UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22482 |

|

Nuveen Energy MLP Total Return Fund |

(Exact name of registrant as specified in charter) |

|

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606 |

(Address of principal executive offices) (Zip code) |

|

Kevin J. McCarthy Nuveen Investments 333 West Wacker Drive Chicago, IL 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 917-7700 | |

|

Date of fiscal year end: | November 30 | |

|

Date of reporting period: | May 31, 2012 | |

| | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

Nuveen Investments

Closed-End Funds

Seeking to provide a high level of after-tax total return.

Semi-Annual Report

May 31, 2012

MLP & Strategic

Equity Fund Inc.

MTP

Nuveen Energy MLP Total

Return Fund

JMF

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you'll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Table of Contents

| Chairman's Letter to Shareholders | | | 4 | | |

|

| Portfolio Managers' Comments | | | 5 | | |

|

| Share Distribution and Price Information | | | 9 | | |

|

| Performance Overviews | | | 11 | | |

|

| Portfolios of Investments | | | 13 | | |

|

| Statement of Assets & Liabilities | | | 17 | | |

|

| Statement of Operations | | | 18 | | |

|

| Statement of Changes in Net Assets | | | 19 | | |

|

| Statement of Cash Flows | | | 20 | | |

|

| Financial Highlights | | | 22 | | |

|

| Notes to Financial Statements | | | 24 | | |

|

| Annual Investment Management Agreement Approval Process | | | 33 | | |

|

| Reinvest Automatically, Easily and Conveniently | | | 42 | | |

|

| Glossary of Terms Used in this Report | | | 44 | | |

|

| Additional Fund Information | | | 47 | | |

|

Chairman's

Letter to Shareholders

Dear Shareholders,

Investors have many reasons to remain cautious. The challenges in the Euro area are casting a shadow over global economies and financial markets. The political support for addressing fiscal issues is eroding as the economic and social impacts become more visible. At the same time, member nations appear unwilling to provide adequate financial support or to surrender sufficient sovereignty to strengthen the banks or unify the Euro area financial system. The gains made in reducing deficits, and the hard-won progress on winning popular acceptance of the need for economic austerity, are at risk. To their credit, European political leaders press on to find compromise solutions, but there is increasing concern that time will begin to run out.

In the U.S., strong corporate earnings have enabled the equity markets to withstand much of the downward pressures coming from weakening job creation, slower economic growth and political uncertainty. The Fed remains committed to low interest rates but has refrained from predicting another program of quantitative easing unless economic growth were to weaken significantly or the threat of recession appears on the horizon. Pre-election maneuvering has added to the already highly partisan atmosphere in the Congress. The end of the Bush-era tax cuts and implementation of the spending restrictions of the Budget Control Act of 2011, both scheduled to take place at year-end, loom closer.

During the last year, U.S. based investors have experienced a sharp decline and a strong recovery in the equity markets. The experienced investment teams at Nuveen keep their eye on a longer time horizon and use their practiced investment disciplines to negotiate through market peaks and valleys to achieve long-term goals for investors. Experienced professionals pursue investments that will weather short-term volatility and at the same time, seek opportunities that are created by markets that overreact to negative developments. Monitoring this process is an important consideration for the Fund Board as it oversees your Nuveen fund on your behalf.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Robert P. Bremner

Chairman of the Board

July 20, 2012

Nuveen Investments

4

Portfolio Managers' Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's Group, Moody's Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

MLP & Strategic Equity Fund (MTP)

Nuveen Energy MLP Total Return Fund (JMF)

The Funds' investment adviser is Nuveen Fund Advisors, Inc., an affiliate of Nuveen Investments. Each Fund's portfolio is managed by FAMCO MLP, a division of Advisory Research, Inc., which is a wholly-owned subsidiary of Piper Jaffray Companies. James J. Cunnane Jr., CFA, Chief Investment Officer at FAMCO MLP, and Quinn T. Kiley, Senior Portfolio Manager, co-manage the Funds. Collectively, the team has over 25 years of experience managing Master Limited Partnerships (MLPs). Here they discuss their investment strategies and the performance of the Funds for the six-month period ended May 31, 2012.

How was the general market environment for Master Limited Partnerships (MLPs)?

During the reporting period, the MLP market experienced contradictory influences. While the development of unconventional oil and gas reserves gained momentum, risk aversion in the markets hurt the performance of MLP securities. Despite this risk aversion, MLPs were able to raise almost $18 billion in new equity during the reporting period. Compared to the total equity raised in calendar year 2011 of $20.8 billion, this is a significant amount and reflects two factors in the market: 1) MLPs have significant growth potential, and this new equity will fund acquisition and organic projects that should fuel distributions in the near term; and 2) the supply of new equity likely overwhelmed the inherent natural demand for MLP equity and affected performance for MLPs during the period. While this level of access to capital should ultimately be positive for MLPs, we are mindful that inexpensive capital can lower future returns if management teams overpay for new assets.

As mentioned in the previous shareholder report, a primary issue for MLPs has been the possibility of broad tax reform given governmental fiscal issues. Investor concern that such reform might negatively affect MLP tax treatment has impacted the MLP market. However, a recently proposed bill would expand the application of the MLP model to renewable energy. This development could be positive for the asset class.

What strategies were used to manage the Funds during this reporting period?

MTP's investment objective remained unchanged—to provide a high level of after-tax total return. We attempt to achieve this by investing in a diversified portfolio of publicly traded MLPs with attractive yields and growth profiles operating primarily in the energy

Nuveen Investments

5

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the Performance Overview page for your Fund in this report.

* Six-month returns are cumulative; all other returns are annualized.

** Refer to Glossary of Terms Used in this Report for definitions. Indexes are not available for direct investment.

*** Since inception returns for MTP and its comparative indexes are from 6/29/07. Since inception returns for JMF and its comparative indexes are from 2/23/11.

infrastructure sector of the market. An important focus has been to limit the portfolio's exposure to those securities we deem low quality. The diversified nature of the MTP portfolio makes its weightings and positions different from the benchmark Alerian MLP Index, while exposing the investors to similar underlying fundamentals.

JMF continues to invest in publicly traded MLPs operating primarily in the energy sector with the main objective of providing a tax-advantaged total return. During the reporting period, the Fund also sought higher yielding MLPs with the goal of earning and growing the Fund's distribution to shareholders.

We maintained our preference for holding MLPs that own pipelines and other infrastructure facilities. This comes from our belief in expected growth of production from nonconventional oil and gas reserves throughout the U.S. This potential increase in production from new regions could result in the need for higher utilization rates of existing infrastructure and the need for new pipelines as well. We believe this environment is supportive of MLP cash flows and valuations. Distribution growth has always been an important factor in MLP valuations, and we believe a potential increase in mergers and acquisition activity could drive some of this distribution growth to investors. We continued to position the portfolio to take advantage of these types of industry fundamentals and trends, with a primary goal of earning our distribution while seeking capital appreciation.

How did the Funds perform during this six-month period ending May 31, 2012?

Returns for the Funds, as well as for comparative indexes, are presented in the accompanying table.

Average Annual Total Returns on Net Asset Value*

For periods ended 5/31/12

| Fund | | 6-Month | | 1-Year | | Since

Inception*** | |

| MTP | | | -0.27 | % | | | 1.79 | % | | | 4.32 | % | |

| Alerian MLP Index** | | | 2.01 | % | | | 5.54 | % | | | 9.39 | % | |

| S&P 500 Index** | | | 6.23 | % | | | -0.41 | % | | | -0.63 | % | |

| JMF | | | -2.25 | % | | | -3.02 | % | | | -5.47 | % | |

| Alerian MLP Index** | | | 2.01 | % | | | 5.54 | % | | | 3.94 | % | |

| S&P 500 Index** | | | 6.23 | % | | | -0.41 | % | | | 2.67 | % | |

For the six month period ending May 31, 2012, the Funds' portfolios underperformed the Alerian MLP Index. This underperformance was generally attributable to two factors. The first factor was weak performance of commodity sensitive sectors in which the portfolios were invested. The sectors composed of MLPs that primarily produce oil, natural gas and coal posted negative returns for the period. A second factor that negatively impacted performance was the Funds' underweight positions in the largest MLPs in the Alerian MLP Index. MTP is a diversified fund and therefore has limitations on position sizes that are five percent and greater. Risk management of JMF's portfolio limits position sizes to no more than 10% of the portfolio. The largest Alerian MLP Index constituent, Enterprise Products Partners L.P., is over 15% of the index. As a result of these constraints, both

Nuveen Investments

6

Funds were underweight this large constituent, which dramatically outperformed the Alerian MLP Index.

