Exhibit (c)-(3)

Project Iris

Special Committee Discussion Materials

Goldman Sachs (Asia) L.L.C.

October 29, 2013

Investment Banking Division

Disclaimer

Goldman Sachs (Asia) L.L.C. (“Goldman Sachs”) has prepared and provided these materials and Goldman Sachs’ related presentation (the “Confidential

Information”) solely for the information and assistance of the Special Committee of the Board of Directors the “Special Committee” of Iris (the “Company”) in connection with its consideration of the matters referred to herein. Without Goldman Sachs’ prior written consent, the Confidential Information may not be circulated or referred to publicly, disclosed to or relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything herein to the contrary, the Company may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. The Confidential Information, including this disclaimer, is subject to, and governed by, any written agreement between the Company, the Board and/or any committee thereof, on the one hand, and Goldman Sachs, on the other hand.

Goldman Sachs and its affiliates are engaged in advisory, underwriting and financing, principal investing, sales and trading, research, investment management and other financial and non-financial activities and services for various persons and entities. Goldman Sachs and its affiliates and employees, and funds or other entities in which they invest or with which they co-invest, may at any time purchase, sell, hold or vote long or short positions and investments in securities, derivatives, loans, commodities, currencies, credit default swaps and other financial instruments of the Company, any other party to any transaction and any of their respective affiliates or any currency or commodity that may be involved in any transaction for the accounts of Goldman Sachs and its affiliates and employees and their customers.

The Confidential Information has been prepared and based on information obtained by Goldman Sachs from publicly available sources. In preparing the Confidential Information, Goldman Sachs has relied upon and assumed, without assuming any responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, discussed with or reviewed by, Goldman Sachs. Goldman Sachs does not provide accounting, tax, legal or regulatory advice. Goldman Sachs’ role in any due diligence review is limited solely to performing such a review as it shall deem necessary to support its own advice and analysis and shall not be on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of actual future results, which may be significantly more or less favorable than suggested by these analyses, and Goldman Sachs does not assume responsibility if future results are materially different from those forecast.

Goldman Sachs has not made an independent evaluation or appraisal of the assets and liabilities of the Company (including any contingent, derivative or other off-balance-sheet assets and liabilities) or any other person and has no obligation to evaluate the solvency of the Company or any person under any law. The analyses in the Confidential Information are not appraisals nor do they necessarily reflect the prices at which businesses or securities actually may be sold or purchased. The Confidential Information does not address the underlying business decision of the Company to engage in any transaction, or the relative merits of any strategic alternative referred to herein as compared to any other alternative that may be available to the Company. The Confidential Information is necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Goldman Sachs as of, the date of such Confidential Information and Goldman Sachs assumes no responsibility for updating or revising the Confidential Information. Investment Banking Division

Table of Contents

I. Review of Consortium’s Offer

II. Market Perspectives on Iris III. Financial Analysis Appendix A: Additional Materials

Appendix B: Comparison of Selected Companies and Precedent Transactions Appendix C: WACC Calculation

Investment Banking Division

I. Review of Consortium’s Offer Investment Banking Division

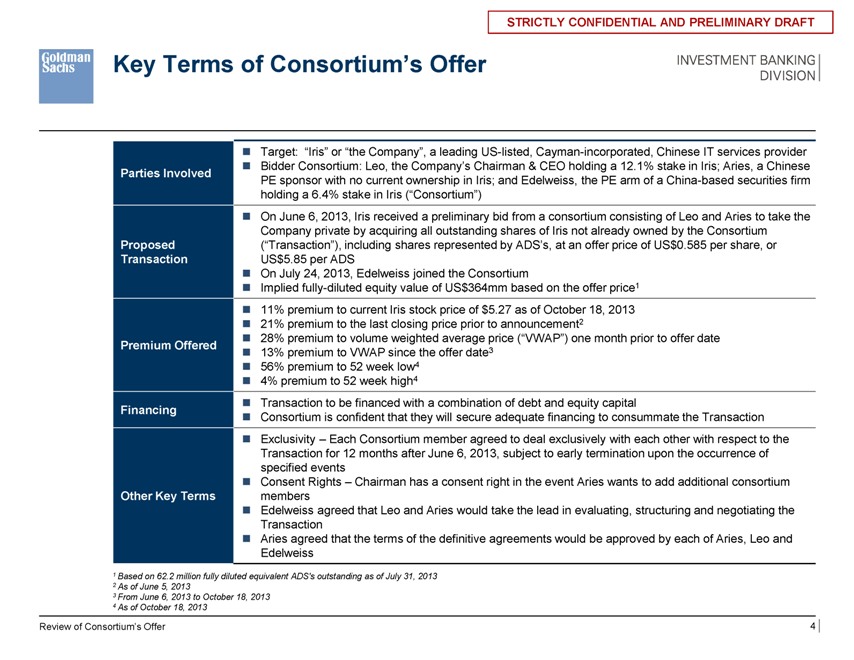

Key Terms of Consortium’s Offer

Target: “Iris” or “the Company”, a leading US-listed, Cayman-incorporated, Chinese IT services provider

Parties Involved Bidder Consortium: Leo, the Company’s Chairman & CEO holding a 12.1% stake in Iris; Aries, a Chinese

PE sponsor with no current ownership in Iris; and Edelweiss, the PE arm of a China-based securities firm

holding a 6.4% stake in Iris (“Consortium”)

On June 6, 2013, Iris received a preliminary bid from a consortium consisting of Leo and Aries to take the

Company private by acquiring all outstanding shares of Iris not already owned by the Consortium

Proposed (“Transaction”), including shares represented by ADS’s, at an offer price of US$0.585 per share, or

Transaction US$5.85 per ADS

On July 24, 2013, Edelweiss joined the Consortium

Implied fully-diluted equity value of US$364mm based on the offer price1

11% premium to current Iris stock price of $5.27 as of October 18, 2013

21% premium to the last closing price prior to announcement2

28% premium to volume weighted average price (“VWAP”) one month prior to offer date

Premium Offered 13% premium to VWAP since the offer date3

56% premium to 52 week low4

4% premium to 52 week high4

Transaction to be financed with a combination of debt and equity capital

Financing Consortium is confident that they will secure adequate financing to consummate the Transaction

Exclusivity – Each Consortium member agreed to deal exclusively with each other with respect to the

Transaction for 12 months after June 6, 2013, subject to early termination upon the occurrence of

specified events Investment Banking Division

Consent Rights – Chairman has a consent right in the event Aries wants to add additional consortium

Other Key Terms members

Edelweiss agreed that Leo and Aries would take the lead in evaluating, structuring and negotiating the

Transaction

Aries agreed that the terms of the definitive agreements would be approved by each of Aries, Leo and

Edelweiss

1 | | Based on 62.2 million fully diluted equivalent ADS’s outstanding as of July 31, 2013 |

3 | | From June 6, 2013 to October 18, 2013 |

Review of Consortium’s Offer 4

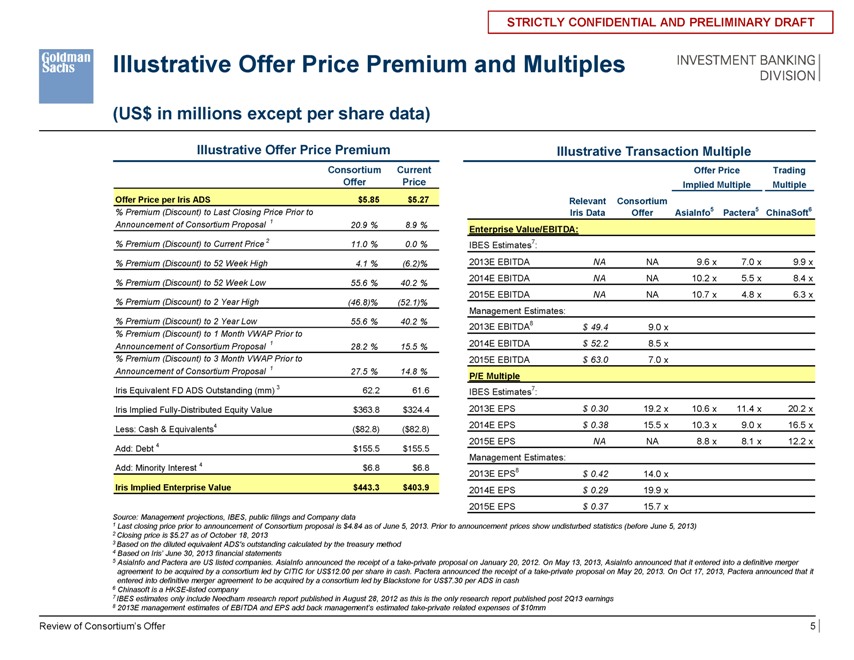

Illustrative Offer Price Premium and Multiples

(US$ in millions except per share data)

Illustrative Offer Price Premium Illustrative Transaction Multiple

Consortium Current Offer Price Trading

Offer Price Implied Multiple Multiple

Offer Price per Iris ADS $5.85 $5.27 Relevant Consortium

% Premium (Discount) to Last Closing Price Prior to Iris Data Offer AsiaInfo5 Pactera5 ChinaSoft6

Announcement of Consortium Proposal 1 20.9 % 8.9 % Enterprise Value/EBITDA:

% Premium (Discount) to Current Price 2 11.0 % 0.0 % IBES Estimates7 :

% Premium (Discount) to 52 Week High 4.1 % (6.2)% 2013E EBITDA NA NA 9.6 x 7.0 x 9.9 x

% Premium (Discount) to 52 Week Low 55.6 % 40.2 % 2014E EBITDA NA NA 10.2 x 5.5 x 8.4 x

2015E EBITDA NA NA 10.7 x 4.8 x 6.3 x

% Premium (Discount) to 2 Year High (46.8)% (52.1)%

Management Estimates:

% Premium (Discount) to 2 Year Low 55.6 % 40.2 % 2013E EBITDA8 $ 49.4 9.0 x

% Premium (Discount) to 1 Month VWAP Prior to

Announcement of Consortium Proposal 1 28.2 % 15.5 % 2014E EBITDA $ 52.2 8.5 x

% Premium (Discount) to 3 Month VWAP Prior to 2015E EBITDA $ 63.0 7.0 x

Announcement of Consortium Proposal 1 27.5 % 14.8 % P/E Multiple

Iris Equivalent FD ADS Outstanding (mm) 3 62.2 61.6 IBES Estimates7 :

Iris Implied Fully-Distributed Equity Value $363.8 $324.4 2013E EPS $ 0.30 19.2 x 10.6 x 11.4 x 20.2 x

4 2014E EPS $ 0.38 15.5 x 10.3 x 9.0 x 16.5 x

Less: Cash & Equivalents ($82.8) ($82.8) Investment Banking Division

2015E EPS NA NA 8.8 x 8.1 x 12.2 x

Add: Debt 4 $155.5 $155.5

Management Estimates:

Add: Minority Interest 4 $6.8 $6.8 2013E EPS8 $ 0.42 14.0 x

Iris Implied Enterprise Value $443.3 $403.9 2014E EPS $ 0.29 19.9 x

2015E EPS $ 0.37 15.7 x

Source: Management projections, IBES, public filings and Company data

1 Last closing price prior to announcement of Consortium proposal is $4.84 as of June 5, 2013. Prior to announcement prices show undisturbed statistics (before June 5, 2013)

2 Closing price is $5.27 as of October 18, 2013

3 Based on the diluted equivalent ADS’s outstanding calculated by the treasury method

4 Based on Iris’ June 30, 2013 financial statements

5 AsiaInfo and Pactera are US listed companies. AsiaInfo announced the receipt of a take-private proposal on January 20, 2012. On May 13, 2013, AsiaInfo announced that it entered into a definitive merger agreement to be acquired by a consortium led by CITIC for US$12.00 per share in cash. Pactera announced the receipt of a take-private proposal on May 20, 2013. On Oct 17, 2013, Pactera announced that it entered into definitive merger agreement to be acquired by a consortium led by Blackstone for US$7.30 per ADS in cash

6 Chinasoft is a HKSE-listed company

7 IBES estimates only include Needham research report published in August 28, 2012 as this is the only research report published post 2Q13 earnings

8 2013E management estimates of EBITDA and EPS add back management’s estimated take-private related expenses of $10mm

Review of Consortium’s Offer 5

II. Market Perspectives on Iris

Investment Banking Division

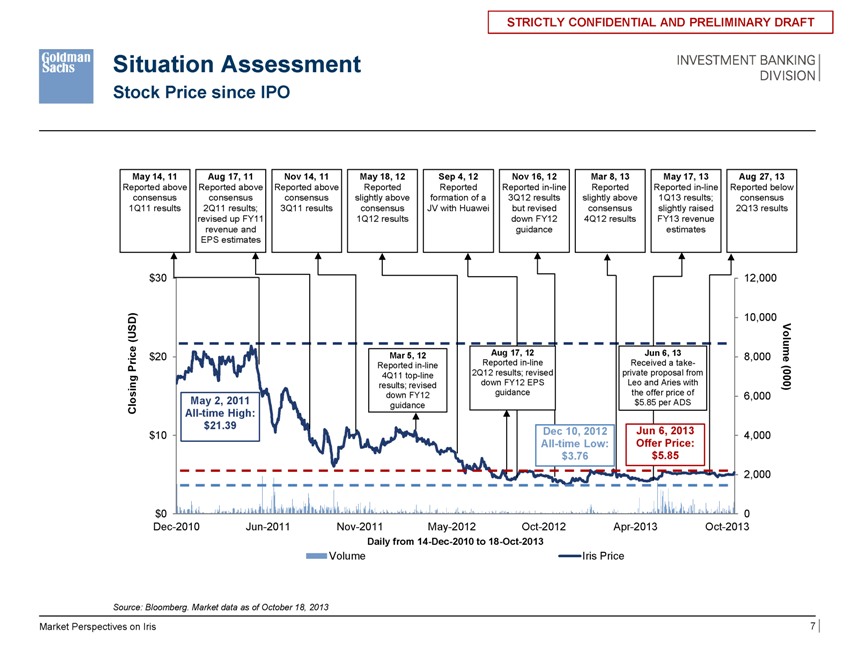

Situation Assessment

Stock Price since IPO

May 14, 11 Aug 17, 11 Nov 14, 11 May 18, 12 Sep 4, 12 Nov 16, 12 Mar 8, 13 May 17, 13 Aug 27, 13

Reported above Reported above Reported above Reported Reported Reported in-line Reported Reported in-line Reported below

consensus consensus consensus slightly above formation of a 3Q12 results slightly above 1Q13 results; consensus

1Q11 results 2Q11 results; 3Q11 results consensus JV with Huawei but revised consensus slightly raised 2Q13 results

revised up FY11 1Q12 results down FY12 4Q12 results FY13 revenue

revenue and guidance estimates

EPS estimates

$30 12,000

10,000

(USD) Vo

ice $20 Mar 5, 12 Aug 17, 12 Jun 6, 13 8,000 lume

Pr Reported in-line 2Q12 Reported results; in-line revised private Received proposal a take- from

4Q11 top-line (00 results; revised down FY12 EPS Leo and Aries with 0)

down FY12 guidance the offer price of 6,000

Closing May 2, 2011 guidance $5.85 per ADS

All-time High:

$21.39 Dec 10, 2012 Jun 6, 2013

$10 4,000

All-time Low: Offer Price:

$3.76 $5.85

2,000

$0 0

Dec-2010 Jun-2011 Nov-2011 May-2012 Oct-2012 Apr-2013 Oct-2013

Daily from 14-Dec-2010 to 18-Oct-2013

Volume Iris Price

Source: Bloomberg. Market data as of October 18, 2013

Investment Banking Division

Market Perspectives on Iris 7

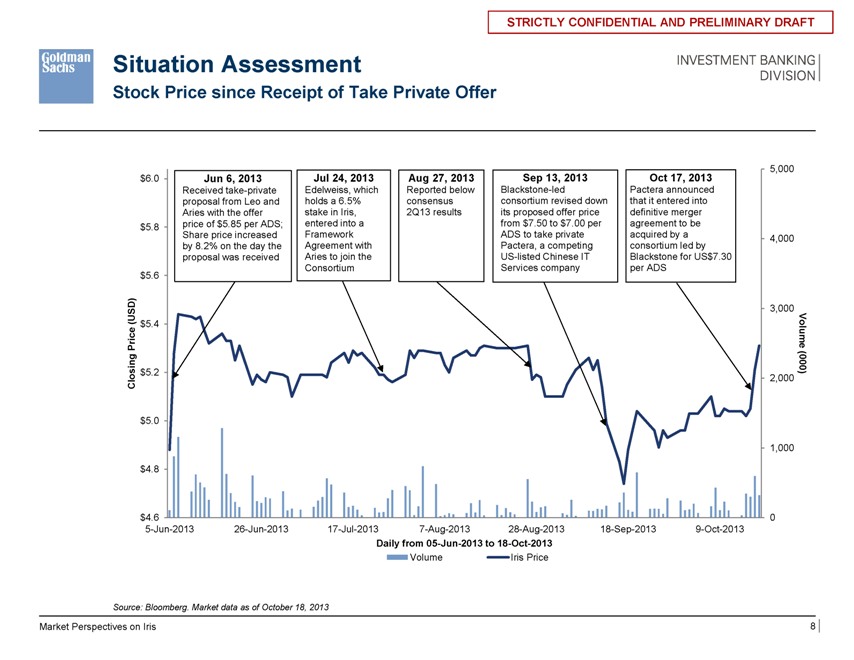

Situation Assessment

Stock Price since Receipt of Take Private Offer

5,000

$6.0 Jun 6, 2013 Jul 24, 2013 Aug 27, 2013 Sep 13, 2013 Oct 17, 2013

Received take-private Edelweiss, which Reported below Blackstone-led Pactera announced

proposal from Leo and holds a 6.5% consensus consortium revised down that it entered into

Aries with the offer stake in Iris, 2Q13 results its proposed offer price definitive merger

$5.8 price of $5.85 per ADS; entered into a from $7.50 to $7.00 per agreement to be

Share price increased Framework ADS to take private acquired by a 4,000

by 8.2% on the day the Agreement with Pactera, a competing consortium led by

proposal was received Aries to join the US-listed Chinese IT Blackstone for US$7.30

Consortium Services company per ADS

$5.6

(USD) 3,000

Price $5.4 Volume

g (00

in $5.2 0)

Clos 2,000

$5.0

1,000

$4.8

$4.6 0

5-Jun-2013 26-Jun-2013 17-Jul-2013 7-Aug-2013 28-Aug-2013 18-Sep-2013 9-Oct-2013

Daily from 05-Jun-2013 to 18-Oct-2013

Volume Iris Price

Source: Bloomberg. Market data as of October 18, 2013

Market Perspectives on Iris 8 Investment Banking Division

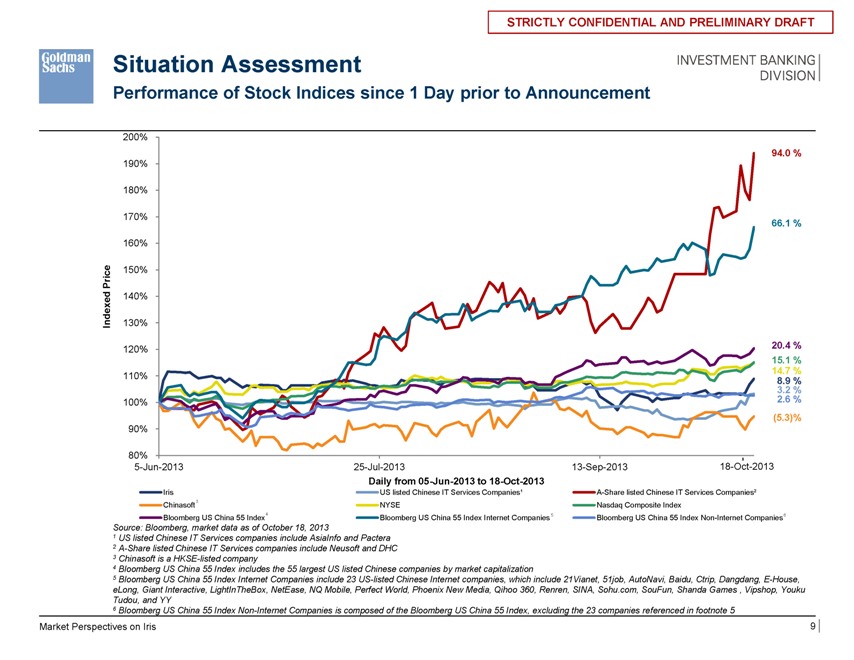

Situation Assessment

Performance of Stock Indices since 1 Day prior to Announcement

200%

94.0 %

190%

180%

170%

66.1 %

160%

e 150%

Pric

d 140%

e

dex

In 130%

120% 20.4 %

15.1 %

110% 14.7 %

8.9 %

3.2 %

100% 2.6 %

(5.3)%

90%

80%

5-Jun-2013 25-Jul-2013 13-Sep-2013 18-Oct-2013

Daily from 05-Jun-2013 to 18-Oct-2013

Iris US listed Chinese IT Services Companies¹ A-Share listed Chinese IT Services Companies²

Chinasoft 3 NYSE Nasdaq Composite Index

Bloomberg US China 55 Index4 Bloomberg US China 55 Index Internet Companies 5 Bloomberg US China 55 Index Non-Internet Companies 6

Source: Bloomberg, market data as of October 18, 2013

1 US listed Chinese IT Services companies include AsiaInfo and Pactera

2 A-Share listed Chinese IT Services companies include Neusoft and DHC

3 Chinasoft is a HKSE-listed company

4 Bloomberg US China 55 Index includes the 55 largest US listed Chinese companies by market capitalization

5 Bloomberg US China 55 Index Internet Companies include 23 US-listed Chinese Internet companies, which include 21Vianet, 51job, AutoNavi, Baidu, Ctrip, Dangdang, E-House, eLong, Giant Interactive, LightInTheBox, NetEase, NQ Mobile, Perfect World, Phoenix New Media, Qihoo 360, Renren, SINA, Sohu.com, SouFun, Shanda Games , Vipshop, Youku Tudou, and YY

6 Bloomberg US China 55 Index Non-Internet Companies is composed of the Bloomberg US China 55 Index, excluding the 23 companies referenced in footnote 5 Investment Banking Division

Market Perspectives on Iris 9

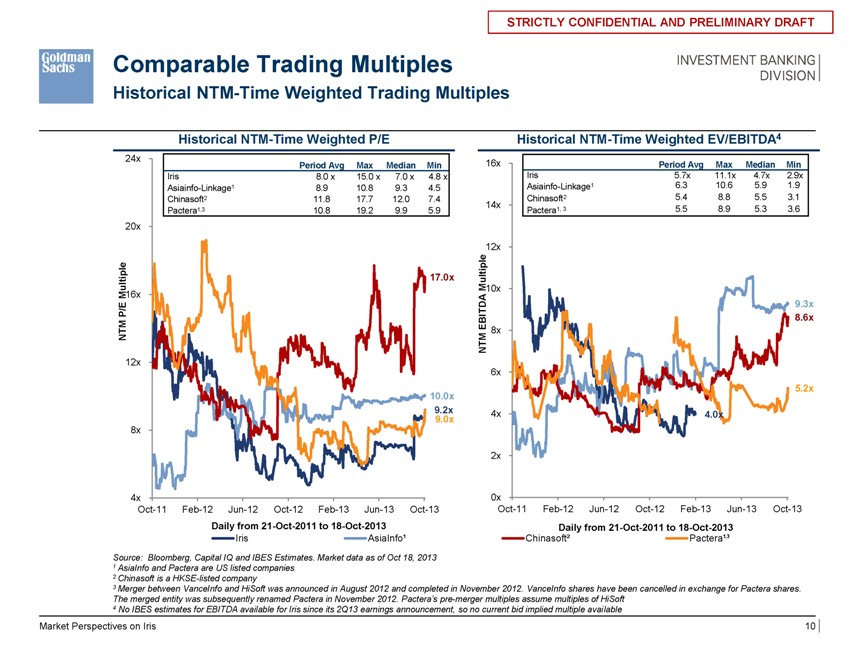

Comparable Trading Multiples

Historical NTM-Time Weighted Trading Multiples

Historical NTM-Time Weighted P/E

24x

Period Avg Max Median Min

Iris 8.0 x 15.0 x 7.0 x 4.8 x

Asiainfo-Linkage1 8.9 10.8 9.3 4.5

Chinasoft2 11.8 17.7 12.0 7.4

Pactera1,3 10.8 19.2 9.9 5.9

20x

tiple 17.0x

Mul16x

P/E

NTM

12x

10.0x

9.2x

9.0x

8x

4x

Oct-11 Feb-12 Jun-12 Oct-12 Feb-13 Jun-13 Oct-13

Daily from 21-Oct-2011 to 18-Oct-2013

Iris AsiaInfo¹

Historical NTM-Time Weighted EV/EBITDA4

16x Period Avg Max Median Min

Iris 5.7x 11.1x 4.7x 2.9x

Asiainfo-Linkage1 6.3 10.6 5.9 1.9

Chinasoft2 5.4 8.8 5.5 3.1

14x Pactera1, 3 5.5 8.9 5.3 3.6

12x

Multiple10x

9.3x

EBITDA 8.6x

NTM 8x

6x

5.2x

4x 4.0x

2x

0x

Oct-11 Feb-12 Jun-12 Oct-12 Feb-13 Jun-13 Oct-13

Daily from 21-Oct-2011 to 18-Oct-2013

Chinasoft² Pactera¹,3

Source: Bloomberg, Capital IQ and IBES Estimates. Market data as of Oct 18, 2013

1 AsiaInfo and Pactera are US listed companies

2 Chinasoft is a HKSE-listed company

3 Merger between VanceInfo and HiSoft was announced in August 2012 and completed in November 2012. VanceInfo shares have been cancelled in exchange for Pactera shares.

The merged entity was subsequently renamed Pactera in November 2012. Pactera’s pre-merger multiples assume multiples of HiSoft

4 No IBES estimates for EBITDA available for Iris since its 2Q13 earnings announcement, so no current bid implied multiple available Investment Banking Division

Market Perspectives on Iris 10

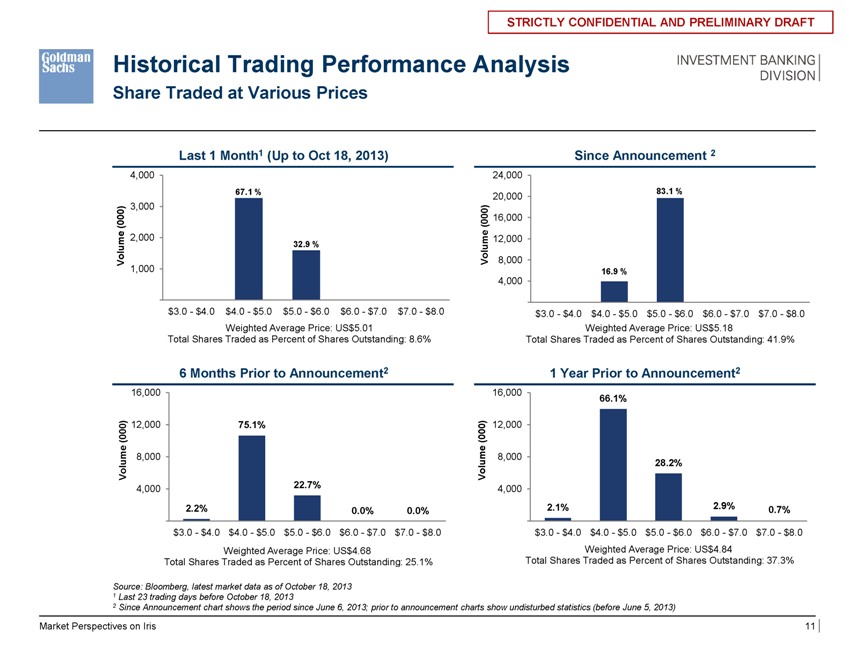

Historical Trading Performance Analysis

Share Traded at Various Prices

Last 1 Month1 (Up to Oct 18, 2013) Since Announcement 2

4,000 24,000

67.1 % 83.1 %

20,000

3,000

(000) (000) 16,000

2,000 m e 12,000

32.9 % u

Volume Vol 8,000

1,000 16.9 %

4,000

$3.0—$4.0 $4.0—$5.0 $5.0—$6.0 $6.0—$7.0 $7.0—$8.0 $3.0—$4.0 $4.0—$5.0 $5.0—$6.0 $6.0—$7.0 $7.0—$8.0

Weighted Average Price: US$5.01 Weighted Average Price: US$5.18 Total Shares Traded as Percent of Shares Outstanding: 8.6% Total Shares Traded as Percent of Shares Outstanding: 41.9%

6 Months Prior to Announcement2 1 Year Prior to Announcement2

16,000 16,000 66.1%

(000) 12,000 75.1% (000) 12,000

Volume 8,000 Volume 8,000 28.2%

4,000 22.7% 4,000

2.2% 0.0% 0.0% 2.1% 2.9% 0.7%

$3.0—$4.0 $4.0—$5.0 $5.0—$6.0 $6.0—$7.0 $7.0—$8.0 $3.0—$4.0 $4.0—$5.0 $5.0—$6.0 $6.0—$7.0 $7.0—$8.0

Weighted Average Price: US$4.68 Weighted Average Price: US$4.84

Total Shares Traded as Percent of Shares Outstanding: 25.1% Total Shares Traded as Percent of Shares Outstanding: 37.3%

Source: Bloomberg, latest market data as of October 18, 2013

1 Last 23 trading days before October 18, 2013

2 Since Announcement chart shows the period since June 6, 2013; prior to announcement charts show undisturbed statistics (before June 5, 2013) Investment Banking Division

Market Perspectives on Iris 11

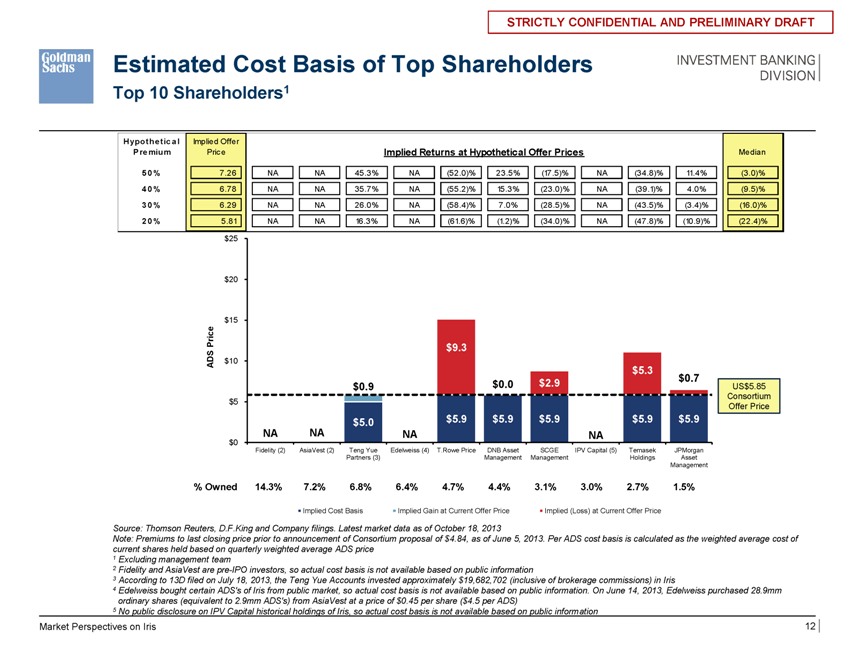

Estimated Cost Basis of Top Shareholders

Top 10 Shareholders1

Hypothe tic a l Implied Offer

P re mium Price Implied Returns at Hypothetical Offer Prices Median

5 | | 0 % 7.26 NA NA 45.3% NA (52.0)% 23.5% (17.5)% NA (34.8)% 11.4% (3.0)% |

40% 6.78 NA NA 35.7% NA (55.2)% 15.3% (23.0)% NA (39.1)% 4.0% (9.5)%

30% 6.29 NA NA 26.0% NA (58.4)% 7.0% (28.5)% NA (43.5)% (3.4)% (16.0)%

20% 5.81 NA NA 16.3% NA (61.6)% (1.2)% (34.0)% NA (47.8)% (10.9)% (22.4)%

$25

$20

$15

Price $ 9.3

S

D $10

A $ 5.3

$ 0.7

$ 0.9 $ 0.0 $ 2.9 US$5.85

Consortium

$5 Offer Price

$ 5.0 $ 5.9 $ 5.9 $ 5.9 $ 5.9 $ 5.9

NA NA NA NA

$0

Fidelity (2) AsiaVest (2) Teng Yue Edelweiss (4) T.Rowe Price DNB Asset SCGE IPV Capital (5) Temasek JPMorgan

