UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| |

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2019 |

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________ |

OR

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report |

Commission file number: 001-36631

GRUPO AVAL ACCIONES Y VALORES S.A.

(Exact name of Registrant as specified in its charter)

Republic of Colombia

(Jurisdiction of incorporation)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive offices)

Jorge Adrián Rincón

Chief Legal Counsel

Grupo Aval Acciones y Valores S.A.

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

Phone: (+57 1) 743-3222

E-mail: jrincon@grupoaval.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Nicholas A. Kronfeld, Esq.

Yasin Keshvargar, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450-4000

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| | |

Title of each class | | Name of each exchange on which

registered |

American Depositary Shares, each representing 20 preferred shares, par value Ps 1.00 per preferred share | | New York Stock Exchange |

Preferred Shares, par value Ps 1.00 per preferred share | | New York Stock Exchange* |

* Grupo Aval Acciones y Valores S.A.’s preferred shares are not listed for trading, but are only listed in connection with the registration of the American Depositary Shares, pursuant to the requirements of the New York Stock Exchange under the trading symbol(s): AVAL.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by the annual report.

Preferred shares: 7,143,227,185

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act:

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act).

☐ Yes ☒ No

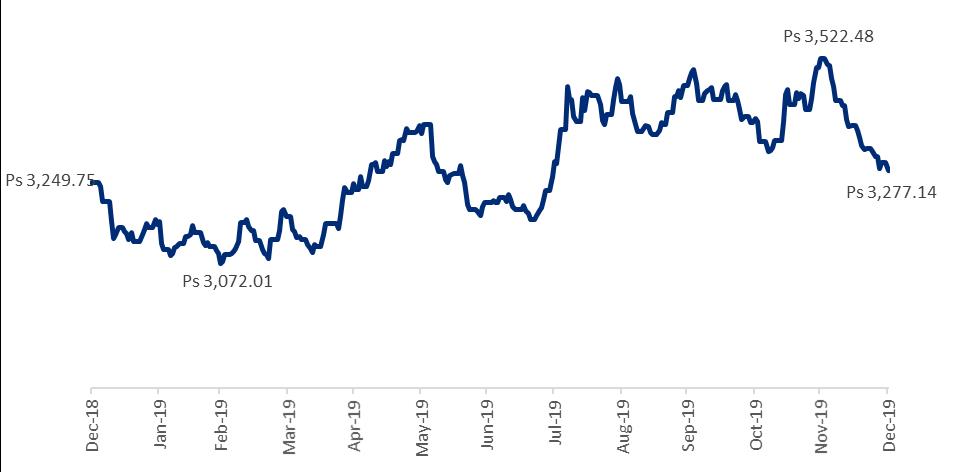

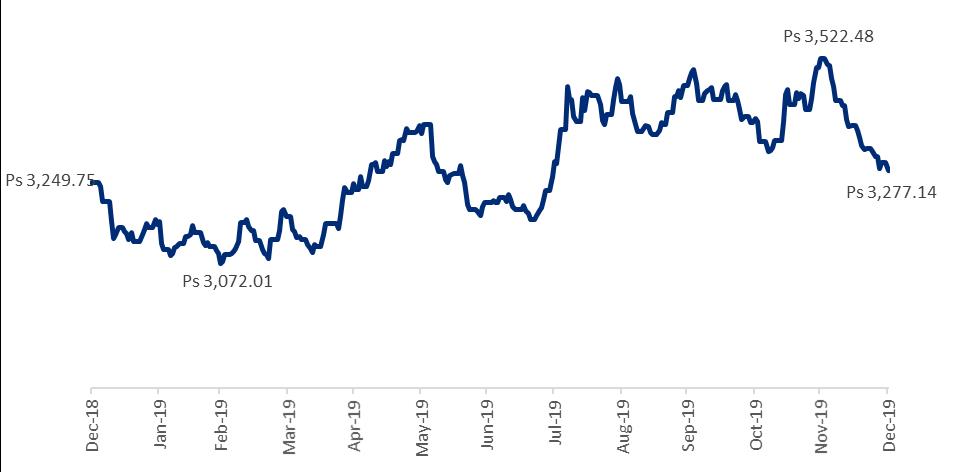

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references herein to “peso”, “pesos”, or “Ps” refer to the lawful currency of Colombia. All references to “U.S. dollars”, “dollars” or “U.S.$” are to United States dollars. This annual report translates certain Colombian peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. The conversion of amounts expressed in pesos as of a specified date at the then prevailing exchange rate may result in the presentation of U.S. dollar amounts that differ from U.S. dollar amounts that would have been obtained by converting Colombian pesos as of another specified date. Unless otherwise noted in this annual report, all such peso amounts have been translated at the rate of Ps 3,277.14 per U.S.$1.00, which was the representative market rate published on December 31, 2019. The representative market rate is computed and certified by the Superintendency of Finance on a daily basis and represents the weighted average of the buy/sell foreign exchange rates negotiated on the previous day by certain financial institutions authorized to engage in foreign exchange transactions. Such conversion should not be construed as a representation that the peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On April 24, 2020 the representative market rate was Ps 4,020.94 per U.S. $1.00.

Definitions

In this annual report, unless otherwise indicated or the context otherwise requires, the terms:

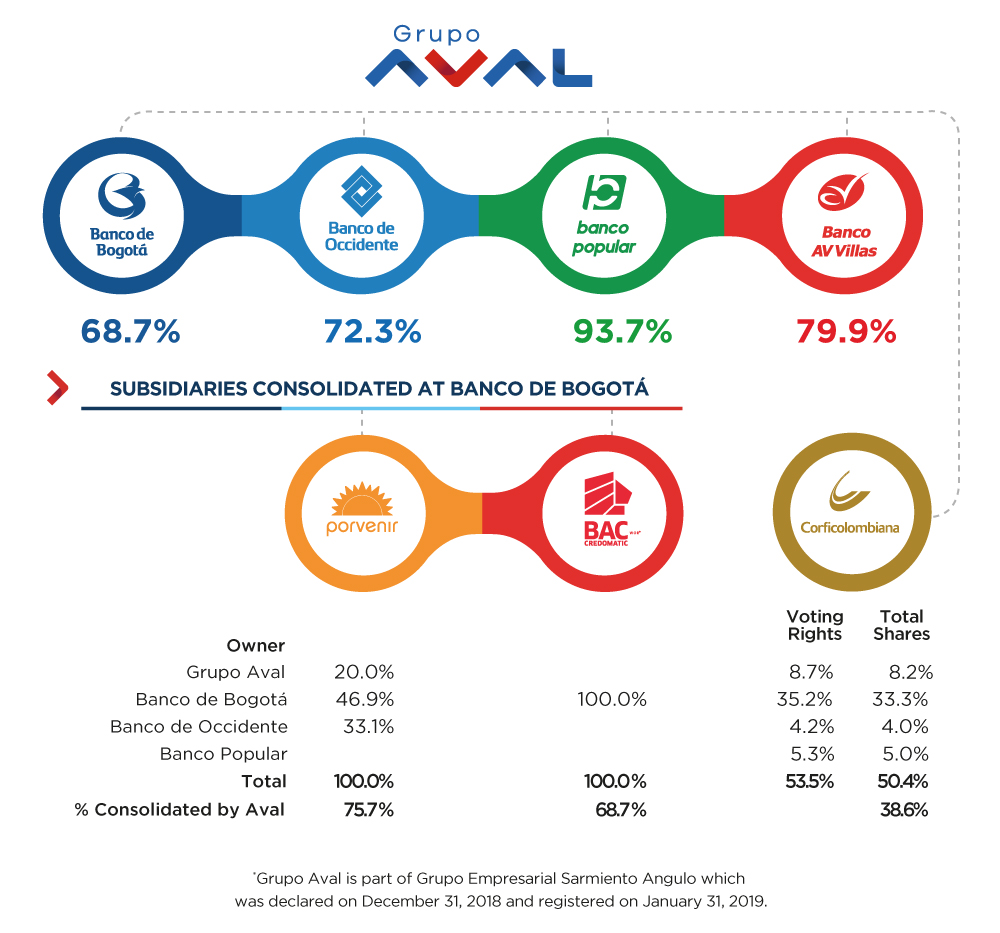

| · | | “Grupo Aval”, “we”, “us”, “our” and “our company” mean Grupo Aval Acciones y Valores S.A. and its consolidated subsidiaries; |

