UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)two

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2015 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________ |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report |

Commission file number: 001-36631

GRUPO AVAL ACCIONES Y VALORES S.A.

(Exact name of Registrant as specified in its charter)

Republic of Colombia

(Jurisdiction of incorporation)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive offices)

Jorge Adrián Rincón

Chief Legal Counsel

Grupo Aval Acciones y Valores S.A.

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

Phone: (+57 1) 241-9700

E-mail: jrincon@grupoaval.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Nicholas A. Kronfeld, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450-4000

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Title of each class | | Name of each exchange on which registered |

| American Depositary Shares, each representing 20 preferred shares, par value Ps 1.00 per preferred share | | New York Stock Exchange |

| Preferred Shares, par value Ps 1.00 per preferred share | | New York Stock Exchange* |

* Grupo Aval Acciones y Valores S.A.’s preferred shares are not listed for trading, but are only listed in connection with the registration of the American Depositary Shares, pursuant to the requirements of the New York Stock Exchange.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by the annual report.

Preferred shares: 7,014,053,500

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes ¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other ¨ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

table of contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references herein to “peso,” “pesos,” or “Ps” refer to the lawful currency of Colombia. All references to “U.S. dollars,” “dollars” or “U.S.$” are to United States dollars. See “Item 3. Key information—A. Selected financial and operating data—Exchange rates” for information regarding exchange rates for the Colombian currency. This annual report translates certain Colombian peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. The conversion of amounts expressed in pesos as of a specified date at the then prevailing exchange rate may result in the presentation of U.S. dollar amounts that differ from U.S. dollar amounts that would have been obtained by converting Colombian pesos as of another specified date. Unless otherwise noted in this annual report, all such peso amounts have been translated at the rate of Ps 3,149.47 per U.S.$1.00, which was the representative market rate calculated on December 31, 2015. The representative market rate is computed and certified by the Superintendency of Finance on a daily basis and represents the weighted average of the buy/sell foreign exchange rates negotiated on the previous day by certain financial institutions authorized to engage in foreign exchange transactions. Such conversion should not be construed as a representation that the peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On April 28, 2016, the representative market rate was Ps 2,943.23 per U.S.$1.00.

Definitions

In this annual report, unless otherwise indicated or the context otherwise requires, the terms:

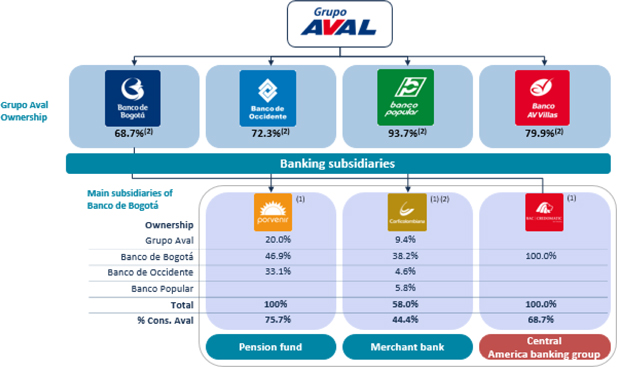

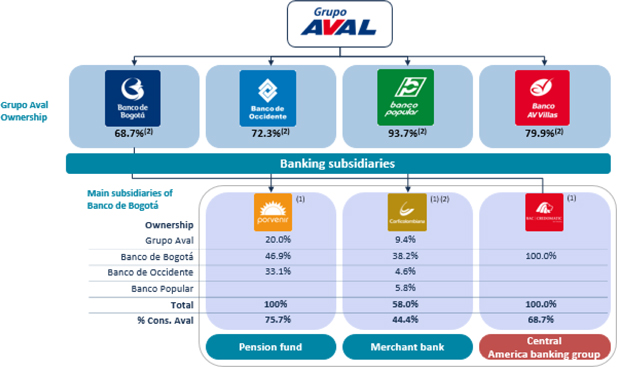

| · | “Grupo Aval,” “we,” “us,” “our” and “our company” mean Grupo Aval Acciones y Valores S.A. and its consolidated subsidiaries; |

| · | “banks” and “our banking subsidiaries” mean Banco de Bogotá S.A., Banco de Occidente S.A., Banco Popular S.A. and Banco Comercial AV Villas S.A., and their respective consolidated subsidiaries; |

| · | “Banco de Bogotá” means Banco de Bogotá S.A. and its consolidated subsidiaries; |

| · | “Banco de Occidente” means Banco de Occidente S.A. and its consolidated subsidiaries; |

| · | “Banco Popular” means Banco Popular S.A. and its consolidated subsidiaries; |

| · | “Banco AV Villas” means Banco Comercial AV Villas S.A. and its consolidated subsidiary; |

| · | “BAC Credomatic” or “BAC” means BAC Credomatic Inc. and its consolidated subsidiaries; |

| · | “Corficolombiana” means Corporación Financiera Colombiana S.A. and its consolidated subsidiaries; |

| · | “LB Panamá” means Leasing Bogotá S.A., Panamá and its consolidated subsidiaries; |

| · | “Porvenir” means Sociedad Administradora de Fondos de Pensiones y Cesantías Porvenir S.A. and its consolidated subsidiary; and |

| · | “Superintendency of Finance” means the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia), a supervisory authority ascribed to the Colombian Ministry of Finance and Public Credit (Ministerio de Hacienda y Crédito Público), or the “Ministry of Finance,” holding the inspection, supervision and control authority over the persons or entities involved in financial activities, securities markets, insurance and any other operations related to the management, use or investment of resources collected from the public. |

In this annual report, references to “beneficial ownership” are calculated pursuant to the definition ascribed by the U.S. Securities and Exchange Commission, or the “SEC,” of beneficial ownership for foreign private issuers contained in Form 20-F. Form 20-F defines the term “beneficial owner” of securities as referring to any person who, even if not the record owner of the securities, has or shares the underlying benefits of ownership, including the power to direct the voting or the disposition of the securities or to receive the economic benefit of ownership of the securities. A person is also considered to be the “beneficial owner” of securities when such person has the right to acquire within 60 days pursuant to an option or other agreement. Beneficial owners include persons who hold their

securities through one or more trustees, brokers, agents, legal representatives or other intermediaries, or through companies in which they have a “controlling interest,” which means the direct or indirect power to direct the management and policies of the entity.

Financial statements

We are an issuer in Colombia of securities registered with the National Registry of Shares and Issuers, and in this capacity, we are subject to oversight by the Superintendency of Finance. We are not a financial institution in Colombia. We are required to comply with corporate governance and periodic reporting requirements to which all issuers are subject, but we are not supervised or regulated as a financial institution or as a holding company of banking subsidiaries and, thus, are not required to comply with the capital adequacy regulations applicable to banks and other financial institutions. All of our banking subsidiaries (Banco de Bogotá, Banco de Occidente, Banco Popular, Banco AV Villas, and their respective financial subsidiaries, including Porvenir and Corficolombiana) are entities under the direct comprehensive supervision of, and subject to inspection and surveillance as financial institutions by, the Superintendency of Finance and, in the case of BAC Credomatic, subject to inspection and surveillance as a financial institution by the relevant regulatory authorities in each country where BAC Credomatic operates.

