UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22468

Ashmore Funds

(Exact name of registrant as specified in charter)

c/o Ashmore Investment Advisors Limited

61 Aldwych

London WC2B 4AE

England

(Address of principal executive offices) (Zip code)

Corporation Service Company

84 State Street

Boston, MA 20109

(Name and address of agent for service)

Registrant’s telephone number, including area code: 011-44-20-3077-6000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Item 1. Reports to Stockholders.

ASHMORE FUNDS

ANNUAL FINANCIAL STATEMENTS

October 31, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or your financial intermediary. Instead, the reports will be made available on the Fund’s website (www.ashmoregroup.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 866-876-8294.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can contact the Fund to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the Trust if you invest directly with the Fund.

(THIS PAGE INTENTIONALLY LEFT BLANK)

ASHMORE FUNDS

TABLE OF CONTENTS

*Effective January 1, 2019, the Ashmore Emerging Markets Corporate Debt Fund changed its name to the Ashmore Emerging Markets Income Fund.

Ashmore Investment Management (US) Corporation is the Distributor for Ashmore Funds.

This material is authorized for use only when preceded or accompanied by the current Ashmore Funds’ prospectus. Investors should consider the investment objectives, principal risks, charges and expenses of these Funds carefully before investing. This and other information is contained in the Funds’ prospectus. Please read the prospectus carefully before you invest or send money.

A Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

The performance data quoted in this report represents past performance. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted in this report. For performance information current to the most recent month-end, please call (866) 876-8294.

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT

For the period November 1, 2017 to October 31, 2018

Overview

The last quarter of 2017 capped a year of strong performance for global macro-economic performance and asset prices, and offered promises of further strength going into the new year. Global economic data was strong across all regions, both in developed and emerging markets, and global growth expectations were revised upwards. While this economic backdrop was very supportive for financial markets in 2017 Q4, it came with associated policy risks. The first one was the swift approval of a significant package of tax cuts in the US, first proposed in the middle of September, and signed by President Trump before Christmas. This lifted US growth forecasts, but also increased the risk of higher inflation. The second risk was the potential change in the Fed’s policy stance as leadership transferred to governor-elect Jay Powell at the March 2018 meeting. Political developments across emerging markets were broadly supportive during Q4, notably the narrow election victory by Cyril Ramaphosa in South Africa’s ANC Elective Conference, which paved the way for much welcome political and policy changes, and the convincing victory by center-right candidate Sebastian Pinera in Chile’s presidential election.

Towards the end of the first quarter of 2018, newly-installed Fed chair Jay Powell delivered a 25 basis points (bps) hike in the Fed Funds rate to 1.75%. The February sell-off in global equities continued in March as fears of a “trade war” dominated market developments. The White House first announced new tariffs on steel and aluminum imports to the US, which rattled global markets and led to the resignation of President Trump’s economic advisor Gary Cohn. Although these tariffs were eventually watered down by exemptions negotiated with a number of trading partners, they were followed by specific actions against China on “national security” grounds for breach of intellectual property, targeting around $50 billion worth of export to the US. The risk of escalation increased when China responded with tariffs of similar magnitude and President Trump vowed to broaden tariffs on a wider array of Chinese goods.

The second quarter of 2018 was characterized by a global risk-off sentiment as markets incorporated revisions to the prior belief in global synchronous economic growth. The realignment of the USDEUR exchange rate had a knock-on impact on Emerging Markets (EM) that led to significant credit spread widening, a tightening of liquidity conditions and outflows from the asset class. The risk-off environment was sustained by concerns about trade wars, the potential impact of domestic defaults in China, and friction between the US and its G7 and NATO partners. With the release of the March Federal Open Market Committee (FOMC) minutes, the Fed confirmed the view that it was the sole hawk in the central bank world. Argentina faced a classic balance of payments crisis in May. The central bank was forced to raise benchmark interest rates by 12.75% in three emergency meetings, to 40%. Ultimately, Argentina was forced to approach the IMF for a support package, requesting $30 billion in support but ultimately receiving $50 billion in a strong show of support by the multilateral institution. Turkey was also under the microscope due to its large current account deficit of 5.5% of GDP, high inflation, and its reliance on portfolio flows to finance its deficit. The market responded poorly to President Erdogan’s proposal to curb the central bank’s independence, in the lead-up to June’s presidential and parliamentary elections. As in Argentina, the central bank was forced to raise interest rates by 300 bps. The risk aversion trade continued into June, as defensive assets outperformed and EM remained under pressure.

Although most investors will remember the summer of 2018 for the difficult financial markets of August, it was actually book-ended by relatively good months in July and September. The dominant theme was the extreme divergence in stock market performance and momentum between the US the rest of the world, from Europe to China and Emerging Markets, which culminated in August. Although US economic data printed some impressive numbers, such as a strong 4.2% Q2 GDP growth, a few indicators such as housing suggested that the US economy had already peaked. The Fed hiked its target rate by 25 bps at its September meeting, as expected, and guided the market towards another rate hike at its December meeting. However, by the middle of September, with a “new NAFTA” in the works, Fed rate hikes telegraphed and priced-in, and adequate policy measures announced in Turkey (rate hikes) and Argentina (expanded IMF package), market worries focused on two main items: US-China trade relations and the presidential election in Brazil, where the expected election of right-wing candidate Jair Bolsonaro was well-received by investors due to his fiscal pledges. As the quarter ended, attention shifted to the early-November mid-term elections in the US.

The net result for the EM fixed income indices over the period was negative. The JP Morgan Emerging Markets Bond Index Global Diversified (JPM EMBI GD) index was down 4.4%. The broad corporate bond index, the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified (JPM CEMBI BD), was down 1.9%. The reference local currency bond index, the JP Morgan Government Bond Index – Emerging Markets Global Diversified (JPM GBI-EM GD), was down 6.6%, while the reference local currency FX index, the JP Morgan Emerging Markets Local Markets Index Plus (JPM ELMI+), was down 3.1%.

1

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Portfolio Overview

Ashmore Emerging Markets Total Return Fund

The Ashmore Emerging Markets Total Return Fund (the “Fund”) seeks to achieve its objective by investing principally in the debt instruments of sovereign, quasi-sovereign, and corporate issuers, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -5.53% (net of fees) versus -4.57% for the composite 50% JP Morgan Emerging Markets Bond Index Global Diversified (“JP Morgan EMBI GD”), 25% JP Morgan Government Bond Index - Emerging Markets Global Diversified (“JP Morgan GBI-EM GD”), and 25% JP Morgan Emerging Local Markets Index Plus (“JP Morgan ELMI+”). Local currency, external debt and corporate debt detracted from performance. Brazil, South Africa, and United Arab Emirates were the main contributors to Fund performance. Argentina, Indonesia, and Venezuela were the main detractors from Fund performance.

Argentina was a detractor during the period, and its poor performance emanated from a classic balance of payments crisis. Following the initial relaxation of inflation targets and rate cuts earlier this year, the central bank initially sought to stem the ARS depreciation via USD sales (using its reserves). When this faltered (after having spent more than $6 billion in the markets), it raised benchmark rates by 12.75% to 40% in three emergency meetings. When this still proved insufficient, it approached the International Monetary Fund (IMF). The IMF stand-by agreement, with its $50 billion loan facility, was signed off in late June and obviates the government’s need to approach the market to finance its fiscal deficit. However, the central bank continued to send mixed messages and the market hopes that the recent replacement of its President with ex-Finance Minister Luis Caputo will provide more clarity and coordination with the Finance Ministry.

