UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of November, 2011

Commission File Number 001-35052

Adecoagro S.A.

(Translation of registrant’s name into English)

13-15 Avenue de la Liberté

L-1931 Luxembourg

R.C.S. Luxembourg B 153 681

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

ANNOUNCEMENT OF RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2011

On November 16, 2011, the registrant issued a press release pertaining to its results of operations for the three months ended September 30, 2011. Attached hereto is a copy of the press release. The financial and operational information contained in the press release is based on unaudited condensed consolidated interim financial statements presented in U.S. Dollars and prepared in accordance with International Financial Reporting Standards.

The attachment contains forward-looking statements. The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the registrant’s actual results to differ materially from those set forth in the attachment.

The registrant’s forward-looking statements are based on the registrant’s current expectations, assumptions, estimates and projections about the registrant and its industry. These forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,” or other similar expressions.

The forward-looking statements included in the attached relate to, among others: (i) the registrant’s business prospects and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the laws, regulations and governmental policies governing the registrant’s business, including limitations on ownership of farmland by foreign entities in certain jurisdictions in which the registrant operate, environmental laws and regulations; (iv) the implementation of the registrant’s business strategy, including its development of the Ivinhema mill and other current projects; (v) the registrant’s plans relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the implementation of the registrant’s financing strategy and capital expenditure plan; (vii) the maintenance of the registrant’s relationships with customers; (viii) the competitive nature of the industries in which the registrant operates; (ix) the cost and availability of financing; (x) future demand for the commodities the registrant produces; (xi) international prices for commodities; (xii) the condition of the registrant’s land holdings; (xiii) the development of the logistics and infrastructure for transportation of the registrant’s products in the countries where it operates; (xiv) the performance of the South American and world economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; as well as other risks included in the registrant’s other filings and submissions with the United States Securities and Exchange Commission.

These forward-looking statements involve various risks and uncertainties. Although the registrant believes that its expectations expressed in these forward-looking statements are reasonable, its expectations may turn out to be incorrect. The registrant’s actual results could be materially different from its expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in the attached might not occur, and the registrant’s future results and its performance may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements made in the attached relate only to events or information as of the date on which the statements are made in the attached. The registrant undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Adecoagro S.A. | ||

By: | /s/ Carlos A. Boero Hughes | |

Name: | Carlos A. Boero Hughes | |

Title: | Chief Financial Officer and | |

| Chief Accounting Officer | ||

Date: November 16, 2011

3Q11

Earnings Release Conference Call

English Conference Call

Nov. 17th, 2011

11 a.m. (US EST)

1 p.m. Buenos Aires time

2 p.m. São Paolo time

5 p.m. Luxembourg time

Tel: (877) 317-6776

Participants calling from the US

Tel: +1 (412) 317-6776

Participants calling from other countries

Access Code: Adecoagro

Investor Relations

Charlie Boero Hughes

CFO

Hernan Walker

IR Manager

ir@adecoagro.com

Website

www.adecoagro.com

AGRO

LISTED

NYSE

Adecoagro reports Adjusted EBITDA of

$50.1 million in 3Q11, bringing 9M11

Adjusted EBITDA to $125.9 million

Luxembourg, November 16th, 2011 – Adecoagro S.A. (NYSE: AGRO, Bloomberg: AGRO US, Reuters: AGRO.K), one of the leading agricultural companies in South America, announced today its results for the third quarter of 2011. The financial and operational information contained in this press release is based on unaudited condensed consolidated interim financial statements presented in US dollars and prepared in accordance with International Financial Reporting Standards (IFRS).

Highlights

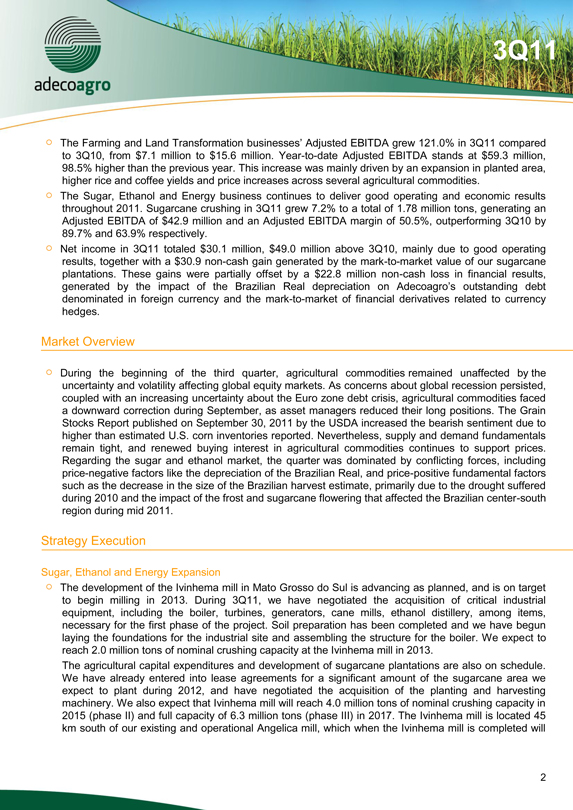

Financial & Operating Performance

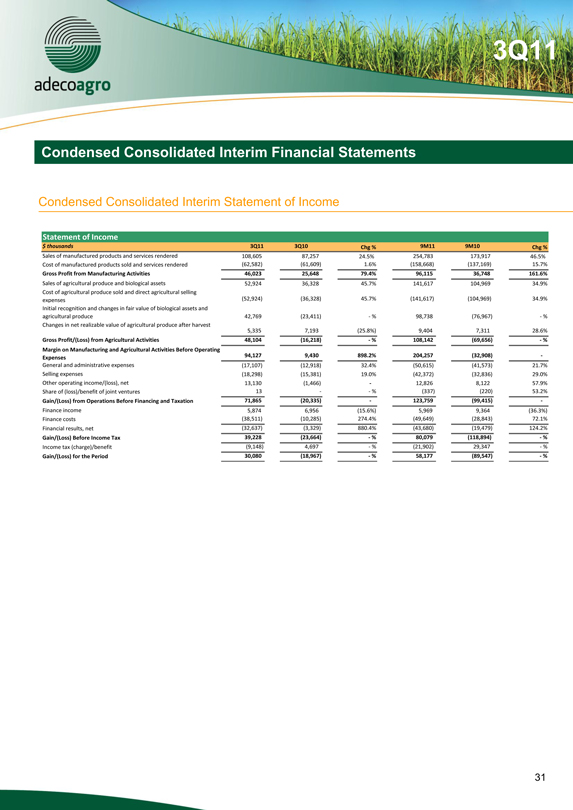

$ thousands 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales 161,529 123,585 30.7% 396,400 278,886 42.1%

Adjusted EBITDA (1)

Farming & Land Transformation 15,585 7,051 121.0% 59,294 29,864 98.5%

Sugar & Ethanol 42,885 22,596 89.8% 86,886 26,758 224.7%

Corporate Expenses (8,367) (3,573) 134.2% (20,213) (15,649) 29.2%

Total Adjusted EBITDA 50,103 26,074 92.2% 125,967 40,973 207.4%

Net Income 30,080 (18,967) -% 58,177 (89,547) -%

Farming Planted Area (Hectares) 192,207 183,454 4.8% 192,207 183,454 4.8%

Sugarcane Plantation Area (Hectares) 63,104 54,352 16.1% 63,104 54,352 16.1%

Adecoagro recorded Adjusted EBITDA of $50.1 million in 3Q11 (adjusted EBITDA margin of 31.0%), representing a 92.2% increase compared to 3Q10.

Accumulated Adjusted EBITDA for 9M11 stands at $125.9 million (adjusted EBITDA margin of 31.8%), $85.0 million or 207.4% higher than 9M10.

Net income has grown by $49.0 million in 3Q11 and $147.7 million in 9M11 compared to the same period of the previous year.

(1) Please see “Reconciliation of Non-IFRS measures” starting on page 28 for a reconciliation of Adjusted EBITDA and Adjusted EBIT to Profit/Loss. Adjusted EBITDA is defined as consolidated profit from operations before financing and taxation, depreciation, amortization and unrealized changes in fair value of long-term biological assets (sugarcane, coffee and cattle). Adjusted EBIT is defined as consolidated profit from operations before financing and taxation, and unrealized changes in fair value of long-term biological assets (sugarcane, coffee and cattle). Adjusted EBITDA margin and Adjusted EBIT margin are calculated as a percentage of gross sales.

3Q11

The Farming and Land Transformation businesses’ Adjusted EBITDA grew 121.0% in 3Q11 compared to 3Q10, from $7.1 million to $15.6 million. Year-to-date Adjusted EBITDA stands at $59.3 million, 98.5% higher than the previous year. This increase was mainly driven by an expansion in planted area, higher rice and coffee yields and price increases across several agricultural commodities.

The Sugar, Ethanol and Energy business continues to deliver good operating and economic results throughout 2011. Sugarcane crushing in 3Q11 grew 7.2% to a total of 1.78 million tons, generating an Adjusted EBITDA of $42.9 million and an Adjusted EBITDA margin of 50.5%, outperforming 3Q10 by 89.7% and 63.9% respectively.

Net income in 3Q11 totaled $30.1 million, $49.0 million above 3Q10, mainly due to good operating results, together with a $30.9 non-cash gain generated by the mark-to-market value of our sugarcane plantations. These gains were partially offset by a $22.8 million non-cash loss in financial results, generated by the impact of the Brazilian Real depreciation on Adecoagro’s outstanding debt denominated in foreign currency and the mark-to-market of financial derivatives related to currency hedges.

Market Overview

During the beginning of the third quarter, agricultural commodities remained unaffected by the uncertainty and volatility affecting global equity markets. As concerns about global recession persisted, coupled with an increasing uncertainty about the Euro zone debt crisis, agricultural commodities faced a downward correction during September, as asset managers reduced their long positions. The Grain Stocks Report published on September 30, 2011 by the USDA increased the bearish sentiment due to higher than estimated U.S. corn inventories reported. Nevertheless, supply and demand fundamentals remain tight, and renewed buying interest in agricultural commodities continues to support prices. Regarding the sugar and ethanol market, the quarter was dominated by conflicting forces, including price-negative factors like the depreciation of the Brazilian Real, and price-positive fundamental factors such as the decrease in the size of the Brazilian harvest estimate, primarily due to the drought suffered during 2010 and the impact of the frost and sugarcane flowering that affected the Brazilian center-south region during mid 2011.

Strategy Execution

Sugar, Ethanol and Energy Expansion

The development of the Ivinhema mill in Mato Grosso do Sul is advancing as planned, and is on target to begin milling in 2013. During 3Q11, we have negotiated the acquisition of critical industrial equipment, including the boiler, turbines, generators, cane mills, ethanol distillery, among items, necessary for the first phase of the project. Soil preparation has been completed and we have begun laying the foundations for the industrial site and assembling the structure for the boiler. We expect to reach 2.0 million tons of nominal crushing capacity at the Ivinhema mill in 2013.

The agricultural capital expenditures and development of sugarcane plantations are also on schedule. We have already entered into lease agreements for a significant amount of the sugarcane area we expect to plant during 2012, and have negotiated the acquisition of the planting and harvesting machinery. We also expect that Ivinhema mill will reach 4.0 million tons of nominal crushing capacity in 2015 (phase II) and full capacity of 6.3 million tons (phase III) in 2017. The Ivinhema mill is located 45 km south of our existing and operational Angelica mill, which when the Ivinhema mill is completed will

2

3Q11

form a cluster of 10.3 million tons of crushing capacity that will generate significant synergies and cost efficiencies.

We will finance the construction of the Ivinhema mill using the proceeds from our IPO, operating cash flow and debt financing.

Farmland Expansion

During the 3Q11 and the first days of November 2011, Adecoagro expanded its farmland portfolio by incorporating 13,003 new hectares, for a total investment of $47.7 million.

This expansion represents an attractive opportunity for Adecoagro to continue generating value through the tranformation of underproductive land and expanding its production of agricultural commodities. Through the implementation of our sustainable production model, based on no-till farming, crop rotation, integrated pest management, balanced fertilization and other best practices, we aim to continue improving the quality and productivity of this farmland in order to maximize crop yields and margins.

Moreover, we believe this new farmland has the potential to produce value added products and specialty crops, such as high oleic sunflower, or to transform vegetable protein into animal protein through dairy facilities and feed lots.

After several months of analyzing and negotiating farm deals, we have executed these attractive opportunities that meet Adecoagro’s growth strategy. Through this expansion, Adecoagro has increased its land portfolio from 282,898 to 295,801 hectares spread throughout the most productive regions of Argentina, Brazil and Uruguay. Adecoagro will continue implementing its growth strategy through the acquisition of farmland with high transformation and productive potential and attractive return on invested capital.

Value Creation through Land Transformation

As of September 30, 2011, Cushman & Wakefield updated its independent appraisal of Adecoagro’s farmland. Adecoagro’s 292,401 hectares were valued at $899.1 million, $115.5 million higher than Cushman & Wakefield’s previous appraisal.

