UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22468

Ashmore Funds

(Exact name of registrant as specified in charter)

c/o Ashmore Investment Advisors Limited

61 Aldwych

London WC2B 4AE

England

(Address of principal executive offices) (Zip code)

Corporation Service Company

84 State Street

Boston, MA 20109

(Name and address of agent for service)

Registrant’s telephone number, including area code: 011-44-20-3077-6000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2016

Item 1. Reports to Stockholders.

2

ASHMORE FUNDS

SEMI ANNUAL FINANCIAL STATEMENTS

April 30, 2016

ASHMORE FUNDS

TABLE OF CONTENTS

* Effective November 8, 2015, the Ashmore Emerging Markets Debt Fund changed its name to the Ashmore Emerging Markets Hard Currency Debt Fund and the Fund made certain related changes to its principal investment strategies. The performance information in this report was achieved using the Fund’s previous principal investment strategies. For more information, see Note 1: “Organization.”

** Effective February 29, 2016, the Ashmore Emerging Markets Equity Fund changed its name to the Ashmore Emerging Markets Value Fund. For more information, see Note 1: “Organization.”

Ashmore Investment Management (US) Corporation is the Distributor for the Ashmore Funds.

This material is authorized for use only when preceded or accompanied by the current Ashmore Funds’ prospectuses. Investors should consider the investment objectives, principal risks, charges and expenses of these Funds carefully before investing. This and other information is contained in the Funds’ prospectus. Please read the prospectus carefully before you invest or send money.

A Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT

For the period November 1, 2015 to April 30, 2016

Overview

The reporting period got off to a difficult start as investors digested a combination of poor global growth figures and sharp sell-off in the Chinese equity markets due to concerns about the trajectory of growth of the Chinese economy. There was also a divergence in monetary policy in the developed world as the US Federal Reserve finally hiked interest rates in December while the European Central Bank further expanded its Quantitative Easing (QE) program in December and the Bank of Japan moved to negative interest rates in early 2016. Indeed, the turn of the year saw renewed market volatility with a sharp sell-off across all asset classes as concerns over growth, both globally and China, continued to be at the forefront of investors’ minds.

In the US, Fed chairwoman Janet Yellen finally bit the bullet and announced a 25 bps hike in the Fed Funds target at the December FOMC meeting, over 11 years after the start of the previous hiking cycle in 2004. Few investors were surprised, considering the benign US economic data and careful communication of intentions; investor relief was evident as the S&P rallied 1.45%, high yield spreads tightened 11 bps and the US 10 year bond yield was largely unchanged on the day of the Fed’s announcement. European Central Bank (ECB) President Draghi moved rates further into negative territory at the December 3 ECB meeting with a cut in the deposit rate to -0.30%, and fell short of expectations on the expansion of the QE program, which many attributed as a clear victory for the hawks within the Governing Council. This led to the unwinding of long Eurostoxx 50/short EUR positions. European bourses ended sharply lower on the month, with the Eurostoxx 50 down 6.8% in December.

One other important policy development was the publication by the China Foreign Exchange Trade System (CFETS) of a new currency basket comprised of 13 currencies, of which USD is 26% and EUR is 21%. This index signals that the Chinese authorities are moving away from a pure bilateral exchange rate of RMB against USD in favor of a more global reference basket for the Chinese currency. This new policy instrument, combined with weaker fixings in late December, is contributing to the de-anchoring of CNY (onshore) and CNH (offshore) from the USD.

The first four months of 2016 saw the sharpest risk reversal in global financial markets since 2009, with a very strong finish in April erasing most of the early losses, as Emerging Markets (EM) outperformed significantly across equities and fixed income markets. The year opened with the worst January since 2009 (Shanghai composite -23%, S&P -5%). Concerns about China and fears of Renminbi devaluation fueled a sharp drop in commodity prices and a dramatic widening in credit spreads. Oil prices dropped by 21% in two weeks, to below USD 30 per barrel, before recovering somewhat in late January. The US High Yield (HY) market was hit particularly hard owing to its large exposure to distressed shale oil producers and a surge in mutual fund outflows. European financials and capital securities seized up, as concerns about profitability and liquidity were exacerbated by the ECB’s second deposit rate cut to negative in December.

However, as global equity markets fell precipitously and credit markets tightened, short-dated US Treasury yields dropped by 30 bps and the market nearly entirely priced out the probability of any further Fed Fund rate hikes in 2016. This was a very important development for global currency markets; for the last three years the largest consensus view has been that the US Fed would be the only major central bank with room to hike policy rates, and that as a result the US dollar could only rise. Suddenly, the market realized that the Fed could not hike rates much further, lest global markets fall further under the weight of tighter liquidity (due to hedging needs and flight into the US dollar by global corporations and households).

A weaker Dollar and a ’truce’ in the period of monetary policy divergence that dominated most of the last year was enough to send global markets sharply higher in March. Emerging Markets (EM) currencies did especially well over the period, helped by a very favorable technical position. As soon as Emerging Markets Foreign Exchange stabilized, foreigners and domestic investors could no longer keep their long US dollar positions and hedged at extremely high costs (negative carry), precipitating a scramble to sell US dollars.

The net result for EM fixed income indices over the period was positive; the JP Morgan EMBI GD index was up 5.4%. The broad corporate bonds index (JP Morgan CEMBI BD) was up 3.8%, with the high yield index outperformed at 5.0%. The reference local currency bond index; the JP Morgan GBI-EM GD was up +8.9%, and the reference local currency FX index (JPM ELMI+) was up 3.8%.

1

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Portfolio Overview

Ashmore Emerging Markets Total Return Fund

The Ashmore Emerging Markets Total Return Fund (“the Fund”) seeks to achieve its objective by investing principally in the debt instruments of sovereign, quasi-sovereign, and corporate issuers, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency.

Over the period, the Fund’s institutional class outperformed its benchmark. Local currency was the main contributor to relative performance, while corporate debt was the largest detractor. Among the Fund’s best performing positions were Brazil, Ecuador, and Venezuela. Colombia, Mongolia, and Nigeria were the main detractors from performance.

Ecuador bonds rallied as the government adopted a pro-active stance in response to the dramatic drop in oil prices, announcing expenditure cuts and confirming agreement on a series of multilateral loans, primarily from China, that would cover the country’s financing needs. Having exited the IG index, Brazil was also a strong performer as the curve flattened, the current account deficit moderated and FDI remained resilient. Nigerian credits have been under pressure for most of the period; an offshore oil transportation company was one of the worst hit names, with pressure on daily rates for ships translating into a weak set of results for 2015. Fleet utilization decreased as well by about 25% as local and international operators have been reducing capex.

Ashmore Emerging Markets Hard Currency Debt Fund

The Ashmore Emerging Markets Hard Currency Debt Fund (“the Fund”) (formerly known as the Ashmore Emerging Markets Debt Fund) seeks to achieve its objective by investing principally in debt instruments of, and derivative instruments related to, Sovereign, Quasi-Sovereign and Corporate issuers of EM countries that are denominated in hard currencies (i.e., the U.S. dollar or any currency of a nation in the G-7).

Over the period, the Fund’s institutional class underperformed its benchmark; the JP Morgan EMBI Global Diversified index, which returned 5.35%. Among the Fund’s best performing positions were Ecuador, Venezuela, and Ukraine. Colombia, Indonesia, and Brazil were the main detractors.

As with the Ashmore Emerging Markets Total Return Fund, the Fund benefited from its positions in Ecuador bonds which rallied as the government adopted a pro-active stance in response to the dramatic drop in oil prices, announcing expenditure cuts and confirming agreement on a series of multilateral loans, primarily from China, that would cover the country’s financing needs.

Ashmore Emerging Markets Local Currency Bond Fund

The Ashmore Emerging Markets Local Currency Bond Fund (“the Fund”) seeks to achieve its objective by investing principally in the debt instruments of sovereign and quasi-sovereign EM issuers, denominated in the local currency of the issuer. The Fund’s returns are driven by EM currency appreciation, interest rate positioning and credit worthiness.

EM currencies are not only supported by stronger growth, more robust fundamentals and higher interest rates than developed markets, but it is also likely that a gradual depreciation of developed market currencies will be one mechanism by which developed markets will de-leverage and reduce their enormous debt burdens. In terms of bonds, we continue to find attractive opportunities across EM countries. EM monetary policymakers are acting in an idiosyncratic fashion to meet their particular domestic needs and local expertise is increasingly necessary to help understand the dynamics that drive local decision-making.

Over the period, the Fund’s institutional class outperformed its benchmark. The Fund’s top EM contributors for the period were gains from positions in the Brazilian Real, Chinese renminbi, and Argentine peso. The Mexican peso, Polish zloty, and South African rand were the most significant detractors from performance.

Brazilian bonds benefited from the end of the monetary tightening cycle, the weakening of the US dollar, rises in commodity prices and a higher likelihood of impeachment of the president.

