UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report Of Foreign Private Issuer

Pursuant To Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of March 2022

Commission File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact name of registrant as specified in its charter)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO AVAL ACCIONES Y VALORES S.A.

TABLE OF CONTENTS

| ITEM | |

| | |

| 1. | Information Statement Regarding Spinoff of BAC Holding International Corp., dated March 18, 2022 |

| | |

| 2. | Notice Regarding Availability of Information Statement |

Item 1

INFORMATION STATEMENT

BAC Holding International Corp.

Grupo Aval Acciones y Valores S.A. (“Grupo Aval”), a company domiciled in Bogotá, Colombia and organized under Colombian laws and regulations, and BAC Holding International Corp. (“BHI”), a holding company organized under Panamanian law (formerly, Leasing Bogotá S.A. Panamá), are furnishing this information statement in connection with the demerger (escisión) of Grupo Aval’s indirect majority ownership stake in BHI and the distribution, through a series of transactions described in this information statement under the caption “The Spinoff,” of 43,220,189,095 common shares of BHI (par value $0.0662975983446469 per share) (each a “BHI Share” and collectively, the “BHI Shares”) to (i) the shareholders of Grupo Aval’s consolidated subsidiary, Banco de Bogotá S.A. (“Banco de Bogotá”), a bank organized under Colombian laws and regulations, which, prior to the Spinoff, was BHI’s sole shareholder, and (ii) in turn, the distribution of the BHI Shares received by Grupo Aval from Banco de Bogotá to its own shareholders, in each case on a pro rata basis, proportionally to such shareholders’ ownership stakes in Banco de Bogotá and Grupo Aval, respectively. The aforementioned transactions, which along with certain related transactions described in greater detail under the caption “The Spinoff” are referred to herein as the “Spinoff.”

Grupo Aval’s shareholders will receive an aggregate of 22,281,017,159 BHI Shares in the Spinoff. You are receiving this information statement because Grupo Aval believes that you are a resident of the United States and own its common or preferred shares, including preferred shares represented by American Depositary Shares (“ADSs”), each of which represents 20 Grupo Aval preferred shares.

To the extent you hold Grupo Aval’s common or preferred shares, you will receive one BHI Share for each one Grupo Aval common or preferred share that you own of record immediately prior to the open of business (Bogotá, Colombia time) on March 28, 2022 (the “Colombian Record Date”).

If you own Grupo Aval ADSs, you will be entitled to elect to take delivery in your Colombian brokerage account of 20 BHI Shares for each Grupo Aval ADS that you own of record at the close of business (New York City time) on March 28, 2022 (the “ADS Record Date” and the Colombian Record Date, each a “Record Date”). If you hold Grupo Aval’s ADSs and do not timely or properly elect to receive BHI Shares in the manner described in this information statement, you will automatically receive the net cash proceeds from the sale of the BHI Shares to which you would otherwise have been entitled. See the section of this information statement titled “Questions and Answers About the Spinoff and Your BHI Securities—I am an ADS holder. How do I elect to receive BHI common shares?”

Except as set forth in the preceding paragraph, you are not required to take any action to receive the BHI Shares. The BHI Shares will be registered in each holder’s name with Depósito Centralizado de Valores, “DECEVAL”, in Colombia and Central Latinoamericana de Valores, or “Latinex,” in Panamá; both BHI’s registrars and custodian agents.

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 20.

Neither the U.S. Securities and Exchange Commission (“SEC”) nor any state securities commission or regulator in any other jurisdiction has approved or disapproved the securities described in this information statement or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Grupo Aval is not soliciting a proxy or consent authority in connection with the Spinoff. The Spinoff has been approved by Grupo Aval’s common shareholders and has received all requisite regulatory approvals.

The date of this information statement is March 18, 2022.

table of contents

| i. NOTE REGARDING THE USE OF CERTAIN TERMS | 7 |

| ii. AVAILABLE INFORMATION | 8 |

| Grupo Aval | 8 |

| BAC Holding International Corp. | 8 |

| iii. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 9 |

| 1. SUMMARY | 10 |

| Overview | 10 |

| The Spinoff | 10 |

| The Banco de Bogotá Demerger | 10 |

| The Grupo Aval Demerger | 10 |

| The BHI Listing and Mergers | 10 |

| Effect of the Spinoff | 11 |

| Corporate Information | 11 |

| 2. THE SPINOFF | 12 |

| Summary of the Spinoff | 12 |

| The Spinoff | 13 |

| Effect of the Spinoff | 13 |

| Listing and Trading of Our Common Shares | 14 |

| 3. QUESTIONS AND ANSWERS ABOUT THE SPINOFF AND YOUR BHI SECURITIES | 15 |

| 4. RISK FACTORS | 20 |

| Summary | 20 |

| Risks Relating to the Spinoff | 22 |

| Risks relating to the countries in which we operate | 23 |

| Risks relating to our businesses and industry | 26 |

| Risks relating to our banking business | 27 |

| Other risks relating to our businesses | 32 |

| Risks Relating to Our Common Shares | 37 |

| 5. Dividend policy of BHI | 40 |

| Net Income and Declared Dividends Corresponding to the Past Three (3) Years | 40 |

| 6. CAPITALIZATION | 41 |

| 7. UNAUDITED CONDENSED PRO FORMA FINANCIAL INFORMATION | 42 |

| Overview | 42 |

| Unaudited Pro Forma Income Statement Information | 42 |

| 8. STATISTICAL BANK INFORMATION | 45 |

| Selected Statistical Data | 45 |

| Distribution of Assets, Liabilities and Shareholders' Equity; Interest Rates and Interest Differential | 45 |

| Average Statement of Financial Position | 45 |

| Analysis of Changes in Volume and Rate on Interest Income and Interest Expense | 47 |

| Interest-earning assets – net interest margin and spread | 48 |

| Investment Portfolio | 49 |

| Loan Portfolio | 49 |

| Maturity Profile of the Loan Portfolio | 49 |

| Credit Ratios | 51 |

| Deposits | 52 |

| Uninsured deposits | 53 |

| 9. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 54 |

| Overview: BAC Holding International Corp. | 54 |

| Principal factors affecting our financial condition and results of operations | 54 |

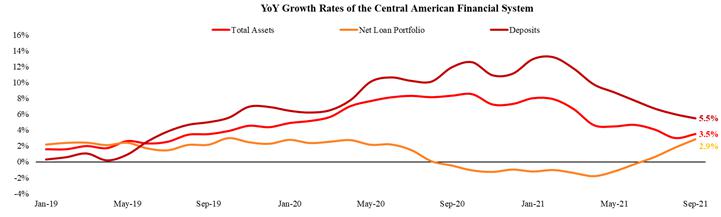

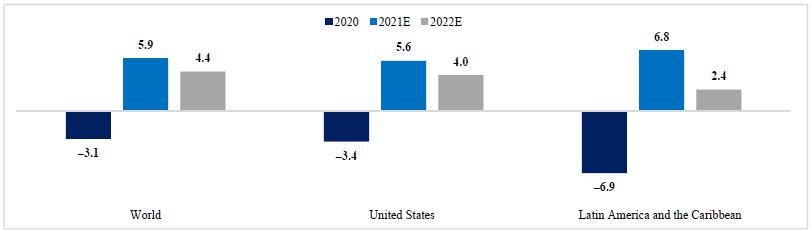

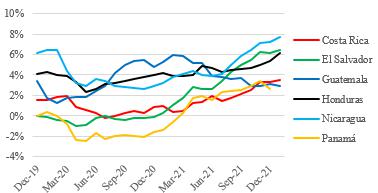

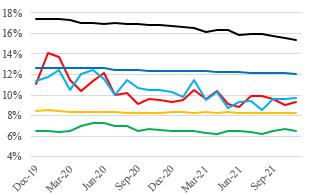

| International context | 54 |

| Inflation and Interest Rates | 56 |

| Central American Economic Conditions | 56 |

| Critical Accounting Policies | 58 |

| Results of Operations for the Nine Months Ended September 30, 2021 Compared to the Nine Months Ended September 30, 2020 | 59 |

| Net interest income | 59 |

| Net impairment loss on financial assets | 61 |

| Service charges and Commissions and other fees, net | 64 |

| Other income | 65 |

| General and administrative expenses | 65 |

| Tax expense | 66 |

| Net income attributable to non-controlling interest | 66 |

| Net income (loss) from discontinued operations | 66 |

| Results of Operations for the Year Ended December 31, 2020 Compared to the Year Ended December 31, 2019 | 67 |

