UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22480

Adviser Managed Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esq.

SEI Investments Co.

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-610-676-1000

Date of fiscal year end: July 31, 2021

Date of reporting period: July 31, 2021

Item 1. Reports to Stockholders.

July 31, 2021 ANNUAL REPORT Adviser Managed Trust Tactical Offensive Equity Fund Tactical Offensive Core Fixed Income Fund Tactical Offensive Enhanced Fixed Income Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-PORT. The Trust’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended July 31, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS (Unaudited)

JULY 31, 2021

To Our Shareholders:

The fiscal year ending July 31, 2021, began with markets continuing their remarkable rally from the March 2020 lows. The “risk-on” sentiment came amid a push by local governments to slowly reverse lockdowns of non-essential economic activity; the promising news of progress made in the race to develop COVID-19 vaccines; and the sustained extraordinary support of central banks. U.S. equity markets eclipsed their pre-pandemic peaks early in the period and finished the fiscal year near all-time highs.

Central banks aggressively pursued accommodative monetary policy, asset purchase programs and record fiscal stimulus measures during the reporting period. In September, the millionth victim of the COVID-19 outbreak was claimed globally, a figure that would climb to over 4 million by the end of July. Cases had seemed to abate for a time during late-summer 2020, but then once again began to rise in the fall as variant strains were identified and met with another round of lockdowns in Europe and more sporadically in the U.S. Fears of yet another wave of outbreaks kept markets in a more cautious stance.

Markets advanced once it became clearer that former Vice President Joe Biden would become the next U.S. president in what would likely be a split government. Expectations of further, but less expansive, fiscal stimulus from Congress and a less likely reversal of the corporate tax cuts under the Trump administration fueled this appreciation. Investor exuberance kicked off in earnest in November after a series of positive vaccine clinical trial results; the enthusiasm was sustained by subsequent emergency use authorizations by the FDA.

Financial markets anticipated increased volatility around the U.S. presidential election, but with Joe Biden winning a close election for U.S. president and the announcement of effective vaccines thereafter, markets advanced higher and volatility declined. Despite no sign of the Federal Reserve tightening in the near term, the U.S. Treasury yield curve steepened over the course of the fiscal year, especially as future expectations for a rebound in economic growth increased along with rising inflation expectations; long-term yields rose more than shorter-term yields.

Government-bond yields (which had been rising slowly since the fall) began to spike further in February. The specter of a sharp increase in borrowing costs sent chills through markets during the second half of February, leading to selloffs of varying intensity before markets resumed their climb again in March.

The Federal Reserve’s (Fed) federal-funds rate target continued to range between 0.0% and 0.25%, and the Federal Open Market Committee (FOMC)—the Fed’s monetary policymakers—remained committed to purchasing Treasurys and agency mortgage-backed securities (MBS) to support the flow of credit to households and businesses. Fed Chair Jerome Powell pledged to continue supporting the economy via monetary policy during his semi-annual congressional testimony on July 14, 2021.

Equities continued to roll along, although work-from-home and mega-cap stocks gave up ground to cyclical and “go-out” names before a slight reversal over the final months of the period. Market observers attributed this to the FOMC deciding to increase its projection for the federal-funds rate in 2023. Meanwhile, for the first time since April this year, the seven-day moving average of new COVID-19 cases reported in the U.S. stopped falling in mid-June after an impressive period of declines that brought cases to their lowest levels since March 2020.

Geopolitical Events

In the U.S. general election in November, Joe Biden was declared the winner of the presidential race in early November. Most candidates from the Republican Party performed better in their races for state- and national-level offices compared to President Trump’s quest for a second term; in January, a violent security breach of the U.S. Capitol by a mob of protesters delayed—but did not stop—the counting of electoral votes in the U.S. Congress. Trump was impeached by the House of Representatives for inciting an insurrection—the first president in U.S. history to be impeached twice. Two weeks later, Joe Biden was inaugurated as president under heavy security provided by 25,000 National Guard troops.

President Joe Biden’s administration proposed a $6 trillion budget for the 2022 fiscal year that would serve as a starting point from which Congress can decide how to appropriate the country’s economic funding. The president incorporated his two major economic initiatives into the budget, infrastructure and families programs.

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 1 |

LETTER TO SHAREHOLDERS (Unaudited) (Continued)

JULY 31, 2021

At the end of July, the U.S. Senate voted to begin negotiations about a bipartisan infrastructure plan. Formally called the Infrastructure Investment and Jobs Act, the plan includes roughly $1 trillion with $550 billion in new spending over a five-year period. It is projected to add approximately two million jobs per year for a decade as the nation undertakes modernizing roads, railways, ports, public transit, airports and power grids; improving water quality and broadband access; and cleaning abandoned environmentally hazardous sites.

The United States-Mexico-Canada trade agreement was ratified by all three countries and officially replaced the North American Free Trade Agreement just prior to the start of the reporting period on July 1. The Trump administration announced in September that it would not pursue a 10% tariff on U.S. imports of Canadian aluminum previously announced in August, as trade is now expected to normalize following high import levels earlier in 2020. President Trump and France’s President Emmanuel Macron successfully walked back threats of tariffs that originated with French plans for a digital tax that would have targeted U.S.-based multi-national technology companies..

In a push to re-establish tourism ahead of the traditionally busy summer season, the EU approved a proposal made by the European Commission in May to ease travel restrictions within the bloc for vaccinated foreigners. Tensions between the EU and China—which have flared over the last six months as the EU condemned China’s record on human rights and China imposed retaliatory economic sanctions—remained unsettled. In May, the European Parliament suspended ratification of the Comprehensive Agreement on Investment that EU and Chinese leaders had finalized in December 2020. As for U.S.-EU trade relations, friction smoothed as the European Commission delayed an increase to tariffs on the U.S. that had been planned in response to the Trump administration’s tariffs on European metals; existing tariffs will remain as the two sides negotiate a long-term solution.

Toward the end of the period, finance ministers and central bank leaders from the Group of 20 (G-20), representing the world’s 20 largest economies, unanimously agreed to endorse the major components of a tax plan that would establish a global minimum corporate tax of at least 15%. Finalization of the plan requires approval from national leaders. In deference to this effort, EU officials postponed review of its digital levy proposal until autumn.

Economic Performance

U.S. gross domestic product (GDP) saw a record 33.4% rebound in the third quarter of 2020, fueled by over $3 trillion in pandemic relief. A 4.0% gain in the fourth quarter resulted in a decline of 3.5% for the full year, the worst figure since at least the end of World War II. The U.S. economy expanded at a robust annualized rate of 6.3% in the first quarter of 2021; consumer spending (which accounts for nearly 70% of U.S. economic activity) spiked by 11.3% as Americans put their stimulus payments to work, providing a much-needed boost to restaurants, hotels and airlines. Overall U.S. economic growth measured an annualized 6.5% during the second quarter, just above the first-quarter pace, as service-oriented businesses anticipated saw continued gains from the rise in vaccinations and re-openings.

After touching a 50-year low of 3.5% and then jumping as high as 14.8% prior to the start of the fiscal year, the U.S. unemployment rate remained over 6.0% through April, with the final figure settling at 5.4% in July 2021, down from 10.2% a year earlier. The labor-force participation rate ended at 61.7%, up from 61.5% a year earlier. Average hourly earnings gained 4.0% over the fiscal year, as the leisure and hospitality industry continued to reopen and looked to boost pay in order to fill vacant positions.

Two off-cycle moves before the start of the fiscal year brought the federal-funds rate to near zero and were designed to bolster the economy in response to the economic threat posed by the coronavirus outbreak; the emergency actions were the first since the global financial crisis. Additionally, the Fed committed to purchasing unlimited amounts of Treasurys and established or renewed multiple facilities designed to support the economy. The FOMC held the federal-funds rate near zero throughout the second quarter and continued its asset purchases apace ($80 billion in Treasurys and $40 billion in agency mortgage-backed securities per month). Its latest Summary of Economic Projections (SEP), released in mid-June, featured a projected increase in the federal-funds rate to 0.6% in 2023 (up from 0.1% in its March projection). The SEP also depicted significantly higher real gross domestic product (GDP) and inflation projections for 2021, although out-year projections were only modestly higher.

| | |

| 2 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

Market Developments

The S&P 500 Index returned 36.45% during the fiscal year. Large-cap value stocks (as measured by the Russell 1000® Value Index) edged out large-cap growth stocks (as measured by the Russell 1000® Growth Index). At the sector level, financials, industrials and capital goods stocks led, while utilities, healthcare, consumer staples and consumer discretionary lagged. Overall, U.S. equities outpaced major developed markets during the fiscal year.

Small-cap stocks, which tend to be value-oriented and sensitive to the success or decline in a local economy, outperformed large caps overall. U.S. large-cap stocks (Russell 1000® Index) finished the reporting period up 37.97%, while small-cap stocks (Russell 2000® Index) finished the period ahead 51.97%. The reason for this difference in performance was a shift in investor preference toward companies with smaller market caps and lower valuation ratios. These companies were viewed as able to benefit from the post-pandemic economic recovery and primed for a rebound following a prolonged period of prior underperformance.

