UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22472

(Investment Company Act File Number)

RiverNorth Opportunities Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

1290 Broadway, Suite 1100

Denver, CO 80203

(Address of Principal Executive Offices)

Christopher A. Moore

RiverNorth Opportunities Fund, Inc.

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

(303) 623-2577

(Registrant’s Telephone Number)

Date of Fiscal Year End: July 31

Date of Reporting Period: July 31, 2018

| Item 1. | Reports to Shareholders. |

| Section 19(b) Disclosure | July 31, 2018 (Unaudited) |

The RiverNorth Opportunities Fund (the “Fund”), acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Directors (the “Board”), has adopted a plan, consistent with the Fund’s investment objectives and policies, to support a level monthly distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Fund currently distributes $0.21 per share on a monthly basis.

The fixed amount distributed per share is subject to change at the discretion of the Board. Under the Plan, the Fund will distribute all available investment income to its shareholders, consistent with the Fund’s primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate the Plan at any time without prior notice if it deems such action to be in the best interest of either the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if a Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to the Fund’s prospectus for a more complete description of its risks.

Please refer to the Additional Information section in this shareholder report for a cumulative summary of the Section 19(a) notices for the Fund’s current fiscal period. Section 19(a) notices for the Fund, as applicable, are available on the RiverNorth Opportunities Fund’s website: www.rivernorthcef.com.

| RiverNorth Opportunities Fund, Inc. | Table of Contents |

| Performance Overview | 2 |

| Statement of Investments | 6 |

| Statement of Assets and Liabilities | 11 |

| Statements of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Financial Highlights | 14 |

| Notes to Financial Statements | 16 |

| Report of Independent Registered Public Accounting Firm | 30 |

| Dividend Reinvestment Plan | 31 |

| Directors and Officers | 33 |

| Additional Information | 39 |

| Portfolio Holdings | 39 |

| Proxy Voting | 39 |

| Section 19(a) Notices | 39 |

| Stockholder Meeting Results | 40 |

| Unaudited Tax Information | 41 |

| Data Privacy Policies and Procedures | 41 |

| Custodian and Transfer Agent | 42 |

| Legal Counsel | 42 |

| Independent Registered Public Accounting Firm | 42 |

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | July 31, 2018 (Unaudited) |

INVESTMENT OBJECTIVE

RiverNorth Opportunities Fund, Inc.’s (the “Fund”) investment objective is total return consisting of capital appreciation and current income.

PERFORMANCE OVERVIEW

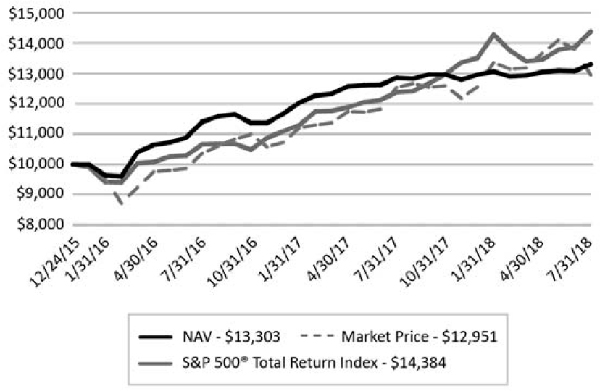

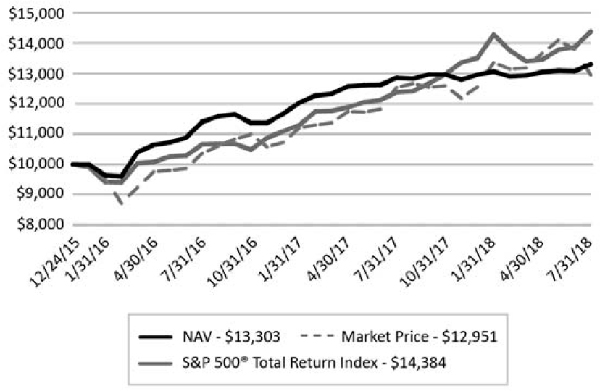

For the nine month period ended July 31, 2018, the Fund returned 2.56% on a net asset value (“NAV”) basis and 2.84% on a market price basis. The S&P 500 Total Return Index returned 10.94% during the same period.

The Fund benefitted from its exposure to general equity closed-end funds, as these funds generally had positive NAV returns over the period. In addition, several of the Fund’s holdings had corporate actions such as tender offers or rights offerings, which generated positive alpha.

Similar to last year, the Fund’s exposure to fixed income closed-end funds detracted from performance relative to the benchmark. On average, fixed income closed-end fund NAV returns underperformed the S&P 500 Index, and these funds also saw discounts widen out. According to Morningstar, discounts for taxable fixed income closed-end funds widened out from an average of 2.86% on October 31, 2017 to 4.43% on July 31, 2018. In addition, closed-end fund holdings that had exposure to emerging markets detracted from performance.

Effective July 16, 2018, the Board approved changing the fiscal year-end of the Fund from October 31 to July 31.

PERFORMANCE as of July 31, 2018

| | CUMULATIVE | AVERAGE ANNUAL |

| TOTAL RETURNS(1) | 6 Months | 1 Year | Since

Inception(2) |

| RiverNorth Opportunities Fund, Inc. - NAV(3) | 1.88% | 3.47% | 11.58% |

| RiverNorth Opportunities Fund, Inc. - Market Price(4) | -3.04% | 3.30% | 10.43% |

| S&P 500® Total Return Index | 0.70% | 16.24% | 14.97% |

| (1) | Total returns assume reinvestment of all distributions. |

| (2) | The Fund commenced operations on December 24, 2015. |

| (3) | Performance returns are net of management fees and other Fund expenses. |

| (4) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (855) 830-1222 or by visiting www.rivernorthcef.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | July 31, 2018 (Unaudited) |

Total annual expense ratio as a percentage of net assets attributable to common shares as of July 31, 2018, is 1.72% (excluding interest and dividend expense). Including interest and dividend expense, the expense ratio is 2.07%.

The Fund is a closed-end fund and does not continuously issue shares for sale as open-end mutual funds do. The Fund now trades only in the secondary market. Investors wishing to buy or sell shares need to place orders through an intermediary or broker and additional charges or commissions will apply. The share price of a closed-end fund is based on the market’s value.

Distributions may be paid from sources of income other than ordinary income, such as net realized short-term capital gains, net realized long-term capital gains and return of capital. Based on current estimates, we anticipate the most recent distribution has been paid from Net Investment income and Net Realized short-term Capital gains. The actual amounts and sources of the amounts for tax reporting purposes will depend upon a Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms after the end of the year.

S&P 500® Total Return Index – A market value weighted index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. This index is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. This index reflects the effects of dividend reinvestment.

Indices are unmanaged; their returns do not reflect any fees, expenses, or sales charges.

An investor cannot invest directly in an index.

ALPS Advisors, Inc. is the investment adviser to the Fund.

RiverNorth Capital Management, LLC is the investment sub-adviser to the Fund. RiverNorth Capital Management, LLC is not affiliated with ALPS Advisors, Inc. or any of its affiliates.

Secondary market support provided to the Fund by ALPS Fund Services, Inc.’s affiliate, ALPS Portfolio Solutions Distributor, Inc., a FINRA member.

| Annual Report | July 31, 2018 | 3 |

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | July 31, 2018 (Unaudited) |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the closing market price (NYSE: RIV) of $19.40 on December 24, 2015, and tracking its progress through July 31, 2018.