| Net interest income | 67 |

| Net impairment loss on financial assets | 69 |

| Service Charges and Commissions and other fees, net | 71 |

| Other income | 72 |

| General and administrative expenses | 72 |

| Tax expense | 73 |

| Net income attributable to non-controlling interest | 73 |

| Results of Operations for the Year Ended December 31, 2019 Compared to the Year Ended December 31, 2018 | 74 |

| Net interest income | 74 |

| Net impairment loss on financial assets | 75 |

| Service charges and Commissions and other fees, net | 77 |

| Other income | 78 |

| General and administrative expenses | 78 |

| Tax expense | 79 |

| Net income attributable to non-controlling interest | 79 |

| B. Liquidity and capital resources | 79 |

| Capitalization ratios | 80 |

| Funding | 80 |

| Capital Expenditures | 83 |

| C. Research and development, patents and licenses, etc. | 83 |

| D. Trend Information | 83 |

| E. Off-balance sheet arrangements | 85 |

| F. Other Commitments and Obligations | 84 |

| 10. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT RISK | 86 |

| Risk Management | 86 |

| Control Environment | 86 |

| Lines of defense | 86 |

| Risk Culture | 86 |

| Risk Management Systems | 87 |

| Credit Risk | 87 |

| Commercial Lending | 88 |

| Consumer Lending | 89 |

| Mortgage Lending | 89 |

| COVID-19 Event: Main government measures in Central America | 89 |

| Credit Classification and Provisioning | 90 |

| Loss allowance | 90 |

| Liquidity Risk | 91 |

| Market Risk Management | 92 |

| Investment Securities | 92 |

| Consolidated Statement of Financial Position | 93 |

| Non-Financial Risk Review | 93 |

| Operational Risk Management | 94 |

| Anti-money laundering, terrorist financing and the proliferation of weapons of mass destruction financing | 95 |

| Anti-Bribery and Anti-corruption Program | 95 |

| Legal Risk | 95 |

| 11. BUSINESS OVERVIEW | 96 |

| Overview | 96 |

| History and Development of the Company | 96 |

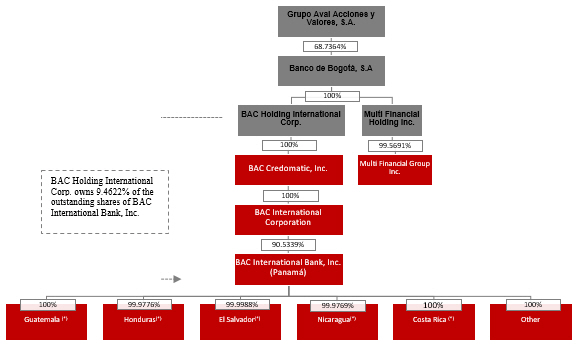

| Corporate Structure | 97 |

| Business Overview | 98 |

| Strategic Overview | 98 |

| Regional Strategy | 98 |

| Payment Chain Strategy | 99 |

| Digital Strategy | 100 |

| ESG Strategy | 101 |

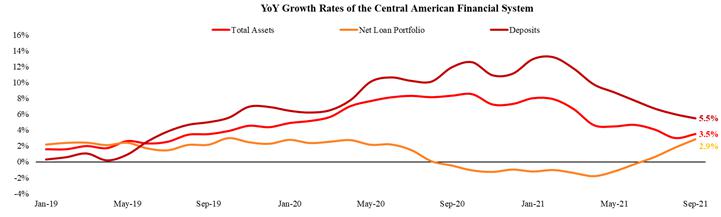

| Central American Financial System | 102 |

| Our Operations | 103 |

| Corporate customers | 103 |

| Individual customers | 103 |

| Lending activities | 104 |

| Mortgages portfolio | 105 |

| Treasury operations | 105 |

| Deposits | 105 |

| Distribution channels | 105 |

| Competition | 107 |

| Property, plant and equipment | 108 |

| Human Capital | 108 |

| Legal Proceedings | 108 |

| 12. MANAGEMENT | 109 |

| Identity of Directors, Senior Management and Advisers | 109 |

| Directors | 109 |

| Executive Officers | 111 |

| Important employees and advisors | 114 |

| External Auditors | 114 |

| Legal Advisors | 114 |

| Executive Compensation | 114 |

| Board Practices | 114 |

| Meetings, voting and responsibilities of the Board of Directors | 115 |

| Mechanisms Adopted to Guarantee the Independence of Members of the Board of Directors | 116 |

| Indemnification Obligations to D&Os / Limitations | 116 |

| Audit Committee | 117 |

| 13. CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 118 |

| Relationship of the Members of the Board of Directors with the Company or its Related Companies | 118 |

| Loans or Deposits Involving Related Parties | 118 |

| Loans Granted to Related Parties by our banking subsidiaries | 119 |

| Financial liabilities issued by BHI and its subsidiaries with Grupo Aval and its subsidiaries | 119 |

| Other Financial Obligations | 119 |

| 14. BENEFICIAL OWNERSHIP BY CERTAIN SHAREHOLDERS | 120 |

| Shareholding Composition and Information on Main Shareholders | 120 |

| Beneficial ownership | 120 |

| 15. MATERIAL TAX CONSEQUENCES | 121 |

| Applicable Tax Regime to Shares | 121 |

| General Description of the Tax Regime Applicable to Shares that are Traded Through the Colombian Stock Exchange | 121 |

| Profits from the sale of shares in Colombia | 121 |

| Special income tax on dividends | 122 |

| General Description of the Tax Regime of the Panamanian Law Applicable to Shares | 122 |

| Profits from the sale of shares in Panama | 122 |

| Income Tax on Dividends | 123 |

| “Stamp” tax | 123 |

| Material Tax Consequences to U.S. Persons Resulting from the Spinoff or the Holding of BHI Shares | 123 |

| United States Federal Income Taxation Considerations for U.S. Holders | 123 |

| Tax Treatment of the Spinoff | 124 |

| Taxation of Dividends | 124 |

| Sale or Other Taxable Disposition of Common Shares | 125 |

| Passive Foreign Investment Company Rules | 125 |

| Information Reporting and Backup Withholding | 125 |

| 16. DESCRIPTION OF CAPITAL STOCK | 126 |

| Share Capital | 126 |

| Information Related to Equity Accounts | 126 |

| Convertible Obligations | 126 |

| Memorandum and Articles of Incorporation | 126 |

| Rights granted by the Shares | 126 |

| Obligations of the Shareholders | 127 |

| Process for changing the shareholder´s rights over their shares | 128 |

| Shares Available for Future Sale Under U.S. Securities Laws | 128 |

| 17. FINANCIAL STATEMENTS OF BHI | 129 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | 129 |

| Exhibit A | A-1 |

| Form of DR Market Announcement with ADS Holder Election Instructions | A-1 |

| ¹Investor Disclosures | A-2 |

| Exhibit B | B-1 |

| Form of Share Delivery Instruction Form | B-1 |

i. NOTE REGARDING THE USE OF CERTAIN TERMS

We frequently use the following terms in this information statement to refer to the items indicated (this is not an exhaustive list of definitions used in this information statement, and certain terms are defined elsewhere in this information statement):

The terms “BAC,” “BAC Holding,” the “Company,” “BHI”,” “we,” “us” and “our” refer, unless the context otherwise specifies, to BAC Holding International Corp., a holding company organized under Panamanian law (formerly Leasing Bogotá S.A. Panamá), and the entity in which you are receiving shares in connection with the Spinoff.

BAC Credomatic Group ("BAC Credomatic" or the "Group") refers generally to BAC Credomatic Inc., the main and direct subsidiary of BHI, and the remaining regulated and/or operating subsidiaries that operate under the BAC Credomatic trademark as a single institution throughout Central America, whose shares are held directly and indirectly by BAC Credomatic Inc.

The term “BHI Listing” is defined in this information statement under the caption “The Spinoff” starting on page 12.

The term “Banco de Bogotá” and “BdB”, refers to Banco de Bogotá S.A., a bank organized under Colombian laws and regulations, and a majority-owned subsidiary of Grupo Aval.

The term “BdB Demerger” is defined in this information statement under the caption “The Spinoff” starting on page 12.

The term “BVC” refers to Bolsa de Valores de Colombia, the Colombian stock exchange.

The term “Deceval” refers to Depósito Centralizado de Valores, the Colombian central deposit for securities.

The term “Depositary” refers to JPMorgan Chase Bank, N.A., as depositary for the ADSs, each ADS representing 20 preferred shares of Grupo Aval.

The term “Distribution” means the completion of the Grupo Aval Distribution, as such term is defined in this information statement under the caption “The Spinoff” starting on page 12.

The term “Grupo Aval” refers to Grupo Aval Acciones y Valores S.A. (“Grupo Aval”), a company domiciled in Bogotá, Colombia and organized under Colombian laws and regulations.

