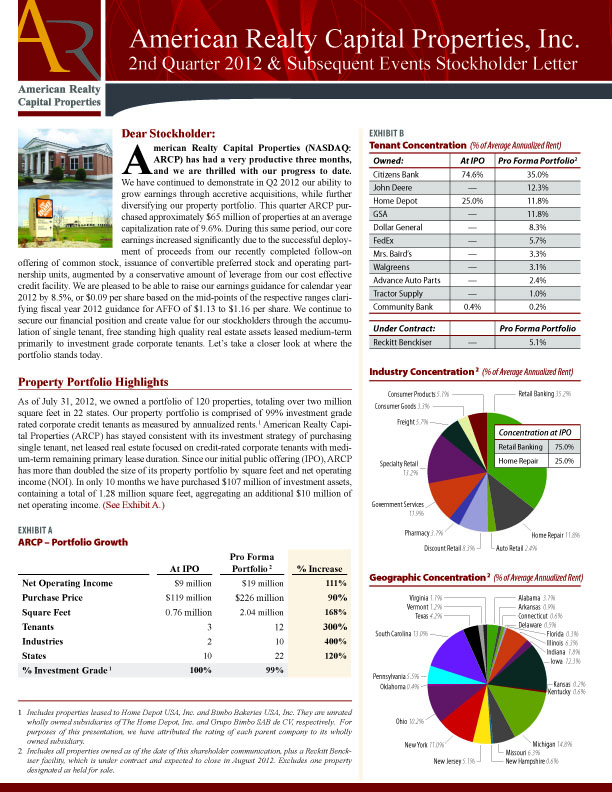

Dear Stockholder: A merican Realty Capital Properties (NASDAQ: ARCP) has had a very productive three months, and we are thrilled with our progress to date. We have continued to demonstrate in Q2 2012 our ability to grow earnings through accretive acquisitions, while further diversifying our property portfolio. This quarter ARCP purchased approximately $65 million of properties at an average capitalization rate of 9.6%. During this same period, our core earnings increased signi.cantly due to the successful deployment of proceeds from our recently completed follow-on offering of common stock, issuance of convertible preferred stock and operating partnership units, augmented by a conservative amount of leverage from our cost effective credit facility. We are pleased to be able to raise our earnings guidance for calendar year 2012 by 8.5%, or $0.09 per share based on the mid-points of the respective ranges clari fying .scal year 2012 guidance for AFFO of $1.13 to $1.16 per share. We continue to secure our .nancial position and create value for our stockholders through the accumulation of single tenant, free standing high quality real estate assets leased medium-term primarily to investment grade corporate tenants. Let's take a closer look at where the portfolio stands today. Property Portfolio Highlights EXHIBIT B Tenant Concentration (% of Average Annualized Rent) Owned: At IPO Pro Forma Portfolio2 Citizens Bank 74.6% 35.0% John Deere 12.3% Home Depot 25.0% 11.8% GSA 11.8% Dollar General 8.3% FedEx 5.7% Mrs. Baird's 3.3% Walgreens 3.1% Advance Auto Parts 2.4% Tractor Supply 1.0% Community Bank 0.4% 0.2% Under Contract: Pro Forma Portfolio Reckitt Benckiser 5.1% Industry Concentration 2 (% of Average Annualized Rent) As of July 31, 2012, we owned a portfolio of 120 properties, totaling over two million square feet in 22 states. Our property portfolio is comprised of 99% investment grade rated corporate credit tenants as measured by annualized rents.1 American Realty Capital Properties (ARCP) has stayed consistent with its investment strategy of purchasing single tenant, net leased real estate focused on credit-rated corporate tenants with medi um-term remaining primary lease duration. Since our initial public offering (IPO), ARCP has more than doubled the size of its property portfolio by square feet and net operating income (NOI). In only 10 months we have purchased $107 million of investment assets, containing a total of 1.28 million square feet, aggregating an additional $10 million of net operating income. (See Exhibit A.) EXHIBIT A ARCP Portfolio Growth Pro Forma At IPO Portfolio 2 % Increase Net Operating Income $9 million $19 million 111% Purchase Price $119 million $226 million 90% Square Feet 0.76 million 2.04 million 168% Tenants 3 12 300% Industries 2 10 400% States 10 22 120% % Investment Grade 1 100% 99% 1 Includes properties leased to Home Depot USA, Inc. and Bimbo Bakeries USA, Inc. They are unrated wholly owned subsidiaries of The Home Depot, Inc. and Grupo Bimbo SAB de CV, respectively. For purposes of this presentation, we have attributed the rating of each parent company to its wholly owned subsidiary. 2 Includes all properties owned as of the date of this shareholder communication, plus a Reckitt Benckiser facility, which is under contract and expected to close in August 2012. Excludes one property designated as held for sale. Consumer Products 5.1% Retail Banking 35.2% Consumer Goods 3.3% Specialty Retail Concentration at IPO Retail Banking 75.0% Home Repair 25.0% 13.2% Government Services Pharmacy 3.1% Home Repair 11.8% Discount Retail 8.3% Auto Retail 2.4% Geographic Concentration 2 (% of Average Annualized Rent) South Carolina 13.0% Florida 0.3% Illinois 6.3% Indiana 1.8% Iowa 12.3% Pennsylvania 5.5% Kansas 0.2% Oklahoma 0.4% Kentucky 0.6% Ohio 10.2% Michigan 14.8% Missouri 6.3% New Jersey 5.1% New Hampshire 0.6%

