Exhibit 99.1

TPG Specialty Lending Inc. Provides Business and Portfolio Update

NEW YORK—(BUSINESS WIRE)—March 16, 2020—TPG Specialty Lending, Inc. (NYSE: TSLX, or the “Company”) today sent the following letter to update its stakeholders on its business and portfolio.

March 16, 2020

Dear Stakeholder,

First and foremost in our minds is the health and well-being of our broader community. As we together face the challenges of the coronavirus(COVID-19), our thoughts are with everyone who has been affected (both directly and indirectly) by this unprecedented event. We recognize that uncertainty, especially when it pertains to the health of our loved ones and our communities, can result in significant anxiety and concern. We believe the ongoing implications ofCOVID-19 will have a significant impact on the real global economy, and we, like many others, are executing contingency plans for this public health and economic event. In the meantime, our priority remains maintaining close dialogue and providing the highest possible level of transparency with all our stakeholders, including our shareholders, bondholders, rating agencies, portfolio companies, sponsors, and referral partners. Please know that we are vigilantly monitoring this continually evolving situation and have implemented steps to keep our people safe while ensuring full business continuity.

Portfolio Positioning

We have long operated with a late-cycle mindset and have taken a number of steps to proactively manage risk in our portfolio. Specifically, we have been primarily focused on investing at the top of the capital structure in businesses with limited commodity and cyclical exposure. Since our IPO in Q1 2014 toyear-end 2019, we’ve increased the first lien composition of our portfolio from 82.4% to 96.5% of the portfolio on a fair value basis. Over this period, we’ve also decreased the cyclical exposure in our portfolio from 19.0% to 2.9% of the portfolio on a fair value basis. Note that this excludes our asset-based loans in retail and reserve- and asset-based loans in energy.

Our energy exposure atyear-end was limited to four portfolio companies representing 4.2% of the portfolio by fair value. The largest position, Verdad Resources, representing 1.8% of the portfolio at fair value or approximately 44% of our total energy exposure, is a first lien reserve-based loan in an upstream company with significantly hedged production volume through 2023 and hedged collateral value. Our second largest position is Energy Alloys, which represents 0.9% of the portfolio at fair value or approximately 23% of our total energy exposure. This is an asset-based loan secured by working capital collateral, which we believe provides more downside protection than the typical energy services loan.

Across our core portfolio companies, our average net attachment point and last-dollar leverage atyear-end 2019 was relatively conservative at 0.2x and 4.2x, respectively. As ofyear-end 2019, we had no investments onnon-accrual status. We continue to stay close to our portfolio companies with regular conversations withC-suite executives to proactively assess and manage potential risks across our portfolio. While things are evolving given the underlying uncertainty in the broader markets, in the spirit of transparency, we wanted to provide a substantive update on our current portfolio positioning.

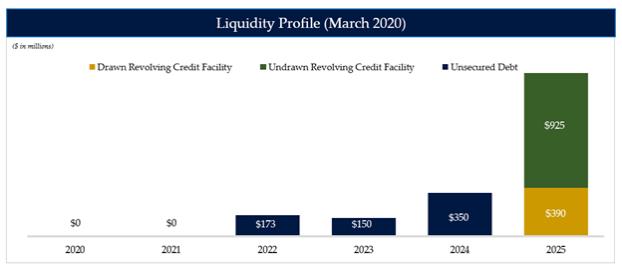

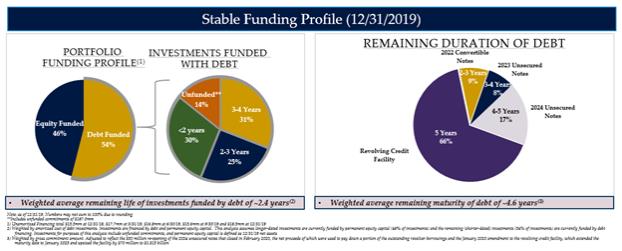

Liquidity, Funding Profile and Capital

Given our ongoing focus on liability management, we believe we have ample and diverse funding sources with long-dated maturities to support our capital needs in the period ahead. Currently, we have in excess of $925 million of capacity available and expect that to increase to over $1.0 billion in the near-term given

1