UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22517

Corbin Multi-Strategy Fund, LLC

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Ann Maurer

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1.(a) REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

Corbin Multi-Strategy Fund, LLC

Financial Statements

For the Year Ended March 31, 2022

With Report of Independent Registered Public Accounting Firm

Corbin Multi-Strategy Fund, LLC

Table of Contents

For the Year Ended March 31, 2022

| | |

Management’s Discussion of Fund Performance | 2-5 |

Report of Independent Registered Public Accounting Firm | 6 |

Fund Performance | 7-8 |

Schedule of Investments | 9-12 |

Statement of Assets and Liabilities | 13 |

Statement of Operations | 14 |

Statements of Changes in Net Assets | 15-16 |

Statement of Cash Flows | 17 |

Financial Highlights | 18-19 |

Notes to Financial Statements | 20-36 |

Supplemental Information | 37-42 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by the Fund’s private placement memorandum. Please read it carefully before investing.

1

Corbin Multi-Strategy Fund, LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2022

Corbin Multi-Strategy Fund, LLC’s (the “Fund”) Class I shares returned +6.14% net of fees and expenses in fiscal year ended March 31, 2022, decently outperforming the HFRI Fund of Funds Composite Index, which returned +1.07% for the same period.

FY 2021 Market Overview

US equity markets were mostly strong from April 2021 through March 2022, with the S&P 500 Index climbing +15.65% during that period. In 2021, investors cheered the economic recovery while seemingly overlooking escalating inflation concerns and continued uncertainty around the COVID-19 pandemic, but those concerns were exacerbated at the beginning of 2022 by Russia’s war in Ukraine. The top performing sectors in the S&P 500 Index during the fiscal year were energy (+64.30%), real estate (+25.75%), and information technology (+20.90%). Strong results for US equity indices masked turbulence beneath the surface that adversely impacted hedge fund alpha generation.

European equity markets posted similarly strong results during the first three quarters of the fiscal year due to the European Central Bank’s continued accommodative stance in 2021. However, in Q1 2022, European markets were more heavily impacted by the outbreak of war in Ukraine. For the full fiscal year, the performance of the Euro Stoxx 50 Index was modestly negative, falling -0.43%. In the UK, the FTSE 100 Index returned +11.95% for the fiscal year on economic optimism and strong growth. Chinese equities, on the other hand, were weak during the period, mainly due to persistent regulatory concerns and a resurgence of COVID-19 in Q1 2022. The Hang Seng Index fell -22.49% for the fiscal year, while China’s CSI 300 Index fared slightly better and returned -16.36% for the same period. Emerging markets, as measured by the MSCI EM (Emerging Markets) Index, fell -13.27% during the fiscal year.

Fixed income markets experienced significant volatility during the fiscal year, with the Bloomberg US Aggregate Bond Index ultimately falling -4.15%. The US treasury curve steepened in 2021 on a surge in growth and inflation, with meaningful volatility in rates throughout the fiscal year as investors struggled to interpret inflation data and the resulting Federal Reserve policy stance. In Q1 2022, the US treasury curve flattened as the Federal Reserve announced and moved forward with concrete plans for interest rate hikes. The Federal Reserve became progressively more hawkish in its efforts to combat growing inflation, which reached +8.5% year-over-year in March 2022. At the December Federal Open Market Committee meeting, the Federal Reserve announced it was doubling the rate of tapering and signaled three rate hikes in 2022. In March 2022, for the first time since 2018, the Federal Reserve raised its benchmark interest rate by +25 basis points and signaled that several more rate hikes are in store during 2022. During the fiscal year, 10-year US treasury yield rose by +60 basis points. The largest increase occurred between January and March 2022 when with the 10-year US treasury yield climbed by +83 basis points after declining by -23 basis points between April and December 2021.

US credit markets were mostly negative during the Fund’s fiscal year. For the fiscal year, lower-rated corporate and structured credit investments outperformed investment grade credit investments; the ICE BofA US Corporate Index fell -4.31% while high yield credit investments (as measured by the ICE BofA US High Yield Index) fell -0.29% and riskier bonds (as measured by the ICE BofA CCC & Lower US High Yield Index) posted a +1.03% gain. Leveraged loans (as measured by the S&P/LSTA Leveraged Loan Total Return Index) were up +3.25% for the fiscal year due to both price appreciation and interest. Structured credit markets continued to build on their recovery from 2020, benefitting from improved credit metrics and fundamentals. The J.P. Morgan CLO BB Post-Crisis Total Return Index ended the fiscal year up +7.62%

Portfolio Overview

The Fund pursues its investment objective principally by allocating its capital among various collective investment vehicles that pursue a range of investment strategies (each, a “sub-strategy” and collectively, the “sub-strategies”). All of the Fund’s six sub-strategy allocations posted positive results during the fiscal year. The Fund’s equity sub-strategies were positive overall for the period, despite unusual dispersion between returns of equity managers and negative alpha. The Fund’s allocation to credit sub-strategies contributed to Fund performance on a similar scale as the Fund’s equity sub-strategies during the period, reflecting credit outperformance given the Fund’s smaller allocation to credit sub-strategies. The Fund’s Relative Value and Global Macro sub-strategy allocations were the top contributors to Fund performance during the fiscal year, largely on the back of good performance from the Fund’s investments in D.E. Shaw Composite and D.E. Shaw Oculus. Our hedges detracted from Fund performance during the period, given strength in equity markets. We are pleased that our diversified sub-strategy exposures positioned the Fund to produce strong results in a volatile market backdrop during the fiscal year ended March 31, 2022.

2

Corbin Multi-Strategy Fund, LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2022 (continued)

Fiscal Year 2021 Performance Review by Strategy (as of March 31, 2022)

Fund Strategy | | Avg. Allocation

(Fiscal Year) | | | Gross

Return | | | HFRI Strategy

Index Return | | | Gross

Contribution | |

Long/Short Equity | | | 40.46 | % | | | 1.48 | % | | | 0.03 | % | | | 0.92 | % |

Equity Special Situations | | | 5.01 | % | | | 31.52 | % | | | 0.98 | % | | | 0.05 | % |

Event-Driven/Distressed Credit | | | 16.55 | % | | | 5.49 | % | | | 7.54 | % | | | 0.82 | % |

Asset-Backed Securities | | | 7.50 | % | | | 2.64 | % | | | 5.09 | % | | | 0.24 | % |

Relative Value | | | 16.68 | % | | | 22.19 | % | | | 4.44 | % | | | 3.62 | % |

Global Macro | | | 10.20 | % | | | 26.25 | % | | | 10.32 | % | | | 2.62 | % |

Portfolio Hedge | | | — | | | | — | | | | — | | | | -0.45 | % |

Fund - Class I Total (Net) Return | | | 100 | % | | | — | | | | — | | | | 6.14 | % |

Return and contribution figures shown above for the Fund’s Class I shares are estimated and unaudited as of March 31, 2022. Figures include the reinvestment of dividends, gains and other earnings and may include slight rounding error. Return and contribution figures for the various strategies are gross of the Fund’s fees and expenses but are net of the underlying manager fees and expenses. Sector classifications and investment allocations are at the sole discretion of Corbin Capital Partners, L.P. (“Corbin”) and subject to change at any time. It should not be assumed that investments identified herein or in the future will be profitable or will equal performance above. HFRI indices used for comparison to the Fund’s strategies are the following: Long/Short Equity (HFRI Equity Hedge (Total) Index); Equity Special Situations (HFRI ED: Special Situations Index); Event-Driven/Distressed Credit (HFRI ED: Distressed/Restructuring Index); Asset-Backed Securities (HFRI RV: Fixed Income-Asset Backed Index); Relative Value (HFRI Relative Value (Total) Index); Global Macro (HFRI Macro (Total) Index). Past performance is not indicative of future results.

Equity Strategies

The Fund’s Long/Short Equity sub-strategy allocation was up +1.48% in FY 2021 and its Equity Special Situations sub-strategy allocation was up +31.52% for the same period, as compared to the HFRI Equity Hedge Index, which was up +0.03%, and the HFRI ED: Special Situations Index, which was up +0.98%, for the fiscal year. Equity alpha was weak, as was true in the hedge fund universe more broadly. According to Goldman Sachs and Morgan Stanley prime brokerage1, fundamental long/short equity hedge funds exhibited very weak alpha in 2021 and into the first quarter of 2022. We think the HFRI Equity Hedge Index, far stronger than the Goldman Sachs and Morgan Stanley reports, may overstate equity hedge fund returns, perhaps because it is equal-weighted and omits weak performance from a number of very large managers.

