November 29, 2011

Dear Shareholder:

Enclosed is the Semi-Annual Report of the GuideMarkSM and GuidePathSM Funds covering the six-month period from April 1, 2011 through September 30, 2011.

Six-Month Market Review

The dominant theme for the period was flight to safety, with bonds generally rising and stocks falling sharply. Key areas of focus for the markets included global economic prospects, European sovereign debt, and the uncertainty about US political leadership in support of growth.

Most US bond indexes ended the period higher, with the Barclays Capital US Aggregate Bond Index gaining 6.20% and the Barclays Capital Municipal Bond Index delivering 7.85% for the six months ended September 30, 2011. Notably, long-term US Treasuries benefited handsomely from the implementation of Operation Twist, the Federal Reserve’s program to sell short-term and buy long-term government debt.

Within US equities, the typically riskier small caps were down more than large caps. As well, international equities, encompassing emerging and developed markets, underperformed the US market. While the MSCI All Country World ex-US Index retreated -19.29% over the six-month period, the drop in the S&P 500® Index was smaller at -13.78%.

Commodities and real estate also lost ground. The Dow Jones UBS Commodity Index ended the quarter down -17.30%, while the FTSE NAREIT All Equity REITs Index fell -11.62% over the six months.1

Flight to Safety Dominates

Underlying company fundamentals did not drive performance over this reporting period. Instead, as mentioned above, markets were characterized by a flight to safety, responding to developments in the macro economy, notably in Europe. In addition, because stocks in particular tended to move as a group during this time, with little spread between the prices of individual equities, active security selection was challenged. In this environment, a low percentage of stocks outperformed their benchmarks and investors saw historic low variations in the performance of individual stocks within economic sectors.

The GuideMark and GuidePath Funds are actively managed and the investment processes employed by many of the funds are based on analysis of company fundamentals. The fact that the stock market was extremely sensitive to short-term economic data and much more focused on the global economy than on the financial health of particular companies caused the equity funds to struggle relative to their benchmarks. In addition, the equity funds generally had active exposures to cyclical stocks that tend to rise with an improving economy, whereas over the past six months defensive holdings, such as utilities, performed better.

The fixed income funds were biased toward credit and significantly underweight Treasuries, which rose dramatically following government intervention. Secondarily, the fixed income funds were underweight the US dollar, and the dollar gathered strength over this period. These two factors contributed to the underperformance of the fixed income funds.

International equity holdings were a detractor, while some conservative positioning with exposure to fixed income proved beneficial to the GuidePath Tactical ConstrainedSM and GuidePath Tactical Unconstrained Asset Allocation Funds.

For more detailed information on each fund, please refer to the Manager’s Discussion of Fund Performance in the report.

Looking Ahead

While past experience shows that the fourth quarter is likely to usher in a market rally, it’s also possible for extended market volatility to lead to a recession. Of course, no one can predict the future. That is why a well-constructed portfolio – positioned to capture potential upside while seeking to diversify some of the downside risk – is important for navigating today’s volatile markets. The GuideMark and GuidePath Funds are designed to be used in combination, either by portfolio strategists or within the Genworth Portfolio Solutions (GPS) strategies, to provide this type of diversification.

Please contact your financial advisor to discuss any questions about your investment strategy or changes in your financial goals. We thank you for including the Funds in your portfolio and appreciate the trust you have placed in us.

Sincerely,

Carrie E. Hansen

President of the Funds

The Genworth Financial Wealth Management platform provides fee-based investment advisory programs. Investors are advised to refer to the appropriate Disclosure Brochure, which can be obtained from your financial advisor, for a full description of services provided, including all applicable fees.

Genworth Financial Wealth Management, Inc. is an investment advisor registered with the Securities and Exchange Commission. Genworth Financial Wealth Management and Capital Brokerage Corporation are wholly owned subsidiaries of Genworth Financial, Inc.

Index Definitions

Barclays Capital US Aggregate Bond Index: a broad-based index that measures the investment grade, US dollar-denominated, fixed rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed rate and hybrid ARM pass-throughs), ABSs, and CMBs.

Barclays Capital Municipal Bond Index: an index that measures the performance of investment-grade, fixed-rate, tax-exempt bonds.

Dow Jones UBS Commodity Index: an index that is composed of futures contracts of 19 physical commodities traded on US exchanges, with the exception of aluminum, nickel and zinc, which trade on the London Metal Exchange (LME). The component weightings are also determined by several rules designed to insure diversified commodity exposure.

FTSE NAREIT All Equity REITs Index: an index of US publicly traded REITs. Equity REITs include those firms that own, manage and lease investment-grade commercial real estate. Specifically, a company is classified as an equity REIT if 75% or more of its gross invested book assets are invested in real property.

MSCI All Country World ex-US Index: a free-float-adjusted, market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging market countries, excluding the US.

S&P 500® Index: an index of 500 leading companies in leading industries of the US economy, capturing 75% coverage of US equities.

| | |

| | |

1 | All index returns are from Morningstar except the FTSE NAREIT, which is sourced from Zephyr. |

Past performance is not indicative of future results. You cannot invest directly into an index.

Investments in the Funds will fluctuate, and when redeemed may be worth more or less than originally invested. Investors should consider the Funds’ Investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Funds. Please read the prospectus carefully before you invest or send money. The prospectus is available upon request, without charge, by calling 1-800-238-0810.

FINRA 133658 111811

2

|

GuideMarkSM Large Cap Growth Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

|

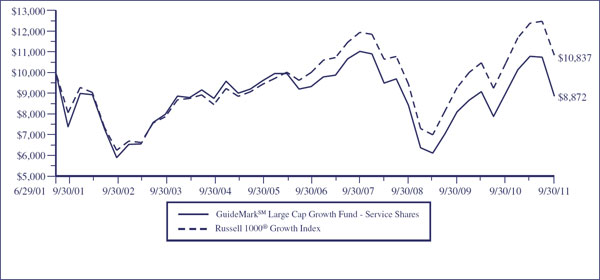

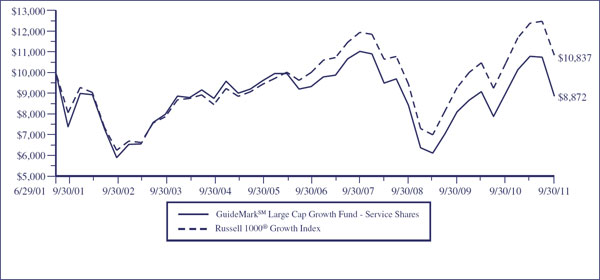

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on June 29, 2001 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

RUSSELL 1000® GROWTH INDEX – An unmanaged index which measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Index is an unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000® Index. The Russell 3000® Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

|

AVERAGE ANNUAL TOTAL RETURN (for the period ended September 30) |

| |

| | | | | | | | | | | | | | | | | | | | | |

| | | One Year | | | Five Year | | | Ten Year | | | Since Inception1 | |

| | | | | | | | | | | | | |

GuideMarkSM Large Cap Growth Fund Service Shares | | | | -1.44 | % | | | | -0.98 | % | | | | 1.86 | % | | | | -1.16 | % | |

Institutional Shares | | | | N/A | | | | | N/A | | | | | N/A | | | | | -20.06 | % | |

Russell 1000® Growth Index | | | | 3.78 | % | | | | 1.62 | % | | | | 3.01 | % | | | | 0.79 | %2 | |

| |

1 | Since Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Russell 1000® Growth Index is from the since inception date of the Service Shares. The Russell 1000® Growth Index return from the since inception date of the Institutional Shares is -12.89%. |

3

|

GuideMarkSM Large Cap Growth Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

• | For the 6 months ended September 30, 2011, the Fund returned -17.72%, underperforming the Russell 1000® Growth Index, which returned -12.48%. |

| |

• | The Fund’s overweight exposure to cyclical stocks contributed to the relative underperformance for the period, as broader macroeconomic concerns led investors to sell out of cyclical positions. |

| |

• | A relative overweight positioning within the Industrial sector negatively impacted returns for the period. Concerns of a slowdown in China that could potentially decrease the demand for industrial-related goods and equipment and could reduce future earnings growth, weighed on the sector. |

| |

• | Three of the Fund’s worst performing stocks for the period were within the Information Technology sector – EMC, Oracle, and Altera. Technology stocks fell out of favor with investors as questions over future top-line growth in light of muted technology spending weighed on the sector. |

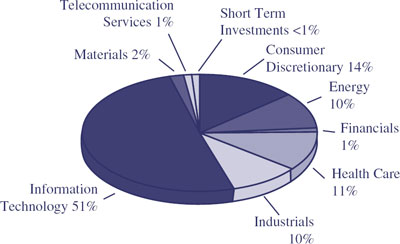

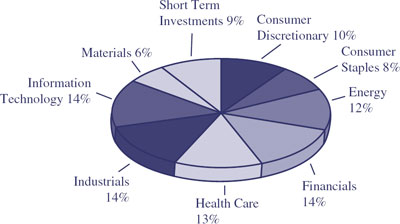

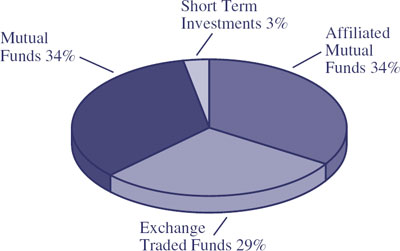

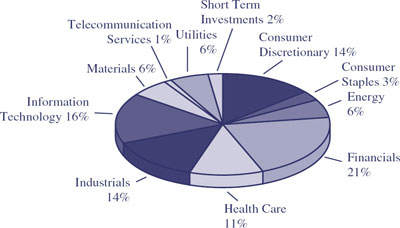

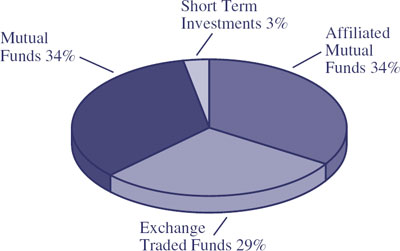

Components of Portfolio Holdings*

| | | | | | |

*Pie chart represents percentages of total portfolio, less securities lending collateral. |

| | | | | | |

Top Ten Holdings |

|

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | Apple, Inc. | | 7.21 | |

2 | | | International Business Machines Corp. | | 5.53 | |

3 | | | Cisco Systems, Inc. | | 4.57 | |

4 | | | Microsoft Corp. | | 4.32 | |

5 | | | Oracle Corp. | | 3.52 | |

6 | | | EMC Corp. | | 3.37 | |

7 | | | Altera Corp. | | 3.00 | |

8 | | | Exxon Mobil Corp. | | 2.30 | |

9 | | | UnitedHealth Group, Inc. | | 1.91 | |

10 | | | Caterpillar, Inc. | | 1.79 | |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