2

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Ashmore Emerging Markets Corporate Debt Fund

The Ashmore Emerging Markets Corporate Debt Fund (“the Fund”) seeks to achieve its objective by investing principally in the debt instruments of EM corporate issuers, which may be denominated in any currency, including the local currency of the issuer. EM corporates operate in an environment that typically consists of higher growth and maturing capital markets. In many cases, EM corporates are characterized by new and growing businesses in industries such as mobile communications, technology and food production. We expect these industries to benefit from the developing economies in which they operate. Increased “south/south” trade (between EM countries as opposed to trade with developed markets) and development of domestic markets have resulted in a material structural change for EM corporates and has helped them to broaden their customer bases. We continue to focus efforts on companies that are less followed by the market and which thus allow us to add maximum value based on our views, research and global EM network capabilities.

Over the period, the Fund’s institutional class underperformed its benchmark, the JP Morgan CEMBI Broad Diversified index, which rose 3.84%. The Fund’s top contributors were positions in Brazil, Venezuela and Ecuador, while Colombia, Mongolia, Russia, and the Czech Republic were the largest detractors from performance.

An overweight position in Brazil was the largest absolute contributor to performance, notably following the loss of the country’s investment grade rating from Moody’s in late February. Holdings in Petrobras and Vale were notable contributors in a period of political turmoil and an economic downturn. The position in Venezuela also added value, especially in the short end of the curve, riding the reaction to the shift in global oil prices during the period.

Mongolia detracted from performance as bonds of a Mongolian coal mine suffered weakness over the period from declines in coal prices. The company is the largest producer of coking coal in Mongolia, but the lack of adequate infrastructure between Mongolia and China means that the company has to Transport its coal by truck to the Chinese steel plants in the north. With coal prices being so low in recent months, the shipping cost has become a real problem for the company.

Technicals remain supportive of market performance, especially given weak new issuance in the first quarter of 2016 as supply was 33% less than the year before. With USD 158bn in coupons and principal repayments scheduled for 2016 and in excess of USD 40bn of bond buybacks to be conducted by EM companies this year, total issuance for 2016 might well come in under USD 200bn for the full year, potentially leaving the market in a situation of negative net supply. International investors who exited EM last year are now underweight and are potentially looking for the right trigger to get back into the market. The fact that issuance is picking up is a good sign for the markets, because it shows that investors’ appetite for EM credit has started to come back.

Ashmore Emerging Markets Short Duration Fund

The Ashmore Emerging Markets Short Duration Fund (“the Fund”) seeks to achieve its objective by investing principally in short-term debt instruments of, and derivative instruments related to, Sovereign, Quasi-Sovereign and Corporate issuers of EM countries denominated exclusively in Hard Currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain weighted average portfolio duration of between 1 and 3 years. The Fund has no restrictions on individual security duration.

Over the period, the Fund’s institutional class outperformed its benchmark. The Fund’s top contributors for the period were gains from positions in Ecuador, Venezuela, and Brazil. Colombia, Indonesia, and Mongolia were the largest detractors from performance.

The recovery in commodity prices, especially oil, had a positive impact on credits. The Fund benefits from significant “pull to par,” as short-maturity instruments trading at a discount rapidly approach par as the maturity date approaches. The environment of spread widening offered many attractive opportunities to acquire quality credits that were adversely impacted in a general “risk off” environment.

Ashmore Emerging Markets Equity Opportunities Fund

The Ashmore Emerging Markets Equity Opportunities Fund (“the Fund”) seeks to provide exposure through a single investment vehicle to various emerging markets equity strategies managed by the Subadviser. The Fund initially allocated its portfolio approximately in the same proportion among the three existing Underlying Equity Funds: Ashmore Emerging Markets Value Fund, Ashmore Emerging Markets Small-Cap Equity Fund and Ashmore Emerging Markets Frontier Equity Fund.

3

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

These relative allocations may vary over time, and the Fund has the flexibility to invest in other Underlying Funds (including those that may be formed in the future) and directly in securities of other issuers, derivatives and other investments in order to pursue its investment objective.

Ashmore Emerging Markets Value Fund

The Ashmore Emerging Markets Value Fund (“the Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of EM issuers, which may be denominated in any currency, including the local currency of the issuer.

For the six months ended April 30, 2016, EM equities moderately declined by -0.13% (MSCI EM Net), experiencing periods of mark downs and upswings during the period. The first four months of the period saw declines, especially in January 2016, when EM and global equities alike suffered as renewed fears related to lower oil prices, US growth concerns, and slower growth and currency policy uncertainty in China took center stage. In addition, the fits and starts of the use of newly implemented circuit breakers in the domestic (A-share) markets dampened investor sentiment in the early days of trading in China, including in H-share stocks. Trading halts were effectively suspended after the second run at implementing this measure. Furthermore, December FX reserve numbers recorded a sharp decline of USD 106bn, although the decline slowed in January (-USD 99.4bn). Investors’ concerns began to abate as oil and commodity prices picked up and EM currencies began to stabilize. EM equities then staged a strong recovery in March, up 13.5%. Oil prices reached some of their highest levels since November 2015, with WTI up about 20% in April 2016, and buoying sentiment in markets such as Russia and Brazil.

Politics has also been a notable factor, especially in Brazil, as well as in Peru. In Brazil, the majority of the representatives in the lower house voted to move the impeachment process to the Senate. At the time of writing, the majority of the Senate voted in favor of impeachment, causing current President Dilma Rousseff to be suspended, awaiting trial, and the Vice President taking over as Acting President. Market developments in the past few months have signaled that investor sentiment is more aligned to a change in government. In Peru, elections held on April 10 produced two candidates for the presidency largely seen as market friendly. A second-round for the presidential elections is slated for June 5.

The Fund outperformed its benchmark over the period, with country allocation being the primary source of value added, and stock selection modestly contributing. In terms of allocation, our overweight in Peru, Brazil and Russia added most value. The Peruvian economy continued to grow at a brisk pace during Q4 2015 and Q1 2016 resulting in upward revisions to GDP growth for the full year, now closer to 3.8% and driven by primary sectors: mining, construction and infrastructure. We are invested in Credicorp Ltd, the country’s largest fully integrated bank, trading at about 1.8x estimated 2017 price to book value (PBV) with a return on equity (ROE) of 19% 2017E. Investor sentiment in Brazil and Russian sharply recovered with the gain in commodity and energy prices, especially in the latter part of the reporting period. Additionally, while earnings have been in the doldrums for stocks in Brazil especially, we may be at the beginning of a recovery as the operating environment begins to stabilize, especially on the political front. Modest detraction was seen in our overweight in China and Mexico, and lack of exposure in Hungary.

Stock selection added most value in Russia, Korea and UAE, while selection in China, Indonesia and India detracted most. Aeroflot contributed the most. With margins expanding and the company gaining market share following the Transaero merger, we continue to hold onto Aeroflot, as valuations are still reasonable despite its good performance so far. Lotte Chemical (petrochemicals) and Posco (steel) in Korea added value as did Emaar Properties in UAE.

Over the period we have reduced our exposure to China and Taiwan, taking profits in specific holdings as their investment theses played out. We also reduced our allocation to Turkey, as tourism revenues are projected to decline after a spate of terrorist attacks. Tourism is a material driver of GDP growth (10% contribution to GDP) and is expected to reduce GDP growth by over one half percentage point in 2016 as visitors seek safer destinations. Early in the new year (2016), we took advantage of low valuations in Brazil adding stocks in the energy, materials and real estate sectors. We also added to our Russia and Mexico allocations, and initiated a position in the UAE, Emaar Properties.

4

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Many EMs have started the easing cycle, and others may well join, as stronger currencies and lower inflation than feared allows central banks to lower rates. This action is already benefiting housing, commercial and industrial real estate, and farmland throughout EMs. Energy and materials also look attractive. Although we have seen some recovery, we believe these stocks still look underpriced. Should market conditions continue to stabilize, we expect relative valuations to drive returns. In that environment, EM equities are still trading at a discount to developed market equities, and in our view still offer appreciable upside potential even after the good first quarter of 2016. Per Bloomberg data, estimated 2016 price to earnings (PE) for EM is 12x, compared to 16x for developed markets and 17x for the S&P 500.

Ashmore Emerging Markets Small-Cap Equity Fund

The Ashmore Emerging Markets Small-Cap Equity Fund (“the Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of small-capitalization EM issuers, which may be denominated in any currency, including the local currency of the issuer.

EM small-cap stocks had a modest decline of 0.08% during the 6 month period to April 30, 2016 according to the MSCI EM Small Cap Index Net. Markets leading the decline were Greece (-11%), Peru (-11%), Qatar (-10%) and Egypt (-8%). Bucking the trend were small caps in Colombia (+74%), Hungary (+25%), Czech Republic (+23%) and Russia (+21%). Colombia and Russia in particular staged remarkable recoveries, after having gone through a period of marked market and currency declines.

The Fund outperformed its benchmark with country allocation adding value while stock selection detracted. In terms of country, our overweight in Brazil, Colombia and Russia contributed most, while our lack of exposure in South Africa and Malaysia, as well as the allocation to Argentina, detracted.