Our consolidated financial statements at December 31, 2015 and 2014 and January 1, 2014 and for the years ended December 31, 2015 and 2014 have been audited, as stated in the report appearing therein, by KPMG Ltda., and are included in this annual report and referred to as our audited consolidated financial statements. Our historical results are not necessarily indicative of results to be expected for future periods. We have prepared the audited consolidated financial statements included herein in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). These are the first financial statements prepared under IFRS, and therefore the opening statement of financial position was prepared as of January 1, 2014, the date of our transition to IFRS, as required by IFRS 1—“First Time Adoption of International Financial Reporting Standards”. The comparative figures at and for the year ended December 31, 2014 reflect adjustments and reclassifications made as a result of our adoption of IFRS. Previously, our consolidated financial statements were prepared in accordance with the regulations of the Superintendency of Finance applicable to financial institutions (Resolution 3600 of 1988 and External Circular 100 of 1995) and, on issues not addressed by these regulations, generally accepted accounting principles prescribed by the Superintendency of Finance for banks operating in Colombia (which we refer to in this annual report, collectively, as “Colombian Banking GAAP”). See Note 38 to our audited consolidated financial statements included in this document for a discussion of the main differences between IFRS and Colombian Banking GAAP. We have included certain information prepared under Colombian Banking GAAP at and for the years ended December 31, 2013, 2012 and 2011 in Appendix A — “Selected 2013, 2012 and 2011 Financial and Statistical Data Prepared under Colombian Banking GAAP” to provide information for prior years. Colombian Banking GAAP is not comparable to IFRS.

We, and our Colombian subsidiaries, are also required to prepare consolidated financial statements for publication in Colombia under International Financial Reporting Standards as adopted by the Superintendency of Finance in accordance with Decree 1851 of 2013 and 3023 of 2013 as modified by Decree 2420 of 2015 (which we refer to as “Colombian IFRS”). Colombian IFRS differs from IFRS as issued by the International Accounting Standards Board (“IASB”) in certain material respects.

Colombian IFRS is based on IFRS as of December 31, 2013, and certain Colombian regulation. As a result, certain rules subsequently issued by the IASB are not applicable under Colombian IFRS and our financial statements for local purposes differ from our financial statements under IFRS in the following principal aspects:

| 1. | Under Colombian regulations, wealth tax, created by the Colombian congress in 2014 and to be paid by companies during 2015, 2016 and 2017, calculated based on the tax equity method can be recorded against equity reserves. However under IFRS, according to IFRIC 21, wealth tax liabilities must be recorded against the statement of income. |

| 2. | Under Colombian IFRS, allowances for loan losses are calculated based on specific rules of the Financial and Accounting Basic Circular (Circular Básica Contable y Financiera) issued by the Superintendency of Finance for the separate financial statements; and according to the criteria set forth in International Accounting Standard (“IAS”) 39 for consolidated financial statements. Under Colombian IFRS, the difference between both methodologies in the consolidated financial statements is recorded in other comprehensive income, whereas under IFRS, allowances for loan losses are calculated according to the criteria set forth in IAS 39 and recorded in the statement of income of each period. |

| 3. | Consolidated financial statements prepared under Colombian IFRS classify debt securities into one of two categories: fair value through profit or loss or amortized cost. Entities with non-controlling or non-significant influence in equity securities must record fair value changes in other comprehensive income, in accordance with the guidance set out in IFRS 9. |

Non-IFRS financial measures

We have included in this annual report non-IFRS measures such as return on average assets, or “ROAA,” and return on average equity, or “ROAE”. These measures should not be construed as an alternative to IFRS measures and should also not be compared to similarly titled measures reported by other companies, which may evaluate such measures differently from how we do. For Non-IFRS measures to IFRS measures, see “Item 3-Key Information—A. Selected financial and operating data—Non-IFRS measures.”

Market share and other information

We obtained the market and competitive position data, including market forecasts, used throughout this annual report from market research, publicly available information and industry publications. We have presented this data on the basis of information from third-party sources that we believe are reliable, including, among others, the International Monetary Fund, or “IMF,” the Superintendency of Finance, the Colombian Stock Exchange, the Colombian National Bureau of Statistics (Departamento Administrativo Nacional de Estadística), or “DANE,” the 2010 and 2011 World Bank Development Indicators, the Economist Intelligence Unit and Euromonitor International. Industry and government publications, including those referenced herein, generally state that the information presented has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Unless otherwise indicated, gross domestic product, or “GDP,” figures with respect to Colombia in this annual report are based on the 2005 base year data series published by DANE. Although we have no reason to believe that any of this information or these reports is inaccurate in any material respect, we have not independently verified the competitive position, market share, market size, market growth or other data provided by third parties or by industry or other publications. We do not make any representation or warranty as to the accuracy of such information.

Our statement of financial position and statement of income for the periods commencing on January 1, 2014, reflects information prepared under IFRS, while comparative disclosures of our financial and operating performance from our competitors are based on unconsolidated information prepared on the basis of Colombian IFRS reported to the Superintendency of Finance. We and our banking subsidiaries also report unconsolidated financial data to the Superintendency of Finance. Unless otherwise indicated or the context otherwise requires, market share and other data comparing our performance to that of our competitors reflects the unconsolidated results of our banking subsidiaries, Porvenir, Corficolombiana and BAC Credomatic. “Grupo Aval aggregate” data throughout this annual report reflects the sum of the unconsolidated financial statements of our four Colombian banking subsidiaries (Banco de Bogotá, Banco de Occidente, Banco Popular and Banco AV Villas) as reported to the Superintendency of Finance. These unconsolidated financial statements under Colombian IFRS do not reflect the consolidation of subsidiaries such as Corficolombiana, Porvenir or LB Panamá, are not intended to reflect the consolidated financial results of Grupo Aval and are not necessarily indicative of the results for any other future interim period. Except where otherwise indicated, financial and market share data pertaining to BAC Credomatic has been prepared in accordance with IFRS, unless otherwise indicated. All information regarding our market share and those of our competitors is presented on an unconsolidated basis under Colombian IFRS is based on publicly available information filed with the Superintendency of Finance. This unconsolidated information does not account for businesses of our banking subsidiaries or those of our competitors that are operated through their respective subsidiaries.

Banks, financing companies and finance corporations are deemed credit institutions by the Superintendency of Finance and are the principal institutions authorized to accept deposits and make loans in Colombia. Banks undertake traditional deposit-taking and lending activities. Financing companies place funds in circulation by means of active credit operations, with the purpose of fostering the sale of goods and services, including the development of leasing operations. Finance corporations invest directly in the economy and thus are the only credit institutions that may invest in non-financial sectors. Banks are permitted to invest in finance corporations. See “Item 4. Information on the Company—B. Business overview—Supervision and regulation.” In Colombia, we operate four banks, one financing company and one finance corporation, and our market share is determined by comparing our banks to other banks reporting their results to the Superintendency of Finance. However, if financing companies and finance corporations are included in the calculation of market share data, our market shares would generally be lower than in a bank-only comparison, and the gaps between our market shares and those of our competitors would be smaller, but our market leadership in most market categories would be unaffected.

We consider our principal competitors in Colombia to be Bancolombia S.A., or “Bancolombia,” Banco Davivienda S.A., or “Davivienda,” and Banco Bilbao Vizcaya Argentaria Colombia S.A., or “BBVA Colombia,” which are the three leading banking groups in Colombia after Grupo Aval.

The principal competitors of Porvenir, our pension and severance fund administrator, include Administradora de Fondos de Pensiones y Cesantías Protección S.A., or “Protección,” Colfondos S.A. Pensiones y Cesantías, or “Colfondos,” and Old Mutual Administradora de Fondos de Pensiones y Cesantías S.A., or “Old Mutual,” We have

included in this annual report competitive market position data for Porvenir as compared to its principal competitors. Corficolombiana, our merchant bank, is a financial corporation, and its competitors include Banca de Inversión Bancolombia S.A., J.P. Morgan Corporación Financiera S.A., BNP Paribas Colombia Corporación Financiera S.A. and Itaú BBA Colombia S.A. Corporación Financiera.

Our principal competitors in Costa Rica, El Salvador, Guatemala, Nicaragua and Panamá include Banco Industrial, Scotiabank, G&T Continental and Bancolombia.

We include certain ratios in this annual report which we believe provide investors with important information regarding our operations, such as return on average equity, or “ROAE,” return on average assets, or “ROAA,” net interest margin, and operational efficiency and asset quality indicators, among others. Certain of these ratios are also used in this annual report to compare us to our principal competitors.