4

|

GuideMarkSM Large Cap Value Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

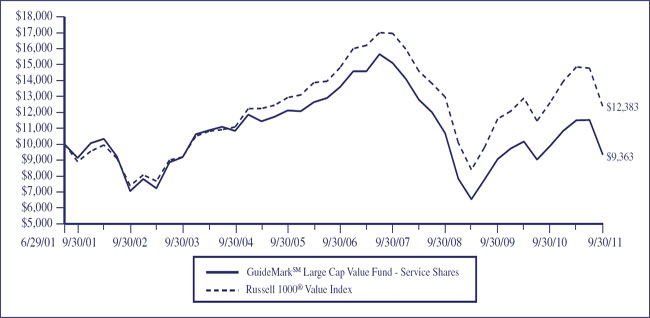

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on June, 29, 2001 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

RUSSELL 1000® VALUE INDEX – An unmanaged index which measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000® Index is an unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000® Index. The Russell 3000® Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

| | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN (for the period ended September 30) |

| | One Year | | Five Year | | Ten Year | | Since Inception1 | |

| | | | | | | | | |

GuideMarkSM Large Cap Value Fund | | | | | | | | | | | | | |

Service Shares | | -5.39 | % | | -7.19 | % | | 0.24 | % | | -0.64 | % | |

Institutional Shares | | N/A | | | N/A | | | N/A | | | -20.49 | % | |

Russell 1000® Value Index | | -1.89 | % | | -3.53 | % | | 3.36 | % | | 2.11 | %2 | |

| |

1 | Since Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Russell 1000® Value Index is from the since inception date of the Service Shares. The Russell 1000® Value Index return from the since inception date of the Institutional Shares is -18.79%. |

5

|

GuideMarkSM Large Cap Value Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

• | For the 6 months ended September 30, 2011, the Fund returned -18.63%, underperforming the Russell 1000® Value Index, which returned -16.62%. |

| |

• | The Fund trailed the benchmark for the period due largely to relative sector positioning, which more than offset the positive contribution from security selection. Relative sector under/overweight exposures are a by product of the investment process and underscored the Fund’s bias to cyclical stocks. |

| |

• | A relative overweight exposure to stocks in the Industrial sector detracted from performance for the period, as fears of a larger than expected slowdown in global economic growth, particularly China, weighed on the sector. However, Goodrich was acquired by United Technologies at the end of the period for a premium, validating the Fund’s original investment thesis and valuation analysis. |

| |

• | Underweight exposure to defensive sectors, including Utilities, contributed to the Fund’s relative underperformance, as investors favored more defensive equity stocks with lower volatility and stable cash flow. |

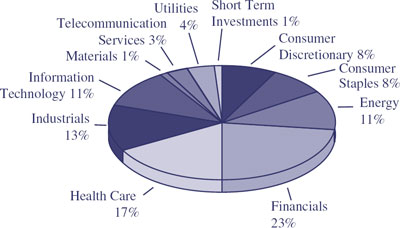

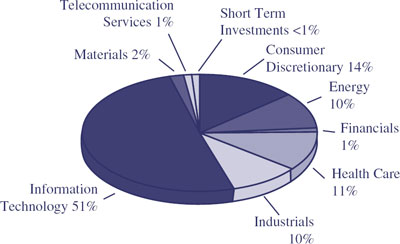

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio, less securities lending collateral.

| | | | | | |

Top Ten Holdings |

| | | | | | |

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | Capital One Financial Corp. | | 2.94 | |

2 | | | Stanley Black & Decker, Inc. | | 2.50 | |

3 | | | UnitedHealth Group, Inc. | | 2.22 | |

4 | | | SLM Corp. | | 2.19 | |

5 | | | Philip Morris International, Inc. | | 2.13 | |

6 | | | Wellpoint, Inc. | | 1.94 | |

7 | | | PNC Financial Services Group, Inc. | | 1.89 | |

8 | | | Johnson & Johnson | | 1.86 | |

9 | | | ConocoPhillips | | 1.82 | |

10 | | | Pfizer, Inc. | | 1.78 | |

6

|

GuideMarkSM Small/Mid Cap Core Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

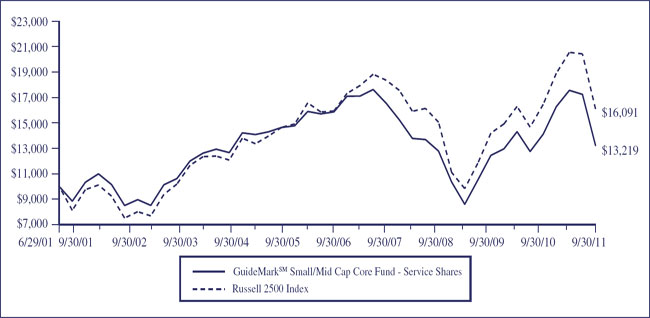

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on June, 29, 2001 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

RUSSELL 2500 INDEX – Measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is a subset of the Russell 3000® Index. The Russell 2500 Index includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership.

| | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN (for the period ended September 30) |

| | One Year | | Five Year | | Ten Year | | Since Inception1 | |

| | | | | | | | | |

GuideMarkSM Small/Mid Cap Core Fund | | | | | | | | | | | | | |

Service Shares | | -6.32 | % | | -3.58 | % | | 4.10 | % | | 2.76 | % | |

Institutional Shares | | N/A | | | N/A | | | N/A | | | -26.86 | % | |

Russell 2500 Index | | -2.22 | % | | 0.19 | % | | 7.08 | % | | 4.75 | %2 | |

| |

1 | Since Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Russell 2500 Index is from the since inception date of the Service Shares. The Russell 2500 Index return from the since inception date of the Institutional Shares is -23.88%. |

7

|

GuideMarkSM Small/Mid Cap Core Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

• | For the 6 months ended September 30, 2011, the Fund returned -24.72%, underperforming the Russell 2500 Index, which returned -21.68%. |

| |

• | Security selection was the largest driver of the relative underperformance for the period, especially within the Financial sector. |

| |

• | Within the Financial sector, Jones Lang Lasalle, a real estate services company, was the largest detractor for the period. The company fell under pressure after cautioning that the rebound in global commercial real estate may be dissipating. |

| |

• | Owning stocks in the Industrial sector negatively impacted relative performance over the period. Concerns that a slowdown in global economic growth, especially in China, could negatively impact the ability of industrial goods and equipment providers to increase top-line sales going forward, weighed on the sector. |

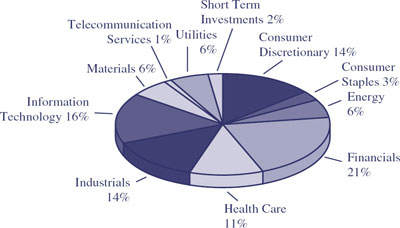

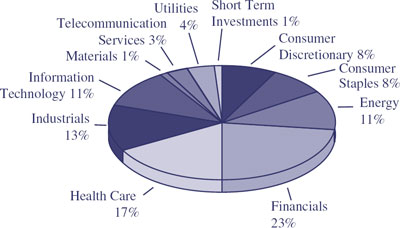

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio, less securities lending collateral.

| | | | | | |

Top Ten Holdings |

| | | | | | |

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | DFC Global Corp. | | 1.79 | |

2 | | | Carlisle Companies, Inc. | | 1.70 | |

3 | | | Triumph Group, Inc. | | 1.63 | |

4 | | | Iberiabank Corp. | | 1.62 | |

5 | | | Invesco Ltd. | | 1.60 | |

6 | | | Check Point Software Technologies Ltd. | | 1.59 | |

7 | | | Post Properties, Inc. | | 1.51 | |

8 | | | Autoliv, Inc. | | 1.50 | |

9 | | | Essex Property Trust, Inc. | | 1.43 | |

10 | | | Dicks Sporting Goods, Inc. | | 1.42 | |

8

|

GuideMarkSM World ex-US Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

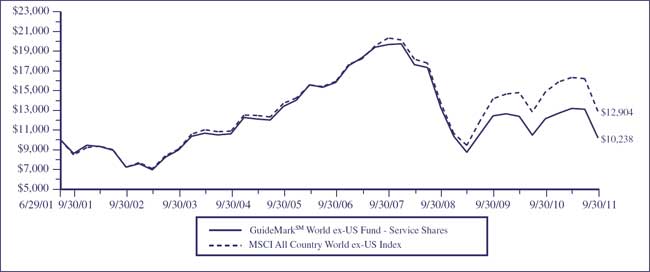

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on June, 29, 2001 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

MSCI ALL COUNTRY WORLD EX-US INDEX – A free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It consists of country indices comprising of developed and emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

| | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN (for the period ended September 30) |

| |

| | One Year | | Five Year | | Ten Year | | Since Inception1 | |

| | | | | | | | | |

GuideMarkSM World ex-US Fund | | | | | | | | | | | | | |

Service Shares | | -15.80 | % | | -8.36 | % | | 1.73 | % | | 0.23 | % | |

Institutional Shares | | N/A | | | N/A | | | N/A | | | -25.49 | % | |

MSCI All Country World ex-US Index | | -13.24 | % | | -4.13 | % | | 4.28 | % | | 2.52 | %2 | |

| |

1 | Since Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the MSCI All Country World ex-US Index is from the since inception date of the Service Shares. The MSCI All Country World ex-US Index return from the since inception date of the Institutional Shares is -24.44%. |

