Filed by Breitburn Energy Partners LP

Commission File No. 001-33055

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: QR Energy, LP

Commission File No. 001-35010

This filing relates to a proposed business combination involving QR Energy, LP, a Delaware limited partnership (“QR Energy”) and Breitburn Energy Partners LP, a Delaware limited partnership (“Breitburn”).

NASDAQ: BBEP PRESENTATION TO QR ENERGY EMPLOYEES BREITBURN ENERGY PARTNERS LP AUGUST 2014

pg. 2 • Who are we? • What is our strategy? • Where and how do we operate? • How are we organized? • What can you expect from us? INTRODUCTION TO BREITBURN Today’s Agenda Speakers • Jim Jackson – Chief Financial Officer & Executive Vice President • Dave Baker – Senior Vice President BBEP Operations • Tom Thurmond – Vice President Operations Support • John Gillespie – Vice President Human Resources

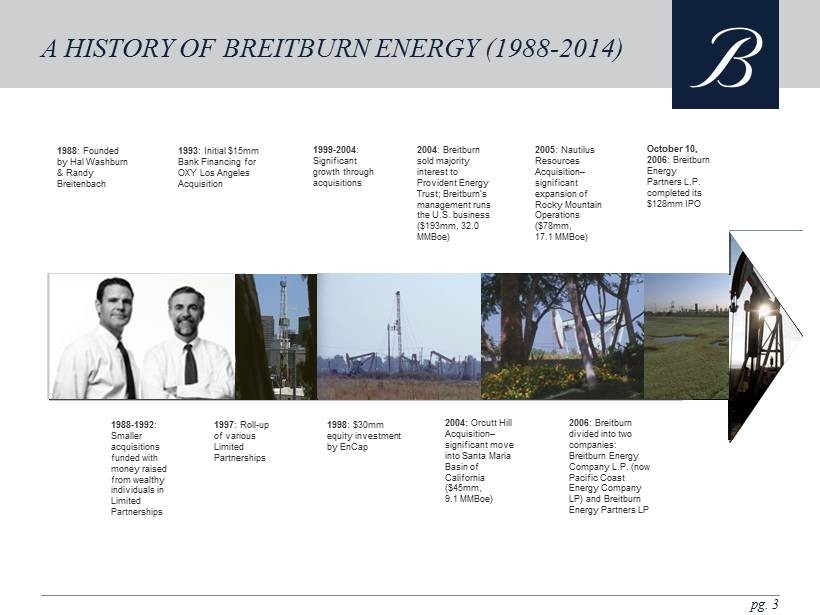

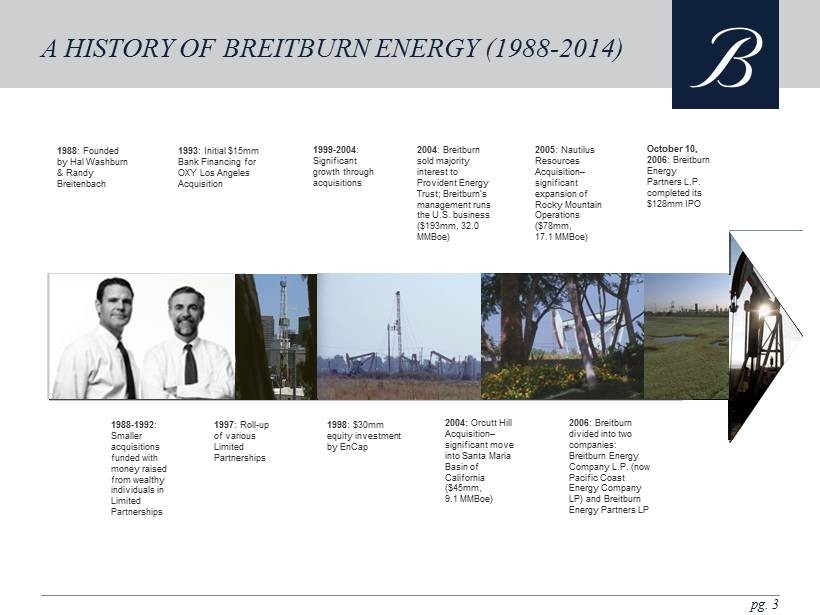

pg. 3 A HISTORY OF BREITBURN ENERGY (1988 - 2014) 1988 - 1992 : Smaller acquisitions funded with money raised from wealthy individuals in Limited Partnerships 2006 : Breitburn divided into two companies: Breitburn Energy Company L.P. (now Pacific Coast Energy Company LP) and Breitburn Energy Partners LP 1997 : Roll - up of various Limited Partnerships 1998 : $30mm equity investment by EnCap 2004: Orcutt Hill Acquisition – significant move into Santa Maria Basin of California ($45mm, 9.1 MMBoe) 1988 : Founded by Hal Washburn & Randy Breitenbach 2005 : Nautilus Resources Acquisition – significant expansion of Rocky Mountain Operations ($78mm, 17.1 MMBoe) October 10, 2006 : Breitburn Energy Partners L.P. completed its $128mm IPO 1993 : Initial $15mm Bank Financing for OXY Los Angeles Acquisition 1999 - 2004 : Significant growth through acquisitions 2004 : Breitburn sold majority interest to Provident Energy Trust; Breitburn’s management runs the U.S. business ($193mm, 32.0 MMBoe)

