Exhibit 10.45

FIRST AMENDMENT TO LEASE

This FIRST AMENDMENT TO LEASE dated December 31, 2009 (this “Amendment”), is by and between PALM SPRINGS RADIATION ENTERPRISES, LLC (“Landlord”), and CALIFORNIA RADIATION THERAPY MANAGEMENT SERVICES, INC. (“Tenant”).

WITNESSETH:

WHEREAS, Landlord and Tenant are parties to that certain Lease dated December 12, 2005 (the “Lease”), for certain real property commonly known as 77 840 Flora Road, Palm Desert, California; and

WHEREAS, Landlord and Tenant desire to amend certain provisions of the Lease upon and subject to the terms and conditions set forth herein.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, Landlord and Tenant hereby agree as follows:

1. Worker’s Compensation. The second sentence of the second paragraph of Section 5.2 of the Lease is hereby deleted in its entirety and replaced with the following:

The liability insurance policy (other than any policy of worker’s compensation insurance) shall name Landlord, any person, firms or corporations designated by Landlord, and Tenant as insured, and shall contain a clause that the insurer will not cancel or change the insurance without first giving the Landlord twenty (20) days’ prior notice.

2. Tenant’s Leasehold Improvements and Trade Fixtures. Section 10.3 of the Lease is hereby amended by:

(a) in the third and fourth lines of the second paragraph, deleting the phrase “provided Tenant shall not at such time be in default of any terms or covenants of this Lease, and”; and

(b) in the fourth line of the second paragraph, deleting the word “further.”

3. Damage and Destruction. The third paragraph of Section 15.1 of the Lease is hereby deleted in its entirety and replaced with the following:

Tenant covenants and agrees to (i) equip and furnish the Premises as Tenant reasonably deems necessary to operate the business from the Premises and (ii) reopen for business in the Premises within thirty (30) days after notice from Landlord that the Premises are ready for re-occupancy.

4. Defined Terms. Capitalized terms used herein but not defined herein shall have the meanings ascribed to them in the Lease.

5. Governing Law. This Amendment and the Lease shall be governed by and construed in accordance with the laws of the State of Florida.

6. Amendment. Neither this Amendment nor any terms hereof may be amended, supplemented or modified except by a written instrument executed by the parties hereto. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns.

7. Full Force and Effect. The Lease shall continue in full force and effect except as modified by this Amendment, and the Lease is hereby ratified and confirmed by Landlord and Tenant. In the event of a conflict between the terms and conditions of the Lease and this Amendment, the terms of this Amendment shall prevail.

8. Counterparts. This Amendment may be executed in counterparts, each of which shall be an original, but all of which shall constitute one and the same Amendment.

[Remainder of page intentionally left blank;

signatures on following page.]

IN WITNESS WHEREOF, Landlord and Tenant have caused this Amendment to be duly executed as of the day, month and year first above written.

| LANDLORD:

PALM SPRINGS RADIATION ENTERPRISES, LLC | |

|

|

|

|

|

|

| By: | /s/ Daniel E. Dosoretz |

| Name: | Daniel E. Dosoretz, MD |

| Its: |

|

|

|

|

|

|

|

| TENANT:

CALIFORNIA RADIATION THERAPY MANAGEMENT SERVICES, INC. | |

|

| |

|

| |

| By: | /s/ Bryan J. Carey |

| Name: | Bryan J. Carey |

| Its: | EVP & CFO |

LEASE

FEB 21 2006

THIS LEASE (“Lease”) is made and entered into as of the 12th day of December, 2005, by and between, Palm Springs Radiation Enterprises, LLC, whose business address is 2234 Colonial Boulevard, Fort Myers, FL 33907 (“Landlord”), and California Radiation Therapy Management Services, Inc. whose business address is 2234 Colonial Boulevard, Fort Myers, FL 33907(“Tenant”).

WITNESSETH:

ARTICLE 1

TERMS

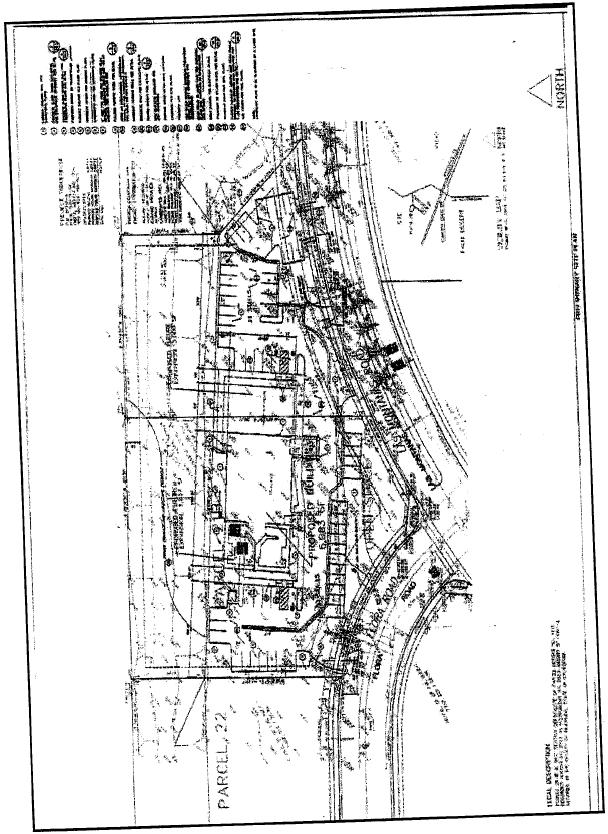

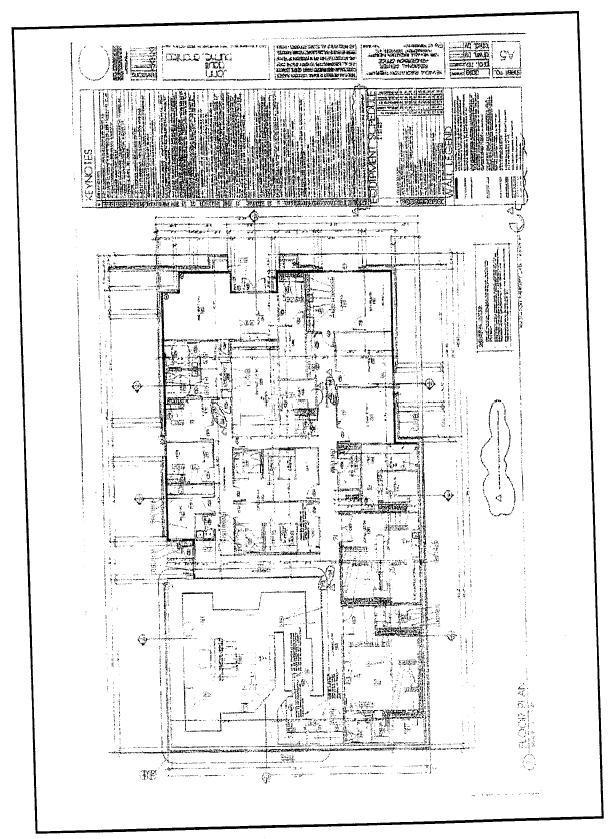

1.1 Premises. Landlord hereby demises and leases to Tenant and Tenant hereby hires and rents from Landlord the premises located at 77 840 Flora Road, Palm Desert, California,(“Premises”) upon the terms, covenants and conditions set forth herein, which Premises has a floor area containing the approximate square footage of 6,963 square feet.

1.2 Use. The Premises are to be used for a medical office and radiation therapy center.

1.3 Commencement of Term. The commencement of the Term of this Lease under which Tenant shall be obligated to commence payment of Minimum Rent and Additional Rent shall be on or about the 1lth day of October, 2005 (“Commencement Date”).

1.4 Length of the Term. The term of this lease period is for seven (7) years (“Term”). The starting date of this lease is the Commencement Date and, unless this Lease is renewed in accordance with Article 4 below, the ending date is on or about the 1lth day of October, 2012 (“Expiration Date”).

