UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22482

Nuveen Energy MLP Total Return Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: November 30

Date of reporting period: May 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

Item 1. Reports to Stockholders.

Closed-End Funds

Nuveen Investments

Closed-End Funds

Seeking to provide a high level of tax-advantaged total return.

Semi-Annual Report

May 31, 2011

| | | | | | | | |

Nuveen Energy MLP Total Return Fund JMF | | | | | | | | |

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp — the parent of FAF Advisors — received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long-term investment business of FAF Advisors, including investment-management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $206 billion of assets as of March 31, 2011.

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

In 2010, the global economy recorded another year of recovery from the financial and economic crises of 2008, but many of the factors that caused the downturn still weigh on the prospects for continued improvement. In the U.S., ongoing weakness in housing values has put pressure on homeowners and mortgage lenders. Similarly, the strong earnings recovery for corporations and banks is only slowly being translated into increased hiring or more active lending. Globally, deleveraging by private and public borrowers has inhibited economic growth and that process is far from complete.

Encouragingly, constructive actions are being taken by governments around the world to deal with economic issues. In the U.S., the recent passage of a stimulatory tax bill relieved some of the pressure on the Federal Reserve to promote economic expansion through quantitative easing and offers the promise of sustained economic growth. A number of European governments are undertaking programs that could significantly reduce their budget deficits. Governments across the emerging markets are implementing various steps to deal with global capital flows without undermining international trade and investment.

The success of these government actions could determine whether 2011 brings further economic recovery and financial market progress. One risk associated with the extraordinary efforts to strengthen U.S. economic growth is that the debt of the U.S. government will continue to grow to unprecedented levels. Another risk is that over time there could be inflationary pressures on asset values in the U.S. and abroad, because what happens in the U.S. impacts the rest of the world economy. Also, these various actions are being taken in a setting of heightened global economic uncertainty, primarily about the supplies of energy and other critical commodities. In this challenging environment, your Nuveen investment team continues to seek sustainable investment opportunities and to remain alert to potential risks in a recovery still facing many headwinds. On your behalf, we monitor their activities to assure they maintain their investment disciplines.

As you will note elsewhere in this report, on December 31, 2010, Nuveen Investments completed a strategic combination with FAF Advisors, Inc., the manager of the First American Funds. The combination adds highly respected and distinct investment teams to meet the needs of investors and their advisors and is designed to benefit all fund shareholders by creating a fund organization with the potential for further economies of scale and the ability to draw from even greater talent and expertise to meet those investor needs.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

July 21, 2011

Portfolio Managers’ Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

The Fund’s investment adviser is Nuveen Fund Advisors, Inc., an affiliate of Nuveen Investments. The Fund’s portfolio is managed by Fiduciary Asset Management Inc. (FAMCO), a wholly owned affiliate of Piper Jaffray Investment Management, Inc. Mr. James J. Cunnane Jr., CFA, chief investment officer at FAMCO, and Mr. Quinn T. Kiley, senior portfolio manager at FAMCO, co-manage the Fund. Collectively, Mr. Cunnane and Mr. Kiley have over 25 years of experience managing Master Limited Partnerships. Here, the management team reviews their investment strategy and the Fund’s performance for the period between its inception and the end of its initial reporting period.

What strategies were used to manage the Fund from inception through May 31, 2011?

The Fund launched on February 24, 2011. Since its inception, the proceeds from the Fund’s initial public offering have been invested in publicly traded Master Limited Partnerships (MLPs) operating primarily in the energy sector with the main objective of providing a tax-advantaged total return. The Fund seeks to achieve its objective by investing primarily in a portfolio of MLPs in the energy sector. The Fund believes that MLPs represent a timely investment opportunity since MLPs can provide an attractive level of tax-deferred income and offer the potential for increased distributions and capital appreciation over time. To implement its strategy, the Fund’s portfolio management team combines its top-down strategic investment style with its rigorous, bottom-up investment process. The Fund seeks to identify MLPs that it believes have the most attractive current yields and total return potential. In seeking to mitigate certain key risks of MLP investing, the Fund may use various hedging techniques consistent with its top-down investment style with the goal of enhancing its risk-adjusted total return over the longer term. During this initial reporting period, the Fund invested with a focus on higher yielding MLPs, such as those involved with the exploration, development and production of oil and gas reserves.

We maintained our preference for holding MLPs that own pipelines and other infrastructure facilities. This comes from our belief in the expected growth of production from nonconventional oil and gas reserves throughout the United States. This potential increase in production from new regions, combined with what we believe to be an increasingly favorable policy shift towards domestic natural gas consumption, could result in the need for higher utilization rates of existing infrastructure and the need for new pipelines as well. We believe this environment is supportive of MLP cash flows and valuations. Distribution growth has always been an important factor in MLP valuations, and we believe a potential increase in mergers and acquisition activity could drive some of this distribution growth to investors. Consequently, we continued to carefully evaluate these types of opportunities. Historically, MLPs have increased their cash flow and distributions by either building or buying new energy infrastructure. When built or bought for the right price, such transactions have been significant contributors of value to MLP investors over time. This is based upon the premise that a diverse asset base can provide growth opportunities, and

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the Performance Overview page for the Fund in this report.

| * | Since inception returns are from 2/24/11. |

| 1 | The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis, and the corresponding total-return index is disseminated daily. The index returns assume reinvestment of dividends, but do not reflect any applicable sales charges. You cannot invest directly in an index. |

| 2 | The S&P 500 Index is an unmanaged index generally considered representative of the U.S. stock market. The index returns assume reinvestment of dividends, but do not reflect any applicable sales charges. You cannot invest directly in an index. |

the right additions can be both profitable in their own right and increase efficiency and profitability to existing businesses. We continued to position the portfolio to take advantage of these types of industry fundamentals and trends, trying to identify the best value propositions to gain exposure to the characteristics we seek.

In this environment, how did the Fund perform over the period and what were the key drivers of this performance?

Returns for the Fund, as well as for comparative indexes, are presented in the accompanying table.

Cumulative Total Returns on Net Asset Value

For the period ended 5/31/11

| | | | |

| | | Since Inception* | |

JMF | | | -4.00% | |

Alerian MLP Index1 | | | -0.47% | |

S&P 500 Index2 | | | 3.44% | |

Over this abbreviated time period, JMF’s return trailed the index results. JMF implemented its leverage strategy in early May through the use of bank borrowings, which magnified the month’s negative performance. In addition, as a new issue, JMF’s net asset value (NAV) had comparatively very little benefit from the NAV support experienced by many of the more seasoned funds in the MLP market. These more seasoned funds generally had unrealized portfolio gains and an associated deferred tax liability. As the market retreated, the NAV declines of these seasoned funds were partially, but meaningfully, offset by a reduction in their deferred tax liabilities. Together, the effects of leverage and the relative absence of deferred tax liability had a greater effect on JMF than the effects of sector and security selection.