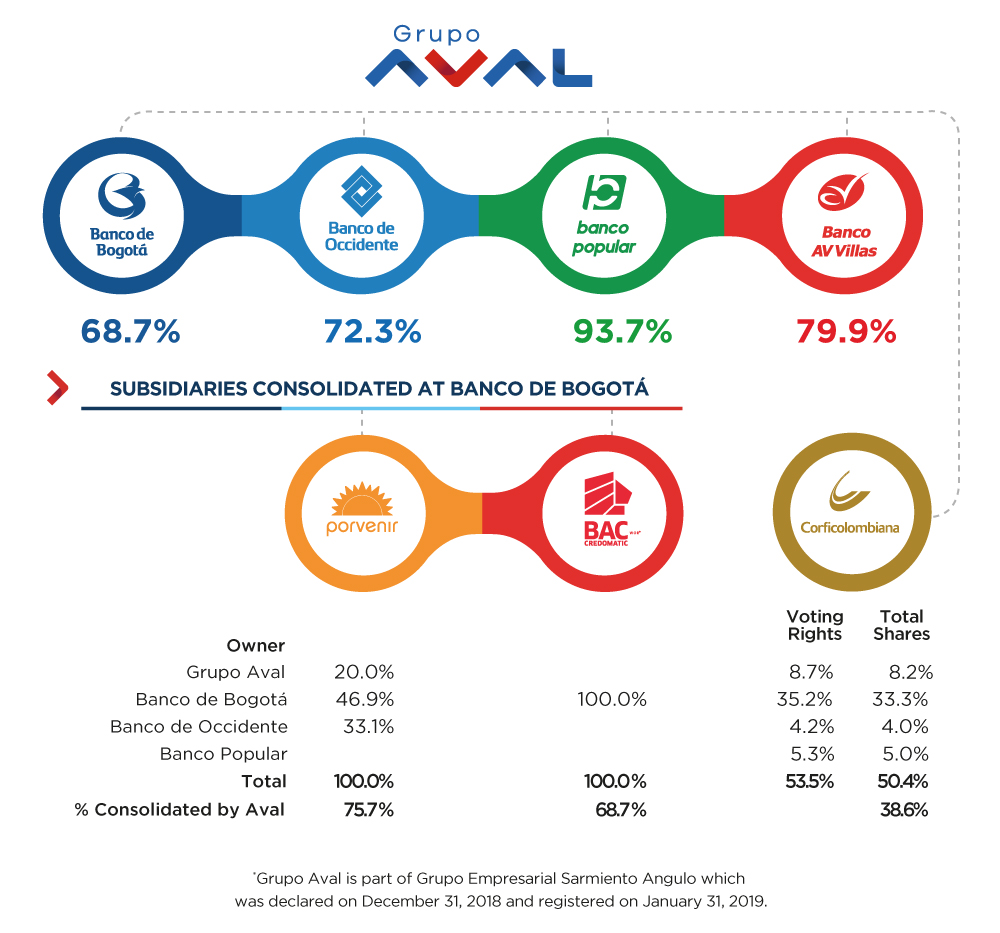

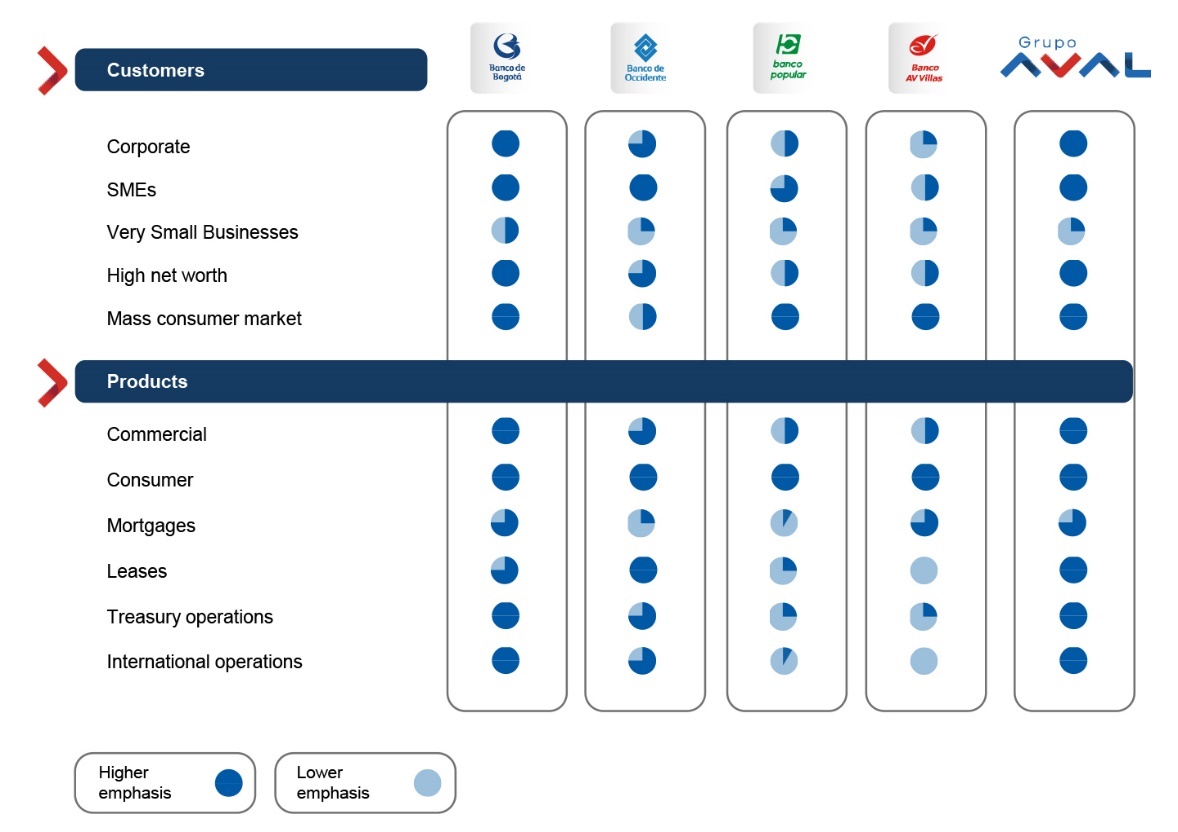

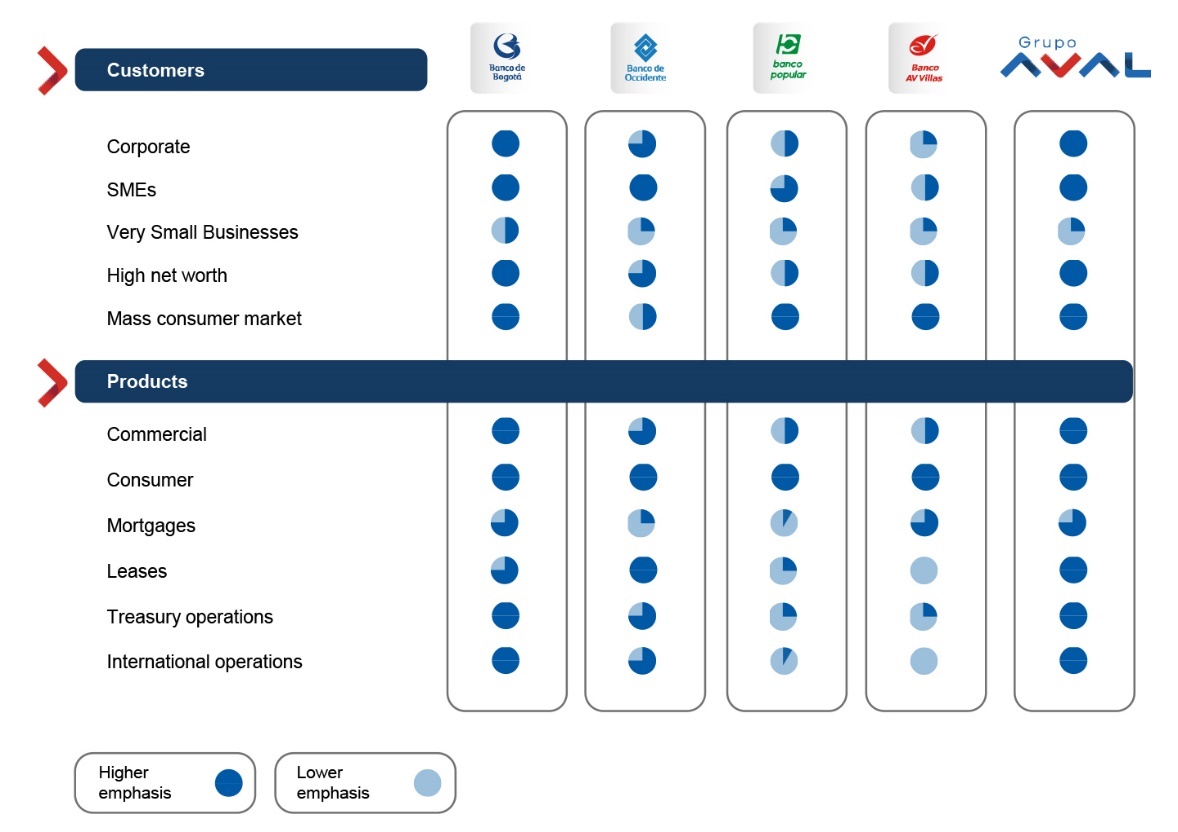

| · | | “banks” and “our banking subsidiaries” mean Banco de Bogotá S.A., Banco de Occidente S.A., Banco Popular S.A. and Banco Comercial AV Villas S.A., and their respective consolidated subsidiaries; |

| · | | “Banco de Bogotá” means Banco de Bogotá S.A. and its consolidated subsidiaries; |

| · | | “Banco de Occidente” means Banco de Occidente S.A. and its consolidated subsidiaries; |

| · | | “Banco Popular” means Banco Popular S.A. and its consolidated subsidiaries; |

| · | | “Banco AV Villas” means Banco Comercial AV Villas S.A. and its consolidated subsidiary; |

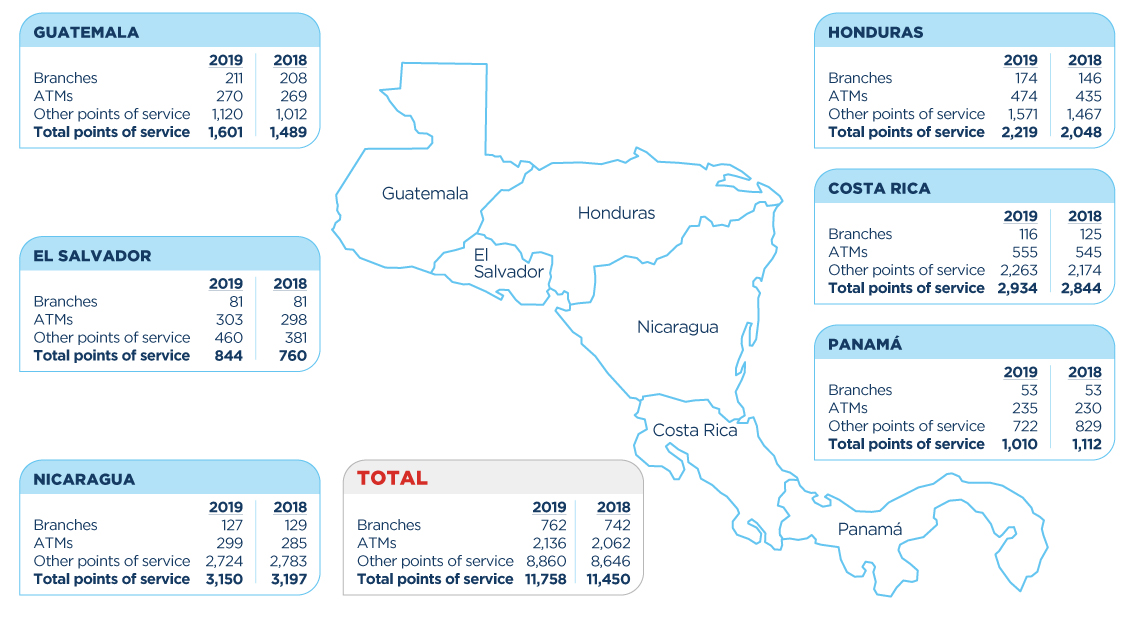

| · | | “BAC Credomatic” or “BAC” means BAC Credomatic Inc. and its consolidated subsidiaries; |

| · | | “Corficolombiana” means Corporación Financiera Colombiana S.A. and its consolidated subsidiaries; |

| · | | “LB Panamá” means Leasing Bogotá S.A., Panamá and its consolidated subsidiaries; |

| · | | “Multi Financial Group” or “MFG” means Multi Financial Group Inc. and its consolidated subsidiaries. |

| · | | “Porvenir” means Sociedad Administradora de Fondos de Pensiones y Cesantías Porvenir S.A. and its consolidated subsidiary; and |

| · | | “Superintendency of Finance” means the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia), a supervisory authority ascribed to the Colombian Ministry of Finance and Public Credit (Ministerio de Hacienda y Crédito Público), or the “Ministry of Finance”, holding the inspection, supervision and control authority over the individuals or entities involved in financial activities, securities markets, insurance and any other operations related to the management, use or investment of resources collected from the public, as well as inspection and supervision authority over the holding companies of financial conglomerates in Colombia. |

In this annual report, references to “beneficial ownership” are calculated pursuant to the definition ascribed by the U.S. Securities and Exchange Commission, or the “SEC”, of beneficial ownership for foreign private issuers contained in Form 20‑F. Form 20‑F defines the term “beneficial owner” of securities as referring to any person who, even if not the record owner of the securities, has or shares the underlying benefits of ownership, including the power to direct the voting or the disposition of the securities or to receive the economic benefit of ownership of the securities. A person is also considered to be the “beneficial owner” of securities when such person has the right to acquire within 60 days pursuant to an option or other agreement. Beneficial owners include persons who hold their securities through one or more trustees, brokers, agents, legal representatives or other intermediaries, or through companies in which they have a “controlling interest”, which means the direct or indirect power to direct the management and policies of the entity.