Ashmore Emerging Markets Local Currency Bond Fund

The Ashmore Emerging Markets Local Currency Bond Fund (the “Fund”) seeks to achieve its objective by investing principally in the debt instruments of sovereign and quasi-sovereign EM issuers, denominated in the local currency of the issuer. The Fund’s returns are driven by EM currency appreciation, interest rate positioning and credit worthiness.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -7.33% (net of fees) versus -6.58% for the JP Morgan GBI-EM GD. Allocations to the South African Rand, Brazilian Real, and Malaysian Ringgit were the main contributors to Fund performance. Allocations to the Turkish Lira, Indonesian Rupiah, and Argentine Peso were the main detractors from Fund performance.

Argentina was a detractor during the period, and its poor performance emanated from a classic balance of payments crisis. Following the initial relaxation of inflation targets and rate cuts earlier this year, the central bank initially sought to stem the ARS depreciation via USD sales (using its reserves). When this faltered (after having spent more than $6 billion in the markets), it raised benchmark rates by 12.75% to 40% in three ‘emergency’ meetings. When this still proved insufficient, it approached the International Monetary Fund (IMF). The IMF stand-by agreement, with its $50 billion loan facility, was signed off in late June and obviates the government’s need to approach the market to finance its fiscal deficit. However, the central bank continued to send mixed messages and the market hopes that the recent replacement of its President with ex-Finance Minister Luis Caputo will provide more clarity and coordination with the Finance Ministry.

Ashmore Emerging Markets Corporate Debt Fund

The Ashmore Emerging Markets Corporate Debt Fund (the “Fund”) seeks to achieve its objective by investing principally in the debt instruments of EM corporate issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -2.34% (net of fees) versus -1.86% for the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified (“JP Morgan CEMBI BD”). Ukraine, United Arab Emirates, and Nigeria were the main contributors to Fund performance. Jamaica, Russia, and China were the main detractors from Fund performance.

2

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

China was a detractor during the period. Increased trade sanctions by the US and further threats of escalation between China and the US put pressure on credit spreads of USD denominated Chinese bonds.

Ashmore Emerging Markets Short Duration Fund

The Ashmore Emerging Markets Short Duration Fund (the “Fund”) seeks to achieve its objective by investing principally in short-term debt instruments of, and derivative instruments related to, Sovereign, Quasi-Sovereign and Corporate issuers of emerging markets countries denominated exclusively in Hard Currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain weighted average portfolio duration of between 1 and 3 years. The Fund has no restrictions on individual security duration.

Over the period, the Fund’s institutional class underperformed its benchmark, returning +0.11% (net of fees) versus +1.32% for the JP Morgan CEMBI BD 1-3 Year. Venezuela, Brazil, and United Arab Emirates were the main contributors to Fund performance. Jamaica, China, and Russia were the main detractors from Fund performance.

Venezuela, an off-benchmark allocation, was a noteworthy contributor during the period. The decision to focus the portfolio’s Venezuelan exposure entirely in the collateralized bond issued by the state-owned oil company PDVSA continued to benefit the portfolio, as this bond is the only one in Venezuela that continues to be current, with the latest coupon arriving on time and in full during the quarter.

Ashmore Emerging Markets Active Equity Fund

The Ashmore Emerging Markets Active Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of emerging markets issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class outperformed its benchmark, returning -8.41% (net of fees) versus -12.52% for the MSCI Emerging Markets Index. Positions in Chinese energy, Indian banks and South Korea semiconductors were the main contributors to Fund relative performance. Positions in certain Russian banks were the main detractor from Fund relative performance.

Favorable demand and supply dynamics led to energy price strength. This supported the Fund’s position in a Chinese exploration and production energy company. The normalization of non-performing loans and increased visibility over retail lending was a positive for the Fund’s position in an Indian bank, although the default of an Indian leasing company weighed on performance towards the end of the period. Semiconductors performed well on strong demand from data centers. The Fund’s position in a Russian bank performed poorly on increased sanction risk.

Ashmore Emerging Markets Small-Cap Equity Fund

The Ashmore Emerging Markets Small-Cap Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of small-capitalization EM issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -20.60% (net of fees) versus -17.21% for the MSCI Emerging Markets Small Cap Index. Positions in Taiwanese and Indian consumer discretionary stocks were the primary drivers of Fund relative returns. Positions in certain Indian banks were the primary detractors to relative Fund performance.

The Fund’s position in a Taiwanese food and cosmetics manufacturer performed well on strong results. The Fund’s position in an Indian fashion retailer performed well on significant structural growth in organized retail.

The Fund’s positions in an Indian bank and an Indian diversified financial company both performed poorly in part due to liquidity pressure in the Indian financial sector following the default of a leasing company. Higher energy prices and pressure on the rupee further weighed on market sentiment in India.

3

ASHMORE FUNDS

INVESTMENT MANAGER’S REPORT (CONTINUED)

Ashmore Emerging Markets Frontier Equity Fund

The Ashmore Emerging Markets Frontier Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of Frontier Market issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -15.11% (net of fees) versus -12.07% for the MSCI Frontier Markets Index. Positions in Saudi Arabia and an underweight position in Argentina were the main contributors to Fund relative performance. Underweight positions in Kuwait and Vietnam were the main detractors from Fund relative performance.

The Saudi Arabian market performed well driven higher primarily by energy price strength and news from index provider MSCI that the Kingdom will be reclassified to the MSCI Emerging Markets index. The Argentinian market fell sharply on peso weakness compared to the dollar due to a balance of payment crisis.

Kuwait performed well on increased infrastructure spending. Sentiment was also boosted by news from FTSE that the market will be included in their Emerging Markets index. Vietnam performed well as the economy enjoyed strong growth.

Ashmore Emerging Markets Equity Fund

The Ashmore Emerging Markets Equity Fund (the “Fund”) seeks to achieve its objective by investing principally in equity securities and equity-related investments of EM issuers, which may be denominated in any currency, including the local currency of the issuer.

Over the period, the Fund’s institutional class underperformed its benchmark, returning -14.01% (net of fees) versus -12.52% for the MSCI Emerging Markets Index. Positions in South Korea were the primary contributor to relative Fund performance. Positions in Taiwan and India were the primary detractors to Fund relative performance.

The Fund’s position in a South Korean dental company performed strongly. The company continues to take market share from its competitors due to its superior sales network and marketing strategy. It is also expanding successfully in India, an underpenetrated high growth market.

The Fund’s position in an Asian bakery chain performed poorly as it got embroiled in politics between Taiwan and China. The Fund’s position in an Indian diversified financial company performed poorly in part due to liquidity pressure in the Indian financial sector following the default of a leasing company.

4

IMPORTANT INFORMATION ABOUT THE FUNDS

Ashmore Investment Advisors Limited

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Funds and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are those of Ashmore Investment Advisors Limited as of the date indicated and are subject to change at any time based upon economic, market, or other conditions and Ashmore Investment Advisors Limited undertakes no obligation to update the views expressed herein. Any discussions of specific securities or markets should not be considered a recommendation to buy or sell or invest in those securities or markets. The views expressed above may not be relied upon as investment advice or as an indication of the Funds’ trading intent. Information about the Funds’ holdings, asset allocation or country diversification is historical and is not an indication of future portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments. In addition, the returns do not reflect certain charges that an investor in the Funds may pay. If these additional fees were reflected, the performance shown would have been lower.

