ascena retail group 2015 Investor Day - Supplement Investor Day 2015 Supplemental Package Exhibit 99.2

Supporting material Historical financials – operating margin Store fleet detail Debt financing Brand fact sheets Competitive positioning Historical financial performance Fleet health metrics

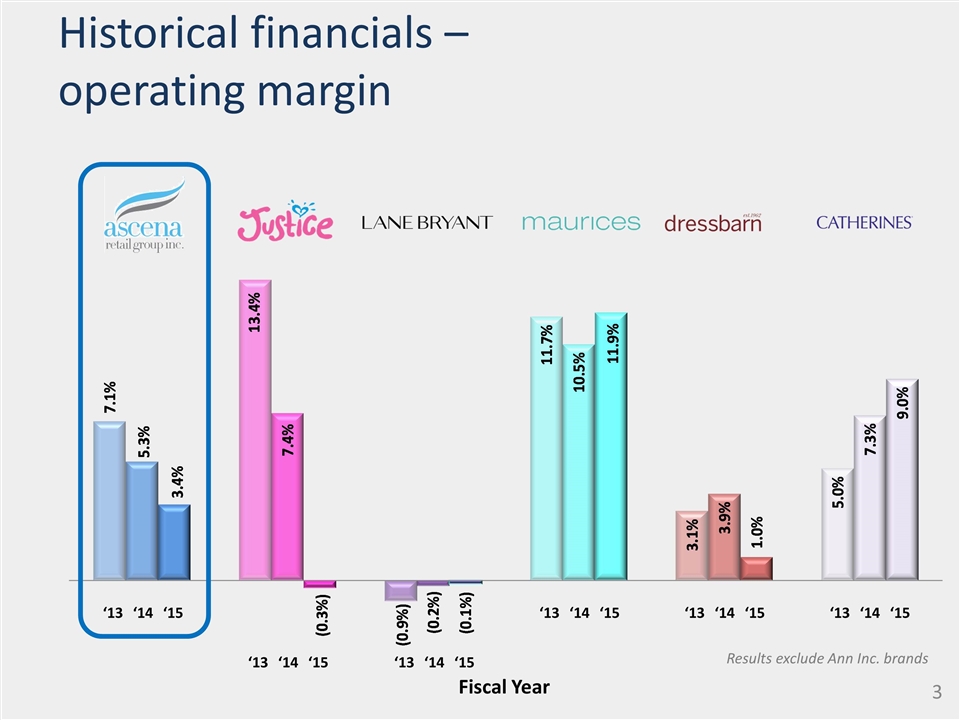

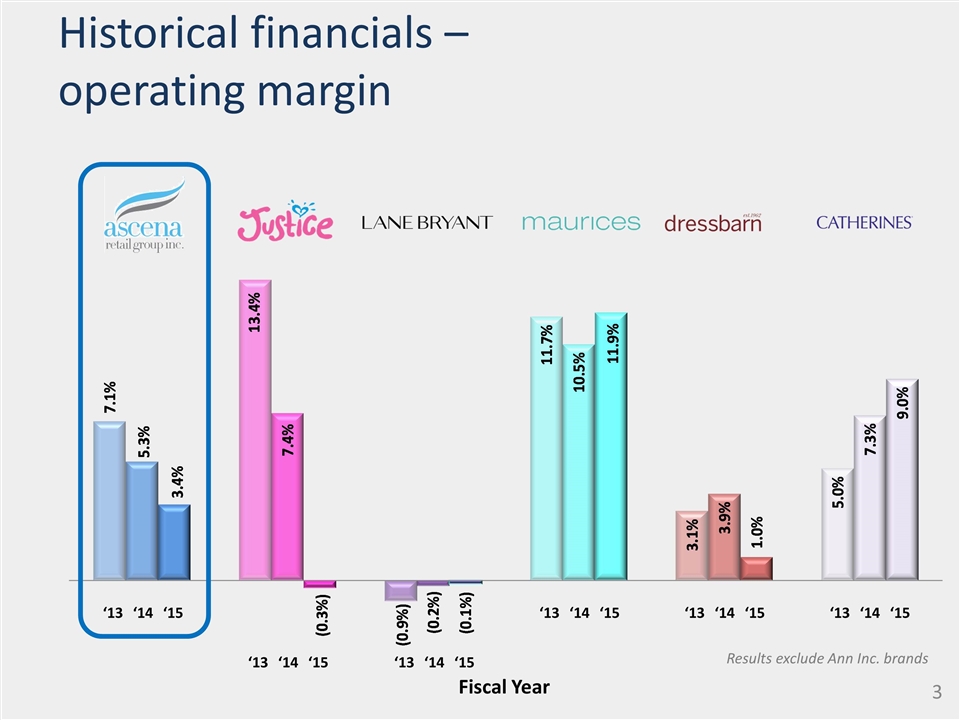

Historical financials – operating margin ‘13 ‘14 ‘15 Fiscal Year ‘13 ‘14 ‘15 ‘13 ‘14 ‘15 ‘13 ‘14 ‘15 ‘13 ‘14 ‘15 ‘13 ‘14 ‘15 Results exclude Ann Inc. brands

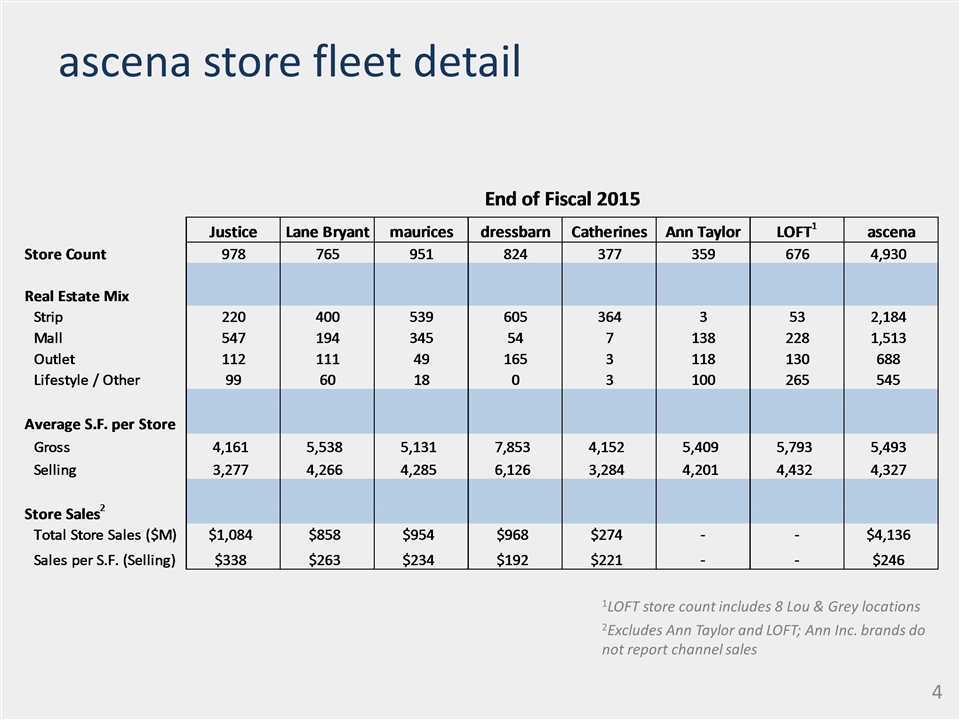

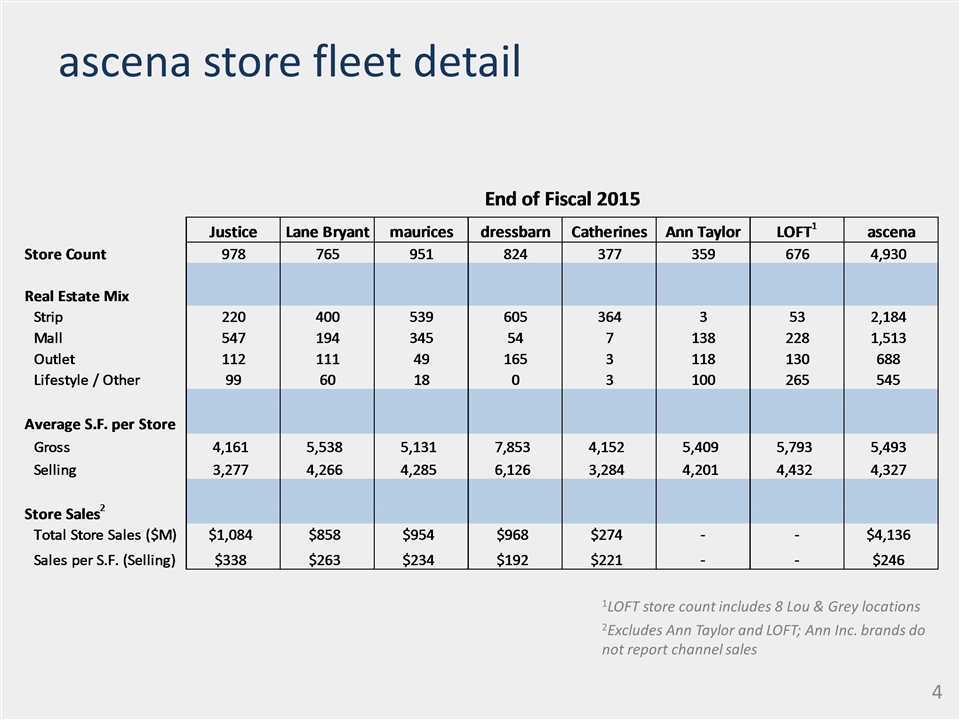

ascena store fleet detail 1LOFT store count includes 8 Lou & Grey locations 2Excludes Ann Taylor and LOFT; Ann Inc. brands do not report channel sales

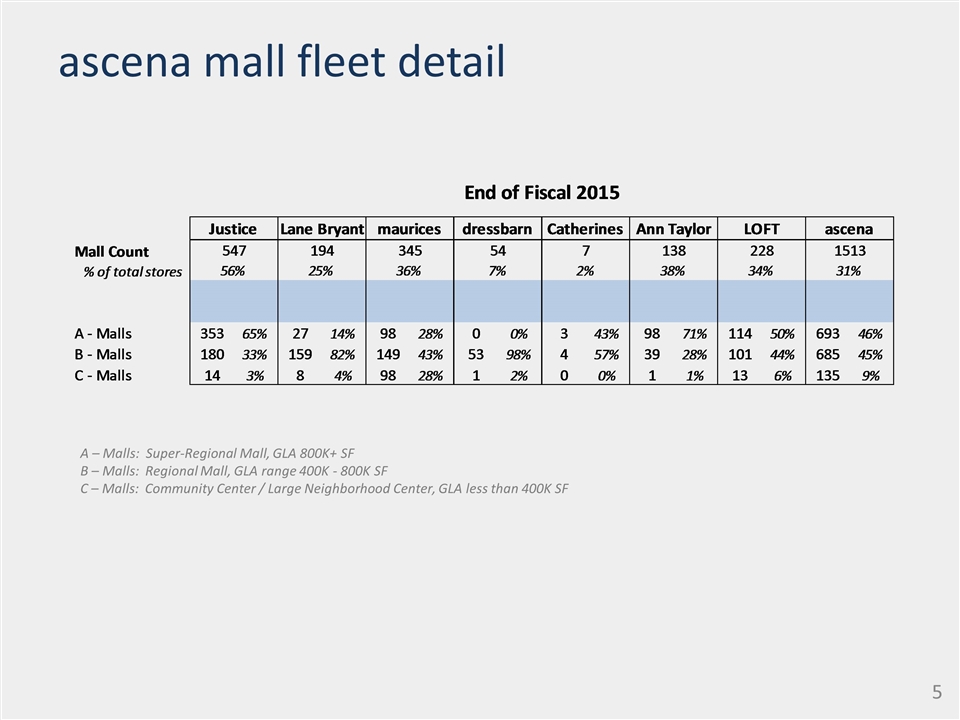

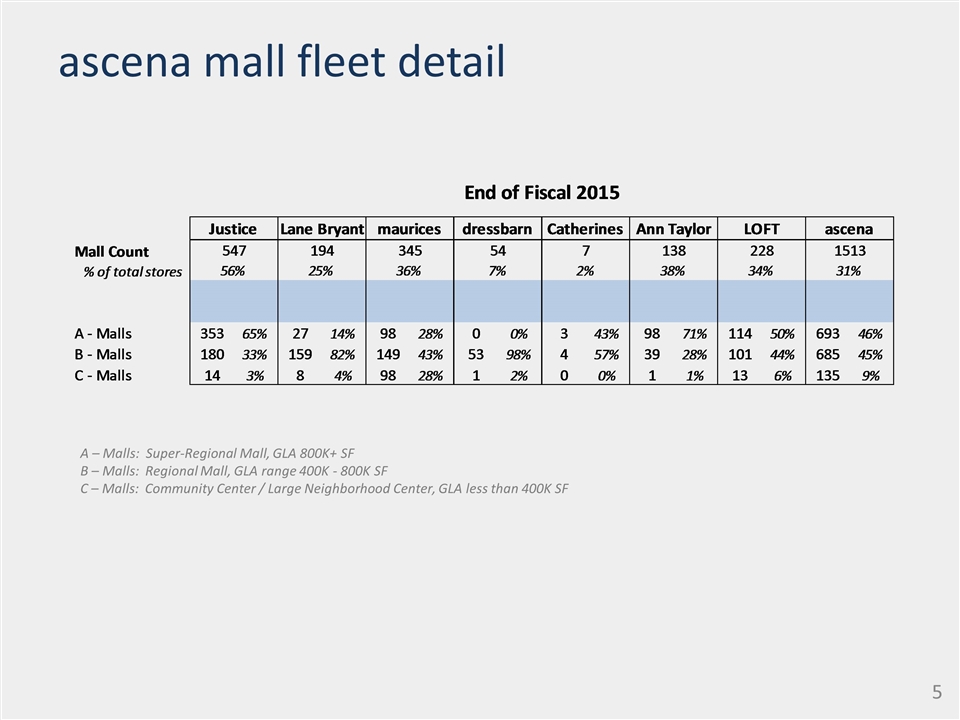

ascena mall fleet detail A – Malls: Super-Regional Mall, GLA 800K+ SF B – Malls: Regional Mall, GLA range 400K - 800K SF C – Malls: Community Center / Large Neighborhood Center, GLA less than 400K SF