9

|

GuideMarkSM World ex-US Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| | |

| • | For the 6 months ended September 30, 2011, the Fund returned -22.41%, underperforming the MSCI All Country World ex-US Index, which returned -21.01%. |

| | |

| • | The Fund trailed the benchmark for the period due to security selection primarily within the global cyclical sectors. |

| | |

| • | Security selection within the Financials sector detracted from returns and more than offset the benefit from the underweight exposure to the sector. Specifically, owning banks like Societe Generale was a significant detractor over the period. Societe Generale, a large French bank, experienced a sell-off due to its outstanding exposure to Greece and other European countries facing potential default scenarios. |

| | |

| • | Underweight exposure to more defensive sectors, including Utilities, also contributed to the relative lag over the period. While the valuation of Utilities stocks looked relatively less attractive, Utilities companies benefited from a ‘risk-off’ trade, whereby investors sought safety in defensive stocks with less earnings variability. |

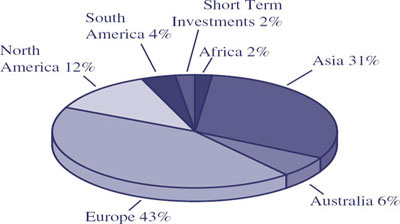

Components of Portfolio Holdings*

| | | | | | |

*Pie chart represents percentages of total portfolio, less securities lending collateral. |

|

Top Ten Holdings |

|

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | Nestle SA | | 2.00 | |

2 | | | PowerShares India Portfolio | | 1.85 | |

3 | | | Royal Dutch Shell Plc | | 1.19 | |

4 | | | Roche Holding AG | | 1.17 | |

5 | | | Vodafone Group Plc | | 1.14 | |

6 | | | Sanofi-Aventis SA | | 1.04 | |

7 | | | HSBC Holdings Plc | | 1.01 | |

8 | | | British American Tobacco Plc | | 0.93 | |

9 | | | Toronto-Dominion Bank | | 0.93 | |

10 | | | Unilever NV | | 0.93 | |

10

|

GuideMarkSM Opportunistic Equity Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 1, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

RUSSELL 3000® INDEX – Measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market..

| | | |

CUMULATIVE TOTAL RETURN (for the period ended September 30) |

| |

| | Since Inception1 |

| | |

GuideMarkSM Opportunistic Equity Fund | | | |

Service Shares | | -21.10 | % |

Institutional Shares | | -22.53 | % |

Russell 3000® Index | | -15.73 | %2 |

| |

1 | Since Inception date is 4/1/11 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Russell 3000® Index is from the since inception date of the Service Shares. The Russell 3000® Index return from the since inception date of the Institutional Shares is -17.75%. |

11

|

GuideMarkSM Opportunistic Equity Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

• | For the 6 months ended September 30, 2011, the Fund returned -21.10%, underperforming the Russell 3000® Index, which returned -15.73%. |

| |

• | An overweight exposure to economically sensitive securities and to securities with higher volatility than the benchmark were the primary drivers of the relative underperformance for the period. With investors taking a more defensive stance during the period, securities with higher volatility sold off significantly. |

| |

• | Continued bias to cyclical stocks detracted from performance, as these economically sensitive stocks sold off due to broader macroeconomic concerns. |

| |

• | Exposure to securities in the Energy and Financial sectors negatively impacted relative returns, as broader global economic concerns continued to place downward pricing pressure on oil prices and the global sovereign debt crisis weighed heavily on stocks in the Financial sector. |

Components of Portfolio Holdings*

| | | | | | |

*Pie chart represents percentages of total portfolio, less securities lending collateral. |

|

Top Ten Holdings |

|

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | Newmont Mining Corp. | | 2.25 | |

2 | | | Apple, Inc. | | 2.16 | |

3 | | | Devon Energy Corp. | | 2.10 | |

4 | | | United Technologies Corp. | | 1.89 | |

5 | | | Occidental Petroleum Corp. | | 1.74 | |

6 | | | Conagra Foods, Inc. | | 1.56 | |

7 | | | Prudential Financial, Inc. | | 1.42 | |

8 | | | Sysco Corp. | | 1.42 | |

9 | | | General Electric Co. | | 1.40 | |

10 | | | General Mills, Inc. | | 1.29 | |

12

|

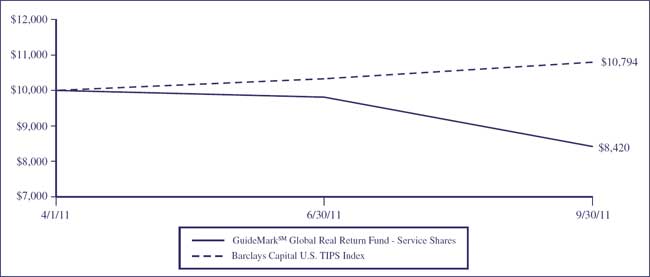

GuideMarkSM Global Real Return Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 1, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BARCLAYS CAPITAL U.S. TIPS INDEX – Includes all publicly-issued, U.S. Treasury inflation-protected securities that have at least one year remaining to maturity, are rated investment grade, and have $250 million or more of outstanding face value.

| | | | |

CUMULATIVE TOTAL RETURN (for the period ended September 30) |

| |

| | Since Inception1 | |

| | | |

GuideMarkSM Global Real Return Fund | | | | |

Service Shares | | -15.80 | % | |

Institutional Shares | | -18.04 | % | |

Barclays Capital U.S. TIPS Index | | 7.94 | %2 | |

| |

1 | Since Inception date is 4/1/11 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Barclays Capital U.S. TIPS Index is from the since inception date of the Service Shares. The Barclays Capital U.S. TIPS Index return from the since inception date of the Institutional Shares is 5.68%. |

13

|

GuideMarkSM Global Real Return Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

• | For the 6 months ended September 30, 2011, the Fund returned -15.80%, underperforming the Barclays Capital U.S. TIPS Index, which returned 7.94%. |

| |

• | The Fund’s relative underperformance for the period reflects its exposure to real asset classes outside of the TIPs index, including commodities and natural resources. |

| |

• | The relative returns over the period underscores the “risk-off” trade that occurred over the period, as investors fled to U.S. Treasuries and other defensive assets like gold. |

| |

• | Although the Fund did have exposure to gold, it was not enough to offset the negative impact from exposure to energy and material-related commodities. |

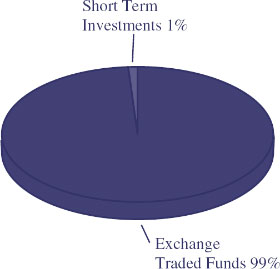

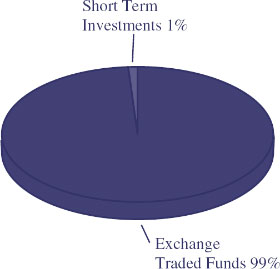

Components of Portfolio Holdings*

|

*Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

| | | | | |

Rank | | Security/Holding | | % of Net

Assets |

1 | | SPDR S&P Global Natural Resources ETF | | 20.99 | |

2 | | PowerShares DB Commodity Index Tracking Fund | | 17.09 | |

3 | | SPDR Barclays Capital TIPS ETF | | 13.03 | |

4 | | SPDR Dow Jones International Real Estate ETF | | 11.27 | |

5 | | SPDR Dow Jones REIT ETF | | 11.13 | |

6 | | SPDR DB International Government Inflation-Protected

Bond ETF | | 9.27 | |

7 | | PowerShares Global Agriculture ETF | | 4.12 | |

8 | | SPDR Metals and Mining ETF | | 3.47 | |

9 | | Energy Select Sector SPDR Fund | | 3.47 | |

10 | | SPDR S&P International Energy Sector ETF | | 2.02 | |

14

|

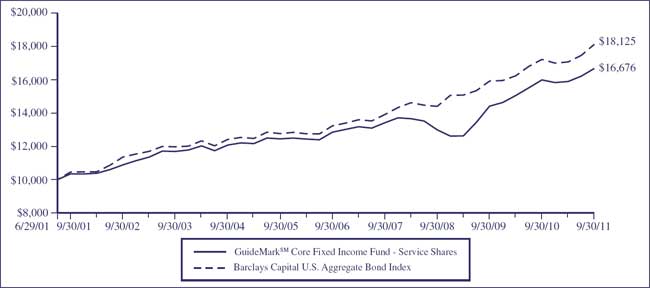

GuideMarkSM Core Fixed Income Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on June, 29, 2001 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BARCLAYS CAPITAL U.S. AGGREGATE BOND INDEX – A broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate debt securities, and mortgage- and asset-backed securities. All securities contained in the Barclays Capital U.S. Aggregate Bond Index have a minimum term to maturity of one year.

| | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN (for the period ended September 30) |

| |

| | One Year | | Five Year | | Ten Year | | Since Inception1 | |

| | | | | | | | | |

GuideMarkSM Core Fixed Income Fund | | | | | | | | | | | | | |

Service Shares | | 4.31 | % | | 5.37 | % | | 4.90 | % | | 5.12 | % | |

Institutional Shares | | N/A | | | N/A | | | N/A | | | 3.81 | % | |

Barclays Capital U.S. Aggregate Bond Index | | 5.26 | % | | 6.53 | % | | 5.66 | % | | 5.98 | %2 | |

| |

1 | Since Inception date is 4/1/11 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Barclays Capital U.S. Aggregate Bond Index is from the since inception date of the Service Shares. The Barclays Capital U.S. Aggregate Bond Index return from the since inception date of the Institutional Shares is 4.87%. |