Net of farm sales (La Macarena farm sold in 4Q10 - 5,086 hectares) and farm purchases (9,603 hectares acquired in 3Q11) closed during the period in between both valuations, our farmland portfolio has increased its value by $105.6 million or 14.0%, since September 30, 2010.

This value creation is driven by (i) the transformation of underutilized or undermanaged cattle land into high yielding crop and rice farmland; (ii) the ongoing transformation and productivity improvement of all our farmland through our sustainable production model focused on cutting edge technology and best practices, such as, no-till farming, crop rotations, balanced fertilization, integrated pest management and water economy; and (iii) the increase or decrease in relative commodity and input prices.(2)

(2) The Cushman & Wakefield farmland valuations are only intended to provide an indicative approximation of the market value of our farmland property as of September 30, 2011 based on then current market conditions. This information is subject to change based on a host of variables and market conditions. Therefore, these valuations are not intended to provide an indication of the sale price of our properties. Their inclusion in this earnings release is for informational purposes only and investors should not rely on these valuations as the current value of our properties may be materially different from these valuations. For additional information concerning the methodology employed in these valuations please see “Item 4 – Information on the Company – Business Overview – Our Farms – Apprisal of Farms” in our Annual Report on Form 20-F for the year ended December 31, 2010.

3

3Q11

Environmental Sustainability

RTRS Certification

On August 22, 2011, Adecoagro’s soybean operations were certified by the Round Table on Responsible Soybean (RTRS). RTRS is an international multi-stakeholder initiative founded in 2006 that promotes the use and growth of responsible production of soy, through the commitment of the main stakeholders of the soy value chain and through a global standard for responsible production. It aims to improve social benefits and reduce environmental impacts of soybean production while maintaining or improving the economic status of the producers.

Adecoagro’s Carmen and Abolengo farms, located in the Argentine Humid Pampas were submitted to intensive independent audits that evaluated several principles, criteria and indicators intended to ensure the responsible management of soybean production, such as protecting areas with high conservation value, promoting best management practices, providing fair working conditions, and respecting land tenure rights.

Since its inception, Adecoagro’s business model has been focused on operational efficiency to achieve low cost balanced with environmental and social sustainability to ensure long term profitability. The RTRS certification evidences Adecoagro’s strong commitment to the highest sustainability standards. We expect this accomplishment to allow Adeocoagro to obtain premium prices for its soybean, expand its commercial opportunities and client base, and enhance the value of its assets.

Ethanol Exports to the United States

Pursuant to Adecoagro’s registration as an advanced biofuel producer under the Environmental Protection Agency’s RFS2 program in July 2011, Adecoagro took advantage of arbitrage opportunities during 3Q11 and entered into agreements to export ethanol to the United States. Adecoagro’s strategic position as a sustainable producer of sugarcane-based ethanol has allowed us to seize this arbitrage window and capture cash premiums for renewable fuels, generating attractive spreads compared to domestic market prices.

Recent Developments

IDB Loan Amendment

On November 15, 2011, Adecoagro executed an agreement with the Inter-American Development Bank (IDB) to amend the A/B secured senior loan facility, which was entered into by its Argentine subsidiaries and IDB in December 2008.

Pursuant to the agreement, the IDB and a group of commercial banks participating in the B-Loan, have agreed to: (i) increase the amount outstanding under tranche B-Loan by $30.8 million, reaching a total outstanding amount of $80 million; (ii) reduce the interest rate of both tranche A-Loan and B-Loan by 55 basis points, resulting in an average interest rate of Libor plus 451 basis points; and (iii) extend the maturity of the tranche A-Loan to 7 years and the tranche B-Loan to 5 years, including a grace period of 1 year.

The new funds received will be used by Adecoagro to continue expanding and developing its vertically integrated rice and dairy operations in Argentina. This agreement enhances Adecoagro’s strategy to maintain an efficient capital structure within a cost efficient and long term debt profile.

4

3Q11

Furthermore, this agreement is evidence of the IDB’s continuing support and commitment to Adecoagro’s ongoing operations and growth plans focused on economic, environmental and social sustainability.

Operating Performance

Farming Business

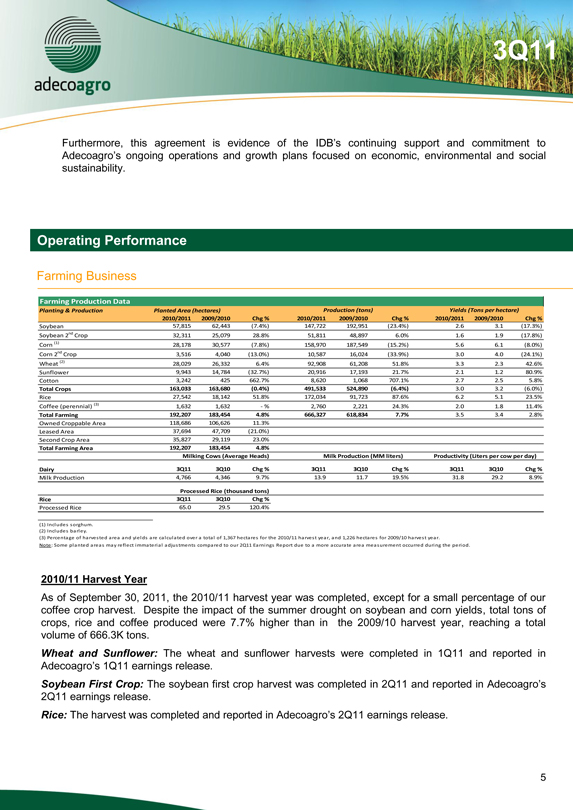

Farming Production Data

Planting & Production Planted Area (hectares) Production (tons) Yields (Tons per hectare)

2010/2011 2009/2010 Chg % 2010/2011 2009/2010 Chg % 2010/2011 2009/2010 Chg %

Soybean 57,815 62,443 (7.4%) 147,722 192,951 (23.4%) 2.6 3.1 (17.3%)

Soybean 2nd Crop 32,311 25,079 28.8% 51,811 48,897 6.0% 1.6 1.9 (17.8%)

Corn (1) 28,178 30,577 (7.8%) 158,970 187,549 (15.2%) 5.6 6.1 (8.0%)

Corn 2nd Crop 3,516 4,040 (13.0%) 10,587 16,024 (33.9%) 3.0 4.0 (24.1%)

Wheat (2) 28,029 26,332 6.4% 92,908 61,208 51.8% 3.3 2.3 42.6%

Sunflower 9,943 14,784 (32.7%) 20,916 17,193 21.7% 2.1 1.2 80.9%

Cotton 3,242 425 662.7% 8,620 1,068 707.1% 2.7 2.5 5.8%

Total Crops 163,033 163,680 (0.4%) 491,533 524,890 (6.4%) 3.0 3.2 (6.0%)

Rice 27,542 18,142 51.8% 172,034 91,723 87.6% 6.2 5.1 23.5%

Coffee (perennial) (3) 1,632 1,632 -% 2,760 2,221 24.3% 2.0 1.8 11.4%

Total Farming 192,207 183,454 4.8% 666,327 618,834 7.7% 3.5 3.4 2.8%

Owned Croppable Area 118,686 106,626 11.3%

Leased Area 37,694 47,709 (21.0%)

Second Crop Area 35,827 29,119 23.0%

Total Farming Area 192,207 183,454 4.8%

Milking Cows (Average Heads) Milk Production (MM liters) Productivity (Liters per cow per day)

Dairy 3Q11 3Q10 Chg % 3Q11 3Q10 Chg % 3Q11 3Q10 Chg %

Milk Production 4,766 4,346 9.7% 13.9 11.7 19.5% 31.8 29.2 8.9%

Processed Rice (thousand tons)

Rice 3Q11 3Q10 Chg %

Processed Rice 65.0 29.5 120.4%

(1) Includes sorghum.

(2) Includes barley.

(3) Percentage of harvested area and yields are calculated over a total of 1,367 hectares for the 2010/11 harvest year, and 1,226 hectares for 2009/10 harvest year.

Note: Some planted areas may reflect immaterial adjustments compared to our 2Q11 Earnings Report due to a more accurate area measurement occurred during the period.

2010/11 Harvest Year

As of September 30, 2011, the 2010/11 harvest year was completed, except for a small percentage of our coffee crop harvest. Despite the impact of the summer drought on soybean and corn yields, total tons of crops, rice and coffee produced were 7.7% higher than in the 2009/10 harvest year, reaching a total volume of 666.3K tons.

Wheat and Sunflower: The wheat and sunflower harvests were completed in 1Q11 and reported in Adecoagro’s 1Q11 earnings release.

Soybean First Crop: The soybean first crop harvest was completed in 2Q11 and reported in Adecoagro’s 2Q11 earnings release.

Rice: The harvest was completed and reported in Adecoagro’s 2Q11 earnings release.

5

3Q11

Soybean Second Crop: As of September 30, 2011, the 32.3K hectares planted were harvested. Total production reached 51.8K tons, 6.0% greater than that of 2009/10 harvest year due to the increase in planted area.

Corn: As of September 30, 2011, 28.2K hectares planted were harvested. Production was 15.2% below that of 2009/10 harvest year due to a smaller planted area, as a result of the crop rotation schedule, and lower yields, as a consequence of the summer drought experienced in Argentina during the harvest year.

Corn Second Crop: As of the end of 3Q11, all 3.5K hectares had been harvested. Given the lack of rains during the critical growth stage of the crop, yields were 24.1% below those realized in the 2009/10 harvest year.

Cotton: Cotton production increased to 8.6K tons, 707.1% higher than the 2009/10 harvest year due to a 662.7% increase in planted area, complemented by a 5.8% increase in yields.

Coffee: 97.3% of our coffee plantation was harvested as of September 30, 2011. Harvested area yields stood at 2.0 tons per hectare as of September 30, 2011, 11.4% higher than the previous harvest year. We expect yields for the remaining unharvested area to be in line with actual yields. This increase in yield reflects the successful application of our production technology to western Bahia, a new frontier for frost free coffee production.

2011/12 Harvest Year

Although wheat planting commences during the end of 2Q11, the bulk of our 2011/12 planting season began during 3Q11. Our operational teams on the farms are set and our contractors have their machinery up and ready. Weather conditions are adequate for planting. As of September 30, 2011, we completed the planting of wheat, are well advanced in the rice planting, and have begun planting corn and sunflower in the northern Argentine farms. A total of 73.6K hectares have been successfully planted and we expect total planted area to grow approximately 15% over the 2010/11 harvest year.

Wheat: As of September 30, 2011, a total of 42.6K hectares were planted, representing a 52% or 14.6K hectare growth compared to the previous harvest season. During September, some of the regions where the crop was planted experienced below average rains. However, rains in early October normalized and improved the crop’s situation. Therefore, yields should remain unaffected.

Corn: During 3Q11, we began with the planting of corn in the northern Argentine farms, reaching a total of 7.7K hectares. Weather has been suitable for the initiation of the planting phase and the crop is developing normally.

Sunflower: As of September 30, 2011, 3.0K hectares were planted. The crop is in excellent shape due to good soil humidity together with optimal temperatures during the initial growth phase of the crop.

Rice: The rice planted area was 18.7K by the end of September 2011. Climatic conditions have been optimal for the crop. Abundant rainfall have already ensured most of the water supply needed to flood the rice fields, which is a critical factor to ensure good yields.

6

3Q11

Sugar, Ethanol & Energy Business

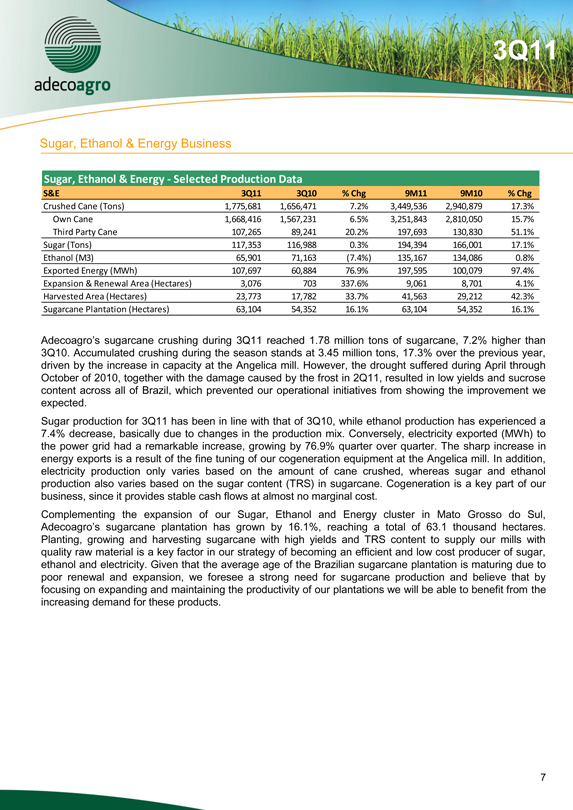

Sugar, Ethanol & Energy - Selected Production Data

S&E 3Q11 3Q10 % Chg 9M11 9M10 % Chg

Crushed Cane (Tons) 1,775,681 1,656,471 7.2% 3,449,536 2,940,879 17.30%

Own Cane 1,668,416 1,567,231 6.50% 3,251,843 2,810,050 15.70%

Third Party Cane 107,265 89,241 20.2% 197,693 130,830 51.1%

Sugar (Tons) 117,353 116,988 0.3% 194,394 166,001 17.1%

Ethanol (M3) 65,901 71,163 (7.4%) 135,167 134,086 0.8%

Exported Energy (MWh) 107,697 60,884 76.9% 197,595 100,079 97.4%

Expansion & Renewal Area (Hectares) 3,076 703 337.6% 9,061 8,701 4.1%

Harvested Area (Hectares) 23,773 17,782 33.7% 41,563 29,212 42.3%

Sugarcane Plantation (Hectares) 63,104 54,352 16.1% 63,104 54,352 16.1%

Adecoagro’s sugarcane crushing during 3Q11 reached 1.78 million tons of sugarcane, 7.2% higher than 3Q10. Accumulated crushing during the season stands at 3.45 million tons, 17.3% over the previous year, driven by the increase in capacity at the Angelica mill. However, the drought suffered during April through October of 2010, together with the damage caused by the frost in 2Q11, resulted in low yields and sucrose content across all of Brazil, which prevented our operational initiatives from showing the improvement we expected.