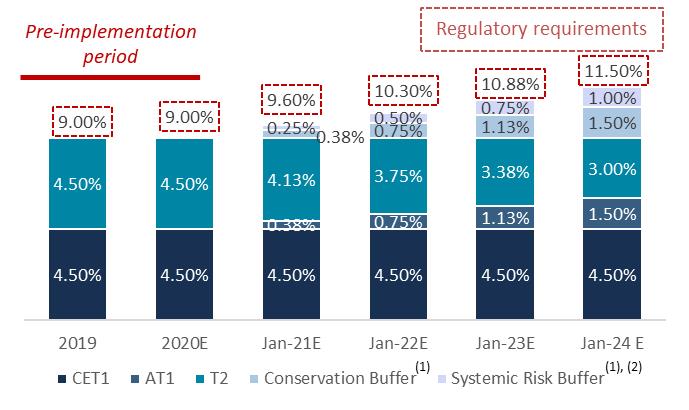

Financial statements

We are a financial holding company and an issuer in Colombia of securities registered with the National Registry of Shares and Issuers (Registro Nacional de Emisores y Valores), and in this capacity, we are subject to inspection and surveillance by the Superintendency of Finance and required to comply with corporate governance and periodic reporting requirements to which all financial holdings and issuers are subject. We are not a financial institution in Colombia and we are not supervised or regulated as a financial institution. Since February 6, 2019, we are subject to the inspection and surveillance of the Superintendency of Finance as the financial holding company of the Aval Financial Conglomerate and we are required to comply with capital adequacy and additional regulations applicable to financial conglomerates. See “Item 4. Information on the Company—B. Business overview—Supervision and regulation”. All of our Colombian financial subsidiaries, including Banco de Bogotá, Banco de Occidente, Banco Popular, Banco AV Villas, Corficolombiana, Porvenir, and their respective financial subsidiaries, are entities under the direct comprehensive supervision of, and subject to inspection and surveillance as financial institutions by, the Superintendency of Finance and, in the case of BAC Credomatic, subject to inspection and surveillance as a financial institution by the relevant regulatory authorities in each country where BAC Credomatic operates.

Our consolidated financial statements at December 31, 2019 and 2018 and for the years ended December 31, 2019, 2018, and 2017 are included in this annual report and referred to as our audited consolidated financial statements. Our historical results are not necessarily indicative of results to be expected for future periods. We have prepared the audited consolidated financial statements included herein in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Grupo Aval adopted IFRS 16 using the modified retrospective approach with the cumulative effect of initial adoption being recognized on January 1, 2019. Grupo Aval has not restated comparatives for prior reporting periods, as permitted under the specific transitional provisions in the standard. The reclassifications and the adjustments arising from the new leasing rules are therefore recognized in the opening Consolidated Statement of Financial Position on January 1, 2019. For more information on the effects of the adoption on Grupo Aval, please refer to “Note 2.4 Changes in Accounting Policies—A. IFRS 16 Leases” of our audited consolidated financial statements.

For comparative purposes, following the adoption of IFRS 9 on January 1, 2018, Grupo Aval adjusted the presentation of financial instruments in the consolidated statement of financial position for prior reporting periods. In addition, following the adoption of IFRS 15 on January 1, 2018, Grupo Aval adjusted the presentation of revenue from contracts with customers within the consolidated statements of income for prior reporting periods.

We and our Colombian subsidiaries prepare consolidated financial statements for publication in Colombia under IFRS as adopted by the Superintendency of Finance in accordance with Decree 1851 of 2013 and 3023 of 2013, as modified by Decrees 2420 and 2496 of 2015, 2131 of 2016, 2170 of 2017, 2483 of 2018 and 2270 of 2019 (which we refer to as “Colombian IFRS”). Prior to January 1, 2018, Colombian IFRS differed from IFRS as issued by the IASB in certain material respects. Starting on January 1, 2018, Grupo Aval’s consolidated financial statements for publication in Colombia do not differ from the consolidated financial statements prepared under IFRS as issued by the IASB.

Separate financial statements under Colombian IFRS are based on IFRS issued by the IASB in Spanish as of December 31, 2018, and requirements pursuant to certain Colombian regulations. As a result, rules subsequently issued by the IASB are

not applicable under Colombian IFRS. Our separate financial statements for local purposes, differed from IFRS as issued by the IASB in the following principal aspects:

| · | | Wealth tax, created by the Colombian congress in 2014 and to be paid by companies during 2015, 2016 and 2017, calculated based on the value of their shareholder’s equity can be recorded against equity reserves. However, under IFRS, according to IFRIC 21, wealth tax liabilities must be recorded in the statement of income. |

| · | | Loss allowances are calculated based on specific rules of the Financial and Accounting Basic Circular (Circular Básica Contable y Financiera) issued by the Superintendency of Finance (which is applied in the local separate financial statements), whereas under IFRS, loss allowances were calculated according to the criteria set forth in IAS 39 and recorded in the statement of income until December 31, 2017 and under IFRS 9 beginning on January 1, 2018. |

| · | | Financial instruments under Colombian IFRS are classified and measured under specific rules of the Financial and Accounting Basic Circular, whereas under IFRS, financial instruments were classified and measured according to the criteria set forth in IAS 39 until December 31, 2017 and under IFRS 9 beginning on January 1, 2018 (with the exception of hedge accounting which is still treated under guidelines set forth in IAS 39). |

Ratios and Measures of Financial Performance

We have included in this annual report ratios and measures of financial performance such as return on average assets, or “ROAA”, and return on average equity, or “ROAE”.

These measures should not be construed as an alternative to IFRS measures and should not be compared to similarly titled measures reported by other companies, which may evaluate such measures differently from how we do. For ratios and measures of financial performance, see “Item 3. Key Information—A. Selected financial data— Ratios and Measures of Financial Performance”.

Market share and other information

We obtained the market and competitive position data, including market forecasts, used throughout this annual report from market research, publicly available information and industry publications. We have presented this data on the basis of information from third-party sources that we believe are reliable, including, among others, the International Monetary Fund, or “IMF”, the Superintendency of Finance, the Colombian Banking Association (Asociación Bancaria y de Entidades Financieras de Colombia) or “Asobancaria”, the Colombian Stock Exchange, the Colombian National Bureau of Statistics (Departamento Administrativo Nacional de Estadística), or “DANE”, the World Bank, the Superintendency of Banks in Panama (Superintendencia de Bancos de Panamá), the Superintendency of Financial Institutions in Costa Rica (Superintendencia General de Entidades Financieras), the Superintendency of Banks in Guatemala (Superintendencia de Bancos de Guatemala), the National Commission of Banks and Insurances in Honduras (Comisión Nacional de Bancos y Seguros), the Financial System Superintendency in El Salvador (Superintendencia del Sistema Financiero) and the Superintendency of Banks and Other Financial Institutions in Nicaragua (Superintendencia de Bancos y Otras Instituciones Financieras). Industry and government publications, including those referenced herein, generally state that the information presented has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Unless otherwise indicated, gross domestic product, or “GDP”, figures with respect to Colombia in this annual report are based on the 2015 base year data series published by DANE. Although we have no reason to believe that any of this information or these reports is inaccurate in any material respect, we have not independently verified the competitive position, market share, market size, market growth or other data provided by third parties or by industry or other publications. We do not make any representation or warranty as to the accuracy of such information.

IMF’s April 2020 World Economic Outlook (WEO) database does not contain all the usual analytical groups and countries and contains only these indicators: real GDP growth, consumer price index, current account balance, unemployment, per capita GDP growth, and fiscal balance. Projections for these indicators are provided only through 2021 due to the high

level of uncertainty in current global economic conditions. Therefore, some information used herein refers expressly to the October 2019 WEO as the last information available.

Our consolidated statement of financial position and statement of income reflect information prepared under IFRS, while comparative disclosures of our financial and operating performance and that of our competitors are based on separate information prepared under Colombian IFRS as reported to the Superintendency of Finance. We, our banking subsidiaries, Corficolombiana and Porvenir also report separate financial data to the Superintendency of Finance under Colombian IFRS. Unless otherwise indicated or the context otherwise requires, market share and other data comparing our performance to that of our competitors reflects the separate results of our banking subsidiaries, Corficolombiana, Porvenir and BAC Credomatic. “Grupo Aval aggregate” data throughout this annual report reflects the sum of the separate financial statements of our four Colombian banking subsidiaries (Banco de Bogotá, Banco de Occidente, Banco Popular and Banco AV Villas) as reported to the Superintendency of Finance under Colombian IFRS, and it is used for purposes of comparing our performance against that of our peer banks. These separate financial statements under Colombian IFRS do not reflect the consolidation of subsidiaries such as Corficolombiana, Porvenir or LB Panamá, are not intended to reflect the consolidated financial results of Grupo Aval and are not necessarily indicative of the results for any other future period. Except where otherwise indicated, financial and market share data pertaining to BAC Credomatic and its competitors has been presented in accordance with IFRS and is based on publicly available information filed with regulators. All information regarding our market share and other comparative ratios and measures of financial performance to those of our competitors is presented on a separate basis under Colombian IFRS, in the case of our Colombian banking subsidiaries, Corficolombiana and Porvenir, and it is based on publicly available information filed with the Superintendency of Finance.

Throughout this document, unless otherwise noted, references to average consolidated statement of financial position for 2019, 2018, 2017, 2016 and 2015 have been calculated as follows: the average of balances at December 31, at September 30, at June 30, and at March 31 of the corresponding year, and the balance at December 31, of the previous year.

Banks, merchant banks (corporaciones financieras) and financing companies (compañías de financiamiento comercial) are deemed credit institutions by the Superintendency of Finance and are the principal institutions authorized to accept deposits and make loans in Colombia. Banks undertake traditional deposit-taking and lending activities. Financing companies place funds in circulation by means of active credit operations, with the purpose of fostering the sale of goods and services, including the development of leasing operations. Merchant banks invest directly in the real economy and thus are the only credit institutions that may invest in non-financial sectors. Banks are permitted to invest in merchant banks. See “Item 4. Information on the Company—B. Business overview—Supervision and regulation”. In Colombia, we operate four banks, one merchant bank and one financing company (under voluntary liquidation), and our market share is determined by comparing our banks to other banks reporting their results to the Superintendency of Finance.

We consider our principal competitors in Colombia to be Bancolombia S.A., or “Bancolombia”, Banco Davivienda S.A., or “Davivienda”, and Banco Bilbao Vizcaya Argentaria Colombia S.A., or “BBVA Colombia”, which are the three leading banking groups in Colombia after Grupo Aval.

