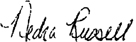

STATE OF ARKANSAS secretary of state Mark Martin SECRETARY OF STATE To All to Whom These Presents Shall Come, Greetings: I, Mark Martin, Secretary of State of Arkansas, do hereby certify that the following and hereto attached instrument of writing is a true and perfect copy of Articles of Conversion of FIDELITY INFORMATION SERVICES, INC. converting to FIDELITY INFORMATION SERVICES, LLC filed in this office March 25, 2011. In Testimony Whereof, I have hereunto set my hand and affixed my official Seal. Done at my office in the City of Little Rock, this 25th day of March 2011. Secretary of State

Exhibit 3.49

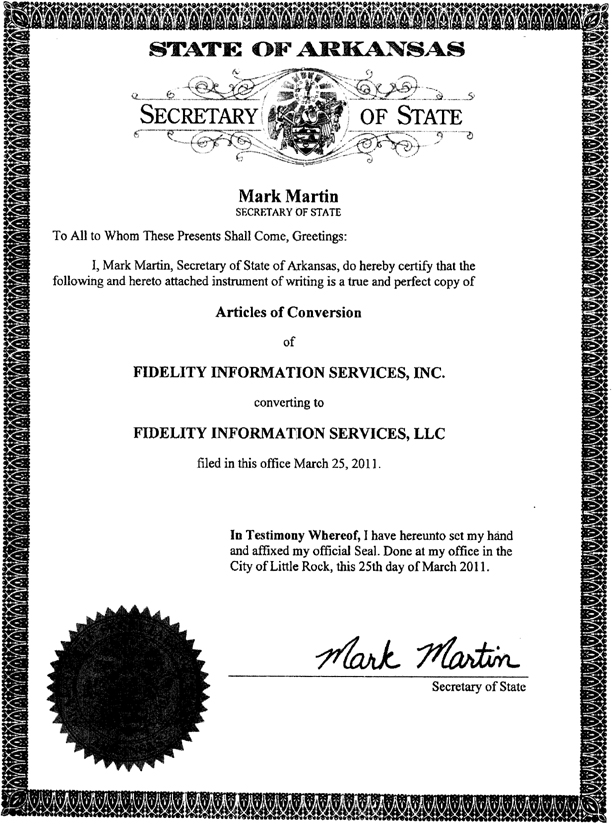

Arkansas Secretary of State State Capitol . Little Rock, Arkansas 72201-1094 501-682-3409 ‘www.sos.arkan5as.gov Business & Commercial Services, 250 Victory Building, 1401W. Capitol, Little Rock ARTICLES OF CONVERSION ACT 408 OF 2009 (PLEASE TYPE OR PRINT CLEARLY IN INK) The undersigned hereby state: Fidelity Information Services, Inc. Name of the entity converting from Corporation Arkansas Type of entity converting from Jurisdiction Is converting to: Fidelity Information Services, LLC Name of entity Limited liability company Arkansas Type of entity converting to Jurisdiction The conversion has been approved as required by Arkansas law; and That the conversion has been approved as required by the governing statute of the converted organization; and That the converted organization has filed a statement appointing an agent for service of process under § 4-20-112 if the converted organization is a nonfiling or nonqualified foreign entity; and That a copy of the plan of conversion is attached or a copy of the plan of conversion is on file at the office located at: 601 Riverside Avenue. Jacksonville, Florida 32204 And that the effective date of conversion is March 24,2011 I understand that knowingly signing a false document with the Went to file with the Arkansas Secretary of State is a Class C misdemeanor and is punishable by a fine up to $100.00 and/or imprisonment up to 30 days. Executed this 22nd day of March 2011 . Day Month Year Richard L Cox, SVP and Chief Tax Officer Signature of Authorizing Officer Authorizing Officer and Title of Officer (Type or Print) These Articles of Conversion must be filed in conjunction with an initial filing appropriate for the specific converted entity type

| Filing Fee: Partnership $15.00, Limited Liability Company $26.00, Corporation $50.00 | Art_Conv Rev 12/2009 |

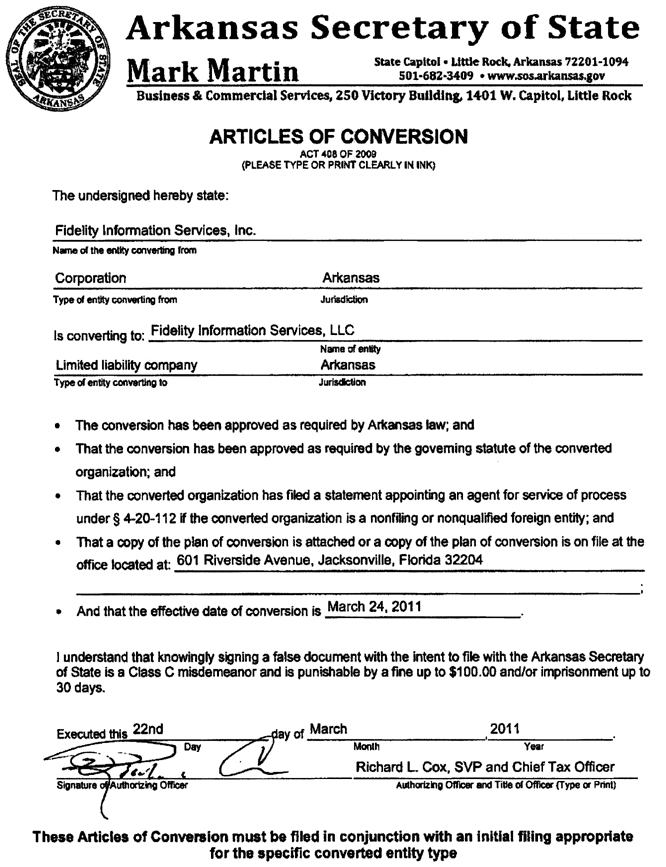

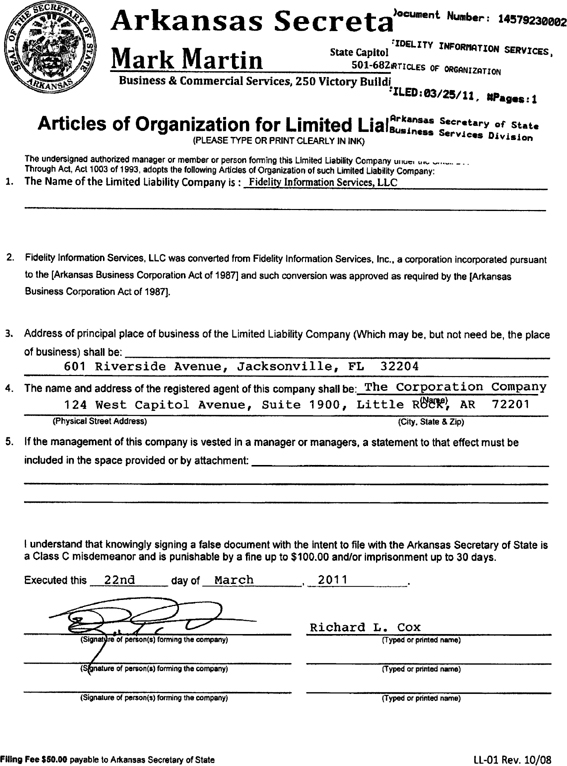

STATE OF ARKANSAS secretary ( of state Mark Martin SECRETARY OF STATE To All to Whom These Presents Shall Come, Greetings: I, Mark Martin, Secretary of State of Arkansas, do hereby certify that the following and hereto attached instrument of writing is a true and perfect copy of Articles of Organization of FIDELITY INFORMATION SERVICES, LLC filed in this office March 25, 2011 In Testimony Whereof, I have hereunto set my hand and affixed my official Seal. Done at my office in the City of Little Rock, this 25th day of March 2011. Secretary of State

Arkansas Secreta

Document Number : 14579230002

FIDELITY INFORMATION SERVICES,

RTICLES OF ORGANIZATION

FILED:03/25/11, Pages:1

Arkansas Secretary of State

Business Services Divisi on

Mark Martin

State Capital

501-682

Business & Commercial Services, 250 Victory Buildi

Articles of Organization for Limited Lial

(PLEASE TYPE OR PRINT CLEARLY IN INK)

The undersigned authorized manager or member or person forming this Limited Liability Company

Through Act, Act 1003 of 1993, adopts the following Articles of Organization of such Limited Liability Company:

1. | The Name of the Limited Liability Company is : Fidelity Information Services, LLC |

2. | Fidelity Information Services, LLC was converted from Fidelity Information Services. Inc., a corporation incorporated pursuant to the [Arkansas Business Corporation Act of 1987] and such conversion was approved as required by the [Arkansas Business Corporation Act of 1987]. |

3. | Address of principal place of business of the Limited Liability Company (Which may be, but not need be, the place of business) shall be: |

601 Riverside Avenue, Jacksonville, FL 32204

4. | The name and address of the registered agent of this company shall be: The Corporation Company |

124 West Capitol Avenue, Suite 1900, Little ROCK(Name), AR 72201

(Physical Street Address) | (City, State & Zip) |

5. | If the management of this company is vested in a manager or managers, a statement to that effect must be included in the space provided or by attachment: |

I understand that knowingly signing a false document with the intent to file with the Arkansas Secretary of State is a Class C misdemeanor and is punishable by a fine up to $100.00 and/or imprisonment up to 30 days.

