Anpulo Food, Inc.

Hangkong Road, Xiangfeng Town,

Laifeng County, Hubei 445700, China

Via EDGAR

Ryan Adams

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

Re: Anpulo Food, Inc.

Registration Statement on Form S-1

Filed October 31, 2013

File No. 333-192006

Dear Mr. Adams:

We hereby submit the responses of Anpulo Food, Inc. (the “Company”) to the comments of the staff of the Division of Corporation Finance (the “Staff”) contained in your letter, dated November 27, 2013, to Wenping Luo of the Company in regard to the above-referenced Registration Statement on Form S-1 filed on October 31, 2013, as amended (“Form S-1”).

For convenience of reference, each Staff comment contained in your letter is reprinted below in italics, numbered to correspond with the paragraph numbers assigned in your letter, and is followed by the corresponding response of the Company. References herein to page numbers are to the page numbers in Amendment No. 1 to the Form S-1 (“Amendment No. 1”), filed with the Securities and Exchange Commission on January 2, 2014. Unless the context indicates otherwise, references in this letter to “we,” “us” and “our” refer to the Company on a consolidated basis. Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in Amendment No.1, as amended by the amendment(s).

General

1. Please provide us your analysis in support of the characterization of the transaction being registered as a secondary offering, rather than a primary offering. Refer to Securities Act Rules Compliance & Disclosure Interpretation 612.09 for guidance.

Response: We consider that this offering is a secondary offering and selling shareholders are offering shares on their own behalf because there has been a genuine exchange of consideration when the selling shareholders received the shares being offered.

On October 30, 2013, the selling shareholders received the shares being offered by this prospectus in a share exchange transaction where each of the selling shareholders tendered for exchange the shares of Anpulo HK that they held. Among the 36 selling shareholders, six shareholders received their shares of Anpulo HK transferred from the Company’s officer and director, Mr. Wenping Luo, in exchange for the cancellation of Mr. Luo’s debts owed to them and, 30 shareholders received their shares from the Company as compensation for their services provided to the Company.

Shares-for-Debt Transaction

On October 21, 2013, Mr. Wenping Luo transferred 280 shares of the common stock of Anpulo HK that he owned, to six creditors in exchange for the cancellation of $5.6 million of debt that owed by Mr. Luo. These creditors subsequently exchanged each of their shares of the common stock of Anpulo HK for 100,000 ordinary shares of the Company in the share exchange occurred on October 30, 2013.

Share Grants to Employees

On October 21, 2013, Anpulo HK issued a total of 30 shares of its common stock to 30 of its employees as compensation for services rendered. Same as above, these employees subsequently exchange each of their shares of Anpulo HK for the 100,000 common shares of the Company in the share exchange occurred on October 30, 2013.

As described above, the circumstances under which the selling shareholders received the shares clearly demonstrate that there has been a genuine exchange of consideration when the selling shareholders received Anpulo HK shares and the ordinary shares of the Company being offered.

We consider it irrelevant that the selling shareholders received the shares being registered not long before this filing because registering part of their shares on the Company’s first registration statement was simply part of the bargained consideration in each case. In addition, none of the selling shareholders is in the business of underwriting securities.

Although there is currently no liquid trading market for our securities, taking all the factors into consideration as a whole, we believe that under this circumstance the 36 selling shareholders are offering shares in a true secondary offering and they are not acting as a conduit of the Company.

2. Please tell us whether the company is required to file this registration statement pursuant to a contractual obligation to the selling shareholders. If so, please revise your disclosure accordingly. If not, please explain why the company has filed the registration statement.

Response: There is no written registration rights agreement between the Company and the selling shareholders. However, in the case of the shares-for-debt transaction, it was the mutual understanding of both Mr. Wenping Luo and the six creditors that Mr. Luo would cause the Company to register the number of the Company’s shares held by the six creditors that the Company would have registered for Mr. Luo on the Company’s first registration statement as reward to Mr. Luo’s service to the Company. Also, in the case of share grants, it was the mutual understanding of both the Company and the employees that the Company would register a number of shares held by the employees on the Company’s first registration statement.

3. It appears that large portions of the registration statement are identical or substantially similar to periodic Exchange Act reports filed by Zhongpin Inc. We note, for example, that you have nearly identical business strategies, customer bases, competitive strengths, products sold and risk factors. We also note that you both characterize your retail operations as part of a “unique” business model. However, there is no reference in the filing to any relationship between the company and Zhongpin or the fact that Zhongpin would appear to be a competitor. Please provide us an explanation for the substantial disclosure similarities and revise your filing as appropriate.

Response: There is no relationship between the Company and Zhongpin and Zhongpin is not a direct competitor. We have revised our disclosure to clarify and clearly describe our operations, including business strategies, customer bases, competitive strengths, products sold.

4. It does not appear that a Form 8-K was filed within four business days following the closing of your acquisition of Anpulo HK. Please explain or file the appropriate Form 8- K to report this acquisition.

Response: We will file the current report on Form 8-K to incorporate the applicable disclosures on the Form S-1 to report this acquisition.

5. We note your statement in the risk factors section on page 23, in the risk factor titled “We may be classified as a “resident enterprise” for PRC enterprise income tax purposes . . .”, that you do not currently consider your company to be a PRC resident enterprise. Please file a tax opinion of counsel related to this disclosure or explain why you are not required to do so.

Response: We will file a tax opinion of our PRC counsel regarding this matter.

6. Please update your financial statements to comply with Rule 8-08 of Regulation S-X.

Response: We have updated to include our financial statements for the quarter ended September 30, 2013.

7. Please note that, in your next annual filing, you will need to provide the internal control assessments required by Item 308 of Regulation S-K unless management does not have the ability to assess certain aspects of the internal control structure. In your next annual report following this Form S-1, management must conclude whether Internal Control over Financial Reporting is effective or not, taking into consideration any scope limitation. In this regard, we note that a reverse acquisition between an issuer and a private operating company may qualify as a scope exception when it is not possible to conduct an the assessment of the private operating company or accounting acquirer’s ICFR in the period between the consummation date of a reverse acquisition and the date of management’s assessment. As such, if you determine that you are not able to complete the internal control assessments due to the reverse acquisition, your internal control assessments should so state, and include a discussion of the barriers to performing the assessment. See the Division of Corporation Finance’s C&DIs for Regulation S-K, Question 215.02.

Response: We will provide the internal control assessments required by Item 308 of Regulation S-K or include a discussion of the barriers to performing the assessment in our next annual filing.

8. Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering.

Response: We did not engage, and did not authorize anyone on our behalf to engage, in written communications, as defined in Rule 405 under the Securities Act. Also, we did not publish or distribute by any broker or dealer that is participating or will participate in our offering.

Registration Statement Cover Page

9. Please explain the reference to Rule 416(a) in the Calculation of Registration Fee table.

Response: We referenced to Rule 416(a) because pursuant to Rule 416(a) this registration statement on Form S-1 purports to register the additional securities to be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. Also, we believe that the Calculation of Registration Fee table is an appropriate and commonly seen place to include such information.