Partners (3) Management Management Holdings Asset

Management

% Owned 14.3% 7.2% 6.8% 6.4% 4.7% 4.4% 3.1% 3.0% 2.7% 1.5%

Implied Cost Basis Implied Gain at Current Offer Price Implied (Loss) at Current Offer Price

Source: Thomson Reuters, D.F.King and Company filings. Latest market data as of October 18, 2013

Note: Premiums to last closing price prior to announcement of Consortium proposal of $4.84, as of June 5, 2013. Per ADS cost basis is calculated as the weighted average cost ofcurrent shares held based on quarterly weighted average ADS price

1 Excluding management team

2 Fidelity and AsiaVest are pre-IPO investors, so actual cost basis is not available based on public information

3 According to 13D filed on July 18, 2013, the Teng Yue Accounts invested approximately $19,682,702 (inclusive of brokerage commissions) in Iris

4 Edelweiss bought certain ADS’s of Iris from public market, so actual cost basis is not available based on public information. On June 14, 2013, Edelweiss purchased 28.9mmordinary shares (equivalent to 2.9mm ADS’s) from AsiaVest at a price of $0.45 per share ($4.5 per ADS)

5 No public disclosure on IPV Capital historical holdings of Iris, so actual cost basis is not available based on public information

Market Perspectives on Iris 12 Investment Banking Division

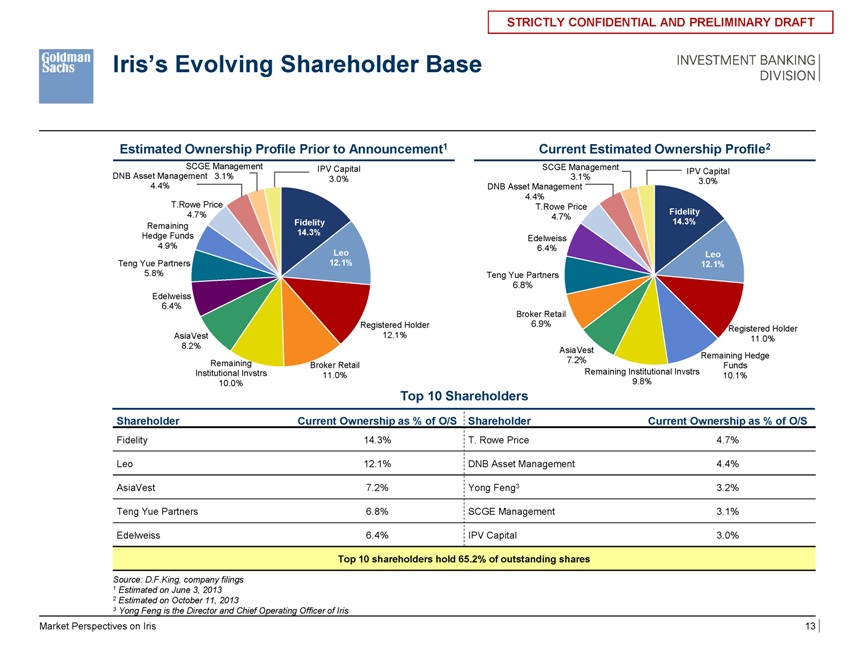

Iris’s Evolving Shareholder Base

Estimated Ownership Profile Prior to Announcement1 Current Estimated Ownership Profile2

SCGE Management IPV Capital SCGE Management IPV Capital

DNB Asset Management 3.1% 3.0% 3.1% 3.0%

4.4% DNB Asset Management

4.4%

T.Rowe Price T.Rowe Price

4.7% 4.7% Fidelity

Remaining Fidelity 14.3%

Hedge Funds 14.3% Edelweiss

4.9% 6.4%

Leo Leo

Teng Yue Partners 12.1% 12.1%

5.8% Teng Yue Partners

6.8%

Edelweiss

6.4%

Broker Retail

Registered Holder 6.9% Registered Holder

AsiaVest 12.1% 11.0%

8.2% AsiaVest

7.2% Remaining Hedge

Remaining Broker Retail Funds

Institutional Invstrs 11.0% Remaining Institutional Invstrs 10.1%

10.0% 9.8%

Top 10 Shareholders

Shareholder Current Ownership as % of O/S Shareholder Current Ownership as % of O/S

Fidelity 14.3% T. Rowe Price 4.7%

Leo 12.1% DNB Asset Management 4.4%

AsiaVest 7.2% Yong Feng3 3.2%

Teng Yue Partners 6.8% SCGE Management 3.1%

Edelweiss 6.4% IPV Capital 3.0%

Top 10 shareholders hold 65.2% of outstanding shares

Source: D.F.King, company filings

1 Estimated on June 3, 2013

2 Estimated on October 11, 2013

3 Yong Feng is the Director and Chief Operating Officer of Iris

Perspectives on Iris

Market Perspectives on Iris 13 Investment Banking Division

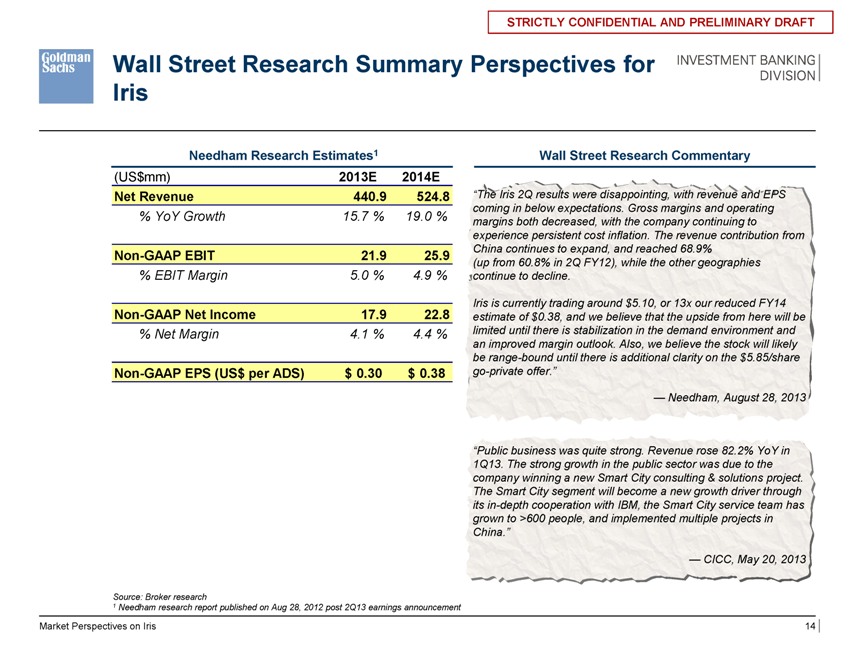

Wall Street Research Summary Perspectives for Iris

Needham Research Estimates1

(US$mm) 2013E 2014E

Net Revenue 440.9 524.8

% YoY Growth 15.7 % 19.0 %

Non-GAAP EBIT 21.9 25.9

% EBIT Margin 5.0 % 4.9 %

Non-GAAP Net Income 17.9 22.8

% Net Margin 4.1 % 4.4 %

Non-GAAP EPS (US$ per ADS) $ 0.30 $ 0.38

Wall Street Research Commentary

“The Iris 2Q results were disappointing, with revenue and EPS coming in below expectations. Gross margins and operating margins both decreased, with the company continuing to experience persistent cost inflation. The revenue contribution from China continues to expand, and reached 68.9% (up from 60.8% in 2Q FY12), while the other geographies continue to decline.

Iris is currently trading around $5.10, or 13x our reduced FY14 estimate of $0.38, and we believe that the upside from here will be limited until there is stabilization in the demand environment and an improved margin outlook. Also, we believe the stock will likely be range-bound until there is additional clarity on the $5.85/share go-private offer.”

— Needham, August 28, 2013

“Public business was quite strong. Revenue rose 82.2% YoY in

1Q13. The strong growth in the public sector was due to the company winning a new Smart City consulting & solutions project. The Smart City segment will become a new growth driver through its in-depth cooperation with IBM, the Smart City service team has grown to >600 people, and implemented multiple projects in China.”

— CICC, May 20, 2013

Source: Broker research

1 | | Needham research report published on Aug 28, 2012 post 2Q13 earnings announcement |

Market Perspectives on Iris 14 Investment Banking Division

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

III. Financial Analysis Investment Banking Division

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

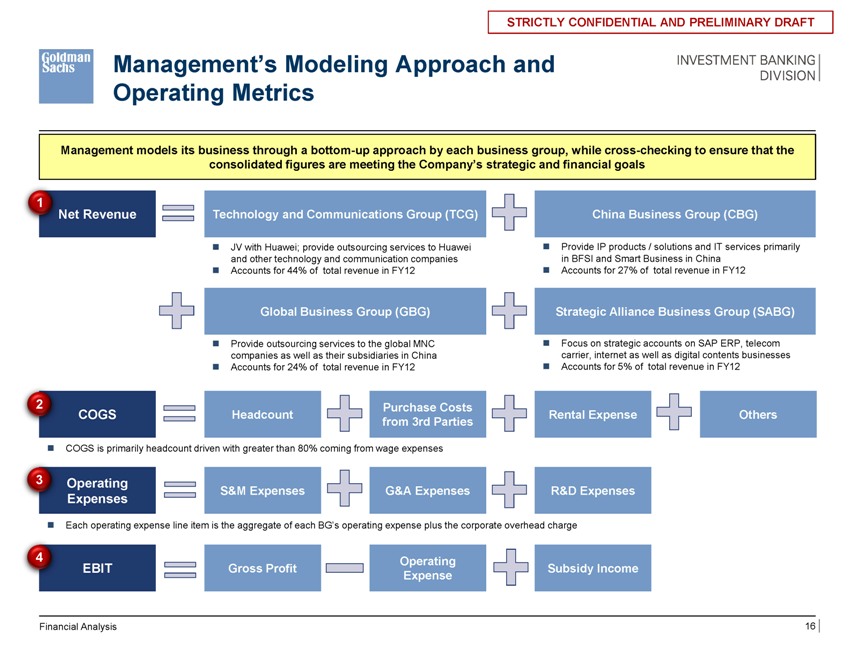

Management’s Modeling Approach and

Operating Metrics

Management models its business through a bottom-up approach by each business group, while cross-checking to ensure that the consolidated figures are meeting the Company’s strategic and financial goals

Net Revenue

COGS

Operating Expenses

EBIT

Technology and Communications Group (TCG)

JV with Huawei; provide outsourcing services to Huawei and other technology and communication companies Accounts for 44% of total revenue in FY12

Global Business Group (GBG)

Provide outsourcing services to the global MNC companies as well as their subsidiaries in China Accounts for 24% of total revenue in FY12

COGS is primarily headcount driven with greater than 80% coming from wage expenses

Each operating expense line item is the aggregate of each BG’s operating expense plus the corporate overhead charge

Headcount

Purchase Costs from 3rd Parties

S&M Expenses

G&A Expenses

Gross Profit

Operating Expense

China Business Group (CBG)

Provide IP products / solutions and IT services primarily in BFSI and Smart Business in China Accounts for 27% of total revenue in FY12

Strategic Alliance Business Group (SABG)

Focus on strategic accounts on SAP ERP, telecom carrier, internet as well as digital contents businesses Accounts for 5% of total revenue in FY12

Rental Expense

Others

R&D Expenses

Subsidy Income

Financial Analysis

16 Investment Banking Division

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

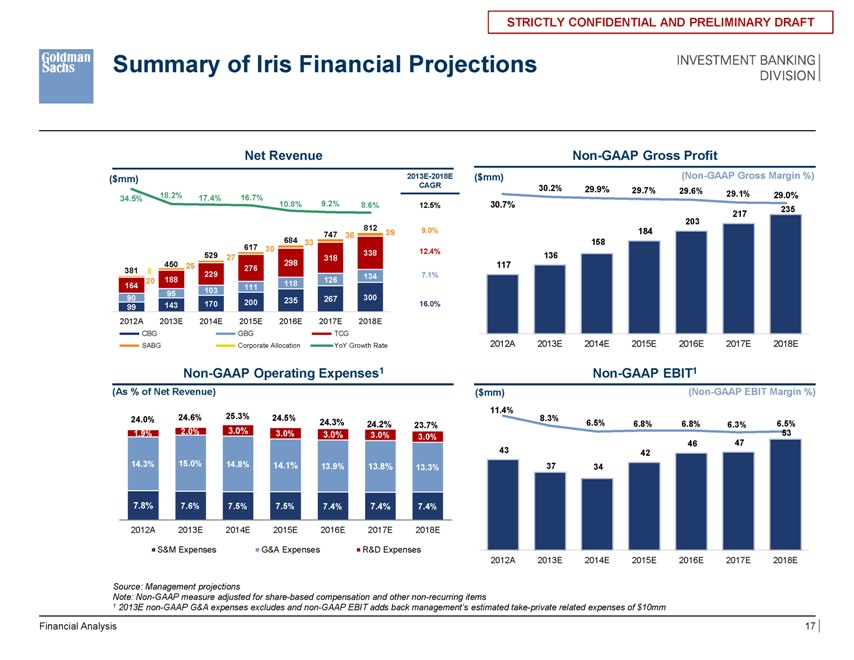

Summary of Iris Financial Projections

Net Revenue

($mm)

34.5% 18.2% 17.4% 16.7% 10.8% 9.2% 8.6% 812 747 36 39 684 33

529 27 617 30 318 338 381 450 25 276 298 8 229 134

20 188 118 126 164 103 111 95 99 90 143 170 200 235 267 300

2012A 2013E 2014E 2015E 2016E 2017E 2018E

CBG GBG TCG

SABG Corporate Allocation YoY Growth Rate

Non-GAAP Operating Expenses1

(As % of Net Revenue)

24.0% 24.6% 25.3% 24.5% 24.3% 24.2% 23.7%

1.9% 2.0% 3.0% 3.0% 3.0% 3.0% 3.0%

14.3% 15.0% 14.8% 14.1% 13.9% 13.8% 13.3%

7.8% 7.6% 7.5% 7.5% 7.4% 7.4% 7.4%

2012A 2013E 2014E 2015E 2016E 2017E 2018E

S&M Expenses G&A Expenses R&D Expenses

2013E-2018E

CAGR

12.5% 9.0% 12.4% 7.1% 16.0%

Non-GAAP Gross Profit

($mm) (Non-GAAP Gross Margin %)

30.2% 29.9% 29.7% 29.6% 29.1% 29.0%

30.7% 235 217 203 184 158 136 117

2012A 2013E 2014E 2015E 2016E 2017E 2018E

Non-GAAP EBIT1

($mm) (Non-GAAP EBIT Margin %)

11.4%

8.3% 6.5% 6.8% 6.8% 6.3% 6.5%

53 46 47 43 42 37 34 2012A 2013E 2014E 2015E 2016E 2017E 2018E

Source: Management projections

Note: Non-GAAP measure adjusted for share-based compensation and other non-recurring items

1 2013E non-GAAP G&A expenses excludes and non-GAAP EBIT adds back management’s estimated take-private related expenses of $10mm