The term “Grupo Aval Demerger” is defined in this information statement under the caption “The Spinoff” starting on page 12.

The term “Spinoff” is defined in this information statement under the caption “The Spinoff” starting on page 12.

The term “Transactions” is defined in this information statement under the caption “The Spinoff” starting on page 12.

The term “Latinclear” refers to Central Latinoamericana de Valores, the Panamanian central deposit for securities.

The term “Latinex” refers to Bolsa Latinoamericana de Valores, the Panamanian stock exchange.

The term “Newco BdB” refers to Sociedad Beneficiaria Bogotá S.A.S., a company organized under Colombian laws and regulations

The term “Newco Aval” refers to Sociedad Beneficiaria Aval S.A.S., a company organized under Colombian laws and regulations.

The term “RNVE” refers to Registro Nacional de Valores y Emisores, an entity attached by the SFC and in which the shares and issuers are registered.

The term “SBP” refers to Superintendencia de Bancos de Panamá, the Panamanian Bank Superintendency.

The term “SEC” refers to the United States of America Securities and Exchange Commission.

The term “SFC” refers to Superintendencia Financiera de Colombia, the financial Superintendency of Colombia.

The term “SVM” refers to Superintendencia del Mercado de Valores, the stock market Superintendency in Panama.

The terms “U.S. dollar”, “USD”, “U.S.$” and “$”, refers to the lawful currency of the United States of America.

ii. AVAILABLE INFORMATION

Grupo Aval

Grupo Aval is the holding company to Colombia’s largest banking group (based on total assets as of December 31, 2020). Through its subsidiaries, Grupo Aval provides a comprehensive range of financial services and products from traditional banking services, such as making loans and taking deposits, to pension and severance fund management.

Grupo Aval files or furnishes annual, quarterly and other reports and other relevant information with the Registro Nacional de Valores y Emisores (“RNVE”), a registration system of the Superintendencia Financiera de Colombia (“SFC”), Colombia’s principal financial markets regulator, pursuant to Colombian securities laws and regulations as amended, and with the SEC, pursuant to the U.S. Securities Exchange Act of 1934, as amended. The documents filed or furnished by Grupo Aval with the SEC are available to the public at the SEC’s website at http://www.sec.gov. Certain of these documents and certain other information is also available for download free of charge on Grupo Aval’s investor relations website at https://www.grupoaval.com/investor-relations. Statements made in this information statement concerning the provisions of any contract, agreement, indenture, or other document referred to herein are not necessarily complete. With respect to each such statement concerning a contract, agreement, indenture or other document filed with the SEC, reference is made to such filing for a more complete description of the matter involved.

Grupo Aval’s website, the information contained therein or linked thereto and the information on the SEC’s website is not incorporated by reference into and should not be deemed part of this information statement.

BAC Holding International Corp.

BHI is a financial entity in the Republic of Panama, with a leasing license and, therefore, supervised and regulated by the General Direction of Financial Entities of the Ministry of Commerce and Industries of the Republic of Panama. BHI is the holding company of BAC Credomatic Inc, the leading private bank in Central America (based on total assets as of September 30, 2021). As of September 30, 2021, BHI had more than 4.1 million clients and 18,947 direct employees in the region.

Those Banking Groups over which SBP exercises a supervision of origin are subject to the consolidated supervision of banking groups, pursuant to the applicable provisions of Accord 7-2014.

Banking Group is defined, pursuant to Executive Decree No. 52 of April 30, 2008, whereby the Sole Text of Decree Law 9 dated 26 February 1998, modified by Decree Law 2 dated 22 February 2008 is adopted (“Banking Law”), as one constituted by a bank holding company and its subsidiaries at any level, whose activities consist, predominantly, of providing services in the banking or financial sectors, including nonbanking subsidiaries of the latter which, in the opinion of the SBP, operate under common management, either through the bank holding company or through different holdings or agreements.

As of the date of this information statement, BHI is not supervised, nor regulated by the SBP. However, BAC Holding International Corp. is the controlling entity of BAC International Bank Inc, a general license bank in Panama, supervised and regulated by the SBP.

As a listed issuer in the Colombian and Panamanian stock exchange, BHI will be required to keep up-to-date information with the RNVE and Latinex, and provide periodic information to the SFC and the SMV such as annual, quarterly, and other reports and relevant information pursuant to Colombian and Panamanian securities laws and regulations. Certain of these documents and other information will also be made available for download on BHI’s website at www.bac-holding.com.

The documents referred to in this information statement and the information accessible through the Company website are not incorporated by reference in and should not be deemed part of this information statement.

iii. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements under the captions “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and in other sections of this information statement that are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections, forecasts or assumptions of our future financial performance, our anticipated growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including the numerous risks discussed under the caption entitled “Risk Factors.”

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Except as required by law, neither Grupo Aval nor BHI are under any duty to update any of these forward-looking statements after the date of this information statement to conform our prior statements to actual results or revised expectations.

1. SUMMARY

This summary highlights information contained elsewhere in this information statement. This summary does not contain all of the information that you should consider. You should read this entire information statement carefully, especially the risks of owning our common stock discussed under “Risk Factors” and our audited and unaudited financial statements and our unaudited condensed pro forma financial information, and the respective notes thereto, appearing elsewhere in this information statement. Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement assumes the completion of all the transactions referred to in this information statement in connection with the Spinoff.

Overview

Prior to the Spinoff (as defined hereunder), BAC Holding International Corp. was a wholly owned subsidiary of Banco de Bogotá, a consolidated subsidiary of Grupo Aval. BHI is holding company whose only material tangible assets are its 100% equity ownership stake in BAC Credomatic Inc. and its 9.46% direct participation in BAC International Bank Inc. and its subsidiaries. BHI has a single class of ordinary shares outstanding with equal voting and economic rights.

BHI, through its subsidiary BAC International Bank, Inc. (a bank organized under the laws of Panama), is a full-service Central American financial institution with leading credit card issuance and merchant-acquiring franchises and operations in Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama.

Until September 30, 2021, BHI also owned an approximate 99.6% equity stake in Multi Financial Group, Inc., a company organized under Panamanian law (“MFG”), which provides financial services, mainly commercial, investment, mortgage and consumer banking, insurance, factoring and leasing, in Panama. MFG was acquired by Banco de Bogotá through BHI on May 22, 2020, and was demerged from BHI on September 30, 2021, and retained by Banco de Bogotá (the “MFG Demerger”). BHI’s audited financial statements for the year ended December 31, 2020, include eight months of MFG’s results within continuing operations, while BHI’s unaudited interim financial statements for the nine-month periods ended September 30, 2021 and 2020 reflect MFG’s results as discontinued operations. To facilitate comparability of the financial information included in this information statement, we have prepared unaudited pro forma income statement information for the nine-month period ended September 30, 2021, and the year ended December 31, 2020, which assume that MFG Demerger and the Spinoff occurred on January 1, 2020. For additional information see Section 7. “Unaudited Condensed Pro Forma Financial Information”.

The Spinoff

Grupo Aval has entered and caused certain of its direct and indirect subsidiaries, including Banco de Bogotá and BHI, to enter into a series of transactions, as follows:

The Banco de Bogotá Demerger

Grupo Aval (A) created a new Colombian corporation, Newco BdB, a wholly-owned subsidiary of Grupo Aval, and (B) on January 18, 2022, caused Banco de Bogotá to obtain authorization by the Superintendence of Finance of Colombia to execute an escisión, or demerger, under Colombian law, pursuant to which Banco de Bogotá will transfer to Newco BdB a 75% ownership stake in the share capital of BHI, and 100% of the share capital of Newco BdB will be issued pro rata to Banco de Bogotá’s shareholders (the “BdB Distribution”), resulting in both Banco de Bogotá and Newco BdB being owned by the shareholders of Banco de Bogotá (including Grupo Aval) pro rata to their respective ownership interests in Banco de Bogotá immediately prior to the BdB Demerger (as defined below).

The Grupo Aval Demerger

Grupo Aval (A) has created a new Colombian corporation, Newco Aval, a wholly-owned subsidiary of Grupo Aval, and (B) will execute an escisión, or demerger, under Colombian law pursuant to which Grupo Aval will transfer to Newco Aval the approximately 68.7% ownership stake in the share capital of Newco BdB that Grupo Aval received in the BdB Demerger, and 100% of the share capital of Newco Aval will be issued pro rata to Grupo Aval’s shareholders (the “Grupo Aval Distribution”), resulting in both Grupo Aval and Newco Aval being owned by the shareholders of Grupo Aval pro rata to their respective ownership interests in Grupo Aval immediately prior to the Grupo Aval Demerger (as defined below).