ARTICLE 2

RENT

2.1 Rent. Minimum rent shall be four hundred ten thousand, five hundred fourteen dollars ($410,514) per year (“Minimum Rent”). Tenant shall pay to Landlord without previous demand thereof and without any abatement, reduction, setoff or deduction whatsoever, the Minimum Rent (together with any applicable sales tax and local taxes if the same are ever required by law), payable in equal monthly installments, in advance, on the first day of each and every calendar month throughout the Term of this Lease. The Minimum Rent shall commence to accrue on the Commencement Date. The first such monthly installments of Minimum Rent shall be due and payable to Landlord no later than the Commencement Date and each subsequent monthly installment shall be due and payable to Landlord on the first day of each and every month following the Commencement Date during the Term hereof. If the Commencement Date is a date other than the first day of the month, Minimum Rent and other charges for the period commencing with and including the Commencement Date through the first day of the following month shall be prorated at the rate of one-thirtieth (1/30) of the monthly Minimum Rent per day.

In addition, Tenant shall pay as Additional Rent monthly payments of applicable taxes, assessments and insurance on the property. This amount will be of 1/12 of the bill for real estate and assessment taxes and 1/12 of the bill on insurance. Estimated figures for taxes and insurance

monthly rate will be produced within ten (10) days after the signing of this Lease. Each year Landlord will produce any insurance, real estate tax and assessment bills to the Tenant to show how the estimated taxes and insurance were computed as Additional Rent.

2.1.1 There will be an increase in the Minimum Rent starting on the first anniversary of the lease if the Consumer Price Index increases. Minimum Rent specified in this lease shall be subject to increase in accordance with changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as promulgated by the Bureau of Labor Statistics of the United States Department of Labor, using the year of the Commencement Date as a base of 100. On each anniversary date there will be a rent adjustment based on the percentage increase in the Consumer Price Index. If the Consumer Price Index goes down the rent will not change for that year. Consumer Price Index increases will apply on the anniversary date of each year of the Commencement Date. The percentage increase in the Consumer Price Index will increase the minimum rent for that year.

2.1.2 In the event that the Consumer Price Index ceases to incorporate significant number of items, or if a substantial change is made in the method of establishing such Consumer Price Index shall be adjusted to the figure that would have resulted had no change occurred in the manner of computing such Consumer Price Index, or a successor or substitute index, is not available, a reliable governmental or other nonpartisan publication, evaluating the information for use in determining the Consumer Price Index, shall be used in lieu of such Consumer Price Index.

2.2 Late Charge. Tenant shall pay to Landlord a late charge equal to five percent (5%) of the monthly payment of Minimum Rent, Additional Rent and any other payment or charge due hereunder if any such amount is received by Landlord more than five (5) days after the same shall be due, such amount being the agreed upon liquidated damages solely to defray the additional administrative expenses incurred by Landlord in processing such payment.

2.3 Interest on Past Due Rent. If Tenant shall fail to pay, when the same is due and payable, Minimum Rent, or Additional Rent, such unpaid amounts shall bear interest from the due date thereof to the date of payment, at the prime interest rate of the Chase Manhattan Bank, N.A. as of such due date, plus Five percent (5%) (“Default Date”).

2.4 Definition of Rent. The term “Rent” shall refer collectively to Minimum Rent and Additional Rent. The term “Additional Rent” is sometimes used herein to refer to any and all other sums payable by Tenant hereunder, including, but not limited to, parking charges and sums payable on account of default by Tenant. All Rent shall be paid by Tenant without offset, demand or other credit, and shall be payable only in lawful money of the United States of America which shall be legal tender in payment of all debts and dues, public and private, at the time of payment. All sums payable by Tenant hereunder by check shall be obtained against a financial institution located in the United States of America. The rent shall be paid by Tenant at 2234 Colonial Boulevard, Fort Myers, FL 33907.

2.5 Rent Taxes. In addition to Minimum Rent and Additional Rent, Tenant shall and hereby agrees to pay to Landlord each month a sum equal to any sales tax, tax on rentals and any other similar charges now existing or hereafter imposed, based upon the privilege of leasing the space leased hereunder or based upon the amount of rent collected therefore.

ARTICLE 3

NET LEASE

3.1 Net Lease. This Lease shall be deemed and construed to be a triple net lease and, except as herein otherwise expressly provided, the Landlord shall receive the fixed Minimum Rent and Additional Rent and all other payments hereunder to be made by the Tenant absolutely free from any charges, assessments, imposition, expenses or deductions of any kind and every kind or nature whatsoever. Tenant is to pay for all real estate tax and assessments on any and all taxes of any We of nature. Tenant is to pay for all insurance and any and all costs for repairs, replacements, maintenance and improvements. Tenant will also pay any and all expenses for common areas, utilities, and association fees, if any. Tenant also is responsible for:

3.1.1 Parking lot repairs, maintenance and replacements.

3.1.2 Installation of outside and inside lighting for parking.

3.1.3 Any security, pest control or contrasts for air conditioner and cleaning services, etc.

ARTICLE 4

OPTION TO RENEW

4.1 Option to renew. Provided that Tenant is not, and at no time has been, in default during the Term under any of the covenants, terms, conditions, and provisions of this Lease, then Tenant shall have three (3) options to renew this Lease (each an “Option”) for consecutive five (5) year option periods, provided that, in order to exercise this Option, Tenant is required to give to Landlord written notice thereof not less than six (6) months before the date of expiration of the Term of this Lease or during any option period. Any renewal pursuant to this Option shall be on the same terms and conditions as are contained in this Lease.

ARTICLE 5

INSURANCE AND INDEMNITY

5.1 Liability Insurance. Tenant shall, during the entire term hereof, keep in full force and effect bodily injury and public liability insurance in an amount not less than FIVE HUNDERED THOUSAND DOLLARS ($500,000) / ONE MILLION DOLLARS ($1,000,000) per injury and accident, respectively; property damage insurance in an amount not less than ONE HUNDRED THOUSAND DOLLARS ($100,000).

5.2 Workers Compensation. Tenant shall, during the entire term hereof, keep in full force worker’s compensation insurance in the maximum amount permitted under California law.

Landlord may require such insurance coverage to be increased after the first five years of the term of this Lease, provided that such increase shall not cause the required limits of coverage to exceed those then commonly prevailing in the marketplace for similar situations. The policy(s) shall name Landlord, any person, firms or corporations designated by Landlord, and Tenant as insured, and shall contain a clause that the insurer will not cancel or change the insurance without first giving the Landlord twenty (20) days prior notice. The insurance shall be in an insurance company licensed by the State of California and a copy of the policy or a certificate of insurance shall be delivered to Landlord prior to the commencement of the term of

this Lease. In no event shall the limits of said insurance policies be considered as limiting the liability of Tenant under this Lease. In the event that Tenant shall fail to obtain or maintain in full force and effect any insurance coverage required to be obtained by Tenant under this Lease, Landlord may procure same from insurance carriers as Landlord may deem proper, irrespective that a lesser premium for such insurance coverage may have been obtained from another insurance carrier, and Tenant shall pay as additional rent, upon demand of Landlord, any and all premiums, costs, charges and expenses incurred or expended by Landlord in obtaining such insurance. Notwithstanding shall procure insurance coverage required of Tenant hereunder, Landlord shall in no manner be liable to Tenant for any insufficiency or failure of coverage with regard to such insurance or any loss to Tenant occasioned thereby, and additionally, the procurement of such insurance by Landlord shall not relieve Tenant of its obligations under this Lease to maintain insurance coverage in the types and amounts herein specified, and Tenant shall nevertheless hold Landlord harmless from any loss or damage incurred or suffered by Landlord from Tenant’s failure to maintain such insurance.

5.3 Plate Glass Insurance. The replacement of any plate glass damaged or broken from any cause whatsoever in and about the Premises shall be Tenant’s responsibility. Tenant shall, during the entire term hereof, keep in full force and effect a policy of plate glass insurance covering all the plate glass of the Premises, in amounts satisfactory to Landlord. The policy shall name Landlord as additional insured and shall contain a clause that the insurer will not cancel or change the insurance without first giving the Landlord twenty (20) days prior notice. A copy of the policy together with the declarations page therefore shall be delivered to Landlord prior to the commencement of the term of this Lease.

5.4 Increases in Fire Insurance Premium. Tenant agrees that it will not keep, use or sell in or upon the Premises any article, machinery or equipment which may be prohibited by the standard form of fire and extended risk insurance policy. Tenant agrees to pay any increase in premiums for fire and extended coverage insurance that may be charged during the term of this Lease on the amount of such insurance which may be carried by Landlord on the Premises or the building of which it is a part, resulting from the type of merchandise, machinery or equipment sold or kept by Tenant in the Premises or resulting from Tenant’s use of the Premises, whether or not Landlord has consented to the same.