As JMF's portfolio produced negative returns during the period, the Fund's leverage negatively impacted performance. Given the relatively low cost of the credit facility, the leverage allowed the portfolio to pay out a higher distribution than it would have been capable of without the credit facility.

FUND REORGANIZATIONS

During the current fiscal period, the Board of Directors/Trustees of the Nuveen closed-end funds approved the reorganization of MTP into JMF. At a special meeting of shareholders on July 12, 2012, (following the end of this reporting period) shareholders of JMF approved the reorganization. A special meeting of shareholders for MTP for purpose of voting on the reorganization is scheduled for August 2, 2012. If the reorganization is approved by shareholders of MTP, it will occur on or around August 15, 2012.

RISK CONSIDERATIONS

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. The following risks are listed in order of priority.

Investment and Market Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Funds, which generally trade in the over-the-counter markets. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Tax Risk. The Funds' investment program and the tax treatment of Fund distributions may be affected by IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations, including changes resulting from the "sunset" provisions that may apply to the favorable tax treatment of tax-advantaged dividends. There can be no assurance as to the percentage of a Fund's distributions that will qualify as tax-advantaged dividends.

Price Risk. This refers to the fact that shares of closed-end investment companies like the Funds have during some periods traded at prices higher than net asset value and have during other periods traded at prices lower than net asset value. The Funds cannot predict whether the common shares will trade at, above or below net asset value.

Energy Sector Risk. Because the Funds invest primarily in energy sector MLPs, concentration in this sector may present more risks than if the Funds were invested in numerous sectors of the economy.

MLP Units Risk. An investment in MLP units involves risks that differ from a similar investment in equity securities. Holders of MLP units have the rights typically afforded to limited partners in a limited partnership. As compared to common stockholders of a

Nuveen Investments

7

corporation, holders of MLP units have more limited control and limited rights to vote on matters affecting the partnership.

Non-Diversification and Concentration Risk. The Fund is able to invest a greater portion of its assets in obligations of a single issuer than a "diversified" fund. A nondiversified fund, or one with a portfolio concentrated in a particular industry or geographical region, may be affected disproportionately by the performance of a single security or relatively few securities as a result of adverse economic, regulatory, or market occurrences.

Leverage Risk. A Fund's use of leverage creates the possibility of higher volatility for the Funds' per share NAV, market price, and distributions. Leverage risk can be introduced through regulatory leverage (issuing preferred shares or debt borrowings at the Fund level) or through certain derivative investments held in a Fund's portfolio. Leverage typically magnifies the total return of a Fund's portfolio, whether that return is positive or negative. The use of leverage creates an opportunity for increased common share net income, but there is no assurance that a Fund's leveraging strategy will be successful.

Nuveen Investments

8

Share Distribution

and Price Information

Distribution Information

The following information regarding your Fund's distributions is current as of May 31, 2012, and likely will vary over time based on the Fund's investment activities and portfolio investment value changes.

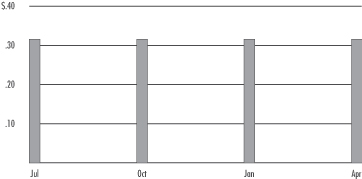

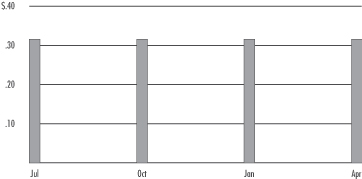

The quarterly distribution to shareholders for both MTP and JMF remained stable during the six-month reporting period.

The Funds' quarterly distributions are set pursuant to a managed distribution program. Under that program, the Funds may source their distributions from the following: net distributable cash flow, net realized gains, unrealized gains, and, in certain cases, a return of Fund principal. Net distributable cash flow consists primarily of distributions received from a Fund's investments in shares of energy Master Limited Partnerships (MLPs), less payments on any of its leveraging instruments and other Fund expenses (including taxes paid at the Fund level since each Fund is taxed as an ordinary "C" corporation). Currently, the Funds intend to distribute substantially all of their net distributable cash flow received without sourcing incremental amounts from other components. For additional information regarding the managed distribution program please visit the distribution section of each Fund's website at www.nuveen.com.

For purposes of determining the income tax characterization of each Fund's distributions, amounts in excess of each Fund's earnings and profits for federal income tax purposes are characterized as a return of capital. Distributions attributable to earnings and profits for federal income tax purposes are characterized as taxable ordinary dividends. Each Fund will calculate its earnings and profits based on its taxable period ended November 30 and will report the character of its distributions to shareholders shortly after the end of the calendar year. The primary components of each Fund's annual earnings and profits calculation are: income, loss and other flow-through items (including earnings and profits adjustments) reported by the MLPs on Schedule K-1, realized gain or loss on sales of Fund investments and deductible operating expenses. In addition, a Fund will recognize income (and increase its earnings and profits) should it receive a distribution from an MLP that exceeds its income tax basis. Distributions from any given MLP are treated as a return of capital to the extent of a Fund's income tax basis in that MLP.

Nuveen Investments

9

The following table provides estimated information regarding each Fund's distributions and actual total return performance for the six months ended May 31, 2012. This information is provided on a tax basis rather than a generally accepted accounting principles (GAAP) basis. This information is intended to help you better understand whether the Fund's returns for the specified time period were sufficient to meet the Fund's distributions.

| As of May 31, 2012 | | MTP | | JMF | |

| Inception date | | 6/29/07 | | 2/23/11 | |

| Six months ended May 31, 2012 | |

| Per share distribution: | |

| From net investment income | | $ | 0.47 | | | $ | — | | |

| Return of capital | | | — | | | | 0.63 | | |

| Total per share distribution | | $ | 0.47 | | | $ | 0.63 | | |

| Annualized distribution rate on NAV | | | 5.44 | % | | | 7.76 | % | |

| Average annual total returns: | |

| Six-Month (Cumulative) on NAV | | | -0.27 | % | | | -2.25 | % | |

| 1-Year on NAV | | | 1.79 | % | | | -3.02 | % | |

| Since inception on NAV | | | 4.32 | % | | | -5.47 | % | |

Price Information

The Funds have not repurchased any of their outstanding shares since the inception of their repurchase programs.

As of May 31, 2012, and during the six-month reporting period, the Funds' share prices were trading at (+) premiums or (-) discounts to their NAVs as shown in the accompanying table.

| Fund | | 5/31/12

(+)Premium/(-)Discount | | Six-Month Average

(+)Premium/(-)Discount | |

| MTP | | (-)5.96% | | (-)6.08% | |

| JMF | | (+)3.94% | | (+)0.17% | |

Nuveen Investments

10

MTP

Performance

OVERVIEW

MLP & Strategic Equity Fund Inc.

as of May 31, 2012

Portfolio Allocation (as a % of total investments)2

2011-2012 Quarterly Dividends Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Holdings are subject to change.