Financial Analysis

17 Investment Banking Division

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

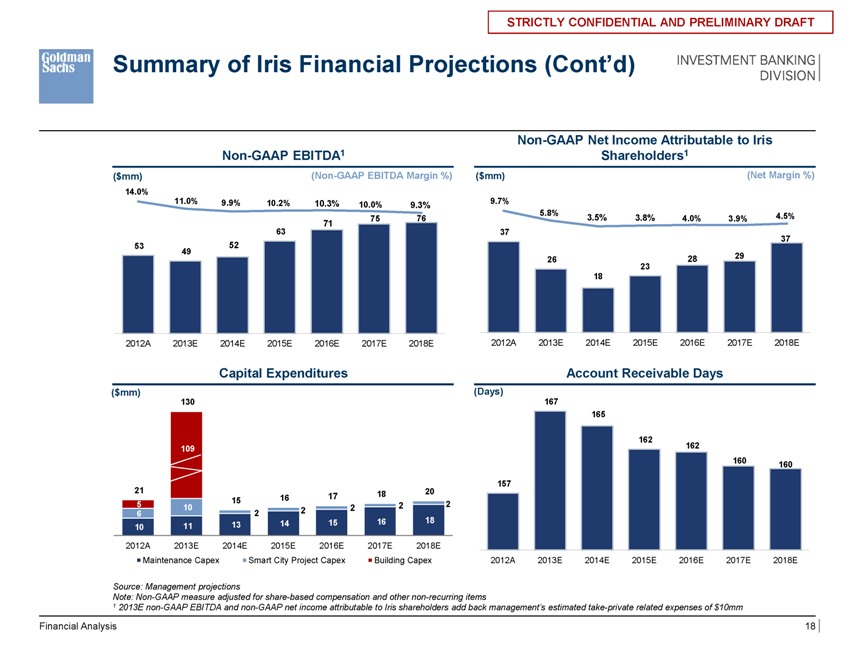

Summary of Iris Financial Projections (Cont’d)

Non-GAAP EBITDA1

($mm) (Non-GAAP EBITDA Margin %)

14.0%

11.0% 9.9% 10.2% 10.3% 10.0% 9.3%

71 75 76

63

53 52

49

2012A 2013E 2014E 2015E 2016E 2017E 2018E

Capital Expenditures

($mm)

130

109

21 15 16 17 18 20

6 5 10 2 2 2 2 2

10 11 13 14 15 16 18

2012A 2013E 2014E 2015E 2016E 2017E 2018E

Maintenance Capex Smart City Project Capex Building Capex

Non-GAAP Net Income Attributable to Iris Shareholders1

($mm) (Net Margin %)

9.7%

5.8% 3.5% 3.8% 4.0% 3.9% 4.5%

37 37 26 28 29 23 18

2012A 2013E 2014E 2015E 2016E 2017E 2018E

Account Receivable Days

(Days)

167 165 162 162 160 160 157

2012A 2013E 2014E 2015E 2016E 2017E 2018E

Source: Management projections

Note: Non-GAAP measure adjusted for share-based compensation and other non-recurring items

1 2013E non-GAAP EBITDA and non-GAAP net income attributable to Iris shareholders add back management’s estimated take-private related expenses of $10mm

Financial Analysis

18 Investment Banking Division

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

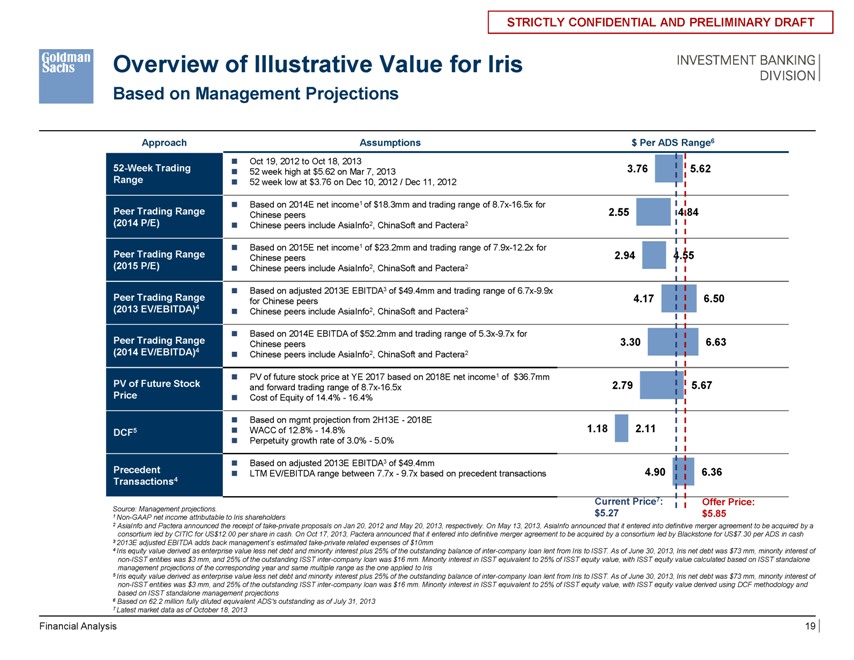

Overview of Illustrative Value for Iris

Based on Management Projections

Approach Assumptions $ Per ADS Range6

52-Week Trading Range

Peer Trading Range (2014 P/E)

Peer Trading Range (2015 P/E)

Peer Trading Range (2013 EV/EBITDA)4

Peer Trading Range (2014 EV/EBITDA)4

PV of Future Stock Price DCF5 Precedent Transactions4

Oct 19, 2012 to Oct 18, 2013 52 week high at $5.62 on Mar 7, 2013 52 week low at $3.76 on Dec 10, 2012 / Dec 11, 2012

Based on 2014E net income1 of $18.3mm and trading range of 8.7x-16.5x for Chinese peers Chinese peers include AsiaInfo2, ChinaSoft and Pactera2

Based on 2015E net income1 of $23.2mm and trading range of 7.9x-12.2x for Chinese peers Chinese peers include AsiaInfo2, ChinaSoft and Pactera2

Based on adjusted 2013E EBITDA3 of $49.4mm and trading range of 6.7x-9.9x for Chinese peers Chinese peers include AsiaInfo2, ChinaSoft and Pactera2

Based on 2014E EBITDA of $52.2mm and trading range of 5.3x-9.7x for Chinese peers Chinese peers include AsiaInfo2, ChinaSoft and Pactera2

PV of future stock price at YE 2017 based on 2018E net income1 of $36.7mm and forward trading range of 8.7x-16.5x Cost of Equity of 14.4%—16.4%

Based on mgmt projection from 2H13E—2018E WACC of 12.8%—14.8% Perpetuity growth rate of 3.0%—5.0%

Based on adjusted 2013E EBITDA3 of $49.4mm

LTM EV/EBITDA range between 7.7x—9.7x based on precedent transactions

3.76 5.62

2.55 4.84 2.94 4.55 4.17 6.50 3.30 6.63 2.79 5.67 1.18 2.11 4.90 6.36

Current Price7: Offer Price:

$5.27 $5.85

Source: Management projections. $5.27

1 Non-GAAP net income attributable to Iris shareholders $5.85

2 AsiaInfo and Pactera announced the receipt of take-private proposals on Jan 20, 2012 and May 20, 2013, respectively. On May 13, 2013, AsiaInfo announced that it entered into definitive merger agreement to be acquired by a

consortium led by CITIC for US$12.00 per share in cash. On Oct 17, 2013, Pactera announced that it entered into definitive merger agreement to be acquired by a consortium led by Blackstone for US$7.30 per ADS in cash

3 2013E adjusted EBITDA adds back management’s estimated take-private related expenses of $10mm

4 Iris equity value derived as enterprise value less net debt and minority interest plus 25% of the outstanding balance of inter-company loan lent from Iris to ISST. As of June 30, 2013, Iris net debt was $73 mm, minority interest of

non-ISST entities was $3 mm, and 25% of the outstanding ISST inter-company loan was $16 mm. Minority interest in ISST equivalent to 25% of ISST equity value, with ISST equity value calculated based on ISST standalone

management projections of the corresponding year and same multiple range as the one applied to Iris

5 Iris equity value derived as enterprise value less net debt and minority interest plus 25% of the outstanding balance of inter-company loan lent from Iris to ISST. As of June 30, 2013, Iris net debt was $73 mm, minority interest of

non-ISST entities was $3 mm, and 25% of the outstanding ISST inter-company loan was $16 mm. Minority interest in ISST equivalent to 25% of ISST equity value, with ISST equity value derived using DCF methodology and based on ISST standalone management projections

6 Based on 62.2 million fully diluted equivalent ADS’s outstanding as of July 31, 2013

7

Financial Analysis Investment Banking Division

19

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

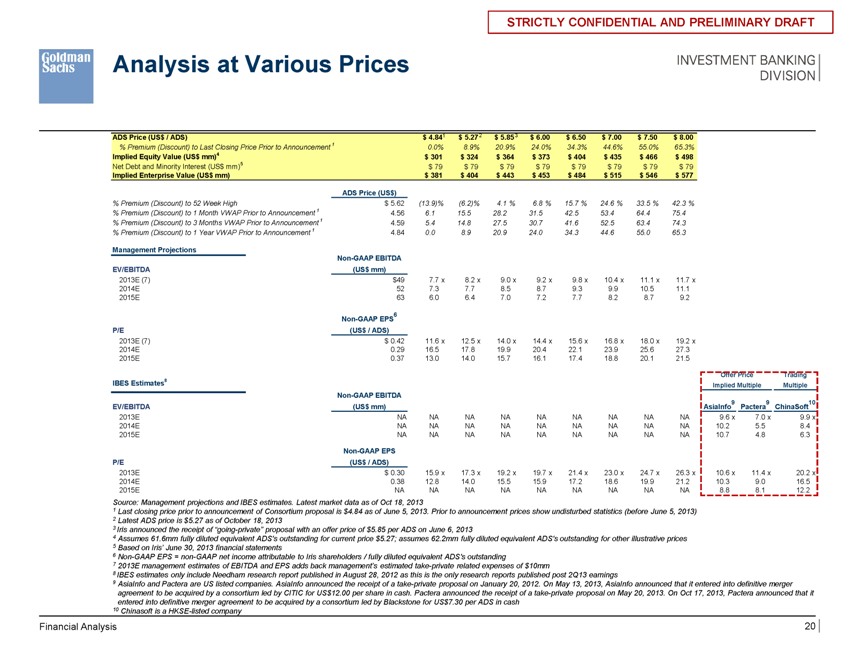

Analysis at Various Prices

ADS Price (US$ / ADS) $ 4.841 $ 5.272 $ 5.85 3 $ 6.00 $ 6.50 $ 7.00 $ 7.50 $ 8.00

% Premium (Discount) to Last Closing Price Prior to Announcement 1 0.0% 8.9% 20.9% 24.0% 34.3% 44.6% 55.0% 65.3%

Implied Equity Value (US$ mm)4 $ 301 $ 324 $ 364 $ 373 $ 404 $ 435 $ 466 $ 498

Net Debt and Minority Interest (US$ mm)5 $ 79 $ 79 $ 79 $ 79 $ 79 $ 79 $ 79 $ 79

Implied Enterprise Value (US$ mm) $ 381 $ 404 $ 443 $ 453 $ 484 $ 515 $ 546 $ 577

ADS Price (US$)

% Premium (Discount) to 52 Week High $ 5.62 (13.9)% (6.2)% 4.1 % 6.8 % 15.7 % 24.6 % 33.5 % 42.3 %

% Premium (Discount) to 1 Month VWAP Prior to Announcement 1 4.56 6.1 15.5 28.2 31.5 42.5 53.4 64.4 75.4

% Premium (Discount) to 3 Months VWAP Prior to Announcement 1 4.59 5.4 14.8 27.5 30.7 41.6 52.5 63.4 74.3

% Premium (Discount) to 1 Year VWAP Prior to Announcement 1 4.84 0.0 8.9 20.9 24.0 34.3 44.6 55.0 65.3

Management Projections

Non-GAAP EBITDA

EV/EBITDA (US$ mm)

2013E (7) $49 7.7 x 8.2 x 9.0 x 9.2 x 9.8 x 10.4 x 11.1 x 11.7 x

2014E 52 7.3 7.7 8.5 8.7 9.3 9.9 10.5 11.1

2015E 63 6.0 6.4 7.0 7.2 7.7 8.2 8.7 9.2

Non-GAAP EPS6

P/E (US$ / ADS)

2013E (7) $ 0.42 11.6 x 12.5 x 14.0 x 14.4 x 15.6 x 16.8 x 18.0 x 19.2 x

2014E 0.29 16.5 17.8 19.9 20.4 22.1 23.9 25.6 27.3

2015E 0.37 13.0 14.0 15.7 16.1 17.4 18.8 20.1 21.5

IBES Estimates8

Non-GAAP EBITDA

EV/EBITDA (US$ mm)

2013E NA NA NA NA NA NA NA NA NA

2014E NA NA NA NA NA NA NA NA NA

2015E NA NA NA NA NA NA NA NA NA

Non-GAAP EPS

P/E (US$ / ADS)

2013E $ 0.30 15.9 x 17.3 x 19.2 x 19.7 x 21.4 x 23.0 x 24.7 x 26.3 x

2014E 0.38 12.8 14.0 15.5 15.9 17.2 18.6 19.9 21.2

2015E NA NA NA NA NA NA NA NA NA

2015E NA NA NA NA NA NA NA NA NA 8.8 8.1 12.2

Source: Management projections and IBES estimates. Latest market data as of Oct 18, 2013

1 Last closing price prior to announcement of Consortium proposal is $4.84 as of June 5, 2013. Prior to announcement prices show undisturbed statistics (before June 5, 2013)

2 Latest ADS price is $5.27 as of October 18, 2013

3 Iris announced the receipt of “going-private” proposal with an offer price of $5.85 per ADS on June 6, 2013

4 Assumes 61.6mm fully diluted equivalent ADS’s outstanding for current price $5.27; assumes 62.2mm fully diluted equivalent ADS’s outstanding for other illustrative prices

5 Based on Iris’ June 30, 2013 financial statements

6 Non-GAAP EPS = non-GAAP net income attributable to Iris shareholders / fully diluted equivalent ADS’s outstanding

7 2013E management estimates of EBITDA and EPS adds back management’s estimated take-private related expenses of $10mm

8 IBES estimates only include Needham research report published in August 28, 2012 as this is the only research reports published post 2Q13 earnings

9 AsiaInfo and Pactera are US listed companies. AsiaInfo announced the receipt of a take-private proposal on January 20, 2012. On May 13, 2013, AsiaInfo announced that it entered into definitive merger agreement to be acquired by a consortium led by CITIC for US$12.00 per share in cash. Pactera announced the receipt of a take-private proposal on May 20, 2013. On Oct 17, 2013, Pactera announced that it entered into definitive merger agreement to be acquired by a consortium led by Blackstone for US$7.30 per ADS in cash

10 Chinasoft is a HKSE-listed company

Offer Price Trading

Implied Multiple Multiple

AsiaInfo9 Pactera9 ChinaSoft10

9.6 x 7.0 x 9.9 x 10.2 5.5 8.4 10.7 4.8 6.3 10.6 x 11.4 x 20.2 x 10.3 9.0 16.5 8.8 8.1 12.2

Financial Analysis Investment Banking Division

20

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

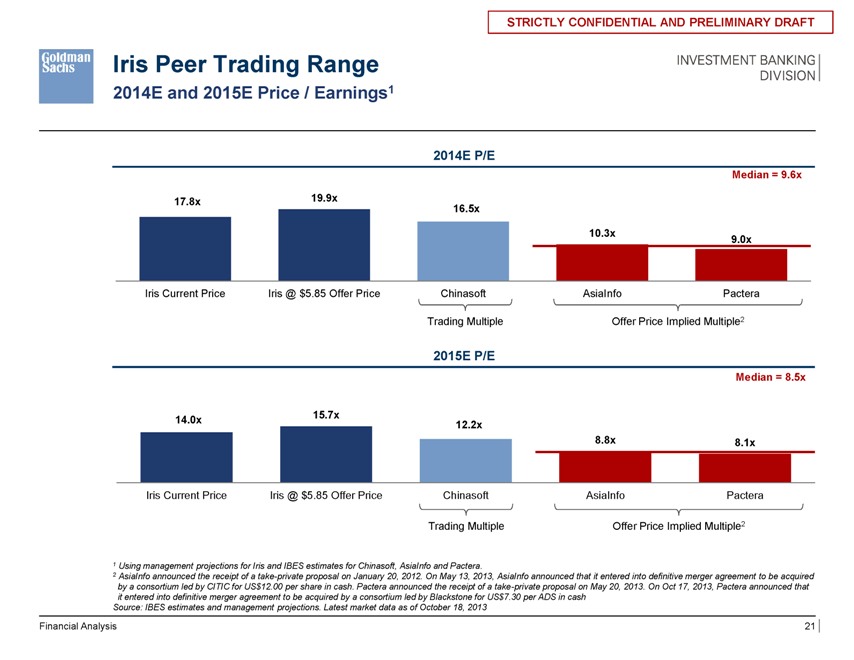

Iris Peer Trading Range

2014E and 2015E Price / Earnings1

2014E P/E

Median = 9.6x

17.8x 19.9x

16.5x

10.3x 9.0x

Iris Current Price Iris @ $5.85 Offer Price Chinasoft AsiaInfo Pactera

Trading Multiple Offer Price Implied Multiple2

2015E P/E

Median = 8.5x

15.7x

14.0x 12.2x

8.8x 8.1x

Iris Current Price Iris @ $5.85 Offer Price Chinasoft AsiaInfo Pactera

Trading Multiple Offer Price Implied Multiple2

1 Using management projections for Iris and IBES estimates for Chinasoft, AsiaInfo and Pactera.

2 AsiaInfo announced the receipt of a take-private proposal on January 20, 2012. On May 13, 2013, AsiaInfo announced that it entered into definitive merger agreement to be acquired by a consortium led by CITIC for US$12.00 per share in cash. Pactera announced the receipt of a take-private proposal on May 20, 2013. On Oct 17, 2013, Pactera announced that it entered into definitive merger agreement to be acquired by a consortium led by Blackstone for US$7.30 per ADS in cash Source: IBES estimates and management projections. Latest market data as of October 18, 2013

