Exhibit (c)(3)

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Special Committee Discussion Materials

19 December 2014

Morgan Stanley

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Table of Contents

Section 1 Situation Overview

Section 2 Banff Overview

Section 3 Banff Preliminary Valuation

– Historical Share Price Trading

– Banff Research Analyst Highlights

– Comparable Companies

– Precedent Transactions

– Discounted Cash Flow Analysis

– Net Asset Value Analysis

Appendix A

Supplemental Materials

Morgan Stanley 2

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Section 1

Situation Overview

Morgan Stanley 3

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Project Bow River

On October 23, 2014, Blue Mountain announced that it proposed to acquire the approximately 30% of common shares of Banff that it did not currently own

Morgan Stanley has been engaged as financial advisor to the Special Committee of Banff and asked to provide a preliminary valuation of Banff

Unless indicated otherwise, all references in these materials to $ are US$

SITUATION OVERVIEW

Situation Overview

Introduction

Banff is a public North American land developer and homebuilder with operations in three active operating segments and 11 major markets

– Canada: Calgary, Edmonton, Greater Toronto Area

– California: Greater Los Angeles Area, Sacramento, San Diego, San Francisco Bay Area

– Central and Eastern U.S.: Austin, Denver, Phoenix, Washington D.C. Area

Banff is dual-listed on the Toronto Stock Exchange and New York Stock Exchange

Background

On October 23, 2014, Blue Mountain announced that it had made a proposal to Banff’s Board of Directors to acquire the approximately 30% of common shares of Banff that it did not already own for $23.00 per share in cash

– In response to this announcement, the Board of Directors of Banff established a committee of Independent Directors (the “Special Committee”) to review and consider the proposal

As of November 24, 2014, Morgan Stanley was engaged as exclusive financial advisor to the Special Committee of Banff

We have been asked to provide a preliminary valuation and, if requested, a formal valuation of the common shares of Banff in accordance with the requirements of Multilateral Instrument 61–101 Protection of Minority Security Holders in Special Transactions (“MI 61–101”) of the Ontario Securities Commission and the Autorite des marches financiers

– The following pages contain our preliminary valuation report based upon information provided to us by Banff’s Management as of December 18, 2014

– We have prepared this report solely for informational purposes for the Special Committee and it is preliminary in nature

Morgan Stanley 4

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

SITUATION OVERVIEW

Overview of Current Blue Mountain Proposal

Project Bow River

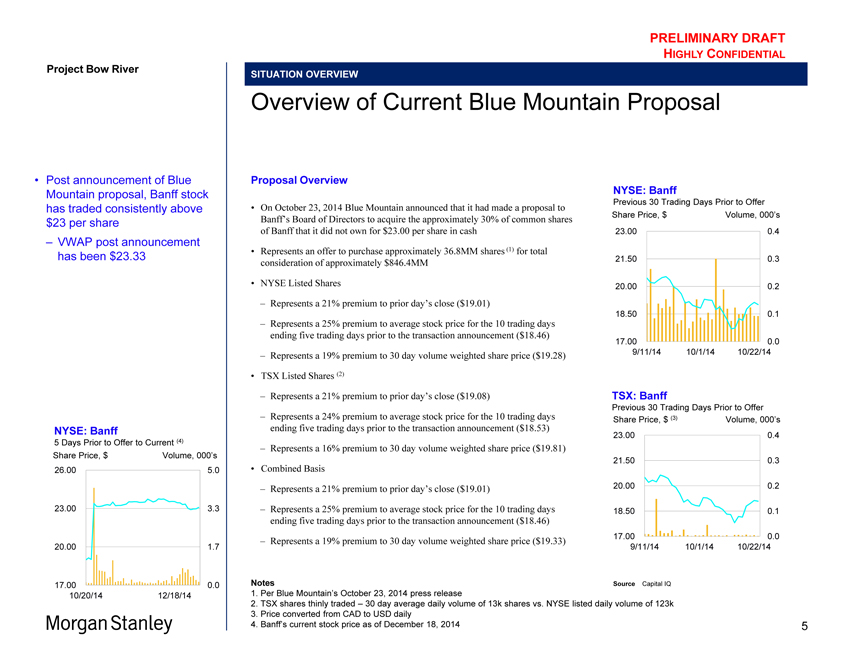

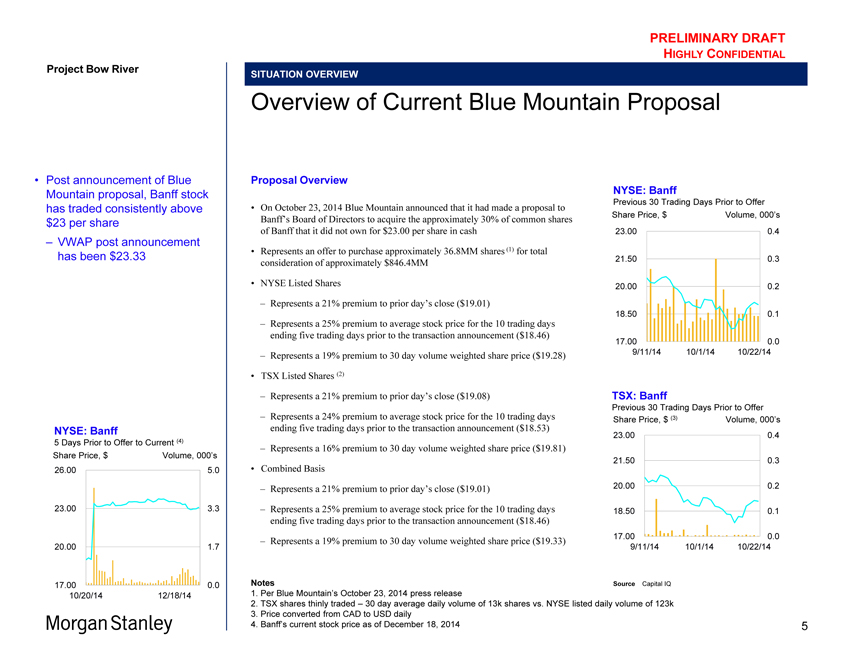

Post announcement of Blue Mountain proposal, Banff stock has traded consistently above $23 per share

– VWAP post announcement has been $23.33

NYSE: Banff

5 Days Prior to Offer to Current (4)

Share Price, $ Volume, 000’s 26.00 5.0

23.00 3.3

20.00 1.7

17.00 0.0 10/20/14 12/18/14

Proposal Overview

On October 23, 2014 Blue Mountain announced that it had made a proposal to Banff’s Board of Directors to acquire the approximately 30% of common shares of Banff that it did not own for $23.00 per share in cash

Represents an offer to purchase approximately 36.8MM shares (1) for total consideration of approximately $846.4MM

NYSE Listed Shares

– Represents a 21% premium to prior day’s close ($19.01)

– Represents a 25% premium to average stock price for the 10 trading days ending five trading days prior to the transaction announcement ($18.46)

– Represents a 19% premium to 30 day volume weighted share price ($19.28)

TSX Listed Shares (2)

– Represents a 21% premium to prior day’s close ($19.08)

– Represents a 24% premium to average stock price for the 10 trading days ending five trading days prior to the transaction announcement ($18.53)

– Represents a 16% premium to 30 day volume weighted share price ($19.81)

Combined Basis

– Represents a 21% premium to prior day’s close ($19.01)

– Represents a 25% premium to average stock price for the 10 trading days ending five trading days prior to the transaction announcement ($18.46)

– Represents a 19% premium to 30 day volume weighted share price ($19.33)

NYSE: Banff

Previous 30 Trading Days Prior to Offer Share Price, $ Volume, 000’s 23.00 0.4

21.50 0.3 20.00 0.2 18.50 0.1

17.00 0.0 9/11/14 10/1/14 10/22/14

TSX: Banff

Previous 30 Trading Days Prior to Offer Share Price, $ (3) Volume, 000’s 23.00 0.4

21.50 0.3 20.00 0.2 18.50 0.1

17.00 0.0 9/11/14 10/1/14 10/22/14

Notes Source Capital IQ

1. Per Blue Mountain’s October 23, 2014 press release

2. TSX shares thinly traded – 30 day average daily volume of 13k shares vs. NYSE listed daily volume of 123k

3. Price converted from CAD to USD daily

4. Banff’s current stock price as of December 18, 2014

5

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

As financial advisor to the Special Committee of Banff, Morgan Stanley has conducted extensive due diligence on Banff

– Diligence remains ongoing

SITUATION OVERVIEW

Summary of Diligence To-Date

Diligence / Interactions with Banff Management

Morgan Stanley has held eight scheduled calls / meetings with Banff to discuss its land and housing inventory, capital structure, financial projections model, business plan, and corporate strategy, among other topics

– Does not include frequent one-off and follow up communications

We have participated in asset tours of projects in the Calgary, Greater Los Angeles, Greater Toronto Area, and Washington D.C. area markets

Key Information Reviewed To-Date

Management’s five-year business plan

– Key assumptions and financial projections

Individual project financial projections for all land / housing assets

Individual asset summaries for all land / housing assets

We have also reviewed public filings, earnings call transcripts, equity research, and data room contents covering topics such as corporate records, financings, material agreements, corporate and management information, among others

Morgan Stanley 6

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Section 2

Banff Overview

Morgan Stanley

7

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

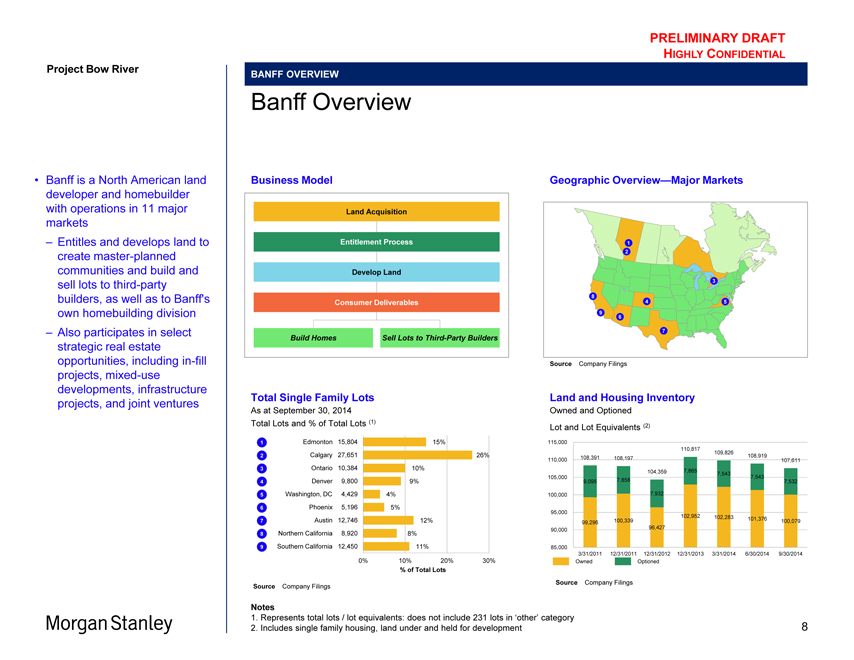

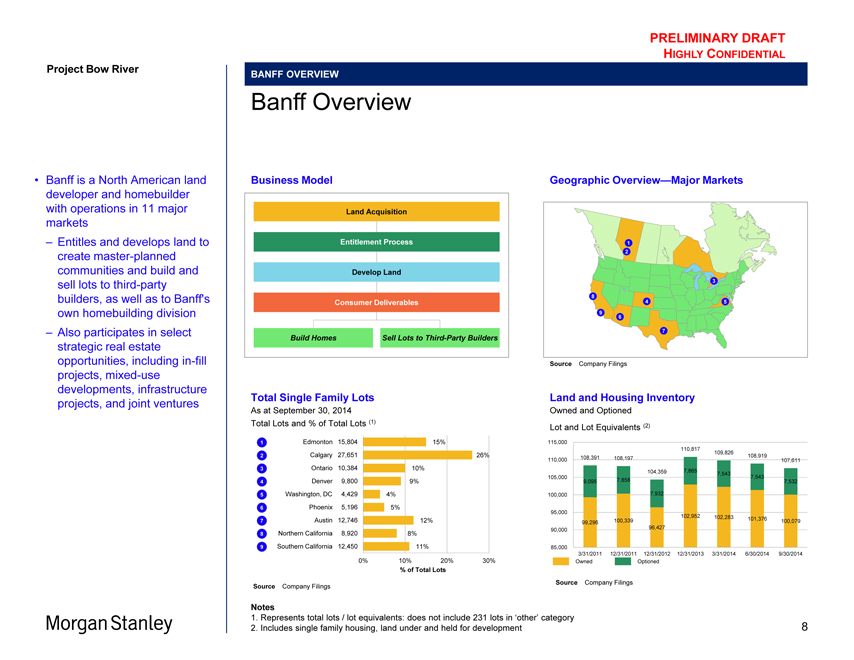

Banff is a North American land developer and homebuilder with operations in 11 major markets

– Entitles and develops land to create master-planned communities and build and sell lots to third-party builders, as well as to Banff’s own homebuilding division

– Also participates in select strategic real estate opportunities, including in-fill projects, mixed-use developments, infrastructure projects, and joint ventures

BANFF OVERVIEW

Banff Overview

Business Model Geographic Overview—Major Markets

Land Acquisition

Entitlement Process 1

2

Develop Land

3

Consumer Deliverables 8 4 5

9 6

7

Build Homes Sell Lots to Third-Party Builders

Source Company Filings

Total Single Family Lots Land and Housing Inventory

As at September 30, 2014 Owned and Optioned Total Lots and % of Total Lots (1) Lot and Lot Equivalents (2)

1 Edmonton 15,804 15% 115,000

110,817

Calgary 27,651 26% 109,826

2 108,391 108,919

110,000 108,197 107,611

3 Ontario 10,384 10% 7,865

104,359 7,543 7,543 105,000

4 Denver 9,800 9% 9,095 7,858 7,532

5 Washington, DC 4,429 4% 100,000 7,932

6 Phoenix 5,196 5% 95,000

102,952 102,283

7 Austin 12,746 12% 100,339 101,376 100,079 99,296 96,427 90,000

8 Northern California 8,920 8%

9 Southern California 12,450 11% 85,000

3/31/2011 12/31/2011 12/31/2012 12/31/2013 3/31/2014 6/30/2014 9/30/2014

0% 10% 20% 30% Owned Optioned

% of Total Lots

Source Company Filings Source Company Filings

Notes

1. Represents total lots / lot equivalents: does not include 231 lots in ‘other’ category

2. Includes single family housing, land under and held for development

8

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

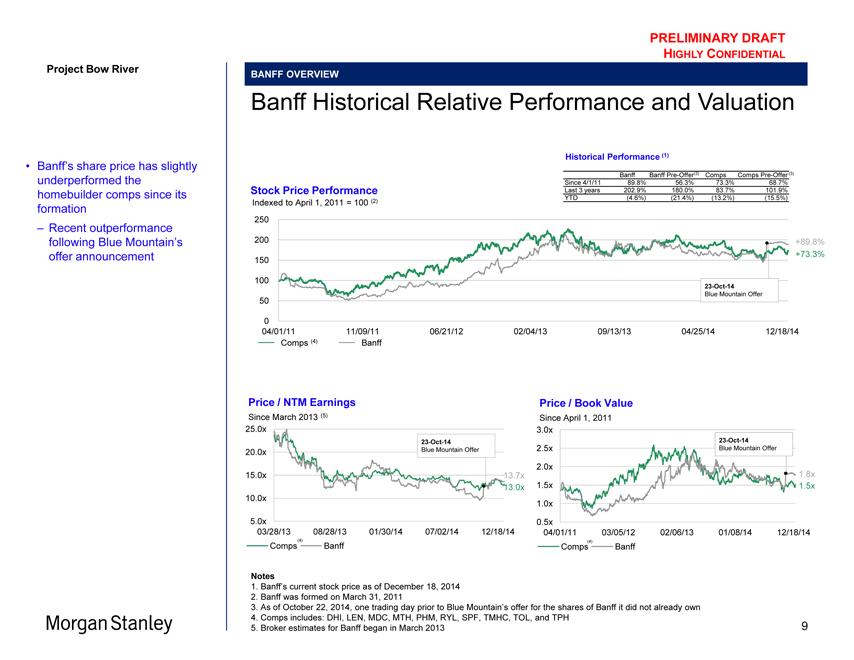

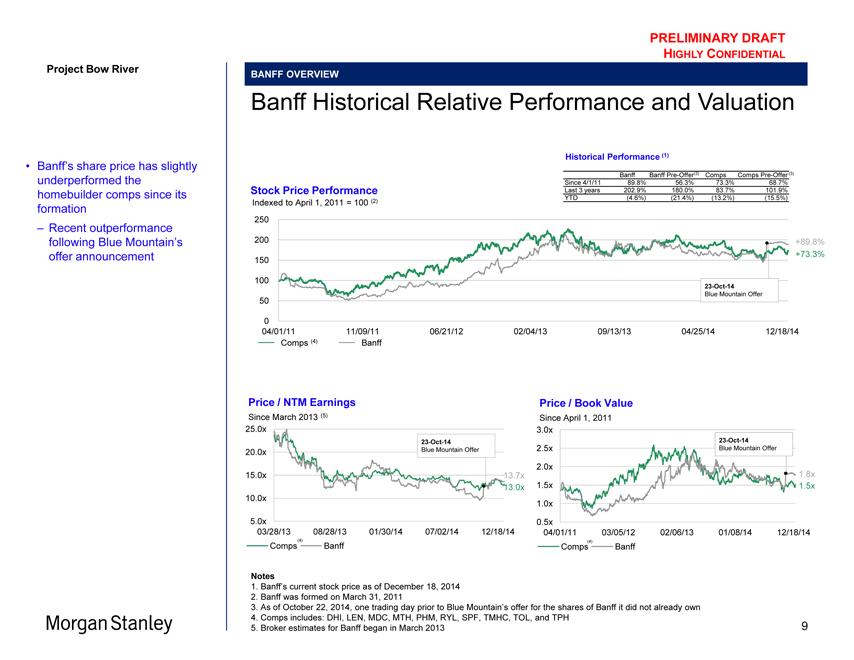

Banff’s share price has slightly underperformed the homebuilder comps since its formation

– Recent outperformance following Blue Mountain’s offer announcement

BANFF OVERVIEW

Banff Historical Relative Performance and Valuation

Historical Performance (1)

Banff Banff Pre-Offer(3) Comps Comps Pre-Offer (3) Since 4/1/11 89.8% 56.3% 73.3% 68.7% Stock Price Performance Last 3 years 202.9% 180.0% 83.7% 101.9% YTD (4.6%) (21.4%) (13.2%) (15.5%)

Indexed to April 1, 2011 = 100 (2) 250

200 +89.8% +73.3% 150

100

23-Oct-14

50 Blue Mountain Offer

0

04/01/11 11/09/11 06/21/12 02/04/13 09/13/13 04/25/14 12/18/14 Comps (4) Banff

Price / NTM Earnings Price / Book Value

Since March 2013 (5) Since April 1, 2011

25.0x 3.0x

23-Oct-14 23-Oct-14

20.0x Blue Mountain Offer 2.5x Blue Mountain Offer

2.0x 1.8x

15.0x 13.7x

13.0x 1.5x 1.5x

10.0x

1.0x

5.0x 0.5x

03/28/13 08/28/13 01/30/14 07/02/14 12/18/14 04/01/11 03/05/12 02/06/13 01/08/14 12/18/14

(4) (4)

Comps Banff Comps Banff

Notes

1. Banff’s current stock price as of December 18, 2014

2. Banff was formed on March 31, 2011

3. As of October 22, 2014, one trading day prior to Blue Mountain’s offer for the shares of Banff it did not already own

4. Comps includes: DHI, LEN, MDC, MTH, PHM, RYL, SPF, TMHC, TOL, and TPH

5. Broker estimates for Banff began in March 2013

9

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

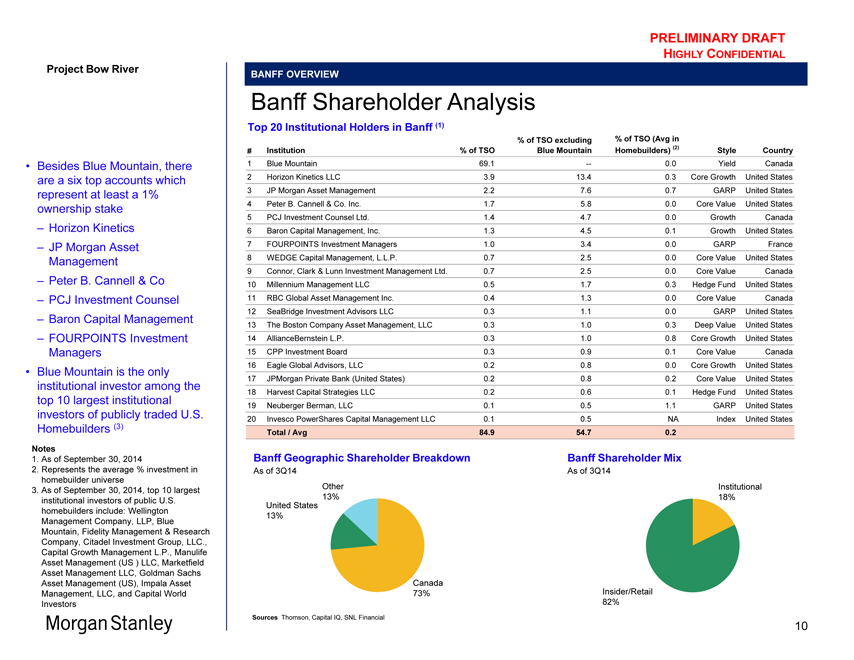

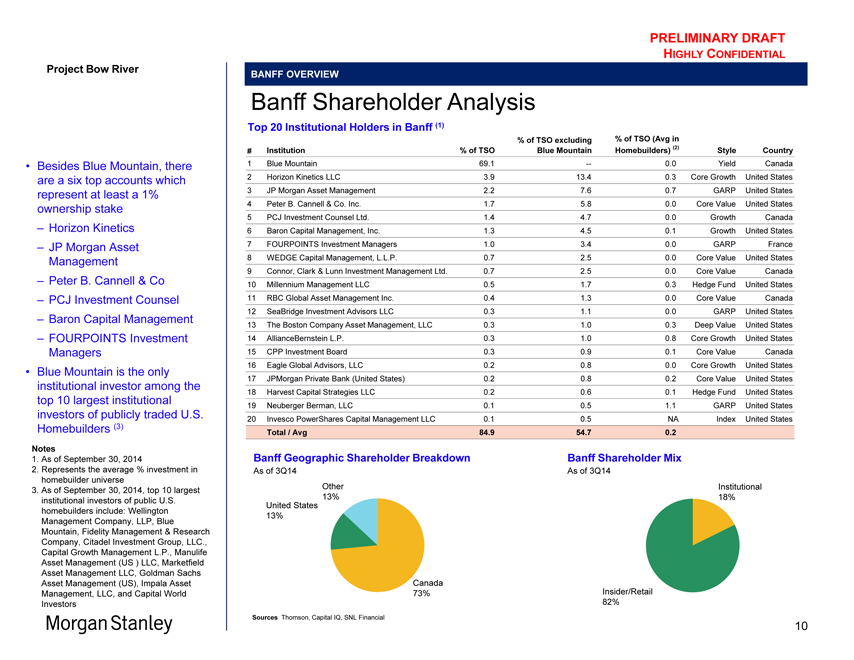

Besides Blue Mountain, there are a six top accounts which represent at least a 1% ownership stake

– Horizon Kinetics JP Morgan Asset Management

– Peter B. Cannell & Co

– PCJ Investment Counsel

– Baron Capital Management

– FOURPOINTS Investment Managers

Blue Mountain is the only institutional investor among the top 10 largest institutional investors of publicly traded U.S. Homebuilders (3)

Notes

1. As of September 30, 2014

2. Represents the average % investment in homebuilder universe

3. As of September 30, 2014, top 10 largest institutional investors of public U.S. homebuilders include: Wellington Management Company, LLP, Blue Mountain, Fidelity Management & Research Company, Citadel Investment Group, LLC., Capital Growth Management L.P., Manulife Asset Management (US ) LLC, Marketfield Asset Management LLC, Goldman Sachs Asset Management (US), Impala Asset Management, LLC, and Capital World Investors

BANFF OVERVIEW

Banff Shareholder Analysis

Top 20 Institutional Holders in Banff (1)