5.5 Indemnification. Tenant shall indemnify, defend and save Landlord harmless from and against any and all claims, actions, damages, liability and expense in connection with loss of life, personal injury and/or damage to or destruction of property arising from or out of any occurrence in, upon or at the Premises, or any part thereof, or the occupancy or use by Tenant of the Premises or any part thereof, or occasioned wholly or in part by any act or omission of Tenant, its agents, contractors, employees, servants, lessees or concessionaires. Landlord shall indemnify, defend and save Tenant harmless from and against any and all claims, actions, damages, liability and expense in connection with loss of life, personal injury and/or damage to or destruction of property arising from or out of any occurrence in, upon or at the Premises occasioned in whole or in part by any negligent act or omission by Landlord, its agents, contractors, employees, servants or concessionaires. In case the indemnifying party shall be made a party to any litigation commenced by or against the other party, then such other party shall protect and hold the indemnified party harmless and pay all costs and attorney’s fees incurred by the indemnified party in connection with such litigation, and any appeals thereof. The defaulting party shall also pay all costs, expenses and reasonable attorney’s fees that may be incurred or paid by the other party in enforcing the covenants and agreements in this Lease.

ARTICLE 6

UTILITIES

6.1 Utilities. Tenant shall be solely responsible for and shall promptly pay all charges for water, gas, electricity, garbage, and any other utility used and consumed in the Premises. In the event that such utilities charges, or any portion thereof shall be separately metered for the Premises, tenant shall pay such meter charges directly to the utility company supplying such service. In the event, however, that such utilities charges, or any portion thereof, shall not be separately metered for the Premises, tenant shall pay to Landlord its pro rata share of such non-metered charges. If any such charges are not paid when due, Landlord may, at its option pay the same, and any amount so paid by Landlord shall thereupon become due to Landlord from tenant as additional rent. In no event, however, shall Landlord be liable for an interruption or failure in the supply of any such utilities to the Premises.

ARTICLE 7

SUBORDINATION AND ATTORNMENT

7.1 Subordination. Tenant hereby subordinates its rights hereunder to the lien of any ground or underlying leases, any mortgage or mortgages, or the lien resulting from any other method of financing or refinancing, now or hereafter in force against the Premises and to all advances made or hereafter to be made upon the security thereof. This Section shall be self-operative and no further instrument of subordination shall be required by any mortgagee, but Tenant agrees upon request of Landlord, from time to time, to promptly execute and deliver any and all documents evidencing such subordination, and failure to do so shall constitute a default under this Lease.

7.2 Attornment. In the event any proceedings are brought for the foreclosure of, or in the event of exercise of the power of sale under, any mortgage covering the Premises or in the event a deed is given in lieu of foreclosure of any such mortgage, Tenant shall attorn to the purchaser, or grantee in lieu of foreclosure, upon any such foreclosure or sale and recognize such purchaser, or grantee in lieu of foreclosure, as the Landlord under this Lease.

7.3 Financing Agreements. Tenant shall not enter into, execute or deliver any financing agreement that can be considered as having priority to any mortgage or deed of trust that Landlord may have placed upon the Premises.

ARTICLE 8

ASSIGNMENT AND SUBLETTING

Tenant may not assign this lease in whole or in part, nor sublet all or any portion of the Premises, without the prior written consent of Landlord in each instance. The consent by Landlord to any assignment or subletting shall not constitute a waiver of the necessity for such consent to any subsequent assignment or subletting. It is understood that Landlord may refuse to grant consent to any assignment or subletting by Tenant with or without cause and without stating in its refusal to grant such consent the reasons for which it refuses to grant such consent and may not, under any circumstances, be required or compelled to grant such consent. No assignment, under letting, occupancy or collection shall be deemed acceptance of the assignee, subtenant or occupant as Tenant, or a release of Tenant from the further performance by Tenant of the covenants on the part of Tenant herein contained. This prohibition against any assignment or subleasing by operation of law, legal process, receivership, bankruptcy or otherwise, whether

voluntary or involuntary and a prohibition against any encumbrance of all and any part of Tenant’s leasehold interest. Tenant shall remain fully liable on this Lease and shall not be released from performing any of the terms, covenants and conditions hereof or any rents or other sums to be paid hereunder. Tenant acknowledges and agrees that any and all right and interest of the Landlord in and to the Premises, and all right and interest of the Landlord in this Lease, may be conveyed, assigned or encumbered at the sole discretion of the Landlord at any time.

ARTICLE 9

FACILITIES

9.1 Control of Common Areas by Landlord. All automobile parking areas, driveways, entrances and exits thereto, and other facilities furnished by Landlord at or near the Premises, including employee parking areas, the truck way or ways, loading docks, package pick-up stations, pedestrian sidewalks and ramps, landscaped areas, exterior stairways, and other areas and improvements provided by Landlord for the general use, in common, of tenants, their officers, agents, employees and customers, shall at all times be subject to the exclusive control and management of Landlord, and Landlord shall have the right from time to time to establish, modify and enforce reasonable rules and regulations with respect to all facilities and areas mentioned in this Article. Landlord shall have the right to construct, maintain and operate lighting facilities on all said areas and improvements; from time to time to change the area, level, location and arrangement of parking areas and other facilities hereinabove referred to and to restrict parking by tenants, their officers, agents and employees to employee parking areas. Landlord shall not have any duty to police the traffic in the parking areas. Tenant is to maintain and repair parking and at tenant’s expense.

ARTICLE 10

TENANT’S FIXTURES AND IMPROVEMENTS

10.1 Alterations by Tenant. Tenant shall not make any alterations, renovations, improvements or other installations (collectively “Alterations”) in, on or to any part of the Premises (including, without limitation, any alterations of the front, signs, structural alterations, or any cutting or drilling into any part of the Premises or any securing of any fixture, apparatus, or equipment of any kind to any part of the Premises) unless and until Tenant shall have caused plans and specifications therefore to have been prepared, at Tenant’s expense, by an architect or other duly qualified person and shall have obtained Landlord’s approval thereof. Tenant shall submit to Landlord detailed drawings and plans of the proposed Alterations at the time Landlord’s approval is sought. If such approval is granted, Tenant shall cause the work described in such plans and specifications to be performed, at its expense, promptly, efficiently, competently and in a good and workmanlike manner by duly qualified and licensed persons or entities approved by Landlord, using first grade materials. All such work shall comply with all applicable codes, rules, regulations and ordinances. The Tenant shall at all times maintain fire insurance with extended coverage in an amount adequate to cover the cost of replacement of all alterations, decorations, additions or improvements to the Premises by Tenant in the event of fire or extended coverage loss. Tenant shall deliver to the Landlord certificates of such fire insurance policies, which shall contain a clause requiring the insurer to give the Landlord ten (10) days notice of cancellation of such policies.

10.2 Mechanic’s Liens. No work performed by Tenant pursuant to this Lease, whether in the nature of erection, construction, alteration or repair, shall be deemed to be for the

immediate use and benefit of Landlord so that no mechanic’s or other lien shall be allowed against the estate of Landlord by reason of any consent given by Landlord to Tenant to improve the Premises. Tenant shall place such contractual provisions as Landlord may request in all contracts and subcontracts for Tenant’s improvements assuring Landlord that no mechanic’s liens will be asserted against Landlord’s interest in the Premises or the property of which the Premises are a part. Said contracts and subcontracts shall provide, among other things, the following: That notwithstanding anything in said contracts or subcontracts to the contrary, Tenant’s contractors, subcontractors, suppliers and materialmen (hereinafter collectively referred to as “Contractors”) will perform the work and/or furnish the required materials on the sole credit of Tenant; that no lien for labor or materials will be filed or claimed by the Contractors against Landlord’s interest in the Premises or the property of which the Premises are a part; that the Contractors will immediately discharge any such lien filed by any of the Contractor’s suppliers, laborers, materialmen or subcontractors; and that the Contractors will indemnify and save Landlord harmless from any and all costs and expenses, including reasonable attorney’s fees, suffered or incurred as a result of any such lien against Landlord’s interest that may be filed or claimed in connection with or arising out of work undertaken by the Contractors. Tenant shall pay promptly all persons furnishing labor or materials with respect to any work performed by Tenant or its Contractors on or about the Premises. If any mechanic’s or other liens shall at any time be filed against the Premises or the property of which the Premises are a part by reason of work, labor, services or materials performed of furnished, or alleged to have been performed or furnished, to Tenant or to anyone holding the Premises through or under Tenant, and regardless of whether any such lien is asserted against the interest of Landlord or Tenant, Tenant shall cause the same to be discharged of record or bonded to the satisfaction of Landlord within thirty (30) days of notice of such lien. If Tenant shall fail to cause such lien to be so discharged or bonded after being notified of the filing thereof, then, in addition to being an Event of Default and any other right or remedy of Landlord, Landlord may bond or discharge the same by paying the amount claimed to be due, and the amount so paid by Landlord, including reasonable attorneys’ fees incurred by Landlord either in defending against such lien or in procuring the bonding or discharge of such lien, together with interest thereon at the Default Rate, shall be due and payable by Tenant to Landlord as Additional Rent.

