Exhibit (c)(2)

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Special Committee

Discussion Materials

Morgan Stanley

15 December 2014

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Table of Contents

Section 1

Section 2

Section 3

Appendix A

Situation Overview

Banff Overview

Banff Preliminary Valuation

Supplemental Materials

Morgan Stanley

2

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Section 1

Situation Overview

Morgan Stanley

3

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Project Bow River

On October 23, 2014, Blue Mountain announced that it proposed to acquire the approximately 30% of common shares of Banff that it did not currently own

Morgan Stanley has been engaged as financial advisor to the Special Committee of Banff and asked to provide a preliminary valuation of Banff

Unless indicated otherwise, all references in these materials to $ are US$

SITUATION OVERVIEW

Situation Overview

Introduction

Banff is a public North American land developer and homebuilder with operations in three active operating segments and 11 major markets

- Canada: Calgary, Edmonton, Greater Toronto Area

- California: Greater Los Angeles Area, Sacramento, San Diego, San Francisco Bay Area

- Central and Eastern U.S.: Austin, Denver, Phoenix, Washington D.C. Area

Banff is dual-listed on the Toronto Stock Exchange and New York Stock Exchange

Background

On October 23, 2014, Blue Mountain announced that it had made a proposal to Banff’s Board of Directors to acquire the approximately 30% of common shares of Banff that it did not already own for $23.00 per share in cash

- In response to this announcement, the Board of Directors of Banff established a committee of Independent Directors (the “Special Committee”) to review and consider the proposal

As of November 24, 2014, Morgan Stanley was engaged as exclusive financial advisor to the Special Committee of Banff

We have been asked to provide a preliminary valuation and, if requested, a formal valuation of the common shares of Banff in accordance with the requirements of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”) of the Ontario Securities Commission and the Autorite des marches financiers

- The following pages contain our preliminary valuation report based upon information provided to us by Banff’s Management as of December 15, 2014

- We have prepared this report solely for informational purposes for the Special Committee and it is preliminary in nature

Morgan Stanley

4

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

SITUATION OVERVIEW

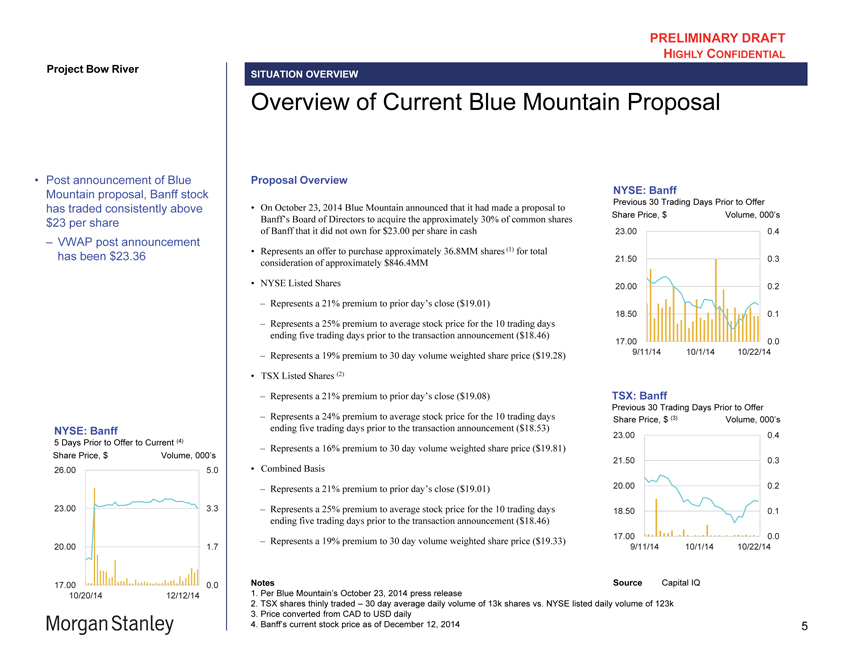

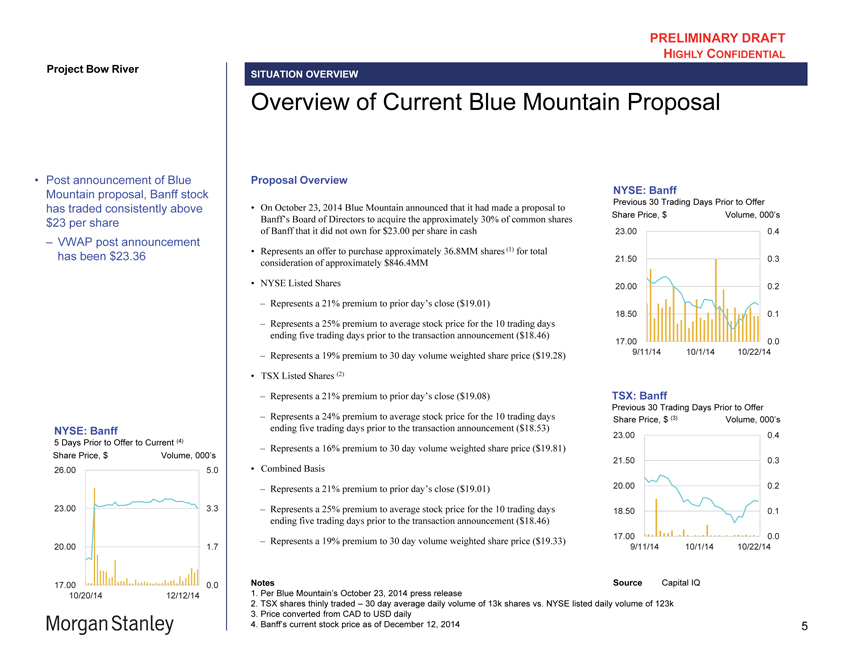

Overview of Current Blue Mountain Proposal

Proposal Overview

On October 23, 2014 Blue Mountain announced that it had made a proposal to Banff’s Board of Directors to acquire the approximately 30% of common shares of Banff that it did not own for $23.00 per share in cash

Represents an offer to purchase approximately 36.8MM shares (1) for total consideration of approximately $846.4MM

NYSE Listed Shares

Represents a 21% premium to prior day’s close ($19.01)

Represents a 25% premium to average stock price for the 10 trading days ending five trading days prior to the transaction announcement ($18.46)

Represents a 19% premium to 30 day volume weighted share price ($19.28)

TSX Listed Shares (2)

Represents a 21% premium to prior day’s close ($19.08)

Represents a 24% premium to average stock price for the 10 trading days ending five trading days prior to the transaction announcement ($18.53)

Represents a 16% premium to 30 day volume weighted share price ($19.81)

Combined Basis

Represents a 21% premium to prior day’s close ($19.01)

Represents a 25% premium to average stock price for the 10 trading days ending five trading days prior to the transaction announcement ($18.46)

Represents a 19% premium to 30 day volume weighted share price ($19.33)

1. Per Blue Mountain’s October 23, 2014 press release

2. TSX shares thinly traded 30 day average daily volume of 13k shares vs. NYSE listed daily volume of 123k

3. Price converted from CAD to USD daily

4. Banff’s current stock price as of December 12, 2014

NYSE: Banff

Previous 30 Trading Days Prior to Offer Share Price, $ Volume, 000’s 23.00 0.4

21.50 0.3 20.00 0.2 18.50 0.1

17.00 0.0 9/11/14 10/1/14 10/22/14

TSX: Banff

Previous 30 Trading Days Prior to Offer Share Price, $ (3) Volume, 000’s 23.00 0.4

21.50 0.3 20.00 0.2 18.50 0.1

17.00 0.0 9/11/14 10/1/14 10/22/14

Source Capital IQ

Project Bow River

Post announcement of Blue Mountain proposal, Banff stock has traded consistently above $23 per share

VWAP post announcement has been $23.36

NYSE: Banff

5 Days Prior to Offer to Current (4)

Share Price, $ Volume, 000’s

26.00 5.0

23.00 3.3

20.00 1.7

17.00 0.0

10/20/14 12/12/14

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

As financial advisor to the Special Committee of Banff, Morgan Stanley has conducted extensive due diligence on Banff

- Diligence remains ongoing

SITUATION OVERVIEW

Summary of Diligence To-Date

Diligence / Interactions with Banff Management

Morgan Stanley has held eight scheduled calls / meetings with Banff to discuss its land and housing inventory, capital structure, financial projections model, business plan, and corporate strategy, among other topics

- Does not include frequent one-off and follow up communications

We have participated in asset tours of projects in the Calgary, Greater Los Angeles, Greater Toronto Area, and Washington D.C. area markets

Key Information Reviewed To-Date

Management’s five-year business plan

- Key assumptions and financial projections

Individual project financial projections for all land / housing assets

Individual asset summaries for all land / housing assets

We have also reviewed public filings, earnings call transcripts, equity research, and data room contents covering topics such as corporate records, financings, material agreements, corporate and management information, among others

Morgan Stanley

6

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Section 2

Banff Overview

Morgan Stanley

7

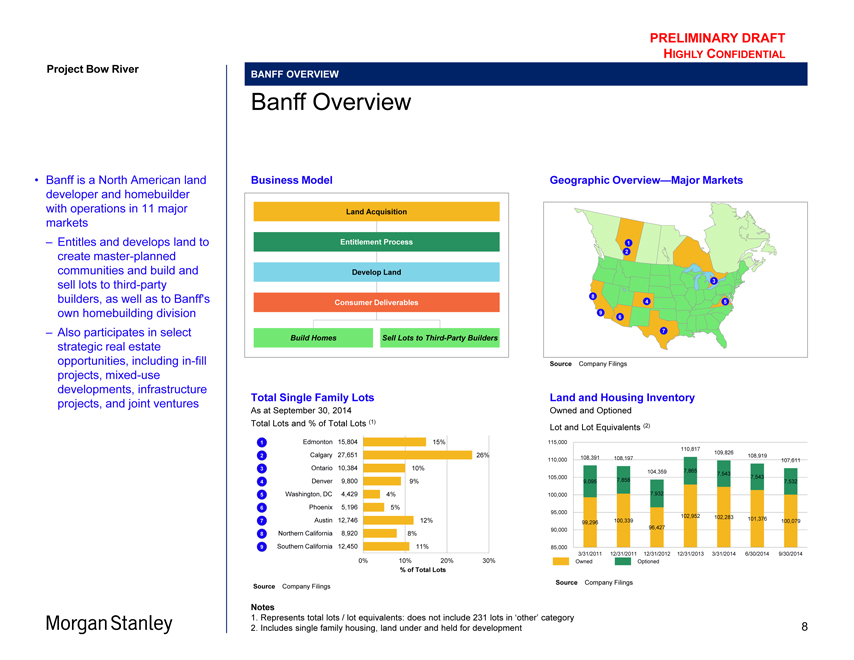

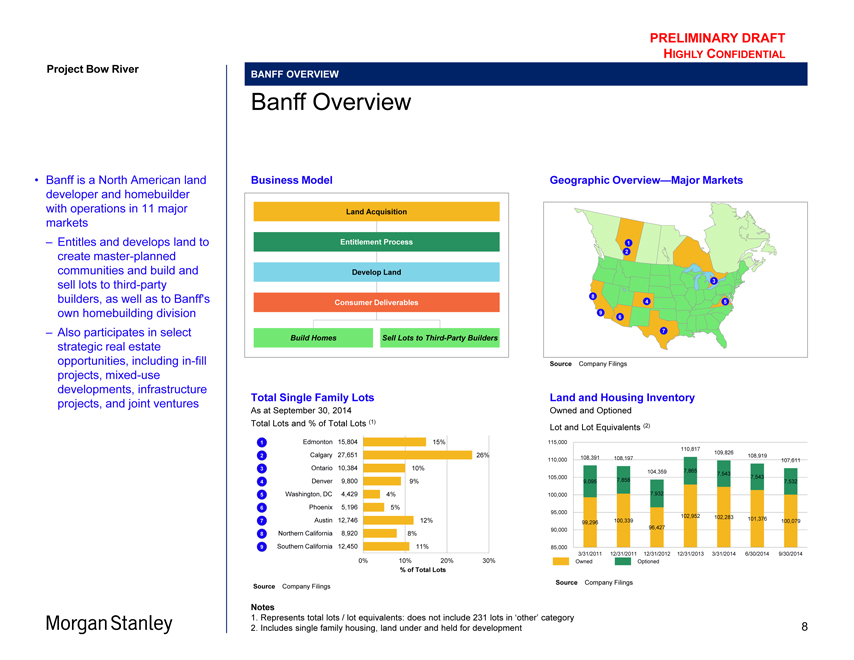

Project Bow River

Banff is a North American land developer and homebuilder with operations in 11 major markets

– Entitles and develops land to create master-planned communities and build and sell lots to third-party builders, as well as to Banff’s own homebuilding division

– Also participates in select strategic real estate opportunities, including in-fill projects, mixed-use developments, infrastructure projects, and joint ventures

Morgan Stanley

BANFF OVERVIEW

Banff Overview

Business Model Geographic Overview—Major Markets

Land Acquisition

Entitlement Process

Develop Land

Consumer Deliverables

Build Homes Sell Lots to Third-Party Builders

1 2

3

8 4 5 9 6

7

1 2

3

8 4 5 9 6

7

Total Single Family Lots

As at September 30, 2014 Total Lots and % of Total Lots (1)

1 Edmonton 15,804 15%

2 Calgary 27,651 26%

3 Ontario 10,384 10%

4 Denver 9,800 9%

5 Washington, DC 4,429 4%

6 Phoenix 5,196 5%

7 Austin 12,746 12%

8 Northern California 8,920 8%

9 Southern California 12,450 11%

0% 10% 20% 30%

% of Total Lots

Source Company Filings

Land and Housing Inventory

Owned and Optioned Lot and Lot Equivalents (2)

115,000

110,817

109,826 108,919

110,000 108,391 108,197 107,611

104,359 7,865 7,543

105,000 7,543

9,095 7,858 7,532

100,000 7,932

95,000

100,339 102,952 102,283 101,376

99,296 100,079

90,000 96,427

85,000

3/31/2011 12/31/2011 12/31/2012 12/31/2013 3/31/2014 6/30/2014 9/30/2014

Owned Optioned

Source Company Filings

Notes

1. Represents total lots / lot equivalents: does not include 231 lots in ‘other’ category

2. Includes single family housing, land under and held for development

8

Project Bow River

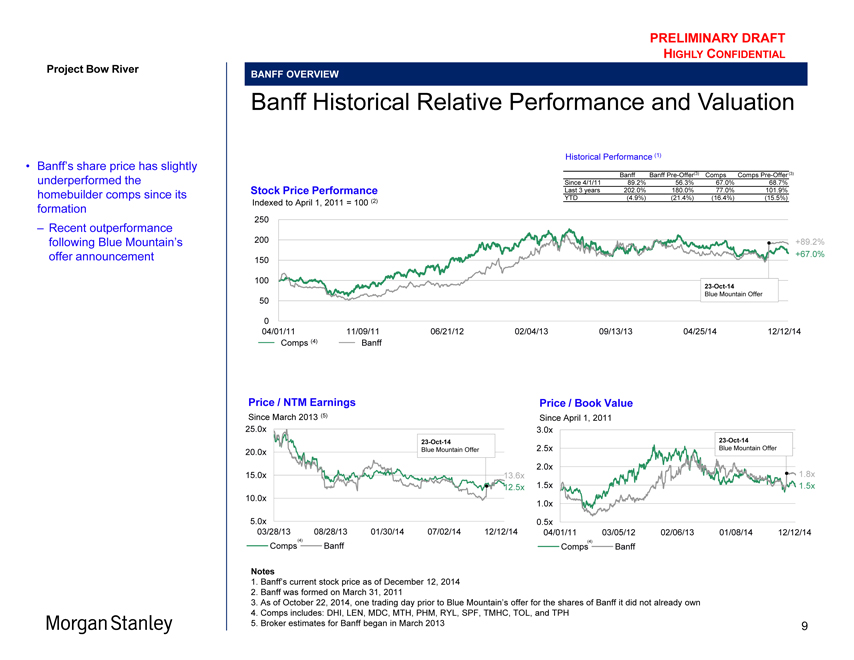

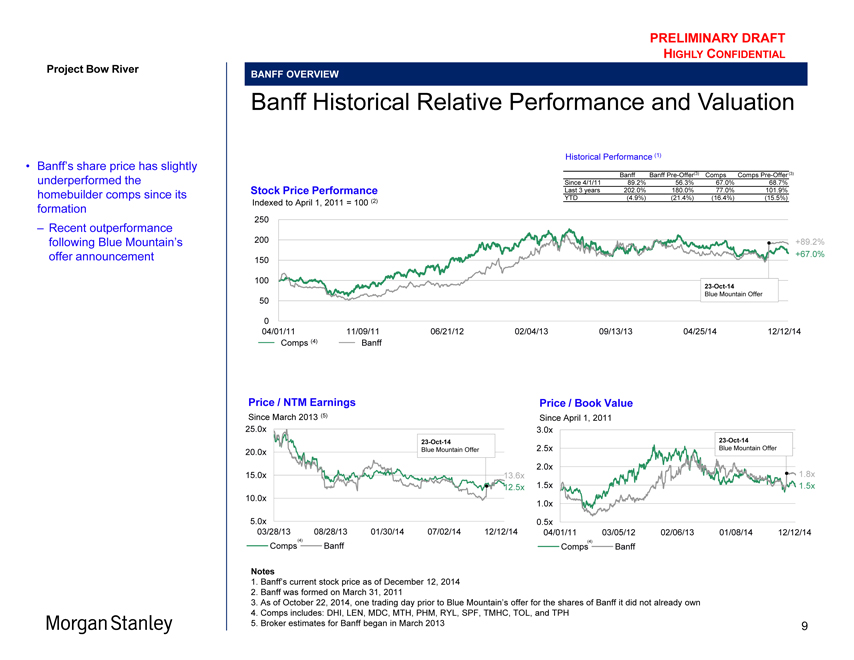

Banff’s share price has slightly underperformed the homebuilder comps since its formation

– Recent outperformance following Blue Mountain’s offer announcement

Morgan Stanley

BANFF OVERVIEW

Banff Historical Relative Performance and Valuation

Historical Performance (1)

Banff Banff Pre-Offer(3) Comps Comps Pre-Offer (3)

Since 4/1/11 89.2% 56.3% 67.0% 68.7%

Last 3 years 202.0% 180.0% 77.0% 101.9%

YTD (4.9%) (21.4%) (16.4%) (15.5%)

Stock Price Performance

Indexed to April 1, 2011 = 100 (2)

250

200 +89.2%

+67.0%

150

100

23-Oct-14

Blue Mountain Offer

50

0

04/01/11 11/09/11 06/21/12 02/04/13 09/13/13 04/25/14 12/12/14

Comps (4) Banff

Price / NTM Earnings

Since March 2013 (5)

25.0x

23-Oct-14

20.0x Blue Mountain Offer

15.0x 13.6x

12.5x

10.0x

5.0x

03/28/13 08/28/13 01/30/14 07/02/14 12/12/14

Comps(4) Banff

Price / Book Value

Since April 1, 2011

3.0x

23-Oct-14

2.5x Blue Mountain Offer

2.0x

1.8x

1.5x 1.5x

1.0x

0.5x

04/01/11 03/05/12 02/06/13 01/08/14 12/12/14

Comps(4) Banff

Notes

1. Banff’s current stock price as of December 12, 2014

2. Banff was formed on March 31, 2011

3. As of October 22, 2014, one trading day prior to Blue Mountain’s offer for the shares of Banff it did not already own

4. Comps includes: DHI, LEN, MDC, MTH, PHM, RYL, SPF, TMHC, TOL, and TPH

5. Broker estimates for Banff began in March 2013

9

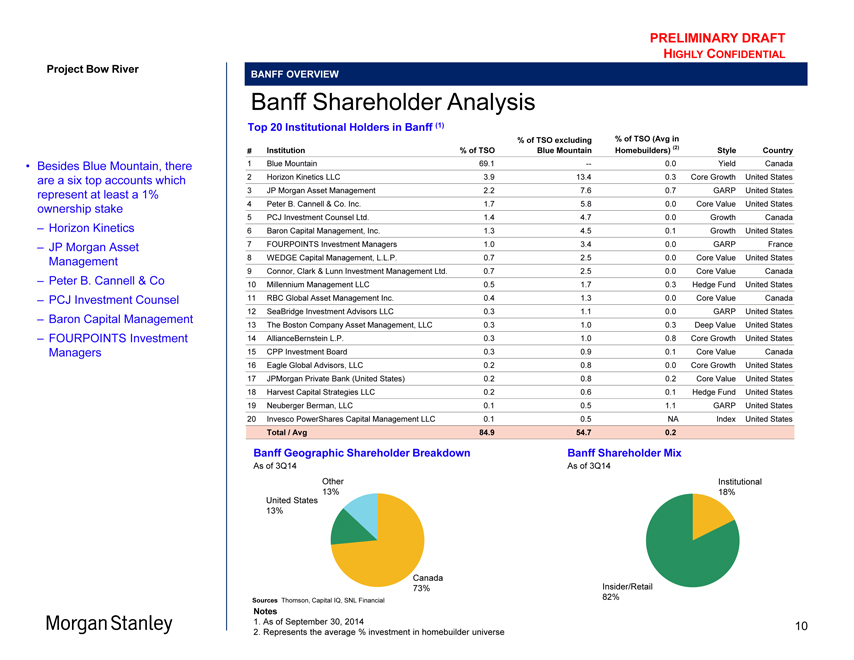

Project Bow River

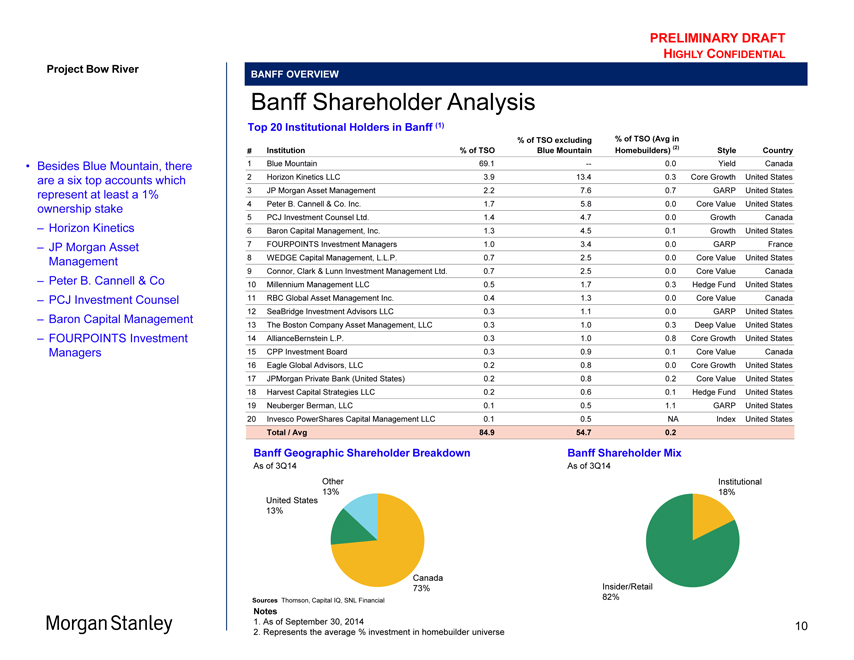

Besides Blue Mountain, there are a six top accounts which represent at least a 1% ownership stake

– Horizon Kinetics JP Morgan Asset Management

– Peter B. Cannell & Co

– PCJ Investment Counsel

– Baron Capital Management

– FOURPOINTS Investment Managers

Morgan Stanley

BANFF OVERVIEW

Banff Shareholder Analysis

Top 20 Institutional Holders in Banff (1)

