Exhibit 3.83

COMMONWEALTH OF PENNSYLVANIA

DEPARTMENT OF STATE

JUNE 18, 2010

TO ALL WHOM THESE PRESENTS SHALL COME, GREETING:

GHR SYSTEMS, INC.

I, Basil L Merenda, Acting Secretary, Secretary of the Commonwealth of Pennsylvania

do hereby certify that the foregoing and annexed is a true and correct

copy of

| 1 | ARTICLES OF INCORPORATION filed on June 24, 1992, |

| 2 | CHANGE OF REGISTERED OFFICE - Domestic filed on April 29, 1993, |

| 3 | ARTICLES OF AMENDMENT-BUSINESS filed on March 24, 1994, |

| 4 | ARTICLES MERGER/CONSOLIDATION-ALL TYPES filed on May 5, 1994, |

| 5 | ARTICLES OF AMENDMENT-BUSINESS filed on November 15, 1994, |

(List of documents continued on next page)

(List of documents continued)

| 6 | MISCELLANEOUS FILINGS - Domestic filed on December 20, 1995, |

| 7 | MISCELLANEOUS FILINGS - Domestic filed on December 20, 1995, |

| 8 | MISCELLANEOUS FILINGS - Domestic filed on December 20, 1995, |

| 9 | MISCELLANEOUS FILINGS - Domestic filed on December 20, 1995, |

| 10 | MISCELLANEOUS FILINGS - Domestic filed on July 31, 1997, |

| 11 | ARTICLES OF AMENDMENT-BUSINESS filed on July 31, 1997, |

| 12 | ARTICLES OF AMENDMENT-BUSINESS filed on January 11, 2000, |

| 13 | CHANGE OF REGISTERED OFFICE - Domestic filed on September 26, 2000, |

| 14 | MISCELLANEOUS FILINGS - Domestic filed on October 31, 2000, |

| 15 | MISCELLANEOUS FILINGS - Domestic filed on October 31, 2000, |

| 16 | MISCELLANEOUS FILINGS - Domestic filed on April 13, 2001, |

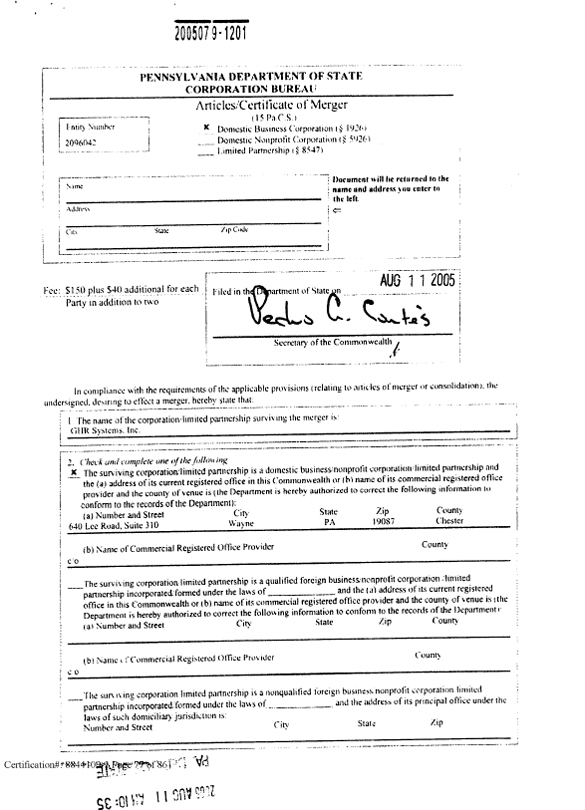

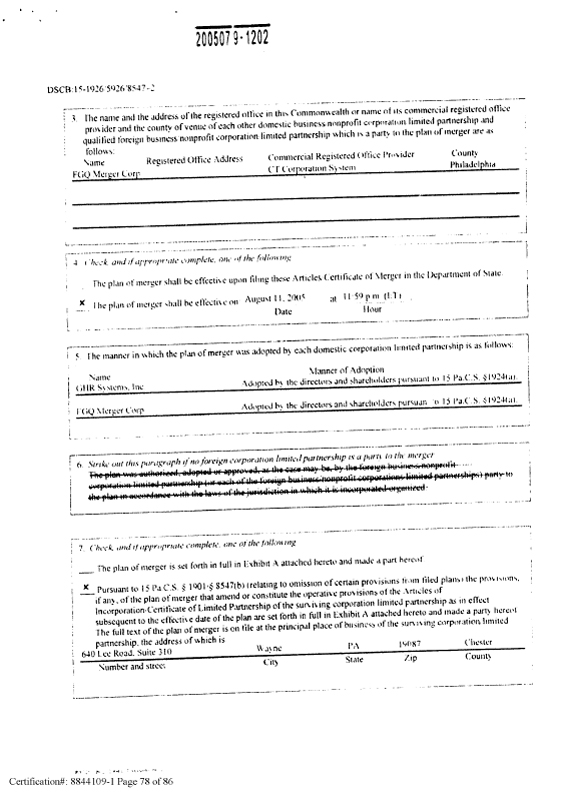

| 17 | ARTICLES MERGER/CONSOLIDATION-ALL TYPES filed on August 11, 2005, |

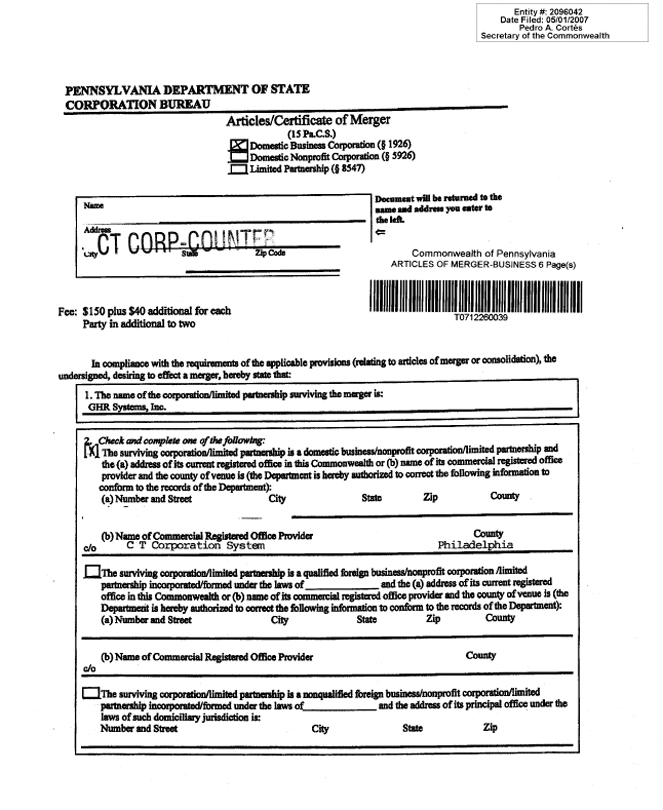

| 18 | ARTICLES OF MERGER-BUSINESS filed on May 1, 2007 |

which appear of record in this department.

| IN TESTIMONY WHEREOF, I have hereunto set my hand and caused the Seal of the Secretary’s Office to be affixed, the day and year above written. | |

| ||

| Acting Secretary of the Commonwealth |

9249-1376 |  |

2096042

ARTICLES OF INCORPORATION

OF

GHR SERVICES, INC.

(A Pennsylvania Business Corporation)

1. The name of the corporation is: GHR Services, Inc.

2. The corporation’s initial registered office in the Commonwealth is Valley Forge Office Colony, Suite 2-155, Davis Rd., Valley Forge, PA 19481.

3. The corporation is incorporated under the provisions of the Business Corporation Law of 1988, as amended.

4. The corporation shall have authority to issue an aggregate of 1,000 shares, all of which are designated Common Stock. The board of directors shall have the full authority permitted by law to divide the authorized and unissued shares into classes or series, or both, and to determine for any such class or series its designation and the number of shares of the class or series and the voting rights, preferences, limitations and special rights, if any, of the shares of the class or series.

(a)Dividends. Holders of Common Stock shall be entitled to receive such dividends as may be declared by the board of directors, except that the corporation will not declare, pay or set apart for payment any dividend on shares of Common Stock, or directly or indirectly make any distribution on, redeem, purchase or otherwise acquire any such shares, if at the time of such action the terms of any other outstanding shares prohibit the corporation from taking such action.

(b)Distribution of Assets. In the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, holders of Common Stock shall be entitled to receive pro rata all of the assets of the corporation remaining available for distribution to its shareholders after all preferential distributions, if any, to which the holders of any other outstanding shares may be entitled by the terms of such shares have been paid or set aside in cash for payment.

(c)Voting Rights. Except as otherwise required by law or by the terms of any other outstanding shares, the holders of Common Stock shall have the exclusive right to vote in the election of directors and for all other purposes, each such holder being entitled to one vote for each share of Common Stock standing in his name on the books of the corporation.

9249-1377

5. The name and address of the sole incorporator are: Ellen Weiner, Dechert Price & Rhoads, 4000 Bell Atlantic Tower, 1717 Arch Street, Philadelphia, PA 19103-2793.

