Filed Pursuant to Rule 424(b)(3)

Registration No. 333-170802

NORTHSTAR HEALTHCARE INCOME, INC.

SUPPLEMENT NO. 16 DATED DECEMBER 9, 2014

TO THE PROSPECTUS DATED APRIL 29, 2014

This Supplement No. 16 supplements, and should be read in conjunction with, our prospectus dated April 29, 2014, as supplemented by Supplement No. 13 dated October 29, 2014, Supplement No. 14 dated November 12, 2014 and Supplement No. 15 dated November 13, 2014. Defined terms used in this Supplement shall have the meaning given to them in the prospectus unless the context otherwise requires. The purpose of this Supplement No. 16 is to disclose:

| |

| • | the status of our initial public offering; and |

| |

| • | the completion of a joint venture investment. |

Status of Our Initial Public Offering

We commenced our initial public offering of $1.1 billion in shares of common stock on August 7, 2012, of which up to $1.0 billion in shares are being offered pursuant to our primary offering and up to $100 million in shares are being offered pursuant to our distribution reinvestment plan, or DRP. We refer to our primary offering and our DRP collectively as our offering.

As of December 8, 2014, we received and accepted subscriptions in our offering for 76.6 million shares, or $763.3 million, including 0.3 million shares, or $2.7 million, sold to NorthStar Realty Finance Corp., or NorthStar Realty. As of December 8, 2014, 34.0 million shares remain available for sale pursuant to our offering. Our primary offering is expected to terminate on the earlier of August 7, 2015 or the date on which the maximum offering has been sold.

Completion of a Joint Venture Investment

Acquisition by NorthStar Realty of Griffin-American Healthcare REIT II, Inc.

On December 3, 2014, NorthStar Realty completed its acquisition of Griffin-American Healthcare REIT II, Inc., a Maryland corporation, or Griffin-American, pursuant to the Agreement and Plan of Merger, dated as of August 5, 2014, or the Merger Agreement, by and among NorthStar Realty, Griffin-American, Griffin-American Healthcare REIT II Holdings, LP, a Delaware limited partnership, or Griffin-American Operating Partnership, NRF Healthcare Subsidiary, LLC, a Delaware limited liability company and direct wholly-owned subsidiary of NorthStar Realty, or Merger Sub, and NRF OP Healthcare Subsidiary, LLC, a Delaware limited liability company and direct wholly-owned subsidiary of Merger Sub, or the Partnership Merger Sub. Pursuant to the Merger Agreement, Griffin-American was merged with and into Merger Sub, or the Parent Merger, and Partnership Merger Sub was merged with and into Griffin-American Operating Partnership, or the Partnership Merger and, together with the Parent Merger, the Merger, with Merger Sub continuing as the surviving entity of the Parent Merger and Griffin-American Operating Partnership (which has been renamed Healthcare GA Operating Partnership-T, LP), or the GA Operating Partnership, continuing as the surviving entity of the Partnership Merger.

Pursuant to the Merger Agreement, the Parent Merger became effective upon the filing of the Articles of Merger with the State Department of Assessments and Taxation of Maryland and the filing of a certificate of merger with the Secretary of the State of Delaware, and the Partnership Merger became effective upon the filing of a certificate of merger with the Secretary of State of the State of Delaware, each with an effective date of December 3, 2014. The assets acquired in the Merger include 295 healthcare real estate properties.

At the effective time of the Parent Merger, each share of issued and outstanding Griffin-American common stock was converted into the right to receive $7.75 cash and 0.2071 shares of NorthStar Realty’s common stock, or the Merger Consideration, and at the effective time of the Partnership Merger, each issued and outstanding limited partnership unit of Griffin-American Operating Partnership also converted into the right to receive the Merger Consideration. No fractional shares were issued in the Merger, and cash was paid in lieu thereof. NorthStar Realty issued approximately 60.82 million shares of its common stock in connection with the Merger. Based on the volume weighted average price of NorthStar Realty’s common stock during the ten-day period ending December 1, 2014, the aggregate value of the Merger Consideration, including debt repaid at closing, was approximately $4.0 billion.