% of TSO excluding % of TSO (Avg in

# Institution % of TSO Blue Mountain Homebuilders) (2) Style Country

1 Blue Mountain 69.1 — 00. Yield Canada

2 Horizon Kinetics LLC 3.9 13.4 0.3 Core Growth United States

3 JP Morgan Asset Management 2.2 7.6 0.7 GARP United States

4 Peter B. Cannell & Co. Inc. 1.7 5.8 0.0 Core Value United States

5 PCJ Investment Counsel Ltd. 1.4 4.7 0.0 Growth Canada

6 Baron Capital Management, Inc. 1.3 4.5 0.1 Growth United States

7 FOURPOINTS Investment Managers 1.0 3.4 0.0 GARP France

8 WEDGE Capital Management, L.L.P. 0.7 2.5 0.0 Core Value United States

9 Connor, Clark & Lunn Investment Management Ltd. 0.7 2.5 0.0 Core Value Canada

10 Millennium Management LLC 0.5 1.7 0.3 Hedge Fund United States

11 RBC Global Asset Management Inc. 0.4 1.3 0.0 Core Value Canada

12 SeaBridge Investment Advisors LLC 0.3 1.1 0.0 GARP United States

13 The Boston Company Asset Management, LLC 0.3 1.0 0.3 Deep Value United States

14 AllianceBernstein L.P. 0.3 1.0 0.8 Core Growth United States

15 CPP Investment Board 0.3 0.9 0.1 Core Value Canada

16 Eagle Global Advisors, LLC 0.2 0.8 0.0 Core Growth United States

17 JPMorgan Private Bank (United States) 0.2 0.8 0.2 Core Value United States

18 Harvest Capital Strategies LLC 0.2 0.6 0.1 Hedge Fund United States

19 Neuberger Berman, LLC 0.1 0.5 1.1 GARP United States

20 Invesco PowerShares Capital Management LLC 0.1 0.5 NA Index United States

Total / Avg 84.9 54.7 0.2

Banff Geographic Shareholder Breakdown

As of 3Q14

Other

13%

United States

13%

Canada

73%

Sources Thomson, Capital IQ, SNL Financial

Banff Shareholder Mix

As of 3Q14

Institutional

18%

Insider/Retail

82%

Notes

1. As of September 30, 2014

2. Represents the average % investment in homebuilder universe

10

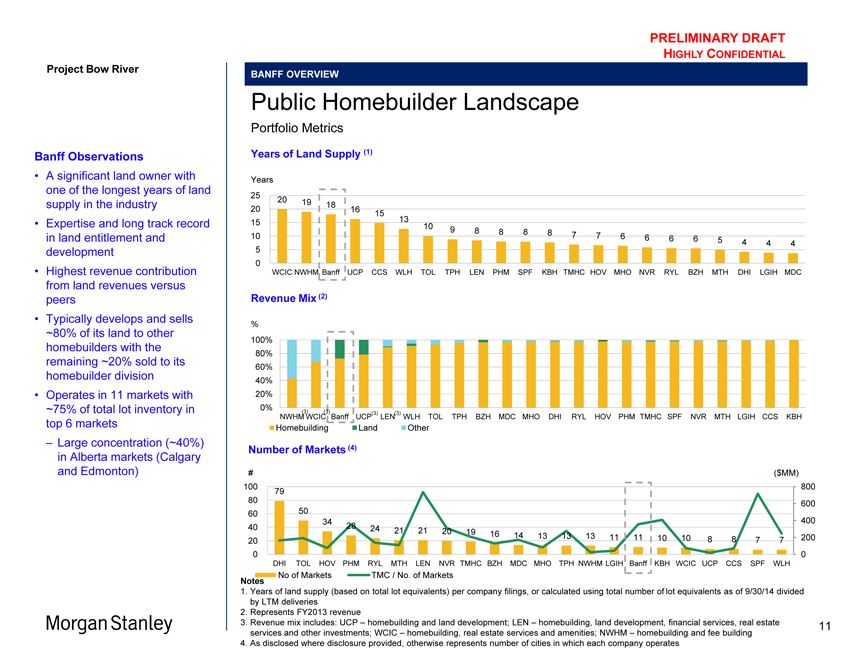

Project Bow River

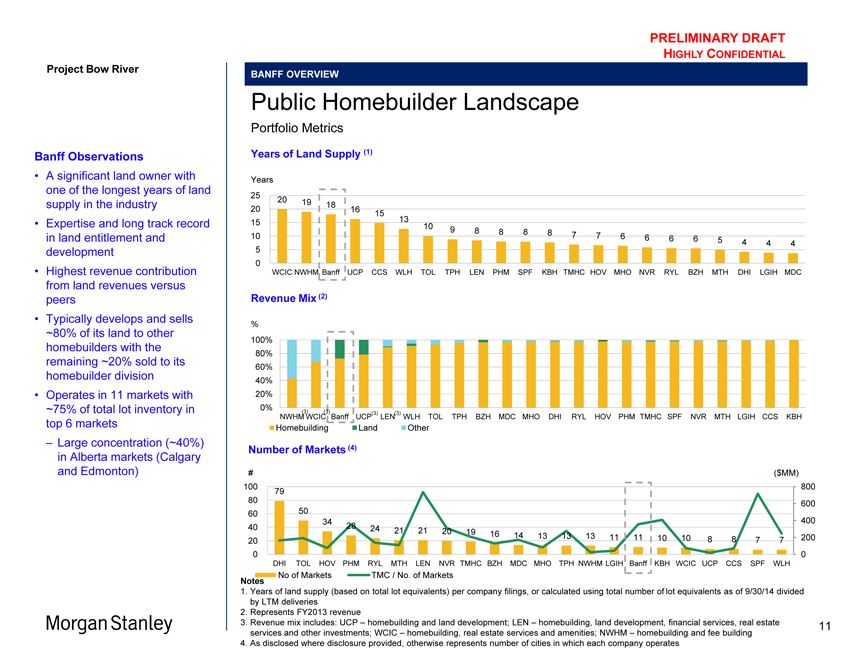

Banff Observations

A significant land owner with one of the longest years of land supply in the industry

Expertise and long track record in land entitlement and development

Highest revenue contribution from land revenues versus peers

Typically develops and sells ~80% of its land to other homebuilders with the remaining ~20% sold to its homebuilder division

Operates in 11 markets with

~75% of total lot inventory in top 6 markets

– Large concentration (~40%) in Alberta markets (Calgary and Edmonton)

Morgan Stanley

BANFF OVERVIEW

Public Homebuilder Landscape

Portfolio Metrics

Years of Land Supply (1)

Years

25 20 19 18

20 16 15

15 13

10 9 8 8 8 8 7 7 6 6

10 6 6 5 4 4 4

5

0

WCIC NWHM Banff UCP CCS WLH TOL TPH LEN PHM SPF KBH TMHC HOV MHO NVR RYL BZH MTH DHI LGIH MDC

Revenue Mix (2)

%

100%

80%

60%

40%

20%

0% (3) (3) (3) (3)

NWHM WCIC Banff UCP LEN WLH TOL TPH BZH MDC MHO DHI RYL HOV PHM TMHC SPF NVR MTH LGIH CCS KBH

Homebuilding Land Other

Number of Markets (4)

# ($MM)

100 800

79

80 600

60 50

34 400

40 28 24 21 21 20 19 16

20 14 13 13 13 11 11 10 10 88 77 200

0 0

DHI TOL HOV PHM RYL MTH LEN NVR TMHC BZH MDC MHO TPH NWHM LGIH Banff KBH WCIC UCP CCS SPF WLH

No of Markets TMC / No. of Markets

Notes

1. Years of land supply (based on total lot equivalents) per company filings, or calculated using total number of lot equivalents as of 9/30/14 divided by LTM deliveries

2. Represents FY2013 revenue

3. Revenue mix includes: UCP – homebuilding and land development; LEN – homebuilding, land development, financial services, real estate services and other investments; WCIC – homebuilding, real estate services and amenities; NWHM – homebuilding and fee building

4. As disclosed where disclosure provided, otherwise represents number of cities in which each company operates

11

Project Bow River

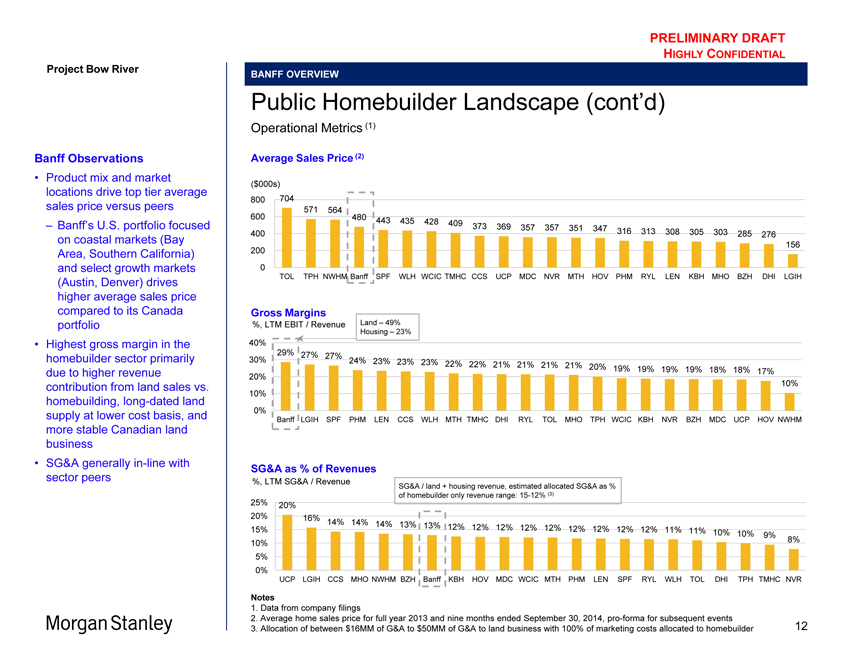

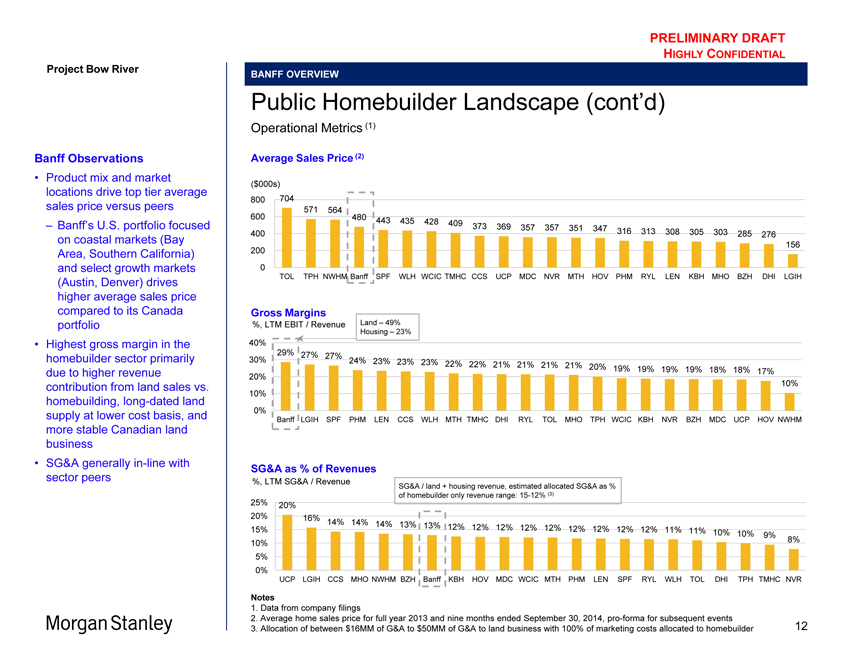

Banff Observations

Product mix and market locations drive top tier average sales price versus peers

– Banff’s U.S. portfolio focused on coastal markets (Bay Area, Southern California) and select growth markets (Austin, Denver) drives higher average sales price compared to its Canada portfolio

Highest gross margin in the homebuilder sector primarily due to higher revenue contribution from land sales vs. homebuilding, long-dated land supply at lower cost basis, and more stable Canadian land business

SG&A generally in-line with sector peers

Morgan Stanley

BANFF OVERVIEW

Public Homebuilder Landscape (cont’d)

Operational Metrics (1)

Average Sales Price (2)

($000s)

800 704

571 564

600 480 443 435 428 409

400 373 369 357 357 351 347 316 313 308 305 303 285 276

200 156

0

TOL TPH NWHM Banff SPF WLH WCIC TMHC CCS UCP MDC NVR MTH HOV PHM RYL LEN KBH MHO BZH DHI LGIH

Gross Margins

%, LTM EBIT / Revenue Land – 49%

Housing – 23%

40%

29% 27% 27%

30% 24% 23% 23% 23% 22% 22% 21% 21% 21% 21% 20% 19% 19% 19% 19% 18% 18% 17%

20%

10%

10%

0%

Banff LGIH SPF PHM LEN CCS WLH MTH TMHC DHI RYL TOL MHO TPH WCIC KBH NVR BZH MDC UCP HOV NWHM

SG&A as % of Revenues

%, LTM SG&A / Revenue SG&A / land + housing revenue, estimated allocated SG&A as %

of homebuilder only revenue range: 15-12% (3)

25% 20%

20% 16%

15% 14% 14% 14% 13% 13% 12% 12% 12% 12% 12% 12% 12% 12% 12% 11% 11% 10% 10% 9%

10% 8%

5%

0%

UCP LGIH CCS MHO NWHM BZH Banff KBH HOV MDC WCIC MTH PHM LEN SPF RYL WLH TOL DHI TPH TMHC NVR

Notes

1. Data from company filings

2. Average home sales price for full year 2013 and nine months ended September 30, 2014, pro-forma for subsequent events

3. Allocation of between $16MM of G&A to $50MM of G&A to land business with 100% of marketing costs allocated to homebuilder

12

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

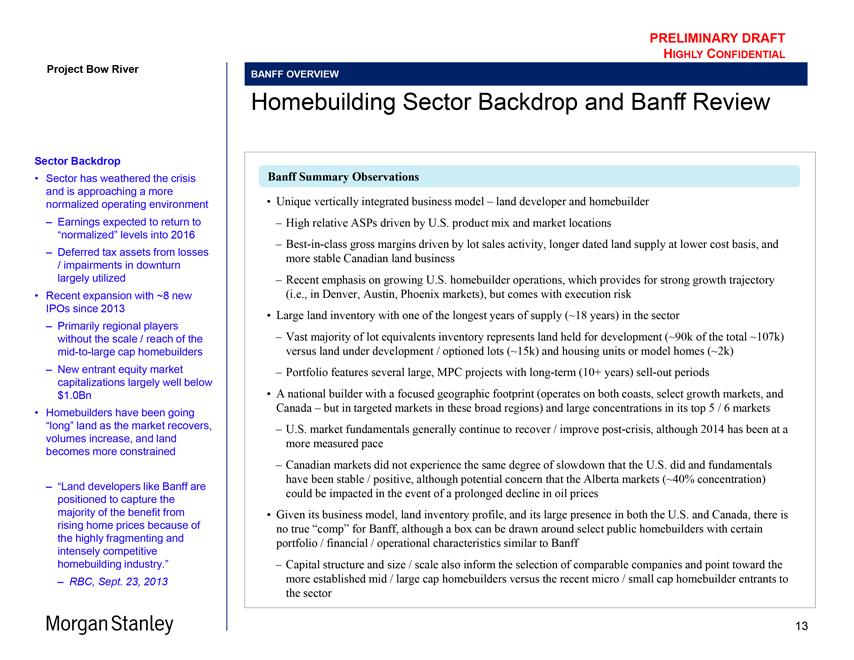

Sector Backdrop

Sector has weathered the crisis and is approaching a more normalized operating environment

- Earnings expected to return to “normalized” levels into 2016

- Deferred tax assets from losses / impairments in downturn largely utilized

Recent expansion with ~8 new IPOs since 2013

- Primarily regional players without the scale / reach of the mid-to-large cap homebuilders

- New entrant equity market capitalizations largely well below

$1.0Bn

Homebuilders have been going “long” land as the market recovers, volumes increase, and land becomes more constrained

- “Land developers like Banff are positioned to capture the majority of the benefit from rising home prices because of the highly fragmenting and intensely competitive homebuilding industry.”

- RBC, Sept. 23, 2013

BANFF OVERVIEW

Homebuilding Sector Backdrop and Banff Review

Banff Summary Observations

Unique vertically integrated business model - land developer and homebuilder

- High relative ASPs driven by U.S. product mix and market locations

- Best-in-class gross margins driven by lot sales activity, longer dated land supply at lower cost basis, and more stable Canadian land business

- Recent emphasis on growing U.S. homebuilder operations, which provides for strong growth trajectory

(i.e., in Denver, Austin, Phoenix markets), but comes with execution risk

Large land inventory with one of the longest years of supply (~18 years) in the sector

- Vast majority of lot equivalents inventory represents land held for development (~90k of the total ~107k) versus land under development / optioned lots (~15k) and housing units or model homes (~2k)

- Portfolio features several large, MPC projects with long-term (10+ years) sell-out periods

A national builder with a focused geographic footprint (operates on both coasts, select growth markets, and Canada - but in targeted markets in these broad regions) and large concentrations in its top 5 / 6 markets

- U.S. market fundamentals generally continue to recover / improve post-crisis, although 2014 has been at a more measured pace

- Canadian markets did not experience the same degree of slowdown that the U.S. did and fundamentals have been stable / positive, although potential concern that the Alberta markets (~40% concentration) could be impacted in the event of a prolonged decline in oil prices

Given its business model, land inventory profile, and its large presence in both the U.S. and Canada, there is no true “comp” for Banff, although a box can be drawn around select public homebuilders with certain portfolio / financial / operational characteristics similar to Banff

- Capital structure and size / scale also inform the selection of comparable companies and point toward the more established mid / large cap homebuilders versus the recent micro / small cap homebuilder entrants to the sector

Morgan Stanley

13

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Section 3

Banff Preliminary Valuation

Morgan Stanley

14

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

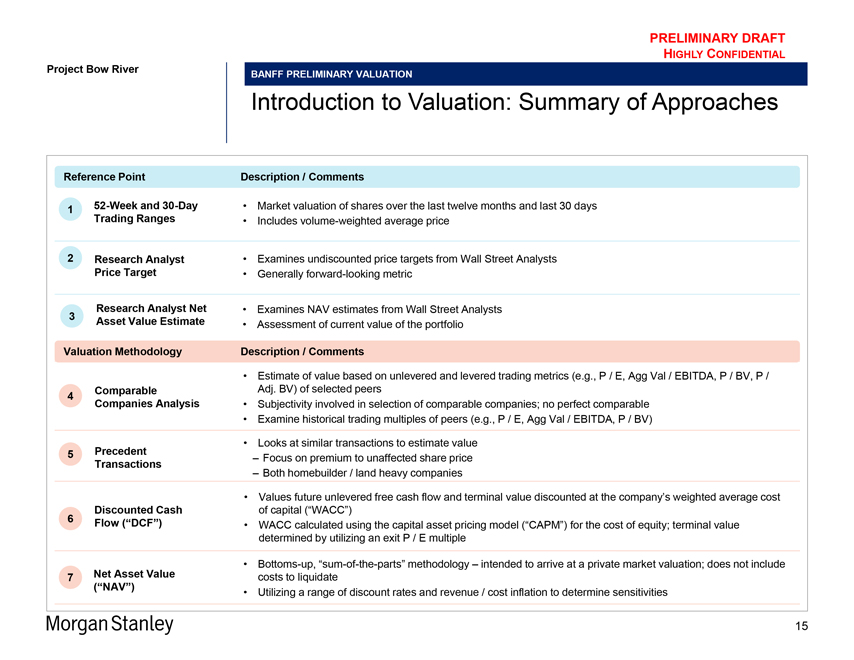

BANFF PRELIMINARY VALUATION

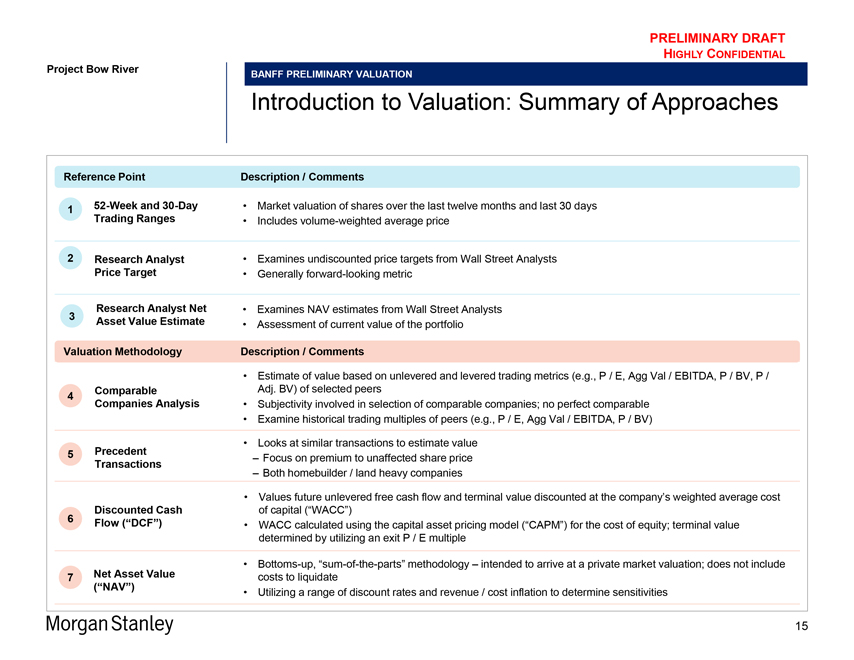

Introduction to Valuation: Summary of Approaches

Reference Point

1 52-Week and 30-Day Trading Ranges

2 Research Analyst Price Target

3 Research Analyst Net Asset Value Estimate

Description / Comments

Market valuation of shares over the last twelve months and last 30 days

Includes volume-weighted average price

Examines undiscounted price targets from Wall Street Analysts

Generally forward-looking metric

Examines NAV estimates from Wall Street Analysts

Assessment of current value of the portfolio

Valuation Methodology

4 Comparable Companies Analysis

5 Precedent Transactions

6 Discounted Cash

Flow (“DCF”)

7 Net Asset Value (“NAV”)

Description / Comments

Estimate of value based on unlevered and levered trading metrics (e.g., P / E, Agg Val / EBITDA, P / BV, P / Adj. BV) of selected peers

Subjectivity involved in selection of comparable companies; no perfect comparable

Examine historical trading multiples of peers (e.g., P / E, Agg Val / EBITDA, P / BV)

Looks at similar transactions to estimate value

- Focus on premium to unaffected share price

- Both homebuilder / land heavy companies

Values future unlevered free cash flow and terminal value discounted at the company’s weighted average cost of capital (“WACC”)

WACC calculated using the capital asset pricing model (“CAPM”) for the cost of equity; terminal value determined by utilizing an exit P / E multiple

Bottoms-up, “sum-of-the-parts” methodology - intended to arrive at a private market valuation; does not include costs to liquidate

Utilizing a range of discount rates and revenue / cost inflation to determine sensitivities

Morgan Stanley

15

Project Bow River

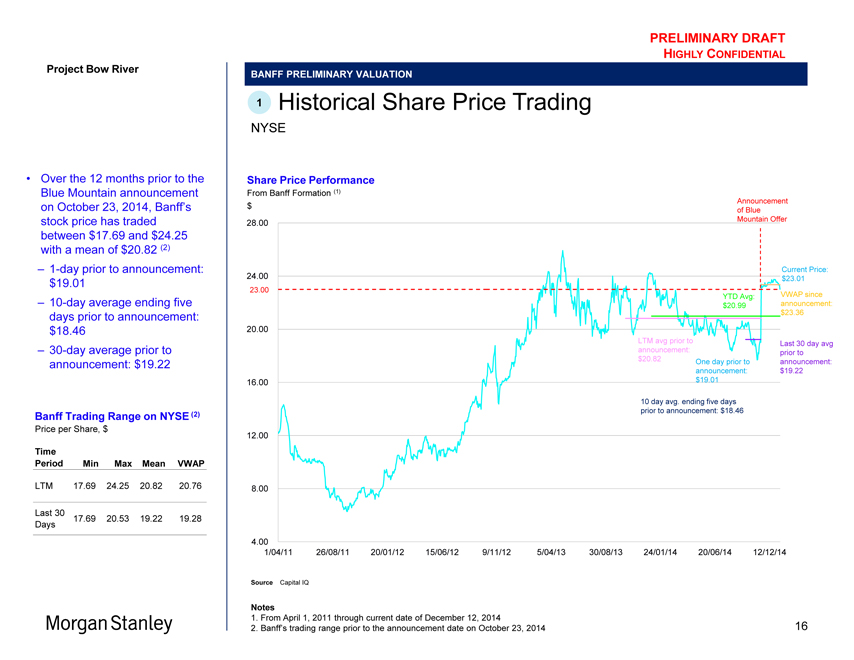

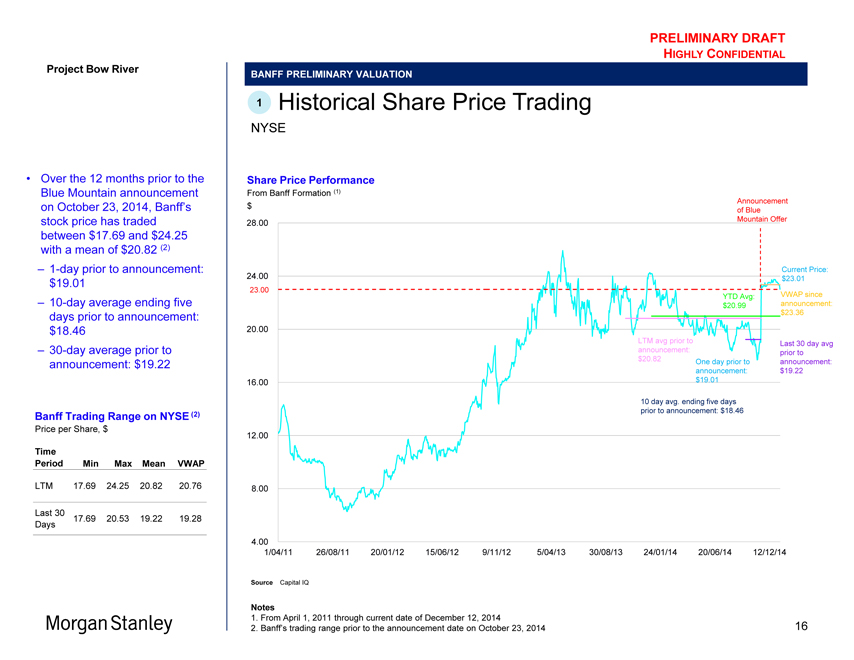

Over the 12 months prior to the Blue Mountain announcement on October 23, 2014, Banff’s stock price has traded between $17.69 and $24.25 with a mean of $20.82 (2)