Executed this 22nd day of March , 2011 ,

Richard L. Cox

(Signature of person(s) forming the company)

(Typed or printed name)

(Signature of person(s) forming the company)

(Typed or printed name)

(Signature of person(s) forming the company)

(Typed or printed name)

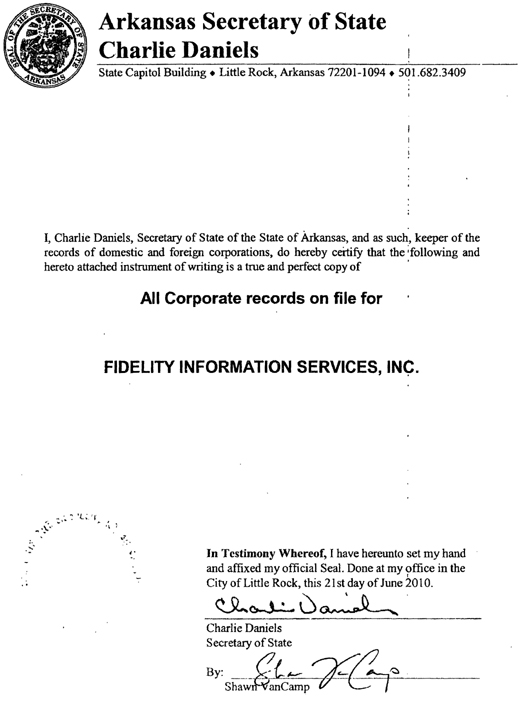

Arkansas Secretary of State Charlie Daniels State Capitol Building * Little Rock, Arkansas 72201-1094 501.682.3409 I, Charlie Daniels, Secretary of State of the State of Arkansas, and as such, keeper of the records of domestic and foreign corporations, do hereby certify that the following and hereto attached instrument of writing is a true and perfect copy of All Corporate records on file for FIDELITY INFORMATION SERVICES, INC. In Testimony Whereof, I have hereunto set my hand and affixed my official Seal. Done at my office in the City of Little Rock, this 21 st day of June 2010. Charlie Daniels Secretary of State By: Shawn VanCamp

FILED 50067 JUN 15 1967 SECRETARY OF STATE BY |

ARTICLES OF INCORPORATION

OF

REAL ESTATE PROPERTIES, INC.

WE, the undersigned, in order to form a Corporation for the purposes hereinafter stated, under and pursuant to the provisions of the Arkansas Business Corporation Act (Acts 1965, No. 576) DO HEREBY CERTIFY AS FOLLOWS:

FIRST:

The name of this Corporation is REAL ESTATE PROPERTIES, INC.

SECOND:

The nature of the business of the Corporation and the objects or purposes proposed to be transacted, promoted or carried on by it are as follows:

1. To hold, own, lease, develop and improve real estate for industrial, commercial, or residential purposes.

2. To buy, sell, exchange, or generally deal in real property, improved and unimproved, and buildings of every class and description; to improve, construct improvements on, manage, operate, sell, buy, mortgage, lease, hypothecate, or otherwise acquire or dispose of any real property or interest in real property or personal property or interest in personal property of an improved or unimproved nature, giving or taking evidence of indebtedness and the securing of the payment thereof by a mortgage, trust agreement, trust deeds, pledges or otherwise to enter into contracts to buy or sell any property, either real or personal, to buy and sell mortgages, deeds of trust, contracts and evidence of indebtedness; to purchase or otherwise acquire for the purpose of holding or disposing of the same, real or personal property of every kind and description, including the good will, stock, rights and property of any person, firm, association or corporation, paying

for the same in cash, notes, bonds or other obligations of this Corporation; to draw, make, accept, endorse, discount, execute and issue promissory notes, bills of exchange, warrants, bonds, debentures and other negotiable or transferrable instruments or obligations of the Corpation or any other Corporation, individual or person, from time to time, without restriction as to amount.

3. To manufacture, purchase or otherwise acquire, own, mortgage, pledge, sell, assign and transfer, or otherwise dispose of, to invest, trade, deal in and deal with goods, wares and merchandise and real and personal property of every class and description.

4. To make estimates for itself and for others, and to bid upon, enter into and carry out contracts for the furnishing and installation of industrial plants, factories, shops, and parts thereof, including but not limited to pipes, piping, joints, valves, gas and liquid distribution or storage systems, pipelines or other similar improvements and related facilities; and to construct, acquire by purchase or otherwise and maintain and operate machinery, appliances and equipment of any and all kinds necessary or deemed necessary for any or all of these purposes, and to sell or otherwise dispose of and deal in machinery, appliances and equipment of all kinds and character that may be or be deemed to be of use or in connection with any of these purposes; and to buy, sell, deal in or with building materials of any and all types and of any nature whatsoever.

5. To prospect for, explore, work and develop oil, gas and minerals. To sink, dig, drill, and drive wells. To acquire by purchase in fee, or lease, and contract, and rent, hold, own and control lands to be held in fee, or under lease, or contract, and sell and dispose of the same. To acquire by purchase or by contract, oil productions, oil royalties and sell or dispose of same.

6. To acquire, by purchase, lease or otherwise, machinery, equipment, tools and other mechanical, electrical, electronic and any and all other types and description of apparatus and personal property; to deal in, trade, barter, sell, lease, rent and otherwise dispose of any or all of same; to enter into short and long-term contracts for the lease of any machinery, equipment or property of any kind whatsoever; to manufacture, design and otherwise construct machinery or equipment of any and all types and to hold, own and deal in patents on the same; to borrow or lend money, with or without security and to issue its notes, debentures and other security where necessary.

-2-

7. To transact any business or engage in any business activity whether or not of the type or nature heretofore described which may be permitted under the laws of the State of Arkansas, the United States of America or any other state or foreign country in which this Corporation may engage in business.

8. To do all and everything necessary, suitable and proper for the accomplishment of any of the purposes or the attainment of any of the objects for the furtherance of any of the powers hereinabove set forth, either alone, or in association with other corporations, firms or individuals, and to do every other act or acts, thing or things, incidental or pertaining to or growing out of or connected with the aforesaid objects or purposes or any part or parts thereof, provided the same be not inconsistent with the laws under which this Corporation is organized and/or operating.

THIRD:

The period of existence of this Corporation shall be perpetual.

FOURTH:

The principal office or place of business of this Corporation shall be located in the County of Pulaski, City of Little Rock, State of Arkansas, and the address of the office or place of business shall be 115 East Capitol Avenue.

FIFTH:

The name of the resident agent of this Corporation is Jack Young, whose address is 115 East Capitol Avenue, Pulaski County, Arkansas.

-3-

SIXTH:

The total amount of authorized capital stock of this Corporation is Twenty Thousand (20,000) Shares of $5.00 par value, common stock.

SEVENTH:

The amount of capital with which this Corporation will begin business is Five Thousand and no/100 ($5,000.00) DOLLARS.

EIGHTH:

The name and post office address of each of the Incorporators, and the number of shares of capital stock subscribed by each of them is as follows:

Jack Young

115 East Capitol Avenue

Little Rock, Arkansas 400 Shares

Clifford E. McCloy, Jr.

115 East Capitol Avenue

Little Rock, Arkansas 400 Shares

Rose Jolley

115 East Capitol Avenue

Little Rock, Arkansas 200 Shares

NINTH:

The business of this Corporation shall be conducted under the supervision and by direction of a Board of Directors consisting of not less than three (3) nor more than five (5) Directors. The initial Board of Directors shall have three (3) members.

In lieu of formal meetings, the shareholders or directors, or both, shall be authorized to execute written consents to action desired and by such written consent shall have full power to bind the Corporation for the intents and purposes therein contained.

-4-

IN WITNESS WHEREOF, we have hereunto set our hands on this 14th day of June, 1967.

| /s/ Jack Young |

| Jack Young |

| /s/ Clifford E. McCloy, Jr. |

| Clifford E. McCloy, Jr. |

| /s/ Rose Jolley |

| Rose Jolley |

-5-

FILED 50067 NOV - 6 1968 | ||

| SECRETARY OF STATE | ||

| BY | ||

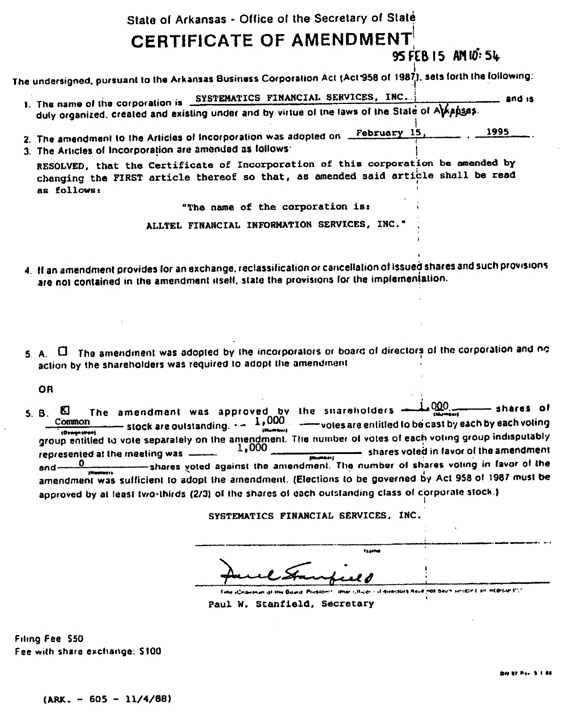

CERTIFICATE OF AMENDMENT

REAL ESTATE PROPERTIES, INC., a Corporation duly organized, created and existing under and by virtue of the laws of the State of Arkansas, by its President and its Secretary, DOES HEREBY CERTIFY:

At a special meeting of the Stockholders of said Corporation, duly called and held at the office of said Corporation, in the City of Little Rock, in the State of Arkansas, on the 10th day of October, 1968, notice thereof having been waived in writing by all of the Stockholders entitled to such notice, and at which meeting all of the issued and outstanding stock of said Corporation was represented either in person or by duly authorized proxies, the following resolution was offered and adopted by the votes of all of the stock so outstanding:

BE IT RESOLVED, That Article First and Fifth of the Articles of Incorporation of this Company be, and the same are herebyamended to read as follows:

FIRST:

The name of this Corporation is SYSTEMATICS, INC.