6. Shareholders shall not have cumulative voting rights in the election of directors.

7. Section 1715, Exercise of Powers Generally, of the Business Corporation Law of 1988, as amended, shall not be applicable to the corporation.

IN WITNESS WHEREOF, the sole incorporator has signed these Articles of Incorporation this 23rd day of June, 1992.

/s/ Ellen Weiner |

| Ellen Weiner |

| Sole Incorporator |

- 2 -

| Microfilm Number | Filed with the Department of State on APR 29 1993 | |||

| ||||

| Entity Number 2096042 | Secretary of the Commonwealth | |||

STATEMENT OF CHANGE OF REGISTERED OFFICE

DSCB: 15-1507/4144/5507/6144/8506 (Rev 90)

| Indicate type of entity (check one): | ||

| X Domestic Business Corporation (15 Pa.C.S. § 1507) | Foreign Nonprofit Corporation (15 Pa.C.S. § 6144) | |

| Foreign Business Corporation (15 Pa.C.S. § 4144) | Domestic Limited Partnership (15 Pa.C.S. § 8506) | |

| Domestic Nonprofit Corporation (15 Pa.C.S. § 5507) | ||

In compliance with the requirements of the applicable provisions of 15 Pa.C.S. (relating to corporations and unincorporated associations) the undersigned corporation or limited partnership, desiring to effect a change of registered office, hereby states that.

| 1 | The name of the corporation or limited partnership is: | GHR Services, Inc. | ||||||||||||

| ||||||||||||||

| ||||||||||||||

| 2 | The (a) address of this corporation’s or limited partnership’s current registered office in this Commonwealth or (b) name of its commercial registered office provider and the county of venue is: (the Department is hereby authorized to correct the following information to conform to the records of the Department): | |||||||||||||

| Valley Forge Office Colony | ||||||||||||||

| (a) | Suite 2 – 155, Davis Road | Valley Forge | PA | 19481 | Chester | |||||||||

| ||||||||||||||

| Number and Street | City | State | Zip | County | ||||||||||

| (b) | c/o: | |||||||||||||

| Name of Commercial Registered Office Provider | County | |||||||||||||

| For a corporation or a limited partnership represented by a commercial registered office provider, the county in (b) shall be deemed the county in which the corporation or limited partnership is located for venue and official publication purposes. | ||||||||||||||

| 3 | (Complete part (a) or (b)): | |||||||||||||

| (a) | The address to which the registered office of the corporation or limited partnership in this Commonwealth is to be changed is: | |||||||||||||

| 995 Old Eagle School Road, Suite 310 | Wayne | PA | 19087 | Delaware | ||||||||||

| ||||||||||||||

| Number and Street | City | State | Zip | County | ||||||||||

| (b) | The registered office of the corporation or limited partnership shall be provided by: | |||||||||||||

| c/o: | ||||||||||||||

| Name of Commercial Registered Office Provider | County | |||||||||||||

For a corporation or a limited partnership represented by a commercial registered office provider, the county in (b) shall be deemed to county in which the corporation or limited partnership is located for venue and official publication purposes.

| ||||||||||||||

93 APR 29 AM 10:33 PA DEPT. OF STATE |

DSCB:15-1507/4144/5507/6144/8506 (Rev 90)-2

(Strike out if a limited partnership): Such change was authorized by the Board of Directors of the corporation.

IN TESTIMONY WHEREOF, the undersigned corporation or limited partnership has caused this statement to be signed by a duly authorized officer this 26th day of April, 1993.

GHR SERVICES, INC. | ||

| Name of Corporation/Limited Partnership | ||

| BY: |

| |

| (Signature) | ||

| TITLE: | Secretary | |

2096042 |  | |||

| ARTICLES OF AMENDMENT | ||||

| OF | ||||

| ARTICLES OF INCORPORATION | ||||

| OF | ||||

| GHR SERVICES, INC. |

1. GHR Services, Inc. (the “Company”) was incorporated on June 24, 1992 in the Commonwealth of Pennsylvania under the Business Corporation Law of 1988, as amended, 15 Pa.C.S.A §§1101, et seq., (“the BCL”).

2. The Company’s registered address in the Commonwealth of Pennsylvania is 995 Old Eagle School Road, Suite 310, Wayne, Pennsylvania 19087 (Delaware County).

3. On December 22, 1993, by unanimous written consent pursuant to BCL §1727(b), the Board of Directors adopted a resolution proposing amendment to the Company’s Articles of Incorporation pursuant to BCL §1915, declared the proposed amendment advisable, and called for the Company’s stockholders (the “Stockholders”) to consider the proposed amendment.

4. On December 22, 1993, by unanimous written consent pursuant to BCL §1766(a), the Stockholders approved the amendment(s) proposed by the Board of Directors.

5. The resolution setting forth the amendment proposed by the Board of Directors and adopted by the Stockholders is as follows:

RESOLVED, that Article 4 of the Company’s Articles of Incorporation be amended to read as follows:

| 4. | Authorized Capital. The aggregate number of shares of stock which the Corporation shall have authority to issue is Ten Thousand (10,000) shares, all of which are of one class and are designated as Common Stock and each of which has a par value of One Cent ($.01) |

IN WITNESS WHEREOF, the Company has caused this Certificate to be executed by Allan J. Redstone, its President, and by E. Gerald Hurst, Jr., its Secretary, effective this 22nd day of December, 1993.

| GHR SERVICES, INC. | ||

| By: | /s/ Allan J. Redstone | |

| Allan J. Redstone, President | ||

| Attest: |

/s/ E. Gerald Hurst, Jr. |

| E. Gerald Hurst, Jr., Secretary |

PADEPT.OFSTATE

MAR 24 1994

[ILLEGIBLE]

| 2096042 | Filed in the Department of | |||

| ARTICLES OF MERGER | State on MAY 05 1994 | |||

| OF | Robert M. Grant | |||

| GHR Holdings, Inc. | ACTING Secretary of the Commonwealth | |||

| (A Delaware Corporation) | ||||

| and | ||||

| GHR Services, Inc. | ||||

| (a Pennsylvania Corporation) |

1. The name and state of incorporation of each constituent corporation is as follows:

GHR Holdings, Inc., a Delaware corporation; and,

GHR Services, Inc., a Pennsylvania corporation.

2. GHR Holdings, Inc. has approved, adopted, certified, executed and acknowledged an Agreement and Plan of Merger in accordance with §§ 103 and 252 (c) of the Delaware General Corporation Law. GHR Services, Inc., has approved, adopted, certified, executed and acknowledged an Agreement and Plan of Merger in accordance with § 1924 of the Pennsylvania Business Corporation Law of 1988, as amended.

3. The surviving corporation is GHR Services, Inc., a Pennsylvania corporation, the registered office of which is 995 Old Eagle School Road, Suite 310, Wayne, Pennsylvania 19087 (Delaware County).

4. The name of the surviving corporation will be GHR SYSTEMS, INC.

5. The Articles of Incorporation of the surviving corporation GHR Services, Inc., with such amendments as are effected by the merger, will be amended and restated upon filing of these Articles of Merger, as follows:

RESTATED AND AMENDED

ARTICLES OF INCORPORATION

OF

GHR Services, Inc.

(A Pennsylvania Corporation)

1. The corporation’s name is:GHR SYSTEMS, INC.

2. The corporation’s registered office in the Commonwealth of Pennsylvania is at 995 Old Eagle School Road, Suite 310, Wayne, Pennsylvania, 19087 (Delaware County).

3. The corporation was incorporated on June 24, 1992 under the Business Corporation Law of 1988, as amended.

4. The corporation shall have authority to issue an aggregate of twelve thousand (12,000)

[ILLEGIBLE]

1

shares, all of which are designated as Common Stock and each of which has a par value of One Cent ($.01). The corporation’s Board of Directors shall have authority by resolution to divide the authorized and unissued shares into classes or series, or both, and to determine the designation, number of shares, voting rights, preferences, limitations and special rights, if any, of the shares of such class or series.

(a)Dividends. Holders of Common Stock shall be entitled to receive such dividend as may be declared by the Board of Directors, except that the corporation will not declare, pay or set apart for payment any dividend on shares of Common Stock, or directly or indirectly make any distribution on, redeem, purchase or otherwise acquire any such shares of Common Stock, if at the time of such action the terms of any other outstanding shares of Common Stock prohibit the corporation from taking such action.

(b)Distribution of Assets. In the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, holders of Common Stock shall be entitled to receive pro rata all of the assets of the corporation remaining available for distribution to its shareholders after the corporation has paid or set aside for payment all liabilities and preferential distributions, if any, to which the holders of any other outstanding shares of Common Stock may be entitled by the terms of such shares of Common Stock.

(c)Voting Rights. Except as otherwise required by law or by the terms of any other outstanding shares of Common Stock, the holders of Common Stock shall have the exclusive right to vote in the election of directors and for all other purposes; and, each such holder of Common Stock is entitled to one vote for each share of Common Stock standing in such holder’s name on the books of the corporation as of the record date for the determination of the holders of Common Stock entitled to notice of, or to vote at, the meeting of shareholders.

