Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | |

| (Mark One) | | |

o |

|

Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or |

ý |

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2011. |

or |

o |

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to |

o |

|

Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

Commission file number 001-34990

Bona Film Group Limited

(Exact Name of Registrant as Specified in Its Charter)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

11/F, Guan Hu Garden 3

105 Yao Jia Yuan Road, Chaoyang District

Beijing 100025, People's Republic of China

(Address of Principal Executive Offices)

Mr. Liang Xu

(86 10) 5928 3663

11/F, Guan Hu Garden 3

105 Yao Jia Yuan Road, Chaoyang District

Beijing 100025, People's Republic of China

Email: ir@bonafilm.cn

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange On Which Registered |

|---|

American Depositary Shares, each two representing one Ordinary Shares |

|

The NASDAQ Stock Market LLC |

Ordinary Shares, par value US$0.0005 per share* |

|

(The NASDAQ Global Market) |

| | | The NASDAQ Stock Market LLC |

| | | (The NASDAQ Global Market) |

- *

- Not for trading, but only in connection with the registration of American Depositary Shares representing such Ordinary Shares pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the Issuer's classes of capital or common stock as of the close of the period covered by the annual report.

30,402,346 Ordinary Shares were issued and outstanding as of December 31, 2011

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yeso No ý

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | |

| | Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: U.S. GAAP ý

International Financial Reporting Standards as issued by the International Accounting Standards Board o Other o

If "Other" has been checked in responses to the previous question, indicate check mark which financial statement item the registrant has elected to follow. Item 17o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes o No ý

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

Table of Contents

BONA FILM GROUP LIMITED

FORM 20-F ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

2

Table of Contents

Conventions That Apply To This Annual Report On Form 20-F

Except where the context otherwise requires and for purposes of this annual report only:

- •

- "ADSs" refers to our American depositary shares, each two of which represent one ordinary share, and "ADRs" refers to the American depositary receipts that may evidence our ADSs;

- •

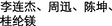

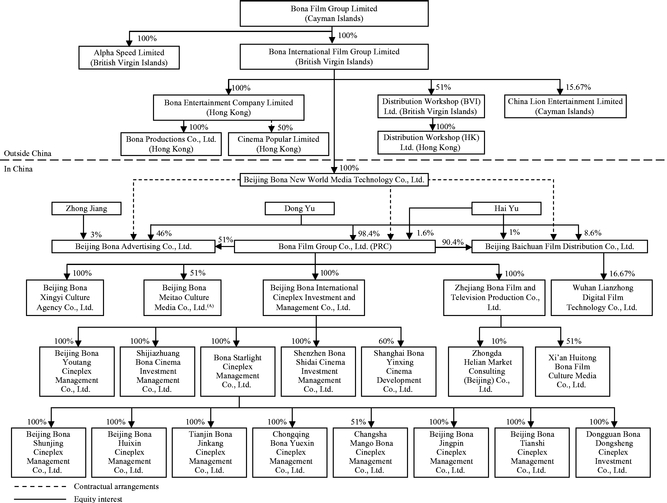

- "affiliated consolidated entities" refer to Beijing Baichuan Film Distribution Co., Ltd., Bona Film Group Co., Ltd. (PRC) (formerly known as Beijing Bona Film and Culture Communications Co., Ltd.) and Beijing Bona Advertising Co., Ltd., each of which are companies organized under PRC law. Substantially all of our operations in China are conducted by our affiliated consolidated entities or their subsidiaries, in which we do not own any equity interest, through our contractual arrangements. We treat the affiliated consolidated entities as variable interest entities and have consolidated their financial results in our financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP;

- •

- "Bona New World" refers to Beijing Bona New World Media Technology Co., Ltd., our PRC subsidiary;

- •

- "China" or "PRC" refers to the People's Republic of China, excluding, for the purposes of this annual report only, Taiwan, Hong Kong and Macau;

- •

- "Matrix Partners China Funds" refers to Matrix Partners China I L.P., Matrix Partners China I-A L.P., and their affiliates, collectively;

- •

- "our films" refers to films (i) for which we have acquired distribution rights, whether as the principal distributor or as a participating distributor, (ii) in which we own all or a portion of the copyright, or (iii) of which we have the right to receive a share of the net revenue;

- •

- "preferred shares" refers to our Series A preferred shares and Series B preferred shares;

- •

- "RMB" or "Renminbi" refers to the legal currency of China; "$," "dollars," "US$" and "U.S. dollars" refer to the legal currency of the United States;

- •

- "Series A preferred shares" refers to our Series A convertible redeemable preferred shares, par value US$0.0005 per share;

- •

- "Series B-1 preferred shares" refers to our Series B-1 convertible redeemable preferred shares, par value US$0.0005 per share; "Series B-2 preferred shares" refers to our Series B-2 convertible redeemable preferred shares, par value US$0.0005 per share; "Series B-3 preferred shares" refers to our Series B-3 convertible redeemable preferred shares, par value US$0.0005 per share; and "Series B preferred shares" refers to our Series B-1 preferred shares, Series B-2 preferred shares and Series B-3 preferred shares;

- •

- "Sequoia Funds" refers to Sequoia Capital China I L.P., Sequoia Capital China Partners Fund I L.P., Sequoia Capital China Principals Fund I L.P. and their affiliates, collectively;

- •

- "shares" or "ordinary shares" refers to our ordinary shares, par value US$0.0005 per share; and

- •

- "we," "us," "our company" and "our" refer to Bona Film Group Limited, a Cayman Islands company, and its predecessor entities and subsidiaries, and, unless the context otherwise requires, our affiliated consolidated entities in China.

This annual report contains statistical data that we obtained from various government and private publications. We have not independently verified the data in these reports. Statistical data in these publications also include projections based on a number of assumptions. If any one or more of the assumptions underlying the statistical data turns out to be incorrect, actual results may differ from the projections based on these assumptions. In particular, this annual report contains statistical data provided to us by EntGroup International Consulting (Beijing) Co. Ltd., or EntGroup, a PRC consulting and market research firm and a member company of the ComInsight Group, for a fee that is more than nominal.

This annual report includes our audited consolidated financial statements for the years ended December 31, 2009, 2010 and 2011 and as of December 31, 2010 and 2011.

Our ADSs are listed on the NASDAQ Global Market under the symbol "BONA."