FIFTH:

The name of the Resident Agent of this Corporation is R. H. Thornton, Jr., whose address is 115 East Capitol Avenue, City of Little Rock, County of Pulaski, State of Arkansas.

IN WITNESS WHEREOF, The said REAL ESTATE PROPERTIES, INC., now SYSTEMATICS, INC. has caused this Certificate to be subscribed by Jack T. Stephens, its President, and its Corporate Seal hereto affixed and duly attested by Vernon J. Giss, its Secretary, on this 10th day of October, 1968 and said Officers have individually acknowledged and

verified this Certificate and state that there are One Thousand (1,000) shares of Capital Stock issued and outstanding, that all of said shares were entitled to vote upon the Amendment, and that One Thousand (1,000) shares voted for the foregoing Amendment, and that no shares were voted against the Amendment.

| SYSTEMATICS, INC. | ||

| By |  | |

| President | ||

| ATTEST: |

| /s/ [ILLEGIBLE] |

| Secretary |

(SEAL)

-2-

VERIFICATION

| STATE OF ARKANSAS | ) | |

| ) SS | ||

| COUNTY OF PULASKI | ) |

BE IT REMEMBERED, that on this 10th day of October, 1968, personally cane before me, the undersigned,aNotary Public within and for the State and County aforesaid, JACK T. STEPHENS and VERNON J. GISS, who stated that they were the President and Secretary, respectively, of SYSTEMATICS, INC., and being first duly sworn and known to me personally to be such President and Secretary, severally acknowledged the above and foregoing Certificate to be the act and deed of the signers respectively and that the facts therein stated are true.

GIVEN under my hand and seal of office the day and year aforesaid.

|

| Notary Public |

| My Commission Expires: |

| 12-6-71 |

ARTICLES OF AMENDMENT

OF

SYSTEMATICS, INC.

We, Walter Smiley, President, and Jon E. M. Jacoby, Secretary, of SYSTEMATICS, INC., a corporation duly organized, created and existing under and by virtue of the laws of the State of Arkansas, hereby certify that:

The following amendment to the Articles of Incorporation was adopted at a special meeting of the stockholders on June 30, 1969:

“RESOLVED, that Article SIXTH of the Articles of Incorporation be superseded by the following:

SIXTH: The aggregate number of shares which the corporation shall have the authority to issue is one million (1,000,000) shares of common stock having a par value of $.10 per share.”

On the date of the adoption of the resolution there were 1,000 shares of common stock outstanding and 1,000 shares of said stock voted affirmatively for the amendment hereinabove set forth.

IN TESTIMONY WHEREOF, we have hereunto set our hands as president and secretary, respectively, on the 30th day of June, 1969.

FILED 50067 | ||

| JUN 30 1969 | ||

KELLY BRYANT SECRETARY OF STATE | ||

| By | ||

| /s/ Walter Smiley |

| WALTER SMILEY, President |

| /s/ Jon E. M. Jacoby |

| JON E. M. JACOBY, Secretary |

ACKNOWLEDGMENT

| STATE OF ARKANSAS | ||

| COUNTY OF PULASKI | ||

Walter Smiley and Jon E. M. Jacoby, president and secretary, respectively, of SYSTEMATICS, INC., state on oath that the foregoing statements are true and correct to the best of their knowledge and belief.

| /s/ Walter Smiley |

| WALTER SMILEY |

| /s/ Jon E. M. Jacoby |

| JON E. M. JACOBY |

Subscribed and sworn to before me this 30th day of June, 1969.

|

| Notary Public |

| My Commission Expires: |

| July 10, 1969 |

NOTICE OF CHANGE OF REGISTERED OFFICE

OR REGISTERED AGENT, OR BOTH

| To: | Kelly Bryant Secretary of State State of Arkansas Little Rock, Arkansas 72201 |

Pursuant to the Arkansas Business Corporation Act, (Act 576 of 1965) the undersigned corporation, organized under the laws of the State of Arkansas, submits the following statement for the purpose of changing its registered office or its registered agent, or both, in the State of Arkansas.

| 1. | Name of corporation SYSTEMATICS, INC. |

| 2. | Address of its present registered office: 115 EAST CAPITOL AVENUE, City of LITTLE ROCK, County of PULASKI, State of ARKANSAS. |

| 3. | Address to which registered office is to be changed: 114 EAST CAPITOL AVENUE, City of LITTLE ROCK, County of PULASKI, State of ARKANSAS. |

| 4. | Name of present registered agent: R. H. THORNTON, JR. |

| 5. | Name of successor registered agent: J. BRYAN SIMS, JR. |

The address of the registered office and the address of the business office of the registered agent, as changed, will be identical.

MUST BE FILED IN DUPLICATE

The duplicate copy bearing the file marks of the Secretary of State shall be returned.

Such change must be filed with the County Clerk, unless the registered office is located in Pulaski County, in which event no filing with the County Clerk is required.

Dated February 25, 1971.

| SYSTEMATICS INC. | ||

| By: | /s/ Walter Smiley | |

| Its President | ||

FILING FEE: $3.00

FILED 50067 | ||

| MAR 3 1971 | ||

KELLY BRYANT SECRETARY OF STATE | ||

| BY | ||

FILED 50067

MAR 7 1975

KELLY BRYANT

SECRETARY OF STATE

By/s/ Kelly Bryant

CERTIFICATE OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

SYSTEMATICS, INC.

Pursuant to the provisions of Sections 64-507 and 64-509, Ark. Stats. (1947), the undersigned corporation adopts the following Articles of Amendment to its Articles of Incorporation.

FIRST. The name of the corporation is SYSTEMATICS, INC.

SECOND. The following amendment to the Articles of Incorporation were adopted by the stockholders of the corporation in the manner prescribed by the Arkansas Business Corporation Act:

RESOLVED, that Article SIXTH of the Articles of Incorporation of this Corporation be amended to read as follows:

“SIXTH. The aggregate number of shares which the corporation shall be authorized to issue is 1,500,000 shares of common stock having a par value of $.10 per share. The shareholders shall not have pre-emptive rights to subscribe for authorized but unissued, newly authorized, or treasury shares of stock of the corporation or securities convertible into or having options to purchase such shares.”

THIRD. The date of adoption of such amendments was November 22, 1974.

FOURTH. The number of shares of stock of the corporation outstanding at the time of such adoption was 973,020, and the number of shares entitled to vote thereon was 973,020. The designation and number of shares of each class of stock entitled to vote thereon as a class were as follows: None.

FIFTH. The number of shares of stock of the corporation which voted for the adoption of such amendments was 845,000 and no shares voted against such amendments.

IN WITNESS WHEREOF, the undersigned corporation has caused it Chairman and Secretary to execute this Certificate of Amendment on this 28th day of February, 1975.

| SYSTEMATICS, INC. | ||

| BY: | /s/ Walter V. Smiley | |

Walter V. Smiley Chairman of the Board | ||

| ATTEST: |

| /s/ Jon E. M. Jacoby |

Jon E. M. Jacoby Secretary |

VERIFICATION

| STATE OF ARKANSAS | ) | |

| ) SS. | ||

| COUNTY OF PULASKI | ) |

WALTER V. SMILEY states upon oath that he la Chairman of the Board of Directors of SYSTEMATICS, INC. an Arkansas corporation, that he has read the foregoing Certificate of Amendment to the Articles of Incorporation, and that the matters and things stated therein are true, correct and complete to the best of his knowledge and belief.

| /s/ Walter V. Smiley |

| Walter V. Smiley |

SUBSCRIBED AND SWORN TO before me this 28th day of February, 1975.

|

| Notary Public |

| My Commission Expires: |

| July 1, 1975 |

FILED

50067

JUL 7 1981

PAUL RIVIERE

SECRETARY OF STATE

BY/s/ Paul Riviere

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

SYSTEMATICS, INC.

Pursuant to the provisions of Section 64-511, Ark. Stat. Ann. (1980 Repl.), the undersigned corporation hereby amends and restates its Articles of Incorporation, in their entirety:

FIRST: The name of this corporation is:

SYSTEMATICS, INC.

SECOND: The period of its duration shall be perpetual.

THIRD: The purposes for which the corporation is organized are:

To buy, sell, lease, develop, license and use computer software and hardware of every type and kind and to furnish data processing services.

To engage in any lawful act or activity as permitted under the laws of the State of Arkansas, the United States of America or any other state or foreign country in which this corporation may engage in business.

To do each and every thing necessary, suitable or proper for the accomplishment of any purpose or for the attainment of any one or more objects which shall at any time appear conducive to or expedient for the protection or benefit of the corporation.

FOURTH: The aggregate number of shares which the corporation shall have authority to issue is as follows:

(a) 10,000,000 shares of Common Stock, $.025 par value, 6,000,000 shares of which shall be reflected by a four-for-one split of the 1,500,000 previously authorized shares of common stock, $.10 par value, and 4,000,000 of which are newly authorized hereby; and

(b) 1,000,000 shares of Preferred Stock, $1.00 par value.