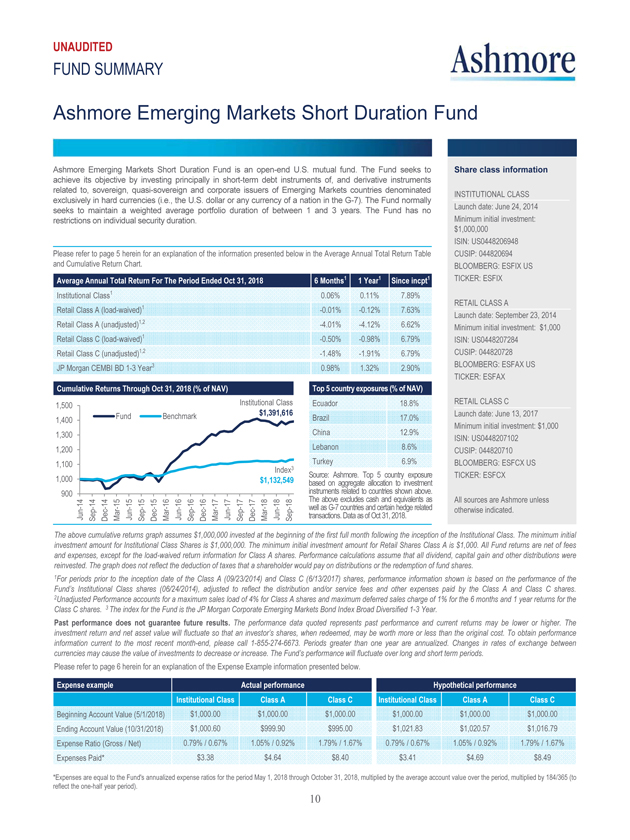

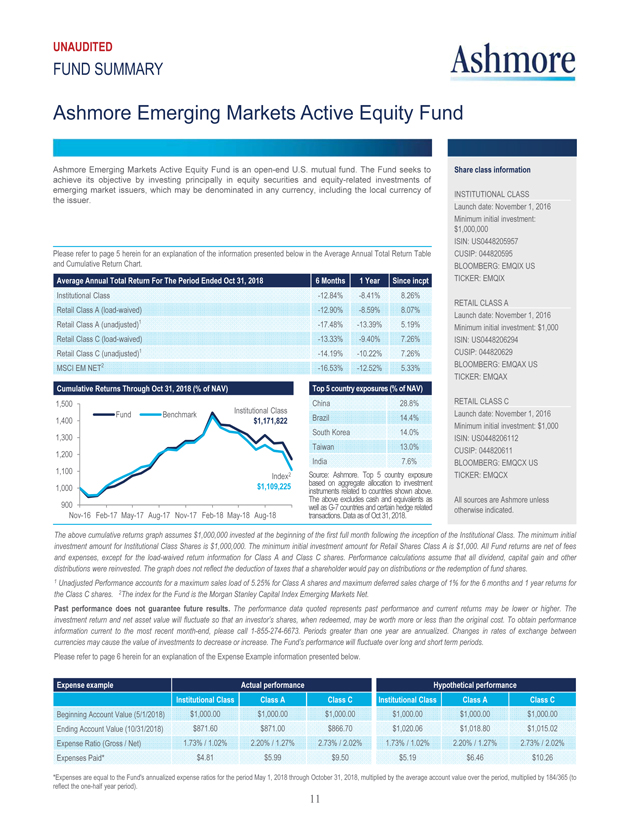

The following disclosure provides important information regarding each Fund’s Average Annual Total Return table and Cumulative Returns chart, which appear on each Fund’s individual page in this report (the “Shareholder Report” or the “Report”). Please refer to this information when reviewing the table and chart for a Fund.

On each individual Fund Summary page in this Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the redemption of Fund shares. The Cumulative Returns Chart reflects only Institutional Class performance. Performance for Class A and Class C shares is typically lower than Institutional Class performance due to the lower expenses paid by Institutional Class shares. Except for the load-waived performance for the Class A and C shares of each Fund (as applicable), performance shown is net of fees and expenses. The load-waived performance for Class A and Class C shares does not reflect the sales charges shareholders of those classes may pay in connection with a purchase or redemption of Class A and Class C shares. The load-waived performance of those share classes is relevant only to shareholders who purchased Class A or Class C shares on a load-waived basis. The figures in the line graph are calculated at net asset value and assume the investment of $1,000,000 at the beginning of the first full month following the inception of the Institutional Class. Each Fund measures its performance against a broad-based securities market index (“benchmark index”). Each benchmark index does not take into account fees, expenses or taxes.

For periods prior to the inception date of the Class A and Class C shares (if applicable), performance information shown is based on the performance of the Fund’s Institutional Class shares, adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively.

A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

5

IMPORTANT INFORMATION ABOUT THE FUNDS (CONTINUED)

The following disclosure provides important information regarding each Fund’s Expense Example, which appears on each Fund’s individual page in this Shareholder Report. Please refer to this information when reviewing the Expense Example for a Fund.

EXPENSE EXAMPLE

Fund Expenses

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in Dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, from May 1, 2018 or the inception date (if later), through October 31, 2018.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information based on actual performance and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class, in the row titled “Expenses Paid” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical Performance” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