3

Table of Contents

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

The selected financial data shown below should be read in conjunction with "Item 5. Operating and Financial Review and Prospects," and the financial statements and the notes to those statements included elsewhere in this annual report. The selected statement of income data for the years ended December 31, 2009, 2010 and 2011 and the selected balance sheet data as of December 31, 2010 and 2011 have been derived from our audited financial statements included elsewhere in this annual report. The selected statement of income data for the years ended December 31, 2007 and 2008 and the selected balance sheet data as of December 31, 2007, 2008 and 2009 have been derived from our audited financial statements not included in this annual report.

| | | | | | | | | | | | | | | | |

| | For the years ended December 31, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | |

|---|

| | (US$)

| | (US$)

| | (US$)

| | (US$)

| | (US$)

| |

|---|

Consolidated Statement of Operations Data | | | | | | | | | | | | | | | | |

Net revenues | | | 22,398,483 | | | 23,396,442 | | | 38,372,551 | | | 52,819,786 | | | 126,161,270 | |

Cost of revenue | | | 12,916,429 | | | 12,706,866 | | | 19,888,461 | | | 26,501,853 | | | 66,458,217 | |

Operating expenses | | | 7,192,395 | | | 6,979,288 | | | 12,922,235 | | | 17,215,013 | | | 47,198,859 | |

Government subsidy | | | — | | | — | | | — | | | 88,147 | | | 220,559 | |

| | | | | | | | | | | | |

Operating income | | | 2,289,659 | | | 3,710,288 | | | 5,561,855 | | | 9,191,067 | | | 12,724,753 | |

Other income (loss): | | | | | | | | | | | | | | | | |

Changes in fair value of warrants | | | (183 | ) | | (306,050 | ) | | 119,451 | | | — | | | — | |

Changes in fair value of derivatives | | | 31,000 | | | (1,994,000 | ) | | 90,000 | | | (14,528,000 | ) | | — | |

Other | | | (261,061 | ) | | 308,238 | | | (145,767 | ) | | 1,193,672 | | | 2,318,103 | |

| | | | | | | | | | | | |

Net income (loss)(1) | | | 2,002,401 | | | 440,955 | | | 5,459,665 | | | (4,223,060 | ) | | 14,572,376 | |

| | | | | | | | | | | | |

Net income (loss) attributable to the non-controlling interests | | | 367,939 | | | 199,225 | | | (168,429 | ) | | (131,686 | ) | | 140,295 | |

Deemed dividend on Series A and Series B convertible redeemable preferred shares | | | 381,073 | | | 873,652 | | | 1,394,985 | | | 2,150,146 | | | — | |

Undistributed earnings allocated to holders of participating Series A and Series B convertible redeemable preferred shares | | | 254,303 | | | — | | | 1,947,831 | | | �� | | | — | |

| | | | | | | | | | | | |

Net income (loss) attributable to holders of ordinary shares of Bona Film Group Limited | | | 999,086 | | | (631,922 | ) | | 2,285,278 | | | (6,241,520 | ) | | 14,432,081 | |

| | | | | | | | | | | | |

Net income (loss) per ordinary share: | | | | | | | | | | | | | | | | |

Basic | | | 0.10 | | | (0.07 | ) | | 0.27 | | | (0.49 | ) | | 0.49 | |

Diluted | | | 0.10 | | | (0.07 | ) | | 0.27 | | | (0.49 | ) | | 0.48 | |

Shares used in computation of net income per ordinary share: | | | | | | | | | | | | | | | | |

Basic | | | 9,542,114 | | | 9,051,563 | | | 8,453,842 | | | 12,758,575 | | | 29,353,936 | |

Diluted | | | 9,542,114 | | | 9,051,563 | | | 8,518,402 | | | 12,758,575 | | | 29,844,462 | |

- (1)

- As a supplement to net income, we use a non-GAAP financial measure of net income that is adjusted from results based on U.S. GAAP to exclude share-based compensation, changes in fair value of warrants and changes in fair value of

4

Table of Contents

derivatives. This non-GAAP financial measure is provided as additional information to help our investors compare business trends among different reporting periods on a consistent basis and to enhance investors' overall understanding of our current financial performance and prospects for the future. This non-GAAP financial measure should be considered in addition to results prepared in accordance with U.S. GAAP, but should not be considered a substitute for or superior to U.S. GAAP results. In addition, our definition of non-GAAP net income may be different from the definitions used by other companies, and therefore comparability may be limited.

The following table sets forth the reconciliation of our non-GAAP net income to our U.S. GAAP net income.

| | | | | | | | | | | | | | | | |

| | For the years ended December 31, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | |

|---|

| | (US$)

| | (US$)

| | (US$)

| | (US$)

| | (US$)

| |

|---|

Net income (loss) | | | 2,002,401 | | | 440,955 | | | 5,459,665 | | | (4,223,060 | ) | | 14,572,376 | |

Adjustment for share-based compensation | | | — | | | — | | | 132,902 | | | 447,345 | | | 3,647,144 | |

Adjustment for changes in fair value of warrants | | | 183 | | | 306,050 | | | (119,451 | ) | | — | | | — | |

Adjustment for changes in fair value of derivatives | | | (31,000 | ) | | 1,994,000 | | | (90,000 | ) | | 14,528,000 | | | — | |

| | | | | | | | | | | | |

Adjusted net income (non-GAAP) | | | 1,971,584 | | | 2,741,005 | | | 5,383,116 | | | 10,752,285 | | | 18,219,520 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | As of December 31, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | |

|---|

| | (US$)

| | (US$)

| | (US$)

| | (US$)

| | (US$)

| |

|---|

Consolidated Balance Sheet Data | | | | | | | | | | | | | | | | |

Cash | | | 6,663,011 | | | 4,771,897 | | | 7,418,213 | | | 84,247,984 | | | 20,107,349 | |

Accounts receivable, net of allowance for doubtful accounts | | | 4,347,569 | | | 4,673,515 | | | 19,491,100 | | | 15,225,792 | | | 41,642,787 | |

Total current assets | | | 11,350,873 | | | 13,567,290 | | | 33,940,357 | | | 118,052,862 | | | 100,616,945 | |

Distribution rights | | | 6,300,851 | | | 3,847,906 | | | 5,550,394 | | | 2,265,601 | | | 3,663,966 | |

Production costs | | | — | | | 3,785,691 | | | 19,528,560 | | | 64,815,878 | | | 69,844,822 | |

| | | | | | | | | | | | |

Total assets | | | 20,007,342 | | | 24,923,695 | | | 67,028,414 | | | 231,216,536 | | | 273,751,929 | |

Accounts payable | | | 5,766,634 | | | 4,237,192 | | | 8,902,182 | | | 9,533,672 | | | 27,807,118 | |

Bank borrowing | | | — | | | — | | | 6,590,317 | | | 22,012,560 | | | 12,561,806 | |

Other borrowings | | | — | | | — | | | 6,089,373 | | | 1,445,150 | | | 1,831,658 | |

Current film participation liabilities | | | — | | | 351,154 | | | 8,337,483 | | | 10,209,351 | | | 16,224,219 | |

Non-current film participation liabilities | | | — | | | 994,938 | | | 1,562,304 | | | 6,306,818 | | | — | |

Derivatives | | | 698,000 | | | 2,692,000 | | | 2,903,000 | | | — | | | | |

| | | | | | | | | | | | |

Total liabilities | | | 11,090,113 | | | 15,681,869 | | | 46,859,438 | | | 71,144,370 | | | 90,957,784 | |

Net assets | | | 8,917,229 | | | 9,241,826 | | | 20,168,976 | | | 160,072,166 | | | 182,794,145 | |

Series A convertible redeemable preferred shares | | | 7,560,727 | | | 8,434,379 | | | 9,727,866 | | | — | | | — | |

Series B convertible redeemable preferred shares | | | — | | | — | | | 9,074,270 | | | — | | | — | |

| | | | | | | | | | | | |

Total equity | | | 1,356,502 | | | 807,447 | | | 1,366,840 | | | 160,072,166 | | | 182,794,145 | |

| | | | | | | | | | | | |

Currency Translations and Exchange Rates

We have translated certain Renminbi, or RMB, amounts included in this annual report into U.S. dollars for the convenience of the readers. The rate we used for the translations was RMB6.2939 = US$1.00, which was the noon buying rate as certified for customs purposes by the Federal Reserve Bank of New York on December 30, 2011 (the last day of 2011 for which exchange rate data was available). The translation does not mean that RMB could actually be converted into