November 1, 2007 : Completed Quicksilver acquisition – expanded to Michigan, Indiana and Kentucky ($1,474mm, 88.3 MMBoe) May 17, 2007 : Announced acquisition in Florida’s Sunniland Trend ($100mm, 9.5 MMBoe) June 17, 2008 : Announced repurchase of Provident’s interests in BreitBurn ($345mm) May 25, 2007 : Announced acquisition in Los Angeles Basin ($92mm, 6.5 MMBoe) April 17, 2009 : Announced temporary suspension of distributions to repay debt February 8, 2010 Announces settlement of all litigation with Quicksilver and reinstatement of distributions at $1.50 in Q1 2010 July 28, 2011 Completed acquisition of Greasewood Field in WY ($58mm, 500 Boe/d) October 6, 2011 Completed acquisition of Evanston and Green River Basins in WY ($283mm, 30MMcfe/d) November 2011: Quicksilver sold remaining ownership in BBEP April 25, 2012 Completed acquisition of Wyoming oil properties for $93 million May – December 2012 Completed 5 acquisitions in the Permian Basin, Texas for a combined purchase price of $420 million December 3, 2012 Completed acquisition of oil properties in Kern County, CA for ~$100 million ($38 million cash and ~3 million in common units) December 31, 2012 Randy Breitenbach retires as President. Mark Pease appointed President and COO. 2012 BBEP achieves record production and Adjusted EBITDA A HISTORY OF BREITBURN ENERGY (CONT’D) pg. 4

2013: BBEP celebrated 25 years of experience with the NASDAQ closing bell ceremony on May 21, 2013 November 6, 2013 : Announced the conversion to a monthly distribution payment policy from a quarterly distribution policy beginning in January 2014 December 13, 2013 : Announced the acquisition of additional Permian Basin Interests and properties for ~$302 million June 24, 2013 : Announced the acquisition of oil and gas properties in Oklahoma panhandle from Whiting Oil and Gas and other sellers for ~$875 million A HISTORY OF BREITBURN ENERGY (CONT’D) July 24, 2014 : Announced the acquisition of QR Energy, LP for ~$3.0 billion. $7.8 billion merger forms the largest oil - weighted upstream MLP pg. 5 2013: Completed ~$1.2 billion in total acquisitions