5. Shareholders shall not have cumulative voting rights in the election of directors.

6. Except as otherwise provided in these Articles:

(a) Each holder of Common Stock shall have a pre-emptive right to subscribe for shares of Common Stock, option rights to purchase Common Stock, or securities having either conversion rights into or option rights to purchase Common Stock, either issued or proposed to be issued for cash by the corporation (collectively “Common Stock Equivalents”). Subject to the terms and conditions of this Article 6., each holder of Common Stock shall be entitled to purchase from the corporation such number of shares or other units of Common Stock Equivalents issued by the corporation so that the holder of Common Stock who exercises a pre-emptive right would hold the same proportion of issued and outstanding Common Stock Equivalents immediately following the corporation’s issuance of such Common Stock Equivalents as such holder of Common Stock held immediately prior to such issuance. Each holder of Common Stock shall have the

2

right to exercise a pre-emptive right in whole or in part. Not less than twenty (20) days prior to the day on which the corporation either intends to offer or actually offers Common Stock Equivalents to any person or persons other than the holders of such pre-emptive rights, the corporation shall give written notice to each holder of Common Stock having a pre-emptive right to purchase Common Stock Equivalents of the (i) cash price, (ii) terms of purchase, and (ii) number of shares or units of Common Stock Equivalents for which such holder of Common Stock is entitled to subscribe. Such written notice shall be in the manner provided in § 1702 (a) of the Business Corporation Law of 1988, as amended. If any holder of Common Stock having a pre-emptive right to purchase Common Stock Equivalents has not subscribed to purchase, in whole or in part, the shares or units of Common Stock Equivalents offered at the price and upon terms duly fixed by the Board of Directors of the corporation within twenty (20) days after the date such written notice to such holder of Common Stock is deemed delivered, such holder of Common Stock shall have waived such pre-emptive right for such noticed issuance of Common Stock Equivalents; and the corporation may thereafter offer for subscription such Common Stock Equivalents to any person or persons at a price and upon terms not more favorable than those at which the Common Stock Equivalents were offered to such holders of Common Stock having pre-emptive rights. The failure of a holder of Common Stock to exercise a pre-emptive right for a noticed issuance of Common Stock Equivalents is not a waiver of pre-emptive rights for any subsequent issuance of Common Stock Equivalents.

(b) Holders of Common Stock shall not have pre-emptive rights to subscribe for Common Stock Equivalents hereafter offered by the corporation to any employee or prospective employee of the corporation if:

(i) the offeree is not an officer or director of the corporation at the time of such offer, or

(ii) such offer is pursuant to an initial contract of employment, or

(iii) the offeree is a participant in an incentive stock option plan or other employee stock, compensation or bonus plan adopted and approved by the holders of Common Stock of the corporation; and

(iv) the aggregate number of shares of Common Stock issuable in conversion of or in exchange for Common Stock Equivalents offered under Article 6. (b) (i), (ii), and (iii) do not exceed ten percent (10%) of the issued and outstanding shares of Common Stock of the corporation on a fully diluted basis at the time of any such offer.

Pre-emptive rights granted to holders of Common Stock under this Article shall expire and terminate at such time as (i) the corporation consummates an initial public offering of securities in a firm commitment underwriting under the Securities Act of 1933, as

3

amended, (ii) the corporation sells or exchanges all, or substantially all, of the property and assets, with or without goodwill, of the corporation, its consolidated subsidiaries or a parent corporation of the corporation whereupon the corporation receives cash, securities, and/or property of equivalent value for such properties or assets so sold or exchanged, or (iii) any person acquires more than eighty percent (80%) of the issued and outstanding shares of Common Stock for equivalent value.

7. Section 1715 of the Business Corporation Law of 1988, as amended,Exercise of Powers Generally, shall not be applicable to the corporation.

8. These Restated and Amended Articles of Incorporation of GHR SYSTEMS, INC., supersede the original articles of incorporation of GHR Services, Inc., and all amendments thereto.

6. The executed Agreement of Merger is on file at GHR SYSTEMS, INC.’s principal place of business:

995 Old Eagle School Road,

Suite 310,

Wayne, Pennsylvania, 19087

(Delaware County)

7. GHR SYSTEMS, INC., will furnish a copy of the Agreement of Merger, on request and without cost, to any stockholder of any constituent corporation.

8. GHR SYSTEMS, INC., the surviving corporation, will be governed by the laws of the Commonwealth of Pennsylvania. GHR SYSTEMS, INC., (previously GHR Services, Inc.) as the surviving corporation, agrees to service of process in the State of Delaware in any proceeding for enforcement of any obligation of GHR Holdings, Inc., a constituent corporation of the State of Delaware merged into the surviving corporation, as well as for the enforcement of any obligation of the surviving corporation arising from the merger, including any suit or other proceeding to enforce the right of any stockholders as determined in appraisal proceedings pursuant to § 262 of the Delaware General Corporation Law, and irrevocably appoints the Secretary of State of the State of Delaware as agent to accept service of process in any such suit or other proceedings. The address to which the Secretary of State of the State of Delaware may mail a copy of such process is as follows:

GHR SYSTEMS, INC.

995 Old Eagle School Road,

Suite 310,

Wayne, Pennsylvania, 19087

(Delaware County)

IN WITNESS WHEREOF, GHR Services, Inc., and GHR Holdings, Inc., by and through their respective authorized officers, have executed and caused to be filed these ARTICLES OF MERGER in accordance with § 1927 of the Pennsylvania Business Corporation Law of 1988, as amended.

4

| ATTEST: | GHR Holdings, Inc. | |||||

/s/ E. Gerald Hurst, Jr. | BY: | /s/ Allan J. Redstone | ||||

| E. Gerald Hurst, Jr., Secretary | Allan J. Redstone, President | |||||

| ATTEST: | GHR Services, Inc. | |||||

/s/ E. Gerald Hurst, Jr. | BY: | /s/ Allan J. Redstone | ||||

| E. Gerald Hurst, Jr., Secretary | Allan J. Redstone, President | |||||

CERTIFICATION

I, E. Gerald Hurst, Jr., Secretary of GHR Holdings, Inc., certify that at a Special Meeting of Shareholders lawfully noticed and held on the 8th day of April 1994 pursuant to the provisions of the Articles of Incorporation and Bylaws, the holders of all the issued and outstanding shares of the common stock of GHR Holdings, Inc., unanimously voted for and adopted the Agreement of Merger to which these ARTICLES OF MERGER refer.

/s/ E. Gerald Hurst, Jr. |

| E. Gerald Hurst, Jr., Secretary |

CERTIFICATION

I, E. Gerald Hurst, Jr., Secretary of GHR Services, Inc., certify that at a Special Meeting of Shareholders lawfully noticed and held on the 8TH day of April 1994 pursuant to the provisions of the Articles of Incorporation and Bylaws, the holders of all the issued and outstanding shares of the common stock of GHR Services, Inc., unanimously voted for and adopted the Agreement of Merger to which these ARTICLES OF MERGER refer.

/s/ E. Gerald Hurst, Jr. |

| E. Gerald Hurst, Jr., Secretary |

5

[ILLEGIBLE]

COMMONWEALTH OF PENNSYLVANIA

COUNTY OF DELAWARE

ACKNOWLEDGEMENT

BEFORE ME, a Notary Public, in and for Chester County, Pennsylvania, personally appeared ALLAN J. REDSTONE, known to me or satisfactorily proven to be PRESIDENT of GHR Services, Inc., who acknowledged that he signed the foregoing ARTICLES OF MERGER on behalf of and as the act and deed of GHR Services, Inc, and the facts stated therein are true.

| Sworn to and subscribed before me this 8th day of April, 1994. | ||

|

| |

| Notary Public | ||

STATE OF DELAWARE

COUNTY OF NEW CASTLE

ACKNOWLEDGEMENT

BEFORE ME, a Notary Public, in and for New Castle County, Delaware, personally appeared ALLAN J. REDSTONE, known to me or satisfactorily proven to be PRESIDENT of GHR Holdings, Inc., who acknowledged that he signed the foregoing ARTICLES OF MERGER on behalf of and as the act and deed of GHR Holdings, Inc., and the facts stated therein are true.

| Sworn to and subscribed before me this 8th day of April, 1994. | ||

|

| |

| Notary Public | ||

6

[ILLEGIBLE]

Filed in the Department of State on NOV 15 1994 | ||||

Robert M. Grant | ||||

| Secretary of the Commonwealth |

ARTICLES OF AMENDMENT

EFFECTING THE RESTATEMENT AND AMENDMENT

of the

ARTICLES OF INCORPORATION

of

GHR Systems, Inc.

I. GHR Systems, Inc. (the “Corporation”) was incorporated on June 24, 1992 in the Commonwealth of Pennsylvania under the Business Corporation Law of 1968, as amended, 15 Pa.C.S.A §§1101, et seq.

