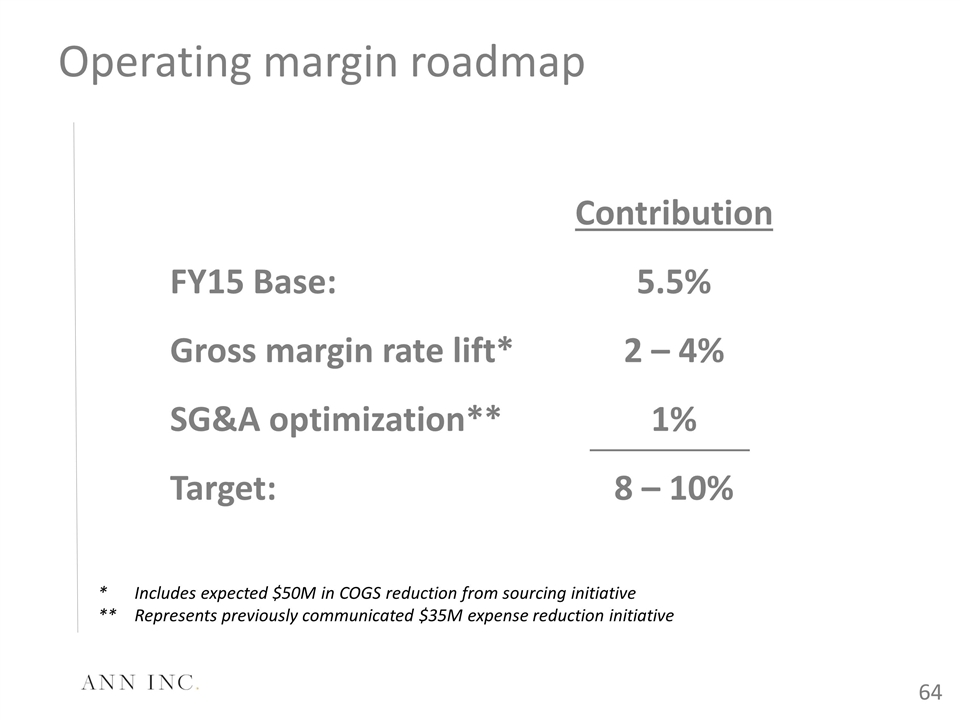

Operating margin roadmap * Includes expected $50M in COGS reduction from sourcing initiative **Represents previously communicated $35M expense reduction initiative Contribution FY15 Base:5.5% Gross margin rate lift*2 – 4% SG&A optimization**1% Target:8 – 10%

Closing comments Strong brands with loyal client bases Comprehensive product strategies to drive growth Advanced omni-channel capability On track with SG&A optimization program Transition has begun toward hybrid sourcing initiative

LINDA HEASLEY – PRESIDENT AND CEO

INTRODUCTION

INTRODUCTION

#ImNoAngel

CHANGING THE CONVERSATION 110-year-old brand Unique experience, capability, and credibility to serve “her size” customer Reshaping customer and industry perspectives

TURNAROUND JOURNEY

OPERATING MARGIN OPPORTUNITY Revenue growth at 3-5% annually Gross margin expansion: additional 200-300 bps Expense initiatives support 300 bps leverage

REVENUE DRIVERS Product Marketing Channel development

REVENUE DRIVERS PRODUCT “Best At” = Fit solutions - Pants and jeans, bras

REVENUE DRIVERS PRODUCT “Best At” = Fit solutions - Pants and jeans, bras “Win At” = Growth distortions - Tops, Livi Active, Panties

REVENUE DRIVERS PRODUCT “Best At” = Fit solutions - Pants and jeans, bras “Win At” = Growth distortions - Tops, Livi Active, Panties Cacique Intimates

REVENUE DRIVERS PRODUCT “Best At” = Fit solutions - Pants and jeans, bras “Win At” = Growth distortions - Tops, Livi Active, Panties Cacique Intimates Outfitting vs. Key items

REVENUE DRIVERS PRODUCT “Best At” = Fit solutions - Pants and jeans, bras “Win At” = Growth distortions - Tops, Livi Active, Panties Cacique Intimates Outfitting vs. Key items Designer Collaborations

REVENUE DRIVERS MARKETING Rebalancing investments Focus on fashion first Reframing the value proposition Fully leverage credit

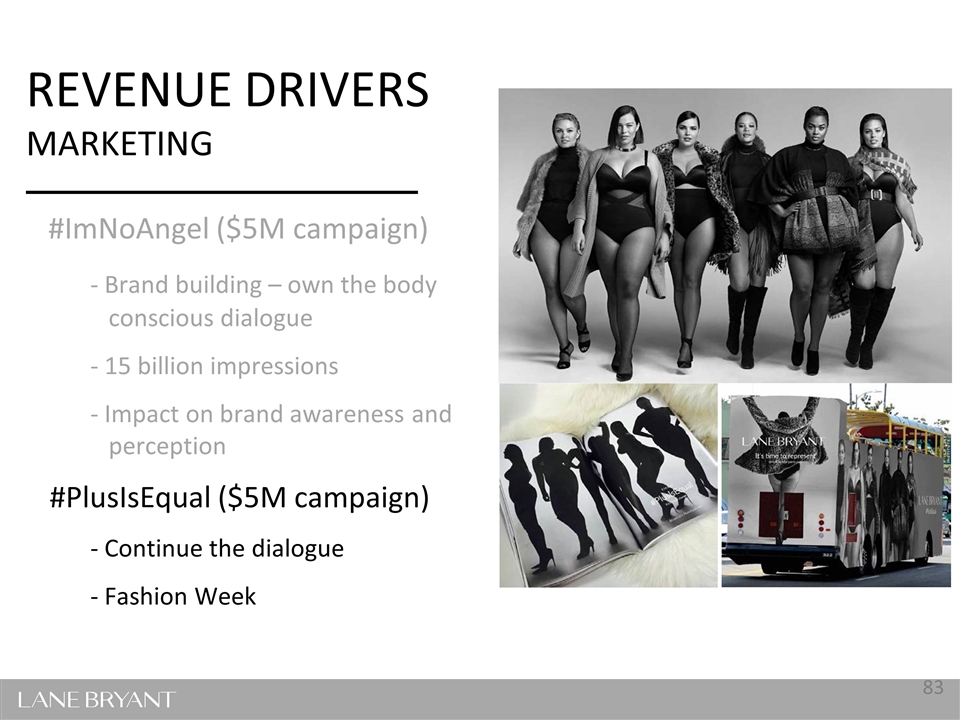

REVENUE DRIVERS MARKETING #ImNoAngel ($5M campaign) - Brand building – own the body conscious dialogue - 15 billion impressions - Impact on brand awareness and perception

REVENUE DRIVERS MARKETING #ImNoAngel ($5M campaign) - Brand building – own the body conscious dialogue - 15 billion impressions - Impact on brand awareness and perception #PlusIsEqual ($5M campaign) - Continue the dialogue - Fashion Week

REVENUE DRIVERS CHANNEL DEVELOPMENT ecommerce growth - Online exclusives - Re-platform - Digital marketplaces

REVENUE DRIVERS CHANNEL DEVELOPMENT ecommerce growth - Online exclusives - Re-platform - Digital marketplaces Real estate strategy - Repositioning: 15% of chain new/renovated in 2 years - Outlets

REVENUE DRIVERS CHANNEL DEVELOPMENT ecommerce growth - Online exclusives - Re-platform - Digital marketplaces Real estate strategy - Repositioning: 15% of chain new/renovated in 2 years - Outlets Omni-channel initiative

GROSS MARGIN EXPANSION Promotion rationalization Sourcing, speed

GROSS MARGIN PROMOTION RATIONALIZATION Cacique semi-annual sale

GROSS MARGIN PROMOTION RATIONALIZATION Cacique semi-annual sale Apparel clearance

GROSS MARGIN PROMOTION RATIONALIZATION Cacique semi-annual sale Apparel clearance Reduced storewide events and coupon limitations

GROSS MARGIN SOURCING Increased direct penetration Speed initiative

EXPENSE INITIATIVES Store, corporate SG&A Occupancy Long-term marketing leverage

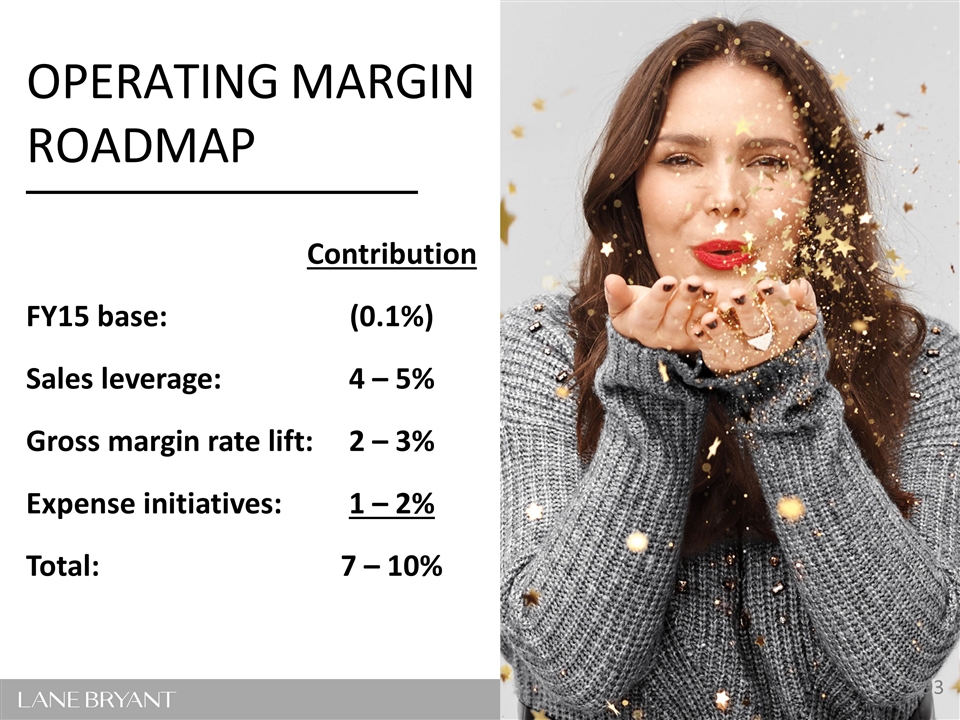

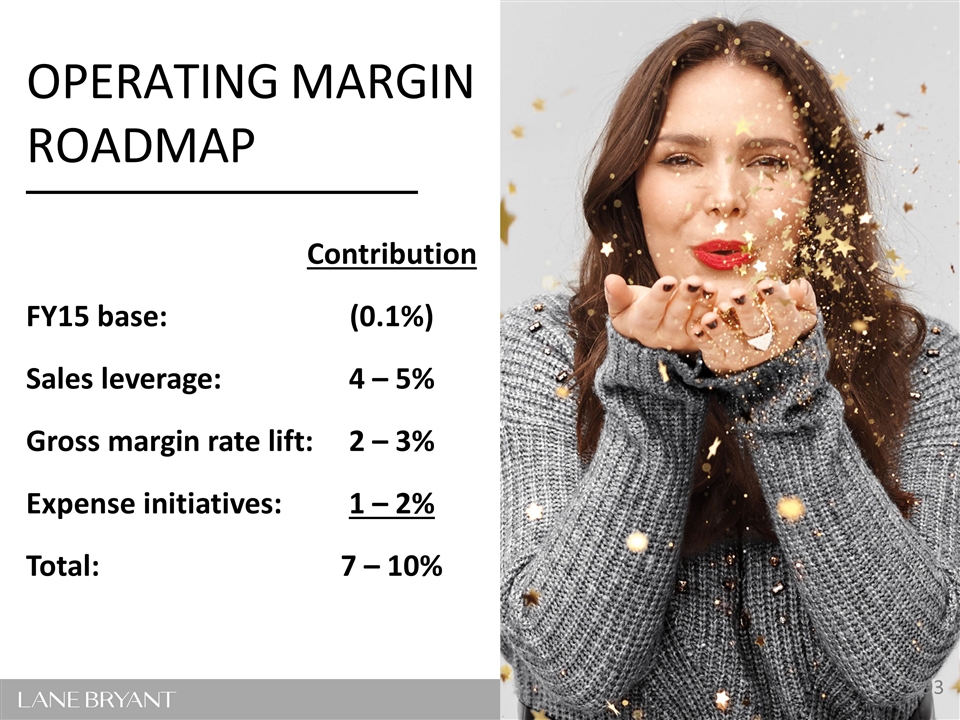

Contribution FY15 base:(0.1%) Sales leverage:4 – 5% Gross margin rate lift:2 – 3% Expense initiatives:1 – 2% Total:7 – 10% OPERATING MARGIN ROADMAP

CLOSING COMMENTS Multiple levers to drive operating margin growth Consistent fashion and assortment execution Gross margin upside Expense leverage and productivity improvement Expanding the brand’s appeal and reach

George Goldfarb | President and CEO

Top-tier industry profits and significant growth potential Unique niche Customer focus and innovation Top talent Introduction / overview

Revenue growth Product Direct channel Marketing New store expansion Gross margin rate Internal sourcing Regular price sell-through Inventory turn Key operating margin drivers

Speed & Innovation NYC Design & Trend Studio Leveraging factory design capability Revenue growth – product

Assortment Expansion PLUS Online extensions Accessories Revenue growth – product

New loyalty program New platform and mobile site Digital attribution / enterprise analytics Expansion of online exclusives Revenue growth – direct channel

Drive new-to-file acquisition and expand reactivation initiatives Leverage personalization and segmentation capabilities Drive omni-customer traffic Revenue growth – marketing

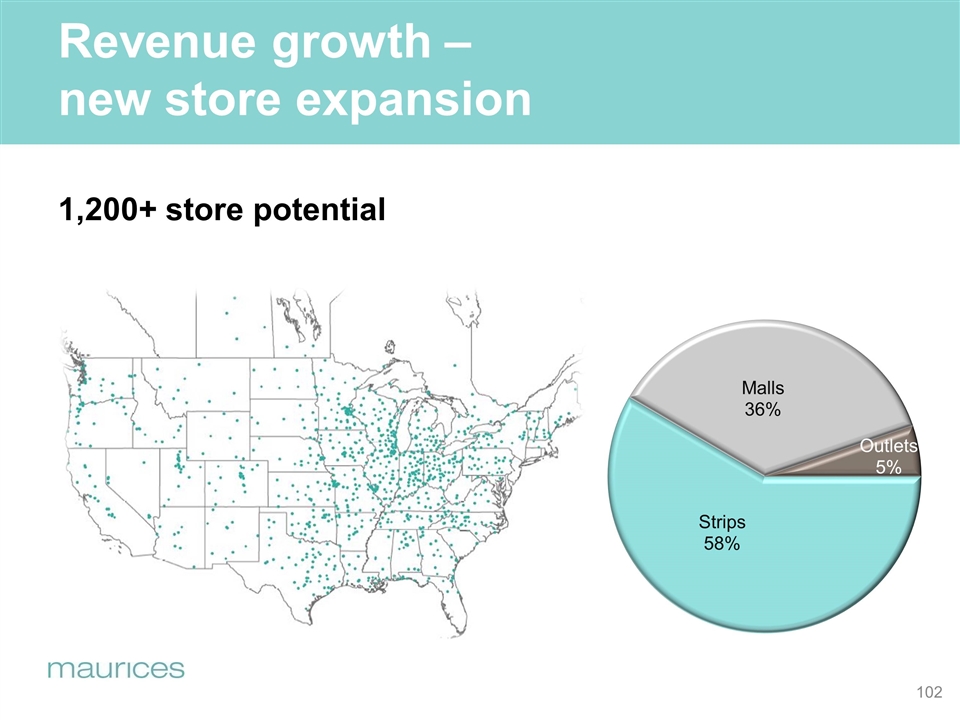

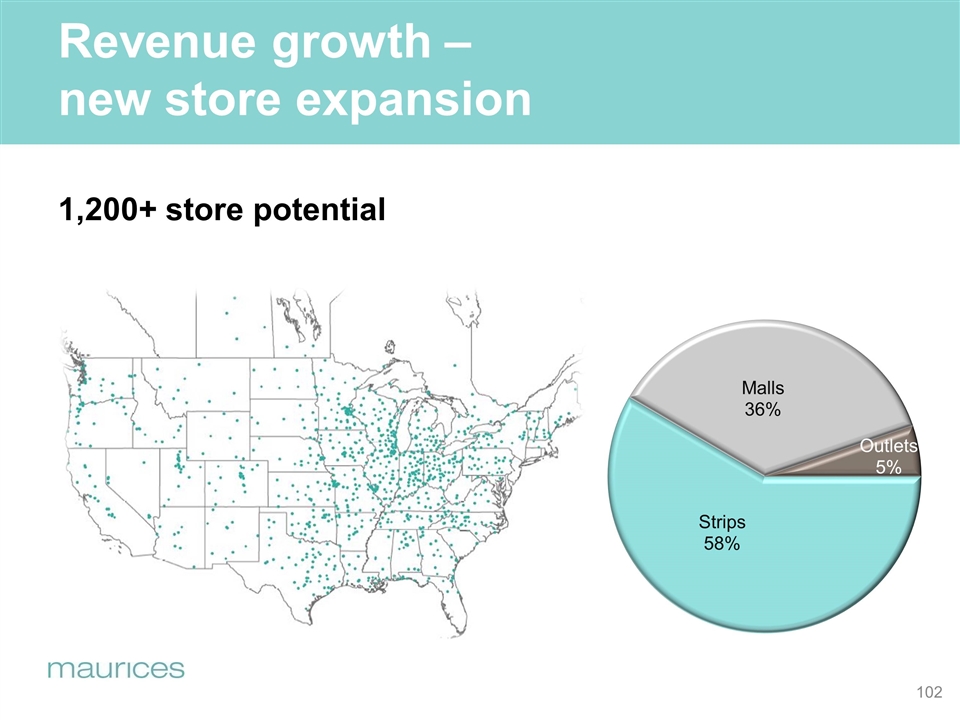

1,200+ store potential Revenue growth – new store expansion

Revenue growth – annual opportunity Growth Product:1 - 2% Direct:2 – 3% marketing:0 – 1% Unit growth: 2 – 3% Total:5 – 9%