Portfolio Diversity In acquiring properties, we focus on assembling a portfolio of homogenous assets carefully diversi.ed by tenant, industry and geography. In the past 10 months, we have added nine new tenants, eight new industries and 12 new states. (See Exhibit B.) As illustrated in Exhibit A, these acquisitions signi.cantly increased the diversity of our portfolio, and we plan to continue to grow our existing business and maintain a well-diversi.ed portfolio consistent with our investment strategy. Dividend Increase ARCP has increased its dividend three times since its IPO. At the IPO, on September 7, 2011, our board of directors authorized an annual dividend rate of $0.875 per share, or $0.0729 monthly. On February 27, 2012, our board of directors increased the annualized dividend from $0.875 per common share to $0.880 per share, or $0.0733 monthly. On March 16, 2012, we declared an additional annual dividend rate increase to $0.885 per share, or $0.07375 monthly. On June 27, 2012, the Company's board of directors authorized an increase to the Company's annual dividend rate from $0.885 to $0.890 per share. The new annual dividend rate will be payable monthly commencing September 15, 2012, to stockholders of record on September 8, 2012. Signi.cant Balance Sheet Initiatives We have taken several important steps during the second quarter to appropriately position our balance sheet and increase earnings. On May 21, 2012, we expanded the capacity of our senior secured revolving credit facility led by RBC Citizens, N.A., from $55.0 million to $75.0 million. We drew an additional $25.3 million on our senior secured revolving credit facility on May 31, 2012, thereby bringing our aggregate borrowings under this facility to $74.9 million as of June 30, 2012. On June 18, 2012, ARCP completed a follow-on offering of 3.25 million shares of its common stock and announced the full exercise of the underwriters' option to purchase an additional 487,500 newly issued shares of common stock, bringing the total net proceeds from the offering to approximately $35.3 million. ARCP used the net proceeds from the offering to make additional property acquisitions, and repay indebtedness. Robert W. Baird & Co. Incorporated, Ladenburg Thalmann & Co. Inc. and JMP Securities LLC served as joint bookrunning managers of the offering. Maxim Group LLC and National Securities Corporation acted as comanagers for the offering. Research Coverage and Index Inclusions Research coverage was initiated by two sell-side research analysts on ARCP during the quarter. JMP Securities began coverage in April while Robert W. Baird commenced its research in June. This is in addition to current coverage by Ladenburg Thalmann, which was initiated in December 2011. ARCP was also added to the MSCI U.S. Micro Cap Index and the Russell Micro Cap Index, broadening our institutional stockholder base. Fiscal 2012 and 2013 Earnings Guidance We are especially pleased to be able to raise our earnings guidance for calendar year 2012 by 8.5%, or $0.09 per share based on the midpoints of the respective ranges clarifying .scal year 2012 guidance for AFFO of $1.13 to $1.16 per share. Furthermore, we are initiating preliminary guidance for 2013, at AFFO levels of $1.25 to $1.28 per share, thereby targeting AFFO growth of over 10% for 2013. Our con.dence level is bolstered by the fact that the current portfolio of properties has virtually no lease expirations until 2015. Acquisitions Pipeline Our acquisitions team has built a robust pipeline of future transactions that will continue to diversify our portfolio of free standing, single tenant properties net leased on a medium-term basis to predominantly investment grade tenants and grow core earnings. We announced in early July that we have an agreement to acquire an approximately $10 million property, consistent with our investment strategy, tenanted by Reckitt Benckiser's French's Mustard division. The purchase has a remaining lease term of approximately six years and is priced at an average cap rate of 9.6%. This acquisition adds a new tenant to the real estate portfolio, bringing the total number of tenants to 12. The acquisition is in line with our strategy to acquire real estate that is net leased to investment grade and creditworthy corporate tenants and is scheduled to close in August 2012. . $113 Million Equity Market Cap . 120 Properties Owned 2 . 12 Tenants . 2 Million Square Feet . 99% Rents from Investment Grade Credit Tenants 1 $0.885 Per Share Annualized Distribution (Increased to $0.890 per share subsequent to the end of the quarter) Value Creation Through the remainder of 2012, we will continue to focus on acquiring high-quality properties consistent with our investment strategy, while increasing earnings per share and reducing our cost of capital. We will buy properties that are attractively priced and have contractual rent growth, thereby allowing us to potentially increase dividends over time. Management's interests remain closely aligned with those of our stockholders, and we will build upon the previous successes of the Company by focusing on earnings growth, dividend growth and asset growth.