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of the Fund relative to the comparative indexes was the Fund’s use of leverage through bank borrowings. The Fund uses leverage because its managers believe that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by the Fund decline, the negative impact of these valuation changes on net asset value and total return is magnified by the use of leverage. This is what happened in the Fund during the period, as the use of structural leverage hurt its overall performance.

RISK CONSIDERATIONS

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Master Limited Partnerships (MLPs) are subject to additional risks including sector risk, tax risk, inflation and deflation risk, and valuation risk. Past performance is no guarantee of future results.

Leverage Risk; The Fund’s use of leverage creates the possibility of higher volatility for the Fund’s per share NAV, market price, and distributions. Leverage risk can be introduced through structural leverage (issuing preferred shares or debt borrowings at the Fund level) or through certain derivative investments held in the Fund’s portfolio. Leverage typically magnifies the total return of a Fund’s portfolio, whether that return is positive or negative. The use of leverage creates an opportunity for increased common share net income, but there is no assurance that a Fund’s leveraging strategy will be successful.

Tax Risk; The Fund’s investment program and the tax treatment of Fund distributions may be affected by IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations, including changes resulting from the “sunset” provisions that may apply to the favorable tax treatment of tax-advantaged dividends. There can be no assurance as to the percentage of a Fund’s distributions that will qualify as tax-advantaged dividends. Tax risk also includes the risk that the tax treatment and characterization of the Fund’s distributions may vary significantly from time to time. This is particularly true for funds employing a managed distribution program.

Price Risk; Common shares of closed-end investment companies like the Fund frequently trade at a discount to their net asset value. The Fund cannot predict whether the common shares will trade at, above or below net asset value. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Share Distribution

and Share Price Information

The following information regarding your Fund’s distributions is current as of May 31, 2011, and likely will vary over time based on the Fund’s investment activities and portfolio investment value changes.

On April 27, 2011, the Fund declared its first quarterly distribution to shareholders of $.3160 per share payable May 16, 2011. Some of the important factors affecting the amount and composition of this distribution are summarized below.

The Fund has a managed distribution program. The goal of this program is to provide shareholders with relatively consistent and predictable cash flow by systematically converting the Fund’s expected long-term return potential into regular distributions. As a result, regular distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about the managed distribution program are:

| • | | The Fund seeks to establish a relatively stable distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about the Fund’s past or future investment performance from its current distribution rate. |

| • | | Actual returns will differ from projected long-term returns (and therefore the Fund’s distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value. |

| • | | Each distribution is expected to be paid from some or all of the following sources: |

| | • | | net investment income (regular interest and dividends), |

| | • | | realized capital gains, and |

| | • | | unrealized gains, or, in certain cases, a return of principal (non-taxable distributions). |

| • | | A non-taxable distribution is a payment of a portion of the Fund’s capital. When the Fund’s returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund’s return falls short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund’s total return exceeds distributions. |

| • | | Because distribution source estimates are updated during the year based on the Fund’s performance and forecast for its current fiscal year, estimates on the nature of your distributions provided at the time distributions are paid may differ from both the tax information reported to you in your Fund’s IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment. |

The following table provides estimated information regarding the Fund’s distributions and total return performance for the period since inception on February 24, 2011 through May 31, 2011. The distribution information is presented on a tax basis rather than a generally accepted accounting principles (GAAP) basis. This information is intended to help you better understand whether the Fund’s returns for the specified time period were sufficient to meet the Fund’s distributions.

| | | | |

| As of 5/31/11 | | JMF | |

Inception date | | | 2/24/11 | |

For the period February 24, 2011 through May 31, 2011: | | | | |

Per share distribution: | | | | |

From net investment income | | | $0.00 | |

From realized capital gains* | | | 0.00 | |

Return of capital | | | 0.32 | |

| | | | |

Total per share distribution | | | $0.32 | |

| | | | |

| |

Annualized distribution rate on NAV | | | 7.11% | |

| |

Since inception (cumulative) total return on NAV | | | -4.00% | |

| * | Note that because the Fund is treated as a regular corporation for U.S. federal income tax purposes, no portion of the Fund’s distributions are eligible for designation as capital gain dividends. Consequently, the tax characterization (i.e. Form 1099 reporting) of the Fund’s distribution will be either ordinary dividend or return of capital. |

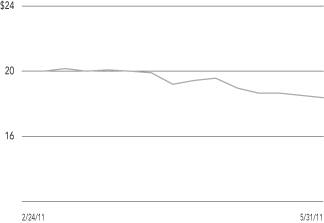

Share Price Information

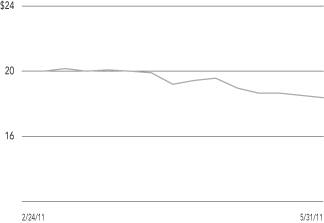

As of May 31, 2011, the Fund’s share price was trading at a premium of +2.00%, compared with an average premium of +4.25% for the entire reporting period.

| | |

JMF Performance OVERVIEW | | Nuveen Energy MLP Total Return Fund as of May 31, 2011 |

| | | | |

| Fund Snapshot | | | | |

| Common Share Price | | | $18.37 | |

| Common Share Net Asset Value (NAV) | | | $18.01 | |

| Premium/(Discount) to NAV | | | 2.00% | |

Current Distribution Rate1 | | | 6.88% | |

Net Assets Applicable to

Common Shares ($000) | | | $426,832 | |

| | | | |

| |

Leverage (as a % of managed assets)3 | | | | |

| Structural Leverage | | | 20.86% | |

| | | | | | | | |

| |

Cumulative Total Return (Inception 2/24/11) | | | | | |

| | | On Share Price | | | On NAV | |

Since Inception | | | -6.49% | | | | -4.00% | |

| | | | |

| |

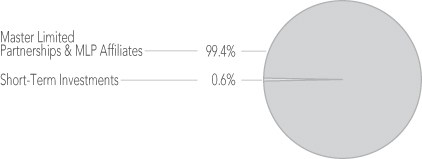

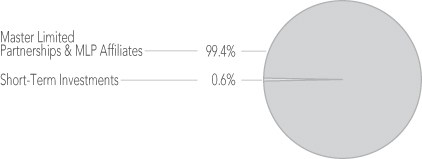

Portfolio Composition (as a % of total investments)2 | | | | |

Oil, Gas & Consumable Fuels | | | 96.3% | |

Gas Utilities | | | 1.4% | |

Energy Equipment & Services | | | 1.7% | |

| Short-Term Investments | | | 0.6% | |

| | | | |

| |

Ten Largest Master Limited Partnerships & MLP Affiliates Holdings (as a % of total investments)2 | | | | |

| Kinder Morgan Management LLC | | | 9.5% | |

| Regency Energy Partners LP | | | 6.4% | |

| Enbridge Energy Partners | | | 6.3% | |

| Plains All American Pipeline LP | | | 6.2% | |

| Enterprise Products Partners LP | | | 5.3% | |

| Inergy LP | | | 5.1% | |

| Copano Energy, LLC | | | 4.6% | |

| Targa Resources Partners LP | | | 4.3% | |

| DCP Midstream Partners LP | | | 4.0% | |

| Boardwalk Pipeline Partners, LP | | | 3.4% | |

Portfolio Allocation (as a % of total investments)2

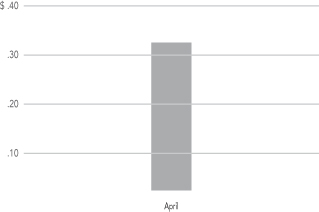

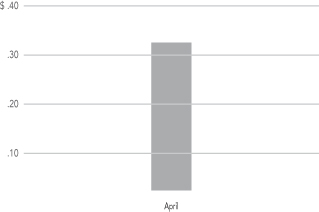

2011 Quarterly Dividends Per Common Share4

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page.