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

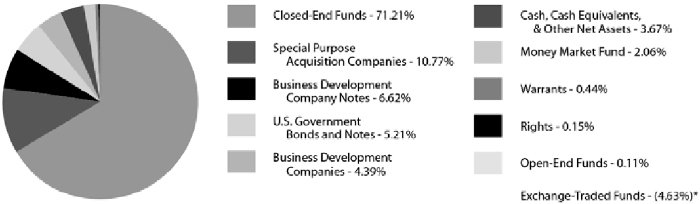

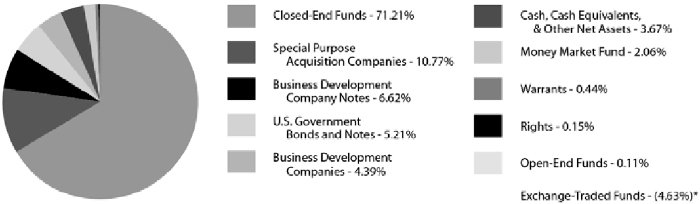

ASSET ALLOCATION as of July 31, 2018^

| ^ | Holdings are subject to change. |

| * | Represents securities sold short. |

| | Percentages are based on total net assets of the Fund. |

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | July 31, 2018 (Unaudited) |

TOP TEN HOLDINGS* as of July 31, 2018

| | % of Net Assets** |

| U.S. Treasury Notes | 5.21% |

| Delaware Enhanced Global Dividend & Income Fund | 4.55% |

| Prudential Global Short Duration High Yield Fund, Inc. | 4.35% |

| Alpine Total Dynamic Dividend Fund | 3.87% |

| Highland Floating Rate Opportunities Fund | 3.51% |

| Clough Global Opportunities Fund | 3.47% |

| Invesco High Income Trust II | 3.09% |

| Nuveen Mortgage Opportunity Term Fund 2 | 3.05% |

| Templeton Emerging Markets Income Fund | 2.98% |

| Managed Duration Investment Grade Municipal Fund | 2.87% |

| | 36.95% |

| * | Holdings are subject to change and exclude cash equivalents. Only long positions are listed. |

| ** | Percentages are based on total net assets, including securities sold short. |

| Annual Report | July 31, 2018 | 5 |

| | |

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

July 31, 2018

| Description | | Shares | | | Value

(Note 2) | |

| CLOSED-END FUNDS - COMMON SHARES (71.21%) | | | | | | | | |

| Aberdeen Emerging Markets Equity Income Fund, Inc. | | | 59,386 | | | $ | 426,985 | |

| Advent Claymore Convertible Securities and Income Fund | | | 2,442 | | | | 37,802 | |

| Advent/Claymore Enhanced Growth & Income Fund | | | 119,731 | | | | 930,310 | |

| AllianzGI Convertible & Income 2024 Target Term Fund | | | 185,146 | | | | 1,707,046 | |

| AllianzGI NFJ Dividend Interest & Premium Strategy Fund | | | 124,438 | | | | 1,600,273 | |

| Alpine Total Dynamic Dividend Fund | | | 443,269 | | | | 3,931,796 | |

| BlackRock Resources & Commodities Strategy Trust | | | 31,101 | | | | 283,952 | |

| China Fund, Inc. | | | 13,868 | | | | 289,009 | |

| Clough Global Equity Fund | | | 10,240 | | | | 149,197 | |

| Clough Global Opportunities Fund(a) | | | 314,683 | | | | 3,524,450 | |

| Cornerstone Strategic Value Fund, Inc. | | | 168,065 | | | | 2,388,204 | |

| Cornerstone Total Return Fund, Inc. | | | 57,575 | | | | 808,353 | |

| Delaware Enhanced Global Dividend & Income Fund | | | 403,841 | | | | 4,619,941 | |

| Delaware Investments Dividend & Income Fund, Inc. | | | 3,909 | | | | 48,511 | |

| Eagle Growth & Income Opportunities Fund | | | 136,249 | | | | 2,122,759 | |

| Eaton Vance Limited Duration Income Fund | | | 7,173 | | | | 90,308 | |

| First Trust Senior Floating Rate 2022 Target Term Fund | | | 37,235 | | | | 347,775 | |

| Gabelli Utility Trust | | | 15,807 | | | | 92,155 | |

| Highland Floating Rate Opportunities Fund | | | 223,368 | | | | 3,562,720 | |

| India Fund, Inc. | | | 36,732 | | | | 937,401 | |

| Invesco High Income Trust II | | | 231,266 | | | | 3,142,905 | |

| Invesco Senior Income Trust | | | 384,198 | | | | 1,663,577 | |

| Kayne Anderson MLP/Midstream Investment Co. | | | 120,025 | | | | 2,275,674 | |

| Lazard World Dividend & Income Fund, Inc. | | | 116,590 | | | | 1,235,737 | |

| Legg Mason BW Global Income Opportunities Fund, Inc. | | | 157,132 | | | | 1,803,875 | |

| Madison Covered Call & Equity Strategy Fund | | | 212,563 | | | | 1,621,856 | |

| Managed Duration Investment Grade Municipal Fund | | | 203,973 | | | | 2,916,814 | |

| Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 196,459 | | | | 1,752,414 | |

| Morgan Stanley Emerging Markets Fund, Inc. | | | 138,888 | | | | 2,312,485 | |

| NexPoint Credit Strategies Fund | | | 115,344 | | | | 2,594,087 | |

| Nuveen California Quality Municipal Income Fund | | | 8,966 | | | | 119,427 | |

| Nuveen Credit Strategies Income Fund | | | 106,497 | | | | 840,261 | |

| Nuveen Emerging Markets Debt 2022 Target Term Fund | | | 36,408 | | | | 317,478 | |

| Nuveen Intermediate Duration Quality Municipal Term Fund | | | 39,571 | | | | 493,054 | |

| Nuveen Mortgage Opportunity Term Fund | | | 65,004 | | | | 1,537,280 | |

| Nuveen Mortgage Opportunity Term Fund 2(a) | | | 135,912 | | | | 3,104,230 | |

| Prudential Global Short Duration High Yield Fund, Inc.(a) | | | 324,648 | | | | 4,424,952 | |

| Prudential Short Duration High Yield Fund, Inc. | | | 25,383 | | | | 355,362 | |

| Special Opportunities Fund, Inc. | | | 32,659 | | | | 493,477 | |

| Sprott Focus Trust, Inc. | | | 58,526 | | | | 457,088 | |

| Templeton Emerging Markets Income Fund | | | 285,442 | | | | 3,031,394 | |

| Templeton Global Income Fund | | | 323,069 | | | | 2,032,104 | |

| Tortoise MLP Fund, Inc. | | | 184,665 | | | | 2,899,240 | |

| Virtus Total Return Fund, Inc.(a) | | | 126,560 | | | | 1,356,723 | |

| Voya Prime Rate Trust | | | 171,297 | | | | 851,346 | |

See Notes to Financial Statements.

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

July 31, 2018

| Description | | Shares | | | Value

(Note 2) | |

| Western Asset Global High Income Fund, Inc. | | | 55,673 | | | $ | 512,192 | |

| Western Asset/Claymore Inflation-Linked Opportunities & Income Fund | | | 29,511 | | | | 325,211 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS | | | | | | | | |

| (Cost $72,410,966) | | | | | | | 72,369,190 | |

| | | | | | | | | |

| OPEN-END FUNDS - COMMON SHARES (0.11%) | | | | | | | | |

| Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio, Class I | | | 9,510 | | | | 112,216 | |

| | | | | | | | | |

| TOTAL OPEN-END FUNDS | | | | | | | | |

| (Cost $114,922) | | | | | | | 112,216 | |

| | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES - COMMON SHARES (4.39%) | | | | | | | | |

| American Capital Senior Floating, Ltd. | | | 126,270 | | | | 1,553,121 | |

| Garrison Capital, Inc. | | | 242,231 | | | | 2,032,318 | |

| OHA Investment Corp. | | | 601,728 | | | | 878,523 | |

| | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | | | | | |

| (Cost $5,381,061) | | | | | | | 4,463,962 | |

| | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANY NOTES - PREFERRED SHARES (6.62%) | | | | | | | | |

| Capital Southwest Corp., 5.95%, 12/15/2022 | | | 29,239 | | | | 737,115 | |

| Hercules Capital, Inc., 6.25%, 7/30/2024 | | | 3,032 | | | | 76,316 | |

| KCAP Financial, Inc., 6.13%, 9/30/2022 | | | 21,877 | | | | 553,269 | |

| Oxford Square Capital Corp., 6.50%, 3/30/2024 | | | 77,272 | | | | 1,986,663 | |

| Stellus Capital Investment Corp., 5.75%, 9/15/2022 | | | 12,767 | | | | 322,750 | |

| THL Credit, Inc., 6.75%, 12/30/2022 | | | 25,673 | | | | 656,330 | |

| Triangle Capital Corp., 6.38%, 3/15/2022 | | | 30,204 | | | | 762,953 | |

| Triangle Capital Corp., 6.38%, 12/15/2022 | | | 51,052 | | | | 1,288,042 | |

| TriplePoint Venture Growth Corp., 5.75%, 7/15/2022 | | | 13,497 | | | | 342,824 | |

| | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANY NOTES | | | | | | | | |

| (Cost $6,642,172) | | | | | | | 6,726,262 | |

| | | | | | | | | |

| SPECIAL PURPOSE ACQUISITION COMPANIES - COMMON SHARES (10.77%) | | | | | | | | |

| Allegro Merger Corp.(b) | | | 24,649 | | | | 250,927 | |

| Atlantic Acquisition Corp.(b) | | | 16,904 | | | | 173,942 | |

| Big Rock Partners Acquisition Corp.(b) | | | 35,482 | | | | 352,336 | |

| Bison Capital Acquisition Corp.(b) | | | 22,246 | | | | 223,461 | |

| Black Ridge Acquisition Corp.(b) | | | 24,390 | | | | 239,022 | |

| CM Seven Star Acquisition Corp.(b) | | | 32,478 | | | | 323,156 | |

| Constellation Alpha Capital Co.(b) | | | 15,886 | | | | 158,701 | |

| Draper Oakwood Technology Acquisition, Inc., Class A(b) | | | 13,212 | | | | 133,441 | |

| Far Point Acquisition Corp.(b) | | | 5,103 | | | | 52,051 | |

| Greenland Acquisition Corp.(b) | | | 23,749 | | | | 240,340 | |

| Haymaker Acquisition Corp.(b) | | | 1 | | | | 10 | |

| Haymaker Acquisition Corp., Class A(b) | | | 51,090 | | | | 498,127 | |

See Notes to Financial Statements.

| Annual Report | July 31, 2018 | 7 |

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

July 31, 2018

| Description | | Shares | | | Value

(Note 2) | |

| Hennessy Capital Acquisition Corp. III(b) | | | 29,724 | | | $ | 300,510 | |

| HL Acquisitions Corp.(b) | | | 30,748 | | | | 298,870 | |

| Industrea Acquisition Corp., Class A(b) | | | 16,655 | | | | 165,717 | |

| KBL Merger Corp. IV(b) | | | 20,375 | | | | 204,871 | |

| Legacy Acquisition Corp., Class A(b) | | | 29,594 | | | | 284,990 | |

| Leisure Acquisition Corp.(b) | | | 56,828 | | | | 551,232 | |

| LF Capital Acquisition Corp., Class A(b) | | | 33,437 | | | | 320,828 | |

| Modern Media Acquisition Corp.(b) | | | 20,850 | | | | 208,917 | |

| One Madison Corp., Class A(b) | | | 75,084 | | | | 730,943 | |

| Osprey Energy Acquisition Corp.(b) | | | 12,916 | | | | 135,489 | |

| Pensare Acquisition Corp.(b) | | | 38,862 | | | | 385,511 | |

| Pure Acquisition Corp.(b) | | | 42,171 | | | | 406,529 | |

| Thunder Bridge Acquisition, Ltd., Class A(b) | | | 50,206 | | | | 484,237 | |

| Triangle Capital Corp. | | | 186,700 | | | | 2,240,400 | |

| Trident Acquisitions Corp.(b) | | | 50,476 | | | | 492,141 | |

| Trinity Merger Corp., Class A(b) | | | 20,397 | | | | 199,687 | |

| Twelve Seas Investment Co.(b) | | | 45,379 | | | | 434,731 | |

| VectoIQ Acquisition Corp.(b) | | | 47,906 | | | | 457,981 | |

| | | | | | | | | |

| TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES | | | | | | | | |

| (Cost $10,584,223) | | | | | | | 10,949,098 | |

| | | | | | | | | |

| RIGHTS (0.15%) | | | | | | | | |

| Atlantic Acquisition Corp., Expires 12/31/2049 | | | 16,904 | | | | 15,214 | |

| Big Rock Partners Acquisition Corp., Expires 12/31/2049 | | | 35,482 | | | | 15,098 | |

| Bison Capital Acquisition Corp., Expires 07/18/2022 | | | 22,246 | | | | 8,309 | |

| Black Ridge Acquisition Corp., Expires 10/25/2022 | | | 12,194 | | | | 4,274 | |

| CM Seven Star Acquisition Corp., Expires 11/06/2018 | | | 32,478 | | | | 14,290 | |

| Constellation Alpha Capital Co., Expires 03/23/2024 | | | 15,886 | | | | 9,214 | |

| Draper Oakwood Technology Acquisition, Inc., Expires 09/30/2024 | | | 13,212 | | | | 6,084 | |

| HL Acquisitions Corp., Expires 07/19/2023 | | | 30,748 | | | | 26,920 | |

| KBL Merger Corp. IV, Expires 07/01/2023 | | | 20,375 | | | | 7,183 | |

| Modern Media Acquisition Corp., Expires 06/07/2022 | | | 20,850 | | | | 9,070 | |

| Pensare Acquisition Corp., Expires 08/08/2022 | | | 38,862 | | | | 16,322 | |

| Twelve Seas Investment Co., Expires 07/14/2023 | | | 45,379 | | | | 18,832 | |

| | | | | | | | | |

| TOTAL RIGHTS | | | | | | | | |

| (Cost $113,374) | | | | | | | 150,810 | |

| | | | | | | | | |

| WARRANTS (0.44%) | | | | | | | | |

| Big Rock Partners Acquisition Corp., Strike Price $11.50, Expires 12/01/2022 | | | 17,741 | | | | 8,604 | |

| Bison Capital Acquisition Corp., Strike Price $11.50, Expires 07/18/2022 | | | 11,123 | | | | 4,672 | |

| Black Ridge Acquisition Corp., Strike Price $11.50, Expires 10/25/2022 | | | 32,819 | | | | 14,769 | |

See Notes to Financial Statements.

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

July 31, 2018

| Description | | Shares | | | Value

(Note 2) | |

| CM Seven Star Acquisition Corp., Strike Price $11.50, Expires 11/06/2018 | | | 16,239 | | | $ | 6,983 | |

| Constellation Alpha Capital Co., Strike Price $11.50, Expires 03/23/2024 | | | 15,886 | | | | 7,466 | |

| Draper Oakwood Technology Acquisition, Inc., Strike Price $11.50, Expires 09/30/2024 | | | 6,606 | | | | 5,087 | |

| Haymaker Acquisition Corp., Strike Price $11.50, Expires 11/17/2022 | | | 25,545 | | | | 26,056 | |

| Hennessy Capital Acquisition Corp. III, Strike Price $11.50, Expires 06/15/2024 | | | 22,293 | | | | 32,994 | |

| HL Acquisitions Corp., Strike Price $11.50, Expires 07/18/2023 | | | 30,748 | | | | 12,607 | |

| I-AM Capital Acquisition Co., Strike Price $11.50, Expires 10/09/2022 | | | 16,748 | | | | 5,148 | |

| Industrea Acquisition Corp., Strike Price $11.50, Expires 08/01/2024 | | | 16,655 | | | | 11,075 | |

| KBL Merger Corp. IV, Strike Price $5.75, Expires 07/01/2023 | | | 20,375 | | | | 6,530 | |

| Legacy Acquisition Corp., Strike Price $5.75, Expires 12/01/2022 | | | 29,594 | | | | 14,797 | |

| Leisure Acquisition Corp., Strike Price $11.50, Expires 12/28/2022 | | | 28,414 | | | | 36,796 | |

| LF Capital Acquisition Corp., Strike Price $11.50, Expires 06/27/2023 | | | 33,437 | | | | 18,056 | |

| Modern Media Acquisition Corp., Strike Price $11.50, Expires 06/07/2022 | | | 10,425 | | | | 7,806 | |

| National Energy Services Reunited Corp., Strike Price $11.50, Expires 06/05/2022 | | | 20,850 | | | | 31,275 | |

| One Madison Corp., Strike Price $11.50, Expires 02/23/2023 | | | 37,542 | | | | 41,672 | |

| Osprey Energy Acquisition Corp., Strike Price $11.50, Expires 08/15/2022 | | | 9,674 | | | | 19,154 | |

| Pensare Acquisition Corp., Strike Price $11.50, Expires 08/08/2022 | | | 19,431 | | | | 12,047 | |

| Pure Acquisition Corp., Strike Price $11.50, Expires 04/17/2023 | | | 21,085 | | | | 27,621 | |

| Thunder Bridge Acquisition, Ltd., Strike Price $11.50, Expires 07/17/2022 | | | 50,206 | | | | 26,107 | |

| Trident Acquisitions Corp., Strike Price $11.50, Expires 06/14/2021 | | | 50,476 | | | | 15,395 | |

| Trinity Merger Corp., Strike Price $11.50, Expires 06/01/2023 | | | 20,397 | | | | 8,363 | |

| Twelve Seas Investment Co., Strike Price $11.50, Expires 07/13/2023 | | | 45,379 | | | | 15,656 | |

| VectoIQ Acquisition Corp., Strike Price $11.50, Expires 06/12/2023 | | | 47,906 | | | | 27,342 | |

| | | | | | | | | |

| TOTAL WARRANTS | | | | | | | | |

| (Cost $338,085) | | | | | | | 444,078 | |

See Notes to Financial Statements.