Other conventions

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic summation of the figures that precede them. References to “billions” in this annual report are to 1,000,000,000s and to “trillions” are to 1,000,000,000,000s.

“Non-controlling interest” refers to the participation of minority shareholders in Grupo Aval or our subsidiaries, as applicable.

“Central American acquisitions” refers to the acquisitions by Banco de Bogotá of (i) a 98.92% equity interest in Banco BAC de Panamá on December 19, 2013 through its subsidiary LB Panamá and (ii) 100.00% equity interest in Grupo Financiero Reformador de Guatemala on December 23, 2013 through its indirect subsidiary Credomatic International Corporation (a subsidiary of LB Panamá). On December 9, 2014, Banco BAC de Panamá was merged into BAC International Bank, Inc. and on December 12, 2015 Grupo Financiero Reformador de Guatemala´s operation merged with Banco de América Central S.A. (Guatemala).

FORWARD-LOOKING STATEMENTS

This annual report contains estimates and forward-looking statements, principally in “Item 3. Key information—D. Risk factors,” “Item 5. Operating and financial review and prospects” and “Item 4. Information on the Company—B. Business overview.” Some of the matters discussed concerning our operations and financial performance include estimates and forward-looking statements within the meaning of the Securities Act and the U.S. Securities Exchange Act of 1934, as amended, or the “Exchange Act.”

Our estimates and forward-looking statements are mainly based on our current expectations and estimates on projections of future events and trends, which affect or may affect our businesses and results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are made in light of information currently available to us. Our estimates and forward-looking statements may be influenced by the following factors, among others:

| · | changes in Colombian, Central American, regional and international business and economic, political or other conditions; |

| · | developments affecting Colombian, Central American and international capital and financial markets; |

| · | government regulation and tax matters and developments affecting our company and industry; |

| · | declines in the oil and affiliated services sector in the Colombian and global economies; |

| · | increases in defaults by our customers; |

| · | increases in goodwill impairment losses; |

| · | decreases in deposits, customer loss or revenue loss; |

| · | increases in provisions for contingent liabilities; |

| · | our ability to sustain or improve our financial performance; |

| · | increases in inflation rates, particularly in Colombia and in jurisdictions in which we operate in Central America; |

| · | the level of penetration of financial products and credit in Colombia and Central America; |

| · | changes in interest rates which may, among other effects, adversely affect margins and the valuation of our treasury portfolio; |

| · | decreases in the spread between investment yields and implied interest rates in annuities; |

| · | movements in exchange rates; |

| · | competition in the banking and financial services, credit card services, insurance, asset management, pension fund administration and related industries; |

| · | adequacy of risk management procedures and credit, market and other risks of lending and investment activities; |

| · | decreases in our level of capitalization; |

| · | changes in market values of Colombian and Central American securities, particularly Colombian government securities; |

| · | adverse legal or regulatory disputes or proceedings; |

| · | successful integration and future performance of acquired businesses or assets; |

| · | natural disasters and internal security issues affecting countries where we operate; |

| · | loss of any key member of our senior management; and |

| · | other risk factors as set forth under ““Item 3. Key information—D. Risk factors.” |

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements speak only at the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this annual report might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to the factors mentioned above, among others. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

These cautionary statements should be considered in connection with any written or oral forward-looking statements that we may issue in the future.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| A. | Directors and senior management |

Not applicable.

Not applicable.

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| B. | Method and expected timetable |

Not applicable.

ITEM 3. KEY INFORMATION

| A. | Selected financial data |

The following financial data of Grupo Aval at December 31, 2015 and 2014 and January 1, 2014 and for the years ended December 31, 2015 and 2014 have been derived from our audited consolidated financial statements prepared in accordance with IFRS that are included in this annual report. Our historical results are not necessarily indicative of results to be expected for future periods.

This financial data should be read in conjunction with our audited annual consolidated financial statements and the related notes, “Presentation of financial and other information” and “Item 5. Operating and financial review and prospects” included in this annual report.

Statement of income

| | | Grupo Aval | |

| | | For the year ended December 31, | |

| | | 2015 | | | 2015 | | | 2014 | |

| | | (in U.S.$ millions,

unless otherwise

indicated)(1) | | | (in Ps billions, except share and per share data) | |

| Interest income | | | 4,469.2 | | | | 14,075.6 | | | | 11,421.8 | |

| Interest expense | | | (1,826.2 | ) | | | (5,751.5 | ) | | | (4,498.7 | ) |

| Net interest income | | | 2,643.0 | | | | 8,324.1 | | | | 6,923.1 | |

| Impairment loss on loans and accounts receivable | | | (675.6 | ) | | | (2,127.7 | ) | | | (1,697.5 | ) |

| Impairment loss on other financial assets (1) | | | (10.2 | ) | | | (32.2 | ) | | | (12.0 | ) |

| Recovery of charged-off assets | | | 69.8 | | | | 219.7 | | | | 189.6 | |

| Net impairment loss on financial assets | | | (616.1 | ) | | | (1,940.2 | ) | | | (1,519.9 | ) |

| Net income from commissions and fees | | | 1,162.8 | | | | 3,662.3 | | | | 3,037.2 | |

| Net trading income | | | 77.9 | | | | 245.2 | | | | 369.9 | |

| Total other income (expense) (2) | | | 807.2 | | | | 2,542.4 | | | | 2,269.0 | |

| Total other expenses | | | (2,416.0 | ) | | | (7,609.1 | ) | | | (6,273.5 | ) |

| Income before income tax expense | | | 1,658.9 | | | | 5,224.7 | | | | 4,805.8 | |

| Income tax expense | | | (596.6 | ) | | | (1,879.0 | ) | | | (1,808.3 | ) |

| Net Income | | | 1,062.3 | | | | 3,345.7 | | | | 2,997.5 | |

| Net income attributable to : | | | | | | | | | | | | |

| Controlling interest | | | 648.2 | | | | 2,041.4 | | | | 1,815.0 | |

| Non-controlling interest | | | 414.1 | | | | 1,304.3 | | | | 1,182.5 | |

| | | | | | | | | | | | | |

| Earnings per 1,000 shares (basic and diluted earnings): | | | | | | | | | | | | |

| Common and preferred shares (in pesos) | | | | | | | 91,619.0 | | | | 86,853.8 | |

| Common and preferred shares (in U.S. dollars) (3) | | | | | | | 29.1 | | | | 36.3 | |

| Dividends per 1,000 shares (4): | | | | | | | | | | | | |

| Common and preferred shares (in pesos) | | | | | | | 58,800.0 | | | | 61,733.7 | |

| Common and preferred shares (in U.S. dollars) (3) | | | | | | | 18.7 | | | | 25.8 | |

| | | | | | | | | | | | | |

| Weighted average number of common and preferred fully paid shares outstanding (basic and diluted): | | | | | | | | | | | | |

| Outstanding shares in thousands | | | | | | | 22,281,017.2 | | | | 20,897,356.4 | |

| (1) | Includes impairment loss on non-current assets held for sale and investments in debt and equity securities. |

| (2) | Includes net income from financial instruments designated at fair value. |

| (3) | Translated for convenience only using the representative market rate as computed and certified by the Superintendency of Finance of 3,149.47 and 2,392.46 per U.S.$1.00 at December 31, 2015 and 2014, respectively. |

| (4) | Dividends are declared semi-annually in March (for the six-month period ended December 31 of the previous year) and September (for the six-month period ended June 30 of the current year) of each year. We do not declare dividends on a quarterly basis. |