On a stock basis, weighing most on returns were the holdings in Brazil, China and Korea, although selections in India, Taiwan and Russia helped. Agro-business Adecoagro and parts manufacturer Tupy lost value most in the Brazil holdings – their export related segments were expected to be impacted by the firming in the country’s currency over the period. However, we continue to hold as we believe the underlying businesses remain well valued. Among the China holdings, our holding in Boer Power Holdings lost most during the period. The company manufactures and supplies high tech electrical components to industry (utilities, hospitals, etc.). Following a delay in the release of results, the company restated its balance sheet by adding back certain off-balance sheet receivables factored with banks, thereby turning from a net cash position (22%) to a gearing of 77%. This hurt investor confidence resulting in a significant sell-down of the company’s shares at quarter end. While the receivables are to end clients that are expected to pay back, and the owner-CEO of the company has made an interest free loan to the company and fired the CFO to continue with ongoing capex and regain investor confidence. The firm is now looking to hire a CFO from one of the big four accounting firms. The stock has remained under pressure as investors await any improvements related to changes on the governance and financial controls front. Modetour suffered as Q4 2015 operating profits came in below consensus, although top-line growth remains sustainable. At a forward 2016 PE of 13x, we continue to see value in the company as tourist activity remains strong.

The portfolio’s Indian holdings added value especially the exposure in Balrampur Chini Mills. The company is one of the biggest sugar mills in the country, based in North India. Sugar output in the current season (October 2015 –April 2016) is lower than in recent years and will just about meet India’s local demand. In addition, government subsidies have helped export some 1.5m tons in recent months and sugar inventory is at reasonable levels. Poor rains in 2015 have hit cane farmers hard, especially in the state of Maharashtra, India’s biggest cane producing region. As a result, the outlook for sugar production in the coming season (October 2016 – April 2017) is significantly weaker. Internationally, sugar is in deficit by 5m tons after several years of surplus. All of this has helped the firming up of sugar prices in India from INR 27-28/kg to INR 32/kg over the last 6 months, while international raw sugar prices have moved up from a low of 10.5c/lb to 14.3c/lb. Higher sugar prices should allow Balrampur Chini to report significant earnings growth in the coming year. Taiwan tech holdings, Casetek (casings manufacturer), Inventec (a leading ODM for notebooks, server and mobile devices) and Inotera Memories (DRAM wafer manufacturer) contributed over the period. We sold out of Inventec and Inotera Memories by period end as our target fair value was reached.

5

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

We reduced our allocation to Taiwan and China, ending the period with an underweight position for the latter. Early in the new year (2016), we took advantage of low valuations in Brazil adding stocks such as Cosan, a sugar/ethanol producer with solid operations and expected to benefit from any uptick in energy prices, Suzano (pulp & paper), the cheapest pulp and paper/soft tissue producer globally, Cyrela (real estate) and SLC Agricola (agriculture).

Relative company valuations continue to guide our exposures in the coverage universe, while the overall small cap universe continues to offer competitive value compared to the developed markets.

Ashmore Emerging Markets Frontier Equity Fund

The Ashmore Emerging Markets Frontier Equity Fund (“the Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of Frontier Market issuers, which may be denominated in any currency, including the local currency of the issuer.

Frontier Markets, according to the MSCI Frontier Markets Index Net, declined by 2.73% for the 6 months ended April 30, 2016. Markets such as Nigeria (-16%), Bahrain (-16%), Kazakhstan (-14%) and Sri Lanka (-12%) lost the most ground, although markets such as Estonia (+24%), Morocco (+16%), Kenya (+11%) and Tunisia (+10%) held up very well, serving as safe havens in a relatively weak equity environment.

In Nigeria, investors continue to price in weak oil and policy mistakes that have led to FX scarcity, shortages of goods, and stubbornly high inflation. There has been no change to the official FX rate which remains at NGN 199 to the Dollar, while the black market rate is closer to NGN 340. While a recent fuel price deregulation has lifted investor mood in the market, overall sentiment continues to be weak as expectation mounts of a potential FX devaluation. In Sri Lanka equities sold off reflecting mounting concerns on the fiscal deficit and external debt repayments over the next year. Although the economy is relatively well balanced – and is expected to grow by 5-6% this year – the risk is that cutbacks on fiscal expenditure, continued foreign capital outflows, and a weaker FX could undermine the outlook. Policy rates were increased by 50 bps in February to support the Rupee and limit credit growth/inflation. Stock specific news was limited and the sell-off was broad based.

Morocco and Kenya also performed well due, to some extent, their relative safe-haven status within Africa given the issues in Nigeria. Although in Kenya there was also some encouraging macro data that drove equity prices higher, namely 1) rising reserves, now at 4.5 months cover, 2) the recent approval of a new IMF precautionary fund of USD 1.5bn which serves as a buffer against short term shocks, and 3) falling inflation (now at 6.8% from 7.8% in January, versus a target range of 2.5-7.5%).

The Fund outperformed its index over the period with overall contribution from exposures in Pakistan, Peru and Nigeria helping most, while exposures Kazakhstan, Morocco, Egypt and Sri Lanka detracting. Our overweight in Pakistan contributed most, especially our holdings in DG Khan Cement, Maple Leaf Cement, Pakistan Oilfields and Bank Al Habib. We hold Credicorp in Peru which added value. Our underweight in Nigeria helped given the relative weakness. We hold one of the top tier banks there trading at a 2017E PBV of 0.9x. We continue to closely monitor that market. The decline in oil prices impacted our exposure in oil-exporter Kazakhstan, Halyk Savings Bank, although the bank trades at a compelling 2017E PBV of 0.5x. We do not have any holdings in Morocco, hurting relative performance. The market out-performed as a safe haven and one of the bellwether real estate businesses in that market rallied on progress made in its balance sheet restructuring plan.

During the period, we reduced and consolidated our positions in Sri Lanka, selling out of People’s Leasing and reducing the weight in Sampath Bank. We also reduced our exposure in Indonesia and Kenya. We initiated positions in Egypt (Commercial International Bank, Eastern Tobacco and IDH) and UAE (e.g., Emaar Properties, NMC Health), based on relative valuations and improved growth prospects in specific names. We also added Banco Davivienda and Gran Tierra Energy in Colombia.

Frontier Markets remain a compelling investment universe on a relative valuation basis. They tend to be less correlated with the global equity markets although providing higher than global and EM dividend yield. Continued improvement in investor sentiment towards EM and Frontier Markets should have positive implications for flows and returns.

6

IMPORTANT INFORMATION ABOUT THE FUNDS

Ashmore Investment Advisors Limited

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Funds and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of Ashmore Investment Advisors Limited as of the date indicated and are subject to change at any time based upon economic, market, or other conditions and Ashmore Investment Advisors Limited undertakes no obligation to update the views expressed herein. Any discussions of specific securities or markets should not be considered a recommendation to buy or sell or invest in those securities or markets. The views expressed above may not be relied upon as investment advice or as an indication of the Funds’ trading intent. Information about the Funds’ holdings, asset allocation or country diversification is historical and is not an indication of future portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments. In addition, the returns do not reflect certain charges that an investor in the Funds may pay. If these additional fees were reflected, the performance shown would have been lower.

The following disclosure provides important information regarding each Fund’s Average Annual Total Return table and Cumulative Returns chart, which appear on each Fund’s individual page in this report (the “Shareholder Report” or “Report”). Please refer to this information when reviewing the table and chart for a Fund.

On each individual Fund Summary page in this Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the redemption of Fund shares. The Cumulative Returns Chart reflects only Institutional Class performance. Performance for Class A and Class C shares is typically lower than Institutional Class performance due to the lower expenses paid by Institutional Class shares. Except for the load-waived performance for the Class A and C shares of each Fund (as applicable), performance shown is net of fees and expenses. The load-waived performance for Class A and Class C shares does not reflect the sales charges shareholders of those classes may pay in connection with a purchase or redemption of Class A and Class C shares. The load-waived performance of those share classes is relevant only to shareholders who purchased Class A or Class C shares on a load-waived basis. The figures in the line graph are calculated at net asset value and assume the investment of $1,000,000 at the beginning of the first full month following the inception of the Institutional Class. Each Fund measures its performance against a broad-based securities market index (“benchmark index”). Each benchmark index does not take into account fees, expenses or taxes.

For periods prior to the inception date of the Class A and Class C shares (if applicable), performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

7

IMPORTANT INFORMATION ABOUT THE FUNDS (CONTINUED)

The following disclosure provides important information regarding each Fund’s Expense Example, which appears on each Fund’s individual page in this Shareholder Report. Please refer to this information when reviewing the Expense Example for a Fund.