3 Excluding short-term investments.

Fund Snapshot

| Share Price | | $ | 16.24 | | |

| Net Asset Value (NAV) | | $ | 17.27 | | |

| Premium/(Discount) to NAV | | | -5.96 | % | |

| Current Distribution Rate1 | | | 5.84 | % | |

| Net Assets ($000) | | $ | 255,804 | | |

Average Annual Total Returns

(Inception 6/29/07)

| | | On Share Price | | On NAV | |

| 6-Month (Cumulative) | | | 3.31 | % | | | -0.27 | % | |

| 1-Year | | | -0.50 | % | | | 1.79 | % | |

| Since Inception | | | 2.27 | % | | | 4.32 | % | |

Portfolio Composition

(as a % of total investments)2

| Oil, Gas & Consumable Fuels | | | 99.4 | % | |

| Energy Equipment & Services | | | 0.5 | % | |

| Short-Term Investments | | | 0.1 | % | |

Ten Largest Master Limited

Partnerships & MLP Affiliates

Holdings

(as a % of total investments)2, 3

| Energy Transfer Equity LP | | | 8.2 | % | |

| Enterprise Products Partners LP | | | 6.0 | % | |

| Kinder Morgan Management LLC | | | 5.5 | % | |

| Plains All American Pipeline LP | | | 5.4 | % | |

| Western Gas Partners LP | | | 5.1 | % | |

| Williams Partners LP | | | 4.9 | % | |

| ONEOK Partners LP | | | 4.8 | % | |

| Targa Resources Partners LP | | | 4.7 | % | |

| DCP Midstream Partners LP | | | 4.4 | % | |

| Copano Energy LLC | | | 3.5 | % | |

Nuveen Investments

11

Fund Snapshot

| Share Price | | $ | 16.88 | | |

| Net Asset Value (NAV) | | $ | 16.24 | | |

| Premium/(Discount) to NAV | | | 3.94 | % | |

| Current Distribution Rate1 | | | 7.49 | % | |

Net Assets Applicable to

Common Shares ($000) | | $ | 386,513 | | |

Leverage

| Regulatory Leverage | | | 29.28 | % | |

| Effective Leverage | | | 29.28 | % | |

Average Annual Total Returns

(Inception 2/23/11)

| | | On Share Price | | On NAV | |

| 6-Month (Cumulative) | | | 4.92 | % | | | -2.25 | % | |

| 1-Year | | | -1.20 | % | | | -3.02 | % | |

| Since Inception | | | -6.04 | % | | | -5.47 | % | |

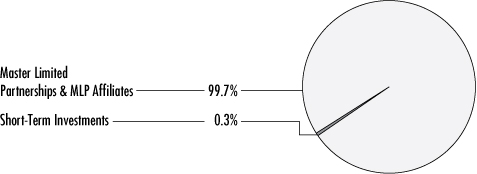

Portfolio Composition

(as a % of total investments)2

| Oil, Gas & Consumable Fuels | | | 98.1 | % | |

| Energy Equipment & Services | | | 1.6 | % | |

| Short-Term Investments | | | 0.3 | % | |

Ten Largest Master Limited

Partnerships & MLP Affiliates

Holdings

(as a % of total investments)2, 3

| Plains All American Pipeline LP | | | 9.3 | % | |

| Kinder Morgan Management LLC | | | 9.2 | % | |

| Enterprise Products Partners LP | | | 8.2 | % | |

| Energy Transfer Equity LP | | | 7.6 | % | |

| Enbridge Energy Partners LP | | | 7.4 | % | |

| Regency Energy Partners LP | | | 5.2 | % | |

| Williams Partners LP | | | 5.1 | % | |

| Genesis Energy LP | | | 5.0 | % | |

| DCP Midstream Partners LP | | | 5.0 | % | |

| Copano Energy LLC | | | 4.0 | % | |

JMF

Performance

OVERVIEW

Nuveen Energy MLP Total Return Fund

as of May 31, 2012

Portfolio Allocation (as a % of total investments)2

2011-2012 Quarterly Dividends Per Share

Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Holdings are subject to change.

3 Excluding short-term investments.

Nuveen Investments

12

MTP

MLP & Strategic Equity Fund Inc.

Portfolio of INVESTMENTS

May 31, 2012 (Unaudited)

Shares/

Units | | Description (1) | | Value | |

| | | Master Limited Partnerships & MLP Affiliates – 110.0% (99.9% of Total Investments) | |

| | | Energy Equipment & Services – 0.5% (0.5% of Total Investments) | |

| | 65,616 | | | Exterran Partners LP | | $ | 1,294,604 | | |

| | | Oil, Gas & Consumable Fuels – 109.5% (99.4% of Total Investments) | |

| | 54,300 | | | Alliance Holding GP LP | | | 2,257,251 | | |

| | 69,296 | | | Alliance Resource Partners LP | | | 3,950,565 | | |

| | 21,100 | | | American Midstream Partners LP | | | 416,514 | | |

| | 87,700 | | | BreitBurn Energy Partners LP | | | 1,455,820 | | |

| | 136,069 | | | Buckeye Partners LP, Class B Shares, (2), (3), (4) | | | 6,035,543 | | |

| | 45,300 | | | Chesapeake Midstream Partners LP | | | 1,133,859 | | |

| | 368,475 | | | Copano Energy LLC | | | 9,875,130 | | |

| | 133,188 | | | Crestwood Midstream Partners LP, Class C Shares, (2), (3), (4) | | | 3,251,896 | | |

| | 317,182 | | | DCP Midstream Partners LP | | | 12,474,768 | | |

| | 170,400 | | | El Paso Pipeline Partners LP | | | 5,590,824 | | |

| | 259,692 | | | Enbridge Energy Management LLC, (3) | | | 8,099,794 | | |

| | 201,438 | | | Enbridge Energy Partners LP | | | 5,890,047 | | |

| | 631,457 | | | Energy Transfer Equity LP | | | 22,940,831 | | |

| | 348,364 | | | Enterprise Products Partners LP | | | 16,986,229 | | |

| | 122,690 | | | EV Energy Partners LP | | | 6,291,543 | | |

| | 106,039 | | | Genesis Energy LP | | | 3,050,742 | | |

| | 105,695 | | | Holly Energy Partners LP | | | 5,979,166 | | |

| | 484,175 | | | Inergy LP | | | 8,293,918 | | |

| | 244,020 | | | Inergy Midstream LP | | | 5,087,817 | | |

| | 218,324 | | | Kinder Morgan Management LLC, (3) | | | 15,507,554 | | |

| | 34,960 | | | LRR Energy LP | | | 506,570 | | |

| | 125,898 | | | Magellan Midstream Partners LP | | | 8,663,041 | | |

| | 196,800 | | | MarkWest Energy Partners LP | | | 9,434,592 | | |

| | 23,400 | | | Natural Resource Partners LP | | | 536,796 | | |

| | 10,000 | | | NGL Energy Partners LP | | | 232,200 | | |

| | 150,800 | | | NuStar GP Holdings LLC | | | 4,809,012 | | |

| | 249,706 | | | ONEOK Partners LP | | | 13,633,948 | | |

| | 15,800 | | | Oxford Resource Partners LP | | | 121,344 | | |

| | 27,603 | | | Pioneer Southwest Energy Partners LP | | | 708,845 | | |

| | 194,474 | | | Plains All American Pipeline LP | | | 15,272,043 | | |

| | 355,263 | | | Regency Energy Partners LP | | | 7,645,260 | | |

| | 184,801 | | | Spectra Energy Partners LP | | | 5,760,247 | | |

| | 227,310 | | | Sunoco Logistics Partners LP | | | 7,655,801 | | |

| | 340,625 | | | Targa Resources Partners LP | | | 13,359,313 | | |

| | 144,999 | | | TC PipeLines LP | | | 5,944,959 | | |

| | 293,344 | | | Teekay Offshore Partners LP | | | 9,233,629 | | |

| | 118,426 | | | TransMontaigne Partners LP | | | 3,735,156 | | |

| | 326,420 | | | Western Gas Partners LP | | | 14,391,858 | | |

| | 261,122 | | | Williams Partners LP | | | 13,813,354 | | |

| | | Total Oil, Gas & Consumable Fuels | | | 280,027,779 | | |

| | | Total Master Limited Partnerships & MLP Affiliates (cost $212,836,879) | | | 281,322,383 | | |

Nuveen Investments

13

MTP

MLP & Strategic Equity Fund Inc. (continued)

Portfolio of INVESTMENTS May 31, 2012 (Unaudited)

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Value | |

| | | Short-Term Investments — 0.1% (0.1% of Total Investments) | |

| $ | 335 | | | Repurchase Agreement with State Street Bank, dated 5/31/12, repurchase

price $335,150, collateralized by $310,000 U.S. Treasury Notes,

2.625%, due 8/15/20, value $345,017 | | | 0.010 | % | | 6/01/12 | | $ | 335,150 | | |

| | | Total Short-Term Investments (cost $335,150) | | | | | | | 335,150 | | |

| | | Total Investments (cost $213,172,029) – 110.1% | | | | | | | 281,657,533 | | |

| | | Other Assets Less Liabilities – (10.1)% | | | | | | | (25,853,825 | ) | |

| | | Net Assets – 100% | | | | | | $ | 255,803,708 | | |

For Fund portfolio compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

(1) All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted.