Sugar production for 3Q11 has been in line with that of 3Q10, while ethanol production has experienced a 7.4% decrease, basically due to changes in the production mix. Conversely, electricity exported (MWh) to the power grid had a remarkable increase, growing by 76.9% quarter over quarter. The sharp increase in energy exports is a result of the fine tuning of our cogeneration equipment at the Angelica mill. In addition, electricity production only varies based on the amount of cane crushed, whereas sugar and ethanol production also varies based on the sugar content (TRS) in sugarcane. Cogeneration is a key part of our business, since it provides stable cash flows at almost no marginal cost.

Complementing the expansion of our Sugar, Ethanol and Energy cluster in Mato Grosso do Sul, Adecoagro’s sugarcane plantation has grown by 16.1%, reaching a total of 63.1 thousand hectares. Planting, growing and harvesting sugarcane with high yields and TRS content to supply our mills with quality raw material is a key factor in our strategy of becoming an efficient and low cost producer of sugar, ethanol and electricity. Given that the average age of the Brazilian sugarcane plantation is maturing due to poor renewal and expansion, we foresee a strong need for sugarcane production and believe that by focusing on expanding and maintaining the productivity of our plantations we will be able to benefit from the increasing demand for these products.

7

3Q11

Financial Performance

Farming & Land Transformation Businesses

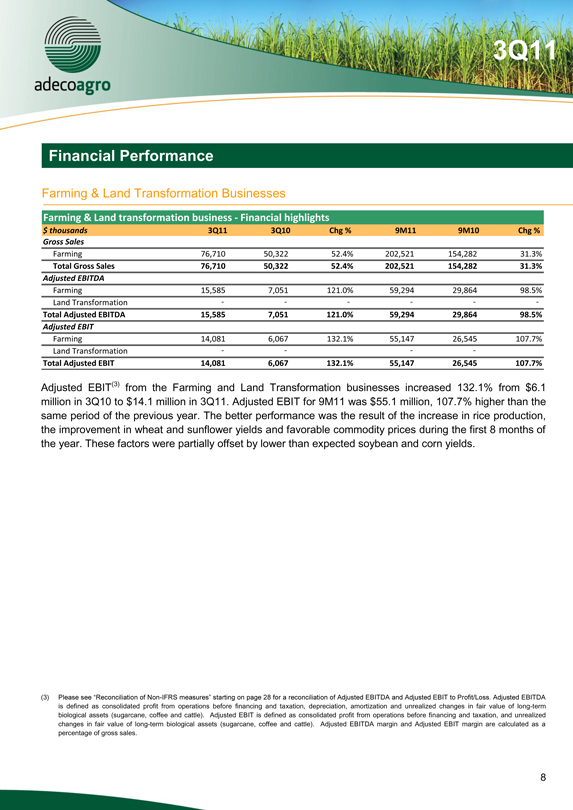

Farming & Land transformation business - Financial highlights

$ thousands 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales

Farming 76,710 50,322 52.4% 202,521 154,282 31.3%

Total Gross Sales 76,710 50,322 52.4% 202,521 154,282 31.3%

Adjusted EBITDA

Farming 15,585 7,051 121.0% 59,294 29,864 98.5%

Land Transformation - - - - - -

Total Adjusted EBITDA 15,585 7,051 121.0% 59,294 29,864 98.5%

Adjusted EBIT

Farming 14,081 6,067 132.1% 55,147 26,545 107.7%

Land Transformation - - - - - -

Total Adjusted EBIT 14,081 6,067 132.1% 55,147 26,545 107.7%

Adjusted EBIT(3) from the Farming and Land Transformation businesses increased 132.1% from $6.1 million in 3Q10 to $14.1 million in 3Q11. Adjusted EBIT for 9M11 was $55.1 million, 107.7% higher than the same period of the previous year. The better performance was the result of the increase in rice production, the improvement in wheat and sunflower yields and favorable commodity prices during the first 8 months of the year. These factors were partially offset by lower than expected soybean and corn yields.

(3) Please see “Reconciliation of Non-IFRS measures” starting on page 28 for a reconciliation of Adjusted EBITDA and Adjusted EBIT to Profit/Loss. Adjusted EBITDA is defined as consolidated profit from operations before financing and taxation, depreciation, amortization and unrealized changes in fair value of long-term biological assets (sugarcane, coffee and cattle). Adjusted EBIT is defined as consolidated profit from operations before financing and taxation, and unrealized changes in fair value of long-term biological assets (sugarcane, coffee and cattle). Adjusted EBITDA margin and Adjusted EBIT margin are calculated as a percentage of gross sales.

8

3Q11

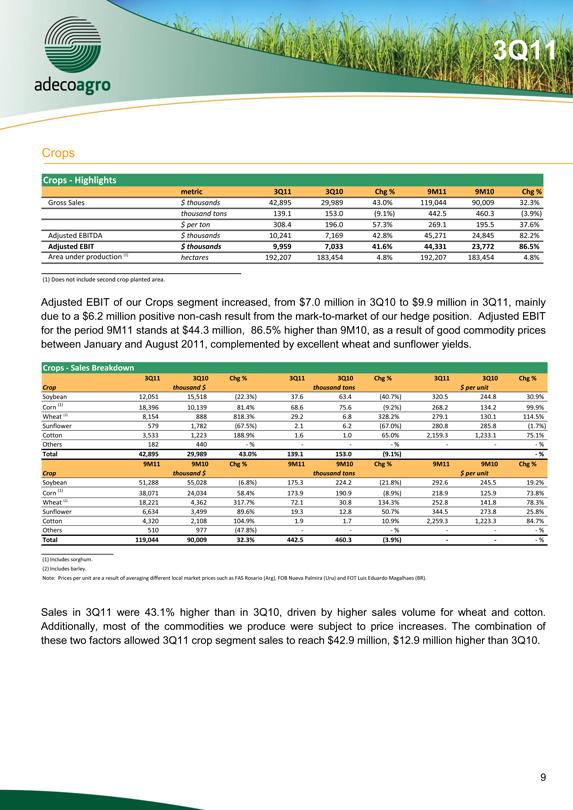

Crops

Crops - Highlights

metric 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales $ thousands 42,895 29,989 43.0% 119,044 90,009 32.3%

thousand tons 139.1 153.0 (9.1%) 442.5 460.3 (3.9%)

$ per ton 308.4 196.0 57.3% 269.1 195.5 37.6%

Adjusted EBITDA $ thousands 10,241 7,169 42.8% 45,271 24,845 82.2%

Adjusted EBIT $ thousands 9,959 7,033 41.6% 44,331 23,772 86.5%

Area under production (1) hectares 192,207 183,454 4.8% 192,207 183,454 4.8%

(1) Does not include second crop planted area.

Adjusted EBIT of our Crops segment increased, from $7.0 million in 3Q10 to $9.9 million in 3Q11, mainly due to a $6.2 million positive non-cash result from the mark-to-market of our hedge position. Adjusted EBIT for the period 9M11 stands at $44.3 million, 86.5% higher than 9M10, as a result of good commodity prices between January and August 2011, complemented by excellent wheat and sunflower yields.

Crops - Sales Breakdown

3Q11 3Q10 Chg % 3Q11 3Q10 Chg % 3Q11 3Q10 Chg %

Crop thousand $ thousand tons $ per unit

Soybean 12,051 15,518 (22.3%) 37.6 63.4 (40.7%) 320.5 244.8 30.9%

Corn (1) 18,396 10,139 81.4% 68.6 75.6 (9.2%) 268.2 134.2 99.9%

Wheat (2) 8,154 888 818.3% 29.2 6.8 328.2% 279.1 130.1 114.5%

Sunflower 579 1,782 (67.5%) 2.1 6.2 (67.0%) 280.8 285.8 (1.7%)

Cotton 3,533 1,223 188.9% 1.6 1.0 65.0% 2,159.3 1,233.1 75.1%

Others 182 440 - % - - - % - - - %

Total 42,895 29,989 43.0% 139.1 153.0 (9.1%) - %

9M11 9M10 Chg % 9M11 9M10 Chg % 9M11 9M10 Chg %

Crop thousand $ thousand tons $ per unit

Soybean 51,288 55,028 (6.8%) 175.3 224.2 (21.8%) 292.6 245.5 19.2%

Corn (1) 38,071 24,034 58.4% 173.9 190.9 (8.9%) 218.9 125.9 73.8%

Wheat (2) 18,221 4,362 317.7% 72.1 30.8 134.3% 252.8 141.8 78.3%

Sunflower 6,634 3,499 89.6% 19.3 12.8 50.7% 344.5 273.8 25.8%

Cotton 4,320 2,108 104.9% 1.9 1.7 10.9% 2,259.3 1,223.3 84.7%

Others 510 977 (47.8%) - - - % - - - %

Total 119,044 90,009 32.3% 442.5 460.3 (3.9%) - - - %

(1) Includes sorghum.

(2) Includes barley.

Note: Prices per unit are a result of averaging different local market prices such as FAS Rosario (Arg), FOB Nueva Palmira (Uru) and FOT Luis Eduardo Magalhaes (BR).

Sales in 3Q11 were 43.1% higher than in 3Q10, driven by higher sales volume for wheat and cotton. Additionally, most of the commodities we produce were subject to price increases. The combination of these two factors allowed 3Q11 crop segment sales to reach $42.9 million, $12.9 million higher than 3Q10.

9

3Q11

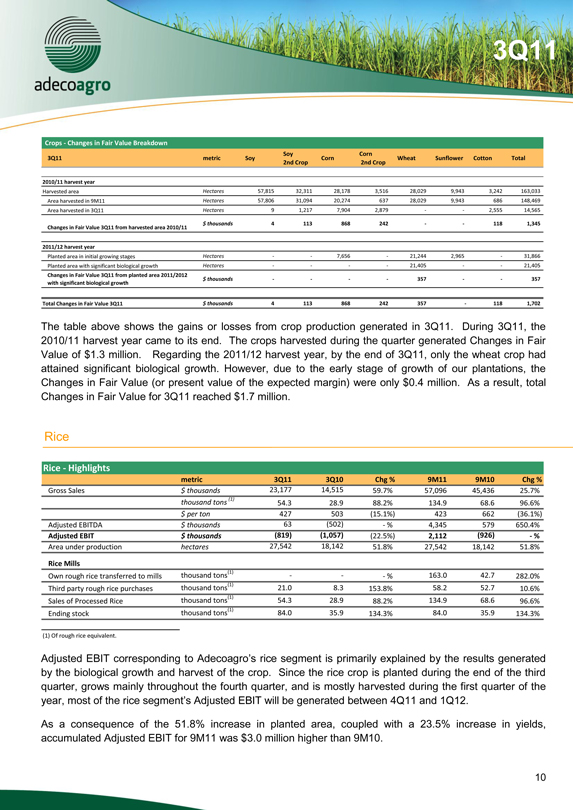

Crops - Changes in Fair Value Breakdown

Soy Corn

3Q11 metric Soy Corn Wheat Sunflower Cotton Total

2nd Crop 2nd Crop

2010/11 harvest year

Harvested area Hectares 57,815 32,311 28,178 3,516 28,029 9,943 3,242 163,033

Area harvested in 9M11 Hectares 57,806 31,094 20,274 637 28,029 9,943 686 148,469

Area harvested in 3Q11 Hectares 9 1,217 7,904 2,879 - - 2,555 14,565

$ thousands 4 113 868 242 - - 118 1,345

Changes in Fair Value 3Q11 from harvested area 2010/11

2011/12 harvest year

Planted area in initial growing stages Hectares - - 7,656 - 21,244 2,965 - 31,866

Planted area with significant biological growth Hectares - - - - 21,405 - - 21,405

Changes in Fair Value 3Q11 from planted area 2011/2012

$ thousands - - - - 357 - - 357

with significant biological growth

Total Changes in Fair Value 3Q11 $ thousands 4 113 868 242 357 - 118 1,702

The table above shows the gains or losses from crop production generated in 3Q11. During 3Q11, the 2010/11 harvest year came to its end. The crops harvested during the quarter generated Changes in Fair Value of $1.3 million. Regarding the 2011/12 harvest year, by the end of 3Q11, only the wheat crop had attained significant biological growth. However, due to the early stage of growth of our plantations, the Changes in Fair Value (or present value of the expected margin) were only $0.4 million. As a result, total Changes in Fair Value for 3Q11 reached $1.7 million.