Increased internal sourcing penetration Higher regular price sell-through Faster inventory turn Gross margin rate

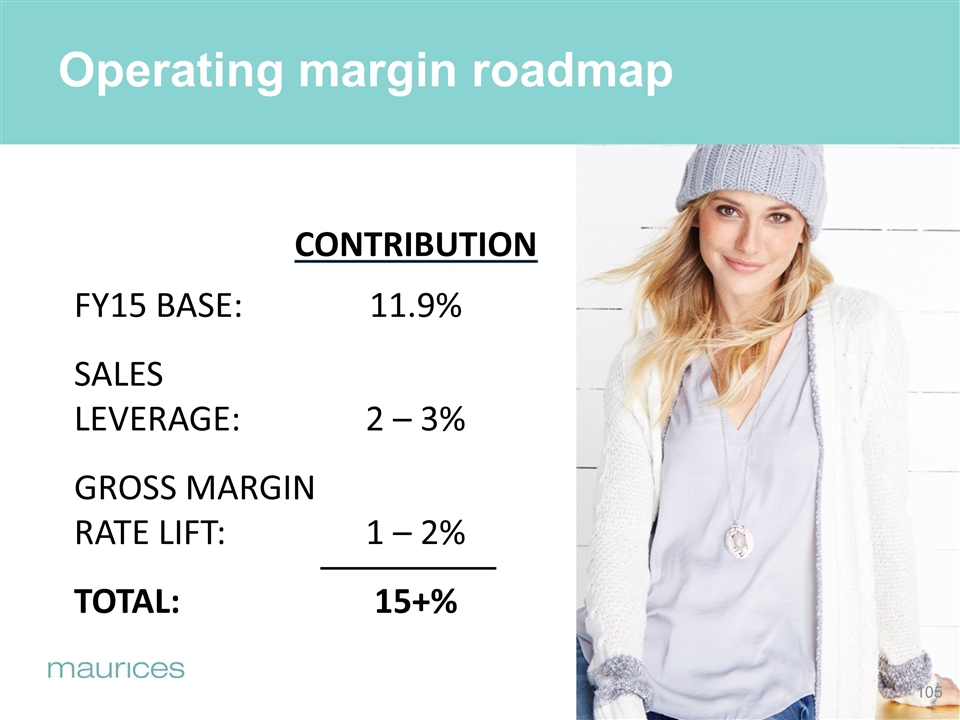

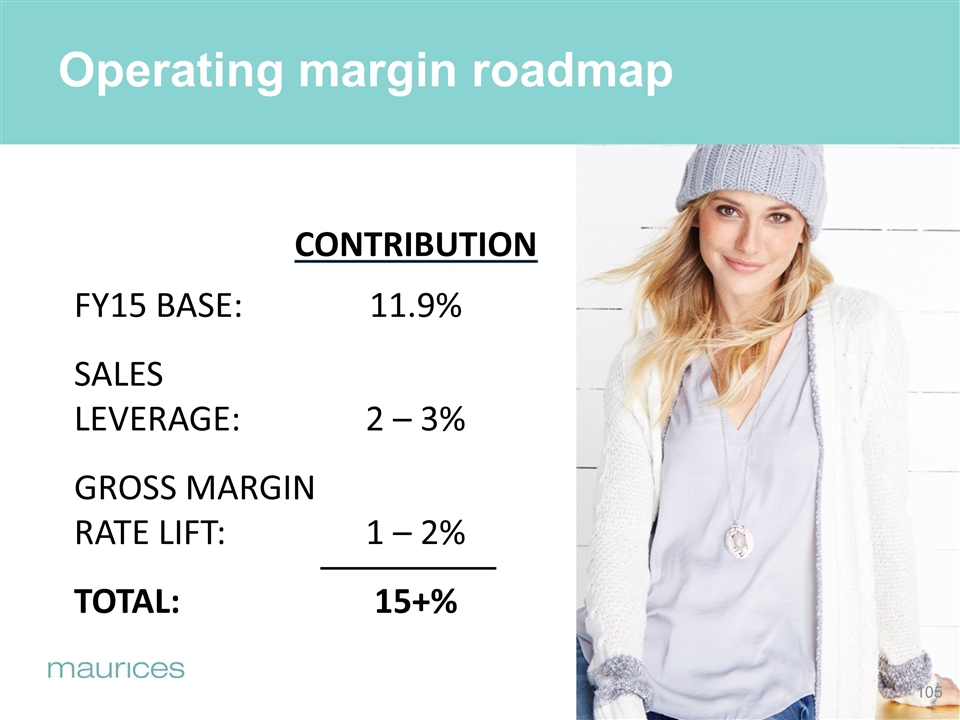

Operating margin roadmap Contribution FY15 base:11.9% SALES LEVERAGE:2 – 3% GROSS MARGIN RATE LIFT:1 – 2% Total:15+%

Unique niche and strong economic model Sales and gross margin levers to drive continued operating margin growth Strength of team and culture Closing comments

Jeff Gerstel President and CEO

Overview – the journey from a ‘store’ to a ‘brand’ Growth strategy Challenges / evidence of progress Size of the prize

Growth strategy Differentiate merchandise Drive direct channel Build brand relevance Leverage design and sourcing

Operating margin opportunities Revenue growth Merchandise Digital channel Brand relevance Gross margin rate Design / sourcing Inventory turn / promotional position

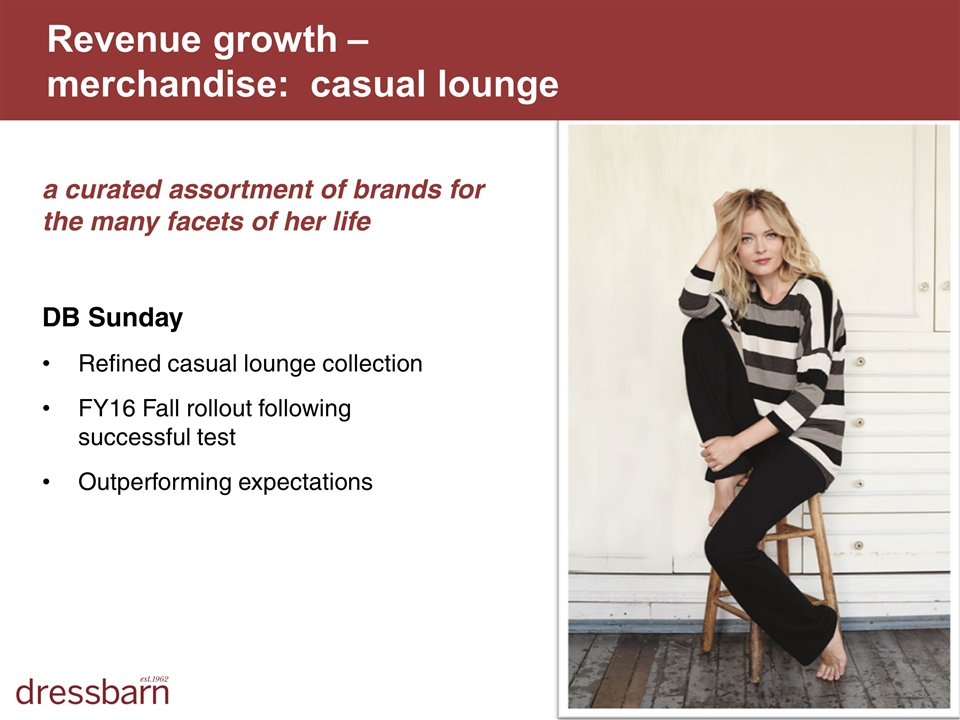

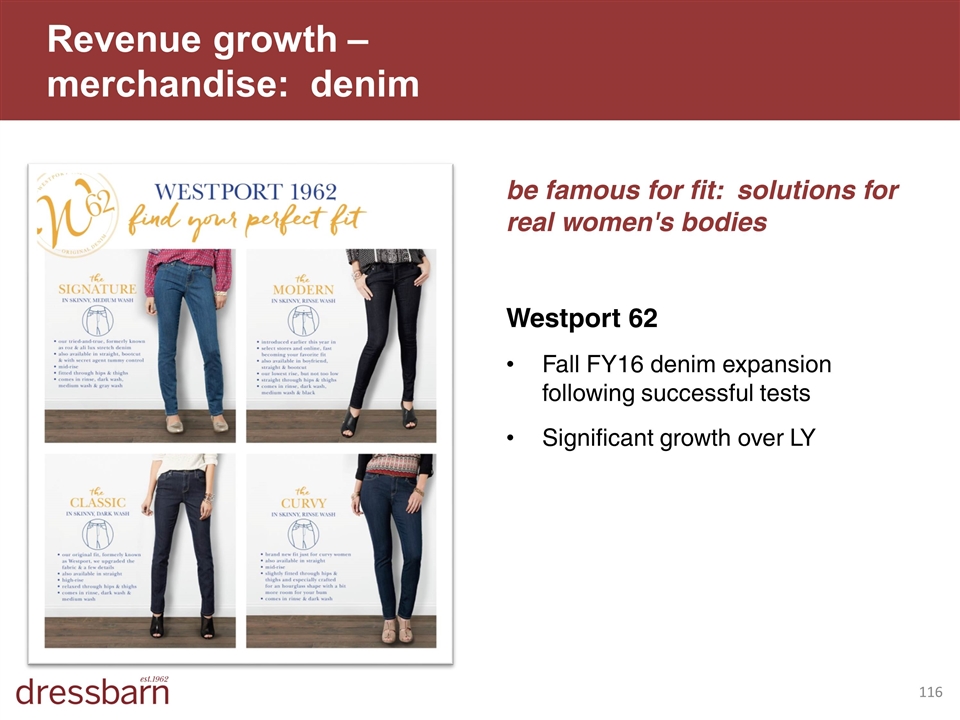

Revenue growth – merchandise: core brand differentiators create products & experiences for value-minded, 40-ish women Strategy example: Re-invent the core be famous for the dress: her #1 dress destination Strategy example: DRESSBAR a curated assortment of brands for the many facets of her life Strategy example: DB Sunday (refined casual) be famous for fit: solutions for real women's bodies Strategy example: Westport 1962 denim be her go-to place for go to work styles Strategy example: under development

Revenue growth – merchandise: sweaters Create products & experiences for value-minded, 40-ish women Re-invent the core New merchant / design team Refined assortment

Revenue growth – merchandise: dresses be famous for the dress: her #1 dress destination DRESSBAR FY15 Q3 launch Dress sales +8% vs. industry -5%; continuing momentum FY16 strengthen and expand Successful guest designer program; new collaboration launch for Spring Internal design driven margin gain

Revenue growth – merchandise: casual lounge a curated assortment of brands for the many facets of her life DB Sunday Refined casual lounge collection FY16 Fall rollout following successful test Outperforming expectations

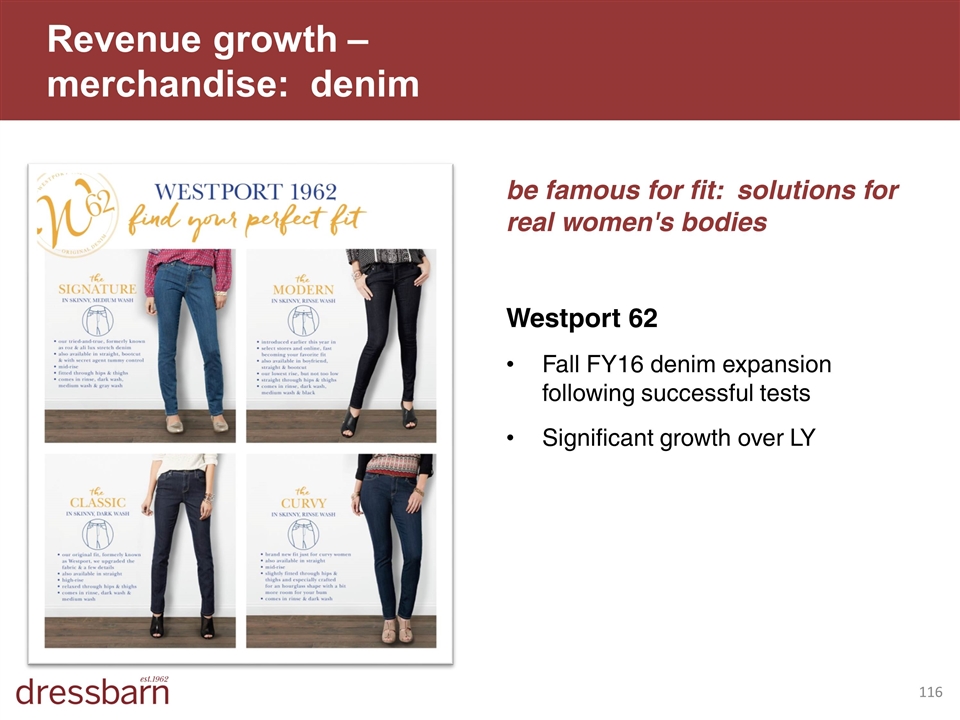

Revenue growth – merchandise: denim be famous for fit: solutions for real women's bodies Westport 62 Fall FY16 denim expansion following successful tests Significant growth over LY

Revenue growth – direct channel Conversion opportunities Site performance User experience Free ship to store Optimize mobile Drive traffic – organic search performance Create omni environment in stores

Revenue growth – brand relevance: marketing campaigns #labelmeconfident Fall awareness campaign Shift perceptions Influence the influencers Prepare for Spring acquisition campaign

Revenue growth – brand relevance: direct mail / analytics Enhance direct mail effectiveness using customer lifetime value Identify likely high value new customers through data mining of behavioral patterns Target reactivation efforts and direct mail based on predicted profitability

Gross margin initiatives Scale internal design and sourcing Increase product differentiation Improve technical fit Reduce product cost Inventory management Reduce clearance levels Faster turns