Except as set forth below, authority to designate all of the voting rights and other rights and preferences, if any, of the Preferred Stock is hereby delegated to the Board of Directors which may, in its sole discretion, determine that the Preferred Stock shall be issued in one or more series. In addition, the preferences, limitations and relative rights of holders of the Preferred Stock shall be as follows:

DIVIDENDS. The holder of each share of Preferred Stock shall be entitled to receive cash dividends, when and as declared by the Board of Directors, out of the surplus or net profits of the corporation at an annual rate to be set by the Board of Directors at the time of issue of any series of such Preferred Stock, and no more, before any dividends on the Common Stock shall be paid or declared and set apart for payment. The holders of the Preferred stock shall not be entitled to receive any dividends other than as referred to in this paragraph. Dividends, if not declared and paid yearly, shall accumulate from year to year until paid, and if not paid shall constitute a preference in the event of liquidation or dissolution over any distributions made to common shareholders.

-2-

REDEMPTION. The Corporation, at the option of its Board of Directors, may redeem the whole or any part of the Preferred Stock at any time outstanding, at any time or from time to time, upon at least 30 days’ previous notice by mail (and by publication, if so determined by the Board of Directors) to the holders of record of the Preferred Stock to be redeemed, by paying as a cash redemption price the par value of each share of Preferred Stock so redeemed, in addition to any redemption premium authorized by the Board of Directors at the time such shares are issued. In the case of the redemption of a part only of the Preferred Stock at the time outstanding, the corporation shall select by lot and in such manner as the Board of Directors may determine the shares to be redeemed. The Board of Directors shall have the full power and authority, subject to the limitations and provisions herein contained, to prescribe the manner in which, and the terms and conditions upon which the Preferred Stock shall redeemed from time to time.

LIQUIDATION. In the event of any liquidation, dissolution, or winding-up of the affairs of the corporation, whether voluntary or involuntary, then before any distribution shall be made to the holders of the Common Stock, the holders of the Preferred Stock at the time outstanding shall be entitled to be paid in cash the sum of One and 00/100 Dollar ($1.00) per share plus any accumulated, but unpaid dividends. The holders of the Preferred Stock shall not be entitled to receive any distributive amount upon the liquidation, dissolution, or winding-up of the corporation other than the distributive amounts referred to in this paragraph.

-3-

VOTING RIGHTS. The holders of the Preferred Stock shall be entitled to vote only on matters pertaining to merger, consolidation or liquidation, or other matters as to which Arkansas law shall require voting by classes of stock. Where class voting is required under Arkansas law, all series of Preferred Stock outstanding shall vote as one class.

FIFTH: The corporation will not commence business until at least $300 has been received by it as consideration for the issuance of shares.

SIXTH: No shareholder shall have any preemptive right to acquire additional or treasury shares of the corporation.

SEVENTH: The internal affairs of the corporation shall be managed by a Board of Directors, which board shall have the power to make, adopt, alter, amend or repeal the by-laws of the corporation.

EIGHTH: The address of the initial registered office of the corporation is 212 Center Street, and the name of its initial registered agent at such address is Walter V. Smiley.

NINTH: The number of directors constituting the Board of Directors shall be not less than three (3) nor more than eleven (11). The initial number of directors shall be seven, and the number of directors shall be fixed by the by-laws and may be increased or decreased from time to time by amendment to the by-laws.

TENTH: In lieu of formal meetings, the shareholders or directors, or both, are authorized to execute written consents to action desired and by such written consent shall have full power to bind the corporation for the intents and purposes therein contained.

-4-

The number of shares of the stock of the corporation outstanding at the time of such adoption was 1,014,706 shares of common stock, and the number of shares entitled to vote thereon was 1,014,706 shares.

FOURTH: The number of shares voting for such Restated Articles of Incorporation were 891,097 shares. There were no shares voting against the Restated Articles of Incorporation.

DATED this 29th day of June, 1981.

SYSTEMATICS, INC.

/s/ Walter V. Smiley

Walter V. Smiley, President

ATTEST:

/s/ Jon E. M. Jacoby

Jon E. M. Jacoby, Secretary

-5-

VERIFICATION

STATE OF ARKANSAS )

) SS.

COUNTY OF PULASKI )

BE IT REMEMBERED, that on this 7th day ofJuly, 1981, personally appeared before me, the undersigned Notary Public within and for the State and County aforesaid, Walter V. Smiley and Jon E. M. Jacoby to me well-known, who, being first duly sworn by me, declared that they were President and Secretary, respectively, of SYSTEMATICS, INC., and in such capacities had executed the foregoing Amended and Restated Articles of Incorporation of Systematics, Inc., and they stated that the statements contained therein are true.

WITNESS my hand and seal this 7th day of July, 1981.

| ||||

Notary Public

My Commission Expire 10-19-82 |

-6-

FILED 50067 1983 PAUL RIVIERE SECRETARY OF STATE BY/s/ Paul Riviere |

ARTICLES OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

SYSTEMATICS, INC.

Pursuant to the provisions of Section 64-509 Ark. Stat. Ann. (1980 Repl.), the undersigned corporation hereby amends its Amended and Restated Articles of Incorporation filed in the office of the Secretary of State on July 7, 1981 (the “Articles of Incorporation”). The following is set forth in support of this filing:

1. The name of the corporation is Systematics, Inc. (the “Corporation”).

2. The fourth section of the Corporation’s Articles of Incorporation is hereby amended to read as follows:

FOURTH: The aggregate number of shares which the corporation shall have authority to issue is as follows:

(a) 40,000,000 shares of Common Stock, $.025 par value; and

(b) 1,000,000 shares of Preferred Stock, $1.00 par value.

Except as set forth below, authority to designate all of the voting rights and other rights and preferences, if any, of the Preferred Stock is hereby delegated to the Board of Directors which

may, in its sole discretion, determine that the Preferred Stock shall be issued in one or more series. In addition, the preferences, limitations and relative rights of holders of the Preferred Stock shall be as follows:

DIVIDENDS. The holder of each share of Preferred Stock shall be entitled to receive cash dividends, when and as declared by the Board of Directors, out of the surplus or net profits of the corporation at an annual rate to be set by the Board of Directors at the time of issue of any series of such Preferred Stock, and no more, before any dividends on the Common Stock shall be paid or declared and set apart for payment. The holders of the Preferred Stock shall not be entitled to receive any dividends other than as referred to in this paragraph. Dividends, if not declared and paid yearly, shall accumulate from year to year until paid, and if not paid shall constitute a preference in the event of liquidation or dissolution over any distributions made to common shareholders.

REDEMPTION: The corporation, at the option of its Board of Directors, may redeem the whole or any part of the Preferred Stock at any time outstanding, at any time or from time to time, upon at least 30 days’ previous notice by mail (and by publication, if so determined by the Board of Directors) to the holders of record of the Preferred Stock to be redeemed, by paying as a cash redemption price the par value of each share of Preferred Stock so redeemed, in addition to any redemption premium authorized by the Board of Directors at the time such shares are issued. In the case of the redemption of a part only of the Preferred Stock at the time outstanding, the corporation shall select by lot and in such manner as the Board of directors may determine the shares to be redeemed. The Board of Directors shall have the full power and authority, subject to the limitations and provisions herein contained, to prescribe the manner in which, and the terms and conditions upon which the Preferred Stock shall be redeemed from time to time.

-2-

LIQUIDATION: In the event of any liquidation, dissolution, or winding-up of the affairs of the corporation, whether voluntary or involuntary, then before any distribution shall be made to the holders of the Common Stock, the holders of the Preferred Stock at the time outstanding shall be entitled to be paid in cash the sum of One and 00/100 Dollar ($1.00) per share plus any accumulated, but unpaid dividends. The holders of the Preferred Stock shall not be entitled to receive any distributive amount upon the liquidation, dissolution, or winding-up of the corporation other than the distributive amounts referred to in this paragraph.

VOTING RIGHTS: The holders of the Preferred Stock shall be entitled to vote only on matters pertaining to merger, consolidation or liquidation, or other matters as to which Arkansas law shall require voting by classes of stock. Where class voting is required under Arkansas law, all series of Preferred Stock outstanding shall vote as one class.

3. This amendment was adopted by the shareholders of the Corporation on September 20, 1983.

4. The number of shares of the stock of the Corporation outstanding at the time of such adoption was 5,378,449 shares of common stock, and the number of shares entitled to vote thereon was 5,376,424 shares. The Corporation’s 1,000,000 shares of Preferred Stock, $1.00 par value is, where required under Arkansas law, entitled to vote as a class. However no shares of the Corporation’s Preferred Stock is outstanding or entitled to vote.

5. The number of shares voting for this amendment to the Articles of Incorporation were 2,960,147 shares. The number of shares voting against this amendment to the Articles of Incorporation were 1,972 shares. 1,471 shares abstained from voting on this amendment.

-3-

6. This amendment does not provide for an exchange, reclassification or cancellation of issued shares of the Corporation.

7. This amendment will permit the declaration of a two-for-one stock split by means of a 100% stock dividend. Thus, immediately following such stock dividend, the Corporation’s stated capital will be $268,922.45.

DATED this 20th day of September, 1983.

| SYSTEMATICS, INC. | ||

| /s/ H. Dudley Shollmie | ||

| Vice-President | ||

| ATTEST: | ||

| /s/ James H. Wilkins, Jr. | ||

James H. Wilkins, Jr., Assistant Secretary | ||

-4-

VERIFICATION

STATE OF ARKANSAS )

) SS

COUNTY OF PULASKI )

BE IT REMEMBERED, that on this 20th day of September, 1983, personally appeared before me, the undersigned Notary Public within and for the State and County aforesaid, H. Dudley Shollmier and James H. Wilkins, Jr. to me well-known, who, being first duly sworn by me, declared that they were the Vice President and Assistant Secretary, respectively, of SYSTEMATICS, INC., and in such capacities had executed the foregoing Articles of Amendment to Articles of Incorporation of Systematics, Inc., and they stated that the statements contained therein are true.

WITNESS my hand and seal this 20th day of September, 1983.