Rice

Rice - Highlights

metric 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales $ thousands 23,177 14,515 59.7% 57,096 45,436 25.7%

thousand tons (1)

54.3 28.9 88.2% 134.9 68.6 96.6%

$ per ton 427 503 (15.1%) 423 662 (36.1%)

Adjusted EBITDA $ thousands 63 (502) - % 4,345 579 650.4%

Adjusted EBIT $ thousands (819) (1,057) (22.5%) 2,112 (926) - %

Area under production hectares 27,542 18,142 51.8% 27,542 18,142 51.8%

Rice Mills

Own rough rice transferred to mills thousand tons(1) - - - % 163.0 42.7 282.0%

Third party rough rice purchases thousand tons(1) 21.0 8.3 153.8% 58.2 52.7 10.6%

Sales of Processed Rice thousand tons(1) 54.3 28.9 88.2% 134.9 68.6 96.6%

Ending stock thousand tons(1) 84.0 35.9 134.3% 84.0 35.9 134.3%

(1) Of rough rice equivalent.

Adjusted EBIT corresponding to Adecoagro’s rice segment is primarily explained by the results generated by the biological growth and harvest of the crop. Since the rice crop is planted during the end of the third quarter, grows mainly throughout the fourth quarter, and is mostly harvested during the first quarter of the year, most of the rice segment’s Adjusted EBIT will be generated between 4Q11 and 1Q12.

As a consequence of the 51.8% increase in planted area, coupled with a 23.5% increase in yields, accumulated Adjusted EBIT for 9M11 was $3.0 million higher than 9M10.

10

3Q11

Rice - Changes in Fair Value Breakdown

3Q11 metric Rice

2010/11 harvest year

Harvested area Hectares 27,542

Changes in Fair Value in 2011 from harvested area 2010/11 (i) $ thousands (49)

2011/12 harvest year

Planted area in initial growing stages Hectares 15,006

Planted area with significant biological growth Hectares 3,661

Changes in Fair Value 2011 from planted area 2011/2012 with significant biological growth $ thousands 4

Total Changes in Fair Value in 3Q11 $ thousands (45)

As of September 30, 2011, 18.7K hectares corresponding to the 2011/12 harvest year had been planted in our rice fields. Only 19.6% of total planted area had attained significant biological growth by the end of the quarter, and practically no gains were generated by the new crop, since the risk of achieving projected yields is still high at this point of the growth cycle. Changes in Fair Value generated by the 2011/12 rice crop are expected to be recognized mostly between 4Q11 and 1Q12.

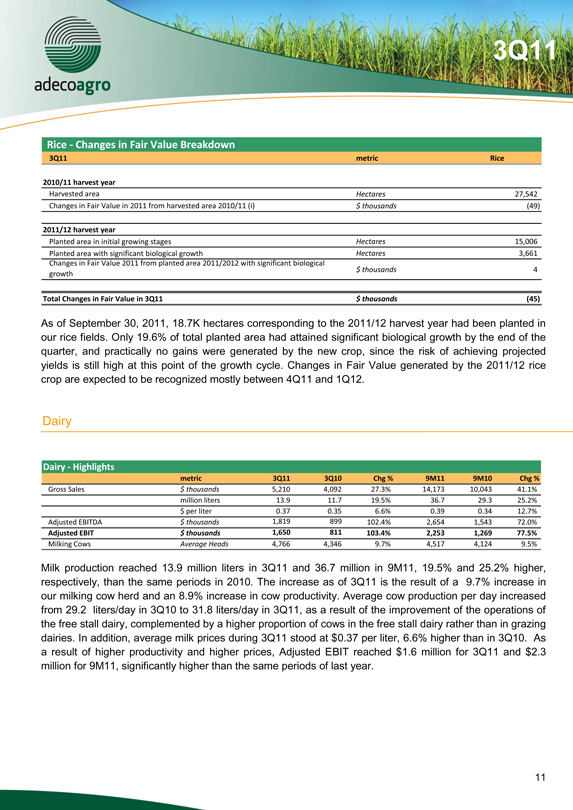

Dairy

Dairy - Highlights

metric 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales $ thousands 5,210 4,092 27.3% 14,173 10,043 41.1%

million liters 13.9 11.7 19.5% 36.7 29.3 25.2%

$ per liter 0.37 0.35 6.6% 0.39 0.34 12.7%

Adjusted EBITDA $ thousands 1,819 899 102.4% 2,654 1,543 72.0%

Adjusted EBIT $ thousands 1,650 811 103.4% 2,253 1,269 77.5%

Milking Cows Average Heads 4,766 4,346 9.7% 4,517 4,124 9.5%

Milk production reached 13.9 million liters in 3Q11 and 36.7 million in 9M11, 19.5% and 25.2% higher, respectively, than the same periods in 2010. The increase as of 3Q11 is the result of a 9.7% increase in our milking cow herd and an 8.9% increase in cow productivity. Average cow production per day increased from 29.2 liters/day in 3Q10 to 31.8 liters/day in 3Q11, as a result of the improvement of the operations of the free stall dairy, complemented by a higher proportion of cows in the free stall dairy rather than in grazing dairies. In addition, average milk prices during 3Q11 stood at $0.37 per liter, 6.6% higher than in 3Q10. As a result of higher productivity and higher prices, Adjusted EBIT reached $1.6 million for 3Q11 and $2.3 million for 9M11, significantly higher than the same periods of last year.

11

3Q11

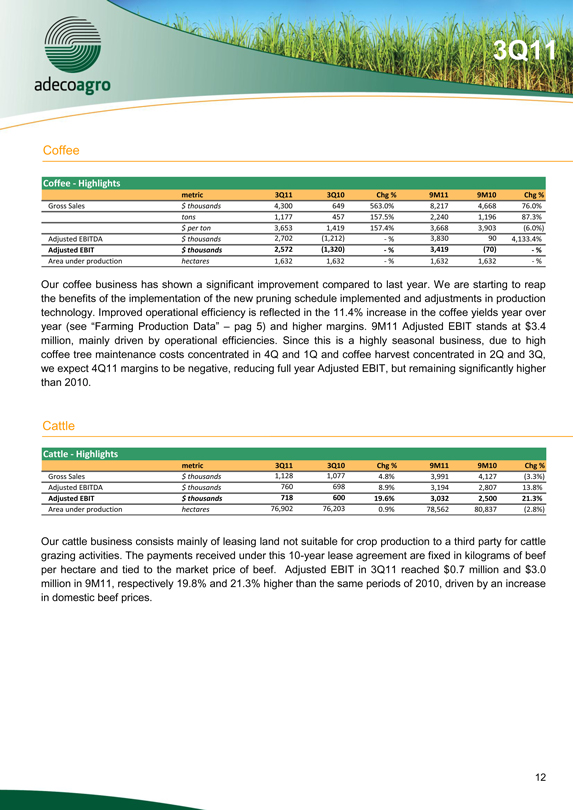

Coffee

Coffee - Highlights

metric 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales $ thousands 4,300 649 563.0% 8,217 4,668 76.0%

tons 1,177 457 157.5% 2,240 1,196 87.3%

$ per ton 3,653 1,419 157.4% 3,668 3,903 (6.0%)

Adjusted EBITDA $ thousands 2,702 (1,212) - % 3,830 90 4,133.4%

Adjusted EBIT $ thousands 2,572 (1,320) - % 3,419 (70) - %

Area under production hectares 1,632 1,632 - % 1,632 1,632 - %

Our coffee business has shown a significant improvement compared to last year. We are starting to reap the benefits of the implementation of the new pruning schedule implemented and adjustments in production technology. Improved operational efficiency is reflected in the 11.4% increase in the coffee yields year over year (see “Farming Production Data” – pag 5) and higher margins. 9M11 Adjusted EBIT stands at $3.4 million, mainly driven by operational efficiencies. Since this is a highly seasonal business, due to high coffee tree maintenance costs concentrated in 4Q and 1Q and coffee harvest concentrated in 2Q and 3Q, we expect 4Q11 margins to be negative, reducing full year Adjusted EBIT, but remaining significantly higher than 2010.

Cattle

Cattle - Highlights

metric 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gross Sales $ thousands 1,128 1,077 4.8% 3,991 4,127 (3.3%)

Adjusted EBITDA $ thousands 760 698 8.9% 3,194 2,807 13.8%

Adjusted EBIT $ thousands 718 600 19.6% 3,032 2,500 21.3%

Area under production hectares 76,902 76,203 0.9% 78,562 80,837 (2.8%)

Our cattle business consists mainly of leasing land not suitable for crop production to a third party for cattle grazing activities. The payments received under this 10-year lease agreement are fixed in kilograms of beef per hectare and tied to the market price of beef. Adjusted EBIT in 3Q11 reached $0.7 million and $3.0 million in 9M11, respectively 19.8% and 21.3% higher than the same periods of 2010, driven by an increase in domestic beef prices.

12

3Q11

Land transformation business

There were no farm sales completed during 3Q11 or 3Q10, so no profit has been recognized in Adecoagro’s Statement of Income. However, land transformation is an ongoing process in our farms. This process consists of transforming undervalued or undermanaged land into its highest production capabilities. All our farmland is managed under a sustainable production model that is focused on cutting edge technologies such as no-till farming, crop rotations, balanced fertilization, integrated pest management, among other, which enhances soil productivity and reduces the use of fertilizers and agrochemicals.

Adecoagro continuously seeks to redeploy its capital by disposing of a portion of its fully developed farmland. This allows Adecoagro to monetize the capital gains generated by land transformation and better allocate its capital to acquire land with higher transformation potential.

13

3Q11

Sugar, Ethanol & Energy business

Sugar, Ethanol & Energy - Highlights

$ thousands 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Net Sales Angelica (1) 49,781 33,691 47.8% 129,639 56,760 128.4%

Net Sales UMA (1) 21,765 16,900 28.8% 37,506 37,622 (0.3%)

Total Sales 71,546 50,591 41.4% 167,145 94,382 77.1%

Gross Profit Manufacturing Activities - Angelica 32,853 12,249 168.2% 71,115 13,271 435.9%

Gross Profit Manufacturing Activities - UMA 7,790 11,497 (32.2%) 13,042 15,444 (15.6%)

Gross Profit Manufacturing Activities 40,642 23,745 71.2% 84,156 28,715 193.1%

Adjusted EBITDA Angelica 31,598 14,822 113.2% 73,935 11,955 518.5%

Adjusted EBITDA UMA 11,278 7,774 45.1% 12,942 14,803 (12.6%)

Total Adjusted EBITDA 42,885 22,596 89.8% 86,886 26,758 224.7%

Adjusted EBITDA Margin Angelica 63.5% 44.0% 44.3% 57.0% 21.1% 170.8%

Adjusted EBITDA Margin UMA 51.8% 46.0% 12.6% 34.5% 39.3% (12.3%)

Adjusted EBITDA Margin Total 59.9% 44.7% 34.2% 52.0% 28.4% 83.4%

1) Net Sales are calculated as Gross Sales net of sales taxes.

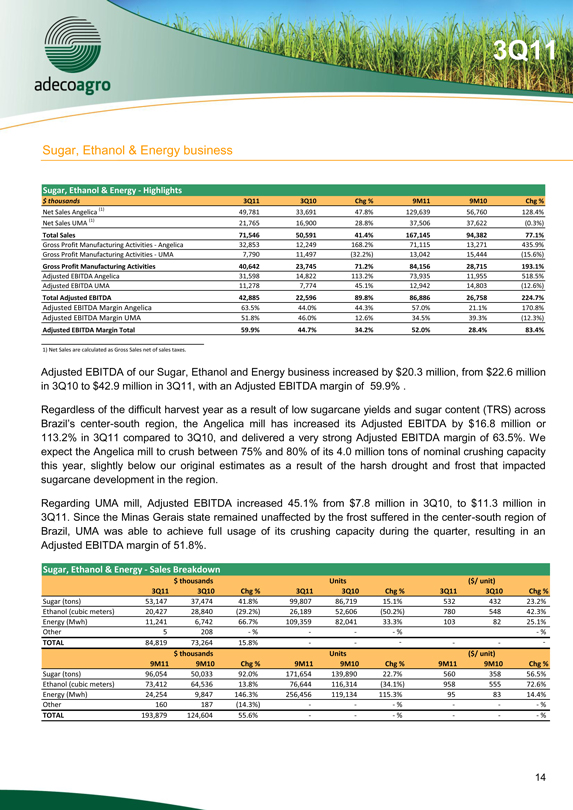

Adjusted EBITDA of our Sugar, Ethanol and Energy business increased by $20.3 million, from $22.6 million in 3Q10 to $42.9 million in 3Q11, with an Adjusted EBITDA margin of 59.9% .