6

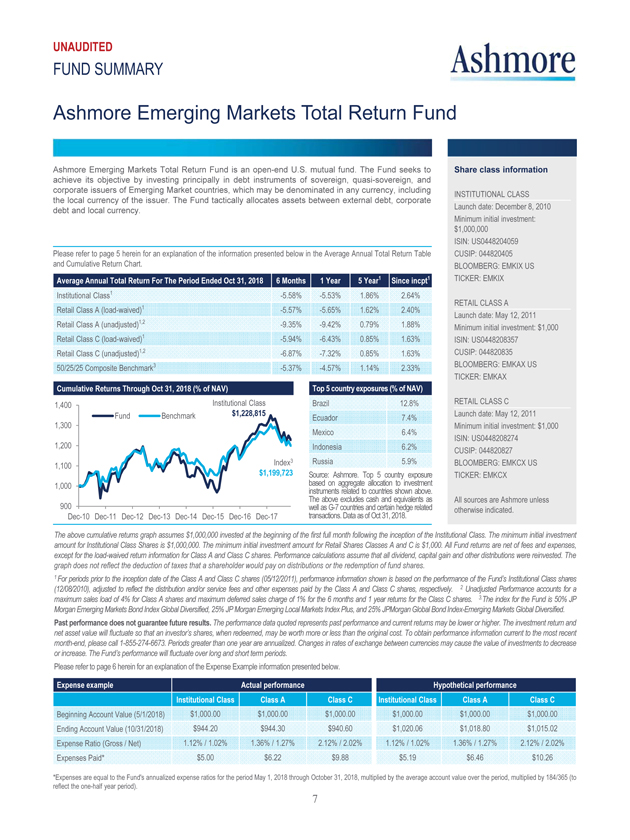

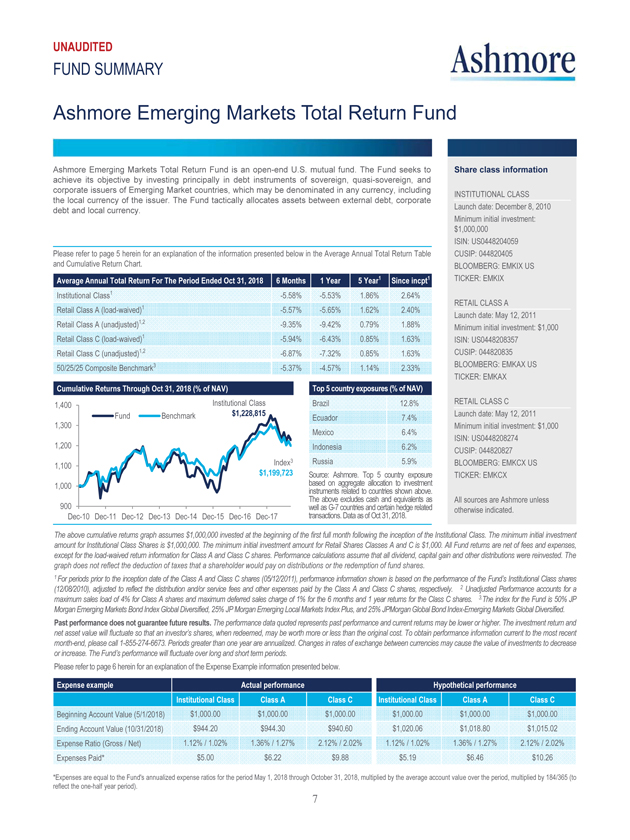

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Total Return Fund Ashmore Emerging Markets Total Return Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of sovereign, quasi-sovereign, and corporate issuers of Emerging Market countries, which may be denominated in any currency, including the local currency of the issuer. The Fund tactically allocates assets between external debt, corporate debt and local currency. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class1 -5.58% -5.53% 1.86% 2.64% Retail Class A (load-waived)1 -5.57% -5.65% 1.62% 2.40% Retail Class A (unadjusted)1,2 -9.35% -9.42% 0.79% 1.88% Retail Class C (load-waived)1 -5.94% -6.43% 0.85% 1.63% Retail Class C unadjusted)1,2 -6.87% -7.32% 0.85% 1.63% 50/25/25 Composite Benchmark3 -5.37% -4.57% 1.14% 2.33 Brazil 12.8% Ecuador 7.4% Mexico 6.4% Indonesia 6.2% Russia 5.9% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: December 8, 2010 Minimum initial investment: $1,000,000 ISIN: US0448204059 CUSIP: 044820405 BLOOMBERG: EMKIX US TICKER: EMKIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208357 CUSIP: 044820835 BLOOMBERG: EMKAX US TICKER: EMKAX RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208274 CUSIP: 044820827 BLOOMBERG: EMKCX US TICKER: EMKCX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1 For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2 Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3.The index for the Fund is 50% JP Morgan Emerging Markets Bond Index Global Diversified, 25% JP Morgan Emerging Local Markets Index Plus, and 25% JPMorgan Global Bond Index-Emerging Markets Global Diversified. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below. Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $944.20 $944.30 $940.60 $1,020.06 $1,018.80 $1,015.02 Expense Ratio (Gross / Net) 1.12% / 1.02% 1.36% / 1.27% 2.12% / 2.02% 1.12% / 1.02% 1.36% / 1.27% 2.12% / 2.02% Expenses Paid* $5.00 $6.22 $9.88 $5.19 $6.46 $10.26 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 7

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Local Currency Bond Fund Ashmore Emerging Markets Local Currency Bond Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of sovereign and quasi-sovereign issuers of Emerging Market countries that are denominated in the local currency of the issuer. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class1 -12.00% -7.33% -2.53% -0.58% Retail Class A (load-waived)1 -12.12% -7.47% 2.77% -0.82% Retail Class A (unadjusted)1,2 -15.64% -11.17% -3.57% -1.33% Retail Class C (load-waived)1 -12.48% -8.24% -3.53% -1.57% Retail Class C (unadjusted)1,2 -13.35% -9.14% -3.53% -1.57% JP Morgan GBI-EM GD3 -11.15% -6.58% -2.59% -0.36% Brazil 17.3% South Africa 11.7% Indonesia 11.7% Russia 9.7% Poland 9.2% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: December 8, 2010 Minimum initial investment: $1,000,000 ISIN: US0448202079 CUSIP: 044820207 BLOOMBERG: ELBIX US TICKER: ELBIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208761 CUSIP: 044820876 BLOOMBERG: ELBAX US TICKER: ELBAX RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448208688 CUSIP: 044820868 BLOOMBERG: ELBCX US TICKER: ELBCX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3The index for the Fund is the JP Morgan Global Bond Index—Emerging Markets Global Diversified. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below. Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $880.00 $878.80 $875.20 $1,020.27 $1,019.00 $1,015.22 Expense Ratio (Gross / Net) 1.32% / 0.97% 1.57% / 1.22% 2.31% / 1.97% 1.32% / 0.97% 1.57% / 1.22% 2.31% / 1.97% Expenses Paid* $4.64 $5.82 $9.36 $4.99 $6.26 $10.06 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 8

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Corporate Debt Fund Ashmore Emerging Markets Corporate Debt Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in debt instruments of Emerging Market corporate issuers, which may be denominated in any currency, including the local currency of the issuer. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class1 -1.10% -2.34% 4.66% 5.16% Retail Class A (load-waived)1 -1.28% -2.58% 4.39%4.89% Retail Class A (unadjusted)1,2 -5.23% -6.48% 3.54% 4.35% Retail Class C (load-waived)1 -1.65% -3.30% 3.61% 4.10% Retail Class C (unadjusted)1,2 -2.61% -4.22% 3.61% 4.10% JP Morgan CEMBI BD3 -0.42% -1.86% 4.19% 4.75% Brazil 22.7% China9.8% Israel 6.8% Ukraine 6.0% Jamaica 5.0% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries .Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: December 8, 2010 Minimum initial investment: $1,000,000 ISIN: US044825049 CUSIP: 044820504 BLOOMBERG: EMCIX US TICKER: EMCIX RETAIL CLASS A Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448206039 CUSIP: 044820603 BLOOMBERG: ECDAX US TICKER: ECDAX RETAIL CLASS C Launch date: May 12, 2011 Minimum initial investment: $1,000 ISIN: US0448207029 CUSIP: 044820702 BLOOMBERG: ECDCX US TICKER: ECDCX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1For periods prior to the inception date of the Class A and Class C shares (05/12/2011), performance information shown is based on the performance of the Fund’s Institutional Class shares (12/08/2010), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3The index for the Fund is the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below. Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $989.00 $987.20 $983.50 $1,019.31 $1,018.05 $1,014.27 Expense Ratio (Gross / Net) 1.29% / 1.17% 1.53% / 1.42% 2.29% / 2.17% 1.29% / 1.17% 1.53% / 1.42% 2.29% / 2.17% Expenses Paid* $5.87 $7.11 $10.85 $5.96 $7.22 $11.02 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 9