Notary Public

-5-

FILED

50067

FEB 16 3 43 pm ’88

AMENDED

ARTICLES OF INCORPORATION

of

SYSTEMATICS, INC.

Pursuant to the provisions of Ark. Stat. §4-27-l006 (1987) and Ark. Stat. §4-27-1701 (1987), Systematics, Inc. by and through the undersigned hereby amends its Articles of Incorporation to add the following:

ELEVENTH: To the fullest extent permitted by the Arkansas Business Corporation Act, as the same exists or may hereafter be amended, a director of this Corporation shall not be liable to the Corporation or its shareholders for monetary damages for breach of fiduciary duty as director.

TWELFTH: Effective as of the date of the filing of this Amendment, this Corporation shall be governed by the provisions of the Arkansas Business Corporation Act of 1987 (Act 958 of 1987) as it exists or is hereafter amended.

This Amendment was approved by an affirmative vote of at least two-thirds (2/3) of the shareholders of each outstanding class of the Corporation’s capital stock. At the time of the approval, the Corporation had one class of common stock with 10,857,530 shares issued and outstanding and entitled to vote separately on the amendments. Of that group 9,523,567 shares were indisputably represented at the meeting.

For the amendment designated “ELEVENTH” above, 9,479,711 undisputed votes were cast in favor of such amendment and the number cast in favor was sufficient for approval by that voting group.

For the amendment designated “TWELFTH” above, 9,460,405 undisputed votes were cast in favor of such amendment and the number cast in favor was sufficient for approval by that voting group.

Dated this 15th day of February, 1988.

| SYSTEMATICS, INC. | ||

| By: |  | |

| ATTEST: | ||

| /s/ James H. Wilkins, Jr. | ||

VERIFICATION

STATE OF ARKANSAS )

) ss.

COUNTY OF PULASKI )

BE IT REMEMBERED, that on this 15th day of February, 1988, personally appeared before me, the undersigned Notary Public within and for the State and County aforesaid, Raymond R. Maturi and James H. Wilkins, Jr. to me well known, who, being first duly sworn by me, declared that they were President and Secretary, respectively, of SYSTEMATICS, INC., and in such capacities had executed the foregoing Amended and Restated Articles of Incorporation of Systematics, Inc., and they stated that the statements contained therein are true.

WITNESS my hand and seal this 15th day of February, 1988.

| ||

| Notary Public | ||

| My Commission Expires: |

02-17-92

|

-2-

ARTICLES OF MERGER

These ARTICLES OF MERGER (“Articles of Merger”), dated as of May 31, 1990, are among Systematics, Inc., an Arkansas corporation (“Systematics”), ALLTEL CORPORATION, a Delaware corporation (“ALLTEL”), and Systematics Merger Co., an Arkansas corporation and a wholly-owned subsidiary of ALLTEL (“Sub”). Systematics and Sub are collectively referred to herein as the “Constituent Corporations.”

WITNESSETH:

WHEREAS, Systematics and ALLTEL are parties to a Plan of Reorganization and Merger, dated as of March 2, 1990 (the “Plan of Reorganization and Merger”), providing for the merger of Sub and Systematics (the “Merger”);

NOW, THEREFORE, in consideration of the mutual agreements, covenants, representations and warranties herein contained, and for the purpose of prescribing the terms and conditions of the Merger, the mode of carrying the Merger into effect, the manner and basis of converting the shares of Sub into shares of the Surviving Corporation (as defined in Article II) and the shares of Systematics into shares of ALLTEL, and such other details and provisions as are deemed necessary or desirable with respect to the Merger, in accordance with the applicable statutes of the State of Arkansas, the parties agree as follows:

ARTICLE I

CAPITAL STOCK

The shares of capital stock of the Constituent Corporations outstanding consist of the following:

SYSTEMATICS

| Designation | Shares Outstanding | |||

Common Stock, par value $.025 | 10,729,667 | |||

None of the foregoing shares of capital stock are entitled to vote as a class.

SUB

| Designation | Shares Outstanding | |||

Common Stock, $1.00 par value | 1,000 | |||

None of the foregoing shares of capital stock are entitled to vote as a class.

The number of the shares of capital stock of the Constituent Corporations entitled to vote that were cast for and against the Merger are as follows:

SYSTEMATICS

| Designation | Cast For | Cast Against | ||||||

Common Stock, par value $.025 | 7,907,117 | 3,464 | ||||||

SUB

| Designation | Cast For | Cast Against | ||||||

Common Stock, $1.00 par value | 1,000 | 0 | ||||||

1

ARTICLES OP MERGER

These ARTICLES OF MERGER (“Articles of Merger”), dated as of May 31, 1990, are among Systematics, Inc., an Arkansas corporation (“Systematics”), ALLTEL CORPORATION, a Delaware corporation (“ALLTEL”), and Systematics Merger Co., an Arkansas corporation and a wholly-owned subsidiary of ALLTEL (“Sub”). Systematics and Sub are collectively referred to herein as the “Constituent Corporations.”

WITNESSETH:

WHEREAS, Systematics and ALLTEL are parties to a Plan of Reorganization and Merger, dated as of March 2, 1990 (the “Plan of Reorganization and Merger”), providing for the merger of Sub and Systematics (the “Merger”);

NOW, THEREFORE, in consideration of the mutual agreements, covenants, representations and warranties herein contained, and for the purpose of prescribing the terms and conditions of the Merger, the mode of carrying the Merger into effect, the manner and basis of converting the shares of Sub into shares of the Surviving Corporation (as defined in Article II) and the shares of Systematics into shares of ALLTEL, and such other details and provisions as are deemed necessary or desirable with respect to the Merger, in accordance with the applicable statutes of the State of Arkansas, the parties agree as follows:

ARTICLE I

CAPITAL STOCK

The shares of capital stock of the Constituent Corporations outstanding consist of the following:

SYSTEMATICS

| Designation | Shares Outstanding | |

Common Stock, par value $.025 |

None of the foregoing shares of capital stock are entitled to vote as a class.

SUB

| Designation | Shares Outstanding | |||

Common Stock, $1.00 par value | 1,000 | |||

None of the foregoing shares of capital stock are entitled to vote as a class.

The number of the shares of capital stock of the Constituent Corporations entitled to vote that were cast for and against the Merger are as follows:

SYSTEMATICS

| Designation | Cast For | Cast Against | ||

Common Stock, par value $.025 |

SUB

| Designation | Cast For | Cast Against | ||||||

Common Stock, $1.00 par value | 1,000 | 0 | ||||||

1

ARTICLE II

MERGER, EFFECTIVE DATE

Sub shall be merged into Systematics, which shall be the surviving corporation (Systematics is hereinafter sometimes referred to as the “Surviving Corporation”). The Surviving Corporation shall be governed by the laws of the State of Arkansas.

The Merger shall become effective at the close of business on the day on which these Articles of Merger shall be executed and filed with the Secretary of State of Arkansas in accordance with the laws of the State of Arkansas (hereinafter referred to as the “Effective Date”).

ARTICLE III

ARTICLES oF INCORPORATIONAND BYLAWSOF SURVIVING CORPORATION

The articles of Incorporation and the bylaws of Systematics, as they exist on the Effective Date, shall be the articles of incorporation and the bylaws of the Surviving Corporation until thereafter amended as provided by law.

ARTICLE IV

SURVIVING CORPORATIONTO SUCCEEDTO

PROPERTIESAND OBLIGATIONSOF SYSTEMATICSAND SUB

From and after the Effective Date, the Surviving Corporation, without other transfer or assumption, shall succeed to and possess all the rights, privileges, immunities and powers, and shall be subject to all the duties and liabilities, of each of the Constituent Corporations, all without further act or deed, as provided in Section 4-27-1101 et seq. of the Arkansas Business Corporation Act of 1987.

If at any time the Surviving Corporation shall consider, upon the advice of its legal counsel, that any further assignments, conveyances or assumptions of liability are necessary or desirable to carryout the provisions hereof, the proper officers and directors of the Constituent Corporations as of the Effective Date shall execute and deliver any and all proper deeds, assignments and assumptions of liability and do all things necessary or proper to carry out the provisions hereof.

ARTICLE V

PLANOF MERGER

(a) On or prior to the Effective Date, ALLTEL shall have transferred and delivered to Sub, as a contribution to Sub’s capital, such numbers of shares of common stock of ALLTEL and rights (as defined in the Plan of Reorganization and Merger) to be issued in accordance with the Rights Plan, as shall be necessary to carry out the provisions of paragraph (d) below.

(b) On the Effective Date, each share of common stock of Sub outstanding immediately prior to the Merger shall, by virtue of the Merger and without any action on the part of any holder thereof, be converted into one share of common stock of the Surviving Corporation (the “Post-Merger Shares”), and each certificate evidencing ownership of any such Sub shares as of the Effective Date shall evidence ownership of the same number of Post-Merger Shares.

(c) On the Effective Date, each share of common stock of Systematics outstanding immediately prior to the Merger (the “Pre-Merger Shares”), and all rights in respect thereof, shall forthwith cease to exist and be cancelled, except for the rights set forth below and except as provided by law in respect of shares as to which the holders may exercise rights of dissenting shareholders. Shares with respect to which the holders have perfected their dissenters’ rights in accordance with Subchapter 13 of the Arkansas Business Corporation Act of 1987 (“Dissenting Shares”) shall be deemed no longer outstanding and shall be converted into the rights provided by such Subchapter 13, and the provisions set forth below shall not apply to those shares.