In our portfolio, equity managers generated decent alpha in Q2 2021 and Q3 2021, clawing back some of their losses from the extraordinary meme stock short squeeze that occurred in January 2021. The long side pain started in the five weeks post-Thanksgiving 2021, when the confluence of the Omicron variant and a more hawkish Federal Reserve caused deep drawdowns across re-opening themes and growth stocks. This theme has worsened in 2022 as the Federal Reserve wound down and eventually ended its asset purchase program and raised the benchmark interest rate for the first time since 2018 in an effort to curb heightened inflation. Furthermore, our relatively small exposure to some of the strongest performing sectors, like energy and real estate, also hurt Fund performance during the fiscal year.

SRS, the Fund’s top contributing equity sub-strategy manager for the year, returned +38.88%, led by strength in the manager’s long-held investment in Avis. After suffering during the pandemic, Avis benefitted from re-opening trends and the rental car boom to rally +263% between April 2021 and March 2022. Our Europe-focused equity sub-strategy manager, Pelham (Long/Short-Small Cap), was the largest detractor in FY 2021, falling -21.41%. The vast majority of the loss was generated in Q4 2021 and Q1 2022 when the manager was down -23.02% as several core long equity positions, particularly growth-oriented consumer discretionary names, sold off on rising rate concerns. The Fund’s position in Cadian lost -9.27% in FY 2021, as the portfolio holding was severely impacted by COVID resurgence fears, which hurt some re-opening names, and Federal Reserve tapering concerns, which weighed on some of the higher growth biotech names. Cadian had a significant drawdown of -15.55% in November 2021, driven by a sell-off in software and biotechnology long positions.

1 | Source: Morgan Stanley Prime Brokerage (data back to 2009) and Goldman Sachs Hedge Fund Insights & Analytics (data back to 2015). |

3

Corbin Multi-Strategy Fund, LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2022 (continued)

The Fund’s allocation to Equity Special Situations sub-strategy outperformed its allocation to Long/Short Equity sub-strategies during the fiscal year, largely due to the Fund’s investment in Third Point listed shares (TPOU LN), which were up +12.84% on the back of strong underlying fund performance and a significant narrowing of TPOU LN’s discount to the underlying fund’s net asset value. The position was up +25.84% in Q2-Q4 2021 before falling -10.07% in Q1 2022 as broad-based losses in the fund were led by recent initial public offering investments. In November 2021, we initiated a new position in the Antara Capital Fund, a manager who invests in special situations across the capitalization structure. This investment fell -4.96% from November 2021 to March 2022 due to weakness in growth positions and de-SPAC names.

Credit Strategies

The Fund’s allocation to Event-Driven/Distressed Credit sub-strategy returned +5.49% during the fiscal year, versus the HFRI ED: Distressed/Restructuring Index’s return of +7.54% for the same period. The Fund’s investment in Redwood rose +4.19% during the year, benefitting from re-opening trades in particular.

The Fund’s allocations to Asset-Backed Securities sub-strategy returned +2.64% during the fiscal year, underperforming the HFRI RV: Fixed Income-Asset Backed Index’s return of +5.09% for the same period. Select Fund positions saw markups and the Fund’s investment in East Lodge, which returned +2.95% for the fiscal year, experienced strong performance in its European exposures.

Relative Value

The Fund’s Relative Value sub-strategy allocation was up +22.19% during the fiscal year, significantly outperforming the HFRI RV: Fixed Income-Asset Backed Index, which returned +4.44% for the same period. The Fund’s main relative value position, D.E. Shaw Composite, was the largest contributor to performance during the period, returning +24.92% on the back of broad-based gains across strategies.

Global Macro

The Fund’s Global Macro sub-strategy allocation returned +26.25% during the fiscal year, outperforming the HFRI Macro (Total) Index’s return of +10.32% for the same period. The largest core position in that sub-strategy allocation, D.E. Shaw Oculus, gained +28.98% during the period on gains in systematic equities and macro trading.

Hedge Overlay

The Fund’s hedge overlay detracted -45 basis points from Fund performance during the fiscal year, roughly in-line with expectations given the S&P 500 Total Return Index’s +15.65% rise during the same period.

Fund performance and contribution figures shown above are presented as of March 31, 2022, reflect the period of April 1, 2021 through March 31, 2022, are estimated and unaudited, and include the reinvestment of dividends, gains and other earnings. Figures as presented may include slight rounding error. Fund performance and contribution figures for the various sectors are gross of the Fund’s fees and expenses, but are net of the underlying manager fees and expenses. Sector classifications and investment allocations are at the sole discretion of the Fund’s investment manager and subject to change at any time. It should not be assumed that investments identified herein or in the future will be profitable or will equal performance shown above. Past performance is not necessarily indicative of future results.

Indices referenced herein are passive, and do not reflect any fees or expenses unless otherwise stated. While the performance of the Fund discussed herein has been compared here with the performance of well-known and widely recognized indices, the various indices may not represent an appropriate benchmark for the Fund. The holdings of the Fund discussed herein may differ significantly from the securities that comprise the various indices. Also, the performance and volatility of the indices may be materially different from that of the Fund. Investors cannot invest directly in an index (although one can invest in an index fund designed to closely track such index).

The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. This Index does not reflect any fees or expenses.

The MSCI EM (Emerging Markets) Index is a free-float weighted equity index that captures large mid-cap representation across emerging markets countries.

4

Corbin Multi-Strategy Fund, LLC

Management’s Discussion of Fund Performance (Unaudited)

March 31, 2022 (continued)

The Euro Stoxx 50 Index provides a blue-chip representation of supersector leaders in the Eurozone. The index covers 50 stocks from 12 Eurozone countries.

The FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange.

The CSI 300 Index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges.

The S&P/LSTA Leveraged Total Return Loan Index is a market value-weighted index designed to measure the performance of the US leveraged loan market based upon market weightings.

The ICE BofA US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market.

The ICE BofA CCC & Lower US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market.

JP Morgan CLO BB Post-Crisis Total Return Index is a JP Morgan Dataquery Index containing more than 600 underlying CLOs to demonstrate CLO market price action.

The ICE BofA US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.

The HFRI Monthly Indices are provided by Hedge Fund Research, Inc. (“HFR”). HFRI Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. Due to mutual agreements with the hedge fund managers listed in the HFR Database, HFR is not at liberty to disclose the particular funds behind any index to non-database subscribers. HFRI Indices are updated by HFR at various points during each month. HFRI data included in this letter may not be the most current data issued by HFR. Additionally, HFR reserves the right to modify previously issued data.

The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

The Bloomberg US Aggregate Bond Index represents securities that are US domestic, taxable and dollar denominated. The index covers the US investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. This Index does not reflect any fees or expenses.

5

6

Corbin Multi-Strategy Fund, LLC

Fund Performance (Unaudited)

