There is great industry interest in the field of immuno-oncology, particularly given the therapeutic benefits achieved by FDA-approved checkpoint inhibitors targeting CTLA-4, PD-1, PD-L1 or LAG-3. These positive results for checkpoint monotherapies are typically only seen in a relatively small subset of the targeted patient population which has led to hundreds of immune-oncology combination treatments being tested in clinical trials.

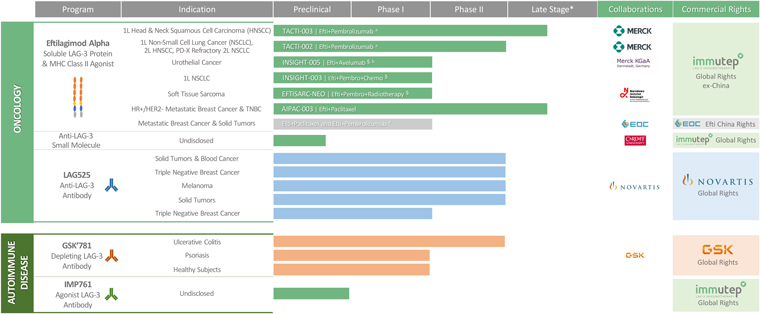

Our lead product candidate, eftilagimod alpha (IMP321 or efti), is being developed as a cancer therapeutic. Efti’s MOA stimulates and augments the human body’s natural immune response to fight cancer tumors, and it is a member of a class of drugs known as “antigen presenting cell (APC) activators.” Efti’s unique MOA leads to the activation of APCs, such as monocytes and dendritic cells, which results in increased T cell levels.

Potential competition arises from compounds with a comparable mode of cation (MoA) like other APC activators, other immune-oncology assets or generally any development in the targeted indications.

Other types of APC activators include toll like receptor (TLR) agonists, stimulator of interferon genes (STING) agonists, CD40 agonists, or oncolytic viral therapies.

We are aware of other companies that are developing cancer therapeutics in the same specific indications we are currently targeting and may target in the future. Some of these competitors are developing APC product candidates, other immune-modulating therapeutics (e.g., anti-TIGIT) that promote an immunological response against cancer and therapies targeting patients who have received prior anti-PD-1/PD-L1 therapies.

Efti is being developed in different indications. Currently the three main indications are non-small-cell-lung cancer (NSCLC), metastatic breast cancer (MBC) and squamous head and neck cancer (HNSCC).

In non-EGFR/ALK/ROS targetable metastatic non-small cell lung cancer, where efti is tested, platinum-based chemotherapies were mostly replaced as 1st line therapy by anti-PD-(L)1 monotherapies or anti-PD-(L)1 + chemotherapy combination treatments in recent years. Current developments comprise other targeted therapies (e.g., KRAS), improved chemotherapy (e.g. ADCs) and other immune-oncology assets (e.g. anti-TIGIT).

Current treatments for not HER2 high metastatic breast cancer, include predominantly parp inhibitors, CDK4/6 inhibitors, and endocrine based therapies. Only thereafter different types of chemotherapy are usually applied. Efti is tested as an adjacent therapy to chemotherapy (e.g., paclitaxel). So called ADCs are being developed for patients with HER low expression and may replace chemotherapy here for a subset of patients after exhaustion of endocrine based therapy.

Efti is also being investigated in patients with recurrent/metastatic head and neck squamous cell carcinomas (R/M HNSCC). Current treatments for recurrent HNSCC include combination therapy with cetuximab, cisplatin, and 5-fluoruracil (5-FU). More recently, immunotherapy through PD-1 blockade has become an option, either alone or in combination with platinum plus 5-FU.

Despite all the progress made in these three indications, there is still a high unmet medical need as the median overall survival in these indications is still predominantly between 12-24 months dependent on the indication.

Many competitors, or potential competitors, either alone, or with their strategic partners, have substantially greater financial, technical and human resources than we do. Therefore, our competitors may be more successful than us in obtaining approval for treatments and achieving widespread market adoption which may render our treatments obsolete or non-competitive. In addition, many of our competitors have significantly greater experience than we have in undertaking preclinical studies and human clinical trials of new pharmaceutical products, obtaining FDA and other regulatory approvals of products for use in health care, manufacturing and marketing and selling approved products. Our competitors may also obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for ours.

We expect our product candidates, if approved and commercialized, to compete with other products on a number of factors including, but not limited to, product safety and efficacy, time to market, price, insurance coverage and reimbursement by third-party payors, extent of adverse side effects, and convenience of treatment. We may not be able to effectively compete in any of these areas.

Regulatory Authorities

Our ongoing research and development, clinical, regulatory, commercial and manufacturing activities of our pharmaceutical products are subject to extensive regulation by numerous governmental authorities, including (i) in Australia, principally the Therapeutics Goods Administration, or TGA; (ii) in the United States, principally the Food and Drug Administration, or FDA; and (iii) in Europe, principally the European Medicines Agency, or EMA and local competent authorities, human research ethic committee (HREC), ethics committees (ECs), institutional research boards (IRBs) and other regulatory authorities at federal, state or local levels. We, along with our third-party contractors, will be required to navigate the various preclinical, clinical and commercial approval and post-approval requirements of the governing regulatory agencies of the countries in which we wish to conduct studies or seek approval or licensure of our product candidates.

United States – FDA process

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or the FDCA, and its implementing regulations. Regulations that govern the testing, manufacturing, safety, efficacy, labeling, storage, record keeping, advertising and promotion of such products under the Federal Food, Drug and Cosmetic Act, the Public Health Service Act, and their implementing regulations. The process of obtaining FDA approval and achieving and maintaining compliance with applicable laws and regulations requires the expenditure of substantial time and financial resources.

35