2

(d) On the Effective Date, each Pre-Merger Share issued and outstanding Immediately prior to the Merger shall, by virtue of the Merger and without any action on the part of any holder thereof, be converted into 1.325 shares of common stock of ALLTEL and the corresponding number of Rights determined in accordance with the Rights Plan. The foregoing basis of conversion shall be appropriately adjusted (to the nearest .001 of a share) in the event of any stock dividend, reclassification, split-up, combination or exchange of Systematics common stock or ALLTEL common stock prior to the Effective Date. Notwithstanding the foregoing provisions of this paragraph (d), in lieu of issuing certificates for or including fractional shares of common stock of ALLTEL and Rights resulting from the conversion on the Effective Date of Pre-Merger Shares into shares of common stock of ALLTEL and Rights, the Surviving Corporation shall pay to each holder of Pre-Merger Shares otherwise entitled to receive such certificates, cash in an amount equal to the product of such fraction and the average of the closing sale prices of shares of common stock of ALLTEL on the New York Stock Exchange on the twenty trading days last preceding the Effective Date.

(e) After the Effective Date, no holder of a certificate for Pre-Merger Shares shall be entitled to vote at any meeting of shareholders of ALLTEL or to receive any dividends from ALLTEL until surrender of his certificate for a certificate for shares of common stock of ALLTEL and Rights. Upon such surrender, there shall be paid to the holder any dividends (without interest thereon) that have become payable, but that have not been paid by reason of the foregoing, with respect to the number of whole shares of common stock of ALLTEL and Rights represented by the certificates issued in exchange therefor. ALLTEL shall be entitled, however, after the Effective Date, to treat any certificate for Pre-Merger Shares as evidencing ownership of the number of full shares of common stock of ALLTEL and Rights into which the Pre-Merger Shares represented by such certificate shall have been converted, notwithstanding the failure to surrender such certificate.

(f) On the Effective Date, all rights to acquire common stock of Systematics (other than the Post-Merger Shares) shall be converted into rights to acquire shares of common stock of ALLTEL and Rights upon the basis set forth in subsection (d) above and subject to the terms and conditions of such rights that exist on the Effective Date.

(g) Shares of common stock of ALLTEL into which the Pre-Merger Shares have been converted by virtue of the Merger shall, when issued in accordance with the provisions of these Articles of Merger, be fully paid and nonassessable, and, together with the corresponding number of Rights determined in accordance with the Rights Plan, shall be deemed to have been issued in full satisfaction of all rights pertaining to such converted shares, except unpaid dividends, if any, declared prior to the Effective Date with respect to the Pre-Merger Shares.

(h) Certificates representing the Pre-Merger Shares shall be delivered for conversion into shares of ALLTEL common stock and Rights as follows: ALLTEL shall prepare a form (the “Form of Transmittal Letter”) under which each holder of Pre-Merger Shares shall transmit the certificate or certificates representing such holder’s Pre-Merger Shares to ALLTEL for conversion into the consideration provided herein. As promptly as practicable after the Effective Date, the Form of Transmittal Letter shall be mailed to holders of Pre-Merger Shares.

(i) An agent shall be designated by ALLTEL to effect the exchange of Pre-Merger Shares for ALLTEL common stock and Rights (the “Exchange Agent”). The Exchange Agent shall be authorized to issue ALLTEL common stock and Rights for any certificates evidencing Pre-Merger Shares that have been lost, stolen or destroyed upon receipt of satisfactory evidence of ownership of the Pre-Merger Shares represented thereby, and after appropriate indemnification.

3

(j) If any check for cash in lieu of fractional shares or certificates for ALLTEL common stock and Rights is to be issued hereunder in a name other than that in which the certificates for Pre-Merger Shares surrendered in exchange therefor are registered, it shall be a condition of such exchange that the person requesting such exchange shall pay to the Exchange Agent any transfer or other taxes required by reason of the issuance of such check or such certificates for such ALLTEL common stock and Rights in a name other than that of the registered holder of the certificates surrendered, or shall establish to the satisfaction of the Exchange Agent that such tax has been paid or is not applicable.

ARTICLE VI

APPROVALS

After approval of these Articles of Merger by the Boards of Directors of Systematics, ALLTEL and Sub, these Articles of Merger shall be submitted for such approval and adoption by the shareholders of Systematics and Sub, as required by the laws of the State of Arkansas, and by the shareholders of ALLTEL. If these Articles of Merger shall be so approved and adopted, the Constituent Corporations shall, subject to the provisions of Article VII concerning abandonment, forthwith proceed to effect the transactions contemplated hereby.

ARTICLE VII

ABANDONMENT

These Articles of Merger may be abandoned at any time before or after action thereon by the shareholders of Systematics, Sub or ALLTEL, notwithstanding favorable action of the Merger by those shareholders, but not later than the Effective Date, by the Board of Directors of Systematics or ALLTEL, to the extent permitted under Section 8.1 of the Plan of Reorganization and Merger.

ARTICLE VIII

AMENDMENTSAND WAIVER

These Articles of Merger may be amended by the Boards of Directors of the parties hereto to the extent permitted by applicable law, and, to the extent permitted by applicable law, no action by the shareholders of the parties hereto shall be required with respect to any amendment if any such amendment does not change the conversion ratio for shares of common stock of ALLTEL and Rights into which Pre-Merger Shares are to be converted hereunder or change any other provision hereof in any manner that would have a material adverse effect on the rights of such shareholders.

Systematics or ALLTEL may, by action of its Board of Directors by an instrument in writing, extend the time for or waive the performance of any of the obligations of the other or waive compliance by the other with respect to any of the covenants or conditions contained in these Articles of Merger if any such extension or waiver does not affect the rights of the shareholders of Systematics, Sub or ALLTEL in a manner that is materially adverse to such shareholders.

ARTICLE IX

COUNTERPARTS

These Articles of Merger may be executed in counterparts, each of which when so executed shall be deemed to be an original, and such counterparts shall together constitute but one and the same instrument.

4

IN WITNESS WHEREOF, the parties hereto, pursuant to authority given by, their respective Boards of Directors, have caused these Articles of Merger to be entered into and signed, attested and verified and sealed by their respective authorized officers, as of the day and year first above written.

SYSTEMATICS:

Systematics, Inc., an Arkansas corporation | ||||||

| [Corporate Seal] | By: | /s/ John E. Steuri | ||||

Title: John E. Steuri President and Chief Executive Officer | ||||||

| ATTESTED AND VERIFIED: | ||

| ||

| Secretary | ||

| SUB: | ||||||

| [Corporate Seal] | SYSTEMATICS MERGER CO., | |||||

| an Arkansas corporation | ||||||

| By: | /s/ Joe T. Ford (Joe T. Ford) | |||||

| Title: President | ||||||

| ATTESTED AND VERIFIED: | ||

| ||

| Secretary | ||

ALLTEL:

ALLTEL CORPORATION, a Delaware corporation | ||||||

| [Corporate Seal] | ||||||

| By: | /s/ Joe T. Ford (Joe T. Ford) | |||||

Title: President and Chief Executive officer | ||||||

| ATTESTED AND VERIFIED: | ||

| ||

| Secretary | ||

5

NOTICE OF CHANGE OF REGISTERED OFFICE OR REGISTERED AGENT, OR BOTH

| To: | W. J. “Bill” McCuen |

| Secretary of State |

| Corporation Division |

| State Capitol |

| Little Rock, Arkansas 72201-1094 |

Pursuant to the Corporation Laws of the State of Arkansas, the undersigned corporation submits the following statement for the purpose of changing its registered office or its registered agent, or both in the state of Arkansas. If this statement reflects a change of registered office, this form must be accompanied by notice of such change to any and all applicable corporations.

¨ Foreign

x Domestic

| 1. | Name of corporation: SYSTEMATICS, INC. |

| 2. | Address of its present registered office: 212 Center Street |

Street Address

Little Rock, Arkansas 72201

City, State, Zip

| 3. | Address to which registered office is to be changed: |

| 4001 Rodney Parham Road, Little Rock, Arkansas 72212 |

Street Address, City, State, Zip

| 4. | Name of present registered agent: Walter V. Smiley |

| 5. | Name of successor registered agent: Paul W. Stanfield |

I, Paul W. Stanfield, hereby consent to serve as registered agent for this corporation.

/s/ Paul W. Stanfield

Successor Agent

A letter of consent from successor agent may be substituted in lieu of this signature.

| 6. | The address of its registered office and the address of the business office of its registered agent, as changed, will be identical. |

MUST BE FILED IN DUPLICATE

A copy bearing the file marks of the Secretary of State shall be returned.

If this corporation is governed by Act 576 of 1965 such change must be filed with the County Clerk of the County in which its registered office is located, unless the registered office is located in Pulaski County, in which event no filing with the County Clerk is required.

Dated October 31 1990. | ||||||

| /s/ John E. Steuri | ||||||

| Name of Authorized Officer | ||||||

| Chairman and Chief Executive Officer | ||||||

| Title of Authorized Officer | ||||||

| /s/ Paul W. Stanfield | ||||||

| Secretary or Assistant Secretary | ||||||

THE CORPORATION COMPANY, hereby consents to serve as registered agent for ALLTEL INFORMATION SERVICES, INC. (Delaware Domestic)

| BY | /s/ J. L. Miles | |

| J. L. Miles, Assistant Secretary | ||

[ILLEGIBLE]

AMENDED

ARTICLES OF INCORPORATION

of

SYSTEMATICS, INC.

Pursuant to the provisions of Arkansas Code Annotated §4-27-1006 (Supp. 1989) and Arkansas Code Annotated §4-27-1003 (Supp. 1989), Systematics, Inc. by and through the undersigned hereby amends its Articles of Incorporation as follows:

ARTICLE “FIRST” is amended in its entirety as follows:

FIRST: The name of the Corporation shall be Systematics Financial Services, Inc.