Financial Analysis

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

21

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

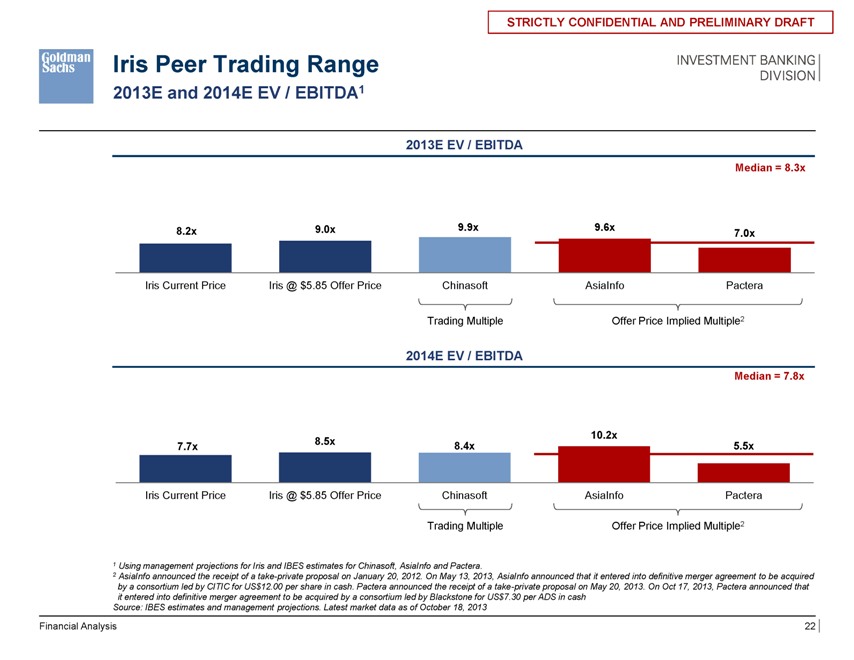

Iris Peer Trading Range

2013E and 2014E EV / EBITDA1

2013E EV / EBITDA

Median = 8.3x

8.2x 9.0x 9.9x 9.6x 7.0x

Iris Current Price Iris @ $5.85 Offer Price Chinasoft AsiaInfo Pactera

Trading Multiple Offer Price Implied Multiple2

2014E EV / EBITDA

Median = 7.8x

8.5x 10.2x

7.7x 8.4x 5.5x

Iris Current Price Iris @ $ 5.85 Offer Price Chinasoft AsiaInfo Pactera

Trading Multiple Offer Price Implied Multiple2

1 Using management projections for Iris and IBES estimates for Chinasoft, AsiaInfo and Pactera.

2 AsiaInfo announced the receipt of a take-private proposal on January 20, 2012. On May 13, 2013, AsiaInfo announced that it entered into definitive merger agreement to be acquired by a consortium led by CITIC for US$12.00 per share in cash. Pactera announced the receipt of a take-private proposal on May 20, 2013. On Oct 17, 2013, Pactera announced that it entered into definitive merger agreement to be acquired by a consortium led by Blackstone for US$7.30 per ADS in cash Source: IBES estimates and management projections. Latest market data as of October 18, 2013

Financial Analysis

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

22

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

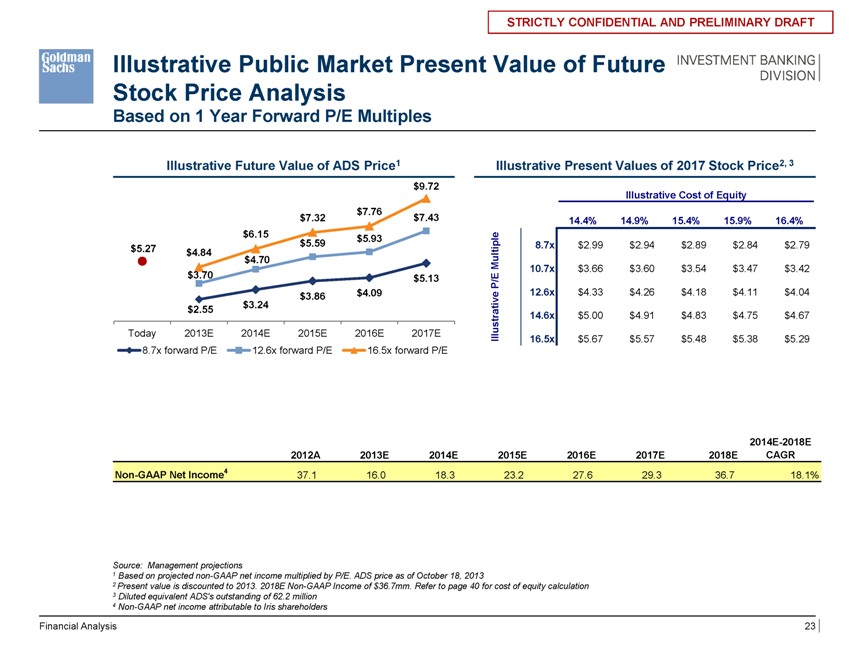

Illustrative Public Market Present Value of Future Stock Price Analysis

Based on 1 Year Forward P/E Multiples

Illustrative Future Value of ADS Price1

$ 9.72

$ 7.76

$ 7.32 $ 7.43

$6.15 $ 5.93

$ 5.59

$5.27 $4.84

$4.70

$3.70 $ 5.13

$ 3.86 $ 4.09

$2.55 $3.24

Today 2013E 2014E 2015E 2016E 2017E

8.7x forward P/E 12.6x forward P/E 16.5x forward P/E

Illustrative Present Values of 2017 Stock Price2, 3

Illustrative Cost of Equity

$3.32 14.4% 14.9% 15.4% 15.9% 16.4%

Multiple 8.7x $ 2.99 $ 2.94 $ 2.89 $ 2.84 $ 2.79

10.7x $ 3.66 $ 3.60 $ 3.54 $ 3.47 $ 3.42

P/E

12.6x $ 4.33 $ 4.26 $ 4.18 $ 4.11 $ 4.04

ative

r 14.6x $ 5.00 $ 4.91 $ 4.83 $ 4.75 $ 4.67

Illust 16.5x $ 5.67 $ 5.57 $ 5.48 $ 5.38 $ 5.29

2014E-2018E

2012A 2013E 2014E 2015E 2016E 2017E 2018E CAGR

Non-GAAP Net Income4 37.1 16.0 18.3 23.2 27.6 29.3 36.7 18.1%

Source: Management projections

1 Based on projected non-GAAP net income multiplied by P/E. ADS price as of October 18, 2013

2 Present value is discounted to 2013. 2018E Non-GAAP Income of $36.7mm. Refer to page 40 for cost of equity calculation

3 Diluted equivalent ADS’s outstanding of 62.2 million

4 Non-GAAP net income attributable to Iris shareholders

Financial Analysis

23

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

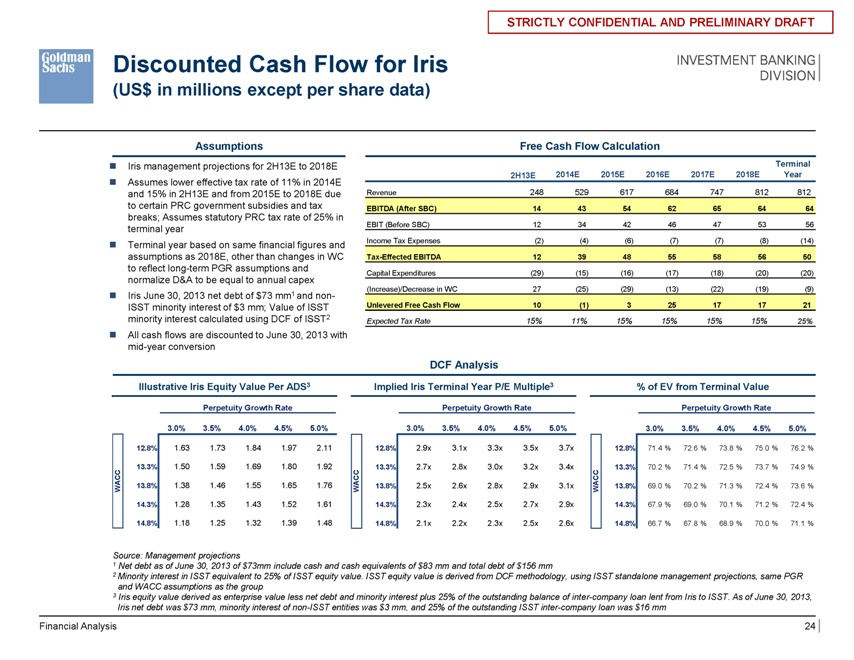

Discounted Cash Flow for Iris

(US$ in millions except per share data)

Assumptions

?Iris management projections for 2H13E to 2018E ?Assumes lower effective tax rate of 11% in 2014E and 15% in 2H13E and from 2015E to 2018E due to certain PRC government subsidies and tax breaks; Assumes statutory PRC tax rate of 25% in terminal year ?Terminal year based on same financial figures and assumptions as 2018E, other than changes in WC to reflect long-term PGR assumptions and normalize D&A to be equal to annual capex ?Iris June 30, 2013 net debt of $73 mm1 and non-ISST minority interest of $3 mm; Value of ISST minority interest calculated using DCF of ISST2 ?All cash flows are discounted to June 30, 2013 with mid-year conversion

Free Cash Flow Calculation

Terminal

2H13E 2014E 2015E 2016E 2017E 2018E Year

Revenue 248 529 617 684 747 812 812

EBITDA (After SBC) 14 43 54 62 65 64 64

EBIT (Before SBC) 12 34 42 46 47 53 56

Income Tax Expenses (2) (4) (6) (7) (7) (8) (14)

Tax-Effected EBITDA 12 39 48 55 58 56 50

Capital Expenditures (29) (15) (16) (17) (18) (20) (20)

(Increase)/Decrease in WC 27 (25) (29) (13) (22) (19) (9)

Unlevered Free Cash Flow 10 (1) 3 25 17 17 21

Expected Tax Rate 15% 11% 15% 15% 15% 15% 25%

DCF Analysis

Illustrative Iris Equity Value Per ADS3 Implied Iris Terminal Year P/E Multiple3 % of EV from Terminal Value

Perpetuity Growth Rate Perpetuity Growth Rate Perpetuity Growth Rate

$1.539 3.0% 3.5% 4.0% 4.5% 5.0% 276.2% 3.0% 3.5% 4.0% 4.5% 5.0% 71% 3.0% 3.5% 4.0% 4.5% 5.0%

12.8% 1.63 1.73 1.84 1.97 2.11 12.8% 2.9x 3.1x 3.3x 3.5x 3.7x 12.8% 71.4 % 72.6 % 73.8 % 75.0 % 76.2 %

13.3% 1.50 1.59 1.69 1.80 1.92 13.3% 2.7x 2.8x 3.0x 3.2x 3.4x 13.3% 70.2 % 71.4 % 72.5 % 73.7 % 74.9 %

WACC 13.8% 1.38 1.46 1.55 1.65 1.76 WACC 13.8% 2.5x 2.6x 2.8x 2.9x 3.1x WACC 13.8% 69.0 % 70.2 % 71.3 % 72.4 % 73.6 %

14.3% 1.28 1.35 1.43 1.52 1.61 14.3% 2.3x 2.4x 2.5x 2.7x 2.9x 14.3% 67.9 % 69.0 % 70.1 % 71.2 % 72.4 %

14.8% 1.18 1.25 1.32 1.39 1.48 14.8% 2.1x 2.2x 2.3x 2.5x 2.6x 14.8% 66.7 % 67.8 % 68.9 % 70.0 % 71.1 %

Source: Management projections

1 Net debt as of June 30, 2013 of $73mm include cash and cash equivalents of $83 mm and total debt of $156 mm

2 Minority interest in ISST equivalent to 25% of ISST equity value. ISST equity value is derived from DCF methodology, using ISST standalone management projections, same PGR and WACC assumptions as the group

3 Iris equity value derived as enterprise value less net debt and minority interest plus 25% of the outstanding balance of inter-company loan lent from Iris to ISST. As of June 30, 2013, Iris net debt was $73 mm, minority interest of non-ISST entities was $3 mm, and 25% of the outstanding ISST inter-company loan was $16 mm

Financial Analysis

24

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

Appendix A: Additional Materials

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

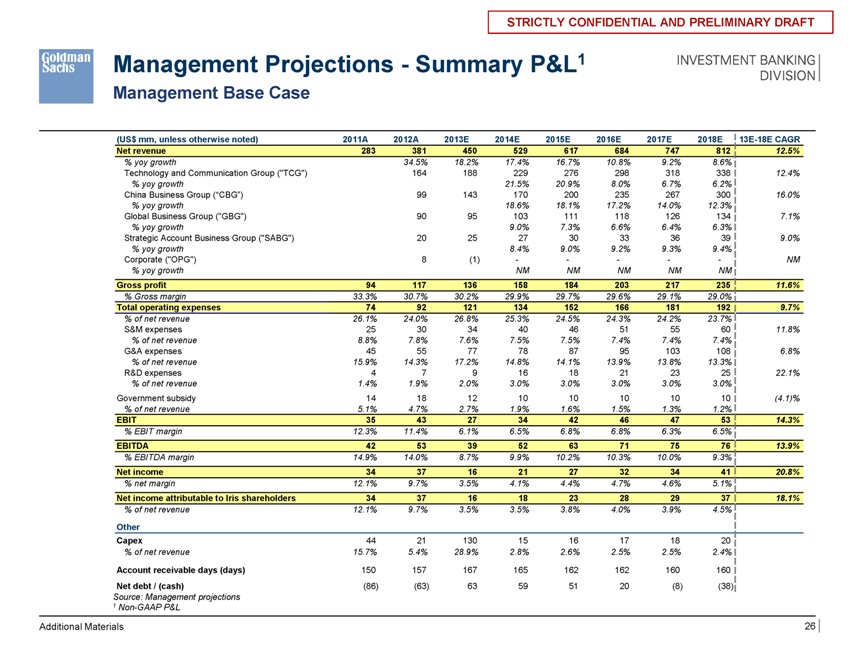

Management Projections—Summary P&L1

Management Base Case

(US$ mm, unless otherwise noted) 2011A 2012A 2013E 2014E 2015E 2016E 2017E 2018E 13E-18E CAGR