The BHI Listing and Mergers

Grupo Aval (A) caused BHI to submit an application to list its shares on the Bolsa de Valores de Panamá, the Panamanian stock exchange and the Colombian stock exchange, and has taken and will take other necessary actions to list the BHI Shares on these stock exchanges (as described under “The Spinoff” below) and (B) will cause Newco Aval and Newco BdB to merge with and into BHI, with BHI as the surviving company.

Effect of the Spinoff

The Transactions, as summarized in subsections (i) through (iii) above (collectively, the “Spinoff”), are expected to occur within a short period of each other, except for the BHI Listing on the Latinex, which became effective in Panamá on February 24, 2022.

The transactions, as summarized in subsections (i) through (iii) above will result in the share capital of BHI being publicly traded on the Latinex (the Panamanian stock exchange) and the BVC (Colombian stock exchange) and 75% of that share capital being owned by the shareholders of Grupo Aval and Banco de Bogotá (other than Grupo Aval, which will have spun off its direct interest) on a pro rata basis to their respective beneficial ownership stakes in BHI’s share capital immediately prior to the Spinoff. Immediately following the Spinoff, Grupo Aval’s shareholders will own approximately 51.5%, Banco de Bogotá’s shareholders (other than Grupo Aval) will own approximately 23.5% and Banco de Bogotá will continue to directly own 25% of the share capital of BHI. BHI’s only material asset is its ownership of 100% of the share capital of BAC Credomatic Inc. and its subsidiaries.

For more information, see Section 4. “Risk Factors—Risks Relating to the Spinoff” and Section 2. “The Spinoff” included elsewhere in this information statement.

Corporate Information

BAC Holding International Corp. is a company incorporated under the laws of the Republic of Panama, in the form of a corporation and existing in accordance with the laws of the Republic of Panama, through Public Deed No. 5,700 of August 30, 1972 of the Second Notary of the Circuit of Panama, registered in File 11657 of the Microfilm Section (Mercantile) of the Public Registry of the Republic of Panama, Volume 902, Folio 0070, Seat 104403, Roll 492, Image 90, since September 14, 1972. Its operation and extinction are governed by Panamanian law, which is, therefore, that of its nationality.

The main offices of BAC Holding International Corp. are located in Calle 26 #92-32, Bogotá D.C., Colombia; our secondary offices are located in Aquilino de la Guardia with Calle 49, PH B. Bogotá, Local No.1, Panama City, Republic of Panama. Their contact information is detailed below:

Phone:

In Panama: (507) 306-1100 ext. 110

Email: notificaciones@bac-holding.com

Website: www.bac-holding.com

Our website and the information contained therein or connected thereto is not incorporated into this information statement.

2. THE SPINOFF

Summary of the Spinoff

The following is a summary of the material terms of the Spinoff.

| Distributing Company | Grupo Aval Acciones y Valores S.A., a company domiciled in Bogotá, Colombia and organized under Colombian laws and regulations. After the Spinoff, Grupo Aval will beneficially own approximately 17.2% of BHI’s equity and BAC’s assets indirectly, through its equity stake in Banco de Bogotá, which will continue to directly own 25% of BHI’s equity. |

| | |

| Distributed Company | BAC Holding International Corp. (hereinafter “BHI”), is a Panamanian corporation and, following the Spinoff, will be a publicly traded company. |

| | |

| Distributed Company Structure | BHI is a holding company whose only material tangible assets are its beneficial 100% equity ownership stake in BAC Credomatic Inc. and its subsidiaries. |

| | |

| Colombian Record Date | The record date for the entitlement to a distribution of BHI Shares to holders of Grupo Aval’s common or preferred shares prior to the open of business (Bogotá, Colombia time) on March 28, 2022 (the “Colombian Record Date”). |

| | |

| ADS Record Date | The record date for the entitlement to a distribution of BHI Shares to holders of Grupo Aval’s ADSs (each ADS representing 20 Grupo Aval preferred shares), or the net proceeds of the sale thereof, is on the close of business (New York City time) on March 28, 2022 (the “ADS Record Date”). |

| | |

| Distributed Securities | BHI’s 43,220,189,095 common shares, par value $ 0.0662975983446469 per share (each, a “BHI Share” and together the “BHI Shares”) |

| | |

| Distribution Ratio | Holders of Grupo Aval’s common and preferred shares (including the Depositary for Grupo Aval’s ADSs) are each entitled to receive one BHI Share for each one common and preferred shares of Grupo Aval that they own. Holders of Grupo Aval’s ADSs will be entitled to elect to take delivery in their brokerage account in Colombia of 20 BHI Shares for each one Grupo Aval ADS that they own on the ADS Record Date. See “Questions and Answers About the Spinoff and Your BHI Securities—I am an ADS holder. How do I elect to receive BHI common shares?” Alternatively, holders of Grupo Aval’s ADSs that do nothing or fail to validly make an election will receive the net cash proceeds from the sale of the BHI Shares they would otherwise have been entitled to receive. |

| | |

| Fractional Shares | There will be no fractional BHI Shares distributed in the Spinoff. |

| | |

| Stock Exchange Listing | The BHI Shares are listed on the Latinex under the ticker symbol BHOL. The BHI Shares are expected to be listed and to commence trading on the BVC under the (ticker symbol not yet available) on or around March 30, 2022. |

| | |

| Dividend Policy | For more information, see “Dividend Policy.” |

| | |

| Registrar | Depósito Centralizado de Valores (“Deceval”), the Colombian central deposit for securities. |

The Spinoff

Grupo Aval has entered and caused certain of its direct and indirect subsidiaries, including Banco de Bogotá and BHI, to enter into a series of transactions, as follows (the “Transactions”):

(i) The Banco de Bogotá Demerger

Grupo Aval (A) created a new Colombian corporation Sociedad Beneficiaria Banco de Bogotá S.A.S. (“Newco BdB”), a wholly-owned subsidiary of Grupo Aval, and (B) on January 18, 2022, caused Banco de Bogotá to approve an escisión, or demerger, under Colombian law, pursuant to which Banco de Bogotá will transfer to Newco BdB a 75% ownership stake in the share capital of BHI, and 100% of the share capital of Newco BdB will be issued pro rata to Banco de Bogotá’s shareholders (the “BdB Distribution”), resulting in both Banco de Bogotá and Newco BdB being owned by the shareholders of Banco de Bogotá (including Grupo Aval) pro rata to their respective ownership interests in Banco de Bogotá immediately prior to such demerger (the “BdB Demerger”).

The Banco de Bogotá Demerger is expected to be completed on or around March 25, 2022.

(ii) The Grupo Aval Demerger

Grupo Aval (A) has created a new Colombian corporation Sociedad Beneficiaria Aval S.A.S. (“Newco Aval”), a wholly-owned subsidiary of Grupo Aval, and (B) on February 4, 2022 obtained approval from its shareholders to execute an escisión, or demerger, under Colombian law pursuant to which Grupo Aval will transfer to Newco Aval the approximately 68.7% ownership stake in the share capital of Newco BdB that Grupo Aval received in the BdB Demerger, and 100% of the share capital of Newco Aval will be issued pro rata to Grupo Aval’s shareholders (the “Grupo Aval Distribution”), resulting in both Grupo Aval and Newco Aval being owned by the shareholders of Grupo Aval pro rata to their respective ownership interests in Grupo Aval immediately prior to such demerger (the “Grupo Aval Demerger”).

The Grupo Aval Demerger is expected to be completed on or around March 28, 2022.

(iii) The BHI Listing and Mergers

Grupo Aval (A) caused BHI to submit an application to list its shares on the Bolsa de Valores de Panamá, the Panamanian stock exchange (the “Latinex”), which became effective on February 24, 2022, and the Bolsa de Valores de Colombia S.A. (the “BVC”), which is expected to become effective on or around March 30, 2022, and has taken and will take other necessary actions to list the BHI Shares on these stock exchanges (the “BHI Listing”) and (B) will cause Newco Aval and Newco BdB to merge with and into BHI, with BHI as the surviving company (the “Mergers”).

The Mergers are expected to be completed on or around March 29, 2022.

Effect of the Spinoff

The Transactions, as summarized in subsections (i) through (iii) above (collectively, the “Spinoff”), are expected to occur within a short period of each other, except for the BHI Listing on the Latinex, which became effective in Panamá on February 24, 2022.