Acquisition by NorthStar Healthcare of the Portfolio Interest

As previously disclosed, on October 22, 2014, we entered into a Purchase and Sale Agreement with NorthStar Realty pursuant to which we agreed to acquire an equity interest, or the Portfolio Interest, in the assets acquired by NorthStar Realty in the Merger that were previously held by Griffin-American, or the Portfolio, upon completion of the Merger. In connection with the Merger and on December 3, 2014, we acquired the Portfolio Interest (an approximate 14% interest in the Portfolio) for $188.0 million in cash (including a pro rata share of transaction costs). Our board of directors approved an increase in the size of our equity investment in the Portfolio from $100.0 million to up to $200.0 million on December 2, 2014.

We and NorthStar Realty hold our interests in the Portfolio through a general partnership, or the GA General Partnership, on a pari passu basis, over which NorthStar Realty has day-to-day control of the management. NorthStar Realty is externally managed by a subsidiary of NorthStar Asset Management Group Inc., our sponsor and the parent of our advisor. Pursuant to the partnership agreement of the GA General Partnership, we have the right to consent to certain major decisions by the GA General Partnership and the Portfolio Interest is subject to certain transfer restrictions, each as more fully described in the partnership agreement.

Financing

In connection with the Merger and the acquisition of the Portfolio Interest, on December 3, 2014, various indirect subsidiaries of the GA General Partnership entered into (either as borrowers or guarantors): (i) a mortgage loan agreement and three mezzanine loan agreements, or, collectively, the U.S. Loan Agreements, pursuant to which Citigroup Global Markets Realty Corp., JPMorgan Chase Bank, National Association, Barclays Bank PLC and Column Financial, Inc. funded term loans in the aggregate amount of approximately $2.6 billion or, collectively, the U.S. Loan and (ii) a term loan facility agreement, or the U.K. Loan Agreement, pursuant to which Credit Suisse AG, London Branch funded an approximately £223.8 million term loan, or the U.K. Loan.

The terms of the U.S. Loan include, without limitation, the following: (i) no amortization; (ii) a fixed rate component of approximately $1.8 billion with a weighted average interest rate of 4.576% per annum; (iii) a floating rate component of $892.0 million with a weighted average interest rate of one month LIBOR plus 3.10%, or the U.S. Floating Rate; (iv) a term of five years for the fixed rate component; (v) a term of two years for the floating rate component, with three one-year extension options subject to the satisfaction of certain conditions precedent and an increase of 0.25% in the interest rate upon exercise of the second extension option; (vi) restrictions on prepayment and sales of assets; (vii) the creation of reserves to pay for certain ongoing expenses associated with the secured properties; (viii) the establishment of a cash management system with respect to the secured properties; and (ix) customary representations and warranties, affirmative and negative covenants and events of default. Both the fixed and floating rate components may be prepaid, subject to certain restrictions, as more fully described in the U.S. Loan Agreements. In the event the GA General Partnership determines to prepay any of the U.S. Loan, such prepayment shall be first applied to the floating rate component. Although recourse for repayment of the U.S. Loan is generally limited to the GA Operating Partnership’s U.S. assets, NorthStar Realty Healthcare, LLC, an indirect wholly-owned subsidiary of NorthStar Realty, or NRH, provided a “non-recourse carveout” guaranty, and is required to maintain a minimum net worth of $400.0 million. The borrowers under the U.S. Loan have purchased a two-year interest rate “cap” with respect to the U.S. Floating Rate with a one-month LIBOR “strike rate” of 4.75%. In accordance with certain “flex” procedures in connection with the securitization and syndication of the U.S. Loan, the interest rates on the U.S. Loan may be increased and the interest rates may also be decreased if the GA General Partnership “buys down” those rates with the consent of the lenders.

The terms of the U.K. Loan include, without limitation, the following: (i) required amortization payments equal to 1.0% of the original loan amount during each year of the term of the U.K. Loan, payable in four equal quarterly installments on each quarterly interest payment date; (ii) a term of three years, with two one-year extension options, subject to the satisfaction of certain conditions; (iii) restrictions on sales of assets; (iv) the creation of reserves to pay for certain ongoing expenses associated with the secured properties; (v) the establishment of a cash management system with respect to the secured properties; and (vi) customary representations and warranties, affirmative and negative covenants and events of default. The annual interest rate on the U.K. Loan is three-month LIBOR plus 4.25%, or the U.K. Interest Rate. Although recourse for repayment of the U.K. Loan is generally limited to the GA Operating Partnership’s U.K. and Jersey subsidiaries, NRH provided a “non-recourse carveout” guaranty, similar to the non-recourse carveout guaranty for the U.S. Loan and is required to maintain a minimum net worth of $100.0 million. The borrowers under the U.K. Loan intend to purchase a three-year interest rate “cap” with respect to the U.K. Interest Rate with a three-month LIBOR “strike rate” of 2.50%.