EXPENSE EXAMPLE

Fund Expenses

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, from November 1, 2015 or the inception date (if later), through April 30, 2016.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information based on actual performance and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class, in the row titled “Expenses Paid” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical Performance” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

UNAUDITED

FUND SUMMARY Ashmore

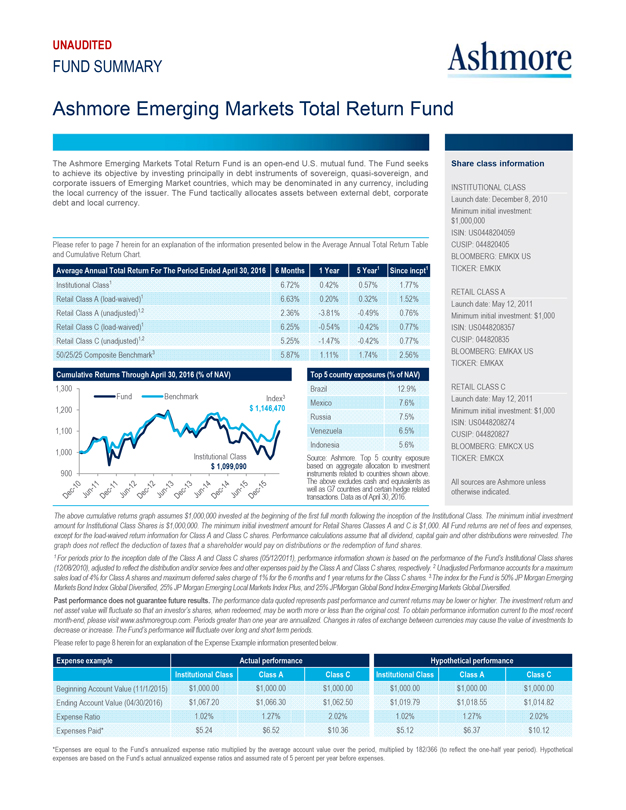

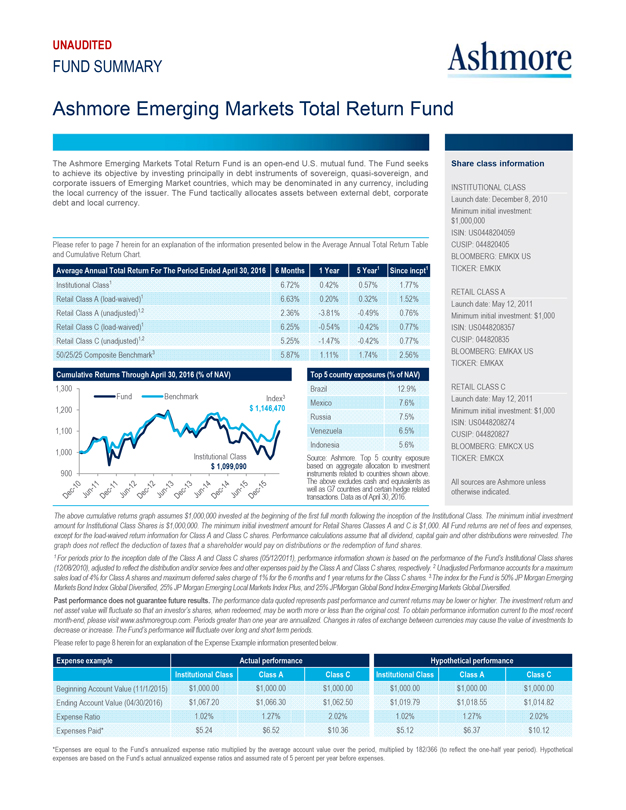

Ashmore Emerging Markets Total Return Fund

The Ashmore Emerging Markets Total Return Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of sovereign, quasi-sovereign, and corporate issuers of Emerging Market countries, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year 5 Year1 Since incpt1

Institutional Class1 6.72% 0.42% 0.57% 1.77%

Retail Class A (load-waived)1 6.63% 0.20% 0.32% 1.52%

Retail Class A (unadjusted)1,2 2.36% -3.81% -0.49% 0.76%

Retail Class C (load-waived)1 6.25% -0.54% -0.42% 0.77%

Retail Class C (unadjusted)1,2 5.25% -1.47% -0.42% 0.77%

50/25/25 Composite Benchmark3 5.87% 1.11% 1.74% 2.56%

Cumulative Returns Through April 30, 2016 (% of NAV)

1,300

Fund Benchmark Index3

1,200 $ 1,146,470

1,100

1,000 Institutional Class

$ 1,099,090

900

Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15

Top 5 country exposures (% of NAV)

Brazil 12.9% Mexico 7.6% Russia 7.5% Venezuela 6.5% Indonesia 5.6%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS

Launch date: December 8, 2010

Minimum initial investment:

$1,000,000

ISIN: US0448204059

CUSIP: 044820405

BLOOMBERG: EMKIX US

TICKER: EMKIX

RETAIL CLASS A

Launch date: May 12, 2011

Minimum initial investment: $1,000

ISIN: US0448208357

CUSIP: 044820835

BLOOMBERG: EMKAX US

TICKER: EMKAX

RETAIL CLASS C

Launch date: May 12, 2011

Minimum initial investment: $1,000

ISIN: US0448208274

CUSIP: 044820827

BLOOMBERG: EMKCX US

TICKER: EMKCX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1 For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2 Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3.The index for the Fund is 50% JP Morgan Emerging Markets Bond Index Global Diversified, 25% JP Morgan Emerging Local Markets Index Plus, and 25% JPMorgan Global Bond Index-Emerging Markets Global Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,067.20 $1,066.30 $1,062.50 $1,019.79 $1,018.55 $1,014.82

Expense Ratio 1.02% 1.27% 2.02% 1.02% 1.27% 2.02%

Expenses Paid* $5.24 $6.52 $10.36 $5.12 $6.37 $10.12

*Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

9

UNAUDITED

FUND SUMMARY Ashmore

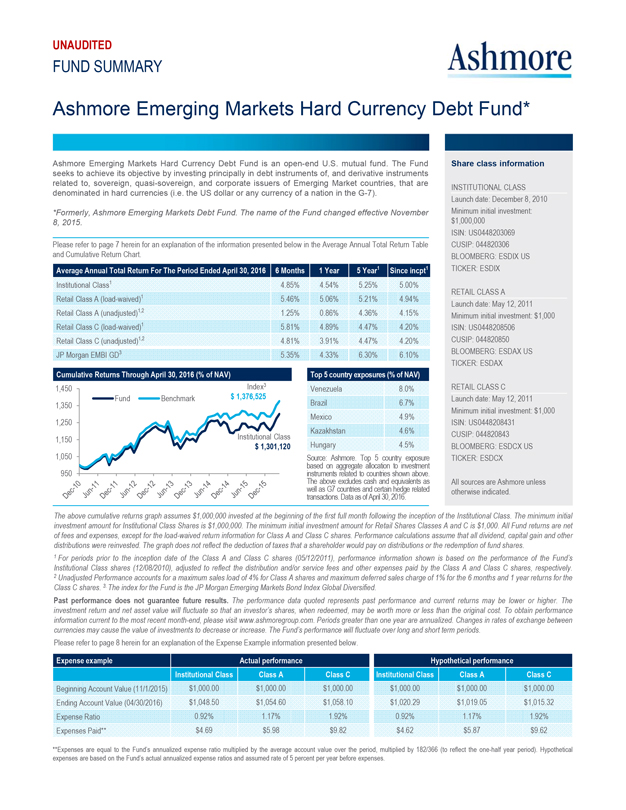

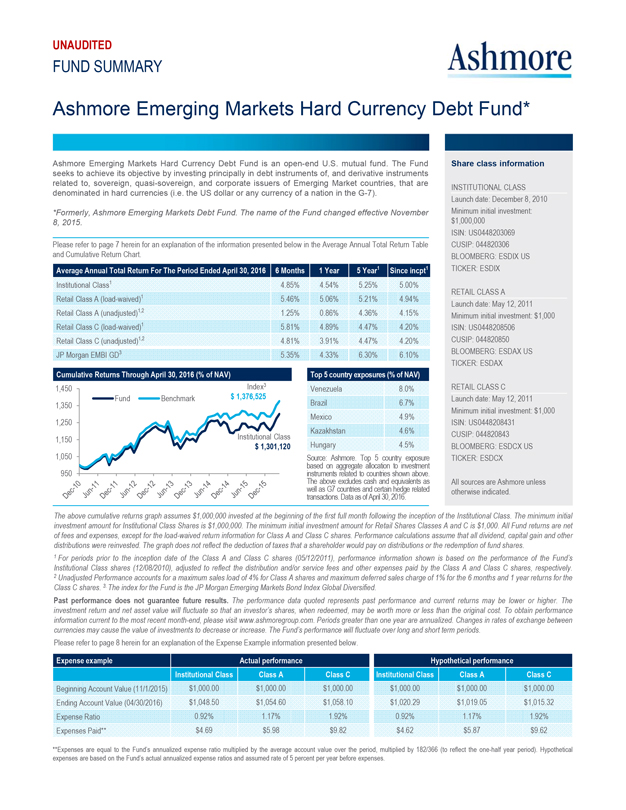

Ashmore Emerging Markets Hard Currency Debt Fund*

Ashmore Emerging Markets Hard Currency Debt Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of, and derivative instruments related to, sovereign, quasi-sovereign, and corporate issuers of Emerging Market countries, that are denominated in hard currencies (i.e. the US dollar or any currency of a nation in the G-7).