This Amendment was approved by an affirmative vote of at least two-thirds (2/3) of the shareholders of each outstanding class of the Corporation’s capital stock. At the time of the time of the approval, the Corporation had one class of common stock with 78,909,887 shares issued and outstanding and entitled to vote separately on the amendments. Of that group 78,909,887 shares were indisputably represented at the meeting.

For the amendment all outstanding shares were voted in favor of such amendment and the number of cast in favor was sufficient for approval by that voting group.

Dated this 30th day of April, 1991.

| SYSTEMATICS, INC. | ||

| By: | /s/ John E. Steuri | |

| JOHN E. STEURI, President | ||

| ATTEST: |

| /s/ Paul W. Stanfield |

| PAUL W. STANFIELD, Secretary |

VERIFICATION

STATE OF ARKANSAS )

ss.

COUNTY OF PULASKI )

BE IT REMEMBERED, that on this 30th day of April, 1991, personally appeared before me, the undersigned Notary Public within and for the State and County aforesaid, JOHN E. STEURI and PAUL W. STANFIELD, to me well known, who, being first duly sworn by me, declared that they were President and Secretary, respective, of SYSTEMATICS, INC., and in such capacities had executed the foregoing Amended and Restated Articles of Incorporation of Systematics, Inc., and they stated that the statements contained therein are true.

WITNESS my hand and seal this 30th day of April, 1991.

|

| Notary Public |

My Commission Expires:

My Commission Expires

February 17, 1992

-2-

THE CORPORATION COMPANY, hereby consents to serve as registered agent for ALLTEL FINANCIAL INFORMATION SERVICES, INC. (Arkansas Domestic)

| BY | /s/ J. L. Miles | |

| J. L. Miles, Assistant Secretary | ||

NOTICE OF CHANGE OF REGISTERED OFFICE OR REGISTERED AGENT, OR BOTH

| To: | Sharon Priest |

| Secretary of State |

| Corporation Division |

| State Capitol |

| Little Rock, Arkansas 72201-1094 |

Pursuant to the Corporation Laws of the State of Arkansas, the undersigned corporation submits the following statement for the purpose of changing its registered office or its registered agent, or both in the state of Arkansas. If this statement reflects a change of registered office, this form must be accompanied by notice of such change to any and all applicable corporations.

¨ Foreign

x Domestic

| 1. | Name of corporation: ALLTEL Financial Information Services, Inc. |

| 2. | Address of its present registered office:4001 Rodney Parham Road, Little Rock, |

| Street Address |

| Arkansas 72212 |

| City, State, Zip |

| 3. | Address to which registered office is to be changed: |

| 417 Spring Street, Little Rock Arkansas, 72201 |

| Street Address, City, State, Zip |

| 4. | Name of present registered agent: Paul W. Stanfield |

| 5. | Name of successor registered agent: The Corporation Company |

I, , hereby consent to serve as registered agent for this corporation.

Successor Agent

A letter of consent from successor agent may be substituted in lieu of this signature.

| 6. | The address of its registered office and the address of the business office of its registered agent, as changed, will be identical. |

MUST BE FILED IN DUPLICATE

A copy bearing the file marks of the Secretary of State shall be returned.

If this corporation is governed by Act 576 of 1986 such change must be filed with the County Clerk of the County in which its registered office is located, unless the registered office is located in Pulaski County, In which event no filing with the County Clerk is required.

| Dated April 26 1996. | ||||||

| /s/ Michael L. Gravelle | ||||||

| Name of Authorized Officer | ||||||

| Vice President and Secretary | ||||||

| Title of Authorized Officer | ||||||

| Michael L. Gravelle, Secretary | ||||||

| Secretary or Assistant Secretary | ||||||

| Fee $25.00 | DC-3/DN-04/F-06/10-1-56 |

ARTICLES OF MERGER

THIS ARTICLES OF MERGER (“Articles of Merger”) dated as of December 30, 1996 is among ALLTEL Information Services, Inc., a Delaware corporation (“ALLTEL Information”) and ALLTEL Financial Information Services, Inc., an Arkansas corporation (“ALLTEL Financial”). ALLTEL Information and ALLTEL Financial are collectively referred to herein as the “Constituent Corporations.”

WITNESSETH:

WHEREAS, ALLTEL Information is a corporation duly organized and existing under the laws of the State of Delaware, having been incorporated on March 5, 1991 by a Certificate of Incorporation filed with the Secretary of State and recorded in the Office of the Recorder of Deeds of the County of New Castle, Delaware, on that date, as amended from time to time thereafter, and the registered office of ALLTEL Information in the State of Delaware is located at 1209 Orange Street, Wilmington, Delaware, and the name of its registered agent at such office is The Corporation Trust Company;

WHEREAS, ALLTEL Information has an authorized and outstanding capitalization consisting of:

Designation | Authorization | Outstanding | ||||||

Common Stock $1.00 Par Value | 1,000 | 1,000 | ||||||

WHEREAS, ALLTEL Financial is a corporation duly organized and existing under the laws of the State of Arkansas, having been incorporated on June 16, 1967 by a Certificate of Incorporation filed with the Secretary of State on that date, as amended from time to time thereafter, and the registered office of ALLTEL Financial in the State of Arkansas is located at 417 Spring Street, Little Rock, Arkansas, and the name of its registered agent at such office is The Corporation Trust Company;

WHEREAS, ALLTEL Financial has an authorized and outstanding capitalization consisting of:

Designation | Authorization | Outstanding | ||||||

Common Stock $1.00 Par Value | 1,000 | 1,000 | ||||||

NOW, THEREFORE, in consideration of the mutual agreements, covenants, representations and warranties herein contained, and for the purpose of prescribing the terms and conditions of the merger of ALLTEL Information into ALLTEL Financial, the mode of

carrying the merger into effect, the manner and basis of canceling the shares of ALLTEL Information common stock, and such other provisions as are deemed necessary or desirable with respect to the merger, in accordance with the applicable statutes of the State of Arkansas, it is agreed as follows:

ARTICLE I

MERGER, EFFECTIVE DATE

ALLTEL Information shall be merged into ALLTEL Financial, which shall be the surviving corporation (hereinafter sometimes referred to as the “Surviving Corporation”). The Surviving Corporation shall be governed by the Laws of the State of Arkansas.

The merger shall become effective on December 31, 1996 at 11:59 p.m. Eastern Time (hereinafter referred to as the “Effective Date”).

ARTICLE II

ARTICLES OF INCORPORATION AND BY-LAWS OF

SURVIVING CORPORATION

The Articles of Incorporation of ALLTEL Financial, as it exists on the Effective Date, shall be the articles of incorporation of the Surviving Corporation until thereafter amended as provided by law, except that on the Effective Date, Article FIRST of the Surviving Corporation’s articles of incorporation shall be amended on the Effective Date to be and read as follows:

| FIRST: | The name of the corporation shall be: ALLTEL INFORMATION SERVICES, INC. |

The by-laws of ALLTEL Financial, as it exists on the Effective Date, shall be the by-laws of the Surviving Corporation until thereafter amended as provided by law.

ARTICLE III

SURVIVING CORPORATION TO SUCCEED TO

PROPERTIES AND OBLIGATIONS OF ALLTEL FINANCIAL AND ALLTEL

INFORMATION

From and after the Effective Date, the Surviving Corporation, without other transfer of assumption, shall succeed to and possess all the estate, property rights (whether tangible or intangible), privileges, powers, and franchises of a public as well as a private nature, and shall

2

assume and be subject to all of the liabilities, obligations, debts, restitutions, disabilities, and duties of each of the Constituent Corporations, all without further act or deed, as provided in Arkansas Code Annotated § 4-26-1005 (Repl. 1991).

If at any time the Surviving Corporation shall consider, upon the advice of its legal counsel, that any further assignments, conveyances or assumptions of liability are necessary or desirable to carry out the provisions hereof, the proper officers and directors of the Constituent Corporations as of the Effective Date shall execute and deliver any and all proper deeds, assignments and assumptions of liability and do all things necessary or proper to carry out the provisions hereof.

ARTICLE IV

CANCELLATION OF SHARES IN MERGER

(a) On the Effective Date, each share of common stock of ALLTEL Information outstanding immediately prior to the Merger and all rights in respect thereof, shall, by virtue of the Merger and without any action on the part of any holder thereof, cease to exist and be cancelled.

(b) On the Effective Date, each share of common stock of ALLTEL Financial outstanding immediately prior to the Merger shall, by virtue of the Merger and without any action on the part of the holder thereof, constitute all of the outstanding common stock of the Surviving Corporation.

ARTICLE V

APPROVALS

These Articles of Merger have been approved by unanimous written consent of the Boards of Directors of ALLTEL Financial and ALLTEL Information, and has been approved by unanimous written consent of the sole stockholder of ALLTEL Financial and ALLTEL Information, in accordance with Arkansas Code Annotated §§ 4-26-1001 and 4-26-1006.

ARTICLE VI

ABANDONMENT

These Articles of Merger may be abandoned at any time before or after action thereon by the stockholders of ALLTEL Financial and ALLTEL Information, notwithstanding favorable action of the Merger by those stockholders, but not later than the Effective Date, by the Board of Directors of ALLTEL Financial or ALLTEL Information.

3

ARTICLE VII

AMENDMENTS AND WAIVER

These Articles of Merger may be amended by the Boards of Directors of the parties hereto to the extent permitted by applicable law, and, to the extent permitted by applicable law, no action by the stockholders of the parties hereto shall be required with respect to any amendment if any such amendment does not have a material adverse effect on the rights of such stockholders.

ALLTEL Financial or ALLTEL Information may, by action of its Board of Directors by an instrument in writing, extend the time for or waive the performance of any of the obligations of the other or waive compliance by the other with respect to any of the covenants or conditions contained in these Articles of Merger if any such extension or waiver does not affect the rights of the stockholders of ALLTEL Financial or ALLTEL Information in a manner that is materially adverse to such stockholders.

