Exhibit 99.4

January 2025 Presentation to Spirit

Frontier’s proposal ensures superior economics, certainty, and speed for Spirit’s stakeholders relative to the Spirit standalone plan Stronger, More Competitive Airline » Transaction with Frontier creates America’s first low - cost carrier with sufficient scale to compete with the Big Four » Complementary networks bring more low fares to more markets and generate meaningful and achievable synergies Challenges with Spirit’s Standalone Plan » Spirit’s plan relies on robust valuation assumptions against a business plan with significant execution risk to generate equity value » Even if the plan is achieved, creditors do not realize a full recovery , and shareholders have zero recovery » Leverage remains high on 2025E EBITDAR (8.9x) Frontier’s Superior Alternative » Even without synergies , Frontier’s plan provides greater creditor recovery while also providing value to shareholders » On a combined basis, significantly lower leverage on 2025E EBITDAR (4.1x) » On a standalone basis, Spirit would need to achieve a valuation meaningfully higher than its plan currently contemplates for its creditors to realize the economics offered in Frontier’s alternative » A combination with Frontier de - risks Spirit’s business transformation plan and positions the combined airline to more effectively compete with the Big Four over the long term A combination with Frontier can proceed quickly, with minimal required due diligence or closing conditions 2 Confidential and proprietary

Notes: Spirit RSA and Frontier Proposal reflect $350mm equity rights offering. Recovery rates for senior secured notes and convertible notes are based on principal value and share of equity rights offering. Recovery rates exclude impact from other secured / priority claims. (1) Figures include $600mm of run - rate synergies. (2) Net leverage reflects net debt as of 02/28/2025 divided by 2025E Pro forma EBITDAR incl. 50% credit for synergies. (3) Reflects Spirit equity ownership split of 76% senior secured noteholders, 24% convertible notes. (4) Illustrative equity ownership split of 65% senior secured noteholders, 30% convertible notes, 5% common stock. (5) Per share figures based on Spirit basic shares outstanding as of November 14, 2024; rounded to the nearest $0.05. ($ in millions) Creditor Consideration $400 $840 Exit Secured Notes 11.0% Cash / 8.0% Cash + 4.0% PIK (specifics to be discussed) 11.0% Cash / 8.0% Cash + 4.0% PIK Coupon 19.0% of PF Frontier + Spirit 100% of Spirit % Ownership Frontier + Spirit Spirit Pro Forma Entity $11,059 $5,411 Revenue (FY26) $3,476 (1) $1,041 EBITDAR (FY26) $9,356 $5,937 Net Debt (2/28/2025) 4.1x 8.9x Net Leverage (2) $600 -- Run - Rate Synergies $13,161 $806 Equity Value (@ 6.5x EBITDAR FY26 per RSA Plan) $2,901 $1,646 Total Value to Stakeholders Recovery % (4) (Incl. Synergies) Recovery % (4) (Excl. Synergies) Recovery % (3) Recovery 141% 106% 95% Senior Secured Notes 137% 100% 56% Convertible Notes $1.15 / share $0.80 / share $0.00 / share Common Stock (5) Spirit Standalone Restructuring Frontier Proposal 3 Confidential and proprietary

Compelling Proposal to Acquire Spirit To Create America’s First At - Scale, Low - Cost Competitor to Big Four Creating a Stronger Airline with Long - Term Viability to Compete More Effectively • 5 th largest U.S. airline , growing to 100M annual passengers and 400+ aircraft within a few years • Top three carrier in more than half of the top 25 U.S. airports • Meaningfully increases presence in numerous major U . S . markets Offering More Low Fares and Premium Options to Travelers • Provides more low fares to more consumers , enabling billions in savings compared to prices charged by Big Four • Improves frequent flyer and loyalty programs as well as a more diversified product with premium options • Enables more reliable service through operating efficiencies • Enhances travel experience for customers Delivering Value for Financial Stakeholders • Creates compelling financial opportunity for Spirit creditors and shareholders • Provides greater value and recovery relative to Spirit standalone restructuring plan Significant Synergy Potential • Opportunity to participate in upside potential from owning a larger, more competitive airline with estimated synergies of $600M+ 4 Confidential and proprietary

Unite d A m eri c a n De lta S o u t hwe s t F ront i e r + S pi r it P F A la s k a / J et B lu e S p i r i t F ront i e r A llegiant Hawaiian Stronger Airline with Long - Term Viability to Compete Against Big Four Frontier + Spirit C o m bin e d 5th largest U.S. airline , growing to 100M annual passengers and 400+ aircraft within a few years Top three carrier in more than half of the top 25 U.S. airports Consumers Win: Low Fares with Premium Options 2023 Available Seat Miles » Provides more low fares to more consumers, enabling billions in savings compared to prices charged by Big Four » Improves frequent flyer and loyalty programs as well as a more diversified product with premium options » Enables more reliable service through operating efficiencies » Enhances travel experience for customers Source: Company filings. 5 Confidential and proprietary