The transactions, as summarized in subsections (i) through (iii) above will result in the share capital of BHI being publicly traded on the Latinex (the Panamanian stock exchange) and the BVC (Colombian stock exchange) and 75% of that share capital being owned by the shareholders of Grupo Aval and Banco de Bogotá (other than Grupo Aval, which will have spun off its direct interest) on a pro rata basis to their respective beneficial ownership stakes in BHI’s share capital immediately prior to the Spinoff. Immediately following the Spinoff, Grupo Aval’s shareholders will own approximately 51.5%, Banco de Bogotá’s shareholders (other than Grupo Aval) will own approximately 23.5% and Banco de Bogotá will continue to directly own 25% of the share capital of BHI. BHI’s only material asset is its ownership of 100% of the share capital of BAC Credomatic Inc. and its subsidiaries.

In anticipation of the Spinoff, in order to avoid the issuance of fractional shares to Grupo Aval’s shareholders, BHI split its 77,443,101 common shares outstanding as of September 30, 2021 into 43,220,189,095 common shares, reflecting a stock split ratio of approximately 558.09 to 1, which will be outstanding immediately prior to the Spinoff.

For more information, see Section 4. “Risk Factors—Risks Relating to the Spinoff” and Section 2. “The Spinoff” included elsewhere in this information statement. The Spinoff resulted in the share capital of BHI being publicly traded on the Latinex and the BVC and 75% of that share capital being owned by the shareholders of Grupo Aval and Banco de Bogotá (other than Grupo Aval, which has spun off its direct interest) on a pro rata basis to their respective beneficial ownership stakes in BHI’s share capital immediately prior to the Spinoff. Immediately following the Spinoff, Grupo Aval’s shareholders will beneficially own approximately 51.5%, Banco de Bogotá’s minority shareholders (other than Grupo Aval) will own approximately 23.5% and Banco de Bogotá will continue to directly own 25% of the share capital of BHI. BHI’s only material asset is its ownership of 100% of the share capital of BAC Credomatic Inc. and its subsidiaries.

Listing and Trading of Our Common Shares

The Superintendencia del Mercado de Valores de Panama authorized the registration of the BHI shares, under resolution number smv-531-21, dated December 13, 2021; BHI is also listed in the Latinex as of February 24, 2020.

In addition, BHI’s shares are expected to be registered in the RNVE and listed for trading on the BVC on or around March 30, 2022.

In relation to the operational processes to allow the simultaneous trading of the shares in both Exchanges, Latinex and the BVC, as well as the Central Latinoamericana de Valores, S.A. and the Depósito Centralizado de Valores de Colombia S.A. ("DECEVAL"), established procedures for the regulation of simultaneous trading of shares on both stock exchanges; the purpose is to have an orderly and transparent process for investors to decide where to acquire their shares: in Colombia or in Panama.

3. QUESTIONS AND ANSWERS ABOUT THE SPINOFF AND YOUR BHI SECURITIES

| Why am I receiving this document? | Grupo Aval is distributing, through several steps in the Spinoff, its equity stake in BHI to its shareholders on a pro rata basis. See Section 1. “Summary—The Spinoff.” BHI is delivering this document to you because it believes you are resident in the United States or are a “U.S. person” (as defined under U.S. securities laws) and that you are a holder of Grupo Aval’s common or preferred shares Grupo Aval’s preferred shares in the form or ADSs (a “U.S. shareholder”). As a U.S. shareholder of Grupo Aval, you are entitled to receive this English-language information statement, in compliance with the requirements of the U.S. Securities and Exchange Commission’s Staff Legal Bulletin No. 4. |

| | |

| What are the reasons for the Spinoff? | The main objectives of the Spinoff are to simplify Banco de Bogotá’s and Grupo Aval´s corporate structure, to allow for a more efficient use of capital and to simplify the decision-making processes throughout the regions in which they operate. Also, Grupo Aval believes that the proposed spin-off would allow Grupo Aval, Banco de Bogotá, and BHI to improve their respective strategic positions to capture future growth and to enhance adaptability to their local market dynamics. Here are some of the Spinoff’s drivers: · Since the BAC acquisition, Grupo Aval has experienced a material increase in exposure to i) non-Colombian assets, ii) non-Colombian sovereign risks, and iii) exchange rate (FX) fluctuations. · Banco de Bogotá and Grupo Aval’s decrease in its ownership in BAC would eliminate current multi-jurisdictional complexities, potentially unlocking value for their respective shareholders. · As a result of the Spinoff, Banco de Bogotá’s management team would be mainly focused on the Colombian market, allowing the company to execute its business plan with reduced capital requirements. Both management teams at Banco de Bogotá and BAC would work independently in their own markets towards their strategic objectives: digital transformation, operational excellence, risk control and the best human talent. This would greatly simplify the execution of the strategies in both markets. · Grupo Aval would continue to operate as a financial holding with equity controlling positions in banks, in its pension fund manager, and in the non-financial sector, mainly in oil and gas and infrastructure. It would continue focusing on maximizing returns to its shareholders, leading the strategic planning and sharing best practices among portfolio companies, receiving dividends from its subsidiaries, analyzing opportunities to optimize its portfolio, and identifying avenues for growth across markets. · Grupo Aval, Banco de Bogotá and BAC would have a cleaner story for the market and ease the understanding of the performance and potential of both operations for investors, lenders, regulators, research analysts and others. · Grupo Aval would strengthen its strategic focus in Colombia and improve its capacity to compete. · Grupo Aval’s and Banco de Bogotá’s shareholders, as direct shareholders of BAC, would continue to benefit from the high performance and growth potential of BAC throughout Central America. · Because Banco de Bogotá would reduce its equity ownership in BAC to 25% as a result of the Spinoff, each of Banco de Bogotá and Grupo Aval would cease to consolidate BAC in its financial statements, including BAC’s risk assets and BAC’s goodwill. This would in turn eliminate the impact of FX volatility and several important current capital restrictions. · Banco de Bogotá would strengthen its capital level supporting its transition to Basel III. · The Spinoff would grant stakeholders flexibility to choose in which markets they wish to participate. · Investors would have direct access to the only listed regional bank in Central America with a strong presence in the region and significant U.S. dollar exposure. · The Spinoff would not affect the scope of the services provided to clients and account holders in Colombia or Central America. Clients are at the center of our strategy; therefore, Banco de Bogotá and BAC would continue to serve them through top-notch customer experiences and product offerings. The ultimate controlling shareholder (i.e., majority shareholder) of Grupo Aval, Banco de Bogotá and BAC would not change as a result of the Spinoff. |

| How is the Spinoff of BHI structured and why? | The Spinoff is structured as a demerger (“escisión” under Colombian law). Under Colombian law and practice, spin-offs are not effected as share dividends but rather through demerger transactions. Further, under Colombian law, an escisión is the only way that a regulated financial entity, such as Banco de Bogotá, is permitted to spin-off a subsidiary (as Colombian law imposes limitations on in-kind dividends that may be distributed by a regulated financial entity). An escisión is also the only way a regulated non-financial entity, such as Grupo Aval, is permitted to effectively distribute assets with a value in excess of its distributable income. As a result of these Colombian law requirements, the Spinoff must be effected through a series of demerger and merger transactions described below. The end result of these transactions is a distribution of BHI shares to Banco de Bogotá’s and Grupo Aval’s shareholders, identical to what would have resulted from a simple dividend in kind of BHI shares by each of Banco de Bogotá and Grupo Aval |

| | |

| What will I receive in the Spinoff? | If you are a holder of record date of Grupo Aval’s common or preferred shares immediately prior to the open of business (Bogotá, Colombia time) on March 28, 2022 (the “Colombian Record Date”), you will receive one BHI common share for each Grupo Aval common or preferred share that you own. If you are a holder of record of Grupo Aval’s ADSs (each of which represents 20 Grupo Aval preferred shares) as of the close of business (New York City time) on March 28, 2022 (the “ADS Record Date”), you are entitled to elect to receive either: (1) 20 BHI common shares for each Grupo Aval ADS that you own (provided that you follow the instructions described below under “How do I elect to elect to receive BHI common shares?”; or (2) The net cash proceeds from the sale of the BHI common shares you would have been entitled to receive had you made the election and followed the instructions set forth in the preceding bullet. |

| | |

| Is the Spinoff subject to approval? Do I have a vote on the Spinoff? | All of the conditions to the Spinoff have been met. The Spinoff has been approved by Grupo Aval’s common shareholders and has received all other requisite corporate and regulatory approvals. Accordingly, Grupo Aval is not seeking your approval for the Spinoff. Grupo Aval is not asking for a proxy to vote on the Spinoff or the distribution to you of BHI’s common shares or cash in lieu thereof, and requests that you do not send Grupo Aval a proxy. |