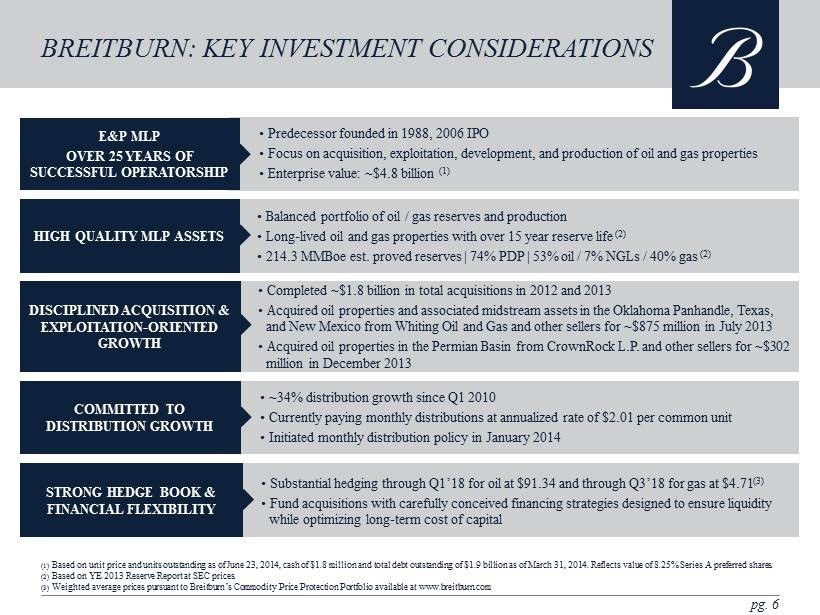

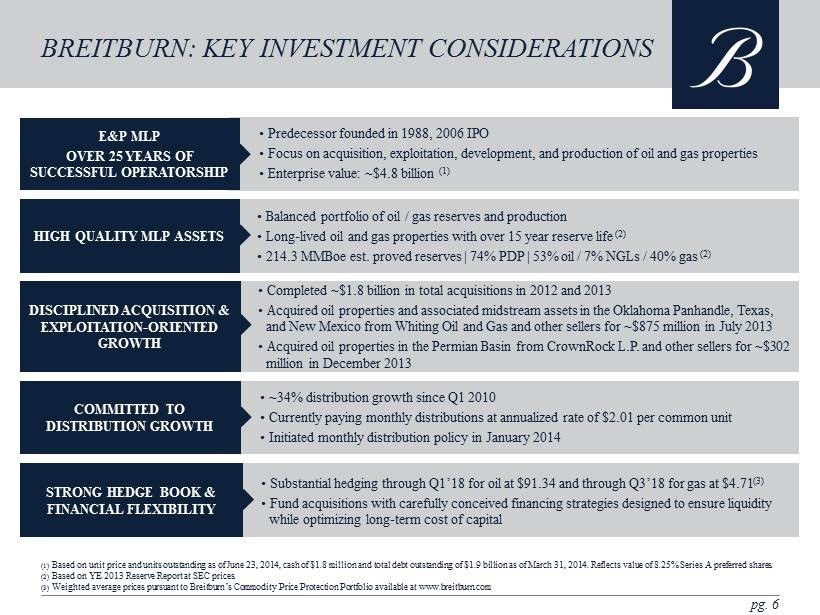

STRONG HEDGE BOOK & FINANCIAL FLEXIBILITY COMMITTED TO DISTRIBUTION GROWTH E&P MLP OVER 25 YEARS OF SUCCESSFUL OPERATORSHIP pg. 6 • Predecessor founded in 1988, 2006 IPO • Focus on acquisition, exploitation, development, and production of oil and gas properties • Enterprise value: ~$4.8 billion (1) BREITBURN: KEY INVESTMENT CONSIDERATIONS HIGH QUALITY MLP ASSETS • Balanced portfolio of oil / gas reserves and production • Long - lived oil and gas properties with over 15 year reserve life (2) • 214.3 MMBoe est. proved reserves | 74% PDP | 53% oil / 7% NGLs / 40% gas (2) • Completed ~$ 1.8 billion in total acquisitions in 2012 and 2013 • Acquired oil properties and associated midstream assets in the Oklahoma Panhandle, Texas, and New Mexico from Whiting Oil and Gas and other sellers for ~$ 875 million in July 2013 • Acquired oil properties in the Permian Basin from CrownRock L.P. and other sellers for ~$302 million in December 2013 • ~34% distribution growth since Q1 2010 • Currently paying monthly distributions at annualized rate of $2.01 per common unit • Initiated monthly distribution policy in January 2014 • Substantial hedging through Q1’18 for oil at $91.34 and through Q3’18 for gas at $4.71 (3) • Fund acquisitions with carefully conceived financing strategies designed to ensure liquidity while optimizing long - term cost of capital DISCIPLINED ACQUISITION & EXPLOITATION - ORIENTED GROWTH (1) Based on unit price and units outstanding as of June 23, 2014, cash of $1.8 million and total debt outstanding of $1.9 billion as of March 31, 2014. Reflects value of 8.25% Series A preferred shares. (2) Based on YE 2013 Reserve Report at SEC prices . (3) Weighted average prices pursuant to Breitburn’s Commodity Price Protection Portfolio available at www.breitburn.com