II. The Corporation’s registered address in the Commonwealth of Pennsylvania is 995 Old Eagle School Road, Suite 310, Wayne, Pennsylvania 19087 (Delaware County).

III. The Corporation restates and amends its Articles of Incorporation as follows:

RESTATED AND AMENDED

ARTICLES OF INCORPORATION

OF

GHR Systems, Inc.

(A Pennsylvania Corporation)

1.Name. The Corporation’s name is:GHR Systems, Inc.

2.Registered Office. The Corporation’s registered office in the Commonwealth of Pennsylvania is at 995 Old Eagle School Road, Suite 310, Wayne, Pennsylvania, 19087 (Delaware County).

3.Date of Incorporation. The Corporation was incorporated on June 24, 1992 under the Business Corporation Law of 1988, as amended.

4.Capital Stock. The Corporation shall have authority to issue an aggregate of fifteen thousand (15,000) shares of capital stock comprised of twelve thousand (12,000) shares of Common Stock, each of which has a par value of One Cent ($.01) and three thousand (3,000) shares of Preferred Stock.

5.Issuance of Stock in Series. Subject to limitations prescribed by law and the provisions of these Restated and Amended Articles of Incorporation (the

“Articles”), the Corporation’s Board of Directors is authorized by resolution or resolutions to provide for the issuance of shares of Preferred Stock in series, to establish the number of shares to be included in each such series of Preferred Stock, and to fix the designation, relative rights, preferences and limitations of the shares (“rights and preferences”) of each such series of Preferred Stock. The authority of the Board of Directors to designate rights and preferences of each such series of Preferred Stock shall include, but not be limited to, determination of the following:

(a) The number of shares constituting that series and the distinctive designation of that series:

(b) The dividend rate, if any, on the shares of such series, whether dividends shall be cumulative, and, if so, from which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series;

(c) Whether that series shall have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights;

(d) Whether that series shall have conversion preferences, and if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors shall determine; provided, if the designation of rights and preferences for a series of Preferred Stock provides for the conversion of such shares of Preferred Stock into shares of Common Stock, the Board of Directors is authorized to reserve and shall reserve, from time to time, sufficient shares of Common Stock for issuance upon conversion of shares of such series of Preferred Stock.

(e) Whether the shares of that series shall be redeemable, and, if so, the terms and conditions of such redemption, including the date or dates upon or after which they shall be redeemable, and the amount per share payable in each case of redemption, which amount may vary under different conditions at different redemption rates;

(f) Whether that series shall have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund;

(g) The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative rights of priority, if any, of payment of shares of that series;

(h) Any other relative rights, preferences and limitations of that series.

6.Dividends. Holders of Common Stock shall be entitled to receive such dividends as may be declared by the Board of Directors, except that the Corporation will not declare, pay or set apart for payment any dividend on shares of Common Stock, or directly or indirectly make any distribution on, redeem, purchase or otherwise acquire any such shares of Common Stock, if at

the time of such action the designation of rights and preferences for any other outstanding shares of any series of Preferred Stock prohibit the Corporation from taking such action. If the designation of rights and preferences for a series of Preferred Stock authorizes dividends on outstanding shares of such series of Preferred Stock, the Board of Directors shall declare and pay, or set apart for payment, dividends on outstanding shares of any such series of Preferred Stock before the Board of Directors declares and pays, or sets aside for payment, any dividends on shares of Common Stock with respect to the same dividend period.

7.Voting Rights. Except as required by law or as otherwise provided in the designation of rights and preferences for any series of Preferred Stock, (i) each share of Common Stock and each share of any series of Preferred Stock shall have equal voting rights, and (ii) each holder of shares of Common Stock and each holder of shares of any series of Preferred Stock entitled to vote, shall have one vote for each share of Common Stock or Preferred Stock standing in such holder’s name on the books of the Corporation as of the record date for the determination of the holders of Common Stock and Preferred Stock entitled to notice of, or to vote at, the meeting of shareholders. No change in the Articles which either would amend any portion of the rights and preferences of, or would affect adversely, any series of Preferred Stock shall be made without the affirmative vote or consent of the holders of a majority of the shares of such series of Preferred Stock.

8.Distribution of Assets. In the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, holders of Common Stock shall be entitled to receive pro rata all of the assets of the Corporation remaining available for distribution to its shareholders after the Corporation has paid or set aside for payment (a) all liabilities and (b) preferential distributions, if any, to which the holders of any other outstanding shares of any series of Preferred Stock may be entitled by the terms of any designation of rights and preferences of such shares of Preferred Stock.

9.No Cumulative Voting. Shareholders shall not have cumulative voting rights in the election of directors.

10.Exercise of Powers. Section 1715 of the Business Corporation Law of 1988, as amended, 15 Pa.C.S.A. § 1715,Exercise of Powers Generally, shall not be applicable to the Corporation.

11.Supersedes. These Articles supersede the Restated and Amended Articles of Incorporation of GHR Services set forth in The Articles of Merger of GHR Holdings, Inc. (a Delaware Corporation) and GHR Services, Inc. (a Pennsylvania Corporation) filed May 5, 1994 in the Department of State of the Commonwealth of Pennsylvania.

IN WITNESS WHEREOF, the Corporation has caused these ARTICLES OF AMENDMENT EFFECTING THE RESTATED AND AMENDED ARTICLES OF INCORPORATION OF GHR Systems, Inc., to be executed by Jack M. Guttentag, Chairman of the Board, and by E. Gerald Hurst, Jr., Its Secretary, effective upon filing with the Secretary of State of the Commonwealth of Pennsylvania.

| GHR Systems, Inc. | ||

| By: | /s/ Jack M. Guttentag | |

| Jack M. Guttentag, Chairman | ||

| Attest: |

/s/ E. Gerald Hurst, Jr. |

| E. Gerald Hurst, Jr., Secretary |

| 9581- 996 | Filed in the Department of State on DEC 20 1995 | |||

Yvette Kane | ||||

| Secretary of the Commonwealth |

STATEMENT OF DESIGNATION, PREFERENCES

AND RIGHTS OF CONVERTIBLE PREFERRED STOCK, SERIES A.

2096042

GHR Systems, Inc. a corporation organized and existing under the laws of the Commonwealth of Pennsylvania (the “Company”), by its Secretary, does hereby certify that, pursuant to the authority conferred upon the Board of Directors by Article 5 of the Articles of Incorporation of the Company, which authorized 10,000 shares of Preferred Stock of the Company, $.01 par value per share, and pursuant to the provisions of the Pennsylvania Business Corporation Law (the “PBCL”), as amended, the Board of Directors of the Company, by unanimous consent in writing, has duly adopted resolutions providing for the issuance of up to 3,000 shares of Convertible Preferred Stock and setting forth the voting powers, designations, preferences and relative, participating, optional and other special rights, and the qualifications, limitations and restrictions thereof, which resolution is as follows:

RESOLVED, that pursuant to the authority vested in the Board of Directors of this Company pursuant to the provisions of the PBCL and the Company’s Articles of Incorporation, the Corporation is authorized to issue 2,052 shares of the 3,000 shares of Preferred Stock of the Company authorized in Article 5 of its Articles of Incorporation, as a class of Preferred Stock of the Company to be designated as “Convertible Preferred Stock, Series A, “$.01 par value per share (“Convertible Preferred Stock”), which shall have such rights, preferences and characteristics in relation to the Common Stock as set forth below:

1.Voting Rights. Except as otherwise provided by law, the holders of Convertible Preferred Stock shall have full voting rights and powers, shall be entitled to vote on all matters as to which holders of Common Stock shall be entitled to vote, shall vote together with the holders of Common Stock as a single class and shall be entitled to cast the number of votes equal to the number of shares of Common Stock then issuable upon conversion of the Convertible Preferred Stock owned by such holder, in accordance with the provisions hereof.

2.Dividends.

(a) The holders of shares of the Convertible Preferred Stock shall not be entitled to receive any preferred dividends thereof.

(b) In the event that the Corporation declares a dividend with respect to or makes a distribution on the Common Stock, then the holders of the Convertible Preferred Stock shall be

DEC 20 95 PA Dept. of State |

1

9581 - 997

entitled to participate with the holders of the Common Stock in any such dividends or distributions paid or set aside for payment, such that the holders of the Convertible Preferred Stock shall receive, with respect to each share of Convertible Preferred Stock held, an amount equal to (i) the dividend or distribution payable with respect to each share of Common Stock, multiplied by (ii) the number of shares of Common Stock into which such share of Convertible Preferred Stock is convertible as of the record date for such dividend or distribution.

(c) The provisions of this Section 2 shall not apply to any dividends or distributions that would result in an adjustment of the Conversion Factor (as hereinafter defined) pursuant to Section 4(c).

3.No Cumulative Voting. The holders of Common Stock and the holders of Convertible Preferred Stock shall not have the right to vote cumulatively in the election of directors.

4.Conversion Rights of Convertible Preferred Stock.