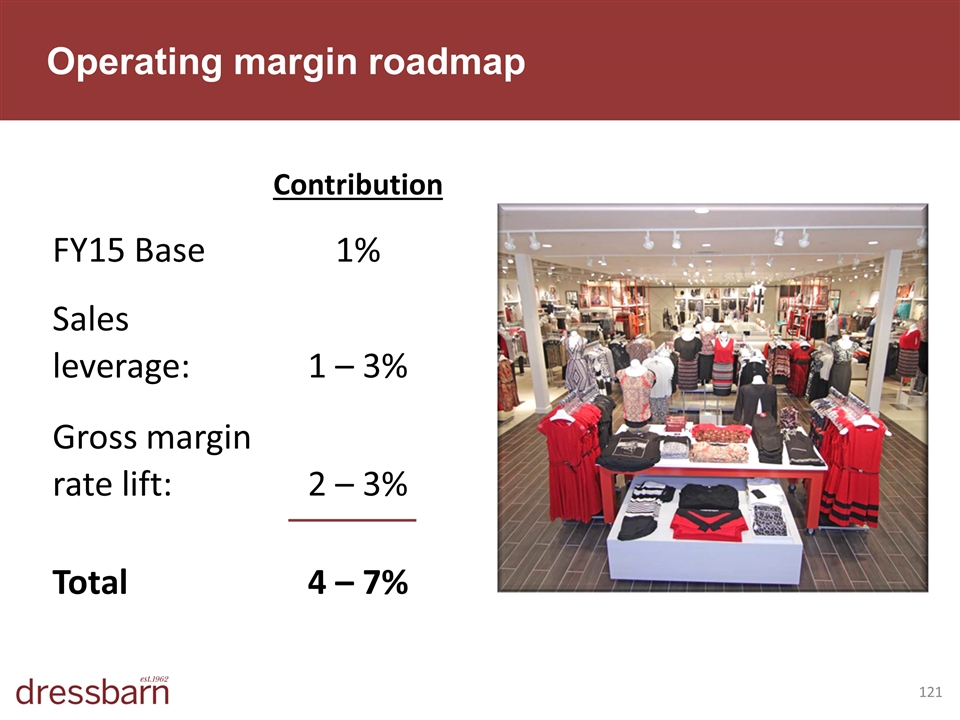

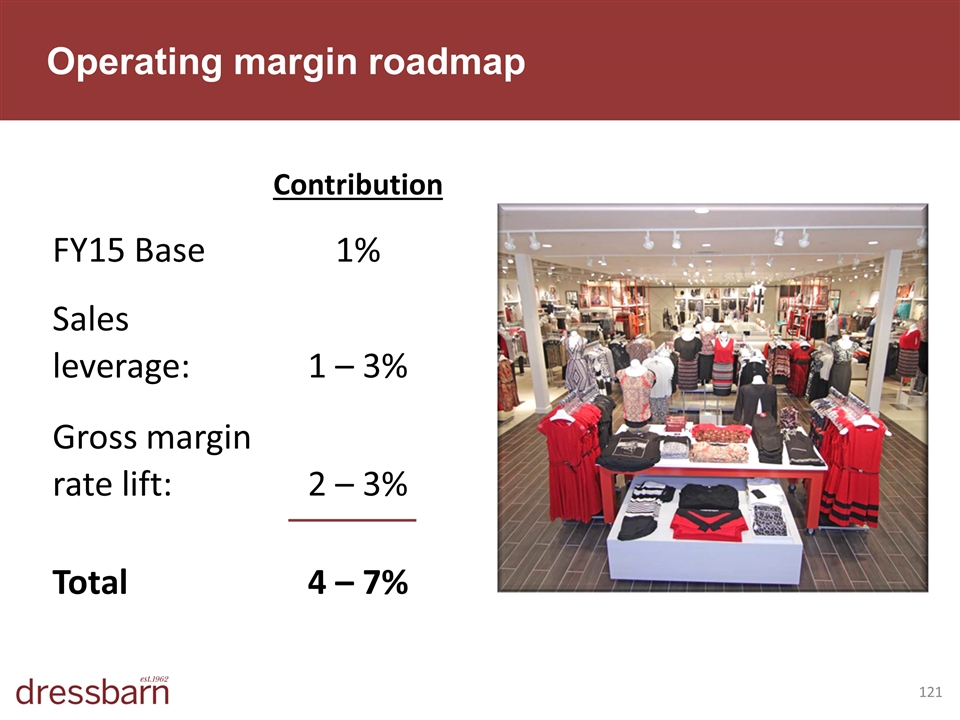

Operating margin roadmap Contribution FY15 Base1% Sales leverage:1 – 3% Gross margin rate lift:2 – 3% Total4 – 7%

Closing comments Talent in place -- driving journey from a ‘store’ to a ‘brand’ Wins with major initiatives Fashion execution Brand awareness Sourcing penetration Poised to expand digital Ready to drive customer acquisition

Brett Schneider President

OVERVIEW WE ARE: Product-focused Uniquely positioned Driving results Positioned for growth

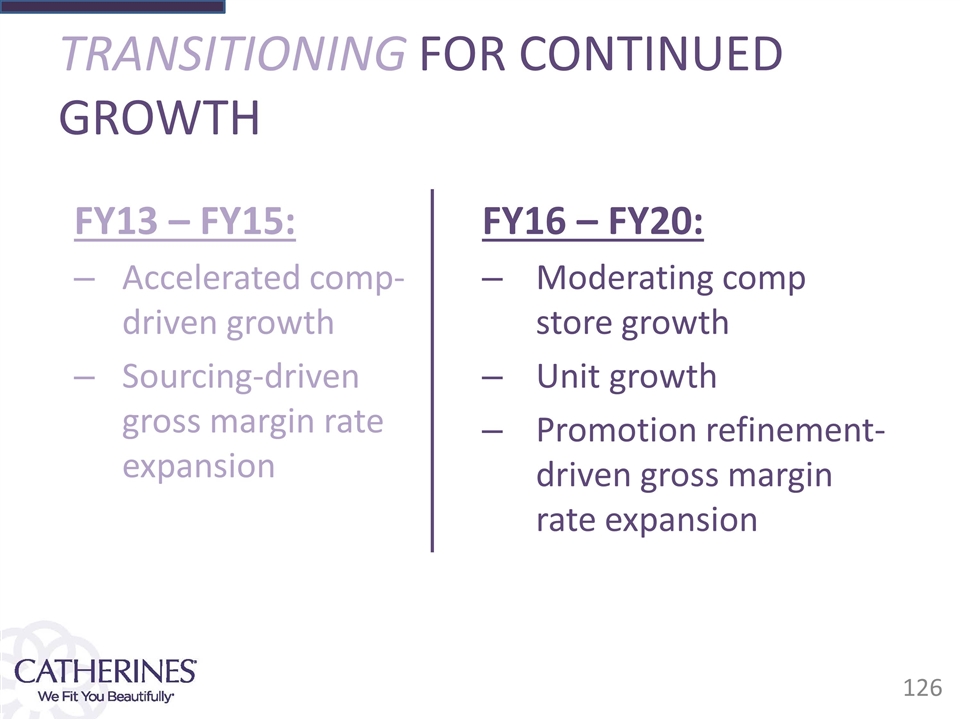

TRANSITIONING FOR CONTINUED GROWTH FY13 – FY15: Accelerated comp-driven growth Sourcing-driven gross margin rate expansion

TRANSITIONING FOR CONTINUED GROWTH FY13 – FY15: Accelerated comp-driven growth Sourcing-driven gross margin rate expansion FY16 – FY20: Moderating comp store growth Unit growth Promotion refinement-driven gross margin rate expansion

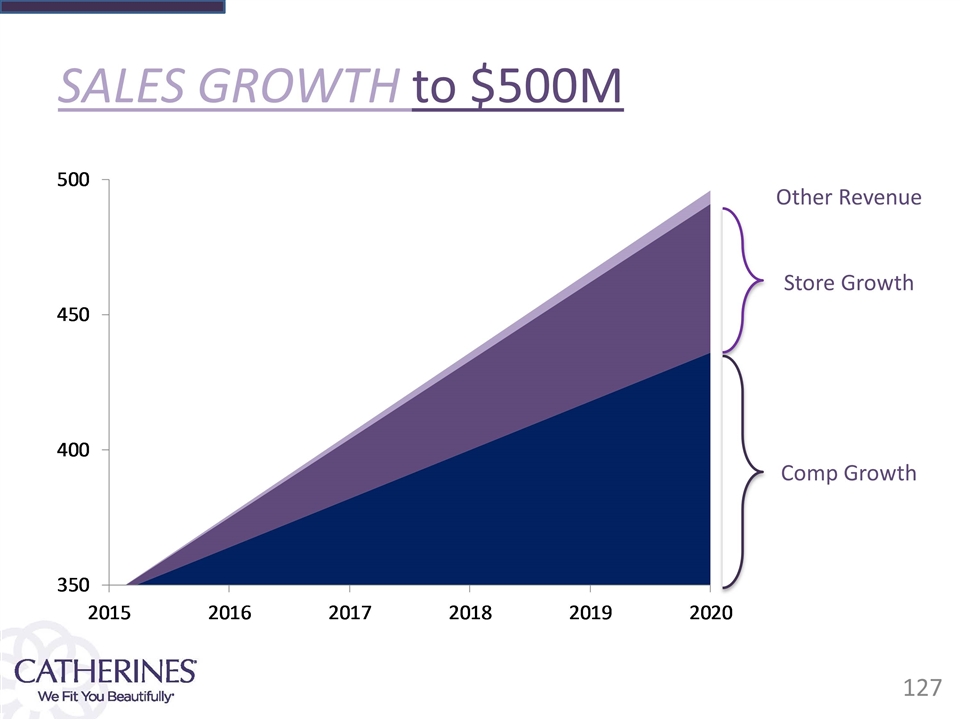

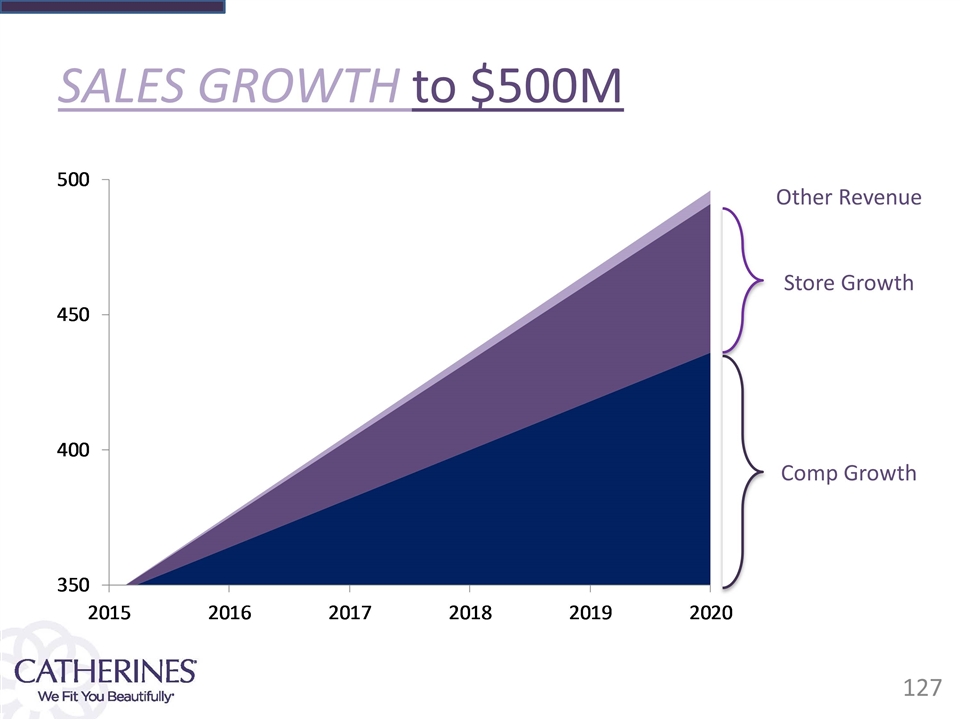

SALES GROWTH to $500M Comp Growth Store Growth Other Revenue

STORE GROWTH OPPORTUNITY NEW STORES, NEW MARKETS REPOSITIONING IN CURRENT MARKETS CLOSURE OF NON-PRODUCTIVE UNITS

DIRECT GROWTH OPPORTUNITY New platform with enhanced mobile site Expanded merchandise categories and online extensions Amplifying effect of new stores in new markets

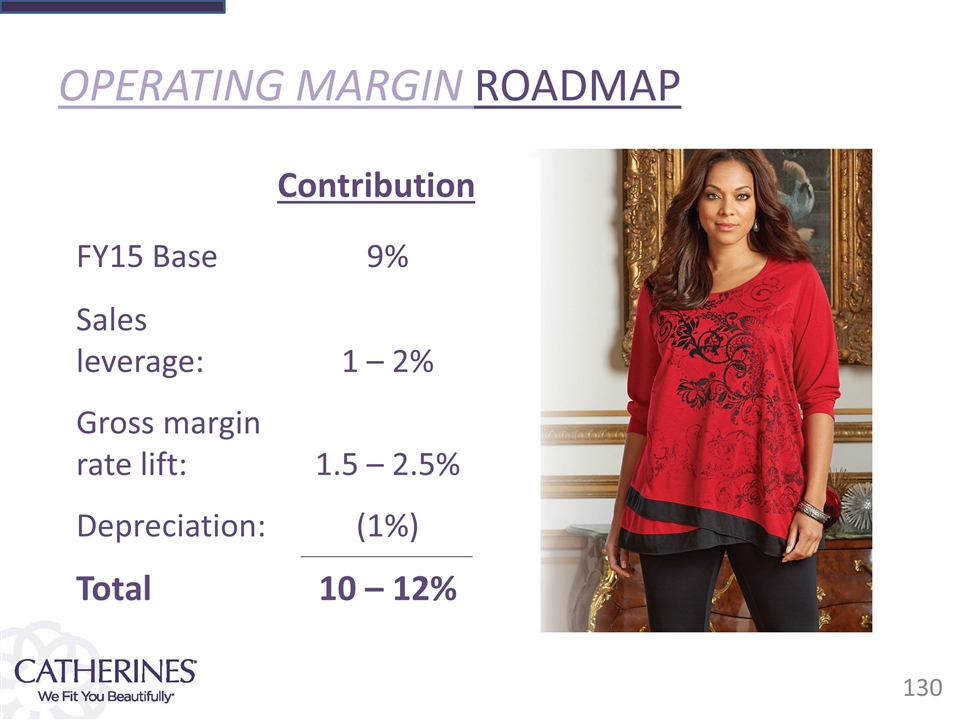

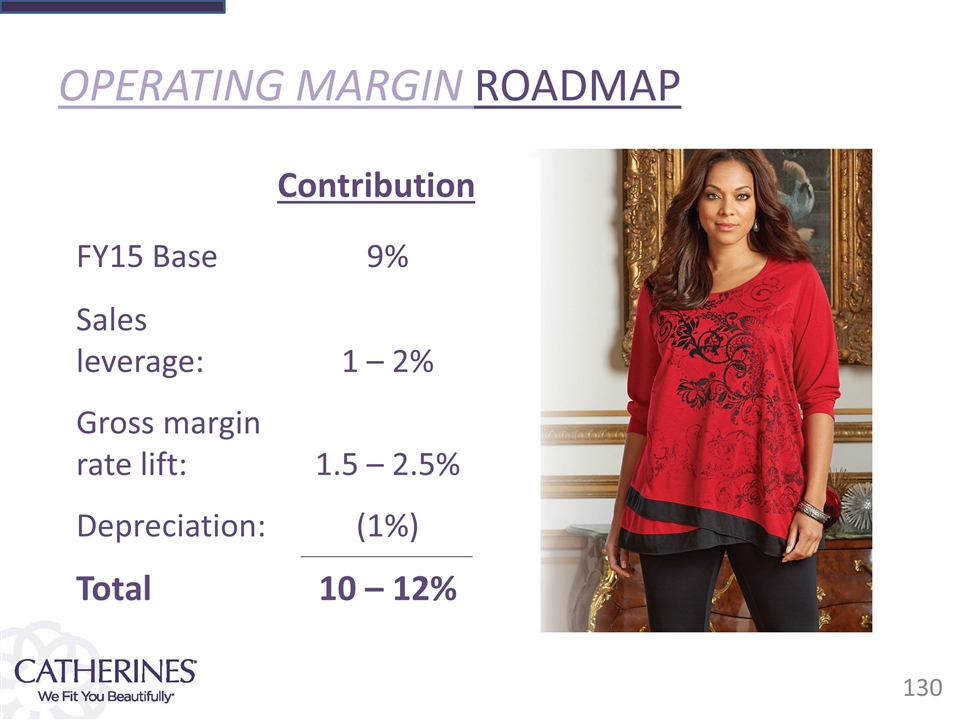

OPERATING MARGIN ROADMAP Contribution FY15 Base9% Sales leverage:1 – 2% Gross margin rate lift:1.5 – 2.5% Depreciation:(1%) Total10 – 12%

Robb Giammatteo EVP and Chief Financial Officer

Investment considerations Multiple EBITDA drivers Significant earnings power Normalizing CapEx Accelerating free cash flow De-levering balance sheet

Multiple EBITDA drivers Top-line Gross margin rate ANN cost savings / integration synergies Expense management