Description of the Portfolio and Our Investments

The Portfolio

The Portfolio includes 295 healthcare real estate properties located throughout the United States and in the United Kingdom, including 145 medical office buildings, or MOBs, 91 senior housing facilities, 45 skilled nursing facilities, or SNFs, and 14 hospitals. As of June 30, 2014, the Portfolio's occupancy rate was 92% for the MOB properties and 88% for the remaining properties in the Portfolio. We believe that the properties comprising the Portfolio are suitable for their intended purpose and are adequately covered by insurance. These properties compete for tenants and residents with a number of properties providing comparable services in their respective markets, whose relative performance, along with other factors, could impact the future operating results of the Portfolio. We have no plans for any material renovations, improvements or development with respect to the Portfolio, except in accordance with planned budgets.

Our Investments

The following table presents our investments as of December 9, 2014, adjusted for our acquisition of the Portfolio Interest:

|

| | | | | | | |

| Investment Type: | | Principal Amount/ Cost (1) | | % of Total |

Real estate equity (2) | | | | |

ALF (3) | | $ | 400,736,297 |

| | 37.3 | % |

MOB (3) | | 273,519,269 |

| | 25.5 | % |

SNF (3) | | 136,816,841 |

| | 12.8 | % |

| ILF | | 58,446,448 |

| | 5.4 | % |

Hospital (3) | | 36,344,868 |

| | 3.4 | % |

| MCF | | 20,997,652 |

| | 2.0 | % |

| Total real estate equity | | 926,861,375 |

| | 86.4 | % |

| | | | | |

Real estate debt (4) | | | | |

| First mortgage loans | | 25,887,000 |

| | 2.4 | % |

| Mezzanine loans | | 120,000,000 |

| | 11.2 | % |

| Total real estate debt | | 145,887,000 |

| | 13.6 | % |

| Total investments | | $ | 1,072,748,375 |

| | 100.0 | % |

____________________________________

| |

| (1) | Based on cost for real estate equity investments, which includes preliminary net purchase price allocation related to net intangibles, deferred costs and other assets, if any, and principal amount for real estate debt. |

| |

| (2) | Classification based on predominant services but may include other services. MCF-memory care facility; ALF-assisted living facility; and ILF-independent living facility. |

| |

| (3) | Includes cost attributable to investments held through joint ventures. |

| |

| (4) | Excludes our pro rata share of approximately $31.4 million in real estate notes receivable acquired in connection with the Merger. |

Update to Our Real Estate Equity Investments

As of December 9, 2014, $926.9 million, or 86.4% of our assets, were invested in healthcare real estate equity. The properties were 100% leased to four operators, with an 11-year weighted average remaining lease term, excluding our healthcare investments held through joint ventures.

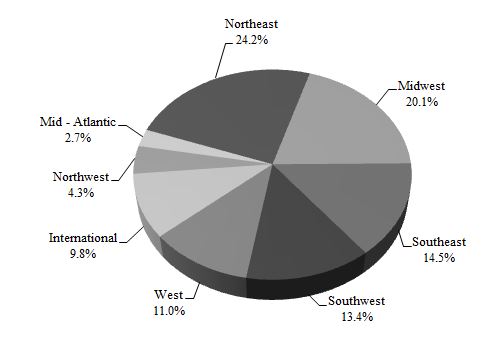

The following presents our real estate equity diversity across property type and geographic location based on cost (including our proportionate interest in gross assets for our investments in joint ventures):

|

| | |

Real Estate Equity by Property Type (1) | | Real Estate Equity by Geographic Location |

| | |

____________________________________

| |

| (1) | Classification based on predominant services provided, but may include other services. |

As of December 9, 2014, $657.9 million, or 61.3% of our assets, were invested in three portfolios held through joint ventures, with an ownership interest of 5.6%, 11.4% and 14.0%, respectively. Portfolios held through joint ventures are comprised of over 20,000 units/beds across 129 senior housing facilities and 101 SNFs and MCFs, located across the United States and the United Kingdom. The portfolio also includes 145 MOBs and 14 hospitals.