(a)Optional Conversion. A holder of record of any share or shares of Convertible Preferred Stock shall have the right, at any time, at such holder’s option, to convert, without the payment of any additional consideration, each share of Convertible Preferred Stock held by such holder into the number of fully paid and non-assessable shares of Common Stock that equals the Conversion Rate (as defined below).

(b)Mandatory Conversion.

(i) Upon the first closing of a Qualified Public Offering (as hereinafter defined) of the Common Stock of the Company, all of the shares of Convertible Preferred Stock then outstanding shall be converted into that number of fully paid and non-assessable shares of Common Stock as the holders of such Convertible Preferred Stock are then entitled to receive pursuant to the provisions of Section 4 hereof (a “Mandatory Conversion”).

(ii) A “Qualified Public Offering” is hereby defined as an underwritten, firm commitment public offering pursuant to an effective Registration Statement under the Securities Act of 1933, as amended, covering the offer and sale by the Company of its Common Stock in which the aggregate net proceeds to the Company exceed $10,000,000 and in which the price per share equals or exceeds $1,500 (as appropriately adjusted for stock dividends, stock splits, combinations, reorganizations, reclassifications or other similar transactions).

(iii) From and after the date of the Mandatory Conversion (the “Mandatory Conversion Date”): (A) all rights of the holders of any shares of Convertible Preferred Stock shall cease

2

9581 - 998

and terminate; (B) the shares of Convertible Preferred Stock shall no longer be deemed outstanding; and (C) the holders thereof shall on and after such date be conclusively deemed for all purposes to be holders of shares of Common Stock regardless of whether the holders of such shares of Convertible Preferred Stock have tendered their certificates therefor as required by Section 4(d).

(c)Conversion Rate. The initial Conversion Rate shall be 1, subject to adjustment in accordance with the provisions in this subsection 4(c). Such respective conversion rates in effect from time to time, as adjusted pursuant to this Section 4(c), are referred to herein as the “Conversion Rate.” All of the remaining provisions of this Section 4(c) shall apply separately to the respective Conversion Rates in effect from time to time.

(i) Each adjustment to the Conversion Rate shall be calculated to the nearest two decimal places.

(ii) In the event that: (A) the Company shall, at any time, issue any shares of Common Stock, by stock dividend or any other distribution upon any stock of the Company, payable in shares of Common Stock; (B) the Company shall, at any time, issue any shares of Common Stock, by subdivision of its shares of outstanding Common Stock, by reclassification, stock split or otherwise; or (C) the Company shall combine shares of outstanding Common Stock into a lesser number of shares, by reclassification, reverse stock split, or otherwise (for purposes of this Section 4(c) (ii), the events described in (A), (B) and (C) above shall be referred to as “Capital Transactions”); then the Conversion Rate then in effect shall be adjusted to a number determined by multiplying the Conversion Rate in effect immediately prior to such Capital Transaction by the following fraction:

X

Y

| wherein: | ||

X = | the number of shares of Common Stock outstanding immediately after such Capital Transaction; and | |

Y = | the number of shares of Common Stock outstanding immediately prior to such Capital Transaction. | |

(d)Mechanics of Conversion.

(i)Optional Conversion. If a holder of shares of Convertible Preferred Stock desires to exercise the optional conversion right pursuant to subsection 4(a) above, such

3

9581 - 999

holder shall give written notice to the Company of such holder’s election to convert a stated number of shares of Convertible Preferred Stock into shares of Common Stock, at the conversion rate then in effect, which notice shall be accompanied by the certificate or certificates representing such shares of Convertible Preferred Stock which shall be converted into Common Stock. The notice shall also contain a statement of the name or names in which the certificate or certificates for Common Stock shall be issued. Promptly after receiving the aforesaid notice and certificate or certificates representing the Convertible Preferred Stock surrendered for conversion, the Company shall issue and deliver to such holder of Convertible Preferred Stock or to such holder’s nominee or nominees, a certificate or certificates for the number of shares of Common Stock issuable upon conversion of such Convertible Preferred Stock, and the certificates representing shares of Convertible Preferred Stock surrendered for conversion shall be cancelled by the Company. If the number of shares represented by the certificate or certificates surrendered for conversion shall exceed the number of shares to be converted, the Company shall issue and deliver to the person entitled thereto a certificate representing the balance of any unconverted shares.

(ii)Mandatory Conversion. If there shall be a Mandatory Conversion pursuant to subsection 4(b) above, all holders of record of shares of Convertible Preferred Stock shall be given fifteen (15) days prior written notice of the Mandatory Conversion Date. Such notice also shall specify the place designated for exchanging shares of Convertible Preferred Stock for shares of Common Stock. On or before the Mandatory Conversion Date, each holder of Convertible Preferred Stock shall surrender such holder’s certificate or certificates for all such shares to the company or the transfer agent at the place designated in such notice. On the Mandatory Conversion Date, all certificates representing shares of Convertible Preferred Stock shall be deemed cancelled by the Company and no longer outstanding. As soon as practicable after the Mandatory Conversion shall have been effected, certificates representing the Common Stock issued upon the Mandatory Conversion shall be delivered to those holders who delivered their certificate or certificates to the Company or the designated transfer agent as aforesaid.

(e)No Fractional Shares. Notwithstanding anything herein to the contrary, no fractional shares shall be issued to any holder of Convertible Preferred Stock on conversion of such holder’s Convertible Preferred Stock. With respect to any fraction of a share of Common Stock called for upon any conversion after completion of the calculation of the aggregate number of shares of Common Stock to be issued to such holder, the Company shall pay to such holder an amount in cash equal to any fractional share to which such holder would be entitled, multiplied by the current market value of a share, as determined by the Board of Directors of the Company.

4

9581 - 1000

(f)Reservation of Common Stock. The Company shall at all times reserve and keep available out of its authorized but unissued Common Stock, solely for issuance upon conversion of shares of Convertible Preferred Stock as herein provided, such number of shares of Common Stock as shall be issuable from time to time upon the conversion of all of the shares of Convertible Preferred Stock at the time issued and outstanding.

5.Liquidation Rights.

(a) In the event of any liquidation, dissolution or winding up (either voluntary or involuntary) of the Company (a “Liquidation”), the holders of the Convertible Preferred Stock shall be entitled to receive, before any distribution or payments are made upon any Common Stock or any other security subordinate to the Convertible Preferred Stock, and after payment by the Company of all sums due all creditors, to be paid out of the assets of the Company available for distribution to its shareholders, $747.40 per share for each outstanding share of Convertible Preferred Stock, plus any declared but unpaid dividends. If, upon a Liquidation, the assets available for distribution to the holders of Convertible Preferred Stock shall be insufficient to pay such holders their liquidation preference in full, then such holders shall share ratably in the distribution of such assets in proportion to the respective sums which would otherwise be payable upon such distribution if all sums so payable to the holders of Convertible Preferred Stock were paid in full. In the event of any stock split, stock dividend, combination or other recapitalization transaction by which the Company increases or decreases its outstanding Convertible Preferred Stock, the liquidation price of $719.50 per share of Convertible Preferred Stock shall be adjusted to reflect such recapitalization. The Series A Convertible Preferred Stock shall beparipassu with the Series B Convertible Preferred Stock, but shall be senior to any other class or series of Convertible Preferred Stock authorized by the Company.

(b) A merger or consolidation involving the Company and a sale, lease or transfer of all or substantially all of the assets of the Corporation shall, at the option of holders representing a majority of the Convertible Preferred Stock, be deemed a Liquidation, unless in connection with such transaction, each holder of Convertible Preferred Stock received a preferred stock having terms and conditions which are no less favorable than the terms and conditions of the Convertible Preferred Stock.

6.Notices. Any notice required to be given herein shall be deemed to be given if deposited in the United States mail, first class postage prepaid, and addressed to the holder of record, at his, her or its address appearing on the books of the Company.

5

9581 - 1001

7.Relative Rights. The shares of Convertible Preferred Stock shall not have any powers, designations, preferences, or relative, participating, optional or other rights or qualifications, limitations or restrictions except as set forth herein.

IN WITNESS WHEREOF, GHR Systems, Inc. has caused this Certificate to be signed by its Secretary on this 15th day of November, 1994.

| GHR SYSTEMS, INC. | ||

| By: |

| |

6

Filed in the Department of State on DEC 20 1995 Yvette Kane Secretary of the Commonwealth |

STATEMENT OF DESIGNATION, PREFERENCES

AND RIGHTS OF CONVERTIBLE PREFERRED STOCK, SERIES B.