The principal competitors of Porvenir, our pension and severance fund administrator, include Administradora de Fondos de Pensiones y Cesantías Protección S.A., or “Protección”, Colfondos S.A. Pensiones y Cesantías, or “Colfondos”, and Skandia Administradora de Fondos de Pensiones y Cesantías S.A., or “Skandia”. Corficolombiana, our merchant bank, is a merchant bank (corporación financiera), and its competitors include Banca de Inversión Bancolombia S.A., J.P. Morgan Corporación Financiera S.A., BNP Paribas Colombia Corporación Financiera S.A. and Corporación Financiera GNB Sudameris S.A.

Our principal competitors in Central America include Bancolombia, Banco General, Banco Industrial, Banco Promerica, Davivienda and Banrural.

We include certain ratios in this annual report which we believe provide investors with important information regarding our operations, such as return on average equity, or “ROAE”, return on average assets, or “ROAA”, net interest margin, or “NIM”, and operational efficiency and asset quality indicators, among others. Some of these ratios are also used in this annual report to compare us to our principal competitors.

Other conventions

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic summation of the figures that precede them. As such, percentage calculations presented may differ from those of rounded numbers. References to “billions” in this annual report are to 1,000,000,000s and to “trillions” are to 1,000,000,000,000s.

“Non-controlling interest” refers to the participation of minority shareholders in a subsidiary’s equity or net income, as applicable.

FORWARD-LOOKING STATEMENTS

Some of the matters discussed in this annual report concerning our operations and financial performance include estimates and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 “Reform Act” including such statements contained in “Item 3. Key Information—D. Risk factors”, “Item 5. Operating and Financial Review and Prospects” and “Item 4. Information on the Company—B. Business overview”.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates on projections of future events and trends, which affect or may affect our businesses and results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made in light of information currently available to us. Our estimates and forward-looking statements may be influenced by the following factors, among others:

| · | | changes in Colombian, Central American, regional and international business and economic, political or other conditions; |

| · | | developments affecting Colombian, Central American and international capital and financial markets; |

| · | | government regulation and tax matters and developments affecting our company and industry; |

| · | | declines in the oil and affiliated services sector in the Colombian and global economies; |

| · | | increases in defaults by our customers; |

| · | | increases in goodwill impairment losses, or other impairments; |

| · | | decreases in deposits, customer loss or revenue loss; |

| · | | increases in allowances for contingent liabilities; |

| · | | our ability to sustain or improve our financial performance; |

| · | | increases in inflation rates, particularly in Colombia and in jurisdictions in which we operate in Central America; |

| · | | the level of penetration of financial products and credit in Colombia and Central America; |

| · | | changes in interest rates which may, among other effects, adversely affect margins and the valuation of our treasury portfolio; |

| · | | decreases in the spread between investment yields and implied interest rates in annuities; |

| · | | movements in exchange rates; |

| · | | competition in the banking and financial services, credit card services, insurance, asset management, pension fund administration and related industries; |

| · | | adequacy of risk management procedures and credit, market and other risks of lending and investment activities; |

| · | | decreases in the level of capitalization of our subsidiaries; |

| · | | changes in market values of Colombian and Central American securities, particularly Colombian government securities; |

| · | | adverse legal or regulatory disputes or proceedings; |

| · | | successful integration and future performance of acquired businesses or assets; |

| · | | natural disasters, public health crises or internal security issues affecting countries where we operate; |

| · | | loss of any key member of our senior management; and |

| · | | other risk factors as set forth under “Item 3. Key Information—D. Risk factors” or “Item 5. Operating and Financial Review and Prospects—D. Trend information”. |

The words “believe”, “may”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “should”, “could”, “would”, “plan”, “predict”, “potential” and similar words are intended to identify estimates and forward-looking statements. All statements addressing our future operating performance, and statements addressing events and developments that we expect or anticipate will occur in the future, are forward-looking statements within the meaning of the Reform Act. Estimates and forward-looking statements are intended to be valid only at the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this annual report might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to the factors mentioned above, among others. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

These cautionary statements should be considered in connection with any written or oral forward-looking statements that we may issue in the future.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and senior management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

A. Offer statistics

Not applicable.

B. Method and expected timetable

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected financial data

The following financial data of Grupo Aval at December 31, 2019 and 2018 and for the years ended December 31, 2019, 2018 and 2017 have been derived from our audited consolidated financial statements prepared in accordance with IFRS, included in this report. We have derived our selected statement of financial position data as of December 31, 2017, 2016, and 2015 and our consolidated statement of income data prepared in accordance with IFRS for the years ended December 31, 2016 and 2015 from our consolidated financial statements not included in this annual report. For comparative purposes, following the adoption of IFRS 9 on January 1, 2018, Grupo Aval adjusted the presentation of financial instruments in the consolidated statement of financial position for prior reporting periods. In addition, Grupo Aval adjusted the presentation of revenue from contracts with customers within the consolidated statements of income for prior reporting periods. Our historical results are not necessarily indicative of results to be expected for future periods.

This financial data should be read in conjunction with our audited consolidated financial statements and the related notes, “Presentation of financial and other information” and “Item 5. Operating and Financial Review and Prospects” included in this annual report.

Statement of income

IFRS

| | | | | | | | | | |

| | | | | | Grupo Aval | | | | |

| | For the years ended December 31, |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| | (in Ps billions, except share and per share data) |

Total interest income | | 19,552.7 | | 18,356.6 | | 18,741.8 | | 17,547.0 | | 14,075.6 |

Total interest expense | | (8,267.2) | | (7,484.8) | | (8,227.7) | | (8,392.4) | | (5,751.5) |

Net interest income | | 11,285.5 | | 10,871.8 | | 10,514.1 | | 9,154.6 | | 8,324.1 |

Impairment loss on loans and other accounts receivable | | (4,194.0) | | (4,150.0) | | (4,119.3) | | (3,004.2) | | (2,127.7) |

Impairment (loss) recovery on other financial assets | | 60.0 | | 32.5 | | (0.1) | | (70.4) | | (6.2) |

Recovery of charged-off financial assets | | 378.9 | | 320.1 | | 264.6 | | 290.4 | | 219.7 |

Net impairment loss on financial assets | | (3,755.1) | | (3,797.3) | | (3,854.9) | | (2,784.2) | | (1,914.3) |

Net income from commissions and fees | | 5,455.3 | | 4,839.6 | | 4,579.0 | | 4,259.7 | | 3,662.3 |

Gross profit from sales of goods and services | | 2,374.8 | | 2,643.9 | | 757.0 | | 929.3 | | 838.6 |

Net trading income | | 761.9 | | 582.7 | | 561.4 | | 724.7 | | 245.2 |

Net income from other financial instruments mandatorily at fair value through profit or loss | | 217.6 | | 205.8 | | 209.9 | | 181.0 | | 153.1 |

Other income | | 1,283.0 | | 1,358.7 | | 1,151.7 | | 1,676.1 | | 1,550.7 |

Other expenses | | (10,171.3) | | (9,371.0) | | (9,003.1) | | (8,567.3) | | (7,635.1) |

Income before income tax expense | | 7,451.7 | | 7,334.1 | | 4,915.2 | | 5,573.8 | | 5,224.7 |

Income tax expense | | (2,086.3) | | (2,149.6) | | (1,752.8) | | (2,056.9) | | (1,879.0) |

Net income for the year | | 5,365.5 | | 5,184.6 | | 3,162.4 | | 3,516.9 | | 3,345.7 |

Net income for the year attributable to: | | | | | | | | | | |

Owners of the parent | | 3,034.4 | | 2,912.7 | | 1,962.4 | | 2,139.9 | | 2,041.4 |

Non-controlling interest | | 2,331.0 | | 2,271.9 | | 1,200.0 | | 1,377.1 | | 1,304.3 |

| | | | | | | | | | |

Earnings per 1,000 shares (basic and diluted earnings): | | | | | | | | | | |

Common shares (in pesos) | | 136,188.1 | | 130,725.4 | | 88,075.6 | | 96,039.9 | | 91,619.0 |

Earnings per 1,000 shares (basic and diluted earnings): | | | | | | | | | | |

Preferred shares (in pesos) | | 136,188.1 | | 130,725.4 | | 88,075.6 | | 96,039.9 | | 91,619.0 |

Dividends per 1,000 shares(1): | | | | | | | | | | |

Common and preferred shares (in pesos) | | 60,000.0 | | 60,000.0 | | 48,000.0 | | 88,200.0 | | 58,800.0 |

| | | | | | | | | | |

Weighted average number of shares: | | | | | | | | | | |

Outstanding common shares in thousands | | 15,158,004.8 | | 15,169,502.8 | | 15,216,468.6 | | 15,262,660.1 | | 15,309,380.7 |

Outstanding preferred shares in thousands | | 7,123,012.3 | | 7,111,514.4 | | 7,064,548.6 | | 7,018,357.0 | | 6,971,636.5 |

Outstanding common and preferred shares in thousands | | 22,281,017.2 | | 22,281,017.2 | | 22,281,017.2 | | 22,281,017.2 | | 22,281,017.2 |

| (1) | | Until 2016, Grupo Aval declared dividends semi-annually in March (from the net income generated in the six-month period between July 1 and December 31 of the previous year) and in September (from the net income generated in the six-month period between January 1 and June 30 of the ongoing year) of each year. Since March 2017, the Company declares dividends on an annual basis (from the net income generated in the twelve-month period between January 1 and December 31 of the previous year). Dividends per 1,000 shares figures for 2016 include dividends declared in September 2016 from the net income generated in the six-month period ended June 30, 2016 and dividends declared in March 2017 from the net income generated in the six-month period ended December 31, 2016, which was paid in twelve equal installments between April 2017 and March 2018. |

Statement of financial position

| | | | | | | | | | |

| | | | | | Grupo Aval | | | | |

| | At December 31, |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| | (in Ps billions) |

Assets: | | | | | | | | | | |

Cash and cash equivalents | | 30,117.2 | | 28,401.3 | | 22,336.8 | | 22,193.0 | | 22,285.0 |

Trading assets | | 9,113.7 | | 7,204.3 | | 5,128.1 | | 4,593.7 | | 5,608.2 |

Investment securities | | 26,000.3 | | 23,030.2 | | 21,513.2 | | 20,963.0 | | 22,080.2 |

Hedging derivative assets | | 166.6 | | 30.1 | | 55.3 | | 128.5 | | 33.7 |

Total loans, net | | 173,942.3 | | 168,685.7 | | 160,754.3 | | 150,898.7 | | 141,827.7 |

Other accounts receivables, net | | 11,702.3 | | 9,300.6 | | 6,521.9 | | 5,597.3 | | 5,093.9 |

Non-current assets held for sale | | 206.2 | | 186.7 | | 101.4 | | 259.5 | | 199.5 |

Investments in associates and joint ventures | | 988.0 | | 982.7 | | 1,043.0 | | 1,146.6 | | 927.6 |