Statement of financial position

| | | Grupo Aval | |

| | | For the year ended December 31, | | | January 1, | |

| | | 2015 | | | 2015 | | | 2014 | | | 2014 | |

| | | (in U.S.$ millions,

unless otherwise

indicated)(1) | | | (in Ps billions, except share and per share data) | |

| | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 7,075.8 | | | | 22,285.0 | | | | 17,269.8 | | | | 14,599.3 | |

| Financial assets held for trading through profit or losses | | | 1,780.7 | | | | 5,608.2 | | | | 5,864.5 | | | | 7,090.4 | |

| Other financial assets at fair value through profit or losses | | | 600.6 | | | | 1,891.7 | | | | 1,738.6 | | | | 1,565.7 | |

| Available for sale financial assets | | | 6,250.2 | | | | 19,684.9 | | | | 18,758.8 | | | | 14,815.7 | |

| Investments held to maturity | | | 760.5 | | | | 2,395.3 | | | | 2,665.8 | | | | 3,040.4 | |

| Total Financial assets | | | 9,392.1 | | | | 29,580.1 | | | | 29,027.7 | | | | 26,512.2 | |

| Loans and receivables | | | 45,032.2 | | | | 141,827.7 | | | | 114,400.7 | | | | 98,920.7 | |

| Other accounts receivables | | | 1,016.7 | | | | 3,202.2 | | | | 2,233.4 | | | | 1,768.8 | |

| Hedging derivatives | | | 10.7 | | | | 33.7 | | | | 64.8 | | | | 17.1 | |

| Non-current assets held for sale | | | 63.3 | | | | 199.5 | | | | 211.2 | | | | 303.7 | |

| Tangible assets | | | 2,068.3 | | | | 6,514.0 | | | | 5,886.7 | | | | 5,467.7 | |

| Goodwill (2) | | | 2,240.4 | | | | 7,056.0 | | | | 5,867.2 | | | | 5,130.5 | |

| Concession arrangements rights | | | 759.1 | | | | 2,390.7 | | | | 1,842.7 | | | | 1,759.2 | |

| Other intangible assets | | | 194.6 | | | | 612.9 | | | | 388.1 | | | | 212.0 | |

| Intangible assets (2) | | | 953.7 | | | | 3,003.6 | | | | 2,230.8 | | | | 1,971.2 | |

| Income tax assets | | | 471.6 | | | | 1,485.2 | | | | 440.0 | | | | 229.9 | |

| Other assets | | | 473.8 | | | | 1,492.3 | | | | 1,209.6 | | | | 937.2 | |

| Total assets | | | 68,798.6 | | | | 216,679.3 | | | | 178,842.2 | | | | 155,858.2 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Derivatives instruments held for trading | | | 363.0 | | | | 1,143.2 | | | | 1,183.1 | | | | 214.5 | |

| Customer deposits | | | 43,167.5 | | | | 135,954.6 | | | | 113,528.5 | | | | 100,553.0 | |

| Interbank borrowings and overnight funds | | | 3,008.4 | | | | 9,474.9 | | | | 4,964.4 | | | | 5,340.4 | |

| Borrowings from banks and others | | | 5,953.6 | | | | 18,750.6 | | | | 13,685.8 | | | | 10,753.0 | |

| Long-term debt (bonds) | | | 5,260.3 | | | | 16,567.1 | | | | 14,130.1 | | | | 12,747.6 | |

| Borrowings from development entities | | | 795.9 | | | | 2,506.6 | | | | 2,108.5 | | | | 2,108.8 | |

| Hedging derivatives | | | 107.2 | | | | 337.7 | | | | 559.5 | | | | 47.4 | |

| Provisions | | | 190.6 | | | | 600.2 | | | | 744.7 | | | | 749.0 | |

| Income tax liabilities | | | 600.8 | | | | 1,892.1 | | | | 1,691.3 | | | | 1,702.7 | |

| Employee benefits | | | 324.6 | | | | 1,022.3 | | | | 975.7 | | | | 954.1 | |

| Other liabilities | | | 1,753.8 | | | | 5,523.5 | | | | 3,914.7 | | | | 3,848.1 | |

| Total liabilities | | | 61,525.6 | | | | 193,773.0 | | | | 157,486.2 | | | | 139,018.8 | |

| | | | | | | | | | | | | | | | | |

| Equity | | | | | | | | | | | | | | | | |

| Controlling interest | | | | | | | | | | | | | | | | |

| Subscribed and paid-in capital: | | | | | | | | | | | | | | | | |

| Common and preferred shares | | | 7.1 | | | | 22.3 | | | | 22.3 | | | | 20.2 | |

| Additional paid-in capital | | | 2,637.8 | | | | 8,307.8 | | | | 8,311.9 | | | | 5,784.5 | |

| Retained earnings: | | | | | | | | | | | | | | | | |

| Appropriated | | | 2,722.6 | | | | 8,574.8 | | | | 6,205.6 | | | | 4,510.8 | |

| Unappropriated | | | (1,514.8 | ) | | | (4,770.9 | ) | | | (2,889.9 | ) | | | (958.2 | ) |

| First time IFRS adoption | | | 249.8 | | | | 786.7 | | | | 786.7 | | | | 786.7 | |

| Net income for the year | | | 352.1 | | | | 1,108.9 | | | | 859.1 | | | | 0.0 | |

| Accumulated other comprehensive income | | | 170.9 | | | | 538.1 | | | | 372.3 | | | | 120.1 | |

| Controlling interest | | | 4,625.4 | | | | 14,567.6 | | | | 13,668.0 | | | | 10,264.1 | |

| Non-controlling interest | | | 2,647.6 | | | | 8,338.7 | | | | 7,687.9 | | | | 6,575.4 | |

| Total equity | | | 7,273.1 | | | | 22,906.3 | | | | 21,356.0 | | | | 16,839.4 | |

| Total liabilities and equity | | | 68,798.6 | | | | 216,679.3 | | | | 178,842.2 | | | | 155,858.2 | |

| (1) | Translated for convenience only using the representative market rate as computed and certified by the Superintendency of Finance at December 31, 2015 of Ps 3,149.47 per U.S.$1.00. |

| (2) | Goodwill attributable to Grupo Aval was Ps 3,854.9 billion, Ps 3,063.9 billion and Ps 2,947.6 billion at December 31, 2015 and 2014 and January 1, 2014, respectively. Our attributable tangible equity (calculated as total equity attributable to |

controlling interest minus goodwill and intangible assets attributable to Grupo Aval) was Ps 10,216.6 billion, Ps 10,330.5 billion and Ps 7,168.4 billion at December 31, 2015 and 2014 and January 1, 2014, respectively.

Other financial and operating data

| | | Grupo Aval | |

| | | At and for the years ended December 31, | |

| | | 2015 | | | 2014 | |

| | | (in percentages, unless otherwise indicated) | |

| Profitability ratios: | | | | | | | | |

| Net interest margin (1) | | | 5.5 | % | | | 5.4 | % |

| ROAA (2) | | | 1.7 | % | | | 1.8 | % |

| ROAE (3) | | | 14.5 | % | | | 15.2 | % |

| | | | | | | | | |

| Efficiency ratio (4): | | | 47.6 | % | | | 46.2 | % |

| Capital ratios: | | | | | | | | |

| Period-end equity as a percentage of period-end total assets | | | 10.6 | % | | | 11.9 | % |

| Tangible equity ratio (5) | | | 7.3 | % | | | 8.7 | % |

| Credit quality data: | | | | | | | | |

| Charge-offs as a percentage of average gross loans (6) | | | 1.3 | % | | | 1.3 | % |

| Delinquency ratio loans past due more than 30 days (6) | | | 2.7 | % | | | 2.8 | % |

| Non-performing loans (6) (7) | | | 1.7 | % | | | 1.7 | % |

| Allowance for loans as a percentage of past due loans more than 30 days | | | 98.9 | % | | | 96.7 | % |

| Allowance for loans as a percentage of non-performing loans | | | 157.9 | % | | | 157.0 | % |

| Allowance for loans as a percentage of gross loans (6) | | | 2.6 | % | | | 2.7 | % |