5

Table of Contents

U.S. dollars at that rate. The following table shows the noon buying rates for RMB expressed in RMB per US$1.00.

| | | | | | | | | | | | | |

| | Renminbi per U.S. Exchange Rate | |

|---|

| | Average | | High | | Low | | Period-end | |

|---|

2007 | | | 7.5806 | | | 7.8127 | | | 7.2946 | | | 7.2946 | |

2008 | | | 6.9193 | | | 7.2946 | | | 6.7800 | | | 6.8225 | |

2009 | | | 6.8295 | | | 6.8470 | | | 6.8176 | | | 6.8259 | |

2010 | | | 6.7603 | | | 6.8330 | | | 6.6000 | | | 6.6000 | |

2011 | | | 6.4630 | | | 6.6364 | | | 6.2939 | | | 6.2939 | |

October | | | 6.3710 | | | 6.3825 | | | 6.3534 | | | 6.3547 | |

November | | | 6.3564 | | | 6.3839 | | | 6.3400 | | | 6.3765 | |

December | | | 6.3482 | | | 6.3733 | | | 6.2939 | | | 6.2939 | |

2012 (through April 20) | | | 6.3073 | | | 6.3330 | | | 6.2935 | | | 6.3080 | |

January | | | 6.3119 | | | 6.3330 | | | 6.2940 | | | 6.3080 | |

February | | | 6.2997 | | | 6.3120 | | | 6.2935 | | | 6.2935 | |

March | | | 6.3125 | | | 6.3315 | | | 6.2975 | | | 6.2975 | |

April (through April 20) | | | 6.3052 | | | 6.3150 | | | 6.2975 | | | 6.3080 | |

Source: The source of the exchange rate is: (i) with respect to any period ending on or prior to December 31, 2008, the Federal Reserve Bank of New York, and (ii) with respect to any period ending on or after January 1, 2009, the H.10 statistical release of the Federal Reserve Board.

- (1)

- Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period.

Not applicable.

Not applicable.

Our business and operations are subject to various risks, many of which are beyond our control. If any of the risks described below actually occurs, our business, financial condition or results of operations could be seriously harmed.

Risks Relating to Our Business and Industry

Our success is largely dependent on a limited number of film releases each year and factors in the film industry that are difficult to predict, and accordingly our results of operations may vary widely from period to period.

Our top five films for 2009, 2010 and 2011 accounted for 67.9%, 53.5% and 58.3% of our net revenue in each of those years, respectively. We generally distribute between 16 and 20 films theatrically each year. Because we distribute a limited number of films, the success or failure of a small number of these films could have a significant impact on our business, financial condition and results of operations in both the year of release and in the future.

6

Table of Contents

In general, the economic success of a film is largely determined by the appeal of the film to a broad audience and by the effectiveness of the marketing of the film. We cannot precisely predict the economic success of any of the films we distribute or invest in because a film's acceptance by the public cannot be predicted with certainty. If we do not accurately judge audience acceptance in selecting the films for which we acquire the distribution rights or in which we invest, or if we do not market the film effectively, we may not recoup our costs or realize our anticipated profits. In addition, the economic success of a film also depends upon the public's acceptance of competing films, the availability of alternative forms of entertainment and leisure-time activities, general economic conditions and other tangible and intangible factors, all of which can change and none of which can be predicted with certainty. Accordingly, our net revenue and other results of operations may fluctuate significantly from period to period, and the results of any one period may not be indicative of the results for any future periods.

Due to the risks inherent in producing and distributing films, we may be unable to recoup advances paid for or investments in films.

Our most significant costs and cash expenditures relate to acquiring film distribution rights and investing in films for which we also secure distribution rights. Many of our agreements to acquire distribution rights require up-front payments. We determine the amount of the payments or investment we are willing to make based on our estimate of the economic success of the film. Although these estimates are based on our knowledge of industry trends, market conditions and the market potential of the film, actual results may ultimately differ from our estimates.

The production and distribution of films are subject to a number of uncertainties, including delays and increased expenditures due to creative differences among key cast members and other key creative personnel or other disruptions or events beyond our control. Risks such as illness, disability or death of star performers, technical complications with special effects or other aspects of production, shortages of necessary equipment, damage to film negatives, master tapes and recordings or adverse weather conditions may cause cost overruns and delay or frustrate completion of a production. In China, directors tend to hold substantial control over the production of films, and this may aggravate our ability to control the production schedule and budget. In addition, when we co-invest in a film, we generally have less control over the investment and production processes, than when we are lead investor in a film.

If a film production in which we have invested incurs substantial budget overruns, we may be required to seek additional financing from outside sources to complete production. Such financing may not be available on terms acceptable to us, and failure to complete a film due to the lack of such financing could have a material adverse effect on our business, financial condition and results of operations. In addition, we may not be able to recoup our investment as a result of increased costs from budget overruns. Increased costs may also delay the release of a film to a less favorable time, which could hurt its box office performance and thus our revenue from the distribution of the film and its overall financial success.

If a film fails to perform to our original estimates or expectations, we may (i) fail to realize the expected economic return from a film, (ii) fail to recoup advances we paid or investments we made or (iii) record accelerated amortization and/or fair value write downs of capitalized film production costs or distribution rights. Any of these events may adversely impact our business, financial condition and results of operations.

The production and distribution of films are capital-intensive processes, and our capacity to generate cash or obtain financing on favorable terms may be insufficient to meet our anticipated cash requirements.

The costs to develop, produce and distribute a film are substantial. In 2009, 2010 and 2011, for example, our cost of revenue (excluding the movie theater segment) amounted to US$19.9 million,

7

Table of Contents

US$21.5 million and US$57.3 million and accounted for 51.8%, 51.7% and 57.2% of our net revenue (excluding the movie theater segment), respectively. We are required to fund our costs for film-related activities and other commitments with cash retained from operations including the proceeds of films that are generating revenue from theatrical and non-theatrical channels, as well as from bank and other borrowing and participation by other investors. If our films fail to perform, we may be forced to seek substantial sources of outside financing. Such financing may not be available in sufficient amounts for us to continue to make substantial investments in the production of new films or may be available only on terms that are disadvantageous to us, either of which could have a material adverse effect on our growth or our business.

We believe that as a common industry practice, film producers often agree to pledge their interests in the copyrights in a film as collateral for loans to finance the production of that film. We have agreed, and may in the future agree, to use our interests in film copyrights to secure loans for productions of films. If we are unable to repay such loans, the lenders may foreclose on the collateral securing such loans and take possession of the pledged copyright, which in turn could adversely affect our ability to distribute the corresponding films.

Moreover, the costs of producing and distributing films have increased in recent years and may further increase in the future, which may make it more difficult for a film we distribute or have invested in to generate a profit or compete against other films. For example, compensation for star performers and other key creative personnel has increased recently. As a result, we may need to rely on revenue from television and digital distribution or continue to expand internationally or into other distribution channels such as home video products in order for a film to be profitable to us, and there can be no assurance that revenue from such sources would be sufficient to offset increases in the cost of film production and distribution or that any such expansion would be successful.

We depend substantially on the continuing efforts of our senior executives and key personnel, and our business and prospects may be severely disrupted if we lose their services.