Prospectus Cover Page

10. We note your disclosure that the selling shareholders “will offer and sell our ordinary shares at a price as negotiated in private transactions until a public market emerges for our ordinary shares and, thereafter, at prevailing market prices.” Please revise to state the price at which selling shareholders will offer and sell your ordinary shares until your shares are quoted on the OTCBB. Similarly, revise the fee table and the applicable statement on page 28. Refer to Item 501(b)(3) of Regulation S-K.

Response: We have revised to state that the selling shareholders will offer and sell our ordinary shares at $0.20 per share until our shares are quoted on the OTC BB.

Third Party Data

11. Please remove the disclaimer that investors are “cautioned not to give undue weight to these estimates.”

Response: We have removed the referenced disclaimer.

Overview, page 4

12. We note your statement that you are focused on “targeting China’s middle class.” Please reconcile this with the disclosure on pages 6, 32 and 36 that you are “targeting middle and high end market.”

Response: We have revised to reconcile and clarify that our products are targeting middle and high income class.

13. Please revise to eliminate non-substantiable statements or other marketing language, including statements such as those in this section that you “use state-of-the-art equipment,” that you have business alliances with “leading supermarket chains,” that you have achieved technological “superiority”, and similar statements elsewhere in the prospectus.

Response: We have revised to eliminate the discussed statements and similar statements throughout the prospectus.

14. In one of the opening paragraphs of the summary prospectus, please provide your revenues and net income or loss for your last fiscal year and most recent interim period.

Response: We have revised to provide on page 4 our revenues and net income or loss for the past two fiscal years and most recent interim period.

15. We note your disclosure that your wholesale customers include “eight fast food companies in China, 16 processing factories and 51 school cafeterias, factory canteens, hotels, army bases, hospitals and government departments.” Please revise to disclose whether you have any contracts with these businesses.

Response: We have contracts with some of our wholesale customers but not all of them. Like many meat product distributors in China, our sales are made pursuant to supply contracts with undetermined sales price floating with the market price or spot orders that often are not documented with written contracts. Each sale, initiated in whichever form, is substantiated with product delivery forms, customer’s signature on the delivery form upon receipt of products and proof of payment. We have revised our risk factor to highlight the risk of doing business with customers without contracts.

We had a supply contract with our biggest customer Wuhan Zhongbai Chain Warehouse Supermarket Co., Ltd. in 2012. Because the contract only provided for the supply for 2012 and is not a continuing contract on which the Company relies to sell a major part of its products, we do not consider that the contract is required to be filed with this prospectus under Item 601(a)(10) of Regulation S-K.

Our History and Corporate Structure, page 4

16. It appears that prior to October 30, 2013, you had no assets and had generated no revenue. Please revise the second sentence in this section accordingly.

Response: We have revised to clarify that the company had no assets or revenue from its inception on July 30, 2010 to October 30, 2013.

Our Industry, page 5

17. We note your reliance on a 2010 report by the United States Department of Agriculture.

Please explain why you did not use a more current report.

Response: We have revised to include information in the November 2013 report by the United States Department of Agriculture.

Competitive Strength, page 5

18. We note your statement that your “geographic location, Laifeng county, and its neighboring counties, are rich in pig farming, which provides us reliable sources to grow and expand; Laifeng County, along with its neighboring counties, are also rich in pig farming, which provides us reliable sources to grow and expand.” Please revise to avoid unnecessary repetition.

Response: We have revised to remove the redundant sentence.

19. Please revise to state as a belief and provide a basis for the statements that “[t]he ‘Anpulo’ and ‘Linghaotuzhu’ brand names are well recognized throughout [y]our target markets in Hubei Province, China,” and that your brand products are “free from drug residue, hormone and heavy metals residues, are believed to be safer, better tastes, better quality by consumers,” here, and that your Linghaotuzhu brand products “are perceived by consumers to be better taste and higher quality” than competitors’ products on page 6. Please provide us with copies of any reports or other documentation in support of these and similar assertions regarding your competitive strengths contained in this section.’

Response: We have revised to state as our management’s belief that the “Anpulo” brand name is well recognized throughout our target markets in Hubei Province, China because our management and employees have received repeated and extensive feedbacks from our retail and wholesale customers that have led to our management’s belief. In addition, our “Anpulo” brand name was recognized as “Well-Known Tradename” by Enshi Tujia and Miao Autonomous Prefecture and, our “Anpulo” branded chilled pork and frozen pork products were certified as a “Hubei Province Famous Brand Product.” We have revised to clarify that we believe our products are free from drug residue, hormone and heavy metals residue because our hogs are fed by local farmers with mountain grown herbs, fruits and crops, which are free from drug, hormone and heavy metals. We have revised to remove the statements that our products are believed to be safer, better tastes, better quality by consumers and that our products are perceived by consumers to be better taste and higher quality than competitors’ products.

Our Strategy, page 6

20. Please substantiate your statements regarding your “technological superiority.” In particular, please expand upon the discussion that you have “purchased state-of-the-art equipment and installed production lines with the most advanced technology in our processing plants” with specific examples.

Response: We have removed all of the references throughout the prospectus to our technological superiority, state-of-the-art equipment and most advanced technology in our processing plants.

Risk Factors, page 8

21. We note your disclosure on page 51 that you have over $14 million in debt obligations due in the next three years. Please revise to discuss the implications of this in an appropriate risk factor.

Response: We have revised to add a risk factor with respect to our over $14 million debt obligations due in the next three years.

22. As appropriate, please include risk factor disclosure regarding the lack of public company experience of your sole officer and director. Please also address his experience serving as a chief financial officer of a public company.

Response: We have revised to add a risk factor regarding the lack of public company experience of our management, including those appointed on December 1, 2013.

We utilize our exclusive network of branded stores and supermarket counters to sell, page 12

23. We note your statement that you “do not own or franchise any of the retail outfits.” In light of your disclosure that you have “38 branded stores,” please explain your ownership arrangements with these stores in your business section. Please also file any material agreements as may be appropriate.

Response: We have revised to clarify that our products are distributed through specialty boutique retail stores that are owned and operated by independent third parties. All these specialty retail stores share uniform interior decoration and layout designed by us. For these specialty retail stores, we provide operators with refrigerated showcases, signage, uniforms, labels and packaging, technical assistance, and permission to sell our products under our brand names. These independent operators agree to exclusively sell our products, and may sell other products only with our consent. These independent operators of the specialty boutique stores manage the business following our management guidelines and pricing policies. These independent operators are responsible for payment of their own taxes and government fees, leasing expenses, and other operating costs. We generate revenue from selling our products to these retail stores. We do not collect any commissions from these resellers.

We maintain exclusive distribution agreements with these specialty boutique stores. We will file a form of these agreements as an exhibit to the Form S-1.

The loss of any of our significant customers could reduce our revenues, page 12

24. We note your disclosure on page 40 that you have one customer who accounts for 10% or more of your revenues. Please revise this risk factor accordingly.