| Annual Report | July 31, 2018 | 9 |

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

July 31, 2018

| | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2) | |

| U.S. GOVERNMENT BONDS AND NOTES (5.21%) | | | | | |

| U.S. Treasury Notes(a) | | | 1.125% | | | 01/31/19 | | $ | 5,327,100 | | | $ | 5,297,759 | |

| | | | | | | | | | | | | | | |

| TOTAL U.S. GOVERNMENT BONDS AND NOTES | | | | | |

| (Cost $5,309,069) | | | | 5,297,759 | |

| | | 7-Day

Yield | | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS - COMMON SHARES (2.06%) | | | | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund | | | 1.804% | | | | 2,096,826 | | | | 2,096,826 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $2,096,826) | | | | | | | | | | | 2,096,826 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (100.96%) | | | | | | | | | | | | |

| (Cost $102,990,698) | | | | | | | | | | $ | 102,610,201 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets (-0.96%)(c) | | | | | | | | | | | (985,908 | ) |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 101,624,293 | |

SCHEDULE OF SECURITIES SOLD SHORT

| Description | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS - COMMON SHARES(-4.63%) | | | | | | | | |

| Alerian MLP ETF | | | (101,583 | ) | | $ | (1,111,318 | ) |

| SPDR® Bloomberg Barclays High Yield Bond ETF | | | (100,000 | ) | | | (3,594,000 | ) |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | (4,705,318 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT | | | | | | | | |

| (Proceeds $4,737,847) | | | | | | $ | (4,705,318 | ) |

| (a) | All or a portion of the security is pledged as collateral for securities sold short. As of July 31, 2018, the aggregate market value of those securities was $10,410,893 representing 10.24% of net assets. |

| (b) | Non-income producing security. |

| (c) | Includes cash, in the amount of $3,504,329 which is being held as collateral for securities sold short. |

See Notes to Financial Statements.

RiverNorth Opportunities Fund, Inc.

| Statement of Assets and Liabilities | July 31, 2018 |

| ASSETS: | | | |

| Investments, at value | | $ | 102,610,201 | |

| Cash | | | 4,756 | |

| Deposit with broker for securities sold short | | | 3,504,329 | |

| Receivable for investments sold | | | 477,833 | |

| Receivable for reinvested fund shares | | | 65,610 | |

| Dividends receivable | | | 76,958 | |

| Deferred offering costs (Note 6) | | | 148,833 | |

| Prepaid and other assets | | | 17,142 | |

| Total Assets | | | 106,905,662 | |

| | | | | |

| LIABILITIES: | | | | |

| Securities Sold Short (Proceeds $4,737,847) | | | 4,705,318 | |

| Payable for investments purchased | | | 188,185 | |

| Interest payable for borrowing | | | 3,333 | |

| Payable to adviser | | | 85,929 | |

| Payable to administrator | | | 28,967 | |

| Accrued offering costs (Note 6) | | | 126,807 | |

| Payable to transfer agent | | | 3,953 | |

| Payable for director fees | | | 30,643 | |

| Payable for custodian fees | | | 9,250 | |

| Payable for professional fees | | | 58,500 | |

| Payable for printing fees | | | 29,048 | |

| Other payables | | | 11,436 | |

| Total Liabilities | | | 5,281,369 | |

| Net Assets | | $ | 101,624,293 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 102,210,829 | |

| Distributions in excess of net investment income | | | (130,680 | ) |

| Accumulated undistributed net realized loss | | | (107,888 | ) |

| Net unrealized depreciation | | | (347,968 | ) |

| Net Assets | | $ | 101,624,293 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 101,624,293 | |

| Shares of common stock outstanding (37,500,000 of shares authorized, at $0.0001 par value per share) | | | 5,330,225 | |

| Net asset value per share | | $ | 19.07 | |

| | | | | |

| Cost of Investments | | $ | 102,990,698 | |

See Notes to Financial Statements.

| Annual Report | July 31, 2018 | 11 |

| RiverNorth Opportunities Fund, Inc. | Statements of Operations |

| | | For the

Period Ended

July 31, 2018(a) | | | For the

Year Ended

October 31, 2017 | |

| INVESTMENT INCOME: | | | | | | | | |

| Interest | | $ | 61,811 | | | $ | 84,774 | |

| Dividends | | | 3,852,101 | | | | 3,172,918 | |

| Total Investment Income | | | 3,913,912 | | | | 3,257,692 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 766,857 | | | | 768,097 | |

| Administration fees | | | 120,796 | | | | 118,368 | |

| Transfer agent fees | | | 19,071 | | | | 25,085 | |

| Dividend expense - short sales | | | 235,433 | | | | 314,308 | |

| Interest expense - borrowing | | | 27,313 | | | | 21,063 | |

| Cost of borrowing | | | 1,257 | | | | 13,741 | |

| Audit fees | | | 24,000 | | | | 24,000 | |

| Legal fees | | | 61,750 | | | | 172,346 | |

| Custodian fees | | | 21,330 | | | | 20,759 | |

| Director fees | | | 105,809 | | | | 141,218 | |

| Printing fees | | | 42,320 | | | | 13,827 | |

| Insurance fees | | | 19,230 | | | | 22,799 | |

| Other expenses | | | 140,340 | | | | 42,460 | |

| Total Expenses | | | 1,585,506 | | | | 1,698,071 | |

| Net Investment Income | | | 2,328,406 | | | | 1,559,621 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain/(loss) on: | | | | | | | | |

| Investments | | | 4,104,678 | | | | 7,981,591 | |

| Securities sold short | | | (1,609,966 | ) | | | – | |

| Long-term capital gains from other investment companies | | | 510,008 | | | | 856,146 | |

| Net realized gain | | | 3,004,720 | | | | 8,837,737 | |

| Net change in unrealized appreciation/(depreciation) on: | | | | | | | | |

| Investments | | | (2,591,642 | ) | | | 1,014,115 | |

| Securities sold short | | | 1,458,603 | | | | (1,426,074 | ) |

| Net change in unrealized appreciation/(depreciation) | | | (1,133,039 | ) | | | (411,959 | ) |

| Net Realized and Unrealized Gain on Investments | | | 1,871,681 | | | | 8,425,778 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 4,200,087 | | | $ | 9,985,399 | |

| (a) | Effective July 16, 2018, the Board approved changing the fiscal year-end of the Fund from October 31 to July 31. |

See Notes to Financial Statements.

RiverNorth Opportunities Fund, Inc.