(2) For fair value measurement disclosure purposes, Master Limited Partnership & MLP Affiliates categorized as Level 2. See Notes to Financial Statements, Footnote 1 - General Information and Significant Accounting Policies, Investment Valuation for more information.

(3) Distributions are paid in-kind.

(4) Security is restricted and may be resold only in transactions exempt from registration, normally to qualified institutional buyers.

See accompanying notes to financial statements.

Nuveen Investments

14

JMF

Nuveen Energy MLP Total Return Fund

Portfolio of INVESTMENTS

May 31, 2012 (Unaudited)

Shares/

Units | | Description (1) | | Value | |

| | | Master Limited Partnerships & MLP Affiliates – 141.2% (99.7% of Total Investments) | |

| | | Energy Equipment & Services – 2.2% (1.6% of Total Investments) | |

| | 427,695 | | | Exterran Partners LP | | $ | 8,438,422 | | |

| | | Oil, Gas & Consumable Fuels — 139.0% (98.1% of Total Investments) | |

| | 114,000 | | | Alliance Holding GP LP | | | 4,738,980 | | |

| | 145,450 | | | American Midstream Partners LP | | | 2,871,183 | | |

| | 295,000 | | | BreitBurn Energy Partners LP | | | 4,897,000 | | |

| | 253,779 | | | Buckeye Partners LP, Class B Shares, (2), (3), (4) | | | 11,256,746 | | |

| | 811,220 | | | Copano Energy LLC | | | 21,740,696 | | |

| | 691,850 | | | DCP Midstream Partners LP | | | 27,210,461 | | |

| | 316,375 | | | El Paso Pipeline Partners LP | | | 10,380,264 | | |

| | 1,372,540 | | | Enbridge Energy Partners LP | | | 40,133,070 | | |

| | 1,148,150 | | | Energy Transfer Equity LP | | | 41,712,290 | | |

| | 912,865 | | | Enterprise Products Partners LP | | | 44,511,297 | | |

| | 237,550 | | | EV Energy Partners LP | | | 12,181,564 | | |

| | 956,665 | | | Genesis Energy LP | | | 27,523,252 | | |

| | 942,455 | | | Inergy LP | | | 16,144,254 | | |

| | 447,020 | | | Inergy Midstream LP | | | 9,320,367 | | |

| | 708,411 | | | Kinder Morgan Management LLC, (3) | | | 50,318,433 | | |

| | 64,880 | | | LRR Energy LP | | | 940,111 | | |

| | 372,000 | | | NGL Energy Partners LP | | | 8,637,840 | | |

| | 333,300 | | | NuStar GP Holdings LLC | | | 10,628,937 | | |

| | 693,815 | | | Oxford Resource Partners LP | | | 5,328,499 | | |

| | 649,265 | | | Plains All American Pipeline LP | | | 50,986,779 | | |

| | 1,309,505 | | | Regency Energy Partners LP | | | 28,180,548 | | |

| | 363,175 | | | Spectra Energy Partners LP | | | 11,320,165 | | |

| | 471,550 | | | Targa Resources Partners LP | | | 18,494,191 | | |

| | 384,970 | | | TC PipeLines LP | | | 15,783,770 | | |

| | 576,335 | | | Teekay Offshore Partners LP | | | 15,964,480 | | |

| | 162,660 | | | TransMontaigne Partners LP | | | 5,130,296 | | |

| | 300,000 | | | Western Gas Partners LP | | | 13,227,000 | | |

| | 523,680 | | | Williams Partners LP | | | 27,702,672 | | |

| | | Total Oil, Gas & Consumable Fuels | | | 537,265,145 | | |

| | | Total Master Limited Partnerships & MLP Affiliates (cost $544,124,747) | | | 545,703,567 | | |

Nuveen Investments

15

JMF

Nuveen Energy MLP Total Return Fund (continued)

Portfolio of INVESTMENTS May 31, 2012 (Unaudited)

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Value | |

| | | Short-Term Investments – 0.5% (0.3% of Total Investments) | |

| $ | 1,833 | | | Repurchase Agreement with State Street Bank, dated 5/31/12, repurchase

price $1,833,191, collateralized by $1,685,000 U.S. Treasury Notes,

2.625%, due 8/15/20, value $1,875,333 | | | 0.010 | % | | 6/01/12 | | $ | 1,833,190 | | |

| | | Total Short-Term Investments (cost $1,833,190) | | | | | | | 1,833,190 | | |

| | | Total Investments (cost $545,957,937) – 141.7% | | | | | | | 547,536,757 | | |

| | | Borrowings – (41.4)% (5), (6) | | | | | | | (160,000,000 | ) | |

| | | Other Assets Less Liabilities – (0.3)% | | | | | | | (1,024,004 | ) | |

| | | Net Assets – 100% | | | | | | $ | 386,512,753 | | |

For Fund portfolio compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

(1) All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted.

(2) For fair value measurement disclosure purposes, Master Limited Partnership & MLP Affiliates categorized as Level 2. See Notes to Financial Statements, Footnote 1 - General Information and Significant Accounting Policies, Investment Valuation for more information.

(3) Distributions are paid in-kind.

(4) Security is restricted and may be resold only in transactions exempt from registration, normally to qualified institutional buyers.

(5) Borrowings Payable as a percentage of Total Investments is 29.2%.

(6) The Fund may pledge up to 100% of its eligible investments in the Portfolio of Investments as collateral for Borrowings. As of May 31, 2012, investments with a value of $347,331,789 have been pledged as collateral for Borrowings.

See accompanying notes to financial statements.

Nuveen Investments

16

Statement of

ASSETS & LIABILITIES

May 31, 2012 (Unaudited)

| | | MLP & Strategic

Equity (MTP) | | Energy MLP Total

Return (JMF) | |

| Assets | |

| Investments, at value (cost $213,172,029 and $545,957,937, respectively) | | $ | 281,657,533 | | | $ | 547,536,757 | | |

| Other assets | | | 8,083 | | | | 15,473 | | |

| Total assets | | | 281,665,616 | | | | 547,552,230 | | |

| Liabilities | |

| Borrowings | | | — | | | | 160,000,000 | | |

| Payables: | |

| Interest | | | — | | | | 181,388 | | |

| Federal income tax | | | 910,707 | | | | — | | |

| State income tax | | | 713,462 | | | | — | | |

| Net deferred tax liability | | | 23,722,919 | | | | — | | |

| Accrued expenses: | |

| State franchise tax | | | 33,821 | | | | 31,815 | | |

| Management fees | | | 278,289 | | | | 514,436 | | |

| Other | | | 202,710 | | | | 311,838 | | |

| Total liabilities | | | 25,861,908 | | | | 161,039,477 | | |

| Net assets | | $ | 255,803,708 | | | $ | 386,512,753 | | |

| Shares outstanding | | | 14,810,750 | | | | 23,800,246 | | |

| Net asset value per share outstanding | | $ | 17.27 | | | $ | 16.24 | | |

| Net assets consist of: | |

| Shares, $.001 and $.01 par value per share, respectively | | $ | 14,811 | | | $ | 238,002 | | |

| Paid-in surplus | | | 222,761,903 | | | | 415,494,807 | | |

| Accumulated net investment income (loss), net of tax | | | 9,870,053 | | | | 47,890 | | |

| Accumulated net realized gain (loss), net of tax | | | (45,587,970 | ) | | | (30,846,766 | ) | |

| Net unrealized appreciation (depreciation), net of tax | | | 68,744,911 | | | | 1,578,820 | | |

| Net assets | | $ | 255,803,708 | | | $ | 386,512,753 | | |

| Authorized shares | | | 100,000,000 | | | | Unlimited | | |

See accompanying notes to financial statements.