1 Current Distribution Rate is based on the Fund’s current annualized quarterly distribution divided by the Fund’s current market price. The Fund’s quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes.

2 Holdings are subject to change.

3 As defined in Footnote 7 – Management Fees and Other Transactions with Affiliates.

4 On April 27, 2011, the Fund declared its first quarterly distribution of $.3160 per share.

JMF

Nuveen Energy MLP Total Return Fund

Portfolio of Investments

May 31, 2011 (Unaudited)

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | Master Limited Partnerships & MLP Affiliates – 126.1% (99.4% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | | | Energy Equipment & Services – 2.2% (1.7% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 368,020 | | | Exterran Partners, LP | | | | | | | | | | | $ 9,461,794 | |

| | | | Gas Utilities – 1.9% (1.4% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 99,965 | | | Ferrellgas Partners LP | | | | | | | | | | | 2,632,078 | |

| | 96,490 | | | Suburban Propane Partners LP | | | | | | | | | | | 5,091,777 | |

| | | | Total Gas Utilities | | | | | | | | | | | 7,723,855 | |

| | | | Oil, Gas & Consumable Fuels – 122.0% (96.3% of Total Investments) | | | | | | | | | | | | |

| | | | |

| | 620,187 | | | Boardwalk Pipeline Partners, LP | | | | | | | | | | | 18,047,442 | |

| | 180,520 | | | Buckeye Partners, LP | | | | | | | | | | | 11,453,994 | |

| | 263,250 | | | Capital Product Partners LP | | | | | | | | | | | 2,445,593 | |

| | 739,770 | | | Copano Energy, LLC | | | | | | | | | | | 24,826,681 | |

| | 181,520 | | | Crestwood Midstream Partners LP | | | | | | | | | | | 5,051,702 | |

| | 530,070 | | | DCP Midstream Partners LP | | | | | | | | | | | 21,483,737 | |

| | 157,600 | | | El Paso Pipeline Partners, LP | | | | | | | | | | | 5,416,712 | |

| | 482,928 | | | Enbridge Energy Management LLC (5) | | | | | | | | | | | 14,980,438 | |

| | 1,104,190 | | | Enbridge Energy Partners LP | | | | | | | | | | | 33,909,675 | |

| | 474,190 | | | Encore Energy Partners LP | | | | | | | | | | | 10,541,244 | |

| | 382,800 | | | Energy Transfer Equity LP | | | | | | | | | | | 16,131,192 | |

| | 179,085 | | | Energy Transfer Partners LP | | | | | | | | | | | 8,508,328 | |

| | 687,190 | | | Enterprise Products Partners LP | | | | | | | | | | | 28,614,592 | |

| | 301,000 | | | EV Energy Partners, LP | | | | | | | | | | | 16,660,350 | |

| | 160,870 | | | Holly Energy Partners, LP | | | | | | | | | | | 8,852,676 | |

| | 740,680 | | | Inergy LP | | | | | | | | | | | 27,471,821 | |

| | 783,080 | | | Kinder Morgan Management LLC (5) | | | | | | | | | | | 51,111,630 | |

| | 115,040 | | | MarkWest Energy Partners LP | | | | | | | | | | | 5,466,701 | |

| | 214,040 | | | Martin Midstream Partners LP | | | | | | | | | | | 8,315,454 | |

| | 171,950 | | | Natural Resource Partners LP | | | | | | | | | | | 5,552,266 | |

| | 187,578 | | | NGL Energy Partners LP | | | | | | | | | | | 3,927,883 | |

| | 726,150 | | | Niska Gas Storage Partners LLC | | | | | | | | | | | 14,094,572 | |

| | 241,000 | | | NuStar GP Holdings LLC | | | | | | | | | | | 8,738,660 | |

| | 693,815 | | | Oxford Resource Partners LP | | | | | | | | | | | 17,185,798 | |

| | 537,590 | | | Plains All American Pipeline LP | | | | | | | | | | | 33,459,602 | |

| | 261,960 | | | QR Energy, LP | | | | | | | | | | | 5,708,108 | |

| | 625,000 | | | Regency Energy Partners LP (2) | | | | | | | | | | | 14,294,119 | |

| | 789,155 | | | Regency Energy Partners LP | | | | | | | | | | | 19,878,814 | |

| | 672,450 | | | Targa Resources Partners LP | | | | | | | | | | | 23,239,872 | |

| | 120,670 | | | TC Pipelines LP | | | | | | | | | | | 5,570,127 | |

| | 574,600 | | | Teekay Offshore Partners LP | | | | | | | | | | | 16,692,130 | |

| | 456,970 | | | Teekay LNG Partners LP | | | | | | | | | | | 16,295,550 | |

| | 162,660 | | | TransMontaigne Partners, LP | | | | | | | | | | | 5,645,929 | |

| | 213,930 | | | Williams Partners LP | | | | | | | | | | | 11,321,176 | |

| | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | 520,894,568 | |

| | | | Total Master Limited Partnerships & MLP Affiliates (cost $550,783,717) | | | | | | | | | | | 538,080,217 | |

| | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Value | |

| | | | Short-Term Investments – 0.7% (0.6% of Total Investments) | | | | | | | | | | | | |

| | | | |

| $ | 3,090 | | | Repurchase Agreement with State Street Bank, dated 5/31/11, repurchase price $3,089,510, collateralized by $3,130,000 U.S. Treasury Notes, 1.000%, due 4/30/12, value $3,154,793 | | | 0.010% | | | | 6/01/11 | | | | $3,089,509 | |

| | | | Total Short-Term Investments (cost $3,089,509) | | | | | | | | | | | 3,089,509 | |

| | | | Total Investments (cost $553,873,226) – 126.8% | | | | | | | | | | | 541,169,726 | |

| | | | Borrowings – (26.4)% (3), (4) | | | | | | | | | | | (112,500,000 | ) |

| | | | Other Assets Less Liabilities – (0.4)% | | | | | | | | | | | (1,838,099 | ) |

| | | | Net Assets – 100% | | | | | | | | | | | $426,831,627 | |

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted. |

| | (2) | | Investment valued at fair value using methods determined in good faith by, or at the discretion of, the Board of Trustees. For fair value measurement disclosure purposes, investment categorized as Level 3. See Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies, Investment Valuation for more information. |

| | (3) | | Borrowings Payable as a percentage of total investments is 20.8%. |

| | (4) | | The Fund may pledge up to 100% of its eligible investments in the Portfolio of Investments as collateral for Borrowings. As of May 31, 2011, investments with a value of $381,463,442 have been pledged as collateral for Borrowings. |

| | (5) | | Distributions are paid in-kind. |

See accompanying notes to financial statements.