10.3 Tenant’s Leasehold Improvements and Trade Fixtures. All leasehold improvements (as distinguished from trade fixtures and apparatus) installed in the Premises at any time, whether by or on behalf of Tenant or by or on behalf of Landlord, shall not be removed from the Premises at any time, unless such removal is consented to in advance by Landlord; and at the expiration of this Lease (either on the Expiration Date or upon such earlier termination as provided in this Lease), all such leasehold improvements shall be deemed to be part of the Premises, shall not be removed by Tenant when it vacates the Premises, and title thereto shall vest solely in Landlord without payment of any nature to Tenant.

All trade fixtures and apparatus (as distinguished from leasehold improvements) owned by Tenant and installed in the Premises shall remain the property of Tenant and shall be removable at any time, including upon the expiration of the Term; provided Tenant shall not at such time be in default of any terms or covenants of this Lease, and provided further, that Tenant shall repair any damage to the Premises caused by the removal of said trade fixtures and apparatus and shall restore the Premises to substantially the same condition as existed prior to the installation of said trade fixtures and apparatus and shall restore the Premises to substantially the same condition as existed prior to the installation of said trade fixtures and apparatus.

ARTICLE 11

MAINTENANCE AND REPAIR OF PREMISES

11.1 Maintenance by Tenant. Tenant shall at all times keep in good order, condition and repair (which shall include the providing of replacements where necessary) the entire Premises, including, without limitation, the roof, the exterior and all glass and show window moldings; and all partitions, doors, interior walls, fixtures, equipment and appurtenances thereto, including lighting, heating and plumbing fixtures and any air conditioning system and sprinkler system situated within and/or servicing the Premises. Said maintenance by Tenant shall include, without limitation, periodic painting as is reasonably necessary. All cutting and patching of the roof area required for any reason whatsoever shall be performed by the Landlord’s roofing subcontractor. In the event that Tenant causes such work to be performed by anyone other than the Landlord’s roofing subcontractor, Landlord will have the right, at Tenant’s sole cost and expense and without notice to Tenant, to cause said work and the roof area affected thereby to be inspected and/or repaired by Landlord’s roofing subcontractor. All repairs, replacements, or maintenance of any item or any type of the Premises is the responsibility of the Tenant and to be paid for by tenant.

ARTICLE 12

SIGNS

On or before the Commencement Date, Tenant will at its sole cost and expense purchase and cause to be installed upon the exterior of the Premises a sign which in all respects conforms to the criteria established by Landlord. However, Tenant will not install said sign without first obtaining Landlord’s written approval thereof. Thereafter, Tenant will not place or suffer to be placed or maintain on any portion of the exterior (including windows) of the Premises any sign, awning, canopy or advertising matter or other thing of any kind, without first obtaining Landlord’s written approval and consent. Without limitation as to the foregoing, Landlord specifically reserves the right at any time during the term of this Lease to require Tenant to remove from the Premises any sign(s) situated thereon and to replace same with a sign or signs which in all respects conform to a sign standard designated by Landlord, all of which will be performed at Tenant’s sole cost and expense. Tenant agrees to maintain any such sign, awning, canopy, decoration, lettering, advertising matter or other thing as may be approved in good condition and repair at all times and to repaint or replace such signs from time to time when reasonably necessary and to illuminate such signs in accordance with standards established by Landlord from time to time, including hours of illumination. All signs in addition must be conform to code and local ordinances rules, laws and regulations.

ARTICLE 13

WASTE AND GOVERNMENTAL REGULATIONS

13.1 Nuisance or Waste. Tenant shall not commit or suffer to be committed any waste upon the Premises or any nuisance or other act or thing which may disturb the quiet enjoyment of any other tenant in the building in which the Premises may be located.

13.2 Compliance with Laws. Tenant, at its sole cost, will promptly comply with all applicable laws, guidelines, rules, regulations and requirements, whether of federal, state, or local origin, applicable to the Premises, including, but not limited to, the Americans with Disabilities Act, 42 U.S.C. § 12101 et seq., and those for the correction, prevention and abatement of nuisance, unsafe conditions, or other grievances arising from or pertaining to the use or occupancy of the Premises. Tenant at its sole cost and expense shall be solely responsible for taking any and all measures which are required to comply with the requirements of the ADA within the Premises. Any Alterations to the Premises made by or on behalf of Tenant for the purpose of complying with the ADA or which otherwise require compliance with the ADA shall be done in accordance with this Lease; provided, that Landlord’s consent to such Alterations shall not constitute either Landlord’s assumption, in whole or in part, of Tenant’s responsibility for compliance with the ADA, or representation or confirmation by Landlord that such Alterations comply with the provisions of the ADA.

13.3 Governmental Regulations. Tenant shall, at Tenant’s sole costs and expense, comply with all regulations of all county, municipal, state, federal and other applicable governmental authorities, not in force or which may hereafter be in force, pertaining to Tenant or its use of the Premises, and shall faithfully observe in the use of the Premises all municipal and county ordinances and state and federal statutes now in force or which may hereinafter be in force. Tenant shall indemnify, defend and save Landlord harmless from penalties, fines, costs, expenses suits, claims, or damages resulting from Tenant’s failure to perform its obligations in this Section.

13.4 Rules and Regulations. Landlord reserves the right from time to time to make reasonable rules and regulations, governing loading of supplies, trash collection, pest control, parking, noise, electrical overloads and similar issues of general concern to all tenants in the event that the need therefore should ever arise. Notice of such rules and regulations and amendments and supplements thereto, if any, shall be given to the Tenant.

ARTICLE 14

HAZARDOUS MATERIALS

14.1 Hazardous Materials. Tenant shall not use or allow the Premises to be used for the Release, storage, use, treatment, disposal or other handling of any Hazardous Materials, without the prior consent of Landlord. The term “Release” shall have the same meaning as is ascribed to it in the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601 et seq., as amended, (“CERCLA”). The term “Hazardous Materials” means (i) any substance defined as a “hazardous substance” under CERCLA, (ii) petroleum, petroleum products, natural gas, natural gas liquids, liquefied natural gas, and synthetic gas, and (iii) any other substance or material deemed to be hazardous, dangerous, toxic, or a pollutant under any federal, state, or local law, code, ordinance or regulation (“Hazardous Materials Laws”).

Tenant shall: (a) give prior notice to Landlord of any activity or operation to be conducted by Tenant at the Premises which involves the Release, use, handling, generation, treatment, storage, or disposal of any Hazardous Materials (“Tenant’s Hazardous Materials Activity”), (b) comply with all federal, state, and local laws, codes, ordinances, regulations, permits and licensing conditions governing the Release, discharge, emission, or disposal of any Hazardous Materials and prescribing methods for or other limitations on storing, handling, or otherwise managing Hazardous Materials, (c) at its own expense, promptly contain and

remediate any Release of Hazardous Materials arising from or related to Tenant’s Hazardous Materials Activity in the Premises and remediate and pay for any resultant damage to properly, persons, and/or the environment, (d) give prompt notice to Landlord, and all appropriate regulatory, authorities, of any Release of any Hazardous Materials in the Premises arising from or related to, Tenant’s Hazardous Materials Activity, which Release is not made pursuant to and in conformance with the terms of any permit or license duly issued by appropriate governmental authorities, any such notice to include a description of “measures taken or proposed to be taken by Tenant to contain and remediate the Release and any resultant damage to property, persons, or the environment, (e) at Landlord’s request, which shall not be more frequent than once per calendar year, retain an independent engineer or other qualified consultant or, expert acceptable to Landlord, to conduct, at Tenant’s expense, an environmental audit of the Premises and immediate surrounding areas, and the scope of work to be performed by such engineer, consultant, or expert shall be approved in advance by Landlord, and all of the engineer’s, consultant’s or expert’s work product shall be made available to Landlord, (f) at Landlord’s request from time to time, executed affidavits, representations and the like concerning Tenant’s best knowledge, and belief regarding the presence of Hazardous Materials in the Premises, (g) reimburse to Landlord, upon demand, the reasonable cost of any testing for the purpose of ascertaining if there has been any Release of Hazardous Materials in the Premises, if such testing is required by any governmental agency or Landlord’s Mortgagee, (h) upon expiration or termination of this Lease, surrender the Premises to Landlord free from the presence and contamination of any Hazardous Materials. Tenant shall indemnify, protect, defend (by counsel reasonably acceptable to Landlord), and hold Landlord and free and harmless from and against any and all claims, liabilities, penalties, forfeitures, losses and expenses (including attorneys’ fees) or death of or injury to any person or damage to any property whatsoever arising from or caused in whole or in part, directly or indirectly, by the presence in or about the Premises of any of Tenant’s Hazardous Materials Activity or by Tenant’s failure to comply with any Hazardous Materials Law regarding Tenant’s Hazardous Materials Activity or in connection with any removal, remediation, clean up, restoration and materials required hereunder to return the Premises and any other property of whatever nature to their condition existing prior to Tenant’s Hazardous Materials Activity.