Response: We have revised our disclosure on page 13 to include the information of our 10% or more customer.

Our largest shareholder has significant influence over our management, page 13

25. We note your statement that “Mr. Wenping Luo, our founder, Chairman and Chief Executive Officer and our largest shareholder, along with his wife, beneficially owned approximately 74.8% of our outstanding common shares, and our other executive officers and directors collectively beneficially owned an additional 0.16% of our outstanding common shares.” Please revise to reconcile this with the disclosure on page 53 indicating that you only have one executive officer and director.

Response: In addition to Wenping Luo, Maochun Kang, who was appointed as our Chief Financial Officer on December 1, 2013, and Tao Yang, who was appointed as a director on the same day, own a total of 0.16% of our outstanding ordinary shares.

If we fail to develop and maintain an effective system of internal controls, page 13

26. Please revise to discuss the specific difficulties in establishing and maintaining effective disclosure controls and procedures and internal control over financial reporting with only one executive officer and director.

Response: On December 1, 2013, one individual was appointed as our Chief Financial Officer and, four individuals were each appointed as our directors, to expand and enhance our management team.

If we do not complete remigration of equity pledge with SAIC local branch, page 18

27. Please revise this risk factor to more clearly discuss what the impact would be on the company if you do not complete registration of the equity pledge with SAIC local branch. Please also revise here and in the business section to discuss the status of the process and your expectations regarding the timing of completion.

Response: We have revised this risk factor to include further discussion on the impact on the Company if we do not complete the equity pledge registration. We have also revised to discuss the status of the process and our expected timing of completion.

Determination of Offering Price, page 25

28. Once you have revised the cover page to disclose the fixed offering price of the ordinary shares, please revise this section to clarify how the offering price of these shares was determined. Refer to Item 505 of Regulation S-K. If material, please also disclose the price at which Anpulo HK’s common stock was sold in a private equity-for-debt transaction.

Response: We have revised to clarify how the offering price of the shares being registered on this Form S-1was determined.

Selling Shareholders, page 26

29. Please revise to discuss in greater detail the transactions by which the selling shareholders received their shares. In this regard, please revise to include the applicable dates of the private placements. Also, file as exhibits any material agreements regarding those transactions.

Response: The selling shareholders received their shares in the share exchange transaction closed on October 30, 2013. There was no private placements prior to the share exchange. We have revised to discuss in greater detail how the selling shareholders received their shares of Anpulo HK prior to the share exchange transaction.

Plan of Distribution, page 28

30. We note your statement that “[t]he selling shareholders may also resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.” Please revise to disclose that Rule 144 is currently unavailable to the selling shareholders and discuss how and when it might become available.

Response: We have revised to disclose that Rule 144 is currently unavailable to the selling shares and how and when it might become available.

31. We note your statement on page 29 that you estimate the costs of registration to amount to $127,000. Please reconcile this with your disclosure on page 59 that you expect the costs of issuance and distribution to be $75,400.

Response: We have revised to correct that the costs of issuance and distribution is $75,400.

32. Please revise to disclose that all of the selling shareholders may be deemed underwriters under the Securities Act.

Response: We previously stated in the Form S-1 that any selling shareholders who are affiliates of broker dealers that participate in the sale of the ordinary shares or interests therein may be deemed as underwriters within the meaning of Section 2(11) of the Securities Act. Other than the foregoing qualified circumstances, we do not consider the selling shareholders as underwriters under the Securities Act.

Description of Securities, page 30

Other Provisions, page 31

33. We note your statement that you urge investors “to read applicable British Virgin Islands law.” Please remove this statement and revise to summarize all material and relevant aspects of British Virgin Islands law as they may relate to investors. Refer to Instruction 2 to Item 202 of Regulation S-K.

Response: We have removed the discussed statement and summarized all of the material and relevant aspects of British Virgin Islands law as required under Item 202 of Regulation S-K.

Description of Business, page 31

Overview, page 32

34. Please revise to provide additional background information regarding the transaction with Anpulo HK. Please discuss, for example, at what point you identified this company as a potential target and began negotiating a transaction. We note in this regard that Mr. Luo controlled both companies prior to the share exchange. We also note, however, that he changed the name of the company to Anpulo Food, Inc. in February 2012 but that all subsequent Exchange Act reports, including the Form 10-K filed on September 9, 2013, included disclosure that the company had made no efforts to identify a possible business combination and there had not been any specific discussions with any potential business combination candidate regarding business opportunities for the company.

Response: Mr. Wenping Luo acquired control of Anpulo Food, Inc. in connection with the intention of management of Anpulo Laifeng to effect a reverse merger between Anpulo Laifeng and an U.S. reporting company. The management of Anpulo Laifeng did not make determination to proceed with the reverse merger until September 2013. Anpulo Food, Inc. did not identify Anpulo Laifeng as a potential target because the mere statement of a potential reverse merger between a specific operating company and a shell company, when such merger was no more than an intention or indefinite plan to the belief of Mr. Wenping Luo, may have the effect of conditioning market. We consider amending our prior Exchange Act reports to clarify that, we made efforts to identify a possible business combination and there had been discussions with potential business combination candidate, without mentioning the specific operating company.

Corporate History, page 33

35. Please explain why you alternately refer to the company in this section and elsewhere in the prospectus as “Laifeng Anpulo” and “Anpulo Laifeng.”

Response: We have revised to consistently use the term “Anpulo Laifeng” to refer to Laifeng Anpulo (Group) Food Development Co., Ltd.