| What do I have to do to participate in the Spinoff? | You are not required to take any action to participate in the Spinoff or, if you own Grupo Aval common or preferred shares, to receive BHI Shares in the Distribution. If you own Grupo Aval ADSs, and wish to take delivery of the BHI preferred shares to which you are entitled, you are required to take action to receive BHI common shares, as described under “How do I elect to elect to receive BHI common shares?” below. You are urged to read this entire document carefully. If you are unable to take delivery of the BHI Shares in Colombia, no action is required on your part and you will receive the net cash proceeds from the Depositary’s sale of the BHI Shares that you would otherwise have been entitled to receive. |

| | |

| I am an ADS holder. How do I elect to receive BHI common shares? | In order to elect to receive BHI Shares you will need to have an account with a bank or broker located in Colombia. You will then need to instruct the bank or broker with whom you hold your Grupo Aval ADSs that you wish to elect to take delivery of the BHI Shares, have such bank or broker make the election through the Elective Dividends System function at The Depository Trust Company (“DTC”) and provide such bank or broker with a properly completed “Instruction Form for Delivery of Spun-Off Shares in the Colombian Local Market” (the form of which is available as an attachment to the market announcement made by the Depositary to DTC). |

| | |

| I am an ADS holder. How do I elect to receive cash instead of the BHI common shares to which I am entitled? | You do not need to make any election to receive an entitlement to the net cash proceeds from the sale of the BHI Shares received on account of your Grupo Aval ADSs. The Depositary will also automatically sell any and all BHI Shares not delivered to ADS holders who elect to receive the BHI Shares they are entitled to in Colombia, whether as a result of improper instructions, failure by the receiving institution to take necessary action, or for any other reason. |

| | |

| How will fractional shares be treated in the Spinoff? | As the distribution ratio is one-to-one, no fractional BHI shares will be issued in the Spinoff. |

| | |

| Will the number of Grupo Aval shares I own change as a result of the distribution? | No, the number of Grupo Aval shares you own will not change as a result of the distribution. Immediately following the Spinoff, you will hold the same number of shares or ADSs of Grupo Aval that you held immediately prior to the Spinoff. Your proportionate interest will also not change, so you will own the same proportionate amount of Grupo Aval immediately following the Spinoff that you owned of Grupo Aval immediately prior to the Spinoff. |

| | |

| When will the Spinoff occur? | The Spinoff is being completed in steps. The last step, which is expected to be the listing and commencement of trading of BHI Shares on the BVC, is expected to be completed on or around March 30, 2022. |

| | |

If I sell my shares of Grupo Aval common shares, preferred shares or ADSs on or before the Spinoff date, will I still be entitled to receive shares of BHI common stock in the Spinoff? | You will be entitled to receive BHI Shares in the Spinoff only if you held of record (or are a beneficial owner holding through a nominee who held of record) Grupo Aval common or preferred shares on the Colombian Record Date or Grupo Aval ADSs on the ADS Record Date. |

How will I receive my shares of BHI common stock? | If you hold Grupo Aval common or preferred shares through Deceval or through a Colombian broker or nominee who holds such shares through Deceval, the BHI shares to which you are entitled will be delivered to you through the facilities of Deceval or will be deposited in book-entry form in your brokerage account, as applicable. If you hold Grupo Aval ADSs and wish to receive the BHI Shares to which you are entitled, you must: (1) procure that the broker through which you own such ADSs makes or procures a proper and timely election on your behalf; (2) if you do not have a Colombian brokerage account, establish an account with a bank or broker in Colombia (or make arrangements with your current broker for establishing a correspondent account); and (3) properly complete and timely deliver (or have your broker properly complete and timely deliver on your behalf) the “Spin-Off Share Delivery Instruction Form” to the Depositary. The instructions and deadlines for completing the “Spin-Off Share Delivery Instruction Form”, in the form of a “DR Market Announcement” that was sent to DTC participants for transmission to brokers, is attached as Exhibit A to this information statement. The “Spin-Off Share Delivery Instruction Form” is attached as Exhibit B to this information statement. The Depositary will attempt to deliver any BHI Shares to which you are entitled to the account set forth in such instruction form. The Depositary will only attempt delivery once. If delivery fails for any reason, the BHI Shares for which you sought delivery will be sold and you will receive the net cash proceeds to which you would have been entitled as if no election were made. |

| | |

| What are the conditions to the Spinoff? | There are no conditions to the distribution; all regulatory and other requisite approvals have been obtained, and the record date has been established. |

| | |

Can Grupo Aval decide to cancel the Spinoff even if all the conditions have been met? | No. As of the date of this information statement, Grupo Aval is not entitled to, nor does it intend to, cancel the Spinoff. |

| | |

What are the U.S. federal income tax consequences of the Spinoff to me? | The Spinoff is not expected to qualify for tax-free treatment for U.S. federal income tax purposes. Accordingly, the receipt of our common shares will be taxable to you as a dividend to the extent of Grupo Aval’s current and accumulated earnings and profits, as determined under U.S. federal income tax principles. For a more detailed description, see the section entitled “Material Tax Consequences—United States Federal Income Taxation Considerations for U.S. Holders.” |

| | |

Will my Grupo Aval common or preferred shares continue to trade before and following the Spinoff? | Your Grupo Aval common and preferred shares will temporarily cease trading on the BVC starting on March 22, 2022 and will resume trading on the BVC on March 30, 2022. The last day to trade your Grupo Aval common and preferred shares on the BVC prior to the trading stoppage is March 18, 2022 (as March 21, 2022 is a holiday in Colombia). This temporary trading stoppage is necessary to effect the corporate formalities and register the BHI shares in the correct account, It is also customary in Colombia for effecting a demerger (escisión). The duration of the trading stoppage is necessary to complete the multiple steps of the Spinoff. |

| | |

| Will my shares of Grupo Aval ADSs continue to trade before and following the Spinoff? | Your Grupo Aval ADSs will continue to trade on the New York Stock Exchange (the “NYSE”) as normal, without interruption. |

| | |

| Can I cancel my ADSs for Grupo Aval’s preferred shares, or deposit my Grupo Aval preferred shares for ADSs? | The Depositary’s books for issuances and cancellations of Grupo Aval ADSs will be closed starting on the close of business (New York City time) on March 18, 2022 through the close of business (New York City time) on March 29, 2022. During this period you will not be able to “exchange” Grupo Aval’s preferred shares for its ADSs, or vice versa. |

| | |

| How will BHI common stock trade? | BHI’s shares of common stock will commence trading on the Latinex under the ticker symbol BHOL as soon as you receive the shares and the BVC (ticker symbol not yet available) on or around March 30, 2022. We expect the principal trading market for the BHI shares to be the BVC, although we cannot guarantee that a liquid trading market will develop on either the BVC or the Latinex. |

| Are there risks associated with owning shares of BHI common stock? | Yes. BHI’s business is subject to both general and specific risks, including risks relating to BHI’s business, BHI’s relationship with Grupo Aval and Banco de Bogota following the Spinoff and of BHI being a separate, publicly traded company. Accordingly, you should read carefully the information set forth in the section entitled “Risk Factors.” |

| | |

| Does BHI intend to pay cash dividends? | The General Shareholders' Meeting of BHI, which will first occur only some time after the Spinoff, has not determined a general policy for the payment of future dividends other than as described under the caption “Description of Capital Stock.” While BHI has in the past paid dividends, as described under “Dividend Policy,” there is no assurance that we will do so in the future. |

| | |

| What will BHI’s relationship be with Grupo Aval and Banco de Bogotá following the Spinoff? | BHI has certain relationships with Banco de Bogotá and Grupo Aval whereby BHI and its subsidiaries have obtained loans from Grupo Aval and its subsidiaries in the ordinary course of business, and may enter into certain other agreements with Banco de Bogotá and Grupo Aval in future. For more information on this and other transactions with related parties see Section 13. “Certain Relationships and Related Party Transactions”. |

| | |

| Do I have appraisal or similar rights in connection with the Spinoff? | Grupo Aval shareholders are not entitled to appraisal rights, or “withdrawal rights” as similar rights are referred to under Colombian law, in connection with the Spinoff. |

| | |

| Who is the registrar for BHI common shares? | The registrar for BHI common shares is Deceval, the entity that operates the Colombian national stockholder registry. |

| | |

| Where can I get more information? | If you hold Grupo Aval ADSs, and have questions about your rights to receive BHI Shares or cash in the Spinoff, you may contact the Depositary at: JPMorgan Service Center Toll Free: +1 800-990-1135 Toll: +1 651-453-2128 If you hold Grupo Aval common or preferred shares or have other questions about the Spinoff, you may contact Grupo Aval’s Investor Relations department at: Grupo Aval Investor Relations Phone: +571-743-3222 ext. 23350 Email: investorrelations@grupoaval.com |

| |

4. RISK FACTORS

Our business, financial condition and results of operations could be materially and adversely affected if any of the risks described below occur. In such an event, the market price of our common shares could decline, and you could lose all or part of your investment. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business.