March 31, 2022

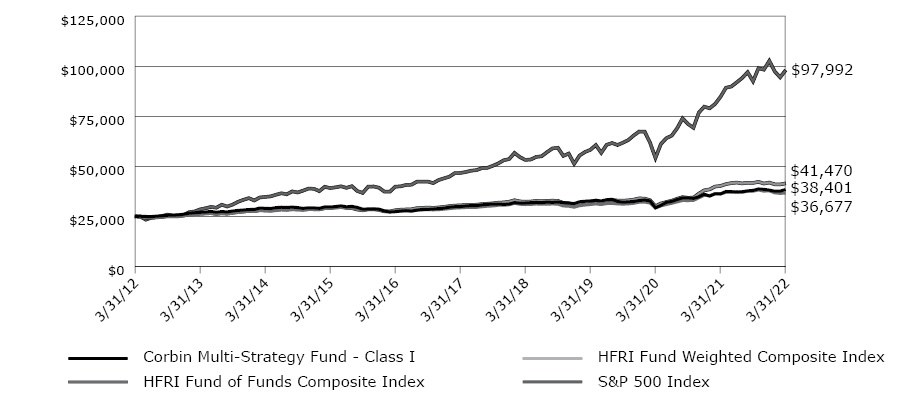

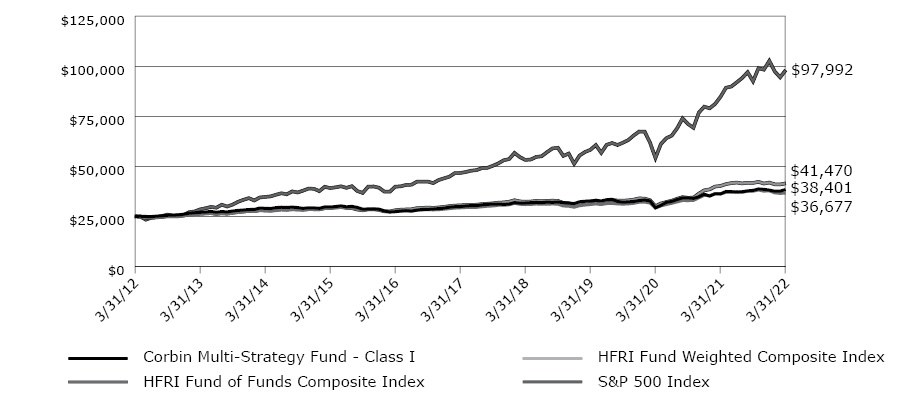

Performance of a $25,000 Investment

This graph compares a hypothetical $25,000 investment in the Fund’s Class I Shares with a similar investment in the HFRI Fund of Funds Composite Index, the HFRI Fund Weighted Composite Index and the S&P 500 Index. These indices do not serve as benchmarks for the Fund and are shown for illustrative purposes only. The Fund does not have a designated performance benchmark. Results include the reinvestment of all dividends and capital gains. The indices do not reflect expenses, fees, or sales charges, which would lower performance. Please note that the performance of the Fund’s other share class, Class A, will differ based on the differences in sales load and fees paid by shareholders investing in the Fund’s Class A Shares.

HFRI Fund of Funds Composite Index

The HRFI Fund of Funds Composite Index is an equal weighted index that consists of over 800 constituent hedge funds that report to the HFR Database, including both domestic and offshore funds. Fund of funds invest with multiple managers through funds or managed accounts. The index is unmanaged and, unlike the Fund, is not affected by cash flows. The HFRI Fund of Funds Composite Index is not included in the HFRI Fund Weighted Composite Index. It is not possible to invest directly in an index.

HFRI Fund Weighted Composite Index

The HFRI Fund Weighted Composite Index is a global, equal-weighted index of single-manager funds that report to HFR Database. Constituent funds report monthly net of all fees performance in US Dollar and have a minimum of (a) $50 Million under management, or (b) $10 Million under management and a twelve (12) month track record of active performance. The HFRI Fund Weighted Composite Index does not include funds of hedge funds. It is not possible to invest directly in an index.

S&P 500 Index

The S&P 500 Index includes a representative sample of 500 leading companies in leading industries of the U.S. economy and assumes any dividends are reinvested back into the index. It is not possible to invest directly in an index.

7

Corbin Multi-Strategy Fund, LLC

Fund Performance (Unaudited)

March 31, 2022 (continued)

Average Annual Total Returns as of March 31, 2022 | 1 Year | 5 Years | 10 Years |

Corbin Multi-Strategy Fund - Class I | 6.14% | 5.13% | 4.39% |

Corbin Multi-Strategy Fund - Class A | 5.38% | 4.40% | 3.79% |

HFRI Fund of Funds Composite Index | 1.07% | 4.60% | 3.91% |

HFRI Fund Weighted Composite Index | 3.17% | 6.34% | 5.19% |

S&P 500 Index | 15.65% | 15.99% | 14.64% |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1 (844) 626-7246.

Performance results may include the effect of expense reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

Corbin Multi-Strategy Fund, LLC

Schedule of Investments

March 31, 2022

Strategy | Investments | | Original

Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

Investments in Investment Funds — 83.74%1 |

Asset-Backed Securities — 7.22% |

| | East Lodge Capital Credit Opportunities Fund, LP | | | 10/1/2019 | | | | 2,172 | | | $ | 2,360,312 | | | $ | 2,244,089 | |

| | East Lodge Capital Credit Opportunities Fund, Ltd. | | | 3/1/2015 | | | | 250 | | | | 277,084 | | | | 313,686 | |

| | Perella Weinberg Partners Asset Based Value Offshore Fund, LP2 | | | 3/1/2015 | | | | — | | | | 810,727 | | | | 781,414 | |

| | Serengeti Lycaon Overseas, Ltd. | | | 3/1/2015 | | | | 1,638 | | | | 967,819 | | | | 1,447,973 | |

| | VPC Offshore Unleveraged Private Debt Fund Feeder, LP2 | | | 10/1/2016 | | | | — | | | | 34,118 | | | | 99,375 | |

| | | | | | | | | | | | 4,450,060 | | | | 4,886,537 | |

Equity Special Situations — 7.21% |

| | Antara Capital Offshore Fund, Ltd. | | | 11/1/2021 | | | | 5,000 | | | | 5,000,000 | | | | 4,752,047 | |

| | Luxor Capital Partners Offshore Liquidating SPV, Ltd. | | | 10/1/2016 | | | | 32 | | | | 43,604 | | | | 19,513 | |

| | SGOF Liquidating Feeder, Ltd. | | | 7/1/2020 | | | | 87 | | | | 87,368 | | | | 111,890 | |

| | | | | | | | | | | | 5,130,972 | | | | 4,883,450 | |

Event Driven/Distressed — 15.53% |

| | Centerbridge Credit Partners Offshore, Ltd. | | | 10/1/2016 | | | | 17 | | | | 20,804 | | | | 25,750 | |

| | Redwood Domestic Fund, LP2 | | | 10/1/2019 | | | | — | | | | 5,500,000 | | | | 7,175,292 | |

| | Redwood Offshore Fund, Ltd. | | | 3/1/2015 | | | | 15,024 | | | | 1,674,042 | | | | 3,315,762 | |

| | | | | | | | | | | | 7,194,846 | | | | 10,516,804 | |

Global Macro — 11.9% |

| | D.E. Shaw Oculus International Fund2 | | | 3/1/2015 | | | | — | | | | 3,423,538 | | | | 8,060,438 | |

| | | | | | | | | | | | 3,423,538 | | | | 8,060,438 | |

Long/Short Equity — 22.87% |

| | Cadian Offshore Fund Ltd. | | | 3/1/2015 | | | | 899 | | | | 956,383 | | | | 2,315,516 | |

| | Pelham Long/Short Fund, LP2 | | | 10/1/2019 | | | | — | | | | 1,686,504 | | | | 1,451,112 | |

| | Pelham Long/Short Small Cap Fund, Ltd. | | | 10/1/2018 | | | | 13,869 | | | | 2,625,000 | | | | 2,705,884 | |

| | SRS Partners Ltd. | | | 10/1/2020 | | | | 975 | | | | 2,665,412 | | | | 4,258,256 | |

| | Steamboat Capital Partners Offshore Fund, Ltd. | | | 4/1/2018 | | | | 435 | | | | 750,488 | | | | 817,726 | |

| | Tal China Focus Fund | | | 11/1/2019 | | | | 2,425 | | | | 779,874 | | | | 1,238,119 | |

| | Tal China Focus US Fund | | | 1/1/2021 | | | | 6,394 | | | | 3,000,000 | | | | 2,700,307 | |

| | | | | | | | | | | | 12,463,661 | | | | 15,486,920 | |

Relative Value — 19.01% |

| | D.E. Shaw Composite International Fund2 | | | 3/1/2015 | | | | — | | | | 4,162,602 | | | | 12,875,087 | |

| | | | | | | | | | | | | 4,162,602 | | | | 12,875,087 | |

Total Investments in Investment Funds | | | | | | | | | | | 36,825,679 | | | | 56,709,236 | |

See accompanying Notes to Financial Statements.