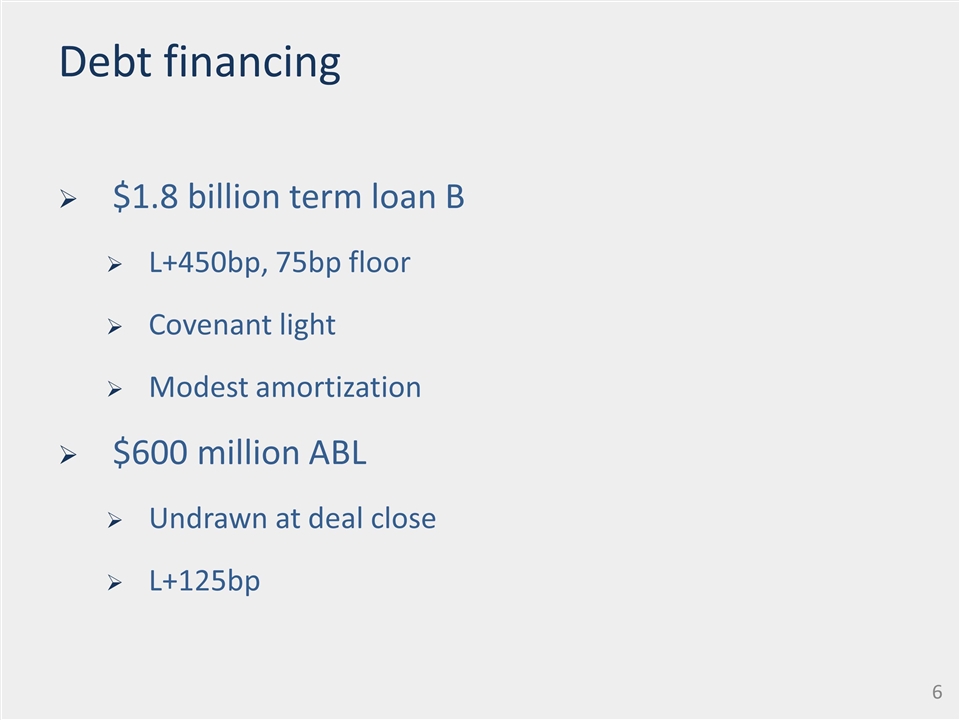

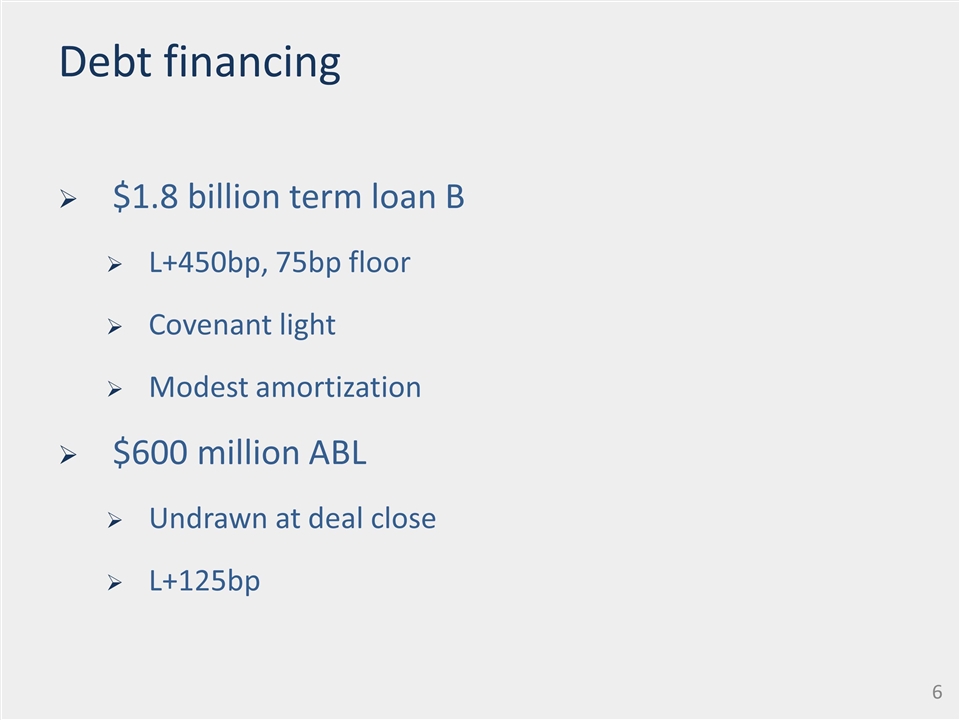

Debt financing $1.8 billion term loan B L+450bp, 75bp floor Covenant light Modest amortization $600 million ABL Undrawn at deal close L+125bp

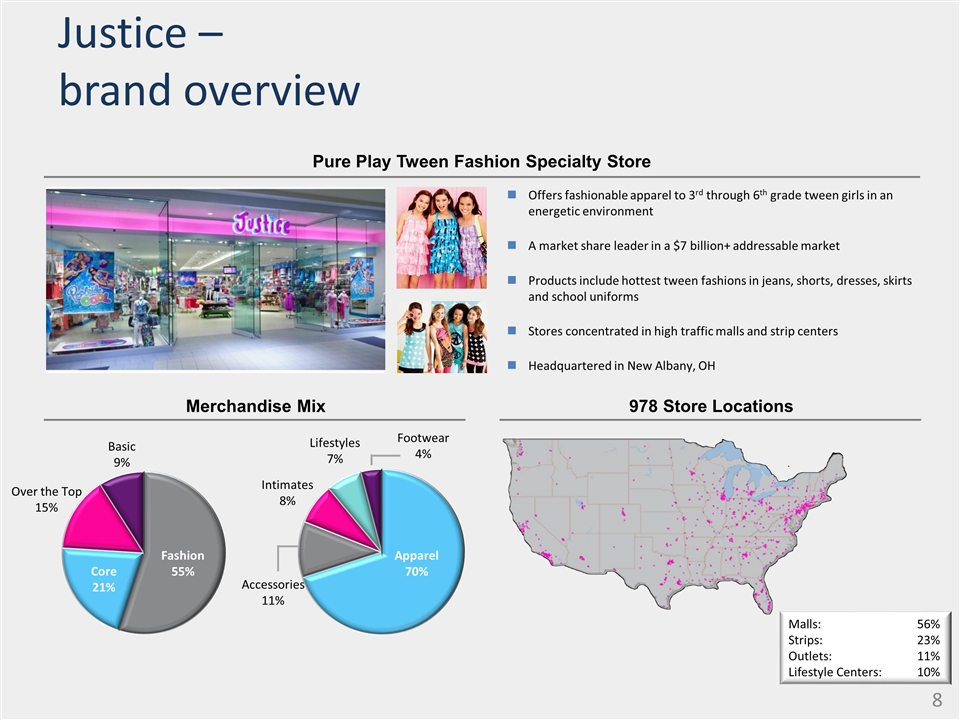

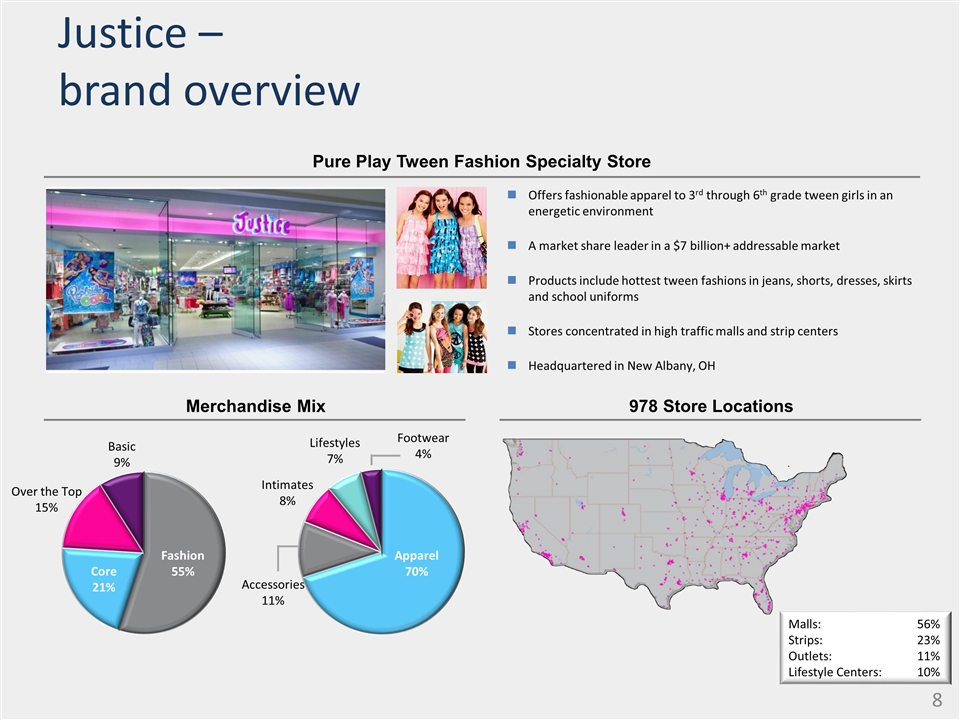

Justice – brand overview Pure Play Tween Fashion Specialty Store Merchandise Mix 978 Store Locations Offers fashionable apparel to 3rd through 6th grade tween girls in an energetic environment A market share leader in a $7 billion+ addressable market Products include hottest tween fashions in jeans, shorts, dresses, skirts and school uniforms Stores concentrated in high traffic malls and strip centers Headquartered in New Albany, OH Malls:56% Strips:23% Outlets:11% Lifestyle Centers:10% Fashion 55% Core 21% Over the Top 15% Basic 9% Apparel 70% Accessories 11% Intimates 8% Lifestyles 7% Footwear 4%

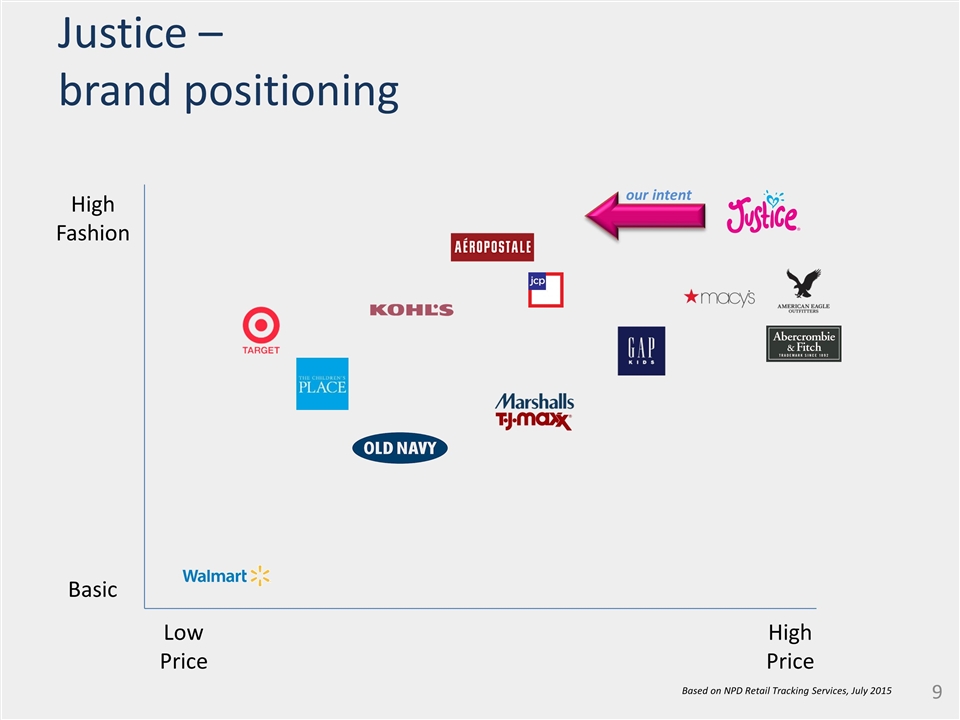

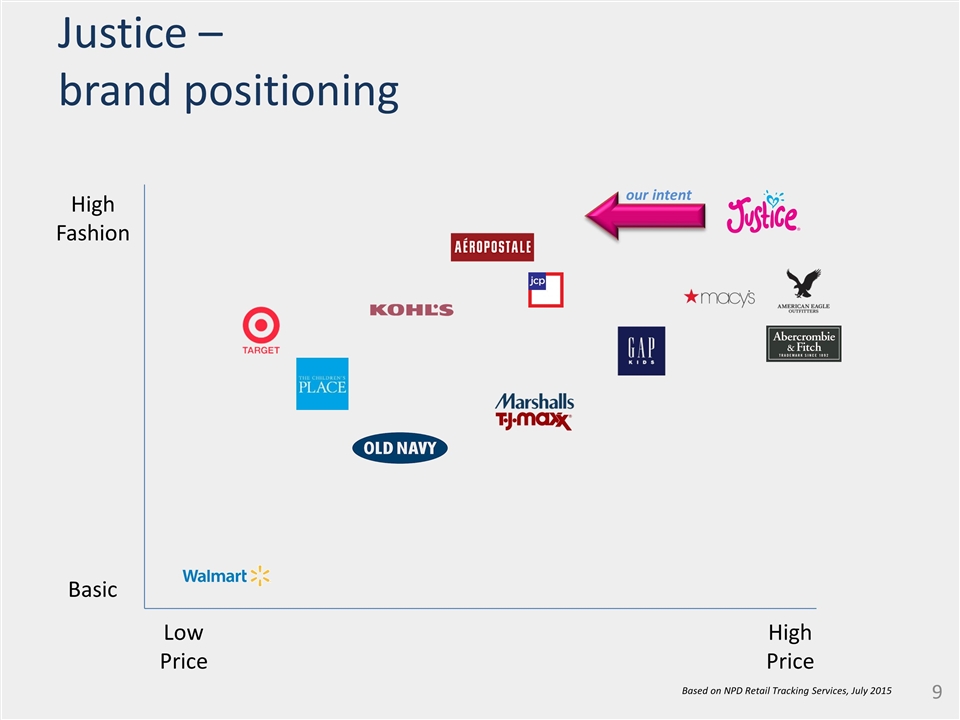

Justice – brand positioning Basic High Fashion High Price Low Price Based on NPD Retail Tracking Services, July 2015 our intent