Nuveen Investments

17

Statement of

OPERATIONS

Six Months Ended May 31, 2012 (Unaudited)

| | | MLP & Strategic

Equity (MTP) | | Energy MLP Total

Return (JMF) | |

| Investment Income | |

| Distributions from MLPs | | $ | 8,393,174 | | | $ | 17,419,745 | | |

| Less: Return of capital on distributions from MLPs | | | (8,393,174 | ) | | | (17,419,745 | ) | |

| Interest | | | 83 | | | | 252 | | |

| Total investment income | | | 83 | | | | 252 | | |

| Expenses | |

| Management fees | | | (1,485,494 | ) | | | (3,102,409 | ) | |

| Shareholders' servicing agent fees and expenses | | | (102 | ) | | | (76 | ) | |

| Interest expense on borrowings | | | — | | | | (1,085,719 | ) | |

| Custodian's fees and expenses | | | (41,431 | ) | | | (36,145 | ) | |

| Directors'/Trustees' fees and expenses | | | (6,030 | ) | | | (12,846 | ) | |

| Professional fees | | | (26,029 | ) | | | (56,240 | ) | |

| Shareholders' reports—printing and mailing expenses | | | (1,734 | ) | | | (20,688 | ) | |

| Stock exchange listing fees | | | (3,529 | ) | | | (5,900 | ) | |

| Investor relations expense | | | (24,638 | ) | | | (31,727 | ) | |

| Franchise tax expense | | | (33,821 | ) | | | (31,815 | ) | |

| Other expenses | | | (35,246 | ) | | | (40,051 | ) | |

| Total expenses before custodian fee credit | | | (1,658,054 | ) | | | (4,423,616 | ) | |

| Custodian fee credit | | | 11 | | | | 3 | | |

| Net expenses | | | (1,658,043 | ) | | | (4,423,613 | ) | |

| Net investment income (loss) before taxes | | | (1,657,960 | ) | | | (4,423,361 | ) | |

| Deferred tax benefit | | | 2,153,651 | | | | — | | |

| Current tax (expense) | | | (1,532,263 | ) | | | — | | |

| Net investment income (loss) | | | (1,036,572 | ) | | | (4,423,361 | ) | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) from investments before taxes | | | 19,618,751 | | | | (1,183,928 | ) | |

| Deferred tax (expense)/benefit | | | (7,352,927 | ) | | | — | | |

| Net realized gain (loss) from investments | | | 12,265,824 | | | | (1,183,928 | ) | |

| Change in net unrealized appreciation (depreciation) of investments before taxes | | | (18,637,257 | ) | | | (2,742,822 | ) | |

| Deferred tax (expense)/benefit | | | 6,985,073 | | | | — | | |

| Change in net unrealized appreciation (depreciation) of investments | | | (11,652,184 | ) | | | (2,742,822 | ) | |

| Net realized and unrealized gain (loss) | | | 613,640 | | | | (3,926,750 | ) | |

| Net increase (decrease) in net assets from operations | | $ | (422,932 | ) | | $ | (8,350,111 | ) | |

See accompanying notes to financial statements.

Nuveen Investments

18

Statement of

Changes in Net Assets (Unaudited)

| | | MLP & Strategic Equity (MTP) | | Energy MLP Total Return (JMF) | |

| | | Six Months

Ended

5/31/12 | | One Month

Ended

11/30/11 | | Year

Ended

10/31/11 | | Six Months

Ended

5/31/12 | | For the Period

2/23/11

(commencement

of operations)

through 11/30/11 | |

| Operations | |

| Net investment income (loss) | | $ | (1,036,572 | ) | | $ | (141,443 | ) | | $ | (3,077,977 | ) | | $ | (4,423,361 | ) | | $ | (5,516,747 | ) | |

| Net realized gain (loss) from investments | | | 12,265,824 | | | | 21,231,000 | | | | 10,063,568 | | | | (1,183,928 | ) | | | (19,664,936 | ) | |

Change in net unrealized appreciation (depreciation)

of investments | | | (11,652,184 | ) | | | (20,694,058 | ) | | | 11,292,508 | | | | (2,742,822 | ) | | | 4,321,642 | | |

| Net increase (decrease) in net assets from operations | | | (422,932 | ) | | | 395,499 | | | | 18,278,099 | | | | (8,350,111 | ) | | | (20,860,041 | ) | |

| Distributions to Shareholders | |

| From and in excess of net investment income | | | (7,020,296 | ) | | | — | | | | — | | | | (15,041,755 | ) | | | — | | |

| From net investment income | | | — | | | | — | | | | (8,719,354 | ) | | | — | | | | — | | |

| Return of capital | | | — | | | | — | | | | (5,053,525 | ) | | | — | | | | (22,473,984 | ) | |

| Decrease in net assets from distributions to shareholders | | | (7,020,296 | ) | | | — | | | | (13,772,879 | ) | | | (15,041,755 | ) | | | (22,473,984 | ) | |

| Fund Share Transactions | |

| Proceeds from sale of shares, net of offering costs | | | — | | | | — | | | | — | | | | — | | | | 450,006,600 | | |

Proceeds from shares issued to shareholders due to reinvestment

of distributions | | | — | | | | — | | | | 188,523 | | | | — | | | | 3,131,769 | | |

Net increase (decrease) in net assets from Fund

share transactions | | | — | | | | — | | | | 188,523 | | | | — | | | | 453,138,369 | | |

| Net increase (decrease) in net assets | | | (7,443,228 | ) | | | 395,499 | | | | 4,693,743 | | | | (23,391,866 | ) | | | 409,804,344 | | |

| Net assets at the beginning of period | | | 263,246,936 | | | | 262,851,437 | | | | 258,157,694 | | | | 409,904,619 | | | | 100,275 | | |

| Net assets at the end of period | | $ | 255,803,708 | | | $ | 263,246,936 | | | $ | 262,851,437 | | | $ | 386,512,753 | | | $ | 409,904,619 | | |

Accumulated net investment income (loss), net of tax at the

end of period | | $ | 9,870,053 | | | $ | 4,267,893 | | | $ | (6,901,946 | ) | | $ | 47,890 | | | $ | (5,516,747 | ) | |

See accompanying notes to financial statements.

Nuveen Investments

19

Statement of

Cash Flows

Six Months Ended May 31, 2012 (Unaudited)

| | | Energy MLP Total

Return (JMF) | |

| Cash Flows from Operating Activities: | |

| Net Increase (Decrease) in Net Assets from Operations | | $ | (8,350,111 | ) | |

Adjustments to reconcile the net increase (decrease) in net assets from operations

to net cash provided by (used in) operating activities: | |

| Purchases of investments | | | (77,967,405 | ) | |

| Proceeds from sales of investments | | | 46,432,848 | | |

| Payment-in-kind distributions from MLPs | | | (510,661 | ) | |

| Return of capital distributions from MLPs | | | 17,419,745 | | |

| Proceeds from (Purchase of) short-term investments, net | | | (1,206,140 | ) | |

| (Increase) Decrease in: | |

| Receivable for distributions from MLPs | | | 245,427 | | |

| Other assets | | | (5,437 | ) | |

| Increase (Decrease) in: | |

| Payable for interest | | | 43,375 | | |

| Accrued state franchise tax expense | | | (86,404 | ) | |

| Accrued management fees | | | 45,937 | | |

| Accrued other expenses | | | 53,831 | | |

| Net realized (gain) loss from investments | | | 1,183,928 | | |

| Change in net unrealized (appreciation) depreciation of investments | | | 2,742,822 | | |

| Net cash provided by (used in) operating activities | | | (19,958,245 | ) | |

| Cash Flows from Financing Activities: | |

| Increase (Decrease) in borrowings | | | 35,000,000 | | |

| Cash distributions paid to shareholders | | | (15,041,755 | ) | |

| Net cash provided by (used in) financing activities | | | 19,958,245 | | |

| Net Increase (Decrease) in cash | | | — | | |

| Cash at the beginning of period | | | — | | |

| Cash at the End of Period | | $ | — | | |

Supplemental Disclosure of Cash Flow Information

Cash paid by Energy MLP Total Return (JMF) for interest on borrowings during the period ended May 31, 2012 was $1,003,895.

Non-cash operating activities included herein consist of payment-in-kind distributions of $510,661 during the period ended May 31, 2012.