*Formerly, Ashmore Emerging Markets Debt Fund. The name of the Fund changed effective November 8, 2015.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year 5 Year1 Since incpt1

Institutional Class1 4.85% 4.54% 5.25% 5.00%

Retail Class A (load-waived)1 5.46% 5.06% 5.21% 4.94%

Retail Class A (unadjusted)1,2 1.25% 0.86% 4.36% 4.15%

Retail Class C (load-waived)1 5.81% 4.89% 4.47% 4.20%

Retail Class C (unadjusted)1,2 4.81% 3.91% 4.47% 4.20%

JP Morgan EMBI GD3 5.35% 4.33% 6.30% 6.10%

Cumulative Returns Through April 30, 2016 (% of NAV)

1,450 Index3

Fund Benchmark $ 1,376,525

1,350 1,250

1,150 Institutional Class $ 1,301,120

1,050 950

Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15

Top 5 country exposures (% of NAV)

Venezuela 8.0% Brazil 6.7% Mexico 4.9% Kazakhstan 4.6% Hungary 4.5%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS

Launch date: December 8, 2010

Minimum initial investment:

$1,000,000

ISIN: US0448203069

CUSIP: 044820306

BLOOMBERG: ESDIX US

TICKER: ESDIX

RETAIL CLASS A

Launch date: May 12, 2011

Minimum initial investment: $1,000

ISIN: US0448208506

CUSIP: 044820850

BLOOMBERG: ESDAX US

TICKER: ESDAX

RETAIL CLASS C

Launch date: May 12, 2011

Minimum initial investment: $1,000

ISIN: US0448208431

CUSIP: 044820843

BLOOMBERG: ESDCX US

TICKER: ESDCX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1 For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

2 Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3. The index for the Fund is the JP Morgan Emerging Markets Bond Index Global Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,048.50 $1,054.60 $1,058.10 $1,020.29 $1,019.05 $1,015.32

Expense Ratio 0.92% 1.17% 1.92% 0.92% 1.17% 1.92%

Expenses Paid** $4.69 $5.98 $9.82 $4.62 $5.87 $9.62

**Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

10

UNAUDITED

FUND SUMMARY Ashmore

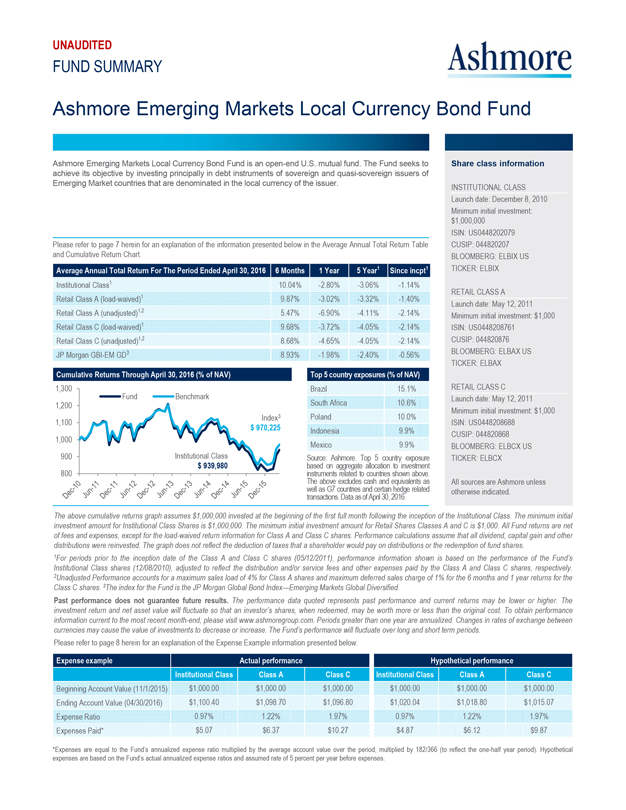

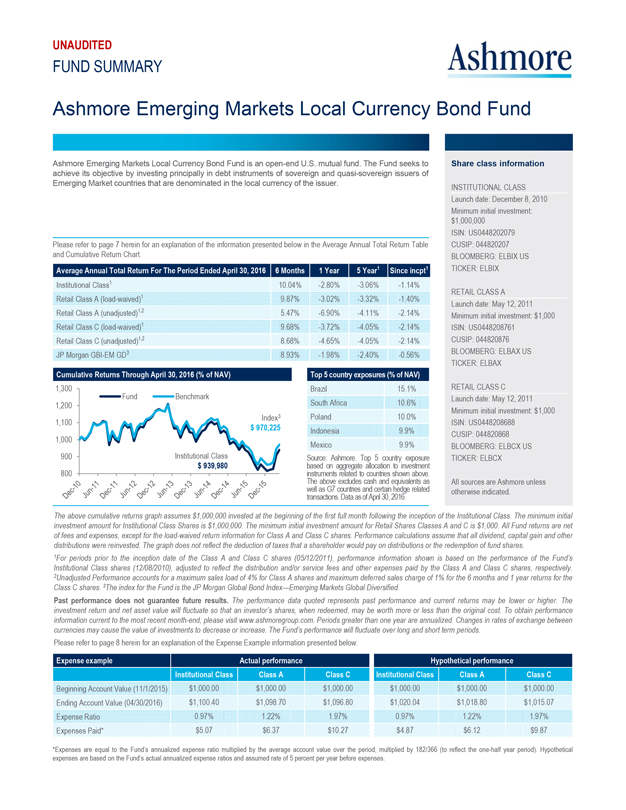

Ashmore Emerging Markets Local Currency Bond Fund

Ashmore Emerging Markets Local Currency Bond Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of sovereign and quasi-sovereign issuers of Emerging Market countries that are denominated in the local currency of the issuer.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year 5 Year1 Since incpt1

Institutional Class1 10.04% -2.80% -3.06% -1.14%

Retail Class A (load-waived)1 9.87% -3.02% -3.32% -1.40%

Retail Class A (unadjusted)1,2 5.47% -6.90% -4.11% -2.14%

Retail Class C (load-waived)1 9.68% -3.72% -4.05% -2.14%

Retail Class C (unadjusted)1,2 8.68% -4.65% -4.05% -2.14%

JP Morgan GBI-EM GD3 8.93% -1.98% -2.40% -0.56%

Cumulative Returns Through April 30, 2016 (% of NAV)

1,300

Fund Benchmark

1,200

1,100 Index3

$ 970,225

1,000

900 Institutional Class

$ 939,980

800

Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15

Top 5 country exposures (% of NAV)

Brazil 15.1% South Africa 10.6% Poland 10.0% Indonesia 9.9% Mexico 9.9%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS

Launch date: December 8, 2010

Minimum initial investment:

$1,000,000

ISIN: US0448202079

CUSIP: 044820207

BLOOMBERG: ELBIX US

TICKER: ELBIX

RETAIL CLASS A

Launch date: May 12, 2011

Minimum initial investment: $1,000

ISIN: US0448208761

CUSIP: 044820876

BLOOMBERG: ELBAX US

TICKER: ELBAX

RETAIL CLASS C

Launch date: May 12, 2011

Minimum initial investment: $1,000

ISIN: US0448208688

CUSIP: 044820868

BLOOMBERG: ELBCX US

TICKER: ELBCX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3The index for the Fund is the JP Morgan Global Bond Index—Emerging Markets Global Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,100.40 $1,098.70 $1,096.80 $1,020.04 $1,018.80 $1,015.07

Expense Ratio 0.97% 1.22% 1.97% 0.97% 1.22% 1.97%

Expenses Paid* $5.07 $6.37 $10.27 $4.87 $6.12 $9.87

*Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

11

UNAUDITED

FUND SUMMARY Ashmore

Ashmore Emerging Markets Corporate Debt Fund

Ashmore Emerging Markets Corporate Debt Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Emerging Market corporate issuers, which may be denominated in any currency, including the local currency of the issuer.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year 5 Year1 Since incpt1

Institutional Class1 0.64% -4.59% 1.96% 2.87%

Retail Class A (load-waived)1 0.62% -4.82% 1.70% 2.61%

Retail Class A (unadjusted)1,2 -3.42% -8.63% 0.87% 1.84%

Retail Class C (load-waived)1 0.25% -5.51% 0.95% 1.86%

Retail Class C (unadjusted)1,2 -0.72% -6.38% 0.95% 1.86%

JP Morgan CEMBI BD3 3.84% 2.83% 5.02% 5.23%

Cumulative Returns Through April 30, 2016 (% of NAV)

1,400 Index3 Fund Benchmark $ 1,316,824

1,300 1,200 1,100 1,000 Institutional Class $ 1,164,930 900

Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15

Top 5 country exposures (% of NAV)

Brazil 15.0% Russia 10.0% United Arab Emirates 8.1% Kazakhstan 6.8% Mexico 6.6%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS

Launch date: December 8, 2010

Minimum initial investment:

$1,000,000 ISIN: US044825049 CUSIP: 044820504 BLOOMBERG: EMCIX US

TICKER: EMCIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000

ISIN: US0448206039 CUSIP: 044820603 BLOOMBERG: ECDAX US TICKER: ECDAX

RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448207029

CUSIP: 044820702 BLOOMBERG: ECDCX US TICKER: ECDCX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

2Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3The index for the Fund is the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,006.40 $1,006.20 $1,002.50 $1,019.05 $1,017.80 $1,014.07

Expense Ratio 1.17% 1.42% 2.17% 1.17% 1.42% 2.17%

Expenses Paid* $5.84 $7.08 $10.80 $5.87 $7.12 $10.87

*Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

12

UNAUDITED

FUND SUMMARY Ashmore

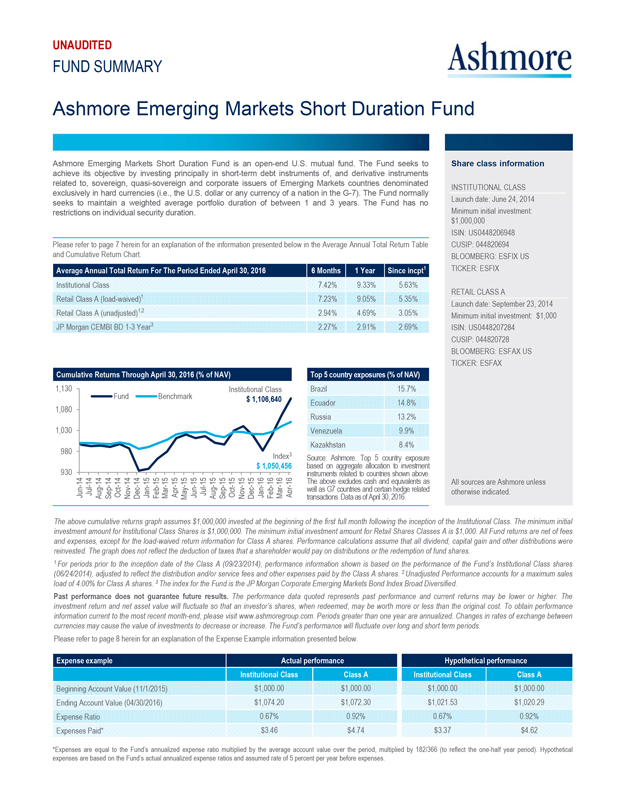

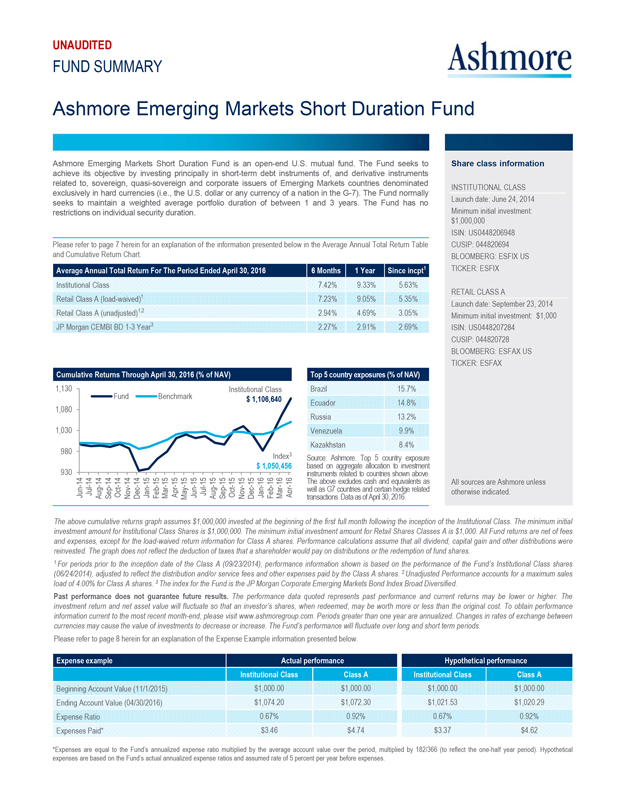

Ashmore Emerging Markets Short Duration Fund

Ashmore Emerging Markets Short Duration Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in short-term debt instruments of, and derivative instruments related to, sovereign, quasi-sovereign and corporate issuers of Emerging Markets countries denominated exclusively in hard currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain a weighted average portfolio duration of between 1 and 3 years. The Fund has no restrictions on individual security duration.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year Since incpt1

Institutional Class 7.42% 9.33% 5.63%

Retail Class A (load-waived)1 7.23% 9.05% 5.35%

Retail Class A (unadjusted)1,2 2.94% 4.69% 3.05%

JP Morgan CEMBI BD 1-3 Year3 2.27% 2.91% 2.69%

Cumulative Returns Through April 30, 2016 (% of NAV)

1,130 Institutional Class

Fund Benchmark $ 1,106,640

1,080 1,030 980 Index3 $ 1,050,456 930

Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15

May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16

Top 5 country exposures (% of NAV)

Brazil 15.7% Ecuador 14.8% Russia 13.2% Venezuela 9.9% Kazakhstan 8.4%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as transactions. well as G7 countries Data as and of April certain 30, 2016. hedge related

Share class information

INSTITUTIONAL CLASS

Launch date: June 24, 2014

Minimum initial investment:

$1,000,000 ISIN: US0448206948 CUSIP: 044820694 BLOOMBERG: ESFIX US

TICKER: ESFIX RETAIL CLASS A Launch date: September 23, 2014

Minimum initial investment: $1,000

ISIN: US0448207284 CUSIP: 044820728 BLOOMBERG: ESFAX US TICKER: ESFAX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1.For periods prior to the inception date of the Class A (09/23/2014), performance information shown is based on the performance of the Fund’s Institutional Class shares (06/24/2014), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A shares. 2 Unadjusted Performance accounts for a maximum sales load of 4.00% for Class A shares. 3 The index for the Fund is the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Institutional Class Class A

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,074.20 $1,072.30 $1,021.53 $1,020.29

Expense Ratio 0.67% 0.92% 0.67% 0.92%

Expenses Paid* $3.46 $4.74 $3.37 $4.62

*Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

13

UNAUDITED

FUND SUMMARY Ashmore

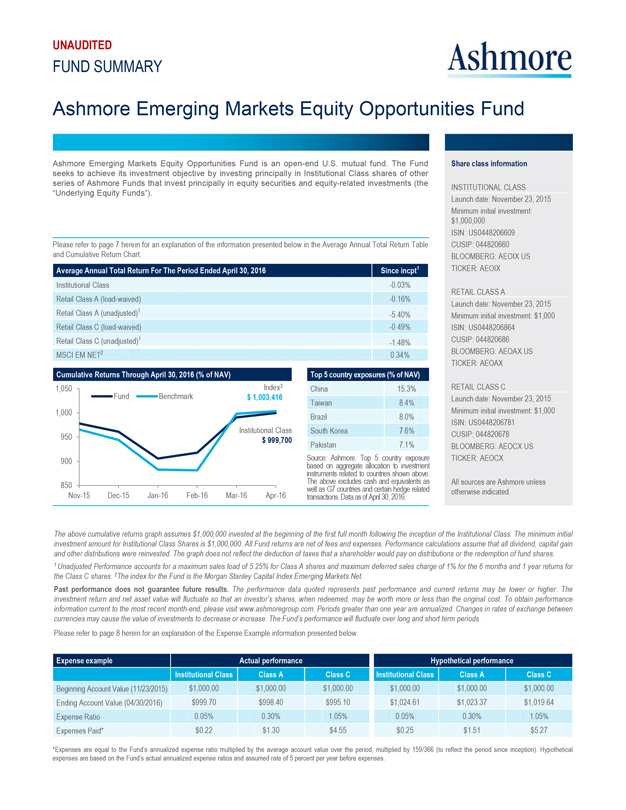

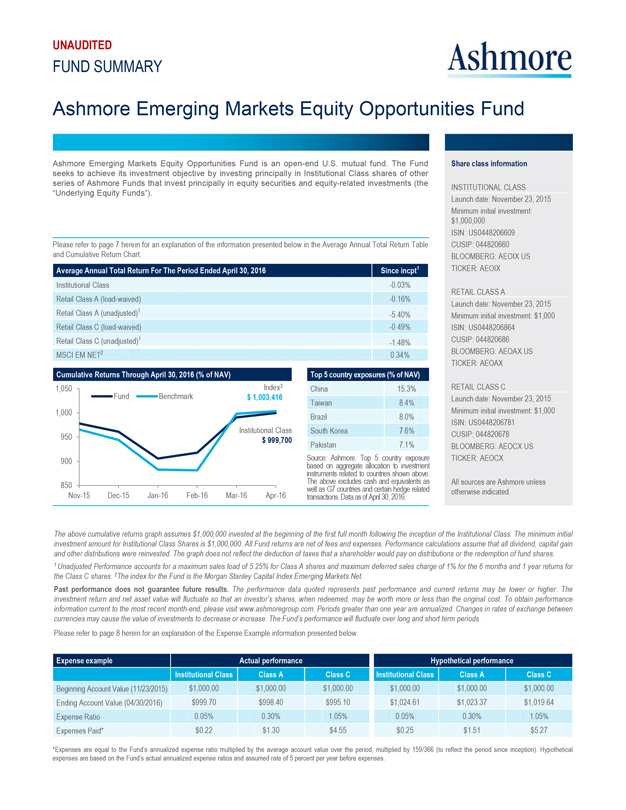

Ashmore Emerging Markets Equity Opportunities Fund

Ashmore Emerging Markets Equity Opportunities Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its investment objective by investing principally in Institutional Class shares of other series of Ashmore Funds that invest principally in equity securities and equity-related investments (the “Underlying Equity Funds”).