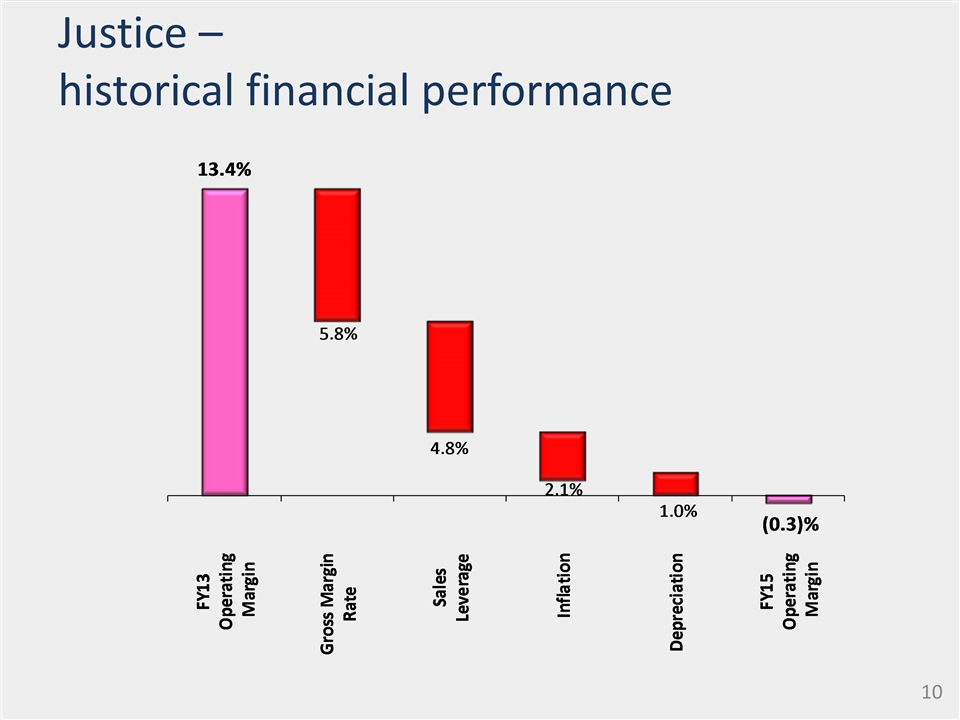

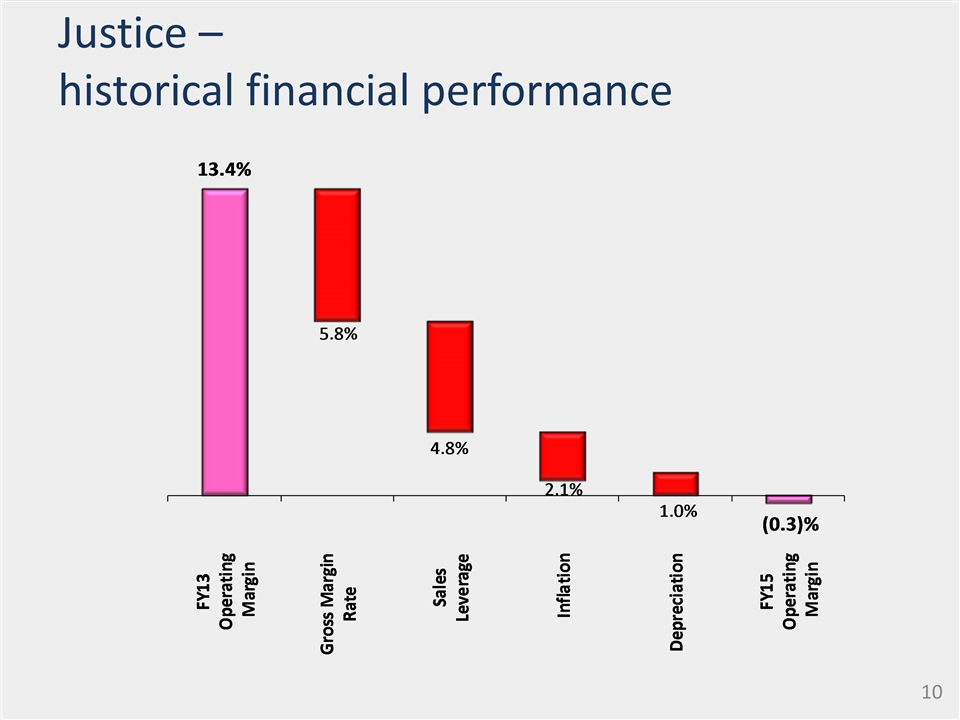

Justice – historical financial performance

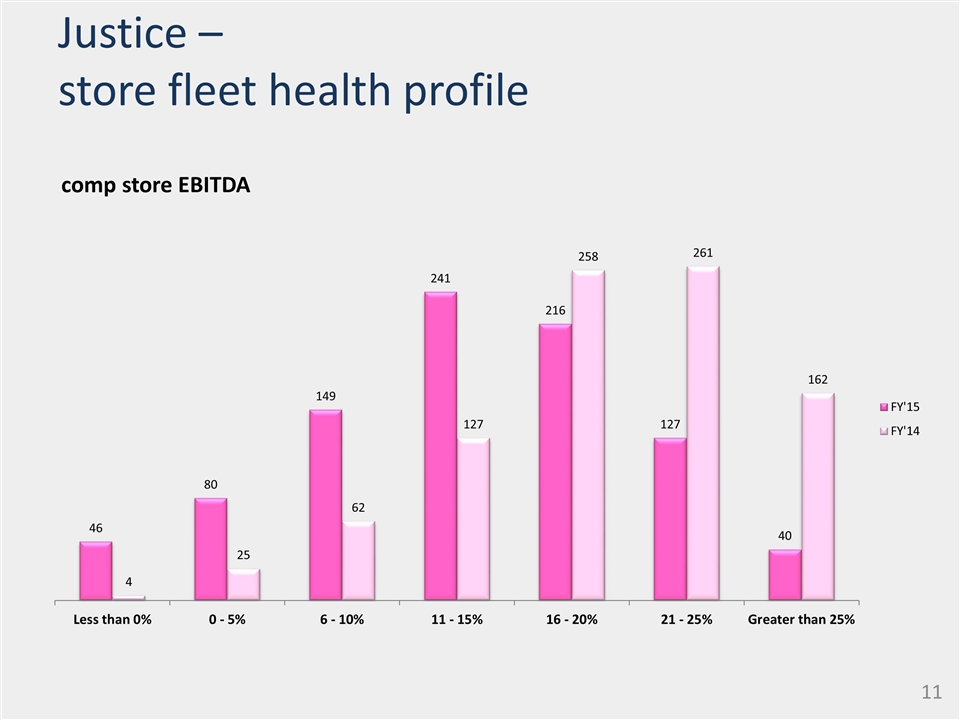

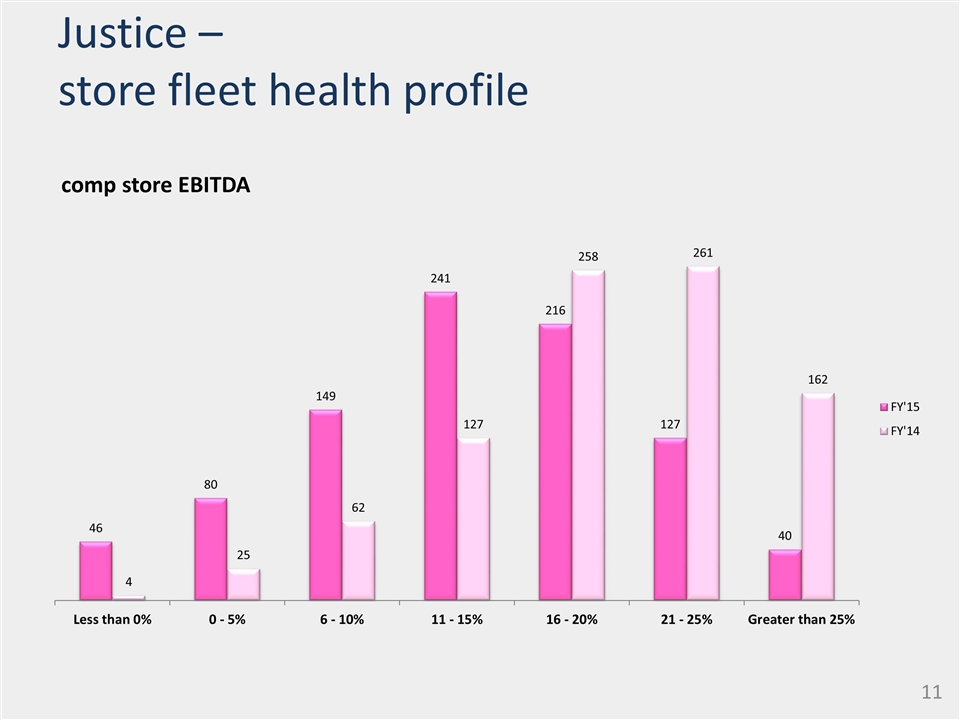

Justice – store fleet health profile

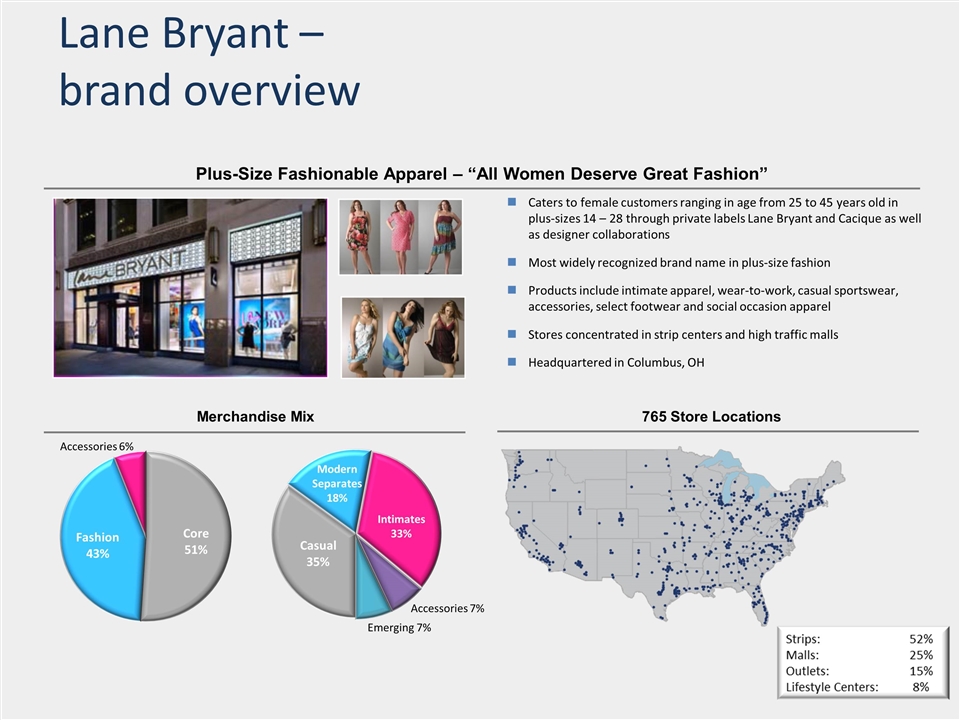

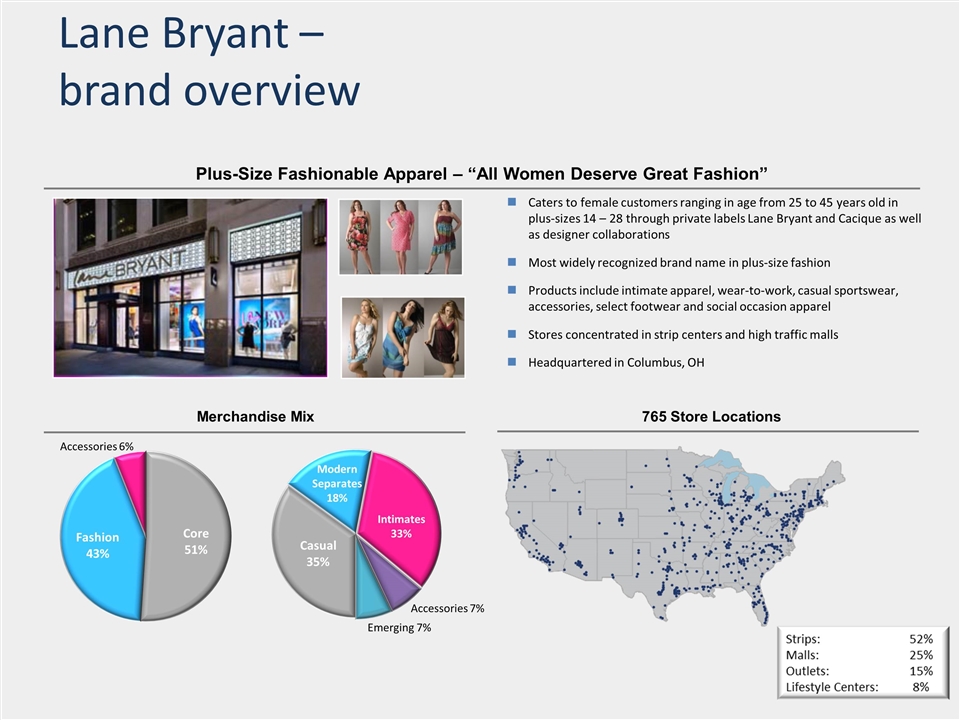

Lane Bryant – brand overview Plus-Size Fashionable Apparel – “All Women Deserve Great Fashion” Merchandise Mix 765 Store Locations Caters to female customers ranging in age from 25 to 45 years old in plus-sizes 14 – 28 through private labels Lane Bryant and Cacique as well as designer collaborations Most widely recognized brand name in plus-size fashion Products include intimate apparel, wear-to-work, casual sportswear, accessories, select footwear and social occasion apparel Stores concentrated in strip centers and high traffic malls Headquartered in Columbus, OH Modern Separates 18% Accessories 6% Intimates 33% Accessories 7% Emerging 7%

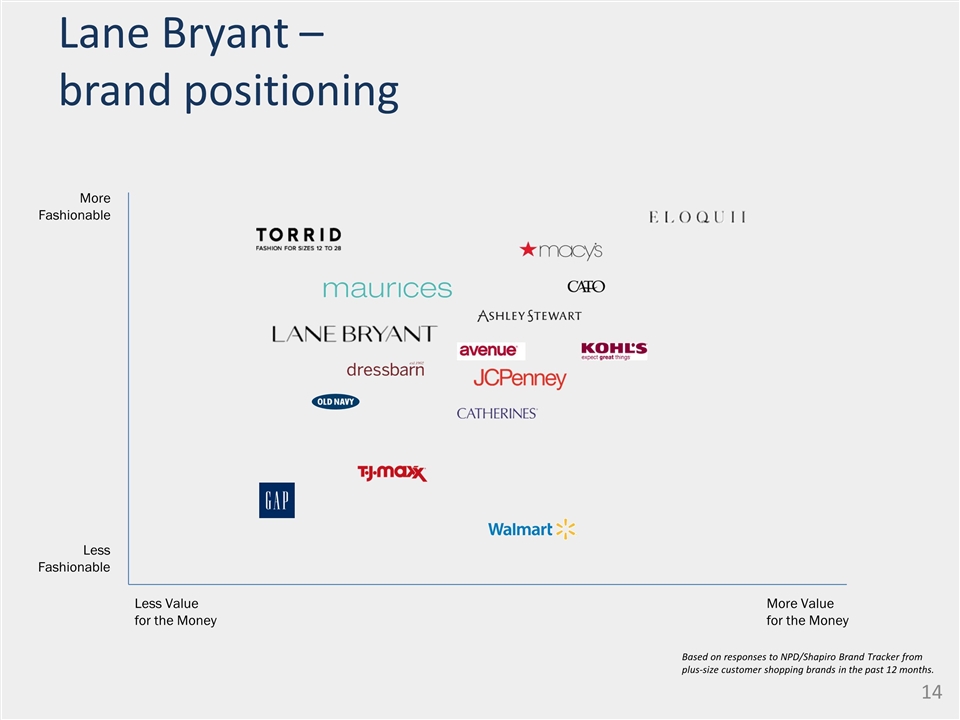

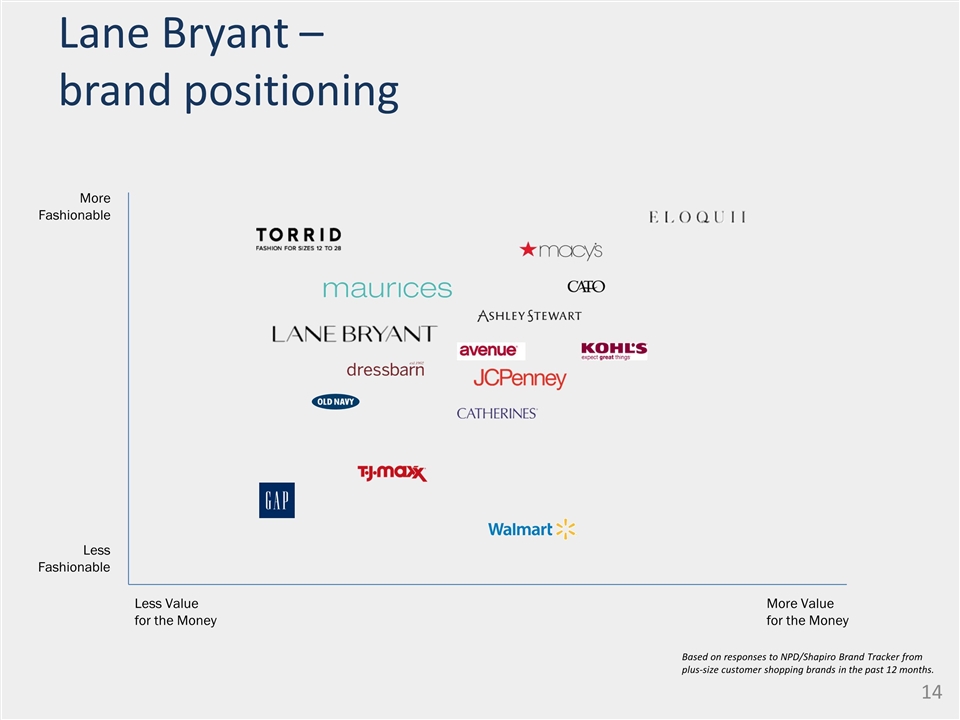

Lane Bryant – brand positioning Less Value for the Money More Value for the Money Less Fashionable More Fashionable Based on responses to NPD/Shapiro Brand Tracker from plus-size customer shopping brands in the past 12 months.