Statements of Changes in Net Assets

| | | For the Period Ended July 31, 2018(a) | | | For the Year Ended October 31, 2017 | | | For the Period December 24, 2015 (Commencement of Operations) to October 31, 2016 | |

| OPERATIONS: | | | | | | | | | |

| Net investment income | | $ | 2,328,406 | | | $ | 1,559,621 | | | $ | 2,563,412 | |

| Net realized gain | | | 2,494,712 | | | | 7,981,591 | | | | 3,932,768 | |

| Long-term capital gains from other investment companies | | | 510,008 | | | | 856,146 | | | | 1,821,535 | |

| Net change in unrealized appreciation/(depreciation) | | | (1,133,039 | ) | | | (411,959 | ) | | | 1,197,030 | |

| Net increase in net assets resulting from operations | | | 4,200,087 | | | | 9,985,399 | | | | 9,514,745 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | |

| From net investment income | | | (2,483,811 | ) | | | (2,004,560 | ) | | | (6,496,219 | ) |

| From net realized gains | | | (7,147,088 | ) | | | (5,092,757 | ) | | | (1,682,509 | ) |

| From tax return of capital | | | (426,607 | ) | | | – | | | | – | |

| Net decrease in net assets from distributions to shareholders | | | (10,057,506 | ) | | | (7,097,317 | ) | | | (8,178,728 | ) |

| | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | |

| Proceeds from sales of shares, net of offering costs | | | 30,359,843 | | | | – | | | | 72,599,794 | |

| Dividend Reinvestment | | | 194,875 | | | | 3,094 | | | | – | |

| Net increase in net assets from capital share transactions | | | 30,554,718 | | | | 3,094 | | | | 72,599,794 | |

| | | | | | | | | | | | | |

| Net Increase in Net Assets | | | 24,697,299 | | | | 2,891,176 | | | | 73,935,811 | |

| | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | |

| Beginning of period | | | 76,926,994 | | | | 74,035,818 | | | | 100,007 | |

| End of period (including distributions in excess of net investment income of $(130,680), $(45,864) and $–) | | $ | 101,624,293 | | | $ | 76,926,994 | | | $ | 74,035,818 | |

| | | | | | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | | | |

| Shares outstanding - beginning of period | | | 3,755,304 | | | | 3,755,155 | | | | 5,155 | |

| Shares issued in connection with public offering | | | 1,564,710 | | | | – | | | | 3,750,000 | |

| Shares issued as reinvestment of dividends | | | 10,211 | | | | 149 | | | | – | |

| Shares outstanding - end of period | | | 5,330,225 | | | | 3,755,304 | | | | 3,755,155 | |

| (a) | Effective July 16, 2018, the Board approved changing the fiscal year-end of the Fund from October 31 to July 31. |

See Notes to Financial Statements.

| Annual Report | July 31, 2018 | 13 |

| RiverNorth Opportunities Fund, Inc. | Financial Highlights |

For a share outstanding throughout the periods presented.

| | | For the Period Ended July 31, 2018(a) | | | For the Year Ended October 31, 2017 | | | For the Period December 24, 2015 (Commencement of Operations) to October 31, 2016 | |

| Net asset value - beginning of period | | $ | 20.48 | | | $ | 19.72 | | | $ | 19.40 | |

| Income/(loss) from investment operations: | | | | | | | | | | | | |

| Net investment income(b) | | | 0.44 | | | | 0.42 | | | | 0.68 | |

| Net realized and unrealized gain | | | 0.40 | | | | 2.23 | | | | 1.86 | |

| Total income from investment operations | | | 0.84 | | | | 2.65 | | | | 2.54 | |

| Less distributions to shareholders: | | | | | | | | | | | | |

| From net investment income | | | (0.47 | ) | | | (0.53 | ) | | | (1.73 | ) |

| From net realized gains | | | (1.34 | ) | | | (1.36 | ) | | | (0.45 | ) |

| From tax return of capital | | | (0.08 | ) | | | – | | | | – | |

| Total distributions | | | (1.89 | ) | | | (1.89 | ) | | | (2.18 | ) |

| Capital share transactions: | | | | | | | | | | | | |

| Dilutive effect of rights offering | | | (0.32 | )(c) | | | – | | | | – | |

| Common share offering costs charged to paid-in capital | | | (0.04 | ) | | | – | | | | (0.04 | ) |

| Total capital share transactions | | | (0.36 | ) | | | – | | | | (0.04 | ) |

| Net increase/(decrease) in net asset value | | | (1.41 | ) | | | 0.76 | | | | 0.32 | |

| Net asset value - end of period | | $ | 19.07 | | | $ | 20.48 | | | $ | 19.72 | |

| Market price - end of period | | $ | 19.14 | | | $ | 20.50 | | | $ | 19.65 | |

| Total Return(d) | | | 2.56 | % | | | 14.11 | % | | | 13.67 | % |

| Total Return - Market Price(d) | | | 2.84 | % | | | 14.63 | % | | | 9.87 | % |

See Notes to Financial Statements.

| RiverNorth Opportunities Fund, Inc. | Financial Highlights |

For a share outstanding throughout the periods presented.

| | | For the Period Ended July 31, 2018(a) | | | For the Year Ended October 31, 2017 | | | For the Period December 24, 2015 (Commencement of Operations) to October 31, 2016 | |

| Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 101,624 | | | $ | 76,927 | | | $ | 74,036 | |

| Ratios to Average Net Assets (including dividend expense and line of credit expense) | | | | | | | | | | | | |

| Total expenses | | | 2.07 | %(e) | | | 2.21 | % | | | 1.69 | %(e) |

| Net investment income | | | 3.03 | %(e) | | | 2.03 | % | | | 4.03 | %(e) |

| Ratios to Average Net Assets (excluding dividend expense and line of credit expense) | | | | | | | | | | | | |

| Total expenses | | | 1.72 | %(e) | | | 1.75 | % | | | N/A | |

| Net investment income | | | 2.68 | %(e) | | | 1.57 | % | | | N/A | |

| Portfolio turnover rate | | | 74 | %(f) | | | 162 | % | | | 113 | %(f) |

| (a) | Effective July 16, 2018, the Board approved changing the fiscal year-end of the Fund from October 31 to July 31. |

| (b) | Calculated using average shares throughout the period. |

| (c) | Represents the impact of the Fund's rights offering of 1,564,710 common shares in November 2017 at a subscription price per share based on a formula. For more details please refer to Note 6 of the Notes to Financial Statements. |

| (d) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. For purposes of this calculation, dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any. Periods less than one year are not annualized. |

See Notes to Financial Statements.

| Annual Report | July 31, 2018 | 15 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

1. ORGANIZATION

RiverNorth Opportunities Fund, Inc. (the “Fund”) is a Maryland corporation registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). Effective July 18, 2018, the Board of Directors (the “Board”) approved changing the fiscal year-end of the Fund from October 31 to July 31.

The Fund’s investment objective is total return consisting of capital appreciation and current income. The Fund seeks to achieve its investment objective by pursuing a tactical asset allocation strategy and opportunistically investing under normal circumstances in closed-end funds and exchange-traded funds (“ETFs” and collectively, “Underlying Funds”). Underlying Funds also may include business development companies (“BDCs”) and special purpose acquisition companies (“SPACs”). All Underlying Funds are registered under the Securities Act of 1933, as amended (the “Securities Act”). The Fund incurs higher and additional expenses when it invests in Underlying Funds. There is also the risk that the Fund may suffer losses due to the investment practices or operations of the Underlying Funds. To the extent that the Fund invests in one or more Underlying Funds that concentrate in a particular industry, the Fund would be vulnerable to factors affecting that industry and the concentrating Underlying Funds’ performance, and that of the Fund, may be more volatile than Underlying Funds that do not concentrate. In addition, one Underlying Fund may purchase a security that another Underlying Fund is selling.

The Fund may be converted to an open-end investment company at any time if approved by two-thirds of the entire Board and at least two-thirds of the Fund’s total outstanding shares. If the Fund converted to an open-end investment company, it would be required to redeem all preferred stock of the Fund then outstanding (requiring in turn that it liquidate a portion of its investment portfolio). Conversion to open-end status could also require the Fund to modify certain investment restrictions and policies. The Board may at any time (but is not required to) propose conversion of the Fund to open-end status, depending upon its judgment regarding the advisability of such action in light of circumstances then prevailing.

The Fund’s Charter provides that, during calendar year 2021, the Fund will call a shareholder meeting for the purpose of voting to determine whether the Fund should convert to an open-end management investment company (such meeting date, as may be adjourned, the “Conversion Vote Date”). Such shareholder meeting may be adjourned or postponed in accordance with the By-Laws of the Fund to a date in calendar year 2021. A vote on such Conversion Vote Date to convert the Fund to an open-end management investment company under the Declaration requires approval by a majority of the Fund’s total outstanding shares. A majority is defined as greater than 50% of the Fund’s total outstanding shares. If approved by shareholders on the Conversion Vote Date, the Fund will seek to convert to an open-end management investment company within 12 months of such approval. If the requisite number of votes to convert the Fund to an open-end management investment company is not obtained on the Conversion Vote Date, the Fund will continue in operation as a closed-end management investment company.