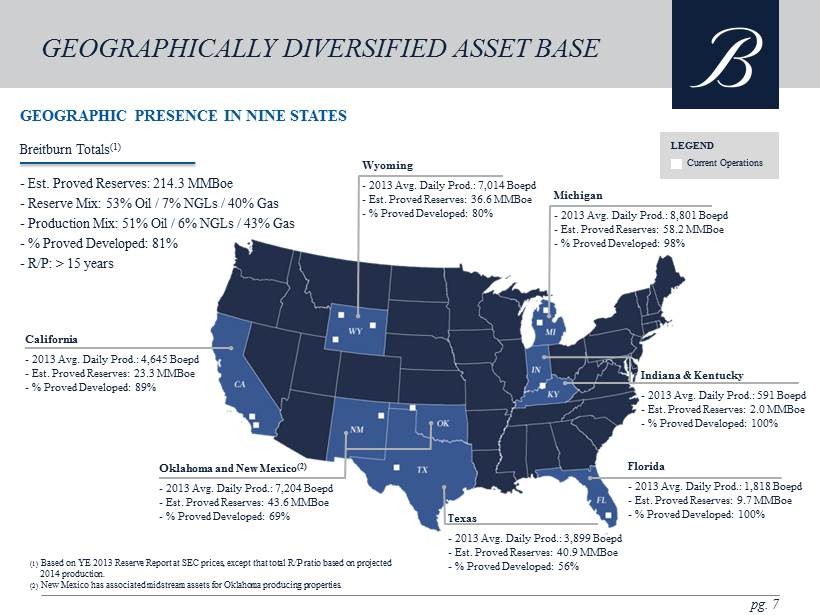

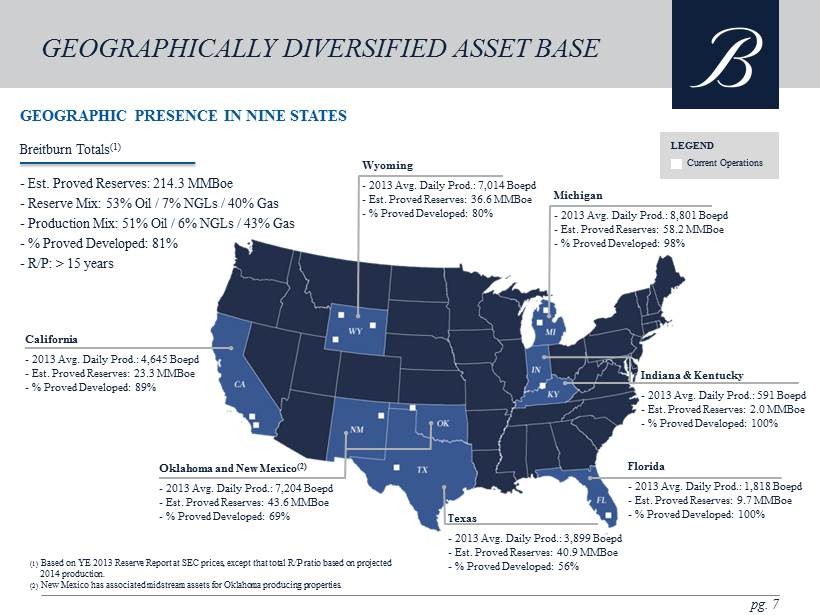

pg. 7 Breitburn Totals (1) - Est. Proved Reserves: 214.3 MMBoe - Reserve Mix: 53% Oil / 7% NGLs / 40% Gas - Production Mix: 51% Oil / 6% NGLs / 43% Gas - % Proved Developed: 81% - R/P: > 15 years GEOGRAPHIC PRESENCE IN NINE STATES GEOGRAPHICALLY DIVERSIFIED ASSET BASE (1) Based on YE 2013 Reserve Report at SEC prices, except that total R/P ratio based on projected 2014 production. (2) New Mexico has associated midstream assets for Oklahoma producing properties. California - 2013 Avg. Daily Prod.: 4,645 Boepd - Est . Proved Reserves: 23.3 MMBoe - % Proved Developed: 89% Oklahoma and New Mexico (2) - 2013 Avg. Daily Prod.: 7,204 Boepd - Est . Proved Reserves: 43.6 MMBoe - % Proved Developed: 69 % Texas - 2013 Avg. Daily Prod.: 3,899 Boepd - Est . Proved Reserves: 40.9 MMBoe - % Proved Developed: 56 % Florida - 2013 Avg. Daily Prod.: 1,818 Boepd - Est . Proved Reserves: 9.7 MMBoe - % Proved Developed: 100 % Indiana & Kentucky - 2013 Avg. Daily Prod.: 591 Boepd - Est . Proved Reserves: 2.0 MMBoe - % Proved Developed: 100 % Michigan - 2013 Avg. Daily Prod.: 8,801 Boepd - Est . Proved Reserves: 58.2 MMBoe - % Proved Developed: 98 % Wyoming - 2013 Avg. Daily Prod.: 7,014 Boepd - Est . Proved Reserves: 36.6 MMBoe - % Proved Developed: 80 % LEGEND Current Operations