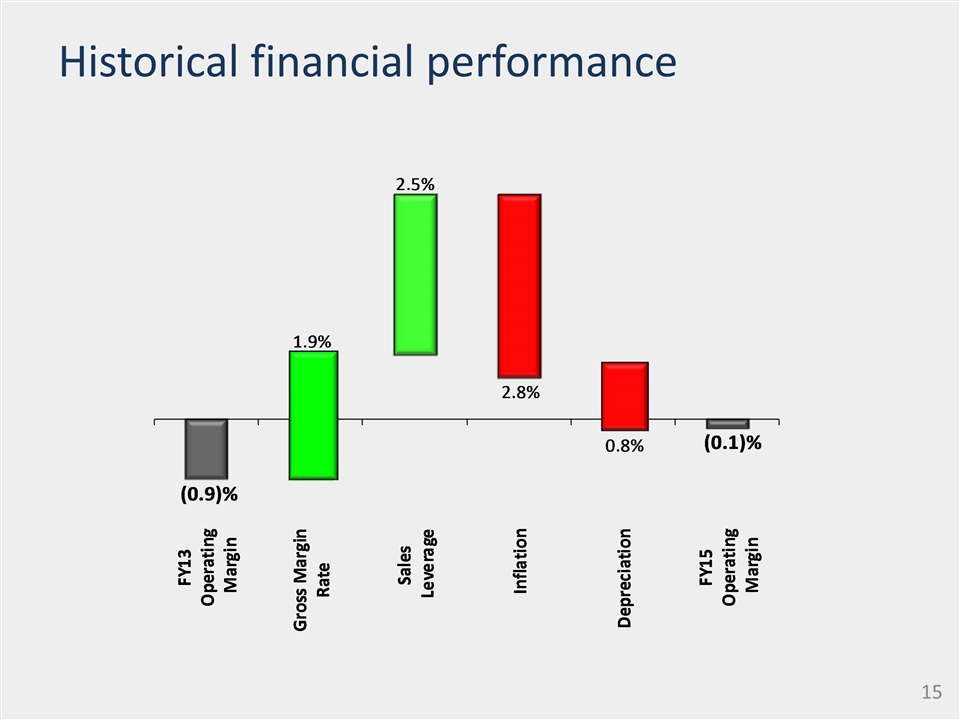

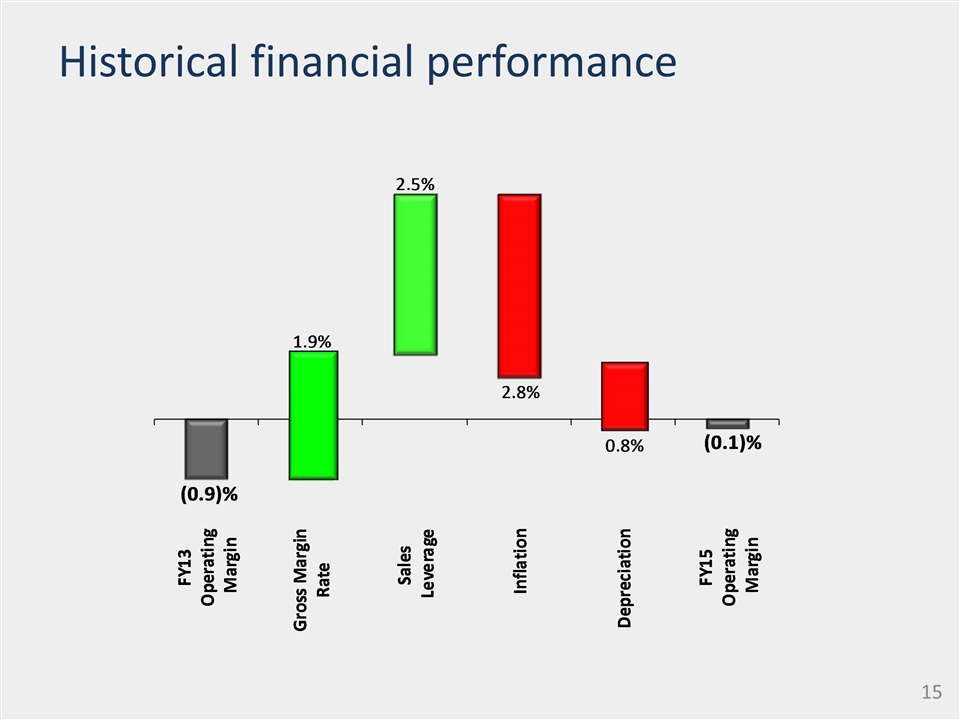

Historical financial performance

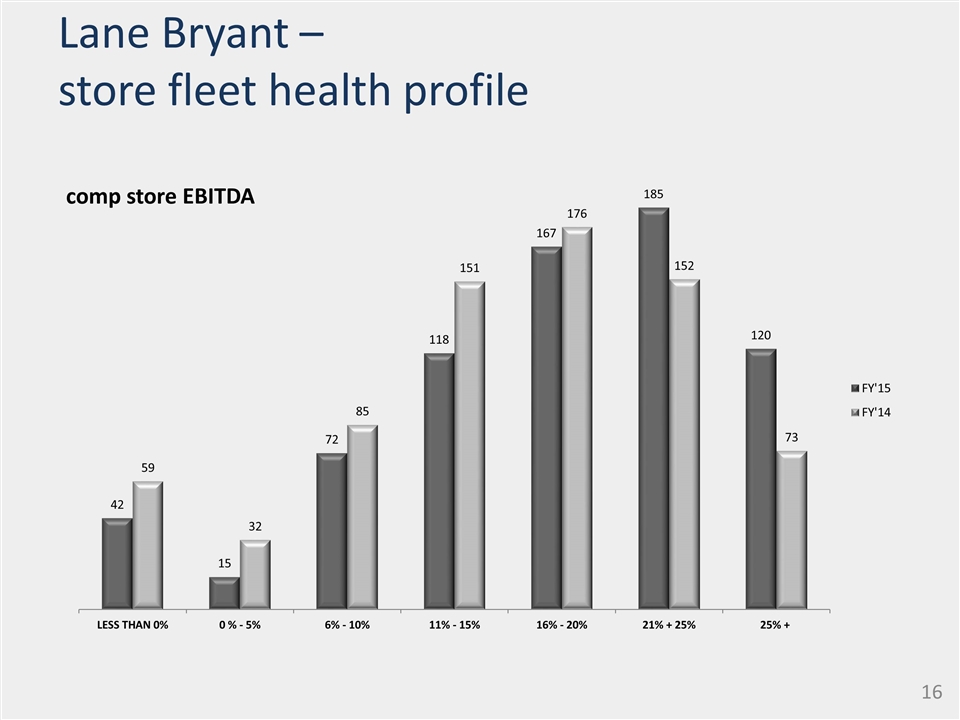

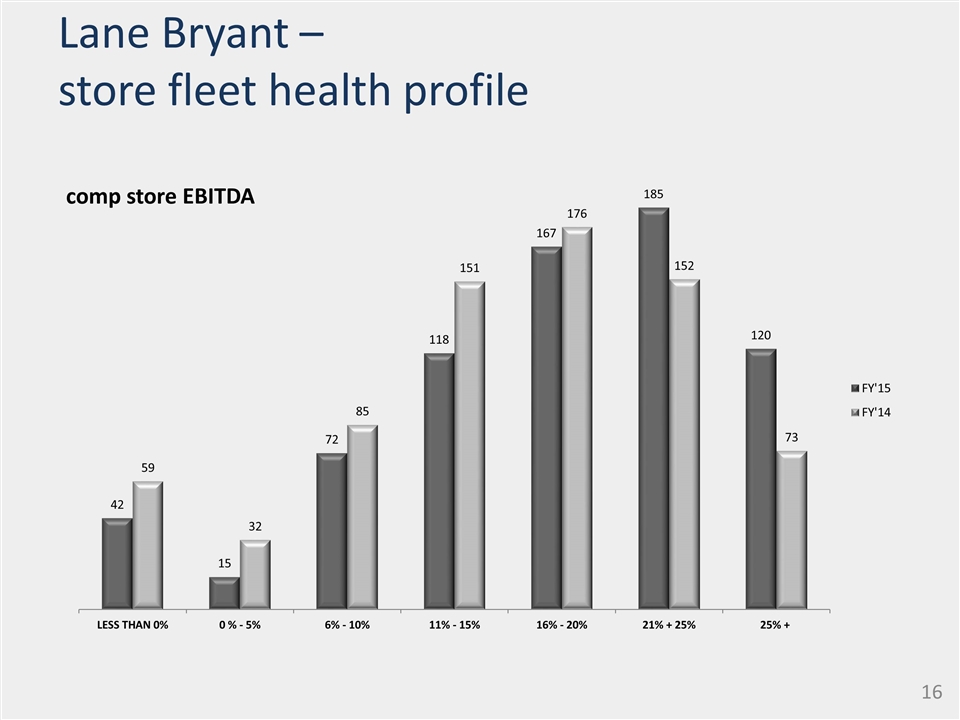

Lane Bryant – store fleet health profile comp store EBITDA

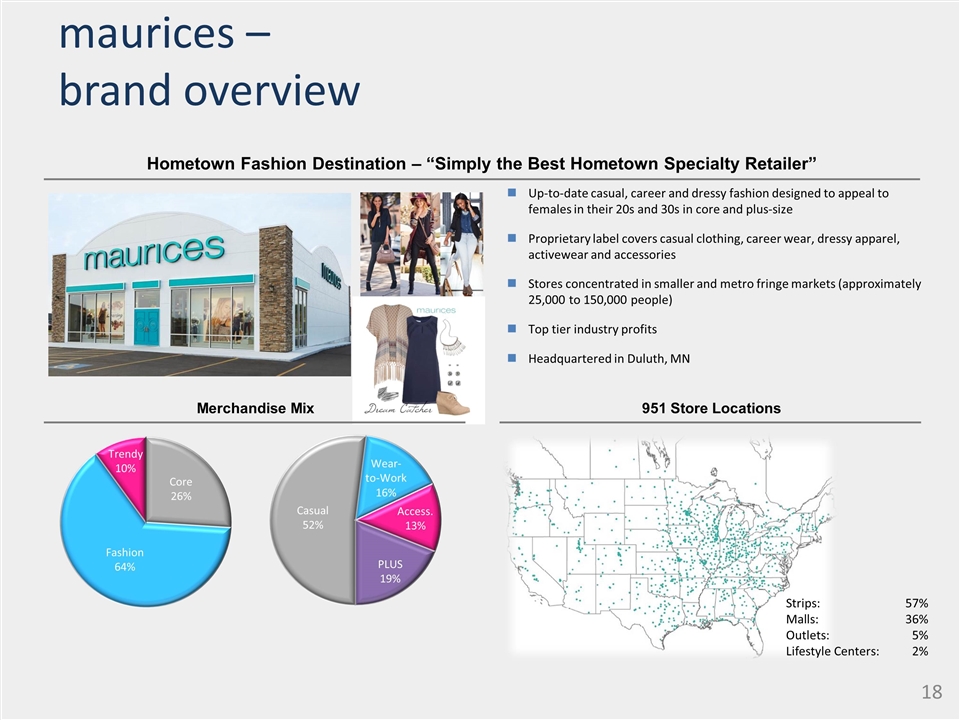

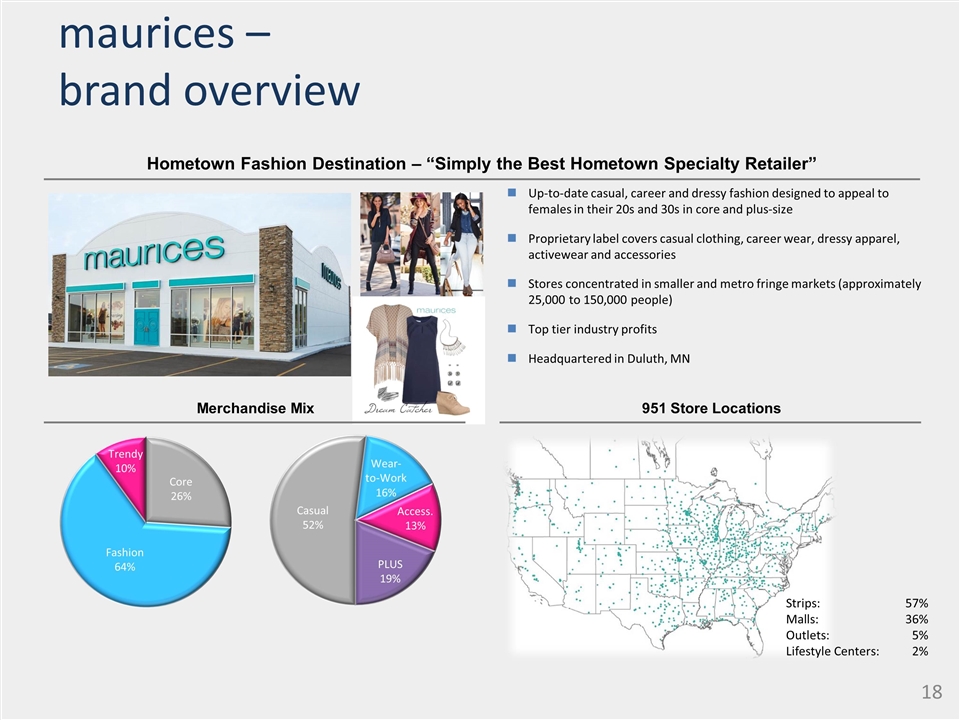

maurices – brand overview Hometown Fashion Destination – “Simply the Best Hometown Specialty Retailer” Merchandise Mix 951 Store Locations Up-to-date casual, career and dressy fashion designed to appeal to females in their 20s and 30s in core and plus-size Proprietary label covers casual clothing, career wear, dressy apparel, activewear and accessories Stores concentrated in smaller and metro fringe markets (approximately 25,000 to 150,000 people) Top tier industry profits Headquartered in Duluth, MN Strips:57% Malls:36% Outlets:5% Lifestyle Centers:2%

maurices – brand positioning Basic High Fashion High Price Low Price Based on Brand Performance Tracker and NPD data.