9

Corbin Multi-Strategy Fund, LLC

Schedule of Investments

March 31, 2022 (continued)

Strategy | Investments | | Original

Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

Investments in Securities 3.47% |

Collateralized Loan Obligations — 2.15% |

| | Anchorage Credit Funding 2019-9A, Ltd.* (Estimated Yield: 7.63%; Maturity Date: 10/25/2037; Par Value: $680,000) | | | | | | | | | | $ | 680,000 | | | $ | 535,500 | |

| | Strata CLO I, Ltd.* (Interest Rate: 7.32% (3-Month USD Libor+708 basis points); Maturity Date: 1/15/2031; Par Value: $1,000,000) | | | | | | | | | | | 970,000 | | | | 922,512 | |

| | | | | | | | | | | | 1,650,000 | | | | 1,458,012 | |

Equity — 1.3% |

| | Third Point Offshore Investors Ltd. | | | | | | | 35,151 | | | | 491,352 | | | | 878,775 | |

| | | | | | | | | | | | 491,352 | | | | 878,775 | |

| | | | | | | Contracts | | | | | | | | | |

Purchased Options Contracts 0.02% |

Put Options — 0.02% |

| | S&P 500 Index3 | | | | | | | | | | | | | | | | |

| | Exercise Price: $4,200.00, Notional Amount: $3,360,000, Expiration Date: April 29, 2022 | | | | | | | 8 | | | | 53,944 | | | | 14,560 | |

| | | | | | | | | | | | | 53,944 | | | | 14,560 | |

Total Investments in Securities | | | | | | | | | | | 2,195,296 | | | | 2,351,347 | |

| | | | | | | | | | | | | | | | | | |

Total Investments (Cost $39,020,975) — 87.21% | | | | | | | | | | | | | | | 59,060,583 | |

Other assets in excess of liabilities — 12.79% | | | | | | | | | | | | | | | 8,651,775 | |

Net Assets — 100% | | | | | | | | | | | | | | $ | 67,712,358 | |

* | Investment is income-producing. |

1 | All or portion of these securities are segregated as collateral for a Line of Credit. The total value of securities segregated as collateral was $56,709,236 as of March 31, 2022. |

2 | Investment does not issue shares. |

See accompanying Notes to Financial Statements.

10

Corbin Multi-Strategy Fund, LLC

Schedule of Investments

March 31, 2022 (continued)

Investments by Strategy (as a percentage of total investments)* | | | |

Investment Funds | | | | |

Long/Short Equity | | | 26.22 | % |

Relative Value | | | 21.80 | % |

Event Driven/Distressed | | | 17.81 | % |

Global Macro | | | 13.65 | % |

Asset-Backed Securities | | | 8.27 | % |

Equity Special Situations | | | 8.27 | % |

Total Investment Funds | | | 96.02 | % |

Investments in Securities | | | | |

Equity | | | 1.49 | % |

Collateralized Loan Obligations | | | 2.47 | % |

Purchased Options Contracts | | | 0.02 | % |

Total Investments in Securities | | | 3.98 | % |

| | | | 100.00 | % |

* | Does not include credit default swaps or written call and put options. |

SWAP CONTRACTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CREDIT DEFAULT SWAPS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exchange | | Reference

Entity | | | Buy/Sell(1)

Protection | | | Pay/Receive

Fixed

Rate | | | Pay/Receive

Frequency | | | Fixed

Rate | | | Expiration

Date | | | Notional

Value(2) | | | Fair

Value(3) | | | Premiums

Paid/

(Received) | | | Unrealized

Appreciation/

(Depreciation) | |

Intercontinental Exchange | | | CDX North America

High Yield Index

Series 29 | | | | Buy | | | | Pay | | | | Quarterly | | | | 5.00% | | | | 12/20/2022 | | | $ | 669,900 | | | $ | (14,850 | ) | | $ | 36,575 | | | $ | (51,425 | ) |

Intercontinental Exchange | | | CDX North America

Investment Grade Index

Series 29 | | | | Buy | | | | Pay | | | | Quarterly | | | | 1.00% | | | | 12/20/2022 | | | $ | 2,145,000 | | | $ | (12,476 | ) | | $ | 51,696 | | | $ | (64,172 | ) |

TOTAL SWAP CONTRACTS | | $ | 2,814,900 | | | $ | (27,326 | ) | | $ | 88,271 | | | $ | (115,597 | ) |

(1) | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation of underlying securities comprising the referenced index. |

(2) | The maximum potential amount the Fund could be required to make as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

(3) | The prices and resulting values for credit default swap agreements on credit indices serve as an indicator of the current status of the payment/performance risk and represent the likelihood of an expected liability (or profit) for the credit derivative should the notional amount of the swap agreement be closed/sold as of the period end. Increasing market values, in absolute terms when compared to the notional amount of the swap, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

See accompanying Notes to Financial Statements.

11

Corbin Multi-Strategy Fund, LLC

Schedule of Investments

March 31, 2022 (continued)

Strategy | Investments | | Contracts | | | Premiums | | | Fair Value | |

Written Options Contracts | | | | | | | | | | | | |

Call Options Contracts | | | | | | | | | | | | |

| | S&P 500 Index1 | | | | | | | | | | | | |

| | Exercise Price: $4,650.00, Notional Amount: $3,720,000, | | | | | | | | | | | | |

| | Expiration Date: April 29, 2022 | | | (8 | ) | | $ | (18,376 | ) | | $ | (26,992 | ) |

| | | | | | | | | (18,376 | ) | | | (26,992 | ) |

Put Options Contracts | | | | | | | | | | | | |

| | S&P 500 Index1 | | | | | | | | | | | | |

| | Exercise Price: $4,050.00, Notional Amount: $3,240,000, | | | | | | | | | | | | |

| | Expiration Date: April 29, 2022 | | | (8 | ) | | | (33,576 | ) | | | (9,040 | ) |

| | | | | | | | | (33,576 | ) | | | (9,040 | ) |

Total Written Options Contracts | | | | | | $ | (51,952 | ) | | $ | (36,032 | ) |

See accompanying Notes to Financial Statements.

12

Corbin Multi-Strategy Fund, LLC

Statement of Assets and Liabilities

March 31, 2022

Assets | | | | |

Investments, at fair value (cost $39,020,975) | | $ | 59,060,583 | |

Cash | | | 1,344,015 | |

Cash held in escrow for shares tendered | | | 919,479 | |

Receivable for investments sold | | | 10,325,345 | |

Due from broker for swap contracts and written options contracts | | | 1,165,912 | |

Interest receivable | | | 15,479 | |

Prepaid expenses and other assets | | | 26,626 | |

Total Assets | | | 72,857,439 | |

| | | | | |

Liabilities | | | | |

Tenders payable | | | 1,881,901 | |

Written options contracts, at fair value (premiums $51,952) | | | 36,032 | |

Credit default swaps, at fair value (upfront premiums paid $88,271) | | | 27,326 | |

Loan payable | | | 3,000,000 | |

Management Fee payable | | | 84,994 | |

Accounting and administration fees payable | | | 11,792 | |

Transfer agent fees payable | | | 12,619 | |

Custody fees payable | | | 3,219 | |

Investor Distribution and Servicing Fees payable (Class A) | | | 6,570 | |

Board of Managers’ fees payable | | | 1,383 | |

Professional fees and other accrued expenses | | | 79,245 | |

Total Liabilities | | | 5,145,081 | |

Net Assets | | $ | 67,712,358 | |

| | | | | |

Composition of Net Assets: | | | | |

Paid-in capital | | $ | 101,638,755 | |

Total accumulated deficit | | | (33,926,397 | ) |

Net Assets | | $ | 67,712,358 | |

| | | | | |

Net Assets Attributable to: | | | | |

Class A Shares | | $ | 3,858,144 | |

Class I Shares | | | 63,854,214 | |

| | | $ | 67,712,358 | |

| | | | | |

Shares of Limited Liability Company Interest Outstanding (Unlimited Number of Shares Authorized): | | | | |

Class A Shares | | | 47,805 | |

Class I Shares | | | 715,257 | |

| | | | 763,062 | |

| | | | | |

Net Asset Value per Share: | | | | |

Class A Shares | | $ | 80.71 | |

Class I Shares | | $ | 89.27 | |

* | Investments in Class A Shares of less than $500,000 are subject to a placement fee of 2.00%; investments in Class A Shares of $500,000 or more and less than $1,000,000 are subject to a placement fee of 1.00% and investments in Class A Shares of $1,000,000 or more are subject to a placement fee of 0.50% (in each case, the “Class A Share Placement Fee”). |

See accompanying Notes to Financial Statements.

