As filed with the Securities and Exchange Commission on February 10, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TIMMINS GOLD CORP.

(Exact name of registrant as specified in its charter)

| | | | |

| British Columbia, Canada | | 1040 | | N/A |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

609 Granville Street, Suite 520

Vancouver, British Columbia

Canada V7Y 1G5

(604) 682-4002

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue, 13th Floor

New York, New York 10011

(212) 894-8700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Bruce Bragagnolo Timmins Gold Corp. 609 Granville Street, Suite 520 Vancouver, British Columbia Canada V7Y 1G5 (604) 682-4002 | | Adam M. Givertz Robert M. Katz Shearman & Sterling LLP Commerce Court West 199 Bay Street, Suite 4405 Toronto, Ontario Canada M5L 1E8 (416) 360-8484 |

Approximate date of commencement of proposed sale of the securities to public: As soon as practical after the effective date of this registration statement and completion of the transactions described in the enclosed prospectus/offer to exchange.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

| | | | |

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) | | ¨ | | |

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) | | ¨ | | |

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| |

Title of each class of

Securities to be Registered (1) | | Amount to be

Registered (2) | | Proposed Maximum

Aggregate Offering

Price Per Unit | | Proposed Maximum

Aggregate Offering

Price (3) | | Amount of

Registration Fee (4) |

Common Shares, without par value | | NA | | NA | | $321,004,802 | | $37,269 |

| |

| |

| (1) | This registration statement relates to the common shares of the registrant, Timmins Gold Corp., a British Columbia corporation (“Timmins”), exchangeable for shares of common stock, $0.0001 par value per share, of Capital Gold Corporation, a Delaware corporation (“CGC”), in the offer by a wholly-owned subsidiary of the registrant for all outstanding shares of CGC common stock. |

| (2) | In accordance with Rule 457(o), the number of shares has not been included. |

| (3) | Pursuant to Rule 457(c) and Rule 457(f), and solely for the purpose of calculating the registration fee, the market value of the securities to be received was calculated as the product of (i) 64,718,710 shares of CGC common stock (the sum of (x) 61,324,632 shares of CGC common stock outstanding as of December 2, 2010, (y) 1,772,097 shares of CGC common stock issuable upon the exercise of outstanding options as of October 31, 2010 and (z) 1,621,981 shares of CGC common stock issuable upon the exercise of outstanding warrants as of October 31, 2010, each as set forth by CGC in its quarterly report on Form 10-Q, filed on December 10, 2010); and (ii) the average of the high and low sales prices of CGC common stock as reported on the NYSE Amex on February 3, 2011 ($4.96)). |

| (4) | The amount of the filing fee, calculated in accordance with Rule 457(c) and 457(f), equals $0.0001161 multiplied by the proposed maximum offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus/offer to exchange may be changed. Timmins may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus/offer to exchange is not an offer to sell these securities and Timmins and Timmins Gold Acquisition Corp. are not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale of these securities is not permitted.

The Offer has not yet commenced in Canada and this document does not constitute an offer to buy or the solicitation of an offer to sell in Canada or to or from any person or company in Canada. It is Timmins’ intention to make the Offer to persons or companies in Canada pursuant to an offer and accompanying take-over bid circular to be sent to such persons and companies in due course, all in accordance with applicable Canadian securities laws.

The information in this prospectus/offer to exchange is not complete and may be changed. Timmins Gold Corp. may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus/offer to exchange is not an offer to sell these securities and Timmins Gold Corp. and Timmins Gold Acquisition Corp. are not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 10, 2011

TIMMINS GOLD CORP.

Offer by Timmins Gold Acquisition Corp.,

its Wholly-Owned Subsidiary

to

Exchange Each Outstanding Share of Common Stock

of

CAPITAL GOLD CORPORATION

for

2.27 Common Shares of Timmins Gold Corp.

THE OFFER AND THE WITHDRAWAL RIGHTS WILL EXPIRE AT 12:00 MIDNIGHT, NEW YORK CITY TIME, ON [—], 2011, UNLESS EXTENDED. SHARES TENDERED PURSUANT TO THE OFFER MAY BE WITHDRAWN AT ANY TIME PRIOR TO THE EXPIRATION OF THE OFFER.

Timmins Gold Acquisition Corp., a Delaware corporation (“Offeror”) and a wholly-owned subsidiary of Timmins Gold Corp., a British Columbia corporation (“Timmins”), is offering to exchange for each outstanding share of common stock of Capital Gold Corporation (“CGC”), par value $0.0001 per share (the “CGC Shares”), validly tendered and not properly withdrawn, 2.27 common shares, without par value, of Timmins (the “Timmins Shares” and, such Timmins Shares as are offered in exchange for each CGC Share, the “Consideration”), subject to the procedures described in this prospectus/offer to exchange and the accompanying letter of transmittal (which together, as each may be amended, supplemented or otherwise modified from time to time, constitute the “Offer”).

The purpose of the Offer is for Timmins to acquire control of, and ultimately the entire equity interest in, CGC. The Offer is the first step in Timmins’ plan to acquire all of the outstanding CGC Shares. Timmins currently intends, as soon as practicable following the consummation of the Offer, to seek to effect the merger of Offeror with and into CGC, with CGC surviving the merger (the “Proposed Merger”). CGC after the Proposed Merger is sometimes referred to as the “Surviving Corporation.” The purpose of the Proposed Merger is for Timmins to acquire all CGC Shares not acquired in the Offer. After the Proposed Merger, the Surviving Corporation will be a wholly-owned subsidiary of Timmins and the former CGC stockholders will no longer have any direct ownership interest in the Surviving Corporation. Pursuant to the Proposed Merger, at the effective time of the Proposed Merger, each CGC Share then outstanding (except for CGC Shares held in CGC’s treasury, CGC Shares owned by any direct or indirect wholly-owned subsidiary of CGC and CGC Shares owned by Timmins, Offeror or any of their direct or indirect wholly-owned subsidiaries, including CGC Shares acquired in the Offer) will be converted into the right to receive the Consideration. Holders who otherwise would be entitled to receive a fractional Timmins Share will instead receive cash in lieu of any fractional Timmins Share such holder may have otherwise been entitled to receive. See “The Offer—Fractional Shares” for a detailed description of the treatment of fractional Timmins Shares.

Timmins is seeking to negotiate a merger agreement with CGC. Subject to applicable law, Offeror reserves the right to amend the Offer in all respects upon entering into a merger agreement with CGC, or to negotiate a merger agreement with CGC not involving a tender offer or exchange offer pursuant to which Offeror would terminate the Offer and the CGC Shares would, upon consummation of such proposed merger, be converted into the consideration negotiated by Timmins, Offeror and CGC.

Offeror’s obligation to accept for exchange, and to exchange, CGC Shares for Timmins Shares in the Offer is subject to a number of conditions, which are more fully described in “The Offer—Conditions of the Offer.”

Timmins Shares are listed on the TSX Venture Exchange (“TSX-V”) under the symbol “TMM.” On February 9, 2011, the last reported sale price of a Timmins Share on the TSX-V was C$2.46 per Timmins Share, which was the equivalent of US$2.47 based on the Bank of Canada’s noon exchange rate on such date.

For a discussion of certain factors that CGC stockholders should consider in connection with the Offer, please carefully read “Risk Factors” beginning on page 30.

Neither Timmins nor Offeror has authorized any person to provide any information or to make any representation in connection with the Offer, other than the information contained or incorporated by reference in this prospectus/offer to exchange, and if any person provides any information or makes any representation of this kind, that information or representation must not be relied upon as having been authorized by Timmins or Offeror.

TIMMINS IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY TO TIMMINS. As described in this prospectus/offer to exchange, Timmins may solicit proxies through separate proxy solicitation materials. Any such proxy solicitation will be made only pursuant to separate proxy materials complying with the requirements of the rules and regulations of the Securities and Exchange Commission (“SEC”).

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus/offer to exchange. Any representation to the contrary is a criminal offense.

The date of this prospectus/offer to exchange is [—], 2011.