Our future success depends on the continued services of the key members of our management team, in particular, the continued service of Mr. Dong Yu, our founder, chairman and chief executive officer, Ms. Nansun Shi, our director, Mr. Jeffrey Chan, our director and chief operating officer, Mr. Hao Zhang, the general manager of our domestic distribution business, and Mr. Liang Xu, our chief financial officer. Our film distribution and film investment and production businesses are highly reliant on the personal instincts, tastes and market experiences of Mr. Dong Yu, Ms. Nansun Shi, Mr. Jeffrey Chan and Mr. Hao Zhang, and the loss of any one of these individual may have a material negative effect on our business. On March 1, 2012, we announced that Mr. Liang Xu will resign as chief financial officer of our company effective as of May 1, 2012 to become chief executive officer of a China-based private equity fund. Following his resignation, Mr. Xu will serve in an advisory capacity on our "strategy committee" to help oversee the transition to a new chief financial officer and provide insight in support of our strategic expansion. We cannot assure you that we will have a smooth transition to a new chief financial officer, and any difficulties we experience during such transition could have a material adverse effect on our business, financial condition and results of operation.

In addition, our ability to attract and retain other key personnel is a critical aspect of our competitiveness. We face competition for personnel from other film distribution and production companies and other organizations. Competition for these individuals could require us to offer higher compensation and other benefits in order to attract and retain them, which would increase our operating expenses and, in turn, could materially and adversely affect our business, financial condition and results of operations. We may be unable to attract or retain the personnel required to achieve our business objectives, and failure to do so could severely disrupt our business and prospects. In addition, as we expect to continue to expand our operations and expand the scope of our services, we will need

8

Table of Contents

to continue attracting and retaining experienced management in the relevant businesses. Our business requires specialized skills and the Chinese market has a limited supply of persons qualified for such positions. Therefore, the process of hiring suitable qualified personnel is often lengthy. If our recruitment and retention efforts are unsuccessful in the future, it may be more difficult for us to execute our business strategy. In addition, the loss of any of our key employees could adversely affect our services as well as our marketing efforts or adversely impact the perception of us by our clients, media and investors. Our business may also be severely disrupted as our senior executives may have to divert their attention to recruiting replacements for key personnel.

We do not maintain key-person insurance for members of our management team. If we lose the services of any senior management, we may not be able to locate suitable or qualified replacements, and we may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and prospects. Further, if any of our executive officers joins a competitor or forms a competing company, we may lose a significant number of our clients, which would have an adverse effect on our business and revenue. Although certain of our executive officers, including Mr. Dong Yu, have entered into a confidentiality and non-competition agreement with us regarding their employment, disputes may arise between our executive officers and us, and, in light of uncertainties associated with the PRC legal system, these agreements may not be enforced in accordance with their terms.

Accounting practices used in our industry may aggravate fluctuations in operating results that result from the cyclical nature of the film industry.

In accordance with U.S. GAAP and as is standard for our industry, we amortize film costs using the "individual-film-forecast" method. Under this accounting method, we amortize film costs for each film based on the following ratio:

Revenue earned by title in the current period

Estimated total future revenue that will be earned by title

We regularly review our revenue estimates on a title-by-title basis and revise them when necessary. Our review generally takes into account estimated future revenue from international distribution, non-theatrical channels and other potential revenue that a film may generate. Any reviews subsequent to the initial review may result in a change in the rate of amortization and/or a write-down of the film asset to its estimated fair value. Results of operations in future years depend upon our amortization of our film costs. Periodic adjustments in amortization rates may significantly affect these results. In 2011, we decreased the estimate of the ultimate overseas revenue expected to be realized from six films and a television series based on their levels of economic performance and public acceptance, and as a result incurred additional amortization of US$2.1 million. In addition, we are required to expense film advertising costs as incurred. Any fluctuations we experience in our operating results as a result of these accounting practices could also cause corresponding fluctuations in the trading price of our ADSs and negatively affect the value of your investment in our ADSs.

Failure to manage the expansion of our operations could strain our management and personnel, operational, technological and other resources, which could materially and adversely affect our business and prospects.

We have experienced substantial growth since our inception. We increased our net revenue from US$23.4 million in 2008 to US$126.2 million in 2011, and we intend to continue to expand our operations. This expansion has placed, and will continue to place, substantial demands on our managerial, operational, technological and other resources. In particular, the management of our growth will require, among other things:

- •

- our ability to develop and improve our existing administrative and operational systems;

9

Table of Contents

- •

- stringent cost controls and sufficient working capital;

- •

- strengthening of our financial and management controls; and

- •

- hiring, training and retaining key personnel.

As we execute this growth strategy, we may incur substantial costs and expend substantial resources. We may not be able to manage our current or future operations effectively and efficiently or compete effectively in new markets that we may enter. If we are not able to manage our growth successfully, our business, financial condition and results of operations would be materially and adversely affected.

We may not successfully expand into existing or emerging non-theatrical distribution channels.

A substantial portion of net revenue from the films we distribute or have invested in have historically been derived from our share of box office receipts, with only a small portion of our net revenue generated from non-theatrical distribution channels, such as home video products, digital distribution (including Internet) and television. We are continuing to expand our distribution business into non-theatrical distribution channels through strategic collaborations with third parties. Historically, the box office success of a film has been a key factor in predicting revenue from non-theatrical distribution channels. We can make no assurances that the historical correlation between box office success and success of other non-theatrical distribution channels, which can provide a stable, long-term source of revenue, will subsist in the future. In addition, we can make no assurances that the prices for films on non-theatrical distribution channels can be maintained at current levels due to market or other factors. Internet companies have become an increasingly important distribution channel for our company. We cannot assure you that we will be able to maintain good relationships with major Internet companies in China. The Internet industry is relatively new and evolving and we may not able to successfully navigate its development and competitive environment. We cannot assure you that our expansion into non-theatrical distribution channels will be successful.

Moreover, emerging non-theatrical distribution channels resulting from technological developments may significantly change the film industry in China. Due to shifting consumer tastes, we cannot accurately predict the overall effect that emerging distribution channels may have on the potential revenue from and profitability of the films we distribute or invest in. For example, improvements in the quality of home entertainment systems may reduce the demand to see films in the theaters. Moreover, a material reduction in the length of time between the theatrical release of a film and the availability of the film on non-theatrical distribution channels could significantly dilute the consumer appeal of in-theater film offerings. In addition, we may not be able to accurately predict which existing non-theatrical distribution channels consumers will continue to use or which emerging distribution channels will be broadly accepted by the public.

If some non-theatrical distribution channels are broadly accepted by the public, we cannot assure you that we will be successful in exploiting such channels or that such channels will provide commercially feasible business models. Moreover, to the extent that emerging non-theatrical distribution channels gain popular acceptance, it is possible that demand for existing distribution channels, such as DVD and other home video products, Internet and other digital distribution, in-flight entertainment and television, will decrease, which could adversely affect our ability to generate revenue from existing distribution channels. In addition, emerging distribution channels may prove to be less profitable than existing distribution channels. If we are unable to successfully expand into non-theatrical distribution channels or adapt to emerging distribution channels, our business, financial condition or results of operations could be materially and adversely affected.

10

Table of Contents

Our business depends on our relationships with theater circuits.