13

Corbin Multi-Strategy Fund, LLC

Statement of Operations

For the Year Ended March 31, 2022

Investment Income | | | | |

Interest income | | $ | 607,443 | |

Total Income | | | 607,443 | |

| | | | | |

Fund Expenses | | | | |

Management Fee | | | 604,904 | |

Accounting and administration fees | | | 165,242 | |

Commitment fees | | | 130,740 | |

Professional fees | | | 121,739 | |

Transfer Agency fees | | | 77,805 | |

Board of Managers’ fees and expenses | | | 76,054 | |

Other operating expenses | | | 44,667 | |

Investor Distribution and Servicing Fee (Class A) | | | 31,212 | |

Custodian fees | | | 25,611 | |

Interest expense | | | 34,163 | |

Total Fund Expenses | | | 1,312,137 | |

| | | | | |

Net Investment Loss | | | (704,694 | ) |

| | | | | |

Net Realized Gain/(Loss) and Change in Unrealized Appreciation/Depreciation on Investments | | | | |

Capital gain distributions from Investment Funds | | | 119 | |

Net realized gain on investments | | | 10,089,895 | |

Net realized gain on written options | | | 332,204 | |

Net realized loss on credit default swaps | | | (55,685 | ) |

Net change in unrealized appreciation/depreciation on investments | | | (4,650,197 | ) |

Net change in unrealized appreciation/depreciation on written options | | | (89,082 | ) |

Net change in unrealized appreciation/depreciation on credit default swaps | | | 42,267 | |

Net Realized Gain and Change in Unrealized Appreciation/Depreciation on Investments | | | 5,669,521 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 4,964,827 | |

See accompanying Notes to Financial Statements.

14

Corbin Multi-Strategy Fund, LLC

Statements of Changes in Net Assets

| | | For the

Year Ended

March 31, 2022 | | | For the

Year Ended

March 31, 2021 | |

Changes in Net Assets Resulting from Operations | | | | | | | | |

Net investment loss | | $ | (704,694 | ) | | $ | (1,256,175 | ) |

Net realized gain on investments | | | 10,366,533 | | | | 8,104,193 | |

Net change in unrealized appreciation/depreciation on investments | | | (4,697,012 | ) | | | 14,100,862 | |

Net Change in Net Assets Resulting from Operations | | | 4,964,827 | | | | 20,948,880 | |

| | | | | | | | | |

Distributions to Investors | | | | | | | | |

Class A | | | (506,436 | ) | | | (251,787 | ) |

Class I | | | (8,076,607 | ) | | | (4,927,842 | ) |

Net Change in Net Assets from Distributions to Investors | | | (8,583,043 | ) | | | (5,179,629 | ) |

| | | | | | | | | |

Change in Net Assets Resulting from Capital Transactions | | | | | | | | |

Class A | | | | | | | | |

Reinvested distributions | | | 306,699 | | | | 150,928 | |

Shares tendered | | | (600,445 | ) | | | (1,468,894 | ) |

Total Class A Transactions | | | (293,746 | ) | | | (1,317,966 | ) |

| | | | | | | | | |

Class I | | | | | | | | |

Issuance of shares | | | 575,000 | | | | 3,975,000 | |

Reinvested distributions | | | 1,992,077 | | | | 1,380,567 | |

Shares tendered | | | (20,369,631 | ) | | | (19,767,273 | ) |

Total Class I Transactions | | | (17,802,554 | ) | | | (14,411,706 | ) |

| | | | | | | | | |

Net Change in Net Assets Resulting from Capital Transactions | | | (18,096,300 | ) | | | (15,729,672 | ) |

| | | | | | | | | |

Total Net Increase/(Decrease) in Net Assets | | | (21,714,516 | ) | | | 39,579 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of year | | | 89,426,874 | | | | 89,387,295 | |

End of year | | $ | 67,712,358 | | | $ | 89,426,874 | |

| | | | | | | | | |

See accompanying Notes to Financial Statements.

15

Corbin Multi-Strategy Fund, LLC

Statements of Changes in Net Assets (continued)

| | | For the

Year Ended

March 31, 2022 | | | For the

Year Ended

March 31, 2021 | |

Shareholder Activity | | | | | | | | |

Class A Shares | | | | | | | | |

Reinvested distributions | | | 3,820 | | | | 1,752 | |

Shares tendered | | | (7,346 | ) | | | (17,141 | ) |

Net Change in Class A Shares Outstanding | | | (3,526 | ) | | | (15,389 | ) |

| | | | | | | | | |

Class I Shares | | | | | | | | |

Issuance of shares | | | 5,794 | | | | 46,964 | |

Reinvested distributions | | | 22,471 | | | | 14,677 | |

Shares tendered | | | (213,890 | ) | | | (212,233 | ) |

Net Change in Class I Shares Outstanding | | | (185,625 | ) | | | (150,592 | ) |

| | | | | | | | | |

See accompanying Notes to Financial Statements.

16

Corbin Multi-Strategy Fund, LLC

Statement of Cash Flows

For the Year Ended March 31, 2022

Cash Flows From Operating Activities | | | | |

Net increase in net assets from operations | | $ | 4,964,827 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

Purchases of investments | | | (6,146,355 | ) |

Written options covered | | | (649,973 | ) |

Proceeds from sales of investments | | | 37,581,728 | |

Proceeds from written options | | | 861,410 | |

Net realized gain on investments | | | (10,089,895 | ) |

Net realized gain on written options | | | (332,204 | ) |

Net change in unrealized appreciation/depreciation on investments | | | 4,650,197 | |

Net change in unrealized appreciation/depreciation on written options | | | 89,082 | |

Net change in unrealized appreciation/depreciation on credit default swaps | | | (42,114 | ) |

(Increase)/Decrease in Assets: | | | | |

Decrease in receivable for investments sold | | | (4,251,901 | ) |

Increase in interest receivable | | | 74 | |

Decrease in prepaid expenses and other assets | | | 8,237 | |

Increase/(Decrease) in Liabilities: | | | | |

Decrease in payable for investment purchased | | | (39,633 | ) |

Decrease in Management Fee payable | | | (91,447 | ) |

Decrease in accounting and administration fees payable | | | (13,980 | ) |

Decrease in Commitment Fees | | | (9,718 | ) |

Decrease in custody fees payable | | | (5,813 | ) |

Decrease in transfer agent fees payable | | | (7,120 | ) |

Decrease in Investor Distribution and Servicing fees payable | | | (1,325 | ) |

Increase in Board of Managers’ fees | | | 270 | |

Decrease in other accrued expenses | | | (48,945 | ) |

Net Cash Provided by Operating Activities | | | 26,425,402 | |

| | | | | |

Cash Flows from Financing Activities | | | | |

Proceeds from loan facility | | | 10,000,000 | |

Payments on loan facility | | | (14,000,000 | ) |

Proceeds from issuance of shares, net of decrease in subscriptions received in advance | | | 575,000 | |

Distributions to investors, net of reinvestments of distributions | | | (6,284,267 | ) |

Payments for shares tendered, net of decrease in payable for tenders | | | (25,319,016 | ) |

Net Cash Used in Financing Activities | | | (35,028,283 | ) |

| | | | | |

Net change in Cash and Restricted Cash | | | (8,602,881 | ) |

Cash and Restricted Cash - Beginning of Year | | | 12,032,287 | |

Cash and Restricted Cash - End of Year* | | $ | 3,429,406 | |

| | | | | |

Supplemental disclosure of non-cash activities and financing activities | | | | |

Cash paid for loan interest | | $ | 33,461 | |

Reinvested dividends | | $ | 2,298,776 | |

* | Cash and restricted cash include cash, cash held in escrow, and deposits held at broker, as outlined further on the Statement of Assets and Liabilities. |

See accompanying Notes to Financial Statements.