Table of Contents

i

ii

iii

THIS PROSPECTUS/OFFER TO EXCHANGE INCORPORATES BY REFERENCE IMPORTANT BUSINESS AND FINANCIAL INFORMATION ABOUT CGC AND ITS SUBSIDIARIES FROM DOCUMENTS FILED WITH THE SEC THAT HAVE NOT BEEN INCLUDED IN OR DELIVERED WITH THIS PROSPECTUS/OFFER TO EXCHANGE. THIS INFORMATION IS AVAILABLE WITHOUT CHARGE AT THE SEC’S WEBSITE AT WWW.SEC.GOV, AS WELL AS FROM OTHER SOURCES. SEE “WHERE TO OBTAIN MORE INFORMATION.”

CGC STOCKHOLDERS ALSO MAY REQUEST COPIES OF THESE PUBLICLY-FILED DOCUMENTS FROM TIMMINS, WITHOUT CHARGE, UPON WRITTEN OR ORAL REQUEST TO TIMMINS’ INFORMATION AGENT AT ITS ADDRESS OR TELEPHONE NUMBER SET FORTH ON THE BACK COVER OF THIS PROSPECTUS/OFFER TO EXCHANGE. IN ORDER TO RECEIVE TIMELY DELIVERY OF THE DOCUMENTS, CGC STOCKHOLDERS MUST MAKE SUCH REQUEST NO LATER THAN [—], 2011, OR FIVE BUSINESS DAYS BEFORE THE EXPIRATION DATE OF THE OFFER, WHICHEVER IS LATER.

THIS PROSPECTUS/OFFER TO EXCHANGE DOES NOT CONSTITUTE A SOLICITATION OF PROXIES FOR ANY MEETING OF STOCKHOLDERS OF CGC. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. ANY SOLICITATION OF PROXIES THAT TIMMINS OR CGC MIGHT MAKE WILL BE MADE ONLY PURSUANT TO SEPARATE PROXY SOLICITATION MATERIALS COMPLYING WITH THE REQUIREMENTS OF SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED (THE “EXCHANGE ACT”).

iv

INFORMATION CONCERNING CGC

All the information concerning CGC, its subsidiaries, business operations, financial condition, management and affiliates contained or incorporated by reference in this prospectus/offer to exchange has been taken from or is based upon publicly available documents and records filed with the SEC and other public sources, and Timmins was not involved in the preparation of such information. This information may be examined and copies may be obtained at the places and in the manner set forth in the section entitled “Where to Obtain More Information.” Timmins is not affiliated with CGC and CGC has not permitted Timmins to have access to its books and records. Therefore, with the exception of a site visit to CGC’s El Chanate mine by Timmins’ representatives in August 2010, non-public information concerning CGC was not available to Timmins for the purpose of preparing this prospectus/offer to exchange. While Timmins has no means of verifying the accuracy or completeness of any of the information contained or incorporated by reference in this prospectus/offer to exchange that is derived from publicly available documents or records or whether there has been any failure by CGC to disclose events that may have occurred or may affect the significance or accuracy of any information, Timmins has no knowledge that would indicate that any statements contained or incorporated by reference in this prospectus/offer to exchange concerning CGC are untrue or incomplete. See “Risk Factors—Timmins has conducted a review of CGC’s publicly available information, but was not granted access to CGC’s non-public information. Therefore, if Timmins acquires CGC, Timmins may be subject to unknown liabilities of CGC which may have a material adverse effect on Timmins’ profitability, financial condition and results of operations.”

This prospectus/offer to exchange incorporates by reference financial statements of CGC and Nayarit Gold Inc. (“Nayarit Gold”), which was acquired by CGC on August 2, 2010.

Pursuant to Rule 409 under the Securities Act and Rule 12b-21 under the Exchange Act, Timmins is requesting that CGC provide Timmins with information required for complete disclosure regarding the businesses, operations, financial condition and management of CGC. Timmins and Offeror will amend or supplement this prospectus/offer to exchange to provide any and all information Timmins receives from CGC, if Timmins receives the information before the Offer expires and Timmins considers it to be material, reliable and appropriate.

Although audit reports were issued with respect to each of CGC and Nayarit Gold’s financial statements and are included in CGC’s filings with the SEC, CGC and Nayarit Gold’s respective auditors have not permitted use of their reports in Timmins’ registration statement of which this prospectus/offer to exchange forms a part. Pursuant to Rule 439 under the Securities Act, Timmins and Offeror require the consent of each of CGC and Nayarit Gold’s independent auditors to incorporate their audit reports into this prospectus/offer to exchange by reference. Timmins is requesting and has, as of the date hereof, not received such consents from CGC or Nayarit Gold’s independent auditors. If Timmins receives such consents, Timmins and Offeror will promptly file them as exhibits to Timmins’ registration statement of which this prospectus/offer to exchange forms a part.

1

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The historical consolidated financial data of Timmins contained in this prospectus/offer to exchange are reported in Canadian dollars and have been prepared in accordance with accounting principles generally accepted in Canada, or Canadian GAAP. Canadian GAAP differs in certain material respects from United States generally accepted accounting principles, or U.S. GAAP, and so this financial data may not be comparable to the financial data of U.S. companies. For a discussion of the differences between Canadian GAAP and U.S. GAAP as they relate to Timmins, see note 16 to Timmins’ audited consolidated financial statements, which are included elsewhere in this prospectus/offer to exchange.

The consolidated financial data of CGC incorporated by reference in this prospectus/offer to exchange are reported in U.S. dollars and have been prepared in accordance with U.S. GAAP. The consolidated financial data of Nayarit Gold incorporated by reference in this prospectus/offer to exchange are reported in Canadian dollars and have been prepared in accordance with Canadian GAAP.

Unless otherwise stated or the context otherwise requires, all references in this prospectus/offer to exchange to “C$” are to Canadian dollars and all references to “dollars,” “$,” and “US$” are to United States dollars.

NON-GAAP FINANCIAL MEASURES

Timmins has reported total cash costs per gold ounce, which is a common performance measure in the gold mining industry but does not have any standardized meaning, and is a non-GAAP measure. Timmins follows the recommendations of the Gold Institute standard. Timmins believes that, in addition to conventional measures, prepared in accordance with GAAP, certain investors use this information to evaluate Timmins’ performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

EXCHANGE RATE DATA

The following tables set forth certain exchange rates as reported by the Bank of Canada. On February 9, 2011 the inverse of the noon buying rate was C$1.00 equals US$1.0053.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended March 31, | | | Quarter

Ended

June 30, | | | Quarter

Ended

September 30, | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2010 | | | 2010 | |

Average(1) | | US$ | 0.8417 | | | US$ | 0.8813 | | | US$ | 0.9769 | | | US$ | 0.8895 | | | US$ | 0.9237 | | | US$ | 0.9624 | | | US$ | 0.9624 | |

| (1) | The average of the exchange rates on the last day of each month during the year or quarter indicated. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Month | |

| | | August 2010 | | | September 2010 | | | October 2010 | | | November 2010 | | | December 2010 | | | January 2011 | |

High | | US$ | 0.9844 | | | US$ | 0.9783 | | | US$ | 0.9970 | | | US$ | 0.9987 | | | US$ | 1.0054 | | | US$ | 1.0140 | |

Low | | US$ | 0.9397 | | | US$ | 0.9506 | | | US$ | 0.9690 | | | US$ | 0.9743 | | | US$ | 0.9825 | | | US$ | 0.9978 | |

2

CAUTIONARY NOTE REGARDING MINERAL RESERVE ESTIMATES

Timmins is subject to the reporting requirements of the applicable Canadian securities laws, and as a result we report our mineral reserves according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum. U.S. reporting requirements are governed by the SEC Industry Guide 7 (“Guide 7”). This prospectus/offer to exchange includes reserves reported in accordance with Guide 7 and also includes reserves and resources reported in accordance with NI 43-101. These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. For example, under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. In particular, we report “resources” in accordance with NI 43-101. While the terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” are recognized and required by Canadian regulations, they are not defined terms under standards of the SEC and, generally, U.S. companies are not permitted to report resources in documents filed with the SEC. As such, certain information contained in this report concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the SEC. In addition, an “Inferred Mineral Resource” has a great amount of uncertainty as to its existence and as to its economic and legal feasibility, and you cannot assume that all or any part of an “Inferred Mineral Resource” will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Resources will ever be converted into Mineral Reserves. Readers are also cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists, or is economically or legally mineable. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under CIM standards differ in certain respects from the standards of the SEC.