Net revenue 283 381 450 529 617 684 747 812 12.5%

% yoy growth 34.5% 18.2% 17.4% 16.7% 10.8% 9.2% 8.6%

Technology and Communication Group (“TCG”) 164 188 229 276 298 318 338 12.4%

% yoy growth 21.5% 20.9% 8.0% 6.7% 6.2%

China Business Group (“CBG”) 99 143 170 200 235 267 300 16.0%

% yoy growth 18.6% 18.1% 17.2% 14.0% 12.3%

Global Business Group (“GBG”) 90 95 103 111 118 126 134 7.1%

% yoy growth 9.0% 7.3% 6.6% 6.4% 6.3%

Strategic Account Business Group (“SABG”) 20 25 27 30 33 36 39 9.0%

% yoy growth 8.4% 9.0% 9.2% 9.3% 9.4%

Corporate (“OPG”) 8 (1) — ——NM

% yoy growth NM NM NM NM NM

Gross profit 94 117 136 158 184 203 217 235 11.6%

% Gross margin 33.3% 30.7% 30.2% 29.9% 29.7% 29.6% 29.1% 29.0%

Total operating expenses 74 92 121 134 152 166 181 192 9.7%

% of net revenue 26.1% 24.0% 26.8% 25.3% 24.5% 24.3% 24.2% 23.7%

S&M expenses 25 30 34 40 46 51 55 60 11.8%

% of net revenue 8.8% 7.8% 7.6% 7.5% 7.5% 7.4% 7.4% 7.4%

G&A expenses 45 55 77 78 87 95 103 108 6.8%

% of net revenue 15.9% 14.3% 17.2% 14.8% 14.1% 13.9% 13.8% 13.3%

R&D expenses 4 7 9 16 18 21 23 25 22.1%

% of net revenue 1.4% 1.9% 2.0% 3.0% 3.0% 3.0% 3.0% 3.0%

Government subsidy 14 18 12 10 10 10 10 10 (4.1)%

% of net revenue 5.1% 4.7% 2.7% 1.9% 1.6% 1.5% 1.3% 1.2%

EBIT 35 43 27 34 42 46 47 53 14.3%

% EBIT margin 12.3% 11.4% 6.1% 6.5% 6.8% 6.8% 6.3% 6.5%

EBITDA 42 53 39 52 63 71 75 76 13.9%

% EBITDA margin 14.9% 14.0% 8.7% 9.9% 10.2% 10.3% 10.0% 9.3%

Net income 34 37 16 21 27 32 34 41 20.8%

% net margin 12.1% 9.7% 3.5% 4.1% 4.4% 4.7% 4.6% 5.1%

Net income attributable to Iris shareholders 34 37 16 18 23 28 29 37 18.1%

% of net revenue 12.1% 9.7% 3.5% 3.5% 3.8% 4.0% 3.9% 4.5%

Other

Capex 44 21 130 15 16 17 18 20

% of net revenue 15.7% 5.4% 28.9% 2.8% 2.6% 2.5% 2.5% 2.4%

Account receivable days (days) 150 157 167 165 162 162 160 160

Net debt / (cash) (86) (63) 63 59 51 20 (8) (38)

Source: Management projections

Additional Materials

26

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

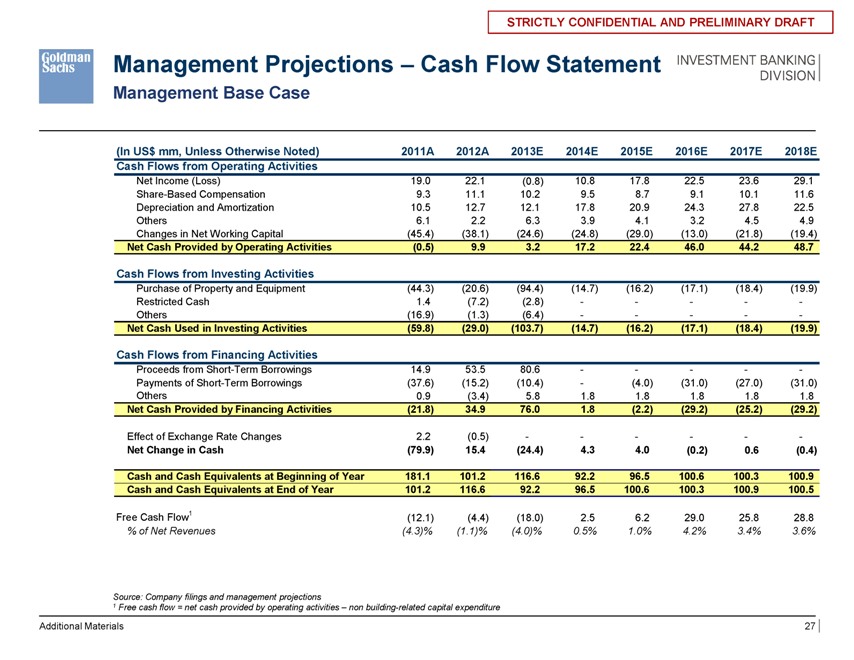

Management Projections – Cash Flow Statement

Management Base Case

(In US$ mm, Unless Otherwise Noted) 2011A 2012A 2013E 2014E 2015E 2016E 2017E 2018E

Cash Flows from Operating Activities

Net Income (Loss) 19.0 22.1 (0.8) 10.8 17.8 22.5 23.6 29.1

Share-Based Compensation 9.3 11.1 10.2 9.5 8.7 9.1 10.1 11.6

Depreciation and Amortization 10.5 12.7 12.1 17.8 20.9 24.3 27.8 22.5

Others 6.1 2.2 6.3 3.9 4.1 3.2 4.5 4.9

Changes in Net Working Capital (45.4) (38.1) (24.6) (24.8) (29.0) (13.0) (21.8) (19.4)

Net Cash Provided by Operating Activities (0.5) 9.9 3.2 17.2 22.4 46.0 44.2 48.7

Cash Flows from Investing Activities

Purchase of Property and Equipment (44.3) (20.6) (94.4) (14.7) (16.2) (17.1) (18.4) (19.9)

Restricted Cash 1.4 (7.2) (2.8) — — -

Others (16.9) (1.3) (6.4)

Net Cash Used in Investing Activities (59.8) (29.0) (103.7) (14.7) (16.2) (17.1) (18.4) (19.9)

Cash Flows from Financing Activities

Proceeds from Short-Term Borrowings 14.9 53.5 80.6

Payments of Short-Term Borrowings (37.6) (15.2) (10.4)—(4.0) (31.0) (27.0) (31.0)

Others 0.9 (3.4) 5.8 1.8 1.8 1.8 1.8 1.8

Net Cash Provided by Financing Activities (21.8) 34.9 76.0 1.8 (2.2) (29.2) (25.2) (29.2)

Effect of Exchange Rate Changes 2.2 (0.5

Net Change in Cash (79.9) 15.4 (24.4) 4.3 4.0 (0.2) 0.6 (0.4)

Cash and Cash Equivalents at Beginning of Year 181.1 101.2 116.6 92.2 96.5 100.6 100.3 100.9

Cash and Cash Equivalents at End of Year 101.2 116.6 92.2 96.5 100.6 100.3 100.9 100.5

Free Cash Flow1 (12.1) (4.4) (18.0) 2.5 6.2 29.0 25.8 28.8

% of Net Revenues (4.3)% (1.1)% (4.0)% 0.5% 1.0% 4.2% 3.4% 3.6%

Source: Company filings and management projections

1 | | Free cash flow = net cash provided by operating activities – non building-related capital expenditure |

Materials

Additional Materials

27

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

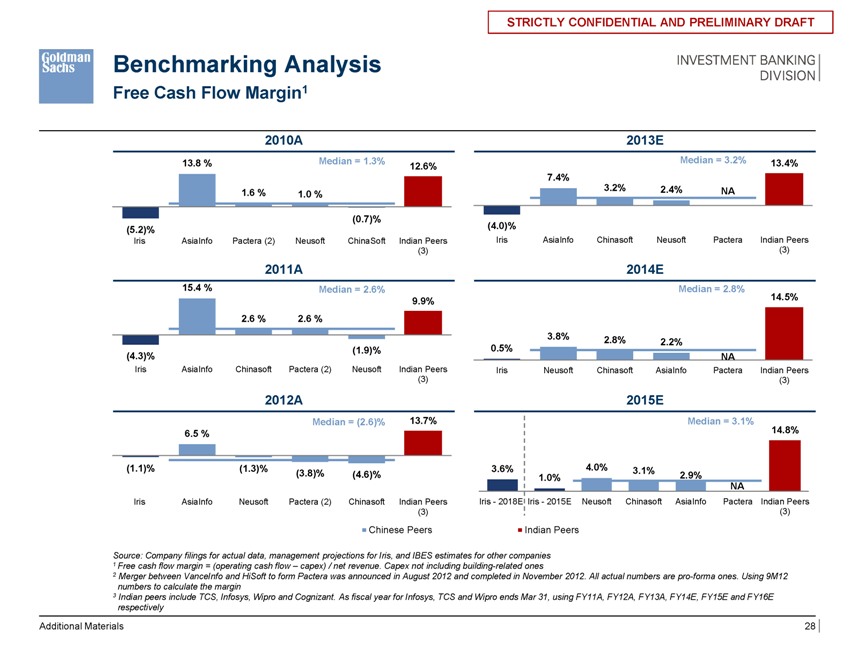

Benchmarking Analysis

Free Cash Flow Margin1

2010A 2013E

13.8 % Median = 1.3% 12.6% Median = 3.2% 13.4%

7.4%

1.6 % 1.0 % 3.2% 2.4% NA

(0.7)%

(5.2)% (4.0)%

Iris AsiaInfo Pactera (2) Neusoft ChinaSoft Indian Peers Iris AsiaInfo Chinasoft Neusoft Pactera Indian Peers

2011A 2014E

15.4 % Median = 2.6% Median = 2.8%

9.9% 14.5%

2.6 % 2.6 %

3.8% 2.8% 2.2%

(1.9)% 0.5%

(4.3)% NA

Iris AsiaInfo Chinasoft Pactera (2) Neusoft Indian Peers Iris Neusoft Chinasoft AsiaInfo Pactera Indian Peers

2012A 2015E

Median = (2.6)% 13.7% Median = 3.1%

6.5 % 14.8%

(1.1)% (1.3)% (3.8)% (4.6)% 3.6% 4.0% 3.1% 2.9%

1.0%

NA

Iris AsiaInfo Neusoft Pactera (2) Chinasoft Indian Peers Iris—2018E Iris—2015E Neusoft Chinasoft AsiaInfo Pactera Indian Peers

Chinese Peers Indian Peers

Source: Company filings for actual data, management projections for Iris, and IBES estimates for other companies

1 | | Free cash flow margin = (operating cash flow – capex) / net revenue. Capex not including building-related ones |

2 Merger between VanceInfo and HiSoft to form Pactera was announced in August 2012 and completed in November 2012. All actual numbers are pro-forma ones. Using 9M12 numbers to calculate the margin

3 Indian peers include TCS, Infosys, Wipro and Cognizant. As fiscal year for Infosys, TCS and Wipro ends Mar 31, using FY11A, FY12A, FY13A, FY14E, FY15E and FY16E respectively

Additional Materials

28

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

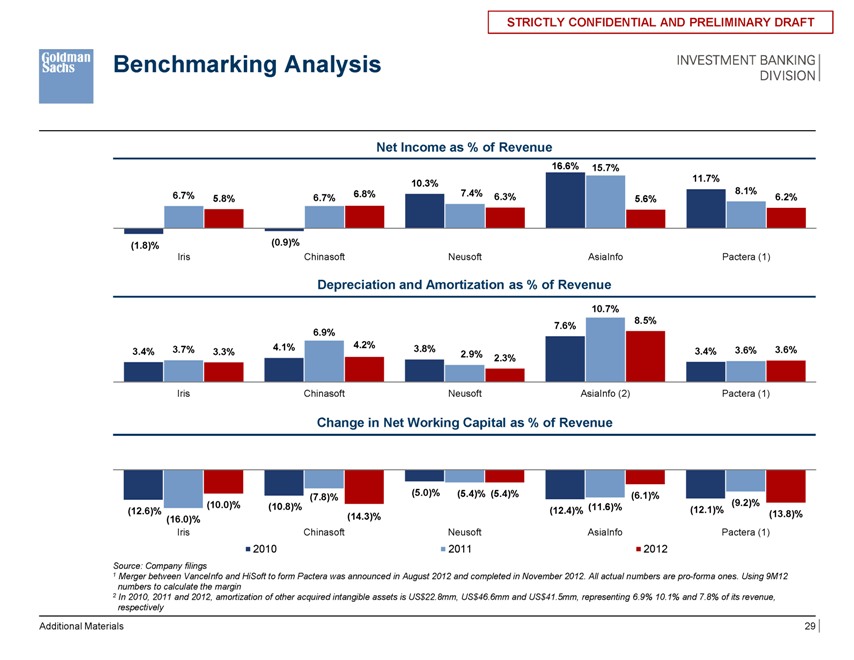

Benchmarking Analysis

Net Income as % of Revenue

16.6% 15.7%

10.3% 11.7%

6.7% 5.8% 6.7% 6.8% 7.4% 6.3% 5.6% 8.1% 6.2%

(1.8)% (0.9)%

Iris Chinasoft Neusoft AsiaInfo Pactera (1)

Depreciation and Amortization as % of Revenue

10.7%

7.6% 8.5%

6.9%

3.4% 3.7% 3.3% 4.1% 4.2% 3.8% 2.9% 3.4% 3.6% 3.6%

2.3%

Iris Chinasoft Neusoft AsiaInfo (2) Pactera (1)

Change in Net Working Capital as % of Revenue

6.7% 5.8% 6.7% 6.8% 10.3% 7.4% 6.3% 16.6% 15.7% 5.6% 11.7% 8.1% 6.2%

(7.8)% (5.0)% (5.4)% (5.4)% (6.1)%

(1.8)% (10.0)% (0.9)%(10.8)% (11.6)% (9.2)%

(12.6)% (16.0)% (14.3)% (12.4)% (12.1)% (13.8)%

Iris Chinasoft Neusoft AsiaInfo Pactera (1)

Iris Chinasoft Neusoft AsiaInfo Pactera (1)

2010 2011 2012

2010 2011 2012

Source: Company filings

1 Merger between VanceInfo and HiSoft to form Pactera was announced in August 2012 and completed in November 2012. All actual numbers are pro-forma ones. Using 9M12

numbers to calculate the margin

2 In 2010, 2011 and 2012, amortization of other acquired intangible assets is US$22.8mm, US$46.6mm and US$41.5mm, representing 6.9% 10.1% and 7.8% of its revenue,

respectively

Additional Materials

29

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

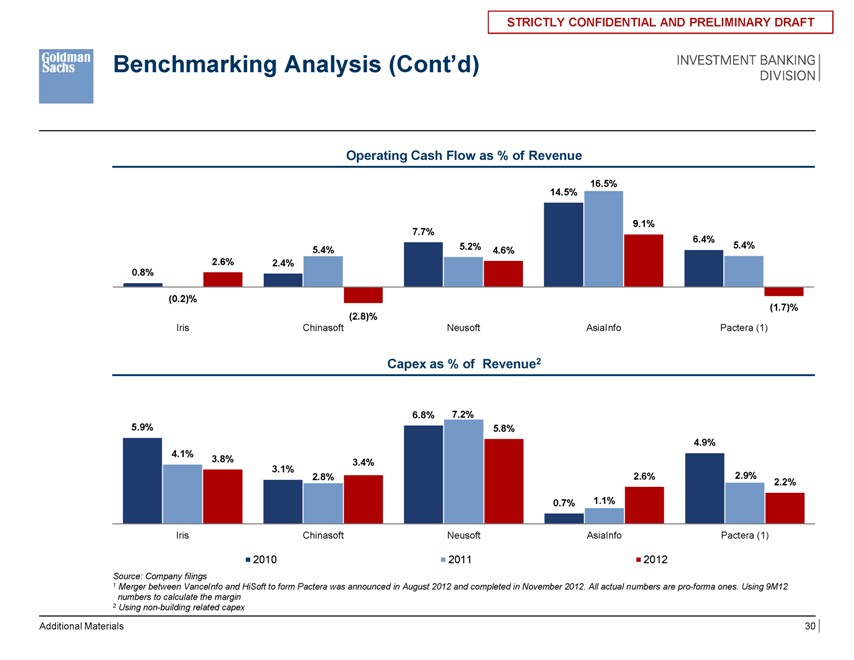

Benchmarking Analysis (Cont’d)

Operating Cash Flow as % of Revenue

16.5%

14.5%

9.1%

7.7%

6.4%

5.4% 5.2% 4.6% 5.4%

2.6% 2.4%

0.8%

(0.2)%

(1.7)%

(2.8)%

Iris Chinasoft Neusoft AsiaInfo Pactera (1)

Capex as % of Revenue2

6.8% 7.2%

5.9% 5.8%

4.9%

4.1%

3.8% 3.4%

3.1%

2.8% 2.6% 2.9% 2.2%

0.7% 1.1%

(1.8)% (0.9)

