LoCorr Investment Trust

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

April 22, 2022

VIA EDGAR TRANSMISSION

Mr. David Orlic

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street N.E.

Washington D.C. 20549

Re: LoCorr Investment Trust (the “Trust”)

File Nos. 333-171360 and 811-22509

Dear Mr. Orlic:

We are responding to comments provided to Rachel Spearo of U.S. Bank Global Fund Services, the Trust’s Administrator, by the U.S. Securities and Exchange Commission (the “SEC”) Division of Investment Management staff (the “Staff”) on April 18, 2022, regarding the Trust’s Post-Effective Amendment (“PEA”) No. 50 to its registration statement on Form N-1A. PEA No. 50 was filed on February 28, 2022 pursuant to Rule 485(a) under the Securities Act of 1933, as amended (the “Securities Act”) for the purpose of adding disclosure related to a change in the investment strategy for the LoCorr Macro Strategy Fund (the “Fund”) concerning exposure in bitcoin. The Staff’s comments, along with the Trust’s responses, are set forth below.

For your convenience, each comment has been reproduced below with a response following the comment. Capitalized terms not otherwise defined have the same meaning as in the PEA.

Prospectus Comments

1.Staff Comment: Please provide a completed fee table, Example and Performance disclosures for the Fund.

Response: The Fund’s completed fee table, Example and Performance chart/table are provided below.

Fees and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below. You may qualify for sales charge discounts on purchases of Class A shares if you and your family invest, or agree to invest in the future, at least $25,000 in the Fund. More information about these and other discounts is available from your financial intermediary, in How to Purchase Shares on page 84 of this Prospectus, and in Appendix A to this Prospectus.

| | | | | | | | | | | |

Shareholder Fees (fees paid directly from your investment) | Class A | Class C | Class I |

Maximum Sales Charge (Load)

Imposed on Purchases (as a % of offering price) | 5.75% | None | None |

Maximum Deferred Sales Charge (Load) (as a % of original purchase price) | 1.00%⁽¹⁾ | 1.00%⁽²⁾ | None |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 1.65% | 1.65% | 1.65% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 0.00% |

| Other Expenses | 0.25% | 0.25% | 0.25% |

| Total Annual Fund Operating Expenses | 2.15% | 2.90% | 1.90% |

(1) Applied to purchases of $1 million or more that are redeemed within 12 months of their purchase.

(2) Applied to shares redeemed within 12 months of their purchase.

Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based upon these assumptions your costs would be:

| | | | | | | | | | | | | | |

| Class | 1 Year | 3 Years | 5 Years | 10 Years |

| A | $881 | $1,209 | $1,663 | $2,915 |

| C | $393 | $898 | $1,528 | $3,223 |

| I | $193 | $597 | $1,026 | $2,222 |

Performance:

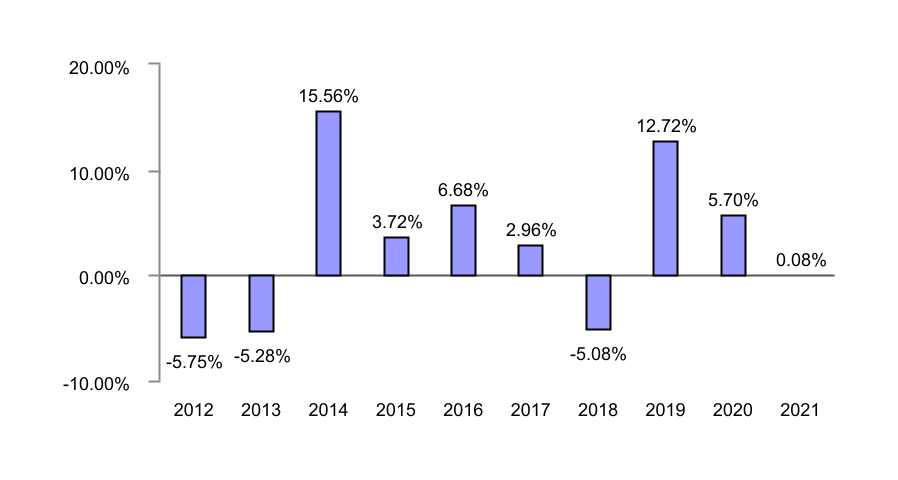

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the performance of the Fund’s Class I shares from year to year and by showing how the one-year, five-year, ten-year and since inception average annual total returns for the Fund’s Class I shares compare with that of a broad-based securities index and a secondary index The returns in the bar chart and best/worst quarter are for Class I shares which do not have sales charges. The performance of Class A and Class C Shares would be lower due to differing expense structures and sales charges. The returns in the table reflect the maximum applicable sales load of 5.75% on Class A shares, and the maximum deferred sales load of 1.00% on Class C shares for the one-year period. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future and does not guarantee future results. Net asset value (“NAV”) per share information and updated performance information is available on the Fund’s website at www.LoCorrFunds.com.