3

QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER

Below are some of the questions that you as a holder of shares of common stock of Capital Gold Corporation, par value $0.0001 per share (the “CGC Shares”), may have regarding the Offer and answers to those questions. You are urged to read carefully the remainder of this prospectus/offer to exchange and the accompanying letter of transmittal and the other documents to which we have referred because the information contained in this section and in the “Summary” is not complete. Additional important information is contained in the remainder of this prospectus/offer to exchange and the accompanying letter of transmittal. See “Where To Obtain More Information.”

As used in this prospectus/offer to exchange, unless otherwise indicated or the context requires, “Timmins,” “we,” “our” or “us” refers to Timmins and its consolidated subsidiaries, including Offeror, “Offeror” refers to Timmins Gold Acquisition Corp. alone and “CGC” refers to Capital Gold Corporation and its consolidated subsidiaries.

Who is offering to buy my CGC Shares?

The Offer is made by Timmins Gold Corp., a British Columbia corporation, through Offeror, Timmins’ wholly-owned subsidiary Timmins Gold Acquisition Corp., a Delaware corporation which was organized for the purpose of effecting the Offer.

Timmins is a resource company engaged in the acquisition, exploration and development and operation of gold properties in Mexico. Timmins was founded in 2005 and it commenced commercial production on April 1, 2010 at the San Francisco Mine in Sonora, Mexico, which we refer to as the San Francisco Mine.

What are the classes and amounts of CGC securities that Timmins is offering to acquire in the Offer?

Timmins is seeking to acquire all issued and outstanding CGC Shares. The Offer is also being made with respect to CGC Shares that may become outstanding after [—], 2011, but prior to the expiration of the Offer, upon the exercise of any stock options, warrants or other derivative securities that are exercisable for or converted into CGC Shares.

What will I receive for my CGC Shares?

Timmins is offering to exchange for each issued and outstanding CGC Share, validly tendered pursuant to the Offer and not properly withdrawn, 2.27 common shares, without par value, of Timmins (the “Timmins Shares” and, such Timmins Shares as are offered in exchange for each CGC Share, the “Consideration”). Holders who otherwise would be entitled to receive a fractional Timmins Share will instead receive cash in lieu of any fractional Timmins Share such holder may have otherwise been entitled to receive. See “The Offer—Fractional Shares” for a detailed description of the treatment of fractional Timmins Shares.

Solely for purposes of illustration, the following table indicates the value of the Consideration based on different assumed prices for Timmins Shares:

| | |

Assumed Timmins

Share Price | | Market Value of

Consideration (Per

CGC Share

Exchanged) |

$1.60 | | $3.632 |

$1.80 | | $4.086 |

$2.00 | | $4.540 |

$2.20 | | $4.994 |

$2.40 | | $5.448 |

$2.60 | | $5.902 |

$2.80 | | $6.356 |

4

The prices of Timmins Shares used in the above table are for purposes of illustration only. The value of the Consideration will change as the price of Timmins Shares fluctuates during the Offer period and thereafter, and may therefore be higher or lower than the prices set forth in the examples above at the expiration of the Offer and at the time you receive the Timmins Shares. CGC’s stockholders are encouraged to obtain current market quotations for the Timmins Shares and the CGC Shares prior to making any decision with respect to the Offer.

On [—], 2011, the last trading day immediately preceding the date of this Offer, the closing price of a Timmins Share on the TSX-V was $[—], based on the Bank of Canada’s noon exchange rate on such date, and the closing price of a CGC Share on the NYSE Amex was $[—]. Consequently, the implied value of the Consideration per CGC Share was $[—].

We intend to apply to list our common shares on the NYSE Amex under the symbol “[—]”, and it is a condition to the consummation of this Offer that our common shares, including the shares issued in connection with this Offer, will be listed on the NYSE Amex upon the consummation of this Offer.

CGC stockholders should obtain current market quotations for the Timmins Shares and the CGC Shares before deciding whether to tender pursuant to the Offer. Please also see the section of this prospectus/offer to exchange entitled “Risk Factors.”

Will I have to pay any fee or commission to exchange CGC Shares?

If you are the record owner of your CGC Shares and you tender your CGC Shares in the Offer, you will not have to pay any brokerage fees, commissions or similar expenses. If you own your CGC Shares through a broker, dealer, commercial bank, trust company or other nominee and your broker, dealer, commercial bank, trust company or other nominee tenders your CGC Shares on your behalf, your broker or such other nominee may charge a fee for doing so. You should consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply.

Why is Offeror making the Offer?

The purpose of the Offer is for Timmins to acquire control of, and ultimately the entire equity interest in, CGC. The Offer is the first step in Timmins’ plan to acquire all of the outstanding CGC Shares. Timmins currently intends, as soon as practicable following the consummation of the Offer, to seek to effect the merger of Offeror with and into CGC, with CGC surviving the merger (the “Proposed Merger”). CGC after the Proposed Merger is sometimes referred to as the “Surviving Corporation.” The purpose of the Proposed Merger is for Timmins to acquire all CGC Shares not acquired in the Offer. After the Proposed Merger, the Surviving Corporation will be a wholly-owned subsidiary of Timmins and the former CGC stockholders will no longer have any direct ownership interest in the Surviving Corporation. Pursuant to the Proposed Merger, at the effective time of the Proposed Merger, each CGC Share then outstanding (except for CGC Shares held in CGC’s treasury, CGC Shares owned by any direct or indirect wholly-owned subsidiary of CGC and CGC Shares owned by Timmins, Offeror or any of their direct or indirect wholly-owned subsidiaries, including CGC Shares acquired in the Offer) will be converted into the right to receive the Consideration. Holders who otherwise would be entitled to receive a fractional Timmins Share will instead receive cash in lieu of any fractional Timmins Share such holder may have otherwise been entitled to receive. See “The Offer—Fractional Shares” for a detailed description of the treatment of fractional Timmins Shares.

Timmins is seeking to negotiate a merger agreement with CGC. Subject to applicable law, Offeror reserves the right to amend the Offer in all respects upon entering into a merger agreement with CGC, or to negotiate a merger agreement with CGC not involving a tender offer or exchange offer pursuant to which Offeror would terminate the Offer and the CGC Shares would, upon consummation of such proposed merger, be converted into the consideration negotiated by Timmins, Offeror and CGC.

5

Why is Offeror making the Offer now?

Timmins and CGC had discussions regarding a combination in August and September of 2010, and Timmins continued to seek to engage with CGC’s board of directors to negotiate a friendly merger of Timmins and CGC. Despite repeated attempts and proposals, CGC rejected our proposals. Then, on October 1, 2010, CGC entered into an agreement and plan of merger (as amended on October 29, 2010, the “Gammon Agreement”) with Gammon Gold Inc. (“Gammon”), pursuant to which CGC would become a wholly-owned subsidiary of Gammon. Timmins subsequently attempted to engage with CGC in October and December 2010 but was rejected by CGC each time. In January 2011, CGC invited Timmins to discuss a potential transaction and requested that Timmins provide due diligence materials to CGC. Timmins provided the due diligence materials, but CGC again rejected Timmins’ proposal and publicly announced that it had discontinued negotiations with Timmins. It has therefore become imperative to act now to ensure that CGC stockholders have an opportunity to consider Timmins’ proposal prior to CGC consummating the proposed merger with Gammon. See “Background and Reasons for the Offer and Proposed Merger—Background of the Offer and Proposed Merger.”

What are the conditions of the Offer?

