standards of the NYSE and any other applicable laws, rules or regulations; a candidate’s experiences, qualifications, attributes or skills described above under “Information About Each Director’s and Nominee’s Experience, Qualifications, Attributes or Skills”; and personal and professional integrity, character, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate. Each Nominating and Corporate Governance Committee may consider whether a potential nominee’s professional experience, education, skills, and other individual qualities and attributes, including gender, race or national origin, would provide beneficial diversity of skills, experience or perspective to the Boards’ membership and collective attributes. Such considerations will vary based on the Boards’ existing membership and other factors, such as the strength of a potential nominee’s overall qualifications relative to diversity considerations. Each Nominating and Corporate Governance Committee will consider Director candidates recommended by shareholders and submitted in accordance with applicable law and procedures as described in this Joint Proxy Statement (see “Submission of Shareholder Proposals” below).

Other Board-Related Matters

Shareholders who wish to send communications to the relevant Fund’s Board should send them to the Secretary of the Apollo Senior Floating Rate Fund Inc. or the Apollo Tactical Income Fund Inc., as applicable, at 9 West 57th Street, New York, NY 10019. All such communications will be directed to the relevant Board’s attention.

The Funds do not have a formal policy regarding Director attendance at the annual meeting of shareholders. Each Director attended each Fund’s 2020 Annual Meeting of Shareholders.

Required Vote

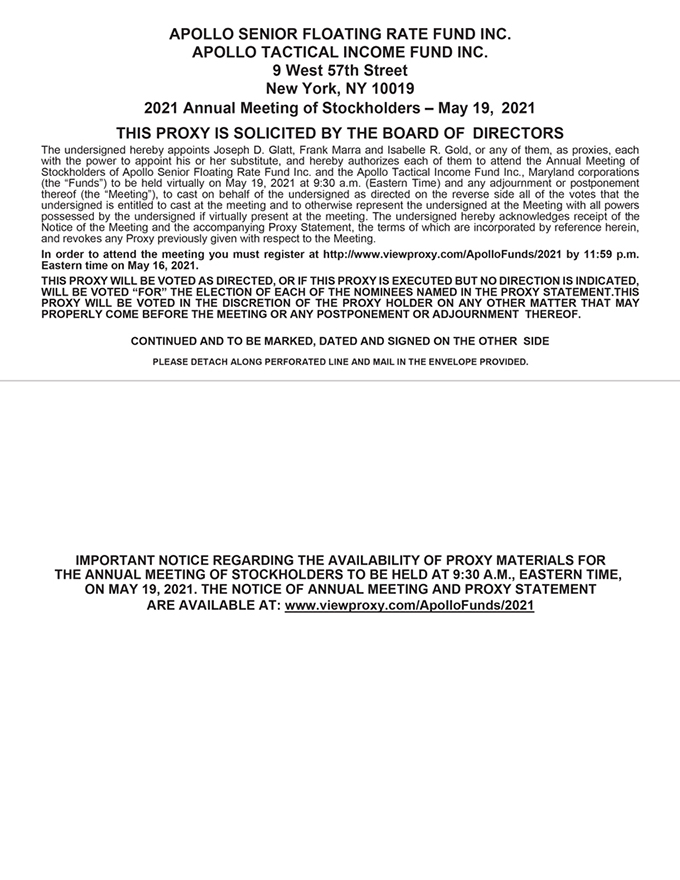

The election of each of Messrs. Cohen and Stein as a Director of the Funds requires the affirmative vote of a majority of the outstanding shares of each Fund’s Common Stock entitled to vote at the Meeting in person or by proxy. In person attendance constitutes attendance at the virtual Meeting via live webcast.

SUBMISSION OF SHAREHOLDER PROPOSALS

All proposals by shareholders of a Fund that are intended to be presented at the Funds’ next Annual Meeting of Shareholders to be held in 2022 must be received by the Fund for consideration for inclusion in the Funds’ proxy statement relating to the meeting no later than December 10, 2021 and must satisfy the requirements of federal securities laws.

The Bylaws of each Fund currently require shareholders wishing to nominate Directors or propose other business to be brought before the Funds’ 2022 Annual Meeting to provide timely notice of the proposal in writing to the Secretary of the Fund and, in the case of such other business, such other business must otherwise be a proper matter for action by the Fund’s shareholders. To be considered timely, any such notice must be delivered to the principal executive office of the Apollo Senior Floating Rate Fund Inc. or the Apollo Tactical Income Fund Inc. at 9 West 57th Street, New York, NY 10019 not earlier than November 10, 2021, nor later than 5:00 p.m., E.T., on December 10, 2021. Any such notice by a shareholder must set forth all information required by the relevant Fund’s Bylaws with respect to each nominee or other matter the shareholder proposes to bring before the annual meeting.

ADDITIONAL INFORMATION

Independent Registered Public Accounting Firm

Deloitte & Touche LLP (“Deloitte”), 30 Rockefeller Plaza, New York, NY 10112, has been selected to serve as the Funds’ independent registered public accounting firm for each Fund’s fiscal year ending December 31, 2021. A representative of Deloitte will be present at the Meeting where he or she will have the opportunity to make a statement, if the representative desires, and will be available to respond to appropriate questions.

13