Statement of

Assets & Liabilities (Unaudited)

May 31, 2011

| | | | |

Assets | | | | |

Investments, at value (cost $553,873,226) | | $ | 541,169,726 | |

Receivables for investments sold | | | 6,652,594 | |

Total assets | | | 547,822,320 | |

Liabilities | | | | |

Borrowings | | | 112,500,000 | |

Payables: | | | | |

Interest | | | 110,110 | |

Investments purchased | | | 6,832,333 | |

Offering costs | | | 944,400 | |

Accrued expenses: | | | | |

Management fees | | | 481,014 | |

Other | | | 122,836 | |

Total liabilities | | | 120,990,693 | |

Net assets | | $ | 426,831,627 | |

Shares outstanding | | | 23,704,705 | |

Net asset value per share outstanding | | $ | 18.01 | |

Net assets consist of: | | | | |

Shares, $.01 par value per share | | $ | 237,047 | |

Paid-in surplus | | | 451,429,937 | |

Accumulated net investment loss | | | (9,018,647 | ) |

Accumulated net realized gain (loss) | | | (3,113,210 | ) |

Net unrealized appreciation (depreciation) | | | (12,703,500 | ) |

Net assets | | $ | 426,831,627 | |

Authorized shares | | | Unlimited | |

See accompanying notes to financial statements.

Statement of

Operations (Unaudited)

For the Period February 24, 2011 (commencement of operations) through May 31, 2011

| | | | |

Investment Income | | | | |

Distributions from master limited partnerships | | $

| 7,039,870

|

|

Less: Return of capital on distributions | |

| (7,039,870

| )

|

Interest | |

| 1,063

|

|

Total investment income | | | 1,063 | |

Expenses | | | | |

Management fees | | | 1,266,886 | |

Shareholders’ servicing agent fees and expenses | | | 64 | |

Interest expense on borrowings and amortization of borrowing costs | | | 184,460 | |

Custodian’s fees and expenses | | | 16,944 | |

Trustees’ fees and expenses | | | 4,059 | |

Professional fees | | | 20,894 | |

Shareholders’ reports – printing and mailing expenses | | | 42,151 | |

Investor relations expense | | | 21,145 | |

Other expenses | | | 5,381 | |

Total expenses before custodian fee credit | | | 1,561,984 | |

Custodian fee credit | | | (4,693 | ) |

Net expenses | | | 1,557,291 | |

Net investment income (loss) | | | (1,556,228 | ) |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from investments | | | (3,113,210 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | (12,703,500 | ) |

Net realized and unrealized gain (loss) | | | (15,816,710 | ) |

Net increase (decrease) in net assets from operations | | $ | (17,372,938 | ) |

See accompanying notes to financial statements.

Statement of

Changes in Net Assets (Unaudited)

For the Period February 24, 2011 (commencement of operations) through May 31, 2011

| | | | |

| | | | |

Operations | | | | |

Net investment income (loss) | | $ | (1,556,228 | ) |

Net realized gain (loss) from investments | | | (3,113,210 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | (12,703,500 | ) |

Net increase (decrease) in net assets from operations | | | (17,372,938 | ) |

Distributions to Shareholders | | | | |

From and in excess of net investment income | | | (7,462,419 | ) |

From net investment income | | | – | |

Return of capital | | | – | |

Decrease in net assets from distributions to shareholders | | | (7,462,419 | ) |

Fund Share Transactions | | | | |

Proceeds from sale of shares, net of offering costs | | | 450,006,600 | |

Net proceeds from shares issued to shareholders due to reinvestment of distributions | | | 1,560,109 | |

Net increase (decrease) in net assets from Fund share transactions | | | 451,566,709 | |

Net increase (decrease) in net assets | | | 426,731,352 | |

Net assets at the beginning of period | | | 100,275 | |

Net assets at the end of period | | $ | 426,831,627 | |

Accumulated net investment loss at end of period | | $ | (9,018,647 | ) |

See accompanying notes to financial statements.

Statement of

Cash Flows (Unaudited)

For the Period February 24, 2011 (commencement of operations) through May 31, 2011

| | | | |

Cash Flows from Operating Activities: | | | | |

Net Increase (Decrease) in Net Assets from Operations | | $ | (17,372,938 | ) |

Adjustments to reconcile the net increase (decrease) in net assets from operations | | | | |

to net cash provided by (used in) operating activities: | | | | |

Purchases of investments | | | (606,019,683 | ) |

Proceeds from sales and maturities of investments | | | 52,122,756 | |

Proceeds from (Purchase of) short-term investments, net | | | (3,089,509 | ) |

(Increase) Decrease in receivable for investments sold | | | (6,652,594 | ) |

Increase (Decrease) in: | | | | |

Payable for interest | | | 110,110 | |

Payable for investments purchased | | | 6,832,333 | |

Accrued management fees | | | 481,014 | |

Accrued other expenses | | | 122,836 | |

Net realized (gain) loss from investments | | | 3,113,210 | |

Change in net unrealized (appreciation) depreciation of investments | | | 12,703,500 | |

Net cash provided by (used in) operating activities | | | (557,648,965 | ) |

Cash Flows from Financing Activities: | | | | |

Increase (Decrease) in: | | | | |

Borrowings | | | 112,500,000 | |

Payable for offering costs | | | 944,400 | |

Cash distributions paid to shareholders | | | (5,902,310 | ) |

Proceeds from sale of shares | | | 450,951,000 | |

Offering costs | |

| (944,400

| )

|

Net cash provided by (used in) financing activities | | | 557,548,690 | |

Net Increase (Decrease) in Cash | | | (100,275 | ) |

Cash at the beginning of period | | | 100,275 | |

Cash at the End of Period | | $ | – | |

Supplemental Disclosure of Cash Flow Information | | | | |

Non-cash financing activities not included herein consist of reinvestments of share distributions of $1,560,109. | | | | |

See accompanying notes to financial statements.