Regardless of the difficult harvest year as a result of low sugarcane yields and sugar content (TRS) across Brazil’s center-south region, the Angelica mill has increased its Adjusted EBITDA by $16.8 million or 113.2% in 3Q11 compared to 3Q10, and delivered a very strong Adjusted EBITDA margin of 63.5%. We expect the Angelica mill to crush between 75% and 80% of its 4.0 million tons of nominal crushing capacity this year, slightly below our original estimates as a result of the harsh drought and frost that impacted sugarcane development in the region.

Regarding UMA mill, Adjusted EBITDA increased 45.1% from $7.8 million in 3Q10, to $11.3 million in 3Q11. Since the Minas Gerais state remained unaffected by the frost suffered in the center-south region of Brazil, UMA was able to achieve full usage of its crushing capacity during the quarter, resulting in an Adjusted EBITDA margin of 51.8%.

Sugar, Ethanol & Energy - Sales Breakdown

$ thousands Units ($/ unit)

3Q11 3Q10 Chg % 3Q11 3Q10 Chg % 3Q11 3Q10 Chg %

Sugar (tons) 53,147 37,474 41.8% 99,807 86,719 15.1% 532 432 23.2%

Ethanol (cubic meters) 20,427 28,840 (29.2%) 26,189 52,606 (50.2%) 780 548 42.3%

Energy (Mwh) 11,241 6,742 66.7% 109,359 82,041 33.3% 103 82 25.1%

Other 5 208 -% - - -% - %

TOTAL 84,819 73,264 15.8% - - - - - -

$ thousands Units ($/ unit)

9M11 9M10 Chg % 9M11 9M10 Chg % 9M11 9M10 Chg %

Sugar (tons) 96,054 50,033 92.0% 171,654 139,890 22.7% 560 358 56.5%

Ethanol (cubic meters) 73,412 64,536 13.8% 76,644 116,314 (34.1%) 958 555 72.6%

Energy (Mwh) 24,254 9,847 146.3% 256,456 119,134 115.3% 95 83 14.4%

Other 160 187 (14.3%) - - -% - - -%

TOTAL 193,879 124,604 55.6% - - -% - - -%

14

3Q11

Total Sales during 3Q11 reached $84.8 million, 15.8% above 3Q10. The increase in prices and the higher amount of megawatts and sugar tons sold have allowed sugar and energy sales to increase considerably, by 41.8% and 66.7% respectively compared to 3Q10. Ethanol sales volume fell 50.2% compared to 3Q10 as a result of a higher proportion of sugar in the production mix, and the decision to build inventories to carry ethanol into the off season in the expectation of higher prices.

Sugar, Ethanol & Energy - Productive indicators

metric 3Q11 3Q10 % Chg 9M11 9M10 % Chg

Milling Angelica thousand tons 1,307 1,212 7.9% 2,632 1,999 31.7%

Milling UMA thousand tons 468 445 5.1% 817 942 (13.3%)

Milling Total thousand tons 1,776 1,656 7.2% 3,449 2,941 17.3%

Own sugarcane % 94.0% 94.6% (0.7%) 94.3% 95.6% (1.3%)

Sugar mix in production % 54.5% 53.3% 2.1% 48.9% 45.2% 8.1%

Ethanol mix in production % 45.5% 46.7% (2.4%) 51.1% 54.8% (6.7%)

Energy per milled ton Kwh/ton 61 37 65.0% 57 34 68.4%

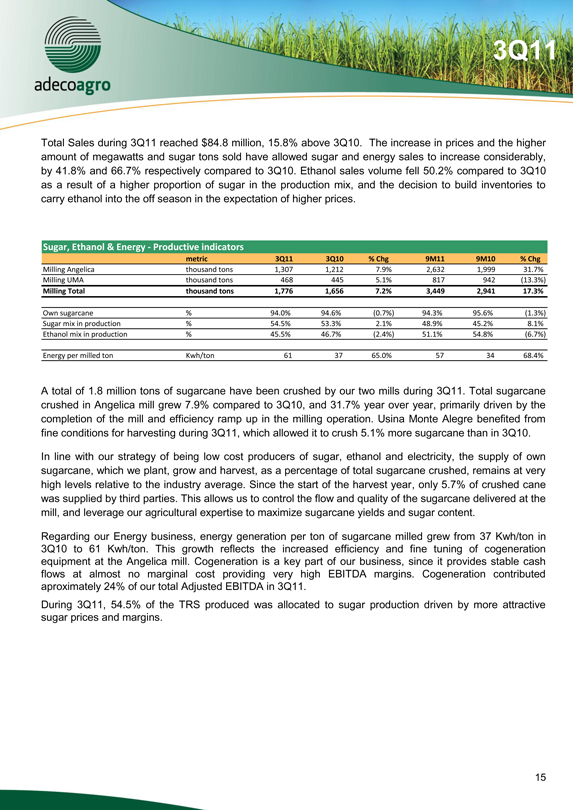

A total of 1.8 million tons of sugarcane have been crushed by our two mills during 3Q11. Total sugarcane crushed in Angelica mill grew 7.9% compared to 3Q10, and 31.7% year over year, primarily driven by the completion of the mill and efficiency ramp up in the milling operation. Usina Monte Alegre benefited from fine conditions for harvesting during 3Q11, which allowed it to crush 5.1% more sugarcane than in 3Q10.

In line with our strategy of being low cost producers of sugar, ethanol and electricity, the supply of own sugarcane, which we plant, grow and harvest, as a percentage of total sugarcane crushed, remains at very high levels relative to the industry average. Since the start of the harvest year, only 5.7% of crushed cane was supplied by third parties. This allows us to control the flow and quality of the sugarcane delivered at the mill, and leverage our agricultural expertise to maximize sugarcane yields and sugar content.

Regarding our Energy business, energy generation per ton of sugarcane milled grew from 37 Kwh/ton in 3Q10 to 61 Kwh/ton. This growth reflects the increased efficiency and fine tuning of cogeneration equipment at the Angelica mill. Cogeneration is a key part of our business, since it provides stable cash flows at almost no marginal cost providing very high EBITDA margins. Cogeneration contributed aproximately 24% of our total Adjusted EBITDA in 3Q11.

During 3Q11, 54.5% of the TRS produced was allocated to sugar production driven by more attractive sugar prices and margins.

15

3Q11

Sugar, Ethanol & Energy - Changes in Fair Value

3Q11 3Q10

Biological Asset

$ Hectares $/hectare $ Hectares $/hectare

(+) Sugarcane plantations at end of period 153,082,563 63,104 2,426 76,916,199 54,352 1,415

(-) Sugarcane plantations at begining of period (132,209,000) 59,647 2,217 (101,730,000) 53,613 1,897

(-) Planting investment (14,242,894) 3,076 4,630 (4,661,863) 739 6,306

(-) Exchange difference 24,237,091 - - (5,347,973) - -

Changes in Fair Value of Biological Assets 30,867,760 - - (34,823,637) - -

Agricultural produce

$ Tons $/ton $ Tons $/ton

(+) Harvested own sugarcane transferred to mill 65,011,187 1,668,416 39 46,340,494 1,567,231 30

(-) Expenses (59,439,967) - - (39,132,017) - -

Changes in Fair Value of Agricultural Produce 5,571,220 - - 7,208,477 - -

Total Changes in Fair Value 36,438,980 - - (27,615,160) - -

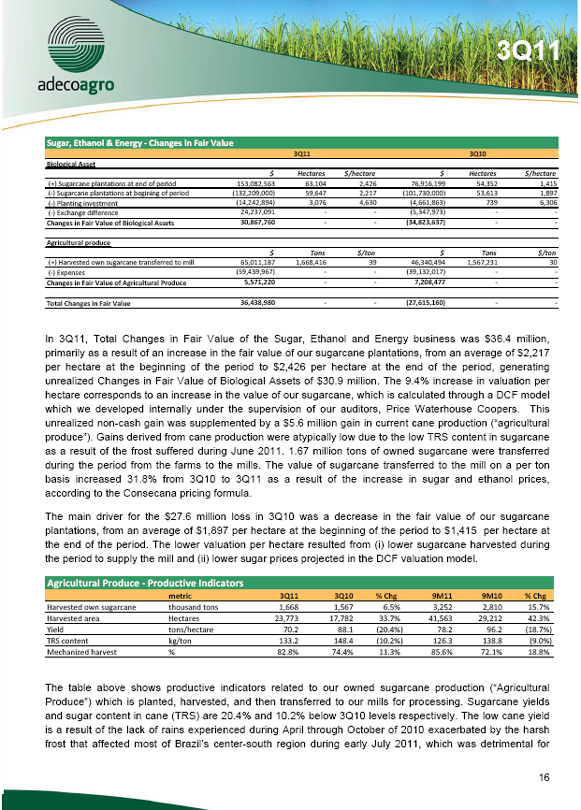

In 3Q11, Total Changes in Fair Value of the Sugar, Ethanol and Energy business was $36.4 million, primarily as a result of an increase in the fair value of our sugarcane plantations, from an average of $2,217 per hectare at the beginning of the period to $2,426 per hectare at the end of the period, generating unrealized Changes in Fair Value of Biological Assets of $30.9 million. The 9.4% increase in valuation per hectare corresponds to an increase in the value of our sugarcane, which is calculated through a DCF model which we developed internally under the supervision of our auditors, Price Waterhouse Coopers. This unrealized non-cash gain was supplemented by a $5.6 million gain in current cane production (“agricultural produce”). Gains derived from cane production were atypically low due to the low TRS content in sugarcane as a result of the frost suffered during June 2011. 1.67 million tons of owned sugarcane were transferred during the period from the farms to the mills. The value of sugarcane transferred to the mill on a per ton basis increased 31.8% from 3Q10 to 3Q11 as a result of the increase in sugar and ethanol prices, according to the Consecana pricing formula.

The main driver for the $27.6 million loss in 3Q10 was a decrease in the fair value of our sugarcane plantations, from an average of $1,897 per hectare at the beginning of the period to $1,415 per hectare at the end of the period. The lower valuation per hectare resulted from (i) lower sugarcane harvested during the period to supply the mill and (ii) lower sugar prices projected in the DCF valuation model.

Agricultural Produce - Productive Indicators

metric 3Q11 3Q10 % Chg 9M11 9M10 % Chg

Harvested own sugarcane thousand tons 1,668 1,567 6.5% 3,252 2,810 15.7%

Harvested area Hectares 23,773 17,782 33.7% 41,563 29,212 42.3%

Yield tons/hectare 70.2 88.1 (20.4%) 78.2 96.2 (18.7%)

TRS content kg/ton 133.2 148.4 (10.2%) 126.3 138.8 (9.0%)

Mechanized harvest % 82.8% 74.4% 11.3% 85.6% 72.1% 18.8%

The table above shows productive indicators related to our owned sugarcane production (“Agricultural Produce”) which is planted, harvested, and then transferred to our mills for processing. Sugarcane yields and sugar content in cane (TRS) are 20.4% and 10.2% below 3Q10 levels respectively. The low cane yield is a result of the lack of rains experienced during April through October of 2010 exacerbated by the harsh frost that affected most of Brazil’s center-south region during early July 2011, which was detrimental for

16

3Q11

sugarcane development. In turn, TRS content decreased as a consequence of excessive rains during 1Q11 and the frost during 2Q11. These two factors have impacted sugarcane production throughout Brazil’s center-south region, reducing total production estimates significantly.

Following the expansion of our sugarcane plantation and increase in milling capacity, harvested cane and harvested area were up by 6.5% and 33.7%, respectively. Despite the large increase in harvested area, harvested cane has only had a slight increase resulting from the poor yields explained above. The percentage of mechanized harvest has increased to 82.8%, driven by the gradual mechanization of harvest at Usina Monte Alegre, increasing the efficiency of our harvesting operations.

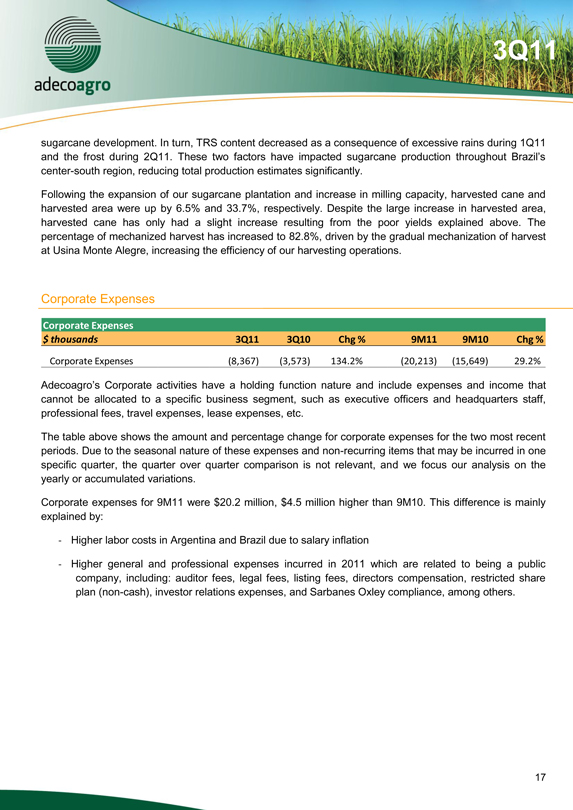

Corporate Expenses

Corporate Expenses $ thousands 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Corporate Expenses (8,367) (3,573) 134.2% (20,213) (15,649) 29.2%

Adecoagro’s Corporate activities have a holding function nature and include expenses and income that cannot be allocated to a specific business segment, such as executive officers and headquarters staff, professional fees, travel expenses, lease expenses, etc.