15

|

GuideMarkSM Core Fixed Income Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

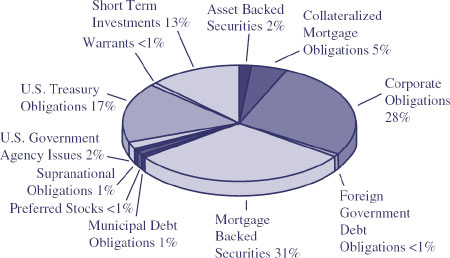

• | For the 6 months ended September 30, 2011, the Fund returned 4.93%, underperforming the Barclays Capital U.S. Aggregate Bond Index, which returned 6.20%. |

| |

• | An overweight exposure to corporate credit and an underweight exposure to U.S. Treasuries were the primary contributors to the Fund’s relative underperformance for the period. Uncertainty over the rate of global economic growth, coupled with sovereign debt issues in Europe, led investors to “safe haven” assets like U.S. Treasuries starting in May. |

| |

• | Within corporate credit, owning bonds from the Financial and Industrial sectors contributed to the relative lag, as these bonds trailed for the period. Specifically, financial companies underperformed due largely to the European debt crisis, while fears of a slowdown in China’s growth rate caused concern for industrial companies. |

| |

• | A noticeable lack of liquidity in the bond market forced investors to sell out of higher-quality investment grade corporates bonds to raise cash for redemptions. This negatively impacted the Fund, which typically holds higher-quality issues. |

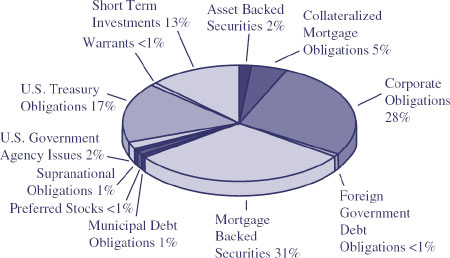

Components of Portfolio Holdings*

|

*Pie chart represents percentages of total portfolio, less securities lending collateral. |

Top Ten Holdings

| | | | | |

Rank | | Security/Holding | | % of Net

Assets |

1 | | | U.S. Treasury Note, 3.625%, 02/15/2021 | | 3.57 |

2 | | | U.S. Treasury Note, 2.000%, 01/31/2016 | | 2.66 |

3 | | | Federal National Mortgage Association, Pool# TBA,

3.000%, 11/15/2026 | | 2.62 |

4 | | | U.S. Treasury Note, 2.000%, 04/30/2016 | | 2.53 |

5 | | | U.S. Treasury Bond, 4.250%, 11/15/2040 | | 2.32 |

6 | | | U.S. Treasury Note, 3.125%, 05/15/2021 | | 2.25 |

7 | | | Federal National Mortgage Association, Pool# TBA, 4.000%, 10/01/2039 | | 1.71 |

8 | | | Federal Home Loan Mortgage Corp. – Gold, Pool# TBA, 4.000%, 11/15/2040 | | 1.70 |

9 | | | Federal National Mortgage Association, Pool# AD6943,

5.000%, 07/01/2040 | | 1.39 |

10 | | | Federal National Mortgage Association, Pool# TBA,

3.000%, 10/15/2026 | | 1.20 |

16

|

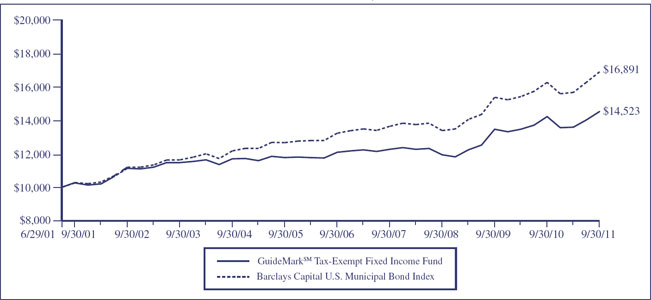

GuideMarkSM Tax-Exempt Fixed Income Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

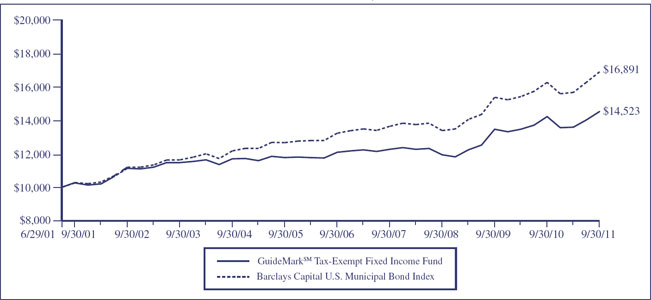

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on June, 29, 2001 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BARCLAYS CAPITAL U.S. MUNICIPAL BOND INDEX – The Barclays Capital U.S. Municipal Bond Index is a market-value-weighted index for the long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

| | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN (for the period ended September 30) | | | | | | | |

| | | | | | | | |

| | One Year | | Five Year | | Ten Year | | Since Inception (6/29/01) | |

| | | | | | | | | |

GuideMarkSM Tax-Exempt Fixed Income Fund | | 2.13 | % | | 3.74 | % | | 3.54 | % | | 3.70 | % | |

Barclays Capital U.S. Municipal Bond Index | | 3.88 | % | | 5.01 | % | | 5.09 | % | | 5.25 | % | |

17

|

GuideMarkSM Tax-Exempt Fixed Income Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

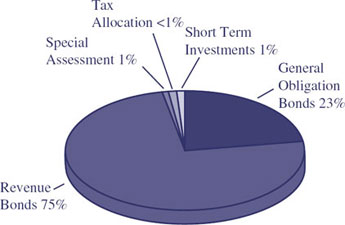

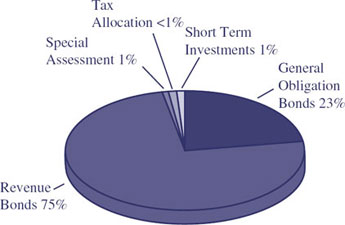

• | For the 6 months ended September 30, 2011, the Fund returned 6.88%, underperforming the Barclays Capital U.S. Municipal Bond Index, which returned 7.85%. |

| |

• | The Fund trailed the benchmark due to the Fund’s modest overweight exposure to BBB-rated bonds. Although the Fund collected higher yields on its BBB and below investment grade holdings, these bonds faced pricing pressure over the period due to investors flight to quality. |

| |

• | Over the period, the municipal market traded in-line with the U.S. Treasuries market, as rumors of massive municipal defaults proved unfounded. Although BBB-rated bonds did hold up relatively well in the first months of the period, they fell under pressure in the latter months, as spreads widened, reflecting the higher level of overall fear in the market. |

| |

• | A more neutral to slightly shorter duration exposure relative to the benchmark contributed to the modest underperformance, The longest dated bonds in the municipal market outperformed their shorter dated brethren due to both technical and market factors. |

Components of Portfolio Holdings*

| |

*Pie chart represents percentages of total portfolio. |

| | | | |

| | Top Ten Holdings | | |

| | | | |

Rank | | Security/Holding | | % of Net

Assets |

1 | | Maryland Department of Transportation County T

Construction, Revenue Bond, 5.500%, 02/01/2017 | | 1.61 |

2 | | Allegheny County Hospital Development Authority,

Series A, Revenue Bond, 5.000%, 09/01/2014 | | 1.58 |

3 | | Massachusets Health & Educational Facilities Authority,

Revenue Bond, 5.500%, 07/01/2032 | | 1.49 |

4 | | San Francisco Steinhart Aquarium, Series F, GO,

5.000%, 06/15/2023 | | 1.40 |

5 | | Indiana State Finance Authority, Series A, Refunding,

Revenue Bond, 5.000%, 02/01/2021 | | 1.38 |

6 | | Henry County Public Service Authority Water & Sewer,

Refunding, Revenue Bond, FSA Insured, 5.500%, 11/15/2019 | | 1.37 |

7 | | Gilroy Unified School District, GO, Assured Guaranty Insured,

6.000%, 08/01/2025 | | 1.34 |

8 | | California, GO, 6.500%, 04/01/2033 | | 1.33 |

9 | | Ohio, Series A, GO, 5.000%, 09/01/2015 | | 1.32 |

10 | | Salt River Project, Series A, Revenue Bond,

5.000%, 01/01/2021 | | 1.30 |

18

|

GuideMarkSM Opportunistic Fixed Income Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

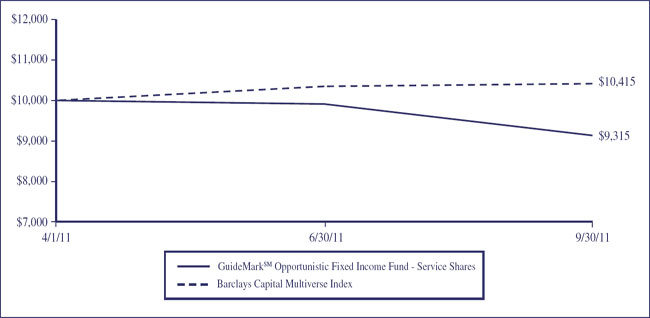

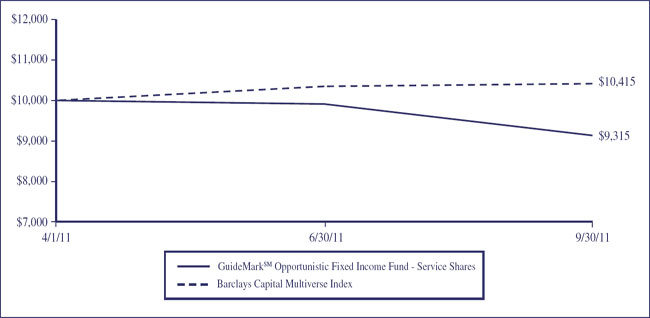

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 1, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BARCLAYS CAPITAL MULTIVERSE INDEX – The Barclays Capital Multiverse Index is a broad-based index that provides a measure of the global fixed income market.