Summary

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in this Section 4. “Risk Factors” in this information statement for a more thorough description of these and other risks:

Risks relating to the Spinoff

| · | BHI has never operated as a standalone public company and the resulting obligations including the process of compliance with the issuer’s duties to the public according to the rules of two different national securities regulators, including the Superintendencia Financiera de Colombia, the Bolsa de Valores de Colombia, the Latinex and the Superintendencia de Valores de Panama, may be costly and cumbersome and can represent challenges for BHI. |

| · | As result of the Spinoff, Bolsa de Valores de Panamá, Bolsa de Valores de Colombia and their respective clearing houses have entered into an agreement related to the operative procedures that are required for this dual listing. For that reason, all the operations related to dividend payments in the Colombian jurisdiction, including Tax and Foreign Exchange Matters, may take some time for the issuer to process without delay or error. |

| · | Grupo Aval and BHI may be unable to achieve some or all of the benefits that they expect to achieve from BHI’s separation from Grupo Aval. |

| · | Following the Spinoff, BHI will need to provide for or arrange for certain services to be provided in order to function as a public Company. |

| · | Neither BHI’s historical financial information nor BHI’s unaudited pro forma financial information included in this information statement are necessarily representative of the results BHI would have achieved as an independent, publicly traded company and may not be a reliable indicator of BHI’s future results. |

Risks relating to the countries in which we operate

| · | We are exposed to adverse economic and political conditions in the Central American countries in which BAC Credomatic Group operates (Guatemala, Honduras, El Salvador, Honduras, Nicaragua, Costa Rica and Panama), including variations in the exchange rates or downgrades in credit ratings of sovereign debt securities. |

| · | We are exposed to the vulnerability to external shocks of the Central American economies; |

| · | We are exposed to internal security issues that have had or could have a negative effect on the Central American economies; |

| · | We are exposed to political and economic instability in the Central American region; |

| · | We are exposed to changes in Government policies and actions, as well as judicial decisions in the countries in which we operate that could significantly affect the local economy; |

| · | We are exposed to claims related to violations of anti-corruption laws and other laws in the jurisdictions in which we operate; |

| · | We are exposed to significant compliance risks in connection with a multi-jurisdictional regulatory regime in the countries which we operate; |

| · | We are exposed to changes in tax regulations or the interpretation thereof that could result in new or higher taxes; |

| · | We are exposed to natural disasters, acts of war or terrorism, rioting or other external events; |

| · | We are exposed to public health threats such as the coronavirus outbreak and other pandemic diseases; and |

| · | We are exposed to risks related to global climate change and environmental requirements; |

Risks relating to our businesses and industry

| · | Risks relating to our banking business |

| o | we are exposed to a deterioration in asset quality, including the loan portfolios of our banking subsidiaries; |

| o | we are exposed to the inability of our banking subsidiaries to realize on collateral or guarantees of secured loans; |

| o | we are exposed to limitations on the ability of our banking subsidiaries to collect on monetary obligations and enforce rights against collateral or under guarantees imposed by Central American insolvency laws; |

| o | we are exposed to failures of our risk management processes, including credit and market risk; |

| o | we are exposed to declines in the value of our banks’ fixed income portfolios; |

| o | we are exposed to counterparty risk; |

| o | we are exposed to liquidity risk; |

| o | we are exposed to defaults by one or more of our largest borrowers; |

| o | we are exposed to downgrades in our long-term credit ratings or in the credit ratings of our banking subsidiaries; |

| o | we are exposed to prepayment risk; |

| o | we are exposed to high competition in the credit card industry; |

| o | we are exposed to fraud related the collateral and guaranties granted by clients in secured loans; |

| o | we are exposed to changes in banking and financial services laws and regulations in the countries in which we operate; |

| o | we are exposed to changes in accounting standards; |

| o | we are exposed to regulatory actions that may result in fines, penalties or restrictions, including the closure of an operation; |

| o | we are exposed to legal and other challenges to maximize revenue from credit card fees and other fees from customers; |

| o | we are exposed to the failure to protect personal information; |

| · | Other risks relating to our businesses |

| o | we are exposed to fluctuations in interest rates and other market risks; |

| o | we are exposed to our inability to effectively manage risks associated with the replacement of benchmark indices; |

| o | we are exposed to fluctuations between the local currencies where we operate, and the U.S. dollar; |

| o | we are exposed to risks derived from acquisitions and strategic partnerships not performing in accordance with expectations, failing to receive required regulatory approvals or disrupting our operations; |

| o | we are exposed to risks derived from our inability to manage our growth successfully; |

| o | we are exposed to operational risks; |

| o | we are exposed to risks derived from the failure of our information systems; |

| o | we are exposed to cybersecurity threats; |

| o | we are exposed to risks derived from our inability to detect money laundering and other illegal or improper activities fully or on a timely basis; |

| o | we are exposed to competition and consolidation in the Central American banking and financial industry; |

| o | we are exposed to risks derived from our dependency on our senior management and Board of Directors; |

| o | we are exposed to reputational risk; |

| o | we are exposed to risks derived from conflicting interests between our controlling shareholder and other common shareholders; |

| o | we are exposed to risks relating to the different processes of reorganization, insolvency, and liquidation to which the Company may be subjected; and |

| o | we are exposed to new incumbent risks related to countries changing its currencies and declaring crypto assets as the legal tender currency. |

| o | we are exposed to Public Purchase Operations (OPA´s) that may result in an attempt of a hostile takeover and the entering of new unknown partners into the structure of the Company, as the Company becomes publicly traded. |

Risks Relating to Our Common Shares

| · | There is currently no market and historically has not been a market for BHI’s securities, and upon commencement of trading, the price of BHI’s securities may be volatile until and to the extent a market develops for such securities. |

| · | The relative illiquidity of the Colombian and Panamanian securities markets may impair the ability of shareholders to sell common stock. |

| · | An active market for our securities may never develop or be maintained and the market price of our common stock may fluctuate in response to numerous factors. |

| · | We are subject to different corporate rules and regulations than those available in other jurisdictions which may make it more difficult to holders of our securities to protect their interests. |

| · | We are traded on more than one market and this may result in price variations; in addition, investors may not be able to easily move shares for trading between such markets. |

| · | Banking regulations, accounting standards and corporate disclosure applicable to us differ from those in the United States and other countries. |

| · | U.S. investors in our securities may find it difficult or impossible to enforce service of process and enforcement of judgments against us and our officers and directors. |

| · | Our shareholders are exposed to a risk that the Company will not generate profits in one or more financial years and may affect the production, decree and/or distribution of profits. |

| · | Our shareholders are exposed to a risk related to the collection of dividends by judicial means. |

Risks Relating to the Spinoff

BHI has never operated as a standalone public company and the resulting obligations including the process of compliance with the issuer’s duties to the public according to the rules of two different national securities regulators, including the Superintendencia Financiera de Colombia, the Bolsa de Valores de Colombia, the Latinex and the Superintendencia de Valores de Panama, may be costly and cumbersome and can represent challenges for BHI.

As a listed company on both the Latinex, the Panamanian stock exchange, and the Bolsa de Valores de Colombia (BVC), the Colombian Stock Exchange, BHI will be subject to a series of new compliance duties pursuant to the Panamanian and Colombian securities laws and regulations established by the Superintendencia de Valores de Panama (SBP) and the Superintendencia Financiera de Colombia (SFC), the principal financial regulators in each of those countries, respectively. These duties and obligations include, but are not limited to, periodic reporting of annual, quarterly and other periodic financial information, relevant regulatory communications for investors and the general public, and any additional current or future reporting and disclosure requirements established by the relevant regulatory authorities for publicly listed companies in Colombia and Panama. Having never operated as a standalone public company, these obligations represent new processes and requirements that BHI will need to fully integrate into its internal processes and operations to ensure compliance. This integration may pose challenges as well as additional costs to the Company as any necessary changes are implemented over time and in areas across the organization such as finance, technology, legal, and human resources, among others, to effectively manage the additional obligations resulting from being a public company. Furthermore, and as an example of potential additional costs, senior management may have limited experience in operating a standalone public company and may need to hire additional resources to efficiently execute additional duties. To the extent that all requirements are not fulfilled completely or in a timely manner, the Company may be subject to and incur in sanctions and fines according to the disciplinary actions established by the relevant regulatory authorities which may impact the Company’s results of operations in the future. Additionally, as a consequence of the Spinoff, BHI amended and restated its by-laws, including several provisions, as described elsewhere in this information statement, that are advised and required for any issuer trading shares in the Bolsa de Valores de Colombia. These changes will result in new procedures, duties and corporate government instances that may take time to be fully implemented by the Company. For more information on provisions included in the Articles of Incorporation see Section 16. “Description of Capital Stock”.