– 1-day prior to announcement: $19.01

– 10-day average ending five days prior to announcement: $18.46

– 30-day average prior to announcement: $19.22

Banff Trading Range on NYSE (2)

Price per Share, $

Time

Period Min Max Mean VWAP

LTM17.6924.2520.82 20.76

Last 30

17.69 20.5319.22 19.28 Days

Morgan Stanley

BANFF PRELIMINARY VALUATION

1 Historical Share Price Trading

NYSE

Share Price Performance

From Banff Formation (1)

Announcement

$ of Blue

28.00 Mountain Offer

Current Price:

24.00 $23.01

23.00 YTD Avg: VWAP since

$20.99 announcement:

$23.36

20.00

LTM avg prior to Last 30 day avg

announcement: prior to

$20.82 One day prior to announcement:

announcement: $19.22

16.00 $19.01

10 day avg. ending five days

prior to announcement: $18.46

12.00

8.00

4.00

1/04/11 26/08/11 20/01/12 15/06/12 9/11/12 5/04/13 30/08/13 24/01/14 20/06/14 12/12/14

Source Capital IQ

Notes

1. From April 1, 2011 through current date of December 12, 2014

2. Banff’s trading range prior to the announcement date on October 23, 2014

16

Project Bow River

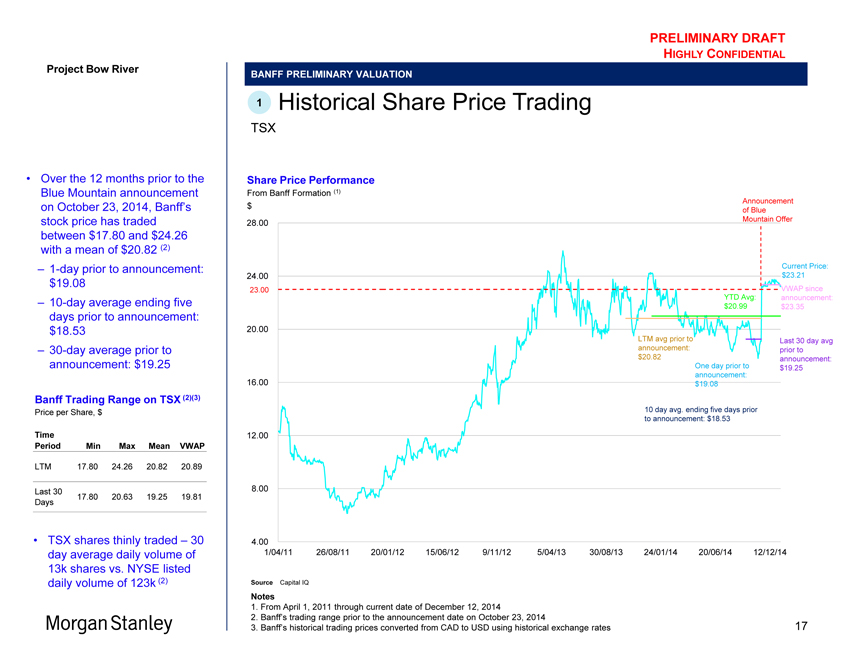

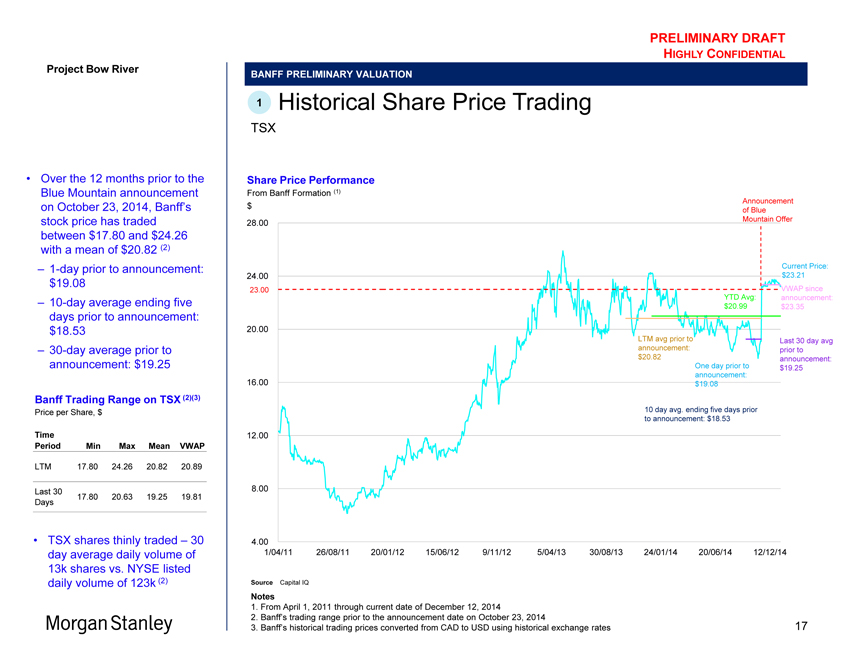

Over the 12 months prior to the Blue Mountain announcement on October 23, 2014, Banff’s stock price has traded between $17.80 and $24.26 with a mean of $20.82 (2)

– 1-day prior to announcement: $19.08

– 10-day average ending five days prior to announcement: $18.53

– 30-day average prior to announcement: $19.25

Banff Trading Range on TSX (2)(3)

Price per Share, $

Time

Period Min Max Mean VWAP

LTM 17.80 24.26 20.82 20.89

Last 30

17.80 20.63 19.25 19.81 Days

TSX shares thinly traded – 30 day average daily volume of 13k shares vs. NYSE listed daily volume of 123k (2)

Morgan Stanley

BANFF PRELIMINARY VALUATION

1 Historical Share Price Trading

TSX

Share Price Performance

From Banff Formation (1)

Announcement

$ of Blue

28.00 Mountain Offer

Current Price:

24.00 $23.21

23.00 VWAP since

YTD Avg: announcement:

$20.99 $23.35

20.00

LTM avg prior to Last 30 day avg

announcement: prior to

$20.82 announcement:

One day prior to $19.25

announcement:

16.00 $19.08

10 day avg. ending five days prior

to announcement: $18.53

12.00

8.00

4.00

1/04/11 26/08/11 20/01/12 15/06/12 9/11/12 5/04/13 30/08/13 24/01/14 20/06/14 12/12/14

Source Capital IQ

Notes

1. From April 1, 2011 through current date of December 12, 2014

2. Banff’s trading range prior to the announcement date on October 23, 2014

3. Banff’s historical trading prices converted from CAD to USD using historical exchange rates

17

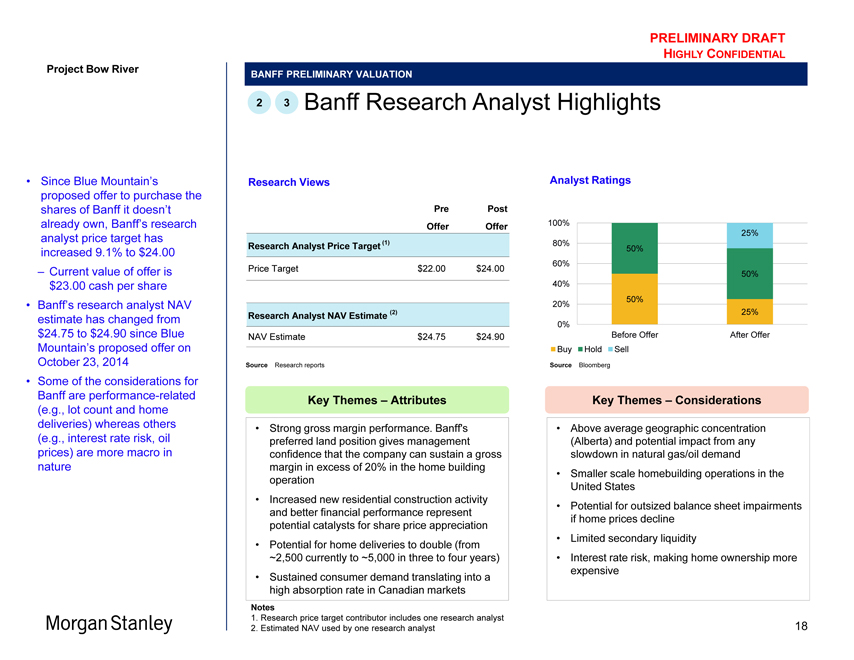

Project Bow River

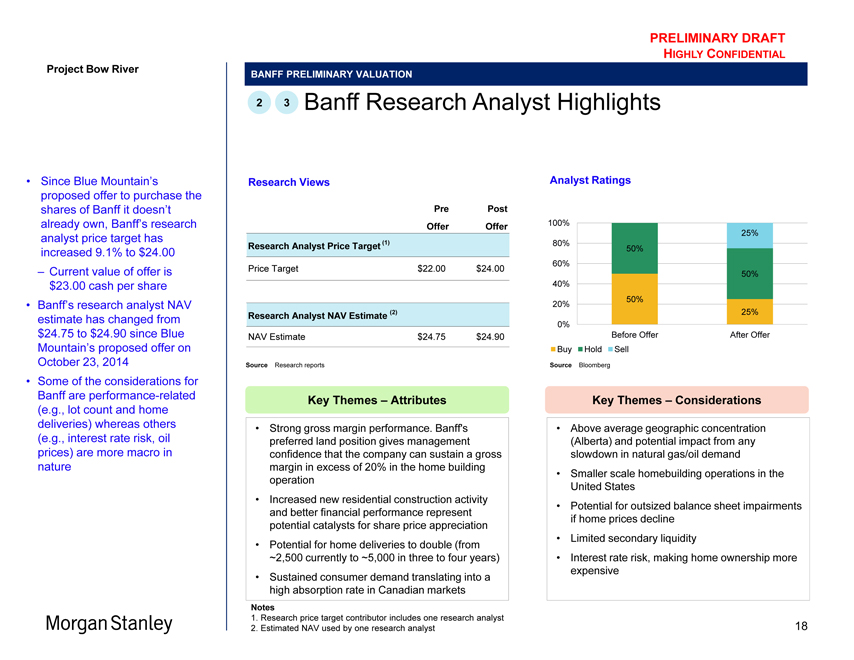

Since Blue Mountain’s proposed offer to purchase the shares of Banff it doesn’t already own, Banff’s research analyst price target has increased 9.1% to $24.00

– Current value of offer is $23.00 cash per share

Banff’s research analyst NAV estimate has changed from $24.75 to $24.90 since Blue Mountain’s proposed offer on October 23, 2014

Some of the considerations for Banff are performance-related (e.g., lot count and home deliveries) whereas others (e.g., interest rate risk, oil prices) are more macro in nature

Morgan Stanley

BANFF PRELIMINARY VALUATION

2 3 Banff Research Analyst Highlights

Research Views

Pre Post

Offer Offer

Research Analyst Price Target (1)

Price Target $ 22.00 $ 24.00

Research Analyst NAV Estimate (2)

NAV Estimate $ 24.75 $ 24.90

Source Research reports

Analyst Ratings

100%

25%

80% 50%

60%

50%

40%

20% 50%

25%

0%

Before Offer After Offer

Buy Hold Sell

Source Bloomberg

Key Themes – Attributes

Strong gross margin performance. Banff’s preferred land position gives management confidence that the company can sustain a gross margin in excess of 20% in the home building operation

Increased new residential construction activity and better financial performance represent potential catalysts for share price appreciation

Potential for home deliveries to double (from ~2,500 currently to ~5,000 in three to four years)

Sustained consumer demand translating into a high absorption rate in Canadian markets

Key Themes – Considerations

Above average geographic concentration (Alberta) and potential impact from any slowdown in natural gas/oil demand

Smaller scale homebuilding operations in the United States

Potential for outsized balance sheet impairments if home prices decline

Limited secondary liquidity

Interest rate risk, making home ownership more expensive

Notes

1. Research price target contributor includes one research analyst

2. Estimated NAV used by one research analyst

18

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

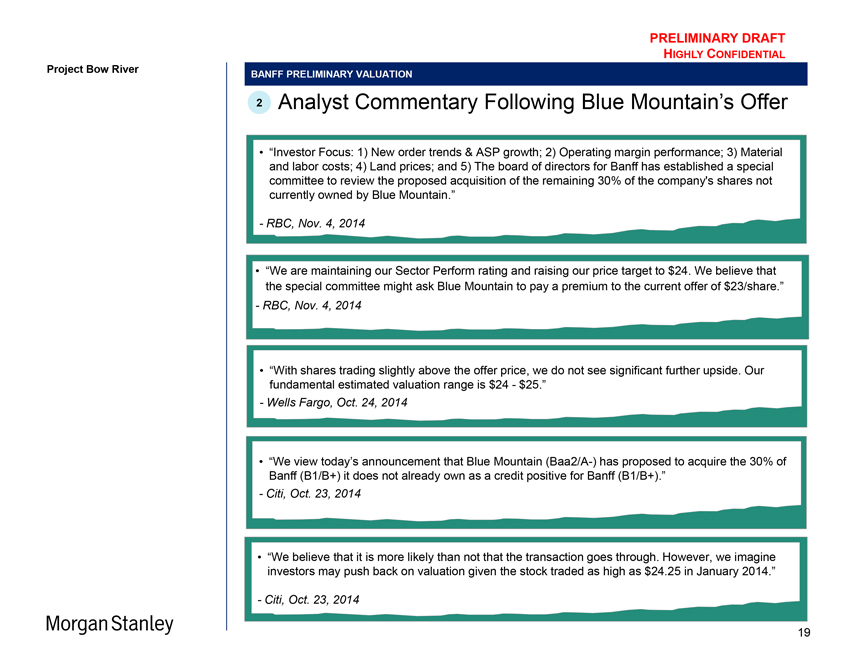

Morgan Stanley

BANFF PRELIMINARY VALUATION

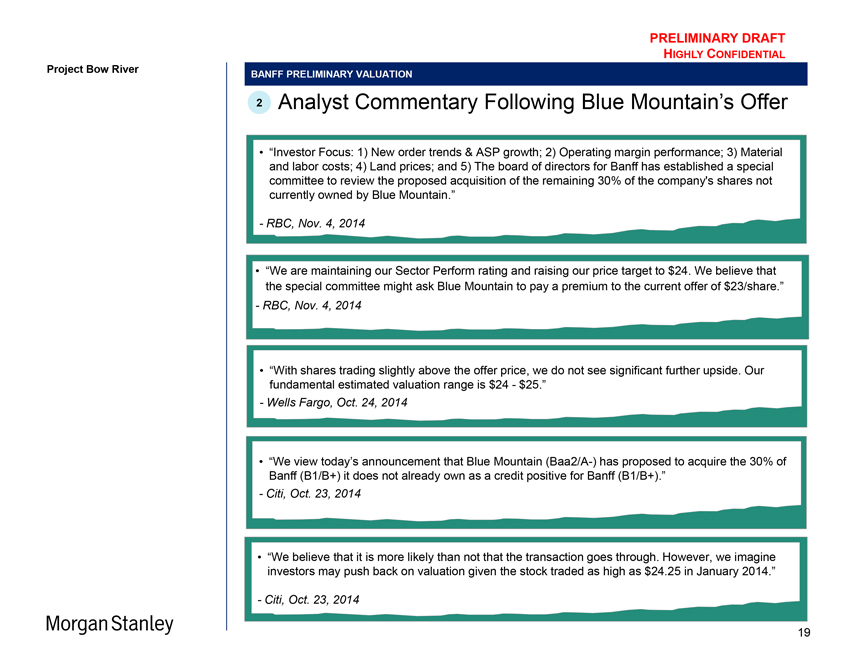

2 Analyst Commentary Following Blue Mountain’s Offer

“Investor Focus: 1) New order trends & ASP growth; 2) Operating margin performance; 3) Material and labor costs; 4) Land prices; and 5) The board of directors for Banff has established a special committee to review the proposed acquisition of the remaining 30% of the company’s shares not currently owned by Blue Mountain.”

- RBC, Nov. 4, 2014

“We are maintaining our Sector Perform rating and raising our price target to $24. We believe that the special committee might ask Blue Mountain to pay a premium to the current offer of $23/share.”

- RBC, Nov. 4, 2014

“With shares trading slightly above the offer price, we do not see significant further upside. Our fundamental estimated valuation range is $24 - $25.”

- Wells Fargo, Oct. 24, 2014

“We view today’s announcement that Blue Mountain (Baa2/A-) has proposed to acquire the 30% of Banff (B1/B+) it does not already own as a credit positive for Banff (B1/B+).”

- Citi, Oct. 23, 2014

“We believe that it is more likely than not that the transaction goes through. However, we imagine investors may push back on valuation given the stock traded as high as $24.25 in January 2014.”

- Citi, Oct. 23, 2014

19

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

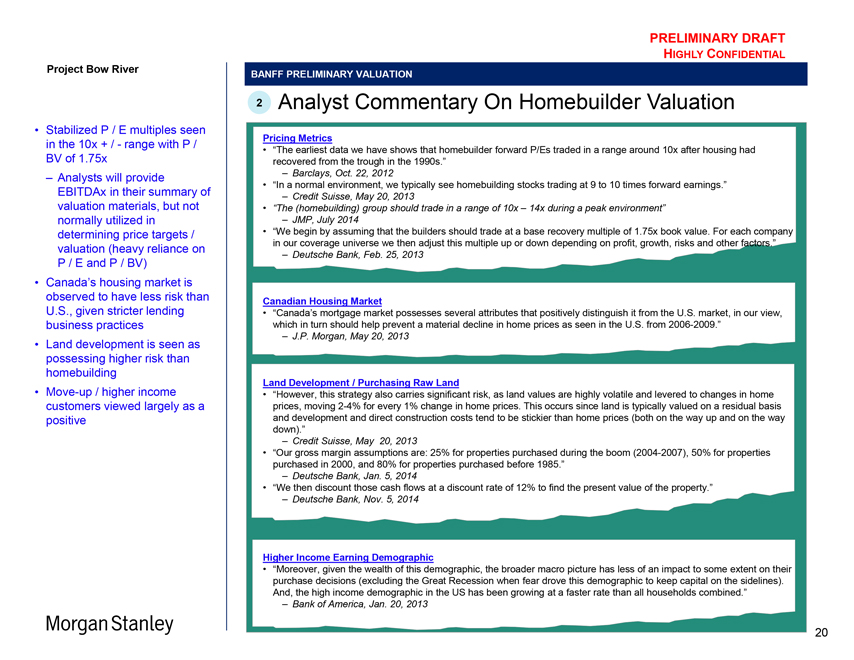

Stabilized P / E multiples seen in the 10x + / - range with P / BV of 1.75x

– Analysts will provide EBITDAx in their summary of valuation materials, but not normally utilized in determining price targets / valuation (heavy reliance on P / E and P / BV)

Canada’s housing market is observed to have less risk than U.S., given stricter lending business practices

Land development is seen as possessing higher risk than homebuilding

Move-up / higher income customers viewed largely as a positive

BANFF PRELIMINARY VALUATION

2 Analyst Commentary On Homebuilder Valuation

Pricing Metrics

“The earliest data we have shows that homebuilder forward P/Es traded in a range around 10x after housing had recovered from the trough in the 1990s.”

– Barclays, Oct. 22, 2012

“In a normal environment, we typically see homebuilding stocks trading at 9 to 10 times forward earnings.”

– Credit Suisse, May 20, 2013

“The (homebuilding) group should trade in a range of 10x – 14x during a peak environment”

– JMP, July 2014

“We begin by assuming that the builders should trade at a base recovery multiple of 1.75x book value. For each company in our coverage universe we then adjust this multiple up or down depending on profit, growth, risks and other factors.”

– Deutsche Bank, Feb. 25, 2013

Canadian Housing Market

“Canada’s mortgage market possesses several attributes that positively distinguish it from the U.S. market, in our view, which in turn should help prevent a material decline in home prices as seen in the U.S. from 2006-2009.”

– J.P. Morgan, May 20, 2013

Land Development / Purchasing Raw Land

“However, this strategy also carries significant risk, as land values are highly volatile and levered to changes in home prices, moving 2-4% for every 1% change in home prices. This occurs since land is typically valued on a residual basis and development and direct construction costs tend to be stickier than home prices (both on the way up and on the way down).”

– Credit Suisse, May 20, 2013

“Our gross margin assumptions are: 25% for properties purchased during the boom (2004-2007), 50% for properties purchased in 2000, and 80% for properties purchased before 1985.”

– Deutsche Bank, Jan. 5, 2014

“We then discount those cash flows at a discount rate of 12% to find the present value of the property.”

– Deutsche Bank, Nov. 5, 2014

Higher Income Earning Demographic

“Moreover, given the wealth of this demographic, the broader macro picture has less of an impact to some extent on their purchase decisions (excluding the Great Recession when fear drove this demographic to keep capital on the sidelines). And, the high income demographic in the US has been growing at a faster rate than all households combined.”