| | | | |

CUMULATIVE TOTAL RETURN (for the period ended September 30) | |

| |

| | Since Inception1 | |

| | | |

GuideMarkSM Opportunistic Fixed Income Fund | | | | |

Service Shares | | -6.85 | % | |

Institutional Shares | | -7.24 | % | |

Barclays Capital Multiverse Index | | 4.16 | %2 | |

| |

1 | Since Inception date is 4/1/11 for Service Shares and 4/29/11 for Institutional Shares. |

| |

2 | The since inception return shown for the Barclays Capital Multiverse Index is from the since inception date of the Service Shares. The Barclays Capital Multiverse Index return from the since inception date of the Institutional Shares is 0.63%. |

19

|

GuideMarkSM Opportunistic Fixed Income Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| | |

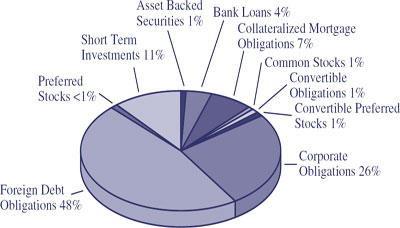

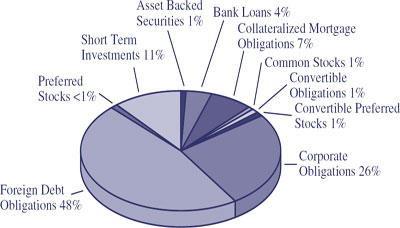

| • | For the 6 months ended September 30, 2011, the Fund returned -6.85%, underperforming the Barclays Capital Multiverse Index, which returned 4.16%. |

| | |

| • | An underweight exposure to US Treasuries, along with an overweight exposure to credit and currency positioning, were the primary drivers of the underperformance for the period. |

| | |

| • | Exposure to corporate credit, particularly to lower-rated corporate bonds, detracted from performance over the period, as bond investors fled to ‘safe-haven’ assets like U.S. Treasuries due to fears over European sovereign debt and the deteriorating global economic outlook. |

| | |

| • | Relative overweight exposure to emerging market currencies, both Asian and Latin American, dampened returns, as investors traded out of higher volatility currencies in favor of the dollar due to broader macroeconomic uncertainties and the increasing crisis in Europe. |

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio.

| | | | | |

Top Ten Holdings |

| | | | | |

Rank | | Security/Holding | | % of Net

Assets | |

1 | | Republic of Korea, 3.000%, 12/10/2013 | | 6.77 | |

2 | | Malaysia Government Bond, 3.718%, 06/15/2012 | | 4.61 | |

3 | | Indonesia Treasury Bill, 0.000%, 02/09/2012 | | 3.51 | |

4 | | Poland Government Bond, 0.000%, 01/25/2013 | | 2.38 | |

5 | | Mexican Bonos, 8.000%, 12/19/2013 | | 2.18 | |

6 | | Canadian Government Bond, 1.750%, 03/01/2013 | | 2.05 | |

7 | | Queensland Treasury Corp., 6.000%, 08/21/2013 | | 1.88 | |

8 | | New South Wales Treasury Corp., 5.500%, 08/01/2013 | | 1.87 | |

9 | | Petroleos de Venezuela SA, 4.900%, 10/29/2014 | | 1.63 | |

10 | | Western Australia Treasury Corp., 8.000%, 06/15/2013 | | 1.31 | |

20

|

GuidePathSM Strategic Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

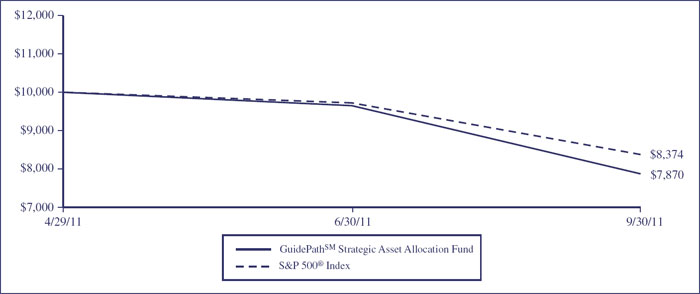

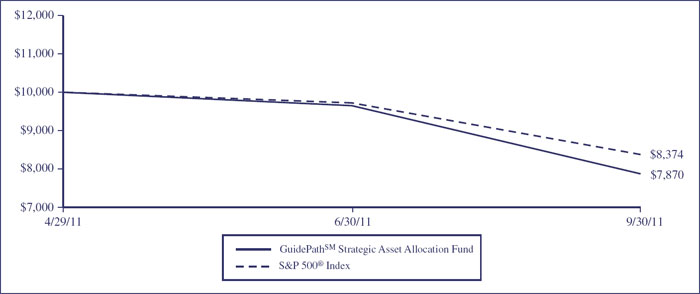

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P 500® INDEX – Focuses on the large-cap segment of the U.S. equities market. It includes 500 leading companies in leading industries of the U.S. economy, capturing approximately 75% coverage of U.S. equities.

|

CUMULATIVE TOTAL RETURN (for the period ended September 30) |

| |

| | | | | | |

| | | Since Inception (4/29/11) | |

| | | | |

| | | | | | |

GuidePathSM Strategic Asset Allocation Fund | | | | -21.30 | % | |

S&P 500® Index | | | | -16.26 | % | |

21

|

GuidePathSM Strategic Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

• | For the period since the Fund commenced operations on April 29, 2011 through September 30, 2011, the Fund returned -21.30%, underperforming the S&P 500® Index, which returned -16.26%. |

| |

• | Exposure to international equities was the largest driver of underperformance, as the international markets sold off given growing concerns about the European debt crisis and the slow path to restructuring Greek debt. The strengthening of the U.S. dollar also damped returns from the international markets. |

| |

• | Exposure to real return assets dragged on returns over the period as positions in global natural resources and commodities fell significantly as investors fled to U.S. Treasuries and other defensive assets like gold. |

| |

• | Overweight exposure to the pro-cyclical Financial, Industrial, and Energy sectors, and underweight exposure to the defensive sector of Utilities dragged on returns as fears of the global recession increased. |

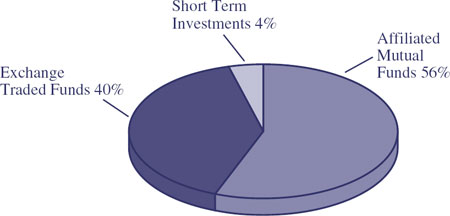

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | |

Rank | | Security/Holding | | % of Net

Assets |

1 | | | GuideMarkSM World ex-US Fund – Institutional Shares | | 17.14 | |

2 | | | Vanguard FTSE All-World ex-US Index Fund | | 17.10 | |

3 | | | SPDR S&P 500 ETF Trust | | 16.85 | |

4 | | | GuideMarkSM Small/Mid Cap Core Fund – Institutional Shares | | 9.68 | |

5 | | | GuideMarkSM Large Cap Value Fund – Institutional Shares | | 8.49 | |

6 | | | GuideMarkSM Large Cap Growth Fund – Institutional Shares | | 8.23 | |

7 | | | GuideMarkSM Opportunistic Equity Fund – Institutional Shares | | 8.04 | |

8 | | | GuideMarkSM Global Real Return Fund – Institutional Shares | | 4.94 | |

9 | | | Vanguard REIT ETF | | 1.77 | |

10 | | | SPDR S&P China ETF | | 1.74 | |

22

|

GuidePathSM Tactical Constrained Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

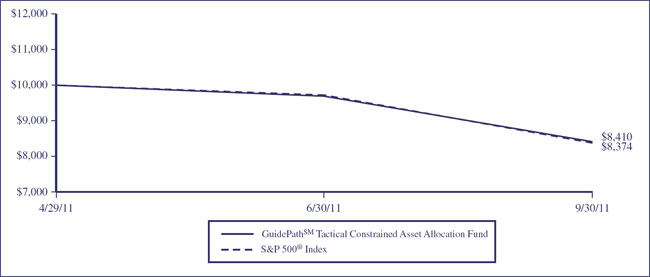

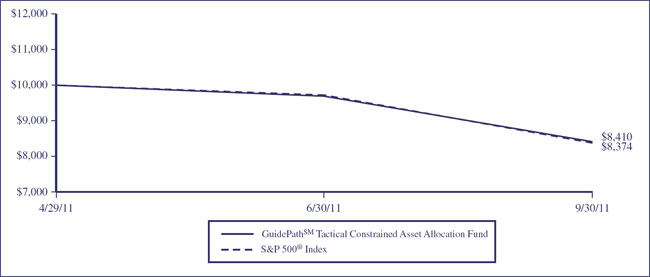

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P 500® INDEX – Focuses on the large-cap segment of the U.S. equities market. It includes 500 leading companies in leading industries of the U.S. economy, capturing approximately 75% coverage of U.S. equities.

|

CUMULATIVE TOTAL RETURN (for the period ended September 30) |

| |

| | | | | | |

| | | Since Inception (4/29/11) | |

GuidePathSM Tactical Constrained Asset Allocation Fund | | | | -15.90 | % | |

S&P 500® Index | | | | -16.26 | % | |

23

|

GuidePathSM Tactical Constrained Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

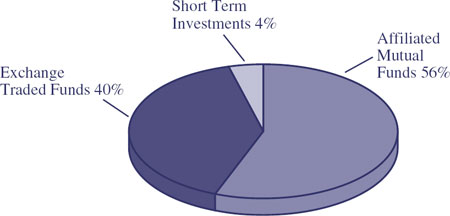

• | For the period since the Fund commenced operations on April 29, 2011 through September 30, 2011, the Fund returned -15.90%, outperforming the S&P 500® Index, which returned -16.26%. |

| |

• | The core fixed income position was the largest contributer of relative positive performance to the Fund, as U.S. Treasuries rallied strongly in a flight-to-safety environment. Small positions in emerging local bonds and alternative investments added to outperformance in the Fund, as investors sought out yield and diversification. |

| |

• | Domestic equity exposure was the largest drag on returns. Specifically, overweight exposure to the pro-cyclical Financial, Industrial and Energy sectors, and underweight exposure to the defensive sector of Utilities dragged on returns as fears of the global recession increased. |

| |

• | Exposure to international equity, including emerging markets, also detracted from returns, as the international markets sold off because of growing concerns about the European debt crisis and the slow path to restructuring Greek debt. The strengthening of the U.S. dollar also dampened returns from the international markets. |