% of TSO excluding % of TSO (Avg in

# Institution % of TSO Blue Mountain Homebuilders) (2) Style Country

1 Blue Mountain 69.1 -- 00. Yield Canada

2 Horizon Kinetics LLC 3.9 13.4 0.3 Core Growth United States

3 JP Morgan Asset Management 2.2 7.6 0.7 GARP United States

4 Peter B. Cannell & Co. Inc. 1.7 5.8 0.0 Core Value United States

5 PCJ Investment Counsel Ltd. 1.4 4.7 0.0 Growth Canada

6 Baron Capital Management, Inc. 1.3 4.5 0.1 Growth United States

7 FOURPOINTS Investment Managers 1.0 3.4 0.0 GARP France

8 WEDGE Capital Management, L.L.P. 0.7 2.5 0.0 Core Value United States

9 Connor, Clark & Lunn Investment Management Ltd. 0.7 2.5 0.0 Core Value Canada

10 Millennium Management LLC 0.5 1.7 0.3 Hedge Fund United States

11 RBC Global Asset Management Inc. 0.4 1.3 0.0 Core Value Canada

12 SeaBridge Investment Advisors LLC 0.3 1.1 0.0 GARP United States

13 The Boston Company Asset Management, LLC 0.3 1.0 0.3 Deep Value United States

14 AllianceBernstein L.P. 0.3 1.0 0.8 Core Growth United States

15 CPP Investment Board 0.3 0.9 0.1 Core Value Canada

16 Eagle Global Advisors, LLC 0.2 0.8 0.0 Core Growth United States

17 JPMorgan Private Bank (United States) 0.2 0.8 0.2 Core Value United States

18 Harvest Capital Strategies LLC 0.2 0.6 0.1 Hedge Fund United States

19 Neuberger Berman, LLC 0.1 0.5 1.1 GARP United States

20 Invesco PowerShares Capital Management LLC 0.1 0.5 NA Index United States

Total / Avg 84.9 54.7 0.2

Banff Geographic Shareholder Breakdown Banff Shareholder Mix

As of 3Q14 As of 3Q14

Other Institutional 13% 18% United States 13%

Canada

73% Insider/Retail 82%

Sources Thomson, Capital IQ, SNL Financial

10

Project Bow River

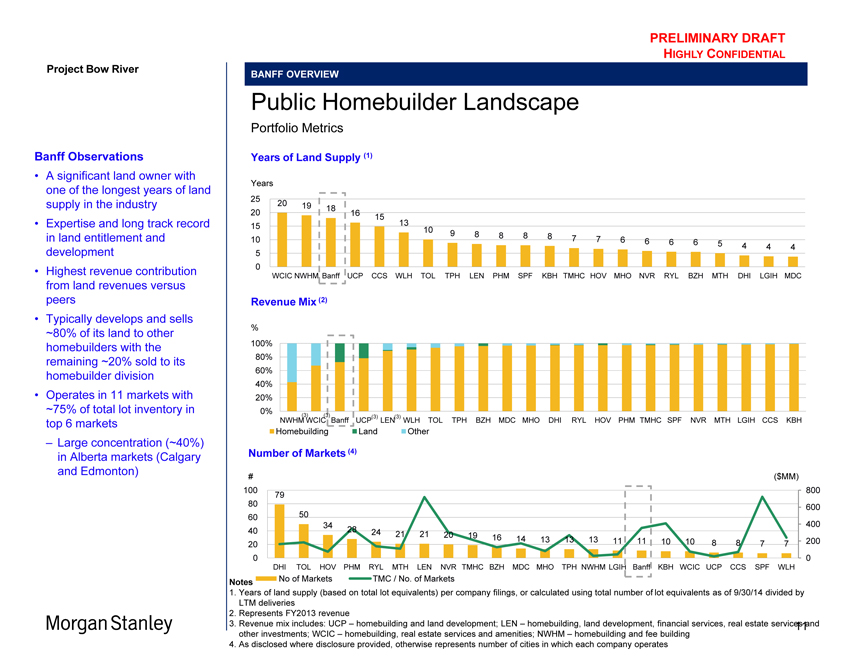

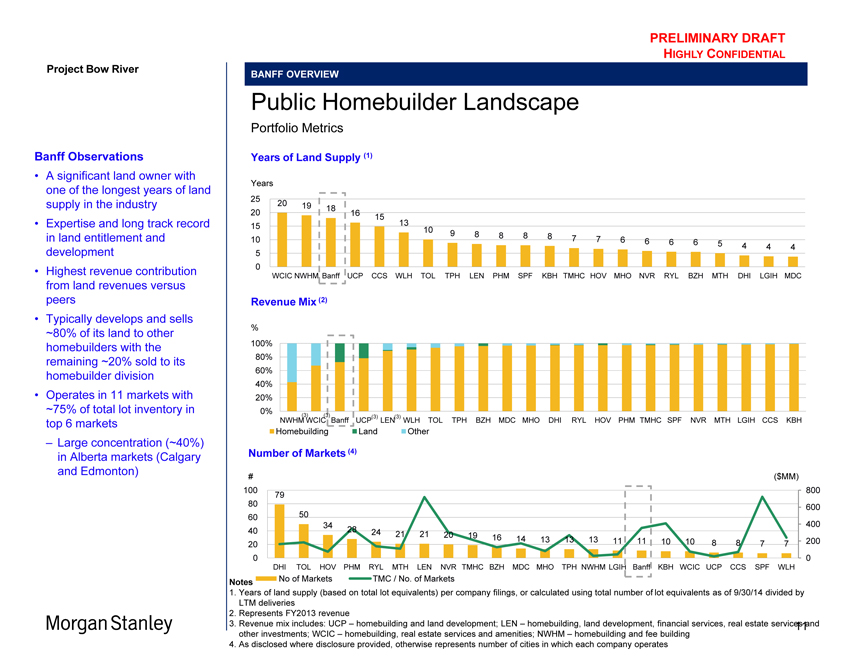

Banff Observations

A significant land owner with

one of the longest years of land

supply in the industry

Expertise and long track record

in land entitlement and

development

Highest revenue contribution

from land revenues versus

peers

Typically develops and sells

~80% of its land to other

homebuilders with the

remaining ~20% sold to its

homebuilder division

Operates in 11 markets with

~75% of total lot inventory in

top 6 markets

– Large concentration (~40%)

in Alberta markets (Calgary

and Edmonton)

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF OVERVIEW

Public Homebuilder Landscape

Portfolio Metrics

Years of Land Supply (1)

Years

25 20 19 18

20 16 15

15 13

10 9 8 8 8 8 7 7 6 6

10 6 6 5 4 4 4

5

0

WCIC NWHM Banff UCP CCS WLH TOL TPH LEN PHM SPF KBH TMHC HOV MHO NVR RYL BZH MTH DHI LGIH MDC

Revenue Mix (2)

%

100%

80%

60%

40%

20%

0%(3) (3)(3) (3)

NWHM WCIC Banff UCP LEN WLH TOL TPH BZH MDC MHO DHI RYL HOV PHM TMHC SPF NVR MTH LGIH CCS KBH

Homebuilding Land Other

Number of Markets (4)

#($MM)

100 800

79

80 600

60 50

34 400

40 28 24 21 21 20 19 16

20 14 13 13 13 11 11 10 10 88 77 200

0 0

DHI TOL HOV PHM RYL MTH LEN NVR TMHC BZH MDC MHO TPH NWHM LGIH Banff KBH WCIC UCP CCS SPF WLH

Notes No of Markets TMC / No. of Markets

1. Years of land supply (based on total lot equivalents) per company filings, or calculated using total number of lot equivalents as of 9/30/14 divided by LTM deliveries

2. Represents FY2013 revenue

3. Revenue mix includes: UCP – homebuilding and land development; LEN – homebuilding, land development, financial services, real estate services and other investments; WCIC – homebuilding, real estate services and amenities; NWHM – homebuilding and fee building

4. As disclosed where disclosure provided, otherwise represents number of cities in which each company operates

11

Project Bow River

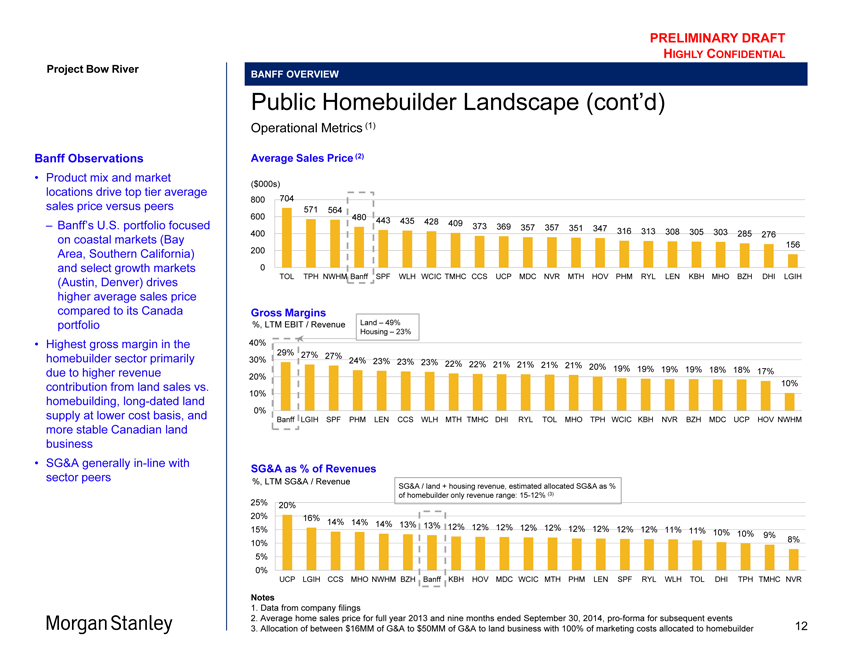

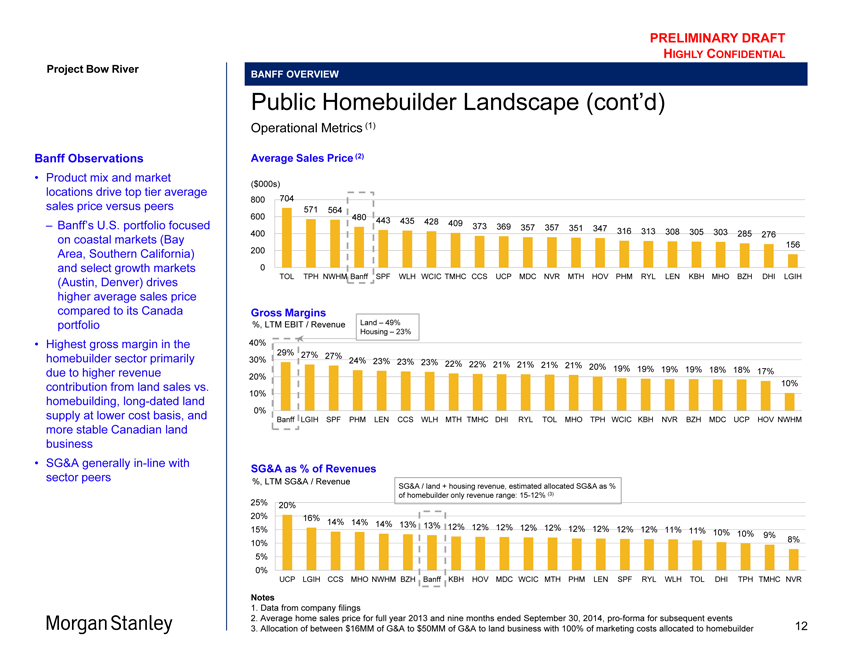

Banff Observations

Product mix and market

locations drive top tier average

sales price versus peers

– Banff’s U.S. portfolio focused

on coastal markets (Bay

Area, Southern California)

and select growth markets

(Austin, Denver) drives

higher average sales price

compared to its Canada

portfolio

Highest gross margin in the

homebuilder sector primarily

due to higher revenue

contribution from land sales vs.

homebuilding, long-dated land

supply at lower cost basis, and

more stable Canadian land

business

SG&A generally in-line with

sector peers

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF OVERVIEW

Public Homebuilder Landscape (cont’d)

Operational Metrics (1)

Average Sales Price (2)

($000s)

800 704

571 564

600 480 443 435 428 409

400 373 369 357 357 351 347 316 313 308 305 303 285 276

200 156

0

TOL TPH NWHM Banff SPF WLH WCIC TMHC CCS UCP MDC NVR MTH HOV PHM RYL LEN KBH MHO BZH DHI LGIH

Gross Margins

%, LTM EBIT / Revenue Land – 49%

Housing – 23%

40%

29% 27% 27%

30% 24% 23% 23% 23% 22% 22% 21% 21% 21% 21% 20% 19% 19% 19% 19% 18% 18% 17%

20%

10%

10%

0%

Banff LGIH SPF PHM LEN CCS WLH MTH TMHC DHI RYL TOL MHO TPH WCIC KBH NVR BZH MDC UCP HOV NWHM

SG&A as % of Revenues

%, LTM SG&A / Revenue SG&A / land + housing revenue, estimated allocated SG&A as %

of homebuilder only revenue range: 15-12% (3)

25% 20%

20% 16%

15% 14% 14% 14% 13% 13% 12% 12% 12% 12% 12% 12% 12% 12% 12% 11% 11% 10% 10% 9%

10% 8%

5%

0%

UCP LGIH CCS MHO NWHM BZH Banff KBH HOV MDC WCIC MTH PHM LEN SPF RYL WLH TOL DHI TPH TMHC NVR

Notes

1. Data from company filings

2. Average home sales price for full year 2013 and nine months ended September 30, 2014, pro-forma for subsequent events

3. Allocation of between $16MM of G&A to $50MM of G&A to land business with 100% of marketing costs allocated to homebuilder

12

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

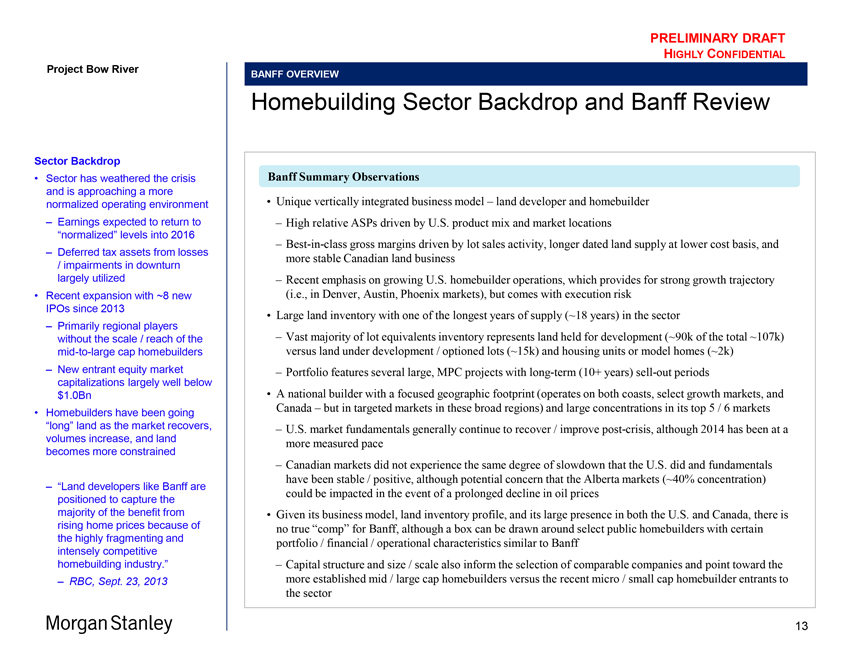

Sector Backdrop

Sector has weathered the crisis and is approaching a more normalized operating environment

– Earnings expected to return to “normalized” levels into 2016

– Deferred tax assets from losses / impairments in downturn largely utilized

Recent expansion with ~8 new IPOs since 2013

– Primarily regional players without the scale / reach of the mid-to-large cap homebuilders

– New entrant equity market capitalizations largely well below $1.0Bn

Homebuilders have been going “long” land as the market recovers, volumes increase, and land becomes more constrained

– “Land developers like Banff are positioned to capture the majority of the benefit from rising home prices because of the highly fragmenting and intensely competitive homebuilding industry.”

– RBC, Sept. 23, 2013

BANFF OVERVIEW

Homebuilding Sector Backdrop and Banff Review

Banff Summary Observations

Unique vertically integrated business model – land developer and homebuilder

– High relative ASPs driven by U.S. product mix and market locations

– Best-in-class gross margins driven by lot sales activity, longer dated land supply at lower cost basis, and more stable Canadian land business

– Recent emphasis on growing U.S. homebuilder operations, which provides for strong growth trajectory

(i.e., in Denver, Austin, Phoenix markets), but comes with execution risk

Large land inventory with one of the longest years of supply (~18 years) in the sector

– Vast majority of lot equivalents inventory represents land held for development (~90k of the total ~107k) versus land under development / optioned lots (~15k) and housing units or model homes (~2k)

– Portfolio features several large, MPC projects with long-term (10+ years) sell-out periods

A national builder with a focused geographic footprint (operates on both coasts, select growth markets, and Canada – but in targeted markets in these broad regions) and large concentrations in its top 5 / 6 markets

– U.S. market fundamentals generally continue to recover / improve post-crisis, although 2014 has been at a more measured pace

– Canadian markets did not experience the same degree of slowdown that the U.S. did and fundamentals have been stable / positive, although potential concern that the Alberta markets (~40% concentration) could be impacted in the event of a prolonged decline in oil prices

Given its business model, land inventory profile, and its large presence in both the U.S. and Canada, there is no true “comp” for Banff, although a box can be drawn around select public homebuilders with certain portfolio / financial / operational characteristics similar to Banff

– Capital structure and size / scale also inform the selection of comparable companies and point toward the more established mid / large cap homebuilders versus the recent micro / small cap homebuilder entrants to the sector

Morgan Stanley

13

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Section 3

Banff Preliminary Valuation

Morgan Stanley

14

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

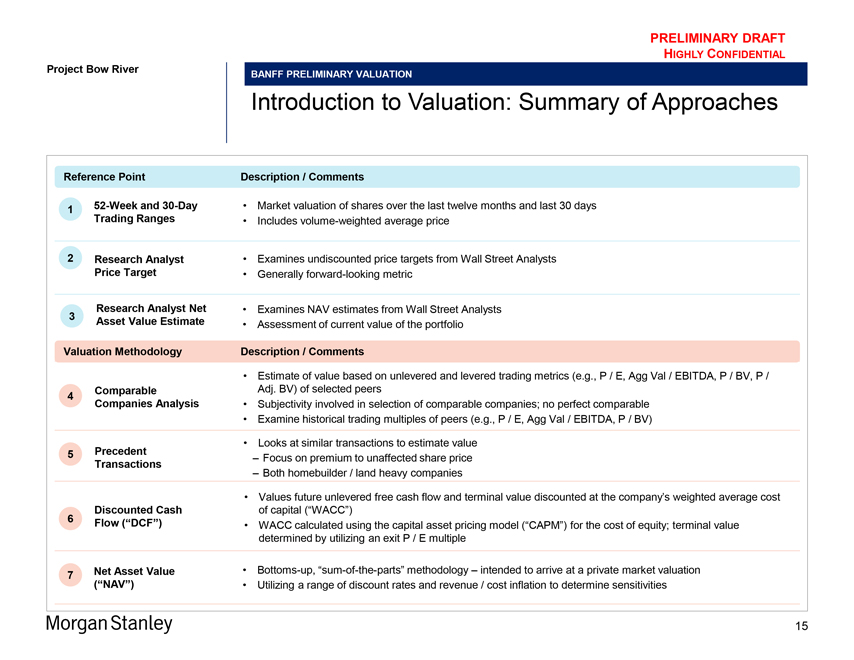

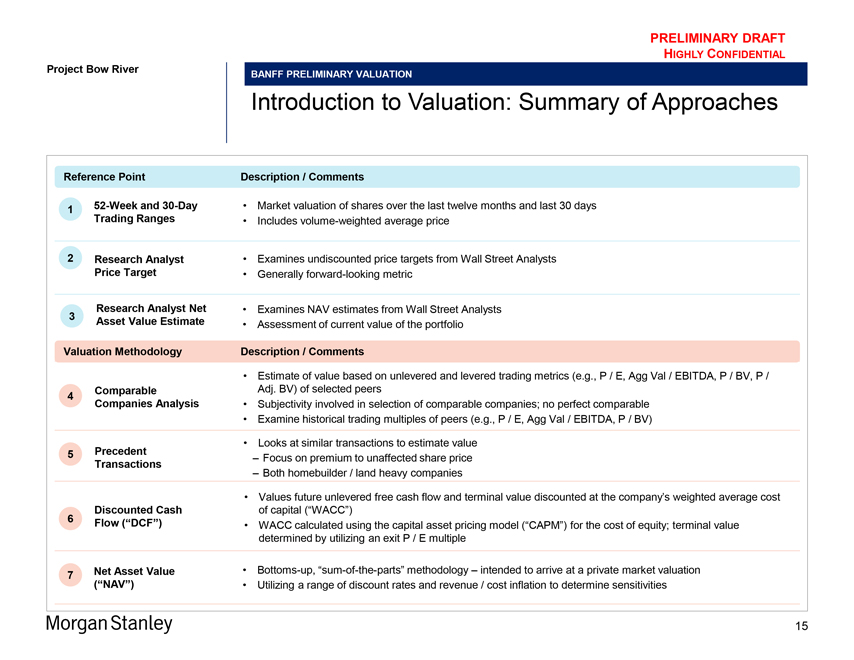

BANFF PRELIMINARY VALUATION

Introduction to Valuation: Summary of Approaches

Reference Point

1 52-Week and 30-Day Trading Ranges

2 Research Analyst Price Target

Research Analyst Net

3 Asset Value Estimate

Description / Comments

Market valuation of shares over the last twelve months and last 30 days

Includes volume-weighted average price

Examines undiscounted price targets from Wall Street Analysts

Generally forward-looking metric

Examines NAV estimates from Wall Street Analysts

Assessment of current value of the portfolio

Valuation Methodology

4 Comparable Companies Analysis

5 Precedent Transactions

Discounted Cash

6 Flow (“DCF”)

7 Net Asset Value (“NAV”)

Description / Comments

Estimate of value based on unlevered and levered trading metrics (e.g., P / E, Agg Val / EBITDA, P / BV, P / Adj. BV) of selected peers

Subjectivity involved in selection of comparable companies; no perfect comparable

Examine historical trading multiples of peers (e.g., P / E, Agg Val / EBITDA, P / BV)

Looks at similar transactions to estimate value

– Focus on premium to unaffected share price

– Both homebuilder / land heavy companies

Values future unlevered free cash flow and terminal value discounted at the company’s weighted average cost of capital (“WACC”)

WACC calculated using the capital asset pricing model (“CAPM”) for the cost of equity; terminal value determined by utilizing an exit P / E multiple

Bottoms-up, “sum-of-the-parts” methodology – intended to arrive at a private market valuation

Utilizing a range of discount rates and revenue / cost inflation to determine sensitivities

Morgan Stanley

15

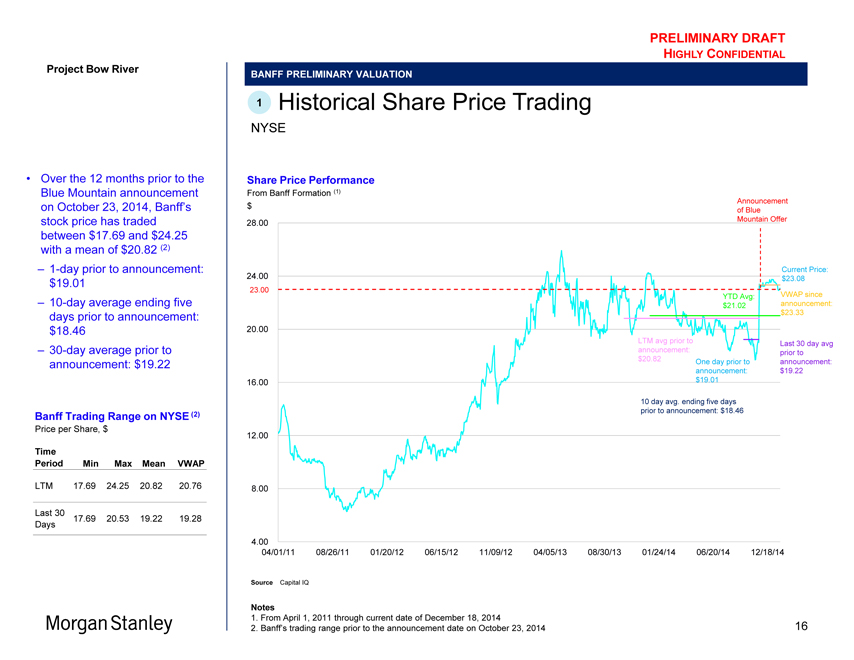

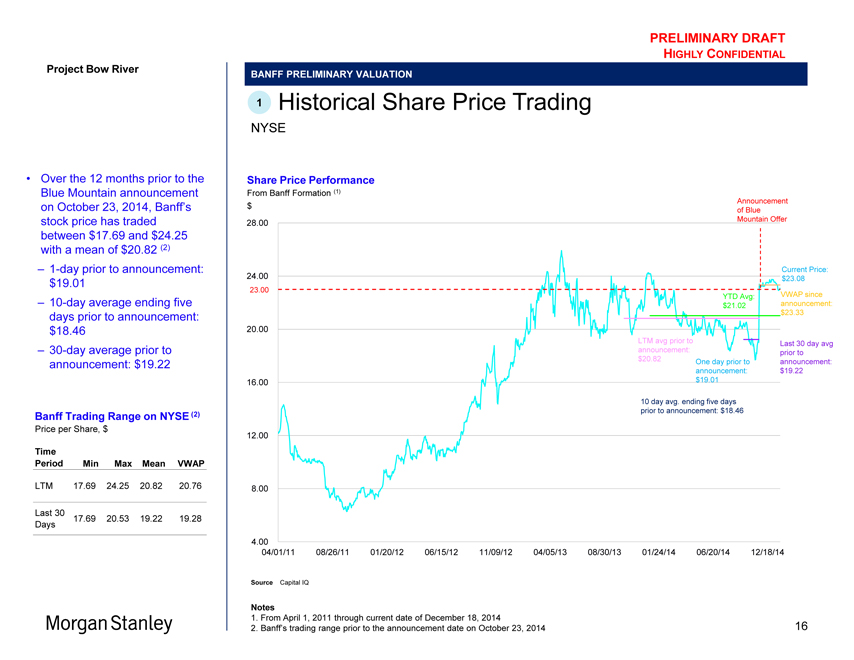

Project Bow River

Over the 12 months prior to the Blue Mountain announcement on October 23, 2014, Banff’s stock price has traded between $17.69 and $24.25 with a mean of $20.82 (2)

1-day prior to announcement: $19.01

10-day average ending five days prior to announcement: $18.46

30-day average prior to announcement: $19.22

Banff Trading Range on NYSE (2)

Price per Share, $

Time

Period Min Max Mean VWAP

LTM 17.69 24.25 20.82 20.76

Last 30 17.69 20.53 19.22 19.28

Days

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

1 Historical Share Price Trading

NYSE

Share Price Performance

From Banff Formation (1)

Announcement

$ of Blue

28.00 Mountain Offer

Current Price:

24.00 $23.08

23.00 YTD Avg: VWAP since

$21.02 announcement:

$23.33

20.00

LTM avg prior to Last 30 day avg

announcement: prior to

$20.82 One day prior to announcement:

announcement: $19.22

16.00 $19.01

10 day avg. ending five days

prior to announcement: $18.46

12.00

8.00

4.00

04/01/11 08/26/11 01/20/12 06/15/12 11/09/12 04/05/13 08/30/13 01/24/14 06/20/14 12/18/14

Source Capital IQ

Notes

1. From April 1, 2011 through current date of December 18, 2014

2. Banff’s trading range prior to the announcement date on October 23, 2014

16

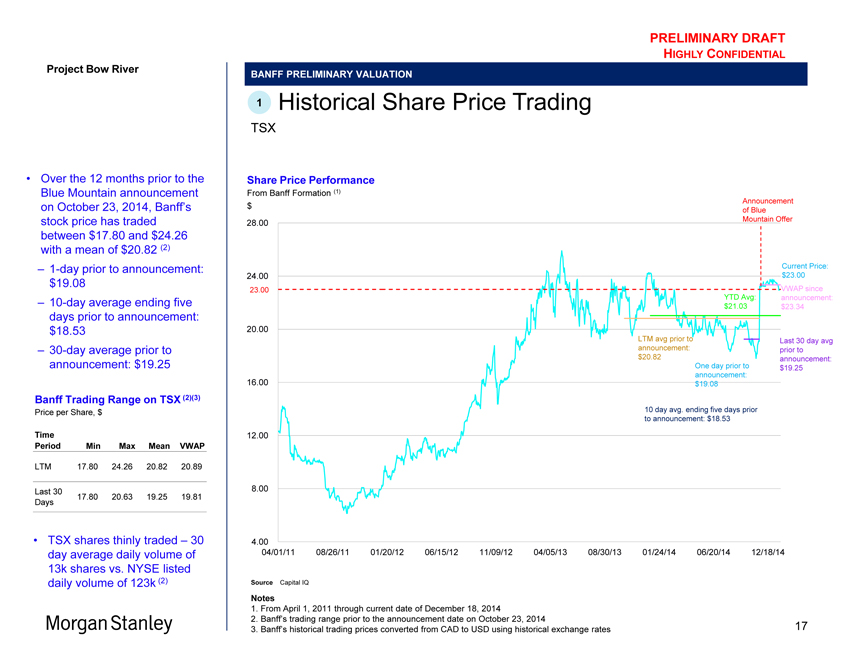

Project Bow River

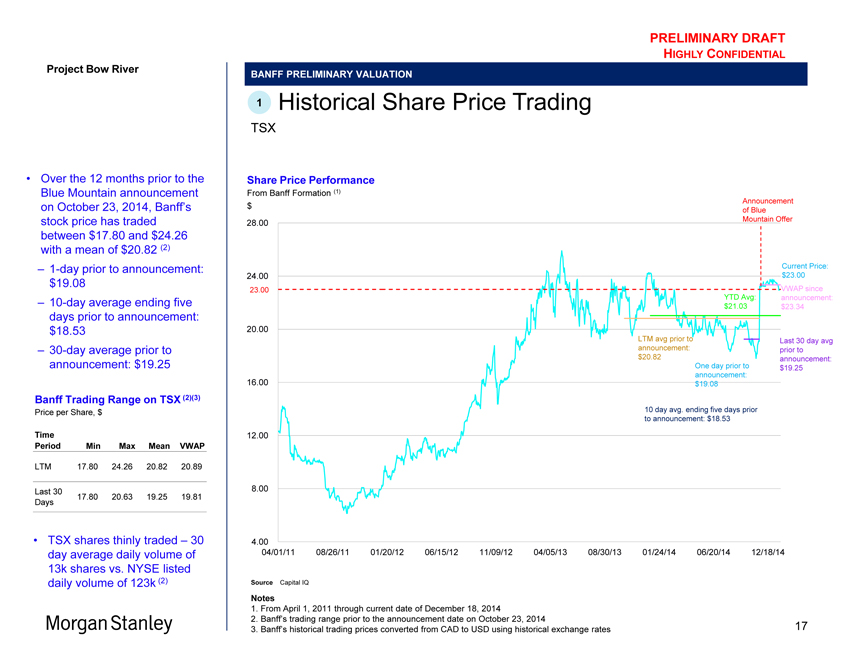

Over the 12 months prior to the Blue Mountain announcement on October 23, 2014, Banff’s stock price has traded between $17.80 and $24.26 with a mean of $20.82 (2)

1-day prior to announcement: $19.08

10-day average ending five days prior to announcement: $18.53

30-day average prior to announcement: $19.25

Banff Trading Range on TSX (2)(3)

Price per Share, $

Time

Period Min Max Mean VWAP

LTM 17.80 24.26 20.82 20.89

Last 30 17.80 20.63 19.25 19.81

Days

• TSX shares thinly traded – 30 day average daily volume of 13k shares vs. NYSE listed daily volume of 123k (2)

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

1 Historical Share Price Trading

TSX

Share Price Performance

From Banff Formation (1)

Announcement

$ of Blue

28.00 Mountain Offer

Current Price:

24.00 $23.00

23.00 VWAP since

YTD Avg: announcement:

$21.03 $23.34

20.00

LTM avg prior to Last 30 day avg

announcement: prior to

$20.82 announcement:

One day prior to $19.25

announcement:

16.00 $19.08

10 day avg. ending five days prior

to announcement: $18.53

12.00

8.00

4.00

04/01/11 08/26/11 01/20/12 06/15/12 11/09/12 04/05/13 08/30/13 01/24/14 06/20/14 12/18/14

Source Capital IQ

Notes

1. From April 1, 2011 through current date of December 18, 2014

2. Banff’s trading range prior to the announcement date on October 23, 2014

3. Banff’s historical trading prices converted from CAD to USD using historical exchange rates

17

Project Bow River

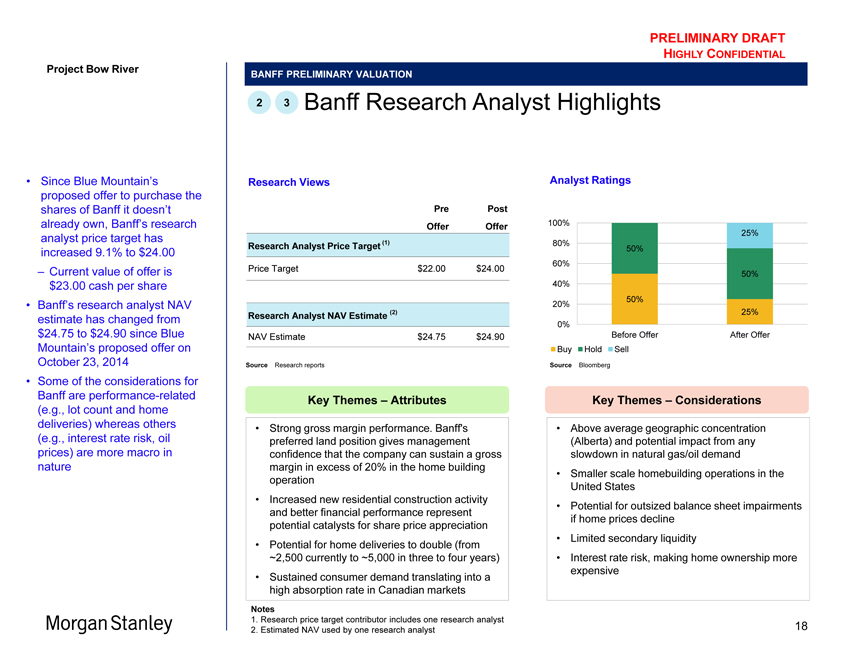

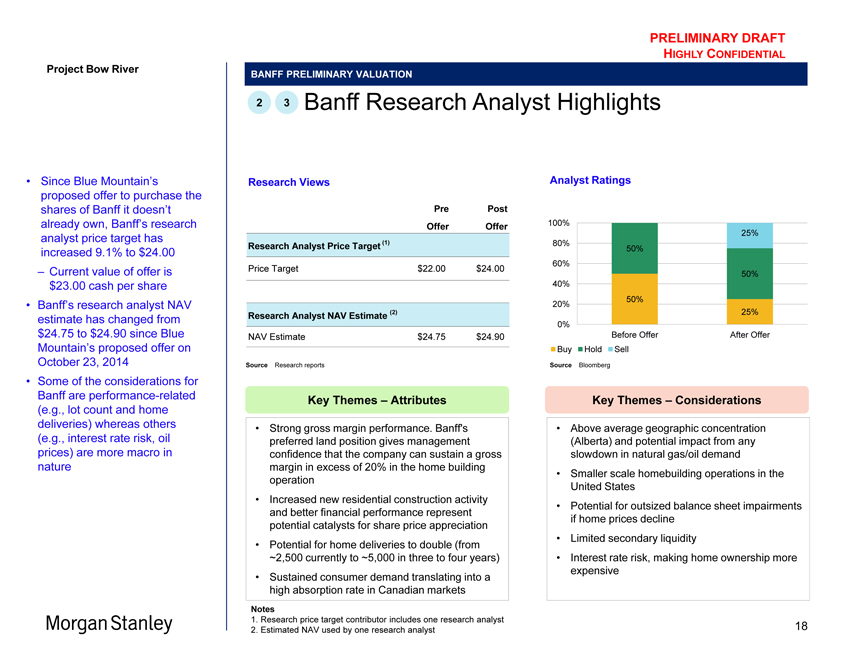

Since Blue Mountain’s proposed offer to purchase the shares of Banff it doesn’t already own, Banff’s research analyst price target has increased 9.1% to $24.00

Current value of offer is $23.00 cash per share

Banff’s research analyst NAV estimate has changed from $24.75 to $24.90 since Blue Mountain’s proposed offer on October 23, 2014

Some of the considerations for Banff are performance-related (e.g., lot count and home deliveries) whereas others (e.g., interest rate risk, oil prices) are more macro in nature

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

2 3 Banff Research Analyst Highlights

Research Views

Pre Post

Offer Offer

Research Analyst Price Target (1)

Price Target $ 22.00 $ 24.00

Research Analyst NAV Estimate (2)

NAV Estimate $ 24.75 $ 24.90

Source Research reports

Analyst Ratings

100%

25%

80% 50%

60%

50%

40%

20% 50%

25%

0%

Before Offer After Offer

Buy Hold Sell

Source Bloomberg

Key Themes – Attributes

Strong gross margin performance. Banff’s preferred land position gives management confidence that the company can sustain a gross margin in excess of 20% in the home building operation

Increased new residential construction activity and better financial performance represent potential catalysts for share price appreciation

Potential for home deliveries to double (from ~2,500 currently to ~5,000 in three to four years)

Sustained consumer demand translating into a high absorption rate in Canadian markets

Key Themes – Considerations

Above average geographic concentration (Alberta) and potential impact from any slowdown in natural gas/oil demand

Smaller scale homebuilding operations in the United States

Potential for outsized balance sheet impairments if home prices decline

Limited secondary liquidity

Interest rate risk, making home ownership more expensive

Notes

1. Research price target contributor includes one research analyst

2. Estimated NAV used by one research analyst

18

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

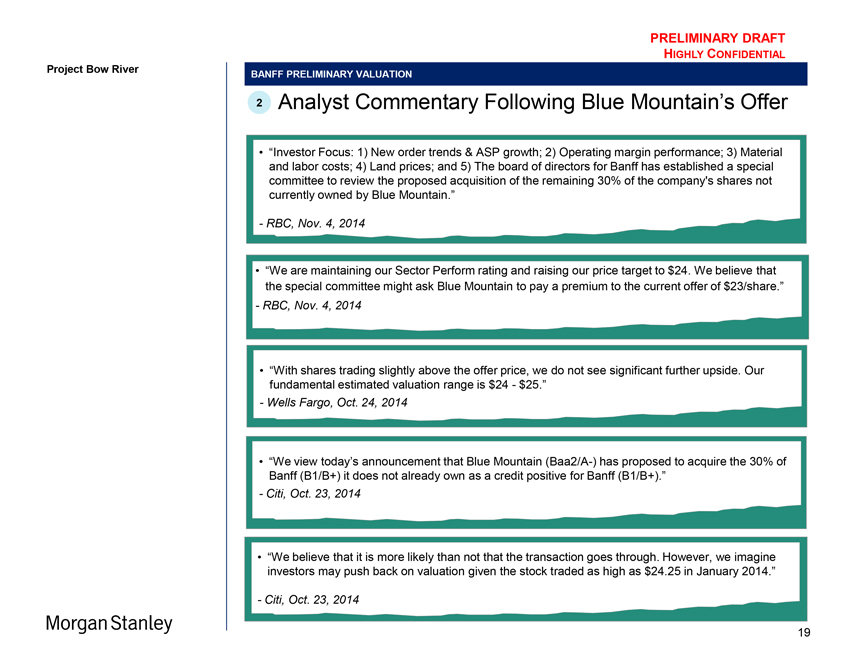

BANFF PRELIMINARY VALUATION

2 Analyst Commentary Following Blue Mountain’s Offer

“Investor Focus: 1) New order trends & ASP growth; 2) Operating margin performance; 3) Material and labor costs; 4) Land prices; and 5) The board of directors for Banff has established a special committee to review the proposed acquisition of the remaining 30% of the company’s shares not currently owned by Blue Mountain.”

- RBC, Nov. 4, 2014

“We are maintaining our Sector Perform rating and raising our price target to $24. We believe that the special committee might ask Blue Mountain to pay a premium to the current offer of $23/share.”

- RBC, Nov. 4, 2014

“With shares trading slightly above the offer price, we do not see significant further upside. Our fundamental estimated valuation range is $24 - $25.”

- Wells Fargo, Oct. 24, 2014

“We view today’s announcement that Blue Mountain (Baa2/A-) has proposed to acquire the 30% of Banff (B1/B+) it does not already own as a credit positive for Banff (B1/B+).”

- Citi, Oct. 23, 2014

“We believe that it is more likely than not that the transaction goes through. However, we imagine investors may push back on valuation given the stock traded as high as $24.25 in January 2014.”

- Citi, Oct. 23, 2014

19

Morgan Stanley

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

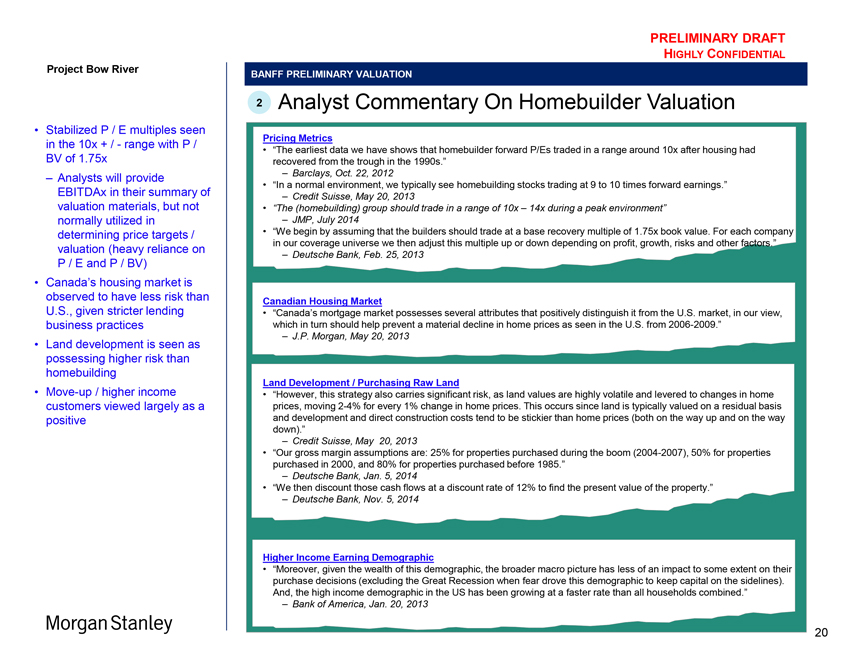

Project Bow River

Stabilized P / E multiples seen in the 10x + / - range with P / BV of 1.75x

– Analysts will provide EBITDAx in their summary of valuation materials, but not normally utilized in determining price targets / valuation (heavy reliance on P / E and P / BV)

Canada’s housing market is observed to have less risk than U.S., given stricter lending business practices

Land development is seen as possessing higher risk than homebuilding

Move-up / higher income customers viewed largely as a positive

BANFF PRELIMINARY VALUATION

2 Analyst Commentary On Homebuilder Valuation

Pricing Metrics

“The earliest data we have shows that homebuilder forward P/Es traded in a range around 10x after housing had recovered from the trough in the 1990s.”

– Barclays, Oct. 22, 2012

“In a normal environment, we typically see homebuilding stocks trading at 9 to 10 times forward earnings.”

– Credit Suisse, May 20, 2013

“The (homebuilding) group should trade in a range of 10x – 14x during a peak environment”

– JMP, July 2014

“We begin by assuming that the builders should trade at a base recovery multiple of 1.75x book value. For each company in our coverage universe we then adjust this multiple up or down depending on profit, growth, risks and other factors.”

– Deutsche Bank, Feb. 25, 2013

Canadian Housing Market

“Canada’s mortgage market possesses several attributes that positively distinguish it from the U.S. market, in our view, which in turn should help prevent a material decline in home prices as seen in the U.S. from 2006-2009.”

– J.P. Morgan, May 20, 2013

Land Development / Purchasing Raw Land

“However, this strategy also carries significant risk, as land values are highly volatile and levered to changes in home prices, moving 2-4% for every 1% change in home prices. This occurs since land is typically valued on a residual basis and development and direct construction costs tend to be stickier than home prices (both on the way up and on the way down).”

– Credit Suisse, May 20, 2013

“Our gross margin assumptions are: 25% for properties purchased during the boom (2004-2007), 50% for properties purchased in 2000, and 80% for properties purchased before 1985.”

– Deutsche Bank, Jan. 5, 2014

“We then discount those cash flows at a discount rate of 12% to find the present value of the property.”

– Deutsche Bank, Nov. 5, 2014

Higher Income Earning Demographic

“Moreover, given the wealth of this demographic, the broader macro picture has less of an impact to some extent on their purchase decisions (excluding the Great Recession when fear drove this demographic to keep capital on the sidelines). And, the high income demographic in the US has been growing at a faster rate than all households combined.”

– Bank of America, Jan. 20, 2013

Morgan Stanley

20

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

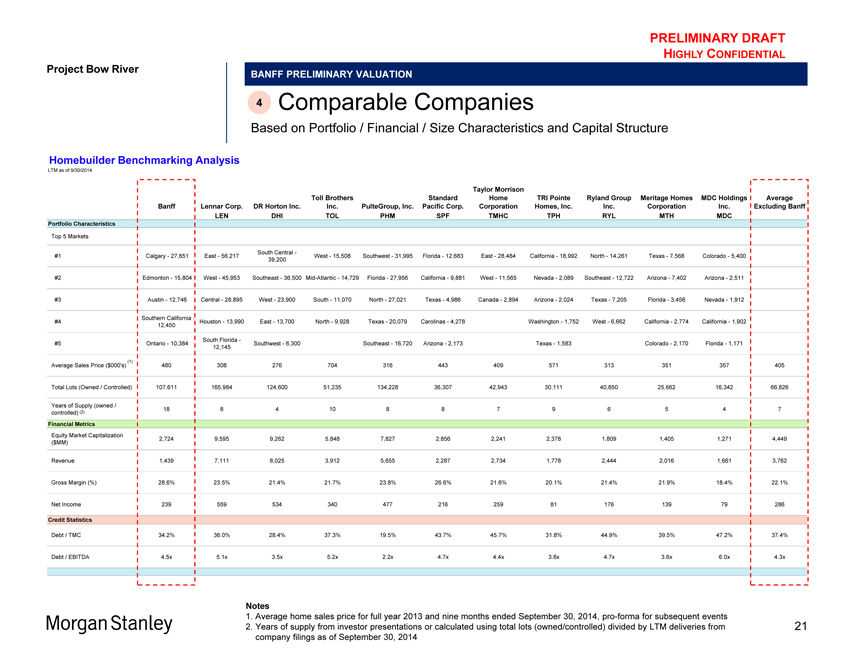

4 Comparable Companies

Based on Portfolio / Financial / Size Characteristics and Capital Structure

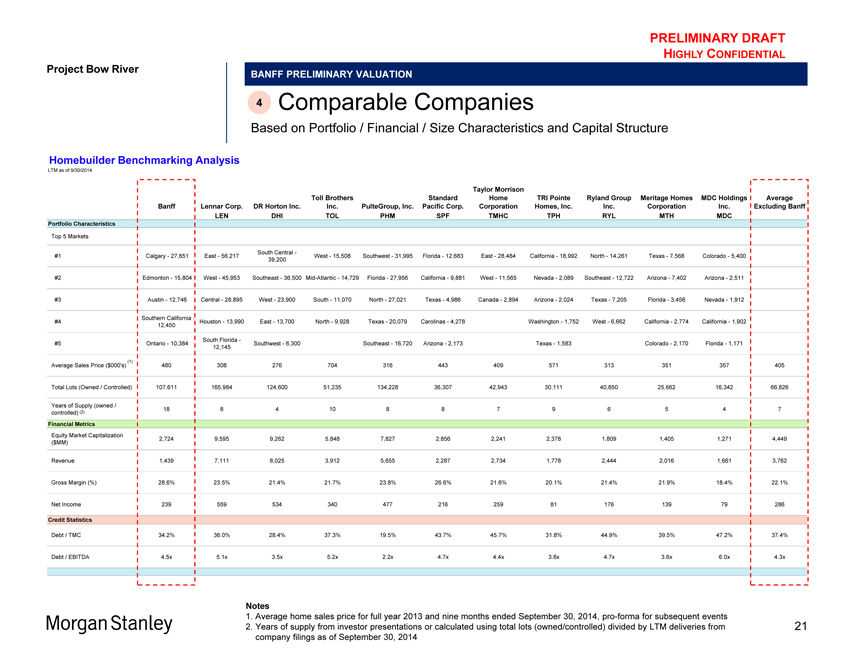

Homebuilder Benchmarking Analysis

LTM as of 9/30/2014

Taylor Morrison

Toll Brothers Standard Home TRI Pointe Ryland Group Meritage Homes MDC Holdings Average

Banff Lennar Corp. DR Horton Inc. Inc. PulteGroup, Inc. Pacific Corp. Corporation Homes, Inc. Inc. Corporation Inc. Excluding Banff

LEN DHI TOL PHM SPF TMHC TPH RYL MTH MDC

Portfolio Characteristics

Top 5 Markets

South Central -

#1 Calgary—27,651 East—56,217 West—15,508 Southwest—31,995 Florida—12,683 East—28,484 California—18,992 North—14,261 Texas—7,568 Colorado—5,400

39,200

#2 Edmonton—15,804 West—45,953 Southeast—36,500 Mid-Atlantic—14,729 Florida—27,956 California—9,881 West—11,565 Nevada—2,089 Southeast—12,722 Arizona—7,402 Arizona—2,511

#3 Austin—12,746 Central—28,895 West—23,900 South—11,070 North—27,021 Texas—4,986 Canada—2,894 Arizona—2,024 Texas—7,205 Florida—3,456 Nevada—1,912

Southern California -

#4 Houston—13,990 East—13,700 North—9,928 Texas—20,079 Carolinas—4,278 Washington—1,752 West—6,662 California—2,774 California—1,902

12,450

South Florida -

#5 Ontario—10,384 Southwest—6,300 Southeast—16,720 Arizona—2,173 Texas—1,583 Colorado—2,170 Florida—1,171

12,145

Average Sales Price ($000’s) (1) 480 308 276 704 316 443 409 571 313 351 357 405

Total Lots (Owned / Controlled) 107,611 165,984 124,600 51,235 134,228 36,307 42,943 30,111 40,850 25,662 16,342 66,826

Years of Supply (owned /

controlled) (2) 18 8 4 10 8 8 7 9 6 5 4 7

Financial Metrics

Equity Market Capitalization 2,724 9,595 9,262 5,848 7,827 2,856 2,241 2,378 1,809 1,405 1,271 4,449

($MM)

Revenue 1,439 7,111 8,025 3,912 5,655 2,287 2,734 1,778 2,444 2,016 1,661 3,762

Gross Margin (%) 28.6% 23.5% 21.4% 21.7% 23.8% 26.6% 21.6% 20.1% 21.4% 21.9% 18.4% 22.1%

Net Income 239 559 534 340 477 216 259 81 176 139 79 286

Credit Statistics

Debt / TMC 34.2% 36.0% 28.4% 37.3% 19.5% 43.7% 45.7% 31.8% 44.9% 39.5% 47.2% 37.4%

Debt / EBITDA 4.5x 5.1x 3.5x 5.2x 2.2x 4.7x 4.4x 3.8x 4.7x 3.6x 6.0x 4.3x

Notes

1. Average home sales price for full year 2013 and nine months ended September 30, 2014, pro-forma for subsequent events

2. Years of supply from investor presentations or calculated using total lots (owned/controlled) divided by LTM deliveries from company filings as of September 30, 2014

21

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

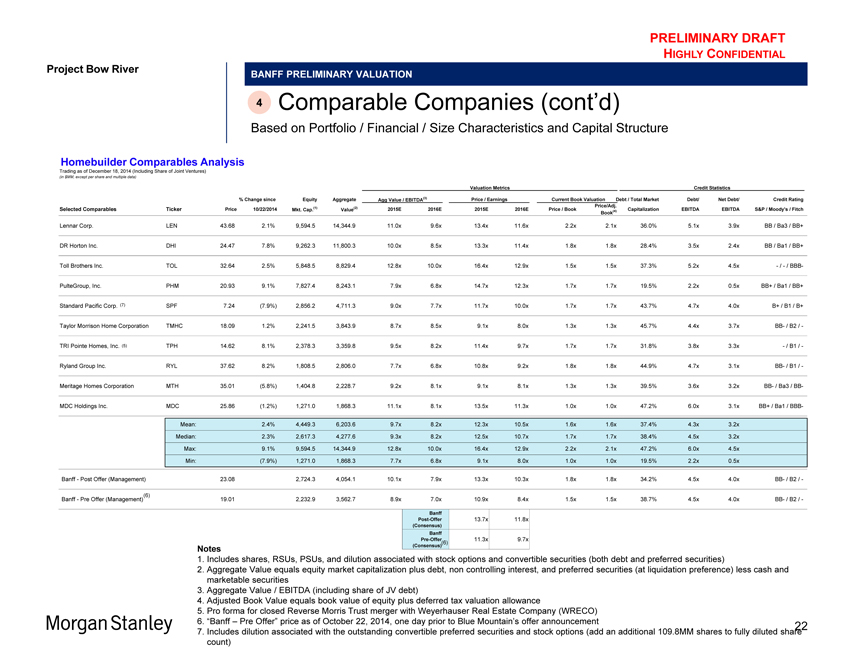

4 Comparable Companies (cont’d)

Based on Portfolio / Financial / Size Characteristics and Capital Structure

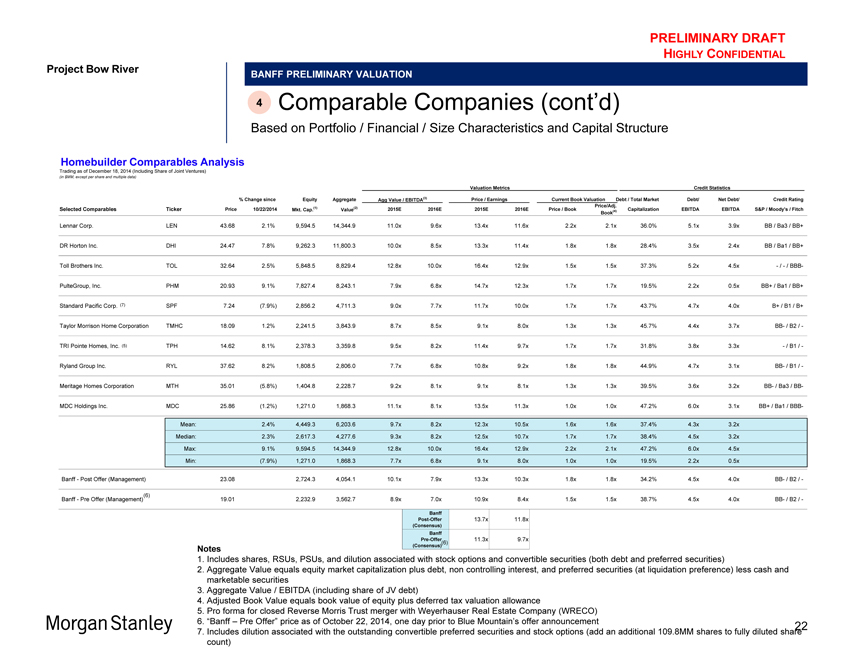

Homebuilder Comparables Analysis

Trading as of December 18, 2014 (Including Share of Joint Ventures)

(in $MM, except per share and multiple data)

Valuation Metrics Credit Statistics

% Change since Equity Aggregate Agg Value / EBITDA(3) Price / Earnings Current Book Valuation Debt / Total Market Debt/ Net Debt/ Credit Rating

Price/Adj.