14.2 Disclosure Warning and Notice Obligations. Tenant shall comply with all laws, ordinances and regulations in the State of California regarding the disclosure of the presence or danger of Tenant’s Hazardous Materials. Tenant acknowledges and agrees that all reporting and warning obligations required under the Hazardous Materials Laws with respect to Tenant’s Hazardous Materials Activity are the sole responsibility of Tenant, whether or not such Hazardous Materials Laws permit or require Landlord to provide such reporting or warnings, and Tenant shall be solely responsible for complying with such Hazardous Materials Laws regarding the disclosure of, the presence or danger of Tenant’s Hazardous Materials Activity. Tenant shall immediately notify Landlord, in writing, of any complaints, notices, warnings, reports or asserted violations of which Tenant becomes aware relating to Hazardous Materials on or about the Premises. Tenant shall also immediately notify Landlord if Tenant knows or has reason to believe Tenant’s Hazardous Materials have or will be released in or about the Premises.

14.3 Environmental Tests and Audits. Tenant shall not perform or cause to be performed, any Hazardous Materials surveys, studies, reports or inspection, relating to the Premises without obtaining Landlord’s advance written consent, which consent may be withheld in Landlord’s sole discretion. At any time prior to the expiration of the Term, Landlord shall have the right to enter upon the Premises in order to conduct appropriate tests and to deliver to

Tenant the results of such tests to demonstrate that levels of any Hazardous Materials in excess of permissible levels has occurred as a result of Tenant’s use of the Premises.

14.4 Survival/Tenant’s Obligations. The respective rights and obligations of Landlord and Tenant under this Article shall survive the expiration or termination of this Lease.

ARTICLE 15

DESTRUCTION OF PREMISES

15.1 Damage and Destruction. If all or any part of the Premises shall be damaged or destroyed by fire or other casualty, this Lease shall continue in full force and effect, unless terminated as hereinafter provided, and Landlord shall repair, restore or rebuild the Premises to the condition existing at the time of the occurrence of the loss; provided, however, Landlord shall not be obligated to commence such repair, restoration or rebuilding until insurance proceeds are received by Landlord, and Landlord’s obligation hereunder shall be limited to the proceeds actually received by Landlord under any insurance policy or policies, if any, less those amounts (i) which have been required to be applied towards the reduction of any indebtedness secured by a mortgage covering the Premises or any portion thereof, and (ii) which are used to reimburse Landlord for all costs and expenses, including but not limited to attorneys’ fees, incurred by Landlord to recover any such insurance proceeds.

Tenant agrees to notify Landlord in writing not less than thirty (30) days prior, to the date Tenant opens for business in the Premises of the actual cost of all permanent leasehold improvements and betterments installed or to be installed by Tenant in the Premises (whether same have been paid for entirely or partially by Tenant), but exclusive of Tenant’s personal property, movable trade fixtures and inventory. Similar notifications shall be given to Landlord not less than thirty (30) days prior to the commencement of any proposed alterations, additions or improvements to the Premises. If Tenant fails to comply, with the foregoing provisions, any loss or damage Landlord shall sustain by reason thereof shall be borne by Tenant and shall be paid immediately by Tenant upon receipt of a bill therefore and evidence of such loss, and in addition to any other rights or remedies reserved by Landlord under this Lease, Landlord’s obligations under this Article to repair, replace and/or rebuild the Premises shall be deemed inapplicable, and in lieu thereof, Landlord may, at its election, either restore or require Tenant to restore the Premises to the condition which existed prior to such loss, and in either case Tenant shall pay the cost of such restoration.

Tenant covenants and agrees to repair or replace Tenant’s fixtures, furniture, furnishings, floor coverings, equipment and stock in trade and reopen for business in the Premises within thirty (30) days after notice from Landlord that the Premises are ready for re-occupancy.

No damage or destruction to the Premises shall allow Tenant to surrender possession of the Premises nor affect Tenant’s liability for the payment of rents or charges or any other covenant herein contained, except as may be specifically provided in this Lease.

Notwithstanding anything to the contrary contained in this Section or elsewhere in this Lease, Landlord, at its option, may terminate this Lease by giving Tenant notice thereof within one hundred and eighty (180) days from the date of the casualty if:

(a) The Premises or the building in which the Premises are located shall be damaged or destroyed as a result of an occurrence which is not covered by Landlord’s insurance; or

(b) The Premises shall be damaged or destroyed during the last two (2) years of the Term or any renewals thereof; or

(c) The Premises are damaged or destroyed to the extent of twenty five-percent (25%) or more of the replacement cost thereof, in which event Landlord will have the option of terminating this Lease or any renewal thereof by serving written notice upon Tenant and any prepaid Rent or Additional Rent will be prorated as of the date of destruction and the unearned portion of such Rent will be refunded to Tenant without interest.

If the Premises shall be damaged or destroyed and in the event that Landlord has elected to continue this Lease, Landlord and Tenant shall commence their respective obligations under this Article as soon as is reasonably possible and prosecute the same to completion with all due diligence.

Except where the damage or destruction results from the wrongful or negligent act or omission of Tenant, the Minimum Rent shall be abated proportionately with the degree to which Tenant’s use of the Premises is impaired during the period of any damage, repair or restoration provided for in this Article; provided further, that in the event Landlord elects to repair any damages as herein contemplated, any abatement of Minimum Rent shall end ten (10) days after notice by Landlord to Tenant that the Premises have been repaired. Tenant shall continue the operation of its business on the Premises during any such period to the extent reasonably practicable from the standpoint of prudent business management, and any obligation of Tenant under the Lease to apply charges reserved as Additional Rent shall remain in full force and nothing in the Section shall be construed to abate Additional Rent. Except for the abatement of Minimum Rent hereinabove provided, Tenant shall not be entitled to any compensation or damage for loss in the use of the whole or any part of the Premises and/or any inconvenience or annoyance occasioned by any damage, destruction, repair or restoration. If Minimum Rent is abated there shall be all corresponding and appropriate reduction made to the Minimum Annual Volume.

Unless this Lease is terminated by Landlord, Tenant shall repair, restore and re-fixture all parts of the Premises not insured under any insurance policies insuring Landlord in a manner and to a condition equal to that existing prior to its destruction or damage, including, without limitation, all exterior signs, trade fixtures, equipment, display cases, furniture, furnishings and other installations of personality of Tenant. The proceeds of all insurance carried by Tenant on its property and improvements shall be held in trust by Tenant for the purpose of said repair and replacement. Tenant shall give to Landlord prompt written notice of, any damage to or destruction of any portion of the Premises resulting from fire or other casualty.

ARTICLE 16

EMINENT DOMAIN

16.1 Total Condemnation of Premises. If the whole of the Premises shall be acquired or condemned by eminent domain for any public or quasi-public use or purpose, then the Term of this Lease shall cease and terminate as of the date of title vesting in such proceeding and all rentals shall be paid up to that date.

16.2 Partial Condemnation of Premises.

16.2.1 If twenty (20%) percent or more of the Premises shall be acquired or condemned by eminent domain for any public or quasi-public use or purpose, then the Tenant shall have the option to cancel and terminate this Lease upon notice thereof given to the Landlord within ninety (90) days after the vesting of title in such proceeding.