– Bank of America, Jan. 20, 2013

Morgan Stanley

20

Project Bow River

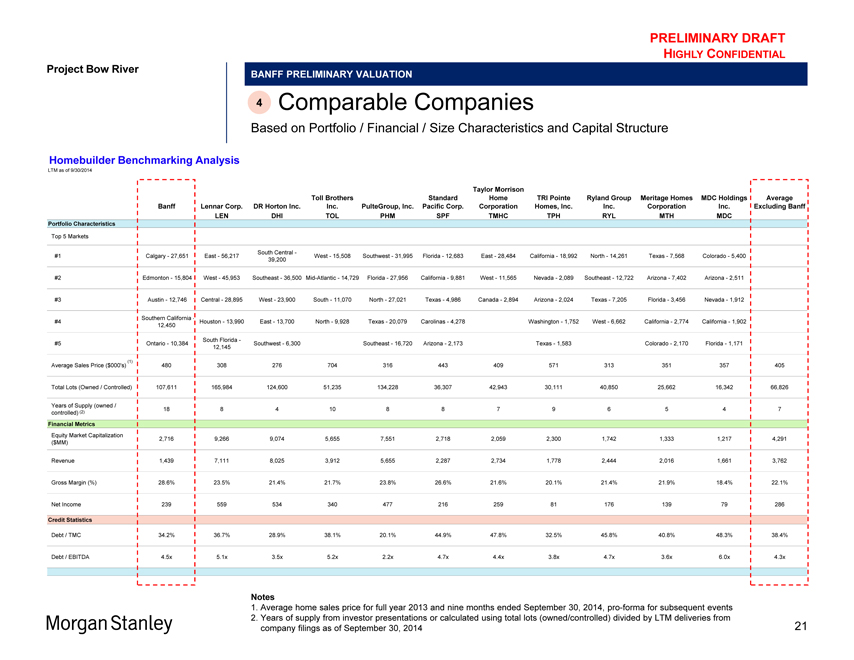

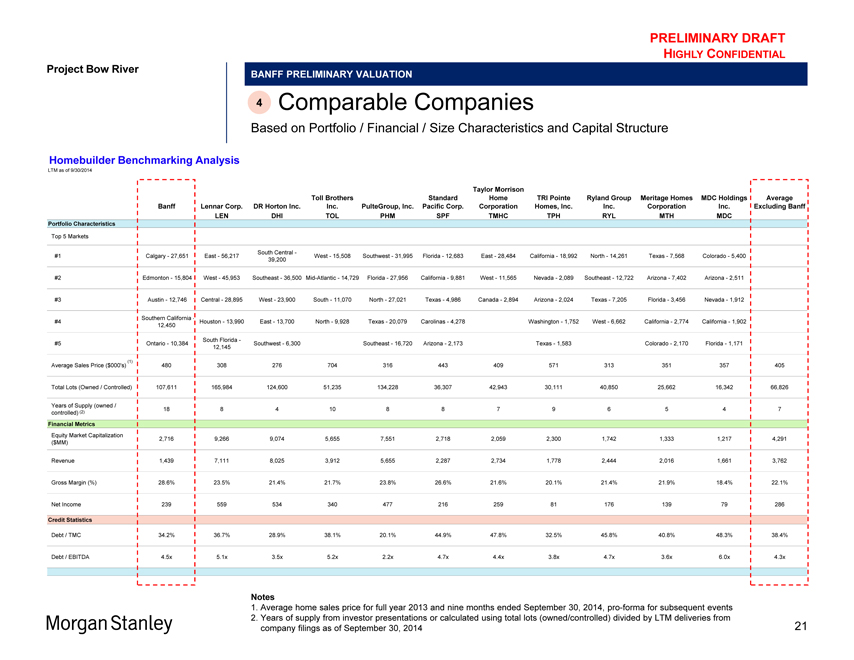

BANFF PRELIMINARY VALUATION

4 Comparable Companies

Based on Portfolio / Financial / Size Characteristics and Capital Structure

Homebuilder Benchmarking Analysis

LTM as of 9/30/2014

Taylor Morrison

Toll Brothers Standard Home TRI Pointe Ryland Group Meritage Homes MDC Holdings Average

Banff Lennar Corp. DR Horton Inc. Inc. PulteGroup, Inc. Pacific Corp. Corporation Homes, Inc. Inc. Corporation Inc. Excluding Banff

LEN DHI TOL PHM SPF TMHC TPH RYL MTH MDC

Portfolio Characteristics

Top 5 Markets

South Central—

#1 Calgary—27,651 East—56,217 West—15,508 Southwest—31,995 Florida—12,683 East—28,484 California—18,992 North—14,261 Texas—7,568 Colorado—5,400

39,200

#2 Edmonton—15,804 West—45,953 Southeast—36,500 Mid-Atlantic—14,729 Florida—27,956 California—9,881 West—11,565 Nevada—2,089 Southeast—12,722 Arizona—7,402 Arizona—2,511

#3 Austin—12,746 Central—28,895 West—23,900 South—11,070 North—27,021 Texas—4,986 Canada—2,894 Arizona—2,024 Texas—7,205 Florida—3,456 Nevada—1,912

Southern California—

#4 Houston—13,990 East—13,700 North—9,928 Texas—20,079 Carolinas—4,278 Washington—1,752 West—6,662 California—2,774 California—1,902

12,450

South Florida—

#5 Ontario—10,384 Southwest—6,300 Southeast—16,720 Arizona—2,173 Texas—1,583 Colorado—2,170 Florida—1,171

12,145

Average Sales Price ($000’s) (1) 480 308 276 704 316 443 409 571 313 351 357 405

Total Lots (Owned / Controlled) 107,611 165,984 124,600 51,235 134,228 36,307 42,943 30,111 40,850 25,662 16,342 66,826

Years of Supply (owned /

controlled) (2) 18 8 4 10 8 8 7 9 6 5 4 7

Financial Metrics

Equity Market Capitalization 2,716 9,266 9,074 5,655 7,551 2,718 2,059 2,300 1,742 1,333 1,217 4,291

($MM)

Revenue 1,439 7,111 8,025 3,912 5,655 2,287 2,734 1,778 2,444 2,016 1,661 3,762

Gross Margin (%) 28.6% 23.5% 21.4% 21.7% 23.8% 26.6% 21.6% 20.1% 21.4% 21.9% 18.4% 22.1%

Net Income 239 559 534 340 477 216 259 81 176 139 79 286

Credit Statistics

Debt / TMC 34.2% 36.7% 28.9% 38.1% 20.1% 44.9% 47.8% 32.5% 45.8% 40.8% 48.3% 38.4%

Debt / EBITDA 4.5x 5.1x 3.5x 5.2x 2.2x 4.7x 4.4x 3.8x 4.7x 3.6x 6.0x 4.3x

Morgan Stanley

Notes

1. Average home sales price for full year 2013 and nine months ended September 30, 2014, pro-forma for subsequent events

2. Years of supply from investor presentations or calculated using total lots (owned/controlled) divided by LTM deliveries from company filings as of September 30, 2014

21

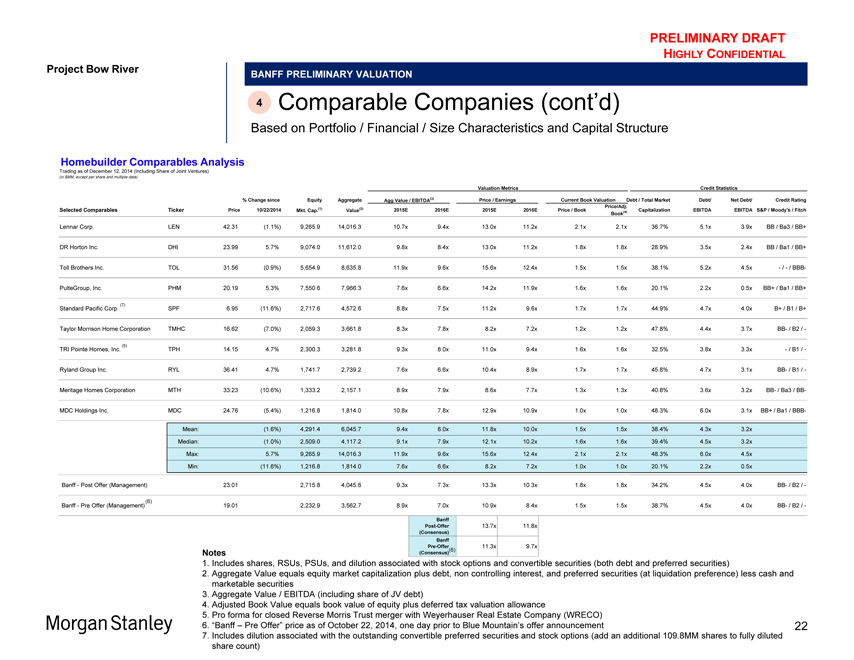

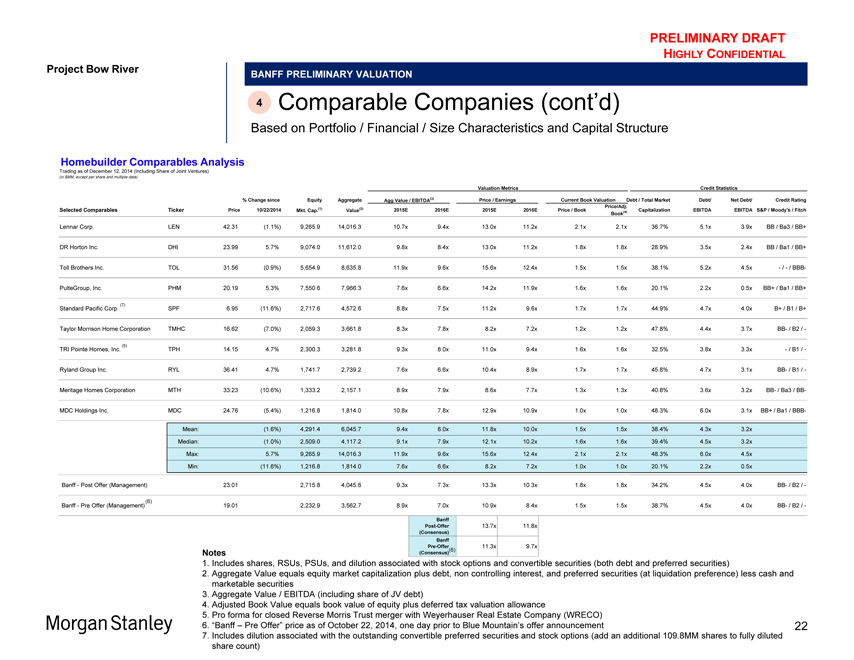

Project Bow River

BANFF PRELIMINARY VALUATION

4 Comparable Companies (cont’d)

Based on Portfolio / Financial / Size Characteristics and Capital Structure

Homebuilder Comparables Analysis

Trading as of December 12, 2014 (Including Share of Joint Ventures)

(in $MM, except per share and multiple data)

Valuation Metrics Credit Statistics

% Change since Equity Aggregate Agg Value / EBITDA(3) Price / Earnings Current Book Valuation Debt / Total Market Debt/ Net Debt/ Credit Rating

Price/Adj.

Selected Comparables Ticker Price 10/22/2014 Mkt. Cap.(1) Value(2) 2015E 2016E 2015E 2016E Price / Book (4) Capitalization EBITDA EBITDA S&P / Moody’s / Fitch

Book

Lennar Corp. LEN 42.31 (1.1%) 9,265.9 14,016.3 10.7x 9.4x 13.0x 11.2x 2.1x 2.1x 36.7% 5.1x 3.9x BB / Ba3 / BB+

DR Horton Inc. DHI 23.99 5.7% 9,074.0 11,612.0 9.8x 8.4x 13.0x 11.2x 1.8x 1.8x 28.9% 3.5x 2.4x BB / Ba1 / BB+

Toll Brothers Inc. TOL 31.56 (0.9%) 5,654.9 8,635.8 11.9x 9.6x 15.6x 12.4x 1.5x 1.5x 38.1% 5.2x 4.5x —/—/ BBB-

PulteGroup, Inc. PHM 20.19 5.3% 7,550.6 7,966.3 7.6x 6.6x 14.2x 11.9x 1.6x 1.6x 20.1% 2.2x 0.5x BB+ / Ba1 / BB+

Standard Pacific Corp. (7) SPF 6.95 (11.6%) 2,717.6 4,572.6 8.8x 7.5x 11.2x 9.6x 1.7x 1.7x 44.9% 4.7x 4.0x B+ / B1 / B+

Taylor Morrison Home Corporation TMHC 16.62 (7.0%) 2,059.3 3,661.8 8.3x 7.8x 8.2x 7.2x 1.2x 1.2x 47.8% 4.4x 3.7x BB- / B2 / -

TRI Pointe Homes, Inc. (5) TPH 14.15 4.7% 2,300.3 3,281.8 9.3x 8.0x 11.0x 9.4x 1.6x 1.6x 32.5% 3.8x 3.3x —/ B1 / -

Ryland Group Inc. RYL 36.41 4.7% 1,741.7 2,739.2 7.6x 6.6x 10.4x 8.9x 1.7x 1.7x 45.8% 4.7x 3.1x BB- / B1 / -

Meritage Homes Corporation MTH 33.23 (10.6%) 1,333.2 2,157.1 8.9x 7.9x 8.6x 7.7x 1.3x 1.3x 40.8% 3.6x 3.2x BB- / Ba3 / BB-

MDC Holdings Inc. MDC 24.76 (5.4%) 1,216.8 1,814.0 10.8x 7.8x 12.9x 10.9x 1.0x 1.0x 48.3% 6.0x 3.1x BB+ / Ba1 / BBB-

Mean: (1.6%) 4,291.4 6,045.7 9.4x 8.0x 11.8x 10.0x 1.5x 1.5x 38.4% 4.3x 3.2x

Median: (1.0%) 2,509.0 4,117.2 9.1x 7.9x 12.1x 10.2x 1.6x 1.6x 39.4% 4.5x 3.2x

Max: 5.7% 9,265.9 14,016.3 11.9x 9.6x 15.6x 12.4x 2.1x 2.1x 48.3% 6.0x 4.5x

Min: (11.6%) 1,216.8 1,814.0 7.6x 6.6x 8.2x 7.2x 1.0x 1.0x 20.1% 2.2x 0.5x

Banff—Post Offer (Management) 23.01 2,715.8 4,045.6 9.3x 7.3x 13.3x 10.3x 1.8x 1.8x 34.2% 4.5x 4.0x BB- / B2 / -

Banff—Pre Offer (Management)(6) 19.01 2,232.9 3,562.7 8.9x 7.0x 10.9x 8.4x 1.5x 1.5x 38.7% 4.5x 4.0x BB- / B2 / -

Banff

Post-Offer 13.7x 11.8x

(Consensus)

Banff

Pre-Offer 11.3x 9.7x

(Consensus) (6)

Morgan Stanley

Notes

1. Includes shares, RSUs, PSUs, and dilution associated with stock options and convertible securities (both debt and preferred securities)

2. Aggregate Value equals equity market capitalization plus debt, non controlling interest, and preferred securities (at liquidation preference) less cash and marketable securities

3. Aggregate Value / EBITDA (including share of JV debt)

4. Adjusted Book Value equals book value of equity plus deferred tax valuation allowance

5. Pro forma for closed Reverse Morris Trust merger with Weyerhauser Real Estate Company (WRECO)

6. “Banff – Pre Offer” price as of October 22, 2014, one day prior to Blue Mountain’s offer announcement

7. Includes dilution associated with the outstanding convertible preferred securities and stock options (add an additional 109.8MM shares to fully diluted share count)

22

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

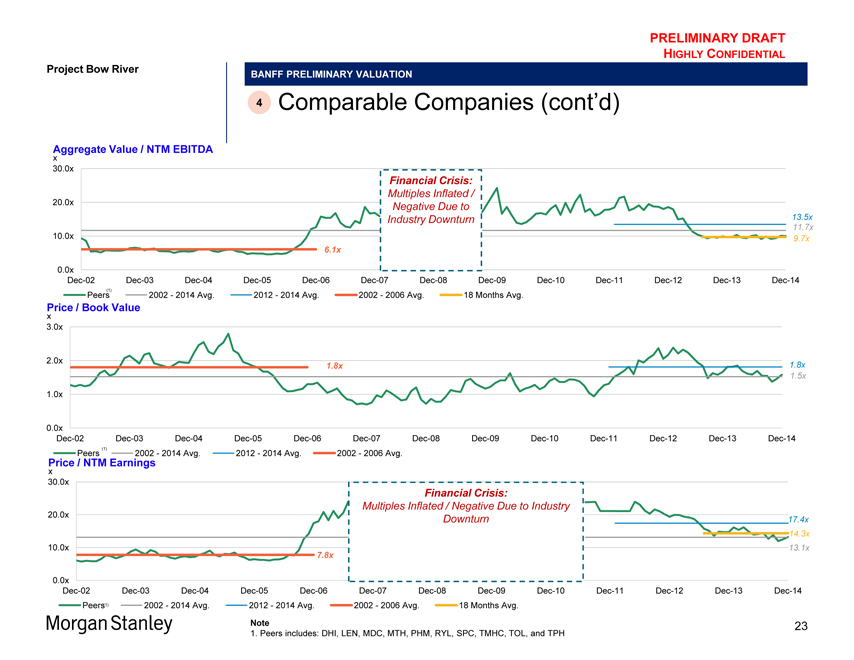

Project Bow River

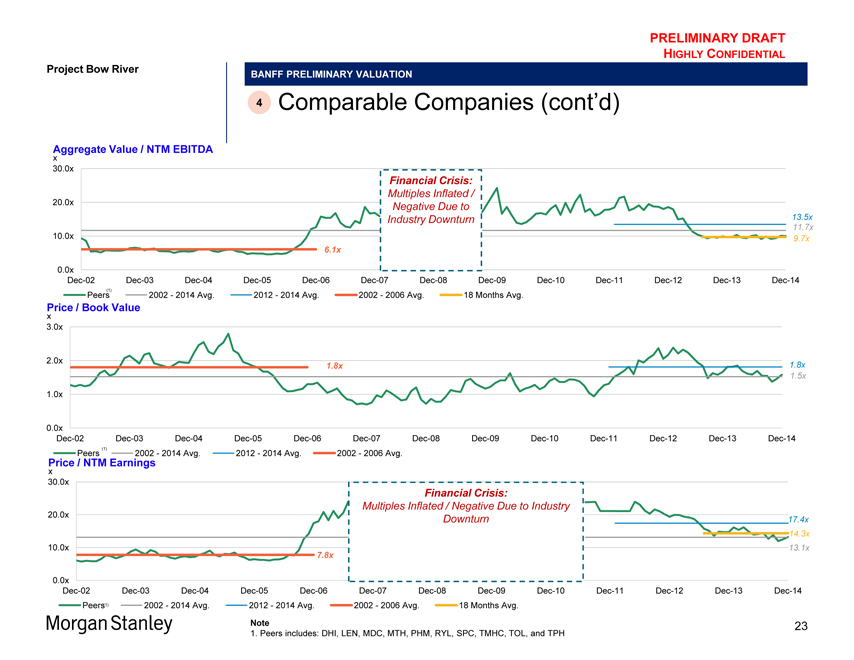

BANFF PRELIMINARY VALUATION

4 Comparable Companies (cont’d)

Aggregate Value / NTM EBITDA

30.0x 20.0x 10.0x 0.0x

Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14

(1)

6.1x

Financial Crisis:

Multiples Inflated / Negative Due to Industry Downturn

13.5x 11.7x 9.7x

Peers(1)

2002—2014 Avg.

2012—2014 Avg.

2002—2006 Avg.

18 Months Avg.

x Price / Book Value

x 3.0x

2.0x 1.0x 0.0x

Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14

1.8x

1.8x 1.5x

Peers(1) 2002—2014 Avg. 2012—2014 Avg. 2002—2006 Avg.

Price Peers / NTM Earnings 2002 -

x 30.0x

20.0x 10.0x 0.0x

Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14

7.8x

Financial Crisis:

Multiples Inflated / Negative Due to Industry Downturn

17.4x 14.3x 13.1x

Peers(1) 2002—2014 Avg. 2012—2014 Avg. 2002—2006 Avg. 18 Months Avg.

Note

1. Peers includes: DHI, LEN, MDC, MTH, PHM, RYL, SPC, TMHC, TOL, and TPH

23

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

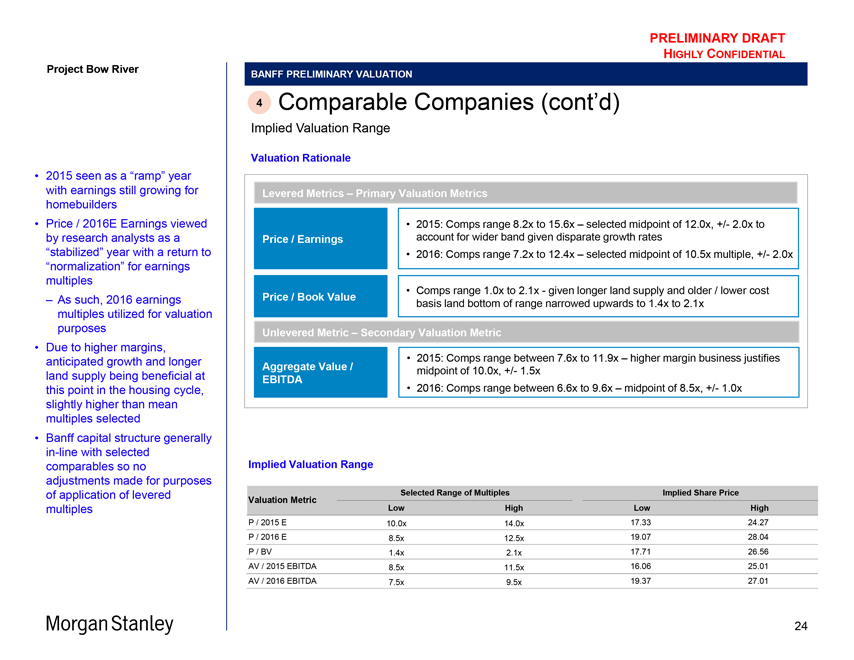

Project Bow River

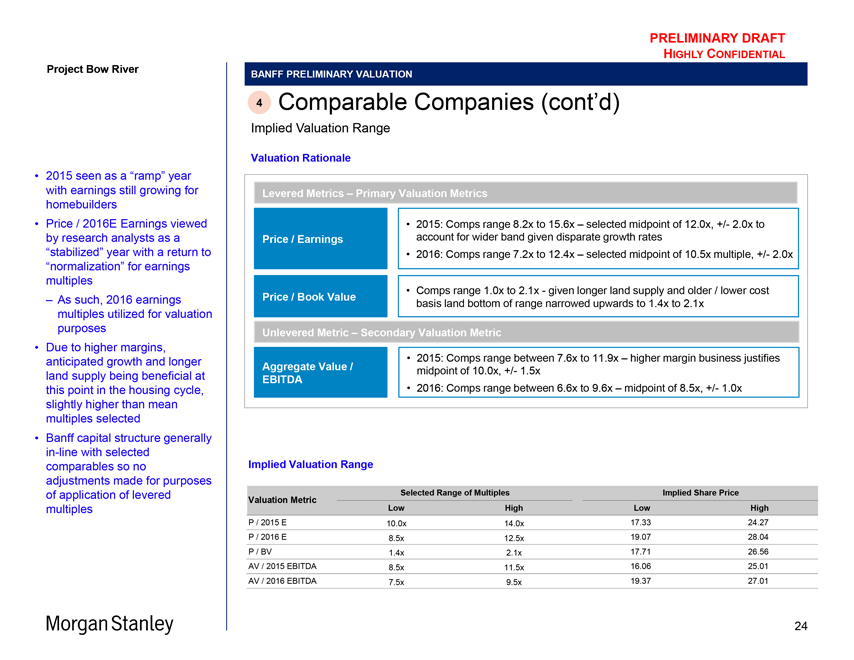

2015 seen as a “ramp” year with earnings still growing for homebuilders

Price / 2016E Earnings viewed by research analysts as a “stabilized” year with a return to “normalization” for earnings multiples

– As such, 2016 earnings multiples utilized for valuation purposes

Due to higher margins, anticipated growth and longer land supply being beneficial at this point in the housing cycle, slightly higher than mean multiples selected

Banff capital structure generally in-line with selected comparables so no adjustments made for purposes of application of levered multiples

BANFF PRELIMINARY VALUATION

4 Comparable Companies (cont’d)

Implied Valuation Range

Valuation Rationale

Levered Metrics – Primary Valuation Metrics

Price / Earnings

2015: Comps range 8.2x to 15.6x – selected midpoint of 12.0x, +/- 2.0x to account for wider band given disparate growth rates

2016: Comps range 7.2x to 12.4x – selected midpoint of 10.5x multiple, +/- 2.0x

Price / Book Value

Comps range 1.0x to 2.1x - given longer land supply and older / lower cost basis land bottom of range narrowed upwards to 1.4x to 2.1x

Unlevered Metric – Secondary Valuation Metric

Aggregate Value / EBITDA

2015: Comps range between 7.6x to 11.9x – higher margin business justifies midpoint of 10.0x, +/- 1.5x