See accompanying notes to financial statements.

Nuveen Investments

20

Intentionally Left Blank

Nuveen Investments

21

Financial

HIGHLIGHTS (Unaudited)

Selected data for a share outstanding throughout each period:

| | | | |

| | | | | Investment Operations | | Less Distributions | | | | | | | |

| | | Beginning

Net

Asset

Value | | Net

Investment

Income

(Loss)(a) | | Net

Realized/

Unrealized

Gain

(Loss) | | Total | | Net

Investment

Income | | Return

of

Capital | | Total | | Offering

Costs | | Ending

Net

Asset

Value | | Ending

Market

Value | |

| MLP & Strategic Equity (MTP) | | | |

| Year Ended 11/30: | |

| | 2012 | (i) | | $ | 17.77 | | | $ | (.07 | ) | | $ | .04 | | | $ | (.03 | ) | | $ | (.47 | )* | | $ | — | | | $ | (.47 | ) | | $ | — | | | $ | 17.27 | | | $ | 16.24 | | |

| | 2011 | (f) | | | 17.75 | | | | (.01 | ) | | | .03 | | | | .02 | | | | — | | | | — | | | | — | | | | — | | | | 17.77 | | | | 16.15 | | |

| Year Ended 10/31: | |

| | 2011 | | | | 17.44 | | | | (.21 | ) | | | 1.45 | | | | 1.24 | | | | (.59 | ) | | | (.34 | ) | | | (.93 | ) | | | — | | | | 17.75 | | | | 16.35 | | |

| | 2010 | | | | 13.47 | | | | (.14 | ) | | | 4.95 | | | | 4.81 | | | | — | | | | (.84 | ) | | | (.84 | ) | | | — | | | | 17.44 | | | | 17.41 | | |

| | 2009 | | | | 11.70 | | | | (.15 | ) | | | 2.82 | | | | 2.67 | | | | — | | | | (.90 | ) | | | (.90 | ) | | | — | | | | 13.47 | | | | 14.42 | | |

| | 2008 | | | | 18.06 | | | | (.09 | ) | | | (5.07 | ) | | | (5.16 | ) | | | — | | | | (1.20 | ) | | | (1.20 | ) | | | — | | | | 11.70 | | | | 13.00 | | |

| | 2007 | (g) | | | 19.10 | | | | .04 | | | | (.74 | ) | | | (.70 | ) | | | (.03 | ) | | | (.27 | ) | | | (.30 | ) | | | (.04 | ) | | | 18.06 | | | | 16.24 | | |

| Energy MLP Total Return (JMF) | | | |

| Year Ended 11/30: | |

| | 2012 | (i) | | | 17.22 | | | | (.19 | ) | | | (.16 | ) | | | (.35 | ) | | | (.63 | )* | | | — | | | | (.63 | ) | | | — | | | | 16.24 | | | | 16.88 | | |

| | 2011 | (h) | | | 19.10 | | | | (.24 | ) | | | (.65 | ) | | | (.89 | ) | | | — | | | | (.95 | ) | | | (.95 | ) | | | (.04 | ) | | | 17.22 | | | | 16.66 | | |

| | | Borrowings at the End of Period | |

| | | Aggregate

Amount

Outstanding

(000) | | Asset

Coverage

Per $1,000 | |

| Energy MLP Total Return (JMF) | |

| Year Ended 11/30: | |

| | 2012 | (i) | | $ | 160,000 | | | $ | 3,417 | | |

| | 2011 | (h) | | | 125,000 | | | | 4,280 | | |

Nuveen Investments

22

| | | | | Ratios/Supplemental Data | |

| | | Total Returns | | | | Ratios to Average

Net Assets Before

Reimbursement/Income Taxes/

Tax Benefit (Expense) | | Ratios to Average

Net Assets After

Reimbursement(c)(d)(e) | | Ratios

to Average

Net Assets | | | |

| | | Based on

Market

Value(b) | | Based on

Net

Asset

Value(b) | | Ending

Net

Assets

(000) | | Expenses | | Net

Investment

Income

(Loss) | | Expenses | | Net

Investment

Income

(Loss) | | Current and

Deferred Tax

Benefit

(Expense) | | Portfolio

Turnover

Rate | |

| MLP & Strategic Equity (MTP) | |

| Year Ended 11/30: | |

| | 2012 | (i) | | | 3.31 | % | | | (.27 | )% | | $ | 255,804 | | | | (1.22 | )%** | | | (1.22 | )%** | | | 1.03 | %** | | | (.76 | )%** | | | .19 | %** | | | 14 | % | |

| | 2011 | (f) | | | (1.22 | ) | | | .11 | | | | 263,247 | | | | (1.45 | )** | | | (1.45 | )** | | | (2.52 | )** | | | (.66 | )** | | | (1.13 | )** | | | 20 | | |

| Year Ended 10/31: | |

| | 2011 | | | | (.82 | ) | | | 7.25 | | | | 262,851 | | | | (1.20 | ) | | | (1.20 | ) | | | (4.93 | ) | | | (1.17 | ) | | | (3.73 | ) | | | 37 | | |

| | 2010 | | | | 26.91 | | | | 36.28 | | | | 258,158 | | | | (1.31 | ) | | | (1.31 | ) | | | (8.36 | ) | | | (.86 | ) | | | (7.05 | ) | | | 16 | | |

| | 2009 | | | | 20.47 | | | | 25.04 | | | | 198,284 | | | | (1.35 | ) | | | (1.32 | ) | | | (1.35 | ) | | | (1.32 | ) | | | — | | | | 38 | | |

| | 2008 | | | | (12.82 | ) | | | (29.45 | ) | | | 170,399 | | | | (1.33 | ) | | | (.62 | ) | | | (1.33 | ) | | | (.62 | ) | | | — | | | | 5 | | |

| | 2007 | (g) | | | (17.37 | ) | | | (3.77 | ) | | | 262,603 | | | | (1.35 | )** | | | .62 | ** | | | (1.35 | )** | | | .62 | ** | | | — | | | | 0 | | |

| Energy MLP Total Return (JMF) | |

| Year Ended 11/30: | |

| | 2012 | (i) | | | 4.92 | | | | (2.25 | ) | | | 386,513 | | | | (2.07 | )** | | | (2.07 | )** | | | (2.07 | )** | | | (2.07 | )** | | | — | | | | 8 | | |

| | 2011 | (h) | | | (11.94 | ) | | | (4.76 | ) | | | 409,905 | | | | (1.78 | )** | | | (1.78 | )** | | | (1.78 | )** | | | (1.78 | )** | | | — | | | | 46 | | |

(a) Per share Net Investment Income (Loss) is calculated using the average daily shares method.

(b) For the fiscal years ended subsequent to October 31, 2009, where applicable, Total Return Based on Market Value is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized.

For the fiscal years ended subsequent to October 31, 2009, where applicable, Total Return Based on Net Asset Value is the combination of changes in net asset value, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending net asset value. The actual reinvest price for the last dividend declared in the period may often be based on the Fund's market price (and not its net asset value), and therefore may be different from the price used in the calculation. Total returns are not annualized.

For the period June 29, 2007, (commencement of operations) through October 31, 2009, MLP & Strategic Equity's (MTP) Total Returns Based on Market Value and Net Asset Value reflect the performance of the Fund based on a calculation approved by Fund management of IQ Advisors. Total returns based on the calculations described above may have produced substantially different results. Total returns are not annualized.

(c) After expense reimbursement from the Adviser, where applicable. Ratios do not reflect the effect of custodian fee credits earned on the Fund's net cash on deposit with the custodian bank, where applicable.

(d) Expenses ratios include current and deferred tax benefit (expense) allocated to net investment income (loss) and deferred tax benefit (expense) allocated to realized and unrealized gain (loss). Net Investment Income (Loss) ratios exclude deferred tax benefit (expense) allocated to realized and unrealized gain (loss).

(e) • Net Investment Income (Loss) ratios reflect income earned and expenses incurred on assets attributable to borrowings, as described in Footnote 7– Borrowing Arrangements.