17

Corbin Multi-Strategy Fund, LLC

Financial Highlights

Class A Shares

Per Share Data and Ratios for a Share of Limited Liability Company Interest Outstanding Throughout each year. |

| |

| | | Class A Shares | |

| | | For the Year

Ended

March 31,

2022 | | | For the Year

Ended

March 31,

2021 | | | For the Year

Ended

March 31,

2020 | | | For the Year

Ended

March 31,

2019 | | | For the Year

Ended

March 31,

2018 | |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value per share, beginning of year | | $ | 86.25 | | | $ | 73.76 | | | $ | 91.98 | | | $ | 93.79 | | | $ | 99.39 | |

Activity from investment operations:(1) | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (1.36 | ) | | | (1.64 | ) | | | (1.81 | ) | | | (1.87 | ) | | | (2.02 | ) |

Net realized and unrealized gain/(loss) on investments | | | 5.95 | | | | 18.42 | | | | (7.12 | ) | | | 3.82 | | | | 7.01 | |

Total from investment operations | | | 4.59 | | | | 16.78 | | | | (8.93 | ) | | | 1.95 | | | | 4.99 | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions to investors | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (10.13 | ) | | | (4.29 | ) | | | (9.29 | ) | | | (3.76 | ) | | | (10.59 | ) |

From net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions to investors | | | (10.13 | ) | | | (4.29 | ) | | | (9.29 | ) | | | (3.76 | ) | | | (10.59 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net Asset Value per share, end of year | | $ | 80.71 | | | $ | 86.25 | | | $ | 73.76 | | | $ | 91.98 | | | $ | 93.79 | |

| | | | | | | | | | | | | | | | | | | | | |

Net Assets, end of year (in thousands) | | $ | 3,858 | | | $ | 4,427 | | | $ | 4,921 | | | $ | 7,046 | | | $ | 8,027 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data:(2) | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (1.58 | )% | | | (1.98 | )% | | | (2.05 | )% | | | (2.04 | )% | | | (2.09 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Gross Expenses (3) | | | 2.35 | % | | | 2.47 | % | | | 2.42 | % | | | 2.51 | % | | | 2.31 | % |

Fund Management Fee waiver | | | — | | | | (0.04 | )% | | | — | | | | — | | | | — | |

Net Expenses (4) | | | 2.35 | % | | | 2.43 | % | | | 2.42 | % | | | 2.51 | % | | | 2.31 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover Rate (8) | | | 6.98 | % | | | 16.89 | % | | | 32.73 | % | | | 9.89 | % | | | 1.49 | % |

Total Return (5) | | | 5.38 | % | | | 22.76 | % | | | (10.79 | )% | | | 2.24 | % | | | 5.19 | % |

| | | | | | | | | | | | | | | | | | | | | |

Senior Securities | | | | | | | | | | | | | | | | | | | | |

Total borrowings (000’s omitted) | | $ | 3,000 | | | $ | 7,000 | | | $ | 23,000 | | | $ | — | (7) | | $ | — | (7) |

Asset coverage per $1,000 unit of senior indebtedness(6) | | $ | 23,571 | | | $ | 13,775 | | | $ | 4,886 | | | $ | — | (7) | | $ | — | (7) |

(1) | Based on average Shares outstanding throughout the year. |

(2) | The expenses and net investment loss ratios do not include income or expenses of the Investment Funds in which the Fund invests. |

(3) | Represents the ratio of expenses to average net assets absent Management Fee waivers, expense reimbursements and/or expense recoupment by the Adviser. |

(4) | Through June 30, 2020, net expenses excluding non-reimbursable expenses are capped at 2.75% for Class A. Effective July 1, 2020 net expenses excluding non-reimbursable expenses are no longer capped for Class A. For the period from July 1, 2020 to December 31, 2020 the Adviser voluntarily agreed to implement a fee reduction of 10% on the Management Fee. |

(5) | Total return based on per Share net asset value reflects the change in net asset value based on the effects of the performance of the Fund during the year and assumes distributions, if any, were reinvested. Total returns shown exclude the effect of applicable placement fee and early withdrawal fees. |

(6) | Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. |

(8) | Calculated for the Fund as a whole. |

See accompanying Notes to Financial Statements.

18

Corbin Multi-Strategy Fund, LLC

Financial Highlights

Class I Shares

Per Share Data and Ratios for a Share of Limited Liability Company Interest Outstanding Throughout each year. |

| |

| | | Class I Shares | |

| | | For the Year

Ended

March 31,

2022 | | | For the Year

Ended

March 31,

2021 | | | For the Year

Ended

March 31,

2020 | | | For the Year

Ended

March 31,

2019 | | | For the Year

Ended

March 31,

2018 | |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value per share, beginning of year | | $ | 94.35 | | | $ | 80.33 | | | $ | 99.40 | | | $ | 100.37 | | | $ | 104.92 | |

Activity from investment operations:(1) | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.81 | ) | | | (1.15 | ) | | | (1.31 | ) | | | (1.34 | ) | | | (1.49 | ) |

Net realized and unrealized gain/(loss) on investments | | | 6.52 | | | | 20.11 | | | | (7.77 | ) | | | 4.13 | | | | 7.53 | |

Total from investment operations | | | 5.71 | | | | 18.96 | | | | (9.08 | ) | | | 2.79 | | | | 6.04 | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions to investors | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (10.79 | ) | | | (4.94 | ) | | | (9.99 | ) | | | (3.76 | ) | | | (10.59 | ) |

From net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions to investors | | | (10.79 | ) | | | (4.94 | ) | | | (9.99 | ) | | | (3.76 | ) | | | (10.59 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net Asset Value per share, end of year | | $ | 89.27 | | | $ | 94.35 | | | $ | 80.33 | | | $ | 99.40 | | | $ | 100.37 | |

| | | | | | | | | | | | | | | | | | | | | |

Net Assets, end of year (in thousands) | | $ | 63,854 | | | $ | 85,000 | | | $ | 84,466 | | | $ | 125,156 | | | $ | 141,013 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data:(2) | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.85 | )% | | | (1.26 | )% | | | (1.37 | )% | | | (1.36 | )% | | | (1.44 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Gross Expenses (3) | | | 1.62 | % | | | 1.75 | % | | | 1.74 | % | | | 1.84 | % | | | 1.66 | % |

Fund management fee waiver | | | — | | | | (0.04 | )% | | | — | | | | — | | | | — | |

Net Expenses (4) | | | 1.62 | % | | | 1.71 | % | | | 1.74 | % | | | 1.84 | % | | | 1.66 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover Rate (8) | | | 6.98 | % | | | 16.89 | % | | | 32.73 | % | | | 9.89 | % | | | 1.49 | % |

Total Return (5) | | | 6.14 | % | | | 23.62 | % | | | (10.19 | )% | | | 2.93 | % | | | 5.93 | % |

| | | | | | | | | | | | | | | | | | | | | |

Senior Securities | | | | | | | | | | | | | | | | | | | | |

Total borrowings (000’s omitted) | | $ | 3,000 | | | $ | 7,000 | | | $ | 23,000 | | | $ | — | (7) | | $ | — | (7) |

Asset coverage per $1,000 unit of senior indebtedness(6) | | $ | 23,571 | | | $ | 13,775 | | | $ | 4,886 | | | $ | — | (7) | | $ | — | (7) |

(1) | Based on average Shares outstanding throughout the year. |

(2) | The expenses and net investment loss ratios do not include income or expenses of the Investment Funds in which the Fund invests. |

(3) | Represents the ratio of expenses to average net assets absent Management Fee waivers, expense reimbursements and/or expense recoupment by the Adviser. |

(4) | Through June 30, 2020, net expenses excluding non-reimbursable expenses are capped at 2.00% for Class I. Effective July 1, 2020 net expenses excluding non-reimbursable expenses are no longer capped for Class I. For the period from July 1, 2020 to December 31, 2020 the Adviser voluntarily agreed to implement a fee reduction of 10% on the Management Fee. |

(5) | Total return based on per Share net asset value reflects the change in net asset value based on the effects of the performance of the Fund during the year and assumes distributions, if any, were reinvested. Total returns shown exclude the effect of early withdrawal fees. |

(6) | Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. |

(8) | Calculated for the Fund as a whole. |

See accompanying Notes to Financial Statements.

19

Corbin Multi-Strategy Fund, LLC

Notes to Financial Statements

March 31, 2022

Note 1 – Organization

Corbin Multi-Strategy Fund, LLC (the “Fund”), is a Delaware limited liability company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a closed-end management investment company. Corbin Capital Partners, L.P. (the “Adviser”), a Delaware limited partnership, serves as the investment adviser to the Fund. Prior to July 1, 2019 the Fund was known as the GAI Multi-Strategy Fund, LLC and Wells Fargo Investment Institute, Inc. (the “Former Adviser”) served as the investment adviser to the Fund and the Adviser served as the sub-adviser to the Fund. The Fund has two separate classes of shares of limited liability company interest outstanding, Class A Shares and Class I Shares (“Shares”).