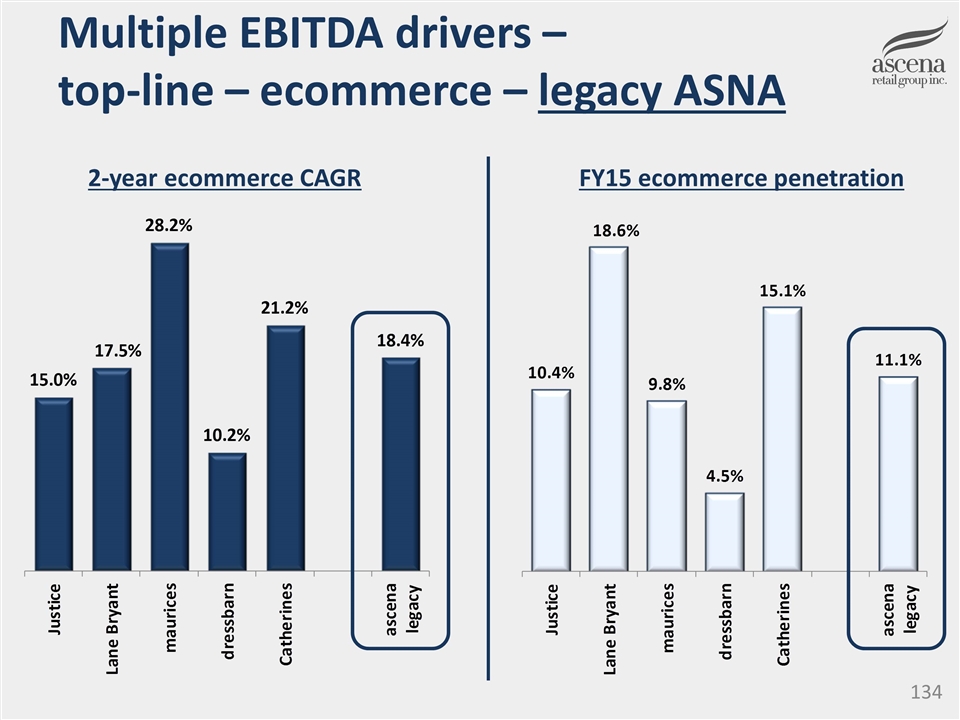

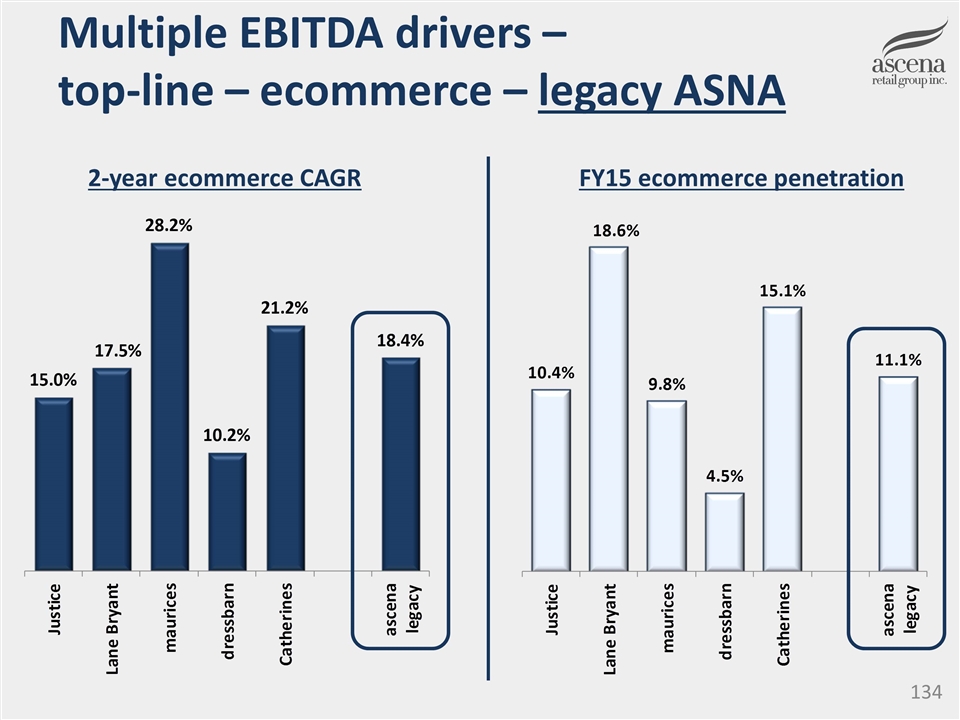

Multiple EBITDA drivers – top-line – ecommerce – legacy ASNA 2-year ecommerce CAGR FY15 ecommerce penetration

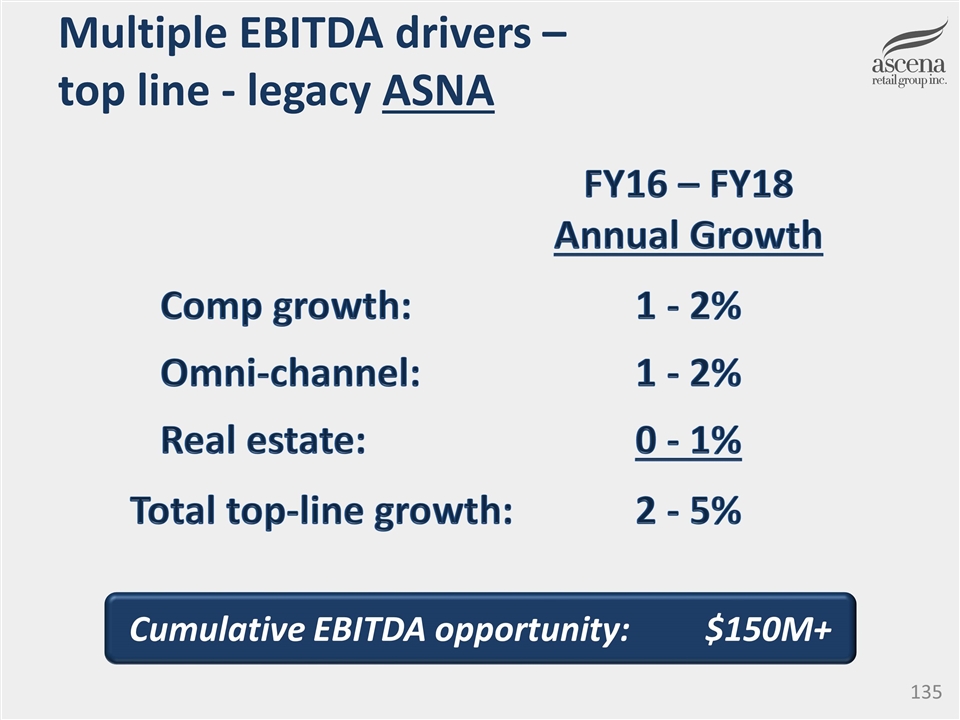

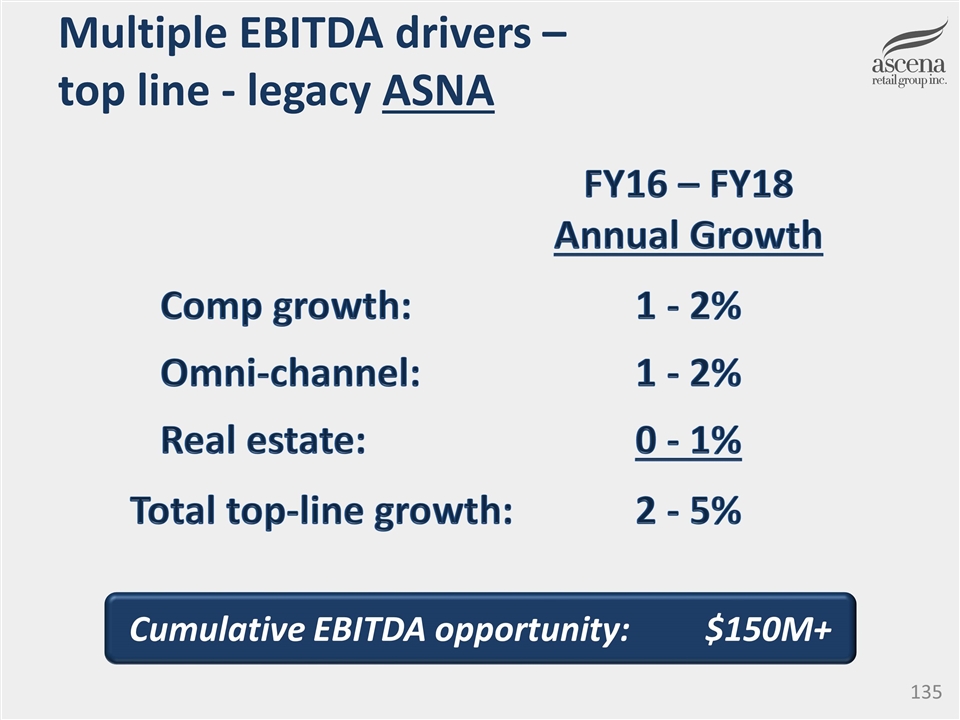

Multiple EBITDA drivers – top line - legacy ASNA FY16 – FY18 Annual Growth Comp growth:1 - 2% Omni-channel:1 - 2% Real estate:0 - 1% Total top-line growth:2 - 5% Cumulative EBITDA opportunity:$150M+

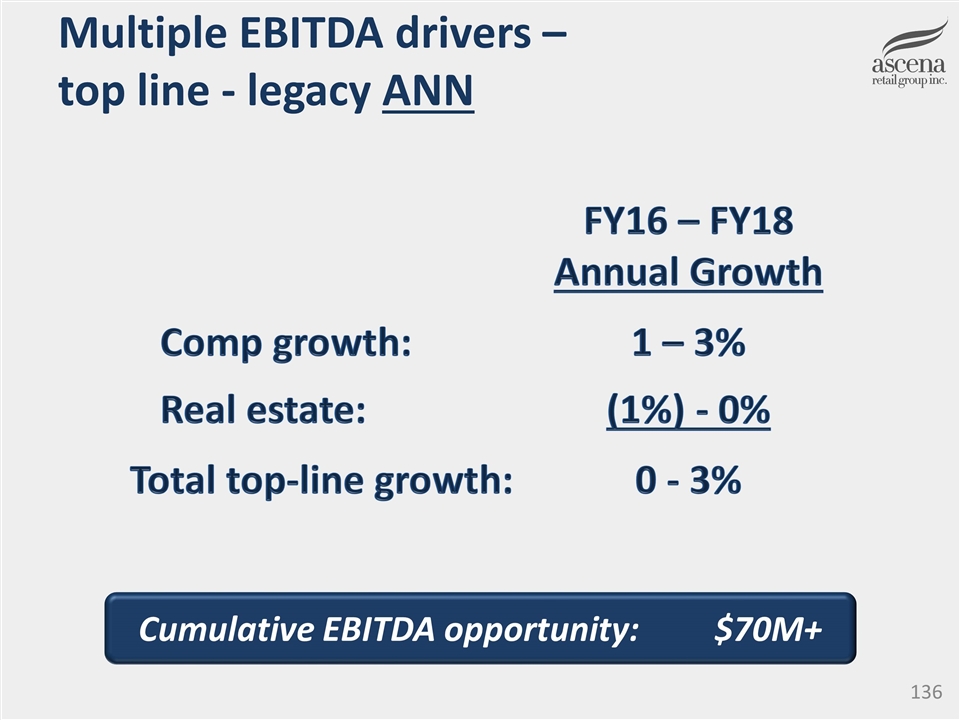

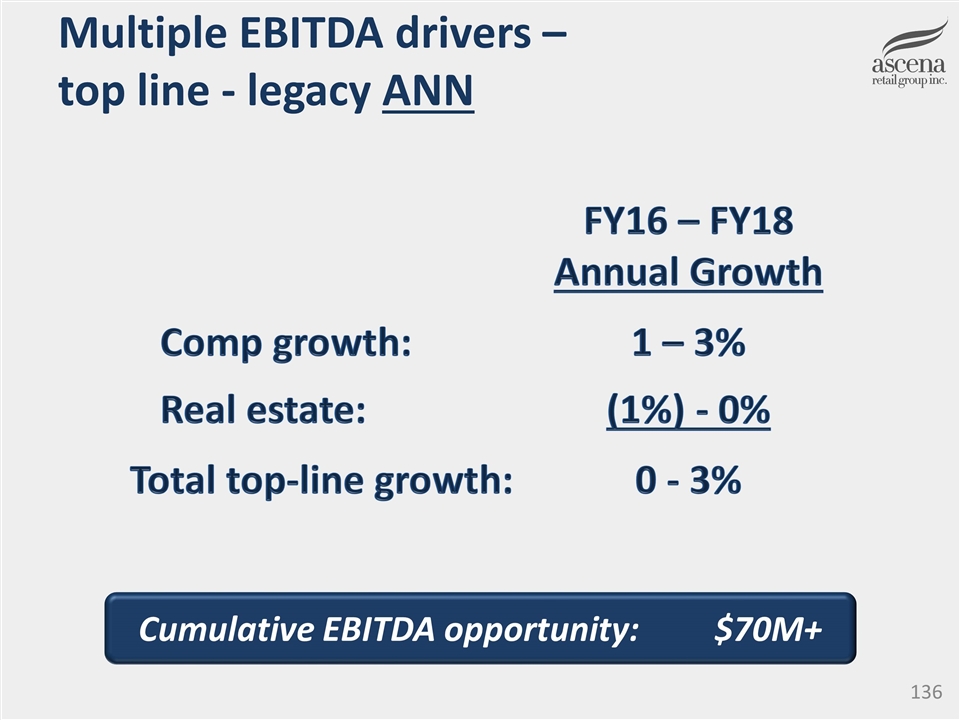

Multiple EBITDA drivers – top line - legacy ANN FY16 – FY18 Annual Growth Comp growth:1 – 3% Real estate:(1%) - 0% Total top-line growth:0 - 3% Cumulative EBITDA opportunity:$70M+

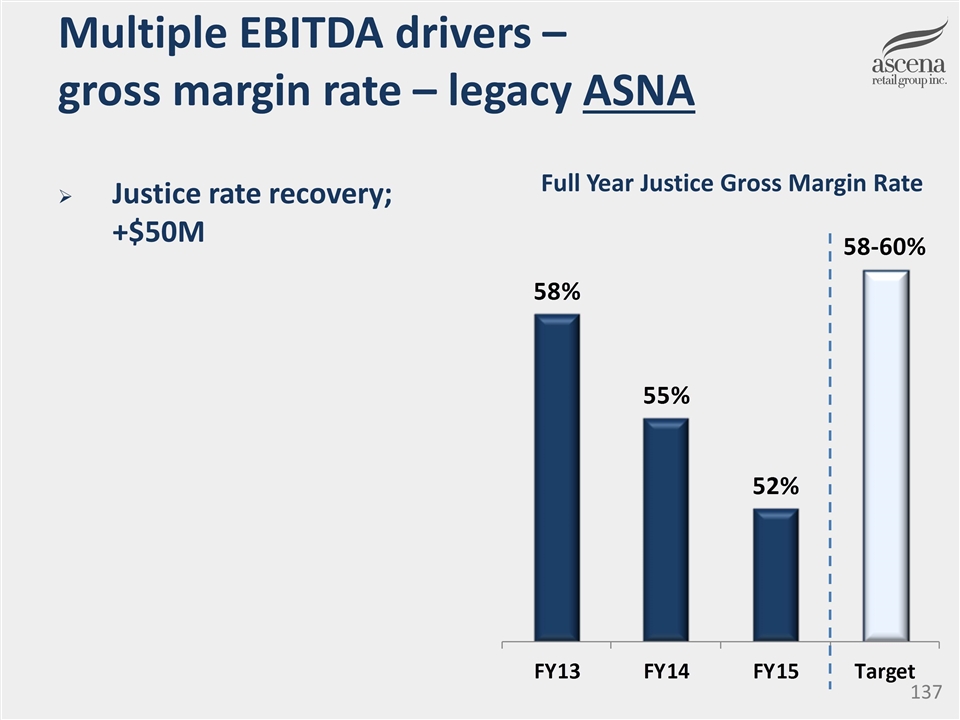

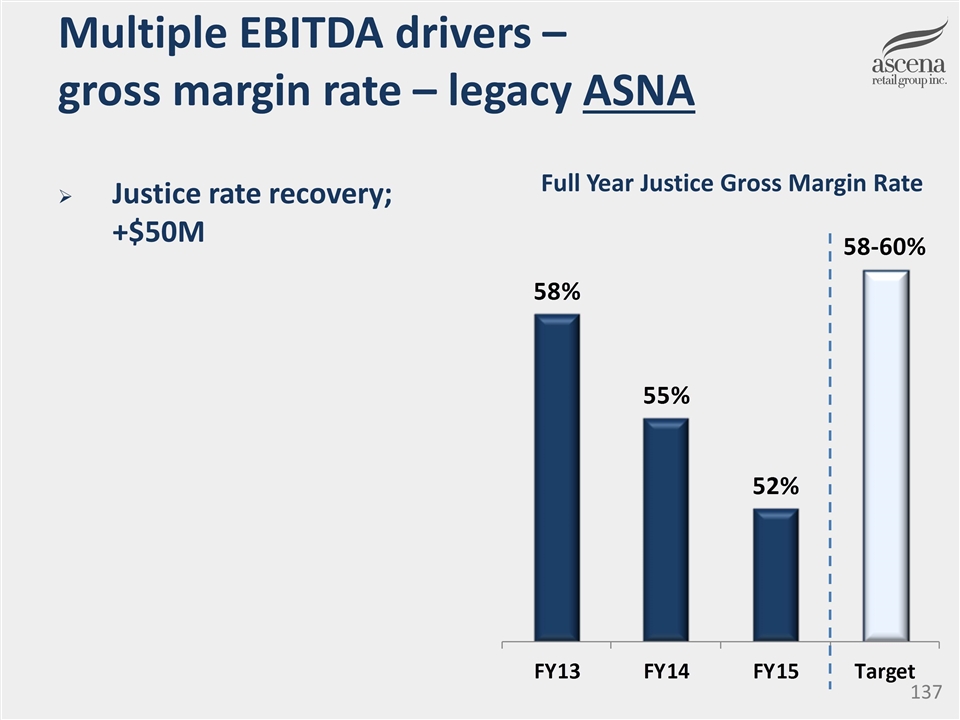

Multiple EBITDA drivers – gross margin rate – legacy ASNA Justice rate recovery; +$50M Full Year Justice Gross Margin Rate