Developed markets, as measured by the MSCI World Index (Net), finished up 35.07% for the year, outperforming emerging markets. The MSCI Emerging Markets Index (Net) finished the reporting period up 20.64% in U.S. dollar terms. Emerging-market equities were on a tear in the first half of the fiscal year (after bottoming early in the pandemic) but gave up some ground over the final few months. The best-performing region was EM Latin America, which was lifted by strong performance from Brazil and Mexico, both of which benefited from the shift in market appetite for cyclical sectors like materials. China was a relative benchmark laggard as government regulations weighed on social media and ecommerce equity prices.

The MSCI Europe Index (Net) advanced 32.50% in U.S. dollar terms. The MSCI ACWI Index (Net), a proxy for global equities in both developed and emerging markets, rose 33.18% in U.S. dollar terms. The FTSE UK Series All-Share Index recorded a 34.15% gain in U.S. dollar terms over the full reporting period.

U.S. investment-grade corporate debt, as represented by the Bloomberg Barclays US Corporate Investment Grade Index, returned 1.42%, while the U.S. high-yield market, as measured by the ICE BofA US High Yield Constrained Index, benefited from a broad reopening of the U.S. economy and was up 10.75% during the reporting period. Within the high-yield market, the energy sector outperformed the broader market during the period. Lower-quality issues also outperformed, as CCC rated securities led, followed by B and BB rated. U.S. asset-backed securities managed gains during the fiscal year, benefiting from improving supply-and-demand dynamics; mortgage-backed securities were close to flat, as elevated supply and fast prepayment speeds offset the Fed adding around $40 billion of MBS to its balance sheet each month.

Global fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, climbed 0.78%. Emerging-market debt (EMD) delivered positive performance due to an improving growth outlook in the region relative to developed markets. The J.P. Morgan Global Bond Index-Emerging Markets (GBI-EM) Global Diversified Index, which tracks local-currency-denominated EM bonds, gained 3.00% in U.S. dollar terms. The J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index, which tracks EMD denominated in external currencies (such as the U.S. dollar), was up 4.11%.

After the U.S. dollar initially rebounded from its January low (relative to a trade-weighted basket of foreign currencies), it resumed an overall downward trend and neared its earlier low again in May before recovering some as the fiscal year closed. After hitting an all-time low before the start of the reporting period, the West Texas Intermediate crude-oil price reached a 40-month high in the final month of the fiscal year due to optimistic forecasts for global economic growth and increased demand for crude.

Our View

Equity markets have long anticipated the economic improvement we are watching unfold. There is increasing concern, however, that equity prices have risen so much that there is little appreciation potential left, even if the global economy continues to forge ahead into 2022.

Since mid-June, we have witnessed a partial unwinding of the rotation trade (from expensive technology-oriented stay-at-home companies to less-expensive cyclically-oriented companies) that began last autumn. So far, this appears to us as a temporary pause in a longer-term upswing. The global recovery and expansion have a long way to go, especially since many countries are still imposing lockdown measures to varying degrees.

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 3 |

LETTER TO SHAREHOLDERS (Unaudited) (Continued)

JULY 31, 2021

We can’t rule out a choppier and more lackluster performance for U.S. equities in the months ahead given their strong outperformance since March 2009 and elevated stock-market valuations relative to much of the rest of the world. If stock-market volatility does increase, we don’t think there’s reason to be overly concerned; corrections that range from 5% to 10% can occur without any fundamental reason.

In today’s environment, with economies opening up around the globe and interest rates still at extraordinarily low levels, the dominant trend favors further price gains over the next year or two. Still, investors must take into account that the U.S. economy appears to have reached “peak growth.”

Growth slowdowns, not just recessions, can lead to equity underperformance versus bonds. The relative performance of equities versus bonds was phenomenal over the past 16 months; a major narrowing of the performance gap is inevitable. Yet, with interest rates still at exceptionally low levels, it is hard to see equities losing ground to fixed-income securities while economic growth remains robust. Not only should consumer demand remain strong as long as economies continue to reopen, but businesses have been in a spending mood—desperately seeking materials and workers.

In the meantime, companies are expected to enjoy a great deal of pricing power and will almost certainly pass along at least a portion of their increased costs to customers. Unfortunately, one person’s pricing power is another person’s inflation. The big question is whether the price pressures seen this year are transitory, as central bankers around the world say they are.

Investors in the bond market seem to agree with the central bankers. Although U.S. bond yields rose sharply in the first quarter, they have since fallen. There’s no telling how long bond investors will maintain such a calm perspective if inflation persists at a pace not seen in almost 30 years.

Fed Chairman Jerome Powell has continued to reiterate that the U.S. labor market has a long way to go before it reaches full employment. Job openings in the country are now soaring. If the rise in the Employment Cost Index accelerates as we expect, inflation could become a greater concern for investors.

The recent stumble in the rotation theme was exacerbated by the marginally hawkish shift in Fed expectations. It is clear, however, that the U.S. central bank intends to cautiously move away from its current policy stance. The first move will likely be the tapering of its bond-buying programme, which may be announced in late August at the annual Jackson Hole conference, with actual tapering beginning no earlier than the first quarter of 2022.

The path of U.S. fiscal policy is harder to decipher given strained bipartisanship and the narrowness of the Democratic majority in the Congress. A traditional infrastructure bill appears likely to get passed with bipartisan support, but the push for non-traditional forms of infrastructure—and the taxes to pay for all the added spending—will depend on whether the Democrats in the Senate can come to terms with each other.

The combination of above-average economic growth, significantly higher inflation than seen in the past decade, a fiscal policy that expands the size of federal government spending, and extreme monetary ease aimed at suppressing interest rates is the perfect backdrop for risk assets—and the creation of speculative bubbles.

The relative success of the U.S. vaccination effort and the country’s state-by-state response has resulted in a significantly stronger economy this year than in other major developed countries. Fortunately, injection rates have been accelerating in Europe and Japan. We anticipate other advanced economies will record strong economic results in the second half of the year and into 2022, exceeding the pace of growth in the U.S.

Although economists correctly point out that the U.S. has employed direct fiscal measures (emergency spending, income support and tax breaks) more aggressively than any other nation, other countries have used different tactics that far exceed the U.S. effort.

Several European nations and Japan have relied on equity injections, loans and guarantees. Italy (35% of gross domestic product), Japan and Germany (both at 28%) are the most notable, according to the International Monetary Fund. In the eurozone, some of these loan commitments have only just begun to flow. Italy and Spain are big beneficiaries of the eurozone’s €750 billion in loans and grants as part of the so-called NextGenerationEU program.

The ECB also seems dedicated to maintaining its pandemic-related monetary support at least through March 2022. As a percentage of gross domestic product (GDP), the ECB’s balance sheet has risen more than 25% since the

| | |

| 4 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

beginning of the COVID-19 crisis, more than any other major central bank besides the BOJ (30%). The ECB’s actions have succeeded in keeping peripheral Europe’s sovereign bond yields well behaved through the crisis period.

While the U.S., the U.K. and Canada seem to be enduring a much sharper inflationary increase than Japan or the eurozone, the latter two are probably relieved to have a respite from the deflationary pressures that have afflicted their economies for many years. There seems little reason for the ECB or BOJ to join the Fed when it comes to discussing a near-term reduction in asset purchases, much less raising their policy rates ahead of the U.S.

We do not see much sign that the Fed’s shift toward an earlier lift-off in rates will lead to a 2013-style “taper tantrum” among emerging economies. A strong U.S. dollar would certainly threaten the bull market in commodity prices.

While we are still bullish on the outlook for commodities, we are watching price trends carefully. Commodity prices of all types have enjoyed a spectacular run since March 2020 and were already in the process of consolidating or correcting in the weeks before the Fed revised its views.

We remain optimistic that the more cyclical and value-oriented areas within emerging markets will bounce back from their recent stumble. But there are near-term challenges besides the shift in perceptions about Fed policy and the future course of the U.S. dollar and commodity prices. Credit growth has decelerated significantly in China, similar to the slowdowns recorded in 2013 and 2018—years when the performance of emerging markets was less than stellar.

Another potential source of market volatility could stem from the increasingly fraught relationship between China and the U.S. and its allies. If there is any consensus in Washington nowadays, it is focused on countering China’s growing economic and military strength; although market participants have mostly managed to look past political tensions to date.

Fundamentally, emerging markets continue to look relatively cheap versus most other regions. The forward price-to-earnings multiple of the MSCI Emerging Markets Index is still selling at a 36.4% discount to that of the MSCI USA Index. Outside the March-to-April 2020 low point, this is as cheap a relative multiple against the U.S. as seen at any time in the past 16 years.

We are counting on advanced economies to take up the slack while vaccines ramp up in developing countries. There has been a tremendous amount of excess savings and pent-up demand in North America and Europe. That said, as we’ve witnessed with the surge in new cases driven by the Delta variant, the possibility of regional spikes cannot be dismissed. If severe enough, markets could switch back to a decidedly risk-off position.