Our Industry, page 35

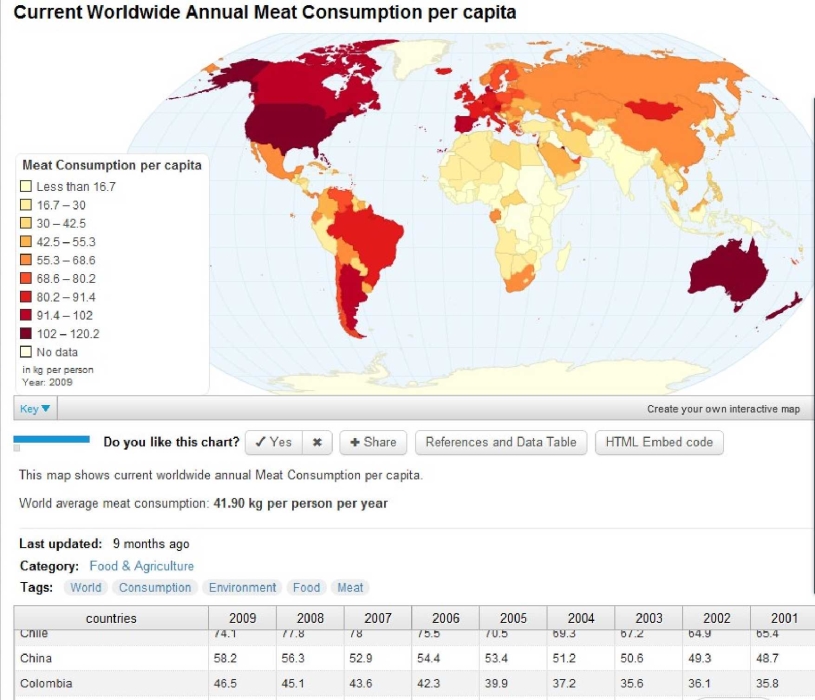

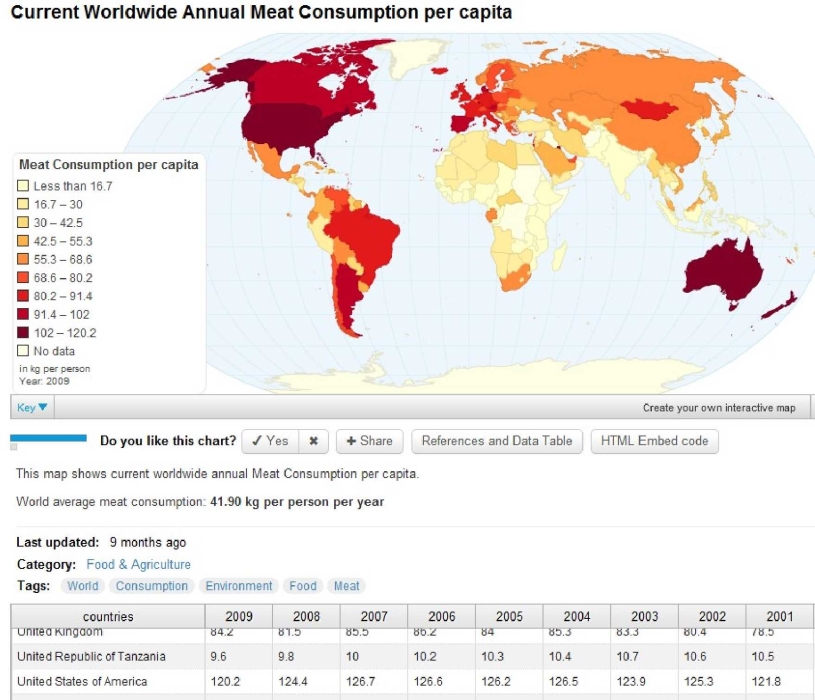

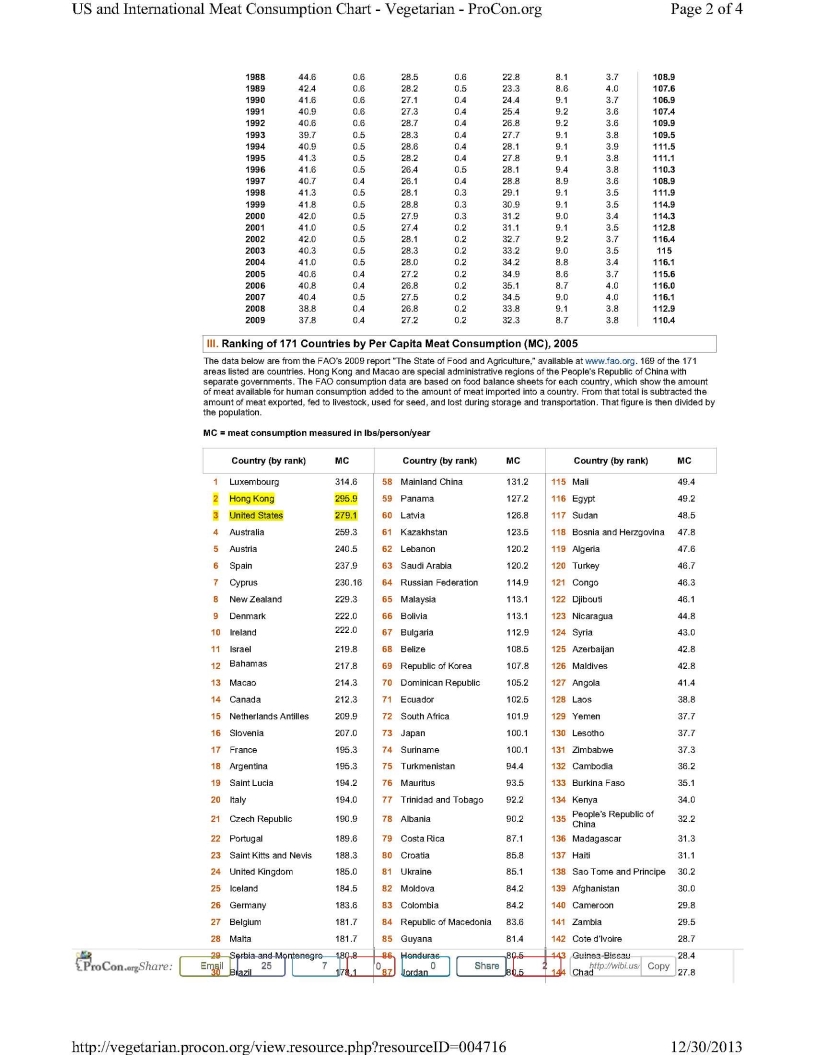

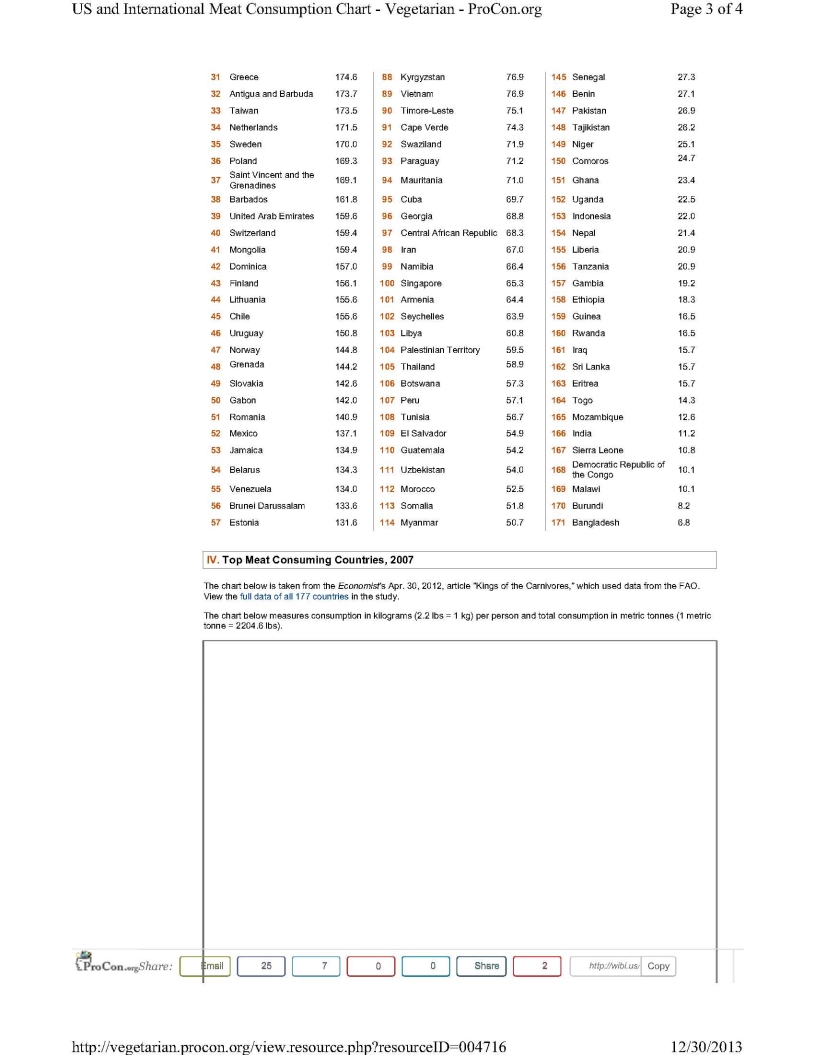

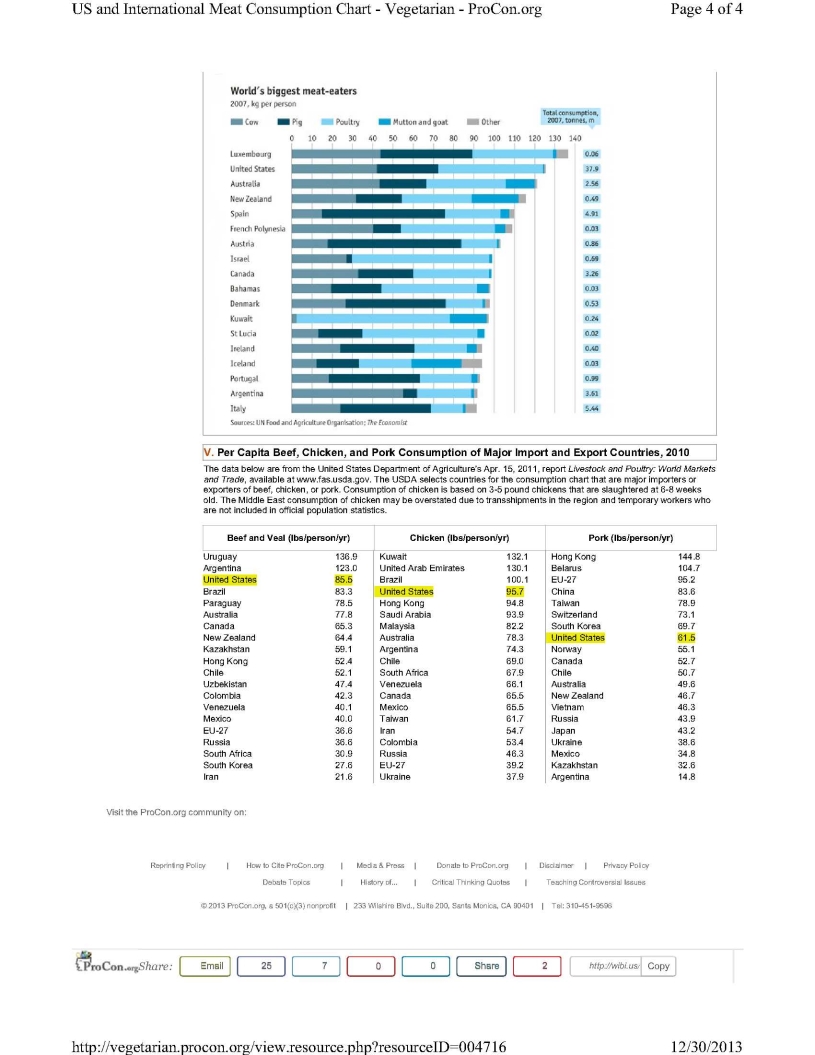

36. Please supplementally provide us with copies of the reports and other industry data in support of your industry disclosure in this section.

Response: We have revised to identify the source of our industry disclosure. We have also included copies of the reports and industry data as exhibits to this correspondence letter.

37. Please revise this section to clearly indicate whether your statements are being attributed to outside sources or are based on your own beliefs. For example, we note that the bullet points under the subheading “The Retail Meat Market” are not substantiated or expressed as a belief of management.

Response: We have revised to indicate whether our statements are attributed to outside sources or based on our own beliefs.

38. Please revise to provide a basis for your statement on page 36 that “consumer lifestyles in China's cities have become busier, people are finding that they have less time to prepare meals at home from fresh products alone.”

Response: We have revised to remove the referenced statement.

Competitive Strengths, page 36

39. Please revise the disclosure in the first paragraph on page 37 that your “management team comprises seasoned industry veterans with in-depth knowledge of customer trends and extensive relationships with industry participants in China” with the disclosure that you only have one executive and director who has fewer than 10 years of experience in the industry.

Response: We have revised to remove the discussed statement.

Our Strategies, page 37

40. Please revise to provide a basis for the statement that you have “leading logistics capabilities.” In this regard, please provide further detailing concerning your “integration and coordination of our transportation and warehouses, warehouse management, inventory and transportation control systems . . .” As it appears a large portion of your business is dependent on logistics, please explain in greater detail how these operations work. For example, please discuss whether you have a dedicated trucking fleet.