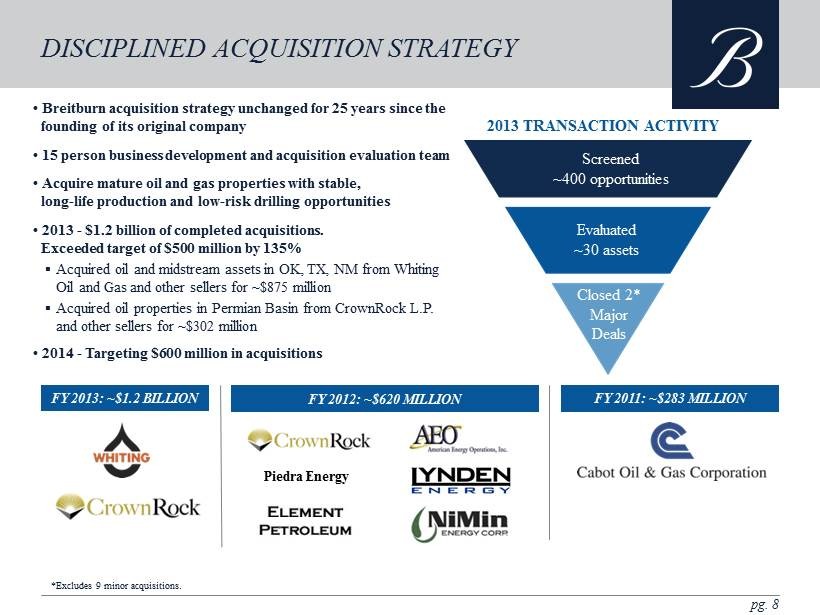

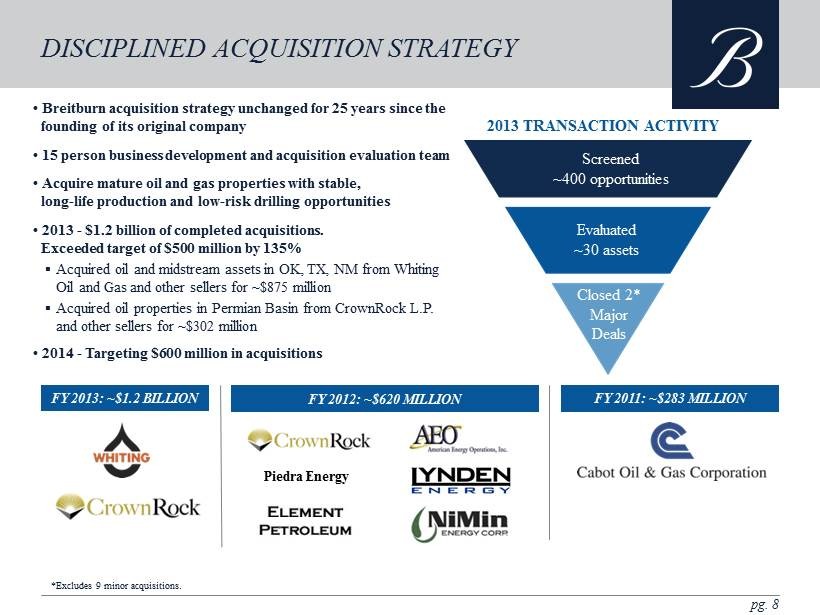

• Breitburn acquisition strategy unchanged for 25 years since the founding of its original company • 15 person business development and acquisition evaluation team • Acquire mature oil and gas properties with stable, long - life production and low - risk drilling opportunities • 2013 - $1.2 billion of completed acquisitions. Exceeded target of $500 million by 135% ▪ Acquired oil and midstream assets in OK, TX, NM from Whiting Oil and Gas and other sellers for ~$875 million ▪ Acquired oil properties in Permian Basin from CrownRock L.P. a nd other sellers for ~$302 million • 2014 - Targeting $600 million in acquisitions pg. 8 2013 TRANSACTION ACTIVITY DISCIPLINED ACQUISITION STRATEGY Piedra Energy FY 2013: ~$1.2 BILLION FY 2012: ~$620 MILLION FY 2011: ~$283 MILLION Screened~400 opportunities \ Evaluated~30 assets \ Closed 2* Major Acquisitions *Excludes 9 minor acquisitions. Screened ~ 400 opportunities Evaluated ~ 30 assets Closed 2* Major Deals

SEQUENTIAL DISTRIBUTION GROWTH • Consistent distribution growth for the past 4 years • 2013 distribution growth of ~4.8% (1) ACCRETIVE ACQUISITIONS • Acquire assets that complement existing portfolio and are accretive to DCF and NAV per unit EFFECTIVE HEDGING STRATEGY • Mitigate commodity price volatility, stabilize cash flow • Add additional hedges systematically and in conjunction with new acquisitions ORGANIC GROWTH OPPORTUNITIES • Identify and develop growth opportunities in base business STRONG MLP ASSET BASE • Exploit base business of long - life, low - decline assets with predictable production profiles pg. 9 SUCCESSFUL OPERATING PLAN THAT PAYS (1) Based on Q4 2013 annualized monthly distribution of $1.97 divided by Q4 2012 annualized quarterly distribution of $1.88 . DISTRIBUTION GROWTH ACCRETIVE ACQUISITIONS EFFECTIVE HEDGING STRATEGY ORGANIC GROWTH OPPORTUNITIES STRONG MLP ASSET BASE