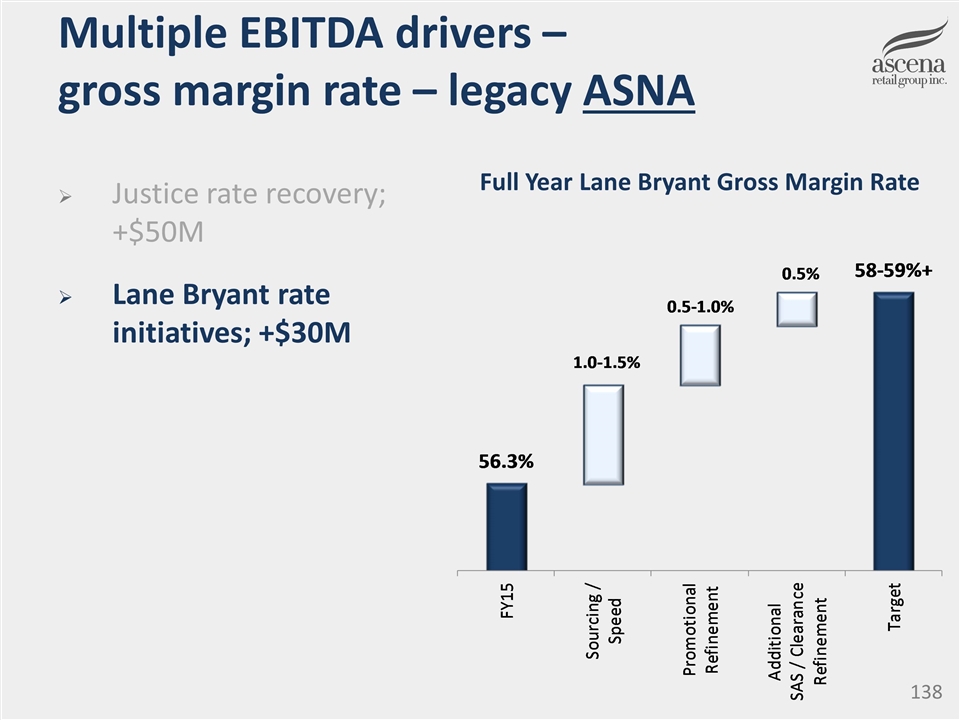

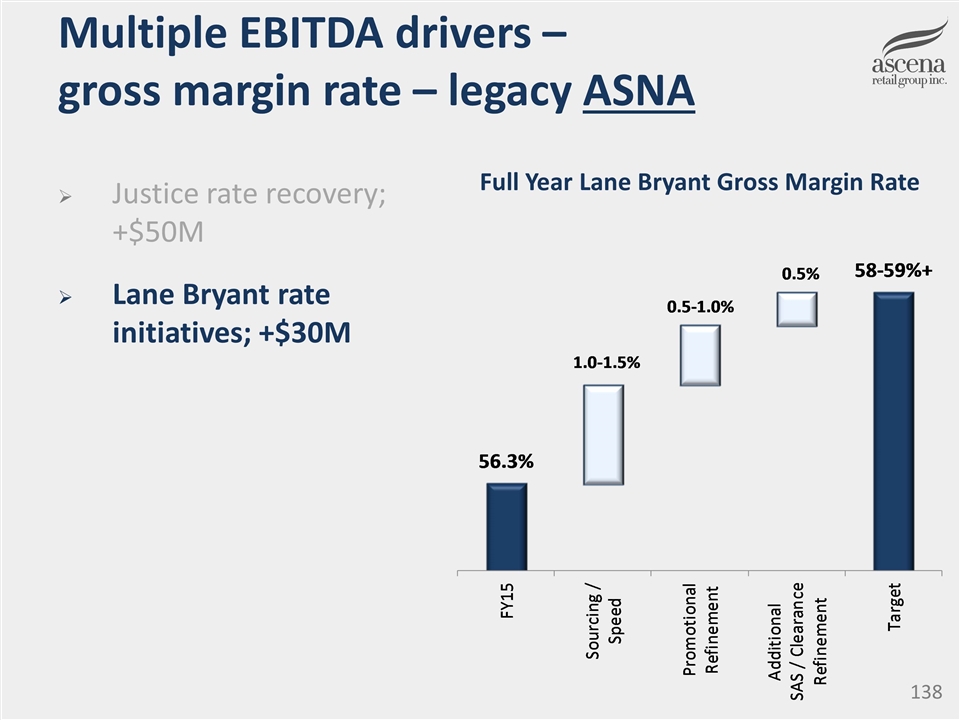

Multiple EBITDA drivers – gross margin rate – legacy ASNA Justice rate recovery; +$50M Lane Bryant rate initiatives; +$30M Full Year Lane Bryant Gross Margin Rate

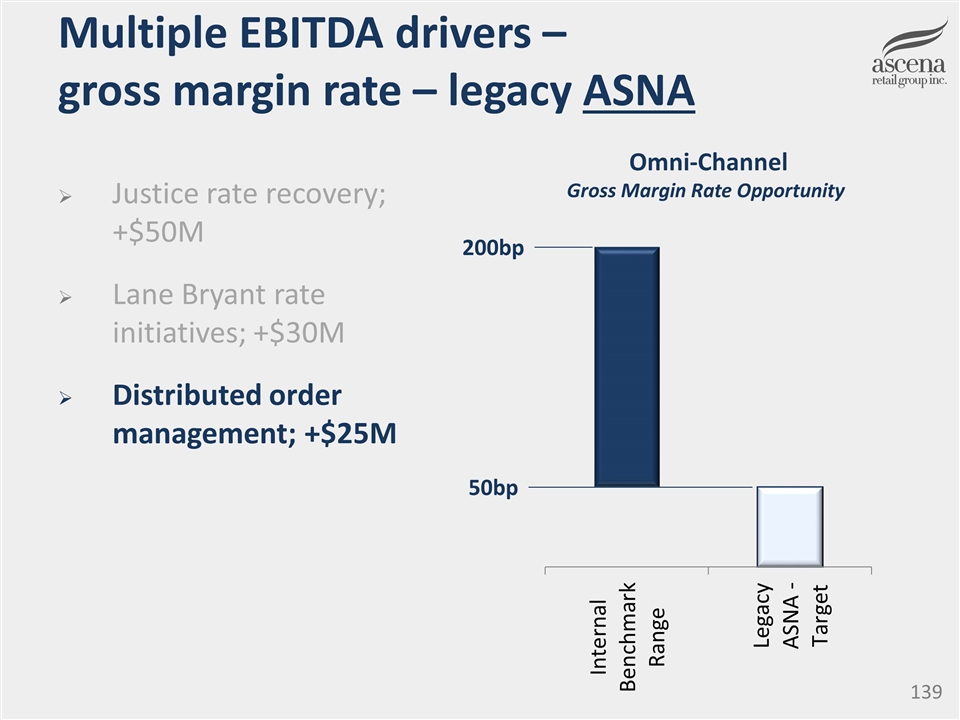

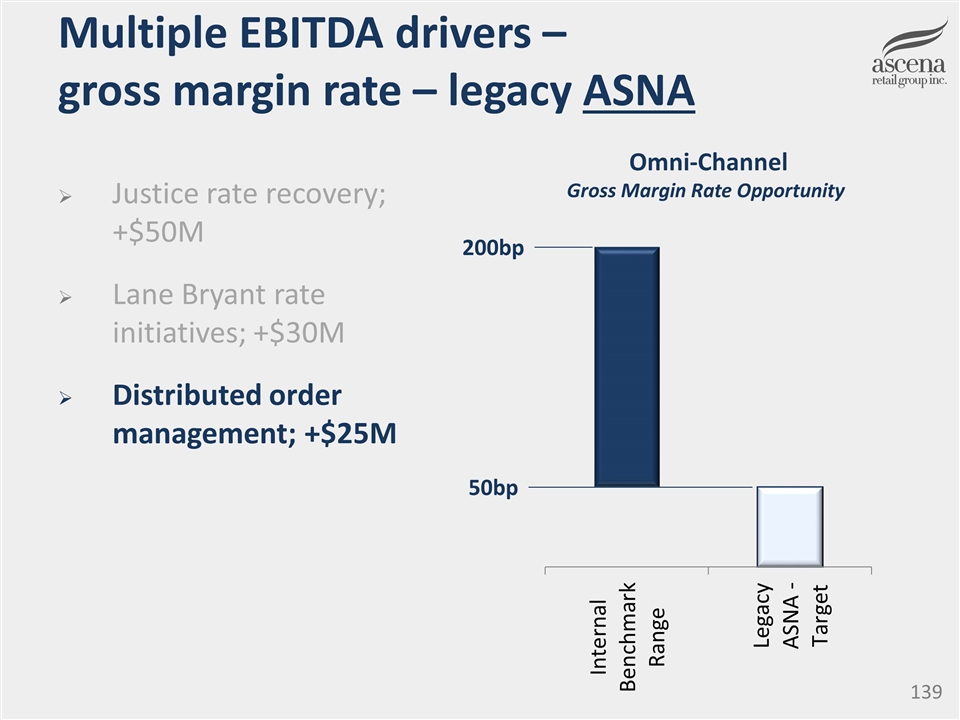

Multiple EBITDA drivers – gross margin rate – legacy ASNA Justice rate recovery; +$50M Lane Bryant rate initiatives; +$30M Distributed order management; +$25M Omni-Channel Gross Margin Rate Opportunity 50bp 200bp

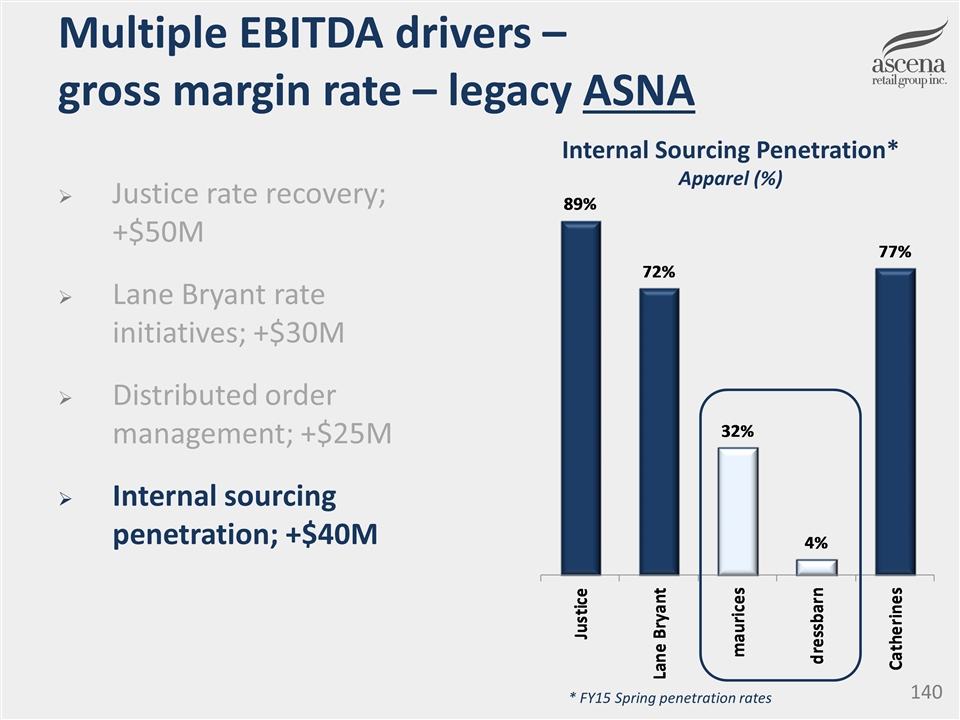

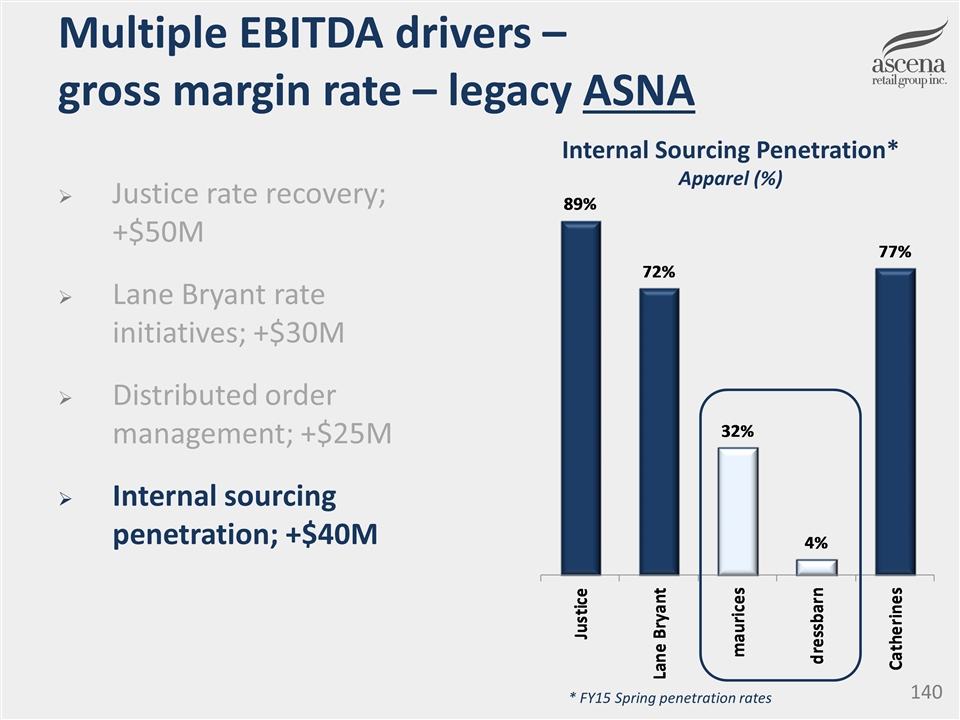

Multiple EBITDA drivers – gross margin rate – legacy ASNA Justice rate recovery; +$50M Lane Bryant rate initiatives; +$30M Distributed order management; +$25M Internal sourcing penetration; +$40M Internal Sourcing Penetration* Apparel (%) * FY15 Spring penetration rates