As vaccination rates slow in the developed world, more shots are becoming available to the rest of the world. We expect a rolling reopening of the global economy that will extend well into 2022. This wave of recovery could resemble a prolonged up-cycle that keeps the pressure on supply chains, leading to continued shortages of goods and labor. Investor faith in the “transitory inflation” narrative probably will be tested as we head into year end and enter 2022.

Sincerely,

|

| James Smigiel |

|

| Chief Investment Officer |

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 5 |

LETTER TO SHAREHOLDERS (Unaudited) (Concluded)

JULY 31, 2021

Index Definitions

Bloomberg Global Aggregate Index: is a broad-based benchmark that is considered representative of global investment-grade, fixed-income markets.

Bloomberg US Corporate Investment Grade Index: is a broad-based benchmark that measures the investment-grade, fixed-rate, taxable corporate bond market.

Bloomberg US Aggregate Bond Index: The Bloomberg Barclays U.S. Aggregate Bond Index is a benchmark index composed of U.S. securities in Treasury, government-related, corporate and securitized sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity and have an outstanding par value of at least $250 million.

Dow Jones Industrial Average: The Index measures the stock performance of 30 large companies listed on stock exchanges in the United States.

FTSE UK Series All-Share Index: is a capitalization-weighted index, comprising around 600 of more than 2,000 companies traded on the London Stock Exchange.

ICE BofA US High Yield Constrained Index: tracks the performance of below-investment-grade, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market; exposure to individual issuers is capped at 2%.

JP Morgan EMBI Global Diversified Index: tracks the performance of external debt instruments (including U.S.-dollar-denominated and other external-currency-denominated Brady bonds, loans, eurobonds and local-market instruments) in emerging markets.

JP Morgan GBI-EM Global Diversified Composite Index: tracks the performance of debt instruments issued in local currencies by emerging-market governments.

MSCI Europe Index: is a free float-adjusted market-capitalization-weighted index designed to measure the performance of large- and mid-capitalization stocks across developed-market countries in Europe.

MSCI Emerging Markets Index: is a free float-adjusted market-capitalization-weighted index designed to measure the performance of global emerging-market equities.

MSCI World Index: is a free float-adjusted market-capitalization-weighted index that is designed to measure the equity-market performance of developed markets. The Index consists of 24 developed-market country indexes.

Russell 1000® Index: includes 1,000 of the largest U.S. stocks based on market cap and current index membership; it is used to measure the activity of the U.S. large-cap equity market.

Russell 2000® Index: The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index.

S&P 500 Index: is an unmanaged, market-weighted index that consists of 500 of the largest publicly-traded U.S. companies and is considered representative of the broad U.S. stock market.

| | |

| 6 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE (Unaudited)

JULY 31, 2021

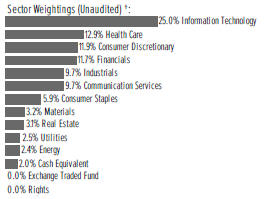

Tactical Offensive Equity Fund

I. Objective

The investment objective of the Tactical Offensive Equity Fund (the “Fund”) is capital appreciation.

II. Adviser Managed Strategy Component

Only persons who are clients of the Financial Adviser (as defined below) and who participate in the Adviser Managed Strategy should invest in the Fund. The Fund may not be purchased by any other investor. The Fund is designed to be a component of a broader strategy employed by a third party investment manager (Financial Adviser) for the benefit of its clients. The Financial Adviser seeks to take advantage of broad market changes by tactically shifting its clients’ assets among the Fund, the Tactical Offensive Core Fixed Income Fund, Tactical Offensive Enhanced Fixed Income Fund and a money market fund affiliated with the Fund, depending on the Financial Adviser’s evaluation of current market conditions (Adviser Managed Strategy). The Financial Adviser is not the adviser to the Fund and is not affiliated with SEI Investments Management Corporation (SIMC), the adviser to the Fund.

When the Financial Adviser determines to reallocate its clients’ assets to one or more of the other funds that compose the Adviser Managed Strategy, the Financial Adviser may request the redemption of a substantial portion of or all of the shares for which the Financial Adviser exercises investment discretion. In such an instance, the Financial Adviser’s notice of its intent to redeem or formal redemption request (collectively, “Redemption Request”) will cause the Fund to liquidate a substantial portion of or substantially all of its assets in order to fulfill the Redemption Request. If the Financial Adviser’s Redemption Request includes all of the shares for which it exercises investment discretion, the Fund will no longer be an active component of the Adviser Managed Strategy. When the Fund is not an active component of the Adviser Managed Strategy, the Fund may invest up to 100% of its remaining assets in cash, money market instruments, repurchase agreements and other short-term obligations pending the Financial Adviser’s formal redemption request; and exchange-traded funds (ETFs) that are designed to track the performance of the broad U.S. equity market. The Fund could be invested in these types of investments for extended periods of time. At such times, SIMC will manage the assets of the Fund. SIMC, the Financial Adviser or one or more of their affiliates will be the only investors in the Fund following the Financial Adviser’s redemption of all of its clients’ shares from the Fund. Due

to this strategy, the Fund may buy and sell securities and other instruments frequently.

III. Investment Approach

When the Fund is an active component of the Adviser Managed Strategy, the Fund employs a passive strategy designed to track, before fees and expenses, the performance of one or more indexes that represent broad exposure to the U.S. equity market and issuers located in developed and emerging-market countries outside the U.S. (each an Index, and collectively, the Indexes). The passive strategy is implemented by SSGA Funds Management, Inc., as sub-advisor under the general supervision of SIMC. SIMC may adjust the Fund’s allocation of assets among the Indexes over time on the basis of its long-term capital market assumptions.

IV. Return vs. Benchmark

For the full year ended July 31, 2021, the Fund returned 36.45%. The Fund’s benchmark, the S&P 500 Index—which measures the performance of 500 of the largest U.S. companies and is considered representative of the broad U.S. equity market—returned 36.45%.

V. Performance Discussion

The Fund was an active part of the Adviser Managed Strategy for the full period from August 1, 2020, to July 31, 2021. While the benchmark of the Fund generally tracks large-cap U.S. equities, the Fund also seeks passive exposure to U.S. small caps, as well as stocks in developed- and emerging-market countries. During this period, the Fund’s allocation to U.S. small- and mid-cap stocks allowed it to match the S&P 500 Index.

U.S. large-cap stocks (as represented by the Russell 1000® Index) returned 37.97% during the fiscal year, which was slightly greater than the S&P 500 Index return during the same period. The reason for this was the strong performance of mid-cap stocks within the benchmark, which returned 42.58% (as represented by the Russell Midcap Index). Most of those stocks were not in the Fund’s S&P 500 Index benchmark, so the allocation to them was accretive to relative performance over the period.

The Fund’s exposure to small-cap stocks was beneficial during the period. Small caps (as represented by the Russell 2000® Index) returned 51.97% during the fiscal year, which was the greatest return out of all the market segments in which the Fund was invested. As noted in the shareholder letter, the reason for this strong performance was a shift in investor preference toward companies with smaller market caps and lower valuation

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 7 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE (Unaudited)

JULY 31, 2021

Tactical Offensive Equity Fund (Concluded)

ratios. These companies were viewed as able to benefit from the post-pandemic economic recovery and primed for a rebound following a prolonged period of underperformance.

The passive exposure to developed-market stocks outside the U.S. slightly detracted during the period, as the MSCI EAFE Index returned 30.31% during the fiscal year. Developed-market international stocks performed well at the end of 2020 due to their low valuations and initial signs of a strong economic recovery in Europe; however, they underperformed over the second half of the period. While the MSCI EAFE Index still had a positive return during this time frame, it underperformed the U.S. indexes as the recovery in Europe was hurt by new restrictions intended to combat the recent resurgence in COVID-19 cases within the region.

The Fund’s exposure to emerging-market equities was a headwind to performance, with these stocks (as represented by the MSCI Emerging Markets Index) returning 20.64% during the fiscal year. The primary reason for this was the underperformance of Asian and Latin American countries within the Index, as these regions were hit the hardest by the onset of new COVID-19 variants. This hampered their ability to participate in the recovery from the pandemic, and with vaccine distribution also being more challenging in those countries, many investors elected to shift their allocations to regions with greater short- and medium-term economic prospects.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

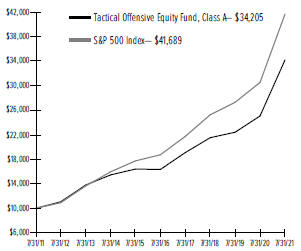

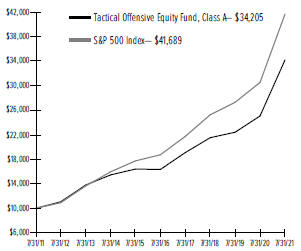

AVERAGE ANNUAL TOTAL RETURN1

| | | | | | | | | | | | | | | | | | | | |

| | | One Year Return | | | Annualized 3-Year Return | | | Annualized 5-Year Return | | | Annualized 10-Year Return | | | Annualized Inception to Date | |

| Tactical Offensive Equity Fund, Class A | | | 36.45% | | | | 16.68%4,5 | | | | 15.93%4,5 | | | | 13.09%2,3,4,5 | | | | 12.30%2,3,4,5 | |

| S&P 500 Index | | | 36.45% | | | | 18.16% | | | | 17.35% | | | | 15.35% | | | | 14.51% | |