Tangible assets | | 8,950.4 | | 6,588.5 | | 6,654.0 | | 6,559.5 | | 6,514.0 |

Concession arrangement rights | | 7,521.5 | | 5,514.5 | | 3,114.2 | | 2,805.3 | | 2,390.7 |

Goodwill | | 7,348.6 | | 7,318.6 | | 6,901.1 | | 6,824.9 | | 7,056.0 |

Other intangible assets | | 1,206.5 | | 1,033.9 | | 848.7 | | 735.0 | | 612.9 |

Income tax assets | | 1,141.8 | | 935.2 | | 1,046.9 | | 779.1 | | 1,485.2 |

Other assets | | 427.2 | | 462.9 | | 519.8 | | 589.4 | | 564.7 |

Total assets | | 278,832.6 | | 259,675.2 | | 236,538.5 | | 224,073.7 | | 216,679.3 |

| | | | | | | | | | |

Liabilities: | | | | | | | | | | |

Trading liabilities | | 962.4 | | 811.3 | | 298.7 | | 640.7 | | 1,143.2 |

Hedging derivatives liabilities | | 94.3 | | 195.5 | | 13.5 | | 43.4 | | 337.7 |

Customer deposits | | 175,491.4 | | 164,359.5 | | 154,885.2 | | 143,887.1 | | 135,954.6 |

Interbank borrowings and overnight funds | | 9,240.5 | | 6,814.1 | | 4,970.4 | | 6,315.7 | | 9,474.9 |

Borrowings from banks and others | | 19,803.3 | | 20,610.8 | | 18,205.3 | | 17,906.6 | | 18,750.6 |

Bonds issued | | 21,918.3 | | 20,140.3 | | 19,102.2 | | 18,568.2 | | 16,567.1 |

Borrowings from development entities | | 3,882.5 | | 3,646.8 | | 2,998.1 | | 2,725.7 | | 2,506.6 |

Provisions | | 868.6 | | 695.3 | | 692.6 | | 620.4 | | 600.2 |

Income tax liabilities | | 3,258.6 | | 2,574.4 | | 2,027.7 | | 1,651.9 | | 1,892.1 |

Employee benefits | | 1,235.0 | | 1,264.9 | | 1,238.2 | | 1,097.6 | | 1,022.3 |

Other liabilities | | 8,729.4 | | 9,008.0 | | 6,235.5 | | 5,957.2 | | 5,523.5 |

Total liabilities | | 245,484.3 | | 230,120.8 | | 210,667.3 | | 199,414.5 | | 193,773.0 |

| | | | | | | | | | |

Equity: | | | | | | | | | | |

Attributable to the owners of the parent | | | | | | | | | | |

Subscribed and paid-in capital | | 22.3 | | 22.3 | | 22.3 | | 22.3 | | 22.3 |

Additional paid-in capital | | 8,445.8 | | 8,472.3 | | 8,303.4 | | 8,307.5 | | 8,307.8 |

Retained earnings | | 10,289.1 | | 8,598.3 | | 7,174.4 | | 6,522.1 | | 5,699.4 |

Other comprehensive income | | 1,093.4 | | 696.8 | | 786.9 | | 749.6 | | 538.1 |

Equity attributable to owners of the parent | | 19,850.6 | | 17,789.7 | | 16,287.0 | | 15,601.6 | | 14,567.6 |

Non-controlling interest | | 13,497.7 | | 11,764.6 | | 9,584.2 | | 9,057.7 | | 8,338.7 |

Total equity | | 33,348.3 | | 29,554.3 | | 25,871.2 | | 24,659.2 | | 22,906.3 |

Total liabilities and equity | | 278,832.6 | | 259,675.2 | | 236,538.5 | | 224,073.7 | | 216,679.3 |

Other financial and operating data

| | | | | | | | | | | |

| | Grupo Aval | |

| | At and for the years ended December 31, | |

| | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | |

| | (in percentages, unless otherwise | |

| | indicated) | |

Profitability ratios: | | | | | | | | | | | |

Net interest margin(1) | | 5.6% | | 5.7% | | 5.8% | | 5.4% | | 5.4% | |

ROAA(2) | | 2.0% | | 2.2% | | 1.4% | | 1.6% | | 1.7% | |

ROAE(3) | | 16.4% | | 17.8% | | 12.6% | | 14.3% | | 14.6% | |

Efficiency ratio(4): | | 47.6% | | 45.7% | | 50.1% | | 49.0% | | 49.6% | |

Capital ratios: | | | | | | | | | | | |

Period-end equity as a percentage of period-end total assets | | 12.0% | | 11.4% | | 10.9% | | 11.0% | | 10.6% | |

Tangible equity ratio(5) | | 9.2% | | 8.4% | | 7.9% | | 7.9% | | 7.3% | |

Credit quality data: | | | | | | | | | | | |

Cost of risk: Impairment loss on loans and other accounts receivable / average gross loans(6) | | 2.4% | | 2.6% | | 2.7% | | 2.1% | | 1.7% | |

Cost of risk, net: Impairment loss on loans and other accounts receivable, net / average gross loans(6)(7) | | 2.2% | | 2.4% | | 2.5% | | 1.9% | | 1.5% | |

Charge-offs as a percentage of average gross loans(6) | | 2.7% | | 2.0% | | 1.7% | | 1.6% | | 1.3% | |

Loans past due more than 30 days / gross loans(6) | | 4.4% | | 4.3% | | 3.9% | | 3.0% | | 2.7% | |

Loans past due more than 90 days / gross loans(6) | | 3.3% | | 3.1% | | 2.8% | | 2.0% | | 1.7% | |

Loans classified as Stage 2 / gross loans(6) | | 4.5% | | 4.6% | | N.A. | | N.A. | | N.A. | |

Loans classified as Stage 3 / gross loans(6) | | 5.5% | | 6.0% | | N.A. | | N.A. | | N.A. | |

Loans classified as Stage 2 and Stage 3 / gross loans(6) | | 10.0% | | 10.6% | | N.A. | | N.A. | | N.A. | |

Loss allowance as a percentage of loans past due more than 30 days(8) | | 104.6% | | 113.9% | | 90.7% | | 95.0% | | 98.9% | |

Loss allowance as a percentage of loans past due more than 90 days(8) | | 140.1% | | 158.0% | | 128.2% | | 143.9% | | 157.9% | |

Loss allowance for Stage 2 loans as a percentage of Stage 2 loans(6)(8) | | 14.4% | | 15.5% | | N.A. | | N.A. | | N.A. | |

Loss allowance for Stage 3 loans as a percentage of Stage 3 loans(6)(8) | | 52.4% | | 50.8% | | N.A. | | N.A. | | N.A. | |

Loss allowance for Stage 2 and Stage 3 loans as a percentage of Stage 2 and Stage 3 loans(6)(8) | | 35.3% | | 35.6% | | N.A. | | N.A. | | N.A. | |

Loss allowance as a percentage of gross loans(6)(8) | | 4.6% | | 4.8% | | 3.5% | | 2.8% | | 2.6% | |

Operational data (in units): | | | | | | | | | | | |

Number of customers of the banks(9) | | 16,103,141 | | 15,654,858 | | 14,700,386 | | 13,883,370 | | 13,678,194 | |

Number of employees(10) | | 111,192 | | 91,191 | | 80,565 | | 77,050 | | 76,095 | |