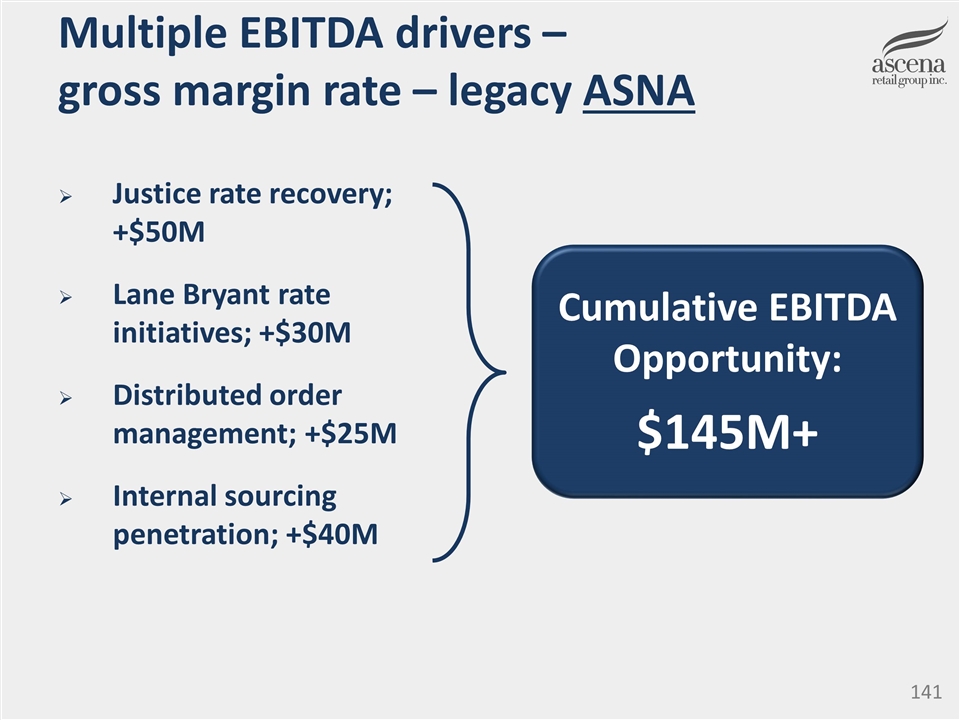

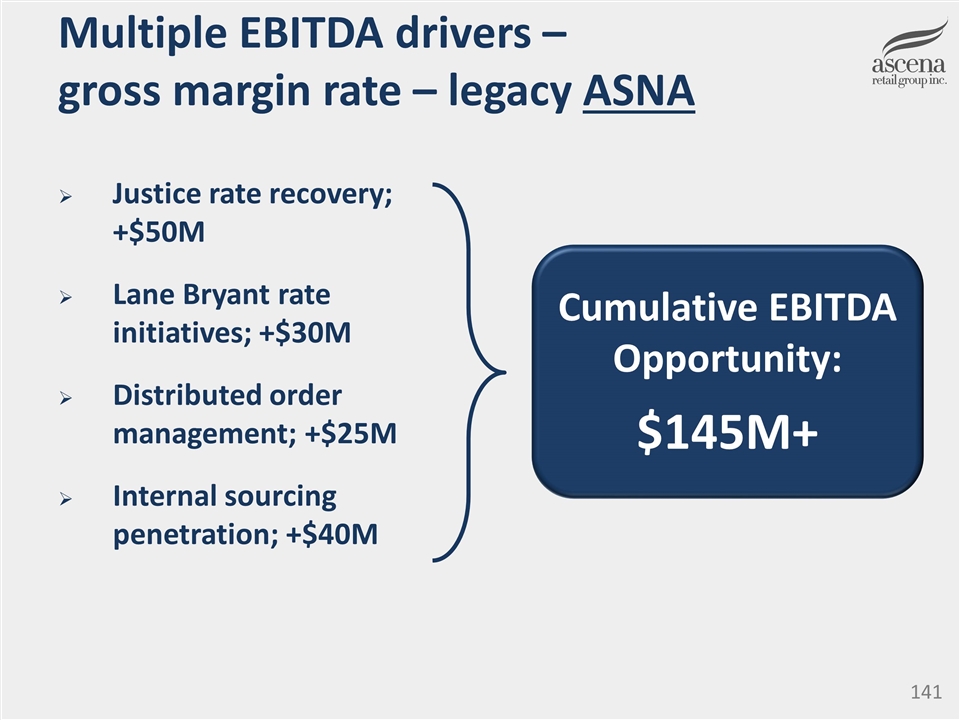

Multiple EBITDA drivers – gross margin rate – legacy ASNA Justice rate recovery; +$50M Lane Bryant rate initiatives; +$30M Distributed order management; +$25M Internal sourcing penetration; +$40M Cumulative EBITDA Opportunity: $145M+

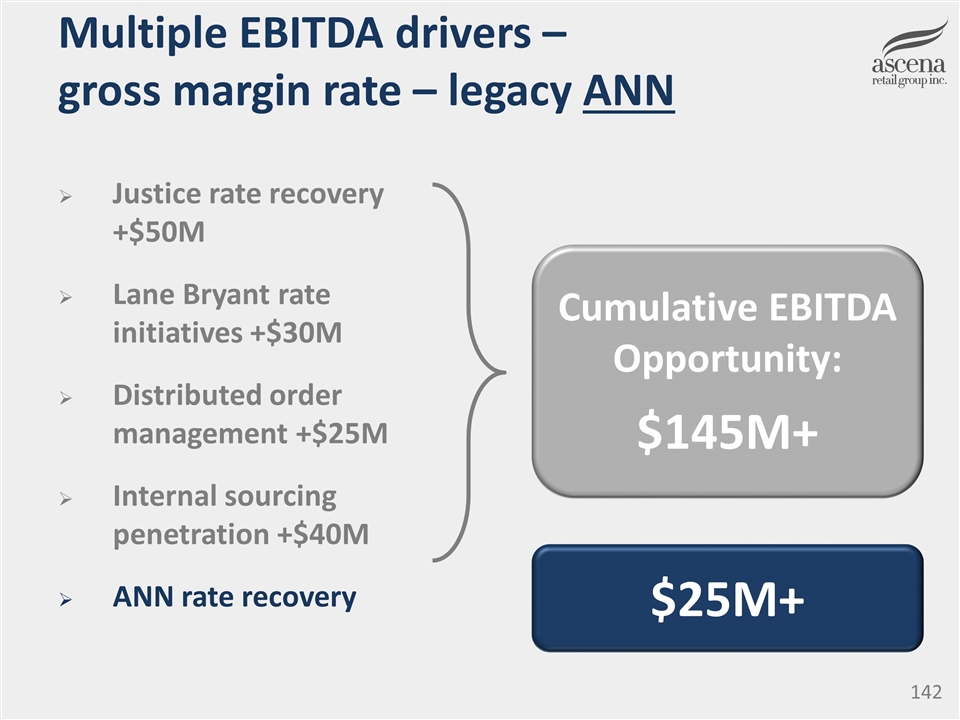

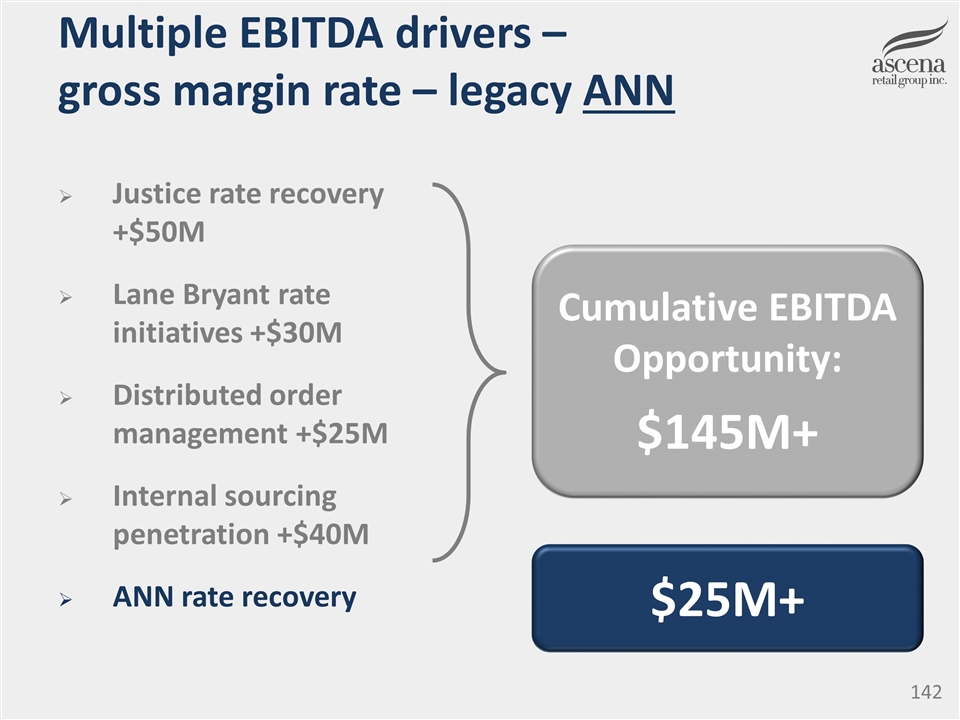

Multiple EBITDA drivers – gross margin rate – legacy ANN Justice rate recovery +$50M Lane Bryant rate initiatives +$30M Distributed order management +$25M Internal sourcing penetration +$40M ANN rate recovery Cumulative EBITDA Opportunity: $145M+ $25M+