Comparison of Change in the Value of a $10,000 Investment in the Tactical Offensive Equity Fund, Class A, versus the S&P 500 Index.

| 1 | For the year ended July 31, 2021. Past performance is no indication of future performance. Prior to October 1, 2014, the Fund’s investment approach was an “active” investment strategy where an investment manager would buy and sell securities based on its own economic, financial, and market analysis. On October 1, 2014, SIMC implemented a “passive” investment strategy which seeks to track an index return. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Shares of the Fund were offered beginning February 25, 2011. |

| 2 | The Fund was not an active component of the Adviser Managed Strategy for the period of August 6, 2011 through January 25, 2012. |

| 3 | The Fund was not an active component of the Adviser Managed Strategy for the period of August 28, 2015 through April 14, 2016. |

| 4 | The Fund was not an active component of the Adviser Managed Strategy for the period of December 18, 2018 through March 24, 2019. |

| 5 | The Fund was not an active component of the Adviser Managed Strategy for the period of March 10, 2020 through June 3, 2020. |

| | |

| 8 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE (Unaudited)

JULY 31, 2021

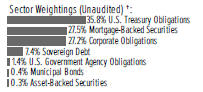

Tactical Offensive Core Fixed Income Fund

I. Objective

The investment objective of the Tactical Offensive Core Fixed Income Fund (the “Fund”) is total return.

II. Adviser Managed Strategy Component

Only persons who are clients of the Financial Adviser (as defined below) and who participate in the Adviser Managed Strategy should invest in the Fund. The Fund may not be purchased by any other investor. The Fund is designed to be a component of a broader strategy employed by a third party investment manager (Financial Adviser) for the benefit of its clients. The Financial Adviser seeks to take advantage of broad market changes by tactically shifting its clients’ assets among the Fund, the Tactical Offensive Equity Fund, the Tactical Offensive Enhanced Fixed Income Fund and a money market fund affiliated with the Fund, depending on the Financial Adviser’s evaluation of current market conditions (Adviser Managed Strategy). The Financial Adviser is not the adviser to the Fund and is not affiliated with SEI Investments Management Corporation (SIMC), the adviser to the Fund.

When the Financial Adviser determines to reallocate its clients’ assets to one or more of the other funds that compose the Adviser Managed Strategy, the Financial Adviser may request the redemption of a substantial portion of or all of the shares for which the Financial Adviser exercises investment discretion. In such an instance, the Financial Adviser’s notice of its intent to redeem or formal redemption request (collectively, “Redemption Request”) will cause the Fund to liquidate a substantial portion of or substantially all of its assets in order to fulfil the Redemption Request. If the Financial Adviser’s Redemption Request includes all of the shares for which it exercises investment discretion, the Fund will no longer be an active component of the Adviser Managed Strategy. When the Fund is not an active component of the Adviser Managed Strategy, the Fund may invest up to 100% of its remaining assets in cash, money market instruments, repurchase agreements and other short-term obligations that would not ordinarily be consistent with the Fund’s investment goal. The Fund could be invested in these types of investments for extended periods of time. At such times, SIMC will manage the assets of the Fund. SIMC, the Financial Adviser or one or more of their affiliates will be the only investors in the Fund following the Financial Adviser’s redemption of all of its clients’ shares from the Fund. Due to this strategy, the Fund may buy and sell securities and other instruments frequently.

III. Investment Approach

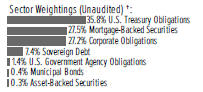

When the Fund is an active component of the Adviser Managed Strategy, the Fund employs a passive strategy designed to track, before fees and expenses, the performance of one or more U.S. Investment Grade Indexes (each an Index, and collectively, the Indexes) implemented by SSGA Funds Management, Inc., as sub-advisor under the general supervision of SEI Investments Management Corporation (SIMC). In addition, SIMC directly manages a portion of the Fund’s assets to invest in a portfolio of securities designed to track, before fees and expenses, the performance of one or more Foreign Sovereign Debt Indexes. Prior to a change in the Fund’s allocation and investment strategy during the reporting period, SSGA also implemented a strategy designed to track, before fees and expenses, the performance of High Yield and Emerging Market Fixed Income Indexes. SIMC may adjust the Fund’s allocation of assets among the Indexes over time on the basis of its long-term capital market assumptions.

IV. Return vs. Benchmark

For the full year ended July 31, 2021, the Fund returned -1.13%. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index—which measures the performance of intermediate-term investment-grade bonds traded in the U.S.—returned -0.70%.

V. Performance Discussion

The Fund was an active part of the Adviser Managed Strategy for the full period from August 1, 2020, to July 31, 2021.

The Fund sought passive exposure to U.S. investment-grade fixed income—primarily a diversified mix of U.S. dollar-denominated fixed-income securities, which included U.S. government, corporate and securitized assets—that was in line with the Fund’s benchmark. The Fund’s passive exposure to G7 ex-U.S. debt, however, contributed to performance, as developed-market sovereign debt outperformed U.S. investment-grade debt. The U.S. investment-grade bond market (as represented by the Bloomberg Barclays US Aggregate Bond Index), generated a -0.70% return as U.S. Treasury yields rose on higher inflation expectations due to accommodative monetary policy, sizable fiscal stimulus and a fuller reopening of the U.S. economy. Spread sectors continued to outperform Treasurys. Early in the period, lending facilities launched by the Federal Reserve (Fed) provided support for both the corporate and securitized markets. Spreads continued to grind tighter during 2021 as the pace of vaccination improved

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 9 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE (Unaudited)

JULY 31, 2021

Tactical Offensive Core Fixed Income Fund (Concluded)

and the U.S. economy moved toward a broader reopening following health-related economic lockdowns in response to COVID-19. As noted in the shareholder letter, the Treasury curve steepened during the fiscal year; the Fed remained committed to a zero interest-rate policy, while longer-term rates rose significantly in the first quarter of 2021 as investors became increasingly concerned with the prospects of higher inflation, before yields declined again over the final three months of the period. The Fed also maintained the pace of its asset-purchase program, providing support for Treasury and agency mortgage-backed securities markets. Developed-market foreign sovereign bonds (as represented by the Bloomberg Barclays Global Aggregate ex-USD Index (Hedged)) outperformed investment-grade, U.S. dollar-denominated bonds (as represented by the Bloomberg Barclays US Aggregate Bond Index); foreign countries were slower to come out of health-related lockdowns and bonds in those countries generally rose less than similar bonds in the U.S.

The Tactical Offensive Enhanced Fixed Income Fund was launched in January and was funded from the Tactical Offensive Core Fixed Income Fund. The significant outgoing cash flows to the Tactical Offensive Enhanced Fixed Income Fund led to increased transaction costs for the Tactical Offensive Core Fixed Income Fund and detracted from its performance. Although over the course of a typical fiscal year, there will generally be some performance drag due to normal cash flows, this outflow led to the more notable performance deviation.

The Fund used foreign-exchange currency forwards to hedge currency exposure to sovereign bonds. The associated derivatives did not have a material impact on overall Fund performance.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

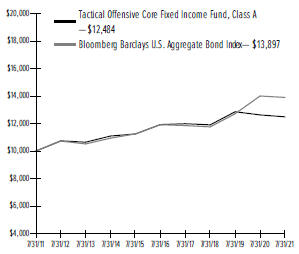

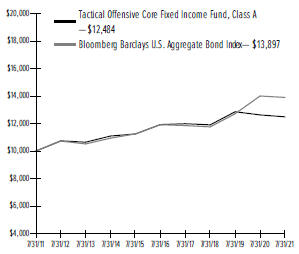

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN1 | | | | | |

| | | One Year Return | | | Annualized 3-Year Return | | | Annualized 5-Year Return | | | Annualized 10-Year Return | | | Annualized Inception to Date | |

| Tactical Offensive Core Fixed Income Fund, Class A ‡ | | | (1.13)% | | | | 1.60%2 | | | | 0.92%2 | | | | 2.24%2 | | | | 2.47%2 | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | (0.70)% | | | | 5.73% | | | | 3.13% | | | | 3.35% | | | | 3.61% | |

Comparison of Change in the Value of a $10,000 Investment in the Tactical Offensive Core Fixed Income Fund, Class A, versus the Bloomberg Barclays U.S. Aggregate Bond Index.

| 1 | For the year ended July 31, 2021. Past performance is no indication of future performance. Prior to October 1, 2014, the Fund’s investment approach was an “active” investment strategy where an investment manager would buy and sell securities based on its own economic, financial, and market analysis. On October 1, 2014, SIMC implemented a “passive” investment strategy which seeks to track an index return. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Shares of the Fund were offered beginning February 25, 2011. |

| 2 | The Fund was not an active component of the Adviser Managed Strategy for the period of March 19, 2020 through June 16, 2020. |

| ‡ | Prior to March 20, 2020, the Fund also materially invested in non-investment grade fixed income securities and fixed income securities of issuers located in emerging markets as part of its principal investment strategies. |

| | |

| 10 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE (Unaudited)

JULY 31, 2021

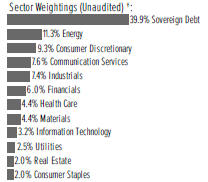

Tactical Offensive Enhanced Fixed Income Fund

I. Objective

The investment objective of the Tactical Offensive Enhanced Fixed Income Fund (the “Fund”) is total return.