Spirit Standalone Restructuring As of 02/28/2025, $840mm Exit Secured Notes Frontier Proposal (Excluding Synergies) $400mm Exit Secured Notes; 19.0% Ownership to Spirit Frontier Proposal (Incl. $600mm of Synergies) $400mm Exit Secured Notes; 19.0% Ownership to Spirit Frontier Proposal creates significantly greater value than Spirit Standalone Restructuring Plan. ($ in millions); FY26 EBITDAR Multiples 4.1x Spirit Standalone Frontier + Spirit Source: Spirit Disclosure Statement (Chapter 11 Plan of Reorganization), filed as of December 18, 2024. Notes: Spirit RSA and Frontier Proposal reflect $350mm equity rights offering. Recovery rates for senior secured notes and convertible notes are based on principal value and share of equity rights offering. Recovery rates exclude impact from other secured / priority claims. (1) Median industry multiple based on Southwest Airlines, JetBlue Airways, Frontier Airlines, Allegiant, and Sun Country Airlines. Net Leverage Net Debt as of 02/28/2025 divided by FY25 EBITDAR 8.9x Equity Value Exit Secured Notes -- $539 $700 Equity Interest -- -- $613 Sr. Secured Sr. Secured Noteholders -- $539 $1,313 % Recovery -- 39% 95% Exit Secured Notes -- $89 $140 Equity Interest -- -- $194 Convert Convertible Noteholders -- $89 $334 % Recovery -- 15% 56% Equity Value Valuation Multiple 4.5x 5.5x 6.5x $3,586 $6,462 $9,274 Exit Secured Notes $333 $333 $333 Equity Interest $442 $796 $1,142 Sr. Secured Sr. Secured Noteholders $775 $1,129 $1,475 % Recovery 56% 81% 106% Exit Secured Notes $67 $67 $67 Equity Interest $206 $371 $532 Convert Convertible Noteholders $272 $437 $599 % Recovery 45% 73% 100% Valuation Multiple 6.5x 5.5x 4.5x $13,161 $9,762 $6,286 Equity Value 6 Confidential and proprietary Exit Secured Notes $333 $333 $333 Equity Interest $774 $1,202 $1,620 Sr. Secured Sr. Secured Noteholders $1,107 $1,535 $1,954 % Recovery 80% 111% 141% Exit Secured Notes $67 $67 $67 Equity Interest $361 $560 $755 Convert Convertible Noteholders $427 $627 $822 % Recovery 71% 105% 137% Frontier Median (1) RSA Plan Valuation Multiple 4.5x 5.5x 6.5x -- -- $806