Under normal circumstances, the Fund intends to maintain long positions in Underlying Funds, but may engage in short sales for investment purposes. When the Fund engages in a short sale, it sells a security it does not own and, to complete the sale, borrows the same security from a broker or other institution. The Fund may benefit from a short position when the shorted security decreases in value.

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

2. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates: The financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures in the financial statements and reported amount of increase or decrease in net assets from operations during the period reported. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on July 31, 2018.

Portfolio Valuation: The net asset value per common share of the Fund is determined daily, on each day that the NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. New York time). The Fund’s net asset value per common share is calculated by dividing the value of the Fund’s total assets, less its liabilities by the number of shares outstanding.

The Board has established the following procedures for valuation of the Fund’s assets under normal market conditions. Marketable securities listed on foreign or U.S. securities exchanges generally are valued at closing sale prices or, if there were no sales, at the mean between the closing bid and ask prices on the exchange where such securities are primarily traded. If the independent primary or secondary pricing service is unable to provide a price for a security, if the price provided by the independent primary or secondary pricing service is deemed unreliable, or if events occurring after the close of the market for a security but before the time as of which the Fund values its common shares would materially affect net asset value, such security will be valued at its fair value as determined in good faith under procedures approved by the Board.

When applicable, fair value of an investment is determined by the Fund’s Fair Valuation Committee as a designee of the Board. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the fundamental business data relating to the issuer, borrower, or counterparty; an evaluation of the forces which influence the market in which the investments are purchased and sold; the type, size and cost of the investment; the information as to any transactions in or offers for the investment; the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies; the coupon payments, yield data/cash flow data; the quality, value and saleability of collateral, if any, securing the investment; the business prospects of the issuer, borrower, or counterparty, as applicable, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s, borrower’s, or counterparty’s management; the prospects for the industry of the issuer, borrower, or counterparty, as applicable, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; one or more independent broker quotes for the sale price of the portfolio security; and other relevant factors.

| Annual Report | July 31, 2018 | 17 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the specific identification method for both financial reporting and tax purposes.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2018:

| Investments in Securities at Value | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Closed-End Funds | | $ | 72,369,190 | | | $ | – | | | $ | – | | | $ | 72,369,190 | |

| Open-End Funds | | | 112,216 | | | | – | | | | – | | | | 112,216 | |

| Business Development Companies | | | 4,463,962 | | | | – | | | | – | | | | 4,463,962 | |

| Business Development Company Notes | | | 6,726,262 | | | | – | | | | – | | | | 6,726,262 | |

| Special Purpose Acquisition Companies | | | 10,949,098 | | | | – | | | | – | | | | 10,949,098 | |

| Rights | | | 150,810 | | | | – | | | | – | | | | 150,810 | |

| Warrants | | | 444,078 | | | | – | | | | – | | | | 444,078 | |

| U.S. Government Bonds and Notes | | | – | | | | 5,297,759 | | | | – | | | | 5,297,759 | |

| Short-Term Investments | | | 2,096,826 | | | | – | | | | – | | | | 2,096,826 | |

| Total | | $ | 97,312,442 | | | $ | 5,297,759 | | | $ | – | | | $ | 102,610,201 | |

| Other Financial Instruments Liabilities: | | | | | | | | | | | | | | | | |

| Securities Sold Short Exchange-Traded Funds | | $ | (4,705,318 | ) | | $ | – | | | $ | – | | | $ | (4,705,318 | ) |

| Total | | $ | (4,705,318 | ) | | $ | – | | | $ | – | | | $ | (4,705,318 | ) |

The Fund recognizes transfers between levels as of the end of the period. For the period ended July 31, 2018, the Fund had transfers between Level 1 and Level 2 securities.

| | | Level 1 - Quoted Prices | | | Level 2 - Other Significant

Observable Inputs | |

| | | Transfers In | | | Transfers (Out) | | | Transfers In | | | Transfers (Out) | |

| Special Purpose Acquisition Companies | | $ | 1,058,514 | | | $ | – | | | $ | – | | | $ | (1,058,514 | ) |

| Rights | | | 22,397 | | | | – | | | | – | | | | (22,397 | ) |

| Warrants | | | 43,122 | | | | – | | | | – | | | | (43,122 | ) |

| Total | | $ | 1,124,033 | | | $ | – | | | $ | – | | | $ | (1,124,033 | ) |

The above transfers from Level 2 to Level 1 were due to the ability to obtain a closing market price within an active market at July 31, 2018.

| Annual Report | July 31, 2018 | 19 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

The Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value at any time during the period ended July 31, 2018.

Short Sale Risks: The Fund and the Underlying Funds may engage in short sales. A short sale is a transaction in which a fund sells a security it does not own in anticipation that the market price of that security will decline. To establish a short position, a fund must first borrow the security from a broker or other institution. The fund may not always be able to borrow a security at a particular time or at an acceptable price. Accordingly, there is a risk that a fund may be unable to implement its investment strategy due to the lack of available securities or for other reasons. After selling a borrowed security, a fund is obligated to “cover” the short sale by purchasing and returning the security to the lender at a later date. The Fund and the Underlying Funds cannot guarantee that the security will be available at an acceptable price. Positions in shorted securities are speculative and more risky than long positions (purchases) in securities because the maximum sustainable loss on a security purchased is limited to the amount paid for the security plus the transaction costs, whereas there is no maximum attainable price of the shorted security. Therefore, in theory, securities sold short have unlimited risk. Short selling will also result in higher transaction costs (such as interest and dividends), and may result in higher taxes, which reduce a fund’s return.

Special Purpose Acquisition Company Risk: The Fund may invest in special purpose acquisition companies (“SPACs”). SPACs are collective investment structures that pool funds in order to seek potential acquisition opportunities. Unless and until an acquisition is completed, a SPAC generally invests its assets (less an amount to cover expenses) in U.S. Government securities, money market fund securities and cash. SPACs and similar entities may be blank check companies with no operating history or ongoing business other than to seek a potential acquisition. Certain SPACs may seek acquisitions only in limited industries or regions. If an acquisition that meets the requirements for the SPAC is not completed within a predetermined period of time, the invested funds are returned to the entity’s shareholders. Investments in SPACs may be illiquid and/or be subject to restrictions on resale.

Rights and Warrants Risks: Warrants are securities giving the holder the right, but not the obligation, to buy the stock of an issuer at a given price (generally higher than the value of the stock at the time of issuance) during a specified period or perpetually. Warrants do not carry with them the right to dividends or voting rights with respect to the securities that they entitle their holder to purchase and they do not represent any rights in the assets of the issuer. As a result, warrants may be considered to have more speculative characteristics than certain other types of investments. In addition, the value of a warrant does not necessarily change with the value of the underlying securities and a warrant ceases to have value if it is not exercised prior to its expiration date.

Rights are usually granted to existing shareholders of a corporation to subscribe to shares of a new issue of common stock before it is issued to the public. The right entitles its holder to buy common stock at a specified price. Rights have similar features to warrants, except that the life of a right is typically much shorter, usually a few weeks.

During the period ended July 31, 2018, the Fund invested in rights and warrants, which are disclosed in the Statement of Investments.