Selected Comparables Ticker Price 10/22/2014 Mkt. Cap.(1) Value(2) 2015E 2016E 2015E 2016E Price / Book(4) Capitalization EBITDA EBITDA S&P / Moody’s / Fitch

Book

Lennar Corp. LEN 43.68 2.1% 9,594.5 14,344.9 11.0x 9.6x 13.4x 11.6x 2.2x 2.1x 36.0% 5.1x 3.9x BB / Ba3 / BB+

DR Horton Inc. DHI 24.47 7.8% 9,262.3 11,800.3 10.0x 8.5x 13.3x 11.4x 1.8x 1.8x 28.4% 3.5x 2.4x BB / Ba1 / BB+

Toll Brothers Inc. TOL 32.64 2.5% 5,848.5 8,829.4 12.8x 10.0x 16.4x 12.9x 1.5x 1.5x 37.3% 5.2x 4.5x—/—/ BBB-

PulteGroup, Inc. PHM 20.93 9.1% 7,827.4 8,243.1 7.9x 6.8x 14.7x 12.3x 1.7x 1.7x 19.5% 2.2x 0.5x BB+ / Ba1 / BB+

Standard Pacific Corp. (7) SPF 7.24(7.9%) 2,856.2 4,711.3 9.0x 7.7x 11.7x 10.0x 1.7x 1.7x 43.7% 4.7x 4.0x B+ / B1 / B+

Taylor Morrison Home Corporation TMHC 18.09 1.2% 2,241.5 3,843.9 8.7x 8.5x 9.1x 8.0x 1.3x 1.3x 45.7% 4.4x 3.7x BB- / B2 / -

TRI Pointe Homes, Inc. (5) TPH 14.62 8.1% 2,378.3 3,359.8 9.5x 8.2x 11.4x 9.7x 1.7x 1.7x 31.8% 3.8x 3.3x—/ B1 / -

Ryland Group Inc. RYL 37.62 8.2% 1,808.5 2,806.0 7.7x 6.8x 10.8x 9.2x 1.8x 1.8x 44.9% 4.7x 3.1x BB- / B1 / -

Meritage Homes Corporation MTH 35.01(5.8%) 1,404.8 2,228.7 9.2x 8.1x 9.1x 8.1x 1.3x 1.3x 39.5% 3.6x 3.2x BB- / Ba3 / BB-

MDC Holdings Inc. MDC 25.86(1.2%) 1,271.0 1,868.3 11.1x 8.1x 13.5x 11.3x 1.0x 1.0x 47.2% 6.0x 3.1x BB+ / Ba1 / BBB-

Mean: 2.4% 4,449.3 6,203.6 9.7x 8.2x 12.3x 10.5x 1.6x 1.6x 37.4% 4.3x 3.2x

Median: 2.3% 2,617.3 4,277.6 9.3x 8.2x 12.5x 10.7x 1.7x 1.7x 38.4% 4.5x 3.2x

Max: 9.1% 9,594.5 14,344.9 12.8x 10.0x 16.4x 12.9x 2.2x 2.1x 47.2% 6.0x 4.5x

Min:(7.9%) 1,271.0 1,868.3 7.7x 6.8x 9.1x 8.0x 1.0x 1.0x 19.5% 2.2x 0.5x

Banff—Post Offer (Management) 23.08 2,724.3 4,054.1 10.1x 7.9x 13.3x 10.3x 1.8x 1.8x 34.2% 4.5x 4.0x BB- / B2 / -

Banff—Pre Offer (Management)(6) 19.01 2,232.9 3,562.7 8.9x 7.0x 10.9x 8.4x 1.5x 1.5x 38.7% 4.5x 4.0x BB- / B2 / -

Banff

Post-Offer 13.7x 11.8x

(Consensus)

Banff

Pre-Offer 11.3x 9.7x

(Consensus) (6)

Notes

1. Includes shares, RSUs, PSUs, and dilution associated with stock options and convertible securities (both debt and preferred securities)

2. Aggregate Value equals equity market capitalization plus debt, non controlling interest, and preferred securities (at liquidation preference) less cash and marketable securities

3. Aggregate Value / EBITDA (including share of JV debt)

4. Adjusted Book Value equals book value of equity plus deferred tax valuation allowance

5. Pro forma for closed Reverse Morris Trust merger with Weyerhauser Real Estate Company (WRECO)

6. “Banff – Pre Offer” price as of October 22, 2014, one day prior to Blue Mountain’s offer announcement

7. Includes dilution associated with the outstanding convertible preferred securities and stock options (add an additional 109.8MM shares to fully diluted share count)

22

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

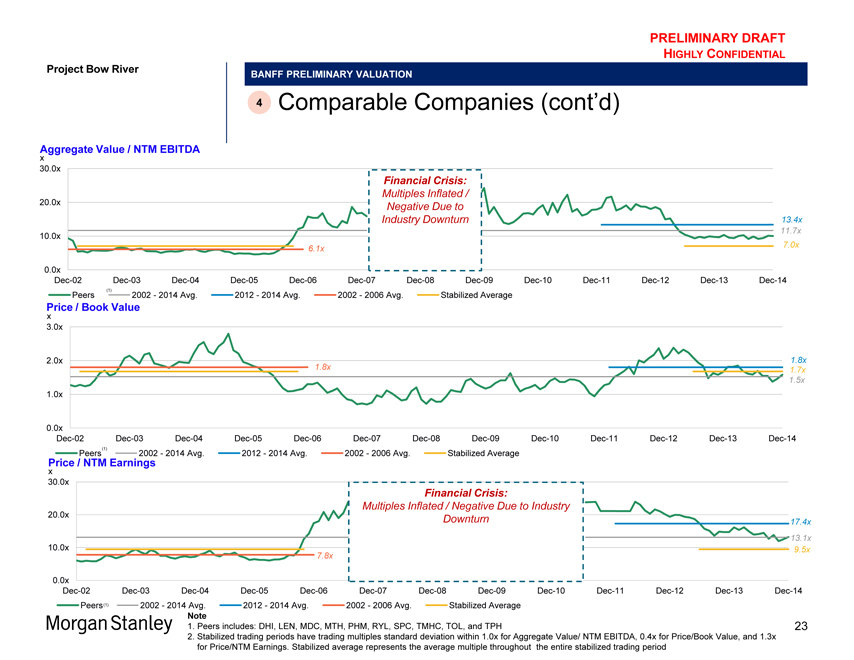

BANFF PRELIMINARY VALUATION

4 Comparable Companies (cont’d)

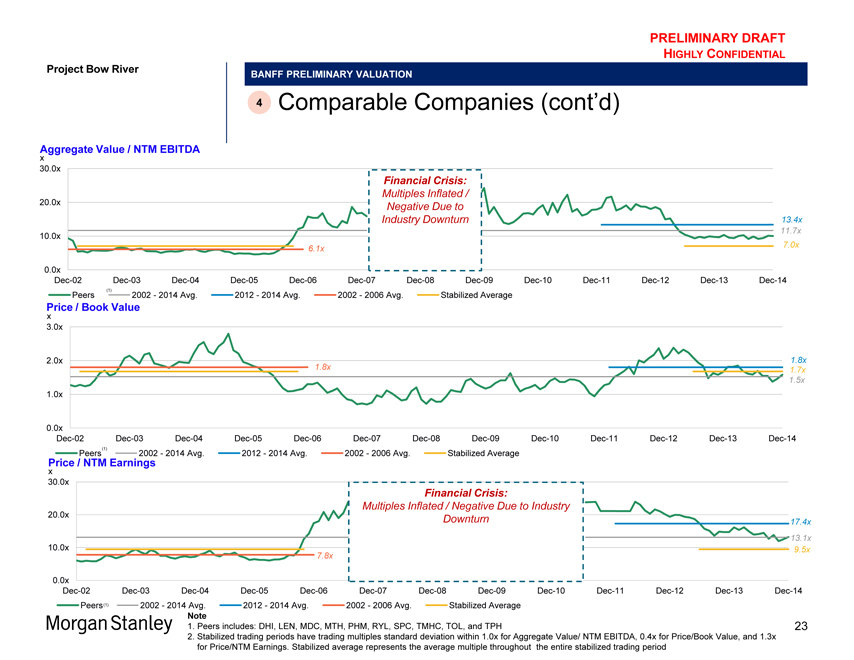

Aggregate Value / NTM EBITDA

x

30.0x

Financial Crisis:

Multiples Inflated /

20.0x Negative Due to

Industry Downturn 13.4x

10.0x 11.7x

616.1x 7.0x

0.0x

Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14

(1)

Peers 2002—2014 Avg. 2012—2014 Avg. 2002—2006 Avg. Stabilized Average

Price / Book Value

x

3.0x

2.0x 1.8x

1.8x 1.7x

1.5x

1.0x

0.0x

Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14

Peers(1) 2002—2014 Avg. 2012—2014 Avg. 2002—2006 Avg. Stabilized Average

Price / NTM Earnings

x

30.0x

Financial Crisis:

Multiples Inflated / Negative Due to Industry

20.0x

Downturn 17.4x

13.1x

10.0x 9.5x

7.8x

0.0x

Dec-02 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14

Peers(1) 2002—2014 Avg. 2012—2014 Avg. 2002—2006 Avg. Stabilized Average

Note

1. Peers includes: DHI, LEN, MDC, MTH, PHM, RYL, SPC, TMHC, TOL, and TPH

2. Stabilized trading periods have trading multiples standard deviation within 1.0x for Aggregate Value/ NTM EBITDA, 0.4x for Price/Book Value, and 1.3x for Price/NTM Earnings. Stabilized average represents the average multiple throughout the entire stabilized trading period

23

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

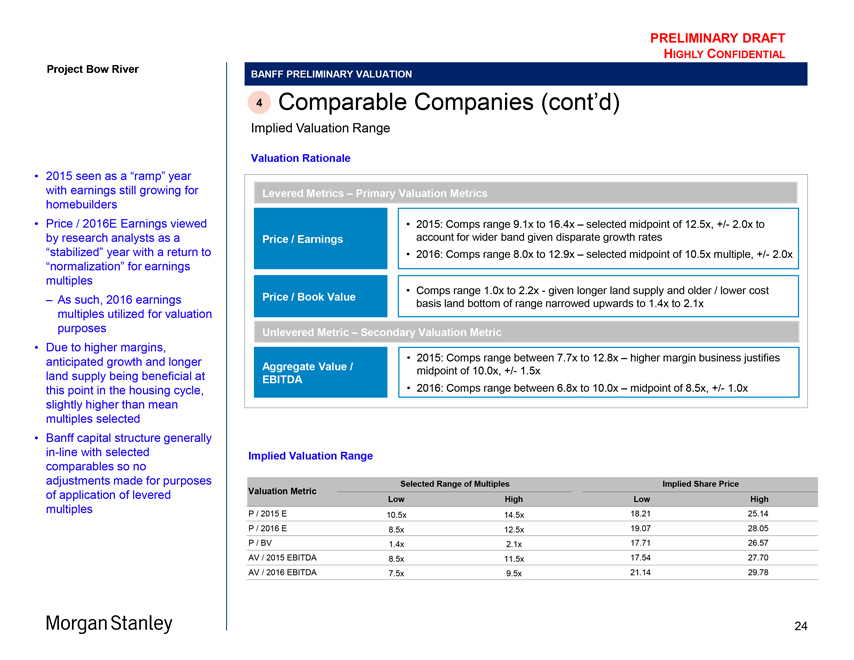

Project Bow River

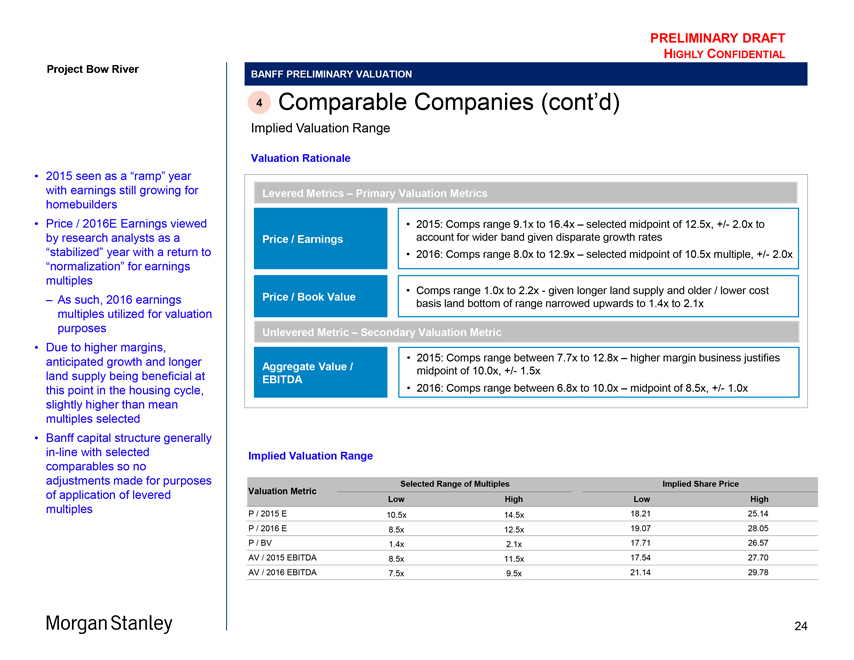

2015 seen as a “ramp” year with earnings still growing for homebuilders

Price / 2016E Earnings viewed by research analysts as a “stabilized” year with a return to “normalization” for earnings multiples

As such, 2016 earnings multiples utilized for valuation purposes

Due to higher margins, anticipated growth and longer land supply being beneficial at this point in the housing cycle, slightly higher than mean multiples selected

Banff capital structure generally in-line with selected comparables so no adjustments made for purposes of application of levered multiples

BANFF PRELIMINARY VALUATION

4 Comparable Companies (cont’d)

Implied Valuation Range

Valuation Rationale

Levered Metrics – Primary Valuation Metrics

Price / Earnings

Price / Book Value

2015: Comps range 9.1x to 16.4x – selected midpoint of 12.5x, +/- 2.0x to account for wider band given disparate growth rates

2016: Comps range 8.0x to 12.9x – selected midpoint of 10.5x multiple, +/- 2.0x

Comps range 1.0x to 2.2x - given longer land supply and older / lower cost basis land bottom of range narrowed upwards to 1.4x to 2.1x

Unlevered Metric – Secondary Valuation Metric

Aggregate Value / EBITDA

2015: Comps range between 7.7x to 12.8x – higher margin business justifies midpoint of 10.0x, +/- 1.5x

2016: Comps range between 6.8x to 10.0x – midpoint of 8.5x, +/- 1.0x

Implied Valuation Range

Valuation Metric Selected Range of Multiples Implied Share Price

Low High Low High

P / 2015 E

10.5x

14.5x

18.21

25.14

P / 2016 E

8.5x

12.5x

19.07

28.05

P / BV

1.4x

2.1x

17.71

26.57

AV / 2015 EBITDA

8.5x

11.5x

17.54

27.70

AV / 2016 EBITDA

7.5x

9.5x

21.14

29.78

Morgan Stanley

24

Project Bow River

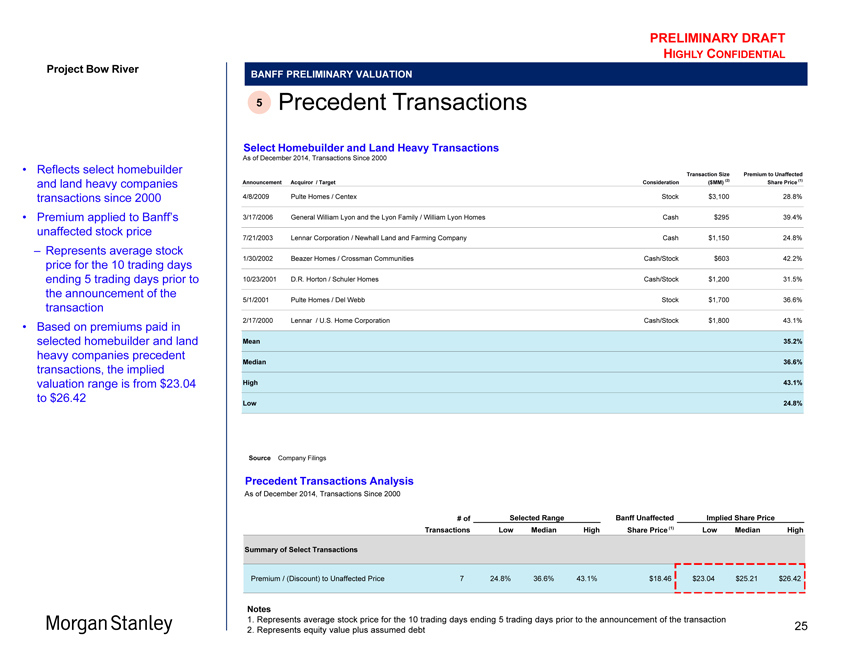

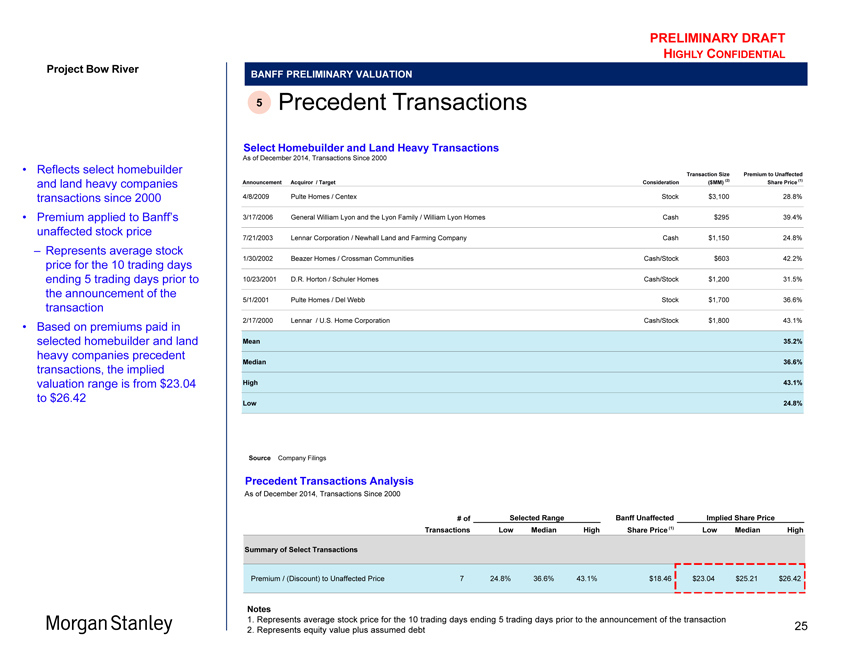

Reflects select homebuilder and land heavy companies transactions since 2000

Premium applied to Banff’s unaffected stock price

Represents average stock price for the 10 trading days ending 5 trading days prior to the announcement of the transaction

Based on premiums paid in selected homebuilder and land heavy companies precedent transactions, the implied valuation range is from $23.04 to $26.42

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

5 Precedent Transactions

Select Homebuilder and Land Heavy Transactions

As of December 2014, Transactions Since 2000

Transaction Size Premium to Unaffected

Announcement Acquiror / Target Consideration($MM) (2) Share Price (1)

4/8/2009 Pulte Homes / Centex Stock $3,100 28.8%

3/17/2006 General William Lyon and the Lyon Family / William Lyon Homes Cash $295 39.4%

7/21/2003 Lennar Corporation / Newhall Land and Farming Company Cash $1,150 24.8%

1/30/2002 Beazer Homes / Crossman Communities Cash/Stock $603 42.2%

10/23/2001 D.R. Horton / Schuler Homes Cash/Stock $1,200 31.5%

5/1/2001 Pulte Homes / Del Webb Stock $1,700 36.6%

2/17/2000 Lennar / U.S. Home Corporation Cash/Stock $1,800 43.1%

Mean 35.2%

Median 36.6%

High 43.1%

Low 24.8%

Source Company Filings

Precedent Transactions Analysis

As of December 2014, Transactions Since 2000

# of Selected Range Banff Unaffected Implied Share Price

Transactions Low Median High Share Price (1) Low Median High

Summary of Select Transactions

Premium / (Discount) to Unaffected Price 7 24.8% 36.6% 43.1% $18.46 $23.04 $25.21 $26.42

Notes

1. Represents average stock price for the 10 trading days ending 5 trading days prior to the announcement of the transaction

2. Represents equity value plus assumed debt

25

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

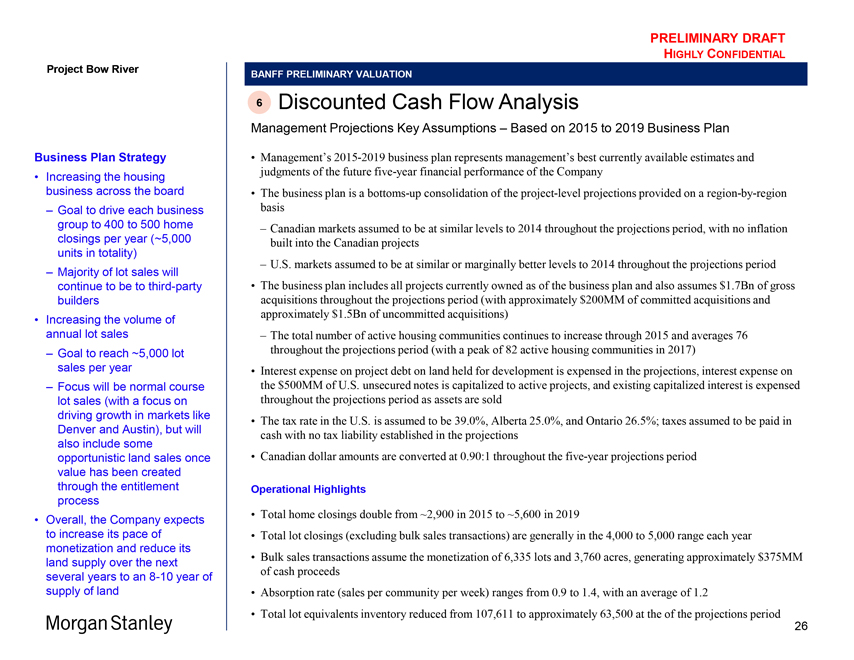

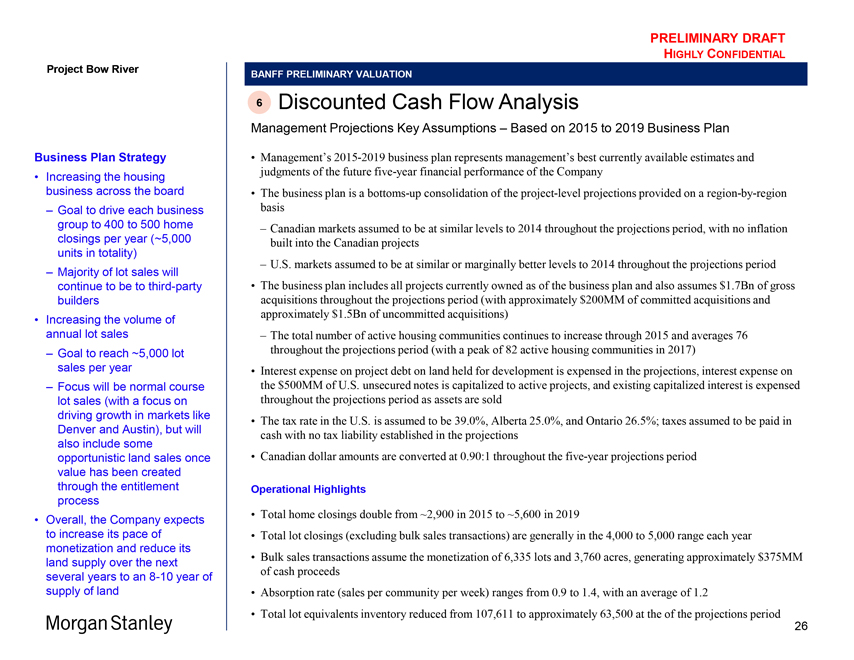

Business Plan Strategy

Increasing the housing business across the board

– Goal to drive each business group to 400 to 500 home closings per year (~5,000 units in totality)