As result of the Spinoff, Bolsa de Valores de Panamá, Bolsa de Valores de Colombia and their respective clearing houses have entered into an agreement related to the operative procedures that are required for this dual listing. For that reason, all the operations related to dividend payments in the Colombian jurisdiction, including Tax and Foreign Exchange Matters, may take some time for the issuer to process without delay or error.

As a result of the dual listing, the Panamanian and Colombian stock exchanges have adopted an agreement that will regulate BHI´s shareholders activities, including stock trading and dividend payment process. For the dividend payment process, once the Shareholders Meeting agrees to a dividend payment, BHI will communicate to both stock exchanges the amount and payment dates and will proceed to deposit the corresponding amount directly to Deceval in Colombia and to Latinclear in Panamá. BHI will declare its dividend in U.S. dollars, and it will be paid in U.S. dollars for all the shareholders listed in Panamá and in Colombian Pesos, at the market exchange rate at that date, for the shareholders listed in Colombia, such that these shareholders will bear the risk of foreign exchange fluctuations between the date of payment to Deceval and the date of dividend payment to the shareholders. Additionally, before the payment BHI will coordinate with each stock exchange the final amount to be paid to each shareholder net of any applicable tax deductions, considering the personal data base that will include the corresponding tax rate to be applied in each jurisdiction. Due to the complexity of payments in two separate jurisdictions, as well as foreign exchange considerations in Colombia and different tax treatments in each jurisdiction, it may take some time for BHI to process without delay or error operations related to dividend payments.

Grupo Aval and BHI may be unable to achieve some or all of the benefits that they expect to achieve from BHI’s separation from Grupo Aval.

Grupo Aval believes that, with BHI as an independent, publicly traded company, Grupo Aval and BHI will both be better positioned to, among other things, work independently in their own markets towards their strategic objectives; digital transformation, operational excellence, risk control and the best human talent. However, BHI and Grupo Aval may be unable to achieve some or all of these benefits. For example, in order to position BHI for the Spinoff, BHI is undertaking a series of strategic, structural, process and system realignment and restructuring actions within its operations. These actions may not provide the benefits BHI and Grupo Aval currently expect, and could lead to disruption of BHI’s operations, loss of, or inability to recruit, key personnel needed to operate and grow BHI’s businesses following the separation, weakening of BHI’s system of internal controls or procedures and impairment of BHI’s key customer and supplier relationships. In addition, completion of the separation will require significant amounts of management’s time and effort, which may divert management’s attention from operating and growing BHI’s and Aval’s respective businesses. If BHI and Aval fail to achieve some or all of the benefits that they to achieve from the Spinoff, or does not achieve them in the time BHI and Aval expect, BHI and Aval’s respective business, financial condition and results of operations could be materially and adversely affected.

Following the Spinoff, BHI will need to provide for or arrange for certain services to be provided in order to function as a public Company.

Following the separation and distribution, BHI will need to provide internally or obtain from unaffiliated third parties certain services in order to function as a public company. These services include certain information technology, finance, legal, insurance and human resources activities, the effective and appropriate performance of which is critical to BHI’s operations. BHI may be unable to obtain these services in a timely manner or on favorable terms and conditions. In particular, the information technology networks and systems that BHI will require in order to function as a public company are challenging, and arranging for these networks and systems will be challenging. BHI may be unable to successfully establish the infrastructure or implement the changes necessary to effectively perform these activities within the context of BHI’s consolidated business, or BHI may incur additional costs in doing so that could adversely affect its business. If BHI fails to obtain the quality of administrative services necessary to operate effectively or incurs greater costs in obtaining these services, BHI’s profitability, financial condition and results of operations may be materially and adversely affected.

In connection with the Spinoff, trading in Grupo Aval’s common and preferred shares will be temporarily suspended starting on March 22, 2022 through the close of business (Bogotá, Colombia time) on March 29, 2022 and exchanges of preferred shares for ADSs, and vice versa, will not be permitted during a similar period. This could have a material adverse effect on the liquidity of Grupo Aval’s shares and could cause the market prices of its securities to decline once trading resumes.

To facilitate the Spinoff in compliance with Colombian law and practice, Grupo Aval’s common and preferred shares will be suspended from trading on the BVC starting on March 22, 2022 through close of business (Bogotá, Colombia time) on March 29, 2022, and will resume trading on March 30, 2022. During this time, there will not be a liquid market for your Grupo Aval common or preferred shares. Any private sale of Grupo Aval common or preferred shares during this period will not be based on a quoted market price and therefore may not reflect the underlying value of such securities. In addition, once trading of Grupo Aval common or preferred shares on the BVC reopens, it may take time for the market to absorb recent developments, including the Spinoff, and such trading could result in substantial price fluctuations or declines in the market price of some or all of Grupo Aval’s outstanding securities.

While Grupo Aval’s ADSs will continue to trade on the New York Stock Exchange, the deposit of preferred shares in exchange for the issuance of ADSs and the redemption of ADSs for preferred shares will be prohibited from the close of business (New York City time) on March 18, 2022 through close of business (New York City time) on March 29, 2022. This could cause a decline in market liquidity for Grupo Aval’s ADSs, which in turn could result in substantial price fluctuations or declines in their market price.

Neither BHI’s historical financial information nor BHI’s unaudited pro forma financial information included in this information statement are necessarily representative of the results BHI would have achieved as an independent, publicly traded company and may not be a reliable indicator of BHI’s future results.

The financial information of BHI included in this information statement, and accompanying notes thereto, and BHI’s unaudited pro forma financial information included herein may not reflect what BHI’s financial condition, results of operations and cash flows would have been had BHI been an independent, publicly traded company during the periods presented or what BHI’s financial condition, results of operations and cash flows will be in the future when BHI is an independent public company. This is primarily because:

| · | The historical financial information included in this information statement (except for the consolidated balance sheet as of September 30, 2021) includes the results of MFG, which was spun off by BHI on September 30, 2021, in contemplation of the Spin-off; |

| · | The historical financial information included in this information statement does not reflect certain changes that BHI intends to make or is likely to experience in connection with the Spin-off, including the establishment of new functions, such as investor relations, and the compliance and other costs of being a public company; |

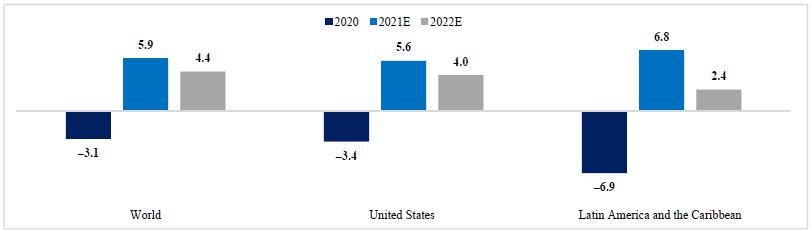

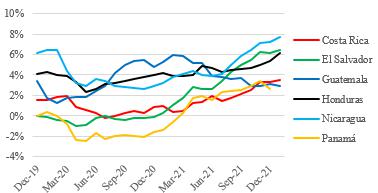

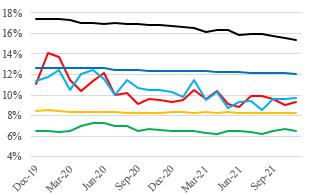

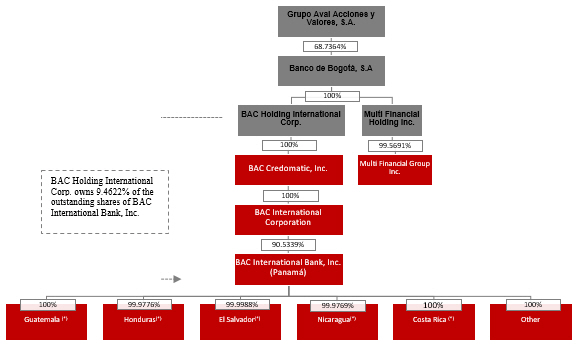

| · | BHI’s has previously obtained capital for its general corporate purposes, including working capital, acquisitions and capital expenditures, as part of Banco de Bogotá’s and/or Grupo Aval’s enterprise-wide cash management policies, and while existing lending and similar arrangements will not be unwound as a result of the Spin-off, there is no guarantee that Banco de Bogotá and/or Grupo Aval will be willing to provide such funding in the future on similar terms, if at all; and |