The Offer is conditioned upon the following:

| | • | | there shall have been validly tendered and not withdrawn prior to the expiration of the Offer, as it may be extended from time to time, that number of CGC Shares which, when added to CGC Shares owned by Timmins or Offeror, if any, represents a majority of the total number of outstanding CGC Shares on a fully diluted basis (assuming the conversion or exercise of all stock options, other derivative securities or other rights to acquire CGC Shares regardless of the conversion or exercise price, the vesting schedule or other terms and conditions thereof) at the time of the expiration of the Offer (the “Minimum Condition”); |

| | • | | CGC shall have entered into a definitive merger agreement with Timmins with respect to the Proposed Merger, which terms and conditions will be reasonably satisfactory to Timmins and shall provide, among other things, that: (i) the board of directors of CGC has approved the Offer and the Proposed Merger and (ii) the board of directors of CGC has removed any legal or contractual impediment to the consummation of the Offer and the Proposed Merger (the “Approval Condition”); |

| | • | | Timmins shall have completed, to its reasonable satisfaction, customary confirmatory due diligence with respect to CGC’s business, assets and liabilities and shall have concluded, in its reasonable judgment, that there are no material adverse facts or developments concerning or affecting CGC’s business, assets and liabilities that have not been publicly disclosed prior to the commencement of the Offer (the “Due Diligence Condition”); |

| | • | | the Gammon Agreement shall have been terminated, and any “break-fee” owing as a result of such termination shall have been paid in full (the “Termination Condition”); |

| | • | | Timmins shall have concluded, in its reasonable judgment, that the restrictions on “Business Combinations” with an “Interested Stockholder” set forth in Section 203 of the Delaware General Corporation Law (the “DGCL”) are inapplicable to the Offer and the Proposed Merger or any other business combination involving Timmins or any of its subsidiaries and CGC (the “Section 203 Condition”); |

| | • | | there shall not have been any “material adverse change” to CGC at any time on or after July 31, 2010 and prior to the expiration of the Offer (see “The Offer—Conditions of the Offer” for a definition of “material adverse change”); |

| | • | | there shall be no pending private, regulatory or governmental inquiry, action, suit, proceeding, litigation, claim, arbitration or investigation against CGC or any of its affiliates, or any of their respective properties or assets, or any officer, director, partner, member or manager, in his or her capacity as such, of CGC or any of their affiliates, with respect to the Offer or the consummation of the Proposed Merger or the transactions contemplated thereby which could reasonably be expected to result in a material adverse change; |

6

| | • | | each of CGC and its subsidiaries shall have carried on their respective businesses in the ordinary course consistent with past practice at any time on or after the date of this prospectus/offer to exchange and prior to the expiration of the Offer; |

| | • | | any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”) and Mexican Law, shall have expired or been terminated, and any other requisite clearances and/or approvals under any other federal, state or foreign antitrust, competition or other regulatory law shall have been obtained; |

| | • | | the shareholders of Timmins shall have approved the issuance of Timmins Shares pursuant to the Offer and the Proposed Merger; |

| | • | | the registration statement of which this prospectus/offer to exchange is a part shall have become effective under the Securities Act of 1933, as amended (the “Securities Act”), and no stop order or proceeding seeking a stop order shall have been issued and no other proceeding shall have been instituted or threatened by the SEC; and |

| | • | | the Timmins Shares to be issued pursuant to the Offer shall have been approved for listing on the TSX-V and the NYSE Amex, subject to official notice of issuance. |

CGC’s board of directors has the ability to satisfy certain of the principal conditions of the Offer, including the Section 203 Condition, the Approval Condition, the Termination Condition and the Due Diligence Condition. Timmins and Offeror believe that CGC’s board of directors should take all necessary actions to facilitate the satisfaction of such conditions and the consummation of the Offer and the Proposed Merger and hereby request that they do so. Although Timmins believes that, under the circumstances of the Offer and the Proposed Merger, CGC’s board of directors should do so, CGC’s board of directors may not act to satisfy these conditions. If CGC does not act to facilitate these conditions Timmins will not be able to consummate the Offer and the Proposed Merger.

Is Timmins’ financial condition relevant to my decision to tender CGC Shares in the Offer?

Yes. Timmins’ financial condition is relevant to your decision to tender your CGC Shares because the Consideration you will receive if your CGC Shares are exchanged in the Offer consists of Timmins Shares. You should therefore consider Timmins’ financial condition as you will become one of Timmins’ shareholders by accepting the Offer. You also should consider the likely effect that Timmins’ acquisition of CGC would have on Timmins’ financial condition. This prospectus/offer to exchange contains financial information regarding Timmins, as well as pro forma financial information for the proposed combination of Timmins and CGC, all of which we encourage you to review.

What percentage of Timmins Shares will former holders of the CGC Shares own after the Offer and the Proposed Merger?

Timmins estimates that, if all of CGC’s stock options and warrants are exercised, former CGC stockholders would own, in the aggregate, approximately 51.8% of Timmins Shares outstanding after the consummation of the Proposed Merger. For a detailed discussion of the assumptions on which this estimate is based, see “The Offer—Ownership of Timmins After the Offer and the Proposed Merger.”

When does the Offer expire? Can the Offer be extended and, if so, under what circumstances?

The Offer is scheduled to expire at 12:00 midnight, New York City time, on [—], 2011, which is the Initial Expiration Date, unless further extended by Offeror. CGC Shares tendered pursuant to the Offer may be withdrawn at any time prior to the expiration of the Offer. Any extension, delay, termination, waiver or amendment of the Offer will be followed as promptly as practicable by a public announcement thereof to be made no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date. During any such extension, all CGC Shares previously tendered and not properly withdrawn

7

will remain subject to the Offer, subject to the rights of a tendering stockholder to withdraw such stockholder’s CGC Shares. “Expiration Date” means the Initial Expiration Date, unless and until Offeror has extended the Offer, subject to applicable laws, in which case the term “Expiration Date” means the latest time and date at which the Offer, as so extended by Offeror, will expire.

How long will it take to complete the Offer and the Proposed Merger?

Timmins hopes to complete the Offer promptly after its expiration at 12:00 midnight, New York City time, on [—], 2011. However, Timmins may extend the Offer if the conditions to the Offer have not been satisfied as of the Initial Expiration Date or if Timmins is required to extend the Offer pursuant to the SEC’s tender offer rules. Timmins intends to complete the Proposed Merger as soon as practicable after the successful completion of the Offer, unless a court or other circumstances prevents Timmins from doing so. If following the consummation of the Offer Timmins owns 90% or more of the CGC Shares, subject to receipt of any required regulatory approvals, Timmins will consummate a short-form merger without a vote of, or prior notice to, CGC stockholders in accordance with Section 253 of the DGCL. If Timmins does not own 90% or more of the outstanding CGC Shares following consummation of this Offer, Timmins, as CGC’s majority stockholder, intends to approve the Proposed Merger in accordance with Section 251 of the DGCL. When the Proposed Merger takes place, all remaining stockholders (other than stockholders properly exercising their appraisal rights) will receive the same Consideration as was paid in the Offer, less any applicable withholding of taxes.

Will CGC’s board of directors make a recommendation concerning the Offer?

We do not know whether CGC’s board of directors will make a recommendation. Under SEC rules, CGC’s board of directors will be required to make a recommendation or state that it is neutral or is unable to take a position with respect to the Offer, and file with the SEC a solicitation/recommendation statement on Schedule 14D–9 describing its position, if any, and related matters, no later than ten business days from the date Timmins files this prospectus/offer to exchange. CGC is also required to send to you a copy of its Schedule 14D–9 which you should review carefully upon receipt.

Has Timmins negotiated, or sought the approval of, the terms of the Offer or the Proposed Merger with CGC?