Iris Iris ChinasoftChinasoft NeNeusoftsoft AsiaInfoiaI f PacteraPactera(1)(1)

2010 2011 2012

Source: Company filings

1 Merger between VanceInfo and HiSoft to form Pactera was announced in August 2012 and completed in November 2012. All actual numbers are pro-forma ones. Using 9M12 numbers to calculate the margin

2 | | Using non-building related capex |

Additional Materials

30

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

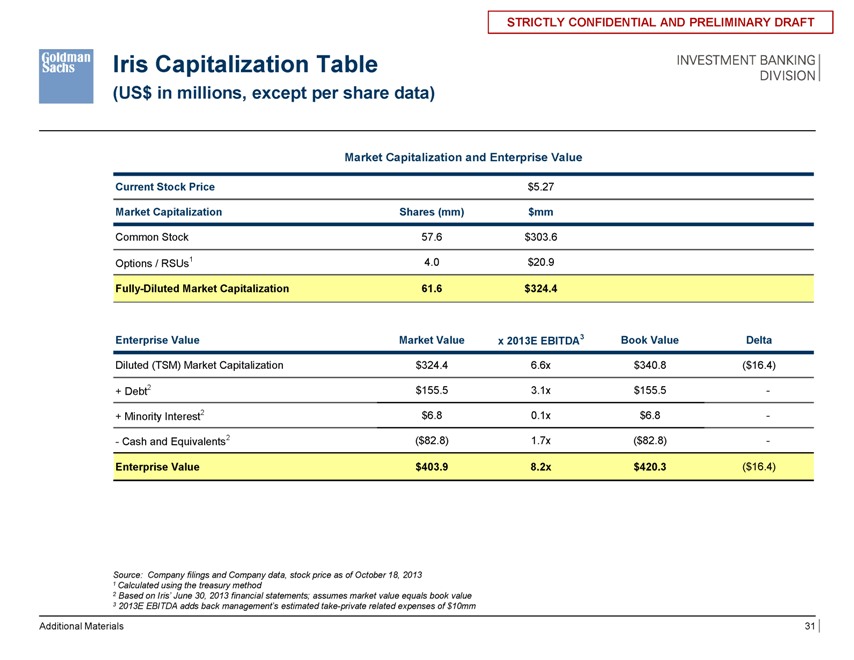

Iris Capitalization Table

(US$ in millions, except per share data)

Market Capitalization and Enterprise Value

Current Stock Price $5.27

Market Capitalization Shares (mm) $mm

Common Stock 57.6 $303.6

Options / RSUs1 4.0 $20.9

Fully-Diluted Market Capitalization 61.6 $324.4

Enterprise Value Market Value x 2013E EBITDA3 Book Value Delta

Diluted (TSM) Market Capitalization $324.4 6.6x $340.8 ($ 16.4)

+ Debt2 $155.5 3.1x $155.5 -

+ Minority Interest2 $6.8 0.1x $6.8 -

- Cash and Equivalents2 ($82.8) 1.7x ($82.8) -

Enterprise Value $403.9 8.2x $420.3 ($ 16.4)

Source: Company filings and Company data, stock price as of October 18, 2013

1 | | Calculated using the treasury method |

2 | | Based on Iris’ June 30, 2013 financial statements; assumes market value equals book value |

3 | | 2013E EBITDA adds back management’s estimated take-private related expenses of $10mm |

Additional Materials

31

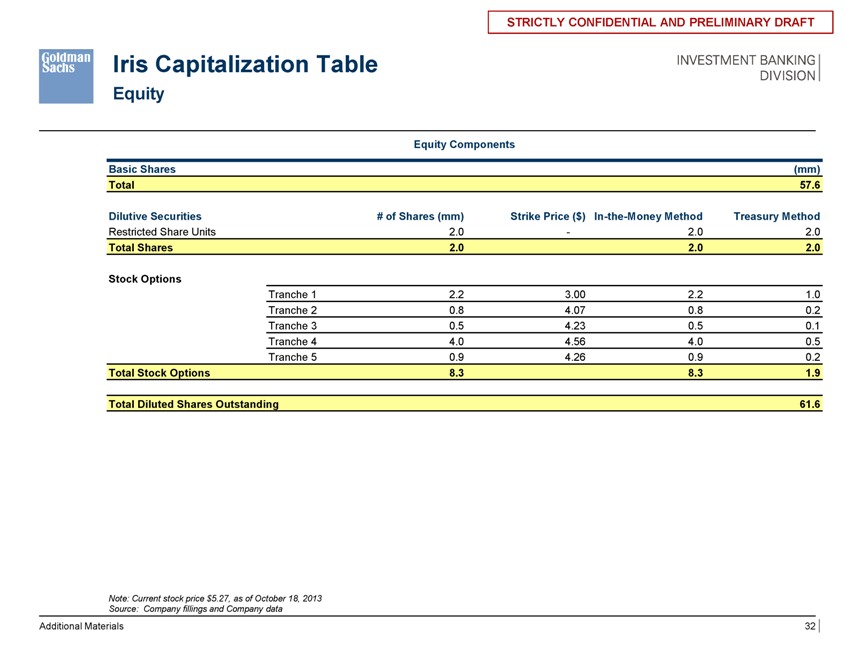

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

Iris Capitalization Table

Equity

Equity Components

Basic Shares (mm)

Total 57.6

Dilutive Securities # of Shares (mm) Strike Price ($) In-the-Money Method Treasury Method

Restricted Share Units 2.0 — 2.0 2.0

Total Shares 2.0 2.0 2.0

Stock Options

Tranche 1 2.2 3.00 2.2 1.0

Tranche 2 0.8 4.07 0.8 0.2

Tranche 3 0.5 4.23 0.5 0.1

Tranche 4 4.0 4.56 4.0 0.5

Tranche 5 0.9 4.26 0.9 0.2

Total Stock Options 8.3 8.3 1.9

Total Diluted Shares Outstanding 61.6

Note: Current stock price $5.27, as of October 18, 2013 Source: Company fillings and Company data

Additional Materials

32

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

Aries Profile

Overview of Aries

Aries is an alternative investment platform and an affiliate of China Asset Management (Hong Kong) Limited China Asset Management (Hong Kong) Limited is a wholly-owned subsidiary of China Asset Management Co., Ltd. and strategically develops the international investment business, offering a range of both traditional and alternative investment products

Overview of China Asset Management Co., Ltd.

China Asset Management Co., Ltd. is one of the leading asset management firms in China, with total assets under management and advisory amounted to US$56.71 billion as of March 31, 2013 China Asset Management Co., Ltd. has a highly skilled and experienced team of more than 150 investment and research professionals focusing on China and acts as investment manager for various clients and funds, including mutual funds, National Social Securities Fund, corporate annuities, QDII (Qualified Domestic Institutional Investor) funds and Exchange Traded Funds in China

Source: Company filings

Additional Materials

33

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

Edelweiss Profile

Overview

Edelweiss has been managing private equity investments in Mainland China through its subsidiary, China Edelweiss Investment Management Limited Its Fund I, SeaBright China Special Opportunities Fund

(“SOF I”) and Fund II, China Special Opportunities Fund, L.P. (“CSOF”) established in 2004 and 2008 respectively, with portfolio companies listed on stock exchanges in Hong Kong, Shenzhen and the U.S Edelweiss Private Equity launched its third fund, China Special Opportunities Fund III, L.P.

(“CSOF III”) in 2010 focusing on sectors with high growth potential in China Both CSOF and CSOF III hold Iris shares

SOF I

AUM: US$50mm

Focuses on companies based in China with strong growth prospects. Single investment size US$5mm to US$10mm with expected 25% average annual return

CSOF

AUM: US$200mm

Focuses on companies with strong growth prospect in China in telecom, agriculture, domestic consumption, service industries. Single investment size US$5mm to US$30mm with expected 25% average annual return

CSOF III

AUM: US$399mm

Focuses on investments in the domestic consumption, alternative energy, healthcare and financial services sectors

Management Members

Ling He, Chief Investment Officer

Joined Edelweiss in 2000. Prior to joining Edelweiss, she was Assistant to Chief Executive Officer of Edelweiss Securities Company Limited

Over 20 years of experience and knowledge in securities investment and fund management Cheng Liu, Managing Director

Joined Edelweiss in 2001. Prior to joining Edelweiss, he worked in the Asset Management Departments of China Edelweiss Securities and China Merchants Securities

Over 17 years of investment experience in the Hong Kong and China markets

Selected Portfolio Companies

Home of Health, China’s largest home medical appliances and equipment retail chain Global Market Group, an international trade-marketing corp China Outfitters Holdings, a designer and seller of menswear in China Beijing Jingneng Clean Energy, largest gas-fired cogeneration provider in Beijing, China Other investments include: China UnionPay Merchant Services, Zhejiang Beingmate Technology Industry & Trade, Harbin Sego Sports Franchise, Liaoning Wufeng Rice Industry Group, etc.

Source: Public information

Additional Materials

34

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

Appendix B: Comparison of Selected Companies and Precedent Transactions

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

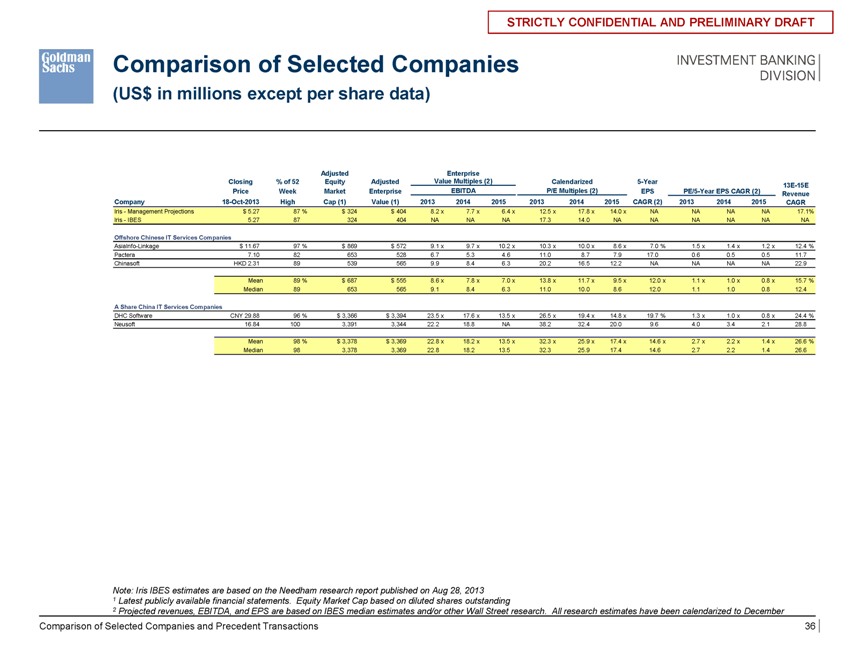

Comparison of Selected Companies

(US$ in millions except per share data)

Adjusted Enterprise

Closing % of 52 Equity Adjusted Value Multiples (2) Calendarized 5-Year 13E-15E

Price Week Market Enterprise EBITDA P/E Multiples (2) EPS PE/5-Year EPS CAGR (2) Revenue

Company 18-Oct-2013 High Cap (1) Value (1) 2013 2014 2015 2013 2014 2015 CAGR (2) 2013 2014 2015 CAGR

Iris—Management Projections $ 5.27 87 % $ 324 $ 404 8.2 x 7.7 x 6.4 x 12.5 x 17.8 x 14.0 x NA NA NA NA 17.1%

Iris—IBES 5.27 87 324 404 NA NA NA 17.3 14.0 NA NA NA NA NA NA

Offshore Chinese IT Services Companies

AsiaInfo-Linkage $ 11.67 97 % $ 869 $ 572 9.1 x 9.7 x 10.2 x 10.3 x 10.0 x 8.6 x 7.0 % 1.5 x 1.4 x 1.2 x 12.4 %

Pactera 7.10 82 653 528 6.7 5.3 4.6 11.0 8.7 7.9 17.0 0.6 0.5 0.5 11.7

Chinasoft HKD 2.31 89 539 565 9.9 8.4 6.3 20.2 16.5 12.2 NA NA NA NA 22.9

Mean 89 % $ 687 $ 555 8.6 x 7.8 x 7.0 x 13.8 x 11.7 x 9.5 x 12.0 x 1.1 x 1.0 x 0.8 x 15.7 %

Median 89 653 565 9.1 8.4 6.3 11.0 10.0 8.6 12.0 1.1 1.0 0.8 12.4

A Share China IT Services Companies

DHC Software CNY 29.88 96 % $ 3,366 $ 3,394 23.5 x 17.6 x 13.5 x 26.5 x 19.4 x 14.8 x 19.7 % 1.3 x 1.0 x 0.8 x 24.4 %

Neusoft 16.84 100 3,391 3,344 22.2 18.8 NA 38.2 32.4 20.0 9.6 4.0 3.4 2.1 28.8

Mean 98 % $ 3,378 $ 3,369 22.8 x 18.2 x 13.5 x 32.3 x 25.9 x 17.4 x 14.6 x 2.7 x 2.2 x 1.4 x 26.6 %

Median 98 3,378 3,369 22.8 18.2 13.5 32.3 25.9 17.4 14.6 2.7 2.2 1.4 26.6

Note: Iris IBES estimates are based on the Needham research report published on Aug 28, 2013

1 | | Latest publicly available financial statements. Equity Market Cap based on diluted shares outstanding |

2 Projected revenues, EBITDA, and EPS are based on IBES median estimates and/or other Wall Street research. All research estimates have been calendarized to December

Comparison of Selected Companies and Precedent Transactions

36

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

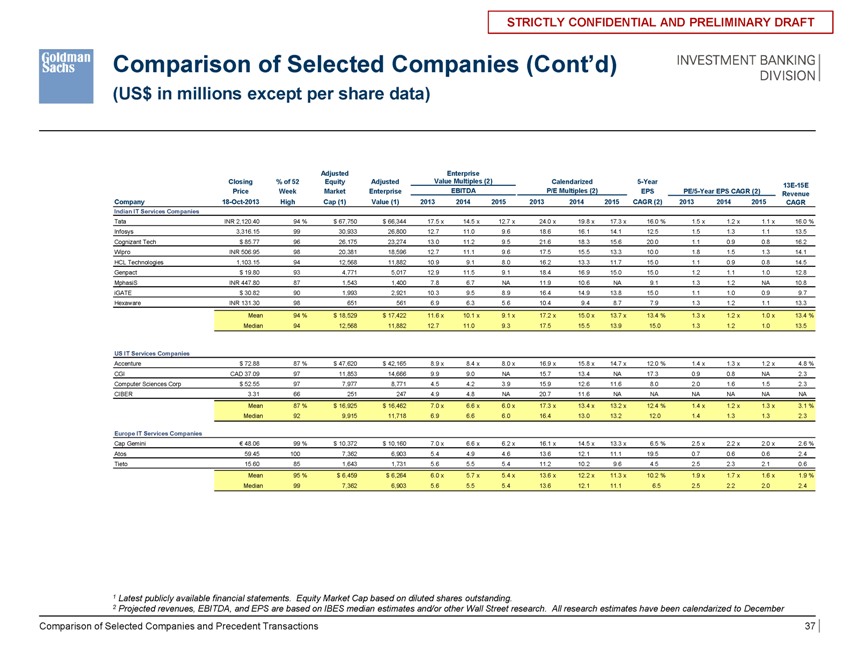

Comparison of Selected Companies (Cont’d)

(US$ in millions except per share data)

Adjusted Enterprise

Closing % of 52 Equity Adjusted Value Multiples (2) Calendarized 5-Year 13E-15E

Price Week Market Enterprise EBITDA P/E Multiples (2) EPS PE/5-Year EPS CAGR (2) Revenue

Company 18-Oct-2013 High Cap (1) Value (1) 2013 2014 2015 2013 2014 2015 CAGR (2) 2013 2014 2015 CAGR

Indian IT Services Companies

Tata INR 2,120.40 94 % $ 67,750 $ 66,344 17.5 x 14.5 x 12.7 x 24.0 x 19.8 x 17.3 x 16.0 % 1.5 x 1.2 x 1.1 x 16.0 %

Infosys 3,316.15 99 30,933 26,800 12.7 11.0 9.6 18.6 16.1 14.1 12.5 1.5 1.3 1.1 13.5