Response: We have revised to remove the reference to leading logistics capabilities and clarify that our logistics facilities principally comprise of one warehouse in each of Laifeng County, Enshi Tujia and Miao Autonomous Prefecture and Wuhan City in China, where our sales office are located, and a 12 temperature-controlled truck fleet. We regard our logistics capabilities a key to our business and therefore, our management intends to build more storage facilities to increase our logistic capabilities.

Our Products, page 38

41. We note your reference to “Item 1A. Risk Factors . . .” on page 39. Please revise to provide appropriate cross references here and throughout the filing. We note that there is no Item 1A in your prospectus. Please also correct similar cross references on pages 42 and 43.

Response: We have revised throughout the prospectus to include appropriate cross references to the “Risk Factors” section.

42. Please revise the last paragraph of this section to include a discussion of your suppliers. Discuss any material agreements with your suppliers and the general nature of your supply relationships.

Response: We have revised to include a discussion of our suppliers. Our suppliers are largely local pig farms and local farmers who raise one or two pigs in their backyards. The farmers ship the hogs to our slaughter house and we pay them on cash-on-delivery basis. We have contracts with a selective few of suppliers but not with other suppliers at large given to the nature of loosely managed businesses of small local farms and individual farmers. We are not dependent on any one particular supplier for a material portion of live native hogs and have no supplier that accounts for more than 10% of the entire supply.

Manufacturing and Production, page 39

43. We note your disclosure in the second paragraph of this section that “[a]s of October 30, 2013, we owned and operated one slaughterhouse in Laifeng County, Hubei . . .” Please reconcile this with the disclosure throughout this section referring to your multiple “slaughterhouses.”