Calendar Year Total Return

LoCorr Macro Strategies Fund – Class I

| | | | | | | | |

| Highest Quarterly Return: | Q2 2014 | 8.13% |

| | |

| Lowest Quarterly Return: | Q2 2013 | -9.97% |

| | | | | | | | | | | | | | |

| Average Annual Total Return as of December 31, 2021 |

| 1 Year | 5 Years | 10 Years | Since Inception (3/24/2011)(1) |

| Class I Shares | | | | |

| Return Before Taxes | 0.08% | 3.11% | 2.89% | 2.05% |

| Return After Taxes on Distributions | -1.83% | 1.23% | 1.26% | 0.54% |

Return After Taxes on Distributions and Sale of Fund Shares | 0.06% | 1.62% | 1.52% | 0.92% |

| Class A Shares | | | | |

| Return Before Taxes | -5.89% | 1.64% | 2.03% | 1.23% |

| Class C Shares | | | | |

| Return Before Taxes | -1.86% | 2.09% | 1.87% | 1.04% |

Bank of America Merrill Lynch 3-Month Treasury Bill Index (reflects no deduction for fees, expenses or taxes) | 0.05% | 1.14% | 0.63% | 0.59% |

Barclay CTA Index

(reflects no deduction for fees, expenses or taxes) | 5.07% | 2.63% | 1.46% | 1.12% |

(1) The Fund offers three classes of shares. The Class I shares and Class C shares commenced operations on March 24, 2011 and Class A shares commenced operations on March 22, 2011. “Since Inception” performance for Class A shares is shown as of March 22, 2011.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and does not reflect the impact of state and local taxes. Actual after-tax returns depend on the individual investor’s situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or Individual Retirement Accounts (“IRAs”). After-tax returns are shown for Class I shares only and will vary for Class A and Class C shares. The Fund’s return after taxes on distributions and sale of Fund shares is

greater than its return after taxes on distributions because it includes a tax benefit resulting from the capital losses that would have been incurred, and could be utilized against other capital gains an investor may have.

2.Staff Comment: Please delete or clarify the statement that the Example “reflects the expense limitation or recoupment in the first year only” given the expense limitation will expire in less than one year.

Response: The Trust responds by deleting the applicable disclosure, as shown in the disclosure provided in response to the Staff’s comment above.

3.Staff Comment: With regard to the Fund’s investment in Bitcoin futures in the discussion of the Fund’s principal investment strategies, please enhance the disclosure as necessary to address the following:

a.Please disclose the extent to which the Fund will be investing in Bitcoin futures.

b.Please disclose that the Fund’s investments in Bitcoin futures will be cash settled and state the exchange upon which they will be traded.

c.Please disclose in the Fund’s Item 9 disclosures what bitcoin is and the markets upon which it and Bitcoin futures are traded.

Response:

a.The Trust responds by adding disclosure stating that the Fund will allocate less than 5% of Fund assets in Bitcoin futures.

b.The Trust has added disclosure stating that the Fund’s investments in Bitcoin futures only invest in cash-settled Bitcoin futures traded on the Chicago Mercantile Exchange.

c.The Trust responds by adding the following disclosure to the Item 9 section of the Prospectus:

Bitcoin is a digital asset, also as known as a cryptocurrency, that can be transferred on a peer-to-peer basis. Unlike traditional currencies, bitcoin is decentralized, meaning that the supply of bitcoin is not determined by a central government, but rather by software protocols that limit both the total amount of bitcoin that will be produced and the rate at which such bitcoin are released into the Bitcoin network. The Bitcoin network is a decentralized record of bitcoin transactions that is kept in multiple locations and updated by multiple contributors to the network. In addition, the official ledger or record of who owns what bitcoin is not maintained by any central entity, but rather, is maintained by multiple different independent computers and entities simultaneously. Ownership and transaction records for bitcoin are protected through public-key cryptography on a “blockchain.” Public-key cryptography uses a pair of keys to encrypt and decrypt data — a public key and a private key. The public key can be disclosed to others so that anyone can send encrypted data to the holder, but that data can only be decrypted with the holder’s private key.

The transactions on the bitcoin blockchain are verified by “miners.” Bitcoin “miners” are people or companies who create new bitcoin by solving complex math problems that verify transactions in the currency. Miners support the Bitcoin network by adding new blocks of data on bitcoin transactions to the blockchain. To add bitcoin transactions to the blockchain, miners’ computers must solve complex equations generated by the blockchain system. Miners are rewarded with a certain amount of bitcoin algorithmically determined by the blockchain system for supporting the Bitcoin network. In addition to miners, the Bitcoin network is collectively maintained by developers (who propose improvements to the protocols) and users. Bitcoin and Bitcoin Futures are a relatively new asset class and are subject to unique and substantial risks, including the risk that the value of the Fund’s investments could decline rapidly, including to zero. Bitcoin and Bitcoin Futures have historically been more volatile than traditional asset classes.