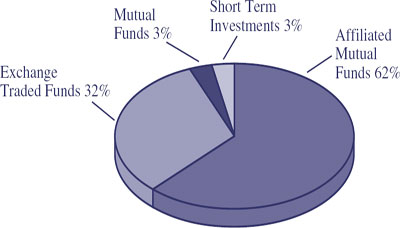

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio, less securities lending collateral.

| | | | | | |

Top Ten Holdings |

| | | | | | |

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | GuideMarkSM Core Fixed Income Fund – Institutional Shares | | 13.77 | |

2 | | | SPDR S&P 500 ETF Trust | | 13.73 | |

3 | | | GuideMarkSM Opportunistic Equity Fund – Institutional Shares | | 11.95 | |

4 | | | GuideMarkSM World ex-US Fund – Institutional Shares | | 8.14 | |

5 | | | GuideMarkSM Large Cap Value Fund – Institutional Shares | | 6.88 | |

6 | | | GuideMarkSM Opportunistic Fixed Income Fund –

Institutional Shares | | 6.74 | |

7 | | | GuideMarkSM Large Cap Growth Fund – Institutional Shares | | 6.73 | |

8 | | | Vanguard FTSE All-World ex-US Index Fund | | 6.73 | |

9 | | | GuideMarkSM Small/Mid Cap Core Fund – Institutional Shares | | 5.19 | |

10 | | | Vanguard MSCI Emerging Markets ETF | | 2.87 | |

24

|

GuidePathSM Tactical Unconstrained Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

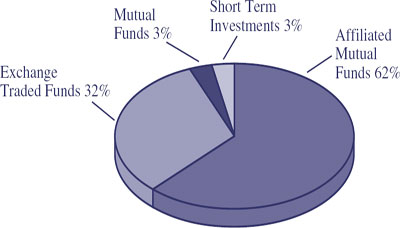

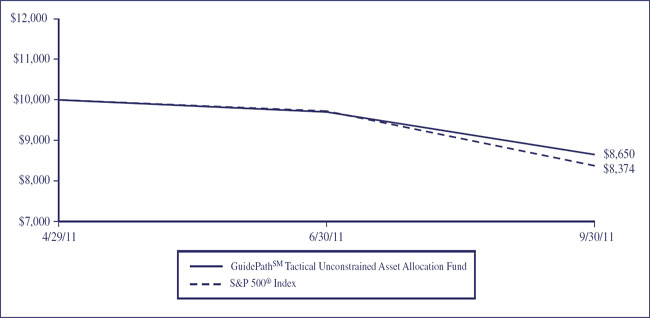

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P 500® INDEX – Focuses on the large-cap segment of the U.S. equities market. It includes 500 leading companies in leading industries of the U.S. economy, capturing approximately 75% coverage of U.S. equities.

| | | | |

CUMULATIVE TOTAL RETURN (for the period ended September 30) |

| |

| | Since Inception (4/29/11) | |

| | | |

GuidePathSM Tactical Unconstrained Asset | | | | |

Allocation Fund | | -13.50 | % | |

S&P 500® Index | | -16.26 | % | |

25

|

GuidePathSM Tactical Unconstrained Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| |

• | For the period since the Fund commenced operations on April 29, 2011 through September 30, 2011, the Fund returned -13.5%, outperforming the S&P 500® Index, which returned -16.26%. |

| |

• | The biggest source of outperformance in the Fund came from a large exposure throughout most of the period to 1-3 Month T-Bills, which held flat versus negative equity markets. Exposure to absolute return strategies, which held positions in floating rate notes and local currency emerging market debt, also added value. |

| |

• | Domestic equity exposure was the largest drag on returns. Specifically, overweight exposure to the pro-cyclical Financial, Industrial and Energy sectors, and underweight exposure to the defensive sector of Utilities dragged on returns as fears of the global recession increased. |

| |

• | Exposure to international equity, including emerging markets, also detracted from returns as the international markets sold off because of growing concerns about the European debt crisis and the slow path to restructuring Greek debt. The strengthening of the U.S. dollar also damped returns from the international markets. |

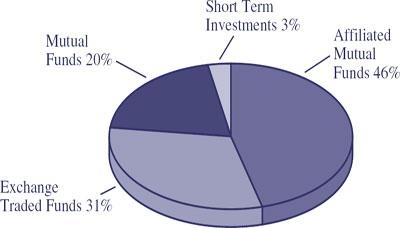

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio, less securities lending collateral.

| | | | | | |

Top Ten Holdings |

| | | | | | |

Rank | | Security/Holding | | % of Net

Assets | |

1 | | | SPDR Barclays Capital 1-3 Month T-Bill ETF | | 24.74 | |

2 | | | GuideMarkSM Opportunistic Fixed Income Fund –

Institutional Shares | | 11.83 | |

3 | | | GuideMarkSM Opportunistic Equity Fund – Institutional Shares | | 9.69 | |

4 | | | Stadion Managed Portfolio Trust – Institutional Shares | | 9.56 | |

5 | | | GuideMarkSM Large Cap Value Fund – Institutional Shares | | 8.10 | |

6 | | | GuideMarkSM World ex-US Fund – Institutional Shares | | 5.82 | |

7 | | | GuideMarkSM Small/Mid Cap Core Fund – Institutional Shares | | 5.71 | |

8 | | | Eaton Vance Multi-Strategy Absolute Return Fund –

Institutional Shares | | 4.87 | |

9 | | | GuideMarkSM Large Cap Growth Fund – Institutional Shares | | 4.39 | |

10 | | | SPDR Barclays Capital High Yield Bond ETF | | 3.26 | |

26

|

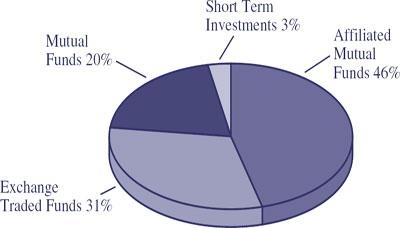

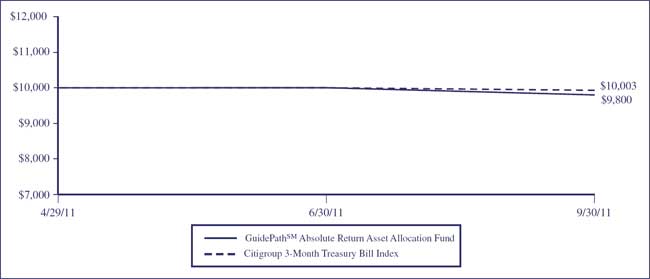

GuidePathSM Absolute Return Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) |

| |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

CITIGROUP 3-MONTH TREASURY BILL INDEX – Tracks the performance of U.S. Treasury Bills with a remaining maturity of three months.

CUMULATIVE TOTAL RETURN (for the period ended September 30)

| | | | |

| | | |

| | Since Inception (4/29/11) | |

| | |

GuidePathSM Absolute Real Return Fund | | -2.00 | % | |

Citigroup 3-Month Treasury Bill Index | | 0.02 | % | |

27

|

GuidePathSM Absolute Return Asset Allocation Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited) |

| |

| | |

| • | For the period since the Fund commenced operations on April 29, 2011 through September 30, 2011, the Fund returned -2.00%, underperforming the Citigroup 3-month Treasury Bill Index, which returned 0.02%. |

| | |

| • | Exposure to both credit and currency, combined with a position in iPath US Treasury 10-year Bear ETN, were the largest detractors to performance as U.S. Treasuries rallied strongly in a flight to safety environment and the yield on 10-year U.S. Treasuries dropped to historic lows. |

| | |

| • | Market neutral exposure dragged on returns as the market experienced high levels of correlation and low levels of dispersion between stock returns leading to little differentiation between winners and losers. |

| | |

| • | Core fixed income and TIPS exposure, along with the position in the iPath US Treasury Flattener ETN, contributed positively as long-term U.S. Treasuries rallied strongly as a result of the flight to safety and the announcement of the Federal Reserve regarding its purchase program of long-term U.S. Treasuries. |

Components of Portfolio Holdings*

*Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | |

Rank | | Security/Holding | | % of Net

Assets |

1 | | | iShares Barclays Aggregate Bond Fund | | 17.46 | |

2 | | | GuideMarkSM Core Fixed Income Fund – Institutional Shares | | 17.44 | |

3 | | | GuideMarkSM Opportunistic Fixed Income Fund – Institutional Shares | | 15.54 | |

4 | | | Eaton Vance Multi-Strategy Absolute Return Fund – Institutional Shares | | 9.47 | |

5 | | | Eaton Vance Global Macro Absolute Return Fund – Institutional Shares | | 4.42 | |

6 | | | iShares Barclays Credit Bond Fund | | 4.06 | |

7 | | | SPDR Barclays Capital 1-3 Month T-Bill ETF | | 3.81 | |

8 | | | JPMorgan Research Market Neutral Fund – Institutional Shares | | 3.36 | |