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 Since incpt1

Institutional Class -0.03%

Retail Class A (load-waived) -0.16%

Retail Class A (unadjusted)1 -5.40%

Retail Class C (load-waived) -0.49%

Retail Class C (unadjusted)1 -1.48%

MSCI EM NET2 0.34%

Cumulative Returns Through April 30, 2016 (% of NAV)

1,050 Index3 Fund Benchmark $ 1,003,416

1,000 Institutional Class 950 $ 999,700 900 850

Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16

Top 5 country exposures (% of NAV)

China 15.3% Taiwan 8.4% Brazil 8.0% South Korea 7.6% Pakistan 7.1%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS

Launch date: November 23, 2015

Minimum initial investment:

$1,000,000 ISIN: US0448206609 CUSIP: 044820660

BLOOMBERG: AEOIX US TICKER: AEOIX RETAIL CLASS A

Launch date: November 23, 2015

Minimum initial investment: $1,000

ISIN: US0448206864 CUSIP: 044820686

BLOOMBERG: AEOAX US TICKER: AEOAX RETAIL CLASS C

Launch date: November 23, 2015

Minimum initial investment: $1,000

ISIN: US0448206781 CUSIP: 044820678

BLOOMBERG: AEOCX US TICKER: AEOCX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. All Fund returns are net of fees and expenses. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 2The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Net.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/23/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $999.70 $998.40 $995.10 $1,024.61 $1,023.37 $1,019.64

Expense Ratio 0.05% 0.30% 1.05% 0.05% 0.30% 1.05%

Expenses Paid* $0.22 $1.30 $4.55 $0.25 $1.51 $5.27

*Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 159/366 (to reflect the period since inception). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

14

UNAUDITED

FUND SUMMARY Ashmore

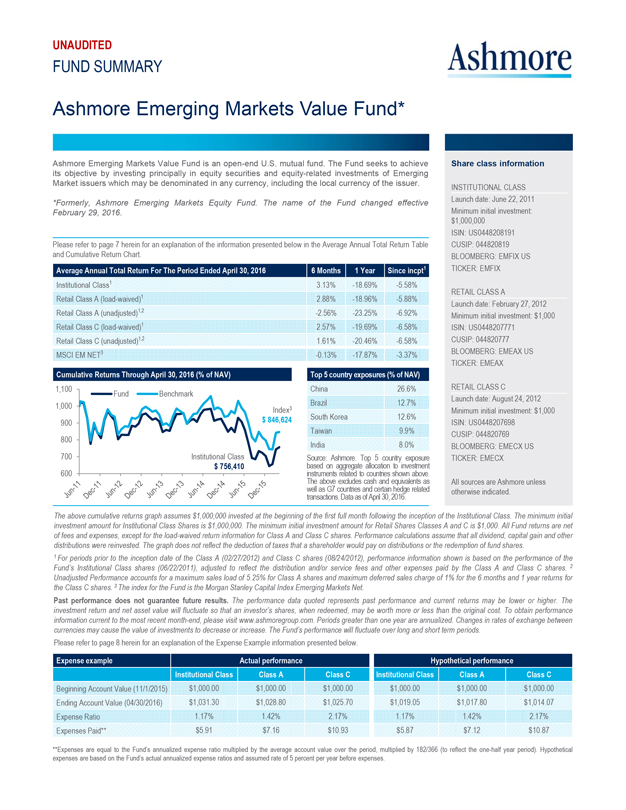

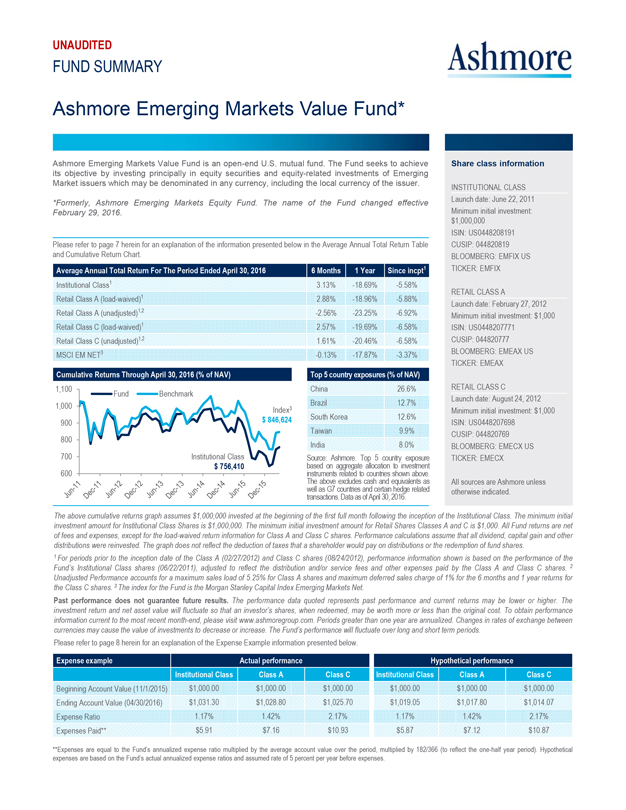

Ashmore Emerging Markets Value Fund*

Ashmore Emerging Markets Value Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Emerging Market issuers which may be denominated in any currency, including the local currency of the issuer.

*Formerly, Ashmore Emerging Markets Equity Fund. The name of the Fund changed effective February 29, 2016.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year Since incpt1

Institutional Class1 3.13% -18.69% -5.58%

Retail Class A (load-waived)1 2.88% -18.96% -5.88%

Retail Class A (unadjusted)1,2 -2.56% -23.25% -6.92%

Retail Class C (load-waived)1 2.57% -19.69% -6.58%

Retail Class C (unadjusted)1,2 1.61% -20.46% -6.58%

MSCI EM NET3 -0.13% -17.87% -3.37% Cumulative Returns Through April 30, 2016 (% of NAV)

1,100 Fund Benchmark 1,000 Index3 900 $ 846,624 800 700 Institutional Class $ 756,410 600

Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Top 5 country exposures (% of NAV)

China 26.6% Brazil 12.7% South Korea 12.6% Taiwan 9.9% India 8.0%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS Launch date: June 22, 2011

Minimum initial investment: $1,000,000 ISIN: US0448208191 CUSIP: 044820819

BLOOMBERG: EMFIX US TICKER: EMFIX RETAIL CLASS A

Launch date: February 27, 2012 Minimum initial investment: $1,000 ISIN: US0448207771

CUSIP: 044820777 BLOOMBERG: EMEAX US TICKER: EMEAX

RETAIL CLASS C Launch date: August 24, 2012 Minimum initial investment: $1,000

ISIN: US0448207698 CUSIP: 044820769 BLOOMBERG: EMECX US TICKER: EMECX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1 For periods prior to the inception date of the Class A (02/27/2012) and Class C shares (08/24/2012), performance information shown is based on the performance of the Fund’s Institutional Class shares (06/22/2011), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares. 2 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3 The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Net.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,031.30 $1,028.80 $1,025.70 $1,019.05 $1,017.80 $1,014.07