| Operational data (in units): | | | | | | | | |

| Number of customers of the banks (8) | | | 13,678,194 | | | | 12,950,374 | |

| Number of employees | | | 76,095 | | | | 74,211 | |

| Number of branches (9) | | | 1,785 | | | | 1,769 | |

| Number of ATMs (9) | | | 5,623 | | | | 5,429 | |

| (1) | Net interest margin is calculated as net interest income divided by total average interest-earning assets. If net interest margin was calculated as net interest income plus net trading income from securities held for trading through profit or loss divided by total average interest-earning assets plus investment securities held for trading through profit or loss it would be 5.4% and 5.5% for the years ended December 31, 2015 and 2014, respectively. |

| (2) | For the years ended December 31, 2015 and 2014, ROAA is calculated as net income divided by average assets. Average assets for 2015 is calculated as the sum of assets at December 31, 2015 and 2014 divided by two. Average assets for 2014 is calculated as the sum of assets at December 31, 2014 and January 1, 2014 divided by two. |

| (3) | For the years ended December 31, 2015 and 2014, ROAE is calculated as net income attributable to controlling interest divided by average equity attributable to controlling interest. Average equity attributable to controlling interest for 2015 is calculated as the sum of equity attributable to controlling interest at December 31, 2015 and 2014 divided by two. Average equity attributable to controlling interest for 2014 is calculated as the sum of equity attributable to controlling interest at December 31, 2014 and January 1, 2014 divided by two. |

| (4) | Efficiency ratio is calculated as personnel expenses plus administrative and other expenses divided by net interest income, net income from commissions and fees, net trading income and other income excluding other. |

| (5) | Tangible equity ratio is calculated as total equity minus intangible assets (calculated as goodwill plus other intangible assets excluding those related to concession arrangements rights) divided by total assets minus intangible assets (calculated as goodwill plus other intangible assets excluding those related to concession arrangements rights). If tangible equity ratio is calculated as total equity minus intangible assets (calculated as goodwill plus other intangible assets) divided by total assets minus intangible assets (calculated as goodwill plus other intangible assets) tangible equity ratio would be 6.2% and 7.8% for the years ended December 31, 2015 and 2014, respectively. |

See “Item 3. Key Information—A. Selected financial and operating data—Non-IFRS measures.”

| (6) | Gross loans excludes Interbank and overnight funds |

| (7) | Non-performing loans are loans with more than 90 days past due. |

| (8) | Reflects aggregated customers of our banking subsidiaries. Customers of more than one of our banking subsidiaries and BAC Credomatic are counted separately for each banking subsidiary. |

| (9) | Reflects aggregated number of branches or ATMs of our banking subsidiaries and BAC Credomatic, as applicable, located throughout Colombia and Central America. |

Non-IFRS measures

The tables in this section and elsewhere in this annual report provide the calculation of certain Non-IFRS measures. The Non-IFRS financial measures as determined and measured by us should not be construed as an alternative to IFRS measures and should also not be compared to similarly titled measures reported by other companies. Other companies may calculate and report such measures differently.

ROAA and ROAE

ROAA, which is calculated as net income divided by average assets, provides a measure of return on assets. We believe ROAE, which is calculated as net income divided by average equity, provides a measure of the return generated for our shareholders.

The following table sets forth ROAA and ROAE using end of period consolidated information under IFRS for average assets and average equity for Grupo Aval for the indicated years.

| | | Year ended December 31, | |

| | | 2015 | | | 2014 | |

| | | (in Ps billions, except percentages) | |

| Grupo Aval (consolidated): | | | | | | | | |

| Average assets(1) | | | 197,760.7 | | | | 167,350.2 | |

| Average equity attributable to controlling interest (2) | | | 14,117.8 | | | | 11,966.0 | |

| Net income | | | 3,345.7 | | | | 2,997.5 | |

| Net income attributable to controlling interest | | | 2,041.4 | | | | 1,815.0 | |

| Net income attributable to non-controlling interest | | | 1,304.3 | | | | 1,182.5 | |

| ROAA(1) | | | 1.7 | % | | | 1.8 | % |

| ROAE(2) | | | 14.5 | % | | | 15.2 | % |

| Net Income attributable to non-controlling interest divided by net income | | | 39.0 | % | | | 39.4 | % |

| (1) | For methodology used to calculate ROAA, see note (2) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data.” |

| (2) | For methodology used to calculate ROAE, see note (3) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data.” |

The following table sets forth ROAA and ROAE using end of period consolidated financial information of our banking subsidiaries under IFRS for average assets and average equity for the year ended December 31, 2015.

| | | Year ended December 31, 2015 | |

| | | Banco de Bogotá | | | Banco de

Occidente | | | Banco

Popular | | | Banco AV

Villas | |

| | | (in Ps billions, except percentages) | |

| Average assets(1) | | | 135,953.6 | | | | 34,191.9 | | | | 18,000.9 | | | | 11,258.5 | |

| Average equity attributable to controlling interest (2) | | | 12,376.2 | | | | 3,991.0 | | | | 2,503.4 | | | | 1,249.6 | |

| Net income | | | 2,639.0 | | | | 473.1 | | | | 349.3 | | | | 175.6 | |

| Net income attributable to controlling interest | | | 1,894.0 | | | | 471.8 | | | | 348.5 | | | | 175.6 | |

| Net income attributable to non-controlling interest | | | 745.1 | | | | 1.3 | | | | 0.8 | | | | 0.0 | |

| ROAA(1) | | | 1.9 | % | | | 1.4 | % | | | 1.9 | % | | | 1.6 | % |

| ROAE(2) | | | 15.3 | % | | | 11.8 | % | | | 13.9 | % | | | 14.0 | % |

| Net Income attributable to non-controlling interest divided by net income | | | 28.2 | % | | | 0.3 | % | | | 0.2 | % | | | 0.0 | % |

| (1) | For methodology used to calculate ROAA, see note (2) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data.” |

| (2) | For methodology used to calculate ROAE, see note (3) to the table under “Item 3. Key Information—A. Selected financial data—Other financial and operating data.” |

Tangible equity ratio

The following table sets forth the tangible equity ratio on a consolidated basis in accordance with IFRS of Grupo Aval and each of its subsidiaries at December 31, 2015.

| | | Grupo Aval entities | |

| | | Banco de

Bogotá | | | Banco de

Occidente | | | Banco

Popular | | | Banco AV

Villas | | | Grupo Aval

consolidated | |

| | | (in Ps billions, except percentages) | |

| Total Equity | | | 17,433.6 | | | | 4,035.2 | | | | 2,567.3 | | | | 1,265.7 | | | | 22,906.3 | |

| Total assets | | | 152,269.3 | | | | 35,649.9 | | | | 19,109.4 | | | | 11,547.2 | | | | 216,679.3 | |

| Total Equity / Assets | | | 11.4 | % | | | 11.3 | % | | | 13.4 | % | | | 11.0 | % | | | 10.6 | % |

| Intangible assets (1) | | | 6,445.3 | | | | 145.1 | | | | 18.4 | | | | 20.9 | | | | 7,668.9 | |

| Total Equity – Intangible assets | | | 10,998.3 | | | | 3,890.2 | | | | 2,548.9 | | | | 1,244.8 | | | | 15,237.4 | |

| Total assets – Intangible assets | | | 145,824.0 | | | | 35,504.8 | | | | 19,091.0 | | | | 11,526.3 | | | | 209,010.4 | |

| Tangible equity ratio (2) | | | 7.5 | % | | | 11.0 | % | | | 13.4 | % | | | 10.8 | % | | | 7.3 | % |

Source: Company calculations based on Grupo Aval’s IFRS consolidated information and each banking subsidiary’s consolidated financial statements for the period indicated.

| (1) | Intangible Assets are: goodwill and other intangible assets (excluding intangible assets related to concession arrangements rights). |

| (2) | Tangible equity ratio is calculated as total equity minus intangible assets divided by total assets minus intangible assets. |

Exchange rates

The Colombian foreign exchange system allows the purchase and sale of foreign currency and the international transfer of pesos by any person or legal entity, regardless of the amount, subject to certain regulatory procedures.