2016: Comps range between 6.6x to 9.6x – midpoint of 8.5x, +/- 1.0x

Implied Valuation Range

Valuation Metric

Selected Range of Multiples Implied Share Price

Low High Low High

P / 2015 E 10.0x 14.0x 17.33 24.27

P / 2016 E 8.5x 12.5x 19.07 28.04

P / BV 1.4x 2.1x 17.71 26.56

AV / 2015 EBITDA 8.5x 11.5x 16.06 25.01

AV / 2016 EBITDA 7.5x 9.5x 19.37 27.01

Morgan Stanley

24

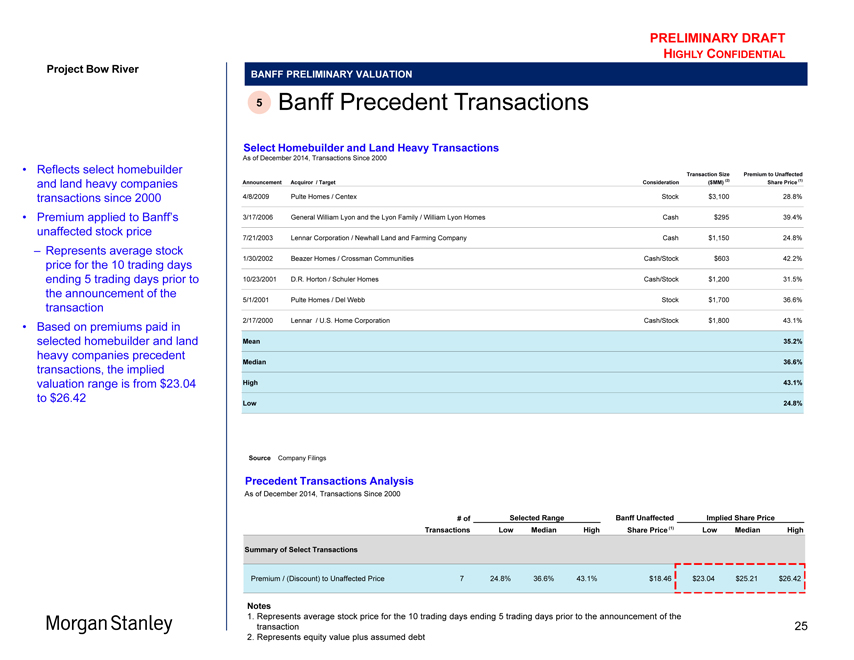

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

5 Banff Precedent Transactions

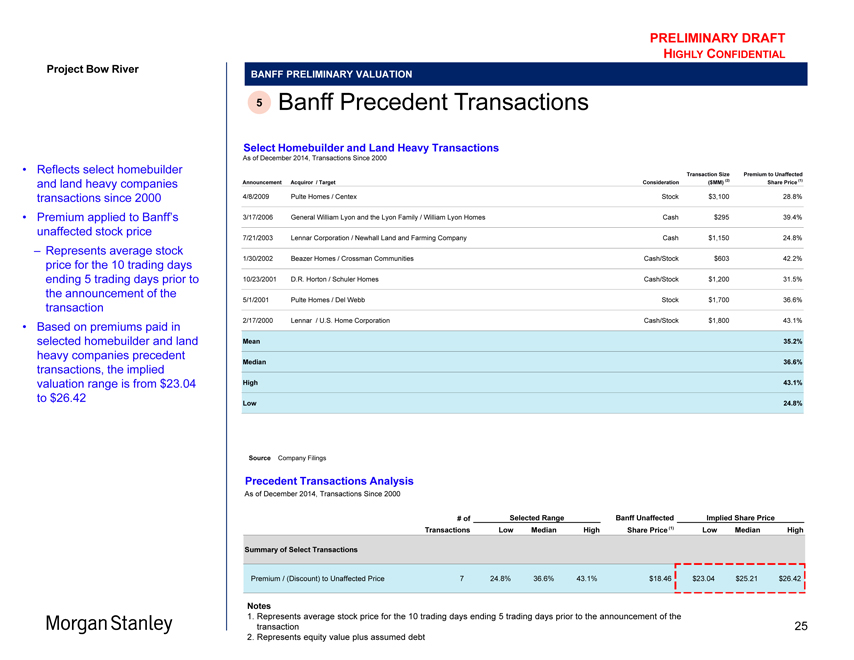

Reflects select homebuilder and land heavy companies transactions since 2000

Premium applied to Banff’s unaffected stock price

– Represents average stock price for the 10 trading days ending 5 trading days prior to the announcement of the transaction

Based on premiums paid in selected homebuilder and land heavy companies precedent transactions, the implied valuation range is from $23.04 to $26.42

Select Homebuilder and Land Heavy Transactions

As of December 2014, Transactions Since 2000

Transaction Size Premium to Unaffected Announcement Acquiror / Target Consideration ($MM) (2) Share Price (1)

4/8/2009 Pulte Homes / Centex Stock $3,100 28.8% 3/17/2006 General William Lyon and the Lyon Family / William Lyon Homes Cash $295 39.4% 7/21/2003 Lennar Corporation / Newhall Land and Farming Company Cash $1,150 24.8% 1/30/2002 Beazer Homes / Crossman Communities Cash/Stock $603 42.2% 10/23/2001 D.R. Horton / Schuler Homes Cash/Stock $1,200 31.5% 5/1/2001 Pulte Homes / Del Webb Stock $1,700 36.6% 2/17/2000 Lennar / U.S. Home Corporation Cash/Stock $1,800 43.1%

Mean 35.2% Median 36.6% High 43.1% Low 24.8%

Source Company Filings

Precedent Transactions Analysis

As of December 2014, Transactions Since 2000

# of Selected Range Banff Unaffected Implied Share Price Transactions Low Median High Share Price (1) Low Median High

Summary of Select Transactions

Premium / (Discount) to Unaffected Price 7 24.8% 36.6% 43.1% $18.46 $23.04 $25.21 $26.42

Notes

1. Represents average stock price for the 10 trading days ending 5 trading days prior to the announcement of the transaction

2. Represents equity value plus assumed debt

25

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

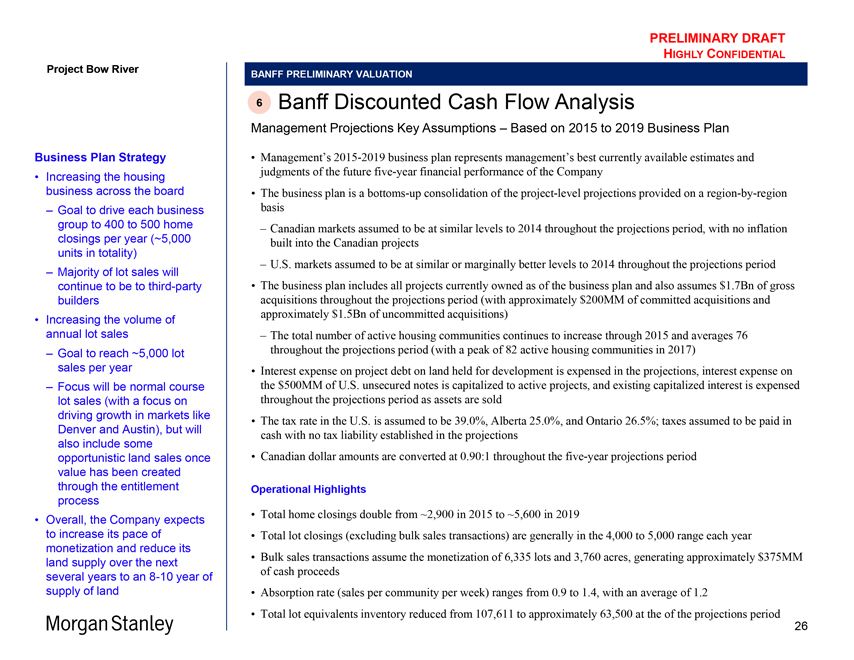

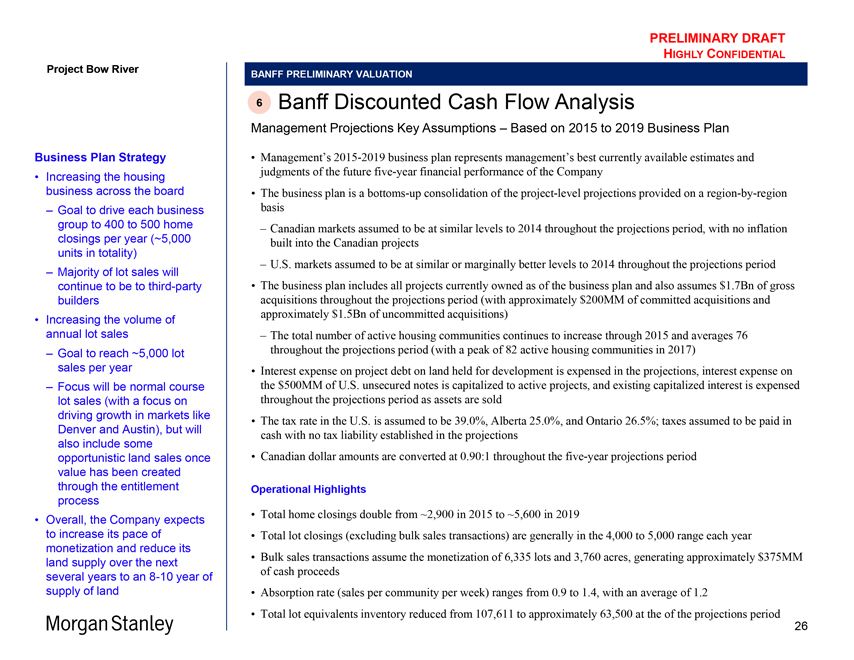

Business Plan Strategy

Increasing the housing business across the board

– Goal to drive each business group to 400 to 500 home closings per year (~5,000 units in totality)

– Majority of lot sales will continue to be to third-party builders

Increasing the volume of annual lot sales

– Goal to reach ~5,000 lot sales per year

– Focus will be normal course lot sales (with a focus on driving growth in markets like Denver and Austin), but will also include some opportunistic land sales once value has been created through the entitlement process

Overall, the Company expects to increase its pace of monetization and reduce its land supply over the next several years to an 8-10 year of supply of land

Morgan Stanley

BANFF PRELIMINARY VALUATION

6 Banff Discounted Cash Flow Analysis

Management Projections Key Assumptions – Based on 2015 to 2019 Business Plan

Management’s 2015-2019 business plan represents management’s best currently available estimates and judgments of the future five-year financial performance of the Company

The business plan is a bottoms-up consolidation of the project-level projections provided on a region-by-region basis

– Canadian markets assumed to be at similar levels to 2014 throughout the projections period, with no inflation built into the Canadian projects

– U.S. markets assumed to be at similar or marginally better levels to 2014 throughout the projections period

The business plan includes all projects currently owned as of the business plan and also assumes $1.7Bn of gross acquisitions throughout the projections period (with approximately $200MM of committed acquisitions and approximately $1.5Bn of uncommitted acquisitions)

– The total number of active housing communities continues to increase through 2015 and averages 76 throughout the projections period (with a peak of 82 active housing communities in 2017)

Interest expense on project debt on land held for development is expensed in the projections, interest expense on the $500MM of U.S. unsecured notes is capitalized to active projects, and existing capitalized interest is expensed throughout the projections period as assets are sold

The tax rate in the U.S. is assumed to be 39.0%, Alberta 25.0%, and Ontario 26.5%; taxes assumed to be paid in cash with no tax liability established in the projections

Canadian dollar amounts are converted at 0.90:1 throughout the five-year projections period

Operational Highlights

Total home closings double from ~2,900 in 2015 to ~5,600 in 2019

Total lot closings (excluding bulk sales transactions) are generally in the 4,000 to 5,000 range each year

Bulk sales transactions assume the monetization of 6,335 lots and 3,760 acres, generating approximately $375MM of cash proceeds

Absorption rate (sales per community per week) ranges from 0.9 to 1.4, with an average of 1.2

Total lot equivalents inventory reduced from 107,611 to approximately 63,500 at the of the projections period

26

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

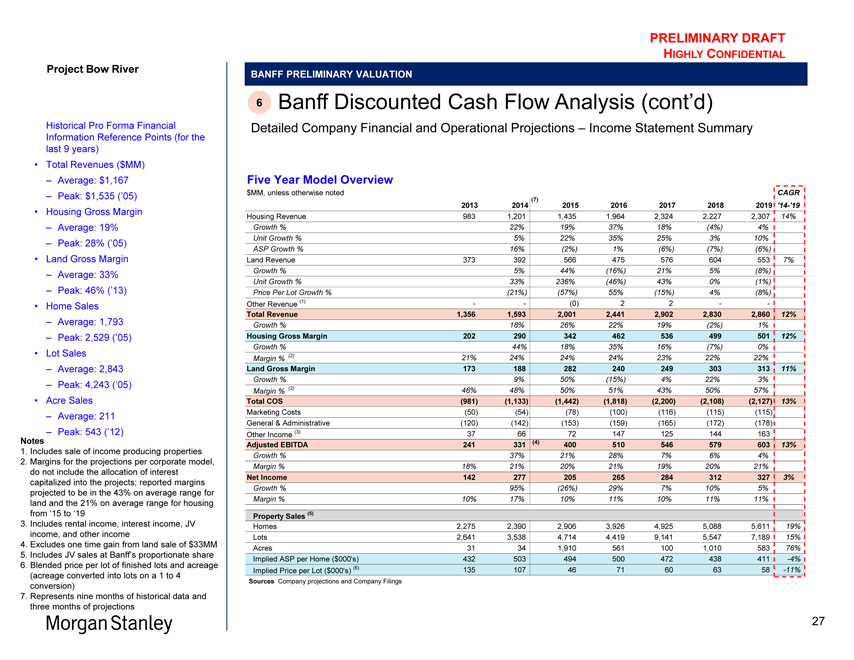

BANFF PRELIMINARY VALUATION

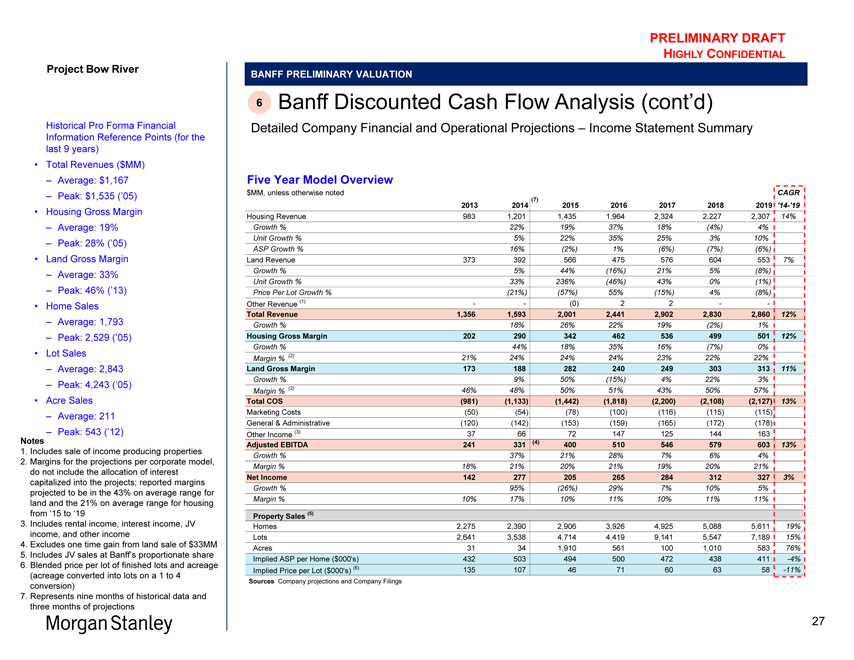

6 Banff Discounted Cash Flow Analysis (cont’d)

Detailed Company Financial and Operational Projections – Income Statement Summary

Five Year Model Overview

$MM, unless otherwise noted CAGR

2013 2014 (7) 2015 2016 2017 2018 2019 ‘14-‘19

Housing Revenue 983 1,201 1,435 1,964 2,324 2,227 2,307 14% Growth % 22% 19% 37% 18% (4%) 4% Unit Growth % 5% 22% 35% 25% 3% 10% ASP Growth % 16% (2%) 1% (6%) (7%) (6%)

Land Revenue 373 392 566 475 576 604 553 7% Growth % 5% 44% (16%) 21% 5% (8%) Unit Growth % 33% 236% (46%) 43% 0% (1%) Price Per Lot Growth % (21%) (57%) 55% (15%) 4% (8%)

Other Revenue (1) — (0) 2 2 —

Total Revenue 1,356 1,593 2,001 2,441 2,902 2,830 2,860 12%

Growth % 18% 26% 22% 19% (2%) 1%

Housing Gross Margin 202 290 342 462 536 499 501 12%

Growth % 44% 18% 35% 16% (7%) 0% Margin % (2) 21% 24% 24% 24% 23% 22% 22%

Land Gross Margin 173 188 282 240 249 303 313 11%

Growth % 9% 50% (15%) 4% 22% 3% Margin % (2) 46% 48% 50% 51% 43% 50% 57%

Total COS (981) (1,133) (1,442) (1,818) (2,200) (2,108) (2,127) 13%

Marketing Costs (50) (54) (78) (100) (116) (115) (115) General & Administrative (120) (142) (153) (159) (165) (172) (178) Other Income (3) 37 66 72 147 125 144 163

Adjusted EBITDA 241 331 (4) 400 510 546 579 603 13%

Growth % 37% 21% 28% 7% 6% 4% Margin % 18% 21% 20% 21% 19% 20% 21%

Net Income 142 277 205 265 284 312 327 3%

Growth % 95% (26%) 29% 7% 10% 5% Margin % 10% 17% 10% 11% 10% 11% 11%

Property Sales (5)

Homes 2,275 2,390 2,906 3,926 4,925 5,088 5,611 19% Lots 2,641 3,538 4,714 4,419 9,141 5,547 7,189 15% Acres 31 34 1,910 561 100 1,010 583 76% Implied ASP per Home ($000’s) 432 503 494 500 472 438 411 -4% Implied Price per Lot ($000’s) (6) 135 107 46 71 60 63 58 -11%

Sources Company projections and Company Filings

Project Bow River

Historical Pro Forma Financial Information Reference Points (for last 9 years)

Total Revenues ($MM)

– Average: $1,167

– Peak: $1,535 (’05)

Housing Gross Margin

– Average: 19%

– Peak: 28% (’05)

Land Gross Margin

– Average: 33%

– Peak: 46% (’13)

Home Sales

– Average: 1,793

– Peak: 2,529 (’05)

Lot Sales

– Average: 2,843

– Peak: 4,243 (’05)

Acre Sales

– Average: 211

– Peak: 543 (’12)

– Peak: 543 (’12)

Notes

1. Includes sale of income producing properties

2. Margins for the projections per corporate model, do not include the allocation of interest capitalized into the projects; reported margins projected to be in the 43% on average range for land and the 21% on average range for housing from ’15 to ‘19

3. Includes rental income, interest income, JV income, and other income

4. Excludes one time gain from land sale of $33MM

5. Includes JV sales at Banff’s proportionate share

6. Blended price per lot of finished lots and acreage (acreage converted into lots on a 1 to 4 conversion)

7. Represents nine months of historical data and three months of projections

27

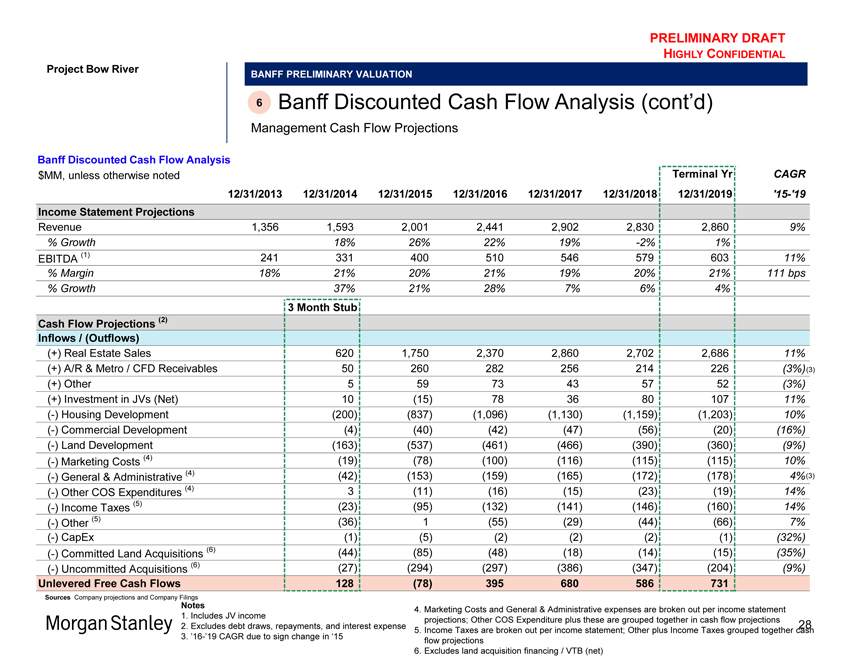

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

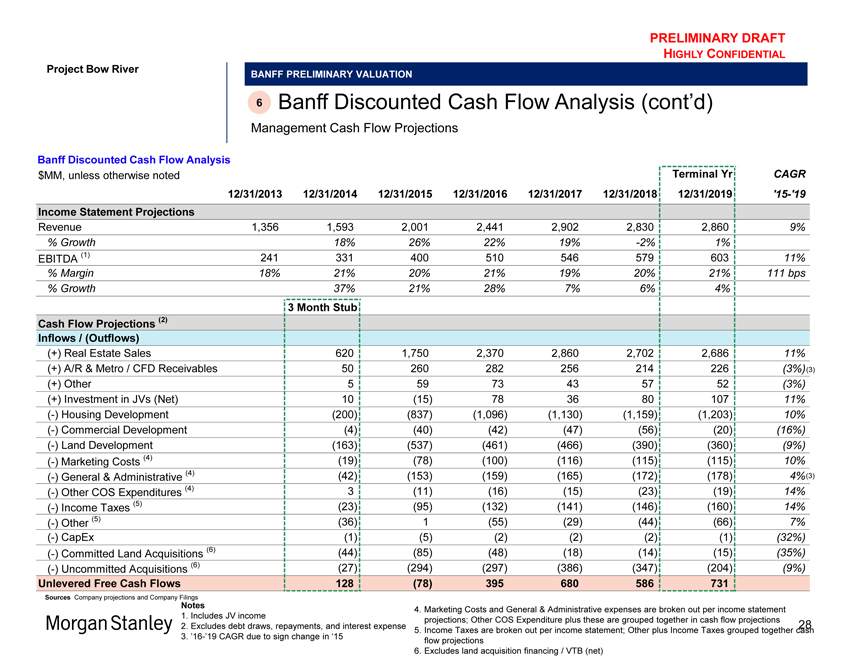

6 Banff Discounted Cash Flow Analysis (cont’d)

Management Cash Flow Projections

Project Bow River

Banff Discounted Cash Flow Analysis $MM, unless otherwise noted Terminal Yr CAGR

12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 ‘15-‘19 Income Statement Projections

Revenue 1,356 1,593 2,001 2,441 2,902 2,830 2,860 9%

% Growth 18% 26% 22% 19% -2% 1%

EBITDA (1) 241 331 400 510 546 579 603 11%

% Margin 18% 21% 20% 21% 19% 20% 21% 111 bps

% Growth 37% 21% 28% 7% 6% 4%

3 Month Stub Cash Flow Projections (2) Inflows / (Outflows)

(+) Real Estate Sales 620 1,750 2,370 2,860 2,702 2,686 11% (+) A/R & Metro / CFD Receivables 50 260 282 256 214 226 (3%)(3) (+) Other 5 59 73 43 57 52 (3%) (+) Investment in JVs (Net) 10 (15) 78 36 80 107 11% (-) Housing Development (200) (837) (1,096) (1,130) (1,159) (1,203) 10% (-) Commercial Development (4) (40) (42) (47) (56) (20) (16%) (-) Land Development (163) (537) (461) (466) (390) (360) (9%) (-) Marketing Costs (4) (19) (78) (100) (116) (115) (115) 10% (-) General & Administrative (4) (42) (153) (159) (165) (172) (178) 4%(3) (-) Other COS Expenditures (4) 3 (11) (16) (15) (23) (19) 14% (-) Income Taxes (5) (23) (95) (132) (141) (146) (160) 14% (-) Other (5) (36) 1 (55) (29) (44) (66) 7% (-) CapEx (1) (5) (2) (2) (2) (1) (32%) (-) Committed Land Acquisitions (6) (44) (85) (48) (18) (14) (15) (35%) (-) Uncommitted Acquisitions (6) (27) (294) (297) (386) (347) (204) (9%)

Unlevered Free Cash Flows 128 (78) 395 680 586 731

Sources Company projections and Company Filings

Notes

1. Includes JV income

2. Excludes debt draws, repayments, and interest expense

3. ’16-’19 CAGR due to sign change in ‘15

4. Marketing Costs and General & Administrative expenses are broken out per income statement projections; Other COS Expenditure plus these are grouped together in cash flow projections