Under PRC regulations, we are required to distribute films through theater circuits, which act as intermediaries between film distributors and movie theater operators. Theater circuits negotiate the terms of arrangements for the exhibition of films and provide film prints to movie theater operators. As a result, our film distribution business depends on maintaining relationships with these theater circuits. There can be no assurance that we will be able to maintain these relationships and that theater circuits will continue to enter into arrangements with us on favorable terms or at all. In addition, any deterioration in our relationships with the theater circuits could require us to enter into arrangements with alternative theater circuits. If alternative theater circuits do not provide us with comparable services at favorable terms or at all, we may not be able to maintain the scale or quality of our film distribution services, which in turn could materially and adversely affect our business, financial condition and results of operations.

We may encounter difficulties when expanding our movie theater network in new markets. In addition, we have limited experience in operating movie theaters as part of our overall business and may not successfully integrate our movie theater business into our existing operations.

We began operating our movie theater business in 2010 following our acquisition of Beijing Bona International Cineplex Investment & Management Co., Ltd., or Beijing Bona Cineplex, and Beijing Bona Youtang Cineplex Management Co., Ltd., or Beijing Bona Youtang. We further expanded our movie theater business by acquiring a 100% equity interest in Beijing Bona Starlight Cineplex Management Co., Ltd., or Bona Starlight, an affiliated company of our company focused primarily on the operation of movie cinemas in China, in July 2011 and by developing new theaters. The number of movie theaters we operate grew from six as of December 31, 2010 to 11 as of December 31, 2011. Our movie theater business generated revenue of US$11.3 million and US$26.0 million in 2010 and 2011, respectively, and generated segment profit of US$6.0 million and US$14.6 million in the same respective periods. We intend to increase the number of movie theaters we operate to approximately 30 to 40 by the end of 2014, primarily by developing new theaters.

We have limited experience in operating movie theaters, and we may not be able to realize the intended benefits from our acquisitions and development of new theaters, or otherwise successfully operate our movie theaters as a result of numerous factors, some of which are beyond our control. These factors include, among other things:

- •

- intense competition in the movie theater industry in China due to low barriers to entry, including competition with property developers who have opened their own movie theaters in their properties in prime urban locations;

- •

- our ability to make a proper selection of films, set screening schedules that will generate optimal box office revenue, maintain competitive pricing and implement a successful marketing strategy to attract moviegoers;

- •

- increased competition from non-theatrical distribution channels;

- •

- diversion of financial or management resources from our other business;

- •

- demands of audiences for facilities and features that enhance the movie-going experience; and

- •

- our ability to control costs and expenses.

We face particular challenges when we open movie theaters in new areas, including unfamiliarity with new local markets, inability to precisely determine market potential in new areas, market barriers such as strong local competitors that have prime locations and local know-how, difficulties in finding

11

Table of Contents

suitable locations, difficulties in hiring, motivating, training and retaining qualified employees and higher operating costs. Moreover, developing new theaters requires a significant amount of time and resources and poses a number of risks. We develop new theaters by renting a piece of property (for example, in a shopping mall) and then refurbishing and installing movie theater equipment in the property. Developing new theaters may result in delays, cost overruns and unanticipated expenses related to zoning, tax and other government requirements for construction. We may also encounter difficulties in managing the refurbishment and installation process, including managing subcontractors who we hire to do this work.

We cannot assure you that we will be able to successfully expand and operate our movie theater business. If our movie theater business is not successful or does not produce its intended benefits, our business, results of operations, financial condition and prospects could be materially and adversely affected.

The expansion and operation of our movie theater business is capital-intensive and if the development of our movie theater business is not successful, our cash flow may be negatively affected.

The acquisition, refurbishment and construction of movie theaters, as well as the rental expenses for our movie theaters, has increased our cash requirements in 2010 and 2011, and our planned expansion of our movie theater business will continue to increase our cash requirements going forward. In addition to the increasing scale of our movie theater business, a number of other factors could cause acquisition, refurbishment or rental expenses to increase in the future. For example, our movie theater refurbishment expenses may increase as Chinese audiences increasingly demand state-of-the-art audio-visual effects and inflation or other market factors could cause rental rates to increase. We intend to continue to finance our movie theater business, in part, with bank loans. However, it may be difficult for us to obtain bank loans to finance our movie theaters because banks may not accept leased property as mortgage for loans. Due to the capital intensive nature of the movie theater business, if the expansion of our movie theater business is not successful, our cash flow may be negatively affected. This, in turn, could have a material adverse effect on our business, financial condition and results of operations.

Movie theaters in China are subject to a range of regulatory requirements, including regulations relating to advertising, hygiene and food licensing. Some of our movie theaters sell unpackaged foods without the requisite permits to do so. The failure of our movie theaters to comply with applicable regulations may subject us to fines and penalties, including the suspension of our movie theater operations.

Operation of movie theaters subjects us to additional regulatory requirements, including complying with pre-screening film advertising regulations and obtaining and maintaining licenses to exhibit movies and sell concessions.

Each movie theater is required to obtain a public facility hygiene permit. Movie theaters selling food or beverages to their audiences must also obtain certain food hygiene permits and comply with hygiene and food safety-related requirements. Pursuant to the Food Safety Law of the PRC, which took effect from June 1, 2009, sale of food or beverages requires a Food Distribution Permit issued by the relevant administration for industry and commerce, and catering services require a Catering Service Permit issued by the relevant food and drug administration authorities. Some of our movie theaters sell both packaged and unpackaged foods while they have obtained a permit to sell only packaged foods. Failure to obtain a public facility hygiene permit may result in fines of up to RMB3,000. Failure to obtain food hygiene permits may result in penalties, including confiscation of food, income and equipment, and fines of five to ten times the value of the food sold if the value exceeds RMB10,000 or fines from RMB2,000 to RMB50,000 if the value of the food sold is below RMB10,000.

12

Table of Contents

In addition, while all of our movie theaters maintain the film exhibition licenses required for exhibiting films, they have not obtained the requisite certificates for technical qualification of exhibition equipment required to exhibit digital films. However, if the lack of certificates is deemed by relevant PRC regulatory authorities to constitute the exhibition of films without the applicable approval, they may impose penalties on us, including confiscation of the relevant films, equipment or income, suspension of operations and fines of five to ten times of the violator's income if such income exceeds RMB50,000 or fines from RMB200,000 to RMB500,000 if such income is below RMB50,000.

If we fail to obtain any of the business permits or licenses required for the operation of our business, we may be ordered to cease the applicable activities, have our income from such activities or tools, equipment, raw materials, products and other property that are used for such activities confiscated and be subject to fines of up to RMB500,000.

Our movie theater business has substantial lease obligations, which could impair our financial condition.