– Majority of lot sales will continue to be to third-party builders

Increasing the volume of annual lot sales

– Goal to reach ~5,000 lot sales per year

– Focus will be normal course lot sales (with a focus on driving growth in markets like Denver and Austin), but will also include some opportunistic land sales once value has been created through the entitlement process

Overall, the Company expects to increase its pace of monetization and reduce its land supply over the next several years to an 8-10 year of supply of land

BANFF PRELIMINARY VALUATION

6 Discounted Cash Flow Analysis

Management Projections Key Assumptions – Based on 2015 to 2019 Business Plan

Management’s 2015-2019 business plan represents management’s best currently available estimates and judgments of the future five-year financial performance of the Company

The business plan is a bottoms-up consolidation of the project-level projections provided on a region-by-region basis

– Canadian markets assumed to be at similar levels to 2014 throughout the projections period, with no inflation built into the Canadian projects

– U.S. markets assumed to be at similar or marginally better levels to 2014 throughout the projections period

The business plan includes all projects currently owned as of the business plan and also assumes $1.7Bn of gross acquisitions throughout the projections period (with approximately $200MM of committed acquisitions and approximately $1.5Bn of uncommitted acquisitions)

– The total number of active housing communities continues to increase through 2015 and averages 76 throughout the projections period (with a peak of 82 active housing communities in 2017)

Interest expense on project debt on land held for development is expensed in the projections, interest expense on the $500MM of U.S. unsecured notes is capitalized to active projects, and existing capitalized interest is expensed throughout the projections period as assets are sold

The tax rate in the U.S. is assumed to be 39.0%, Alberta 25.0%, and Ontario 26.5%; taxes assumed to be paid in cash with no tax liability established in the projections

Canadian dollar amounts are converted at 0.90:1 throughout the five-year projections period

Operational Highlights

Total home closings double from ~2,900 in 2015 to ~5,600 in 2019

Total lot closings (excluding bulk sales transactions) are generally in the 4,000 to 5,000 range each year

Bulk sales transactions assume the monetization of 6,335 lots and 3,760 acres, generating approximately $375MM of cash proceeds

Absorption rate (sales per community per week) ranges from 0.9 to 1.4, with an average of 1.2

Total lot equivalents inventory reduced from 107,611 to approximately 63,500 at the of the projections period

Morgan Stanley

26

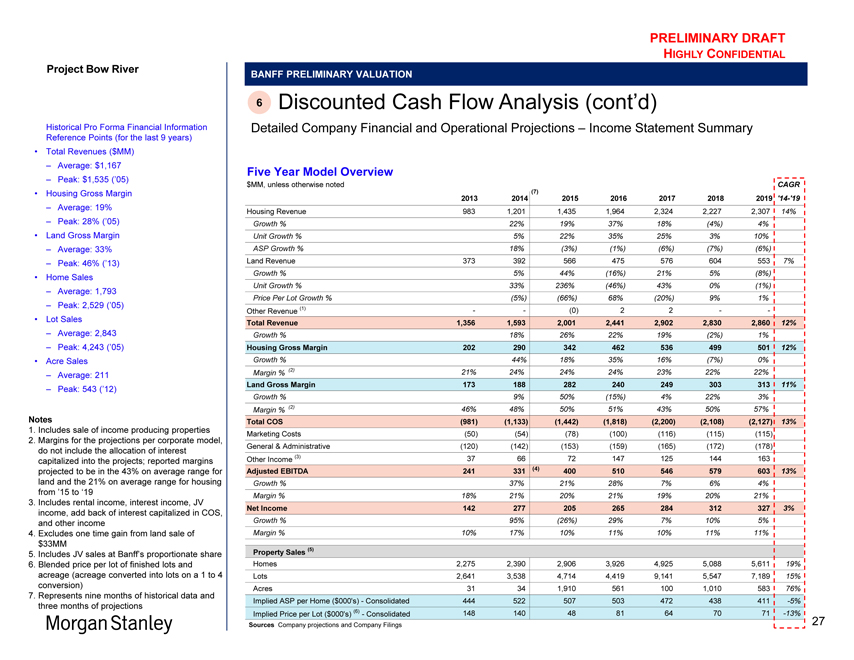

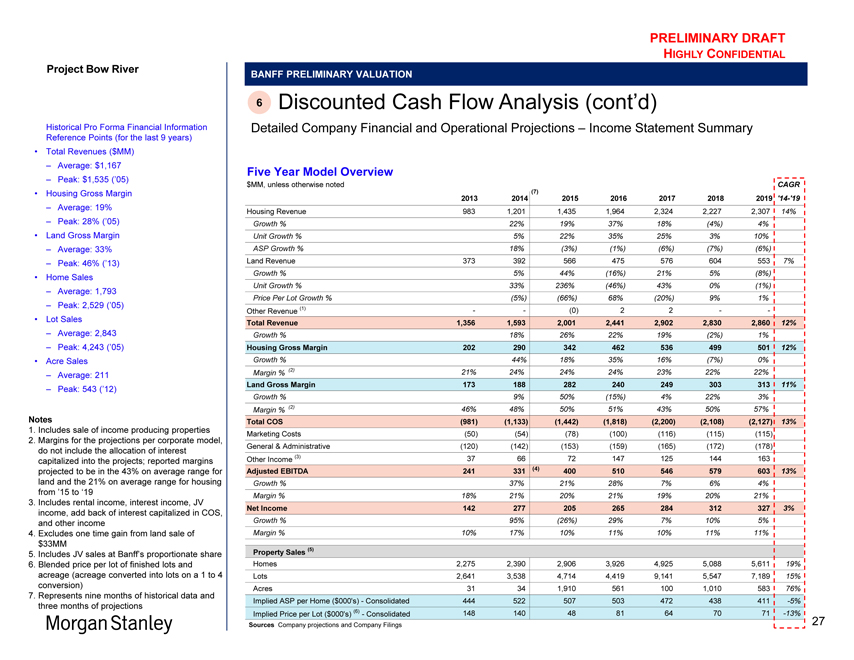

Project Bow River

Historical Pro Forma Financial Information Reference Points (for the last 9 years)

Total Revenues ($MM)

Average: $1,167

Peak: $1,535 (’05)

Housing Gross Margin

Average: 19%

Peak: 28% (’05)

Land Gross Margin

Average: 33%

Peak: 46% (’13)

Home Sales

Average: 1,793

Peak: 2,529 (’05)

Lot Sales

Average: 2,843

Peak: 4,243 (’05)

Acre Sales

Average: 211

Peak: 543 (’12)

Notes

1. Includes sale of income producing properties

2. Margins for the projections per corporate model,

do not include the allocation of interest

capitalized into the projects; reported margins

projected to be in the 43% on average range for

land and the 21% on average range for housing

from ’15 to ‘19

3. Includes rental income, interest income, JV

income, add back of interest capitalized in COS,

and other income

4. Excludes one time gain from land sale of

$33MM

5. Includes JV sales at Banff’s proportionate share

6. Blended price per lot of finished lots and

acreage (acreage converted into lots on a 1 to 4

conversion)

7. Represents nine months of historical data and

three months of projections

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

6 Discounted Cash Flow Analysis (cont’d)

Detailed Company Financial and Operational Projections – Income Statement Summary

Five Year Model Overview

$MM, unless otherwise noted CAGR

(7)

2013 2014 2015 2016 2017 2018 2019 ‘14-‘19

Housing Revenue 983 1,201 1,435 1,964 2,324 2,227 2,307 14%

Growth % 22% 19% 37% 18%(4%) 4%

Unit Growth % 5% 22% 35% 25% 3% 10%

ASP Growth % 18%(3%)(1%)(6%)(7%)(6%)

Land Revenue 373 392 566 475 576 604 553 7%

Growth % 5% 44%(16%) 21% 5%(8%)

Unit Growth % 33% 236%(46%) 43% 0%(1%)

Price Per Lot Growth %(5%)(66%) 68%(20%) 9% 1%

Other Revenue (1) —(0) 2 2 —

Total Revenue 1,356 1,593 2,001 2,441 2,902 2,830 2,860 12%

Growth % 18% 26% 22% 19%(2%) 1%

Housing Gross Margin 202 290 342 462 536 499 501 12%

Growth % 44% 18% 35% 16%(7%) 0%

Margin % (2) 21% 24% 24% 24% 23% 22% 22%

Land Gross Margin 173 188 282 240 249 303 313 11%

Growth % 9% 50%(15%) 4% 22% 3%

Margin % (2) 46% 48% 50% 51% 43% 50% 57%

Total COS(981)(1,133)(1,442)(1,818)(2,200)(2,108)(2,127) 13%

Marketing Costs(50)(54)(78)(100)(116)(115)(115)

General & Administrative(120)(142)(153)(159)(165)(172)(178)

Other Income (3) 37 66 72 147 125 144 163

Adjusted EBITDA 241 331 (4) 400 510 546 579 603 13%

Growth % 37% 21% 28% 7% 6% 4%

Margin % 18% 21% 20% 21% 19% 20% 21%

Net Income 142 277 205 265 284 312 327 3%

Growth % 95%(26%) 29% 7% 10% 5%

Margin % 10% 17% 10% 11% 10% 11% 11%

Property Sales (5)

Homes 2,275 2,390 2,906 3,926 4,925 5,088 5,611 19%

Lots 2,641 3,538 4,714 4419, 9141, 5,547 7,189 15%

Acres 31 34 1,910 561 100 1,010 583 76%

Implied ASP per Home ($000’s)—Consolidated 444 522 507 503 472 438 411 -5%

Implied Price per Lot ($000’s) (6)—Consolidated 148 140 48 81 64 70 71 -13%

Sources Company projections and Company Filings

27

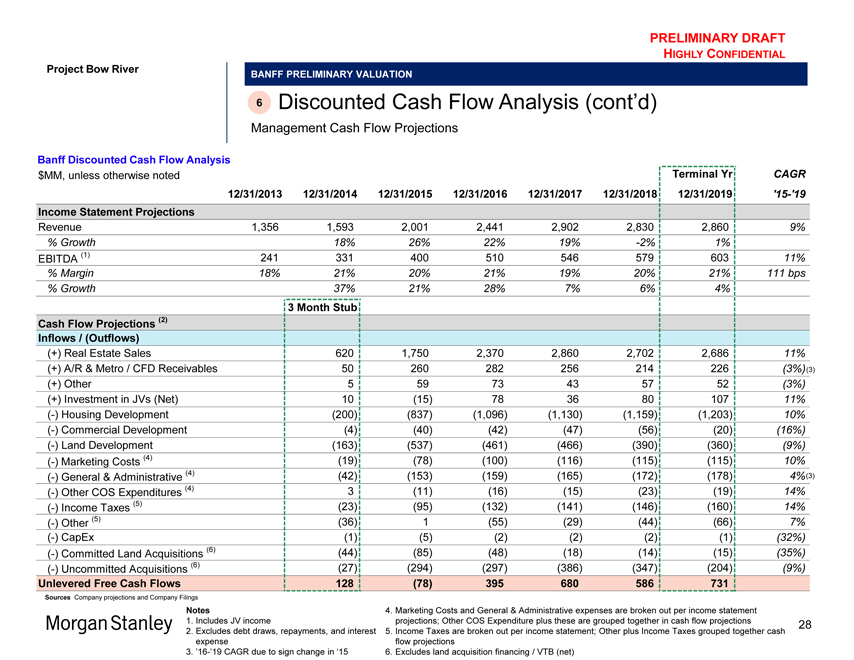

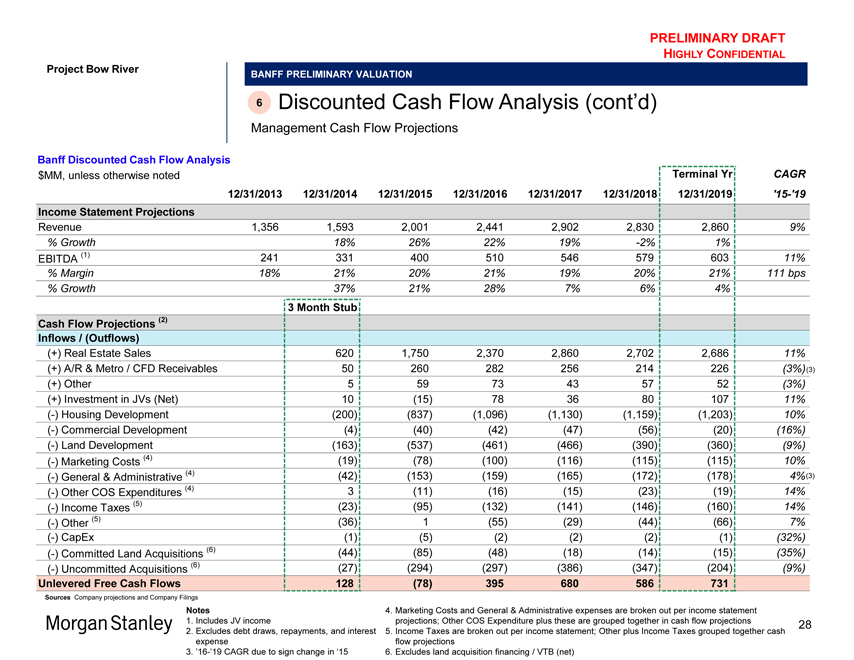

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

6 Discounted Cash Flow Analysis (cont’d)

Management Cash Flow Projections

Banff Discounted Cash Flow Analysis

$MM, unless otherwise noted Terminal Yr CAGR

12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 ‘15-‘19

Income Statement Projections

Revenue 1,356 1,593 2,001 2,441 2,902 2,830 2,860 9%

% Growth 18% 26% 22% 19% -2% 1%

EBITDA (1) 241 331 400 510 546 579 603 11%

% Margin 18% 21% 20% 21% 19% 20% 21% 111 bps

% Growth 37% 21% 28% 7% 6% 4%

3 Month Stub

Cash Flow Projections (2)

Inflows / (Outflows)

(+) Real Estate Sales 620 1,750 2,370 2,860 2,702 2,686 11%

(+) A/R & Metro / CFD Receivables 50 260 282 256 214 226(3%)(3)

(+) Other 5 59 73 43 57 52(3%)

(+) Investment in JVs (Net) 10(15) 78 36 80 107 11%

(-) Housing Development(200)(837)(1,096)(1,130)(1,159)(1,203) 10%

(-) Commercial Development(4)(40)(42)(47)(56)(20)(16%)

(-) Land Development(163)(537)(461)(466)(390)(360)(9%)

(-) Marketing Costs (4)(19)(78)(100)(116)(115)(115) 10%

(-) General & Administrative (4)(42)(153)(159)(165)(172)(178) 4%(3)

(-) Other COS Expenditures (4) 3(11)(16)(15)(23)(19) 14%

(-) Income Taxes (5)(23)(95)(132)(141)(146)(160) 14%

(-) Other (5)(36) 1(55)(29)(44)(66) 7%

(-) CapEx(1)(5)(2)(2)(2)(1)(32%)

(-) Committed Land Acquisitions (6)(44)(85)(48)(18)(14)(15)(35%)

(-) Uncommitted Acquisitions (6)(27)(294)(297)(386)(347)(204)(9%)

Unlevered Free Cash Flows 128(78) 395 680 586 731

Sources Company projections and Company Filings

Notes

1. Includes JV income

2. Excludes debt draws, repayments, and interest expense

3. ’16-’19 CAGR due to sign change in ‘15

4. Marketing Costs and General & Administrative expenses are broken out per income statement projections; Other COS Expenditure plus these are grouped together in cash flow projections

5. Income Taxes are broken out per income statement; Other plus Income Taxes grouped together cash flow projections

6. Excludes land acquisition financing / VTB (net)

28

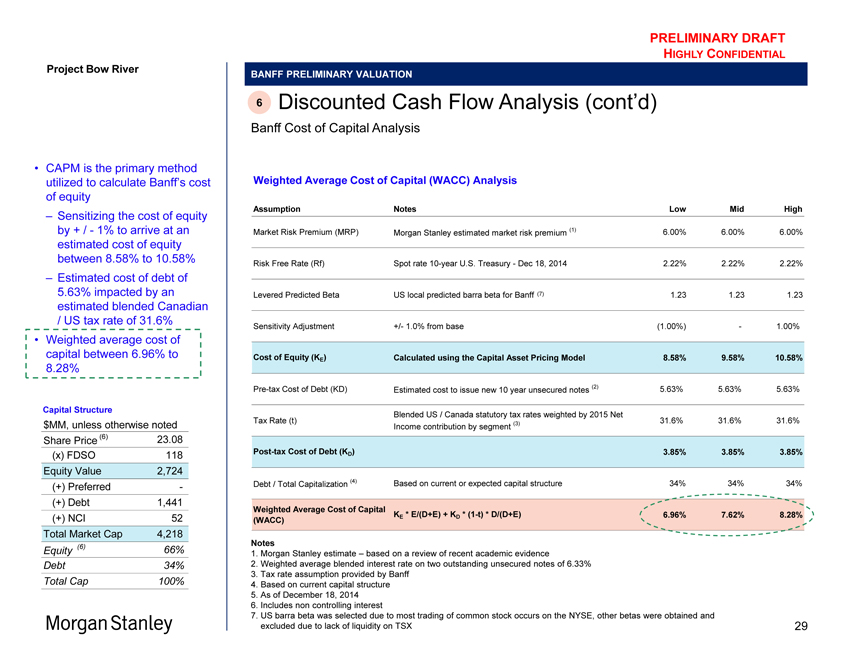

Project Bow River

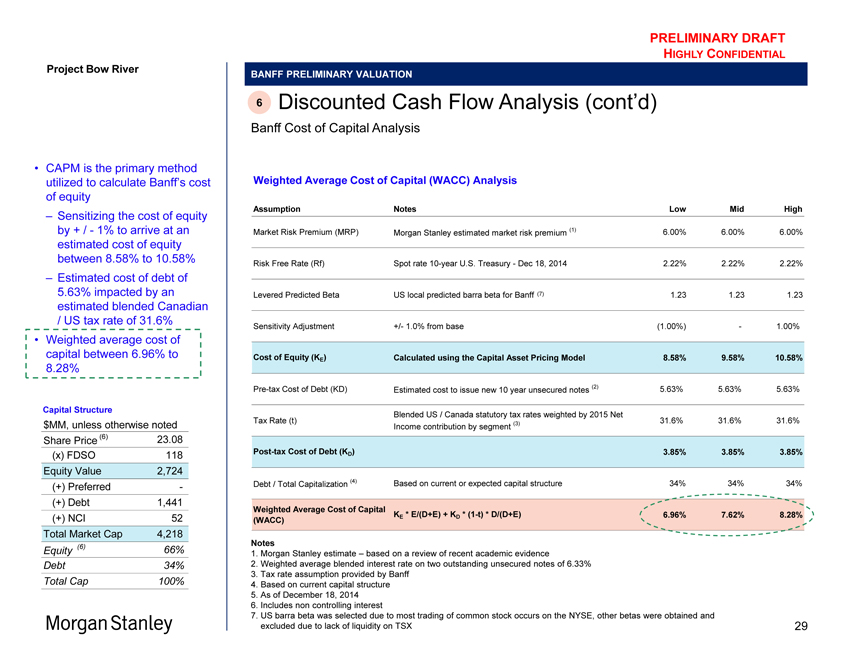

CAPM is the primary method utilized to calculate Banff’s cost of equity

Sensitizing the cost of equity by + /—1% to arrive at an estimated cost of equity between 8.58% to 10.58%

Estimated cost of debt of 5.63% impacted by an estimated blended Canadian / US tax rate of 31.6%

Weighted average cost of capital between 6.96% to 8.28%

Capital Structure

$MM, unless otherwise noted

Share Price (6) 23.08

(x) FDSO 118

Equity Value 2,724

(+) Preferred -

(+) Debt 1,441

(+) NCI 52

Total Market Cap 4,218

Equity (6) 66%

Debt 34%

Total Cap 100%

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

6 Discounted Cash Flow Analysis (cont’d)

Banff Cost of Capital Analysis

Weighted Average Cost of Capital (WACC) Analysis

Assumption Notes Low Mid High

Market Risk Premium (MRP) Morgan Stanley estimated market risk premium (1) 6.00% 6.00% 6.00%

Risk Free Rate (Rf) Spot rate 10-year U.S. Treasury—Dec 18, 2014 2.22% 2.22% 2.22%

Levered Predicted Beta US local predicted barra beta for Banff (7) 1.23 1.23 1.23

Sensitivity Adjustment +/- 1.0% from base(1.00%)—1.00%

Cost of Equity (KE ) Calculated using the Capital Asset Pricing Model 8.58% 9.58% 10.58%

Pre-tax Cost of Debt (KD) Estimated cost to issue new 10 year unsecured notes (2) 5.63% 5.63% 5.63%

Blended US / Canada statutory tax rates weighted by 2015 Net

Tax Rate (t) 31.6% 31.6% 31.6%

Income contribution by segment (3)

Post-tax Cost of Debt (KD ) 3.85% 3.85% 3.85%

Debt / Total Capitalization (4) Based on current or expected capital structure 34% 34% 34%

Weighted Average Cost of Capital

(WACC) KE * E/(D+E) + KD * (1-t) * D/(D+E) 6.96% 7.62% 8.28%

Notes

1. Morgan Stanley estimate – based on a review of recent academic evidence

2. Weighted average blended interest rate on two outstanding unsecured notes of 6.33%

3. Tax rate assumption provided by Banff

4. Based on current capital structure

5. As of December 18, 2014

6. Includes non controlling interest

7. US barra beta was selected due to most trading of common stock occurs on the NYSE, other betas were obtained and excluded due to lack of liquidity on TSX

29

Project Bow River

Based on Management projections provided by Banff

Key assumptions:

– Applied exit EBITDA multiple range of 6.0x to 8.0x and P / BV range of 1.8x to 2.7x

– Implied P / E multiple range of 7.1x to 10.7x

– Discount rate assumption reflects an estimated range of Banff’s weighted average cost of capital (“WACC”) of 6.96% to 8.28%

Going concern valuation: no transaction costs assumed

Resulting implied per share range of $22.43 to $31.53

• Previous analysis included a midpoint exit EBITDA multiple of 6.4x

Notes

1. Forward year net income per Company model, exit assumes same capital structure as present

2. Current equity book value less change in equity book value over projection period

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

6 Discounted Cash Flow Analysis (cont’d)

Discounted Cash Flow Sensitivities

Discounted Cash Flow Sensitivity Analysis

Price Per Share, AV / 2015 EBITDA / AV / 2016 EBITDA, P / 2015 Earnings / P / 2016 Earnings, P / Book Value