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

The effect of derivative instruments on the Statement of Assets and Liabilities for the period ended July 31, 2018:

| | | Asset Derivatives | | | |

| Risk Exposure | | Statement of Assets and Liabilities Location | | Fair Value | |

| Equity Contracts (Rights) | | Investments, at value | | $ | 150,810 | |

| Equity Contracts (Warrants) | | Investments, at value | | | 444,078 | |

| | | | | $ | 594,888 | |

The effect of derivative instruments on the Statements of Operations for the period ended July 31, 2018:

| Risk Exposure | | Statement of Operations Location | | Realized Gain/(Loss) on Derivatives | | | Change in Unrealized Appreciation/ (Depreciation) on Derivatives | |

| Equity Contracts (Rights) | | Net realized gain/(loss) on investments/ Net change in unrealized appreciation/(depreciation) on investments | | $ | (415 | ) | | $ | 34,292 | |

| Equity Contracts (Warrants) | | Net realized gain/(loss) on investments/ Net change in unrealized appreciation/(depreciation) on investments | | | – | | | | 103,610 | |

| Total | | | | $ | (415 | ) | | $ | 137,902 | |

The Fund’s average value of rights and warrants held for the period ended July 31, 2018 were $86,123 and $164,886 respectively.

| Annual Report | July 31, 2018 | 21 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

The effect of derivative instruments on the Statements of Operations for the year ended October 31, 2017:

| Risk Exposure | | Statement of Operations Location | | Realized Gain/(Loss) on Derivatives | | | Change in Unrealized Appreciation/ (Depreciation) on Derivatives | |

| Equity Contracts (Rights) | | Net realized gain/(loss) on investments/ Net change in unrealized appreciation/(depreciation) on investments | | $ | (1,285 | ) | | $ | 3,144 | |

| Equity Contracts (Warrants) | | Net realized gain/(loss) on investments/ Net change in unrealized appreciation/(depreciation) on investments | | | – | | | | 2,383 | |

| Total | | | | $ | (1,285 | ) | | $ | 5,527 | |

The Fund’s average value of rights and warrants held for the year ended October 31, 2017 were $4,755 and $9,992 respectively.

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

ALPS Advisors, Inc. (“AAI”) serves as the Fund’s investment adviser pursuant to an investment advisory agreement with the Fund, which became effective on June 29, 2018. Pursuant to an investment sub-advisory agreement, AAI has retained RiverNorth Capital Management LLC (“RiverNorth”) to serve as the Fund’s sub-adviser, which also became effective on June 29, 2018. AAI and RiverNorth each served under previous investment advisory and sub-advisory agreements, respectively, since the commencement of the Fund until these agreements were terminated on April 16, 2018, due to a change of control of AAI’s parent company, as described below. Beginning April 16, 2018 until June 29, 2018, AAI and RiverNorth each served under an interim investment advisory agreement and interim sub-advisory agreement, respectively, until the current investment advisory and sub-advisory agreements were approved by the Fund’s shareholders. As compensation for its services to the Fund under each of the applicable investment advisory agreements, AAI is paid an annual investment advisory fee of 1.00% based on the Fund’s average daily Managed Assets (as defined below). Under each of the applicable investment sub-advisory agreements, AAI (not the Fund) pays RiverNorth an annual fee of 0.85% based on the Fund’s average daily Managed Assets.

ALPS Fund Services, Inc. (‘‘AFS’’), an affiliate of AAI, serves as administrator to the Fund. Under an Administration, Bookkeeping and Pricing Services Agreement, AFS is responsible for calculating the net asset values, providing additional fund accounting and tax services, and providing fund administration and compliance-related services to the Fund. AFS is entitled to receive a monthly fee, accrued daily based on the Fund’s average Managed Assets, as defined below, plus reimbursement for certain out-of-pocket expenses.

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

DST Systems, Inc. (‘‘DST’’), the parent company of AAI and AFS, serves as the Transfer Agent to the Fund. Under the Transfer Agency Agreement, DST is responsible for maintaining all shareholder records of the Fund. DST is entitled to receive an annual minimum fee of $22,500 plus out-of-pocket expenses. DST is a wholly-owned subsidiary of SS&C Technologies Holdings, Inc. (“SS&C”), a publicly traded company listed on the NASDAQ Global Select Market, which acquired DST in a transaction which closed on April 16, 2018.

The Fund pays no salaries or compensation to any of its interested Directors or its Officers. For their services, the four independent Directors of the Fund receive an annual retainer in the amount of $17,000, an additional $2,000 for attending each meeting of the Board and $1,000 for attending a special meeting of the Board. In addition, the Independent Chairman receives an additional $10,000 annually. The independent Directors are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings of the Board.

Certain Officers and an Interested Director of the Fund are also officers of AAI and AFS. An Interested Director is an officer of RiverNorth.

Managed Assets: For these purposes, the term Managed Assets is defined as the total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding), calculated as of 4:00 p.m. Eastern time on such day or as of such other time or times as the Board may determine in accordance with the provisions of applicable law and of the declaration and bylaws of the Fund and with resolutions of the Board as from time to time in force.

4. LEVERAGE

The Fund may borrow money and/or issue preferred stock, notes or debt securities for investment purposes. These practices are known as leveraging. The Fund may use leverage through borrowings or the issuance of preferred stock, in an aggregate amount of up to 15% of the Fund’s Managed Assets immediately after such borrowings or issuance. “Managed Assets” means the total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding). However, the Fund is not required to decrease its use of leverage if leverage exceeds 15%, but is less than 20% of the Fund’s Managed Assets due solely to changes in market conditions. Based on market conditions at the time, the Fund may instead use such leverage in amounts that represent less than 15% of the Fund’s Managed Assets. The Sub-adviser will assess whether or not to engage in leverage based on its assessment of conditions in the debt and credit markets. Leverage, if used, may take the form of a borrowing or the issuance of preferred stock, although the Fund currently anticipates that leverage will initially be obtained through the use of bank borrowings or other similar term loans. The Underlying Funds that the Fund invests in may also use leverage; provided, however, it is the intention of the Fund that the Fund’s direct use of leverage and the Fund’s overall exposure to leverage utilized by all the Underlying Funds, (i) attributable to debt, will not exceed 33 1/3% of the Fund’s Managed Assets and (ii), attributable to debt and preferred stock, will not exceed 50% of its Managed Assets. To the extent that the Fund’s exposure to leverage utilized by all the Underlying Funds is 50% of the Fund’s Managed Assets, the Fund intends to not utilize leverage directly. The Fund’s intention to limit leverage is contingent upon the Sub-adviser’s ability to adequately determine an Underlying Fund’s current amount of leverage, which may be severely limited, and ultimately unsuccessful.

| Annual Report | July 31, 2018 | 23 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

If the net rate of return on the Fund’s investments purchased with the leverage proceeds exceeds the interest or dividend rate payable on the leverage, such excess earnings will be available to pay higher dividends to the Fund’s Common Shareholders. If the net rate of return on the Fund’s investments purchased with leverage proceeds does not exceed the costs of leverage, the return to Common Shareholders will be less than if leverage had not been used. The use of leverage magnifies gains and losses to Common Shareholders. Since the holders of common stock pay all expenses related to the issuance of debt or use of leverage, any use of leverage would create a greater risk of loss for the shares of common stock than if leverage is not used. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

The Fund has entered into a $15,000,000 secured committed line of credit agreement with State Street Bank and Trust Company (“SSB”), which by its terms expires on November 28, 2018, subject to the restrictions and terms of the credit agreement. For borrowing under this credit agreement, the Fund will be charged either an interest rate of:

| (1) | 1.00% (per annum) plus the One-Month LIBOR (London Interbank Offered Rate)

or |

| (2) | as of any day, the higher of (a) 1.05% (per annum) plus the daily Federal Funds Rate as in effect on that day, and (b) 1.05% (per annum) plus the One-Month LIBOR as in effect on that day. |

Borrowing under this credit agreement, the commitment fee on the daily unused loan balance of the line of credit accrues; (a) at all other times, as of any date upon which the loan balance equals or exceeds 75% of the commitment amount, 0.15% and as of any other date, 0.25%. Until November 28, 2017 the commitment fee on the unused loan balance was 0.15%. The Fund pledges its investment securities as the collateral for the line of credit per the terms of the agreement. During the period ended July 31, 2018, the Fund did not draw down on its credit line. Prior to submitting a request to borrow from the line of credit, the Fund will evaluate the economic suitability of the credit terms above.

5. DISTRIBUTIONS

The Fund intends to make a level distribution each month to common shareholders after payment of interest on any outstanding borrowings. The level dividend rate may be modified by the Board from time to time. In addition, the Fund intends to distribute its net realized capital gains, if any, at least annually. At times, to maintain a stable level of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return capital, in addition to current net investment income. Any distribution that is treated as a return of capital generally will reduce a shareholder’s basis in his or her shares, which may increase the capital gain or reduce the capital loss realized upon the sale of such shares. Any amounts received in excess of a shareholder’s basis are generally treated as capital gain, assuming the shares are held as capital assets.

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

Distributions to shareholders are recorded on ex-date.