Our movie theater business, which we initially acquired in April 2010, has substantial lease obligations. In 2010 and 2011, the total rent expense in our movie theater business was approximately US$2.8 million and US$5.7 million, respectively. As of December 31, 2010 and 2011, our movie theater business had lease obligations totaling approximately US$51.5 million and US$105.3 million, respectively, throughout the terms of the leases which range from 10 to 20 years. As we plan to grow the number of movie theaters we operate significantly in 2012 and 2013, we expect our rent expenses and lease obligations to increase. If we are unable to meet our lease obligations, we could be forced to restructure our obligations and seek additional funding from other sources, or sell assets. We may be unable to restructure our lease obligations and obtain additional funding or sell assets on satisfactory terms or at all. As a result, inability to meet our lease obligations could cause us to default on those lease obligations. Many of our lease agreements contain restrictive covenants that limit our ability to take specific actions or require us not to allow specific events to occur. Under the lease agreements, our movie theaters have agreed to use the premises for theater-related operations, to maintain the premises in accordance with the provisions of the leases, to comply with regulatory requirements relating to matters such as sanitary standards, fire protection and public security, to pay the lease payments on time and not to sub-lease the premises without the prior consent of the lessor. If our movie theaters were to breach any of these obligations, subject in some cases to a materiality threshold or an opportunity to cure, the lessor could terminate the lease agreement and require our theaters to hand over the leased premises and pay all outstanding expenses and damages. If we violate the restrictive covenants, we would be in default under that lease, which could, in turn, result in defaults under other leases. Any such default could materially impair our financial condition and liquidity. If any of these lease agreements is terminated, our movie theater business, financial condition and results of operations may be materially and adversely affected. Moreover, if our movie theater business does not generate sufficient revenue to service our payment obligations under these leases, our business, financial condition and results of operations could be materially and adversely affected. In addition, there may be defects in the titles to some of the properties that our landlords lease to us, as a result of which our rights under the lease agreements may be materially and adversely affected.

We face risks relating to the international distribution of our films and related products.

In 2011, we derived approximately 8.5% of our net revenue from the monetization of our films outside of China. In addition, we entered into an agreement to acquire a strategic equity stake in China Lion Entertainment Limited in November 2011 in order to strengthen our distribution capabilities in the U.S. and Canada. As we expand the distribution of our films overseas, our business

13

Table of Contents

will be increasingly subject to risks inherent in international trade, many of which are beyond our control. These risks include:

- •

- fluctuating foreign exchange rates. For a more detailed discussion of the potential effects of fluctuating foreign exchange rates, please see "Item 11. Quantitative and Qualitative Disclosures About Market Risk—Foreign Exchange Risk" elsewhere in this annual report;

- •

- laws and policies affecting trade, investment and taxes, including laws and policies relating to the repatriation of funds and withholding taxes and changes in these laws;

- •

- differing cultural tastes and attitudes, including varied censorship laws;

- •

- differing degrees of protection for intellectual property;

- •

- financial instability and increased market concentration of buyers in foreign markets;

- •

- the instability of foreign economies and governments; and

- •

- war and acts of terrorism.

Events or developments related to these and other risks associated with international trade could adversely affect our revenue from non-PRC sources, which could have a material adverse effect on our business, financial condition and results of operations.

Our advertising operations are sensitive to changes in economic conditions and advertising trends.

Demand for advertising on the films we distribute and in movie theaters we operate, and the resulting advertising spending by advertisers, are particularly sensitive to changes in general economic conditions. For example, advertising expenditures typically decrease during periods of economic downturn. Advertisers may reduce their spending to advertise through us for a number of reasons, including:

- •

- a general decline in economic conditions;

- •

- a decline in economic conditions in the particular cities where we conduct business;

- •

- a decision to shift advertising expenditures to other available advertising media; and

- •

- a decline in advertising spending in general.

A decrease in demand for advertising media in general, and for advertising in the films we distribute in particular, could materially and adversely affect our ability to generate advertising revenue from our films, and could have a material and adverse effect on our business, financial condition and results of operations.

If advertisers or the viewing public do not accept, or lose interest in, pre-screening or in-film advertising, our revenue may be negatively affected and our business may not expand or be successful.

The market for pre-screening and in-film advertising in China is relatively new and its potential is uncertain. We compete for advertising revenue with many forms of more established advertising media. Our success depends on the acceptance of pre-screening and in-film advertising by advertisers and their continuing interest in this medium as part of their advertising strategies. Our success also depends on the viewing public's continued receptiveness towards our advertising model. Advertisers may elect not to use our services if they believe that viewers are not receptive to our advertising model or that our advertising services do not provide sufficient value as an effective advertising medium. Likewise, if viewers find some element of our advertising model, such as the length of the advertising segments

14

Table of Contents

prior to a film or product placement in films, to be disruptive or intrusive, film producers and movie theater operators may not want advertising. As a result, advertisers may reduce their spending on pre-screening or in-film advertising. If a substantial number of advertisers lose interest in these forms of advertising for these or other reasons, our business, financial condition and results of operations could be materially and adversely affected.

We may not successfully comply with regulations governing the placement of pre-screening advertising.

PRC regulations specifically applicable to pre-screening and in-film advertising are less extensive than those of other segments of the advertising industry. Currently, only a few regulations have been issued particularly for pre-screening advertising, including the Circular on Strengthening of Administration of Film Pre-screening Advertising, effective on June 25, 2004, and the Circular on Further Regulation of Film Pre-screening Advertising, effective on February 10, 2009. Pursuant to those regulations, consent of the copyright owners of the film is needed for the placement of pre-screening advertisements and film distributors and exhibitors may not delete or replace any pre-screening advertisement without the consent of the copyright owners. There can be no assurance that our advertising clients have always obtained or will always obtain the consent of the copyright owners for the pre-screening advertisements that we have been engaged to place. Our movie theaters, acting as the advertising distributors, may be held jointly liable in the event that our advertising clients fail to obtain such consents.

Our business may suffer reputational injury if we do not effectively manage our selection of products for use in our in-film advertisements. In addition, we may be subject to, and may expend significant resources in defending against, government actions based on the advertising services we provide and advertising content we disseminate.

We engage in the in-film advertising and pre-screening advertising businesses. We generate revenue from in-film advertising by charging advertising commissions for featuring certain third-party products in our movies. If we do not effectively manage our selection of products for our in-film advertisements, our reputation may be harmed. For example, if we feature any products in our films that later turn out to be defective and cause significant harm to the public, the reputation of the film featuring such product and the reputation of our company would suffer injury. Any harm to our films' or our company's reputation would have a material adverse effect on our business, financial condition and results of operations.

In addition, PRC advertising laws and regulations require advertisers, advertising operators and advertising distributors, including businesses such as ours, to ensure that the content of the advertisements they prepare or distribute is true to facts, lawful, in compliance with relevant laws and regulations, does not contain any false information or cheat or mislead consumers. Violation of these laws, rules or regulations may result in penalties, including fines of one to five times advertising fees, confiscation of advertising fees, orders to cease dissemination of the advertisements and orders to publish advertisements correcting the misleading information. In circumstances involving serious violations, the PRC government may revoke a violator's business license. In circumstances where the interests of consumers are harmed, the advertisers may bear civil liabilities and the advertising operators and advertising distributors may be held jointly liable. In cases of serious violations, criminal liabilities may be prosecuted.

15

Table of Contents

As an operator of an advertising medium, we are obligated under PRC laws, rules and regulations to monitor the advertising content for compliance with applicable laws. In addition, we are required to confirm that the advertisers have obtained requisite government approvals including the advertisers' operating qualifications, proof of quality inspection of the advertised products, and government pre-approval of the advertisement contents relating to certain specific types of products and services, such as pharmaceuticals, medical facilities, agricultural chemical and veterinary chemicals. We endeavor to comply with such requirements, including by requesting relevant documents from the advertisers. We employ, and our affiliated consolidated entities are required by the applicable PRC laws, rules and regulations to employ, qualified advertising inspectors who are trained to review advertising content for compliance with applicable PRC laws, rules and regulations. Our reputation will be tarnished and our results of operations may be adversely affected if pre-screening or in-film advertisements shown are provided to us by our advertisers in violation of relevant PRC content laws and regulations, or if the supporting documentation and government approvals provided to us by our advertising clients in connection with such advertising content are not complete or if the advertisements are not content compliant.