Financial

Highlights (Unaudited)

Selected data for a share outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment Operations | | | Less Distributions | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Net

Asset

Value | | | Net

Investment

Income

(Loss)(a) | | | Net

Realized/

Unrealized

Gain (Loss) | | | Total | | | Net

Investment

Income | | | Return

of

Capital | | | Total | | | Offering

Costs | | | Ending

Net

Asset

Value | | | Ending

Market

Value | |

Year Ended 11/30: | | | | | | | | | | | | | | | | | | | | | | | | | |

2011(f) | | $ | 19.10 | | | $ | (.07 | ) | | $ | (.74 | ) | | $ | (.81 | ) | | $ | (.32 | )* | | $ | – | | | $ | (.32 | ) | | | 0.04 | | | $ | 18.01 | | | $ | 18.37 | |

| | | | | | | | |

| | | Borrowings at End of Period | |

| | | Aggregate

Amount

Outstanding

(000) | | | Asset

Coverage

per

$1,000 | |

Year Ended 11/30: | | | | | |

2011(f) | | $

| 112,500

|

| | $

| 4,794

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Ratios/Supplemental Data | |

| Total Returns | | | | | | Ratios to Average

Net Assets Before

Tax Expense/(Benefit) | | | Ratios to Average

Net Assets(c)(e) | | | | | | | |

Based on

Market

Value(b) | | Based on

Net

Asset

Value(b) | | | Ending

Net

Assets

(000) | | | Expenses | | | Net

Investment

Income

(Loss) | | | Expenses | | | Net

Investment

Income

(Loss)(d) | | | Current and

Deferred Tax

Expense/

(Benefit) | | | Portfolio

Turnover

Rate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (6.49)% | | | (4.00 | )% | | $ | 426,832 | | | | 1.39 | %** | | | (1.39 | )%** | | | 1.39 | %** | | | (1.39 | )%** | | | – | %** | | | 11 | % |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily share method. |

| (b) | Total Return Based on Market Value is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized. |

| | Total Return Based on Net Asset Value is the combination of changes in net asset value, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending net asset value. The actual reinvest price for the last dividend declared in the period may often be based on the Fund’s market price (and not its net asset value), and therefore may be different from the price used in the calculation. Total returns are not annualized. |

| (c) | Ratios do not reflect the effect of custodian fee credits earned on the Fund’s net cash on deposit with the custodian bank, where applicable. |

| (d) | Excludes deferred tax expense allocated to realized and unrealized gain (loss). |

| (e) | • Net Investment Income (Loss) ratios reflect income earned and expenses incurred on assets attributable to borrowings, as described in Footnote 7 – Borrowing Arrangements. |

• Each ratio includes the effect of the interest expense and fees (excluding one-time closing fee) paid on borrowings as follows:

| | | | |

Ratios of Borrowings Interest Expense to Average Net Assets | |

Year Ended 11/30:

2011(f) | | | .46 | %** |

| (f) | For the period February 24, 2011 (commencement of operations) through May 31, 2011. |

| * | Represents distributions paid “From and in excess of net investment income.” |

See accompanying notes to financial statements.

Notes to

Financial Statements (Unaudited)

1. General Information and Significant Accounting Policies

General Information

Nuveen Energy MLP Total Return Fund (the “Fund”) is a closed-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund’s shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “JMF.” The Fund was organized as a Massachusetts business trust on September 27, 2010.

Prior to commencement of operations, the Fund had no operations other than those related to organizational matters, the initial capital contribution of $100,275 by Nuveen Fund Advisors, Inc. (the “Adviser”), a wholly-owned subsidiary of Nuveen Investments, Inc. (“Nuveen”), and the recording of the Fund’s organizational expenses ($11,000) and their reimbursement by the Adviser.

The Fund’s investment objective is to provide tax-advantaged total return. The Fund seeks to achieve its investment objective by investing primarily in a portfolio (as defined in Footnote 6 – Management Fees and Other Transactions with Affiliates) of master limited partnerships (“MLPs”) in the energy sector. Under normal market circumstances, the Fund will invest at least 80% of its managed assets in MLPs in the energy sector. The Fund considers investments in MLPs to include investments that offer economic exposure to publicly traded and private MLPs in the form of equity securities of MLPs, securities of entities holding primarily general partner or managing member interests in MLPs, securities that are derivatives of interests in MLPs and debt securities of MLPs. Further, the Fund considers an entity to be part of the energy sector if it derives at least 50% of its revenues from the business of exploring, developing, producing, gathering, transporting, processing, storing, refining, distributing, mining or marketing natural gas, natural gas liquids, crude oil, refined petroleum products or coal. The Fund may invest up to 20% of its managed assets in securities of issuers that are not MLPs. In addition, under normal market circumstances, the Fund may invest up to 30% of its managed assets in unregistered or otherwise restricted securities, and may also invest up to 30% of its managed assets in debt securities, all of which may be below investment grade quality. Securities of below investment grade quality are regarded as having predominately speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal, and are commonly referred to as “junk” bonds.

Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

Investment Valuation

Common stocks and other equity-type securities, such as MLPs, are valued at the last sales price on the securities exchange on which such securities are primarily traded and are generally classified as Level 1 for fair value measurement purposes. Securities primarily traded on the NASDAQ National Market (“NASDAQ”) are valued, except as indicated below, at the NASDAQ Official Closing Price and are generally classified as Level 1. However, securities traded on a securities exchange or NASDAQ for which there were no transactions on a given day or securities not listed on a securities exchange or NASDAQ are valued at the quoted bid price.

Repurchase agreements are valued at contract amount plus accrued interest, which approximates market value. These securities are generally classified as Level 2.

Certain securities may not be able to be priced by the pre-established pricing methods as described above. Such securities may be valued by the Fund’s Board of Trustees or its designee at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; debt securities that have gone into default and for which there is no current market quotation; a security whose market price is not available from a pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of the Fund’s net asset value (as may be the case in non-U.S. markets on which the security is primarily traded) or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, is not deemed to reflect the security’s fair value. As a general principle, the fair value of a security would appear to be the amount that the owner might reasonably expect to receive for it in a current sale. A variety of factors may be considered in determining the fair value of such securities, which may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant. These securities are generally classified as Level 2 or Level 3 depending on the priority of the significant inputs. Regardless of the method employed to value a particular security, all valuations are subject to review by the Fund’s Board of Trustees or its designee.

Refer to Footnote 2 – Fair Value Measurements for further details on the leveling of securities held by the Fund as of the end of the reporting period.

Master Limited Partnerships

An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the MLP. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions.

The Fund may invest in both domestic and international MLPs. The Fund’s investment in MLPs may include ownership of MLP common units, subordinated units and preferred units. The Fund may also invest in MLP I-Shares (together with the MLPs, the “MLP Entities”). MLP I-Shares are pay-in-kind securities created as a means to facilitate institutional ownership of MLPs by simplifying the tax and administrative implications of the MLP structure. Generally, when an MLP pays its quarterly cash distribution to unitholders, holders of I-Shares do not receive a cash distribution; rather, they receive a dividend of additional I-Shares from the MLP of comparable value to the cash distribution paid to each unitholder. The Fund may purchase interests in MLP Entities on an exchange or may utilize non-public market transactions to obtain its holdings, including but not limited to privately negotiated purchases of securities from the issuers themselves, broker-dealers, or other qualified institutional buyers.