II. Adviser Managed Strategy Component

Only persons who are clients of the Financial Adviser (as defined below) and who participate in the Adviser Managed Strategy should invest in the Fund. The Fund may not be purchased by any other investor. The Fund is designed to be a component of a broader strategy employed by a third party investment manager (Financial Adviser) for the benefit of its clients. The Financial Adviser seeks to take advantage of broad market changes by tactically shifting its clients’ assets among the Fund, the Tactical Offensive Equity Fund, the Tactical Offensive Core Fixed Income Fund and a money market fund affiliated with the Fund, depending on the Financial Adviser’s evaluation of current market conditions (Adviser Managed Strategy). The Financial Adviser is not the adviser to the Fund and is not affiliated with SEI Investments Management Corporation (SIMC), the adviser to the Fund.

When the Financial Adviser determines to reallocate its clients’ assets to one or more of the other funds that compose the Adviser Managed Strategy, the Financial Adviser may request the redemption of a substantial portion of or all of the shares for which the Financial Adviser exercises investment discretion. In such an instance, the Financial Adviser’s notice of its intent to redeem or formal redemption request (collectively, “Redemption Request”) will cause the Fund to liquidate a substantial portion of or substantially all of its assets in order to fulfill the Redemption Request. If the Financial Adviser’s Redemption Request includes all of the shares for which it exercises investment discretion, the Fund will no longer be an active component of the Adviser Managed Strategy. When the Fund is not an active component of the Adviser Managed Strategy, the Fund may invest up to 100% of its remaining assets in cash, money market instruments, repurchase agreements and other short-term obligations that would not ordinarily be consistent with the Fund’s investment goal. The Fund could be invested in these types of investments for extended periods of time. At such times, SIMC will manage the assets of the Fund. SIMC, the Financial Adviser or one or more of their affiliates will be the only investors in the Fund following the Financial Adviser’s redemption of all of its clients’ shares from the Fund. Due to this strategy, the Fund may buy and sell securities and other instruments frequently.

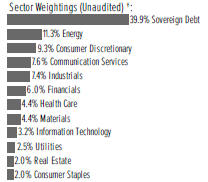

III. Investment Approach

When the Fund is an active component of the Adviser Managed Strategy, the Fund employs a passive strategy designed to track, before fees and expenses, the performance of one or more indexes that represent broad exposure to non-investment grade fixed income securities and issuers located in emerging market countries (each an Index, and collectively, the Indexes) implemented by SSGA Funds Management, Inc., as sub-advisor under the general supervision of SEI Investments Management Corporation (SIMC). SIMC may adjust the Fund’s allocation of assets among the Indexes over time on the basis of its long-term capital market assumptions.

IV. Return vs. Benchmark

The Fund was incepted on January 12, 2021. For the period ended July 31, 2021, the Fund returned 2.29%. The Fund’s benchmark, the ICE BofA US High Yield Constrained Index—which measures performance of below-investment grade, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market—returned 3.97%.

V. Performance Discussion

The Fund was an active part of the Adviser Managed Strategy from its inception on January 12, 2021, through the end of its fiscal year on July 31, 2021. The Fund sought passive exposure to U.S. high-yield securities (as represented by the ICE BofA US High Yield Constrained Index) and dollar-denominated emerging-market debt (EMD) securities (as represented by the JPM EMBI Global Diversified Index). The Fund also experienced tracking error against the above mentioned indexes to which it seeks passive exposures. This was due to the implementation costs associated with reinvesting into the market over the course of the period. On a relative basis, the high-yield market outperformed dollar-denominated EMD during the Fund’s reporting period. Throughout the year, high-yield securities rallied as credit spreads continued to tighten and yields declined to record lows. As noted in the shareholder letter, the high-yield market benefited from a broader reopening of the U.S. economy; higher nominal yields relative to the rest of the U.S. bond market, as well as strong demand, also helped. Additionally, inflationary pressures and the reopening of the economy helped to push energy prices higher, providing support for the energy sub-sector. While dollar-denominated EMD underperformed high-yield securities from the Fund’s inception through the end of the period, absolute returns were still positive. The pace of vaccination within emerging-market

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 11 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE (Unaudited)

JULY 31, 2021

Tactical Offensive Enhanced Fixed Income Fund (Concluded)

countries lagged that of the developed world where the vaccine was more readily available. The rebound in China was beneficial for EMD, with first-quarter 2021 GDP increasing over 18% and growth moving above pre-pandemic levels. Additionally, with the uptick in growth and increasing prospect of inflation, several emerging-market central banks began the process of gradually raising rates, with Ukraine, Mexico and Russia each hiking during the period, while others indicated future rate hikes were probable.

Investing is subject to risk, including the possible loss of principal. Past performance is no indication of future results.

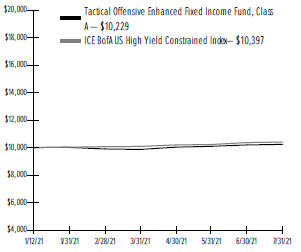

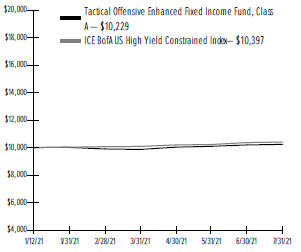

| | |

AVERAGE ANNUAL TOTAL RETURN1 |

| | | Cumulative Inception to Date |

Tactical Offensive Enhanced Fixed Income Fund, Class A | | 2.29% |

ICE BofA US High Yield Constrained Index | | 3.97% |

Comparison of Change in the Value of a $10,000 Investment in the Tactical Offensive Enhanced Fixed Income Fund, Class A, versus the ICE BofA US High Yield Constrained Index.

| 1 | For the period ended July 31, 2021. Past performance is no indication of future performance. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Shares of the Fund were offered beginning January 12, 2021. |

| | |

| 12 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

SUMMARY SCHEDULE OF INVESTMENTS

July 31, 2021

Tactical Offensive Equity Fund

†Percentages are based on total investments.

| | | | | | | | | | |

| | | | |

Description | | Percentage of Net Assets (%) | | Shares | | | Market Value ($ Thousands) |

| | |

COMMON STOCK — 90.5% | | | | | | | | |

| | |

Australia — 0.9% | | | | | | | | |

Other Securities ‡ | | 0.9% | | | | | | $ | 22,964 | |

| | | | | | | | | | |

| | |

Austria — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 584 | |

| | | | | | | | | | |

| | |

Belgium — 0.1% | | | | | | | | |

Other Securities | | 0.1 | | | | | | | 3,067 | |

| | | | | | | | | | |

| | | |

China — 0.0% | | | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 102 | |

| | | | | | | | | | |

| | |

Denmark — 0.3% | | | | | | | | |

Other Securities | | 0.3 | | | | | | | 8,687 | |

| | | | | | | | | | |

| | |

Finland — 0.1% | | | | | | | | |

Other Securities | | 0.1 | | | | | | | 3,628 | |

| | | | | | | | | | |

| | |

France — 1.3% | | | | | | | | |

Other Securities ‡ | | 1.3 | | | | | | | 35,997 | |

| | | | | | | | | | |

| | |

Germany — 1.1% | | | | | | | | |

Other Securities | | 1.1 | | | | | | | 28,478 | |

| | | | | | | | | | |

| | |

Greece — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | — | |

| | | | | | | | | | |

| | |

Hong Kong — 0.4% | | | | | | | | |

Other Securities ‡ | | 0.4 | | | | | | | 9,799 | |

| | | | | | | | | | |

| | |

Ireland — 0.7% | | | | | | | | |

Accenture PLC, Cl A | | 0.4 | | | 32,147 | | | | 10,212 | |

Other Securities | | 0.3 | | | | | | | 7,376 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 17,588 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