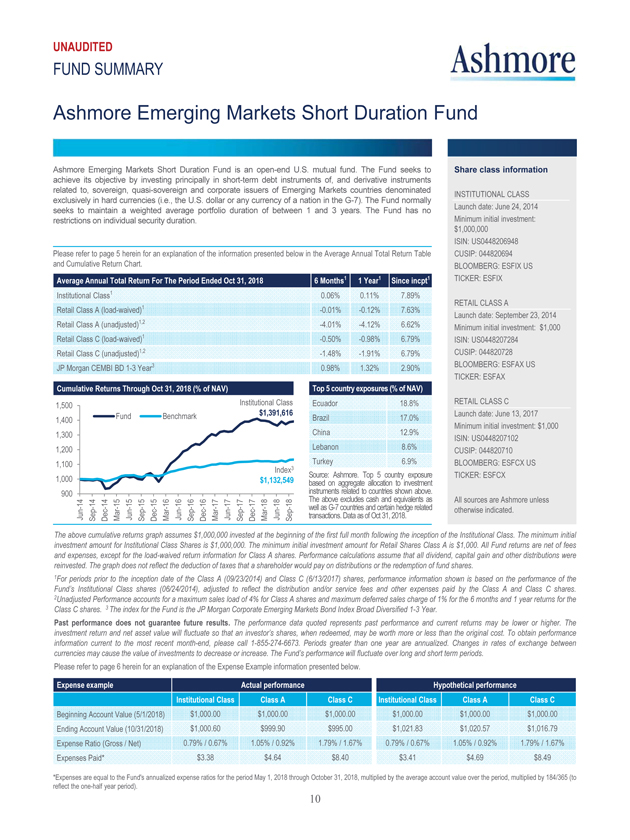

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Short Duration Fund Ashmore Emerging Markets Short Duration Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in short-term debt instruments of, and derivative instruments related to, sovereign, quasi-sovereign and corporate issuers of Emerging Markets countries denominated exclusively in hard currencies (i.e., the U.S. dollar or any currency of a nation in the G-7). The Fund normally seeks to maintain a weighted average portfolio duration of between 1 and 3 years. The Fund has no restrictions on individual security duration. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class1 0.06% 0.11% 7.89% Retail Class A (load-waived)1 -0.01% -0.12% 7.63% Retail Class A (unadjusted)1,2 -4.01% -4.12% 6.62% Retail Class C (load-waived)1 -0.50% -0.98% 6.79% Retail Class C (unadjusted)1,2 -1.48% 1.91% 6.79% JP Morgan CEMBI BD 1-3 Year3 0.98% 1.32% 2.90% Ecuador 18.8% Brazil 17.0% China 12.9% Lebanon 8.6% Turkey 6.9% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: June 24, 2014 Minimum initial investment: $1,000,000 ISIN: US0448206948 CUSIP: 044820694 BLOOMBERG: ESFIX US TICKER: ESFIX RETAIL CLASS A Launch date: September 23, 2014 Minimum initial investment: $1,000 ISIN: US0448207284 CUSIP: 044820728 BLOOMBERG: ESFAX US TICKER: ESFAX RETAIL CLASS C Launch date: June 13, 2017 Minimum initial investment: $1,000 ISIN: US0448207102 CUSIP: 044820710 BLOOMBERG: ESFCX US TICKER: ESFCX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Class A is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1For periods prior to the inception date of the Class A (09/23/2014) and Class C (6/13/2017) shares, performance information shown is based on the performance of the Fund’s Institutional Class shares (06/24/2014), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares. 2Unadjusted Performance accounts for a maximum sales load of 4% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3 The index for the Fund is the JP Morgan Corporate Emerging Markets Bond Index Broad Diversified 1-3 Year. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below.Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $1,000.60 $999.90 $995.00 $1,021.83 $1,020.57$1,016.79 Expense Ratio (Gross / Net) 0.79% / 0.67% 1.05% / 0.92% 1.79% / 1.67% 0.79% / 0.67% 1.05% / 0.92% 1.79% /1.67% Expenses Paid* $3.38 $4.64 $8.40 $3.41 $4.69 $8.49 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 10

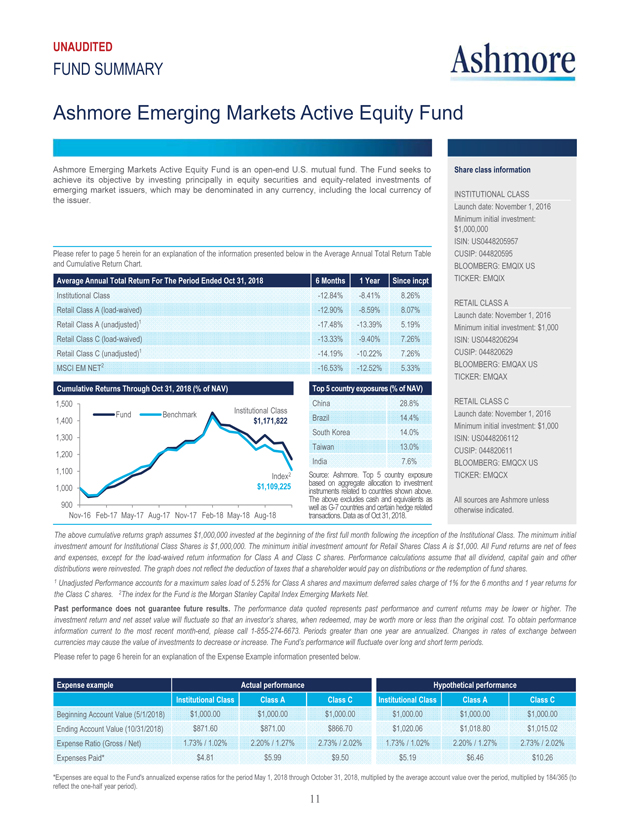

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Active Equity Fund Ashmore Emerging Markets Active Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of emerging market issuers, which may be denominated in any currency, including the local currency of the issuer. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class -12.84% -8.41% 8.26% Retail Class A (load-waived) -12.90% -8.59% 8.07% Retail Class A (unadjusted)1 -17.48% -13.39% 5.19% Retail Class C (load-waived) -13.33% -9.40% 7.26% Retail Class C (unadjusted)1 14.19% -10.22% 7.26% MSCI EM NET2 -16.53% -12.52% 5.33% China 28.8% Brazil 14.4% South Korea 14.0% Taiwan 13.0% India 7.6% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: November 1, 2016 Minimum initial investment: $1,000,000 ISIN: US0448205957 CUSIP: 044820595 BLOOMBERG: EMQIX US TICKER: EMQIX RETAIL CLASS A Launch date: November 1, 2016 Minimum initial investment: $1,000 ISIN: US0448206294 CUSIP: 044820629 BLOOMBERG: EMQAX US TICKER: EMQAX RETAIL CLASS C Launch date: November 1, 2016 Minimum initial investment: $1,000 ISIN: US0448206112 CUSIP: 044820611 BLOOMBERG: EMQCX US TICKER: EMQCX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Class A is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 2The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Net. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below. Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $871.60 $871.00 $866.70 $1,020.06 $1,018.80 $1,015.02 Expense Ratio (Gross / Net) 1.73% / 1.02% 2.20% / 1.27% 2.73% / 2.02% 1.73% / 1.02% 2.20% / 1.27% 2.73% / 2.02% Expenses Paid* $4.81$5.99 $9.50 $5.19 $6.46 $10.26 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 11