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from investment transactions are determined on the specific identification method, which is the same basis used for federal income tax purposes.

Investment Income

Dividend income is recorded on the ex-dividend date, or for foreign securities, when information is available. Interest income is recognized on an accrual basis.

The Fund records the character of distributions received from MLPs based on estimates made at the time such distributions are received. These estimates are based upon a historical review of information available from each MLP and other industry sources. The Fund’s characterization of the estimates may subsequently be revised based on information received from MLPs after their tax reporting periods conclude. Distributions from the MLPs are recognized as “Distributions from master limited partnerships” and are offset by amounts recognized as “Return of capital on distributions” on the Statement of Operations. For the period February 24, 2011 (commencement of operations) through May 31, 2011, the Fund did not receive any distributions from MLPs.

Income Taxes

The Fund is treated as a regular corporation, or “C” corporation, for U.S. federal income tax purposes. Accordingly, the Fund is generally subject to U.S. federal income tax on its taxable income at statutory rates applicable to corporations (currently at a maximum rate of 35%). The estimated effective state income tax rate is 4.04%. The Fund may be subject to a 20% federal alternative minimum tax on its federal alternative minimum taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax. For the period February 24, 2011 (commencement of operations) through May 31, 2011, the Fund had no tax liability.

The reconciliation between the federal statutory income tax rate of 35% and the effective tax rate on net investment income (loss) and net realized and unrealized gain (loss) follows:

| | | | | | | | |

| Description | | Amount | | | Rate | |

Application of statutory income tax rate | | $ | (6,080,528 | ) | | | (35.00 | )% |

State income taxes net of federal benefit | | | (701,867 | ) | | | (4.04 | ) |

Effect of valuation allowance | | | 6,782,395 | | | | 39.04 | |

Total income tax expense (benefit) | | $ | – | | | | – | % |

The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for Federal income tax purposes. As a limited partner in the MLPs, the Fund includes its allocable share of the MLPs’ taxable income in computing its own taxable income. The Fund’s tax expense or benefit is recognized on the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/(losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance is required. The determination of whether a valuation allowance is required is based on the evaluation criterion provided by ASC 740, Income Taxes (“ASC 740”) that it is more-likely-than-not

Notes to

Financial Statements (Unaudited) (continued)

that some portion or all of the deferred tax asset will not be realized. Among the factors considered in assessing the Fund’s valuation allowance: the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory carryforward periods and the associated risk that operating and capital loss carryforwards may expire unused. At the current time management has offset all potential deferred tax benefits pursuant to the valuation allowance principles.

Components of the Fund’s deferred tax assets and liabilities as of May 31, 2011, are as follows:

| | | | |

| Description | | Deferred

Benefit (Liability) | |

Deferred tax assets: | | | | |

Net operating loss (current year-to-date, tax basis) | | $ | 607,490 | |

Capital loss (current year-to-date, tax basis) | | | 1,215,964 | |

Accumulated net unrealized gain on investments (tax basis) | | | 4,958,941 | |

Less: valuation allowance | | | (6,782,395 | ) |

Net deferred tax assets (liabilities) | | $ | – | |

For all open tax years and all major taxing jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those that are open for examination by taxing authorities (i.e., generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

At May 31, 2011, the cost and unrealized appreciation (depreciation) of investments, as determined on a federal income tax basis, were as follows:

| | | | |

Cost of investments | | $ | 553,873,226 | |

Gross unrealized: | | | | |

Appreciation | | $ | 5,558,301 | |

Depreciation | | | (18,261,801 | ) |

Net unrealized appreciation (depreciation) of investments | | $ | (12,703,500 | ) |

Dividends and Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

The Fund makes quarterly cash distributions of a stated dollar amount per share. Subject to approval and oversight by the Fund’s Board of Trustees, the Fund seeks to maintain a stable distribution level designed to deliver the long-term return potential of the Fund’s investment strategy through regular quarterly distributions (a “Managed Distribution Program”). Total distributions during the fiscal year generally will be made from the Fund’s net investment income, net realized capital gains and net unrealized capital gains in the Fund’s portfolio, if any. The portion of distributions paid attributed to net unrealized gains, if any, is distributed from the Fund’s assets and is treated by shareholders as a non-taxable distribution (“Return of Capital”) for tax purposes. In the event that total distributions during the fiscal year exceed the Fund’s total return on net asset value, the difference will reduce net asset value per share. If the Fund’s total return on net asset value exceeds total distributions during the fiscal year, the excess will be reflected as an increase in net asset value per share. The final determination of the source and character of all distributions for the fiscal year are made after the end of the fiscal year and are reflected in the financial statements contained in the annual report as of November 30 each year.

The distributions made by the Fund during the period February 24, 2011 (commencement of operations) through May 31, 2011, are provisionally classified as being “From and in excess of net investment income.” Those distributions will be classified as being from net investment income, net realized capital gains and/or a return of capital for tax purposes after the fiscal year end.

Derivative Financial Instruments

The Fund is authorized to invest in certain derivative instruments, including futures, options and swap contracts. Although the Fund is authorized to invest in such derivative instruments, and may do so in the future, it did not invest in any such investments during the period February 24, 2011 (commencement of operations) through May 31, 2011.

Organizational and Offering Costs

The Adviser has agreed to reimburse all organizational expenses (approximately $11,000) and to pay all offering costs (other than the sales load) that exceed $.04 per share. The Fund’s share of offering costs ($944,400) was recorded as a reduction of proceeds from the sale of shares.

Repurchase Agreements

In connection with transactions in repurchase agreements, it is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. If the counterparty defaults, and the fair value of the collateral declines, realization of the collateral may be delayed or limited.

Custodian Fee Credit

The Fund has an arrangement with the custodian bank whereby certain custodian fees and expenses are reduced by net credits earned on the Fund’s cash on deposit with the bank. Such deposit arrangements are an alternative to overnight investments. Credits for cash balances may be offset by charges for any days on which the Fund overdraws its account at the custodian bank.

Indemnifications

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results may differ from those estimates.

2. Fair Value Measurements

Fair value is defined as the price that the Fund would receive upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – Significant unobservable inputs (including management’s assumptions in determining the fair value of investments).