The Superintendency of Finance calculates the representative market rate based on the weighted averages of the buy/sell foreign exchange rates quoted daily by certain financial institutions, including certain of our banking subsidiaries, for the purchase and sale of U.S. dollars. On April 28, 2016, the representative market rate was Ps 2,943.23 per U.S.$1.00, and on December 31, 2015, the representative market rate was Ps 3,149.47 per U.S.$1.00. The Federal Reserve Bank of New York does not report a noon buying rate for pesos/U.S. dollars.

The following table presents the monthly high and low representative market rate during the months indicated.

| Recent exchange rates of pesos per U.S. dollar | | Low | | | High | |

| Month: | | | | | | | | |

| November 2015 | | | 2,819.63 | | | | 3,108.70 | |

| December 2015 | | | 3,131.95 | | | | 3,356.00 | |

| January 2016 | | | 3,149.47 | | | | 3,375.80 | |

| February 2016 | | | 3,287.31 | | | | 3,434.89 | |

| March 2016 | | | 3,022.35 | | | | 3,319.80 | |

| April 2016 (through April 28, 2016) | | | 2,899.92 | | | | 3,109.60 | |

Source: Superintendency of Finance.

The following table presents the average pesos/U.S. dollar representative market rate for each of the five most recent years, calculated by using the average of the exchange rates on the last day of each month during the period, and the representative year-end market rate for each of the five most recent years.

Pesos/U.S.$1.00

representative market rate | | Average | | | Year-end | |

| Period: | | | | | | | | |

| 2011 | | | 1,854.02 | | | | 1,942.70 | |

| 2012 | | | 1,798.72 | | | | 1,768.23 | |

| 2013 | | | 1,879.53 | | | | 1,926.83 | |

| 2014 | | | 2,017.85 | | | | 2,392.46 | |

| 2015 | | | 2,771.55 | | | | 3,149.47 | |

Source: Superintendency of Finance.

Exchange rate fluctuation will affect the U.S. dollar value of any distributions we make with respect to our shares of preferred stock. See “—D. Risk factors—Risks relating to our preferred shares and ADSs.”

| B. | Capitalization and indebtedness |

Not applicable.

| C. | Reasons for the offer and use of proceeds |

Not applicable.

Our business, financial condition and results of operations could be materially and adversely affected if any of the risks described below occur. In such an event, the market price of our preferred shares or our American Depositary Shares, or ADSs, could decline, and you could lose all or part of your investment. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business.

Risks relating to Colombia and other countries in which we operate

Adverse economic and political conditions in Colombia and other countries in which we operate, including variations in the exchange rates, in particular in the Central American region, may have an adverse effect on our results of operations and financial condition.

Our principal subsidiaries in Colombia are financial institutions (four commercial banks, a pension and severance fund administrator and a merchant bank), and a substantial majority of our operations, properties and customers are located in Colombia. As a consequence, our results of operations and financial condition are materially affected by economic and political conditions in Colombia.

Colombia is subject to economic, political and other uncertainties, including changes in monetary, exchange control and trade policies that could affect the overall business environment in Colombia, which would, in turn, affect our results of operations and financial condition. For example, the Central Bank of Colombia, or the “Colombian Central Bank,” could sharply raise or lower interest rates, which could negatively affect our net interest income and asset quality and also restrict our growth. Extreme variations in exchange rates could also negatively affect the foreign currency positions of our borrowers. Any of these events could have an adverse effect on our results of operations and financial condition.

Decreases in the growth rate of the Colombian economy, periods of negative growth, material increases in inflation or interest rates, or high fluctuations in the exchange rate could result in lower demand for, or affect the pricing of, our services and products. Because a large percentage of the costs and expenses of our subsidiaries is fixed, we may not be able to reduce costs and expenses upon the occurrence of any of these events, in which case our profitability could be affected.

In the case of our pension and severance fund management business, economic conditions may affect the businesses and financial capacity of employers, which may result in a reduction in employee-contributor head counts or decrease the ability of employers to create new jobs or increase employee incomes.

BAC Credomatic’s results of operations and financial condition depend on economic, political and social conditions in the countries where it operates, primarily in Central America. The political, economic and social environments in such countries are affected by many different factors, including significant governmental influence over local economies, substantial fluctuations in economic growth, high levels of inflation, exchange rate movements, exchange controls or restrictions on expatriation of earnings, high domestic interest rates, drug trafficking and other forms of organized crime, wage and price controls, changes in tax policies, imposition of trade barriers, changes in the prices of commodities and unexpected changes in regulation. The results of operations and financial condition of our Central American operations could be affected by changes in economic and other policies of each country’s government, which have exercised and continue to exercise substantial influence over many

aspects of the private sector, and by other social and political developments in each such country. During the past several decades, El Salvador, Guatemala, Honduras, Nicaragua and Panamá have experienced civil strife and political instability that have included a succession of regimes with differing economic policies and programs. Previous governments have imposed, among other measures, controls on prices, exchange rates, local and foreign investment and international trade, and restricted the ability of companies to dismiss employees, expropriated private sector assets and prohibited the remittance of profits to foreign investors.

Adverse economic, political and social developments in Central America may adversely affect demand for banking services and create uncertainty regarding our operating environment, which could have a material adverse effect on BAC Credomatic and, consequently, on our company. In addition, changes in political administrations may result in changes in governmental policy, which could affect BAC Credomatic and, consequently, our business.

The Colombian and Central American economies remain vulnerable to external shocks.

A significant decline in economic growth of any of Colombia’s or Central America’s major trading partners—in particular, the United States, China, Ecuador and Venezuela—could have a material adverse effect on each country’s balance of trade and economic growth. In addition, a “contagion” effect, where an entire region or class of investments becomes less attractive to, or subject to outflows of funds by, international investors could negatively affect Colombia or Central American countries. Lower economic growth than expected may result in asset quality deterioration and could negatively affect our business.

Pension funds, such as those managed by Porvenir, are global investors and thus are affected by regional and global economic factors. Lower economic growth of Colombia’s major trading partners or a contagion effect in the region or globally may lead to lower pension fund returns, which may in turn result in decreases in assets under management and impair our business, results of operations or financial condition. In recent years, pension fund returns have been subject to increased volatility in international financial markets. Foreign investments represented 27.8% and 20.1% of Porvenir’s total assets under management at December 31, 2015 and 2014, respectively.

Even though exports from Colombia grew at accelerated rates through 2014 in recent years, fluctuations in commodity prices and volatility in exchange rates have led to a deceleration in recent years. In particular, the oil industry remains an important determinant of the country’s economic growth. Substantial or extended declines in international oil prices or oil production falls may have an adverse effect on the overall performance of the Colombian economy and could have an adverse impact on the results of operations and financial condition of oil industry companies, which could have an adverse impact on our loans to oil industry companies. Our banking subsidiaries do not maintain a significant overall exposure to oil industry clients and have not been materially impacted by the decrease in international oil prices, however, continuing falling market prices, such as the one experienced during the recent year, pose significant challenges to Colombia’s near-term outlook and may impair the ability of some of the clients of our banking subsidiaries to repay their debt obligations. As of December 31, 2015, our combined exposure to the oil sector is 3.8% of the combined loan portfolio (including BAC and excluding contingencies and derivatives) with the principal exposure being toEmpresa Colombiana de Petroleos S.A. “Ecopetrol,” (1.0%) and to oil pipelines (1.7%) in which Ecopetrol is the majority shareholder. While the fall in international oil prices will affect Ecopetrol, the Colombian national oil company, we do not expect its credit quality to deteriorate materially. As of December 31, 2015, our exposure to oil service companies and suppliers to the oil sector (0.6% and 0.4%, respectively) is not material. While the credit quality of the companies participating in these sectors has been affected and additional allowances for loan losses will be required, we do not believe that they will materially affect our results. Unemployment continues to be high in Colombia compared to other economies in Latin America. Furthermore, recent political and economic actions in the Latin American region, including actions taken in Argentina before a new government took office in December 2015 and by the Venezuelan government, may negatively affect international investor perception of the region. We cannot assure you that the growth achieved by the Colombian economy over the past decade will continue in future periods. A reversal of the rate of growth of the Colombian economy, a slowdown in the growth of customer demand, an increase in market competition, or changes in governmental regulations, could adversely affect the rate of growth of our loan portfolio and our risk index and, accordingly, increase our required allowances for loan losses. All of these conditions could lead to a general decrease in demand for borrowings.