Our talent agency business is subject to a range of factors, which may lead to fluctuations in revenue from this business and make it difficult to predict the performance of this aspect of our business.

The success of our talent agency business is highly dependent on our ability to attract and retain high-profile movie stars and other artists with high earning potential, the popularity of positive public image of the artist we choose to represent, our ability to successfully procure lucrative contracts and engagements for the artists we represent, and the box office performance of the films and performances in which the artists we represent appear, among other factors. The earnings of the artists we represent may vary significantly from year to year depending on these and other factors. In addition, we may lose the earnings generated by an artist as a result of the artist suffering injury, disease or death, performing in a country outside the scope of our agreed upon representation, or due to other circumstances. Although our agency agreements provide for penalties upon early termination of the contract by the artists we represent, if any such artist terminates his or her contract prior to its agreed upon term, whether to move to another talent agency or for any other reason, we may lose the revenue streams generated by that artist in the future, and the penalty amount we are entitled to may be substantially less than we would have earned were the contract performed in full. As a result, the revenue generated by our talent agency may fluctuate significantly from period to period, and the results of any one period may not be indicative of the results for any future periods.

Our failure to make adequate contributions to various employee benefit plans as required by PRC regulations may subject us to penalties.

We are required by PRC laws and regulations to participate in various government sponsored employee benefit plans, including social insurance funds (namely a pension contribution plan, a medical insurance plan, an unemployment insurance plan, a work-related injury insurance plan and a maternity insurance plan) and a housing provident fund and contribute to the plans in amounts equal to certain percentages of salaries, including bonuses and allowances, of our employees up to a maximum amount specified by the local government from time to time at locations where we operate our businesses. Employers who fail to report and pay social insurance funds in accordance with the relevant rules may be ordered to rectify the problem and pay the social insurance funds within a stipulated deadline. According to the Interim Regulation on the Collection and Payment of Social Insurance Premiums, if payment of certain social insurance funds is not made by the stipulated deadline, the relevant authority can charge a late fee payment of 0.2% per day from the original due date and fine the responsible persons of the employer up to RMB10,000. If an employer is found to be concealing the actual number of employees or the total amount of salaries from competent social insurance authorities, the employer may be subject to a fine ranging from one to three times of the amount of salaries concealed. According to the Social Insurance Law, which became effective on July 1, 2011, if employers fail to

16

Table of Contents

register or pay social insurance in accordance with the relevant rules, they may be ordered to rectify the problem and be subject to a late fee payment of 0.05% per day from the due date; if employers fail to comply with such orders, they may be subject to a fine ranging from one to three times of the unpaid amount. According to relevant PRC laws, for the failure of to register or open housing provident fund accounts for employees, the employer may be required to rectify such breach within certain period and if such breach persists after such period, the employer may be subject to a fine ranging from RMB10,000 to RMB50,000. For the failure of payment of housing provident fund and failure to rectify such breach within certain period prescribed by the relevant authorities, the relevant housing provident fund authorities may apply for a court order requiring employers to make such payment.

Our PRC subsidiary and affiliated consolidated entities and their subsidiaries have not fully paid the contributions for such plans, as required by applicable PRC regulations. As of December 31, 2011, our PRC subsidiary and affiliated consolidated entities and their subsidiaries, excluding those engaged in our movie theater business, owed contributions to social insurance funds and the housing provident fund of RMB2.5 million (US$0.4 million). As of December 31, 2011, our affiliated consolidated entities and their subsidiaries engaged in our movie theater business owed contributions to social insurance funds and the housing provident fund of RMB1.9 milion (US$0.3 million). These amounts have been accrued as a liability in our consolidated financial statements. In addition, there can be no assurance that our affiliated consolidated entities did not owe additional contributions prior to their acquisition by us in April 2010 and in 2011 respectively.

If, as a result of our failure to make adequate contributions to employee benefit plans, we are required to pay the outstanding social insurance funds and housing provident fund and are subject to fines or other penalties, our business, financial condition, results of operations and prospects would be adversely affected.

The discontinuation or withdrawal of any of the preferential tax treatments, government subsidies or tax concessions we have enjoyed or currently available to us in the PRC could materially and adversely affect our financial condition and results of operations.

Under PRC laws and regulations, we had enjoyed preferential tax benefits afforded to the cultural industry and motion picture enterprises. Pursuant to applicable PRC regulations, cultural enterprises established between January 1, 2004 and December 31, 2008 are exempted from enterprise income tax for three years after establishment or for a period from their establishment to December 31, 2010, whichever ends earlier. Zhejiang Bona Film and Television Production Co., Ltd. was established in December 2008 as a cultural enterprise and was exempted from income tax for the years 2009, 2010 and 2011 pursuant to an approval by the relevant tax authority in June 2009. Starting on January 1, 2012, Zhejiang Bona Film and Television Production Co., Ltd. will be subject to the standard enterprise income tax rate of 25%.

Some of our affiliated consolidated entities have enjoyed or been granted special tax treatment by local tax authorities which may not be entirely consistent with relevant tax laws and regulations and may therefore be challenged by higher level tax authorities. Beijing Bona Advertising Co., Ltd. was subject to income tax at a special concession. The taxable income is deemed to be 6% of its revenues for the year 2009 as approved by the relevant tax authority. This concession was applicable only for 2009. Deemed profit may be lower than the actual profit, as a result of which we may have paid less tax than we would have been required to pay had we not received the relevant approvals from the local tax authorities. Without our preferential tax holidays and concessions, we would have had to pay additional amounts of approximately US$1.4 million, US$3.2 million and US$5.1 million in 2009, 2010 and 2011, respectively.

Distribution revenue earned by film distributors from theater exhibitions are exempted from business tax from January 1, 2004 to December 31, 2013. Currently, distribution revenue obtained by

17

Table of Contents

our affiliated consolidated entities, Beijing Baichuan Film Distribution Co., Ltd. and Zhejiang Bona Film and Television Production Co., Ltd., are exempted from business tax from 2004 to 2013.

If the PRC government phases out preferential tax benefits, if the rules or policies under which we enjoy preferential tax treatments are abolished or altered, if the tax authorities' interpretation of such rules change or if these approvals by local tax authorities of special concession income taxes rates are challenged by the relevant higher level tax authorities and withdrawn in the future, we could be subject to the standard statutory income tax rate and our effective income tax rate would increase. We also cannot assure you that we will be able to continue to receive subsidies from the government. Loss of these preferential tax treatments and subsidies could have material and adverse effects on our business, financial condition and results of operations.

We face substantial competition in most aspects of our business.