The table above shows the amount and percentage change for corporate expenses for the two most recent periods. Due to the seasonal nature of these expenses and non-recurring items that may be incurred in one specific quarter, the quarter over quarter comparison is not relevant, and we focus our analysis on the yearly or accumulated variations.

Corporate expenses for 9M11 were $20.2 million, $4.5 million higher than 9M10. This difference is mainly explained by:

- Higher labor costs in Argentina and Brazil due to salary inflation

- Higher general and professional expenses incurred in 2011 which are related to being a public company, including: auditor fees, legal fees, listing fees, directors compensation, restricted share plan (non-cash), investor relations expenses, and Sarbanes Oxley compliance, among others.

17

3Q11

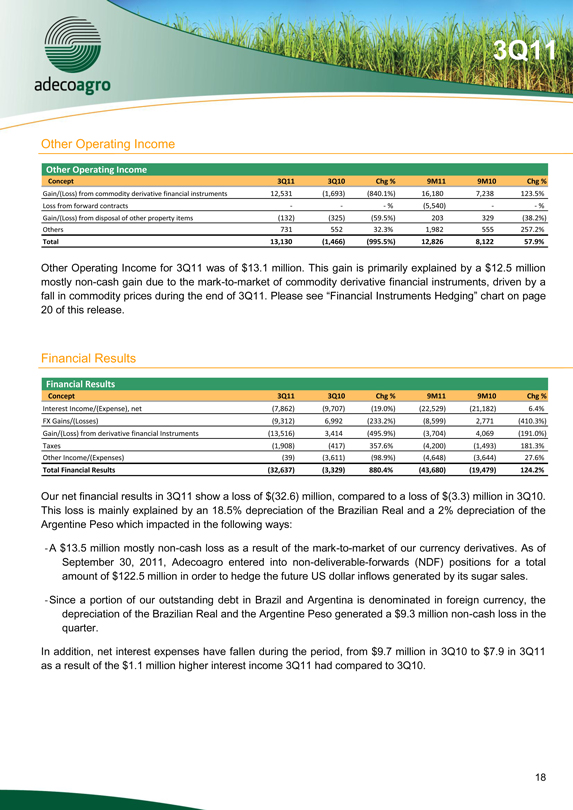

Other Operating Income

Other Operating Income

Concept 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Gain/(Loss) from commodity derivative financial instruments 12,531 (1,693) (840.1%) 16,180 7,238 123.5%

Loss from forward contracts - - - % (5,540) - - %

Gain/(Loss) from disposal of other property items (132) (325) (59.5%) 203 329 (38.2%)

Others 731 552 32.3% 1,982 555 257.2%

Total 13,130 (1,466) (995.5%) 12,826 8,122 57.9%

Other Operating Income for 3Q11 was of $13.1 million. This gain is primarily explained by a $12.5 million mostly non-cash gain due to the mark-to-market of commodity derivative financial instruments, driven by a fall in commodity prices during the end of 3Q11. Please see “Financial Instruments Hedging” chart on page 20 of this release.

Financial Results

Financial Results

Concept 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Interest Income/(Expense), net (7,862) (9,707) (19.0%) (22,529) (21,182) 6.4%

FX Gains/(Losses) (9,312) 6,992 (233.2%) (8,599) 2,771 (410.3%)

Gain/(Loss) from derivative financial Instruments (13,516) 3,414 (495.9%) (3,704) 4,069 (191.0%)

Taxes (1,908) (417) 357.6% (4,200) (1,493) 181.3%

Other Income/(Expenses) (39) (3,611) (98.9%) (4,648) (3,644) 27.6%

Total Financial Results (32,637) (3,329) 880.4% (43,680) (19,479) 124.2%

Our net financial results in 3Q11 show a loss of $(32.6) million, compared to a loss of $(3.3) million in 3Q10. This loss is mainly explained by an 18.5% depreciation of the Brazilian Real and a 2% depreciation of the Argentine Peso which impacted in the following ways:

- A $13.5 million mostly non-cash loss as a result of the mark-to-market of our currency derivatives. As of September 30, 2011, Adecoagro entered into non-deliverable-forwards (NDF) positions for a total amount of $122.5 million in order to hedge the future US dollar inflows generated by its sugar sales.

- Since a portion of our outstanding debt in Brazil and Argentina is denominated in foreign currency, the depreciation of the Brazilian Real and the Argentine Peso generated a $9.3 million non-cash loss in the quarter.

In addition, net interest expenses have fallen during the period, from $9.7 million in 3Q10 to $7.9 in 3Q11 as a result of the $1.1 million higher interest income 3Q11 had compared to 3Q10.

18

3Q11

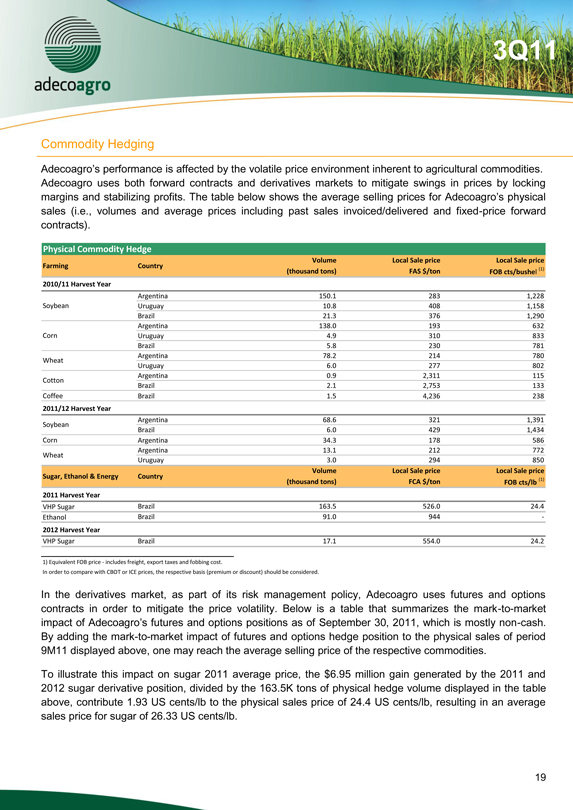

Commodity Hedging

Adecoagro’s performance is affected by the volatile price environment inherent to agricultural commodities. Adecoagro uses both forward contracts and derivatives markets to mitigate swings in prices by locking margins and stabilizing profits. The table below shows the average selling prices for Adecoagro’s physical sales (i.e., volumes and average prices including past sales invoiced/delivered and fixed-price forward contracts).

Physical Commodity Hedge

Farming Country Volume (thousand tons) Local Sale price FAS $/ton Local Sale price FOB cts/bushel (1)

2010/11 Harvest Year

Soybean

Argentina 150.1 283 1,228

Uruguay 10.8 408 1,158

Brazil 21.3 376 1,290

Corn

Argentina 138.0 193 632

Uruguay 4.9 310 833

Brazil 5.8 230 781

Wheat

Argentina 78.2 214 780

Uruguay 6.0 277 802

Cotton

Argentina 0.9 2,311 115

Brazil 2.1 2,753 133

Coffee

Brazil 1.5 4,236 238

2011/12 Harvest Year

Soybean

Argentina 68.6 321 1,391

Brazil 6.0 429 1,434

Corn

Argentina 34.3 178 586

Argentina 13.1 212 772

Wheat

Uruguay 3.0 294 850

Sugar, Ethanol & Energy Country Volume (thousand tons) Local Sale price FCA $/ton Local Sale price FOB cts/lb (1)

2011 Harvest Year

VHP Sugar Brazil 163.5 526.0 24.4

Ethanol Brazil 91.0 944 -

2012 Harvest Year

VHP Sugar Brazil 17.1 554.0 24.2

1) Equivalent FOB price - includes freight, export taxes and fobbing cost.

In order to compare with CBOT or ICE prices, the respective basis (premium or discount) should be considered.

In the derivatives market, as part of its risk management policy, Adecoagro uses futures and options contracts in order to mitigate the price volatility. Below is a table that summarizes the mark-to-market impact of Adecoagro’s futures and options positions as of September 30, 2011, which is mostly non-cash. By adding the mark-to-market impact of futures and options hedge position to the physical sales of period 9M11 displayed above, one may reach the average selling price of the respective commodities.

To illustrate this impact on sugar 2011 average price, the $6.95 million gain generated by the 2011 and 2012 sugar derivative position, divided by the 163.5K tons of physical hedge volume displayed in the table above, contribute 1.93 US cents/lb to the physical sales price of 24.4 US cents/lb, resulting in an average sales price for sugar of 26.33 US cents/lb.

19

3Q11

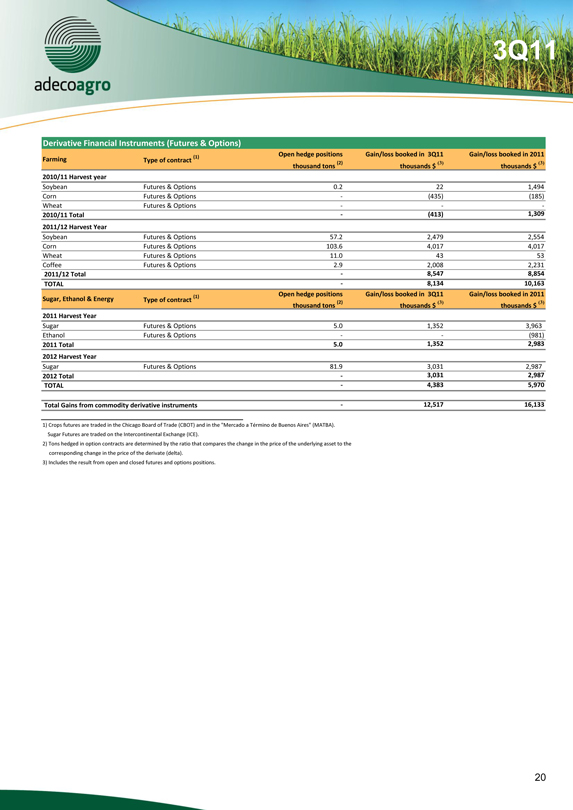

Derivative Financial Instruments (Futures & Options)

Farming

Type of contract (1)

Open hedge positions thousand tons (2)

Gain/loss booked in 3Q11 thousands $ (3)

Gain/loss booked in 2011 thousands $ (3)

2010/11 Harvest year

Soybean

Futures & Options 0.2 22 1,494

Corn

Futures & Options - (435) (185)

Wheat

Futures & Options - - -

2010/11 Total - (413) 1,309

2011/12 Harvest Year

Soybean

Futures & Options 57.2 2,479 2,554

Corn

Futures & Options 103.6 4,017 4,017

Wheat

Futures & Options 11.0 43 53

Coffee

Futures & Options 2.9 2,008 2,231

2011/12 Total - 8,547 8,854

TOTAL - 8,134 10,163

Sugar, Ethanol & Energy

Type of contract (1)

Open hedge positions

thousand tons (2)

Gain/loss booked in 3Q11

thousands $ (3)

Gain/loss booked in 2011

thousands $ (3)

2011 Harvest Year

Sugar

Futures & Options 5.0 1,352 3,963

Ethanol

Futures & Options - - (981)

2011 Total 5.0 1,352 2,983

2012 Harvest Year

Sugar

Futures & Options 81.9 3,031 2,987

2012 Total - 3,031 2,987

TOTAL - 4,383 5,970

Total Gains from commodity derivative instruments - 12,517 16,133

1) Crops futures are traded in the Chicago Board of Trade (CBOT) and in the “Mercado a Termino de Buenos Aires” (MATBA). Sugar Futures are traded on the Intercontinental Exchange (ICE).

2) Tons hedged in option contracts are determined by the ratio that compares the change in the price of the underlying asset to the corresponding change in the price of the derivate (delta).

3) Includes the result from open and closed futures and options positions.