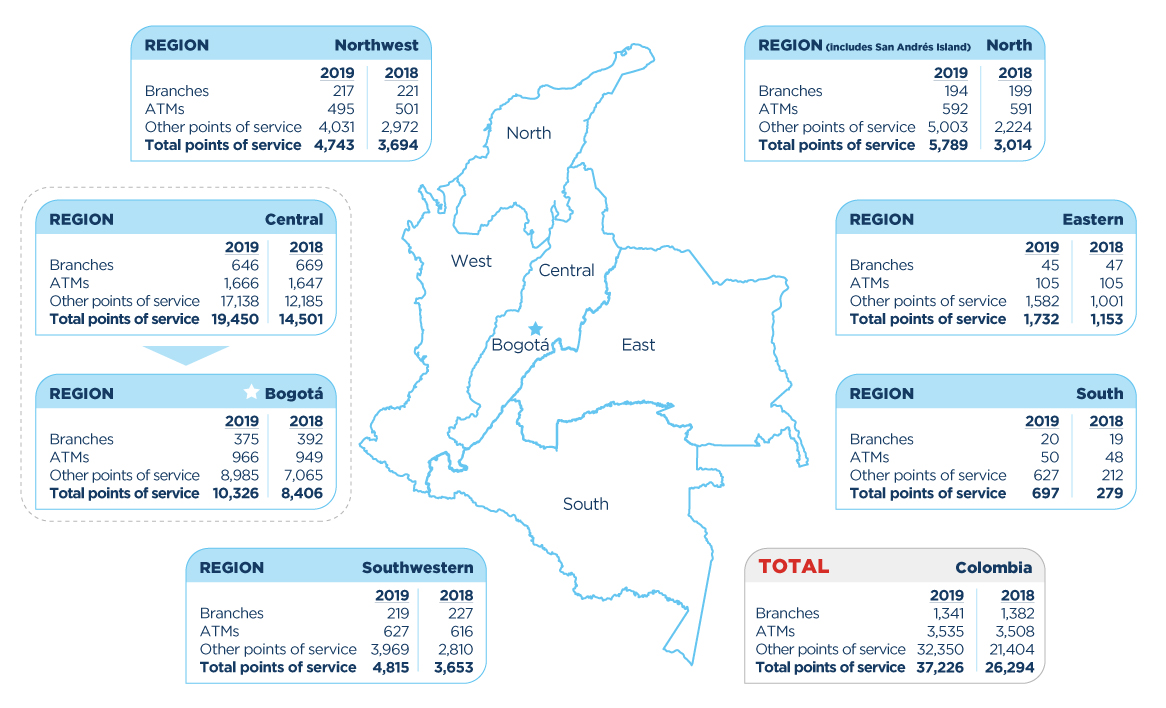

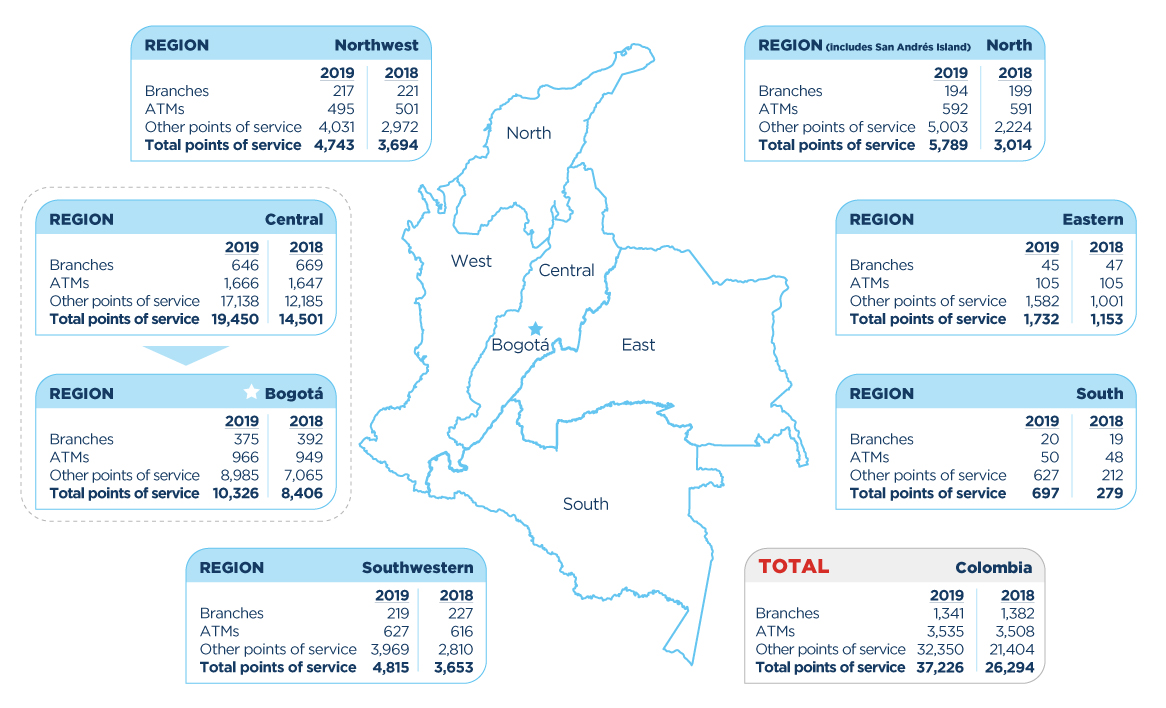

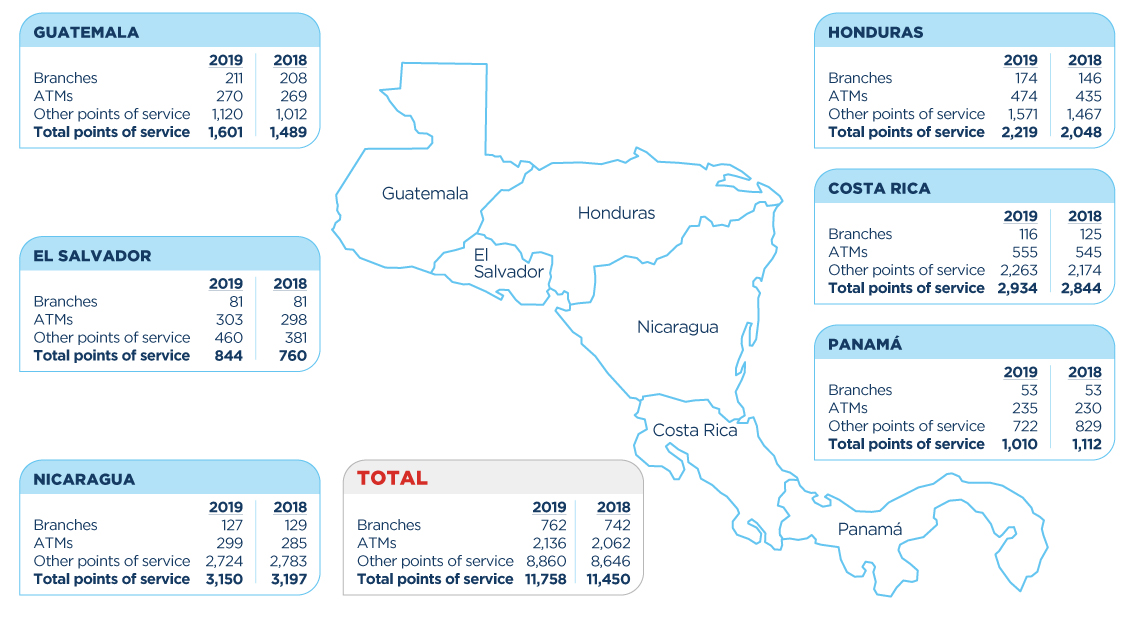

Number of branches(11) | | 1,692 | | 1,734 | | 1,771 | | 1,789 | | 1,785 | |

Number of ATMs(11) | | 5,671 | | 5,570 | | 5,774 | | 5,739 | | 5,623 | |

| (1) | | Net interest margin is calculated as net interest income divided by total average interest-earning assets. Average interest-earning assets for 2019, 2018, 2017, 2016 and 2015 are calculated as the sum of interest-earning assets at each quarter-end during the applicable year and the prior year end divided by five. See “Item 3. Key Information—A. Selected financial data—Ratios and Measures of Financial Performance”. |

| (2) | | For the years ended December 31, 2019, 2018, 2017, 2016 and 2015, ROAA is calculated as net income divided by average assets. Average assets for 2019, 2018, 2017, 2016 and 2015 are calculated as the sum of assets at each quarter-end during the applicable year and the prior year end divided by five. See “Item 3. Key Information—A. Selected financial data— Ratios and Measures of Financial Performance”. |

| (3) | | For the years ended December 31, 2019, 2018, 2017, 2016 and 2015, ROAE is calculated as net income attributable to owners of the parent divided by average equity attributable to owners of the parent. Average equity attributable to owners of the parent for 2019, 2018, 2017, 2016 and 2015 is calculated as the sum of equity attributable to owners of the parent at each quarter-end during the applicable year end and the prior year end divided by five. |

| (4) | | Efficiency ratio is calculated as Other expenses (see Note 30 of our audited consolidated financial statements) excluding wealth tax for 2017, 2016 and 2015, divided by total income before net impairment losses on financial assets (defined as the sum of net interest income, net income from commissions and fees, gross profit (loss) from sales of goods and services, net trading income, net income from other financial instruments mandatorily at fair value through profit or loss “FVTPL” and other income). Prior to the adoption of IFRS 16 on January 1, 2019 we reported this measure as Personnel expenses plus Administrative and other expenses (excluding wealth tax for 2017, 2016 and 2015), both contained in the Other expenses line in our audited consolidated financial statements, divided by the sum of net interest income, net income from commissions and fees, net income (expense) from sales of goods and services, net trading income and other income (excluding other). However, given the decrease in Administrative expenses that was offset by an increase in Depreciation and Amortization derived from this accounting principle, we decided all expenses (except for impairment loss on financial assets) and all income reflect efficiency in a more comprehensive manner. For the year ended December 31, 2019, efficiency measured under the previous methodology was materially the same as in 2018 at 43.1%. |

| (5) | | Tangible equity ratio is calculated as total equity minus intangible assets (calculated as goodwill plus other intangible assets, excluding those related to concession arrangements rights, Ps 7,521.5 billion in 2019, Ps 5,514.5 billion in 2018, Ps 3,114.2 billion in 2017, Ps 2,805.3 billion in 2016 and Ps 2,390.7 billion in 2015) divided by total assets minus intangible assets (as defined before). See “Item 3. Key Information—A. Selected financial data— Ratios and Measures of Financial Performance”. |

| (6) | | Gross loans exclude Interbank and overnight funds (Ps 2,719.0 billion in 2019, Ps 7,635.2 billion in 2018, Ps 7,279.0 billion in 2017, Ps 3,569.6 billion in 2016 and Ps 4,085.0 billion in 2015) as these are short-term liquidity operations not subject to deterioration. Total gross loan portfolio includes Interbank and overnight funds. Throughout this document charge-offs and write-offs refer to the same concept. |

| (7) | | Impairment (loss) on loans and other accounts receivable, net refers to Impairment (loss) on loans and other accounts receivable minus Recovery of charged-off financial assets. |

| (8) | | Includes the impact of IFRS 9 adoption on January 1, 2018 of Ps 1,163.0 billion. |

| (9) | | Reflects aggregated customers of our banking subsidiaries. Customers of more than one of our banking subsidiaries and BAC Credomatic are counted separately for each banking subsidiary. |

| (10) | | Number of employees is defined as the sum of direct, temporary and outsourced personnel in financial entities (71,269 in 2019, 71,851 in 2018, 73,834 in 2017, 73,041 in 2016 and 71,638 in 2015) and call-centers (8,538 in 2019, 8,081 in 2018, 6,731 in 2017, 4,009 in 2016 and 4,457 in 2015) for 2015 through 2019. Additionally, 2019 and 2018 figures include the number of employees of non-financial entities of Corficolombiana (31,385 and 11,259). |

| (11) | | Reflects aggregated number of full-service branches or ATMs of our banking subsidiaries and BAC Credomatic, as applicable, located throughout Colombia and Central America. |

Ratios and Measures of Financial Performance

The tables in this section, and elsewhere in this annual report, provide the calculation of certain ratios and measures of financial performance, which are used by our management to analyze the evolution and results of our company. Some of the ratios and measures of financial performance presented by us are either non-IFRS or use non-IFRS inputs. This non-IFRS information should not be construed as an alternative to IFRS measures. The ratios and measures of financial performance as determined and measured by us should not be compared to similarly titled measures reported by other companies as other companies may calculate and report such measures differently.

ROAA and ROAE

ROAA, which is calculated as net income divided by average assets, provides a measure of return on assets. ROAE, which is calculated as net income attributable to owners of the parent, divided by average equity attributable to owners of the

parent, provides a measure of the total return generated from our company and our subsidiaries for shareholders. Net income attributable to non-controlling interest divided by net income, provides an indication of non-controlling interest ownership of Grupo Aval’s consolidated subsidiaries net income; where a higher ratio typically implies that higher net income was generated in subsidiaries in which Grupo Aval has lower ownerships and vice versa.