The film industry in China is fragmented and highly competitive. Our competitors include not only privately owned companies, but also state-owned enterprises, which have historically dominated, and have in recent years continued to play a prominent role in, the PRC film industry. Moreover, two state-owned film distributors have the exclusive right to distribute the stipulated number of foreign films, mainly Hollywood blockbusters that may be exhibited in China on a box office sharing basis. It is expected that such foreign films which these two state-owned enterprises are exclusively eligible to distribute each year will be increased substantially from 20 films to 34 films because the PRC government has agreed, in connection with a World Trade Organization dispute settlement, to increase the number of foreign premium format films, such as 3-D or IMAX films, that may be imported into China by 14 films per year.

The number of films distributed by competitors, particularly films from major Chinese and foreign film studios, may create an oversupply of films in the market and make it more difficult for the films we distribute to succeed or to be successfully exhibited in movie theaters at desirable times. Oversupply may become most pronounced during peak release times, such as holidays and the summer release season, when theater attendance is traditionally highest. Although we seek to release our films during peak release times, we may not be able to release all of our films during those times and, therefore, may potentially receive lower gross box-office receipts. In addition, a significant number of the movie theaters in China typically are committed at any one time to only 10 to 15 films distributed nationally, including U.S. and other foreign-produced films. As a result, we must identify and compete for the distribution of the most promising films. If our competitors increase the number of films available for distribution while the number of movie theaters remains unchanged, it could be more difficult for us to release our films during optimal release periods or to obtain the most desirable screen allocations and times. In addition, production or other delays that might cause us to alter our distribution schedule and any such change could adversely impact a film's financial performance. The increased quota of foreign premium films that our state-owned competitors will be able to distribute each year is expected to heighten the competition we face for film distribution, especially given that we may not be able to share in the distribution business for such foreign films.

In film production, we compete with large Chinese movie production companies for access to a limited pool of high quality directors, actors and other production team members. If our competitors are more successful than us in securing high quality production teams for their film productions, the members of these teams may have limited or no availability to work on our movies, and the quality of our production teams and, consequently, the quality of our films, may be negatively affected. Any deterioration in the quality of the films we produce would have a material negative effect on our business, financial condition and results of operations. In addition, such competition places upward pressure on the costs for securing directors, actors and other production team members, which may have a negative impact on our gross margin.

18

Table of Contents

Movie theaters operated by national theater circuits, property developers and small independent exhibitors compete with our movie theaters, particularly with respect to attracting patrons and developing new theater sites. Moviegoers are generally not brand conscious and usually choose a theater primarily based on its location, the films showing there, the quality of its facilities and price. If other movie theater operators choose to build and operate theaters in the markets where our movie theaters are located, or secure more prime locations than we do, including by building movie theaters in prime urban real estate that they already own, the performance of our movie theaters in these markets may be significantly and negatively impacted. The foregoing could have a material adverse effect on our business, financial condition and results of operations.

We may face increased competition in the future from foreign films, as a result of changes in PRC regulation or other factors, and we may not be able to compete effectively.

Current PRC laws and regulations limit the number of foreign films that may be imported into China and, at present, only one state-owned film import company has the right to import foreign films into China. In addition, under current PRC regulations, only two state-owned film distributors have the right to distribute foreign films in China. Imported foreign films may involve larger budgets, more recognized stars, more established brands or otherwise have greater access to other resources than domestic PRC films. We do not have the right to distribute foreign films and it may be difficult for our films to compete successfully against foreign films, which may be preferred by our target audiences.

It was recently reported that the PRC government has agreed, in connection with a World Trade Organization dispute settlement, to increase the number of foreign premium format films, such as 3-D or IMAX films, that may be imported into China by 14 films per year. This change may increase the supply of foreign films in the PRC and competition in the PRC film industry.

As China develops economically and politically, the PRC government may feel increased pressure from, for example, PRC audiences or international organizations, to further relax rules restricting the import of foreign films. In addition, as the PRC film market becomes more attractive over time, foreign film makers may expend greater resources to attract PRC audiences, which would further increase competitive pressure. The films we invest in and/or distribute may not be able to compete successfully against foreign films, which may materially and adversely affect our business, financial condition and results of operations.

The film industry is regulated extensively in China, and our production, distribution and exhibition of films are subject to various PRC laws, rules and regulations.

In accordance with the Regulations on Administration of Films which became effective on February 1, 2002 and the Interim Provisions on Business Access Qualification for Film Enterprises which became effective on November 10, 2004, production, distribution, import and exhibition of films are subject to licenses issued by the State Administration of Radio, Film and Television, or the SARFT, and/or its local counterparts. A Film Production License or a Film Production License (Single Film) is required for production of films in China. If a PRC producer cooperates with a foreign producer to produce a film, an additional License for Sino-foreign Cooperation in Film Production must be obtained. A film distribution company in China must obtain a Film Distribution License and only entities approved by the SARFT may be engaged in import of foreign films. Movie theaters must obtain a Film Exhibition License for exhibition of films. In addition, existing PRC law requires movie theaters to obtain a Certificate for Digital Films Exhibition Equipment and Technology for exhibition of digital films. However, based on verbal consultations with the SARFT, we understand that the SARFT is not enforcing the regulation, is not requiring movie theaters to obtain a Certificate for Technical Qualification of Digital Film Exhibition Equipment for the exhibition of digital films and had not issued and is not currently issuing such certificate to any movie theater. In addition, other aspects of the film industry, including the contents of films and scripts, the foreign investment in the industry, the

19

Table of Contents

exhibition time for different types of films by movie theaters, and the distributions of films through the Internet or other media, are also subject to detailed and extensive regulations.

If we are found to be in violation of these laws, rules or regulations, PRC governmental authorities could impose penalties on us, including fines of five to ten times income or up to RMB500,000, confiscation of relevant films, equipment or income and suspension of operations. In circumstances of serious violations, the PRC government may revoke a violator's license and criminal liabilities may be prosecuted.

The production and distribution of television programs is regulated extensively in China, and our production and distribution of Television Series are subject to various PRC laws, rules and regulations.

In accordance with the Administrative Regulations on Radio and Television effective on September 1, 1997, the Administrative Regulations on the Production and Operation of Radio and Television Program effective on August 20, 2004, the Administrative Regulations on Content of Television Series effective on July 1, 2010, which superseded and replaced the Administrative Regulations on the Examination of Television Series effective on October 20, 2004, and its supplementary regulations, and other regulations issued based on the foregoing regulations, television series can only be produced by entities that hold either a Film Production License or a License for the Production and Operation of Radio and Television Program or by qualified broadcasters. Licenses for the Production and Operation of Radio and Television Program are issued to entities which meet requirements set forth in the Administrative Regulations on the Production and Operation of Radio and Television Program and pass the examination of the SARFT or its provincial counterparts. In addition to the Film Production License or the Operating License for the Production of Radio and Television Program, the television series producers must obtain either a Multiple Television Series Production License or a Single Television Series Production License for the shooting and production of television series. The Multiple Television Series Production License has an effective term of two years and may be applied to all television series produced by the holder during the effective term. The Single Television Series Production License only applies to the specific television series, as indicated in such license.

Under the Administrative Regulations on Content of Television Series effective on July 1, 2010, a filing with, and announcement by, the SARFT or its provincial counterparts is required before production of any television series. Television series will be subject to censorship by the SARFT or its provincial counterparts, which will issue a Television Series Distribution License for television series passing their examination. No television series may be distributed or broadcasted without a Television Series Distribution License. However, the SARFT may, according to public interest require editing of or terminate distribution or broadcasting of television series which have been granted with a Television Series Distribution License.