In addition, the effect on consumer confidence of any actual or perceived deterioration of household incomes in the Colombian or Central American economies may have a material adverse effect on our results of operations and financial condition.

Colombia has experienced and continues to experience internal security issues that have had or could have a negative effect on the Colombian economy.

Colombia has experienced and continues to experience internal security issues, primarily due to the activities of guerrilla groups such as the Revolutionary Armed Forces of Colombia (Fuerzas Armadas Revolucionarias de Colombia), or “FARC,” and the National Liberation Army (Ejercito de Liberación Nacional), or “ELN”, paramilitary groups and drug cartels. In remote regions of the country with minimal governmental presence, these groups have exerted influence over the local population and funded their activities by protecting, and rendering services to drug traffickers. Even though the Colombian government’s policies have reduced guerilla and criminal activity, particularly in the form of terrorist attacks, homicides, kidnappings and extortion, such activity persists in Colombia, and possible escalation of such activity and the effects associated with them have had and may have in the future a negative effect on the Colombian economy and on us, including our customers, employees, results of operations and financial condition. The Colombian government commenced peace talks with the FARC in August 2012, which are still ongoing and negotiations with ELN are also expected to take place in near future. Despite these efforts, drug-related crime and guerilla and paramilitary activities may have a negative impact on the Colombian economy in the future. Our business or financial condition could be adversely affected by rapidly changing economic or social conditions, including the Colombian government’s response to current peace negotiations which may result in legislation that increases our tax burden, or that of other Colombian companies, which could, in turn, impact the overall economy.

Political and economic instability in the region may affect the Colombian economy and, consequently, our results of operations and financial condition.

Some of Colombia’s neighboring countries and principal trading partners, particularly Venezuela, have experienced and continue to experience periods of political and economic instability. Moreover, diplomatic relations with Venezuela and Ecuador have from time to time been tense and affected by events surrounding the Colombian armed forces’ confrontations with FARC and ELN throughout Colombia, particularly on Colombia’s borders with each of Venezuela and Ecuador.

On November 19, 2012, the International Court of Justice placed a sizeable area of the Caribbean Sea within Nicaragua’s exclusive economic zone, that until then had been deemed by Colombia as part of its own exclusive economic zone. A worsening of diplomatic relations between Colombia and Nicaragua involving the disputed waters could result in the Nicaraguan government taking measures, or a reaction among the Nicaraguan public, which would be detrimental to Colombian-owned interests in that country, including those owned by us through BAC Credomatic.

Further economic and political instability in Colombia’s main trading partners or any future deterioration in relations with Venezuela, Ecuador, Nicaragua and other countries in the region may result in the closing of borders, the imposition of trade barriers and a breakdown of diplomatic ties, or a negative effect on Colombia’s trade balance, economy and general security situation, which may adversely affect our results of operations and financial condition.

Government policies and actions as well as judicial decisions in Colombia could significantly affect the local economy and, as a result, our results of operations and financial condition.

Our results of operations and financial condition may be adversely affected by changes in Colombian governmental policies and actions, and judicial decisions, involving a broad range of matters, including interest rates, exchange rates, exchange controls, inflation rates, taxation, banking and pension fund regulations and other political or economic developments affecting Colombia. The Colombian government has historically exercised substantial influence over the economy, and its policies are likely to continue to have a significant effect on Colombian companies, including us. The president of Colombia has considerable power to determine governmental policies and actions relating to the economy, and may adopt policies that could negatively affect us. Future governmental policies and actions, or judicial decisions, could adversely affect our results of operations or financial condition.

New or higher taxes resulting from changes in tax regulations or the interpretation thereof in Colombia and other countries in which we operate could adversely affect our results of operations and financial condition.

New tax laws and regulations, and uncertainties with respect to future tax policies, pose risks to us. In recent years, Colombian tax authorities have imposed additional taxes in a variety of areas, such as taxes on financial transactions and taxes to fund Colombia’s war against terrorism and taxes to fund the post-conflict related to the peace negotiations with guerrilla forces. Changes in tax-related laws and regulations, and interpretations thereof, can affect tax burdens by increasing tax rates and fees, creating new taxes, limiting tax deductions, and eliminating tax-based incentives and non-taxed income. In addition, tax authorities or courts may interpret tax regulations differently than we do, which could result in tax litigation and associated costs and penalties. In order to avoid double taxation, our Colombian subsidiaries usually distribute dividends from profits that have already been subject to income tax at the corporate level. These dividends are usually not taxable for Grupo Aval in Colombia, and dividends paid by Grupo Aval to its shareholders in Colombia from these sources of income also are usually not taxable, in each case provided that such profits have been taxed at the subsidiary level. This tax treatment may not be maintained in the future, and any change could have a material adverse effect on our results of operations and financial condition.

Currently, according to Article 36-1 of the Colombian Tax Code, capital gains obtained in a sale of shares listed on the Colombian Stock Exchange are not subject to income tax in Colombia, provided that the shares sold by the same beneficial owner during each fiscal year do not represent more than 10% of the issued and outstanding shares of the listed company. The Colombian government may implement changes in the tax rules applicable to the sale of the offered securities which may adversely affect our shareholders or holders of ADSs.

ADSs do not have the same tax benefits as equity investments in Colombia. Although ADSs represent our preferred shares, they are subject to a different tax regulatory regime. Accordingly, the tax benefits applicable in Colombia to equity investments, in particular those relating to dividends and profits from sale, are not applicable to ADSs.

The Colombian government publicly announced that a new tax reform may be required and approved in 2016 to take effect in 2017, in addition to the one approved in December 2014, in order to obtain additional funds and close potential deficits, especially considering the more challenging medium-term outlook for the oil sector and implementation of the post-conflict agreements resulting from peace talks with guerrilla groups. The new tax reform may expand the number of individuals required to pay income tax, increase VAT rates and create taxes on dividend income. This eventual new tax reform may result in higher levels of taxation than we currently expect which can significantly affect our results of operations or financial condition.

Colombian tax haven regulations could adversely affect our results of operations and financial condition.

Pursuant to Decree 1966 of 2014, as amended by National Decree 2095 of 2014, a number of jurisdictions, including countries in which our banking subsidiaries operate, were either declared tax havens for Colombian tax purposes or temporarily excluded from such list subject to the completion of tax information exchange treaties within a short timeframe. As a result, some of our clients with financial products offered by our banking subsidiaries in such countries may experience, among other effects, an increase in their withholding tax rates, transfer pricing regulation, increased likelihood of being found in violation of tax regulations by the Colombian authorities and elevated information disclosure requirements which could have a negative impact on our business, financial condition and results of operations.

In order to avoid Panama’s designation as a tax haven, Colombia and Panama signed a memorandum of understanding establishing that both countries will negotiate a treaty in order to avoid double taxation. The treaty is expected to include provisions regarding the exchange of information between Colombian and Panamanian tax authorities. Failure to execute this treaty or the designation of Panama as a tax haven could have a negative impact on our customer base and on our business, financial condition and results of operations.

Natural disasters, acts of war or terrorism, or other external events could disrupt our businesses and affect our results of operations and financial condition.