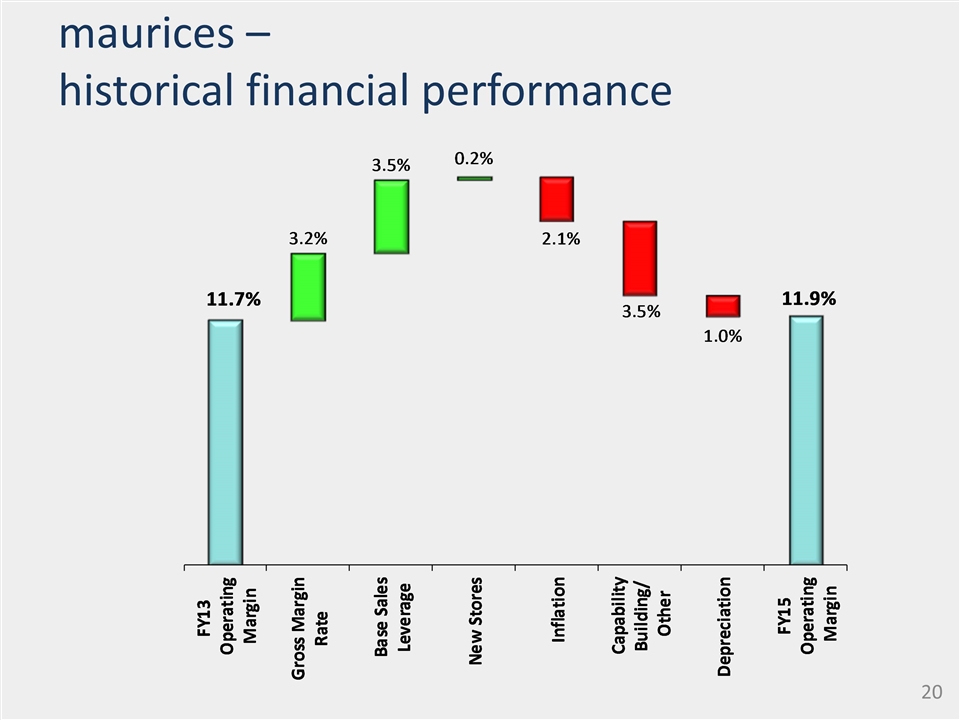

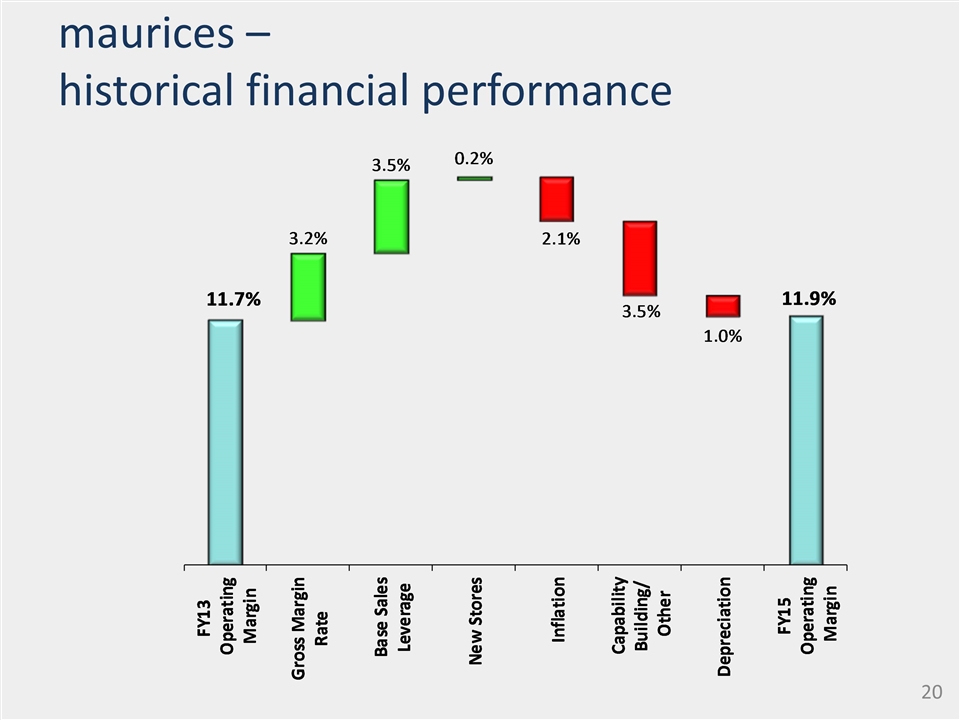

maurices – historical financial performance

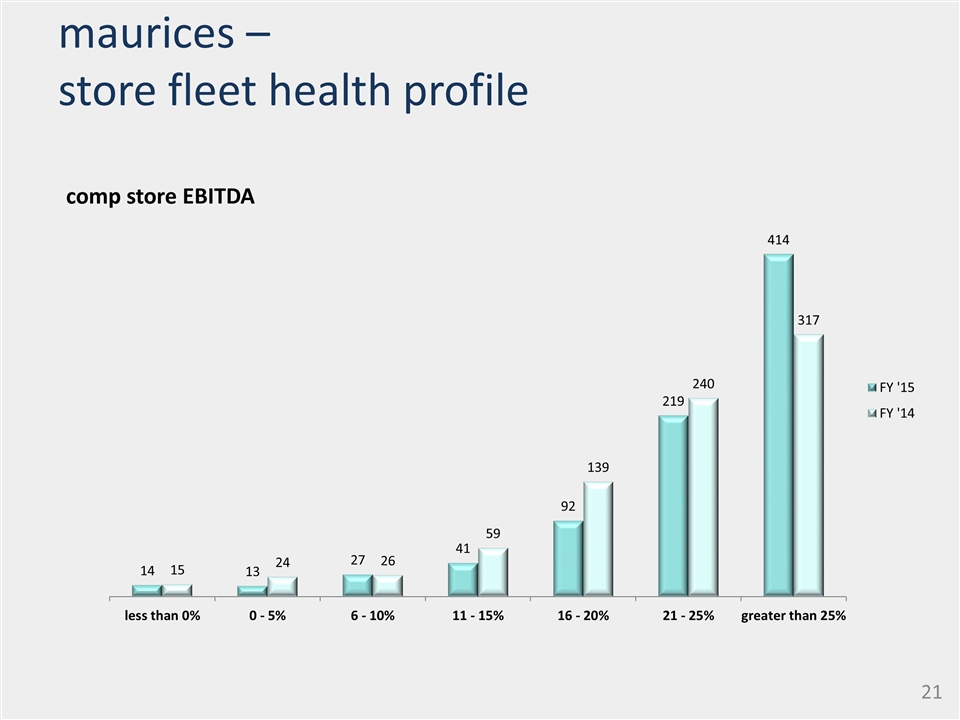

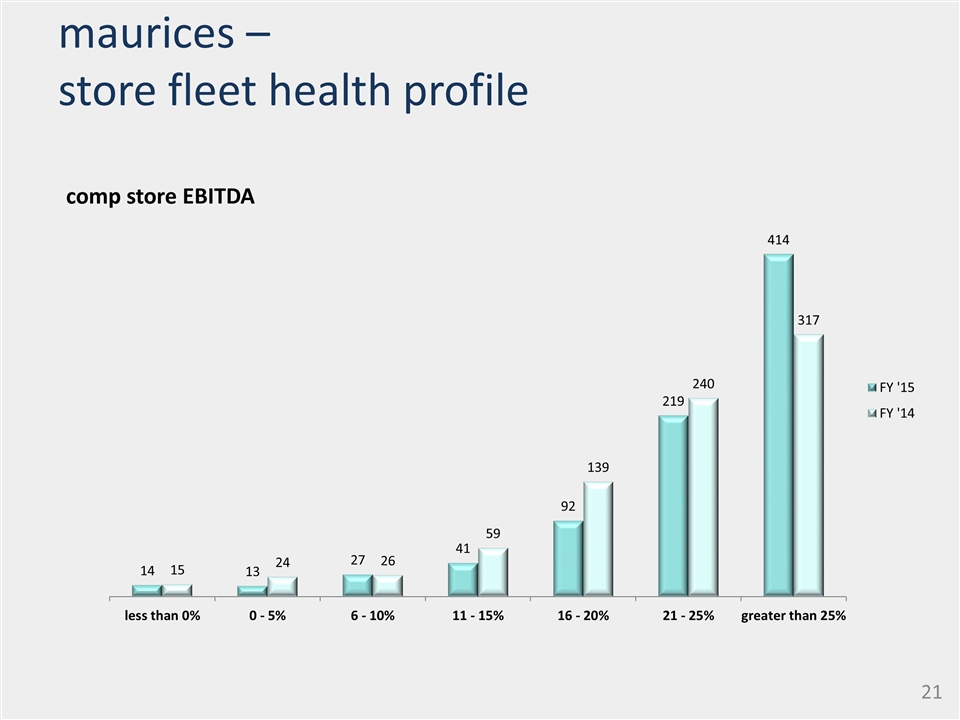

maurices – store fleet health profile comp store EBITDA

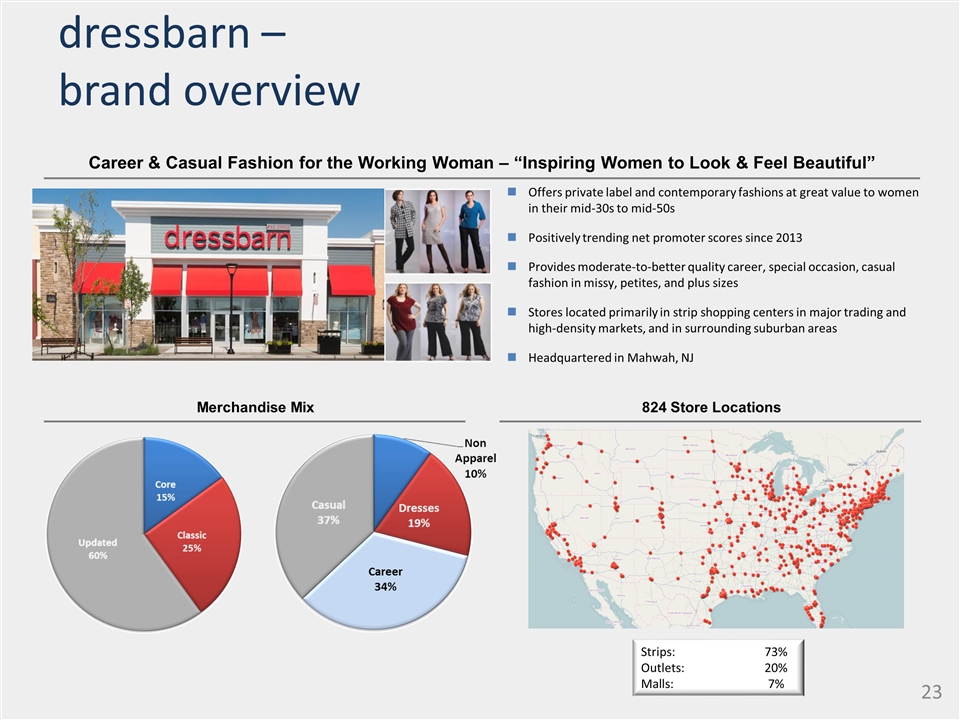

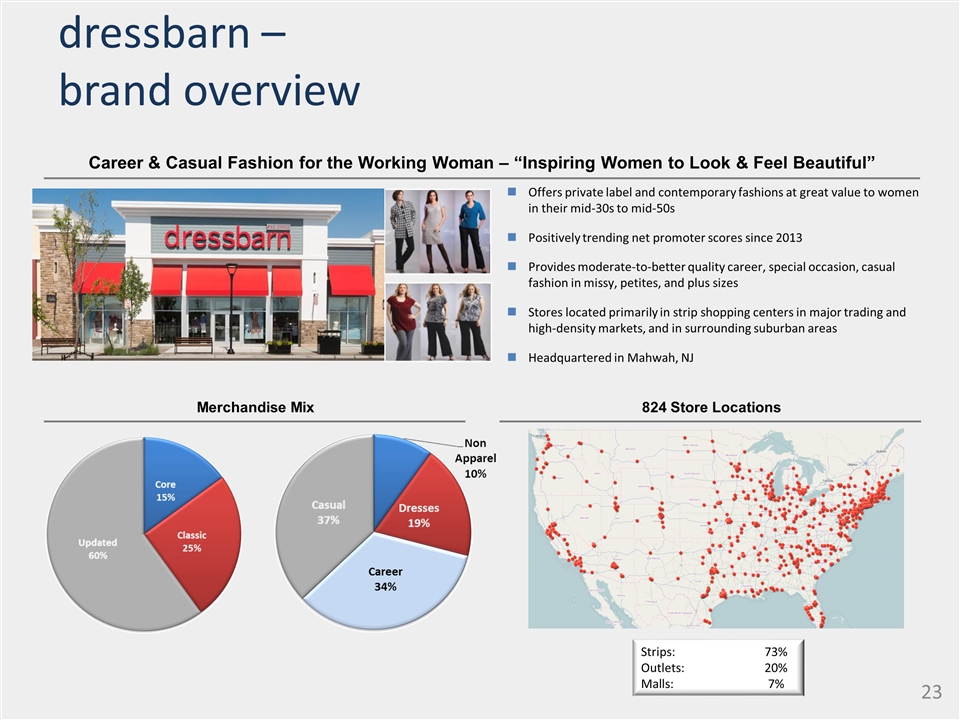

dressbarn – brand overview Career & Casual Fashion for the Working Woman – “Inspiring Women to Look & Feel Beautiful” Merchandise Mix 824 Store Locations Offers private label and contemporary fashions at great value to women in their mid-30s to mid-50s Positively trending net promoter scores since 2013 Provides moderate-to-better quality career, special occasion, casual fashion in missy, petites, and plus sizes Stores located primarily in strip shopping centers in major trading and high-density markets, and in surrounding suburban areas Headquartered in Mahwah, NJ Strips:73% Outlets:20% Malls:7%

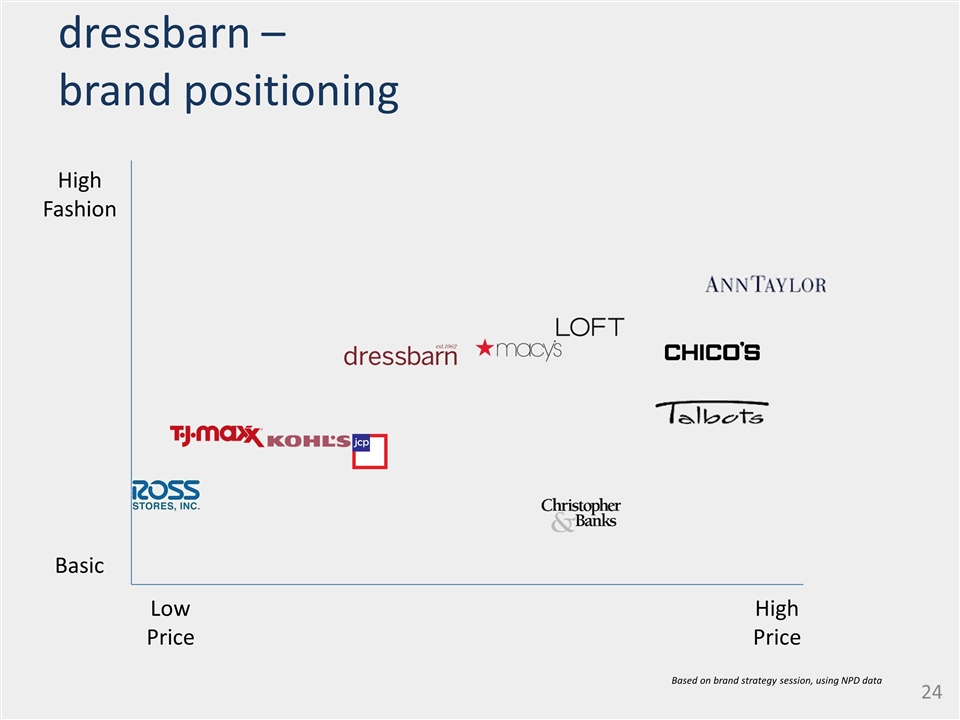

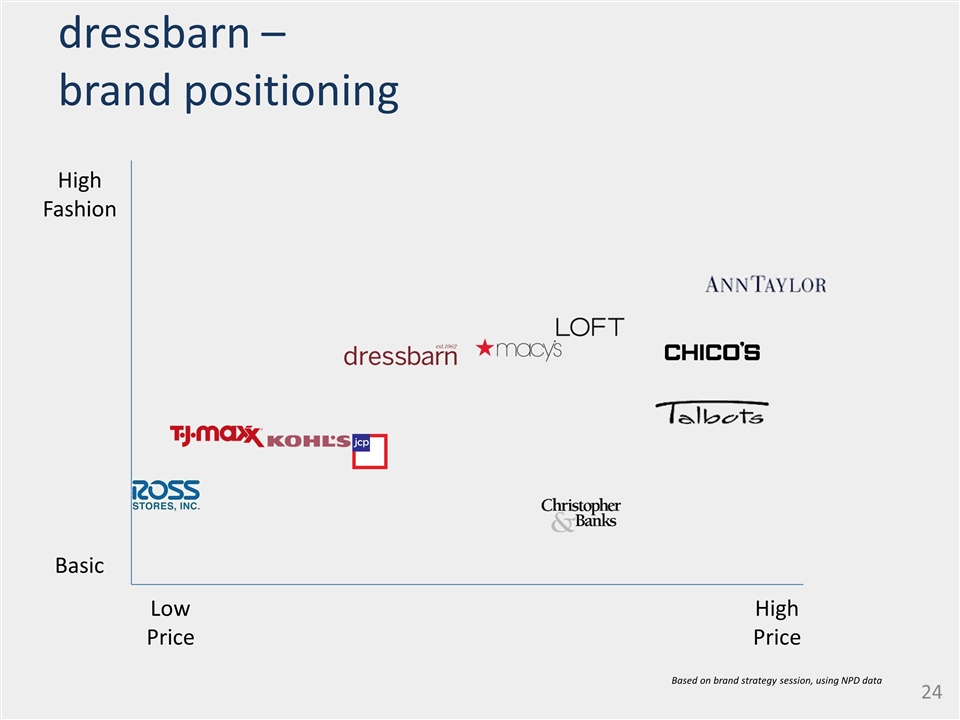

dressbarn – brand positioning Basic High Fashion High Price Low Price Based on brand strategy session, using NPD data