20

3Q11

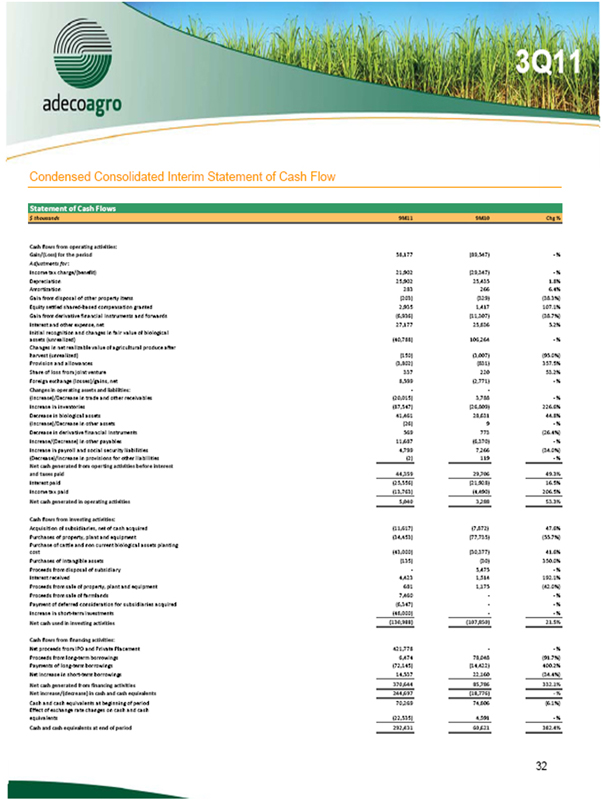

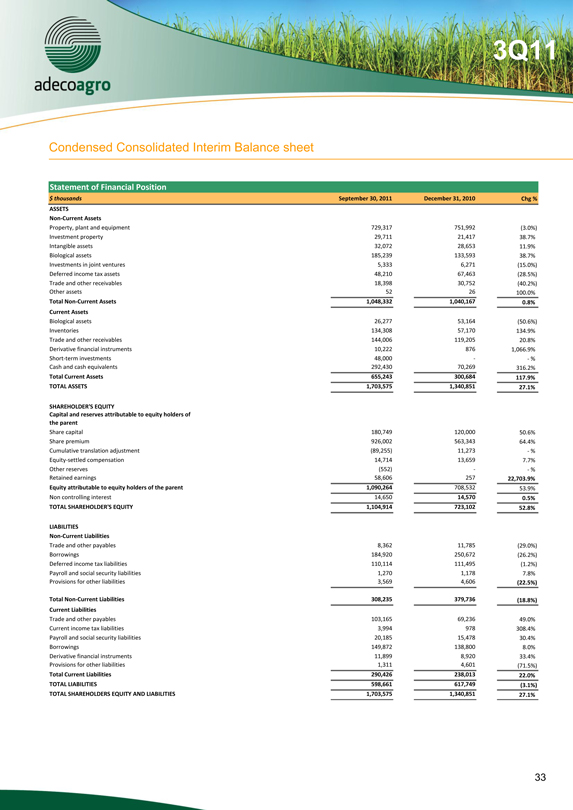

Indebtedness

Debt Breakdown

$ thousands 3Q11 2Q11 Chg %

Short Term Debt 149,873 179,016 (16.3%)

Farming 73,845 72,552 1.8%

Sugar, Ethanol & Energy 76,028 106,464 (28.6%)

Long Term Debt 184,920 254,060 (27.2%)

Farming 60,150 61,154 (1.6%)

Sugar, Ethanol & Energy 124,770 192,906 (35.3%)

Total Debt 334,793 433,076 (22.7%)

Cash & Equivalents 292,430 209,006 39.9%

Short Term Financial Investments (1) 48,000 263,604 (81.8%)

Total Cash & ST Financial Investments 340,430 467,722 (27.2%)

Net Debt (5,637) (34,645) (83.7%)

(1) Includes short term fixed term deposits and currency derivative instruments.

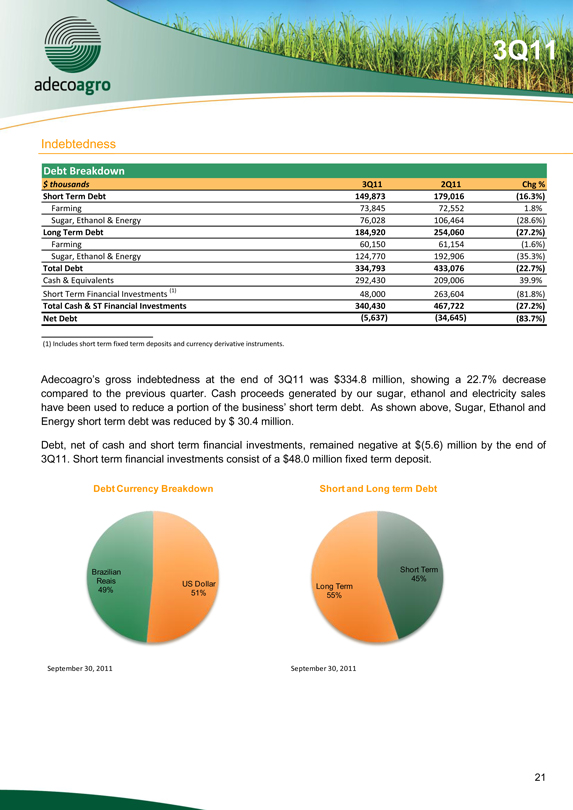

Adecoagro’s gross indebtedness at the end of 3Q11 was $334.8 million, showing a 22.7% decrease compared to the previous quarter. Cash proceeds generated by our sugar, ethanol and electricity sales have been used to reduce a portion of the business’ short term debt. As shown above, Sugar, Ethanol and Energy short term debt was reduced by $ 30.4 million.

Debt, net of cash and short term financial investments, remained negative at $(5.6) million by the end of 3Q11. Short term financial investments consist of a $48.0 million fixed term deposit.

Debt Currency Breakdown

Brazilian Reais 49%

US Dollar 51%

September 30, 2011

Short and Long term Debt

Short Term 45% Long Term 55%

September 30, 2011

21

3Q11

Capital Expenditures & Investments

Capital Expenditures & Investments

$ thousands 3Q11 3Q10 Chg % 9M11 9M10 Chg %

Farming & Land Transformation 48,170 28,126 71.3% 54,773 32,523 68.4%

Land Acquisitions 40,522 21,537 88.2% 40,522 21,537 88.2%

Land Transformation 1,048 2,645 (60.4%) 2,459 4,720 (47.9%)

Rice Mill Construction 5,754 2,307 149.4% 9,568 2,492 284.0%

Dairy Free Stall Unit 356 434 (17.8%) 502 1,294 (61.2%)

Others 490 1,203 (59.3%) 1,723 2,480 (30.5%)

Sugar, Ethanol & Energy 23,699 21,863 8.4% 62,062 99,526 (37.6%)

Sugar & Ethanol Mills 9,456 17,202 (45.0%) 19,664 70,266 (72.0%)

Sugarcane Planting 14,243 4,662 205.5% 42,398 29,260 44.9%

Total 71,869 49,989 43.8% 116,835 132,049 (11.5%)

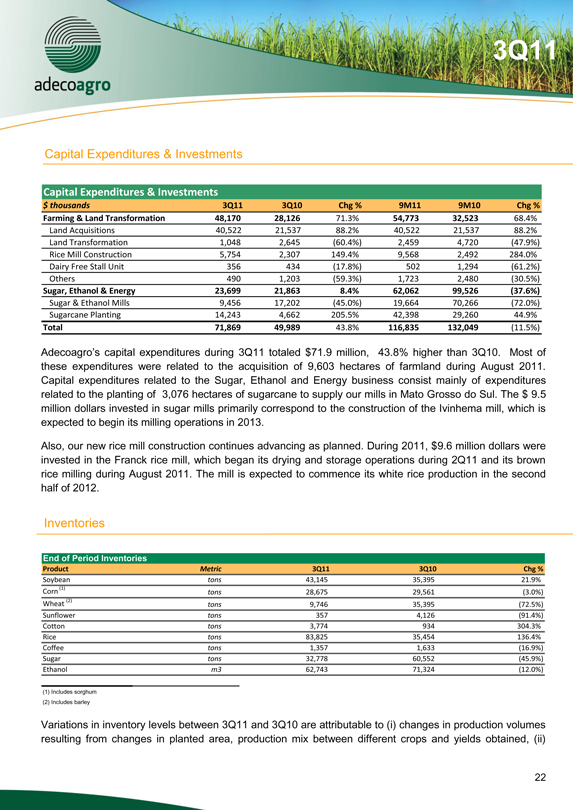

Adecoagro’s capital expenditures during 3Q11 totaled $71.9 million, 43.8% higher than 3Q10. Most of these expenditures were related to the acquisition of 9,603 hectares of farmland during August 2011. Capital expenditures related to the Sugar, Ethanol and Energy business consist mainly of expenditures related to the planting of 3,076 hectares of sugarcane to supply our mills in Mato Grosso do Sul. The $ 9.5 million dollars invested in sugar mills primarily correspond to the construction of the Ivinhema mill, which is expected to begin its milling operations in 2013.

Also, our new rice mill construction continues advancing as planned. During 2011, $9.6 million dollars were invested in the Franck rice mill, which began its drying and storage operations during 2Q11 and its brown rice milling during August 2011. The mill is expected to commence its white rice production in the second half of 2012.

Inventories

End of Period Inventories

Product Metric 3Q11 3Q10 Chg %

Soybean tons 43,145 35,395 21.9%

Corn (1) tons 28,675 29,561 (3.0%)

Wheat (2) tons 9,746 35,395 (72.5%)

Sunflower tons 357 4,126 (91.4%)

Cotton tons 3,774 934 304.3%

Rice tons 83,825 35,454 136.4%

Coffee tons 1,357 1,633 (16.9%)

Sugar tons 32,778 60,552 (45.9%)

Ethanol m3 62,743 71,324 (12.0%)

(1) Includes sorghum

(2) Includes barley

Variations in inventory levels between 3Q11 and 3Q10 are attributable to (i) changes in production volumes resulting from changes in planted area, production mix between different crops and yields obtained, (ii)

22

3Q11

different percentage of area harvested during the period, and (iii) changes in commercial strategy or selling pace for each product.

Forward-looking Statements

This press release contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. These forward-looking statements can be identified by words or phrases such as “anticipate,” “forecast”, “believe,” “continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,” or other similar expressions.

The forward-looking statements included in this press release relate to, among others: (i) our business prospects and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the laws, regulations and governmental policies governing our business, including limitations on ownership of farmland by foreign entities in certain jurisdictions in which we operate, environmental laws and regulations; (iv) the implementation of our business strategy, including our development of the Ivinhema mill and other current projects; (v) our plans relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the implementation of our financing strategy and capital expenditure plan; (vii) the maintenance of our relationships with customers; (viii) the competitive nature of the industries in which we operate; (ix) the cost and availability of financing; (x) future demand for the commodities we produce; (xi) international prices for commodities; (xii) the condition of our land holdings; (xiii) the development of the logistics and infrastructure for transportation of our products in the countries where we operate; (xiv) the performance of the South American and world economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; as well as other risks included in the registrant’s other filings and submissions with the United States Securities and Exchange Commission.

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this press release might not occur, and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements made in this press release related only to events or information as of the date on which the statements are made in this press release. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

23

3Q11

Appendix

Market Outlook

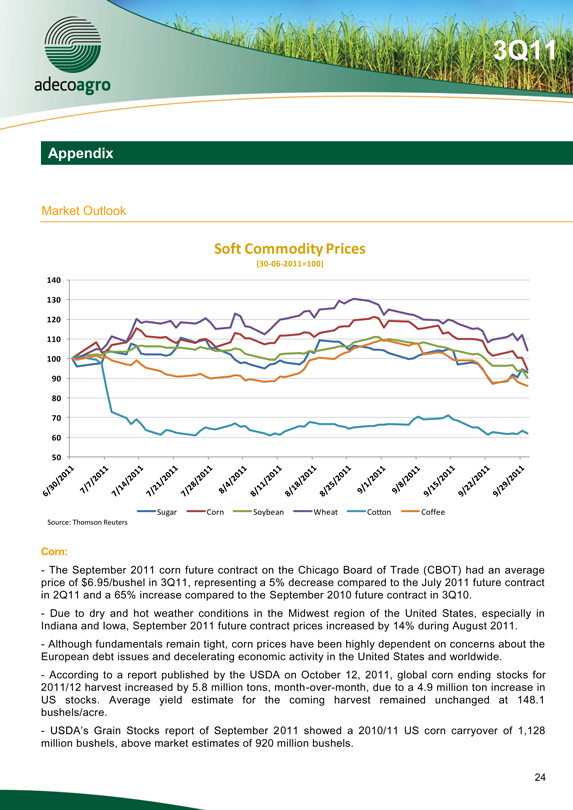

Soft Commodity Prices

(30-06-2011=100)

140 130 120 110 100 90 80 70 60 50

6/30/2011 7/7/2011 7/14/2011 7/21/2011 7/28/2011 8/4/2011 8/11/2011 8/18/2011 8/25/2011 9/1/2011 9/8/2011 9/15/2011 9/22/2011 9/29/2011

Sugar Corn Soybean Wheat Cotton Coffee

Source: Thomson Reuters

Corn:

- The September 2011 corn future contract on the Chicago Board of Trade (CBOT) had an average price of $6.95/bushel in 3Q11, representing a 5% decrease compared to the July 2011 future contract in 2Q11 and a 65% increase compared to the September 2010 future contract in 3Q10.