On September 1, 2010, Timmins made a non-binding proposal to the board of directors of CGC to acquire CGC. On September 3, 2010, Timmins revised its proposal by increasing the consideration from 2.02 to 2.27 Timmins Shares for each CGC Share (the “Revised Proposal”). Thereafter, Timmins tried to contact CGC on several occasions in order to discuss a potential acquisition of CGC by Timmins. On September 27, 2010, Timmins publicly announced that it had made the Revised Proposal. On October 1, 2010, CGC announced that its board of directors entered into the Gammon Agreement. Timmins continued to seek to negotiate a friendly merger with CGC, and sent a letter to CGC’s board of directors on October 12, 2010, stating that Timmins wished to acquire all CGC Shares in exchange for 2.27 Timmins Shares. Timmins also indicated that it was willing to enter into a merger agreement with CGC on significantly more favorable terms to CGC than contained in the Gammon Agreement. On October 14, 2010, CGC rejected our proposal, stating that it was not a superior proposal. After allowing CGC’s board of directors time to reflect on the Revised Proposal, we reaffirmed our commitment to the Revised Proposal in a letter to CGC’s board of directors on December 2, 2010. In addition to our offer of 2.27 Timmins Shares for each CGC Share, we also offered to reduce the termination fee to 1% of the equity value of the transaction compared to approximately 3.6% in the Gammon Agreement, eliminate the five-day matching rights, eliminate the $2 million unilateral termination right afforded Gammon and to delete a number of other closing conditions that affect the certainty of closing the Gammon transaction. However, CGC again rejected our request to consider a friendly merger with Timmins. In January 2011, CGC invited Timmins to discuss a potential transaction and requested that Timmins provide due diligence materials to CGC. Timmins provided the due diligence materials, but on February 1, 2011, CGC again rejected Timmins’ proposal and publicly announced that it had discontinued negotiations with Timmins. Subject to applicable law, Offeror reserves the right to amend the Offer in all respects upon entering into a merger agreement with CGC, or to negotiate a merger agreement with CGC not involving a tender offer or exchange offer pursuant to which Offeror would terminate

8

the Offer and the CGC Shares would, upon consummation of such Proposed Merger, be converted into the consideration negotiated by Timmins, Offeror and CGC. See “Background and Reasons for the Offer and Proposed Merger—Background of the Offer and Proposed Merger.”

How do I tender my CGC Shares?

To tender CGC Shares into the Offer, you must deliver the certificates representing your CGC Shares, together with a completed letter of transmittal and any other documents required by the accompanying letter of transmittal, to Computershare Investor Services Inc., the exchange agent for the Offer, not later than the time the Offer expires. The letter of transmittal (and its instructions) is enclosed with this prospectus/offer to exchange. If your CGC Shares are held in street name (i.e., through a broker, dealer, commercial bank, trust company or other nominee), your CGC Shares can be tendered by your nominee by book-entry transfer through The Depository Trust Company.

For a complete discussion of the procedures for tendering your CGC Shares, please see the section of this prospectus/offer to exchange entitled “The Offer—Procedure for Tendering.”

Until what time can I withdraw tendered CGC Shares?

You may withdraw previously tendered CGC Shares at any time prior to the expiration of the Offer. For a complete discussion of the procedures for withdrawing your CGC Shares, please see the section of this prospectus/offer to exchange entitled “The Offer—Withdrawal Rights.”

How do I withdraw previously tendered CGC Shares?

To withdraw previously tendered CGC Shares, you must deliver a written or facsimile notice of withdrawal with the required information to the exchange agent while you still have the right to withdraw. If you tendered CGC Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct the broker, dealer, commercial bank, trust company or other nominee to arrange for the withdrawal of your CGC Shares. For a complete discussion on the procedures for withdrawing your CGC Shares, including the applicable deadlines for effecting withdrawals, please see the section of this prospectus/offer to exchange entitled “The Offer—Withdrawal Rights.”

When and how will I receive the Consideration in exchange for my tendered CGC Shares?

Offeror will exchange all validly tendered and not properly withdrawn CGC Shares promptly after the Expiration Date, subject to the terms of the Offer and the satisfaction or waiver of the conditions to the Offer, as set forth in the section of this prospectus/offer to exchange entitled “The Offer—Conditions of the Offer.” Offeror will deliver the Consideration for your validly tendered and not properly withdrawn CGC Shares by depositing the Timmins Shares therefore with the exchange agent, which will act as your agent for the purpose of receiving the Consideration from Offeror and transmitting such Consideration to you. In all cases, an exchange of tendered CGC Shares will be made only after timely receipt by the exchange agent of certificates for such CGC Shares (or a confirmation of a book-entry transfer of such CGC Shares as described in the section of this prospectus/offer to exchange entitled “The Offer—Procedure for Tendering”), a properly completed and duly executed letter of transmittal and any other required documents for such CGC Shares.

Will I receive any fractional Timmins Shares in the Offer?

No. Fractional Timmins Shares will not be distributed in the Offer. Instead, CGC stockholders entitled to receive fractional Timmins Shares will receive cash in lieu of a fractional Timmins Share. The exchange agent, acting as agent for CGC stockholders otherwise entitled to receive a fractional Timmins Share, will aggregate all fractional Timmins Shares that would otherwise have been required to be distributed and cause them to be sold in the open market for the accounts of such stockholders. The stockholders will receive the proceeds, if any, less any brokerage commissions or other fees, from the sale of these fractional Timmins Shares in accordance with their fractional interest in the aggregate number of Timmins Shares sold.

9

Why does the cover page to this prospectus/offer to exchange state that the information in this prospectus/offer to exchange may be changed and that the registration statement filed with the SEC is not yet effective? Does this mean that the Offer may not commence?

No. Completion of this preliminary prospectus/offer to exchange and effectiveness of the registration statement of which this prospectus/offer to exchange is a part are not necessary for the Offer to commence. Following the commencement of the Offer, the information in this prospectus/offer to exchange may be changed. Timmins cannot accept for exchange any CGC Shares tendered in the Offer or exchange any CGC Shares until the registration statement of which this prospectus/offer to exchange is a part is declared effective by the SEC and the other conditions to the Offer have been satisfied or waived. The Offer will commence when we first mail this prospectus/offer to exchange and the related letter of transmittal to CGC stockholders.

What will I receive in the Proposed Merger if I do not tender my CGC Shares?

In the Proposed Merger, each CGC Share outstanding at the effective time will be converted into the right to receive the Consideration, which is 2.27 Timmins Shares for each CGC Share, and cash in lieu of fractional shares.

Are dissenters’ or appraisal rights available in either the Offer or the Proposed Merger?

No dissenters’ or appraisal rights are available in connection with the Offer. However, if the Proposed Merger is effected as a short-form merger under the DGCL, CGC stockholders who do not tender their CGC Shares in the Offer and who properly seek appraisal rights for their CGC Shares in accordance with Section 262 of the DGCL would have appraisal rights if the Proposed Merger takes place. The value you will receive if you perfect appraisal rights could be more or less than, or the same as, the price per CGC Share to be paid in the Offer and the Proposed Merger. See “The Offer—Purpose of the Offer; the Proposed Merger; Dissenters’ or Appraisal Rights.”

Do shareholders of Timmins need to vote to approve the Offer or the Proposed Merger?

Yes. The TSX-V rules require Timmins to obtain the approval of its shareholders for the Offer and the Proposed Merger, and Timmins intends to seek such approval as promptly as practicable.

How will U.S. taxpayers be taxed?

The exchange of CGC Shares for Timmins Shares pursuant to the Offer and any related transactions to acquire CGC Shares, including the Proposed Merger (collectively, the “Integrated Acquisition Transactions”), should qualify as a tax-deferred reorganization under the provisions of Section 368(a) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). However, because the exchange of CGC Shares for Timmins Shares will represent an exchange of stock of a U.S. corporation for the stock of a non-U.S. corporation, the additional requirements of Section 367 of the Code and the U.S. Treasury Regulations thereunder would need to be met in order for U.S. Holders (as defined under “U.S. Federal Income Tax Consequences”) of CGC Shares to avoid fully recognizing gain pursuant to the Integrated Acquisition Transactions. As more fully discussed under “U.S. Federal Income Tax Consequences,” it is unclear whether Timmins would satisfy certain technical requirements under Section 367, and, accordingly, except as specifically noted, the U.S. federal income tax discussion in this document assumes that the Integrated Acquisition Transactions will qualify as a reorganization for U.S. federal income tax purposes, but that the additional requirements of Section 367 will not be met. In such case, a U.S. Holder will recognize gain (but not loss) equal to the difference between (i) the sum of the fair market value, as of the date of the exchange, of the Timmins Shares received in exchange for CGC Shares and any cash received in lieu of fractional Timmins Shares and (ii) the U.S. Holder’s adjusted tax basis in the CGC Shares exchanged. Such gain will be long-term capital gain if the U.S. Holder’s holding period with respect to its CGC Shares is more than one year as of the date of the exchange. You should review the more detailed information under “The Offer—U.S. Federal Income Tax Consequences” and “The Offer—Certain Canadian Federal Income Tax Consequences.”