5. Income Taxes are broken out per income statement; Other plus Income Taxes grouped together cash flow projections

6. Excludes land acquisition financing / VTB (net)

28

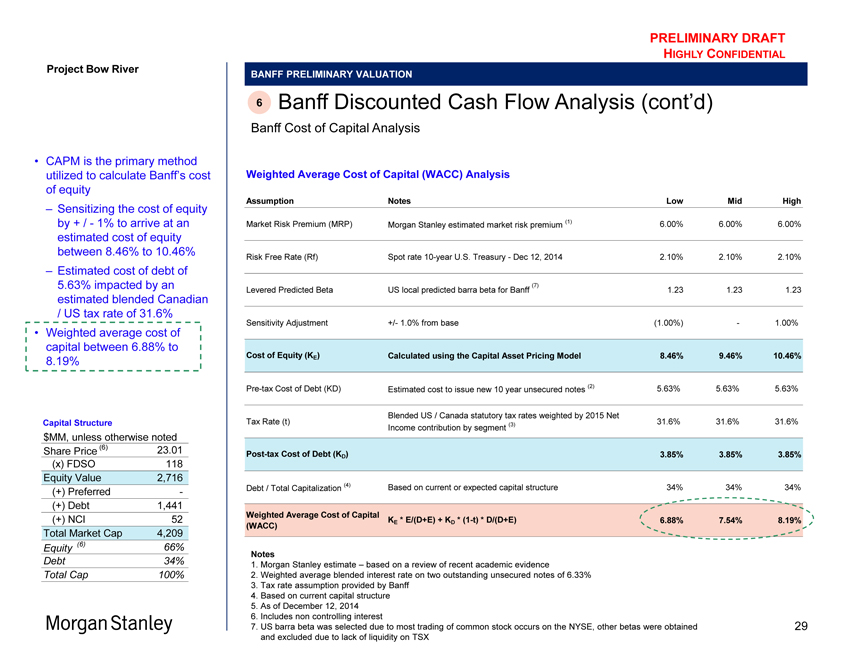

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

6 Banff Discounted Cash Flow Analysis (cont’d)

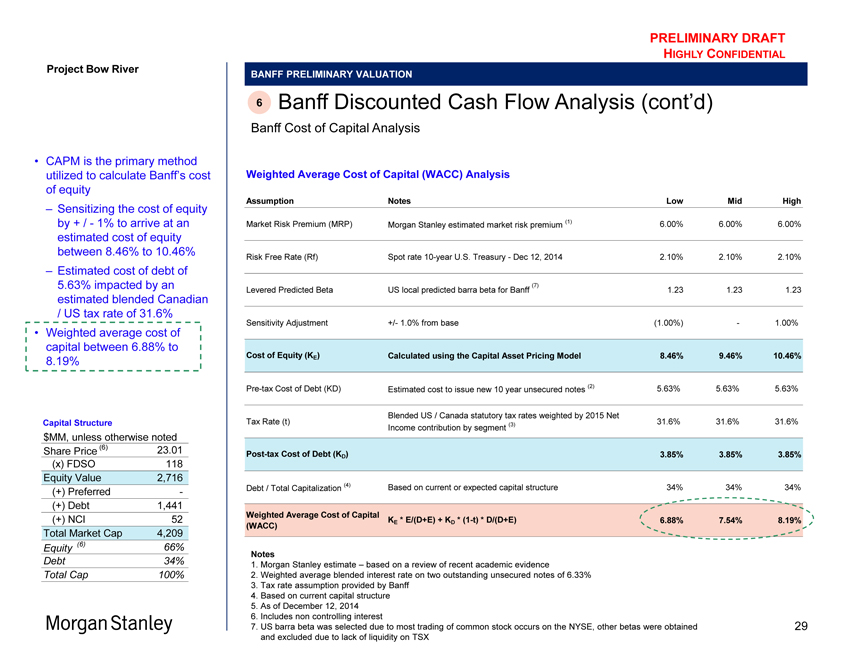

Banff Cost of Capital Analysis

Weighted Average Cost of Capital (WACC) Analysis

Assumption Notes Low Mid High

Market Risk Premium (MRP) Morgan Stanley estimated market risk premium (1) 6.00% 6.00% 6.00%

Risk Free Rate (Rf) Spot rate 10-year U.S. Treasury—Dec 12, 2014 2.10% 2.10% 2.10%

(7)

Levered Predicted Beta US local predicted barra beta for Banff 1.23 1.23 1.23

Sensitivity Adjustment +/- 1.0% from base (1.00%)—1.00%

Cost of Equity (KE) Calculated using the Capital Asset Pricing Model 8.46% 9.46% 10.46%

Pre-tax Cost of Debt (KD) Estimated cost to issue new 10 year unsecured notes (2) 5.63% 5.63% 5.63%

Blended US / Canada statutory tax rates weighted by 2015 Net

Tax Rate (t) (3) 31.6% 31.6% 31.6% Income contribution by segment

Post-tax Cost of Debt (KD) 3.85% 3.85% 3.85%

Debt / Total Capitalization (4) Based on current or expected capital structure 34% 34% 34%

Weighted Average Cost of Capital

KE * E/(D+E) + KD * (1-t) * D/(D+E) 6.88% 7.54% 8.19% (WACC)

Notes

1. Morgan Stanley estimate – based on a review of recent academic evidence

2. Weighted average blended interest rate on two outstanding unsecured notes of 6.33%

3. Tax rate assumption provided by Banff

4. Based on current capital structure

5. As of December 12, 2014

6. Includes non controlling interest

7. US barra beta was selected due to most trading of common stock occurs on the NYSE, other betas were obtained and excluded due to lack of liquidity on TSX

Project Bow River

CAPM is the primary method utilized to calculate Banff’s cost of equity

– Sensitizing the cost of equity by + /—1% to arrive at an estimated cost of equity between 8.46% to 10.46%

– Estimated cost of debt of 5.63% impacted by an estimated blended Canadian

/ US tax rate of 31.6%

Weighted average cost of capital between 6.88% to 8.19%

Capital Structure $MM, unless otherwise noted Share Price (6) 23.01 (x) FDSO 118 Equity Value 2,716 (+) Preferred -(+) Debt 1,441 (+) NCI 52 Total Market Cap 4,209

Equity (6) 66% Debt 34% Total Cap 100%

29

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

6 Banff Discounted Cash Flow Analysis (cont’d)

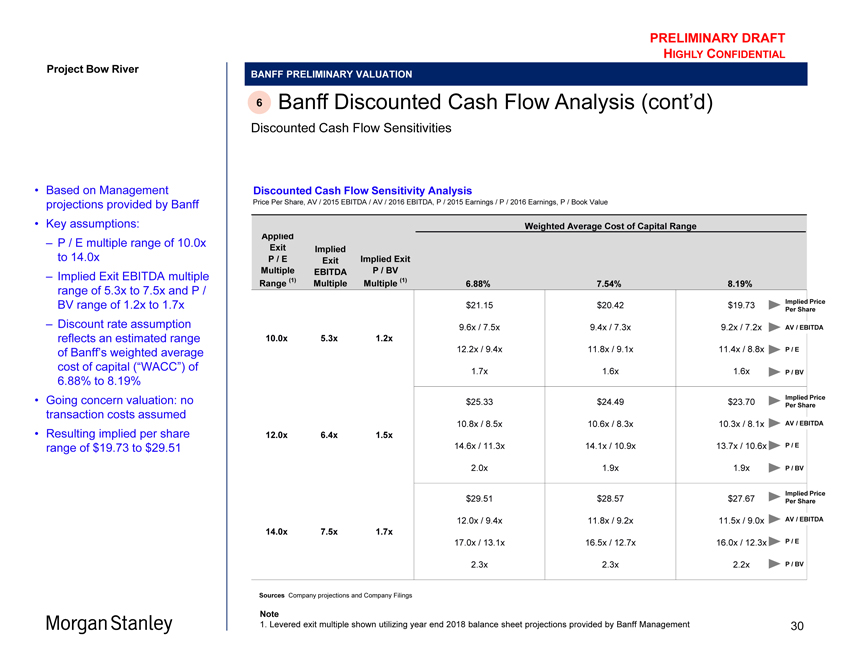

Discounted Cash Flow Sensitivities

Discounted Cash Flow Sensitivity Analysis

Price Per Share, AV / 2015 EBITDA / AV / 2016 EBITDA, P / 2015 Earnings / P / 2016 Earnings, P / Book Value

Weighted Average Cost of Capital Range Applied Exit Implied P / E Exit Implied Exit Multiple EBITDA P / BV

Range (1) Multiple Multiple (1) 6.88% 7.54% 8.19%

$21.15 $20.42 $19.73 Implied Price

Per Share

9.6x / 7.5x 9.4x / 7.3x 9.2x / 7.2x AV / EBITDA

10.0x 5.3x 1.2x

12.2x / 9.4x 11.8x / 9.1x 11.4x / 8.8x P / E

1.7x 1.6x 1.6x P / BV

Implied Price

$25.33 $24.49 $23.70 Per Share

10.8x / 8.5x 10.6x / 8.3x 10.3x / 8.1x AV / EBITDA

12.0x 6.4x 1.5x

14.6x / 11.3x 14.1x / 10.9x 13.7x / 10.6x P / E

2.0x 1.9x 1.9x P / BV

Implied Price

$29.51 $28.57 $27.67 Per Share

12.0x / 9.4x 11.8x / 9.2x 11.5x / 9.0x AV / EBITDA

14.0x 7.5x 1.7x

17.0x / 13.1x 16.5x / 12.7x 16.0x / 12.3x P / E

2.3x 2.3x 2.2x P / BV

Sources Company projections and Company Filings

Note

1. Levered exit multiple shown utilizing year end 2018 balance sheet projections provided by Banff Management

Project Bow River

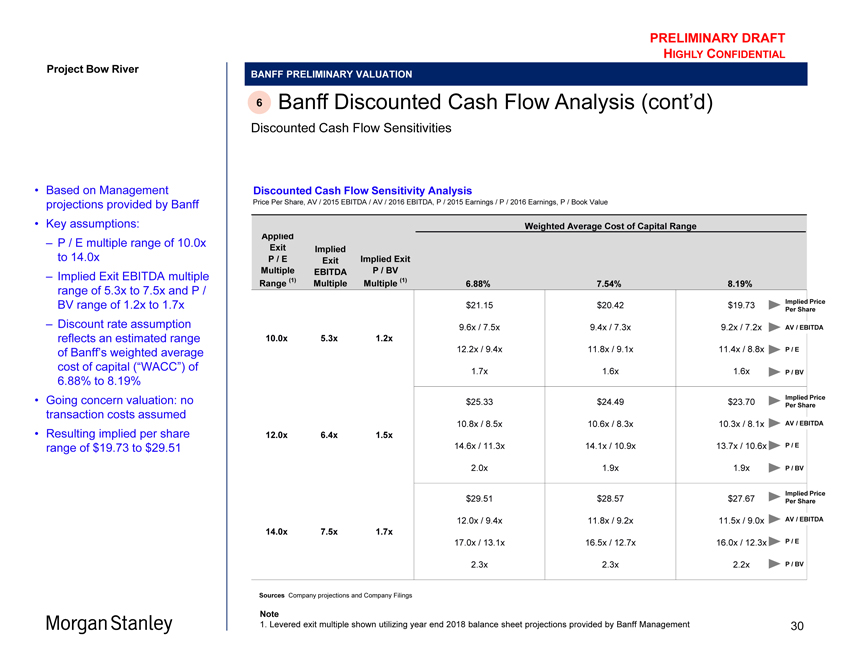

Based on Management projections provided by Banff

Key assumptions:

– P / E multiple range of 10.0x to 14.0x

– Implied Exit EBITDA multiple range of 5.3x to 7.5x and P / BV range of 1.2x to 1.7x

– Discount rate assumption reflects an estimated range of Banff’s weighted average cost of capital (“WACC”) of 6.88% to 8.19%

Going concern valuation: no transaction costs assumed

Resulting implied per share range of $19.73 to $29.51

30

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Morgan Stanley

BANFF PRELIMINARY VALUATION

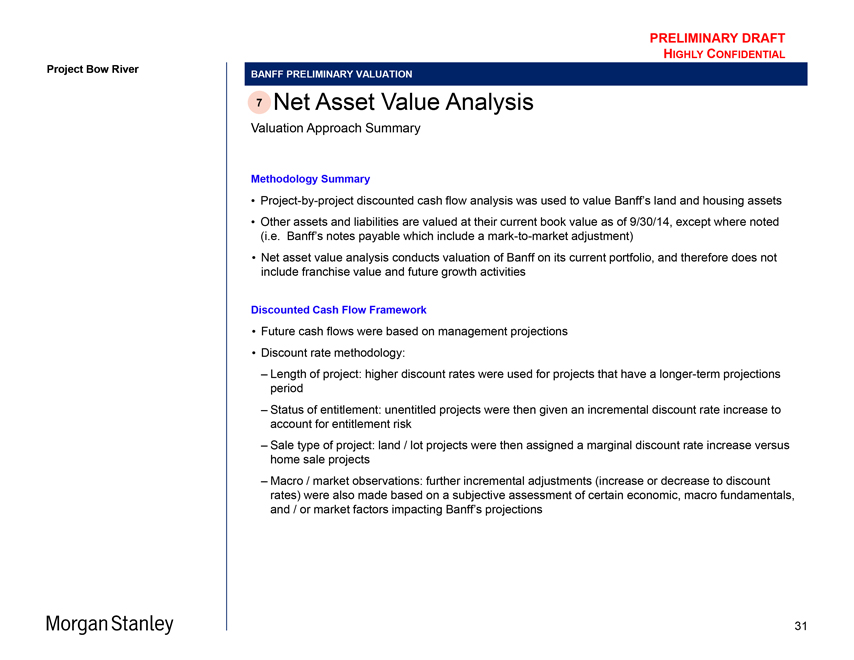

7 Net Asset Value Analysis

Valuation Approach Summary

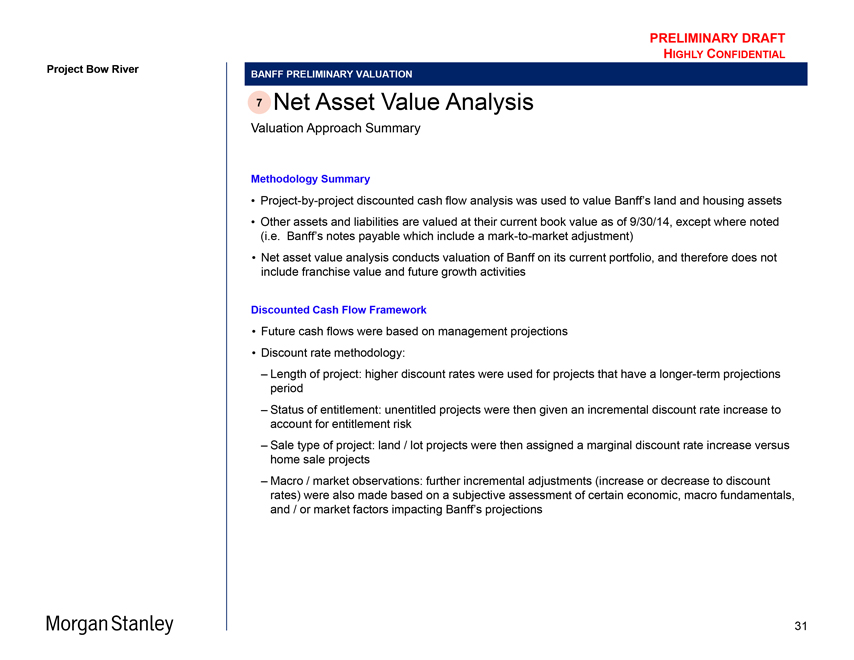

Methodology Summary

Project-by-project discounted cash flow analysis was used to value Banff’s land and housing assets

Other assets and liabilities are valued at their current book value as of 9/30/14, except where noted (i.e. Banff’s notes payable which include a mark-to-market adjustment)

Net asset value analysis conducts valuation of Banff on its current portfolio, and therefore does not include franchise value and future growth activities

Discounted Cash Flow Framework

Future cash flows were based on management projections

Discount rate methodology:

– Length of project: higher discount rates were used for projects that have a longer-term projections period

– Status of entitlement: unentitled projects were then given an incremental discount rate increase to account for entitlement risk

– Sale type of project: land / lot projects were then assigned a marginal discount rate increase versus home sale projects

– Macro / market observations: further incremental adjustments (increase or decrease to discount rates) were also made based on a subjective assessment of certain economic, macro fundamentals, and / or market factors impacting Banff’s projections

31

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

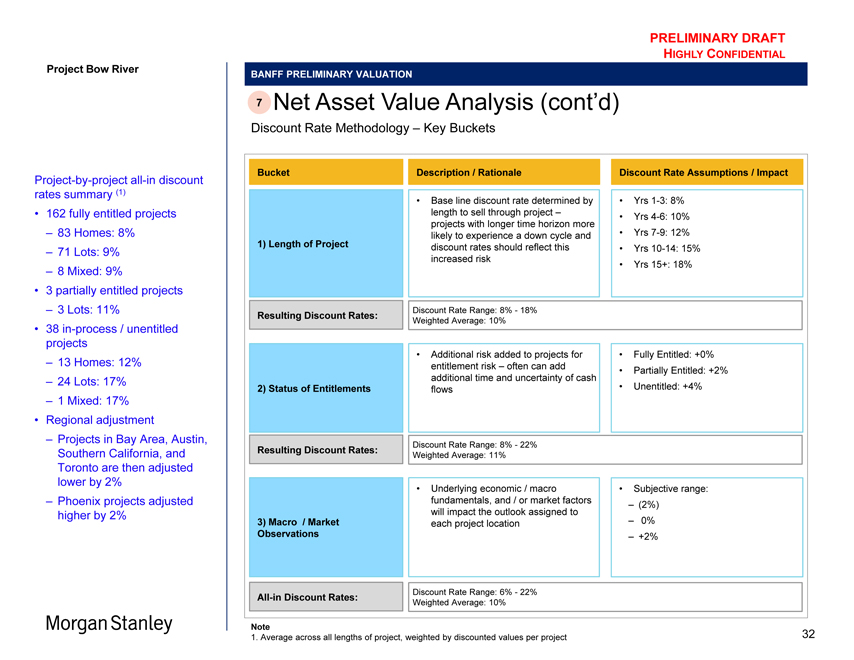

7 Net Asset Value Analysis (cont’d)

Discount Rate Methodology – Key Buckets

Project Bow River

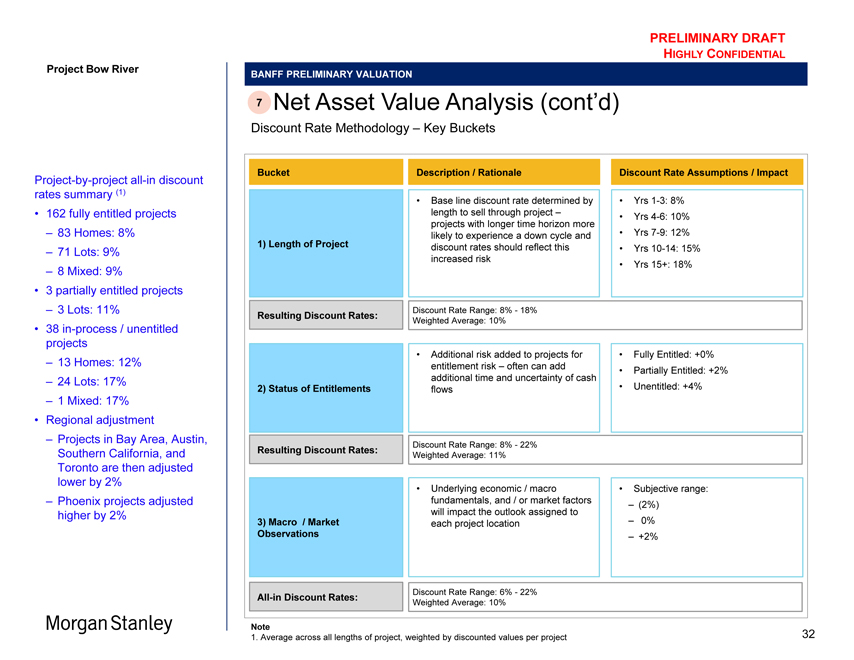

Bucket Description / Rationale Discount Rate Assumptions / Impact

Base line discount rate determined by Yrs 1-3: 8% length to sell through project – Yrs 4-6: 10% projects with longer time horizon more Yrs 7-9: 12%

1) Length of Project likely to experience a down cycle and discount rates should reflect this • Yrs 10-14: 15% increased risk

Yrs 15+: 18%

Discount Rate Range: 8%—18%

Resulting Discount Rates:

Weighted Average: 10%

Additional risk added to projects for Fully Entitled: +0% entitlement risk – often can add Partially Entitled: +2% additional time and uncertainty of cash Unentitled: +4%

2) Status of Entitlements flows

Discount Rate Range: 8%—22%

Resulting Discount Rates:

Weighted Average: 11%

Underlying economic / macro Subjective range: fundamentals, and / or market factors

– (2%) will impact the outlook assigned to – 0%

3) Macro / Market each project location

Observations – +2%

Discount Rate Range: 6%—22%

All-in Discount Rates:

Weighted Average: 10%

Note

1. Average across all lengths of project, weighted by discounted values per project

Project-by-project all-in discount rates summary (1)

162 fully entitled projects

– 83 Homes: 8%

– 71 Lots: 9%

– 8 Mixed: 9%

3 partially entitled projects

– 3 Lots: 11%

38 in-process / unentitled projects

– 13 Homes: 12%

– 24 Lots: 17%

– 1 Mixed: 17%

Regional adjustment

– Projects in Bay Area, Austin, Southern California, and Toronto are then adjusted lower by 2%

– Phoenix projects adjusted higher by 2%

32

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

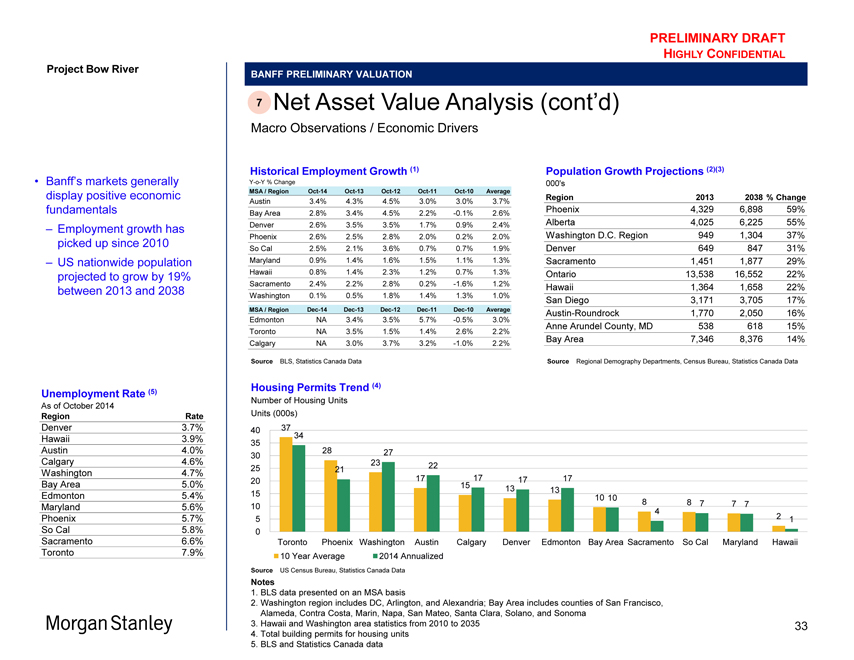

Macro Observations / Economic Drivers

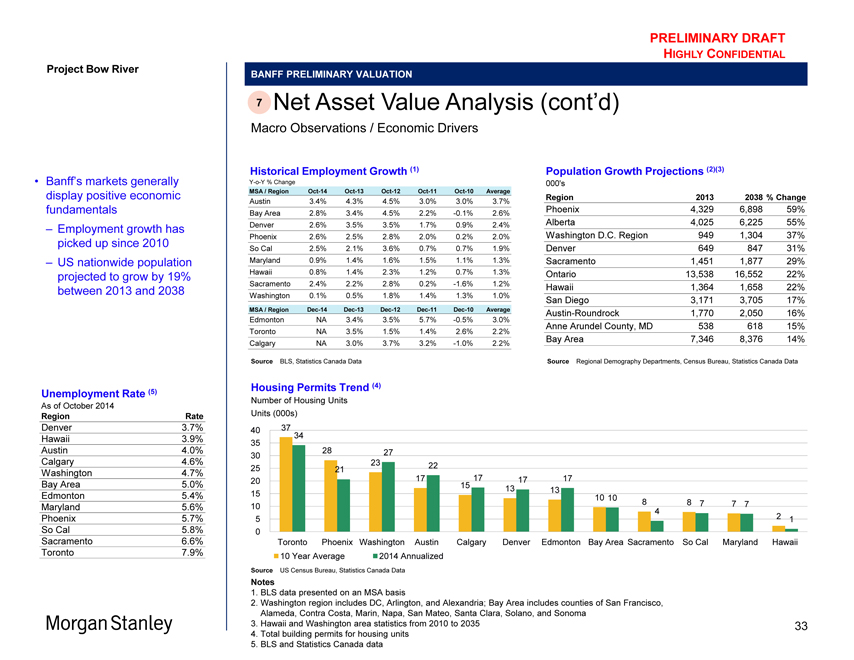

Historical Employment Growth (1) Population Growth Projections (2)(3)