16.2.2 In the event that less than ten (10%) percent of the Premises shall be acquired or condemned by eminent domain for any public or quasi-public use or purpose, or in the event ten (10%) percent or more of the Premises shall have been so taken, and Tenant shall not elect to terminate this Lease as set forth above, then the Landlord shall promptly restore the Premises to a condition reasonably comparable under the circumstances to its condition at the time of such condemnation, less the portion lost in the taking; and this Lease shall thereafter continue in full force and effect. In such event of a partial taking, described hereinabove, from the effective date that physical possession is taken by the condemning authority through the end of the term of this Lease, the annual Minimum Rent payable by Tenant to Landlord under this Lease shall be reduced by a fraction, the numerator of which shall be the gross area of the premises so taken by the condemning authority and the denominator of which shall be the gross area of the Premises on the date immediately prior to the effective date of such taking.

16.3 Total Condemnation of Parking. If the whole of the common parking areas at or near the Premises shall be acquired or condemned by eminent domain for any public or quasi-public use or purpose, then the term of this Lease shall cease and terminate as of the date of title vesting in such proceeding.

16.4 Partial Condemnation of Parking Area. If twenty (20%) percent or more of the common parking areas at or near the Premises shall be acquired or condemned by eminent domain for any public or quasi-public use or purpose, then the Tenant shall have the option to cancel and terminate this Lease upon notice thereof given to the Landlord within ninety (90) days after the vesting of title in such proceeding.

If less than twenty (20%) percent of the parking areas at or near the Premises shall be acquired or condemned by eminent domain for any public or quasi-public use or purpose, or if more than twenty (20%) percent of the parking areas shall be so acquired or condemned, but Tenant shall not elect to cancel and terminate this Lease, then the Landlord shall restore the parking areas to a condition reasonably comparable under the circumstances to its condition at the time of such condemnation, less the portion lost in the taking. In such event, this Lease shall be and remain in full force and effect and no reduction of Minimum Rent or any Additional Rent payable by Tenant under this Lease shall be allowed in such circumstances, but Tenant shall continue to pay the full Minimum Rent or any Additional Rent payable under this Lease for the balance of the term hereof.

ARTICLE 17

DEFAULTS

17.1 Events of Default By Tenant. If (1) Tenant vacates, abandons or surrenders all or any part of the Premises prior to the expiration of the Term of the Lease or (2) Tenant fails to fulfill any of the terms or conditions of this Lease or any other lease heretofore made by Tenant

for space in the Premises or (3) the appointment of a trustee or a receiver to take possession of all or substantially all of Tenant’s assets occurs, or if the attachment, execution or other judicial seizure of all or substantially all of Tenant’s assets located at the Premises, or of Tenant’s interest in this Lease, occurs, or (4) Tenant or any of its successors or assigns or any guarantor of this Lease (“Guarantor”) should file any voluntary petition in bankruptcy, reorganization or arrangement, or an assignment for the benefit of creditors or for similar relief under any present or future statute, law or regulation relating to relief of debtors, or (5) Tenant or any of its successors or assigns or any Guarantor should be adjudicated bankrupt or have an involuntary petition in bankruptcy, reorganization or arrangement filed against it, or (6) Tenant shall permit, allow or suffer to exist any lien, judgment, writ, assessment, charge, attachment or execution upon Landlord’s or Tenant’s interest in this Lease or to the Premises, and/or the fixtures, improvements and furnishings located thereon; then, Tenant shall be in default hereunder.

17.2 Tenant’s Grace Periods. If (1) Tenant fails to pay Rent or Additional Rent within five (5) days after notice from Landlord of delinquency or (2) Tenant fails to cure any other default within ten (10) days after notice faith), then Landlord shall have such remedies as are provided under this Lease and/or under the laws of the State of Arizona.

17.3 Repeated Late Payment. Regardless of the number of times of Landlord’s prior acceptance of late payments and/or late charges, (i) if Landlord notifies Tenant twice in any 6-month period that Minimum Rent or any Additional Rent has not been paid when due, then any other late payment within such 6-month period shall automatically constitute a default hereunder without the necessity of notice and (ii) the mere acceptance by Landlord of late payments in the past shall not, regardless of any applicable laws to the contrary, thereafter be deemed to waive Landlord’s right to strictly enforce this Lease, including Tenant’s obligation to make payment of Rent on the exact day same is due, against Tenant.

17.4 Landlord’s Default. If Tenant asserts that Landlord has failed to meet any of its obligations under this Lease, Tenant shall provide written notice (“Notice of Default”) to Landlord specifying the alleged failure to perform, and Tenant shall send by certified mail, return receipt requested, a copy of such Notice of Default to any and all mortgage holders, provided that Tenant has been previously advised of the addresses) of such mortgage holder(s). Landlord shall have a thirty (30) day period after receipt of the Notice of Default in which to commence curing any non-performance by Landlord, and Landlord shall have as much time thereafter to complete such cure as is necessary so long as Landlord’s cure efforts are diligent and continuous, if Landlord has not begun the cure within thirty (30) days of receipt of the Notice of Default, or Landlord does not thereafter diligently and continuously attempt to cure, then Landlord shall be in default under this Lease. If Landlord is in default under this Lease, then the mortgage holder(s) shall have an additional thirty (30) days, after receipt of a second written notice from Tenant, within which to cure such default or, if such default cannot be cured within that time, then such additional time as may be necessary so long as their efforts are diligent and continuous.

ARTICLE 18

LANDLORD’S REMEDIES FOR TENANT’S DEFAULT

18.1 Landlord’s Options. If Tenant is in default of this Lease, Landlord may, at its option, in addition to such other remedies as may be available under the law of the State of Arizona:

(a) Terminate this Lease and Tenant’s right of possession; or

(b) Terminate Tenant’s right to possession but not the Lease and/or proceed in accordance with any and all provisions of Section 18.2 below.

18.2 Landlord’s Remedies. Landlord may without further notice reenter the Premises either by force or otherwise and dispossess Tenant by summary proceedings or otherwise, as well as the legal representatives) of Tenant and/or other occupants) of the Premises, and remove their effects and hold the Premises as if this Lease had not been made, and Tenant hereby waives the service of notice of intention to re-enter or to institute legal proceedings to that end; and/or at Landlord’s option.

All Rent for the balance of the Term will, at the election of Landlord, be accelerated and the present worth of same for the balance of the Term, net of amounts actually collected by Landlord, shall become immediately due thereupon and be paid, together with all expenses of every nature which Landlord may incur such as (by way of illustration and not limitation) those for attorneys’ fees, brokerage, advertising, and refurbishing the Premises in good order or preparing them for re-rental. For purposes of this clause (2), “present worth” shall be computed by discounting such amount to present worth at a discount rate equal to one percentage point above the discount rate then in effect at the Federal Reserve Bank nearest to the location of the Premises.

Landlord may re-let the Premises or any part thereof, either in the name of Landlord or otherwise, for a term or terms which may at Landlord’s option be less than or exceed the period which would otherwise have constituted the balance of the Term, and may grant concessions or free rent or charge a higher rental than that reserved in this Lease; and/or at Landlord’s option, Tenant or its legal representatives will also pay to Landlord as liquidated damages any deficiency between the Rent and all Additional Rent hereby reserved and/or agreed to be paid and the net amount, if any, of the rents collected on account of the lease or leases of the Premises for each month of the period which would otherwise have constituted the balance of the Term.

If Landlord exercises the remedy above, and provided that Tenant has paid Landlord the accelerated Rent as required by this Section, Landlord shall remit to Tenant on a monthly basis until the Expiration Date any amounts actually collected by Landlord as a result of are letting remaining after subtracting therefrom all reasonable costs paid by Landlord to secure a replacement tenant including reasonable marketing/leasing costs, fees and commissions, and costs of preparing improvements and refurbishment to the Premises for the replacement tenant. In no event shall the total amount paid to Tenant pursuant to the preceding sentence exceed the accelerated Rent paid by Tenant to Landlord. If this Lease is terminated, Landlord may re-let the Premises or any part thereof, alone or together with other premises, for such term or terms (which may be greater or less than the period which otherwise would have constituted the balance of the Term) and on such terms and conditions (which may include concessions or free rent and alterations of the Premises) as Landlord, in its sole discretion, may determine, but Landlord shall not be liable for nor shall Tenant’s obligations hereunder be diminished by reason of, any failure by Landlord to re-let the Premises or any failure by Landlord to collect any rent due upon such re-letting.