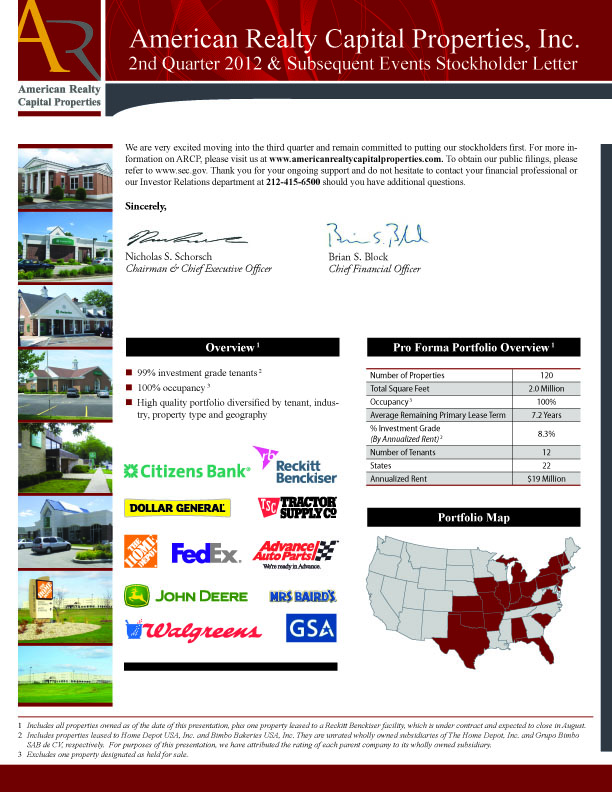

American Realty Capital Properties, Inc. 2nd Quarter 2012 & Subsequent Events Stockholder Letter We are very excited moving into the third quarter and remain committed to putting our stockholders . rst. For more information on ARCP, please visit us at www.americanrealtycapitalproperties.com. To obtain our public . lings, please refer to www.sec.gov. Thank you for your ongoing support and do not hesitate to contact your .. nancial professional or our Investor Relations department at 212-415-6500 should you have additional questions. Sincerely, Nicholas S. Schorsch Brian S. Block Chairman & Chief Executive Offi cer Chief Financial Offi cer Overview 1 Pro Forma Portfolio Overview 1 99% investment grade tenants 2 Number of Properties 120 100% occupancy 3 Total Square Feet 2.0 Million High quality portfolio diversi. ed by tenant, indus- Occupancy 3 100% try, property type and geography Average Remaining Primary Lease Term 7.2 Years % Investment Grade (By Annualized Rent) 2 8.3% Number of Tenants 12 States 22 Annualized Rent $19 Million Portfolio Map 1 Includes all properties owned as of the date of this presentation, plus one property leased to a Reckitt Benckiser facility, which is under contract and expected to close in August. 2 Includes properties leased to Home Depot USA, Inc. and Bimbo Bakeries USA, Inc. They are unrated wholly owned subsidiaries of The Home Depot, Inc. and Grupo Bimbo SAB de CV, respectively. For purposes of this presentation, we have attributed the rating of each parent company to its wholly owned subsidiary. 3 Excludes one property designated as held for sale.