2096042

GHR Systems, Inc. a corporation organized and existing under the laws of the Commonwealth of Pennsylvania (the “Company”), by its Secretary, does hereby certify that, pursuant to the authority conferred upon the Board of Directors by Article 5 of the Articles of Incorporation of the Company, which authorized 10,000 shares of Preferred Stock of the Company, $.01 par value per share, and pursuant to the provisions of the Pennsylvania Business Corporation Law (the “PBCL”), as amended, the Board of Directors of the Company, by unanimous consent in writing, has duly adopted resolutions providing for the issuance of up to 3,000 shares of Convertible Preferred Stock and setting forth the voting powers, designations, preferences and relative, participating, optional and other special rights, and the qualifications, limitations and restrictions thereof, which resolution is as follows:

RESOLVED, that pursuant to the authority vested in the Board of Directors of this Company pursuant to the provisions of the PBCL and the Company’s Articles of Incorporation, the Corporation is authorized to issue, 684 shares of the 3,000 shares of Preferred Stock of the Company authorized in Article 5 of its Articles of Incorporation, as a class of Preferred Stock of the Company to be designated as “Convertible Preferred Stock, Series B, ” $.01 par value per share (“Convertible Preferred Stock”), which shall have such rights, preferences and characteristics in relation to the Common Stock as set forth below:

1.Voting Rights. Except as otherwise provided by law, the holders of Convertible Preferred Stock shall have full voting rights and powers, shall be entitled to vote on all matters as to which holders of Common Stock shall be entitled to vote, shall vote together with the holders of Common Stock as a single class and shall be entitled to cast the number of votes equal to the number of shares of Common Stock then issuable upon conversion of the Convertible Preferred Stock owned by such holder, in accordance with the provisions hereof.

2.Dividends.

(a) The holders of shares of the Convertible Preferred Stock shall not be entitled to receive any preferred dividends thereof.

(b) In the event that the Corporation declares a dividend with respect to or makes a distribution on the Common Stock, then the holders of the Convertible Preferred Stock shall be

DEC 20 95

PA Dept. of State

1

9581 - 997

entitled to participate with the holders of the Common Stock in any such dividends or distributions paid or set aside for payment, such that the holders of the Convertible Preferred Stock shall receive, with respect to each share of Convertible Preferred Stock held, an amount equal to (i) the dividend or distribution payable with respect to each share of Common Stock, multiplied by (ii) the number of shares of Common Stock into which such share of Convertible Preferred Stock is convertible as of the record date for such dividend or distribution.

(c) The provisions of this Section: shall not apply to any dividends or distributions that would result in an adjustment of the Conversion Factor (as hereinafter defined) pursuant to Section 4(c).

3.No Cumulative Voting. The holders of Common Stock and the holders of Convertible Preferred Stock shall not have the right to vote cumulatively in the election of directors.

4.Conversion Rights of Convertible Preferred Stock.

(a)Optional Conversion. A holder of record of any share or shares of Convertible Preferred Stock shall have the right, at any time, at such holder’s option, to convert, without the payment of any additional consideration, each share of Convertible Preferred Stock held by such holder into the number of fully paid and non-assessable shares of Common Stock that equals the Conversion Rate (as defined below).

(b)Mandatory Conversion.

(i) Upon the first closing of a Qualified Public Offering (as hereinafter defined) of the Common Stock of the Company, all of the shares of Convertible Preferred Stock then outstanding shall be converted into that number of fully paid and non-assessable shares of Common Stock as the holders of such Convertible Preferred Stock are then entitled to receive pursuant to the provisions of Section 4 hereof (a “Mandatory Conversion”).

(ii) A “Qualified Public Offering” is hereby defined as an underwritten, firm commitment public offering pursuant to an effective Registration Statement under the Securities Act of 1933, as amended, covering the offer and sale by the Company of its Common Stock in which the aggregate net proceeds to the Company exceed $10,000,000 and in which the price per share equals or exceeds $2,900 (as appropriately adjusted for stock dividends, stock splits, combinations, reorganizations, reclassifications or other similar transactions).

(iii) From and after the date of the Mandatory Conversion (the “Mandatory Conversion Date”) : (A), all rights of the holders of any shares of Convertible Preferred Stock shall cease

2

9581 - 998

and terminate; (B) the shares of Convertible Preferred Stock shall no longer be deemed outstanding; and (C) the holders thereof shall on and after such date be conclusively deemed for all purposes to be holders of shares of Common Stock regardless of whether the holders of such shares of Convertible Preferred Stock have tendered their certificates therefor as required by Section 4(d).

(c)Conversion Rate. The initial Conversion Rate shall be 1, subject to adjustment in accordance with the provisions in this subsection 4(c). Such respective conversion rates in effect from time to time, as adjusted pursuant to this Section 4(c), are referred to herein as the “Conversion Rate.” All of the remaining provisions of this Section 4(c) shall apply separately to the respective Conversion Rates in effect from time to time.

(i) Each adjustment to the Conversion Rate shall be calculated to the nearest two decimal places.

(ii) In the event that: (A) the Company shall, at any time, issue any shares of Common Stock, by stock dividend or any other distribution upon any stock of the Company, payable in shares of Common Stock; (B) the Company shall, at any time, issue any shares of Common Stock, by subdivision of its shares of outstanding Common Stock, by reclassification, stock split or otherwise; or (C) the Company shall combine shares of outstanding Common Stock into a lesser number of shares, by reclassification, reverse stock split, or otherwise (for purposes of this Section 4(c) (ii), the events described in (A), (B) and (C) above shall be referred to as “Capital Transactions”); then the Conversion Rate then in effect shall be adjusted to a number determined by multiplying the Conversion Rate in effect immediately prior to such Capital Transaction by the following fraction:

X

Y

wherein:

| X | = | the number of shares of Common Stock outstanding immediately after such Capital Transaction; and | ||||

| Y | = | the number of shares of Common Stock outstanding immediately prior to such Capital Transaction. | ||||

(d)Mechanics of Conversion.

(i)Optional Conversion. If a holder of shares of Convertible Preferred Stock desires to exercise the optional conversion right pursuant to subsection 4(a) above, such

3

holder shall give written notice to the Company of such holder’s election to convert a stated number of shares of Convertible Preferred Stock into shares of Common Stock, at the conversion rate then in effect, which notice shall be accompanied by the certificate or certificates representing such shares of Convertible Preferred Stock which shall be converted into Common Stock. The notice shall also contain a statement of the name or names in which the certificate or certificates for Common Stock shall be issued. Promptly after receiving the aforesaid notice and certificate or certificates representing the Convertible Preferred Stock surrendered for conversion, the Company shall issue and deliver to such holder of Convertible Preferred Stock or to such holder’s nominee or nominees, a certificate or certificates for the number of shares of Common Stock issuable upon conversion of such Convertible Preferred Stock, and the certificates representing shares of Convertible Preferred Stock surrendered for conversion shall be cancelled by the Company. If the number of shares represented by the certificate or certificates surrendered for conversion shall exceed the number of shares to be converted, the Company shall issue and deliver to the person entitled thereto a certificate representing the balance of any unconverted shares.

(ii)Mandatory Conversion. If there shall be a Mandatory Conversion pursuant to subsection 4 (b) above, all holders of record of shares of Convertible Preferred Stock shall be given fifteen (15) days prior written notice of the Mandatory Conversion Date. Such notice also shall specify the place designated for exchanging shares of Convertible Preferred Stock for shares of Common Stock. On or before the Mandatory Conversion Date, each holder of Convertible Preferred Stock shall surrender such holder’s certificate or certificates for all such shares to the company or the transfer agent at the place designated in such notice. On the Mandatory Conversion Date, all certificates representing shares of Convertible Preferred Stock shall be deemed cancelled by the Company and no longer outstanding. As soon as practicable after the Mandatory Conversion shall have been effected, certificates representing the Common Stock issued upon the Mandatory Conversion shall be delivered to those holders who delivered their certificate or certificates to the Company or the designated transfer agent as aforesaid.

(e)No Fractional Shares. Notwithstanding anything herein to the contrary, no fractional shares shall be issued to any holder of Convertible Preferred Stock on conversion of such holder’s Convertible Preferred Stock. With respect to any fraction of a share of Common Stock called for upon any conversion after completion of the calculation of the aggregate number of shares of Common Stock to be issued to such holder, the Company shall pay to such holder an amount in cash equal to any fractional share to which such holder would be entitled, multiplied by the current market value of a share, as determined by the Board of Directors of the Company.

4

9581 - 1000

(f)Reservation of Common Stock. The Company shall at all times reserve and keep available out of its authorized but unissued Common Stock, solely for issuance upon conversion of shares of Convertible Preferred Stock as herein provided, such number of shares of Common Stock as shall be issuable from time to time upon the conversion of all of the shares of Convertible Preferred Stock at the time issued and outstanding.

5.Liquidation Rights.

(a) In the event of any liquidation, dissolution or winding up (either voluntary or involuntary) of the Company (a “Liquidation”), the holders of the Convertible Preferred Stock shall be entitled to receive, before any distribution or payments are made upon any Common Stock or any other security subordinate to the Convertible Preferred Stock, and after payment by the Company of all sums due all creditors, to be paid out of the assets of the Company available for distribution to its shareholders, $1462.50 per share for each outstanding share of Convertible Preferred Stock, plus any declared but unpaid dividends. If, upon a Liquidation, the assets available for distribution to the holders of Convertible Preferred Stock shall be insufficient to pay such holders their liquidation preference in full, then such holders shall share ratably in the distribution of such assets in proportion to the respective sums which would otherwise be payable upon such distribution if all sums so payable to the holders of Convertible Preferred Stock were paid in full. In the event of any stock split, stock dividend, combination or other recapitalization transaction by which the Company increases or decreases its outstanding Convertible Preferred Stock, the liquidation price of $1406.50 per share of Convertible Preferred Stock shall be adjusted to reflect such recapitalization. The Series B Convertible Preferred Stock shall beparipassu with the Series A Convertible Preferred Stock, but shall be senior to any other series or class of Preferred Stock authorized by the Company.