18.3 Waiver of Jury Trial. To the extent permitted by law, Tenant hereby waives: (a) jury trial in any action or proceeding regarding a monetary default by Tenant and/or Landlord’s

right to possession of the Premises, and (b) in any action or proceeding by Landlord for eviction where Landlord has also filed a separate action for damages, Tenant waives the right to interpose any counterclaim in such eviction action. Moreover, Tenant agrees that it shall not interpose or maintain any counterclaim in such damages action unless it pays and continues to pay all Rent, as and when due, into the registry of the court in which the damages action is filed.

18.4 Waiver of Rights of Redemption. Tenant hereby expressly waives any and all rights of redemption granted by or under any present or future laws in the event of Tenant being evicted or dispossessed for any cause, or in the event of Landlord obtaining possession of the Premises, by reason of the violation by Tenant of any of the covenants or conditions of this Lease or otherwise.

ARTICLE 19

BANKRUPTCY PROVISIONS

19.1 Event of Bankruptcy. If this Lease is assigned to any person or entity pursuant to the provisions of the United States Bankruptcy Code, 11 U.S.C. Section 101 et seq. (the “Bankruptcy Code”), any and all monies or other consideration payable or otherwise to be delivered in connection with such assignment shall be paid or delivered to Landlord, shall be and remain the exclusive property of Landlord, and shall not constitute the property of Tenant or of the estate of Tenant within the meaning of the Bankruptcy Code. Any and all monies or other considerations constituting Landlord’s property under this Section not paid or delivered to Landlord shall be held in trust for the benefit of Landlord and shall be promptly paid or delivered to Landlord. Any person or entity to which this Lease is assigned pursuant to the provisions of the Bankruptcy Code shall be deemed without further act or deed to have assumed all of the obligations arising under this Lease on and after the date of such assignment.

19.2 Additional Remedies. In addition to any rights or remedies hereinbefore or hereinafter conferred upon Landlord under the terms of this Lease, the following remedies and provisions shall specifically apply in the event Tenant is in default of this Lease:

19.2.1 In all events, any receiver or trustee in bankruptcy shall either expressly assume or reject this Lease within sixty (60) days following the entry of an “Order for Relief” or within such earlier time as may be provided by applicable law.

19.2.2 In the event of an assumption of this Lease by a debtor or by a trustee, such debtor or trustee shall within fifteen (15) days after such assumption (i) cure any default or provide adequate assurance that defaults will be promptly cured; (ii) compensate Landlord for actual pecuniary loss or provide adequate assurance that compensation will be made for actual monetary loss, including, but not limited to, all attorneys’ fees and costs incurred by Landlord resulting from any such proceedings; and (iii) provide adequate assurance of future performance.

19.2.3 Where a default exists under this Lease, the trustee or debtor assuming this Lease may not require Landlord to provide services or supplies incidental to this Lease before its assumption by such trustee or debtor, unless Landlord is compensated under the terms of this Lease for such services and supplies provided before the assumption of such Lease.

19.2.4 The debtor or trustee may only assign this Lease if (i) it is assumed and the asignee agrees to be bound by this Lease, (ii) adequate assurance of future performance by the assignee is provided, whether or not there has been a default under this Lease, and (iii) the debtor or trustee has

received Landlord’s prior written consent pursuant to the provisions of this Lease. Any consideration paid by any assignee in excess of the rental reserved in this Lease shall be the sole property of, and paid to Landlord.

19.2.5 Landlord shall be entitled to the fair market value for the Premises and the services provided by Landlord (but in no event less than the rental reserved in this Lease) subsequent to the commencement of a bankruptcy event.

19.2.6 Any security deposit given by Tenant to Landlord to secure the future performance by Tenant of all or any of the terms and conditions of this Lease shall be automatically transferred to Landlord upon the entry of an “Order of Relief.”

19.2.7 The parties agree that Landlord is entitled to adequate assurance of future performance of the terms and provisions of this Lease in the event of an assignment under the provisions of the Bankruptcy Code. For purposes of any such assumption or assignment of this Lease, the parties agree that the term “adequate assurance” shall include, without limitation, at least the following: (i) any proposed assignee must have, as demonstrated to Landlord’s satisfaction, a net worth (as defined in accordance with generally accepted accounting principles consistently applied) in an amount sufficient to assure that the proposed assignee will have the resources to meet the financial responsibilities under this Lease, including the payment of all Rent; the financial condition and resources of Tenant are material inducements to Landlord entering into this Lease; (ii) any proposed assignee must have engaged in the Use described in Section 1.2 for at least five (5) years prior to any such proposed assignment, the parties hereby acknowledging that in entering into this Lease, Landlord considered extensively Tenant’s permitted use and determined that such permitted business would add substantially to the tenant balance in the Premises, and were it not for Tenant’s agreement to operate only Tenant’s permitted business on the Premises, Landlord would not have entered into this Lease, and that Landlord’s operation of the Premises will be materially impaired if a trustee in bankruptcy or any assignee of this Lease operates any business other than Tenant’s permitted business; (iii) any assumption of this Lease by a proposed assignee shall not adversely affect Landlord’s relationship with any of the remaining tenants in the building in which the Premises are located, taking into consideration any and all other “use” clauses and/or “exclusivity” clauses which may then exist under their leases with Landlord; and (iv) any proposed assignee must not be engaged in any business or activity which it will conduct on the Premises and which will subject the Premises to contamination by any Hazardous Materials.

ARTICLE 20

LIMITATIONS OF LANDLORD’S LIABILITY

The term “Landlord” as used in this Lease, so far as covenants or obligations on the part of the Landlord are concerned shall be limited to mean and include only a ground lessee if the named Landlord herein is holding the premises under a ground lease for so long as the named Landlord is the holder of such ground lease interest or the owner or owners of the fee simple of the Premises; and in the event of transfer or transfers of either the ground leasehold interest to any other person or the transfer of title to the fee premises to any person, the Landlord herein named (and in the case of subsequent transfers or conveyances the then grantor or assignor), shall be automatically freed and relieved from and after the date of such transfer or conveyance or assignment of all liability as respects the performance of any covenant or obligation on the part of the Landlord contained in this Lease thereafter to be performed, it being the intention of the parties that the covenants and obligations to be observed and performed by the Landlord

shall be binding upon the Landlord only during and in respect of its period of ownership of either a leasehold interest, or a fee interest as the case may be. Anything in this Lease to the contrary notwithstanding, Tenant agrees that Tenant shall, subject to prior rights of any mortgagee of the Premises, look solely to the estate and property of Landlord in the Premises for the collection of any judgment (or other judicial process) requiring the payment of money by Landlord in the event of any default or breach by Landlord with respect to any of the terms, covenants and conditions of this Lease to be observed and/or performed by Landlord, and no other assets of Landlord or any principal of Landlord shall be subject to levy, execution or other procedures for the satisfaction of Tenant’s remedies.

ARTICLE 21

ACCESS BY LANDLORD

Landlord or Landlord’s agents shall have the right to enter the Premises at all times to examine the same and to show them to prospective purchasers of the building, and to make such repairs, alterations, improvements or additions as Landlord may deem necessary or desirable, and Landlord shall be allowed to take all material into and upon said premises that may be required therefore, without the same constituting an eviction of Tenant in whole or in part and the Rent reserved shall in no way abate while said repairs, alterations, improvements, or additions are being made, by reason of loss or interruption of business of Tenant, or otherwise. During the six (6) month period prior to the expiration of the term of this Lease or any renewal term, Landlord may exhibit the Premises to prospective tenants or purchasers, and place upon the premises the usual notices “To Let” or “For Sale” which notices Tenant shall permit to remain thereon without molestation. Nothing herein contained, however, shall be deemed or construed to impose upon Landlord any obligation, responsibility or liability whatsoever, for the care, maintenance, or repair of the Premises or any part thereof, except as otherwise herein specifically provided. Landlord to give Tenant reasonable notice during business hours prior to any entry.

ARTICLE 22

QUIET ENJOYMENT

22.1 Landlord’s Covenant. Upon payment by the Tenant of the rents and other charges herein provided, and upon the observance and performance of all the covenants, terms and conditions on Tenant’s part to be observed and performed, Tenant shall peaceably and quietly hold and enjoy the Premises for the term hereby demised without hindrance or interruption by Landlord or any other person or persons lawfully or equitably claiming by, through or under the Landlord, subject, nevertheless, to the terms and conditions of this Lease.

ARTICLE 23

MISCELLANEOUS

23.1 Accord and Satisfaction. No payment by Tenant or receipt by Landlord of a lesser amount than the rent herein stipulated to be paid shall be deemed to be other than on account of the earliest stipulated rent, nor shall any endorsement or statement on any check or any letter accompanying any check or payment as rent be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of such rent or pursue any other remedy provided herein or by law.

