Filed Pursuant to Rule 424(b)(3)

Registration No. 333-199125

NORTHSTAR HEALTHCARE INCOME, INC.

SUPPLEMENT NO. 1 DATED FEBRUARY 25, 2015

TO THE PROSPECTUS DATED FEBRUARY 6, 2015

This Supplement No. 1 supplements, and should be read in conjunction with, our prospectus dated February 6, 2015. Defined terms used in this Supplement shall have the meaning given to them in the prospectus unless the context otherwise requires. The purpose of this Supplement No. 1 is to disclose:

| |

| • | the status of our current public offering; |

| |

| • | an amendment to the terms of our secured credit facility; |

| |

| • | an update to the suitability standards in our prospectus; and |

| |

| • | our current form of subscription agreement. |

Status of Our Current Public Offering

We commenced our follow-on public offering of $700.0 million in shares of common stock on February 6, 2015, of which up to $500.0 million in shares are being offered pursuant to our primary offering and up to $200.0 million in shares are being offered pursuant to our distribution reinvestment plan, or DRP. We refer to our primary offering and our DRP collectively as our offering.

As of February 23, 2015, we had not yet received any subscriptions in our offering. As of February 23, 2015, 69.7 million shares remain available for sale pursuant to our offering, including shares offered pursuant to our DRP. Our primary offering is expected to terminate on the earlier of the date that all of the shares offered in the offering are sold and February 6, 2017, subject to extension.

Amendment to the Terms of our Credit Facility

On February 19, 2015, we amended the terms of our secured credit facility agreement, dated as of November 13, 2013, as amended, or the credit facility, by and among our operating partnership, KeyBank National Association, or KeyBank, and the other lenders named therein. Under the terms of the amended credit facility, our aggregate investments held through minority-owned joint ventures shall be limited as a percentage of our consolidated total asset value (as defined in the credit facility) as set forth in the following schedule:

|

| |

| Periods | Percentage of Consolidated Total Asset Value |

| Through June 30, 2015 | 50% |

| July 1, 2015 to September 30, 2015 | 45% |

| October 1, 2015 to December 31, 2015 | 40% |

| January 1, 2016 to December 31, 2016 | 35% |

| January 1, 2017 and thereafter | 30% |

In addition, our combined investments in land and development properties (as defined in the credit facility) shall not exceed 10% of our consolidated total asset value. All other terms governing the credit facility remain substantially the same.

Update to Suitability Standards

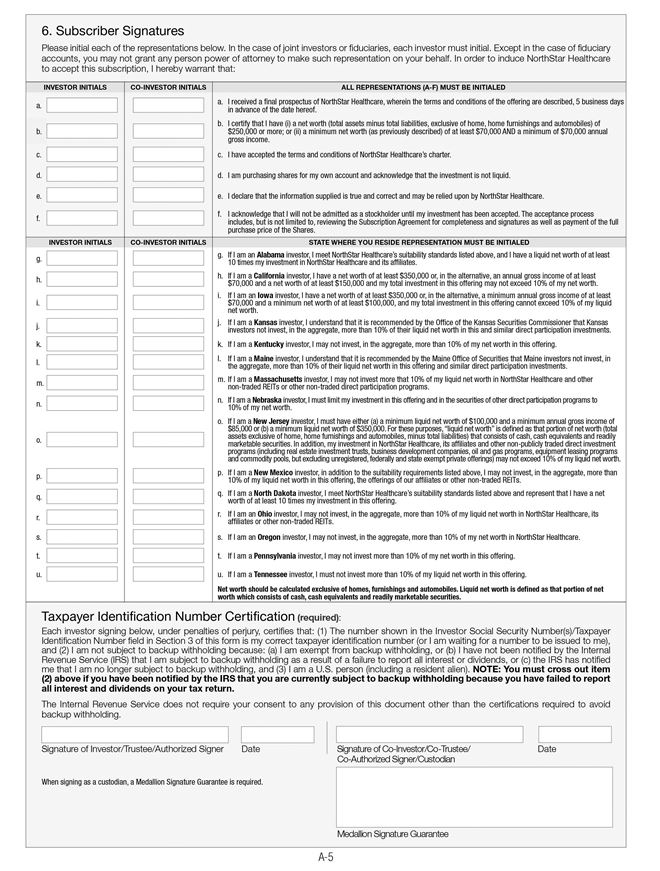

In connection with the registration of our follow-on public offering of common stock, we have been asked by the New Jersey Bureau of Securities to revise our suitability standard disclosure. Accordingly, the New Jersey suitability standard on page i of our prospectus is superseded in its entirety with the following:

New Jersey—New Jersey investors must have either (a) a minimum liquid net worth of $100,000 and a minimum annual gross income of $85,000 or (b) a minimum liquid net worth of $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings and automobiles, minus total liabilities) that consists of cash, cash equivalents and readily marketable securities. In addition, a New Jersey investor’s investment in us, our affiliates and other non-publicly traded direct investment programs (including real estate investment trusts, business development companies, oil and gas programs, equipment leasing programs and commodity pools, but excluding unregistered, federally and state exempt private offerings) may not exceed 10% of his or her liquid net worth.