Weighted Average Cost of Capital Range

Implied

Exit Applied

P / E Exit Implied Exit

Multiple EBITDA P / BV

Range (1) Multiple Multiple (2) 6.96% 7.62% 8.28%

$24.00 $23.20 $22.43 Implied Price

Per Share

10.4x / 8.2x 10.2x / 8.0x 9.9x / 7.8x AV / EBITDA

7.1x 6.0x 1.8x

13.8x / 10.7x 13.4x / 10.3x 12.9x / 10.0x P / E

1.9x 1.8x 1.8x P / BV

$27.52 $26.64 $25.77 Implied Price

Per Share

11.4x / 9.0x 11.2x / 8.8x 10.9x / 8.6x AV / EBITDA

8.8x 7.0x 2.2x

15.9x / 12.3x 15.4x / 11.9x 14.9x / 11.5x P / E

2.2x 2.1x 2.0x P / BV

$31.53 $30.54 $29.58 Implied Price

Per Share

12.6x / 9.9x 12.3x / 9.7x 12.1x / 9.5x AV / EBITDA

10.7x 8.0x 2.7x

18.2x / 14.1x 17.6x / 13.6x 17.1x / 13.2x P / E

2.5x 2.4x 2.3x P / BV

Sources Company projections and Company Filings

30

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis

Valuation Approach Summary

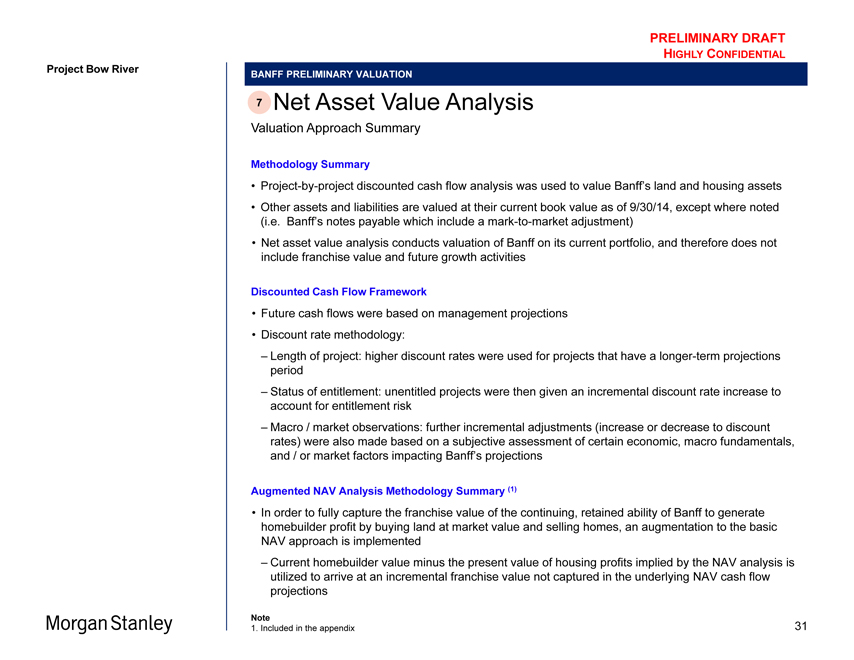

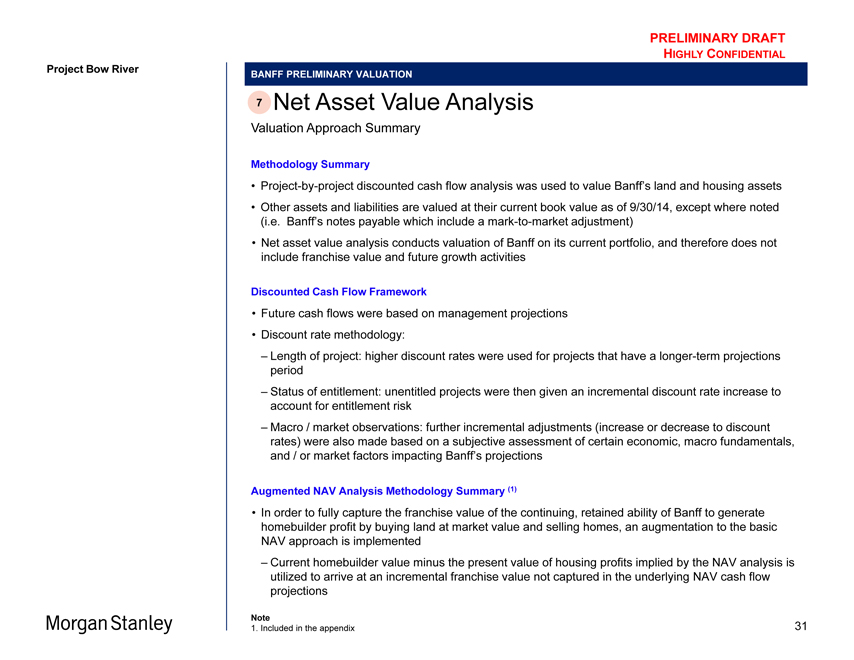

Methodology Summary

Project-by-project discounted cash flow analysis was used to value Banff’s land and housing assets

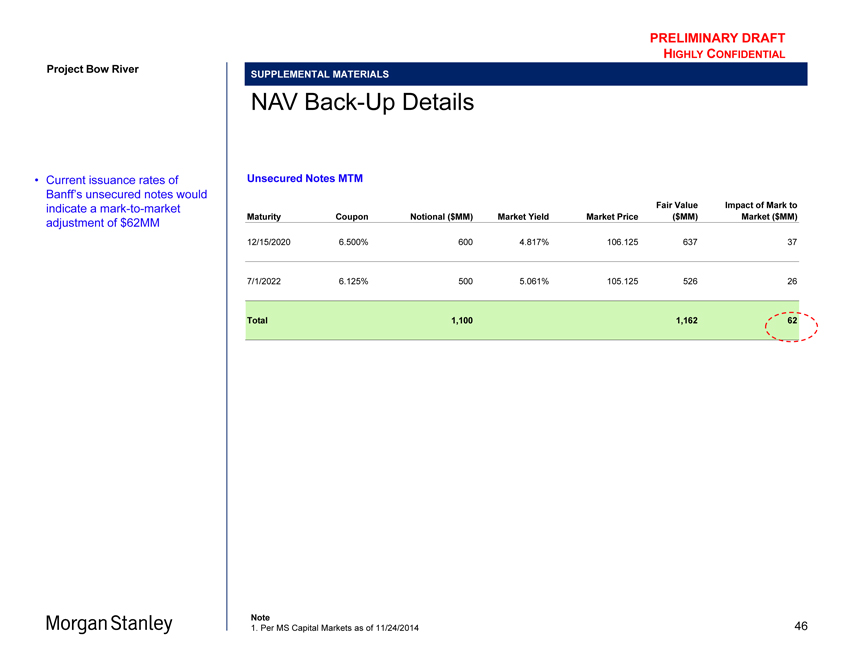

Other assets and liabilities are valued at their current book value as of 9/30/14, except where noted

(i.e. Banff’s notes payable which include a mark-to-market adjustment)

Net asset value analysis conducts valuation of Banff on its current portfolio, and therefore does not

include franchise value and future growth activities

Discounted Cash Flow Framework

Future cash flows were based on management projections

Discount rate methodology:

– Length of project: higher discount rates were used for projects that have a longer-term projections

period

– Status of entitlement: unentitled projects were then given an incremental discount rate increase to

account for entitlement risk

– Macro / market observations: further incremental adjustments (increase or decrease to discount

rates) were also made based on a subjective assessment of certain economic, macro fundamentals,

and / or market factors impacting Banff’s projections

Augmented NAV Analysis Methodology Summary (1)

In order to fully capture the franchise value of the continuing, retained ability of Banff to generate

homebuilder profit by buying land at market value and selling homes, an augmentation to the basic

NAV approach is implemented

– Current homebuilder value minus the present value of housing profits implied by the NAV analysis is

utilized to arrive at an incremental franchise value not captured in the underlying NAV cash flow

projections

Note

1. Included in the appendix

31

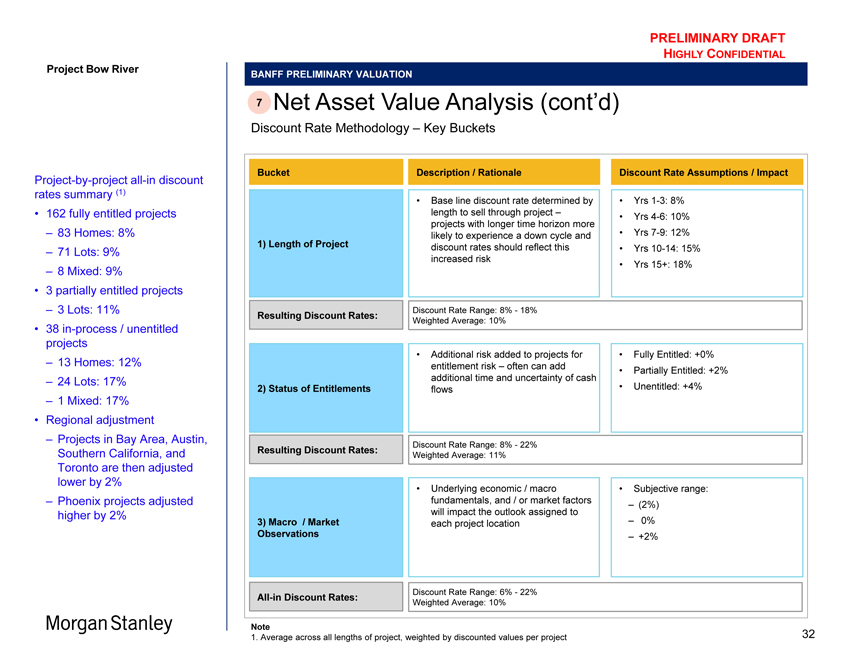

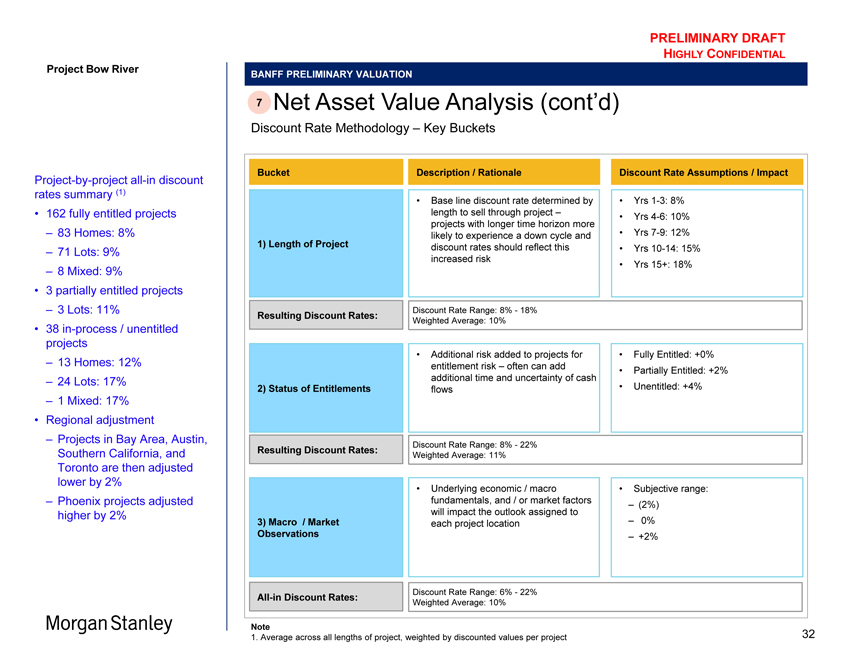

Project Bow River

Project-by-project all-in discount

rates summary (1)

162 fully entitled projects

– 83 Homes: 8%

– 71 Lots: 9%

– 8 Mixed: 9%

3 partially entitled projects

– 3 Lots: 11%

38 in-process / unentitled

projects

– 13 Homes: 12%

– 24 Lots: 17%

– 1 Mixed: 17%

Regional adjustment

– Projects in Bay Area, Austin,

Southern California, and

Toronto are then adjusted

lower by 2%

– Phoenix projects adjusted

higher by 2%

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

Discount Rate Methodology – Key Buckets

Bucket Description / Rationale Discount Rate Assumptions / Impact

• Base line discount rate determined by • Yrs 1-3: 8%

length to sell through project – • Yrs 4-6: 10%

projects with longer time horizon more

likely to experience a down cycle and • Yrs 7-9: 12%

1) Length of Project discount rates should reflect this • Yrs 10-14: 15%

increased risk • Yrs 15+: 18%

Discount Rate Range: 8%—18%

Resulting Discount Rates: Weighted Average: 10%

• Additional risk added to projects for • Fully Entitled: +0%

entitlement risk – often can add • Partially Entitled: +2%

additional time and uncertainty of cash

2) Status of Entitlements flows • Unentitled: +4%

Discount Rate Range: 8%—22%

Resulting Discount Rates: Weighted Average: 11%

• Underlying economic / macro • Subjective range:

fundamentals, and / or market factors –(2%)

will impact the outlook assigned to

3) Macro / Market each project location – 0%

Observations �� +2%

All-in Discount Rates: Discount Rate Range: 6%—22%

Weighted Average: 10%

Note

1. Average across all lengths of project, weighted by discounted values per project

32

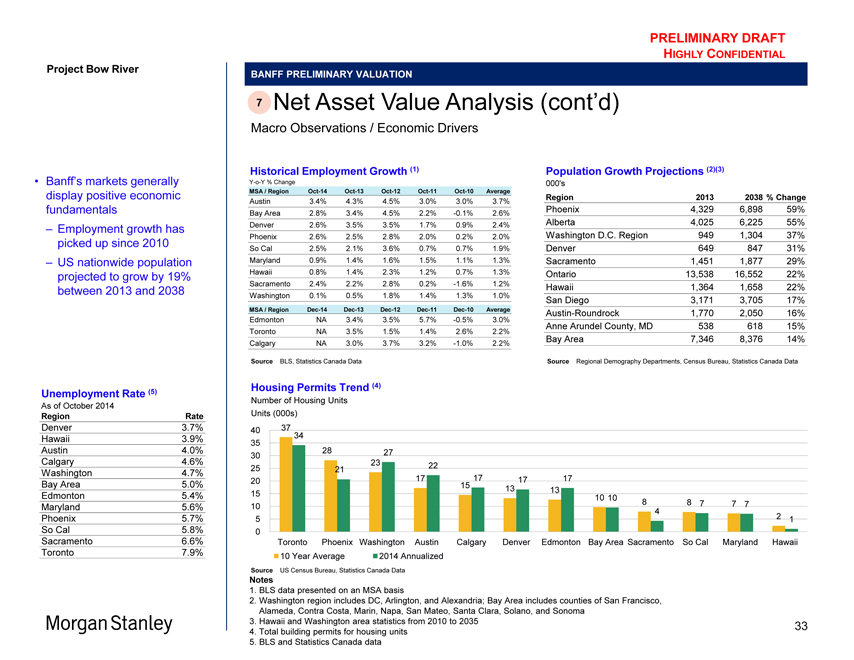

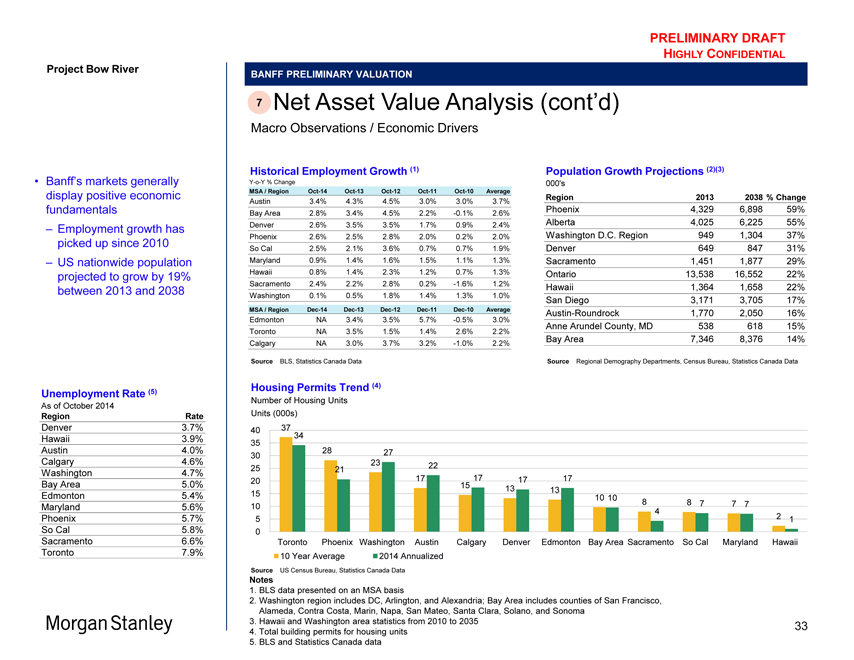

Project Bow River

Banff’s markets generally display positive economic fundamentals

Employment growth has picked up since 2010

US nationwide population projected to grow by 19% between 2013 and 2038

Unemployment Rate (5)

As of October 2014

Region Rate

Denver 3.7%

Hawaii 3.9%

Austin 4.0%

Calgary 4.6%

Washington 4.7%

Bay Area 5.0%

Edmonton 5.4%

Maryland 5.6%

Phoenix 5.7%

So Cal 5.8%

Sacramento 6.6%

Toronto 7.9%

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

Macro Observations / Economic Drivers

Historical Employment Growth (1)

Y-o-Y % Change

MSA / Region Oct-14 Oct-13 Oct-12 Oct-11 Oct-10 Average

Austin 3.4% 4.3% 4.5% 3.0% 3.0% 3.7%

Bay Area 2.8% 3.4% 4.5% 2.2% -0.1% 2.6%

Denver 2.6% 3.5% 3.5% 1.7% 0.9% 2.4%

Phoenix 2.6% 2.5% 2.8% 2.0% 0.2% 2.0%

So Cal 2.5% 2.1% 3.6% 0.7% 0.7% 1.9%

Maryland 0.9% 1.4% 1.6% 1.5% 1.1% 1.3%

Hawaii 0.8% 1.4% 2.3% 1.2% 0.7% 1.3%

Sacramento 2.4% 2.2% 2.8% 0.2% -1.6% 1.2%

Washington 0.1% 0.5% 1.8% 1.4% 1.3% 1.0%

MSA / Region Dec-14 Dec-13 Dec-12 Dec-11 Dec-10 Average

Edmonton NA 3.4% 3.5% 5.7% -0.5% 3.0%

Toronto NA 3.5% 1.5% 1.4% 2.6% 2.2%

Calgary NA 3.0% 3.7% 3.2% -1.0% 2.2%

Source BLS, Statistics Canada Data

Population Growth Projections (2)(3)

000’s

Region 2013 2038 % Change

Phoenix 4,329 6,898 59%

Alberta 4,025 6,225 55%

Washington D.C. Region 949 1,304 37%

Denver 649 847 31%

Sacramento 1,451 1,877 29%

Ontario 13,538 16,552 22%

Hawaii 1,364 1,658 22%

San Diego 3,171 3,705 17%

Austin-Roundrock 1,770 2,050 16%

Anne Arundel County, MD 538 618 15%

Bay Area 7,346 8,376 14%

Source Regional Demography Departments, Census Bureau, Statistics Canada Data

Housing Permits Trend (4)

Number of Housing Units

Units (000s)

40 37 34

35

30 28 27

23

25 21 22

20 17 17 17 17

15 13 13

15 10 10

10 8 8 7 7 7

4

5 2 1

0

Toronto Phoenix Washington Austin Calgary Denver Edmonton Bay Area Sacramento So Cal Maryland Hawaii

10 Year Average 2014 Annualized

Source US Census Bureau, Statistics Canada Data

Notes

1. BLS data presented on an MSA basis

2. Washington region includes DC, Arlington, and Alexandria; Bay Area includes counties of San Francisco, Alameda, Contra Costa, Marin, Napa, San Mateo, Santa Clara, Solano, and Sonoma

3. Hawaii and Washington area statistics from 2010 to 2035

4. Total building permits for housing units

5. BLS and Statistics Canada data

33

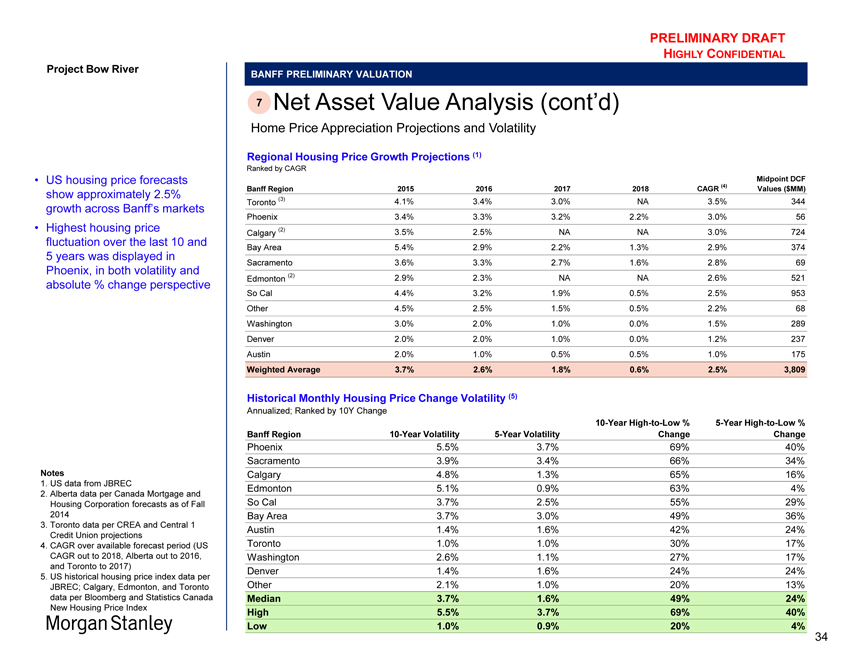

Project Bow River

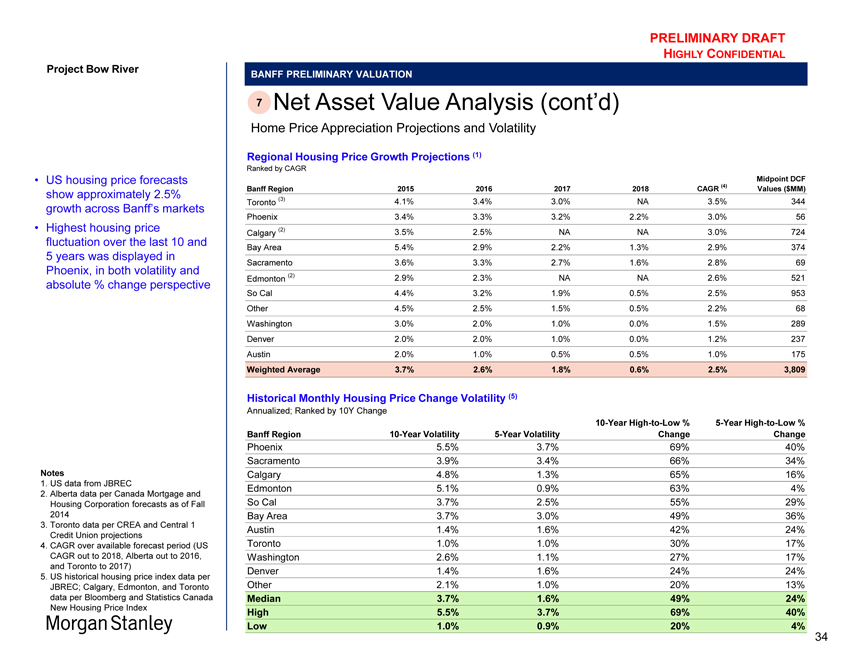

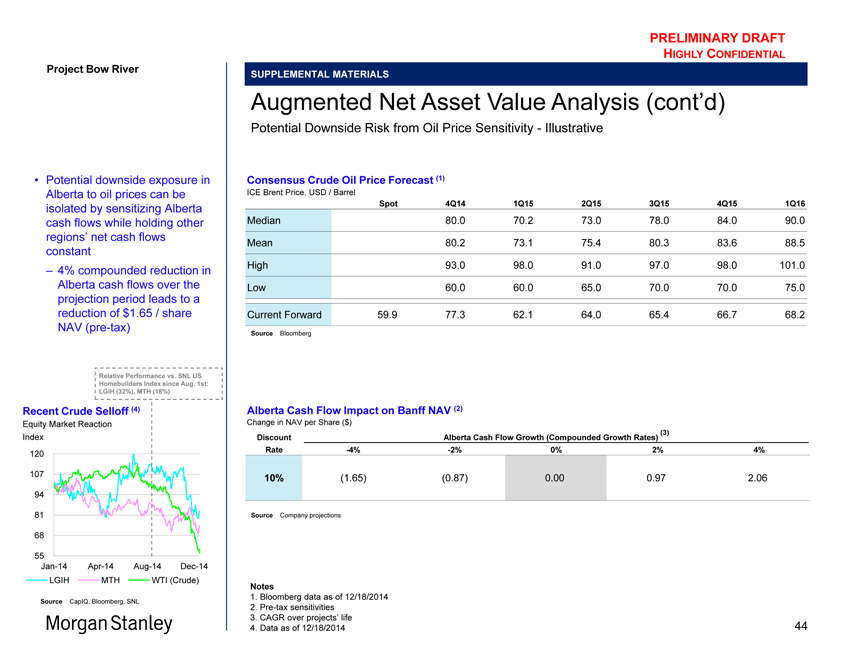

US housing price forecasts show approximately 2.5% growth across Banff’s markets

Highest housing price fluctuation over the last 10 and 5 years was displayed in Phoenix, in both volatility and absolute % change perspective

Notes

1. US data from JBREC

2. Alberta data per Canada Mortgage and Housing Corporation forecasts as of Fall 2014

3. Toronto data per CREA and Central 1 Credit Union projections

4. CAGR over available forecast period (US CAGR out to 2018, Alberta out to 2016, and Toronto to 2017)

5. US historical housing price index data per JBREC; Calgary, Edmonton, and Toronto data per Bloomberg and Statistics Canada New Housing Price Index

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

Home Price Appreciation Projections and Volatility

Regional Housing Price Growth Projections (1)

Ranked by CAGR

Midpoint DCF

Banff Region 2015 2016 2017 2018 CAGR (4) Values ($MM)

Toronto (3) 4.1% 3.4% 3.0% NA 3.5% 344

Phoenix 3.4% 3.3% 3.2% 2.2% 3.0% 56

Calgary (2) 3.5% 2.5% NA NA 3.0% 724

Bay Area 5.4% 2.9% 2.2% 1.3% 2.9% 374

Sacramento 3.6% 3.3% 2.7% 1.6% 2.8% 69

Edmonton (2) 2.9% 2.3% NA NA 2.6% 521

So Cal 4.4% 3.2% 1.9% 0.5% 2.5% 953

Other 4.5% 2.5% 1.5% 0.5% 2.2% 68

Washington 3.0% 2.0% 1.0% 0.0% 1.5% 289

Denver 2.0% 2.0% 1.0% 0.0% 1.2% 237

Austin 2.0% 1.0% 0.5% 0.5% 1.0% 175

Weighted Average 3.7% 2.6% 1.8% 0.6% 2.5% 3,809

Historical Monthly Housing Price Change Volatility (5)