Y-o-Y % Change 000’s

MSA / Region Oct-14 Oct-13 Oct-12 Oct-11 Oct-10 Average

Region 2013 2038 % Change

Austin 3.4% 4.3% 4.5% 3.0% 3.0% 3.7% Phoenix 4,329 6,898 59% Bay Area 2.8% 3.4% 4.5% 2.2% -0.1% 2.6% Denver 2.6% 3.5% 3.5% 1.7% 0.9% 2.4% Alberta 4,025 6,225 55%

Phoenix 2.6% 2.5% 2.8% 2.0% 0.2% 2.0% Washington D.C. Region 949 1,304 37%

So Cal 2.5% 2.1% 3.6% 0.7% 0.7% 1.9% Denver 649 847 31% Maryland 0.9% 1.4% 1.6% 1.5% 1.1% 1.3% Sacramento 1,451 1,877 29% Hawaii 0.8% 1.4% 2.3% 1.2% 0.7% 1.3% Ontario 13,538 16,552 22% Sacramento 2.4% 2.2% 2.8% 0.2% -1.6% 1.2% Hawaii 1,364 1,658 22% Washington 0.1% 0.5% 1.8% 1.4% 1.3% 1.0%

San Diego 3,171 3,705 17%

MSA / Region Dec-14 Dec-13 Dec-12 Dec-11 Dec-10 Average Austin-Roundrock 1,770 2,050 16%

Edmonton NA 3.4% 3.5% 5.7% -0.5% 3.0%

Anne Arundel County, MD 538 618 15%

Toronto NA 3.5% 1.5% 1.4% 2.6% 2.2% Bay Area 7,346 8,376 14% Calgary NA 3.0% 3.7% 3.2% -1.0% 2.2%

Source BLS, Statistics Canada Data Source Regional Demography Departments, Census Bureau, Statistics Canada Data

Housing Permits Trend (4)

Number of Housing Units Units (000s)

40 37 34

35 28

30 27

23 22

25 21

20 17 15 17 17 17

13 13 15

10 10

8 8 7 7 7 10 4

5 2 1 0 Toronto Phoenix Washington Austin Calgary Denver Edmonton Bay Area Sacramento So Cal Maryland Hawaii

10 Year Average 2014 Annualized

Source US Census Bureau, Statistics Canada Data

Notes

1. BLS data presented on an MSA basis

2. Washington region includes DC, Arlington, and Alexandria; Bay Area includes counties of San Francisco, Alameda, Contra Costa, Marin, Napa, San Mateo, Santa Clara, Solano, and Sonoma

3. Hawaii and Washington area statistics from 2010 to 2035

4. Total building permits for housing units

5. BLS and Statistics Canada data

Project Bow River

Banff’s markets generally display positive economic fundamentals

– Employment growth has picked up since 2010

– US nationwide population projected to grow by 19% between 2013 and 2038

Unemployment Rate (5)

As of October 2014

Region Rate

Denver 3.7% Hawaii 3.9% Austin 4.0% Calgary 4.6% Washington 4.7% Bay Area 5.0% Edmonton 5.4% Maryland 5.6% Phoenix 5.7% So Cal 5.8% Sacramento 6.6% Toronto 7.9%

33

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

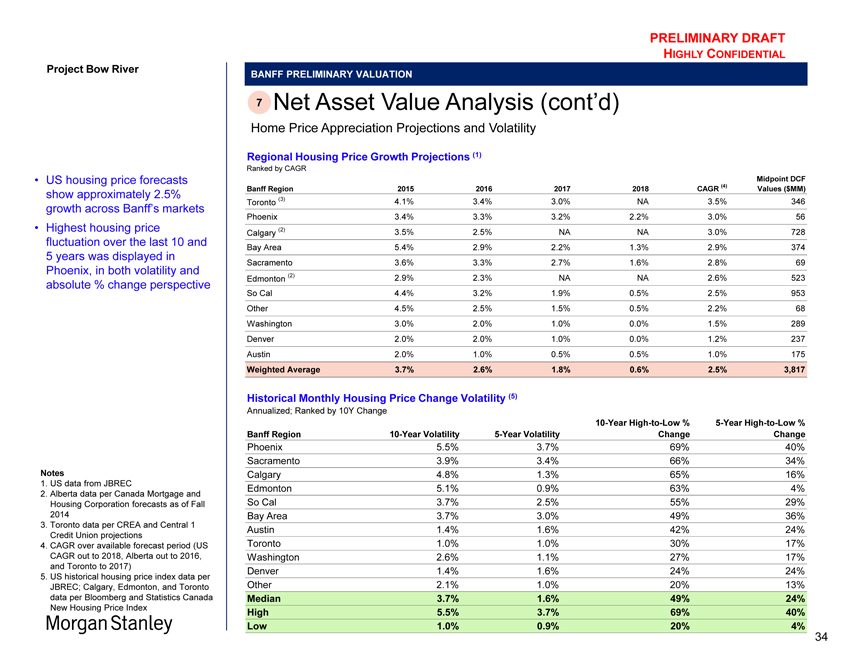

7 Net Asset Value Analysis (cont’d)

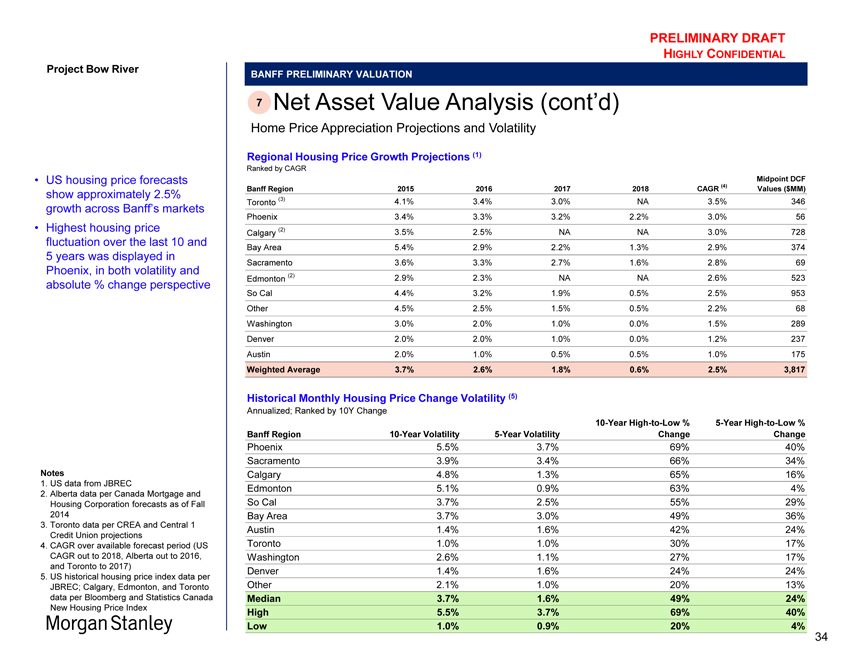

Home Price Appreciation Projections and Volatility

Regional Housing Price Growth Projections (1)

Ranked by CAGR

Midpoint DCF Banff Region 2015 2016 2017 2018 CAGR (4) Values ($MM)

Toronto (3) 4.1% 3.4% 3.0% NA 3.5% 346 Phoenix 3.4% 3.3% 3.2% 2.2% 3.0% 56 Calgary (2) 3.5% 2.5% NA NA 3.0% 728 Bay Area 5.4% 2.9% 2.2% 1.3% 2.9% 374 Sacramento 3.6% 3.3% 2.7% 1.6% 2.8% 69 Edmonton (2) 2.9% 2.3% NA NA 2.6% 523 So Cal 4.4% 3.2% 1.9% 0.5% 2.5% 953 Other 4.5% 2.5% 1.5% 0.5% 2.2% 68 Washington 3.0% 2.0% 1.0% 0.0% 1.5% 289 Denver 2.0% 2.0% 1.0% 0.0% 1.2% 237 Austin 2.0% 1.0% 0.5% 0.5% 1.0% 175

Weighted Average 3.7% 2.6% 1.8% 0.6% 2.5% 3,817

Historical Monthly Housing Price Change Volatility (5)

Annualized; Ranked by 10Y Change

10-Year High-to-Low % 5-Year High-to-Low % Banff Region 10-Year Volatility 5-Year Volatility Change Change

Phoenix 5.5% 3.7% 69% 40% Sacramento 3.9% 3.4% 66% 34% Calgary 4.8% 1.3% 65% 16% Edmonton 5.1% 0.9% 63% 4% So Cal 3.7% 2.5% 55% 29% Bay Area 3.7% 3.0% 49% 36% Austin 1.4% 1.6% 42% 24% Toronto 1.0% 1.0% 30% 17% Washington 2.6% 1.1% 27% 17% Denver 1.4% 1.6% 24% 24% Other 2.1% 1.0% 20% 13%

Median 3.7% 1.6% 49% 24% High 5.5% 3.7% 69% 40% Low 1.0% 0.9% 20% 4%

Project Bow River

US housing price forecasts show approximately 2.5% growth across Banff’s markets

Highest housing price fluctuation over the last 10 and 5 years was displayed in Phoenix, in both volatility and absolute % change perspective

Notes

1. US data from JBREC

2. Alberta data per Canada Mortgage and Housing Corporation forecasts as of Fall 2014

3. Toronto data per CREA and Central 1 Credit Union projections

4. CAGR over available forecast period (US CAGR out to 2018, Alberta out to 2016, and Toronto to 2017)

5. US historical housing price index data per JBREC; Calgary, Edmonton, and Toronto data per Bloomberg and Statistics Canada New Housing Price Index

34

PRELIMINARY DRAFT

_Bow_River H_IGHLY Discussion_Materials CONFIDENTIAL _vF.pptx\15 DEC 2014\2:24 PM\35

Project Bow River

2014-12-15_Project_Bow_River H

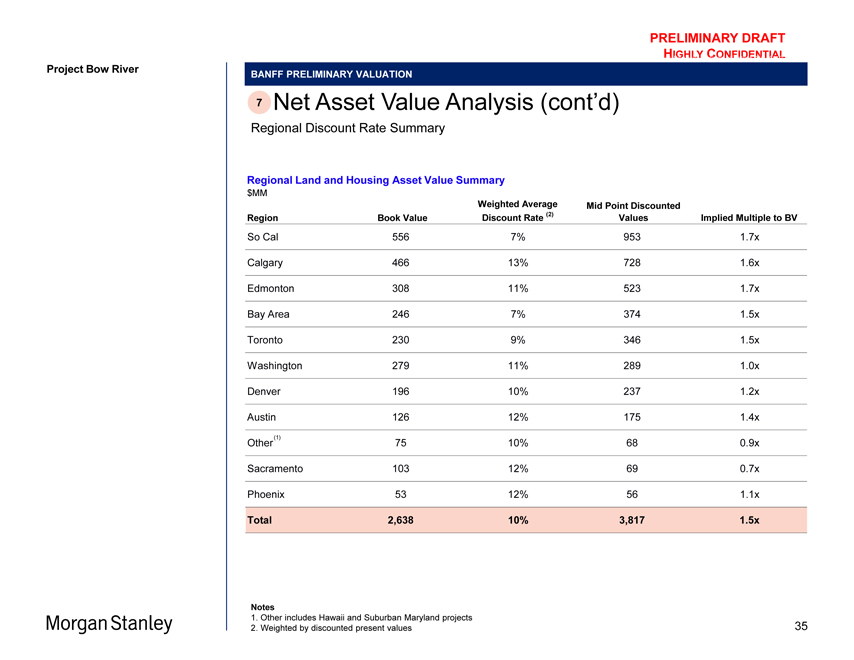

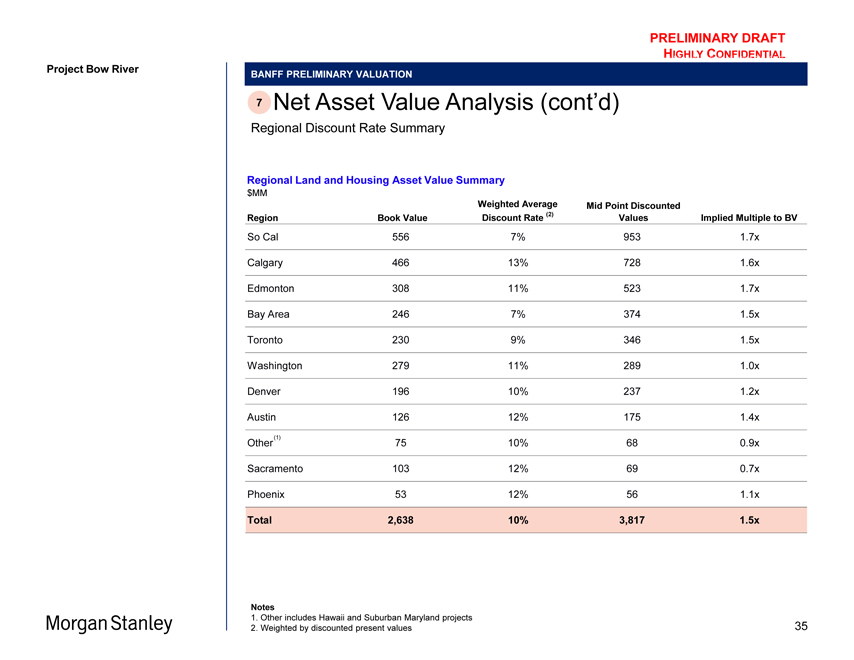

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

Regional Discount Rate Summary

Regional Land and Housing Asset Value Summary $MM

Weighted Average Mid Point Discounted

Region Book Value Discount Rate (2) Values Implied Multiple to BV

So Cal 556 7% 953 1.7x Calgary 466 13% 728 1.6x Edmonton 308 11% 523 1.7x Bay Area 246 7% 374 1.5x Toronto 230 9% 346 1.5x Washington 279 11% 289 1.0x Denver 196 10% 237 1.2x Austin 126 12% 175 1.4x

(1)

Other 75 10% 68 0.9x Sacramento 103 12% 69 0.7x Phoenix 53 12% 56 1.1x

Total 2,638 10% 3,817 1.5x

Notes

1. Other includes Hawaii and Suburban Maryland projects

2. Weighted by discounted present values

35

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

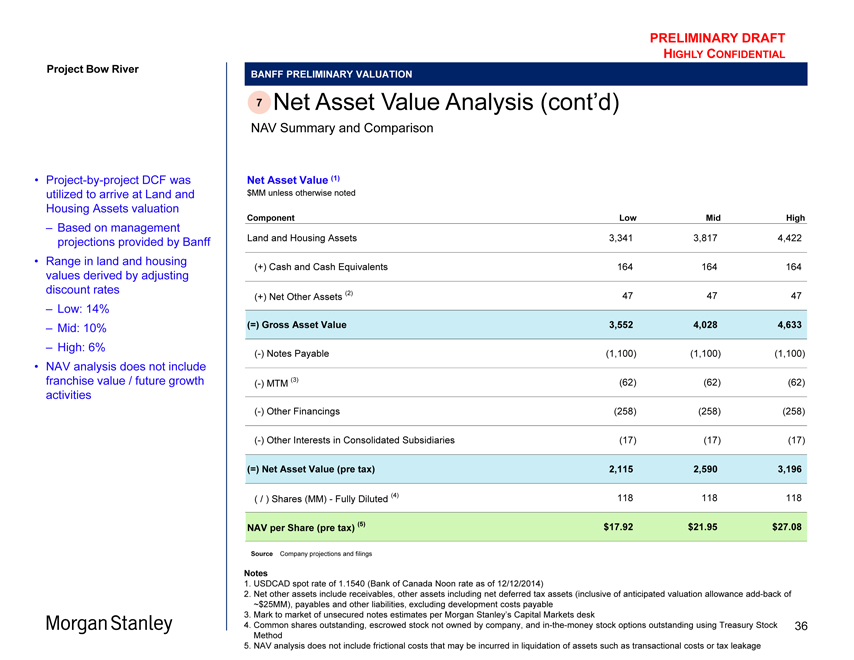

Project Bow River

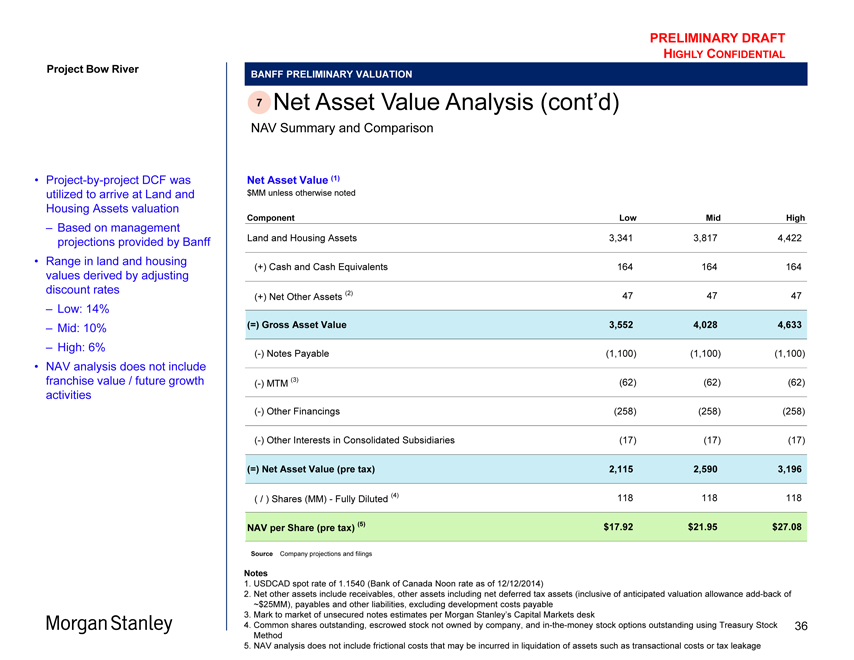

Project-by-project DCF was utilized to arrive at Land and Housing Assets valuation

Based on management projections provided by Banff

Range in land and housing values derived by adjusting discount rates

Low: 14%

Mid: 10%

High: 6%

NAV analysis does not include franchise value / future growth activities

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

NAV Summary and Comparison

Net Asset Value (1)

$MM unless otherwise noted

Component Low Mid High

Land and Housing Assets 3,341 3,817 4,422

(+) Cash and Cash Equivalents 164 164 164

(+) Net Other Assets (2) 47 47 47

(=) Gross Asset Value 3,552 4,028 4,633

(-) Notes Payable (1,100) (1,100) (1,100)

(-) MTM (3) (62) (62) (62)

(-) Other Financings (258) (258) (258)

(-) Other Interests in Consolidated Subsidiaries (17) (17) (17)

(=) Net Asset Value (pre tax) 2,115 2,590 3,196

( / ) Shares (MM) - Fully Diluted (4) 118 118 118

NAV per Share (pre tax) (5) $17.92 $21.95 $27.08

Source Company projections and filings

Notes

1. USDCAD spot rate of 1.1540 (Bank of Canada Noon rate as of 12/12/2014)

2. Net other assets include receivables, other assets including net deferred tax assets (inclusive of anticipated valuation allowance add-back of

~$25MM), payables and other liabilities, excluding development costs payable

3. Mark to market of unsecured notes estimates per Morgan Stanley’s Capital Markets desk

4. Common shares outstanding, escrowed stock not owned by company, and in-the-money stock options outstanding using Treasury Stock Method

5. NAV analysis does not include frictional costs that may be incurred in liquidation of assets such as transactional costs or tax leakage

36

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

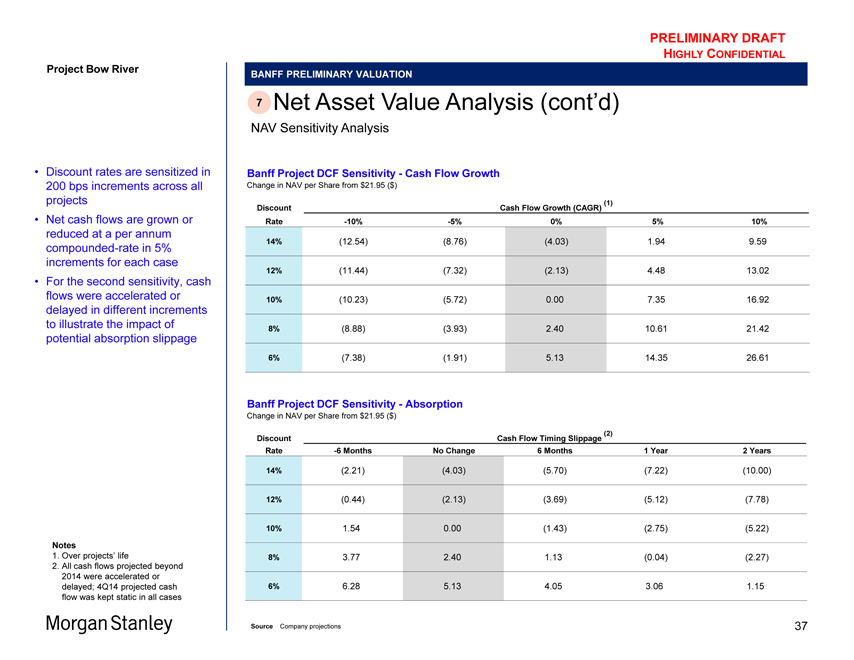

Project Bow River

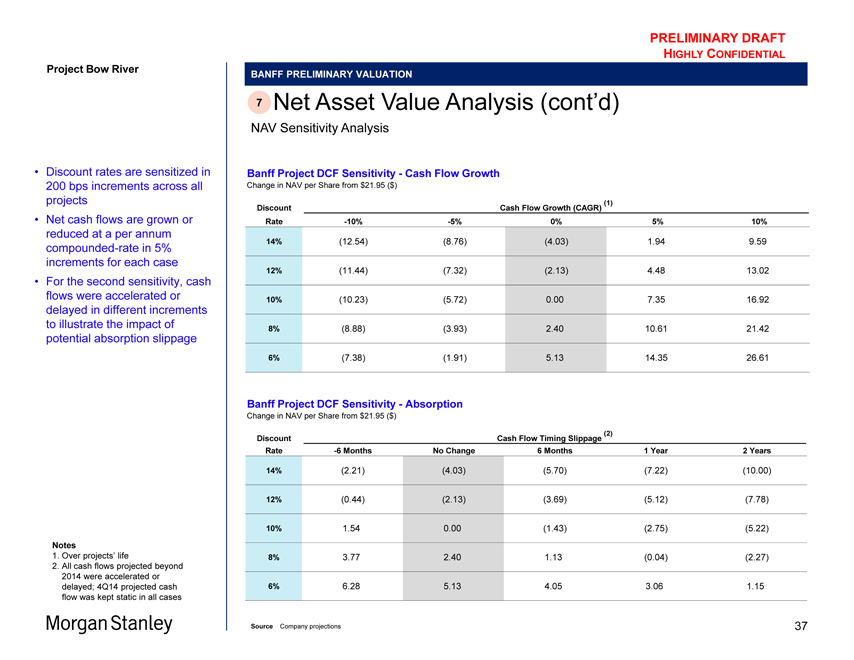

Discount rates are sensitized in 200 bps increments across all projects

Net cash flows are grown or reduced at a per annum compounded-rate in 5% increments for each case

For the second sensitivity, cash flows were accelerated or delayed in different increments to illustrate the impact of potential absorption slippage

Notes

1. Over projects’ life

2. All cash flows projected beyond 2014 were accelerated or delayed; 4Q14 projected cash flow was kept static in all cases

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

NAV Sensitivity Analysis

Banff Project DCF Sensitivity - Cash Flow Growth

Change in NAV per Share from $21.95 ($)

(1)

Discount Cash Flow Growth (CAGR)