Cognizant Tech $ 85.77 96 26,175 23,274 13.0 11.2 9.5 21.6 18.3 15.6 20.0 1.1 0.9 0.8 16.2

Wipro INR 506.95 98 20,381 18,596 12.7 11.1 9.6 17.5 15.5 13.3 10.0 1.8 1.5 1.3 14.1

HCL Technologies 1,103.15 94 12,568 11,882 10.9 9.1 8.0 16.2 13.3 11.7 15.0 1.1 0.9 0.8 14.5

Genpact $ 19.80 93 4,771 5,017 12.9 11.5 9.1 18.4 16.9 15.0 15.0 1.2 1.1 1.0 12.8

MphasiS INR 447.80 87 1,543 1,400 7.8 6.7 NA 11.9 10.6 NA 9.1 1.3 1.2 NA 10.8

iGATE $ 30.82 90 1,993 2,921 10.3 9.5 8.9 16.4 14.9 13.8 15.0 1.1 1.0 0.9 9.7

Hexaware INR 131.30 98 651 561 6.9 6.3 5.6 10.4 9.4 8.7 7.9 1.3 1.2 1.1 13.3

Mean 94 % $ 18,529 $ 17,422 11.6 x 10.1 x 9.1 x 17.2 x 15.0 x 13.7 x 13.4 % 1.3 x 1.2 x 1.0 x 13.4 %

Median 94 12,568 11,882 12.7 11.0 9.3 17.5 15.5 13.9 15.0 1.3 1.2 1.0 13.5

US IT Services Companies

Accenture $ 72.88 87 % $ 47,620 $ 42,165 8.9 x 8.4 x 8.0 x 16.9 x 15.8 x 14.7 x 12.0 % 1.4 x 1.3 x 1.2 x 4.8 %

CGI CAD 37.09 97 11,853 14,666 9.9 9.0 NA 15.7 13.4 NA 17.3 0.9 0.8 NA 2.3

Computer Sciences Corp $ 52.55 97 7,977 8,771 4.5 4.2 3.9 15.9 12.6 11.6 8.0 2.0 1.6 1.5 2.3

CIBER 3.31 66 251 247 4.9 4.8 NA 20.7 11.6 NA NA NA NA NA NA

Mean 87 % $ 16,925 $ 16,462 7.0 x 6.6 x 6.0 x 17.3 x 13.4 x 13.2 x 12.4 % 1.4 x 1.2 x 1.3 x 3.1 %

Median 92 9,915 11,718 6.9 6.6 6.0 16.4 13.0 13.2 12.0 1.4 1.3 1.3 2.3

Europe IT Services Companies

Cap Gemini € 48.06 99 % $ 10,372 $ 10,160 7.0 x 6.6 x 6.2 x 16.1 x 14.5 x 13.3 x 6.5 % 2.5 x 2.2 x 2.0 x 2.6 %

Atos 59.45 100 7,362 6,903 5.4 4.9 4.6 13.6 12.1 11.1 19.5 0.7 0.6 0.6 2.4

Tieto 15.60 85 1,643 1,731 5.6 5.5 5.4 11.2 10.2 9.6 4.5 2.5 2.3 2.1 0.6

Mean 95 % $ 6,459 $ 6,264 6.0 x 5.7 x 5.4 x 13.6 x 12.2 x 11.3 x 10.2 % 1.9 x 1.7 x 1.6 x 1.9 %

Median 99 7,362 6,903 5.6 5.5 5.4 13.6 12.1 11.1 6.5 2.5 2.2 2.0 2.4

1 | | Latest publicly available financial statements. Equity Market Cap based on diluted shares outstanding. |

2 Projected revenues, EBITDA, and EPS are based on IBES median estimates and/or other Wall Street research. All research estimates have been calendarized to December

Comparison of Selected Companies and Precedent Transactions

37

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

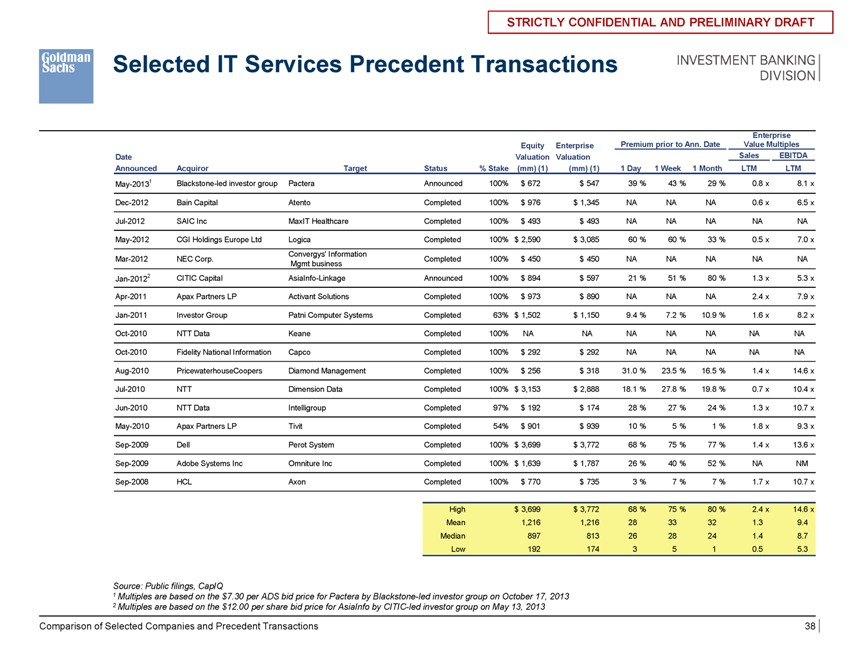

Selected IT Services Precedent Transactions

Enterprise

Equity Enterprise Premium prior to Ann. Date Value Multiples

Date Valuation Valuation Sales EBITDA

Announced Acquiror Target Status % Stake (mm) (1) (mm) (1) 1 Day 1 Week 1 Month LTM LTM

May-20131 Blackstone-led investor group Pactera Announced 100% $ 672 $ 547 39 % 43 % 29 % 0.8 x 8.1 x

Dec-2012 Bain Capital Atento Completed 100% $ 976 $ 1,345 NA NA NA 0.6 x 6.5 x

Jul-2012 SAIC Inc MaxIT Healthcare Completed 100% $ 493 $ 493 NA NA NA NA NA

May-2012 CGI Holdings Europe Ltd Logica Completed 100% $ 2,590 $ 3,085 60 % 60 % 33 % 0.5 x 7.0 x

Convergys’ Information

Mar-2012 NEC Corp. Completed 100% $ 450 $ 450 NA NA NA NA NA

Mgmt business

Jan-20122 CITIC Capital AsiaInfo-Linkage Announced 100% $ 894 $ 597 21 % 51 % 80 % 1.3 x 5.3 x

Apr-2011 Apax Partners LP Activant Solutions Completed 100% $ 973 $ 890 NA NA NA 2.4 x 7.9 x

Jan-2011 Investor Group Patni Computer Systems Completed 63% $ 1,502 $ 1,150 9.4 % 7.2 % 10.9 % 1.6 x 8.2 x

Oct-2010 NTT Data Keane Completed 100% NA NA NA NA NA NA NA

Oct-2010 Fidelity National Information Capco Completed 100% $ 292 $ 292 NA NA NA NA NA

Aug-2010 PricewaterhouseCoopers Diamond Management Completed 100% $ 256 $ 318 31.0 % 23.5 % 16.5 % 1.4 x 14.6 x

Jul-2010 NTT Dimension Data Completed 100% $ 3,153 $ 2,888 18.1 % 27.8 % 19.8 % 0.7 x 10.4 x

Jun-2010 NTT Data Intelligroup Completed 97% $ 192 $ 174 28 % 27 % 24 % 1.3 x 10.7 x

May-2010 Apax Partners LP Tivit Completed 54% $ 901 $ 939 10 % 5 % 1 % 1.8 x 9.3 x

Sep-2009 Dell Perot System Completed 100% $ 3,699 $ 3,772 68 % 75 % 77 % 1.4 x 13.6 x

Sep-2009 Adobe Systems Inc Omniture Inc Completed 100% $ 1,639 $ 1,787 26 % 40 % 52 % NA NM

Sep-2008 HCL Axon Completed 100% $ 770 $ 735 3 % 7 % 7 % 1.7 x 10.7 x

High $ 3,699 $ 3,772 68 % 75 % 80 % 2.4 x 14.6 x

Mean 1,216 1,216 28 33 32 1.3 9.4

Median 897 813 26 28 24 1.4 8.7

Low 192 174 3 5 1 0.5 5.3

Source: Public filings, CapIQ

1 | | Multiples are based on the $7.30 per ADS bid price for Pactera by Blackstone-led investor group on October 17, 2013 |

2 | | Multiples are based on the $12.00 per share bid price for AsiaInfo by CITIC-led investor group on May 13, 2013 |

Comparison of Selected Companies and Precedent Transactions

38

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

Appendix C: WACC Calculation

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

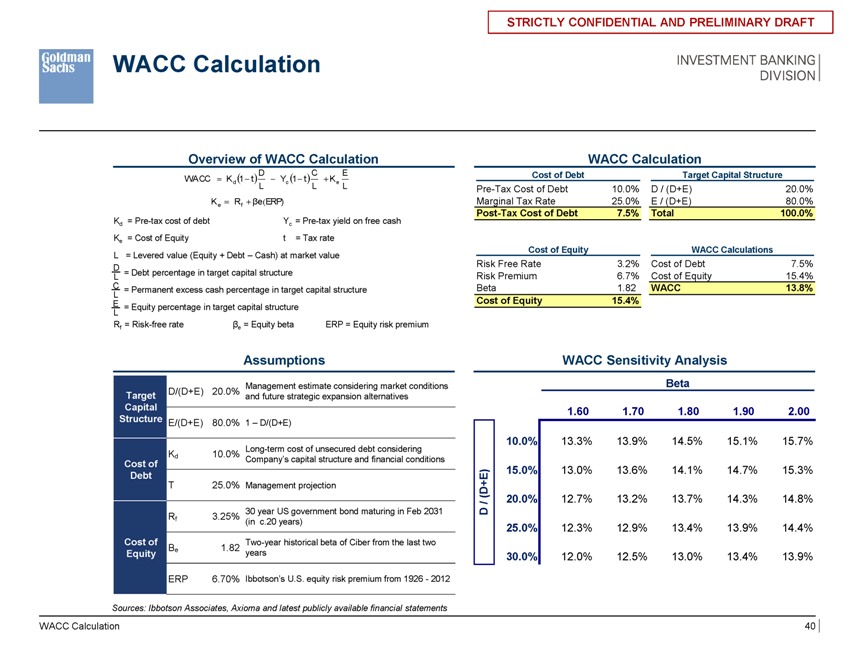

WACC Calculation

Overview of WACC Calculation

WACC ? Kd ?1??t??D ??Yc ?1??t??C ??Ke E

L L L

Ke ??Rf ???e?ERP)

Kd = Pre-tax cost of debt Yc = Pre-tax yield on free cash

Ke = Cost of Equity t = Tax rate

L = Levered value (Equity + Debt – Cash) at market value

DL = Debt percentage in target capital structure

C = Permanent excess cash percentage in target capital structure

L

E = Equity percentage in target capital structure

L

Rf = Risk-free rate ?e = Equity beta ERP = Equity risk premium

WACC Calculation

Cost of Debt Target Capital Structure

Pre-Tax Cost of Debt 10.0% D / (D+E) 20.0%

Marginal Tax Rate 25.0% E / (D+E) 80.0%

Post-Tax Cost of Debt 7.5% Total 100.0%

Cost of Equity WACC Calculations

Risk Free Rate 3.2% Cost of Debt 7.5%

Risk Premium 6.7% Cost of Equity 15.4%

Beta 1.82 WACC 13.8%

Cost of Equity 15.4%

Assumptions

D/(D+E) 20.0% Management estimate considering market conditions

Target and future strategic expansion alternatives

Capital

Structure E/(D+E) 80.0% 1 – D/(D+E)

Long-term cost of unsecured debt considering

Cost of Kd 10.0% Company’s capital structure and financial conditions

Debt

T 25.0% Management projection

30 year US government bond maturing in Feb 2031

Rf 3.25% (in c.20 years)

Cost of Two-year historical beta of Ciber from the last two

?e 1.82

Equity years

ERP 6.70% Ibbotson’s U.S. equity risk premium from 1926—2012

WACC Sensitivity Analysis

Beta

D / (D+E)

$0.14 1.60 1.70 1.80 1.90 2.00

10.0% 13.3% 13.9% 14.5% 15.1% 15.7%

15.0% 13.0% 13.6% 14.1% 14.7% 15.3%

20.0% 12.7% 13.2% 13.7% 14.3% 14.8%

25.0% 12.3% 12.9% 13.4% 13.9% 14.4%

30.0% 12.0% 12.5% 13.0% 13.4% 13.9%

Sources: Ibbotson Associates, Axioma and latest publicly available financial statements

WACC Calculation

40

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

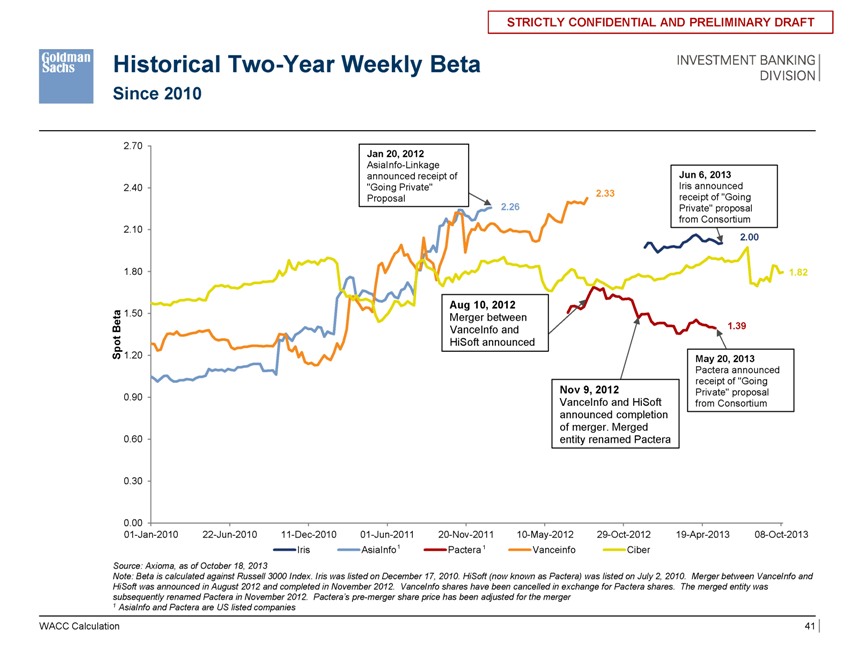

Historical Two-Year Weekly Beta

Since 2010

Jan 20, 2012

AsiaInfo-Linkage announced receipt of “Going Private” Proposal

Jun 6, 2013

Iris announced receipt of “Going Private” proposal from Consortium

Aug 10, 2012

Merger between

VanceInfo and

HiSoft announced

Nov 9, 2012

VanceInfo and HiSoft announced completion of merger. Merged entity renamed Pactera

May 20, 2013

Pactera announced receipt of “Going Private” proposal from Consortium

2.70 2.40 2.10 1.80 Beta 1.50 t po S 1.20 0.90 0.60 0.30 0.00

01-Jan-2010 22-Jun-2010 11-Dec-2010 01-Jun-2011 20-Nov-2011 10-May-2012 29-Oct-2012 19-Apr-2013 08-Oct-2013 Iris AsiaInfo1 Pactera 1 Vanceinfo Ciber

2.26 2.33 1.39 1.82 2.00

Source: Axioma, as of October 18, 2013

Note: Beta is calculated against Russell 3000 Index. Iris was listed on December 17, 2010. HiSoft (now known as Pactera) was listed on July 2, 2010. Merger between VanceInfo and HiSoft was announced in August 2012 and completed in November 2012. VanceInfo shares have been cancelled in exchange for Pactera shares. The merged entity was subsequently renamed Pactera in November 2012. Pactera’s pre-merger share price has been adjusted for the merger

1 | | AsiaInfo and Pactera are US listed companies |

WACC Calculation

41

STRICTLY CONFIDENTIAL AND PRELIMINARY DRAFT

INVESTMENT BANKING DIVISION