The following table sets forth ROAA, ROAE and Net income attributable to non-controlling interest divided by net income for Grupo Aval for the indicated years.

| | | | | | | |

| | Year ended December 31, | |

| | 2019 | | 2018 | | 2017 | |

| | (in Ps billions, except percentages) | |

Grupo Aval (consolidated): | | | | | | | |

Average assets(1) | | 267,058.8 | | 240,905.4 | | 229,315.3 | |

Average equity attributable to owners of the parent(2) | | 18,521.1 | | 16,349.5 | | 15,635.9 | |

Net income | | 5,365.5 | | 5,184.6 | | 3,162.4 | |

Net income attributable to owners of the parent | | 3,034.4 | | 2,912.7 | | 1,962.4 | |

Net income attributable to non-controlling interest | | 2,331.0 | | 2,271.9 | | 1,200.0 | |

ROAA(1) | | 2.0% | | 2.2% | | 1.4% | |

ROAE(2) | | 16.4% | | 17.8% | | 12.6% | |

Net income attributable to non-controlling interest divided by net income | | 43.4% | | 43.8% | | 37.9% | |

| (1) | | For methodology used to calculate Average assets and ROAA, see note (2) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data”. |

| (2) | | For methodology used to calculate Average equity attributable to owners of the parent and ROAE, see note (3) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data”. |

The following table sets forth ROAA and ROAE of our main consolidated subsidiaries for the year ended December 31, 2019.

| | | | | | | | | | | |

| | Year ended December 31, 2019 | |

| | Banco de | | Banco de | | Banco | | Banco | | | |

| | Bogotá | | Occidente | | Popular | | AV Villas | | Corficolombiana | |

| | (in Ps billions, except percentages) | | | |

Average assets(1) | | 167,078.3 | | 40,557.2 | | 25,027.2 | | 14,790.7 | | 28,830.7 | |

Average equity attributable to owners of the parent(2)(3) | | 19,270.9 | | 4,610.1 | | 2,937.3 | | 1,670.2 | | 6,923.3 | |

Net income | | 3,073.7 | | 568.1 | | 302.1 | | 236.6 | | 2,004.2 | |

Net income attributable to owners of the parent(3) | | 2,766.4 | | 563.4 | | 301.3 | | 236.0 | | 1,531.3 | |

Net income attributable to non-controlling interest | | 307.2 | | 4.7 | | 0.9 | | 0.6 | | 472.9 | |

ROAA(1) | | 1.8% | | 1.4% | | 1.2% | | 1.6% | | 7.0% | |

ROAE(2) | | 14.4% | | 12.2% | | 10.3% | | 14.1% | | 22.1% | |

Net income attributable to non-controlling interest divided by net income | | 10.0% | | 0.8% | | 0.3% | | 0.3% | | 23.6% | |

| (1) | | For methodology used to calculate Average assets and ROAA, see note (2) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data”. |

| (2) | | For methodology used to calculate Average equity attributable to owners of the parent and ROAE, see note (3) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data”. |

| (3) | | Attributable to the owners of each of the subsidiaries presented in this table. Grupo Aval’s ownership in each subsidiary is described in “Item 4. Information on the company—B. Business overview—Our operations”. |

Tangible equity ratio

The following table sets forth the tangible equity ratio of Grupo Aval and each of its business segments at December 31, 2019.

| | | | | | | | | | | | | |

| | | | Grupo Aval entities | |

| | Grupo Aval | | Banco de | | Banco de | | Banco | | Banco | | | |

| | Consolidated | | Bogotá | | Occidente | | Popular | | AV Villas | | Corficolombiana | |

| | (in Ps billions, except percentages) | |

Total equity | | 33,348.3 | | 21,860.0 | | 4,869.1 | | 3,070.0 | | 1,795.1 | | 9,968.1 | |

Total assets | | 278,832.6 | | 175,019.6 | | 42,577.7 | | 25,117.6 | | 15,207.5 | | 31,809.6 | |

Total equity / Total assets | | 12.0% | | 12.5% | | 11.4% | | 12.2% | | 11.8% | | 31.3% | |

Intangible assets(1) | | 8,555.1 | | 6,630.4 | | 293.9 | | 166.0 | | 74.0 | | 498.8 | |

Total equity less intangible assets | | 24,793.2 | | 15,229.6 | | 4,575.2 | | 2,903.9 | | 1,721.2 | | 9,469.3 | |

Total assets less intangible assets | | 270,277.5 | | 168,389.2 | | 42,283.8 | | 24,951.5 | | 15,133.6 | | 31,310.8 | |

Tangible equity ratio(2) | | 9.2% | | 9.0% | | 10.8% | | 11.6% | | 11.4% | | 30.2% | |

| (1) | | Intangible assets for this measure are defined as goodwill and other intangible assets (excluding intangible assets related to concession arrangements rights of Ps 7,521.5 billion for both Grupo Aval and Corficolombiana as of December 31, 2019). |

| (2) | | Tangible equity ratio is calculated as total equity minus intangible assets divided by total assets minus intangible assets. |

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

Our business, financial condition and results of operations could be materially and adversely affected if any of the risks described below occur. In such an event, the market price of our preferred shares or our American Depositary Shares, or ADSs, could decline, and you could lose all or part of your investment. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business.

Risks relating to Colombia and other countries in which we operate

Adverse economic and political conditions in Colombia and other countries in which we operate, including variations in the exchange rates or downgrades in credit ratings of sovereign debt securities, may have an adverse effect on our results of operations and financial condition.

Our principal subsidiaries in Colombia are financial institutions (four commercial banks, a pension and severance fund administrator and a merchant bank), and the majority of our operations, properties and customers are located in Colombia. As a consequence, our results of operations and financial condition are materially affected by economic and political conditions in Colombia.

Colombia is subject to economic, political and other uncertainties, including changes in monetary, exchange control and trade policies that could affect the overall business environment in Colombia, which would, in turn, affect our results of operations and financial condition. For example, the Central Bank of Colombia (the “Colombian Central Bank” or “Central

Bank”), could sharply raise or lower interest rates, which could negatively affect our net interest income and asset quality, and also restrict our growth. Extreme variations in exchange rates could also negatively affect the foreign currency positions of our borrowers. Any of these events could have an adverse effect on our results of operations and financial condition.

Decreases in the growth rate of the Colombian economy, periods of negative growth, material increases in inflation or interest rates, or high fluctuations in the exchange rate could result in lower demand for, or affect the cost of risk and the pricing of, our services and products. Due to the fact that a large percentage of the costs and expenses of our subsidiaries is fixed, we may not be able to reduce costs and expenses upon the occurrence of any of these events, in which case our profitability could be affected.

In the case of our pension and severance fund management business, economic conditions may affect the businesses and financial capacity of employers, which may result in a reduction in employee-contributor head counts or decrease the ability of employers to create new jobs or increase employee incomes and could reduce returns on “stabilization reserves” and/or performance-based fees.

BAC Credomatic’s results of operations and financial condition depend on economic, political and social conditions in the countries where it operates, primarily in Central America. The political, economic and social environments in such countries are affected by many different factors, including significant governmental influence over local economies, substantial fluctuations in economic growth, high levels of inflation, exchange rate movements, exchange controls or restrictions on expatriation of earnings, high domestic interest rates, drug trafficking and other forms of organized crime, wage and price controls, changes in tax policies, imposition of trade barriers, changes in the prices of commodities and unexpected changes in regulation. The results of operations and financial condition of our Central American operations could be affected by changes in economic and other policies of each country’s government, which have exercised and continue to exercise substantial influence over many aspects of the private sector, and by other social and political developments in each country. During the past several decades, El Salvador, Guatemala, Honduras, Nicaragua and Panamá have experienced civil strife and political instability that have included a succession of regimes with differing economic policies and programs. Previous governments have imposed, among other measures, controls on prices, exchange rates, local and foreign investment, and international trade. They have also restricted the ability of companies to dismiss employees, expropriated private sector assets and prohibited the remittance of profits to foreign investors.

Adverse economic, political and social developments, including allegations of corruption against the Colombian government and governments of other countries in which we operate in Central America, may adversely affect demand for banking services and create uncertainty regarding our operating environment, which could have a material adverse effect on our subsidiaries and, consequently, on our company. In addition, changes in political administrations may result in changes in governmental policy, which could affect our subsidiaries and, consequently, our business. Downgrades in credit ratings of debt securities, issued or guaranteed by governments in countries in which we operate, may increase our and our subsidiaries’ cost of funding or limit the ability of borrowing funds from customary sources of capital.

The Colombian and Central American economies remain vulnerable to external shocks.

A significant decline in economic growth of any of Colombia’s or Central America’s major trading partners could have a material adverse effect on each country’s trade balance and economic growth. In addition, a “contagion” effect, where an entire region or class of investments becomes less attractive to, or subject to outflows of funds by, international investors could negatively affect Colombia or Central American countries in which we operate. Lower than expected economic growth may result in asset quality deterioration and could negatively affect our business.

Pension funds, such as those managed by Porvenir, invest globally and thus are affected by regional and global economic factors. Lower economic growth of Colombia’s major trading partners or a contagion effect in the region or globally may lead to lower pension funds returns, which may in turn result in decreases in assets under management and affect our business, results of operations or financial condition. In recent years, pension fund returns have been subject to increased volatility in international financial markets. Foreign investments represented 31.5% of Porvenir’s total assets under management at December 31, 2019.

Fluctuations in commodity prices and volatility in exchange rates in the past have led to a deceleration in growth. In particular, the oil industry remains an important determinant of Colombia’s economic growth. Substantial or extended declines in international oil prices or national oil production may have an adverse effect on the overall performance of the Colombian economy and could have an adverse impact on the results of operations and financial condition of oil industry companies, which could have an adverse impact on our loans to oil industry companies. Our banking subsidiaries do not maintain a significant overall exposure to oil industry clients and have not been materially impacted by the decrease in international oil prices, however, continuing falling market prices, such as the one experienced during 2014 and 2015, pose significant challenges to Colombia’s near-term outlook and may impair the ability of some of the clients of our banking subsidiaries to repay their debt obligations. As of December 31, 2019, our combined gross exposure to the oil sector is 1.2% of the consolidated total gross loan portfolio, with the principal exposure being to companies which own or run oil pipelines (0.63%) in which Empresa Colombiana de Petróleos S.A. “Ecopetrol” is a majority shareholder. Ecopetrol is Colombia’s largest oil producer, with a majority ownership by the Colombian Government, and has a BBB- (S&P), BBB (Fitch Ratings), and Baa3 (Moody’s) long-term foreign currency issuer ratings. As of December 31, 2019, our gross exposure to oil service companies and suppliers to the oil sector (0.25% and 0.29% of the consolidated total gross loan portfolio, respectively) was immaterial. We do not believe this exposure will materially affect our results. Although the growth of the Colombian economy is expected to be steady in the future, there is no guarantee that the past decade’s average growth will be maintained.

A low rate of growth of the Colombian economy, a slowdown in the growth of customer demand, an increase in market competition, or changes in governmental regulations, could adversely affect the rate of growth of our loan portfolio and our cost of risk and, accordingly, increase our required loss allowances for loans. All of these conditions could lead to a general decrease in demand for borrowings. In addition, the effect on consumer confidence of any actual or perceived deterioration of household incomes in the Colombian or Central American economies may have a material adverse effect on our results of operations and financial condition.

Colombia has experienced and continues to experience internal security issues that have had or could have a negative effect on the Colombian economy.

Colombia has experienced internal security issues, primarily due to the activities of guerrilla groups, such as the National Liberation Army (Ejército de Liberación Nacional), or “ELN”, urban militias, paramilitary groups, former members of the Revolutionary Armed Forces of Colombia (Fuerzas Armadas Revolucionarias de Colombia), or “FARC”, and drug cartels. These groups have exerted influence over the local population and funded their activities by protecting, and rendering services to drug traffickers. The Colombian government reached a peace deal with the FARC in November 2016. Under Juan Manuel Santos’ administration, the Colombian government also began negotiations with ELN in October 2016, which had continued under a slower pace during the government of President Duque until January 17, 2019. As a result of an attack made by ELN to a police academy in Bogotá, the Colombian President cancelled peace talks. Any breakdown in peace, renewed or continuing drug-related crime and guerilla and paramilitary activities may have a negative impact on the Colombian economy in the future. Our business or financial condition could be adversely affected by rapidly changing economic or social conditions, including the Colombian government’s response to the peace deal with the FARC, or any peace negotiation with ELN or other group, which may result in legislation that increases our tax burden, or that of other Colombian companies, which could, in turn, impact the overall economy, or legislation that could directly impact our business, such as those requiring more flexible credit conditions for, or the employment of, former FARC members.