9 | | | Highbridge Statistical Market Neutral Fund – Select Shares | | 3.28 | |

10 | | | JPMorgan Income Builder Fund – Select Shares | | 3.17 | |

28

|

GuideMarkSM Funds & GuidePathSM Funds |

EXPENSE EXAMPLE (Unaudited) |

September 30, 2011 |

| |

|

As a shareholder of the GuideMarkSM & GuidePathSM Funds (the “Funds”), you incur ongoing costs, including management fees, distribution and/or service fees, and other Fund expenses. The Expense Example shown in this section is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. |

|

The Expense Examples are based on an investment of $1,000 invested at the beginning of a six-month period and held for the entire period, which for the GuideMarkSM Large Cap Growth Fund – Service Shares, GuideMarkSM Large Cap Value Fund –Service Shares, GuideMarkSM Small/Mid Cap Core Fund – Service Shares, GuideMarkSM World ex-US Fund – Service Shares, GuideMarkSM Opportunistic Equity Fund – Service Shares, GuideMarkSM Global Real Return Fund – Service Shares, GuideMarkSM Core Fixed Income Fund – Service Shares, GuideMarkSM Tax-Exempt Fixed Income Fund and GuideMarkSM Opportunistic Fixed Income Fund – Service Shares was from April 1, 2011 to September 30, 2011, and for GuideMarkSM Large Cap Growth Fund – Institutional Shares, GuideMarkSM Large Cap Value Fund – Institutional Shares, GuideMarkSM Small/Mid Cap Core Fund – Institutional Shares, GuideMarkSM World ex-US Fund – Institutional Shares, GuideMarkSM Opportunistic Equity Fund – Institutional Shares, GuideMarkSM Global Real Return Fund – Institutional Shares, GuideMarkSM Core Fixed Income Fund – Institutional Shares, GuideMarkSM Opportunistic Fixed Income Fund – Institutional Shares, GuidePathSM Strategic Asset Allocation Fund, GuidePathSM Tactical Constrained Asset Allocation Fund, GuidePathSM Tactical Unconstrained Asset Allocation Fund, and GuidePathSM Absolute Return Asset Allocation Fund was from April 29, 2011 to September 30, 2011. |

|

Actual Expenses |

The first line of the Expense Example table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

|

The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting fees, custody fees and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense or dividends on short positions taken by a Fund and other extraordinary expenses as determined under generally accepted accounting principles. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. |

|

Hypothetical Example for Comparison Purposes |

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expenses ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. |

29

|

GuideMarkSM & GuidePathSM Funds |

EXPENSE EXAMPLE (Continued) (Unaudited) |

September 30, 2011 |

| |

| | | | | | | | | | | | | | |

Fund | | | | Beginning

Account

Value

April 29,

2011 | | Ending

Account

Value

September 30,

2011 | | Annualized

Expense Ratio1

based on

the period

April 29, 2011–

September 30,

2011 | | Expenses Paid

During Period2

April 29, 2011–

September 30,

2011 | |

| | | | | | | | | | | | |

INSTITUTIONAL SHARES | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

GuideMarkSM Large Cap | | Actual | | $1,000.00 | | | $ | 799.40 | | | 0.92% | | $3.46 | |

Growth Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.06 | | | 0.92% | | $3.88 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Large Cap | | Actual | | $1,000.00 | | | $ | 795.10 | | | 0.94% | | $3.53 | |

Value Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,016.97 | | | 0.94% | | $3.96 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Small/Mid Cap | | Actual | | $1,000.00 | | | $ | 731.40 | | | 1.13% | | $4.09 | |

Core Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,016.18 | | | 1.13% | | $4.76 | |

| | | | | | | | | | | | | | | |

GuideMarkSM World | | Actual | | $1,000.00 | | | $ | 745.10 | | | 0.38% | | $1.39 | |

ex-US Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,019.31 | | | 0.38% | | $1.60 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Opportunistic | | Actual | | $1,000.00 | | | $ | 774.70 | | | 1.09% | | $4.04 | |

Equity Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,016.35 | | | 1.09% | | $4.59 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Global | | Actual | | $1,000.00 | | | $ | 819.60 | | | 0.92% | | $3.50 | |

Real Return Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.06 | | | 0.92% | | $3.88 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Core | | Actual | | $1,000.00 | | | $ | 1,038.10 | | | 0.70% | | $2.98 | |

Fixed Income Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.98 | | | 0.70% | | $2.95 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Opportunistic | | Actual | | $1,000.00 | | | $ | 927.60 | | | 1.05% | | $4.23 | |

Fixed Income Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,016.51 | | | 1.05% | | $4.43 | |

| | | | | | | | | | | | | | | |

SERVICE SHARES | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

GuidePathSM Strategic | | Actual | | $1,000.00 | | | $ | 787.00 | | | 1.01% | | $3.77 | |

Asset Allocation Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,020.82 | | | 1.01% | | $4.27 | |

| | | | | | | | | | | | | | | |

GuidePathSM Tactical Constrained | | Actual | | $1,000.00 | | | $ | 841.00 | | | 1.02% | | $3.92 | |

Asset Allocation Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,020.74 | | | 1.02% | | $4.31 | |

| | | | | | | | | | | | | | | |

GuidePathSM Tactical Unconstrained | | Actual | | $1,000.00 | | | $ | 865.00 | | | 1.14% | | $4.44 | |

Asset Allocation Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,020.23 | | | 1.14% | | $4.81 | |

| | | | | | | | | | | | | | | |

GuidePathSM Absolute Return | | Actual | | $1,000.00 | | | $ | 980.00 | | | 1.11% | | $4.59 | |

Asset Allocation Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,020.36 | | | 1.11% | | $4.69 | |

| | | | | | | | | | | | | | | |

| |

1 | The expense ratio excludes the securities lending credit. |

2 | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 153/366 to reflect the one-half year period. |

3 | 5% return before expenses. |

30

|

GuideMarkSM & GuidePathSM Funds |

EXPENSE EXAMPLE (Continued) (Unaudited) |

September 30, 2011 |

| |

| | | | | | | | | | | | | | |

Fund | | | | Beginning

Account

Value

April 1,

2011 | | Ending

Account

Value

September 30,

2011 | | Annualized

Expense Ratio1

based on

the period

April 1, 2011–

September 30,

2011 | | Expenses Paid

During Period2

April 1, 2011–

September 30,

2011 | |

| | | | | | | | | | | | |

SERVICE SHARES | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

GuideMarkSM Large Cap | | Actual | | $1,000.00 | | | $ | 822.80 | | | 1.51% | | $6.88 | |

Growth Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.45 | | | 1.51% | | $7.62 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Large Cap | | Actual | | $1,000.00 | | | $ | 813.70 | | | 1.51% | | $6.85 | |

Value Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.45 | | | 1.51% | | $7.62 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Small/Mid Cap | | Actual | | $1,000.00 | | | $ | 752.80 | | | 1.63% | | $7.14 | |

Core Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,016.85 | | | 1.63% | | $8.22 | |

| | | | | | | | | | | | | | | |

GuideMarkSM World | | Actual | | $1,000.00 | | | $ | 755.90 | | | 1.59% | | $7.06 | |

ex-US Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.05 | | | 1.59% | | $8.02 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Opportunistic | | Actual | | $1,000.00 | | | $ | 789.00 | | | 1.63% | | $7.29 | |

Equity Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,016.85 | | | 1.63% | | $8.22 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Global | | Actual | | $1,000.00 | | | $ | 842.00 | | | 1.53% | | $7.05 | |

Real Return Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.35 | | | 1.53% | | $7.72 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Core | | Actual | | $1,000.00 | | | $ | 1,049.30 | | | 1.28% | | $6.56 | |

Fixed Income Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,018.60 | | | 1.28% | | $6.46 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Tax-Exempt | | Actual | | $1,000.00 | | | $ | 1,068.80 | | | 1.29% | | $6.67 | |

Fixed Income Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,018.55 | | | 1.29% | | $6.51 | |

| | | | | | | | | | | | | | | |

GuideMarkSM Opportunistic | | Actual | | $1,000.00 | | | $ | 931.50 | | | 1.55% | | $7.48 | |

Fixed Income Fund | | Hypothetical3 | | $1,000.00 | | | $ | 1,017.25 | | | 1.55% | | $7.82 | |