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Small-Cap Equity Fund Ashmore Emerging Markets Small-Cap Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing at least 80% of its net assets in equity securities and equity-related investments of Emerging Market small-capitalization issuers, which may be denominated in any currency, including the local currency of the issuer. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class1 -25.74% -20.60%-1.24% 3.60% Retail Class A (load-waived)1 -25.94% -20.96% -1.52% 3.29% Retail Class A (unadjusted)1,2 -29.83% -25.11% -2.57% 2.50% Retail Class C (load-waived)1 -26.31% -21.62% -2.30% 2.51% Retail Class C (unadjusted)1,2 -27.04% -22.40% -2.30% 2.51% MSCI EM Small Cap NET3 -21.59% -17.21% -0.25% 3.50% China 22.6% India 17.8% Taiwan 17.3% South Korea 16.3% Brazil 6.4% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: October 4, 2011 Minimum initial investment: $1,000,000 ISIN: US0448201162 CUSIP: 044820116 BLOOMBERG: ESCIX US TICKER: ESCIX RETAIL CLASS A Launch date: February 1, 2012 Minimum initial investment: $1,000 ISIN: US0448207938 CUSIP: 044820793 BLOOMBERG: ESSAX US TICKER: ESSAX RETAIL CLASS C Launch date: August 24, 2012 Minimum initial investment: $1,000 ISIN: US0448207854 CUSIP: 044820785 BLOOMBERG: ESSCX US TICKER: ESSCX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1 For periods prior to the inception date of the Class A (02/01/2012) and Class C shares (08/24/2012), performance information shown is based on the performance of the Fund’s Institutional Class shares (10/04/2011), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3 The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Small-Cap Net. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below. Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $742.60 $740.60 $736.90 $1,017.54 $1,016.28 $1,012.50 Expense Ratio (Gross / Net) 2.06% / 1.52% 2.37% / 1.77% 3.09% / 2.52% 2.06% / 1.52% 2.37% / 1.77% 3.09% / 2.52% Expenses Paid* $6.68 $7.77 $11.03 $7.73 $9.00 $12.78 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Frontier Equity Fund Ashmore Emerging Markets Frontier Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Frontier Market issuers, which may be denominated in any currency, including the local currency of the issuer. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class -20.37% -15.11% 2.26% Retail Class A (load-waived)1 -20.69% -15.44% 1.92% Retail Class A (unadjusted)1,2 -24.85% -19.88% 0.83% Retail Class C (load-waived)1 -21.19% -16.30% 1.07% Retail Class C (unadjusted)1,2 -21.97% -17.07% 1.07% MSCI Frontier Markets NET3 -17.20% -12.07% 1.62% Nigeria 12.1% Kuwait 11.2% Vietnam 11.0% Argentina 9.2% United Arab Emirates 8.5% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: November 5, 2013 Minimum initial investment: $1,000,000 ISIN: US0448207367 CUSIP: 044820736 BLOOMBERG: EFEIX US TICKER: EFEIX RETAIL CLASS A Launch date: May 7, 2014 Minimum initial investment: $1,000 ISIN: US0448207516 CUSIP: 044820751BLOOMBERG: EFEAX US TICKER: EFEAX RETAIL CLASS C Launch date: May 7, 2014 Minimum initial investment: $1,000 ISIN: US0448207441 CUSIP: 044820744 BLOOMBERG: EFECX US TICKER: EFECX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. All Fund returns are net of fees and expenses. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1 For periods prior to the inception date of the Class A (05/07/2014) and Class C shares (05/07/2014), performance information shown is based on the performance of the Fund’s Institutional Class shares (11/05/2013), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares, respectively. 2 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3The index for the Fund is the Morgan Stanley Capital Index Frontier Markets Net. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented belowBeginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $796.30 $793.10 $788.10 $1,017.54 $1,016.28 $1,012.50 Expense Ratio (Gross / Net) 1.95% / 1.52% 2.20% / 1.77% 2.94% / 2.52% 1.95% / 1.52% 2.20% / 1.77% 2.94% / 2.52% Expenses Paid* $6.88 $8.00 $11.36 $7.73 $9.00 $12.78 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 13

UNAUDITED FUND SUMMARY Ashmore Emerging Markets Equity Fund* Ashmore Emerging Markets Equity Fund is an open-end U.S. mutual fund. The Fund seeks to achieve its objective by investing principally in equity securities and equity-related investments of Emerging Market issuers which may be denominated in any currency, including the local currency of the issuer. *Effective November 1, 2017 the Fund’s name changed from Ashmore Emerging Markets Value Fund to Ashmore Emerging Markets Equity Fund. Please refer to page 5 herein for an explanation of the information presented below in the Average Annual Total Return Table and Cumulative Return Chart. Institutional Class1 -17.85% -14.01% 0.86% -0.07% Retail Class A (load-waived)1 -17.88% 14.16% 0.62% -0.35% Retail Class A (unadjusted)1,2 -22.20% -18.66% -0.47% -1.08% Retail Class C (load-waived)1 -18.38% 14.92% -0.19% -1.12% Retail Class C (unadjusted)1,2 -19.19% -15.75% -0.19% -1.12% MSCI EM NET3 -16.53% -12.52% 0.78% 0.33% China 27.8% India 12.0% Brazil 9.8% Taiwan 9.8% Russia 7.8% based Source:on Ashmore aggregate . Top allocation 5 country to investment exposure instruments The above excludes related tocash countries and equivalents shown above as. well transactions as G-7 countries . Data as of and Oct certain 31, 2018 hedge . related Share class information INSTITUTIONAL CLASS Launch date: June 22, 2011 Minimum initial investment: $1,000,000 ISIN: US0448208191 CUSIP: 044820819 BLOOMBERG: EMFIX US TICKER: EMFIX RETAIL CLASS A Launch date: February 27, 2012 Minimum initial investment: $1,000 ISIN: US0448207771 CUSIP: 044820777 BLOOMBERG: EMEAX US TICKER: EMEAX RETAIL CLASS C Launch date: March 7, 2017 Minimum initial investment: $1,000 ISIN: US0448207698 CUSIP: 044820769 BLOOMBERG: EMECX US TICKER: EMECX All sources are Ashmore unless otherwise indicated. The above cumulative returns graph assumes $1,000,000 invested at the beginning of the first full month following the inception of the Institutional Class. The minimum initial investment amount for Institutional Class Shares is $1,000,000. The minimum initial investment amount for Retail Shares Classes A and C is $1,000. All Fund returns are net of fees and expenses, except for the load-waived return information for Class A and Class C shares. Performance calculations assume that all dividend, capital gain and other distributions were reinvested. The graph does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. 1 For periods prior to the inception date of the Class A (02/27/2012) and Class C shares (03/07/2017), performance information shown is based on the performance of the Fund’s Institutional Class shares (06/22/2011), adjusted to reflect the distribution and/or service fees and other expenses paid by the Class A and Class C shares. 2 Unadjusted Performance accounts for a maximum sales load of 5.25% for Class A shares and maximum deferred sales charge of 1% for the 6 months and 1 year returns for the Class C shares. 3 The index for the Fund is the Morgan Stanley Capital Index Emerging Markets Net. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-855-274-6673. Periods greater than one year are annualized. Changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The Fund’s performance will fluctuate over long and short term periods. Please refer to page 6 herein for an explanation of the Expense Example information presented below. Beginning Account Value (5/1/2018) $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Ending Account Value (10/31/2018) $821.50 $821.20 $816.20 $1,019.31 $1,018.05 $1,014.32 Expense Ratio (Gross / Net) 1.95% / 1.17% 2.19% / 1.42% 2.96% / 2.17% 1.95% / 1.17% 2.19% / 1.42% 2.96% / 2.17% Expenses Paid* $5.37 $6.52 $9.89 $5.96 $7.22 $10.97 *Expenses are equal to the Fund’s annualized expense ratios for the period May 1, 2018 through October 31, 2018, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). 14

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees

Ashmore Funds:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Ashmore Emerging Markets Total Return Fund, Ashmore Emerging Markets Local Currency Bond Fund, Ashmore Emerging Markets Corporate Debt Fund, Ashmore Emerging Markets Short Duration Fund, Ashmore Emerging Markets Active Equity Fund, Ashmore Emerging Markets Small-Cap Equity Fund, Ashmore Emerging Markets Frontier Equity Fund, and Ashmore Emerging Markets Equity Fund (funds within Ashmore Funds)(the Funds), including the schedules of investments, as of October 31, 2018, the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years or periods in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of October 31, 2018, the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2018, by correspondence with custodians and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of Ashmore Funds since 2010.