10

Where can I find more information about Timmins and CGC?

You can find more information about Timmins and CGC by reading this prospectus/offer to exchange and from various sources described in the section of this prospectus/offer to exchange entitled “Where To Obtain More Information.”

Whom can I contact if I have questions about the Offer?

You should contact Timmins’ information agent at the following address and telephone numbers with any questions about the Offer or the Proposed Merger, or to request additional copies of this prospectus/offer to exchange or other documents:

The information agent for the Offer is:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Shareholders May Call Toll-Free: 877-800-5182

Banks & Brokers May Call Collect: 212-750-5833

11

SUMMARY

This section summarizes material information presented in greater detail elsewhere in this prospectus/offer to exchange. However, this summary does not contain all of the information that may be important to CGC stockholders. You are urged to read carefully the remainder of this prospectus/offer to exchange and the accompanying letter of transmittal and the other documents to which we have referred because the information in this section is not complete. See “Where To Obtain More Information.”

The Offer (see page 116)

Under the terms of the Offer, each CGC stockholder will receive, for each outstanding share of CGC common stock, par value $0.0001 per share (the “CGC Shares”), validly tendered and not withdrawn in the Offer, 2.27 common shares, without par value, of Timmins (the “Timmins Shares” and, such Timmins Shares as are offered in exchange for each CGC Share, the “Consideration”).

The value of the Consideration will fluctuate prior to the Expiration Date as the market price of Timmins Shares changes.

Consideration to be received by holders of the CGC Shares

Solely for purposes of illustration, the following table indicates the value of the Consideration based on different assumed prices for Timmins Shares:

| | |

Assumed Timmins Share Price | | Market Value of Consideration (Per CGC Share Exchanged) |

$1.60 | | $3.632 |

$1.80 | | $4.086 |

$2.00 | | $4.540 |

$2.20 | | $4.994 |

$2.40 | | $5.448 |

$2.60 | | $5.902 |

$2.80 | | $6.356 |

The prices of Timmins Shares used in the above table are for purposes of illustration only. The value of the Consideration will change as the price of Timmins Shares fluctuates during the Offer period and thereafter, and may therefore be higher or lower than the prices set forth in the examples above at the expiration of the Offer and at the time you receive the Timmins Shares. CGC’s stockholders are encouraged to obtain current market quotations for the Timmins Shares and the CGC Shares prior to making any decision with respect to the Offer.

On [—], 2011, the last trading day immediately preceding the date of this Offer, the closing price of a Timmins Share on the TSX-V was $[—], based on the Bank of Canada’s noon exchange rate on such date, and the closing price of a CGC Share on the NYSE Amex was $[—]. Consequently, the implied value of the Consideration per CGC Share was $[—].

We intend to apply to list our common shares on the NYSE Amex under the symbol “[—]”, and it is a condition to the consummation of this Offer that our common shares, including the shares issued in connection with this Offer, will be listed on the NYSE Amex upon the consummation of this Offer.

12

CGC stockholders should obtain current market quotations for the Timmins Shares and the CGC Shares before deciding whether to tender pursuant to the Offer. Please also see the section of this prospectus/offer to exchange entitled “Risk Factors.”

Purpose of the Offer; the Proposed Merger (see page 130)

The purpose of the Offer is for Timmins to acquire control of, and ultimately the entire equity interest in, CGC. The Offer is the first step in Timmins’ plan to acquire all of the outstanding CGC Shares. Timmins currently intends, as soon as practicable following the consummation of the Offer, to seek to effect the merger of Offeror with and into CGC, with CGC surviving the merger (the “Proposed Merger”). CGC after the Proposed Merger is sometimes referred to as the “Surviving Corporation.” The purpose of the Proposed Merger is for Timmins to acquire all CGC Shares not acquired in the Offer. After the Proposed Merger, the Surviving Corporation will be a wholly-owned subsidiary of Timmins and the former CGC stockholders will no longer have any direct ownership interest in the Surviving Corporation. Pursuant to the Proposed Merger, at the effective time of the Proposed Merger, each CGC Share then outstanding (except for CGC Shares held in CGC’s treasury, CGC Shares owned by any direct or indirect wholly-owned subsidiary of CGC and CGC Shares owned by Timmins, Offeror or any of their direct or indirect wholly-owned subsidiaries, including CGC Shares acquired in the Offer) will be converted into the right to receive the Consideration. Holders who otherwise would be entitled to receive a fractional Timmins Share will instead receive cash in lieu of any fractional Timmins Share such holder may have otherwise been entitled to receive. See “The Offer—Fractional Shares” for a detailed description of the treatment of fractional Timmins Shares.

Timmins is seeking to negotiate a merger agreement with CGC. Subject to applicable law, Offeror reserves the right to amend the Offer in all respects upon entering into a merger agreement with CGC, or to negotiate a merger agreement with CGC not involving a tender offer or exchange offer pursuant to which Offeror would terminate the Offer and the CGC Shares would, upon consummation of such proposed merger, be converted into the consideration negotiated by Timmins, Offeror and CGC.

The Companies (see page 48)

Timmins

Timmins Gold Corp.

609 Granville Street, Suite 520

Vancouver, British Columbia

Canada V7Y 1G5

(604) 682-4002

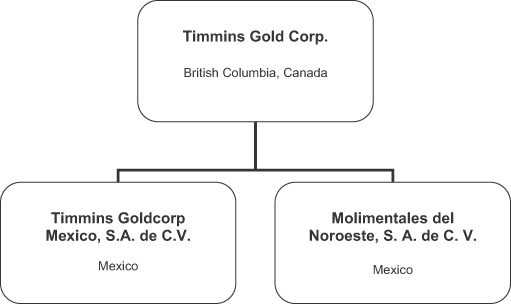

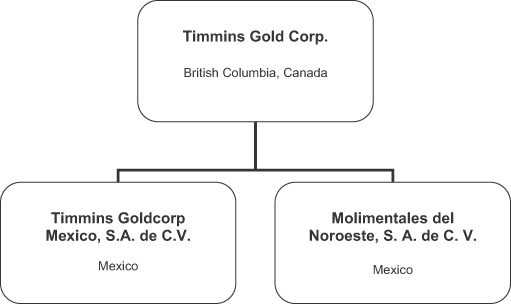

Timmins, a British Columbia corporation, is a resource company engaged in the acquisition, exploration and development and operation of gold properties in Mexico. Timmins was founded in 2005 and it commenced commercial production on April 1, 2010 at the San Francisco Mine in Sonora, Mexico.

Timmins Gold Acquisition Corp.

c/o Timmins Gold Corp.

609 Granville Street, Suite 520

Vancouver, British Columbia

Canada V7Y 1G5

(604) 682-4002

13

Offeror, a Delaware corporation, is a wholly-owned subsidiary of Timmins. Offeror is newly formed, and was organized for the purpose of making the Offer and consummating the Proposed Merger. Offeror has engaged in no business activities to date and it has no material assets or liabilities of any kind, other than those incidental to its formation and those incurred in connection with the Offer and the Proposed Merger.

CGC

Capital Gold Corporation

76 Beaver Street, 14thFloor

New York, NY 10005

(212) 344-2785

CGC is engaged in the mining, exploration and development of gold properties in Mexico. CGC’s primary focus is on the operation and development of the El Chanate project, and CGC also conducts gold exploration in other locations in Sonora, Mexico.

Reasons for the Offer and the Proposed Merger (see page 114)

Timmins believes that a combination of Timmins and CGC would create significant value for both CGC stockholders and Timmins shareholders. The issuance of Timmins Shares to a CGC stockholder will allow that stockholder to participate in the growth and value creation of the combined company.