Rate -10% -5% 0% 5% 10%

14% (12.54) (8.76) (4.03) 1.94 9.59

12% (11.44) (7.32) (2.13) 4.48 13.02

10% (10.23) (5.72) 0.00 7.35 16.92

8% (8.88) (3.93) 240 . 10.61 21.42

6% (7.38) (1.91) 5.13 14.35 26.61

Banff Project DCF Sensitivity - Absorption

Change in NAV per Share from $21.95 ($)

(2)

Discount Cash Flow Timing Slippage

Rate -6 Months No Change 6 Months 1 Year 2 Years

14% (2.21) (4.03) (5.70) (7.22) (10.00)

12% (0.44) (2.13) (3.69) (5.12) (7.78)

10% 1.54 0.00 (1.43) (2.75) (5.22)

8% 3.77 2.40 1.13 (0.04) (2.27)

6% 6.28 5.13 4.05 3.06 1.15

Source Company projections

37

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Appendix A

Supplemental Materials

Morgan Stanley

38

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

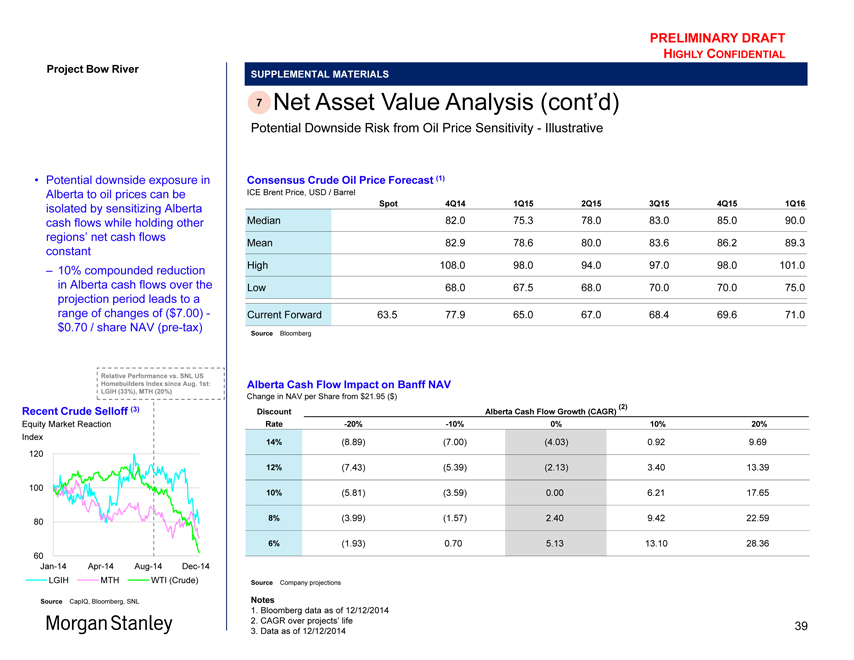

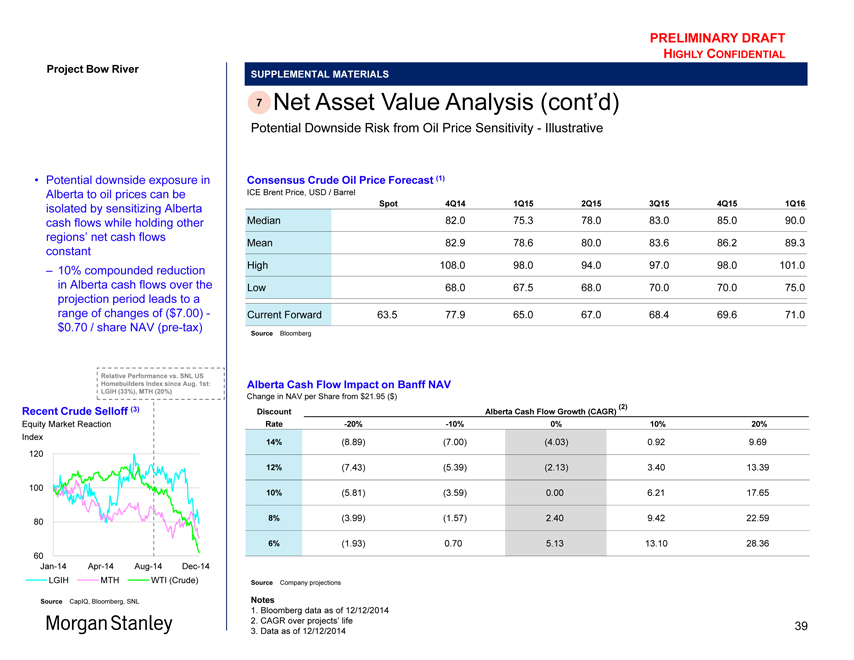

Potential downside exposure in Alberta to oil prices can be isolated by sensitizing Alberta cash flows while holding other regions’ net cash flows constant

– 10% compounded reduction in Alberta cash flows over the projection period leads to a range of changes of ($7.00) -

$0.70 / share NAV (pre-tax)

SUPPLEMENTAL MATERIALS

7 Net Asset Value Analysis (cont’d)

Potential Downside Risk from Oil Price Sensitivity - Illustrative

Consensus Crude Oil Price Forecast (1)

ICE Brent Price, USD / Barrel

Spot 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16

Median 82.0 75.3 78.0 83.0 85.0 90.0 Mean 82.9 78.6 80.0 83.6 86.2 89.3 High 108.0 98.0 94.0 97.0 98.0 101.0 Low 68.0 67.5 68.0 70.0 70.0 75.0

Current Forward 63.5 77.9 65.0 67.0 68.4 69.6 71.0

Source Bloomberg

Alberta Cash Flow Impact on Banff NAV

Change in NAV per Share from $21.95 ($)

(2)

Discount Alberta Cash Flow Growth (CAGR)

Rate -20% -10% 0% 10% 20%

14% (8.89) (7.00) (4.03) 0.92 9.69

12% (7.43) (5.39) (2.13) 3.40 13.39

10% (5.81) (3.59) 0.00 6.21 17.65

8% (3.99) (1.57) 2.40 9.42 22.59

6% (1.93) 0.70 5.13 13.10 28.36

Relative Performance vs. SNL US Homebuilders Index since Aug. 1st: LGIH (33%), MTH (20%)

Recent Crude Selloff (3)

Equity Market Reaction Index 120

100

80

60

Jan-14 Apr-14 Aug-14 Dec-14 LGIH MTH WTI (Crude)

Source CapIQ, Bloomberg, SNL

Source Company projections

Notes

1. Bloomberg data as of 12/12/2014

2. CAGR over projects’ life

3. Data as of 12/12/2014

39

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

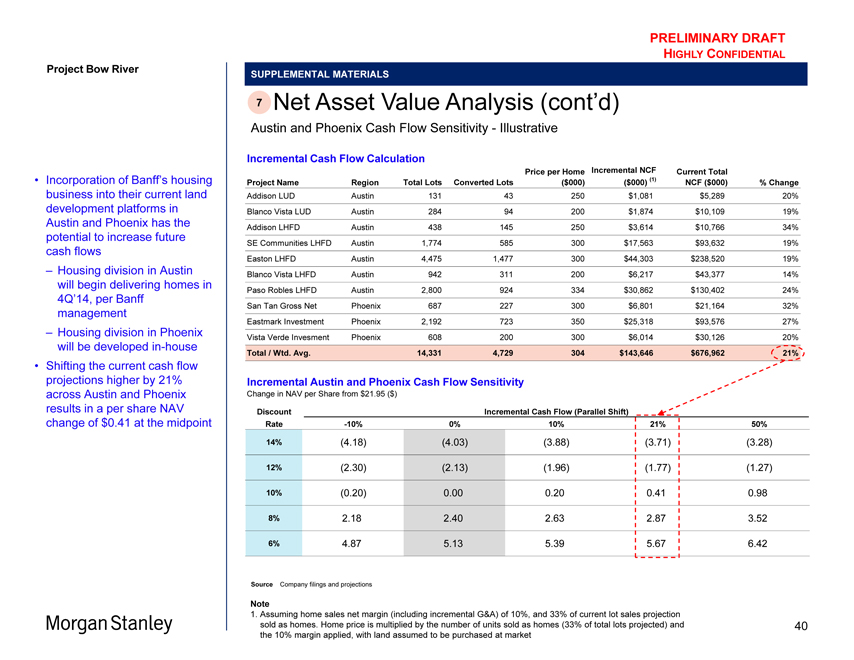

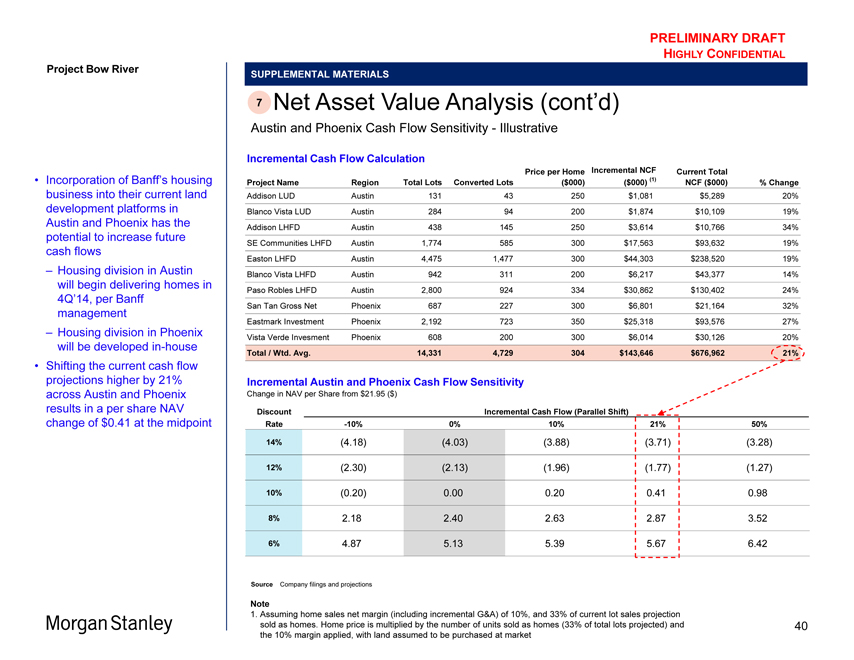

Incorporation of Banff’s housing business into their current land development platforms in Austin and Phoenix has the potential to increase future cash flows

– Housing division in Austin will begin delivering homes in 4Q’14, per Banff management

– Housing division in Phoenix will be developed in-house

Shifting the current cash flow projections higher by 21% across Austin and Phoenix results in a per share NAV change of $0.41 at the midpoint

SUPPLEMENTAL MATERIALS

7 Net Asset Value Analysis (cont’d)

Austin and Phoenix Cash Flow Sensitivity - Illustrative

Incremental Cash Flow Calculation

Price per Home Incremental NCF Current Total

Project Name Region Total Lots Converted Lots ($000) ($000) (1) NCF ($000) % Change

Addison LUD Austin 131 43 250 $1,081 $5,289 20% Blanco Vista LUD Austin 284 94 200 $1,874 $10,109 19% Addison LHFD Austin 438 145 250 $3,614 $10,766 34% SE Communities LHFD Austin 1,774 585 300 $17,563 $93,632 19% Easton LHFD Austin 4,475 1,477 300 $44,303 $238,520 19% Blanco Vista LHFD Austin 942 311 200 $6,217 $43,377 14% Paso Robles LHFD Austin 2,800 924 334 $30,862 $130,402 24% San Tan Gross Net Phoenix 687 227 300 $6,801 $21,164 32% Eastmark Investment Phoenix 2,192 723 350 $25,318 $93,576 27% Vista Verde Invesment Phoenix 608 200 300 $6,014 $30,126 20%

Total / Wtd. Avg. 14,331 4,729 304 $143,646 $676,962 21%

Incremental Austin and Phoenix Cash Flow Sensitivity

Change in NAV per Share from $21.95 ($)

Discount Incremental Cash Flow (Parallel Shift)

Rate -10% 0% 10% 21% 50% 14% (4.18) (4.03) (3.88) (3.71) (3.28) 12% (2.30) (2.13) (1.96) (1.77) (1.27) 10% (0.20) 000. 020. 041. 098.

8% 2.18 2.40 2.63 2.87 3.52

6% 4.87 5.13 5.39 5.67 6.42

Source Company filings and projections

Note

1. Assuming home sales net margin (including incremental G&A) of 10%, and 33% of current lot sales projection sold as homes. Home price is multiplied by the number of units sold as homes (33% of total lots projected) and the 10% margin applied, with land assumed to be purchased at market

40

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

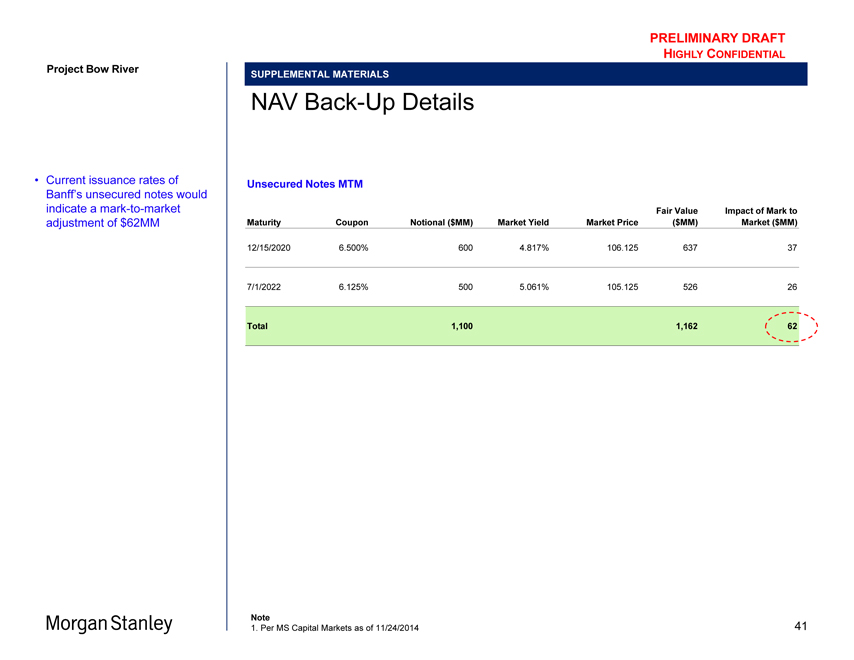

Project Bow River

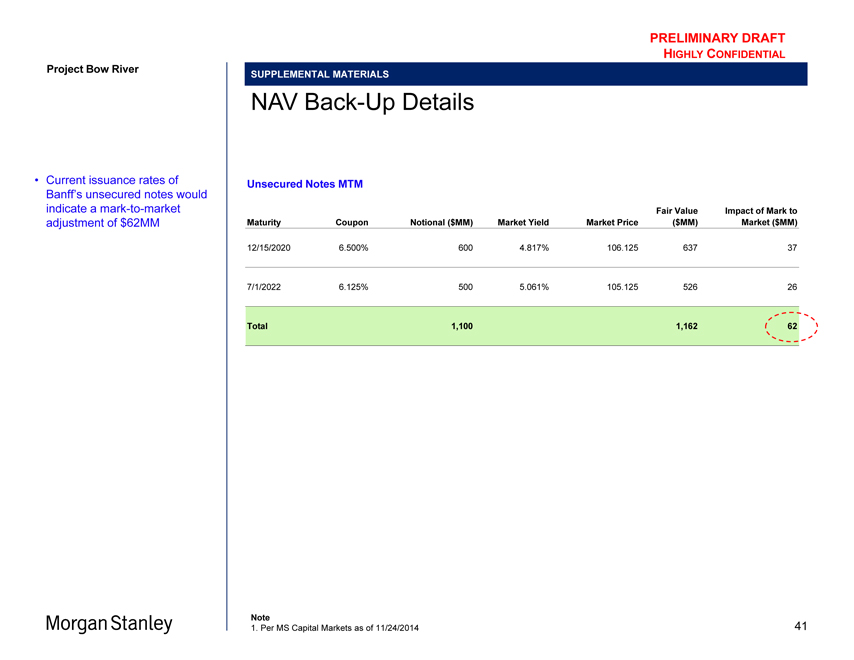

Current issuance rates of Banff’s unsecured notes would indicate a mark-to-market adjustment of $62MM

SUPPLEMENTAL MATERIALS

NAV Back-Up Details

Unsecured Notes MTM

Fair Value Impact of Mark to Maturity Coupon Notional ($MM) Market Yield Market Price ($MM) Market ($MM)

12/15/2020 6500% . 600 4817% . 106.125 637 37

7/1/2022 6.125% 500 5.061% 105.125 526 26

Total 1,100 1,162 62

Note

1. Per MS Capital Markets as of 11/24/2014

41

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

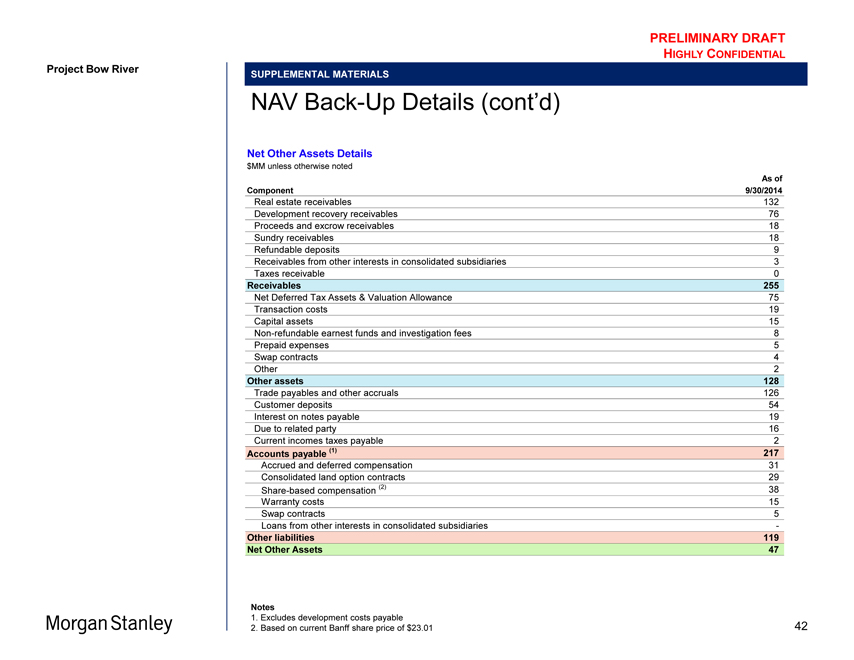

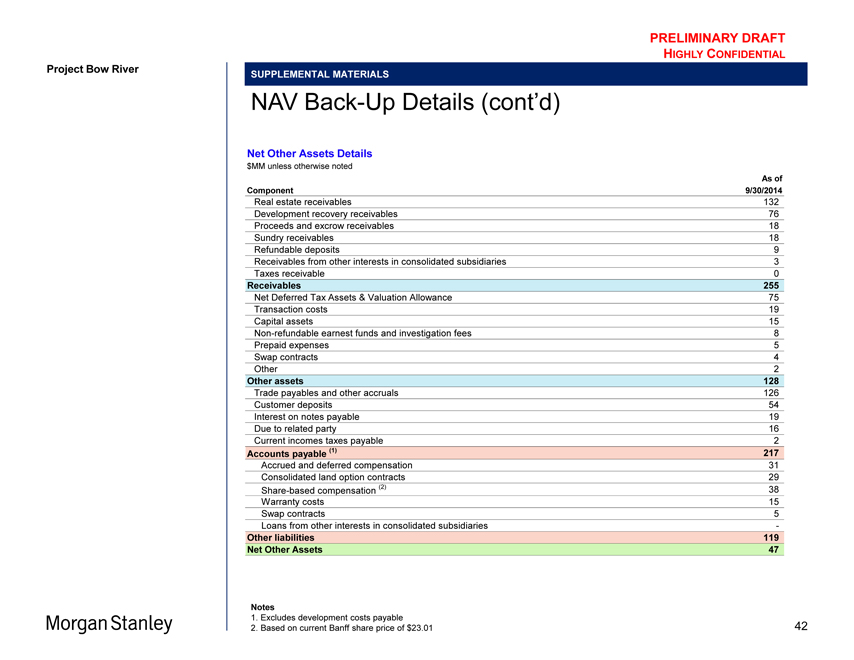

SUPPLEMENTAL MATERIALS

NAV Back-Up Details (cont’d)

Net Other Assets Details

$MM unless otherwise noted

As of Component 9/30/2014

Real estate receivables 132 Development recovery receivables 76 Proceeds and excrow receivables 18 Sundry receivables 18 Refundable deposits 9 Receivables from other interests in consolidated subsidiaries 3 Taxes receivable 0

Receivables 255

Net Deferred Tax Assets & Valuation Allowance 75 Transaction costs 19 Capital assets 15 Non-refundable earnest funds and investigation fees 8 Prepaid expenses 5 Swap contracts 4 Other 2

Other assets 128

Trade payables and other accruals 126 Customer deposits 54 Interest on notes payable 19 Due to related party 16 Current incomes taxes payable 2

Accounts payable (1) 217

Accrued and deferred compensation 31 Consolidated land option contracts 29 Share-based compensation (2) 38 Warranty costs 15 Swap contracts 5 Loans from other interests in consolidated subsidiaries -

Other liabilities 119 Net Other Assets 47

Project Bow River

Notes

1. Excludes development costs payable

2. Based on current Banff share price of $23.01

42

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Disclaimer

We have prepared this document solely for informational purposes. You should not definitively rely upon it or use it to form the definitive basis for any decision, contract, commitment or action whatsoever, with respect to any proposed transaction or otherwise. You and your directors, officers, employees, agents and affiliates must hold this document and any oral information provided in connection with this document in strict confidence and may not communicate, reproduce, distribute or disclose it to any other person, or refer to it publicly, in whole or in part at any time except with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately.

We have prepared this document and the analyses contained in it based, in part, on certain assumptions and information obtained by us from the recipient, its directors, officers, employees, agents, affiliates and/or from other sources. Our use of such assumptions and information does not imply that we have independently verified or necessarily agree with any of such assumptions or information, and we have assumed and relied upon the accuracy and completeness of such assumptions and information for purposes of this document. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. We and our affiliates and our and their respective officers, employees and agents expressly disclaim any and all liability which may be based on this document and any errors therein or omissions therefrom. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any representation or warranty, express or implied, that any transaction has been or may be effected on the terms or in the manner stated in this document, or as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any. Any views or terms contained herein are preliminary only, and are based on financial, economic, market and other conditions prevailing as of the date of this document and are therefore subject to change. We undertake no obligation or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance.

This document and the information contained herein do not constitute an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related derivative, nor do they constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and do not constitute legal, regulatory, accounting or tax advice to the recipient. We recommend that the recipient seek independent third party legal, regulatory, accounting and tax advice regarding the contents of this document. This document does not constitute and should not be considered as any form of financial opinion or recommendation by us or any of our affiliates. This document is not a research report and was not prepared by the research department of Morgan Stanley or any of its affiliates.

Notwithstanding anything herein to the contrary, each recipient hereof (and their employees, representatives, and other agents) may disclose to any and all persons, without limitation of any kind from the commencement of discussions, the U.S. federal and state income tax treatment and tax structure of the proposed transaction and all materials of any kind (including opinions or other tax analyses) that are provided relating to the tax treatment and tax structure. For this purpose, “tax structure” is limited to facts relevant to the U.S. federal and state income tax treatment of the proposed transaction and does not include information relating to the identity of the parties, their affiliates, agents or advisors.

This document is provided by Morgan Stanley & Co. LLC and/or certain of its affiliates or other applicable entities, which may include Morgan Stanley Realty Incorporated, Morgan Stanley Senior Funding, Inc., Morgan Stanley Bank, N.A., Morgan Stanley & Co. International plc, Morgan Stanley Securities Limited, Morgan Stanley Bank AG, Morgan Stanley MUFG Securities Co., Ltd., Mitsubishi UFJ Morgan Stanley Securities Co., Ltd., Morgan Stanley Asia Limited, Morgan Stanley Australia Securities Limited, Morgan Stanley Australia Limited, Morgan Stanley Asia (Singapore) Pte., Morgan Stanley Services Limited, Morgan Stanley & Co. International plc Seoul Branch and/or Morgan Stanley Canada Limited Unless governing law permits otherwise, you must contact an authorized Morgan Stanley entity in your jurisdiction regarding this document or any of the information contained herein.

Morgan Stanley © Morgan Stanley and/or certain of its affiliates. All rights reserved. 43