(b) A merger or consolidation involving the Company and a sale, lease or transfer of all or substantially all of the assets of the Corporation shall, at the option of holders representing a majority of the Convertible Preferred Stock, be deemed a Liquidation, unless in connection with such transaction, each holder of Convertible Preferred Stock received a preferred stock having terms and conditions which are no less favorable than the terms and conditions of the Convertible Preferred Stock.

6.Notices. Any notice required to be given herein shall be deemed to be given if deposited in the United States mail, first class postage prepaid, and addressed to the holder of record, at his, her or its address appearing on the books of the Company.

7.Relative Rights. The shares of Convertible Preferred Stock shall not have any powers, designations,

5

9582 - 652

preferences, or relative, participating, optional or other rights or qualifications, limitations or restrictions except as set forth herein.

IN WITNESS WHEREOF, GHR Systems, Inc. has caused this Certificate to be signed by its Secretary on this 15th day of November, 1994.

| GHR SYSTEMS, INC. | ||

| By: |

| |

6

Filed in the Department of State on DEC 20 1995 Yvette Kane Secretary of the Commonwealth |

AMENDED STATEMENT OF DESIGNATION, PREFERENCES

AND RIGHTS OF CONVERTIBLE PREFERRED STOCK, SERIES A

AND

REVOCATION OF DESIGNATION, PREFERENCES

AND RIGHTS OF CONVERTIBLE PREFERRED STOCK, SERIES B

2096042

GHR Systems, Inc. a corporation organized and existing under the laws of the Commonwealth of Pennsylvania (the “Company”), by its Secretary, does hereby certify that, (i) Article 4 of the Articles of Incorporation of the Company authorizes the Company to issue three thousand (3.000) shares of Preferred Stock, and (ii) pursuant to the authority conferred upon the Board of Directors by Article 5 of the Articles of incorporation of the Company, which authorized 3,000 shares of Preferred Stock of the Company, $ 01 par value per share:

A. The Shareholders of the Company, by unanimous consent and pursuant to the provisions of the Pennsylvania Business Corporation Law (the “PBCL””), as amended, have duly adopted resolutions authorizing and providing for the reduction to Seven Hundred Fourteen (714) the number of authorized shares of Convertible Preferred Stock, Series A, (a number equal to the issued and outstanding shares of Convertible Preferred Stock, Series A) and revoked and rescinded and canceled Statement of Designation, Preferences and Rights of Convertible Preferred Stock, Series B (no shares of which are issued or outstanding), which resolution is as follows:

RESOLVED, that the Corporation shall, Amend the Statement of Designation, Preferences and Rights of Convertible Preferred Stock, Series A, authorizing the issuance of Preferred Stock designated “Series A Convertible Preferred Stock” and reducing the number of Shares of Convertible Preferred Stock, Series A authorized for issuance by the Corporation from two thousand fifty two (2052) shares to Seven Hundred Fourteen (714) shares; and further,

RESOLVED, that the Corporation shall revoke and rescind the Statement of Designation, Preferences and Rights of Convertible Preferred Stock. Series B, (which authorized the issuance of 684 shares of Preferred Stock designated “Series B Convertible Preferred Stock”) and prohibit and no longer authorize the issuance of such Convertible Preferred Stock, Series B;

and.

B. The Board of Directors of the Company, by unanimous consent in writing, has duly adopted resolutions authorizing and providing for the issuance of up to 714 shares of Series A. Convertible Preferred Stock and setting forth the voting powers, designations, preferences and relative, participating, optional and other special rights, and the qualifications, limitations and restrictions thereof, which resolution is as follows:

RESOLVED, that pursuant to the authority vested in the Board of Directors of this Company pursuant to the provisions of the “PBCL” and the Company’s Articles of incorporation, the Corporation is authorized to issue 7i4 shares of the 3,000 shares of Preferred Stock of the Company authorized in Article 5 of its Articles of incorporation, as a class of Preferred Stock of the Company to be designated as Convertible Preferred Stock, Series A, $.01 par value per share (“Convertible Preferred Stock” ), which shall have such rights, preferences and characteristics in relation to the Common Stock as set forth below:

1. Voting Rights. Except as otherwise provided by law, the holders of Convertible Preferred Stock shall have full voting rights and powers, shall be entitled to vote on all matters as to which holders of Common Stock shall be entitled to vote shall vote together with the holders of Common Stock as a single class and shall be entitled to cast the number of votes equal to the number of shares of Common Stock then issuable upon conversion of the Convertible Preferred Stock owned by such holder, in accordance with the provisions hereof.

DEC 20 95

PA Dept. of State

1

2. Dividends.

(a) The holders of shares of the Convertible Preferred Stock shall not be entitled to receive any preferred dividends thereof.

(b) In the event that the Corporation declares a dividend with respect to or makes a distribution on the Common Stock, then the holders of the Convertible Preferred Stock shall be entitled to participate with the holders of the Common Stock in any such dividends or distributions paid or set aside for payment such that the holders of the Convertible Preferred Stock shall receive, with respect to each share of Convertible Preferred Stock held, an amount equal to (i) the dividend or distribution payable with respect to each share of Common Stock, multiplied by (ii) the number of shares of Common Stock into which such share of Convertible Preferred Stock is convertible as of the record date for such dividend or distribution.

(c) The provisions of this Section 2 shall not apply to any dividends or distributions that would result in an adjustment of the Conversion Factor (as hereinafter defined) pursuant to Section 4(c)

3. No Cumulative Voting. The holders of Common Stock and the holders of Convertible Preferred Stock shall not have the right to vote cumulatively in the election of directors.

4. Conversion Rights of Convertible Preferred Stock.

(a) Optional Conversion. A holder of record of any share or shares of Convertible Preferred Stock shall have the right, at any time, at such holder’s option, to convert, without the payment of any additional considerations each share of Convertible Preferred Stock held by such holder into the number of fully paid and non-assessable shares of Common Stock that equals the Conversion Rate (as defined below).

(b) Mandatory Conversion.

(i) Upon the first closing of a Qualified Public Offering (as hereinafter defined) of the Common Stock of the Company, all of the shares of Convertible Preferred Stock then outstanding shall be converted into that number of fully paid and non-assessable shares of Common Stock as the holders of such Convertible Preferred Stock are then entitled to receive pursuant to the provisions of Section 4 hereof (a “Mandatory Conversion”).

2

(ii) A Qualified Public Offering is hereby defined as an underwritten, firm commitment public offering pursuant to an effective Registration Statement under the Securities Act of 1933, as amended, covering the offer and sale by the Company of its Common Stock in which the aggregate net proceeds to the Company exceed $10,000,000 and in which the price per share equals or exceeds $1,500 (as appropriately adjusted for stock dividends, stock splits, combinations, reorganizations reclassification or other similar transactions).

(iii) From and after the date of the Mandatory Conversion (the “Mandatory Conversion Date”): (A) all rights of the holders of any shares of Convertible Preferred Stock shall cease and terminate: (B) the shares of Convertible Preferred Stock shall no longer be deemed outstanding and (C) the holders thereof shall on and after such date be conclusively deemed for all purposes to be holders of shares of Common Stock regardless of whether the holders of such shares of Convertible Preferred Stock have tendered their certificates therefor as required by Section 4 (f).

(c) Conversion Rate. The initial Conversion Rate shall be 1, subject to adjustment in accordance with the provisions in this subsection 4 (c). Such respective conversion rates in effect from time to time, as adjusted pursuant to this Section 4 (c), are referred to herein as the “Conversion Rates”. All of the remaining provisions of this Section 4 (c) shall apply separately to the respective Conversion Rates in effect from time to time.

(i) Each adjustment to the Conversion Rate shall be calculated to the nearest two decimal places.

(ii) In the event that: (A) the Company shall, at any time, issue any shares of Common Stock, by stock dividend or any other distribution upon any stock of the Company, payable in shares of Common Stock: (B) the Company shall, at any time, issue any shares of Common Stock, by subdivision of its shares of outstanding Common Stock, by reclassification, stock split or otherwise: or (C) the Company shall combine shares of outstanding Common Stock into a lesser number of shares, by reclassification, reverse stock split, or otherwise (for purposes of this Section 4 (c) (ii). the events described in (A). (B) and (C) above shall be referred to as “Capital Transactions): then the Conversion Rate then in effect shall be adjusted to a number determined by multiplying the Conversion Rate in effect immediately prior to such Capital Transaction by the following fraction:

X

Y

wherein

X = the number of shares of Common Stock outstanding immediately after such Capital Transaction; and,

Y = the number of shares of Common Stock outstanding immediately prior to such Capital Transaction.

(d) Mechanics of Conversion.