Description | | Percentage of Net Assets (%) | | Shares | | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

| | |

Israel — 0.1% | | | | | | | | |

Other Securities | | 0.1% | | | | | | $ | 2,747 | |

| | | | | | | | | | |

| | |

Italy — 0.3% | | | | | | | | |

Other Securities | | 0.3 | | | | | | | 7,556 | |

| | | | | | | | | | |

| | |

Japan — 2.7% | | | | | | | | |

Other Securities ‡ | | 2.7 | | | | | | | 74,036 | |

| | | | | | | | | | |

| | |

Luxembourg — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 98 | |

| | | | | | | | | | |

| | |

Netherlands — 0.9% | | | | | | | | |

Other Securities ‡ | | 0.9 | | | | | | | 24,259 | |

| | | | | | | | | | |

| | |

New Zealand — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 761 | |

| | | | | | | | | | |

| | |

Norway — 0.1% | | | | | | | | |

Other Securities | | 0.1 | | | | | | | 2,020 | |

| | | | | | | | | | |

| | |

Panama — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 128 | |

| | | | | | | | | | |

| | |

Portugal — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 613 | |

| | | | | | | | | | |

| | |

Singapore — 0.1% | | | | | | | | |

Other Securities ‡ | | 0.1 | | | | | | | 3,729 | |

| | | | | | | | | | |

| | |

South Korea — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 1 | |

| | | | | | | | | | |

| | |

Spain — 0.3% | | | | | | | | |

Other Securities | | 0.3 | | | | | | | 7,834 | |

| | | | | | | | | | |

| | |

Sweden — 0.5% | | | | | | | | |

Other Securities | | 0.5 | | | | | | | 12,751 | |

| | | | | | | | | | |

| | |

Switzerland — 1.2% | | | | | | | | |

Other Securities | | 1.2 | | | | | | | 32,897 | |

| | | | | | | | | | |

| | |

Taiwan — 0.0% | | | | | | | | |

Other Securities | | 0.0 | | | | | | | 83 | |

| | | | | | | | | | |

| | |

United Kingdom — 1.6% | | | | | | | | |

Other Securities ‡ | | 1.6 | | | | | | | 41,982 | |

| | | | | | | | | | |

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 13 |

SUMMARY SCHEDULE OF INVESTMENTS

July 31, 2021

Tactical Offensive Equity Fund (Continued)

| | | | | | | | | | |

| | | | |

Description | | Percentage of Net Assets (%) | | Shares | | | Market Value ($ Thousands) |

COMMON STOCK (continued) | | | | | | | | |

| | |

United States — 77.8% | | | | | | | | |

| | |

Communication Services — 8.4% | | | | | | | | |

Alphabet Inc, Cl A * | | 1.5% | | | 15,188 | | | $ | 40,924 | |

Alphabet Inc, Cl C * | | 1.5 | | | 14,359 | | | | 38,833 | |

AT&T Inc | | 0.4 | | | 361,066 | | | | 10,128 | |

Comcast Corp, Cl A | | 0.5 | | | 230,600 | | | | 13,566 | |

Facebook Inc, Cl A * | | 1.6 | | | 121,106 | | | | 43,150 | |

Netflix Inc * | | 0.4 | | | 21,900 | | | | 11,335 | |

Verizon Communications Inc | | 0.4 | | | 209,480 | | | | 11,685 | |

Walt Disney Co/The * | | 0.6 | | | 91,800 | | | | 16,159 | |

Other Securities | | 1.5 | | | | | | | 40,714 | |

| | | | | | | | | | |

| | | | | | | | | 226,494 | |

| | | | | | | | | | |

| | |

Consumer Discretionary — 9.5% | | | | | | | | |

Amazon.com Inc * | | 2.7 | | | 21,991 | | | | 73,177 | |

Home Depot | | 0.7 | | | 54,330 | | | | 17,831 | |

McDonald’s | | 0.4 | | | 37,747 | | | | 9,162 | |

NIKE Inc, Cl B | | 0.4 | | | 62,605 | | | | 10,487 | |

Tesla Inc * | | 1.0 | | | 39,190 | | | | 26,931 | |

Other Securities | | 4.3 | | | | | | | 119,140 | |

| | | | | | | | | | |

| | | | | | | | | 256,728 | |

| | | | | | | | | | |

| | |

Consumer Staples — 4.3% | | | | | | | | |

Coca-Cola | | 0.4 | | | 196,226 | | | | 11,191 | |

Costco Wholesale Corp | | 0.4 | | | 22,317 | | | | 9,590 | |

PepsiCo Inc | | 0.4 | | | 69,814 | | | | 10,957 | |

Philip Morris International | | 0.3 | | | 78,700 | | | | 7,877 | |

Procter & Gamble Co/The | | 0.7 | | | 123,124 | | | | 17,512 | |

Walmart Inc | | 0.4 | | | 72,531 | | | | 10,339 | |

Other Securities | | 1.7 | | | | | | | 49,500 | |

| | | | | | | | | | |

| | | | | | | | | 116,966 | |

| | | | | | | | | | |

| | |

Energy — 1.9% | | | | | | | | |

Chevron Corp | | 0.4 | | | 97,834 | | | | 9,961 | |

Exxon Mobil Corp | | 0.5 | | | 214,072 | | | | 12,324 | |

Other Securities | | 1.0 | | | | | | | 29,137 | |

| | | | | | | | | | |

| | | | | | | | | 51,422 | |

| | | | | | | | | | |

| | |

Financials — 8.7% | | | | | | | | |

Bank of America Corp | | 0.5 | | | 381,300 | | | | 14,627 | |

Berkshire Hathaway Inc, Cl B * | | 1.0 | | | 94,809 | | | | 26,384 | |

JPMorgan Chase & Co | | 0.9 | | | 152,070 | | | | 23,081 | |

Wells Fargo & Co | | 0.4 | | | 209,100 | | | | 9,606 | |

Other Securities ‡(A) | | 5.9 | | | | | | | 162,679 | |

| | | | | | | | | | |

| | | | | | | | | 236,377 | |

| | | | | | | | | | |

| | |

Health Care — 10.4% | | | | | | | | |

Abbott Laboratories | | 0.4 | | | 87,800 | | | | 10,622 | |

AbbVie Inc | | 0.4 | | | 89,300 | | | | 10,386 | |

Danaher Corp | | 0.4 | | | 32,164 | | | | 9,568 | |

Eli Lilly | | 0.4 | | | 42,800 | | | | 10,422 | |

Johnson & Johnson | | 0.8 | | | 133,223 | | | | 22,941 | |

| | | | | | | | | | | | |

| | | | |

Description | | Percentage of Net Assets (%) | | Shares | | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | | |

| | |

Health Care (continued) | | | | | | | | | |

Medtronic PLC | | | 0.3 | % | | | 67,800 | | | $ | 8,903 | |

Merck & Co Inc | | | 0.4 | | | | 128,000 | | | | 9,839 | |

Pfizer Inc | | | 0.4 | | | | 282,167 | | | | 12,079 | |

Thermo Fisher Scientific | | | 0.4 | | | | 19,879 | | | | 10,735 | |

UnitedHealth Group Inc | | | 0.7 | | | | 47,561 | | | | 19,606 | |

Other Securities | | | 5.8 | | | | | | | | 156,750 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 281,851 | |

| | | | | | | | | | | | |

| | |

Industrials — 6.9% | | | | | | | | | |

Honeywell International Inc | | | 0.3 | | | | 35,100 | | | | 8,206 | |

Other Securities | | | 6.6 | | | | | | | | 178,802 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 187,008 | |

| | | | | | | | | | | | |

| | |

Information Technology — 21.4% | | | | | | | | | |

Adobe Inc * | | | 0.6 | | | | 24,107 | | | | 14,986 | |

Apple | | | 4.3 | | | | 795,164 | | | | 115,983 | |

Broadcom Inc | | | 0.4 | | | | 20,256 | | | | 9,832 | |

Cisco Systems Inc | | | 0.5 | | | | 213,647 | | | | 11,830 | |

Intel Corp | | | 0.4 | | | | 204,325 | | | | 10,976 | |

Mastercard Inc, Cl A | | | 0.6 | | | | 44,230 | | | | 17,070 | |

Microsoft Corp | | | 4.0 | | | | 381,692 | | | | 108,748 | |

NVIDIA Corp | | | 0.9 | | | | 120,800 | | | | 23,555 | |

PayPal Holdings * | | | 0.6 | | | | 59,451 | | | | 16,381 | |

QUALCOMM Inc | | | 0.3 | | | | 57,004 | | | | 8,539 | |

salesforce.com Inc * | | | 0.4 | | | | 46,743 | | | | 11,309 | |

Texas Instruments Inc | | | 0.3 | | | | 46,700 | | | | 8,902 | |

Visa Inc, Cl A | | | 0.8 | | | | 85,620 | | | | 21,096 | |

Other Securities | | | 7.3 | | | | | | | | 200,433 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 579,640 | |

| | | | | | | | | | | | |

| | |

Materials — 1.9% | | | | | | | | | |

Other Securities | | | 1.9 | | | | | | | | 50,341 | |

| | | | | | | | | | | | |

| | |

Real Estate — 2.5% | | | | | | | | | |

Other Securities ‡ | | | 2.5 | | | | | | | | 67,811 | |

| | | | | | | | | | | | |

| | |

Utilities — 1.9% | | | | | | | | | |

Other Securities | | | 1.9 | | | | | | | | 50,867 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 2,105,505 | |

| | | | | | | | | | | | |

| | |

Total Common Stock

(Cost $1,831,900) ($ Thousands) | | | | | | | | 2,447,894 | |

| | | | | | | | | | | | |

| | |

| 14 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

| | | | | | | | | | | | |

| | | | |

Description | | Percentage of Net Assets (%) | | Shares | | | Market Value ($ Thousands) |