Timmins believes the combination of Timmins and CGC is compelling and offers a number of strategic benefits, including the following:

| | • | | Increased Production: We estimate that the combined company will have 2011 production of approximately 160,000 ounces of gold, making it a solid mid-tier producer. |

| | • | | Re-Rating Opportunity: We expect that the combined company will be recognized as a solid mid-tier producer, which should lead to a re-rating of the combined company’s share price. We believe this re-rating opportunity offers CGC stockholders a significant potential benefit that would not be available at all or in the same degree in connection with the sale of CGC to Gammon. In fact, CGC’s proxy statement in connection with the Gammon transaction states that CGC’s own financial advisor noted that “the long-term valuation re-rating was potentially greater under a transaction with Timmins Gold.” |

| | • | | Low-Cost Producer: We estimate that the combined company will have a cash production cost of approximately $484 per ounce of gold. |

| | • | | Strong Gold Reserves: We estimate that the combined company will have approximately 2.2 million ounces of proven and probable reserves, with significant opportunities to further develop and add to such reserves. |

| | • | | Complementary Assets: CGC’s El Chanate Mine and Timmins’ San Francisco Mine are located within 65 kilometres of each other in the Sonora region of Mexico, making the combination of these assets ideal from an operational and strategic perspective. |

| | • | | Experienced Management Team: The combination of key members of CGC’s and Timmins’ management teams will provide excellent leadership from an operational perspective and have a strong track record raising capital. |

| | • | | Supportive Shareholder Base. The combined company will benefit from a supportive base of institutional shareholders that understand the combined business and want to see it succeed. Currently, stockholders representing approximately 35% of the CGC Shares have advised us of their support for the Revised Proposal, including some of CGC’s largest institutional stockholders. |

14

Timing of the Offer (see page 102)

Timmins and CGC had discussions regarding a combination in August and September of 2010, and Timmins continued to seek to engage with CGC’s board of directors to negotiate a friendly merger of Timmins and CGC. Despite repeated attempts and proposals, CGC rejected our proposals. Then, on October 1, 2010, CGC entered into an agreement and plan of merger (the “Gammon Agreement”) with Gammon Gold Inc. (“Gammon”), pursuant to which CGC would become a wholly-owned subsidiary of Gammon. Timmins subsequently attempted to engage with CGC in October and December 2010 but was rejected by CGC each time. In January 2011, CGC invited Timmins to discuss a potential transaction and requested that Timmins provide due diligence materials to CGC. Timmins provided the due diligence materials, but CGC again rejected Timmins’ proposal and publicly announced that it had discontinued negotiations with Timmins. It has therefore become imperative to act now to ensure that CGC stockholders have an opportunity to consider Timmins’ proposal prior to CGC consummating the proposed merger with Gammon.

Conditions of the Offer (see page 134)

The Offer is conditioned upon the following:

| | • | | there shall have been validly tendered and not withdrawn prior to the expiration of the Offer, as it may be extended from time to time, that number of CGC Shares which, when added to CGC Shares owned by Timmins or Offeror, if any, represents a majority of the total number of outstanding CGC Shares on a fully diluted basis (assuming the conversion or exercise of all stock options, other derivative securities or other rights to acquire CGC Shares regardless of the conversion or exercise price, the vesting schedule or other terms and conditions thereof) at the time of the expiration of the Offer (the “Minimum Condition”); |

| | • | | CGC shall have entered into a definitive merger agreement with Timmins with respect to the Proposed Merger, which terms and conditions will be reasonably satisfactory to Timmins and shall provide, among other things, that: (i) the board of directors of CGC has approved the Offer and the Proposed Merger and (ii) the board of directors of CGC has removed any legal or contractual impediment to the consummation of the Offer and the Proposed Merger (the “Approval Condition”); |

| | • | | Timmins shall have completed, to its reasonable satisfaction, customary confirmatory due diligence with respect to CGC’s business, assets and liabilities and shall have concluded, in its reasonable judgment, that there are no material adverse facts or developments concerning or affecting CGC’s business, assets and liabilities that have not been publicly disclosed prior to the commencement of the Offer (the “Due Diligence Condition”); |

| | • | | the Gammon Agreement shall have been terminated, and any “break-fee” owing as a result of such termination shall have been paid in full (the “Termination Condition”); |

| | • | | Timmins shall have concluded, in its reasonable judgment, that the restrictions on “Business Combinations” with an “Interested Stockholder” set forth in Section 203 of the DGCL are inapplicable to the Offer and the Proposed Merger or any other business combination involving Timmins or any of its subsidiaries and CGC (the “Section 203 Condition”); |

| | • | | there shall not have been any “material adverse change” to CGC at any time on or after July 31, 2010 and prior to the expiration of the Offer (see “The Offer—Conditions of the Offer” for a definition of “material adverse change”); |

| | • | | there shall be no pending private, regulatory or governmental inquiry, action, suit, proceeding, litigation, claim, arbitration or investigation against CGC or any of its affiliates, or any of their respective properties or assets, or any officer, director, partner, member or manager, in his or her capacity as such, of CGC or any of their affiliates, with respect to the Offer or the consummation of the Proposed Merger or the transactions contemplated thereby which could reasonably be expected to result in a material adverse change; |

15

| | • | | each of CGC and its subsidiaries shall have carried on their respective businesses in the ordinary course consistent with past practice at any time on or after the date of this prospectus/offer to exchange and prior to the expiration of the Offer; |

| | • | | any applicable waiting period under the HSR Act and Mexican law shall have expired or been terminated, and any other requisite clearances and/or approvals under any other federal, state or foreign antitrust, competition or other regulatory law shall have been obtained; |

| | • | | the shareholders of Timmins shall have approved the issuance of Timmins Shares pursuant to the Offer and the Proposed Merger; |

| | • | | the registration statement of which this prospectus/offer to exchange is a part shall have become effective under the Securities Act, and no stop order or proceeding seeking a stop order shall have been issued and no other proceeding shall have been instituted or threatened by the SEC; and |

| | • | | the Timmins Shares to be issued pursuant to the Offer shall have been approved for listing on the TSX-V and the NYSE Amex, subject to official notice of issuance. |

CGC’s board of directors has the ability to satisfy certain of the principal conditions of the Offer, including the Section 203 Condition, the Approval Condition, the Termination Condition and the Due Diligence Condition. Timmins and Offeror believe that CGC’s board of directors should take all necessary actions to facilitate the satisfaction of such conditions and the consummation of the Offer and the Proposed Merger and hereby request that they do so. Although Timmins believes that, under the circumstances of the Offer and the Proposed Merger, CGC’s board of directors should do so, CGC’s board of directors may not act to satisfy these conditions. If CGC does not act to facilitate these conditions Timmins will not be able to consummate the Offer and the Proposed Merger.

Comparative Market Price Data (see page 27)

Timmins Shares are listed on the TSX-V under the symbol “TMM.” The CGC Shares trade on the NYSE Amex and on the Toronto Stock Exchange (the “TSX”) under the symbol “CGC.” On [—], 2011, the last full trading day before the date of this Offer, the closing sales price of a Timmins Share on the TSX-V was $[—], based on the Bank of Canada’s noon exchange rate on such date, and the closing sales price of a CGC Share on the NYSE Amex was $[—]. CGC stockholders should obtain current market quotations for the Timmins Shares and the CGC Shares before deciding whether to tender CGC Shares in the Offer. See “Comparative Market Price and Dividend Matters” for a discussion of pro forma per share data.

Ownership of Timmins after the Offer and the Proposed Merger (see page 122)

Timmins estimates that, if all of CGC’s stock options and warrants are exercised, former CGC stockholders would own, in the aggregate, approximately 51.8% of Timmins Shares outstanding after the consummation of the Proposed Merger. For a detailed discussion of the assumptions on which this estimate is based, see “The Offer—Ownership of Timmins After the Offer and the Proposed Merger.”

