Exhibit 99.3

Exhibit 99.3

QR Energy, LP

General Partner Buy-out Presentation

March 2014

Disclosures

This presentation contains forward-looking statements relating to QR Energy’s operations that are based on management’s current expectations, estimates and projections about its operations. Words and phrases such as “expect,” “estimates,” “guidance,” “opportunities,” “potential,” “may,” “believe” and “target,” references to future years, and variations of such words and similar expressions are intended to identify forward-looking statements. QR Energy believes that its expectations and forecasts are based on reasonable assumptions, however, no assurance can be given that such expectations and forecasts will prove to be correct. A number of risks and uncertainties, many of which are beyond our control, could cause actual results to differ materially from the expectations and forecasts, anticipated results and other forward-looking information expressed in this presentation, including risks relating to QR Energy’s financial performance and results, availability of sufficient cash flow to execute our business plan, our level of indebtedness, a significant reduction in the borrowing base under our bank credit facility, our ability to raise capital, prices and demand for oil and natural gas, our ability to replace reserves and efficiently develop our current reserves, adverse market conditions, competition and governmental regulations. For a more complete list of these risks, please read QR Energy’s filings with the Securities and Exchange Commission (the “SEC”), which are available on QR Energy’s Investor Relations website at http://ir.qrenergylp.com or on the SEC’s website at www.sec.gov.

The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Unless legally required, QR Energy undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Unpredictable or unknown factors not discussed herein could also have material adverse effects on forward-looking statements.

NYSE: QRE www.QREnergyLP.com 2

Transaction Summary

The board of directors of QR Energy, L.P. (“QRE”) has simplified its capital structure by purchasing QRE GP, LLC (“GP”) in a 100% conditional unit exchange

Terms of the transaction were approved by the conflicts committee and the board of directors

The transaction is expected to result in immediate accretion to QRE’s distributable cash flow per unit of approximately 7% in 2014 (1)

GP unitholders will have the right to earn up to 11.6 Class B units as consideration in exchange for the GP’s economic interest and Management Incentive Fee (“MIF”)

Ability to earn payments over four years at the anniversary of the first issuance, with the first issuance occurring on the same date as the distribution payment date for the year ended December 31, 2014 The GP may earn units in any 4 of the next 6 calendar years provided QRE meets the conditions listed below in such year:

Cash distribution to unitholders met or exceeded Target Distribution, as defined in the partnership agreement, in each of the previous four quarters (at least $0.4744/unit per quarter) Distribution Coverage, as defined in the partnership agreement, is 1.0x or greater on a calendar annual basis Maximum 4.0x Debt / LTM EBITDA, on a quarterly basis (if greater than 4.0x, the independent directors must agree to such exceptions)

Demonstrates management’s commitment to long-term value creation and the partnership’s prospect for growth

(1) Assuming (a) 2013 distributable cash flow and MIF held constant during 2014 and (b) QR Energy had paid sufficient cash distributions and earned sufficient operating surplus to pay the full amount of the MIF in 2014.

NYSE: QRE www.QREnergyLP.com 3

Transaction Benefits

Lowers cost of capital by removing MIF

Eliminates MIF payments related to future acquisitions

Lower Cost of

Capital Deferred payment enhances competitiveness for acquisitions

100% equity transaction, earned over time, maintains balance sheet flexibility and

liquidity

Simplified

Provides a capital structure more easily understood by the investing public

Structure

Removal of the MIF increases potential for accelerated growth given enhanced

Enhances competitive position

Distribution

Growth Profile Buyout of the GP and associated MIF results in greater economic return for QRE