Expense Ratio 1.17% 1.42% 2.17% 1.17% 1.42% 2.17%

Expenses Paid** $5.91 $7.16 $10.93 $5.87 $7.12 $10.87

**Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

15

UNAUDITED

FUND SUMMARY Ashmore

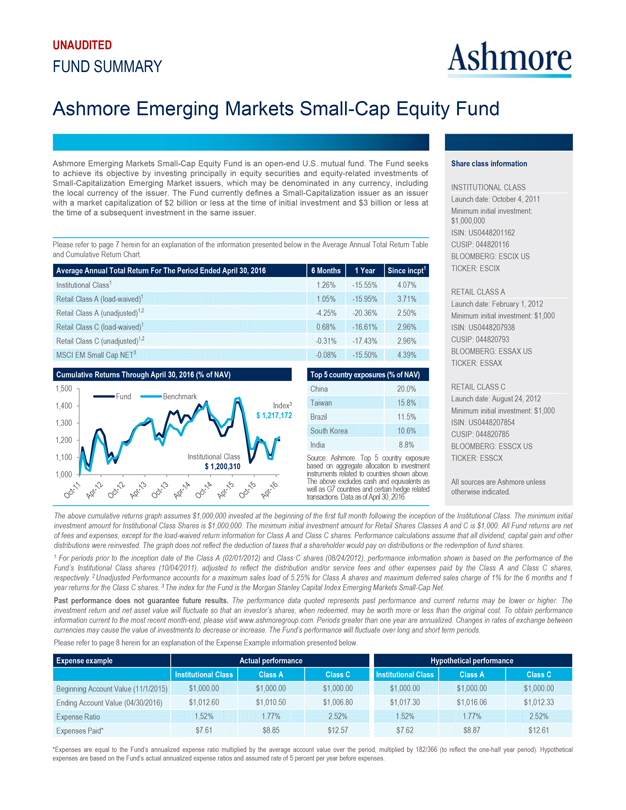

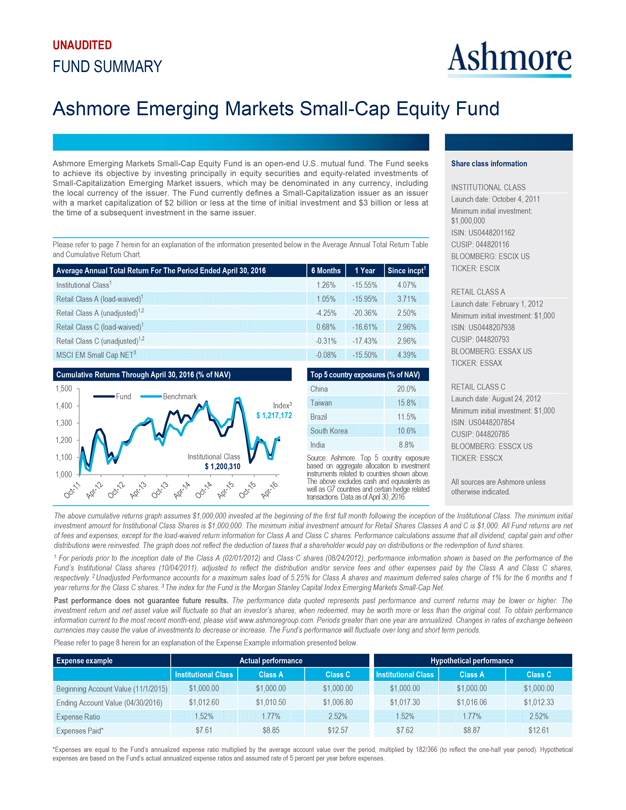

Ashmore Emerging Markets Small-Cap Equity Fund

Ashmore Emerging Markets Small-Cap Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Small-Capitalization Emerging Market issuers, which may be denominated in any currency, including the local currency of the issuer. The Fund currently defines a Small-Capitalization issuer as an issuer with a market capitalization of $2 billion or less at the time of initial investment and $3 billion or less at the time of a subsequent investment in the same issuer.

Please refer to page 7 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart.

Average Annual Total Return For The Period Ended April 30, 2016 6 Months 1 Year Since incpt1

Institutional Class1 1.26% -15.55% 4.07%

Retail Class A (load-waived)1 1.05% -15.95% 3.71%

Retail Class A (unadjusted)1,2 -4.25% -20.36% 2.50%

Retail Class C (load-waived)1 0.68% -16.61% 2.96%

Retail Class C (unadjusted)1,2 -0.31% -17.43% 2.96%

MSCI EM Small Cap NET3 -0.08% -15.50% 4.39%

Cumulative Returns Through April 30, 2016 (% of NAV)

Fund Benchmark Index3 1,500

1,400 $ 1,217,172 1,300 1,200 1,100 Institutional Class

$ 1,200,310 1,000 Oct-11 Apr-12 Oct-12 Apr-13 Oct-13 Apr-14 Oct-14 Apr-15 Oct-15 Apr-16

Top 5 country exposures (% of NAV) China 20.0% Taiwan 15.8% Brazil 11.5% South Korea 10.6% India 8.8%

Source: Ashmore. Top 5 country exposure based on aggregate allocation to investment instruments related to countries shown above. The above excludes cash and equivalents as well as G7 countries and certain hedge related transactions. Data as of April 30, 2016.

Share class information

INSTITUTIONAL CLASS

Launch date: October 4, 2011 Minimum initial investment: $1,000,000 ISIN: US0448201162 CUSIP: 044820116

BLOOMBERG: ESCIX US TICKER: ESCIX RETAIL CLASS A

Launch date: February 1, 2012 Minimum initial investment: $1,000

ISIN: US0448207938 CUSIP: 044820793 BLOOMBERG: ESSAX US TICKER: ESSAX RETAIL CLASS C

Launch date: August 24, 2012 Minimum initial investment: $1,000

ISIN: US0448207854 CUSIP: 044820785 BLOOMBERG: ESSCX US TICKER: ESSCX

All sources are Ashmore unless otherwise indicated.

The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares.

1 For periods prior to the inception date of the Class A (02/01/2012) and Class C shares (08/24/2012), performance information shown is based on the performance of the Fund’s Institutional Class shares (10/04/2011), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3 The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Small-Cap Net.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.ashmoregroup.com. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods.

Please refer to page 8 herein for an explanation of the Expense Example information presented below.

Expense example Actual performance Hypothetical performance

Institutional Class Class A Class C Institutional Class Class A Class C

Beginning Account Value (11/1/2015) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00

Ending Account Value (04/30/2016) $1,012.60 $1,010.50 $1,006.80 $1,017.30 $1,016.06 $1,012.33

Expense Ratio 1.52% 1.77% 2.52% 1.52% 1.77% 2.52%

Expenses Paid* $7.61 $8.85 $12.57 $7.62 $8.87 $12.61

*Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Hypothetical expenses are based on the Fund’s actual annualized expense ratios and assumed rate of 5 percent per year before expenses.

16

UNAUDITED

FUND SUMMARY Ashmore

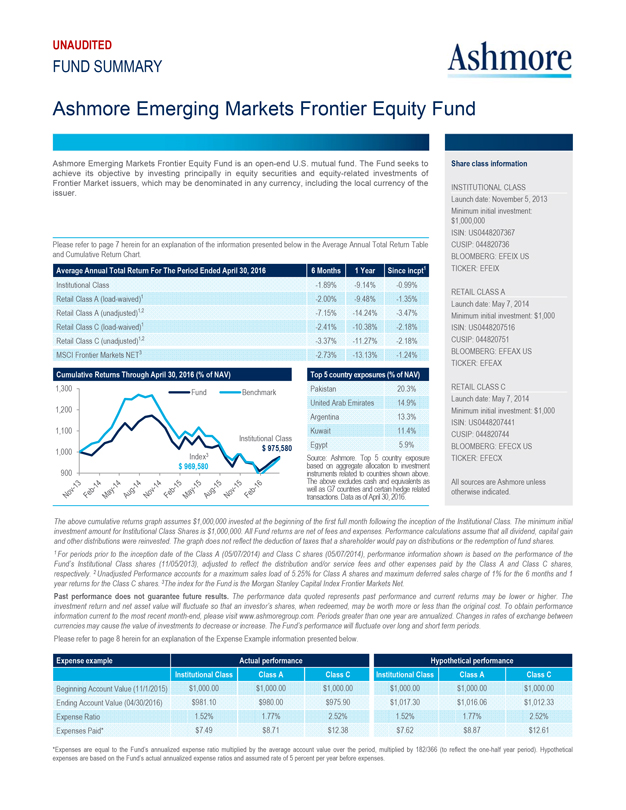

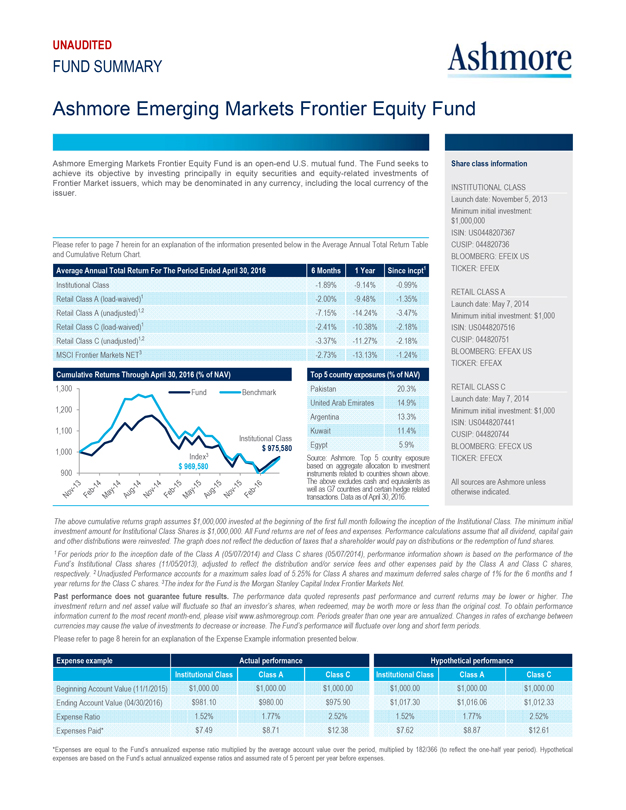

Ashmore Emerging Markets Frontier Equity Fund

Ashmore Emerging Markets Frontier Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Frontier Market issuers, which may be denominated in any currency, including the local currency of the issuer.