The inputs or methodologies used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the Fund’s fair value measurements as of May 31, 2011:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments: | | | | | | | | | | | | | | | | |

Master Limited Partnerships & MLP Affiliates | | $ | 523,786,098 | | | $ | – | | | $ | 14,294,119 | | | $ | 538,080,217 | |

Short-Term Investments | | | – | | | | 3,089,509 | | | | – | | | | 3,089,509 | |

Total | | $ | 523,786,098 | | | $ | 3,089,509 | | | $ | 14,294,119 | | | $ | 541,169,726 | |

Notes to

Financial Statements (Unaudited) (continued)

The following is a reconciliation of the Fund’s Level 3 investments held at the beginning and end of the measurement period:

| | | | |

| | | Level 3

Master Limited

Partnerships &

MLP Affiliates | |

Balance at the beginning of period | | $ | – | |

Gains (losses): | | | | |

Net realized gains (losses) | | | – | |

Net change in unrealized appreciation (depreciation) | | | (427,756 | ) |

Purchases at cost | | | 15,000,000 | |

Sales at proceeds | | | (278,125 | ) |

Net discounts (premiums) | | | – | |

Transfers in to | | | – | |

Transfers out of | | | – | |

Balance at the end of period | | $ | 14,294,119 | |

Net change in unrealized appreciation (depreciation) during the period of Level 3 securities held as of May 31, 2011 | | $ | (427,756 | ) |

During the period February 24, 2011 (commencement of operations) through May 31, 2011, the Fund recognized no significant transfers to/from Level 1, Level 2 or Level 3.

3. Derivative Instruments and Hedging Activities

The Fund records derivative instruments at fair value, with changes in fair value recognized on the Statement of Operations, when applicable. Even though the Fund’s investments in derivatives may represent economic hedges, they are not considered to be hedge transactions for financial reporting purposes. The Fund did not invest in derivative instruments during the period February 24, 2011 (commencement of operations) through May 31, 2011.

4. Fund Shares

Transactions in Fund shares for the period February 24, 2011 (commencement of operations) through May 31, 2011, were as follows:

| | | | | | |

Shares: | | | | | | |

Sold | | | | | 23,610,000 | |

Issued to shareholders due to reinvestment of distributions | | | | | 89,455 | |

| | | | | | 23,699,455 | |

5. Investments Transactions

Purchases and sales (excluding short-term investments) during the period February 24, 2011 (commencement of operations) through May 31, 2011, aggregated $606,019,683 and $52,122,756, respectively.

6. Management Fees and Other Transactions with Affiliates

The Fund’s management fee consists of two components – a fund-level fee, based only on the amount of assets within the Fund, and a complex-level fee, based on the aggregate amount of all fund assets managed by the Adviser. This pricing structure enables Fund shareholders to benefit from growth in the assets within the Fund as well as from growth in the amount of complex-wide assets managed by the Adviser.

The annual fund-level fee, payable monthly, is calculated according to the following schedule:

| | | | |

| Average Daily Managed Assets* | | Fund-Level Fee Rate | |

For the first $500 million | | | .9000 | % |

For the next $500 million | | | .8750 | |

For the next $500 million | | | .8500 | |

For the next $500 million | | | .8250 | |

For managed assets over $2 billion | | | .8000 | |

The annual complex-level fee, payable monthly, is calculated according to the following schedule:

| | | | |

| Complex-Level Managed Asset Breakpoint Level* | | Effective Rate at Breakpoint Level | |

$55 billion | | | .2000 | % |

$56 billion | | | .1996 | |

$57 billion | | | .1989 | |

$60 billion | | | .1961 | |

$63 billion | | | .1931 | |

$66 billion | | | .1900 | |

$71 billion | | | .1851 | |

$76 billion | | | .1806 | |

$80 billion | | | .1773 | |

$91 billion | | | .1691 | |

$125 billion | | | .1599 | |

$200 billion | | | .1505 | |

$250 billion | | | .1469 | |

$300 billion | | | .1445 | |

* For the fund-level and complex-level fees, managed assets include closed-end fund assets managed by the Adviser that are attributable to financial leverage. For these purposes, financial leverage includes the funds’ use of preferred stock and borrowings and certain investments in the residual interest certificates (also called inverse floating rate securities) in tender option bond (TOB) trusts, including the portion of assets held by a TOB trust that has been effectively financed by the trust’s issuance of floating rate securities, subject to an agreement by the Adviser as to certain funds to limit the amount of such assets for determining managed assets in certain circumstances. The complex-level fee is calculated based upon the aggregate daily managed assets of all Nuveen funds that constitute “eligible assets.” Eligible assets do not include assets attributable to investments in other Nuveen funds or assets in excess of $2 billion added to the Nuveen Fund complex in connection with the Adviser’s assumption of the management of the former First American Funds effective January 1, 2011. As of May 31, 2011, the complex-level fee rate for the Fund was .1774%.

The management fee compensates the Adviser for overall investment advisory and administrative services and general office facilities. The Adviser has entered into an investment subadvisory agreement with Fiduciary Asset Management, Inc. (“FAMCO”). FAMCO has day-to-day responsibility for managing the Fund’s direct investments in MLPs and other permitted investments. FAMCO is compensated for its services to the Fund from the management fee paid to the Adviser.

The Fund pays no compensation directly to those of its directors who are affiliated with the Adviser or to its officers, all of whom receive remuneration for their services to the Fund from the Adviser or its affiliates. The Board of Trustees has adopted a deferred compensation plan for independent directors that enables directors to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from certain Nuveen advised funds. Under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of select Nuveen advised funds.

7. Borrowing Arrangements

The Fund has entered into a $130 million (maximum commitment amount) prime brokerage facility with Deutsche Bank as a means of financial leverage. On April 29, 2011, the Fund began to draw on this borrowing facility. As of May 31, 2011, the Fund’s outstanding balance on these borrowings was $112.5 million. For the period April 29, 2011 through May 31, 2011, the average daily balance outstanding and annual interest rate on this borrowing facility were $97,121,212 and 1.11%, respectively.

In order to maintain this borrowing facility, the Fund must meet certain collateral, asset coverage and other requirements. Borrowings outstanding are fully secured by securities held in the Fund’s portfolio of investments. Interest charged on the used portion of these borrowings is calculated at a rate per annum equal to 3-Month LIBOR (London Inter-bank Offered Rate) plus .85%. In addition, the Fund accrues a commitment fee of .50% per annum on the unused portion of the maximum commitment amount. The Fund also paid a .05% one-time closing fee on the maximum commitment amount, which was fully expensed during the current reporting period.

Interest expense, commitment and closing fees are recognized as a component of “Interest expense on borrowings” on the Statement of Operations.

8. New Accounting Pronouncements

Fair Value Measurements and Disclosures

On May 12, 2011, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standard Update (“ASU”) modifying Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (“IASB”) issued International Financial Reporting Standard (“IFRS”) 13, Fair Value Measurement. The objective by the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. Specifically, the ASU requires reporting entities to disclose i) the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers, ii) for Level 3 fair value measurements, a) quantitative information about significant unobservable inputs used, b) a description of the valuation processes used by the reporting entity and c) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of the ASU is for interim and annual periods beginning after December 15, 2011. At this time, management is evaluating the implications of this guidance and the impact it will have on the financial statement amounts and footnote disclosures, if any.