Response: We have revised to correct that we own and operate one slaughterhouse in Laifeng County, Hubei and remove references to slaughterhouse in plurality.

44. We note your disclosure in this section regarding your “team of certified veterinarians.” In particular, we note your reference on page 40 to your “veterinarians and quality control staff.” Please clarify how many veterinarians you currently employ. Please also explain whether you count veterinarians as operating personnel, sales personnel, research and development personnel, or administrative personnel, as disclosed in your employees section on page 43.

Response: We have revised to clarify that we currently employ four certified veterinarians. We have disclosed the veterinarians in its own category in the section titled “Employees.”

Sales, Marketing and Distribution, page 40

45. Please identify the customer that accounted for 10% or more of your revenues and quantify more specifically the percentage of revenues this customer accounted for in your two most recently completed fiscal years.

Response: We have identified the only customer that accounted for 10% or more of our revenues and included the percentage of revenues this customer accounted for in our two most recently completed fiscal years.

Retail Operations, page 41

46. Please provide more detail regarding the nature of your retail operations. For example, please clarify what you mean by your statement that you sell products “through” branded stores. Please also clarify what you mean by the statement that Anpulo supermarket counters are “owned and operated by ourselves.” Please provide enough detail so that investors can understand the nature of your retail operations and how those operations generate revenue.

Response: We have revised to describe our retail operations in details on page 51. We have clarified the nature of the specialty retail stores and supermarket counters.

Research and Development, page 41

47. We note your disclosure that you launched 15 new products that were developed in your technology center and have over 30 new products under development. Please revise to discuss in greater detail the research and development costs associated with these new products, your anticipated time frame to complete development, and, if true, the need for future financing. Please also disclose whether you have any agreements with Huazhong Agricultural University and Hubei Normal University.

Response: We have revised to discuss the research and development costs associated with these new products. We are unable to decide the anticipated time frame to complete development. We have also disclosed that we require additional financing to continue these development projects.

Our agreements with Huzhong Agricultural University and Hubei Normal University, which were executed in March 2009, have been performed in whole when the research relating to the “Linhaotuzhu” meat was completed in mid-2011. Our collaboration with the two universities ended in 2011 after the project was completed.

Competition, page 42

48. Please provide a basis for your statement that you have “aggressive marketing and strong quality assurance programs . . .”

Response: We have revised to eliminate reference to “aggressive marketing and strong quality assurance programs” and clarify our competition strategies.

Description of Properties, page 43

49. It appears that you may own numerous properties which are not disclosed in this section.

We note your disclosure on page 39 concerning your slaughterhouse, or slaughterhouses, and your disclosure on page 40 concerning your multiple warehouses and sales offices. Please explain why these properties are not disclosed here.

Response: We have revised to clarify that we only have two physical properties. Our slaughterhouse, one sale office and one warehouse situate at our headquarter in Laifeng County. Also, our distribution center in Wuhan City contains one warehouse and one sale office.

Management’s Discussion and Analysis, page 44

Results of Operations, page 44

50. We note that your discussion of operating results does not specifically address cost of sales. Rather, you have combined the cost of sales discussion with the discussion of changes in gross profit. In this regard, we believe your gross profit discussion should be presented separately from your analysis of cost of sales. See Instruction 4 to Item 303(a) of Regulation S-K.

Response: We have revised to separately discuss cost of sales and gross profit.

51. You indicate that the increase in general and administrative expenses was primarily the result of the new opening of your sales office in Wuhan City. In this regard, please expand your disclosures to discuss, in detail, the underlying costs associated with opening the sales office that impacted your results.

Response: We have revised to discuss the underlying costs associated with opening the sales office that impacted our results.

52. You indicate that the increase in selling expenses was primarily the result of the increased supermarket stores. Please expand your disclosures to discuss, in detail, the underlying reason that the increase in supermarket stores increased selling expenses.

Response: We have revised to expand our disclosure to discuss the underlying reason that the increase in supermarket counters increased our selling expenses.

Interest Expense, pages 48 and 49

53. Please revise your discussion of interest expense to include the interest expense on a gross basis, total subsidies received, how these subsidies were determined, and your expectation for the continued receipt thereof.

Response: We have revised to discuss the interest expense on a gross basis, total subsidies received, how these subsidies were determined, and our expectation for the continued receipt thereof.

Liquidity and Capital Resources, page 50

54. It appears that your discussion focuses on the changes in your statement of cash flows, with little or no discussion of the underlying reasons for changes in certain line items. Please revise your disclosures to discuss the underlying reason for the changes in line items that had a material impact on your liquidity. This disclosure should also focus on your concerns and views regarding liquidity and the capital resources available to execute your strategic plans and meet your obligations.

Response: We have revised to discuss the underlying reason for the changes in line items that had a material impact on our liquidity. We have also included disclosure regarding our need to raise additional capital to fund our operations for the next twelve months.

55. Please discuss the material terms of your long and short-term loan agreements. Please also file any material agreements as exhibits to the registration statement.

Response: We have revised to discuss the material terms of your long and short-term loan agreements. We will file material loan agreements as exhibits to the Form S-1.

Contractual Commitments, page 51

56. Please expand your contractual obligations table to disclose, at a minimum, the amount of scheduled interest payments on your long-term debt obligations (i.e., fixed and variable rate). Your methodology and significant assumptions used in the determination of payments should be disclosed in a footnote to the table. These interest payments should be shown gross of any subsidies expected to be received, with a footnote explanation of the material terms of any subsidies expected. This footnote should include the manner in which subsidies are calculated, timing of expected receipt, and likelihood of cancellation. If the amount of interest on variable rate debt cannot be reliably estimated, please disclose this fact and state the significant terms of the obligations.

Response: We have revised to disclose below the contractual obligation table the amount of scheduled interest payments on our long-term debt obligations (i.e., fixed and variable rate) and our methodology and significant assumptions used in the determination of payments. We also clarified that there is no guarantee that we will continue to receive subsidies from local government in future periods at the interest expense payments.

Quantitative and Qualitative Disclosures About Market Risk, page 51

57. We note your disclosure here that “[s]ubstantially all of [y]our operations are conducted in the PRC, with the exception of our export business and limited overseas purchases of raw materials.” Please reconcile this with the disclosure on page 39 that you “procure hogs from local hog farms and breeders located in close proximity to our slaughterhouses.” Please also explain the nature of your “export business.”

Response: The statement that [s]ubstantially all of our operations are conducted in the PRC, with the exception of our export business and limited overseas purchases of raw materials were included by mistake. We have revised to clarify that all of our operations are conducted in the PRC and all of our revenue and expenses are denominated in Renminbi.

Directors, Executive Officers, Promoters and Control Persons, page 53

58. Please revise to briefly discuss the specific experience, qualifications, attributes or skills of Mr. Luo that led to the conclusion that he should serve as a director. Refer to Item 401(e) of Regulation S-K.