On June 30, 2017 the Board approved the adoption of a managed distribution plan in accordance with AAI’s Section 19(b) exemptive order described below (the “Managed Distribution Plan”). Under the Managed Distribution Plan, to the extent that sufficient investment income is not available on a monthly basis, the Fund will make regular monthly distributions, which may consist of long-term capital gains and/or return of capital in order to maintain the distribution rate. In accordance with the Managed Distribution Plan, beginning with its August 2017 distribution, the Fund made monthly distributions to common shareholders set initially at a fixed monthly rate of $0.21 per common share. For the period of December 2015 through July 2017, the Fund made regular monthly distributions of $0.14 per share.

The amount of the Fund's distributions pursuant to the Managed Distribution Plan are not related to the Fund's performance and, therefore, investors should not make any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the Fund’s Managed Distribution Plan. The Board may amend, suspend or terminate the Managed Distribution Plan at any time without notice to shareholders.

AAI has received an order granting an exemption from Section 19(b) of the 1940 Act and Rule 19b-1 thereunder to permit the Fund, subject to certain terms and conditions, to include realized long-term capital gains as a part of its regular distributions to its stockholders more frequently than would otherwise be permitted by the 1940 Act (generally once per taxable year). To the extent that the Fund relies on the exemptive order, the Fund will be required to comply with the terms and conditions therein, which, among other things, requires the Fund to make certain disclosures to shareholders and prospective shareholders regarding distributions, and would require the Board to make determinations regarding the appropriateness of the use of the distribution policy. Under such a distribution policy, it is possible that the Fund might distribute more than its income and net realized capital gains; therefore, distributions to shareholders may result in a return of capital. The amount treated as a return of capital will reduce a shareholder’s adjusted basis in the shareholder’s shares, thereby increasing the potential gain or reducing the potential loss on the sale of shares. There is no assurance that the Fund will continue to rely on the exemptive order in the future.

The Board approved the termination of the Fund’s Managed Distribution Plan, effective following the close of business on July 31, 2018 (See Note 9).

6. CAPITAL TRANSACTIONS

The Fund’s authorized capital stock consists of 37,500,000 shares of common stock, $0.0001 par value per share, all of which is initially classified as common shares. Under the rules of the NYSE applicable to listed companies, the Fund is required to hold an annual meeting of stockholders in each year.

Under the Fund’s Charter, the Board is authorized to classify and reclassify any unissued shares of stock into other classes or series of stock and authorize the issuance of shares of stock without obtaining stockholder approval. Also, the Fund’s Board, with the approval of a majority of the entire Board, but without any action by the stockholders of the Fund, may amend the Fund’s Charter from time to time to increase or decrease the aggregate number of shares of stock of the Fund or the number of shares of stock of any class or series that the Fund has authority to issue.

| Annual Report | July 31, 2018 | 25 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

The Fund issued 3,755,155 common shares in its initial public offering on December 24, 2015. These common shares were issued at $20.00 per share before the underwriting discount of $0.60 per share. Offering costs of $150,206 (representing $0.04 per common share) were offset against proceeds of the offerings and have been charged to paid-in capital of the common shares. AAI and RiverNorth agreed to pay those offering costs of the Fund (other than the sales load) that exceeded $0.04 per common share.

On September 25, 2017, the Board approved the rights offering to participating shareholders of record as of October 12, 2017 (the “Record Date”) who were allowed to subscribe for new common shares of the Fund (the “Primary Subscription”). Record Date Shareholders received one Right for each common share held on the Record Date. For every three Rights held, a holder of the Rights was entitled to buy one new common share of the Fund. Record Date Shareholders who fully exercised all Rights initially issued to them in the Primary Subscription were entitled to buy those common shares that were not purchased by other Record Date Shareholders. The Fund issued 1,564,710 new shares of common stock as a result of a rights offering which closed on November 9, 2017 (the “Expiration Date”). The subscription price of $19.54 per share was established on the Expiration Date, which represented 95% of the market price per share, based on the average of the last reported sales price on the NYSE for the five trading days preceding the Expiration Date. Costs of $214,591 were charged to paid-in-capital upon the exercise of the rights.

Offering costs incurred as a result of the Fund’s shelf registration statement, through July 31, 2018, are approximately $148,833. Management estimates an additional $495,735 of costs expected to be incurred resulting in total offering costs of approximately $644,568. The Statement of Assets and Liabilities reflects the current offering costs of $148,833 as deferred offering costs. These offering costs, as well as offering costs incurred subsequent to July 31, 2018, will be charged to paid-in-capital upon the issuance of shares.

Additional shares of the Fund may be issued under certain circumstances, including pursuant to the Fund’s Automatic Dividend Reinvestment Plan, as defined within the Fund’s organizational documents. Additional information concerning the Automatic Dividend Reinvestment Plan is included within this report.

7. PORTFOLIO INFORMATION

Purchases and Sales of Securities: For the period ended July 31, 2018, the cost of purchases and proceeds from sales of securities, excluding short-term obligations, were $101,186,169 and $68,528,190 respectively.

8. TAXES

Classification of Distributions: Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

The tax character of distributions paid during the period ended July 31, 2018, the year ended October 31, 2017 and the period ended October 31, 2016 were as follows:

| | | For the Period Ended July 31, 2018 | | | For the Year Ended October 31, 2017 | | | For the Period Ended October 31, 2016 | |

| Ordinary Income | | $ | 5,015,176 | | | $ | 7,094,912 | | | $ | 6,496,219 | |

| Tax-Exempt Income | | | 38,747 | | | | 2,405 | | | | – | |

| Long-Term Capital Gain | | | 4,576,976 | | | | – | | | | 1,682,509 | |

| Return of Capital | | | 426,607 | | | | – | | | | – | |

| Total | | $ | 10,057,506 | | | $ | 7,097,317 | | | $ | 8,178,728 | |

Components of Earnings: Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under accounting principles generally accepted in the United States. Accordingly, for the period ended July 31, 2018, certain differences were reclassified.

The reclassifications were as follows:

| Paid-in capital | Accumulated net investment income | Accumulated net realized gain |

| $(93,499) | $70,589 | $22,910 |

These differences are primarily attributed to excise taxes paid, investments in passive foreign investment companies and investments in real estate investment trusts.

Tax Basis of Distributable Earnings: Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under GAAP.

As of July 31, 2018, the components of distributable earnings on a tax basis were as follows:

| Unrealized Depreciation | | $ | (549,742 | ) |

| Cumulative Effect of Other Timing Difference | | | (36,794 | ) |

| Total | | $ | (586,536 | ) |

| Annual Report | July 31, 2018 | 27 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

July 31, 2018

Tax Basis of Investments: Net unrealized appreciation/(depreciation) of investments based on federal tax cost as of July 31, 2018, was as follows:

| Cost of investments for income tax purposes | | $ | 103,192,472 | |

| Gross appreciation on investments (excess of value over tax cost)(a) | | | 2,955,637 | |

| Gross depreciation on investments (excess of tax cost over value)(a) | | | (3,505,379 | ) |

| Net unrealized depreciation on investments | | $ | (549,742 | ) |

| (a) | Includes appreciation/(depreciation) on securities sold short. |

The differences between book-basis and tax-basis are primarily due to wash sales, investments in passive foreign investment companies and tax treatment of certain other investments.

Federal Income Tax Status: For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its investment company taxable net income and realized gain, not offset by capital loss carryforwards, if any, to its shareholders. No provision for federal income taxes has been made.

As of and during the period ended July 31, 2018, the Fund did not have a liability for any unrecognized tax benefits in the accompanying financial statements. The Fund recognizes the interest and penalties, if any, related to the unrecognized tax benefits as income tax expense in the Statements of Operations. Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax periods and has concluded that no provision for federal income tax is required in the Fund’s financial statements. During the year, the Fund did not incur any interest or penalties. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return.

9. SUBSEQUENT EVENTS

Distributions

Subsequent to July 31, 2018, the Fund paid the following distributions:

| Ex-Date | | Record Date | | Payable Date | | Rate (per share) |

| August 16, 2018 | | August 17, 2018 | | August 31, 2018 | | $ | 0.210 | |

| September 13, 2018 | | September 14, 2018 | | September 28, 2018 | | $ | 0.210 | |