Annual Investment Management

Agreement Approval Process (Unaudited)

The Board of Trustees (the “Board,” and each Trustee, a “Board Member”) of the Nuveen Energy MLP Total Return Fund (the “Fund”) is responsible for approving advisory arrangements for the Fund and, at meetings held on November 17, 2010 and December 7, 2010 (together, the “Meeting”), was asked to approve the advisory arrangements on behalf of the Fund. At the Meeting, the Board Members, including the Board Members who are not parties to the advisory agreements or “interested persons” of any such parties (the “Independent Board Members”), considered and approved the investment management agreement (the “Investment Management Agreement”) between the Fund and Nuveen Fund Advisors, Inc. (formerly known as Nuveen Asset Management) (the “Adviser”) and the investment sub-advisory agreement (the “Sub-Advisory Agreement”) between the Adviser and Fiduciary Asset Management Inc. (the “Sub-Adviser”), on behalf of the Fund. The Adviser and the Sub-Adviser are each hereafter a “Fund Adviser.” The Investment Management Agreement and the Sub-Advisory Agreement are each hereafter an “Advisory Agreement.”

To assist the Board in its evaluation of an Advisory Agreement with a Fund Adviser at the Meeting, the Independent Board Members had received, in adequate time in advance of the Meeting or at prior meetings, materials which outlined, among other things:

| • | | the nature, extent and quality of services expected to be provided by the Fund Adviser; |

| • | | the organization of the Fund Adviser, including the responsibilities of various departments and key personnel; |

| • | | the expertise and background of the Fund Adviser with respect to the Fund’s investment strategy; |

| • | | certain performance-related information (as described below); |

| • | | the profitability of Nuveen Investments, Inc. (“Nuveen”) (which incorporated Nuveen’s wholly-owned affiliated sub-advisers) and certain financial information of the parent company of the Sub-Adviser; |

| • | | the proposed management fees of the Fund Adviser, including comparisons of such fees with the management fees of comparable funds; |

| • | | the expected expenses of the Fund, including comparisons of the Fund’s expected expense ratio with the expense ratios of comparable funds; and |

| • | | the soft dollar practices of the Fund Adviser, if any. |

At the Meeting, the Adviser made a presentation to and responded to questions from the Board. During the Meeting, the Independent Board Members also met privately with their legal counsel to review the Board’s duties under the Investment Company Act of 1940 (the “1940 Act”), the general principles of state law in reviewing and approving advisory contracts, the standards used by courts in determining whether investment company boards of directors have fulfilled their duties, factors to be considered in voting on advisory contracts and an adviser’s fiduciary duty with respect to advisory agreements and compensation. It is with this background that the Independent Board Members considered the Advisory Agreements. As outlined in more detail below, the Independent Board Members considered all factors they believed relevant with respect to the Fund, including the following: (a) the nature, extent and quality of the services to be provided by the Fund Adviser; (b) investment performance, as described below; (c) the profitability of Nuveen and its affiliates and certain financial information of the parent company of the Sub-Adviser; (d) the extent to which economies of scale would be realized; and (e) whether fee levels reflect these economies of scale for the benefit of Fund investors.

A. Nature, Extent and Quality of Services

The Independent Board Members considered the nature, extent and quality of the respective Fund Adviser’s services, including advisory services and administrative services. As the Adviser already serves as adviser to other Nuveen funds overseen by the Board Members, the Board has a good understanding of such Fund Adviser’s organization, operations and personnel. As the Independent Board Members meet regularly throughout the year to oversee the Nuveen funds, including funds currently advised by the Adviser, the Independent Board Members have relied upon their knowledge from their meetings and any other interactions throughout the year of the Adviser and its services in evaluating the Investment Management Agreement. In addition, the Independent Board Members recognized that the Sub-Adviser acts as sub-adviser to the MLP & Strategic Equity Fund Inc. (the “MLP & Strategic Equity Fund”). In October 2010, the Adviser became the investment adviser to the MLP & Strategic Equity Fund (which had previously been advised by IQ Investment Advisors LLC), and such fund (along with certain other funds that were previously advised by IQ Investment Advisors LLC) became part of the Nuveen fund complex.

At the Meeting and at prior meetings, the Independent Board Members reviewed materials outlining, among other things, the respective Fund Adviser’s organization and business; the types of services that the Fund Adviser or its affiliates provide to the Nuveen funds and are expected to provide to the Fund; and the experience of the Fund Adviser with applicable investment strategies. Further, the Independent Board Members have considered the background, experience and track record of the Fund Adviser’s investment personnel.

In addition to advisory services, the Independent Board Members considered the quality of any administrative or non-advisory services to be provided. In this regard, the Adviser is expected to provide the Fund with such administrative and other services (exclusive of, and in addition to, any such services provided by others for the Fund) and officers and other personnel as are necessary for the operations of the Fund. In addition to investment management services, the Adviser and its affiliates will provide the Fund with a wide range of services, including, among other things, product management, fund administration, oversight of service providers, shareholder services, administration of Board relations, regulatory and portfolio compliance and legal support. The Independent Board Members also recognized that the Adviser would oversee the Sub-Adviser.

In addition to the foregoing services, the Independent Board Members also noted the additional services that the Adviser or its affiliates provide to closed-end funds, including, in particular, Nuveen’s continued commitment to supporting the secondary market for the common shares of its closed-end funds through a variety of programs designed to raise investor and analyst awareness and understanding of closed-end funds. These efforts include maintaining an investor relations program to provide timely information and education to financial advisers and investors; providing marketing for the closed-end funds; maintaining and enhancing a closed-end fund website; participating in conferences; and having direct communications with analysts and financial advisors.

In evaluating the services expected to be provided by the Sub-Adviser, the Independent Board Members noted that the Sub-Advisory Agreement was essentially an agreement for portfolio management services only and the Sub-Adviser was not expected to supply other significant administrative services to the Fund. The Board Members recognized the Sub-Adviser’s experience in Master Limited Partnership (MLP) investment products. In addition, the Sub-Adviser made a presentation and, in December 2010, certain of the Independent Board Members visited the offices of the Sub-Adviser.

Based on their review, the Independent Board Members found that, overall, the nature, extent and quality of services expected to be provided to the Fund under each Advisory Agreement were satisfactory.

B. Investment Performance

The Fund is new and therefore does not have its own performance history. The Independent Board Members were provided, however, with certain information relating to the investment performance of the Sub-Adviser’s MLP Composite, including, among other things, returns for the third quarter of 2010, and the 2010 year-to-date, one-year, three-year, five-year, seven-year, ten-year, and since inception (March 31, 1995) periods as of September 30, 2010, as well as, for the periods available, corresponding returns of the relevant benchmark index.

Annual Investment Management

Agreement Approval Process (Unaudited) (continued)

C. Fees, Expenses and Profitability

1. Fees and Expenses