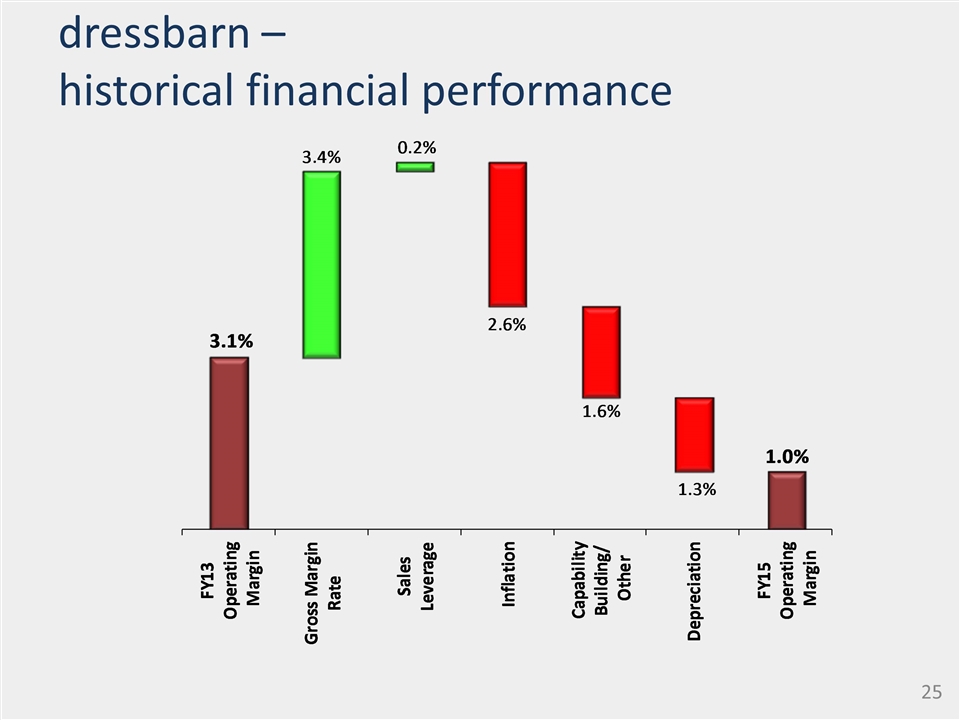

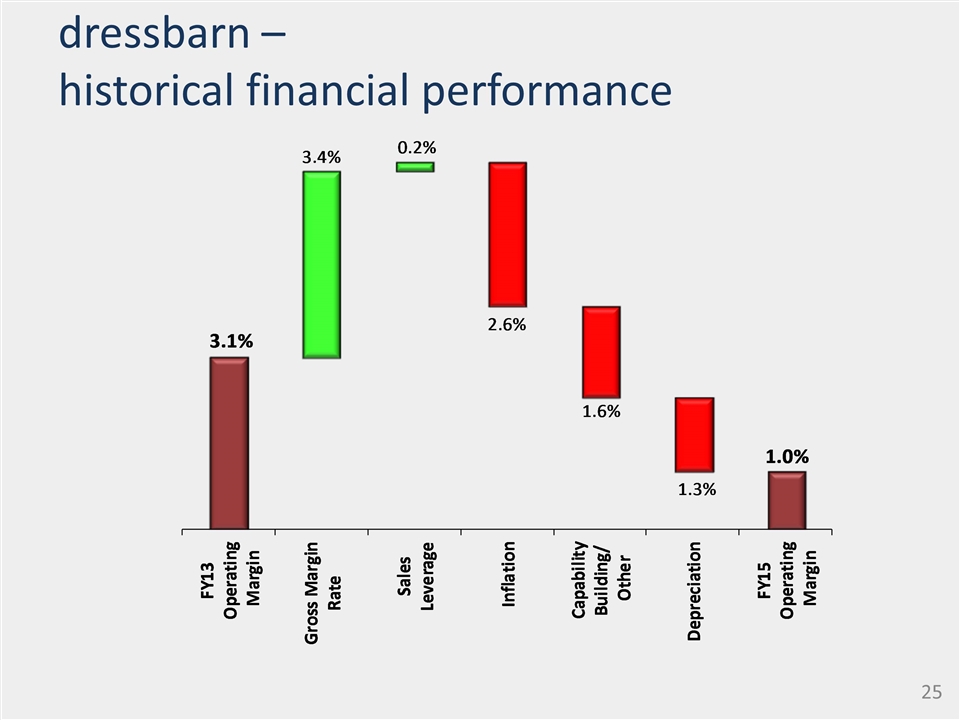

dressbarn – historical financial performance

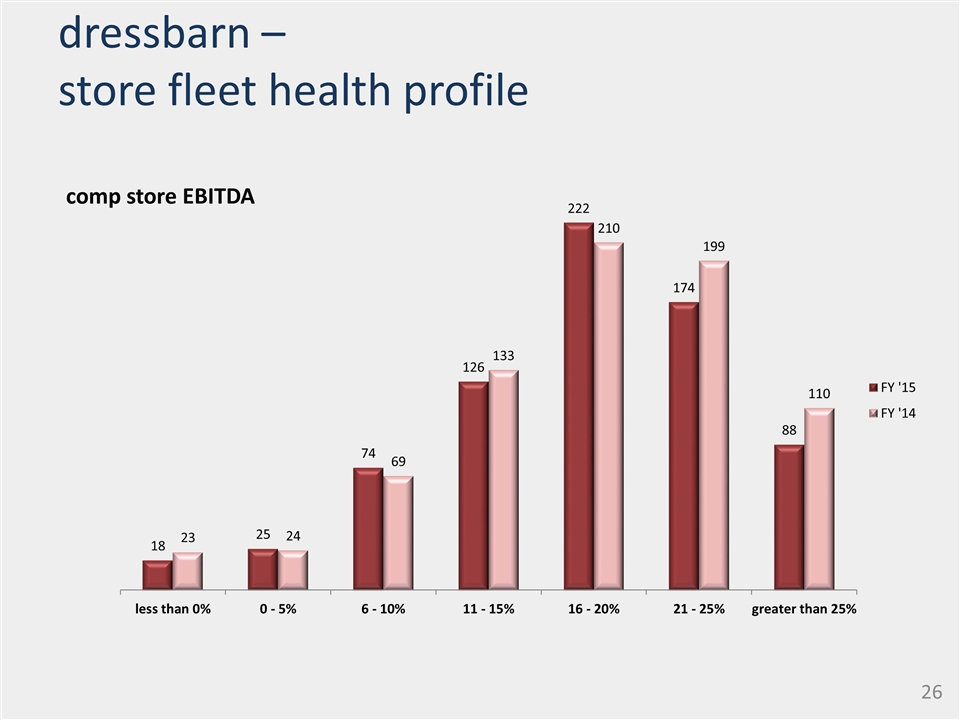

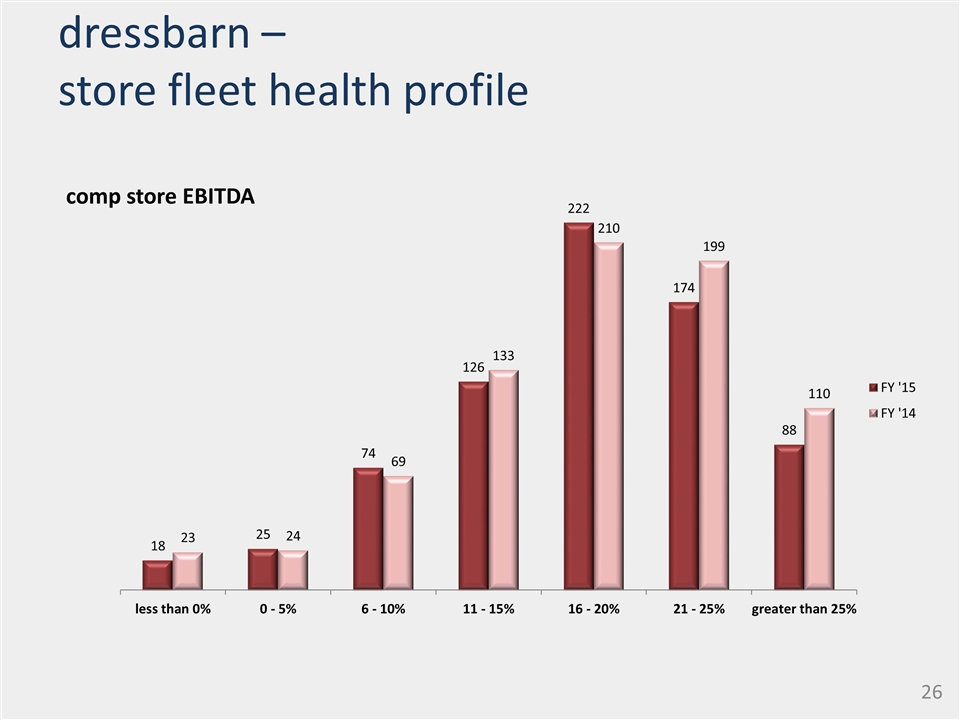

dressbarn – store fleet health profile comp store EBITDA

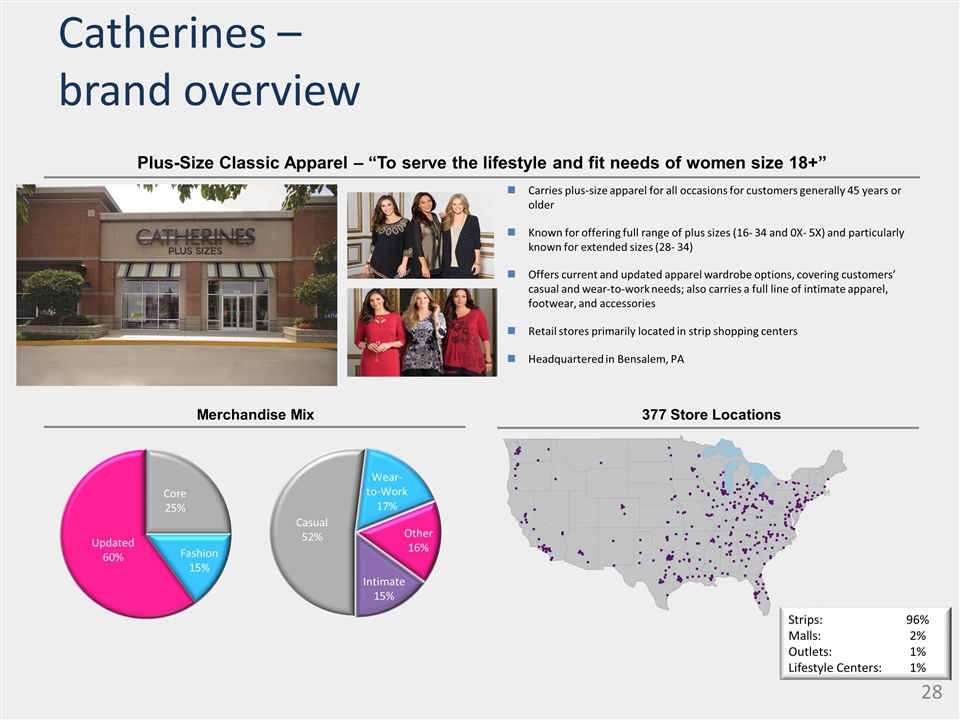

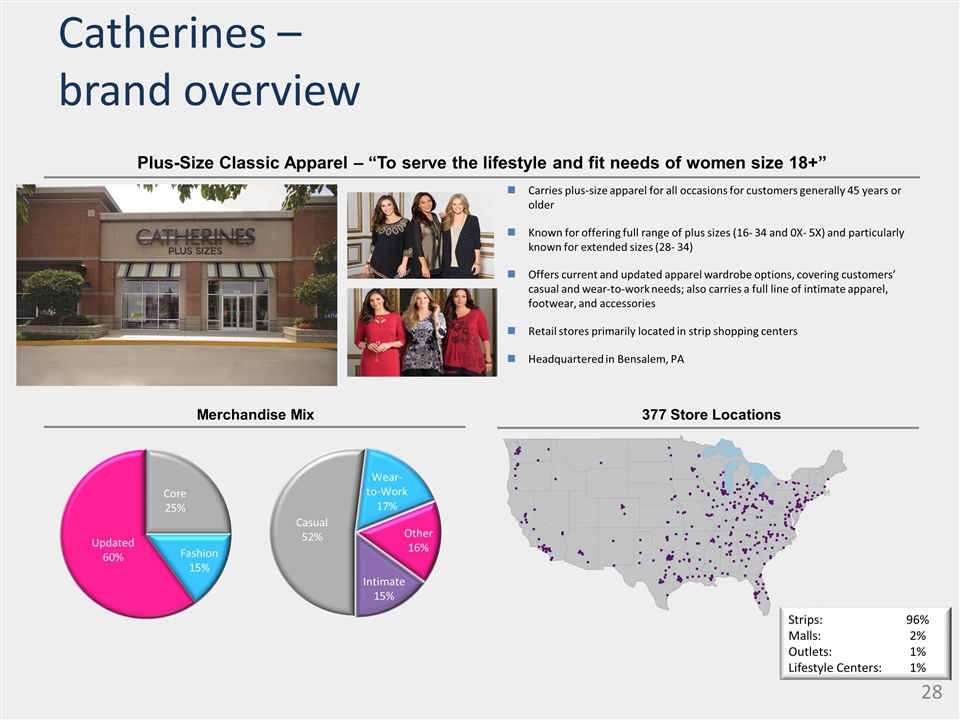

Catherines – brand overview Plus-Size Classic Apparel – “To serve the lifestyle and fit needs of women size 18+” Merchandise Mix 377 Store Locations Carries plus-size apparel for all occasions for customers generally 45 years or older Known for offering full range of plus sizes (16- 34 and 0X- 5X) and particularly known for extended sizes (28- 34) Offers current and updated apparel wardrobe options, covering customers’ casual and wear-to-work needs; also carries a full line of intimate apparel, footwear, and accessories Retail stores primarily located in strip shopping centers Headquartered in Bensalem, PA Strips:96% Malls:2% Outlets:1% Lifestyle Centers:1%

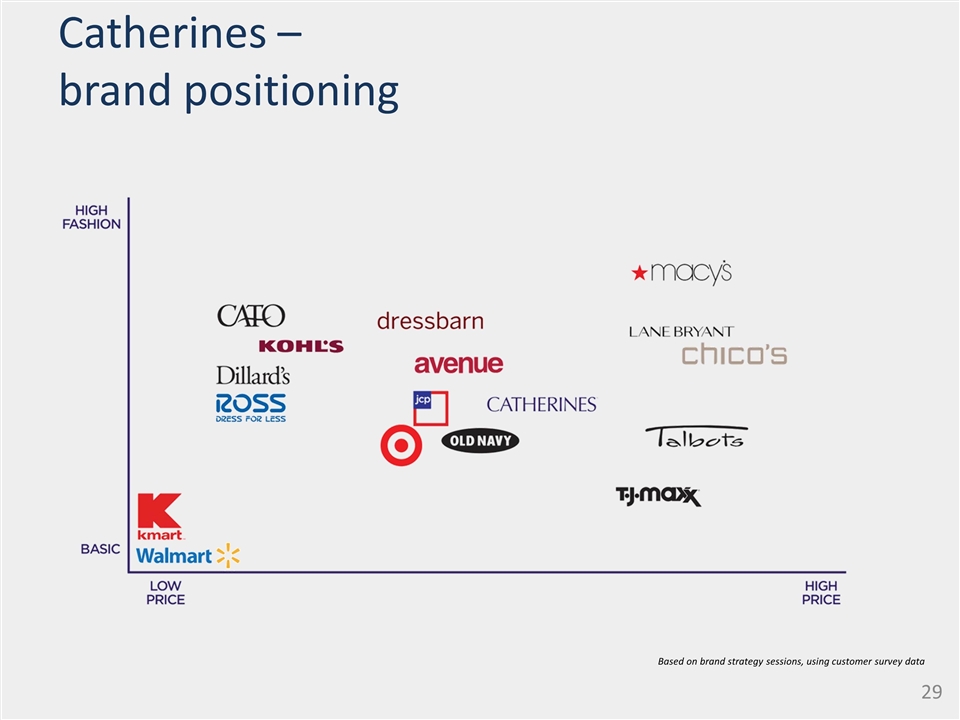

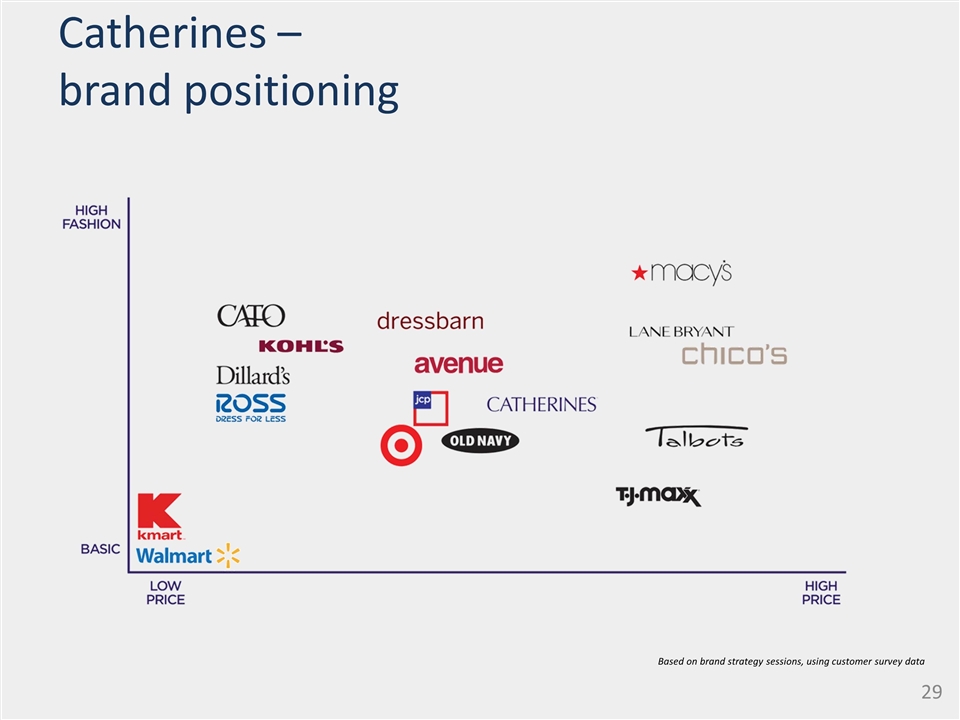

Catherines – brand positioning Based on brand strategy sessions, using customer survey data