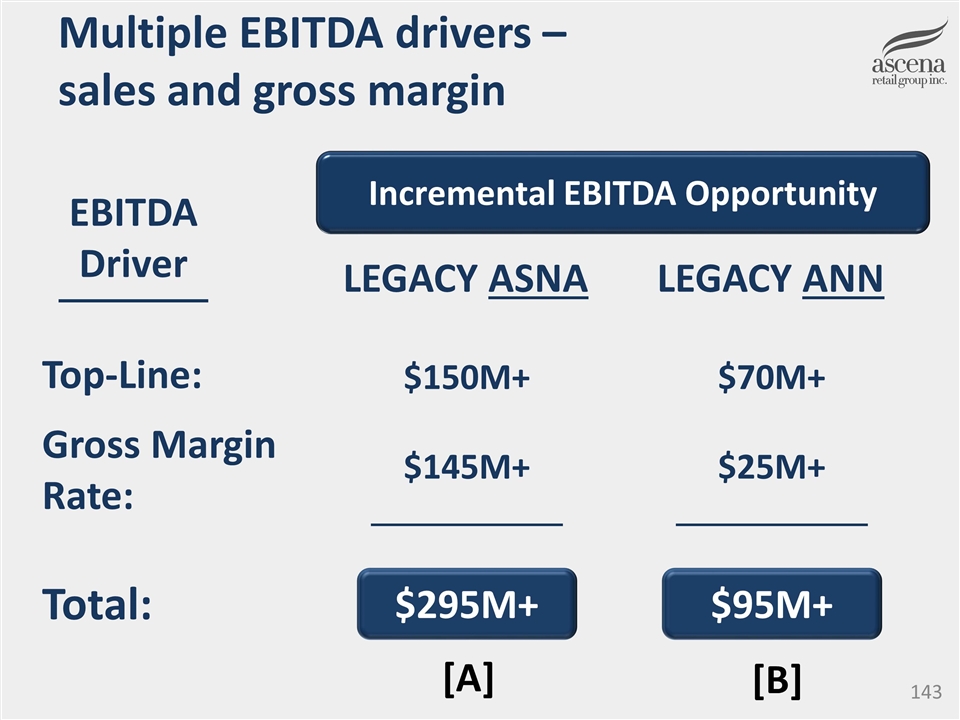

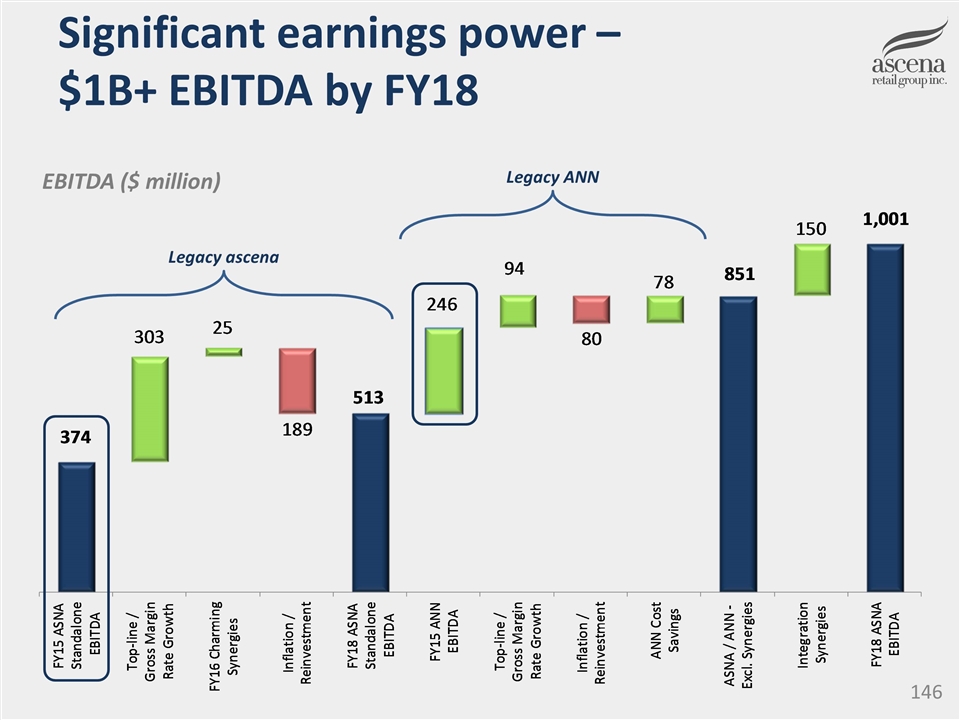

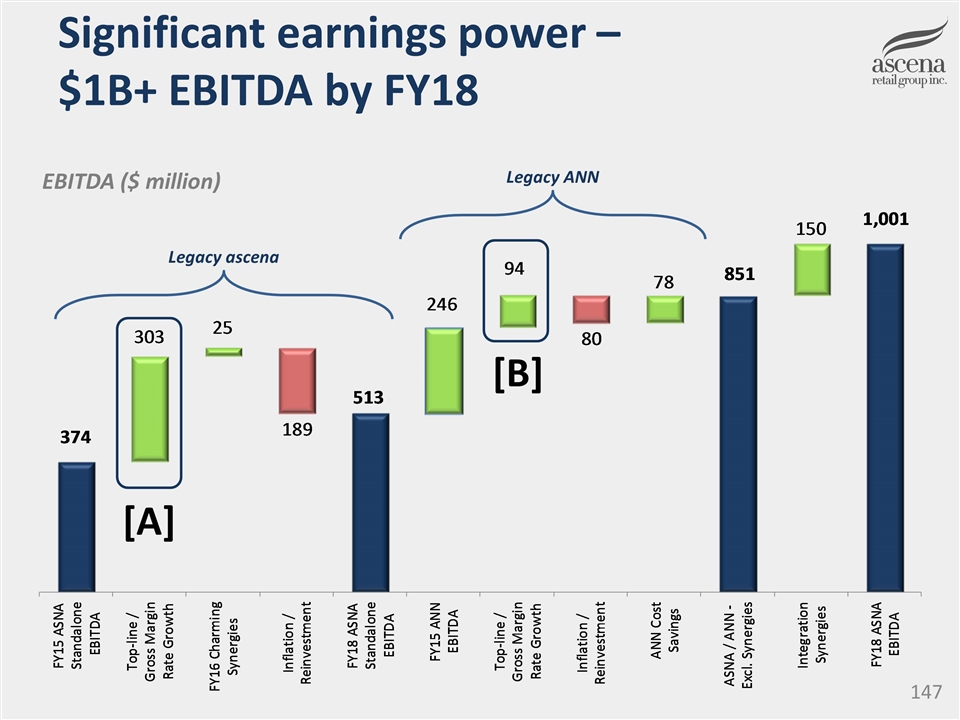

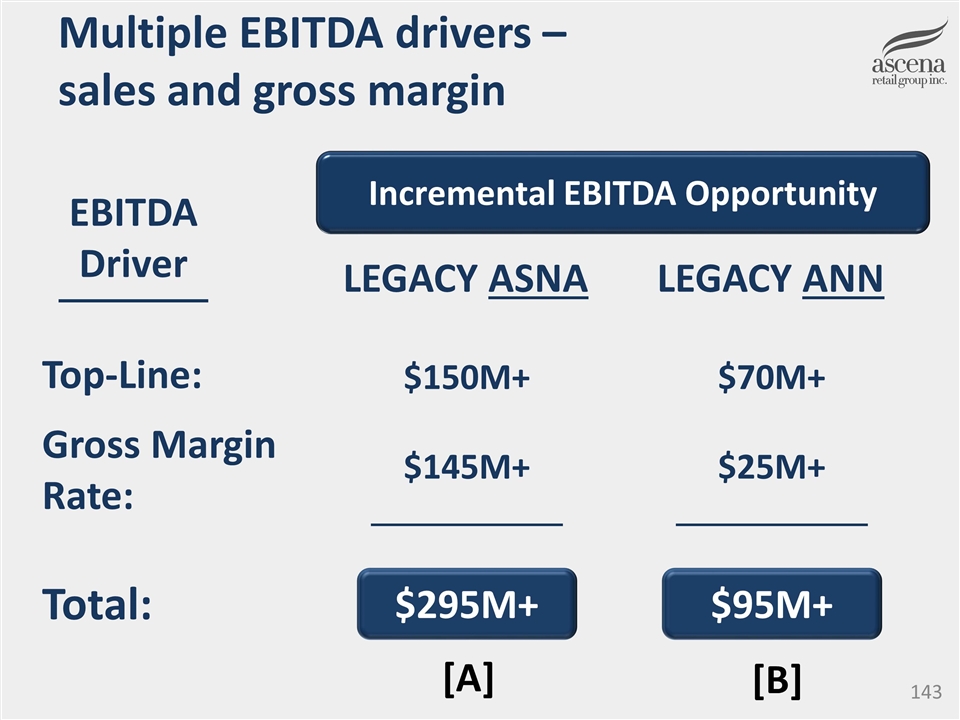

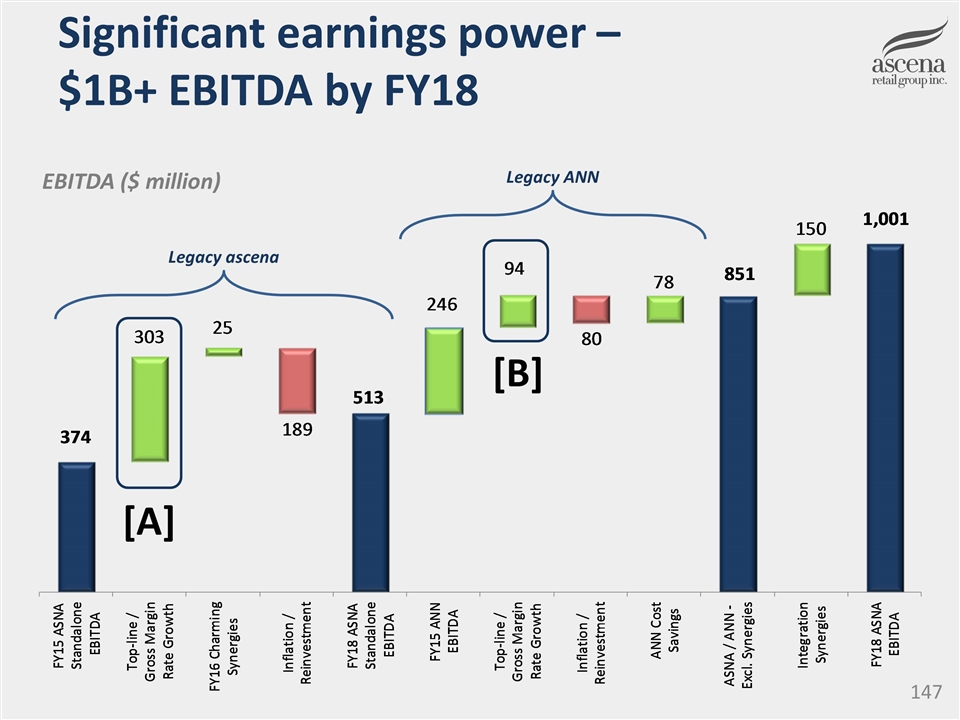

Multiple EBITDA drivers – sales and gross margin Incremental EBITDA Opportunity $295M+ LEGACY ASNA $150M+ $145M+ $95M+ LEGACY ANN $70M+ $25M+ EBITDA Driver Top-Line: Gross Margin Rate: Total: [A] [B]

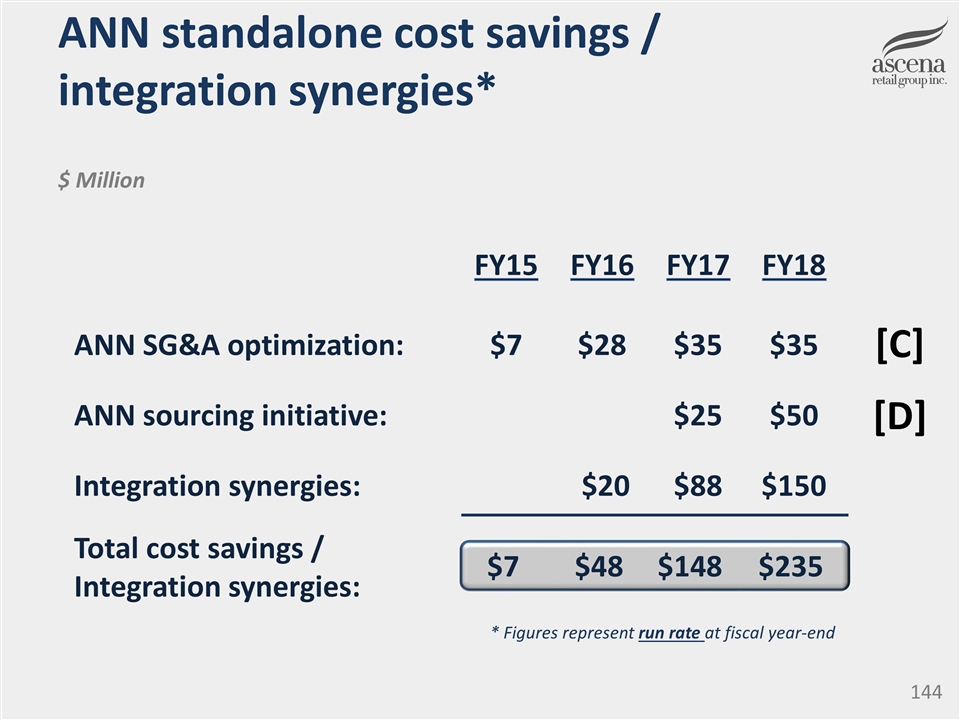

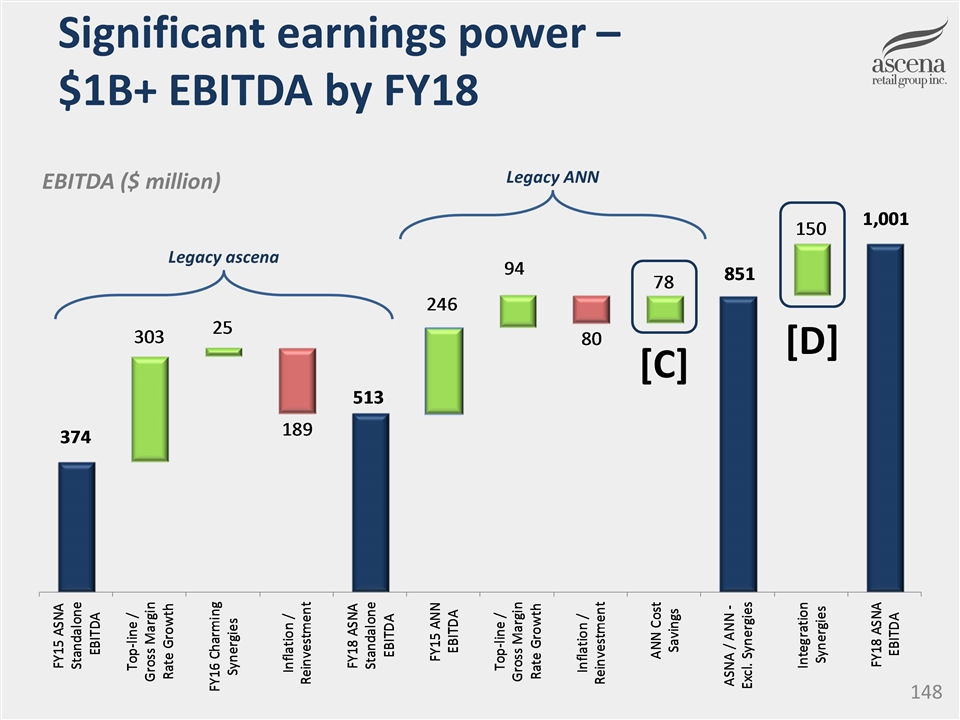

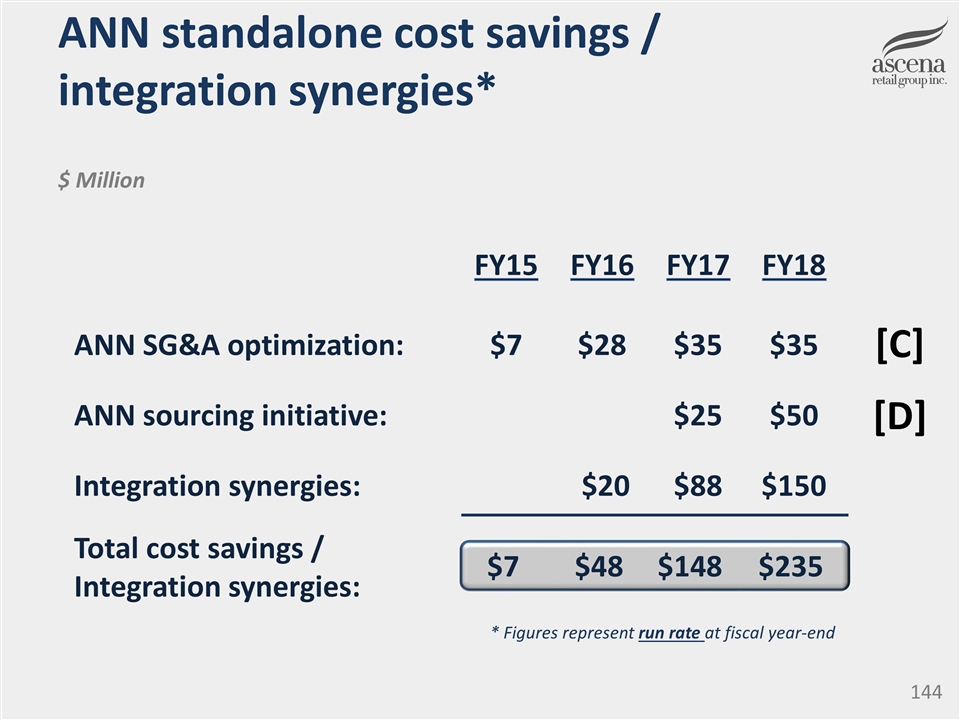

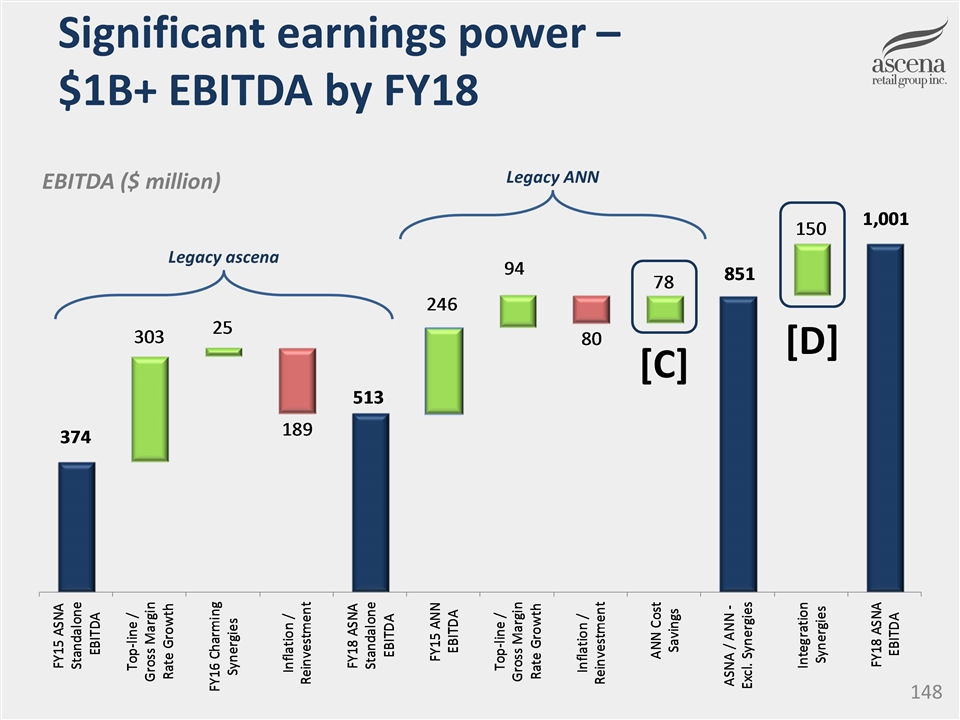

FY15 FY16 FY17 FY18 ANN SG&A optimization: $7$28$35$35 ANN sourcing initiative: $25$50 Integration synergies: $20$88$150 Total cost savings / Integration synergies: $7$48$148 $235 ANN standalone cost savings / integration synergies* $ Million * Figures represent run rate at fiscal year-end [C] [D]

Expense management Recent operating expense growth Shared service capacity build-out Brand capability development Discrete brand initiatives Steady-state marketing support

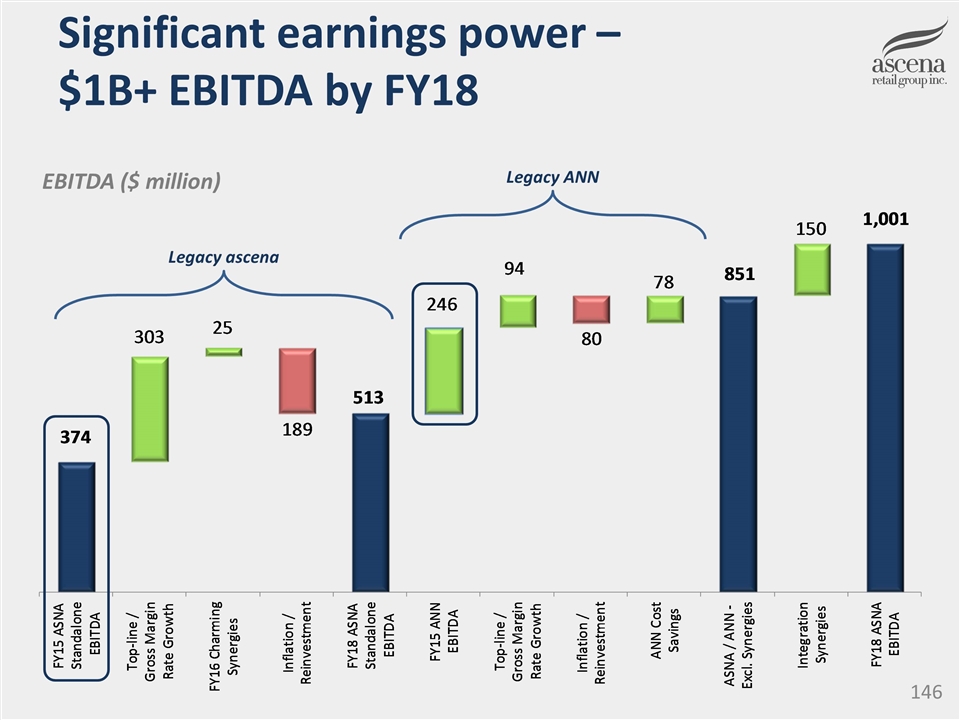

Significant earnings power – $1B+ EBITDA by FY18 EBITDA ($ million) Legacy ascena Legacy ANN

Significant earnings power – $1B+ EBITDA by FY18 EBITDA ($ million) Legacy ascena Legacy ANN [A] [B]

Significant earnings power – $1B+ EBITDA by FY18 EBITDA ($ million) Legacy ascena Legacy ANN [C] [D]