| | | | | | | | | | | | | | | |

| |

1 | The expense ratio excludes the securities lending credit. |

2 | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

3 | 5% return before expenses. |

31

|

GuideMarkSM Large Cap Growth Fund |

SCHEDULE OF INVESTMENTS (Unaudited) |

September 30, 2011 |

| |

| | | | | | | | |

Number of

Shares | | | | | | Value | |

| | | | | | | | |

| | | COMMON STOCKS - 98.80% | | | | |

| | | Aerospace & Defense - 2.24% | | | | |

| 32,383 | | Boeing Co. | | $ | 1,959,495 | |

| 43,361 | | Honeywell International, Inc. | | | 1,903,982 | |

| | | | | | | |

| | | | | | 3,863,477 | |

| | | | | | | |

| | | Biotechnology - 1.55% | | | | |

| 48,669 | | Amgen, Inc. (a) | | | 2,674,362 | |

| | | Communications Equipment - 6.60% | | | | |

| 509,313 | | Cisco Systems, Inc. | | | 7,889,258 | |

| 4,915 | | F5 Networks, Inc. (a) | | | 349,211 | |

| 47,761 | | Qualcomm, Inc. | | | 2,322,618 | |

| 41,890 | | Riverbed Technology, Inc. (a)(b) | | | 836,124 | |

| | | | | | | |

| | | | | | 11,397,211 | |

| | | | | | | |

| | | Computers & Peripherals - 19.53% | | | | |

| 32,646 | | Apple, Inc. (a) | | | 12,444,002 | |

| 150,705 | | Dell, Inc. (a) | | | 2,132,476 | |

| 277,304 | | EMC Corp. (a)(b) | | | 5,820,611 | |

| 54,508 | | International Business Machines | | | | |

| | | Corp. (b) | | | 9,540,535 | |

| 57,508 | | NetApp, Inc. (a)(b) | | | 1,951,822 | |

| 143,713 | | QLogic Corp. (a)(b) | | | 1,822,281 | |

| | | | | | | |

| | | | | | 33,711,727 | |

| | | | | | | |

| | | Consumer Finance - 0.76% | | | | |

| 29,316 | | American Express Co. (b) | | | 1,316,288 | |

| | | | | | | |

| | | Diversified Consumer Services - 1.00% | | | | |

| 43,736 | | Apollo Group, Inc. (a) | | | 1,732,383 | |

| | | | | | | |

| | | Energy Equipment & Services - 3.73% | | | | |

| 20,346 | | Baker Hughes, Inc. | | | 939,171 | |

| 31,749 | | Cameron International Corp. (a)(b) | | | 1,318,853 | |

| 12,146 | | Core Laboratories NV | | | 1,091,075 | |

| 35,425 | | Diamond Offshore Drilling, Inc. (b) | | | 1,939,165 | |

| 32,543 | | Oceaneering International, Inc. | | | 1,150,070 | |

| | | | | | | |

| | | | | | 6,438,334 | |

| | | | | | | |

| | | Health Care Equipment & Supplies - 2.32% | | | | |

| 6,845 | | Edwards Lifesciences Corp. (a)(b) | | | 487,911 | |

| 89,923 | | Hologic, Inc. (a) | | | 1,367,729 | |

| 5,918 | | Intuitive Surgical, Inc. (a)(b) | | | 2,155,809 | |

| | | | | | | |

| | | | | | 4,011,449 | |

| | | | | | | |

| | | Health Care Providers & Services - 4.01% | | | | |

| 33,717 | | AmerisourceBergen Corp. (b) | | | 1,256,633 | |

| 32,769 | | Cardinal Health, Inc. (b) | | | 1,372,366 | |

| 12,570 | | Laboratory Corporation of | | | | |

| | | America Holdings (a)(b) | | | 993,658 | |

| | | | | | | | |

Number of

Shares | | | | | | Value | |

| | | | | | | | |

| | | Health Care Providers & Services (Continued) | | | | |

| 71,653 | | UnitedHealth Group, Inc. | | $ | 3,304,636 | |

| | | | | | | |

| | | | | | 6,927,293 | |

| | | | | | | |

| | | Hotels, Restaurants & Leisure - 1.14% | | | | |

| 9,886 | | Ctrip.com International, | | | | |

| | | Ltd. - ADR (a)(b) | | | 317,934 | |

| 44,045 | | Starbucks Corp. | | | 1,642,438 | |

| | | | | | | |

| | | | | | 1,960,372 | |

| | | | | | | |

| | | Industrial Conglomerates - 1.86% | | | | |

| 153,150 | | General Electric Co. | | | 2,334,006 | |

| 21,721 | | Tyco International Ltd. - ADR | | | 885,131 | |

| | | | | | | |

| | | | | | 3,219,137 | |

| | | | | | | |

| | | Internet & Catalog Retail - 2.07% | | | | |

| 7,706 | | Amazon.com, Inc. (a)(b) | | | 1,666,268 | |

| 4,252 | | Priceline.com, Inc. (a) | | | 1,911,104 | |

| | | | | | | |

| | | | | | 3,577,372 | |

| | | Internet Software & Services - 4.75% | | | | |

| 94,122 | | eBay, Inc. (a) | | | 2,775,658 | |

| 4,582 | | Google, Inc. (a) | | | 2,356,889 | |

| 66,316 | | IAC/InterActiveCorp (a)(b) | | | 2,622,798 | |

| 9,308 | | Sohu.com, Inc. (a)(b) | | | 448,645 | |

| | | | | | | |

| | | | | | 8,203,990 | |

| | | | | | | |

| | | IT Services - 0.57% | | | | |

| 15,786 | | Cognizant Technology Solutions | | | | |

| | | Corp. (a) | | | 989,782 | |

| | | | | | | |

| | | Life Sciences Tools & Services - 2.46% | | | | |

| 58,290 | | Bruker Corp. (a)(b) | | | 788,664 | |

| 12,435 | | Life Technologies Corp. (a) | | | 477,877 | |

| 39,516 | | Waters Corp. (a)(b) | | | 2,983,063 | |

| | | | | | | |

| | | | | | 4,249,604 | |

| | | | | | | |

| | | Machinery - 5.34% | | | | |

| 41,784 | | Caterpillar, Inc. (b) | | | 3,085,331 | |

| 15,145 | | Cummins, Inc. | | | 1,236,741 | |

| 24,576 | | Dover Corp. (b) | | | 1,145,242 | |

| 23,888 | | Joy Global, Inc. (b) | | | 1,490,133 | |

| 35,726 | | Parker Hannifin Corp. (b) | | | 2,255,382 | |

| | | | | | | |

| | | | | | 9,212,829 | |

| | | | | | | |

| | | Media - 3.45% | | | | |

| 31,286 | | DIRECTV (a)(b) | | | 1,321,833 | |

| 103,357 | | News Corp. (b) | | | 1,598,933 | |

| 60,517 | | Omnicom Group, Inc. (b) | | | 2,229,446 | |

| 534,282 | | Sirius Xm Radio, Inc. (a)(b) | | | 806,766 | |

| | | | | | | |

| | | | | | 5,956,978 | |

| | | | | | | |

See notes to financial statements.

32

|

GuideMarkSM Large Cap Growth Fund |

SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

September 30, 2011 |

| |

| | | | | | | | |

Number of

Shares | | | | | | Value | |

| | | | | | | | |

| | | COMMON STOCKS (Continued) | | | | |

| | | Metals & Mining - 2.23% | | | | |

| 15,726 | | Cliffs Natural Resources, Inc. (b) | | $ | 804,700 | |

| 33,892 | | Freeport-McMoran Copper & | | | | |

| | | Gold, Inc. | | | 1,032,011 | |

| 15,248 | | Rio Tinto Plc - ADR | | | 672,132 | |

| 24,409 | | Teck Resources Ltd. | | | 712,499 | |

| 10,339 | | Walter Energy, Inc. (b) | | | 620,443 | |

| | | | | | | |

| | | | | | 3,841,785 | |

| | | | | | | |

| | | Oil & Gas - 6.57% | | | | |

| 20,358 | | Anadarko Petroleum Corp. | | | 1,283,572 | |

| 13,546 | | BP Plc - ADR | | | 488,604 | |

| 43,245 | | Canadian Natural Resource | | | | |

| | | Ltd. - ADR | | | 1,265,781 | |

| 54,631 | | Exxon Mobil Corp. | | | 3,967,850 | |

| 29,314 | | Occidental Petroleum Corp. (b) | | | 2,095,951 | |

| 57,338 | | Sandridge Energy, Inc. (a)(b) | | | 318,799 | |

| 108,142 | | Valero Energy Corp. (b) | | | 1,922,765 | |

| | | | | | | |

| | | | | | 11,343,322 | |

| | | | | | | |

| | | Pharmaceuticals - 0.54% | | | | |

| 18,151 | | Abbott Laboratories (b) | | | 928,242 | |

| | | | | | | |

| | | Semiconductor & Semiconductor | | | | |

| | | Equipment - 6.16% | | | | |

| 164,111 | | Altera Corp. (b) | | | 5,174,420 | |

| 60,986 | | Analog Devices, Inc. (b) | | | 1,905,812 | |

| 160,996 | | Intersil Corp. (b) | | | 1,656,649 | |

| 69,316 | | Xilinx, Inc. (b) | | | 1,902,031 | |

| | | | | | | |

| | | | | | 10,638,912 | |

| | | | | | | |

| | | Software - 12.50% | | | | |

| 44,742 | | Adobe Systems, Inc. (a) | | | 1,081,414 | |

| 53,067 | | Autodesk, Inc. (a) | | | 1,474,201 | |

| 38,651 | | BMC Software, Inc. (a) | | | 1,490,382 | |

| 32,276 | | Check Point Software Technologies | | | | |

| | | Ltd. - ADR (a)(b) | | | 1,702,882 | |

| 22,374 | | Citrix Systems, Inc. (a) | | | 1,220,054 | |

| 299,831 | | Microsoft Corp. | | | 7,462,794 | |

| 211,667 | | Oracle Corp. | | | 6,083,310 | |

| 25,385 | | Red Hat, Inc. (a) | | | 1,072,770 | |

| | | | | | | |

| | | | | | 21,587,807 | |

| | | | | | | |

| | | | | | | | |

Number of

Shares | | | | | | Value | |

| | | | | | | | |

| | | Specialty Retail - 3.75% | | | | |

| 16,068 | | Bed Bath & Beyond, Inc. (a) | | $ | 920,857 | |

| 10,217 | | PetSmart, Inc. | | | 435,755 | |

| 24,755 | | Ross Stores, Inc. (b) | | | 1,947,971 | |

| 10,105 | | Sherwin Williams Co. (b) | | | 751,003 | |

| 22,760 | | The Buckle, Inc. (b) | | | 875,350 | |

| 27,659 | | The TJX Companies, Inc. (b) | | | 1,534,245 | |

| | | | | | | |

| | | | | | 6,465,181 | |

| | | | | | | |

| | | Textiles, Apparel & Luxury Goods - 2.92% | | | | |

| 28,508 | | Coach, Inc. | | | 1,477,570 | |

| 14,864 | | Deckers Outdoor Corp. (a)(b) | | | 1,386,217 | |

| 3,521 | | Fossil, Inc. (a)(b) | | | 285,412 | |

| 12,964 | | Lululemon Athletica, Inc. (a)(b) | | | 630,698 | |

| 9,743 | | Polo Ralph Lauren Corp. (b) | | | 1,263,667 | |

| | | | | | | |

| | | | | | 5,043,564 | |

| | | | | | | |

| | | Wireless Telecommunication | | | | |

| | | Services - 0.75% | | | | |

| 50,767 | | Vodafone Group Plc - ADR (b) | | | 1,302,174 | |

| | | | | | | |

| | | Total Common Stocks | | | | |

| | | (Cost $177,203,983) | | | 170,593,575 | |

| | | | | | | |

| | | SHORT TERM INVESTMENTS - 0.04% | | | | |