23.2 Entire Agreement. This Lease constitutes all covenants, promises, agreements, conditions and understandings between Landlord and Tenant concerning the Premises and the

Building and there are no covenants, promises, conditions or understandings, either oral or written, between them other than are herein set forth. Neither Landlord nor Landlord’s agents have made nor shall be bound to any representations with respect to the Premises or the Building except as herein expressly set forth, and all representations, either oral or written, shall be deemed to be merged into this Lease Agreement. Except as herein otherwise provided, no subsequent alteration change or addition to this lease shall be binding upon Landlord or Tenant unless reduced to writing and signed by them.

23.3 Notices.

23.3.1 Any notice by Tenant to Landlord must be served by certified mail return requested, addressed to Landlord at the address first hereinabove given or at such other address as Landlord may designate by written notice. Tenant shall also provide copies of any notice given to Landlord to such mortgagees, agents or attorneys of Landlord as Landlord may direct.

23.3.2 After commencement of the term hereof any notice by Landlord to Tenant shall be served by certified mail, return receipt requested addressed to Tenant at the Premises or at such other address as Tenant shall designate by written notice, or by delivery by Landlord to the Premises or to such other address.

Landlord: |

| Tenant: |

Daniel Dosoretz |

| David Koeninger |

2234 Colonial Blvd. |

| 2234 Colonial Blvd. |

Fort Myers, FL 33907 |

| Fort Myers, FL 33907 |

23.3.3 All notices given hereunder shall be in writing, and shall be effective and deemed to have been given only upon receipt by the party to which notice is being given, said receipt being deemed to have occurred upon hand delivery or posting, or upon such date as the postal authorities shall show the notice to have been delivered, refused, or undeliverable, as evidenced by the return receipt. Notwithstanding any other provision hereof, Landlord shall also have the right to give notice to Tenant in any other manner provided by law.

23.4 Successors. All rights and liabilities herein given to, or imposed upon, the respective parties hereto shall extend to and bind the several respective heirs, legal representatives, and permitted successors and assigns of the said parties; and if there shall be more than one person or party constituting the Tenant, they shall be bound jointly and severally by the terms, covenants and agreements herein. No rights, however, shall inure to the benefit of any assignee of Tenant unless the assignment to such has been approved by Landlord in writing as provided herein. Nothing contained in this Lease shall in any manner restrict Landlord’s right to assign or encumber this Lease and, in the event Landlord sells its interest in the Building and the purchaser assumes Landlord’s obligations and covenant, Landlord shall thereupon be relieved of all further obligations hereunder.

23.5 Captions and Section Numbers. The captions, section numbers, and article numbers appearing in this Lease are inserted only as a matter of convenience and in no way define, limit, construe, or describe the scope or intent of such sections or articles of this Lease nor in any way affect this Lease.

23.6 Broker’s Commission. The Tenant represents and warrants to Landlord that it has dealt with no real estate broker, agent, salesperson or finder in connection with this Lease or the Premises. Notwithstanding the foregoing, Tenant agrees to indemnify, defend and save the Landlord harmless from all liabilities arising from claims by any real estate broker or agent claiming through Tenant. Such indemnity of Tenant shall include, without limitation, all of attorneys, fees incurred in connection therewith.

23.7 Partial Invalidity. If any term, covenant or condition of this Lease or the application thereof to any person or circumstances shall, to any extent, be invalid or unenforceable, the remainder of this Lease the application of such term, covenant or condition to persons or circumstances other than those as to which it is held invalid or unenforceable, shall not be affected thereby and each term, covenant or condition of this Lease shall be valid and enforceable to the fullest extent permitted by law.

23.8 Estoppel Certificate. Landlord and Tenant agree that each will, at any time and from time to time, within ten (10) days following written notice by the other party hereto specifying that it is given pursuant to this Section, execute, acknowledge and deliver to the party who gave such notice, or its designate, a statement in writing certifying that this Lease is unmodified and in full force and effect (or if there have been modifications, that the same is in full force and effect and stating the modifications), and the date to which the annual rent and any other payments due hereunder from Tenant have been paid in advance, if any, and stating whether or not there are defenses or offsets claimed by the maker of the certificate and whether or not to the best of knowledge of the signer of such certificate the other party is in default in performance of any covenant agreement or condition contained in this Lease, and if so, Specifying each such default of which the maker may have knowledge and if requested, such financial information concerning Tenant and Tenant’s business operations (and the Guarantor of this Lease, if this Lease be guaranteed) as may be reasonably requested by any Mortgagee or prospective mortgagee or purchaser. The failure of either party to execute, acknowledge and deliver to the other a statement in accordance with the provisions of this Section within said ten (10) business day period shall constitute an acknowledgment, by the party given such notice, which may be relied on by any person holding or proposing to acquire an interest in the Building or any party thereof or the Premises or this Lease from or through the other party, that this Lease is unmodified and in full force and effect and that such rents have been duly and fully paid to an including the respective due dates immediately preceding the date of such notice and shall constitute, as to any person entitled as aforesaid to rely upon such statements, waiver of any defaults which may exist prior to the date of such notice; provided, however that nothing contained in the provision of this Section shall constitute waiver by Landlord of any default in payment of rent or other charges existing as of the date of such notice and, unless expressly consented to in writing by Landlord, and Tenant shall still remain liable for the same.

23.9 Liability of Landlord. Tenant shall look solely to the estate and property of the Landlord in the Premises for the collection of any judgment, or in connection with any other judicial process, requiring the payment of money by Landlord in the event of any default by Landlord with respect to any of the terms, covenants and conditions of this Lease to be observed and performed by Landlord, and no other property or estates of Landlord shall be subject to levy, execution or other enforcement procedures for the satisfaction of Tenant’s remedies and rights under this Lease. Both parties waive a jury trial if any litigation arises.

23.10 Recordings. Tenant shall not record this Lease, or any memorandum or short form thereof, without the written consent and joinder of Landlord.

23.11 Time of Essence. Time is of the essence with respect to the performance of every provision of this Lease in which time of performance is a factor.

ARTICLE 24

TENANT’S PROPERTY

24.1 Taxes on Leasehold. Tenant shall be responsible for and shall pay before delinquency all municipal, county or state taxes assessed during the term of this Lease against any leasehold interest or personal property of any kind, owned by or placed in, upon or about the Premises by the Tenant.

24.2 Personal Property. Landlord shall not be liable for any damage to property of Tenant or of others located on the Premises, nor for the loss of or damage to any property of Tenant or of others by theft or otherwise. Landlord shall not be liable for any injury or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water, rain, or snow or leaks from any part of the Premises or from the pipes, appliances or plumbing works or from the roof, street or subsurface or from any other place or by dampness or by any other cause of whatsoever nature. Landlord shall not be liable for any such damage caused by other tenants or persons in the Premises, occupants of adjacent property, or caused by operation in construction of any private, public or quasi-public work. All property of Tenant kept or stored on the Premises shall be so kept or stored at the sole risk of Tenant only.

24.3 Notice by Tenant. Tenant shall give immediate notice to Landlord in case of fire or accidents in the Premises or in the building of which the Premises are a part or of defects therein or in any fixtures or equipment.

ARTICLE 25

HOLDING OVER SUCCESSORS

25.1 Surrender of Premises. At the expiration of the tenancy hereby created, Tenant shall surrender the Premises in the same condition as the Premises were in upon the Commencement Date, reasonable wear and tear excepted, and damage by unavoidable casualty excepted, and shall surrender all keys for the Premises to Landlord at the place then fixed for the payment of rent and shall inform Landlord of all combinations on locks, safes and vaults, if any, in the Premises. Tenant shall remove all its trade fixtures before surrendering the premises as aforesaid and shall repair any damage to the Premises caused thereby. Tenant’s obligation to observe or perform this covenant shall survive the expiration or other termination of the term of this Lease.

ARTICLE 26

ATTORNEY FEES AND COSTS

26.1 Attorney Fees and Costs. In the event of a lawsuit or litigation concerning this Lease or enforcement of this Lease the prevailing party shall be entitled to reasonable attorney fees and costs. This will also cover appellant fees and appellant costs.

ARTICLE 27

VENUE

27.1 Venue. In the event of a lawsuit, litigation or interpretation of this Lease Agreement parties shall be governed by the laws of the State of Florida.