| | |

PREFERRED STOCK — 0.1% | | | | | | | | | |

| | |

Germany — 0.1% | | | | | | | | | |

Other Securities (B) | | | 0.1 | % | | | | | | $ | 2,005 | |

| | | | | | | | | |

| | |

Total Preferred Stock

(Cost $1,431) ($ Thousands) | | | | | | | | 2,005 | |

| | | | | | | | | |

| |

EXCHANGE TRADED FUND — 0.0% | | | | | |

Other Securities | | | 0.0 | | | | | | | | 330 | |

| | | | | | | | | |

| | |

Total Exchange Traded Fund

(Cost $100) ($ Thousands) | | | | | | | | 330 | |

| | | | | | | | | |

| | |

RIGHTS — 0.0% | | | | | | | | | |

| | |

United States — 0.0% | | | | | | | | | |

Other Securities (C) | | | 0.0 | | | | | | | | — | |

| | | | | | | | | |

| | |

Total Rights

(Cost $–) ($ Thousands) | | | | | | | | — | |

| | | | | | | | | |

| | |

CASH EQUIVALENT — 1.9% | | | | | | | | | |

SEI Daily Income Trust,

Government Fund, Cl F

0.010% **† | | | 1.9 | | | | 50,776,582 | | | | 50,777 | |

| | | | | | | | | |

| | |

Total Cash Equivalent

(Cost $50,777) ($ Thousands) | | | | | | | | 50,777 | |

| | | | | | | | | |

| |

Total Investments in Securities — 92.5%

(Cost $1,884,208)($ Thousands) | | | $ | 2,501,006 | |

| | | | | | | | | |

A list of the open futures contracts held by the Fund at July 31, 2021, is as follows:

| | | | | | | | | | | | | | | | | | | | |

| |

| Type of Contract | | Number of Contracts | | | Expiration Date | | | Notional Amount (Thousands) | | | Value (Thousands) | | | Unrealized Appreciation/ (Depreciation) (Thousands) | |

| |

Long Contracts | | | | | | | | | | | | | | | | | | | | |

MSCI EAFE Index | | | 115 | | | | Sep-2021 | | | $ | 13,391 | | | $ | 13,337 | | | $ | (54) | |

MSCI Emerging Markets | | | 1,335 | | | | Sep-2021 | | | | 91,500 | | | | 85,286 | | | | (6,214) | |

NASDAQ 100 Index E-MINI | | | 8 | | | | Sep-2021 | | | | 2,248 | | | | 2,393 | | | | 145 | |

Russell 2000 Index E-MINI | | | 802 | | | | Sep-2021 | | | | 93,059 | | | | 89,086 | | | | (3,973) | |

S&P 500 Index E-MINI | | | 280 | | | | Sep-2021 | | | | 59,158 | | | | 61,453 | | | | 2,295 | |

S&P Mid Cap 400 Index E-MINI | | | 11 | | | | Sep-2021 | | | | 2,961 | | | | 2,969 | | | | 8 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | 262,317 | | | $ | 254,524 | | | $ | (7,793) | |

| | | | | | | | | | | | | | | | | | | | |

For the year ended July 31, 2021, the total amount of all open futures contracts, as presented in the table above, are representative of the volume of activity for this derivative type during the period.

| | Percentages are based on a Net Assets of $2,704,616 ($ Thousands). |

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust. |

| ** | The rate reported is the 7-day effective yield as of July 31, 2021. |

| † | Investment in Affiliated Security (see Note 6). |

| (A) | Security is a Master Limited Partnership. At July 31, 2021, such securities amounted to $4,232 ($ Thousands), or 0.2% of Net Assets (See Note 2). |

| (B) | There is currently no rate available. |

| (C) | Level 3 security in accordance with fair value hierarchy. |

Cl — Class

EAFE — Europe, Australasia and Far East

MSCI — Morgan Stanley Capital International

NASDAQ — National Association of Securities Dealers and Automated Quotations

PLC — Public Limited Company

S&P— Standard & Poor’s

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 15 |

SUMMARY SCHEDULE OF INVESTMENTS

July 31, 2021

Tactical Offensive Equity Fund (Concluded)

The following is a list of the level of inputs used as of July 31, 2021, in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| | | | | | | | | | | | | | | | |

| | | | | |

Investments in Securities | | Level 1 ($) | | Level 2 ($) | | Level 3 ($)(1) | | Total ($) |

Common Stock | | | 2,447,839 | | | | 55 | | | | – | | | | 2,447,894 | |

Preferred Stock | | | 2,005 | | | | – | | | | – | | | | 2,005 | |

Exchange Traded Fund | | | 330 | | | | – | | | | – | | | | 330 | |

Rights | | | – | | | | – | | | | –(2) | | | | – | |

Cash Equivalent | | | 50,777 | | | | – | | | | – | | | | 50,777 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 2,500,951 | | | | 55 | | | | – | | | | 2,501,006 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments | | Level 1 ($) | | Level 2 ($) | | Level 3 ($) | | Total ($) |

Futures Contracts * | | | | | | | | | | | | | | | | |

Unrealized Appreciation | | | 2,448 | | | | — | | | | — | | | | 2,448 | |

Unrealized Depreciation | | | (10,241) | | | | — | | | | — | | | | (10,241) | |

| | | | | | | | | | | | | | | | |

Total Other Financial Instruments | | | (7,793) | | | | — | | | | — | | | | (7,793) | |

| | | | | | | | | | | | | | | | |

* Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument.

(1) A reconciliation of Level 3 investments is presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets.

(2) This category includes securities with a value of $0.

For the year ended July 31, 2021, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The following is a summary of the transactions the Fund had with affiliates for the year ended July 31, 2021 ($ Thousands):

| | | | | | | | | | | | | | | | | | |

Security Description | | Value 7/31/2020 | | Purchases at Cost | | Proceeds from Sales | | Realized Gain (Loss) | | Change in Unrealized Appreciation (Depreciation) | | Value 7/31/2021 | | Shares | | Dividend Income | | Capital Gains |

SEI Daily Income Trust, Government Fund, Cl F | | $ — | | $ 140,042 | | $ (89,265) | | $ — | | $ — | | $ 50,777 | | 50,776,582 | | $ 1 | | $ — |

| | | | | | | | | | | | | | | | | | |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | |

| 16 | | Adviser Managed Trust / Annual Report / July 31, 2021 |

SCHEDULE OF INVESTMENTS

July 31, 2021

Tactical Offensive Core Fixed Income Fund

†Percentages based on total investments.