Comparison of Shareholders’ Rights (see page 147)

The rights of Timmins shareholders are different in some respects from the rights of CGC stockholders. Therefore, CGC stockholders will have different rights as stockholders once they become Timmins shareholders. The differences are described in more detail under “Comparison of Shareholders’ Rights.”

16

Expiration of the Offer (see page 117)

The Offer is scheduled to expire at 12:00 midnight, New York City time, on [—], 2011, which is the Initial Expiration Date, unless further extended by Offeror. CGC Shares tendered pursuant to the Offer may be withdrawn at any time prior to the expiration of the Offer. “Expiration Date” means the Initial Expiration Date, unless and until Offeror has extended the Offer, subject to applicable laws, in which case the term “Expiration Date” means the latest time and date at which the Offer, as so extended by Offeror, will expire.

Extension, Termination or Amendment (see page 117)

Timmins may extend the Offer from time to time if the conditions to the Offer have not been satisfied as of the Initial Expiration Date or any other scheduled Expiration Date or if Offeror is required to extend the Offer pursuant to the SEC’s tender offer rules.

Offeror will effect any extension, termination, amendment or delay by giving oral or written notice to the exchange agent and by making a public announcement as promptly as practicable thereafter as described under “The Offer—Extension, Termination and Amendment.” In the case of an extension, any such announcement will be issued no later than 9:00 a.m., New York City time, on the next business day following the previously scheduled Expiration Date. Subject to applicable law (including Rules 14d-4(c) and 14d-6(d) under the Exchange Act, which require that any material change in the information published, sent or given to stockholders in connection with the Offer be promptly disseminated to stockholders in a manner reasonably designed to inform them of such change) and without limiting the manner in which Offeror may choose to make any public announcement, Offeror assumes no obligation to publish, advertise or otherwise communicate any such public announcement of this type other than by issuing a press release. During any extension, CGC Shares previously tendered and not properly withdrawn will remain subject to the Offer, subject to the right of each CGC stockholder to withdraw previously tendered CGC Shares.

Subject to applicable SEC rules and regulations and applicable law, Offeror also reserves the right, in its sole discretion, at any time or from time to time to waive any or all conditions to the Offer.

Timmins is seeking to negotiate a merger agreement with CGC. Subject to applicable law, Offeror reserves the right to amend the Offer in all respects upon entering into a merger agreement with CGC, or to negotiate a merger agreement with CGC not involving a tender offer or exchange offer pursuant to which Offeror would terminate the Offer and the CGC Shares would, upon consummation of such proposed merger, be converted into the consideration negotiated by Timmins, Offeror and CGC.

No subsequent offering period will be available following the expiration of the Offer.

Withdrawal Rights (see page 121)

Tendered CGC Shares may be withdrawn at any time prior to the Expiration Date and at any time after the Expiration Date until Offeror accepts the CGC Shares for exchange. Once Offeror accepts CGC Shares for exchange pursuant to the Offer, all tenders not previously withdrawn become irrevocable.

Procedure for Tendering (see page 119)

To validly tender CGC Shares pursuant to the Offer, CGC stockholders must:

| | • | | deliver a properly completed and duly executed letter of transmittal, along with any required signature guarantees and any other required documents, and certificates for tendered CGC Shares to the exchange agent at its address set forth on the back cover of this prospectus/offer to exchange, all of which must be received by the exchange agent prior to the Expiration Date; |

17

| | • | | deliver an agent’s message in connection with a book-entry transfer, and any other required documents, to the exchange agent at its address set forth on the back cover of this prospectus/offer to exchange, and CGC Shares must be tendered pursuant to the procedures for book entry tender set forth in this prospectus/offer to exchange (and a confirmation of receipt of that tender received), and in each case be received by the exchange agent prior to the Expiration Date; or |

| | • | | comply with the guaranteed delivery procedures set forth in “The Offer—Guaranteed Delivery.” |

CGC stockholders who hold CGC Shares in “street name” through a bank, broker or other nominee holder, and desire to tender their CGC Shares pursuant to the Offer, should instruct the nominee holder to do so prior to the Expiration Date.

Exchange of CGC Shares; Delivery of Timmins Shares (see page 118)

Upon the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of any extension or amendment), promptly following the Expiration Date, Offeror will accept for exchange, and will exchange, all CGC Shares validly tendered and not withdrawn prior to the Expiration Date.

Fractional Shares (see page 119)

Fractional Timmins Shares will not be distributed in the Offer or the Proposed Merger. Instead, CGC stockholders entitled to receive fractional Timmins Shares will receive cash in lieu of a fractional Timmins Share. The exchange agent, acting as agent for CGC stockholders otherwise entitled to receive a fractional Timmins Share, will aggregate all fractional Timmins Shares that would otherwise have been required to be distributed and cause them to be sold in the open market for the accounts of such stockholders. The stockholders will receive the proceeds, if any, less any brokerage commissions or other fees, from the sale of these fractional Timmins Shares in accordance with their fractional interest in the aggregate number of Timmins Shares sold.

Certain Legal Matters; Regulatory Approvals (see page 136)

Antitrust

The Offer and the Proposed Merger cannot be consummated until after Timmins and CGC file the premerger Notification and Report Forms (each an “HSR Form”) required by the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and observe the corresponding waiting period. These requirements and other issues are discussed under “The Offer—Certain Legal Matters; Regulatory Approvals.” Shortly after Timmins announced the Offer and the Proposed Merger, Timmins commenced voluntary discussions with the staff (the “Staff”) of the Federal Trade Commission (the “FTC”). Pursuant to these informal discussions, Timmins agreed to provide voluntarily information to the Staff in order to expedite its investigation. Timmins believes that the provision of this information prior to the filing of its HSR Form will shorten the time necessary for FTC review once the Forms are filed. Timmins intends to file the HSR Form once the FTC has sufficient information to allow such an expedited review.

In addition, under applicable Mexican antitrust laws, the Offer and the Proposed Merger cannot be consummated until the expiration of the 10 business day waiting period beginning on the date of filing the premerger filing with the Comisión Federal de Competencia, or the “Mexican Antitrust Commission,” subject to the Mexican Antitrust Commission not issuing a “stop order” and assuming the risk of closing the Offer and Proposed Merger before a decision is issued. If during such waiting period the Mexican Antitrust Commission issues a “stop order,” then the Offer and the Proposed Merger may only be consummated upon receiving clearance from the Mexican Antitrust Commission. Generally, the Mexican Antitrust Commission has up to 35 business days from the date the case file is complete to issue its decision on a transaction. In complicated cases,

18

such period may be extended by the Mexican Antitrust Commission. Timmins will make the application and file responses as may be required in connection with questions that may be posed by the Mexican Antitrust Commission during the comment period. Under applicable Mexican antitrust laws, once the time limit has expired and no decision has been issued to the interested parties, it shall be understood that the Mexican Antitrust Commission has no objection.

State Takeover Laws

In general, Section 203 of the DGCL prevents an “Interested Stockholder” (including a person who owns or has the right to acquire 15% or more of a corporation’s outstanding voting stock) from engaging in a “Business Combination” (which term includes mergers and certain other actions) with a Delaware corporation for a period of three years following the date such person became an Interested Stockholder.

The Offer is subject to the condition that the board of directors of CGC shall have approved the Offer and the Proposed Merger pursuant to the requirements of Section 203 of the DGCL, or Timmins shall have concluded, in its reasonable judgment, that Section 203 does not apply to or otherwise restrict the Offer, the Proposed Merger or any such business combination. This condition will be satisfied if (1) prior to the acceptance for exchange of CGC Shares pursuant to the Offer, CGC’s board of directors (x) shall have unconditionally approved the Offer and the Proposed Merger or (y) shall have approved each of Timmins and its subsidiaries as an Interested Stockholder or (2) there are validly tendered and not withdrawn prior to the Expiration Date a number of CGC Shares that, together with the CGC Shares then owned by Timmins, would represent at least 85% of the CGC Shares outstanding on the date of this prospectus/offer to exchange (excluding CGC Shares owned by certain employee stock plans and persons who are directors and also officers of CGC).

Other Regulatory Approvals