Annualized; Ranked by 10Y Change

10-Year High-to-Low % 5-Year High-to-Low %

Banff Region 10-Year Volatility 5-Year Volatility Change Change

Phoenix 5.5% 3.7% 69% 40%

Sacramento 3.9% 3.4% 66% 34%

Calgary 4.8% 1.3% 65% 16%

Edmonton 5.1% 0.9% 63% 4%

So Cal 3.7% 2.5% 55% 29%

Bay Area 3.7% 3.0% 49% 36%

Austin 1.4% 1.6% 42% 24%

Toronto 1.0% 1.0% 30% 17%

Washington 2.6% 1.1% 27% 17%

Denver 1.4% 1.6% 24% 24%

Other 2.1% 1.0% 20% 13%

Median 3.7% 1.6% 49% 24%

High 5.5% 3.7% 69% 40%

Low 1.0% 0.9% 20% 4%

34

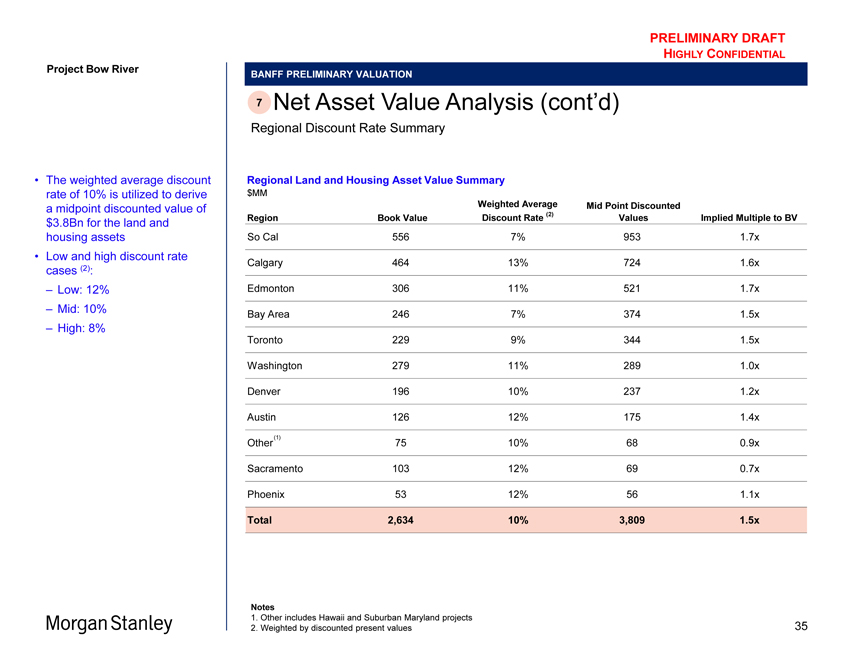

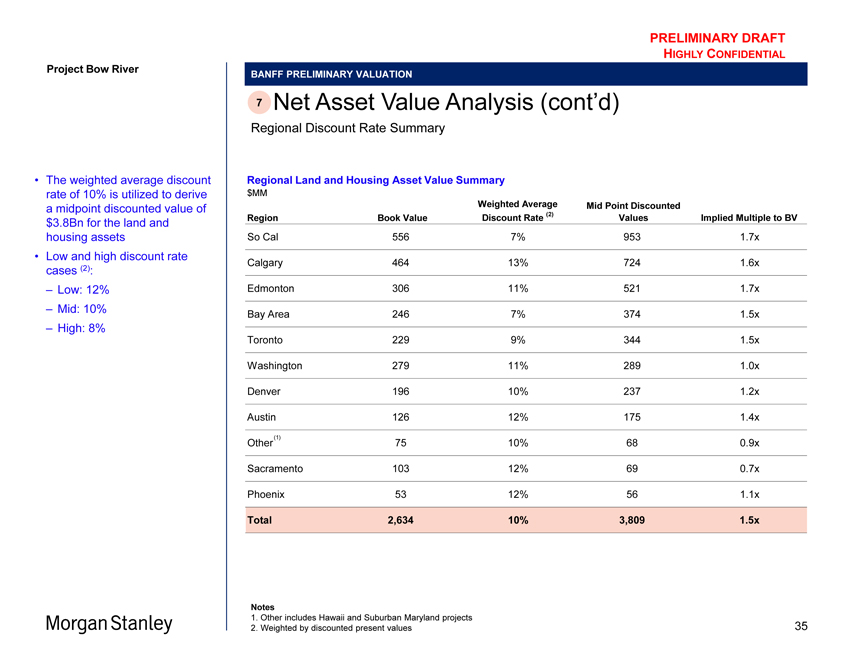

Project Bow River

The weighted average discount rate of 10% is utilized to derive a midpoint discounted value of $3.8Bn for the land and housing assets

Low and high discount rate cases (2): – Low: 12% – Mid: 10% – High: 8%

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

Regional Discount Rate Summary

Regional Land and Housing Asset Value Summary

$MM

Weighted Average Mid Point Discounted

Region Book Value Discount Rate (2) Values Implied Multiple to BV

So Cal 556 7% 953 1.7x

Calgary 464 13% 724 1.6x

Edmonton 306 11% 521 1.7x

Bay Area 246 7% 374 1.5x

Toronto 229 9% 344 1.5x

Washington 279 11% 289 1.0x

Denver 196 10% 237 1.2x

Austin 126 12% 175 1.4x

Other (1) 75 10% 68 0.9x

Sacramento 103 12% 69 0.7x

Phoenix 53 12% 56 11x.

Total 2,634 10% 3,809 1.5x

Notes

1. Other includes Hawaii and Suburban Maryland projects

2. Weighted by discounted present values

35

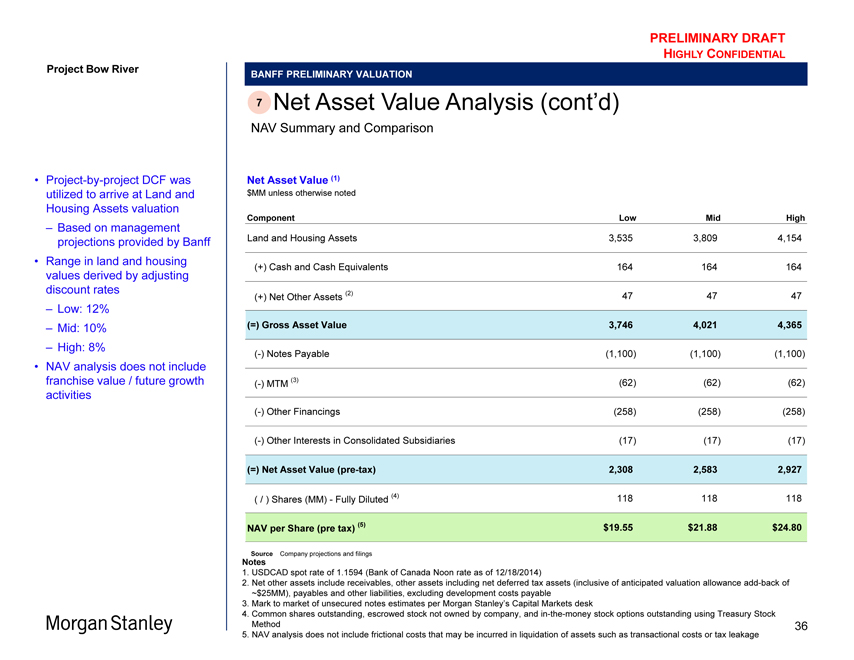

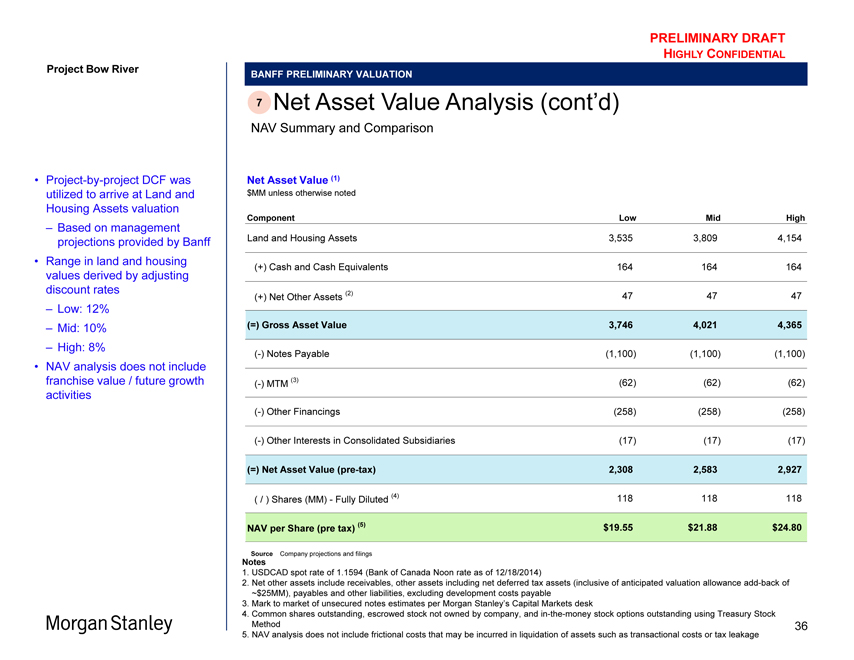

Project Bow River

Project-by-project DCF was utilized to arrive at Land and Housing Assets valuation

Based on management projections provided by Banff

Range in land and housing values derived by adjusting discount rates

Low: 12%

Mid: 10%

High: 8%

NAV analysis does not include franchise value / future growth activities

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

7 Net Asset Value Analysis (cont’d)

NAV Summary and Comparison

Net Asset Value (1)

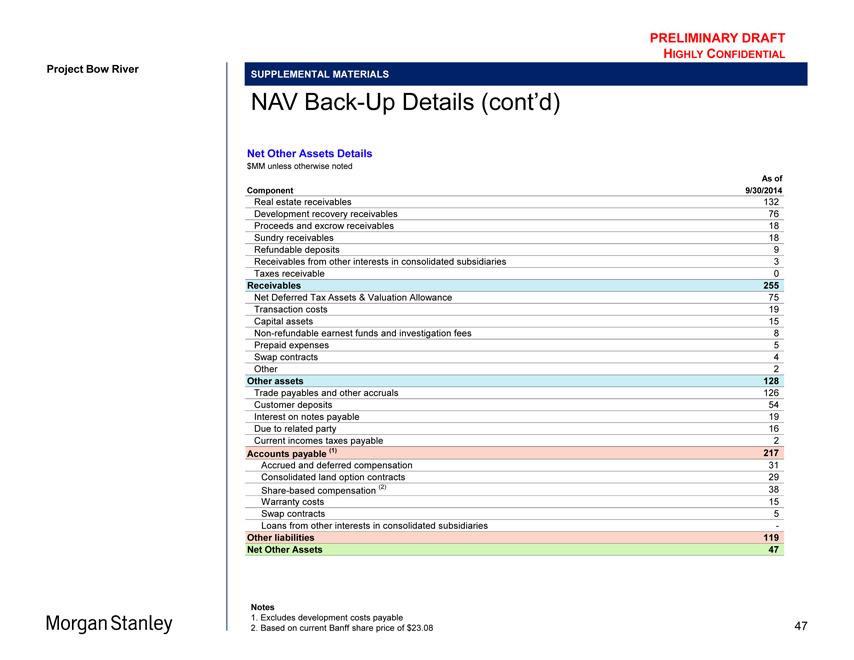

$MM unless otherwise noted

Component Low Mid High

Land and Housing Assets 3,535 3,809 4,154

(+) Cash and Cash Equivalents 164 164 164

(+) Net Other Assets (2) 47 47 47

(=) Gross Asset Value 3,746 4,021 4,365

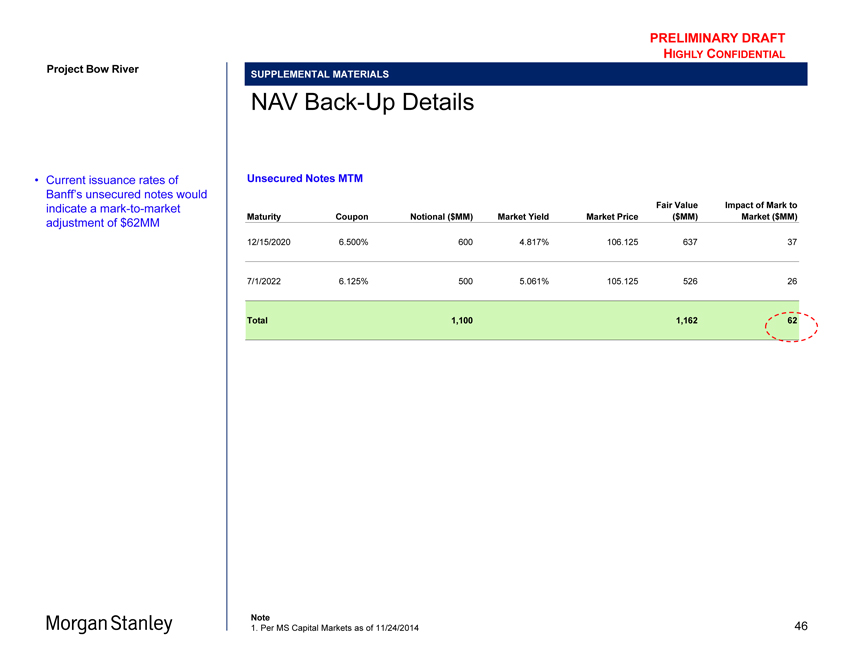

(-) Notes Payable(1,100)(1,100)(1,100)

(-) MTM (3)(62)(62)(62)

(-) Other Financings(258)(258)(258)

(-) Other Interests in Consolidated Subsidiaries(17)(17)(17)

(=) Net Asset Value (pre-tax) 2,308 2,583 2,927

( / ) Shares (MM)—Fully Diluted (4) 118 118 118

NAV per Share (pre tax) (5) $19.55 $21.88 $24.80

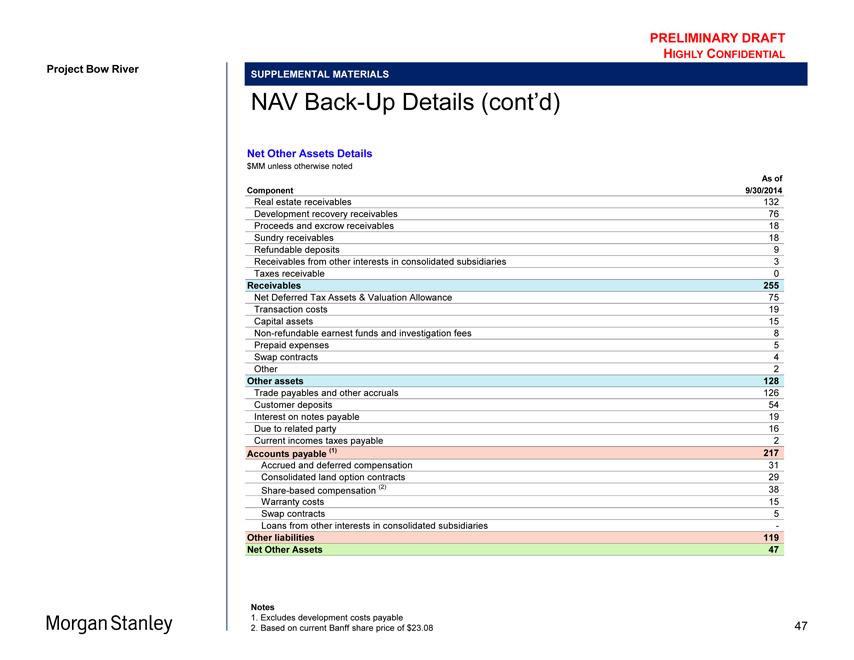

Source Company projections and filings

Notes

1. USDCAD spot rate of 1.1594 (Bank of Canada Noon rate as of 12/18/2014)

2. Net other assets include receivables, other assets including net deferred tax assets (inclusive of anticipated valuation allowance add-back of

~$25MM), payables and other liabilities, excluding development costs payable

3. Mark to market of unsecured notes estimates per Morgan Stanley’s Capital Markets desk

4. Common shares outstanding, escrowed stock not owned by company, and in-the-money stock options outstanding using Treasury Stock Method

5. NAV analysis does not include frictional costs that may be incurred in liquidation of assets such as transactional costs or tax leakage

36

Project Bow River

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

BANFF PRELIMINARY VALUATION

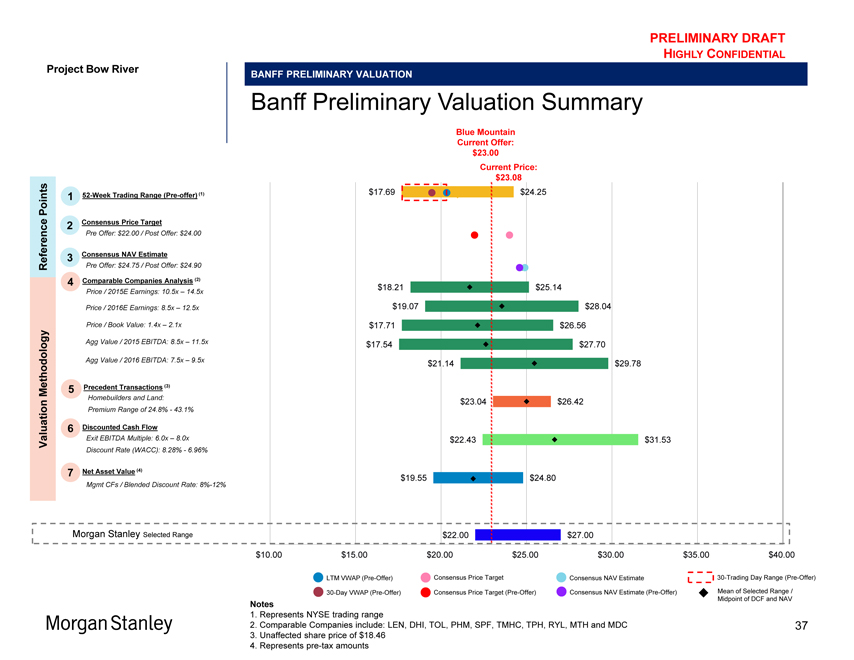

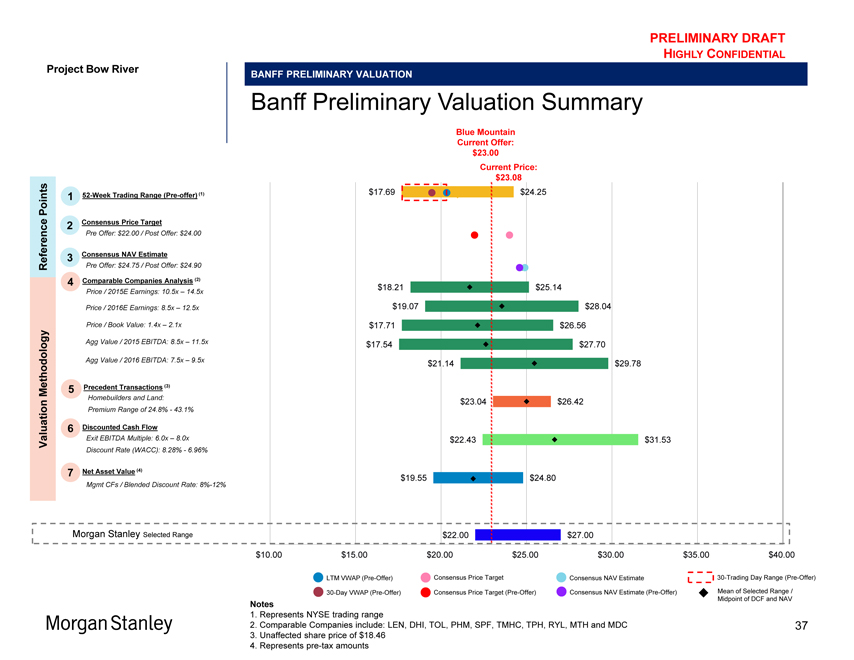

Banff Preliminary Valuation Summary

Blue Mountain

Current Offer:

$23.00

Current Price:

$23.08

Points 1 52-Week Trading Range (Pre-offer) (1) $17.69 $24.25

2 Consensus Price Target

rence Pre Offer: $ 22.00 / Post Offer: $24.00

3 Consensus NAV Estimate

Refe Pre Offer: $24.75 / Post Offer: $24.90

4 Comparable Companies Analysis (2)

Price / 2015E Earnings: 10.5x – 14.5x $18.21 $25.14

Price / 2016E Earnings: 8.5x – 12.5x $19.07 $28.04

Price / Book Value: 1.4x – 2.1x $17.71 $26.56

Agg Value / 2015 EBITDA: 8.5x – 11.5x $17.54 $27.70

Agg Value / 2016 EBITDA: 7.5x – 9.5x $21.14 $29.78

Methodology 5 Precedent Transactions (3)

Homebuilders and Land: $23.04 $26.42

on Premium Range of 24.8%—43.1%

6 Discounted Cash Flow

Valuati Exit EBITDA Multiple: 6.0x – 8.0x $22.43 $31.53

Discount Rate (WACC): 8.28%—6.96%

7 Net Asset Value (4)

$19.55 $24.80

Mgmt CFs / Blended Discount Rate: 8%-12%

Morgan Stanley Selected Range $22.00 $27.00

$10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00

LTM VWAP (Pre-Offer) Consensus Price Target Consensus NAV Estimate 30-Trading Day Range (Pre-Offer)

30-Day VWAP (Pre-Offer) Consensus Price Target (Pre-Offer) Consensus NAV Estimate (Pre-Offer) Mean of Selected Range /

Midpoint of DCF and NAV

Notes

1. Represents NYSE trading range

2. Comparable Companies include: LEN, DHI, TOL, PHM, SPF, TMHC, TPH, RYL, MTH and MDC

3. Unaffected share price of $18.46

4. Represents pre-tax amounts

37

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

Appendix A

Supplemental Materials

Reference materials included at the request of the Special Committee

Morgan Stanley

38

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

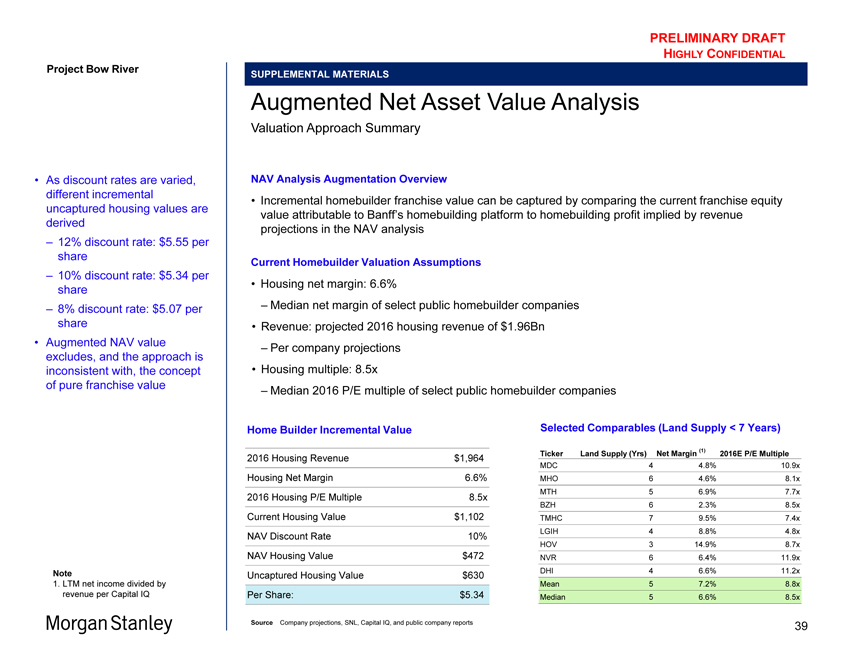

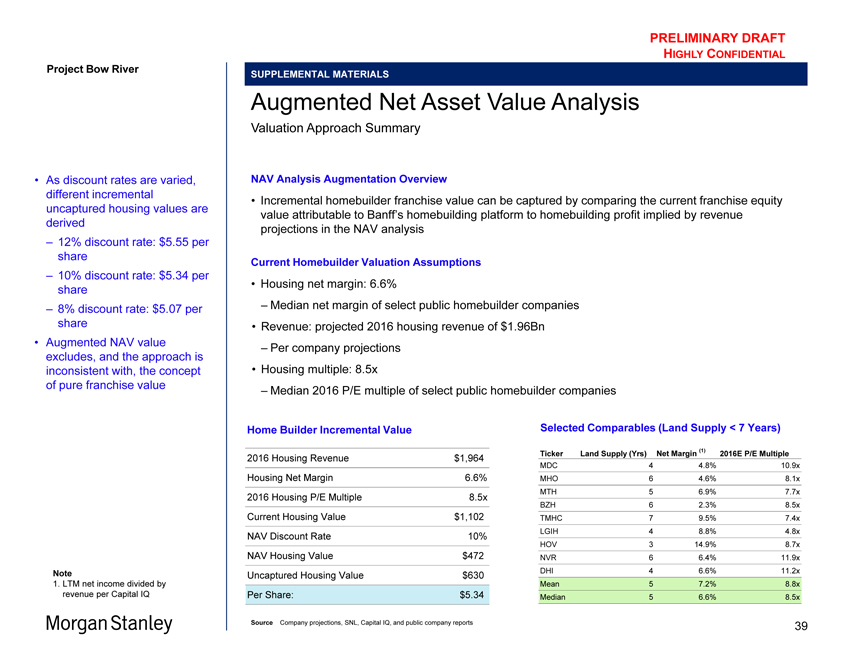

As discount rates are varied, different incremental uncaptured housing values are derived

– 12% discount rate: $5.55 per share

– 10% discount rate: $5.34 per share

– 8% discount rate: $5.07 per share

Augmented NAV value excludes, and the approach is inconsistent with, the concept of pure franchise value

SUPPLEMENTAL MATERIALS

Augmented Net Asset Value Analysis

Valuation Approach Summary

NAV Analysis Augmentation Overview

Incremental homebuilder franchise value can be captured by comparing the current franchise equity value attributable to Banff’s homebuilding platform to homebuilding profit implied by revenue projections in the NAV analysis

Current Homebuilder Valuation Assumptions

Housing net margin: 6.6%

– Median net margin of select public homebuilder companies

Revenue: projected 2016 housing revenue of $1.96Bn

– Per company projections

Housing multiple: 8.5x

– Median 2016 P/E multiple of select public homebuilder companies

Home Builder Incremental Value Selected Comparables (Land Supply < 7 Years)

2016 Housing Revenue $1,964 Ticker Land Supply (Yrs) Net Margin (1) 2016E P/E Multiple

MDC 4 4.8% 10.9x

Housing Net Margin 6.6% MHO 6 4.6% 8.1x MTH 5 6.9% 7.7x

2016 Housing P/E Multiple 8.5x BZH 6 2.3% 8.5x Current Housing Value $1,102 TMHC 7 9.5% 7.4x LGIH 4 8.8% 4.8x

NAV Discount Rate 10% HOV 3 14.9% 8.7x NAV Housing Value $472 NVR 6 6.4% 11.9x Uncaptured Housing Value $630 DHI 4 6.6% 11.2x Mean 5 7.2% 8.8x