| | | | | | | | |

| | | |

| Description | | Face Amount

(Thousands) | | Market Value

($ Thousands) |

| |

U.S. TREASURY OBLIGATIONS — 35.6% | | | | | |

U.S. Treasury Bonds | | | | | |

4.250%, 05/15/2039 | | $ | 1,000 | | | $ | 1,405 | |

3.625%, 02/15/2044 | | | 6,500 | | | | 8,654 | |

3.375%, 11/15/2048 | | | 3,000 | | | | 3,963 | |

3.125%, 05/15/2048 | | | 2,500 | | | | 3,155 | |

3.000%, 11/15/2044 | | | 2,000 | | | | 2,429 | |

3.000%, 02/15/2047 | | | 2,500 | | | | 3,072 | |

3.000%, 02/15/2048 | | | 5,000 | | | | 6,168 | |

3.000%, 02/15/2049 | | | 2,500 | | | | 3,099 | |

2.875%, 05/15/2043 | | | 2,500 | | | | 2,964 | |

2.750%, 08/15/2042 | | | 5,000 | | | | 5,810 | |

2.750%, 11/15/2042 | | | 2,000 | | | | 2,324 | |

2.500%, 02/15/2045 | | | 2,500 | | | | 2,797 | |

2.500%, 02/15/2046 | | | 3,000 | | | | 3,364 | |

2.375%, 05/15/2051 | | | 2,000 | | | | 2,219 | |

2.250%, 02/15/2027 | | | 5,000 | | | | 5,397 | |

2.250%, 08/15/2049 | | | 3,500 | | | | 3,763 | |

2.000%, 02/15/2050 | | | 1,800 | | | | 1,836 | |

1.875%, 02/15/2041 | | | 1,000 | | | | 1,011 | |

1.875%, 02/15/2051 | | | 2,000 | | | | 1,986 | |

1.625%, 11/15/2050 | | | 4,500 | | | | 4,207 | |

1.375%, 11/15/2040 | | | 7,000 | | | | 6,502 | |

1.375%, 08/15/2050 | | | 3,000 | | | | 2,635 | |

1.250%, 05/15/2050 | | | 6,000 | | | | 5,107 | |

1.125%, 05/15/2040 | | | 8,000 | | | | 7,148 | |

1.125%, 08/15/2040 | | | 4,000 | | | | 3,562 | |

U.S. Treasury Notes | | | | | |

3.125%, 11/15/2028 | | | 5,000 | | | | 5,737 | |

2.875%, 09/30/2023 | | | 10,000 | | | | 10,574 | |

2.750%, 11/15/2023 | | | 5,000 | | | | 5,287 | |

2.625%, 01/31/2026 | | | 5,000 | | | | 5,443 | |

2.625%, 02/15/2029 | | | 2,000 | | | | 2,227 | |

2.500%, 01/31/2024 | | | 10,000 | | | | 10,556 | |

2.500%, 05/15/2024 | | | 10,000 | | | | 10,610 | |

2.375%, 08/15/2024 | | | 5,000 | | | | 5,304 | |

2.375%, 05/15/2027 | | | 3,000 | | | | 3,264 | |

2.250%, 11/15/2024 | | | 5,000 | | | | 5,300 | |

2.250%, 11/15/2025 | | | 10,000 | | | | 10,703 | |

2.250%, 08/15/2027 | | | 2,000 | | | | 2,164 | |

2.125%, 03/31/2024 | | | 5,000 | | | | 5,243 | |

2.125%, 05/15/2025 | | | 5,000 | | | | 5,303 | |

2.000%, 10/31/2022 | | | 5,000 | | | | 5,118 | |

2.000%, 11/30/2022 | | | 5,000 | | | | 5,125 | |

| | | | | | | | |

| | | |

| Description | | Face Amount

(Thousands) | | Market Value

($ Thousands) |

| |

U.S. TREASURY OBLIGATIONS (continued) | | | | | |

2.000%, 02/15/2025 | | $ | 5,000 | | | $ | 5,270 | |

2.000%, 08/15/2025 | | | 10,000 | | | | 10,577 | |

2.000%, 11/15/2026 | | | 5,000 | | | | 5,324 | |

1.750%, 05/15/2023 | | | 7,500 | | | | 7,712 | |

1.625%, 08/15/2022 | | | 15,000 | | | | 15,237 | |

1.625%, 05/15/2026 | | | 5,000 | | | | 5,224 | |

1.625%, 11/30/2026 | | | 2,500 | | | | 2,614 | |

1.625%, 08/15/2029 | | | 5,000 | | | | 5,204 | |

1.625%, 05/15/2031 | | | 6,500 | | | | 6,739 | |

1.500%, 08/15/2022 | | | 2,000 | | | | 2,029 | |

1.500%, 01/15/2023 | | | 3,000 | | | | 3,060 | |

1.500%, 08/15/2026 | | | 3,000 | | | | 3,117 | |

1.500%, 01/31/2027 | | | 5,000 | | | | 5,196 | |

1.500%, 02/15/2030 | | | 3,900 | | | | 4,012 | |

1.375%, 02/15/2023 | | | 10,000 | | | | 10,191 | |

1.250%, 05/31/2028 | | | 5,000 | | | | 5,089 | |

1.125%, 02/28/2025 | | | 5,000 | | | | 5,116 | |

1.125%, 02/29/2028 | | | 2,000 | | | | 2,023 | |

1.125%, 02/15/2031 | | | 5,500 | | | | 5,452 | |

0.875%, 11/15/2030 | | | 5,000 | | | | 4,855 | |

0.750%, 04/30/2026 | | | 2,000 | | | | 2,008 | |

0.750%, 05/31/2026 | | | 4,000 | | | | 4,014 | |

0.750%, 01/31/2028 | | | 5,000 | | | | 4,940 | |

0.625%, 05/15/2030 | | | 5,000 | | | | 4,772 | |

0.625%, 08/15/2030 | | | 1,000 | | | | 952 | |

0.500%, 03/15/2023 | | | 8,000 | | | | 8,046 | |

0.500%, 05/31/2027 | | | 3,000 | | | | 2,942 | |

0.500%, 10/31/2027 | | | 5,000 | | | | 4,879 | |

0.375%, 04/15/2024 | | | 5,000 | | | | 5,010 | |

0.375%, 11/30/2025 | | | 2,000 | | | | 1,981 | |

0.375%, 12/31/2025 | | | 5,000 | | | | 4,948 | |

0.375%, 01/31/2026 | | | 5,000 | | | | 4,943 | |

0.375%, 09/30/2027 | | | 3,000 | | | | 2,908 | |

0.250%, 06/15/2023 | | | 3,000 | | | | 3,004 | |

0.250%, 11/15/2023 | | | 10,000 | | | | 10,005 | |

0.250%, 05/31/2025 | | | 10,000 | | | | 9,898 | |

0.250%, 06/30/2025 | | | 5,000 | | | | 4,945 | |

0.250%, 07/31/2025 | | | 7,000 | | | | 6,917 | |

0.250%, 08/31/2025 | | | 10,000 | | | | 9,872 | |

0.250%, 09/30/2025 | | | 10,000 | | | | 9,865 | |

0.250%, 10/31/2025 | | | 5,000 | | | | 4,928 | |

0.125%, 09/30/2022 | | | 5,000 | | | | 5,001 | |

0.125%, 10/31/2022 | | | 7,000 | | | | 7,002 | |

0.125%, 01/31/2023 | | | 3,000 | | | | 3,000 | |

0.125%, 12/15/2023 | | | 5,000 | | | | 4,986 | |

| | | | | | | | |

| |

Total U.S. Treasury Obligations

(Cost $445,760) ($ Thousands) | | | | 438,342 | |

| | | | | | | | |

| | |

| Adviser Managed Trust / Annual Report / July 31, 2021 | | 17 |

SCHEDULE OF INVESTMENTS

July 31, 2021

Tactical Offensive Core Fixed Income Fund (Continued)

| | | | | | | | |

| | | |

| Description | | Face Amount

(Thousands) | | Market Value

($ Thousands) |

|

MORTGAGE-BACKED SECURITIES — 27.4% | |

|

Agency Mortgage-Backed Obligations — 26.1% | |

FHLMC | | | | | | | | |

4.500%, 05/01/2048 to 10/01/2048 | | $ | 6,324 | | | $ | 6,831 | |

4.000%, 05/01/2050 | | | 5,699 | | | | 6,091 | |

3.500%, 11/01/2045 | | | 783 | | | | 844 | |

3.000%, 07/01/2033 to 08/01/2047 | | | 7,901 | | | | 8,358 | |

2.500%, 10/01/2040 | | | 4,246 | | | | 4,434 | |

2.000%, 06/01/2036 to 01/01/2051 | | | 18,335 | | | | 18,760 | |

FHLMC Multifamily Structured Pass-Through Certificates, Ser K073, Cl A2 | | | | | | | | |

3.350%, 01/25/2028 | | | 1,000 | | | | 1,134 | |

FHLMC Multifamily Structured Pass-Through Certificates, Ser K074, Cl A2 | | | | | | | | |

3.600%, 01/25/2028 | | | 815 | | | | 936 | |

FHLMC Multifamily Structured Pass-Through Certificates, Ser K091, Cl A2 | | | | | | | | |

3.505%, 03/25/2029 | | | 5,000 | | | | 5,773 | |

FHLMC Multifamily Structured Pass-Through Certificates, Ser K092, Cl A2 | | | | | | | | |

3.298%, 04/25/2029 | | | 315 | | | | 360 | |

FHLMC Multifamily Structured Pass-Through Certificates, Ser K722, Cl A2 | | | | | | | | |

2.406%, 03/25/2023 | | | 1,500 | | | | 1,540 | |

FNMA | | | | | | | | |

5.000%, 12/01/2048 | | | 2,922 | | | | 3,191 | |

4.500%, 05/01/2046 | | | 3,279 | | | | 3,647 | |

4.000%, 01/01/2048 to 01/01/2049 | | | 13,630 | | | | 14,626 | |

3.500%, 08/01/2030 to 06/01/2050 | | | 28,913 | | | | 30,849 | |

3.000%, 02/01/2034 to 07/01/2050 | | | 34,426 | | | | 36,292 | |

2.500%, 08/01/2031 to 11/01/2050 | | | 37,511 | | | | 39,177 | |

2.000%, 06/01/2036 to 07/01/2051 | | | 23,308 | | | | 23,841 | |

FNMA, Ser 2019-M7, Cl A2 | | | | | | | | |

3.143%, 04/25/2029 | | | 1,250 | | | | 1,410 | |

GNMA | | | | | | | | |

4.500%, 09/20/2046 to 01/20/2049 | | | 5,112 | | | | 5,534 | |

4.000%, 09/20/2047 to 05/20/2049 | | | 8,023 | | | | 8,509 | |

3.500%, 11/20/2041 to 07/20/2050 | | | 15,716 | | | | 16,634 | |

3.000%, 09/20/2046 to 07/20/2050 | | | 18,062 | | | | 18,994 | |

2.500%, 08/20/2050 to 07/20/2051 | | | 6,515 | | | | 6,776 | |

2.000%, 05/20/2051 to 06/20/2051 | | | 6,420 | | | | 6,581 | |

GNMA TBA | | | | | | | | |

2.500%, 08/01/2043 | | | 2,500 | | | | 2,599 | |

2.000%, 08/20/2169 | | | 3,550 | | | | 3,636 | |

UMBS TBA | | | | | | | | |

2.500%, 08/15/2051 | | | 7,000 | | | | 7,292 | |

2.000%, 08/15/2036 to 08/15/2051 | | | 23,225 | | | | 23,744 | |

1.500%, 08/15/2036 to 08/15/2051 | | | 13,000 | | | | 13,015 | |

| | | | | | | | |

| | |

| | | | | | | 321,408 | |

| | | | | | | | |

|

Non-Agency Mortgage-Backed Obligations — 1.3% | |

BANK, Ser 2019-BN21, Cl A5 | | | | | | | | |