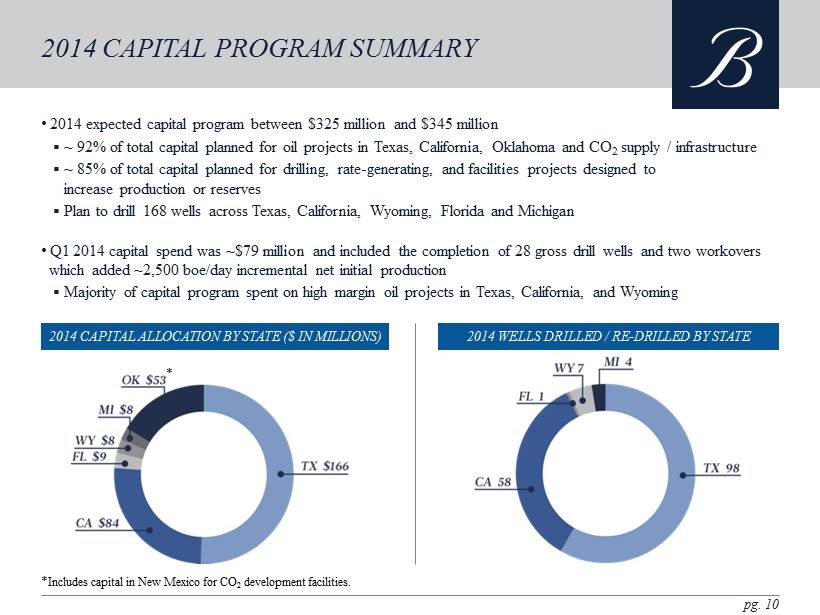

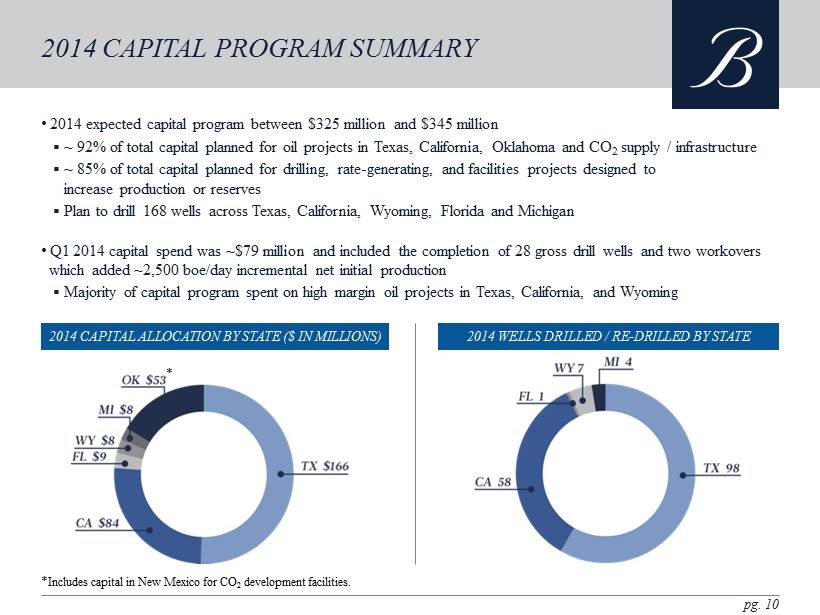

• 2014 expected capital program between $325 million and $345 million ▪ ~ 92% of total capital planned for oil projects in Texas, California, Oklahoma and CO 2 supply / infrastructure ▪ ~ 85% of total capital planned for drilling, rate - generating, and facilities projects designed to increase production or reserves ▪ Plan to drill 168 wells across Texas, California, Wyoming, Florida and Michigan • Q1 2014 capital spend was ~$79 million and included the completion of 28 gross drill wells and two workovers which added ~2,500 boe /day incremental net initial production ▪ Majority of capital program spent on high margin oil projects in Texas, California, and Wyoming pg. 10 2014 CAPITAL PROGRAM SUMMARY 2014 WELLS DRILLED / RE - DRILLED BY STATE 2014 CAPITAL ALLOCATION BY STATE ($ IN MILLIONS) * * Includes capital in New Mexico for CO 2 development facilities.

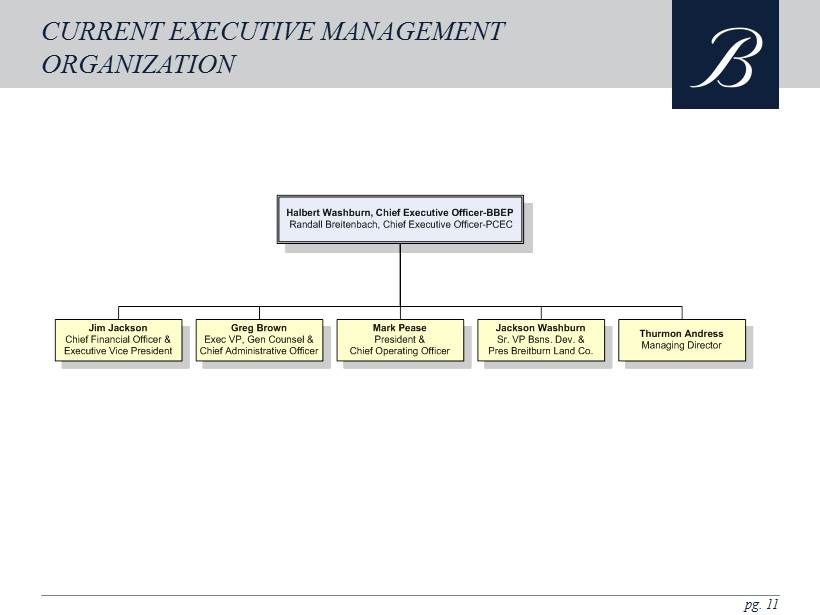

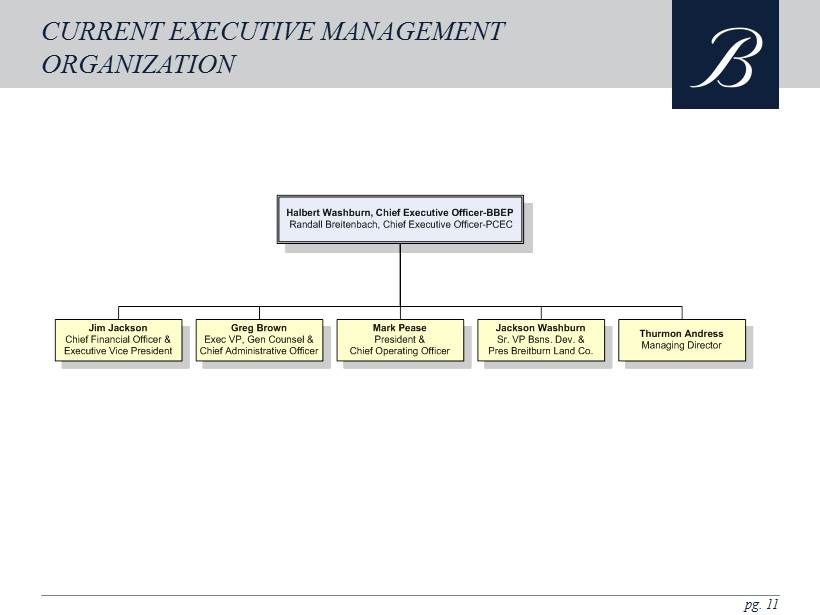

pg. 11 CURRENT EXECUTIVE MANAGEMENT ORGANIZATION Halbert Washburn, Chief Executive Officer-BBEP Randall Breitenbach, Chief Executive Officer-PCEC Jackson Washburn Sr. VP Bsns. Dev. & Pres Breitburn Land Co. Greg Brown Exec VP, Gen Counsel & Chief Administrative Officer Jim Jackson Chief Financial Officer & Executive Vice President Mark Pease President & Chief Operating Officer Thurmon Andress Managing Director