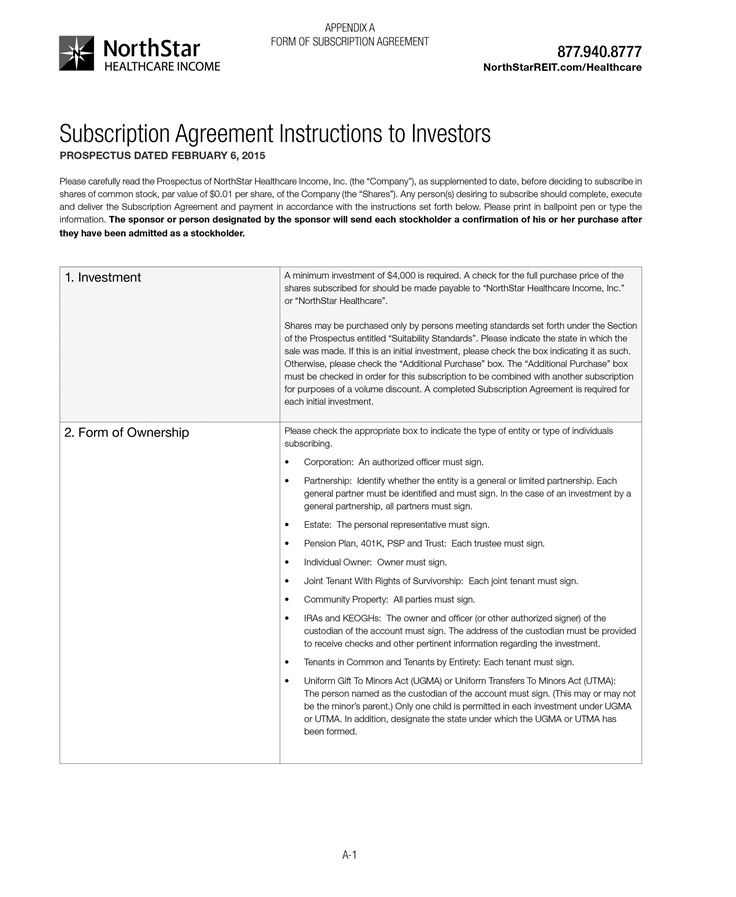

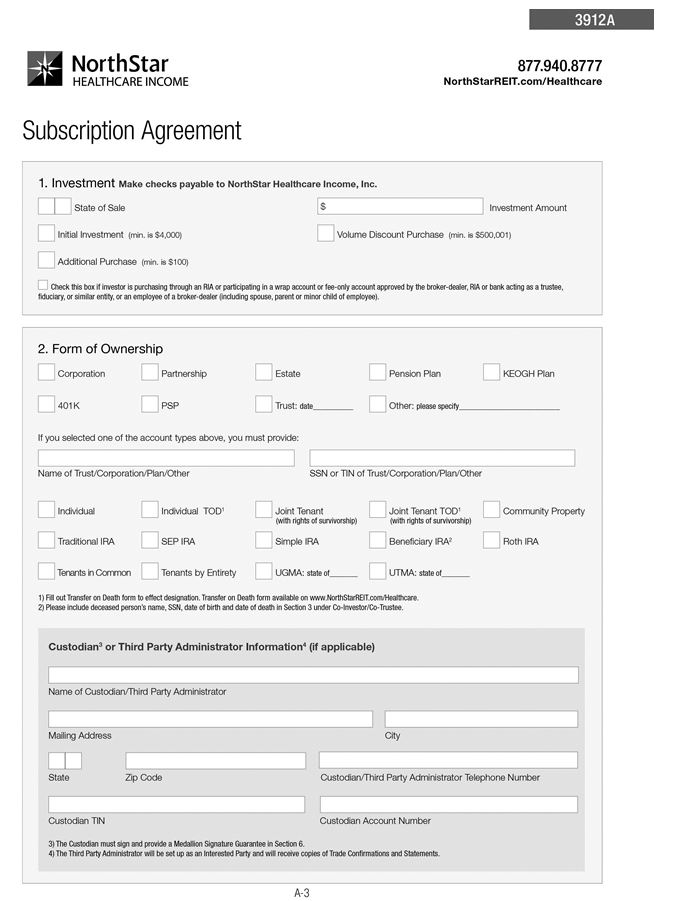

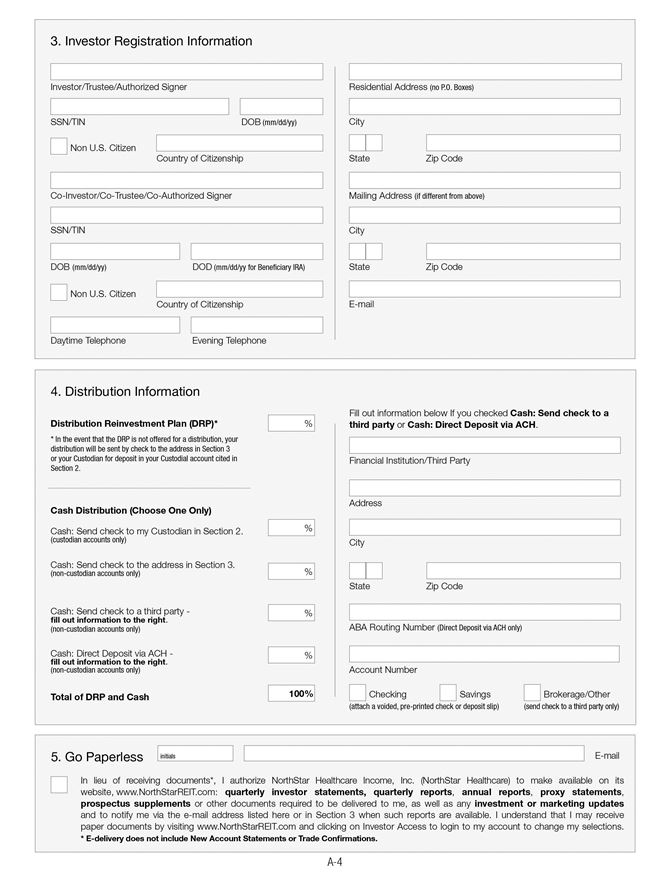

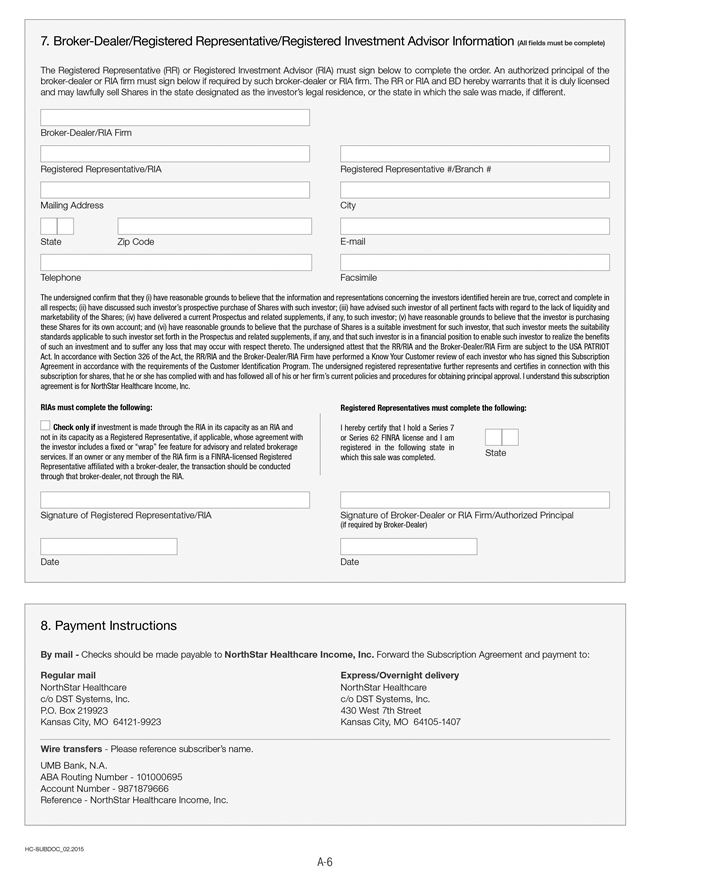

Current Form of Subscription Agreement

Our current form of subscription agreement is attached to this prospectus supplement as Exhibit A. This form supersedes and replaces the form included in the prospectus.

EXHIBIT A