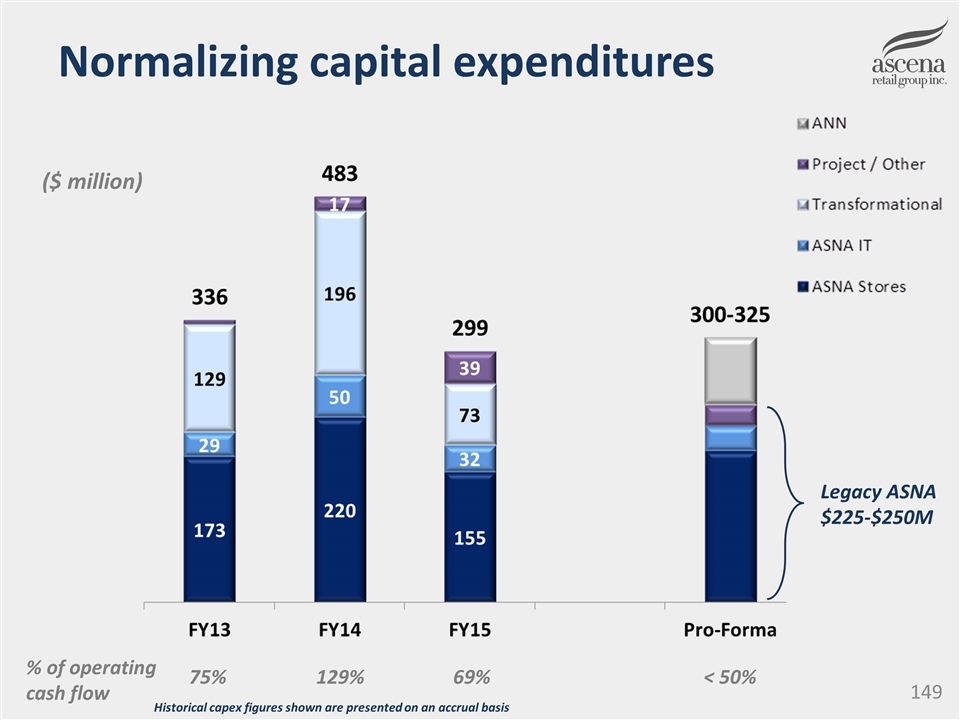

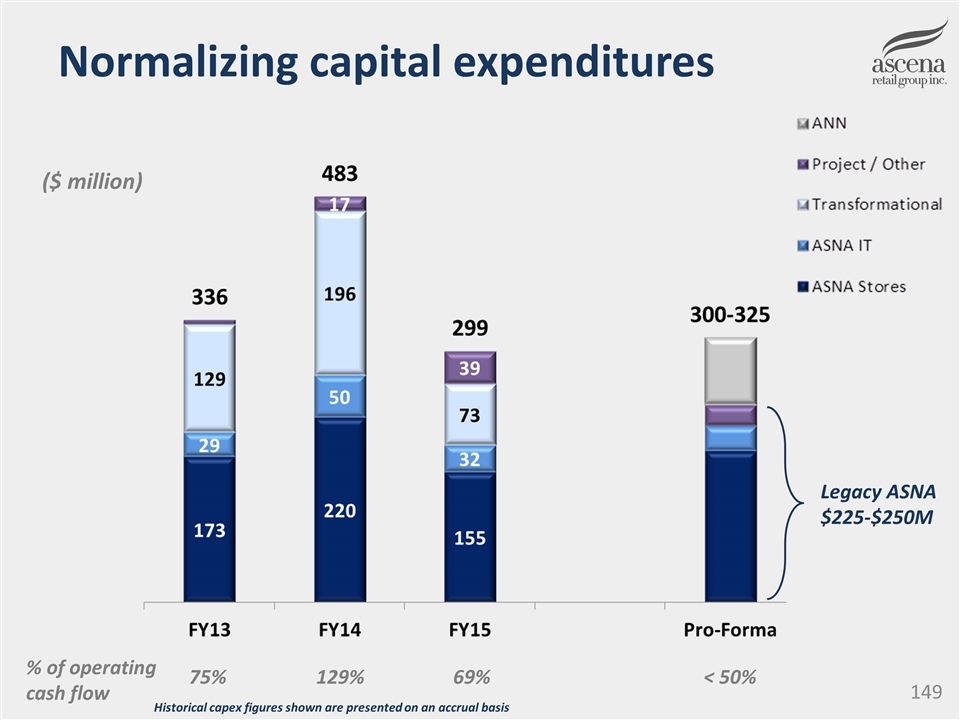

Normalizing capital expenditures ($ million) % of operating cash flow 75%129%69%< 50% Legacy ASNA $225-$250M Historical capex figures shown are presented on an accrual basis

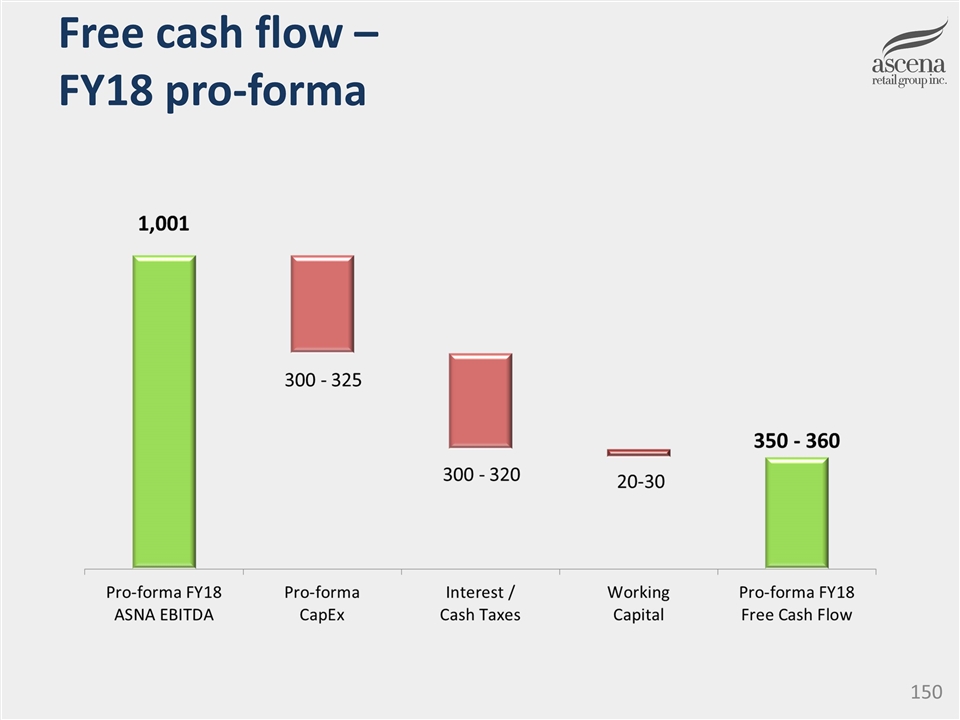

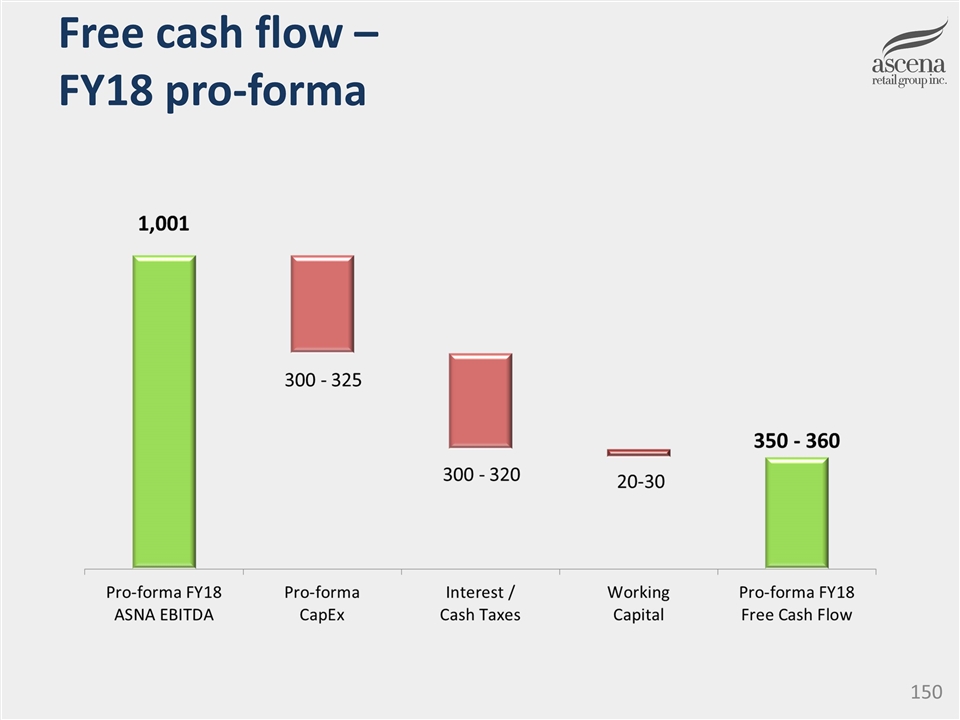

Free cash flow – FY18 pro-forma

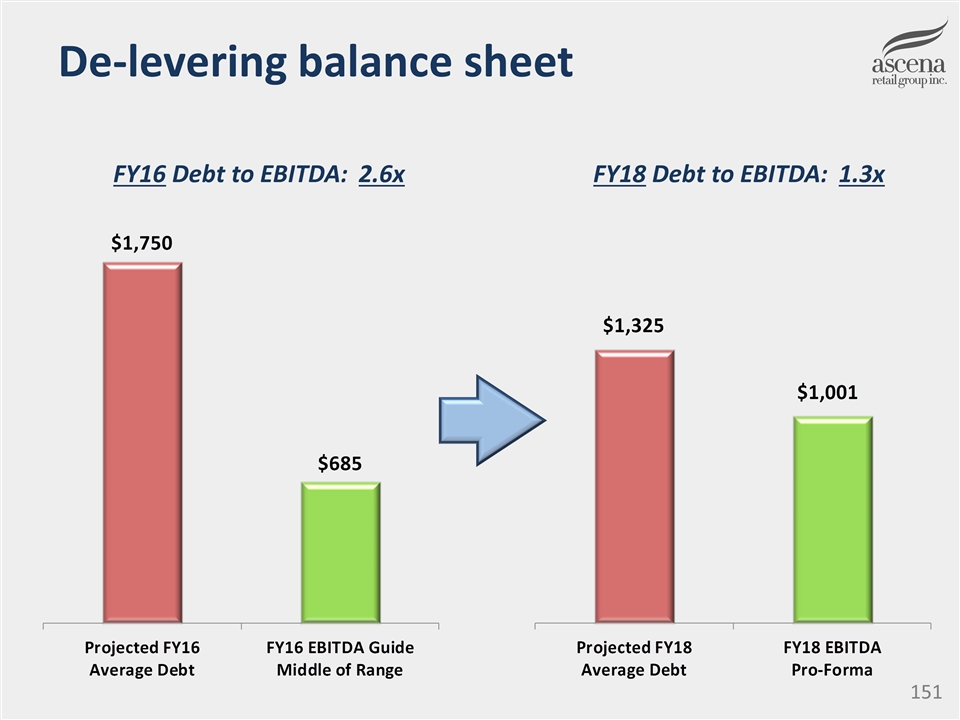

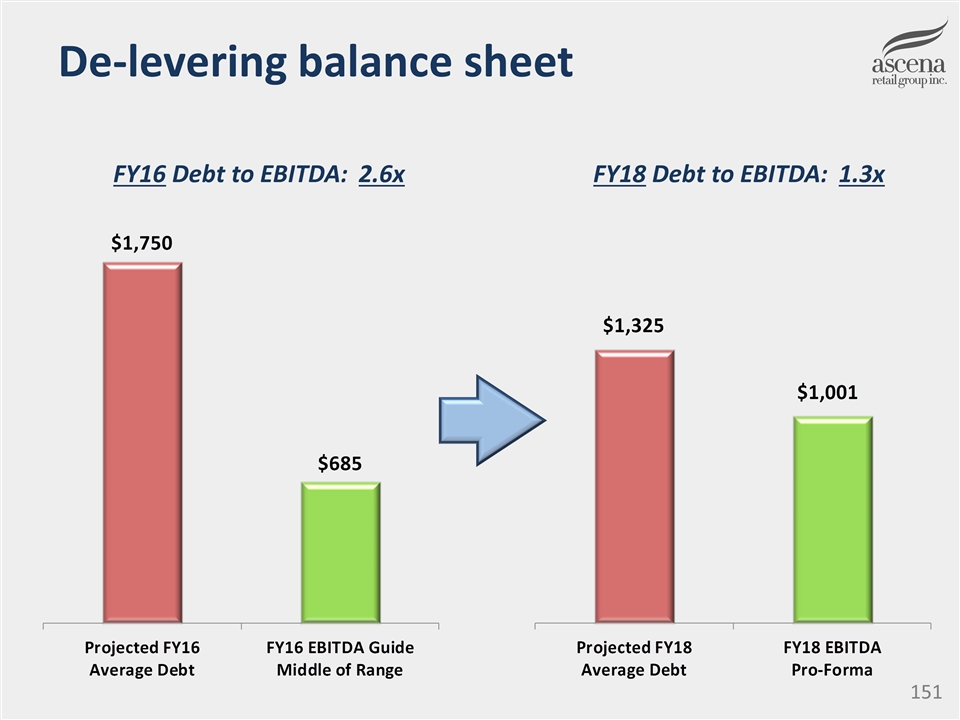

De-levering balance sheet FY16 Debt to EBITDA:2.6x FY18 Debt to EBITDA:1.3x

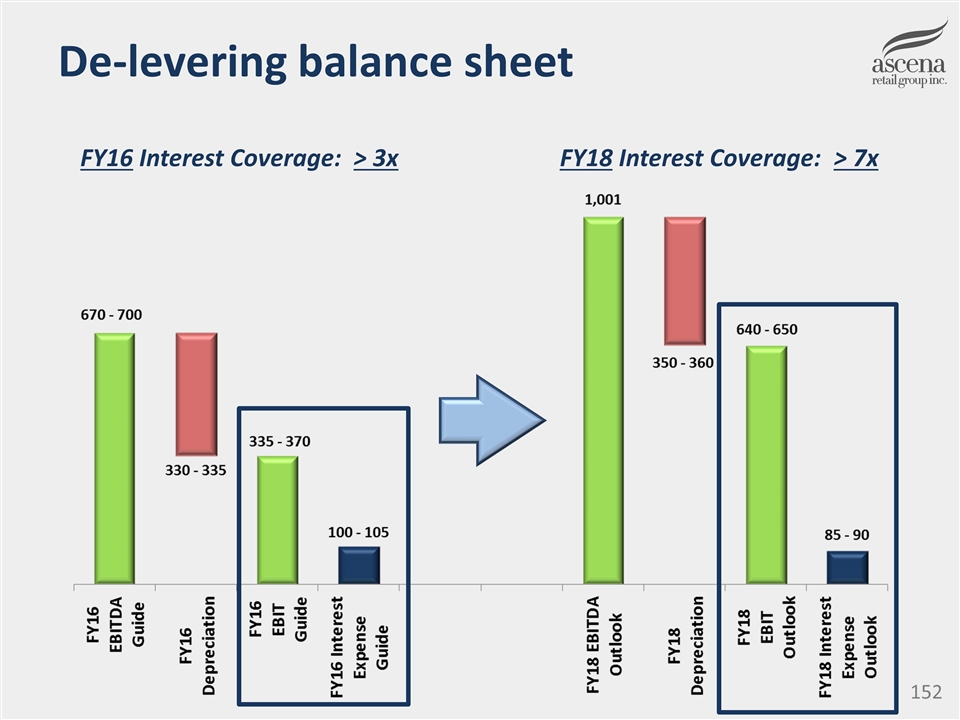

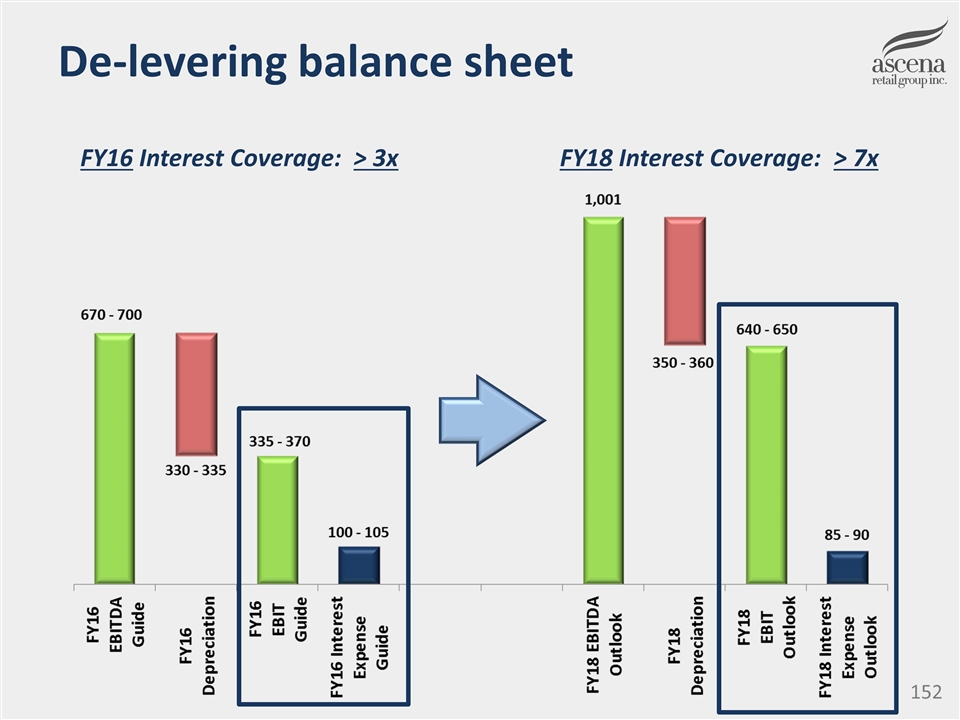

De-levering balance sheet FY16 Interest Coverage: > 3x FY18 Interest Coverage: > 7x

Investment considerations Multiple EBITDA drivers Significant earnings power Normalizing CapEx Accelerating free cash flow De-levering balance sheet

Vision “Serve our shareholders and create value by becoming a family of leading brands with $10 billion in sales and top-tier profitability”

Breakouts JusticeTribeca Hub Ann Taylor / LOFTMurray Hill Hub Lane BryantNolita Hub maurices Soho Hub dressbarn / Catherines / SSGFoyer CEO / CFOWharton Forum