• Each ratio includes the effect of all interest expense, costs and fees paid on borrowings as follows:

| | | Ratios of Borrowings Expense

to Average Net Assets | |

| Energy MLP Total Return (JMF) | |

| Year Ended 11/30: | | | |

| | 2012 | (i) | | | .51 | %** | |

| | 2011 | (h) | | | .30 | ** | |

(f) For the one month ended November 30, 2011.

(g) For the period June 29, 2007 (commencement of operations) through October 31, 2007.

(h) For the period February 23, 2011 (commencement of operations) through November 30, 2011.

(i) For the six months ended May 31, 2012.

* Represents distributions paid "From and in excess of net investment income."

** Annualized.

See accompanying notes to financial statements.

Nuveen Investments

23

Notes to

FINANCIAL STATEMENTS (Unaudited)

1. General Information and Significant Accounting Policies

General Information

The funds covered in this report and their corresponding New York Stock Exchange ("NYSE") symbols are MLP & Strategic Equity Fund Inc. (MTP) and Nuveen Energy MLP Total Return Fund (JMF) (each a "Fund" and collectively the "Funds"). The Funds are registered under the Investment Company Act of 1940, as amended, as closed-end, registered investment companies.

Prior to its commencement of operations on February 24, 2011, Energy MLP Total Return (JMF) had no operations other than those related to organizational matters, the initial capital contribution of $100,275, and the recording of the Fund's organizational expenses ($11,000) and its reimbursement by the Nuveen Fund Advisors, Inc. (the "Adviser"), a wholly-owned subsidiary of Nuveen Investments, Inc. ("Nuveen").

MLP & Strategic Equity's (MTP) investment objective is to provide a high level of after-tax total return. The Fund pursues its investment objective by investing substantially all of its net assets in publicly traded master limited partnerships ("MLPs") operating in the energy sector of the market. Energy MLP Total Return's (JMF) investment objective is to provide tax-advantaged total return. The Fund seeks to achieve its investment objective by investing primarily in a portfolio of MLPs in the energy sector. Under normal market circumstances, Energy MLP Total Return (JMF) will invest at least 80% of its managed assets (as defined in Footnote 6 — Management Fees and Other Transactions with Affiliates) in MLPs in the energy sector. The Funds consider investments in MLPs to include investments that offer economic exposure to publicly traded and private MLPs in the form of equity securities of MLPs, securities of entities holding primarily general partner or managing member interests in MLPs, securities that are derivatives of interests in MLPs and debt securities of MLPs. Further, the Funds consider an entity to be part of the energy sector if it derives at least 50% of its revenues from the business of exploring, developing, producing, gathering, transporting, processing, storing, refining, distributing, mining or marketing natural gas, natural gas liquids, crude oil, refined petroleum products or coal.

Fund Reorganization

During the current fiscal period, the Board of Directors/Trustees of the Nuveen closed-end funds approved the reorganization of MLP & Strategic Equity (MTP) into Energy MLP Total Return (JMF). At a special meeting of shareholders on July 12, 2012, (following the end of this reporting period) shareholders of Energy MLP Total Return (JMF) approved the reorganization. A special meeting of shareholders for MLP & Strategic Equity (MTP) for purpose of voting on the reorganization is scheduled for August 2, 2012. If the reorganization is approved by shareholders of MLP & Strategic Equity (MTP), it will occur on or around August 15, 2012.

Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements in accordance with accounting principles generally accepted in the United States ("U.S. GAAP").

Investment Valuation

Common stocks and other equity-type securities, such as MLPs, are valued at the last sales price on the securities exchange on which such securities are primarily traded and are generally classified as Level 1 for fair value measurement purposes. Securities primarily traded on the NASDAQ National Market ("NASDAQ") are valued, except as indicated below, at the NASDAQ Official Closing Price and are generally classified as Level 1. However, securities traded on a securities exchange or NASDAQ for which there were no transactions on a given day or securities not listed on a securities exchange or NASDAQ are valued at the quoted bid price and are generally classified as Level 2.

Repurchase agreements are valued at contract amount plus accrued interest, which approximates market value. These securities are generally classified as Level 2.

Certain securities may not be able to be priced by the pre-established pricing methods as described above. Such securities may be valued by the Funds' Board of Directors/Trustees or its designee at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; debt securities that have gone into default and for which there is no current market quotation; a security whose market price is not available from a

Nuveen Investments

24

pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of a Fund's net asset value (as may be the case in non-U.S. markets on which the security is primarily traded) or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, is not deemed to reflect the security's fair value. As a general principle, the fair value of a security would appear to be the amount that the owner might reasonably expect to receive for it in a current sale. A variety of factors may be considered in determining the fair value of such securities, which may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor's credit characteristics considered relevant. These securities are generally classified as Level 2 or Level 3 depending on the priority of the significant inputs. Regardless of the method employed to value a particular security, all valuations are subject to review by the Funds' Board of Directors/Trustees or its designee.

Refer to Footnote 2 — Fair Value Measurements for further details on the leveling of securities held by the Funds as of the end of the reporting period.

Master Limited Partnerships

An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the MLP. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, which are intended to have no role in the operation and management of the entity and receive cash distributions.

Each Fund may purchase both domestic and international MLPs. Each Fund's investment in MLPs may include ownership of MLP common units and MLP subordinated units. Each Fund also may purchase MLP I-Shares (together with the MLPs, the "MLP Entities"). MLP I-Shares are pay-in-kind securities created as a means to facilitate institutional ownership of MLPs by simplifying the tax and administrative implications of the MLP structure. Generally, when an MLP pays its quarterly cash distribution to unitholders, holders of I-Shares do not receive a cash distribution; rather, they receive a dividend of additional I-Shares from the MLP of comparable value to the cash distribution paid to each unitholder. Each Fund may purchase interests in MLP Entities on an exchange or may utilize non-public market transactions to obtain its holdings, including but not limited to privately negotiated purchases of securities from the issuers themselves, broker-dealers, or other qualified institutional buyers.

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from investment transactions are determined on the specific identification method, which is the same basis used for federal income tax purposes.

Investment Income

Dividend income is recorded on the ex-dividend date, or for foreign securities, when information is available. Interest income is recognized on an accrual basis.

Each Fund records the character of distributions received from MLPs based on estimates made at the time such distributions are received. These estimates are based upon a historical review of information available from each MLP and other industry sources. Each Fund's characterization of the estimates may subsequently be revised based on information received from MLPs after their tax reporting periods conclude. Distributions, recognized as "Distributions from MLPs" on the Statement of Operations, are offset by amounts characterized as return of capital from the MLP entities, which are recognized as "Return of capital on distributions from MLPs" on the Statement of Operations. For the six months ended May 31, 2012, each Fund estimated and characterized 100% of its distributions from MLPs as return of capital.

Income Taxes

Each Fund is treated as a regular corporation, or "C" corporation, for U.S. federal income tax purposes. Accordingly, each Fund is generally subject to U.S. federal income tax on its taxable income at statutory rates applicable to corporations (currently at a maximum rate of 35%). The estimated effective state income tax rate for MLP & Strategic Equity (MTP) and Energy MLP Total Return (JMF) are (1.30)% and (2.40)%, respectively. Each Fund may be subject to a 20% federal alternative minimum tax on its federal alternative minimum taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax.