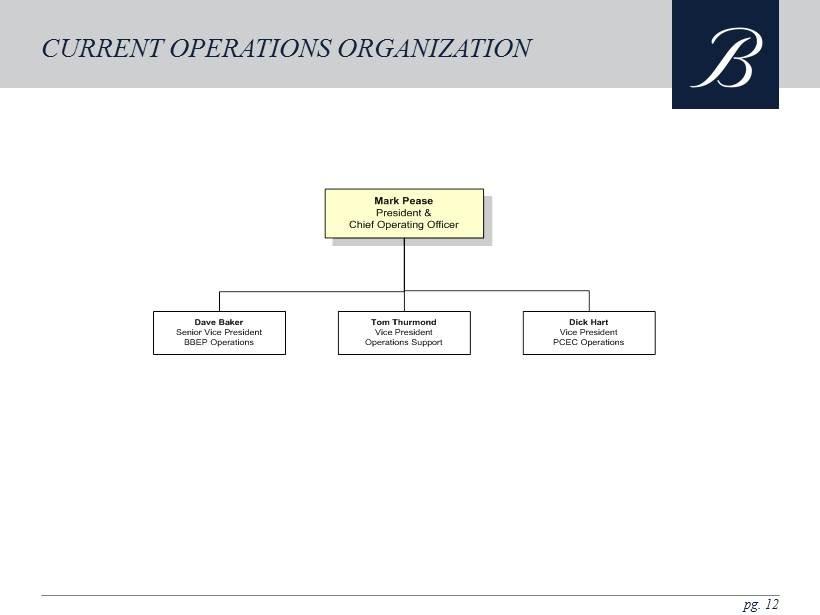

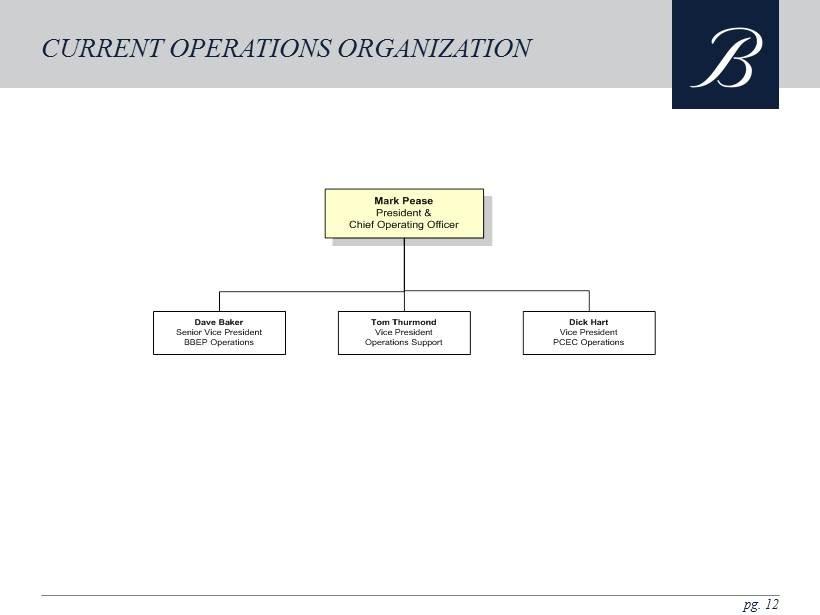

pg. 12 CURRENT OPERATIONS ORGANIZATION Tom Thurmond Vice President Operations Support Dave Baker Senior Vice President BBEP Operations Mark Pease President & Chief Operating Officer Dick Hart Vice President PCEC Operations