- Due to dry and hot weather conditions in the Midwest region of the United States, especially in Indiana and Iowa, September 2011 future contract prices increased by 14% during August 2011.

- Although fundamentals remain tight, corn prices have been highly dependent on concerns about the European debt issues and decelerating economic activity in the United States and worldwide.

- According to a report published by the USDA on October 12, 2011, global corn ending stocks for 2011/12 harvest increased by 5.8 million tons, month-over-month, due to a 4.9 million ton increase in US stocks. Average yield estimate for the coming harvest remained unchanged at 148.1 bushels/acre.

- USDA’s Grain Stocks report of September 2011 showed a 2010/11 US corn carryover of 1,128 million bushels, above market estimates of 920 million bushels.

24

3Q11

- Ethanol producers continue to see positive margins since mid-June 2011. US ethanol exports are up 50% year-over-year, but the weaker Brazilian Real could lead local exports to be more competitive than US exports in the short term.

- Due to tight stocks in the United States, South American corn production will be very important to meet global demand. According to Companhia Nacional de Abastecimento (CONAB), corn planting in Brazil is expected to increase between 4% and 7% year-over-year. USDA’s corn production estimate of Brazil stands at 61 million tons for 2011/12 season, compared to 57.5 million tons in 2010/11 season. Recent rains in Argentina will help to develop planting. Depending on climatic issues, production could reach a record of 25-27 million tons in the 2011/12 harvest year, a 12% increase compared to the 2010/11 harvest year

Soybean:

- The average price for the September 2011 soybean future contract on CBOT was $13.55/bushel in 3Q11, representing a 0.4% decrease compared to July 2011 future contract in 2Q11 and a 31% increase compared to September 2011 future contract in 3Q10.

- The hot and dry weather in the Midwest region of the United States stressed soybean crops during August and weather was a market driver during that month. In addition, the global macroeconomic and financial situation is heavily influencing the soybean market.

- According to the October 12, 2011 USDA Report, global soybean ending stocks for the 2011/12 crop increased by 0.5 million tons. In the United States, soybean ending stocks were reported 0.1 million tons lower and exports were lowered by 1.1 million tons. The soybean supply outlook in the United States was estimated at 83.3 million tons, 0.7 million tons lower compared to the USDA report published in September. Current yield estimate is 41.5 bushels/acre. Harvested area in the United States totaled 73.7 million acres.

- The Grain Stocks report showed that soybeans stocks, as of September 1, 2011, stood at 215 million bushels, below market estimates of 225 million bushels.

- China is the world’s largest soy importer. The USDA forecast for China’s soybean imports in 2011/12 is 56.5 million tons. The CNGOIC (China National Grain and Oils Information Center) calculates that China will import 56 million tons in 2011/12.

- As per CONAB, Brazilian soybean forecast for soybean production is at 72-73 million tons for 2011/12 crop year. Private sources expect a year-over-year increase of harvested area of 3.8% to a record high of 25 million hectares and a range 74-77 million tons of production.

- In Argentina, the corn planted area will limit the growth of soybean plantings, and it could reach about 19 million hectares. Production forecast stands at 53 million tons for 2011/12.

Wheat:

- The September 2011 wheat future contract on CBOT had an average price of $6.87/bushel in 3Q11, a 7.8% decrease compared to July 2011 future contract in 2Q11 and a 5% increase compared to the September 2010 future contract in 3Q10.

- During 3Q11, wheat prices in CBOT were highly correlated with corn prices due to the feed use substitution. During August, wheat quotes were supported by drought conditions in the Southern Plains region of the United States and yield downgrades in the spring wheat.

25

3Q11

- India, the world’s second largest wheat producer, allowed 2 million tons of exports this season, after a four-year ban on wheat exports.

- USDA forecasts wheat exports of 8 million tons, 1 million tons below September estimates. Ukraine’s President signed the export tax elimination on wheat. Russian export prices remain the most competitive in the market, supported by the Ruble’s depreciation.

- According to the October 12, 2011 USDA Report, ending stock estimate in the United States is 837 million bushels, up from 761 million bushels in September 2011. Estimated average yield stood at 43.9 bushels/acre and production was pegged at 2,008 million bushels, compared to 2,077 in September 2011.

- As of September 30, 2011, 59% of US winter wheat estimated planting plan had been effectively planted, compared to a 5 year average of 69%. The national average has been heavily affected by the severe drought in Texas and Oklahoma.

- The Canadian harvest pace and crop quality continue to be above normal. Crop quality suggests a recovery from last season and this could bring a higher amount of protein into the market.

- In Argentina, the production estimate is 15 million tons for the 2011/12 harvest year.

Cotton:

- The average price for the September 2011 cotton future contract traded on ICE Futures U.S. (ICE) was US¢ 108.2/lb in 3Q11. This represents a 36% decrease compared to July 2011 future contract in 2Q11 and a 23.4% increase compared to the September 2010 future contract in 3Q10.

- The price of cotton is highly dependent on global macroeconomic and financial conditions. Lower global activity lowers cotton demand.

- According to the October 12, 2011 USDA Report, global cotton production will reach 12.19 million bales, 1.23 million bales higher than the September 2011 report production estimate. In addition, global ending stocks estimates published in the September 2011 report were marked up by 2.92 million bales.

- USDA’s production forecast for India and Pakistan was estimated at 500,000 and 200,000 bales higher than in the previous month, but Chinese production was lowered by 500,000 bales.

- The October 12, 2011 USDA Report showed United States cotton production of 16.61 million bales, 0.5 million bales higher than the September 2011 report production estimate, but 1.5 million bales lower than 2010/11 season, primarily due to the drought suffered in Texas. Ending stocks in the United States were reported at 3.9 million bales, 0.5 million above the 3.4 million estimate published in the September 2011 report.

Rice:

- The South American market for high quality milled rice stood at a $550/ton FOB price during 3Q11, compared to an average of $530/ton in 3Q10.

- The Thailand government’s rice mortgage scheme started on October 7, 2011. At that time, prices had already increased before the scheme was implemented and Thailand’s 100% B quoted rice stood at $570 PMT basis FOB Bangkok, with lack of interest from the buying side.

- In addition, India decided to sell 2 million tons of non-Basmati rice in the export market. Despite the pressure that India has been under, we expect that the Indian government will continue to be patient

26

3Q11

and monitor whether the decision to allow the export of 2 million tons of non-Basmati rice causes significant inflation in the domestic market before considering further increases in exporting volume.

- As of September 30, 2011, US crop production stood at 9.5 million tons (paddy basis), significantly below last year’s crop production, due to a reduction in planted area and flooding across the Mid-south region of the United States. Long grain prices in the United States have become detached from international markets and face increased competition from South American and Asian markets.

Coffee:

- The September 2011 coffee future contract traded on ICE at an average price of US¢256.3/lb in 3Q11, a 5.5% decrease compared to the July 2011 future contract in 2Q11 and a 47% increase compared to the September 2010 coffee future contract in 3Q10.

- The 2011/12 Brazilian crop is still in need of rain for healthy flowering to ensure the 62 to 64 million bags that the market needs to satisfy demand growth in the coming seasons. Frosts experienced in the Southern region of Brazil during 3Q11 did not have a material impact on the coffee crops.

- According to Fedecafe (Federacion Nacional de Cafeteros de Colombia), Colombian coffee production is estimated to be within the range of 10-10.5 million bags for 2011, compared to 9 million bags last year.

- Robusta 2011/12 global output is forecasted to reach a record of 57 million bags. Supply from Vietnam is calculated at a record 22 million bags and is expected to impact prices as the season begins.

Sugar and Ethanol:

- The development of the harvest in the Centre-South of Brazil did not improve as expected during 3Q11, which caused further downward production revisions in forecasts. In August 2011, UNICA released its new crush forecast of 510 million tons (23 million ton cut). However, other market players had even lower numbers, of which the lowest was from Canaplan of 476 million tons cane, as a result of the expected short tail to the harvest, extensive flowering reducing the TRS content in cane and the frost which reduced yields in many regions.

- Cane quality continued to disappoint when compared with 2010/11 figures (136 vs. 141 kgs TRS/ton cane up to September 30) and the pace of replanting was slower than recommended to recover yields, largely caused by excessive rains during the summer months inhibiting the planting of 18-month cane, as well as drier-than-normal weather restricting the increased planting of winter cane. Planting levels are expected to be not more than 12.5%, which will result in an even older cane field average for next year of 3.8 years.

- Concerns about production caused a new rally in sugar prices at ICE, which were 17% higher in 3Q11 than in 2Q11, reaching the 30 cts/lb level. The hydrous ethanol prices did not increase in 3Q11, but also did not have the usual downtrend that the curve normally follows during the peak of harvest thus creating less volatility but also a higher average price for the year.

- During the quarter, discussions about stricter regulations continued, though no new decisions were made except to reduce the blend from 25% to 20% from October 1, 2011 and onwards.

- In the international market, ethanol import and export arbitrage from and to the United States opened simultaneously driven by favorable exchange rates and an increase in advanced biofuel price premiums over the traditional corn-based ethanol prices. The summer weather in the Northern

27

3Q11

Hemisphere helped in the beet yields and in the Asian cane growth, yet it is still early to estimate how big the sugar surplus will be as recent floods in Asia and frost danger in Europe may impact output.

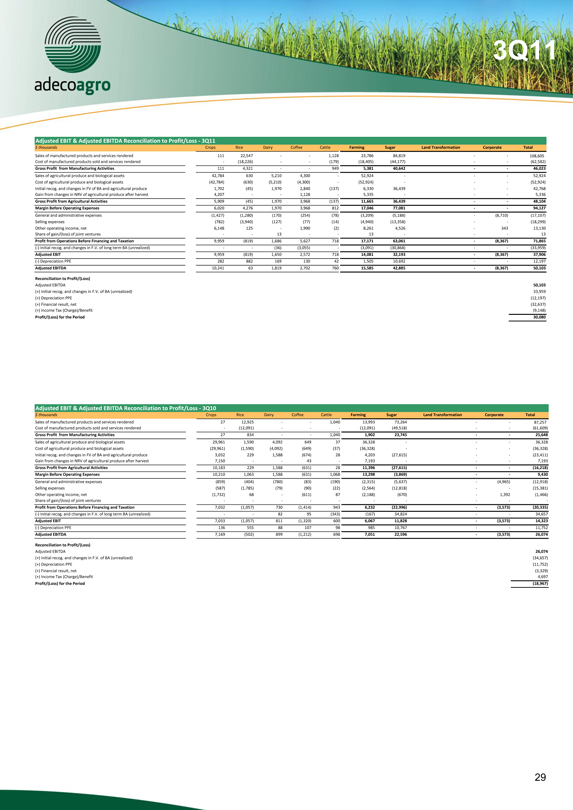

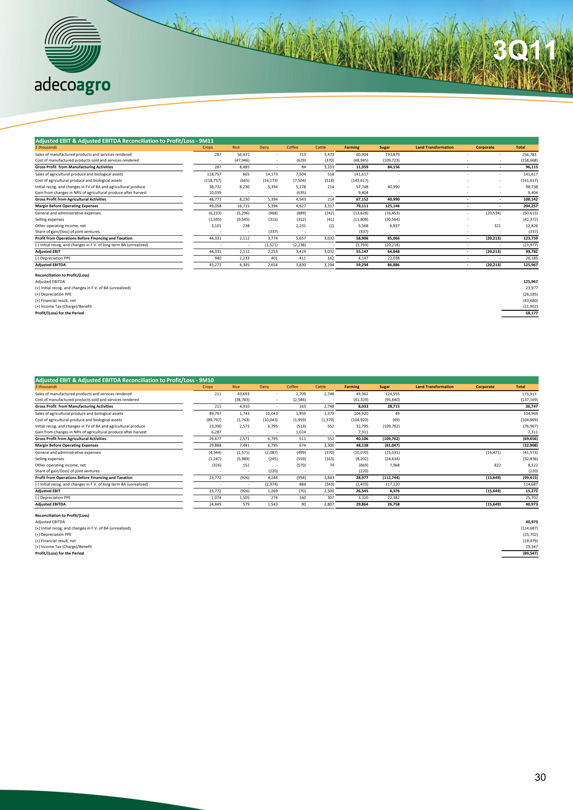

Segment Information - Reconciliation of Non-IFRS measures

(Adjusted EBITDA & Adjusted EBIT) to Profit/(Loss)

We define Adjusted EBITDA for each of our operating segments as the segment’s share of consolidated profit from operations before financing and taxation for the year or period, as applicable, before depreciation and amortization and unrealized changes in fair value of long-term biological assets.

We define Adjusted EBIT for each of our operating segments as the segment’s share of consolidated profit from operations before financing and taxation for the year or period, as applicable, before unrealized changes in fair value of long-term biological assets.