Each Fund's income tax provision consists of the following as of May 31, 2012:

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Current tax expense (benefit): | |

| Federal | | $ | 910,707 | | | $ | — | | |

| State | | | 621,556 | | | | — | | |

| Total current tax expense (benefit) | | $ | 1,532,263 | | | $ | — | | |

Nuveen Investments

25

Notes to

FINANCIAL STATEMENTS (Unaudited) (continued)

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Deferred tax expense (benefit): | |

| Federal | | $ | (1,388,356 | ) | | $ | — | | |

| State | | | (397,441 | ) | | | — | | |

| Total deferred tax expense (benefit) | | $ | (1,785,797 | ) | | $ | — | | |

The reconciliation between the federal statutory income tax rate of 35% and the effective tax rate on net investment income (loss) and realized and unrealized gain (loss) follows:

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Description | | Amount | | Rate | | Amount | | Rate | |

| Application of statutory income tax rate | | $ | (236,764 | ) | | | 35.00 | % | | $ | (2,922,539 | ) | | | 35.00 | % | |

| State income taxes net of federal benefit | | | 8,827 | | | | (1.30 | ) | | | 200,300 | | | | (2.40 | ) | |

| Effect of permanent differences | | | (14,990 | ) | | | 2.22 | | | | 6,069 | | | | (.07 | ) | |

| Effect of valuation allowance | | | (2,256 | ) | | | .33 | | | | 2,725,706 | | | | (32.64 | ) | |

| Effect of other items | | | (8,351 | ) | | | 1.23 | | | | (9,536 | ) | | | .11 | | |

| Total income tax expense (benefit) | | $ | (253,534 | ) | | | 37.48 | % | | $ | — | | | | — | % | |

Each Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, each Fund includes its allocable share of the MLPs' taxable income in computing its own taxable income. Each Fund's tax expense or benefit is recognized on the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/(losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. To the extent a Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance is required. The determination of whether a valuation allowance is required is based on the evaluation criterion provided by ASC 740, Income Taxes ("ASC 740") that it is more-likely-than-not that some portion or all of the deferred tax asset will not be realized. Among the factors considered in assessing each Fund's valuation allowance: the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory carryforward periods and the associated risk that operating and capital loss carryforwards may expire unused.

Nuveen Investments

26

Components of the Funds' deferred tax assets and liabilities as of May 31, 2012, are as follows:

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Description | | Deferred

Benefit

(Liability) | | Deferred

Benefit

(Liability) | |

| Deferred tax assets: | |

| Net operating loss carryforward (tax basis) | | $ | 1,187,749 | | | $ | 14,322,488 | | |

| Capital loss carryforward (tax basis) | | | 5,783,819 | | | | 11,434,847 | | |

| Tax credit carryforward—AMT | | | 905,127 | | | | — | | |

| Other | | | 7,594 | | | | 3,849 | | |

| | | $ | 7,884,289 | | | $ | 25,761,184 | | |

| Deferred tax liabilities: | |

| Accumulated net unrealized gain on investments (tax basis) | | $ | (30,421,545 | ) | | $ | (15,318,824 | ) | |

| Net deferred taxes before valuation allowance | | $ | (22,537,256 | ) | | $ | 10,442,360 | | |

| Less: valuation allowance | | | (1,185,663 | ) | | | (10,442,360 | ) | |

| Net deferred tax assets (liabilities) | | $ | (23,722,919 | ) | | $ | — | | |

| Changes in the valuation allowance were as follows: | |

| Balance at the beginning of period | | $ | 1,187,919 | | | $ | 7,716,655 | | |

| Provision to return | | | (2,256 | ) | | | 2,725,705 | | |

| Balance at the end of period | | $ | 1,185,663 | | | $ | 10,442,360 | | |

For all open tax years and all major taxing jurisdictions, management of the Funds has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those that are open for examination by taxing authorities (i.e., generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Funds is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

At May 31, 2012, the cost and unrealized appreciation (depreciation) of investments, as determined on a federal income tax basis, were as follows:

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Cost of investments | | $ | 200,446,038 | | | $ | 506,590,873 | | |

| Gross unrealized: | |

| Appreciation | | $ | 88,495,226 | | | $ | 85,788,894 | | |

| Depreciation | | | (7,283,731 | ) | | | (44,843,010 | ) | |

| Net unrealized appreciation (depreciation) of investments | | $ | 81,211,495 | | | $ | 40,945,884 | | |

At November 30, 2011, the Funds' last tax year end, the Funds had net operating loss carryforwards available for federal income tax purposes to be applied against future taxable income, if any. If not applied, the carryforwards will expire as follows:

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Expiration: | |

| November 30, 2027 | | $ | 7,691,365 | | | $ | — | | |

| November 30, 2028 | | | 13,309,618 | | | | — | | |

| November 30, 2029 | | | 1,440,597 | | | | — | | |

| November 30, 2030 | | | 1,906,177 | | | | — | | |

| November 30, 2031 | | | — | | | | 4,531,934 | | |

| Total | | $ | 24,347,757 | | | $ | 4,531,934 | | |

Nuveen Investments

27

Notes to

FINANCIAL STATEMENTS (Unaudited) (continued)

At November 30, 2011, the Funds' last tax year end, the Funds had unused capital loss carryforwards available for federal income tax purposes to be applied against future capital gains, if any. If not applied, the carryforwards will expire as follows:

| | | MLP & Strategic

Equity (MTP) | | Energy MLP

Total Return (JMF) | |

| Expiration: | |

| November 30, 2013 | | $ | 9,435,907 | | | $ | — | | |

| November 30, 2014 | | | 36,376 | | | | — | | |

| November 30, 2016 | | | — | | | | 20,390,126 | | |

| Total | | $ | 9,472,283 | | | $ | 20,390,126 | | |

Dividends and Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

The Funds' quarterly distributions are set pursuant to a managed distribution program. Under that program, the Funds may source their distributions from the following: net distributable cash flow, net realized gains, unrealized gains, and, in certain cases, a return of Fund principal. Net distributable cash flow consists primarily of distributions received from a Fund's investments in shares of energy MLPs, less payments on any of its leveraging instruments and other Fund expenses (including taxes paid at the Fund level since each Fund is taxed as an ordinary "C" corporation). Currently, the Funds intend to distribute substantially all of their net distributable cash flow received without sourcing incremental amounts from other components.

For purposes of determining the income tax characterization of each Fund's distributions, amounts in excess of each Fund's earnings and profits for federal income tax purposes are characterized as a return of capital. Distributions attributable to earnings and profits for federal income tax purposes are characterized as taxable ordinary dividends. Each Fund will calculate its earnings and profits based on its taxable period ended November 30 and will report the character of its distributions to shareholders shortly after the end of the calendar year. The primary components of each Fund's annual earnings and profits calculation are: income, loss and other flow-through items (including earnings and profits adjustments) reported by the MLPs on Schedule K-1, realized gain or loss on sales of Fund investments and deductible operating expenses. In addition, a Fund will recognize income (and increase its earnings and profits) should it receive a distribution from an MLP which exceeds its income tax basis. Distributions from any given MLP are treated as a return of capital to the extent of a Fund's income tax basis in that MLP.

The character of each Fund's distributions for U.S. GAAP purposes, which can often differ from the tax character, is based on estimates of the sources of those distributions (which can be from a combination of income and/or a return of capital) made at the time such distributions are received, which in turn are based upon a historical review of information available from each MLP and other industry sources. The Fund's accounting characterization of the estimates may subsequently be revised based on information received from MLPs after their tax reporting periods conclude. It is currently estimated that 100% of each Fund's distributions during the six months ended May 31, 2012, will be characterized for U.S. GAAP purposes as a return of capital.

The distributions made by the Fund during the six months ended May 31, 2012, are provisionally classified as being "From and in excess of net investment income." Those distributions will be classified as being from net investment income, net realized capital gains and/or a return of capital for tax purposes after November 30, 2012, the Funds' fiscal year ends.

Derivative Financial Instruments

Each Fund is authorized to invest in certain derivative instruments, including futures, options and swap contracts. Although each Fund is authorized to invest in such derivative instruments, and may do so in the future, they did not make any such investments during the six months ended May 31, 2012.

Organizational and Offering Costs

The Adviser has agreed to reimburse all Energy MLP Total Return's (JMF) organizational expenses (approximately $11,000) and to pay all offering costs (other than the sales load) that exceed $.04 per share. The Fund's share of offering costs ($944,400) was recorded as

Nuveen Investments

28

a reduction of proceeds from the sale of shares during the period February 23, 2011 (commencement of operations) through November 30, 2011.

Repurchase Agreements

In connection with transactions in repurchase agreements, it is the Funds' policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. If the counterparty defaults, and the fair value of the collateral declines, realization of the collateral may be delayed or limited.

Custodian Fee Credit

Each Fund has an arrangement with the custodian bank whereby certain custodian fees and expenses are reduced by net credits earned on each Fund's cash on deposit with the bank. Such deposit arrangements are an alternative to overnight investments. Credits for cash balances may be offset by charges for any days on which a Fund overdraws its account at the custodian bank.

Indemnifications