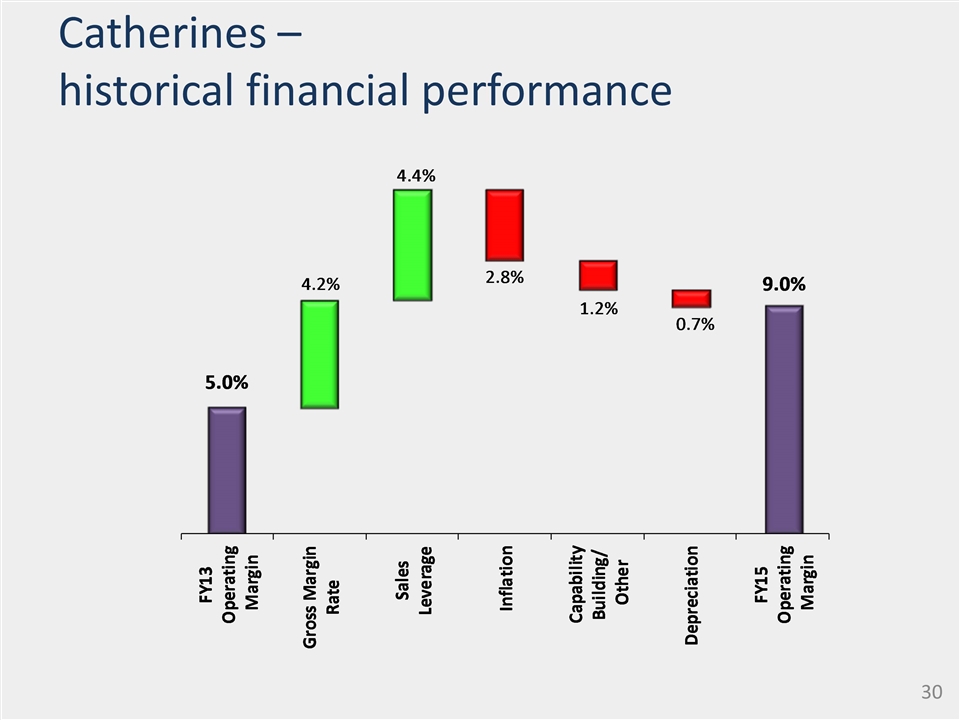

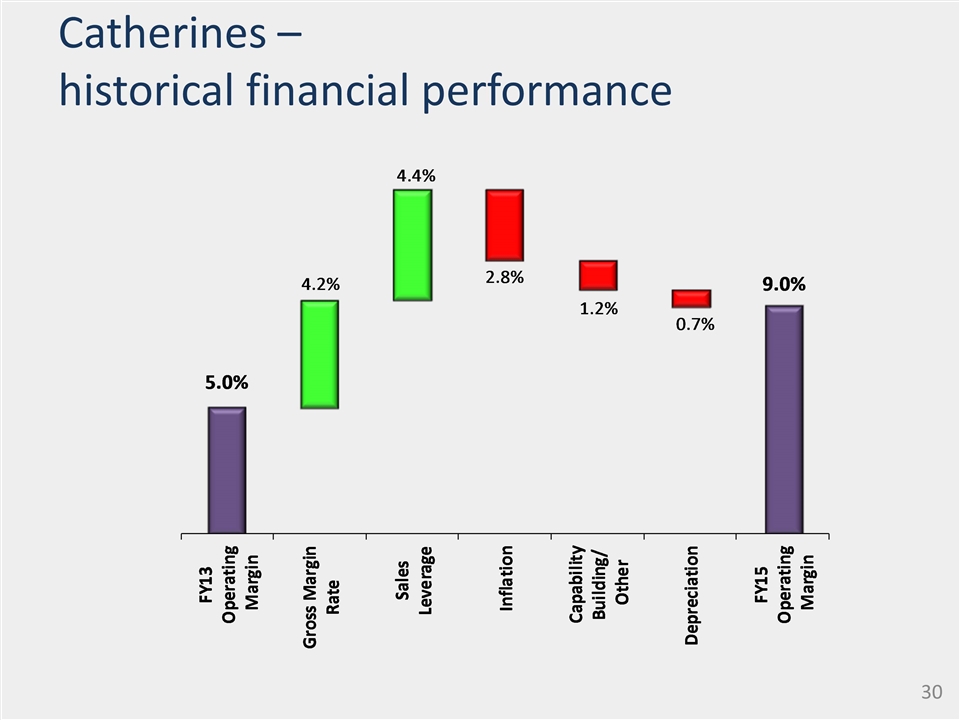

Catherines – historical financial performance

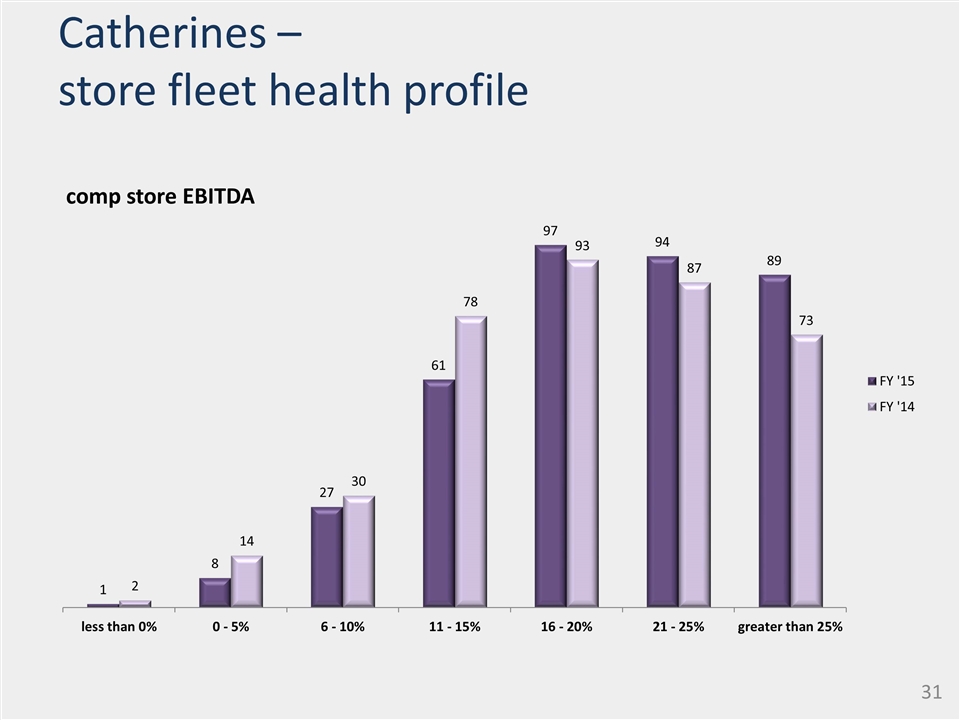

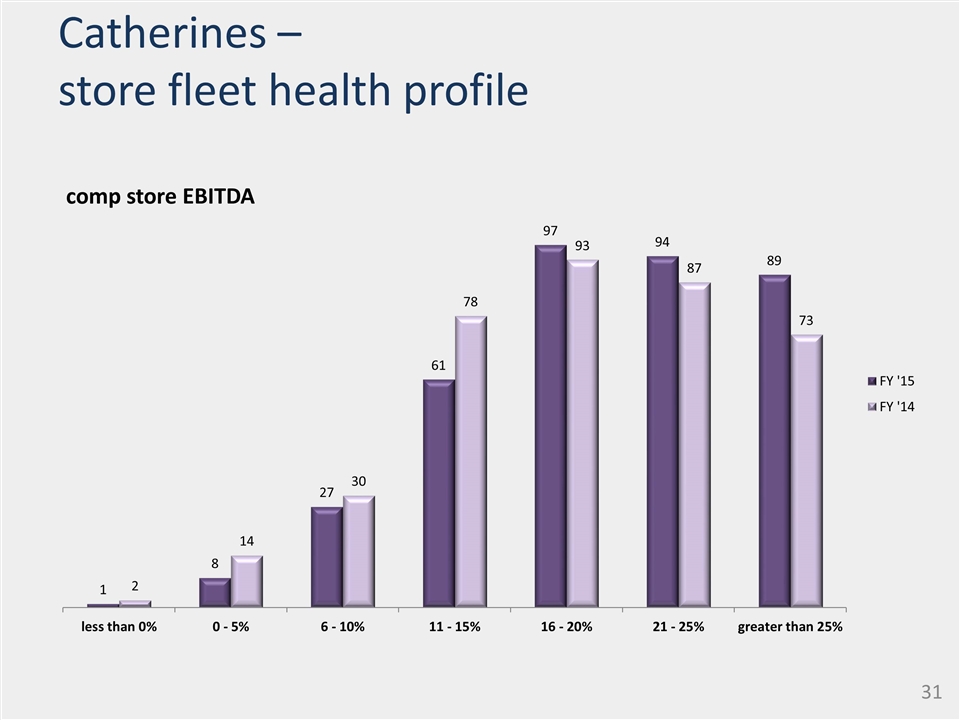

Catherines – store fleet health profile comp store EBITDA

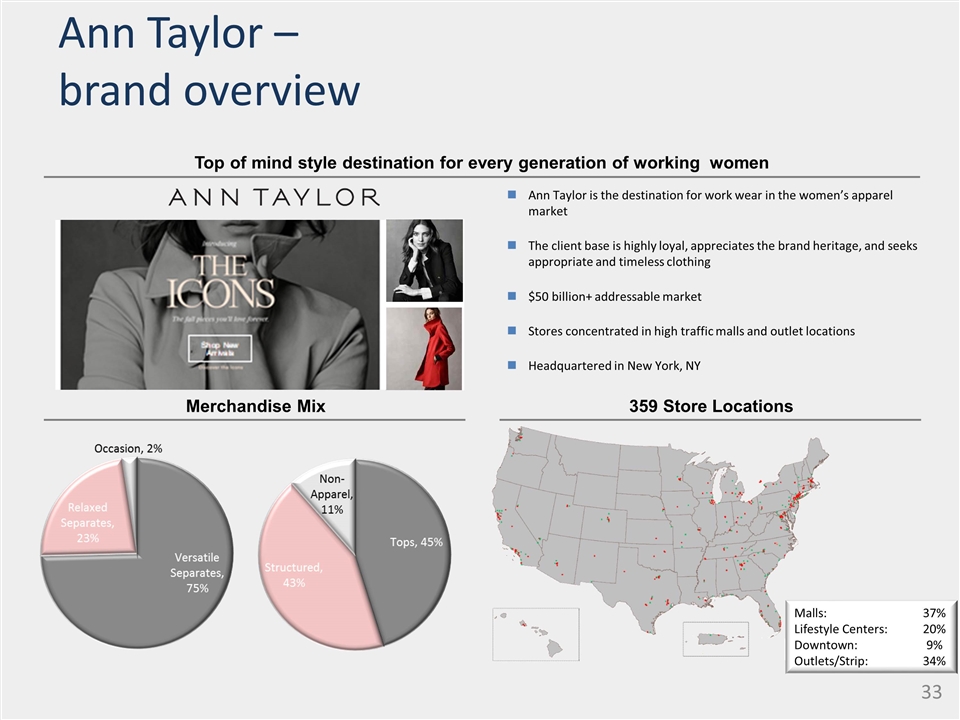

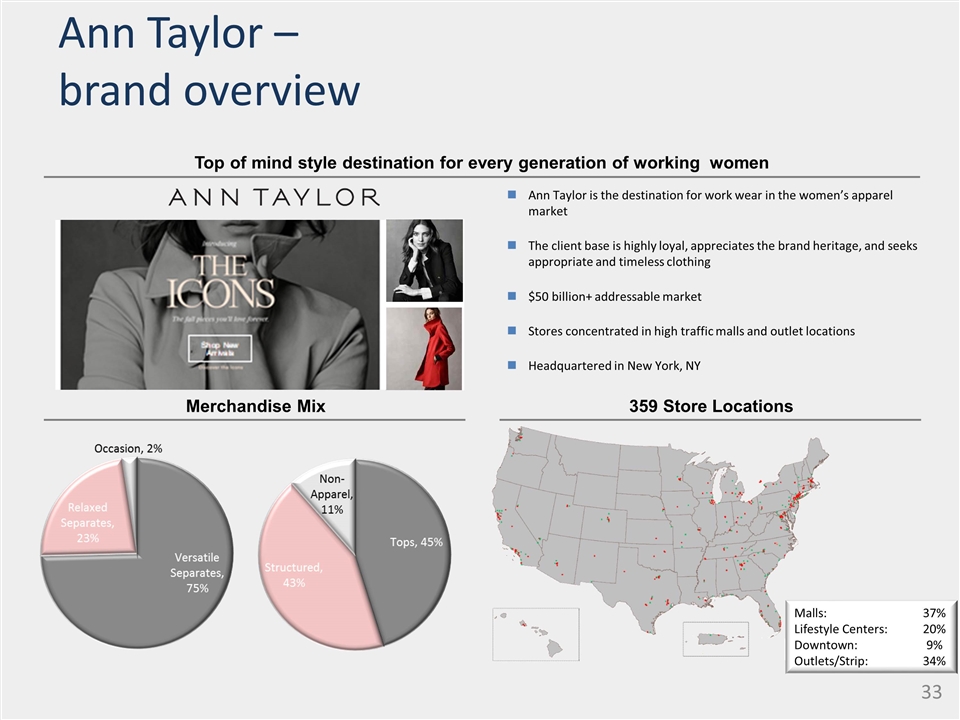

Ann Taylor – brand overview Merchandise Mix 359 Store Locations Ann Taylor is the destination for work wear in the women’s apparel market The client base is highly loyal, appreciates the brand heritage, and seeks appropriate and timeless clothing $50 billion+ addressable market Stores concentrated in high traffic malls and outlet locations Headquartered in New York, NY Malls:37% Lifestyle Centers:20% Downtown:9% Outlets/Strip: 34% Top of mind style destination for every generation of working women

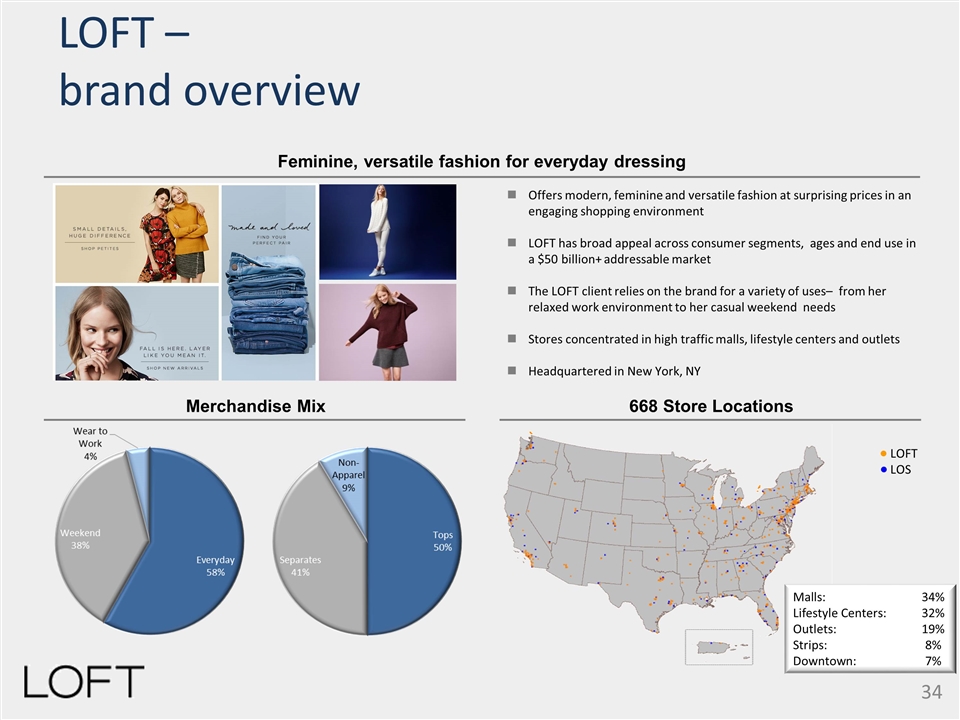

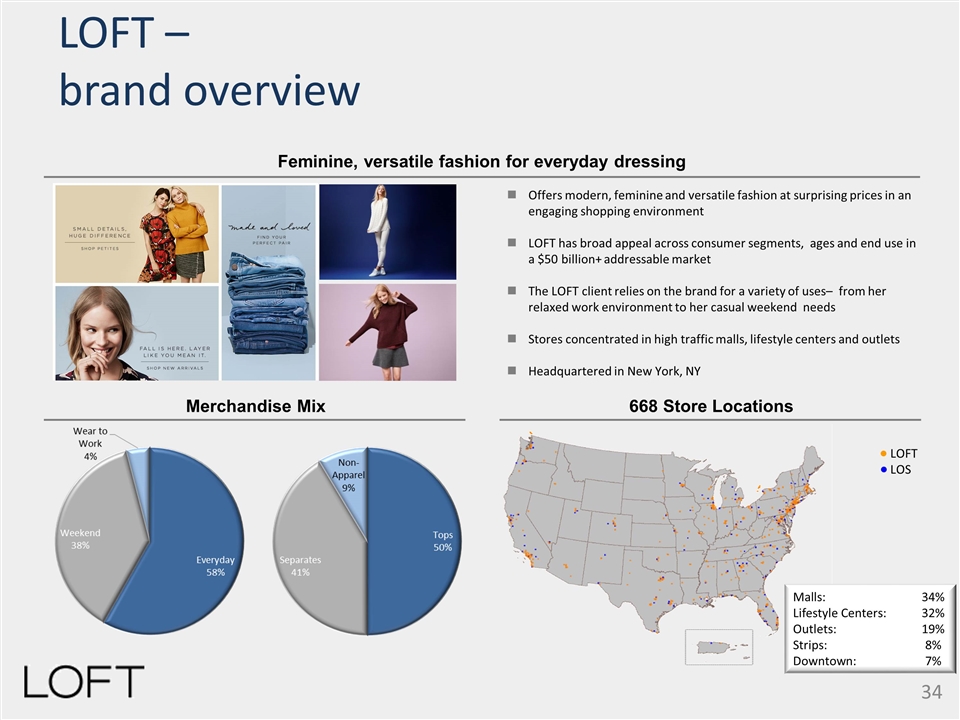

LOFT – brand overview Feminine, versatile fashion for everyday dressing Merchandise Mix 668 Store Locations Offers modern, feminine and versatile fashion at surprising prices in an engaging shopping environment LOFT has broad appeal across consumer segments, ages and end use in a $50 billion+ addressable market The LOFT client relies on the brand for a variety of uses– from her relaxed work environment to her casual weekend needs Stores concentrated in high traffic malls, lifestyle centers and outlets Headquartered in New York, NY Malls:34% Lifestyle Centers: 32% Outlets:19% Strips:8% Downtown:7% LOFT LOS