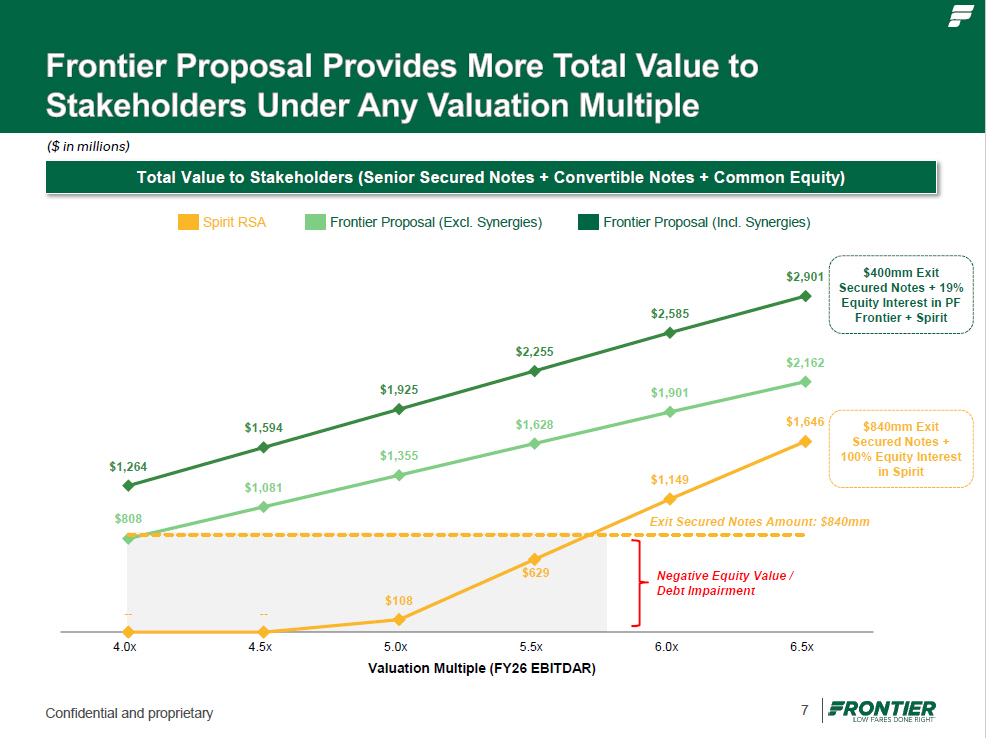

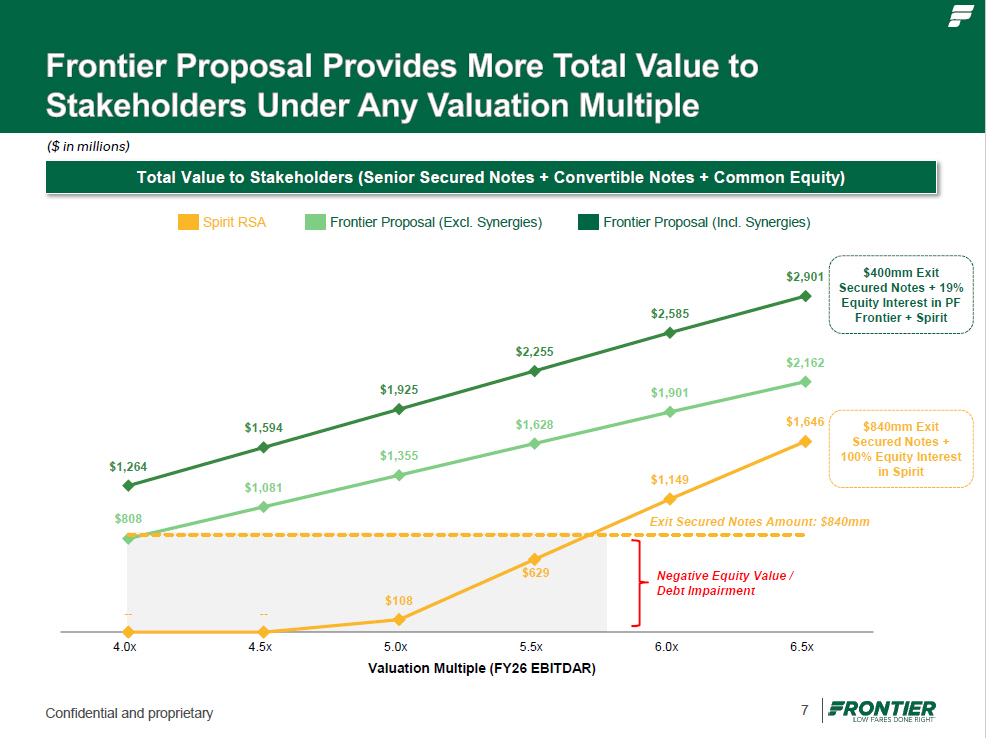

Spirit RSA Frontier Proposal (Excl. Synergies) Frontier Proposal (Incl. Synergies) $840mm Exit Secured Notes + 100% Equity Interest in Spirit $400mm Exit Secured Notes + 19% Equity Interest in PF Frontier + Spirit ($ in millions) Total Value to Stakeholders (Senior Secured Notes + Convertible Notes + Common Equity) -- $108 $629 $1,149 $1,646 $808 $1,081 $1,355 $1,628 $1,901 $2,162 $1,264 $1,594 $1,925 $2,255 $2,585 $2,901 Exit Secured Notes Amount: $840mm -- 4. 0x 4. 5x 6. 0x 6. 5x 5.0x 5.5x Valuation Multiple (FY26 EBITDAR) Negative Equity Value / Debt Impairment 7 Confidential and proprietary

• Given extensive diligence conducted to date, Frontier envisions an expedited due diligence process that may be completed in approximately 5 - 10 days • Key diligence items include : – Sales performance relative to plan – Confirmation of latest Pratt & Whitney agreement providing compensation for 2025 AOGs – Updated 2 - year cash flow forecast, inclusive of Chapter 11 costs – Disclosure of any material contract or business changes – Tax considerations, including any Chapter 11 impact to NOLs 8 Confidential and proprietary