The Fund will only invest in cash-settled Bitcoin Futures. “Cash-settled” means that when the relevant futures contract expires, if the value of the underlying asset exceeds the futures contract price, the seller pays to the purchaser cash in the amount of that excess, and if the futures contract price exceeds the value of the underlying asset, the purchaser pays to the seller cash in the amount of that excess. In a cash-settled futures contract on bitcoin, the amount of cash to be paid is equal to the difference between the value of the bitcoin underlying the futures contract at the close of the last trading day of the contract and the futures contract price specified in the agreement. Currently, the only such contracts are traded on, or subject to the rules of, the CME, a commodity exchange registered with the U.S. Commodity Futures Trading Commission (the “CFTC”). The value of Bitcoin Futures is determined by reference to the CME CF Bitcoin Reference Rate, which provides an indication of the price of bitcoin across certain cash bitcoin exchanges.

4.Staff Comment: Regarding the principal risks of investing in the Fund, please consider adding the following risk disclosures, or advise why they are not deemed necessary:

a.Cybersecurity risks specific to Bitcoin futures.

b.Bitcoin adoption risk.

Response: The Trust responds by adding the following disclosures to the Prospectus:

•Bitcoin Adoption Risk. The further development and acceptance of the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development or acceptance of the Bitcoin network may adversely affect the price of bitcoin and therefore cause the Fund to suffer losses. The growth of this industry is subject to a high degree of uncertainty, and the factors affecting its further development, include, but are not limited to, the continued growth or possible reversal in the adoption of bitcoin, government regulation over bitcoin, the maintenance and development of the Bitcoin network, the availability and popularity of other mediums of exchange for buying and selling goods and services and consumer or public perception of bitcoin specifically or other digital assets generally. Currently, there is relatively limited use of bitcoin in the retail and commercial marketplace in comparison to relatively extensive use as a store of value, thus contributing to price volatility (meaning prices may fluctuate widely) that could adversely affect the Fund’s investment in Bitcoin Futures

•Bitcoin Cybersecurity Risk. Cybersecurity exploitations or attacks against the Bitcoin protocol and of entities that custody or facilitate the transfers or trading of bitcoin could result in a significant theft of bitcoin and a loss of public confidence in bitcoin, which could lead to a decline in the value of bitcoin and, as a result, adversely impact the Fund’s investment in Bitcoin Futures. Additionally, if a malicious actor or botnet (i.e., a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains control of more than 50% of the processing power of the Bitcoin network, such actor or botnet could alter the blockchain and adversely affect the value of bitcoin, which would adversely affect the Fund’s investment in Bitcoin Futures.

5.Staff Comment: In the “Principal Risks” section, please consider listing the principal risks in order of significance instead of in alphabetical order.

Response: The Trust responds supplementally by confirming that the principal investment risk disclosures are currently listed in the Prospectus in alphabetical order. Additionally, the following disclosure is included before the first paragraph under “Principal Investment Risks” in the Fund’s summary section with similar language in response to Item 9 of Form N-1A to help investors understand the importance of reading each risk disclosure regardless of their sequence: “The following risks apply to the Fund’s direct investments in securities and derivatives as well as the Fund’s indirect risks through investing in Underlying Funds and the Subsidiary. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with other funds. Each risk summarized below is considered a principal risk of investing in the Fund, regardless of the order in which it appears. It is important to read the provided risk disclosures in their entirety.”

6.Staff Comment: Under the Sub-heading entitled “Sub-Adviser’s Investment Process – Macro Strategies Fund” please clarify using Plain English the last sentence, which states “Because of this, the strategy has been long realized volatility.”

Response: The Trust responds by revising the applicable disclosure to read as follows: “Because of this, historically, the strategy has typically performed better during periods of heightened market volatility.”

Statement of Additional Information Comments

7.Staff Comment: Regarding Fundamental Investment Restriction 7 on Concentration, the Staff believes that investments in Bitcoin futures fall within a fund’s concentration policy, and as such its concentration policy must account for these investments. Depending on the extent of the Fund’s proposed investments in Bitcoin futures and its exposure to Bitcoin as a result, please revise the Fund’s fundamental concentration policy to address these investments as necessary.

Response: The Trust responds by stating supplementally that the Fund will not concentrate its investments in Bitcoin futures, and as such has made no revisions to the applicable investment restriction.

* * * * * *

I trust the above responses and revisions adequately address your comments. If you have any additional questions or require further information, please contact Rachel Spearo at (262) 993-2124.

Sincerely,

/s/ Jon C. Essen

Trustee, Treasurer and Principal Financial Officer

LoCorr Investment Trust

cc: JoAnn M. Strasser, Thompson Hine LLP