We are exposed to natural disasters, such as earthquakes, volcanic eruptions, tornadoes, tropical storms and hurricanes. Heavy rains or abnormally low rainfall in Colombia, attributable in part to the La Niña and El Niño weather patterns, have resulted in severe flooding and mudslides and prolonged droughts in the past. These are recurring weather phenomena that may contribute to flooding, mudslides, droughts or other natural disasters on an

equal or greater scale in the future. In addition to severe weather and natural disasters, acts of war or terrorism and other adverse external events could have a significant impact on our ability to conduct business and may, among other things, affect the stability of our deposit base, impair the ability of borrowers to repay outstanding loans, impair the value of collateral securing loans, cause significant property damage, cause us to incur additional expenses and/or result in loss of revenue. In the event of such circumstances, our disaster recovery plans may prove to be ineffective, which could have a material adverse effect on our ability to conduct our businesses, particularly if such an occurrence affects computer-based data processing, transmission, storage and retrieval systems or destroys customer or other data. In addition, if a significant number of our employees and senior managers were unavailable because of a natural disaster, our ability to conduct our businesses could be compromised. Natural disasters, acts of war or similar events could also result in substantial volatility in our results of operations for any fiscal quarter or year.

Risks relating to our businesses and industry

Risks relating to our banking business

A decline in asset quality, including the loan portfolios of our bank subsidiaries, may have an adverse effect on our results of operations and financial condition.

Changes in the financial condition or credit profiles of customers of our banking subsidiaries and increases in inflation or interest rates could have a negative effect on the quality of our banks’ loan portfolios, potentially requiring them to increase impairment loss on loan and accounts receivable or resulting in reduced profitability. In particular, the percentage of non-performing loans may increase in the future as a result of factors beyond our control, such as economic conditions and political events affecting Colombia generally or specific sectors of the economy.

A substantial number of our banks’ customers are individuals and small and medium sized enterprises, or “SMEs,” and these customers are potentially more susceptible to downturns in the economy than large corporations and high-income individuals. For example, unemployment directly affects the ability of individuals to obtain and repay consumer and residential mortgage loans. Consequently, our banking subsidiaries may experience higher levels of non-performing loans, which could result in increased impairment loss on loan and accounts receivable due to defaults by, or deterioration in the credit profiles of, individual borrowers. Non-performing loans and resulting loan losses may increase materially in the future and adversely affect our results of operations and financial condition.

Existing loan loss allowances may not be adequate to cover any increases in non-performing loans or deterioration in the credit quality of loan portfolios. As a result, our banking subsidiaries may be required to increase impairment loss on loan and accounts receivable, which may adversely affect our results of operations and financial condition.

In addition, there is no precise method for predicting loan and credit losses, such that loan loss allowances may not be sufficient to cover actual losses. If we and our banking subsidiaries are unable to manage the level of non-performing or other poor credit quality loans, our results of operations and financial condition would be materially and adversely affected.

The loan portfolios of our banking subsidiaries have grown substantially in recent years. See “Item 4. Information on the Company—B. Business overview—Selected statistical data.” As default rates generally increase with the age of loans, the level of non-performing loans may lag behind the rate of growth in loans but may increase when growth slows or the loan portfolios become more mature. As a result, historic loan loss experience may not necessarily be indicative of future loan loss experience.

Our banking subsidiaries may be unable to realize on collateral or guarantees securing loans, which may adversely affect their results of operations and financial condition.

Our banking subsidiaries make loans that are secured by collateral, including real estate and other assets that are generally located in Colombia and the countries where we operate. The value of collateral may significantly fluctuate or decline due to factors beyond the control of our subsidiaries, including, for example, prevailing economic and political conditions in the relevant jurisdiction. At December 31, 2015, 32.2% of total past due loans (including our foreign operations) were secured. An economic slowdown may lead to a downturn in the Colombian

or Central American real estate markets, which may, in turn, result in declines in the value of real estate securing loans to levels below the principal balances of these loans. Any decline in the value of the collateral securing these loans or any other collateral securing these loans may result in reduced recoveries from collateral realization and have an adverse effect on our results of operations and financial condition. We may also not have sufficiently recent information on the value of collateral, which may result in an inaccurate assessment for impairment losses of our loans secured by such collateral. If this were to occur, we may need to make additional impairments to cover actual impairment losses of our loans, which may materially and adversely affect our results of operations and financial condition.

Our banking subsidiaries also make loans on the basis of guarantees from relatives, affiliates or associated persons of their principal borrowers. To the extent that guarantors encounter financial difficulties due to economic conditions, personal or business circumstances, or otherwise, the ability of our banks to enforce such guarantees may be impaired.

In addition, our banking subsidiaries may face difficulties in enforcing their rights as secured creditors against borrowers, collateral or guarantees. In particular, timing delays and procedural problems in realizing against collateral, as well as a debtor-protective judicial interpretations of the law, may make it difficult to foreclose on collateral, realize against guarantees or enforce judgments in our favor, which could materially and adversely affect our results of operations and financial condition.

Colombian insolvency laws may limit the ability of our banking subsidiaries to collect on monetary obligations and enforce rights against collateral or under guarantees.

Colombian insolvency laws provide that creditors of an insolvent debtor are prohibited from initiating collection proceedings outside the bankruptcy or reorganization process of such debtor. In addition, all collection proceedings outstanding at the beginning of the bankruptcy or reorganization process must be suspended and any creditors are prevented from enforcing their rights against the collateral and other assets of the insolvent debtor.

Once a non-merchant individual has ceased paying his or her debts, that individual can initiate a voluntary insolvency proceeding before a notary public or mediator to reach an out-of-court agreement with creditors. The terms of any agreement reached with a group (two or more) of creditors that represent more than 50% of the total amount of the claims will be mandatorily applicable to all relevant creditors. The insolvency law also provides for increased debtor protections, including an automatic stay for a maximum of 90 days. A perception that loans to individuals may be difficult or impossible to recover could cause our banking subsidiaries to enhance credit requirements and result in decreased lending to individuals by making access to credit more expensive or more onerous. In addition, increased difficulties in enforcing debt and other monetary obligations due to Colombian insolvency laws could have an adverse effect on our results of operations and financial condition.

Any failure of risk management processes, including credit and market risk, could materially and adversely affect our banking businesses, results of operations and financial condition.

Credit risk is the principal risk inherent in the business of our banks. Although we have group-wide risk management guidelines, each bank is responsible for managing its own risk. Each bank’s policies and procedures, which are designed to identify, monitor and manage risk, may prove to be insufficient. Furthermore, our banks may not be able to upgrade risk management systems on a timely basis. For example, our banks’ risk management systems utilize an internal credit rating system to assess the risk profile of each customer. As this process involves detailed analyses of the customer’s credit risk, taking into account quantitative and qualitative factors, it is necessarily subject to human error. Due to limitations in the availability of information and the developing information infrastructure in Colombia, our assessment of credit risk associated with a particular customer may not be based on complete, accurate or reliable information. Personnel of our banking subsidiaries may fail to detect risks before they occur, or may not effectively implement their risk management systems, which may increase exposure to credit risk. As a result, any failure by our banking subsidiaries to effectively implement or consistently follow or refine risk management systems may result in higher risk exposures for our banking subsidiaries, which could materially and adversely affect our results of operations and financial condition.

Declines in the value of our banks’ sovereign debt portfolios could have an adverse effect on our results of operations.

Our Colombian banks’ portfolio of securities primarily consists of sovereign bonds, mainly securities issued or guaranteed by the Colombian government. LB Panamá’s securities portfolios primarily consist of securities issued by corporate and sovereign issuers. We are exposed to significant credit, market and liquidity risks associated with sovereign debt. At December 31, 2015 and 2014, debt securities represented 11.3% and 13.5%, respectively, of our consolidated total assets; approximately 55.4% and 57.5%, respectively, of these securities were issued or backed by the Colombian government, and 8.2% and 6.1% of these securities, respectively, were issued or backed by Central American governments during each period. A significant decline in the value of these government securities could materially and adversely affect our debt securities portfolio and, consequently, our financial condition and results of operations. See “Item 4. Information on the Company—B. Business overview—Supervision and regulation—Mandatory investments.”

We are subject to market risk in our banking business.