Response: We have revised to briefly discuss the specific experience, qualifications, attributes or skills of Mr. Luo that led to the conclusion that he should serve as a director.

59. Please revise Mr. Luo’s biography to describe the nature of the business conducted by Anpulo Food Development, Inc. To the extent there is a current or expected relationship between that business and your business, please revise your disclosure elsewhere in the prospectus as appropriate.

Response: We have revised to describe the nature of the business conducted by Anpulo Food Development, Inc. Other than Mr. Luo’s managerial positions at both companies, there is no current or expected relationship between that business and our business.

60. Please remove the knowledge qualifier on page 54 in your discussion of legal proceedings.

Response: The Company relies on its acquired knowledge and the representations of the officers and directors in their involvement in the listed legal proceedings. We do not believe that the Company could or should have had exhaustive knowledge of the involvement in the listed legal proceedings by its officers and director. We do not believe that the Company is in a position to make the representations in the Form S-1 without the knowledge qualifier.

61. Please expand upon the discussion on page 54 of your director and officer indemnity within the general corporation law of the British Virgin Islands, and explain what is meant on page 55 by “[u]nder the NRS . . .”

Response: We have expanded and corrected our discussion of our director and officer indemnity within the general corporation law of the British Virgin Islands.

Security Ownership of Certain Beneficial Owners and Management, page 55

Certain Relationships and Related Transactions, page 56

62. Please revise the discussion of the reverse acquisition to disclose the interest of Mr. Luo in the transaction and the approximate dollar value of the amount involved in this transaction.

Response: We have revised the discussion of the reverse acquisition to disclose the interest of Mr. Luo in the transaction and the approximate dollar value of the amount involved in this transaction.

63. We note your disclosure on page 51 of repayments of indebtedness in the amounts of $1.2 million and $2.2 million to related parties. Please explain to us why these transactions were not disclosed here.

Response: We have added disclosure regarding loans from/to related party.

64. We note your disclosure on pages F-11 and F-27 regarding personal loans to and from Mr. Luo. Please revise to disclose these loans here as required by Item 404 of Regulation S-K. Please also file any agreements with Mr. Luo as exhibits to the registration statement as required by Item 601 of Regulation S-K.

Response: We have added disclosure regarding loans from/to related party.

Consolidated Financial Statements for the Six-Month Period Ended June 30, 2013

Notes to Financial Statements

Note 5 – Other Receivables, page F-12

65. Please tell us in your response and expand your disclosure here to discuss the facts and circumstances surrounding the $2.4 million loan receivable as of June 30, 2013.

Response: The loan receivables of $2.4 million were loaned to three individuals who are the Company’s wholesalers having regular business activities with the Company. The loans were one time loans and made in the second quarter of 2013 for their working capital purpose without interest burden and collateral. The loans were due on demand and had been fully repaid in the third quarter of 2013.

Consolidated Financial Statements for the Year Ended December 31, 2012

Notes to Financial Statements

Note 1 – Organization and Nature of Operations, page F-22

66. During our review of your filing, we did not note a discussion of operating or reporting segments. Please tell us and revise your disclosure here, in your interim statements, and in “Overview” within Management’s Discussion and Analysis to include a discussion of your segment reporting structure. This discussion should include how you determine your operating segments as well as how you determine eligibility for aggregation under FASB ASC 280-50-11. If you consider your operations to be one operating and reporting segment, your disclosure here should so state. Please provide support for us with your response, including the summary reports reviewed by your Chief Operating Decision Maker.

Response: We have revised to include a discussion of our segment reporting structure.

Note 10 – Subsidies, page F-32

67. Please tell us in your response and expand your disclosure here and in Management’s Discussion and Analysis to fully explain the facts and circumstances surrounding the receipt of “subsidies.” This disclosure should include tabular presentation of each type of subsidy received, and should indicate either in the description or footnote disclosure the source, basis of calculation, duration, and amount of each subsidy. Further, Note 2 – Summary of Significant Accounting Policies should be revised to address how these subsidies are recognized in your financial statements. Finally, disclosure in Management’s Discussion and Analysis should include a discussion of the impact of the total subsidies received on net income, why “recurring” subsidies vary significantly from period to period, and your expectation as to future receipt of such subsidies.

Response: We have revised to explain the facts and circumstances surrounding the receipt of “subsidies” as required.

Item 14. Indemnification of Directors and Officers, page 59

68. Please revise this section to explain the general effect of indemnification through the corporate law of the British Virgin Islands and your memorandum of association and articles of association. Refer to Item 702 of Regulation S-K.

Response: We have revised this section to explain the general effect of indemnification through the corporate law of the British Virgin Islands and our memorandum of association and articles of association.

Exhibit 23.1- Accountants’ Consent

69. Please provide a currently dated signed consent from the independent public accountant in the amendment. Reference is made to Rule 402 of Regulation C.

Response: We have provided a currently dated and signed consent from the independent public accountant in the amendment.

The Company acknowledges that:

| ● | should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| ● | the action of the Commission or the staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| ● | the company may not assert staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Sincerely,