Political and economic instability in the region may affect the Colombian economy and, consequently, our results of operations and financial condition.

Some of Colombia’s neighboring countries, particularly Venezuela, have experienced and continue to experience periods of political and economic instability. According to figures from the United Nations, more than two million Venezuelans have emigrated amid food and medicine shortages and profound political divisions in their country. Approximately half of those migrants have opted to live in Colombia, and many have arrived with only what they could carry. Providing migrants with access to healthcare, utilities and education may have a negative impact on Colombia’s economy if the Government is not able to respond adequately to legalize migrants, generate programs to help them find formal jobs, and increase tax revenue and consumption.

Moreover, diplomatic relations with Venezuela and Ecuador have from time to time been tense and affected by events surrounding the Colombian military forces’ confrontations with guerilla groups, particularly on Colombia’s borders with each of Venezuela and Ecuador. More recently, the Colombian government joined an international campaign against Nicolás Maduro, recognizing Juan Guaido, chief of Venezuela’s opposition, as the country’s leader, which has further increased diplomatic tensions with Venezuela.

On November 19, 2012, the International Court of Justice placed a sizeable area of the Caribbean Sea within Nicaragua’s exclusive economic zone, which until then had been deemed by Colombia as part of its own exclusive economic zone. Currently, the Colombian Government is waiting for additional claims to be filed by Nicaragua as part of the first stage process with the International Court of Justice. A worsening of diplomatic relations between Colombia and Nicaragua involving the disputed waters could result in the Nicaraguan government taking measures, or a reaction among the Nicaraguan public, which would be detrimental to Colombian-owned interests in that country, including those owned by us through BAC Credomatic.

Further economic and political instability in Colombia’s neighboring countries or any future deterioration in relations with Venezuela, Ecuador, Nicaragua and other countries in the region may result in the closing of borders, the imposition of trade barriers and a breakdown of diplomatic ties, or a negative effect on Colombia’s trade balance, economy and general security situation, which may adversely affect our results of operations and financial condition.

Finally, political conditions such as changes in the United States policies related to immigration and remittances, could affect the regions in which we operate. Economic conditions in the United States and the region generally may be impacted by the United States-Mexico-Canada Agreement. This could have an indirect effect on the Colombian economy and the countries in which we operate.

Changes in government policies and actions, as well as judicial decisions in Colombia and other countries in which we operate, could significantly affect the local economy and, as a result, our results of operations and financial condition.

Our results of operations and financial condition may be adversely affected by changes in Colombian and Central American governmental policies and actions, and judicial decisions, involving a broad range of matters, including interest rates, fees, exchange rates, exchange controls, inflation rates, taxation, banking and pension fund regulations and other political or economic developments affecting Colombia and other countries in which we operate.

Colombian and Central American governments have historically exercised substantial influence over their economies, and their policies are likely to continue to have a significant effect on companies, including us.

In 2018, presidential elections were held in Colombia, and Mr. Iván Duque Márquez was elected for the presidential period 2018-2022 with 54% of the votes in the second round. President Duque is a former Senator from the Democratic Center party, and his agenda includes (i) tackling corruption, (ii) fighting against the increase of cocaine production, (iii) increasing focus on rule of law, (iv) entrepreneurship and (v) social equity. However, Mr. Duque’s government has experienced social dissatisfaction and generating social tensions within the principal cities of Colombia. The president of Colombia has considerable power to determine governmental policies and actions relating to the economy, and may adopt policies that negatively affect us.

Moreover, regulatory uncertainty, public dialogue on reforms during Mr. Duque’s presidential period and other countries where we operate, or the approval of reforms, may be disruptive to our business or the economy and may result in a material and adverse effect on our financial condition and results of operations.

We and our subsidiaries are subject to anti-corruption laws and other laws in the jurisdictions in which we operate and violation of these regulations could harm our business.

We and our subsidiaries are subject to numerous, and sometimes conflicting, legal regimes on matters as diverse as anti-corruption, taxation, internal and disclosure control obligations, securities and derivatives regulation, anti-competition regulations, data privacy and labor relations. Compliance with diverse legal requirements is costly, time-consuming and requires significant resources. Violations of one or more of these regulations in the conduct of our business or the business

of our subsidiaries could result in significant fines, criminal sanctions against us or our officers, prohibitions on doing business and damage to our reputation. Violations of these laws or regulations in connection with the performance of our obligations to our customers, as well as in connection with the performance of our subsidiaries’ obligations, could also result in liability for significant monetary damages, fines or criminal prosecution, unfavorable publicity and other reputational damage, restrictions on our ability to process information and allegations by our customers that we have not performed our contractual obligations. Because of the varying degrees of development of the legal systems of the countries in which we operate, local laws might be insufficient to protect our rights due in part to a lack of multiple recourses and/or deficiencies in the access to justice.

In particular, practices in the local business community may not conform to international business standards and could violate anti-corruption laws or regulations, including the U.S. Foreign Corrupt Practices Act. Our employees, and joint venture partners, or other third parties with which we associate, could take actions that violate policies or procedures designed to promote legal and regulatory compliance or applicable anti-corruption laws or regulations. Violations of these laws or regulations by us or our subsidiaries, our employees or any of these third parties could subject us to criminal or civil enforcement actions (whether or not we participated or knew about the actions leading to the violations), including fines or penalties, disgorgement of profits and suspension or disqualification from work, including governmental contracting, any of which could materially adversely affect our business, including our results of operations and our reputation.

Grupo Aval and certain of its subsidiaries and officers are defendants in government enforcement actions and/or subject to ongoing governmental investigations relating to the Ruta del Sol Project Sector 2 that could cause us to incur penalties and other sanctions, impact our ability to conduct our business, harm our reputation and negatively impact our financial results.

On December 21, 2016, the United States Department of Justice (“DOJ”) announced that Odebrecht S.A. (“Odebrecht”), a global construction conglomerate based in Brazil, pled guilty and agreed to pay a monetary penalty to resolve charges with authorities in the United States, Brazil and Switzerland, arising out of their schemes to pay approximately U.S.$800 million in bribes to government officials in twelve countries around the world, including U.S.$11.5 million in Colombia, where Odebrecht admitted to offering bribes in order to obtain and extend infrastructure contracts. Odebrecht further admitted to effecting these payments directly from its Brazilian headquarters through its division of structured operations.

Soon after Odebrecht’s guilty plea, Colombia’s Attorney General’s Office (the “Fiscalía General de la Nación” or “Fiscalía”) initiated several lines of investigations that have identified and incarcerated Colombian recipients of the Odebrecht bribes; the Fiscalía also established that Odebrecht effected payments through its “division of structured operations”, directly from its Brazilian headquarters, to obtain the contract for the construction of “Ruta del Sol Project Sector 2” toll road concession awarded to Concesionaria Ruta del Sol S.A.S. (“CRDS”) in 2009 and also to obtain the amendment to the contract in connection with the Ocaña-Gamarra addition to the Ruta del Sol II toll road in 2014. The Concession Contract No. 001 of 2010, for the construction of Ruta del Sol Sector 2 (the “Concession Contract”), was entered into on January 14, 2010 and the amendment in connection with the Ocaña-Gamarra addition was entered into on March 14, 2014. Episol S.A.S. (“Episol”), a wholly-owned subsidiary of Corficolombiana and an indirect subsidiary of Grupo Aval, is a minority (33%) non-controlling shareholder in CRDS and Odebrecht is the majority controlling and operating shareholder with a participation of 62%. A third shareholder, CSS Constructores S.A., has a 5% participation in CRDS.

Episol, and the former president of Corficolombiana are among the defendants in a class action lawsuit brought by the Procuraduría General de la Nación before the Administrative Tribunal of Cundinamarca (“TAC”) relating to the alleged payment of bribes in connection with the Ruta del Sol Project Sector 2. The TAC ruled in December 2018 that Episol, along with Odebrecht, and other defendants, including the former president of Corficolombiana, were jointly liable for the damages to the Nation caused by the payment of bribes confessed by Odebrecht related to the Ruta del Sol Project Sector 2, ordered the defendants to jointly and severally pay the Ministry of Transportation Ps 715.6 billion, and debarred them from contracting with Colombian state entities and from assuming government positions for a period of 10 years. Episol and the other defendants filed an appeal of this ruling before Colombia’s Supreme Court for administrative law matters (Consejo de Estado).

Grupo Aval, Corficolombiana, Episol, Grupo Aval’s president and Grupo Aval’s chief financial officer, Corficolombiana’s Vice President of Investments and Corficolombiana’s Vice President of Investment Banking, the former president of Corficolombiana and other defendants have been charged by the Colombian Superintendency of Industry and Commerce (“SIC”) with alleged violations of Colombian antitrust regulations in connection with the Ruta del Sol Project Sector 2. The proceeding is ongoing.

Grupo Aval is also subject to investigations by the DOJ and by the SEC concerning the Ruta del Sol Project Sector 2. Grupo Aval is cooperating with the DOJ’s and SEC’s investigations, as it has done with all prior government inquiries into this matter.

On April 1, 2019, Jose Elias Melo, the former president of Corficolombiana, was found guilty in a court of first instance of bribery and undue interest in connection with the 2009 bid for the Ruta del Sol Project Sector 2. Mr. Melo appealed the court’s decision.

For further information about the foregoing proceedings and investigations, see “Item 8. Financial Information—A. Consolidated statements and other financial information—Legal proceedings”.

We have not recorded any accrual for the SIC proceeding and the TAC class action, however, there can be no assurance as to the terms of the final resolution and the timing of these matters. At this time it is not possible to predict the scope, duration or likely outcome of the DOJ and SEC investigations. Similarly, it is not possible to predict at this time whether additional investigations or proceedings relating to Ruta del Sol Project Sector 2 may arise.

We and our subsidiaries are exposed to a variety of potential material negative consequences as a result of the proceedings and investigations noted above, which could result in judgments, settlements, admissions of wrongdoing, criminal convictions, fines, penalties, injunctions, cease and desist orders, debarment or other relief and we and our subsidiaries could be exposed to other litigation as a result of these proceedings and investigations, including actions initiated by shareholders.

Such investigations and proceedings, which are the subject of extensive media coverage and political interest in Colombia, could also have significant collateral consequences for our company and our subsidiaries, including damage to reputation, loss of customers and business, the inability to offer certain products and services, disqualification or losing permission to operate certain businesses for a period, the dissemination of potentially damaging information that may come to light in the course of the investigations and proceedings and other direct and indirect adverse effects. Management will need to continue to direct substantial time and attention to resolving such matters, which could prevent them from focusing on our core businesses. We can provide no assurance that the outcome of any such investigations and proceedings will not be material to our business, financial position, results of operations or our financial position.

New or higher taxes resulting from changes in tax regulations or the interpretation thereof in Colombia and other countries in which we operate could adversely affect our results of operations and financial condition.