unitholders from capital expansion projects and acquisitions

Governance Unitholders to vote on directors going forward

NYSE: QRE www.QREnergyLP.com 4

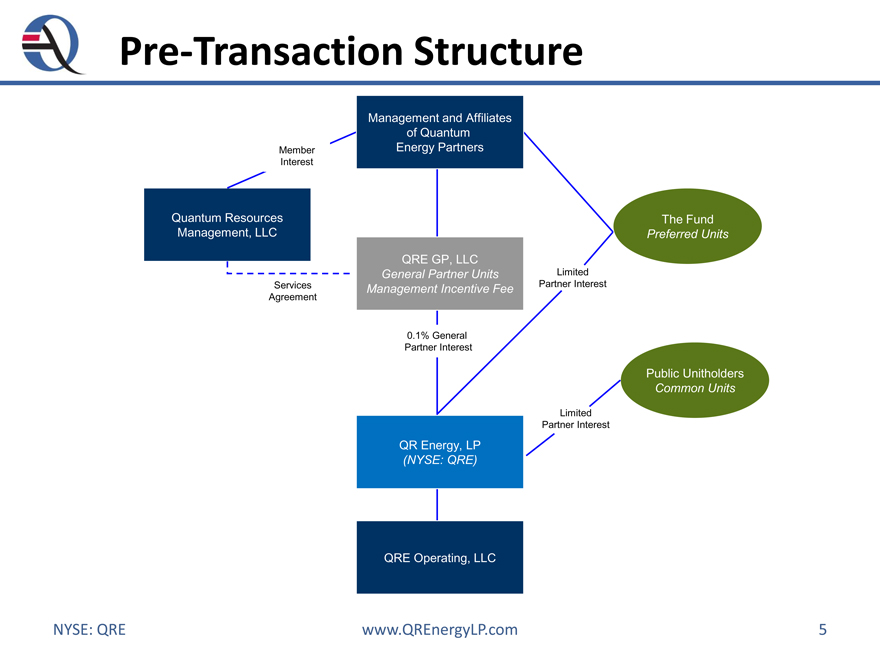

Pre-Transaction Structure

Management and Affiliates

of Quantum

Member Energy Partners

Interest

Quantum Resources The Fund

Management, LLC Preferred Units

QRE GP, LLC

General Partner Units Limited

Services Management Incentive Fee Partner Interest

Agreement

0.1% General

Partner Interest

Public Unitholders

Common Units

Limited

Partner Interest

QR Energy, LP

(NYSE: QRE)

QRE Operating, LLC

NYSE: QRE www.QREnergyLP.com 5

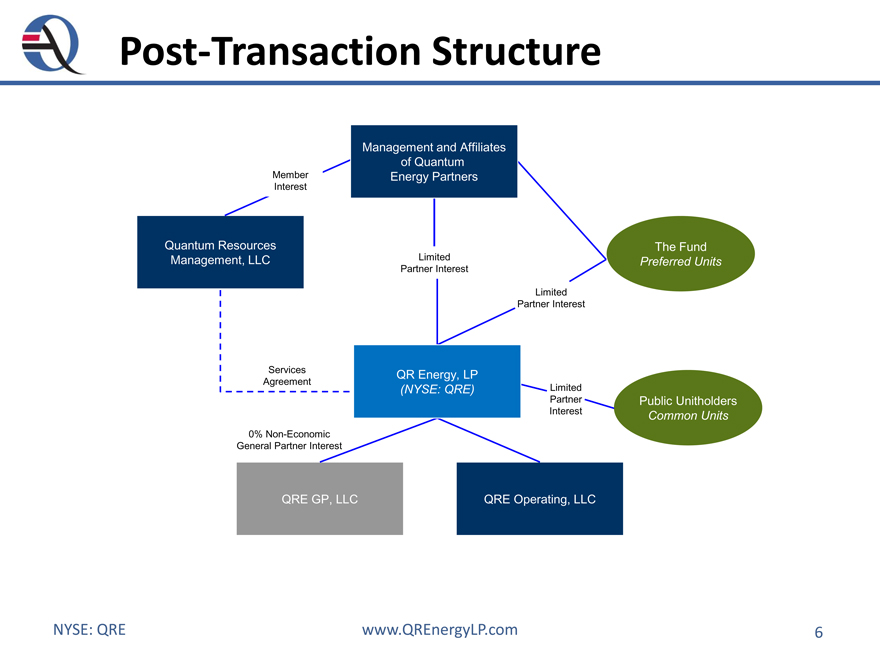

Post-Transaction Structure

Management and Affiliates

of Quantum

Member Energy Partners

Interest

Quantum Resources The Fund

Management, LLC Limited Preferred Units

Partner Interest

Limited

Partner Interest

Services QR Energy, LP

Agreement

(NYSE: QRE) Limited

Partner Public Unitholders

Interest Common Units

0% Non-Economic

General Partner Interest

QRE GP, LLC QRE Operating, LLC

NYSE: QRE www.QREnergyLP.com 6

QR Energy, LP

Investor Relations

Josh Wannarka (713) 452-2990 or ir@qracq.com