ARTICLE VIII

COUNTERPARTS

These Articles of Merger may be executed in counterparts, each of which when so executed shall be deemed to be an original, and such counterparts shall together constitute but one and the same instrument.

IN WITNESS WHEREOF, the parties hereto, pursuant to authority given by their respective Board of Directors, have caused these Articles of Merger to be entered into and signed, by their respective authorized officer, as of the day and year first above written, and each of the parties hereto hereby affirms, under penalties of perjury, that this is their act and deed and the facts stated herein are true.

| ALLTEL INFORMATION SERVICES, INC. | ||

| By: | /s/ William L. Cravens | |

| William L. Cravens, Chairman | ||

| ATTEST: | ||

| By: | /s/ Michael L. Gravelle | |

| Michael L. Gravelle, Secretary | ||

4

| ALLTEL FINANCIAL INFORMATION SERVICES, INC. | ||

| By: | /s/ Jeffrey H. Fox | |

| Jeffrey H. Fox, President | ||

| ATTEST: | ||

| By: | /s/ Michael L. Gravelle | |

| Michael L. Gravelle, Secretary | ||

5

ARTICLES OF MERGER

These ARTICLES OF MERGER (“Articles of Merger”) dated as of December 30, 1996 is among ALLTEL Enterprise Network Services, Inc., a Delaware corporation (“ALLTEL Enterprise”) and ALLTEL Financial Information Services, Inc., an Arkansas corporation (“ALLTEL Financial”). ALLTEL Enterprise and ALLTEL Financial are collectively referred to herein as the “Constituent Corporations.”

WITNESSETH:

WHEREAS, ALLTEL Enterprise is a corporation duly organized and existing under the laws of the State of Delaware, having been incorporated on July 11, 1996 by a Certificate of Incorporation filed with the Secretary of State and recorded in the Office of the Recorder of Deeds of the County of New Castle, Delaware, on that date, as amended from time to time thereafter, and the registered office of ALLTEL Enterprise in the State of Delaware is located at 1209 Orange Street, Wilmington, Delaware, and the name of its registered agent at such office is The Corporation Trust Company;

WHEREAS, ALLTEL Enterprise has an authorized and outstanding capitalization consisting of:

Designation | Authorization | Outstanding | ||||||

Common Stock $1.00 Par Value | 1,000 | 1,000 | ||||||

WHEREAS, ALLTEL Financial is a corporation duly organized and existing under the laws of the State of Arkansas, having been incorporated on June 16, 1967 by a Certificate of Incorporation filed with the Secretary of State on that date, as amended from time to time thereafter, and the registered office of ALLTEL Financial in the State of Arkansas is located at 417 Spring Street, Little Rock, Arkansas, and the name of its registered agent at such office is The Corporation Trust Company;

WHEREAS, ALLTEL Financial has an authorized and outstanding capitalization consisting of:

Designation | Authorization | Outstanding | ||||||

Common Stock $1.00 Par Value | 1,000 | 1,000 | ||||||

NOW, THEREFORE, in consideration of the mutual agreements, covenants, representations and warranties herein contained, and for the purpose of prescribing the terms and conditions of the merger of ALLTEL Enterprise into ALLTEL Financial, the mode of carrying the merger into effect, the manner and basis of canceling the shares of ALLTEL Enterprise common stock, and such other provisions as are deemed necessary or desirable with respect to the merger, in accordance with the applicable statutes of the State of Arkansas, it is agreed as follows:

ARTICLE I

MERGER, EFFECTIVE DATE

ALLTEL Enterprise shall be merged into ALLTEL Financial, which shall be the surviving corporation (hereinafter sometimes referred to as the “Surviving Corporation”). The Surviving Corporation shall be governed by the Laws of the State of Arkansas.

The merger shall become effective on December 31, 1996 at 11:58 p.m. Eastern Time (hereinafter referred to as the “Effective Date”).

ARTICLE II

ARTICLES OF INCORPORATION AND BY-LAWS OF

SURVIVING CORPORATION

The articles of incorporation of ALLTEL Financial, as it exists on the Effective Date, shall be the articles of incorporation of the Surviving Corporation until thereafter amended as provided by law. The by-laws of ALLTEL Financial, as it exists on the Effective Date, shall be the by-laws of the Surviving Corporation until thereafter amended as provided by law.

ARTICLE III

SURVIVING CORPORATION TO SUCCEED TO

PROPERTIES AND OBLIGATIONS OF ALLTEL FINANCIAL AND ALLTEL

ENTERPRISE

From and after the Effective Date, the Surviving Corporation, without other transfer of assumption, shall succeed to and possess all the estate, property rights (whether tangible or intangible), privileges, powers, and franchises of a public as well as a private nature, and shall assume and be subject to all of the liabilities, obligations, debts, restitutions, disabilities, and duties of each of the Constituent Corporations, all without further act or deed, as provided in Arkansas Code Annotated § 4-26-1005 (Repl. 1991).

2

If at any time the Surviving Corporation shall consider, upon the advice of its legal counsel, that any further assignments, conveyances or assumptions of liability are necessary or desirable to carry out the provisions hereof, the proper officers and directors of the Constituent Corporations as of the Effective Date shall execute and deliver any and all proper deeds, assignments and assumptions of liability and do all things necessary or proper to carry out the provisions hereof.

ARTICLE IV

CANCELLATION OF SHARES IN MERGER

(a) On the Effective Date, each share of common stock of ALLTEL Enterprise outstanding immediately prior to the Merger and all rights in respect thereof, shall, by virtue of the Merger and without any action on the part of any holder thereof, cease to exist and be cancelled.

(b) On the Effective Date, each share of common stock of ALLTEL Financial outstanding immediately prior to the Merger shall, by virtue of the Merger and without any action on the part of the holder thereof, constitute all of the outstanding common stock of the Surviving Corporation.

ARTICLE V

APPROVALS

These Articles of Merger have been approved by unanimous written consent of the Boards of Directors of ALLTEL Financial and ALLTEL Enterprise, and has been approved by unanimous written consent of the sole stockholder of ALLTEL Financial and ALLTEL Enterprise, in accordance with Arkansas Code Annotated §§ 4-26-1001 and 4-26-1006 (Repl. 1991).

ARTICLE VI

ABANDONMENT

These Articles of Merger may be abandoned at any time before or after action thereon by the stockholders of ALLTEL Financial and ALLTEL Enterprise, notwithstanding favorable action of the Merger by those stockholders, but not later than the Effective Date, by the Board of Directors of ALLTEL Financial or ALLTEL Enterprise.

3

ARTICLE VII

AMENDMENTS AND WAIVER

These Articles of Merger may be amended by the Boards of Directors of the parties hereto to the extent permitted by applicable law, and, to the extent permitted by applicable law, no action by the stockholders of the parties hereto shall be required with respect to any amendment if any such amendment does not have a material adverse effect on the rights of such stockholders.

ALLTEL Financial or ALLTEL Enterprise may, by action of its Board of Directors by an instrument in writing, extend the time for or waive the performance of any of the obligations of the other or waive compliance by the other with respect to any of the covenants or conditions contained in these Articles of Merger if any such extension or waiver does not affect the rights of the stockholders of ALLTEL Financial or ALLTEL Enterprise in a manner that is materially adverse to such stockholders.

ARTICLE VIII

COUNTERPARTS

These Articles of Merger may be executed in counterparts, each of which when so executed shall be deemed to be an original, and such counterparts shall together constitute but one and the same instrument.

IN WITNESS WHEREOF, the parties hereto, pursuant to authority given by their respective Board of Directors, have caused these Articles of Merger to be entered into and signed, by their respective authorized officer, as of the day and year first above written, and each of the parties hereto hereby affirms, under penalties of perjury, that this is their act and deed and the facts stated herein are true.

| ALLTEL ENTERPRISE NETWORK SERVICES, INC. | ||

| By: | /s/ William L. Cravens | |

| William L. Cravens, Chairman | ||

| ATTEST: | ||

| By: | /s/ Michael L. Gravelle | |

| Michael L. Gravelle, Secretary | ||

4

| ALLTEL FINANCIAL INFORMATION SERVICES, INC. | ||

| By: | /s/ Jeffrey H. Fox | |

| Jeffrey H. Fox, President | ||

| ATTEST: | ||

| By: | /s/ Michael L. Gravelle | |

| Michael L. Gravelle, Secretary | ||

5

ARTICLES OF MERGER

THESE ARTICLES OF MERGER (“Articles of Merger”) dated as of December 30, 1996 is among ALLTEL Telecom Information Services, Inc., a Delaware corporation (“ALLTEL Telecom”) and ALLTEL Financial Information Services, Inc., an Arkansas corporation (“ALLTEL Financial”). ALLTEL Telecom and ALLTEL Financial are collectively referred to herein as the “Constituent Corporations.”

WITNESSETH:

WHEREAS, ALLTEL Telecom is a corporation duly organized and existing under the laws of the State of Delaware, having been incorporated on December 14, 1990 by a Certificate of Incorporation filed with the Secretary of State and recorded in the Office of the Recorder of Deeds of the County of New Castle, Delaware, on that date, as amended from time to time thereafter, and the registered office of ALLTEL Telecom in the State of Delaware is located at 1209 Orange Street, Wilmington, Delaware, and the name of its registered agent at such office is The Corporation Trust Company;

WHEREAS, ALLTEL Telecom has an authorized and outstanding capitalization consisting of:

Designation | Authorization | Outstanding | ||||||

Common Stock $1.00 Par Value | 1,000 | 1,000 | ||||||