The Fund’s Board of Managers (the “Board”) provides broad oversight over the operations and affairs of the Fund, and has overall responsibility to manage and control the business affairs of the Fund, including the complete and exclusive authority to establish policies regarding the management, conduct, and operation of the Fund’s business. The Board exercises the same powers, authority and responsibilities on behalf of the Fund as are customarily exercised by the board of directors of a registered investment company organized as a corporation.

The Shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, subject to the approval of the Board. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains and losses on investments are allocated to each class of shares in proportion to their relative net assets. Members of a class that bears distribution and service expenses under the terms of the distribution plan have exclusive voting rights to that plan.

Plan of Liquidation

At a meeting held on March 8, 2022 and March 9, 2022, the Board approved a Plan of Liquidation (the “Plan”) for the Fund and determined to close and liquidate the Fund, as soon as practicable. This decision was made after careful consideration of the Fund’s current and future prospects. Following such approval by the Board, April 1, 2022 was established as the Plan’s effective date (the “Effective Date”). The Plan provides for the liquidation of the Fund and the pro rata distribution of available cash and cash equivalents of the Fund to its investors (“Members”). Accordingly, effective March 10, 2022, the Fund discontinued accepting orders for the purchase of Shares and ceased making tender offers for the repurchase of Shares. The Plan also provides that, subject to continued compliance with applicable rules and regulations, including Subchapter M of the Internal Revenue Code, the Fund shall from time to time make distributions to Members of its available cash resulting from the liquidation of the Fund’s portfolio securities.

As soon as possible after all of the Fund’s investments in portfolio securities are converted to cash, the Fund shall make to each Member of record on the Effective Date a final liquidating distribution equal to the Member’s proportionate net assets of the Fund and shall make available to each such Member information concerning the sources of the liquidating distribution. All outstanding Shares will be cancelled following the final liquidating distribution. Prior to that time, the net proceeds from the liquidation of portfolio securities will be invested in cash equivalent securities or held in cash and shall be distributed to Members, as described above. During this time, the Fund may hold more cash or cash equivalents than normal, which may prevent the Fund from meeting its stated investment objective. The Fund’s ability to convert its portfolio securities to cash is subject to the redemption restrictions of the underlying investment funds in which the Fund invests (“Investment Funds”) and to the Fund’s ability to sell portfolio securities that by their terms are not redeemable. As a result, the date of the Fund’s final liquidating distribution to Members is not knowable at this time. It is possible that it will take the Fund more than two years to convert all of its portfolio securities to cash, which could result in certain Fund distributions being taxable to both the Fund and its Members for Federal income tax purposes.

Investment Objective and Strategies

The investment objective of the Fund is to achieve a consistent return on capital, with limited correlation with equity market returns over a full market cycle, through investments in a diversified portfolio of securities and other financial instruments including, but not limited to, securities of United States (“U.S.”) and non-U.S. corporations and other entities, U.S. government securities, non-U.S. government securities, partnership interests, money-market instruments, derivatives on securities and other derivatives, commodity interests including futures contracts, options, options on futures, swaps, forward contracts, currencies and physical commodities, and other financial instruments. During the period from the Effective Date until the date on which the Fund makes its final liquidating distribution, the Fund may hold more cash or cash equivalents than normal, which may prevent the Fund from meeting its stated investment objective. The description below reflects the Fund’s investment strategies as of March 31, 2022.

20

Corbin Multi-Strategy Fund, LLC

Notes to Financial Statements

March 31, 2022 (continued)

Note 1 – Organization (continued)

The Fund pursues its investment objective principally by allocating its capital among various collective investment vehicles, commonly referred to as “hedge funds”. The Fund’s investments will consist primarily of Investment Funds across a range of strategies. The Fund may, in addition to investing in Investment Funds, also make investments directly, including, without limitation, for purposes of hedging certain exposures. Direct investments may be made by the Fund independently at the direction of the Adviser. Such direct investments may be made in any strategy or asset class in which the Fund may otherwise invest. The Fund may maintain a portion of its assets in cash, high quality fixed income securities, money market instruments, shares of money market funds, or overnight repurchase agreements. While there is no limit on the amount of the Fund’s assets that may be maintained in cash, the Adviser does not expect such amount to be substantial under normal market conditions and will generally maintain substantial amounts of cash only for defensive or temporary purposes, such as maintaining liquidity for distributions in connection with repurchases by the Fund. The Fund maintains a loan facility, the proceeds of which are used as working capital with the result of creating leverage. That leverage is used, among other things, to make investments and to manage timing mismatches between investments in and withdrawals from Investment Funds and investor cash flows. An investment in the Fund involves substantial risk and an investor may lose some or all of the amount invested. Many factors will affect the performance of the Investment Fund. There is no assurance that the Fund will achieve its objectives. Investment Funds will be managed by investment advisers or investment managers (collectively, “Investment Managers”) who are not affiliated with the Adviser.

The Fund may invest in Investment Funds that purchase and sell futures contracts and options on futures contracts or engage in swap transactions or may purchase and sell such instruments and engage in such transactions directly. The Adviser currently relies on the no-action relief afforded by Commodity Futures Trading Commission (“CFTC”) Staff Letter No. 12-38. Therefore, the Adviser will not be required to deliver a CFTC disclosure document to Members, nor will it be required to provide Members certified annual reports that satisfy the requirements of CFTC regulations generally applicable to registered Commodity Pool Operators. The Adviser is not registered as a “commodity trading advisor” with the CFTC, and the Fund is operated pursuant to CFTC Rule 4.14(a)(5). As of the date of these financial statements, there is no certainty that the Adviser or other parties will be able to rely on these exclusions and any other exemptions in the future. Additional CFTC regulation (or a choice to no longer use strategies that trigger additional regulation) may cause the Fund to change its investment strategies or to incur additional expenses.

Note 2 – Accounting Policies

The following is a summary of significant accounting policies followed by the Fund and are in conformity with accounting principles generally accepted in the United States (“GAAP”). The accompanying financial statements of the Fund are stated in U.S. dollars. The Fund is considered to be an investment company in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies (“FASB ASC 946”), and is following the accounting and reporting guidance found within FASB ASC 946.

(a) Valuation of Investments

The Board has formed a Valuation Committee (the “Valuation Committee”) that is responsible for reviewing fair valuations of securities held by the Fund in instances as required by the valuation procedures (defined below) adopted by the Board. The Fund’s Valuation Committee oversees the valuation of the Fund’s investments on behalf of the Fund. The Board has approved the valuation policy and procedures for the Fund (the “Valuation Procedures”). The fair values of equity securities are determined using last traded or closing prices as reported on the primary exchange where securities are traded and are generally categorized within Level 1 of the Fund’s fair value hierarchy. If no sales of such equity securities are reported on a particular day, the securities are generally valued based upon their closing bid prices. In any case where the Adviser believes that (i) the agreed upon valuation methodology is not appropriate or (ii) market quotations for a security are unavailable, unreliable, or not reflective of the security’s fair value, the investment team will recommend a fair valuation for review by the Valuation Committee. The Valuation Committee shall determine the fair value of the security by taking into account such factors deemed relevant.

The Fund values its investments in Investment Funds at fair value in accordance with procedures established in good faith by the Board using net asset value per share (“NAV”). The fair value of an Investment Fund ordinarily will be the NAV of that Investment Fund determined and reported by the Investment Fund in accordance with the valuation policies established by the Investment Fund and/or its Investment Manager, absent information indicating that such value does not represent the fair value of the interest. The Fund could reasonably expect to receive the NAV of its interests amount from the Investment Fund if the Fund’s interest were redeemed at the time of valuation, based on information reasonably available at the time

21

Corbin Multi-Strategy Fund, LLC

Notes to Financial Statements

March 31, 2022 (continued)

Note 2 – Accounting Policies (continued)

the valuation is made and that the Fund believes to be reliable. In particular, FASB Topic 820, Fair Value Measurements (“FASB ASC 820”) permits a reporting entity to measure the fair value of an investment fund that does not have a readily determinable fair value based on the NAV per share, or its equivalent, of the investment fund as a practical expedient, without further adjustment, unless it is probable that the investment would be sold at a value significantly different than the NAV. If the practical expedient NAV is not as of the reporting entity’s measurement date, then the NAV should be adjusted to reflect any significant events that may change the valuation. In using the NAV as a practical expedient, certain attributes of the investment that may impact its fair value are not considered in measuring fair value. Attributes of those investments include the investment strategies of the investment and may also include, but are not limited to, restrictions on the investor’s ability to redeem its investments at the measurement date and any unfunded commitments. The Fund is permitted to invest in alternative investments that do not have a readily determinable fair value, and as such, has elected to use the NAV as calculated on the reporting entity’s measurement date as the fair value of the investment. A listing of each investment by the Fund by strategy can be found in the Schedule of Investments.