3

(i) Optional Conversion. If a holder of shares of Convertible Preferred Stock desires to exercise the optional conversion right pursuant to subsection 4(a) above, such holder shall give written notice to the Company of such holder’s election to convert a stated number of shares of Convertible Preferred Stock into shares of Common Stock at the conversion rate then in effect, which notice shall be accompanied by the certificate or certificates representing such shares of Convertible Preferred Stock which shall be converted into Common Stock The notice shall also contain a statement of the name or names in which the certificate or certificates for Common Stock shall be issued. Promptly after receiving the aforesaid notice and certificate or certificates representing the Convertible Preferred Stock surrendered for conversion, the Company shall issue and deliver to such holder of Convertible Preferred Stock or to such holder’s nominee or nominees, a certificate or certificates for the number of shares of Common Stock issuable upon conversion of such Convertible Preferred Stock, and the certificates representing shares of Convertible Preferred Stock surrendered for conversion shall be cancelled by the Company. If the number of shares represented by the certificate or certificates surrendered for conversion shall exceed the number of shares to be converted, the Company shall issue and deliver to the person entitled thereto a certificate representing the balance of any unconverted shares.

(ii) Mandatory Conversion. If there shall be a Mandatory Conversion pursuant to subsection 4 (b) above, all holders of record of shares of Convertible Preferred Stock shall be given fifteen (15) days prior written notice of the Mandatory Conversion Date. Such notice also shall specify the place designated for exchanging shares of Convertible Preferred Stock for shares of Common Stock. On or before the Mandatory Conversion Date, each holder of Convertible Preferred Stock shall surrender such holder’s certificate or certificates for all such scares to the Company or the transfer agent at the place designated in such notice. On the Mandatory Conversion Date, all certificates representing shares of Convertible Preferred Stock shall be deemed canceled by the Company and no longer outstanding. As soon as practicable after the Mandatory Conversion shall have been effected, certificates representing the Common Stock issued upon the Mandatory Conversion shall be delivered to those holders who delivered their certificate or certificates to the Company or the designated transfer agent as aforesaid.

(e) No Fractional Shares. Notwithstanding anything herein to the contrary, no fractional shares shall be issued to any holder of Convertible Preferred Stock on conversion of such holders Convertible Preferred Stock. With respect to any fraction of a share of Common Stock called for upon any conversion alter completion of the calculation of the aggregate number of shares of Common Stock to be issued to such holder, the Company shall pay to such holder an amount in cash equal to any fractional share to which such holder would be entitled, multiplied by the current market value of a share, as determined by the Board of Directors of the Company.

(f) Reservation of Common Stock. The Company shall at all times reserve and keep available out of its authorized but unissued Common Stock, solely for issuance upon conversion of shares of Convertible Preferred Stock as herein provided, such number of shares of Common Stock as shall be issuable from time to time upon the conversion of all of the shares of Convertible Preferred Stock at the time issued and outstanding.

5. Liquidation Rights.

(a) in the event of any liquidation, dissolution or winding up (either voluntary or

4

involuntary) of the Company (a “Liquidation” ), the holders of the Convertible Preferred Stock shall be entitled to receive, before any distribution or payments are made upon any Common Stock or any other security subordinate to the Convertible Preferred Stock, and after payment by the Company of all sums due all creditors, to be paid out of the assets of the Company available for distribution to its shareholders. $747.40 per share for each outstanding share of Convertible Preferred Stock, plus any declared but unpaid dividends. If, upon a Liquidation, the assets available for distribution to the holders of Convertible Preferred Stock shall be insufficient to pay such holders their liquidation preference in full, then such holders shall share ratably in the distribution of such assets in proportion to the respective sums which would otherwise be payable upon such distribution if all sums so payable to the holders of Convertible Preferred Stock were paid in full, in the event of any stock split, stock dividend, combination or other recapitalization transaction by which the Company increases or decreases its outstanding Convertible Preferred Stock, the liquidation price of $719.50 per share of Convertible Preferred Stock shall be adjusted to reflect such recapitalization. The Series A Convertible Preferred Stock shall be parri passu with the Series C Convertible Preferred Stock, but shall be senior to any other class or series of Convertible Preferred Stock authorized by the Company.

(b) A merger or consolidation involving the Company and a sale, lease or transfer of all or substantially all of the assets of the Corporation shall, at the option of holders representing a majority of the Convertible Preferred Stock, be deemed a Liquidation, unless in connection with such transaction, each holder of Convertible Preferred Stock received a preferred stock having terms and conditions which are no less favorable than the terms and conditions of the Convertible Preferred Stock.

6. Notices. Any notice required to be given herein shall be deemed to be given if deposited in the United States mail, first class postage prepaid, and addressed to the holder of record, at his, her or its address appearing on the books of the Company.

7. Relative Rights. The shares of Convertible Preferred Stock shall not have any powers, designations, preferences, or relative, participating, optional or other rights or qualifications, limitations or restrictions except as set forth herein

IN WITNESS WHEREOF, GHR Systems, Inc. has caused this Certificate to be signed by its Secretary on this day 20th of December, 1995.

| GHR SYSTEMS, Inc. | ||

| By: | /s/ Gerald Hurst, Jr. | |

| E. Gerald Hurst, Jr., Secretary | ||

5

Filed in the Department of State on DEC 20 1995 Yvette Kane Secretary of the Commonwealth |

STATEMENT OF DESIGNATION, PREFERENCES

AND RIGHTS OF CONVERTIBLE PREFERRED STOCK, SERIES C.

2096042

GHR Systems, Inc. a corporation organized and existing under the laws of the Commonwealth of Pennsylvania (the “Company”), by its Secretary, does hereby certify that (i) Article 4 of the Articles of Incorporation of the Company authorizes the Company to issue 3,000 shares of Preferred Stock, and (ii) pursuant to the authority conferred upon the Board of Directors by Article 5 of the Articles of Incorporation of the Company and pursuant to the provisions of the Pennsylvania Business Corporation Law (the “PBCL”), as amended, the Board of Directors of the Company, by unanimous consent in writing, has duly adopted resolutions providing for the issuance of up to 3,000 shares of Convertible Preferred Stock and setting forth the voting powers, designations, preferences and relative, participating, optional and other special rights, and the qualifications, limitations and restrictions thereof, which resolution is as follows:

RESOLVED, that pursuant to the authority vested in the Board of Directors of this Company pursuant to the provisions of the PBCL and the Company’s Articles of Incorporation, the Corporation is authorized to issue 2,230.25 shares of the 3,000 shares of Preferred Stock of the Company authorized in Article 5 of its Articles of Incorporation, as a class of Preferred Stock of the Company to be designated as “Convertible Preferred Stock, Series C”, $.01 par value per share (the “Convertible Preferred Stock”), which shall have such rights, preferences and characteristics in relation to the Common Stock as set forth below:

1.Voting Rights. Except as otherwise provided by law, the holders of Convertible Preferred Stock shall have full voting rights and powers, shall be entitled to vote on all matters as to which holders of Common Stock shall be entitled to vote, shall vote together with the holders of Common Stock as a single class and shall be entitled to cast the number of votes equal to the number of shares of Common Stock then issuable upon conversion of the Convertible Preferred Stock owned by such holder, in accordance with the provisions hereof.

2.Dividends.

(a) The holders of shares of the Convertible Preferred Stock shall not be entitled to receive any preferred dividends thereof.

(b) In the event that the Corporation declares a dividend with respect to or makes a distribution on the Common Stock, then the holders of the Convertible Preferred Stock shall be entitled to participate with the holders of the Common Stock in any

DEC 20 95

PA Dept. of State

such dividends or distributions paid or set aside for payment, such that the holders of the Convertible Preferred Stock shall receive, with respect to each share of Convertible Preferred Stock held, an amount equal to (i) the dividend or distribution payable with respect to each share of Common Stock, multiplied by (ii) the number of shares of Common Stock into which such share of Convertible Preferred Stock is convertible as of the record date for such dividend or distribution.

(c) The provisions of this Section 2 shall not apply to any dividends or distributions that would result in an adjustment of the Conversion Factor (as hereinafter defined) pursuant to Section 4(c).

3.No Cumulative Voting. The holders of Common Stock and the holders of Convertible Preferred Stock shall not have the right to vote cumulatively in the election of directors.

4.Conversion Rights of Convertible Preferred Stock.

(a)Optional Conversion. A holder of record of any share or shares of Convertible Preferred Stock shall have the right, at any time, at such holder’s option, to convert, without the payment of any additional consideration, each share of Convertible Preferred Stock held by such holder into the number of fully paid and non-assessable shares of Common Stock that equals the Conversion Rate (as defined below).

(b)Mandatory Conversion.

(i) Upon the first closing of a Qualified Public Offering (as hereinafter defined) of the Common Stock of the Company, all of the shares of Convertible Preferred Stock then outstanding shall be converted into that number of fully paid and non-assessable shares of Common stock as the holders of such Convertible Preferred Stock are then entitled to receive pursuant to the provisions of Section 4 hereof (a “Mandatory Conversion”).