Chicago, IL

December 21, 2018

(THIS PAGE INTENTIONALLY LEFT BLANK)

16

ASHMORE FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

As of October 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ashmore

Emerging Markets Total Return

Fund | | | | Ashmore

Emerging Markets

Local Currency

Bond Fund | | | | Ashmore

Emerging Markets

Corporate Debt

Fund |

ASSETS: | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in securities, at value | | | $ | 1,223,200,326 | | | | | | | | | $ | 50,149,642 | | | | | | | | | $ | 319,130,781 | |

Investments in fully funded total return swaps, at value | | | | 3,402,985 | | | | | | | | | | 1,745,774 | | | | | | | | | | — | |

Deposit held at broker | | | | 5,371,689 | | | | | | | | | | 642,318 | | | | | | | | | | — | |

Cash | | | | 84,415,223 | | | | | | | | | | 11,130,889 | | | | | | | | | | 14,335,592 | |

Foreign currency, at value | | | | 3,698,914 | | | | | | | | | | 183,167 | | | | | | | | | | 71,309 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | | 10,500,287 | | | | | | | | | | 846,608 | | | | | | | | | | 56,998 | |

Variation margin receivable on centrally cleared swap contracts | | | | 202,398 | | | | | | | | | | 23,761 | | | | | | | | | | — | |

Due from broker | | | | 1,020,167 | | | | | | | | | | 112,693 | | | | | | | | | | — | |

Receivable for securities and currencies sold | | | | 993,677 | | | | | | | | | | 8,364 | | | | | | | | | | — | |

Receivable for fund shares sold | | | | 391,041 | | | | | | | | | | 14,619 | | | | | | | | | | 2,225,540 | |

Receivable from Investment Manager | | | | 106,087 | | | | | | | | | | 18,449 | | | | | | | | | | 37,839 | |

Interest and dividends receivable | | | | 18,586,049 | | | | | | | | | | 1,012,104 | | | | | | | | | | 4,740,752 | |

Other assets | | | | 18,109 | | | | | | | | | | 8,760 | | | | | | | | | | 13,738 | |

Total Assets | | | | 1,351,906,952 | | | | | | | | | | 65,897,148 | | | | | | | | | | 340,612,549 | |

LIABILITIES: | | | | | | | | | | | | | | | | | | | | | | | | | |

Reverse repurchase agreements | | | | — | | | | | | | | | | — | | | | | | | | | | 294,298 | |

Cash overdraft | | | | — | | | | | | | | | | — | | | | | | | | | | — | |

Unrealized depreciation on forward foreign currency exchange contracts | | | | 8,175,124 | | | | | | | | | | 1,006,476 | | | | | | | | | | — | |

Variation margin payable on centrally cleared swap contracts | | | | 369,347 | | | | | | | | | | 78,547 | | | | | | | | | | — | |

Unrealized depreciation on interest rate swap contracts | | | | — | | | | | | | | | | 8,434 | | | | | | | | | | — | |

Payable for securities and currencies purchased | | | | 7,837,057 | | | | | | | | | | 26,750 | | | | | | | | | | 1,674,968 | |

Payable for when-issued securities | | | | — | | | | | | | | | | — | | | | | | | | | | 450,000 | |

Payable for fund shares redeemed | | | | 563,228 | | | | | | | | | | 40,701 | | | | | | | | | | 777,843 | |

Distributions payable | | | | 3,218,338 | | | | | | | | | | — | | | | | | | | | | 157,302 | |

Due to broker | | | | 3,910,032 | | | | | | | | | | 274,258 | | | | | | | | | | — | |

Investment Manager fee payable | | | | 1,142,528 | | | | | | | | | | 53,382 | | | | | | | | | | 322,746 | |

Trustees’ fees payable | | | | 31,740 | | | | | | | | | | 1,347 | | | | | | | | | | 7,195 | |

Other liabilities | | | | 373,978 | | | | | | | | | | 61,869 | | | | | | | | | | 108,160 | |

Total Liabilities | | | | 25,621,372 | | | | | | | | | | 1,551,764 | | | | | | | | | | 3,792,512 | |

Net Assets | | | $ | 1,326,285,580 | | | | | | | | | $ | 64,345,384 | | | | | | | | | $ | 336,820,037 | |

NET ASSETS: | | | | | | | | | | | | | | | | | | | | | | | | | |

Paid in capital | | | $ | 1,494,173,899 | | | | | | | | | $ | 74,915,827 | | | | | | | | | $ | 394,606,247 | |

Distributable earnings/(Accumulated loss) | | | | (167,888,319 | ) | | | | | | | | | (10,570,443 | ) | | | | | | | | | (57,786,210 | ) |

Net Assets | | | $ | 1,326,285,580 | | | | | | | | | $ | 64,345,384 | | | | | | | | | $ | 336,820,037 | |

| | | | | |

Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | $ | 8,347,036 | | | | | | | | | $ | 1,258,707 | | | | | | | | | $ | 8,616,288 | |

Class C | | | | 4,278,426 | | | | | | | | | | 77,392 | | | | | | | | | | 8,785,014 | |

Institutional Class | | | | 1,313,660,118 | | | | | | | | | | 63,009,285 | | | | | | | | | | 319,418,735 | |

| | | | | |

Shares Issued and Outstanding (no par value, unlimited shares authorized): | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | 1,142,158 | | | | | | | | | | 192,738 | | | | | | | | | | 1,095,027 | |

Class C | | | | 586,825 | | | | | | | | | | 11,961 | | | | | | | | | | 1,117,883 | |

Institutional Class | | | | 177,162,636 | | | | | | | | | | 9,274,887 | | | | | | | | | | 38,968,692 | |

| | | | | |

Net Asset Value and Redemption Price Per Share (Net Asset Per Share Outstanding): | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | $ | 7.31 | | | | | | | | | $ | 6.53 | | | | | | | | | $ | 7.87 | |

Class C | | | | 7.29 | | | | | | | | | | 6.47 | | | | | | | | | | 7.86 | |

Institutional Class | | | | 7.41 | | | | | | | | | | 6.79 | | | | | | | | | | 8.20 | |

| | | | | |

Cost of Investments in securities | | | $ | 1,326,802,997 | | | | | | | | | $ | 57,828,947 | | | | | | | | | $ | 341,345,374 | |

Cost of Investments in fully funded total return swaps | | | $ | 4,793,918 | | | | | | | | | $ | 2,335,577 | | | | | | | | | $ | — | |

Cost of foreign currency held | | | $ | 3,693,644 | | | | | | | | | $ | 181,843 | | | | | | | | | $ | 72,988 | |

See accompanying notes to the financial statements.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | Ashmore