| /s/ Wenping Luo | |

| Wenping Luo | |

| President and Chief Executive Officer | |

Exhibit A

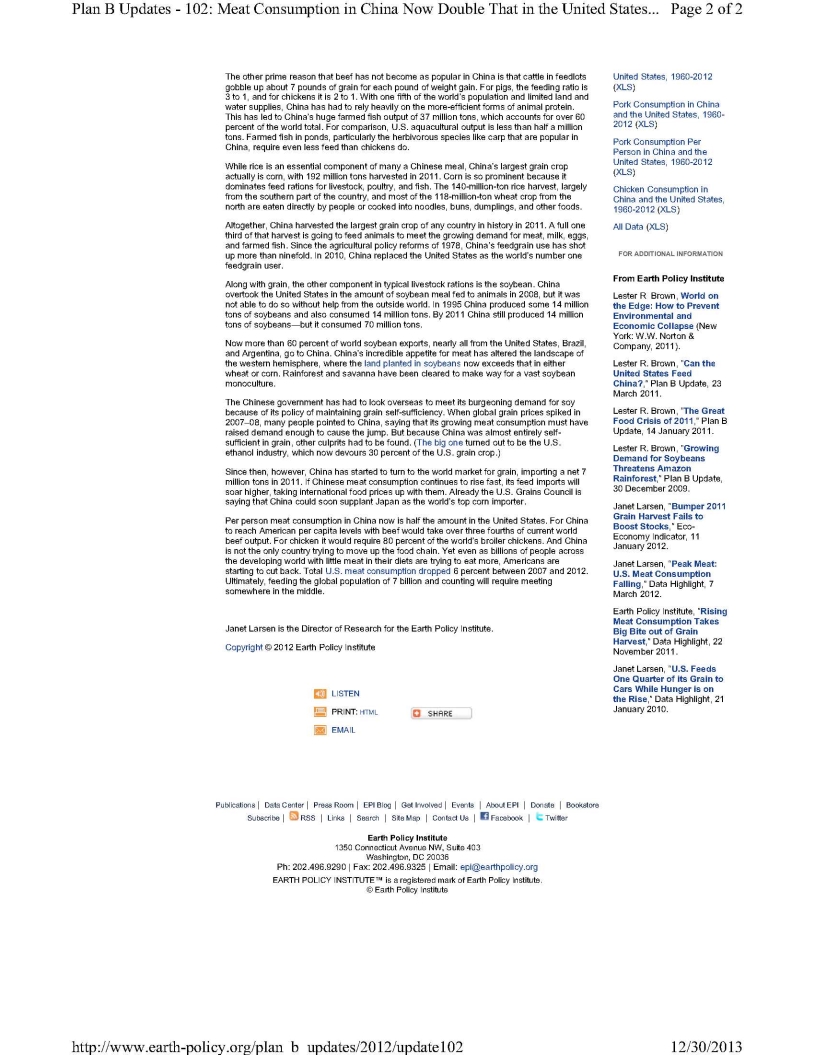

Earth Policy Institute Data

Exhibit B

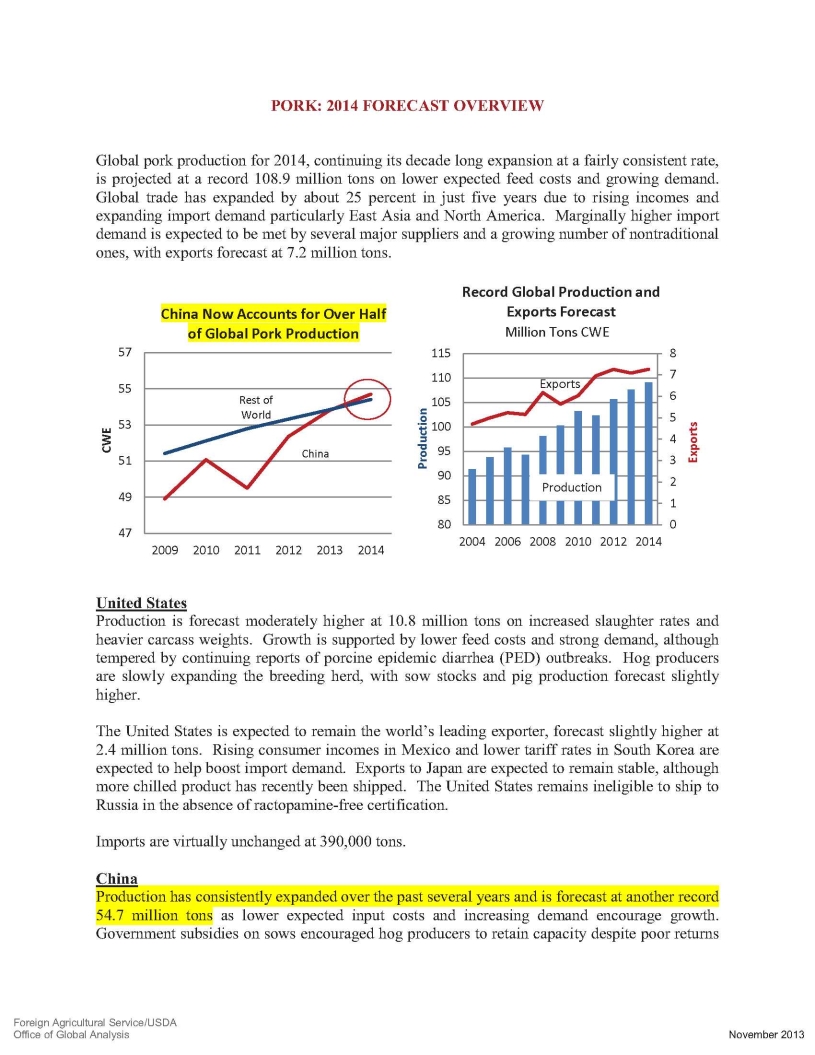

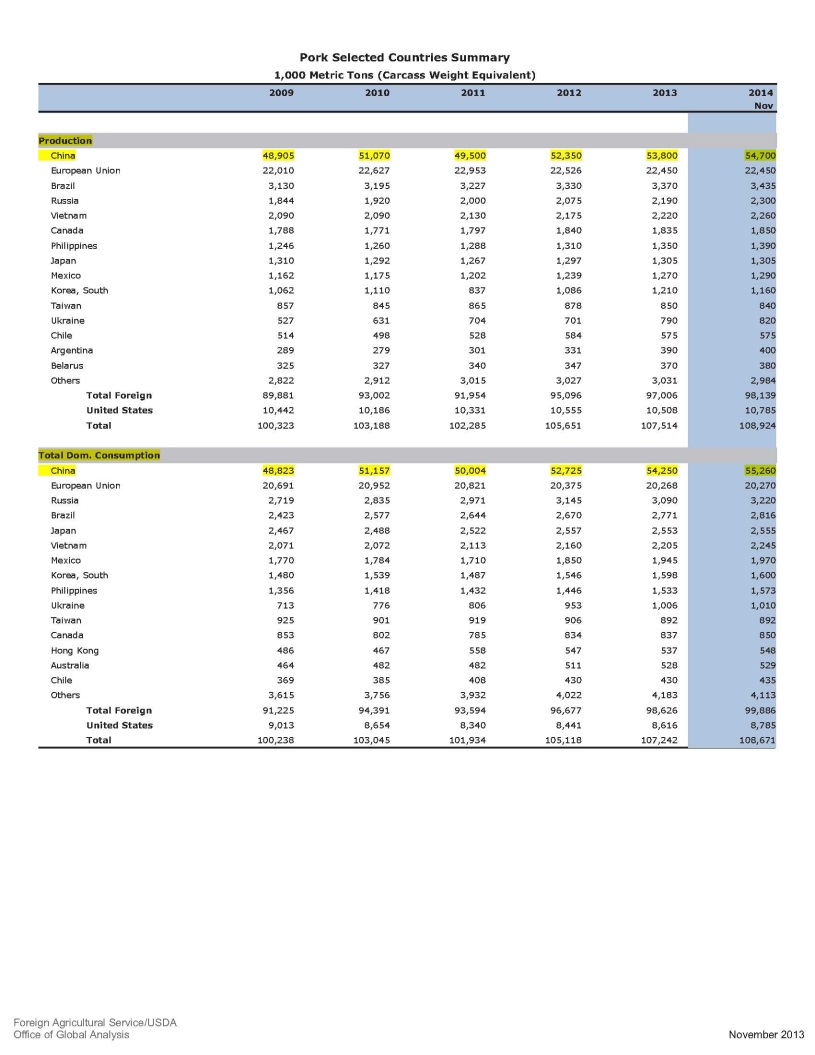

USDA November 2013 Report Abstract

Exhibit C

Robobank and Earth Policy Institute Data Abstract

Exhibit D

Chartsbin Data-China

Exhibit E

Exhibit F

FAO 2009 Report