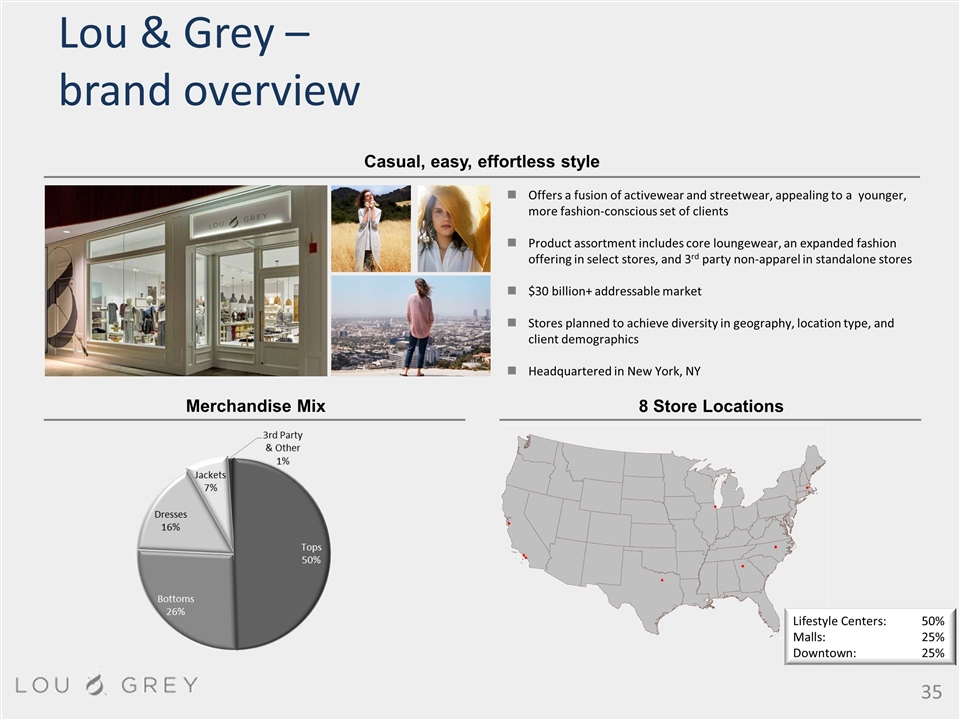

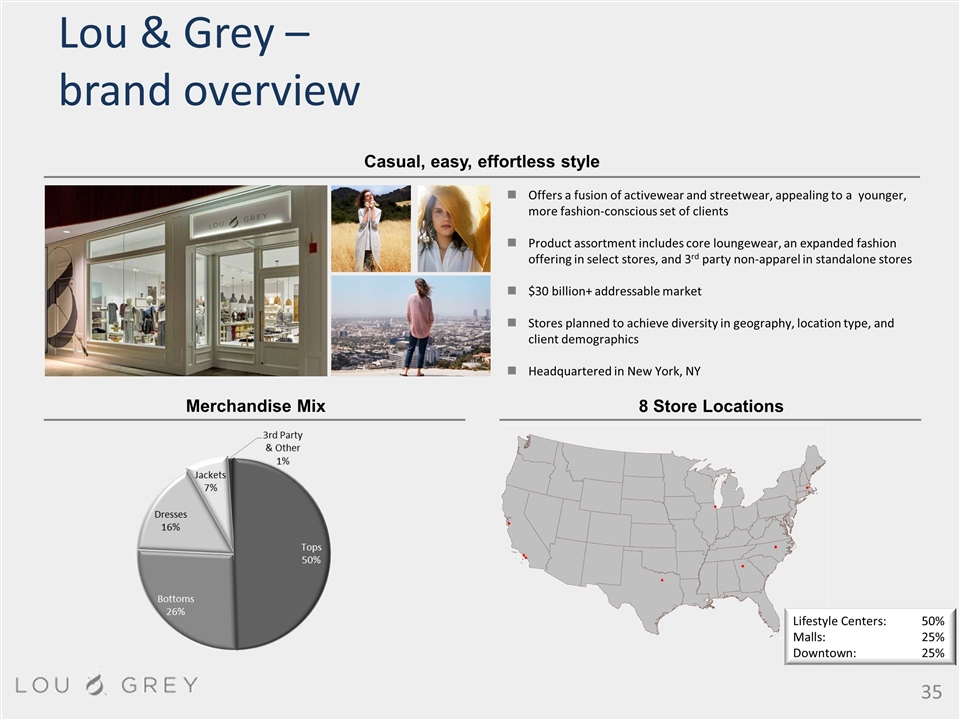

Lou & Grey – brand overview Casual, easy, effortless style Merchandise Mix 8 Store Locations Offers a fusion of activewear and streetwear, appealing to a younger, more fashion-conscious set of clients Product assortment includes core loungewear, an expanded fashion offering in select stores, and 3rd party non-apparel in standalone stores $30 billion+ addressable market Stores planned to achieve diversity in geography, location type, and client demographics Headquartered in New York, NY Lifestyle Centers:50% Malls:25% Downtown:25%

ANN INC – brand positioning Formal / Work Casual Premium Value Based on KSA web and store audits of women’s apparel assortments

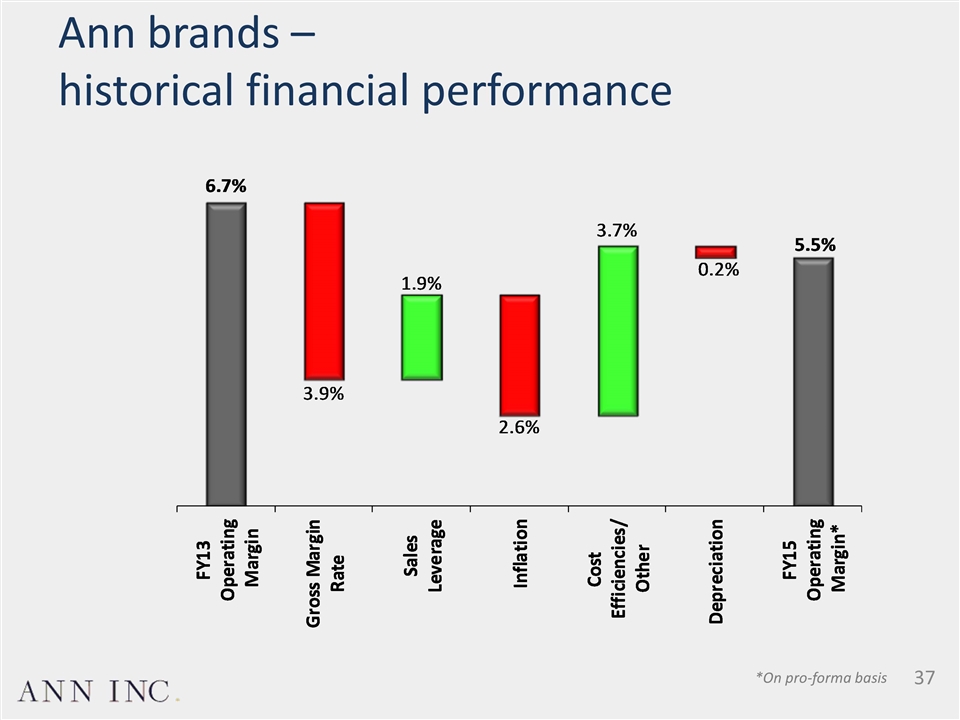

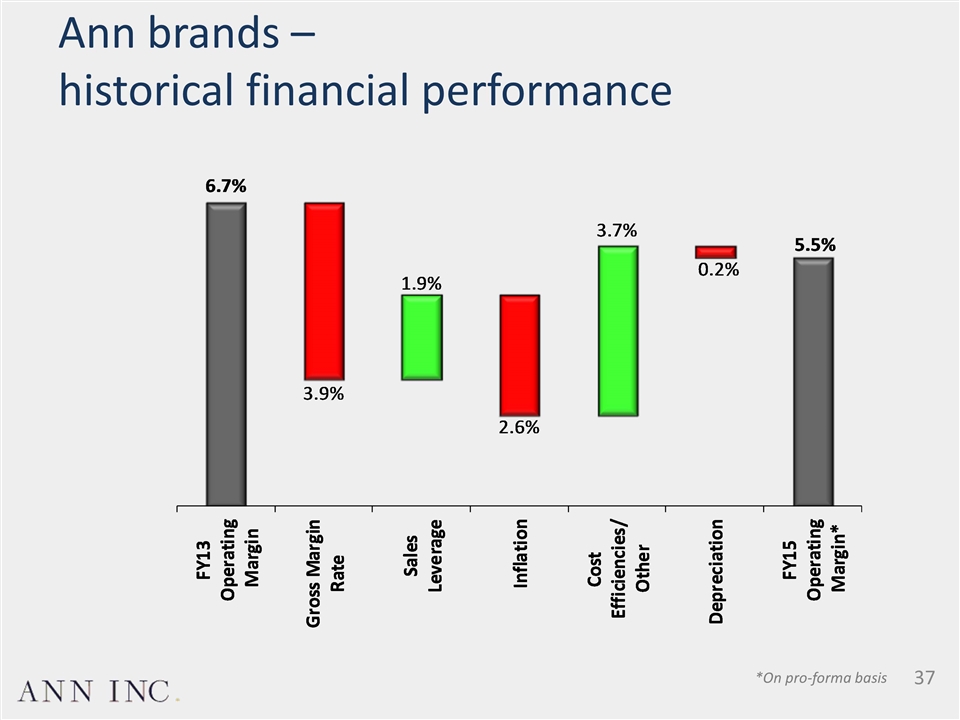

Ann brands – historical financial performance *On pro-forma basis

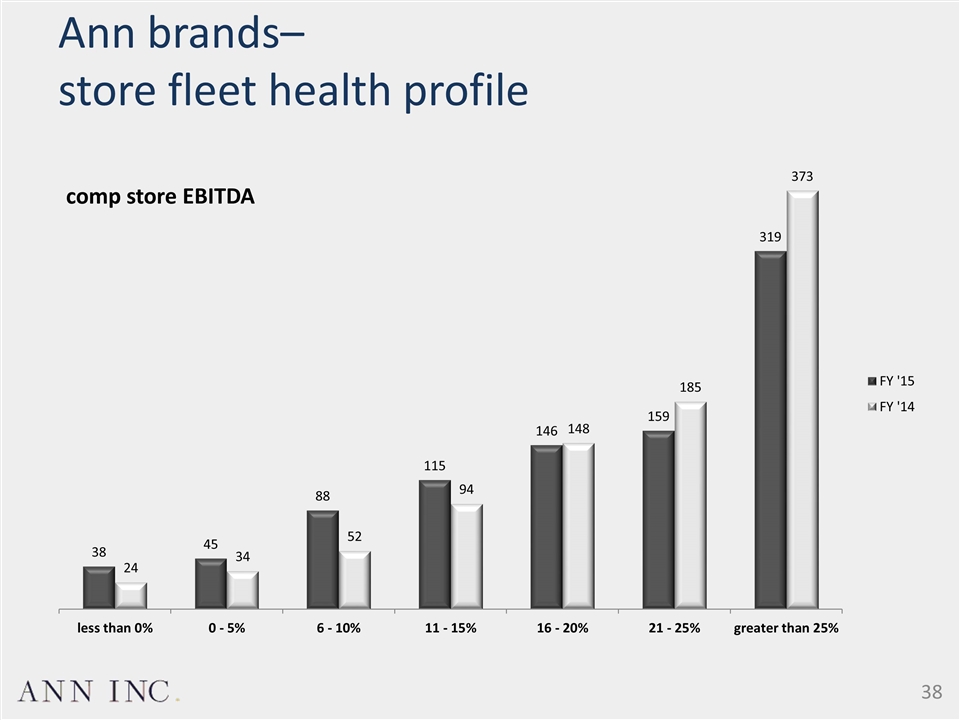

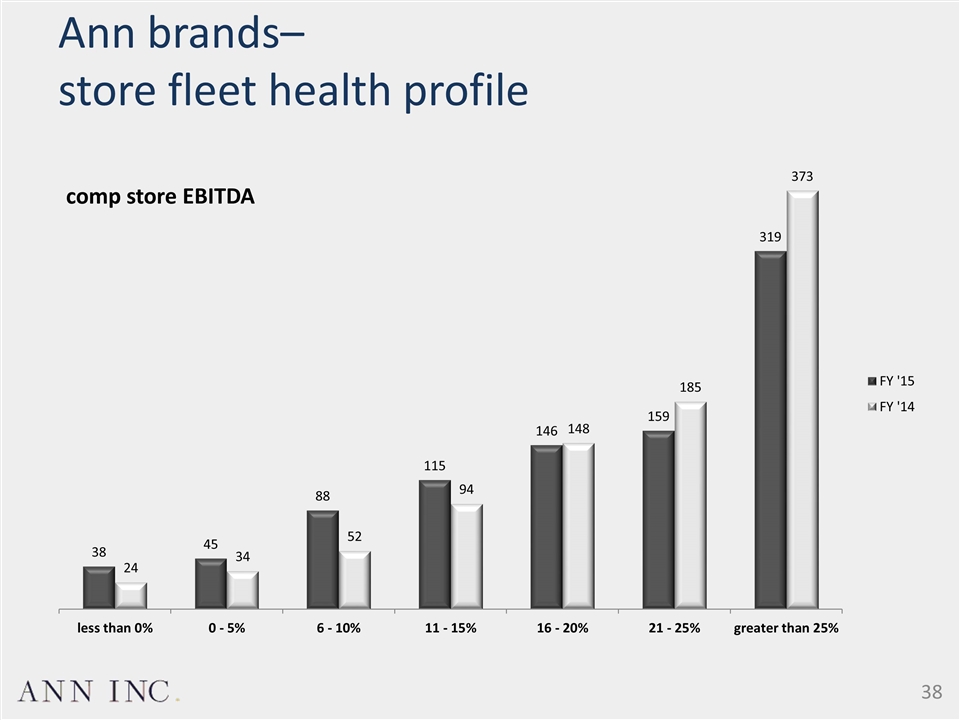

Ann brands– store fleet health profile comp store EBITDA