Emerging Markets

Short Duration

Fund | | | | | | Ashmore

Emerging Markets

Active Equity Fund | | | | | | Ashmore

Emerging Markets

Small-Cap

Equity Fund | | | | | | Ashmore

Emerging Markets

Frontier Equity

Fund | | | | | | Ashmore

Emerging Markets

Equity Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $747,541,804 | | | | | | | | $17,147,582 | | | | | | | | $33,710,611 | | | | | | | | $ 84,230,416 | | | | | | | | $23,973,403 | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | 68,083,179 | | | | | | | | 966,510 | | | | | | | | — | | | | | | | | 695,022 | | | | | | | | 510,431 | |

| | | 39,948 | | | | | | | | 95,242 | | | | | | | | 171,881 | | | | | | | | 458,060 | | | | | | | | 3,413 | |

| | | — | | | | | | | | 4,241 | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | 549,157 | | | | | | | | 504,408 | | | | | | | | 519,144 | | | | | | | | 59,975 | |

| | | 2,806,872 | | | | | | | | — | | | | | | | | 231,492 | | | | | | | | 19,576 | | | | | | | | — | |

| | | 98,670 | | | | | | | | 18,240 | | | | | | | | 34,459 | | | | | | | | 46,857 | | | | | | | | 5,057 | |

| | | 10,156,014 | | | | | | | | 13,447 | | | | | | | | 68,532 | | | | | | | | 67,648 | | | | | | | | 15,924 | |

| | | | 51,453 | | | | | | | | 11,527 | | | | | | | | 9,530 | | | | | | | | — | | | | | | | | 8,512 | |

| | | | 828,777,940 | | | | | | | | 18,805,946 | | | | | | | | 34,730,913 | | | | | | | | 86,036,723 | | | | | | | | 24,576,715 | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | 238,210 | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | 45,733,266 | | | | | | | | 1,090,152 | | | | | | | | 205,831 | | | | | | | | — | | | | | | | | 50,973 | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | 545,400 | | | | | | | | — | | | | | | | | 13,337 | | | | | | | | 3,138 | | | | | | | | 4,109 | |

| | | 3,028,432 | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | |

| | | 413,505 | | | | | | | | 15,190 | | | | | | | | 46,605 | | | | | | | | 111,507 | | | | | | | | 24,705 | |

| | | 12,757 | | | | | | | | 371 | | | | | | | | 782 | | | | | | | | 1,877 | | | | | | | | 550 | |

| | | | 165,907 | | | | | | | | 29,252 | | | | | | | | 50,868 | | | | | | | | 78,253 | | | | | | | | 30,350 | |

| | | | 49,899,267 | | | | | | | | 1,134,965 | | | | | | | | 555,633 | | | | | | | | 194,775 | | | | | | | | 110,687 | |

| | | | $778,878,673 | | | | | | | | $17,670,981 | | | | | | | | $34,175,280 | | | | | | | | $ 85,841,948 | | | | | | | | $24,466,028 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $790,764,739 | | | | | | | | $17,800,716 | | | | | | | | $43,156,945 | | | | | | | | $ 96,001,456 | | | | | | | | $29,347,453 | |

| | | | (11,886,066 | ) | | | | | | | (129,735 | ) | | | | | | | (8,981,665 | ) | | | | | | | (10,159,508 | ) | | | | | | | (4,881,425) | |

| | | | $778,878,673 | | | | | | | | $17,670,981 | | | | | | | | $34,175,280 | | | | | | | | $ 85,841,948 | | | | | | | | $24,466,028 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ 83,289,658 | | | | | | | | $ 223,469 | | | | | | | | $ 1,447,012 | | | | | | | | $ 7,645,159 | | | | | | | | $ 302,629 | |

| | | 2,011,993 | | | | | | | | 11,344 | | | | | | | | 272,299 | | | | | | | | 408,345 | | | | | | | | 1,033 | |

| | | 693,577,022 | | | | | | | | 17,436,168 | | | | | | | | 32,455,969 | | | | | | | | 77,788,444 | | | | | | | | 24,162,366 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 8,518,101 | | | | | | | | 21,229 | | | | | | | | 180,526 | | | | | | | | 998,702 | | | | | | | | 32,276 | |

| | | 213,749 | | | | | | | | 1,088 | | | | | | | | 32,351 | | | | | | | | 54,666 | | | | | | | | 115 | |

| | | 72,238,937 | | | | | | | | 1,650,386 | | | | | | | | 3,146,458 | | | | | | | | 8,774,950 | | | | | | | | 2,666,228 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ 9.78 | | | | | | | | $ 10.53 | | | | | | | | $ 8.02 | | | | | | | | $ 7.66 | | | | | | | | $ 9.38 | |

| | | 9.41 | | | | | | | | 10.43 | | | | | | | | 8.42 | | | | | | | | 7.47 | | | | | | | | 8.96 | |

| | | | 9.60 | | | | | | | | 10.56 | | | | | | | | 10.32 | | | | | | | | 8.86 | | | | | | | | 9.06 | |

| | | | | | | | | |

| | | $762,684,702 | | | | | | | | $18,687,243 | | | | | | | | $41,868,903 | | | | | | | | $ 88,408,731 | | | | | | | | $27,991,566 | |

| | | $ — | | | | | | | | $ — | | | | | | | | $ — | | | | | | | | $ — | | | | | | | | $ — | |

| | | | $ 41,379 | | | | | | | | $ 95,242 | | | | | | | | $ 171,916 | | | | | | | | $ 458,017 | | | | | | | | $ 3,417 | |

See accompanying notes to the financial statements.

18

ASHMORE FUNDS

STATEMENTS OF OPERATIONS

For the Year Ended October 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ashmore

Emerging Markets Total Return

Fund | | | | Ashmore

Emerging Markets

Local Currency

Bond Fund | | | | Ashmore

Emerging Markets

Corporate Debt

Fund |

INVESTMENT INCOME: | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest, net of foreign tax withholdings* | | | $ | 78,074,252 | | | | | | | | | $ | 4,469,128 | | | | | | | | | $ | 24,637,298 | |

Payment-in-kind interest | | | | — | | | | | | | | | | — | | | | | | | | | | 2,080,465 | |

Dividends, net of foreign tax withholdings* | | | | — | | | | | | | | | | — | | | | | | | | | | — | |

Total Income | | | | 78,074,252 | | | | | | | | | | 4,469,128 | | | | | | | | | | 26,717,763 | |

EXPENSES: | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Manager fees | | | | 12,822,198 | | | | | | | | | | 686,177 | | | | | | | | | | 3,998,250 | |

Administration fees | | | | 256,423 | | | | | | | | | | 14,445 | | | | | | | | | | 69,529 | |

Custody fees | | | | 471,870 | | | | | | | | | | 79,707 | | | | | | | | | | 77,041 | |

Professional fees | | | | 311,422 | | | | | | | | | | 56,069 | | | | | | | | | | 109,280 | |

Trustees’ fees | | | | 126,535 | | | | | | | | | | 6,686 | | | | | | | | | | 33,162 | |

Offering expenses and registration fees | | | | 168,389 | | | | | | | | | | 51,252 | | | | | | | | | | 117,927 | |

Insurance fees | | | | 42,073 | | | | | | | | | | 3,427 | | | | | | | | | | 11,962 | |

Printing fees | | | | 44,565 | | | | | | | | | | 13,544 | | | | | | | | | | 20,234 | |