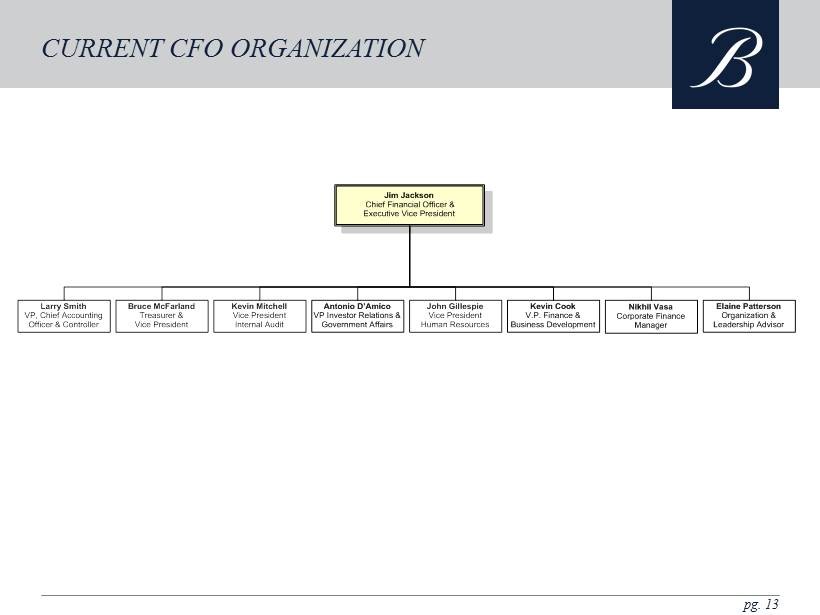

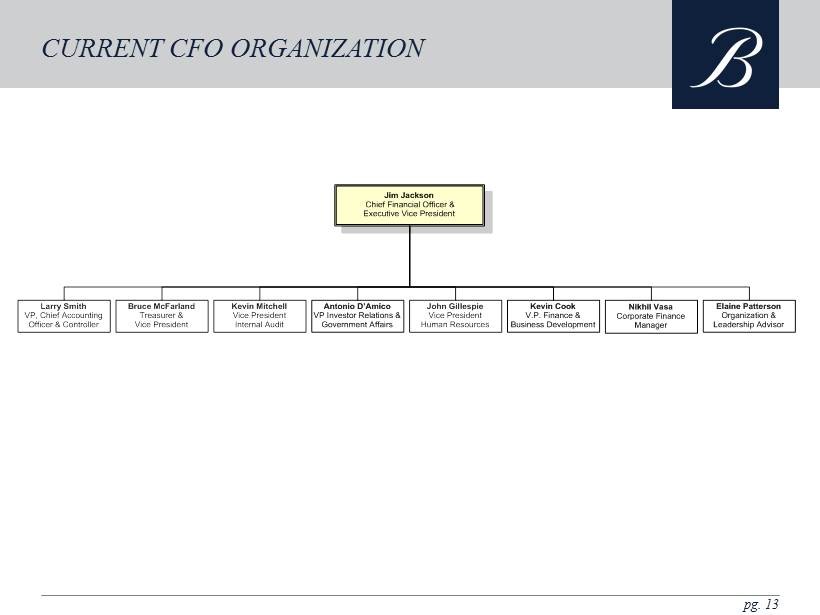

pg. 13 CURRENT CFO ORGANIZATION Kevin Mitchell Vice President Internal Audit Bruce McFarland Treasurer & Vice President John Gillespie Vice President Human Resources Elaine Patterson Organization & Leadership Advisor Nikhil Vasa Corporate Finance Manager Larry Smith VP, Chief Accounting Officer & Controller Jim Jackson Chief Financial Officer & Executive Vice President Antonio D’Amico VP Investor Relations & Government Affairs Kevin Cook V.P. Finance & Business Development

pg. 14 CURRENT BENEFITS OVERVIEW Breitburn Energy Medical Anthem Blue Cross PPO Dental Delta Dental PPO Vision Vision Service Plan (VSP) PPO Life Insurance Basic Life/AD&D Supplemental Employee Life Supplemental Spouse Life Supplemental Child Life Supplemental Individual/Family AD&D Business Travel Accident Short Term Disability (STD) Cigna Long Term Disability (LTD) Cigna Flexible Spending Account (FSA) WageWorks Employee Assiatance Program (EAP) Cigna Tuition Reimbursement Program BreitBurn 75% of tuition & other expenses, subject to mgmt. review 401(k) Prudential Retirement Company Match Dollar for dollar up to 8% of eligible earnings Cigna

pg. 15 ANTICIPATED NEXT STEPS » Team reviews and integration planning ongoing » Breitburn operating management and HR to provide additional information about employment • Compensation: base pay and bonus plans • Benefits: comprehensive package of medical, dental, vision, life, disability, vacation, 401(k) • Policies and pre - employment logistics » Formal offers of employment will be made approximately 1 month prior to closing

pg. 16 In connection with the proposed transactions, Breitburn intends to file with the SEC a registration statement on Form S - 4 that will include a prospectus of Breitburn and a proxy statement of QR Energy. Each of Breitburn and QR Energy also plan to file other relevant documents with the SEC regarding the proposed transactions. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Breitburn and QR Energy with the SEC at the SEC’s website at www.sec.gov. You may also obtain these documents by contacting Breitburn Investor Relations in writing at 515 S. Flower Street, Suite 4800, Los Angeles, CA, 90071, or via e - mail by using the “Contact Form” located at the Investor Relations tab at www.breitburn.com or by calling (213) 225 - 0390; or by contacting QR Energy Investor Relations in writing at 1401 McKinney Street, Suite 2400, Houston, TX 77010, or via e - mail at ir@qracq.com or by calling (713) 452 - 2990 . ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT

pg. 17 Breitburn and QR Energy and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. Information about Breitburn’s directors and executive officers is available in Breitburn’s proxy statement dated April 25, 2014, for its 2014 Annual Meeting of Unitholders . Information about QR Energy’s directors and executive officers is available in QR Energy’s proxy statement dated February 3, 2014, for its Special Meeting of Unitholders held on March 10, 2014. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transactions when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Breitburn or QR Energy using the sources indicated above . This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. PARTICIPANTS IN THE SOLICITATION

pg. 18 This presentation contains statements that Breitburn believe to be “forward - looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934. Words and phrases such as “expected,” “ expansion,” “opportunities,” “target ,” “ future,” “believe,” “will be” and variations of such words and similar expressions are intended to identify such forward - looking statements. It is uncertain whether the events anticipated will transpire, or if they do occur what impact they will have on the results of operations and financial condition of Breitburn or of the combined company. Such forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements. These include risks relating to the ability to obtain unitholder and regulatory approvals of the transaction, the ability to complete the proposed transaction on anticipated terms and timetable, Breitburn’s ability to integrate successfully, unforeseen liabilities of Breitburn, availability of sufficient cash flow and other sources of liquidity, prices and demand for natural gas and oil, increases in operating costs, uncertainties inherent in estimating reserves and production, ability to replace reserves and efficiently develop current reserves, ability to obtain sufficient quantities of CO 2 necessary to carry out EOR projects, political and regulatory developments relating to taxes, derivatives and oil and gas operations, market conditions or operational impediments, risks arising out of hedging transactions, industry competition, and other risks set forth under the heading “Risk Factors” in Breitburn’s Annual Report on Form 10 - K for the period ended December 31, 2013. Unless legally required, Breitburn undertake no obligation to update publicly any forward - looking statements, whether as a result of new information, future events or otherwise. CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING INFORMATION FORWARD LOOKING STATEMENTS

NASDAQ: BBEP PRESENTATION TO QR ENERGY EMPLOYEES BREITBURN ENERGY PARTNERS LP AUGUST 2014