Due to the nature of the investments held by the Investment Funds, changes in market conditions and the economic environment may significantly impact the value of the Investment Funds and the fair value of the Fund’s interests in the Investment Funds. Under some circumstances, the Fund or the Adviser may determine, based on other information available to the Fund or the Adviser, that an Investment Fund’s reported valuation does not represent fair value. If it is determined that the Investment Fund’s reported valuation does not represent fair value, the Adviser may choose to make adjustments to reflect the fair value. During the year ended March 31, 2022, no such adjustments were deemed necessary by the Adviser. In addition, the Fund may not have an Investment Fund’s reported valuation as of a particular fiscal period end. In such cases, the Fund would determine the fair value of such an Investment Fund based on any relevant information available at the time. The Board has also established procedures for the valuation of investment securities other than securities of Investment Funds, if any, held directly by the Fund.

(b) Federal Income Taxes

The Fund elects to be treated as, and qualifies as, a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required for the Fund.

In accounting for income taxes, the Fund follows the guidance in FASB ASC 740, Accounting for Uncertainty in Income Taxes. FASB ASC 740 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity before being measured and recognized in the financial statements. There were no material uncertain tax positions requiring recognition in the Fund’s financial statements as of March 31, 2022.

Management has analyzed the Fund’s tax positions for all open tax years, which include the years ended October 31, 2018 through October 31, 2021, and has concluded that as of March 31, 2022, no provision for income taxes is required in the financial statements. Therefore, no additional tax expense, including any interest and penalties, was recorded in the current year and no adjustments were made to prior periods. To the extent the Fund recognizes interest and penalties, they are included in interest expense and other expenses, respectively, in the Statement of Operations.

The Fund utilizes a tax-year end of October 31 and the Fund’s income and federal excise tax returns and all financial records supporting the 2019, 2020 and 2021 returns are subject to examination by the federal and Delaware revenue authorities.

(c) Security Transactions and Investment Income

The Fund’s transactions are accounted for on a trade-date basis. Realized gains and losses on the Fund’s transactions are determined on a specific identification basis. Interest income is recognized on the accrual basis. Dividend income is recognized on the ex-dividend date. The Fund accounts for capital gain distributions from Investment Funds based on the nature of such distributions as determined by each underlying Investment Fund. Capital gain distributions received are recorded as capital gains as soon as this information is available to the Fund and its service providers.

The Fund will indirectly bear a portion of the Investment Funds’ income and expenses, including management fees and incentive fees charged by the Investment Funds. That income and those expenses are recorded in the Fund’s financial statements as change in unrealized appreciation/depreciation and not as income or expense on the Statement of Operations.

22

Corbin Multi-Strategy Fund, LLC

Notes to Financial Statements

March 31, 2022 (continued)

Note 2 – Accounting Policies (continued)

(d) Cash

The Fund maintains cash and cash held in escrow for shares tendered in an interest-bearing bank account, which, at times, may exceed federally insured limits. The Fund has not experienced any losses in such account and does not believe it is exposed to any significant credit risk on such bank deposits. All interest income earned will be paid to the Fund.

(e) Foreign currency translation

Assets and liabilities denominated in a foreign currency are translated into the U.S. dollar equivalent using the spot foreign currency exchange rate in effect at the time of valuation. Purchases and sales of investments and revenues and expenses denominated in foreign currencies are translated at the spot foreign currency exchange rate in effect at the time of the transaction. The Fund does not isolate the portion of the results of operations that is due to the change in foreign currency translation from changes in the market price of investments held or sold during the period. Realized gains and losses from such translation are included in net realized gain/(loss) from investments on the Statement of Operations.

(f) Options purchased

When an option is purchased, an amount equal to the premium paid is recorded as an investment and is subsequently adjusted to the current fair value of the option purchased. Premiums paid for the purchase of options which expire unexercised are treated by the Fund on the expiration date as realized losses. If a purchased put option is exercised, the premium is subtracted from the proceeds of the sale of the underlying security or foreign currency in determining whether the Fund has realized a gain or loss. If a purchased call option is exercised, the premium increases the cost basis of the security or foreign currency purchased by the Fund. Options purchased on an exchange are standardized while options purchased over-the-counter (“OTC”) have counterparty risk associated with them.

(g) Options written

When an option is written, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from written options which expire unexercised are treated by the Fund as realized gains on the expiration date. If a written call option is exercised, the premium is added to the proceeds from the sale of the underlying security or foreign currency in determining whether the Fund has realized a gain or loss. If a written put option is exercised, the premium reduces the cost basis of the security or foreign currency purchased by the Fund.

(h) Futures contracts

The Fund may purchase or sell futures contracts to gain exposure to, or economically hedge against, changes in interest rates (interest rate risk), changes in the value of equity securities (equity risk) or foreign currencies (foreign currency exchange rate risk). Futures contracts are agreements between the Fund and counterparty to buy or sell a specific quantity of an underlying instrument at a specified price and at a specified date. Depending on the terms of the particular contract, futures contracts are settled either through physical delivery of the underlying instrument on the settlement date or by payment of a cash settlement amount on the settlement date. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized appreciation or depreciation. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The use of futures contracts involves the risk of an imperfect correlation in the movements in the price of futures contracts, interest or foreign currency exchange rates and the underlying assets.

(i) Forward foreign currency exchange contracts

The Fund may enter into forward foreign currency exchange contracts as an economic hedge against either specific transactions or portfolio instruments (foreign currency exchange rate risk). A forward foreign currency exchange contract is an agreement between two parties to buy and sell a currency at a set exchange rate on a future date. The contract is marked-to-market daily and the change in market value is recorded as an unrealized gain or loss. When the contract is closed, a realized gain or loss is recorded equal to the difference between the value at the time it was opened and the value at the time it was closed.

23

Corbin Multi-Strategy Fund, LLC

Notes to Financial Statements

March 31, 2022 (continued)

Note 2 – Accounting Policies (continued)

(j) Credit default swaps

The Fund may enter into credit default swaps to manage its exposure to the market or certain sectors of the market, to reduce its risk exposure to defaults of corporate and/or sovereign issuers or to create exposure to corporate and/or sovereign issuers to which it is not otherwise exposed (credit risk). The Fund enters into credit default swaps to provide a measure of protection against the default of an issuer (as buyer of protection) and/or gain credit exposure to an issuer to which it is not otherwise exposed (as seller of protection). The Fund may either buy or sell (write) credit default swaps on single-name issuers (corporate or sovereign) or traded indices. Credit default swaps on single-name issuers are agreements in which the buyer pays fixed periodic payments to the seller in consideration for a guarantee from the seller to make a specific payment should a negative credit event take place (e.g., bankruptcy, failure to pay, obligation accelerators, repudiation, moratorium or restructuring). Credit default swaps on traded indices are agreements in which the buyer pays fixed periodic payments to the seller in consideration for a guarantee from the seller to make a specific payment should a write-down, principal or interest shortfall or default of all or individual underlying securities included in the index occur. As a buyer, if an underlying credit event occurs, the Fund will either receive from the seller an amount equal to the notional amount of the swap and deliver the referenced security or underlying securities comprising of an index or receive a net settlement of cash equal to the notional amount of the swap less the recovery value of the security or underlying securities comprising of an index. As a seller (writer), if an underlying credit event occurs, the Fund will either pay the buyer an amount equal to the notional amount of the swap and take delivery of the referenced security or underlying securities comprising of an index or pay a net settlement of cash equal to the notional amount of the swap less the recovery value of the security or underlying securities comprising of an index. The Fund may also enter into collateral agreements with certain counterparties to further mitigate counterparty risk on OTC derivative and forward foreign currency contracts. Subject to established minimum levels, collateral is generally determined based on the net aggregate unrealized gain or loss on contracts with a certain counterparty. Collateral pledged to or from the Fund is held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government or related agencies.

(k) Valuation of derivatives