Per Share: $5.34 Median 5 6.6% 8.5x

Source Company projections, SNL, Capital IQ, and public company reports

Note

1. LTM net income divided by revenue per Capital IQ

39

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

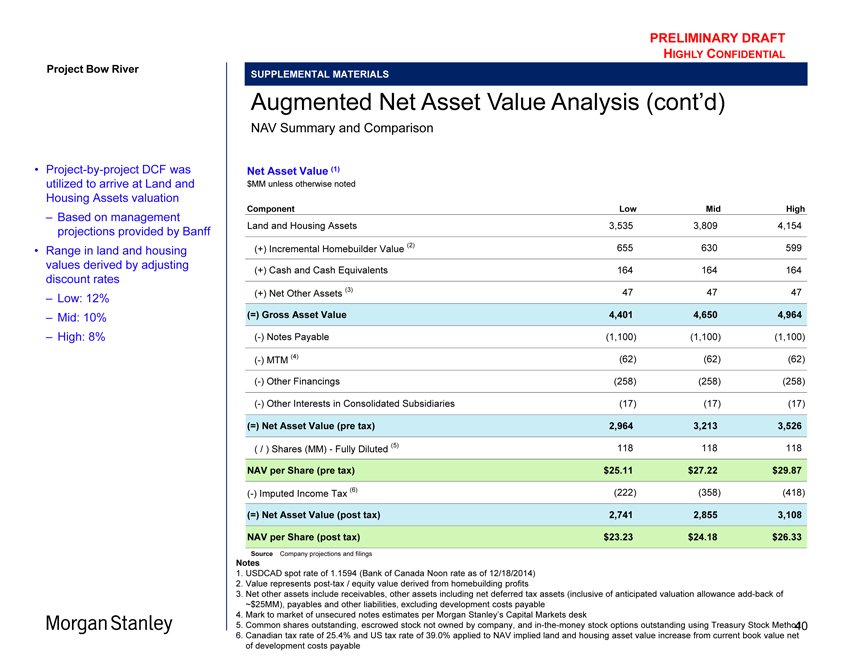

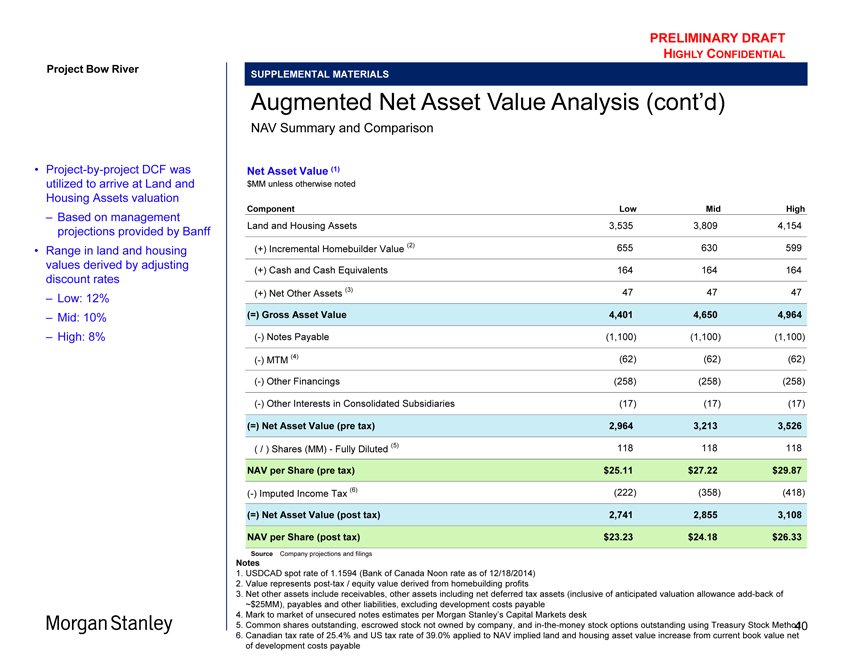

Project-by-project DCF was utilized to arrive at Land and Housing Assets valuation

Based on management projections provided by Banff

Range in land and housing values derived by adjusting discount rates

Low: 12%

Mid: 10%

High: 8%

HIGHLY CONFIDENTIAL

SUPPLEMENTAL MATERIALS

Augmented Net Asset Value Analysis (cont’d)

NAV Summary and Comparison

Net Asset Value (1)

$MM unless otherwise noted

Component Low Mid High

Land and Housing Assets 3,535 3,809 4,154

(+) Incremental Homebuilder Value (2) 655 630 599 (+) Cash and Cash Equivalents 164 164 164

(+) Net Other Assets (3) 47 47 47

(=) Gross Asset Value 4,401 4,650 4,964

(-) Notes Payable (1,100) (1,100) (1,100)

(-) MTM (4) (62) (62) (62) (-) Other Financings (258) (258) (258)

(-) Other Interests in Consolidated Subsidiaries (17) (17) (17)

(=) Net Asset Value (pre tax) 2,964 3,213 3,526

( / ) Shares (MM) - Fully Diluted (5) 118 118 118

NAV per Share (pre tax) $25.11 $27.22 $29.87

(-) Imputed Income Tax (6) (222) (358) (418)

(=) Net Asset Value (post tax) 2,741 2,855 3,108

NAV per Share (post tax) $23.23 $24.18 $26.33

Source Company projections and filings

Notes

1. USDCAD spot rate of 1.1594 (Bank of Canada Noon rate as of 12/18/2014)

2. Value represents post-tax / equity value derived from homebuilding profits

3. Net other assets include receivables, other assets including net deferred tax assets (inclusive of anticipated valuation allowance add-back of

~$25MM), payables and other liabilities, excluding development costs payable

4. Mark to market of unsecured notes estimates per Morgan Stanley’s Capital Markets desk

5. Common shares outstanding, escrowed stock not owned by company, and in-the-money stock options outstanding using Treasury Stock Method

6. Canadian tax rate of 25.4% and US tax rate of 39.0% applied to NAV implied land and housing asset value increase from current book value net of development costs payable

40

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

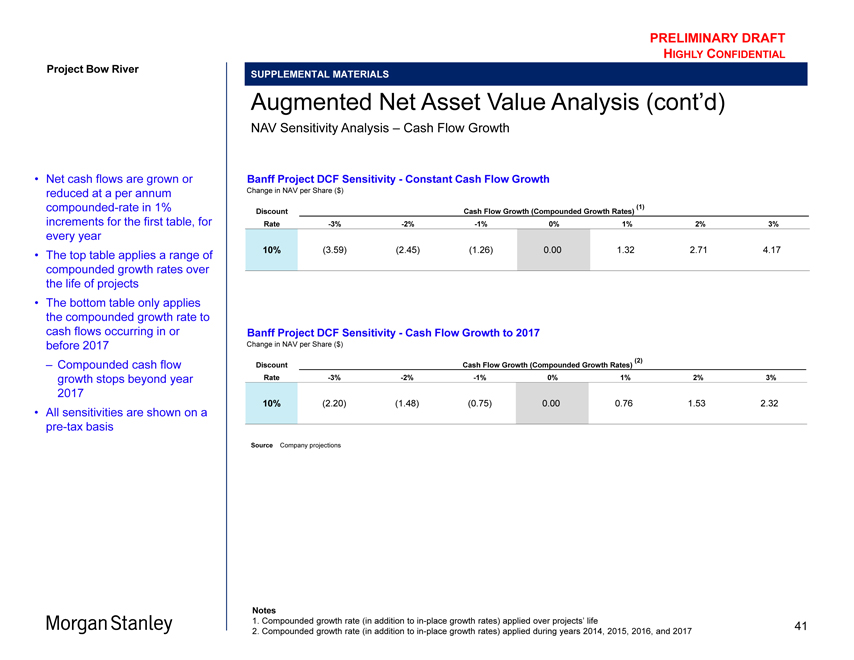

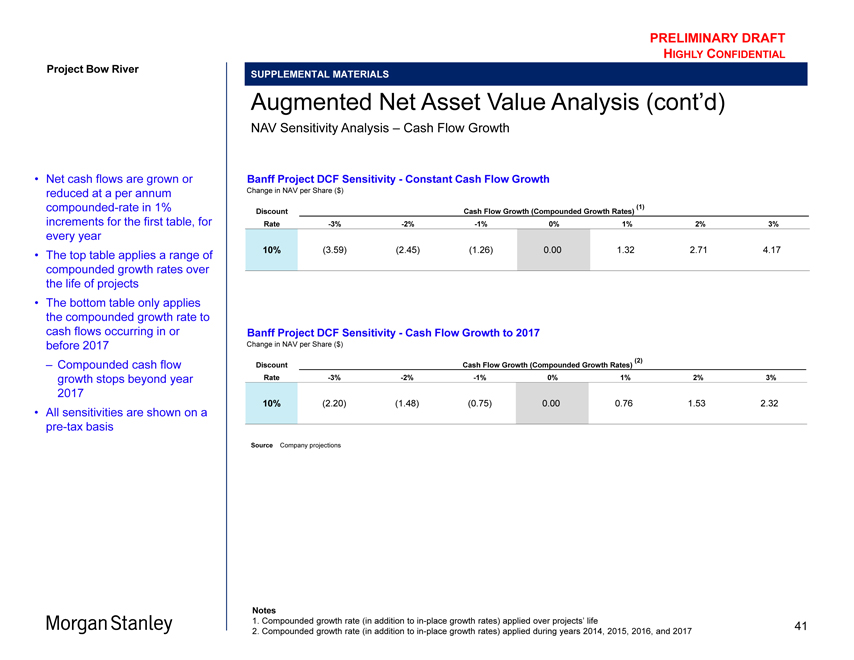

Net cash flows are grown or reduced at a per annum compounded-rate in 1% increments for the first table, for every year

The top table applies a range of compounded growth rates over the life of projects

The bottom table only applies the compounded growth rate to cash flows occurring in or before 2017

– Compounded cash flow growth stops beyond year 2017

All sensitivities are shown on a pre-tax basis

SUPPLEMENTAL MATERIALS

Augmented Net Asset Value Analysis (cont’d)

NAV Sensitivity Analysis – Cash Flow Growth

Banff Project DCF Sensitivity - Constant Cash Flow Growth

Change in NAV per Share ($)

(1)

Discount Cash Flow Growth (Compounded Growth Rates)

Rate -3% -2% -1% 0% 1% 2% 3%

10% (3.59) (2.45) (1.26) 0.00 1.32 2.71 4.17

Banff Project DCF Sensitivity - Cash Flow Growth to 2017

Change in NAV per Share ($)

(2)

Discount Cash Flow Growth (Compounded Growth Rates)

Rate -3% -2% -1% 0% 1% 2% 3%

10% (2.20) (1.48) (0.75) 0.00 0.76 1.53 2.32

Source Company projections

Notes

1. Compounded growth rate (in addition to in-place growth rates) applied over projects’ life

2. Compounded growth rate (in addition to in-place growth rates) applied during years 2014, 2015, 2016, and 2017

41

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

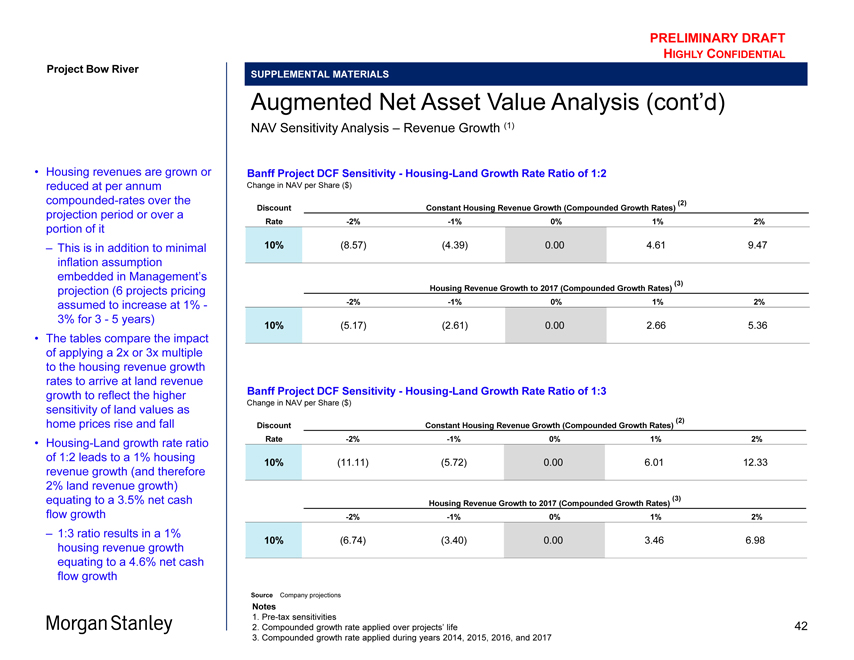

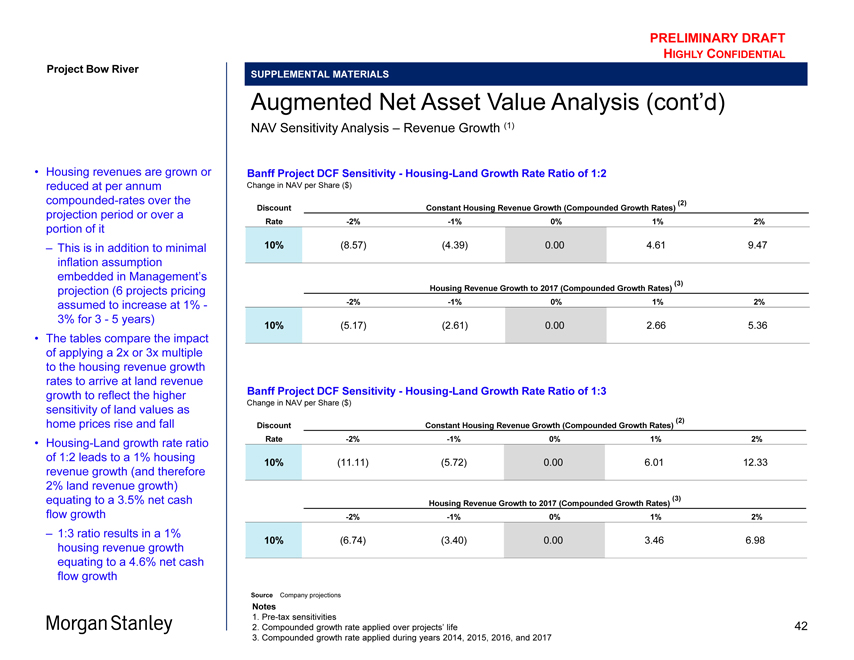

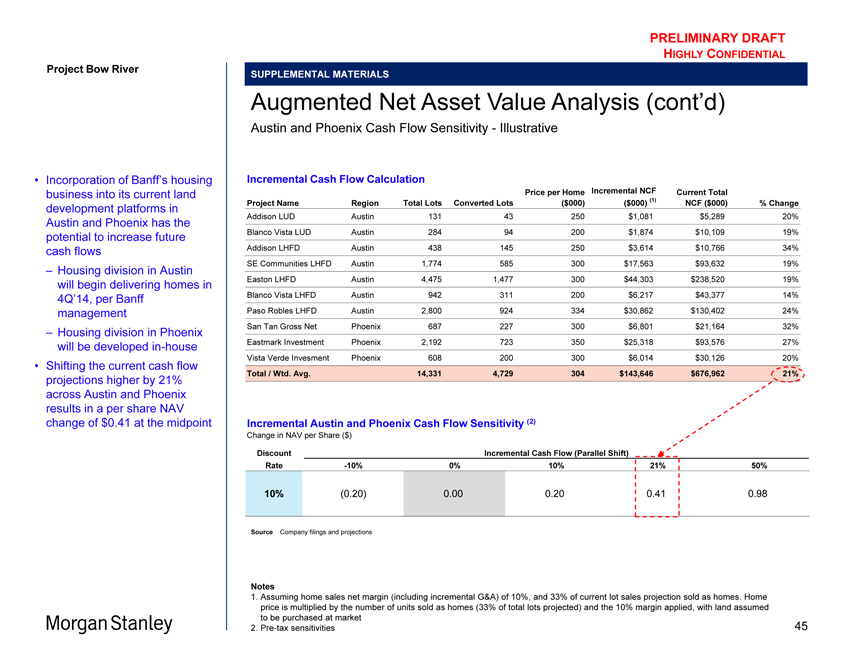

Housing revenues are grown or reduced at per annum compounded-rates over the projection period or over a portion of it This is in addition to minimal inflation assumption embedded in Management’s projection (6 projects pricing assumed to increase at 1% -3% for 3 - 5 years)

The tables compare the impact of applying a 2x or 3x multiple to the housing revenue growth rates to arrive at land revenue growth to reflect the higher sensitivity of land values as home prices rise and fall

Housing-Land growth rate ratio of 1:2 leads to a 1% housing revenue growth (and therefore 2% land revenue growth) equating to a 3.5% net cash flow growth

– 1:3 ratio results in a 1% housing revenue growth equating to a 4.6% net cash flow growth

SUPPLEMENTAL MATERIALS

Augmented Net Asset Value Analysis (cont’d)

NAV Sensitivity Analysis – Revenue Growth (1)

Banff Project DCF Sensitivity - Housing-Land Growth Rate Ratio of 1:2

Change in NAV per Share ($)

(2)

Discount Constant Housing Revenue Growth (Compounded Growth Rates)

Rate -2% -1% 0% 1% 2%

10% (8.57) (4.39) 0.00 4.61 9.47

(3)

Housing Revenue Growth to 2017 (Compounded Growth Rates)

-2% -1% 0% 1% 2%

10% (5.17) (2.61) 0.00 2.66 5.36

Banff Project DCF Sensitivity - Housing-Land Growth Rate Ratio of 1:3

Change in NAV per Share ($)

(2)

Discount Constant Housing Revenue Growth (Compounded Growth Rates)

Rate -2% -1% 0% 1% 2%

10% (11.11) (5.72) 0.00 6.01 12.33

(3)

Housing Revenue Growth to 2017 (Compounded Growth Rates)

-2% -1% 0% 1% 2%

10% (6.74) (3.40) 0.00 3.46 6.98

Source Company projections

Notes

1. Pre-tax sensitivities

2. Compounded growth rate applied over projects’ life

3. Compounded growth rate applied during years 2014, 2015, 2016, and 2017

42

PRELIMINARY DRAFT

HIGHLY CONFIDENTIAL

Project Bow River

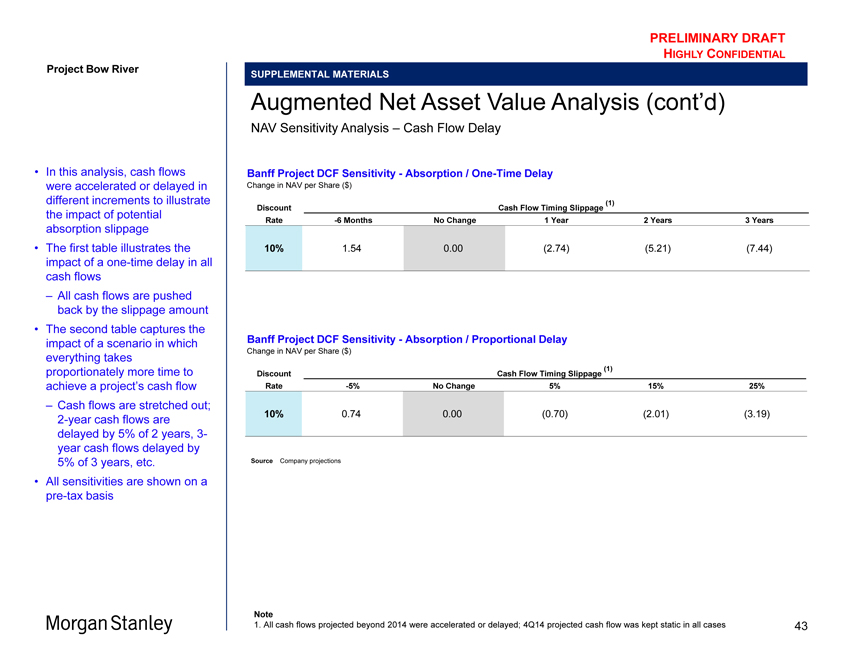

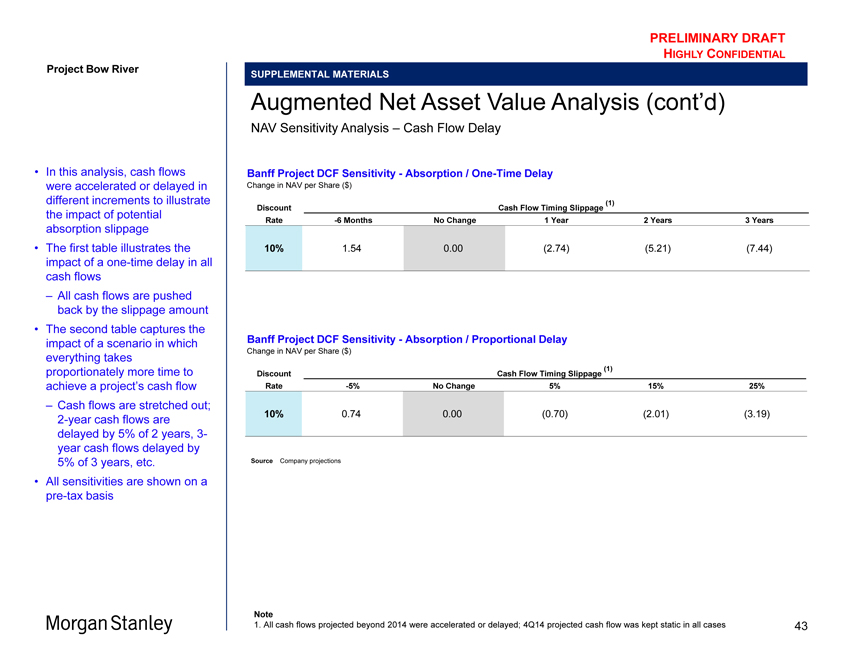

In this analysis, cash flows were accelerated or delayed in different increments to illustrate the impact of potential absorption slippage

The first table illustrates the impact of a one-time delay in all cash flows

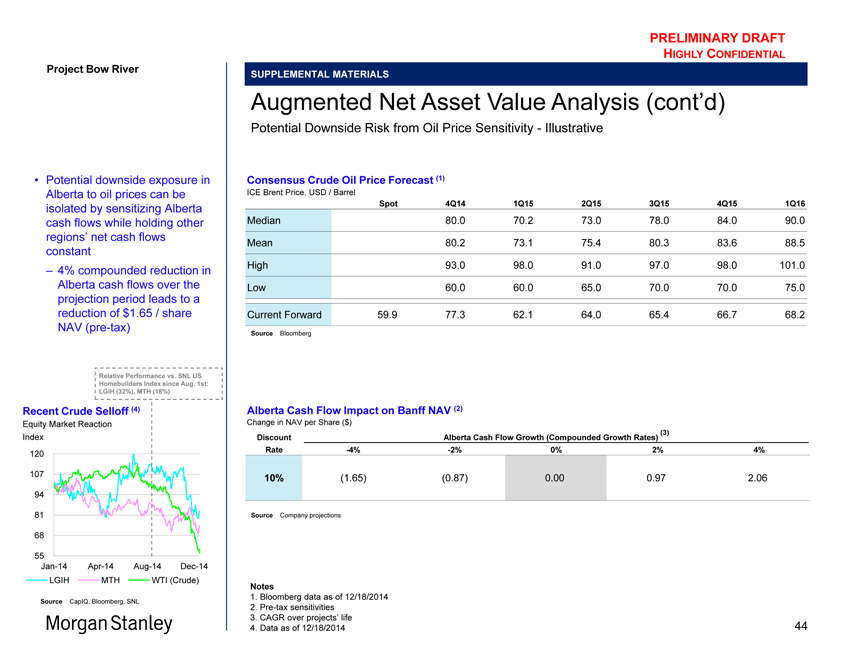

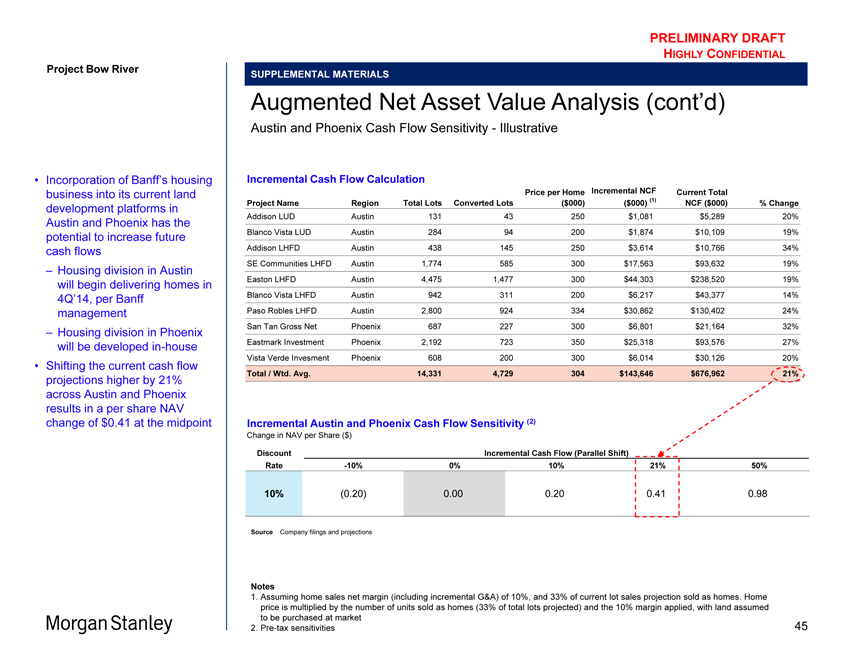

– All cash flows are pushed back by the slippage amount